2Q21 Earnings Presentation August 5, 2021 Exhibit 99

Forward-looking statements Some of the statements contained in this presentation may constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, projections, plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," or "potential" or the negative of these words and phrases. You can also identify forward-looking statements by discussions of strategy, plans, or intentions. The forward-looking statements contained in this presentation reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause actual results to differ significantly from those expressed or contemplated in any forward-looking statement. While forward-looking statements reflect our good faith projections, assumptions and expectations, they are not guarantees of future results. Furthermore, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by applicable law. Factors that could cause our results to differ materially include but are not limited to: (1) the continued course and severity of the COVID-19 pandemic, and its direct and indirect impacts (2) general economic conditions and real estate market conditions, (3) regulatory and/or legislative changes, (4) our customers' continued interest in loans and doing business with us, (5) market conditions and investor interest in our contemplated securitization and (6) changes in federal government fiscal and monetary policies. For a further discussion of these and other factors that could cause future results to differ materially from those expressed or contemplated in any forward-looking statements, see the section titled ''Risk Factors" previously disclosed in our Form 10-Q filed with the SEC on May 14, 2020, as well as other cautionary statements we make in our current and periodic filings with the SEC. Such filings are available publicly on our Investor Relations web page at www.velfinance.com.

2Q21 Highlights Production& Loan Portfolio Earnings Financing & Capital Net Income of $9.5 million and Core income(1) of $8.5 million; diluted EPS of $0.28 and Core diluted EPS of $0.25 Results driven by strong net interest income growth resulting from increased nonperforming asset resolutions and improved loan portfolio performance Portfolio NIM(2) of 4.83%, an increase of 73 basis points (bps) from 1Q21 Book value per common share as of June 30, 2021, was $11.62, compared to $11.12 as of March 31, 2021 Loan production volume in 2Q21 totaled $256.5 million in UPB(3), a 10.1% Q/Q increase driven by continued strong demand and the re-introduction of short-term loans Steady improvement in loan performance drives a 153 bps Q/Q decrease in nonperforming loans (NPL) as a % of loans held for investment NPL and Real Estate Owned (REO) resolutions in 2Q21 recovered 103.9% of UPB(2) resolved, continuing our consistent track record of net gains over and above contractual principal and interest due Completed our VCC 2021-1 securitization totaling $264.5 million of UPB, Velocity’s first securitization of 2021, which priced with a weighted average rate of 1.73% Reflects strong investor appetite and Velocity’s extensive track record of performance Velocity Financial, Inc. (NYSE:VEL) was added to the Russell 2000 and 3000 indices in June 2021 Subsequent to Quarter-End Continued to strengthen the Company’s liquidity profile with the addition of a new non-mark-to-market warehouse financing facility with a maximum capacity of $100.0 million (1) “Core” income is a non-GAAP measure which excludes non-recurring and/or unusual activities from GAAP net income. (2) Net Interest Margin (2) Unpaid Principal Balance

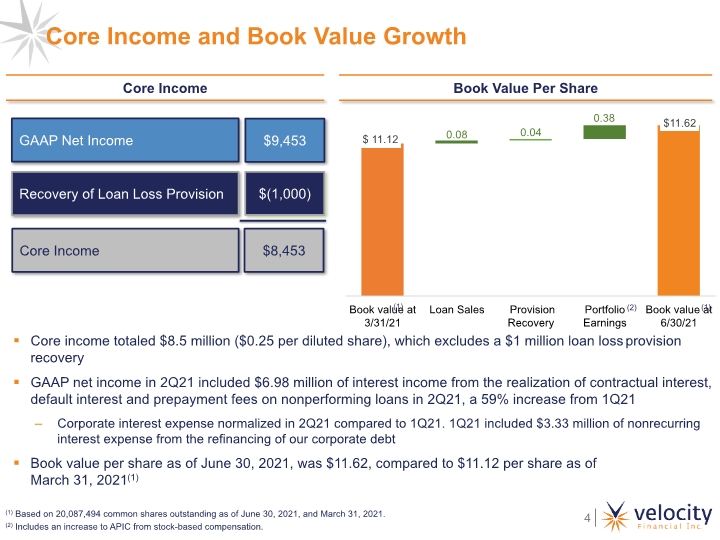

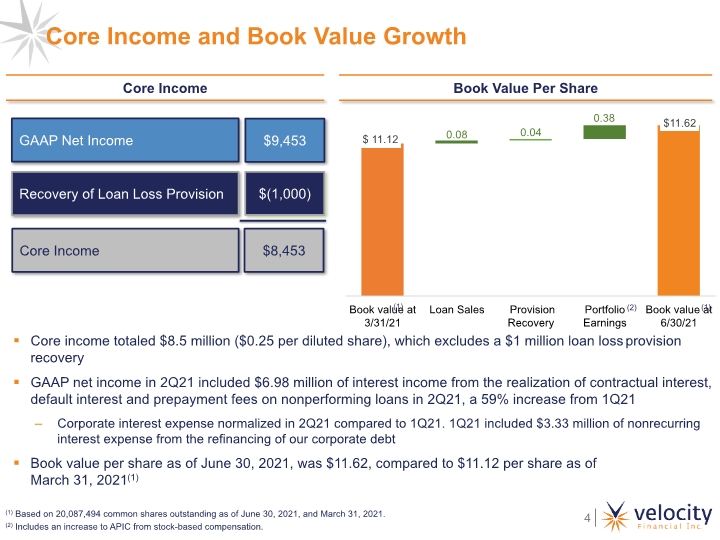

Core Income and Book Value Growth Core income totaled $8.5 million ($0.25 per diluted share), which excludes a $1 million loan loss provision recovery GAAP net income in 2Q21 included $6.98 million of interest income from the realization of contractual interest, default interest and prepayment fees on nonperforming loans in 2Q21, a 59% increase from 1Q21 Corporate interest expense normalized in 2Q21 compared to 1Q21. 1Q21 included $3.33 million of nonrecurring interest expense from the refinancing of our corporate debt Book value per share as of June 30, 2021, was $11.62, compared to $11.12 per share as of March 31, 2021(1) Core Income $8,453 (1) Based on 20,087,494 common shares outstanding as of June 30, 2021, and March 31, 2021. (2) Includes an increase to APIC from stock-based compensation. Recovery of Loan Loss Provision $(1,000) GAAP Net Income $9,453 (1) (1) (2)

