UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-40833

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

(Exact name of registrant as specified in its charter)

| |

Maryland | 32-0506267 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

2901 Butterfield Road Oak Brook, Illinois | 60523 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (800) 826-8228

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

6.75% Series A Cumulative Redeemable Preferred Stock, par value $0.001 | | ICR PR A | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | | |

Non-accelerated filer | ☒ | Smaller Reporting Company | ☒ |

| | | |

Emerging Growth Company | ☒ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 8, 2024, the Registrant had the following shares of common stock outstanding: 8,562,777 shares of Class P common stock, 290,345 shares of Class T common stock, 469,168 shares of Class I common stock, 745,881 shares of Class A common stock, 48,015 shares of Class D common stock and no shares of Class S common stock.

TABLE OF CONTENTS

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED BALANCE SHEETS

(Dollar amounts in thousands, except per share amounts)

| | | | | | | | |

| | June 30, 2024

(unaudited) | | | December 31, 2023 | |

ASSETS | | | | | | |

Cash and cash equivalents | | $ | 44,557 | | | $ | 54,143 | |

Commercial mortgage loans: | | | | | | |

Commercial mortgage loans at cost | | | 705,624 | | | | 743,852 | |

Allowance for credit losses | | | (21,218 | ) | | | (21,849 | ) |

Commercial mortgage loans at cost, net | | | 684,406 | | | | 722,003 | |

Deferred debt finance costs | | | 1,148 | | | | 604 | |

Accrued interest receivable | | | 3,810 | | | | 3,283 | |

Prepaid expenses and other assets | | | 271 | | | | 312 | |

Total assets | | $ | 734,192 | | | $ | 780,345 | |

LIABILITIES AND EQUITY | | | | | | |

Liabilities: | | | | | | |

Repurchase agreements | | $ | 422,944 | | | $ | 457,438 | |

Credit facility payable | | | — | | | | 9,498 | |

Loan participations sold, net | | | 56,226 | | | | 57,226 | |

Due to related parties | | | 1,671 | | | | 2,028 | |

Accrued interest payable | | | 2,215 | | | | 1,792 | |

Distributions payable | | | 1,051 | | | | 1,050 | |

Accrued expenses and other liabilities | | | 493 | | | | 762 | |

Total liabilities | | | 484,600 | | | | 529,794 | |

| | | | | | |

Commitments and contingencies (Note 8) | | | | | | |

| | | | | | |

Stockholders’ Equity: | | | | | | |

Preferred stock, $0.001 par value, 50,000,000 shares authorized: | | | | | | |

6.75% Series A Cumulative Redeemable Preferred Stock, $0.001 par value, 4,025,000 shares

authorized and 3,544,553 shares issued and outstanding as of June 30, 2024 and

December 31, 2023 | | | 4 | | | | 4 | |

Class P common stock, $0.001 par value, 500,000,000 shares authorized, 8,562,777 shares issued

and outstanding as of June 30, 2024 and December 31, 2023 | | | 9 | | | | 9 | |

Class A common stock, $0.001 par value, 500,000,000 shares authorized, 745,881 and 745,887

shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | | | 1 | | | | 1 | |

Class T common stock, $0.001 par value, 500,000,000 shares authorized, 290,345 shares issued

and outstanding as of June 30, 2024 and December 31, 2023 | | | — | | | | — | |

Class S common stock, $0.001 par value, 500,000,000 shares authorized, 0 shares issued

and outstanding as of as of June 30, 2024 and December 31, 2023 | | | — | | | | — | |

Class D common stock, $0.001 par value, 500,000,000 shares authorized, 48,015 shares issued

and outstanding as of June 30, 2024 and December 31, 2023 | | | — | | | | — | |

Class I common stock, $0.001 par value, 500,000,000 shares authorized, 469,168 shares issued

and outstanding as of June 30, 2024 and December 31, 2023 | | | — | | | | — | |

Additional paid in capital | | | 339,525 | | | | 339,581 | |

Accumulated deficit | | | (89,947 | ) | | | (89,044 | ) |

Total stockholders’ equity | | | 249,592 | | | | 250,551 | |

Total liabilities and stockholders’ equity | | $ | 734,192 | | | $ | 780,345 | |

The accompanying notes are an integral part of these consolidated financial statements.

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, dollar amounts in thousands, except per share amounts)

| | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | | Six months ended June 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Income: | | | | | | | | | | | | |

Interest income | | $ | 14,983 | | | $ | 17,332 | | | $ | 30,095 | | | $ | 34,186 | |

Less: Interest expense | | | (9,356 | ) | | | (10,708 | ) | | | (18,832 | ) | | | (20,937 | ) |

Net interest income | | | 5,627 | | | | 6,624 | | | | 11,263 | | | | 13,249 | |

Revenue from real estate | | | — | | | | 5,326 | | | | — | | | | 8,247 | |

Total income | | | 5,627 | | | | 11,950 | | | | 11,263 | | | | 21,496 | |

Operating expenses: | | | | | | | | | | | | |

Advisory fee | | | 799 | | | | 861 | | | | 1,604 | | | | 1,742 | |

Amortization of debt finance costs | | | 369 | | | | 507 | | | | 772 | | | | 878 | |

Directors compensation | | | 19 | | | | 21 | | | | 39 | | | | 40 | |

Professional service fees | | | 212 | | | | 186 | | | | 493 | | | | 377 | |

Real estate operating expenses | | | — | | | | 4,722 | | | | — | | | | 7,910 | |

Provision for asset impairment | | | — | | | | 6,934 | | | | — | | | | 6,934 | |

Depreciation and amortization | | | — | | | | 193 | | | | — | | | | 514 | |

Other expenses | | | 324 | | | | 475 | | | | 715 | | | | 828 | |

Total operating expenses | | | 1,723 | | | | 13,899 | | | | 3,623 | | | | 19,223 | |

Other income (loss): | | | | | | | | | | | | |

Reversal of (provision for) credit losses | | | 1,086 | | | | (13,364 | ) | | | 749 | | | | (12,965 | ) |

Total other income (loss) | | | 1,086 | | | | (13,364 | ) | | | 749 | | | | (12,965 | ) |

Net income (loss) before income taxes | | | 4,990 | | | | (15,313 | ) | | | 8,389 | | | | (10,692 | ) |

Income tax provision | | | — | | | | 22 | | | | — | | | | 22 | |

Net income (loss) | | | 4,990 | | | | (15,335 | ) | | | 8,389 | | | | (10,714 | ) |

Series A Preferred Stock dividends | | | (1,496 | ) | | | (1,496 | ) | | | (2,991 | ) | | | (2,991 | ) |

Gain on repurchase and retirement of preferred stock | | | — | | | | — | | | | — | | | | 21 | |

Net income (loss) attributable to common stockholders | | $ | 3,494 | | | $ | (16,831 | ) | | $ | 5,398 | | | $ | (13,684 | ) |

Net income (loss) attributable to common stockholders per share basic and diluted | | $ | 0.35 | | | $ | (1.66 | ) | | $ | 0.53 | | | $ | (1.35 | ) |

Weighted average number of shares of common stock | | | | | | | | | | | | |

Basic | | | 10,116,191 | | | | 10,114,470 | | | | 10,116,186 | | | | 10,113,849 | |

Diluted | | | 10,116,975 | | | | 10,114,470 | | | | 10,116,748 | | | | 10,113,849 | |

The accompanying notes are an integral part of these consolidated financial statements.

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited, dollar amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the Three Months Ended June 30, 2024 | Par Value

Preferred Stock | | Par Value

Common Stock | | | | | | | |

| Series A | | Class P | | Class A | | Class T | | Class S | | Class D | | Class I | | Additional

Paid in

Capital | | Accumulated Deficit | | Total

Stockholders’

Equity | |

Balance as of March 31, 2024 | $ | 4 | | $ | 9 | | $ | 1 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 339,554 | | $ | (90,291 | ) | $ | 249,277 | |

Offering costs | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (36 | ) | | — | | | (36 | ) |

Net income | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 4,990 | | | 4,990 | |

Common stock distributions declared | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (3,150 | ) | | (3,150 | ) |

Preferred stock distributions declared | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,496 | ) | | (1,496 | ) |

Equity-based compensation | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 7 | | | — | | | 7 | |

Balance at June 30, 2024 | $ | 4 | | $ | 9 | | $ | 1 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 339,525 | | $ | (89,947 | ) | $ | 249,592 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the Three Months Ended June 30, 2023 | Par Value

Preferred Stock | | Par Value

Common Stock | | | | | | | |

| Series A | | Class P | | Class A | | Class T | | Class S | | Class D | | Class I | | Additional

Paid in

Capital | | Accumulated Deficit | | Total

Stockholders’

Equity | |

Balance as of March 31, 2023 | $ | 4 | | $ | 9 | | $ | 1 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 339,718 | | $ | (66,049 | ) | $ | 273,683 | |

Offering costs | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (63 | ) | | — | | | (63 | ) |

Net loss | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (15,335 | ) | | (15,335 | ) |

Common stock distributions declared | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (3,150 | ) | | (3,150 | ) |

Preferred stock distributions declared | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (1,496 | ) | | (1,496 | ) |

Equity-based compensation | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 8 | | | — | | | 8 | |

Balance at June 30, 2023 | $ | 4 | | $ | 9 | | $ | 1 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 339,663 | | $ | (86,030 | ) | $ | 253,647 | |

The accompanying notes are an integral part of these consolidated financial statements.

