August 6, 2019

To Our Fellow Shareholders:

We are pleased to report on our performance for the second quarter of 2019. For details regarding our financial and operating results, please see our second quarter earnings release and supplemental information, which follow this letter.

Over the past three months, we achieved a number of significant milestones across our portfolio and our company. During the quarter, Virginia Tech announced the relocation of its $1 billion Innovation Campus to a site in the Potomac Yard section of National Landing, immediately adjacent to approximately two million square feet of JBG SMITH controlled development density. In addition, Amazon took occupancy of its first short-term space in National Landing, we continued to advance the design and entitlement of Amazon’s new headquarters, the development of our Under Construction assets, and the entitlement of our Future Development Pipeline. During the quarter, we also successfully closed a $472 million equity offering, which we discussed at length in our first quarter investor letter, and we made progress on our ongoing capital recycling efforts. Lastly, we announced the initial $78 million closing of the Washington Housing Initiative Impact Pool, which was launched last year.

Virginia Tech Innovation Campus

In June, Virginia Tech announced that it had moved the planned location of its $1 billion Innovation Campus to a site in Potomac Yard, the southern portion of National Landing, which will be one Metro stop and approximately one mile south of Amazon’s new headquarters. When combined with Amazon’s proximity, the Innovation Campus represents a pivotal moment for the submarket that should substantially benefit all our assets in National Landing. While the campus was originally slated to be on the west side of Richmond Highway, across from our holdings, we believe the new location is a far better outcome for JBG SMITH, as it is immediately adjacent to approximately two million square feet of development density that we own. In addition, JBG SMITH currently serves as the master planner and property manager of the 65-acre development site where the planned Innovation Campus will be located.

On this campus, Virginia Tech intends to create an innovation ecosystem by co-locating academic and private sector uses to accelerate research and development spending, as well as the commercialization of technology. The planned campus is similar in concept to Cornell Tech on Roosevelt Island in New York City (https://tech.cornell.edu/campus/). Virginia Tech has engaged the same fundraising team that Cornell used for its Roosevelt Island campus to augment the $500 million that has been committed to the first phases of the campus by the Commonwealth of Virginia and Virginia Tech. The initial phase of the campus, anticipated to commence construction in the third quarter of 2021, is expected to include approximately two million square feet of mixed-use development, of which 600,000 square feet is expected to be devoted to Virginia Tech. The remaining approximately 1.4 million square feet is expected to include retail, residential, and office, a substantial portion of which could be positioned to attract commercial tenants seeking close proximity to the campus. The first graduate students, who will be housed in existing temporary academic space, are expected to begin classes as early as 2020. When the Innovation Campus is fully operational, Virginia Tech plans to graduate approximately 750 master’s students and 150 PhD students in computer science annually.

Amazon’s New Headquarters at National Landing

In May, Amazon submitted its plans to Arlington County for approval of two new office buildings, totaling 2.1 million square feet, inclusive of 50,000 square feet of street-level retail with new shops and restaurants, on the Metropolitan 6, 7, and 8 land sites. JBG SMITH will serve as the developer, property manager, and retail leasing agent for Amazon. Amazon’s plans also call for 1.1 acres of new public open space designed to accommodate a dog park, recreation areas, farmers markets, and other community uses.

National Landing Leasing Momentum

Not surprisingly, we have seen an increase in inbound leasing traffic in National Landing. Since the Amazon announcement, we have completed approximately 1.0 million square feet of new lease transactions and nearly 400,000 square feet of renewals, increasing our operating commercial leased percentage in National Landing to 89.3%, up 5.0% from the time of the Amazon announcement. One example of new demand is the 10,000 square foot lease we signed with Amify, a company that partners with industry leading brands to drive sales on Amazon.com, reflecting one segment of follow-on demand that we expect Amazon to generate in National Landing.

While our leasing efforts continue to focus on tenants in the DC Metro area, we are also actively marketing National Landing to prospective tenants and brokers in other constrained markets, specifically the San Francisco Bay area. This market is home to scores of tenants that ultimately grew to cluster around Amazon in Seattle, and we believe a similar effect is likely to occur in National Landing. The Bay Area has enjoyed the benefits of rapid growth in the tech sector; however, it suffers from limited office space availability, high housing costs exacerbated by regulatory and geographic constraints on new supply, severe congestion, and limited development opportunities. Many companies outside of the technology sector are being priced out of the real estate and employment markets, and even technology companies have started to turn to other markets to accommodate their growth. We believe that the same advantages Amazon found compelling about the DC Metro region are broadly appealing: availability of tech talent, abundant office space, low housing costs compared to other gateway markets, access to federal policymakers, and a business-friendly climate - particularly in Northern Virginia. While it is still early in these pursuits, we are encouraged by the response we have received, and we believe that Amazon’s selection of National Landing for its second headquarters has increased prospective tenants’ focus and attention on the submarket.

Key Under Construction Assets in National Landing

In addition to the ground-up projects we are developing on behalf of Amazon, we continue to make progress on our Under Construction assets in National Landing, including 1770 Crystal Drive and Central District Retail. Amazon has fully leased the office portion of 1770 Crystal Drive, totaling approximately 272,000 square feet, and we expect to complete construction in the second quarter of 2021, with Amazon’s occupancy occurring shortly thereafter. Central District Retail, totaling 109,000 square feet, will serve as the retail heart of National Landing and includes a 49,000 square foot Alamo Drafthouse Cinema, specialty grocer, restaurants, bars, and other experiential offerings. As is often the case with anchor retail, Central District Retail represents an important investment in our broader submarket repositioning and, even prior to completion, we believe it has already paid dividends by changing the perception of the neighborhood and attracting retail and office tenants to National Landing.

