Filed Pursuant to Rule 424(b)(3)

Registration No. 333-217578

PROCACCIANTI HOTEL REIT, INC.

SUPPLEMENT NO. 2 DATED SEPTEMBER 7, 2018

TO THE PROSPECTUS DATED AUGUST 15, 2018

This Supplement No. 2 supplements, and should be read in conjunction with, the prospectus of Procaccianti Hotel REIT, Inc., dated August 15, 2018, and supersedes and replaces Supplement No. 1 to the prospectus, dated August 28, 2018. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

| (1) | the status of our initial public offering; |

| (2) | an updated notice to Pennsylvania investors; |

| (3) | an additional investor suitability standard applicable to North Dakota investors; |

| (4) | the declaration of distributions to our stockholders and distributions paid through August 2018; |

| (5) | updates regarding our three hotel properties, which includes one hotel property acquired on August 15, 2018, and associated borrowings and hotel management agreements; | |

| (6) | an update to our organizational structure chart; |

| (7) | updates to our risk factors; |

| (8) | an update to the “Questions and Answers About This Offering” section; |

| (9) | an update to our prior performance summary; and |

| (10) | a revised form of our subscription agreement. |

Status of this Offering

Our registration statement on Form S-11 for our initial public offering, or the offering, of $550,000,000 of shares of Class K common stock, or K Shares, Class K-I common stock, or K-I Shares, and Class K-T common stock, or K-T Shares, consisting of up to $500,000,000 of K Shares, K-I Shares and K-T Shares in our primary offering and up to $50,000,000 of K Shares, K-I Shares and K-T Shares pursuant to our distribution reinvestment plan, was declared effective by the U.S. Securities and Exchange Commission, or SEC, on August 14, 2018. As of the date of this supplement, we had not sold any K Shares, K-I Shares or K-T Shares pursuant to the offering.

The following information supersedes and replaces the Question and Answer entitled “Do you currently have shares outstanding?” in the section entitled “Questions and Answers About this Offering” on page 10 of the prospectus. Further, all references in the prospectus to the total amount of proceeds raised at the termination of our private offering are updated in accordance with the information presented below:

Do you currently have shares outstanding?

In connection with our incorporation, we sold an aggregate of 20,000 A Shares to an affiliate of our advisor, TPG Hotel REIT Investor, LLC, for an aggregate purchase price of $200,000, or $10.00 per share. We also issued 125,000 shares of our B Shares. See “What arrangements do you have with the Service Provider?” above for information on the Service Provider’s entitlement to B Shares pursuant to the Services Agreement. On September 30, 2016, we commenced the private offering of K Shares and Units with a targeted maximum offering of $150,000,000 in K Shares (including K Shares sold as part of a Unit) to accredited investors only pursuant to confidential private placement memorandum. We terminated the private offering prior to commencing this offering. At the termination of our private offering, we had received aggregate gross offering proceeds of approximately $15,582,755 from the sale of approximately 1,572,027.064 K Shares and A Shares, consisting of 1,253,617.522 K Shares and 318,409.542 A Shares, which includes 295,409.542 A Shares purchased by TPG Hotel REIT Investor, LLC to fund organization and offering expenses associated with the K Shares and Units sold in the private offering.

Notice to Pennsylvania Investors

The following information is inserted as a new paragraph above the pricing chart on the cover page of the prospectus:

PENNSYLVANIA INVESTORS: Because the minimum offering amount of this offering is less than $33,333,334, you are cautioned to carefully evaluate the program’s ability to fully accomplish its stated objectives and to inquire as to the current dollar volume of program subscriptions.

The following information supersedes and replaces the section entitled “Plan of Distribution – Special Notice to Pennsylvania and Washington Investors” on page 240 of the prospectus:

Special Notice to Washington Investors

We will not offer shares in this offering to Washington residents until we have received total gross proceeds from our private offering and this public offering of at least $20,000,000. At the termination of our private offering, we had received total gross proceeds of approximately $15,582,755.

Investor Suitability Standards

The following information is inserted as a new paragraph in the section entitled “Investor Suitability Standards” on page ii of the prospectus:

North Dakota.In addition to the net income and net worth standards stated above, North Dakota investors must represent that they have a net worth of at least ten times their investment in us.

Distributions

The following information supplements, and should be read in conjunction with, the section entitled “Description of Capital Stock – Distributions” beginning on page 183 of the prospectus:

On August 20, 2018, our board of directors authorized the payment of distributions, which were authorized to be made with funds generated by property operations, with respect to each K Share outstanding as of June 30, 2018, to the holders of record of K Shares as of the close of business on August 21, 2018. Our board of directors determined that, with respect to the K Shares outstanding as of June 30, 2018, the cumulative amount of distributions that had accrued on a daily basis with respect to each K Share since March 31, 2018, was $147,590.31, or $0.0016438356 per K Share per day. On August 23, 2018, we paid such distributions in the cumulative amount of $147,590.31 in cash to the holders of K Shares. We funded such distributions with cash flow from operations.

We have paid the following distributions to holders of K Shares:

| Quarter Ended | | Date Paid | | Distribution Amount | |

| June 30, 2017 | | October 6, 2017 | | $ | 5,724.01 | |

| September 30, 2017 | | October 27, 2017 | | $ | 27,398.88 | |

| December 31, 2017 | | February 9, 2018 | | $ | 61,070.91 | |

| March 31, 2018 | | May 29, 2018 | | $ | 102,690.46 | |

| June 30, 2018 | | August 23, 2018 | | $ | 147,590.31 | |

| Total K Share Distributions: | | | | $ | 344,474.57 | |

Our Hotel Properties

The following information supersedes and replaces the first paragraph of the section entitled “Prospectus Summary – Description of Real Estate Investments” on page 32 of the prospectus:

We engage in the acquisition and ownership of a diversified portfolio of hospitality properties. As of March 31, 2018, through our joint venture with Procaccianti Convertible Fund, LLC, an affiliate of our sponsor, we owned a 51% interest in two select-service hotel properties, comprising an aggregate of 239 rooms and approximately 4,250 square feet of meeting space. We subsequently acquired, through a wholly owned subsidiary of our operating partnership, a select-service hotel property on August 15, 2018, which has 107 rooms and approximately 3,000 square feet of meeting space.

The following information supplements, and should be read in conjunction with, the question and answer entitled “Do you currently own any assets?” in the “Questions and Answers About this Offering” section on page 4 of the prospectus:

On August 15, 2018, we, through a wholly owned subsidiary of our operating partnership, acquired 100% of the fee simple interest in a 107-room, 36,411 square foot select-service hotel property - the Hotel Indigo hotel located in Traverse City, Michigan, or the Hotel Indigo Traverse City property. The Hotel Indigo Traverse City Hotel property opened in May 2016 and features approximately 3,000 square feet of meeting space, 82 underground parking spaces (valet only), a fitness center, business center, restaurant and lobby bar, and a rooftop bar overlooking the Grand Traverse Bay.

The following information supersedes and replaces in its entirety the section entitled “Investment Objectives, Strategy and Policies – Description of Real Estate Investments” section beginning on page 119 of the prospectus:

Description of Real Estate Investments

We engage in the acquisition and ownership of hotel properties throughout the United States. As of the date of this prospectus, we owned interests in three select-service hotel properties.

