Exhibit 10.3

Case 15-40289-rfn11 Doc 2668 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 1 of 4

| David M. Bennett | James Craig Orr, Jr. |

| State Bar No. 02139600 | State Bar No. 15313550 |

| Nicole L. Williams | Michael E. Heygood |

| State Bar No. 24041784 | State Bar No. 00784267 |

| Katharine Battaia Clark | Heygood, Orr & Pearson |

| State Bar No. 24046712 | 6363 North State Highway 161, Suite 150 |

| Thompson & Knight LLP | Irving, Texas 75038 |

| 1722 Routh Street, Suite 1500 | (214) 237-9001 (Telephone) |

| Dallas, Texas 75201 | (214) 237-9002 (Facsimile) |

| (214) 969-1700 (Telephone) | jim@hop-law.com |

| (214) 969-1751 (Facsimile) | michael@hop-law.com |

| David.Bennett@tklaw.com | |

| Nicole.Williams@tklaw.com | Attorneys for Plaintiffs |

| Katie.Clark@tklaw.com | |

| | |

| Attorneys for Chapter 11 Trustee | |

| H. Thomas Moran II and the | |

| Subsidiary Debtors | |

| | |

| Joseph J. Wielebinski | |

| Texas Bar No. 21432400 | |

| Dennis L. Roosien, Jr. | |

| Texas Bar No. 00784873 | |

| Jay H. Ong | |

| Texas Bar No. 24028756 | |

| Munsch Hardt Kopf & Harr, P.C. | |

| 500 N. Akard Street, Suite 3800 | |

| Dallas, Texas 75201-6659 | |

| (214) 855-7500 (Telephone) | |

| (214) 855-7584 (Facsimile) | |

| jwielebinski@munsch.com | |

| droosien@munsch.com | |

| jong@munsch.com | |

| | |

| Attorneys for the Official | |

| Committee of Unsecured Creditors | |

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE NORTHERN DISTRICT OF TEXAS

FORT WORTH DIVISION

| IN RE: | § | | |

| | § | CASE NO. 15-40289-rfn11 | |

| LIFE PARTNERS HOLDINGS, INC., | § | | |

| et. al. | § | JOINTLY ADMINISTERED | |

| | § | (Chapter 11) | |

| Debtors. | § | | |

| | | | |

JOINT SUPPLEMENT IN SUPPORT OF JOINT

MOTION TO COMPROMISE WITH CERTAIN INVESTORS

UNDER FEDERAL RULES OF BANKRUPTCY PROCEDURE 9019

Joint Supplement in Support of Joint Motion to Compromise with Certain

Investors Under Federal Rules of Bankruptcy Procedure 9019 — Page 1

Case 15-40289-rfn11 Doc 2668 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 2 of 4

On June 7, 2016 H. Thomas Moran II (the “Trustee”), as chapter 11 trustee for Life Partners Holdings, Inc. (“LPHI”),1Life Partners, Inc. (“LPI”), and LPI Financial Services, Inc. (“LPIFS,” and together with LPI, the “Subsidiary Debtors,” and together with LPHI, the “Debtors” or “Life Partners”),2along with certain Plaintiffs and the Official Committee of Unsecured Creditors (the “Committee”), filed theirJoint Motion to Compromise with Certain Investors Under Federal Rules of Bankruptcy Procedure 9019[Dkt. No. 2364] (the “Joint Motion”).

The Joint Motion requests, pursuant to Section 105 of the Bankruptcy Code and Bankruptcy Rule 9019(a) the approval of the Settlement Agreement among the Plaintiffs, the Trustee, the Subsidiary Debtors, and the Committee (the “Settlement Agreement”). The Joint Motion will be heard by the Court on July 11, 2016. Due to the sheer number of Plaintiffs at issue in the Joint Motion (nearly 250), at the time the Joint Motion was filed, the Parties filed a partially executed copy of the Settlement Agreement and notified the Court that they would file the fully executed Settlement Agreement prior to the hearing on the Joint Motion.SeeDkt. No. 2364 at p. 3 n.4. An updated copy of the Settlement Agreement, containing the signatures of additional Plaintiffs, is attached asExhibit A to this Joint Supplement.

1Case No. 15-40289-RFN-11.

2The Trustee is serving as the sole director of LPI and LPIFS pursuant to the Trustee’s authority under this Court’sOrder Authorizing the Trustee to Amend the Governing Documents and To File Voluntary Chapter 11 Petitions For Debtor’s Subsidiaries(the “Subsidiary Filing Order”) [Dkt. No. 261].

Joint Supplement in Support of Joint Motion to Compromise with Certain

Investors Under Federal Rules of Bankruptcy Procedure 9019 — Page 2

Case 15-40289-rfn11 Doc 2668 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 3 of 4

| Respectfully submitted, | | |

| | | |

| By:/s/ James Craig Orr, Jr. | | By:/s/ David M. Bennett |

| James Craig Orr, Jr. | | David M. Bennett |

| State Bar No. 15313550 | | Texas Bar No. 02139600 |

| Michael E. Heygood | | Nicole L. Williams |

| State Bar No. 00784267 | | Texas Bar No. 24041726 |

| Heygood, Orr & Pearson | | Jennifer R. Ecklund |

| 6363 North State Highway 161, Suite 150 | | Texas Bar No. 24045626 |

| Irving, Texas 75038 | | |

| (214) 237-9001 (Telephone) | | Thompson & Knight LLP |

| (214) 237-9002 (Facsimile) | | |

| jim@hop-law.com | | 1722 Routh Street, Suite 1500 |

| michael@hop-law.com | | Dallas, Texas 75201 |

| | | Telephone: (214) 969-1700 |

| Attorneys For Plaintiffs | | Facsimile: (214) 969-1751 |

| | | David.Bennett@tklaw.com |

| | | Nicole.Williams@tklaw.com |

| | | Jennifer.Ecklund@tklaw.com |

| By:/s/ Jay H. Ong | | |

| Joseph J. Wielebinski | | Attorneys For Chapter 11 Trustee H. Thomas Moran II and the Subsidiary Debtors |

| Texas Bar No. 21432400 | |

| Dennis L. Roossien, Jr. | | |

| Texas Bar No. 00784873 | | |

| Jay H. Ong | | |

| Texas Bar No. 24028756 | | |

| | | |

| Munsch Hardt Kopf & Harr, P.C. | | |

| | | |

| 3800 Ross Tower | | |

| 500 N. Akard Street | | |

| Dallas, Texas 75201-6659 | | |

| Telephone: (214) 855-7500 | | |

| Facsimile: (214) 978-4335 | | |

| | | |

| Attorneys For The Official Committee of Unsecured Creditors | | |

Joint Supplement in Support of Joint Motion to Compromise with Certain

Investors Under Federal Rules of Bankruptcy Procedure 9019 — Page 3

Case 15-40289-rfn11 Doc 2668 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 4 of 4

CERTIFICATE OF SERVICE

I hereby certify that on July 8, 2016, the foregoing Motion was served on all parties entitled to service via the Court’s Electronic Filing System (“ECF”) and Epiq Bankruptcy Solutions, LLC, as service agent, was directed to serve notice of the foregoing upon all other parties on the Consolidated Master Limited Service List via electronic mail, where available, and otherwise via United States first class mail, postage prepaid.

| | /s/David M. Bennett | |

| | One of Counsel | |

Joint Supplement in Support of Joint Motion to Compromise with Certain

Investors Under Federal Rules of Bankruptcy Procedure 9019 — Page 4

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 1 of 100

Exhibit 10.3

EXHIBIT A

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 2 of 100

COMPROMISE SETTLEMENT AGREEMENT

1.PARTIES

The parties to this Compromise Settlement Agreement (the “Settlement Agreement”)1are:

| | 1.01. | Each person and entity identified onExhibit 1 to this Settlement Agreement, and, if a capacity is provided on Exhibit 1, limited to the capacity in which they are identified onExhibit 1(collectively, the “MDL Plaintiffs”). |

| | | |

| | 1.02. | Each person and entity identified onExhibit 4 to this Settlement Agreement, and, if a capacity is provided on Exhibit 4, limited to the capacity in which they are identified onExhibit 4(collectively, the “McDermott Plaintiffs”). |

| | | |

| | 1.03. | MDL Plaintiffs’ counsel Heygood, Orr & Pearson LLP (“Plaintiffs’ Counsel”). |

| | | |

| | 1.04. | H. Thomas Moran II (“Moran” or the “Trustee”), chapter 11 Trustee for Life Partners Holdings, Inc. (“LPHI”). |

| | | |

| | 1.05. | LPHI, Life Partners, Inc. (“LPI”) and LPI Financial Services, Inc. (“LPIFS”, and together with LPI, the “Subsidiary Debtors”) (collectively, the “Debtors”). |

| | | |

| | 1.06. | The Official Committee of Unsecured Creditors (the “Committee”). |

2.DEFINITIONS

| | 2.01. | “Affiliate”has the meaning set forth in Bankruptcy Code section 101(2). |

| | | |

| | 2.02. | “Allowed”has the meaning set forth in the Plan. |

| | | |

| | 2.03. | “Assigned Claims”has the meaning set forth in ¶ 5.09 of this Agreement. |

| | | |

| | 2.04. | “Claim”has the meaning set forth in the Plan. |

| | | |

| | 2.05. | The“Class Action Settlement Agreement”, a copy of which is attached asExhibit 2to this Settlement Agreement, has the meaning set forth in the Plan. |

| | | |

| | 2.06. | “Continuing Position Holder”has the meaning set forth in the Plan. |

| | | |

| | 2.07. | “Creditors’ Trust”has the meaning set forth in the Plan. |

| | | |

| | 2.08. | “Current Position Holder”has the meaning set forth in the Plan. |

1 Except as otherwise indicated, capitalized terms used in this Settlement Agreement and not defined herein shall have their respective meanings set forth in the Plan.

COMPROMISE SETTLEMENT AGREEMENT—Page 1 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 3 of 100

| | 2.09. | “Debtors’ Counsel”means Thompson & Knight LLP. |

| | | |

| | 2.10. | “Excluded Litigation Parties”means Brian Pardo, Scott Peden, and Pardo Family Holdings, Ltd., and their respective parent corporations, subsidiaries, agents, servants, employees, ex-employees, independent contractors, insurers, attorneys, insiders, and assigns. |

| | | |

| | 2.11. | “Execution Date”means the date that this Settlement Agreement has been executed by all parties. |

| | | |

| | 2.12. | “Former Position Holder”has the meaning set forth in the Plan. |

| | | |

| | 2.13. | “Fractional Interest”has the meaning set forth in the Plan. |

| | | |

| | 2.14. | “Fractional Position”has the meaning set forth in the Plan. |

| | | |

| | 2.15. | The“Gummelt Policy”means American General Life Insurance Co. policy number #####7322L. |

| | | |

| | 2.16. | “IRA Holder”has the meaning set forth in the Plan. |

| | | |

| | 2.17. | “Litigation”means, collectively, the following-captioned lawsuits: |

In re Life Partners, Inc. Litigation, MDL No. 13-0357 (Tex. Dist. Ct. Dallas Cnty., created Sept. 9, 2013)

Arthur W. Morrow, individually and f/b/o Arthur W. Morrow Self-Directed IRA, Jennie E. Morrow, individually and f/b/o Jennie E. Morrow Self-Directed IRA v. Life Partners Holdings, Inc., Life Partners Inc., Brian Pardo, Scott Peden, and Pardo Family Holdings, Case No. 3:14-cv-141 (W.D. Pa., filed July 3, 2014)

John Woelfel, individually and f/b/a John Woelfel Self-Directed IRA, Henry Funke, and Diana Funke, v. Life Partners Inc., Life Partners Holdings Inc., Brian Pardo, Scott Peden, and Pardo Family Holdings, Ltd., Case No. 9:14-cv-80433-JIC (S.D. Fla. filed Mar. 31, 2014)

Mary Steuben, on behalf of herself and all other California citizens v. Life Partners Inc., Case No. 2:16-ap-01109-ER (Bankr. C.D. Cal., filed Nov. 8, 2011, removed March 3, 2016)

Robert Whitehurst v. Life Partners, Inc., Brian Pardo, Life Partners Holdings, Inc., Scott Peden, and Pardo Family Holdings Ltd., No. 16-03059 (Bankr. S.D. Tex., filed Oct. 27, 2014, removed March 14, 2016)

Danny Birtcher v. Life Partners, Inc., Brian Pardo, Life Partners Holdings, Inc., Scott Peden, and Pardo Family Holdings Ltd., No. 16-04041-rfn (Bankr. N.D. Tex., filed Oct. 27, 2014, removed March 14, 2016)

COMPROMISE SETTLEMENT AGREEMENT—Page 2 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 4 of 100

David Whitmire & Somerset Partners Strategic Assets, Inc. v. Life Partners, Inc., Life Partners Holdings, Inc., Brian D. Pardo, Scott Peden, and Pardo Family Holdings, Ltd., Case No. 16-04042-rfn (Bankr. N.D. Tex., filed Oct. 31, 2014, removed March 14, 2016)

Todd McClain et al. v. Life Partners, Inc., Life Partners Holdings, Inc., Brian D. Pardo, and Scott Peden, Case No. 16-04043-rfn (Bankr. N.D. Tex., filed April 9, 2013, removed March 14, 2016)

Stephen Eccles et al. v. Life Partners, Inc., Life Partners Holdings, Inc., Brian D. Pardo, and Scott Peden, Case No. 16-04044-rfn (Bankr. N.D. Tex., filed Jan. 22, 2013, removed March 14, 2016)

John Willingham, individually and on behalf of all other Texas citizens similarly situated v. Life Partners Inc., No. 16-04046-rfn (Bankr. N.D. Tex., filed April 8, 2011, removed March 14, 2016)

| | 2.18. | The“LPHI Petition Date”means January 20, 2015. |

| | | |

| | 2.19. | The “McDermott Litigation” meansHelen McDermott, individually and on behalf of a class v. Life Partners Inc., Case No. 16-04045-rfn (Bankr. N.D. Tex., filed Mar. 11, 2011, removed March 14, 2016). |

| | | |

| | 2.20. | The“Multi-District Litigation”means the multi-district litigation captionedIn re Life Partners, Inc. Litigation, MDL No. 13-0357 (Tex. Dist. Ct. Dallas Cnty., created Sept. 9, 2013). |

| | | |

| | 2.21. | “New IRA Note”has the meaning set forth in the Plan. |

| | | |

| | 2.22. | “Original IRA Note Issuers”has the meaning set forth in the Plan. |

| | | |

| | 2.23. | “Parties”means each person identified in ¶¶ 1.01-1.05 of this Agreement, each of whom shall be individually referred to as a“Party.” |

| | | |

| | 2.24. | “Person”has the meaning set forth in Bankruptcy Code section 101(41). |

| | | |

| | 2.25. | “Plaintiffs’ Counsel’s IOLTA Account”means Compass Bank ABA # 113010547. |

| | | |

| | 2.26. | “Plaintiffs’ Counsel Proof of Claim”means proof of claim numbers 17689 and 18255 filed by Plaintiffs’ Counsel. |

| | | |

| | 2.27. | “Plan”means theSecond Amended Joint Plan of Reorganization of Life Partners Holdings, Inc., et al. Pursuant to Chapter 11 of the Bankruptcy Code[Dkt. No. 1688, filed March 24, 2016], including the Plan Supplement and all exhibits, |

COMPROMISE SETTLEMENT AGREEMENT—Page 3 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 5 of 100

| | | schedules, and attachments thereto, all as may be amended, supplemented, or otherwise modified. |

| | | |

| | 2.28. | “Plan Effective Date”has the meaning of the Effective Date set forth in the Plan. |

| | | |

| | 2.29. | “Position Holder Trust”has the meaning set forth in the Plan. |

3.STATEMENT OF FACTS

The Parties stipulate and agree to the following facts:

| | 3.01. | LPI, LPHI, and MDL Plaintiffs are parties to the Litigation. LPI and the McDermott Plaintiffs are parties to the McDermott Litigation. |

| | | |

| | 3.02. | Debtors, the Committee, and MDL Plaintiffs desire to settle the Litigation and any other potential claims among the Parties. LPI, the Committee, and the McDermott Plaintiffs desire to settle the McDermott Litigation. |

| | | |

| | 3.03. | This Settlement Agreement does not settle and is not intended to settle, impact, or alter in any way the MDL Plaintiffs’ existing or potential claims against other defendants to the Litigation who are not a party to this Settlement Agreement, including but not limited to the Excluded Litigation Parties, other than to assign those claims to the Creditors’ Trust. |

| | | |

| | 3.04. | On or about the dates indicated in the captions contained in ¶ 2.17 above, the MDL Plaintiffs filed the Litigation against LPI, LPHI, and the Excluded Litigation Parties. MDL Plaintiffs asserted claims against LPI, LPHI, and the Excluded Litigation Parties relating to the MDL Plaintiffs’ investment in LPI’s life settlement investments. The MDL Plaintiffs seek damages, including damages due to fraud, a rescission of their life settlement contracts, the return of all amounts invested, disgorgement, the return of dividends issued by LPHI to the other defendants, exemplary damages, and their costs, expenses, and interest. The MDL Plaintiffs represent and warrant that the Litigation includes all pending lawsuits by an MDL Plaintiff against the Debtors and/or the Excluded Litigation Parties. |

| | | |

| | 3.05. | On or about September 9, 2013, the Texas Multi-District Litigation Panel consolidated many of the lawsuits in the Litigation in the Multi-District Litigation for pre-trial proceedings. Prior to the LPHI Petition Date, the Litigation and the McDermott Litigation had collectively reached relatively advanced stages of litigation. For example, some of the Litigation had proceeded through the discovery phase and was set for trial at the time LPHI filed its bankruptcy petition. In addition, a sanctions hearing was set in the Multi-District Litigation in January 2015 over a failure of the defendants to produce discovery. In the McDermott Litigation, the court had certified a class of all investors in the Gummelt Policy who had not already settled with LPI relating to that investment. |

COMPROMISE SETTLEMENT AGREEMENT—Page 4 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 6 of 100

| | | Each member of that class is identified as a McDermott Plaintiff onExhibit 4 to this Settlement Agreement. The sanctions hearing and trial in the Multi-District Litigation, along with the remaining Litigation and the McDermott Litigation, were stayed by the filing of the LPHI bankruptcy petition. |

| | | |

| | 3.06. | On January 20, 2015, LPHI filed a voluntary petition for relief under chapter 11 of title 11 of the United States Code, thereby commencing its bankruptcy case captionedIn re Life Partners Holdings, Inc., Case No. 15-40289-rfn11 (the “LPHI Chapter 11 Case”). On March 13, 2015, the U.S. Trustee appointed Moran as the Chapter 11 Trustee in the LPHI Chapter 11 Case, and on March 19, 2015, the United States Bankruptcy Court for the Northern District of Texas (the “Bankruptcy Court”) affirmed Moran’s appointment. |

| | | |

| | 3.07. | On May 19, 2015, the Subsidiary Debtors filed their respective voluntary petitions for relief under chapter 11 of the Bankruptcy Code, captionedIn re Life Partners, Inc., Case No. 15-41995-rfn11 andIn re LPI Financial Services, Inc., No. 15-41996-rfn11, thereby initiating their bankruptcy cases in the Bankruptcy Court (the “Subsidiary Chapter 11 Cases”). On May 22, 2015, the Bankruptcy Court granted the Subsidiary Debtors’ request to jointly administer the LPHI Bankruptcy Case and the Subsidiary Chapter 11 Cases (collectively, the “Chapter 11 Cases”). |

| | | |

| | 3.08. | Some of the MDL Plaintiffs are members of a proposed Ownership Settlement Subclass in the class adversary proceeding captionedGarner et al. v. Life Partners, Inc., Adversary No. 15-CV-04061-RFN (Bankr. N.D. Tex.) (consolidated withArnold et al. v. Life Partners, Inc., Adversary No. 15-CV-04064-RFN (Bankr. N.D. Tex.) on March 25, 2016). The proposed Ownership Settlement Subclass consists of “All persons or entities (including all IRAs and their respective individual owners and related IRA custodians) who purchased and hold, as of the Plan Effective Date, securities issued or sold by LPI (directly or in the name of any Original IRA Note Issuer) related to viatical settlements or life settlements, regardless of how the investments were denominated (whether as fractional interests in life insurance policies, promissory notes, or otherwise) and who are Current Position Holders under the Plan, regardless of whether or not a claim was filed by a class member. Excluded from the Ownership Settlement Subclass are LPI; all affiliated LPI companies or entities; Linda Robinson-Pardo; Paget Holdings Ltd.; and investors whose only investments relate to Pre-Petition Abandoned Interests under the Plan” (the “Ownership Settlement Subclass”). The MDL Plaintiffs who are also members of the Ownership Settlement Subclass recognize and agree that they will each be bound by the Class Action Settlement Agreement upon its final approval by the Court as provided for in the Class Action Settlement Agreement and its effective date. |

| | | |

| | 3.09. | Some of the MDL Plaintiffs are members of a proposed Rescission Settlement Subclass in the class adversary proceeding captionedGarner et al. v. Life Partners, Inc., Adversary No. 15-CV-04061-RFN (Bankr. N.D. Tex.) (consolidated withArnold et al. v. Life Partners, Inc., Adversary No. 15-CV- |

