Exhibit 99.3

Notice of Annual Meeting of Shareholders

and

Management Proxy Circular

Wednesday, April 20, 2022

Toronto, Ontario

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

APRIL 20, 2022

TAKE NOTICE that the Annual Meeting of Shareholders (the “Meeting”) of VersaBank (the “Bank”) will be held via live webcast and at the TMX Market Centre, 120 Adelaide Street West, Toronto, Ontario, on Wednesday, April 20, 2022, at 10:30 a.m. (EDT) for the following purposes:

| 1. | to receive the financial statements for the fiscal year ended October 31, 2021, and the report of the auditors thereon; |

| 2. | to appoint auditors for the ensuing year and to authorize the directors of the Bank to fix their remuneration; |

| 3. | to elect directors for the ensuing year; and |

| 4. | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

Particulars of the matters above are set forth in the accompanying Management Proxy Circular.

The Board of Directors of the Bank has fixed March 3, 2022, as the record date for determining Shareholders entitled to receive notice of and to vote at the Meeting.

NOTICE FOR REGISTERED SHAREHOLDERS: You are encouraged to complete the form of proxy accompanying this Notice of Meeting and return it to Computershare Investor Services Inc. in accordance with the instructions provided in the form of proxy, whether or not you plan to attend the Meeting. Failure to submit your form of proxy by 10:30 a.m. (EDT) on April 18, 2022, may result in your shares not being voted at the Meeting.

If you have received this Notice of Meeting and the Management Proxy Circular from your broker or another intermediary, we encourage you to complete and return the voting instruction form or form of proxy provided to you by your intermediary in accordance with the instructions provided with such form.

Your vote is important!

DATED at the City of London, in the Province of Ontario, this 3rd day of March 2022.

By order of the Board of Directors,

/s/ Brent T. Hodge

Brent T. Hodge

General Counsel and Corporate Secretary

MANAGEMENT PROXY CIRCULAR

All information is as of March 3, 2022, and all dollar amounts are expressed in Canadian dollars, unless otherwise stated.

Table of Contents

| PART I – VOTING AND PROXY INFORMATION | 4 |

| SOLICITATION OF PROXIES BY MANAGEMENT | 4 |

| APPOINTMENT OF PROXIES | 4 |

| ADVICE TO NON-REGISTERED SHAREHOLDERS | 4 |

| REVOCATION OF PROXIES | 5 |

| EXERCISE OF DISCRETION WITH RESPECT TO PROXIES | 6 |

| QUORUM | 6 |

| PART II – VOTING SHARES AND PRINCIPAL HOLDERS OF VOTING SHARES | 6 |

| PART III – BUSINESS TO BE TRANSACTED AT THE MEETING | 7 |

| 1 FINANCIAL STATEMENTS | 7 |

| 2 APPOINTMENT OF AUDITORS | 7 |

| 3 ELECTION OF DIRECTORS | 7 |

| PART IV – STATEMENT OF EXECUTIVE COMPENSATION | 11 |

| COMPENSATION DISCUSSION & ANALYSIS | 11 |

| PERFORMANCE GRAPH | 19 |

| SUMMARY COMPENSATION TABLE | 20 |

| TERMINATION AND CHANGE OF CONTROL BENEFITS | 23 |

| PART V – STATEMENT OF DIRECTOR COMPENSATION | 25 |

| Part VI – Securities Authorized for Issuance Under Equity Compensation Plans | 27 |

| INCENTIVE PLAN AWARDS | 27 |

| PART VII – INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 29 |

| AGGREGATE INDEBTEDNESS OUTSTANDING | 29 |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | 30 |

| PART VIII – INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | 30 |

| PART IX – AUDIT COMMITTEE | 30 |

| PART X – CORPORATE GOVERNANCE | 30 |

| PART XI – ADDITIONAL INFORMATION | 35 |

| SHAREHOLDER PROPOSALS | 35 |

| ADDITIONAL INFORMATION | 35 |

| DIRECTORS’ APPROVAL | 35 |

| Schedule A – MANDATE OF THE BOARD OF DIRECTORS | 36 |

MANAGEMENT PROXY CIRCULAR

PART I – VOTING AND PROXY INFORMATION

SOLICITATION OF PROXIES BY MANAGEMENT

This Management Proxy Circular is furnished to holders (“Shareholders”) of common shares (“Shares”) of VersaBank (the “Bank”) in connection with the solicitation of proxies by or on behalf of the management of the Bank for use at the Annual Meeting of Shareholders, and any adjournment or postponement thereof (the “Meeting”). The Meeting will be held via live webcast and at the TMX Market Centre, 120 Adelaide Street West, Toronto, Ontario, on Wednesday, April 20, 2022, at 10:30 a.m. (EDT) for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders (the “Notice”). It is expected that management will solicit proxies electronically and by mail. Proxies may also be solicited personally or by telephone by officers and directors and other representatives of the Bank, as the case may be. The cost of solicitation by or on behalf of management will be borne by the Bank.

This Management Proxy Circular and other proxy-related materials are being sent to both Registered and Non-Registered Shareholders (each as defined below). The Bank is not sending proxy-related materials directly to Non-Registered Shareholders and is not relying on the notice-and-access provisions of applicable securities laws for the delivery of proxy-related materials to either Registered or Non-Registered Shareholders. Instead, the Bank will deliver proxy-related materials to intermediaries (as defined below under the heading “Voting and Proxy Information – Advice to Non-Registered Shareholders”) and they will be asked to promptly forward the proxy-related materials to Non-Registered Shareholders. If you are a Non-Registered Shareholder, your intermediary should send you a voting instruction form or form of proxy with this Management Proxy Circular. The Bank has elected to pay for the delivery of the proxy-related materials to objecting Non-Registered Shareholders.

APPOINTMENT OF PROXIES

The persons named in the enclosed form of proxy and voting instruction forms are directors and/or officers of the Bank. AS A SHAREHOLDER, YOU HAVE THE RIGHT TO APPOINT A PERSON, WHO NEED NOT BE A SHAREHOLDER, AS YOUR NOMINEE TO ATTEND AND ACT ON YOUR BEHALF AT THE MEETING OTHER THAN THE PERSONS DESIGNATED IN THE ENCLOSED FORM OF PROXY. This right may be exercised by inserting such person’s name in the blank space provided in the form of proxy. Proxies are to be returned to Computershare Investor Services Inc. in accordance with the instructions provided in the enclosed form of proxy. A proxy is only valid at the Meeting or any adjournment or postponement thereof.

Shareholders who are recorded on the Bank’s share register as the registered owners of their Shares (“Registered Shareholders”) and who plan to attend and vote their Shares in person at the Meeting should not complete or return the enclosed form of proxy. Their votes will be taken and counted at the Meeting. Such Registered Shareholders are to register with the Bank’s transfer agent, Computershare Investor Services Inc., upon their arrival at the Meeting.

ADVICE TO NON-REGISTERED SHAREHOLDERS

The information in this section is of significant importance to a substantial number of Shareholders who do not hold their Shares in their own name, but who hold their Shares indirectly through a bank, trust company, securities

broker, trustee or other entity (an “intermediary”). Shareholders that do not hold their Shares in their own name are referred to in this document as “Non-Registered Shareholders.”

As Shares held by intermediaries on behalf of their clients can only be voted for or against resolutions upon the instructions of the applicable Non-Registered Shareholder, each intermediary is required to seek instructions from such Non-Registered Shareholders as to how their Shares are to be voted at the Meeting. For that reason, if you are a Non-Registered Shareholder, you will have received this Management Proxy Circular from your intermediary along with a form of proxy or a voting instruction form.

Every intermediary has its own mailing procedures and provides its own return instructions, which Non-Registered Shareholders should follow closely in order to ensure that their Shares are voted at the Meeting. A Non-Registered Shareholder may have received from the intermediary either a request for voting instructions or a form of proxy that is identical to the form of proxy provided to Registered Shareholders; however, the purpose of any such form of proxy is limited to instructing the intermediary how to vote on behalf of the Non-Registered Shareholder. A Non-Registered Shareholder must return the voting instruction form or the form of proxy to its intermediary well in advance of the Meeting in order to have his, her or its Shares voted.

A Non-Registered Shareholder that receives a form of proxy or voting instruction form from an intermediary cannot use that form of proxy or voting instruction form to vote shares directly at the Meeting. Non-Registered Shareholders who wish to vote in person at the Meeting or appoint a person as their nominee to attend and vote on their behalf at the Meeting must provide their intermediary with the appropriate documentation in order to be appointed as proxyholder. A Non-Registered Shareholder should contact its intermediary to determine what documentation the intermediary requires in order for such Non-Registered Shareholder or its nominee to be appointed proxyholder, and to attend and vote their Shares at the Meeting. Only after the intermediary appoints a Non-Registered Shareholder or its nominee as a proxyholder can that Non-Registered Shareholder or its nominee vote shares directly at the Meeting.

