Exhibit 99.2 Merger Announcement May 3, 2023

Agenda | Merger Announcement Introductions & Steve Mahoney, President, Chief Financial and Operating Officer Transaction of Magenta Therapeutics Overview Dianthus Marino Garcia, President and Chief Executive Officer of Dianthus Overview Therapeutics DNTH103 Simrat Randhawa, M.D., Chief Medical Officer of Dianthus Overview Therapeutics 2

DISCLAIMER Forward Looking Statements Certain statements in this presentation (“Presentation”), other than purely historical information, may constitute “forward-looking statements” within the meaning of the federal securities laws, including for purposes of the safe harbor provisions under the United Stated Private Securities Litigation Reform Act of 1995, concerning Magenta Therapeutics, Inc. (“Magenta”), Dianthus Therapeutics, Inc. (“Dianthus”), a proposed concurrent financing and the proposed business combination between Magenta and Dianthus (the “Proposed Transaction”) and other matters. These forward-looking statements include, but are not limited to, express or implied statements regarding Magenta’s or Dianthus’ expectations, hopes, beliefs, intentions or strategies regarding the future, including, without limitation, statements regarding: the Proposed Transaction and the expected effects, perceived benefits or opportunities and related timing with respect thereto, expectations regarding or plans for discovery, preclinical studies, clinical trials and research and development programs, in particular with respect to DNTH103, and any developments or results in connection therewith, including the target product profile of DNTH103; the anticipated timing of the results from those studies and trials; expectations regarding the use of proceeds and the time period over which the combined company’s capital resources will be sufficient to fund its anticipated operations; expectations regarding the market and potential opportunities for complement therapies, in particular with respect to DNTH103; and the expected trading of the combined company’s common stock on Nasdaq under the ticker symbol “DNTH.” In addition, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward- looking statements. The words “opportunity,” “potential,” “milestones,” “runway,” “will,” “anticipate,” “achieve,” “near-term,” “catalysts,” “pursue,” “pipeline,” “believe,” continue,” “ could,” “estimate,” “ expect,” “ intend,” “may,” “might,” “plan,” “possible,” “predict,” “project,” “ should,” “ strive,” “would,” “aim,” “target,” “commit,” and similar expressions (including the negatives of these terms or variations of them) generally identify forward-looking statements, but the absence of these words does not mean that statement is not forward looking. Forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based on current expectations and assumptions that, while considered reasonable by Magenta and its management, or Dianthus and its management, as the case may be, are inherently uncertain. New risks and uncertainties may emerge from time to time, and it is not possible to predict or identify all risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the risk that the conditions to the closing or consummation of the Proposed Transaction are not satisfied, including the failure to obtain stockholder approval for the Proposed Transaction; the risk that the concurrent financing is not completed in a timely manner or at all; uncertainties as to the timing of the consummation of the Proposed Transaction and the ability of each of Magenta and Dianthus to consummate the transactions contemplated; risks related to Magenta’s continued listing on the Nasdaq until closing of the Proposed Transaction and the combined company’s ability to remain listed following the Proposed Transaction; risks related to Magenta’s and Dianthus’ ability to correctly estimate their respective operating expenses and expenses associated with the Proposed Transaction, as applicable, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the business combination between Magenta and Dianthus; the effect of the announcement or pendency of the business combination on Magenta’s or Dianthus’ business relationships, operating results and business generally; costs related to the Proposed Transaction; the outcome of any legal proceedings that may be instituted against Magenta, Dianthus or any of their respective directors or officers related to the merger agreement or the transactions contemplated thereby; the ability of Magenta or Dianthus to protect their respective intellectual property rights; competitive responses to the Proposed Transaction; unexpected costs, charges or expenses resulting from the Proposed Transaction; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Proposed Transaction; legislative, regulatory, political and economic developments; and those uncertainties and factors set forth in the sections entitled “Risk Factors,” “Risk Factor Summary” and “Forward-Looking Statements” in Magenta’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 23, 2023, in other filings by Magenta from time to time with the SEC and any risk factors related to Magenta or Dianthus made available to you in connection with the Proposed Transaction, as well as risk factors associated with companies, such as Dianthus, that operate in the biopharma industry. Should one or more of these risks or uncertainties materialize, or should any of Magenta’s or Dianthus’ assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. Neither Magenta nor Dianthus undertakes or accepts any duty to release publicly any updates or revisions to any forward-looking statements. This Presentation does not purport to summarize all of the conditions, risks and other attributes of an investment in Magenta or Dianthus. 3

DISCLAIMER (continued) No Offer or Solicitation This Presentation and the information contained herein, is not intended to and shall not constitute (i) a solicitation of a proxy, consent or approval with respect to any securities or in respect of the Proposed Transaction or (ii) an offer to buy or sell or the solicitation of an offer to buy or sell any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. Important Additional Information About the Proposed Transaction and Where to Find It This Presentation is not a substitute for the registration statement or for any other document that Magenta may file with the SEC in connection with the Proposed Transaction. In connection with the Proposed Transaction, Magenta intends to file relevant materials with the SEC, including a registration statement on Form S-4 that will contain a proxy statement/prospectus of Magenta. MAGENTA URGES INVESTORS AND STOCKHOLDERS TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MAGENTA, DIANTHUS, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and stockholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC by Magenta, when they become available, through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders should note that Magenta communicates with investors and the public using its website (www.magentatx.com) where anyone will be able to obtain free copies of the proxy statement/prospectus and other documents filed by Magenta with the SEC, and stockholders are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the Proposed Transaction. Participants in the Solicitation Magenta, Dianthus and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the Proposed Transaction. Information about Magenta’s directors and executive officers including a description of their interests in Magenta is included in Magenta’s most recent Annual Report on Form 10-K, including any information incorporated therein by reference, as filed with the SEC. Additional information regarding these persons and their interests in the transaction will be included in the proxy statement/prospectus relating to the Proposed Transaction when it is filed with the SEC. These documents can be obtained free of charge from the sources indicated above. Industry and Market Data Certain information contained in this Presentation relates to or is based on studies, publications, surveys and Dianthus’ own internal estimates and research. In this Presentation, Magenta and Dianthus rely on, and refer to, publicly available information and statistics regarding market participants in the sector in which Dianthus competes and other industry data. Any comparison of Dianthus to any other entity assumes the reliability of the information available to Dianthus. Dianthus obtained this information and statistics from third-party sources, including reports by market research firms and company filings. In addition, all of the market data included in this Presentation involve a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while Dianthus believes its internal research is reliable, such research has not been verified by any independent source and neither Magenta nor Dianthus has independently verified the information. Trademarks Magenta and Dianthus own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This Presentation may also contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with Magenta or Dianthus, or an endorsement or sponsorship by or of Magenta or Dianthus. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM, © or ® symbols, but such references are not intended to indicate in any way that 4 Magenta and Dianthus will not assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights.

Merger is transformative for both Magenta and Dianthus with potential for significant value creation • Dianthus Therapeutics opportunity: Provides Magenta stockholders with the opportunity to participate in the exciting Dianthus growth story at a pivotal time in its evolution with potential for significant near-term value-driving catalysts • Differentiated lead program: DNTH103 is a potent, highly differentiated, monoclonal antibody that selectively targets the active C1s complement protein, inhibiting only the classical complement pathway. DNTH103 aims to more effectively and safely treat patients with lower dosing volume and less frequent administration in a convenient subcutaneous injection suitable for a pre-filled pen • Potential for significant near-term value-driving catalysts: Steady cadence of milestones with DNTH103 including top-line Phase 1 data aiming to confirm potent classical pathway inhibition and favorable, extended PK expected by the end of 2023, initiation of planned Phase 2 trial in generalized Myasthenia Gravis expected in Q1 2024 followed by two additional planned Phase 2 trial initiations in other neuro indications, and planned initiation of an open-label proof-of- efficacy trial in Cold Agglutinin Disease with patient data expected in 2H 2024 • Strong balance sheet supports runway into 2026: Combined company expected to have approximately $180 million in cash and cash equivalents upon closing; resources expected to fund operations to mid-2026 5

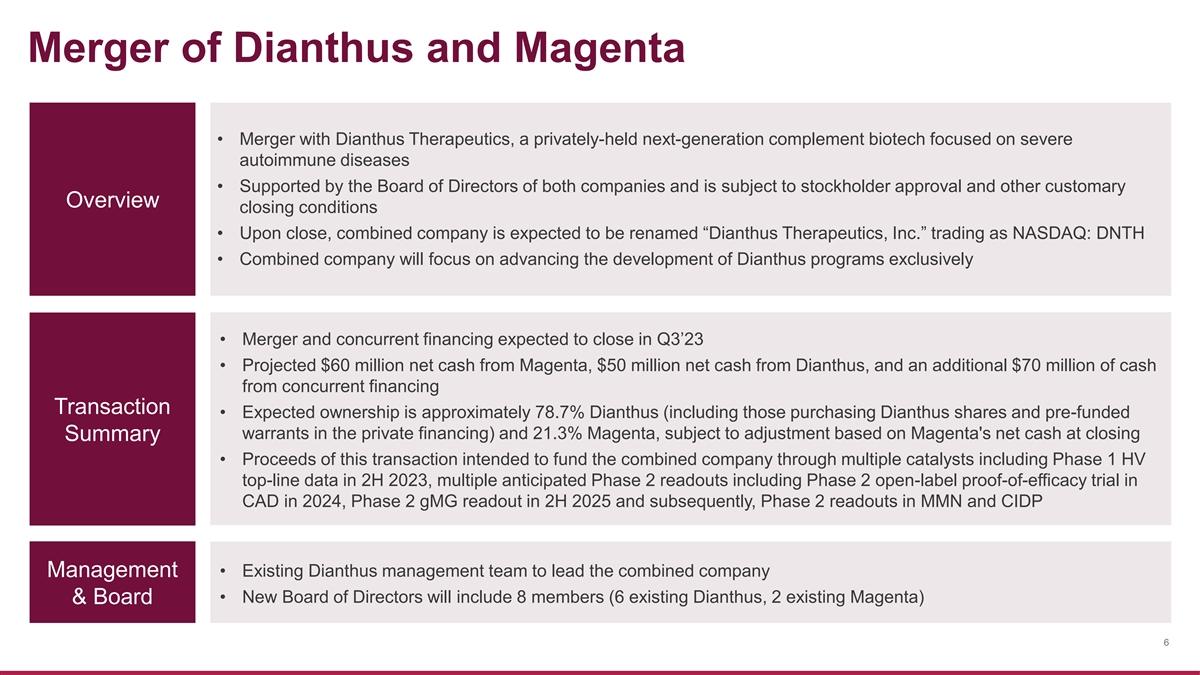

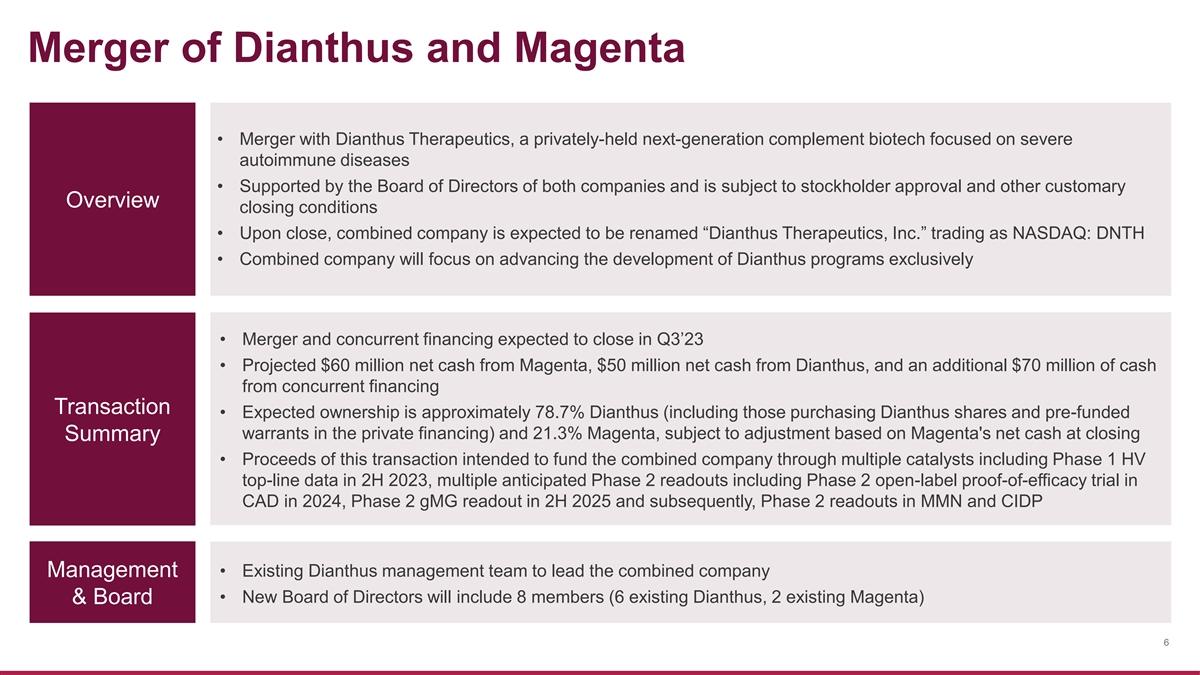

Merger of Dianthus and Magenta • Merger with Dianthus Therapeutics, a privately-held next-generation complement biotech focused on severe autoimmune diseases • Supported by the Board of Directors of both companies and is subject to stockholder approval and other customary Overview closing conditions • Upon close, combined company is expected to be renamed “Dianthus Therapeutics, Inc.” trading as NASDAQ: DNTH • Combined company will focus on advancing the development of Dianthus programs exclusively • Merger and concurrent financing expected to close in Q3’23 • Projected $60 million net cash from Magenta, $50 million net cash from Dianthus, and an additional $70 million of cash from concurrent financing Transaction • Expected ownership is approximately 78.7% Dianthus (including those purchasing Dianthus shares and pre-funded warrants in the private financing) and 21.3% Magenta, subject to adjustment based on Magenta's net cash at closing Summary • Proceeds of this transaction intended to fund the combined company through multiple catalysts including Phase 1 HV top-line data in 2H 2023, multiple anticipated Phase 2 readouts including Phase 2 open-label proof-of-efficacy trial in CAD in 2024, Phase 2 gMG readout in 2H 2025 and subsequently, Phase 2 readouts in MMN and CIDP Management • Existing Dianthus management team to lead the combined company • New Board of Directors will include 8 members (6 existing Dianthus, 2 existing Magenta) & Board 6