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited, dollar amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the Six Months Ended June 30, 2024 | Par Value

Preferred

Stock | | Par Value

Common Stock | | | | | | | |

| Series A | | Class P | | Class A | | Class T | | Class S | | Class D | | Class I | | Additional

Paid in

Capital | | Accumulated Deficit | | Total

Stockholders’

Equity | |

Balance as of December 31, 2023 | $ | 4 | | $ | 9 | | $ | 1 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 339,581 | | $ | (89,044 | ) | $ | 250,551 | |

Offering costs | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (71 | ) | | — | | | (71 | ) |

Net income | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 8,389 | | | 8,389 | |

Common stock distributions declared | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (6,301 | ) | | (6,301 | ) |

Preferred stock distributions declared | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (2,991 | ) | | (2,991 | ) |

Equity-based compensation | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 15 | | | — | | | 15 | |

Balance at June 30, 2024 | $ | 4 | | $ | 9 | | $ | 1 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 339,525 | | $ | (89,947 | ) | $ | 249,592 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the Six Months Ended June 30, 2023 | Par Value

Preferred

Stock | | Par Value

Common Stock | | | | | | | |

| Series A | | Class P | | Class A | | Class T | | Class S | | Class D | | Class I | | Additional

Paid in

Capital | | Accumulated Deficit | | Total

Stockholders’

Equity | |

Balance as of December 31, 2022 | $ | 4 | | $ | 9 | | $ | 1 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 339,470 | | $ | (60,927 | ) | $ | 278,557 | |

Cumulative effect of adoption of ASU 2016-13 | | | | | | | | | | | | | | | | — | | | (5,122 | ) | | (5,122 | ) |

Total stockholders’ equity at beginning of period, as adjusted | | 4 | | | 9 | | | 1 | | | — | | | — | | | — | | | — | | | 339,470 | | | (66,049 | ) | | 273,435 | |

Proceeds from issuance of common stock | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 342 | | | — | | | 342 | |

Repurchase and retirement of preferred stock | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (104 | ) | | 21 | | | (83 | ) |

Offering costs | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (145 | ) | | — | | | (145 | ) |

Net loss | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (10,714 | ) | | (10,714 | ) |

Common stock distributions declared | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (6,297 | ) | | (6,297 | ) |

Preferred stock distributions declared | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (2,991 | ) | | (2,991 | ) |

Distribution reinvestment | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 85 | | | — | | | 85 | |

Equity-based compensation | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 15 | | | — | | | 15 | |

Balance at June 30, 2023 | $ | 4 | | $ | 9 | | $ | 1 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 339,663 | | $ | (86,030 | ) | $ | 253,647 | |

The accompanying notes are an integral part of these consolidated financial statements.

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, dollar amounts in thousands)

| | | | | | | | |

| | Six months ended June 30, | |

| | 2024 | | | 2023 | |

Cash flows from operating activities | | | | | | |

Net income (loss) | | $ | 8,389 | | | $ | (10,714 | ) |

Adjustments to reconcile net income (loss) to cash provided by operations: | | | | | | |

(Reversal of) provision for credit losses | | | (749 | ) | | | 12,965 | |

Depreciation and amortization expense | | | — | | | | 514 | |

Reduction in the carrying amount of the right-of-use asset | | | — | | | | 30 | |

Provision for asset impairment | | | — | | | | 6,934 | |

Amortization of equity-based compensation | | | 15 | | | | 15 | |

Amortization of debt finance costs to operating expense | | | 772 | | | | 878 | |

Amortization of debt finance costs to interest expense | | | — | | | | 3 | |

Amortization of origination fees | | | — | | | | (15 | ) |

Amortization of loan extension fees | | | (227 | ) | | | (371 | ) |

Changes in assets and liabilities: | | | | | | |

Accrued interest receivable | | | (527 | ) | | | (76 | ) |

Accrued expenses and other liabilities | | | (152 | ) | | | (3,060 | ) |

Accrued interest payable | | | 423 | | | | 206 | |

Due to related parties | | | (70 | ) | | | (24 | ) |

Prepaid expenses and other assets | | | 42 | | | | (941 | ) |

Net cash provided by operating activities | | | 7,916 | | | | 6,344 | |

Cash flows from investing activities: | | | | | | |

Origination/funding of commercial loans | | | (5,387 | ) | | | (13,597 | ) |

Loan extension fees received on commercial loans | | | 164 | | | | 126 | |

Principal repayments of commercial loans | | | 43,410 | | | | 66,112 | |

Escrow deposit on real estate held for sale | | | — | | | | 1,250 | |

Real estate capital expenditures | | | — | | | | (496 | ) |

Net cash provided by investing activities | | | 38,187 | | | | 53,395 | |

Cash flows from financing activities: | | | | | | |

Proceeds from issuance of common stock | | | — | | | | 342 | |

Repurchase of preferred stock | | | — | | | | (83 | ) |

Payment of offering costs | | | (90 | ) | | | (164 | ) |

Proceeds from repurchase agreements | | | 8,201 | | | | 359,951 | |

Principal repayments of repurchase agreements | | | (42,695 | ) | | | (372,764 | ) |

Principal repayments of credit facility | | | (9,498 | ) | | | — | |

Proceeds from sale of loan participations | | | — | | | | 435 | |

Principal repayments of loan participations | | | (1,000 | ) | | | (21,423 | ) |

Debt finance costs | | | (1,316 | ) | | | (1,607 | ) |

Distributions paid to common stockholders | | | (6,300 | ) | | | (6,209 | ) |

Distributions paid to preferred stockholders | | | (2,991 | ) | | | (2,991 | ) |

Net cash used in financing activities | | | (55,689 | ) | | | (44,513 | ) |

Net change in cash, cash equivalents and restricted cash | | | (9,586 | ) | | | 15,226 | |

Cash, cash equivalents and restricted cash at beginning of period | | | 54,143 | | | | 29,408 | |

Cash, cash equivalents and restricted cash at end of period | | $ | 44,557 | | | $ | 44,634 | |

Supplemental disclosure of cash flow information: | | | | | | |

Amortization of deferred exit fees due to related party | | $ | (268 | ) | | $ | (89 | ) |

Interest paid | | $ | 18,408 | | | $ | 20,918 | |

Accrued stockholder servicing fee due to related party | | $ | (19 | ) | | $ | (19 | ) |

Distribution reinvestment | | $ | — | | | $ | 85 | |

The accompanying notes are an integral part of these consolidated financial statements.

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

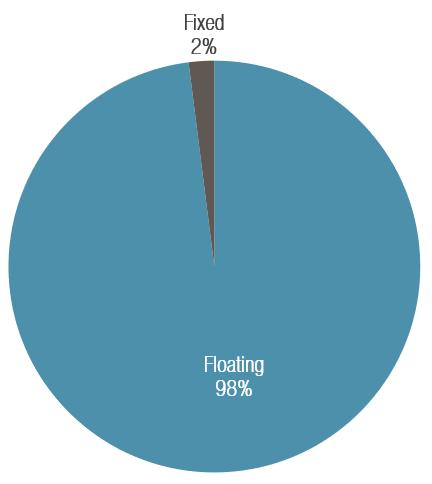

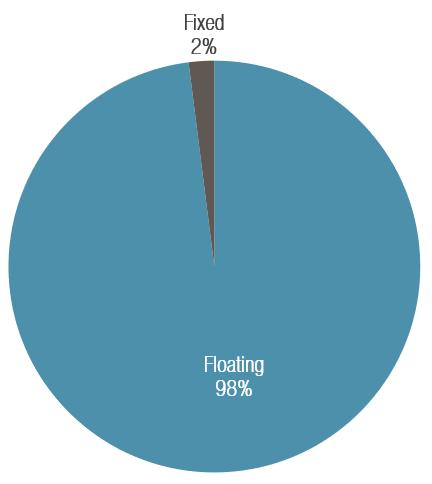

Note 1 – Organization and Business Operations

InPoint Commercial Real Estate Income, Inc. (the “Company”) was incorporated in Maryland on September 13, 2016 to originate, acquire and manage a diversified portfolio of commercial real estate (“CRE”) investments primarily comprised of (i) CRE debt, including (a) primarily floating-rate first mortgage loans, and (b) subordinate mortgage and mezzanine loans, and participations in such loans and (ii) floating-rate CRE securities, such as commercial mortgage-backed securities (“CMBS”), and senior unsecured debt of publicly traded real estate investment trusts (“REITs”). Substantially all of the Company’s business is conducted through InPoint REIT Operating Partnership, LP (the “Operating Partnership”), a Delaware limited partnership. The Company is the sole general partner and directly or indirectly holds all of the limited partner interests in the Operating Partnership. The Company has elected to be taxed as a REIT for U.S. federal income tax purposes.

