Exhibit 10.22

FIRST LOAN MODIFICATION AGREEMENT

THIS FIRST LOAN MODIFICATION AGREEMENT (this “Agreement”) is entered into as of March 9, 2023 (the “Modification Closing Date”), between INPOINT REIT OPERATING PARTNERSHIP, LP, a Delaware limited partnership (“Borrower”), and Western Alliance Bank, an Arizona corporation (“Lender”).

RECITALS

A.Lender heretofore extended to Borrower a revolving line of credit, which currently has a maximum principal amount of Seventy-Five Million and No/100 Dollars ($75,000,000.00) (the “Loan”), which Loan is currently evidenced by, without limitation, that certain Promissory Note, dated as of March 10, 2021, executed by Borrower in favor of Lender (together with any and all amendments thereto or modifications thereof, the “Note”).

B.In connection with the Loan, Borrower also executed and delivered to and in favor of Lender that certain Loan and Security Agreement, dated as of March 10, 2021, between Borrower and Lender (together with any and all amendments thereto or modifications thereof, the “Loan Agreement”), pursuant to which, among other things, Borrower granted to Lender a security interest in the Collateral (as defined in the Loan Agreement) to secure Borrower’s obligations to Lender in connection with the Loan.

C.Payment and performance of Borrower’s indebtedness and obligations in connection with the Loan was guaranteed by INPOINT COMMERCIAL REAL ESTATE INCOME, INC., a Maryland corporation, pursuant to the terms of that certain Guaranty Agreement, dated as of March 10, 2021 (the “Guaranty”).

D.Lender perfected its interest in and to the Collateral by, inter alia, causing to be filed a UCC-1 Financing Statement with the Delaware Secretary of State on March 12, 2021, as Filing No. 20211993535 (the “UCC Financing Statement”). Lender’s security interest in the Collateral is first in priority and duly perfected under applicable law.

E.The Loan Agreement, Note, the Guaranty, UCC Financing Statement, and all other assignments, agreements, instruments and other documents executed by Borrower or Guarantor in connection with the Loan shall at times hereinafter be referred to collectively as the “Loan Documents.”

F.Borrower has requested that Lender modify the Loan and the Loan Documents as provided in this Agreement, and the Lender has agreed to such modifications, subject to, and conditioned upon, the terms and conditions set forth herein.

AGREEMENT

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto do hereby agree as follows:

1.Recitals; Defined Terms. The Recitals are incorporated herein by this reference as are all exhibits. Borrower agrees and acknowledges that the factual information recited above is true and

DOCPROPERTY "DocID" \* MERGEFORMAT DMFIRM #406744954 v4

correct. Except as may be otherwise expressly defined in this Agreement, all terms used in this Agreement beginning with a capital letter shall have the meanings ascribed to them in the Loan Agreement.

2.Acknowledgment of Debt. Borrower declares and acknowledges, for the specific reliance and benefit of Lender, that as of the Modification Closing Date, (a) Borrower has no right, claim, defense or right of offset of any kind or in any amount with respect to this Agreement, the Note, the Loan Agreement or any of the other Loan Documents, and (b) no amounts paid by Borrower to Lender pursuant to or in connection with the execution and delivery of this Agreement shall be applied to or set off against the principal balance of the Note.

3.Reaffirmation of Obligations. This Agreement is, in part, a reaffirmation of the obligations, indebtedness and liability of Borrower to Lender as evidenced by the Loan Agreement and the other Loan Documents. Therefore, Borrower represents, warrants, acknowledges and agrees that, except as specified herein, all of the terms and conditions of the Loan Documents are and shall remain in full force and effect, without waiver or modification of any kind whatsoever, and are ratified and confirmed in all respects.

4.Consent to Modification. In reliance upon the representations, warranties and covenants set forth herein by Borrower, but subject to the satisfaction of the conditions in Section 9 below, Lender hereby consents to this Agreement as of the Modification Closing Date. Lender’s consent to this Agreement is not intended to be, and shall not be construed as, a consent to any subsequent request or action which requires Lender’s consent pursuant to the terms of the Loan Documents.

