Filed Pursuant to Rule 424(b)(3)

Registration No. 333-230465

INPOINT COMMERCIAL REAL ESTATE INCOME, INC.

SUPPLEMENT NO. 4 DATED JANUARY 19, 2021 TO THE

PROSPECTUS DATED OCTOBER 1, 2020

This Prospectus Supplement No. 4 (this “Supplement”) is part of and should be read in conjunction with the prospectus of InPoint Commercial Real Estate Income, Inc. dated October 1, 2020 (the “Prospectus”), Supplement No. 1 dated October 15, 2020, Supplement No. 2 dated November 16, 2020 and Supplement No. 3 dated December 15, 2020. Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Prospectus.

The purposes of this Supplement are as follows:

| • | to disclose the transaction price as of February 1, 2021, the first business day of the month, for each class of our common stock being offered and sold in this offering; |

| • | to update the “Net Asset Value Calculation and Valuation Guidelines—Liabilities” section of the Prospectus to reflect a change to our valuation guidelines; |

| • | to disclose our NAV per share as of December 31, 2020; |

| • | to disclose an update to the performance of the Renaissance Chicago O’Hare Suites Hotel; |

| • | to disclose a fee waiver by the Advisor; |

| • | to disclose the adoption of investment allocation guidelines by our Sub-Advisor; |

| • | to disclose the timing of the reinstatement of our share repurchase plan; and |

| • | to provide updated portfolio metrics regarding the status of our investments as of December 31, 2020. |

Transaction Prices

The transaction price for each share class of our common stock for subscriptions to be accepted as of February 1, 2021, the first business day of the month, and for distribution reinvestments is as follows:

| | Transaction Price (per share) | |

Class A | | $ | 20.1742 | |

Class T | | $ | 20.1732 | |

Class S | | $ | 20.1348 | |

Class D | | $ | 20.1694 | |

Class I | | $ | 20.1749 | |

As of December 31, 2020, we had not sold any Class S shares. The February 1, 2021 transaction price for our Class S shares is based on our aggregate NAV for all share classes as of December 31, 2020. The purchase price of our common stock for each share class equals the transaction price of such class, plus applicable upfront selling commissions and dealer manager fees. A detailed calculation of the NAV per share is set forth below. No transactions or events have occurred since December 31, 2020 that would have a material impact on our NAV per share.

Net Asset Value Calculation and Valuation Guidelines

The disclosure under “Net Asset Value Calculation and Valuation Guidelines—Liabilities” on page 110 of the Prospectus is deleted and replaced with the following to reflect the addition of “reserves for future liabilities” to the non-exclusive list of liabilities to be included as part of our NAV calculation:

We include the fair value of our liabilities as part of our NAV calculation. Our liabilities generally include portfolio-level credit facilities, the fees payable to the Advisor and the Dealer Manager, accounts payable, accrued operating expenses, property-level mortgages, reserves for future liabilities and other liabilities. All liabilities are valued using widely accepted methodologies specific to each type of liability. Our debt is typically valued at fair value in accordance with GAAP. Our aggregate monthly NAV will be reduced to reflect the accrual of the liability to pay any declared (and unpaid) distributions for all classes of common stock. Liabilities allocable to a specific class of shares will only be included in the NAV calculation for that class.

December 31, 2020 NAV per Share

We calculate NAV per share in accordance with the valuation guidelines that have been approved by our board of directors. Our NAV per share, which is updated as of the last calendar day of each month, is posted on our website at www.inland-investments.com/inpoint. Please refer to “Net Asset Value Calculation and Valuation Guidelines” in the Prospectus, as supplemented, for how our NAV is determined. The Advisor is ultimately responsible for determining our NAV. The valuation of our commercial real estate loan portfolio is reviewed by our independent valuation advisor. We have included a breakdown of the components of total NAV and NAV per share for December 31, 2020.