Developing next-generation complement therapies Founded in 2019 to develop next-generation complement therapies targeting severe autoimmune disorders Lead compound, DNTH103, is a potent monoclonal antibody that selectively targets $100M the active C1s protein, inhibiting only the classical complement pathway. DNTH103 Series A aims to treat patients with lower dosing volume and less frequently* as a convenient subcutaneous injection suitable for a self-administered pre-filled pen April ’22 Potentially multiple value driving catalysts expected in next 12 months, including Phase Phase 1 1 data in 2H’23 aiming to confirm potent classical pathway inhibition and favorable, extended PK, followed by the anticipated initiation of a generalized Myasthenia Initiated Gravis Phase 2 trial Nov ’22 In-house discovery team with extensive complement and antibody experience identifying additional novel next-generation therapeutics that target the active protein Merger & $70M Raise Experienced management team and Board validated by leading life-sciences investor syndicate May ’23 7 *DNTH103 is Fc engineered with YTE half-life extension technology

Accomplished team of biotech industry veterans and scientists committed to bringing innovation to market Rivka Gluck, R.N. Marino Garcia Kristina Maximenko Ryan Savitz Edward Carr Simrat Randhawa, M.D. Susan Kalled, Ph.D. President & CEO Chief People Officer Chief Accounting Officer Head of Clinical Chief Medical Officer Chief Financial Officer Chief Scientific Officer Development Operations Douangsone Debra Segal Jud Taylor Scott Nogi Robert McGarr, Ph.D. Polly Hanff Sankalp “Sam Head of Regulatory Head of Technical Head of Program, Alliance and Head of Vadysirisack, Ph.D. Head of Business Gokhale, M.D. Affairs Operations Nonclinical Development Quality Operations VP, Translational Biology VP, Clinical Development Select Experience Includes: Select Auto-Immune Drugs Zilucoplan Developed by Dianthus Team 8

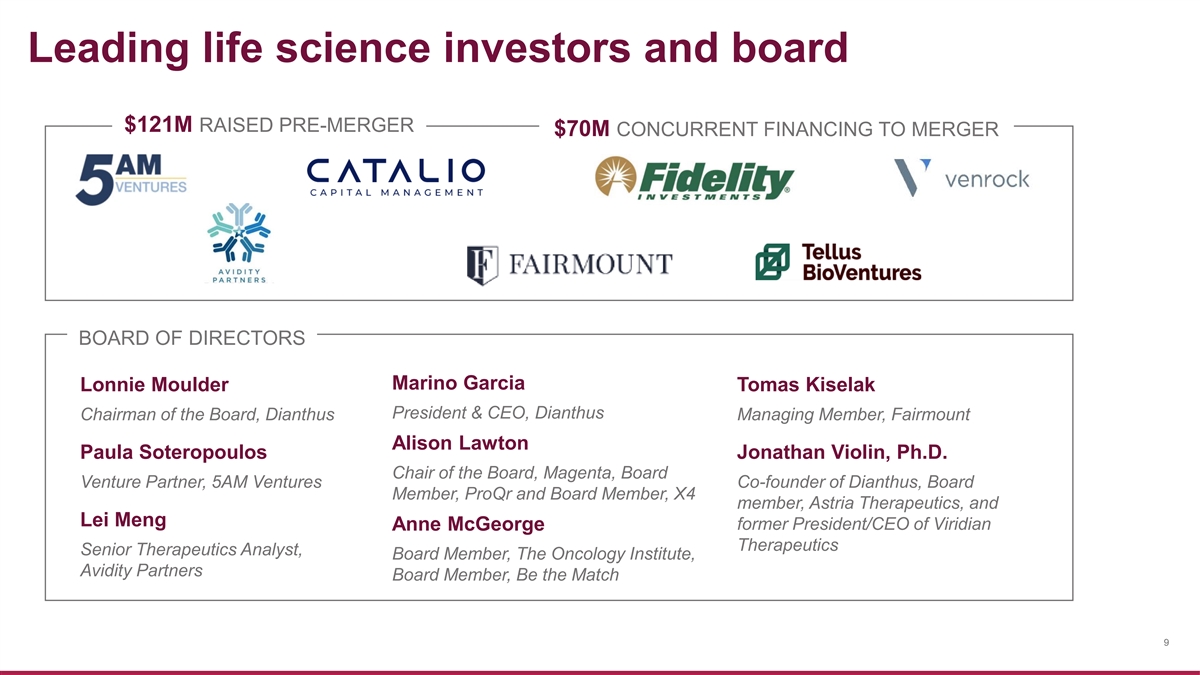

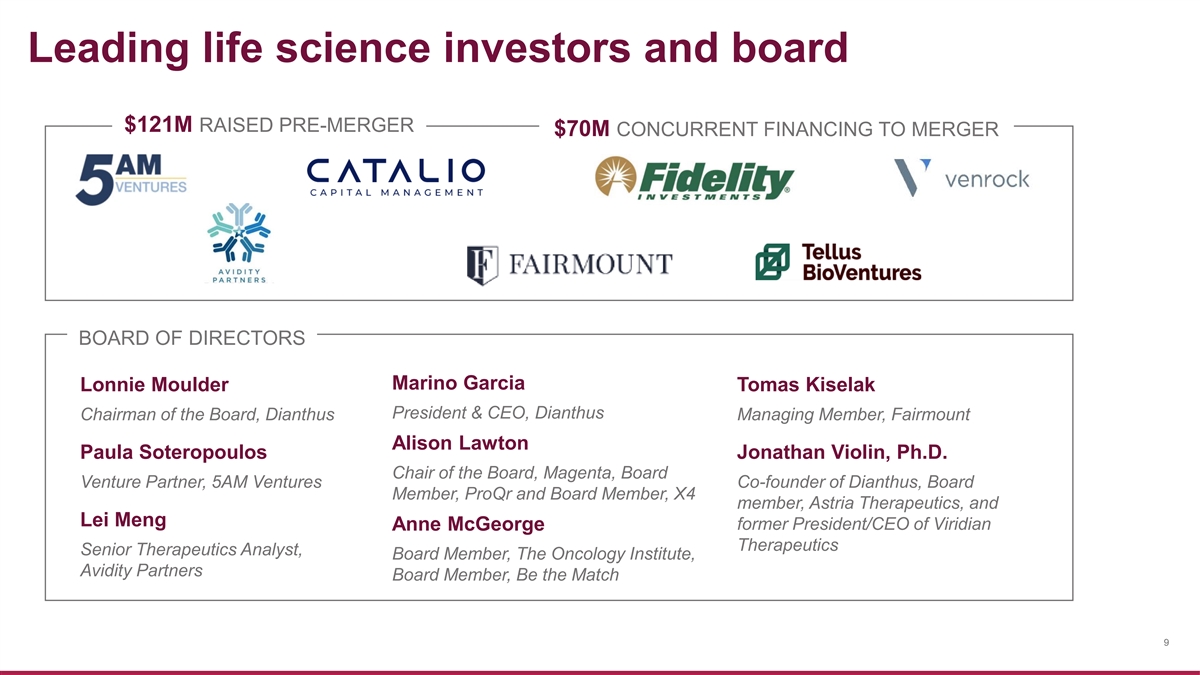

Leading life science investors and board $121M RAISED PRE-MERGER $70M CONCURRENT FINANCING TO MERGER BOARD OF DIRECTORS Marino Garcia Lonnie Moulder Tomas Kiselak President & CEO, Dianthus Chairman of the Board, Dianthus Managing Member, Fairmount Alison Lawton Paula Soteropoulos Jonathan Violin, Ph.D. Chair of the Board, Magenta, Board Venture Partner, 5AM Ventures Co-founder of Dianthus, Board Member, ProQr and Board Member, X4 member, Astria Therapeutics, and Lei Meng former President/CEO of Viridian Anne McGeorge Therapeutics Senior Therapeutics Analyst, Board Member, The Oncology Institute, Avidity Partners Board Member, Be the Match 9

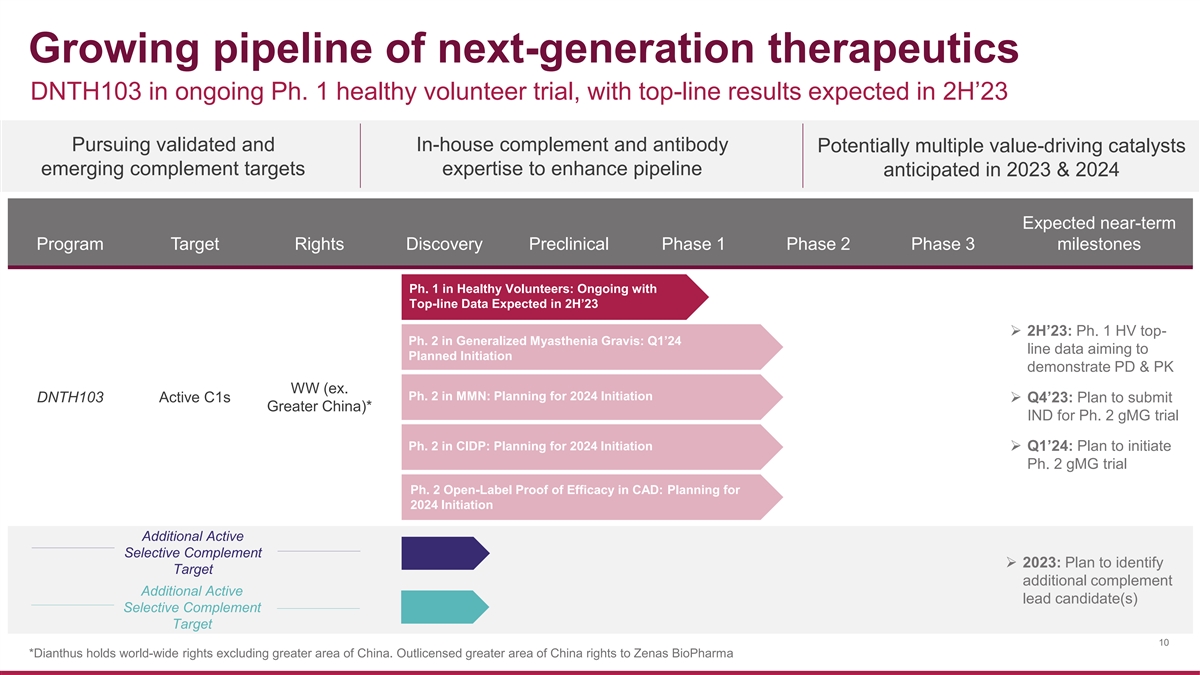

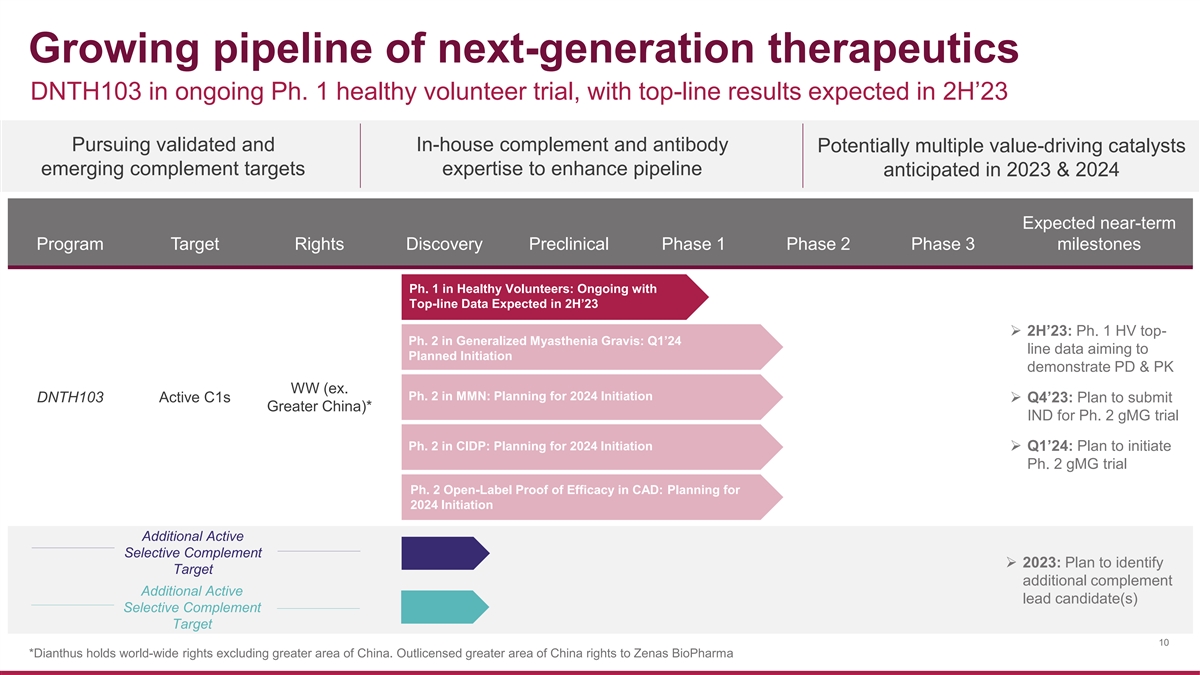

Growing pipeline of next-generation therapeutics DNTH103 in ongoing Ph. 1 healthy volunteer trial, with top-line results expected in 2H’23 Pursuing validated and In-house complement and antibody Potentially multiple value-driving catalysts emerging complement targets expertise to enhance pipeline anticipated in 2023 & 2024 Expected near-term Program Target Rights Discovery Preclinical Phase 1 Phase 2 Phase 3 milestones Ph. 1 in Healthy Volunteers: Ongoing with Top-line Data Expected in 2H’23 ➢ 2H’23: Ph. 1 HV top- Ph. 2 in Generalized Myasthenia Gravis: Q1’24 line data aiming to Planned Initiation demonstrate PD & PK WW (ex. Ph. 2 in MMN: Planning for 2024 Initiation DNTH103 Active C1s➢ Q4’23: Plan to submit Greater China)* IND for Ph. 2 gMG trial Ph. 2 in CIDP: Planning for 2024 Initiation ➢ Q1’24: Plan to initiate Ph. 2 gMG trial Ph. 2 Open-Label Proof of Efficacy in CAD: Planning for 2024 Initiation Additional Active Selective Complement ➢ 2023: Plan to identify Target additional complement Additional Active lead candidate(s) Selective Complement Target 10 *Dianthus holds world-wide rights excluding greater area of China. Outlicensed greater area of China rights to Zenas BioPharma

