2Q20 Earnings Presentation August 12, 2020 Exhibit 99.2

Forward-looking statements Some of the statements contained in this presentation may constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, projections, plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," or "potential" or the negative of these words and phrases. You can also identify forward-looking statements by discussions of strategy, plans, or intentions. The forward-looking statements contained in this presentation reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause actual results to differ significantly from those expressed or contemplated in any forward-looking statement. While forward-looking statements reflect our good faith projections, assumptions and expectations, they are not guarantees of future results. Furthermore, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by applicable law. Factors that could cause our results to differ materially include, but are not limited to: (1) the course and severity of the COVID-19 pandemic, and its direct and indirect impacts (2) general economic conditions and real estate market conditions, (3) regulatory and/or legislative changes, (4) our ability to retain and attract loan originators and other professionals, and (5) changes in federal government fiscal and monetary policies. For a further discussion of these and other factors that could cause future results to differ materially from those expressed or contemplated in any forward-looking statements, see the section titled ''Risk Factors" previously disclosed in our Form 10-K filed with the SEC on April 7, 2020 and Form 10-Q filed with the SEC on May 14, 2020. Such filings are available publicly on our Investor Relations web page at www.velfinance.com.

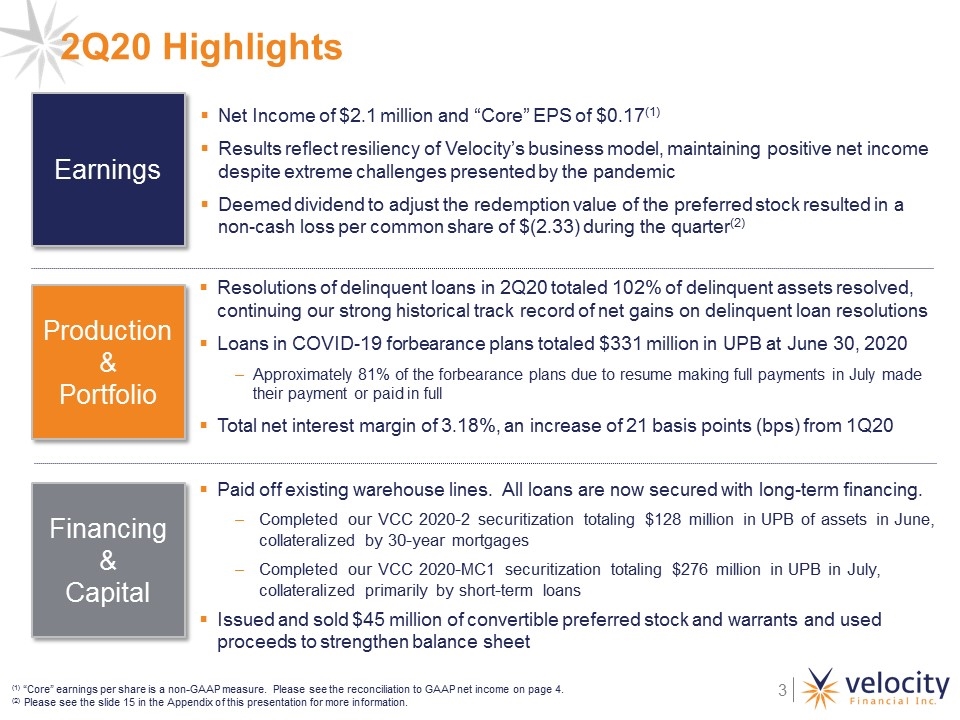

2Q20 Highlights Production& Portfolio Earnings Financing & Capital Net Income of $2.1 million and “Core” EPS of $0.17(1) Results reflect resiliency of Velocity’s business model, maintaining positive net income despite extreme challenges presented by the pandemic Deemed dividend to adjust the redemption value of the preferred stock resulted in a non-cash loss per common share of $(2.33) during the quarter(2) Resolutions of delinquent loans in 2Q20 totaled 102% of delinquent assets resolved, continuing our strong historical track record of net gains on delinquent loan resolutions Loans in COVID-19 forbearance plans totaled $331 million in UPB at June 30, 2020 Approximately 81% of the forbearance plans due to resume making full payments in July made their payment or paid in full Total net interest margin of 3.18%, an increase of 21 basis points (bps) from 1Q20 Paid off existing warehouse lines. All loans are now secured with long-term financing. Completed our VCC 2020-2 securitization totaling $128 million in UPB of assets in June, collateralized by 30-year mortgages Completed our VCC 2020-MC1 securitization totaling $276 million in UPB in July, collateralized primarily by short-term loans Issued and sold $45 million of convertible preferred stock and warrants and used proceeds to strengthen balance sheet (1) “Core” earnings per share is a non-GAAP measure. Please see the reconciliation to GAAP net income on page 4. (2) Please see the slide 15 in the Appendix of this presentation for more information.

