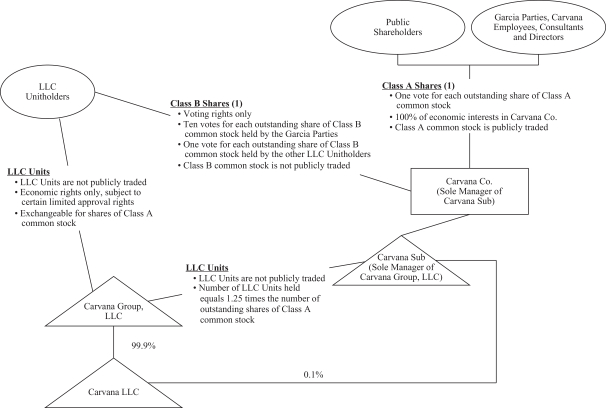

exchanged for Class A common stock). Our Class A common stock, which is the stock we are selling in this offering, will have one vote per share. So long as the Garcia Parties continue to beneficially own a sufficient number of shares of Class B common stock, even if they beneficially own significantly less than 50% of the shares of our outstanding capital stock, the Garcia Parties will continue to be able to effectively control our decisions. For example, if the Garcia Parties hold Class B common stock amounting to 25% of our outstanding capital stock, they would collectively control 72% of the voting power of our capital stock.

As a result, the Garcia Parties have the ability to elect all of the members of our board of directors (the “Board”) and thereby effectively control our policies and operations, including the appointment of management, future issuances of our Class A common stock or other securities, the payment of dividends, if any, on our Class A common stock, the incurrence of debt by us, amendments to our amended and restated certificate of incorporation (our “certificate of incorporation”) and our amended and restated bylaws (our “bylaws”), and the entering into of extraordinary transactions. The interests of the Garcia Parties may not in all cases be aligned with your interests.

In addition, the Garcia Parties can determine the outcome of all matters requiring stockholder approval, cause or prevent a change of control of our company or a change in the composition of our Board, and preclude any acquisition of our company. This concentration of voting control could deprive you of an opportunity to receive a premium for your shares of Class A common stock as part of a sale of our company and ultimately might affect the market price of our Class A common stock.

In addition, the Garcia Parties may have an interest in pursuing acquisitions, divestitures, and other transactions that, in their judgment, could enhance their investment, even though such transactions might involve risks to you. For example, the Garcia Parties could cause us to make acquisitions that increase our indebtedness or cause us to sell revenue-generating assets. The Garcia Parties may from time to time acquire and hold interests in businesses that compete directly or indirectly with us. The Garcia Parties control and own substantially all interest in DriveTime Automotive, Inc., which could compete more directly with us in the future. Our certificate of incorporation provides that none of the Garcia Parties or any director who is not employed by us (including any non-employee director who serves as one of our officers in both his or her director and officer capacities) or his or her affiliates has any duty to refrain from engaging, directly or indirectly, in the same business activities or similar business activities or lines of business in which we operate. The Garcia Parties also may pursue acquisition opportunities that may otherwise be complementary to our business, and, as a result, those acquisition opportunities may not be available to us.

For a description of the dual class structure, see the section “Description of Capital Stock” in the accompanying prospectus.

Holders of our Class A common stock will experience dilution as a result of any shares of Class A common stock sold hereby from time to time in “at the market offerings.” You may also experience future dilution as a result of future equity offerings, including as the result of any issuance of the New Equity.

We expect to issue additional shares of Class A common stock from time to time in this offering. We will have discretion, subject to market demand, to vary the timing, prices, and number of shares sold under the Distribution Agreement.

Holders of our Class A common stock will experience dilution as a result of the issuance of any shares of Class A common stock in this offering. In addition, in order to raise additional capital, we may in the future offer additional shares of our Class A common stock or other securities convertible into or exchangeable for our Class A common stock at various prices. Investors purchasing shares or other securities in the future could have rights superior to existing stockholders, and any future equity offerings will result in further dilution for our existing stockholders.

Our actual operating results may differ significantly from our guidance.

From time to time, we plan to release earnings guidance in our quarterly earnings conference calls, quarterly earnings releases, or otherwise, regarding our future performance that represents our management’s estimates as of the date of release. This guidance, which will include forward-looking statements, will be based on projections prepared by our management. Projections are based upon a number of assumptions and estimates that, while presented with numerical specificity, are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and are based upon specific assumptions with respect to future business decisions, some of which will change. The principal reason that we release guidance is to provide a basis for our management to discuss our business outlook with analysts and investors. We do not accept any responsibility for any projections or reports published by any such third parties.

Guidance is necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying the guidance furnished by us will not materialize or will vary significantly from actual results. Actual results may vary from our guidance and the variations may be material. In light of the foregoing, investors are urged not to place undue reliance upon our guidance in making an investment decision regarding our Class A common stock.

S-9