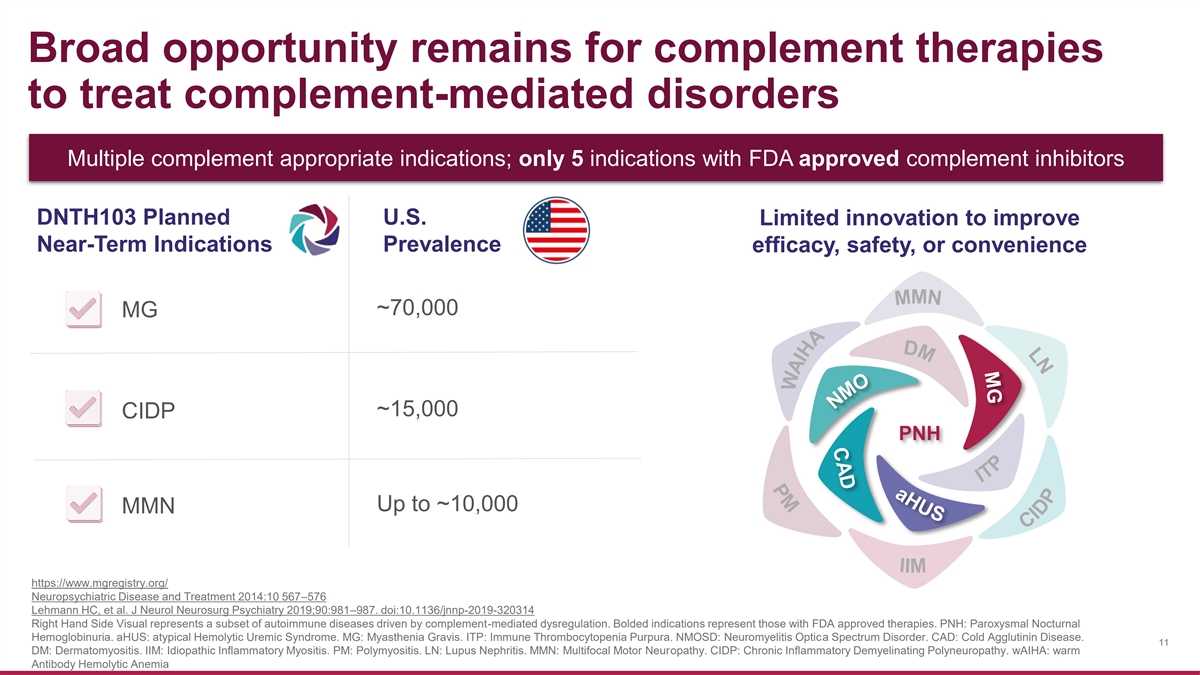

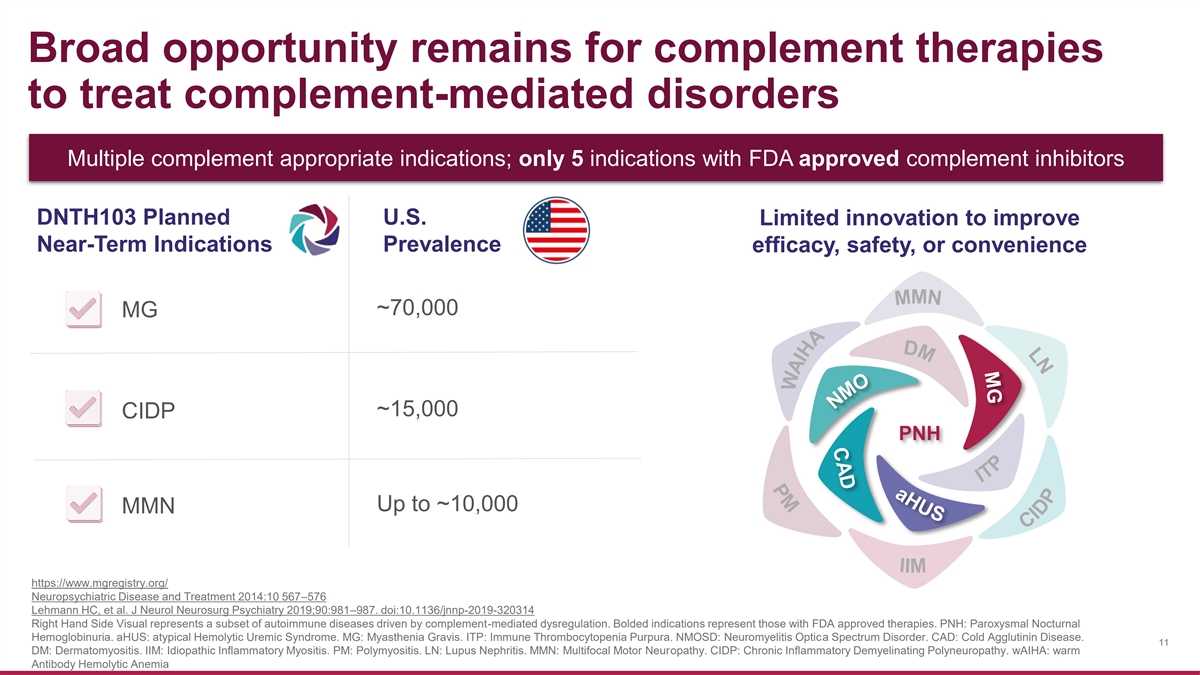

Broad opportunity remains for complement therapies to treat complement-mediated disorders Multiple complement appropriate indications; only 5 indications with FDA approved complement inhibitors DNTH103 Planned U.S. Limited innovation to improve Near-Term Indications Prevalence efficacy, safety, or convenience ~70,000 MG ~15,000 CIDP PNH Up to ~10,000 MMN https://www.mgregistry.org/ Neuropsychiatric Disease and Treatment 2014:10 567–576 Lehmann HC, et al. J Neurol Neurosurg Psychiatry 2019;90:981–987. doi:10.1136/jnnp-2019-320314 Right Hand Side Visual represents a subset of autoimmune diseases driven by complement-mediated dysregulation. Bolded indications represent those with FDA approved therapies. PNH: Paroxysmal Nocturnal Hemoglobinuria. aHUS: atypical Hemolytic Uremic Syndrome. MG: Myasthenia Gravis. ITP: Immune Thrombocytopenia Purpura. NMOSD: Neuromyelitis Optica Spectrum Disorder. CAD: Cold Agglutinin Disease. 11 DM: Dermatomyositis. IIM: Idiopathic Inflammatory Myositis. PM: Polymyositis. LN: Lupus Nephritis. MMN: Multifocal Motor Neuropathy. CIDP: Chronic Inflammatory Demyelinating Polyneuropathy. wAIHA: warm Antibody Hemolytic Anemia

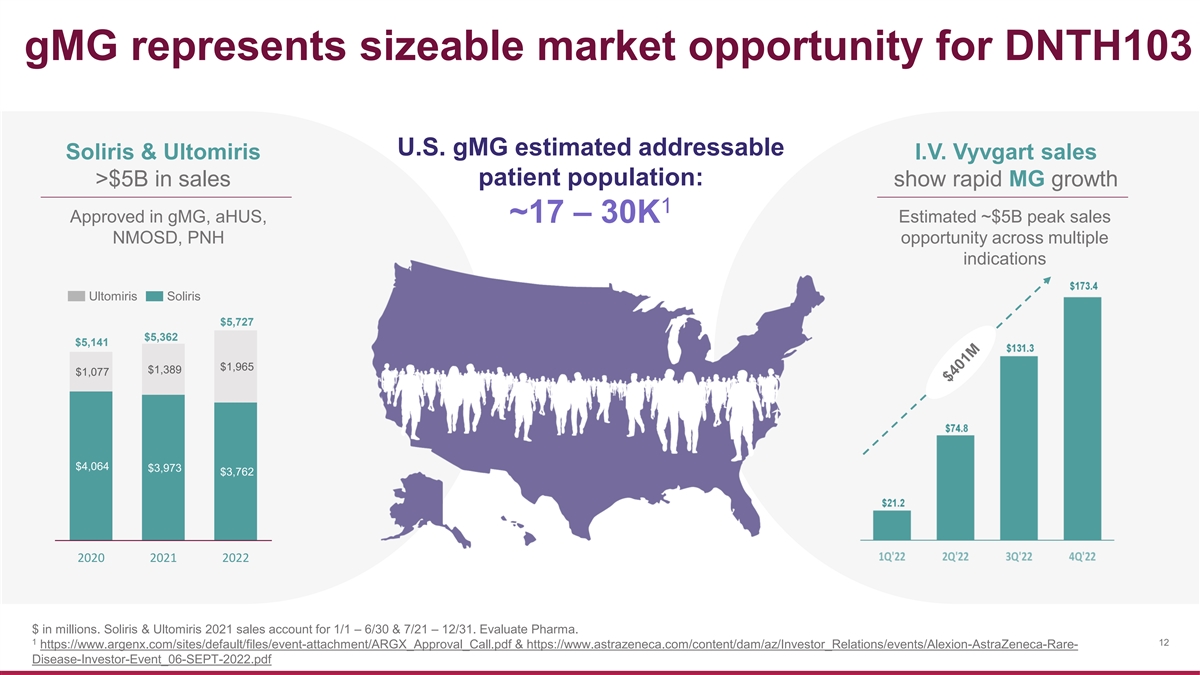

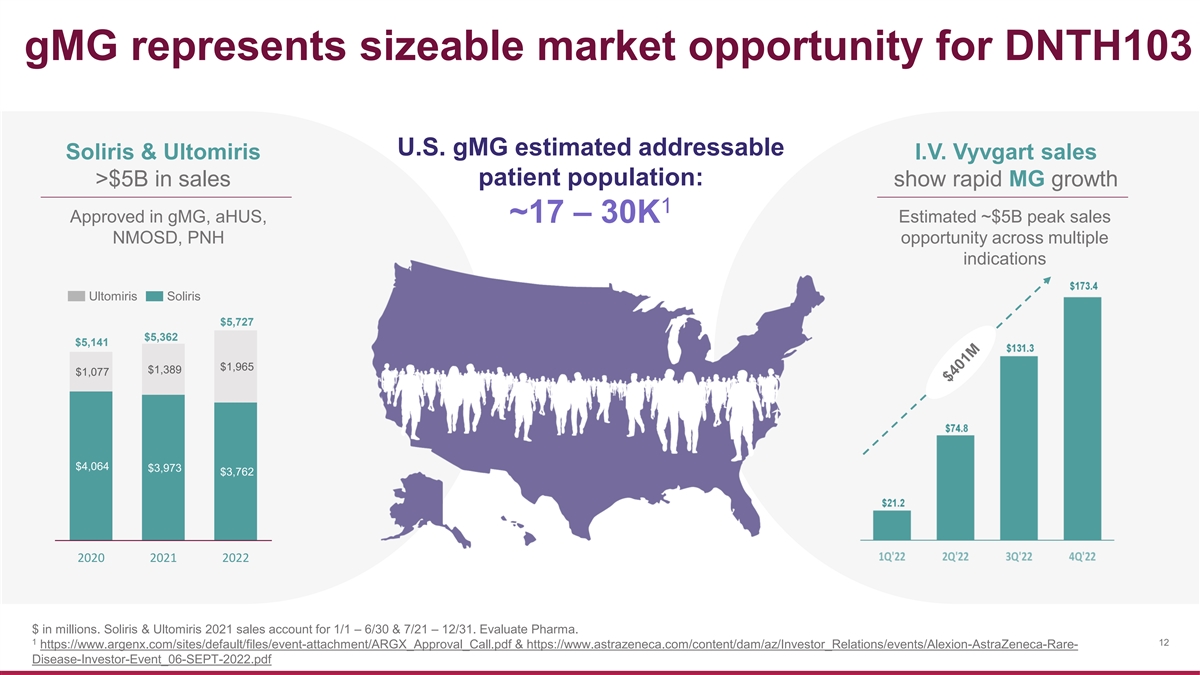

gMG represents sizeable market opportunity for DNTH103 U.S. gMG estimated addressable Soliris & Ultomiris I.V. Vyvgart sales >$5B in sales patient population: show rapid MG growth 1 Approved in gMG, aHUS, ~17 – 30K Estimated ~$5B peak sales NMOSD, PNH opportunity across multiple indications Ultomiris Soliris $5,727 $5,362 $5,141 $1,965 $1,389 $1,077 $4,064 $3,973 $3,762 2020 2021 2022 $ in millions. Soliris & Ultomiris 2021 sales account for 1/1 – 6/30 & 7/21 – 12/31. Evaluate Pharma. 1 12 https://www.argenx.com/sites/default/files/event-attachment/ARGX_Approval_Call.pdf & https://www.astrazeneca.com/content/dam/az/Investor_Relations/events/Alexion-AstraZeneca-Rare- Disease-Investor-Event_06-SEPT-2022.pdf

