increases, appointment of officers, changes in corporate control, among others, as the case may be. Financial institutions in Brazil can operate under various forms—such as commercial banks, investment banks, credit, financing and investment companies, cooperative banks, leasing companies, securities brokerage companies, securities distributor companies, real estate credit companies, mortgage companies, among others—all of which are regulated by different rules issued by the CMN, the Central Bank of Brazil, and, if such financial institutions participate in capital markets activities, the CVM. In addition, like financial institutions, stock exchanges are also subject to CMN, the Central Bank of Brazil, and the CVM approval and regulation as well in accordance with Law No. 4,728/65.

Pursuant to Banking Law, CMN Resolution No. 4,122 of August 2, 2012, as amended, or “CMN Resolution No. 4,122,” financial institutions must seek approval from the Central Bank of Brazil, and, in certain cases, the CVM when appointing managers (including directors, officers and members of certain statutory boards, such as fiscal councils). Moreover, according to Law No. 4,728/65, for securities brokerage firms, managers are subject to further restrictions and are prohibited from working for or fulfilling any administrative, advisory, tax or decision-making positions at entities listed on the Brazilian stock exchange. In addition, managers of securities brokerage firms are prohibited from filling managerial functions in other brokerage firms authorized to carry out foreign exchange transactions pursuant to CMN Resolution No. 1,770, of November 28, 1990.

In addition, according to the Banking Law, Brazilian financial institutions have limits to grant loans or cash advances to their managers (officers, directors, and members of advisory boards, as well as their relatives). Such restrictions are set forth in CMN Resolution No. 4,693 of October 29, 2018.

Credit, Financing and Investment Institutions (Consumer Credit Companies)

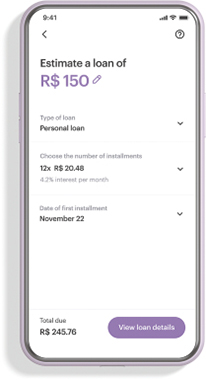

Credit, financing and investment institutions (sociedades de crédito, financiamento e investimento), such as Nu Financeira (“financeiras” or “SCFI”), are financial institutions part of the national financial system and are subject to regulation by and the oversight of the CMN and the Central Bank of Brazil. They were established by the Ordinance of Ministry of Finance No. 309, on November 30, 1959 and are private financial institutions whose basic objective is to carry out financing for the acquisition of goods and services, as well as for working capital. Consumer credit companies must be organized as a corporation (sociedade por ações) and its corporate name must include the expression “Crédito, Financiamento e Investimento” (credit, financing and investment).

An SCFI is not allowed to offer deposit accounts. However, such institutions can raise funds through the acceptance and placement of time deposits with special guarantee from the Credit Guarantee Fund (FGC), known as DPGE (Depósito a Prazo com Garantia Especial do FGC), interbank deposits, bills of exchange, agribusiness bill of credit, known as LCA (Letra de Crédito do Agronegócio), financial bill of exchange, known as LF (Letra Financeira), guaranteed real estate bill, known as LIG (Letra Imobiliária Garantida) and repurchase transaction. More recently, with the enactment of CMN Resolution No. 4,812, of April 30, 2020, the Central Bank of Brazil determined that SCFIs may also raise funds through bank deposit receipts, known as RDB (Recibo de Depósito Bancário) and allowed them to also raise funds through bank deposit certificates, known as CDB (Certificado de Depósito Bancário). Both RDB and CDB are fixed income securities – the main difference between the two securities lies in the fact that the CDB can be traded before maturity, while the RDB is nontransferable and not allowed to be traded.

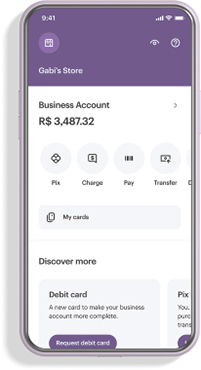

Many credit, financing and investment institutions operate as the financial branch of non-banking economic groups. In our case, Nu Financeira provides financing to our credit card, personal loan to our customers and issues instruments such as RDB, in order to provide funding to our operation.

Securities Brokerage Firms

Securities trading in stock exchange markets shall be carried out exclusively by DTVMs, CTVMs (such as Nu DTVM and NuInvest) and certain other authorized institutions. Securities distributors (distribuidoras de títulos e valores mobiliários) are regulated by Resolution No. 1,120/86 and securities brokers (corretoras de títulos e valores mobiliários) are regulated by Resolution No. 1,655/89. With Central Bank of Brazil and CVM’s joint decision No. 17, of March 2, 2009, which authorized distributors to operate directly in the environments and trading systems of organized stock exchange markets, the main difference between securities brokers and securities distributors was extinguished, and such institutions are today allowed to perform practically the same operations.

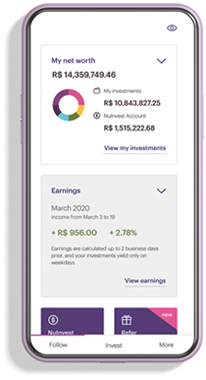

In this regard, both Resolution No. 1,120/86 and Resolution No. 1,655/89 allow brokerage firms to participate, among others, in the following activities: (1) trading in stock exchanges; (2) managing investment portfolios; and (3) providing custody services. More recently, on November 27, 2020, the CMN issued Resolution No. 4,871, which amended Resolution No. 1,120/86 and Resolution No. 1655/89 in order to allow DTVMs and CTVMs to issue electronic

169