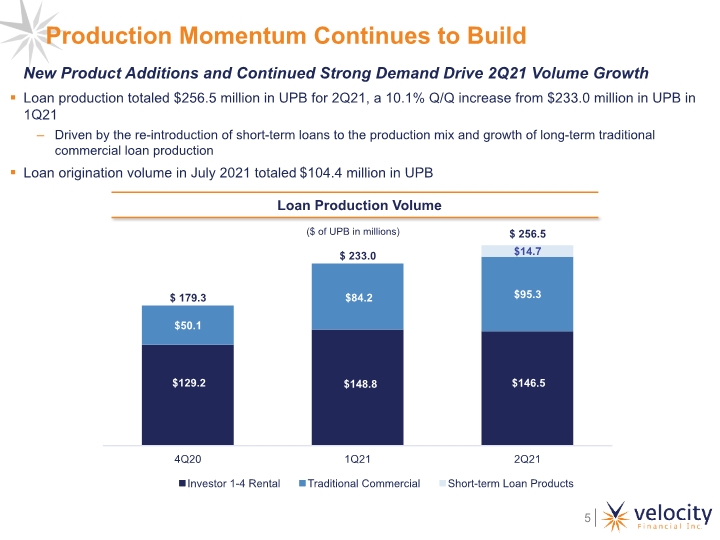

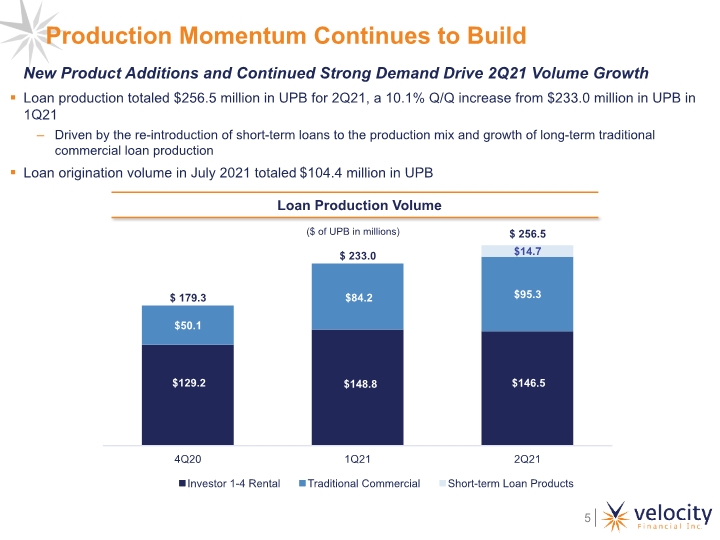

Production Momentum Continues to Build Loan production totaled $256.5 million in UPB for 2Q21, a 10.1% Q/Q increase from $233.0 million in UPB in 1Q21 Driven by the re-introduction of short-term loans to the production mix and growth of long-term traditional commercial loan production Loan origination volume in July 2021 totaled $104.4 million in UPB ($ of UPB in millions) New Product Additions and Continued Strong Demand Drive 2Q21 Volume Growth