The majority of intermediaries now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”). Broadridge typically prepares a special voting instruction form, mails those forms to Non-Registered Shareholders and asks for appropriate instructions respecting the voting of Shares to be represented at the Meeting. Non-Registered Shareholders are requested to complete and return the voting instruction form to Broadridge by mail in the envelope provided. Alternatively, Non-Registered Shareholders can call a toll-free telephone number or access Broadridge’s dedicated voting website (each as noted on the voting instruction form) to deliver their voting instructions and vote the Shares held by them. Broadridge then tabulates the results of all voting instructions received and provides appropriate instructions respecting the voting of Shares to be represented at the Meeting. A Non-Registered Shareholder receiving a voting instruction form from Broadridge must complete and return such form in accordance with the instructions set out thereon well in advance of the Meeting in order to have his, her or its Shares voted. Further, a Non-Registered Shareholder receiving a voting instruction form from Broadridge cannot use that form to vote his, her or its Shares in person at the Meeting. If you are a Non-Registered Shareholder receiving a Broadridge voting instruction form and you wish to vote your Shares in person at the Meeting, you should contact your intermediary and follow their instructions for completion and return of the form of proxy or voting instruction form provided directly by them, once received.

REVOCATION OF PROXIES

Registered Shareholders

A Registered Shareholder may revoke a proxy:

| (a) | by an instrument in writing executed by the Shareholder or by an attorney in writing or, if the Shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized, and deposited: |

| i. | at the registered office of the Bank (Suite 2002, 140 Fullarton Street, London, Ontario N6A 5P2) at any time up to and including the last business day preceding the day of the Meeting or any adjournment or postponement thereof; or |

| ii. | with the chair of the Meeting at the Meeting; or |

| (b) | in any other manner permitted by law. |

Non-Registered Shareholders

If you are a Non-Registered Shareholder and wish to revoke your voting instructions, follow the instructions provided by your intermediary in your voting instruction form or contact your intermediary.

EXERCISE OF DISCRETION WITH RESPECT TO PROXIES

Shares represented by proxies will be voted or withheld from voting by the persons designated in the form of proxy or voting instruction form in accordance with the direction of the Shareholders appointing them. Other than with respect to the election of directors which is addressed below, in the event that no specifications are made in the form of proxy or voting instruction form designating management’s nominees as proxyholders, the Shares represented by the proxies will be voted by such proxyholders FOR the matters identified in the Notice to be voted upon at the Meeting.

As described below under the heading “Business to be Transacted at the Meeting – Election of Directors”, voting for the election of nominees to the Bank’s board of directors (the “Board”) must be done by cumulative voting. Unless a Shareholder giving a proxy or voting instructions specifies that the Shares represented by such proxy or voting instructions be withheld from voting on the election of all or any of the directors, or specifies how the Shareholder wishes to distribute the votes represented by the proxy or voting instructions among the candidates, the persons named in the enclosed form of proxy or voting instruction form intend to vote the Shares represented by such proxy or voting instructions FOR the election of the nominees listed herein (or any replacements thereof) and to distribute votes among such nominees in such manner as in their discretion is most likely to cause such nominees to be duly elected as the directors of the Bank at the Meeting.

The enclosed form of proxy and/or voting instruction form confers discretionary authority upon the persons named therein as proxyholders with respect to amendments and variations to matters identified in the Notice to be voted upon at the Meeting, and with respect to other matters that may properly come before the Meeting. At the time of the preparation of this Management Proxy Circular, management of the Bank knows of no such amendments, variations or other matters to come before the Meeting. If, however, amendments, variations or other matters which are not now known to management of the Bank should properly come before the Meeting, the Shares represented by any proxy or voting instructions will be voted by the persons named in the form of proxy and voting instruction form in accordance with their best judgment.

QUORUM

A quorum is present at the Meeting if the holders of at least twenty-five percent (25%) of the Shares who are entitled to vote at the Meeting are present in person or represented by proxyholders.

PART II – VOTING SHARES AND PRINCIPAL HOLDERS OF VOTING SHARES

As of March 3, 2022, there were 27,441,082 Shares issued and outstanding. Each Share carries the right to one vote in respect of each of the matters properly coming before the Meeting, except for the election of directors, for which cumulative voting is used (for additional details with respect to cumulative voting, please refer to the information set out below under the heading “Business to be Transacted at the Meeting – Election of Directors”).

The Board has fixed March 3, 2022, as the record date for determining Shareholders entitled to receive notice of and to vote at the Meeting. Each Registered Shareholder as of the close of business on March 3, 2022, shall be entitled to vote the Shares in his, her or its name on that date, except to the extent that the person has transferred the ownership of any of his, her or its Shares after March 3, 2022, and the transferee of those Shares produces properly endorsed share certificates or otherwise establishes that he, she or it owned such Shares as of March 3, 2022, and demands, not later than ten (10) days before the Meeting, that his, her or its name be included in the list of Shareholders entitled to receive notice of and to vote at the Meeting, in which event the transferee shall be entitled to vote such Shares at the Meeting.

To the knowledge of the Bank, as of March 3, 2022, no person or company beneficially owned, or exercised control or direction, directly or indirectly, over more than 10% of the Shares, other than 340268 Ontario Limited, which owned 8,135,892 Shares, being approximately 29.6% of the issued and outstanding Shares.

PART III – BUSINESS TO BE TRANSACTED AT THE MEETING

1 FINANCIAL STATEMENTS

The Consolidated Financial Statements of the Bank for the fiscal years ended October 31, 2021 (“Fiscal 2021”), and 2020 (“Fiscal 2020”), have been mailed to Shareholders with this Management Proxy Circular. Shareholders and proxyholders will have an opportunity to review and discuss the Bank’s Fiscal 2021 results with management at the Meeting.

2 APPOINTMENT OF AUDITORS

The directors propose KPMG LLP for reappointment as auditors of the Bank to hold office until the close of the Bank’s next annual meeting of Shareholders. This proposal is supported by the comprehensive review of the external auditor that was carried out in Fiscal 2020 and the annual review of the external auditor that was carried out in Fiscal 2021 by the Board’s audit committee (the “Audit Committee”) following the guidance issued by Chartered Professional Accountants Canada, Canadian Public Accountability Board and the Institute of Corporate Directors. KPMG LLP has acted as auditors of the Bank (and its predecessors) since 1989.

In the past, the Board has fixed the remuneration of the auditors of the Bank. Such remuneration has been based upon the complexity of the matters dealt with and time spent in providing services to the Bank. The Board is satisfied that the remuneration negotiated in the past with the auditors of the Bank has been reasonable under the circumstances and reflective of the audit quality and performance of the auditors. Information concerning the audit-related fees paid to KPMG LLP during Fiscal 2021 and Fiscal 2020 is provided on page 21 of the Bank’s Annual Information Form for Fiscal 2021, which is available on SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar.

It is recommended that Shareholders vote FOR the resolutions relating to the appointment of auditors and the authorization of the directors to fix the remuneration of the auditors. In the absence of contrary instructions, the persons named in the enclosed form of proxy or voting instruction form intend to vote FOR the appointment of the auditors and the authorization of the directors to fix the remuneration of the auditors.

3 ELECTION OF DIRECTORS

Shareholders of the Bank will be asked to elect ten (10) nominees as directors of the Bank by cumulative voting to hold office until the close of the next annual general meeting of the Bank or until his or her successor is duly elected, unless his or her office is earlier vacated and a replacement director is appointed in accordance with the by-laws of the Bank. As required under the Bank Act (Canada), where directors are to be elected by cumulative voting, each Shareholder entitled to vote at an election of directors has the right to cast a number of votes equal to the number of votes attached to the Shares held by the Shareholder multiplied by the number of directors to be elected, and the Shareholder may cast all such votes in favour of one candidate or distribute them among the candidates in any

manner. If a Shareholder has voted for more than one candidate without specifying the distribution of the votes among the candidates, the Shareholder is deemed to have distributed the votes equally among the candidates for whom the Shareholder voted. If the number of candidates nominated for director exceeds the number of positions to be filled, the candidates who receive the least number of votes will be eliminated until the number of candidates remaining equals the number of positions to be filled.

All of the individuals nominated by the Conduct Review, Governance & HR Committee (the “HR Committee”) for election to the Board at the Meeting are currently directors of the Bank and were elected to the Board at the Bank’s annual meeting of Shareholders on April 21, 2021, for a term expiring at the close of the Meeting.

Unless a Shareholder giving a proxy or voting instructions specifies that their Shares be withheld from voting on the election of all or any of the director nominees, or specifies how the Shareholder wishes to distribute the votes represented by his, her or its proxy or voting instructions among the nominees, the persons named in the enclosed form of proxy or voting instruction form intend to cast the votes represented by such proxy FOR the election of the nominees named herein (or any replacements thereof) and to distribute votes among such nominees in such manner as in their discretion is most likely to cause such nominees to be duly elected as the directors of the Bank at the Meeting.

