Consolidated Financial Statements and Report of Independent Certified Public Accountants Durango Permian LLC and Subsidiaries December 31, 2023

Page Report of Independent Certified Public Accountants 3-4 Consolidated Balance Sheet 5 Consolidated Statement of Operations 6 Consolidated Statement of Member’s Capital 7 Consolidated Statement of Cash Flows 8 Notes to Consolidated Financial Statements 9-20 Contents

GT.COM Grant Thornton LLP is a U.S. member firm of Grant Thornton International Ltd (GTIL). GTIL and each of its member firms are separate legal entities and are not a worldwide partnership. Board of Directors Durango Permian LLC Opinion We have audited the consolidated financial statements of Durango Permian LLC (a Delaware limited liability company) and subsidiaries (the “Company”), which comprise the consolidated balance sheet as of December 31, 2023, and the related consolidated statement of operations, member’s capital, and cash flows for the year then ended, and the related notes to the financial statements. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2023, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Basis for opinion We conducted our audit of the consolidated financial statements in accordance with auditing standards generally accepted in the United States of America (US GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of management for the financial statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date the financial statements are available to be issued. REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS GRANT THORNTON LLP 700 Milam St., Suite 300 Houston, TX 77002 D +1 832 476 3600 F +1 713 655 8741

Auditor’s responsibilities for the audit of the financial statements Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the consolidated financial statements. In performing an audit in accordance with US GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the consolidated financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. Houston, Texas April 18, 2024

