Risk Factors – Consider Before Investing 1 Commercial real estate (CRE) credit and securities investments are subject to the risks typically associated with CRE which include, but are not limited to: market risks such as local property supply and demand conditions; tenants’ inability to pay rent; tenant turnover; inflation and other increases in operating costs; adverse changes in laws and regulations; relative illiquidity of real estate investments; changing market demographics; acts of nature such as earthquakes, floods or other uninsured losses; interest rate fluctuations; and availability of financing. Investing in our common stock involves a high degree of risk. You should purchase these securities only if you can afford the complete loss of your investment. You should carefully review the “Risk Factors” section of the prospectus for a more detailed discussion. Capitalized terms used and not defined herein have the meanings set forth in the prospectus. Some of the more significant risks relating to an investment in our shares include: We have a limited operating history, and there is no assurance that we will achieve our investment objectives. This is a “blind pool” offering. You will not have the opportunity to evaluate our future investments before we make them. Since there is no public trading market for shares of our common stock, repurchase of shares by us will likely be the only way to dispose of your shares. Our share repurchase plan was suspended by our board of directors on March 24, 2020, and is expected to be re-opened only gradually until it fully re-opens, which is not expected until October 1, 2021. When our share repurchase plan is in effect, stockholders who have held their shares for at least one year have the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month at our discretion. In addition, repurchases will be subject to available liquidity and other significant restrictions. Further, our board of directors may modify, suspend or terminate our share repurchase plan if it deems such action to be in our best interest and the best interest of our stockholders. As a result, our shares should be considered illiquid at this time and may have only limited liquidity during periods when our share repurchase plan is in effect. We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, return of capital or offering proceeds, and we have no limits on the amounts we may pay from such sources. The purchase and repurchase price for shares of our common stock are generally based on our prior month’s NAV (subject to material changes as described above) and are not based on any public trading market. A substantial portion of our assets consists of CRE debt that is valued by our Advisor, with the assistance of the Sub-Advisor, using factors that are periodically validated by an independent third party. The valuation of our investments is inherently subjective, and our NAV may not accurately reflect the actual price at which our investments could be liquidated on any given day. We have no employees and are dependent on the Advisor and the Sub-Advisor to conduct our operations. The Advisor and the Sub-Advisor will face conflicts of interest as a result of, among other things, the allocation of investment opportunities among us and Other Sound Point Accounts, the allocation of time of their investment professionals and the substantial fees that we will pay to the Advisor and that the Advisor will pay to the Sub-Advisor. This is a “best efforts” offering. If we are not able to raise a substantial amount of capital on an ongoing basis, our ability to achieve our investment objectives could be adversely affected. Principal and interest payments on our borrowings will reduce the amount of funds available for distribution or investment in our targeted assets. If we fail to maintain our qualification as a REIT and no relief provisions apply, we will have to pay corporate income tax on our taxable income (which will be determined without regard to the dividends-paid deduction available to REITs)and our NAV and cash available for distribution to our stockholders could materially decrease. The COVID-19 pandemic has adversely affected the economy and our investments and operations and may have additional adverse effects in the future. For so long as we own hotels, such as the Renaissance Chicago O’Hare Suites Hotel, or invest in loans secured by hotels and securities collateralized by hotels, we will be exposed to the unique risks of the hospitality sector, including seasonality, volatility and the severe reduction in occupancy caused by the COVID-19 pandemic. We use short-term borrowings to finance our investments, which exposes us to increased risks associated with decreases in the fair value of the underlying collateral resulting from adverse changes in the financial markets, including as a result of the COVID-19 pandemic. As with any investment, there are certain risks associated with credit investing. Such risks include, but are not limited to: The risk of nonpayment of scheduled interest or principal payments on a credit investment, which may affect the overall return to the lender; Interest rate fluctuations, which will affect the amount of interest paid by a borrower in a floating-rate loan that adjusts to current market conditions; Default risk, which means that the loan may not be repaid by the borrower; and The risks typically associated with real estate assets, such as changes in national, regional and local economic conditions, local property supply and demand conditions, ability to collect rent from tenants, vacancies or ability to lease on favorable terms, increases in operating costs, including insurance premiums, utilities and real estate taxes, federal, state or local laws and regulations, changing market demographics, changes in availability and costs of financing and acts of nature, such as hurricanes, earthquakes, tornadoes or floods. Exhibit 99.1

