UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MGM Growth Properties Operating Partnership LP

(Exact name of Registrant as specified in its charter)

| Delaware | 6798 | 81-1162318 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification No.) |

MGP Finance Co-Issuer, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware | 6798 | 81-2122880 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification No.) |

1980 Festival Plaza Drive, Suite #750

Las Vegas, NV 89135

(702)

669-1480

See Table of Additional Registrants Below

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Andrew Hagopian III, Esq.

Secretary

MGM Resorts International

6285 S. Rainbow Blvd., Suite 500

Las Vegas, Nevada 89118

(702)

693-7120

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Rod Miller, Esq.

Milbank LLP

55 Hudson Yards

New York, New York 10001

(212)

530-5000

Approximate date of commencement of proposed sale to public:

As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” inRule 12b-2

of the Exchange Act.MGM Growth Properties Operating Partnership LP | ||||||

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

MGP Finance Co-Issuer, Inc. | ||||||

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act

Rule 13e-4(i)

(Cross-Border Issuer Tender Offer) ☐Exchange Act

Rule 14d-1(d)

(Cross-Border Third-Party Tender Offer) ☐CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per unit | Proposed maximum aggregate offering price (1) | Amount of registration fee (2) | ||||

5.750% Senior Notes Due 2027 | $750,000,000 | 100% | $750,000,000 (1) | $97,350 | ||||

Guarantees of the 5.750% Senior Notes Due 2027 (3) | $750,000,000 | N/A | N/A | N/A (4) | ||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(f) of the Securities Act of 1933. |

| (2) | The registration fee has been calculated pursuant to Rule 457(f) under the Securities Act of 1933. |

| (3) | The entities listed on the Table of Subsidiary Guarantor Registrants below have guaranteed the notes being registered hereby. |

| (4) | No separate consideration will be received for the guarantees, and pursuant to Rule 457(n) under the Securities Act, no additional registration fee is due for guarantees. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the SEC, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

Exact Name of Registrant as Specified in Its Charter* | State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification Number | ||||

MGP Lessor Holdings, LLC | Delaware | 81-1170711 | ||||

MGP Lessor, LLC | Delaware | 81-1171355 | ||||

| * | Each additional registrant is a direct or indirect subsidiary of MGM Growth Properties Operating Partnership LP. The address, including zip code, and telephone number, including area code, of each registrant’s principal executive offices is c/o MGM Growth Properties Operating Partnership LP, 1980 Festival Plaza Drive, Suite #750, Las Vegas, NV 89135, telephone (702) 669-1480. The name, address, and telephone number of the agent for service for each additional registrant is Andrew Hagopian III, Secretary, MGM Resorts International, 6385 S. Rainbow Blvd., Suite 500, Las Vegas, Nevada 89118, telephone (702)693-7120. |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER

22

, 2019

PROSPECTUS

$750,000,000

MGM Growth Properties Operating Partnership LP

and

MGP Finance

Co-Issuer,

Inc.OFFER TO EXCHANGE

$750,000,000 aggregate principal amount of 5.750% Senior Notes due 2027 for $750,000,000 aggregate principal amount of 5.750% Senior Notes due 2027 that have been registered

under the Securities Act of 1933, as amended

MGM Growth Properties Operating Partnership LP, a Delaware limited partnership, and MGP Finance

Co-Issuer,

Inc., a Delaware corporation (together, the “Issuers”, “we” or “us”) are offering to exchange, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal $750,000,000 of their outstanding 5.750% Senior Notes due 2027, which were issued on January 25, 2019 (the “initial notes”), for a like aggregate amount of the Issuers’ registered 5.750% Senior Notes due 2027 (the “exchange notes”). The exchange notes will be issued under the indenture dated as of January 25, 2019 (the “Indenture”).Terms of the exchange offer

| • | It will expire at 5:00 p.m., New York City time, on , 2019, unless we extend it. |

| • | If all the conditions to this exchange offer are satisfied, the Issuers will exchange all of the initial notes that are validly tendered and not withdrawn for the applicable exchange notes. |

| • | You may withdraw your tender of initial notes at any time before the expiration of this exchange offer. |

| • | The exchange notes that the Issuers will issue you in exchange for your initial notes will be substantially identical to your initial notes except that, unlike your initial notes, the exchange notes will have no transfer restrictions or registration rights or rights to additional interest under circumstances relating to our registration obligations. |

| • | The exchange notes that the Issuers will issue you in exchange for your initial notes are new securities with no established market for trading. |

| • | We do not intend to list the exchange notes on any securities exchange or seek approval for quotation through any automated quotation system. |

| • | We will not receive any proceeds from the exchange offer. |

Before participating in this exchange offer, please refer to the section in this prospectus entitled “Risk Factors” commencing on page 21.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

None of the Nevada Gaming Commission, the Nevada State Gaming Control Board, the Michigan Gaming Control Board, the Mississippi Gaming Commission, the New Jersey Casino Control Commission, the New Jersey Division of Gaming Enforcement, the Maryland Lottery and Gaming Control Commission, the Ohio Lottery Commission, the Ohio State Racing Commission, the New York State Gaming Commission, nor any other gaming authority has passed upon the accuracy or adequacy of this prospectus or the investment merits of the securities offered. Any representation to the contrary is unlawful. The Attorney General of the State of New York has not passed upon or endorsed the merits of this offering. Any representation to the contrary is unlawful.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of those exchange notes. The letter of transmittal states that, by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”). This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for unregistered notes where those unregistered notes were acquired as a result of market-making activities or other trading activities. To the extent any such broker-dealer participates in the exchange offer, we have agreed that for a period of up to 180 days we will make this prospectus, as amended or supplemented, available to such broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

The date of this prospectus is , 2019.

| Page | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 7 | ||||

| 19 | ||||

| 21 | ||||

| 27 | ||||

| 28 | ||||

| 37 | ||||

| 39 | ||||

| 102 | ||||

| 103 | ||||

| 103 | ||||

| 103 | ||||

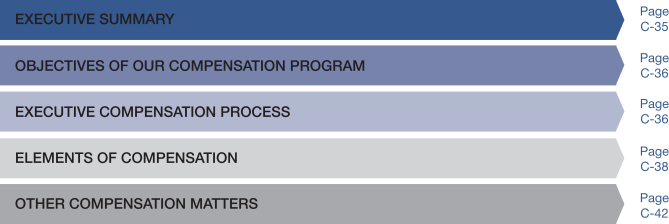

ANNEX A—COMBINED ANNUAL REPORT ON FORM 10-K OF MGM GROWTH PROPERTIES LLC AND MGM GROWTH PROPERTIES OPERATING PARTNERSHIP LP FOR THE YEAR ENDED DECEMBER 31, 2018 (excluding Item 6, Item 7 and the financial statements and financial statement schedule included in Item 8, which have been amended by the Combined Current Report on Form 8-K of MGM Growth Properties LLC and MGM Growth Properties Operating Partnership LP, dated as of August 16, 2019, and included in Annex D attached hereto) | A-1 | |||

| B-1 | ||||

| C-1 | ||||

| D-1 | ||||

Except as otherwise indicated or unless the context otherwise requires, all references in this prospectus to (i) “we,” “our,” “us,” “ourselves” and “Issuers” refer to (a) MGP Finance

Co-Issuer,

Inc. (the“Co-Issuer”)

and (b) MGM Growth Properties Operating Partnership LP (the “Operating Partnership”) and, unless the context requires otherwise, their consolidated subsidiaries, (ii) “the Company” and “our company” refer to the Operating Partnership, and unless the context requires otherwise, its consolidated subsidiaries, (iii) “MGP” refers to MGM Growth Properties LLC, a Delaware limited liability company, and unless the context requires otherwise, its consolidated subsidiaries (which will include the Operating Partnership so long as MGP, or a subsidiary of MGP, is the general partner of the Operating Partnership) and (iv) “MGM” refers to MGM Resorts International, a Delaware corporation, and, unless the context requires otherwise, its consolidated subsidiaries, including MGP.Unless otherwise indicated, the information contained in this prospectus and the related annexes is as of the date set forth on the cover of this prospectus.