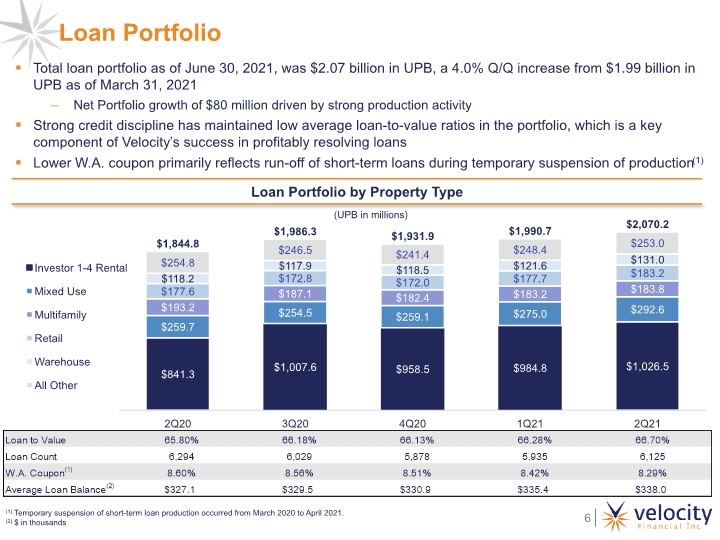

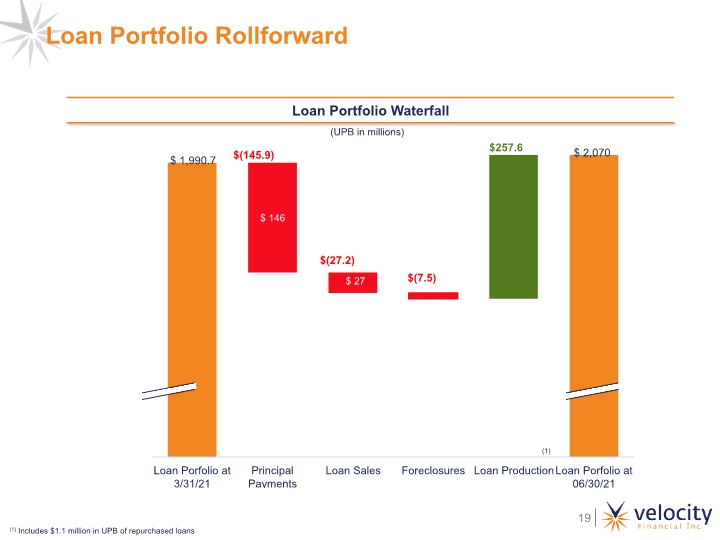

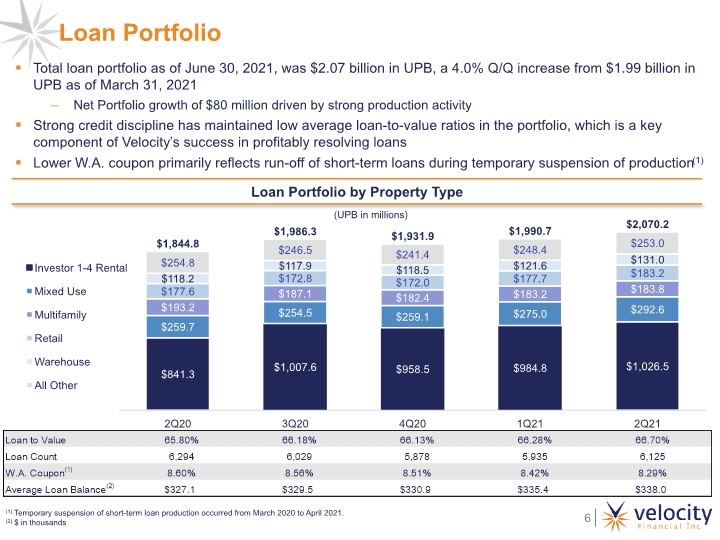

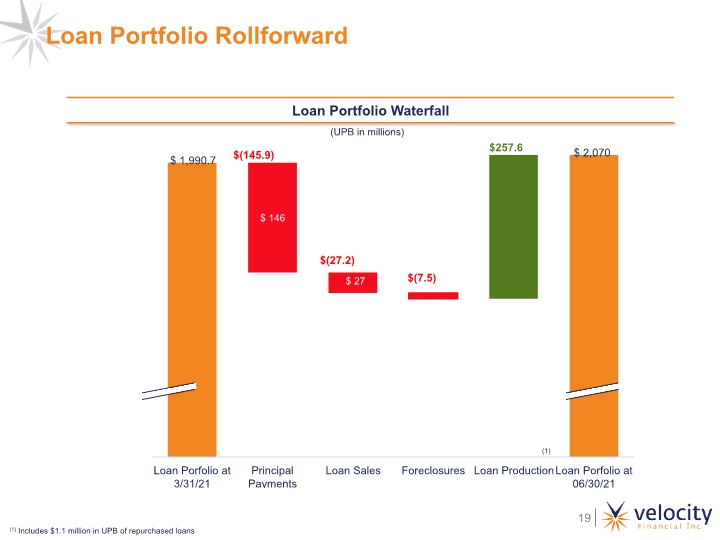

Total loan portfolio as of June 30, 2021, was $2.07 billion in UPB, a 4.0% Q/Q increase from $1.99 billion in UPB as of March 31, 2021 Net Portfolio growth of $80 million driven by strong production activity Strong credit discipline has maintained low average loan-to-value ratios in the portfolio, which is a key component of Velocity’s success in profitably resolving loans Lower W.A. coupon primarily reflects run-off of short-term loans during temporary suspension of production(1) Loan Portfolio (UPB in millions) (1) Temporary suspension of short-term loan production occurred from March 2020 to April 2021. (2) $ in thousands

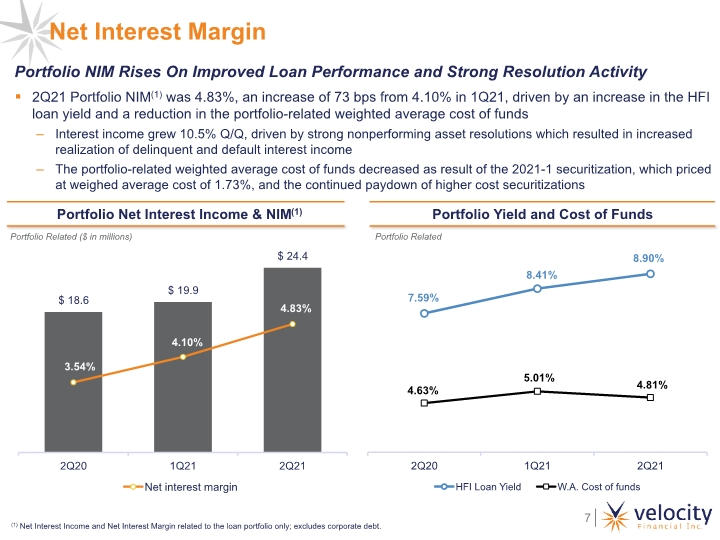

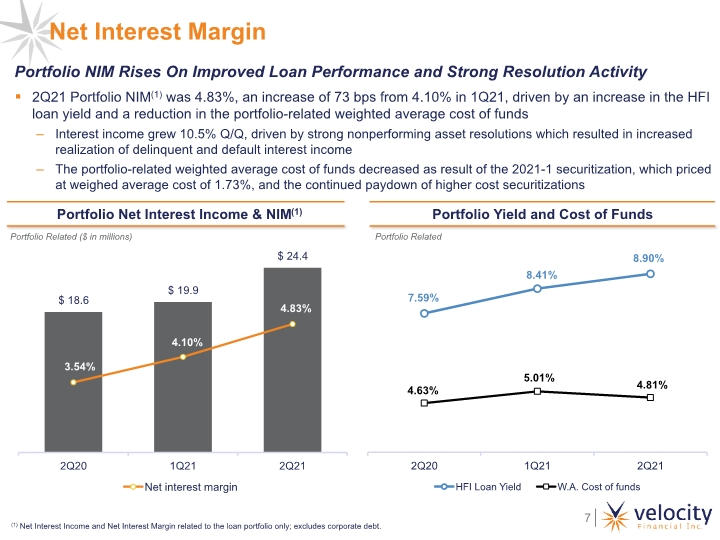

2Q21 Portfolio NIM(1) was 4.83%, an increase of 73 bps from 4.10% in 1Q21, driven by an increase in the HFI loan yield and a reduction in the portfolio-related weighted average cost of funds Interest income grew 10.5% Q/Q, driven by strong nonperforming asset resolutions which resulted in increased realization of delinquent and default interest income The portfolio-related weighted average cost of funds decreased as result of the 2021-1 securitization, which priced at weighed average cost of 1.73%, and the continued paydown of higher cost securitizations Portfolio Related Portfolio NIM Rises On Improved Loan Performance and Strong Resolution Activity Net Interest Margin (1) Net Interest Income and Net Interest Margin related to the loan portfolio only; excludes corporate debt. Portfolio Related ($ in millions)