Cautionary Note Regarding Forward-Looking Statements 2 This presentation may include forward-looking statements about our business, including, in particular, statements about our plans, strategies and objectives. You can generally identify forward-looking statements by our use of terms such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue” or other similar words. These statements include our plans and objectives for future operations, including plans and objectives relating to future growth and availability of funds, and are based on current expectations that involve numerous risks and uncertainties. Assumptions relating to these statements involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to accurately predict and many of which are beyond our control. Although we believe the assumptions underlying the forward-looking statements, and the forward-looking statements themselves, are reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that these forward-looking statements will prove to be accurate. Our actual results, performance and achievements may be materially different from that expressed or implied by these forward-looking statements. In light of the significant uncertainties inherent in forward-looking statements, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans will be achieved. You should carefully review the “Risk Factors” section of our prospectus or our reports on Forms 10-K and 10-Q for a discussion of the risks and uncertainties that we believe are material to our business, operating results, prospects and financial condition. Except as otherwise required by federal securities laws, we do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

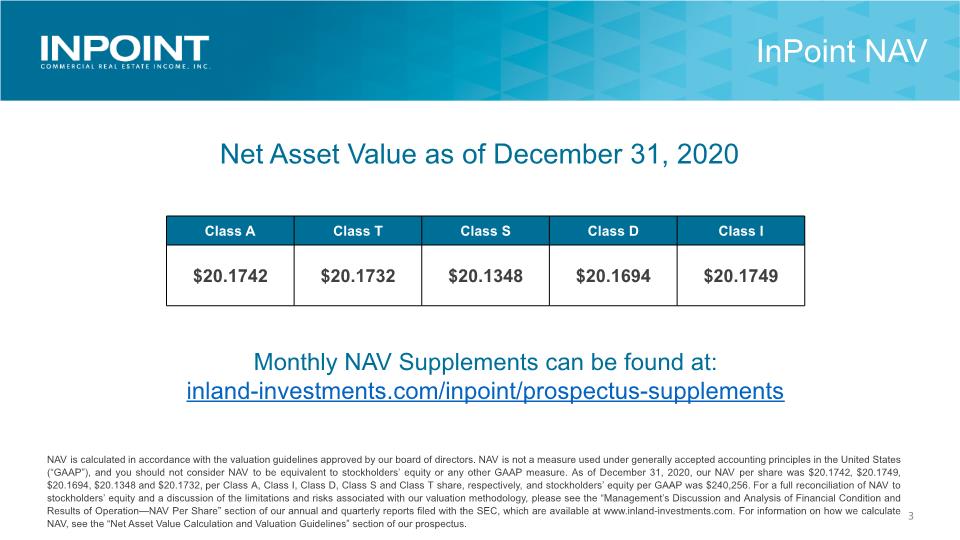

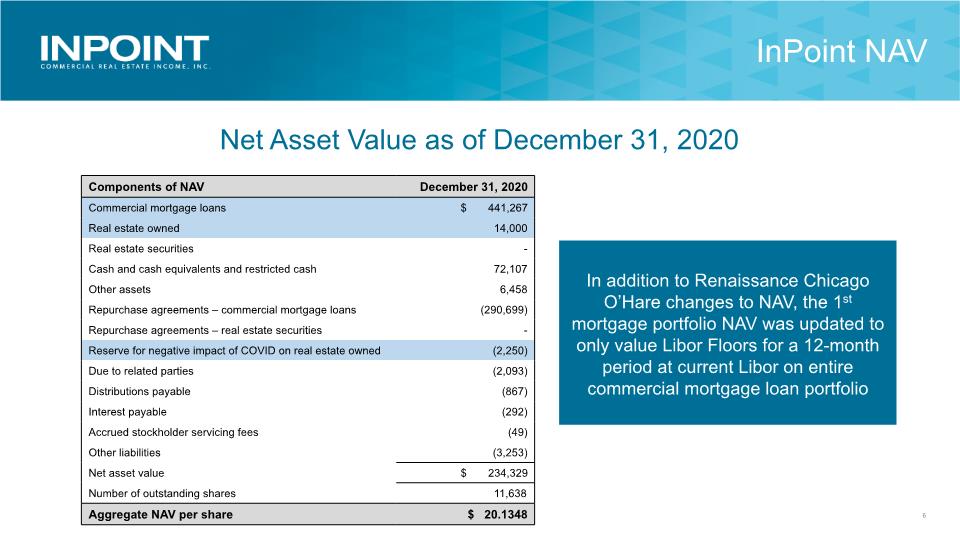

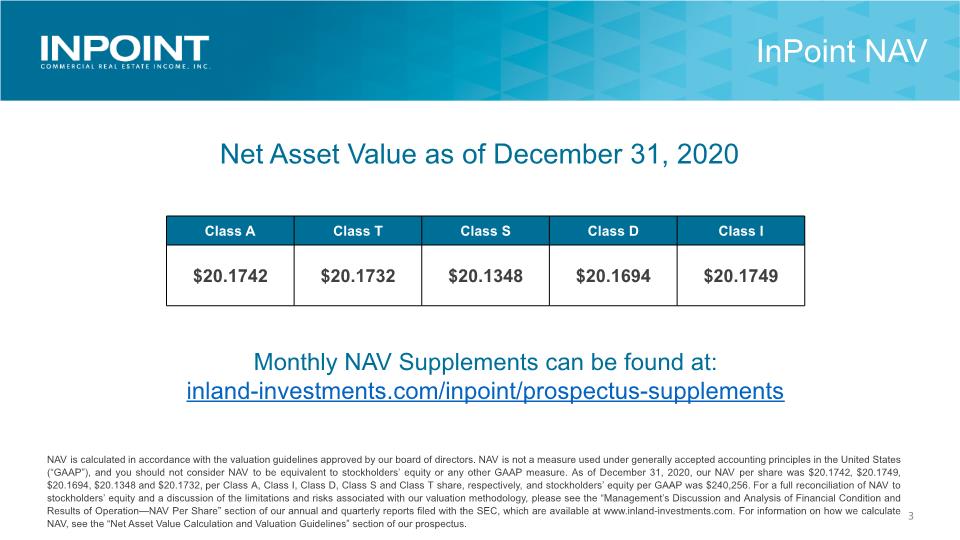

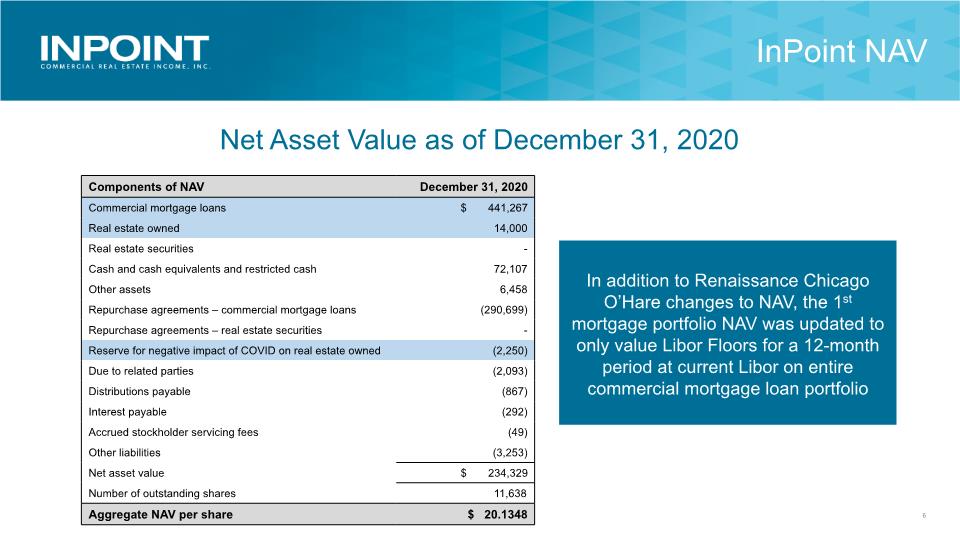

3 Net Asset Value as of December 31, 2020 Monthly NAV Supplements can be found at: inland-investments.com/inpoint/prospectus-supplements NAV is calculated in accordance with the valuation guidelines approved by our board of directors. NAV is not a measure used under generally accepted accounting principles in the United States (“GAAP”), and you should not consider NAV to be equivalent to stockholders’ equity or any