2Q22 Results Presentation August 4, 2022 Exhibit 99

Forward-looking statements Some of the statements contained in this presentation may constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, projections, plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," or "potential" or the negative of these words and phrases. You can also identify forward-looking statements by discussions of strategy, plans, or intentions. The forward-looking statements contained in this presentation reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause actual results to differ significantly from those expressed or contemplated in any forward-looking statement. While forward-looking statements reflect our good faith projections, assumptions and expectations, they are not guarantees of future results. Furthermore, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by applicable law. Factors that could cause our results to differ materially include but are not limited to: (1) the continued course and severity of the COVID-19 pandemic, and its direct and indirect impacts (2) general economic conditions and real estate market conditions, (3) regulatory and/or legislative changes, (4) our customers' continued interest in loans and doing business with us, (5) market conditions and investor interest in our contemplated securitization and (6) changes in federal government fiscal and monetary policies. For a further discussion of these and other factors that could cause future results to differ materially from those expressed or contemplated in any forward-looking statements, see the section titled ''Risk Factors" previously disclosed in our Form 10-Q filed with the SEC on May 14, 2020, as well as other cautionary statements we make in our current and periodic filings with the SEC. Such filings are available publicly on our Investor Relations web page at www.velfinance.com.

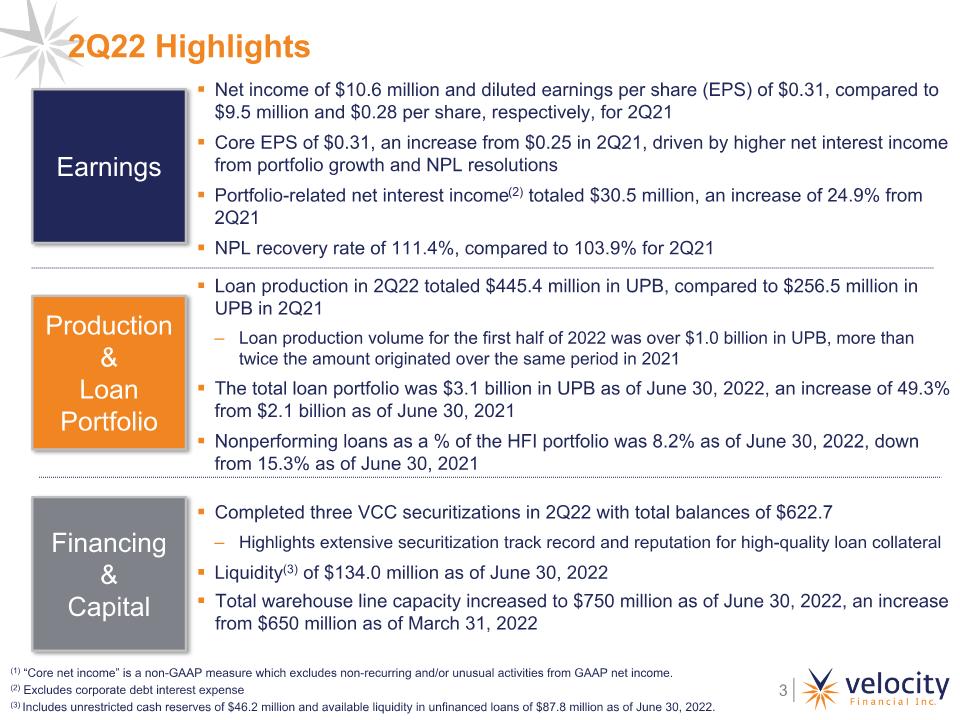

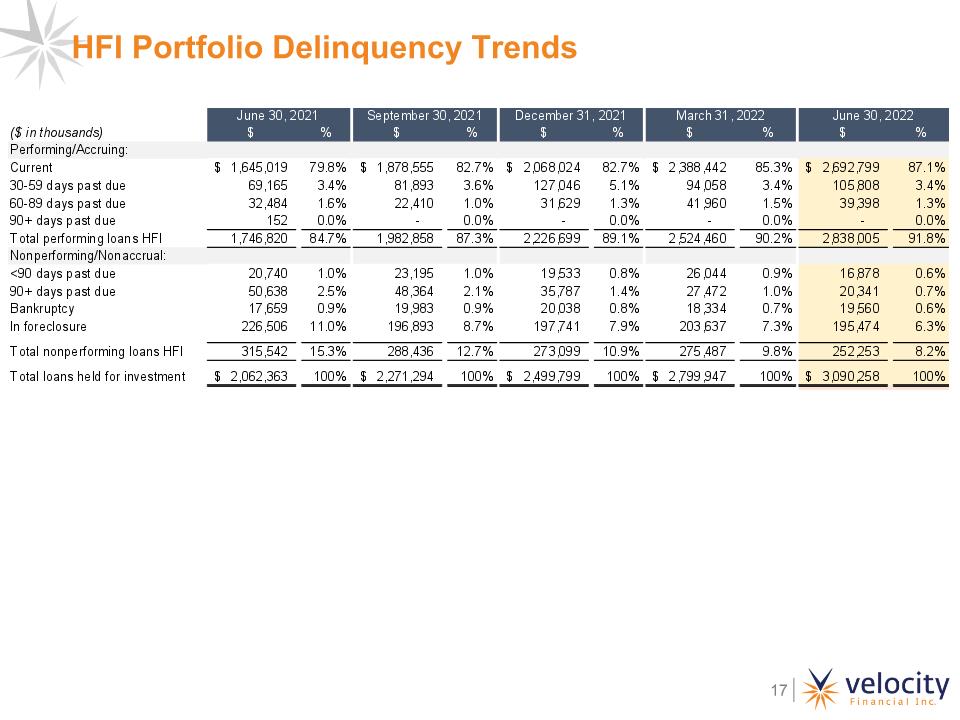

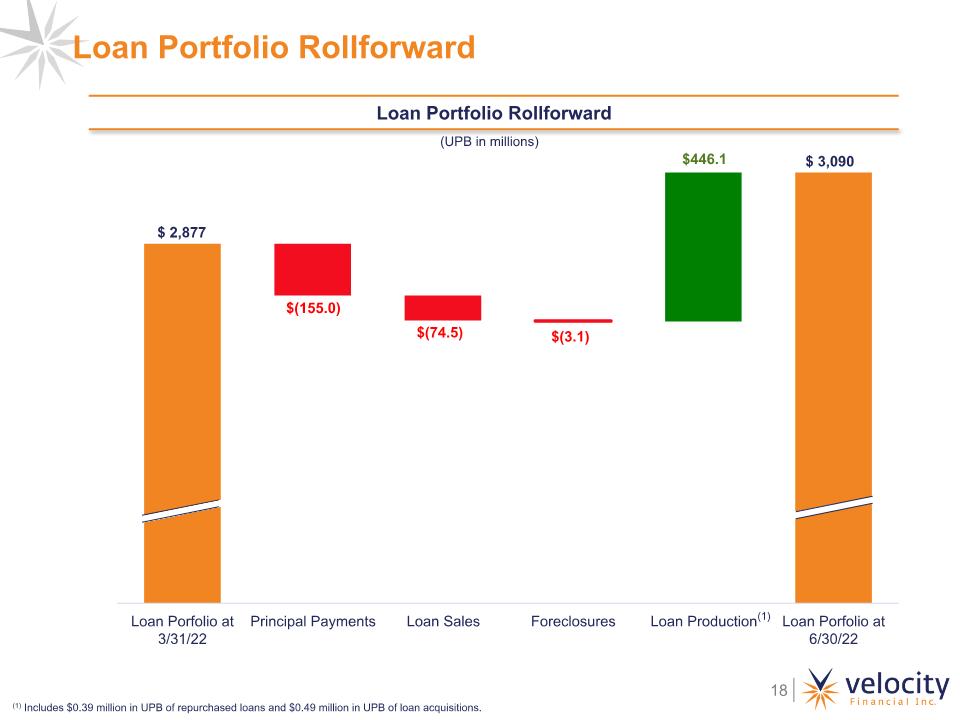

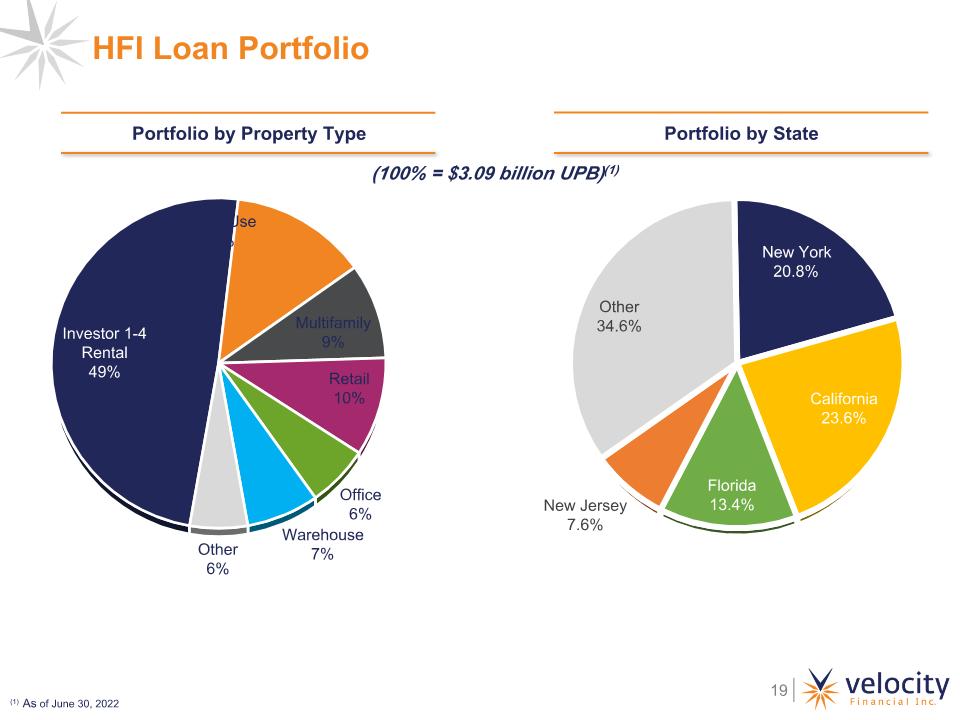

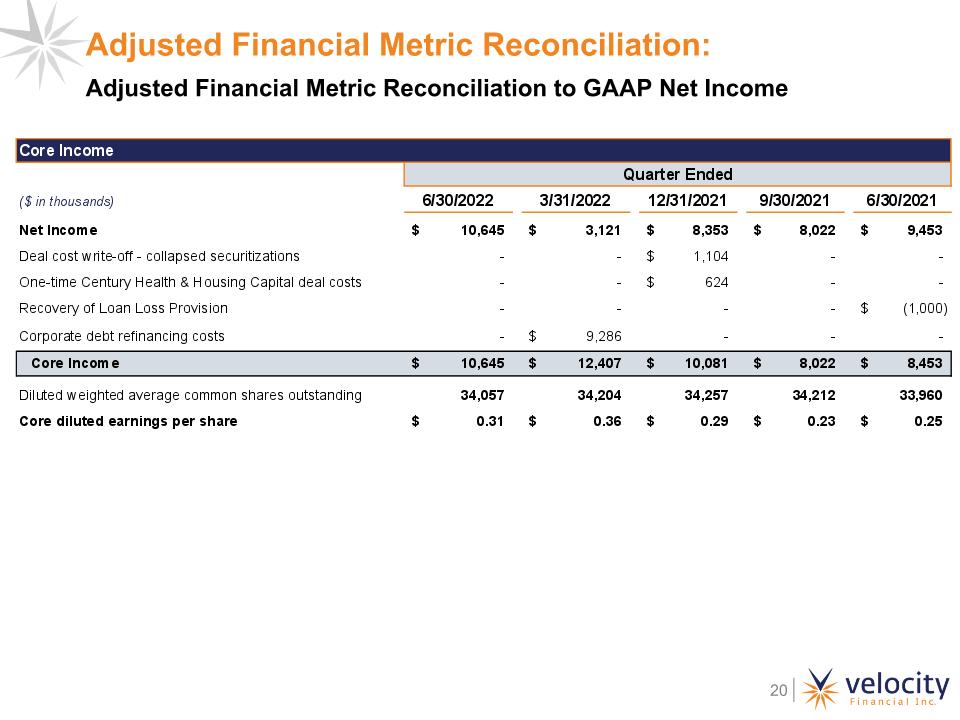