As of September 7, 2018, we, through a wholly-owned subsidiary of our operating partnership, owned 100% of the fee simple interest in a select-service hotel property and, through our joint venture with Procaccianti Convertible Fund, LLC, an affiliate of our sponsor, owned a 51% interest in two select-service hotel properties. Each property was purchased from sellers unaffiliated with us, our sponsor, our advisor or their affiliates. These properties were financed with a combination of debt and offering proceeds from our private placement. For more information on the financing of our hotel properties, see “–Borrowings” below.

The following table summarizes our three select-service hotel properties as of September 7, 2018. Unless otherwise indicated, information in this section is provided as of December 31, 2017.

Property Description* | | Interest Acquired | | | Date Acquired | | | Year Constructed | | | Contract Purchase Price(2) | | | Property Taxes(5) | | | Fees Owed to Advisor(3) | | | Number of Rooms | | | | Estimated Acquisition Cap Rate(6) | | | Location | | MSA |

| Springhill Suites Wilmington Mayfaire | | | 51.0 | %(8) | | 05/24/2017 | (1) | | | 2015 | | | $ | 18,000,000 | | | $ | 84,571 | | | $ | 124,978 | (4) | | | 120 | | | | | 7.73 | % | | Wilmington, NC | | Wilmington, NC |

| Staybridge Suites St. Petersburg | | | 51.0 | %(8) | | 06/29/2017 | (1) | | | 2014 | | | $ | 20,500,000 | | | $ | 214,514 | | | $ | 124,978 | (4) | | | 119 | | | | | 8.65 | % | | St. Petersburg, FL | | Tampa-St. Petersburg – Clearwater, FL |

| Hotel Indigo Traverse City | | | 100.0 | % | | 08/15/2018 | | | | 2016 | | | $ | 26,050,000 | | | $ | 340,272 | | | $ | 413,001 | | | | 107 | | | | | 9.91 | % | | Traverse City, Michigan | | Traverse City, Michigan |

| * | We believe the property is suitable for its present and intended purposes and adequately covered by insurance. |

| (1) | Represents the date that Procaccianti Convertible Fund, LLC, an affiliate of our sponsor, acquired the Springhill Suites property and the Staybridge Suites property. We exercised our option under an option agreement to purchase a 51% membership interest in Procaccianti Convertible Fund, LLC on March 29, 2018. |

| (2) | Contract purchase price excludes acquisition fees and costs. |

| (3) | Fees owed to advisor include payments deferred acquisition fees in connection with the property acquisition. It does not include fees paid to any property manager. For more detailed information on fees paid to our advisor or its affiliates, and the deferral of such fees, see the section captioned “Management Compensation” on page 137 of this prospectus. |

| (4) | Amount represents the total amount of acquisition fees incurred in connection with both the Springhill Suites property and Staybridge Suites property. |

| (5) | Represents real estate taxes for 2017. |

| (6) | Estimated acquisition cap rate equals trailing 12-month net operating income divided by the total acquisition cost for the property. Net operating income for a specific hotel or capital expenditure project is calculated as the hotel or entity level operating profit less an estimate for the annual contractual reserve requirements for renewal and replacement expenditures. The acquisition cap rate is meant as a measure of the trialing 12-month net operating income yield at the time we acquire the property, and is not meant to be either an indication of historical, or a projection of anticipated future, net operating income yield for the acquisition. |

The following tables present occupancy, ADR and RevPar of the hotels in which we have an ownership interest as of the date of this prospectus through July 31, 2018, including periods prior to ownership.

| | | Occupancy(1) | |

| Hotel | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | |

| Springhill Suites Wilmington Mayfaire(2) | | | - | | | | - | | | | 27.8 | % | | | 66.0 | % | | | 73.1 | % | | | 76.1 | % |

| Staybridge Suites St. Petersburg(3) | | | - | | | | 48.9 | % | | | 80.7 | % | | | 78.9 | % | | | 80.8 | % | | | 80.5 | % |

| Hotel Indigo Traverse City(4) | | | - | | | | - | | | | - | | | | 75.2 | % | | | 77.3 | % | | | 77.9 | % |

| (1) | Represents occupancy for each calendar year, unless otherwise noted,, calculated as the number of occupied rooms divided by the number of available rooms. |

| (2) | The Springhill Suites Wilmington Mayfaire opened in August 2015. |

| (3) | The Staybridge Suites St. Petersburg opened in March 2014. |

| (4) | The Hotel Indigo Traverse City opened in May 2016. |

| | | ADR(1) | |

| Hotel | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | |

| Springhill Suites Wilmington Mayfaire(2) | | | - | | | | - | | | $ | 98.40 | | | $ | 114.93 | | | $ | 118.46 | | | $ | 120.46 | |

| Staybridge Suites St. Petersburg(3) | | | - | | | $ | 111.70 | | | $ | 118.10 | | | $ | 136.94 | | | $ | 135.85 | | | $ | 150.12 | |

| Hotel Indigo Traverse City(4) | | | - | | | | - | | | | - | | | $ | 183.17 | | | $ | 165.96 | | | $ | 166.84 | |

| (1) | “ADR” represents the average daily rate for a single room. |

| (2) | The Springhill Suites Wilmington Mayfaire opened in August 2015. |

| (3) | The Staybridge Suites St. Petersburg opened in March 2014. |

| (4) | The Hotel Indigo Traverse City opened in May 2016. |

| | | RevPar(1) | |

| Hotel | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | 2018 | |

| Springhill Suites Wilmington Mayfaire(2) | | | - | | | | - | | | $ | 27.39 | | | $ | 75.84 | | | $ | 85.56 | | | $ | 91.70 | |

| Staybridge Suites St. Petersburg(3) | | | - | | | $ | 54.64 | | | $ | 95.31 | | | $ | 108.07 | | | $ | 109.75 | | | $ | 120.82 | |

| Hotel Indigo Traverse City(4) | | | - | | | | - | | | | - | | | $ | 137.87 | | | $ | 128.30 | | | $ | 129.91 | |

| (1) | “RevPAR” represents the product of the ADR charged and the average daily occupancy rate, but excludes other revenue generated by a hotel property. |

| (2) | The Springhill Suites Wilmington Mayfaire opened in August 2015. |

| (3) | The Staybridge Suites St. Petersburg opened in March 2014. |

| (4) | The Hotel Indigo Traverse City opened in May 2016. |

Because we are prohibited from operating hotel properties pursuant to certain tax laws relating to our qualification as a REIT, we, indirectly through our taxable REIT subsidiaries, or TRSs, will retain a property manager to be responsible for managing each of the hotel properties under a separate hotel management agreement. We will generally pay each property manager a property management fee each fiscal year with respect to each property equal to 3% of total operating revenues of each property (which exclude the gross receipts of any licensees, leases, and concessionaries), paid on a monthly basis, in addition to certain expense and centralized services costs and reimbursements. We may also pay the property manager a construction management fee equal to market rates for supervising and/or coordinating any construction, improvements, refurbishments or renovations of our hotel properties, in addition to certain expense reimbursements.

