February 25, 2020

To Our Fellow Shareholders:

2019 was another extraordinary year for JBG SMITH. The year began with the execution of the Amazon HQ2 agreements and ended with an additional full-building lease to Amazon for 272,000 square feet at 2100 Crystal Drive. Additionally, after receiving final approvals at the end of 2019, we commenced construction on the first 2.15 million square feet of Amazon’s new headquarters. We also succeeded in landing the $1 billion Virginia Tech Innovation Campus directly adjacent to approximately 2.0 million square feet of development density we own in the submarket. With almost 60% of our company located directly in National Landing and approximately 83% within a 20-minute commute, our lease-up, repositioning, and development efforts in the submarket will remain top priorities and sources of growth for years to come.

Our repositioning of National Landing is already underway with approximately 380,000 square feet under construction (Central District Retail and 1770 Crystal Drive) and an additional 650,000 square feet at 1900 Crystal Drive, expected to commence construction by the end of the first quarter. In addition, we have filed entitlement applications for 3.7 million square feet of future development density in National Landing, of which we expect approximately 1.1 million square feet (approximately 1,400 multifamily units) could be ready for construction start as early as next year. These investment opportunities not only represent compelling growth potential in their own right, but also contribute to the overall neighborhood repositioning that will benefit the other 11.3 million square feet we control in the submarket. To that end, the leasing strategy of our operating portfolio is well aligned with the timing and impact of what will be a dramatic upgrade to the amenity base in National Landing. Tenant demand already reflects some of these anticipated changes, but seeing is believing, and when delivery milestones are achieved, we expect further rental rate and occupancy growth from these strategic investments.

Outside of National Landing we are focused on increasing our concentration in a handful of high-growth, rapidly evolving emerging submarkets, such as the Ballpark, Union Market/H Street Corridor, and U Street/Shaw, where our mixed-use skillset, development expertise and our ability to deliver placemaking and amenities are strong differentiators. In these submarkets and across our portfolio, we anticipate strong near-term growth from the five Under Construction assets that we completed in 2019, as well as our remaining four Under Construction assets, which we expect to deliver in 2020 and 2021. Our operating portfolio in these locations is also well positioned for near-term growth given underlying multifamily fundamentals, and the burn off of free rent associated with the proactive early renewal strategy we implemented in our commercial portfolio in 2017 and 2018.

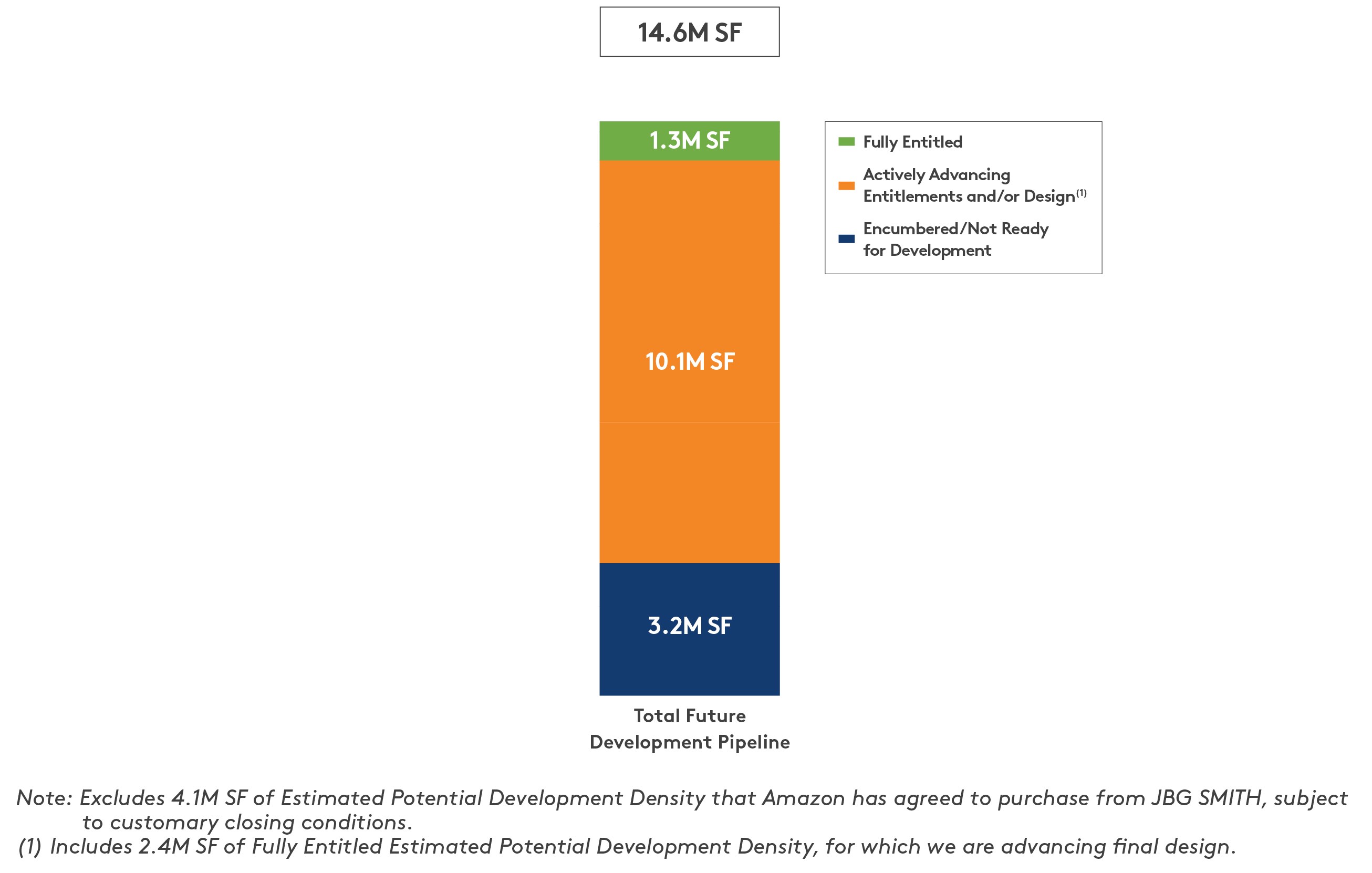

As impatient owners of land, we are always focused on mining value from unproductive assets. In addition to the approximately 4.4 million square feet of entitlements we are seeking in National Landing (1900 Crystal Drive and the 3.7 million square feet referenced above), we are actively advancing entitlement and design of an additional 5.7

million square feet within our 14.6 million square foot Future Development Pipeline (excluding the land held for sale to Amazon). Entitling this combined 10.1 million square feet of density will improve our ability to extract value from these opportunities either through development, sales, recapitalizations, and/or ground leases to third parties.

To maximize the abundant upside of our development portfolio, we continue to cultivate balance sheet capacity and position ourselves to invest both internally and externally when the cycle turns. In addition to our successful $472 million equity offering, we recycled $426 million of assets in 2019, and we expect to continue this opportunistic strategy in 2020 by marketing over $500 million of assets. Based on the current challenging investment sales market, and our opportunistic expectations as a seller, we expect to transact on at least $200 million in 2020. The strong balance sheet capacity we have created will allow us to allocate future capital to opportunities in the path of Amazon’s growth and other high-growth urban infill submarkets without relying on the sale of assets or equity. Positioning ourselves to capitalize on these tailwinds is key to our long-term growth and aligns with our unwavering focus on maximizing long-term net asset value (NAV) per share.

Delivering long-term growth requires prudent near-term capital allocation and excellent operational execution. To that end, our team accomplished a great deal during 2019, which put us well on our way to achieving significant long-term NAV growth per share. The following summarizes our achievements.