Our total NAV presented in the following table includes the NAV of our Class A, Class T, Class S, Class D, and Class I common stock being sold in this offering, as well as our Class P common stock, which is not being sold in this offering. As of December 31, 2020, we had not sold any Class S shares. The following table provides a breakdown of the major components of our total NAV as of December 31, 2020 ($ and shares in thousands, except per share data):

Components of NAV | | December 31, 2020 | |

Commercial mortgage loans | | $ | 441,267 | |

Real estate owned, net | | | 14,000 | |

Cash and cash equivalents and restricted cash | | | 72,107 | |

Other assets | | | 6,458 | |

Repurchase agreements - commercial mortgage loans | | | (290,699 | ) |

Reserve for negative impact of COVID on real estate owned | | | (2,250 | ) |

Due to related parties | | | (2,093 | ) |

Distributions payable | | | (867 | ) |

Interest payable | | | (292 | ) |

Accrued stockholder servicing fees (1) | | | (49 | ) |

Other liabilities | | | (3,253 | ) |

Net asset value | | $ | 234,329 | |

Number of outstanding shares | | | 11,638 | |

Aggregate NAV per share | | $ | 20.1348 | |

| (1) | Stockholder servicing fees only apply to Class T, Class S, and Class D shares. For purposes of NAV, we recognize the stockholder servicing fee as a reduction of NAV on a monthly basis as such fee is paid. Under accounting principles generally accepted in the United States of America (“GAAP”), we accrue the full cost of the stockholder servicing fee as an offering cost at the time we sell Class T, Class S, and Class D shares. As of December 31, 2020, we have accrued under GAAP $723 of stockholder servicing fees payable to the Dealer Manager related to the Class T and Class D shares sold. As of December 31, 2020, we have not sold any Class S shares and, therefore, we have not accrued any stockholder servicing fees payable to the Dealer Manager related to Class S shares. The Dealer Manager does not retain any of these fees, all of which are retained by, or reallowed (paid) to, participating broker-dealers and servicing broker-dealers for ongoing stockholder services performed by such broker-dealers. |

The following table provides a breakdown of our total NAV and NAV per share by share class as of December 31, 2020 ($ and shares in thousands, except per share data):

NAV Per Share | | Class P | | | Class A | | | Class T | | | Class S | | | Class D | | | Class I | | | Total | |

Net asset value | | $ | 204,338 | | | $ | 13,231 | | | $ | 8,034 | | | $ | — | | | $ | 1,016 | | | $ | 7,706 | | | $ | 234,329 | |

Number of outstanding shares | | | 10,152 | | | | 656 | | | | 398 | | | | — | | | | 50 | | | | 382 | | | | 11,638 | |

NAV per share as of December 31, 2020 | | $ | 20.1283 | | | $ | 20.1742 | | | $ | 20.1732 | | | $ | — | | | $ | 20.1694 | | | $ | 20.1749 | | | $ | 20.1348 | |

The NAV as of December 31, 2020 decreased $15.3 million from our November 30, 2020 NAV. The primary drivers of the decrease were a decrease of $7.6 million in the valuation of the Renaissance Chicago O’Hare Suites Hotel, a decrease of $5.3 million in the value of our commercial real estate loan portfolio and the addition of a $2.25 million reserve for expected losses during 2021 for the Renaissance Chicago O’Hare Suites Hotel related to the continuing COVID-19 pandemic.

Our reduction in the value of the Renaissance Chicago O’Hare Suites Hotel was supported by a new third-party appraisal of the value of our interest in the property as of December 31, 2020. The adverse economic impact of COVID-19 that has severely affected hotels across the country has continued and may be worsening. Though vaccinations have begun, there are numerous risks and uncertainties still surrounding the effects of the pandemic, including whether and when a resumption of pre-pandemic levels of travel and in-person

meetings and events might happen. Government restrictions on travel and in-person gatherings, reduced demand for these activities from businesses and individuals, and the uncertainties surrounding the duration and effects of the pandemic persist, so we believe it is prudent to have sought the appraisal and to reflect in the NAV our current valuation of our interest in the hotel and the loss reserve for the continued effect of COVID-19.