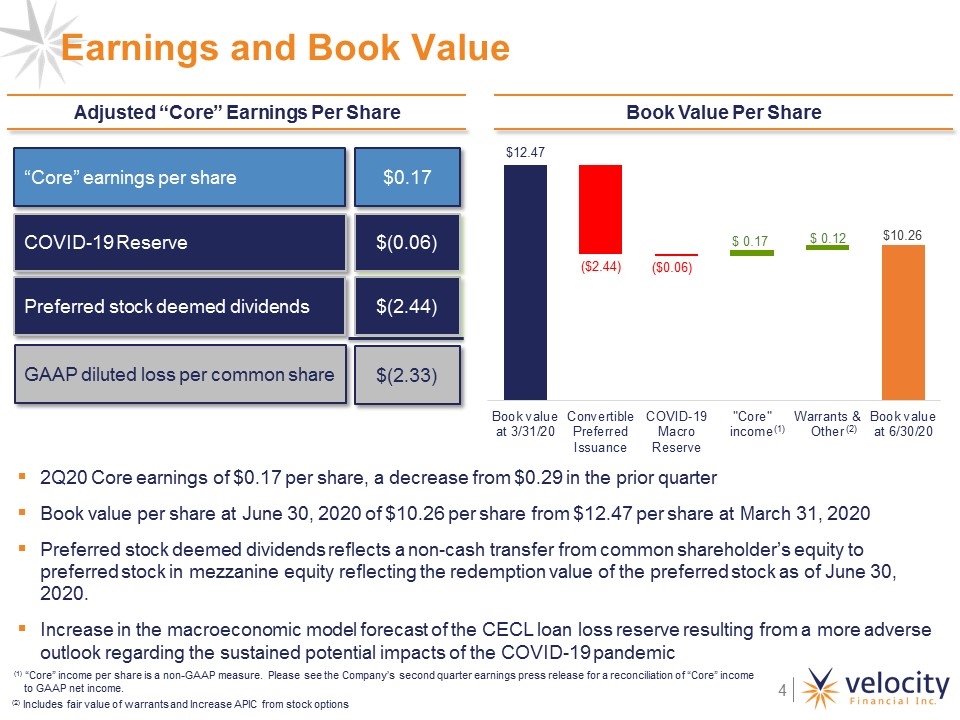

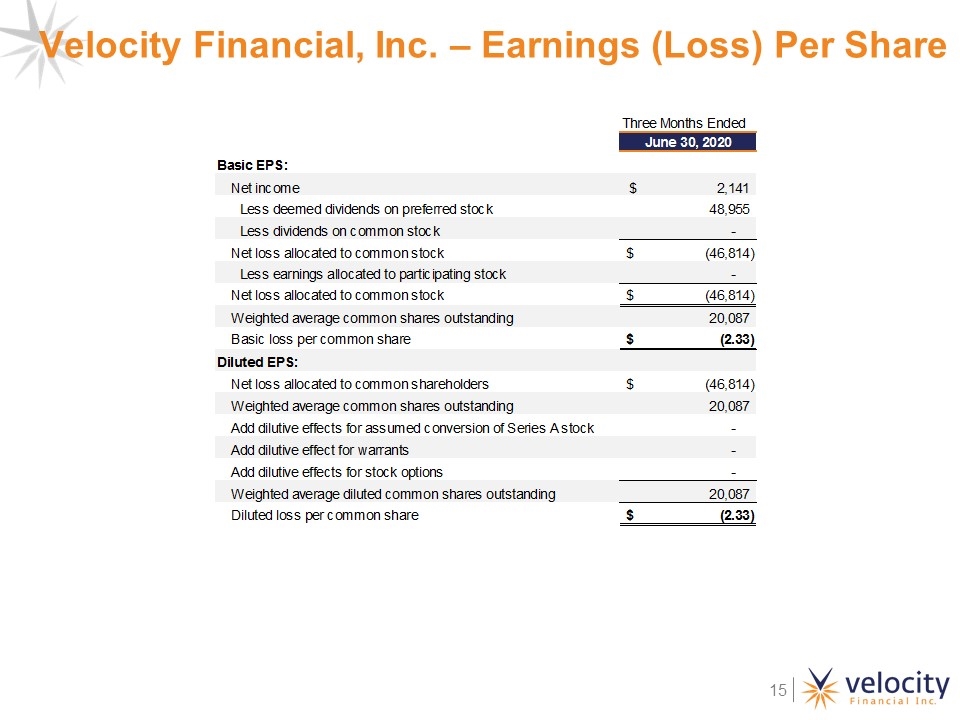

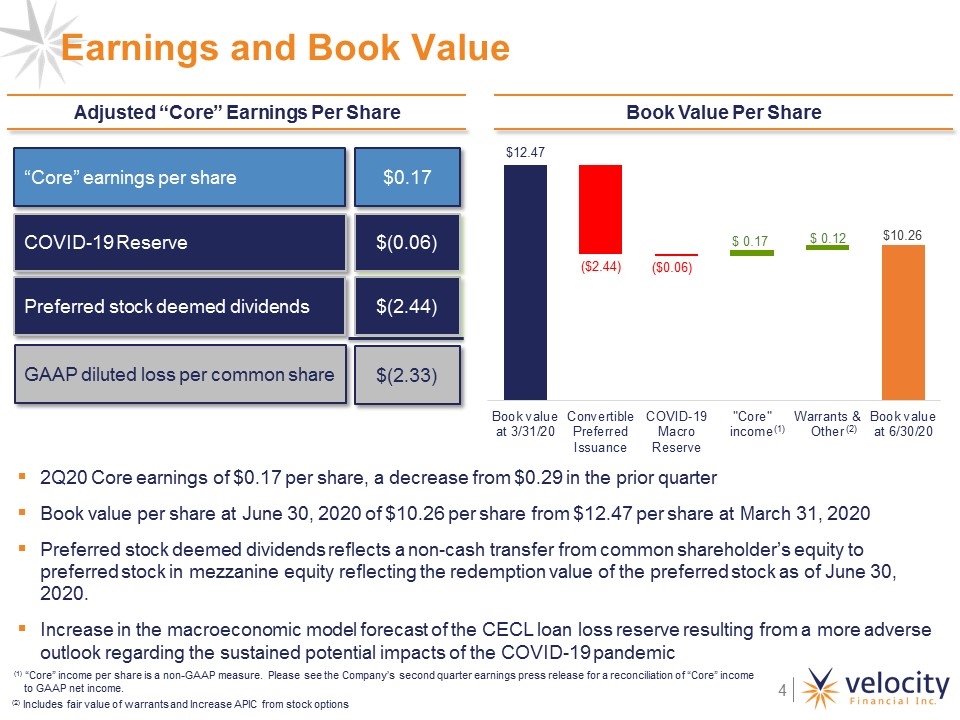

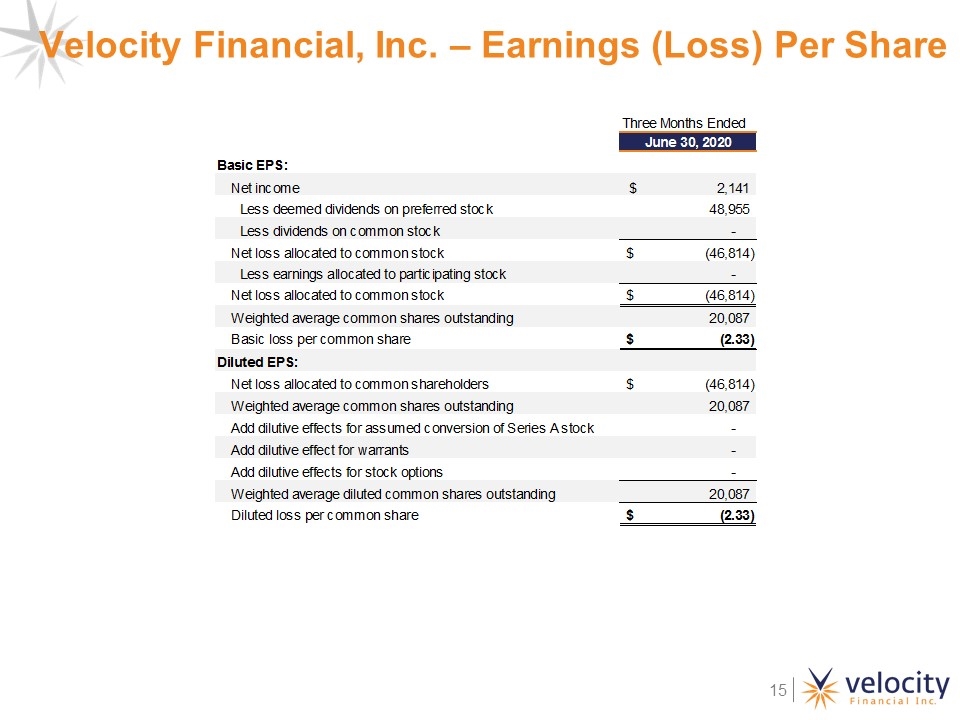

Earnings and Book Value Adjusted “Core” Earnings Per Share Book Value Per Share ($0.06) ($2.44) 2Q20 Core earnings of $0.17 per share, a decrease from $0.29 in the prior quarter Book value per share at June 30, 2020 of $10.26 per share from $12.47 per share at March 31, 2020 Preferred stock deemed dividends reflects a non-cash transfer from common shareholder’s equity to preferred stock in mezzanine equity reflecting the redemption value of the preferred stock as of June 30, 2020. Increase in the macroeconomic model forecast of the CECL loan loss reserve resulting from a more adverse outlook regarding the sustained potential impacts of the COVID-19 pandemic GAAP diluted loss per common share $(2.33) Preferred stock deemed dividends $(2.44) $0.19 (2) (1) “Core” income per share is a non-GAAP measure. Please see the Company’s second quarter earnings press release for a reconciliation of “Core” income to GAAP net income. (2) Includes fair value of warrants and Increase APIC from stock options COVID-19 Reserve $(0.06) “Core” earnings per share $0.17 (1)

