2018 Sagicor Transaction Exhibit 99.1

Forward-Looking Statements This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. You can identify these forward-looking statements by the use of terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words or phrases. Such forward-looking statements are subject to various risks and uncertainties, including those described under the section entitled “Risk Factors” in Playa's Current Report on Form 8-K filed with the SEC on March 14, 2017, as such factors may be updated from time to time in our periodic filings with Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in Playa’s filings with the SEC. While forward-looking statements reflect Playa’s good faith beliefs, they are not guarantees of future performance. Playa disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes after the date of this presentation, except as required by applicable law. You should not place undue reliance on any forward-looking statements, which are based only on information currently available to us (or to third parties making the forward-looking statements). Use of non-GAAP Financial Measures This presentation includes non-GAAP financial measures, including Adjusted EBITDA. Please refer to Playa's Quarterly Report on Form 10-Q for the quarter ended September 30, 2017, for detailed definitions of these measures, reconciliations of these measures to the nearest comparable GAAP measures and cautionary information on the use of non-GAAP measures, as well as to the Appendix to this presentation for an Adjusted EBITDA reconciliation to GAAP net income. Third-Party Information This presentation also contains information and statistics relating to the travel and tourism industry and the all-inclusive segment in certain markets. Playa has derived such information and data from third-party reports or other sources without independent verification. No assurance can be given regarding the accuracy or appropriateness of such information and data. You should not place undue reliance on such information and data in this presentation.

Playa Overview

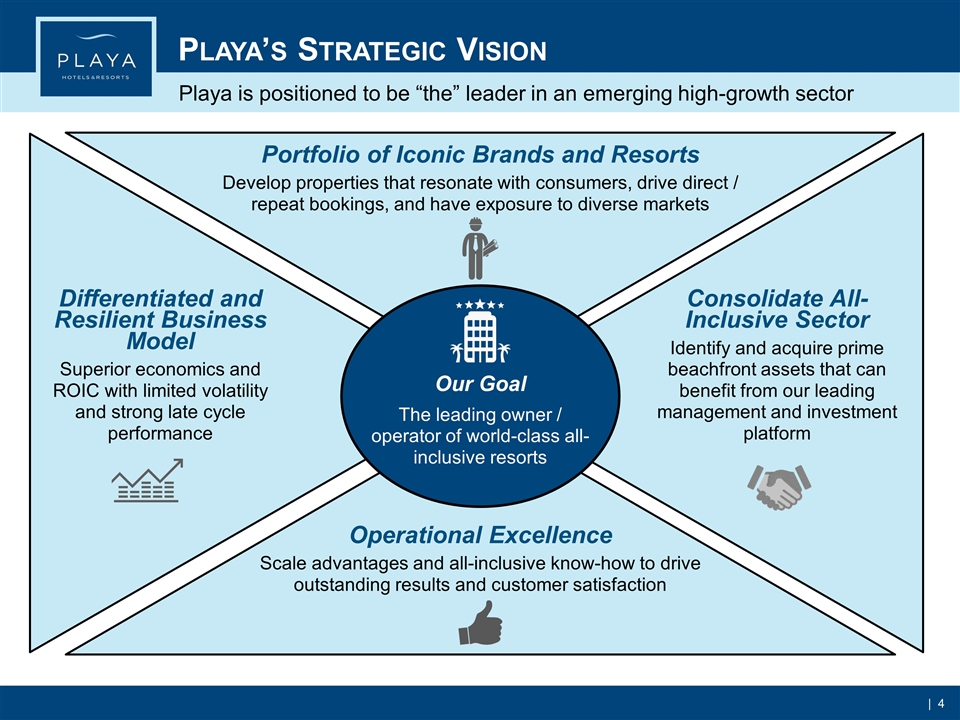

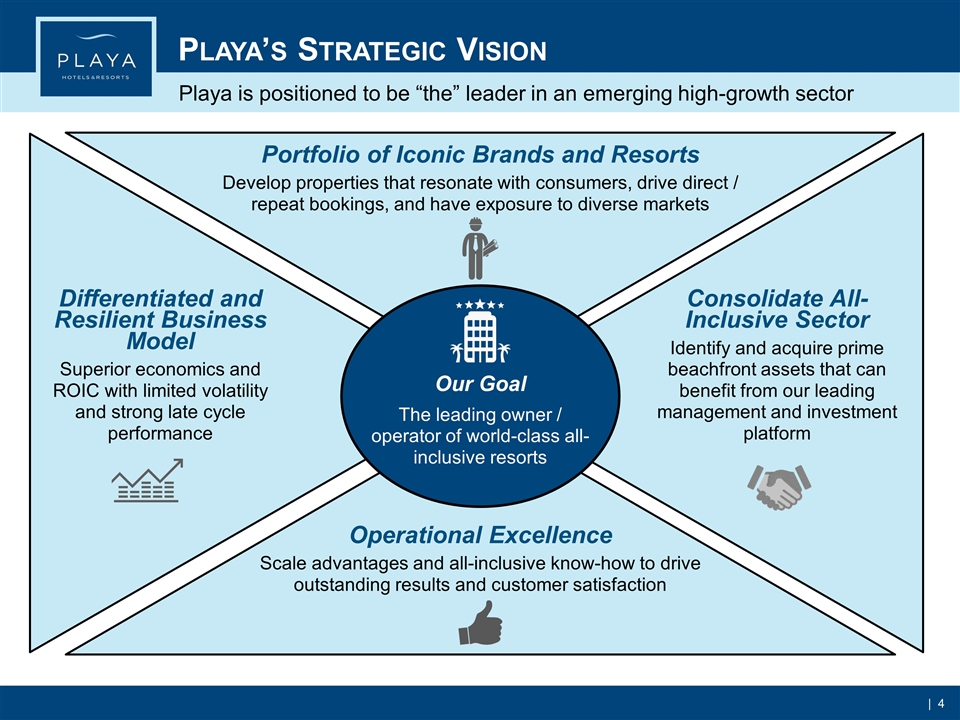

Playa is positioned to be “the” leader in an emerging high-growth sector Playa’s Strategic Vision Operational Excellence Scale advantages and all-inclusive know-how to drive outstanding results and customer satisfaction Portfolio of Iconic Brands and Resorts Develop properties that resonate with consumers, drive direct / repeat bookings, and have exposure to diverse markets Our Goal The leading owner / operator of world-class all-inclusive resorts Differentiated and Resilient Business Model Superior economics and ROIC with limited volatility and strong late cycle performance Consolidate All-Inclusive Sector Identify and acquire prime beachfront assets that can benefit from our leading management and investment platform

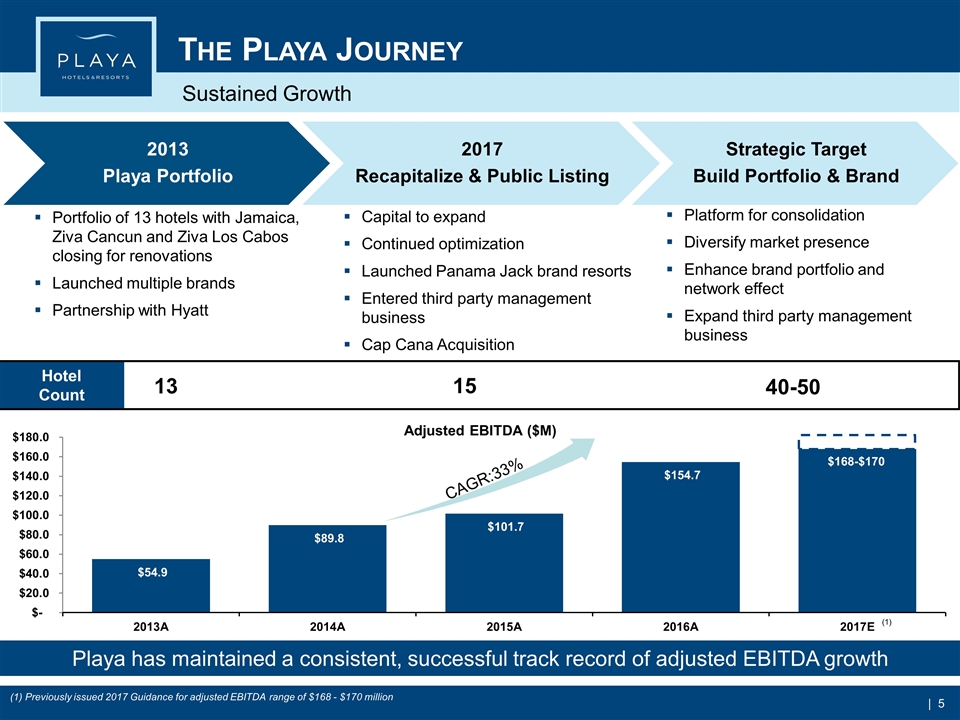

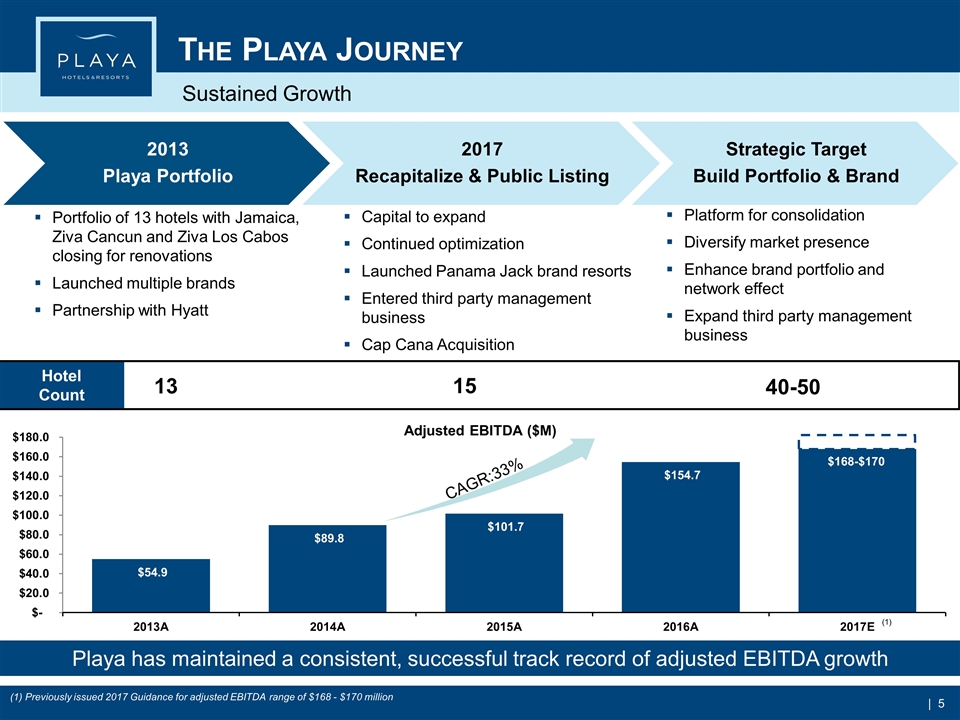

Sustained Growth The Playa Journey Portfolio of 13 hotels with Jamaica, Ziva Cancun and Ziva Los Cabos closing for renovations Launched multiple brands Partnership with Hyatt Capital to expand Continued optimization Launched Panama Jack brand resorts Entered third party management business Cap Cana Acquisition Platform for consolidation Diversify market presence Enhance brand portfolio and network effect Expand third party management business Hotel Count Playa has maintained a consistent, successful track record of adjusted EBITDA growth 13 15 40-50 CAGR:33% $168-$170 (1) Previously issued 2017 Guidance for adjusted EBITDA range of $168 - $170 million (1) 2013 Playa Portfolio 2017 Recapitalize & Public Listing Strategic Target Build Portfolio & Brand

