Filed Pursuant to Rule 424(b)(5)

Registration No. 333-264391

The information in this preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission and is effective. This preliminary prospectus supplement is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | |

PRELIMINARY PROSPECTUS SUPPLEMENT (To Prospectus dated April 20, 2022) | | SUBJECT TO COMPLETION, DATED APRIL 20, 2022 |

$1,000,000,000

Class A Common Stock

We are offering $1.0 billion of shares of our Class A common stock, par value $0.001 per share (our “Class A common stock”).

Our Class A common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “CVNA.” On April 19, 2022, the last reported sale price of our Class A common stock was $101.77 per share. Based upon an assumed public offering price of $101.77 per share, the last reported sale price of our Class A common stock, we expect to offer 9,826,078 shares hereby.

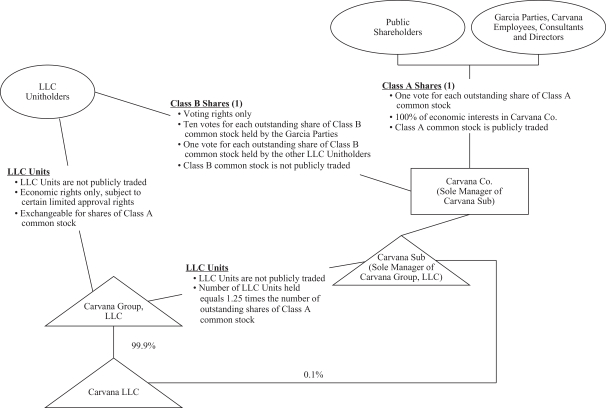

We have two classes of common stock: Class A common stock and Class B common stock. Holders of the Class A common stock are entitled to one vote per share. Ernest Garcia, II, Ernie Garcia, III, and entities controlled by one or both of them (collectively, the “Garcia Parties”) are entitled to ten votes per share of Class B common stock they beneficially own, for so long as the Garcia Parties maintain, in the aggregate, direct or indirect beneficial ownership of at least 25% of the outstanding shares of Class A common stock (determined on an as-exchanged basis assuming that all of the Class A common units (“Class A Units”) and Class B common units (“Class B Units” and together with the Class A Units (“LLC Units”)) of Carvana Group, LLC (“Carvana Group”) were exchanged for Class A common stock). All other holders of Class B common stock are each entitled to one vote per share. All holders of Class A and Class B common stock vote together as a single class except as otherwise required by applicable law. Holders of the Class B common stock do not have any right to receive dividends or distributions upon the liquidation or winding up of us.

Carvana Co. will contribute its net proceeds from this offering to its wholly owned subsidiary, Carvana Co. Sub LLC (“Carvana Sub”), that will in turn use such net proceeds to purchase newly-issued Class A Units in Carvana Group. The purchase price for the Class A Units will be equal to 0.8 times the public offering price of the shares of Class A common stock less the underwriting discounts and commissions referred to below. Carvana Group will use the net proceeds it receives in connection with this offering as described under “Use of Proceeds.” Based upon an assumed public offering price of $101.77 per share, the last reported sale price of our Class A common stock, we expect to offer 9,826,078 shares hereby, we expect that, upon completion of this offering, Carvana Co. will own, indirectly through Carvana Sub, 122,279,131 Class A Units representing a 53.5% economic interest in Carvana Group. Although Carvana Co. has an indirect minority economic interest in Carvana Group, Carvana Sub is the sole manager of Carvana Group and, through Carvana Group, operates and controls its business. The other owners of Carvana Group will hold the remaining 106,272,538 LLC Units representing a 46.5% economic interest in Carvana Group, LLC Units are, from time to time, exchangeable for shares of Class A common stock or, at our election, for cash. Carvana Co. is a holding company and its sole asset is the capital stock of Carvana Sub, whose only assets are equity interests in Carvana Group and Carvana, LLC. Immediately following this offering, the holders of Class A common stock will collectively own 100% of the economic interests in Carvana Co. and have 11.5% of the voting power of Carvana Co. The holders of our Class B common stock will have the remaining 88.5% of the voting power of Carvana Co.

| | | | |

|

| | | Per share | | Total |

Public offering price | | | | |

Underwriting discounts and commissions(1)(2) | | | | |

Proceeds, before expenses(2) | | | | |

|

|

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. The underwriters will not receive any underwriting discounts or commissions from sales of shares of Class A common stock to the Garcia Parties as described in this prospectus supplement. |

| (2) | Total amounts reflect the purchase by the Garcia Parties of shares of Class A common stock in this offering, for which no underwriting discounts or commissions will be paid by us. |

See “Risk Factors” beginning on page S-8, along with the risk factors incorporated by reference herein, to read about factors you should consider before buying shares of our Class A common stock.

Neither the United States Securities and Exchange Commission, nor any state securities commission, has approved or disapproved of the securities that may be offered under this prospectus supplement, nor have any of these regulatory authorities determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The Garcia Parties have indicated an interest in purchasing up to an aggregate of $432.0 million of shares of our Class A common stock offered pursuant to this prospectus supplement in this offering at the public offering price, based on their pro rata ownership. To the extent the Garcia Parties purchase any such shares in this offering, the number of shares available for sale to the public will be reduced accordingly. Because these indications of interest are not binding agreements or commitments to purchase, the Garcia Parties may elect to purchase fewer shares in this offering than they indicated an interest in purchasing. The underwriters will not receive any underwriting discounts or commissions from the sale of shares to the Garcia Parties.

The underwriters expect to deliver the shares on or about , 2022.

, 2022