The Board recommends that Shareholders vote FOR the following director nominees.

| The Honourable Thomas A. Hockin | David A. Bratton | Susan T. McGovern |

| David R. Taylor | R. W. (Dick) Carter | Paul G. Oliver |

| Gabrielle Bochynek | Peter M. Irwin | |

| Robbert-Jan Brabander | Arthur Linton | |

The following table sets forth the record of attendance at Board and committee meetings held during Fiscal 2021 for each director who is standing for re-election at the Meeting. Additional information respecting the Bank’s current Board and its committees is contained in the Bank’s Annual Information Form for Fiscal 2021, which can be found under the Bank’s profile on SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar.

Summary of Attendance of Directors

Director(1)(2) | Number of meetings attended |

Board | Audit Committee | HR Committee | Risk Oversight Committee | Innovation and Technology Committee |

| T. Hockin | 9 of 9 | n/a | n/a | n/a | n/a |

| D. Taylor | 9 of 9 | n/a | n/a | n/a | n/a |

| G. Bochynek | 9 of 9 | n/a | 7 of 7 | n/a | n/a |

| R. J. Brabander | 9 of 9 | n/a | n/a | 12 of 12 | 5 of 5 |

| D. Bratton | 9 of 9 | n/a | 7 of 7 | n/a | n/a |

| R. Carter | 6 of 9(4) | 4 of 7(4) | n/a | n/a | n/a |

| P. Irwin | 8 of 9(3) | 6 of 7(3) | n/a | 11 of 12(3) | n/a |

| A. Linton | 9 of 9 | n/a | n/a | n/a | 5 of 5 |

| S. McGovern | 9 of 9 | n/a | 7 of 7 | n/a | 5 of 5 |

| P. Oliver | 9 of 9 | 7 of 7 | n/a | 12 of 12 | n/a |

Notes:

| (1) | Prior to his sudden passing in December 2020, Mr. Colin Litton attended one Board meeting, one Audit Committee meeting and one Risk Oversight Committee meeting during Fiscal 2021. |

| (2) | At the invitation of the Chair of a committee, directors regularly attend committee meetings to which they are not a member, as observers. This table does not include instances of directors attending any such meetings in an observer capacity. |

| (3) | Joined the Board, Audit Committee and Risk Oversight Committee on January 1, 2021. |

| (4) | Mr. R.W. (Dick) Carter was recused from his duties as a member of the Board and Chair of the Audit Committee for the period of August 27, 2021, through January 31, 2022. |

The information set forth in the table below, not being within the knowledge of the Bank, has been furnished by the respective director nominees individually and is current to March 3, 2021.

| Name, City, Province or State and Country, and Shares(1) | Office held and date first became a director | Principal Occupation |

The Honourable Thomas A. Hockin(2) Rancho Mirage, California, USA Shares – 29,655 Series 1 Preferred Shares(3) – 3,500 | Chair Director since

August 21, 2014 | Retired, former Executive Director of the International Monetary Fund |

David R. Taylor Ilderton, Ontario, Canada Shares – 1,130,606 Series 1 Preferred Shares(3) – Nil Stock Options – 40,000 | President & Chief Executive Officer Director since January 18, 1993 | President & Chief Executive Officer of the Bank

|

Gabrielle Bochynek(6) Stratford, Ontario, Canada Shares – 5,275 Series 1 Preferred Shares(3) – Nil | Director since

April 24, 2019 | Principal, Human Resources and Labour Relations, The Osborne Group |

Robbert-Jan Brabander(4)(5) Richmond Hill, Ontario, Canada Shares – 52,400 Series 1 Preferred Shares(3) – 935 | Director since November 4, 2009 | Managing Director of Bells & Whistles Communications, Inc. and former Chief Financial Officer & Treasurer of General Motors of Canada Limited |

| Name, City, Province or State and Country, and Shares(1) | Office held and date first became a director | Principal Occupation |

David A. Bratton(6) London, Ontario, Canada Shares – 31,300 Series 1 Preferred Shares(3) – Nil | Director since September 23, 1993 | Retired, former President of Bratton Consulting Inc. |

R. W. (Dick) Carter(7) Regina, Saskatchewan, Canada Shares – 36,000 Series 1 Preferred Shares(3) – Nil | Director since December 1, 2014 | Retired, former Chief Executive Officer of the Crown Investments Corporation of Saskatchewan |

| Peter M. Irwin(4)(7) Toronto, Ontario, Canada Shares – 10,500 Series 1 Preferred Shares(3) – Nil | Director since January 1, 2021 | Retired, former Managing Director, CIBC World Markets Inc. |

Arthur Linton(5) Kitchener, Ontario, Canada Shares – 3,800 Series 1 Preferred Shares(3) – Nil | Director since April 22, 2020 | Barrister and Solicitor |

Susan T. McGovern(5)(6) Gormley, Ontario, Canada Shares – 29,000 Series 1 Preferred Shares(3) – Nil | Director since May 6, 2011 | Vice President, External Relations and Advancement, Ontario Tech University |

Paul G. Oliver(4)(7) Markham, Ontario, Canada Shares – 52,483 Series 1 Preferred Shares(3) – 1,400 | Director since June 2, 2005 | Retired, former senior partner of PricewaterhouseCoopers LLP |

Notes:

| (1) | Number of Shares includes the number of Shares beneficially owned or controlled or directed, directly or indirectly, by each director nominee. |

| (2) | Current and proposed Chair of the Board. |

| (3) | Holders of Series 1 Preferred Shares are entitled to receive, as and when declared by the Board, fixed non-cumulative preferential cash dividends at the rate of $0.6772 per share per annum, or $0.1693 per share per quarter. Such dividends are paid quarterly on the last day of January, April, July and October in each year. |

| (4) | Current and proposed member of the Risk Oversight Committee. |

| (5) | Current and proposed member of the Innovation and Technology Committee. |

| (6) | Current and proposed member of the HR Committee. |

| (7) | Current and proposed member of the Audit Committee. |

Majority Voting

The Bank has a majority voting policy for the election of directors, which is applicable at any meeting of Shareholders where an uncontested election of directors is held. A director nominee in an uncontested election who receives more “withheld” votes than votes in his or her favour is expected to promptly tender his or her resignation to the Chair of the Board for consideration; however, such resignation is not effective until it is accepted by the Board. The Board will submit the nominee’s resignation to the HR Committee for consideration. The HR Committee will then recommend to the Board whether or not to accept the resignation. A director who tenders his or her resignation will not participate in any meetings of the Board or the HR Committee to consider whether the resignation shall be accepted. Within 90 days of receiving the final voting results in respect of the uncontested election, the Board will issue a press release announcing whether it has accepted the director nominee’s resignation or explaining its reasons for not accepting the resignation; absent extenuating circumstances, the Board expects that such resignations will be accepted.

PART IV – STATEMENT OF EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION & ANALYSIS

The following Compensation Discussion & Analysis provides a description of the strategy, processes and decisions made pertaining to the oversight, design and payout of the Bank’s compensation for its Named Executive Officers (“NEOs”) for Fiscal 2021. The NEOs as of October 31, 2021, were David Taylor, President & Chief Executive Officer (“President & CEO”); Shawn Clarke, Chief Financial Officer (“CFO”) and each of the next three most highly compensated executive officers of the Bank being Michael Dixon, Senior Vice President, Point-of-Sale Financing, Ross Duggan, Senior Vice President, Commercial Lending and Nick Kristo, Chief Credit Officer.

Compensation Governance

The Board has delegated the responsibility for oversight of the Bank’s compensation program to the HR Committee, which reports regularly to the Board.

The HR Committee is comprised of independent directors within the meaning of National Instrument 58-101 – Disclosure of Corporate Governance Practices (“NI 58-101”). They are currently David A. Bratton (Chair), Susan T.

McGovern and Gabrielle Bochynek. No member of the HR Committee has ever been an officer or employee of the Bank or any of its affiliates, and no member is an active chief executive officer with a publicly traded company.

Mr. Bratton has been a member of the Board since 1993. Mr. Bratton has over 30 years of human resource management experience. He holds Master of Business Administration, Fellow Certified Management Consultant, and Certified Human Resources Leader designations. Mr. Bratton was an affiliate professor at the Rotman School of Business for 18 years.

Ms. McGovern has been a member of the Board since 2011. She has over 30 years of experience in the federal government, the Ontario Public Service, and private and not-for-profit sectors. She is Vice President, External Relations and Advancement at Ontario Tech University. As a senior leader, her strengths include corporate development and governance, human resource management, strategic communications, stakeholder engagement, and philanthropic development.

