Operating Activities

Net cash used in operating activities for the twelve months ended July 31, 2019 was $124,706 as a result of the total net loss for the period ended of $69,608, and a decrease innon-cash working capital of $71,767, as well as netnon-cash expenses of $16,669. In the same prior year period, cash used in operating activities was ($22,185), reflecting the net loss of ($23,350), netnon-cash expenses add back of $8,378, and a decrease in working capital of ($7,213). The change in cash flow reflects ($38,856) of an unrealized change in the fair value of biological assets. Increases to inventory and biological assets of ($53,640) and an increase to trade receivables of ($17,845). These increases to operating cashflows were offset by the stock-based compensation add back of $28,944. Operating activities reflect the general increased size and scale of the Company’s operations when compared to the same fiscal period of the fiscal year 2018, as well as the additional operations obtained through the acquisition of Newstrike.

Financing Activities

Net cash received from financing activities for the fiscal year ended July 31, 2019 was $146,877. On January 30, 2019, the Company closed the marketed equity financing in which a total of 8,855,000 common shares were issued for net proceeds of $53,731. The additional cash generated from the exercised warrants in the amount of $56,075 and exercised stock options of $4,293 incurred during the period. The warrant activity was significantly higher in the fourth quarter due to all time high market prices. The Company’s term loan forming part of its syndicated credit facility contributed net $32,778.

Investing Activities

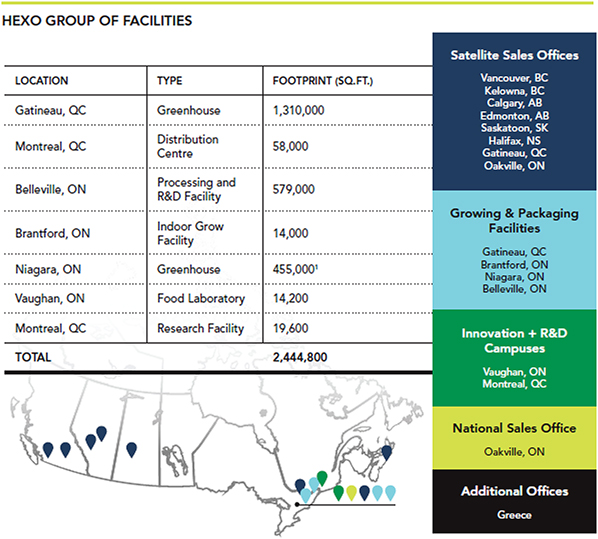

For the twelve months ended July 31, 2019, $7,645 was used for investing activities. The Company gained net cash of $49,366 through its business acquisition. Contributing to the increase is cash was the transfer of short-term investments of $119,810 and its reinvestment into high interest generating vehicles. This is offset by the cash consideration and capitalized transaction costs of ($13,427) of the investment in associate and joint ventures. During the period, we continued additions of ($138,034) to our property, plant and equipment as scalability increases as the new 1 million sq. ft. greenhouse was completed and significant leasehold improvements continue to be made at the Belleville facility. Cash in the amount of ($22,350) was restricted for the purposes of satisfying supply and debt service agreements or held in escrow.

Capital Resources

As at July 31, 2019, working capital totaled $261,868. The exercise of all the issued and outstanding warrants, as at July 31, 2019, would result in an increase in cash of approximately $225,394, and the exercise of all stock options would increase cash by approximately $142,491. During the quarter, the Company realized an increase in cash of $39,932 due to the exercise of 7,130,782 January 2018 warrants which contribute $5.60 per warrant. An additional $3,386 was generated due to the exercise of 2,122,689 options during the quarter end.

On October 23, 2019, the Company announced it has entered into subscription agreements with a group of investors pursuant to which the investors have agreed to purchase, on a private placement basis, $70 million principal amount of 8.0% unsecured debentures of the Company (the “Debentures”).

The Debentures will bear interest from the date of closing at 8.0% per annum payable quarterly and will mature on the date which is three years from issuance. Following the date, which is one year from issuance, the Debentures will be convertible at the option of the holder into common shares of the Company at any time prior to maturity at a conversion price of $3.16 per share, subject to adjustment in certain events.

Beginning on the date which is one year from issuance, the Company may force the conversion of all of the principal amount of the then outstanding Debentures at the Conversion Price on not less than 30 days’ notice should the daily volume weighted average trading price of the common shares of the Company be greater than $7.50 for any 15 consecutive trading days.

The Debentures and any common shares of the Company issuable upon conversion thereof will be subject to a statutory hold period lasting four months and one day following the closing date.

The Company intends to use the net proceeds of the private placement for working capital and general corporate purposes.

Closing of the Offering is occurred on or about December 5, 2019. The private placement is subject to certain conditions including, but not limited to, the receipt of all necessary regulatory and stock exchange approvals, including the approvals of the Toronto Stock Exchange and the New York Stock Exchange.

On February 15, 2019, the Company entered into a syndicated credit facility with Canadian chartered banks for a total of $65,000. This access to capital will provide the Company with additional capital to fund future growth and expansion as well as its strategic initiates without the dilution of current and future shareholders.

On January 30, 2019, the Company closed the marketed public offering which generated gross proceeds of $57,500 for the issuance of 8,855,000 common shares at a price of $6.50 per share. The Company intends to use the net proceeds from the offering to fund general corporate operations, global growth initiatives and research and development activity to further advance the Company’s innovation strategies.

| | | | |

| 29 | | MANAGEMENT’S DISCUSSION & ANALYSIS | | |