Similarly, we have taken what we believe is a proactive approach to updating the valuation of our commercial mortgage loans. We have reduced the value of the loan portfolio by $5.3 million as a result of our limiting the effect of LIBOR floors to a maximum twelve-month period, as opposed to through initial loan maturity. An adjustable rate loan with an interest rate floor provision, such as a LIBOR floor, has a minimum rate that must be paid by the borrower and protects the lender when the benchmark interest rate in the loan (such as LIBOR) drops below the floor rate. Our reduced portfolio value takes into consideration the increased likelihood of loans being paid off prior to maturity given the current low interest rate environment, the growing cost of LIBOR floors to borrowers who have loans with us that may be paid off early, and a more active lending market since the period immediately following the onset of the pandemic that may afford borrowers more opportunities to refinance their debt with a new loan that the borrower perceives as having more attractive terms than their existing loan with us.

Real Estate Properties

The description under “Investment Portfolio—Real Estate Properties” beginning on the top of page 77 of the Prospectus is updated in relevant part as follows:

The table below includes certain historical information with respect to the average occupancy, the average daily rate and the revenue per available room of the Renaissance Chicago O’Hare Suites Hotel.

Year | | Average Occupancy Per Night | | | Average Daily Rate | | | Revenue Per Available Room | |

2016 | | | 73.2 | % | | $ | 145.28 | | | $ | 106.36 | |

2017 | | | 74.8 | % | | $ | 139.29 | | | $ | 104.24 | |

2018 | | | 71.0 | % | | $ | 148.97 | | | $ | 105.68 | |

2019 | | | 72.3 | % | | $ | 146.50 | | | $ | 105.85 | |

2020 | | | 25.3 | % | | $ | 106.81 | | | $ | 26.88 | |

Fee Waiver

In order to support the performance of the Company, the Advisor has agreed to waive 50% of its management fee for the month of January 2021 and for future months until it notifies our board of directors that the waiver is terminated. We will disclose any termination of the fee waiver in a future supplement.

Sub-Advisor Investment Allocation Guidelines

The following modifies the disclosure set forth in (i) the “Prospectus Summary” section of the Prospectus appearing on page 4 under the question “Q: Does your investment strategy overlap with the strategy of any of Sound Point’s affiliates, and do any such affiliates receive priority with respect to certain investments?” and (ii) in the “Conflicts of Interest—Competition for Originating, Acquiring, Managing and Selling Investments” section of the Prospectus.

Our investment strategy is expected to overlap with the investment strategy of one Other Sound Point Account and may overlap with others in the future. As a result, we will compete with one or more Other Sound Point Accounts to originate, acquire or sell our targeted investments. As a result of this competition, certain investment opportunities may not be available to us. The Sub-Advisor has prepared written investment allocation guidelines regarding the allocation of investment opportunities between us and Other Sound Point Accounts, which have been approved by the Advisor and our board of directors and are described below.

If both we and one or more Other Sound Point Accounts are interested in making an investment, the Sub-Advisor or its affiliates will determine which program is ultimately awarded the right to pursue the investment in accordance with the investment allocation guidelines. The Sub-Advisor is responsible for facilitating the investment allocation process and could face conflicts of interest in doing so. Many investment opportunities that are suitable for us may also be suitable for an Other Sound Point Account. The Sub-Advisor is required to provide information to our board of directors to enable the board, including the independent directors, to determine whether such procedures are being fairly applied to us. and are summarized below.

Our Sub-Advisor and its affiliates (collectively, “Sound Point”) have adopted investment allocation guidelines to address conflicts of interest arising from the allocation of investment opportunities among us and any Other Sound Point Accounts. Sound Point will screen the suitability of each investment opportunity for each account based on the following criteria (the “Screening Criteria”): liquidity position (i.e., sufficiency of available cash to make and support the investment or need to raise cash); strategic investment objectives; appropriateness of investment based on current portfolio composition, including loan-type, loan-size, asset-type and geographic or borrower diversity; time horizon; tax sensitivity; and any applicable legal or regulatory restrictions, or governing document applicable covenants or asset tests/restrictions.