Our TRSs each entered into hotel management agreements with property managers affiliated with TPG Hotels & Resorts, Inc., an affiliate of our sponsor, to manage the Springhill Suites property, the Staybridge Suites property, and the Hotel Indigo Traverse City property on March 29, 2018, March 29, 2018 and August 15, 2018, respectively. The property managers will each receive the property management fee described above. Each hotel management agreement has an initial term of 5 years, with four automatic one-year renewals, unless otherwise terminated in accordance with the Hotel Management Agreement.

We currently have no plans for any material renovations, improvements or development of any of the hotel properties and believe each such hotel property is adequately insured and is suitable for its present and intended use, subject to typical maintenance and replacements in the ordinary course.

The following information is added as the fourth paragraph of the section entitled “Investment Objectives, Strategy and Policies-Depreciable Tax Basis” on page 119 of the prospectus:

The Hotel Indigo Traverse City property has a depreciable tax basis of $22,208,902.31 as of August 15, 2018. The property is generally depreciated for U.S. federal income tax purposes under the Modified Accelerated Cost Recovery System, or MACRS. Under MACRS the property is depreciated over a specified life ranging from seven years for furniture, fixtures and equipment to 40 years for the building. Land is not depreciated under MACRS. Depreciation rates are specifically defined by MACRS and vary year to year. We intend to make the election to use the Alternative Depreciation System method, or ADS, under MACRS.

The following information is inserted as a new sub-section entitled "Investment Objectives, Strategy and Policies - Description of Real Estate Investments – Borrowings" on page 119 of the prospectus.

Borrowings

Springhill Suites Property Loan

On March 29, 2018, our operating partnership, through its subsidiaries, took assignment from an affiliate of our sponsor of a loan agreement, promissory note, or the Note, and other loan documents, including a guaranty by TH Investment Holdings II, LLC, an affiliate of our sponsor, to secure an aggregate $13,250,000 mortgage, or the Springhill Suites Property Loan, on the Springhill Suites property with WELLS FARGO BANK, NATIONAL ASSOCIATION, AS TRUSTEE FOR THE BENEFIT OF THE REGISTERED HOLDERS OF JPMDB COMMERCIAL MORTGAGE SECURITIES TRUST 2017-C7, COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2017-C7(as successor to J.P. Morgan Chase Bank, N.A.), as lender. Pursuant to the Springhill Suites Property Loan documents, as of March 29, 2018, the Note had a principal balance of $13, 250,000, matures on July 1, 2024, and bears interest at the rate of 4.34% per annum. Prepayments are allowed under limited circumstances. At the maturity date, all outstanding principal, accrued and unpaid interest and all other amounts are due under the loan. The Springhill Suites Property Loan is secured by the first priority deed of trust and certain other agreements that encumber the Springhill Suites property.

Staybridge Suites Property Loan

On March 29, 2018, our operating partnership, through its subsidiaries, took assignment from an affiliate of our sponsor of a loan agreement, promissory note, or the Note, and other loan documents, including a guaranty by TH Investment Holdings II, LLC, an affiliate of our sponsor, to secure an aggregate $13,325,000 mortgage, or the Staybridge Suites Property Loan, on the Staybridge Suites property with WELLS FARGO BANK, NATIONAL ASSOCIATION, AS TRUSTEE FOR THE BENEFIT OF THE REGISTERED HOLDERS OF JPMDB COMMERCIAL MORTGAGE SECURITIES TRUST 2017-C7, COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2017-C7(as successor to J.P. Morgan Chase Bank, N.A.), as lender. Pursuant to the Staybridge Suites Property Loan documents, as of March 29, 2018, the Note had a principal balance of $13, 325,000, matures on July 1, 2024, and bears interest at the rate of 4.34% per annum. Prepayments are allowed under limited circumstances. At the maturity date, all outstanding principal, accrued and unpaid interest and all other amounts are due under the loan. The Staybridge Suites Property Loan is secured by the first priority mortgage loan and certain other agreements that encumber the Staybridge Suites property.

Hotel Indigo Traverse City Property Loan

Our operating partnership, through one of its subsidiaries, entered into a first mortgage loan on August 15, 2018, with Citizens Bank, National Association, or Citizens, as lender, in the principal amount of $17,836,000, or the Citizens Loan, which matures on August 15, 2021, or the Maturity Date. The Citizens Loan is secured by the Hotel Indigo Traverse City property and bears interest at LIBOR plus 2.08%. On August 15, 2018, the operating partnership, through one of its subsidiaries, entered into a swap derivative contract to fix the interest rate on all but $2,744,000.00 of the Citizens Loan, or the Paydown Amount, which effectively resulted in fixed rate of 4.75% per annum on the remainder of the Citizens Loan. After repayment of the Promissory Note, the Company anticipates using proceeds from its offering to prepay the Paydown Amount. The Citizens Loan provides for interest only monthly payments until August 15, 2019; provided, however, the interest only period will be extended to maturity if the Paydown Amount is repaid to the Citizens Bank prior to August 15, 2019. Following August 15, 2019, in addition to any principal payments necessary to achieve the applicable DSCR (as described below), $35,000 per month in monthly principal payment generally must be paid concurrently with monthly installments of interest on the loan. With respect to first extension term, Borrower is required to achieve a debt service coverage ratio, or DSCR, of at least 1.45x and 1.50x for second and third extension terms. Any extensions require payment of extension fees to the lender of 0.10% for the first extension and 0.20% for the second and third extensions. No principal amortization will be required prior to August 15, 2019. Following August 15, 2019, in addition to any principal payments necessary to achieve the applicable DSCR, $35,000 per month in monthly principal payment shall be paid concurrently with monthly installments of interest on the loan.

Promissory Notes

Hotel Indigo Traverse City Promissory Note

On August 15, 2018, we executed a promissory note, or the Hotel Indigo Traverse City Promissory Note, in favor of our sponsor, in the principal amount of $6,600,000 in order to fund the acquisition of the Hotel Indigo Traverse City property. The Hotel Indigo Traverse City Promissory Note accrues interest at the rate of 4.75% per annum (based on the number of actual days elapsed and a 365 day year) and has a maturity date of August 16, 2019. The Hotel Indigo Traverse City Promissory Note contains customary terms and conditions, including, without limitation, defaults for failure to pay and bankruptcy or insolvency proceedings. Upon the occurrence of a default, interest on the Hotel Indigo Traverse City Promissory Note will accrue at an annual default interest rate equal to 2.0% above the stated interest rate. The Hotel Indigo Promissory Note was approved by a majority of our board of directors (including a majority of the independent directors) not otherwise interested in the transaction as fair, competitive, and commercially reasonable and no less favorable to us than a comparable loan between unaffiliated parties under the same circumstances.

The following information is inserted as a new sub-section entitled "Investment Objectives, Strategy and Policies - Description of Real Estate Investments – Franchise Agreements" on page 119 of the prospectus.