other GAAP measure. As of December 31, 2020, our NAV per share was $20.1742, $20.1749, $20.1694, $20.1348 and $20.1732, per Class A, Class I, Class D, Class S and Class T share, respectively, and stockholders’ equity per GAAP was $240,256. For a full reconciliation of NAV to stockholders’ equity and a discussion of the limitations and risks associated with our valuation methodology, please see the “Management’s Discussion and Analysis of Financial Condition and Results of Operation—NAV Per Share” section of our annual and quarterly reports filed with the SEC, which are available at www.inland-investments.com. For information on how we calculate NAV, see the “Net Asset Value Calculation and Valuation Guidelines” section of our prospectus. InPoint NAV

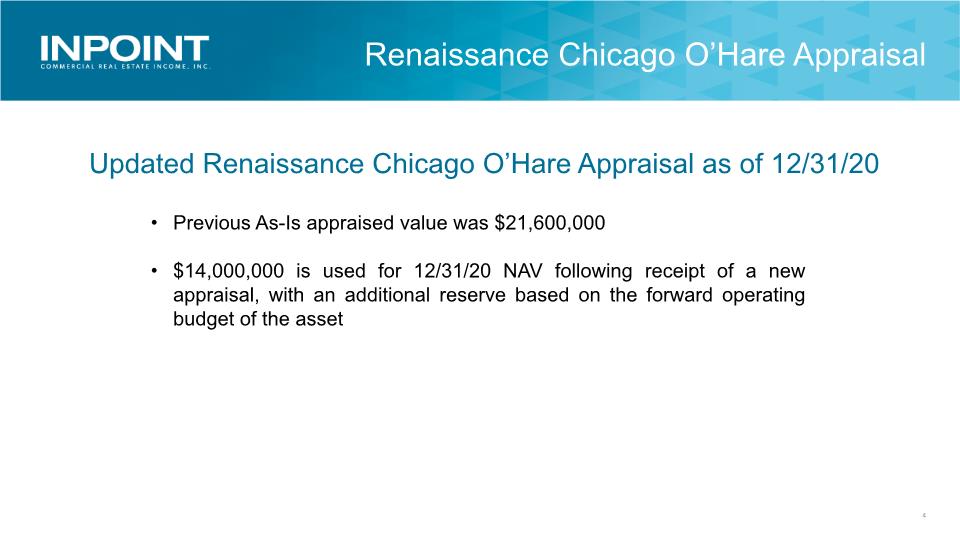

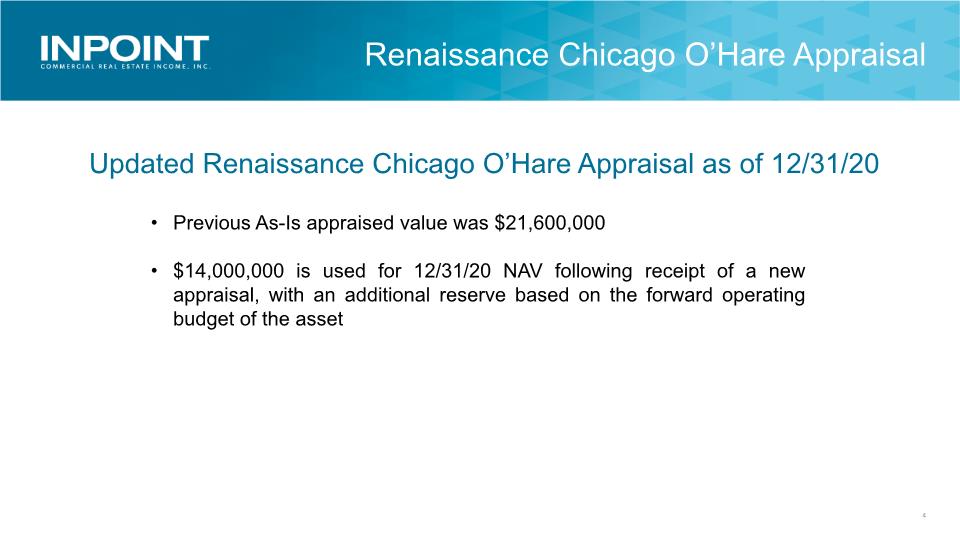

Renaissance Chicago O’Hare Appraisal 4 Updated Renaissance Chicago O’Hare Appraisal as of 12/31/20 Previous As-Is appraised value was $21,600,000 $14,000,000 is used for 12/31/20 NAV following receipt of a new appraisal, with an additional reserve based on the forward operating budget of the asset