Key Entitlements in the Future Development Pipeline

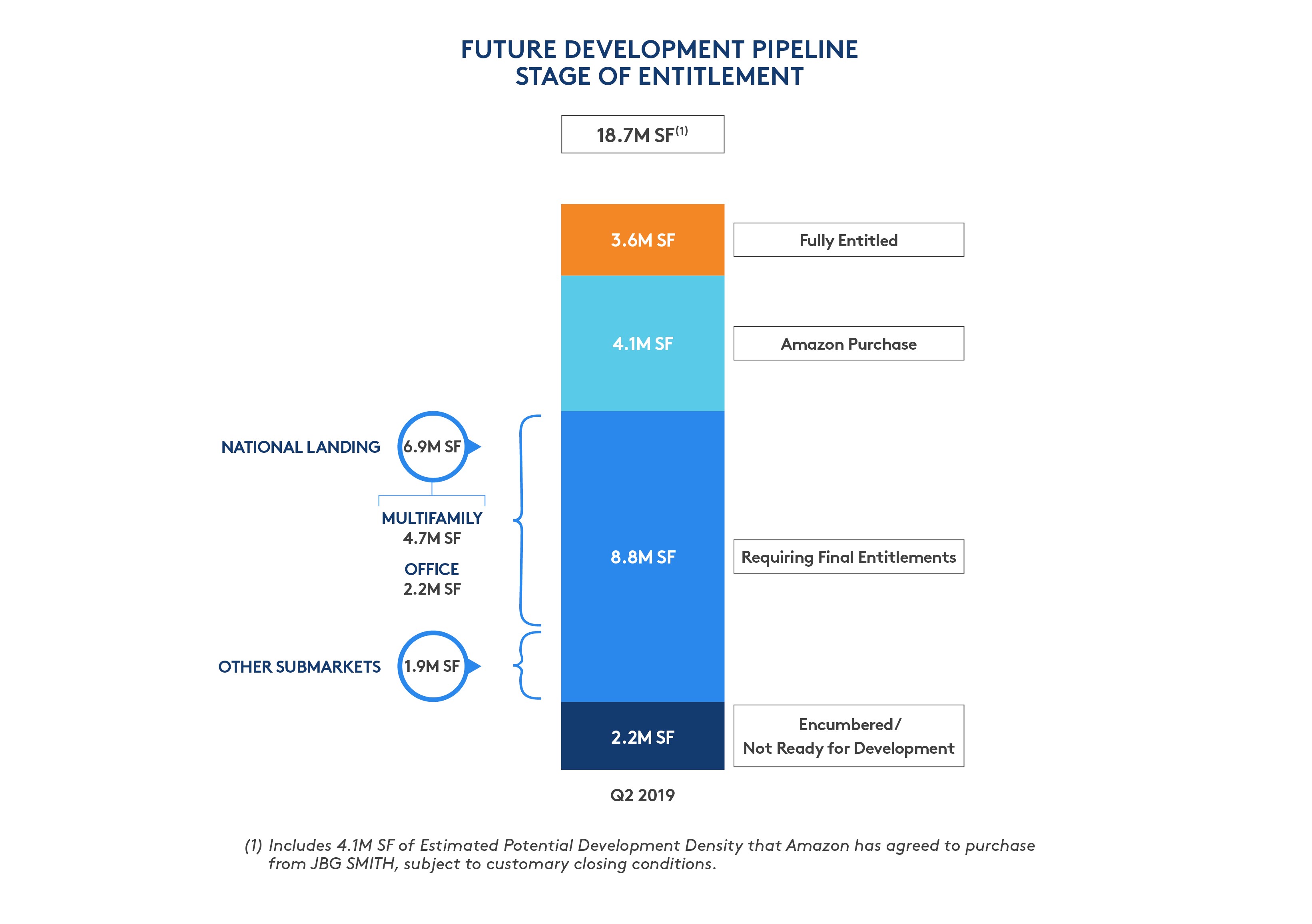

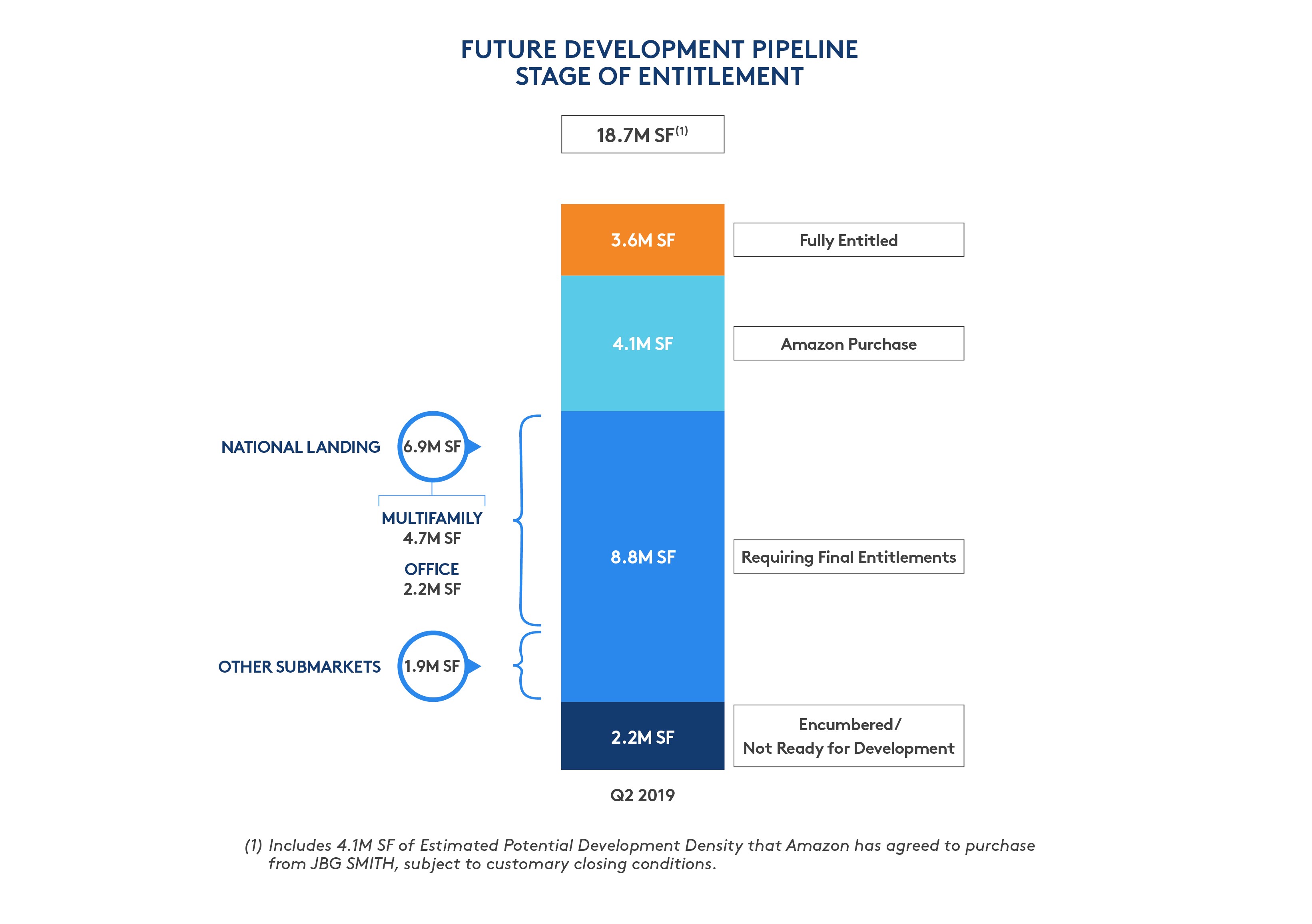

We continue to make progress on the entitlement of our 18.7 million square foot (at share) Future Development Pipeline. Of the 18.7 million square feet, 4.1 million square feet is under contract for sale to Amazon, 3.6 million square feet is fully entitled, and the remaining 11.0 million square feet is zoned for our planned use, subject to the final stage of design and/or entitlement. To that end, Arlington County is moving through its approval process for 1900 Crystal Drive, which currently contemplates two residential towers, totaling approximately 750 units, with retail and neighborhood-serving amenities at the base. In addition, we submitted plans to add nearly 1,000 housing units at RiverHouse Apartments, located along the western edge of National Landing, within three blocks of Amazon’s new headquarters. This new development will occupy existing surface parking enabling the continued operation of the three existing multifamily towers.

Washington, DC Market Update

Outside of National Landing, the DC market finished the second quarter with little change in underlying fundamentals.

According to JLL, the DC Metro office market saw approximately 2.0 million square feet of net absorption through the first half of the year, with 76% in JBG SMITH submarkets - strong performance, particularly in Northern Virginia, but still low relative to historic averages. To put this into context, the submarkets in which JBG SMITH operates contain 50% of the inventory of the overall DC Metro office market. In DC proper, the new supply environment remains challenging with 1.9 million square feet delivered in the first half of the year and another 3.6 million square feet currently under construction. While we believe that this pipeline of new Trophy product will lease, it will likely be at the expense of the Commodity Class A market downtown, which was already 14% vacant at quarter end. The pressure on the Commodity Class A market segment is compounded by the fact that asking rents in many second-generation buildings located in mature markets are nearly equivalent with rents in new construction buildings in amenity-rich emerging markets, such as the Ballpark and the Wharf. This value gap has allowed these emerging markets to attract tenant and investor demand at the expense of the mature markets. As this trend continues, downward pressure downtown may not be limited to Commodity Class A product and should begin to put pressure on today’s relatively healthy Class B market.

In contrast to the broader DC office market, National Landing remains headed in a positive direction, with vacancy dropping 170 basis points to 15.5% - substantially below the 19.9% in the historically better performing Rosslyn-Ballston corridor. After the 16% growth in National Landing asking rents that JLL reported last quarter, rents held steady in the second quarter, suggesting broker-reported asking rent increases reflect a fundamental market reset. At current levels, JLL’s reported rent in National Landing is only a 3% discount to office rents in the Rosslyn-Ballston corridor - a gap we believe will continue to narrow and potentially invert, as National Landing continues to recover, and absorbs the vacancy that caused it to diverge from other close-in Northern Virginia submarkets. As the vacancy decline and resilient rental rate indicate, tenant interest in the submarket is strong, and we are optimistic that other companies will follow Amazon’s lead in selecting National Landing as their entry point into our region.

The multifamily market was another notable bright spot. During the first half of the year, just under 5,200 units delivered, representing approximately 47% of the expected 2019 pipeline of 10,958 units - down significantly from annual peak deliveries of 15,000 units. The pace of new starts has also slowed, with less than 5,000 units starting construction through the first half of the year. As a result, the total number of expected deliveries in 2020 and 2021 combined stands at only 78% of the historic one-year peak, with limited time remaining for additional new starts to increase that figure. The lease-up pace in the DC urban emerging markets where much of the new supply is concentrated demonstrates the appeal of these submarkets, with 93% average occupancy in buildings that delivered 12 to 18 months ago. Year-over-year, same store rents grew by 4%, reflecting continued momentum in rental housing. Top-of-market rents continued to rise, with reported lease-up rental rates north of $5.00 per square foot for the best new units in premium, mature submarkets, leaving ample room for growth in the emerging markets where JBG SMITH is concentrated. While it is too early to see significant increases in multifamily rents in National Landing, we expect to see a narrowing of the current discount to nearby emerging markets, such as the Ballpark

and the Wharf, especially as Amazon hiring picks up, office vacancy continues to decline, and overall market momentum builds.

The downtown office investment sales market was conspicuously quiet for the first six months of the year. According to JLL, volume in DC was just over $1 billion as of the end of the second quarter. For reference, JLL reported consistent full year investment sales volumes of approximately $5 billion (net of corporate transactions) in each of 2017 and 2018, suggesting a marked slowdown this year. It is uncertain whether core fund redemptions, the potential for further downtown office distress, the dollar’s strength impacting foreign buyers’ hedging costs, or all of the above are to blame. Despite reduced sales volume, there continues to be a substantial number of listings in the market, suggesting that buyer and seller expectations remain distant. While this has not yet impacted our current asset recycling strategy, it does suggest that cap rates for office could be widening. One notable change in the market is the increasing interest we have seen among institutional investors for assets in Arlington, Virginia. According to JLL, Arlington is starting to draw more attention from institutional investors and foreign capital which, historically, rarely looked outside downtown DC. JLL notes this increased interest is driven partially by Amazon’s selection of National Landing and partially by worsening fundamentals in the District.