2Q22 Highlights Production& �Loan Portfolio Earnings Financing & �Capital Net income of $10.6 million and diluted earnings per share (EPS) of $0.31, compared to $9.5 million and $0.28 per share, respectively, for 2Q21 Core EPS of $0.31, an increase from $0.25 in 2Q21, driven by higher net interest income from portfolio growth and NPL resolutions Portfolio-related net interest income(2) totaled $30.5 million, an increase of 24.9% from 2Q21 NPL recovery rate of 111.4%, compared to 103.9% for 2Q21 Loan production in 2Q22 totaled $445.4 million in UPB, compared to $256.5 million in UPB in 2Q21 Loan production volume for the first half of 2022 was over $1.0 billion in UPB, more than twice the amount originated over the same period in 2021 The total loan portfolio was $3.1 billion in UPB as of June 30, 2022, an increase of 49.3% from $2.1 billion as of June 30, 2021 Nonperforming loans as a % of the HFI portfolio was 8.2% as of June 30, 2022, down from 15.3% as of June 30, 2021 Completed three VCC securitizations in 2Q22 with total balances of $622.7 Highlights extensive securitization track record and reputation for high-quality loan collateral Liquidity(3) of $134.0 million as of June 30, 2022 Total warehouse line capacity increased to $750 million as of June 30, 2022, an increase from $650 million as of March 31, 2022 (1) “Core net income” is a non-GAAP measure which excludes non-recurring and/or unusual activities from GAAP net income. (2) Excludes corporate debt interest expense (3) Includes unrestricted cash reserves of $46.2 million and available liquidity in unfinanced loans of $87.8 million as of June 30, 2022.

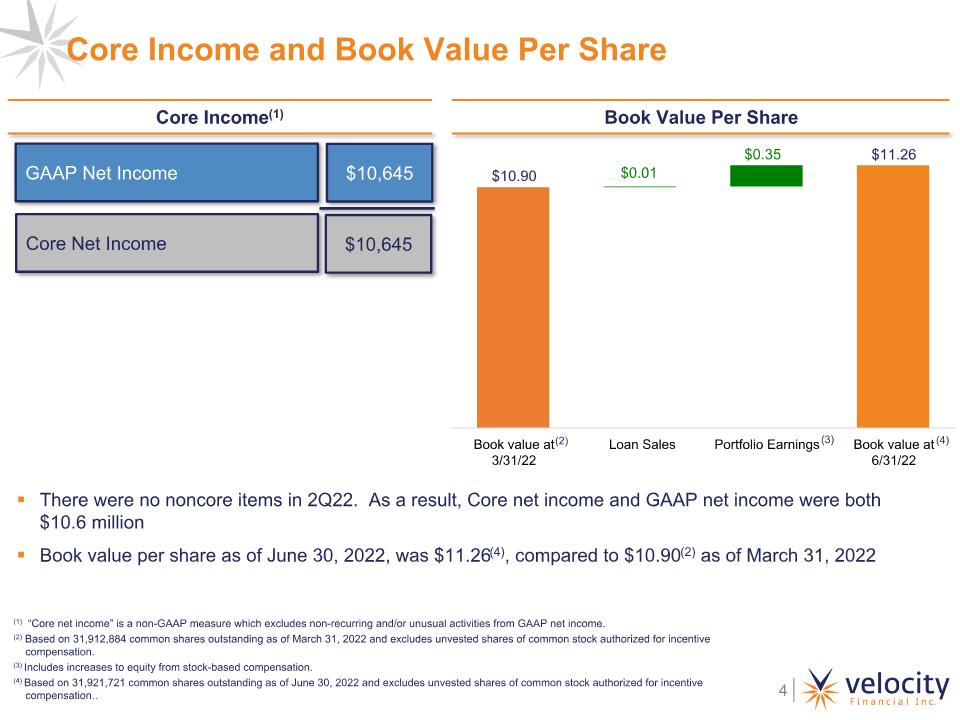

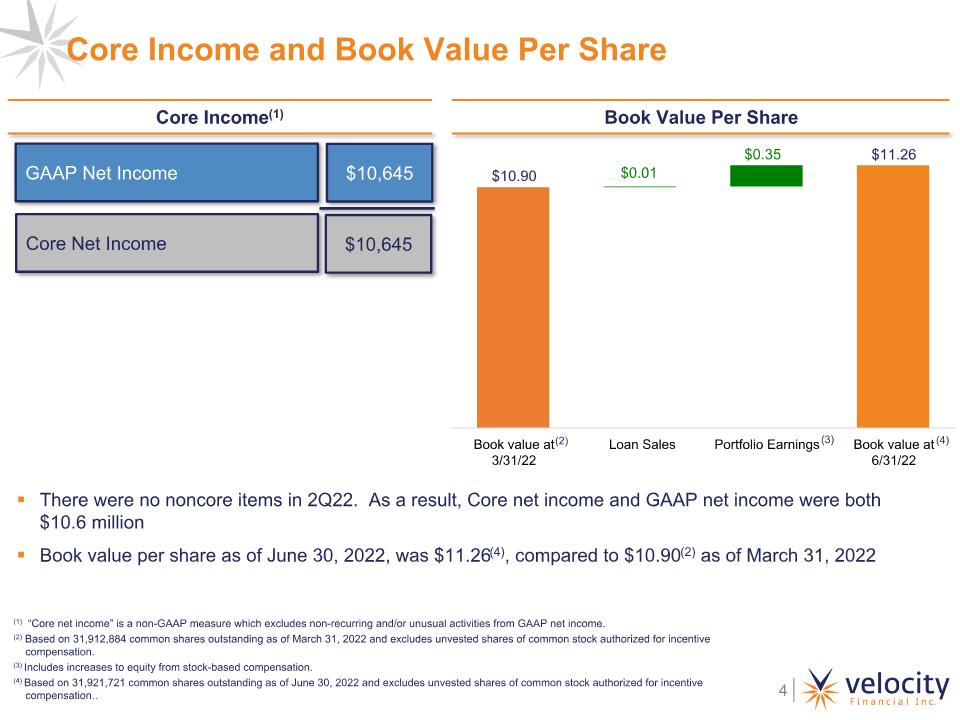

Core Income and Book Value Per Share Core Income(1) Book Value Per Share There were no noncore items in 2Q22. As a result, Core net income and GAAP net income were both �$10.6 million Book value per share as of June 30, 2022, was $11.26(4), compared to $10.90(2) as of March 31, 2022 Core Net Income $10,645 (1) “Core net income” is a non-GAAP measure which excludes non-recurring and/or unusual activities from GAAP net income. (2) Based on 31,912,884 common shares outstanding as of March 31, 2022 and excludes unvested shares of common stock authorized for incentive compensation. (3) Includes increases to equity from stock-based compensation. (4) Based on 31,921,721 common shares outstanding as of June 30, 2022 and excludes unvested shares of common stock authorized for incentive compensation.. GAAP Net Income $10,645 (2) (3) $0.01 $0.35 (4)

