- STZ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Constellation Brands (STZ) DEF 14ADefinitive proxy

Filed: 24 Jun 05, 12:00am

| (1) | Title of each class of securities to which transaction applies: |

_______________________________________________ | |

| (2) | Aggregate number of securities to which transaction applies: |

_______________________________________________ | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

_______________________________________________ | |

(4) | Proposed maximum aggregate value of transaction: |

_______________________________________________ | |

| (5) | Total fee paid: |

_______________________________________________ |

| (1) | Amount Previously Paid: |

____________________________________ | |

| (2) | Form, Schedule or Registration Statement No.: |

____________________________________ | |

| (3) | Filing Party: |

____________________________________ | |

| (4) | Date Filed: |

____________________________________ |

ANNUAL MEETING OF STOCKHOLDERS |

| 1. | To elect directors of the Company (Proposal No. 1). |

| 2. | To consider and act upon a proposal to ratify the selection of KPMG LLP, Certified Public Accountants, as the Company’s independent public accountants for the fiscal year ending February 28, 2006 (Proposal No. 2). |

| 3. | To consider and act upon a proposal to amend the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of the Company’s Class A Common Stock from 275,000,000 shares to 300,000,000 shares (Proposal No. 3). |

| 4. | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class (1) | ||

Sole Power to Vote or Dispose | Shared Power to Vote or Dispose | Total | ||

Richard Sands 370 Woodcliff Drive, Suite 300 Fairport, NY 14450 | 2,506,656 (2) | 601,424 (2) | 3,108,080 | 1.6% |

Robert Sands 370 Woodcliff Drive, Suite 300 Fairport, NY 14450 | 2,420,912 (4) | 601,424 (4) | 3,022,336 | 1.5% |

CWC Partnership-I �� 370 Woodcliff Drive, Suite 300 Fairport, NY 14450 | - | 472,376 (5) | 472,376 | 0.2% |

Trust for the benefit of Andrew Stern, M.D. under the will of Laurie Sands 370 Woodcliff Drive, Suite 300 Fairport, NY 14450 | - | 472,376 (6) | 472,376 | 0.2% |

Stockholders Group Pursuant to Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (7) | - | 5,528,992 (7) | 5,528,992 | 2.8% |

FMR Corp. 82 Devonshire Street Boston, MA 02109 (8) | (8) | (8) | 15,610,122 (8) | 7.9% |

Wellington Management Company, LLP 75 State Street Boston, MA 02109 (9) | - | (9) | 11,081,768 (9) | 5.7% |

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (1) | Percent of Class (1) | ||

Sole Power to Vote or Dispose | Shared Power to Vote or Dispose | Total | ||

Richard Sands 370 Woodcliff Drive, Suite 300 Fairport, NY 14450 | 5,908,232 | 10,860,144 (2) | 16,768,376 | 70.0% |

Robert Sands 370 Woodcliff Drive, Suite 300 Fairport, NY 14450 | 5,902,592 | 10,860,144 (4) | 16,762,736 | 70.0% |

Trust for the benefit of Andrew Stern, M.D. under the will of Laurie Sands 370 Woodcliff Drive, Suite 300 Fairport, NY 14450 | - | 6,662,712 (6) | 6,662,712 | 27.8% |

CWC Partnership-I 370 Woodcliff Drive, Suite 300 Fairport, NY 14450 | - | 6,099,080 (5) | 6,099,080 | 25.5% |

Trust for the benefit of the Grandchildren of Marvin and Marilyn Sands 370 Woodcliff Drive, Suite 300 Fairport, NY 14450 | - | 4,050,000 (10) | 4,050,000 | 16.9% |

Stockholders Group Pursuant to Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (7) | - | 22,670,968 (7) | 22,670,968 | 94.7% |

| (1) | The number of shares and the percentage of ownership set forth in the Class A Stock table includes the number of shares of Class A Stock that can be purchased by exercising stock options that are exercisable on May 31, 2005 or become exercisable within sixty (60) days thereafter (“presently exercisable”). Such number does not include the number of option shares that may become exercisable within sixty (60) days of May 31, 2005 due to certain acceleration provisions in certain awards, which accelerations cannot be foreseen on the date of this Proxy Statement. Additionally, such number does not include the shares of Class A Stock issuable pursuant to the conversion feature of Class B Stock beneficially owned by each person. The number of shares and percentage of ownership assuming conversion of Class B Stock into Class A Stock are contained in the footnotes. For purposes of calculating the percentage of ownership of Class A Stock in the table and in the footnotes, additional shares of Class A Stock equal to the number of presently exercisable options and, as appropriate, the number of shares of Class B Stock owned by each person are assumed to be outstanding pursuant to Rule 13d-3(d)(1) under the Securities Exchange Act. Where the footnotes reflect shares of Class A Stock as being included, such shares are included only in the Class A Stock table and where the footnotes reflect shares of Class B Stock as being included, such shares are included only in the Class B Stock table. As of May 31, 2005, none of the beneficial owners of the Company’s Class A Stock, other than FMR Corp., have reported any interest in the Company’s 5.75% Mandatory Convertible Preferred Stock. The information pertaining to FMR Corp. is set forth in more detail in footnote (8) below. |