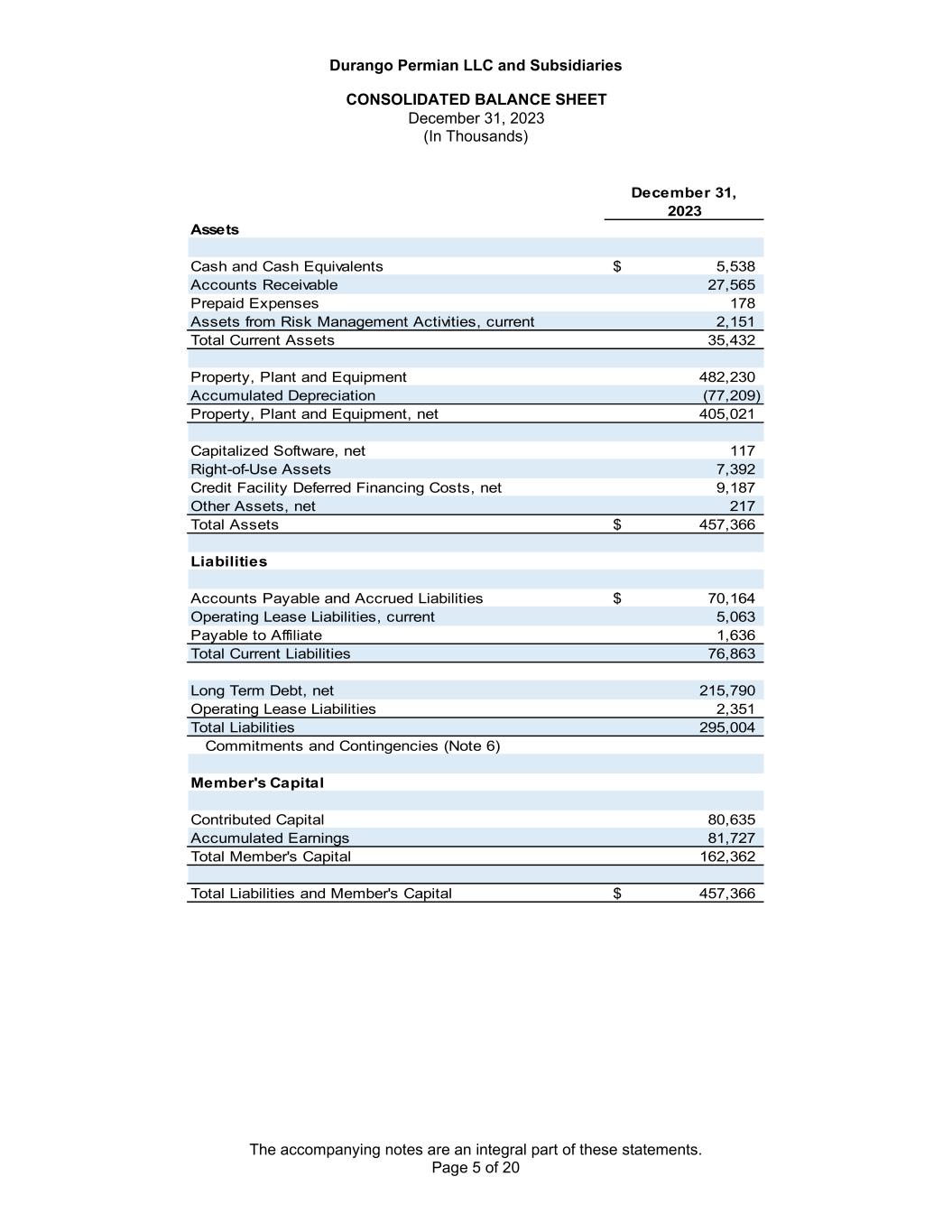

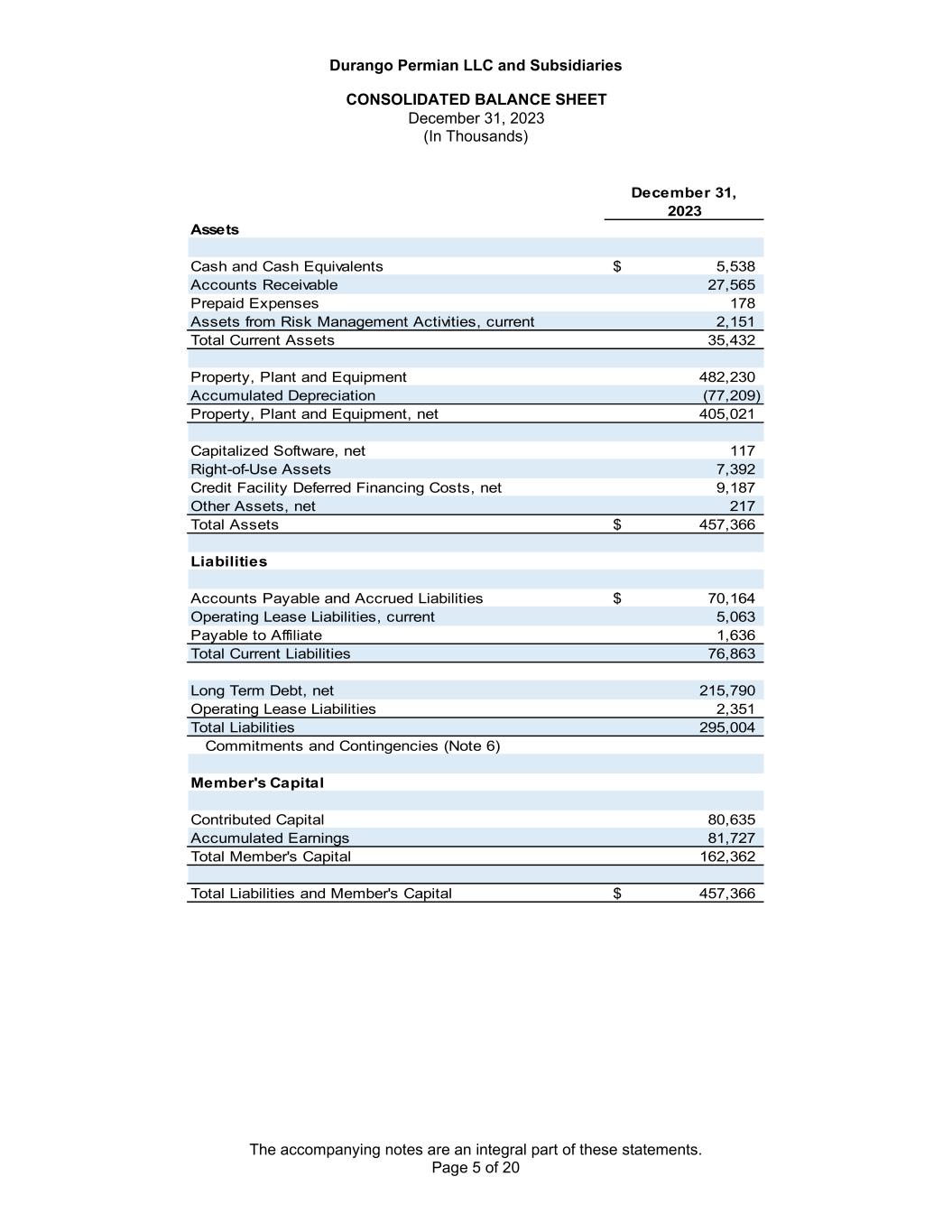

Durango Permian LLC and Subsidiaries CONSOLIDATED BALANCE SHEET December 31, 2023 (In Thousands) The accompanying notes are an integral part of these statements. Page 5 of 20 December 31, 2023 Assets Cash and Cash Equivalents 5,538$ Accounts Receivable 27,565 Prepaid Expenses 178 Assets from Risk Management Activities, current 2,151 Total Current Assets 35,432 Property, Plant and Equipment 482,230 Accumulated Depreciation (77,209) Property, Plant and Equipment, net 405,021 Capitalized Software, net 117 Right-of-Use Assets 7,392 Credit Facility Deferred Financing Costs, net 9,187 Other Assets, net 217 Total Assets 457,366$ Liabilities Accounts Payable and Accrued Liabilities 70,164$ Operating Lease Liabilities, current 5,063 Payable to Affiliate 1,636 Total Current Liabilities 76,863 Long Term Debt, net 215,790 Operating Lease Liabilities 2,351 Total Liabilities 295,004 Commitments and Contingencies (Note 6) Member's Capital Contributed Capital 80,635 Accumulated Earnings 81,727 Total Member's Capital 162,362 Total Liabilities and Member's Capital 457,366$

Durango Permian LLC and Subsidiaries CONSOLIDATED STATEMENT OF OPERATIONS For the year ended December 31, 2023 (In Thousands) The accompanying notes are an integral part of these statements. Page 6 of 20 Revenues Natural Gas Liquids Sales 172,613$ Natural Gas Sales 97,959 Condensate Sales 29,157 Gain (Loss) from Risk Management Activities 4,400 Total Revenue 304,129 Costs and Expenses Cost of Gas 179,845 Operating Expenses 55,895 General, Administrative and Transaction Costs 6,173 Depreciation and Amortization 21,023 Total Costs and Expenses 262,936 Income from Operations 41,193 Interest Expense (16,137) Gain on Sale of Assets 21 Income Before Taxes 25,077 Income Tax Benefit 85 Net Income 25,162$ Year Ended December 31, 2023

Durango Permian LLC and Subsidiaries CONSOLIDATED STATEMENT OF MEMBER’S CAPITAL For the year ended December 31, 2023 (In Thousands) The accompanying notes are an integral part of these statements. Page 7 of 20 Member's Capital Accumulated Earnings Total Member's Capital Balance, December 31, 2022 85,635$ 56,565$ 142,200$ Distributions (5,000) - (5,000) Net Income - 25,162 25,162 Balance, December 31, 2023 80,635$ 81,727$ 162,362$

Durango Permian LLC and Subsidiaries CONSOLIDATED STATEMENT OF CASH FLOWS For the year ended December 31, 2023 (In Thousands) The accompanying notes are an integral part of these statements. Page 8 of 20 Cash Flows from Operating Activities Net Income 25,162$ Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities Depreciation and Amortization 21,023 Amortization of Right-of-Use Assets 5,464 Amortization of Deferred Financing Costs 1,397 Gain on Sale of Assets (21) Unrealized (Gain) Loss from Risk Management Activities 144 Change in Operating Assets and Liabilities: Accounts Receivable 7,631 Prepaids 43 Accounts Payable and Accrued Liabilities 27,425 Operating Lease Liabilities (5,490) Payable to Affiliates (9,168) Net Cash Provided by Operating Activities 73,610 Cash Flows from Investing Activities Capital Expenditures (109,064) Net Cash Used in Investing Activities (109,064) Cash Flows from Financing Activities Borrowings under Credit Facility 252,000 Payment on Credit Facility (200,000) Payment of Deferred Financing Costs (13,378) Capital Distributions (5,000) Net Cash Provided by Financing Activities 33,622 Net Change in Cash and Cash Equivalents (1,832) Cash and Cash Equivalents, Beginning of Period 7,370 Cash and Cash Equivalents, End of Period 5,538$ Supplemental Cash Flow Information: Investing and Financing Activities Accrued Capital Expenditures at End of Year -$ Cash Paid for Interest 14,436$ Year Ended December 31, 2023

Durango Permian LLC and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2023 Page 9 of 20 NOTE 1 - ORGANIZATION, BUSINESS OPERATIONS AND BASIS OF PRESENTATION Durango Permian LLC (“Durango Permian” or “the Company”) is a Delaware limited liability company formed on October 17, 2018 and commenced operations on March 1, 2019. Durango Permian was created for the purpose of acquiring and holding midstream business interests for its ultimate parent company, Durango Investment Holdings LLC (“DIH” or “Parent”). Within these notes to the Consolidated Financial Statements, unless the context requires otherwise, references to “we,” “us,” “our,” “Durango Permian,” or the “Company” are intended to mean the business and operations of Durango Permian and its consolidated subsidiaries. These entities represent businesses engaged in the following: • Gathering, compressing, treating, processing, transporting and selling natural gas; and • Treating, transporting and selling natural gas liquids (“NGLs”) and condensate; and • Sequestering greenhouse gases by compressing and injecting carbon dioxide and other constituents down acid gas injection wells. For the periods presented and disclosed within the Consolidated Financial Statements and these accompanying notes, the Company owned and operated natural gas processing plants and related assets in New Mexico with a combined nameplate processing capacity of 220 million cubic feet per day (“MMcfd”). As a result of armed conflicts in Ukraine and the middle east, inflation, central bank policy actions, bank failures and associated liquidity risks, economic uncertainties could impact business operations, supply chains, energy demand and commodity prices that are beyond the Company’s control. Overall, the Company has not experienced a material adverse impact to its economic performance or ability to continue its business operations. The Company continues to monitor these external forces and developments but does not believe they will have a material adverse impact to its future financial performance at this time. Certain reclassifications have been made to conform prior period information to the current presentation. The reclassifications did not have a material effect on the Company’s consolidated financial position, results of operations or cash flows. The accompanying financial statements and related notes present the Company’s consolidated financial position as of December 31, 2023 and the income, cash flows and changes in member’s capital for the year then ended. The Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). All significant intercompany balances and transactions have been eliminated in consolidation. NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Consolidation Policy The Consolidated Financial Statements include the Company’s accounts and its subsidiaries. For the periods presented in the Consolidated Financial Statements and the accompanying notes, there were no noncontrolling interests in the subsidiaries and the Company did not hold any unconsolidated investments.