Some of the statements in this prospectus and the related annexes constitute forward-looking statements. See “Forward-Looking Statements.”

1

This prospectus is part of a registration statement we filed with the U.S. Securities and Exchange Commission (the “SEC”). Copies of: (i) our and MGP’s Combined Annual Report on

Form 10-K

for the year ended December 31, 2018 (excluding Item 6, Item 7 and the financial statements and financial statement schedule included in Item 8, which have been amended by the Combined Current Report on Form 8-K of MGM Growth Properties LLC and MGM Growth Properties Operating Partnership LP, dated as of August 16, 2019 and included in Annex D attached hereto) (the “2018 10-K”), (ii) our and MGP’s Combined Quarterly Report for the period ended September 30, 2019, (iii) MGP’s Proxy Statement for the 2018 Annual Meeting of Stockholders and (iv) each of our and MGP’s Combined Current Reports on Form8-K,

dated as of January 22, 2019, January 25, 2019, January 28, 2019, January 29, 2019, March 7, 2019, April 1, 2019, April 30, 2019, June 17, 2019, August 16, 2019 (such Current Report and its exhibits including retrospective adjustments made to the consolidated financial statements and certain related information included in the 2018 Form 10-K for discontinued operations related to the Northfield OpCo Transaction (as discussed therein)), November 19, 2019 and November 22, 2019, and filed with the SEC, are being incorporated into and delivered to you with this prospectus as Annex A, Annex B, Annex C and Annex D, respectively. We are submitting this prospectus to holders of outstanding initial notes so that they can consider exchanging their initial notes for exchange notes.You should rely only on the information contained in this prospectus and the annexes hereto, in any applicable prospectus supplement and in the accompanying transmittal documents. We have not authorized any other person to provide you with different information. The information contained in this prospectus and the related annexes attached hereto and any applicable prospectus supplement are accurate only as of the date such information is presented. Our business, financial condition, results of operations and prospects may have subsequently changed. You should not assume that the information contained in this prospectus and the annexes attached hereto, including the information, exhibits and notes included in the periodic reports and other filings with the SEC included in Annex A, Annex B, Annex C and Annex D are accurate as of any date other than their respective date. You should also read this prospectus together with the additional information described under the heading “Where You Can Find More Information.”

This prospectus may be supplemented from time to time to add, update or change information in this prospectus or the annexes. Any statement contained in this prospectus or the annexes will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus.

The registration statement containing this prospectus, including the exhibits to the registration statement, and the related annexes attached hereto, and any exhibits included in or referred to in such annexes, provide additional information about us and the securities offered under this prospectus. The registration statement, including such annexes and exhibits, can be read on the website of the SEC or at the offices of the SEC mentioned under the heading “Where You Can Find More Information.”

This prospectus is not an offer to sell or a solicitation of an offer to buy securities anywhere or to anyone where or to whom we are not permitted to offer or sell securities under applicable law. Each prospective purchaser of the exchange notes must comply with all applicable laws and regulations in force in any jurisdiction in which it purchases, offers or sells the notes or possesses or distributes this prospectus and must obtain any consent, approval or permission required by it for the purchase, offer or sale by it of the exchange notes under the laws and regulations in force in any jurisdiction to which it is subject or in which it makes such purchases, offers or sales, and we shall not have any responsibility therefor.

2

You may obtain copies of other documents filed with the SEC that are not included in or delivered with this prospectus, without charge, from the SEC’s web site at

http://www.sec.gov

. See “Where You Can Find Additional Information.” You may request a copy of any document included in this prospectus (including exhibits to those documents), at no cost by visiting our website athttp://www.mgmgrowthproperties.com

or by writing or calling us at the following address and telephone number:MGM Growth Properties Operating Partnership LP

1980 Festival Plaza Drive, Suite #750

Las Vegas, Nevada 89135

Attn: Corporate Legal (702)

669-1480

Information contained on our website is not intended to be incorporated by reference in this prospectus and you should not consider that information a part of this prospectus.

In order to obtain timely delivery, you must request the information no later than, 2019, which is five business days before the expiration date of the exchange offer.

Although we are responsible for all of the disclosures contained in this prospectus, this prospectus contains industry, market and competitive position data and estimates that are based on industry publications and studies conducted by third parties. The industry publications and third-party studies generally state that the information that they contain has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that the market position, market opportunity and market size information included in this prospectus is generally reliable, we have not independently verified such data. The industry forward-looking statements included in this prospectus may be materially different than our or the industry’s actual results.

3

This prospectus, our and MGP’s Combined Annual Report on

Form 10-K

for the year ended December 31, 2018, our and MGP’s Combined Quarterly Report for the period ended September 30, 2019 and any other documents attached as annexes hereto or incorporated by reference herein may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. In particular, statements pertaining to our capital resources and the amount and frequency of future distributions contain forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will,” “should,” “seeks,” “likely,” “intends,” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Examples of forward-looking statements include, but are not limited to, statements we make regarding the timing and amount of any future dividends and our ability to further grow our portfolio.Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors (which are presented from the perspective of MGP, which has operating control of the Issuers through its ownership interests), among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

| • | We are dependent on MGM (including its subsidiaries) unless and until we substantially diversify our portfolio, and an event that has a material adverse effect on MGM’s business, financial position or results of operations could have a material adverse effect on our business, financial position or results of operations. |

| • | We depend on our properties leased to MGM for substantially all of our anticipated cash flows. |

| • | We may not be able to re-lease our properties following the expiration or termination of the Master Lease. |

| • | MGP’s sole material assets are Operating Partnership units representing 32.3% of the ownership interests in the Operating Partnership, as of September 30, 2019, over which we have operating control through our ownership of its general partner. |

| • | The Master Lease restricts our ability to sell our properties. |

| • | We will have future capital needs and may not be able to obtain additional financing on acceptable terms. |

| • | Covenants in our debt agreements may limit our operational flexibility, and a covenant breach or default could materially adversely affect our business, financial position or results of operations. |

| • | Rising expenses could reduce cash flow and funds available for future acquisitions and distributions. |

| • | We are dependent on the gaming industry and may be susceptible to the risks associated with it, which could materially adversely affect our business, financial position or results of operations. |

| • | Because a significant number of our major gaming resorts are concentrated on the Las Vegas Strip, we are subject to greater risks than a company that is more geographically diversified. |

| • | Our pursuit of investments in, and acquisitions or development of, additional properties (including our rights of first offer with respect to MGM Springfield and with respect to any future gaming developments by MGM on the undeveloped land adjacent to Empire City (as defined herein)) may be unsuccessful or fail to meet our expectations. |