5.Modification of the Loan and Loan Documents. Subject to the satisfaction of all conditions set forth in this Agreement, as of the Modification Closing Date, the Loan Documents will be modified and amended as follows:

5.1Modifications to the Loan Agreement:

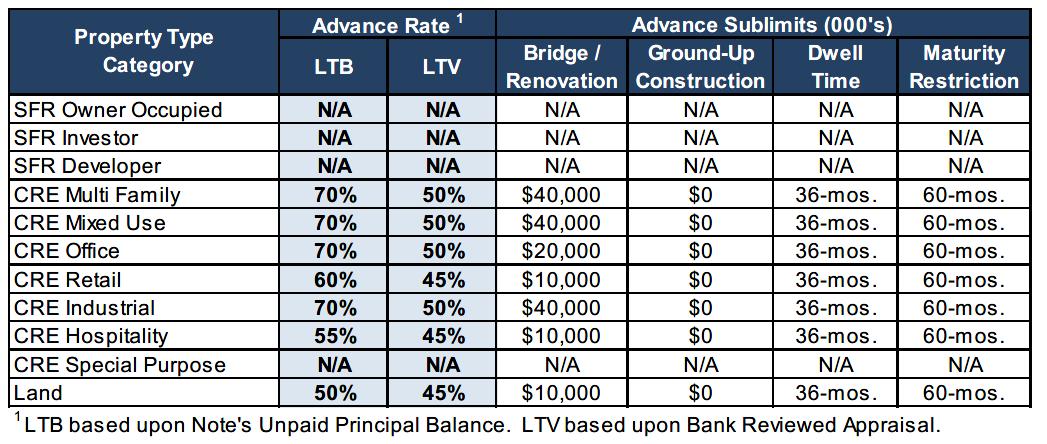

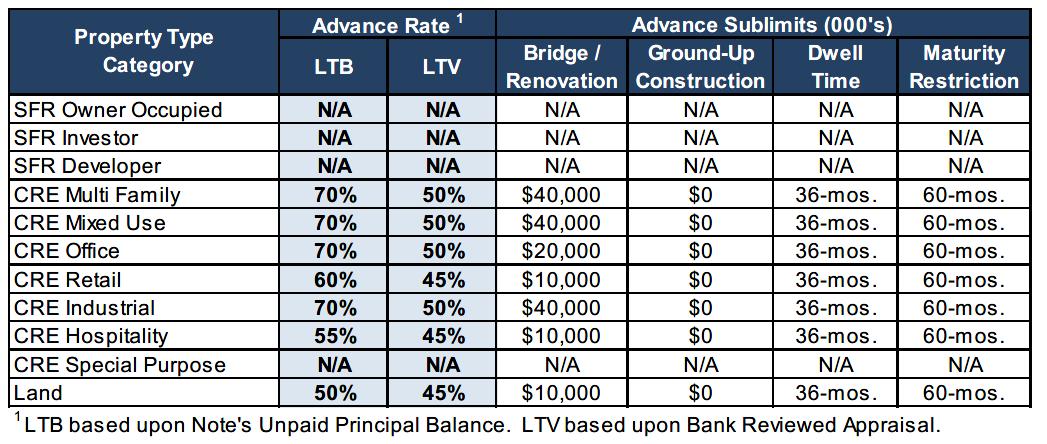

(a)The definition of “Borrowing Base” in Section 1.1 of the Loan Agreement is hereby amended and restated in its entirety as follows:

“Borrowing Base” shall mean, with respect to Eligible Notes pledged as Collateral, the lesser of (i) an amount equal to the applicable percentage of the unpaid principal balance of those Collateral loans that are deemed to be Eligible Notes by Lender, in Lender’s reasonable judgment (“LTB”), or (ii) an amount equal to the applicable percentage of the appraised value (as reflected in the most recent appraisal of the underlying real property collateral delivered by Borrower to, and accepted and approved by, Lender) of the underlying real property collateral securing those Collateral loans that are deemed to be Eligible Notes by Lender, in Lender’s reasonable judgment (“LTV”), in any event in the aggregate up to the Maximum Amount, all as such applicable percentages and amounts are set forth in the table of Borrowing Base Limits and Sublimits attached hereto as Exhibit E.

DOCPROPERTY "DocID" \* MERGEFORMAT DMFIRM #406744954 v4 2

(b)The definition of “Extension” in Section 1.1 of the Loan Agreement is hereby deleted in its entirety.