Playa’s Accomplishments in 2017 STRATEGIC INITIATIVES FINANCIAL IMPROVEMENTS Term Loan B Add-on December 2017 Added $380mm to our existing Term Loan to pay off remaining $360mm of Senior Notes ($10mm annual interest savings) Launch of Panama Jack Brand Resorts January 2017 January licensing agreement Q3 conversion of Gran Caribe and Gran Porto à launched in late Q4 2017 Playa Overview NASDAQ Listing (PLYA) March 2017 Merged with PACE Holdings Corp. Debt Recapitalization April 2017 Upsized Term Loan to $530mm, increased Revolving Credit Facility to $100mm and redeemed $115mm in Senior Notes Reduced interest rates Growth Capex Projects in Jamaica, Puerto Vallarta and Cancún May 2017 Launched capex development projects in various locations Warrant Exchange June 2017 Exchanged all public and certain private warrants for shares of common stock Entered Third Party Management Business September 2017 Launched high margin, high growth management business Exclusive use of Sanctuary brand Cap Cana Acquisition July 2017 Acquired 40+ Acres of World-Class Beachfront Broke ground on a 750-room Hyatt Ziva and Zilara resort in Q3 2017 December 2017 Conversion efforts started during low season to minimize guest disruption Official inauguration began in Dec 2017 Panama Jack Opens

Sagicor Transaction Overview

Transaction Overview Sagicor Portfolio Montego Bay Int’l. Airport Existing Playa Resort Jamaica Hilton Rose Hall Jewel Runaway Bay Jewel Dunn’s River Jewel Palmyra \ Jewel Grande Jewel Paradise Cove 1 1 2 2 3 3 4 5 4 5 Partial transaction of existing Jewel Grande 88 room tower expected to be repositioned as a Hyatt Ziva Palmyra in 2021 Information on expected rooms added and opening dates are based on Playa’s current expectations and are subject to change. +2 Development Sites à +710 New Rooms 1 2 3 4 5 5 (2) (2)

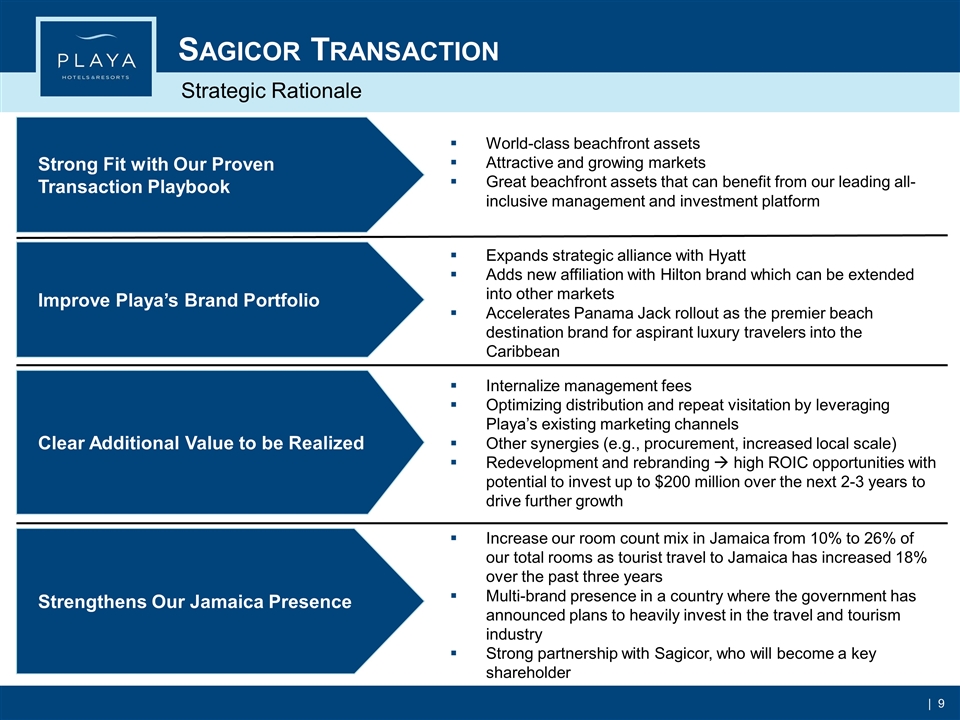

Strategic Rationale Sagicor Transaction Strong Fit with Our Proven Transaction Playbook Improve Playa’s Brand Portfolio Clear Additional Value to be Realized Strengthens Our Jamaica Presence World-class beachfront assets Attractive and growing markets Great beachfront assets that can benefit from our leading all-inclusive management and investment platform Expands strategic alliance with Hyatt Adds new affiliation with Hilton brand which can be extended into other markets Accelerates Panama Jack rollout as the premier beach destination brand for aspirant luxury travelers into the Caribbean Internalize management fees Optimizing distribution and repeat visitation by leveraging Playa’s existing marketing channels Other synergies (e.g., procurement, increased local scale) Redevelopment and rebranding à high ROIC opportunities with potential to invest up to $200 million over the next 2-3 years to drive further growth Increase our room count mix in Jamaica from 10% to 26% of our total rooms as tourist travel to Jamaica has increased 18% over the past three years Multi-brand presence in a country where the government has announced plans to heavily invest in the travel and tourism industry Strong partnership with Sagicor, who will become a key shareholder

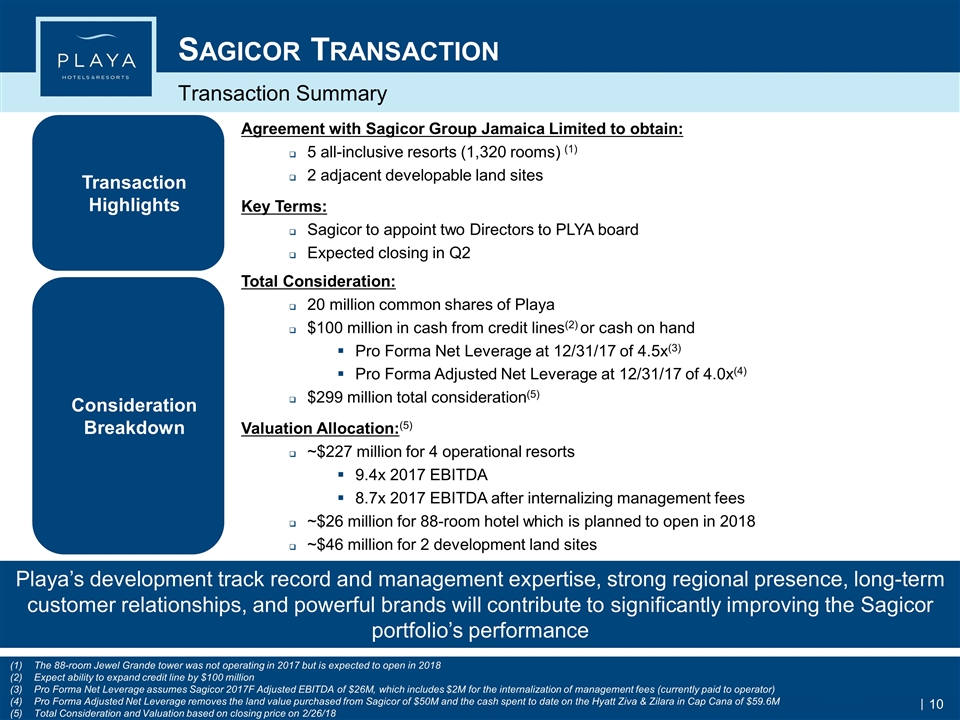

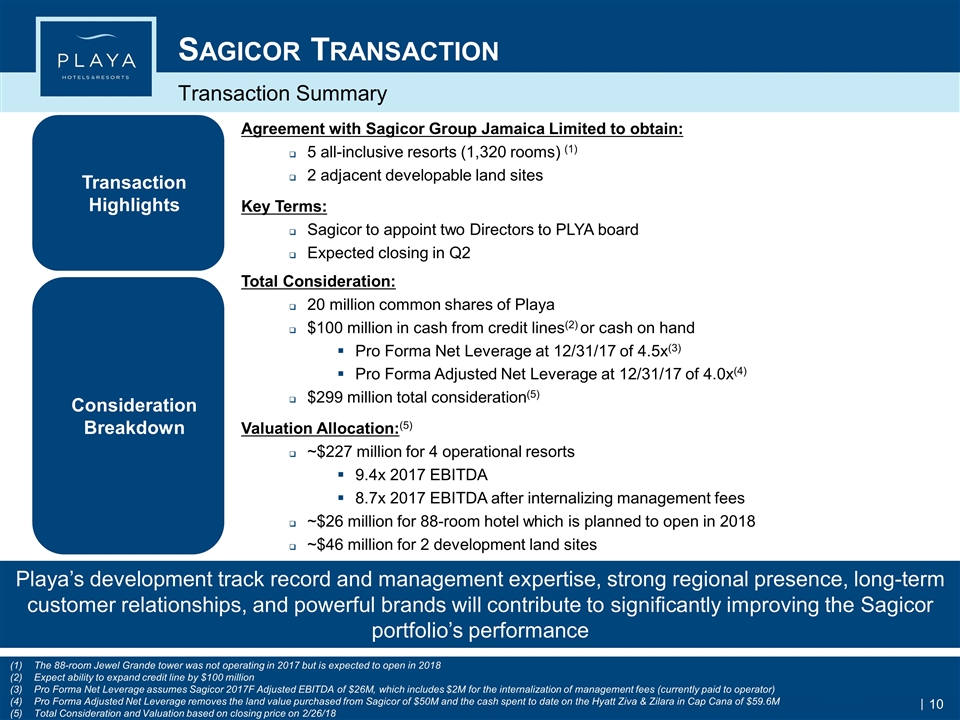

Sagicor Transaction Playa’s development track record and management expertise, strong regional presence, long-term customer relationships, and powerful brands will contribute to significantly improving the Sagicor portfolio’s performance Transaction Summary Agreement with Sagicor Group Jamaica Limited to obtain: 5 all-inclusive resorts (1,320 rooms) (1) 2 adjacent developable land sites Key Terms: Sagicor to appoint two Directors to PLYA board Expected closing in Q2 The 88-room Jewel Grande tower was not operating in 2017 but is expected to open in 2018 Expect ability to expand credit line by $100 million Pro Forma Net Leverage assumes Sagicor 2017F Adjusted EBITDA of $26M, which includes $2M for the internalization of management fees (currently paid to operator) Pro Forma Adjusted Net Leverage removes the land value purchased from Sagicor of $50M and the cash spent to date on the Hyatt Ziva & Zilara in Cap Cana of $59.6M Total Consideration and Valuation based on closing price on 2/26/18 Transaction Highlights Consideration Breakdown Total Consideration: 20 million common shares of Playa $100 million in cash from credit lines(2) or cash on hand Pro Forma Net Leverage at 12/31/17 of 4.5x(3) Pro Forma Adjusted Net Leverage at 12/31/17 of 4.0x(4) $299 million total consideration(5) Valuation Allocation:(5) ~$227 million for 4 operational resorts 9.4x 2017 EBITDA 8.7x 2017 EBITDA after internalizing management fees ~$26 million for 88-room hotel which is planned to open in 2018 ~$46 million for 2 development land sites 10