4

| • | We may face extensive regulation from gaming and other regulatory authorities, and our operating agreement provides that any of our shares held by investors who are found to be unsuitable by state gaming regulatory authorities are subject to redemption. |

| • | Required regulatory approvals can delay or prohibit future leases or transfers of our gaming properties, which could result in periods in which we are unable to receive rent for such properties. |

| • | Net leases may not result in fair market lease rates over time, which could negatively impact our income and reduce the amount of funds available to make distributions to shareholders. |

| • | Our dividend yield could be reduced if we were to sell any of our properties in the future. |

| • | There can be no assurance that we will be able to make distributions to our Operating Partnership unitholders and Class A shareholders or maintain our anticipated level of distributions over time. |

| • | An increase in market interest rates could increase our interest costs on existing and future debt and could adversely affect the price of our Class A shares. |

| • | We are controlled by MGM, whose interests in our business may conflict with ours or yours. |

| • | We are dependent on MGM for the provision of administration services to our operations and assets. |

| • | Our operating agreement contains provisions that reduce or eliminate duties (including fiduciary duties) of our directors, officers and others. |

| • | If MGM engages in the same type of business we conduct, our ability to successfully operate and expand our business may be hampered. |

| • | The Master Lease and other agreements governing our relationship with MGM were not negotiated on an arm’s-length basis and the terms of those agreements may be less favorable to us than they might otherwise have been in anarm’s-length transaction. |

| • | In the event of a bankruptcy of the Tenant (as defined below), a bankruptcy court may determine that the Master Lease is not a single lease but rather multiple severable leases, each of which can be assumed or rejected independently, in which case underperforming leases related to properties we own that are subject to the Master Lease could be rejected by the Tenant while tenant-favorable leases are allowed to remain in place. |

| • | MGM may undergo a change of control without the consent of us or of our shareholders. |

| • | If MGP fails to remain qualified to be taxed as a REIT, it will be subject to U.S. federal income tax as a regular corporation and could face a substantial tax liability, which would have an adverse effect on our business, financial condition and results of operations. |

| • | Legislative or other actions affecting REITs could have a negative effect on us. |

| • | The anticipated benefits of any future acquisitions may not be realized fully and may take longer to realize than expected. |

While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors of new information, data or methods, future events or other changes. For a further discussion of these and other factors that could impact our future results, performance or transactions, see the section entitled “Risk Factors” in this prospectus and in our 2018 Annual Report and our 2019 Third Quarter Quarterly Report that are included as Annex A and Annex B attached hereto, respectively.

Any forward-looking statement made by us in this prospectus or included or incorporated herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from

5

time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any

forward-looking

statement, whether as a result of new information, future developments or otherwise, except as may be required by law. If we update one or more forward-looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements.You should also be aware that while we from time to time communicate with securities analysts, we do not disclose to them any material

non-public

information, internal forecasts or other confidential business information. Therefore, you should not assume that we agree with any statement or report issued by any analyst, irrespective of the content of the statement or report. To the extent that reports issued by securities analysts contain projections, forecasts or opinions, those reports are not our responsibility and are not endorsed by us.6

This summary is not complete and may not contain all of the information that may be important to you. You should read the entire prospectus carefully, including the sections entitled “Risk Factors” together with the more detailed information and consolidated financial statements and the notes to those statements included or attached as an annex to this prospectus.

The Issuers

The Operating Partnership and

Co-Issuer

are subsidiaries of MGP.MGM Growth Properties LLC

MGP is one of the leading publicly traded REITs engaged in the acquisition, ownership and leasing of large-scale destination entertainment and leisure properties, whose tenants generally offer diverse amenities including casino gaming, hotel, convention, dining, entertainment and retail offerings.

MGP is a limited liability company that was formed in Delaware in October 2015. We conduct our operations through the Operating Partnership, a Delaware limited partnership formed in January 2016, which became a subsidiary of MGP in April 2016. We elected to be treated as a real estate investment trust (“REIT”) commencing with its taxable year ended December 31, 2016.

We generate all of our revenues by leasing our real estate properties through a wholly owned subsidiary of the Operating Partnership (the “Landlord”) to a subsidiary of MGM (the “Tenant”), which pursuant to the master lease agreement (the “Master Lease”), requires the Tenant to pay substantially all costs associated with each property, including real estate taxes, ground lease rent, insurance, utilities and routine maintenance, in addition to the base rent and the percentage rent, each as described below. The Master Lease has an initial lease term of ten years (other than with respect to MGM National Harbor, whose initial lease term ends on August 31, 2024 as described further in the accompanying financial statements) with the potential to extend the term for four additional five-year terms thereafter at the option of the Tenant. Base rent and percentage rent that are known at the lease commencement date are recorded on a straight-line basis over 30 years, which represents the initial

ten-year

non-cancelable

lease term and all four five-year renewal terms under the Master Lease, as we have determined such renewal terms to be reasonably assured.Additionally, we expect to grow our portfolio through acquisitions with third parties and with MGM. In pursuing external growth initiatives, we will generally seek to acquire properties that can generate stable rental revenue through long-term,

triple-net

leases with tenants with established operating histories, and we will consider various factors when evaluating acquisitions.As of September 30, 2019, our portfolio consisted of eleven premier destination resorts in Las Vegas and elsewhere across the United States, MGM Northfield Park in Northfield, Ohio, Empire Resort Casino in Yonkers, New York, as well as a retail and entertainment district, The Park in Las Vegas.

On January 29, 2019, we acquired the developed real property associated with the Empire City Casino’s race track and casino (“Empire City”) from MGM upon its acquisition of Empire City (“Empire City Transaction”). Empire City was added to the existing Master Lease between the Landlord and Tenant. As a result, the annual rent payment to MGP increased by $50 million. Consistent with the Master Lease terms, 90% of this rent is fixed and will contractually grow at 2% per year until 2022. In addition, pursuant to the Master Lease, MGP has a right of first offer with respect to certain undeveloped land adjacent to the property to the extent MGM develops additional gaming facilities and chooses to sell or transfer the property in the future.

7

On March 7, 2019, we completed the transaction relating to renovations undertaken by MGM regarding the Park MGM and NoMad Las Vegas property (the “Park MGM Transaction”) for total consideration of $637.5 million. We funded the transaction with $605.6 million in cash and the issuance of approximately 1.0 million of Operating Partnership units to a subsidiary of MGM. As a result of the transaction, we recorded a lease incentive asset and the annual rent payment to us increased by $50 million, prorated for the remainder of the lease year. Consistent with the Master Lease terms, 90% of this rent is fixed and will contractually grow at 2% per year until 2022.

On April 1, 2019, we transferred the membership interests of Northfield Park Associates, LLC, (“Northfield”), the entity that formerly owned the real estate assets and operations of the Hard Rock Rocksino Northfield Park, to a subsidiary of MGM and the Company retained the real estate assets. Our taxable REIT subsidiary (“TRS”) that owned Northfield liquidated immediately prior to the transfer. Subsequently, MGM rebranded the operations it acquired (“Northfield OpCo”) to MGM Northfield Park, which was then added to the existing Master Lease between the Landlord and Tenant. As a result, the annual rent payment to MGP increased by $60 million. Consistent with the Master Lease terms, 90% of this rent is fixed and will contractually grow at 2% per year until 2022. Northfield OpCo is presented as discontinued operations in our condensed consolidated statements of operations for all periods presented and the related operating assets and liabilities are presented as assets held for sale and liabilities related to assets held for sale in our condensed consolidated balance sheet as of December 31, 2018. See Annex D for the Form 8-K which reflects certain retrospective adjustments to the 2018 Form 10-K for discontinued operations associated with the Northfield OpCo Transaction.