Page 10 of 20 Use of Estimates The preparation of Consolidated Financial Statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in these financial statements and accompanying notes. Estimates and judgments are based on information available at the time such estimates and judgments are made. Adjustments made with respect to the use of these estimates and judgments often relate to information not previously available. Uncertainties with respect to such estimates and judgments are inherent in the preparation of financial statements. Estimates and judgments are used in, among other things, (1) developing fair value assumptions, including estimates of future cash flows and discount rates, (2) analyzing long-lived assets for possible impairment, (3) estimating the useful lives of assets and (4) determining amounts to accrue for contingencies, guarantees and indemnifications, if any. Actual results, therefore, could differ from estimated amounts. Management believes that estimates and assumptions applied provide a reasonable basis for the fair presentation of the Consolidated Financial Statements. Cash and Cash Equivalents Cash and cash equivalents include all cash on hand, time deposits, certificates of deposit and all highly liquid instruments with original maturities of three months or less, which at times, exceeds the federally insured limits of $250,000. Accounts Receivable Trade accounts receivable are recorded when products are delivered or processed and are based on contracted prices. Accounts receivable are presented in the Consolidated Balance Sheets at their outstanding balances net of the allowance for credit losses, if any, and are written off when such amounts are determined to be uncollectible. In evaluating the adequacy of the allowance, the Company makes judgments regarding each party’s ability to make required payments, economic events and other factors. As the financial condition of any party changes, circumstances develop or additional information becomes available, adjustments to an allowance for credit losses may be required. There were no allowances for credit losses or write-offs at December 31, 2023. Gas Imbalance Accounting Quantities of natural gas over-delivered or under-delivered related to imbalance agreements are recorded monthly as receivables or payables using weighted average prices at the time of the imbalance. These imbalances are settled with deliveries of natural gas or with cash-out provisions. The Company had an insignificant imbalance payable at December 31, 2023, which is included within Accounts Payable and Accrued Liabilities on the Consolidated Balance Sheets. Derivative Instruments (See Note 4) The Company utilizes derivative instruments to manage the volatility of cash flows due to fluctuating commodity prices. All derivatives not qualifying for the normal purchase and normal sale exception are recorded on the balance sheets at fair value. The Company has elected to not adopt hedge accounting for its hedge positions; accordingly, periodic changes in fair value are recorded in earnings on the Consolidated Statements of Operations. The Company has designated certain commodity marketing contracts that meet the definition of a derivative as normal purchases and normal sales, which under GAAP, are not accounted for as derivatives. As a result, the revenues and expenses associated with such contracts are recognized during the period when volumes are physically delivered or received. The derivative contracts are subject to netting arrangements that permit the Company’s contracting subsidiaries to net cash settle offsetting asset and liability positions with the same counterparty within the same Durango Permian entity. For balance sheet classification purposes,

Page 11 of 20 the Company analyzes the fair values of the derivative instruments on a contract-by-contract basis and reports the related fair values on a net basis. Fair Value Measurements The carrying amounts of cash and cash equivalents, accounts receivable, prepaid expenses, accounts payable and accrued liabilities, insurance financing payable and payable to affiliate approximate their fair values. The Company categorizes the inputs to the fair value measurements of financial assets and liabilities at each balance sheet reporting date using a three-tier fair value hierarchy that prioritizes the significant inputs used in measuring fair value: • Level 1 – observable inputs such as quoted prices in active markets; • Level 2 – inputs other than quoted prices in active markets that can be directly or indirectly observed to the extent that the markets are liquid for the relevant settlement periods; and • Level 3 – unobservable inputs in which little or no market data exists, therefore the Company must develop its own assumptions. The fair value measurement of the Company’s derivative instruments was a $2.2 million net asset at December 31, 2023 and has been classified as level 2 within the fair value hierarchy (see Note 4 - Derivative Instruments and Hedging Activities). Assets acquired and liabilities assumed at inception are accounted for in accordance with ASC 805, as either acquisitions of assets which are recorded at acquisition cost or business combinations which would be classified as level 3 within the fair value hierarchy. Property, Plant and Equipment (See Note3) Property, plant and equipment consist primarily of gas gathering pipelines and rights-of-way, gas plants and related equipment, compression equipment, furniture and fixtures, computer equipment, land and buildings and are stated at acquisition value less accumulated depreciation. Depreciation is computed using the straight-line method over the estimated useful lives of the assets and commences at the time a capitalized asset is placed in service. Expenditures for minor maintenance and repairs are expensed as incurred. Expenditures to refurbish assets that extend useful lives or prevent environmental contamination are capitalized and depreciated over the remaining useful life of the asset or major asset component. The Company also capitalizes certain costs directly related to the construction of assets, including internal labor costs, interest and engineering costs. Capitalized internal labor was $0.2 million during 2023 and there was no capitalized interest. Commodity inventories that are not physically or contractually available for sale under normal operations, such as natural gas and NGLs required to maintain pipeline minimum balances or pressures, are classified as Property, Plant and Equipment. The determination of the useful lives of property, plant and equipment requires various assumptions, including the supply of and demand for hydrocarbons in the markets served by the Company assets, normal wear and tear of the facilities and the extent and frequency of maintenance programs. The Company evaluates the recoverability of property, plant and equipment when events or circumstances such as economic obsolescence, the business climate, legal and other factors indicate the recovery of the carrying amount of the assets is not valid. Asset recoverability is