COMPROMISE SETTLEMENT AGREEMENT—Page 5 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 7 of 100

| | | 04064-RFN (Bankr. N.D. Tex.) on March 25, 2016). The proposed Rescission Settlement Subclass consists of “All persons or entities (including all IRAs and their respective individual owners and related IRA custodians) who purchased and hold, as of the Plan Effective Date, securities issued or sold by LPI (directly or in the name of any Original IRA Note Issuer) related to viatical settlements or life settlements, regardless of how the investments were denominated (whether as fractional interests in life insurance policies, promissory notes, or otherwise) and who are Current Position Holders under the Plan, regardless of whether or not a claim was filed by a class member. Excluded from the Rescission Settlement Subclass are LPI; all affiliated LPI companies or entities; Linda Robinson-Pardo; Paget Holdings Ltd.; investors whose only investments relate to Pre-Petition Abandoned Interests under the Plan; Qualified Plan Holders; and all persons and entities listed on Appendix A [of the Class Action Settlement Agreement]” (the “Rescission Settlement Subclass”) (collectively with the Ownership Settlement Subclass, the “Class Action Settlement Class”). The MDL Plaintiffs who are also members of the Rescission Settlement Subclass recognize and agree that they will each be bound by the Class Action Settlement Agreement upon its final approval by the Court as provided for in the Class Action Settlement Agreement and its effective date. |

| | | |

| | 3.10. | MDL Plaintiffs who are not Current Position Holders are not included in the Class Action Settlement Class, the Ownership Settlement Subclass, or the Rescission Settlement Subclass. |

| | | |

| | 3.11. | Bona fide claims, disputes, and controversies exist between the Parties, both as to the fact and extent of liability, if any, and as to the fact and extent of damages, if any, and by reason of such disputes and controversies, the Parties to this Settlement Agreement desire to settle all claims and causes of action of any kind whatsoever which the Parties have or may have in the future against each other, based upon, relating to, or arising from any events, facts, acts, or omissions related to (1) the MDL Plaintiffs’ investment in LPI’s life settlement investments that have occurred on or before the Plan Effective Date, except as otherwise expressly provided in this Settlement Agreement; and (2) the McDermott Plaintiffs’ investment in the Gummelt Policy, except as otherwise expressly provided in this Settlement Agreement. The Parties acknowledge that the agreed resolution of the Litigation and the McDermott Litigation according to this Settlement Agreement is not an admission of liability or wrongdoing on the part of the Debtors and is solely in order to avoid the cost, inconvenience, and burdens associated with contested litigation, and without admitting any fault or liability on any claim, desire to compromise and settle all matters between them. |

4.REPRESENTATIONS AND WARRANTIES

The following representations and warranties shall survive the execution of this Settlement Agreement and the completion of the settlement provided below.

COMPROMISE SETTLEMENT AGREEMENT—Page 6 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 8 of 100

| | 4.01. | Each Party to this Settlement Agreement warrants and represents that he, she, or it has the power and authority to enter into and execute this Settlement Agreement, and all other agreements and instruments to be executed by it as contemplated by this Settlement Agreement, and to carry out the transactions and perform its obligations provided for in this Settlement Agreement and in those other agreements and instruments, and that this Settlement Agreement and all documents delivered pursuant to this Settlement Agreement are valid, binding, and enforceable upon him or it. |

| | | |

| | 4.02. | Each Party to this Settlement Agreement warrants and represents that no consent, approval, authorization or order of, and no notice to, or filing with any court, governmental authority, person or entity is required for the execution, delivery, and performance of this Settlement Agreement, other than approval by the Bankruptcy Court, which will be sought jointly by the Parties. |

| | | |

| | 4.03. | Each Party to this Settlement Agreement warrants and represents that: (1) the Party on whose behalf it is executing this Settlement Agreement presently owns 100% of the claims or damages, if any, that it releases or assigns herein, and that no other person or entity not signing this Agreement has any rights of ownership or control to such claims or damages; (2) the Party on whose behalf it is executing this Settlement Agreement has, as of the Execution Date, not assigned or otherwise transferred to any person or entity who is not a Party to this Settlement Agreement any interest in the claims or damages, if any, released or assigned by this Settlement Agreement and will not do so except for in this Settlement Agreement; and (3) no person or entity other than the Party on whose behalf it is executing this Settlement Agreement is entitled to assert any claims or damages, if any, released or assigned herein on behalf of the Party on whose behalf it is executing this agreement. |

5.SETTLEMENT TERMS

In consideration of the agreements contained in this Settlement Agreement, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the Parties to this Settlement Agreement, and in reliance upon the representations, warranties and covenants in this Settlement Agreement, the Parties have settled and compromised their claims and causes of action against each other as follows:

| | 5.01. | LPI (and any successor entity) agrees not to sell or otherwise introduce into the market any securities unless those securities are (i) issued pursuant to the Plan or (ii) properly registered as securities with all appropriate federal and state regulatory bodies. |

| | | |

| | 5.02. | As of the Plan Effective Date, Debtors waive any claims to beneficial ownership in the Fractional Interests held in the name of the MDL Plaintiffs that are entitled to treatment as Continuing Fractional Holders, by election or otherwise, as set forth in the Plan and subject to the terms and conditions set forth in the Plan; and |

COMPROMISE SETTLEMENT AGREEMENT—Page 7 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 9 of 100

| | 5.03. | Subject to the terms and conditions set forth in the Plan, Debtors will provide each MDL Plaintiff who is a Current Position Holder, for each Fractional Position, except for those Fractional Positions where any Premium Advance included in a Pre-Petition Default Amount is owed and not paid by the Plan Effective Date, with the Elections described in Section 3.07(b)-(e) of the Plan for each Fractional Interest Holder and IRA Holder, respectively, which are summarized as follows: (i) be treated as a Continuing Position Holder with respect to their Fractional Position and be confirmed as the owner of a Fractional Interest or a New IRA Note, after making the related Continuing Position Holder Contribution (the “Continuing Position Holder Election”); (ii) contribute their Fractional Position to the Position Holder Trust and receive an interest in the Position Holder Trust or the IRA Partnership (the “Position Holder Trust Election”); or (iii) (for Rescission Settlement Subclass Members only) rescind their purchase of the Fractional Interest and receive an interest in the Creditors’ Trust (the “Creditors’ Trust Election”). In addition to the three election options listed above, IRA Holders will have a fourth option (the “Conversion Election”), which allows the individual taxpayer who owns an IRA Holder to take an IRA Note out of his or her IRA Holder and exchange it for the related Fractional Interest, to be registered as owned individually, outside of the IRA Holder in which case the individual owner will be deemed to have made a Continuing Holder Election to become a Continuing Position Holder under the Plan. |

| | | |

| | 5.04. | The MDL Plaintiffs who are IRA Holders stipulate that there was never any transfer of ownership of any Fractional Interest or other interest in any Policy made to any Original IRA Note Issuers by them or on their behalf, nor any effective conveyance of any property to any of the Original IRA Note Issuers. The MDL Plaintiffs who are IRA Holders further stipulate that (i) any authority Brian Pardo had to act on their behalf or for their benefit, as Trustee of an IRA Note Issuer Trust or otherwise, is revoked effective as of the Plan Effective Date, (ii) the MDL Plaintiffs who are IRA Holders are not looking to Pardo to take, and he is not authorized to take, any actions on their behalf, as such a Trustee or in any capacity, and (iii) all claims and causes of action they have or that may be asserted on their behalf against Brian Pardo in any capacity are included in the Assigned Claims. |

| | | |

| | 5.05. | In addition to the claim provided for in the Class Action Settlement Agreement, on the Plan Effective Date, each MDL Plaintiff who is a Current Position Holder shall receive an additional Allowed Claim in Class B4 in an amount equal to 25% of their Allowed Claim amount on LPI’s Bankruptcy Schedule F, for which the MDL Plaintiff will receive a corresponding interest in the Creditors’ Trust (the “Current Position Holder Additional Allowed Claim”). The proceeds of each Current Position Holder Additional Allowed Claim shall be paid directly to Plaintiffs’ Counsel’s IOLTA Account. This interest shall be in addition to any interest in the Creditors’ Trust granted under ¶¶ 5.06 and/or 5.07 of this Agreement. |

COMPROMISE SETTLEMENT AGREEMENT—Page 8 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 10 of 100

| | 5.06. | Upon the Plan Effective Date, each MDL Plaintiff who is a Former Position Holder and is listed onExhibit 3 to this Settlement Agreementshall receive an Allowed Claim in Class B4 in an amount equal to the amount listed onExhibit 3 to this Settlement Agreement, for which the MDL Plaintiff will receive a corresponding interest in the Creditors’ Trust (the “Former Position Holder Allowed Claim”). The proceeds of each Former Position Holder Allowed Claim shall be paid directly to Plaintiffs’ Counsel’s IOLTA Account. This interest shall be in addition to any interest in the Creditors’ Trust granted under ¶¶ 5.05 and/or 5.07 of this Settlement Agreement. |

| | | |

| | 5.07. | Upon the Plan Effective Date, each McDermott Plaintiff who is listed onExhibit 4 to this Settlement Agreementshall receive an Allowed Claim in Class B4 in an amount equal to the amount listed onExhibit 4 to this Settlement Agreement, for which the McDermott Plaintiff will receive a corresponding interest in the Creditors’ Trust (the “Gummelt Policy Allowed Claim”). The proceeds of each Gummelt Policy Allowed Claim shall be paid directly to Plaintiffs’ Counsel’s IOLTA Account. This interest shall be in addition to any interest in the Creditors’ Trust granted under ¶¶ 5.05 and/or 5.06 of this Settlement Agreement. |

| | | |

| | 5.08. | Subject to Court approval and the occurrence of the Plan Effective Date, and in consideration of the post-petition efforts by Plaintiffs’ Counsel to facilitate this Settlement Agreement and the transfer of the Assigned Claims to the Creditors’ Trust, Plaintiffs’ Counsel shall be entitled to recover appropriate fees, not to exceed $50,000 (the “Agreed Fee”), from the Debtors. Plaintiffs’ Counsel agrees to make, and the Trustee, the Subsidiary Debtors, and the Committee agree not to oppose, an administrative fee application (the “Fee Application”) in the amount of the Agreed Fee. Plaintiffs’ Counsel further agrees to withdraw Plaintiffs’ Counsel Proof of Claim (proof of claim numbers 18255 and 17689). Subject to Court approval and the occurrence of the Plan Effective Date, the Debtors shall pay Plaintiffs’ Counsel such amounts of the Agreed Fee as are approved by the Court. Plaintiffs’ Counsel may have the right to recover its additional costs and attorneys’ fees from the MDL Plaintiffs under the agreements between the MDL Plaintiffs and Plaintiffs’ Counsel. Plaintiffs’ Counsel does not waive the right to seek a substantial contribution claim in the Bankruptcy Court. |

| | | |

| | 5.09. | Upon the Plan Effective Date, the MDL Plaintiffs, and all of their current and former parents and subsidiaries, affiliates, partners, officers and directors, agents, employees, and any of their legal representatives (and the predecessors, heirs, executors, administrators, successors, purchasers, and assigns of each of the foregoing) (collectively, the “Assigning Parties”) assign all of their rights in any and all claims, damages, demands, suits, causes of action, obligations, remedies, debts, rights, and liabilities, whether known or unknown, liquidated or unliquidated, fixed or contingent, foreseen or unforeseen, matured or unmatured, whether class or individual, in law, equity, or otherwise, including claims for costs, fees, expenses, penalties, and attorneys’ fees, asserted by the Assigning Parties, or that could have been asserted by the Assigning Parties, or that the |

COMPROMISE SETTLEMENT AGREEMENT—Page 9 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 11 of 100

| | | Assigning Parties have, may have, or are entitled to assert directly, representatively, derivatively, or in any other capacity, against the Debtors, Brian Pardo, Deborah Carr, Kurt Carr, R. Scott Peden, Linda Robinson a/k/a Linda Robinson-Pardo, Pardo Family Holdings, Ltd., Pardo Family Holdings US, LLC, Pardo Family Trust, Paget Holdings, Inc., Paget Holdings Ltd., Tad M. Ballantyne, Fred DeWald, Harold E. Rafuse, Life Settlement Exchange, LLC; Fred A. Cowley; Security Reserve Financial, Inc.; Gallagher Financial Group; Edward G. Burford Corporation; Sun Safety, Inc.; Faye Bagby; Ella Oliver d/b/a Investingmakesmesick.com; Wealthstone Financial; Falco Group, LLC; Mark McKay; Kainos Asset Management, LLC; Peyton Inge a/k/a H. Peyton Inge; Life Strategy Services, LLC; Ted Hasson; James Sundelius; Abundant Income, LLC; B G & S Management Consultants; BG & S Consultants; BG & S; Tim Harper; Brian Harper; American Safe Retirement, LLC; ASR Alternative Investments, LP; Joe Barkate dba MTLRC, LLC; Rich DePaolo; Alpha & Omega Global Risk Mgt., LP; AO Global, LLC; Petra World Wide, Inc.; Tolleson Investments, LLC; William M. Tolleson; Tolleson Holdings, LLC; Steadfast Endeavors, LLC; New Asset Advisors, LLC; Curtis M. Cole; New Asset Alternative, LLC; Lakeside Equity Partners, Inc.; Dewitt & Dunn, LLC; Frank W. Bice; The Retirement & Investment Council; Russell Hagan; all persons listed on Appendix A to the Class Settlement Agreement, and all other prior officers, directors, affiliates, associates, members, principals, partners, officers, directors, trustees, control persons, employees, agents, brokers, attorneys, shareholders, advisors, investment advisors, banks, IRA advisers, IRA brokers, IRA custodians, insurers, insiders, licensees, master licensees, and representatives of the Debtors, and any entities in which any of these persons or entities has a direct or indirect interest, and any other persons or entities against whom the Assigning Parties have a claim arising out of or relating to their investment with LPI or interest in the Debtors, arising out of or relating to any conduct, act, or omission of any of these persons or entities or otherwise related to the business of the Debtors from the beginning of the world until the Effective Date (collectively, the “Assigned Claims”), to the Creditors’ Trust. The Assigning Parties, as of the Plan Effective Date, transfer and assign all aspects of title to the Assigned Claims to the Creditors’ Trust, including but not limited to the right to bring suit on the Assigned Claims, recover any form of relief whatsoever on the Assigned Claims, including but not limited to money damages, and distribute funds to the creditors of the Debtors’ estates in accordance with the terms of the Plan. No further action on the part of the Assigning Parties is necessary to effectuate the assignment of the Assigned Claims set forth in this paragraph, and the Assigning Parties confirm that it is their present intent to retain no right or interest in the Assigned Claims. The Assigning Parties further acknowledge that after the Plan Effective Date the Creditors’ Trust has the exclusive legal right and power to prosecute, compromise, settle, assign, receive proceeds from, or otherwise control the Assigned Claims. The Assigning Parties represent that they have done nothing and will do nothing in the future to impair, release, compromise, waive, or relinquish the Assigned Claims, to defend or take the position that the Assigned Claims were released or do not belong to the Creditors’ Trust, or to assist any |

COMPROMISE SETTLEMENT AGREEMENT—Page 10 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 12 of 100

| | | person in defending any of the Assigned Claims or arguing that the Assigned Claims do not belong to the Creditors’ Trust. The Assigned Claims include, but are not limited to, the claims asserted by the MDL Plaintiffs in the Litigation defined in ¶ 2.17. Nothing in this paragraph shall affect the MDL Plaintiffs’ right to recover under the terms of the Class Action Settlement Agreement or the Plan. |

| | | |

| | 5.10. | To the extent not assigned in ¶ 5.09 of this Agreement or in the Class Action Settlement Agreement, the MDL Plaintiffs and their respective partners, their parent entities, subsidiaries, affiliates, directors, shareholders, officers, agents, employees, servants, representatives, attorneys, successors, predecessors, and assigns (the “MDL Releasing Parties”), shall be deemed to have conclusively, absolutely, unconditionally, irrevocably, and forever, released, waived, and discharged the claims against the Debtors asserted in the Litigation, or that could have been asserted as part of the Litigation (collectively, the “MDL Released Claims”), provided that nothing herein shall be deemed to release the Assigned Claims, as defined and referenced in paragraph 5.09 or the right to seek enforcement by specific performance of (or damages for the breach of) this Settlement Agreement. After the Plan Effective Date, the MDL Releasing Parties shall not seek, and are hereafter barred and enjoined from seeking, to recover from the Debtors based in whole or in part upon any of the MDL Released Claims or conduct at issue in the MDL Released Claims. Nothing in this paragraph shall affect the MDL Plaintiffs’ right to recover under the terms of the Class Action Settlement Agreement or the Plan. |

| | | |

| | 5.11. | The McDermott Plaintiffs and their respective partners, their parent entities, subsidiaries, affiliates, directors, shareholders, officers, agents, employees, servants, representatives, attorneys, successors, predecessors, and assigns (the “McDermott Releasing Parties”), shall be deemed to have conclusively, absolutely, unconditionally, irrevocably, and forever, released, waived, and discharged the claims against the Debtors arising out of or relating to their investment in the Gummelt Policy, including but not limited to the claims asserted in the McDermott Litigation (collectively, the “McDermott Released Claims”), provided that nothing herein shall be deemed to release the right to seek enforcement by specific performance of (or damages for the breach of) this Settlement Agreement. After the Plan Effective Date, the McDermott Releasing Parties shall not seek, and are hereafter barred and enjoined from seeking, to recover from the Debtors based in whole or in part upon any of the McDermott Released Claims or conduct at issue in the McDermott Released Claims. Nothing in this paragraph shall affect the McDermott Plaintiffs’ right to recover under the terms of the Class Action Settlement Agreement or the Plan. |

| | | |

| | 5.12. | The Parties shall file a joint motion pursuant to Section 105(a) of the Bankruptcy Code and Federal Rule of Bankruptcy Procedure 9019 requesting court approval of this Settlement Agreement. If the Bankruptcy Court refuses to approve this Settlement Agreement, then this Settlement Agreement will not take effect and will become null and void for all purposes, and the Parties will be restored to their respective positions in the Litigation and the McDermott Litigation as of the |