Overview of the Master Lease

The Master Lease has an initial lease term of ten years beginning on April 25, 2016 (other than with respect to MGM National Harbor, whose initial lease term ends on August 31, 2024, as described further in the financial statements, which are included in the annexes to this prospectus supplement) with the potential to extend the term for four additional five-year terms thereafter at the option of the Tenant. The Master Lease provides that any extension of its term must apply to all of the properties under the Master Lease at the time of the extension. The Master Lease has a triple-net structure, which requires the Tenant to pay substantially all costs associated with each property, including real estate taxes, insurance, utilities and routine maintenance, in addition to the rent, ensuring that the cash flows associated with our Master Lease will remain relatively predictable for the duration of its term. Additionally, the Master Lease provides us with a right of first offer with respect to MGM Springfield, which we may exercise should MGM elect to sell the property in the future, and with respect to any future gaming development by MGM on the undeveloped land adjacent to Empire City.

Rent under the Master Lease consists of a “base rent” component (the “Base Rent”) and a “percentage rent” component (the “Percentage Rent”). The Base Rent represents approximately 90% of the annual rent amount under the Master Lease and the Percentage Rent represents approximately 10% of the annual rent amount under the Master Lease. The Base Rent includes a fixed annual rent escalator of 2.0% for the second through the sixth lease years (as defined in the Master Lease). Thereafter, the annual escalator of 2.0% will be subject to the Tenant and, without duplication, the MGM operating subsidiary sublessees of our Tenant (such sublessees, collectively, the “Operating Subtenants”), collectively meeting an adjusted net revenue to rent ratio of 6.25:1.00 based on their adjusted net revenue from the leased properties subject to the Master Lease (excluding net revenue attributable to certain scheduled subleases and, at the Tenant’s option, certain reimbursed costs). The Percentage Rent is a fixed amount for approximately the first six lease years and will then be adjusted every five years based on the average annual adjusted net revenues of our Tenant and, without duplication, the Operating Subtenants from the leased properties subject to the Master Lease at such time for the trailing five-calendar-year period (calculated by multiplying the average annual adjusted net revenues, excluding net revenue attributable to certain scheduled subleases and, at the Tenant’s option, certain reimbursed costs for the trailing five-calendar-year period by 1.4%). The Master Lease includes covenants that impose ongoing reporting obligations on the Tenant relating to MGM’s financial statements which, in conjunction with MGM’s public disclosures to the Securities

8

and Exchange Commission gives us insight into MGM’s financial condition on an ongoing basis. The Master

Lease also requires MGM, on a consolidated basis with the Tenant, to maintain an EBITDAR to rent ratio (as described in the Master Lease) of 1.10:1.00.

The annual rent payments under the Master Lease for the fourth lease year, which commenced on April 1, 2019, increased to $946.1 million from $770.3 million at the start of the third lease year. The increase was a result of the $50 million in additional rent for each of the Park MGM Transaction and Empire City Transaction in the beginning of 2019, the $60 million of additional rent for MGM Northfield Park, which entered the Master Lease on April 1, 2019, as well as the third 2.0% fixed annual rent escalator that went into effect on April 1, 2019.

Our Properties

The following table summarizes certain features of our properties, all as of December 31, 2018. Our properties are diversified across a range of primary uses, including gaming, hotel, convention, dining, entertainment, retail and other resort amenities and activities.

| Location | Hotel Rooms | Approximate Acres | Approximate Casino Square Footage (1) | Approximate Convention Square Footage | ||||||||||||||||

REIT Properties | ||||||||||||||||||||

Las Vegas Strip | ||||||||||||||||||||

Mandalay Bay | Las Vegas, NV | 4,750 | (2) | 124 | 152,000 | 2,121,000 | (3) | |||||||||||||

The Mirage | Las Vegas, NV | 3,044 | 77 | 94,000 | 170,000 | |||||||||||||||

New York—New York and The Park | Las Vegas, NV | 2,024 | 23 | 81,000 | 31,000 | |||||||||||||||

Luxor | Las Vegas, NV | 4,397 | 58 | 101,000 | 35,000 | |||||||||||||||

Park MGM | Las Vegas, NV | 2,898 | (4) | 21 | 66,000 | 77,000 | ||||||||||||||

Excalibur | Las Vegas, NV | 3,981 | 51 | 94,000 | 25,000 | |||||||||||||||

Subtotal | 21,094 | 354 | 588,000 | 2,459,000 | ||||||||||||||||

Regional | ||||||||||||||||||||

MGM Grand Detroit | Detroit, MI | 400 | 24 | 127,000 | 30,000 | |||||||||||||||

Beau Rivage | Biloxi, MS | 1,740 | 26 | (5) | 81,000 | 50,000 | ||||||||||||||

Gold Strike Tunica | Tunica, MS | 1,133 | 24 | 48,000 | 17,000 | |||||||||||||||

Borgata | Atlantic City, NJ | 2,767 | 37 | (6) | 160,000 | 106,000 | ||||||||||||||

MGM National Harbor | Prince George’s County, MD | 308 | 23 | (7) | 146,000 | 50,000 | ||||||||||||||

Subtotal | 6,348 | 134 | 562,000 | 253,000 | ||||||||||||||||

TRS Properties | ||||||||||||||||||||

Hard Rock Rocksino Northfield Park (8) | Northfield, OH | — | 113 | 65,000 | — | |||||||||||||||

Subtotal | — | 113 | 65,000 | — | ||||||||||||||||

Total (9) | 27,442 | 601 | 1,215,000 | 2,712,000 | ||||||||||||||||

| (1) | Casino square footage is approximate and includes the gaming floor, race and sports, high limit areas and casino specific walkways, and excludes casino cage and other non-gaming space within the casino area. |

| (2) | Includes 1,117 rooms at the Delano and 424 rooms at the Four Seasons Hotel, both of which are located at our Mandalay Bay property. |

| (3) | Includes 26,000 square feet at the Delano and 30,000 square feet at the Four Seasons, both of which are located at our Mandalay Bay property. |

| (4) | Includes 293 rooms at NoMad which is located at our Park MGM property. |

| (5) | Ten of the 26 acres at Beau Rivage are subject to a tidelands lease. The ground lease rent is reimbursed or paid directly by Tenant pursuant to the Master Lease. |

| (6) | Eleven of the 37 acres at Borgata are subject to ground leases. The ground lease rent is reimbursed or paid directly by Tenant pursuant to the Master Lease. |

9

| (7) | All 23 acres at MGM National Harbor are subject to ground lease. The ground lease rent is reimbursed or paid directly by the Tenant pursuant to the Master Lease. |

| (8) | On April 1, 2019, we transferred the membership interests of Northfield, the entity that owned the real estate assets and operations of the Hard Rock Rocksino Northfield Park (subsequently rebranded MGM Northfield Park) in Northfield, Ohio, to a subsidiary of MGM and we retained the real estate assets. Our TRS, which owned Northfield, liquidated immediately prior to the transfer. |

| (9) | Does not include the real property associated with the Empire City Transaction, which closed on January 29, 2019. |

Other Information

Copies of our Annual Report on Form

10-K

for the year ended December 31, 2018 (as amended by our Current Report on Form 8-K, dated as of August 16, 2019 with respect to retrospective adjustments made to the consolidated financial statements and certain related information included in the 2018 Form 10-K for discontinued operations related to the Northfield OpCo Transaction), Quarterly Report on Form10-Q

for the quarterly period ended September 30, 2019, Proxy Statement on Schedule 14A, filed on March 20, 2019 and certain Current Reports on Form8-K

are being delivered to you with this prospectus as Annexes A, B, C and D, respectively. The information included in these annexes is incorporated into, and form part of, this prospectus, including, but not limited to, the following information:Annual Report on Form