Since bespoke whole commercial real estate loan investments are not divisible and cannot be allocated pro rata as a general matter, Sound Point will allocate investment opportunities on a pre-determined rotational order and maintain a record of such rotations. Any new account will be added to the bottom of the rotational queue. If, upon giving due consideration to the Screening Criteria, Sound Point reasonably determines in its discretion that an investment opportunity is suitable and appropriate for only one account, the investment opportunity will be allocated to such account without regard to or any resulting effect upon the then-current rotational order. If, however, upon giving due consideration to the Screening Criteria, Sound Point reasonably determines that an investment opportunity is suitable and appropriate for two or more accounts, the investment opportunity will be allocated to the account that has not executed a written non-binding expression of interest (subject to Sound Point’s underwriting and due diligence) in providing commercial real estate debt financing related to a separate investment opportunity previously allocated to it for the longest period of time. In such instance, the account receiving allocation of such investment opportunity will thereupon be moved to the bottom of the rotational queue.

Share Repurchase Plan Reinstatement

Our board of directors has approved the reinstatement of our share repurchase plan as described below.

| • | On March 1, 2021, our share repurchase plan will be reinstated for our stockholders requesting repurchase of shares as a result of the death or qualified disability of the holder. Permitted repurchase requests must be submitted on or after March 1, 2021. The first settlement of permitted repurchase requests will be on March 31, 2021, the last business day of the month. |

| • | On July 1, 2021, our share repurchase plan will be reinstated for all stockholders. Repurchase requests must be submitted on or after July 1, 2021. The first settlement of permitted repurchase requests will be on July 30, 2021, the last business day of the month. In accordance with the terms of the share repurchase plan that allow us to repurchase fewer shares than the maximum amount permitted under the share repurchase plan, for the months of July, August and September 2021, the total amount of aggregate repurchases of shares (including Class P shares) will be limited to no more than 1% of our aggregate NAV per month as of the last day of the previous calendar month and no more than 2.5% of our aggregate NAV per calendar quarter as of the last day of the previous calendar month. Beginning on October 1, 2021, the total amount of aggregate repurchases of shares will be limited as set forth in the share repurchase plan (no more than 2% of our aggregate NAV per month as of the last day of the previous calendar month and no more than 5% of our aggregate NAV per calendar quarter as of the last day of the previous calendar month). Notwithstanding the foregoing, we may repurchase fewer shares than these limits in any month, or none. Further, our board of directors may modify, suspend or terminate our share repurchase plan if it deems such action to be in our best interest and the best interest of our stockholders. |