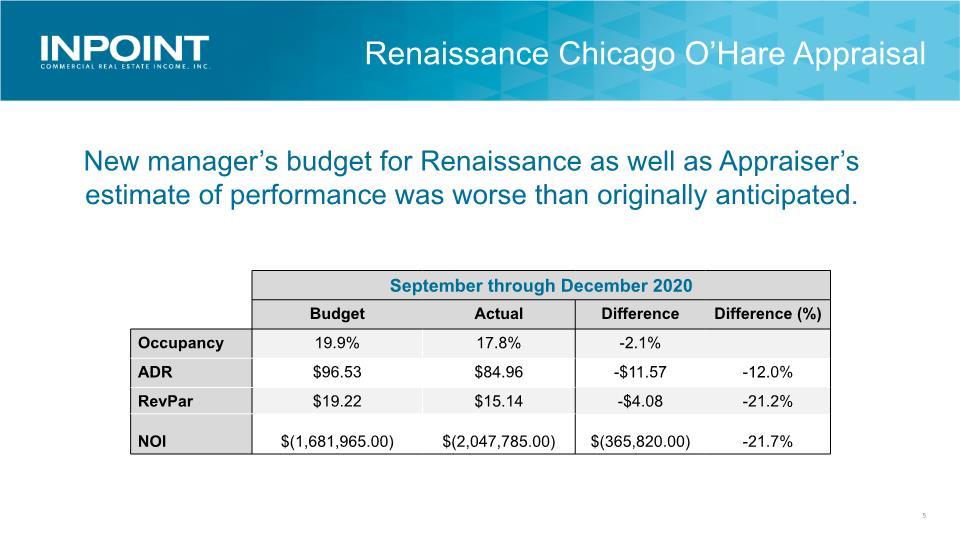

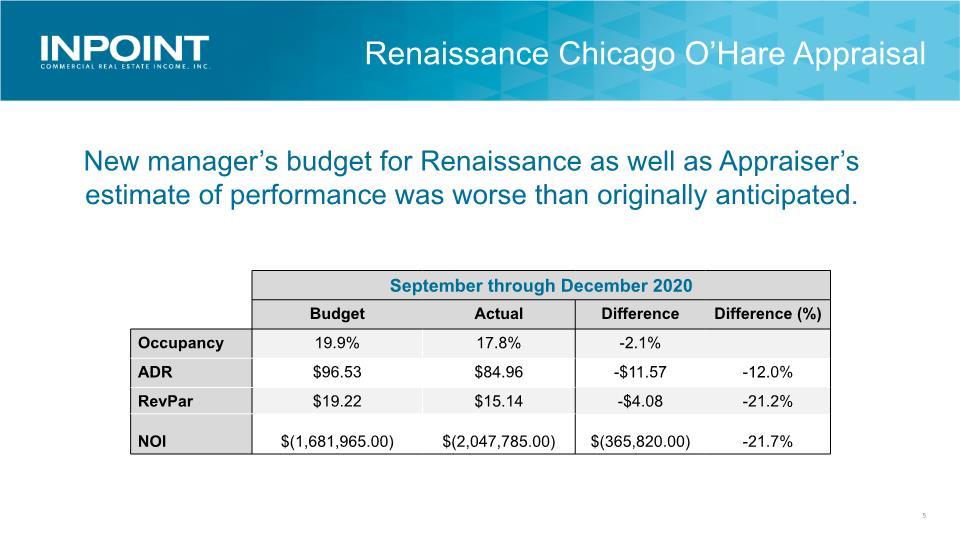

Renaissance Chicago O’Hare Appraisal 5 New manager’s budget for Renaissance as well as Appraiser’s estimate of performance was worse than originally anticipated.