Combined Brand Portfolio Transaction Increases Number of High Quality Brands Under Management Expands total addressable market and positions Playa to drive additional Hilton and Jewel Resorts demand through direct bookings 5 – Star Luxury Boutique 4 – Star 5 – Star Luxury All-Inclusive New Brands |

Expansion/Renovations Potential investment in the renovation and upgrade of certain equipment located at the back of the house of the resort in 2018 Potential expansion of the property by adding 80 rooms expected to open in 2020. The hotel will not need to close and minimal disruption is expected Current estimate of discretionary capital investment to be spent over the next 3 to 4 years is $20M and is still subject to Board approval $5M for renovation and upgrade of equipment $16M ($200k/key) for new rooms Expected stabilized year range is 2020 - 2022 Hilton Rose Hall Resort Redevelopment Project Cost: $20M - 22M (1) Cash-on-Cash Return (3) Stabilized Year: 43% - 49% Adjusted EBITDA and Project Cost does not include any development on the adjacent 13-acre site 2016A and 2017F historical adjusted EBITDA reflect terms of transaction (before synergies) and includes internalization of management fees originally paid to third party Cash-on-Cash return calculated by dividing the incremental EBITDA generated by the renovation (Stabilized Year incremental EBITDA over 2017) by the redevelopment cost (2) (2) Sagicor Portfolio $22 - $23

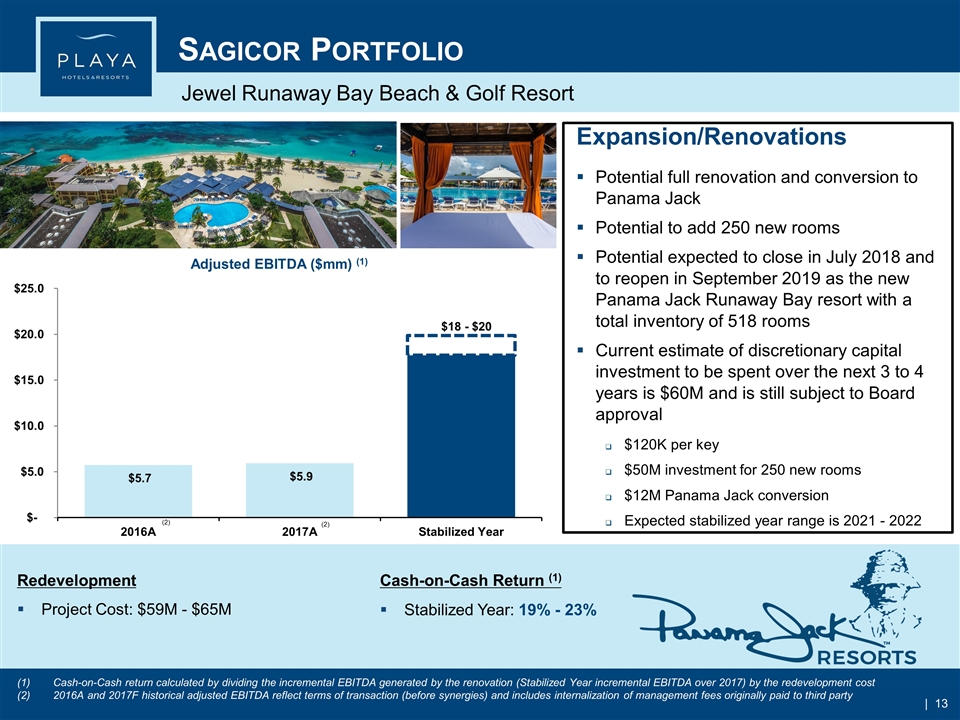

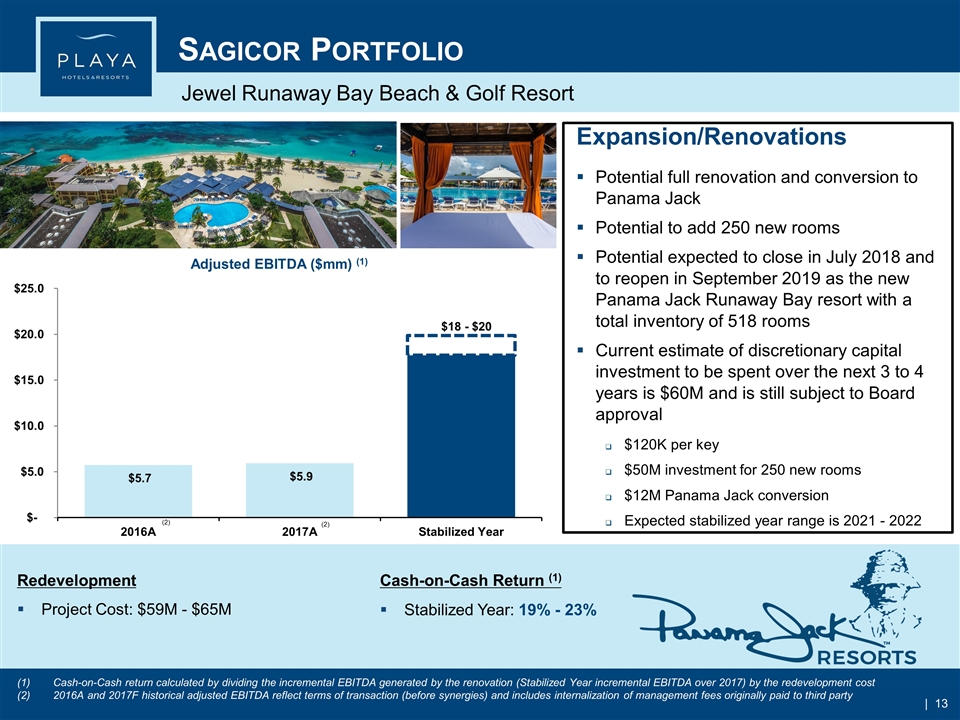

Expansion/Renovations Potential full renovation and conversion to Panama Jack Potential to add 250 new rooms Potential expected to close in July 2018 and to reopen in September 2019 as the new Panama Jack Runaway Bay resort with a total inventory of 518 rooms Current estimate of discretionary capital investment to be spent over the next 3 to 4 years is $60M and is still subject to Board approval $120K per key $50M investment for 250 new rooms $12M Panama Jack conversion Expected stabilized year range is 2021 - 2022 Jewel Runaway Bay Beach & Golf Resort Redevelopment Project Cost: $59M - $65M Cash-on-Cash Return (1) Stabilized Year: 19% - 23% Cash-on-Cash return calculated by dividing the incremental EBITDA generated by the renovation (Stabilized Year incremental EBITDA over 2017) by the redevelopment cost 2016A and 2017F historical adjusted EBITDA reflect terms of transaction (before synergies) and includes internalization of management fees originally paid to third party Sagicor Portfolio (2) (2) $18 - $20