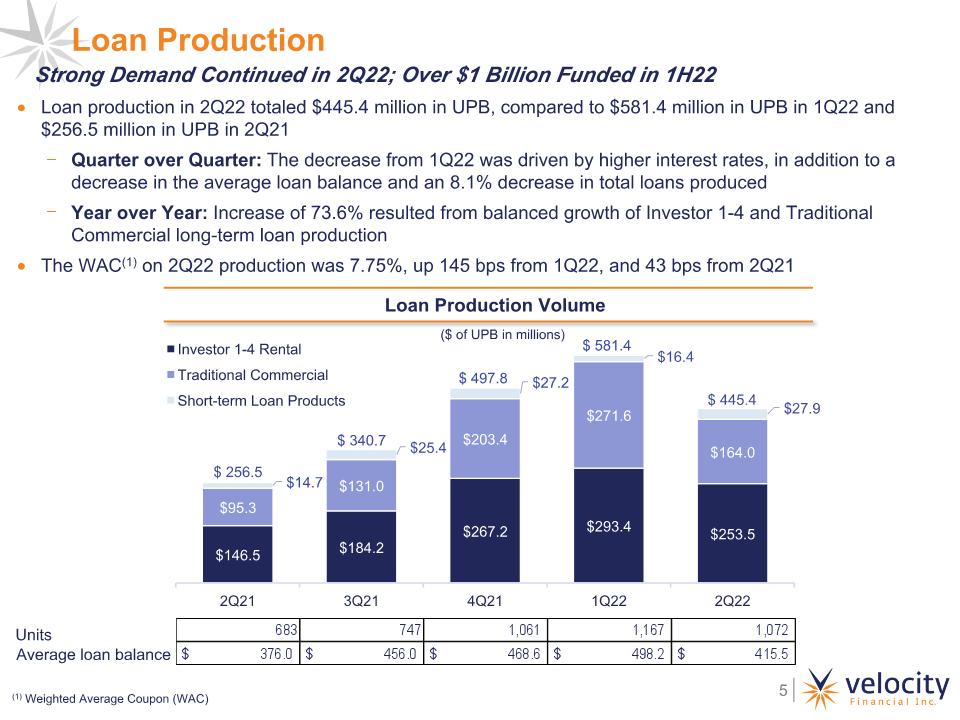

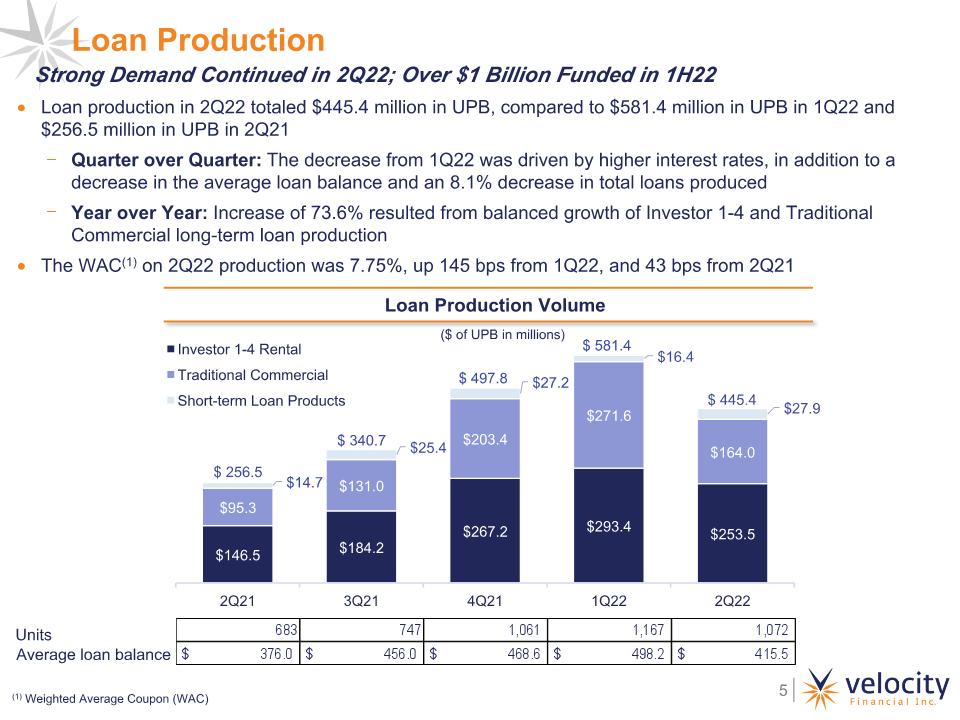

Loan Production Loan production in 2Q22 totaled $445.4 million in UPB, compared to $581.4 million in UPB in 1Q22 and $256.5 million in UPB in 2Q21 Quarter over Quarter: The decrease from 1Q22 was driven by higher interest rates, in addition to a decrease in the average loan balance and an 8.1% decrease in total loans produced Year over Year: Increase of 73.6% resulted from balanced growth of Investor 1-4 and Traditional Commercial long-term loan production The WAC(1) on 2Q22 production was 7.75%, up 145 bps from 1Q22, and 43 bps from 2Q21 Loan Production Volume ($ of UPB in millions) Strong Demand Continued in 2Q22; Over $1 Billion Funded in 1H22 Units Average loan balance (1) Weighted Average Coupon (WAC)

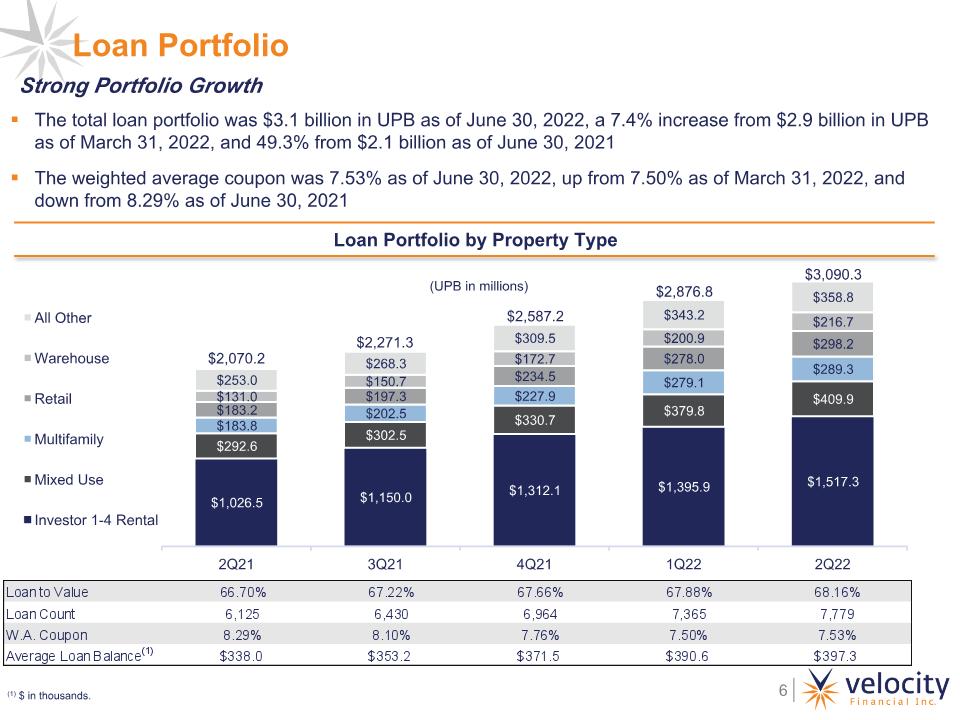

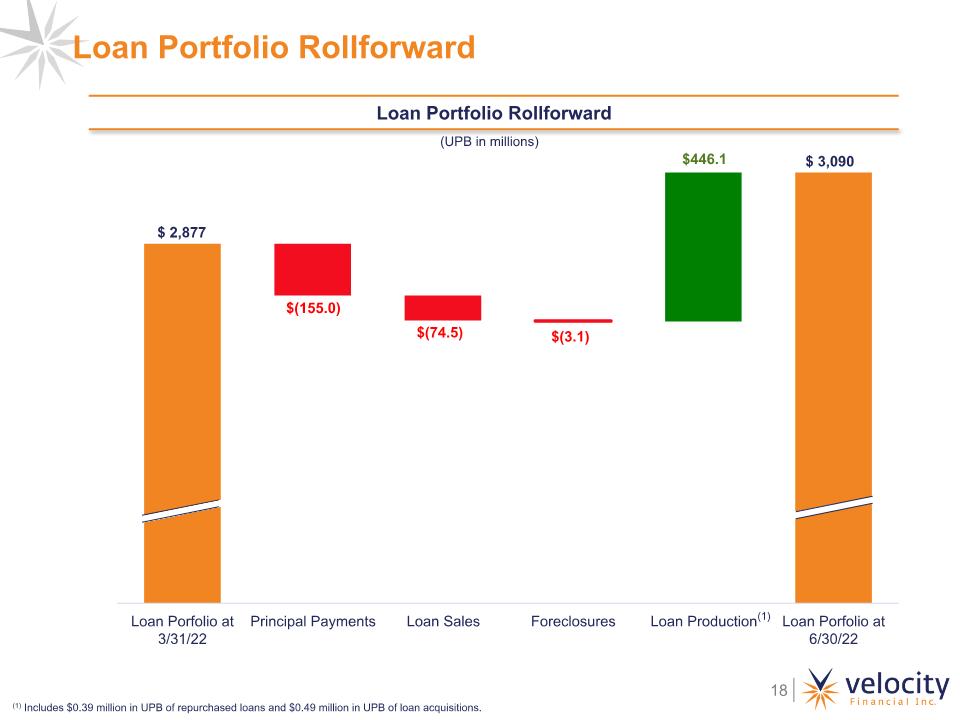

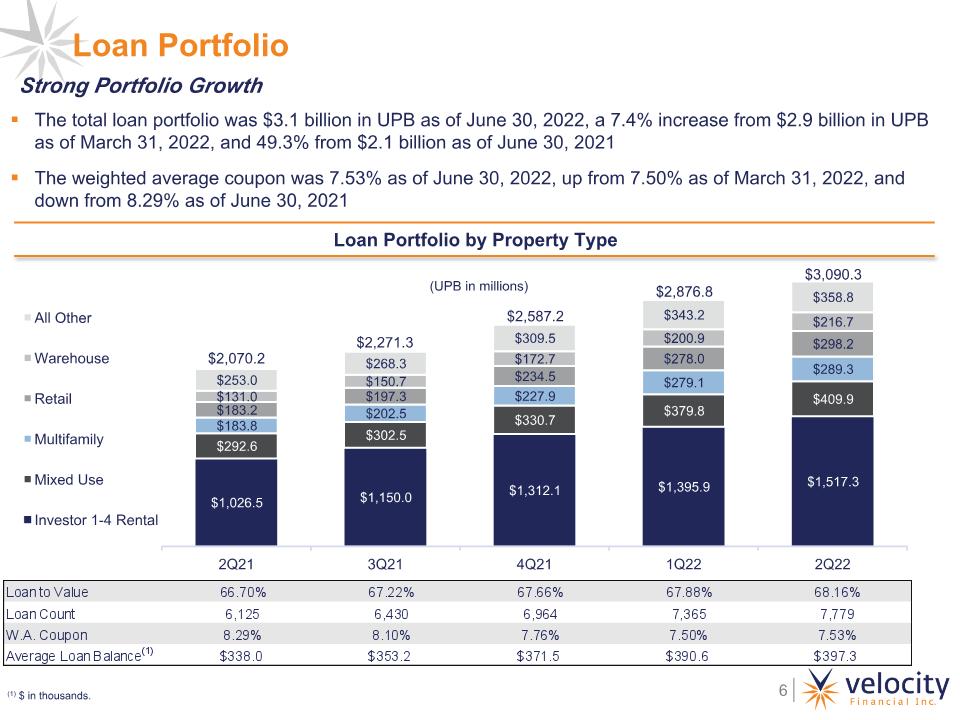

Loan Portfolio by Property Type The total loan portfolio was $3.1 billion in UPB as of June 30, 2022, a 7.4% increase from $2.9 billion in UPB as of March 31, 2022, and 49.3% from $2.1 billion as of June 30, 2021 The weighted average coupon was 7.53% as of June 30, 2022, up from 7.50% as of March 31, 2022, and down from 8.29% as of June 30, 2021 Loan Portfolio (UPB in millions) (1) $ in thousands. Strong Portfolio Growth