(c)The definition of “Ineligible Collateral” in Section 1.1 of the Loan Agreement is hereby amended and restated in its entirety as follows:

“Ineligible Collateral” means the following types of Collateral:

(3.)Note Mortgages that have been subordinated;

(4.)Notes not wholly owned by Borrower, including, without limitation, Notes under participation agreement or owned through joint ventures;

(5.)Notes made by Borrower or any Guarantor, or their respective officers, directors, agents, employees, or trustees, or any Affiliates of any of the foregoing;

(6.)Note Mortgages on mortgaged property with uses other than CRE Multifamily Property, CRE Mixed Use Property, CRE Office Property, CRE Retail Property, CRE Industrial Property, CRE Hospitality Property and vacant land;

(7.)Note Mortgages for ground-up construction;

(8.)Notes which have original maturities equal to or greater than the applicable amount of time set forth in Exhibit E for each of the permitted property or advance types;

(9.)Notes which have been included in the Borrowing Base for periods exceeding the maximum dwell time set forth on Exhibit E for each of the permitted property types;

(10.)Note Mortgages securing bridge or renovation loans which exceed the applicable sublimits set forth in Exhibit E for each of the permitted property types;

(11.)Note Mortgages secured by mortgaged property located outside of the one hundred (100) largest metropolitan statistical areas;

(12.)Any single Note which Advance amount would exceed $15,000,000.00;

DOCPROPERTY "DocID" \* MERGEFORMAT DMFIRM #406744954 v4 3

(13.)Except as otherwise accepted by Lender’s Division Chief Credit Officer, any single Note which Advance amount would exceed $10,000,000.00; and

(14.)Any other Collateral deemed ineligible by Lender in its reasonable discretion.

(d)The definition of “Maximum Amount” in Section 1.1 of the Loan Agreement is hereby amended and restated in its entirety as follows:

“Maximum Amount” means $40,000,000.00 unless this amount is expressly reduced or increased under the terms of this Agreement, in which event it means such lower or higher amount.

(e)The definition of “Promissory Note” in Section 1.1 of the Loan Agreement is hereby amended and restated in its entirety as follows:

“Promissory Note” means the promissory note, dated as of March 10, 2021 in the stated principal amount of the Maximum Amount, executed by Borrower and payable to the order of Lender, and all amendments, extensions, renewals, replacements, increases, and modifications thereof.

(f)Section 2.3(f) of the Loan Agreement is hereby amended and restated in its entirety as follows:

(f) Compensating Balances. In the event at any time the Borrower’s, Guarantor’s and their Affiliates’ average unrestricted aggregate deposit account balances with Lender, measured quarterly for the previous three (3) calendar months, are less than (i) $3,750,000.00 for the calendar quarter ending on June 30, 2023 or (ii) $5,000,000.00 commencing with the calendar quarter ending on September 30, 2023 and each calendar quarter thereafter , then the Stated Interest Rate set forth in the Promissory Note shall increase automatically by one-half of one percent (0.50%) per annum beginning the following quarter in which the compensating balances in this Section are not maintained. These deposit account balances will be tested quarterly and to the extent that the average unrestricted aggregate deposit account balances once again exceed $5,000,000.00, the interest rate shall be re-set to the Stated Interest Rate set forth in the Promissory Note.

(g)Section 2.8 of the Loan Agreement is hereby deleted in its entirety and replaced with “Intentionally Omitted”.

(h)Section 3.3 of the Loan Agreement is hereby amended to delete “March 10, 2023” and insert in lieu thereof “March 10, 2025”.

DOCPROPERTY "DocID" \* MERGEFORMAT DMFIRM #406744954 v4 4

(i)Exhibit E of the Loan Agreement is hereby amended and replaced in its entirety with Schedule 1 attached hereto.

5.2Modifications of the Note:

(a)The face amount of the Note is hereby amended to delete “$75,000,000.00” and insert in lieu thereof “$40,000,000.00”.

(b)The preamble is hereby amended to delete “Seventy Five Million and No/100 Dollars ($75,000,000.00)” and insert in lieu thereof “Forty Million and No/100 Dollars ($40,000,000.00)”.

