Fiscal Year 2018 Financial Results

Operating revenues for the fiscal year 2018 increased by 10.1% to RMB4,287.6 million (US$623.6 million) from RMB3,895.8 million in 2017, primarily due to the old revenue recognition standard ASC 605 used in 2017 and the write-back of provision for expected discretionary payments to investors in investment programs protected by the investor reserve funds. For the fiscal year 2018, the impact of applying the new revenue standard ASC 606 resulted in an increase of approximately RMB511.1 million (US$74.3 million) in revenue.

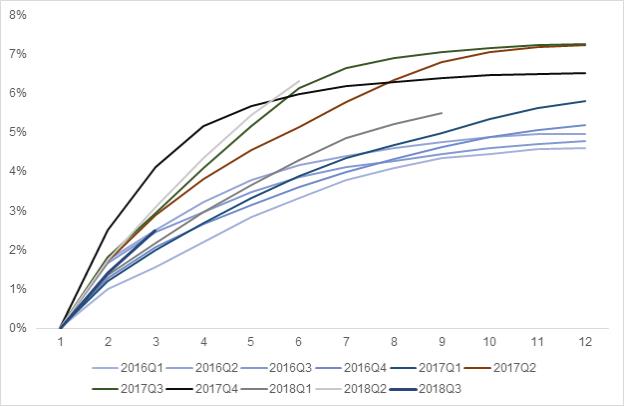

Loan facilitation service fees increased by 2.7% to RMB2,919.2 million (US$424.6 million) for the fiscal year 2018 from RMB2,843.3 million in 2017, primarily due to the old revenue recognition standard ASC 605 used in 2017. The average rate of transaction fees charged to borrowers was 6.77%, compared with 6.5% in 2017. Loan collection fees of RMB342.7 million (US$49.8 million) have been allocated from other revenue to loan facilitation service fees related to the adoption of ASC 606 effective January 1, 2018.

Post-facilitation service fees increased by 38.0% to RMB922.8 million (US$134.2 million) for the fiscal year 2018 from RMB668.8 million in the prior year, primarily due to the rolling impact of deferred transaction fees and the adoption of ASC 606 effective January 1, 2018. Loan collection fees of RMB125.2 million (US$18.2 million) have been allocated from other revenue to post facilitation service fees related to the adoption of ASC 606.

Other revenue decreased by 23.3% to RMB376.9 million (US$54.8 million) for the fiscal year 2018 from RMB491.4 million in 2017, primarily due to the adoption of ASC 606 effective January 1, 2018, which reallocated loan collection fees to loan facilitation fees and post facilitation fees. This was offset by an increase in management fees from investment programs that invest in loans protected by the quality assurance fund.

Net interest income/(expense) and loan provision losses for the fiscal year 2018 was an income of RMB63.4 million (US$9.2 million), compared with an expense of RMB15.2 million in 2017, primarily due to income from the increased number of consolidated investment trusts.

Origination and servicing expenses increased by 1.1% to RMB985.6 million (US$143.3 million) for the fiscal year 2018 from RMB974.5 million in the prior year, primarily due to (i) a decrease in salaries and benefits as a result of a decrease in headcount particularly for consumption loan products, and (ii) a decrease in referral fees paid to third parties for successful loan originations, which was largely offset by an increase in fees paid to third parties for loan collection services.

Sales and marketing expenses decreased by 9.8% to RMB710.8 million (US$103.4 million) for the fiscal year 2018 from RMB788.3 million in 2017, primarily due to a decline in online customer acquisition expenses.

General and administrative expenses increased by 19.1% to RMB701.4 million (US$102.0 million) for the fiscal year 2018 from RMB588.7 million in 2017, primarily due to an increase in research and development costs. General and administrative expenses for the period included share-based compensation of RMB50.3 million (US$7.3 million).