ASV Holdings, Inc. (Nasdaq:ASV) CHANGE THE WAY EVERY JOB GETS DONE As a worldwide expert in designing and producing premium, hard-working machinery, ASV gives operators the advantage they need to get more work done at every jobsite. April 2019 EX 99.1

Forward-Looking Statements & Non-GAAP Financial Measures This presentation contains forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “intends” or “continue,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. Forward-looking statements in this presentation include, without limitation: (1) projections of revenue, earnings, capital structure and other financial items, (2) statements of our plans and objectives, (3) statements regarding the capabilities and capacities of our business operations, (4) statements of expected future economic conditions and the effect on us and on dealers or OEM customers, (5) expected benefits of our cost reduction measures, and (6) assumptions underlying statements regarding us or our business. Our actual results may differ from information contained in these forward looking-statements for many reasons, including those described in the section entitled “Risk Factors” in our Form 10-K and are available on our EDGAR page at www.sec.gov. These statements are only current predictions and are subject to known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in greater detail under the heading “Risk Factors” and elsewhere in the Form 10-K. You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by law, after the date of this presentation, we are under no duty to update or revise any of the forward-looking statements, whether as a result of new information, future events or otherwise. We obtained the industry, market and competitive position data in this presentation from our own internal estimates and research as well as from industry and general publications and research surveys and studies conducted by third parties. While we believe that each of these studies and publications is reliable, we have not independently verified market and industry data from third-party sources. While we believe our internal company research is reliable and the market definitions we use are appropriate, neither such research nor these definitions have been verified by any independent source. We from time to time refer to various non-GAAP financial measures in this presentation. We believe that this information is useful to understanding our operating results by excluding certain items that may not be indicative of our core operating results and business outlook. Reference to these non-GAAP financial measures should not be considered as a substitute for, or superior to, results that are presented in a manner consistent with GAAP. Rather, the non-GAAP financial information should be considered in addition to results that are presented in a manner consistent with GAAP. A reconciliation of non-GAAP financial measures referred to in this presentation is provided in the tables at the conclusion of this presentation.

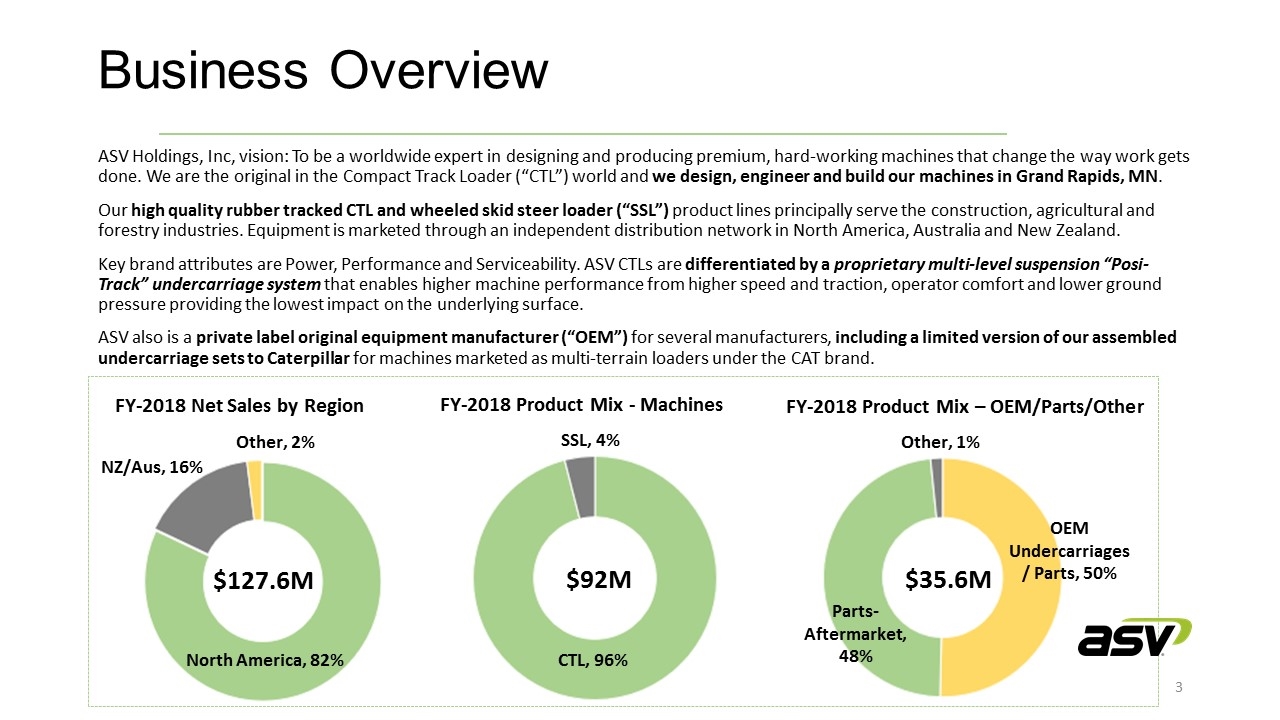

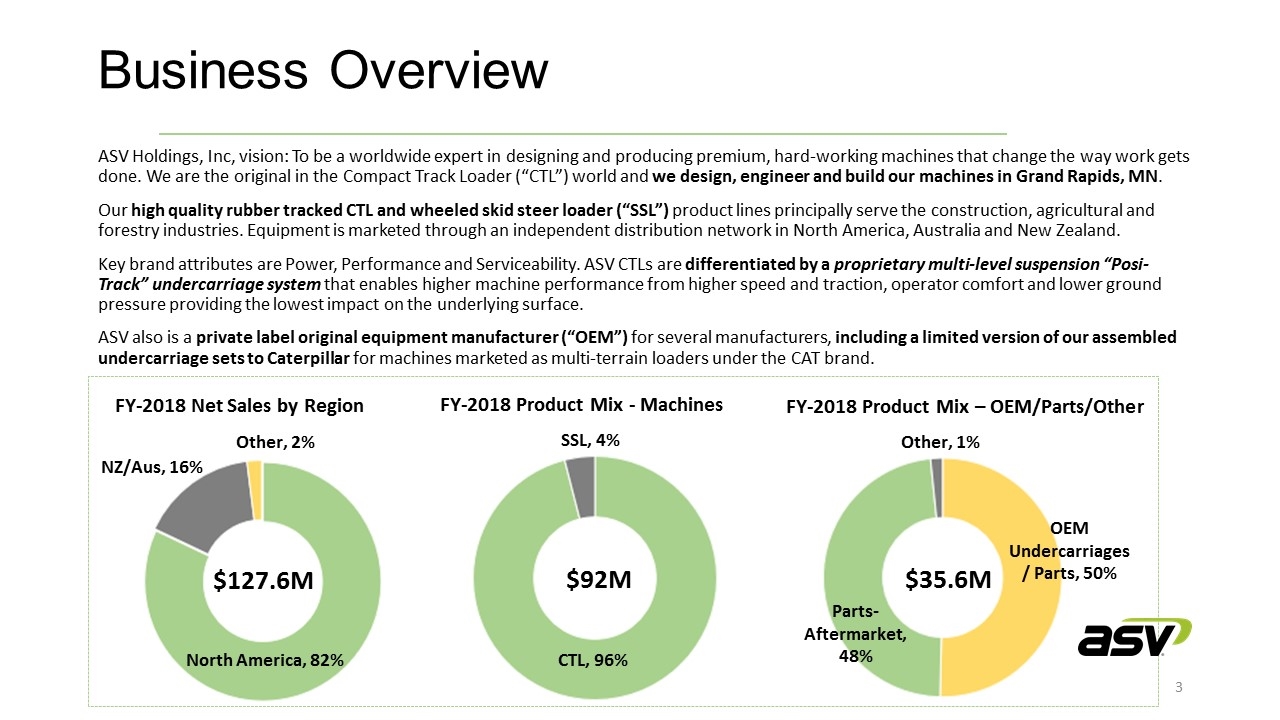

ASV Holdings, Inc, vision: To be a worldwide expert in designing and producing premium, hard-working machines that change the way work gets done. We are the original in the Compact Track Loader (“CTL”) world and we design, engineer and build our machines in Grand Rapids, MN. Our high quality rubber tracked CTL and wheeled skid steer loader (“SSL”) product lines principally serve the construction, agricultural and forestry industries. Equipment is marketed through an independent distribution network in North America, Australia and New Zealand. Key brand attributes are Power, Performance and Serviceability. ASV CTLs are differentiated by a proprietary multi-level suspension “Posi-Track” undercarriage system that enables higher machine performance from higher speed and traction, operator comfort and lower ground pressure providing the lowest impact on the underlying surface. ASV also is a private label original equipment manufacturer (“OEM”) for several manufacturers, including a limited version of our assembled undercarriage sets to Caterpillar for machines marketed as multi-terrain loaders under the CAT brand. Business Overview SSL, 4% CTL, 96% FY-2018 Product Mix - Machines FY-2018 Net Sales by Region $92M NZ/Aus, 16% Other, 2% North America, 82% $127.6M FY-2018 Product Mix – OEM/Parts/Other Parts- Aftermarket, 48% Other, 1% $35.6M OEM Undercarriages / Parts, 50%

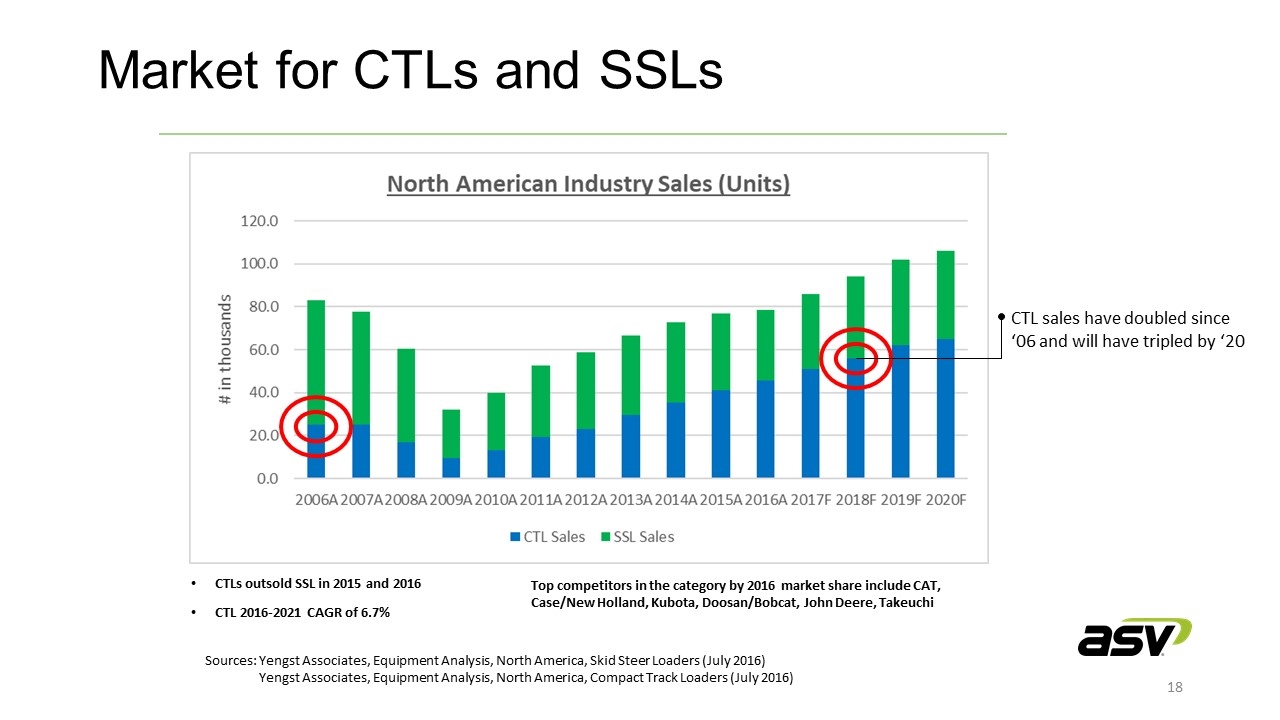

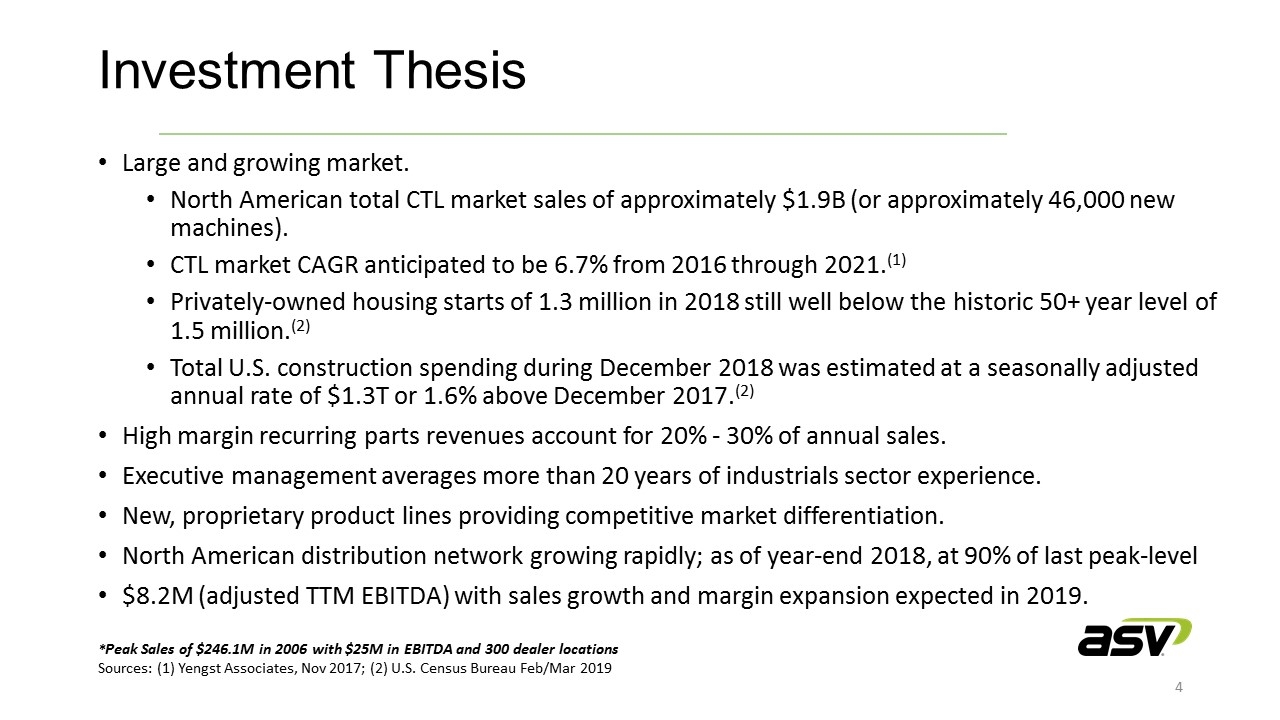

Large and growing market. North American total CTL market sales of approximately $1.9B (or approximately 46,000 new machines). CTL market CAGR anticipated to be 6.7% from 2016 through 2021.(1) Privately-owned housing starts of 1.3 million in 2018 still well below the historic 50+ year level of 1.5 million.(2) Total U.S. construction spending during December 2018 was estimated at a seasonally adjusted annual rate of $1.3T or 1.6% above December 2017.(2) High margin recurring parts revenues account for 20% - 30% of annual sales. Executive management averages more than 20 years of industrials sector experience. New, proprietary product lines providing competitive market differentiation. North American distribution network growing rapidly; as of year-end 2018, at 90% of last peak-level $8.2M (adjusted TTM EBITDA) with sales growth and margin expansion expected in 2019. Investment Thesis *Peak Sales of $246.1M in 2006 with $25M in EBITDA and 300 dealer locations Sources: (1) Yengst Associates, Nov 2017; (2) U.S. Census Bureau Feb/Mar 2019

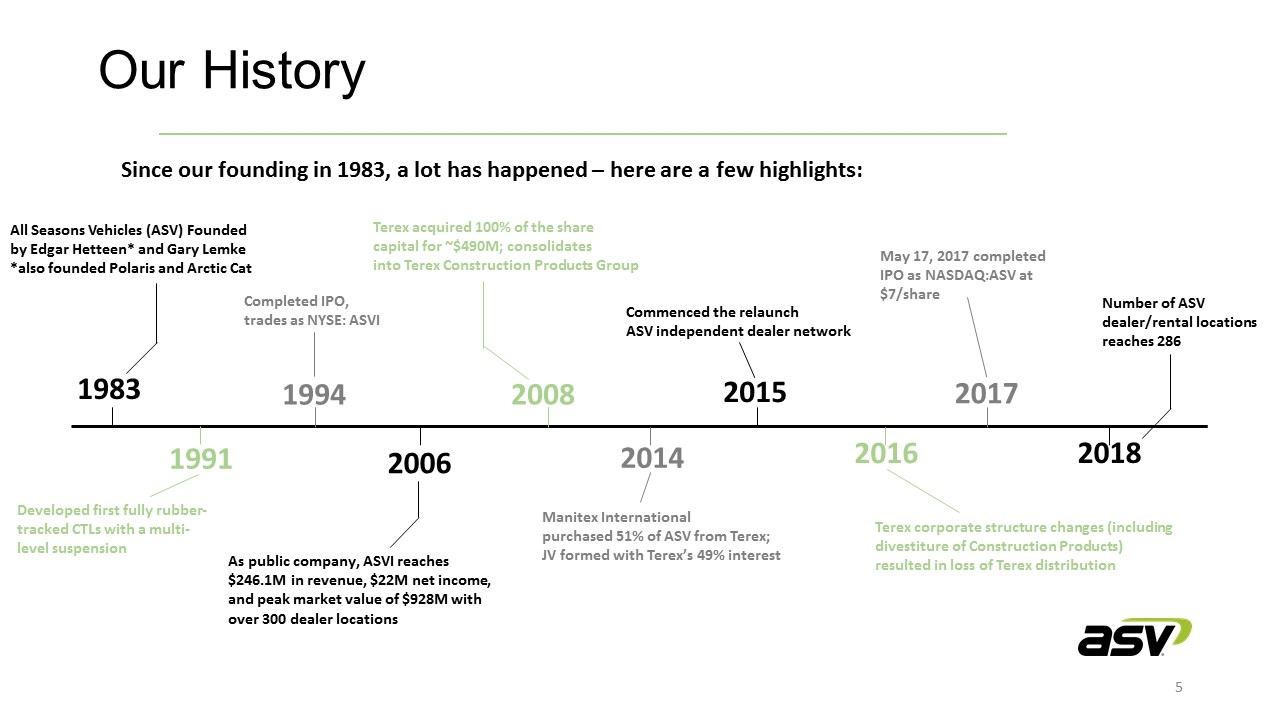

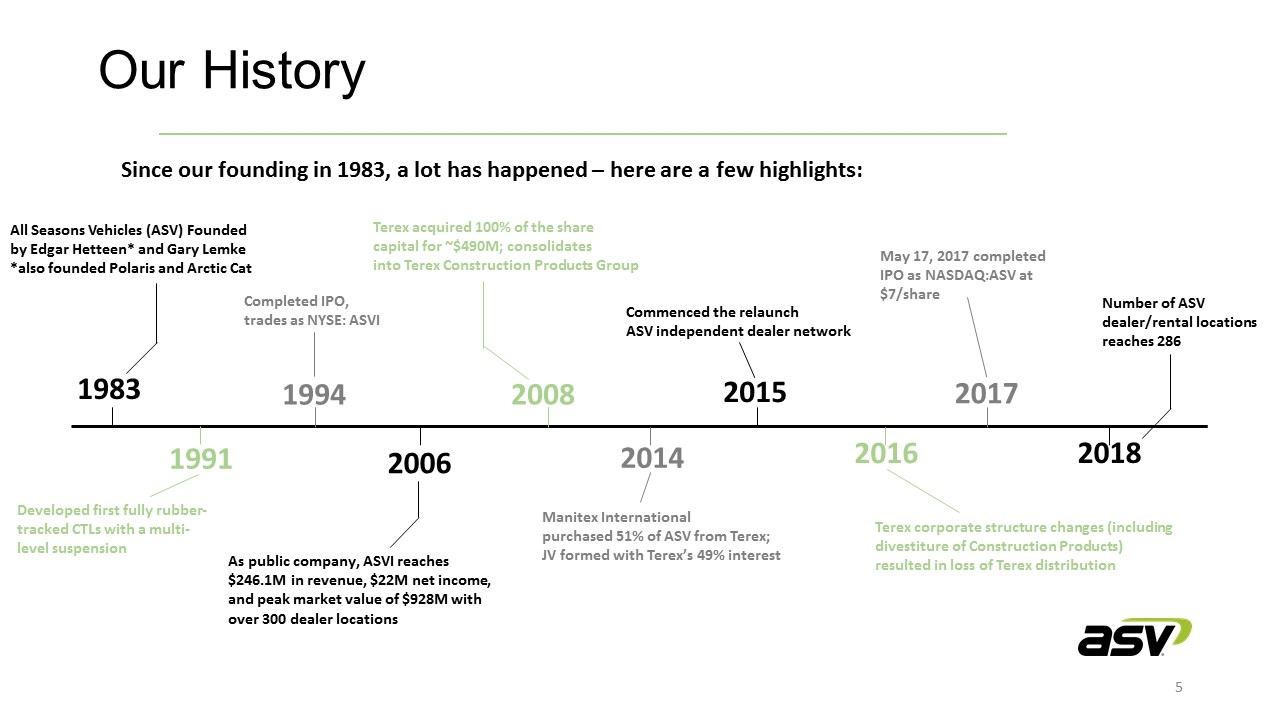

All Seasons Vehicles (ASV) Founded by Edgar Hetteen* and Gary Lemke *also founded Polaris and Arctic Cat Completed IPO, trades as NYSE: ASVI Terex acquired 100% of the share capital for ~$490M; consolidates into Terex Construction Products Group Developed first fully rubber-tracked CTLs with a multi-level suspension As public company, ASVI reaches $246.1M in revenue, $22M net income, and peak market value of $928M with over 300 dealer locations Commenced the relaunch ASV independent dealer network Manitex International purchased 51% of ASV from Terex; JV formed with Terex’s 49% interest Terex corporate structure changes (including divestiture of Construction Products) resulted in loss of Terex distribution May 17, 2017 completed IPO as NASDAQ:ASV at $7/share Number of ASV dealer/rental locations reaches 286 1983 1991 1994 2006 2008 2014 2015 2016 2017 2018 Our History Since our founding in 1983, a lot has happened – here are a few highlights:

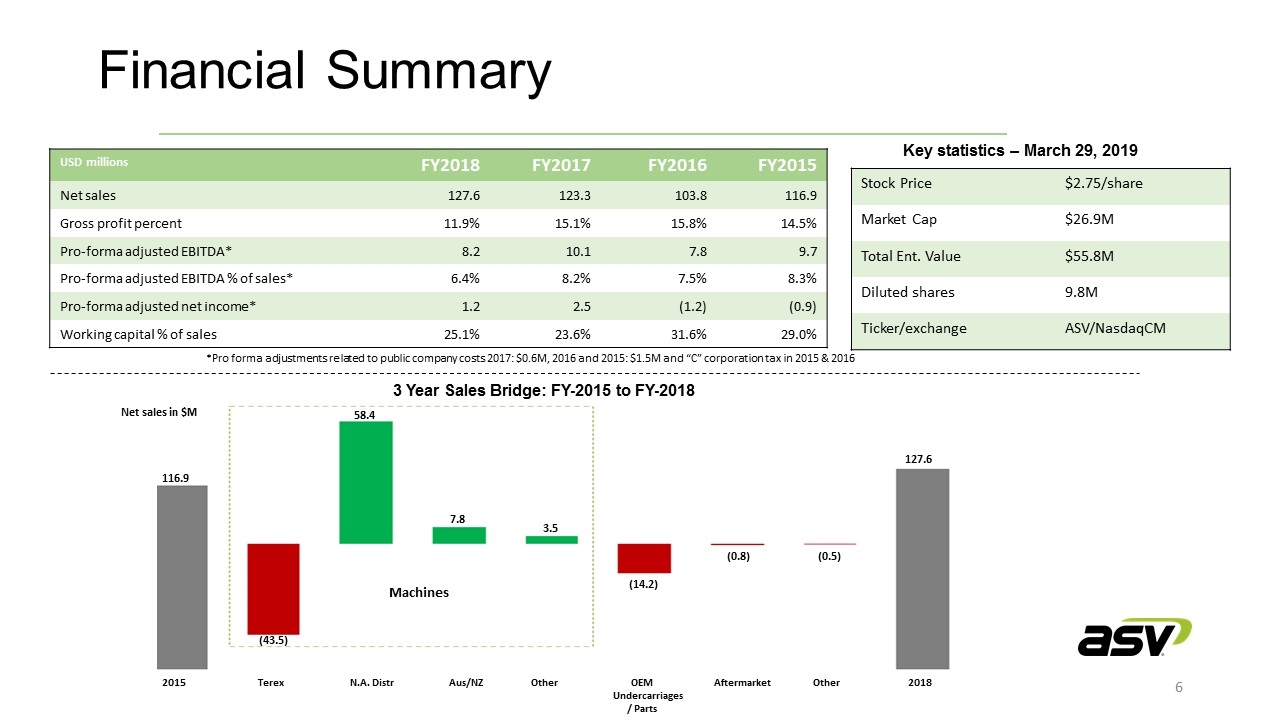

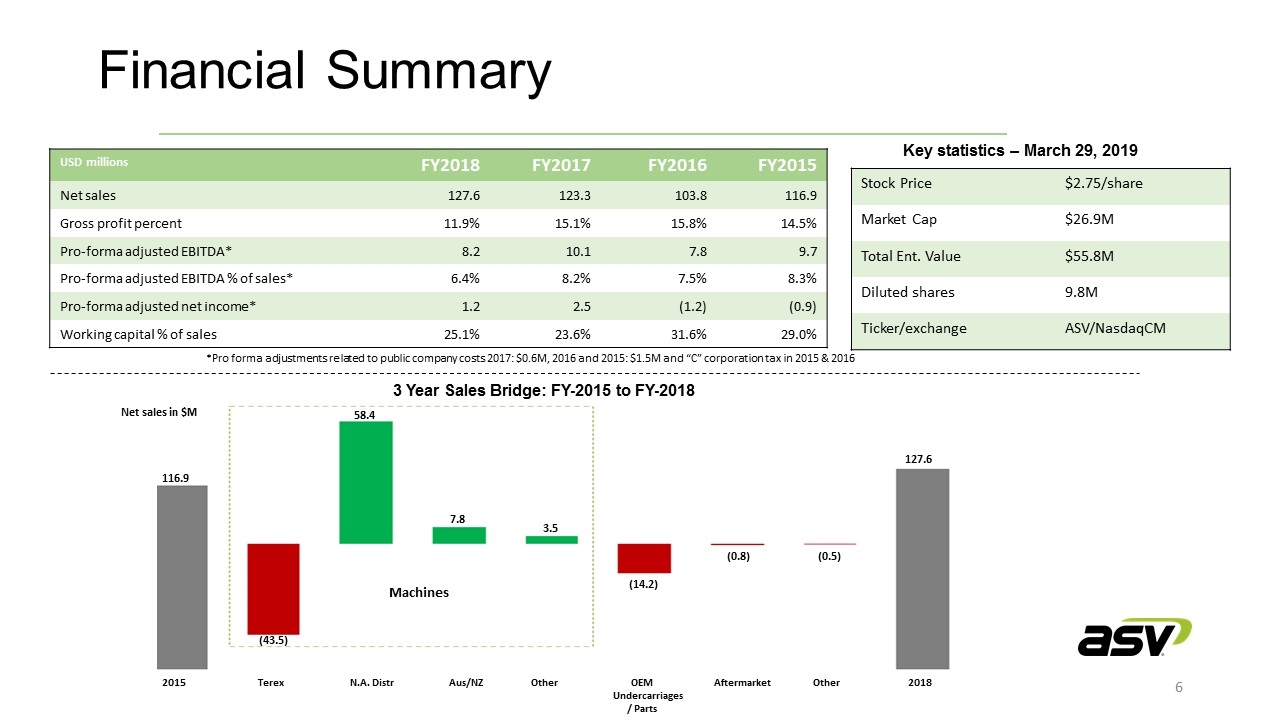

Financial Summary Stock Price $2.75/share Market Cap $26.9M Total Ent. Value $55.8M Diluted shares 9.8M Ticker/exchange ASV/NasdaqCM USD millions FY2018 FY2017 FY2016 FY2015 Net sales 127.6 123.3 103.8 116.9 Gross profit percent 11.9% 15.1% 15.8% 14.5% Pro-forma adjusted EBITDA* 8.2 10.1 7.8 9.7 Pro-forma adjusted EBITDA % of sales* 6.4% 8.2% 7.5% 8.3% Pro-forma adjusted net income* 1.2 2.5 (1.2) (0.9) Working capital % of sales 25.1% 23.6% 31.6% 29.0% Key statistics – March 29, 2019 *Pro forma adjustments related to public company costs 2017: $0.6M, 2016 and 2015: $1.5M and “C” corporation tax in 2015 & 2016 Machines 2015 Terex N.A. Distr Aus/NZ Other OEM Aftermarket Other 2018 Undercarriages / Parts (43.5) (14.2) (0.8) (0.5) 127.6 58.4 7.8 3.5 Net sales in $M 116.9 3 Year Sales Bridge: FY-2015 to FY-2018

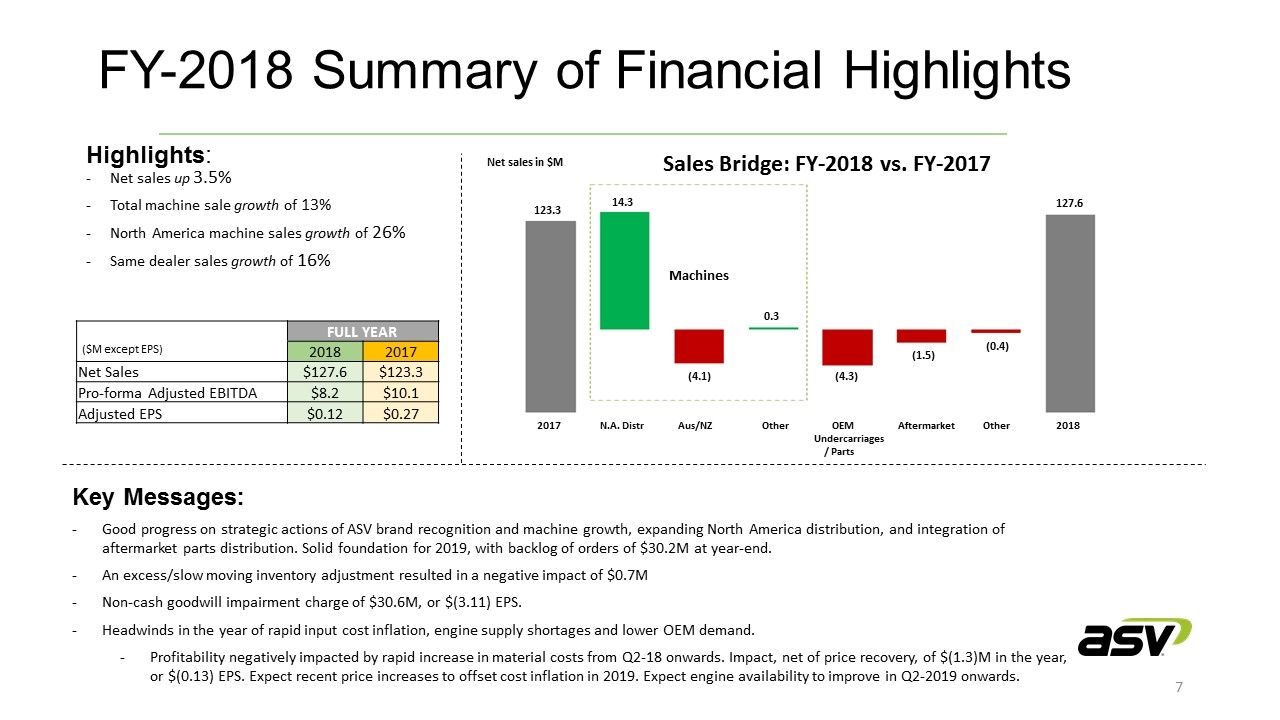

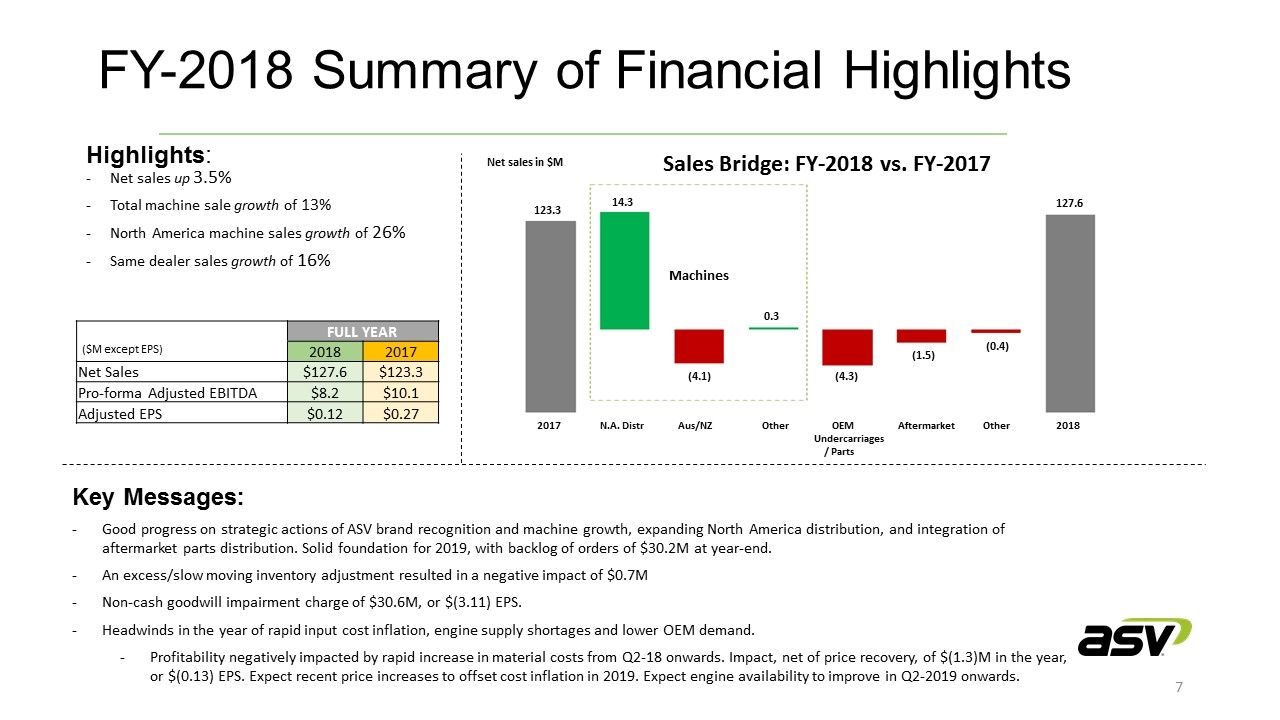

FY-2018 Summary of Financial Highlights Highlights: Net sales up 3.5% Total machine sale growth of 13% North America machine sales growth of 26% Same dealer sales growth of 16% Machines 2017 N.A. Distr Aus/NZ Other OEM Aftermarket Other 2018 Undercarriages / Parts 123.3 (4.3) (1.5) (0.4) 127.6 14.3 (4.1) 0.3 Sales Bridge: FY-2018 vs. FY-2017 Net sales in $M FULL YEAR ($M except EPS) 2018 2017 Net Sales $127.6 $123.3 Pro-forma Adjusted EBITDA $8.2 $10.1 Adjusted EPS $0.12 $0.27 Key Messages: Good progress on strategic actions of ASV brand recognition and machine growth, expanding North America distribution, and integration of aftermarket parts distribution. Solid foundation for 2019, with backlog of orders of $30.2M at year-end. An excess/slow moving inventory adjustment resulted in a negative impact of $0.7M Non-cash goodwill impairment charge of $30.6M, or $(3.11) EPS. Headwinds in the year of rapid input cost inflation, engine supply shortages and lower OEM demand. Profitability negatively impacted by rapid increase in material costs from Q2-18 onwards. Impact, net of price recovery, of $(1.3)M in the year, or $(0.13) EPS. Expect recent price increases to offset cost inflation in 2019. Expect engine availability to improve in Q2-2019 onwards.