Ms. Bochynek has been a member of the Board since 2019. She holds a Bachelor of Arts degree and Certified Human Resources Leader designation and has over 30 years of human resources experience. Her background includes expertise in executive compensation, employee and labor relations, change management and organizational restructuring. She is Principal, Human Resources & Labor Relations, with the Osbourne Group and formerly Chief Human Resources Officer at North York General Hospital.

The Board believes that the members of the HR Committee have the qualifications and experience in human resources matters and, in particular, executive compensation to fulfill their responsibilities.

The HR Committee held 7 meetings during Fiscal 2021. The President & CEO and the Chief Human Resources Executive attend HR Committee meetings but do not have the right to vote. The HR Committee regularly holds in-camera sessions without management present. The HR Committee may also engage the services of an independent compensation consultant at their discretion.

Currently, the HR Committee’s responsibilities with respect to human resources matters include the following:

| (a) | Annually review the Bank’s overall compensation plan and the policies pertaining thereto to ensure that they are consistent with the Bank’s goals of attracting and retaining the best people, aligning executive interests with those of the Bank, and paying for performance. Survey information is obtained from the Chief Human Resources Executive, as well as from compensation consulting companies and other external independent sources, to ensure that compensation paid to executives is appropriate and competitive. |

| (b) | Consider the implications of risks associated with the Bank’s compensation policies and practices. |

| (c) | Approve, at the beginning of each fiscal year, performance measurements for calculating the annual incentive award of the President & CEO. |

| (d) | Review the compensation of the President & CEO, and recommend same to the Board for approval. |

| (e) | Report to the full Board on a timely basis as to the actual calculations of total compensation of the President & CEO. |

| (f) | Review staff compensation, including ranges and benefit programs. |

| (g) | Review staff incentive awards. |

| (h) | Recommend to the Board for approval the annual incentive award pool for executives. |

| (i) | Review a report from the Chief Internal Auditor on the alignment of the Bank’s compensation policies with the Financial Stability Board’s Principles for Sound Compensation Practices. |

With regard to the HR Committee’s consideration of the implications of risks associated with the Bank’s compensation policies and practices and compliance with Financial Stability Board Principles for Sound Compensation Practices, the Board, through the HR Committee, monitors and manages any such risks by taking actions that include the following:

| (a) | Actively overseeing the Bank’s compensation systems, and monitoring and reviewing compensation policies and procedures to ensure they are operating as intended. |

| (b) | Recommending the amount of the annual Senior Management Short Term Incentive Award pool to the Board for approval. |

| (c) | Reviewing decisions made by the President & CEO concerning senior management compensation and providing input. |

| (d) | Establishing appropriate performance measures for the President & CEO at the beginning of the fiscal year and assessing overall performance and recommending compensation decisions to the Board at the end of the fiscal year. |

| (e) | Ensuring that the performance measures assigned to the President & CEO, which are derived from the Bank’s Business Plan, are within the Bank’s tolerance for risk. |

| (f) | Ensuring the compensation decisions for employees in control functions (finance, risk, compliance, and internal audit) are based on enterprise and individual performance, and are not based on the performance of the specific businesses supported by the control function. |

Executive Compensation Philosophy

The key components of the Bank’s compensation plan for NEOs are base salary, short-term (annual) incentive awards, and long-term incentives. NEOs are also entitled to certain employee benefits, including a pension supplement payment.

The Bank’s compensation plan is designed to attract and retain highly qualified individuals, while creating an incentive to align efforts with shareholder interests and motivate NEOs to deliver company performance that will create real long-term shareholder value.

The Bank’s overall objective is to set total compensation at approximately the seventy-fifth percentile of the total compensation paid for comparable positions at comparable companies, being Home Capital Group Inc., Equitable Group Inc., Canadian Western Bank and Genworth MI Canada Inc. (the “Comparable Companies”). The Bank considers compensation information of these entities as a frame of reference in determining NEO compensation due to management’s belief that the Comparable Companies are the Canadian financial institutions that are similar to the Bank. In particular, the Comparable Companies represent mid-sized, federally regulated financial institutions that may raise deposits solely or partly through a brokerage network. However, since the Comparable Companies vary from the Bank in terms of business model, asset size, and organization structure, compensation data from the Comparable Companies is used as a frame of reference only, and not a definitive target for NEO compensation. Other elements that are considered when determining total compensation for NEOs are set forth below.

More detail on each component of the Bank’s compensation plan and its purpose within total compensation is described in the table under the heading “Statement of Executive Compensation – Compensation Discussion and Analysis – Type of Compensation” below, and in subsequent sections of this Management Proxy Circular.

Decision Making Process

The Board, through the HR Committee, actively oversees the Bank’s overall compensation plan and monitors and reviews the Bank’s compensation practices to ensure they operate as intended.

The Chief Human Resources Executive provides the HR Committee with market data, as required, including information concerning compensation paid at the Comparable Companies, to assist the HR Committee in its deliberations.

In conjunction with the President & CEO, the HR Committee establishes performance measurements for the President & CEO at the beginning of the fiscal year, and the Board monitors progress against the performance measures throughout the year. At the end of the year, the HR Committee receives a report from the Chair of the

Board on the results of the President & CEO’s performance appraisal; the HR Committee, in turn, reports on such results to the Board.

The HR Committee recommends to the Board for approval any changes to salary and incentive awards payable to the President & CEO.

The President & CEO has final approval for all compensation decisions concerning NEOs and other staff, other than himself and other than the total amount of the annual incentive award pool for executives, which is reviewed and recommended by the HR Committee to the Board for approval. The HR Committee reviews the balance of the compensation decisions after the fact and provides comment and advice for consideration regarding future compensation decisions.

Type of Compensation

| Description | Form | Eligibility | Performance Period |

| Base Salary | Cash | All employees | Reviewed annually |

Short-Term (Annual) Incentive Awards | Cash | All employees | One year |

| Long-Term Incentive Awards | Chief Executive Officer Share Purchase Program | President & CEO All employees (excluding the President & CEO) All employees at the position of senior vice president or above | 5 years |

| | Employee Share Purchase Plan | One year |

| | Senior Executive Share Award Program | 5 years |

| Other – Pension Supplement | Cash | All employees | Not applicable |

Base Salary

NEOs are paid a base salary that is commensurate with each NEO’s position and level of responsibility within the Bank. The actual base salary paid is determined with consideration to past and current performance, internal equity, salaries paid at the Comparable Companies, salary surveys including Mercer’s Executive, Management and Professional Survey, and the potential impact of the position on the Bank’s performance. Base salaries for executives who report directly to the President & CEO are approved by the President & CEO, upon recommendation of the Chief Human Resources Executive and are reviewed after the fact by the HR Committee.

Short-Term (Annual) Incentive Awards

NEOs and other executives are eligible to participate in the Bank’s short-term incentive award program. The key goals of the short-term incentive award program are to align executive efforts to achieve the objectives set out in the Bank’s Business Plan, to encourage the effective management of risk, to pay for performance, and to encourage teamwork.

Factors considered in determining whether and in what amount short-term incentive awards are paid to the NEOs and certain other executives of the Bank (other than the President & CEO) include: (i) individual results against the predetermined performance objectives; (ii) the executive’s business unit results; and (iii) the Bank’s overall results. For NEOs and executives, other than the President & CEO, individual performance objectives that reflect the executive’s key responsibility areas are set at the beginning of each fiscal year and are intended to align executive efforts with the business, financial, risk management and strategic objectives of the Bank as set out in its Business Plan. Periodically throughout the year, the performance objectives are re-visited to monitor results to date, and to

determine if the stated objectives require modification based on factors that may include a change in job responsibilities or a change in business priorities. At the end of each fiscal year, the actual results achieved by the executive, their business unit and the Bank are reviewed and any extenuating circumstances are considered. The HR Committee reviews and recommends to the Board for approval the annual short-term incentive award pool for the NEOs and other executives, excluding the President & CEO. The final decision on allocating short-term incentive award payments from the approved award pool among the NEOs and other executives (other than the President & CEO) is made by the President & CEO. The HR Committee reviews the President & CEO’s decisions after the fact.

With respect to the President & CEO, performance measurements derived from the Board approved Business Plan for his short-term incentive award are approved by the HR Committee at the beginning of each fiscal year. At the end of the fiscal year, a determination is made by the Board on the advice of the HR Committee as to the amount of any short-term incentive award payable to the President & CEO in respect of such fiscal year. In determining the amount of the short-term incentive award (if any), the Board has discretion to consider subjective measures, including the implementation of the Bank’s philosophy with respect to risk, enterprise risk management and corporate reputation, and the Board may also consider any extraordinary circumstances.

