UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission file number 001-38048

KINETIK HOLDINGS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | | 81-4675947 |

(State or other jurisdiction of incorporation or organization) | | | | (I.R.S. Employer Identification No.) |

2700 Post Oak Boulevard, Suite 300

Houston, Texas 77056-4400

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (713) 621-7330

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value | | KNTK | | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☒ | | Accelerated filer | | ☐ | | Emerging growth company | | ☐ |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes ☐ No ☒

| | | | | | | | | | | | | | |

| Aggregate market value of the voting and non-voting common equity held by non-affiliates of registrant as of June 30, 2024 | $1,563,008,393 |

| Number of shares of registrant’s Class A common stock, $0.0001 issued and outstanding as of February 21, 2025 | 60,078,190 | |

| Number of shares of registrant’s Class C common stock, $0.0001 issued and outstanding as of February 21, 2025 | 97,696,784 | |

Documents Incorporated By Reference

Portions of registrant’s proxy statement relating to registrant’s 2024 annual meeting of stockholders to be filed hereafter are incorporated by reference in Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Page |

| | |

| | |

| | |

| PART I | |

| | |

| 1 and 2. | | |

| 1A. | | |

| 1B. | | |

| 1C. | | |

| 3. | | |

| | |

| | |

| PART II | |

| | |

| 5. | | |

| 6. | | |

| 7. | | |

| 7A. | | |

| 8. | | |

| 9. | | |

| 9A. | | |

| 9B. | | |

| 9C. | | |

| | |

| PART III | |

| | |

| 10. | | |

| 11. | | |

| 12. | | |

| 13. | | |

| 14. | | |

| | |

| PART IV | |

| | |

| 15. | | |

| 16. | | |

| | |

GLOSSARY

The following are abbreviations and definitions of certain terms used in this Annual Report on Form 10-K (“Annual Report”) and certain terms which are commonly used in the exploration, production, and midstream sectors of the oil and natural gas industry:

•ASC. Accounting Standards Codification

•ASU. Accounting Standards Update

•Bbl. One stock tank barrel of 42 United States (“U.S.”) gallons liquid volume used herein in reference to crude oil, condensate or natural gas liquids

•Bcf. One billion cubic feet

•Bcf/d. One Bcf per day

•Btu. One British thermal unit, which is the quantity of heat required to raise the temperature of a one-pound mass of water by one degree Fahrenheit

•CODM. Chief Operating Decision Maker

•Delaware Basin. Located on the western section of the Permian Basin. The Delaware Basin covers a 6.4M acre area

•EBITDA. Earnings before interest, taxes, depreciation, and amortization

•FASB. Financial Accounting Standards Board

•Field. An area consisting of a single reservoir or multiple reservoirs, all grouped on, or related to, the same individual geological structural feature or stratigraphic condition. The field name refers to the surface area, although it may refer to both the surface and the underground productive formations

•Formation. A layer of rock which has distinct characteristics that differs from nearby rock

•GAAP. United States Generally Accepted Accounting Principles

•GHG. Greenhouse gas

•MBbl. One thousand barrels of crude oil, condensate or NGLs

•MBbl/d. One MBbl per day

•Mcf. One thousand cubic feet of natural gas

•Mcf/d. One Mcf per day

•MMBtu. One million British thermal units

•MMcf. One million cubic feet of natural gas

•MMcf/d. One MMcf per day

•MVC. Minimum volume commitments

•NGL or NGLs. Natural gas liquids. Hydrocarbons found in natural gas, which may be extracted as liquefied petroleum gas and natural gasoline

•Throughput. The volume of crude oil, natural gas, NGLs, water and refined petroleum products transported or passing through a pipeline, plant, terminal or other facility during a particular period