Launched Amazon’s 4.1 Million Square Foot New Headquarters

| |

| • | Executed leases with Amazon for approximately 857,000 square feet, including a new full building lease at 2100 Crystal Drive for 272,000 square feet with occupancy expected in 2020. |

| |

| • | Executed purchase and sale agreements with Amazon for land with 4.1 million square feet of estimated potential development density in National Landing. |

| |

| • | Received final approvals from Arlington County for the first 2.15 million square feet of space for Amazon’s new headquarters in National Landing. Construction commenced in January 2020. |

Increased Operating In Service Portfolio Leased Percentage from 91.2% to 92.5%

| |

| • | Leased over 2.1 million square feet of commercial space, bringing occupancy to 88.2% in our operating commercial portfolio. |

| |

| • | Proactively attracted tenant demand to National Landing, increasing our total commercial leased percentage from 88.3% to 91.5% with an average mark-to-market of positive 7.0% and net effective rent growth of 6.5%. |

| |

| • | Leased over 191,400 square feet of retail across the portfolio. In National Landing, leased 32,000 square feet of placemaking retail at Central District Retail, which was 75.2% pre-leased at the end of 2019. |

| |

| • | Achieved in service multifamily occupancy of 93.3%, and successfully completed West Half in the third quarter of 2019, which was 30.2% leased at the end of 2019. |

Completed Five Under Construction Assets Expected to Deliver $48 Million of Stabilized Annualized NOI

| |

| • | Completed five Under Construction assets on or ahead of schedule and delivered all below budget, including: 500 L’Enfant Plaza, West Half, 4747 Bethesda Avenue, Atlantic Plumbing C, and 1900 N Street, |

totaling 550,000 square feet and 721 units in the aggregate. The three commercial assets were 83.4% leased at the end of 2019.

| |

| • | We expect these five assets will deliver approximately $48 million of annualized NOI with a weighted average stabilization date of the second quarter of 2021. |

Increased Value and Readiness of 14.6 Million Square Foot Future Development Pipeline

| |

| • | Actively advancing entitlement and design of 10.1 million square feet (69%) of our Future Development Pipeline (excluding the land held for sale to Amazon). |

| |

| • | Submitted entitlements for 4.4 million square feet of space in National Landing, which represents approximately two-thirds of our Future Development Pipeline in the submarket. |

| |

| • | Made significant progress on entitling and designing the next tranche of multifamily development in National Landing, totaling approximately $1.4 billion of new investment and approximately 2,900 multifamily units. |

| |

| • | As master developer of the planned Virginia Tech Innovation Campus site, we advanced the overall plan in coordination with the directly adjacent 2.0 million square feet of development density we own in National Landing. |

Sold or Recapitalized $426 Million of Assets at or Above our Estimated NAV

| |

| • | Closed on the sale or recapitalization of four assets, totaling $426 million, including the Metropolitan Park land sites sold to Amazon for approximately $155 million (approximately $11 million above the estimated contract value) in January 2020. |

| |

| • | Executed a reverse like-kind exchange (with proceeds from the first Amazon land sale) for the acquisition of F1RST Residences, a multifamily asset in the Ballpark submarket of Washington, DC. |

Strengthened Balance Sheet - Pro forma Net Debt/Total Enterprise Value of 21.0%

| |

| • | Issued 11.5 million shares at $42.00 per share, raising net proceeds of approximately $472 million in our first equity offering. |

| |

| • | Recast our $1 billion credit facility in January 2020, extending the term for five years and reducing the interest rate. |

| |

| • | Raised capital and accumulated balance sheet capacity to develop 1900 Crystal Drive and to pursue future acquisition and development opportunities. |

| |

| • | Adjusted for the $155 million of proceeds from the land sale to Amazon in January 2020, our pro forma Net Debt/Adjusted EBITDA was 5.3x. |

Raised $104 Million for Affordable Housing and Achieved 4-Star GRESB Sustainability Rating

| |

| • | Raised over $104 million for the Washington Housing Initiative Impact Pool (including a $10.2 million commitment from JBG SMITH), which completed its first financing of a 326-unit residential building in Alexandria, Virginia in January 2020. Identified a pipeline to potentially preserve over 6,000 units of workforce affordable housing. |

| |

| • | Received a 4-star rating from GRESB for the second year in a row, ranking in the top quartile of mixed-use office and multifamily portfolios. |

Washington, DC Market Update

As the real estate cycle grows longer and pricing remains aggressive, it is worth noting that Washington, DC is a market with proven resilience to recession. In each of the last three national recessions, Washington, DC Metro area employment shrank by only 1.0% on average while other gateway cities shrank by an average of 3.0%. We believe that our focused investment in high-growth, infill locations with a heavy concentration around Amazon’s new headquarters in National Landing positions JBG SMITH to enjoy the best of all worlds in today’s investment climate - upside through exposure to the fast-growing technology sector and continued urban infill migration against the backdrop of the historically recession resilient DC Metro market.

For our detailed quarterly market update, please see the Appendix to this letter.

Capital Allocation

Since the spin-off, we have sold or recapitalized $1.4 billion of assets at values at or above our estimated NAV. Most of these assets were identified for sale because of their relatively low projected return potential. These sales were executed at very attractive cap rates and even more attractive “economic” cap rates when factoring in go-forward capital requirements. The assets sold or recapitalized would have required an additional $350 million of capital over the next five years, generating an average yield on total cost of 3.5%-4.0% over this time period and a stabilized 4.5%-5.0% yield on total cost. This 5-year stabilized yield is consistent with current market values indicating little to no upside at current market cap rates. By investing the proceeds from these sales into our higher growth development pipeline where we expect to earn an average yield of approximately 6.0%-6.5% on multifamily assets and 7.0%-7.5% on commercial assets, we believe we will deliver higher income and NAV growth over the long term.

Acquisitions

We continue to remain cautious on the acquisition front as a result of aggressive pricing across asset classes. That said, to fulfill our like-kind exchange needs, we expect to be multifamily buyers in the emerging growth submarkets where we are already concentrated and where we see strong rent growth potential. In December, we acquired F1RST Residences, a 325-unit multifamily asset in the Ballpark submarket of Washington, DC with approximately 21,000 square feet of street level retail, for approximately $161 million. The building is located one block from 1221 Van Street and West Half, our other multifamily holdings in the Ballpark submarket. The multifamily portion of the building was 91.7% occupied as of December 31, 2019. The proceeds from the sale of the Metropolitan Park land sites to Amazon completed the reverse like-kind exchange for F1RST Residences. We expect to complete the sale of the Pen Place land to Amazon in 2021, and we intend to identify a like-kind exchange acquisition for the proceeds from that sale.

Dispositions

We continued to be a net seller in 2019 with $426 million of asset sales and recapitalizations against our $400 million goal. We sold or recapitalized 1600 K Street, a 50% joint venture interest in Central Place Tower, Vienna Retail, and the Metropolitan Park land sites, which closed in January 2020. We sold Metropolitan Park to Amazon

for approximately $155 million, $11 million above the estimated contract value due to the development density that was ultimately approved. We completed each of these transactions at or above our estimated NAV.

We have identified over $500 million of additional recycling candidates that we expect to opportunistically market for sale in 2020, assuming market conditions remain supportive. Given the softening of demand for CBD office assets we saw in 2019, we believe it is prudent to expect to transact on at least $200 million of these sale candidates as some of these assets may not ultimately trade. Having already transacted on most of the low hanging fruit in the DC portion of our office portfolio, our current sale candidates are less “core” in nature and may not fetch compelling pricing if market conditions soften. While we intend to pursue these recycling opportunities aggressively, we are fortunate that we have the balance sheet strength to be opportunistic, and only transact if and when we can source capital at attractive levels.

For low-basis sale candidates, such as the land we are selling to Amazon, we plan to seek like-kind exchanges that would allow us to trade out of low-return assets into higher-yielding development opportunities or acquisitions with better long-term growth profiles. In the current environment, these are more likely to be multifamily assets in the emerging growth submarkets where we are already concentrated. We are also focused on opportunities to turn land assets into income streams via like-kind exchanges or ground leases.

Financial and Operating Metrics

For the year ended December 31, 2019, we reported net income attributable to common shareholders of $65.6 million and Core FFO attributable to common shareholders of $210.2 million or $1.61 per share. Same store NOI decreased 7.0% and we ended the year at 90.8% leased and 87.9% occupied. For second generation leases, the rental rate mark-to-market was positive 3.5%. As we have mentioned in the past, our mark-to-market will vary from quarter-to-quarter. That said, this level of performance exceeded our own expectations, which primarily reflects the positive commercial leasing environment in National Landing.

As expected, due to asset sales and the defensive blend-and-extend leasing strategy we implemented in 2017 and 2018, our NOI declined in 2019. Because (i) the concessions in our commercial portfolio have burned off to stabilized levels, (ii) we delivered five Under Construction assets on or ahead of schedule, and (iii) we acquired F1RST Residences, we expect our NOI to rebound in 2020. We do not, however, expect to see this NOI increase immediately flow through to Core FFO in 2020, primarily due to the reduction in capitalized interest from the delivery of our Under Construction assets. As these assets stabilize, we expect the increase in earnings to offset the increase in interest expense, which will increase Core FFO.

Operating Portfolio

For the three months ended December 31, 2019, our 10.7 million square foot operating commercial portfolio generated $246 million of annualized NOI and was 91.4% leased and 88.2% occupied. We completed 40 office lease transactions in our operating commercial portfolio totaling over 724,000 square feet, including 438,000 square feet of new leases and 286,000 square feet of renewals. For second-generation leases, the rental rate mark-to-market was positive 7.6%.