(c)The definition “LIBOR Rate” in Section 1 of the Note is hereby deleted in its entirety.

(d)The following definition is hereby added to Section 1 of the Note in appropriate alphabetical order as follows:

“Term SOFR Rate” means the 1-month Term SOFR Reference Rate (“Term SOFR”) which is published for loans in United States Dollars by CME Group Benchmark Administration Limited and is obtained by Lender from Bloomberg Financial Services Systems with the code SR1M (or, if no longer available, any similar or successor publication selected by Lender).

(e)Section 3 of the Note is hereby amended and restated in its entirety as follows:

3. Stated Interest Rate. Except as provided in Section 4 below, the principal balance outstanding hereunder from time to time shall bear interest at the Stated Interest Rate. Except to the extent affected by Section 2.3(f) of the Loan Agreement, the “Stated Interest Rate” shall be equal to the greater of: (i) Term SOFR Rate plus three and one half of one percent (3.50%), which interest rate shall change when and as the Term SOFR Rate changes; or (ii) six percent (6.00%) per annum (the “Floor”).

The Term SOFR Rate shall initially be determined on the date of this Agreement and shall thereafter be adjusted monthly on the first day of each calendar month to be the Term SOFR determined by Lender to be in effect on such date. If Lender determines (which determination shall be conclusive absent manifest error) that either of the following has occurred: (i) Term SOFR ceases to exist or is no longer available; or (ii) a public announcement by the regulatory supervisor for the administrator of Term SOFR, or a determination made by Lender, that Term SOFR is no longer representative, then commencing on the next reset date, the interest rate hereunder shall be replaced with such alternate base rate and spread (collectively, “Benchmark Replacement”) as Lender determines in its sole

DOCPROPERTY "DocID" \* MERGEFORMAT DMFIRM #406744954 v4 5

discretion to be most comparable to the then-current interest rate. If the Benchmark Replacement as determined pursuant to this Section 3 would be less than the Floor, the Benchmark Replacement will be deemed to be the Floor for the purposes of this Note and the other Loan Documents.

In connection with the implementation of a Benchmark Replacement, Lender will have the right to make Benchmark Replacement Conforming Changes from time to time and, notwithstanding anything to the contrary herein or in any other Loan Document, any amendments implementing such Benchmark Replacement Conforming Changes will become effective without any further action or consent of Borrower. “Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes, such as changes to the definitions of “Business Day,” “Interest Period,” or timing and frequency of determining rates and making payments of interest, that Lender decides may be appropriate to reflect the adoption and implementation of such Benchmark Replacement and to permit the administration thereof in a manner substantially consistent with market practice (or, if the Lender decides that adoption of any portion of such market practice is not administratively feasible or if Lender determines that no market practice for the administration of such Benchmark Replacement exists, in such other manner of administration as Lender decides is reasonably necessary in connection with the administration of this Note and the other Loan Documents).

5.3Modifications to the Guaranty

(a)Recital A of the Guaranty is hereby amended to delete “$75,000,000.00” and insert in lieu thereof “$40,000,000.00”.

6.Agreement as a Loan Document. From and after the Modification Closing Date, this Agreement and any other documents and instruments executed in connection herewith shall each constitute one of the “Loan Documents.”

7.Effective Date of Agreement. This Agreement and the amendments provided for herein shall be effective as of the date set forth above, subject to the timely and complete satisfaction of each and all of the conditions precedent set forth in Section 9 of this Agreement.

8.Borrower’s Representations and Warranties. Borrower hereby represents and warrants to Lender, and covenants and agrees with Lender, as follows:

A.Borrower has full legal right, power and authority to enter into and perform this Agreement. The execution and delivery of this Agreement by Borrower and the consummation by Borrower of the transactions contemplated hereby have been duly authorized by all necessary

DOCPROPERTY "DocID" \* MERGEFORMAT DMFIRM #406744954 v4 6

action by or on behalf of Borrower. This Agreement is a valid and binding obligation of Borrower, enforceable against Borrower in accordance with its terms.

B.Neither the execution and delivery of this Agreement by Borrower, nor the consummation by Borrower of the transactions contemplated hereby, conflicts with or constitutes a violation or a default under any law applicable to Borrower, or any contract, commitment, agreement, arrangement or restriction of any kind to which Borrower is a party, by which Borrower is bound or to which any of Borrower’s property or assets is subject.