Franchise Agreements

Our hotels operate under franchise agreements with a national brand that is separate from the agreement with the property manager pursuant to which the operations of the hotel are managed. Our franchise agreements give us the right to the use of the brand name, systems and marks with respect to specified hotels and establish various management, operational, record-keeping, accounting, reporting and marketing standards and procedures with which the licensed hotel must comply. In addition, the franchisor establishes requirements for the quality and condition of the hotel and its furniture, fixtures and equipment, and we are obligated to expend such funds as may be required to maintain the hotel in compliance with those requirements.

Typically, our franchise agreements provide for a license fee, or royalty, of 5% to 6% of gross room revenues. In addition, we generally pay 1.5% to 3.5% of gross room revenues as a program or reservation fees for the system-wide benefit of brand hotels.

Our typical franchise agreement provides for a term of 15 to 25 years, although some have shorter terms. The agreements typically provide no renewal or extension rights and are not assignable. If we breach one of these agreements, in addition to losing the right to use the brand name for the applicable hotel, we may be liable, under certain circumstances, for liquidated damages.

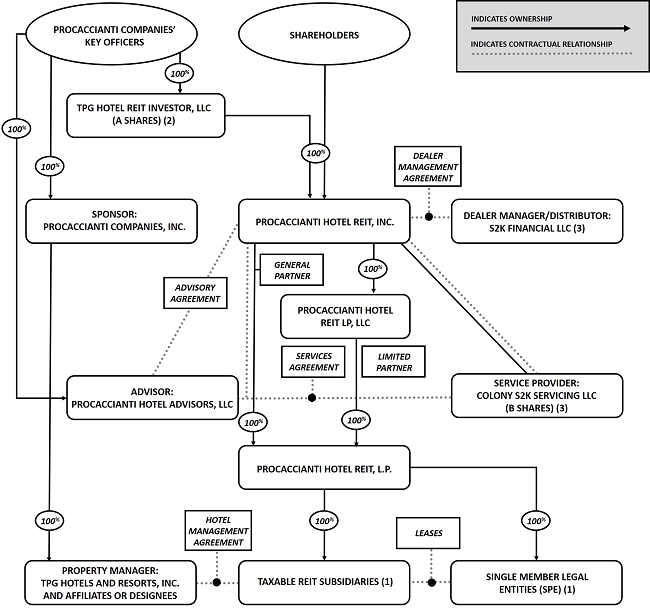

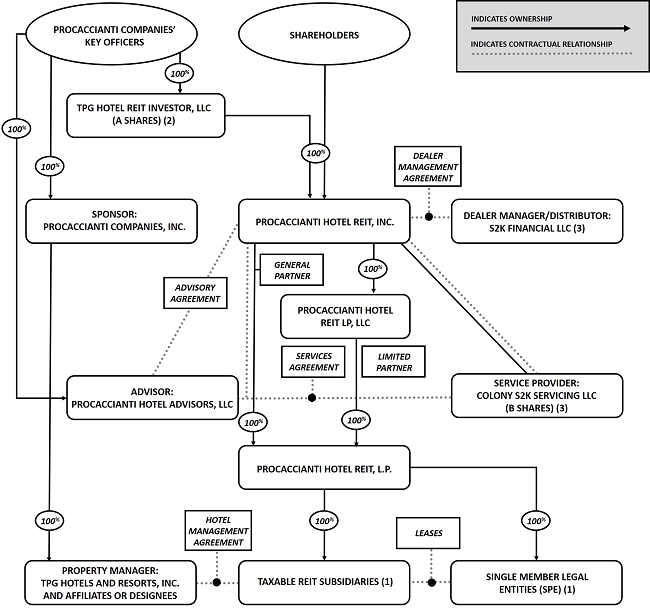

Organizational Structure

The following chart supersedes and replaces the organizational structure chart on page 36 of the “Prospectus Summary” section of the prospectus and page 164 of the “Conflicts of Interest” section of the prospectus:

| (2) | As of the date of this prospectus supplement, TPG Hotel REIT Investor, LLC, an affiliate of our advisor, owned approximately $2,954,095 in A Shares, which were issued pursuant to a private placement. |

| (3) | S2K Financial LLC and Colony S2K Servicing LLC are both wholly owned subsidiaries of Colony S2K Holdings LLC. Colony S2K Servicing LLC owns 125,000 B Shares of Procaccianti Hotel REIT, Inc. |

Risk Factors

The risk factor entitled “Because this is a ‘blind pool’ offering, you will not have the opportunity to evaluate our investments before we make them, which makes an investment in us more speculative” beginning on page 58 of the prospectus is hereby superseded and replaced with the following risk factor:

Because this is a “blind pool” offering, you will not have the opportunity to evaluate our investments before we make them, which makes an investment in us more speculative.

We have not identified all of the properties we will acquire with the net proceeds from the sale of K-I Shares, K Shares and K-T Shares in this offering. Our ability to identify well-performing properties and achieve our investment objectives depends upon the performance of our advisor in the acquisition of our investments and the determination of any financing arrangements. The size of this offering increases the challenges that our advisor will face in investing our net offering proceeds promptly in attractive properties, and the continuing high demand for the type of properties we desire to purchase increases the risk that we may pay too much for the properties that we do purchase. We will seek to invest substantially all of the net proceeds from our K-I Shares, K Shares and K-T Shares, after the payment of certain fees and expenses, in a diversified portfolio of commercial real estate investments consisting primarily of hotel properties across the United States in accordance with our investment objectives and using the strategies described in this prospectus. However, you will be unable to evaluate the economic merit of specific real estate projects before we invest in them. We expect to rely entirely on the ability of our advisor to select suitable and successful investment opportunities. We will not provide you with information to evaluate our proposed investments prior to our acquisition of those investments. Because of the illiquid nature of our shares, even if we disclose information about our potential investments before we make them, it will be difficult for you to sell your shares promptly or at all. Furthermore, our board of directors will have broad discretion in implementing investment policies. These factors increase the risk that your investment may not generate returns consistent with your expectations.

The risk factor entitled “We will pay substantial fees and expenses to our advisor, our property manager, and their affiliates, which payments increase the risk that you will not earn a profit on your investment” beginning on page 66 of the prospectus is hereby superseded and replaced with the following risk factor:

If we were to become internally managed, we would pay substantial fees to our advisor prior to holders of K Shares, K-I Shares and K-T Shares receiving their agreed-upon investment returns. In addition, we will pay substantial fees and expenses to our property manager and their affiliates, and will reimburse our advisor and its affiliates for expenses, which payments increase the risk that you will not earn a profit on your investment.

Pursuant to our agreements with affiliated property managers, we may pay significant property management fees to our property manager and may be obligated to reimburse our property manager for certain expenses it incurs in providing services. We also will be obligated under our advisory agreement with our advisor to reimburse our advisor and its affiliates for expenses they incur in connection with their providing services to us, including certain personnel services.