| (2) | The amount reflected as shares of Class A Stock over which Richard Sands has the sole power to vote or dispose includes 2,059,800 shares of Class A Stock issuable upon the exercise of options that are presently exercisable by Mr. Sands. The amounts reflected as shares over which Mr. Sands shares power to vote or dispose include, as applicable, 471,608 shares of Class A Stock and 5,431,712 shares of Class B Stock owned by CWC Partnership-I, a New York general partnership (“CWCP-I”), of which Richard Sands is a managing partner, 147,432 shares of Class B Stock owned by the Marvin Sands Master Trust (the “Master Trust”), of which Richard Sands is a trustee and beneficiary, 768 shares of Class A Stock and 667,368 shares of Class B Stock owned by M, L, R, & R, a New York general partnership (“MLR&R”), of which Mr. Sands and the Master Trust are general partners, 563,632 shares of Class B Stock owned by CWC Partnership-II, a New York general partnership (“CWCP-II”), of which Mr. Sands is a trustee of the managing partner, 4,050,000 shares of Class B Stock owned by the trust described in footnote (10) below, and 129,048 shares of Class A Stock owned by the Mac and Sally Sands Foundation, Incorporated, a Virginia corporation (the “Sands Foundation”), of which Mr. Sands is a director and officer. Mr. Sands disclaims beneficial ownership of all of the foregoing shares except to the extent of his ownership interest in CWCP-I and MLR&R and his beneficial interest in the Master Trust. The amounts reflected do not include 29,120 shares of Class A Stock owned by Mr. Sands’ wife, individually and as custodian for their children, the remainder interest Mr. Sands has in 1,433,336 of the 4,300,008 shares of Class A Stock subject to the life estate held by Marilyn Sands described in footnote (3) below or the remainder interest of CWCP-II in 1,447,812 of such shares. Mr. Sands disclaims beneficial ownership with respect to all such shares. Assuming the conversion of Class B Stock beneficially owned by Mr. Sands into Class A Stock, Mr. Sands would beneficially own 19,876,456 shares of Class A Stock, representing 9.3% of the outstanding Class A Stock after such conversion. |

| (3) | Marilyn Sands is the beneficial owner of a life estate in 4,300,008 shares of Class A Stock that includes the right to receive income from and the power to vote and dispose of such shares. The remainder interest in such shares is held by Richard Sands, Robert Sands and CWCP-II. |

| (4) | The amount reflected as shares of Class A Stock over which Robert Sands has the sole power to vote or dispose includes 1,838,600 shares of Class A Stock issuable upon the exercise of options that are presently exercisable by Mr. Sands. The amounts reflected as shares over which Mr. Sands shares power to vote or dispose include, as applicable, 471,608 shares of Class A Stock and 5,431,712 shares of Class B Stock owned by CWCP-I, of which Robert Sands is a managing partner, 147,432 shares of Class B Stock owned by the Master Trust, of which Robert Sands is a trustee and beneficiary, 768 shares of Class A Stock and 667,368 shares of Class B Stock owned by MLR&R, of which Mr. Sands and the Master Trust are general partners, 563,632 shares of Class B Stock owned by CWCP-II, of which Mr. Sands is a trustee of the managing partner, 4,050,000 shares of Class B Stock owned by the trust described in footnote (10) below, and 129,048 shares of Class A Stock owned by the Sands Foundation, of which Mr. Sands is a director and officer. Mr. Sands disclaims beneficial ownership of all of the foregoing shares except to the extent of his ownership interest in CWCP-I and MLR&R and his beneficial interest in the Master Trust. The amounts reflected do not include 183,520 shares of Class A Stock owned by Mr. Sands’ wife, individually and as custodian for their children, the remainder interest Mr. Sands has in 1,418,860 of the 4,300,008 shares of Class A Stock subject to the life estate held by Marilyn Sands described in footnote (3) above or the remainder interest of CWCP-II in 1,447,812 of such shares. Mr. Sands disclaims beneficial ownership with respect to all such shares. Assuming the conversion of Class B Stock beneficially owned by Mr. Sands into Class A Stock, Mr. Sands would beneficially own 19,785,072 shares of Class A Stock, representing 9.2% of the outstanding Class A Stock after such conversion. |

| (5) | The amounts reflected include, as applicable, 768 shares of Class A Stock and 667,368 shares of Class B Stock owned by MLR&R, of which CWCP-I is a general partner. The shares owned by CWCP-I are included in the number of shares beneficially owned by Richard Sands and Robert Sands, the managing partners of CWCP-I, the Marital Trust (defined in footnote (6) below), a partner of CWCP-I which owns a majority in interest of the CWCP-I partnership interests, and the group described in footnote (7) below. The other partners of CWCP-I are trusts for the benefit of Laurie Sands’ children. Assuming the conversion of Class B Stock beneficially owned by CWCP-I into Class A Stock, CWCP-I would beneficially own 6,571,456 shares of Class A Stock, representing 3.3% of the outstanding Class A Stock after such conversion. |

