- NMRK Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Newmark (NMRK) CORRESPCorrespondence with SEC

Filed: 1 Dec 17, 12:00am

[WLRK LETTERHEAD]

FOIA Confidential Treatment Requested Pursuant to 17 C.F.R. 200.83

|

VIA EDGAR AND FEDERAL EXPRESS

CONFIDENTIAL

John Reynolds,Assistant Director, Office of Beverages, Apparel, and Mining

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F. Street, N.W.

Washington, D.C. 20549

Re: Newmark Group, Inc.

Registration Statement on FormS-1

FileNo. 333-221078

Dear Mr. Reynolds:

On behalf of our client, Newmark Group, Inc. (f/k/a NRE Delaware, Inc.) (the “Company”), we hereby provide the following preliminary proposed price range and share number information, which will be the basis for the information expected to be included in the Company’s preliminary prospectus (the “Preliminary Prospectus”) forming part of the Company’s Registration Statement on FormS-1 (the “Registration Statement”), filed with the Securities and Exchange Commission (the “Commission”) on December 1, 2017 (FileNo. 333-221078). Based on currently available information and market conditions, the Company expects the preliminary proposed price range to reflect an initial public offering price per share of the Company’s Class A common stock, par value $0.01 per share (the “Shares”), of between $[***] and $[***] (the “Preliminary Price Range”) and 30,000,000 Shares to be offered to the public in connection with the offering (or 34,500,000 Shares if the underwriters’ option to purchase additional shares is exercised in full). We also hereby submit the accompanying changed pages to the Registration Statement, which the Company expects to include in the Preliminary Prospectus. The enclosed pages are marked to indicate changes from the Registration Statement and include, among other things, certain information previously left blank in the Registration Statement that is derived from the Preliminary Price Range, based on information currently available to the Company.

The Preliminary Price Range assumes that the aggregate outstanding shares of common stock of the Company as of immediately prior to the offering will equal the aggregate number of shares of common stock outstanding at BGC Partners, Inc. as of such time,divided by 2.2. For purposes of the figures included in the enclosed pages, the Company has used the outstanding shares of BGC Partners, Inc. as of November 29, 2017 (unless otherwise indicated).

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

Office of Beverages, Apparel, and Mining

December 1, 2017

Page 2

The Company respectfully requests that certain of the information contained in this request letter be treated as confidential information and that the Commission provide timely notice to James R. Ficarro, Chief Operating Officer, Newmark Group, Inc., 125 Park Avenue, New York, New York 10017, telephone(212) 610-2200, before it permits any disclosure of the underlined and highlighted information contained in this request letter.

If you have any questions, please do not hesitate to contact the undersigned at (212)403-1394, or my colleague Raaj Narayan at (212)403-1349, or, at Morgan, Lewis & Bockius LLP, Christopher T. Jensen at (212)309-6134 or his colleague George G. Yearsich at (202)739-5255.

| Very truly yours, |

/s/ David K. Lam |

| David K. Lam |

cc: James R. Ficarro, Chief Operating Officer

Newmark Group, Inc. (f/k/a NRE Delaware, Inc.)

Stephen M. Merkel, Executive Vice President, General Counsel and Secretary

BGC Partners, Inc.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

SUBJECT TO COMPLETION. PRELIMINARY PROSPECTUS, DATED DECEMBER 1, 2017

Newmark Group, Inc.

30,000,000 Shares

Class A Common Stock

This is the initial public offering of Class A common stock of Newmark Group, Inc. We are offering [***] shares of our Class A common stock.

We currently intend to contribute all of the net proceeds of this offering (including the underwriters’ option to purchase additional shares of Class A common stock described below) to Newmark Partners, L.P., our principal operating subsidiary, in exchange for a number of units representing Newmark Partners, L.P. limited partnership interests equal to the number of shares issued by us in this offering. Newmark Partners, L.P. intends to use these net proceeds to partially repay certain intercompany indebtedness owed by Newmark Partners, L.P. to us, which in turn we intend to use to partially repay certain indebtedness that we will assume prior to the closing of this offering from our existing stockholder, BGC Partners, Inc. (which we refer to as “BGC Partners” or “BGC”). See “Use of Proceeds.”

Prior to this offering, there has been no public market for our Class A common stock. The initial public offering price of the Class A common stock is currently estimated to be between $[***] and $[***] per share. We have applied to list our Class A common stock on the NASDAQ Global Market under the symbol “NMRK.”

We have two classes of authorized common stock: the Class A common stock offered hereby and Class B common stock. The economic rights of the holders of Class A common stock and Class B common stock are identical, but they differ as to voting and conversion rights. Each share of Class A common stock is entitled to one vote. Each share of Class B common stock is entitled to 10 votes and is convertible at any time into one share of Class A common stock. All of our shares of Class A common stock and Class B common stock are currently held by BGC Partners. After the completion of this offering, BGC Partners will continue to hold all of our issued and outstanding shares of Class B common stock and will hold approximately [***]% of the total voting power of our common stock (or approximately [***]% of the total voting power of our common stock if the underwriters exercise in full their option to purchase additional shares of Class A common stock in this offering). As a result of its ownership, BGC Partners will be able to control any action requiring the general approval of our stockholders, including the election of our board of directors, the adoption of certain amendments to our certificate of incorporation and bylaws, the approval of any merger or sale of substantially all of our assets, and certain provisions that affect their rights and privileges as Class B common stockholders. See “Description of Capital Stock.”

BGC Partners has advised us that it currently expects to pursue a distribution to its stockholders of all of the shares of our common stock that it then owns in a manner that is intended to qualify as generallytax-free for U.S. federal income tax purposes. As currently contemplated, shares of our Class A common stock held by BGC Partners would be distributed to the holders of shares of Class A common stock of BGC Partners and shares of our Class B common stock held by BGC Partners would be distributed to the holders of shares of Class B common stock of BGC Partners (which are currently Cantor Fitzgerald, L.P. and another entity controlled by Howard W. Lutnick). The determination of whether, when and how to proceed with any such distribution is entirely within the discretion of BGC Partners. See “Certain Relationships and Related-Party Transactions—Separation and Distribution Agreement—The Distribution.” The shares of our common stock that BGC Partners will own upon the completion of this offering will be subject to the180-day“lock-up” restriction contained in the underwriting agreement for this offering. See “Underwriting (Conflicts of Interest).”

Following this offering, BGC Partners will control more than a majority of the total voting power of our common stock, and we will be a “controlled company” within the meaning of the NASDAQ Stock Market rules. However, we do not currently expect to rely upon the “controlled company” exemption.

We qualified as an “emerging growth company” as defined under the federal securities laws, at the time that we submitted to the SEC an initial draft of the registration statement for this offering, and, as such, have elected to comply with certain reduced disclosure requirements for this prospectus. Our revenues for 2016 exceeded $1.00 billion, however, and, as a result, we will no longer be eligible for the exemptions from disclosure provided to an emerging growth company after the earlier of the completion of this offering and December 31, 2017.