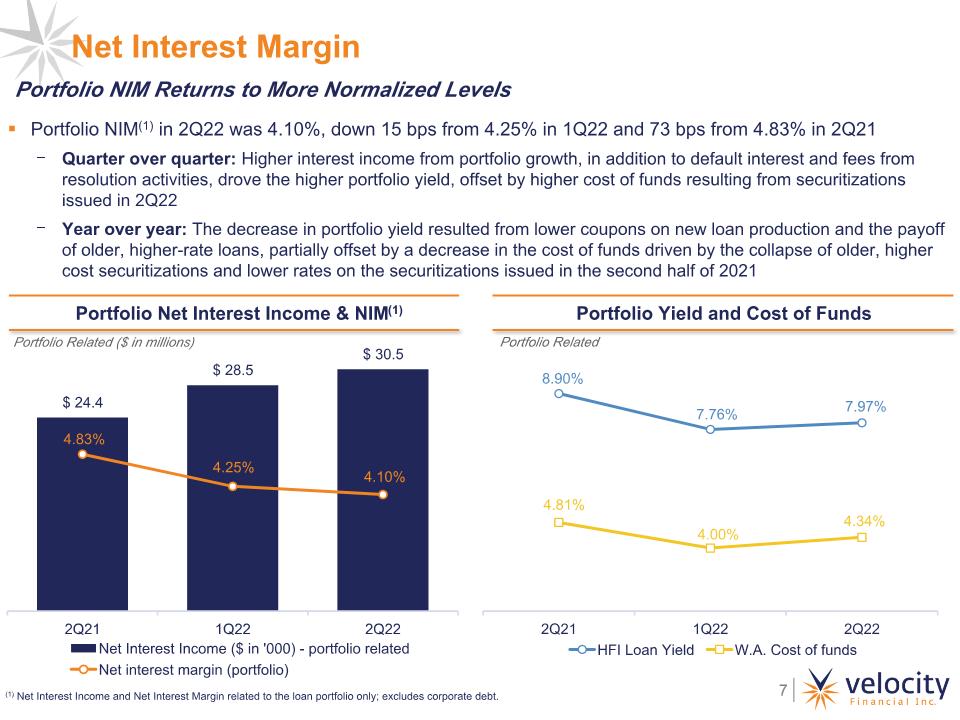

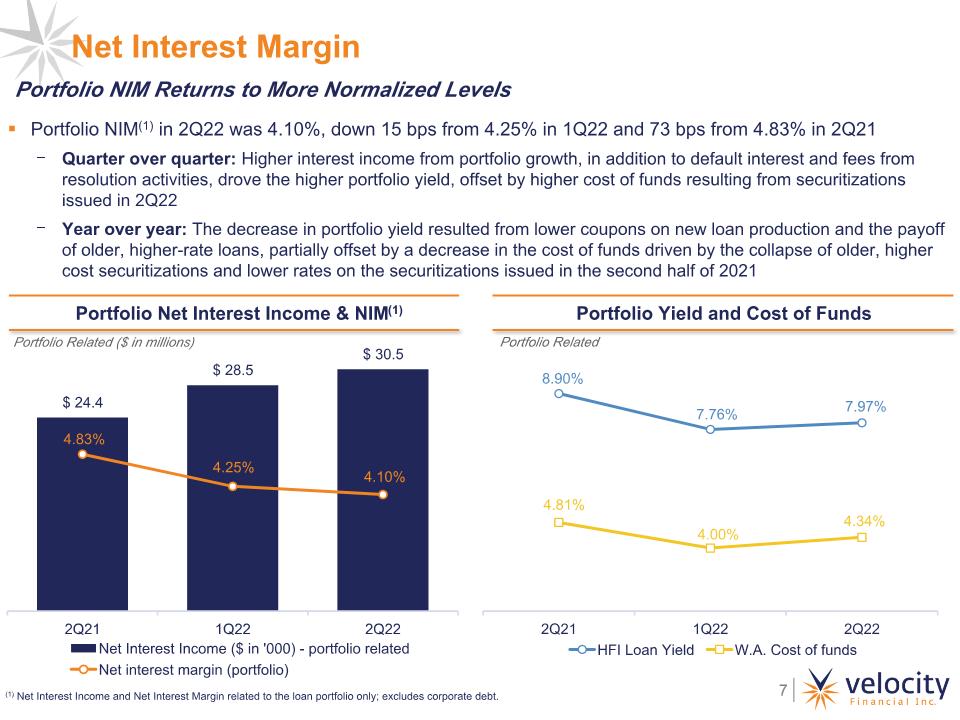

Portfolio NIM(1) in 2Q22 was 4.10%, down 15 bps from 4.25% in 1Q22 and 73 bps from 4.83% in 2Q21 Quarter over quarter: Higher interest income from portfolio growth, in addition to default interest and fees from resolution activities, drove the higher portfolio yield, offset by higher cost of funds resulting from securitizations issued in 2Q22 Year over year: The decrease in portfolio yield resulted from lower coupons on new loan production and the payoff of older, higher-rate loans, partially offset by a decrease in the cost of funds driven by the collapse of older, higher cost securitizations and lower rates on the securitizations issued in the second half of 2021 Portfolio Yield and Cost of Funds Portfolio Related Portfolio NIM Returns to More Normalized Levels Portfolio Net Interest Income & NIM(1) Net Interest Margin (1) Net Interest Income and Net Interest Margin related to the loan portfolio only; excludes corporate debt. Portfolio Related ($ in millions)

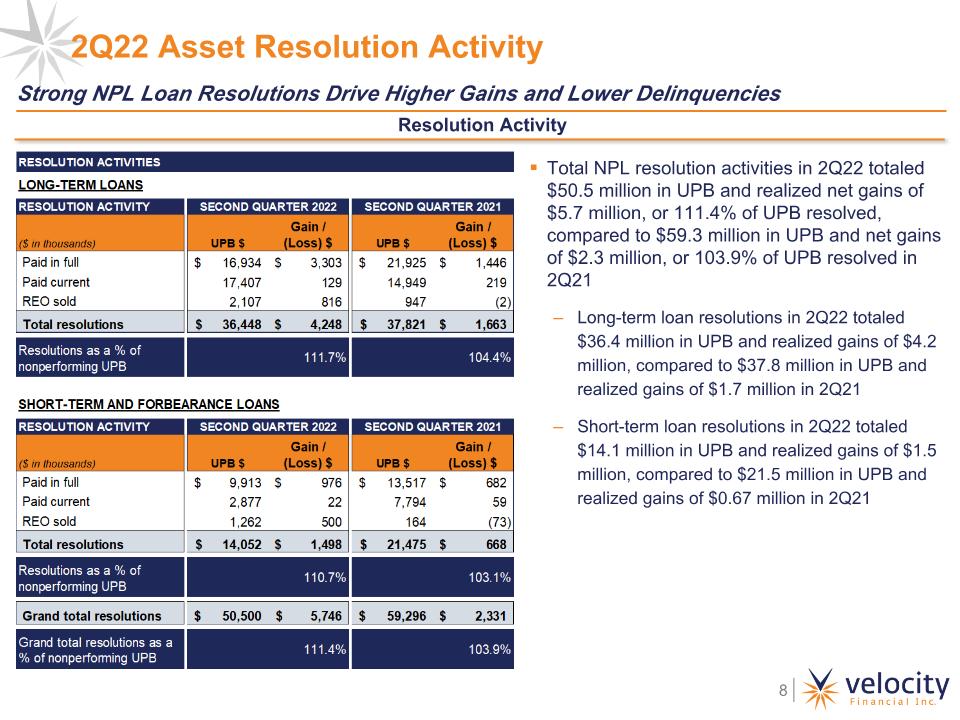

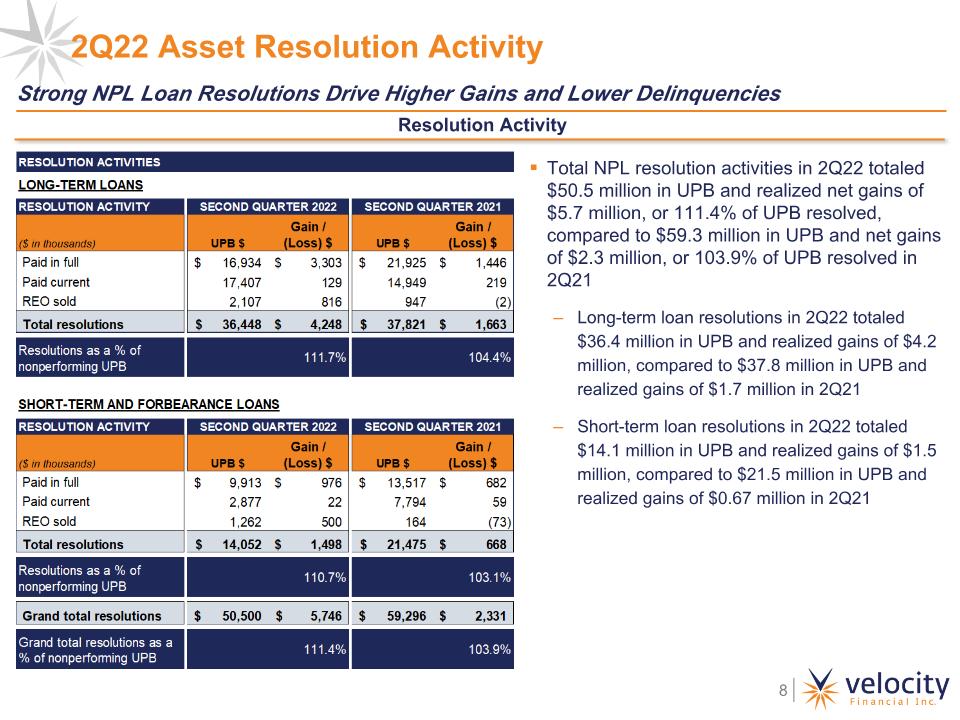

2Q22 Asset Resolution Activity Resolution Activity Total NPL resolution activities in 2Q22 totaled $50.5 million in UPB and realized net gains of $5.7 million, or 111.4% of UPB resolved, compared to $59.3 million in UPB and net gains of $2.3 million, or 103.9% of UPB resolved in 2Q21 Long-term loan resolutions in 2Q22 totaled $36.4 million in UPB and realized gains of $4.2 million, compared to $37.8 million in UPB and realized gains of $1.7 million in 2Q21 Short-term loan resolutions in 2Q22 totaled $14.1 million in UPB and realized gains of $1.5 million, compared to $21.5 million in UPB and realized gains of $0.67 million in 2Q21 Strong NPL Loan Resolutions Drive Higher Gains and Lower Delinquencies