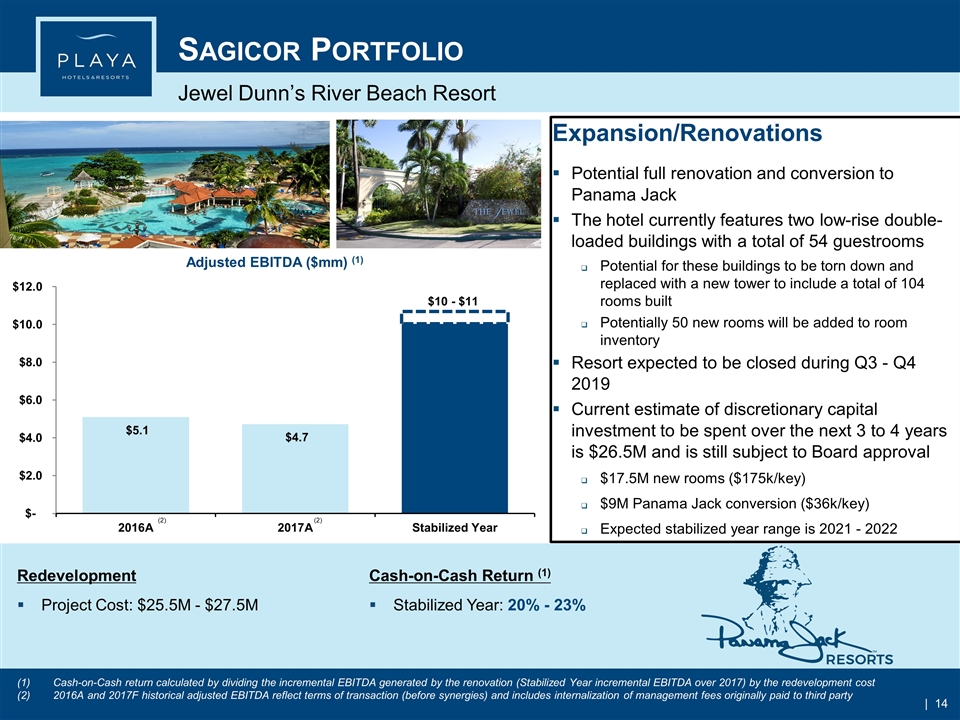

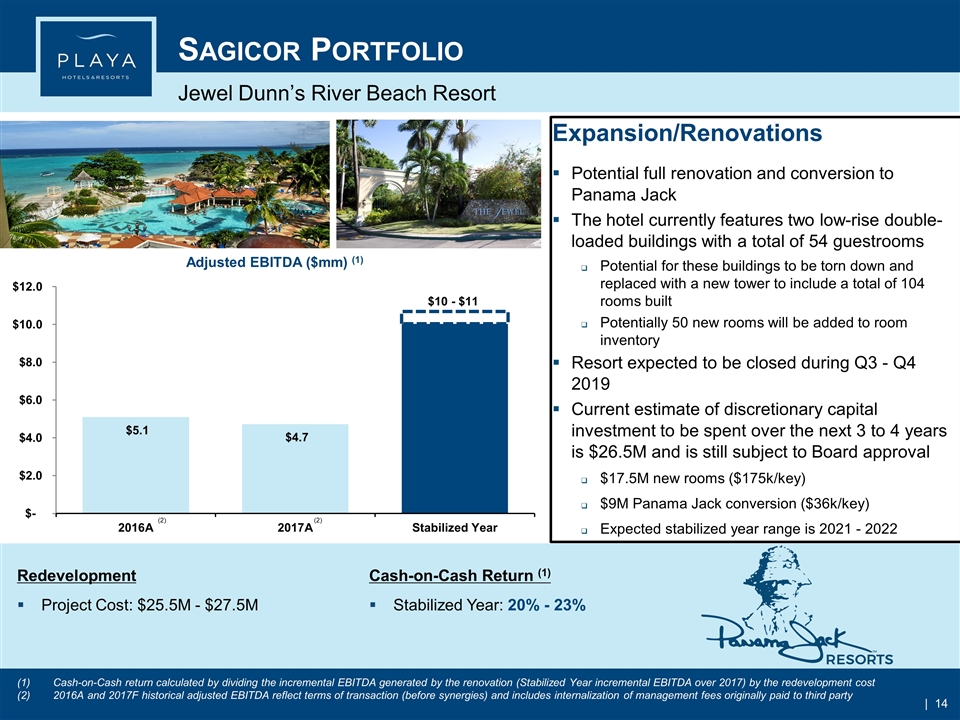

Expansion/Renovations Potential full renovation and conversion to Panama Jack The hotel currently features two low-rise double-loaded buildings with a total of 54 guestrooms Potential for these buildings to be torn down and replaced with a new tower to include a total of 104 rooms built Potentially 50 new rooms will be added to room inventory Resort expected to be closed during Q3 - Q4 2019 Current estimate of discretionary capital investment to be spent over the next 3 to 4 years is $26.5M and is still subject to Board approval $17.5M new rooms ($175k/key) $9M Panama Jack conversion ($36k/key) Expected stabilized year range is 2021 - 2022 Jewel Dunn’s River Beach Resort Redevelopment Project Cost: $25.5M - $27.5M Cash-on-Cash Return (1) Stabilized Year: 20% - 23% Sagicor Portfolio (2) (2) Cash-on-Cash return calculated by dividing the incremental EBITDA generated by the renovation (Stabilized Year incremental EBITDA over 2017) by the redevelopment cost 2016A and 2017F historical adjusted EBITDA reflect terms of transaction (before synergies) and includes internalization of management fees originally paid to third party $10 - $11

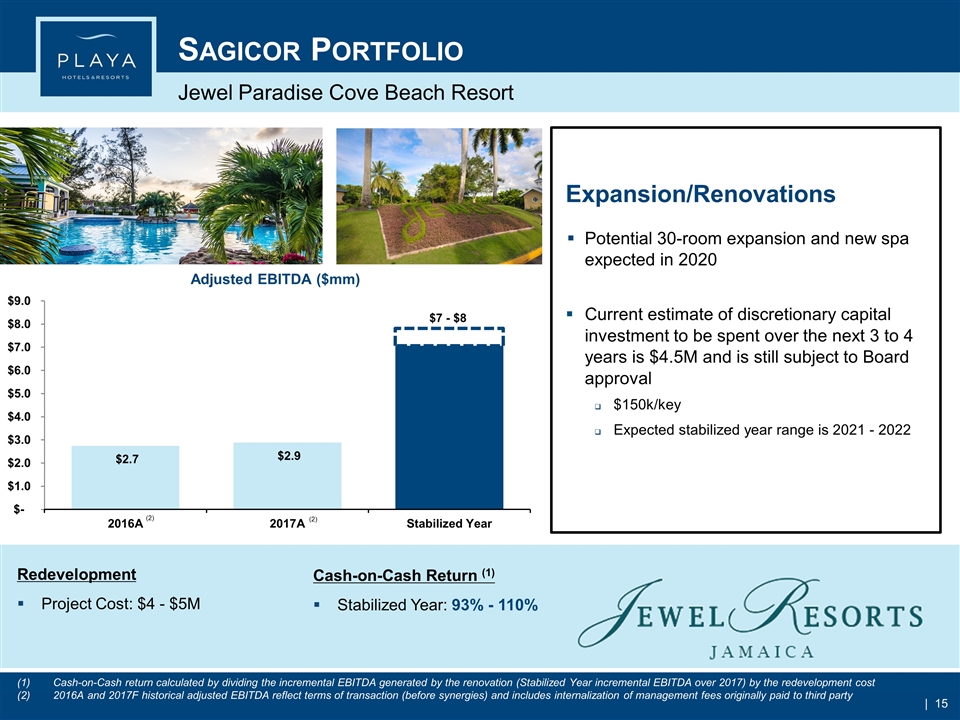

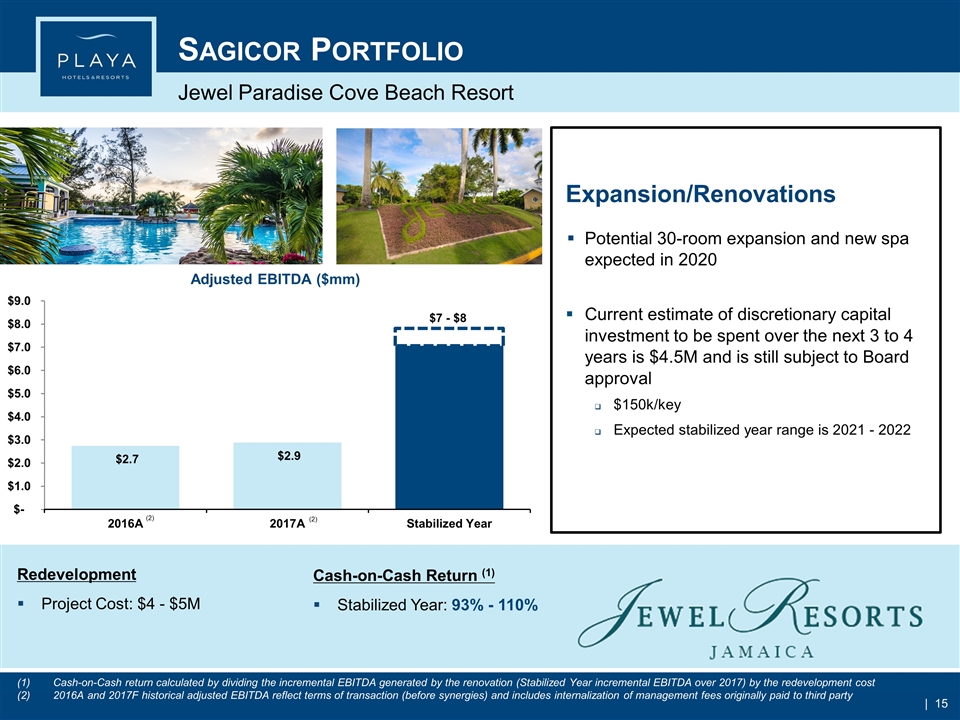

Expansion/Renovations Potential 30-room expansion and new spa expected in 2020 Current estimate of discretionary capital investment to be spent over the next 3 to 4 years is $4.5M and is still subject to Board approval $150k/key Expected stabilized year range is 2021 - 2022 Jewel Paradise Cove Beach Resort Redevelopment Project Cost: $4 - $5M Cash-on-Cash Return (1) Stabilized Year: 93% - 110% (2) (2) Sagicor Portfolio Cash-on-Cash return calculated by dividing the incremental EBITDA generated by the renovation (Stabilized Year incremental EBITDA over 2017) by the redevelopment cost 2016A and 2017F historical adjusted EBITDA reflect terms of transaction (before synergies) and includes internalization of management fees originally paid to third party $7 - $8

