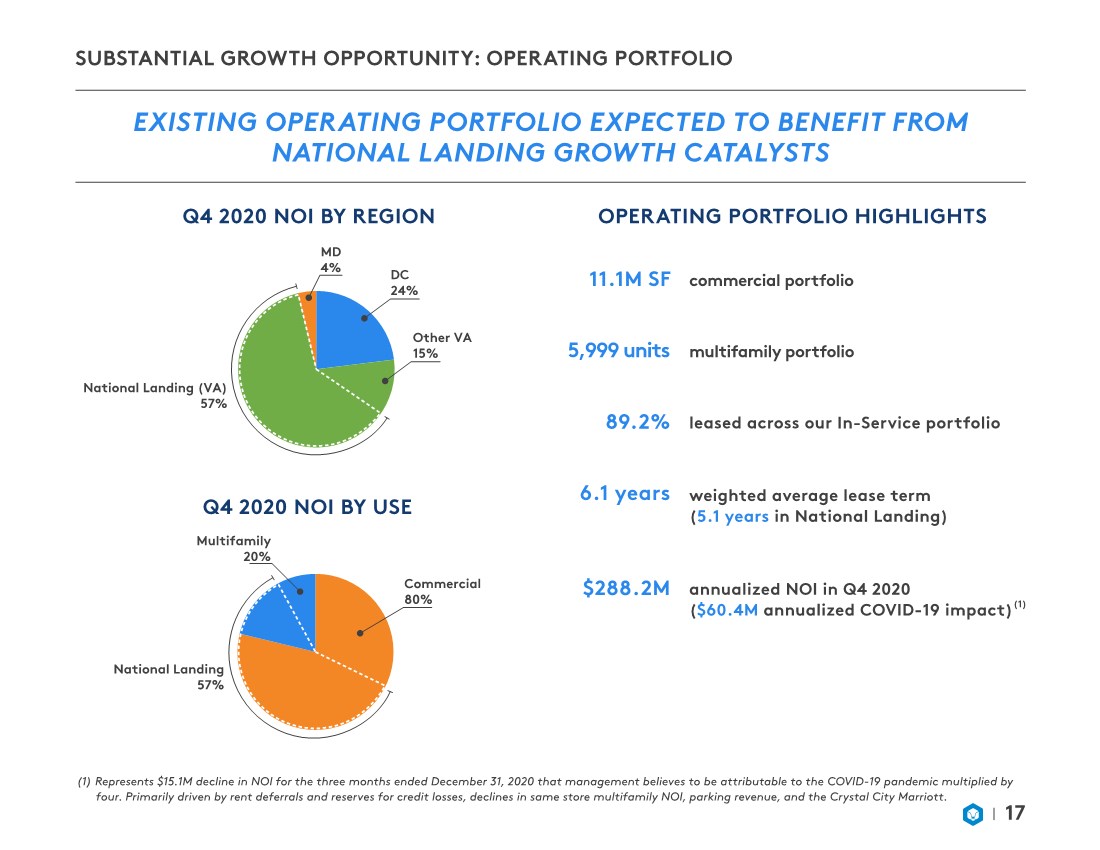

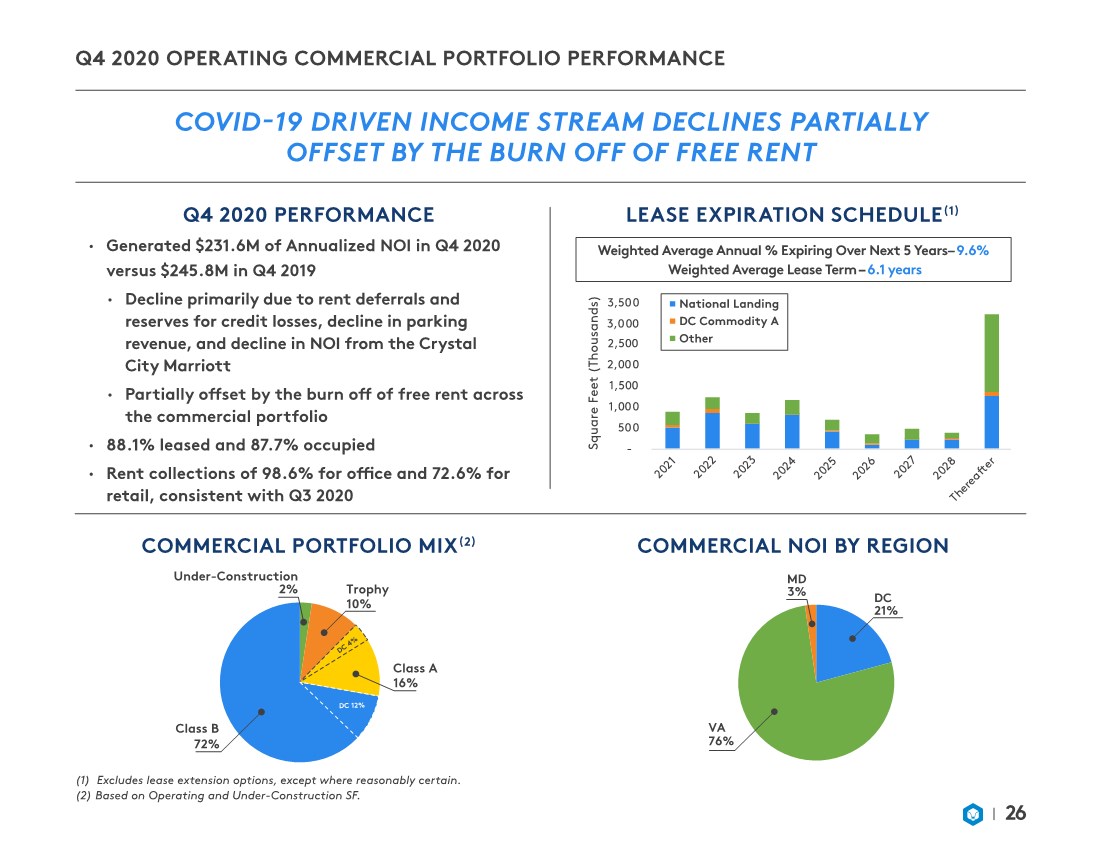

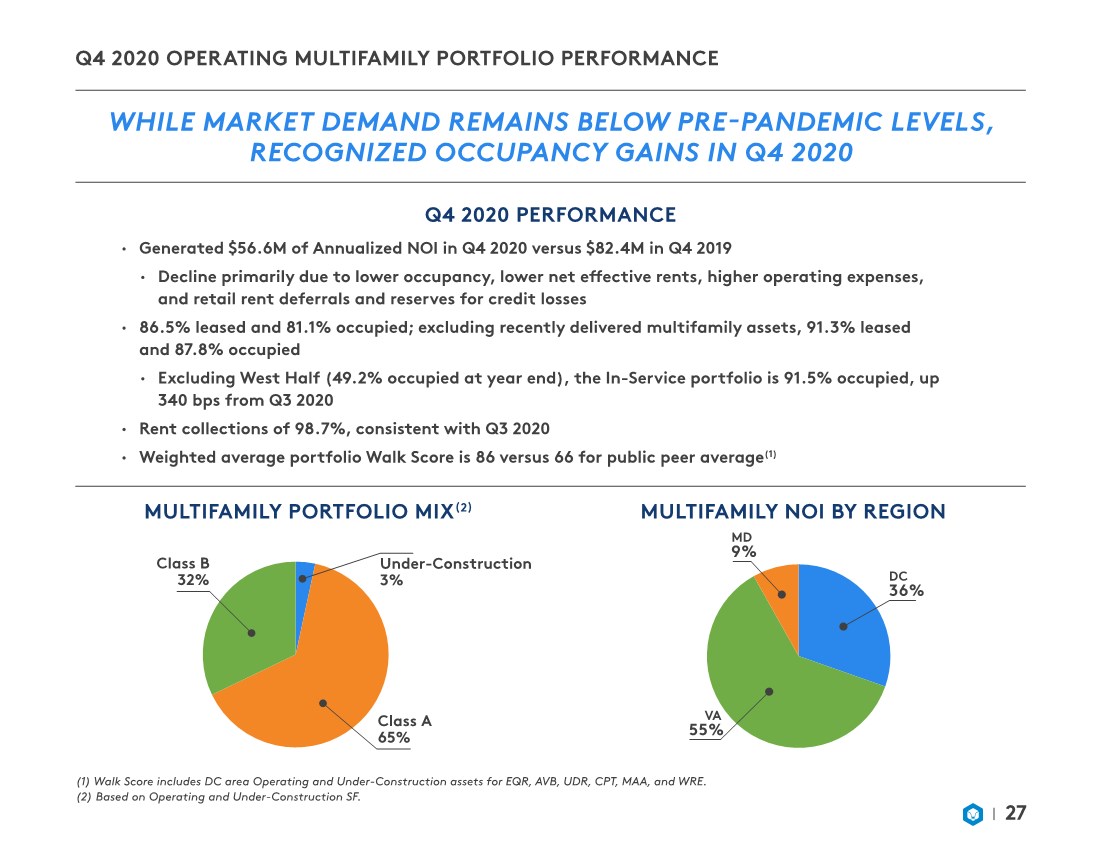

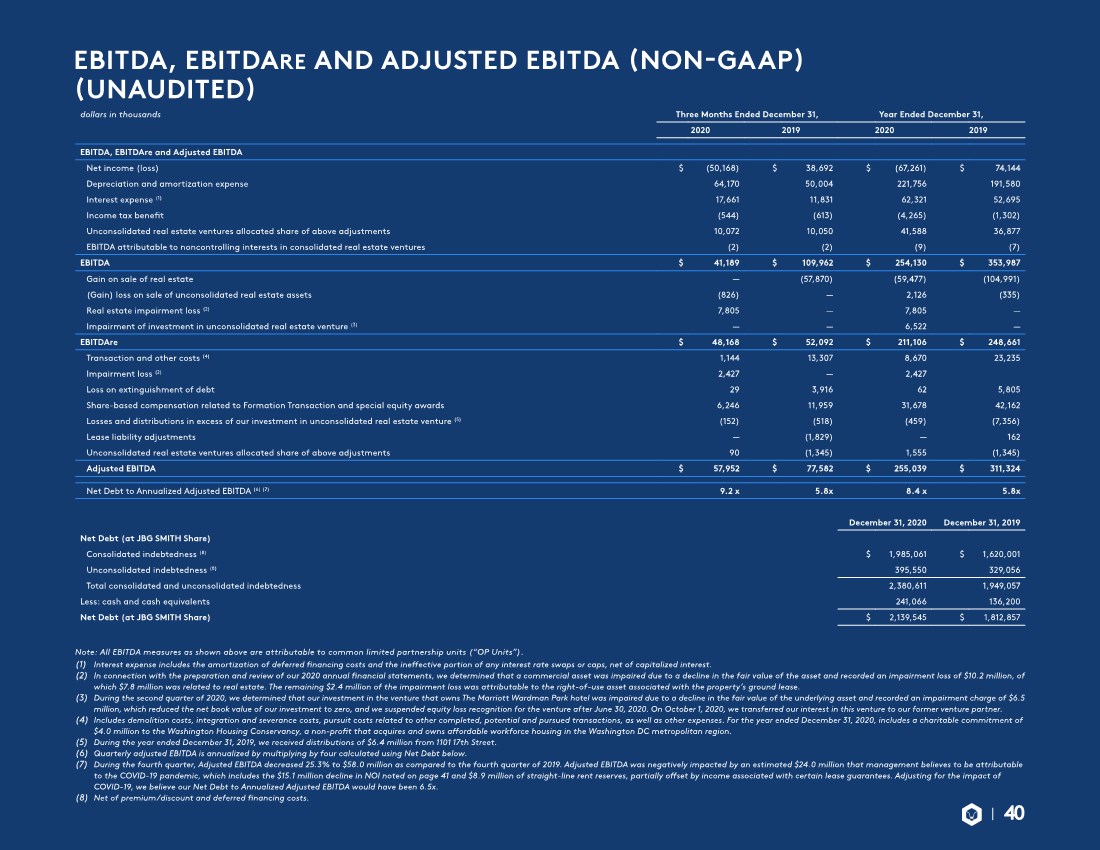

| DISCLOSURES 41 NOI RECONCILIATIONS (NON-GAAP) (UNAUDITED) (1) Adjustment to exclude straight-line rent, above/below market lease amortization and lease incentive amortization. (2) Adjustment to include other revenue and payments associated with assumed lease liabilities related to operating properties and to exclude commercial lease termination revenue and allocated corporate general and administrative expenses to operating properties. (3) Includes the results of our Under-Construction assets, and Near-Term and Future Development Pipelines. (4) During the fourth quarter, NOI for our operating portfolio decreased 13.1% to $71.8 million as compared to the fourth quarter of 2019. NOI was negatively impacted by an estimated $15.1 million that management believes to be attributable to the COVID-19 pandemic, comprising $3.7 million of reserves and rent deferrals for office and retail tenants, a $5.8 million decline in NOI in our same store multifamily assets, a $3.9 million decline in parking revenue, and a $1.7 million decline in NOI from the Crystal City Marriott. The $3.7 million of reserves and rent deferrals for office and retail tenants that impacted NOI include (i) $2.1 million of rent deferrals, (ii) $1.8 million of rent deferrals from expected lease modifications, and (iii) $1.2 million of other reserves, partially offset by $1.4 million we collected from Parking Management Inc, a parking operator who filed for bankruptcy protection during the second quarter of 2020. (5) Includes the results of properties that were not in-service for the entirety of both periods being compared and properties for which significant redevelopment, renovation or repositioning occurred during either of the periods being compared. (6) Includes the results of properties that are owned, operated and in-service for the entirety of both periods being compared except for properties that are being phased out of service for future development. dollars in thousands Three Months Ended December 31, Year Ended December 31, 2020 2019 2020 2019 Net income (loss) attributable to common shareholders $ (45,655) $ 34,390 $ (62,303) $ 65,571 Add: Depreciation and amortization expense 64,170 50,004 221,756 191,580 General and administrative expense: Corporate and other 9,156 11,934 46,634 46,822 Third-party real estate services 28,569 26,910 114,829 113,495 Share-based compensation related to Formation Transaction and special equity awards 6,246 11,959 31,678 42,162 Transaction and other costs 1,144 13,307 8,670 23,235 Interest expense 17,661 11,831 62,321 52,695 Loss on extinguishment of debt 29 3,916 62 5,805 Impairment loss 10,232 — 10,232 — Income tax benefit (544) (613) (4,265) (1,302) Net income (loss) attributable to redeemable noncontrolling interests (4,513) 4,302 (4,958) 8,573 Less: Third-party real estate services, including reimbursements revenue 30,069 29,121 113,939 120,886 Other revenue 9,934 1,686 15,372 7,638 Loss from unconsolidated real estate ventures, net (3,194) (2,042) (20,336) (1,395) Interest and other income (loss), net (1,646) 3,022 (625) 5,385 Gain on sale of real estate — 57,870 59,477 104,991 Consolidated NOI 51,332 78,283 256,829 311,131 NOI attributable to unconsolidated real estate ventures at our share 7,521 6,052 27,693 21,797 Non-cash rent adjustments (1) 15,433 (8,465) 5,535 (34,359) Other adjustments (2) (3,284) 3,913 6,058 13,979 Total adjustments 19,670 1,500 39,286 1,417 NOI $ 71,002 $ 79,783 $ 296,115 $ 312,548 Less: out-of-service NOI loss (3) (801) (2,817) (5,789) (7,013) Operating Portfolio NOI (4) $ 71,803 $ 82,600 $ 301,904 $ 319,561 Non-same store NOI (5) 1,174 3,635 14,028 18,706 Same store NOI (6) $ 70,629 $ 78,965 $ 287,876 $ 300,855 Change in same store NOI (10.6)% (4.3)% Number of properties in same store pool 54 52 |