The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED September 14, 2021

PRELIMINARY PROSPECTUS

Shares

% Series A Cumulative Redeemable Preferred Stock

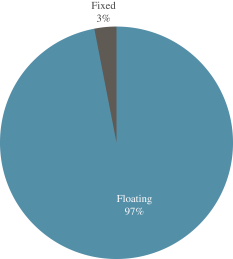

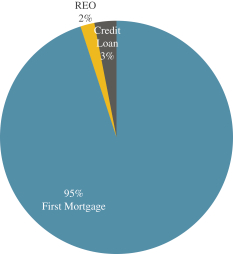

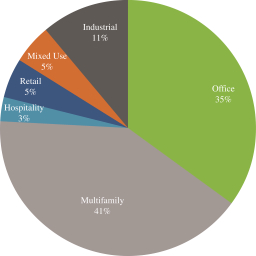

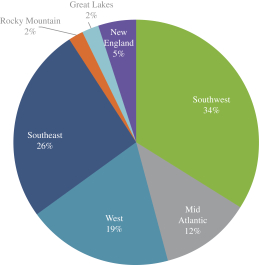

InPoint Commercial Real Estate Income, Inc. originates, acquires and manages a diversified portfolio of commercial real estate (“CRE”) investments primarily comprised of floating-rate CRE debt, including first mortgage loans, subordinate mortgage and mezzanine loans, and participations in such loans, secured by properties located within the United States. We may also invest in floating-rate CRE securities, such as commercial mortgage-backed securities (“CMBS”) and senior unsecured debt of publicly traded real estate investment trusts (“REITs”), and select equity investments in single-tenant, net leased properties.

We have no direct employees. We are externally managed by Inland InPoint Advisor, LLC (the “Advisor”), which is an indirect subsidiary of Inland Real Estate Investment Corporation, a member of The Inland Real Estate Group of Companies, Inc. (“Inland”). The Advisor has engaged SPCRE InPoint Advisors, LLC (the “Sub-Advisor”), which is a subsidiary of Sound Point CRE Management, LP (“Sound Point CRE”), to perform services on behalf of the Advisor for us.

We are offering shares of our % Series A Cumulative Redeemable Preferred Stock (“Series A Preferred Stock”) pursuant to this prospectus. When, as, and if authorized by our board of directors and declared by us, dividends on the Series A Preferred Stock will be payable quarterly in arrears on or about , , and of each year at a rate per annum equal to % per annum of the $25.00 liquidation preference (the “Initial Rate”). Dividends on the shares of the Series A Preferred Stock are cumulative. The first dividend on the Series A Preferred Stock sold in this offering will be paid on , 20 , will cover the period from and including ,2021 to, but not including, , 20 , and will be in the amount of $ per share. If a Change of Control (as defined herein) occurs on or prior to , 2022, we will thereafter accrue cumulative cash dividends on each then-outstanding share of Series A Preferred Stock at a rate equal to (a) the dividend rate in effect immediately prior to the Change of Control, plus (b) an additional % of the liquidation preference per annum.

If either (i) the Applicable Ratings Agency (as defined herein) downgrades the credit rating assigned to the Series A Preferred Stock to below Investment Grade (as defined herein), or (ii) in the case where there is only one Ratings Agency (as defined herein) rating the Series A Preferred Stock, such Ratings Agency ceases to rate the Series A Preferred Stock or fails to make a rating of the Series A Preferred Stock publicly available (each of the events described in clauses (i) and (ii) being a “Downgrade Event”), we will thereafter accrue cumulative cash dividends on each then-outstanding share of Series A Preferred Stock at a rate equal to (a) the dividend rate in effect immediately prior to the Downgrade Event, plus (b) % of the liquidation preference per annum, subject to a maximum annual dividend rate of % while the Series A Preferred Stock remains outstanding (the “Maximum Rate”). If, subsequent to the occurrence of a Downgrade Event that results in an increase in the dividend rate in effect immediately prior to such Downgrade Event , the Applicable Rating Agency subsequently increases its rating of the Series A Preferred Stock to Investment Grade or an Applicable Rating Agency subsequently issues an initial rating of the Series A Preferred Stock at Investment Grade (each such event, an “Upgrade Event”), we will thereafter accrue cumulative cash dividends on each then-outstanding share of Series A Preferred Stock at a rate equal to (a) the dividend rate in effect immediately prior to the Upgrade Event, minus (b) % of the liquidation preference per annum; provided, however, that in no event will we accrue cash dividends at a rate lower than the Initial Rate.

If any shares of Series A Preferred Stock are outstanding after , 2026, beginning on September 30, 2026, we will accrue cumulative cash dividends on each then-outstanding share of Series A Preferred Stock at a rate equal to (a) the dividend rate in effect on , 2026, plus (b) an additional % of the liquidation preference per annum, which will increase by an additional % of the liquidation preference per annum on September 30 each year thereafter, subject to a maximum annual dividend rate equal to the Maximum Rate while the Series A Preferred Stock remains outstanding.