Our same store NOI increased 1.2% across our operating portfolio during the fourth quarter. As noted in prior quarters, throughout most of 2019, the concessions related to blend-and-extend leases signed in 2017 and 2018 significantly increased the portion of our portfolio that was in a free rent period. This elevated level of free rent has burned off and returned to a level consistent with long-term averages. It is worth noting that while we expect the burn-off of rental abatements to result in significant same store NOI growth in 2020, we do not expect this year’s elevated growth rate to continue over the longer term.

In 2019, we leased 2.1 million square feet of space, bringing the leased percentage of our commercial operating portfolio to 91.4% versus 89.6% at the end of 2018. We also increased our occupancy to 88.2% from 85.5% over this same period, a 270 basis point improvement. We achieved these leasing outcomes while also pushing rental rates across the portfolio, which is reflected in the positive 3.5% mark-to-market increase on rents across our portfolio in 2019 versus negative 6.6% in 2018.

In our operating multifamily portfolio, our leased percentage was 89.5% at year-end 2019 and 95.7% at year-end 2018, and our occupied percentage was 87.2% at year-end 2019 compared to 93.9% at year-end 2018. This decrease is a result of West Half, a recently delivered under construction asset, which completed in the third quarter of 2019 and was 30.2% leased as of the end of the fourth quarter. Our operating multifamily portfolio, comprising approximately 5,327 units, generated $82 million of annualized NOI. Our concentration in multifamily assets (based on square footage at share) increased to 30% at year-end 2019 from 26% at year-end 2018.

Development Portfolio

Over the course of 2019, we completed two new multifamily assets - West Half and Atlantic Plumbing C, and three new office assets - 500 L’Enfant Plaza, 1900 N Street, and 4747 Bethesda Avenue, which in aggregate were 83.4% leased as of the end of the fourth quarter. All five assets delivered on or ahead of schedule and below budget.

As of December 31, 2019, our development portfolio consisted of seven assets totaling 1.5 million square feet currently under construction and a Future Development Pipeline totaling 18.7 million square feet. Excluding the land held for sale to Amazon, our pipeline was 14.6 million square feet. Of the 1.5 million square feet in our Under Construction portfolio, 700,000 square feet is multifamily and 800,000 square feet is commercial, which is 86.8% pre-leased.

Under Construction

At the end of the fourth quarter, our seven assets under construction all had guaranteed maximum price construction contracts in place. These assets have weighted average estimated completion and stabilization dates of the third quarter of 2020 and the third quarter of 2021, respectively, with a projected NOI yield based on Estimated Total Project Cost of 6.4%. We expect our Under Construction assets to deliver $56.2 million of annualized NOI.

Near Term Development

We did not have any assets in the Near Term Development pipeline at the end of the fourth quarter. As a reminder, we only place assets into our Near Term Development Pipeline when they have completed the entitlement process and when we intend to commence construction within 12 to 18 months, subject to market conditions. We expect to commence construction on 1900 Crystal Drive in the first quarter, upon receipt of full entitlements from Arlington County. We are also focused on completing design and entitlements for the next tranche of multifamily development opportunities in National Landing including, 2000 and 2001 South Bell Street, 222 23rd Street, and 2525 Crystal Drive, all of which are within a ½ mile of Amazon’s new headquarters. This pipeline includes approximately 2,100 units and is still subject to final entitlements from Arlington County. Subject to market conditions, including today’s escalating construction cost environment, we could be in a position to deliver these projects over the next four to five years. Based on current market conditions these projects would represent an estimated total investment of approximately $1.0 billion and a potential stabilized NOI of between $60 and $65 million.

If we execute these planned multifamily developments in National Landing, without assuming any additional capital recycling activity, we expect our leverage will stabilize in the mid 6x’s, with interim peak levels in the mid 8x’s at the front end of this period.

Future Development Pipeline

As of December 31, 2019, our Future Development pipeline comprises 18.7 million square feet, with an Estimated Total Investment per square foot of approximately $40.52. Excluding the land held for sale to Amazon, our pipeline was 14.6 million square feet. At the end of the fourth quarter, 58.9% of this pipeline was in National Landing, 18.6% was in DC, 13.9% was in Reston, and the remaining 8.6% was in other Virginia and Maryland submarkets. Our DC holdings are concentrated in the fast-growing emerging submarkets of Union Market and Ballpark, and our Reston holdings include one of the best development sites on the Metro, adjacent to Reston Town Center.

Over the course of 2019, we actively advanced the entitlement and design of 10.1 million square feet (69%) of our Future Development Pipeline. This includes the 4.4 million square feet that we submitted for entitlement in National Landing, which is approximately two-thirds of our pipeline in National Landing. Of the remaining 4.5 million square feet, we continue to seek opportunities to monetize our Future Development Pipeline, either through land sales or ground lease structures, as we did with 1700 M Street in 2018.

The following bar chart describes the stage of entitlement of our Future Development Pipeline:

Third-Party Asset Management and Real Estate Services Business

Revenue from our third-party asset management and real estate services business was $16.0 million in the fourth quarter, primarily driven by $5.1 million in property management fees, $4.7 million in development fees, and $3.4 million in asset management fees. The portion of total revenues associated with the JBG Legacy Funds was $5.1 million (approximately 32.2% of total third-party revenue). The JBG Legacy Funds continued to focus on disposing of assets in accordance with their underlying business plans. We expect the fees from retaining management and leasing of sold assets, the Amazon-related fees that we expect to receive, any fee income associated with the Washington Housing Initiative, and other third-party fee income streams to offset the wind down of the JBG Legacy Fund business over time.

Balance Sheet

As of December 31, 2019, we had $126.4 million of cash ($136.2 million of cash at share), $898.5 million available under our credit facility, and over $800 million of multifamily borrowing capacity from our Operating and Under Construction multifamily assets. Our Net Debt/Total Enterprise Value was 22.5%, using our share price at February 21, 2019, and our Net Debt/Adjusted EBITDA was 5.8x. Our Net Debt/Adjusted EBITDA metric includes the short-term impact of a $200 million draw on our credit facility to fund the F1RST Residences acquisition, which was part of the reverse like-kind exchange of the Metropolitan Park land sale to Amazon. Adjusted for the $155 million of proceeds from the land sale to Amazon in January 2020, our pro forma Net Debt/Total Enterprise Value was 21.0%

and our pro forma Net Debt/Adjusted EBITDA was 5.3x. Given that these leverage metrics include the debt incurred to date to develop our seven Under Construction assets, but none of the estimated NOI from those assets, we believe Net Debt/Total Enterprise Value is the most meaningful measure to evaluate our leverage. Our long-term leverage targets remain unchanged at 25% to 35% Net Debt/Total Enterprise Value and between 6x and 7x Net Debt/Adjusted EBITDA, with peak levels in the mid-8x’s during periods of more active development. Based on these long-term leverage targets, we believe that we have ample balance sheet capacity to develop 1900 Crystal Drive and the next tranche of multifamily developments in National Landing without any additional asset sales or capital transactions.

We continue to focus on maintaining a well-laddered debt maturity profile. As of December 31, 2019, our weighted average interest rate was 4.0%, and our average debt maturity was 3.5 years, with approximately $513 million coming due in the next two years. Consistent with our strategy to finance our business primarily with non-recourse, asset-level financing, 74.5% of our consolidated and unconsolidated debt is property-level mortgage debt, of which only approximately $8.3 million is recourse to JBG SMITH. Our debt is 74.8% fixed rate, and we have rate caps in place for 33.3% of our floating rate debt.

Over the course of 2019, we were very active in the debt markets. We closed or modified 8 loans totaling $737 million and repaid $709 million of debt. The weighted average interest rate of the repaid debt was 4.05%, generating $28.7 million of annual interest expense savings. In early January, we amended and extended our existing revolving credit facility, which was set to mature on July 16, 2021. The recast $1.0 billion revolving credit facility extends the maturity date for five years to January 7, 2025, with a slight reduction in the interest rate. We were very pleased with the demand to participate in the recast of our credit facility, which solidified our strong balance sheet by giving us financial flexibility to execute on the significant development opportunities in our portfolio.

Environmental, Social, and Governance

In December 2019, we closed on another round of funding for the Washington Housing Initiative Impact Pool (the “Impact Pool”), bringing the total to approximately $104 million, including a $10.2 million commitment from JBG SMITH. We launched the Washington Housing Initiative (WHI) in partnership with the Federal City Council in 2018 to preserve or build up to 3,000 units of affordable workforce housing in the Washington, DC region over the next decade. The WHI includes a third-party non-profit, the Washington Housing Conservancy, and the Impact Pool, the JBG SMITH-managed financing component of the WHI. The Impact Pool has a targeted size of $150 million, of which we expect to contribute up to 9.75%.