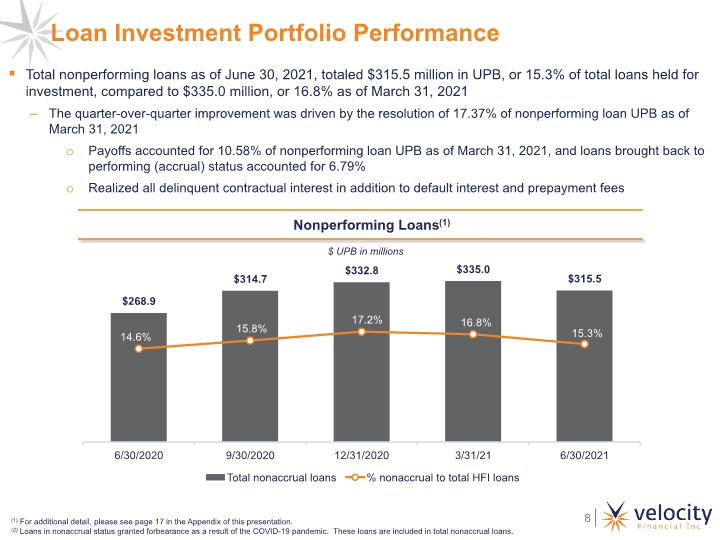

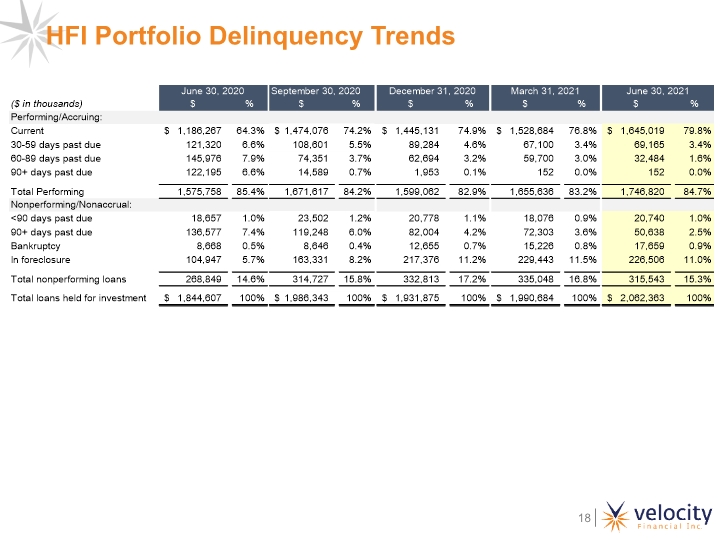

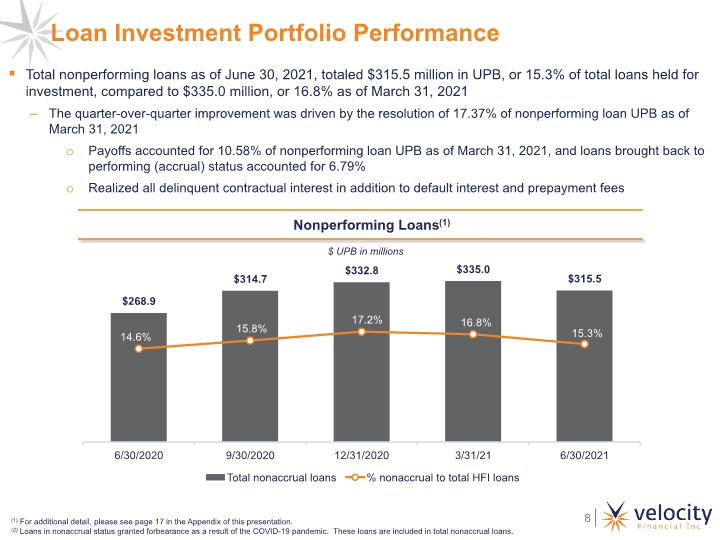

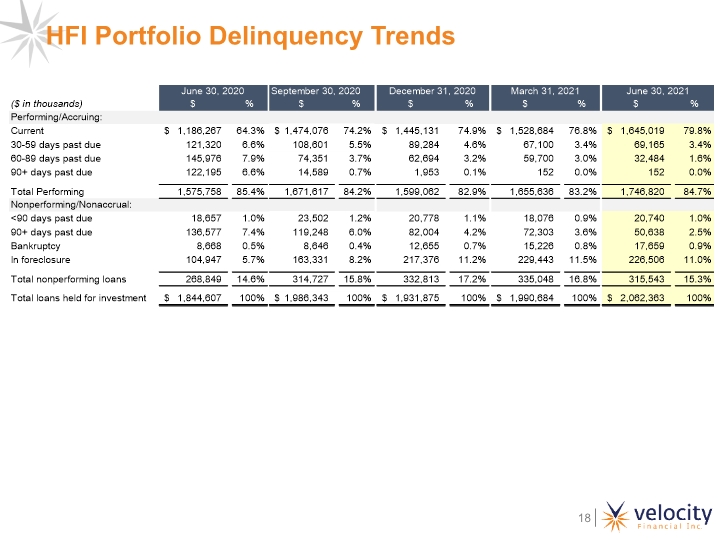

Total nonperforming loans as of June 30, 2021, totaled $315.5 million in UPB, or 15.3% of total loans held for investment, compared to $335.0 million, or 16.8% as of March 31, 2021 The quarter-over-quarter improvement was driven by the resolution of 17.37% of nonperforming loan UPB as of March 31, 2021 Payoffs accounted for 10.58% of nonperforming loan UPB as of March 31, 2021, and loans brought back to performing (accrual) status accounted for 6.79% Realized all delinquent contractual interest in addition to default interest and prepayment fees $ UPB in millions Loan Investment Portfolio Performance (1) For additional detail, please see page 17 in the Appendix of this presentation. (2) Loans in nonaccrual status granted forbearance as a result of the COVID-19 pandemic. These loans are included in total nonaccrual loans.