From a multifamily perspective, investment sales volume remains concentrated in value-add, largely suburban product, with only $773 million in Class A urban sales year-to-date and $1.4 billion in Class B suburban deals during the same time period, according to CoStar. Cap rates for the best downtown assets remain largely stable at around 4.6% and approximately 5.2% for comparable assets located outside of the District, according to CoStar. The notable exception to this stability has been National Landing, where several recent Class A trades have highlighted substantial value appreciation. Following the recent trade of the Meridian at Pentagon City at a 3.7% cap rate, m.flats Crystal City is now reported to be under contract at a 3.8% cap rate, according to local brokers. The 198-unit building, which is proximate to Amazon’s new headquarters, was built on ground-leased land in 2017 and is expected to trade at a cap rate level almost 75 basis points below the three-year Arlington average. The depth of the buyer pool, combined with recent pricing on these two deals, indicate that investors now view National Landing as a core multifamily market.

Operating Portfolio

Our 11.1 million square foot operating commercial portfolio (at share) generated $240 million of annualized NOI and was 90.3% leased and 86.0% occupied as of the end of the second quarter. During the quarter, we completed 41 office lease transactions, totaling 395,000 square feet (at share), including 388,000 square feet in our operating portfolio and 7,000 square feet in our Under Construction portfolio. Notable among this activity was Amazon taking occupancy of 48,000 square feet of short-term space at 2345 Crystal Drive and moving its first employees into National Landing. For second-generation leases, the rental rate mark-to-market was positive 6.0% on a cash basis. Our performance this quarter reflects increased market demand, specifically in National Landing, which accounted for 78.0% of our leasing volume. Our mark-to-market will vary from quarter-to-quarter depending on the leases that are signed. While our performance this quarter (and year-to-date) is better than our expectations, it is still consistent with our long-term assumptions. As a reminder, in conjunction with our investor days, we updated our mark-to-market assumption through 2024 to negative 3%, from negative 5%, due to the expected demand resulting from Amazon’s selection of National Landing.

Consistent with the expectations we outlined last year, same store NOI decreased 9.2% across our operating portfolio during the second quarter, predominately related to the previously discussed blend-and-extend lease renewals we executed in 2017 and 2018. These early blend-and-extend lease renewals significantly de-risk our DC assets at a time of increasing supply and downturn risk, as well as enhance our ability to sell or recapitalize assets on a more attractive basis. We continue to expect that the concessions associated with these early blend-and-extend lease renewals will result in negative same store NOI growth throughout 2019. As the free rent in these leases burns off, we expect the temporary decline in NOI to reverse, resulting in positive same store NOI growth in 2020.

Our operating multifamily portfolio, comprising approximately 4,537 units (at share), generated $82 million of annualized NOI and ended the second quarter at 98.0% leased and 95.0% occupied. We saw particularly strong performance at 1221 Van Street in the Ballpark and The Bartlett in National Landing.

We have seen an increase in property taxes this year, particularly in Arlington County. This increase is expected in a rising market, and while we never like higher expenses, they reflect increased economic activity, the long-awaited arrival of a demand driver like Amazon, and anticipated growth. In addition, while not as impactful as the property tax increases, it is worth noting that we have seen an industry-wide increase in property insurance costs.

Development Portfolio

Our development portfolio consists of eight assets totaling 1.9 million square feet (at share) currently under construction and a Future Development Pipeline totaling 18.7 million square feet. Of the 1.9 million square feet in our Under Construction portfolio, 1.1 million square feet is multifamily and 800,000 square feet is commercial, which is 84.0% pre-leased. We have significant balance sheet capacity to execute on our development opportunities, some of which we expect to develop, while others will likely be sold, recapitalized, or ground leased.

Under Construction

At the end of the second quarter, our eight assets under construction all had guaranteed maximum price construction contracts in place. These assets have weighted average estimated completion and stabilization dates of the second quarter of 2020 and the third quarter of 2021, respectively, with a projected NOI yield based on Estimated Total Project Cost of 6.4%. As a reminder, this yield includes Central District Retail, our anchor investment in National Landing, which we believe will substantially benefit all of our holdings in the submarket.

In the second quarter, we moved 500 L’Enfant Plaza into our recently delivered operating commercial portfolio. The building is 79.3% leased, from the bottom up, to Urban Institute and Noblis.

Near-Term Development

We do not have any assets in the Near-Term Development pipeline as of the end of the second quarter. As a reminder, we only place assets into our Near-Term Development Pipeline when they have substantially completed the entitlement process and when we intend to commence construction within 18 months, subject to market conditions. Once our current plans are approved by Arlington County, we expect 1900 Crystal Drive to be placed into our Near-Term Development pipeline, as we currently plan to commence construction in 2020.

Future Development Pipeline

Our Future Development pipeline comprises 18.7 million square feet, with an Estimated Total Investment per square foot of approximately $38.49. 79% of this pipeline is within a 20-minute rush hour commute of National Landing, in the submarkets that we believe will most directly benefit from Amazon’s growth over time. At the end of the second quarter, approximately 58.9% of this pipeline was in National Landing, 18.6% was in DC, 13.9% was in Reston, and the remaining 8.6% was in other Virginia and Maryland submarkets. Our DC holdings are concentrated in the fast-growing emerging submarkets of Union Market and the Ballpark, and our Reston holdings include one of the best development sites on the Metro, adjacent to Reston Town Center.

Of the 18.7 million square feet in our Future Development Pipeline, 4.1 million square feet is under contract for sale to Amazon, 3.6 million square feet is fully entitled, and the remaining 11.0 million square feet is zoned for our planned use, subject to the final stage of design and/or entitlement. Of this 11.0 million square feet, we are actively advancing the entitlement of 8.8 million square feet, which we expect to be fully entitled within the next two years. The remaining 2.2 million square feet is either encumbered with existing lease term or encompasses land that we do not believe is suitable for new development in the near term.

Of the 11.0 million square feet requiring final entitlements, 6.9 million square feet is in National Landing, excluding the land under contract for sale to Amazon. These development opportunities represent approximately 65% of the unencumbered development opportunities in the submarket. Based on our current plans, we expect the next phase of development to include 2.2 million square feet of office, which could be pre-leased to Amazon or other tenants

seeking to co-locate near Amazon and/or the Virginia Tech Innovation Campus, and 4.7 million square feet of multifamily, comprising approximately 4,000 to 5,000 units. In addition to adding value on their own, we expect these opportunities to be accretive to all our holdings in National Landing by virtue of their placemaking attributes, as well as their ability to activate long dormant, out-of-service sites and street frontage.

The following bar chart summarizes the data described above:

Third-Party Asset Management and Real Estate Services Business

Third-Party Asset Management and Real Estate Services Business

Our share of revenue from our third-party asset management and real estate services business was $14.6 million in the second quarter, primarily driven by $5.4 million in property management fees and $3.5 million in asset management fees. The portion of total revenues associated with the JBG Legacy Funds was $6.0 million. The Funds continued to focus on disposing of assets in accordance with their underlying business plans. We expect the fees from retaining management and leasing of sold assets, the Amazon-related fees that we expect to receive, and other new third-party fee income streams to more than offset the wind down of the JBG Legacy Fund business over the next several years. In addition, any fee income associated with the Washington Housing Initiative will be reflected in the third-party asset management and real estate services business.

Capital Allocation

Acquisitions/Dispositions

On the acquisition front, we continue to remain cautious, given aggressive pricing across asset classes. If shrinking investment sales volumes are a precursor to a downturn and/or a correction in asset pricing, there may be better acquisition opportunities around the corner. That said, we do expect to be active multifamily buyers in the emerging growth submarkets where we are already concentrated to fulfill 1031 exchange needs. We have identified our first exchange candidate for the proceeds from the sale of Metropolitan 6, 7, and 8 land sites - a stabilized DC

multifamily asset which we expect to close later this year, subject to the tenants’ purchase rights. We expect the sale of the Pen Place land to close in 2021, and we intend to seek a 1031 exchange for the proceeds from that sale. We expect the acquisitions from these two 1031 exchanges to generate approximately $15 million of annualized NOI.

As we announced earlier this year, we continue to seek capital recycling opportunities where we can source capital at or above our estimated NAV, and we are targeting approximately $400 million of asset sales and recapitalizations in 2019. As of August, we have entered into firm contracts for $294 million for the sale of land to Amazon, of which we expect $150 million to close by early 2020 with the balance closing in 2021, subject to the final design and entitlement processes. As noted above, we expect to execute on 1031 exchanges with the proceeds from these land sales. In addition, subsequent to quarter-end, we closed on the sale of 1600 K Street for $43 million. We are also currently in the market with an additional $375 million of assets, but it is possible that some of these will not close given the uncertain investment sales climate and our demanding expectations as a seller.