We may also pay significant fees during our listing/liquidation stage. Although most of the fees payable during our listing/liquidation stage are contingent on holders of K-I Shares, K Shares and K-T Shares first enjoying agreed-upon investment returns, affiliates of our advisor could also receive significant payments even without our reaching specific investment-return thresholds should we seek to become internally managed. Due to the apparent preference of the public markets for internally managed companies, a decision to list our shares on a national securities exchange could be preceded by a decision to become internally managed. Given our advisor’s familiarity with our assets and operations, we might prefer to become internally managed by acquiring our advisor. Even though our advisor will not receive internalization fees, such an internalization transaction could result in significant payments to affiliates of our advisor irrespective of whether you received the returns on which we have conditioned other back-end compensation, and we would not be required to seek a stockholder vote to become internally managed.

These fees and other potential payments increase the risk that the amount available for distribution to stockholders upon a liquidation of our portfolio would be less than the purchase price of the shares in this offering. Substantial consideration paid to our advisor and its affiliates also increases the risk that you will not be able to resell your shares at a profit, even if our shares are listed on a national securities exchange. See “Management Compensation.”

The following bullet point supersedes and replaces the eleventh bullet point of the Question and Answer entitled “Are there any risks involved in an investment in your shares?” in the “Questions and Answers About This Offering” section beginning on page 2 of the prospectus and the eleventh bullet point of the “Prospectus Summary – Summary Risk Factors” section beginning on page 31 of the prospectus:

| | · | If we were to become internally managed, we would pay substantial fees to our advisor prior to holders of K Shares, K-I Shares and K-T Shares receiving their agreed-upon investment returns. In addition, we will pay substantial fees and expenses to our property manager and their affiliates, and will reimburse our advisor and its affiliates for expenses, which payments increase the risk that you will not earn a profit on your investment. |

The risk factor entitled “The proposed SEC standard of conduct for investment professionals could impact our ability to raise capital” on page 96 of the prospectus is hereby superseded and replaced with the following:

The proposed SEC standard of conduct for investment professionals could impact our ability to raise capital.

On April 18, 2018, the SEC proposed “Regulation Best Interest,” a new standard of conduct for broker-dealers under the Securities Exchange Act of 1934, as amended, that includes: (i) the requirement that broker-dealers refrain from putting the financial or other interests of the broker-dealer ahead of the retail customer, (ii) a new disclosure document, the consumer or client relationship summary, or Form CRS, which would require both investment advisers and broker-dealers to provide disclosure highlighting details about their services and fee structures and (iii) proposed interpretative guidance that would establish a federal fiduciary standard for investment advisers. The public comment period on Regulation Best Interest ended on August 7, 2018.

Proposed Regulation Best Interest is complex and may be subject to revision or withdrawal. Plan fiduciaries and the beneficial owners of IRAs are urged to consult with their own advisors regarding the impact that proposed Regulation Best Interest may have on purchasing and holding interests in our company. Proposed Regulation Best Interest or any other legislation or regulations that may be introduced or become law in the future could have negative implications on our ability to raise capital from potential investors, including those investing through IRAs.

Questions and Answers About This Offering

The following information supersedes and replaces in its entirety the Question and Answer entitled “How does the potential return to holders of K-I Shares, K Shares and K-T Shares in this offering compare to the potential return to stockholders of other publicly registered, non-traded REITs?”in the “Questions and Answers About This Offering” section beginning on page 14 of the prospectus:

How does the potential return to holders of K-I Shares, K Shares and K-T Shares in this offering compare to the potential return to stockholders of other publicly registered, non-traded REITs?

We intend to use the proceeds from the sale of A Shares to our advisor and its affiliates to fund the selling commissions, dealer manager fees, stockholder servicing fees, the difference between $10.00 per share and the $9.50 per share initial purchase price of K-I Shares purchased in our primary offering, the difference between any discounted purchase price and initial offering price of K-I Shares, K Shares and K-T Shares (excluding volume discount purchases) and other organization and offering expenses payable in connection with the K-I Shares, K Shares and K-T Shares. Therefore, the proceeds from the sale of K-I Shares, K Shares and K-T Shares will not be used to pay organization and offering expenses in connection with the K-I Shares, K Shares and K-T Shares, and 100% of the gross proceeds of the K-I Shares, K Shares and K-T Shares would be available to us for investment in assets.

We believe our intended use of proceeds described above will provide greater protection to holders of K-I Shares, K Shares and K-T Shares than a traditional public non-traded REIT structure in the event of a downturn in the value of our shares. As referred to herein, a traditional public non-traded REIT structure refers to a publicly registered securities offering of a REIT not listed on a national securities exchange that uses proceeds from the sale of a share of common stock to fund the selling commissions, dealer manager fees and organization and offering expenses relating to the purchase of that share of common stock. By investing 100% of the proceeds from K-I Shares, K Shares and K-T Shares in assets, we believe we provide holders of K-I Shares, K Shares and K-T Shares with a greater likelihood of preservation of capital and consistent distributions that are not funded with return of capital sources as compared to the traditional public non-traded REIT structure. In exchange for this lower risk, holders of our K-I Shares, K Shares and K-T Shares would be limited in their potential return on investment should we return in excess of 8.53% on their investment. A stockholder in a traditional public non-traded REIT structure bears a greater risk of loss in the event of a downturn in the value of the REIT’s shares than holders of K-I Shares, K Shares and K-T Shares, but, as demonstrated in the model below, could potentially earn a higher return on investment than holders of K-I Shares, K Shares and K-T Shares in this offering.

The following table provides the assumptions used to calculate the hypothetical proceeds available for investment for each of a traditional non-traded REIT structure and the company. The model following the table below illustrates the potential returns upon liquidation to a holder of K Shares in this offering and a stockholder in a traditional public non-traded REIT structure. For purposes of the model below, “Investor” refers to a Class A stockholder in a traditional public non-traded REIT structure and holders of K Shares, K-I Shares and K-T Shares in the company’s offering, and “A Share Holder” refers to the advisor or its affiliates that own A Shares of the company. We expect that holders of each of the K Shares, K-I Shares and K-T Shares in this offering will receive substantially the same return on their investment as the holders of another class of the K Shares, K-I Shares or K-T Shares, assuming such shares were purchased at the same time. The model presents a hypothetical scenario and is for illustrative purposes only, and is not indicative of our potential investment results.

| | | | | | Traditional Public Non-Traded REIT Structure | | | Procaccianti Hotel REIT, Inc. | |

| Capital Raised(1) | | | | | | $ | 500,000,000 | | | $ | 500,000,000 | |

| Selling Commission | | | 5.00 | % | | $ | (25,000,000 | ) | | $ | (25,000,000 | ) |

| Dealer Manager Fee | | | 3.00 | % | | $ | (15,000,000 | ) | | $ | (15,000,000 | ) |

| Other Organization and Offering Expenses | | | 1.50 | % | | $ | (7,500,000 | ) | | $ | (7,500,000 | ) |

| A Share Holder Funding of Organization and Offering Expenses(3) | | | | | | | — | | | $ | 47,500,000 | |

| Net Proceeds | | | | | | $ | 452,500,000 | | | $ | 500,000,000 | |

| Acquisition Fees(2) | | | 1.50 | % | | $ | (13,179,612 | ) | | | — | |

| Leverage | | | 50.00 | % | | $ | 439,320,388 | | | $ | 500,000,000 | |

| Proceeds Available For Investment | | | | | | $ | 878,640,777 | | | $ | 1,000,000,000 | |