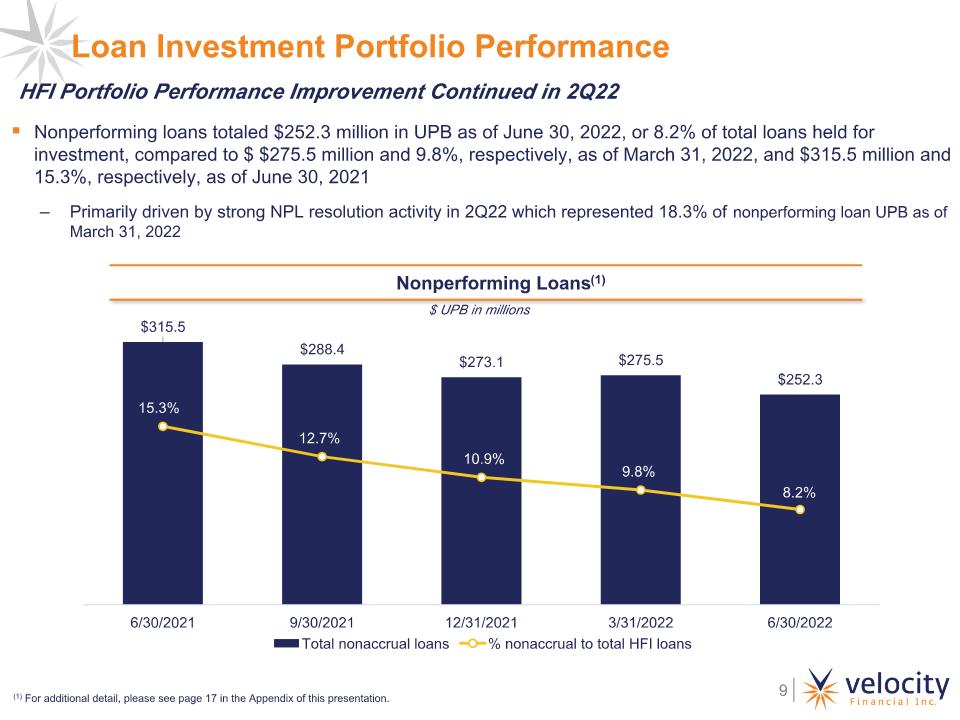

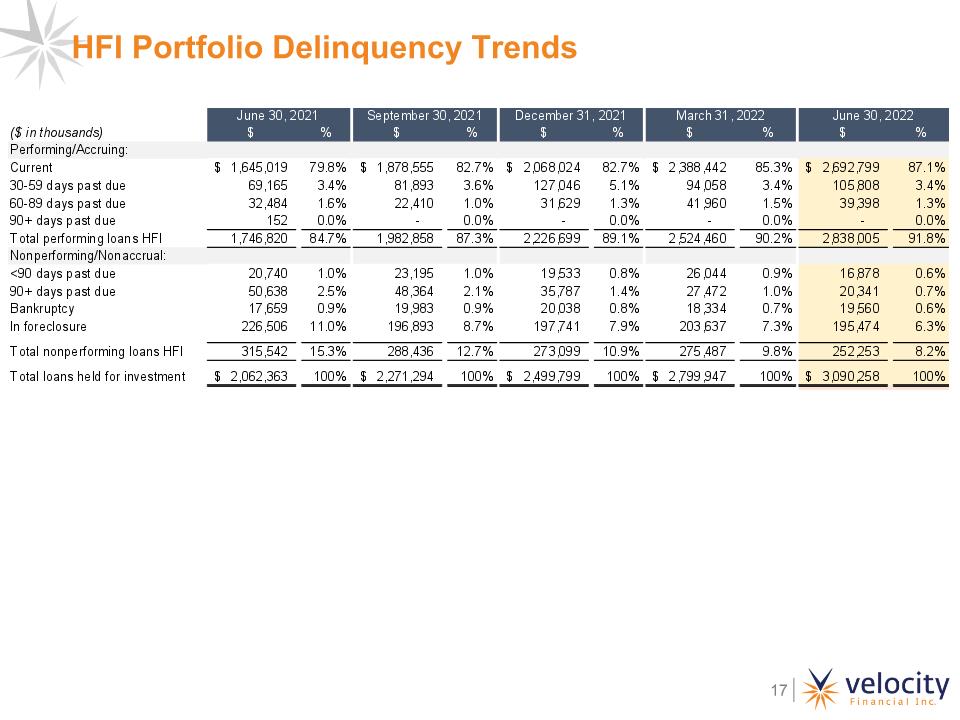

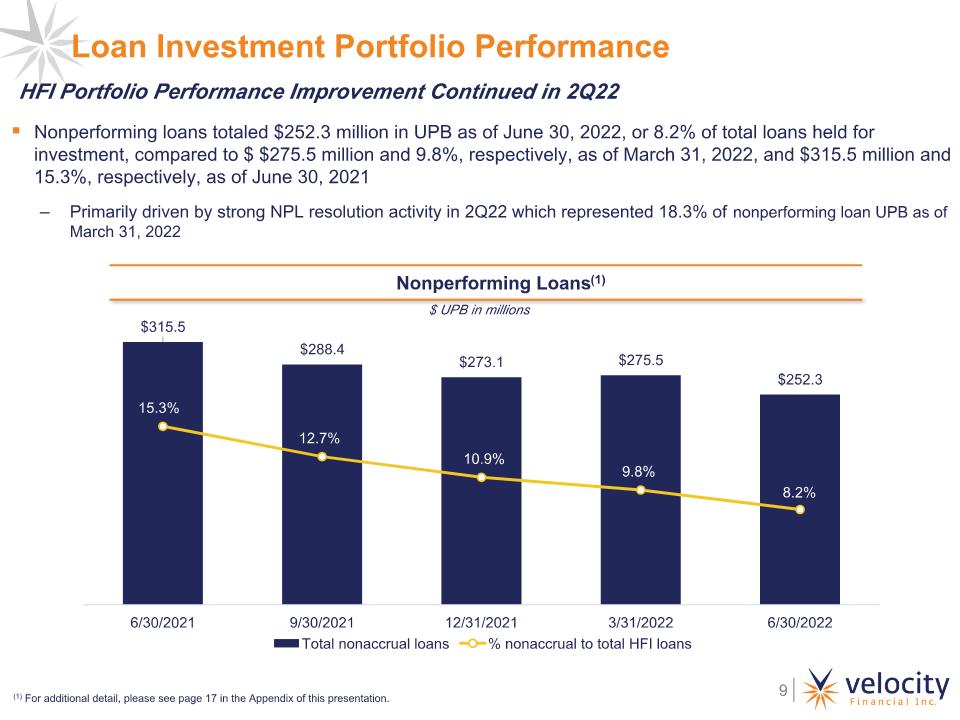

Nonperforming Loans(1) Nonperforming loans totaled $252.3 million in UPB as of June 30, 2022, or 8.2% of total loans held for investment, compared to $ $275.5 million and 9.8%, respectively, as of March 31, 2022, and $315.5 million and 15.3%, respectively, as of June 30, 2021 Primarily driven by strong NPL resolution activity in 2Q22 which represented 18.3% of nonperforming loan UPB as of March 31, 2022 $ UPB in millions Loan Investment Portfolio Performance (1) For additional detail, please see page 17 in the Appendix of this presentation. HFI Portfolio Performance Improvement Continued in 2Q22

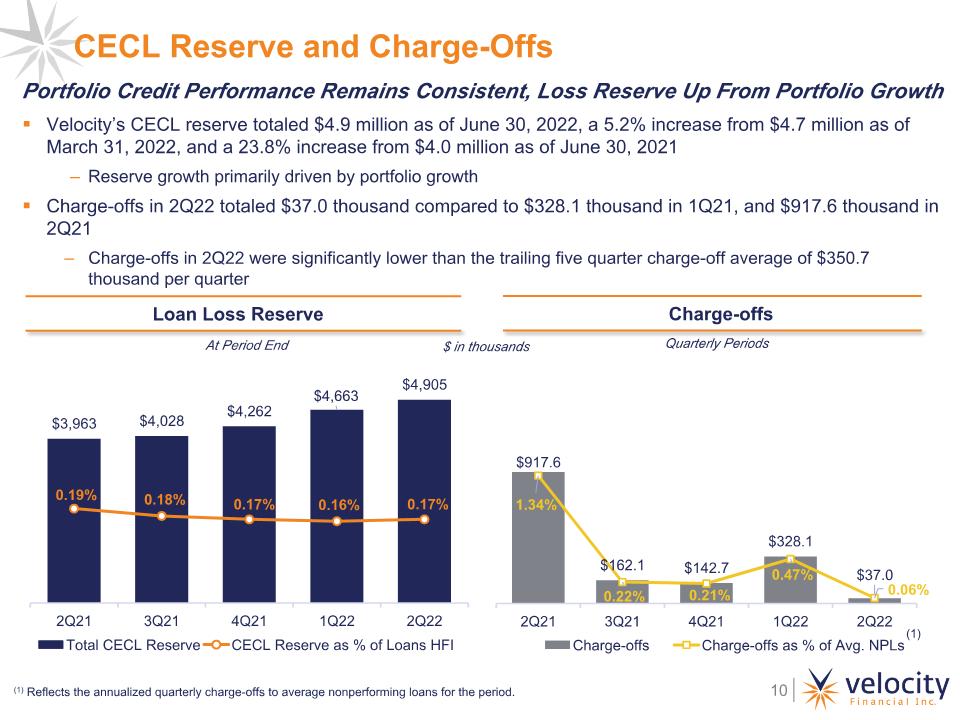

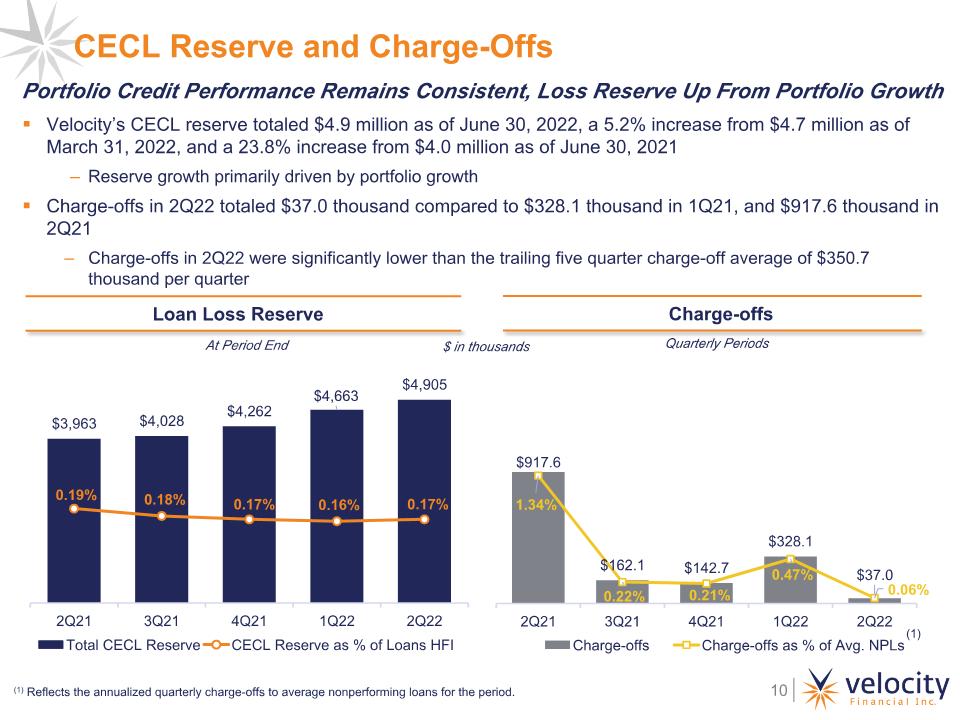

Velocity’s CECL reserve totaled $4.9 million as of June 30, 2022, a 5.2% increase from $4.7 million as of March 31, 2022, and a 23.8% increase from $4.0 million as of June 30, 2021 Reserve growth primarily driven by portfolio growth Charge-offs in 2Q22 totaled $37.0 thousand compared to $328.1 thousand in 1Q21, and $917.6 thousand in 2Q21 Charge-offs in 2Q22 were significantly lower than the trailing five quarter charge-off average of $350.7 thousand per quarter CECL Reserve and Charge-Offs Loan Loss Reserve Portfolio Credit Performance Remains Consistent, Loss Reserve Up From Portfolio Growth Charge-offs (1) Reflects the annualized quarterly charge-offs to average nonperforming loans for the period. $ in thousands (1) Quarterly Periods At Period End