As a result of the proceeds from our recent equity offering, we believe we are sufficiently capitalized to execute on our near-term growth plans while continuing to preserve ample balance sheet capacity. That said, given current market pricing we intend to continue to be opportunistic asset sellers where we can source capital at or above our estimated NAV. Given the low basis of many of the assets in our portfolio, we are likely to seek 1031 exchanges for some of these asset sales. For higher basis assets that generate liquidity, we may deleverage further and accrue capacity for future acquisition and/or development opportunities. When the next downturn or price correction comes, we will be glad to have this capacity.

Development

We continue to advance the entitlement and design readiness of opportunities in our Future Development Pipeline. We expect multifamily development opportunities to remain attractive, particularly in light of potentially declining supply levels, especially in National Landing and other emerging growth submarkets with strong demand drivers. In National Landing, we intend to be active developers because we have the expected benefit of both attractive project level returns on future starts and a broader submarket repositioning. Opportunities for new investment in other emerging growth submarkets are potentially attractive only if supply levels remain in check, rents for new multifamily product continue to grow, and/or construction cost increases moderate.

Balance Sheet

In April, we successfully completed our first equity offering, issuing 11.5 million shares at $42.00 per share, raising net proceeds of approximately $472 million, including an upsize of 1 million shares (out of a potential 1.8 million shares) and full exercise of the overallotment option (1.5 million shares). It is worth noting that when compared to our office and multifamily peers, our pipeline of development opportunities represents 23% of our total assets, which is approximately three times the peer average. At the same time, our Net Debt/Adjusted EBITDA of 5.2x is nearly a full turn lower than the peer average and is among the lowest in our peer group. As a result of our successful equity offering, we believe our balance sheet is very well positioned both to execute on our development opportunities and to take advantage of acquisitions when the next downturn and/or correction in asset pricing occurs.

As of June 30, 2019, we had $280.3 million of cash ($289.6 million of cash at share), $1.1 billion available under our credit facility, and an unencumbered multifamily borrowing base of $750 million, including our Under Construction multifamily assets. During the quarter, we repaid $475.1 million of mortgage debt. Our Net Debt/Total Enterprise Value was 22.2%, using our share price at June 30, 2019, and our Net Debt/Adjusted EBITDA was 5.2x. These leverage metrics include the debt incurred to date to develop our eight Under Construction assets, but none of the estimated NOI from those assets. As a result, we believe Net Debt/Total Enterprise Value is the most meaningful measure to evaluate our leverage. Our long-term leverage targets remain unchanged at 25% to 35% Net Debt/Total Enterprise Value and between 6x and 7x Net Debt/Adjusted EBITDA, with peak levels in the mid-8x’s during periods of more active development.

We have a well-laddered debt maturity profile. As of June 30, 2019, our average debt maturity was 4.0 years, with approximately $593 million (at share) coming due in the next two years. Consistent with our strategy to finance our business primarily with non-recourse, asset-level financing, 85% of our consolidated and unconsolidated debt is mortgage debt, of which only approximately $8.3 million is recourse to JBG SMITH. Our debt was 88% fixed rate, and we have caps in place for 67% of our floating rate debt.

Environmental, Social, and Governance

In July we released our annual sustainability report, which highlights accomplishments, key performance metrics, and our ESG management strategy. We believe that strong environmental sustainability, social responsibility, and corporate governance practices are essential to maximizing long-term NAV per share. We are investing in efficiency at our assets, partnering with regional stakeholders to strengthen community resilience, and creating an inclusive culture that will continue to attract innovative thinkers to our organization, all of which are intended to ensure that we are positioned to create value for our shareholders over the long term. We are committed to transparency in our ESG strategy, and we intend to continue to benchmark our performance to ensure we are exceeding industry expectations. To access our annual sustainability report please visit our website at https://www.jbgsmith.com/about/sustainability.

During the second quarter, we announced the initial $78 million closing of the Washington Housing Initiative Impact Pool, including a commitment from JBG SMITH of approximately $7.6 million. The Washington Housing Initiative was launched by JBG SMITH and the Federal City Council in June 2018 to help preserve housing for middle income renters (defined as affordable workforce housing) for whom housing assistance is often unavailable, despite the fact that market rate housing remains unaffordable. The Initiative seeks to preserve or build up to 3,000 housing units in the DC Metro region over the next decade. The Impact Pool is the JBG SMITH managed component of the Washington Housing Initiative and consists primarily of third-party investment capital. JBG SMITH is the financial sponsor of this vehicle with an investment of just under 10%. The founding investors in the Impact Pool are many of our largest banking relationships, including Bank of America, PNC Bank, SunTrust, JPMorgan Chase, BB&T, United Bank, and Wells Fargo. For more information about the Washington Housing Initiative please visit our website at https://www.jbgsmith.com/about/washington-housing-initiative.

* * *

Thank you for taking the time to read our quarterly investor letter. As always, we encourage you to come visit us in DC, to spend time with our team and see our real estate in person. We are energized and focused on the opportunities before us, and we will continue to work hard to create value and maintain your trust and confidence.

W. Matthew Kelly

Chief Executive Officer

FOR IMMEDIATE RELEASE

CONTACT

Jaime Marcus

SVP, Investor Relations

(240) 333-3643

jmarcus@jbgsmith.com

JBG SMITH ANNOUNCES SECOND QUARTER 2019 RESULTS

Chevy Chase, MD (August 6, 2019) - JBG SMITH (NYSE: JBGS), a leading owner and developer of high-quality, mixed-use properties in the Washington, DC market, today filed its Form 10-Q for the quarter ended June 30, 2019 and reported its financial results.

Additional information regarding our results of operations, properties and tenants can be found in our Second Quarter 2019 Investor Package, which is posted in the Investor Relations section of our website at www.jbgsmith.com.

Second Quarter 2019 Financial Results

| |

| • | Net loss attributable to common shareholders was $3.0 million, or $0.03 per diluted share. |

| |

| • | Funds From Operations (“FFO”) attributable to common shareholders was $39.4 million, or $0.30 per diluted share. |

| |

| • | Core Funds From Operations (“Core FFO”) attributable to common shareholders was $54.5 million, or $0.41 per diluted share. |

Six Months Ended June 30, 2019 Financial Results

| |

| • | Net income attributable to common shareholders was $21.8 million, or $0.16 per diluted share. |

| |

| • | FFO attributable to common shareholders was $74.6 million, or $0.59 per diluted share. |

| |

| • | Core FFO attributable to common shareholders was $98.7 million, or $0.78 per diluted share. |

Operating Portfolio Highlights

| |

| • | Annualized Net Operating Income (“NOI”) for the three months ended June 30, 2019 was $322.0 million, compared to $321.6 million for the three months ended March 31, 2019, at our share. |

| |

| • | The operating commercial portfolio was 90.3% leased and 86.0% occupied as of June 30, 2019, compared to 90.2% and 85.6% as of March 31, 2019, at our share. |

| |

| • | The operating multifamily portfolio was 98.0% leased and 95.0% occupied as of June 30, 2019, compared to 97.0% and 94.8% as of March 31, 2019, at our share. |

| |

| • | Executed approximately 395,000 square feet of office leases at our share in the second quarter, comprising approximately 120,000 square feet of new leases and approximately 275,000 square feet of second generation leases, which generated a 14.9% rental rate increase on a GAAP basis and a 6.0% rental rate increase on a cash basis. |

| |

| • | Executed approximately 1.2 million square feet of commercial leases at our share during the six months ended June 30, 2019, comprising approximately 676,000 square feet of new leases and approximately 504,000 square feet of second generation leases, which generated a 5.1% rental rate increase on a GAAP basis and a 0.3% rental rate decrease on a cash basis. The new leases include three initial leases entered into with Amazon.com, Inc. ("Amazon") during the first quarter totaling 537,000 square feet at three of our existing office buildings in National Landing in conjunction with the creation of Amazon's additional headquarters. The leases encompass approximately 88,000 square feet at 241 18th Street South, approximately 191,000 square feet at 1800 South Bell Street and approximately 258,000 square feet at 1770 Crystal Drive. We expect Amazon to begin moving into 241 18th Street South and 1800 South Bell in 2019 and 1770 Crystal Drive by the end of 2020. Also, in April 2019, we executed an agreement with Amazon to lease an additional approximately 48,000 square feet of office space at 2345 Crystal Drive in National Landing , which it began moving into in the second quarter. |

| |

| • | Same Store Net Operating Income (“SSNOI”) at our share decreased 9.2% to $74.0 million for the three months ended June 30, 2019, compared to $81.5 million for the three months ended June 30, 2018. SSNOI decreased 9.7% to $147.0 million for the six months ended June 30, 2019, compared to $162.9 million for the six months ended June 30, 2018. The decrease in SSNOI for the three months ended June 30, 2019 is largely attributable to increased rental abatements, lower NOI at Crystal City Marriott, as a result of the ongoing room renovations, and an increase in assumed lease liability payments. The reported same store pools as of June 30, 2019 include only the assets that were in service for the entirety of both periods being compared. |

Development Portfolio Highlights

Under Construction

| |

| • | During the quarter ended June 30, 2019, there were eight assets under construction (four commercial assets and four multifamily assets), consisting of 821,099 square feet and 1,298 units, both at our share. |

Near-Term Development

| |

| • | As of June 30, 2019, there were no assets in near-term development. |

Future Development Pipeline

| |

| • | As of June 30, 2019, there were 40 future development assets consisting of 18.7 million square feet of estimated potential density at our share, including the 4.1 million square feet held for sale to Amazon. |

Third-Party Asset Management and Real Estate Services Business

For the three months ended June 30, 2019, revenue from third-party real estate services, including reimbursements, was $29.5 million. Excluding reimbursements and service revenue from our interests in consolidated and unconsolidated real estate ventures, revenue from our third-party asset management and real estate services business was $14.6 million, of which $5.4 million came from property management fees, $3.5 million came from asset management fees, $1.1 million came from leasing fees, $2.5 million came from development fees, $0.5 million came from construction management fees and $1.6 million came from other service revenue.