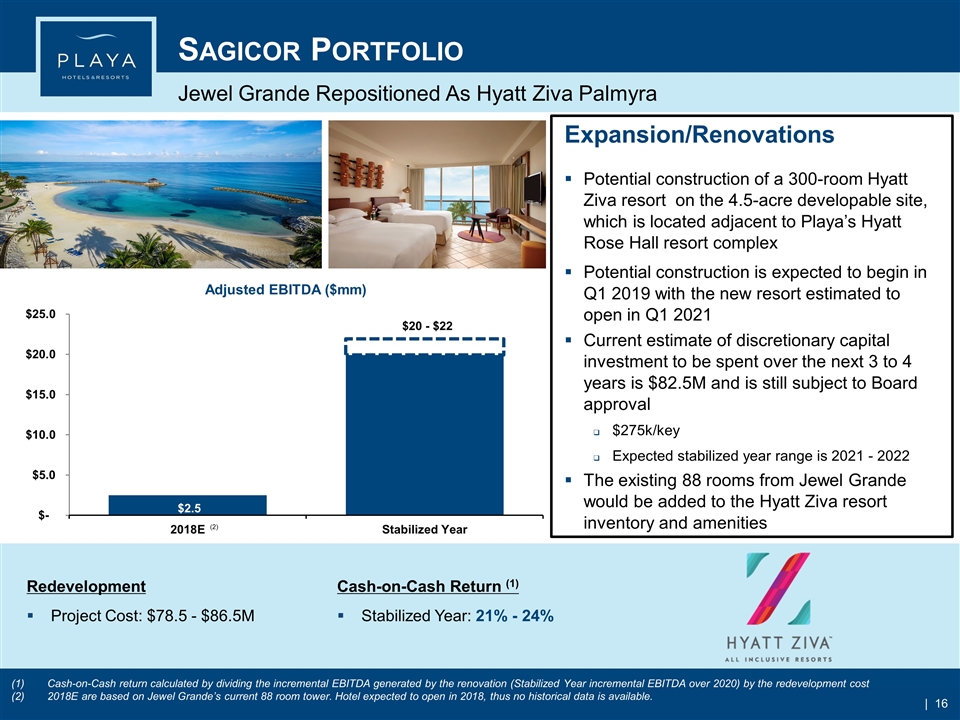

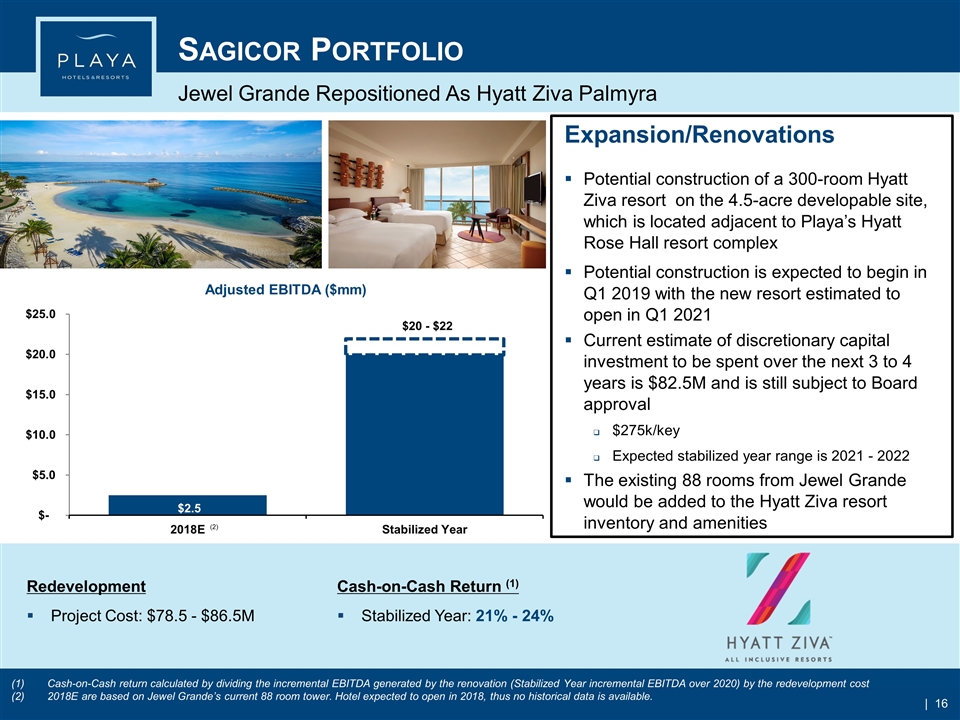

Expansion/Renovations Potential construction of a 300-room Hyatt Ziva resort on the 4.5-acre developable site, which is located adjacent to Playa’s Hyatt Rose Hall resort complex Potential construction is expected to begin in Q1 2019 with the new resort estimated to open in Q1 2021 Current estimate of discretionary capital investment to be spent over the next 3 to 4 years is $82.5M and is still subject to Board approval $275k/key Expected stabilized year range is 2021 - 2022 The existing 88 rooms from Jewel Grande would be added to the Hyatt Ziva resort inventory and amenities Jewel Grande Repositioned As Hyatt Ziva Palmyra Redevelopment Project Cost: $78.5 - $86.5M Cash-on-Cash Return (1) Stabilized Year: 21% - 24% Sagicor Portfolio Cash-on-Cash return calculated by dividing the incremental EBITDA generated by the renovation (Stabilized Year incremental EBITDA over 2020) by the redevelopment cost 2018E are based on Jewel Grande’s current 88 room tower. Hotel expected to open in 2018, thus no historical data is available. (2) $20 - $22

Expansion/Renovations During the second half of 2020, Playa’s existing Hyatt Ziva Rose Hall will be repositioned as a Hyatt Zilara Estimated investment of $5M ($13k/key) As a result, existing Hyatt Rose Hall hotel will be a Hyatt Zilara only – next to the new Hyatt Ziva that will be built on 4.5-acre developable site Playa’s Existing Hyatt Ziva Repositioned as a Hyatt Zilara Redevelopment Project Cost: $5M All 386 Hyatt Ziva Rose Hall rooms to be converted and added to adjoining Hyatt Zilara Rose Hall Sagicor Portfolio

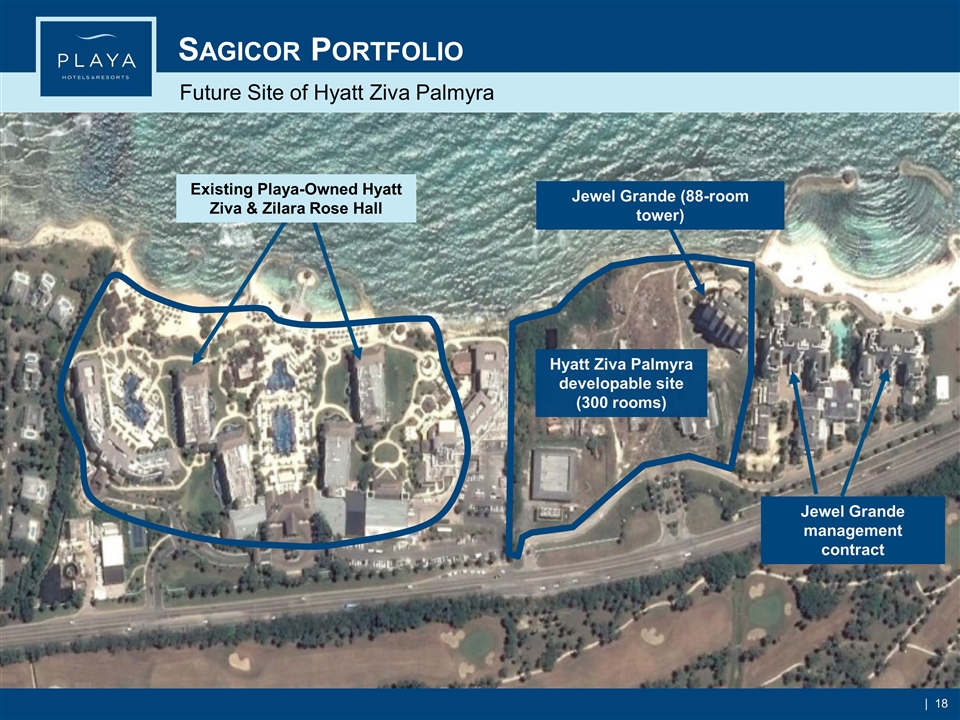

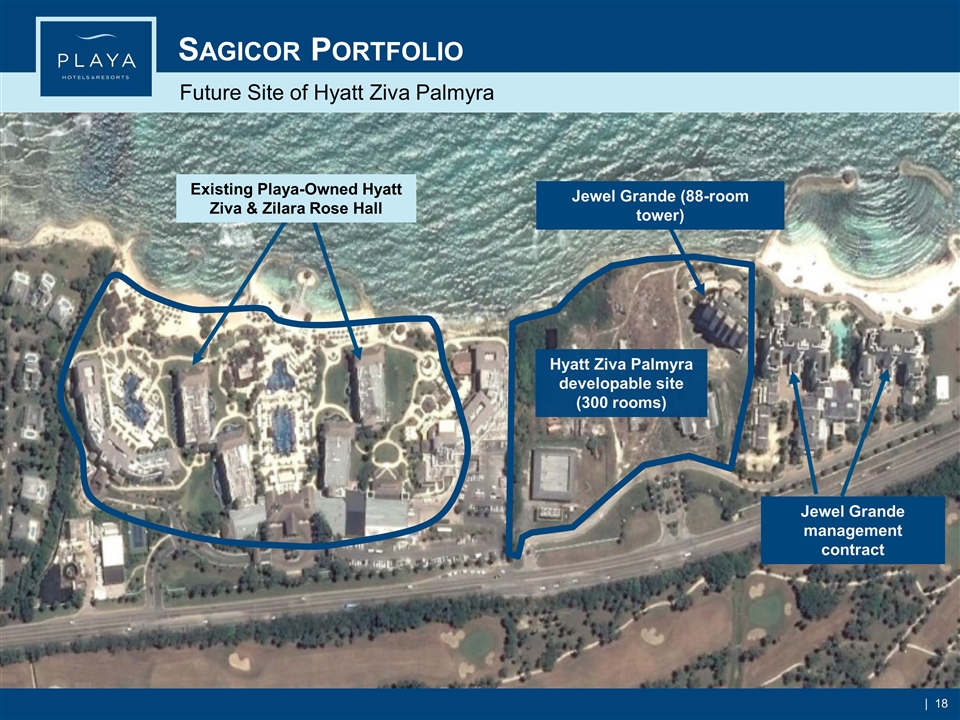

Existing Playa-Owned Hyatt Ziva & Zilara Rose Hall Jewel Grande (88-room tower) Hyatt Ziva Palmyra developable site (300 rooms) Future Site of Hyatt Ziva Palmyra Jewel Grande management contract Sagicor Portfolio

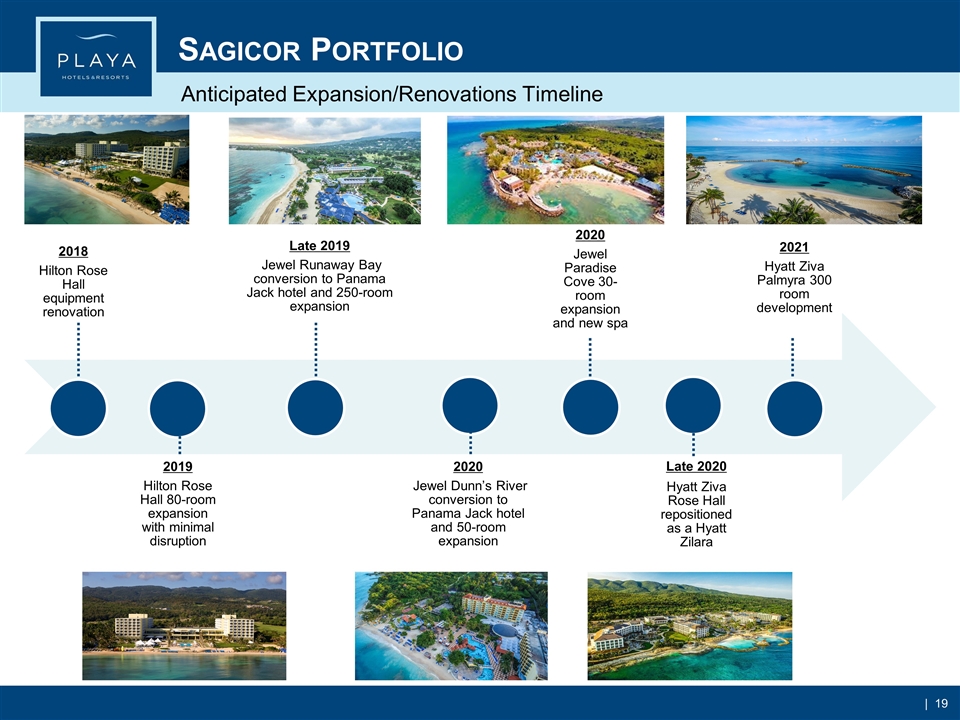

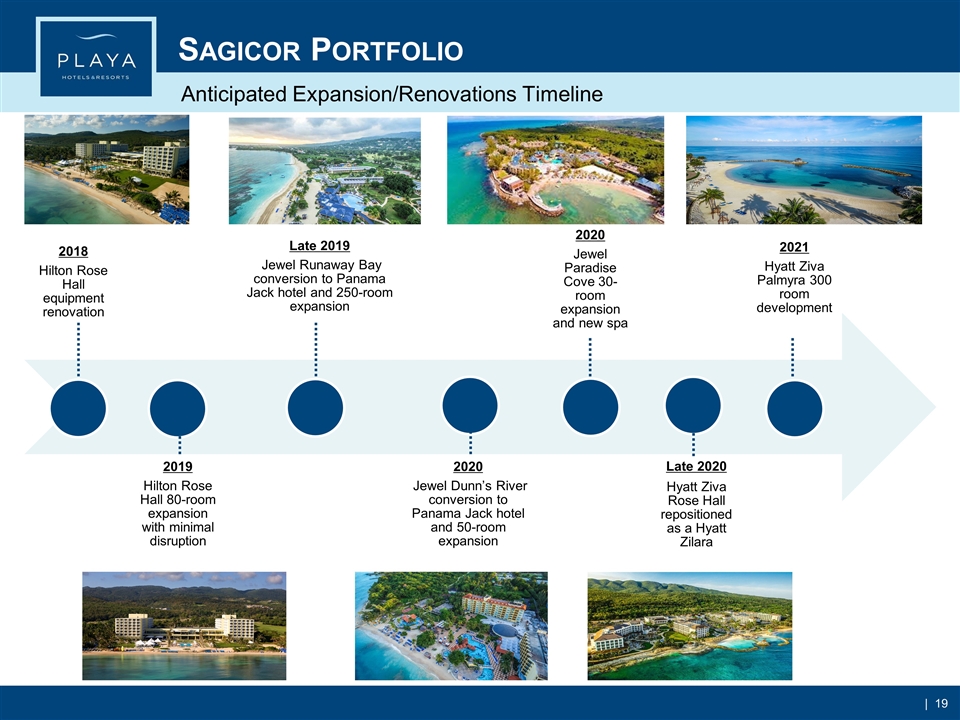

Anticipated Expansion/Renovations Timeline Sagicor Portfolio 2018 Hilton Rose Hall equipment renovation Late 2019 Jewel Runaway Bay conversion to Panama Jack hotel and 250-room expansion 2020 Jewel Dunn’s River conversion to Panama Jack hotel and 50-room expansion 2020 Jewel Paradise Cove 30-room expansion and new spa 2021 Hyatt Ziva Palmyra 300 room development Late 2020 Hyatt Ziva Rose Hall repositioned as a Hyatt Zilara 2019 Hilton Rose Hall 80-room expansion with minimal disruption