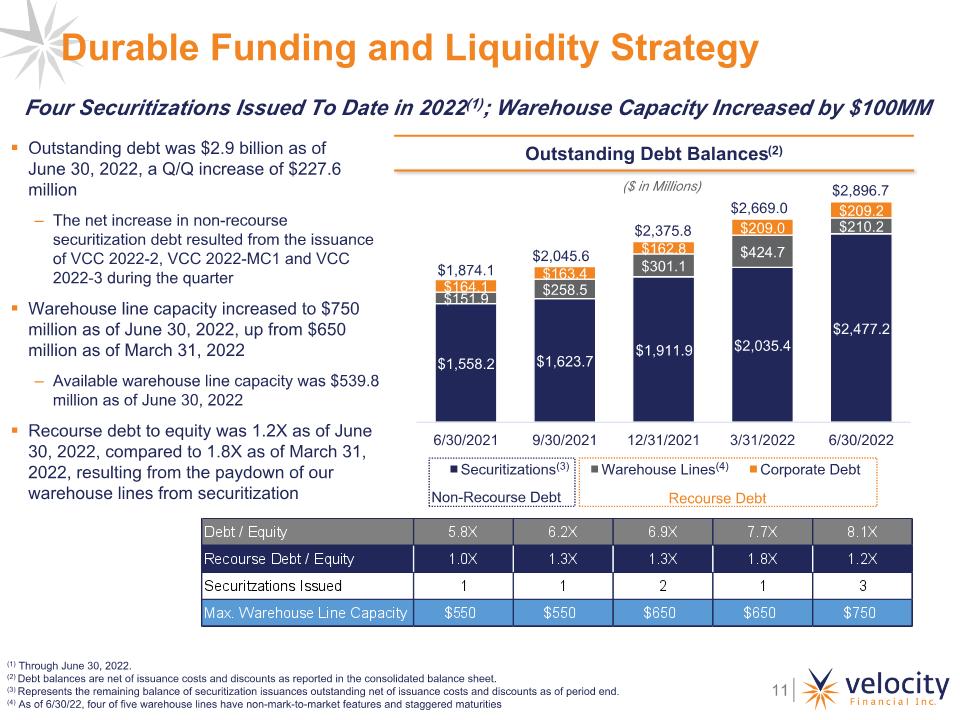

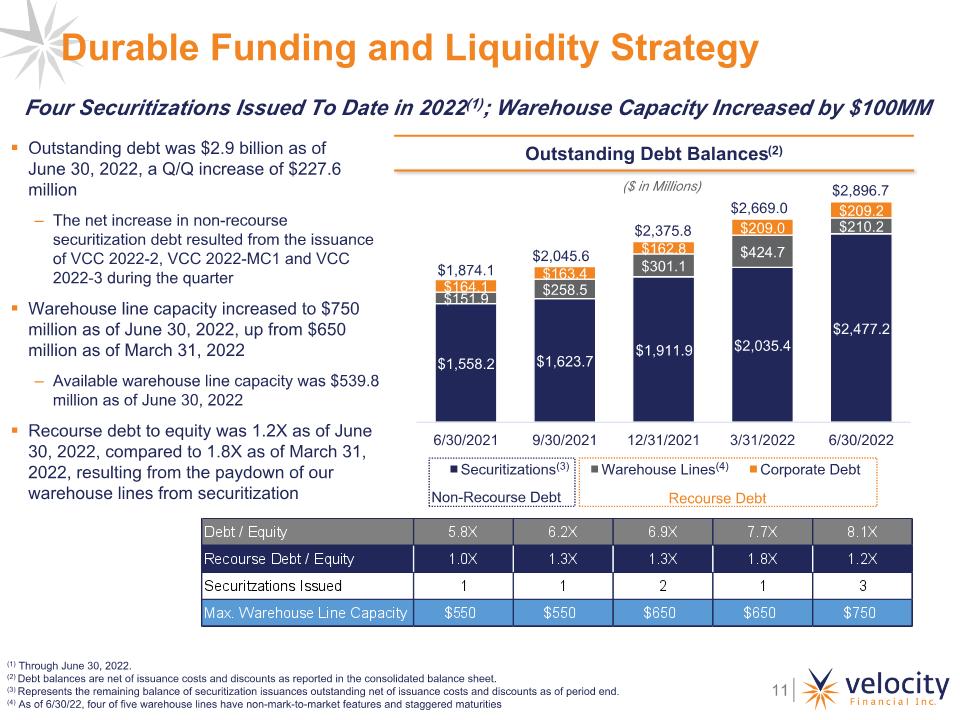

Durable Funding and Liquidity Strategy Four Securitizations Issued To Date in 2022(1); Warehouse Capacity Increased by $100MM Outstanding Debt Balances(2) ($ in Millions) (1) Through June 30, 2022. (2) Debt balances are net of issuance costs and discounts as reported in the consolidated balance sheet. (3) Represents the remaining balance of securitization issuances outstanding net of issuance costs and discounts as of period end. (4) As of 6/30/22, four of five warehouse lines have non-mark-to-market features and staggered maturities Non-Recourse Debt Recourse Debt (3) Outstanding debt was $2.9 billion as of �June 30, 2022, a Q/Q increase of $227.6 million The net increase in non-recourse securitization debt resulted from the issuance of VCC 2022-2, VCC 2022-MC1 and VCC 2022-3 during the quarter Warehouse line capacity increased to $750 million as of June 30, 2022, up from $650 million as of March 31, 2022 Available warehouse line capacity was $539.8 million as of June 30, 2022 Recourse debt to equity was 1.2X as of June 30, 2022, compared to 1.8X as of March 31, 2022, resulting from the paydown of our warehouse lines from securitization (4)