The Company is externally managed by Inland InPoint Advisor, LLC (the “Advisor”), a Delaware limited liability company formed in August 2016 that is a wholly owned indirect subsidiary of Inland Real Estate Investment Corporation (“IREIC”), a member of The Inland Real Estate Group of Companies, Inc. The Advisor is responsible for coordinating the management of the day-to-day operations and originating, acquiring and managing the Company’s CRE investment portfolio, subject to the supervision of the Company’s board of directors (the “Board”). The Advisor performs its duties and responsibilities as the Company’s fiduciary pursuant to an amended and restated advisory agreement dated July 1, 2021 among the Company, the Advisor and the Operating Partnership (the “Advisory Agreement”).

The Advisor has delegated certain of its duties to SPCRE InPoint Advisors, LLC (the “Sub-Advisor”), a Delaware limited liability company formed in September 2016 that is a wholly owned subsidiary of Sound Point CRE Management, LP, pursuant to a second amended and restated sub-advisory agreement between the Advisor and the Sub-Advisor dated July 1, 2021. Among other duties, the Sub-Advisor has the authority to identify, negotiate, acquire and originate the Company’s investments and provide portfolio management, disposition, property management and leasing services to the Company. Notwithstanding such delegation to the Sub-Advisor, the Advisor retains ultimate responsibility for the performance of all the matters entrusted to it under the Advisory Agreement, including those duties which the Advisor has not delegated to the Sub-Advisor, such as (i) valuation of the Company’s assets and calculation of the Company’s net asset value (“NAV”); (ii) management of the Company’s day-to-day operations; (iii) preparation of stockholder reports and communications and arrangement of the Company’s annual stockholder meetings; and (iv) monitoring the Company’s ongoing compliance with the REIT qualification requirements for U.S. federal income tax purposes.

On October 25, 2016, the Company commenced a private offering (the “Private Offering”) of up to $500,000 in shares of Class P common stock (“Class P Shares”). The Company issued 10,258,094 Class P Shares in the Private Offering, resulting in gross proceeds of $276,681 and terminated the Private Offering on June 28, 2019.

On March 22, 2019, the Company filed a registration statement on Form S-11 (File No. 333-230465) (the “2019 Registration Statement”) with the Securities and Exchange Commission (the “SEC”) to register up to $2,350,000 in shares of common stock (the “IPO”).

On May 3, 2019, the SEC declared effective the 2019 Registration Statement and the Company commenced the IPO. The purchase price per share for each class of common stock in the IPO (Class A, Class I, Class D, Class S and Class T) varied and generally equaled the prior month’s NAV per share, as determined monthly, plus applicable upfront selling commissions and dealer manager fees. Inland Securities Corporation (the “Dealer Manager”), an affiliate of the Advisor, served as the Company’s exclusive dealer manager for the IPO on a best efforts basis.

On September 22, 2021, the Company completed an underwritten public offering of 3,500,000 shares of its 6.75% Series A Cumulative Redeemable Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), with a liquidation preference of $25.00 per share (the “Preferred Stock Offering”). In addition, on October 15, 2021, Raymond James & Associates, Inc., as a representative of the underwriters, partially exercised their over-allotment option to purchase an additional 100,000 shares of Series A Preferred Stock. The Series A Preferred Stock were issued and sold pursuant to an effective registration statement on Form S-11 (File No. 333-258802) filed with the SEC. The Company received net proceeds in the Preferred Stock Offering of $86,310, after underwriter’s discount and issuance costs, and contributed the net proceeds to the Operating Partnership in exchange for an equivalent number of Series A units in the Operating Partnership (with economic terms that mirror those of the Series A Preferred Stock). For more information on the Preferred Stock Offering, see “Note 6 – Stockholders’ Equity.”

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

On April 28, 2022, the Company filed a registration statement on Form S-11 (File No. 333-264540) (the “2022 Registration Statement”) with the SEC to register up to $2,200,000 in shares of common stock, which was declared effective by the SEC on November 2, 2022 (the “Second Public Offering” and collectively with the IPO, the “Public Offerings”).

In light of the pace of fundraising in the Second Public Offering and the amount of monthly redemption requests pursuant to the share repurchase plan (the “SRP”), which were in excess of such fundraising, on January 30, 2023, the Board approved, effective immediately, the suspension of the operation of the SRP. In connection with such suspension, the Board also approved the suspension of the sale of shares in the primary portion of the Second Public Offering (the “Primary Offering”), effective immediately, and the suspension of the sale of shares pursuant to the distribution reinvestment plan (the “DRP”), effective as of February 10, 2023. The Primary Offering, the SRP, and the DRP shall each remain suspended unless and until such time as the Board approves their resumption.

Please refer to “Note 14 – Subsequent Events” for updates to the Company’s business after June 30, 2024.

Note 2 – Summary of Significant Accounting Policies

Disclosures discussing all significant accounting policies are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on March 15, 2024 (the “Annual Report”), under the heading “Note 2 – Summary of Significant Accounting Policies.” See below for discussion of changes to the Company’s significant accounting policies for the six months ended June 30, 2024.

Basis of Accounting

The accompanying consolidated financial statements and related footnotes have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) and require management to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the financial statements and the reported amounts of income and expenses during the reported periods. Actual results could differ from such estimates.

In the opinion of management, the accompanying unaudited consolidated financial statements reflect all adjustments, which are normal and recurring in nature, necessary for fair financial statement presentation.

Cash, Cash Equivalents and Restricted Cash

Cash and cash equivalents include funds on deposit with financial institutions, including demand deposits with financial institutions with original maturities of three months or less. The account balance may exceed the Federal Deposit Insurance Corporation (“FDIC”) insurance coverage limits and, as a result, there could be a concentration of credit risk related to amounts on deposit in excess of FDIC insurance coverage limits. The Company believes that the risk will not be significant, as the Company does not anticipate the financial institutions’ non-performance.

Restricted cash represents cash the Company is required to hold in a segregated account as additional collateral on real estate securities repurchase agreements. As of June 30, 2024 and December 31, 2023, no restricted cash was held by the Company.

Allowance for Credit Losses

On January 1, 2023, the Company adopted Accounting Standards Update 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which requires companies to estimate a current expected credit loss (“CECL”) for the recognition of credit losses on financial instruments, including commercial mortgage loans, in their consolidated financial statements. The allowance for credit losses is adjusted each period for changes in expected credit losses. This replaces prior GAAP which required losses to be recognized as incurred. The Company adopted ASU 2016-13 using the modified retrospective method, therefore, the results for reporting periods prior to January 1, 2023 remain unadjusted and reported in accordance with previously applicable GAAP. In connection with the adoption of ASU 2016-13, the Company recorded a $5,122 increase to accumulated deficit with offsets on the consolidated balance sheet as noted below.

The following table illustrates the impact of adoption ASU 2016-13:

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

| | | | | | | | | | | | |

| | January 1, 2023 | |

| | As Reported Under ASU 2016-13 | | | As Reported Pre-Adoption | | | Impact of Adoption | |

Assets: | | | | | | | | | |

Allowance for credit losses | | $ | 8,375 | | | $ | 3,588 | | | $ | 4,787 | |

Liabilities: | | | | | | | | | |

Accrued expenses and other liabilities | | $ | 8,187 | | | $ | 7,852 | | | $ | 335 | |

The allowance for credit losses is recorded in accordance with ASU 2016-13, and is a valuation account that is deducted from the amortized cost basis of loans held-for-investment on the Company’s consolidated balance sheets. Changes to the allowance for credit losses are recognized through net income (loss) on the Company’s consolidated statements of operations. The allowance is based on relevant information about past events, including historical loss experience, current portfolio, market conditions and reasonable and supportable forecasts for the duration of each respective loan. All loans held-for-investment within the Company’s portfolio have some amount of expected loss to reflect the GAAP principal underlying the CECL model that all loans have some inherent risk of loss, regardless of credit quality, subordinate capital or other mitigating factors.

The Company’s loans typically include commitments to fund incremental proceeds to its borrowers over the life of the loan. Those future funding commitments are also subject to an allowance for credit losses. The allowance for credit losses related to future loan fundings is recorded as a component of “Accrued expenses and other liabilities” on the Company’s consolidated balance sheets, and not as an offset to the related loan balance. This allowance for credit losses is estimated using the same process outlined below for the Company’s outstanding loan balances, and changes in this component of the allowance for credit losses similarly flow through the Company’s consolidated statements of operations.

The allowance for credit losses is estimated on a quarterly basis and represents management’s estimates of current expected credit losses in the Company’s investment portfolio. Pools of loans with similar risk characteristics are collectively evaluated while loans that no longer share risk characteristics with loan pools are evaluated individually. Estimating an allowance for credit losses is inherently subjective, as it requires management to exercise significant judgment in establishing appropriate factors used to determine the allowance and a variety of subjective assumptions, including (i) determination of relevant historical loan loss data sets, (ii) the expected timing and amount of future loan fundings and repayments, (iii) the current credit quality of loans and operating performance of loan collateral and the Company’s expectations of performance, and (iv) selecting the forecast for macroeconomic conditions.