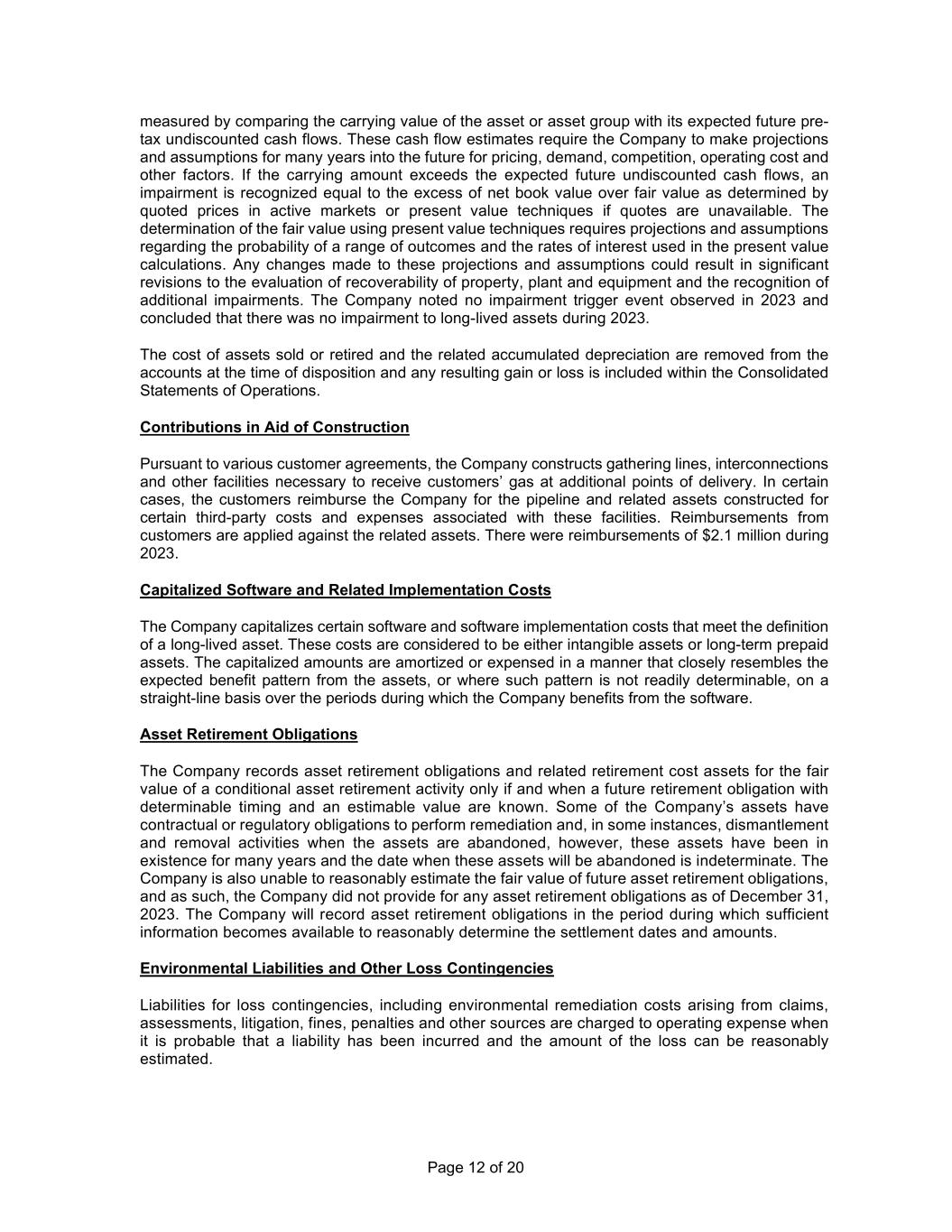

Page 12 of 20 measured by comparing the carrying value of the asset or asset group with its expected future pre- tax undiscounted cash flows. These cash flow estimates require the Company to make projections and assumptions for many years into the future for pricing, demand, competition, operating cost and other factors. If the carrying amount exceeds the expected future undiscounted cash flows, an impairment is recognized equal to the excess of net book value over fair value as determined by quoted prices in active markets or present value techniques if quotes are unavailable. The determination of the fair value using present value techniques requires projections and assumptions regarding the probability of a range of outcomes and the rates of interest used in the present value calculations. Any changes made to these projections and assumptions could result in significant revisions to the evaluation of recoverability of property, plant and equipment and the recognition of additional impairments. The Company noted no impairment trigger event observed in 2023 and concluded that there was no impairment to long-lived assets during 2023. The cost of assets sold or retired and the related accumulated depreciation are removed from the accounts at the time of disposition and any resulting gain or loss is included within the Consolidated Statements of Operations. Contributions in Aid of Construction Pursuant to various customer agreements, the Company constructs gathering lines, interconnections and other facilities necessary to receive customers’ gas at additional points of delivery. In certain cases, the customers reimburse the Company for the pipeline and related assets constructed for certain third-party costs and expenses associated with these facilities. Reimbursements from customers are applied against the related assets. There were reimbursements of $2.1 million during 2023. Capitalized Software and Related Implementation Costs The Company capitalizes certain software and software implementation costs that meet the definition of a long-lived asset. These costs are considered to be either intangible assets or long-term prepaid assets. The capitalized amounts are amortized or expensed in a manner that closely resembles the expected benefit pattern from the assets, or where such pattern is not readily determinable, on a straight-line basis over the periods during which the Company benefits from the software. Asset Retirement Obligations The Company records asset retirement obligations and related retirement cost assets for the fair value of a conditional asset retirement activity only if and when a future retirement obligation with determinable timing and an estimable value are known. Some of the Company’s assets have contractual or regulatory obligations to perform remediation and, in some instances, dismantlement and removal activities when the assets are abandoned, however, these assets have been in existence for many years and the date when these assets will be abandoned is indeterminate. The Company is also unable to reasonably estimate the fair value of future asset retirement obligations, and as such, the Company did not provide for any asset retirement obligations as of December 31, 2023. The Company will record asset retirement obligations in the period during which sufficient information becomes available to reasonably determine the settlement dates and amounts. Environmental Liabilities and Other Loss Contingencies Liabilities for loss contingencies, including environmental remediation costs arising from claims, assessments, litigation, fines, penalties and other sources are charged to operating expense when it is probable that a liability has been incurred and the amount of the loss can be reasonably estimated.

Page 13 of 20 Deferred Financing Costs Costs incurred in connection with the issuance of the Amended Credit Facility (see Note 7) are deferred and charged to interest expense over the term of the related debt, as are any original issue discount or premium. The deferred financing costs related to the Amended Credit Facility are attributable pro rata to the revolving facilities and term loan and then capitalized as either a long term asset or as a reduction to the carrying amount of long term debt, respectively. Income Taxes For federal income tax purposes, Durango Permian is a disregarded entity. As such, the Company’s taxable earnings are included in the income tax returns of its ultimate owners and taxed depending on their individual tax situations. Accordingly, there is no provision for federal income taxes in the accompanying Consolidated Financial Statements relating to Durango Permian and its disregarded subsidiaries. The Company is subject to various state taxes, including the Texas margin tax, consisting generally of a 0.75% tax on the amount by which total revenues exceed certain costs, as apportioned to Texas. Uncertain tax positions are recognized in the financial statements only if that position is reasonably determined to be more-likely-than-not of being sustained upon examination by taxing authorities, based on the technical merits of the position. The Company recognizes interest and penalties related to uncertain tax positions in income tax expense. As of December 31, 2023 there are no uncertain tax positions recorded. Revenue Recognition Operating revenues are primarily derived from the following activities: • Gathering, compressing, treating, processing, transporting and selling natural gas; and • Treating, transporting and selling natural gas liquids (“NGLs”) and condensate The Company accounts for revenue from contracts with customers in accordance with Accounting Standard Codification (“ASC”) 606, Revenue from Contracts with Customers (“ASC 606”). The Company recognizes revenue when it satisfies a performance obligation by transferring control over a product or by providing services to a customer. ASC 606 requires that a contract’s transaction price, which is the amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer, is to be allocated to each performance obligation in the contract based on relative standalone selling prices and recognized as revenue when (point in time) or as (over time) the performance obligation is satisfied. The performance obligations with respect to the contracts are to provide gathering, compression, treating, marketing and processing services, each of which would be completed on or about the same time, and each of which would be recognized on the same line item on the income statement. Therefore, identification of separate performance obligations would not impact the timing or geography of revenue recognition. The Company generates revenues from fees associated with wellhead volumes and gas quality and the sale of residue gas and NGLs at the tailgate of the processing facilities primarily to third-party customers. Revenue is recognized when (or as) the performance obligations are satisfied, that is, when the customer obtains control of the good or service. For natural gas processing activities, the Company receives either fees and/or a percentage-of- proceeds from commodity sales as payment for these services depending on the type of contract. Under fee-based contracts, the Company receives a fee based on throughput volumes, quality of gas and marketing volumes and these amounts are recorded as an offset to the cost of gas. Under percent-of-proceeds contracts, the Company receives either an agreed upon percentage of the actual proceeds received from the sales of the residue natural gas and NGLs or an agreed upon

Page 14 of 20 percentage based on index related prices for the natural gas and NGLs. Typically, the percent-of- proceeds contracts also include a fee-based component, which is recorded as an offset to the cost of gas. Percent-of-value and percent-of-liquids contracts are variations on this arrangement. Under keep-whole contracts, the Company retains the NGLs extracted and returns a percentage of the processed natural gas or purchases the natural gas based on natural gas market indices or the weighted average resale price of natural gas. The Company generally reports sales revenues gross in the Consolidated Statements of Operations, as the Company typically acts as the principal in the transaction where the Company receives commodities, takes title to the natural gas and NGLs and incurs the risks and rewards of ownership. However, buy-sell transactions, including the fee-based transactions discussed above, that involve purchases and sales of inventory with the same counterparty that are legally contingent or in contemplation of one another are reported as a single transaction on a combined net basis. In accordance with certain practical expedients permitted by ASC 606, the Company did not disclose information regarding unsatisfied performance obligations of certain contracts. These include contracts with an original expected length of one year or less, contracts in which the Company elected to recognize revenue in the amount to which the Company has the right to invoice and contracts where the variable consideration is allocated entirely to wholly unsatisfied performance obligations that generally do not get resolved until actual volumes are delivered and prices are known. Contract assets and liabilities primarily relate to contracts where allocations of the transaction prices result in differences to the pattern and timing of revenue recognition as compared to contractual billings. Where payments are received in advance of recognition as revenue, contract liabilities are created. Where the Company may have earned revenue and the right to invoice the customer is conditioned on something other than the passage of time, contract assets are created. As of December 31, 2023 the Company had no differences to report. Leases The Company determines if a contractual arrangement represents or contains a lease at inception. Operating leases with lease terms greater than twelve months are included in Right-of-Use Assets and Operating Lease Liabilities in the Consolidated Balance Sheets. Leases with terms of 12 months or less are recognized straight-line over the lease term. The Company leases office space and equipment under operating leases, some of which include options to permit renewals for additional periods. Such options are included in the measurement of operating lease right-of-use assets and operating lease liabilities at the point in time the determination to renew is made. Operating lease right-of-use assets and lease liabilities are recognized at the commencement date based on the present value of the future lease payments over the lease term. The Company utilizes its incremental borrowing rate in determining the present value of the future lease payments. The incremental borrowing rate is derived from information available at the lease commencement date and represents the rate of interest that the Company would have to pay to borrow on a collateralized basis over a similar term and amount equal to the lease payments in a similar economic environment. The Company has lease arrangements that include both lease and non-lease components. The Company accounts for non-lease components separately from the lease component.

