forecasts and requires enhanced disclosures related to the significant estimates and judgments used in estimating credit losses, as well as the credit quality and underwriting standards of an organization’s portfolio. In addition, ASU 2016-13 amends the accounting for credit losses on available-for-sale debt securities and purchased financial assets with credit deterioration. ASU 2016-13 will become effective January 1, 2020. The Company has selected a CECL software program and is currently working with the vendor to implement the software. The Company expects model validation and parallel runs to begin in the fourth quarter of 2019. Additionally, the Company is assessing updates to accounting policies, and documenting new processes and controls. The Company expects to adopt this ASU on January 1, 2020.

Recent Developments

October 2019 Securitization

In October 2019, we completed the securitization of $162.5 million of investor real estate loans, measured by UPB as of the September 1, 2019 cut-off date, issuing $154.4 million of non-recourse notes payable through the Velocity Commercial Capital Loan Trust 2019-3, or 2019-3. We are the sole beneficial interest holder of 2019-3, a variable interest entity that will be included in our consolidated financial statements.

October 2019 Securitization Sale

In October 2019, the Company sold its remaining retained interests in securitization 2014-1 for approximately $9.7 million. The proceeds were used to fund our loan originations.

Estimates for the Year Ended December 31, 2019

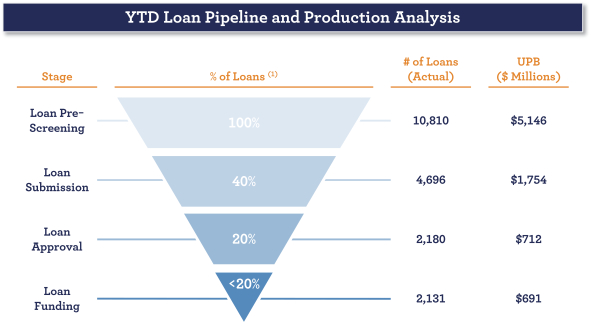

We expect to report total loan originations of at least $1,009.0 million for the year ended December 31, 2019, compared to total loan originations of $737.3 million for the year ended December 31, 2018, and $554.7 million for the year ended December 31, 2017.

We expect to report total loans, as measured by unpaid principal balance, of at least $2,055.0 million as of December 31, 2019, compared to total loans, as measured by unpaid principal balance, of $1,928.2 million as of September 30, 2019, and $1,631.3 million as of December 31, 2018. We expect to report nonperforming loans between 6.50% and 6.90% of total loans, as measured by unpaid principal balance, as of December 31, 2019, compared to nonperforming loans of 6.13% as of September 30, 2019, and of 5.85% as of December 31, 2018. Nonperforming loans includes all loans that are 90 or more days past due, in bankruptcy or in foreclosure.

We expect to report net income between $16.8 million and $18.6 million for the year ended December 31, 2019, compared to net income of $10.5 million for the year ended December 31, 2018, and $14.0 million for the year ended December 31, 2017. The Company was not subject to income tax prior to January 1, 2018 because prior to that time it elected to be treated as a partnership for U.S. federal income tax purposes.

We expect to report members’ equity between $155.3 million and $157.1 million as of December 31, 2019, compared to members’ equity of $150.6 million as of September 30, 2019, and of $139.7 million as of December 31, 2018. The estimated range of members’ equity as of December 31, 2019 includes the impact of $1.2 million dividends paid to the former holders of our Class C preferred units during the year ended December 31, 2019. We repurchased our outstanding Class C preferred units in connection with the refinancing of our corporate debt in August 2019.

The foregoing estimated amount of loans originated and estimated range of net income for the year ended December 31, 2019 and estimated amount of total loans and estimated ranges of nonperforming loans and members’ equity as of December 31, 2019 are preliminary and subject to completion of financial and operating closing procedures for the year ended December 31, 2019. We have begun our normal

57