(a) Item 1. Business, (b) Item 1A. Risk Factors, (c) Item 1B. Unresolved Staff Comments, (d) Item 2. Properties, (e) Item 3. Legal Proceedings, (f) Item 4. Mine Safety Disclosures, (g) Item 6. Selected Financial Data (as amended by our Current Report on Form 8-K, dated as of August 16, 2019 with respect to retrospective adjustments made to the consolidated financial statements and certain related information included in the 2018 Form 10-K for discontinued operations related to the Northfield OpCo Transaction), (h) Item 7. Management’s Discussion and Analysis of Financial Conditions and Results of Operations (as amended by our Current Report on Form 8-K, dated as of August 16, 2019 with respect to retrospective adjustments made to the consolidated financial statements and certain related information included in the 2018 Form 10-K for discontinued operations related to the Northfield OpCo Transaction), (i) Item 7A. Quantitative and Qualitative Disclosures About Market Risk, (j) Item 8. Financial Statements and Supplementary Data (as amended by our Current Report on Form 8-K, dated as of August 16, 2019 with respect to retrospective adjustments made to the consolidated financial statements and certain related information included in the 2018 Form 10-K for discontinued operations related to the Northfield OpCo Transaction), (k) Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure, (l) Item 9A. Controls and Procedures and (l) Item 9B. Other Information.10-K

(Annex A):Quarterly Report on Form

in “Part I. Financial Information” (a) Item 1. Financial Statements (Unaudited), (b) Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, (c) Item 3. Quantitative and Qualitative Disclosure about Market Risk, (d) Item 4. Controls and Procedures Item, and in “Part II. Other Information” (a) Item 1. Legal Proceedings, and (b) Item 1A. Risk Factors.10-Q

(Annex B):Proxy Statement on Schedule 14A (Annex C):

information responsive to Part III ofForm 10-K

for the fiscal year ended December 31, 2018 provided in our Proxy Statement on Schedule 14A, filed on March 20, 2019.Current Reports on Form

the sections and referenced exhibits included in the following current reports dated as of (i) January 22, 2019, (ii) January 25, 2019, (iii) January 28, 2019, (iv) January 29, 2019, (v) March 7, 2019, (vi) April 1, 2019, (vii) April 30, 2019, (viii) June 17, 2019, (ix) August 16, 2019 (such Current Report and its exhibits including retrospective adjustments made to the consolidated financial statements and certain related information included in the 2018 Form 10-K for discontinued operations related to the Northfield OpCo Transaction (as discussed therein)), (x) November 19, 2019 and (xi) November 22, 2019, each as filed with the SEC.8-K

(Annex D):10

Recent Developments

On November 22, 2019, MGP completed an offering of 30,000,000 Class A shares representing limited liability interests (the “shares”) of MGP in a registered public offering (the “Offering”). MGP issued and sold 18,000,000 shares directly to underwriters at the closing of the Offering for net proceeds of approximately $540.8 million, after deducting underwriting discounts and commissions and estimated offering expenses. MGP also granted the underwriters a 30-day option to purchase up to an additional 4,500,000 shares, on the same terms and conditions. In addition, the underwriters purchased, at the request of MGP, 12,000,000 shares from certain institutions acting as forward purchasers under forward sale agreements. MGP received proceeds from its direct sale of 18,000,000 shares in the Offering, but it did not initially receive any proceeds from the sale of shares by the forward purchasers pursuant to the forward sale agreements.

MGP intends to use the net proceeds from the Offering and from any physical settlement of the forward sale agreements primarily to repay a portion of the borrowings outstanding under its senior secured term loan A facility and senior secured term loan B facility. Proceeds received in connection with the exercise by the underwriters of their overallotment option to purchase 4,500,000 additional shares will be used to repay a portion of the borrowings outstanding under the Company’s senior secured term loan A facility or for general corporate purposes.

In connection with the Offering, pursuant to the Operating Partnership’s Second Amended and Restated Agreement of Limited Partnership, the Operating Partnership issued 18,000,000 units to MGP in a private placement in exchange for $540.8 million (representing the net proceeds from the Offering). In addition, in connection with the forward sales agreements, pursuant to the Operating Partnership’s Second Amended and Restated Agreement of Limited Partnership, the Operating Partnership will, from time to time in connection with any issuance of shares by MGP under the forward sale agreements, issue Operating Partnership units to MGP on a one-to-one basis with the number of shares issued by MGP in such sales.

The exchange offer is not contingent on or related to the Offering or any future issuances of shares by MGP pursuant to the forward sales agreements. See “Summary of the Exchange Offer” for a summary of the terms of the Exchange Offer, including conditions applicable to the exchange offer. No shares of MGP or Operating Partnership units are being offered pursuant to this prospectus. For a further description of the Offering and the forward sales agreements please refer to our and MGP’s Combined Current Report on

Form 8-K,

dated November 22, 2019, which has been filed with the SEC and is being incorporated into and delivered to you with this prospectus as part of Annex D attached hereto.Corporate information

MGP elected on its U.S. federal income tax return for its taxable year ended December 31, 2016 to be taxed as a REIT and intends to continue to qualify to do so. U.S. federal income tax law generally requires that a REIT distribute annually at least 90% of its REIT taxable income, without regard to the deduction for dividends paid and excluding net capital gains, and that it pay taxes at the regular corporate income tax rate to the extent that it annually distributes less than 100% of its taxable income. Commencing with our taxable year ended on December 31, 2016, MGP’s annual distribution has not been less than 90% of its REIT taxable income on an annual basis, determined without regard to the dividends paid deduction and excluding any net capital gains. Our principal offices are located at 1980 Festival Plaza Drive, Suite 750, Las Vegas, Nevada 89135, and our main telephone number is

(702) 669-1480.

Our website is www.mgmgrowthproperties.com. The information on our website does not form a part of and is not incorporated by reference into this prospectus.11

Summary of the Exchange Offer

The following summary contains basic information about the exchange offer and the exchange notes. It does not contain all the information that is important to you. For a more complete understanding of the exchange notes

,please refer to the sections of this prospectus entitled

“The Exchange Offer

”and

“Description of the Exchange Notes.

”In this subsection

,“we

”,“us

”,and

“our

”refer only to MGM Growth Properties Operating Partnership LP and MGP Finance

,Co-Issuer

Inc.

,as the

,co-issuers

of the notesexclusive of their subsidiaries.