In January 2020, the Impact Pool made its first investment, providing approximately $15 million of mezzanine financing for the Alexandria Housing Development Corporation (AHDC) to acquire Avana - renamed Parkstone - a recently renovated 326-unit, high rise residential community in Alexandria, Virginia for $106 million. Currently, most of the units at Parkstone are naturally occurring workforce housing with rents affordable to middle-income renters. Using the Impact Pool loan, AHDC will commit to keep the property affordable for middle-income renters through long-term covenants, in addition to making investments to ensure it remains high-quality housing. JBG SMITH will

be the property manager for Parkstone. In addition to this recent investment, the Impact Pool is currently evaluating a pipeline of financings that could preserve nearly 6,000 units of affordable workforce housing across the DC region.

On the corporate governance front, we regularly review best practices and proactively engage with investors on these issues. Accordingly, we recently amended our Bylaws to provide for a majority (rather than plurality) voting standard in uncontested trustee elections.

* * *

As we look ahead into 2020 and beyond, we believe that JBG SMITH is at the front end of a significant wave of growth, and that we are only getting started. The capital allocation decisions we have made over the past few years are bearing fruit, and we anticipate strong growth in our NAV per share as a result. Similarly, the investment opportunities ahead are substantial, and we will pursue them with an obsessive focus on maximizing long-term value. Indeed, we find ourselves in the fortunate position of investing ahead of the tailwinds of Amazon’s expected significant growth, while also enjoying the solid foundation of the historically recession resilient DC market. This combination is especially important given the length of the current real estate cycle and our strong capital position.

We appreciate the continued strong interest in our company, and we encourage you to visit our real estate and spend time with our team. We remain focused on the significant opportunities in front of us, and we will continue to work hard to maintain your trust and confidence.

W. Matthew Kelly

Chief Executive Officer

Appendix

Washington, DC Market Update

Economy

The region’s job growth and office absorption continue to be concentrated in a thriving Northern Virginia. 55% of the region’s overall 2019 job growth (37,000 jobs) was in Northern Virginia, driving 84% of the net absorption in the overall market. This level of regional job growth is in line with the area’s historic long-term average of approximately 40,000 jobs per year and is largely attributable to a surging professional and business services industry, which accounted for 40% of the region’s total job growth. Much of that growth is in cloud computing and cyber security - two areas where federal defense spending is translating into private sector growth. High paying professional services jobs translate into apartment and, to a lesser extent, office demand. By contrast, the federal government continues to be stagnant from a hiring perspective and contributes relatively little net new office demand. As Amazon moves into its first full year of hiring, we expect the region’s diversification away from federal employment drivers to accelerate even further.

Office

Supply and demand fundamentals in Northern Virginia continue to strengthen particularly along the Metro corridor between the tech-talent clusters of National Landing and Reston where professional services job growth is concentrated. In addition to strong demand, supply levels in Northern Virginia remain adequate but not excessive. Despite two new speculative projects (380,000 square feet of available space) breaking ground in the fourth quarter, only roughly 800,000 square feet of speculative office space is scheduled to deliver within the next two years, representing less than 1% of Northern Virginia supply. Given that the bulk of the region’s demand is in submarkets with limited supply, favorable conditions exist for rent growth in the most desirable locations, even while Northern Virginia’s overall vacancy remains relatively high at 17% (having fallen from 20% and 19% in 2017 and 2018, respectively). The contradiction between a high vacancy rate and selective pockets of rent growth continues to highlight the difference between desirable and undesirable locations. Locations with high-quality, walkable amenities continue to outperform, almost irrespective of the level of distress for locations that lack these attributes. National Landing, for example, benefitted from 400,000 square feet of positive absorption in 2019, and continues to exhibit improving office market fundamentals, with occupancy levels up 4% and rents up 17% over fourth quarter 2018 levels. JLL also reports that rents for new construction trophy assets in National Landing are now on par with those in other core Northern Virginia submarkets like the Rosslyn-Ballston Corridor and Reston. While we have not seen enough office trades to judge the impact of these improved fundamentals on investor demand, we expect to see increased interest and pricing based on these trends.

Despite improving fundamentals in Northern Virginia, the outlook in downtown DC remains less sanguine. The 12% vacancy level is the highest it has been in a decade, though it is largely static year-over-year. Direct net absorption for the year was positive by only 525,000 square feet, significantly down from the 10-year peak of 3 million square feet in 2010, and a slight decrease from the 540,000 square feet of positive absorption in 2018. That said, most of this absorption was driven by emerging submarkets, which continue to be a bright spot, with approximately 1.2 million square feet of positive absorption, including a few notable GSA moves such as the Department of Justice

(500,000 square feet) and Peace Corps (176,000 square feet), versus approximately 690,000 of negative absorption in the balance of DC, according to JLL. This negative absorption is exacerbated by a pipeline of new deliveries that remains elevated, with roughly 3.6 million square feet delivering in 2019 and another 4 million square feet under construction. The emerging DC markets account for just 522,000 square feet of 2019 deliveries and 1.5 million square feet of under construction assets, which are 87% pre-leased. In comparison, non-emerging DC markets account for nearly 3.1 million square feet of 2019 deliveries and 2.5 million square feet of assets under construction, which are only 28% pre-leased.

This data suggests that, given the favorable supply-demand dynamics, emerging DC markets will continue to outperform non-emerging DC markets. For several quarters we have been predicting that continued trophy oversupply and tenant preference for amenity-rich, emerging markets will put pressure on commodity Class A assets, which will in turn, put pressure on Class B assets. It appears that the pricing spread between Class A and Class B has narrowed to a point where Class B tenants are making the jump to better-quality product. We have seen that phenomenon play out with JLL reporting a continued decline in commodity Class A vacancy, now at its lowest level (12.8%) since 2015, and a corresponding uptick in Class B vacancy, now at a historical high (12.3%). This movement also indicates that, after protracted vacancy, many commodity Class A buildings have dropped their rents (a current discount of 28% to trophy product) and/or increased concessions to levels necessary to lease the buildings. With overall annual rents in DC proper down (-1%) for the first time in a decade, we expect to continue to see elevated concessions across all classes.

Multifamily

We continue to be encouraged by strong multifamily fundamentals across the region. Combined deliveries remain consistently on track at approximately 14,000 units expected to deliver in 2020 and 2021. As a reminder, this level is roughly on par with the 2014 single-year peak of 15,000 deliveries. With less than 200 units commencing construction in the fourth quarter, the pipeline appears to be declining with just under 1,400 units currently under construction for delivery in 2022. We believe that the shrinking pipeline will be particularly impactful in DC emerging markets where same store Class A market rents have grown by 4.1% over the past two years according to CoStar data, with average stabilization of 16 months for newly delivered buildings with a typical size of 260 units since 2015. As a reminder, our DC multifamily properties are concentrated in those emerging submarkets. We believe approximately 6,000 units will deliver in emerging markets through 2021, representing roughly 29% of the existing inventory as of the end of 2019. As amenity and population growth continue in these emerging markets, we maintain our belief in the eventual convergence of emerging market rents with those in mature markets. As of the fourth quarter, we have seen the spread between emerging and mature market rents narrow by over 5% in buildings delivered since 2015.

Office Sales

Following a spike in third quarter activity totaling $2.1 billion, investor activity within DC proper slowed, ending the fourth quarter at $690 million. The total sales volume of approximately $4.1 billion for the year finished well above the five-year low of $2.9 billion in 2016, but below the 2017 and 2018 levels of approximately $5 billion. Buyers in fourth quarter transactions were mostly high-net worth and domestic buyers, with foreign capital remaining largely on the sidelines. According to JLL, assets with a value-add profile accounted for 12 of the first 16 single-asset

trades in the first half of 2019, most likely in response to the aggressive price tags of Class A and Trophy. The recent sales of 815 Connecticut Avenue and 901 15th Street, both well-leased trophy and Class A buildings, priced at low-5% cap rates, above the 24-month trophy average of 4.8%, according to JLL.

Multifamily Sales

In 2019, multifamily volume reached $7 billion - far higher than the $3.7 to $4.5 billion we have seen in the past three years. This volume increase was almost entirely suburban product, with 76% of 2019 transactions outside urban markets, according to CoStar data for the DC Metro Region. The suburban volume is mostly attributable to significant large portfolio sales, totaling approximately $2 billion, which reflects portfolio re-alignments by large owners and a hunger for value-add suburban deals among investors. Downtown Class A trades were rare and competitively priced, with average cap rates of 4.4% over the past 12 months. According to CoStar, National Landing is an even more competitive environment with trailing 12-month cap rates averaging 3.7%.