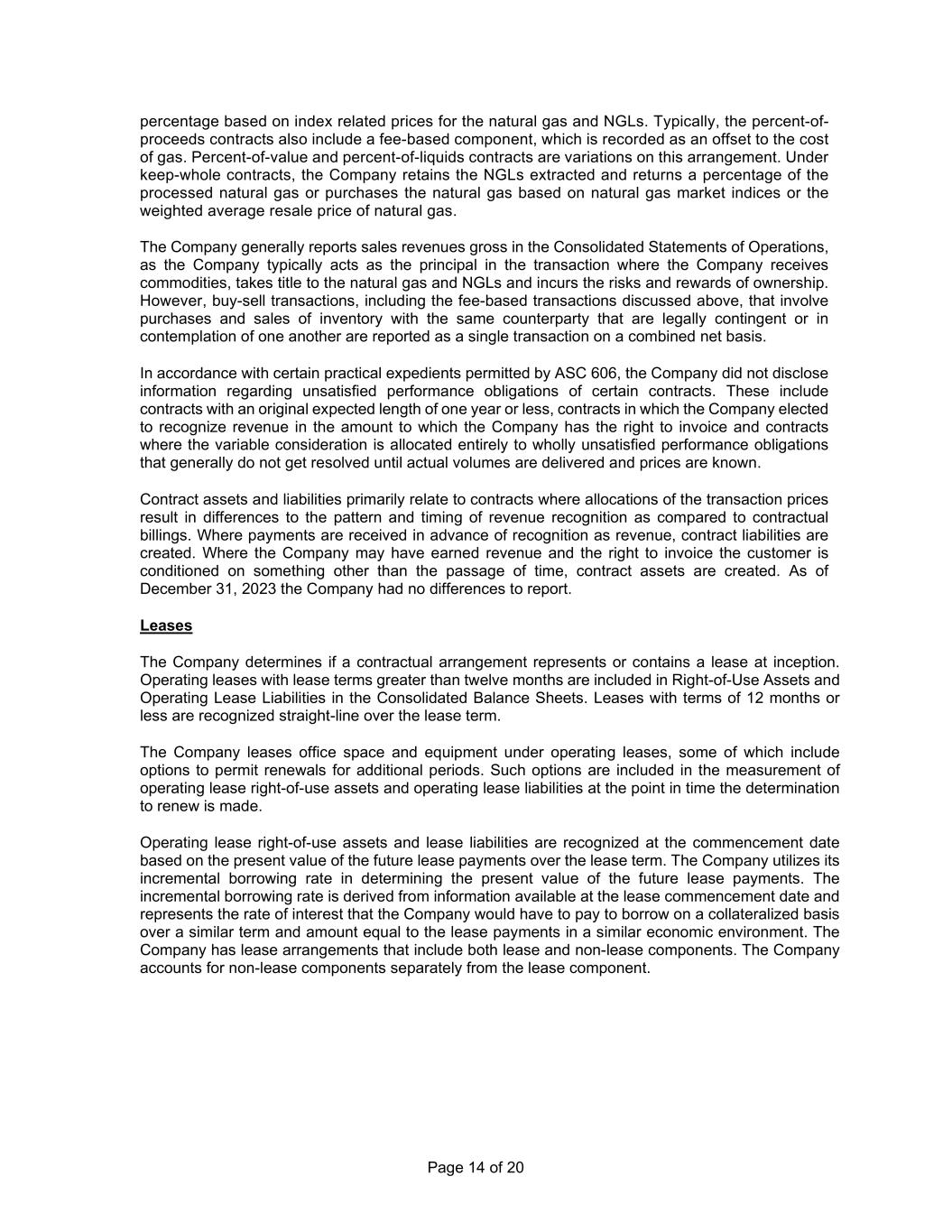

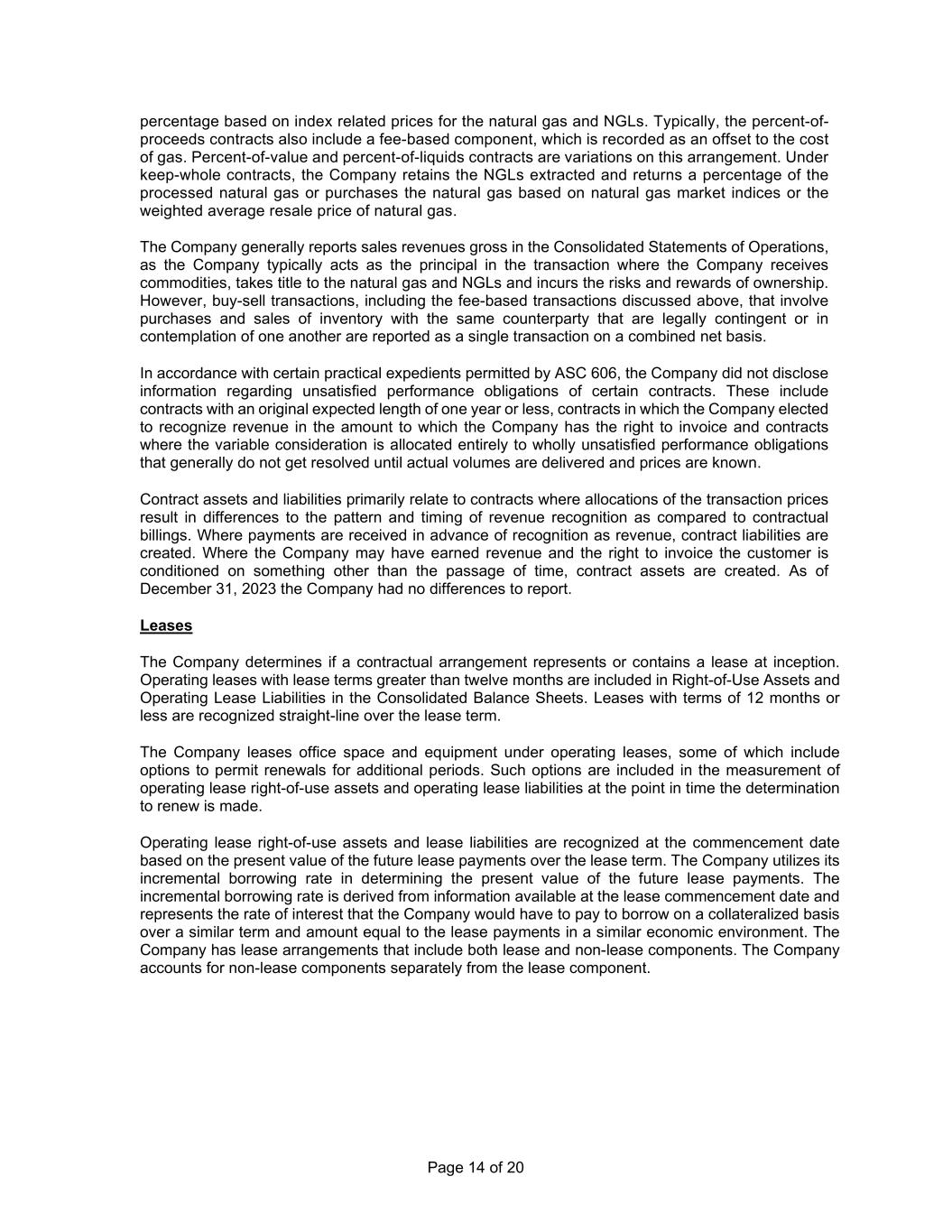

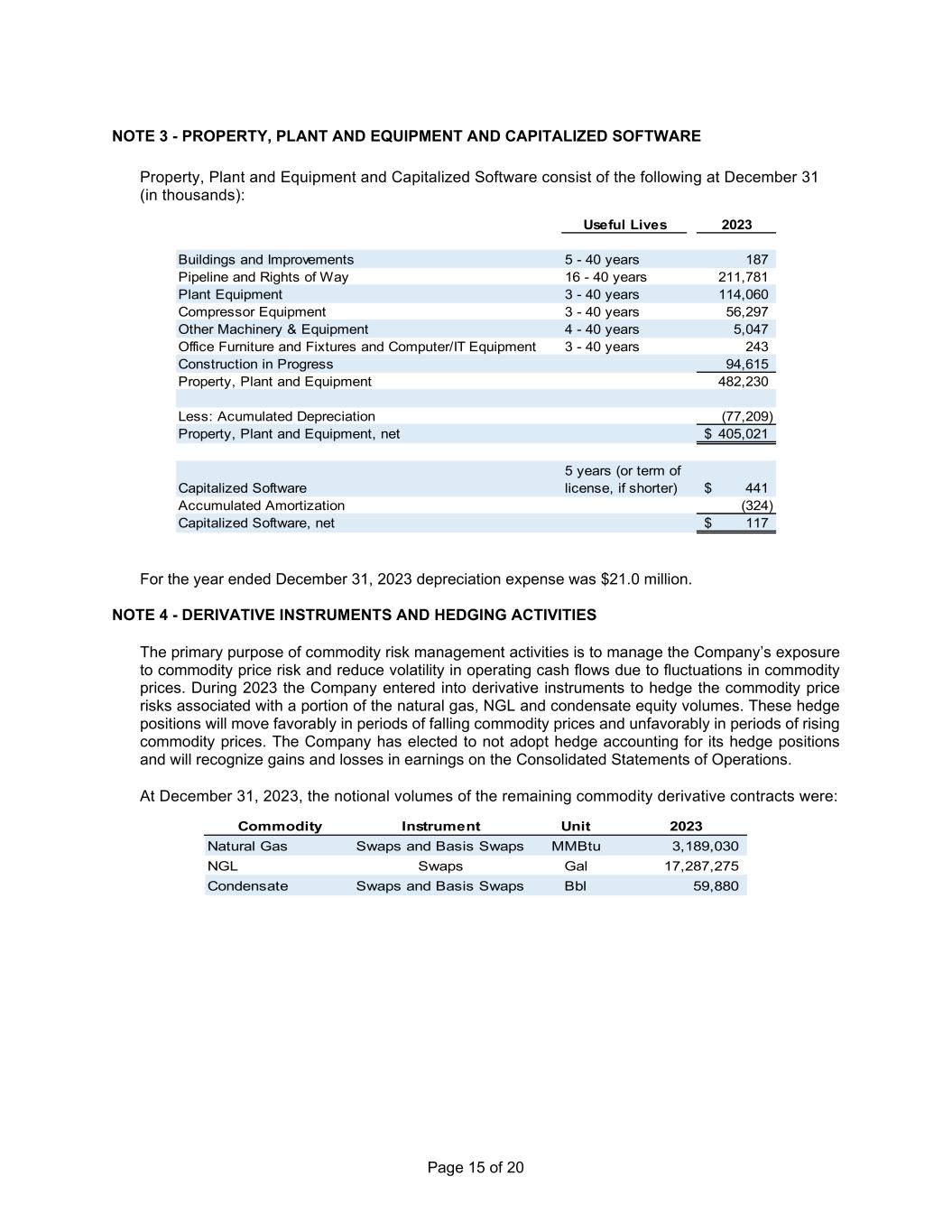

Page 15 of 20 NOTE 3 - PROPERTY, PLANT AND EQUIPMENT AND CAPITALIZED SOFTWARE Property, Plant and Equipment and Capitalized Software consist of the following at December 31 (in thousands): Useful Lives 2023 Buildings and Improvements 5 - 40 years 187 Pipeline and Rights of Way 16 - 40 years 211,781 Plant Equipment 3 - 40 years 114,060 Compressor Equipment 3 - 40 years 56,297 Other Machinery & Equipment 4 - 40 years 5,047 Office Furniture and Fixtures and Computer/IT Equipment 3 - 40 years 243 Construction in Progress 94,615 Property, Plant and Equipment 482,230 Less: Acumulated Depreciation (77,209) Property, Plant and Equipment, net 405,021$ Capitalized Software 5 years (or term of license, if shorter) 441$ Accumulated Amortization (324) Capitalized Software, net 117$ For the year ended December 31, 2023 depreciation expense was $21.0 million. NOTE 4 - DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES The primary purpose of commodity risk management activities is to manage the Company’s exposure to commodity price risk and reduce volatility in operating cash flows due to fluctuations in commodity prices. During 2023 the Company entered into derivative instruments to hedge the commodity price risks associated with a portion of the natural gas, NGL and condensate equity volumes. These hedge positions will move favorably in periods of falling commodity prices and unfavorably in periods of rising commodity prices. The Company has elected to not adopt hedge accounting for its hedge positions and will recognize gains and losses in earnings on the Consolidated Statements of Operations. At December 31, 2023, the notional volumes of the remaining commodity derivative contracts were: Commodity Instrument Unit 2023 Natural Gas Swaps and Basis Swaps MMBtu 3,189,030 NGL Swaps Gal 17,287,275 Condensate Swaps and Basis Swaps Bbl 59,880