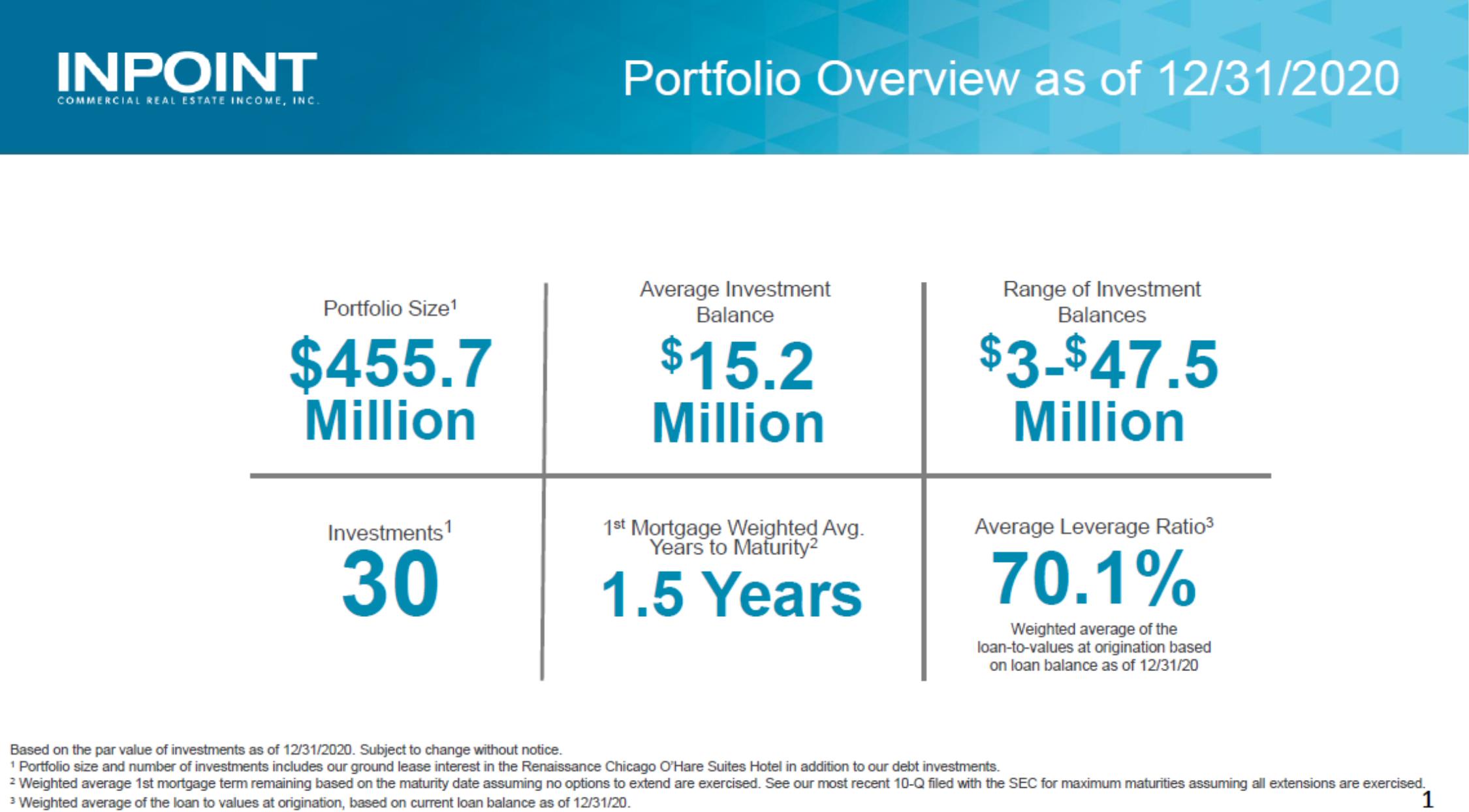

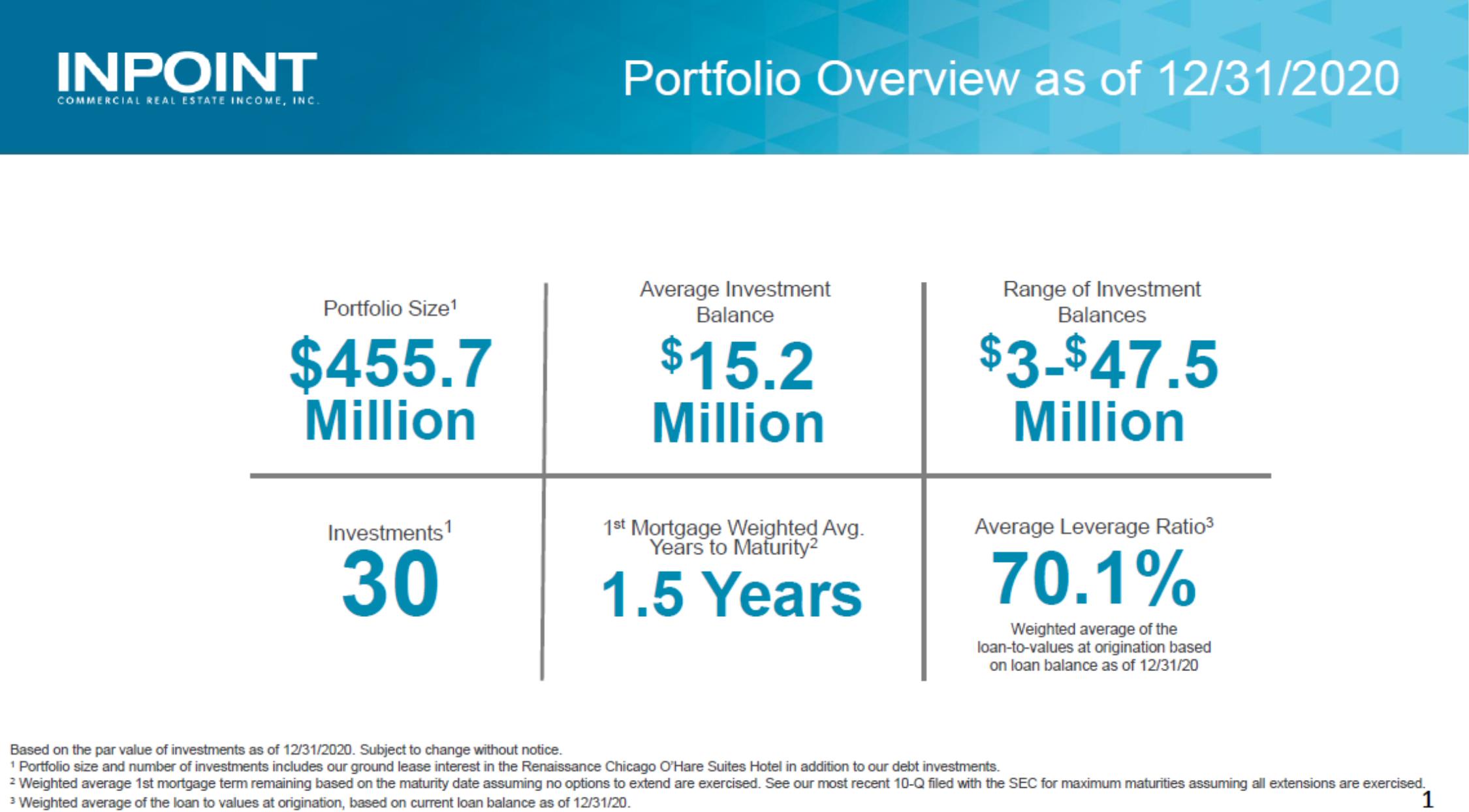

Portfolio Metrics as of December 31, 2020

Attached hereto as Appendix A are portfolio metrics regarding the status of our investments as of December 31, 2020.

Appendix A

INPOINT COMMERCIAL REAL ESTATE INCOME, INC. Portfolio Overview as of 12/31/2020 Portfolio Size1 $455.7 Million Average Investment Balance $15.2 Million Range of Investment Balances $3-$47.5 Million Investments1 30 1st Mortgage Weighted Avg. Years to Maturity2 1.5 Years Average Leverage Ratio3 70.1% Weighted average of the loan-to-values at origination based on loan balance as of 12/31/20 Based on the par value of investments as of 12/31/2020. Subject to change without notice. 1 Portfolio size and number of investments includes our ground lease interest in the Renaissance Chicago O’Hare Suites Hotel in addition to our debt investments. 2 Weighted average 1st mortgage term remaining based on the maturity date assuming no options to extend are exercised. See our most recent 10-Q filed with the SEC for maximum maturities assuming all extensions are exercised. 3 Weighted average of the loan to values at origination, based on current loan balance as of 12/31/20. 1

INPOINT COMMERCIAL REAL ESTATE INCOME, INC. Portfolio Overview as of 12/31/2020 Debt Investments: Floating vs. Fixed Rate Fixed 4% Floating 96% All Investments by Type Credit Loan 4% REO 3% First Mortgage 93% Description of Debt Investments: First mortgage loans finance commercial real estate properties and are loans that generally have the highest priority lien among the loans in a foreclosure proceeding on the collateral securing the loan. The senior position does not protect against default, and losses may still occur. Credit loans, also called mezzanine loans, are secured by one or more direct or indirect ownership interests in an entity that directly or indirectly owns real estate. CMBS or commercial mortgage-backed securities, are securities collateralized (bundled and sold as bonds) by loans secured by commercial real estate property. 2