Compact Track Loaders RT-25 Perkins | T4F Radial 24.7 hp / 665 lbs. RT-40 Kubota | T4F Radial 37.5 hp / 931 lbs. RT-65 Deutz | T4F Radial 67 hp / 1925 lbs. Recent New Products Launched In 2018, ASV introduced three new Posi-Track® machines: RT-25*, ”The World’s Most Compact Track Loader” | RT-40*, “Innovative Iron Award 2018” | RT-65, first orders shipped Feb 2019 *ASV’s RT-25 and RT-40 machines have recently been recognized as “the most impressive equipment and technology released in the compact category in 2018” by Compact Equipment Magazine - November/December 2018 Print Issue

RT-25 is the World’s Most Compact Track Loader 48-inch width, 72.5-inch height Faster than stand-ons ASV RT-25: 1-rotation Competitor: 1-rotation ASV RT-25: 30-rotations Attachment-ready Great for landscapers, rental and contractors Year-round use Minimal ground disturbance Low ground pressure Easily transported

Our Product – Compact Track Loaders Model VT-70 RT-75 RT-75HD RT-120 RT-120F Engine Type Kubota Cummins Cummins Cummins Cummins Emissions T4F T4F T4F T4F T4F Lift Arm Design Vertical Radial Radial Radial Radial HP / ROC 65 hp / 2328 lbs. 74 hp / 2650 lbs. 74 hp / 2650 lbs. 120 hp / 3535 lbs. 120 hp / 3535 lbs. Model RT-30 RT-50 RT-60 Engine Type Perkins Perkins Perkins Emissions T4I T4I T4I Lift Arm Design Radial Radial Radial HP / ROC 32.7 hp / 665 lbs. 50 hp / 1600 lbs. 60 hp / 1900 lbs. International Track Loaders

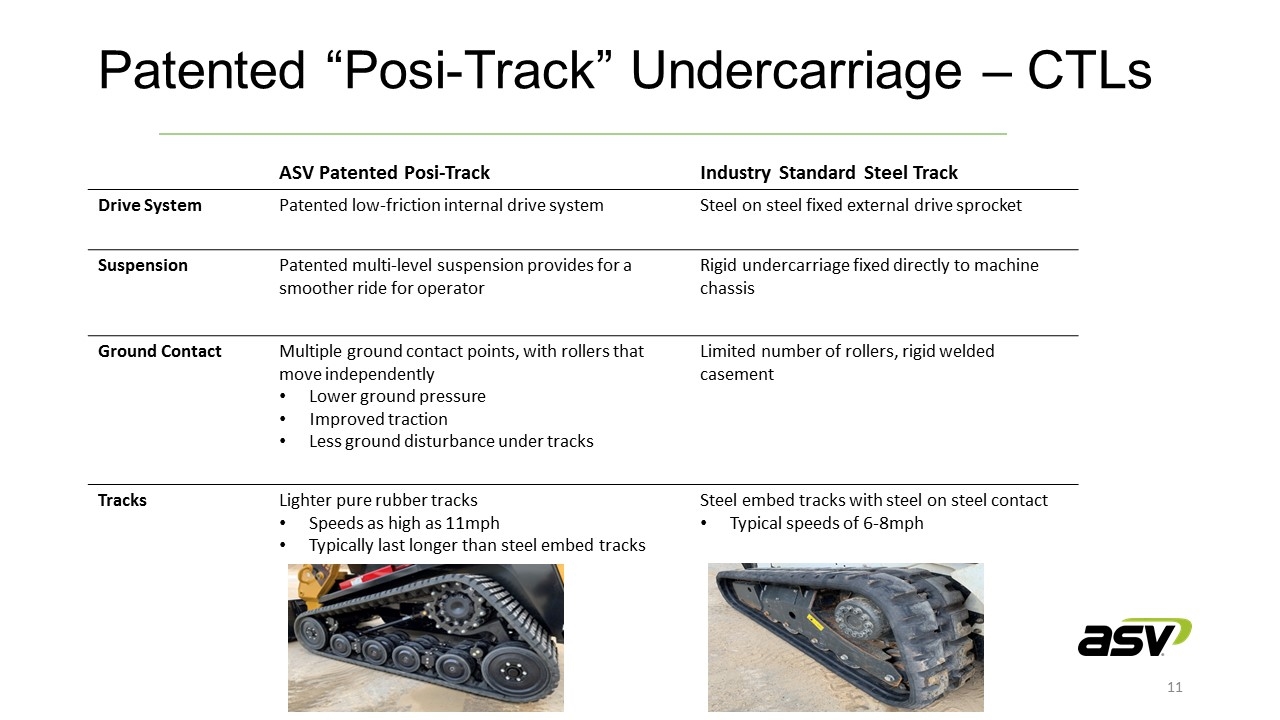

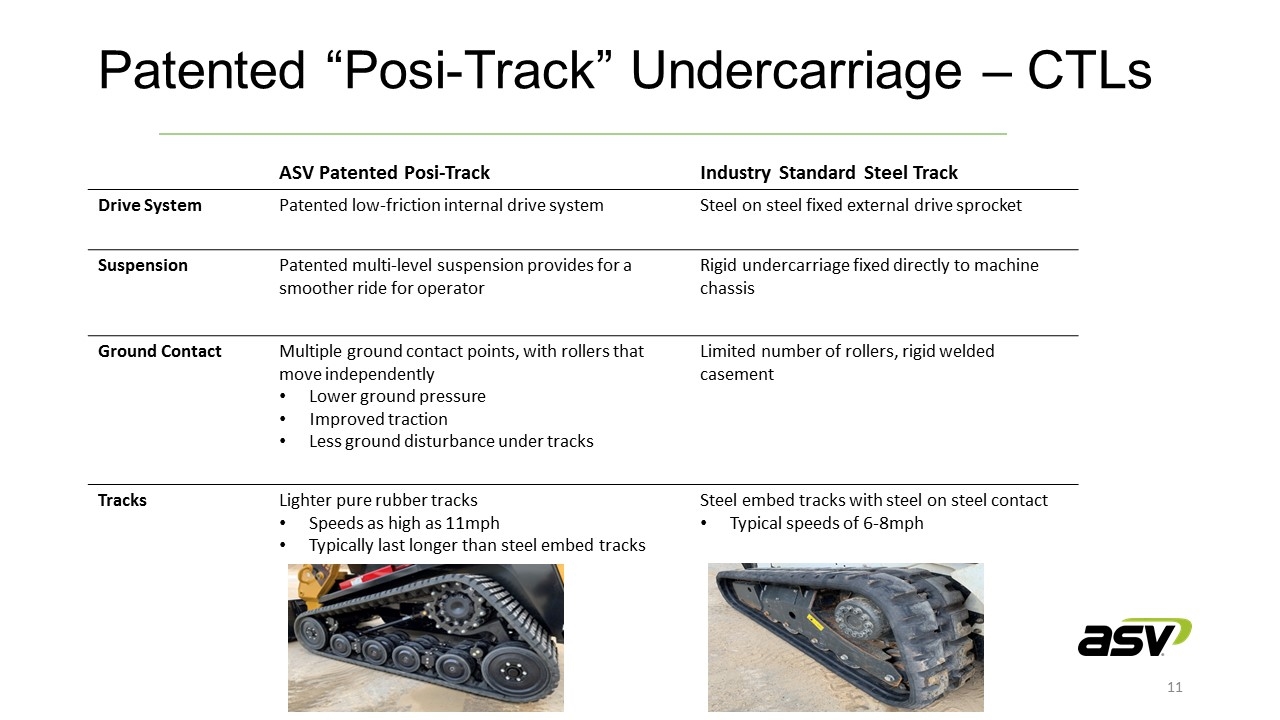

Patented “Posi-Track” Undercarriage – CTLs ASV Patented Posi-Track Industry Standard Steel Track Drive System Patented low-friction internal drive system Steel on steel fixed external drive sprocket Suspension Patented multi-level suspension provides for a smoother ride for operator Rigid undercarriage fixed directly to machine chassis Ground Contact Multiple ground contact points, with rollers that move independently Lower ground pressure Improved traction Less ground disturbance under tracks Limited number of rollers, rigid welded casement Tracks Lighter pure rubber tracks Speeds as high as 11mph Typically last longer than steel embed tracks Steel embed tracks with steel on steel contact Typical speeds of 6-8mph

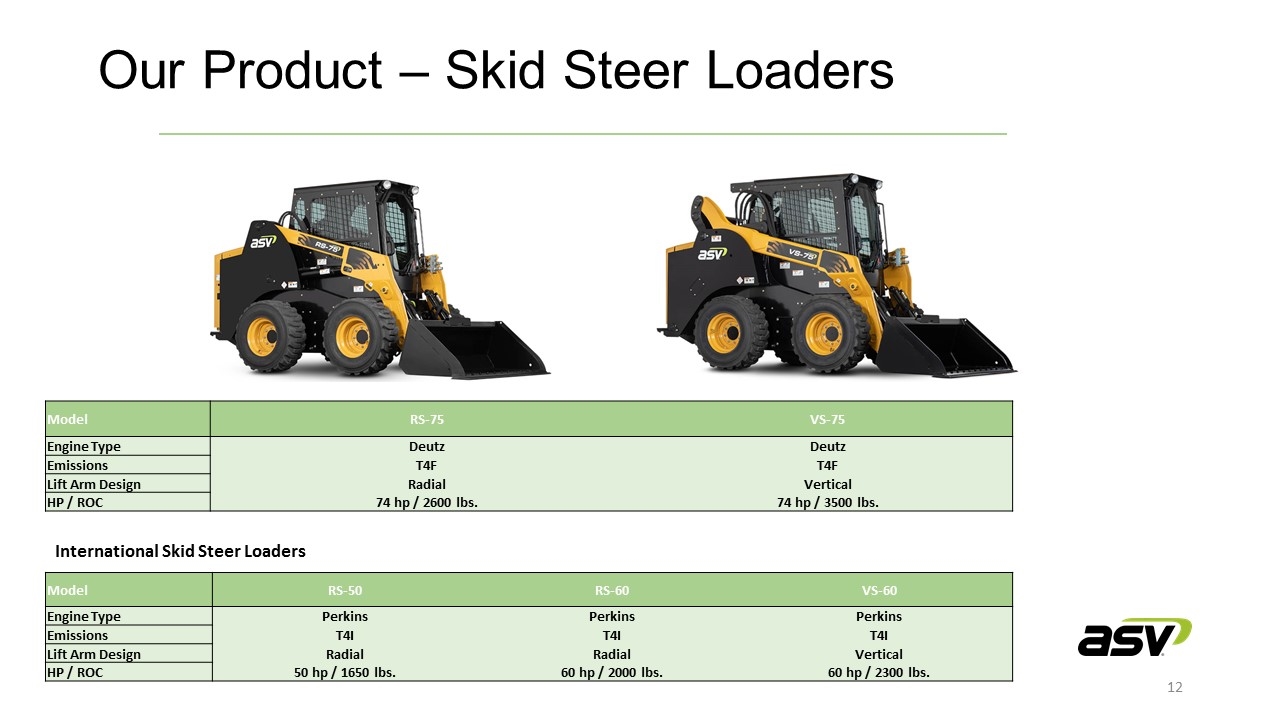

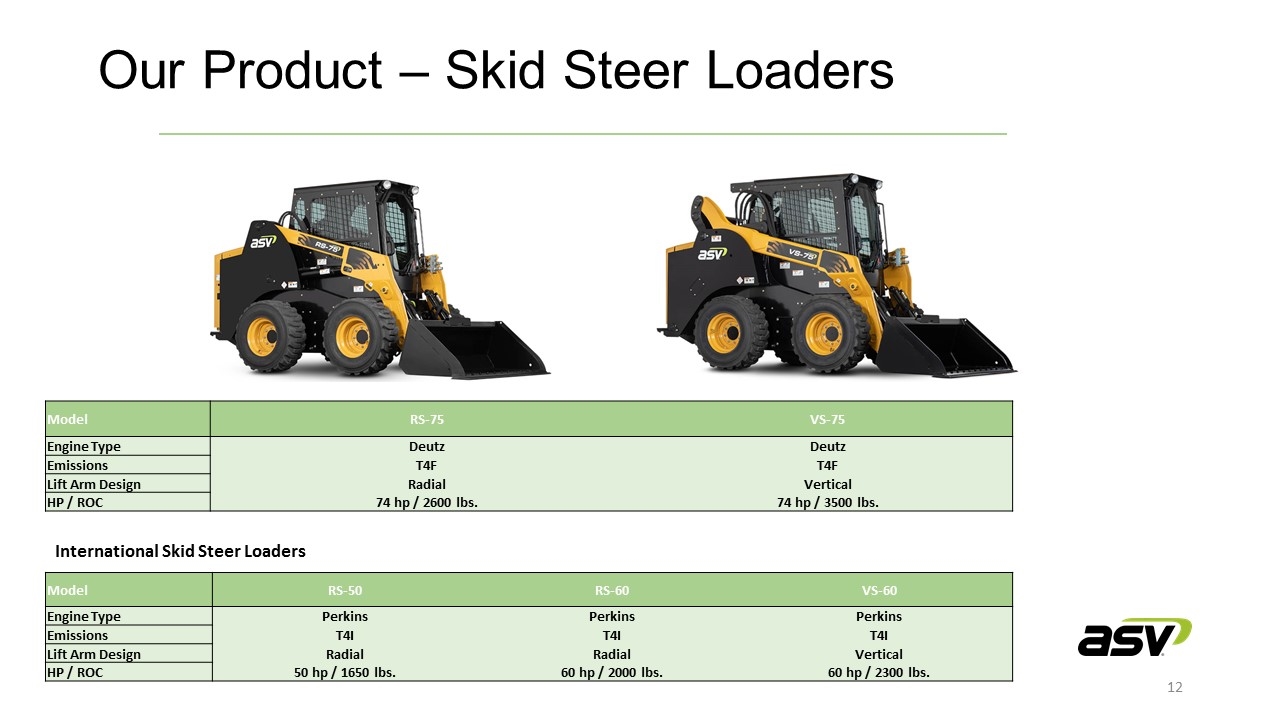

Our Product – Skid Steer Loaders International Skid Steer Loaders Model RS-75 VS-75 Engine Type Deutz Deutz Emissions T4F T4F Lift Arm Design Radial Vertical HP / ROC 74 hp / 2600 lbs. 74 hp / 3500 lbs. Model RS-50 RS-60 VS-60 Engine Type Perkins Perkins Perkins Emissions T4I T4I T4I Lift Arm Design Radial Radial Vertical HP / ROC 50 hp / 1650 lbs. 60 hp / 2000 lbs. 60 hp / 2300 lbs.

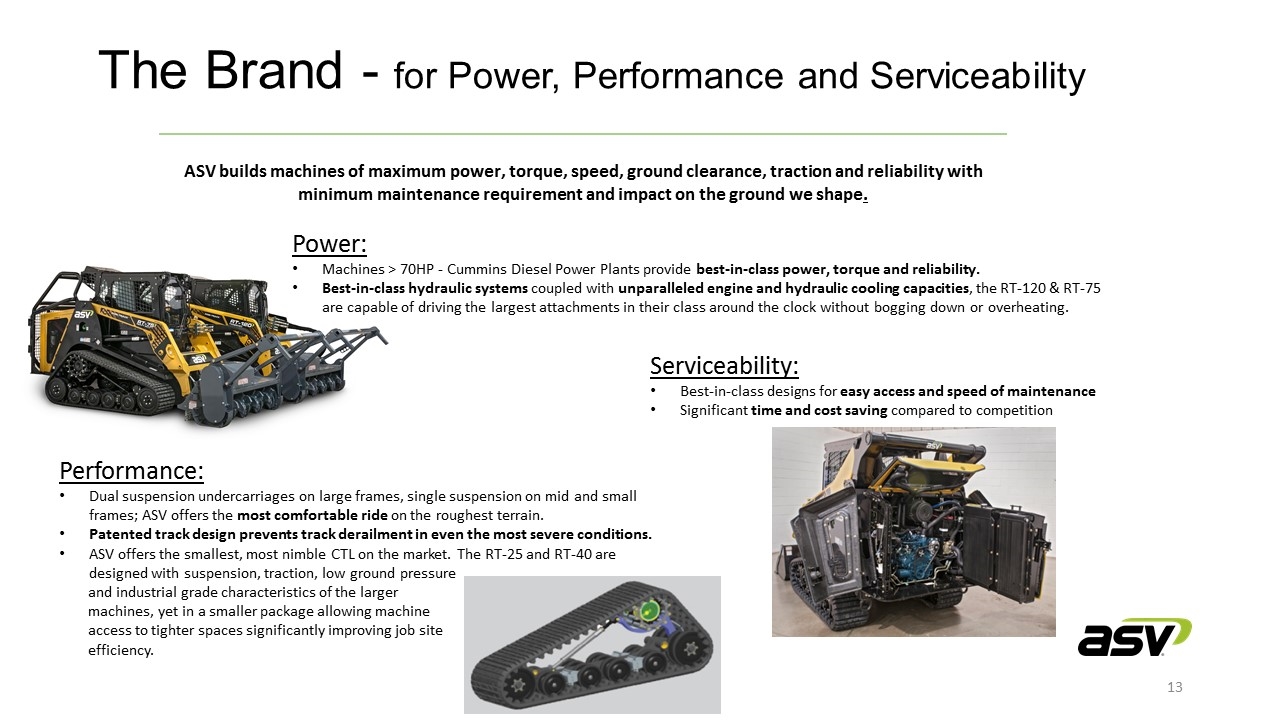

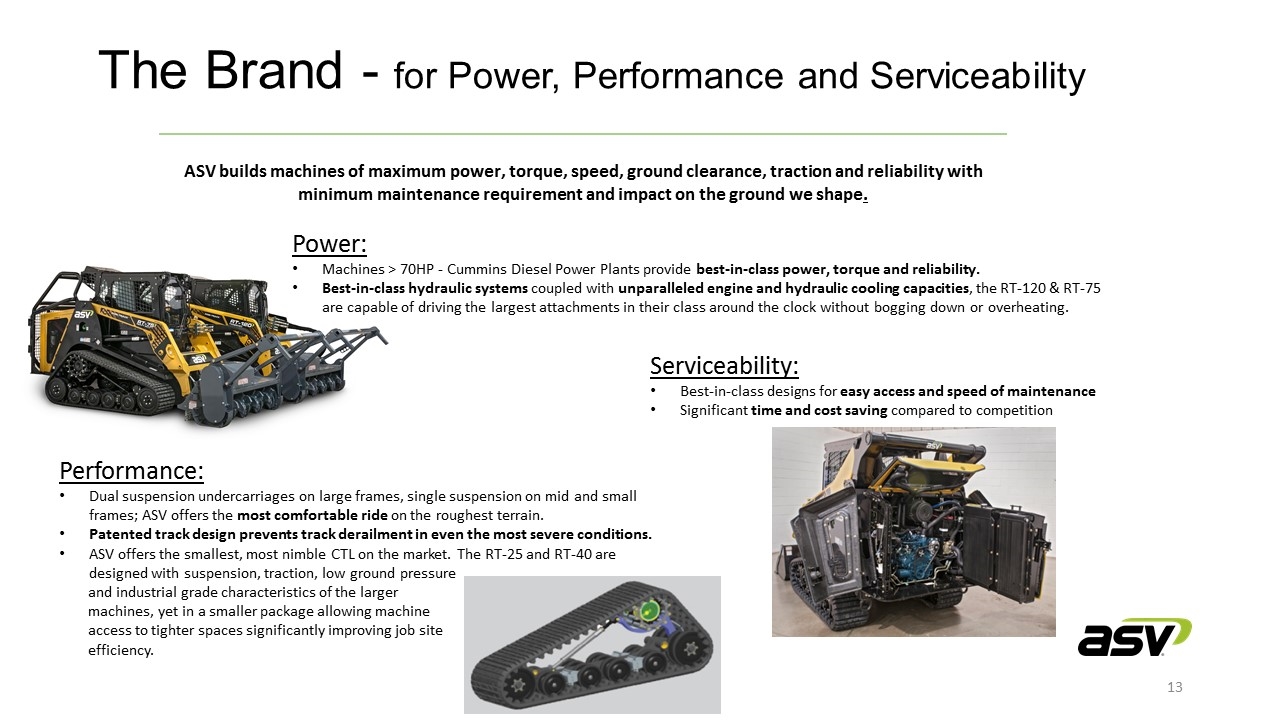

ASV builds machines of maximum power, torque, speed, ground clearance, traction and reliability with minimum maintenance requirement and impact on the ground we shape. Serviceability: Best-in-class designs for easy access and speed of maintenance Significant time and cost saving compared to competition Performance: Dual suspension undercarriages on large frames, single suspension on mid and small frames; ASV offers the most comfortable ride on the roughest terrain. Patented track design prevents track derailment in even the most severe conditions. ASV offers the smallest, most nimble CTL on the market. The RT-25 and RT-40 are designed with suspension, traction, low ground pressure and industrial grade characteristics of the larger machines, yet in a smaller package allowing machine access to tighter spaces significantly improving job site efficiency. The Brand - for Power, Performance and Serviceability Power: Machines > 70HP - Cummins Diesel Power Plants provide best-in-class power, torque and reliability. Best-in-class hydraulic systems coupled with unparalleled engine and hydraulic cooling capacities, the RT-120 & RT-75 are capable of driving the largest attachments in their class around the clock without bogging down or overheating.