Investing in our Class A common stock involves risk. See “Risk Factors” beginning on page 26.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

Public offering price | $ | $ | ||||||

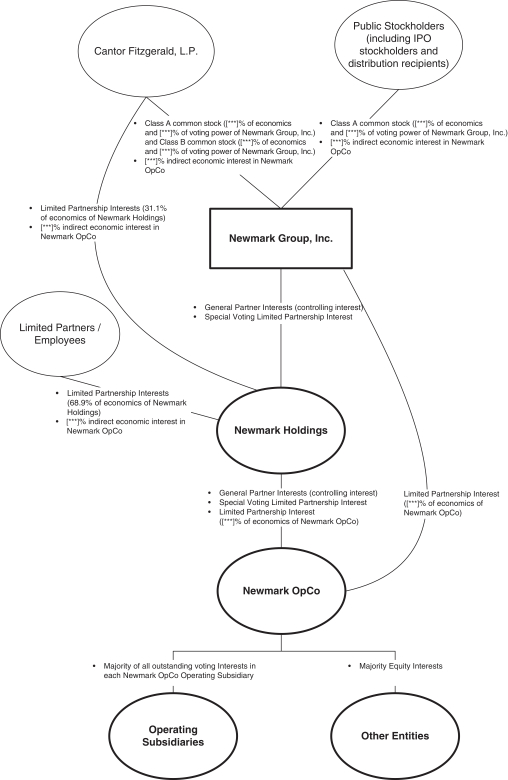

Underwriting discounts and commissions | $ | $ | ||||||

Proceeds, before expenses, to us | $ | $ | ||||||

The underwriters have an option to purchase, within 30 days of the date of this prospectus, a maximum of [***] additional shares of Class A common stock from us as described in “Underwriting (Conflicts of Interest).”

The underwriters expect to deliver the shares against payment in New York, New York on , 2017.

| Goldman Sachs & Co. LLC | BofA Merrill Lynch | Citigroup | Cantor Fitzgerald & Co. |

The date of this prospectus is , 2017.

3.5% per annum as of September 30, 2017. The Term Loan will mature on September 8, 2019. The terms of the Term Loan require that the net proceeds of this offering be used to repay the Term Loan until the Term Loan is repaid in full. The Converted Term Loan has an outstanding principal amount of $400 million, plus accrued but unpaid interest thereon, with an interest rate calculated based on one-month LIBOR plus 2.25%, subject to adjustment, which was approximately 3.5% per annum as of September 30, 2017. The Converted Term Loan will mature on September 8, 2019. The terms of the Converted Term Loan require that any remaining net proceeds of this offering, after repayment of the Term Loan, be used to repay the Converted Term. Following this offering, we estimate that the Converted Term Loan will have an outstanding principal amount of $ , plus accrued but unpaid interest thereon. See “Use of Proceeds.” Following this offering, in the event that any member of the Newmark group receives net proceeds from the incurrence of indebtedness for borrowed money or an equity issuance (in each case subject to certain exceptions) after this offering, Newmark OpCo will be obligated to use such net proceeds to repay the remaining intercompany indebtedness owed by Newmark OpCo to us in respect of the Converted Term Loan (which in turn we will use to repay the Converted Term Loan), and thereafter, in the case of net proceeds from the incurrence of indebtedness, to repay the BGC Notes. In addition, we will be obligated to repay any remaining amounts under the BGC Notes prior to the distribution.

The Distribution

BGC Partners has advised us that it currently expects to pursue a distribution to its stockholders of all of the shares of our common stock that it then owns in a manner that is intended to qualify as generally tax-free for U.S. federal income tax purposes. As currently contemplated, shares of our Class A common stock held by BGC Partners would be distributed to the holders of shares of Class A common stock of BGC Partners and shares of our Class B common stock held by BGC Partners would be distributed to the holders of shares of Class B common stock of BGC Partners (which are currently Cantor and another entity controlled by Mr. Lutnick). The determination of whether, when and how to proceed with any such distribution is entirely within the discretion of BGC Partners. See “Certain Relationships and Related-Party Transactions—Separation and Distribution Agreement—The Distribution.” The shares of our common stock that BGC Partners will own upon the completion of this offering will be subject to the 180-day “lock-up” restriction contained in the underwriting agreement for this offering. See “Underwriting (Conflicts of Interest).”

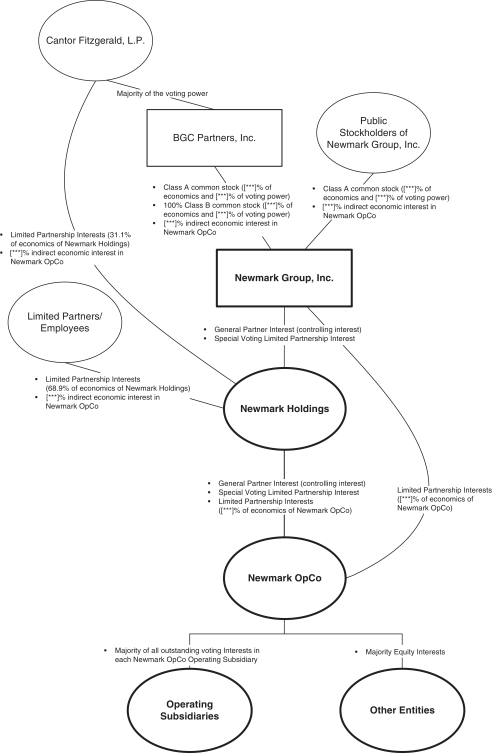

Our Post-IPO Organizational Structure

The number of shares of Newmark common stock that will be outstanding prior to this offering will equal the number of shares of BGC common stock outstanding as of immediately prior to the separation, divided by 2.2. Similarly, the number of units of Newmark Holdings limited partnership interests that will be outstanding prior to this offering will equal the number of units of BGC Holdings limited partnership interests that will be outstanding immediately prior to the separation, divided by 2.2.

In this offering, Newmark will be offering [***] shares of our Class A common stock, assuming that the underwriters do not exercise their option to purchase additional shares of Class A common stock in this offering, and [***] shares of our Class A common stock, assuming that the underwriters exercise in full their option to purchase additional shares of Class A common stock in this offering.

Based on the number of shares of BGC Partners common stock, units of BGC Holdings limited partnership interests and units of BGC U.S. limited partnership interests as of November 29, 2017, there will be outstanding after the offering:

| • | [***] shares of our Class A common stock, assuming that the underwriters do not exercise their option to purchase additional shares of Class A common stock in this offering (or [***] shares of our Class A common stock, assuming that the underwriters exercise in full their option to purchase additional shares of Class A common stock in this offering); |

| • | [***] shares of our Class B common stock; and |

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

11

| • | [***] units of Newmark Holdings limited partnership interests. |

Immediately after this offering, Newmark and Newmark Holdings will hold one unit of Newmark OpCo limited partnership interest for each of such share of Newmark common stock or unit of Newmark Holdings limited partnership interest, respectively.

In addition, as of November 29, 2017, BGC Partners and/or BGC Holdings have reserved a total of [***] shares of BGC Class A common stock and units of BGC Holdings limited partnership interests for issuance in respect of RSU awards, contingent share awards, contingent unit awards and other agreements that have been provided to employees in the event that certain contingent events occur. Newmark and/or Newmark Holdings will reserve a total of [***] shares of Newmark Class A common stock and/or units of Newmark Holdings limited partnership interests for issuance in respect of these RSU awards, contingent share awards, contingent unit awards and other agreements.