COMPROMISE SETTLEMENT AGREEMENT—Page 11 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 13 of 100

| | | Execution Date. In that event, this Settlement Agreement, and representations made in conjunction with it, may not be used in the Litigation or the McDermott Litigation or otherwise for any purpose. The Parties expressly reserve all rights if the Settlement Agreement does not become effective or if it is rescinded. |

| | | |

| | 5.13. | The Parties agree to cooperate in executing any and all supplementary documents and to take all additional actions that may be reasonably necessary or appropriate to give full force and effect to the terms and intent of this Settlement Agreement. |

| | | |

| | 5.14. | The Parties agree that, except as provided herein, each Party shall bear its own costs and attorneys’ fees incurred in connection with the Litigation and the McDermott Litigation and the negotiation, drafting, and execution of this Settlement Agreement. |

| | | |

| | 5.15. | If the Bankruptcy Court does not approve this Settlement Agreement under Federal Rule of Bankruptcy Procedure 9019; if the Bankruptcy Court’s approval of this Settlement Agreement is modified or set aside on appeal; if the Bankruptcy Court does not enter an order confirming the Plan; or if the Bankruptcy Court’s order confirming the Plan is modified, reversed, or vacated on appeal, then the Party or Parties adversely affected by or who opposed such refusal, modification, vacation, or appeal shall each, in their sole discretion, have the option to rescind this Settlement Agreement in its entirety by written notice to the Bankruptcy Court and to counsel for the other Parties that is filed and served within ten (10) days of the event triggering the right to rescind. |

| | | |

| | 5.16. | If the Settlement Agreement is rescinded in accordance with its terms, is not approved by the Bankruptcy Court, or otherwise fails to become effective in accordance with its terms, then this Settlement Agreement will not take effect and will become null and void for all purposes, and the Parties will be restored to their respective positions in the Litigation and the McDermott Litigation as of the Execution Date of this Agreement. In that event, this Settlement Agreement, and representations made in conjunction with it, may not be used in the Litigation or the McDermott Litigation, or otherwise for any purpose. The Parties expressly reserve all rights if the Settlement Agreement does not become effective or if it is rescinded. |

| | | |

| | 5.17. | Plaintiffs’ Counsel agrees to reasonably cooperate with a designee of the Trustee or his successor, the Creditor’s Trustee, or their counsel, free of any charge, to provide information relevant to pursuing the Assigned Claims, securing documents requested from MDL Plaintiffs, providing work product from the Litigation relevant to the Creditors’ Trust’s prosecution of the Assigned Claims or other litigation to benefit the bankruptcy estates, and consulting with a designee of the Trustee or his successor, the Creditor’s Trustee, or their counsel on the discovery and events from the Litigation and the McDermott Litigation, up to twenty (20) hours of attorney time, including travel time. Provided, however, that Plaintiffs’ Counsel shall not be required to provide requested cooperation if Plaintiffs’ Counsel reasonably believes providing such cooperation is unlawful or |

COMPROMISE SETTLEMENT AGREEMENT—Page 12 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 14 of 100

| | | would result in Plaintiffs’ Counsel violating any ethical rule governing the practice of law. |

| | | |

| | 5.18. | The Parties agree that, in the event of a conflict between the terms of this Settlement Agreement and the terms of the Plan, the terms of the Plan shall control;provided, however, that the terms of the Plan may not materially change to be inconsistent with this Settlement Agreement without the written consent of Plaintiffs’ Counsel. |

| | | |

| | 5.19. | For any action brought regarding the breach, enforcement, or interpretation of this Settlement Agreement, the Parties agree that (a) the exclusive and sole venue shall be the Bankruptcy Court, (b) each Party hereby consents to the exercise of personal and subject-matter jurisdiction by the Bankruptcy Court in any such action, and (c)THE PARTIES HEREBY UNCONDITIONALLY WAIVE THEIR RIGHT TO A JURY TRIAL OF ANY AND ALL CLAIMS OR CAUSES OF ACTION ARISING FROM OR RELATING TO ENFORCEMENT OF THIS SETTLEMENT AGREEMENT. PARTIES ACKNOWLEDGE THAT A RIGHT TO A JURY IS A CONSTITUTIONAL RIGHT, THAT THEY HAVE HAD AN OPPORTUNITY TO CONSULT WITH INDEPENDENT COUNSEL, AND THAT THIS JURY WAIVER HAS BEEN ENTERED INTO KNOWINGLY AND VOLUNTARILY BY ALL PARTIES TO THIS AGREEMENT. IN THE EVENT OF LITIGATION, THIS AGREEMENT MAY BE FILED AS A WRITTEN CONSENT TO A TRIAL BY THE COURT. |

| | | |

| | 5.20. | This Settlement Agreement shall be governed and construed in accordance with laws of the State of Texas, except that any conflict of law rule of that jurisdiction that may require reference to the laws of some other jurisdiction shall be disregarded. |

| | | |

| | 5.21. | This Settlement Agreement has been prepared by the joint efforts of the respective attorneys for each of the Parties. |

| | | |

| | 5.22. | Headings, section numbers, and section titles have been set forth herein for convenience only; they shall not be construed to limit or extend the meaning or interpretation of any part of this release. |

| | | |

| | 5.23. | If any provision of this Settlement Agreement is or may be held by a court of competent jurisdiction to be invalid, void, or unenforceable, the remaining provisions shall nevertheless survive and continue in full force and effect to effectuate the intent of this Settlement Agreement without being impaired or invalidated in any way. |

| | | |

| | 5.24. | None of the Parties to this Settlement Agreement has expressed any facts, representations, or express or implied warranties, except as expressly contained in this Settlement Agreement. |

COMPROMISE SETTLEMENT AGREEMENT—Page 13 of 60

Case 15-40289-rfn11 Doc 2668-1 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 15 of 100

| | 5.25. | Each signatory to this Settlement Agreement has full authority to execute this document on behalf of the stated Party. This Settlement Agreement shall continue perpetually and shall be binding upon the Parties and their heirs, successors, and assigns and shall inure to the benefit of the Parties and their heirs, successors, and assigns. |

| | | |

| | 5.26. | This Settlement Agreement represents the entire agreement of the Parties and supersedes all prior written or oral agreements, and the terms are contractual and not mere recitals. |

| | | |

| | 5.27. | This Settlement Agreement may not be amended, altered, modified or changed in any way except in writing signed by all the Parties to this Settlement Agreement. |

| | | |

| | 5.28. | THE PARTIES EXPRESSLY WARRANT THAT THEY HAVE CAREFULLY READ THIS SETTLEMENT AGREEMENT, UNDERSTAND ITS CONTENTS, AND SIGN THIS SETTLEMENT AGREEMENT AS THEIR OWN FREE ACT. THE PARTIES EXPRESSLY WARRANT THAT NO PROMISE OR AGREEMENT WHICH IS NOT HEREIN EXPRESSED HAS BEEN MADE TO THEM IN EXECUTING THIS SETTLEMENT AGREEMENT, AND THAT NONE OF THE PARTIES IS RELYING UPON ANY STATEMENT OR REPRESENTATION OF ANY AGENT OF THE PARTIES BEING RELEASED HEREBY. EACH OF THE PARTIES IS RELYING ON THEIR OWN JUDGMENT AND EACH HAS BEEN REPRESENTED BY LEGAL COUNSEL IN THIS MATTER. THE AFORESAID LEGAL COUNSEL HAVE READ AND EXPLAINED TO THE PARTIES THE ENTIRE CONTENTS OF THIS SETTLEMENT AGREEMENT IN FULL, AS WELL AS THE LEGAL CONSEQUENCES OF THIS SETTLEMENT AGREEMENT. |