The Company estimates the analytical portion of its allowance for credit losses by using a probability-weighted quantitative analytical model that considers the likelihood of default and loss-given-default for each individual loan. The analytical model incorporates a third-party licensed database for over 100,000 commercial real estate loans. The Company licenses certain macroeconomic financial forecasts from a third-party to inform its view of the potential future impact that broader macroeconomic conditions may have on the performance of the loans held-for-investment. These macroeconomic factors include unemployment rates, interest rates, price indices for commercial property and other factors. The Company may use one or more of these forecasts in the process of estimating its allowance for credit losses. Selection of these economic forecasts requires significant judgment about future events that, while based on the information available to the Company as of the balance sheet date, are ultimately unknowable with certainty, and the actual economic conditions impacting the Company’s portfolio could vary significantly from the estimates the Company made for the periods presented. Significant inputs to the Company’s estimate of the allowance for credit losses include the reasonable and supportable forecast period and loan specific factors such as debt service coverage ratio, or DSCR, loan-to-value ratio, or LTV, remaining contractual loan term, property type and others. In addition, the Company also considers relevant loan-specific qualitative factors to estimate its allowance for credit losses.

Accounting Pronouncements Recently Issued but Not Yet Effective

In November 2023, the Financial Accounting Standards Board (the “FASB”) issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which requires a public entity to disclose significant segment expenses and other segment items on an annual and interim basis and to provide in interim periods all disclosures about a reportable segment’s profit or loss and assets that are currently required annually. Public entities with a single reportable segment are required to provide the new disclosures and all the disclosures required under ASC 280. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023 and interim periods within fiscal years beginning after December 15, 2024, and early adoption is permitted. The amendments should be applied retrospectively to all periods presented in the financial statements, unless it is impracticable. The Company is currently evaluating the impact of ASU 2023-07 on the Company’s consolidated financial statements.

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. ASU 2023-09 improves the transparency of income tax disclosures related to rate reconciliation and income taxes. ASU 2023-07 is effective for annual periods beginning after December 15, 2024. Early adoption is permitted for annual financial statements that have not yet been issued or made available for issuance. The amendments should be applied prospectively, however retrospective application is permitted. The Company is currently evaluating the impact of ASU 2023-09 on the Company’s consolidated financial statements.

Note 3 – Commercial Mortgage Loans Held for Investment

The following tables show a summary of the Company’s commercial mortgage loans held for investment as of June 30, 2024 and December 31, 2023:

June 30, 2024

| | | | | | | | | | | | | | | | | | | | | |

Loan Type (1) | Number

of Loans | | Principal

Balance | | Unamortized (fees)/costs, net | | Allowance for credit losses | | Carrying

Value | | Weighted Average

Interest Rate (2) | | Weighted Average

Years to Maturity (3) | |

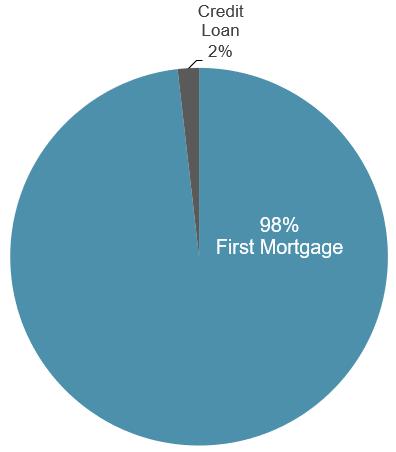

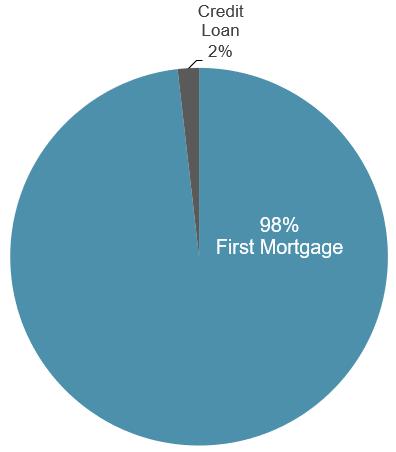

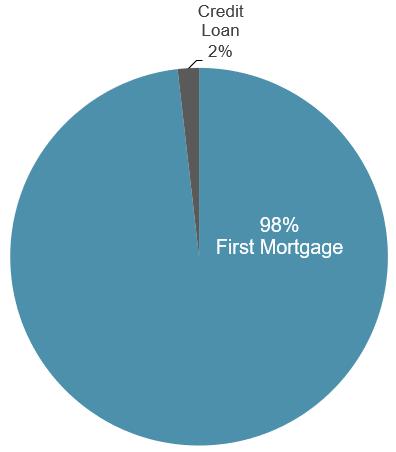

First mortgage loans | | 31 | | $ | 691,356 | | $ | 768 | | $ | (17,189 | ) | $ | 674,935 | | | 7.8 | % | | 0.6 | |

Credit loans | | 2 | | | 13,500 | | | — | | | (4,029 | ) | | 9,471 | | | 9.6 | % | | 1.9 | |

Total and average | | 33 | | $ | 704,856 | | $ | 768 | | $ | (21,218 | ) | $ | 684,406 | | | 7.9 | % | | 0.6 | |

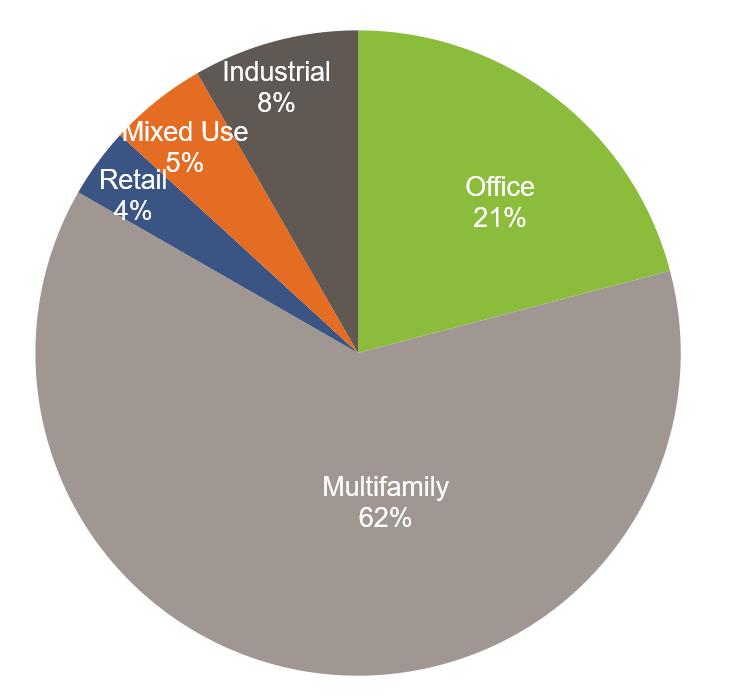

December 31, 2023

| | | | | | | | | | | | | | | | | | | | | |

Loan Type (1) | Number

of Loans | | Principal

Balance | | Unamortized (fees)/costs, net | | Allowance for credit losses | | Carrying

Value | | Weighted Average

Interest Rate (2) | | Weighted Average

Years to Maturity (3) | |

First mortgage loans | | 34 | | $ | 729,380 | | $ | 972 | | $ | (21,809 | ) | $ | 708,543 | | | 8.8 | % | | 0.9 | |

Credit loans | | 2 | | | 13,500 | | | — | | | (40 | ) | | 13,460 | | | 9.6 | % | | 2.4 | |

Total and average | | 36 | | $ | 742,880 | | $ | 972 | | $ | (21,849 | ) | $ | 722,003 | | | 8.8 | % | | 0.9 | |

(1)First mortgage loans are first position mortgage loans and credit loans are mezzanine and subordinated loans.

(2)Weighted average interest rate is based on the loan spreads plus the applicable indices as of the last interest reset date, which is typically the 15th of each month. On June 15, 2024, the one-month term USD Secured Overnight Financing Rate (“SOFR”) rate reset to 5.33%. On December 15, 2023, the SOFR rate reset to 5.36%. Weighted average interest rate excludes maturity default interest and interest on loans placed on nonaccrual status.

(3)Weighted average years to maturity excludes allowable extensions on the loans.

For the six months ended June 30, 2024, the activity in the Company’s commercial mortgage loans, held-for-investment portfolio was as follows:

| | | | | | | | | | | | |

| | Commercial mortgage loans at cost | | | Allowance for credit losses | | | Carrying Value | |

Balance at Beginning of Year | | $ | 743,852 | | | $ | (21,849 | ) | | $ | 722,003 | |

Loan originations/advances | | | 5,387 | | | | — | | | | 5,387 | |

Principal repayments | | | (43,410 | ) | | | — | | | | (43,410 | ) |

Amortization of loan origination and deferred exit fees | | | 287 | | | | — | | | | 287 | |

Origination fees and extension fees received on commercial loans | | | (492 | ) | | | — | | | | (492 | ) |

Reversal of credit losses | | | — | | | | 631 | | | | 631 | |

Balance at End of Period | | $ | 705,624 | | | $ | (21,218 | ) | | $ | 684,406 | |

Allowance for Credit Losses

The following table presents the activity in the Company’s allowance for credit losses for the six months ended June 30, 2024:

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

| | | | | | | | | | | | |

| | Commercial Mortgage Loans | | | Unfunded Loan Commitments (1) | | | Total | |

Balance at beginning of period | | $ | (21,849 | ) | | $ | (289 | ) | | $ | (22,138 | ) |

Reversal of credit losses | | | 631 | | | | 118 | | | | 749 | |

Ending allowance for credit losses | | $ | (21,218 | ) | | $ | (171 | ) | | $ | (21,389 | ) |

(1)The reserve for expected credit losses related to unfunded loan commitments is recorded in “accrued expenses and other liabilities” on the consolidated balance sheets following the adoption of ASU 2016-13 on January 1, 2023.