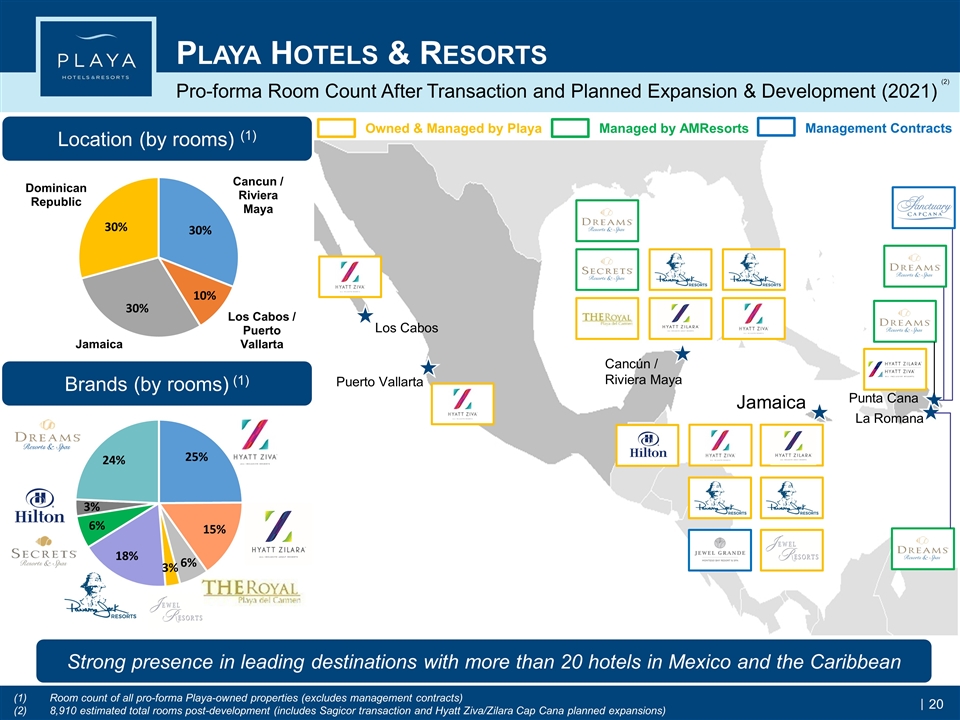

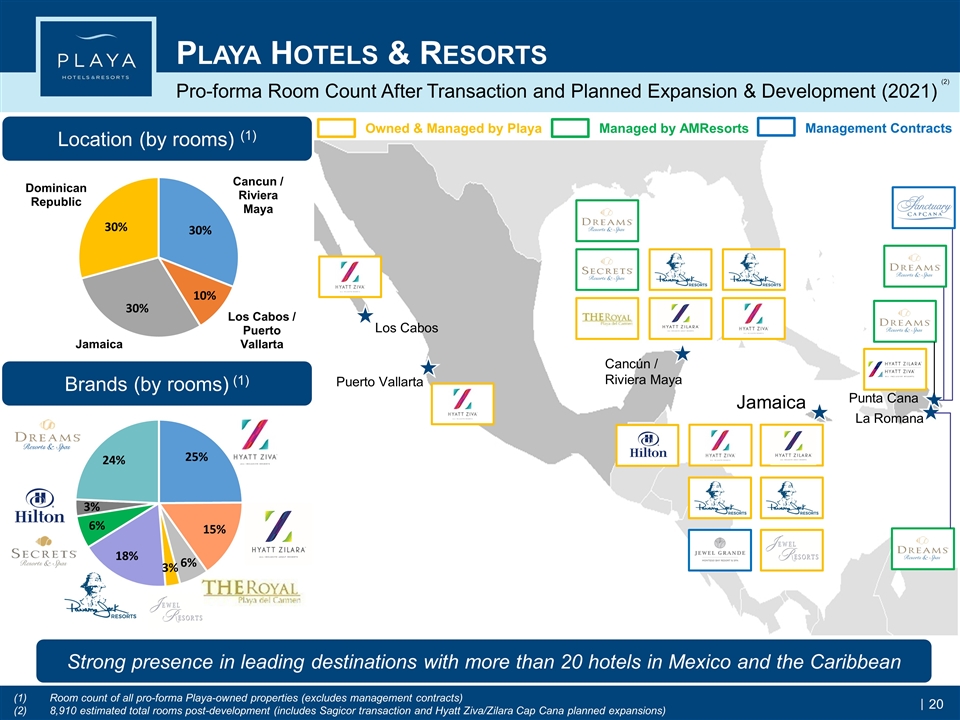

Strong presence in leading destinations with more than 20 hotels in Mexico and the Caribbean Location (by rooms) (1) Brands (by rooms) (1) Owned & Managed by Playa Managed by AMResorts Jamaica Los Cabos Puerto Vallarta Cancún / Riviera Maya Punta Cana La Romana Pro-forma Room Count After Transaction and Planned Expansion & Development (2021) Playa Hotels & Resorts Management Contracts Room count of all pro-forma Playa-owned properties (excludes management contracts) 8,910 estimated total rooms post-development (includes Sagicor transaction and Hyatt Ziva/Zilara Cap Cana planned expansions) (2) 20

Summary Financials

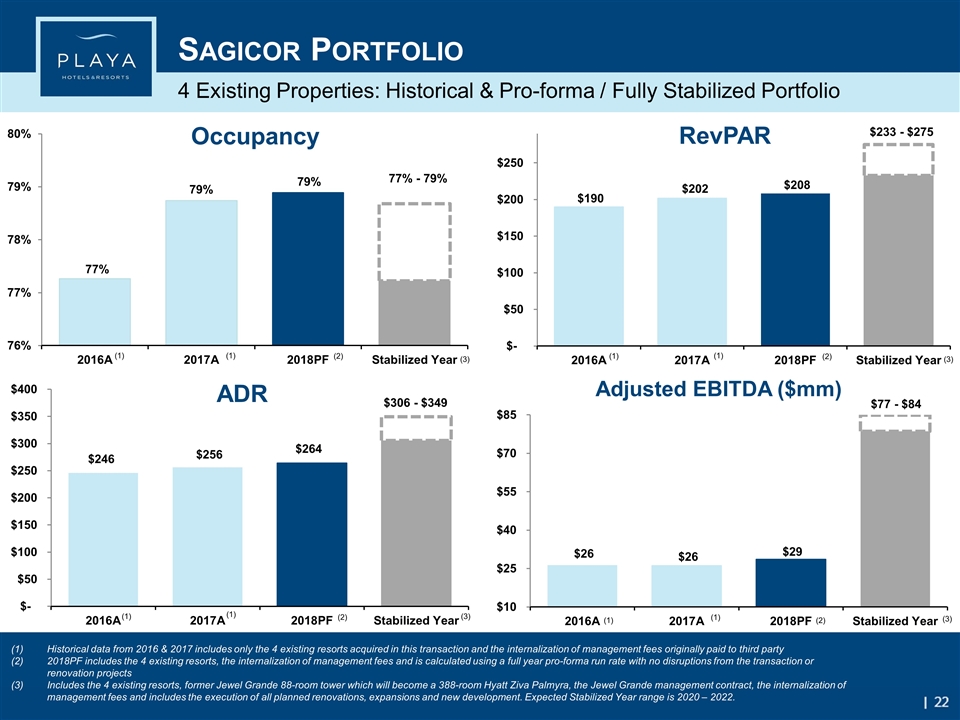

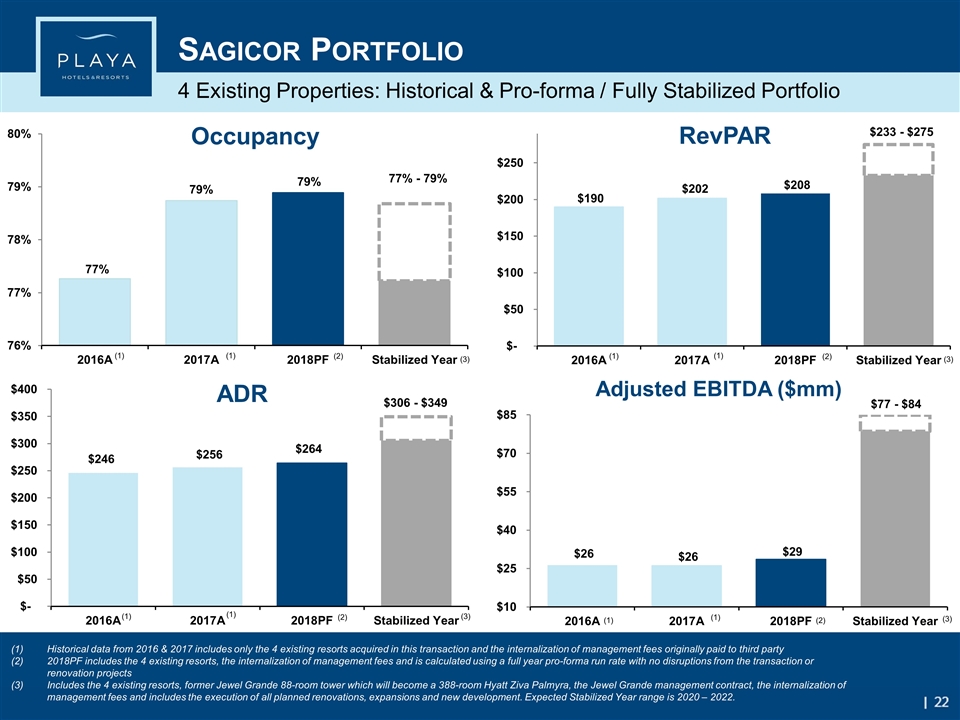

4 Existing Properties: Historical & Pro-forma / Fully Stabilized Portfolio (1) (1) (1) (1) (1) (1) (1) (1) Historical data from 2016 & 2017 includes only the 4 existing resorts acquired in this transaction and the internalization of management fees originally paid to third party 2018PF includes the 4 existing resorts, the internalization of management fees and is calculated using a full year pro-forma run rate with no disruptions from the transaction or renovation projects Includes the 4 existing resorts, former Jewel Grande 88-room tower which will become a 388-room Hyatt Ziva Palmyra, the Jewel Grande management contract, the internalization of management fees and includes the execution of all planned renovations, expansions and new development. Expected Stabilized Year range is 2020 – 2022. (3) (3) (3) (3) 77% - 79% $233 - $275 $306 - $349 $77 - $84 (2) (2) (2) (2) Sagicor Portfolio