| | | |

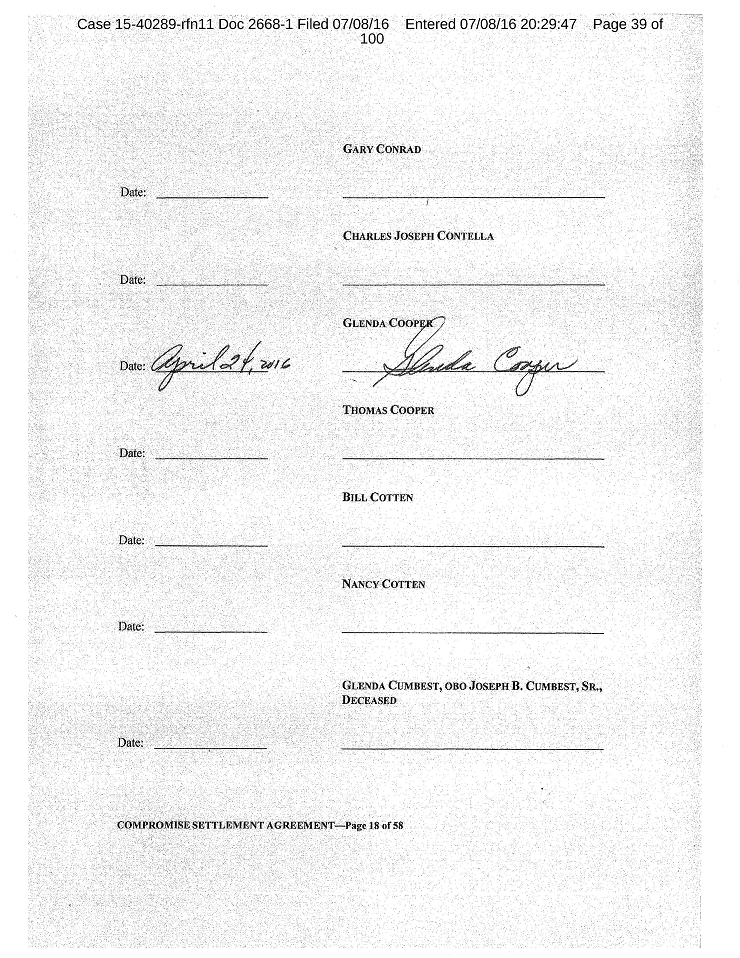

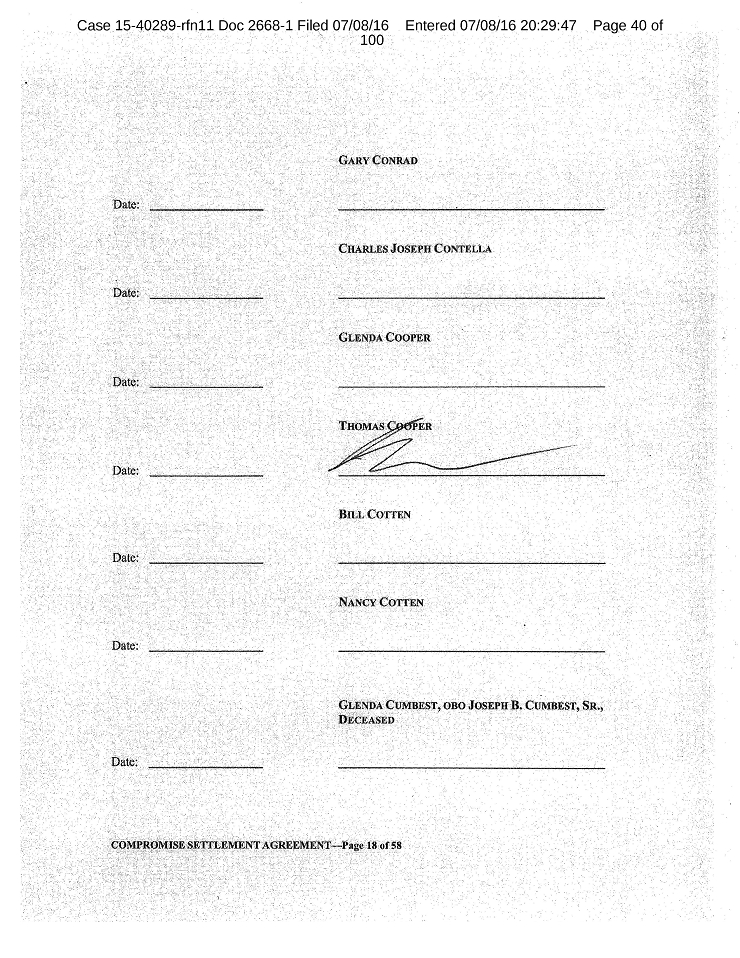

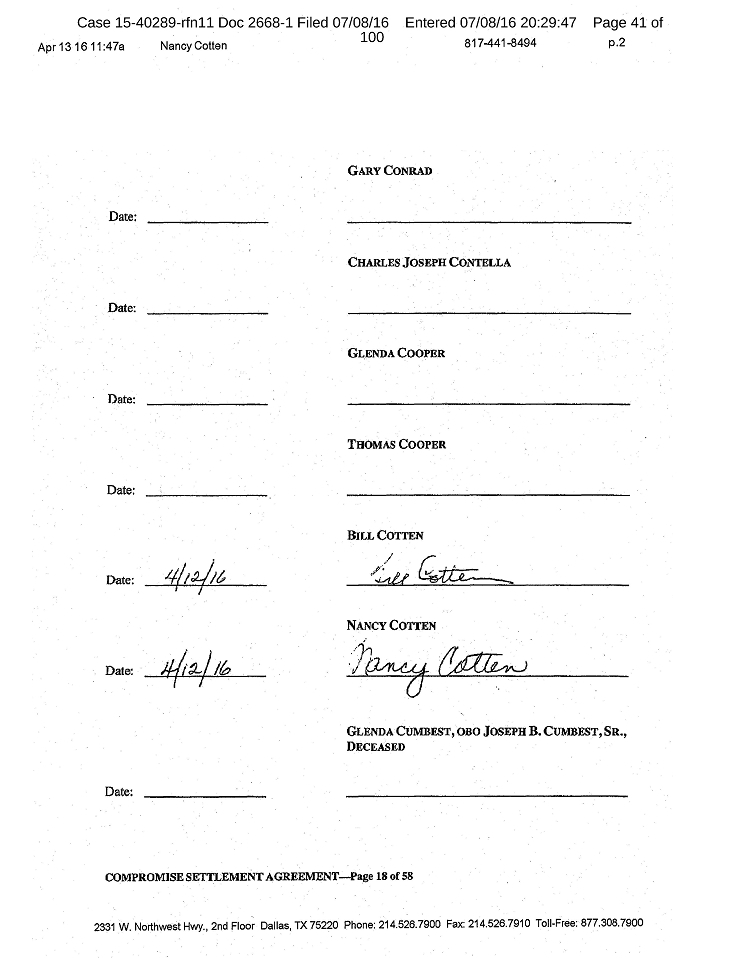

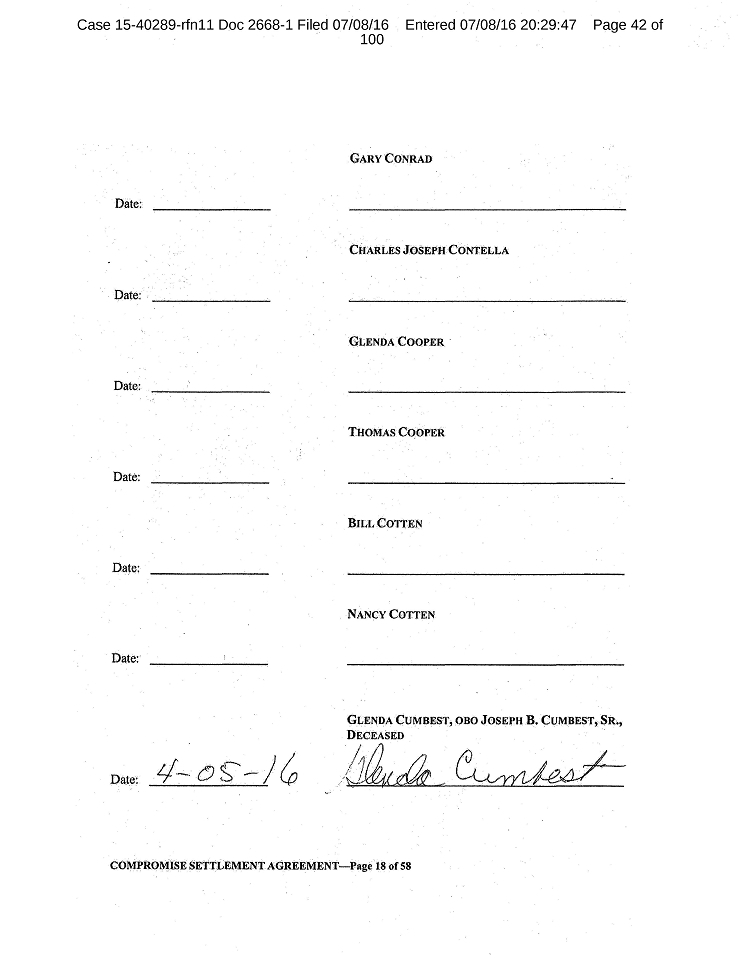

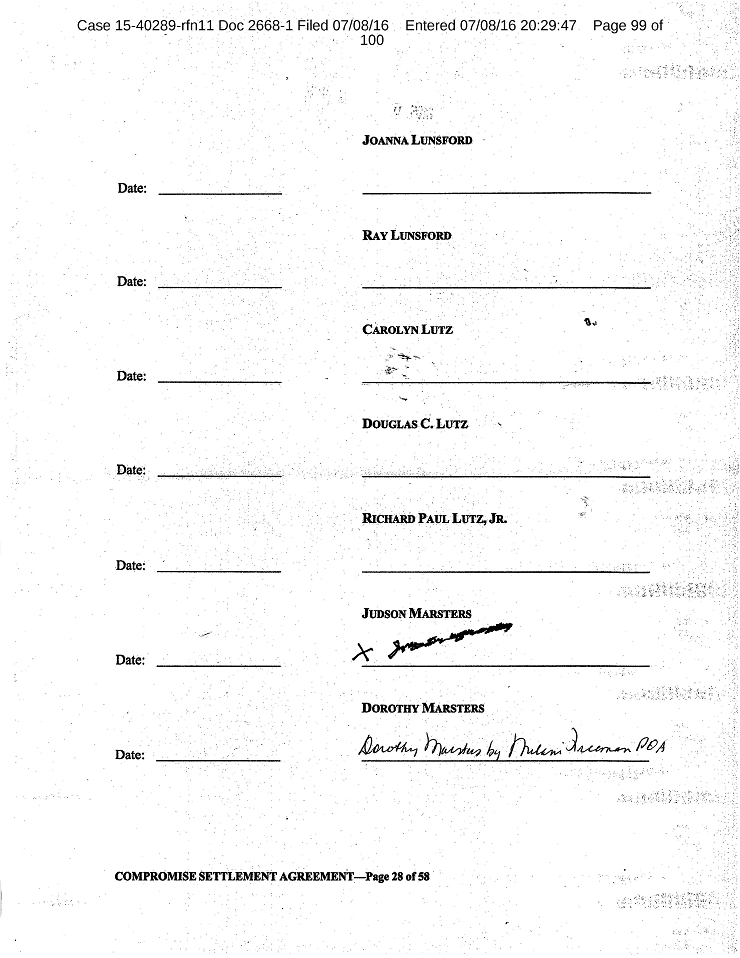

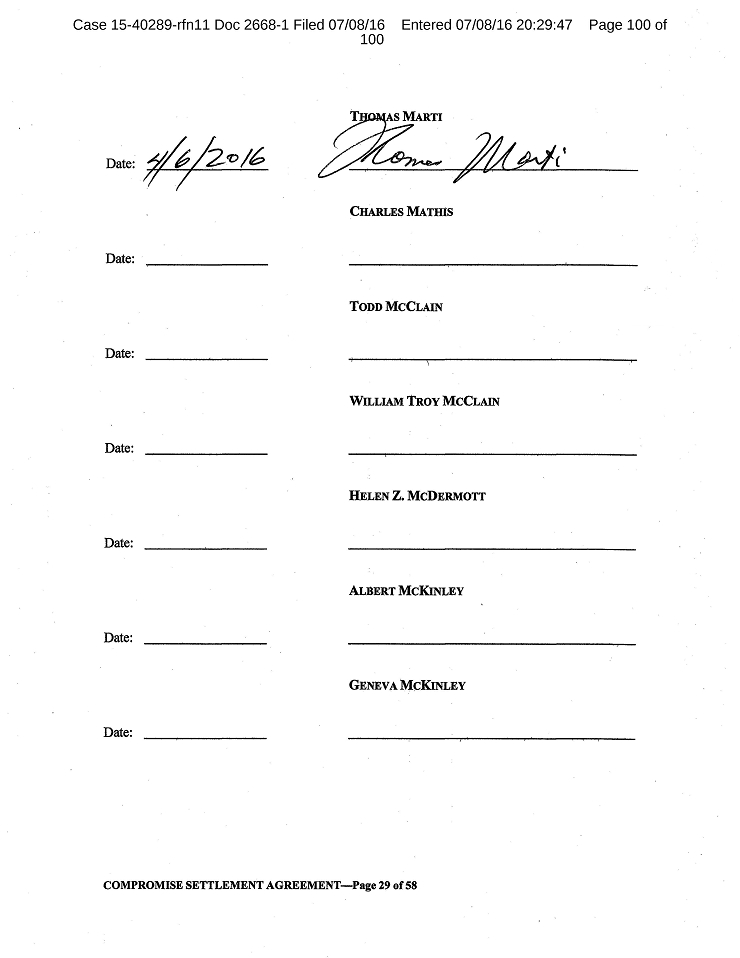

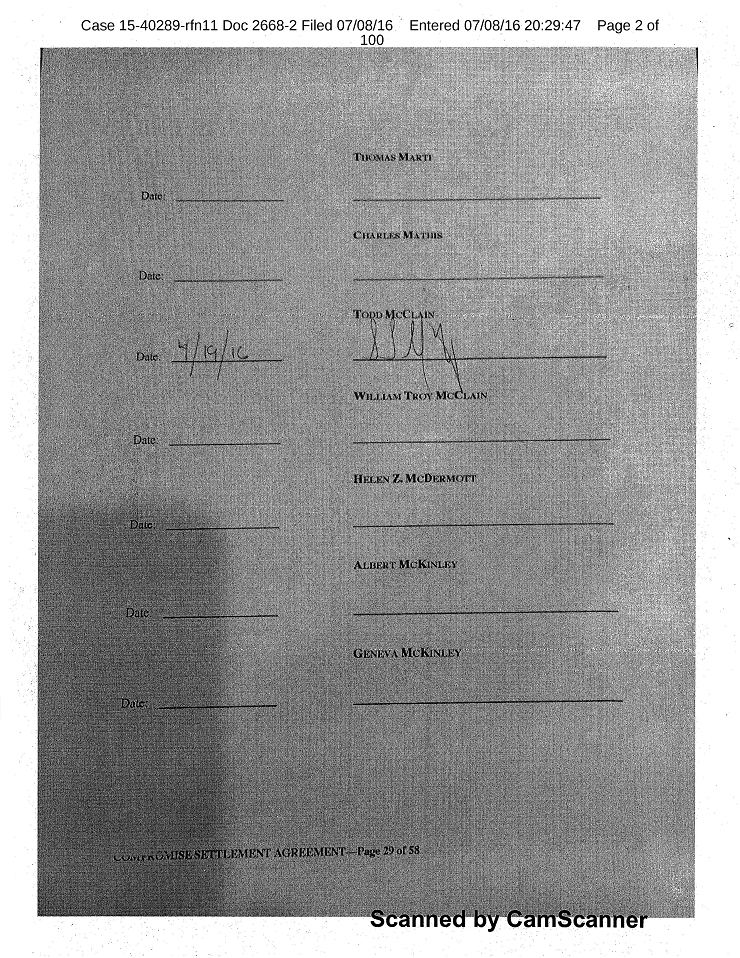

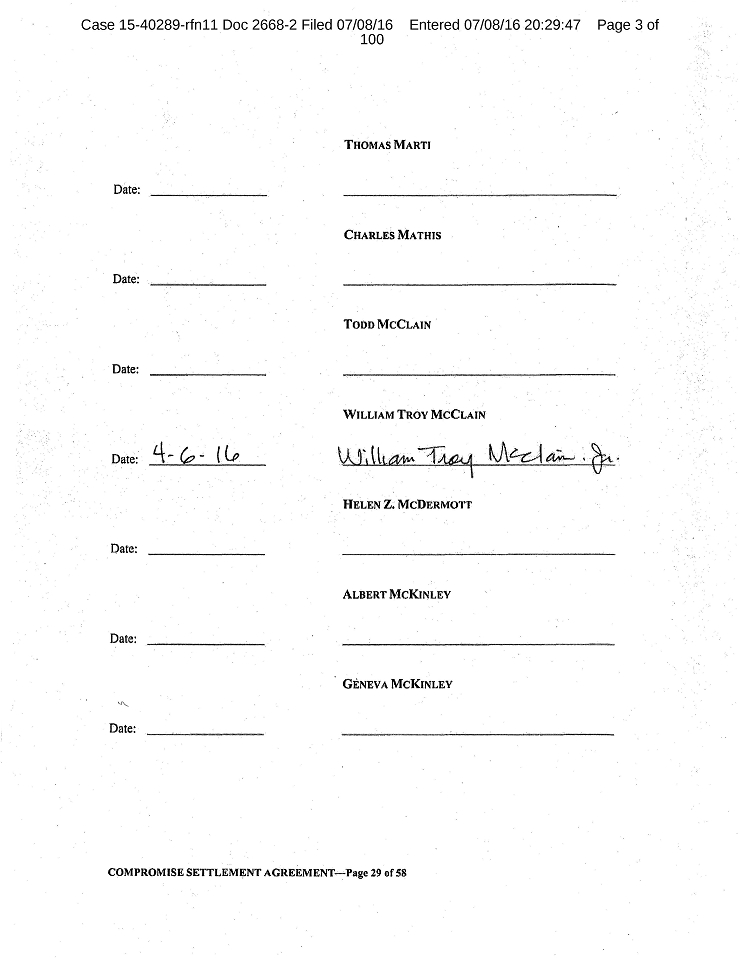

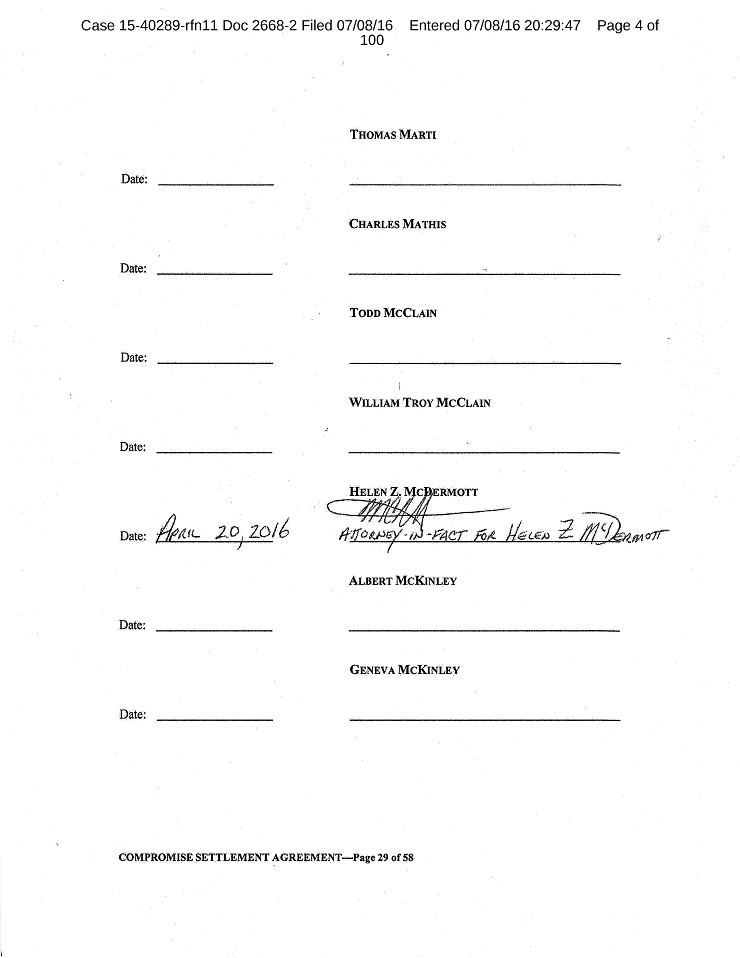

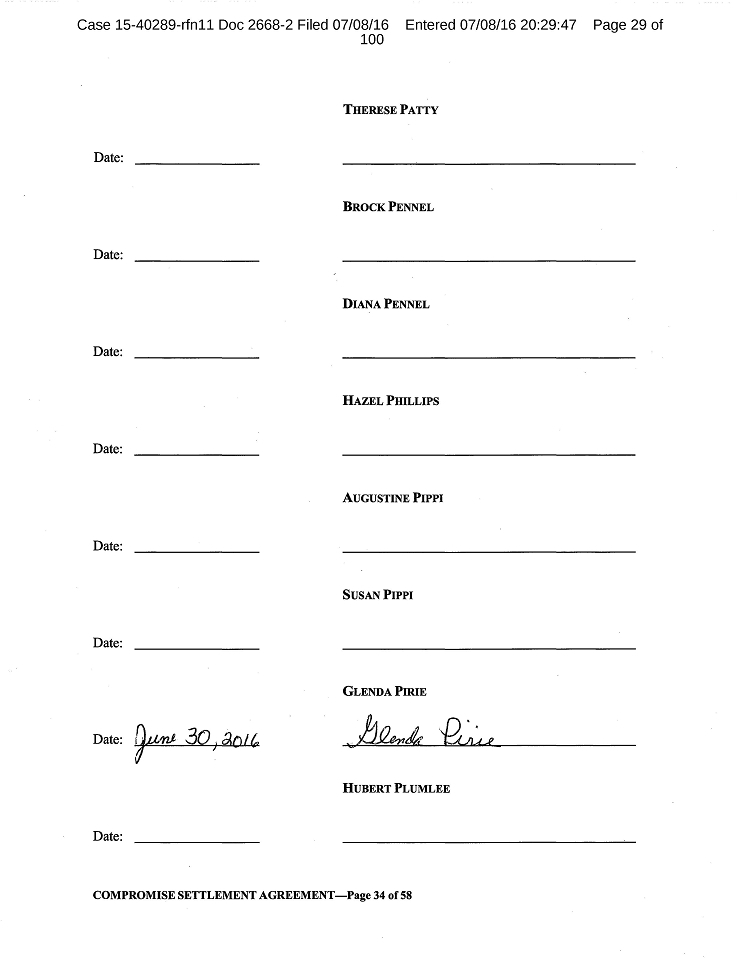

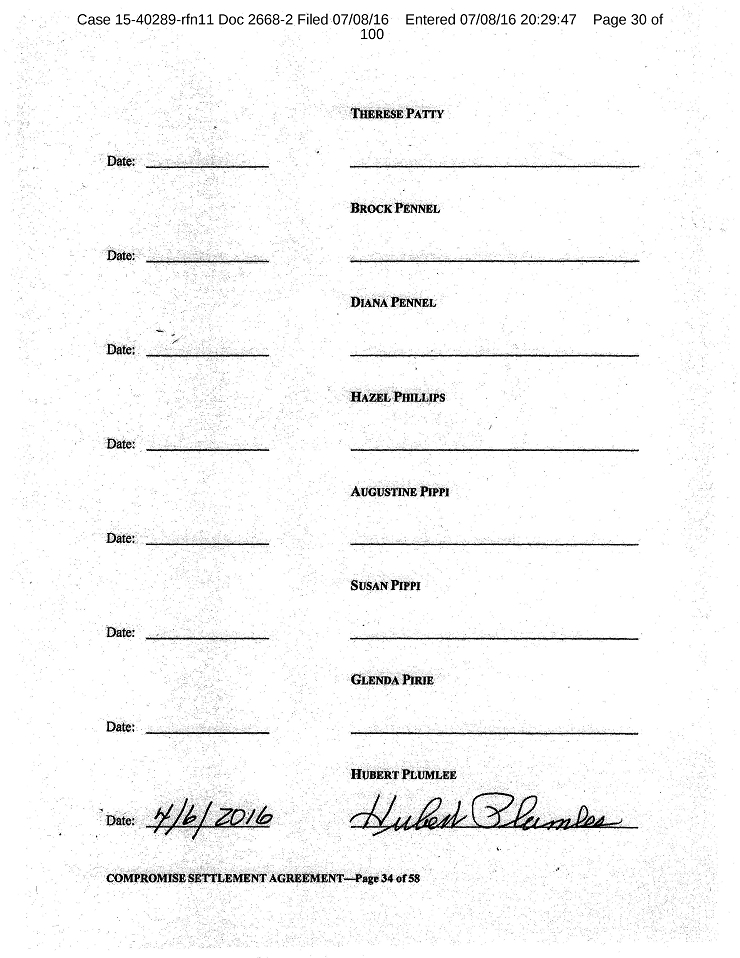

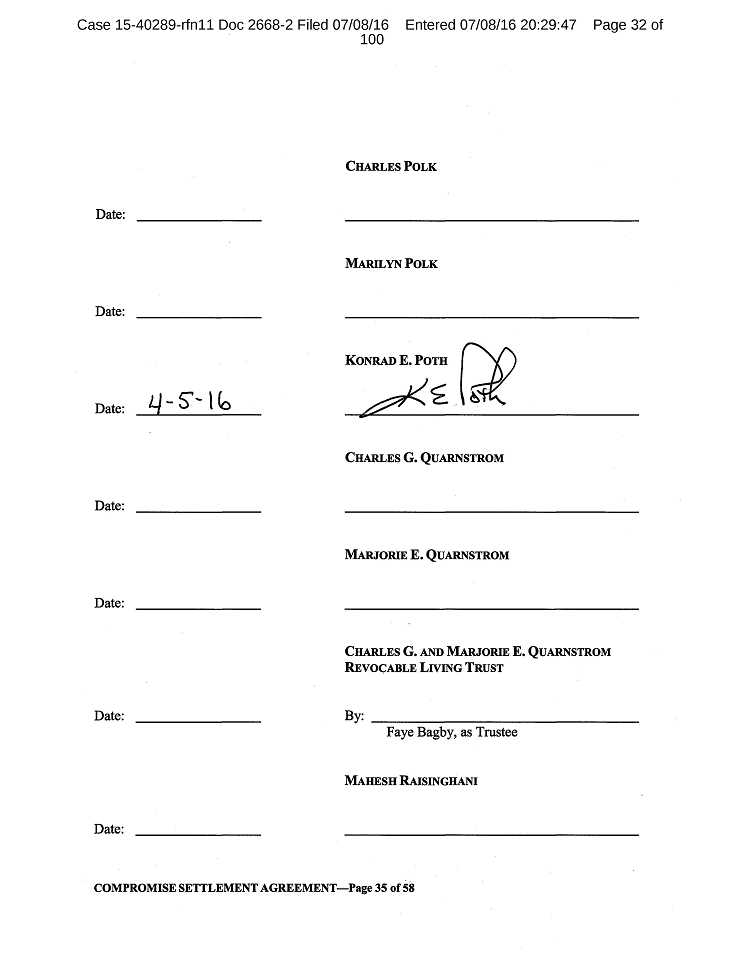

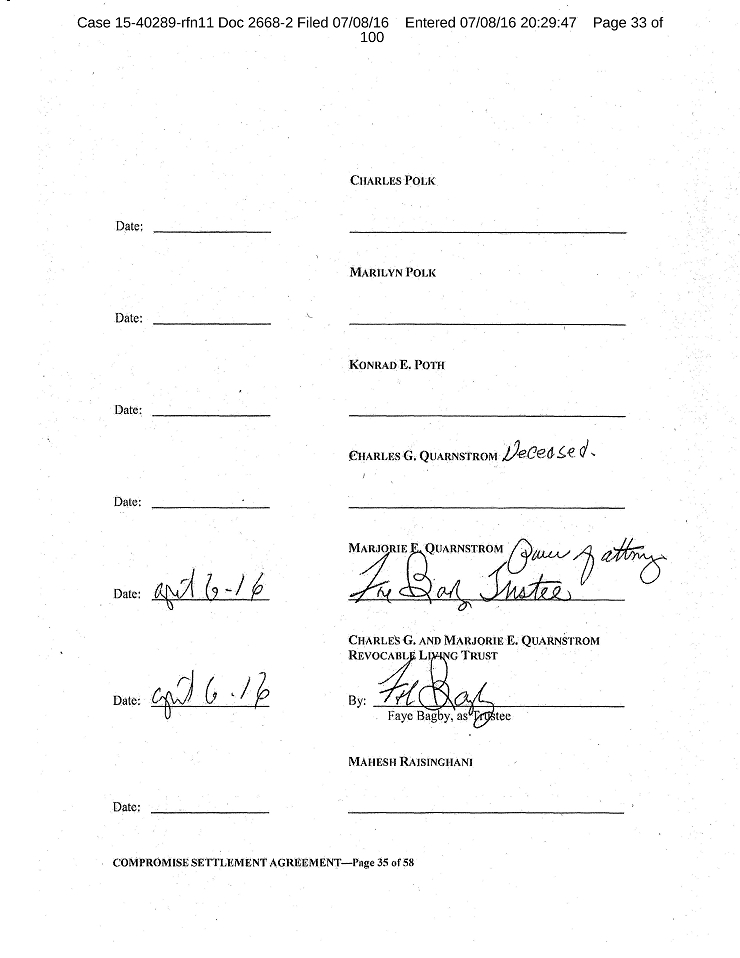

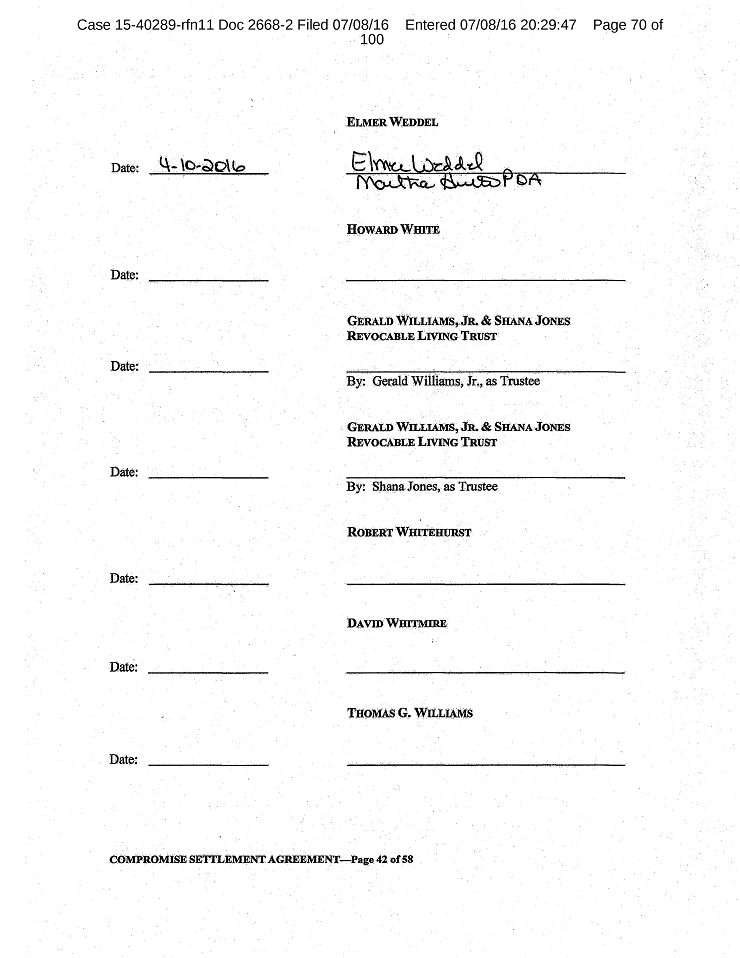

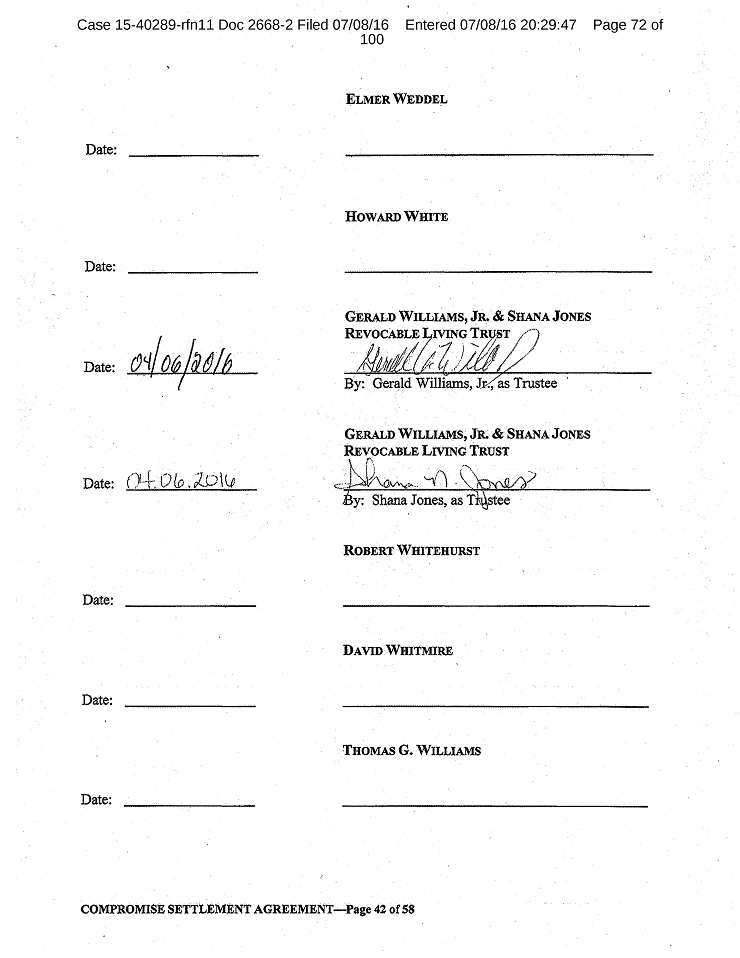

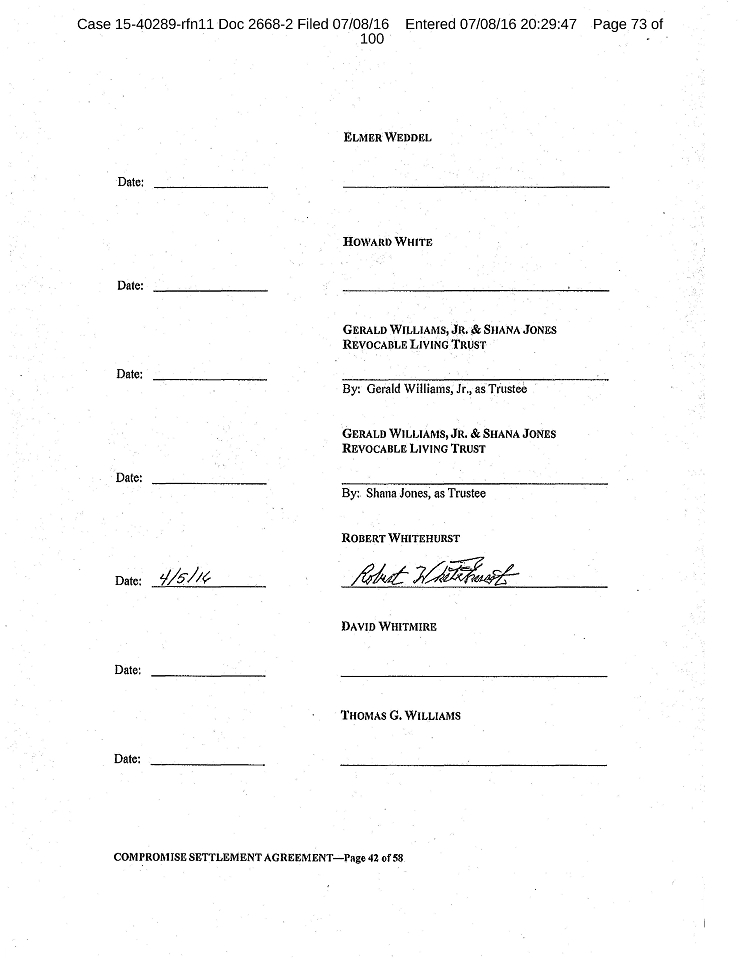

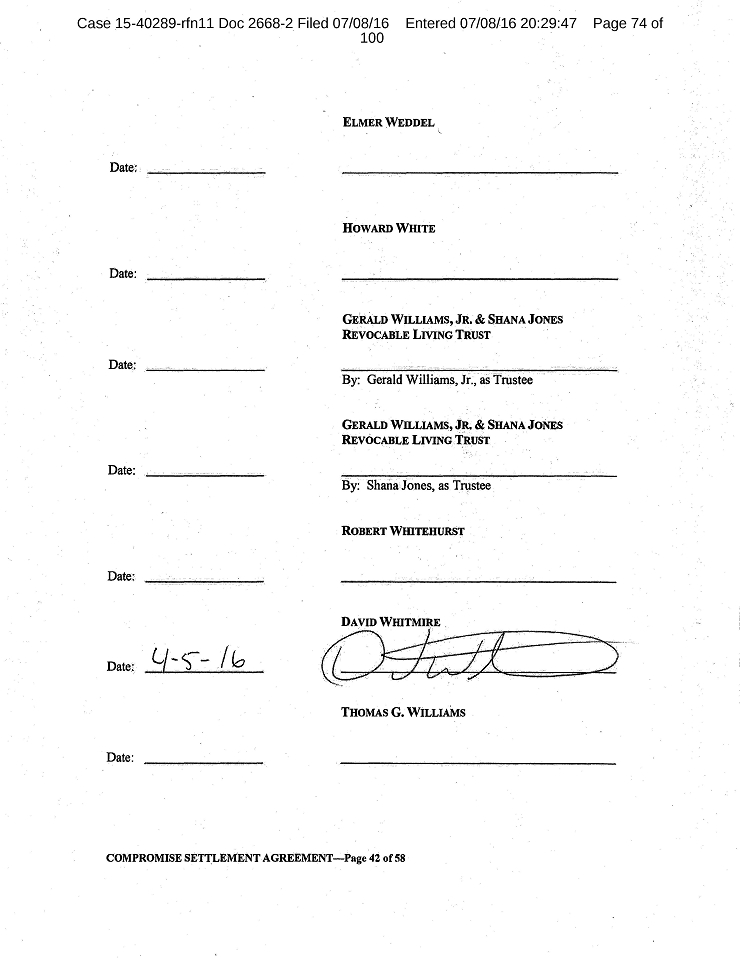

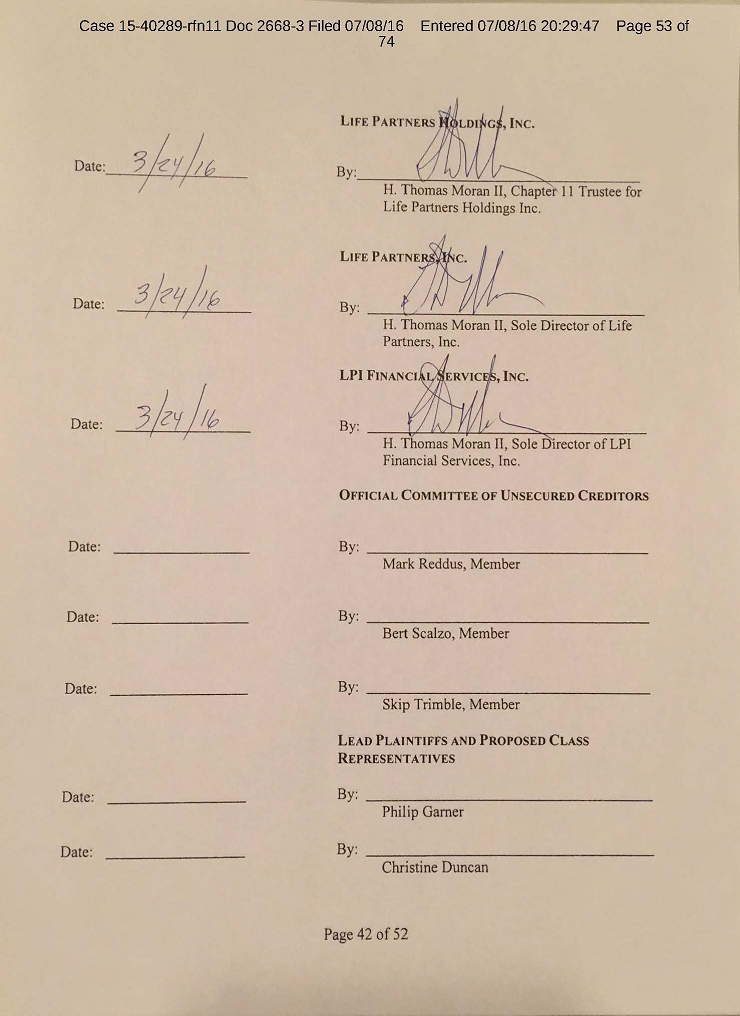

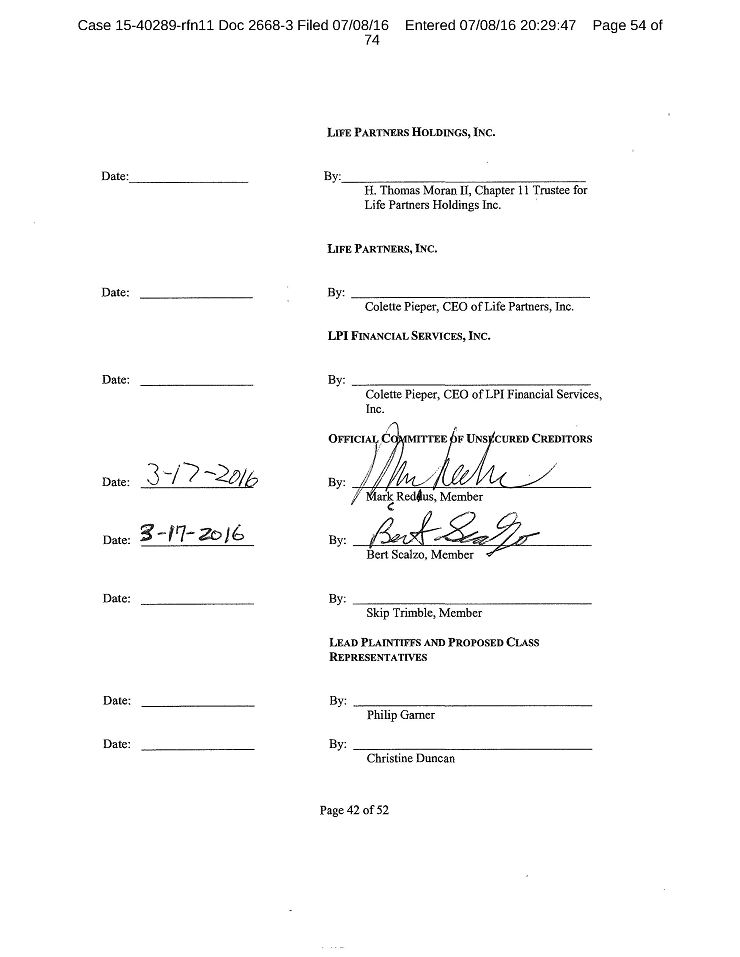

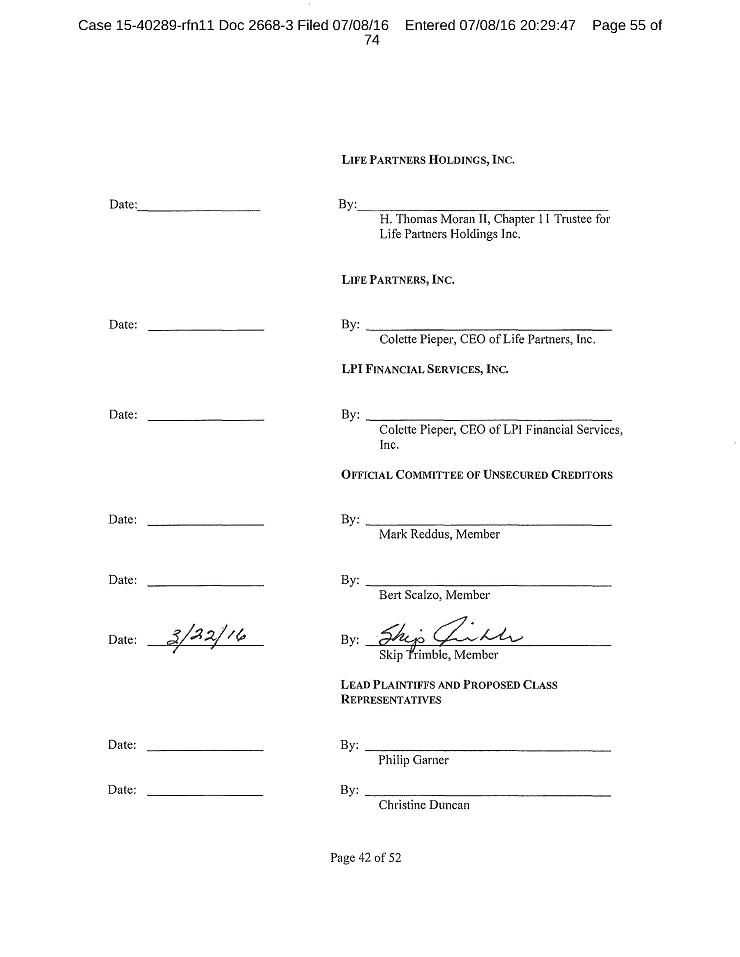

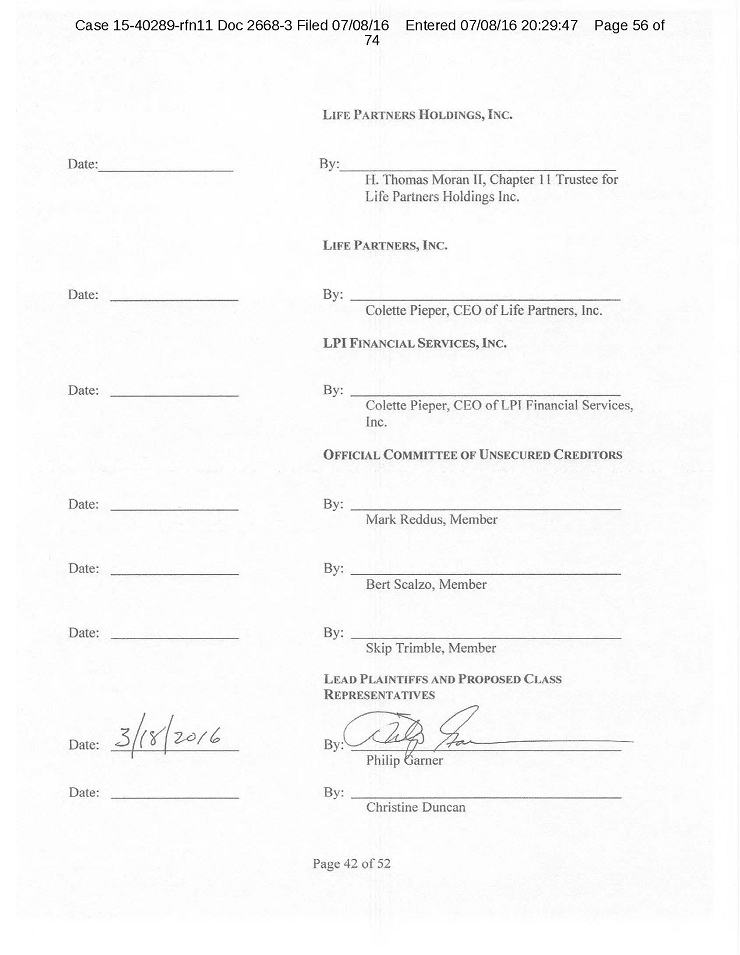

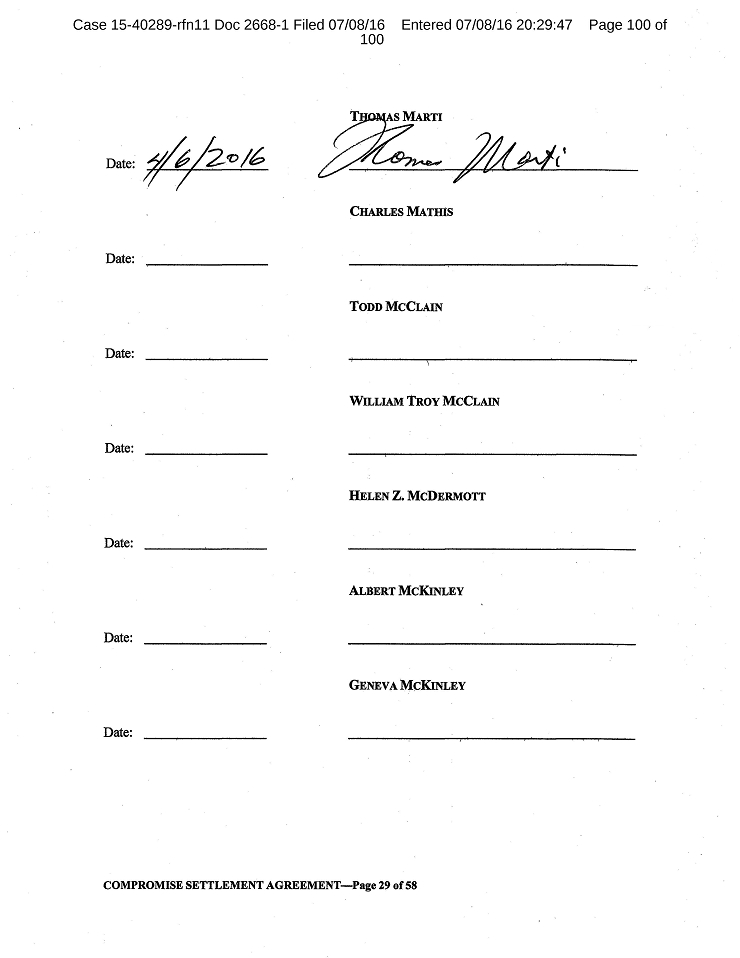

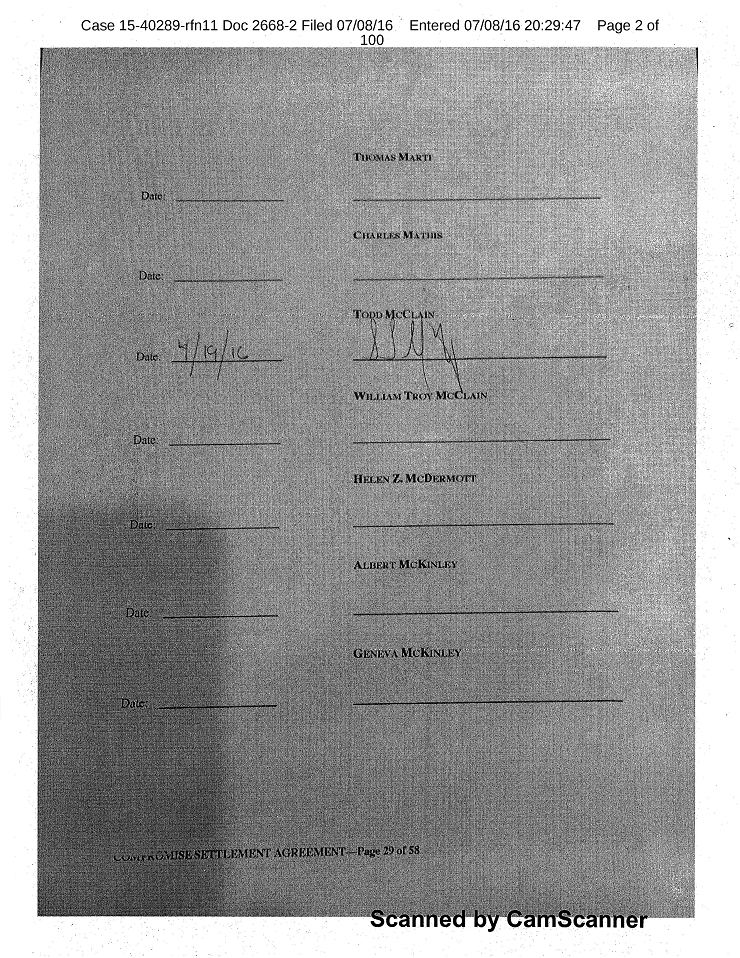

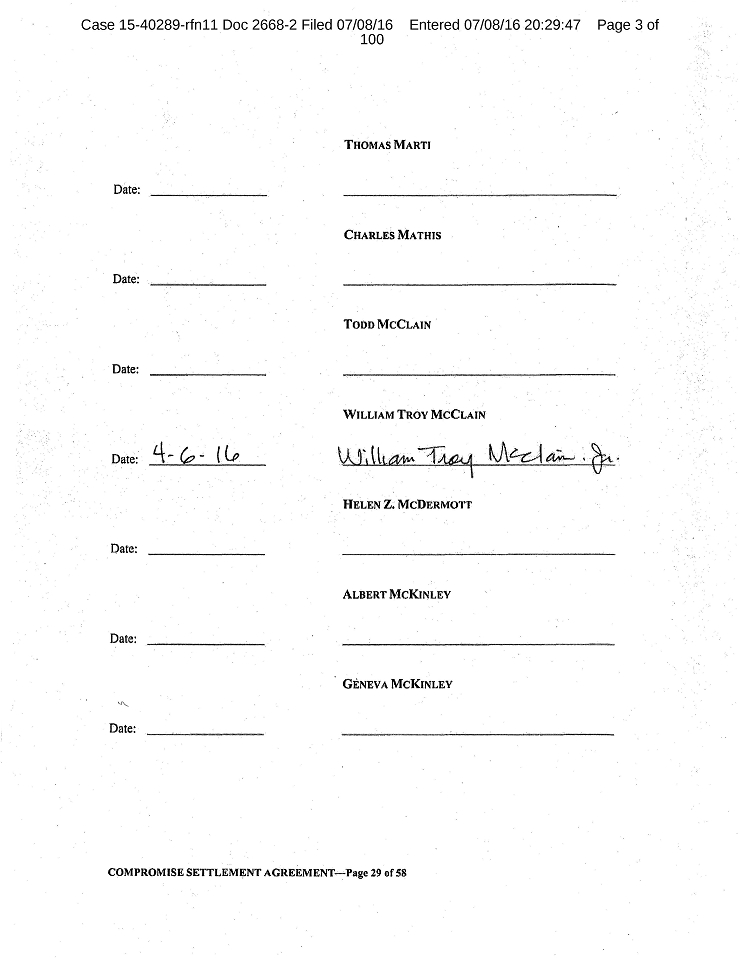

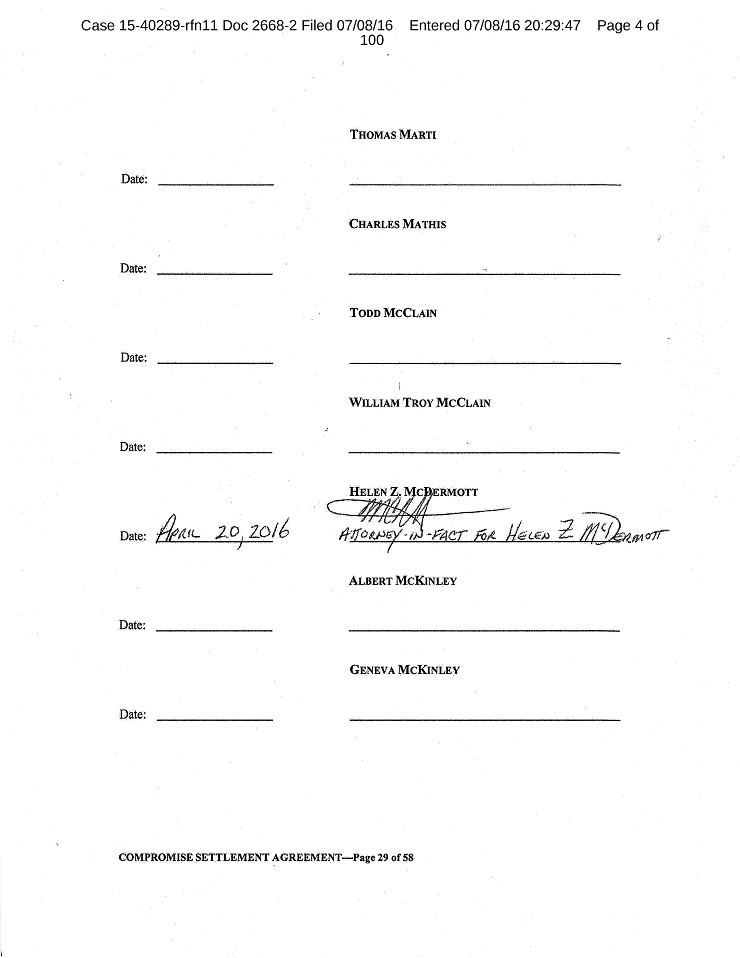

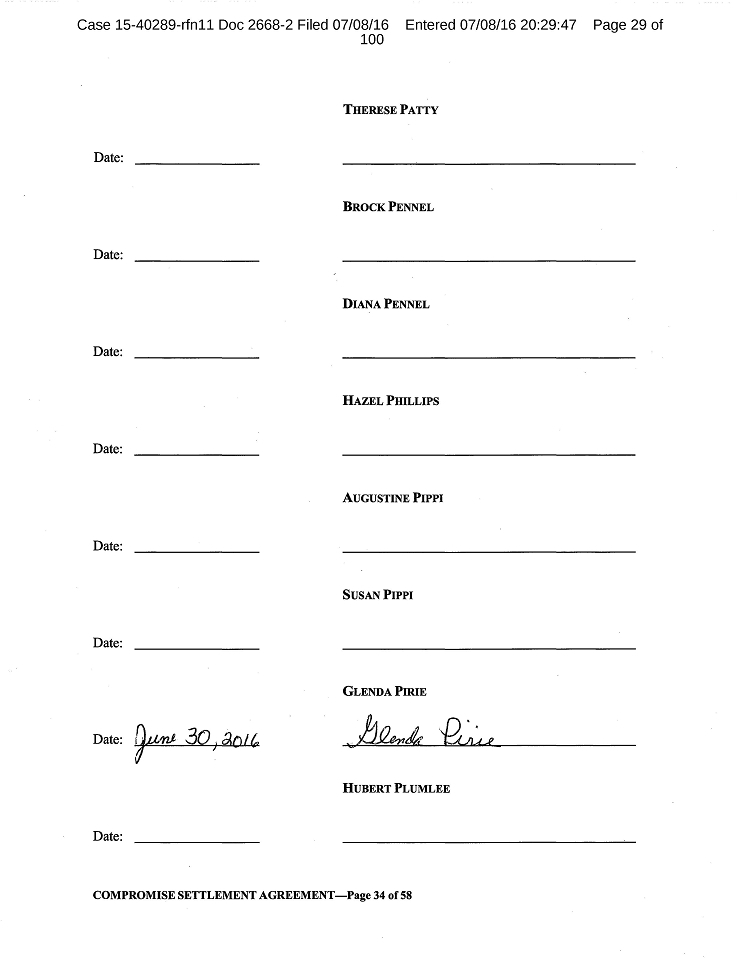

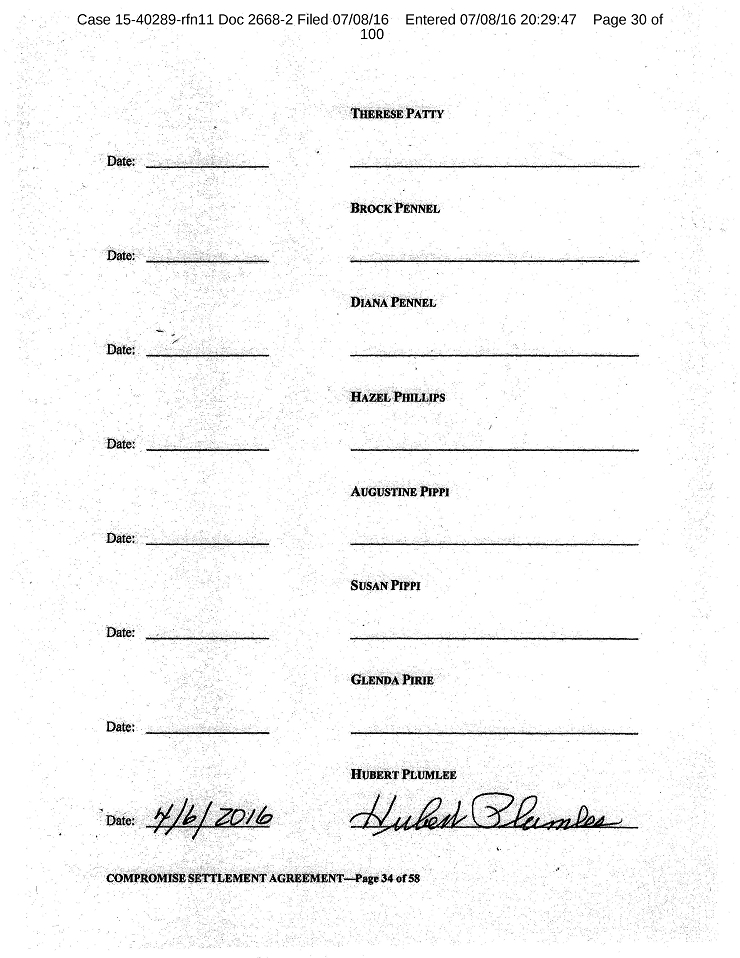

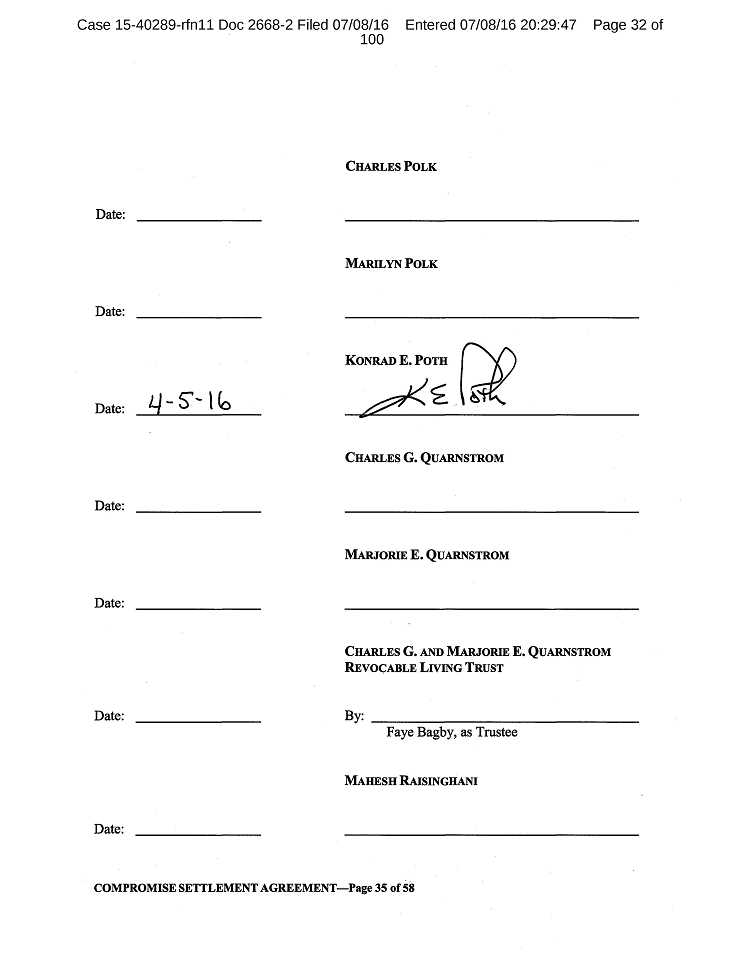

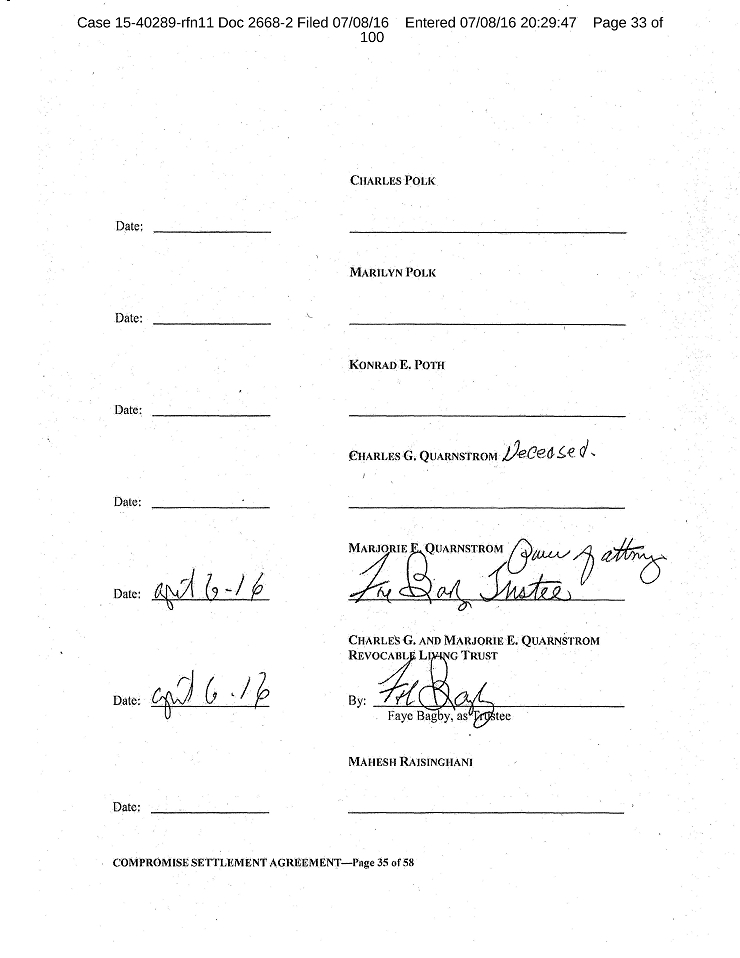

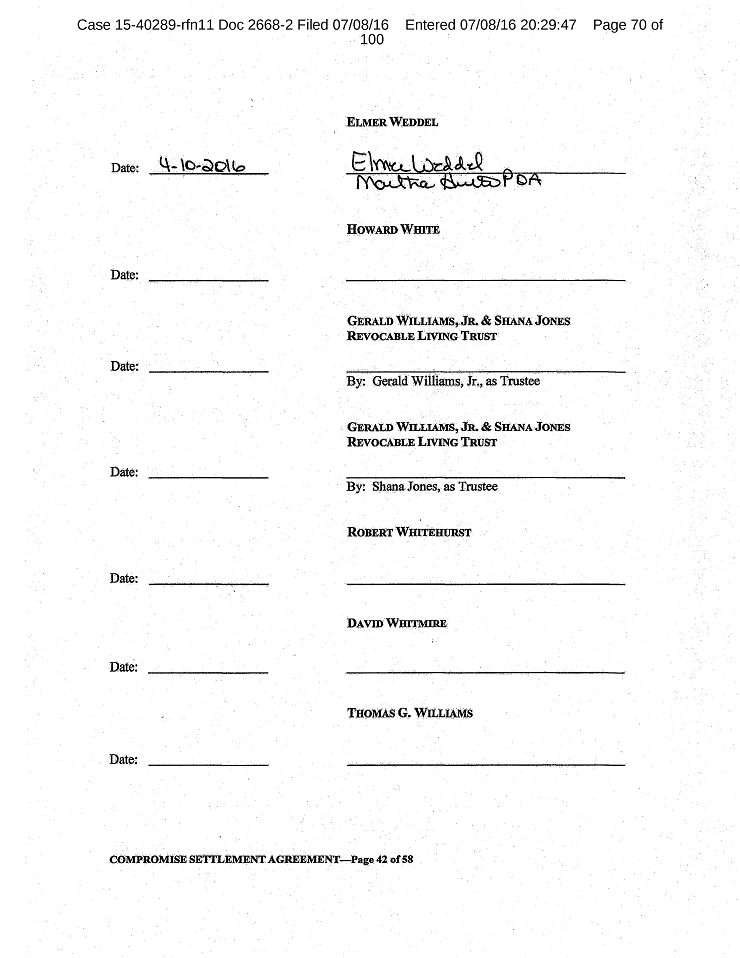

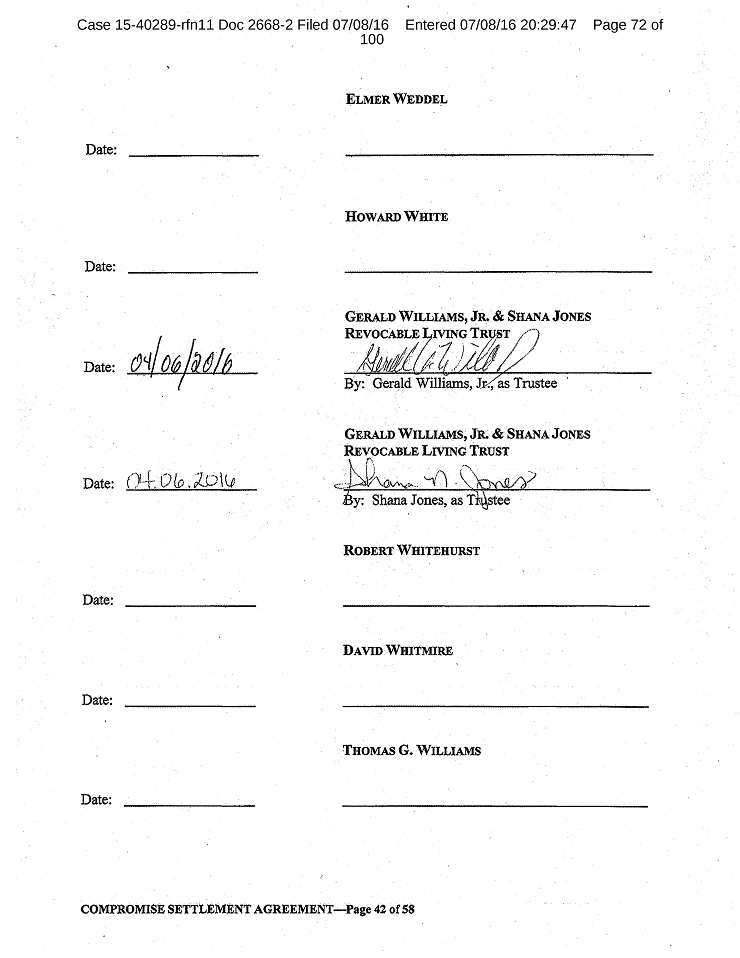

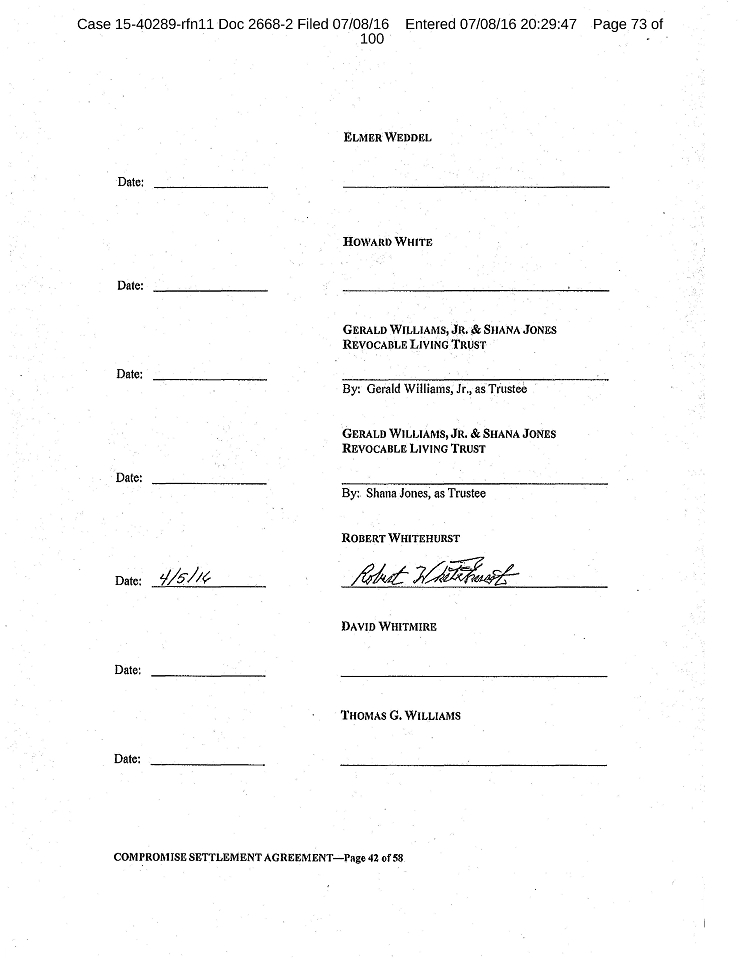

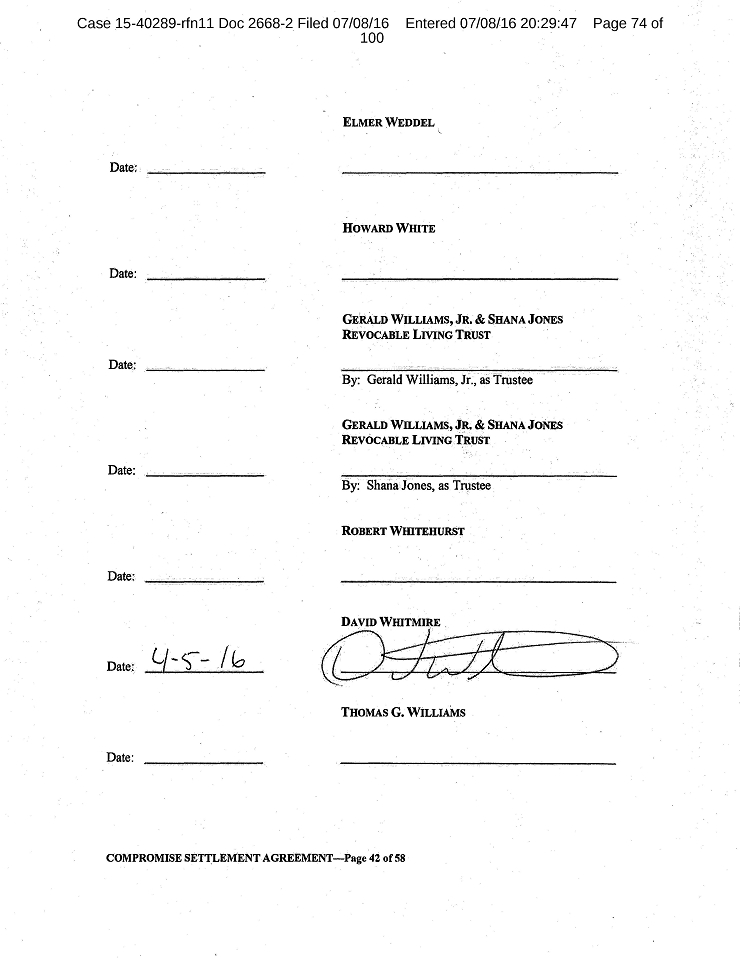

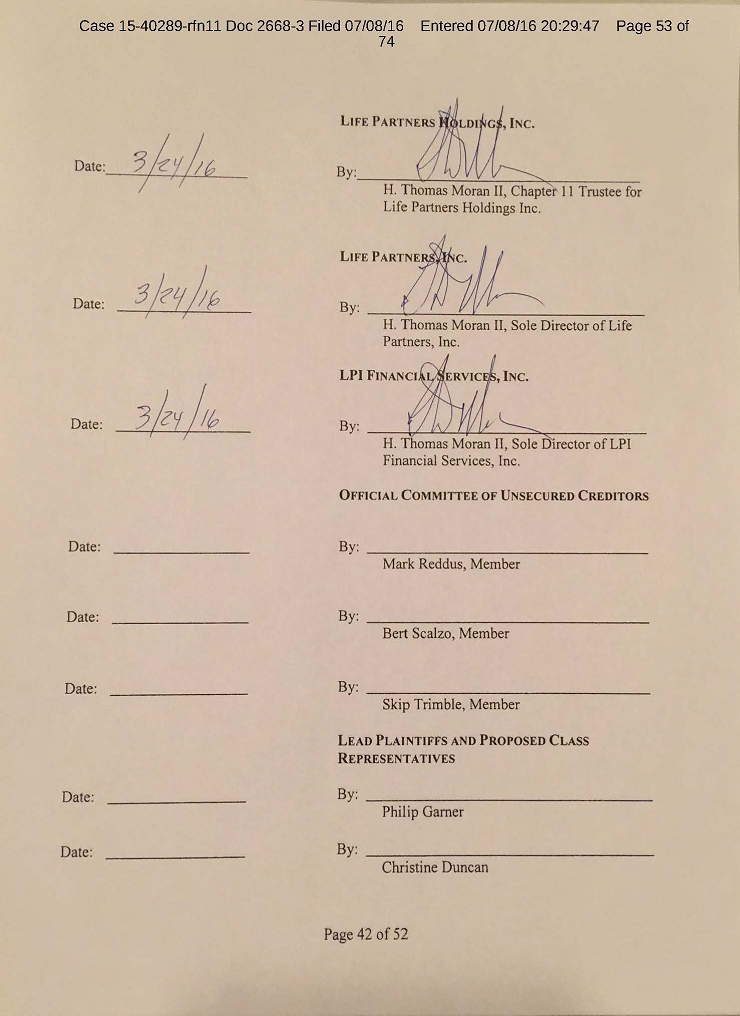

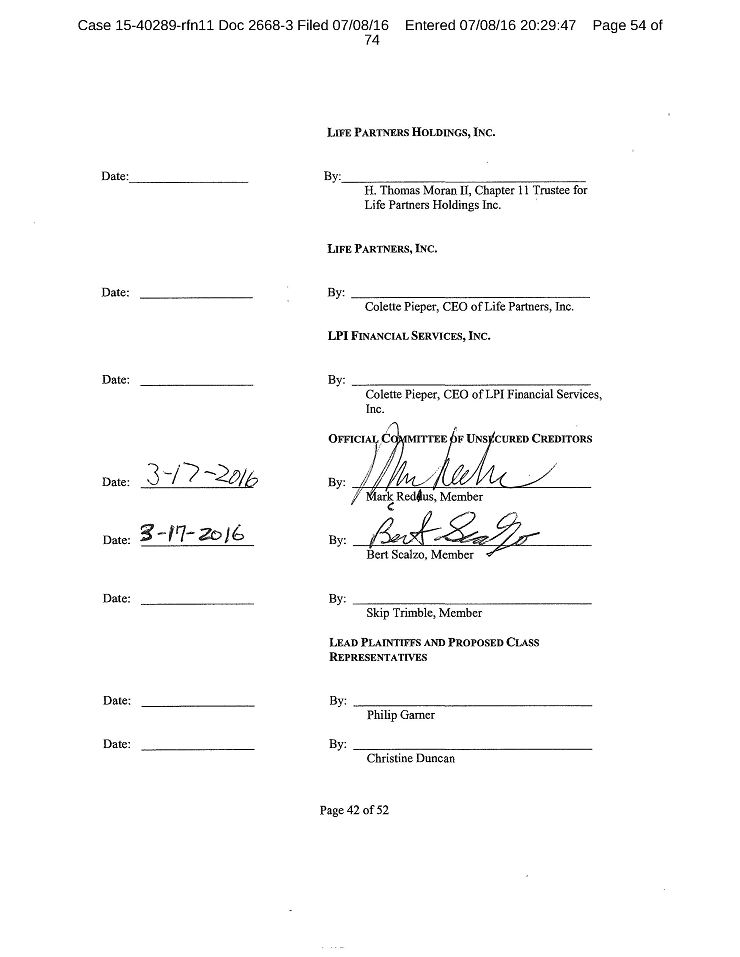

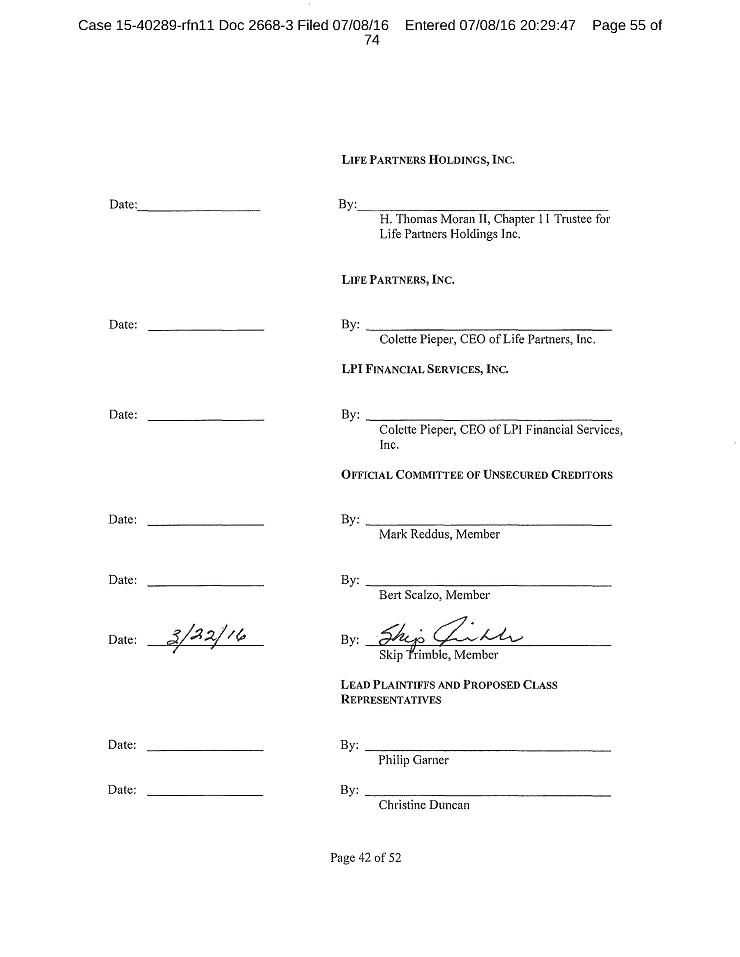

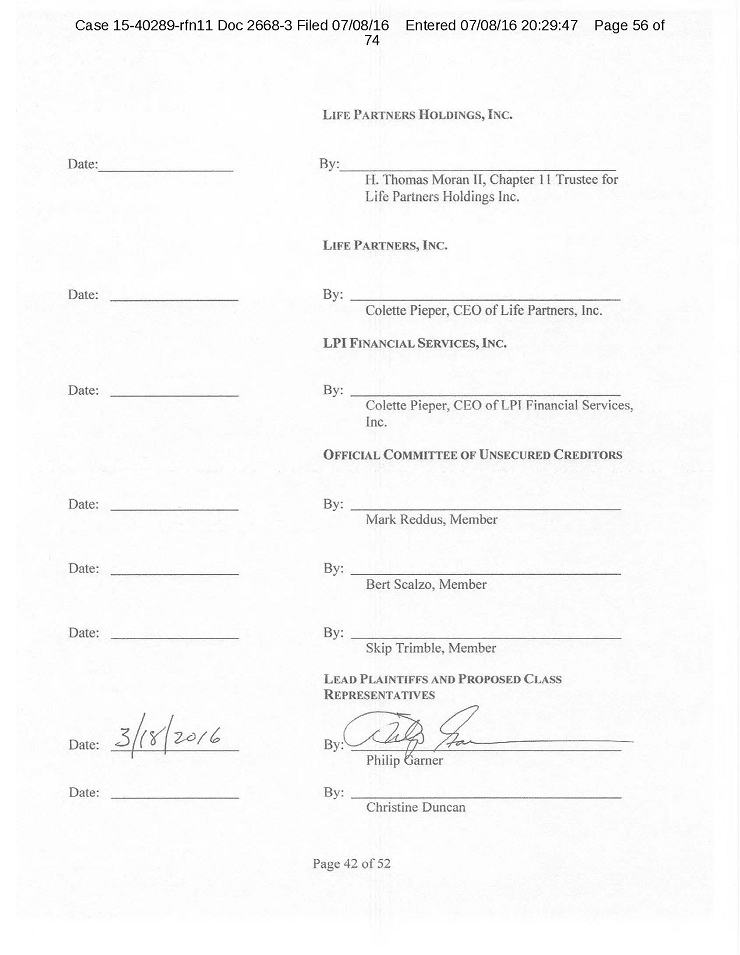

| | 5.29. | This Settlement Agreement may be executed in multiple counterparts or copies and/or on separated signature pages and/or by facsimile transmission, any or all of which when taken together shall be deemed an original for all purposes. The Parties agree that this Settlement Agreement is not binding and enforceable upon any Party until all Parties have executed it. |