The following table presents the activity in the Company’s allowance for credit losses for the six months ended June 30, 2023:

| | | | | | | | | | | | |

| | Commercial Mortgage Loans | | | Unfunded Loan Commitments (1) | | | Total | |

Balance at beginning of period | | $ | (3,588 | ) | | $ | — | | | $ | (3,588 | ) |

Adoption of ASU 2016-13 | | | (4,787 | ) | | | (335 | ) | | | (5,122 | ) |

Balance at beginning of period after adoption | | | (8,375 | ) | | | (335 | ) | | | (8,710 | ) |

Provision for credit losses |

| | (12,962 | ) | | | (3 | ) | | | (12,965 | ) |

Ending allowance for credit losses |

| $ | (21,337 | ) | | $ | (338 | ) | | $ | (21,675 | ) |

(1)The reserve for expected credit losses related to unfunded loan commitments is recorded in “accrued expenses and other liabilities” on the consolidated balance sheets following the adoption of ASU 2016-13 on January 1, 2023.

As of June 30, 2024, the Company had a total CECL reserve of $21,389, which included an asset-specific component of $16,740 related to seven loans. During the six months ended June 30, 2024, the Company decreased the CECL reserve by $749. This CECL reserve reflects certain loans assessed for impairment in the Company’s portfolio as well as reserves determined based on an analysis of macroeconomic conditions.

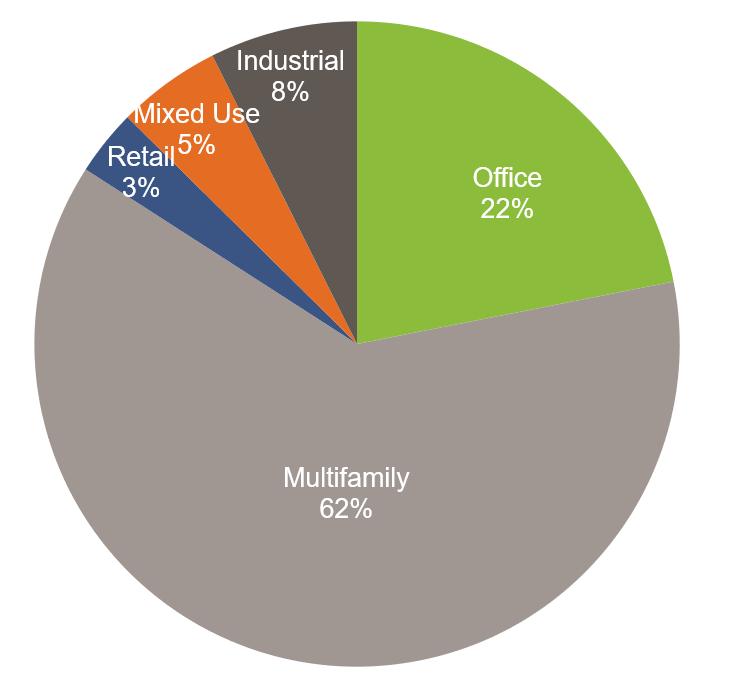

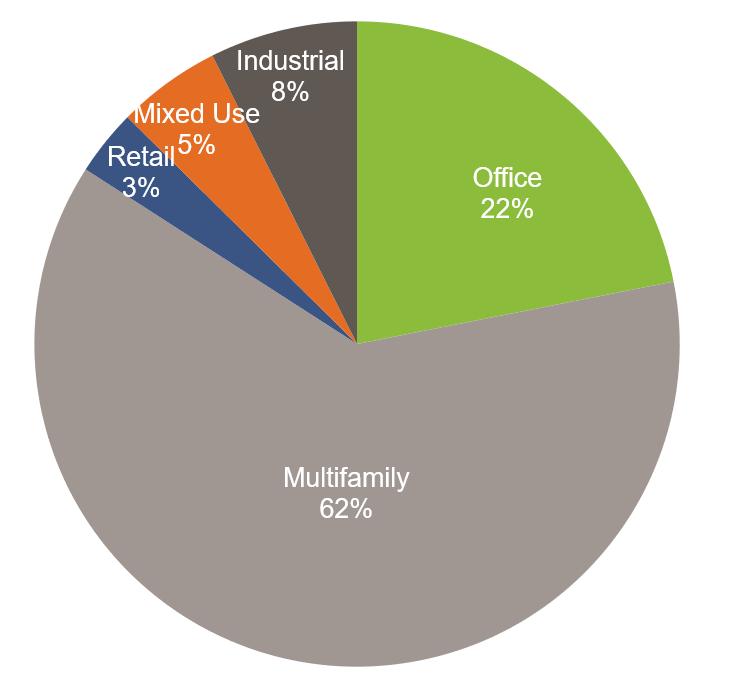

During the six months ended June 30, 2024, the Company recorded a net increase of $474 in the asset-specific component of the CECL reserve. As of June 30, 2024, the asset-specific component relates to three loans secured by office properties and four loans secured by multifamily properties. Since December 31, 2023, the Company observed an improvement in the valuation of the properties securing four loans resulting in a reduction in the asset-specific reserve of $7,231. This was offset by the addition of $7,705 in asset-specific reserve related to four additional loans.

As of June 30, 2023, the Company had a total CECL reserve of $21,675, which included an asset specific component of $11,591 related to five loans. During the six-months ended June 30, 2023, the Company increased the CECL reserve by $18,087, which included $5,122 from adoption of ASU 2016-13 and $12,965 in provision for credit losses bringing the total CECL reserve to $21,675. This CECL reserve reflects certain loans assessed for impairment in the Company’s portfolio as well as reserves determined based on an analysis of macroeconomic conditions. During the six-months ended June 30, 2023, the Company recorded a net increase of $11,591 in the asset-specific component of the CECL reserve. The increase was primarily due to four loans secured by office properties and one loan secured by a multifamily property. While all loans were current on their debt service, the Company observed a decline in the estimated fair value of the collateral since the quarter ended March 31, 2023 due to macroeconomic conditions making the value of the collateral less than the outstanding balances on these loans as of June 30, 2023.

Credit Characteristics

As part of the Company’s process for monitoring the credit quality of its investments, it performs a quarterly asset review of the investment portfolio and assigns risk ratings to each of its loans and certain securities it may own, such as CMBS. Risk factors include payment status, lien position, borrower financial resources and investment in collateral, collateral type, project economics and geographic location, as well as national and regional economic factors. To determine the likelihood of loss, the loans are rated on a 5-point scale as follows:

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

| |

Investment Grade | Investment Grade Definition |

1 | Investment exceeding fundamental performance expectations and/or capital gain expected. Trends and risk factors since time of investment are favorable. |

2 | Performing consistent with expectations and a full return of principal and interest expected. Trends and risk factors are neutral to favorable. |

3 | Performing investment requiring closer monitoring. Trends and risk factors show some deterioration. Collection of principal and interest is still expected. |

4 | Underperforming investment with the potential of some interest loss but still expecting a positive return on investment. Trends and risk factors are negative. |

5 | Underperforming investment with expected loss of interest and some principal. |

All investments are assigned an initial risk rating of 2 at origination or acquisition.

As of June 30, 2024, 16 loans had a risk rating of 2, nine had a risk rating of 3, four had a risk rating of 4 and four had a risk rating of 5. As of December 31, 2023, 24 loans had a risk rating of 2, seven had a risk rating of 3, three had a risk rating of 4 and two had a risk rating of 5.

As of June 30, 2024, the Company has established an asset-specific CECL reserve of $16,740 related to seven loans. Below is a summary of the status of each of the loans:

•A senior loan secured by a multifamily property located in Portland, OR with an outstanding balance of $29,476 and no unfunded commitment was extended in December 2023 to May 9, 2024 to provide the sponsor time to stabilize the rent roll and eventually sell the property. The Company established an interest reserve through maturity that was added to the principal balance in the amount of $1,750. The borrower was unable to sell the property or pay-off the loan at maturity. The Company has begun foreclosure proceedings that are expected to conclude in October 2024. The loan is on nonaccrual status and the Company has recorded an asset-specific CECL reserve of $6,900 on this loan as of June 30, 2024. The loan has a risk rating of 5 as of June 30, 2024.

•A senior loan secured by an office property in Reston, VA with an outstanding loan balance of $13,113, no unfunded commitment and a maturity date of March 9, 2024. The Company has been unsuccessful in negotiating a loan extension with the sponsor. The loan was placed on nonaccrual status as of February 1, 2024. During June 2024, the Company received a letter of intent to purchase the loan at par and the loan sale agreement was signed on August 5, 2024. The Company expects to close the sale in the third quarter of 2024 and, therefore, removed the $3,187 asset-specific CECL reserve that was recorded as of March 31, 2024. The loan has a risk rating of 5 as of June 30, 2024.