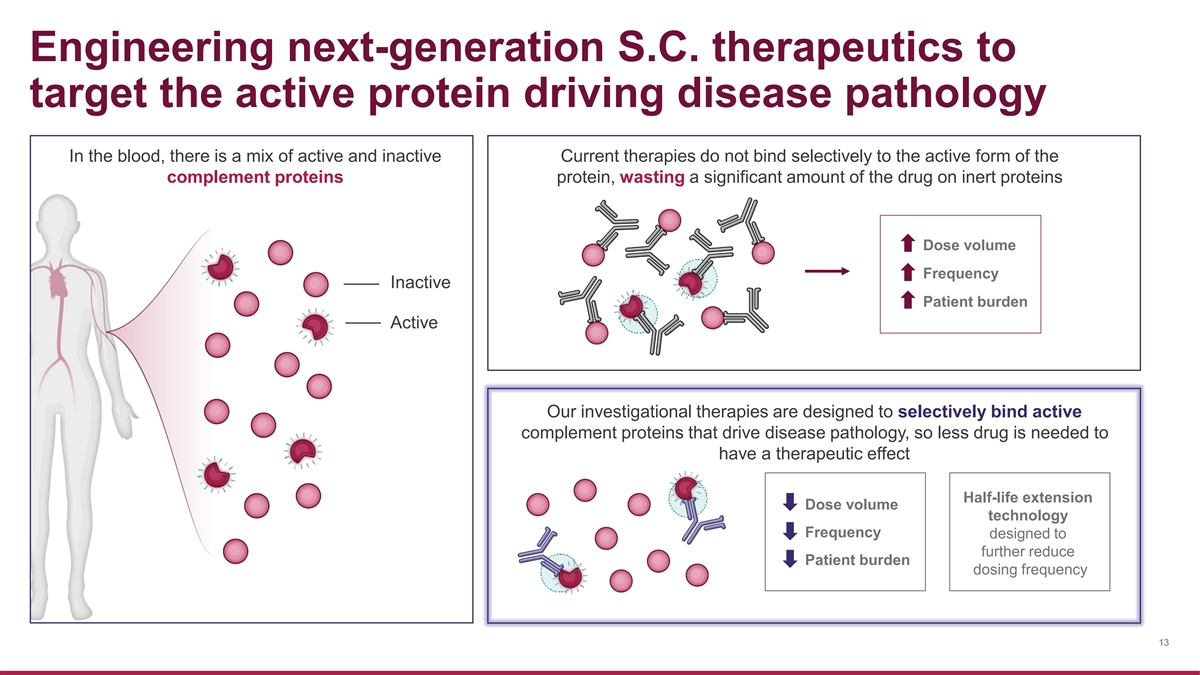

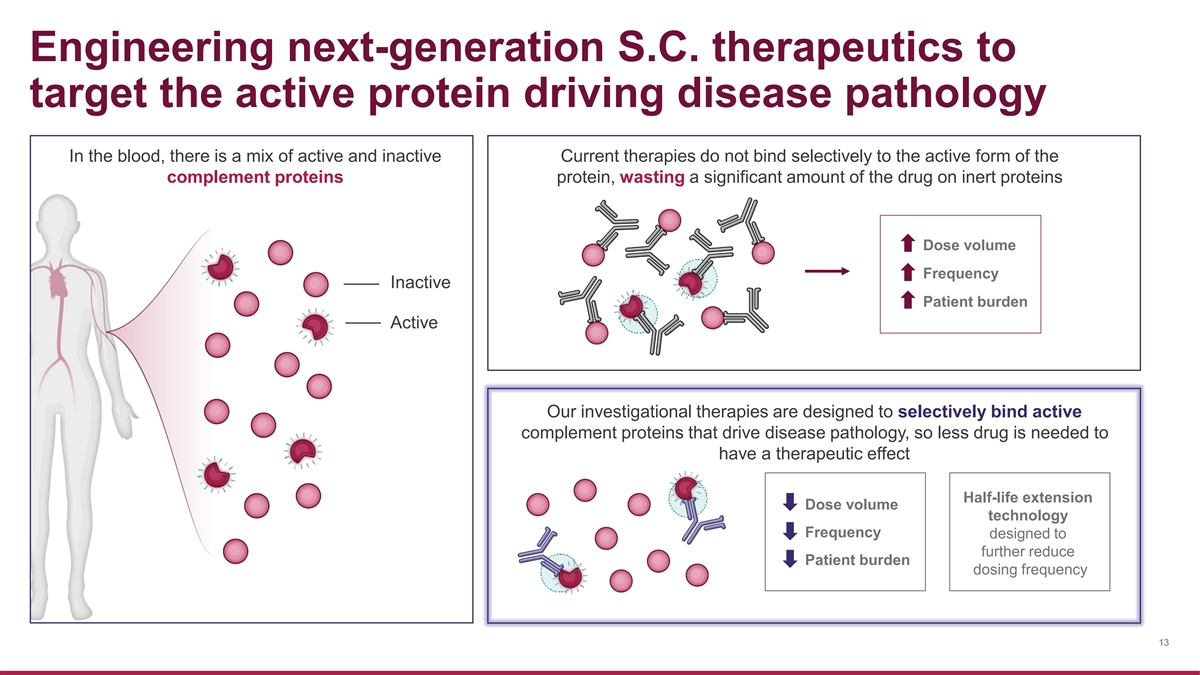

Engineering next-generation S.C. therapeutics to target the active protein driving disease pathology In the blood, there is a mix of active and inactive Current therapies do not bind selectively to the active form of the complement proteins protein, wasting a significant amount of the drug on inert proteins Dose volume Frequency Inactive Patient burden Active Our investigational therapies are designed to selectively bind active complement proteins that drive disease pathology, so less drug is needed to have a therapeutic effect Half-life extension Dose volume technology Frequency designed to further reduce Patient burden dosing frequency 13

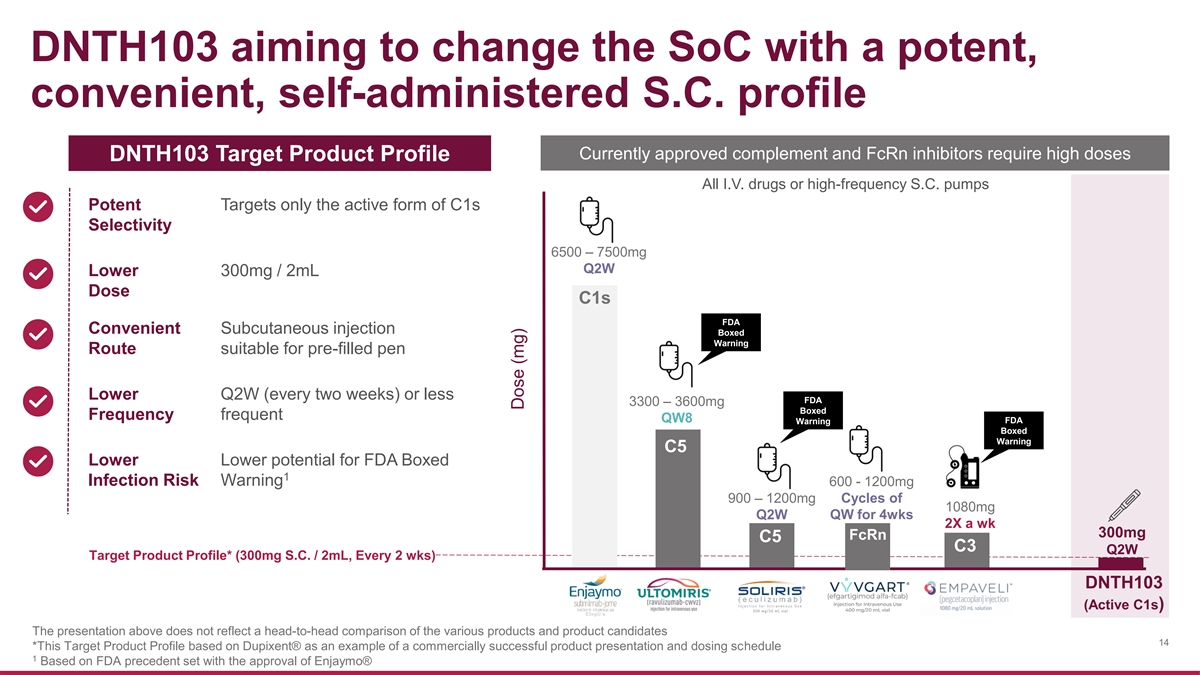

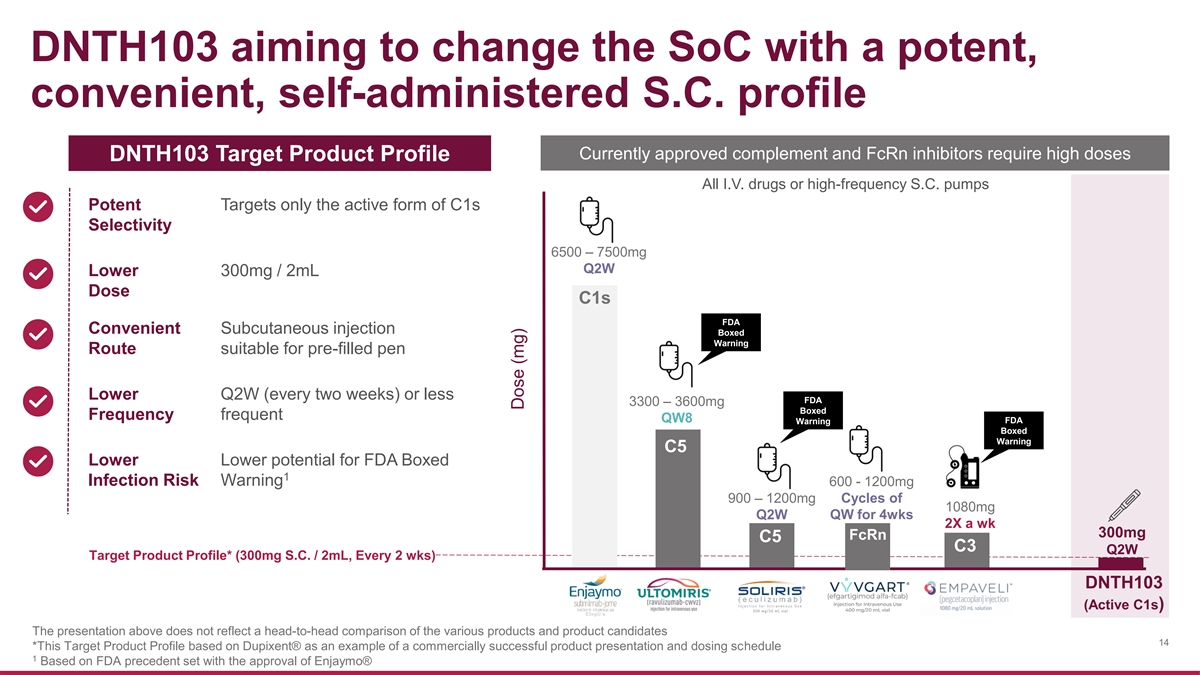

DNTH103 aiming to change the SoC with a potent, convenient, self-administered S.C. profile Currently approved complement and FcRn inhibitors require high doses DNTH103 Target Product Profile All I.V. drugs or high-frequency S.C. pumps Potent Targets only the active form of C1s Selectivity 6500 – 7500mg Q2W Lower 300mg / 2mL Dose C1s FDA Convenient Subcutaneous injection Boxed Warning Route suitable for pre-filled pen Lower Q2W (every two weeks) or less FDA 3300 – 3600mg Boxed Frequency frequent QW8 FDA Warning Boxed Warning C5 Lower Lower potential for FDA Boxed 1 Infection Risk Warning 600 - 1200mg 900 – 1200mg Cycles of 1080mg Q2W QW for 4wks 2X a wk 300mg FcRn C5 C3 Q2W Target Product Profile* (300mg S.C. / 2mL, Every 2 wks) DNTH103 (Active C1s) The presentation above does not reflect a head-to-head comparison of the various products and product candidates 14 *This Target Product Profile based on Dupixent® as an example of a commercially successful product presentation and dosing schedule 1 Based on FDA precedent set with the approval of Enjaymo® Dose (mg)

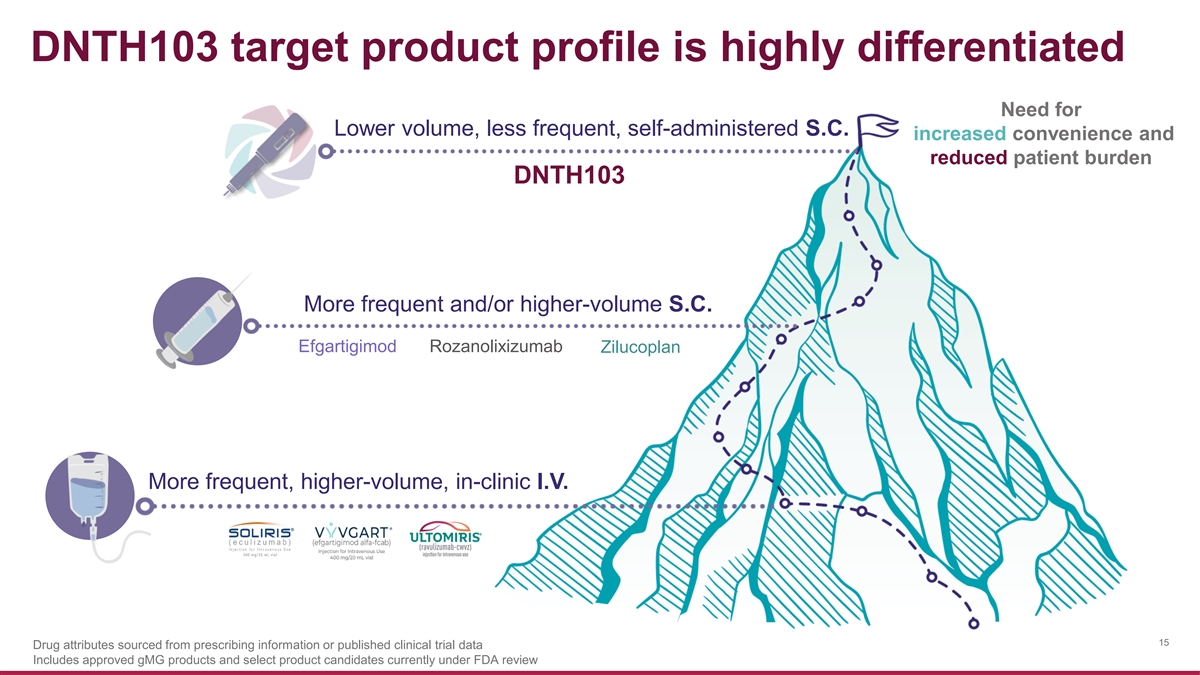

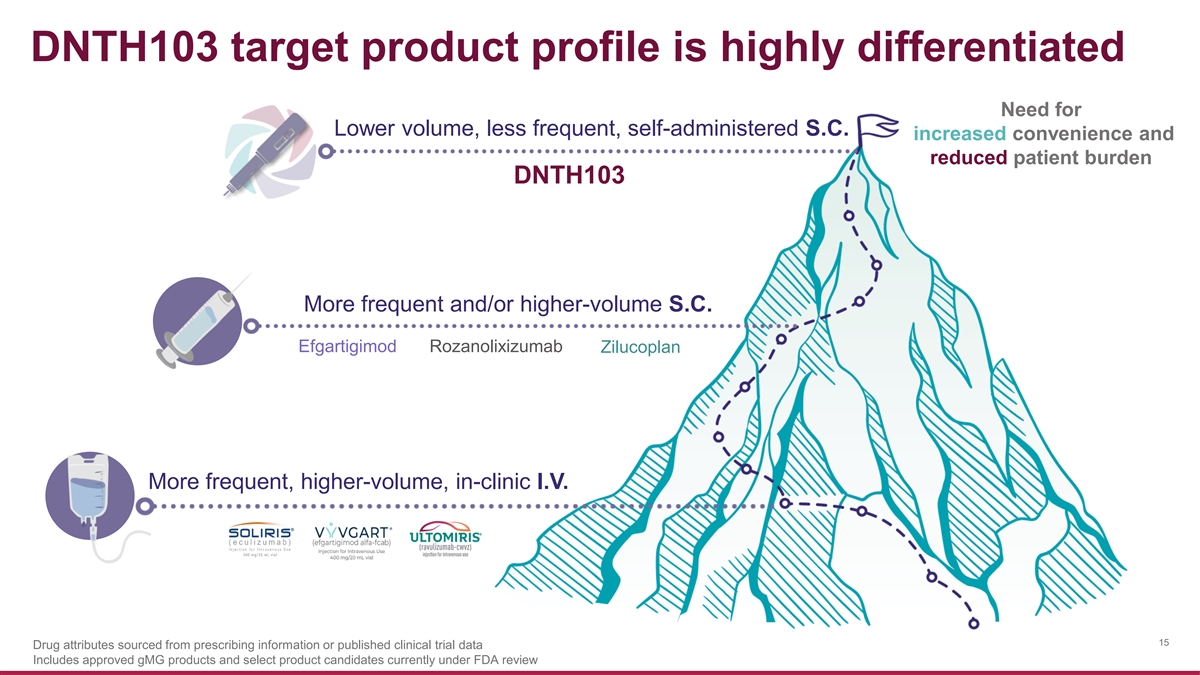

DNTH103 target product profile is highly differentiated Need for Lower volume, less frequent, self-administered S.C. increased convenience and reduced patient burden DNTH103 More frequent and/or higher-volume S.C. Efgartigimod Rozanolixizumab Zilucoplan More frequent, higher-volume, in-clinic I.V. 15 Drug attributes sourced from prescribing information or published clinical trial data Includes approved gMG products and select product candidates currently under FDA review