Balance Sheet

| |

| • | We had $1.7 billion of debt ($2.0 billion including our share of debt of unconsolidated real estate ventures) as of June 30, 2019. Of the $2.0 billion of debt at our share, approximately 88% was fixed-rate and rate caps were in place for approximately 67% of our floating rate debt. |

| |

| • | The weighted average interest rate of our debt at share was 4.27% as of June 30, 2019. |

| |

| • | At June 30, 2019, our total enterprise value was approximately $7.6 billion, comprising 149.3 million common shares and units valued at $5.9 billion and debt (net of premium / (discount) and deferred financing costs) at our share of $2.0 billion, less cash and cash equivalents at our share of $289.6 million. |

| |

| • | As of June 30, 2019, we had $280.3 million of cash and cash equivalents on a GAAP basis ($289.6 million of cash and cash equivalents at our share), $1.1 billion of capacity under our credit facility, and an unencumbered multifamily borrowing base of $750.0 million, including our Under Construction multifamily assets. |

| |

| • | Net Debt to Annualized Adjusted EBITDA at our share for the three and six months ended June 30, 2019 was 5.2x and 5.5x and our Net Debt / Total Enterprise Value was 22.2% as of June 30, 2019. Net Debt to Annualized Adjusted EBITDA for the three and six months ended June 30, 2019 includes the $472.8 million of net proceeds from the underwritten public offering completed in April 2019. |

Financing and Investing Activities

| |

| • | Closed an underwritten public offering of 11.5 million common shares (including 1.5 million common shares related to the exercise of the underwriters' option to cover overallotments) at $42.00 per share, which generated net proceeds, after deducting the underwriting discounts and commissions and other offering expenses, of $472.8 million. We intend to use the net proceeds to fund development opportunities and for general corporate purposes. |

| |

| • | Repaid mortgage debt totaling approximately $475.1 million. |

| |

| • | Amended our credit facility to extend the delayed draw period of our Tranche A-1 Term Loan to July 2020 and reduce the interest rate of the Tranche A-2 Term Loan 40 basis points to LIBOR plus 1.15% effective as of July 17, 2019. |

Subsequent to June 30, 2019:

| |

| • | Closed on the sale of 1600 K Street, an 83,000 square foot commercial asset located in Washington DC, for $43.0 million. |

Dividends

In August 2019, our Board of Trustees declared a quarterly dividend of $0.225 per common share, payable on August 26, 2019 to shareholders of record on August 13, 2019.

About JBG SMITH

JBG SMITH is an S&P 400 company that owns, operates, invests in and develops a dynamic portfolio of high-quality mixed-use properties in and around Washington, DC. Through an intense focus on placemaking, JBG SMITH cultivates vibrant, amenity-rich, walkable neighborhoods throughout the Capital region, including National Landing where it now serves as the exclusive developer for Amazon’s new headquarters. JBG SMITH’s portfolio currently comprises 20.6 million square feet of high-quality office, multifamily and retail assets, 98% at our share of which are Metro-served. It also maintains a robust future pipeline encompassing 18.7 million square feet of mixed-use development opportunities. For more information on JBG SMITH please visit www.jbgsmith.com.

Forward Looking Statements

Certain statements contained herein may constitute “forward-looking statements” as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not guarantees of performance. They represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Consequently, the future results of JBG SMITH Properties (“JBG SMITH”, the “Company”, "we", "us", "our" or similar terms) may differ materially from those expressed in these forward-looking statements. You can find many of these statements by looking for words such as “approximate”, "hypothetical", "potential", “believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans”, “would”, “may” or similar expressions in this earnings release. We also note the following forward-looking statements: our anticipated dispositions, our indicated annual dividend per share and dividend yield, annualized net operating income; in the case of our construction and near-term development assets, estimated square feet, estimated number of units and in the case of our future development assets, estimated potential development density. Expected key Amazon transaction terms and timeframes for closing, planned infrastructure improvements related to Amazon's additional headquarters; the economic impacts of Amazon's additional headquarters on the DC region and National Landing; our development plans related to Amazon's additional headquarters; the expected accretion to our net asset value ("NAV") as a result of the Amazon transaction and our future NAV growth rate; in the case of our Amazon lease transaction and our new development opportunities in National Landing, the total square feet to be leased to Amazon and the expected net effective rent, estimated square feet, estimated number of units, the estimated construction start and occupancy dates, estimated incremental investment, projected NOI yield; and in the case of our future development opportunities, estimated potential development density. Many of the factors that will determine the outcome of these and our other forward-looking statements are beyond our ability to control or predict. These factors include, among others: adverse economic conditions in the Washington, DC metropolitan area, the timing of and costs associated with development and property improvements, financing commitments, and general competitive factors. For further discussion of factors that could materially affect the outcome of our forward-looking statements and other risks and uncertainties, see “Risk Factors” and the Cautionary Statement Concerning Forward-Looking Statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2018 and other periodic reports the Company files with the Securities and Exchange Commission. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements after the date hereof.

We are reiterating the assumptions in our estimated NOI bridge and the potential estimated NAV impact from Amazon in National Landing, which can be found in our Spring 2019 Investor Day presentation on our website at http://investors.jbgsmith.com/presentations.

Pro Rata Information

We present certain financial information and metrics in this release “at JBG SMITH Share,” which refers to our ownership percentage of consolidated and unconsolidated assets in real estate ventures (collectively, “real estate ventures”) as applied to these financial measures and metrics. Financial information “at JBG SMITH Share” is calculated on an asset-by-asset basis by applying our percentage economic interest to each applicable line item of that asset’s financial information. “At JBG SMITH Share” information, which we also refer to as being “at share,” “our pro rata share” or “our share,” is not, and is not intended to be, a presentation in accordance with GAAP. Given that a substantial portion of our assets are held through real estate ventures, we believe this form of presentation,

which presents our economic interests in the partially owned entities, provides investors valuable information regarding a significant component of our portfolio, its composition, performance and capitalization.

We do not control the unconsolidated real estate ventures and do not have a legal claim to our co-venturers’ share of assets, liabilities, revenue and expenses. The operating agreements of the unconsolidated real estate ventures generally allow each co-venturer to receive cash distributions to the extent there is available cash from operations. The amount of cash each investor receives is based upon specific provisions of each operating agreement and varies depending on certain factors including the amount of capital contributed by each investor and whether any investors are entitled to preferential distributions.

With respect to any such third-party arrangement, we would not be in a position to exercise sole decision-making authority regarding the property, real estate venture or other entity, and may, under certain circumstances, be exposed to economic risks not present were a third-party not involved. We and our respective co-venturers may each have the right to trigger a buy-sell or forced sale arrangement, which could cause us to sell our interest, or acquire our co-venturers’ interests, or to sell the underlying asset, either on unfavorable terms or at a time when we otherwise would not have initiated such a transaction. Our real estate ventures may be subject to debt, and the repayment or refinancing of such debt may require equity capital calls. To the extent our co-venturers do not meet their obligations to us or our real estate ventures or they act inconsistent with the interests of the real estate venture, we may be adversely affected. Because of these limitations, the non-GAAP “at JBG SMITH Share” financial information should not be considered in isolation or as a substitute for our financial statements as reported under GAAP.

Non-GAAP Financial Measures

This release includes non-GAAP financial measures. For these measures, we have provided an explanation of how these non-GAAP measures are calculated and why JBG SMITH’s management believes that the presentation of these measures provides useful information to investors regarding JBG SMITH’s financial condition and results of operations. Reconciliations of certain non-GAAP measures to the most directly comparable GAAP financial measure are included in this earnings release. Our presentation of non-GAAP financial measures may not be comparable to similar non-GAAP measures used by other companies. In addition to "at share" financial information, the following non-GAAP measures are included in this release:

Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA"), EBITDA for Real Estate ("EBITDAre") and Adjusted EBITDA

Management uses EBITDA and EBITDAre, non-GAAP financial measures, as supplemental operating performance measures and believes they help investors and lenders meaningfully evaluate and compare our operating performance from period-to-period by removing from our operating results the impact of our capital structure (primarily interest charges from our outstanding debt and the impact of our interest rate swaps) and certain non-cash expenses (primarily depreciation and amortization on our assets). EBITDAre is computed in accordance with the definition established by the National Association of Real Estate Investment Trusts (“NAREIT”). NAREIT defines EBITDAre as GAAP net income (loss) adjusted to exclude interest expense, income taxes, depreciation and amortization expenses, gains on sales of real estate and impairment losses of real estate, including our share of such adjustments of unconsolidated real estate ventures. These supplemental measures may help investors and lenders understand our ability to incur and service debt and to make capital expenditures. EBITDA and EBITDAre are not substitutes for net income (loss) (computed in accordance with GAAP) and may not be comparable to similarly titled measures used by other companies.