[THE REMAINDER OF THIS PAGE IS INTENTIONALLY BLANK]

COMPROMISE SETTLEMENT AGREEMENT—Page 14 of 60

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 6 of 74

Exhibit 10.3

EXHIBIT 1

| 1. | Allen, Jr., James |

| 2. | Armstrong, Sandra |

| 3. | Babb, Joseph |

| 4. | Balady, Louis |

| 5. | Barbarin, Joy C. |

| 6. | Beal, Christopher |

| 7. | Bingiel, Alana |

| 8. | Bingiel, Joseph |

| 9. | Bingiel, Joseph & Alana |

| 10. | Birtcher, Danny |

| 11. | Blackwell, Hurshel Dwayne |

| 12. | Blackwell, Patricia |

| 13. | Broderick, Matthew |

| 14. | Brown, Emily |

| 15. | Padron, Eladio |

| 16. | Byram, Jimmie |

| 17. | Carey, Nancy |

| 18. | Carey, Robert |

| 19. | Carey, Robert & Nancy |

| 20. | Carpenter, Barbara |

| 21. | Carpenter, Michael |

| 22. | Chapman, Rita |

| 23. | Chidester, John D. |

| 24. | Coffey, Mary Jane |

| 25. | Collins, Bruce |

| 26. | Collins, Deborah |

| 27. | Colvin, James |

| 28. | Contella, Charles Joseph |

| 29. | Cooper, Glenda |

| 30. | Cooper, Glenda, as Custodian for Lina Grace Assaad UGMA |

| 31. | Cooper, Glenda, as Custodian for Samuel Mark Assaad UGMA |

| 32. | Harvey Living Trust (Glenda Cooper as Trustee) |

| 33. | Cooper, Thomas |

| 34. | Cotten, Bill & Nancy |

| 35. | Cumbest, Glenda, obo Joseph B. Cumbest, Sr., Deceased |

| 36. | Cummings, Lucinda |

| 37. | Cummings, Terry |

| 38. | DeMars, Sandra, obo Larry Eugen DeMars, Deceased |

| 39. | Dinsmore, Gerald |

| 40. | Dirks, Sherra |

| 41. | Douma, Paul |

| 42. | DuKet, Thomas |

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 7 of 74

| 43. | Eccles, Stephen & Daryl |

| 44. | Evans, Donna |