Page 16 of 20 The components of Gain (Loss) from Risk Management Activities in the Consolidated Statements of Operations related to commodity derivatives are as follows (in millions): December 31, 2023 Realized Gain (Loss) on Derivatives 4,544$ Change in Fair Value of Derivatives (144)$ Gain (Loss) from Risk Management Activities 4,400$ The derivative contracts are subject to netting arrangements that permit the Company’s contracting subsidiaries to net cash settle offsetting asset and liability positions with the same counterparty within the same Durango Permian entity. The Company records derivatives, assets and liabilities on the Consolidated Balance Sheets on a net basis, considering the effect of master netting arrangements. The impact of reporting derivatives on the Consolidated Balance Sheets on a gross basis, as opposed to the net balance as presented at December 31, 2023 (in thousands) is as follows: Valuation at December 31, 2023 Current Risk Management Asset 2,401$ Current Risk Management Liability (250)$ Net Current Risk Management Asset 2,151$ The fair value of the derivative instruments was determined by the use of present value methods with assumptions about commodity prices based on those observed in underlying markets, which represent Level 2 inputs in the valuation hierarchy (See Note 2), and the Company believes it has obtained the most accurate information available for the types of derivative contracts held. The estimated fair value of the derivative instruments was a net asset of $2.2 million as of December 31, 2023. The Company considered the need for a credit risk adjustment and determined that one was not necessary as of December 31, 2023. NOTE 5 - LEASES The Company leases office space and equipment under operating leases expiring through November 2025, some of which include options to permit renewals for additional periods. Such options were not included in the measurement of operating lease right-of-use assets and operating lease liabilities. The Company’s weighted average remaining lease term and weighted average discount rate were 1.5 years and 9%, respectively, as of December 31, 2023. Operating lease right-of-use assets as of December 31, 2023 are as follows (in thousands): December 31, 2023 Office Lease 457$ Compressor Leases 6,935$ Total Operating Lease Right-of-Use Assets, net 7,392$