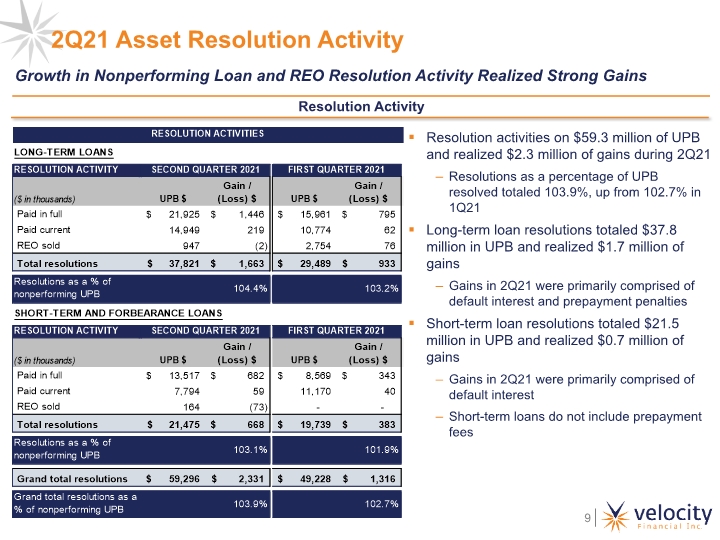

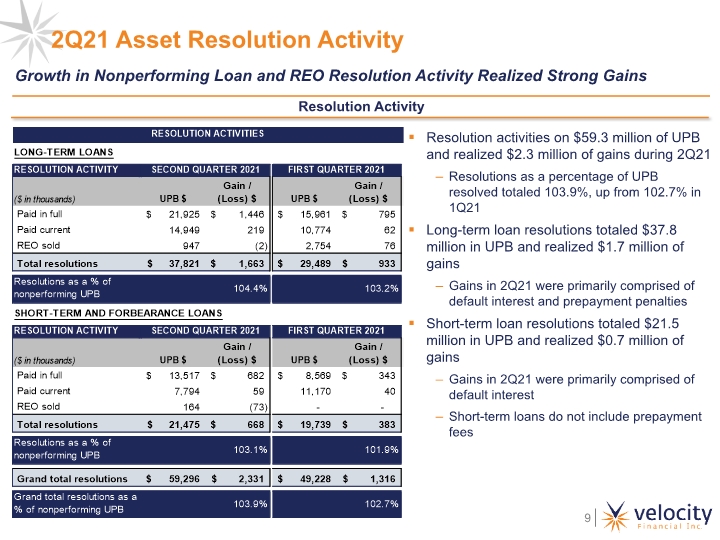

2Q21 Asset Resolution Activity Resolution activities on $59.3 million of UPB and realized $2.3 million of gains during 2Q21 Resolutions as a percentage of UPB resolved totaled 103.9%, up from 102.7% in 1Q21 Long-term loan resolutions totaled $37.8 million in UPB and realized $1.7 million of gains Gains in 2Q21 were primarily comprised of default interest and prepayment penalties Short-term loan resolutions totaled $21.5 million in UPB and realized $0.7 million of gains Gains in 2Q21 were primarily comprised of default interest Short-term loans do not include prepayment fees Growth in Nonperforming Loan and REO Resolution Activity Realized Strong Gains

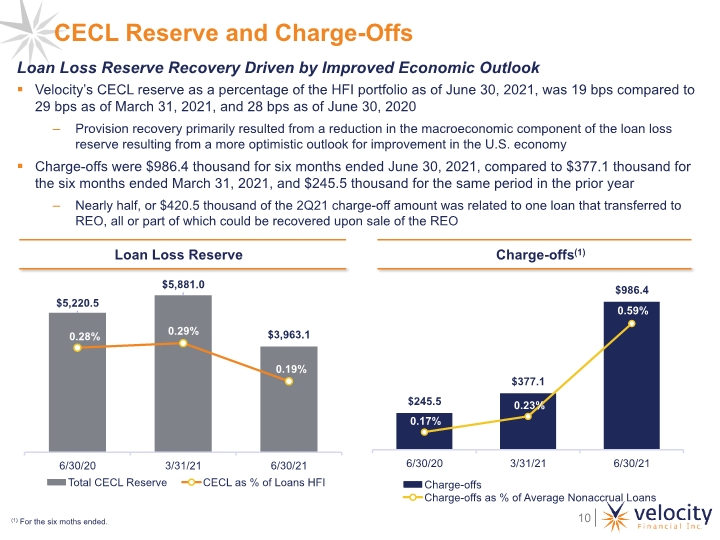

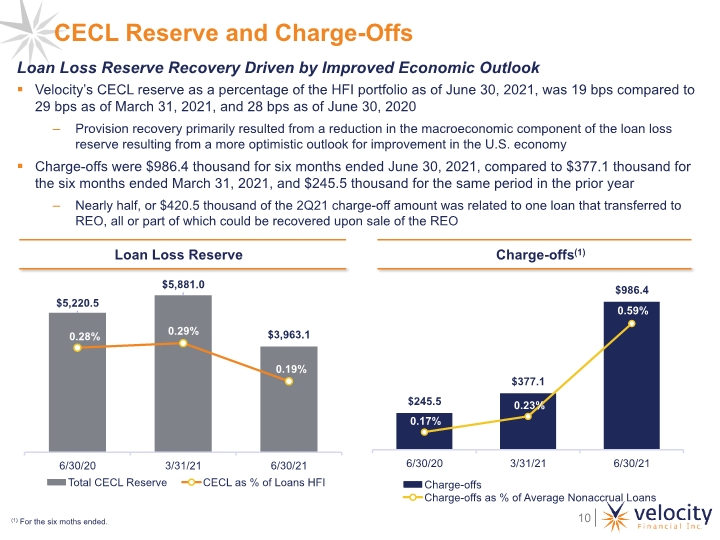

Velocity’s CECL reserve as a percentage of the HFI portfolio as of June 30, 2021, was 19 bps compared to 29 bps as of March 31, 2021, and 28 bps as of June 30, 2020 Provision recovery primarily resulted from a reduction in the macroeconomic component of the loan loss reserve resulting from a more optimistic outlook for improvement in the U.S. economy Charge-offs were $986.4 thousand for six months ended June 30, 2021, compared to $377.1 thousand for the six months ended March 31, 2021, and $245.5 thousand for the same period in the prior year Nearly half, or $420.5 thousand of the 2Q21 charge-off amount was related to one loan that transferred to REO, all or part of which could be recovered upon sale of the REO CECL Reserve and Charge-Offs Loan Loss Reserve Recovery Driven by Improved Economic Outlook (1) For the six moths ended.

