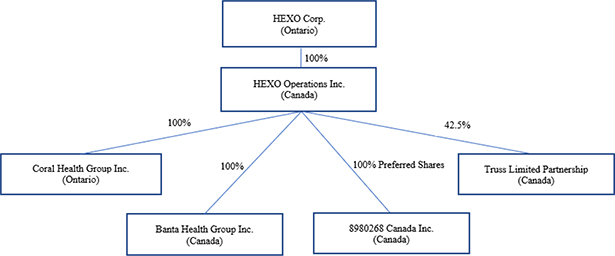

cannabis. The MMPR were replaced by the ACMPR in August 2016. HEXO’s current licence under the ACMPR was most recently renewed on June 21, 2017 and will be up for renewal on October 15, 2019. The Company’s licence is issued by Health Canada to HEXO (formerly Hydropothecaire/Hydropothecary), the operating name of the business run by HEXO Operations Inc.

The Company’s licence designates it as a licensed producer and permits the production, sale, possession, shipping, transportation, delivery and destruction of fresh cannabis, dried cannabis, cannabis plants, cannabis seeds, cannabis oil and cannabis resin, all as set out therein, delivered pursuant to the ACMPR and CDSA. The licence covers Buildings 1, 2, 3, 4, 5, 6, 7 and 8 at the Company’s facilities as described below and authorizes unlimited production of cannabis.

HEXO’s licence has a current term ending on October 15, 2019. At the end of each term of the licence, HEXO must submit an application for renewal to Health Canada containing information prescribed by the ACMPR. HEXO is not currently aware of any reason why it would not be able to receive a renewal of its licence in October 2019.

Private Placement and Conversion of Unsecured 8% Convertible Debentures

On July 18, 2017, the Company closed a bought deal private placement of unsecured convertible debenture units for aggregate gross proceeds of $25.1 million (the “July 2017 Private Placement”). Under the placement, the Company issued a total of $25.1 million of 8.0% senior unsecured convertible debentures (the “July 2017 Debentures”) and 7,856,300 common share purchase warrants (the “July 2017 Warrants”).

Effective December 27, 2017, the Company forced the conversion of all of the outstanding principal amount of the July 2017 Debentures and unpaid accrued interest thereon into Common Shares. The Company became entitled to force the conversion of the July 2017 Debentures on November 19, 2017 on the basis that the volume weighted average price (“VWAP”) of the Common Shares on the TSXV for 15 consecutive trading days was equal to or exceeded $2.25.

Pursuant to the conversion of the July 2017 Debentures, holders of the July 2017 Debentures received 625 Common Shares for each $1,000 principal amount of July 2017 Debentures held, as well as an additional 22 Common Shares for each $1,000 principal amount of July 2017 Debentures held on account of accrued and unpaid interest, for a total of 647 Common Shares for each $1,000 principal amount of July 2017 Debentures held.

Effective January 2, 2018, the Company accelerated the expiry date of the July 2017 Warrants from July 18, 2019 to February 1, 2018. The Company became entitled to accelerate the expiry date of the warrants on December 27, 2017 on the basis that the closing trading price of the Common Shares on the TSXV exceeded $3.00 for 15 consecutive trading days.

Public Offering and Conversion of 7.0% Unsecured Debenture Units

On November 24, 2017, the Company closed a bought deal public offering of 7.0% unsecured convertible debenture units for aggregate gross proceeds of $69.0 million (the “November 2017 Offering”). Under the offering, the Company issued a total of $69.0 million of 7.0% unsecured convertible debentures (the “November 2017 Debentures”) and 15,663,000 common share purchase warrants (the “November 2017 Warrants”).

Effective January 15, 2018, the Company forced the conversion of all of the outstanding principal amount of the November 2017 Debentures and unpaid accrued interest thereon into Common Shares. The Company became entitled to force the conversion of the November 2017 Debentures on December 13, 2017 on the basis that the VWAP of the Common Shares on the TSXV for 10 consecutive trading days was equal to or exceeded $3.15.

Pursuant to the conversion of the November 2017 Debentures, holders of the November 2017 Debentures received 454.54 Common Shares for each $1,000 principal amount of 7.0% Debentures held, as well as an additional 1.33 Common Shares for each $1,000 principal amount of November 2017 Debentures held on account of accrued and unpaid interest, for a total of 455.87 Common Shares for each $1,000 principal amount of November 2017 Debentures held.

7

HEXO –Adult-Use

HEXO –Adult-Use Hydropothecary – Medical

Hydropothecary – Medical