Exchange Offer | The Issuers are offering to exchange $750,000,000 of their outstanding initial notes for a like aggregate amount of the Issuers’ registered exchange notes. |

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on , 2019, or a later date and time to which we may extend it. We do not currently intend to extend the expiration of the exchange offer. You may withdraw your tender of initial notes in the exchange offer at any time before the expiration of the exchange offer. Any initial notes not accepted for exchange for any reason will be returned without expense to you promptly after the expiration or termination of the exchange offer. |

Conditions to the Exchange Offer | The only conditions to completing the exchange offer are that: |

| • | the exchange offer does not violate applicable law or any applicable interpretation of the staff of the SEC; |

| • | no action or proceeding shall have been instituted or threatened in any court or by any governmental agency which might materially impair our ability to proceed with the exchange offer, and no material adverse development shall have occurred in any existing action or proceeding with respect to us; and |

| • | all governmental approvals which we deem necessary for the consummation of the exchange offer shall have been obtained. |

| Please refer to the section in this prospectus entitled “The Exchange Offer—Conditions.” |

Procedures for Tendering Initial Notes | To tender initial notes held in book-entry form through The Depository Trust Company, or “DTC,” you must transfer your initial notes into the exchange agent’s account in accordance with DTC’s Automated Tender Offer Program, or “ATOP” system. In lieu of delivering a letter of transmittal to the exchange agent, a computer-generated message, in which the holder of the initial notes acknowledges and agrees to be bound by the terms of the letter of transmittal, must be transmitted by DTC on behalf of a holder and received by the exchange agent before 5:00 p.m., New York City time, on the expiration date. In all other cases, a letter of transmittal must be manually executed and received by the exchange agent before 5:00 p.m., New York City time, on the expiration date. |

12

| By signing or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things: |

| • | you are acquiring the exchange notes in the ordinary course of your business; |

| • | you have no arrangement or understanding with any person to participate in the distribution of the exchange notes (within the meaning of the Securities Act); |

| • | you are not engaged in and do not intend to engage in a distribution of the exchange notes (within the meaning of the Securities Act); |

| • | you are not our “affiliate” (as defined in Rule 405 under the Securities Act); and |

| • | if you are a broker-dealer that will receive exchange notes for your own account in exchange for initial notes that were acquired as a result of market-making activities or other trading activities, you will deliver or make available a prospectus in connection with any resale of the exchange notes. |

Special Procedures for Beneficial Owners | If you are a beneficial owner of initial notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your initial notes in the exchange offer, you should contact the registered holder promptly and instruct that person to tender on your behalf. |

Acceptance of Initial Notes and Delivery of Exchange Notes | If all the conditions to the completion of this exchange offer are satisfied, we will accept any and all initial notes that are properly tendered in this exchange offer on or before 5:00 p.m., New York City time, on the expiration date. We will return any initial note that we do not accept for exchange to you without expense promptly after the expiration date. We will deliver the exchange notes to you promptly after the expiration date and acceptance of your initial notes for exchange. Please refer to the section in this prospectus entitled “The Exchange Offer—Procedures for Tendering.” |

Federal Income Tax Consequences Relating to the Exchange Offer | Exchanging your initial notes for exchange notes will not be a taxable event to you for United States federal income tax purposes. Please refer to the section of this prospectus entitled “Certain U.S. Federal Income Tax Consequences.” |

Exchange Agent | U.S. Bank National Association is serving as exchange agent in the exchange offer. |

Fees and Expenses | We will pay all expenses related to this exchange offer. Please refer to the section of this prospectus entitled “The Exchange Offer—Fees and Expenses.” |

13

Use of Proceeds | We will not receive any proceeds from the issuance of the exchange notes. We are making this exchange offer solely to satisfy certain of our obligations under our registration rights agreement entered into in connection with the offering of the initial notes. |

Consequences to Holders Who Do Not Participate in the Exchange Offer | Any initial notes that are not tendered or that are tendered but not accepted will remain subject to the restrictions on transfer set forth in the initial notes and the indenture. Since the initial notes have not been registered under the federal securities laws, they may bear a legend restricting their transfer absent registration or the availability of a specific exemption from registration. Upon completion of the exchange offer, we will have no further obligation to register, and currently we do not anticipate that we will register, the initial notes under the Securities Act except in limited circumstances with respect to specific types of holders of initial notes. Please refer to the section of this prospectus entitled “The Exchange Offer—Consequences of Failure to Tender.” |

Transferability | Under existing interpretations of the Securities Act by the staff of the SEC contained in several no-action letters to third parties, and subject to the immediately following sentence, we believe that the exchange notes will generally be freely transferable by holders after the exchange offer without further compliance with the registration and prospectus delivery requirements of the Securities Act (subject to certain representations required to be made by each holder of initial notes, as set forth under “The Exchange Offer—Procedures for Tendering”). However, any holder of initial notes who: |

| • | is one of our “affiliates” (as defined in Rule 405 under the Securities Act); |

| • | does not acquire the exchange notes in the ordinary course of business; |

| • | distributes, intends to distribute, or has an arrangement or understanding with any person to distribute the exchange notes as part of the exchange offer; or |

| • | is a broker-dealer who purchased initial notes from us in the initial offering of the initial notes for resale pursuant to Rule 144A or any other available exemption under the Securities Act; |

| will not be able to rely on the interpretations of the staff of the SEC, will not be permitted to tender initial notes in the exchange offer and, in the absence of any exemption, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes. |

Our belief that transfers of exchange notes would be permitted without registration or prospectus delivery under the conditions described above is based on SEC interpretations given to other, |

14

unrelated issuers in similar exchange offers. We cannot assure you that the SEC would make a similar interpretation with respect to our exchange offer. We will not be responsible for or indemnify you against any liability you may incur under the Securities Act. |

| Each broker-dealer that receives exchange notes for its own account under the exchange offer in exchange for initial notes that were acquired by the broker-dealer as a result of market-making or other trading activity must acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.” |

Dissenters’ Rights | Holders of initial notes do not have any appraisal or dissenters’ rights in connection with the exchange offer. Initial notes that are not tendered for exchange or are tendered but not accepted in connection with the exchange offer will remain outstanding and be entitled to the benefits of the indenture under which they were issued, including accrual of interest, but, subject to a limited exception, will not be entitled to any registration rights under the registration rights agreement. See “The Exchange Offer—Consequences of Failure to Tender.” |

15

Summary of Terms of the Exchange Notes

The summary below describes the principal terms of the exchange notes. Some of the terms and conditions described below are subject to important limitations and exceptions. The “Description of the Exchange Notes” section of this prospectus contain a more detailed description of the terms and conditions of the exchange notes. Capitalized terms used herein and not otherwise defined have the meanings ascribed to such terms in the “Description of the Exchange Notes” section of this prospectus.

The exchange notes will be identical in all material respects to the initial notes for which they have been exchanged, except:

| • | the offer and sale of the exchange notes will have been registered under the Securities Act, and thus the exchange notes generally will not be subject to the restrictions on transfer applicable to the initial notes or bear restrictive legends; |

| • | the exchange notes will not be entitled to registration rights; and |

| • | the exchange notes will not have the right to earn additional interest under circumstances relating to our registration obligations. |

Issuers | The exchange notes will be the joint and several obligations of the Operating Partnership and Co-Issuer (the “Issuers”). |

Exchange Notes Offered | $750,000,000 in aggregate principal amount of 5.750% senior notes due 2027. |

Maturity | The exchange notes will mature on February 1, 2027. |

Interest | Interest on the exchange notes will accrue at a rate of 5.750% per annum. Interest on the exchange notes will be payable semi-annually in cash in arrears on February 1 and August 1 of each year, commencing on February 1, 2020. Interest on each exchange note will accrue from the last interest payment date on which interest was paid on the old note surrendered in exchange thereof or, if no interest has been paid on the old note, from the date of its original issue. |

Guarantees | The exchange notes will be fully and unconditionally guaranteed, jointly and severally, on a senior unsecured basis by each existing and future direct and indirect wholly owned material domestic subsidiary of the Operating Partnership that guarantees the Credit Agreement or any other material capital markets indebtedness, other than certain excluded subsidiaries and the Co-Issuer. See “Description of the Exchange Notes—Brief Description of the Exchange Notes and the Exchange Note Guarantees.” |