| 45. | Evans, Robert |

| 46. | Falvo, Elaine M. |

| 47. | Falvo, III, Louis |

| 48. | Fisher, Warren |

| 49. | Funke, Henry & Diana |

| 50. | Gallina, Pamela |

| 51. | Gartenberg, Joel |

| 52. | Gillespie, Carolyn |

| 53. | Goldstein, Janet |

| 54. | Guion, DDS, H. Don |

| 55. | Halman, Douglas |

| 56. | Harris, Dennis |

| 57. | Hilliard, Robert J. |

| 58. | Hillman, Rebecca |

| 59. | Holland, Theresa |

| 60. | Hubbard, John |

| 61. | Hubbard, William Brent |

| 62. | Hutchinson, George |

| 63. | Hutchinson, Laura |

| 64. | Hutto, Don |

| 65. | Inglis, Lona |

| 66. | Inglis, Ronald |

| 67. | Ira M. Sabbagh Trust (Ira M. Sabbagh as Trustee) |

| 68. | Ivory Artists, Inc. |

| 69. | Jacobi, Richard & Anna |

| 70. | Jennings, Joe |

| 71. | Johnson, Clara |

| 72. | Johnson, Gary |

| 73. | Johnston, Ross |

| 74. | Jones, Henry & Nancy |

| 75. | Jones, Shana |

| 76. | Gerald Williams Jr & Shana Jones Rev. Living Trust (Gerald Williams, Jr. & Shana Jones as Trustees) |

| 77. | Jortner, DDS, Wayne |

| 78. | Joshi, Sanjay |

| 79. | Kanouse, Thomas J. |

| 80. | The Kaye Family Trust (Michael C. Kaye & Pamela S. Gerver-Kaye as Trustees) |

| 81. | Kellogg, Alan |

| 82. | Kitchen, Richard |

| 83. | Kohler, Janet |

| 84. | Kohler, Kirk |

| 85. | Kovac, David L. |

| 86. | The George and Jacqueline Krabbe Family Trust (George & Jacqueline Krabbe as Trustees) |

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 8 of 74

| 87. | Krizman, James |

| 88. | Kwok, Don Chaen & Nguyen, Christine |

| 89. | Lair, Kelly |

| 90. | Lair, Peggy |

| 91. | Langhurst, Kathleen |

| 92. | Langhurst, Paula |

| 93. | Lilli, II, Joseph A. |

| 94. | Love, James |

| 95. | Love, James & Denise |

| 96. | Lunsford, Joanna |

| 97. | Lunsford, Ray & Joanna |