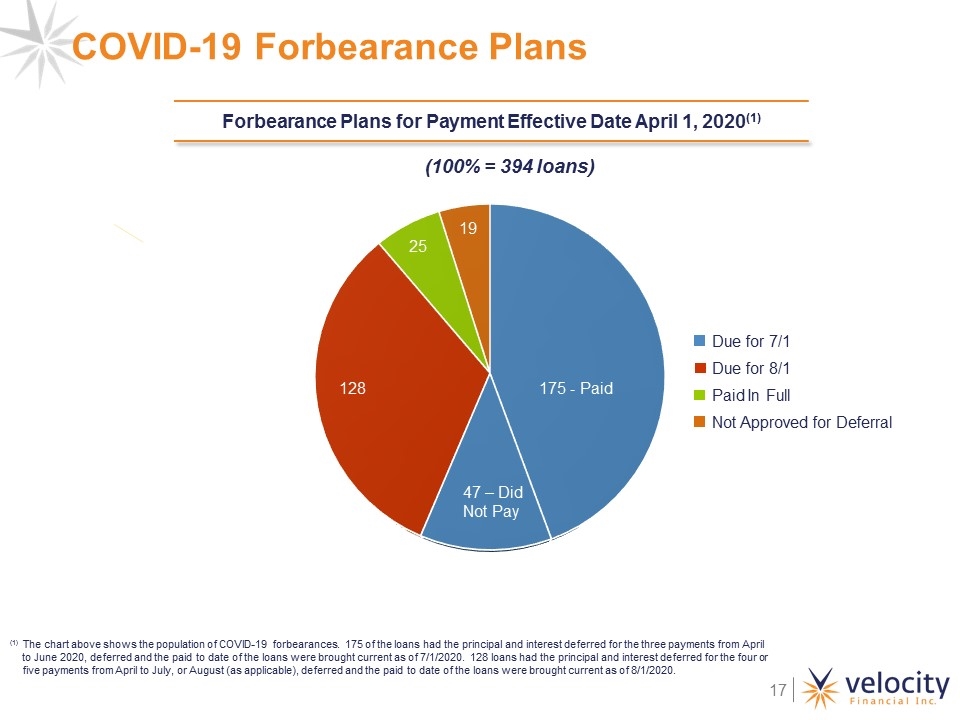

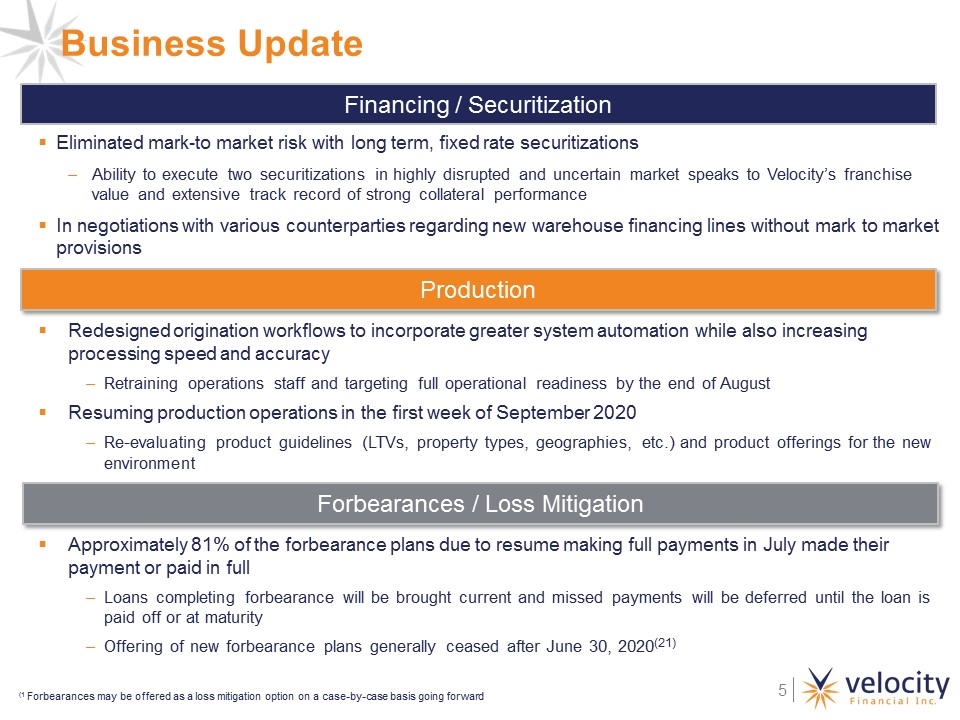

Production Financing / Securitization Eliminated mark-to market risk with long term, fixed rate securitizations Ability to execute two securitizations in highly disrupted and uncertain market speaks to Velocity’s franchise value and extensive track record of strong collateral performance In negotiations with various counterparties regarding new warehouse financing lines without mark to market provisions Redesigned origination workflows to incorporate greater system automation while also increasing processing speed and accuracy Retraining operations staff and targeting full operational readiness by the end of August Resuming production operations in the first week of September 2020 Re-evaluating product guidelines (LTVs, property types, geographies, etc.) and product offerings for the new environment Business Update Forbearances / Loss Mitigation Approximately 81% of the forbearance plans due to resume making full payments in July made their payment or paid in full Loans completing forbearance will be brought current and missed payments will be deferred until the loan is paid off or at maturity Offering of new forbearance plans generally ceased after June 30, 2020(21) (1 Forbearances may be offered as a loss mitigation option on a case-by-case basis going forward