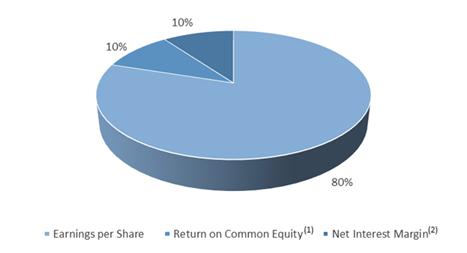

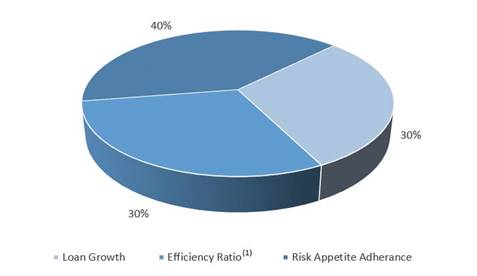

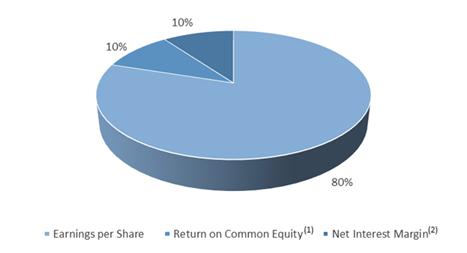

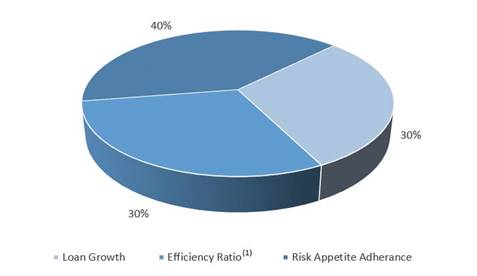

For Fiscal 2021, the President & CEO’s key performance measures were established in three main categories. Under the performance objectives, financial metrics related to shareholder value have been attributed a 70% weighting in the assessment, financial metrics related to operational results have been attributed a 20% weighting, and the remaining 10% was attributed to individual performance in key management areas that have a significant impact on the Bank’s results, including (i) the development/execution of strategic vision, (ii) communication, and (iii) leadership development. The financial metrics used to determine the President & CEO’s performance as it relates to shareholder value and operational results are key business targets derivable directly from the Bank’s Fiscal 2021 Business Plan and are as outlined in the following charts:

Shareholder Value Performance Measures

Notes:

| (1) | This is a non-GAAP financial measure. Return on average common equity for the Bank is defined as annualized net income of the Bank less amounts relating to preferred share dividends, divided by average common shareholders’ equity (which is average shareholders’ equity less amounts relating to preferred shares recorded in equity). For further details regarding non-GAAP financial measures and a reconciliation to their most comparable GAAP measure, please see the Bank’s Management’s Discussion & Analysis for Fiscal 2021, available on SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar. |

| (2) | Net interest margin or spread is defined as net interest income as a percentage of average total assets. For further details regarding non-GAAP financial measures and a reconciliation to their most comparable GAAP measure, please see the Bank’s Management’s Discussion & Analysis for Fiscal 2021, available on SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar |

Operational Results Performance Measures

Note:

| (1) | The efficiency ratio is calculated as non-interest expenses, excluding restructuring charges, as a percentage of total revenue. For further details regarding non-GAAP financial measures and a reconciliation to their most comparable GAAP measure, please see the Bank’s Management’s Discussion & Analysis for Fiscal 2021, available on SEDAR at www.sedar.com and EDGAR at www.sec.gov/edgar |

The extent to which each performance category target is met multiplied by its weighting determines the number of points earned. The total number of points earned is then multiplied by 85% of the President & CEO’s base salary to arrive at the short-term incentive award amount payable to the President & CEO (subject to any adjustments that the Board considers appropriate after considering applicable subjective measures). The target annual incentive award for the President & CEO is 85% of base salary with a maximum cap of 135% of base salary.

Further details respecting the performance metrics considered in determining the payments made to NEOs under the short-term incentive award program in respect of Fiscal 2021 and the payments made to NEOs thereunder in respect of each of the last three fiscal years of the Bank can be found below under the headings “Statement of Executive Compensation – Compensation Discussion and Analysis – Fiscal 2021 Incentive Awards Paid” and “Statement of Executive Compensation – Summary Compensation Table”, respectively.

Long-Term Incentive Awards

Under the Bank’s long-term incentive award program, NEOs (excluding the President & CEO) are eligible to participate in the Bank’s Employee Share Purchase Plan (the “ESPP”) and Senior Executive Share Award Program (the “SESAP”), and the President & CEO participates in Chief Executive Officer Share Purchase Program (“CEOSPP”). Each of these programs is discussed in greater detail below.

Employee Share Purchase Program

The Bank maintains the ESPP, in which all employees of the Bank (excluding the President & CEO) are eligible to participate. The ESPP encourages ownership of the Bank’s securities and aligns the interests of employees, including NEOs (but excluding the President & CEO), more closely with those of Shareholders. Pursuant to the ESPP, employees can purchase Common Shares on the open market with up to an aggregate amount of twenty percent (20%) of their base salary and are eligible for a fifty percent (50%) reimbursement for the cost of such Common Shares. All Common

Shares purchased by employees under the ESPP are to be held for a minimum of one year from the date of purchase. Reimbursement amounts paid to employees under the ESPP are a taxable benefit.

Senior Executive Share Award Program

The Bank’s employees at the senior vice president level and above (excluding the President & CEO) are eligible to participate in the SESAP. The objective of the SESAP is to encourage ownership of the Bank’s securities and to provide a long-term incentive that aligns the participant’s interests with those of Shareholders. At the end of each fiscal year, the President & CEO determines the number of Common Shares to be awarded to each participant as a long-term incentive. Such Share award will be determined by considering the results the Bank achieved relative to its long-term targets in the previous fiscal year and the results the participant obtained relative to his or her long-term incentive objectives. The participant will purchase a number of Shares equal to his or her Shares award on the open market and will be fully reimbursed for the cost of such Common Shares. All Common Shares purchased under the SESAP are to be held for a minimum of five years from the date of purchase, unless otherwise agreed in writing. Additionally, the Common Shares may be sold in the event of the participant’s death, retirement, resignation or termination. Reimbursement amounts paid to participants under the SESAP are a taxable benefit.

Chief Executive Officer Share Purchase Program

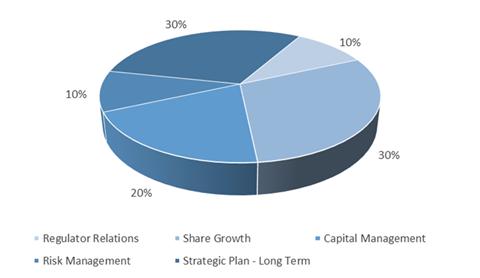

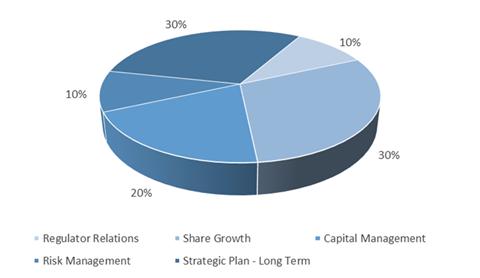

The objective of the CEOSPP is to encourage ownership of the Bank’s securities, and to provide a long-term incentive that aligns the President & CEO’s interests with those of Shareholders. Under the CEO Compensation Policy and Procedures, performance measurements for the long-term incentive award are approved by the HR Committee at the beginning of each fiscal year and each performance measure is assigned a weighting to reflect its relative importance to the Bank’s long-term success. At the end of each fiscal year, the Board on the advice of the HR Committee will determine the number of Shares to be awarded to the President & CEO as a long-term incentive. Such award will be determined by considering the results the Bank achieved relative to the performance measurements in respect of such fiscal year. In making this determination, the Board has discretion to adjust the long-term incentive award payable to the President & CEO on the basis of subjective measures, including the implementation of the Bank’s philosophy with respect to risk, enterprise risk management and corporate reputation, and the Board may also take into account any extraordinary circumstances.

The performance measures and relative weighting in respect of Fiscal 2021 are as outlined in the following chart:

Long-Term Incentive Award Performance Measures

The extent to which each performance category target has been met multiplied by its weighting determines the number of points earned. The total number of points earned is divided by 100 and multiplied by 30,000 to determine the number of Shares awarded to the President & CEO (subject to any adjustments that the Board considers appropriate after considering applicable subjective measures). The President & CEO will purchase such number of Shares awarded to him under the CEOSPP on the open market and will be reimbursed for the full cost of such Shares. All Shares purchased under the CEOSPP are to be held for a minimum of five years from the date of purchase, unless otherwise agreed in writing. Additionally, such Shares may be sold in the event of death, retirement, resignation or termination (including termination as a result of a change of control). Reimbursement amounts paid to the President & CEO under the CEOSPP are a taxable benefit.

See “Statement of Executive Compensation – Summary Compensation Table” below for additional information concerning the long-term incentive awards paid to the NEOs in respect of each of the last three fiscal years of the Bank.