| (1) | Assumes that the full selling commission and dealer manager fees are paid on all shares sold. |

| (2) | As provided in the “Management Compensation — Acquisition Fee — Our Advisor and Our Service Provider” section on beginning on page 136 of this prospectus, the payment of acquisition fees to the company’s advisor will be deferred until the occurrence of (i) a liquidation event (i.e., any voluntary or involuntary liquidation or dissolution of the company, including as a result of the sale of all or substantially all of the company’s assets for cash or other consideration), (ii) the company’s sale or merger in a transaction that provides stockholders with cash, securities or a combination of cash and securities, (iii) the listing of the company’s shares on a national securities exchange, or (iv) the termination (not in connection with one of the preceding events) of the advisory agreement, other than for cause, or the non-renewal of the advisory agreement. Upon a liquidation event described in clause (i) above, all of the deferred acquisition fees, plus all interest accrued thereon, will be paid only after the liquidation preference on the K-I Shares, K Shares, K-T Shares and parity securities has been paid in full to all holders of K-I Shares, K Shares, K-T Shares and parity securities, and all accrued and unpaid asset management fees and all accrued interest thereon have been paid in full. Therefore, the table above reflects that no acquisition fees have been paid to the company’s advisor, as it assumes that holders of K Shares, K-I Shares and K-T Shares have not received their liquidation preference. |

| (3) | “A Share Holder” refers to a holder a A Shares of the Company. |

Hypothetical Return

to Investors: | | 0.00% | | | 8.53%(1) | | | 9.00% | | | 12.00% | |

| | | Traditional Public

Non-Traded REIT Structure | | | Procaccianti

Hotel REIT, Inc. | | | Traditional

Public Non-Traded REIT Structure | | | Procaccianti Hotel REIT, Inc. | | | Traditional

Public Non-Traded

REIT Structure | | | Procaccianti

Hotel REIT, Inc. | | | Traditional Public Non-Traded REIT Structure | | | Procaccianti Hotel REIT, Inc. | |

| Proceeds Available for Investment | | $ | 878,640,777 | | | $ | 1,000,000,000 | | | $ | 878,640,777 | | | $ | 1,000,000,000 | | | $ | 878,640,777 | | | $ | 1,000,000,000 | | | $ | 878,640,777 | | | $ | 1,000,000,000 | |

| Assets at Liquidation(2) | | $ | 878,640,777 | | | $ | 1,000,000,000 | | | $ | 953,624,760 | | | $ | 1,085,340,887 | | | $ | 957,718,447 | | | $ | 1,090,000,000 | | | $ | 984,077,670 | | | $ | 1,120,000,000 | |

| Repayment of Debt | | $ | (439,320,388 | ) | | $ | (500,000,000 | ) | | $ | (439,320,388 | ) | | $ | (500,000,000 | ) | | $ | (439,320,388 | ) | | $ | (500,000,000 | ) | | $ | (439,320,388 | ) | | $ | (500,000,000 | ) |

| Payment of Disposition Fee(3) | | | (13,179,612 | ) | | | — | | | $ | (14,304,371 | ) | | | — | | | $ | (14,365,777 | ) | | | — | | | $ | (14,761,165 | ) | | | — | |

| Return of Capital to Investor(4) | | $ | (426,140,777 | ) | | $ | (500,000,000 | ) | | $ | (500,000,000 | ) | | $ | (500,000,000 | ) | | $ | (500,000,000 | ) | | $ | (500,000,000 | ) | | $ | (500,000,000 | ) | | $ | (500,000,000 | ) |

| Payment of Acquisition Fee(5) | | | — | | | | — | | | | — | | | $ | (22,165,070 | ) | | | — | | | $ | (22,165,070 | ) | | | — | | | $ | (22,165,000 | ) |

| Payment of Disposition Fee(3) | | | — | | | | — | | | | — | | | $ | (16,280,113 | ) | | | — | | | $ | (16,350,000 | ) | | | — | | | $ | (16,800,000 | ) |

| Return of Capital to A Share Holder(6) | | | — | | | | — | | | | — | | | $ | (46,895,703 | ) | | | — | | | $ | (47,500,000 | ) | | | — | | | $ | (47,500,000 | ) |

Excess Cash Available

for Distribution | | | — | | | | — | | | | — | | | | — | | | $ | 4,032,282 | | | $ | 3,984,930 | | | $ | 29,996,117 | | | $ | 33,534,930 | |

| Amount to Sponsor/Service Provider(7) | | | — | | | | — | | | | — | | | | — | | | $ | 604,842.20 | | | $ | 498,116 | | | $ | 4,499,417 | | | $ | 4,191,866 | |

| Investor Capital Returned(4) | | $ | 426,140,777 | | | $ | 500,000,000 | | | $ | 500,000,000 | | | $ | 500,000,000 | | | $ | 500,000,000 | | | $ | 500,000,000 | | | $ | 500,000,000 | | | $ | 500,000,000 | |

| Investor Share of Excess Cash(8) | | | — | | | | — | | | | — | | | | — | | | $ | 3,427,439 | | | $ | 1,992,465 | | | $ | 25,496,699 | | | $ | 16,767,465 | |

| Investor Gain/(Loss)(4) | | $ | (73,859,223 | ) | | | — | | | | — | | | | — | | | $ | 3,427,439 | | | $ | 1,992,465 | | | $ | 25,496,699 | | | $ | 16,767,465 | |

| A Share Holder Gain/(Loss)(9) | | | — | | | $ | (47,500,000 | ) | | | — | | | $ | (604,297 | ) | | | — | | | $ | 1,494,349 | | | | — | | | $ | 12,575,599 | |

| (1) | A holder of K Shares, K-I Shares and/or K-T Shares in this offering would be limited in their potential return on investment as compared to a traditional public non-traded REIT investor in the event the company returns in excess of 8.53% on their investment due to the percentages of excess cash that are distributable to holders of A Shares and the Service Provider. |

| (2) | “Assets at Liquidation” equals the sum of (a) the amount of Proceeds Available for Investment plus (b) the amount of Proceeds Available for Investment multiplied by the respective hypothetical percentage of return to investor. |

| (3) | The model assumes that the disposition fee for both the traditional public non-traded REIT structure and the company are 1.50% of the sales price of each property or real estate-related asset sold. Payment of the disposition fee to the company’s advisor will be deferred until the occurrence of (i) a liquidation event, (ii) the company’s sale or merger in a transaction that provides stockholders with cash, securities or a combination of cash and securities, (iii) the listing of the company’s shares on a national securities exchange, or (iv) the termination (not in connection with one of the preceding events) of the advisory agreement, other than for cause, or the non-renewal of the advisory agreement. Upon a liquidation event described in clause (i), all of the deferred disposition fees, plus all interest accrued thereon, will be paid only after the liquidation preference on the K-I Shares, K Shares, K-T Shares and any parity securities has been paid in full to all holders of K-I Shares, K Shares, K-T Shares and any parity securities, and all accrued and unpaid asset management fees and all accrued interest thereon have been paid in full, and all accrued and unpaid acquisition fees (including interest thereon) have been paid in full. Therefore, for purposes of this model, the company does not pay a disposition fee until holders of K Shares, K-I Shares and K-T Shares have received their liquidation preference (i.e. return of capital). |