FOR IMMEDIATE RELEASE

CONTACT

Jaime Marcus

SVP, Investor Relations and Corporate Communications

(240) 333-3643

jmarcus@jbgsmith.com

JBG SMITH ANNOUNCES FOURTH QUARTER 2019 RESULTS

Chevy Chase, MD (February 25, 2020) - JBG SMITH (NYSE: JBGS), a leading owner and developer of high-growth, mixed-use properties in the Washington, DC market, today filed its Form 10-K for the year ended December 31, 2019 and reported its financial results.

Additional information regarding our results of operations, properties and tenants can be found in our Fourth Quarter 2019 Investor Package, which is posted in the Investor Relations section of our website at www.jbgsmith.com.

Fourth Quarter 2019 Financial Results

| |

| • | Net income attributable to common shareholders was $34.4 million, or $0.25 per diluted share. |

| |

| • | Funds From Operations (“FFO”) attributable to common shareholders was $30.4 million, or $0.23 per diluted share. |

| |

| • | Core Funds From Operations (“Core FFO”) attributable to common shareholders was $52.8 million, or $0.39 per diluted share. |

Year Ended December 31, 2019 Financial Results

| |

| • | Net income attributable to common shareholders was $65.6 million, or $0.48 per diluted share. |

| |

| • | FFO attributable to common shareholders was $150.6 million, or $1.15 per diluted share. |

| |

| • | Core FFO attributable to common shareholders was $210.2 million, or $1.61 per diluted share. |

Operating Portfolio Highlights

| |

| • | Annualized Net Operating Income (“NOI”) for the three months ended December 31, 2019 was $328.2 million, compared to $313.2 million for the three months ended September 30, 2019, at our share. |

| |

| • | The operating commercial portfolio was 91.4% leased and 88.2% occupied as of December 31, 2019, compared to 90.2% and 86.8% as of September 30, 2019, at our share. |

| |

| • | The operating multifamily portfolio was 89.5% leased and 87.2% occupied as of December 31, 2019, compared to 96.5% and 94.9% as of September 30, 2019, at our share. The decreases are due in part to the movement of West Half into our recently delivered operating assets during the quarter. The in service operating multifamily portfolio was 95.1% leased and 93.3% occupied as of December 31, 2019. |

| |

| • | Executed approximately 724,000 square feet of office leases at our share in the fourth quarter, comprising approximately 173,000 square feet of new leases and approximately 551,000 square feet of second generation |

leases, which generated a 15.5% rental rate increase on a GAAP basis and a 7.6% rental rate increase on a cash basis.

| |

| • | Executed approximately 2.1 million square feet of commercial leases at our share during the year ended December 31, 2019, comprising approximately 938,000 square feet of new leases and approximately 1.2 million square feet of second generation leases, which generated a 9.7% rental rate increase on a GAAP basis and a 3.5% rental rate increase on a cash basis. The new leases include leases totaling approximately 857,000 square feet to date at five office buildings in our National Landing portfolio executed by Amazon.com, Inc. ("Amazon") in conjunction with the establishment of their additional headquarters, which is inclusive of 272,000 square feet of office space executed in December at 2100 Crystal Drive in National Landing. |

| |

| • | Same Store Net Operating Income (“SSNOI”) at our share increased 1.2% to $74.9 million for the three months ended December 31, 2019, compared to $74.1 million for the three months ended December 31, 2018. SSNOI decreased 7.0% to $292.3 million for the year ended December 31, 2019, compared to $314.1 million for the year ended December 31, 2018. The increase in SSNOI for the three months ended December 31, 2019 is largely attributable to decreased ground rent expense. The decrease in SSNOI for the year ended December 31, 2019 is largely attributable to increased rental abatements and rent reductions, and an increase in assumed lease liability payments. The lease renewals we executed in 2017 and 2018 have reduced our NOI in 2019, primarily due to free rent associated with these early renewals. Because (i) the concessions in our commercial portfolio have burned off to stabilized levels, (ii) we delivered Under Construction assets on or ahead of schedule, and (iii) we acquired F1RST Residences, we expect NOI to rebound in 2020. We do not, however, expect to see this NOI increase immediately flow through to Core FFO in 2020, primarily due to the reduction in capitalized interest from the delivery of our Under Construction assets. As these assets stabilize, we expect the increase in earnings to offset the increase in interest expense which will increase Core FFO. |

The reported same store pools as of December 31, 2019 include only the assets that were in service for the entirety of both periods being compared.

Development Portfolio Highlights

Under Construction

| |

| • | During the quarter ended December 31, 2019, there were seven assets under construction (four commercial assets and three multifamily assets), consisting of approximately 821,000 square feet and 833 units, both at our share. |

| |

| • | During the quarter ended December 31, 2019, we completed 4747 Bethesda, Atlantic Plumbing C and 1900 N Street, all delivered on or ahead of schedule and below budget. |

Near-Term Development

| |

| • | As of December 31, 2019, there were no assets in near-term development. |

Future Development Pipeline

| |

| • | As of December 31, 2019, there were 40 future development assets consisting of 18.7 million square feet of estimated potential density at our share, including the 4.1 million square feet held for sale to Amazon. |

Third-Party Asset Management and Real Estate Services Business

For the three months ended December 31, 2019, revenue from third-party real estate services, including reimbursements, was $29.1 million. Excluding reimbursements and service revenue from our interests in consolidated and unconsolidated real estate ventures, revenue from our third-party asset management and real

estate services business was $16.0 million, primarily driven by $5.1 million of property management fees, $4.7 million of development fees, $3.4 million of asset management fees and $2.0 million of leasing fees.

Balance Sheet

| |

| • | We had $1.6 billion of debt ($2.0 billion including our share of debt of unconsolidated real estate ventures) as of December 31, 2019. Of the $2.0 billion of debt at our share, approximately 75% was fixed-rate and rate caps were in place for approximately 33% of our floating rate debt. |

| |

| • | The weighted average interest rate of our debt at share was 4.03% as of December 31, 2019. |

| |

| • | As of December 31, 2019, our total enterprise value was approximately $8.1 billion, comprising 149.3 million common shares and units valued at $6.2 billion (calculated using our closing share price as of February 21, 2020) and debt (net of premium / (discount) and deferred financing costs) at our share of $1.9 billion, less cash and cash equivalents at our share of $136.2 million. |

| |

| • | As of December 31, 2019, we had $126.4 million of cash and cash equivalents ($136.2 million of cash and cash equivalents at our share), $898.5 million of capacity under our credit facility, and an unencumbered multifamily borrowing base of approximately $811.0 million, including our Under Construction multifamily assets. |

| |

| • | Net Debt to Annualized Adjusted EBITDA at our share for the three months and year ended December 31, 2019 was 5.8x for both periods and our Net Debt / Total Enterprise Value was 22.5% as of December 31, 2019 (calculated using our closing share price as of February 21, 2020). Pro forma Net Debt to Annualized Adjusted EBITDA at our share would have been 5.3x for the three months and year ended December 31, 2019, and pro forma Net Debt / Total Enterprise Value would have been 21.0% as of December 31, 2019, which includes the $155.0 million of net proceeds from the sale of Metropolitan Park in January 2020. |

Financing and Investing Activities

| |

| • | Acquired F1RST Residences, a 325-unit multifamily asset in the Ballpark submarket of Washington, DC with approximately 21,000 square feet of street level retail, for a purchase price of approximately $160.5 million. The multifamily portion of the building is 91.7% occupied as of December 31, 2019. We used F1RST Residences as a replacement property in a like-kind exchange for the proceeds from the sale of Metropolitan Park to Amazon, which was completed in January 2020. |

| |

| • | Sold a 50.0% interest in a real estate venture that owns Central Place Tower, a 552,000 square foot commercial asset located in Arlington, Virginia. |

| |

| • | Sold Vienna Retail, an 8,600 square foot commercial asset located in Vienna, Virginia, for $7.4 million. |

| |

| • | Drew $200.0 million under the revolving credit facility, which was repaid in 2020. |

Subsequent to December 31, 2019:

| |

| • | Sold Metropolitan Park to Amazon for $155.0 million, which represents an $11.0 million increase over the previously estimated contract value resulting from an increase in the approved development density on the sites. |

| |

| • | Amended our credit facility to extend the maturity date of the revolving credit facility to January 2025. |

| |

| • | Entered into a mortgage loan with a principal balance of $175.0 million collateralized by 4747 and 4749 Bethesda Avenue. |

Dividends

In December 2019, our Board of Trustees declared a quarterly dividend of $0.225 per common share, which was paid on January 8, 2020 to shareholders of record as of December 27, 2019.