Other – Pension Supplement

Although the Bank does not have a formal pension plan, all employees of the Bank, including NEOs, are entitled to an annual cash payment in lieu of pension contributions. A pension supplement is considered a normal component of a competitive executive compensation arrangement. The pension supplement payment calculation for NEOs is based on a variety of factors, including age, life expectancy and current interest rates. The pension supplement amounts paid to each NEO in the previous fiscal year is described in the notes to the table found under “Statement of Executive Compensation – Summary Compensation Table” below.

Incentive Award Deferral and Clawback

All or a portion of any short-term incentive award payable to the Bank’s executives may be deferred until the anticipated benefit to the Bank to which the award is associated actually occurs. As well, the value of the long-term incentive award component of the Bank’s NEOs’ compensation is implicitly deferred, as Shares acquired thereunder must be held for a minimum of one year (in respect of the ESPP) and five years (in respect of the SESAP and CEOSPP).

In addition, the President & CEO’s employment agreement provides that the Board may, in its sole discretion, require the President & CEO to reimburse the Bank for incentive award compensation he received that was based on financial results that were subsequently subject to a material restatement.

Changes to NEO Compensation

There were no significant changes to NEO compensation in Fiscal 2021.

Purchase of Financial Instruments to Offset a Decrease in the Market Value of Equity Securities

The Bank’s NEOs and directors are not permitted to purchase financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds that are designed to hedge or offset a decrease in market value of equity securities of the Bank granted as compensation or held, directly or indirectly, by the NEO or director.

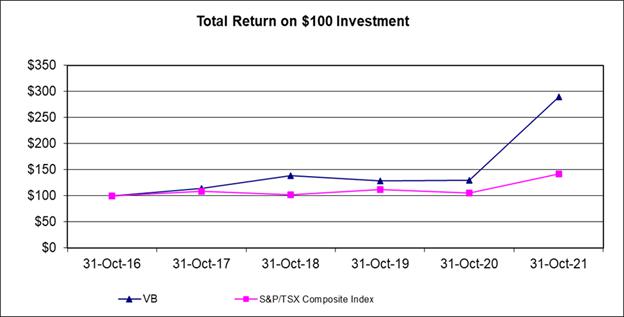

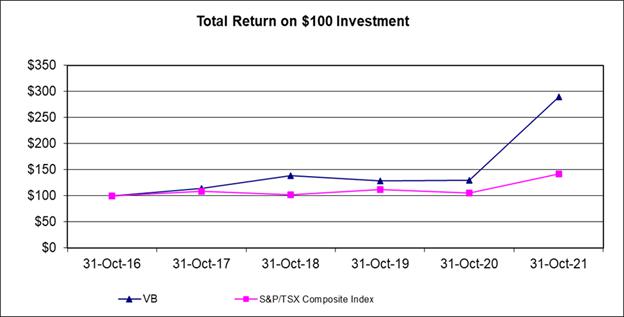

PERFORMANCE GRAPH

The following chart compares the cumulative Bank total shareholder return (“TSR”) on $100 invested in shares of Pacific & Western Bank (a predecessor by amalgamation to the Bank) on November 1, 2016, with the equivalent cumulative value invested in the Toronto Stock Exchange (“TSX”) for the same period.

| | 31-Oct-16 | | 31-Oct-17 | | 31-Oct-18 | | 31-Oct-19 | | 31-Oct-20 | | 31-Oct-21 |

| VB(1) | $100.00 | | $113.73 | | $138.24 | | $128.82 | | $129.22 | | $289.80 |

| S&P/TSX Composite Index | $100.00 | | $108.37 | | $101.62 | | $111.47 | | $105.36 | | $142.26 |

| | | | | | | | | | | | |

Note:

| (1) | The TSR return in respect of the Bank contemplates an investment in shares of Pacific & Western Bank on November 1, 2016, and the exchange of such shares for Shares in connection with the Amalgamation. |

During the period November 1, 2016, to October 31, 2021, the Bank’s trend in total executive compensation, defined as base salary and incentive awards paid, increased to reflect the success of initiatives such as the Point-of-Sale Financing program, the Insolvency Trustee Integrated Banking (“TIB”) Services initiative and the overall Bank’s financial results.

While the Bank believes TSR has an influence on total executive compensation, it does not expect a direct correlation will always exist between TSR and total executive compensation since other factors are considered when making executive compensation decisions. Those factors include changes to NEO responsibilities and corresponding increases in compensation, adjustments to compensation necessary to reflect changes in market conditions, and compensation paid to reward NEOs for results that may not be reflected immediately in TSR.

SUMMARY COMPENSATION TABLE

The following table sets forth all compensation earned by the Bank’s NEOs, for services to the Bank in Fiscal 2021.

Name and principal position(1) | Year | Salary ($) | Share- based awards ($) | Option- based awards ($) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compensation ($) | Total compensation ($) |

Annual incentive plans ($) | Long- term incentive plans ($) |

| David Taylor | 2021 2020 | 650,000 632,000 | nil nil | nil nil | 670,000(3) 670,000 | 651,633(4) 402,147 | nil nil | 499,201(5) 389,663 | 2,470,834 2,093,809 |

| President & CEO | 2019 | 611,500 | nil | nil | 653,344 | 276,124 | nil | 331,312 | 1,872,280 |

| (Avstar Inc.)(2) | | | | | | | | | |

| Shawn Clarke | 2021 2020 | 315,000 295,000 | nil nil | nil nil | 300,000(3) 225,000 | 29,831(6) 25,800 14,001 | nil nil | 275,026(7) 189,962 | 919,857 735,762 |

| Chief Financial Officer | 2019 | 279,000 | nil | nil | 180,000 | nil | 163,186 | 636,187 |

| | | | | | | | | |

Ross Duggan | 2021 2020 | 258,500 252,000 | nil nil | nil nil | 175,000(3) 150,000 | 30,510(6) 25,800 14,500 | nil nil | 204,958(8) 159,200 | 668,968 587,000 |

| Senior Vice President, | 2019 | 242,875 | nil | nil | 100,000 | nil | 134,261 | 491,636 |

| Commercial Lending | | | | | | | | |

| | | | | | | | | |

| Nick Kristo | 2021 2020 | 258,500 252,000 | nil nil | nil nil | 170,000(3) 137,000 | 30,142(6) 17,507 14,415 | nil nil | 223,395(8) 161,960 | 682,037 568,467 |

| Chief Credit Officer | 2019 | 242,875 | nil | nil | 100,000 | nil | 140,782 | 498,072 |

| | | | | | | | | |

| | | | | | | | | |

| Michael Dixon | 2021 2020 | 258,500 252,000 | nil nil | nil nil | 180,000(3) 143,000 | 29,791(6) 22,255 14,207 | nil nil | 206,220(8) 159,167 | 674,511 576,422 |

Senior Vice President, Point-of-Sale Financing | 2019 | 241,542 | nil | nil | 120,000 | nil | 124,656 | 500,405 |

Notes:

| (1) | Name and Principal Position as at October 31, 2021. |

| (2) | Avstar Inc. is David Taylor’s personal holding company. |

| (3) | See section below entitled “Fiscal 2021 Incentive Awards Paid”. |

| (4) | This amount is the cost of Shares acquired pursuant to the terms of the CEOSPP. The Shares must be held for a period not less than five years, subject to certain exceptions. |

| (5) | Of this amount, $477,491 was the amount of pension supplement paid to David Taylor. |

| (6) | This amount was paid as a reimbursement for the cost of Shares acquired pursuant to the terms of the SEASP. The Shares much be held for a period not less than five years, subject to certain exceptions. |

| (7) | Of this amount, $259,146 was the amount of pension supplement paid to Shawn Clarke. |

| (8) | Of this amount, $201,359 was the amount of pension supplement paid to each of Nick Kristo, Michael Dixon and Ross Duggan. |

Fiscal 2021 Incentive Awards Paid

The following summarizes key rationale for the incentive award paid to each NEO for Fiscal 2021:

David Taylor, President & CEO

Short-Term Incentive Award

Mr. D. Taylor led the Bank to another successful year despite the continuing challenges presented by the COVID-19 pandemic. Staff continued to work effectively from home and the Bank was successful hiring 18 new staff members.

All key performance targets related to Shareholder Value as set out in the Bank’s Fiscal 2021 Business Plan were met or exceeded. Targets included earnings per common share, return on common equity and net interest margin.

Performance target results in the Operational category such as loan growth and operating within the risk appetite were exceeded while the Bank’s efficiency target was negatively affected by the ongoing economic impact of the pandemic. Under Mr. D. Taylor’s guidance and oversight the Bank’s credit quality, net interest margin and capital position relative to other banks in Canada, continued to remain very strong.