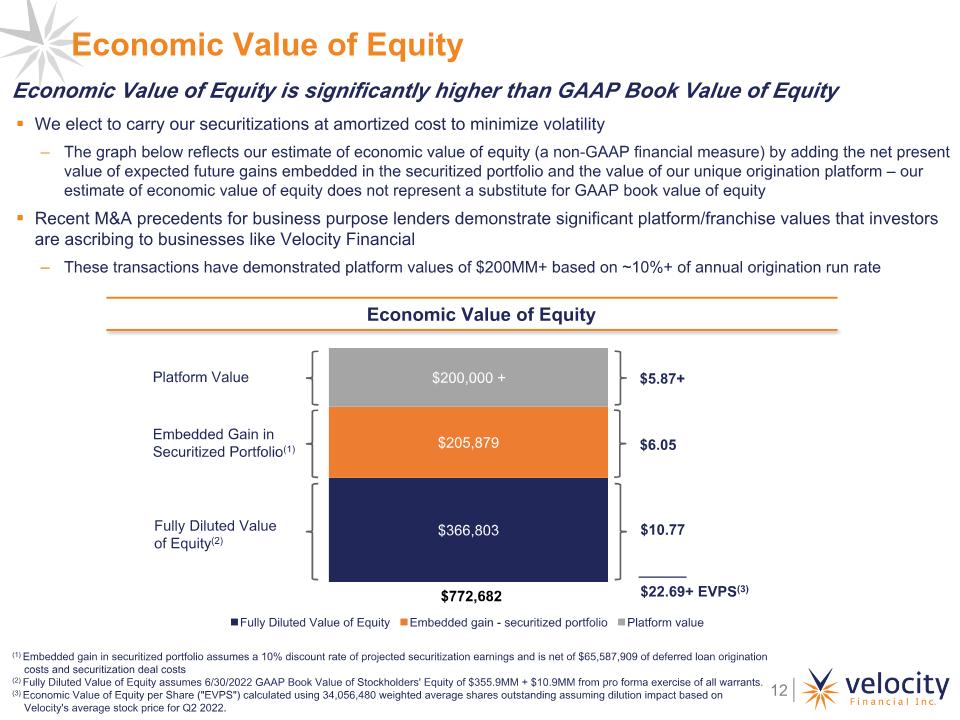

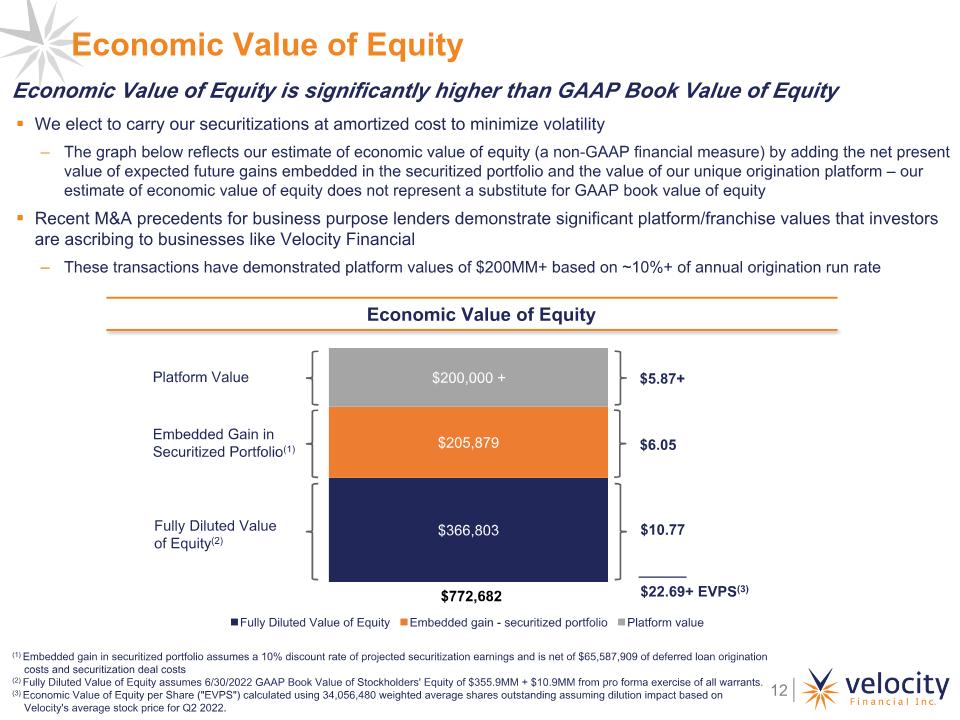

Platform Value Embedded Gain in Securitized Portfolio(1) Fully Diluted Value of Equity(2) $772,682 We elect to carry our securitizations at amortized cost to minimize volatility The graph below reflects our estimate of economic value of equity (a non-GAAP financial measure) by adding the net present value of expected future gains embedded in the securitized portfolio and the value of our unique origination platform – our estimate of economic value of equity does not represent a substitute for GAAP book value of equity Recent M&A precedents for business purpose lenders demonstrate significant platform/franchise values that investors are ascribing to businesses like Velocity Financial These transactions have demonstrated platform values of $200MM+ based on ~10%+ of annual origination run rate Economic Value of Equity is significantly higher than GAAP Book Value of Equity Economic Value of Equity Economic Value of Equity $5.87+ $6.05 $10.77 $22.69+ EVPS(3) (1) Embedded gain in securitized portfolio assumes a 10% discount rate of projected securitization earnings and is net of $65,587,909 of deferred loan origination costs and securitization deal costs (2) Fully Diluted Value of Equity assumes 6/30/2022 GAAP Book Value of Stockholders' Equity of $355.9MM + $10.9MM from pro forma exercise of all warrants. (3) Economic Value of Equity per Share ("EVPS") calculated using 34,056,480 weighted average shares outstanding assuming dilution impact based on Velocity's average stock price for Q2 2022.

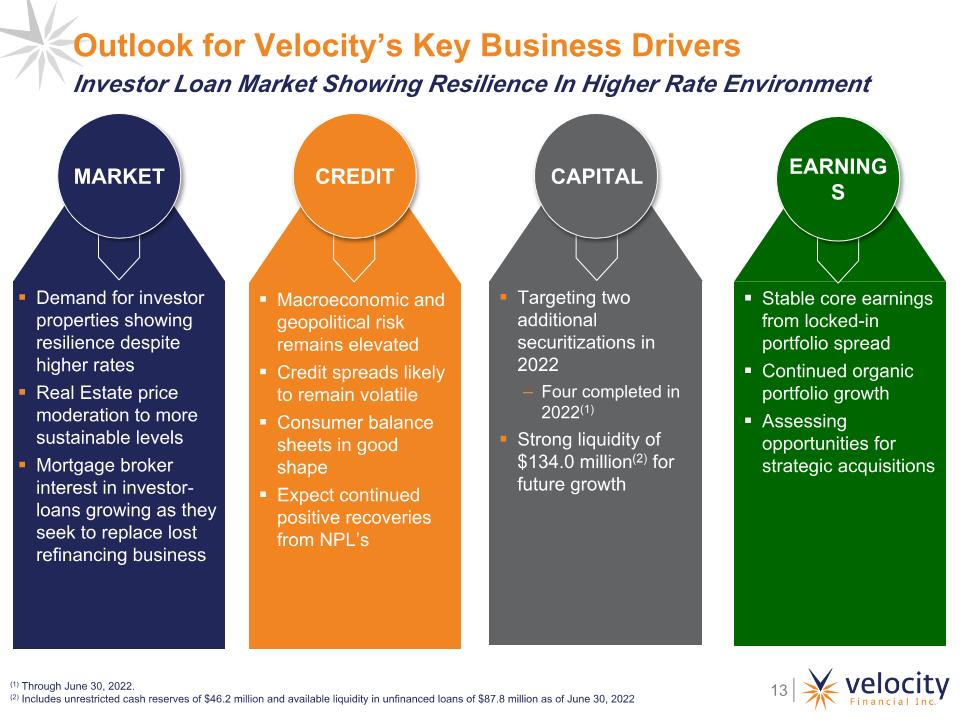

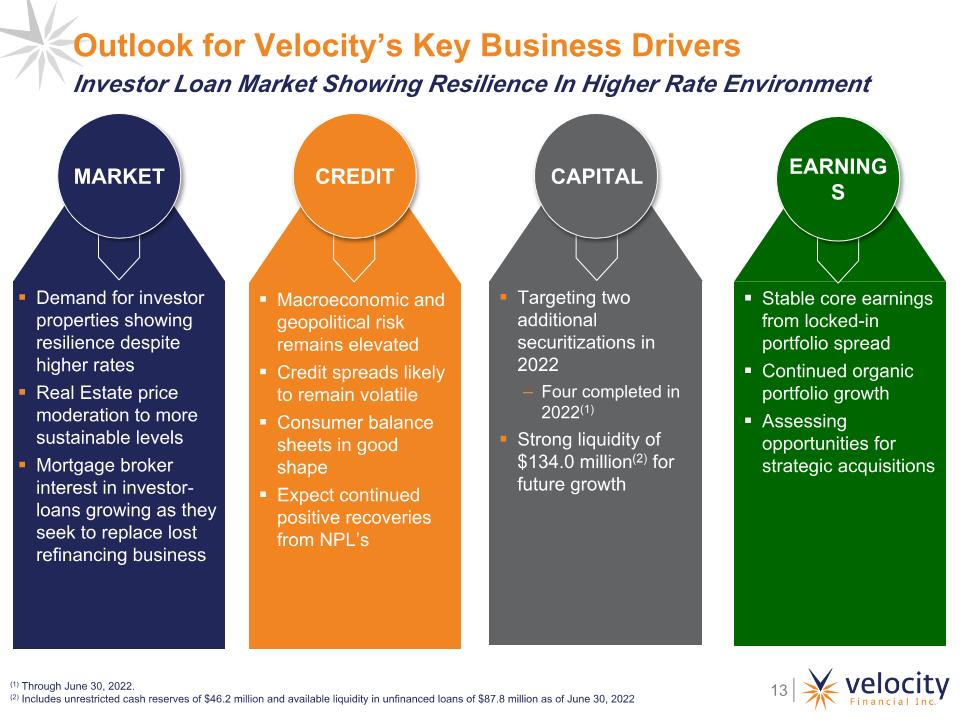

Macroeconomic and geopolitical risk remains elevated Credit spreads likely to remain volatile Consumer balance sheets in good shape Expect continued positive recoveries from NPL’s Demand for investor properties showing resilience despite higher rates Real Estate price moderation to more sustainable levels Mortgage broker interest in investor-loans growing as they seek to replace lost refinancing business Outlook for Velocity’s Key Business Drivers MARKET CREDIT CAPITAL Targeting two additional securitizations in 2022 Four completed in 2022(1) Strong liquidity of $134.0 million(2) for future growth Investor Loan Market Showing Resilience In Higher Rate Environment Stable core earnings from locked-in portfolio spread Continued organic portfolio growth Assessing opportunities for strategic acquisitions EARNINGS (1) Through June 30, 2022. (2) Includes unrestricted cash reserves of $46.2 million and available liquidity in unfinanced loans of $87.8 million as of June 30, 2022