•A senior loan secured by two office properties located in Addison, TX with an outstanding balance of $24,411 and no unfunded commitment was in maturity default since September 9, 2023. The loan was on nonaccrual status and the Company had recorded an asset-specific CECL reserve of $281 on this loan as of June 30, 2024. The loan has a risk rating of 5 as of June 30, 2024. On July 2, 2024, the Company foreclosed on the two properties securing the loan. The Company intends to hold these properties as real estate held for use with the intent to eventually sell when the market improves.

•A senior loan secured by an office property located in Charlotte, NC with an outstanding balance of $22,616, no unfunded commitment and a maturity date of October 9, 2025 for which the Company has recorded an asset-specific CECL reserve of $1,854 as of June 30, 2024 as the estimated value of the property securing the loan was below the loan balance. The loan has a risk rating of 3 as of June 30, 2024.

•A senior loan secured by a multifamily property located in Converse, TX with an outstanding balance of $25,696, an unfunded commitment of $114 and a maturity date of November 9, 2024 for which the Company has recorded an asset-specific CECL reserve of $178 as of June 30, 2024 as the estimated value of the property securing the loan was below the loan balance. The loan has a risk rating of 2 as of June 30, 2024.

•A senior loan secured by a multifamily property located in Atlanta, GA with an outstanding balance of $39,967, an unfunded commitment of $33 and a maturity date of December 9, 2024 for which the Company has recorded an asset-specific CECL reserve of $2,530 as of June 30, 2024 as the estimated value of the property securing the loan was below the loan balance. The loan has a risk rating of 2 as of June 30, 2024.

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

•A senior loan secured by a multifamily property located in Shenandoah, TX with an outstanding balance of $29,070, an unfunded commitment of $815 and a maturity date of March 9, 2025 for which the Company has recorded an asset-specific CECL reserve of $997 as of June 30, 2024 as the estimated value of the property securing the loan was below the loan balance. The loan has a risk rating of 2 as of June 30, 2024.

•A credit loan secured by an office property located in Las Vegas, NV with an outstanding balance of $6,000, no unfunded commitment and a maturity date of October 6, 2024 for which the Company has recorded an asset-specific CECL reserve of $4,000 as of June 30, 2024. The office property has a single tenant that will vacate the property at the end of its lease term, which is after the loan maturity date. The Company believes the sponsor will have difficulty refinancing the loan at maturity without a long-term tenant and, as such, has recorded an asset-specific CECL reserve. The loan has a risk rating of 5 as of June 30, 2024. The loan was placed on nonaccrual status effective July 1, 2024.

During the three and six months ended June 30, 2024, the Company recognized $0 and $123, respectively, in interest income related to the nonaccrual status loans. During the three and six months ended June 30, 2024, there was no reversal of interest income as a result of placing the loans on nonaccrual status. For the three and six months ended June 30, 2024, the total interest income forgone on the loans on nonaccrual status was $1,602 and $3,082, respectively.

Loan Modifications

The Company may amend or modify a loan based on its specific facts and circumstances. These modifications are often in the form of a term extension to provide the borrower additional time to refinance or sell the collateral property in order to repay the principal balance of the loan. Such extensions are generally made at the loan’s contractual interest rate and may require an extension fee be paid to the Company. During the three and six months ended June 30, 2024, the Company made one such modification which is disclosable under ASU 2022-02, Troubled Debt Restructurings and Vintage Disclosures, as it was considered an other-than-insignificant payment delay for a borrower experiencing financial difficulty. In this instance, the Company granted a two-year term extension, which can be further extended by one year subject to certain terms and conditions, for a senior loan secured by an office property located in Charlotte, NC described above. The Company waived maturity default interest of $738 on the loan. No principal was forgiven as a result of the modification. The modification provides for payment-in-kind of any accrued interest that exceeds a per annum rate of 4%. The loan’s modified terms were included in the determination of the CECL reserve. The loan had an amortized cost basis of $20,762, which is net of $1,854 of asset-specific CECL reserve on the loan, representing 3.0% of the Company’s commercial mortgage loans as of June 30, 2024. During the three and six months ended June 30, 2023, the Company made no such modifications which are disclosable under ASU 2022-02, Troubled Debt Restructurings and Vintage Disclosures.

Note 4 – Repurchase Agreements and Credit Facilities

Commercial Mortgage Loans

On February 15, 2018, the Company, through a wholly owned subsidiary, entered into a master repurchase agreement (the “Atlas Repo Facility”) with Column Financial, Inc. as administrative agent for certain of its affiliates. As the Company’s business has grown, it has increased the borrowing limit and extended the maturity. The most recent extension was in November 2023 for a twelve-month term and the maximum advance amount was reduced to $100,000. On February 8, 2023, Column Financial, Inc. and affiliated parties sold and assigned their interest in the Atlas Repo Facility to Atlas Securitized Products Investments 2, L.P. (“Atlas”) with no changes to the terms of the Atlas Repo Facility. Advances under the Atlas Repo Facility accrue interest at a per annum annual rate equal to SOFR plus 2.50% to 3.00% with a 0.15% to 0.25% floor. The Company paid off the outstanding balance on the Atlas Repo Facility in May 2023 and had no outstanding balance as of June 30, 2024. As there were no borrowings outstanding, the Company was not subject to any financial covenants.

On May 6, 2019, the Company, through a wholly owned subsidiary, entered into an uncommitted master repurchase agreement (the “JPM Repo Facility”) with JPMorgan Chase Bank, National Association (“JPM”). The JPM Repo Facility provides up to $150,000 in advances that the Company expects to use to finance the acquisition or origination of eligible loans and participation interests therein. Advances made prior to December 2021 under the JPM Repo Facility accrue interest at per annum rates equal to the sum of (i) the applicable one-month USD London Interbank Offered Rate (“LIBOR”) index rate plus (ii) a margin of between 1.75% to 2.50% with no floor, depending on the attributes of the purchased assets. Advances made subsequent to December 2021 under the JPM Repo Facility accrue interest at per annum rates equal to the sum of SOFR plus an agreed upon margin. As of June 30, 2024, all of the advances made under the JPM Repo Facility were indexed to SOFR and have margins between 1.85% and 2.85% with a floor between 0.00% to 2.00%. In May 2022, the maturity date of the JPM Repo Facility was extended to May 6, 2023. On May 5, 2023, the Company entered into an

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

amendment that extended the maturity date to May 6, 2026, with the option to extend the maturity date further to May 6, 2028 subject to two optional one-year extensions. The amendment also increased the maximum facility amount to $526,076. The Company used the increased capacity to pay off the balance on the Atlas Repo Facility. The JPM Repo Facility is subject to certain financial covenants. The Company was in compliance with all financial covenant requirements as of June 30, 2024 and December 31, 2023.

On March 10, 2021, the Company, through a wholly owned subsidiary, entered into a loan and security agreement and a promissory note (collectively, the “WA Credit Facility”) with Western Alliance Bank (“Western Alliance”). The WA Credit Facility provides for loan advances up to the lesser of $75,000 or the borrowing base. The borrowing base consists of eligible assets pledged to and accepted by Western Alliance in its discretion up to the lower of (i) 60% to 70% of loan-to-unpaid balance or (ii) 45% to 50% of the loan-to-appraised value (depending on the property type underlying the asset, for both (i) and (ii)). Assets that would otherwise be eligible become ineligible after being pledged as part of the borrowing base for 36 months. Advances under the WA Credit Facility accrue interest at an annual rate equal to one-month LIBOR plus 3.25% with a floor of 0.75%. The initial maturity date of the WA Credit Facility was March 10, 2023. On March 9, 2023, the Company extended the maturity date of the WA Credit Facility to March 10, 2025, modified that loan advances are up to the lesser of $40,000 or the borrowing base, and changed the index rate from LIBOR to SOFR. In addition, the spread increased to 3.50% and the floor to 2.50%. The Company has an option to convert the loan made pursuant to the WA Credit Facility upon its initial maturity to a term loan with the same interest rate and floor and a maturity of two years in exchange for, among other things, a conversion fee of 0.25% of the outstanding amount at the time of conversion. The WA Credit Facility requires maintenance of an average unrestricted aggregate deposit account balance with Western Alliance of not less than $3,750, until the calendar quarter ending on June 30, 2023 and not less than $5,000 commencing with the calendar quarter ending on September 30, 2023. Failure to meet the minimum deposit balance will result in, among other things, the interest rate of the WA Credit Facility increasing by 0.50% per annum for each quarter in which the compensating balances are not maintained. The Company paid off the outstanding balance on the WA Credit Facility in May 2024 and had no outstanding balance as of June 30, 2024. As there were no borrowings outstanding, the Company was not subject to any financial covenants.

The JPM Repo Facility, Atlas Repo Facility and WA Credit Facility (collectively, the “Facilities”) are used to finance eligible loans and each act in the manner of a revolving credit facility that can be repaid as the Company’s assets are paid off and re-drawn as advances against new assets.