North America: Dealers (new, rental, new and rental) of construction, agriculture, forestry and landscaping, road building equipment; there are 1,000s of equipment dealers, nationwide Typically dealers choose one or two vendors per product category Products are sold/rented at dealer locations and on their websites to a diverse group of users including contractors, commercial and private users MSRP for new equipment ranges from $43,000-$125,000 depending on features and capacity Direct OEM sales of undercarriages to Caterpillar and equipment to others for private label and branded equipment solutions Australia and New Zealand: Australian sales through master distributor and a strategic account network New Zealand dealer network Go-to Market Strategy

Management Team Missi How Chief Financial Officer 20 years with ASV Justin Rupar VP of Sales & Marketing 1 year with ASV Tom Foster VP of Operations & Supply Chain 1 year with ASV Bill Wake Director of Product Development 17 years with ASV Chad Christianson Director of IT & Business Solutions 13 years with ASV Lori Gill Director of Corporate Core Values & HR 11 years with ASV Andrew Rooke Chief Executive Officer 3 years with ASV

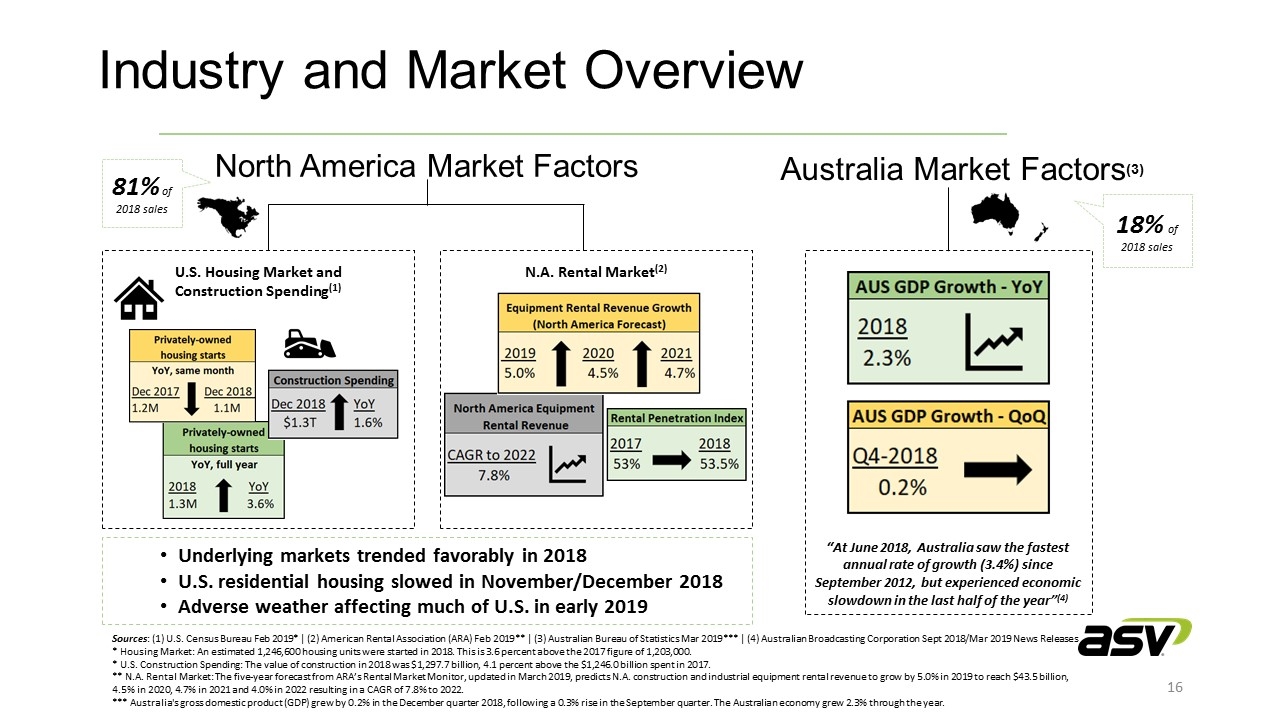

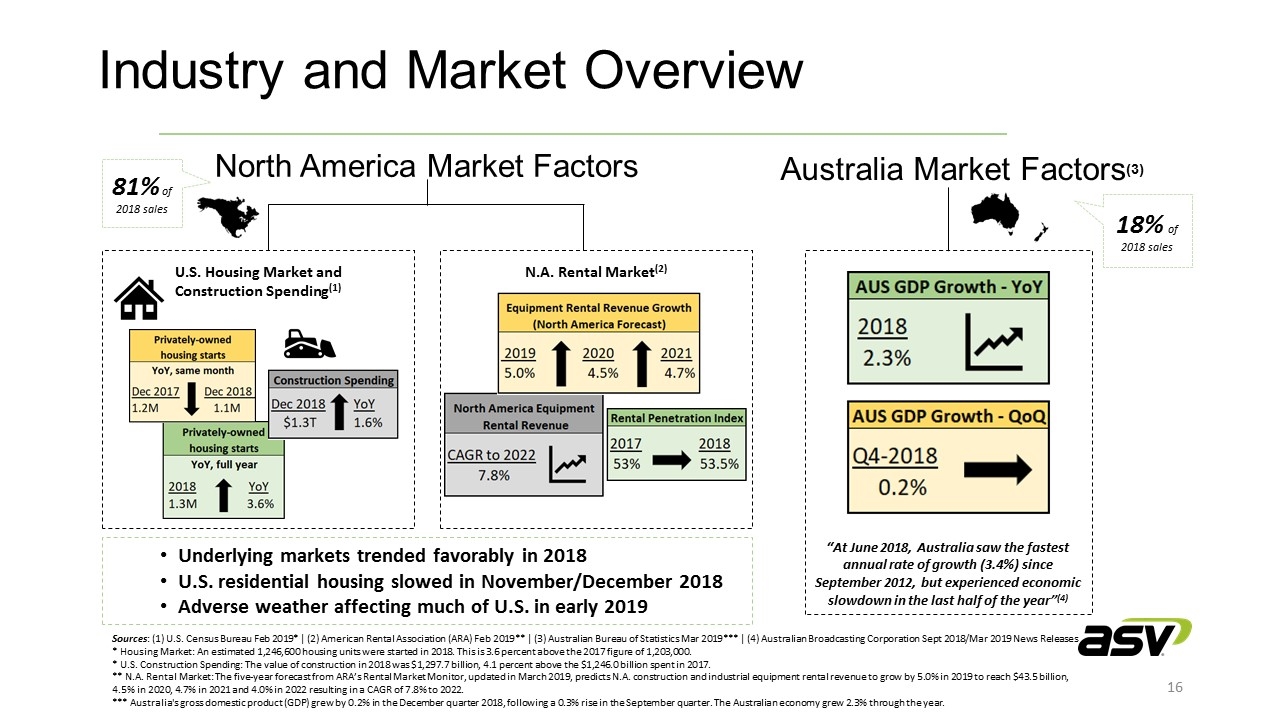

Industry and Market Overview Sources: (1) U.S. Census Bureau Feb 2019* | (2) American Rental Association (ARA) Feb 2019** | (3) Australian Bureau of Statistics Mar 2019*** | (4) Australian Broadcasting Corporation Sept 2018/Mar 2019 News Releases * Housing Market: An estimated 1,246,600 housing units were started in 2018. This is 3.6 percent above the 2017 figure of 1,203,000. * U.S. Construction Spending: The value of construction in 2018 was $1,297.7 billion, 4.1 percent above the $1,246.0 billion spent in 2017. ** N.A. Rental Market: The five-year forecast from ARA’s Rental Market Monitor, updated in March 2019, predicts N.A. construction and industrial equipment rental revenue to grow by 5.0% in 2019 to reach $43.5 billion, 4.5% in 2020, 4.7% in 2021 and 4.0% in 2022 resulting in a CAGR of 7.8% to 2022. *** Australia's gross domestic product (GDP) grew by 0.2% in the December quarter 2018, following a 0.3% rise in the September quarter. The Australian economy grew 2.3% through the year. Australia Market Factors(3) “At June 2018, Australia saw the fastest annual rate of growth (3.4%) since September 2012, but experienced economic slowdown in the last half of the year”(4) 18% of 2018 sales North America Market Factors U.S. Housing Market and Construction Spending(1) N.A. Rental Market(2) 81% of 2018 sales Underlying markets trended favorably in 2018 U.S. residential housing slowed in November/December 2018 Adverse weather affecting much of U.S. in early 2019

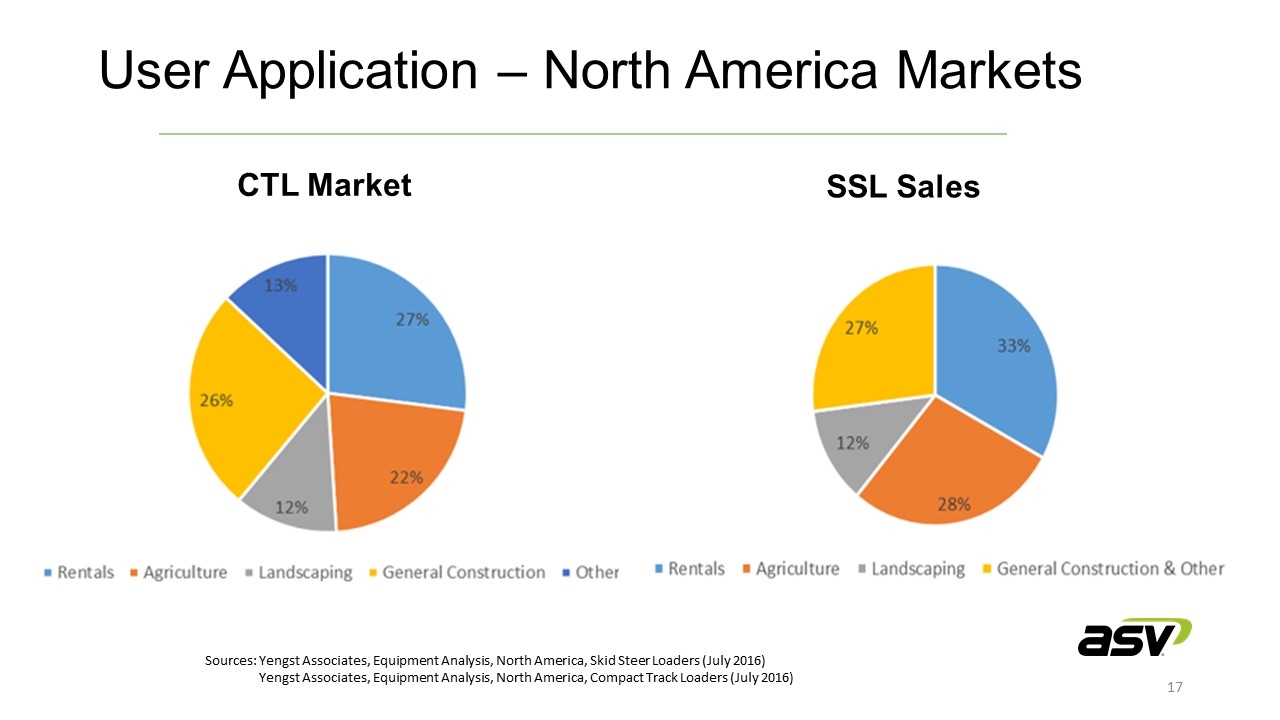

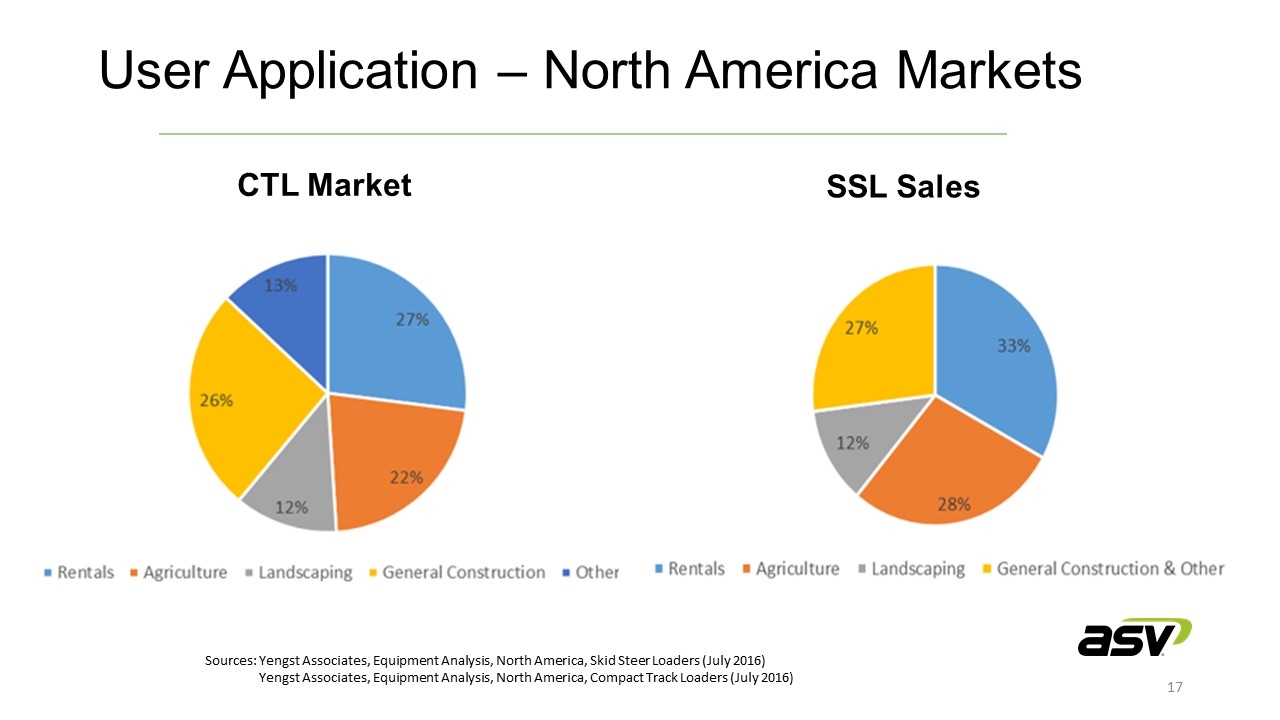

User Application – North America Markets CTL Market SSL Sales Sources:Yengst Associates, Equipment Analysis, North America, Skid Steer Loaders (July 2016) Yengst Associates, Equipment Analysis, North America, Compact Track Loaders (July 2016)

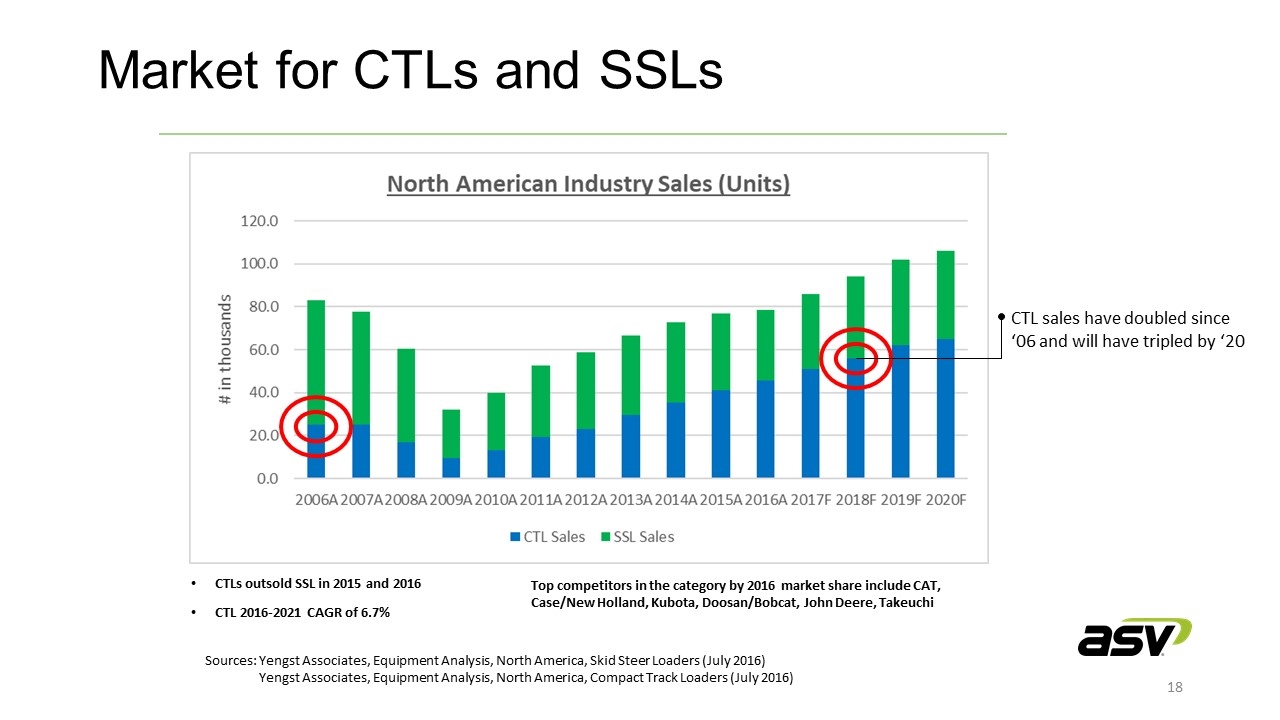

Market for CTLs and SSLs CTLs outsold SSL in 2015 and 2016 CTL 2016-2021 CAGR of 6.7% Sources:Yengst Associates, Equipment Analysis, North America, Skid Steer Loaders (July 2016) Yengst Associates, Equipment Analysis, North America, Compact Track Loaders (July 2016) Top competitors in the category by 2016 market share include CAT, Case/New Holland, Kubota, Doosan/Bobcat, John Deere, Takeuchi CTL sales have doubled since ‘06 and will have tripled by ‘20

Add additional retail distribution locations, principally North America. Expand penetration of rental channel, large national corporates and smaller local players. Grow to 25% of machine sales. Maximize sales throughput of retail dealer locations. Manage the dealer network and motivate dealers. Increase percentage achieving target rate of sales turns. Expand gross and EBITDA margins to 18% and 12%, respectively. Introduce great new products. Expand aftermarket sales. Acquire complementary businesses to accelerate top- and bottom-line growth. Growth Strategy 2018 to 2022