InPoint NAV 6 In addition to Renaissance Chicago O’Hare changes to NAV, the 1st mortgage portfolio NAV was updated to only value Libor Floors for a 12-month period at current Libor on entire commercial mortgage loan portfolio Net Asset Value as of December 31, 2020

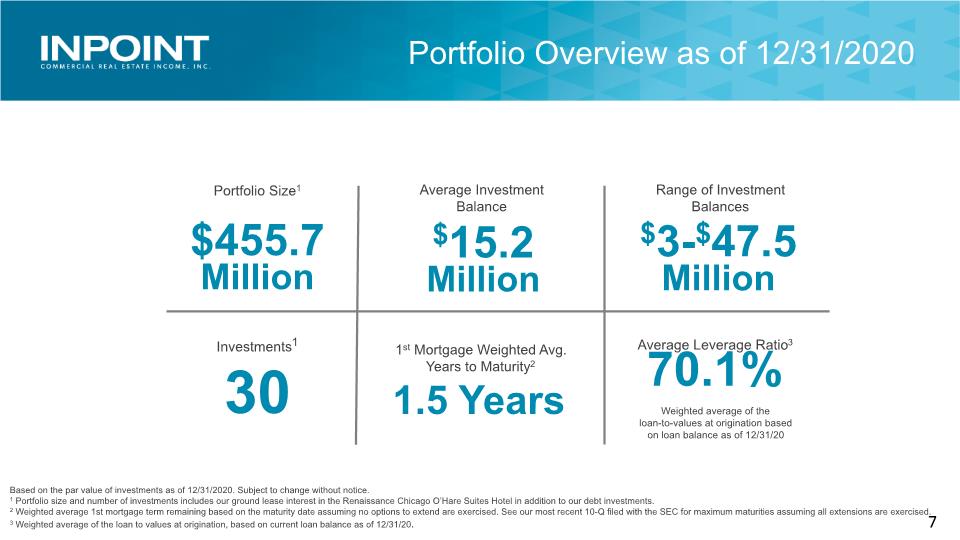

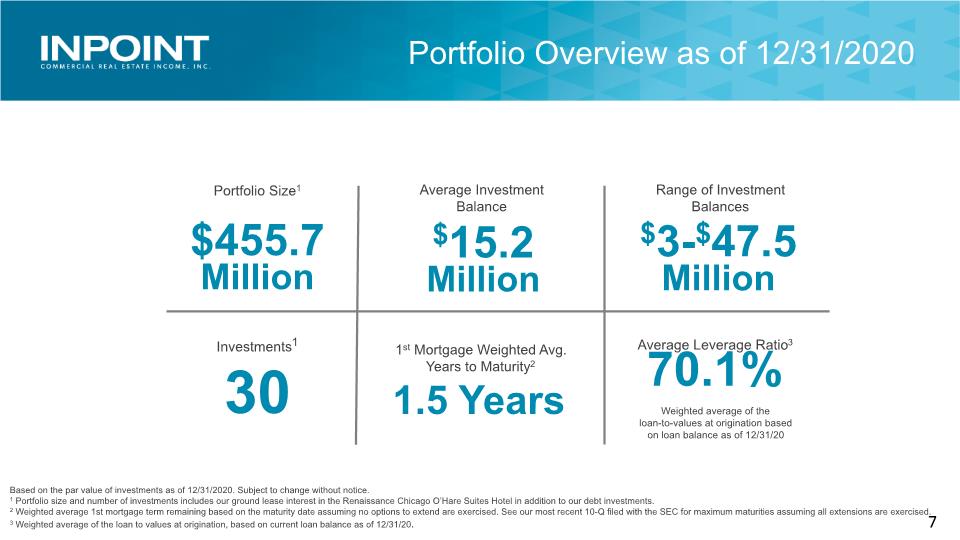

For Institutional Use Only. Dissemination to prospective investors prohibited. 7 Average Leverage Ratio3 $3-$47.5 Million Average Investment Balance Weighted average of the loan-to-values at origination based on loan balance as of 12/31/20 Portfolio Size1 $455.7 Million $15.2 Million Range of Investment Balances Investments1 30 70.1% Based on the par value of investments as of 12/31/2020. Subject to change without notice. 1 Portfolio size and number of investments includes our ground lease interest in the Renaissance Chicago O’Hare Suites Hotel in addition to our debt investments. 2 Weighted average 1st mortgage term remaining based on the maturity date assuming no options to extend are exercised. See our most recent 10-Q filed with the SEC for maximum maturities assuming all extensions are exercised. 3 Weighted average of the loan to values at origination, based on current loan balance as of 12/31/20. Portfolio Overview as of 12/31/2020 1st Mortgage Weighted Avg. Years to Maturity2 1.5 Years