At any time or from time to time on or after , 2026, we may, at our option, redeem the Series A Preferred Stock, in whole or from time to time in part, at a price of $25.00 per share of Series A Preferred Stock plus an amount equal to accrued and unpaid dividends (whether or not declared), if any. See “Description of Series A Preferred Stock—Redemption.” If a Change of Control occurs, we may, at our option, redeem the Series A Preferred Stock, in whole or in part, within 120 days after the first date on which such Change of Control occurred by paying $25.00 per share of Series A Preferred Stock, plus an amount equal to any accrued and unpaid dividends (whether or not declared) to, but excluding, the date of redemption. To the extent we exercise our redemption right relating to the Series A Preferred Stock, the holders of Series A Preferred Stock will not be permitted to exercise the conversion right described below in respect of their shares called for redemption. See “Description of Series A Preferred Stock—Special Optional Redemption.” The Series A Preferred Stock has no maturity date and will remain outstanding indefinitely unless redeemed by us or converted in connection with a Change of Control by the holders of Series A Preferred Stock.

Beginning on the first anniversary of the first date on which any shares of Series A Preferred Stock are issued, upon the occurrence of a Change of Control, each holder of Series A Preferred Stock will have the right (subject to our right to redeem the Series A Preferred Stock in whole or in part, as described above, prior to the Change of Control Conversion Date (as defined herein)) to convert some or all of the Series A Preferred Stock held by such holder on the Change of Control Conversion Date into a number of shares of our Class I common stock, par value $0.001 per share (“Class I common stock”), per share of Series A Preferred Stock to be converted equal to the lesser of:

| | • | | the quotient obtained by dividing (i) the sum of the $25.00 liquidation preference plus the amount of any accrued and unpaid dividends (whether or not declared) to, but not including, the Change of Control Conversion Date (unless the Change of Control Conversion Date is after a record date for a Series A Preferred Stock dividend payment and prior to the corresponding Series A Preferred Stock dividend payment date, in which case no additional amount for such accrued and unpaid dividend will be included in this sum) by (ii) the Common Stock Price (as defined herein); and |

| | • | | , subject to certain adjustments; |

subject, in each case, to provisions for the receipt of alternative consideration as described in this prospectus.

The Series A Preferred Stock will rank senior to all classes and series of our common stock and any class or series of our capital stock expressly designated as ranking junior to the Series A Preferred Stock, equally to any class or series of our capital stock expressly designated as ranking on parity with the Series A Preferred Stock, and junior to any class or series of our capital stock expressly designated as ranking senior to the Series A Preferred Stock, in each case, as to dividend rights and rights upon our liquidation, dissolution or winding up. See “Description of Series A Preferred Stock—Ranking.” The Series A Preferred Stock will not have any voting rights, except as set forth under “Description of Series A Preferred Stock—Voting Rights.”

We are required to file reports with the Securities and Exchange Commission (the “SEC”), but our common stock, including our Class I common stock, is not currently listed on a national securities exchange. We made a tax election to be treated as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2017. To assist us in preserving our qualification as a REIT, among other purposes, our Articles of Amendment and Restatement, as amended, supplemented and corrected (our “Charter”), provide that no person may own more than 9.8% in value or number of shares, whichever is more restrictive, of our outstanding common stock or 9.8% in value of our outstanding capital stock of all classes or series, unless exempted (prospectively or retroactively) by our board of directors.

| | | | | | | | |

| | | Per share | | | Total | |

Public offering price(1) | | $ | | | | $ | | |

Underwriting discounts and commissions(2) | | $ | | | | $ | | |

Proceeds, before expenses, to us(3) | | $ | | | | $ | | |

| (1) | Plus declared and unpaid dividends, if any, from , 2021 if initial settlement occurs after that date. |

| (2) | Excludes certain other compensation payable to the underwriters. See “Underwriting” for a detailed description of compensation payable to the underwriters. |

| (3) | Assumes no exercise of the underwriters’ over-allotment option described below. |

We have granted the underwriters the option to purchase, exercisable within 30 days of the date of this prospectus, up to an additional shares of Series A Preferred Stock on the same terms and conditions set forth above, solely to cover over-allotments.

No current market exists for the Series A Preferred Stock. We have applied to list the Series A Preferred Stock on the New York Stock Exchange (the “NYSE”) under the symbol “ICR PR A.” If the application is approved, we expect trading of the Series A Preferred Stock on the NYSE to begin within 30 days after the Series A Preferred Stock is first issued. This is the original issuance of the Series A Preferred Stock.

Investing in the Series A Preferred Stock involves risks. See “Risk Factors” beginning on page 18 of this prospectus. You should also read carefully the risk factors described in our SEC filings, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, before investing in the Series A Preferred Stock.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect that the shares of the Series A Preferred Stock will be delivered to purchasers in global form through the book-entry delivery system of The Depository Trust Company on or about , 2021.

Raymond James

Prospectus dated , 2021.