“Adjusted EBITDA,” a non-GAAP financial measure, represents EBITDAre adjusted for items we believe are not representative of ongoing operating results, such as transaction and other costs, gain (loss) on the extinguishment of debt, distributions in excess of our investment in unconsolidated real estate ventures, gain on the bargain purchase of a business, lease liability adjustments and share-based compensation expense related to the

Formation Transaction and special equity awards. We believe that adjusting such items not considered part of our comparable operations, provides a meaningful measure to evaluate and compare our performance from period-to-period.

Because EBITDA, EBITDAre and Adjusted EBITDA have limitations as analytical tools, we use EBITDA, EBITDAre and Adjusted EBITDA to supplement GAAP financial measures. Additionally, we believe that users of these measures should consider EBITDA, EBITDAre and Adjusted EBITDA in conjunction with net income (loss) and other GAAP measures in understanding our operating results.

Funds from Operations ("FFO"), Core FFO and Funds Available for Distribution (“FAD")

FFO is a non-GAAP financial measure computed in accordance with the definition established by NAREIT in the NAREIT FFO White Paper - 2018 Restatement issued in 2018. NAREIT defines FFO as “net income (computed in accordance with GAAP), excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in control and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity."

"Core FFO" represents FFO adjusted to exclude items (net of tax) which we believe are not representative of ongoing operating results, such as transaction and other costs, gains (or losses) on extinguishment of debt, gain on the bargain purchase of a business, distributions in excess of our investment in unconsolidated real estate ventures, share-based compensation expense related to the Formation Transaction and special equity awards, lease liability adjustments, amortization of the management contracts intangible and the mark-to-market of derivative instruments.

"FAD" is a non-GAAP financial measure and represents FFO less recurring tenant improvements, leasing commissions and other capital expenditures, net deferred rent activity, third-party lease liability assumption payments, recurring share-based compensation expense, accretion of acquired below-market leases, net of amortization of acquired above-market leases, amortization of debt issuance costs and other non-cash income and charges. FAD is presented solely as a supplemental disclosure that management believes provides useful information as it relates to our ability to fund dividends.

We believe FFO, Core FFO and FAD are meaningful non‑GAAP financial measures useful in comparing our levered operating performance from period-to-period and as compared to similar real estate companies because these non‑GAAP measures exclude real estate depreciation and amortization expense and other non-comparable income and expenses, which implicitly assumes that the value of real estate diminishes predictably over time rather than fluctuating based on market conditions. FFO, Core FFO and FAD do not represent cash generated from operating activities and are not necessarily indicative of cash available to fund cash requirements and should not be considered as an alternative to net income (loss) (computed in accordance with GAAP) as a performance measure or cash flow as a liquidity measure. FFO, Core FFO and FAD may not be comparable to similarly titled measures used by other companies.

Net Operating Income ("NOI") and Annualized NOI

“NOI” is a non-GAAP financial measure management uses to measure the operating performance of our assets and consists of property-related revenue (which includes base rent, tenant reimbursements and other operating revenue, net of free rent and payments associated with assumed lease liabilities) less operating expenses and ground rent, if applicable. NOI also excludes deferred rent, related party management fees, interest expense, and certain other non-cash adjustments, including the accretion of acquired below-market leases and amortization of acquired above-market leases and below-market ground lease intangibles. Annualized NOI, for all assets except Crystal City Marriott, represents NOI for the three months ended June 30, 2019 multiplied by four. Due to seasonality in the hospitality business, annualized NOI for Crystal City Marriott represents the trailing 12-month NOI as of June 30, 2019. Management believes Annualized NOI provides useful information in understanding our financial performance over a 12-month period, however, investors and other users are cautioned against attributing undue certainty to our calculation of Annualized NOI. Actual NOI for any 12-month period will depend on a number

of factors beyond our ability to control or predict, including general capital markets and economic conditions, any bankruptcy, insolvency, default or other failure to pay rent by one or more of our tenants and the destruction of one or more of our assets due to terrorist attack, natural disaster or other casualty, among others. We do not undertake any obligation to update our calculation to reflect events or circumstances occurring after the date of this earnings release. There can be no assurance that the annualized NOI shown will reflect our actual results of operations over any 12-month period.

Management uses each of these measures as supplemental performance measures for its assets and believes they provide useful information to investors because they reflect only those revenue and expense items that are incurred at the asset level, excluding non-cash items. In addition, NOI is considered by many in the real estate industry to be a useful starting point for determining the value of a real estate asset or group of assets.

However, because NOI excludes depreciation and amortization and captures neither the changes in the value of our assets that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our assets, all of which have real economic effect and could materially impact the financial performance of our assets, the utility of NOI as a measure of the operating performance of our assets is limited. Moreover, our method of calculating NOI may differ from other real estate companies and, accordingly, may not be comparable. NOI should be considered only as a supplement to net operating income (loss) (computed in accordance with GAAP) as a measure of the operating performance of our assets.

Same Store and Non-Same Store

“Same store” refers to the pool of assets that were in service for the entirety of both periods being compared, except for assets for which significant redevelopment, renovation, or repositioning occurred during either of the periods being compared.

“Non-same store” refers to all operating assets excluded from the same store pool.

Definitions

GAAP

"GAAP" refers to accounting principles generally accepted in the United States of America.

Formation Transaction

"Formation Transaction" refers collectively to the spin-off on July 17, 2017 of substantially all of the assets and liabilities of Vornado’s Washington, DC segment, which operated as Vornado / Charles E. Smith, and the acquisition of the management business and certain assets and liabilities of The JBG Companies.

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) |

| | | | | | | |

| in thousands | June 30, 2019 | | December 31, 2018 |

| | | | |

| ASSETS | |

| Real estate, at cost: | | | |

| Land and improvements | $ | 1,227,558 |

| | $ | 1,371,874 |

|

| Buildings and improvements | 3,717,356 |

| | 3,722,930 |

|

| Construction in progress, including land | 859,717 |

| | 697,930 |

|

| | 5,804,631 |

| | 5,792,734 |

|

| Less accumulated depreciation | (1,093,665 | ) | | (1,051,875 | ) |

| Real estate, net | 4,710,966 |

| | 4,740,859 |

|

| Cash and cash equivalents | 280,349 |

| | 260,553 |

|

| Restricted cash | 16,429 |

| | 138,979 |

|

| Tenant and other receivables, net | 51,787 |

| | 46,568 |

|

Deferred rent receivable, net

| 162,641 |

| | 143,473 |

|

| Investments in unconsolidated real estate ventures | 319,756 |

| | 322,878 |

|

Other assets, net

| 296,916 |

| | 264,994 |

|

| Assets held for sale | 168,431 |

| | 78,981 |

|

| TOTAL ASSETS | $ | 6,007,275 |

| | $ | 5,997,285 |

|

| | | | |

| LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY | | | |

| Liabilities: | | | |

| Mortgages payable, net | $ | 1,360,467 |

| | $ | 1,838,381 |

|

| Unsecured term loans, net | 296,952 |

| | 297,129 |

|

| Accounts payable and accrued expenses | 140,132 |

| | 130,960 |

|

| Other liabilities, net | 192,638 |

| | 181,606 |

|

| Liabilities related to assets held for sale | — |

| | 3,717 |

|

| Total liabilities | 1,990,189 |

| | 2,451,793 |

|

| Commitments and contingencies |

| |

|

| Redeemable noncontrolling interests | 574,228 |

| | 558,140 |

|

| Total equity | 3,442,858 |

| | 2,987,352 |

|

| TOTAL LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY | $ | 6,007,275 |

| | $ | 5,997,285 |

|

_______________

Note: For complete financial statements, please refer to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2019.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) |

| | | | | | | | | | | | | | | |

| in thousands, except per share data | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| REVENUE | | | | | | | |

| Property rentals | $ | 122,326 |

| | $ | 126,591 |

| | $ | 241,739 |

| | $ | 257,819 |

|

| Third-party real estate services, including reimbursements | 29,487 |

| | 24,160 |

| | 57,178 |

| | 48,490 |

|

| Other income | 8,804 |

| | 8,696 |

| | 16,899 |

| | 16,175 |

|

| Total revenue | 160,617 |

| | 159,447 |

| | 315,816 |

| | 322,484 |

|

| EXPENSES | | | | | | | |

| Depreciation and amortization | 45,995 |

| | 48,117 |

| | 94,714 |

| | 97,277 |

|

| Property operating | 32,113 |

| | 34,464 |

| | 64,287 |

| | 69,622 |

|

| Real estate taxes | 18,266 |

| | 17,509 |

| | 35,501 |

| | 37,119 |

|

| General and administrative: | | | | | | | |

| Corporate and other | 11,559 |

| | 8,603 |

| | 23,873 |

| | 17,017 |

|

| Third-party real estate services | 28,710 |

| | 21,189 |

| | 56,776 |

| | 43,798 |

|

Share-based compensation related to Formation Transaction and

special equity awards

| 9,523 |

| | 9,097 |

| | 20,654 |

| | 18,525 |

|

| Transaction and other costs | 2,974 |

| | 3,787 |

| | 7,869 |

| | 8,008 |

|

| Total expenses | 149,140 |

| | 142,766 |

| | 303,674 |

| | 291,366 |

|

| OTHER INCOME (EXPENSE) |

|

| |

| |

| |

|

| Income (loss) from unconsolidated real estate ventures, net | (1,810 | ) | | 3,836 |