| 98. | Lutz, Carolyn |

| 99. | Lutz, Douglas C. |

| 100. | Lutz, Jr., Richard Paul |

| 101. | Marsters, Dorothy |

| 102. | Marsters, Judson |

| 103. | Marti, Thomas |

| 104. | Mathis, Charles |

| 105. | McClain, Todd |

| 106. | McClain, William Troy |

| 107. | McDermott, Helen Z. |

| 108. | McKinley, Albert |

| 109. | McKinley, Albert & Geneva |

| 110. | McKinley, Geneva |

| 111. | June McLaren Living Trust (William & June McLaren as Trustees) |

| 112. | William McLaren Living Trust (William & June McLaren as Trustees) |

| 113. | Ed E. McWilliams Revocable Trust (Ed & Nancy McWilliams as Trustees) |

| 114. | Mellado, Eduardo & Agueda |

| 115. | Mondeau, Adrienne |

| 116. | Morrow, Arthur |

| 117. | Morrow, Jennie |

| 118. | Morse, Terrance L. |

| 119. | Mucker, Matthew |

| 120. | Mulligan, Ashley |

| 121. | Mullins, Gary |

| 122. | Munger, Ann |

| 123. | Munger, Ann & Robert |

| 124. | Munger, Robert |

| 125. | Neal, Donna |

| 126. | Neal, Earl |

| 127. | Nelson, Jerry & Joan |

| 128. | Ninich, Christene, on behalf of James Henry Ninich, deceased |

| 129. | Nix & Nix Family, LP |

| 130. | Nolin, Wendy |

| 131. | O’Keefe, Mary |

| 132. | Ormsby, Jo |

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 9 of 74

| 133. | Parrott, Robyn |

| 134. | Patty, Kevin |

| 135. | Patty, Therese |

| 136. | Patty, Dayna |

| 137. | Patty, Melissa |

| 138. | Patty, Kevin & Therese |

| 139. | Pennel, Brock & Diana |

| 140. | Phillips, Hazel |

| 141. | Pippi, Augustine & Susan |

| 142. | Pirie, Glenda |

| 143. | Plumlee, Hubert |

| 144. | Polk, Charles & Marilyn |

| 145. | Polk, Marilyn |

| 146. | Poth, Konrad E. |

| 147. | Charles G. & Marjorie E. Quarnstrom Revocable Living Trust (Faye Bagby only in her capacity as Trustee) |