Following the offering, BGC Partners will hold [***] shares of our Class A common stock after this offering representing approximately [***]% of our outstanding Class A common stock, assuming that the underwriters do not exercise their option to purchase additional shares of Class A common stock in this offering and representing approximately [***]% of our outstanding Class A common stock, assuming that the underwriters exercise in full their option to purchase additional shares of Class A common stock in this offering. BGC Partners will also hold all of the issued and outstanding shares of our Class B common stock after this offering. Each share of Class A common stock is generally entitled to one vote on matters submitted to our stockholders. Each share of Class B common stock is generally entitled to the same rights as a share of Class A common stock, except that, on matters submitted to a vote of our stockholders, each share of Class B common stock is entitled to 10 votes. The Class B common stock generally votes together with the Class A common stock on all matters submitted to a vote of our stockholders. After giving effect to this offering, our Class B common stock and our Class A common stock held by BGC Partners will represent approximately [***]% of the total voting power of our common stock, assuming that the underwriters do not exercise their option to purchase additional shares of Class A common stock in this offering, and will represent approximately [***]% of the total voting power of our common stock, assuming that the underwriters exercise in full their option to purchase additional shares of Class A common stock in this offering. We expect to retain our dual class structure, and there are no circumstances under which the holders of Class B common stock would be required to convert their shares of Class B common stock into shares of Class A common stock. Our certificate of incorporation will not provide for automatic conversion of shares of Class B common stock into shares of Class A common stock upon the occurrence of any event.

We are a holding company with no direct operations. We conduct substantially all of our operations through our operating subsidiaries. The limited partnership interests of Newmark OpCo are held by us and Newmark Holdings, and the limited partnership interests of Newmark Holdings are currently held by Cantor and the founding partners, working partners and limited partnership unit holders. As of the completion of this offering, we expect Newmark Holdings to have 157 founding partners holding 5,536,700 founding partner units. Newmark Holdings and Newmark OpCo are variable interest entities. Virtually all of our consolidated net assets and net income are those of consolidated variable interest entities. The exchange ratio between Newmark Holdings exchange right units and our common stock is currently one, but such exchange ratio is subject to adjustment in the event that, among other things, our dividend policy differs from the distribution policy of Newmark Holdings. See “Dividend Policy” and “Certain Relationships and Related-Party Transactions—Adjustment to Exchange Ratio.” We hold the Newmark Holdings general partnership interest and the Newmark Holdings special voting limited partnership interest, which entitle us to remove and appoint the general partner of Newmark Holdings, and serve as the general partner of Newmark Holdings, which entitles us to control Newmark Holdings. Newmark Holdings, in turn, holds the Newmark OpCo general partnership interest and the Newmark OpCo special voting limited partnership interest, which entitle Newmark Holdings to remove and appoint the general partner of Newmark OpCo, and serve as the general partner of Newmark OpCo, which

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

12

Post-IPO Diagram

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

14

This Offering

Class A common stock to be sold in this offering | [***] shares |

Shares of all classes of Newmark common stock to be outstanding immediately following this offering(1):

Class A common stock | [***] shares |

Class B common stock | [***] shares |

Use of Proceeds | We estimate that our net proceeds from this offering will be approximately $[***] ($[***] if the underwriters exercise their option to purchase additional shares of Class A common stock in full), assuming a public offering price of $[***] per share (which is the midpoint of the offering price range set forth on the cover page of this prospectus), after deducting underwriting discounts and commissions in connection with this offering and estimated offering expenses payable by us. We currently intend to contribute all of the net proceeds of this offering (including the underwriters’ option to purchase additional shares of Class A common stock) to Newmark OpCo in exchange for a number of units representing Newmark OpCo limited partnership interests equal to the number of shares issued by us in this offering. Newmark OpCo intends to use approximately $[***] of such net proceeds to repay intercompany indebtedness owed by Newmark OpCo to us in respect of the Term Loan (which intercompany indebtedness was originally issued by BGC U.S. and will be assumed by Newmark OpCo in connection with the separation) and the remainder of such remaining net proceeds to partially repay intercompany indebtedness owed by Newmark OpCo to us in respect of the Converted Term Loan (which intercompany indebtedness was originally issued by BGC U.S. and will be assumed by Newmark OpCo in connection with the separation). We currently intend to use approximately $[***] of such repayment from Newmark OpCo to repay the Term Loan in full and the remainder of such repayment from Newmark OpCo to partially repay the Converted Term Loan. The Term Loan has an outstanding principal amount of $575 million, plus accrued but unpaid interest thereon, with an interest rate calculated based on one-month LIBOR plus 2.25%, subject to adjustment, which was approximately 3.5% per annum as of September 30, 2017. The Term Loan will mature on September 8, 2019. The terms of the Term Loan require that the net proceeds of this offering be used to repay the Term Loan until the Term Loan is repaid in full. The Converted Term Loan has an outstanding principal amount of $400 million, plus accrued but unpaid interest thereon, with an interest rate calculated based on one-month LIBOR plus 2.25%, subject to adjustment, which was approximately 3.5% per annum as of September 30, 2017. The Converted Term Loan |

| (1) | The number of shares of our Class A common stock and our Class B common stock outstanding after the offering does not give effect to the underwriters’ option to purchase additional shares. If the underwriters purchase all of the additional shares available pursuant to their option, [***] shares of Class A common stock will be outstanding immediately following this offering and the exercise of such option. |

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

19

will mature on September 8, 2019. The terms of the Converted Term Loan require that any remaining net proceeds of this offering, after repayment of the Term Loan, be used to repay the Converted Term Loan. Following this offering, we estimate that the Converted Term Loan will have an outstanding principal amount of $[***], plus accrued but unpaid interest thereon. See “Use of Proceeds.” |

Economic and Voting Rights | We have two classes of authorized common stock: the Class A common stock offered hereby and Class B common stock. The economic rights of the holders of Class A common stock and Class B common stock are identical, but they differ as to voting and conversion rights. Each share of our Class A common stock entitles its holder to one vote per share, thereby entitling holders of our Class A common stock to [***] votes in the aggregate immediately after this offering, representing [***]% of our total voting power immediately after this offering, assuming that the underwriters do not exercise their option to purchase additional shares of Class A common stock in this offering, and [***] votes in the aggregate immediately after this offering, representing [***]% of our total voting power immediately after this offering, assuming that the underwriters exercise in full their option to purchase additional shares of Class A common stock in this offering. Each share of our Class B common stock entitles its holder to 10 votes per share, thereby entitling holders of our Class B common stock to [***] votes, representing [***]% of our total voting power immediately after this offering, assuming that the underwriters do not exercise their option to purchase additional shares of Class A common stock in this offering, and representing [***]% of our total voting power immediately after this offering, assuming that the underwriters exercise in full their option to purchase additional shares of Class A common stock in this offering. Our Class B common stock generally votes together with our Class A common stock on all matters submitted to a vote of our stockholders. Before the distribution, our Class B common stock will be solely held by BGC Partners. Each share of Class B common stock is convertible into one share of Class A common stock at the option of the holder thereof at any time. See “Description of Capital Stock—Common Stock.” |

Dividend Policy | We expect our board of directors to authorize a dividend policy that reflects our intention to pay a quarterly dividend, starting with the first full fiscal quarter following this offering. Any dividends to our common stockholders are expected to be calculated based on our post-tax Adjusted Earnings, as a measure of net income, generated over the fiscal quarter ending prior to the record date for the dividend. See “Dividend Policy” for a definition of “post-tax Adjusted Earnings” per fully diluted share. |