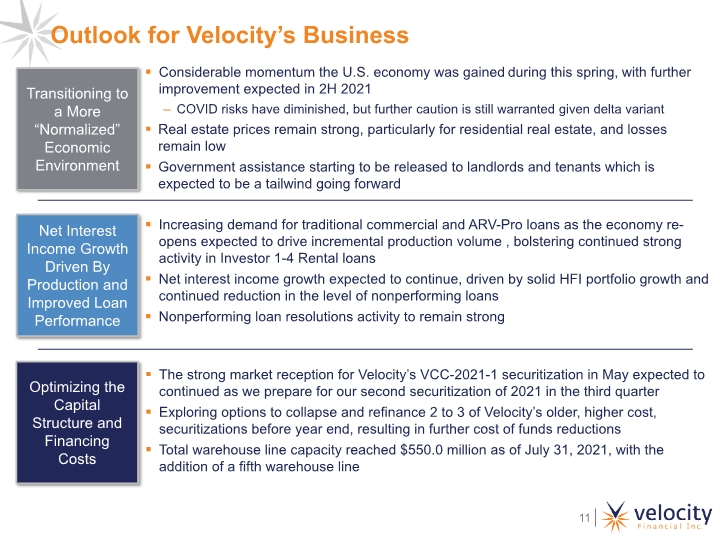

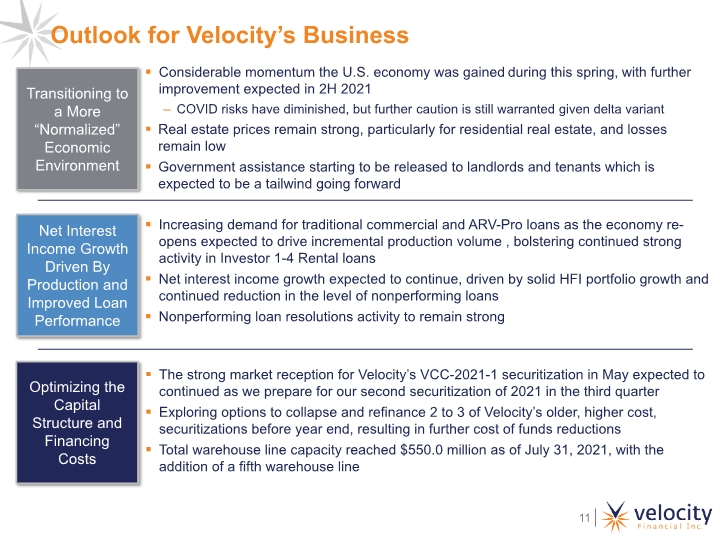

Net Interest Income Growth Driven By Production and Improved Loan Performance Optimizing the Capital Structure and Financing Costs Transitioning to a More “Normalized” Economic Environment Considerable momentum the U.S. economy was gained during this spring, with further improvement expected in 2H 2021 COVID risks have diminished, but further caution is still warranted given delta variant Real estate prices remain strong, particularly for residential real estate, and losses remain low Government assistance starting to be released to landlords and tenants which is expected to be a tailwind going forward The strong market reception for Velocity’s VCC-2021-1 securitization in May expected to continued as we prepare for our second securitization of 2021 in the third quarter Exploring options to collapse and refinance 2 to 3 of Velocity’s older, higher cost, securitizations before year end, resulting in further cost of funds reductions Total warehouse line capacity reached $550.0 million as of July 31, 2021, with the addition of a fifth warehouse line Increasing demand for traditional commercial and ARV-Pro loans as the economy re-opens expected to drive incremental production volume , bolstering continued strong activity in Investor 1-4 Rental loans Net interest income growth expected to continue, driven by solid HFI portfolio growth and continued reduction in the level of nonperforming loans Nonperforming loan resolutions activity to remain strong Outlook for Velocity’s Business