| (6) | The amounts reflected include, as applicable, 471,608 shares of Class A Stock and 5,431,712 shares of Class B Stock owned by CWCP-I, in which the Trust for the benefit of Andrew Stern, M.D. under the will of Laurie Sands (the “Marital Trust”) is a partner and owns a majority in interest of the CWCP-I partnership interests, 563,632 shares of Class B Stock owned by CWCP-II, in which the Marital Trust is a partner and owns a majority in interest of the CWCP-II partnership interests, and 768 shares of Class A Stock and 667,368 shares of Class B Stock owned by MLR&R, of which CWCP-I is a general partner. The Marital Trust disclaims beneficial ownership with respect to all of the foregoing shares except to the extent of its ownership interest in CWCP-I and CWCP-II. The amounts reflected do not include the remainder interest CWCP-II has in 1,447,812 of the 4,300,008 shares of Class A Stock subject to the life estate held by Marilyn Sands described in footnote (3) above. The Marital Trust disclaims beneficial ownership with respect to all such shares. Assuming the conversion of Class B Stock beneficially owned by the Marital Trust into Class A Stock, the Marital Trust would beneficially own 7,135,088 shares of Class A Stock, representing 3.5% of the outstanding Class A Stock after such conversion. |

| (7) | The group, as reported, consists of Richard Sands, Robert Sands, CWCP-I, CWCP-II, and the trust described in footnote (10) (collectively, the “Group”). The basis for the Group consists of: (i) a Stockholders Agreement among Richard Sands, Robert Sands and CWCP-I and (ii) the fact that the familial relationship between Richard Sands and Robert Sands, their actions in working together in the conduct of the business of the Company and their capacity as partners and trustees of the other members of the Group may be deemed to constitute an agreement to “act in concert” with respect to the Company’s shares. The members of the Group disclaim that an agreement to act in concert exists. Except with respect to the shares subject to the Stockholders Agreement, the shares owned by CWCP-I and CWCP-II, and the shares held by the trust described in footnote (10) below and the Master Trust, no member of the Group is required to consult with any other member of the Group with respect to the voting or disposition of any shares of the Company. Assuming the conversion of Class B Stock beneficially owned by the Group into Class A Stock, the Group would beneficially own 28,199,960 shares of Class A Stock, representing 12.7% of the outstanding Class A Stock after such conversion. Of the shares of Class A Stock and Class B Stock held by the Group, 1,300,000 shares of Class A Stock and 4,200,771 shares of Class B Stock have been pledged under a credit facility with a financial institution by certain members of the Group as collateral for loans made to such members of the Group and certain other Sands-related entities. In the event of noncompliance with certain covenants under the credit facility, the financial institution has the right to sell the pledged shares subject to certain protections afforded to the pledgors. |

| (8) | The number of shares equals the number of shares of Class A Stock reported to be beneficially owned by FMR Corp., Edward C. Johnson 3d and Abigail P. Johnson (collectively, “FMR”) in its Schedule 13G (Amendment No. 3) dated February 14, 2005, filed with the Securities and Exchange Commission, and is also adjusted to reflect the effect of the Company’s two-for-one stock split that was distributed in the form of a stock dividend on May 13, 2005 (“2005 Stock Split”). The percentage of ownership reflected in the table is calculated on the basis of 195,947,790 shares of Class A Stock outstanding on May 31, 2005 and includes the additional shares of Class A Stock resulting from the assumed conversion of the Company’s Depositary Shares held by FMR (as described below). The Schedule 13G (Amendment No. 3), as adjusted for the 2005 Stock Split, indicates that of the 15,610,122 shares beneficially owned by FMR, through its control of Fidelity Management & Research Company, FMR has sole dispositive power with respect to 14,847,282 shares (which includes 582,382 shares of Class A Stock resulting from the assumed conversion of Company Depositary Shares, each representing 1/40 of a share of the Company’s 5.75% Series A Mandatory Convertible Preferred Stock, that are beneficially owned by FMR), through its control of Fidelity Management Trust Company, FMR has sole dispositive and voting power with respect to 549,240 shares, and through other relationships, FMR has sole dispositive and voting power with respect to 213,600 shares. For further information pertaining to FMR, reference should be made to FMR’s Schedule 13G (Amendment No. 3) filed with the Securities and Exchange Commission. With respect to the information contained herein pertaining to shares of Class A Stock beneficially owned by FMR, the Company has relied solely on the information reported in FMR’s Schedule 13G (Amendment No. 3) and has not independently verified FMR’s beneficial ownership as of May 31, 2005. |

| (9) | The number of shares equals the number of shares of Class A Stock reported to be beneficially owned by Wellington Management Company, LLP (“WMC”) in its Schedule 13G (Amendment No. 3) dated February 14, 2005, filed with the Securities and Exchange Commission, and is also adjusted to reflect the effect of the 2005 Stock Split. The percentage of ownership reflected in the table is calculated on the basis of 195,947,790 shares of Class A Stock outstanding on May 31, 2005. The Schedule 13G (Amendment No. 3), as adjusted for the 2005 Stock Split, indicates that of the 11,081,768 shares beneficially owned by WMC in its capacity as an investment advisor, WMC has shared voting power with respect to 8,923,404 shares and has shared dispositive power with respect to 11,081,768 shares. For further information pertaining to WMC, reference should be made to WMC’s Schedule 13G (Amendment No. 3) filed with the Securities and Exchange Commission. With respect to the information contained herein pertaining to shares of Class A Stock beneficially owned by WMC, the Company has relied solely on the information reported in WMC’s Schedule 13G (Amendment No. 3) and has not independently verified WMC’s beneficial ownership as of May 31, 2005. |

| (10) | The trust was created by Marvin Sands under the terms of an Irrevocable Trust Agreement dated November 18, 1987 (the “Trust”). The Trust is for the benefit of the present and future grandchildren of Marvin and Marilyn Sands. The Co-Trustees of the Trust are Richard Sands and Robert Sands. Unanimity of the Co-Trustees is required with respect to voting and disposing of Class B Stock owned by the Trust. The shares owned by the Trust are included in the number of shares beneficially owned by Richard Sands, Robert Sands and the Group. Assuming the conversion of Class B Stock beneficially owned by the Trust into Class A Stock, the Trust would beneficially own 4,050,000 shares of Class A Stock, representing 2.0% of the outstanding Class A Stock after such conversion. |