We currently expect that our quarterly dividend will be less than 25% of our post-tax Adjusted Earnings per fully diluted share to our common stockholders. The declaration, payment, timing and amount of any future dividends payable by us will be at the discretion of our board of directors; provided that any quarterly dividend to our common stockholders that is 25% or more of our post-tax Adjusted Earnings per fully diluted share

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

20

tangible and intangible assets of Newmark OpCo that otherwise would not have been available, although the Internal Revenue Service may challenge all or part of that tax basis increase, and a court could sustain such a challenge by the Internal Revenue Service. These increases in tax basis, if sustained, may reduce the amount of tax that we would otherwise be required to pay in the future. In such circumstances, the tax receivable agreement that we will enter into with Cantor will provide for the payment by us to Cantor of 85% of the amount of cash savings, if any, in the U.S. federal, state and local income tax or franchise tax that we actually realize as a result of these increases in tax basis and certain other tax benefits related to its entering into the tax receivable agreement, including tax benefits attributable to payments under the tax receivable agreement. It is expected that we will benefit from the remaining 15% cash savings, if any, in income tax that we realize.

We may not be able to execute transactions that are outside of Treasury Regulations safe harbors.

Under current law, a spin-off can be rendered taxable to the parent corporation and its stockholders as a result of certain post-spin-off acquisitions of shares or assets of the spun-off corporation. For example, a spin-off may result in taxable gain to the parent corporation under Section 355(e) of the Code if the spin-off were later deemed to be part of a plan (or series of related transactions) pursuant to which one or more persons acquire, directly or indirectly, shares representing a 50% or greater interest (by vote or value) in the spun-off corporation. To preserve the tax-free treatment of the separation and the distribution, and in addition to our other indemnity obligations, the tax matters agreement between us and BGC Partners will restrict us, through the end of the two-year period following the distribution, except in specific circumstances, from: (i) entering into any transaction pursuant to which all or a portion of the shares of our common stock would be acquired, whether by merger or otherwise, (ii) issuing equity securities beyond certain thresholds, (iii) repurchasing shares of our common stock other than in certain open-market transactions, and (iv) ceasing to actively conduct certain of our businesses. The tax matters agreement will also prohibit us from taking or failing to take any other action that would prevent the distribution and certain related transactions from qualifying as a transaction that is generally tax-free for U.S. federal income tax purposes under Sections 355 and 368(a)(1)(D) of the Code. In the absence of the availability of a safe harbor under applicable Treasury Regulations, these restrictions may limit our ability to pursue strategic transactions, equity issuances or repurchases or other transactions that we may believe to be in the best interests of our stockholders or that might increase the value of our business. Current Treasury Regulations allow for a number of safe harbors. For more information, see “Certain Relationships and Related-Party Transactions—Tax Matters Agreement.”

RISKS RELATED TO OUR RELATIONSHIP WITH BGC PARTNERS, CANTOR AND THEIR RESPECTIVE AFFILIATES

Upon the completion of this offering, we will be controlled by BGC Partners (which is controlled by Cantor). Upon completion of the distribution, we will be controlled by Cantor. BGC Partners’ and Cantor’s respective interests may conflict with our interests, and BGC Partners and Cantor may exercise their control in a way that favors their respective interests to our detriment.

BGC Partners will hold [***] shares of our Class A common stock after this offering representing approximately [***]% of our outstanding Class A common stock, assuming that the underwriters do not exercise their option to purchase additional shares of Class A common stock in this offering, and representing approximately [***]% of our outstanding Class A common stock, assuming that the underwriters exercise in full their option to purchase additional shares of Class A common stock in this offering. In addition, as of immediately after the offering, BGC Partners will hold [***] shares of our Class B common stock representing all of the outstanding shares of our Class B common stock. Together, the shares of Class A common stock and Class B common stock held by BGC Partners after this offering will represent approximately [***]% of our total voting power, assuming that the underwriters do not exercise their option to purchase additional shares of Class A common stock in this offering, and approximately [***]% of our total voting power, assuming that the underwriters exercise in full their option to purchase additional shares of Class A common stock in this offering. BGC Partners is controlled by Cantor. If the distribution occurs, Cantor will beneficially own [***] shares of

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

51

our Class A common stock representing approximately [***]% of our outstanding Class A common stock, assuming that the underwriters do not exercise their option to purchase additional shares of Class A common stock in this offering, and representing approximately [***]% of our outstanding Class A common stock, assuming that the underwriters exercise in full their option to purchase additional shares of Class A common stock in this offering, and all of the outstanding shares of our Class B common stock, together representing approximately [***]% of our total voting power, assuming that the underwriters do not exercise their option to purchase additional shares of Class A common stock in this offering, and approximately [***]% of our total voting power, assuming that the underwriters exercise in full their option to purchase additional shares of Class A common stock in this offering. We expect to retain our dual class structure, and there are no circumstances under which the holders of Class B common stock would be required to convert their shares of Class B common stock into shares of Class A common stock.

As a result, upon completion of this offering, BGC Partners, directly through its ownership of shares of our Class A common stock and Class B common stock, and Cantor, indirectly through its control of BGC Partners, will each be able to exercise control over our management and affairs and all matters requiring stockholder approval, including the election of our directors and determinations with respect to acquisitions and dispositions, as well as material expansions or contractions of our business, entry into new lines of business and borrowings and issuances of our Class A common stock and Class B common stock or other securities. BGC Partners’ voting power, prior to the completion of the distribution, and Cantor’s voting power, indirectly prior to the completion of the distribution and directly after the completion of the distribution, may also have the effect of delaying or preventing a change of control of us.

BGC Partners’ and Cantor’s ability to exercise control over us could create or appear to create potential conflicts of interest. Conflicts of interest may arise between us and each of BGC Partners and Cantor in a number of areas relating to our past and ongoing relationships, including:

| • | potential acquisitions and dispositions of businesses; |

| • | the issuance or disposition of securities by us; |

| • | the election of new or additional directors to our board of directors; |

| • | the payment of dividends by us (if any), distribution of profits by Newmark OpCo and/or Newmark Holdings and repurchases of shares of our Class A common stock or purchases of Newmark Holdings limited partnership interests or other equity interests in our subsidiaries, including from BGC Partners, Cantor or our executive officers, other employees, partners and others; |

| • | business operations or business opportunities of ours and BGC Partners’ or Cantor’s that would compete with the other party’s business opportunities; |

| • | intellectual property matters; |

| • | business combinations involving us; and |

| • | the nature, quality and pricing of administrative services and transition services to be provided to or by BGC Partners or Cantor or their respective affiliates. |

Potential conflicts of interest could also arise if we decide to enter into any new commercial arrangements with BGC Partners or Cantor in the future or in connection with BGC Partners’ or Cantor’s desire to enter into new commercial arrangements with third parties.

We also expect each of BGC Partners and Cantor to manage its respective ownership of us so that it will not be deemed to be an investment company under the Investment Company Act, including by maintaining its voting power in us above a majority absent an applicable exemption from the Investment Company Act. This may result in conflicts with us, including those relating to acquisitions or offerings by us involving issuances of shares of our Class A common stock, or securities convertible or exchangeable into shares of Class A common stock, that would dilute BGC Partners’ or Cantor’s voting power in us.