Ranking | The exchange notes and guarantees will be general senior unsecured obligations of the Issuers and each subsidiary guarantor, respectively, and will rank equally in right of payment with all existing and future senior indebtedness of the Issuers and each subsidiary guarantor, respectively, and effectively subordinated to the Issuers’ and the subsidiary guarantors’ existing and future secured obligations to the extent of the value of the assets securing such obligations. The notes will also be effectively junior to all indebtedness of the Issuers’ |

16

subsidiaries that do not guarantee the exchange notes. See “Description of the Exchange Notes—Brief Description of the Exchange Notes and the Exchange Note Guarantees.” |

Optional Redemption | The Issuers may, at their option, redeem the exchange notes, in whole or in part, at any time and from time to time prior to November 1, 2026 (the date that is three months prior to their maturity date) at a price equal to 100% of the principal amount of the notes, plus a “make-whole” premium and accrued and unpaid interest, if any, to, but excluding the redemption date. |

| In addition, the Issuers will have the right to redeem the exchange notes, in whole or in part from time to time, at their option, on or after November 1, 2026 (three months prior to their maturity date) at a redemption price equal to 100% of the aggregate principal amount of the exchange notes plus accrued and unpaid interest, if any, to, but excluding, the redemption date. |

Special Gaming Redemption | The exchange notes will be subject to mandatory redemption requirements imposed by gaming laws and regulations. See “Description of the Exchange Notes—Gaming Redemption.” |

Change of Control | If we experience certain kinds of changes of control, we may be required to make an offer to purchase the exchange notes at 101% of the aggregate principal amount thereof, plus accrued and unpaid interest, if any, to, but not including, the repurchase date. |

Covenants | The indenture will contain covenants that, among other things, will limit our ability and the ability of our restricted subsidiaries to: |

| • | incur additional indebtedness and use our or their assets to secure our or their indebtedness; |

| • | create certain liens; |

| • | make certain restricted payments; |

| • | enter into agreements that restrict dividends or other payments from our restricted subsidiaries to us; |

| • | issue guarantees; |

| • | make certain sales and other dispositions of assets; |

| • | engage in certain transactions with affiliates; or |

| • | merge, consolidate or transfer all or substantially all of our assets. |

| The indenture will also provide that the Co-Issuer will not hold any material assets, become liable for any material obligations or engage in any significant business activities, subject to certain exceptions. See “Description of the Exchange Notes—Restrictions on Activities of theCo-Issuer.” |

These covenants are subject to a number of important and significant limitations, qualifications and exceptions. In addition, certain of these covenants will cease to apply to the notes in the event that the |

17

exchange notes have investment grade ratings from two rating agencies.

Absence of a Public Market for the Exchange Notes | The exchange notes generally are freely transferable, but are also new securities for which there will not initially be an active trading market. Accordingly, there can be no assurances to the development or liquidity of any trading market for the exchange notes. |

No Listing of the Notes | We have not applied nor do we intend to list the exchange notes on any securities exchange or have the exchange notes quoted on any automated quotation system. |

Governing Law | The Indenture and the initial notes are, and the exchange notes will be, governed by and construed in accordance with, the laws of the State of New York. |

Trustee, Registrar and Paying Agent | U.S. Bank National Association. |

Risk Factors | See “Risk Factors” beginning on page 21 and other information contained in this prospectus for a discussion of factors that you should carefully consider before deciding to exchange your initial notes for exchange notes. |

18

The summary historical condensed consolidated financial data at December 31, 2017 and 2018 and for the years ended December 31, 2016, 2017 and 2018 have been derived from and should be read in conjunction with MGP’s audited consolidated financial statements which are included in Annex A and Annex D, which reflects retrospective recasting for discontinued operations, attached hereto. The summary historical condensed consolidated financial data at September 30, 2019 and for the nine months ended September 30, 2018 and 2019 have been derived from and should be read in conjunction with MGP’s unaudited condensed consolidated financial statements which are included in Annex B attached hereto, and include, in the opinion of management, all adjustments, consisting of normal, recurring adjustments, necessary for a fair presentation of such information. The financial data presented for the interim periods are not necessarily indicative of the results for the full fiscal year and our historical results presented below are not necessarily indicative of the result to be expected for any future period.

Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||||||

| 2016 | 2017 | 2018 | 2018 | 2019 | ||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||

Revenue | ||||||||||||||||||||

Rental revenue | $ | 419,239 | $ | 675,089 | $ | 746,253 | $ | 559,690 | $ | 636,575 | ||||||||||

Tenant reimbursements and other | 48,309 | 90,606 | 123,242 | 93,198 | 18,618 | |||||||||||||||

Total revenues | 467,548 | 765,695 | 869,495 | 652,888 | 655,193 | |||||||||||||||

Expenses | ||||||||||||||||||||

Depreciation | 220,667 | 260,455 | 266,662 | 199,933 | 233,062 | |||||||||||||||

Property transactions, net | 4,684 | 34,022 | 20,319 | 18,851 | 11,344 | |||||||||||||||

Reimbursable expenses | 68,063 | 88,254 | 119,531 | 90,435 | 17,760 | |||||||||||||||

Amortization of above market lease, net | 286 | 686 | 686 | 514 | — | |||||||||||||||

Acquisition-related expenses | 10,178 | 17,304 | 6,149 | 4,603 | 8,891 | |||||||||||||||

General and administrative | 9,896 | 12,189 | 16,048 | 10,021 | 12,305 | |||||||||||||||

Total expenses | 313,774 | 412,910 | 429,355 | 324,357 | 273,362 | |||||||||||||||

Other income (expense) | ||||||||||||||||||||

Interest income | 774 | 3,907 | 2,501 | 2,473 | 2,189 | |||||||||||||||

Interest expense | (116,212 | ) | (184,175 | ) | (215,532 | ) | (157,249 | ) | (190,973 | ) | ||||||||||

Other | (726 | ) | (1,621 | ) | (7,191 | ) | (6,409 | ) | (806 | ) | ||||||||||

| (116,164 | ) | (181,889 | ) | (220,222 | ) | (161,185 | ) | (189,590 | ) | |||||||||||

Income from continuing operations before income taxes | 37,610 | 170,896 | 219,918 | 167,346 | 192,241 | |||||||||||||||

Provision for income taxes | (2,264 | ) | (4,906 | ) | (5,779 | ) | (5,144 | ) | (5,771 | ) | ||||||||||

Income from continuing operations, net of tax | 35,346 | 165,990 | 214,139 | 162,202 | 186,470 | |||||||||||||||

Income from discontinued operations, net of tax | — | — | 30,563 | 13,949 | 16,216 | |||||||||||||||

Net income | $ | 35,346 | $ | 165,990 | $ | 244,702 | $ | 176,151 | $ | 202,686 | ||||||||||

19

| December 31, | September 30, | |||||||||||

| 2017 | 2018 | 2019 | ||||||||||

Balance Sheet Data: | ||||||||||||

ASSETS | ||||||||||||

Real estate investments, net | $ | 10,021,938 | $ | 10,506,129 | $ | 10,894,121 | ||||||

Lease incentive asset | — | — | 532,186 | |||||||||

Cash and cash equivalents | 259,722 | 3,995 | 153,526 | |||||||||

Tenant and other receivables, net | 6,385 | 7,668 | 463 | |||||||||

Prepaid expenses and other assets | 18,487 | 34,813 | 27,413 | |||||||||

Above market lease, asset | 44,588 | 43,014 | 41,834 | |||||||||

Operating lease right-of-use assets | — | — | 280,020 | |||||||||

Assets held for sale | — | 355,688 | — | |||||||||

Total assets | $ | 10,351,120 | $ | 10,951,307 | $ | 11,929,563 | ||||||

LIABILITIES AND PARTNERS’ CAPITAL | ||||||||||||

Liabilities | ||||||||||||

Debt, net | $ | 3,934,628 | $ | 4,666,949 | $ | 4,847,408 | ||||||

Due to MGM Resorts International and affiliates | 962 | 227 | 298 | |||||||||

Accounts payable, accrued expenses and other liabilities | 10,240 | 20,796 | 59,937 | |||||||||