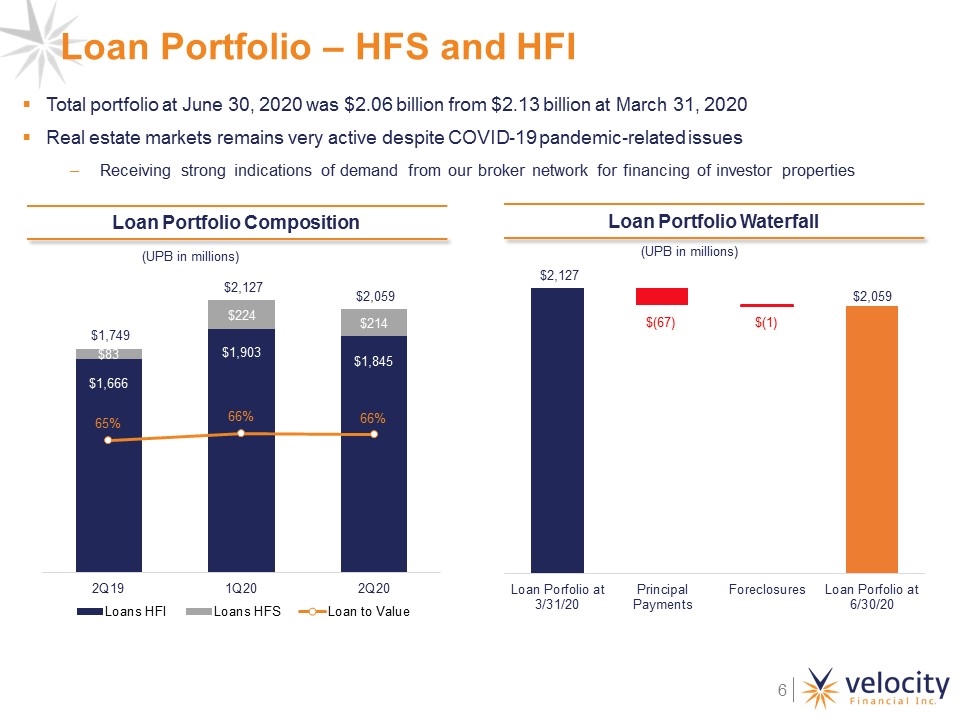

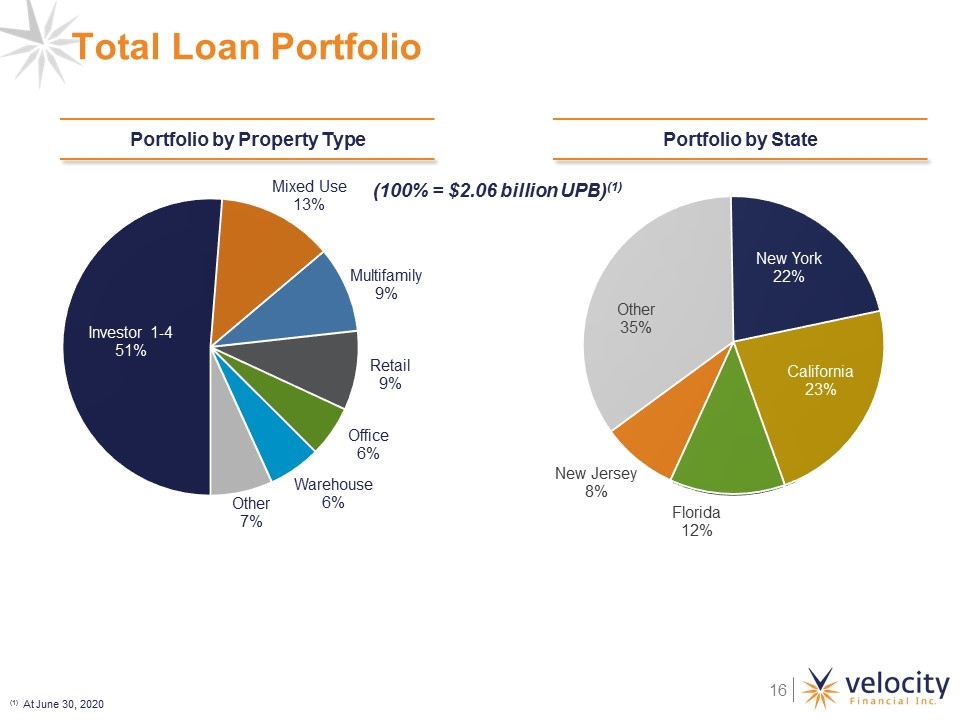

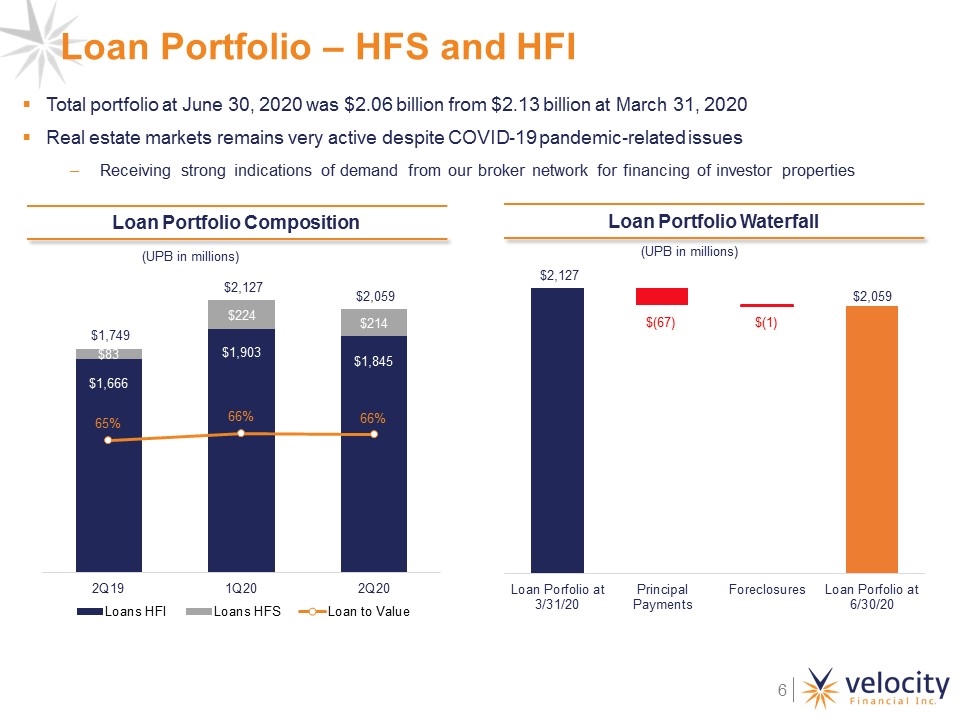

Loan Portfolio – HFS and HFI $(67) $(1) Loan Portfolio Waterfall Loan Portfolio Composition (UPB in millions) Total portfolio at June 30, 2020 was $2.06 billion from $2.13 billion at March 31, 2020 Real estate markets remains very active despite COVID-19 pandemic-related issues Receiving strong indications of demand from our broker network for financing of investor properties (UPB in millions)

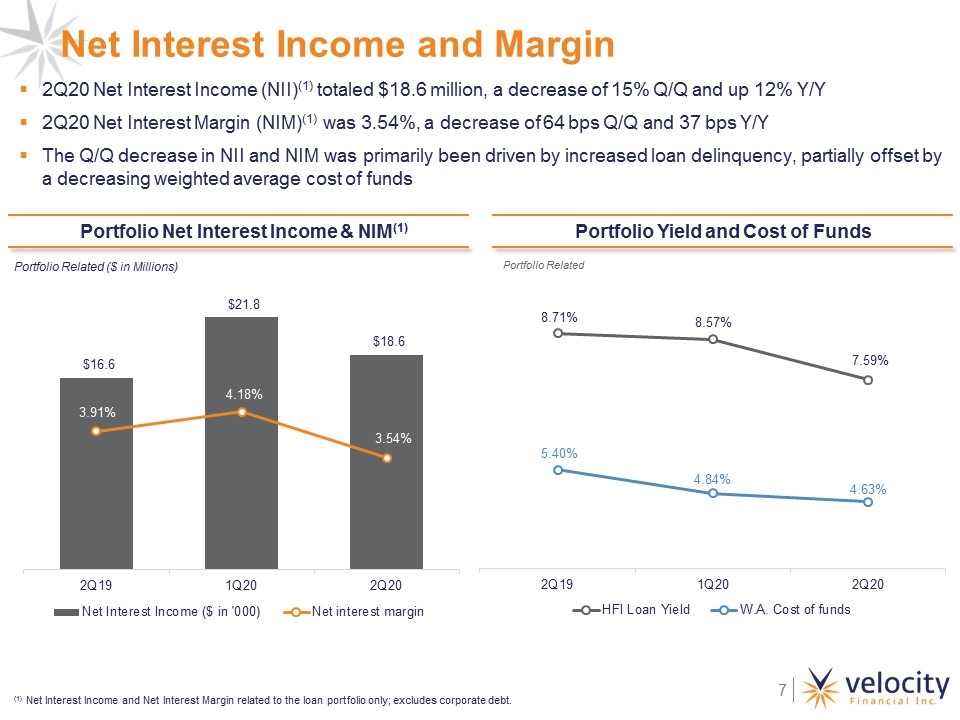

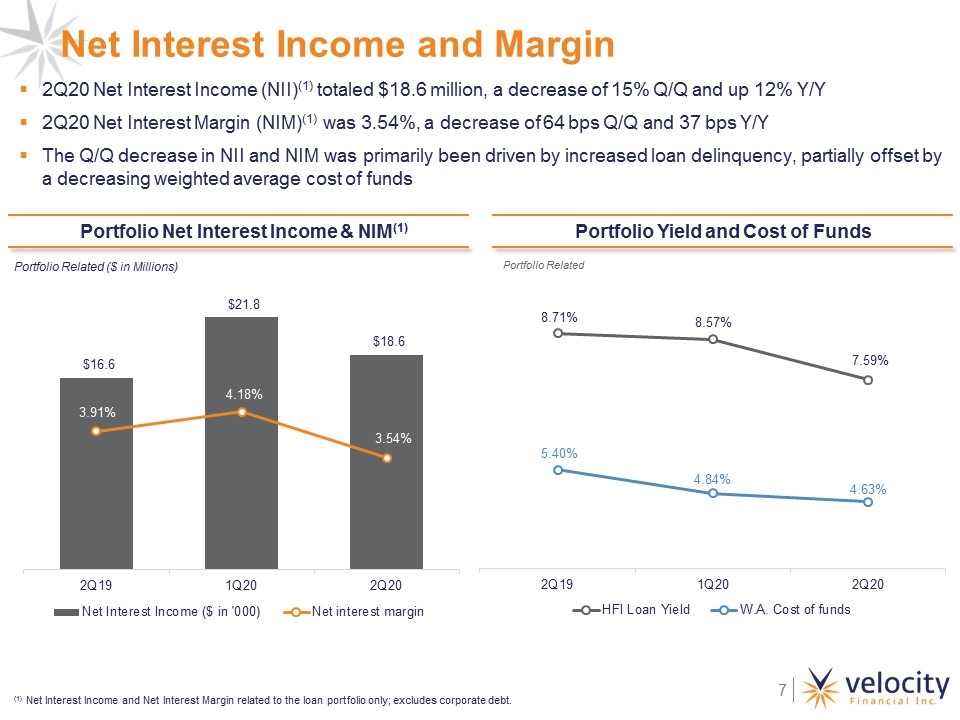

Portfolio Net Interest Income & NIM(1) Net Interest Income and Margin 2Q20 Net Interest Income (NII)(1) totaled $18.6 million, a decrease of 15% Q/Q and up 12% Y/Y 2Q20 Net Interest Margin (NIM)(1) was 3.54%, a decrease of 64 bps Q/Q and 37 bps Y/Y The Q/Q decrease in NII and NIM was primarily been driven by increased loan delinquency, partially offset by a decreasing weighted average cost of funds Portfolio Yield and Cost of Funds Portfolio Related Portfolio Related ($ in Millions) (1) Net Interest Income and Net Interest Margin related to the loan portfolio only; excludes corporate debt.