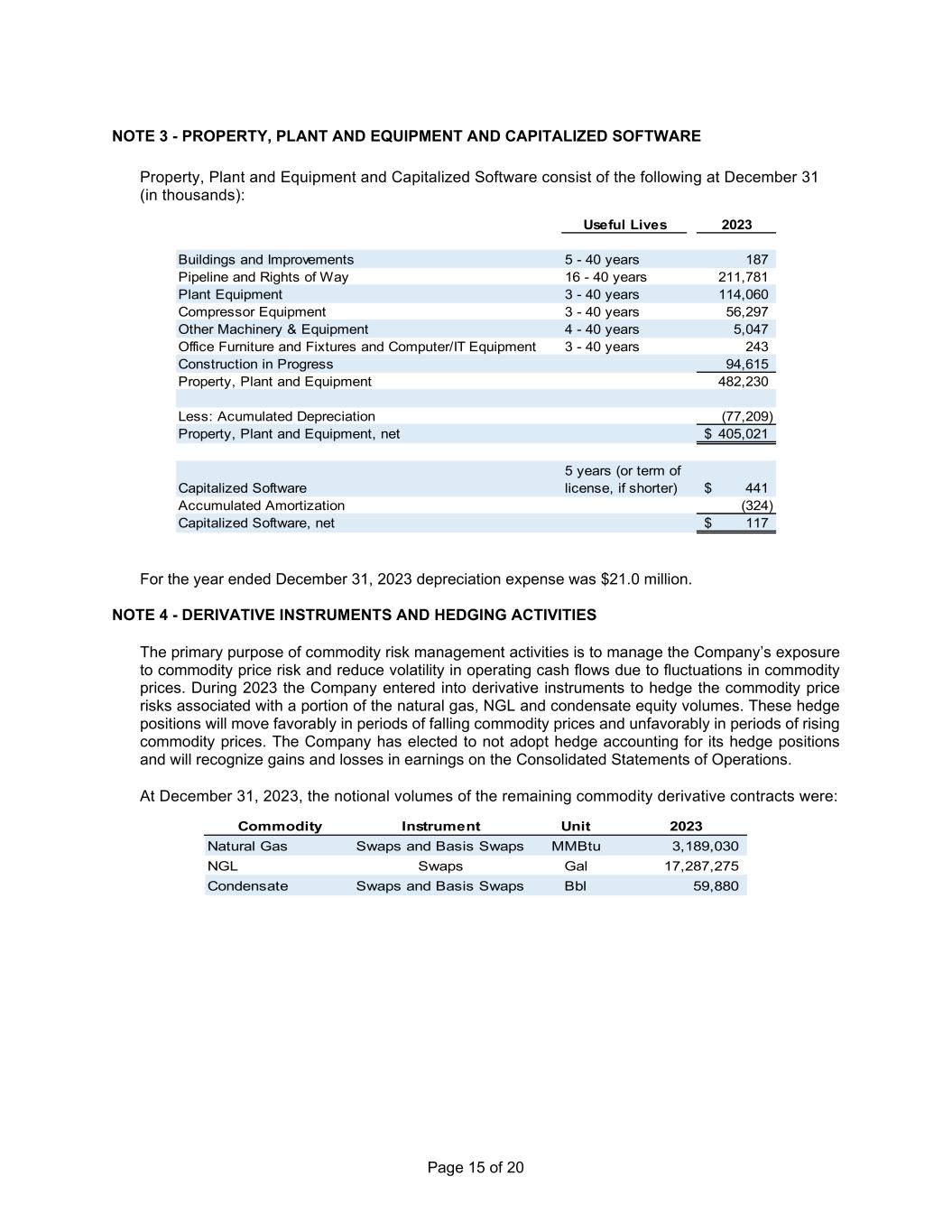

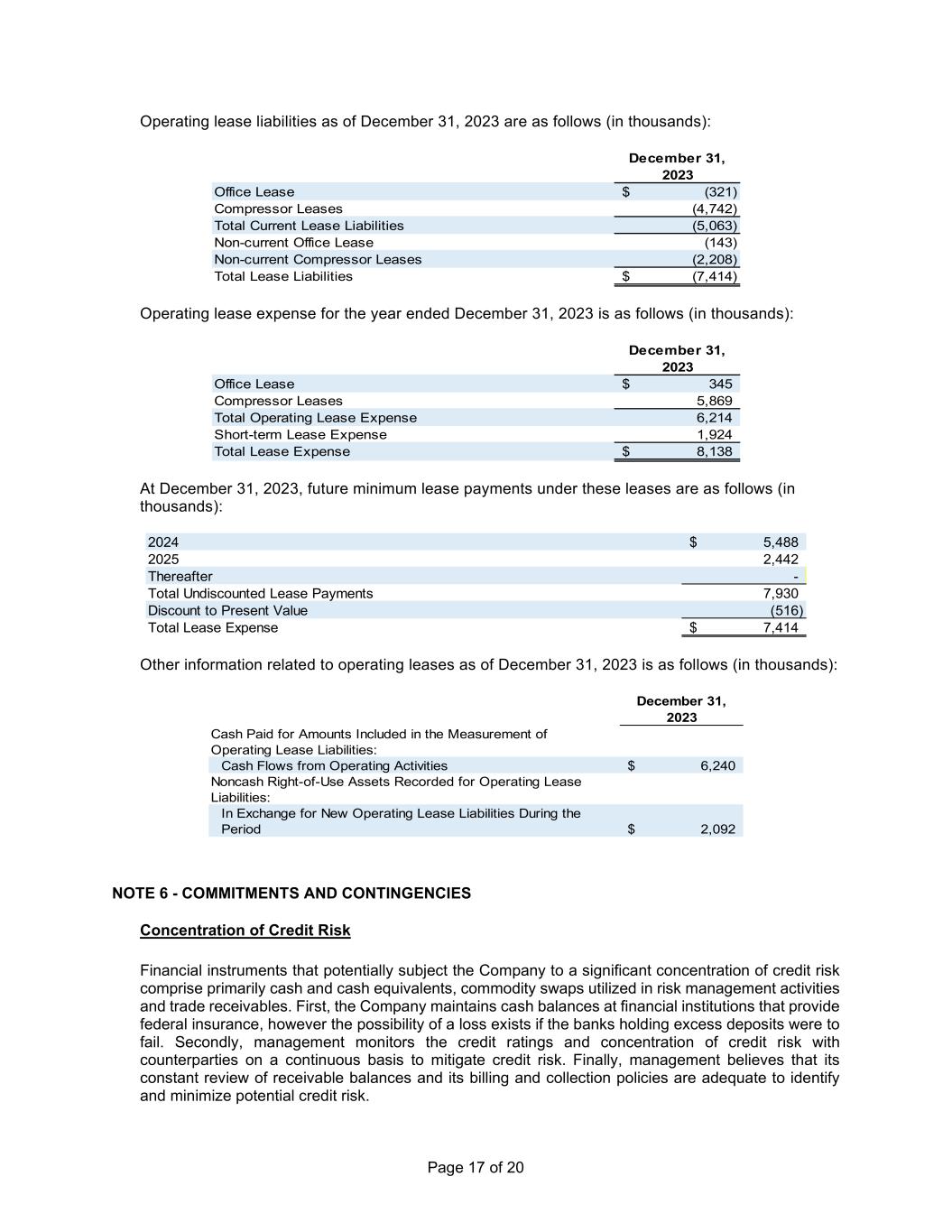

Page 17 of 20 Operating lease liabilities as of December 31, 2023 are as follows (in thousands): December 31, 2023 Office Lease (321)$ Compressor Leases (4,742) Total Current Lease Liabilities (5,063) Non-current Office Lease (143) Non-current Compressor Leases (2,208) Total Lease Liabilities (7,414)$ Operating lease expense for the year ended December 31, 2023 is as follows (in thousands): December 31, 2023 Office Lease 345$ Compressor Leases 5,869 Total Operating Lease Expense 6,214 Short-term Lease Expense 1,924 Total Lease Expense 8,138$ At December 31, 2023, future minimum lease payments under these leases are as follows (in thousands): 2024 5,488$ 2025 2,442 Thereafter - Total Undiscounted Lease Payments 7,930 Discount to Present Value (516) Total Lease Expense 7,414$ Other information related to operating leases as of December 31, 2023 is as follows (in thousands): December 31, 2023 Cash Paid for Amounts Included in the Measurement of Operating Lease Liabilities: Cash Flows from Operating Activities 6,240$ Noncash Right-of-Use Assets Recorded for Operating Lease Liabilities: In Exchange for New Operating Lease Liabilities During the Period 2,092$ NOTE 6 - COMMITMENTS AND CONTINGENCIES Concentration of Credit Risk Financial instruments that potentially subject the Company to a significant concentration of credit risk comprise primarily cash and cash equivalents, commodity swaps utilized in risk management activities and trade receivables. First, the Company maintains cash balances at financial institutions that provide federal insurance, however the possibility of a loss exists if the banks holding excess deposits were to fail. Secondly, management monitors the credit ratings and concentration of credit risk with counterparties on a continuous basis to mitigate credit risk. Finally, management believes that its constant review of receivable balances and its billing and collection policies are adequate to identify and minimize potential credit risk.