Annual Compensation | Long-Term Compensation Awards (2) | |||||

Name and Principal Position | Year | Salary | Bonus | Other Annual Compen- sation (1) | Securities Underlying Options (3) | All Other Compen- sation (4) |

Richard Sands, Chairman of the Board and Chief Executive Officer | 2005 2004 2003 | $ 950,000 875,500 850,000 | $1,154,250 868,715 1,108,613 | $ 121,524 (5) 88,729 (5) 104,002 (5) | 282,800 212,200 - | $ 77,620 64,514 70,313 |

Robert Sands, President and Chief Operating Officer | 2005 2004 2003 | $ 750,000 618,000 600,000 | $ 911,250 613,211 782,550 | $ 113,850 (6) - 54,493 (6) | 231,800 167,600 - | $ 62,431 46,497 49,735 |

Stephen B. Millar, Chief Executive Officer, Constellation Wines (7) | 2005 2004 2003 | $ 652,834 553,703 - | $ 590,684 263,452 - | $ 54,934 (8) 98,796 (8) - | 141,400 431,212 - | $ 128,893 139,023 - |

Alexander L. Berk, Chief Executive Officer, Constellation Beers and Spirits (9) | 2005 2004 2003 | $ 562,277 545,900 530,000 | $ 630,200 610,731 567,784 | - - - | 84,600 81,000 - | $ 52,267 50,352 51,874 |

Thomas S. Summer, Executive Vice President and Chief Financial Officer | 2005 2004 2003 | $ 424,360 412,000 400,000 | $ 412,478 327,046 382,580 | - - - | 103,800 123,000 - | $ 37,778 32,997 34,899 |

| (1) | None of the Named Executives, other than as indicated, received any individual perquisites or other personal benefits exceeding the lesser of $50,000 or 10% of the total salary and bonus reported for such executive officer during the periods covered by the Summary Compensation Table. |

| (2) | None of the Named Executives received any restricted stock awards or any pay-outs under long-term incentive plans during the periods covered by the Summary Compensation Table. |

| (3) | The securities consist of shares of Class A Stock underlying stock options. |

| (4) | Amounts reported for 2005 consist of: |

| • | Company 401(k) contributions under the Company’s 401(k) and Profit Sharing Plan: Richard Sands $6,494; Robert Sands $6,277; Alexander Berk $6,150; and Thomas Summer $6,002. |

| • | Company profit sharing contributions under the Company’s 401(k) and Profit Sharing Plan: Richard Sands $15,355; Robert Sands $15,355; Alexander Berk $16,810; and Thomas Summer $15,355. |

| • | Company contributions under the Company’s 2005 Supplemental Executive Retirement Plan: Richard Sands $55,771; Robert Sands $40,799; Alexander Berk $29,307; and Thomas Summer $16,421. |

| • | Company contributions to the Superannuation Plan for Stephen Millar: $128,893. |

| (5) | The amounts shown include $114,324 in 2005, $83,959 in 2004 and $94,080 in 2003 for use of the corporate aircraft. |

| (6) | The amounts shown include $105,564 in 2005 and $54,267 in 2003 for use of the corporate aircraft. No amount is shown for use of the corporate aircraft in 2004. |

| (7) | Mr. Millar joined the Company in April 2003 with the acquisition of BRL Hardy Limited (now known as Hardy Wine Company Limited) at which time he became an executive officer of the Company. Mr. Millar remains an employee of Hardy Wine Company Limited. The reported information for 2004 is the amount paid to him during the portion of the 2004 fiscal year that he was an executive officer of the Company. Mr. Millar is paid in Australian dollars. The amounts appearing in the table and footnotes are converted into United States dollars using the weighted average exchange rate for the indicated fiscal year. Specifically, amounts were converted to US dollars from Australian dollars at the weighted average exchange rate of 0.7385 for 2005 and the weighted average exchange rate of 0.7057 for 2004. |

| (8) | The amounts shown include use of a motor vehicle in the amount of $42,301 in 2005 and $29,826 in 2004 and air transportation services in the amount of $55,184 in 2004. |

| (9) | Mr. Berk is employed by Barton Incorporated, a wholly-owned subsidiary of the Company. Mr. Berk is also President and Chief Executive Officer of Barton Incorporated. |

Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | |||||

Name | Number of Securities Underlying Options Granted (1) | % of Total Options Granted to Employees in Fiscal Year | Exercise or Base Price ($/Sh) (2) | Expiration Date | ||