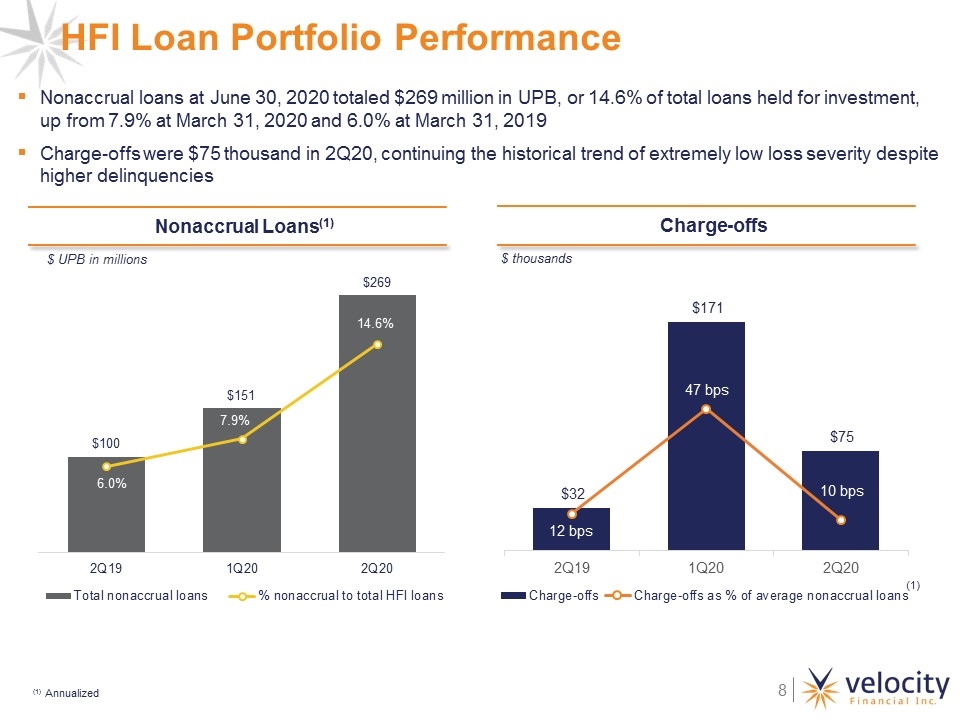

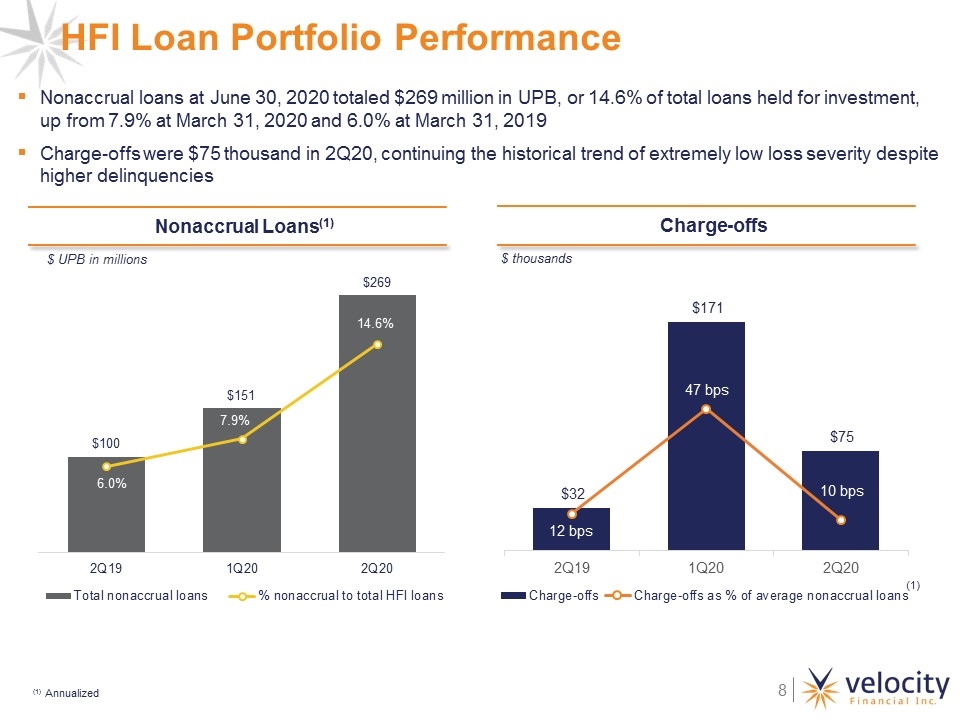

Nonaccrual Loans(1) Nonaccrual loans at June 30, 2020 totaled $269 million in UPB, or 14.6% of total loans held for investment, up from 7.9% at March 31, 2020 and 6.0% at March 31, 2019 Charge-offs were $75 thousand in 2Q20, continuing the historical trend of extremely low loss severity despite higher delinquencies Charge-offs $ UPB in millions HFI Loan Portfolio Performance $ thousands (1) (1) Annualized