Appendix

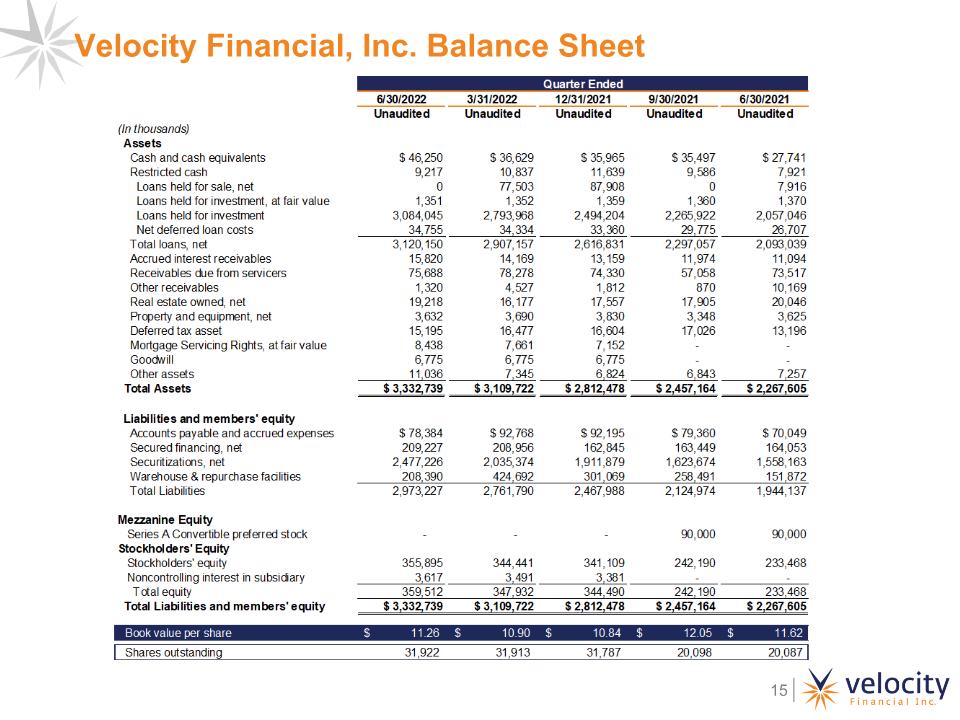

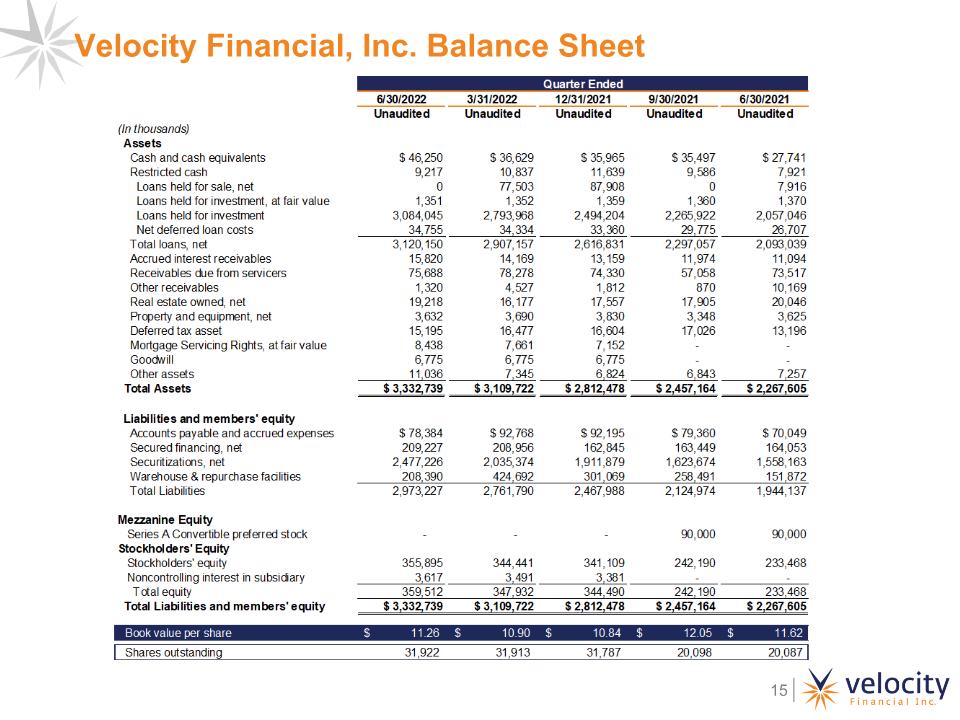

Velocity Financial, Inc. Balance Sheet

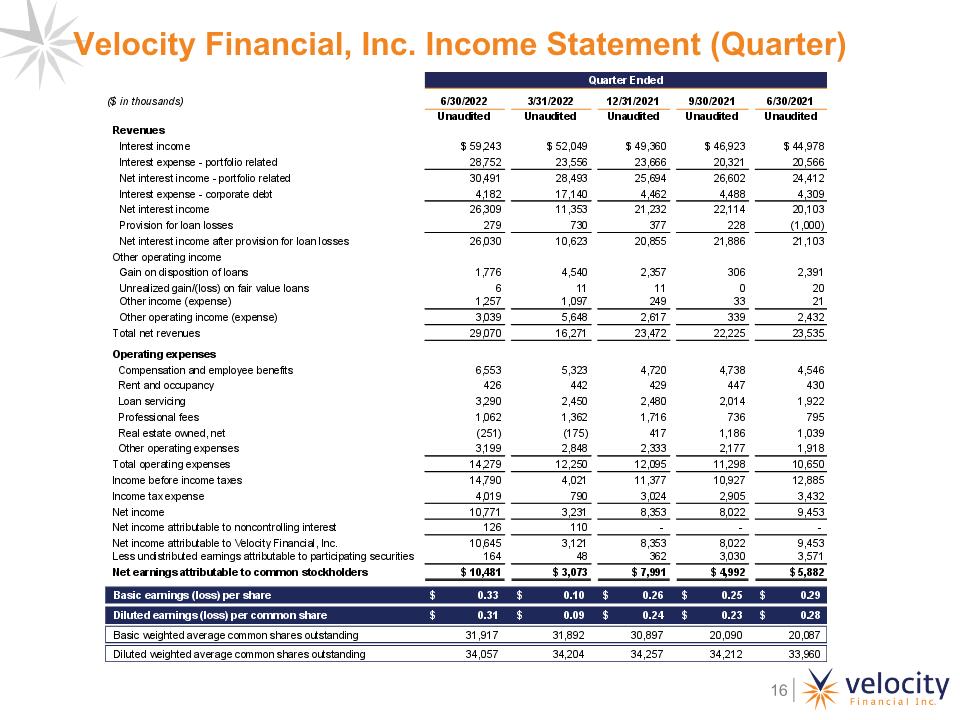

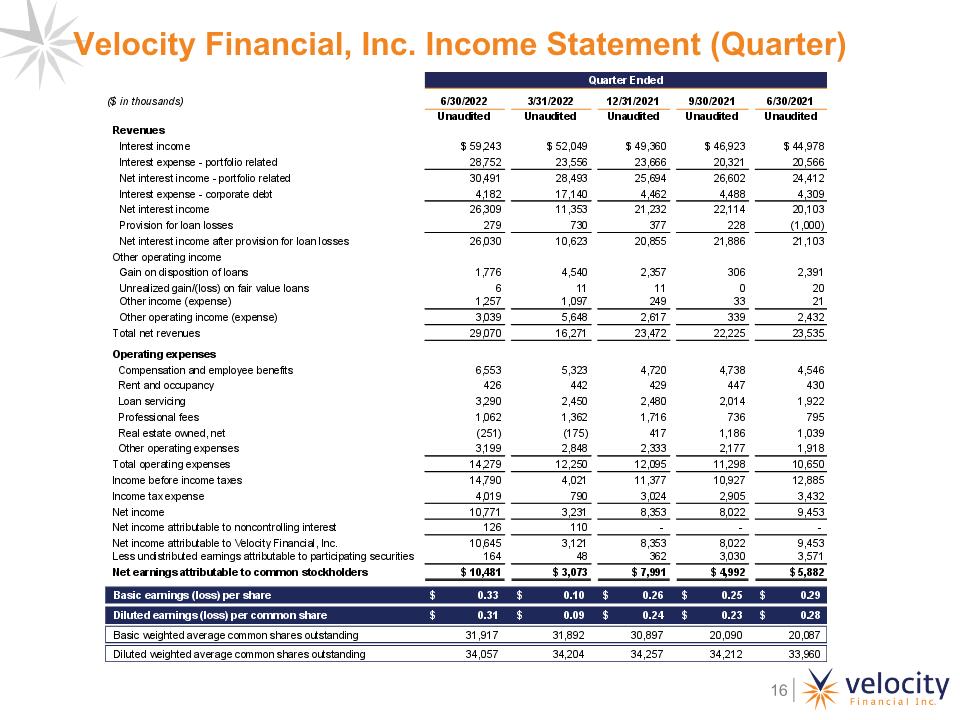

Velocity Financial, Inc. Income Statement (Quarter)

HFI Portfolio Delinquency Trends

Loan Portfolio Rollforward $(155.0) $(74.5) Loan Portfolio Rollforward (UPB in millions) (1) $446.1 $(3.1) (1) Includes $0.39 million in UPB of repurchased loans and $0.49 million in UPB of loan acquisitions.

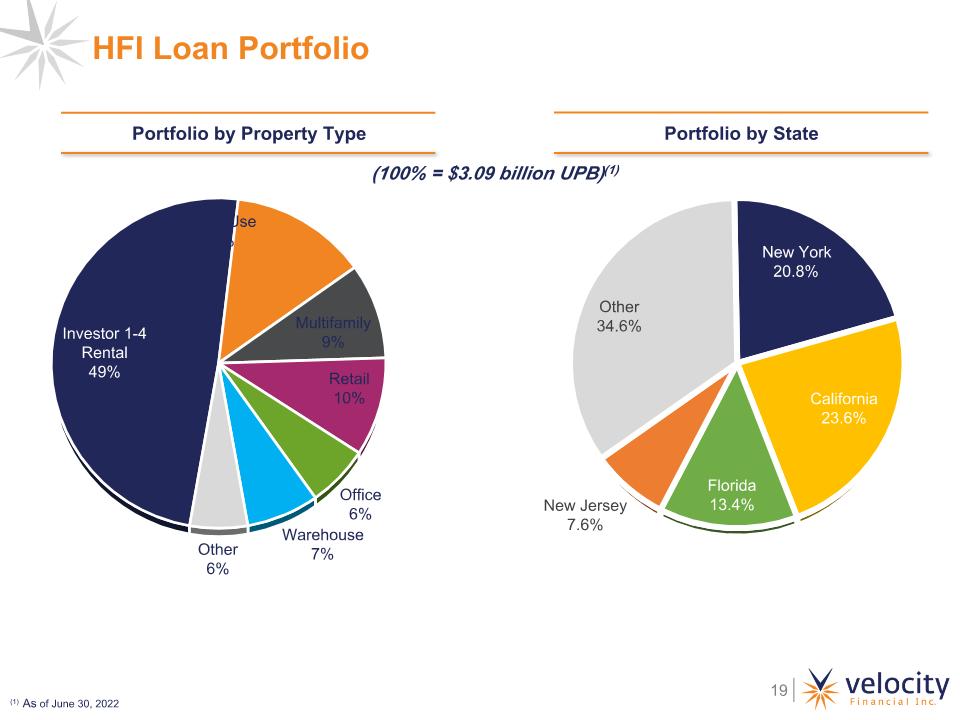

HFI Loan Portfolio Portfolio by Property Type (100% = $3.09 billion UPB)(1) (1) As of June 30, 2022 Portfolio by State

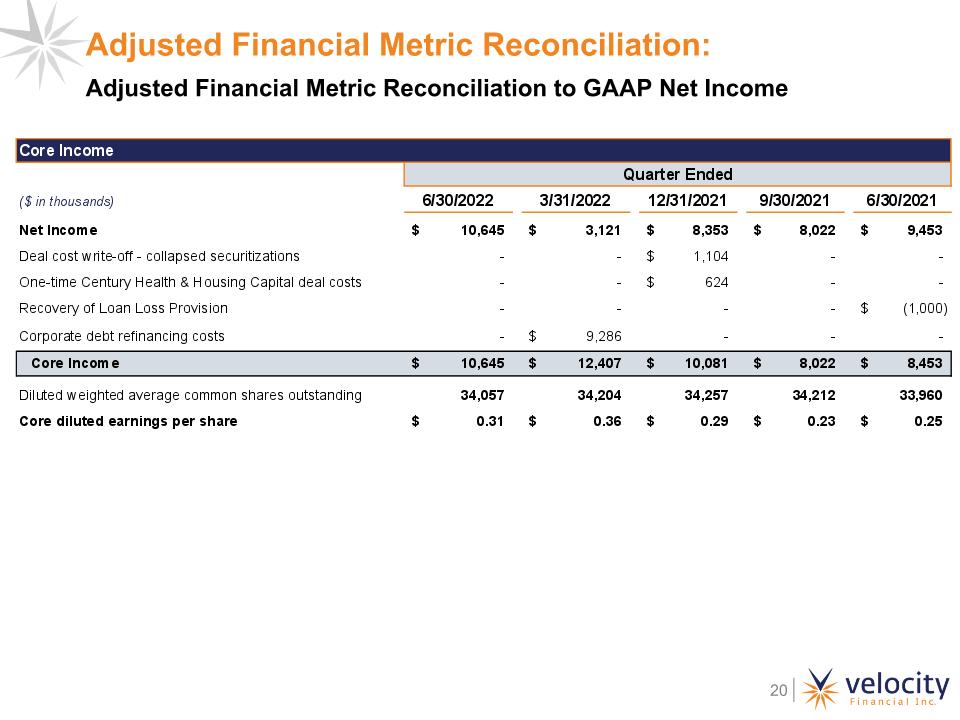

Adjusted Financial Metric Reconciliation: Adjusted Financial Metric Reconciliation to GAAP Net Income