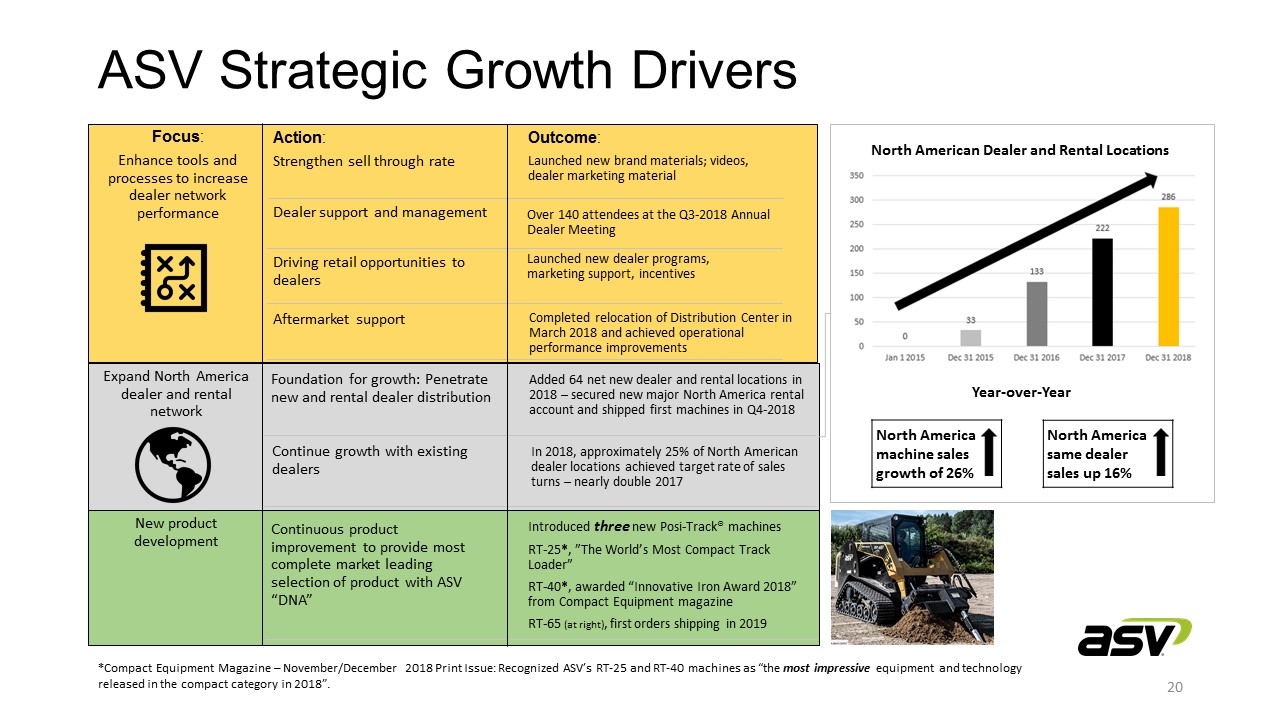

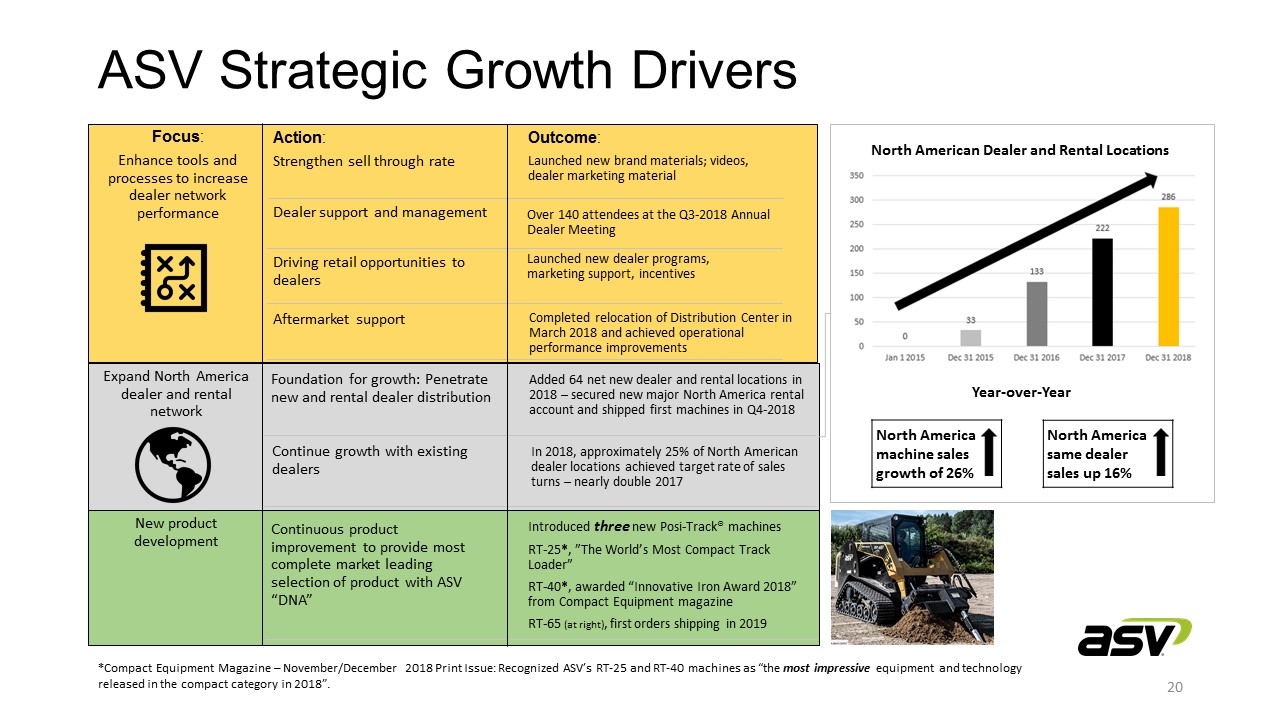

ASV Strategic Growth Drivers *Compact Equipment Magazine – November/December 2018 Print Issue: Recognized ASV’s RT-25 and RT-40 machines as “the most impressive equipment and technology released in the compact category in 2018”. North American Dealer and Rental Locations North America same dealer sales up 16% North America machine sales growth of 26% Year-over-Year Focus : Enhance tools and processes to increase dealer network performance Over 140 attendees at the Q3-2018 Annual Dealer Meeting Completed relocation of Distribution Center in March 2018 and achieved operational performance improvements Launched new dealer programs, marketing support, incentives Aftermarket support Driving retail opportunities to dealers Dealer support and management Outcome : Launched new brand materials; videos, dealer marketing material Action : Strengthen sell through rate Expand North America dealer and rental network Foundation for growth: Penetrate new and rental dealer distribution Continue growth with existing dealers Added 64 net new dealer and rental locations in 2018 – secured new major North America rental account and shipped first machines in Q4-2018 In 2018, approximately 25% of North American dealer locations achieved target rate of sales turns – nearly double 2017 New product development Continuous product improvement to provide most complete market leading selection of product with ASV “DNA” Introduced three new Posi-Track® machines RT-25 * , ”The World’s Most Compact Track Loader” RT-40 * , awarded “Innovative Iron Award 2018” from Compact Equipment magazine RT-65 (at right) , first orders shipping in 2019

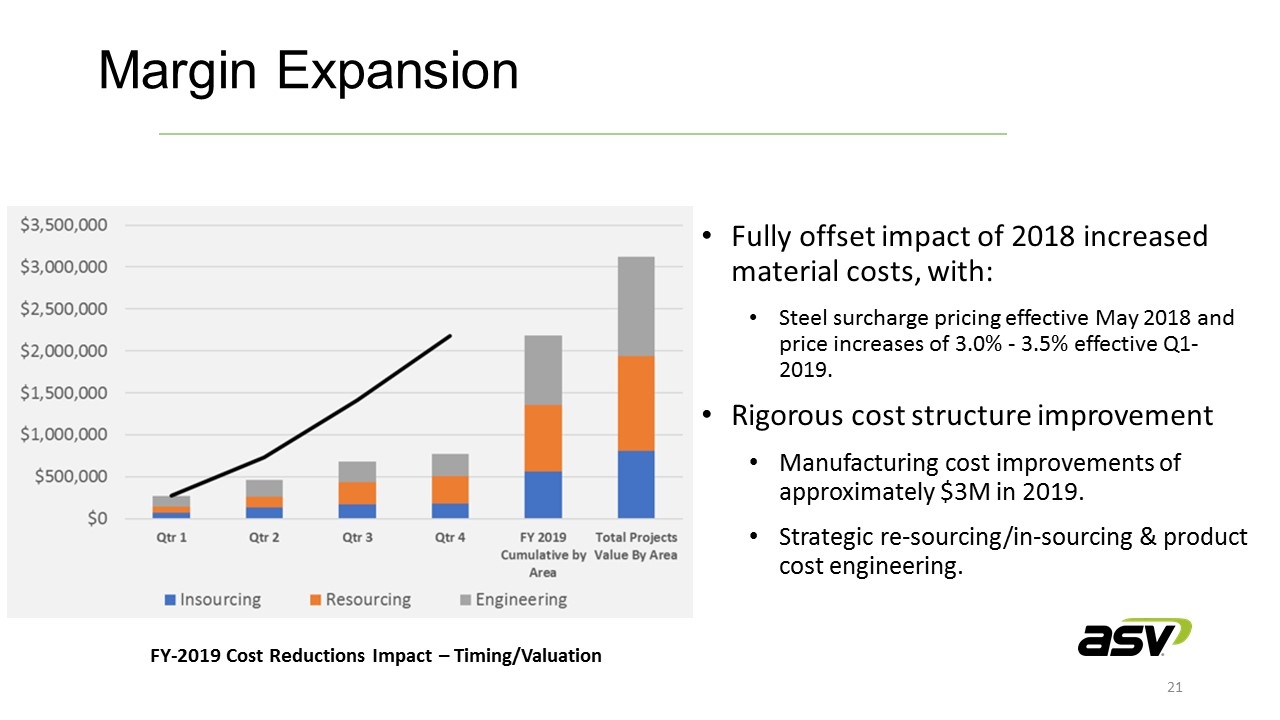

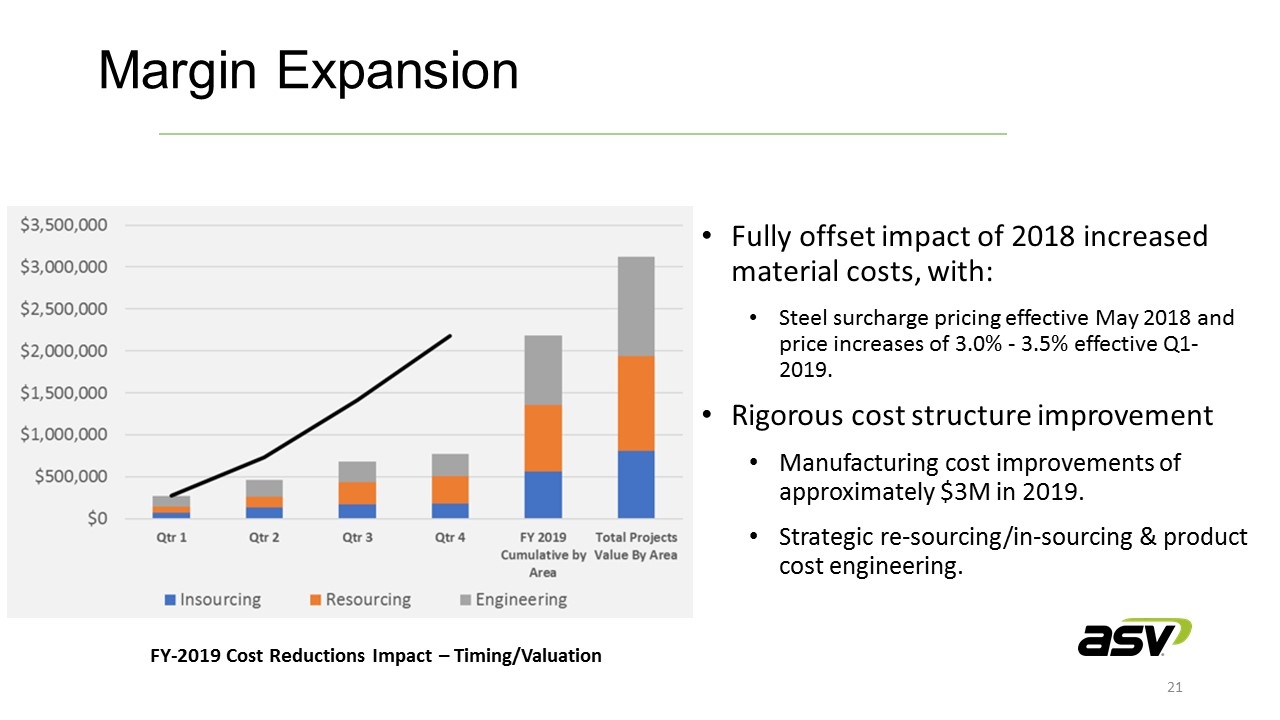

Fully offset impact of 2018 increased material costs, with: Steel surcharge pricing effective May 2018 and price increases of 3.0% - 3.5% effective Q1-2019. Rigorous cost structure improvement Manufacturing cost improvements of approximately $3M in 2019. Strategic re-sourcing/in-sourcing & product cost engineering. Margin Expansion FY-2019 Cost Reductions Impact – Timing/Valuation

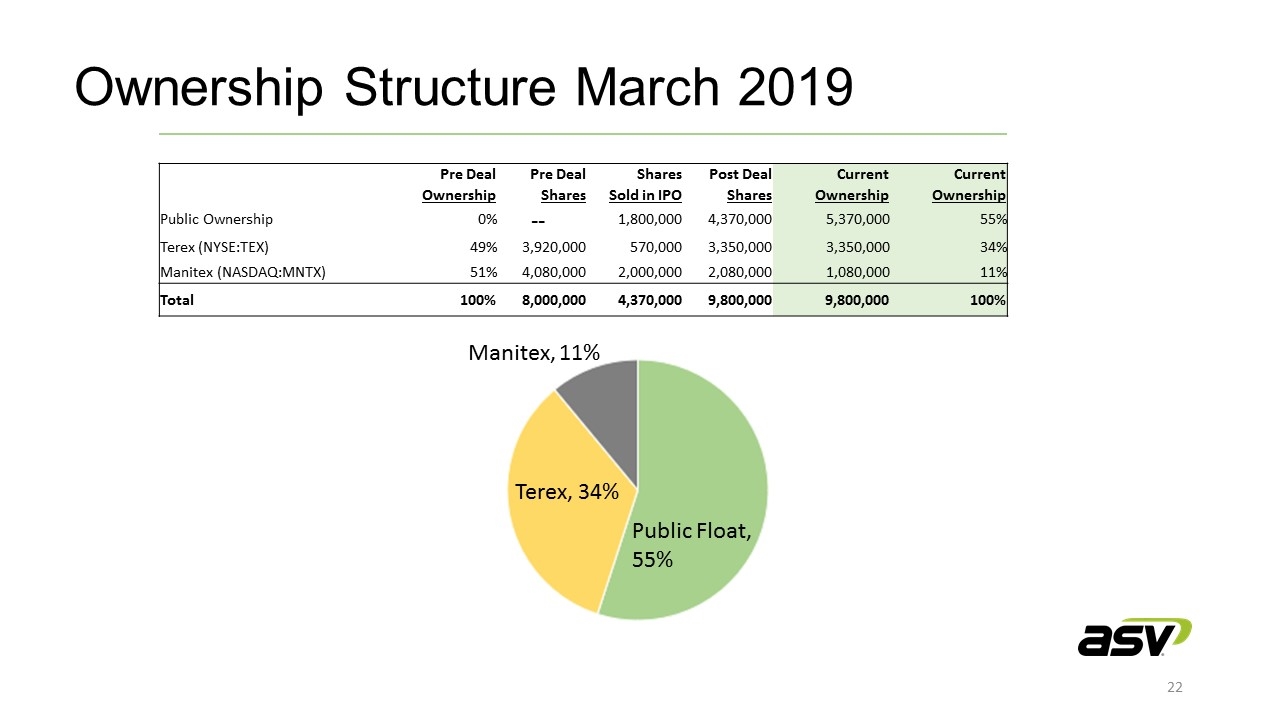

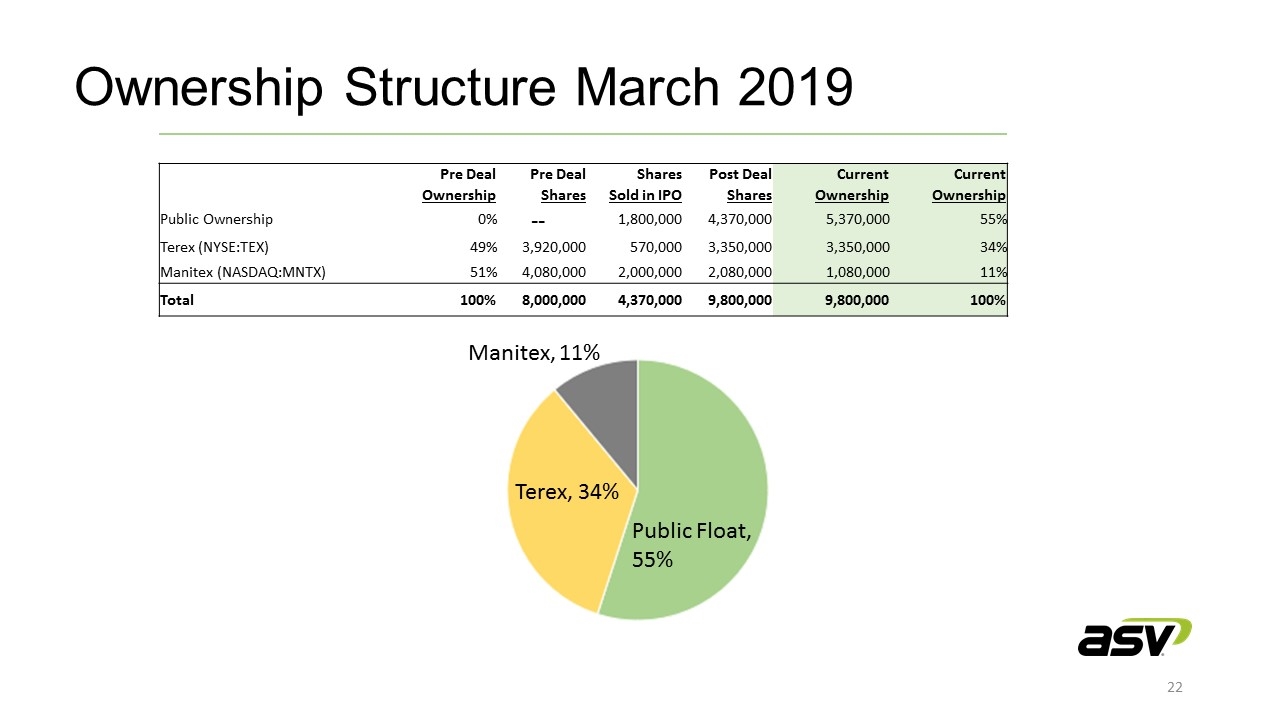

Ownership Structure March 2019 Pre Deal Pre Deal Shares Post Deal Current Current Ownership Shares Sold in IPO Shares Ownership Ownership Public Ownership 0% -- 1,800,000 4,370,000 5,370,000 55% Terex (NYSE:TEX) 49% 3,920,000 570,000 3,350,000 3,350,000 34% Manitex (NASDAQ:MNTX) 51% 4,080,000 2,000,000 2,080,000 1,080,000 11% Total 100% 8,000,000 4,370,000 9,800,000 9,800,000 100% Manitex, 11% Terex, 34% Public Float, 55%