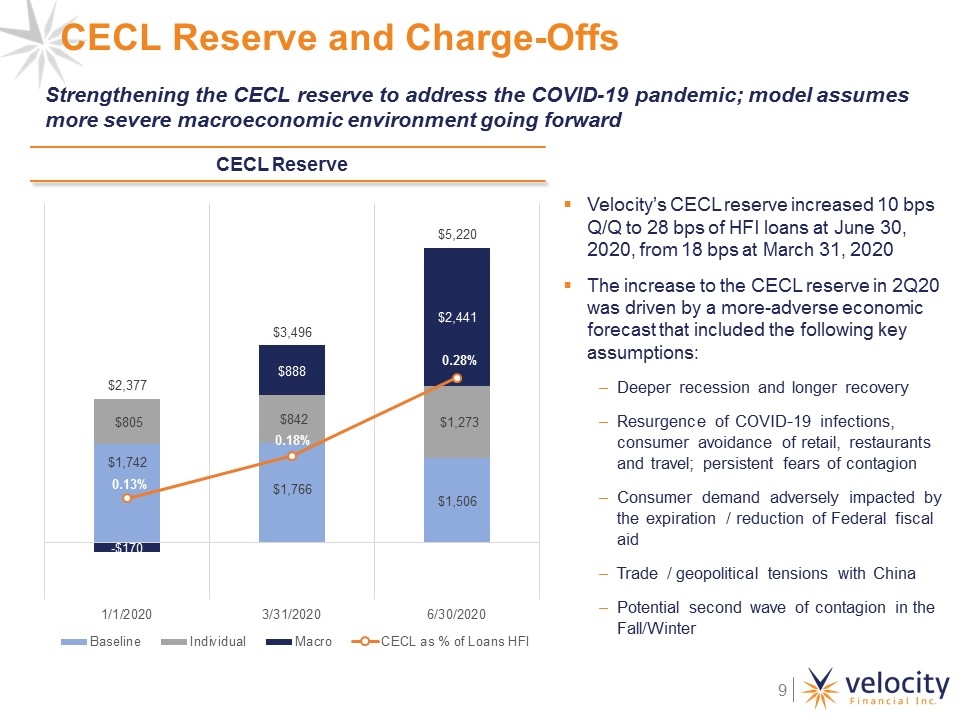

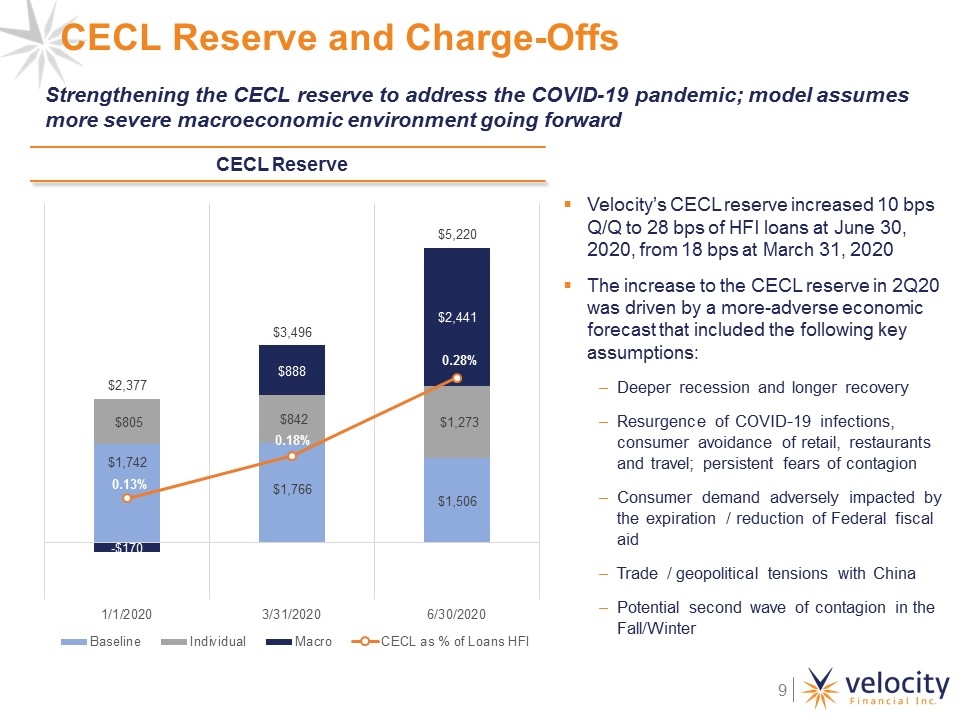

CECL Reserve and Charge-Offs CECL Reserve Velocity’s CECL reserve increased 10 bps Q/Q to 28 bps of HFI loans at June 30, 2020, from 18 bps at March 31, 2020 The increase to the CECL reserve in 2Q20 was driven by a more-adverse economic forecast that included the following key assumptions: Deeper recession and longer recovery Resurgence of COVID-19 infections, consumer avoidance of retail, restaurants and travel; persistent fears of contagion Consumer demand adversely impacted by the expiration / reduction of Federal fiscal aid Trade / geopolitical tensions with China Potential second wave of contagion in the Fall/Winter Strengthening the CECL reserve to address the COVID-19 pandemic; model assumes more severe macroeconomic environment going forward

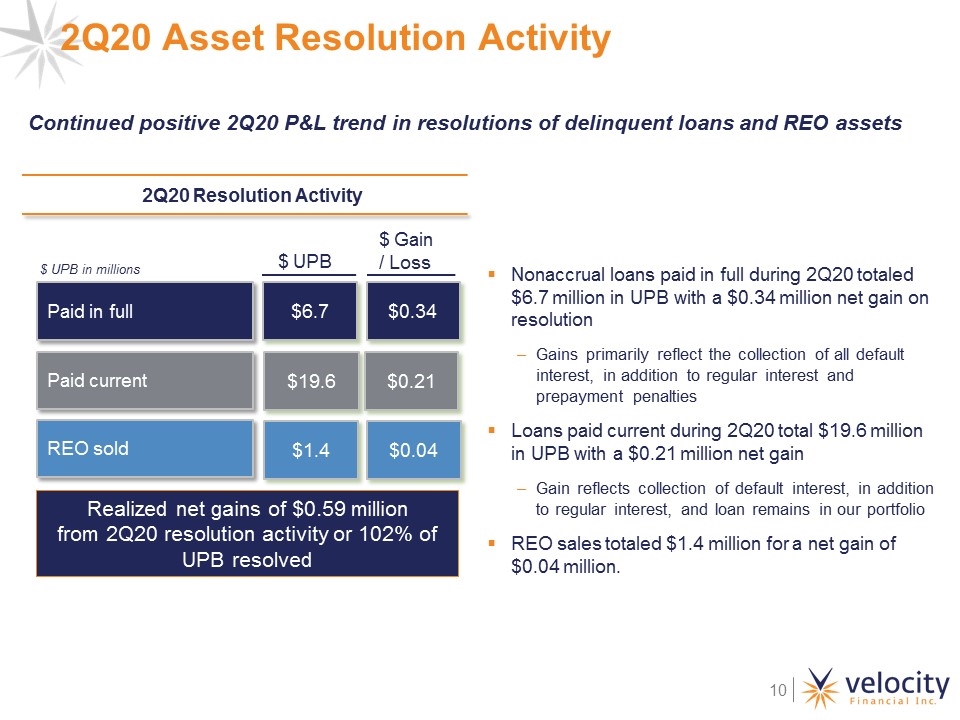

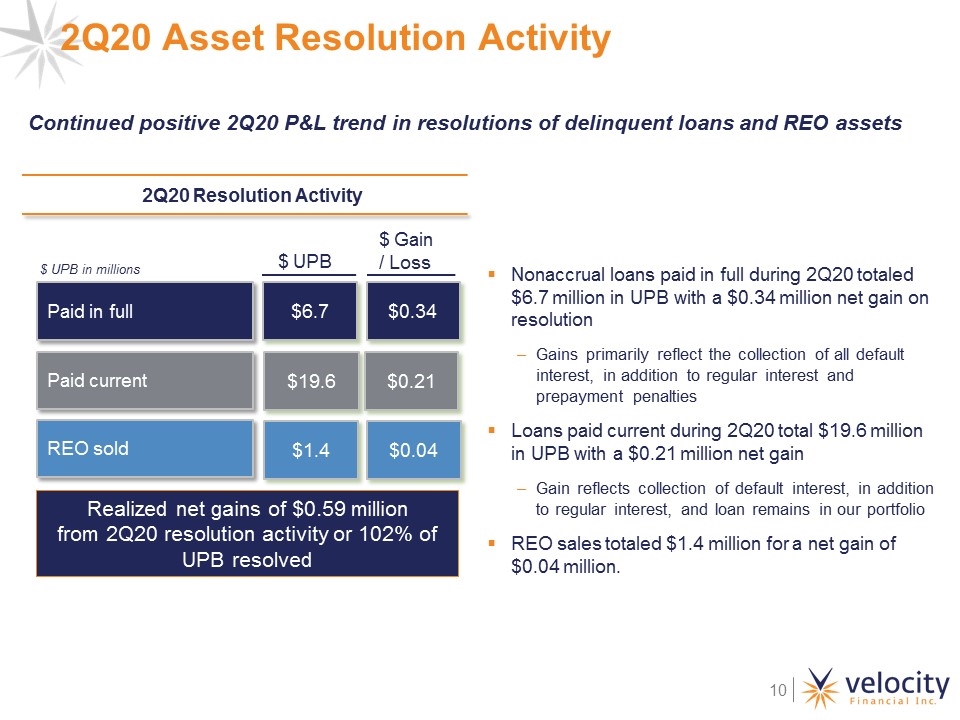

2Q20 Asset Resolution Activity $ UPB in millions Realized net gains of $0.59 million from 2Q20 resolution activity or 102% of UPB resolved Paid in full $6.7 Paid current REO sold $19.6 $1.4 $ UPB $ Gain / Loss $0.34 $0.21 $0.04 2Q20 Resolution Activity Nonaccrual loans paid in full during 2Q20 totaled $6.7 million in UPB with a $0.34 million net gain on resolution Gains primarily reflect the collection of all default interest, in addition to regular interest and prepayment penalties Loans paid current during 2Q20 total $19.6 million in UPB with a $0.21 million net gain Gain reflects collection of default interest, in addition to regular interest, and loan remains in our portfolio REO sales totaled $1.4 million for a net gain of $0.04 million. Continued positive 2Q20 P&L trend in resolutions of delinquent loans and REO assets