DNTH103: ACTIVE C1S INHIBITOR A next-generation classical pathway complement inhibitor

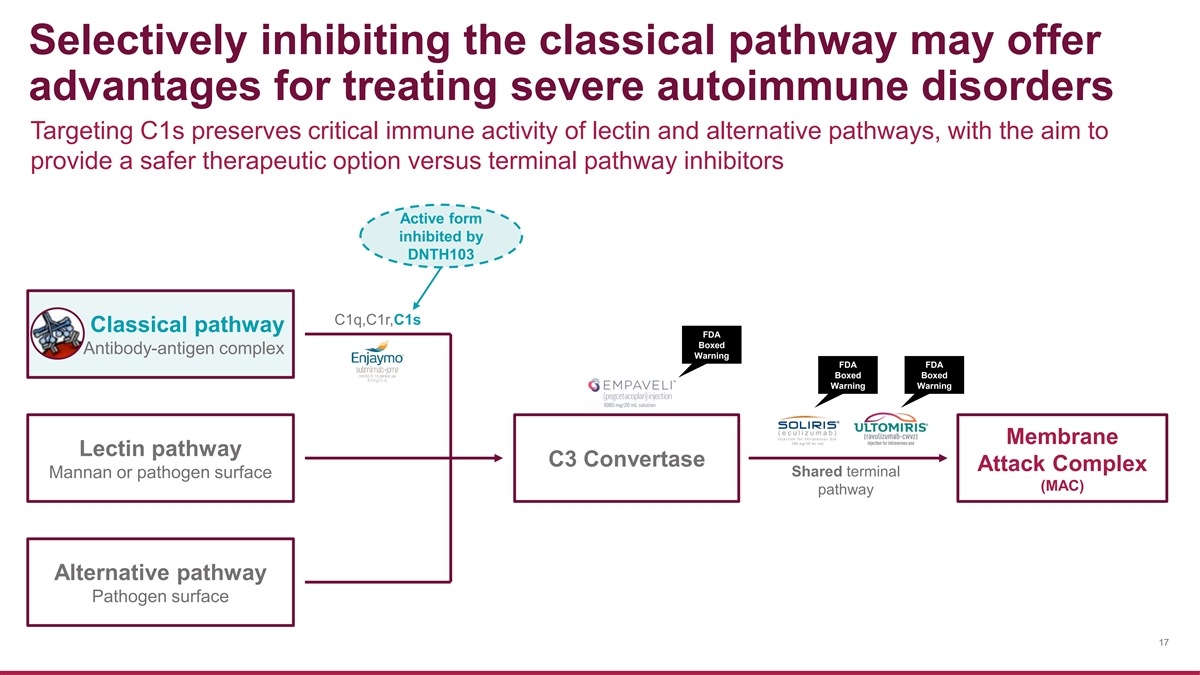

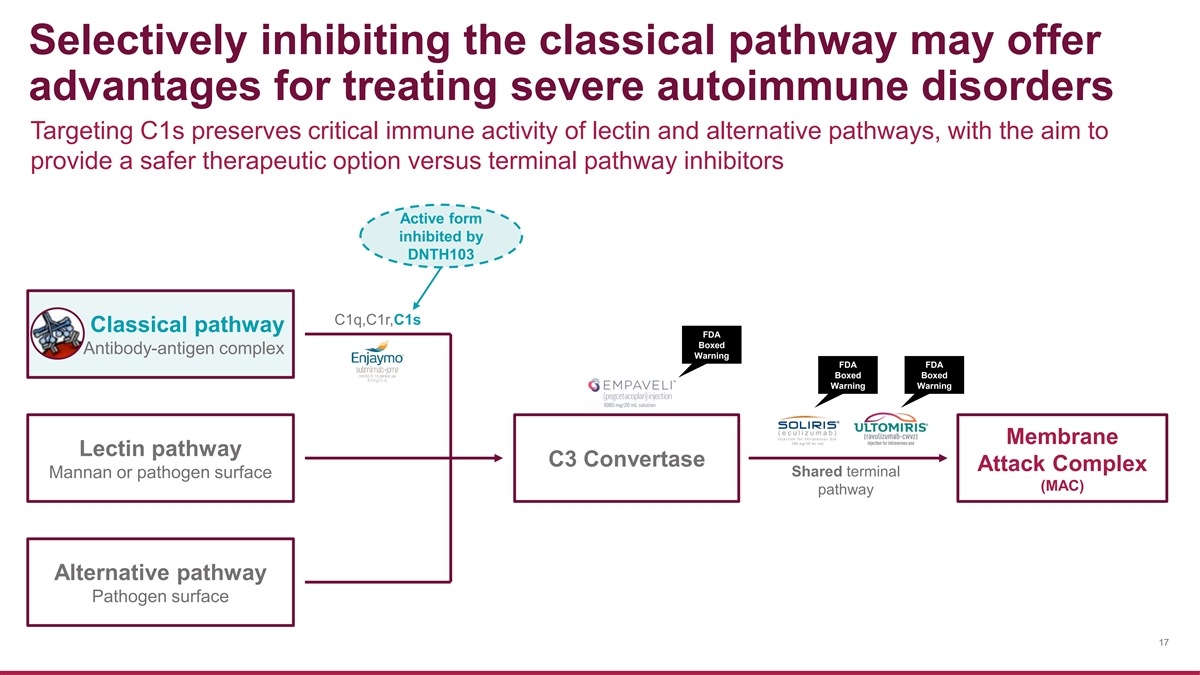

Selectively inhibiting the classical pathway may offer advantages for treating severe autoimmune disorders Targeting C1s preserves critical immune activity of lectin and alternative pathways, with the aim to provide a safer therapeutic option versus terminal pathway inhibitors Active form inhibited by DNTH103 C1q,C1r,C1s Classical pathway FDA Boxed Antibody-antigen complex Warning FDA FDA Boxed Boxed Warning Warning Membrane Lectin pathway C3 Convertase Attack Complex Shared terminal Mannan or pathogen surface (MAC) pathway Alternative pathway Pathogen surface 17

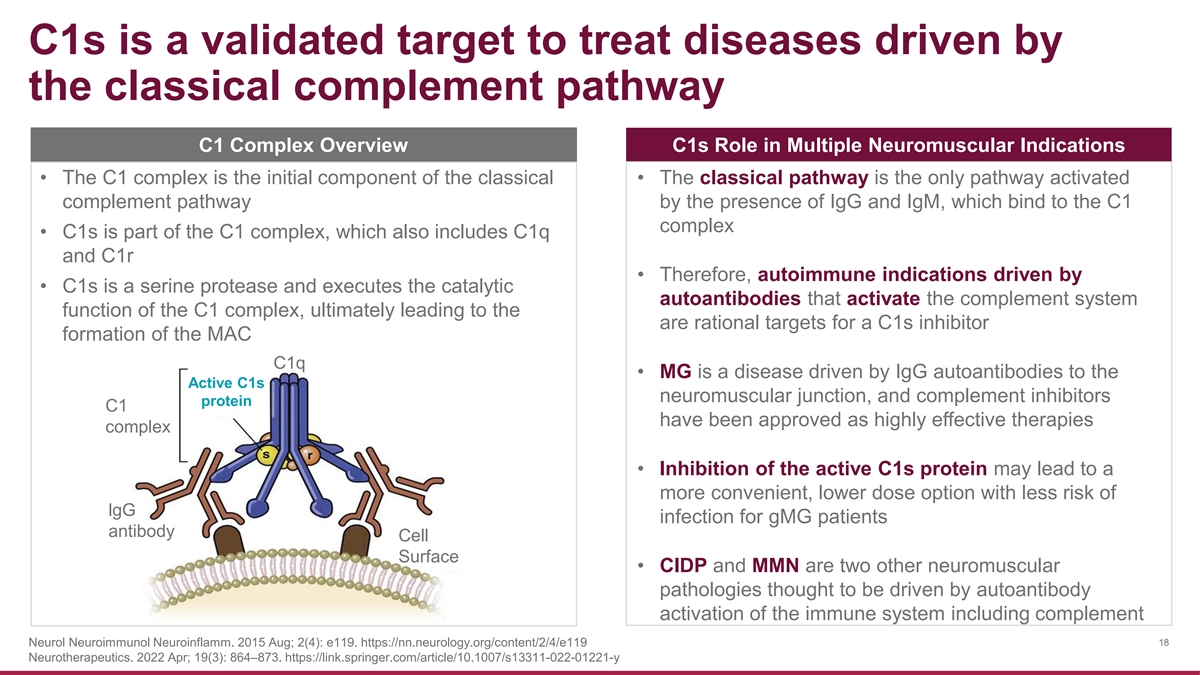

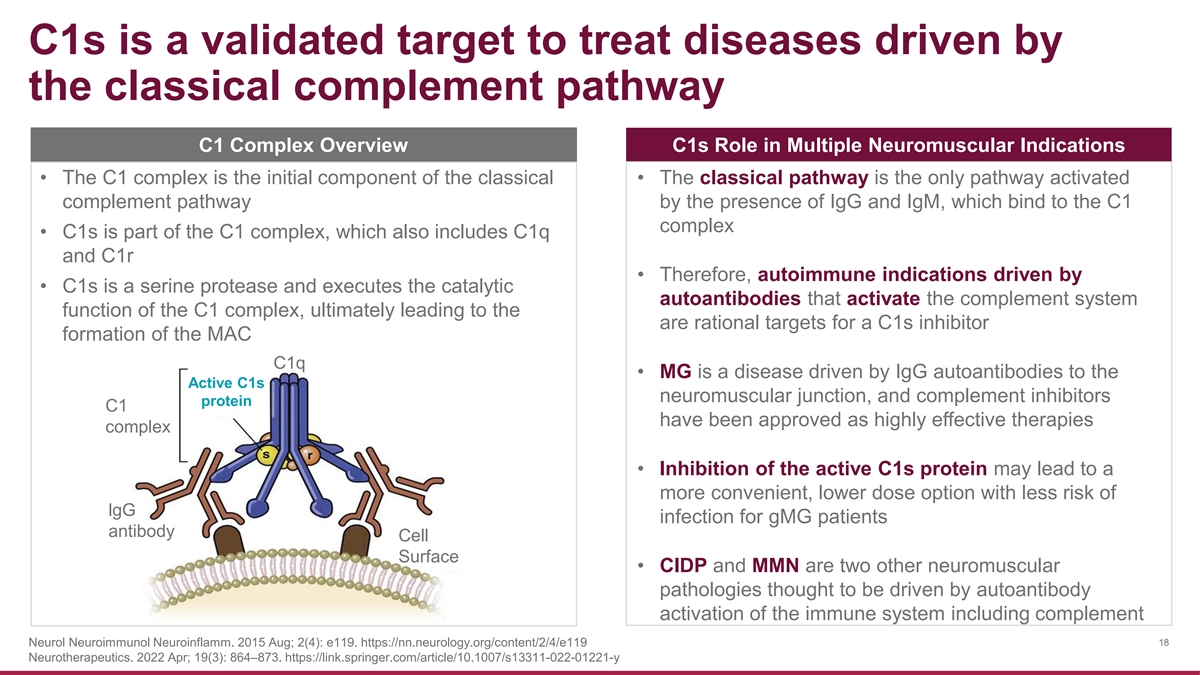

C1s is a validated target to treat diseases driven by the classical complement pathway C1 Complex Overview C1s Role in Multiple Neuromuscular Indications • The C1 complex is the initial component of the classical • The classical pathway is the only pathway activated complement pathway by the presence of IgG and IgM, which bind to the C1 complex • C1s is part of the C1 complex, which also includes C1q and C1r • Therefore, autoimmune indications driven by • C1s is a serine protease and executes the catalytic autoantibodies that activate the complement system function of the C1 complex, ultimately leading to the are rational targets for a C1s inhibitor formation of the MAC C1q • MG is a disease driven by IgG autoantibodies to the Active C1s neuromuscular junction, and complement inhibitors protein C1 have been approved as highly effective therapies complex • Inhibition of the active C1s protein may lead to a more convenient, lower dose option with less risk of lgG infection for gMG patients antibody Cell Surface • CIDP and MMN are two other neuromuscular pathologies thought to be driven by autoantibody activation of the immune system including complement Neurol Neuroimmunol Neuroinflamm. 2015 Aug; 2(4): e119. https://nn.neurology.org/content/2/4/e119 18 Neurotherapeutics. 2022 Apr; 19(3): 864–873. https://link.springer.com/article/10.1007/s13311-022-01221-y