Appendix

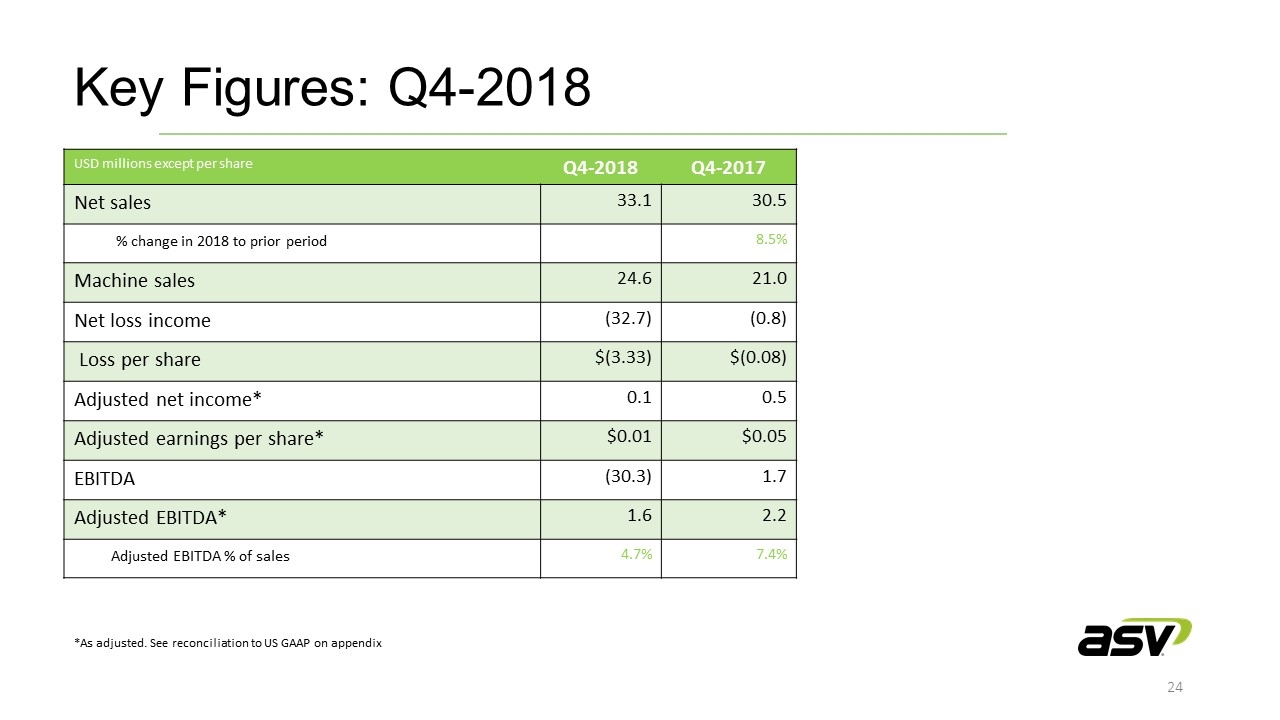

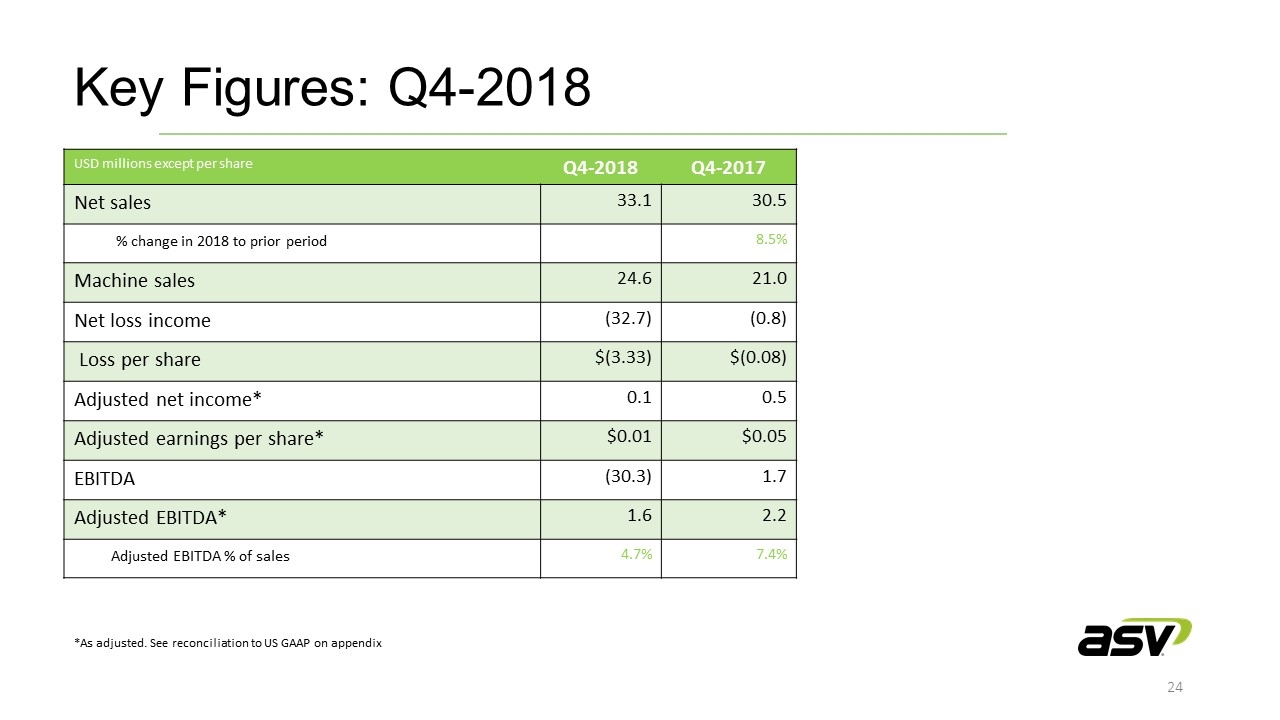

Key Figures: Q4-2018 *As adjusted. See reconciliation to US GAAP on appendix USD millions except per share Q4-2018 Q4-2017 Net sales 33.1 30.5 % change in 2018 to prior period 8.5% Machine sales 24.6 21.0 Net loss income (32.7) (0.8) Loss per share $(3.33) $(0.08) Adjusted net income* 0.1 0.5 Adjusted earnings per share* $0.01 $0.05 EBITDA (30.3) 1.7 Adjusted EBITDA* 1.6 2.2 Adjusted EBITDA % of sales 4.7% 7.4%

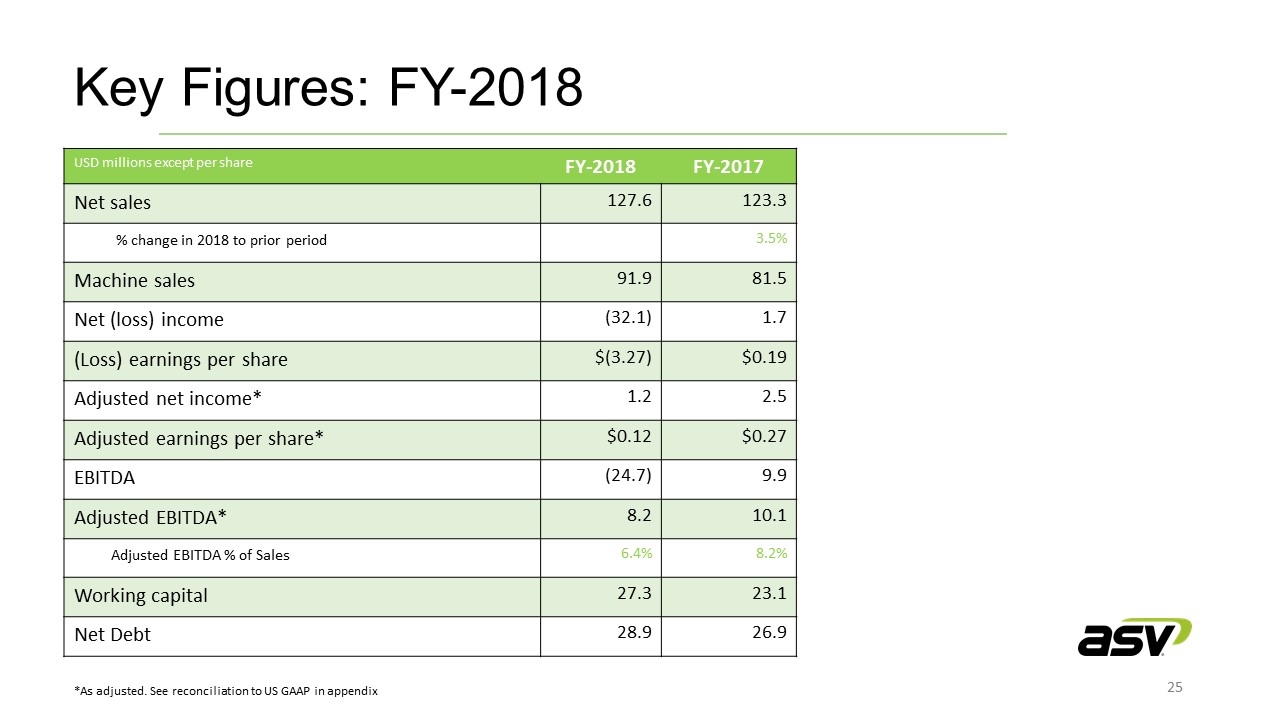

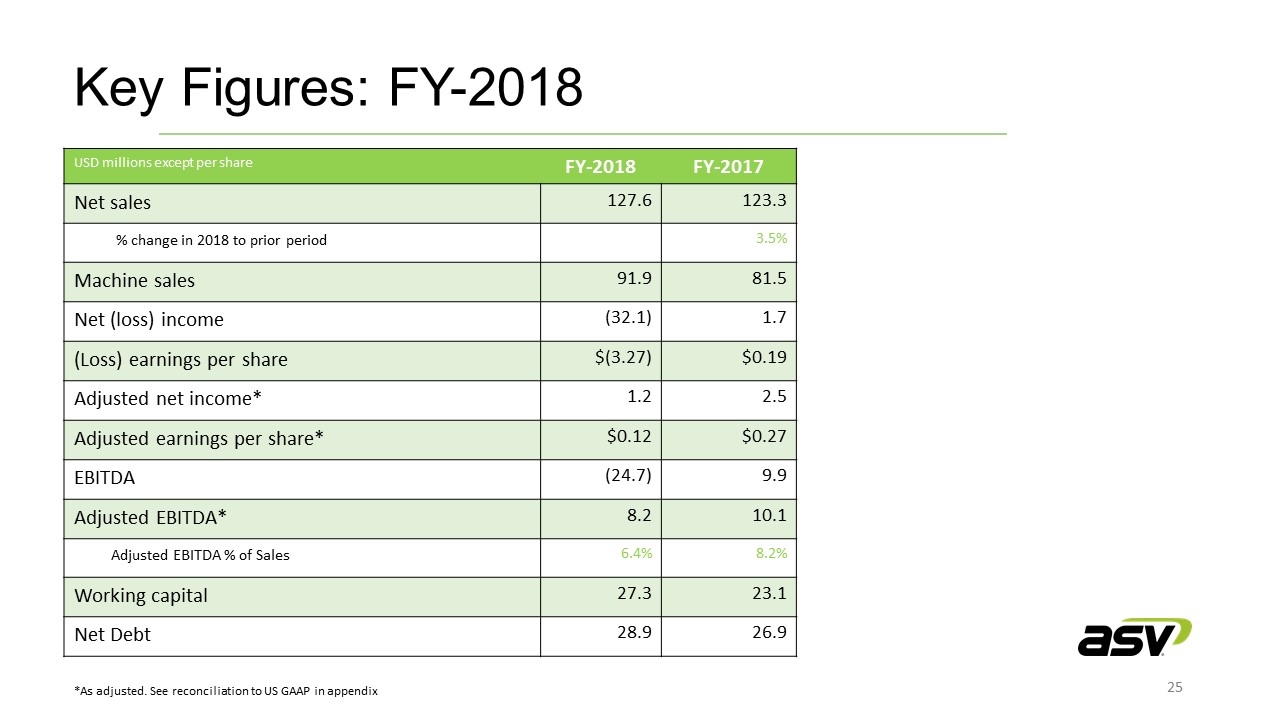

Key Figures: FY-2018 *As adjusted. See reconciliation to US GAAP in appendix USD millions except per share FY-2018 FY-2017 Net sales 127.6 123.3 % change in 2018 to prior period 3.5% Machine sales 91.9 81.5 Net (loss) income (32.1) 1.7 (Loss) earnings per share $(3.27) $0.19 Adjusted net income* 1.2 2.5 Adjusted earnings per share* $0.12 $0.27 EBITDA (24.7) 9.9 Adjusted EBITDA* 8.2 10.1 Adjusted EBITDA % of Sales 6.4% 8.2% Working capital 27.3 23.1 Net Debt 28.9 26.9

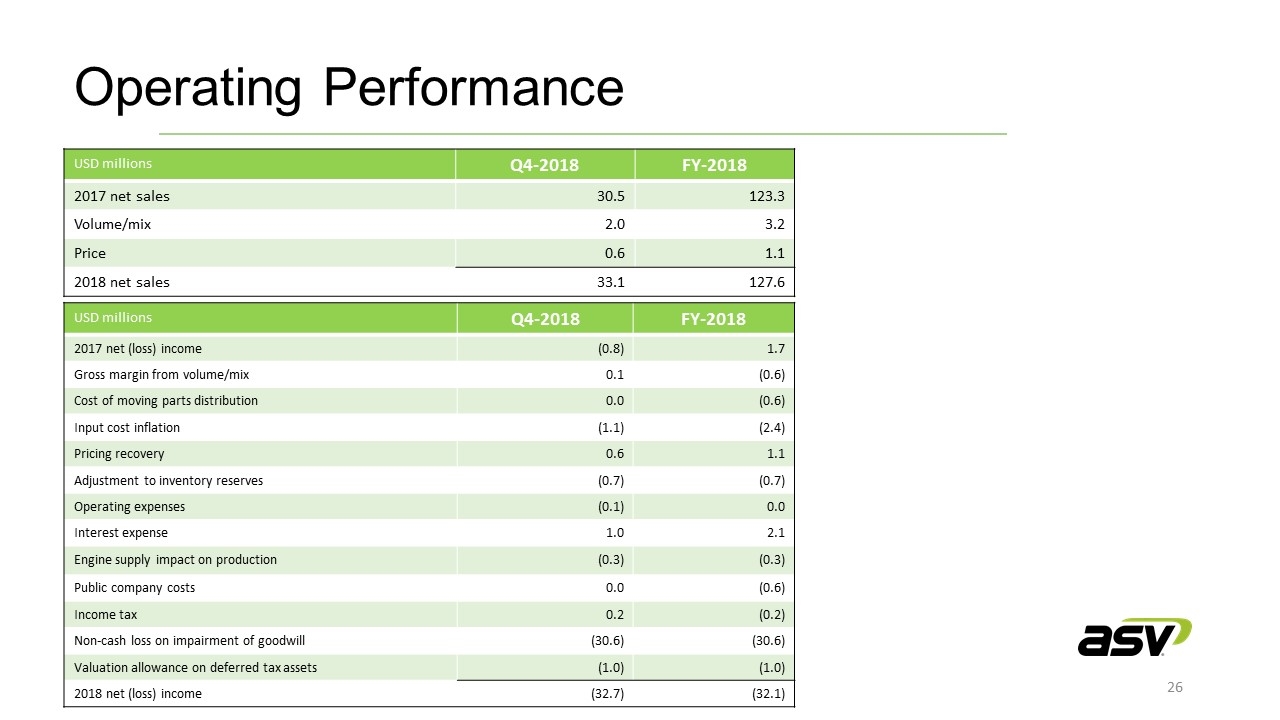

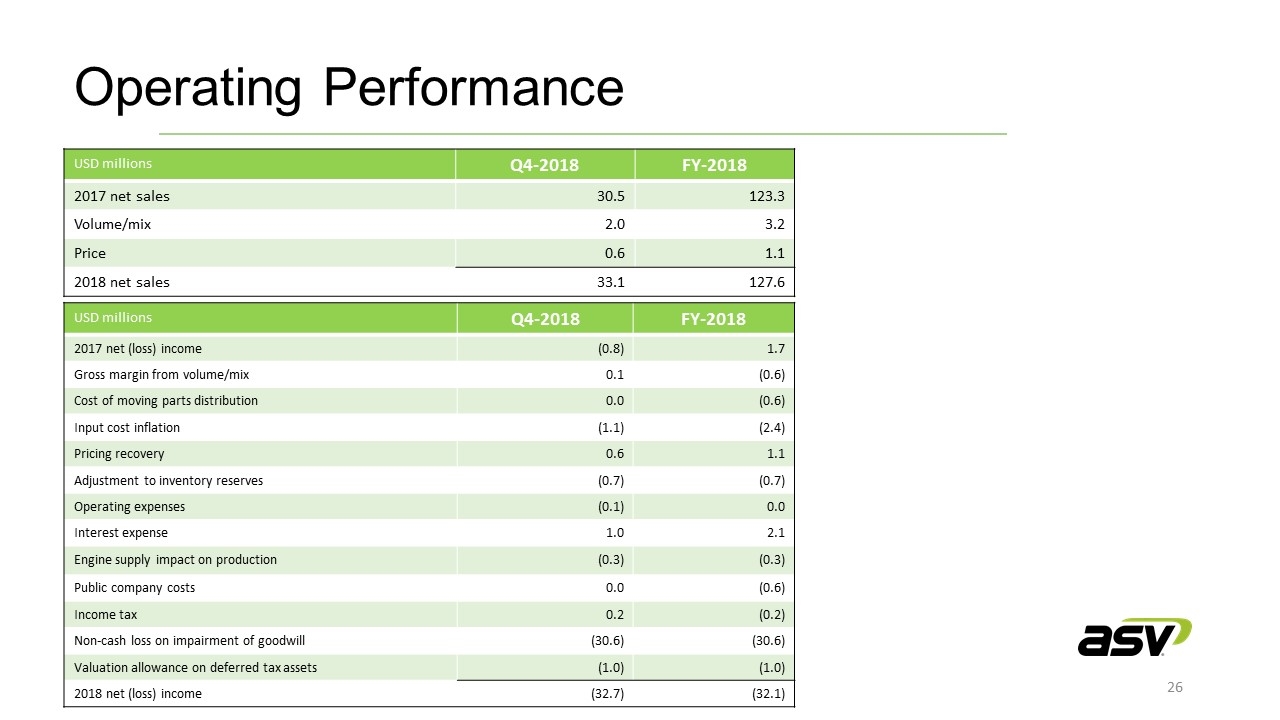

Operating Performance USD millions Q4-2018 FY-2018 2017 net sales 30.5 123.3 Volume/mix 2.0 3.2 Price 0.6 1.1 2018 net sales 33.1 127.6 USD millions Q4-2018 FY-2018 2017 net (loss) income (0.8) 1.7 Gross margin from volume/mix 0.1 (0.6) Cost of moving parts distribution 0.0 (0.6) Input cost inflation (1.1) (2.4) Pricing recovery 0.6 1.1 Adjustment to inventory reserves (0.7) (0.7) Operating expenses (0.1) 0.0 Interest expense 1.0 2.1 Engine supply impact on production (0.3) (0.3) Public company costs 0.0 (0.6) Income tax 0.2 (0.2) Non-cash loss on impairment of goodwill (30.6) (30.6) Valuation allowance on deferred tax assets (1.0) (1.0) 2018 net (loss) income (32.7) (32.1)