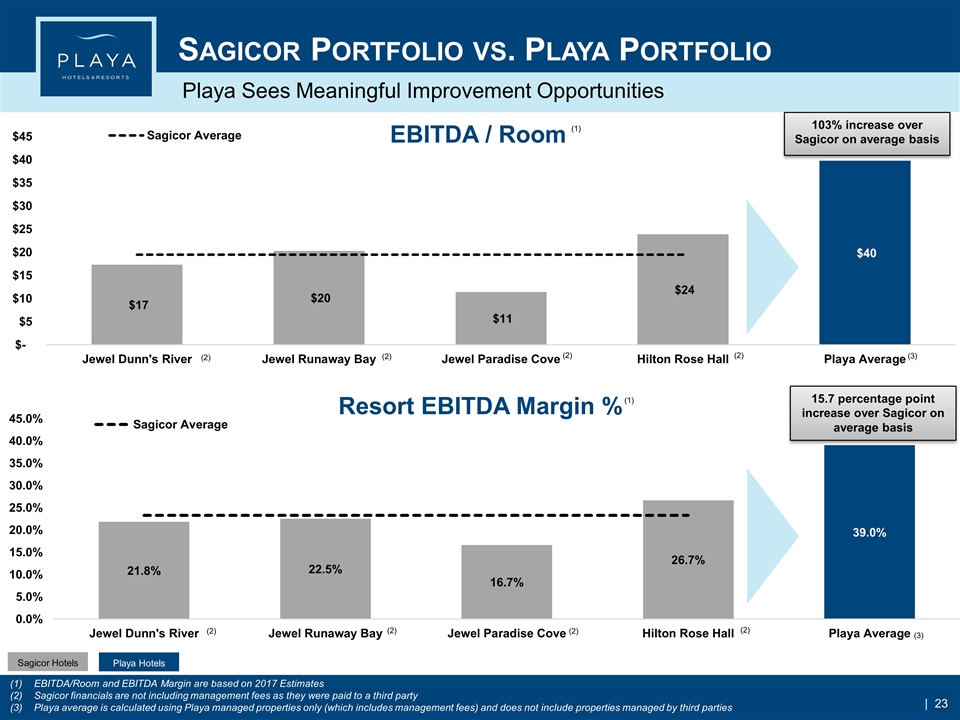

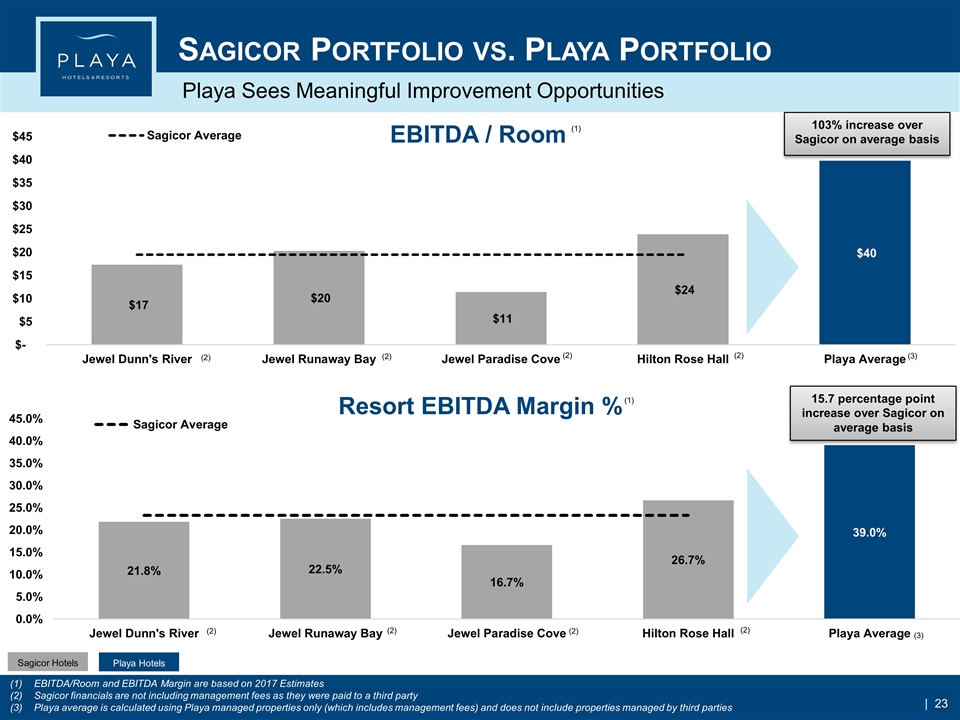

Playa Sees Meaningful Improvement Opportunities Sagicor Portfolio vs. Playa Portfolio (1) 103% increase over Sagicor on average basis 15.7 percentage point increase over Sagicor on average basis Sagicor Hotels Playa Hotels (1) EBITDA/Room and EBITDA Margin are based on 2017 Estimates Sagicor financials are not including management fees as they were paid to a third party Playa average is calculated using Playa managed properties only (which includes management fees) and does not include properties managed by third parties (2) (2) (2) (2) (3) (2) (2) (2) (2) (3)

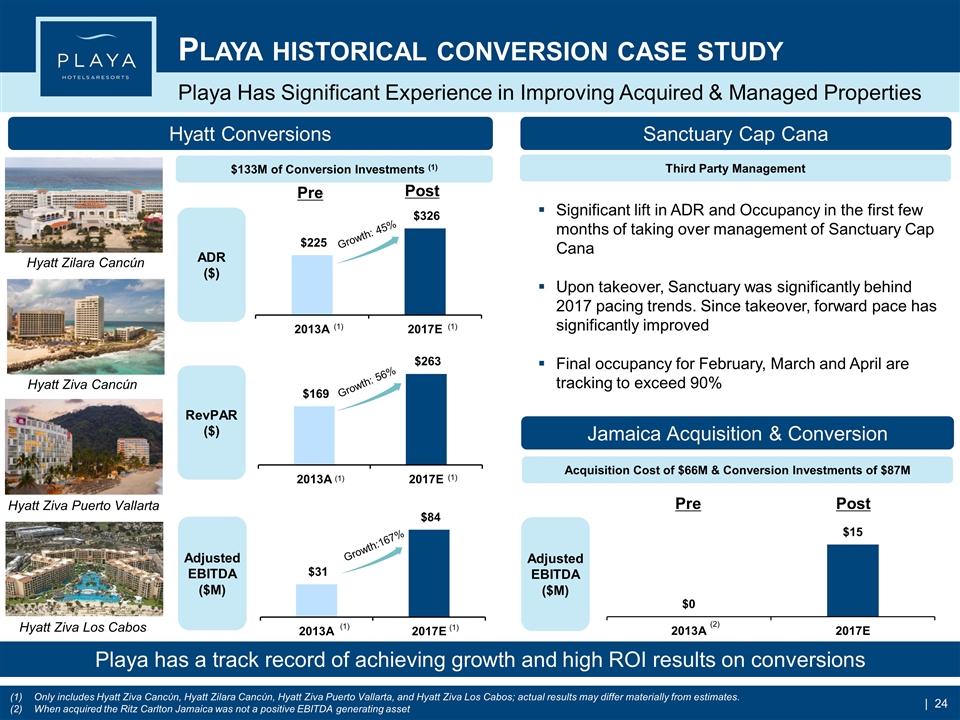

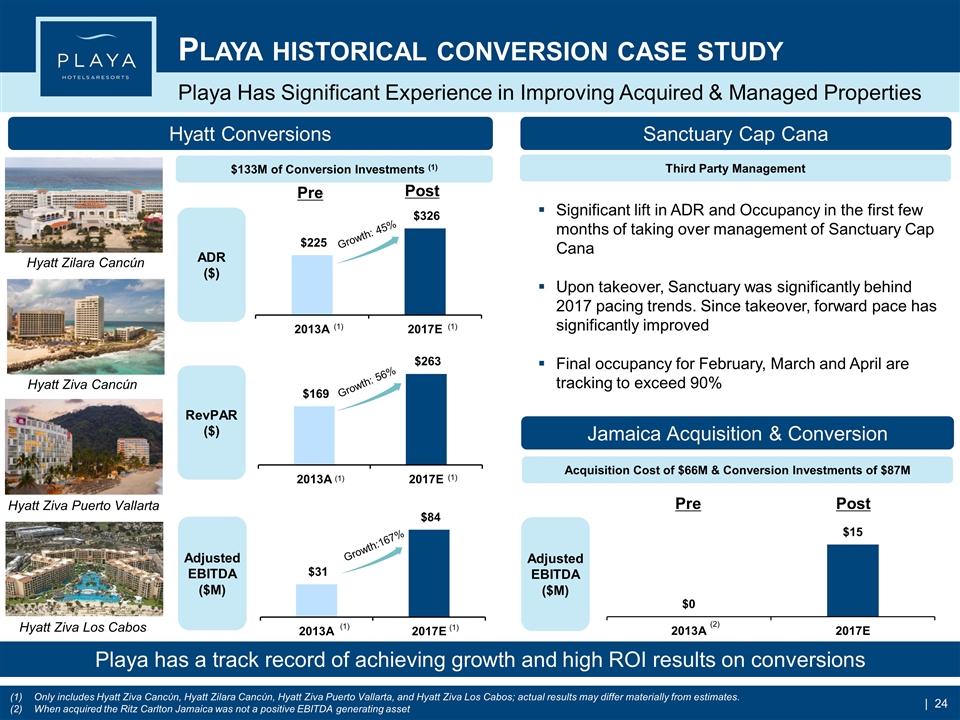

Playa Has Significant Experience in Improving Acquired & Managed Properties Only includes Hyatt Ziva Cancύn, Hyatt Zilara Cancύn, Hyatt Ziva Puerto Vallarta, and Hyatt Ziva Los Cabos; actual results may differ materially from estimates. When acquired the Ritz Carlton Jamaica was not a positive EBITDA generating asset Playa historical conversion case study Playa has a track record of achieving growth and high ROI results on conversions ADR ($) RevPAR ($) Adjusted EBITDA ($M) (1) (1) Pre Post Growth: 45% Growth: 56% Growth:167% (1) (1) (1) (1) Hyatt Zilara Cancún Hyatt Ziva Cancún Hyatt Ziva Puerto Vallarta Hyatt Ziva Los Cabos Hyatt Conversions $133M of Conversion Investments (1) Jamaica Acquisition & Conversion Adjusted EBITDA ($M) Sanctuary Cap Cana Pre Post Third Party Management Acquisition Cost of $66M & Conversion Investments of $87M (2) Significant lift in ADR and Occupancy in the first few months of taking over management of Sanctuary Cap Cana Upon takeover, Sanctuary was significantly behind 2017 pacing trends. Since takeover, forward pace has significantly improved Final occupancy for February, March and April are tracking to exceed 90%