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

52

The following table sets forth our capitalization as of September 30, 2017, on (1) an actual basis and (2) a pro forma as adjusted basis to give effect to the Term Loan, the Converted Term Loan and the BGC Notes assumed by us and to the issuance by us of [***] shares of our Class A common stock in this offering, based upon the assumed initial public offering price of $[***] per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

This table should be read in conjunction with “Selected Combined Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Newmark’s combined financial statements and related notes included elsewhere in this prospectus. The data assume that there has been no exercise, in whole or in part, of the underwriters’ option to purchase additional shares of our Class A common stock in this offering.

| As of September 30, 2017 | ||||||||

| Actual | Pro Forma (as adjusted) | |||||||

| (in thousands) | ||||||||

Cash and cash equivalents | $ | 137,294 | $ | [***] | ||||

Marketable securities | 76,969 | [***] | ||||||

Term Loan, Converted Term Loan and BGC Notes | [***] | |||||||

Stockholders’ equity: | ||||||||

Class A common stock, par value of $0.01 per share: 0 shares authorized on an actual basis; [***] shares authorized, [***] shares issued and outstanding on a pro forma as adjusted basis, assuming that the underwriters do not exercise their option to purchase additional shares of Class A common stock in this offering | [***] | [***] | ||||||

Class B common stock, par value of $0.01 per share: 0 shares authorized on an actual basis; [***] shares authorized, [***] shares issued and outstanding on a pro forma as adjusted basis | [***] | [***] | ||||||

Additional paid-in-capital | [***] | [***] | ||||||

Retained earnings | [***] | [***] | ||||||

|

|

|

| |||||

Total stockholders’ equity | [***] | [***] | ||||||

|

|

|

| |||||

Noncontrolling interests | [***] | [***] | ||||||

|

|

|

| |||||

Total equity | [***] | [***] | ||||||

|

|

|

| |||||

Total capitalization | [***] | [***] | ||||||

|

|

|

| |||||

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

70

If you invest in our Class A common stock, your ownership interest would be diluted to the extent of the difference between the initial public offering price per share of our Class A common stock and the pro forma as adjusted net tangible book value per share of our Class A common stock immediately after completion of this offering.

Our pro forma net tangible book value represents the amount of our total tangible assets less our total liabilities, divided by the total number of pro forma shares of our common stock outstanding. As of September 30, 2017, our pro forma net tangible book value, before giving effect to this offering, the incurrence of indebtedness in connection with the separation and other pro forma adjustments set forth under “Unaudited Pro Forma Condensed Combined Financial Data,” was $[***], or $[***] per share of our common stock.

After giving effect to the sale of [***] shares of our Class A common stock at the assumed initial public offering price of $[***] per share (which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus), after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, the incurrence of indebtedness in connection with the separation and other pro forma adjustments set forth under “Unaudited Pro Forma Condensed Combined Financial Data,” our pro forma net tangible book value, as adjusted, as of September 30, 2017 would have been $[***], or $[***] per share of our common stock. This represents an immediate decrease in pro forma net tangible book value of $[***] per share to BGC Partners, Inc., our sole stockholder before this offering, and an immediate dilution of $[***] per share to new investors purchasing shares of Class A common stock in this offering. The following table illustrates this per share dilution:

Assumed initial public offering price per share of Class A common stock | $ | [***] | ||||||

Pro forma net tangible book value per share as of September 30, 2017 | $ | [***] | ||||||

Decrease in net tangible book value per share attributable to this offering | [***] | |||||||

|

| |||||||

Pro forma as adjusted net tangible book value per share immediately after completion of this offering | [***] | |||||||

|

| |||||||

Dilution per share to new investors purchasing shares of Class A common stock in this offering | $ | [***] | ||||||

|

|

Each $1.00 increase or decrease in the assumed initial public offering price of $[***] per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would not affect our pro forma as adjusted net tangible book value per share immediately after the completion of this offering, based on the assumption that any additional proceeds resulting from an increase in the assumed initial public offering price per share would be used to reduce an equivalent amount of the outstanding indebtedness that we assumed in connection with the separation. However, each $1.00 increase or decrease in the assumed initial offering price of $[***] per share would increase or decrease, respectively, the dilution per share to new investors purchasing shares of Class A common stock in this offering by $1.00 per share.

If the underwriters exercise their option to purchase additional shares of our Class A common stock in full, the pro forma as adjusted net tangible book value per share of our common stock immediately after the completion of this offering would be $[***] per share, and the decrease in pro forma net tangible book value per share to investors purchasing shares of Class A common stock in this offering would be $[***] per share.

The following table sets forth, on the pro forma as adjusted basis described above as of September 30, 2017, the differences between the number of shares of Class A common stock purchased from us, the total consideration and the average price per share paid by our existing stockholder, BGC Partners, Inc., and by the investors purchasing shares of Class A common stock in this offering at the assumed initial offering public

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

71

offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and prior to deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

| Shares Purchased | Total Consideration | Weighted Average Price Per | ||||||||||||||||||

(in millions, except percentages and per share data) | Number | Percent | Amount | Percent | Share | |||||||||||||||

BGC Partners, Inc. (our sole stockholder before this offering) | [***] | (1) | [***] | % | $ | — | — | % | $ | — | ||||||||||

Investors purchasing shares of Class A common stock in this offering | [***] | [***] | % | $ | [***] | [***] | % | [***] | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total | [***] | [***] | % | $ | [***] | [***] | $ | [***] | ||||||||||||

|

|

|

|

|

|

|

| |||||||||||||

| (1) | Represents the total number of our shares of Class A common stock and shares of our Class B common stock to be issued to BGC Partners, Inc. for its contribution of assets and liabilities to us in connection with the separation. |

Each $1.00 increase or decrease in the assumed initial public offering price of $[***] per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, the total consideration paid by investors purchasing shares of our Class A common stock in this offering by $[***], assuming the number of shares of our Class A common stock offered by us, as set forth on the cover page of this prospectus, remains the same and prior to deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

If the underwriters exercise their option to purchase additional shares in full:

| • | the number of shares of common stock held by our existing stockholder will represent approximately [***]% of the total number of shares of our common stock outstanding immediately after completion of this offering; and |

| • | the number of shares held by investors purchasing shares of our Class A common stock in this offering will represent approximately [***]% of the total number of shares of our common stock outstanding immediately after completion of this offering. |

For purposes of the discussion and the tables above, the number of shares of our common stock that will be outstanding after this offering excludes shares of our Class A common stock reserved for issuance under the Equity Plan.

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

72

This selected combined financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Newmark’s combined financial statements and related notes included elsewhere in this prospectus.