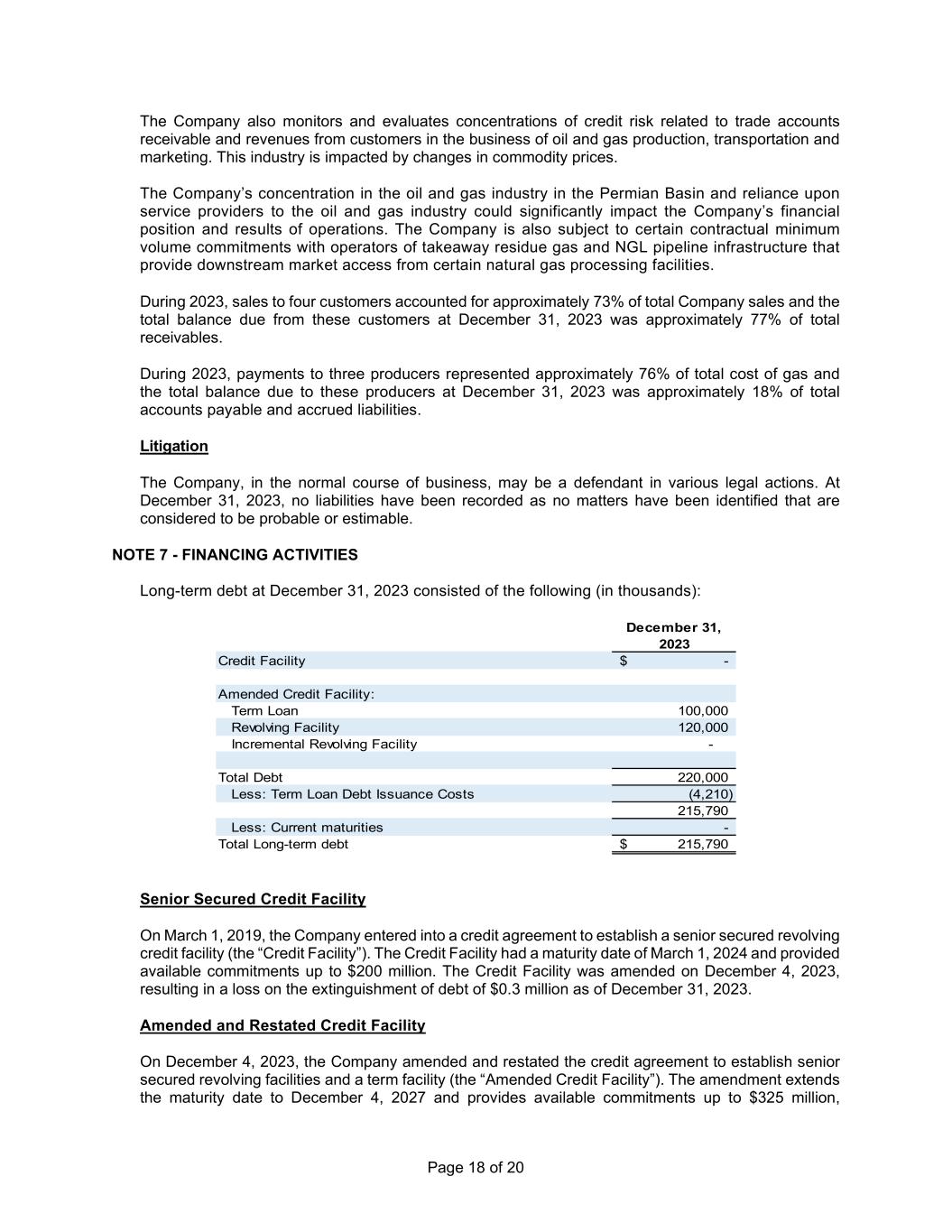

Page 18 of 20 The Company also monitors and evaluates concentrations of credit risk related to trade accounts receivable and revenues from customers in the business of oil and gas production, transportation and marketing. This industry is impacted by changes in commodity prices. The Company’s concentration in the oil and gas industry in the Permian Basin and reliance upon service providers to the oil and gas industry could significantly impact the Company’s financial position and results of operations. The Company is also subject to certain contractual minimum volume commitments with operators of takeaway residue gas and NGL pipeline infrastructure that provide downstream market access from certain natural gas processing facilities. During 2023, sales to four customers accounted for approximately 73% of total Company sales and the total balance due from these customers at December 31, 2023 was approximately 77% of total receivables. During 2023, payments to three producers represented approximately 76% of total cost of gas and the total balance due to these producers at December 31, 2023 was approximately 18% of total accounts payable and accrued liabilities. Litigation The Company, in the normal course of business, may be a defendant in various legal actions. At December 31, 2023, no liabilities have been recorded as no matters have been identified that are considered to be probable or estimable. NOTE 7 - FINANCING ACTIVITIES Long-term debt at December 31, 2023 consisted of the following (in thousands): December 31, 2023 Credit Facility -$ Amended Credit Facility: Term Loan 100,000 Revolving Facility 120,000 Incremental Revolving Facility - Total Debt 220,000 Less: Term Loan Debt Issuance Costs (4,210) 215,790 Less: Current maturities - Total Long-term debt 215,790$ Senior Secured Credit Facility On March 1, 2019, the Company entered into a credit agreement to establish a senior secured revolving credit facility (the “Credit Facility”). The Credit Facility had a maturity date of March 1, 2024 and provided available commitments up to $200 million. The Credit Facility was amended on December 4, 2023, resulting in a loss on the extinguishment of debt of $0.3 million as of December 31, 2023. Amended and Restated Credit Facility On December 4, 2023, the Company amended and restated the credit agreement to establish senior secured revolving facilities and a term facility (the “Amended Credit Facility”). The amendment extends the maturity date to December 4, 2027 and provides available commitments up to $325 million,

Page 19 of 20 dependent on terms and conditions as defined in the credit agreement. Proceeds from the Amended Credit Facility were used to repay outstanding borrowings under the Credit Facility of $200 million, to pay fees and expenses related to the offering and for general working capital needs. The Amended Credit Facility includes a term loan, revolving loan facility, and incremental revolving facility. The incremental revolving facility provides contingent borrowing availability under the Amended Credit Facility. As a condition precedent (“Condition Precedent”) to the availability of any incremental revolving facility commitment, the Company shall have received common equity contributions of no less than $30 million on or before March 31, 2024. The Amended Credit Facility bears interest costs that are dependent on the consolidated leverage as defined in the credit agreement. The Company is required to pay a commitment fee ranging from 0.375% to 0.500% (dependent upon the Company’s consolidated leverage ratio) on the daily average unused portion of the Amended Credit Facility. Loans under the Amended Credit Facility bear interest at either a base rate or SOFR (at the Company’s option) plus for revolving loans, a margin of 2.00% to 3.00% (in the case of alternate base rate loans) or 3.00% to 4.00% (in the case of SOFR loans), in each case based on the Company’s consolidated leverage ratio. The effective interest rate was 8.1% as of December 31, 2023. The Amended Credit Facility is secured by substantially all assets of the Company and subsidiaries. The Company is subject to financial and other covenants related to the Amended Credit Facility. As of December 31, 2023, the Company is in compliance with all financial and other covenants. As of December 31, 2023, the Company had $220 million in aggregate principal amount outstanding under the Amended Credit Facility and there are no letters of credit issued under the Amended Credit Facility. As of December 31, 2023, accrued interest payable was $1.5 million. As of December 31, 2023, there was $105 million available to be drawn on the Amended Credit Facility under the Condition Precedent. NOTE 8 - MEMBER’S CAPITAL The Company is a wholly owned subsidiary of Durango Midstream LLC (“Durango Midstream”) and Member’s Capital consists of contributions and distributions of cash. During 2023 there were no contributions from Durango Midstream and distributions made by Durango Permian totaled $5.0 million. NOTE 9 - EMPLOYEE BENEFIT PLAN The Company’s Parent sponsors a 401(k) savings plan (the “Plan”) in which the Company’s employees are eligible to participate. The Plan is a defined contribution plan in which all eligible salaried and hourly employees may participate. Under the Plan, the Company matches employee contributions up to 5% of participants’ respective annual compensation. For the year ended 2023 the Company’s matching contributions to the Plan were $0.4 million. NOTE 10 - RELATED PARTY TRANSACTIONS During 2023 the Company had transactions with related parties in the normal course of business. The Company is subject to a Services Agreement whereby certain affiliates that are subsidiaries of DIH provide services for the Company including employment and payroll services and whereby general and administrative costs are allocated. During 2023 the Company was charged $0.6 million for employment and payroll services and $4.8 million for general and administrative costs by these affiliates. From time to time and pursuant to the governing documents the Company may reimburse an affiliate of its equity sponsor, Morgan Stanley Energy Partners (“MSEP”), for out-of-pocket costs, fees and expenses incurred in connection with or related to its investment in the Company. The Company conducted a portion of its commodity risk management activities with Morgan Stanley Capital Services LLC in 2023. These activities are discussed in more detail in Note 4 – Derivative Instruments and Hedging Activities.

Page 20 of 20 At December 31, 2023 there was a payable to affiliates of $1.6 million. NOTE 11 - SUBSEQUENT EVENTS The Company evaluated its December 31, 2023 financial statements for subsequent events through April 18, 2024, the date the financial statements were available to be issued. By March 12, 2024, the Company had received $30 million of contributions from an affiliate, in accordance with the Condition Precedent defined in the Amended Credit Facility.