5% | 10% | |||||

| Richard Sands | 242,800 (3) | 3.6 % | $ 16.63 | 04/06/14 | $ 2,539,328 | $ 6,435,156 |

| 40,000 (4) | 0.6 % | $ 23.02 | 12/23/14 | $ 579,086 | $ 1,467,518 | |

| Robert Sands | 191,800 (3) | 2.8 % | $ 16.63 | 04/06/14 | $ 2,005,944 | $ 5,083,455 |

| 40,000 (4) | 0.6 % | $ 23.02 | 12/23/14 | $ 579,086 | $ 1,467,518 | |

| Stephen B. Millar | 101,400 (3) | 1.5 % | $ 16.63 | 04/06/14 | $ 1,060,494 | $ 2,687,499 |

| 40,000 (4) | 0.6 % | $ 23.02 | 12/23/14 | $ 579,086 | $ 1,467,518 | |

| Alexander L. Berk | 84,600 (3) | 1.2 % | $ 16.63 | 04/06/14 | $ 884,791 | $ 2,242,233 |

| Thomas S. Summer | 63,800 (3) | 0.9 % | $ 16.63 | 04/06/14 | $ 667,253 | $ 1,690,951 |

| 40,000 (4) | 0.6 % | $ 23.02 | 12/23/14 | $ 579,086 | $ 1,467,518 | |

| (1) | The securities consist of shares of Class A Stock underlying non-qualified stock options that were granted pursuant to the Company’s Long-Term Stock Incentive Plan, as amended (the “LTSIP Plan”) or the Company’s Incentive Stock Option Plan, as amended (the “ISOP Plan”). The stock options were granted for terms of no greater than 10 years, subject to earlier termination upon the occurrence of certain events related to termination of employment. Under the LTSIP Plan and the ISOP Plan, the vesting of stock options accelerates in the event of a change of control, as defined in the LTSIP Plan and the ISOP Plan. |

| (2) | The exercise price per share of each option is equal to the closing market price of a share of Class A Stock on the date of grant. |

| (3) | This option is 100% vested and fully exercisable. |

| (4) | This option vests and becomes fully exercisable on December 23, 2008, unless it becomes exercisable on an earlier date as follows: (i) 25% of this option has become exercisable; (ii) an additional 25% of this option will become exercisable after the fair market value of a share of Class A Stock has been at least $30.45 for fifteen (15) consecutive trading days; and (iii) the remaining 50% of this option will become exercisable after the fair market value of a share of Class A Stock has been at least $35.01 for fifteen (15) consecutive trading days. |

Name | Shares Acquired on Exercise | Value Realized | Number of Securities Underlying Unexercised Options at FY-End (1) | Value of Unexercised In-the-Money Options at FY-End (2) | ||

Exercisable | Unexercisable | Exercisable | Unexercisable | |||

| Richard Sands | - | - | 2,093,680 | 99,720 | $ 40,225,629 | $ 1,110,160 |

| Robert Sands | - | - | 1,872,480 | 99,720 | $ 36,568,851 | $ 1,110,160 |

| Stephen B. Millar | 50,000 | $ 336,526 | 307,642 | 214,970 | $ 4,112,566 | $ 2,697,080 |

| Alexander L. Berk | 402,560 | $ 5,628,668 | 564,800 | 14,080 | $ 9,659,205 | $ 281,811 |

| Thomas S. Summer | - | - | 557,320 | 94,920 | $ 9,763,919 | $ 1,024,024 |

| (1) | The securities consist of shares of Class A Stock underlying stock options that were granted pursuant to Company plans that were approved by its stockholders. |

| (2) | The indicated dollar values are calculated by determining the difference between the closing price of the Class A Stock on the New York Stock Exchange at the end of fiscal 2005 and the exercise price of each indicated option. |

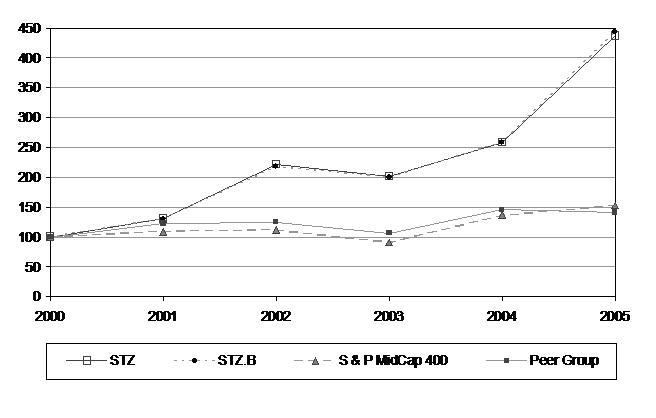

2000 | 2001 | 2002 | 2003 | 2004 | 2005 | |

| STZ | $100.00 | $130.31 | $221.84 | $201.06 | $258.78 | $436.98 |

| STZ.B | 100.00 | 130.61 | 217.71 | 200.00 | 258.78 | 443.35 |

| S & P MidCap 400 Index | 100.00 | 108.93 | 111.87 | 90.99 | 136.24 | 152.77 |

| Peer Group Index | 100.00 | 122.31 | 125.15 | 106.45 | 145.53 | 141.55 |

| (1) | The Selected Peer Group Index is weighted according to the respective issuer's stock market capitalization and is comprised of the following companies: Anheuser-Busch Companies, Inc.; The Boston Beer Company, Inc.; Brown-Forman Corporation (Class A and Class B Shares); Cadbury Schweppes plc; Coca-Cola Bottling Co. Consolidated; The Coca-Cola Company; Coca-Cola Enterprises Inc.; Diageo plc; LVMH Moet Hennessy Louis Vuitton; Molson Coors Brewing Company (Class B Shares); PepsiCo, Inc.; and PepsiAmericas, Inc. |