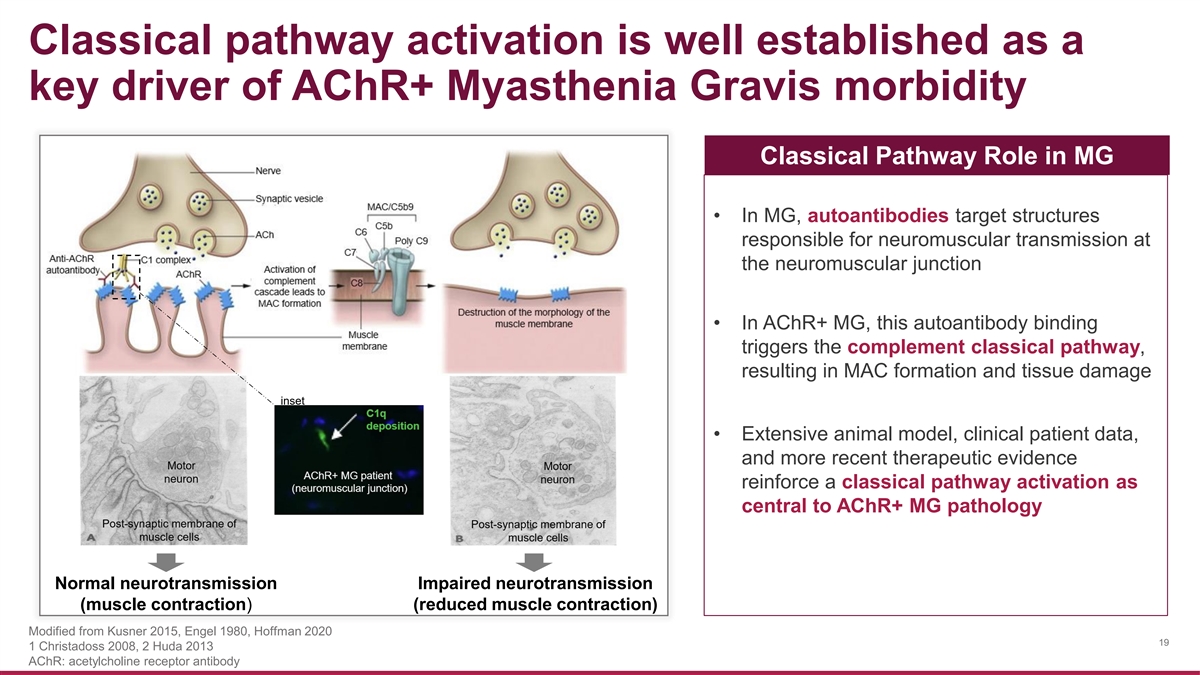

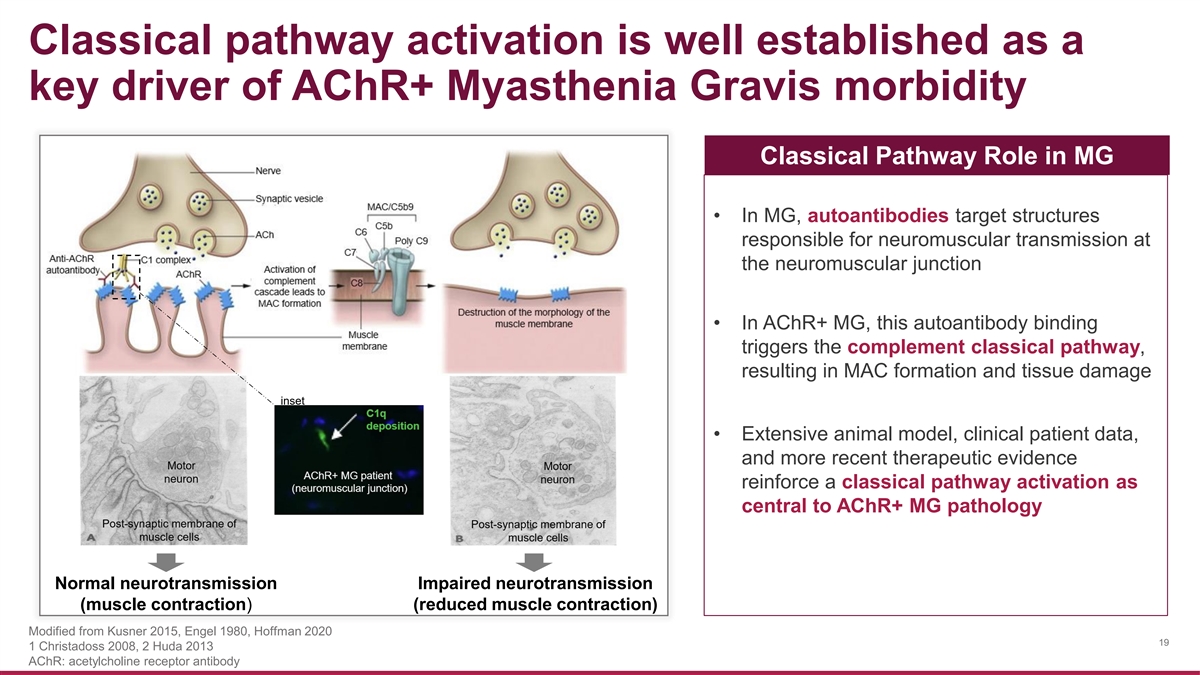

Classical pathway activation is well established as a key driver of AChR+ Myasthenia Gravis morbidity Classical Pathway Role in MG • In MG, autoantibodies target structures responsible for neuromuscular transmission at the neuromuscular junction • In AChR+ MG, this autoantibody binding triggers the complement classical pathway, resulting in MAC formation and tissue damage inset • Extensive animal model, clinical patient data, and more recent therapeutic evidence reinforce a classical pathway activation as central to AChR+ MG pathology Normal neurotransmission Impaired neurotransmission (muscle contraction) (reduced muscle contraction) Modified from Kusner 2015, Engel 1980, Hoffman 2020 19 1 Christadoss 2008, 2 Huda 2013 AChR: acetylcholine receptor antibody

Myasthenia Gravis is a life-long, severe autoimmune disease with no cure and a significant unmet need Need for new therapies that are more effective and safer, with reduced patient burden Market Disease Chronic Treatment gMG Statistics Opportunity Characteristics Paradigm • ~70K patients in the U.S. • Most common primary • Cholinesterase inhibitors • Therapeutics with disorder of the neuromuscular comparable efficacy to • Affects men and women, • Small molecule general junction approved complement across all racial and ethnic immunosuppressants such as inhibitors and lower risk of groups • Presenting symptoms often glucocorticoids, azathioprine due to ocular muscle and mycophenolate mofetil infections leading to no • 85% of patients have dysfunction FDA Boxed Warning autoantibodies against the • Targeted biologics such as C5 acetylcholine receptor • Majority of patients will and FcRn inhibitors • Convenient, predictable, progress to swallowing less frequent, lower dose, problems and limb weakness self-administered S.C. within 2 years of diagnosis • 10-20% experience at least one myasthenic crisis, often requiring ventilatory support https://www.mgregistry.org/ https://medlineplus.gov/genetics/condition/myasthenia-gravis/ 20 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7033452/

DNTH103: PD activity at low concentration Potent inhibition of ex vivo antibody-triggered human red blood cell lysis demonstrated IC50* (nM) sutimlimab** 29.5 sutimlimab ravulizumab** 28.4 ravulizumab DNTH103 DNTH103 5.8 21 *Representative run. Average IC50s are comparable, but run to run variability observed for all mAbs **Competitor products generated in the lab using amino acid sequences from patent filings

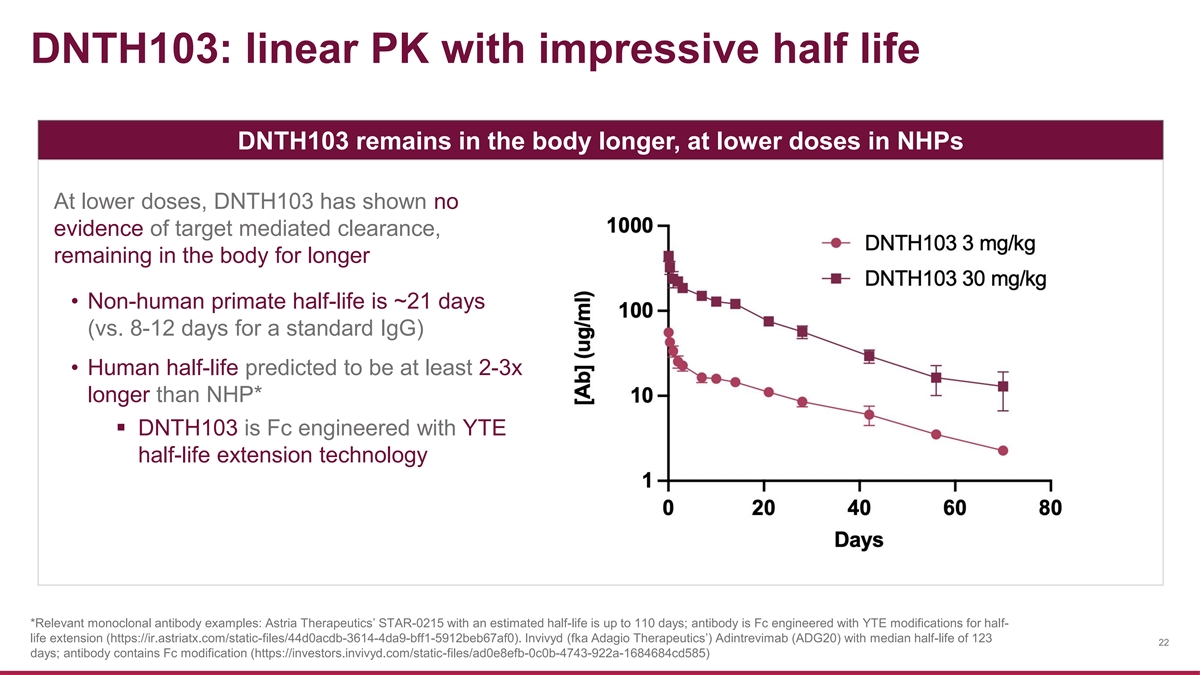

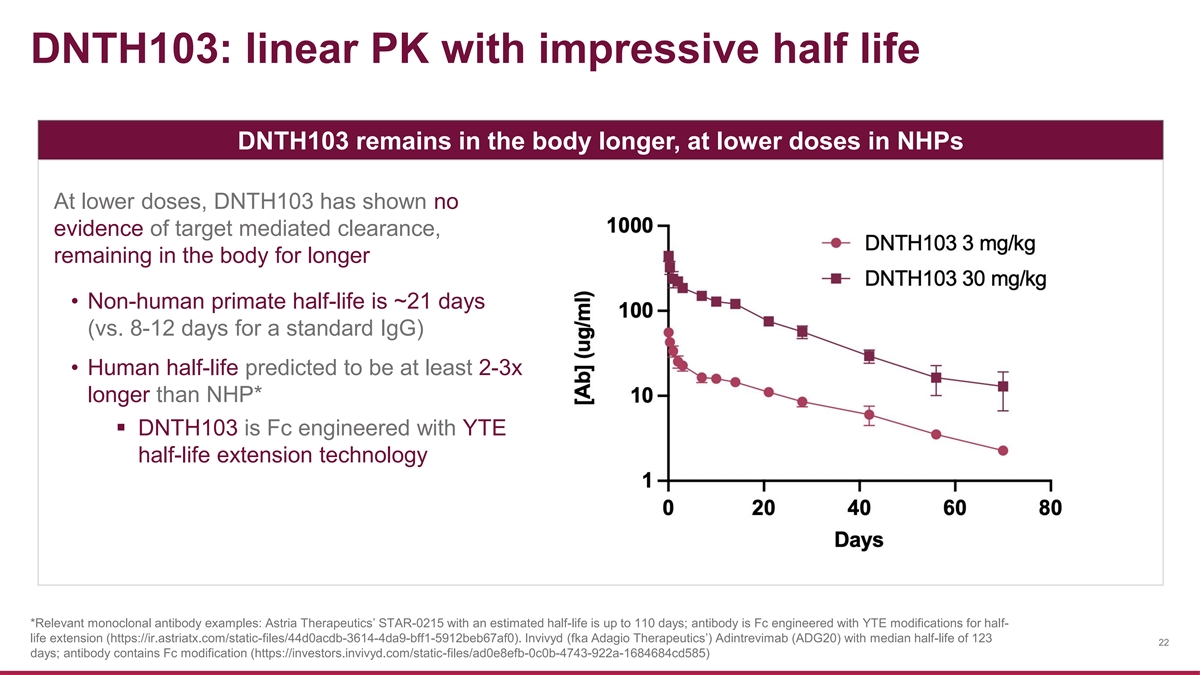

DNTH103: linear PK with impressive half life DNTH103 remains in the body longer, at lower doses in NHPs At lower doses, DNTH103 has shown no evidence of target mediated clearance, remaining in the body for longer • Non-human primate half-life is ~21 days (vs. 8-12 days for a standard IgG) • Human half-life predicted to be at least 2-3x longer than NHP* ▪ DNTH103 is Fc engineered with YTE half-life extension technology *Relevant monoclonal antibody examples: Astria Therapeutics’ STAR-0215 with an estimated half-life is up to 110 days; antibody is Fc engineered with YTE modifications for half- life extension (https://ir.astriatx.com/static-files/44d0acdb-3614-4da9-bff1-5912beb67af0). Invivyd (fka Adagio Therapeutics’) Adintrevimab (ADG20) with median half-life of 123 22 days; antibody contains Fc modification (https://investors.invivyd.com/static-files/ad0e8efb-0c0b-4743-922a-1684684cd585)