C.There are no actions, suits or proceedings pending, or to the knowledge of Borrower threatened against or affecting Borrower in relation to its obligations to Lender, or involving the validity and enforceability of this Agreement, the Loan Agreement, the Note, the Guaranty or any of the other Loan Documents, as applicable, or the priority of any liens given by Borrower to Lender in accordance with the Loan Agreement, and the other Loan Documents, at Law or in equity, or before or by any governmental agency, or which could have an adverse effect on the financial condition, operations, properties, assets, liabilities or earnings of Borrower, or the ability of Borrower to perform its obligations to Lender.

D.Borrower hereby reaffirms and confirms that the representations and warranties of Borrower contained in the Loan Documents are true, correct and complete in all respects as of the date of this Agreement.

E.Borrower is in full and complete compliance with the terms, covenants, provisions and conditions of the Loan Agreement, the Note, the Guaranty and the other Loan Documents to which it is a party.

All covenants, representations and warranties of Borrower herein are incorporated by reference and hereby made a part of the Loan Agreement and the Guaranty, as applicable.

9.Conditions Precedent to Effectiveness of Agreement. The effectiveness of this Agreement shall be expressly conditioned upon the following having occurred or Lender having received all of the following, in form and content satisfactory to Lender, in its sole and absolute discretion, and suitable for filing or recording, as the case may be, as required:

A.This Agreement, fully executed by Borrower;

B.There shall be no Event of Default by Borrower or Guarantor under any of the Loan Documents;

C.Such additional information, assignments, agreements, resolutions, certificates, reports, approvals, instruments, documents, subordination agreements, financing statements, consents and opinions as Lender may request, in its sole and absolute opinion and judgment, in connection with this Agreement and/or any of the matters which are the subject of this Agreement;

D.Payment by Borrower of a fully-earned and non-refundable extension fee (the “Extension Fee”) in the amount of $100,000.00, due upon execution and delivery of this Agreement; and

DOCPROPERTY "DocID" \* MERGEFORMAT DMFIRM #406744954 v4 7

E.Payment of any fees and costs of Lender in connection with the preparation, negotiation, administration and execution of this Agreement including, but not limited to, attorneys’ fees, and other costs and fees of other professionals retained by Lender.

10.General Release of Lender. Except as to the obligations imposed upon Lender, as provided herein, Borrower, on behalf of itself and its successors and assigns, and each of them, do each hereby forever relieve, release, acquit and discharge Lender, and its predecessors, successors and assigns, and their respective past and present attorneys, accountants, insurers, representatives, affiliates, partners, subsidiaries, officers, employees, directors, and shareholders, and each of them (collectively, the “Released Parties”), from any and all claims, debts, liabilities, demands, obligations, promises, acts, agreements, costs and expenses (including, but not limited to, attorneys’ fees), damages, injuries, actions and causes of action, of whatever kind or nature, whether legal or equitable, known or unknown, suspected or unsuspected, contingent or fixed, which Borrower now owns or holds or has at any time heretofore owned or held or may at any time hereafter own or hold against the Released Parties, or any of them, by reason of any acts, facts, transactions or any circumstances whatsoever occurring or existing through the date of this Agreement, including, but not limited to, those based upon, arising out of, appertaining to, or in connection with the Recitals above, the Loan, the Loan Documents, the facts pertaining to this Agreement, any collateral heretofore granted to Lender or granted in connection herewith, or to any other obligations of Borrower to Lender.

A.Section headings used in this Agreement are for convenience only and shall not affect the construction of this Agreement.

B.This Agreement may be executed in one or more counterparts but all of the counterparts shall constitute one agreement; provided, however, this Agreement shall not be effective and enforceable unless and until it is executed by all parties hereto.

C.This Agreement and the other documents and instruments executed in connection therewith constitute the product of the negotiation of the parties hereto and the enforcement hereof shall be interpreted in a neutral manner, and not more strongly for or against any party based upon the source of the draftsmanship hereof.

D.This Agreement shall be binding upon and inure to the benefit of Lender and Borrower, and each of them, and their respective successors and assigns, except that Borrower shall not assign its rights hereunder or any interest therein without the prior written consent of Lender.