Above market lease, liability | 47,069 | 46,181 | — | |||||||||

Accrued interest | 22,565 | 26,096 | 37,407 | |||||||||

Distribution payable | 111,733 | 119,055 | 138,730 | |||||||||

Deferred revenue | 127,640 | 163,926 | 95,306 | |||||||||

Deferred income taxes, net | 28,544 | 33,634 | 29,721 | |||||||||

Operating lease liabilities | — | — | 336,452 | |||||||||

Liabilities related to assets held for sale | — | 28,937 | — | |||||||||

Total liabilities | 4,283,381 | 5,105,801 | 5,545,259 | |||||||||

Partners’ capital | ||||||||||||

General partner | — | — | — | |||||||||

Limited partners: 295,170,610, 266,045,289 and 266,030,918 Operating Partnership units issued and outstanding as of September 30, 2019, December 31, 2018 and December 31, 2017, respectively. | 6,067,739 | 5,845,506 | 6,384,304 | |||||||||

Total partners’ capital | 6,067,739 | 5,845,506 | 6,384,304 | |||||||||

Total liabilities and partners’ capital | $ | 10,351,120 | $ | 10,951,307 | $ | 11,929,563 | ||||||

20

Before you decide to tender your initial notes for exchange notes, you should be aware of various risks, including those described below, that could have a material adverse effect on our business, financial position, results of operations and cashflows. We urge you to carefully consider these risk factors, together with all of the other information included in this prospectus, before you decide to tender your initial notes for exchange notes. In addition, we identify other factors that could affect our business in Part 1, Item 1A. “Risk Factors” in our and MGP’s Combined Annual Report on

Form 10-K

for the fiscal year ended December 31, 2018 and Part II, Item 1A. “Risk Factors” in our Quarterly Report onForm 10-Q

for the period ended September 30, 2019, each of which are included in this prospectus and attached as Annex A and Annex B hereto, respectively.Risks Related to the Exchange Notes

The exchange notes are unsecured. Therefore, our secured creditors would have a prior claim, ahead of the exchange notes, on our assets.

The exchange notes are unsecured. As a result, upon any distribution to our creditors in a bankruptcy, liquidation or reorganization or similar proceeding relating to us or our property, the holders of our or our subsidiaries’ secured debt will be entitled to be paid in full from our assets securing that secured debt before any payment may be made with respect to the exchange notes. In addition, if we or our subsidiaries fail to meet payment or other obligations under such secured debt, the holders of that secured debt would be entitled to foreclose on our assets securing that secured debt and liquidate those assets. Accordingly, we may not have sufficient funds to pay amounts due on the exchange notes. As a result, you may lose a portion of or the entire value of your investment in the exchange notes.

As of September 30, 2019, out of our approximately $4.9 billion in principal amount of total indebtedness, $2.3 billion would have been secured indebtedness that is effectively senior to the exchange notes, and we would have also had an additional $1.4 billion available for borrowing under our revolving credit facility.

We may not have the ability to raise the funds necessary to finance a change of control offer required by the indenture relating to the exchange notes or the terms of our other indebtedness. In addition, under certain circumstances, we may be permitted to use the proceeds from debt to effect merger payments in compliance with the indenture.

Upon the occurrence of a change of control, a default could occur in respect of our Existing Notes or our Credit Agreement, and we will be required to make an offer to purchase all outstanding exchange notes. If such a change of control were to occur, we cannot assure you that we would have sufficient funds to pay the purchase price for all the exchange notes tendered by the holders or such other indebtedness. See “Description of the Exchange Notes—Repurchase of Notes upon a Change of Control.”

Our Existing Notes, Credit Agreement and exchange notes contain, and any future agreements relating to indebtedness to which we become a party may contain, provisions restricting our ability to purchase exchange notes or providing that an occurrence of a change of control constitutes an event of default, or otherwise requiring payment of amounts borrowed under those agreements. If such a change of control occurs at a time when we are prohibited from purchasing the exchange notes, we could seek the consent of our then existing lenders and other creditors to the purchase of the exchange notes or could attempt to refinance the indebtedness that contains the prohibition. If we do not obtain such a consent or repay such indebtedness, we would remain prohibited from purchasing the exchange notes. In that case, our failure to purchase tendered exchange notes would constitute a default under the terms of the indenture governing the exchange notes and any other indebtedness that we may enter into from time to time with similar provisions.

21

You may be required to sell your exchange notes if any gaming authority finds you unsuitable to hold them or otherwise requires us to redeem or repurchase the exchange notes from you.

In the event that any of the applicable regulatory agencies or authorities requires you, as a holder of the exchange notes, to be licensed, qualified or found suitable under the applicable gaming or racing laws, and you fail to do so, if required, we will have the right, at our option, to redeem or repurchase your exchange notes. There can be no assurance that we will have sufficient funds or otherwise will be able to repurchase any or all of your exchange notes. See “Description of the Exchange Notes—Gaming Redemption.”

Illiquidity and an absence of a public market for the exchange notes could cause purchasers of the exchange notes to be unable to resell the exchange notes.

The exchange notes constitute a new issue of securities for which there is no established trading market. We do not intend to apply for listing of the exchange notes on any securities exchange or for quotation of the notes on any automated dealer quotation system. An active trading market for the exchange notes may not develop or, if such market develops, it could be very illiquid.

Holders of the exchange notes may experience difficulty in reselling, or an inability to sell, the exchange notes. If no active trading market develops, the market price and liquidity of the exchange notes may be adversely affected, and you may not be able to resell your exchange notes at their fair market value, at the initial offering price or at all. If a market for the exchange notes develops, any such market may be discontinued at any time. If a trading market develops for the exchange notes, future trading prices of the notes will depend on many factors, including, among other things, prevailing interest rates, our operating results, liquidity of the issue, the market for similar securities and other factors, including our financial condition and prospects and the financial condition and prospects for companies in our industry.

Changes in our credit rating could adversely affect the market price or liquidity of the exchange notes.

Credit rating agencies continually revise their ratings for the companies that they follow, including us. The credit rating agencies also evaluate our industry as a whole and may change their credit ratings for us based on their overall view of our industry. We cannot be sure that credit rating agencies will maintain their ratings on the exchange notes. A negative change in our ratings could have an adverse effect on the price of the exchange notes.

Federal and state statutes allow courts, under specific circumstances, to avoid the exchange notes, the guarantees and certain other transfers, to require holders of the exchange notes to return payments or other value received from us and to otherwise cancel transfers, and to take other actions detrimental to the holders of the exchange notes.

Our creditors or the creditors of our subsidiary guarantors could challenge the issuance of the exchange notes or the subsidiary guarantors’ issuance of their guarantees as fraudulent conveyances or on other grounds. Under the U.S. federal bankruptcy law and similar provisions of state fraudulent transfer and conveyance laws, the issuance of the exchange notes or the delivery of the guarantees could be avoided if a court determined that we, at the time we issued the exchange notes:

| • | issued the exchange notes with the intent of hindering, delaying or defrauding any present or future creditor; or |