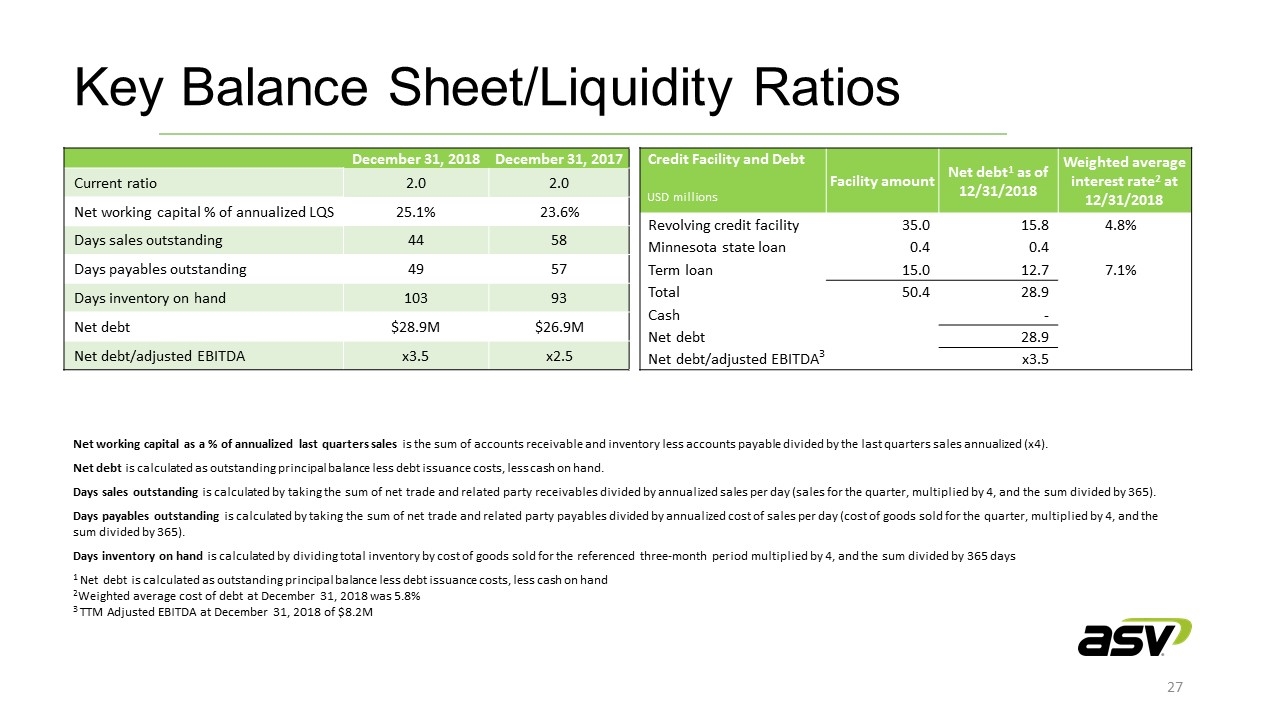

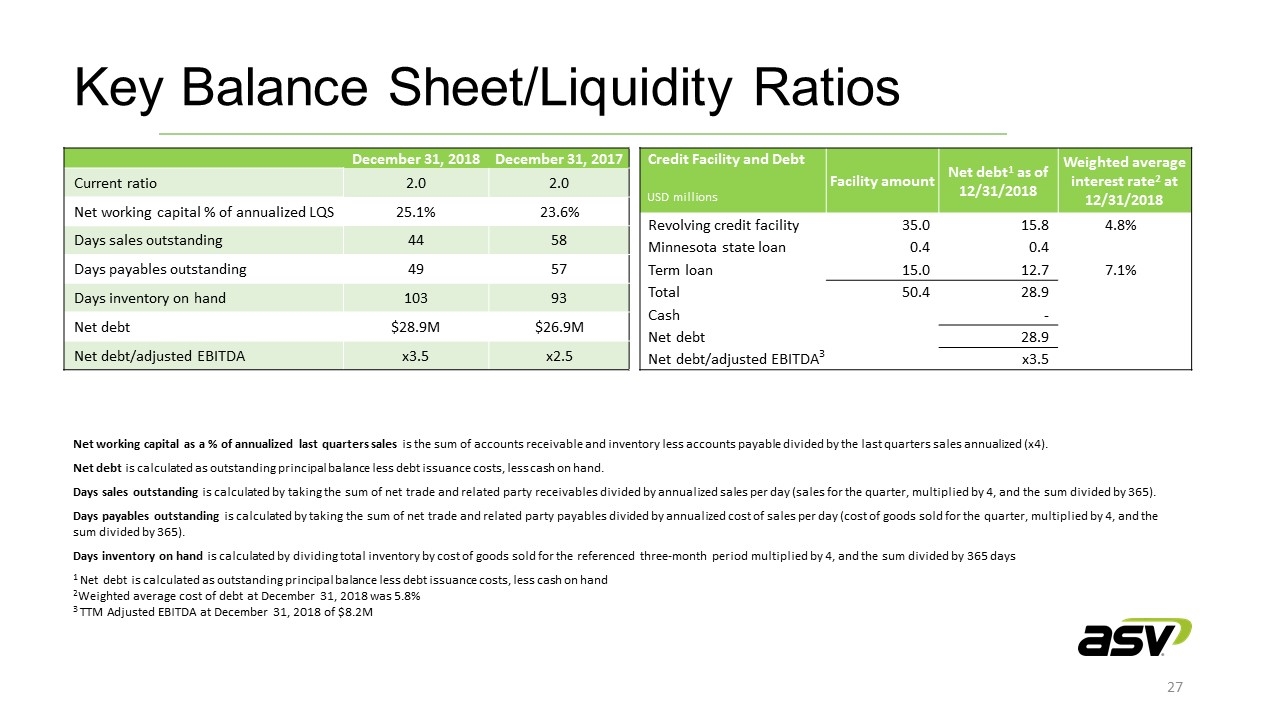

Net working capital as a % of annualized last quarters sales is the sum of accounts receivable and inventory less accounts payable divided by the last quarters sales annualized (x4). Net debt is calculated as outstanding principal balance less debt issuance costs, less cash on hand. Days sales outstanding is calculated by taking the sum of net trade and related party receivables divided by annualized sales per day (sales for the quarter, multiplied by 4, and the sum divided by 365). Days payables outstanding is calculated by taking the sum of net trade and related party payables divided by annualized cost of sales per day (cost of goods sold for the quarter, multiplied by 4, and the sum divided by 365). Days inventory on hand is calculated by dividing total inventory by cost of goods sold for the referenced three-month period multiplied by 4, and the sum divided by 365 days 1 Net debt is calculated as outstanding principal balance less debt issuance costs, less cash on hand 2Weighted average cost of debt at December 31, 2018 was 5.8% 3 TTM Adjusted EBITDA at December 31, 2018 of $8.2M Key Balance Sheet/Liquidity Ratios December 31, 2018 December 31, 2017 Current ratio 2.0 2.0 Net working capital % of annualized LQS 25.1% 23.6% Days sales outstanding 44 58 Days payables outstanding 49 57 Days inventory on hand 103 93 Net debt $28.9M $26.9M Net debt/adjusted EBITDA x3.5 x2.5 Credit Facility and Debt USD millions Facility amount Net debt1 as of 12/31/2018 Weighted average interest rate2 at 12/31/2018 Revolving credit facility 35.0 15.8 4.8% Minnesota state loan 0.4 0.4 Term loan 15.0 12.7 7.1% Total 50.4 28.9 Cash - Net debt 28.9 Net debt/adjusted EBITDA3 x3.5

Non-GAAP Measures and Reconciliations Cautionary Statement Regarding Non-GAAP Measures In an effort to provide investors with additional information regarding the Company’s results, ASV refers to various GAAP (U.S. generally accepted accounting principles) and non-GAAP financial measures which management believes provides useful information to investors. These non-GAAP measures may not be comparable to similarly titled measures being disclosed by other companies. In addition, the Company believes that non-GAAP financial measures should be considered in addition to, and not in lieu of, GAAP financial measures. ASV believes that this non-GAAP information is useful to understanding its operating results and the ongoing performance of its underlying businesses. Management of ASV uses both GAAP and non-GAAP financial measures to establish internal budgets and targets and to evaluate the Company’s financial performance against such budgets and targets. This release contains references to Adjusted Net (Loss) Income, “EBITDA” and “Adjusted EBITDA.” Adjusted Net (Loss) Income is defined as GAAP net income that excludes the gain or loss related to non-recurring events. Adjusted net income per share or "Adjusted EPS" is calculated by dividing the Adjusted Net Income (Loss) for the period by the weighted-average diluted shares outstanding for the period. EBITDA is defined for the purposes of this release as net income or loss before interest, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA plus stock-based compensation, less the gain or loss related to non-recurring events. Management believes that EBITDA and Adjusted EBITDA are useful supplemental measures of our operating performance and provide meaningful measures of overall corporate performance exclusive of our capital structure and the method and timing of expenditures associated with building and placing our products. EBITDA is also presented because management believes that it is frequently used by investment analysts, investors and other interested parties as a measure of financial performance. Adjusted EBITDA is also presented because management believes that it provides a measure of our recurring core business. We use Adjusted Net Income (Loss) and Adjusted EPS to evaluate financial performance, analyze the underlying trends in our business and establish operational goals and forecasts. We believe that Adjusted Net Income (Loss) and Adjusted EPS are useful measures because they permit investors to better understand changes in underlying operating performance over comparative periods by providing financial results that are unaffected by non-recurring events. However, Adjusted Net Income, Adjusted EPS, EBITDA and Adjusted EBITDA are not recognized earnings measures under generally accepted accounting principles of the United States (“U.S. GAAP”) and do not have a standardized meaning prescribed by U.S. GAAP. Therefore, Adjusted Net Income, Adjusted EPS, EBITDA and Adjusted EBITDA may not be comparable to similar measures presented by other issuers. Investors are cautioned that Adjusted Net Income, Adjusted EPS, EBITDA and Adjusted EBITDA should not be construed as alternatives to net income or loss or other income statement data (which are determined in accordance with U.S. GAAP) as an indicator of our performance or as a measure of liquidity and cash flows. Management’s method of calculating Adjusted Net Income, Adjusted EPS, EBITDA and Adjusted EBITDA may differ materially from the method used by other companies and accordingly, may not be comparable to similarly titled measures used by other companies. The amounts described below are unaudited, are reported in millions of U.S. dollars (except per share data and percentages), and are as of or for the three and twelve month periods ended December 31, 2018 and 2017, unless otherwise indicated.

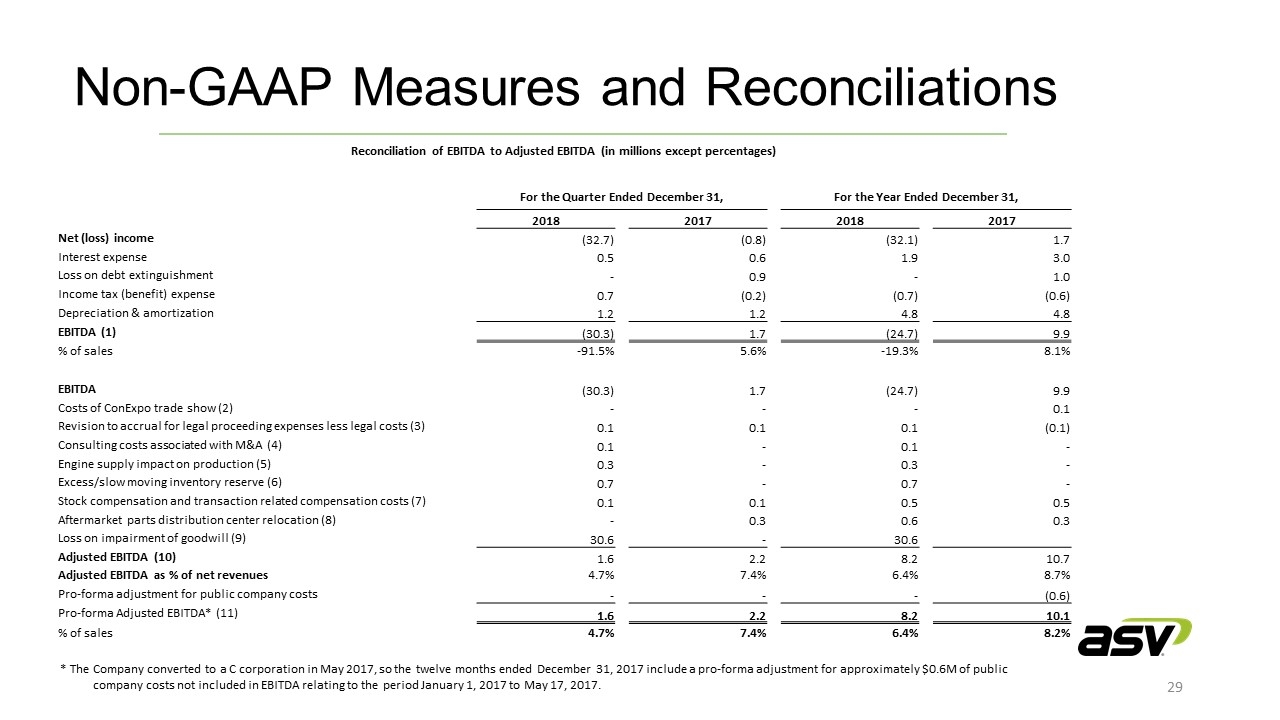

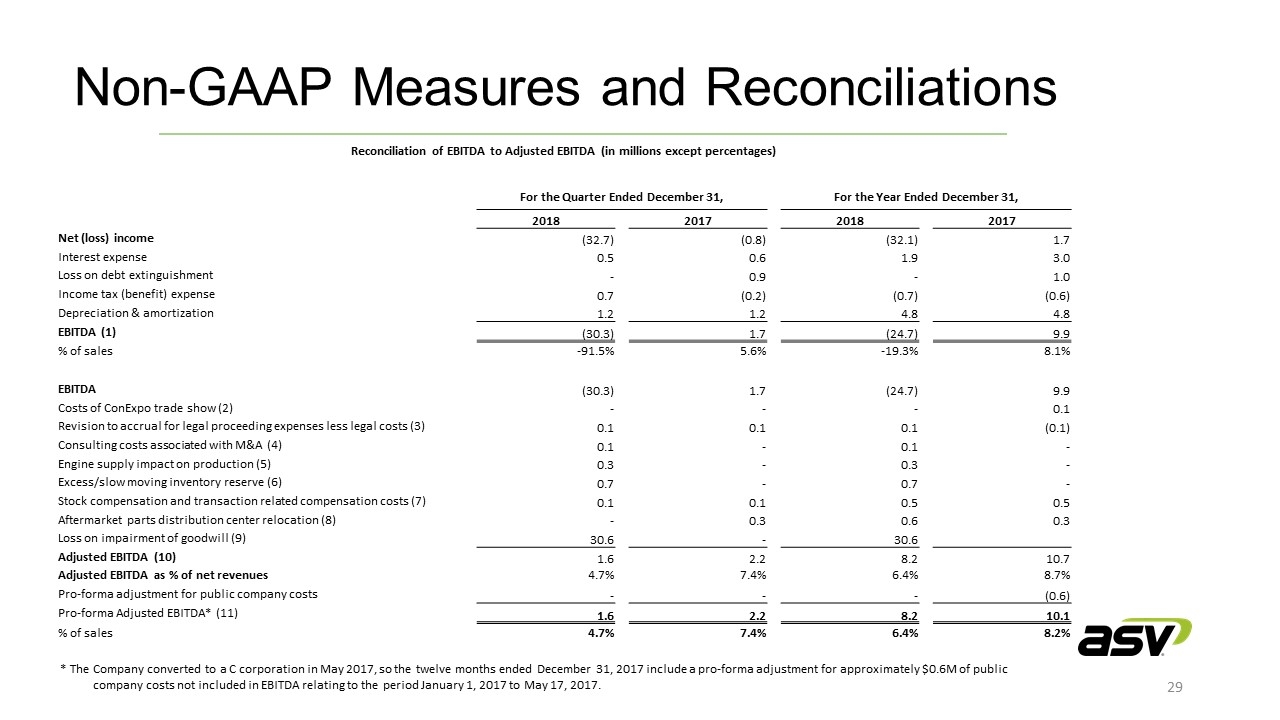

Non-GAAP Measures and Reconciliations * The Company converted to a C corporation in May 2017, so the twelve months ended December 31, 2017 include a pro-forma adjustment for approximately $0.6M of public company costs not included in EBITDA relating to the period January 1, 2017 to May 17, 2017. Reconciliation of EBITDA to Adjusted EBITDA (in millions except percentages) For the Quarter Ended December 31, For the Year Ended December 31, 2018 2017 2018 2017 Net (loss) income (32.7) (0.8) (32.1) 1.7 Interest expense 0.5 0.6 1.9 3.0 Loss on debt extinguishment - 0.9 - 1.0 Income tax (benefit) expense 0.7 (0.2) (0.7) (0.6) Depreciation & amortization 1.2 1.2 4.8 4.8 EBITDA (1) (30.3) 1.7 (24.7) 9.9 % of sales -91.5% 5.6% -19.3% 8.1% EBITDA (30.3) 1.7 (24.7) 9.9 Costs of ConExpo trade show (2) - - - 0.1 Revision to accrual for legal proceeding expenses less legal costs (3) 0.1 0.1 0.1 (0.1) Consulting costs associated with M&A (4) 0.1 - 0.1 - Engine supply impact on production (5) 0.3 - 0.3 - Excess/slow moving inventory reserve (6) 0.7 - 0.7 - Stock compensation and transaction related compensation costs (7) 0.1 0.1 0.5 0.5 Aftermarket parts distribution center relocation (8) - 0.3 0.6 0.3 Loss on impairment of goodwill (9) 30.6 - 30.6 Adjusted EBITDA (10) 1.6 2.2 8.2 10.7 Adjusted EBITDA as % of net revenues 4.7% 7.4% 6.4% 8.7% Pro-forma adjustment for public company costs - - - (0.6) Pro-forma Adjusted EBITDA* (11) 1.6 2.2 8.2 10.1 % of sales 4.7% 7.4% 6.4% 8.2%

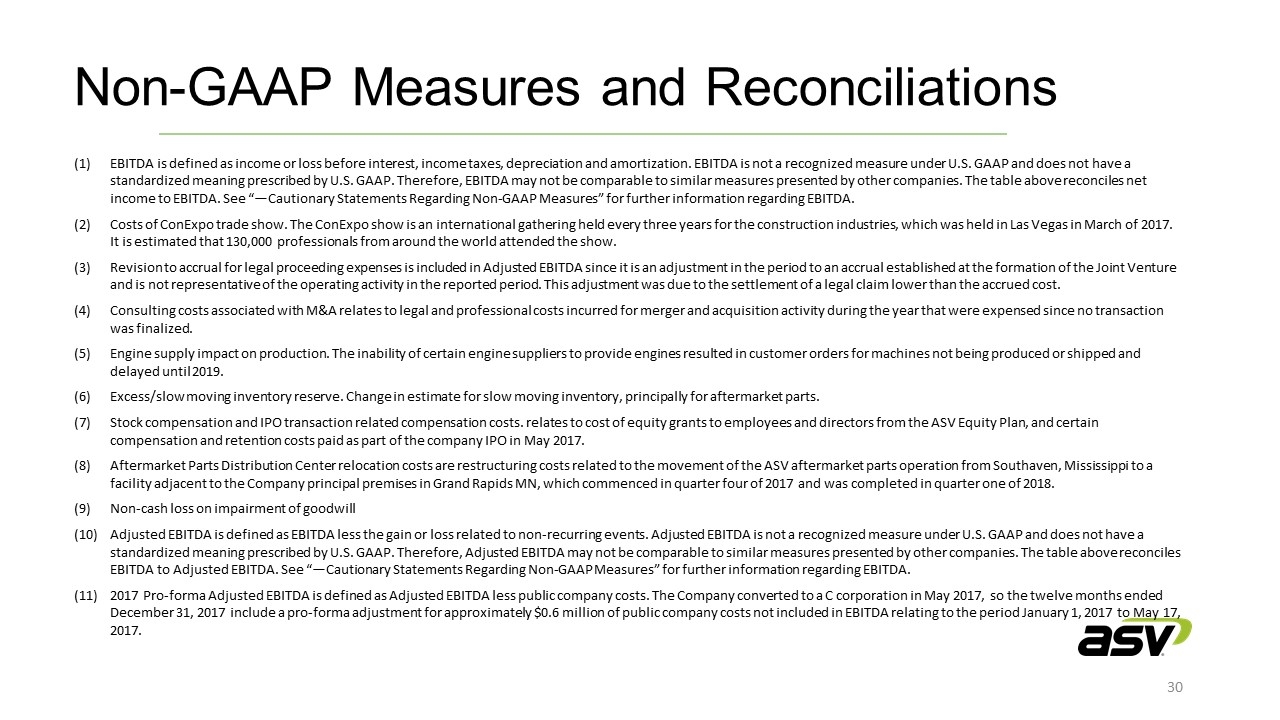

Non-GAAP Measures and Reconciliations EBITDA is defined as income or loss before interest, income taxes, depreciation and amortization. EBITDA is not a recognized measure under U.S. GAAP and does not have a standardized meaning prescribed by U.S. GAAP. Therefore, EBITDA may not be comparable to similar measures presented by other companies. The table above reconciles net income to EBITDA. See “—Cautionary Statements Regarding Non-GAAP Measures” for further information regarding EBITDA. Costs of ConExpo trade show. The ConExpo show is an international gathering held every three years for the construction industries, which was held in Las Vegas in March of 2017. It is estimated that 130,000 professionals from around the world attended the show. Revision to accrual for legal proceeding expenses is included in Adjusted EBITDA since it is an adjustment in the period to an accrual established at the formation of the Joint Venture and is not representative of the operating activity in the reported period. This adjustment was due to the settlement of a legal claim lower than the accrued cost. Consulting costs associated with M&A relates to legal and professional costs incurred for merger and acquisition activity during the year that were expensed since no transaction was finalized. Engine supply impact on production. The inability of certain engine suppliers to provide engines resulted in customer orders for machines not being produced or shipped and delayed until 2019. Excess/slow moving inventory reserve. Change in estimate for slow moving inventory, principally for aftermarket parts. Stock compensation and IPO transaction related compensation costs. relates to cost of equity grants to employees and directors from the ASV Equity Plan, and certain compensation and retention costs paid as part of the company IPO in May 2017. Aftermarket Parts Distribution Center relocation costs are restructuring costs related to the movement of the ASV aftermarket parts operation from Southaven, Mississippi to a facility adjacent to the Company principal premises in Grand Rapids MN, which commenced in quarter four of 2017 and was completed in quarter one of 2018. Non-cash loss on impairment of goodwill Adjusted EBITDA is defined as EBITDA less the gain or loss related to non-recurring events. Adjusted EBITDA is not a recognized measure under U.S. GAAP and does not have a standardized meaning prescribed by U.S. GAAP. Therefore, Adjusted EBITDA may not be comparable to similar measures presented by other companies. The table above reconciles EBITDA to Adjusted EBITDA. See “—Cautionary Statements Regarding Non-GAAP Measures” for further information regarding EBITDA. 2017 Pro-forma Adjusted EBITDA is defined as Adjusted EBITDA less public company costs. The Company converted to a C corporation in May 2017, so the twelve months ended December 31, 2017 include a pro-forma adjustment for approximately $0.6 million of public company costs not included in EBITDA relating to the period January 1, 2017 to May 17, 2017.