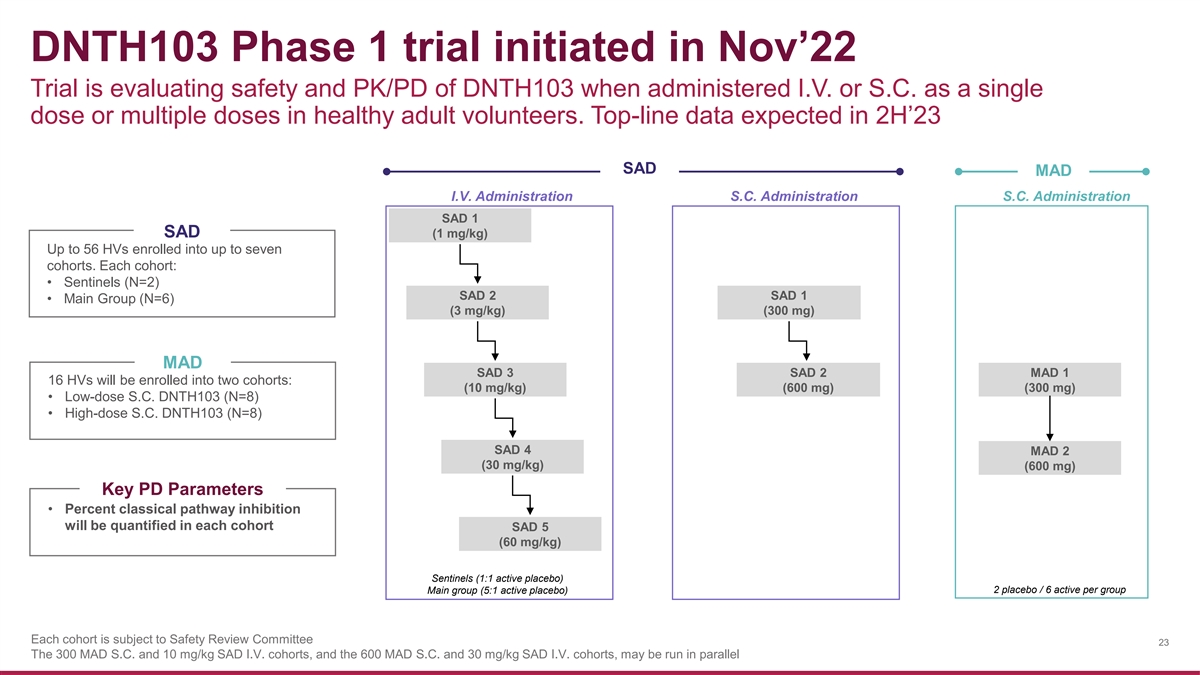

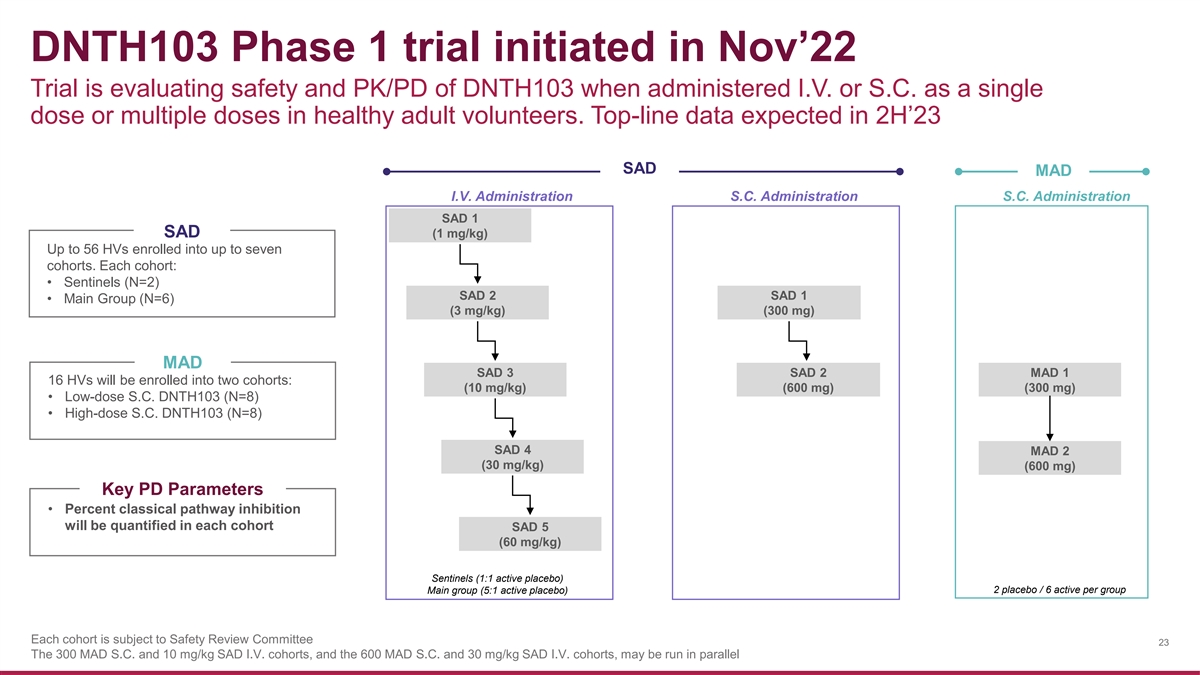

DNTH103 Phase 1 trial initiated in Nov’22 Trial is evaluating safety and PK/PD of DNTH103 when administered I.V. or S.C. as a single dose or multiple doses in healthy adult volunteers. Top-line data expected in 2H’23 SAD MAD I.V. Administration S.C. Administration S.C. Administration SAD 1 SAD (1 mg/kg) Up to 56 HVs enrolled into up to seven cohorts. Each cohort: • Sentinels (N=2) SAD 2 SAD 1 • Main Group (N=6) (3 mg/kg) (300 mg) MAD SAD 3 SAD 2 MAD 1 16 HVs will be enrolled into two cohorts: (10 mg/kg) (600 mg) (300 mg) • Low-dose S.C. DNTH103 (N=8) • High-dose S.C. DNTH103 (N=8) SAD 4 MAD 2 (30 mg/kg) (600 mg) Key PD Parameters • Percent classical pathway inhibition will be quantified in each cohort SAD 5 (60 mg/kg) Sentinels (1:1 active placebo) Main group (5:1 active placebo) 2 placebo / 6 active per group Each cohort is subject to Safety Review Committee 23 The 300 MAD S.C. and 10 mg/kg SAD I.V. cohorts, and the 600 MAD S.C. and 30 mg/kg SAD I.V. cohorts, may be run in parallel

DNTH103: Phase 1 healthy volunteer trial Objectives are to confirm pre-clinical evaluations: Favorable safety profile Extended half-life to enable less frequent S.C. dosing (i.e., every 2 weeks or less frequent) Potent classical pathway inhibition 23 healthy volunteers have been dosed in our Phase 1 trial across multiple dose cohorts, demonstrating favorable tolerability, PK and PD based on early trial results supporting the target product profile* 24 *As of April 4, 2023

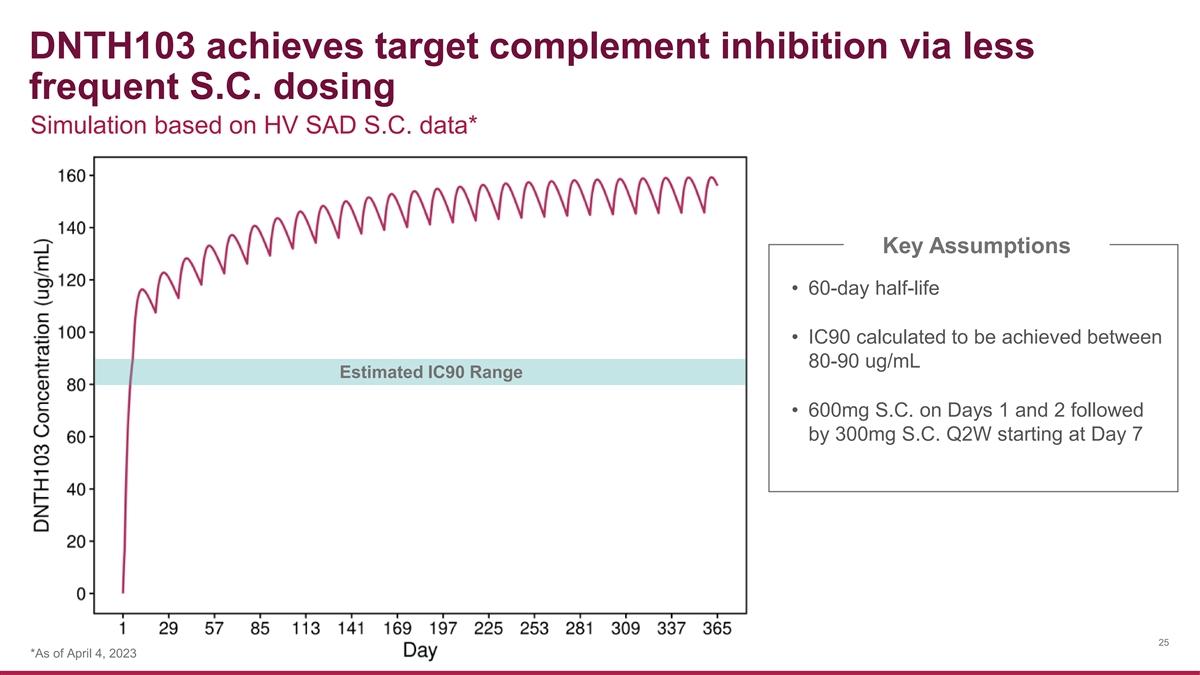

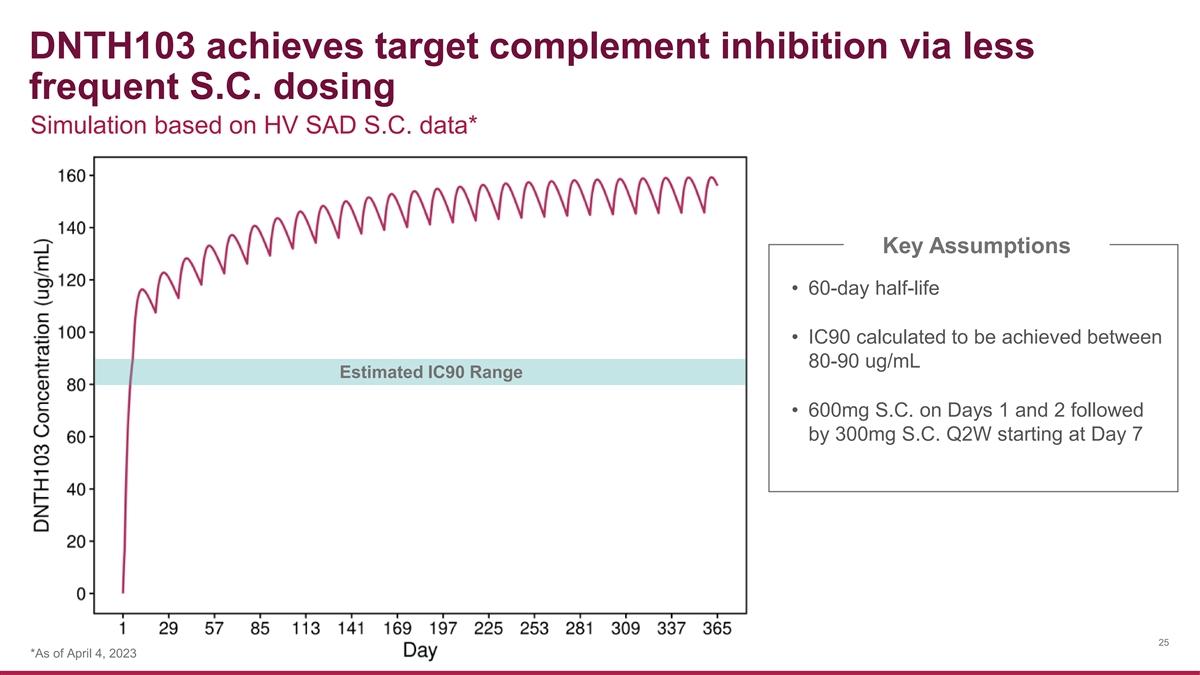

DNTH103 achieves target complement inhibition via less frequent S.C. dosing Simulation based on HV SAD S.C. data* Key Assumptions • 60-day half-life • IC90 calculated to be achieved between 80-90 ug/mL Estimated IC90 Range • 600mg S.C. on Days 1 and 2 followed by 300mg S.C. Q2W starting at Day 7 25 *As of April 4, 2023

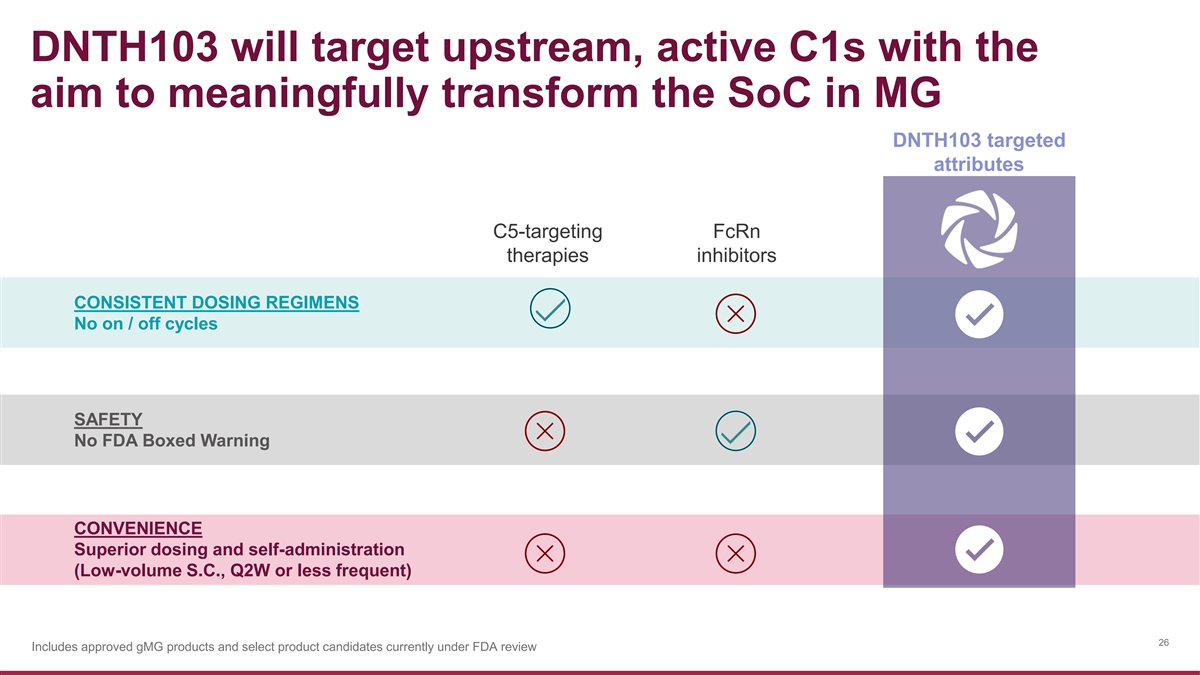

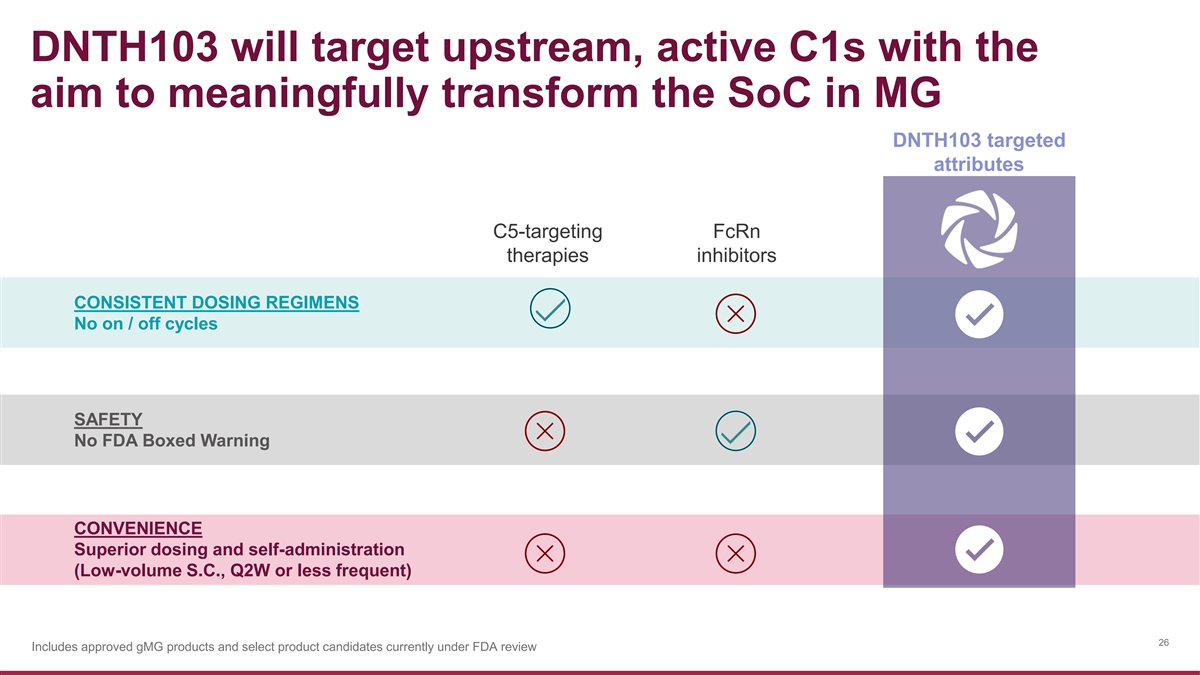

DNTH103 will target upstream, active C1s with the aim to meaningfully transform the SoC in MG DNTH103 targeted attributes C5-targeting FcRn therapies inhibitors CONSISTENT DOSING REGIMENS No on / off cycles SAFETY No FDA Boxed Warning CONVENIENCE Superior dosing and self-administration (Low-volume S.C., Q2W or less frequent) 26 Includes approved gMG products and select product candidates currently under FDA review