Name of Beneficial Owner | Class A Stock (1) | Class B Stock | |||

Shares Beneficially Owned | |||||

Outstanding Shares (2) | Shares Acquirable within 60 days by Exercise of Options (3) | Percent of Class Beneficially Owned | Shares Beneficially Owned | Percent of Class Beneficially Owned | |

Richard Sands | 1,048,280 (4) | 2,059,800 (4) | 1.6% (4) | 16,768,376 (4) | 70.0% |

Robert Sands | 1,183,736 (4) | 1,838,600 (4) | 1.5% (4) | 16,762,736 (4) | 70.0% |

Alexander L. Berk | 46,286 | 578,880 | * | - | * |

Stephen B. Millar | 20,986 (5) | 373,884 | * | - | * |

Thomas S. Summer | 38,922 (6) | 399,440 | * | - | * |

George Bresler | 3,938 | 8,224 | * | - | * |

Jeananne K. Hauswald | 5,506 | 44,224 | * | - | * |

James A. Locke III | 18,330 | 56,224 | * (7) | 264 | * |

Thomas C. McDermott | 9,938 | 88,224 | * | - | * |

Paul L. Smith | 5,942 | 8,224 | * | - | * |

All Executive Officers and Directors as a Group (13 persons) (8) | 1,809,264 | 6,425,336 | 4.1% (8) | 22,671,232 | 94.7% |

| (1) | The shares and percentages of Class A Stock set forth in this table do not include (i) shares of Class A Stock that may be acquired within sixty (60) days by an employee under the Company’s Employee Stock Purchase Plan (because such number of shares is not presently determinable) and (ii) shares of Class A Stock that are issuable pursuant to the conversion feature of the Company’s Class B Stock, although such information is provided in a footnote where appropriate. For purposes of calculating the percentage of Class A Stock beneficially owned in the table and in the footnotes, additional shares of Class A Stock equal to the number of presently exercisable options and, as appropriate, the number of shares of Class B Stock owned by the named person or by the persons in the group of executive officers and directors are assumed to be outstanding only for that person or group of persons pursuant to Rule 13-3(d)(1) under the Securities Exchange Act. |

| (2) | Includes the number of shares of Class A Stock that underlie any holdings of CHESS Depositary Interests. |

| (3) | Reflects the number of shares of Class A Stock that can be purchased by exercising stock options that are exercisable on May 31, 2005 or become exercisable within sixty (60) days thereafter. Such number does not include the number of option shares that may become exercisable within sixty (60) days of May 31, 2005 due to certain acceleration provisions in certain awards, which accelerations cannot be foreseen on the date of this Proxy Statement. |

| (4) | Includes shares in which the named individual shares voting power or investment discretion. See tables and footnotes under “Beneficial Ownership” above for information with respect to such matters and for the number and percentage of shares of Class A Stock that would be owned assuming the conversion of Class B Stock into Class A Stock. |

| (5) | This amount includes 19,550 shares of Class A Stock that underlie the CHESS Depositary Interests held by Mr. Millar. Such amount does not include 29,122 shares of Class A Stock that underlie the CHESS Depositary Interests held by his spouse and for which Mr. Millar disclaims beneficial ownership. |

| (6) | Mr. Summer shares the power to vote and dispose of 36,302 shares with his spouse. Such number does not include 1,600 shares of Class A Stock that his spouse holds as a custodian and for which Mr. Summer disclaims beneficial ownership. |

| (7) | Assuming the conversion of Mr. Locke’s 264 shares of Class B Stock into Class A Stock, Mr. Locke would beneficially own 74,818 shares of Class A Stock, representing less than one percent (1%) of the outstanding Class A Stock after such conversion. |

| (8) | This group consists of the Company’s current executive officers and directors. Assuming the conversion of a total of 22,671,232 shares of Class B Stock beneficially owned by the executive officers and directors as a group into Class A Stock, all executive officers and directors as a group would beneficially own 30,905,832 shares of Class A Stock, representing 13.7% of the outstanding Class A Stock after such conversion. |

George Bresler | Director since 1992 |

Jeananne K. Hauswald | Director since 2000 |

James A. Locke III | Director since 1983 |

Thomas C. McDermott | Director since 1997 |

Richard Sands, Ph.D. | Director since 1982 |

Robert Sands | Director since 1990 |

Paul L. Smith | Director since 1997 |

| · | the integrity of the Company’s financial statements, |

| · | the Company’s compliance with legal and regulatory requirements, |

| · | the qualifications and independence of the independent accountants, and |

| · | the performance of the Company’s internal audit function and the Company’s independent accountants; |

| · | Have the direct authority to approve the engagement letter and the fees to be paid to the independent accountants; |

| · | Pre-approve all audit and non-audit services to be performed by the independent accountants and the related fees for such services (subject to the de minimis exceptions set forth in the Act and in SEC rules thereunder); |

| · | Obtain confirmation and assurance as to the independent accountants’ independence, including ensuring that they submit on a periodic basis (not less than annually) to the Audit Committee a formal written statement delineating all relationships between the independent accountants and the Company. The Audit Committee is responsible for actively engaging in a dialogue with the independent accountants with respect to any disclosed relationships or services that may impact the objectivity and independence of the independent accountants and for taking appropriate action in response to the independent accountants’ report to satisfy itself of their independence; |

| · | At least annually, obtain and review a report by the independent accountants describing: the firm’s internal quality-control procedures; any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues; and, to assess the independent accountants’ independence, all relationships between the independent accountants and the Company; |