With reference to the Leadership category, all performance goals were exceeded. The Bank’s new initiatives continued to contribute to the Bank’s profitability. Progress was made concerning the Bank’s development and introduction of a digital currency (VCAD). The Bank’s Insolvency Trustee Banking deposits grew significantly in F2021. Over $1.8 billion in new trustee deposits were raised which was a 44% increase over F2020. In addition, the Commercial Lending and Point-of-Sale Financing teams had another successful year growing their portfolios by 22% and 30% respectively.

Long-Term Incentive Award

All expectations concerning Mr. D. Taylor’s long-term incentive were met or exceeded. During the year, the Bank was successful in obtaining a NASDAQ listing and raising US $63,250,000 in Common equity and US$75 million in subordinate debt. The Bank also obtained an investment grade A overall credit rating. DRT Cyber Inc. continued to grow and evolve its operations to ensure the Bank’s cyber security remains leading edge and to potentially revolutionize the commercial cyber security space.

Despite the pandemic, under Mr. D. Taylor’s leadership, the Bank performed well again in F2021 and made strong progress and is positioned for continued growth and profitability.

Shawn Clarke, Chief Financial Officer

Mr. Clarke was instrumental in VersaBank’s efforts to further strengthen its balance sheet over the course of 2021 in support of future growth initiatives including the closing of the Bank’s US $75 million private placement of subordinated notes with U.S. institutional investors on April 30, 2021, as well as the execution and closing of the Bank’s treasury offering of common shares for gross proceeds of US $63.25 million and the simultaneous listing of the Bank’s common shares on the NASDAQ stock exchange in September 2021. Further to this Mr. Clarke organized and facilitated underwriter due diligence, as well as supported the CEO in marketing efforts for both capital financings.

Mr. Clarke met or exceeded all performance objectives assigned to him and made a strong contribution to the Bank’s Fiscal 2021 operating performance through his leadership and guidance in the areas of performance planning and analysis, as well as financial and capital management.

Ross Duggan, Senior Vice President, Commercial Lending

In his role as Senior Vice President, Commercial Lending, Mr. Duggan is responsible for strategic management, oversight and the overall performance of the Bank’s Commercial Lending activities.

Over the course of Fiscal 2021, under Mr. Duggan’s guidance, the Commercial Lending team successfully managed the Bank’s commercial lending activities, growing these lending assets to over $797 million, which equates to approximately 38.3% of the Bank’s lending assets as at October 31, 2021. In addition, Commercial Lending significantly exceeded all of its income, portfolio risk and expense management objectives, notwithstanding the continued challenging environment within the COVID-19 economy.

Through Fiscal 2021, Commercial Lending continued to enhance relationships with key long-term clients while adding new strategic lending partners and new borrowing relationships. In addition, Mr. Duggan played a significant

role in the oversight of the existing portfolio with continued heightened attention being placed on portfolio risk due to COVID-19 and the resulting economic challenges that continue. Overall, the Bank’s Commercial Lending portfolio does not have material exposure to industries most impacted by COVID-19 and the Bank has taken proactive steps to ensure any exposure it does have to industries significantly impacted by COVID-19 are monitored very closely and are on low risk lending terms. The Commercial Lending team remains well positioned to achieve long-term objectives of the Bank.

Michael Dixon, Senior Vice President, Point-of-Sale Financing

In his role as Senior Vice President, Point-of-Sale Financing (previously eCommerce), Mr. Dixon is responsible for the strategic management, oversight and overall performance of the Bank’s Point-of-Sale Financing activities.

Over the course of Fiscal 2021, the Point-of-Sale Financing team successfully navigated through an increasingly competitive and low-rate marketplace as well as the evolving challenges presented by COVID-19, including ensuring operational continuity while staff worked remotely. Despite these challenges, the Point-of-Sale Financing team comfortably exceeded all of its objectives for asset growth, income, expenses, and portfolio risk management.

Under Mr. Dixon’s leadership, Point-of-Sale Financing increased its receivable purchase volume by more than 50% over the previous year, which led to overall asset growth of more than 30%, all while maintaining no delinquencies and zero losses throughout the year. As at October 31, 2021, Point-of-Sale Financing assets equated to more than 60% of the Bank’s total lending assets.

Through Fiscal 2021, Point-of-Sale Financing added 4 new vendor partners and Mr. Dixon led the restructuring efforts of several existing partner programs, which provides the opportunity for material organic growth within the Point-of-Sale Financing group. In addition, Mr. Dixon has been tasked with expanding the bank’s Point-of-Sale Financing products into the US, all of which will assist in obtaining the long-term objectives of the Bank.

Nick Kristo, Chief Credit Officer

In his role as Chief Credit Officer, Mr. Kristo is responsible for the credit risk management of the Bank’s lending portfolio. Over the course of fiscal 2021, Mr. Kristo played a key role in ensuring that the Bank’s response to the Pandemic through efficient management of loan provisions, increased risk monitoring and client relief programs.

Credit policy, risk monitoring and risk management frameworks continue to evolve to assist in the support of the growth of both the Commercial Banking and Point-of-Sale loan portfolios. VersaBank had achieved record loan levels during the fiscal period while maintaining a loan portfolio that benefited with limited delinquency, no impaired loans and no credit losses.

Mr. Kristo continues to promote the credit risk culture to staff and ensures that the Bank operates within the tolerances established within VersaBank’s credit risk appetite.

TERMINATION AND CHANGE OF CONTROL BENEFITS

The following table sets out the estimated amount of potential payments to the NEOs if their termination or change of control clauses or retirement clauses were triggered on October 31, 2021. Further detail regarding the termination clauses in each NEO’s employment agreement is set out under “Termination and Change of Control Benefits – Employment Contracts” below.

Name | Entitlement ($) |

| Termination | Change of control | Retirement |

| David Taylor(1) | $4,052,012 | $4,052,012 | $900,000 |

| Ross Duggan(2) | $985,471 | nil | nil |

| Shawn Clarke(2) | $755,764 | nil | nil |

| Michael Dixon(2) | $731,762 | nil | nil |

| Nick Kristo(2) | $825,482 | nil | nil |

Notes:

| (1) | In the case of termination without cause or in the case of change of control, whereby the employment agreement will be deemed to be terminated, any outstanding unvested stock options shall also become exercisable at the date of termination. In addition, all stock options held by Mr. D. Taylor shall expire on the earlier of the expiry date and two years from such date of termination. Further, at the option of Mr. D. Taylor, any stock options are to be redeemed by the Bank at a price calculated as the difference between the stock option exercise price and the average price of the Shares for the four trading days prior to the date of termination and the termination date. |

| (2) | In the case of termination without cause. |

Employment Contracts

At October 31, 2021, each of David Taylor, Shawn Clarke, Michael Dixon, Ross Duggan and Nick Kristo had an Executive Employment Agreement with the Bank. The following tables outline the key terms of such agreements.

| David Taylor |

| Position | President & CEO |

|

| Annual salary | $650,000 |

| Annual short-term incentive awards | Discretionary |

| Annual long-term incentive awards | Entitled to participate in the CEOSPP. |

| Other benefits | Entitled to usual benefits provided to executives. |

| Retirement | Entitled to receive an annual pension supplement payment (the Bank does not have a pension plan). Entitled to receive a retirement allowance of $900,000. |

| Termination | If Mr. D. Taylor’s employment with the Bank is terminated without cause, he is to receive an amount equal to 24 months total compensation less any withholding taxes and other required deductions. Mr. D. Taylor is to immediately receive this amount if the Bank is sold, subject to a change of control, merged or liquidated, or if its normal operations are changed in such a manner so as to eliminate Mr. D. Taylor’s services or the President & CEO position. For the purpose of this termination clause ‘total compensation’ is to include annual salary and allowances and shall include incentive awards and pension supplement paid or approved to be paid in each case during the 24 months immediately preceding the termination date. In addition, all options to purchase shares of the Bank held by Mr. D. Taylor shall become exercisable on the date of termination and expire on the earlier of the original expiry date of the options or two years after the termination date. Alternatively, at Mr. D. Taylor’s discretion, these options are to be repurchased by the Bank at a price calculated as the difference between the option exercise price and the average price of the Shares for the four trading days prior to the termination date and the termination date. |

| Shawn Clarke |

| Position | Chief Financial Officer |

|

| Annual salary | $315,000 |

| Annual short-term incentive awards | Discretionary |

| Annual long-term incentive awards | Entitled to participate in the ESPP and the SESAP. |

| Other benefits | Entitled to usual benefits provided to executives. |

| Retirement | Entitled to receive an annual pension supplement payment (the Bank does not have a pension plan). |

| Termination | If Mr. Clarke’s employment is terminated without cause, he is to receive an amount equal to one month’s total compensation for each completed year of service, with a minimum of 12 months and a maximum of 24 months total compensation, less any withholding taxes and other required deductions. For the purpose of this termination clause ‘total compensation’ is to include Mr. Clarke’s then current base salary, an amount equivalent to the most recent incentive award paid, benefits, vehicle benefit, pension supplement and all allowances paid. |