| | 1,791 |

| | 1,934 |

|

| Interest and other income, net | 2,052 |

| | 513 |

| | 3,003 |

| | 1,086 |

|

| Interest expense | (13,107 | ) | | (18,027 | ) | | (30,281 | ) | | (37,284 | ) |

| Gain on sale of real estate | — |

| | 33,396 |

| | 39,033 |

| | 33,851 |

|

| Loss on extinguishment of debt | (1,889 | ) | | (4,457 | ) | | (1,889 | ) | | (4,457 | ) |

| Reduction of gain on bargain purchase | — |

| | (7,606 | ) | | — |

| | (7,606 | ) |

| Total other income (expense) | (14,754 | ) | | 7,655 |

| | 11,657 |

| | (12,476 | ) |

| INCOME (LOSS) BEFORE INCOME TAX (EXPENSE) BENEFIT | (3,277 | ) | | 24,336 |

| | 23,799 |

| | 18,642 |

|

| Income tax (expense) benefit | (51 | ) | | (313 | ) | | 1,121 |

| | 595 |

|

| NET INCOME (LOSS) | (3,328 | ) | | 24,023 |

| | 24,920 |

| | 19,237 |

|

| Net (income) loss attributable to redeemable noncontrolling interests | 288 |

| | (3,574 | ) | | (3,099 | ) | | (2,980 | ) |

| Net loss attributable to noncontrolling interests | — |

| | 125 |

| | — |

| | 127 |

|

| NET INCOME (LOSS) ATTRIBUTABLE TO COMMON SHAREHOLDERS | $ | (3,040 | ) | | $ | 20,574 |

| | $ | 21,821 |

| | $ | 16,384 |

|

| EARNINGS (LOSS) PER COMMON SHARE: | | | | | | | |

| Basic | $ | (0.03 | ) | | $ | 0.17 |

| | $ | 0.16 |

| | $ | 0.14 |

|

| Diluted | $ | (0.03 | ) | | $ | 0.17 |

| | $ | 0.16 |

| | $ | 0.14 |

|

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING : | | | | | | | |

| Basic | 131,754 |

| | 117,955 |

| | 127,189 |

| | 117,955 |

|

| Diluted | 131,754 |

| | 117,955 |

| | 127,189 |

| | 117,955 |

|

___________________

Note: For complete financial statements, please refer to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2019.

EBITDA, EBITDAre AND ADJUSTED EBITDA (NON-GAAP)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| dollars in thousands | | Three Months Ended June 30, | | Six Months Ended June 30, |

| | | 2019 | | 2018 | | 2019 | | 2018 |

| | | | | | | | | |

| EBITDA, EBITDAre and Adjusted EBITDA | | | | | | | | |

| Net income (loss) |

| $ | (3,328 | ) | | $ | 24,023 |

| | $ | 24,920 |

| | $ | 19,237 |

|

| Depreciation and amortization expense | | 45,995 |

| | 48,117 |

| | 94,714 |

| | 97,277 |

|

Interest expense (1) | | 13,107 |

| | 18,027 |

| | 30,281 |

| | 37,284 |

|

| Income tax (expense) benefit | | 51 |

| | 313 |

| | (1,121 | ) | | (595 | ) |

| Unconsolidated real estate ventures allocated share of above adjustments | | 10,357 |

| | 10,602 |

| | 18,163 |

| | 20,777 |

|

| Allocated share of above adjustments to noncontrolling interests in consolidated real estate ventures | | (4 | ) | | 129 |

| | (5 | ) | | 129 |

|

EBITDA (2) | | $ | 66,178 |

| | $ | 101,211 |

| | $ | 166,952 |

| | $ | 174,109 |

|

| Gain on sale of real estate | | — |

| | (33,396 | ) | | (39,033 | ) | | (33,851 | ) |

| Gain on sale of unconsolidated real estate assets | | (335 | ) | | — |

| | (335 | ) | | — |

|

EBITDAre (2) | | $ | 65,843 |

| | $ | 67,815 |

| | $ | 127,584 |

| | $ | 140,258 |

|

Transaction and other costs (3) | | 2,974 |

| | 3,787 |

| | 7,869 |

| | 8,008 |

|

| Loss on extinguishment of debt | | 1,889 |

| | 4,457 |

| | 1,889 |

| | 4,457 |

|

| Reduction of gain on bargain purchase | | — |

| | 7,606 |

| | — |

| | 7,606 |

|

| Share-based compensation related to Formation Transaction and special equity awards | | 9,523 |

| | 9,097 |

| | 20,654 |

| | 18,525 |

|

Earnings (losses) and distributions in excess of our investment in unconsolidated real estate venture (4) | | (232 | ) | | (5,412 | ) | | (6,673 | ) | | (5,412 | ) |

| Unconsolidated real estate ventures allocated share of above adjustments | | — |

| | — |

| | — |

| | 30 |

|

| Allocated share of above adjustments to noncontrolling interests in consolidated real estate ventures | | — |

| | (124 | ) | | — |

| | (124 | ) |

Adjusted EBITDA (2) | | $ | 79,997 |

| | $ | 87,226 |

| | $ | 151,323 |

| | $ | 173,348 |

|

| | | | | | | | | |

Net Debt to Annualized Adjusted EBITDA (5) | | 5.2x |

| | 6.3x |

| | 5.5x |

| | 6.3x |

|

| | | | | | | | | |

| | | June 30, 2019 | | June 30, 2018 | | | | |

| Net Debt (at JBG SMITH Share) | | | | | | | | |

Consolidated indebtedness (6) | | $ | 1,653,538 |

| | $ | 2,033,183 |

| | | | |

Unconsolidated indebtedness (6) | | 312,686 |

| | 440,177 |

| | | | |

| Total consolidated and unconsolidated indebtedness | 1,966,224 |

| | 2,473,360 |

| | | | |

| Less: cash and cash equivalents | | 289,554 |

| | 276,629 |

| | | | |

| Net Debt (at JBG SMITH Share) | | $ | 1,676,670 |

| | $ | 2,196,731 |

| | | | |

| | | $ | (0.29 | ) | | | | | | |

____________________

Note: All EBITDA measures as shown above are attributable to operating partnership common units. EBITDAre for the six months ended June 30, 2018 was restated in compliance with the definition established by NAREIT in the NAREIT FFO White Paper - 2018 Restatement issued in 2018.

| |

| (1) | Interest expense includes the amortization of deferred financing costs and the ineffective portion of any interest rate swaps or caps, net of capitalized interest. |

| |

| (2) | Due to our adoption of the new accounting standard for leases, beginning in 2019, we no longer capitalize internal leasing costs and expense these costs as incurred (such costs were $1.5 million and $2.8 million for the three and six months ended June 30, 2018). |

| |

| (3) | Includes fees and expenses incurred in connection with the Formation Transaction (including transition services provided by our former parent, integration costs and severance costs), demolition costs and costs related to other completed, potential and pursued transactions. |

| |

| (4) | As of June 30, 2018, we suspended the equity method of accounting for our investment in the real estate venture that owns 1101 17th Street as our investment had been reduced to zero and we did not have an obligation to provide further financial support to the venture. All subsequent distributions from the venture have been recognized as income, which will continue until our share of unrecorded earnings and contributions exceed the cumulative excess distributions previously recognized. |

| |

| (5) | Net Debt to Annualized Adjusted EBITDA for the three and six months ended June 30, 2019 includes $472.8 million of net proceeds from the underwritten public offering completed in April 2019. Adjusted EBITDA for the three months ended June 30, 2019 and 2018 is annualized by multiplying by four. Adjusted EBITDA for the six months ended June 30, 2019 and 2018 is annualized by multiplying by two. |

| |

| (6) | Net of premium/discount and deferred financing costs. |

FFO, CORE FFO AND FAD (NON-GAAP)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| in thousands, except per share data | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| | | | | | | | |

| FFO and Core FFO | | | | | | | |

| Net income (loss) attributable to common shareholders | $ | (3,040 | ) | | $ | 20,574 |

| | $ | 21,821 |

| | $ | 16,384 |

|

| Net income (loss) attributable to redeemable noncontrolling interests | (288 | ) | | 3,574 |

| | 3,099 |

| | 2,980 |

|

| Net loss attributable to noncontrolling interests | — |

| | (125 | ) | | — |

| | (127 | ) |

| Net income (loss) | (3,328 | ) | | 24,023 |

| | 24,920 |

| | 19,237 |

|

| Gain on sale of real estate | — |

| | (33,396 | ) | | (39,033 | ) | | (33,851 | ) |

| Gain on sale of unconsolidated real estate assets | (335 | ) | | — |

| | (335 | ) | | — |

|

| Real estate depreciation and amortization | 43,308 |

| | 45,587 |

| | 89,343 |

| | 92,226 |

|

| Pro rata share of real estate depreciation and amortization from unconsolidated real estate ventures | 4,804 |

| | 6,179 |

| | 9,457 |

| | 12,615 |

|

| Net (income) loss attributable to noncontrolling interests in consolidated real estate ventures | (4 | ) | | 129 |

| | (5 | ) | | 131 |

|

FFO Attributable to Operating Partnership Common Units (1) | $ | 44,445 |

| | $ | 42,522 |

| | $ | 84,347 |

| | $ | 90,358 |

|

| FFO attributable to redeemable noncontrolling interests | (5,014 | ) | | (6,299 | ) | | (9,797 | ) | | (13,426 | ) |