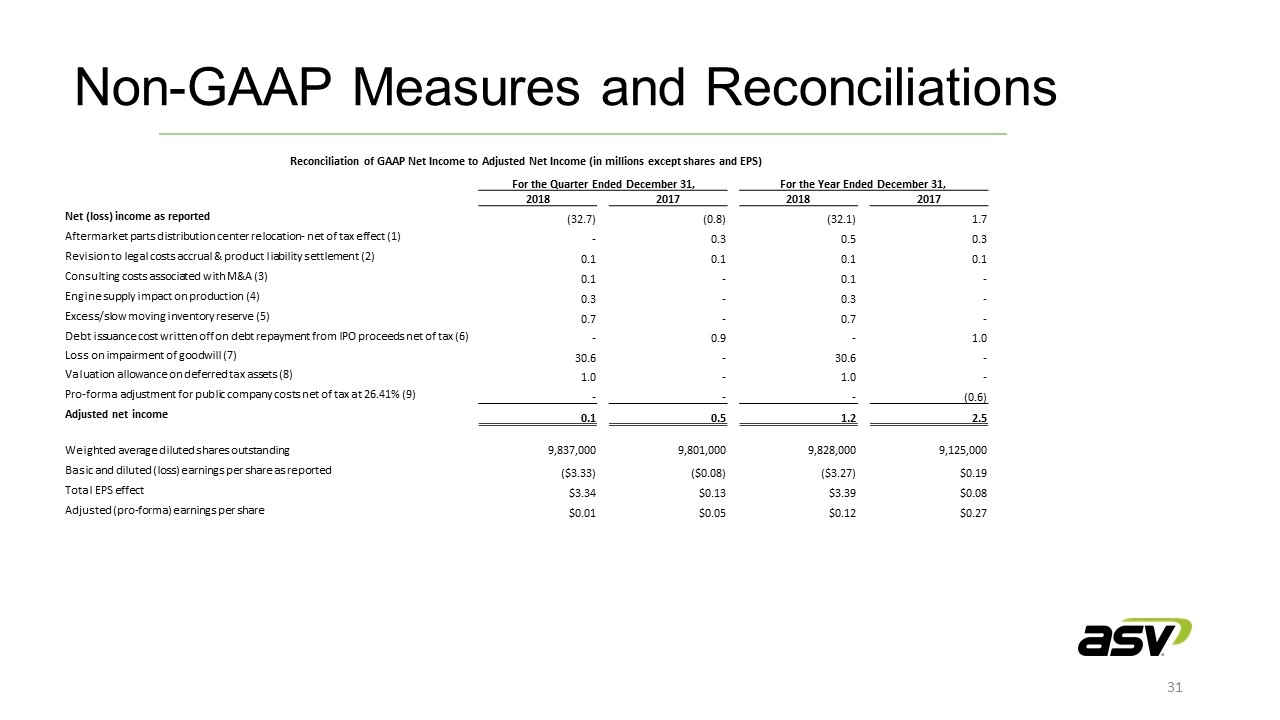

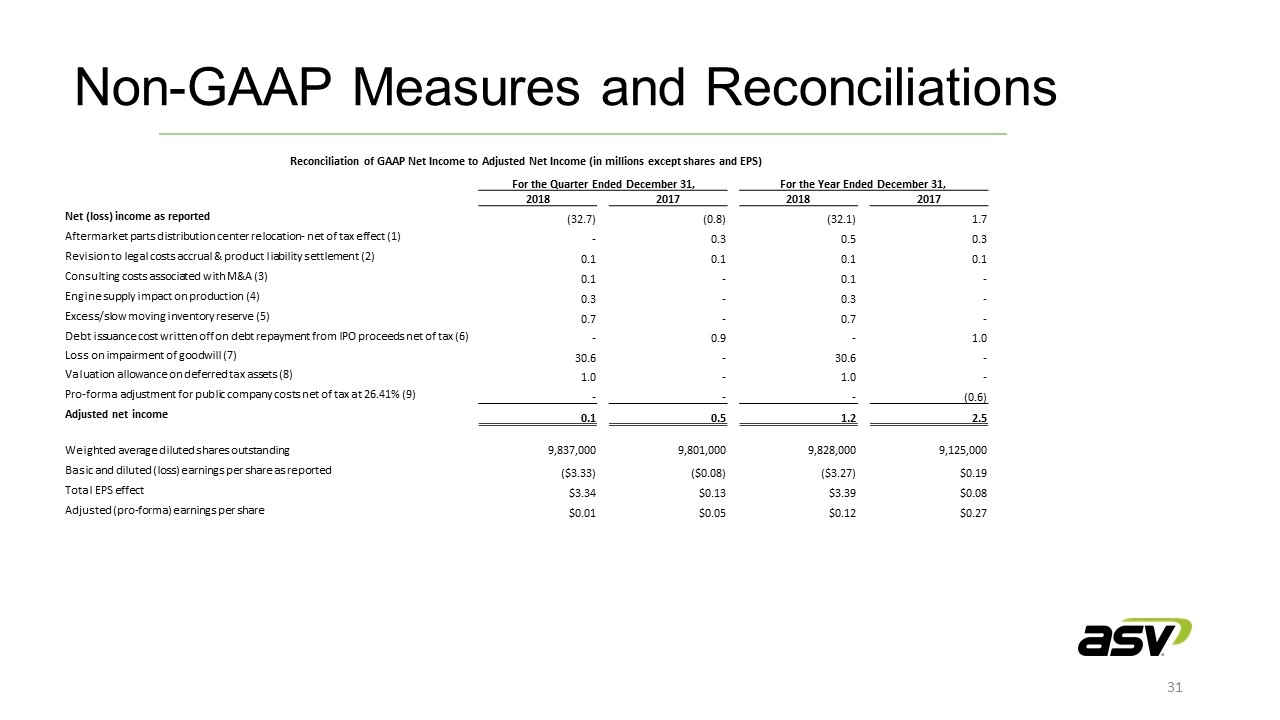

Non-GAAP Measures and Reconciliations Reconciliation of GAAP Net Income to Adjusted Net Income (in millions except shares and EPS) For the Quarter Ended December 31, For the Year Ended December 31, 2018 2017 2018 2017 Net (loss) income as reported (32.7) (0.8) (32.1) 1.7 Aftermarket parts distribution center relocation- net of tax effect (1) - 0.3 0.5 0.3 Revision to legal costs accrual & product liability settlement (2) 0.1 0.1 0.1 0.1 Consulting costs associated with M&A (3) 0.1 - 0.1 - Engine supply impact on production (4) 0.3 - 0.3 - Excess/slow moving inventory reserve (5) 0.7 - 0.7 - Debt issuance cost written off on debt repayment from IPO proceeds net of tax (6) - 0.9 - 1.0 Loss on impairment of goodwill (7) 30.6 - 30.6 - Valuation allowance on deferred tax assets (8) 1.0 - 1.0 - Pro-forma adjustment for public company costs net of tax at 26.41% (9) - - - (0.6) Adjusted net income 0.1 0.5 1.2 2.5 Weighted average diluted shares outstanding 9,837,000 9,801,000 9,828,000 9,125,000 Basic and diluted (loss) earnings per share as reported ($3.33) ($0.08) ($3.27) $0.19 Total EPS effect $3.34 $0.13 $3.39 $0.08 Adjusted (pro-forma) earnings per share $0.01 $0.05 $0.12 $0.27

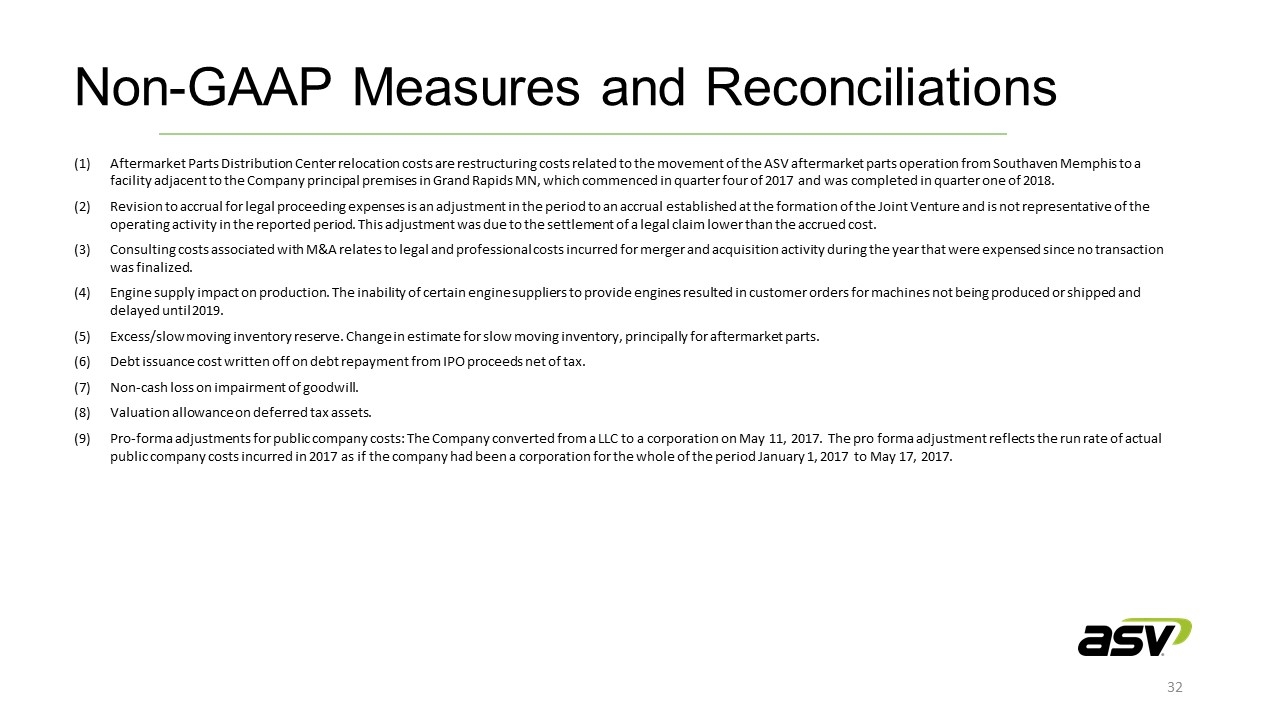

Non-GAAP Measures and Reconciliations Aftermarket Parts Distribution Center relocation costs are restructuring costs related to the movement of the ASV aftermarket parts operation from Southaven Memphis to a facility adjacent to the Company principal premises in Grand Rapids MN, which commenced in quarter four of 2017 and was completed in quarter one of 2018. Revision to accrual for legal proceeding expenses is an adjustment in the period to an accrual established at the formation of the Joint Venture and is not representative of the operating activity in the reported period. This adjustment was due to the settlement of a legal claim lower than the accrued cost. Consulting costs associated with M&A relates to legal and professional costs incurred for merger and acquisition activity during the year that were expensed since no transaction was finalized. Engine supply impact on production. The inability of certain engine suppliers to provide engines resulted in customer orders for machines not being produced or shipped and delayed until 2019. Excess/slow moving inventory reserve. Change in estimate for slow moving inventory, principally for aftermarket parts. Debt issuance cost written off on debt repayment from IPO proceeds net of tax. Non-cash loss on impairment of goodwill. Valuation allowance on deferred tax assets. Pro-forma adjustments for public company costs: The Company converted from a LLC to a corporation on May 11, 2017. The pro forma adjustment reflects the run rate of actual public company costs incurred in 2017 as if the company had been a corporation for the whole of the period January 1, 2017 to May 17, 2017.

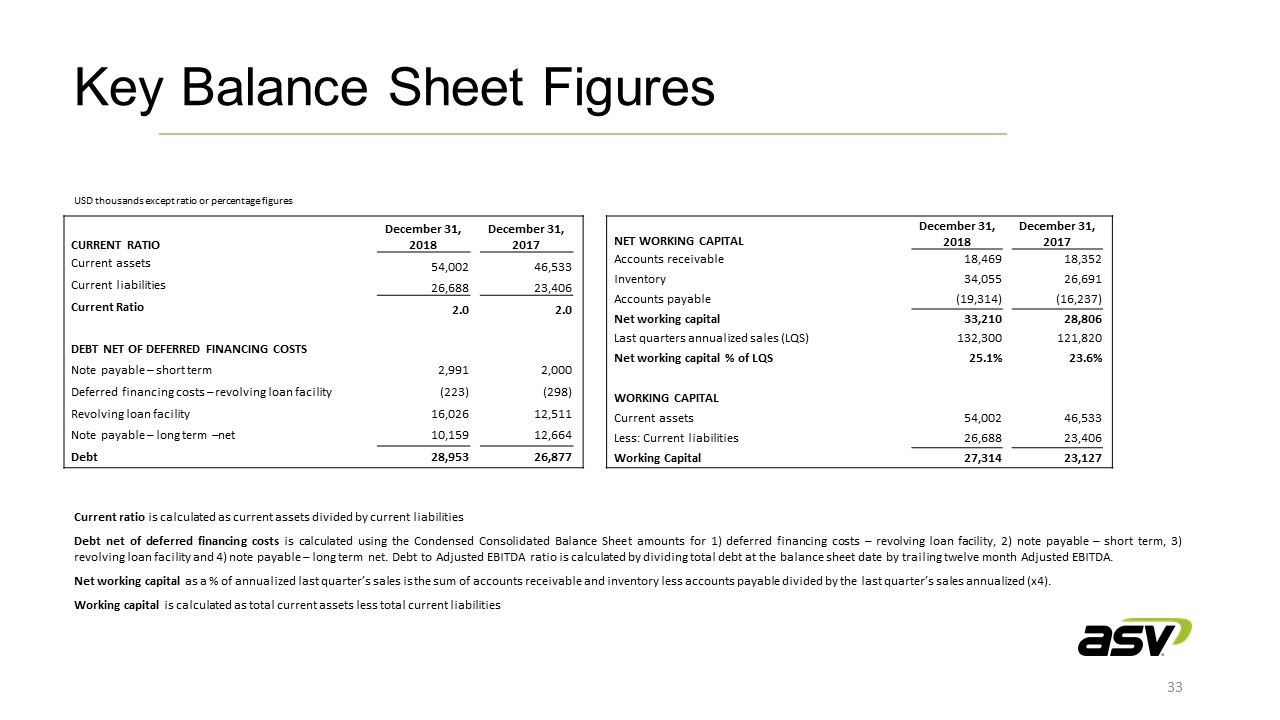

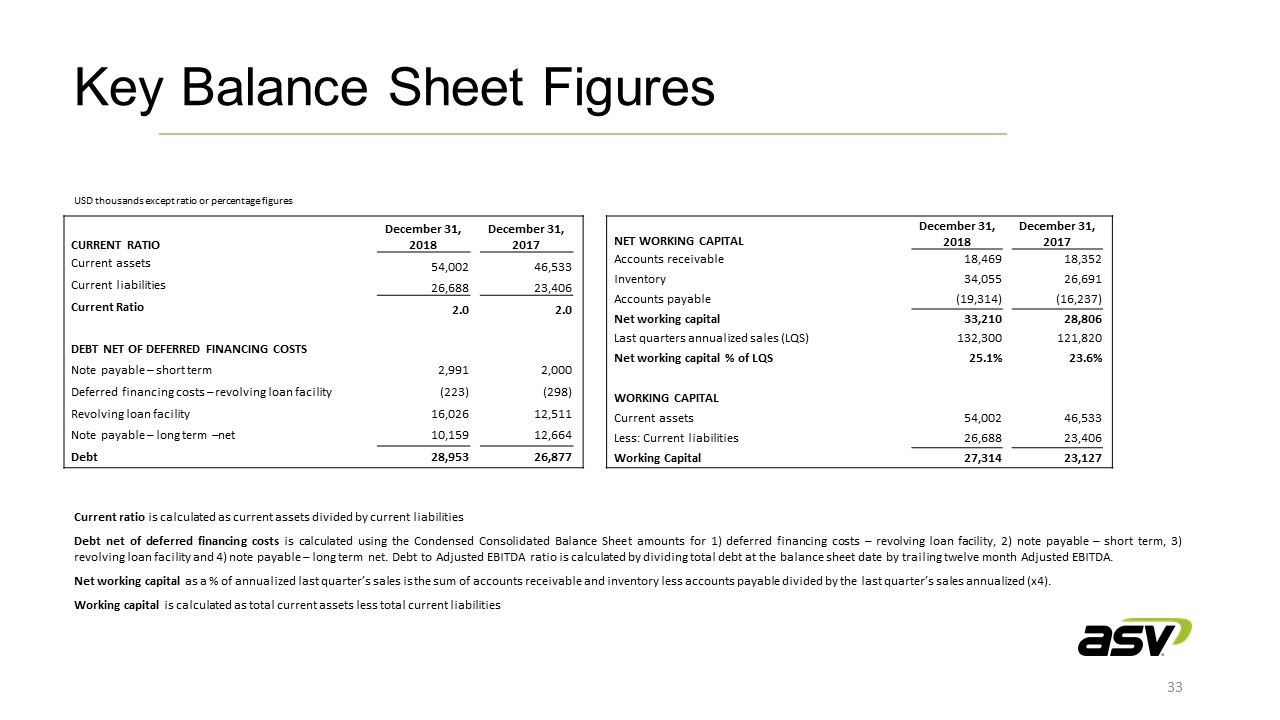

Key Balance Sheet Figures CURRENT RATIO December 31, 2018 December 31, 2017 Current assets 54,002 46,533 Current liabilities 26,688 23,406 Current Ratio 2.0 2.0 DEBT NET OF DEFERRED FINANCING COSTS Note payable – short term 2,991 2,000 Deferred financing costs – revolving loan facility (223) (298) Revolving loan facility 16,026 12,511 Note payable – long term –net 10,159 12,664 Debt 28,953 26,877 Current ratio is calculated as current assets divided by current liabilities Debt net of deferred financing costs is calculated using the Condensed Consolidated Balance Sheet amounts for 1) deferred financing costs – revolving loan facility, 2) note payable – short term, 3) revolving loan facility and 4) note payable – long term net. Debt to Adjusted EBITDA ratio is calculated by dividing total debt at the balance sheet date by trailing twelve month Adjusted EBITDA. Net working capital as a % of annualized last quarter’s sales is the sum of accounts receivable and inventory less accounts payable divided by the last quarter’s sales annualized (x4). Working capital is calculated as total current assets less total current liabilities NET WORKING CAPITAL December 31, 2018 December 31, 2017 Accounts receivable 18,469 18,352 Inventory 34,055 26,691 Accounts payable (19,314) (16,237) Net working capital 33,210 28,806 Last quarters annualized sales (LQS) 132,300 121,820 Net working capital % of LQS 25.1% 23.6% WORKING CAPITAL Current assets 54,002 46,533 Less: Current liabilities 26,688 23,406 Working Capital 27,314 23,127 USD thousands except ratio or percentage figures

ASV Holdings, Inc. (Nasdaq:ASV) Contact: At Darrow Associates, Inc. Peter Seltzberg, IR for ASV 1-516-419-9915 At ASV Holdings, Inc. Andrew Rooke, Chairman & C.E.O. 1-218-327-5389 April 2019