Pro Forma (as adjusted) | Historical | |||||||||||||||||||||||

| Nine Months Ended September 30, | Year Ended December 31, | |||||||||||||||||||||||

| September 30, 2017 | December 31, 2016 | 2017 | 2016 | 2016 | 2015 | |||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

Revenues: | ||||||||||||||||||||||||

Commissions | $ | [***] | $ | [***] | $ | 701,724 | $ | 604,071 | $ | 849,419 | $ | 806,931 | ||||||||||||

Gains from mortgage banking activities, net | [***] | [***] | 164,263 | 139,009 | 193,387 | 115,304 | ||||||||||||||||||

Management services, servicing fees and other | [***] | [***] | 269,887 | 219,317 | 307,177 | 278,012 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total revenues | [***] | [***] | 1,135,874 | 962,397 | 1,349,983 | 1,200,247 | ||||||||||||||||||

Expenses: | ||||||||||||||||||||||||

Compensation and employee benefits | [***] | [***] | 724,606 | 618,065 | 849,975 | 816,268 | ||||||||||||||||||

Allocations of net income and grant of exchangeability to limited partnership units | [***] | [***] | 52,717 | 40,003 | 72,318 | 142,195 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total compensation and employee benefits | [***] | [***] | 777,323 | 658,068 | 922,293 | 958,463 | ||||||||||||||||||

Operating, administrative and other | [***] | [***] | 159,099 | 132,228 | 185,343 | 162,316 | ||||||||||||||||||

Fees to related parties | [***] | [***] | 14,240 | 15,662 | 18,010 | 18,471 | ||||||||||||||||||

Depreciation and amortization | [***] | [***] | 71,377 | 58,356 | 72,197 | 71,774 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total operating expenses | [***] | [***] | 1,022,039 | 864,314 | 1,197,843 | 1,211,024 | ||||||||||||||||||

Other income, net | ||||||||||||||||||||||||

Other income (loss) | [***] | [***] | 75,956 | 15,963 | 15,279 | (460 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total other income (losses), net | [***] | [***] | 75,956 | 15,963 | 15,279 | (460 | ) | |||||||||||||||||

Income (loss) from operations | [***] | [***] | 189,791 | 114,046 | 167,419 | (11,237 | ) | |||||||||||||||||

Interest income, net | [***] | [***] | 4,239 | 2,765 | 3,786 | 1,867 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Income (loss) before income taxes and noncontrolling interests | [***] | [***] | 194,030 | 116,811 | 171,205 | (9,370 | ) | |||||||||||||||||

Provision (benefit) for income taxes | [***] | [***] | 3,396 | 1,983 | 3,993 | (6,644 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income (loss) | $ | [***] | $ | [***] | $ | 190,634 | $ | 114,828 | $ | 167,212 | $ | (2,726 | ) | |||||||||||

Net income (loss) attributable to noncontrolling interests | [***] | [***] | (29 | ) | (1,120 | ) | (1,189 | ) | 77 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Newmark’s net income (loss) available to stockholders/its parent (BGC Partners) | $ | [***] | $ | [***] | $ | 190,663 | $ | 115,948 | $ | 168,401 | $ | (2,803 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Earnings per Share, Basic and Diluted | ||||||||||||||||||||||||

Basic | ||||||||||||||||||||||||

Diluted | ||||||||||||||||||||||||

Weighted Average Shares Outstanding | ||||||||||||||||||||||||

Basic | ||||||||||||||||||||||||

Diluted | ||||||||||||||||||||||||

Combined Balance Sheet Data: | ||||||||||||||||||||||||

Cash and cash equivalents | $ | [***] | $ | 137,294 | $ | 66,627 | $ | 111,430 | ||||||||||||||||

Marketable securities | $ | [***] | $ | 76,969 | — | — | ||||||||||||||||||

Total current assets | $ | [***] | 1,258,913 | 1,482,745 | 826,919 | |||||||||||||||||||

Total assets | $ | [***] | $ | 2,539,916 | $ | 2,534,688 | $ | 1,657,930 | ||||||||||||||||

Total current liabilities | $ | [***] | $ | 1,097,005 | $ | 1,410,374 | $ | 726,019 | ||||||||||||||||

Total liabilities | $ | [***] | 1,249,380 | 1,550,905 | 853,896 | |||||||||||||||||||

Total invested equity | $ | [***] | $ | 1,290,536 | $ | 983,783 | $ | 804,034 | ||||||||||||||||

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

74

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENTS OF OPERATIONS

NINE MONTHS ENDED SEPTEMBER 30, 2017

(in thousands, except per share data)

| (A) | (B) | (C) | ||||||||||||||||||||||

| Newmark Actual | Related Party Debt Financing/ Interest Expense | Separation of Partnership Interests | Tax Effect | Newmark Pro Forma (as adjusted) | ||||||||||||||||||||

Revenues: | ||||||||||||||||||||||||

Commissions | $ | 701,724 | — | — | — | $ | 701,724 | |||||||||||||||||

Gain from mortgage banking activities, net | 164,263 | ��� | — | — | 164,263 | |||||||||||||||||||

Management services, servicing fees and other | 269,887 | — | — | — | 269,887 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total revenues | 1,135,874 | — | — | — | 1,135,874 | |||||||||||||||||||

Expenses: | ||||||||||||||||||||||||

Compensation and employee benefits | 724,606 | — | — | — | 724,606 | |||||||||||||||||||

Allocations of net income and grant of exchangeability to limited partnership units | 52,717 | [***] | [***] | — | [***] | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total compensation and employee benefits | 777,323 | [***] | [***] | — | [***] | |||||||||||||||||||

Operating, administrative and other | 159,099 | — | — | — | 159,099 | |||||||||||||||||||

Fees to related parties | 14,240 | — | — | — | 14,240 | |||||||||||||||||||

Depreciation and amortization | 71,377 | — | — | — | 71,377 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total operating expenses | 1,022,039 | [***] | [***] | — | [***] | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Other income, net | ||||||||||||||||||||||||

Other income | 75,956 | — | — | — | 75,956 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total other income, net | 75,956 | — | — | — | 75,956 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Income from operations | 189,791 | [***] | [***] | — | [***] | |||||||||||||||||||

Interest income (expense), net | 4,239 | [***] | — | — | [***] | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Income before income taxes and noncontrolling interests | 194,030 | [***] | [***] | — | [***] | |||||||||||||||||||

Provision (benefit) for income taxes | 3,396 | — | — | [***] | [***] | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income | 190,634 | [***] | [***] | [***] | [***] | |||||||||||||||||||

Net income (loss) attributable to noncontrolling interests | (29 | ) | — | [***] | — | [***] | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income to Common Shareholders | $ | 190,663 | $ | [***] | $ | [***] | $ | [***] | $ | [***] | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Earnings per Share, Basic and Diluted | ||||||||||||||||||||||||

Basic | N/A | $ | [***] | (D | ) | |||||||||||||||||||

Diluted | N/A | $ | [***] | (D | ) | |||||||||||||||||||

Weighted Average Shares Outstanding | ||||||||||||||||||||||||

Basic | N/A | [***] | (D | ) | ||||||||||||||||||||

Diluted | N/A | [***] | (D | ) | ||||||||||||||||||||

The accompanying notes to the unaudited pro forma condensed combined financial statements are an integral part of these financial statements.