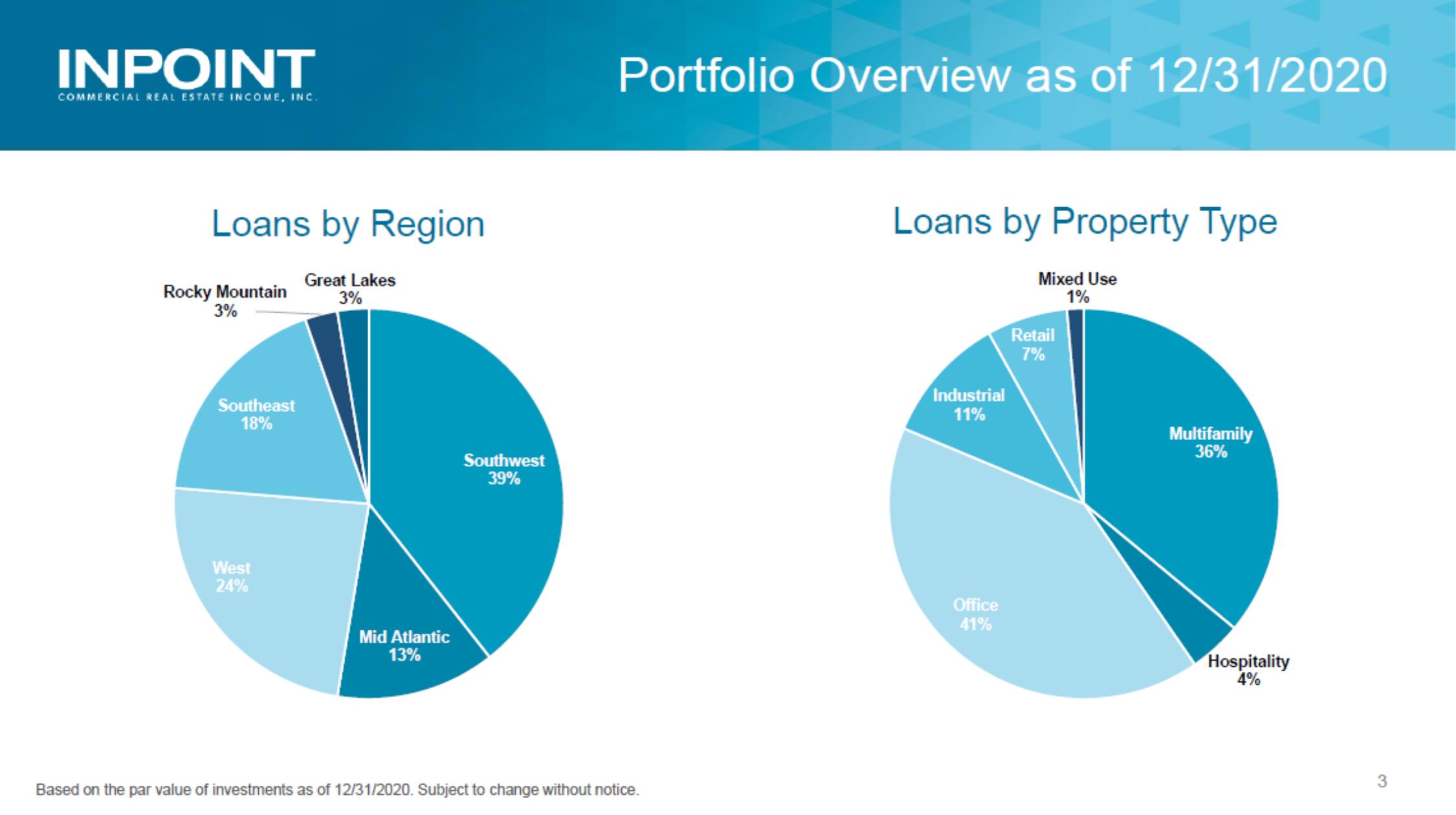

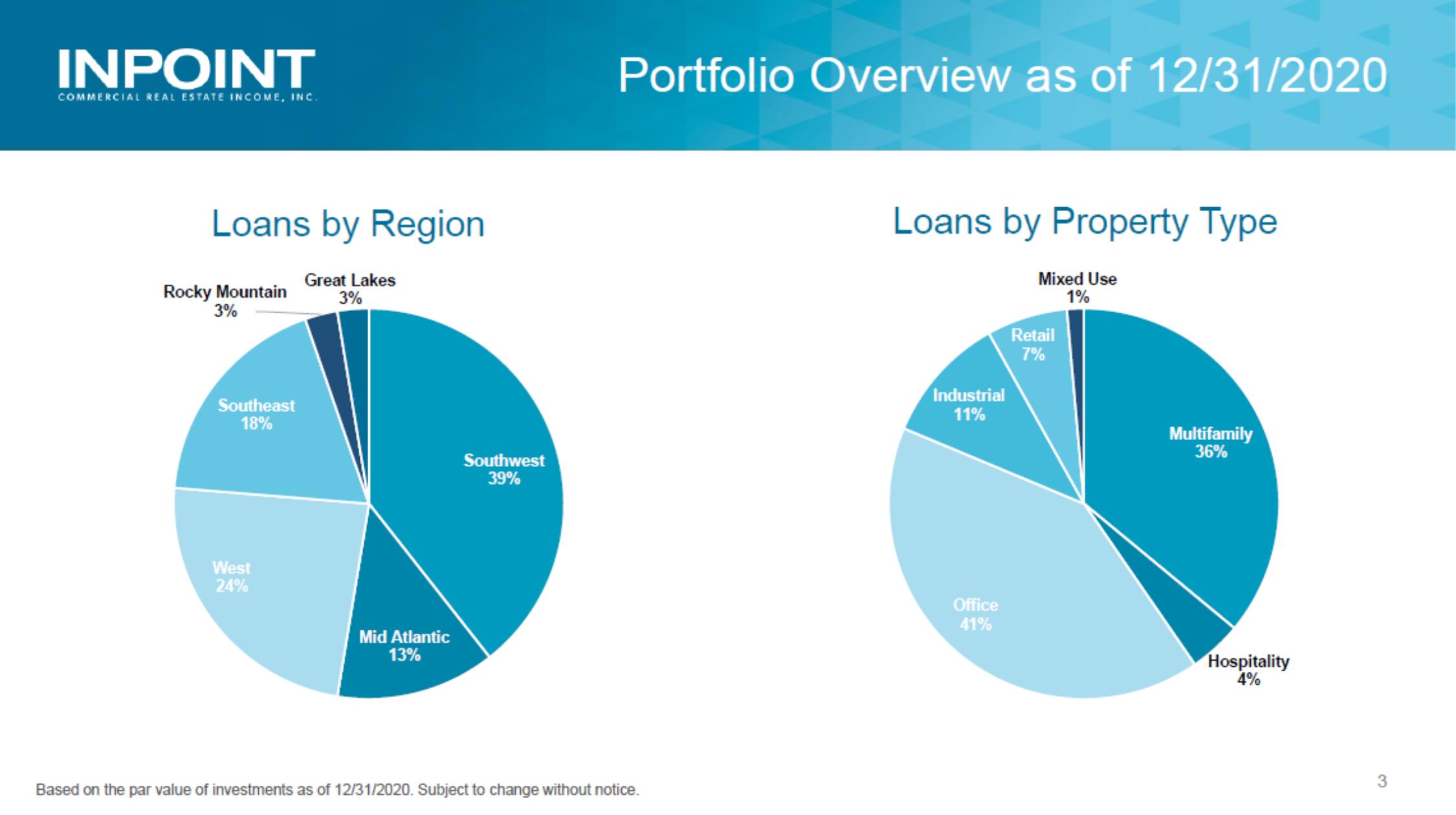

INPOINT COMMERCIAL REAL ESTATE INCOME, INC. Portfolio Overview as of 12/31/2020 Loans by Region Rocky Mountain 3% Great Lakes 3% Southeast 18% Southwest 39% West 24% Mid Atlantic 13% Loans by Property Type Mixed Used 1% Retail 7% Industrial 11% Office 41% Multifamily 36% Hospitality 4% Based on the par value of investments as of 12/31/2020. Subject to change without notice. 3