| (4) | “Investor” refers to a Class A stockholder in a traditional public non-traded REIT structure and holders of K Shares, K-I Shares and K-T Shares in the company’s offering. “Return of Capital to Investor” represents the return of an Investor’s initial investment. |

| (5) | The payment of the acquisition fee to the company’s advisor will be deferred until the occurrence of (i) a liquidation event (i.e., any voluntary or involuntary liquidation or dissolution of the company, including as a result of the sale of all or substantially all of the company’s assets for cash or other consideration), (ii) the company’s sale or merger in a transaction that provides stockholders with cash, securities or a combination of cash and securities, (iii) the listing of the company’s shares on a national securities exchange, or (iv) the termination (not in connection with one of the preceding events) of the advisory agreement, other than for cause, or the non-renewal of the advisory agreement. Upon a liquidation event described in clause (i) above, all of the deferred acquisition fees, plus all interest accrued thereon, will be paid only after the liquidation preference on the K-I Shares, K Shares, K-T Shares and parity securities has been paid in full to all holders of K-I Shares, K Shares, K-T Shares and parity securities, and all accrued and unpaid asset management fees and all accrued interest thereon have been paid in full. Therefore, for purposes of this model, the company does not pay an acquisition fee until holders of K Shares, K-I Shares and K-T Shares have received their liquidation preference (i.e. return of capital). |

| (6) | “A Share Holder” refers to a holder of A Shares of the company. |

| (7) | The model assumes that, with respect to a traditional public non-traded REIT structure, the Sponsor/Service Provider is entitled to receive 15% of any excess cash available for distribution. In the company’s offering, the Service Provider is entitled to receive 12.5% of any excess cash available for distribution. |

| (8) | The model assumes that, with respect to a traditional public non-traded REIT structure, investors are entitled to receive 85% of any excess cash available for distribution. In the company’s offering, holders of K Shares, K-I Shares and K-T Shares are entitled to receive 50% of any excess cash available for distribution. |

| (9) | Holders of A Shares are entitled to receive 37.5% of any excess cash available for distribution. |

Prior Performance Summary

The following information supersedes and replaces in its entirety the section entitled “Prior Performance Summary – Summary Information” on page 176 of the prospectus:

Summary Information

The following table presents certain summary information regarding the Procaccianti Programs for the ten-year period beginning March 31, 2008 and ending March 31, 2018:

| Total Number of Programs: | 38 |

| Total Equity Raised: | $633,097,471 |

| Total Investors: | 114 |

| Total Number of Properties Purchased: | 38 |

| Location of Properties Purchased: | United States |

| Aggregate Purchase Price of Properties: | $1,399,775,452 |

| % of Commercial (Lodging)(1): | 98% |

| % Residential(1): | 2% |

| % New(1): | 0% |

| % Used(1): | 98% |

| % Construction(1): | 2% |

| Total Properties Sold: | 18 |

(1) Percentage based upon aggregate purchase price.