About JBG SMITH

JBG SMITH is an S&P 400 company that owns, operates, invests in and develops a dynamic portfolio of high-growth mixed-use properties in and around Washington, DC. Through an intense focus on placemaking, JBG SMITH cultivates vibrant, amenity-rich, walkable neighborhoods throughout the Capital region, including National Landing where it now serves as the exclusive developer for Amazon’s new headquarters. JBG SMITH’s portfolio currently comprises 20.8 million square feet of high-growth office, multifamily and retail assets, 98% at our share of which are Metro-served. It also maintains a robust future pipeline encompassing 18.7 million square feet of mixed-use development opportunities. For more information on JBG SMITH please visit www.jbgsmith.com.

Forward Looking Statements

Certain statements contained herein may constitute “forward-looking statements” as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not guarantees of performance. They represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Consequently, the future results of JBG SMITH Properties (“JBG SMITH”, the “Company”, "we", "us", "our" or similar terms) may differ materially from those expressed in these forward-looking statements. You can find many of these statements by looking for words such as “approximate”, "hypothetical", "potential", “believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans”, “would”, “may” or similar expressions in this earnings release. We also note the following forward-looking statements: our anticipated dispositions and like-kind exchanges, our indicated annual dividend per share and dividend yield, annualized net operating income; in the case of our construction and near-term development assets, estimated square feet, estimated number of units and in the case of our future development assets, estimated potential development density; expected key Amazon transaction terms and timeframes for closing of any Amazon transactions not yet closed, planned infrastructure improvements related to Amazon's additional headquarters; the economic impacts of Amazon's additional headquarters on the DC region and National Landing; our development plans related to Amazon's additional headquarters; the expected accretion to our net asset value ("NAV") as a result of the Amazon transaction and our future NAV growth rate; in the case of any further Amazon lease transactions and our new development opportunities in National Landing, the total square feet to be leased to Amazon and the expected net effective rent, estimated square feet, estimated number of units, the estimated construction start and occupancy dates, estimated incremental investment, projected NOI yield; and in the case of our future development opportunities, estimated potential development density. Many of the factors that will determine the outcome of these and our other forward-looking statements are beyond our ability to control or predict. These factors include, among others: adverse economic conditions in the Washington, DC metropolitan area, the timing of and costs associated with development and property improvements, financing commitments, and general competitive factors. For further discussion of factors that could materially affect the outcome of our forward-looking statements and other risks and uncertainties, see “Risk Factors” and the Cautionary Statement Concerning Forward-Looking Statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2019 and other periodic reports the Company files with the Securities and Exchange Commission. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements after the date hereof.

We are reiterating the assumptions in our estimated NOI bridge and the potential estimated NAV impact from Amazon in National Landing, which can be found in our Spring 2019 Investor Day presentation on our website at http://investors.jbgsmith.com/presentations.

Pro Rata Information

We present certain financial information and metrics in this release “at JBG SMITH Share,” which refers to our ownership percentage of consolidated and unconsolidated assets in real estate ventures (collectively, “real estate ventures”) as applied to these financial measures and metrics. Financial information “at JBG SMITH Share” is calculated on an asset-by-asset basis by applying our percentage economic interest to each applicable line item of that asset’s financial information. “At JBG SMITH Share” information, which we also refer to as being “at share,” “our pro rata share” or “our share,” is not, and is not intended to be, a presentation in accordance with GAAP. Given that a substantial portion of our assets are held through real estate ventures, we believe this form of presentation, which presents our economic interests in the partially owned entities, provides investors valuable information regarding a significant component of our portfolio, its composition, performance and capitalization.

We do not control the unconsolidated real estate ventures and do not have a legal claim to our co-venturers’ share of assets, liabilities, revenue and expenses. The operating agreements of the unconsolidated real estate ventures generally allow each co-venturer to receive cash distributions to the extent there is available cash from operations. The amount of cash each investor receives is based upon specific provisions of each operating agreement and varies depending on certain factors including the amount of capital contributed by each investor and whether any investors are entitled to preferential distributions.

With respect to any such third-party arrangement, we would not be in a position to exercise sole decision-making authority regarding the property, real estate venture or other entity, and may, under certain circumstances, be exposed to economic risks not present were a third-party not involved. We and our respective co-venturers may each have the right to trigger a buy-sell or forced sale arrangement, which could cause us to sell our interest, or acquire our co-venturers’ interests, or to sell the underlying asset, either on unfavorable terms or at a time when we otherwise would not have initiated such a transaction. Our real estate ventures may be subject to debt, and the repayment or refinancing of such debt may require equity capital calls. To the extent our co-venturers do not meet their obligations to us or our real estate ventures or they act inconsistent with the interests of the real estate venture, we may be adversely affected. Because of these limitations, the non-GAAP “at JBG SMITH Share” financial information should not be considered in isolation or as a substitute for our financial statements as reported under GAAP.

Non-GAAP Financial Measures

This release includes non-GAAP financial measures. For these measures, we have provided an explanation of how these non-GAAP measures are calculated and why JBG SMITH’s management believes that the presentation of these measures provides useful information to investors regarding JBG SMITH’s financial condition and results of operations. Reconciliations of certain non-GAAP measures to the most directly comparable GAAP financial measure are included in this earnings release. Our presentation of non-GAAP financial measures may not be comparable to similar non-GAAP measures used by other companies. In addition to "at share" financial information, the following non-GAAP measures are included in this release:

Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA"), EBITDA for Real Estate ("EBITDAre") and Adjusted EBITDA

Management uses EBITDA and EBITDAre, non-GAAP financial measures, as supplemental operating performance measures and believes they help investors and lenders meaningfully evaluate and compare our operating performance from period-to-period by removing from our operating results the impact of our capital structure (primarily interest charges from our outstanding debt and the impact of our interest rate swaps) and certain non-cash expenses (primarily depreciation and amortization on our assets). EBITDAre is computed in accordance with the definition established by the National Association of Real Estate Investment Trusts (“NAREIT”). NAREIT defines EBITDAre as GAAP net income (loss) adjusted to exclude interest expense, income taxes, depreciation and

amortization expenses, gains on sales of real estate and impairment losses of real estate, including our share of such adjustments of unconsolidated real estate ventures. These supplemental measures may help investors and lenders understand our ability to incur and service debt and to make capital expenditures. EBITDA and EBITDAre are not substitutes for net income (loss) (computed in accordance with GAAP) and may not be comparable to similarly titled measures used by other companies.

“Adjusted EBITDA,” a non-GAAP financial measure, represents EBITDAre adjusted for items we believe are not representative of ongoing operating results, such as transaction and other costs, gain (loss) on the extinguishment of debt, distributions in excess of our investment in unconsolidated real estate ventures, gain on the bargain purchase of a business, lease liability adjustments and share-based compensation expense related to the Formation Transaction and special equity awards. We believe that adjusting such items not considered part of our comparable operations, provides a meaningful measure to evaluate and compare our performance from period-to-period.

Because EBITDA, EBITDAre and Adjusted EBITDA have limitations as analytical tools, we use EBITDA, EBITDAre and Adjusted EBITDA to supplement GAAP financial measures. Additionally, we believe that users of these measures should consider EBITDA, EBITDAre and Adjusted EBITDA in conjunction with net income (loss) and other GAAP measures in understanding our operating results.

Funds from Operations ("FFO"), Core FFO and Funds Available for Distribution (“FAD")

FFO is a non-GAAP financial measure computed in accordance with the definition established by NAREIT in the NAREIT FFO White Paper - 2018 Restatement issued in 2018. NAREIT defines FFO as net income (computed in accordance with GAAP), excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in control and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity, including our share of such adjustments for unconsolidated real estate ventures.

"Core FFO" represents FFO adjusted to exclude items (net of tax) which we believe are not representative of ongoing operating results, such as transaction and other costs, gains (or losses) on extinguishment of debt, gain on the bargain purchase of a business, distributions in excess of our investment in unconsolidated real estate ventures, share-based compensation expense related to the Formation Transaction and special equity awards, lease liability adjustments, amortization of the management contracts intangible and the mark-to-market of derivative instruments.