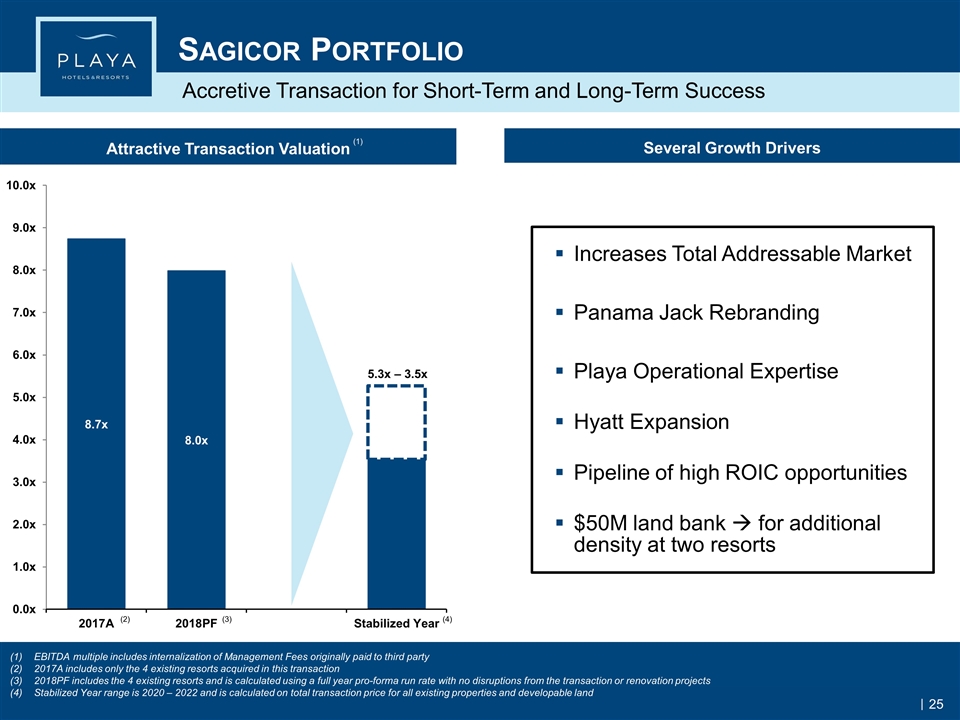

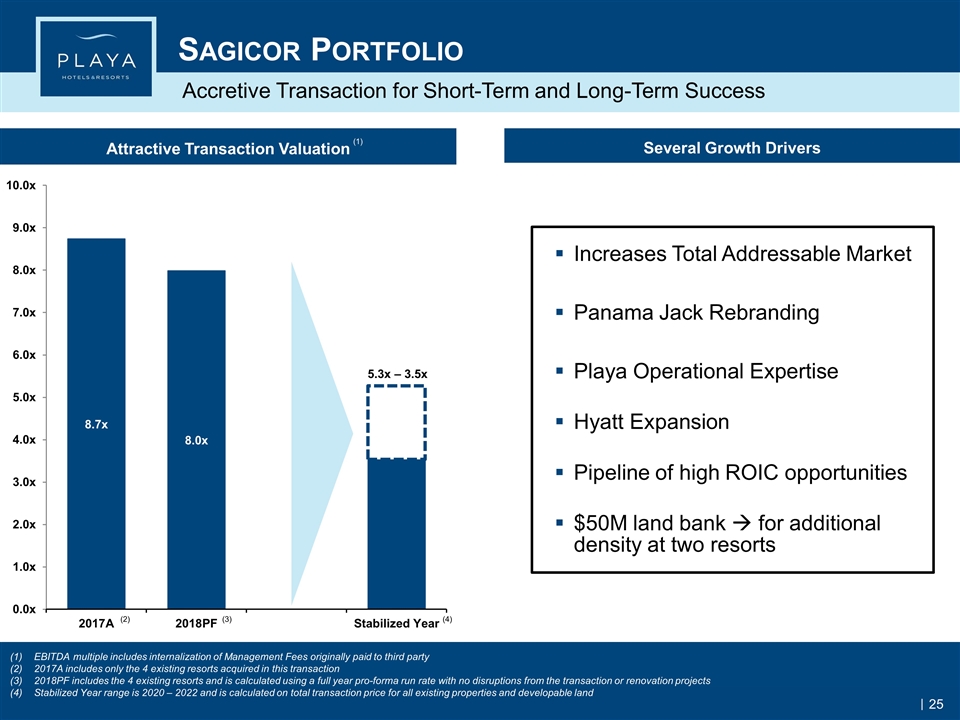

Accretive Transaction for Short-Term and Long-Term Success Sagicor Portfolio Attractive Transaction Valuation (4) Increases Total Addressable Market Panama Jack Rebranding Playa Operational Expertise Hyatt Expansion Pipeline of high ROIC opportunities $50M land bank à for additional density at two resorts Several Growth Drivers EBITDA multiple includes internalization of Management Fees originally paid to third party 2017A includes only the 4 existing resorts acquired in this transaction 2018PF includes the 4 existing resorts and is calculated using a full year pro-forma run rate with no disruptions from the transaction or renovation projects Stabilized Year range is 2020 – 2022 and is calculated on total transaction price for all existing properties and developable land (1) 5.3x – 3.5x (2) (3) 25

Investment Highlights All-Inclusive Market Leader 2 2 Premier Collection of All-Inclusive Resorts in Desirable Locations 1 Robust Internal Growth Opportunity 4 5 Increases footprint in Jamaica’s growing all-inclusive market Extends the position of Panama Jack as the premier beach destination brand for aspirant luxury travelers in Jamaica 4 Accelerates our brand portfolio, positioning Playa to be the operator of premier flags New affiliation with the powerful Hilton Brand and enables Jewel and other quality brands to enter our portfolio Improves Playa market diversification Great beachfront assets that can benefit from our leading management and investment platform 1 6 3 7 Enhances pipeline of future growth opportunities

Appendix

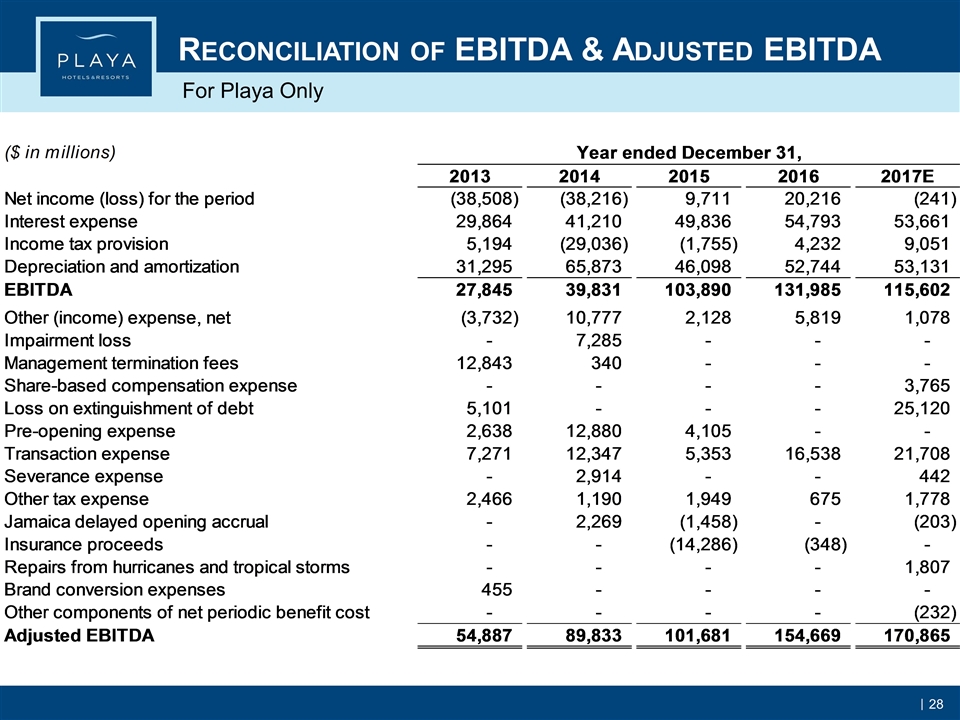

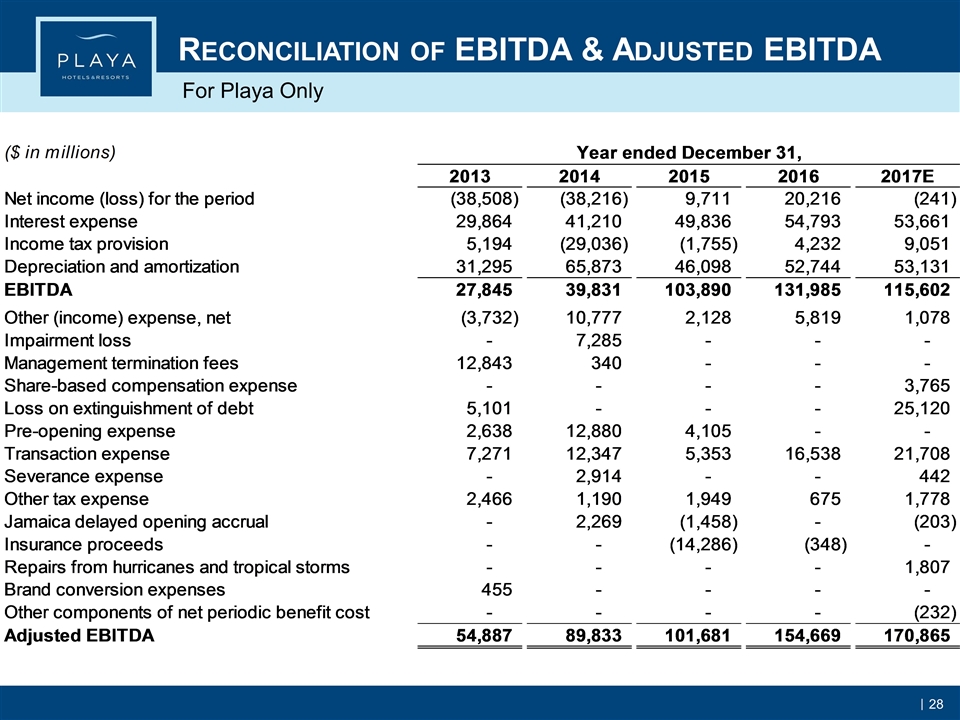

Reconciliation of EBITDA & Adjusted EBITDA For Playa Only 28