| · | Meet with the independent accountants prior to the annual audit to discuss planning and staffing of the audit; |

| · | Review and evaluate the performance of the independent accountants, as the basis for any decision to reappoint or replace the independent accountants; |

| · | Set clear hiring policies for employees or former employees of the independent accountants, as required by applicable laws and regulations; and |

| · | Ensure the regular rotation of audit partners on the audit engagement, as required by applicable laws and regulations, and consider whether rotation of the independent accountant is required to ensure independence. |

| · | Discuss with the independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61 (as may be modified or supplemented) relating to the conduct of the audit; |

| · | Review significant changes in accounting or auditing policies; |

| · | Review with the independent accountants any problems or difficulties encountered in the course of their audit, including any change in the scope of the planned audit work and any restrictions placed on the scope of such work, and management’s response to such problems or difficulties; and |

| · | Review with the independent accountants, management, and the senior internal auditing executive, the condition of the Company’s internal controls, and any significant findings and recommendations with respect to such controls. |

| · | Meet periodically with management and the senior internal auditing executive to review and assess the Company’s major financial risk exposures and the manner in which such risks are being monitored and controlled; and discuss guidelines and policies to govern the process by which risk assessment and management is undertaken; |

| · | Review, in consultation with management and the senior internal auditing executive, the plan and scope of internal audit activities; and |

| · | Review significant reports to management prepared by the internal auditing department and management’s responses to such reports. |

| A. | A director will not be Independent if, (i) currently or within the last three years the director was employed by the Company; (ii) an immediate family member of the director is or has been within the last three years an executive officer of the Company; (iii) the director or an immediate family member of the director received, during any twelve-month period within the last three years, more than $100,000 in direct compensation from the Company (other than director and committee fees and pension or other forms of deferred compensation for prior service, and also provided such deferred compensation is not contingent in any way on continued service); (iv) the director or an immediate family member of the director is a current partner of a firm that is the Company's internal or external auditor; (v) the director is a current employee of a firm that is the Company’s internal or external auditor; (vi) the director has an immediate family member who is a current employee of a firm that is the Company’s internal or external auditor and such immediate family member participates in that firm’s audit, assurance or tax compliance (but not tax planning) practice; (vii) the director or an immediate family member of the director was within the last three years (but is no longer) a partner or employee of a firm that is the Company’s internal or external auditor and such director or immediate family member personally worked on the Company’s audit within that time; (viii) the director or an immediate family member of the director is, or has been within the last three years, employed as an executive officer of another company in which any of the Company’s present executive officers at the same time serve or served on that other company’s compensation committee; or (ix) the director is a current employee, or an immediate family member of the director is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeded the greater of $1,000,000 or two percent (2%) of such other company’s consolidated gross revenues. |

| B. | The following commercial or charitable relationships will not be considered to be material relationships that would impair a director’s independence: (i) an immediate family member of the director is or was employed by the Company other than as an executive officer; (ii) if the director or an immediate family member of the director received $100,000 or less in direct compensation from the Company during any twelve-month period (other than director and committee fees and pension or other forms of deferred compensation for prior service, and also provided such deferred compensation is not contingent in any way on continued service); (iii) if an immediate family member of the director is employed by a present or former internal or external auditor of the Company and such family member does not participate in the firm’s audit, assurance or tax compliance (as distinguished from tax planning) practice and did not personally work on the Company’s audit within the last three years; (iv) if an immediate family member of the director was (but is no longer) a partner or employee of a present or former internal or external auditor of the Company and did not personally work on the Company’s audit within the last three years; (v) if a Company director is or was an executive officer or employee, partner or shareholder, or an immediate family member of the director is or was an executive officer, partner or shareholder of another company that does business with the Company and the annual sales to, or purchases from, the Company for property and/or services are less than or equal to the greater of $1,000,000 or two percent (2%) of the annual revenues of such other company; (vi) if a Company director is or was an executive officer, employee, partner or shareholder of another company which is indebted to the Company, or to which the Company is indebted, and the total amount of either company’s indebtedness to the other is less than or equal to two percent (2%) of the total consolidated assets of the company for which he or she serves as an executive officer, employee, partner or shareholder; and (vii) if a Company director serves or served as an officer, director or trustee of a tax exempt organization, and the Company’s discretionary contributions to the tax exempt organization are less than or equal to the greater of $1,000,000 or two percent (2%) of that organization’s total annual consolidated gross revenues. The Board will annually review all commercial and charitable relationships of directors. |

| C. | In assessing the materiality of a director’s relationship not covered by paragraph B set forth above, the directors at the time sitting on the Board who are independent under the standards set forth in paragraphs A and B above shall determine whether the relationship is material and, therefore, whether the director would be independent. In such instance, the Company will explain in the next proxy statement the basis for any Board determination that a relationship was immaterial despite the fact it did not meet the categorical standards of immateriality in paragraph B above. |

| D. | In accordance with the NYSE’s Transition Rules, the three (3) year look back period referenced in paragraph A above shall be a one (1) year look back period until November 4, 2004. |