FFO attributable to common shareholders (1) | $ | 39,431 |

| | $ | 36,223 |

| | $ | 74,550 |

| | $ | 76,932 |

|

| | | | | | | | |

| FFO attributable to the operating partnership common units | $ | 44,445 |

| | $ | 42,522 |

| | $ | 84,347 |

| | $ | 90,358 |

|

Transaction and other costs, net of tax (2) | 2,847 |

| | 3,394 |

| | 7,473 |

| | 7,530 |

|

| (Gain) loss from mark-to-market on derivative instruments | 524 |

| | (432 | ) | | 48 |

| | (1,551 | ) |

| Share of (gain) loss from mark-to-market on derivative instruments held by unconsolidated real estate ventures | 1,153 |

| | (90 | ) | | 1,380 |

| | (432 | ) |

| Loss on extinguishment of debt, net of noncontrolling interests | 1,889 |

| | 4,333 |

| | 1,889 |

| | 4,333 |

|

Earnings (losses) and distributions in excess of our investment in unconsolidated real estate venture (3) | (232 | ) | | (5,412 | ) | | (6,673 | ) | | (5,412 | ) |

| Reduction of gain on bargain purchase | — |

| | 7,606 |

| | — |

| | 7,606 |

|

| Share-based compensation related to Formation Transaction and special equity awards | 9,523 |

| | 9,097 |

| | 20,654 |

| | 18,525 |

|

| Amortization of management contracts intangible, net of tax | 1,288 |

| | 1,287 |

| | 2,575 |

| | 2,573 |

|

Core FFO Attributable to Operating Partnership Common Units (1) | $ | 61,437 |

| | $ | 62,305 |

| | $ | 111,693 |

| | $ | 123,530 |

|

| Core FFO attributable to redeemable noncontrolling interests | (6,931 | ) | | (9,229 | ) | | (12,955 | ) | | (18,266 | ) |

Core FFO attributable to common shareholders (1) | $ | 54,506 |

| | $ | 53,076 |

| | $ | 98,738 |

| | $ | 105,264 |

|

| FFO per diluted common share | $ | 0.30 |

| | $ | 0.31 |

| | $ | 0.59 |

| | $ | 0.65 |

|

| Core FFO per diluted common share | $ | 0.41 |

| | $ | 0.45 |

| | $ | 0.78 |

| | $ | 0.89 |

|

| Weighted average diluted shares | 131,754 |

| | 117,955 |

| | 127,189 |

| | 117,955 |

|

See footnotes on page 12.

FFO, CORE FFO AND FAD (NON-GAAP)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| in thousands, except per share data | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| | | | | | | | |

| FAD | | | | | | | |

| Core FFO attributable to the operating partnership common units | $ | 61,437 |

| | $ | 62,305 |

| | $ | 111,693 |

| | $ | 123,530 |

|

| Recurring capital expenditures and second generation tenant improvements and leasing commissions | (20,076 | ) | | (11,057 | ) | | (42,373 | ) | | (17,154 | ) |

Straight-line and other rent adjustments (4) | (8,739 | ) | | (1,216 | ) | | (15,547 | ) | | (2,291 | ) |

| Share of straight-line rent from unconsolidated real estate ventures | (1,473 | ) | | 189 |

| | (1,608 | ) | | 348 |

|

| Third-party lease liability assumption payments | (1,183 | ) | | (619 | ) | | (2,319 | ) | | (1,091 | ) |

| Share of third party lease liability assumption payments for unconsolidated real estate ventures | — |

| | — |

| | — |

| | (50 | ) |

| Share-based compensation expense | 5,694 |

| | 5,941 |

| | 11,024 |

| | 10,217 |

|

| Amortization of debt issuance costs | 875 |

| | 1,201 |

| | 1,845 |

| | 2,365 |

|

| Share of amortization of debt issuance costs from unconsolidated real estate ventures | 69 |

| | 66 |

| | 117 |

| | 135 |

|

| Non-real estate depreciation and amortization | 916 |

| | 758 |

| | 1,828 |

| | 1,507 |

|

FAD available to the Operating Partnership Common Units (A) (5) | $ | 37,520 |

| | $ | 57,568 |

| | $ | 64,660 |

| | $ | 117,516 |

|

Distributions to common shareholders and unitholders (6) (B) | $ | 34,006 |

| | $ | 31,197 |

| | $ | 65,290 |

| | $ | 62,394 |

|

FAD Payout Ratio (B÷A) (7) | 90.6 | % | | 54.2 | % | | 101.0 | % | | 53.1 | % |

|

| | | | | | | | | | | | | | | |

| Capital Expenditures | | | | | | | |

| Maintenance and recurring capital expenditures | $ | 7,252 |

| | $ | 3,989 |

| | $ | 12,747 |

| | $ | 6,672 |

|

| Share of maintenance and recurring capital expenditures from unconsolidated real estate ventures | 252 |

| | 250 |

| | 340 |

| | 1,399 |

|

| Second generation tenant improvements and leasing commissions | 12,357 |

| | 6,273 |

| | 28,512 |

| | 8,166 |

|

| Share of second generation tenant improvements and leasing commissions from unconsolidated real estate ventures | 215 |

| | 545 |

| | 774 |

| | 917 |

|

| Recurring capital expenditures and second generation tenant improvements and leasing commissions | 20,076 |

| | 11,057 |

| | 42,373 |

| | 17,154 |

|

| First generation tenant improvements and leasing commissions | 18,996 |

| | 6,676 |

| | 25,193 |

| | 10,861 |

|

| Share of first generation tenant improvements and leasing commissions from unconsolidated real estate ventures | 419 |

| | 1,391 |

| | 652 |

| | 2,386 |

|

| Non-recurring capital expenditures | 5,470 |

| | 3,765 |

| | 12,192 |

| | 7,131 |

|

| Share of non-recurring capital expenditures from unconsolidated joint ventures | 30 |

| | 142 |

| | 30 |

| | 762 |

|

| Non-recurring capital expenditures | 24,915 |

| | 11,974 |

| | 38,067 |

| | 21,140 |

|

| Total JBG SMITH Share of Capital Expenditures | $ | 44,991 |

| | $ | 23,031 |

| | $ | 80,440 |

| | $ | 38,294 |

|

_______________

Note: FFO attributable to operating partnership common units and FFO attributable to common shareholders for the six months ended June 30, 2018 were restated in compliance with the definition established by NAREIT in the NAREIT FFO White Paper - 2018 Restatement issued in 2018.

| |

| (1) | Due to our adoption of the new accounting standard for leases, beginning in 2019, we no longer capitalize internal leasing costs and expense these costs as incurred (such costs were $1.5 million and $2.8 million for the three and six months ended June 30, 2018). |

| |

| (2) | Includes fees and expenses incurred in connection with the Formation Transaction (including transition services provided by our former parent, integration costs, and severance costs), demolition costs and costs related to other completed, potential and pursued transactions. |

| |

| (3) | As of June 30, 2018, we suspended the equity method of accounting for our investment in the real estate venture that owns 1101 17th Street as our investment had been reduced to zero and we did not have an obligation to provide further financial support to the venture. All subsequent distributions from the venture have been recognized as income, which will continue until our share of unrecorded earnings and contributions exceed the cumulative excess distributions previously recognized. |

| |

| (4) | Includes straight-line rent, above/below market lease amortization and lease incentive amortization. |

| |

| (5) | The decline in FAD available to the Operating Partnership Common Units was attributable to a significant increase in second generation tenant improvements and leasing commissions from the early renewal of several leases during the three and six months ended June 30, 2019. |

| |

| (6) | The distribution for the six months ended June 30, 2019 excludes a special dividend of $0.10 per common share that was paid in January 2019. |

| |

| (7) | The FAD payout ratio on a quarterly basis is not necessarily indicative of an amount for the full year due to fluctuation in timing of capital expenditures, the commencement of new leases and the seasonality of our operations. |

NOI RECONCILIATIONS (NON-GAAP)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| dollars in thousands | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| | |