| Nick Kristo |

| Position | Chief Credit Officer |  |

| Annual salary | $258,500 |

| Annual short-term incentive awards | Discretionary |

| Annual long-term incentive awards | Entitled to participate in the ESPP and the SESAP. |

| Other benefits | Entitled to usual benefits provided to executives. |

| Retirement | Entitled to receive an annual pension supplement payment (the Bank does not have a pension plan). |

| Termination | If Mr. Kristo’s employment is terminated without cause, he is to receive an amount equal to one month’s total compensation for each completed year of service, with a minimum of 12 months and a maximum of 24 months total compensation, less any withholding taxes and other required deductions. For the purpose of this termination clause ‘total compensation’ is to include Mr. Kristo’s then current base salary, an amount equivalent to the most recent incentive award paid, benefits, vehicle benefit, pension supplement and any and all allowances paid. |

| Michael Dixon |

| Position | Senior Vice President, eCommerce |

|

| Annual salary | $258,500 |

| Annual short-term incentive awards | Discretionary |

| Annual long-term incentive awards | Entitled to participate in the ESPP and the SESAP. |

| Other benefits | Entitled to usual benefits provided to executives. |

| Retirement | Entitled to receive an annual pension supplement payment (the Bank does not have a pension plan). |

| Termination | If Mr. Dixon’s employment is terminated without cause, he is to receive an amount equal to one month’s total compensation for each completed year of service, with a minimum of 12 months and a maximum of 24 months total compensation, less any withholding taxes and other required deductions. For the purpose of this termination clause ‘total compensation’ is to include Mr. Dixon’s then current base salary, an amount equivalent to the most recent incentive award paid, benefits, vehicle benefit, pension supplement and any and all allowances paid. |

| Ross Duggan |

| Position | Senior Vice President, Commercial Lending |

|

| Annual salary | $258,500 |

| Annual short-term incentive awards | Discretionary |

| Annual long-term incentive awards | Entitled to participate in the ESPP and the SESAP. |

| Other benefits | Entitled to usual benefits provided to executives. |

| Retirement | Entitled to receive an annual pension supplement payment (the Bank does not have a pension plan). |

| Termination | If Mr. Duggan’s employment is terminated without cause, he is to receive an amount equal to one month’s total compensation for each completed year of service, with a minimum of 18 months and a maximum of 24 months total compensation, less any withholding taxes and other required deductions. For the purpose of this termination clause ‘total compensation’ is to include Mr. Duggan’s then current base salary, an amount equivalent to the most recent incentive award paid, benefits, vehicle benefit, pension supplement and any and all allowances paid. |

PART V – STATEMENT OF DIRECTOR COMPENSATION

In Fiscal 2021, non-management directors were compensated for acting as directors of the Bank through a combination of methods including: base retainer; Chair and director Board retainers; Committee member and Committee Chair annual retainers; excess meeting fees; and a director share purchase program (the “DSPP”). The director compensation fees set out in the tables below reflect those in place as at October 31, 2021. Annual retainers were paid to directors, excluding the President & CEO, on the following basis for Fiscal 2021. Remuneration paid to the President & CEO of the Bank, Mr. D. Taylor, is included in the Summary Compensation Table above. Mr. D. Taylor is not compensated as a director of the Bank.

Base Retainer

| | Retainer ($) |

| Director (including Chair of the Board) | 14,400 |

Board Retainer

| | Retainer ($) |

| Chair of the Board | 137,300 |

| Director | 22,500 |

Committee Retainers

| | Retainer ($) |

| Audit Committee Chair | 32,300 |

| Risk Oversight Committee Chair | 28,100 |

| HR Committee Chair | 28,100 |

| Innovation and Technology Committee Chair | 28,100 |

| Audit Committee Member | 21,600 |

| Risk Oversight Committee Member | 19,200 |

| HR Committee Member | 19,200 |

| Innovation and Technology Committee Member | 19,200 |

Excess Meeting Fees

The retainers outlined were based on the assumption of a fixed number of meetings occurring during the fiscal year. If the fixed number of meetings were exceeded during the year, directors, excluding the President & CEO, were paid meeting attendance fees as follows:

| | Per Meeting Fee ($) |

| Board > 10 Board meetings during the year | 1,300 |

| Audit Committee > 6 meetings during the year | 1,800 |

| Risk Oversight Committee > 6 meetings during the year | 1,500(1) |

| HR Committee > 6 meetings during the year | 1,500 |

| Innovation and Technology Committee > 6 meetings during the year | 1,500 |

| Directors – Attendance at special meetings such as the Meeting and with the Office of the Superintendent of Financial Institutions (OSFI) | 1,300 |

Note:

| (1) | Meeting attendance fees are $900 per meeting for credit review only meetings. |

In addition, for Fiscal 2021, the DSPP provided that directors of the Bank, other than the President & CEO, were eligible for reimbursement for the purchase of Shares and/or preferred shares of the Bank. Reimbursement under the DSPP is equal to 50% for Shares and preferred shares of the Bank purchased on the open market, up to a total annual maximum reimbursement amount of $9,900.00. All securities purchased under the DSPP are required to be held for a minimum of one year from the date of purchase.

The Bank pays the membership costs for each of its directors to belong to the Institute of Corporate Directors, and customary payments for mileage and travel time for attending meetings and expense reimbursements for out-of-pocket travel costs incurred in connection with attending meetings. Each director is also entitled to a reimbursement of up to $5,000 annually toward a relevant training and development program of their choice, in accordance with the Director Orientation and Professional Development Program (see “Corporate Governance – Orientation and Continuing Education” below).

The following table sets out the compensation provided to directors for Fiscal 2021:

Name | Fees earned ($) | Share-based awards ($) | All other compensation ($) | Total ($) |

| Hon. Thomas A. Hockin | 153,000 | nil | 900(1) 6,182(2) | 160,082 |

| Gabrielle Bochynek | 58,900 | nil | 9,900(2) | 68,800 |

| Robbert-Jan Brabander | 90,900 | nil | 620(1) 9,741(2) | 101,261 |

| David A. Bratton | 67,800 | nil | 3,875(2) | 71,675 |

| R. W. (Dick) Carter | 72,200 | nil | 9,900(2) | 82,100 |

| Peter M. Irwin | 71,450 | nil | 620(1) 9,900(2) | 81,970 |

| Arthur Linton | 57,400 | nil | 5,265(2) | 62,665 |

| Colin E. Litton | 26,433 | nil | | 26,433 |

| Susan T. McGovern | 78, 100 | nil | 620(1) 9,900(2) | 88,620 |

| Paul G. Oliver | 92,875 | nil | 620(1) 9,874(2) | 103,369 |

Notes:

| (1) | This is an amount representing travel time. |

| (2) | This is an amount reimbursed pursuant to the DSPP. |

Part VI – Securities Authorized for Issuance Under Equity Compensation Plans

INCENTIVE PLAN AWARDS

Stock Option Incentive Plan

As a result of the Amalgamation, the Bank maintained two stock option plans, consisting of the stock option plan of Pacific & Western Bank and the stock option plan of PWC (collectively, the “Predecessor Stock Option Plans”). As of October 31, 2021, there were 40,000 options outstanding under the Predecessor Stock Option Plans. On April 24, 2019, the Shareholders were not asked to re-approve the Predecessor Stock Option Plans at the annual meeting of Shareholders. Accordingly, the Bank is no longer able to grant any further options under either plan.

On April 21, 2021, the shareholders approved a new Omnibus Long-Term Incentive Plan (the “LTIP”) which allows for Shares to be issued up to a maximum of 10% of the then outstanding Shares. As of October 31, 2021, no shares had been issued under the LTIP.

The following table lists the number of Shares to be issued upon the exercise of outstanding stock options, the weighted-average exercise price of the outstanding stock options, and the number of Shares remaining for future issuance under equity compensation plans of the Bank as at October 31, 2021. No preferred shares of the Bank are issuable pursuant to any of the Bank’s equity compensation plans. Additional information on the Predecessor Stock Option Plans can be found above under “Components of Executive Compensation – Stock Option Incentive Plan”.

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights ($) | Number of securities remaining available for future issuance under equity compensation plans |

| Equity compensation plans approved by Shareholders | 40,000(1) | 7.00 | 2,070,338(2) |

| Equity compensation plans not approved by Shareholders | n/a | n/a | n/a |

| Total | 40,000 | 7.00 | 2,070,338 |

Notes:

| (1) | This figure is as of October 31, 2021, and represents 0.14% of the issued and outstanding Shares as of such date. |

| (2) | The maximum number of options available for issuance under the Stock Option Plan is a rolling 10% of issued and outstanding Shares. As of October 31, 2021, options to acquire 2,110,338 Shares is the maximum number of options that could be outstanding under the Stock Option Plan. |