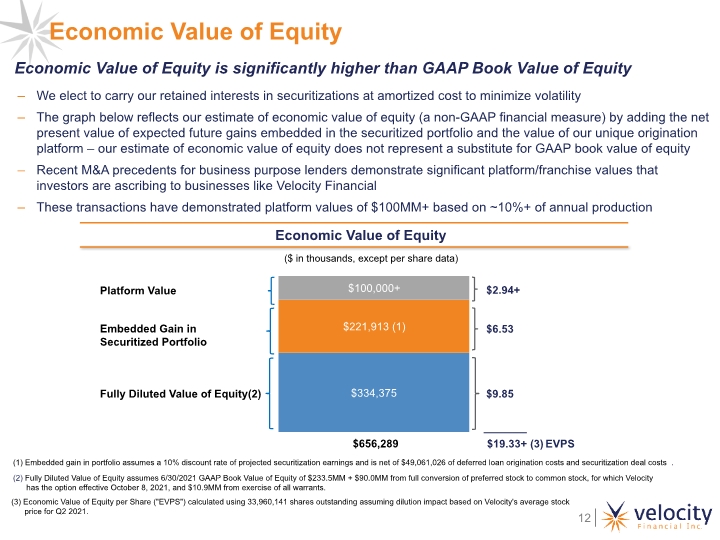

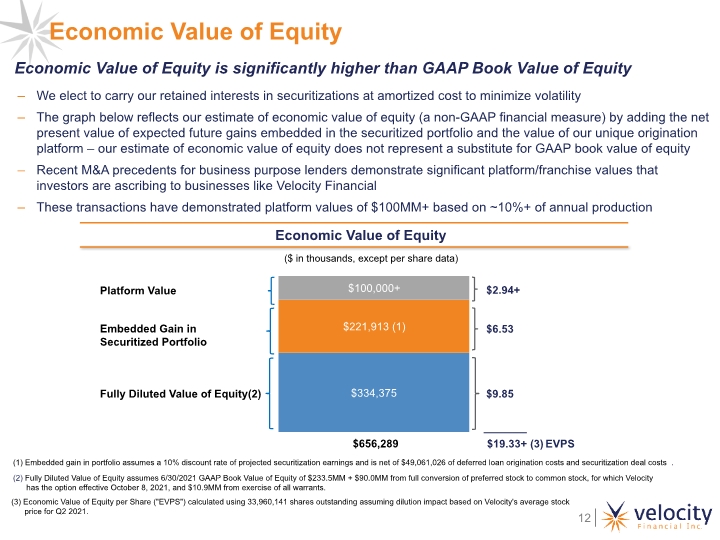

We elect to carry our retained interests in securitizations at amortized cost to minimize volatility The graph below reflects our estimate of economic value of equity (a non-GAAP financial measure) by adding the net present value of expected future gains embedded in the securitized portfolio and the value of our unique origination platform – our estimate of economic value of equity does not represent a substitute for GAAP book value of equity Recent M&A precedents for business purpose lenders demonstrate significant platform/franchise values that investors are ascribing to businesses like Velocity Financial These transactions have demonstrated platform values of $100MM+ based on ~10%+ of annual production Economic Value of Equity is significantly higher than GAAP Book Value of Equity Economic Value of Equity (1) Embedded gain in portfolio assumes a 10% discount rate of projected securitization earnings and is net of $49,061,026 of deferred loan origination costs and securitization deal costs. (2) Fully Diluted Value of Equity assumes 6/30/2021 GAAP Book Value of Equity of $233.5MM + $90.0MM from full conversion of preferred stock to common stock, for which Velocity has the option effective October 8, 2021, and $10.9MM from exercise of all warrants. (3) Economic Value of Equity per Share ("EVPS") calculated using 33,960,141 shares outstanding assuming dilution impact based on Velocity's average stock price for Q2 2021. $2.94+ $6.53 $9.85 $19.33+ (3) EVPS

Appendix

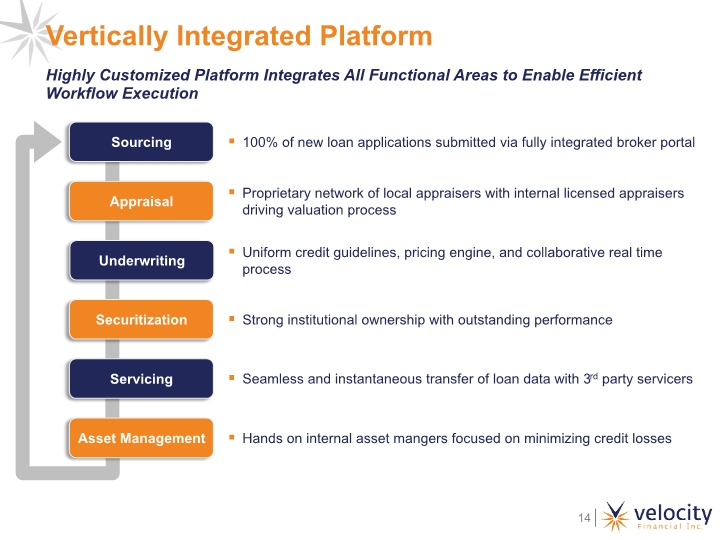

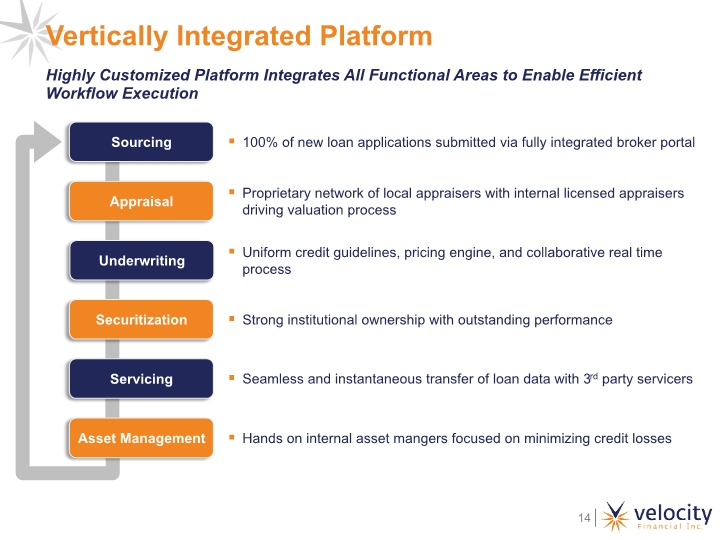

Vertically Integrated Platform Highly Customized Platform Integrates All Functional Areas to Enable Efficient Workflow Execution Sourcing Appraisal Securitization Asset Management Underwriting Servicing 100% of new loan applications submitted via fully integrated broker portal Proprietary network of local appraisers with internal licensed appraisers driving valuation process Uniform credit guidelines, pricing engine, and collaborative real time process Strong institutional ownership with outstanding performance Seamless and instantaneous transfer of loan data with 3rd party servicers Hands on internal asset mangers focused on minimizing credit losses