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

77

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENTS OF OPERATIONS YEAR ENDED DECEMBER 31, 2016

(in thousands, except per share data)

| (A) | (B) | (C) | ||||||||||||||||||||||

| Newmark Actual | RelatedParty Debt Financing/ Interest Expense | Separation of Partnership Interests | Tax Effect | Newmark Pro Forma (as adjusted) | ||||||||||||||||||||

Revenues: | ||||||||||||||||||||||||

Commissions | $ | 849,419 | $ | — | $ | — | $ | — | 849,419 | |||||||||||||||

Gain from mortgage banking activities | 193,387 | — | — | — | 193,387 | |||||||||||||||||||

Management services, servicing fees and other | 307,177 | — | — | — | 307,177 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total revenues | 1,349,983 | — | — | — | 1,349,983 | |||||||||||||||||||

Expenses: | ||||||||||||||||||||||||

Compensation and employee benefits | 849,975 | — | — | — | 849,975 | |||||||||||||||||||

Allocations of net income and grant of exchangeability to limited partnership units | 72,318 | [***] | [***] | [***] | [***] | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total compensation and employee benefits | 922,293 | [***] | [***] | [***] | [***] | |||||||||||||||||||

Operating, administrative and other | 185,344 | [***] | [***] | [***] | 185,344 | |||||||||||||||||||

Fees to related parties | 18,010 | [***] | [***] | [***] | 18,010 | |||||||||||||||||||

Depreciation and amortization | 72,197 | [***] | [***] | [***] | 72,197 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total operating expenses | 1,197,844 | [***] | [***] | [***] | [***] | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Other income (losses), net | ||||||||||||||||||||||||

Other income (loss) | 15,279 | [***] | [***] | [***] | 15,279 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total other income (losses), net | 15,279 | [***] | [***] | [***] | 15,279 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Income (loss) from operations | 167,418 | [***] | [***] | [***] | [***] | |||||||||||||||||||

Interest income (expense), net | 3,787 | [***] | [***] | [***] | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Income (loss) before income taxes and noncontrolling interests | 171,205 | [***] | [***] | [***] | ||||||||||||||||||||

Provision (benefit) for income taxes | 3,993 | [***] | [***] | [***] | [***] | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income (loss) | 167,212 | [***] | [***] | [***] | [***] | |||||||||||||||||||

Net income (loss) attributable to noncontrolling interests | (1,189) | [***] | [***] | [***] | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Net income (loss) to Common Shareholders | $ | 168,401 | $ | [***] | $ | [***] | $ | [***] | $ | [***] | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Earnings per Share, Basic and Diluted | ||||||||||||||||||||||||

Basic | N/A | $ | [***] | (D) | ||||||||||||||||||||

Diluted | N/A | $ | [***] | (D) | ||||||||||||||||||||

Weighted Average Shares Outstanding | ||||||||||||||||||||||||

Basic | N/A | [***] | (D) | |||||||||||||||||||||

Diluted | N/A | [***] | (D) | |||||||||||||||||||||

The accompanying notes to the unaudited pro forma condensed combined financial statements are an integral part of these financial statements.

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

78

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

AS OF SEPTEMBER 30, 2017

(in thousands)

(E) | (F) | (G) | (H) | (I) | (J) | (K) | (L) | (B) | ||||||||||||||||||||||||||||||||||||

Newmark Actual | BGC U.S. Retained Cash | Term Loan | Converted Term Loan | BGC Notes | IPO Proceeds | Repayment of Term Loan and Converted Term Loan | Deferred Tax Asset/ Liability | Related Party Receivables and Payables | Separation of Partnership Interests | Newmark Pro Forma (as adjusted) | ||||||||||||||||||||||||||||||||||

Assets: | ||||||||||||||||||||||||||||||||||||||||||||

Current assets: | ||||||||||||||||||||||||||||||||||||||||||||

Cash and cash equivalents | $ | 137,294 | [***] | [***] | [***] | (31,810 | ) | $ | [***] | |||||||||||||||||||||||||||||||||||

Restricted cash and cash equivalents | 52,219 | 52,219 | ||||||||||||||||||||||||||||||||||||||||||

Marketable securities | 76,969 | 76,969 | ||||||||||||||||||||||||||||||||||||||||||

Loans held for sale | 660,332 | 660,332 | ||||||||||||||||||||||||||||||||||||||||||

Receivables, net | 193,978 | 193,978 | ||||||||||||||||||||||||||||||||||||||||||

Receivable from related parties | 113,871 | (113,871 | ) | — | ||||||||||||||||||||||||||||||||||||||||

Other current assets | 24,250 | 24,250 | ||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

| [***] | [***] | |||||||||||||||||||||||||||||||||||||||||||

Total current assets | 1,258,913 | [***] | [***] | [***] | (145,681 | ) | [***] | |||||||||||||||||||||||||||||||||||||

Goodwill | 476,956 | 476,956 | ||||||||||||||||||||||||||||||||||||||||||

Mortgage servicing rights, net | 386,135 | 386,135 | ||||||||||||||||||||||||||||||||||||||||||

Loans, forgivable loans and other receivables from employees and partners, net | 188,922 | 188,922 | ||||||||||||||||||||||||||||||||||||||||||

Fixed assets, net | 62,819 | 62,819 | ||||||||||||||||||||||||||||||||||||||||||

Other intangible assets, net | 23,970 | 23,970 | ||||||||||||||||||||||||||||||||||||||||||

Other assets | 142,201 | [***] | [***] | |||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Total assets | $ | 2,539,916 | [***] | [***] | [***] | [***] | (145,681 | ) | [***] | |||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Current Liabilities: | ||||||||||||||||||||||||||||||||||||||||||||

Current portion of accounts payable, accrued expenses and other liabilities | 114,183 | 114,183 | ||||||||||||||||||||||||||||||||||||||||||

Payable to related parties | 145,681 | 145,681 | — | |||||||||||||||||||||||||||||||||||||||||

Warehouse notes payable, net | 659,732 | 659,732 | ||||||||||||||||||||||||||||||||||||||||||

Accrued compensation | 177,409 | 177,409 | ||||||||||||||||||||||||||||||||||||||||||

Term Loan | — | 575,000 | [***] | [***] | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Total current liabilities | 1,097,005 | 575,000 | [***] | (145,681 | ) | [***] | ||||||||||||||||||||||||||||||||||||||

Other long term liabilities | 152,375 | [***] | [***] | |||||||||||||||||||||||||||||||||||||||||

Long-term debt | — | 400,000 | 412,500 | [***] | ||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Total liabilities | 1,249,380 | 575,000 | 400,000 | 412,500 | [***] | [***] | (145,681 | ) | [***] | |||||||||||||||||||||||||||||||||||

Commitments and contingencies | ||||||||||||||||||||||||||||||||||||||||||||

Redeemable partnership interest | [***] | [***] | ||||||||||||||||||||||||||||||||||||||||||

Invested Equity/stockholders’ equity: | ||||||||||||||||||||||||||||||||||||||||||||

Stockholders’ equity: | ||||||||||||||||||||||||||||||||||||||||||||

Class A common stock, par value of $0.01 per share: [***] shares issued and outstanding | — | [***] | [***] | |||||||||||||||||||||||||||||||||||||||||

Class B common stock, par value of $0.01 per share: [***] shares issued and outstanding | [***] | [***] | ||||||||||||||||||||||||||||||||||||||||||

Additional paid-in capital | — | [***] | [***] | |||||||||||||||||||||||||||||||||||||||||

BGC’s Partners’ net investment in Newmark | 1,270,720 | [***] | (575,000 | ) | (400,000 | ) | (412,500 | ) | [***] | [***] | (67,121 | ) | [***] | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Total stockholders’ equity | 1,270,720 | [***] | (575,000 | ) | (400,000 | ) | (412,500 | ) | [***] | [***] | (67,121 | ) | [***] | |||||||||||||||||||||||||||||||

Noncontrolling interests | 19,816 | 55,389 | [***] | |||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Total invested equity | 1,290,536 | [***] | (575,000 | ) | (400,000 | ) | (412,500 | ) | [***] | [***] | (11,732 | ) | | [***] | | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

Total liabilities and equity | $2,539,916 | [***] | [***] | [***] | [***] | [***] | [***] | [***] | (145,681) | [***] | [***] | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||

The accompanying notes to the unaudited pro forma condensed combined financial statements are an integral part of these financial statements.