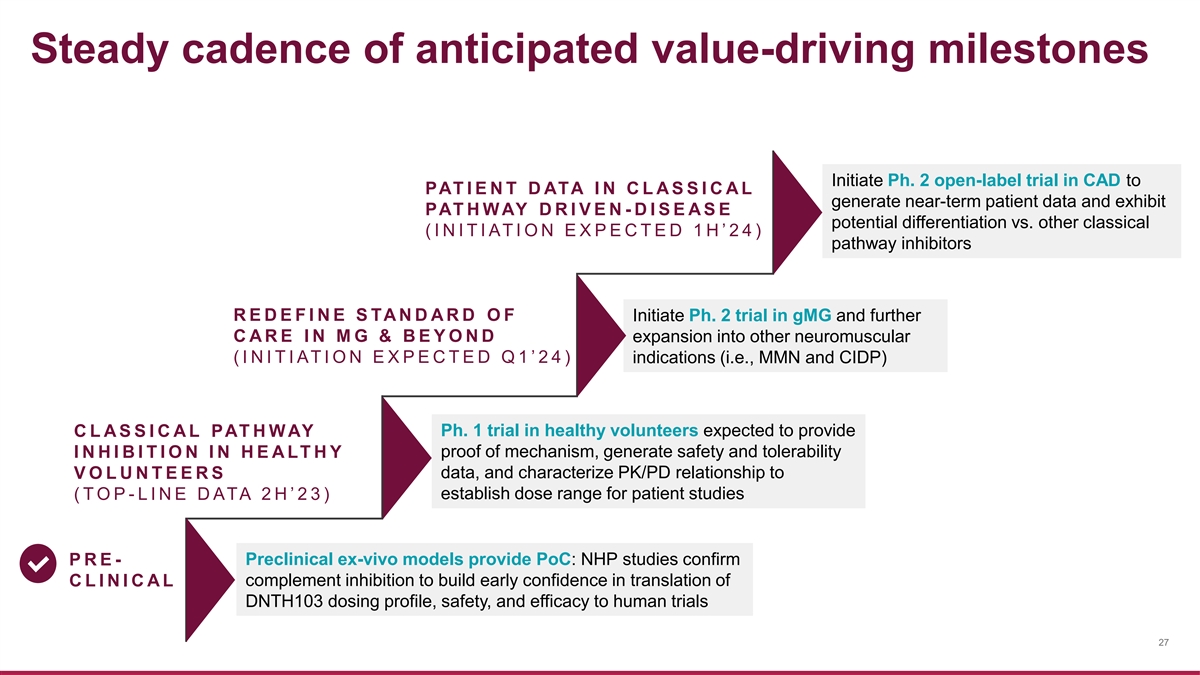

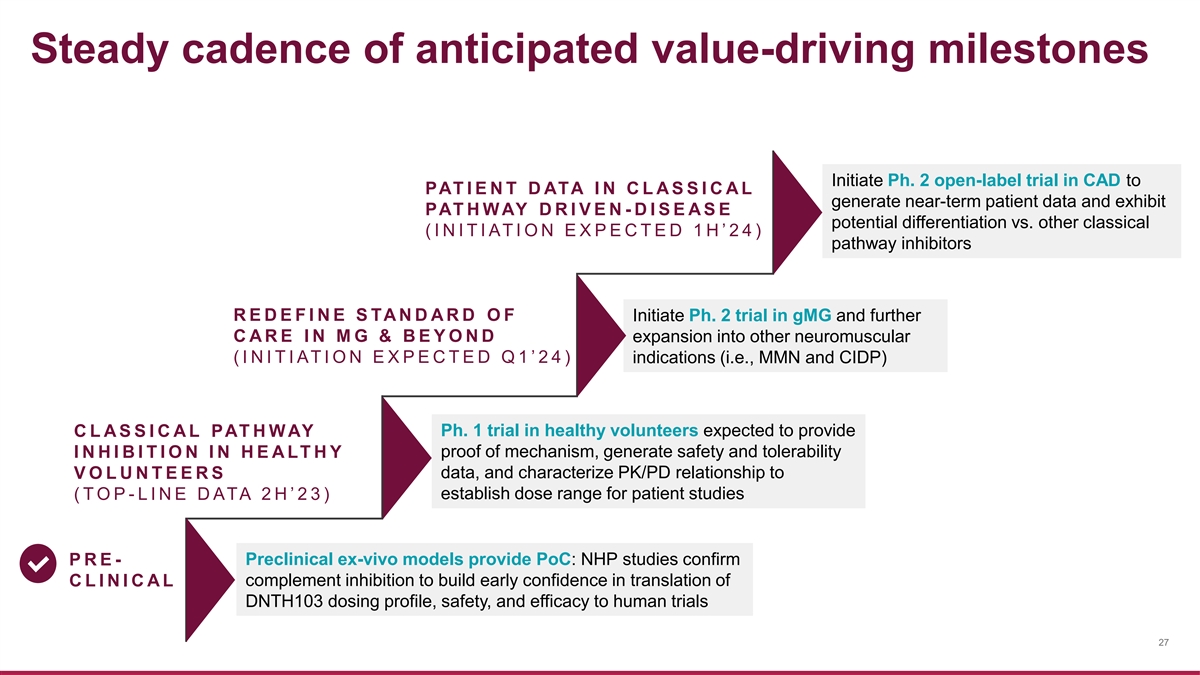

Steady cadence of anticipated value-driving milestones Initiate Ph. 2 open-label trial in CAD to PAT I E N T D ATA I N C L A S S I C A L generate near-term patient data and exhibit PAT H W AY D R I V E N - D I S E A S E potential differentiation vs. other classical ( I N I T I AT I O N E X P E C T E D 1 H ’ 2 4 ) pathway inhibitors R E D E F I N E S TA N D A R D O F Initiate Ph. 2 trial in gMG and further C A R E I N M G & B E Y O N D expansion into other neuromuscular ( I N I T I AT I O N E X P E C T E D Q 1 ’ 2 4 ) indications (i.e., MMN and CIDP) Ph. 1 trial in healthy volunteers expected to provide C L A S S I C A L PAT H W AY I N H I B I T I O N I N H E A LT H Y proof of mechanism, generate safety and tolerability V O L U N T E E R S data, and characterize PK/PD relationship to ( T O P - L I N E D ATA 2 H ’ 2 3 ) establish dose range for patient studies Preclinical ex-vivo models provide PoC: NHP studies confirm P R E - C L I N I C A L complement inhibition to build early confidence in translation of DNTH103 dosing profile, safety, and efficacy to human trials 27

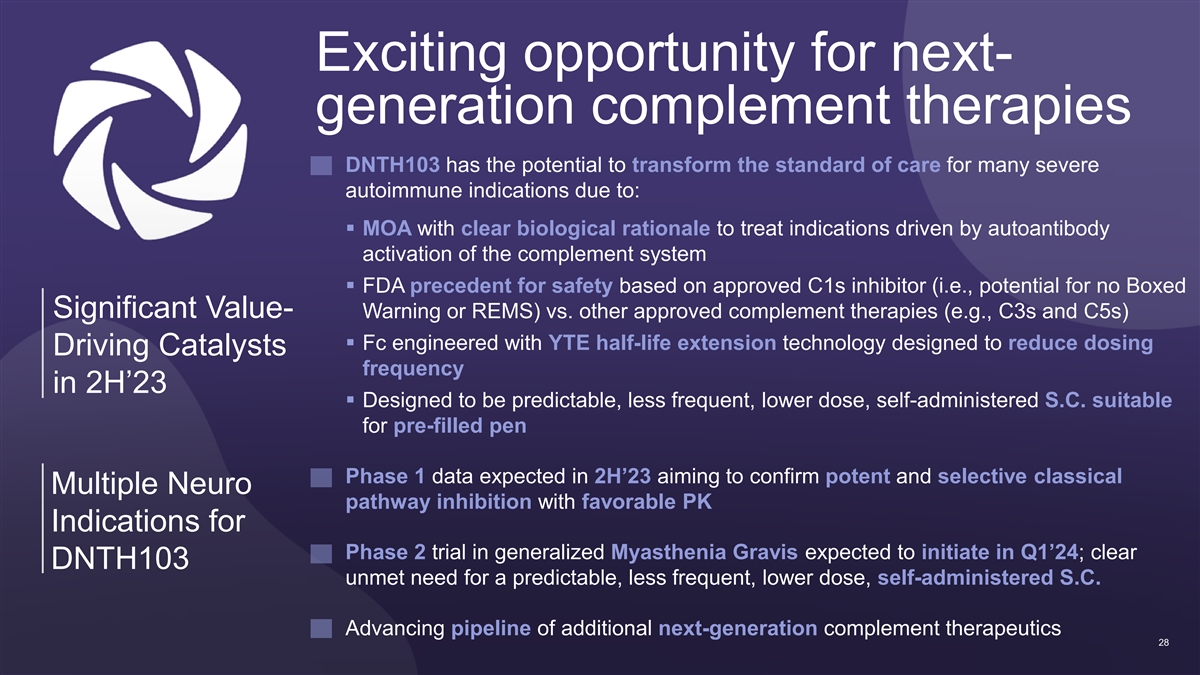

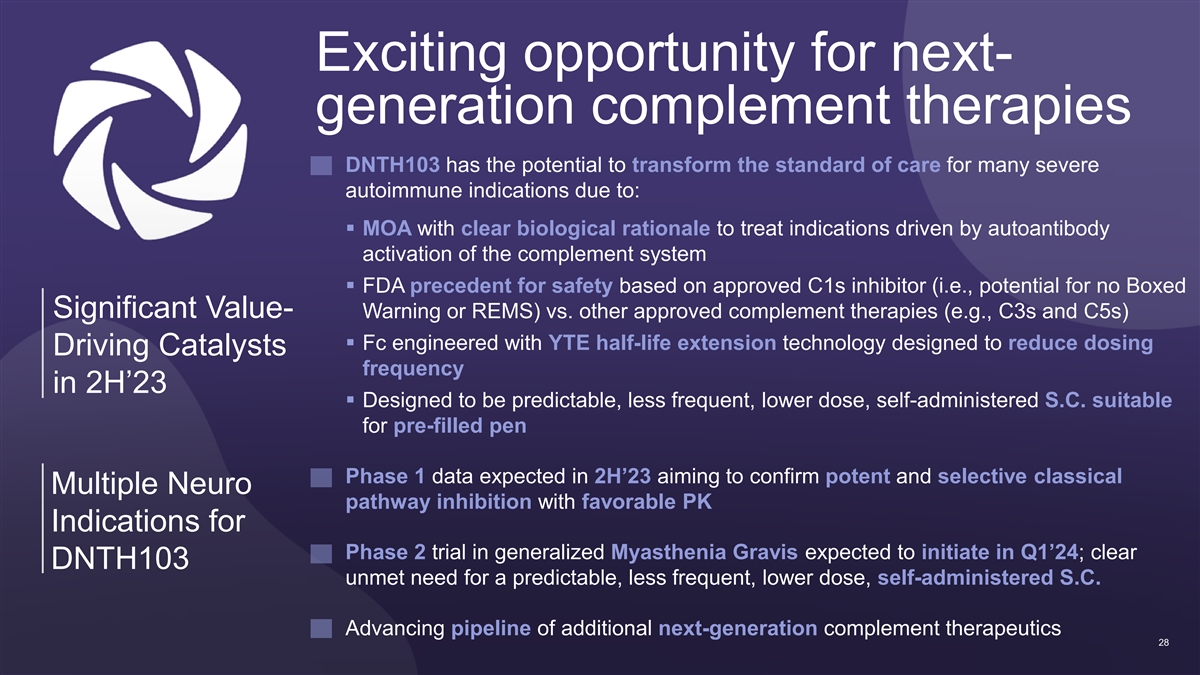

Exciting opportunity for next- generation complement therapies DNTH103 has the potential to transform the standard of care for many severe autoimmune indications due to: ▪ MOA with clear biological rationale to treat indications driven by autoantibody activation of the complement system ▪ FDA precedent for safety based on approved C1s inhibitor (i.e., potential for no Boxed Significant Value- Warning or REMS) vs. other approved complement therapies (e.g., C3s and C5s) ▪ Fc engineered with YTE half-life extension technology designed to reduce dosing Driving Catalysts frequency in 2H’23 ▪ Designed to be predictable, less frequent, lower dose, self-administered S.C. suitable for pre-filled pen Phase 1 data expected in 2H’23 aiming to confirm potent and selective classical Multiple Neuro pathway inhibition with favorable PK Indications for Phase 2 trial in generalized Myasthenia Gravis expected to initiate in Q1’24; clear DNTH103 unmet need for a predictable, less frequent, lower dose, self-administered S.C. Advancing pipeline of additional next-generation complement therapeutics 28