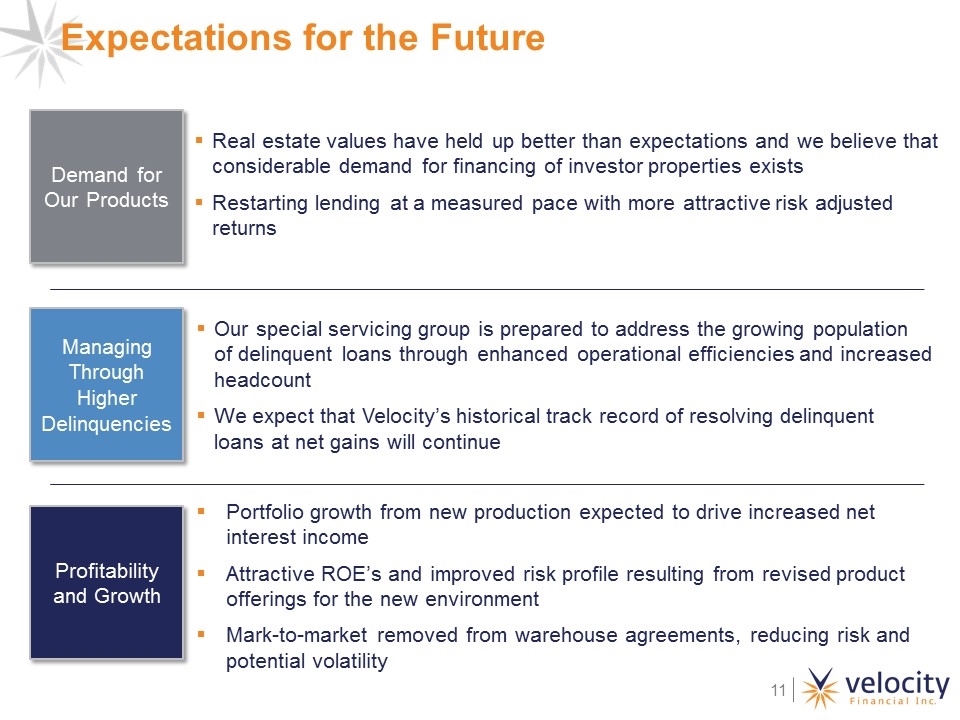

Managing Through Higher Delinquencies Profitability and Growth Demand for Our Products Real estate values have held up better than expectations and we believe that considerable demand for financing of investor properties exists Restarting lending at a measured pace with more attractive risk adjusted returns Portfolio growth from new production expected to drive increased net interest income Attractive ROE’s and improved risk profile resulting from revised product offerings for the new environment Mark-to-market removed from warehouse agreements, reducing risk and potential volatility Our special servicing group is prepared to address the growing population of delinquent loans through enhanced operational efficiencies and increased headcount We expect that Velocity’s historical track record of resolving delinquent loans at net gains will continue Expectations for the Future

Appendix

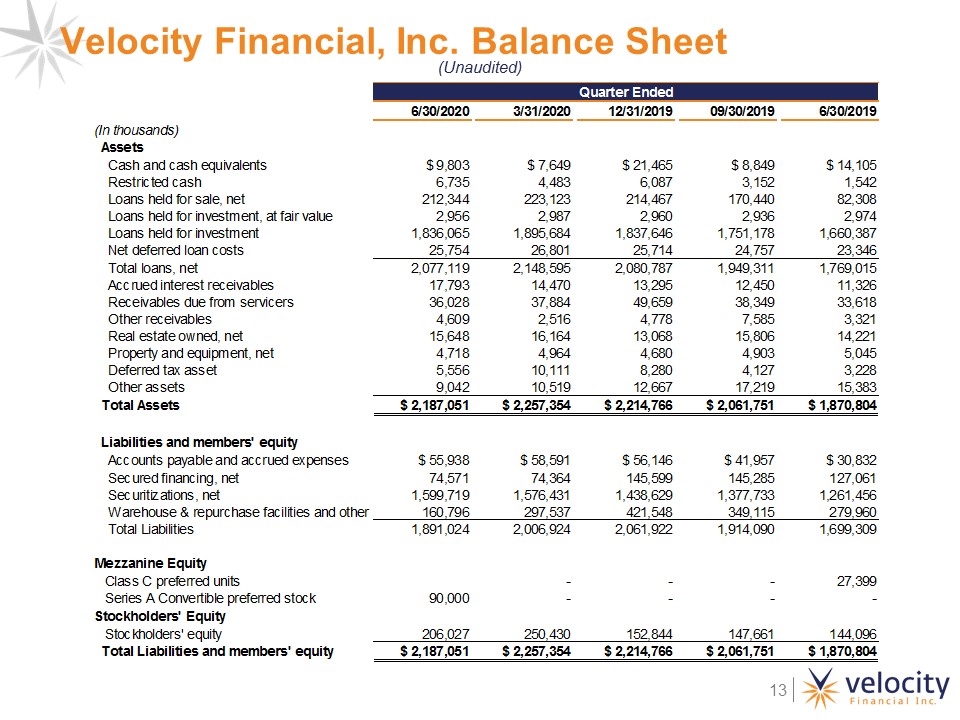

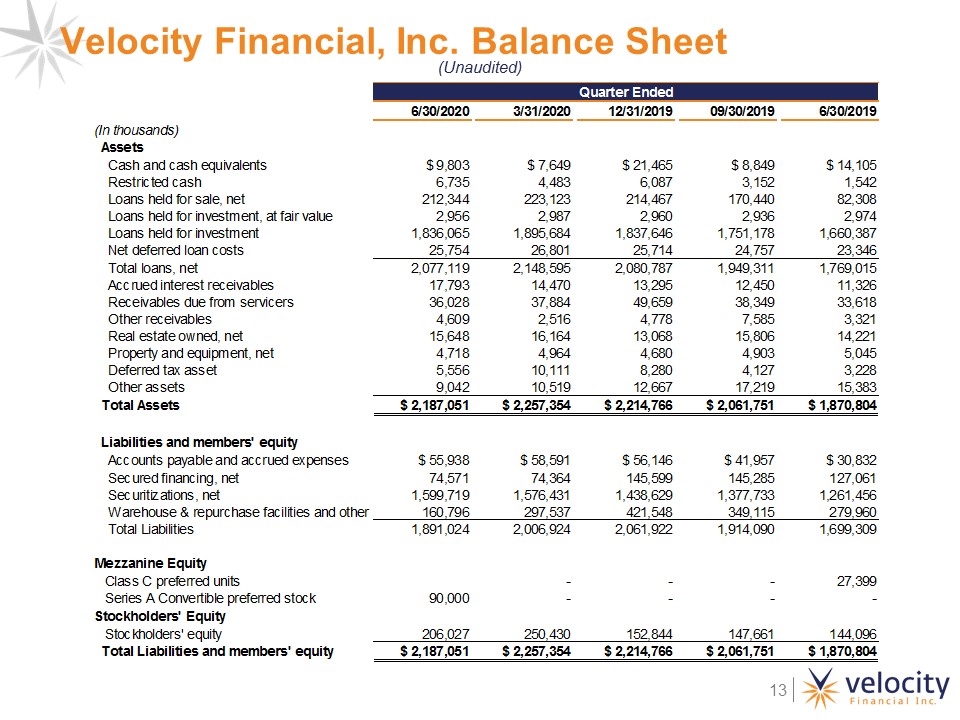

Velocity Financial, Inc. Balance Sheet (Unaudited)

