Transaction services fee and other related income decreased to RMB6.5 million (US$1.0 million) from RMB38.5 million for the second quarter of 2021, mainly as a result of the winding down of the transaction service business.

Sales income and others decreased to RMB8.8 million (US$1.3 million), which was mainly attributable to sales income generated by QD Food, from RMB23.7 million for the second quarter of 2021, which was mainly attributable to sales generated by the Wanlimu e-commerce platform. We have wound down the Wanlimu e-commerce platform.

Total operating costs and expenses increased to RMB135.9 million (US$20.3 million) from RMB89.3 million for the second quarter of 2021.

Cost of revenues decreased by 36.7% to RMB41.1 million (US$6.1 million) from RMB64.9 million for the second quarter of 2022, primarily due to the decrease in cost of goods sold as a result of the wind-down of the Wanlimu e-commerce platform, partially offset by the cost of goods sold relating to QD Food.

Sales and marketing expenses increased by 82.6% to RMB53.2 million (US$7.9 million) from RMB29.1 million for the second quarter of 2021, primarily due to the increase in marketing expenses related to QD Food.

General and administrative expenses decreased by 68.1% to RMB34.8 million (US$5.2 million) from RMB109.1 million for the second quarter of 2021, primarily due to the downsizing of the WLM Kids business.

Research and development expenses decreased by 52.1% to RMB18.8 million (US$2.8 million) from RMB39.2 million for the second quarter of 2021, as a result of the decrease in staff head count, which led to a corresponding decrease in staff salaries.

Provision for receivables and other assets was a reversal of RMB28.7 million (US$4.3 million) for the second quarter of 2022, mainly due to the decrease in past-due on-balance sheet outstanding principal receivables compared to the second quarter of 2021

Impairment loss from long-lived assets was RMB45.5 million (US$6.8 million) for this quarter, as a result of the downsizing of the WLM Kids business.

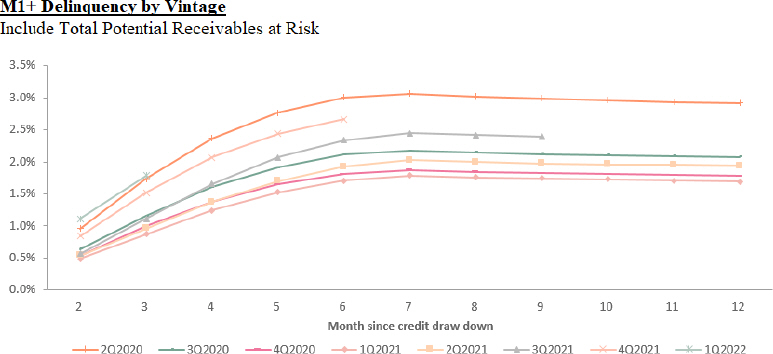

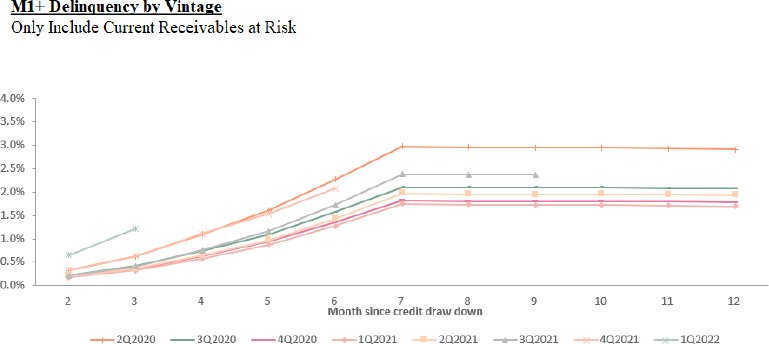

As of June 30, 2022, the total balance of outstanding principal and financing service fee receivables for on-balance sheet transactions for which any installment payment was more than 30 calendar days past due was RMB124.0 million (US$18.5 million), and the balance of allowance for principal and financing service fee receivables at the end of the period was RMB147.2 million (US$22.0 million), indicating M1+ Delinquency Coverage Ratio of 1.2x.