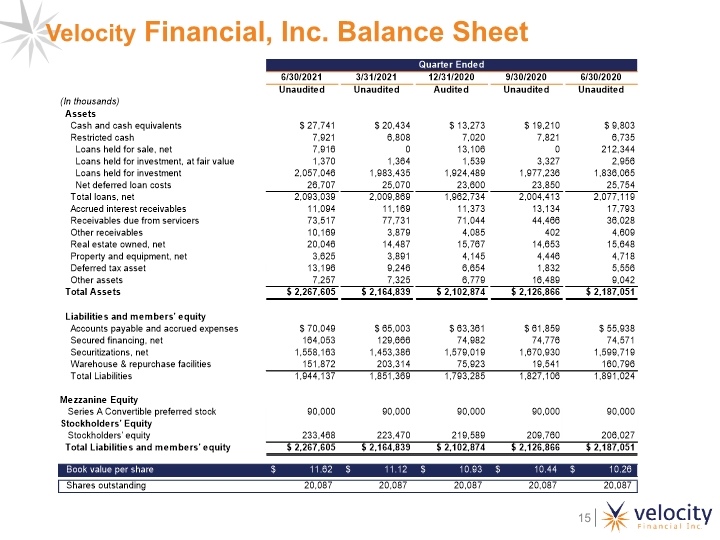

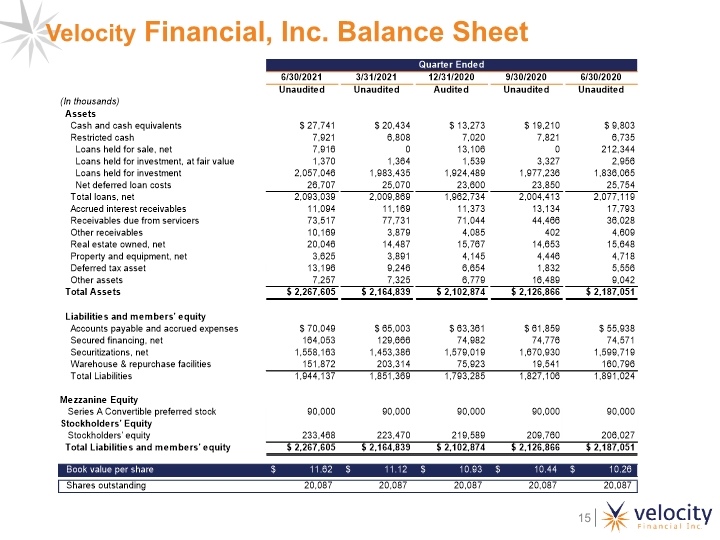

Velocity Financial, Inc. Balance Sheet

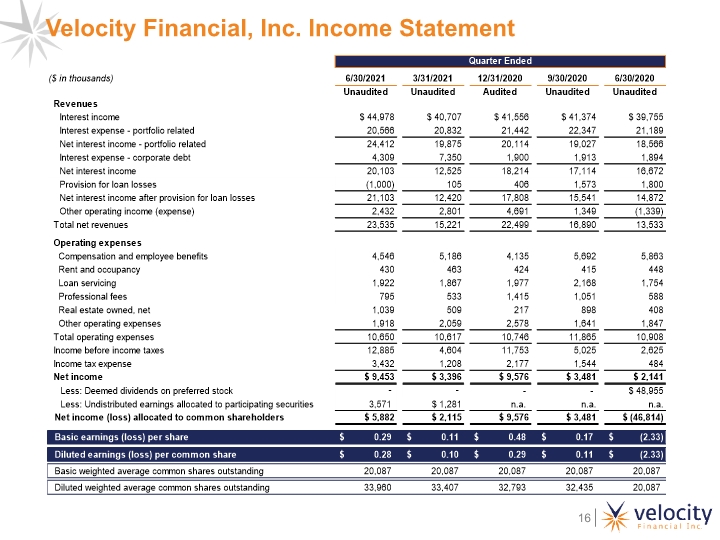

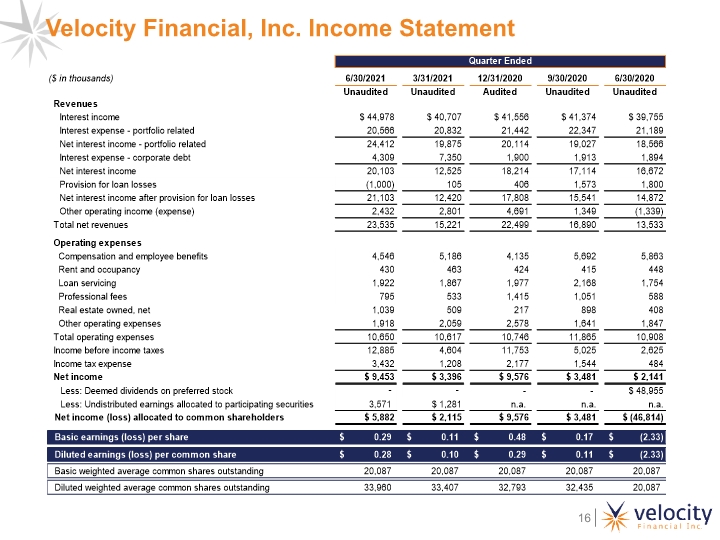

Velocity Financial, Inc. Income Statement

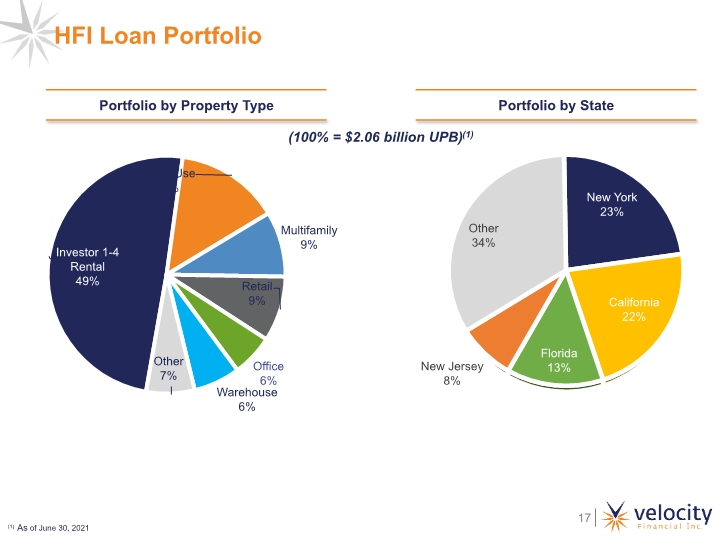

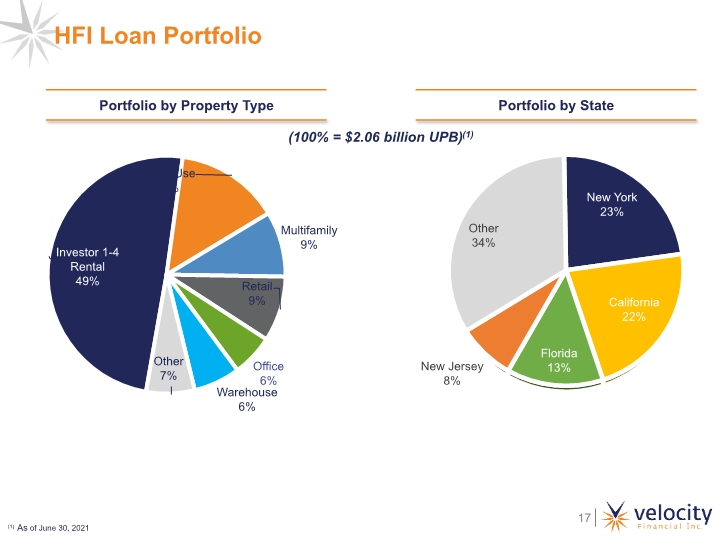

HFI Loan Portfolio (100% = $2.06 billion UPB)(1) (1) As of June 30, 2021

HFI Portfolio Delinquency Trends

Loan Portfolio Rollforward $(145.9) $(27.2) (UPB in millions) (1) $257.6 $(7.5) (1) Includes $1.1 million in UPB of repurchased loans