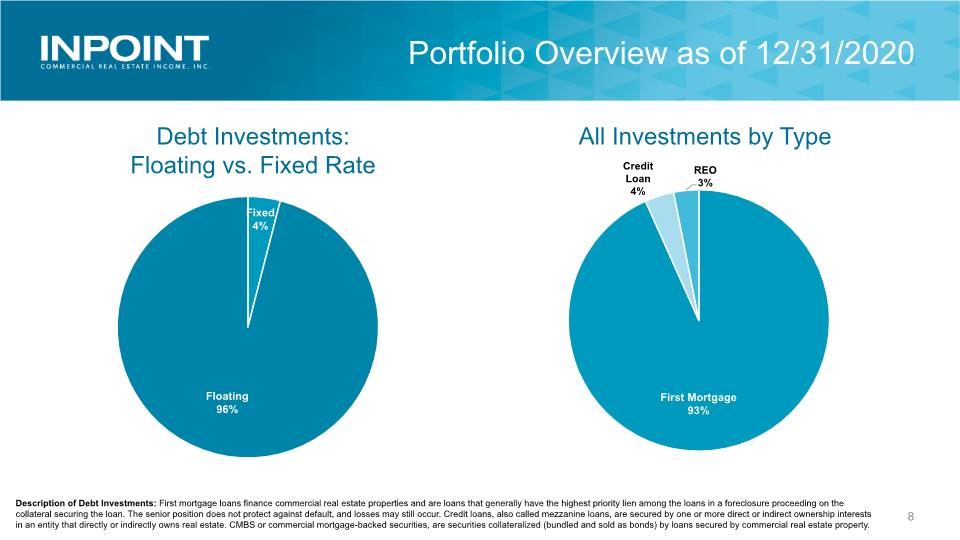

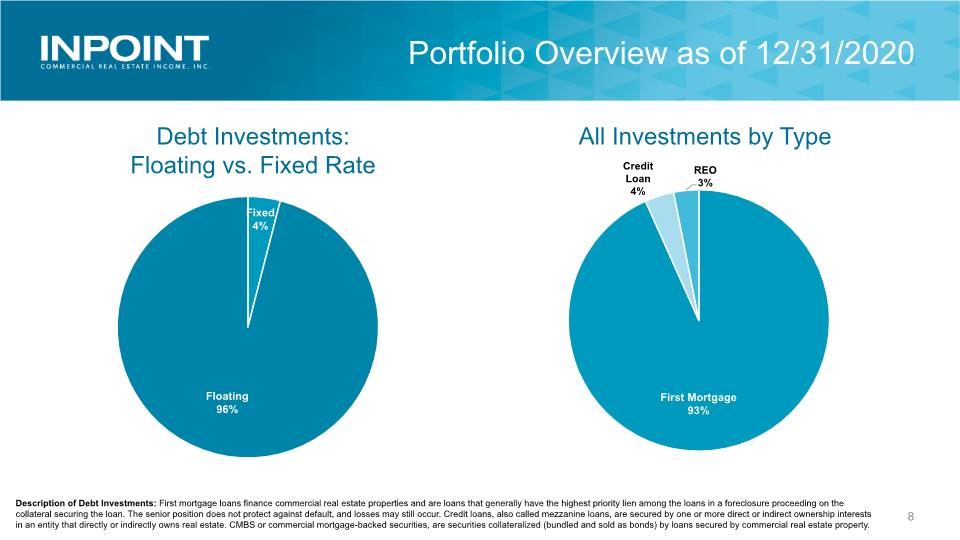

8 Debt Investments: Floating vs. Fixed Rate West Mid Atlantic Description of Debt Investments: First mortgage loans finance commercial real estate properties and are loans that generally have the highest priority lien among the loans in a foreclosure proceeding on the collateral securing the loan. The senior position does not protect against default, and losses may still occur. Credit loans, also called mezzanine loans, are secured by one or more direct or indirect ownership interests in an entity that directly or indirectly owns real estate. CMBS or commercial mortgage-backed securities, are securities collateralized (bundled and sold as bonds) by loans secured by commercial real estate property. All Investments by Type Portfolio Overview as of 12/31/2020