E.This Agreement is not a novation, nor, except as expressly provided in this Agreement, is it to be construed as a release or modification of any of the terms, conditions, warranties, waivers or rights set forth in the Loan Documents. Nothing contained in this Agreement shall be deemed to constitute a waiver by Lender of any required performance by Borrower of any Event of Default or default heretofore or hereafter occurring under or in connection with the other Loan Documents. In the event there is a conflict in any term, condition or provision of this Agreement, on the one hand, and the Loan Agreement, the Guaranty, or any of the other Loan Documents, on the other hand, the terms, conditions and provisions of this Agreement are to control.

DOCPROPERTY "DocID" \* MERGEFORMAT DMFIRM #406744954 v4 8

[SIGNATURES APPEAR ON THE FOLLOWING PAGE]

DOCPROPERTY "DocID" \* MERGEFORMAT DMFIRM #406744954 v4 9

IN WITNESS WHEREOF, Borrower and Lender have executed and delivered this Agreement as of the date set forth above.

BORROWER:

INPOINT REIT OPERATING PARTNERSHIP, LP, a Delaware limited partnership

By: InPoint Commercial Real Estate Income, Inc., a Maryland corporation, its general partner

By:

Name: Jason Fruchtman

Title: Authorized Signatory

[SIGNATURES CONTINUE ON THE FOLLOWING PAGE]

[Signature Page to First Loan Modification Agreement]

LENDER:

WESTERN ALLIANCE BANK,

an Arizona corporation

By:

Name: Kenneth C. Hedberg

Title: Senior Vice President

[Signature Page to First Loan Modification Agreement]

SCHEDULE 1 TO FIRST LOAN MODIFICATION AGREEMENT

EXHIBIT E

BORROWING BASE AND SUBLIMITS

DOCPROPERTY "DocID" \* MERGEFORMAT DMFIRM #406744954 v4 Schedule 1

CONSENT AND AGREEMENT OF GUARANTOR

With respect to the “First Loan Modification Agreement” dated effective March 9, 2023 (the “Agreement”), by and between (i) INPOINT REIT OPERATING PARTNERSHIP, LP, a Delaware limited partnership (“Borrower”), and (ii) WESTERN ALLIANCE BANK, an Arizona corporation, (“Lender”), the undersigned (“Guarantor”) agrees for the benefit of Lender as follows:

1.Unless otherwise indicated, capitalized terms used in this Consent and Agreement of Guarantor (this “Consent”) will correspond to the capitalized terms used in the Agreement. Guarantor acknowledges: (i) receiving a copy of and reading the Agreement, (ii) that Guarantor is not aware of anything that disproves the accuracy of the Recitals in the Agreement, and (iii) the continuing effectiveness of the Limited Guaranty Agreement (the “Guaranty”) to which Guarantor is a party, and any other agreements, documents, or instruments securing or otherwise relating to such Guaranty previously executed and delivered by the undersigned to Lender.

2.Guarantor reaffirms (i) the representations and warrantees in the Guaranty as of the date of this Consent, and (ii) its obligations to Lender under the Guaranty, and agrees that the Guaranty shall continue in full force and effect, without waiver or modification of any kind whatsoever, and is ratified and confirmed in all respects, as modified by the Agreement.

3.Guarantor acknowledges and confirms that Guarantor has no claims, counterclaims, defenses, offsets, or adverse claims of any kind with respect to the enforcement of Lender’s rights and remedies against Borrower and against the Guarantor under the Guaranty and the other Loan Documents.

4.This Consent may be signed in any number of counterparts. Facsimile or e-mail copies of signatures on this Consent will be deemed acceptable as original signatures.

[SIGNATURES APPEAR ON THE FOLLOWING PAGES.]

DOCPROPERTY "DocID" \* MERGEFORMAT DMFIRM #406744954 v4

IN WITNESS WHEREOF, the undersigned Guarantor has executed this Consent dated effective as of the date first written above.

GUARANTOR:

INPOINT COMMERCIAL REAL ESTATE INCOME, INC., a Maryland corporation

By:

Name: Jason Fruchtman

Title: Authorized Signatory

[Signature Page to Consent and Agreement of Guarantor]