The details of the Facilities as of June 30, 2024 and December 31, 2023 are as follows:

| | | | | | | | | | | | | | | | | | | | | | |

June 30, 2024 | | | | | | | | | | | | | Weighted Average | |

| Committed Financing | | | Amount

Outstanding (1) | | | Accrued

Interest

Payable | | | Collateral

Pledged | | | Interest

Rate | | Days to

Maturity | |

| | | | | | | | | | | | | | | | |

Atlas Repo Facility | $ | 100,000 | | | $ | — | | | $ | — | | | $ | — | | | | — | | | — | |

JPM Repo Facility | | 526,076 | | | | 422,944 | | | | 1,181 | | | | 578,485 | | | | 7.75 | % | | 1,406 | |

Total Repurchase Facilities — commercial mortgage loans | | 626,076 | | | | 422,944 | | | | 1,181 | | | | 578,485 | | | | 7.75 | % | | 1,406 | |

WA Credit Facility | | 40,000 | | | | — | | | | — | | | | — | | | | — | | | — | |

| $ | 666,076 | | | $ | 422,944 | | | $ | 1,181 | | | $ | 578,485 | | | | 7.75 | % | | 1,406 | |

| | | | | | | | | | | | | | | | | | | | | | |

December 31, 2023 | | | | | | | | | | | | | Weighted Average | |

| Committed Financing | | | Amount

Outstanding (1) | | | Accrued

Interest

Payable | | | Collateral

Pledged | | | Interest

Rate | | Days to

Maturity | |

Atlas Repo Facility | $ | 100,000 | | | $ | — | | | $ | — | | | $ | — | | | | — | | | — | |

JPM Repo Facility | | 526,076 | | | | 457,438 | | | | 1,385 | | | | 644,201 | | | | 7.78 | % | | 1,588 | |

Total Repurchase Facilities — commercial mortgage loans | | 626,076 | | | | 457,438 | | | | 1,385 | | | | 644,201 | | | | 7.78 | % | | 1,588 | |

WA Credit Facility | | 40,000 | | | | 9,498 | | | | 42 | | | | 13,647 | | | 9.34% (2) | | | 435 | |

| $ | 666,076 | | | $ | 466,936 | | | $ | 1,427 | | | $ | 657,848 | | | | 7.81 | % | | 1,565 | |

(1)Excluding $0 of unamortized debt issuance costs as of June 30, 2024 and December 31, 2023.

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

(2)Includes 0.50% additional interest rate during the third and fourth quarters of 2023 as the minimum deposit balance was not met by the Company as of June 30, 2023.

Note 5 – Loan Participations Sold, Net

On November 15, 2021, the Company sold a non-recourse senior participation interest in nine first mortgage loans to a third party. Under the loan participation agreement, in the event of default by the underlying mortgagor, any amounts paid are first allocated to the third party before any amounts are allocated to the Company’s subordinate interest. The Company, as the directing participant in the loan participation agreement, is entitled to exercise, without the consent of the third party, each of the consent approval and control rights under the applicable underlying mortgage loan documents with a few exceptions. The Company requires the third party’s approval for any modification or amendment to the loan, a bankruptcy plan for an underlying mortgagor where the third party would incur an out-of-pocket loss, or any transfer of the underlying mortgaged property if the Company’s approval is required by the underlying mortgage documents. The Company remains the directing participant unless certain conditions are met related to losses on the property or if the mortgagor is an affiliate of the Company. In the former case, the Company may post cash or short-term U.S. government securities as collateral to retain the rights of the directing participant.

The third party, as the senior participation interest holder, receives interest and principal payments from the borrower until they receive the amounts to which they are entitled. All expenses or losses on the underlying mortgages are allocated first to the Company and then to the third party. If the underlying mortgage is in default, the Company will have the option to purchase the third party’s participation interest and remove it from the loan participation agreement.

The financing or transfer of a portion of a loan by the non-recourse sale of a senior interest in the loan through a participation agreement generally does not qualify as a sale under GAAP. Therefore, in this instance, the Company presents the whole loan as an asset and the loan participation sold as a liability on the consolidated balance sheet until the loan is repaid. The obligation to pay principal and interest on these liabilities is generally based on the performance of the related loan obligation. The gross presentation of loan participations sold does not impact stockholders’ equity or net income.

The following tables detail the Company’s loan participations sold as of June 30, 2024 and December 31, 2023:

| | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 | |

Loan Participations Sold | | Count | | | Principal Balance | | | Book Value | | | Yield/Cost (1) | | Guarantee (2) | | Weighted Average Maximum Maturity (4) | |

Total Loans | | | 4 | | | $ | 70,282 | | | $ | 68,262 | | | SOFR+3.5% | | n/a | | | 0.19 | |

Senior participations (3) | | | 4 | | | $ | 56,226 | | | $ | 56,226 | | | SOFR+2.0% | | n/a | | | 0.19 | |

| | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 | |

Loan Participations Sold | | Count | | | Principal Balance | | | Book Value | | | Yield/Cost (1) | | Guarantee (2) | | Weighted Average Maximum Maturity (4) | |

Total Loans | | | 4 | | | $ | 71,532 | | | $ | 65,435 | | | SOFR+3.5% | | n/a | | | 0.11 | |

Senior participations (3) | | | 4 | | | $ | 57,226 | | | $ | 57,226 | | | SOFR+2.0% | | n/a | | | 0.11 | |

____________ | | | | | | | | | | | | | | | | |

(1)The yield/cost is the present value of all future principal and interest payments on the loan or participation interest and does not include any origination fees or deferred commitment fees. The yield/cost excludes maturity default interest and interest on loans placed on nonaccrual status.

(2)As of June 30, 2024 and December 31, 2023, the loan participations sold were non-recourse to the Company.

(3)During the six months ended June 30, 2024 and 2023, the Company recorded $1,456 and $2,988 of interest expense related to loan participations sold, respectively.

(4)Based on the furthest maximum maturity date of all the loans subject to the participation agreement.

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

Note 6 – Stockholders’ Equity

Preferred Stock Offering

On September 22, 2021, the Company issued and sold 3,500,000 shares of the Series A Preferred Stock at a public offering price of $25.00 per share. In addition, on October 15, 2021, Raymond James & Associates, Inc., as representative of the underwriters, partially exercised their over-allotment option to purchase an additional 100,000 shares of Series A Preferred Stock. The Series A Preferred Stock were issued and sold pursuant to an effective registration statement on Form S-11 (File No. 333-258802) filed with the SEC. The Company received net proceeds of approximately $86,310, after underwriter’s discount and issuance costs, and contributed the net proceeds to the Operating Partnership in exchange for an equivalent number of Series A units in the Operating Partnership.

Dividends on the Series A Preferred Stock are cumulative and payable quarterly in arrears at a rate per annum equal to 6.75% per annum of the $25.00 liquidation preference (the “Initial Rate”). Subject to certain exceptions, upon a Downgrade Event (as such terms are defined in the Articles Supplementary designating the Series A Preferred Stock (the “Articles Supplementary”)) or where any shares of the Series A Preferred Stock remain outstanding after September 22, 2026, the Series A Preferred Stock will thereafter accrue cumulative cash dividends at a rate higher than the Initial Rate.

Subject to certain exceptions, upon the occurrence of a Change of Control, each holder of shares of Series A Preferred Stock will have the right to convert some or all of the Series A Preferred Stock held by such holder into a number of the Company’s shares of Class I common stock as provided for in the Articles Supplementary.

The Company may not redeem the Series A Preferred Stock prior to September 22, 2026, except in limited circumstances relating to maintaining the Company’s qualification as a REIT and in connection with a Change of Control. On and after September 22, 2026, the Company may, at its option, redeem the Series A Preferred Stock, in whole or from time-to-time in part, at a price of $25.00 per share of Series A Preferred Stock plus an amount equal to accrued and unpaid dividends (whether or not declared), if any. The Series A Preferred Stock has no maturity date and will remain outstanding indefinitely unless redeemed by the Company or converted by the holder pursuant to its terms (as set forth in the Articles Supplementary).

On August 11, 2022, the Board authorized and approved a share repurchase program (the “Series A Preferred Repurchase Program”) pursuant to which the Company was permitted to repurchase up to the lesser of 1,000,000 shares or $15,000 of the outstanding shares of the Company’s Series A Preferred Stock through December 31, 2022. On November 10, 2022, the Board approved to extend the Series A Preferred Repurchase Program through December 31, 2023. Under the Series A Preferred Repurchase Program, repurchases of shares of the Company’s Series A Preferred Stock were to be made at management’s discretion from time to time through open market purchases, privately-negotiated transactions, block purchases or otherwise in accordance with applicable federal securities laws. During the three and six months ended June 30, 2024, the Company repurchased and retired zero shares of Series A Preferred Stock. During the three and six months ended June 30, 2023, the Company repurchased and retired zero shares and 4,143 shares, respectively, of Series A Preferred Stock resulting in a gain of zero and $21, respectively, from these repurchases. On January 30, 2023, the Board approved the termination of the Series A Preferred Repurchase Program.

The Series A Preferred Stock is listed on the New York Stock Exchange under the symbol ICR PR A.