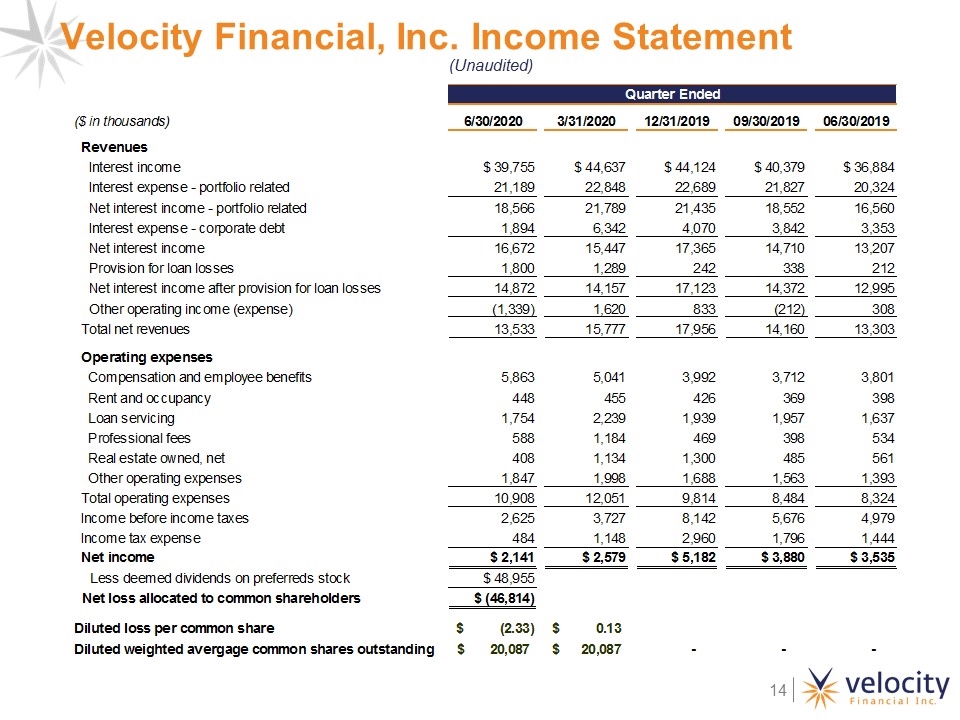

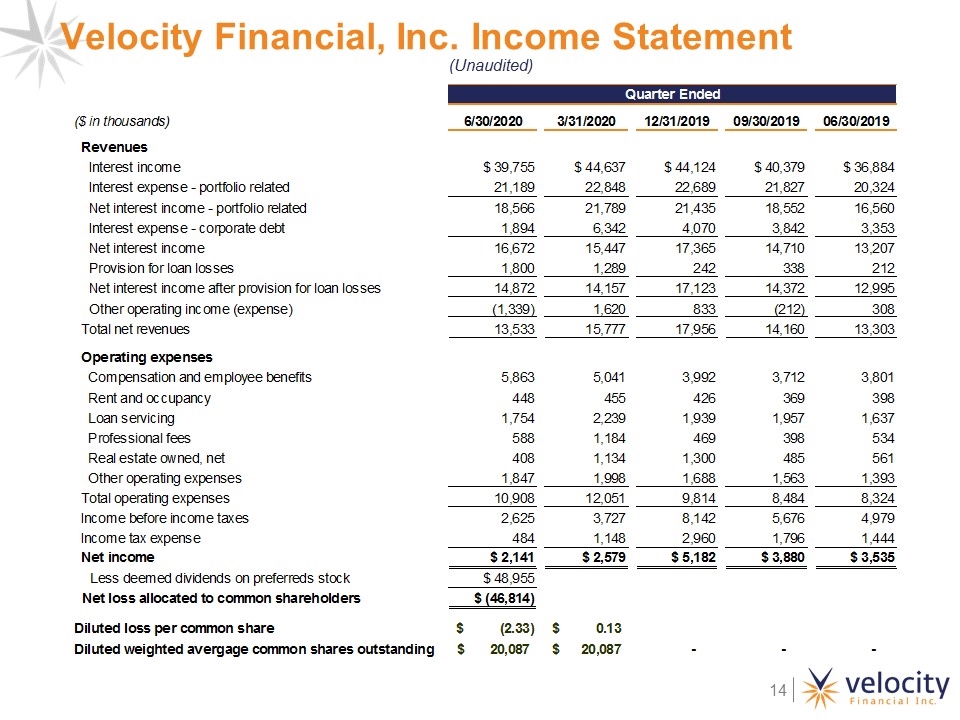

Velocity Financial, Inc. Income Statement (Unaudited)

Velocity Financial, Inc. – Earnings (Loss) Per Share

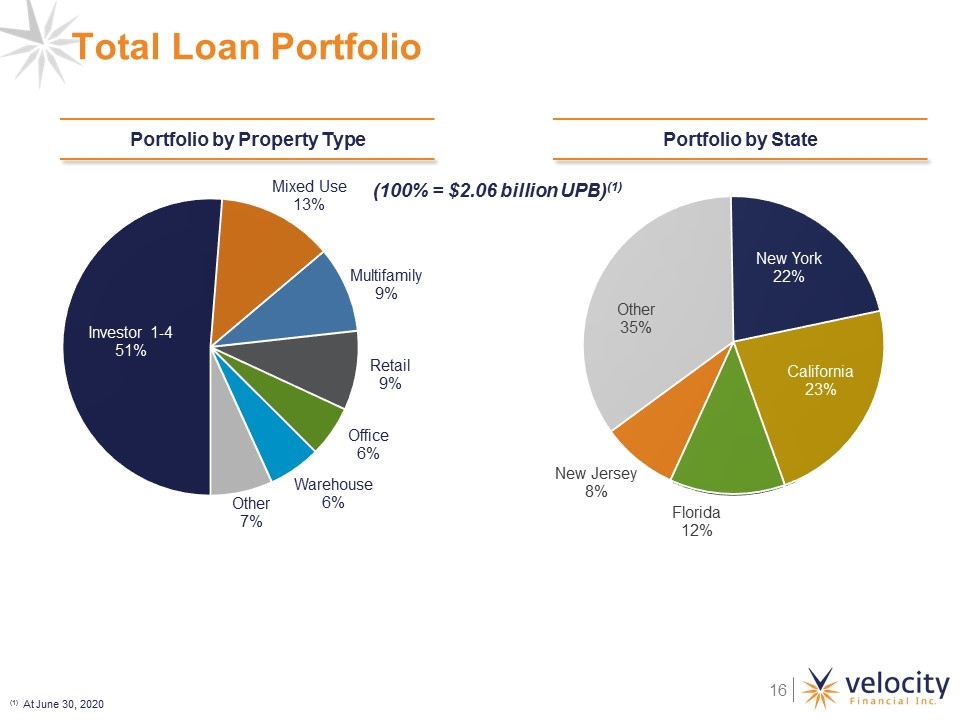

Total Loan Portfolio Portfolio by Property Type (100% = $2.06 billion UPB)(1) (1) At June 30, 2020 Portfolio by State

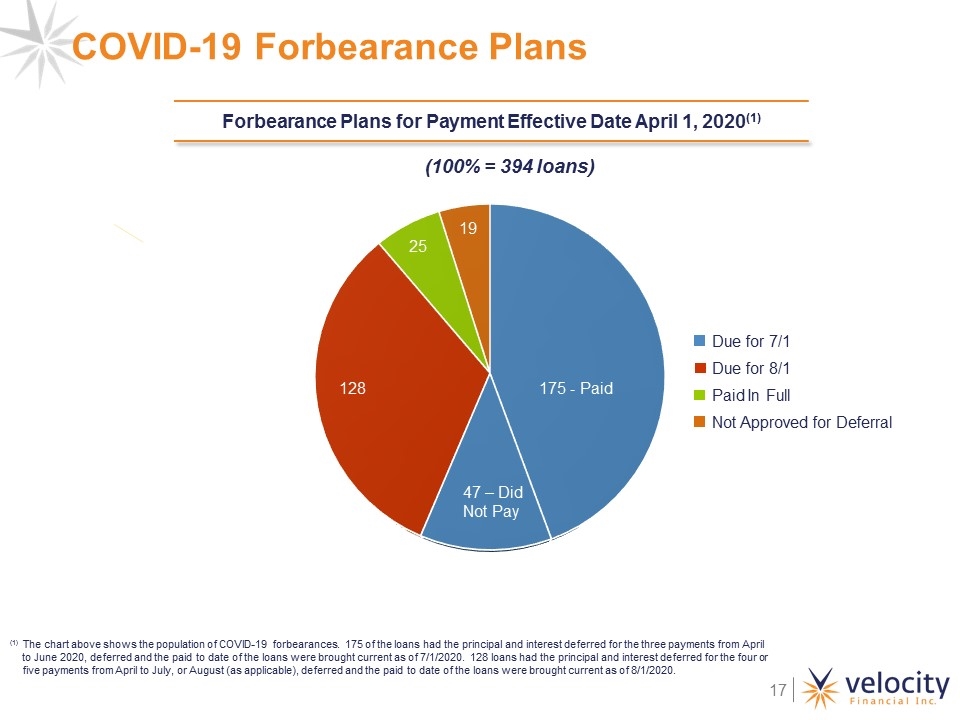

COVID-19 Forbearance Plans (100% = 394 loans) (1) The chart above shows the population of COVID-19 forbearances. 175 of the loans had the principal and interest deferred for the three payments from April to June 2020, deferred and the paid to date of the loans were brought current as of 7/1/2020. 128 loans had the principal and interest deferred for the four or five payments from April to July, or August (as applicable), deferred and the paid to date of the loans were brought current as of 8/1/2020. Forbearance Plans for Payment Effective Date April 1, 2020(1) 175 - Paid 47 – Did Not Pay Due for 7/1 Due for 8/1 Paid In Full Not Approved for Deferral