"FAD" is a non-GAAP financial measure and represents FFO less recurring tenant improvements, leasing commissions and other capital expenditures, net deferred rent activity, third-party lease liability assumption payments, recurring share-based compensation expense, accretion of acquired below-market leases, net of amortization of acquired above-market leases, amortization of debt issuance costs and other non-cash income and charges. FAD is presented solely as a supplemental disclosure that management believes provides useful information as it relates to our ability to fund dividends.

We believe FFO, Core FFO and FAD are meaningful non‑GAAP financial measures useful in comparing our levered operating performance from period-to-period and as compared to similar real estate companies because these non‑GAAP measures exclude real estate depreciation and amortization expense and other non-comparable income and expenses, which implicitly assumes that the value of real estate diminishes predictably over time rather than fluctuating based on market conditions. FFO, Core FFO and FAD do not represent cash generated from operating activities and are not necessarily indicative of cash available to fund cash requirements and should not be considered as an alternative to net income (loss) (computed in accordance with GAAP) as a performance measure or cash flow as a liquidity measure. FFO, Core FFO and FAD may not be comparable to similarly titled measures used by other companies.

Net Operating Income ("NOI") and Annualized NOI

“NOI” is a non-GAAP financial measure management uses to assess a segment’s performance. The most directly comparable GAAP measure is net income attributable to common shareholders. We use NOI internally as a performance measure and believe NOI provides useful information to investors regarding our financial condition and results of operations because it reflects only property related revenue (which includes base rent, tenant reimbursements and other operating revenue, net of free rent and payments associated with assumed lease liabilities) less operating expenses and ground rent, if applicable. NOI also excludes deferred rent, related party management fees, interest expense, and certain other non-cash adjustments, including the accretion of acquired below-market leases and amortization of acquired above-market leases and below-market ground lease intangibles. Management uses NOI as a supplemental performance measure for our assets and believes it provides useful information to investors because it reflects only those revenue and expense items that are incurred at the asset level, excluding non-cash items. In addition, NOI is considered by many in the real estate industry to be a useful starting point for determining the value of a real estate asset or group of assets. However, because NOI excludes depreciation and amortization and captures neither the changes in the value of our assets that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our assets, all of which have real economic effect and could materially impact the financial performance of our assets, the utility of NOI as a measure of the operating performance of our assets is limited. NOI presented by us may not be comparable to NOI reported by other REITs that define these measures differently. We believe that to facilitate a clear understanding of our operating results, NOI should be examined in conjunction with net income attributable to common shareholders as presented in our financial statements. NOI should not be considered as an alternative to net income attributable to common shareholders as an indication of our performance or to cash flows as a measure of liquidity or our ability to make distributions. Annualized NOI, for all assets except Crystal City Marriott, represents NOI for the three months ended December 31, 2019 multiplied by four. Due to seasonality in the hospitality business, annualized NOI for Crystal City Marriott represents the trailing 12-month NOI as of December 31, 2019. Management believes Annualized NOI provides useful information in understanding our financial performance over a 12-month period, however, investors and other users are cautioned against attributing undue certainty to our calculation of Annualized NOI. Actual NOI for any 12-month period will depend on a number of factors beyond our ability to control or predict, including general capital markets and economic conditions, any bankruptcy, insolvency, default or other failure to pay rent by one or more of our tenants and the destruction of one or more of our assets due to terrorist attack, natural disaster or other casualty, among others. We do not undertake any obligation to update our calculation to reflect events or circumstances occurring after the date of this earnings release. There can be no assurance that the annualized NOI shown will reflect our actual results of operations over any 12-month period.

Same Store and Non-Same Store

“Same store” refers to the pool of assets that were in service for the entirety of both periods being compared, except for assets for which significant redevelopment, renovation, or repositioning occurred during either of the periods being compared.

“Non-same store” refers to all operating assets excluded from the same store pool.

Definitions

GAAP

"GAAP" refers to accounting principles generally accepted in the United States of America.

Formation Transaction

"Formation Transaction" refers collectively to the spin-off on July 17, 2017 of substantially all of the assets and liabilities of Vornado’s Washington, DC segment, which operated as Vornado / Charles E. Smith, and the acquisition of the management business and certain assets and liabilities of The JBG Companies.

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) |

| | | | | | | |

| in thousands | December 31, 2019 | | December 31, 2018 |

| | | | |

| ASSETS | |

| Real estate, at cost: | | | |

| Land and improvements | $ | 1,240,455 |

| | $ | 1,371,874 |

|

| Buildings and improvements | 3,880,973 |

| | 3,722,930 |

|

| Construction in progress, including land | 654,091 |

| | 697,930 |

|

| | 5,775,519 |

| | 5,792,734 |

|

| Less accumulated depreciation | (1,119,571 | ) | | (1,051,875 | ) |

| Real estate, net | 4,655,948 |

| | 4,740,859 |

|

| Cash and cash equivalents | 126,413 |

| | 260,553 |

|

| Restricted cash | 16,103 |

| | 138,979 |

|

| Tenant and other receivables, net | 52,941 |

| | 46,568 |

|

Deferred rent receivable, net

| 169,721 |

| | 143,473 |

|

| Investments in unconsolidated real estate ventures | 543,026 |

| | 322,878 |

|

Other assets, net

| 253,687 |

| | 264,994 |

|

| Assets held for sale | 168,412 |

| | 78,981 |

|

| TOTAL ASSETS | $ | 5,986,251 |

| | $ | 5,997,285 |

|

| | | | |

| LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY | | | |

| Liabilities: | | | |

| Mortgages payable, net | $ | 1,125,777 |

| | $ | 1,838,381 |

|

| Revolving credit facility | 200,000 |

| | — |

|

| Unsecured term loans, net | 297,295 |

| | 297,129 |

|

| Accounts payable and accrued expenses | 157,702 |

| | 130,960 |

|

| Other liabilities, net | 206,042 |

| | 181,606 |

|

| Liabilities related to assets held for sale | — |

| | 3,717 |

|

| Total liabilities | 1,986,816 |

| | 2,451,793 |

|

| Commitments and contingencies |

| |

|

| Redeemable noncontrolling interests | 612,758 |

| | 558,140 |

|

| Total equity | 3,386,677 |

| | 2,987,352 |

|

| TOTAL LIABILITIES, REDEEMABLE NONCONTROLLING INTERESTS AND EQUITY | $ | 5,986,251 |

| | $ | 5,997,285 |

|

_______________

Note: For complete financial statements, please refer to the Company's Annual Report on Form 10-K for the year ended December 31, 2019.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) |

| | | | | | | | | | | | | | | |

| in thousands, except per share data | Three Months Ended December 31, | | Year Ended December 31, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| REVENUE | | | | | | | |

| Property rentals | $ | 127,571 |

| | $ | 129,048 |

| | $ | 493,273 |

| | $ | 513,447 |

|

| Third-party real estate services, including reimbursements | 29,121 |

| | 26,421 |

| | 120,886 |

| | 98,699 |

|

| Other revenue | 8,185 |

| | 7,786 |

| | 33,611 |

| | 32,036 |

|

| Total revenue | 164,877 |

| | 163,255 |

| | 647,770 |

| | 644,182 |

|

| EXPENSES | | | | | | | |

| Depreciation and amortization | 50,004 |

| | 67,556 |

| | 191,580 |

| | 211,436 |

|

| Property operating | 37,535 |

| | 40,076 |

| | 137,622 |

| | 148,081 |

|

| Real estate taxes | 18,252 |

| | 17,030 |

| | 70,493 |

| | 71,054 |

|

| General and administrative: | | | | | | | |

| Corporate and other | 11,934 |

| | 8,512 |

| | 46,822 |

| | 33,728 |

|

| Third-party real estate services | 26,910 |

| | 25,274 |

| | 113,495 |

| | 89,826 |

|

Share-based compensation related to Formation Transaction and

special equity awards

| 11,959 |

| | 9,118 |

| | 42,162 |

| | 36,030 |

|

| Transaction and other costs | 13,307 |

| | 15,572 |

| | 23,235 |

| | 27,706 |

|

| Total expenses | 169,901 |

| | 183,138 |

| | 625,409 |

| | 617,861 |

|

| OTHER INCOME (EXPENSE) |

|

| |

| |

| |

|

| Income (loss) from unconsolidated real estate ventures, net | (2,042 | ) | | 23,991 |

| | (1,395 | ) | | 39,409 |

|

| Interest and other income, net | 3,022 |

| | 9,991 |

| | 5,385 |

| | 15,168 |

|

| Interest expense | (11,831 | ) | | (18,184 | ) | | (52,695 | ) | | (74,447 | ) |