Share Activity for Common Stock and Preferred Stock

The following tables detail the change in the Company’s outstanding shares of all classes of common and preferred stock, including restricted common stock:

| | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | Common Stock | |

Six months ended June 30, 2024 | Series A | | Class P | | Class A | | Class T | | Class S | | Class D | | Class I | |

Beginning balance | | 3,544,553 | | | 8,562,777 | | | 745,887 | | | 290,345 | | | — | | | 48,015 | | | 469,168 | |

Administrative correction | | — | | | — | | | (6 | ) | | — | | | — | | | — | | | — | |

Ending balance | | 3,544,553 | | | 8,562,777 | | | 745,881 | | | 290,345 | | | — | | | 48,015 | | | 469,168 | |

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | Common Stock | |

Six months ended June 30, 2023 | Series A | | Class P | | Class A | | Class T | | Class S | | Class D | | Class I | |

Beginning balance | | 3,548,696 | | | 8,562,777 | | | 743,183 | | | 286,341 | | | — | | | 47,888 | | | 452,667 | |

Issuance of shares | | — | | | — | | | 1,445 | | | 3,453 | | | — | | | — | | | 12,386 | |

Distribution reinvestment | | — | | | — | | | 1,259 | | | 551 | | | — | | | 127 | | | 2,393 | |

Repurchase and retirement of preferred stock | | (4,143 | ) | | — | | | — | | | — | | | — | | | — | | | — | |

Ending balance | | 3,544,553 | | | 8,562,777 | | | 745,887 | | | 290,345 | | | — | | | 48,015 | | | 467,446 | |

Distributions – Common Stock and Series A Preferred Stock

The table below presents the aggregate annualized and monthly distributions declared on common stock by record date for all classes of shares.

| | | | | | | | |

Record date | | Aggregate annualized gross distribution declared per share | | | Aggregate monthly gross distribution declared per share | |

January 31, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

February 28, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

March 31, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

April 30, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

May 31, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

June 30, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

July 31, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

August 31, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

September 30, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

October 31, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

November 30, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

December 31, 2023 | | $ | 1.2500 | | | $ | 0.1042 | |

January 30, 2024 | | $ | 1.2500 | | | $ | 0.1042 | |

February 29, 2024 | | $ | 1.2500 | | | $ | 0.1042 | |

March 31, 2024 | | $ | 1.2500 | | | $ | 0.1042 | |

April 30, 2024 | | $ | 1.2500 | | | $ | 0.1042 | |

May 31, 2024 | | $ | 1.2500 | | | $ | 0.1042 | |

June 30, 2024 | | $ | 1.2500 | | | $ | 0.1042 | |

The gross distribution was reduced each month for Class D and Class T of the Company’s common stock for applicable class-specific stockholder servicing fees to arrive at a lower net distribution amount paid to those classes. For a description of the stockholder servicing fees applicable to Class D, Class S and Class T shares of the Company’s common stock, please see “Note 10 – Transactions with Related Parties” below. Since the IPO and through June 30, 2024, the Company had not issued any shares of Class S common stock.

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

The following table shows the monthly net distribution per share for shares of Class D and Class T common stock.

| | | | | | | | |

Record date | | Monthly net distribution declared per share of Class D common stock | | | Monthly net distribution declared per share of Class T common stock | |

January 31, 2023 | | $ | 0.1000 | | | $ | 0.0900 | |

February 28, 2023 | | $ | 0.1004 | | | $ | 0.0914 | |

March 31,2023 | | $ | 0.1001 | | | $ | 0.0903 | |

April 30,2023 | | $ | 0.1002 | | | $ | 0.0907 | |

May 31, 2023 | | $ | 0.1001 | | | $ | 0.0903 | |

June 30, 2023 | | $ | 0.1004 | | | $ | 0.0912 | |

July 31, 2023 | | $ | 0.1005 | | | $ | 0.0916 | |

August 31, 2023 | | $ | 0.1005 | | | $ | 0.0915 | |

September 30, 2023 | | $ | 0.1006 | | | $ | 0.0920 | |

October 31, 2023 | | $ | 0.1005 | | | $ | 0.0916 | |

November 30, 2023 | | $ | 0.1006 | | | $ | 0.0920 | |

December 31, 2023 | | $ | 0.1005 | | | $ | 0.0916 | |

January 30, 2024 | | $ | 0.1006 | | | $ | 0.0919 | |

February 29, 2024 | | $ | 0.1008 | | | $ | 0.0927 | |

March 31, 2024 | | $ | 0.1006 | | | $ | 0.0920 | |

April 30, 2024 | | $ | 0.1007 | | | $ | 0.0925 | |

May 31, 2024 | | $ | 0.1006 | | | $ | 0.0921 | |

June 30, 2024 | | $ | 0.1008 | | | $ | 0.0925 | |

Series A Preferred Stock dividends are paid quarterly in arrears based on an annualized distribution rate of 6.75% of the $25.00 per share liquidation preference, or $1.6875 per share per annum.

The tables below present the aggregate distributions declared per share for each applicable class of common stock and preferred stock during the six months ended June 30, 2024 and 2023. The tables exclude distributions declared for any month for a class of shares of stock when there were no shares of that class outstanding on the applicable record date.

| | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | Common Stock | |

Six months ended June 30, 2024 | Series A | | Class P | | Class A | | Class T | | Class S | | Class D | | Class I | |

Aggregate gross distributions declared per share | $ | 0.8438 | | $ | 0.6252 | | $ | 0.6252 | | $ | 0.6252 | | $ | — | | $ | 0.6252 | | $ | 0.6252 | |

Stockholder servicing fee per share | N/A | | N/A | | N/A | | | 0.0715 | | | — | | | 0.0211 | | $ | — | |

Net distributions declared per share | $ | 0.8438 | | $ | 0.6252 | | $ | 0.6252 | | $ | 0.5537 | | $ | — | | $ | 0.6041 | | $ | 0.6252 | |

| | | | | | | | | | | | | | |

| Preferred Stock | | Common Stock | |

Six months ended June 30, 2023 | Series A | | Class P | | Class A | | Class T | | Class S | | Class D | | Class I | |

Aggregate gross distributions declared per share | $ | 0.8438 | | $ | 0.6252 | | $ | 0.6252 | | $ | 0.6252 | | $ | — | | $ | 0.6252 | | $ | 0.6252 | |

Stockholder servicing fee per share | N/A | | N/A | | N/A | | | 0.0813 | | | — | | | 0.0240 | | N/A | |

Net distributions declared per share | $ | 0.8438 | | $ | 0.6252 | | $ | 0.6252 | | $ | 0.5439 | | $ | — | | $ | 0.6012 | | $ | 0.6252 | |

As of June 30, 2024 and December 31, 2023, distributions declared but not yet paid amounted to $1,051 and $1,050, respectively.

Note 7 – Net Income Per Share Attributable to Common Stockholders

Basic earnings per share attributable to common stockholders (“EPS”) is computed by dividing net income attributable to common stockholders by the weighted average number of common shares outstanding for the period. Diluted EPS is computed by dividing net income attributable to common stockholders by the common shares plus common share equivalents. The Company’s common share equivalents are unvested restricted shares. The Company excludes antidilutive restricted shares from the calculation of weighted-average shares for diluted earnings per share. There were 784 and 562 antidilutive restricted shares for the three and six months ended June 30, 2024, respectively. There were zero antidilutive restricted shares for both the three and six months ended June 30, 2023. For further information about the Company’s restricted shares, see “Note 11 – Equity-Based Compensation.”

InPoint Commercial Real Estate Income, Inc.

Notes to Consolidated Financial Statements

June 30, 2024

(Unaudited, dollar amounts in thousands, except per share amounts)

The following table is a summary of the basic and diluted net income per share attributable to common stockholders computation for the three and six months ended June 30, 2024 and 2023:

| | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | | Six months ended June 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Net income (loss) attributable to common stockholders | | $ | 3,494 | | | $ | (16,831 | ) | | $ | 5,398 | | | $ | (13,684 | ) |

Weighted average shares outstanding, basic | | | 10,116,191 | | | | 10,114,470 | | | | 10,116,186 | | | | 10,113,849 | |

Dilutive effect of restricted stock | | | 784 | | | | — | | | | 562 | | | | — | |

Weighted average shares outstanding, diluted | | | 10,116,975 | | | | 10,114,470 | | | | 10,116,748 | | | | 10,113,849 | |

Net income (loss) attributable to common stockholders per share, basic and diluted | | $ | 0.35 | | | $ | (1.66 | ) | | $ | 0.53 | | | $ | (1.35 | ) |

Note 8 – Commitments and Contingencies

In the ordinary course of business, the Company may become subject to litigation, claims and regulatory matters. The Company has no knowledge of material legal or regulatory proceedings pending or known to be contemplated against the Company at this time.

The Company has made a commitment to advance additional funds under certain of its CRE loans if the borrower meets certain conditions. As of June 30, 2024, the Company had 19 such loans with a total remaining future funding commitment of $16,577. As of December 31, 2023, the Company had 27 such loans with a total remaining future funding commitment of $31,021. The Company could advance future funds at its discretion if requested by the borrower and the borrower meets certain requirements as specified in individual loan agreements.

Note 9 – Segment Reporting

The Company has one reportable segment as defined by GAAP for the six months ended June 30, 2024 and 2023.

Note 10 – Transactions with Related Parties