| 148. | Quarnstrom, Charles & Marjorie |

| 149. | Raisinghani, Mahesh |

| 150. | Reader, Jamieson & Misti |

| 151. | Recker, Janet |

| 152. | Recker, Steven |

| 153. | Redden, Jr., Jim |

| 154. | Reynolds, Charles |

| 155. | Rice, Dennis |

| 156. | Richardson, II, Louis D. |

| 157. | Rivard, William |

| 158. | Roddy, Joe |

| 159. | Rose-McDaniel, Deborah |

| 160. | Sachanko, Susan B. |

| 161. | Sanders, Brandon |

| 162. | Sanderson, Michael |

| 163. | Sandoval, Ana |

| 164. | Sandoval, Will |

| 165. | Sandoval, Will & Ana |

| 166. | Sauceda, Linda |

| 167. | Schwab, III, Carl F. |

| 168. | Schwab, John |

| 169. | See, Bud S. |

| 170. | Sekely, Erick |

| 171. | Sherriff Family, LLC |

| 172. | Shiring, Robert |

| 173. | Simms, Leigh B. |

| 174. | Smith, Charles E. |

| 175. | Smith-Conner, Sandra |

| 176. | Somerset Partners Strategic Asset (Whitmire, David) |

| 177. | Stagner, Cathy M. |

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 10 of 74

| 178. | Stark, Michael P. |

| 179. | The Stelmak Family Trust (Robert & Judith Stelmak as Trustees) |

| 180. | Stelmak, Robert |

| 181. | Stephan, David A. |

| 182. | Steuben, Marilyn |

| 183. | Storey, Debbie T. |

| 184. | Tallhammer, Bela |

| 185. | Tucker, Alan |

| 186. | Vorheis, Jerry |

| 187. | Richard & Judy Walker Family Trust (Richard & Judy Walker as Trustees) |

| 188. | Walker, Van |

| 189. | Warner, Wanda |

| 190. | Weddel, Elmer |

| 191. | White, Howard |

| 192. | Whitehurst, Robert |

| 193. | Whitmire, David |

| 194. | Williams, Thomas G. |

| 195. | Willingham, John |

| 196. | Wilson, Darlene |

| 197. | Woelfel, John |

| 198. | Wohleb, Clifford |

| 199. | Wohleb, Clifford & Jennes |

| 200. | Wood, Daniel |

| 201. | Wood, Sharon |

| 202. | Zagar, Amy |

| 203. | Zagar, Keith |

| 204. | Zanoni, Muriel M. |

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 11 of 74

Exhibit 10.3

EXHIBIT 2

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 12 of 74

CLASS ACTION SETTLEMENT AGREEMENT

This Class Action Settlement Agreement (“Settlement Agreement” or “Agreement”) is entered into as of March24,2016, by and among the following parties (referred to collectively as the “Parties” and each individually as a “Party”): (a) Lead plaintiffs Philip Garner, Steve South as trustee for the South Living Trust, and Christine Duncan, in the class action adversary proceeding captionedGarner et al. v. Life Partners, Inc., Adversary No. 15-CV-04061-RFN (Bankr. N.D. Tex.) (the “Garner Class Adversary”), lead plaintiffs Michael Arnold, Janet Arnold, Dr. John Ferris, Steve South as trustee for the South Living Trust, and Christine Duncan, in the class action adversary proceeding captionedArnold et al. v. Life Partners, Inc., Adversary No. 15-CV-04064-RFN (Bankr. N.D. Tex.) (the “Arnold Class Adversary”), and lead plaintiffs Michael Arnold, Janet Arnold, Dr. John Ferris, Steve South as trustee for the South Living Trust, and Christine Duncan, in the state court putative class action captioned Arnold et al. v. Life Partners, Inc., Case No. DC-11-02995 (Tex. Dist. Ct. 14th Dist.) (the “Arnold State Court Action”) (collectively, “Lead Plaintiffs”), on behalf of themselves and all members of the Ownership Settlement Subclass and/or the Rescission Settlement Subclass as defined herein; (b) Lead Plaintiffs’ counsel, Langston Law Firm, Skelton Slusher Barnhill Watkins Wells PLLC (f/k/a Zelesky Law Firm PLLC), andAldermanCain & Neill PLLC (“Plaintiffs’ Counsel”); (c) H. Thomas Moran II (“Moran” or the “Trustee”), chapter 11 Trustee for Life Partners Holdings, Inc. (“LPHI”); (d) LPHI, Life Partners, Inc. (“LPI”) and LPI Financial Services, Inc. (“LPIFS”, and together with LPI, the “Subsidiary Debtors”) (collectively, the “Debtors”); and (e) The Official Committee of Unsecured Creditors (the “Committee”) (the Trustee, Subsidiary Debtors, and Committee shall be referred to collectively as the “Estate Representatives”).

Page 1 of 52

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 13 of 74

BACKGROUND

1. For years, LPI was engaged in the business of acquiring life insurance policies known as viatical settlements or life settlements. Generally speaking, viatical settlements and life settlements involve the holder of a life insurance policy selling his or her interests in a life insurance policy to a third party in exchange for a lump-sum cash payment less than the policy’s death benefit. LPI marketed and sold investment contracts relating to those policies to investors.

2. LPI’s marketing and business operations were successful in large part because of its intense efforts to create and to maintain a public perception that its investment products held the prospect of substantial returns. These efforts included a vigorous effort to silence and discredit any attempt to question LPI’s claims. These efforts were made by LPI, its affiliates, principals, and hundreds of sales agents. Thus, for example, when a media report suggested that LPI’s life expectancy projections were inaccurate, LPI engaged in a contra campaign to support those projections, point to returns generated when policies did mature, conceal the large number of policies that had not matured as represented, and thus to perpetually convince investors that the maturity of their policy was just around the corner. Similarly, when, in January 2011, the SEC announced that it was investigating LPI, a concerted and sustained effort to disparage the SEC was undertaken by LPI, LPHI, and their principals. LPI also initiated a “resale” program that bought out unhappy investors for a time. As lawsuits were filed, LPI spent millions of dollars opposing the various cases, including those discussed below, and was able to obtain a number of favorable rulings and considerable delays and thus drive up the costs of those working to oppose or expose LPI. Through these combined efforts, LPI was able to maintain its façade essentially throughout the litigation described below.

Page 2 of 52

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 14 of 74

3. In March 2011, the Arnold State Court Action was filed, alleging that LPI violated various federal and state securities laws, as LPI’s life settlement investments were securities that were not registered with either the Texas State Securities Board or the United States Securities and Exchange Commission and therefore LPI was selling unregistered securities. The Arnold State Court Action sought relief in the form of rescission pursuant to the Texas Securities Act § 33, along with attorneys’ fees, costs, and interest. As indicated, this litigation, like others that followed, was vigorously opposed, and was at one point dismissed by the trial court.

4. After more than four years of litigation, in May 2015, the Texas Supreme Court held in the Arnold State Court Action that the agreements LPI used to solicit money from investors are “investment contracts” and therefore securities pursuant to the Texas Securities Act.Life Partners, Inc. v. Arnold,464 S.W.3d 660 (Tex. May 8, 2015).

5. On January 20, 2015, LPHI filed a voluntary petition for relief under chapter 11 of title 11 of the United States Code (as amended, the “Bankruptcy Code”), thereby commencing its bankruptcy case captionedIn re Life Partners Holdings, Inc., Case No. 15-40289-rfn11 (the “LPHI Bankruptcy Case”). On March 13, 2015, the U.S. Trustee appointed Moran as the Chapter 11 Trustee in the LPHI Bankruptcy Case, and on March 19, 2015, the United States Bankruptcy Court for the Northern District of Texas (the “Bankruptcy Court”) affirmed Moran’s appointment.

6. On May 19, 2015, the Subsidiary Debtors filed their respective voluntary petitions for relief under chapter 11 of the Bankruptcy Code, captionedIn re Life Partners, Inc., Case No. 15-41995-rfn11 andIn re LPI Financial Services, Inc., No. 15-41996-rfn11, thereby initiating their bankruptcy cases in the Bankruptcy Court (the “Subsidiary Bankruptcy Cases”). On May 22, 2015, the Bankruptcy Court granted the Subsidiary Debtors’ request to jointly administer the LPHI

Page 3 of 52

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 15 of 74

Bankruptcy Case and the Subsidiary Bankruptcy Cases (collectively, the “Bankruptcy Cases”).

7. The Arnold State Court Action was stayed due to the Bankruptcy Cases.

8. In the Bankruptcy Cases, LPI has claimed that it is the owner of the life insurance policies underlying the securities the Settlement Class Members purchased and that those policies are property of the bankruptcy estates. The Plaintiffs (as defined herein) dispute that the policies, their proceeds, or any rights to which the owners of such policies are entitled (including, without limitation, the cash surrender value of each such policy) are property of the bankruptcy estates pursuant to 11 U.S.C. § 541. This dispute is referred to herein as the “Ownership Issue.”

9. Lead plaintiff Philip Garner filed the Garner Class Adversary on July 19, 2015 in the Bankruptcy Court on behalf of a class of “All persons or entities who invested in viatical settlement or life settlement securities sold by LPI. Excluded from the Class are LPI, all affiliated Life Partners companies or entities and any individual who served as an officer, director, advisor, board member, or otherwise was employed by LPI, including but not limited to all insiders of LPI,” alleging that the class members were the equitable owners of the life settlement securities they purchased from LPI (including all death benefit proceeds), and that the securities held by the class members (including all death benefit proceeds) along with all other monies held in trust are not the property of LPI or its bankruptcy estate. The Garner Class Adversary sought relief in the form of a declaratory judgment pursuant to Federal Rule of Bankruptcy Procedure 7001, 28 U.S.C. § 2201et seq., and 11 U.S.C. § 541. On July 31, 2015, a motion for class certification [Dkt. No. 8] was filed in the Garner Class Adversary.

10. Lead plaintiffs Michael Arnold, Janet Arnold, Dr. John Ferris, Steve South as trustee for the South Living Trust, and Christine Duncan, filed the Arnold Class Adversary on July

Page 4 of 52

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 16 of 74

28, 2015 in the Bankruptcy Court on behalf of a class of “All persons or entities who invested in viatical settlement or life settlement securities sold by LPI. Excluded from the Class are [LPI], all affiliated Life Partners companies or entities and any individual who served as an officer, director, advisor, board member, or otherwise was employed by LPI, including but not limited to all insiders of LPI,” alleging that LPI’s life settlement investments were securities that were not registered with either the Texas State Securities Board or the United States Securities Exchange Commission, and therefore LPI was selling unregistered securities. The Arnold Class Adversary sought relief in the form of rescission pursuant to the Texas Securities Act § 33, along with attorneys’ fees, costs, and interest.

11. There was an unopposed Motion for Leave to File Consolidated Amended Complaint for the Garner Class Adversary and the Arnold Class Adversary filed on March 11, 2016 (when this motion is granted, the resulting proceeding will be the “Consolidated Class Adversary”). The Consolidated Class Adversary is captionedSouth, et al. v. Life Partners, Inc. There also will be a Joint Motion to Withdraw the Reference for the Consolidated Class Adversary filed on March 16, 2016 (the “Motion to Withdraw Reference”).

12. LPI filed an answer to the Garner Class Adversary on August 18, 2015 [Dkt. No. 10], and an answer to the Arnold Class Adversary on August 28, 2015 [Dkt. No. 8]. LPI denied that class treatment was appropriate and also denied that the relief sought in both the Garner Class Adversary and the Arnold Class Adversary was appropriate.

13. The Lead Plaintiffs, on behalf of the Plaintiffs, have filed Claim Nos. 18810, 22128, 22662, 22670, 23205, and 23212 (the “Class Proofs of Claim”), and the Lead Plaintiffs individually have filed Claim Nos. 18813, 18987–19000, 19121–29, 19132, 19753–74, 22663,

Page 5 of 52

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 17 of 74

23666, 23667, 23213, 23215, 23216, 23600, and 23601 (the “Lead Plaintiff Proofs of Claim”) in the Bankruptcy Cases.

14. Plaintiffs’ Counsel has filed Claim Nos. 23211 and 22661 (the “Plaintiffs’ Counsel Proofs of Claim”).

15. Counsel for the Parties, following preliminary correspondence and discussions over telephone, email, and in person, engaged in and conducted in-person settlement meetings among counsel, as well as additional correspondence and discussions over telephone and email from August 2015 through March 2016. Due to these settlement negotiations, and as part of a joint effort to conserve the resources of the bankruptcy estates and maximize the benefits to the Plaintiffs, counsel agreed to stay all deadlines in the Garner Class Adversary and the Arnold Class Adversary.

16. As a result of complex and protracted discussions, the following settlements were agreed to: (a)Term Sheet for Compromise to a Plan of Reorganization of LPHI, LPI, and LPIFS (Sept. 24, 2015) [Exhibit A to Dkt. No. 1032, filed Sept. 25, 2015] (the “Term Sheet”); (b)Debtors’ Expedited Motion for Interim and Final Orders (I) (A) Authorizing Debtors to Obtain Post-Petition Financing, (B) Granting Security Interests and/or Superpriority Administrative Expense Status; and (II) Granting Related Relief[Dkt. No. 958, filed Sept. 16, 2015] (the “Financing Motion”); (c) the Plan (as defined below); and (d) this Settlement Agreement.

17. Plaintiffs’ Counsel conducted extensive investigation relating to the claims and the underlying events and transactions alleged in the Consolidated Class Adversary. Plaintiffs’ Counsel has analyzed evidence adduced during its investigation and has researched the applicable law with respect to the claims Plaintiffs have asserted against LPI, as well as the potential defenses

Page 6 of 52

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 18 of 74

thereto. Additionally, Plaintiffs’ Counsel’s efforts in the Arnold State Court Action were traceable and necessary to the ultimate resolution of the Consolidated Class Adversary because, inter alia, the issue of whether the Settlement Class Members’ investments with Debtors were securities, as that term is defined by the Texas Securities Act, is a prerequisite to determining the ultimate Ownership Issue and the right to rescission in the Consolidated Class Adversary.

18. Due to the complex nature of the issues involved, the Parties recognize that the outcome of the Consolidated Class Adversary is uncertain. The Plaintiffs have the burden of proof on some of the issues in the Consolidated Class Adversary, and LPI has the burden on others. The trial of the Consolidated Class Adversary would be lengthy and complex, adding to cost and potential delay. Importantly, the Plan cannot be formulated or confirmed without resolution of the Consolidated Class Adversary and the Ownership Issue. The interests of creditors of the Debtors are served if the compromise and settlement transactions contemplated in this Settlement Agreement (which resolves the Consolidated Class Adversary and the Ownership Issue) and the Plan are approved and implemented.

19. Based upon investigation, the circumstances surrounding the Bankruptcy Cases and the Consolidated Class Adversary, and the negotiation of the Term Sheet and the Plan, Lead Plaintiffs and Plaintiffs’ Counsel have agreed to settle the Consolidated Class Adversary pursuant to the provisions of this Settlement Agreement after considering such factors as: (a) the substantial benefits to the Settlement Class Members under the terms of this Settlement Agreement; (b) the attendant costs, risks, and uncertainty of litigation, including trial and potential appeals; (c) the benefit to all creditors, including the Settlement Class Members, arising from the implementation of the transactions contemplated by this Settlement Agreement and the Plan; (d) the distraction and

Page 7 of 52

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 19 of 74

diversion of personnel and resources as a result of continuing litigation; (e) the desirability of consummating this Settlement Agreement and the Plan promptly; and (f) the current financial condition of the Debtors.

20. The Estate Representatives have performed extensive due diligence and conducted extensive analysis of the issues that are the subject of this Settlement Agreement and believe that the terms of this Settlement Agreement, and the corresponding terms of the Plan, are an exercise of the Trustee’s and the Subsidiary Debtors’ sound business judgment and in the best interest of the Debtors’ estates, their creditors, including the Settlement Class Members, and all other parties in interest, including, without limitation, the class of creditor interests represented by the Committee.

21. The Parties and their counsel negotiated the terms regarding the attorneys’ fees and the attorney releases provided for in paragraphs 46-52 below after reaching agreement regarding material terms of the Settlement Agreement. Plaintiffs’ Counsel has not received any payment for their services in the Consolidated Class Adversary or the Arnold State Court Action on behalf of the Lead Plaintiffs or the Settlement Class. In addition to the risk of non-payment that Plaintiffs’ Counsel assumed in pursuing the Arnold State Court Action and the Consolidated Class Adversary, prior to the commencement of its Bankruptcy Case, LPI also moved for, and the state trial court entered an order granting, sanctions against Plaintiffs’ Counsel for asserting a frivolous lawsuit and sought an award of attorneys’ fees against Plaintiffs’ Counsel in an amount in excess of $360,000.00, which order of sanction subsequently was reversed and vacated after extensive litigation by Plaintiffs’ Counsel.

22. This Settlement Agreement is the product of sustained, arm’s-length settlement negotiations, including two day-long mediation sessions mediated by retired Federal Bankruptcy

Page 8 of 52

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 20 of 74

Judge Richard Schmidt, and the Parties believe that the terms of this Settlement Agreement, including the provisions regarding the payment of attorneys’ fees to Plaintiffs’ Counsel are fair, reasonable, and adequate. Therefore, the Estate Representatives, joined by Lead Plaintiffs and Plaintiffs’ Counsel, will seek Court approval of this Settlement Agreement as set forth below.

23. This Settlement Agreement shall in no way be construed or deemed to be evidence of, or an admission or concession on the part of any Party, with respect to any claim of fault or liability or wrongdoing or damage whatsoever, or any infirmity in the defenses that any Party has, or could have, asserted. Any and all statements, representations, and findings herein regarding, or in any way related to the Plaintiffs and Plaintiffs’ Counsel (including, but not limited to, whether the Plaintiffs in the Consolidated Class Adversary can be certified as a “class” pursuant to Bankruptcy Rule 7023 or Federal Rule of Civil Procedure 23 or whether the Class Proofs of Claim can proceed on a “class” basis pursuant to Bankruptcy Rule 9014 or 7023) are made solely for the purpose of this Settlement Agreement, and shall not be deemed an admission or concession on the part of the Trustee or the Debtors; however, upon the Court’s entry of the Final Approval Order (as defined below) and the Confirmation Order (as defined herein), the stipulations, representations, and findings in this Settlement Agreement shall be final, conclusive, and binding on the Parties as among each other solely (i) to enforce or construct this Settlement Agreement and (ii) in any proceeding or matter in which the terms of this Settlement Agreement are at issue, subject to the reversal or modification of the Final Approval Order or the Confirmation Order on appeal and the rescission rights under the terms of this Settlement Agreement. The Parties recognize that the Consolidated Class Adversary was filed and defended in good faith and that the Consolidated Class Adversary is being voluntarily settled on terms that the Parties believe to be

Page 9 of 52

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 21 of 74

reasonable considering the merits of the claims or defenses and taking into account the expense and uncertainty of continued litigation and the Bankruptcy Cases. This Settlement Agreement has resulted from extensive, good-faith, and arm’s-length negotiations among the Parties. The Parties agree that each has complied fully with the strictures of Federal Rule of Bankruptcy Procedure 9011 and Federal Rule of Civil Procedure 11 and that no sanctions or other relief against any Party is warranted or appropriate under such circumstances.

24. NOW, THEREFORE, subject to the approval of the Bankruptcy Court and confirmation of the Plan, and in consideration of the agreements and releases and assignments set forth herein and other good and valuable consideration, and intending to be legally bound, the Parties agree that the Consolidated Class Adversary and all other claims of the Plaintiffs and the Settlement Class Members encompassed within the scope of this Settlement Agreement and as set forth in the Plan be fully, finally, and forever settled, compromised, released, or assigned, and that the Consolidated Class Adversary, the Arnold State Court Action, and all other proceedings described herein or in Appendix B be: (i) dismissed with or without prejudice, without costs to the Parties except as provided herein; and/or (ii) assigned to the Creditors’ Trust, as set forth herein, on the following terms and conditions:

DEFINITIONS1

25. When used in this Settlement Agreement, unless otherwise specifically indicated, the following terms shall have the meanings set forth below:

a. “Amended Schedule F” has the meaning set forth in the Plan.

1All other defined terms included throughout this Settlement Agreement shall have the meanings ascribed in this Settlement Agreement.

Page 10 of 52

Case 15-40289-rfn11 Doc 2668-3 Filed 07/08/16 Entered 07/08/16 20:29:47 Page 22 of 74

b. “Assigning Position Holder” has the meaning set forth in the Plan.

c. “Class Notice” means the notice to the Settlement Class as shall be given in the form deemed sufficient by the Court.

d. “Confirmation Order” means the order of the Bankruptcy Court confirming the Plan pursuant to Bankruptcy Code section 1129.