| Gain on sale of real estate | 57,870 |

| | 6,394 |

| | 104,991 |

| | 52,183 |

|

| Loss on extinguishment of debt | (3,916 | ) | | (617 | ) | | (5,805 | ) | | (5,153 | ) |

| Reduction of gain on bargain purchase | — |

| | — |

| | — |

| | (7,606 | ) |

| Total other income (expense) | 43,103 |

| | 21,575 |

| | 50,481 |

| | 19,554 |

|

| INCOME BEFORE INCOME TAX (EXPENSE) BENEFIT | 38,079 |

| | 1,692 |

| | 72,842 |

| | 45,875 |

|

| Income tax (expense) benefit | 613 |

| | (698 | ) | | 1,302 |

| | 738 |

|

| NET INCOME | 38,692 |

| | 994 |

| | 74,144 |

| | 46,613 |

|

| Net income attributable to redeemable noncontrolling interests | (4,302 | ) | | (178 | ) | | (8,573 | ) | | (6,710 | ) |

| Net (income) loss attributable to noncontrolling interests | — |

| | (106 | ) | | — |

| | 21 |

|

| NET INCOME ATTRIBUTABLE TO COMMON SHAREHOLDERS | $ | 34,390 |

| | $ | 710 |

| | $ | 65,571 |

| | $ | 39,924 |

|

| EARNINGS (LOSS) PER COMMON SHARE: | | | | | | | |

| Basic | $ | 0.25 |

| | $ | (0.01 | ) | | $ | 0.48 |

| | $ | 0.31 |

|

| Diluted | $ | 0.25 |

| | $ | (0.01 | ) | | $ | 0.48 |

| | $ | 0.31 |

|

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING : | | | | | | | |

| Basic | 134,129 |

| | 120,917 |

| | 130,687 |

| | 119,176 |

|

| Diluted | 134,129 |

| | 120,917 |

| | 130,687 |

| | 119,176 |

|

___________________

Note: For complete financial statements, please refer to the Company's Annual Report on Form 10-K for the year ended December 31, 2019.

EBITDA, EBITDAre AND ADJUSTED EBITDA (NON-GAAP)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| dollars in thousands | Three Months Ended December 31, | | Year Ended December 31, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| | | | | | | | |

| EBITDA, EBITDAre and Adjusted EBITDA | | | | | | | |

| Net income | $ | 38,692 |

| | $ | 994 |

| | $ | 74,144 |

| | $ | 46,613 |

|

| Depreciation and amortization expense | 50,004 |

| | 67,556 |

| | 191,580 |

| | 211,436 |

|

Interest expense (1) | 11,831 |

| | 18,184 |

| | 52,695 |

| | 74,447 |

|

| Income tax expense (benefit) | (613 | ) | | 698 |

| | (1,302 | ) | | (738 | ) |

| Unconsolidated real estate ventures allocated share of above adjustments | 10,050 |

| | 10,253 |

| | 36,877 |

| | 42,016 |

|

| Net income attributable to noncontrolling interests in consolidated real estate ventures | (2 | ) | | (182 | ) | | (7 | ) | | (53 | ) |

EBITDA (2) | $ | 109,962 |

| | $ | 97,503 |

| | $ | 353,987 |

| | $ | 373,721 |

|

| Gain on sale of real estate | (57,870 | ) | | (6,394 | ) | | (104,991 | ) | | (52,183 | ) |

| Gain on sale from unconsolidated real estate ventures | — |

| | (20,554 | ) | | (335 | ) | | (36,042 | ) |

EBITDAre (2) | $ | 52,092 |

| | $ | 70,555 |

| | $ | 248,661 |

| | $ | 285,496 |

|

Transaction and other costs (3) | 13,307 |

| | 15,572 |

| | 23,235 |

| | 27,706 |

|

| Loss on extinguishment of debt, net of noncontrolling interests | 3,916 |

| | 617 |

| | 5,805 |

| | 5,029 |

|

| Reduction of gain on bargain purchase | — |

| | — |

| | — |

| | 7,606 |

|

| Share-based compensation related to Formation Transaction and special equity awards | 11,959 |

| | 9,118 |

| | 42,162 |

| | 36,030 |

|

Losses and distributions in excess of our investment in unconsolidated real estate venture (4) | (518 | ) | | (7,374 | ) | | (7,356 | ) | | (13,676 | ) |

| Unconsolidated real estate ventures allocated share of above adjustments | (1,345 | ) | | 1,542 |

| | (1,345 | ) | | 1,572 |

|

| Lease liability adjustments | (1,829 | ) | | (7,422 | ) | | 162 |

| | (9,965 | ) |

Adjusted EBITDA (2) | $ | 77,582 |

| | $ | 82,608 |

| | $ | 311,324 |

| | $ | 339,798 |

|

| | | | | | | | |

Net Debt to Annualized Adjusted EBITDA (5) (6) | 5.8x |

| | 6.5x |

| | 5.8x |

| | 6.3x |

|

| | | | | | | | |

| | December 31, 2019 | | December 31, 2018 | | | | |

| Net Debt (at JBG SMITH Share) | | | | | | | |

Consolidated indebtedness (7) | $ | 1,620,001 |

| | $ | 2,130,704 |

| | | | |

Unconsolidated indebtedness (7) | 329,056 |

| | 298,588 |

| | | | |

| Total consolidated and unconsolidated indebtedness | 1,949,057 |

| | 2,429,292 |

| | | | |

| Less: cash and cash equivalents | 136,200 |

| | 273,611 |

| | | | |

| Net Debt (at JBG SMITH Share) | $ | 1,812,857 |

| | $ | 2,155,681 |

| | | | |

| | $ | (0.14 | ) | | | | | | |

____________________

Note: All EBITDA measures as shown above are attributable to operating partnership common units.

| |

| (1) | Interest expense includes the amortization of deferred financing costs and the ineffective portion of any interest rate swaps or caps, net of capitalized interest. |

| |

| (2) | Due to our adoption of the new accounting standard for leases, beginning in 2019, we no longer capitalize internal leasing costs and expense these costs as incurred (such costs were $2.2 million and $6.5 million for the three months and year ended December 31, 2018). |

| |

| (3) | Includes fees and expenses incurred for the relocation of our corporate headquarters, demolition costs, fees and expenses incurred in connection with the Formation Transaction (including amounts incurred for transition services provided by our former parent, integration costs and severance costs), pursuit costs related to other completed, potential and pursued transactions, as well as other expenses. |

| |

| (4) | As of June 30, 2018, we suspended the equity method of accounting for our investment in the real estate venture that owns 1101 17th Street as our investment had been reduced to zero and we did not have an obligation to provide further financial support to the venture. All subsequent distributions from the venture have been recognized as income, which will continue until our share of unrecorded earnings and contributions exceed the cumulative excess distributions previously recognized. |

| |

| (5) | Adjusted EBITDA for the three months ended December 31, 2019 and 2018 is annualized by multiplying by four. |

| |

| (6) | Pro forma Net Debt to Annualized Adjusted EBITDA would have been 5.3x for the three months and year ended December 31, 2019, which includes the $155.0 million of net proceeds from the sale of Metropolitan Park in January 2020. |

| |

| (7) | Net of premium/discount and deferred financing costs. |

FFO, CORE FFO AND FAD (NON-GAAP)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| in thousands, except per share data | Three Months Ended December 31, | | Year Ended December 31, |

| | 2019 | | 2018 | | 2019 | | 2018 |

| | | | | | | | |

| FFO and Core FFO | | | | | | | |

| Net income attributable to common shareholders | $ | 34,390 |

| | $ | 710 |

| | $ | 65,571 |

| | $ | 39,924 |

|

| Net income attributable to redeemable noncontrolling interests | 4,302 |

| | 178 |

| | 8,573 |

| | 6,710 |

|

| Net income (loss) attributable to noncontrolling interests | — |

| | 106 |

| | — |

| | (21 | ) |

| Net income | 38,692 |

| | 994 |

| | 74,144 |

| | 46,613 |

|

| Gain on sale of real estate | (57,870 | ) | | (6,394 | ) | | (104,991 | ) | | (52,183 | ) |

| Gain on sale from unconsolidated real estate ventures | — |

| | (20,554 | ) | | (335 | ) | | (36,042 | ) |

| Real estate depreciation and amortization | 47,001 |

| | 64,891 |

| | 180,508 |

| | 201,062 |

|

| Pro rata share of real estate depreciation and amortization from unconsolidated real estate ventures | 6,407 |

| | 6,079 |

| | 20,577 |

| | 25,039 |

|

| Net income attributable to noncontrolling interests in consolidated real estate ventures | (2 | ) | | (182 | ) | | (7 | ) | | (51 | ) |