CONSTELLATION BRANDS, INC. PROXY FOR CLASS A COMMON STOCK AND CLASS B COMMON STOCK | |

P R O X Y | The undersigned hereby appoints David S. Sorce and Thomas S. Summer, or any one of them, proxies for the undersigned with full power of substitution to vote all shares of CONSTELLATION BRANDS, INC. (the "Company") that the undersigned would be entitled to vote at the Annual Meeting of Stockholders of the Company to be held at the Rochester Riverside Convention Center, 123 Main Street, Rochester, New York, on Thursday, July 28, 2005, at 11:00 a.m. (local time), and any adjournment thereof (the "Meeting"). Class A Stockholders, voting as a separate class, are entitled to elect two directors at the Meeting. Class A Stockholders and Class B Stockholders, voting as a single class, are entitled to elect five directors at the Meeting. Please refer to the Proxy Statement for details. Your shares of Class A Common Stock and/or Class B Common Stock appear on the back of this card. PLEASE SIGN ON THE BACK. THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF THE COMPANY. THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS SPECIFIED BY THE UNDERSIGNED. THIS PROXY REVOKES ANY PRIOR PROXY GIVEN BY THE UNDERSIGNED. UNLESS AUTHORITY TO VOTE FOR ONE OR MORE OF THE NOMINEES IS SPECIFICALLY WITHHELD, THE SHARES REPRESENTED BY A SIGNED PROXY WILL BE VOTED FOR THE ELECTION OF ALL NOMINEES AS DIRECTORS AND, UNLESS OTHERWISE SPECIFIED, THE SHARES REPRESENTED BY A SIGNED PROXY WILL BE VOTED FOR PROPOSALS 2 AND 3. TO APPROVE THE BOARD OF DIRECTORS' RECOMMENDATIONS, SIMPLY SIGN ON THE BACK. YOU NEED NOT MARK ANY BOXES. CONTINUED AND TO BE SIGNED ON REVERSE SIDE Address Change/Comments (Mark the corresponding box on the reverse side) |

Please Mark Here for Address Change SEE REVERSE SIDE | [ ] |

Please mark your votes as indicated in this example | [X] |

1. Election of Directors: To elect Directors as set forth in the Proxy Statement. | FOR ALL NOMINEES (except as noted below) | [ ] | WITHHELD FROM ALL NOMINEES | [ ] | |

Class A Stockholders are entitled to vote for the following: 01 George Bresler, 02 Jeananne K. Hauswald, 03 James A. Locke III, 04 Richard Sands, 05 Robert Sands, 06 Thomas C. McDermott, 07 Paul L. Smith |

Class B Stockholders are entitled to vote for the following: 01 George Bresler, 02 Jeananne K. Hauswald, 03 James A. Locke III, 04 Richard Sands, 05 Robert Sands | FOR ALL NOMINEES (except as noted below) | [ ] | WITHHELD FROM ALL NOMINEES | [ ] |

| 2. | Proposal to ratify the selection of KPMG LLP, Certified Public Accountants, as the Company's independent public accountants for the fiscal year ending February 28, 2006. |

| FOR | AGAINST | ABSTAIN |

| [ ] | [ ] | [ ] |

| 3. | Proposal to amend the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of the Company’s Class A Common Stock from 275,000,000 shares to 300,000,000 shares. |

| FOR | AGAINST | ABSTAIN |

| [ ] | [ ] | [ ] |

| 4. | In their discretion, the proxies are authorized to vote upon such other business not known at the time of the solicitation of this Proxy as may properly come before the Meeting or any adjournment thereof. |

Signature _________________ | Date ________ | Signature _________________ | Date ________ |

| Constellation Brands, Inc. | All Correspondence to: | |

| ARBN 103 442 646 | Computershare Investor Services Pty Limited GPO Box 1903 Adelaide South Australia 5001 Australia Enquiries (within Australia) 1800 030 606 (outside Australia) 61 3 9415 4000 Facsimile 61 8 8236 2305 www.computershare.com |

[ ] | CHESS Depositary Nominees Pty Ltd (CDN) (mark with an “X”) | OR | __________________________________________ | Write here the name of the person you are appointing if this person is someone other than CDN |

For | Withheld | ||

| 1.1 | Election of George Bresler | [ ] | [ ] |

| 1.2 | Election of Jeananne K. Hauswald | [ ] | [ ] |

| 1.3 | Election of James A. Locke III | [ ] | [ ] |

| 1.4 | Election of Richard Sands | [ ] | [ ] |

| 1.5 | Election of Robert Sands | [ ] | [ ] |

| 1.6 | Election of Thomas C. McDermott | [ ] | [ ] |

| 1.7 | Election of Paul L. Smith | [ ] | [ ] |

For | Against | Abstain* | ||

| 2. | Proposal to ratify the selection of KPMG LLP, Certified Public Accountants, as the Company's independent public accountants for the fiscal year ending February 28, 2006. | [ ] | [ ] | [ ] |

For | Against | Abstain* | ||

| 3. | Proposal to amend the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of the Company’s Class A Common Stock from 275,000,000 shares to 300,000,000 shares. | [ ] | [ ] | [ ] |

Individual or Securityholder 1 |

___________________________________ |

Sole Director and Sole Company Secretary |

Securityholder 2 |

___________________________________ |

Director |

Securityholder 3 |

___________________________________ |

Director/Company Secretary |

| (a) | You can give your voting instructions to CHESS Depositary Nominees Pty Ltd (CDN), which will vote the underlying shares on your behalf; or |

| (b) | You can instruct CDN to appoint you or your nominee as proxy to vote the shares underlying your CDIs in person at the annual general meeting of Constellation Brands, Inc. |