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

79

Notes to unaudited pro forma condensed combined financial statements

| (A) | Interest Expense |

The unaudited pro forma condensed combined statements of operations reflect an annual adjustment of [***] million for the expected interest expense on the BGC Notes that will remain outstanding following this offering. Pro forma interest expense reflects interest expense based on the simulated weighted average annual interest rate of [***] % on our indebtedness to be incurred. A 0.25% increase or decrease in annual interest rate or the weighted average annual interest rate would increase or decrease pro forma interest expense by $[***] million annually.

| (B) | Separation of Partnership Interests |

As described in “Structure of Newmark,” immediately following the completion of this offering, Newmark will own less than 100% of the economic interest in Newmark OpCo, but will indirectly have 100% of the voting power and control the management of Newmark OpCo. Newmark Holdings owns the remaining interest in the Newmark OpCo. The founding/working partner units, limited partnership units, and limited partnership interests held by Cantor, collectively, represent all of the “limited partnership interests” in BGC Holdings. Each quarter, net income (loss) is allocated between the limited partnership interests and the common stockholders based on their respective weighted-average pro rata share of economic ownership of Newmark OpCo. The allocations of net income (loss) to FPUs and limited partnership units are reflected as a component of compensation expense under “Allocations of net income and grant of exchangeability to limited partnership units” in Newmark’s unaudited pro forma condensed combined statements of operations. The allocation of net income to Cantor units is reflected as a component of “Net income attributable to noncontrolling interest” in Newmark’s unaudited pro forma combined statements of operations.

The capital attributable to Newmark Holdings is recorded as “Redeemable partnership interest” and “Noncontrolling interests” in the Company unaudited pro forma condensed combined statement of financial condition.

| (C) | Tax Effects |

Reflects the tax effects of the pro forma adjustments at the applicable tax rates. The applicable tax rates could be different (either higher or lower) depending on activities subsequent to the separation and the effect of corporate tax rates. Additionally, represents the pro rata share of income attributable to the Company based on the economic ownership of the underlying entities resulting from the tax structure following this offering.

| (D) | Pro Forma Earnings Per Share and Weighted-Average Shares Outstanding |

Weighted average shares used to calculate EPS on a pro forma basis represents the historical weighted average shares for all periods presented immediately prior to this offering plus the number of shares expected to be issued as a part of this offering.

The following is the calculation of the Company’s basic EPS (in thousands, except per share data):

| Nine Months Ended September 30, 2017 | Year Ended December 31, 2016 | |||||||

Basic earnings per share: | ||||||||

Net income available to common stockholders | $ | — | $ | — | ||||

|

|

|

| |||||

Basic weighted-average shares of common stock outstanding | [***] | [***] | ||||||

|

|

|

| |||||

Basic earnings per share | $ | — | $ | — | ||||

|

|

|

| |||||

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

80

Fully diluted EPS is calculated utilizing net income available to common stockholders plus net income allocations to the limited partnership interests in Newmark Holdings, as the numerator. The denominator is comprised of the Company’s weighted-average number of outstanding shares of common stock and, if dilutive, the weighted-average number of limited partnership interests and other contracts to issue shares of common stock, stock options and RSUs. The limited partnership interests generally are potentially exchangeable into shares of Class A common stock and are entitled to remaining earnings; as a result, they are included in the fully diluted EPS computation to the extent that the effect would be dilutive.

The following is the calculation of the Company’s fully diluted EPS (in thousands, except per share data):

| Nine Months Ended September 30, 2017 | Year Ended December 31, 2016 | |||||||

Fully diluted (loss) earnings per share | ||||||||

Net income (loss) available to common stockholders | $ | — | $ | — | ||||

Allocations of net income (loss) to limited partnership interests | — | — | ||||||

|

|

|

| |||||

Net income (loss) for fully diluted shares | $ | — | $ | — | ||||

|

|

|

| |||||

Weighted-average shares: | ||||||||

Common stock outstanding | [***] | [***] | ||||||

Limited partnership interest in Newmark | [***] | [***] | ||||||

RSUs | [***] | [***] | ||||||

Other | [***] | [***] | ||||||

|

|

|

| |||||

Fully diluted weighted-average shares of common stock outstanding | [***] | [***] | ||||||

|

|

|

| |||||

Fully diluted earnings (loss) per share | $ | — | $ | — | ||||

|

|

|

| |||||

For the nine months ended September 30 2017, there were no potentially dilutive securities that would have had an anti-dilutive effect.

For the year ended December 31, 2016, approximately [***] million potentially dilutive securities were not included in the computation of fully diluted EPS because their effect would have been anti-dilutive. Anti-dilutive securities included, on a weighted-average basis, [***] limited partnership interests and [***] million other securities or other contracts to issue shares of common stock.

| (E) | BGC U.S. Retained Cash |

Represents a sum of approximately $[***] million composed of (1) cash and cash equivalents and marketable securities retained by BGC U.S. in the separation to reflect BGC Partners’ estimate of the sum of (i) all pre-tax net income generated by the Newmark business during the fiscal quarter ended December 31, 2017 up to the closing date of the contribution and (ii) all after-tax net income generated by the Newmark business during the fiscal quarter ended December 31, 2017 after the closing date of the contribution (it being understood that, if such estimate is greater than the actual sum of the amounts described in clauses (i) and (ii) above, then an amount equal to such excess shall be deemed to be a transferred asset) and (2) other distributions by Newmark OpCo to BGC U.S. prior to the completion of this offering, which distributions represent a portion of the assets contributed by BGC to us in the separation.

| (F) | Term Loan |

The pro forma condensed combined balance sheet reflects approximately $575 million of debt under the Term Loan, which we will assume from BGC Partners prior to the completion of this offering.

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

81

| (G) | Converted Term Loan |

The pro forma condensed combined balance sheet reflects approximately $400 million of debt under the Converted Term Loan, which we will assume from BGC Partners prior to the completion of this offering.

| (H) | BGC Notes |

The pro forma condensed combined balance sheet reflects [***] million of long-term debt payable to BGC Partners under the BGC Notes, which Newmark OpCo will assume from BGC U.S. prior to the completion of the offering.

| (I) | Cash Received in this Offering |

Represents [***] million of cash received in this offering, net of offering costs.

| (J) | Repayment of the Term Loan and the Converted Term Loan |

Represents [***] million paid in repayment of the Term Loan and partial repayment of the Converted Term Loan.

| (K) | Deferred Tax Assets and Liabilities |

Represents changes in deferred tax assets and liabilities resulting from pro forma adjustments primarily related to the difference between the inside and outside basis of the assets contributed to us.

| (L) | Related Party Receivables and Payables |

Represents related party receivables and payables, except for the $[***] million of BGC Notes discussed in Note (H) above.

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

82

Post-Distribution Diagram

*** Represents material which has been redacted and filed separately with the Securities and Exchange Commission pursuant to a request for confidential treatment pursuant to 17 C.F.R. 200.83.

111