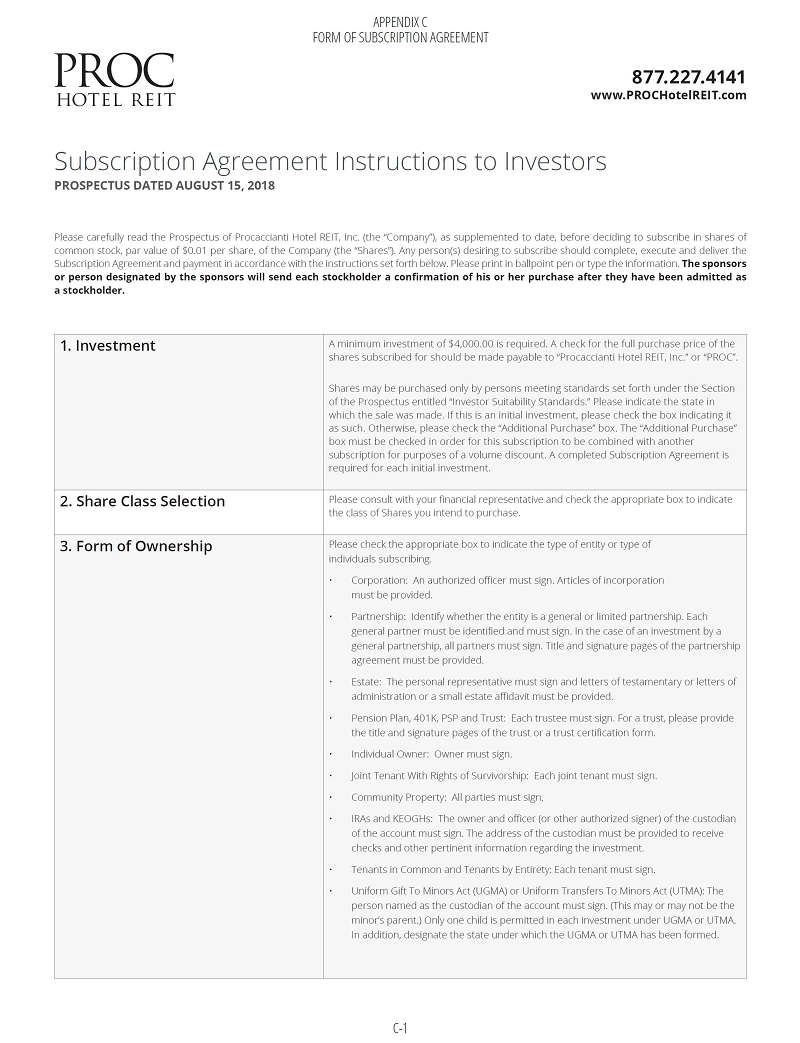

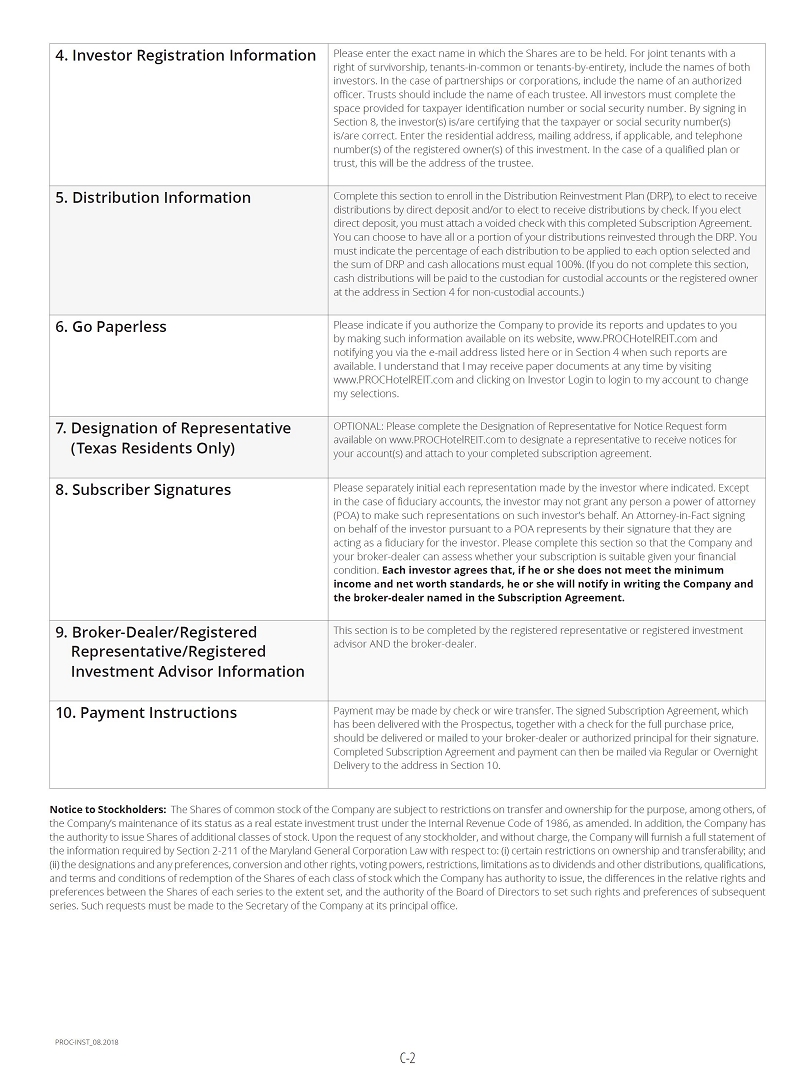

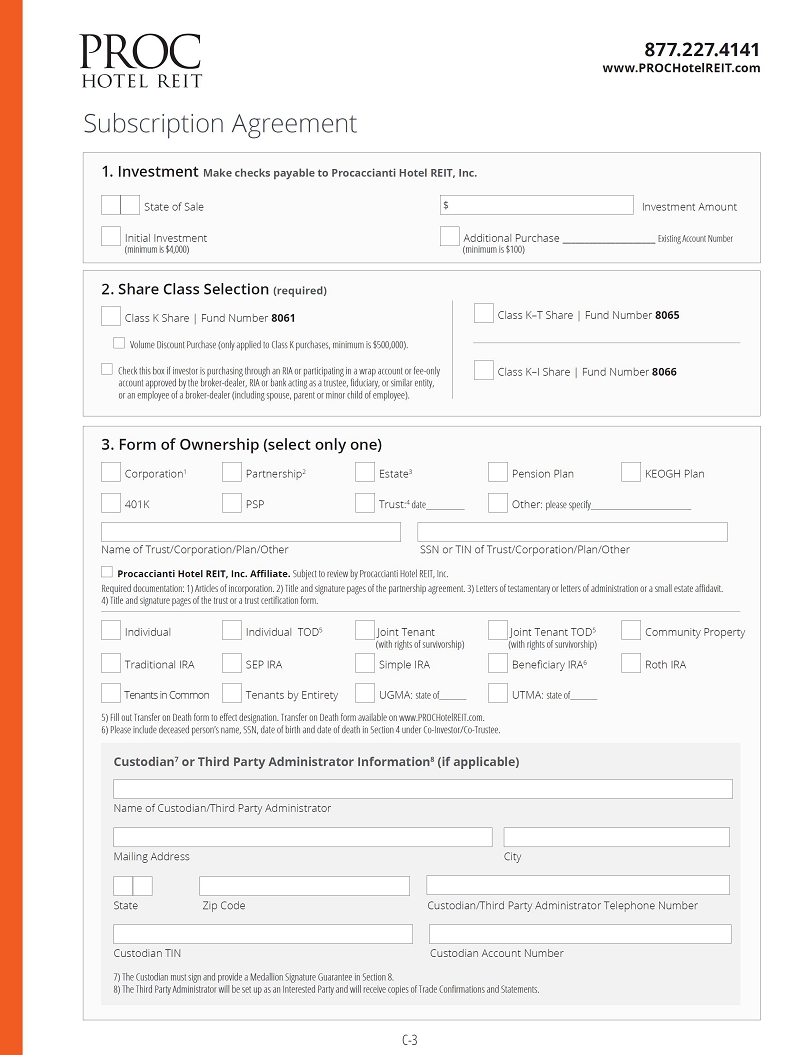

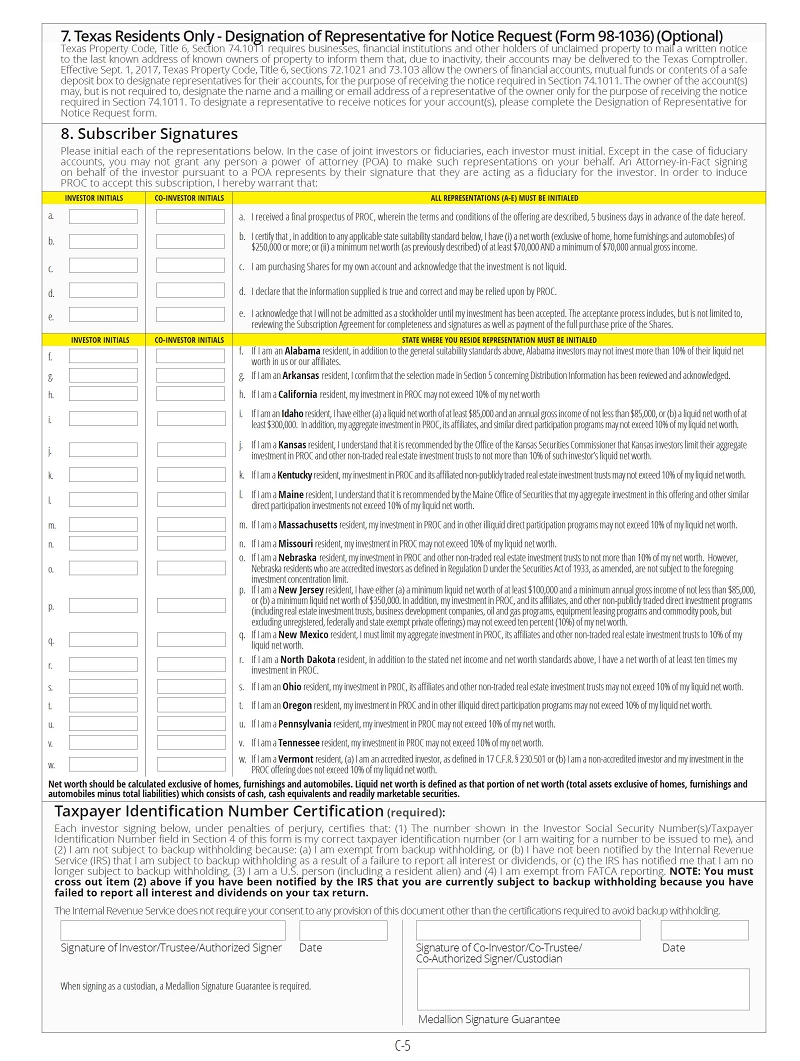

Revised Form of Subscription Agreement

A revised form of our subscription agreement is attached as Appendix C and supersedes and replaces Appendix C in the prospectus.