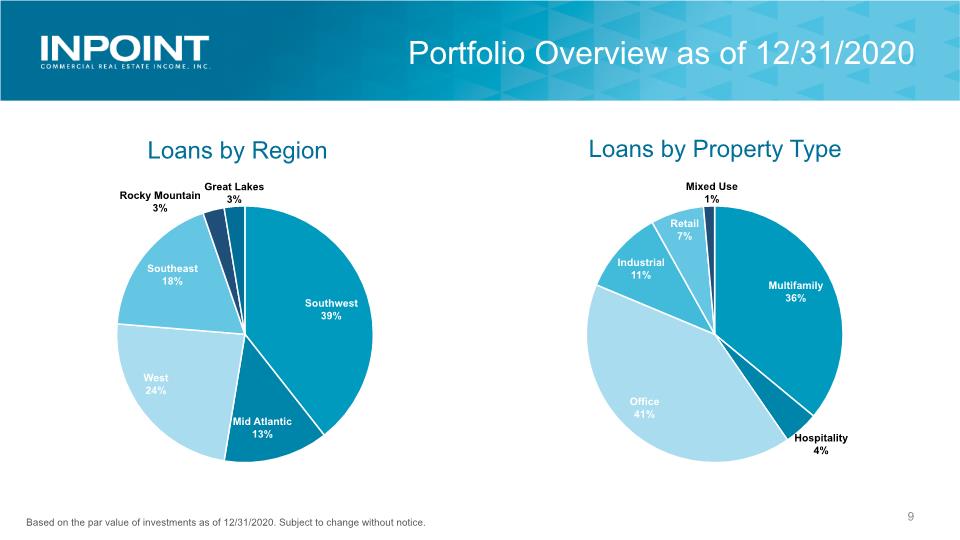

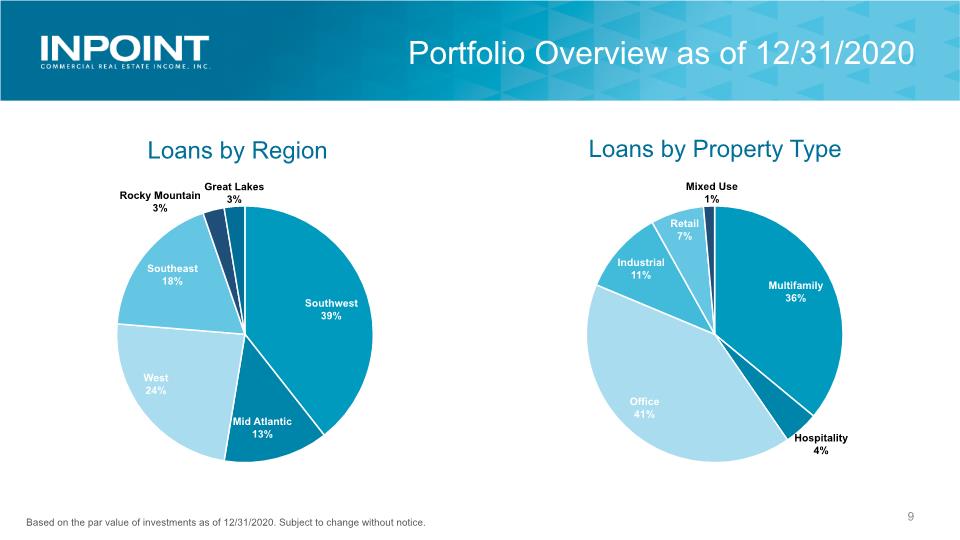

9 Loans by Region West Mid Atlantic Based on the par value of investments as of 12/31/2020. Subject to change without notice. Loans by Property Type Office Multifamily Portfolio Overview as of 12/31/2020