•SEC. United States Securities and Exchange Commission

•SOFR. Secured Overnight Financing Rate

FORWARD-LOOKING STATEMENTS AND RISK

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts included or incorporated by reference in this Annual Report, including, without limitation, statements regarding our future financial position, business strategy, budgets, projected revenues, projected costs and plans, and objectives of management for future operations, are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “could,” “expect,” “intend,” “project,” “estimate,” “anticipate,” “plan,” “believe,” “continue,” “seek,” “guidance,” “might,” “outlook,” “possibly,” “potential,” “prospect,” “should,” “would,” or similar terminology, but the absence of these words does not mean that a statement is not forward looking. Although we believe that the expectations reflected in such forward-looking statements are reasonable under the circumstances, we can give no assurance that such expectations will prove to have been correct. Important factors that could cause actual results to differ materially from our expectations include, but are not limited to, assumptions about:

•the market prices of oil, natural gas, NGLs, and other products or services;

•competition from other pipelines, terminals or other forms of transportation and competition from other service providers for gathering system capacity and availability;

•production rates, throughput volumes, reserve levels, and development success of dedicated oil and gas fields;

•our future financial condition, results of operations, liquidity, compliance with debt covenants and competitive position;

•our future revenues, cash flows and expenses;

•our access to capital and its anticipated liquidity;

•our future business strategy and other plans and objectives for future operations;

•the amount, nature and timing of our future capital expenditures, including future development costs;

•the risks associated with potential acquisitions, divestitures, new joint ventures or other strategic opportunities;

•the recruitment and retention of our officers and personnel;

•the likelihood of success of and impact of litigation and other proceedings, including regulatory proceedings;

•our assessment of our counterparty risk and the ability of our counterparties to perform their future obligations;

•the impact of federal, state, and local political, regulatory and environmental developments where we conduct our business operations;

•the occurrence of an extreme weather event, terrorist attack or other event that materially impacts project construction and our operations, including cyber or other operational electronic systems;

•our ability to successfully implement, execute and achieve our sustainability goals and initiatives;

•our ability to successfully implement our stock repurchase program;

•our ability to integrate operations or realize any anticipated benefits, savings or growth of business combinations. See Note 3 — Business Combination in the Notes to our Consolidated Financial Statements set forth in this Annual Report; •general economic and political conditions, epidemics or pandemics and actions taken by third parties in response to such epidemics or pandemics, the impact of continued inflation, central bank policy actions, bank failures and associated liquidity risks; and

Other factors or events that could cause the Company’s actual results to differ materially from the Company’s expectations may emerge from time to time, and it is not possible for the Company to predict all such factors or events. All subsequent written and oral forward-looking statements attributable to the Company, or persons acting on its behalf, are expressly qualified in their entirety by the cautionary statements. All forward-looking statements speak only as of the date of this Annual Report. Except as required by law, the Company disclaims any obligation to update or revise its forward-looking statements, whether based on changes in internal estimates or expectations, new information, future developments, or otherwise.

Risk Factors Summary

The following is a summary of the principal risks that could adversely affect our business, operations and financial results. Please refer to Part I—Item 1A—Risk Factors in this Annual Report below for additional discussion of the risks summarized in this Risk Factors Summary.

Business and Operational Risks

•The majority of the Company’s operating assets are currently located in the Permian Basin, making it vulnerable to risks associated with operating in a single geographic area.

•Because of the natural decline in hydrocarbon production from existing wells, the Company’s success depends, in part, on its ability to maintain or increase hydrocarbon throughput volumes on its midstream systems, which depends on its customers’ levels of development and completion activity on its dedicated acreage.

•We may experience difficulties completing acquisitions or divestitures or integrating new businesses and properties, and we may be unable to achieve the benefits we expect from any future acquisitions or divestitures.

•The Company owns interests in certain pipeline projects and other joint ventures, and the Company’s control of such entities is limited.

•If the third-party pipelines interconnected to the Company’s pipelines become unavailable to transport or store crude oil, NGLs or natural gas, or if our cost of transporting on such third-party pipelines changes, the Company’s revenue and available cash could be adversely affected.

•The third parties on whom the Company relies for transportation services from its processing facilities are subject to complex federal, state, and other laws that could adversely affect our financial condition and results of operations.

•The Company’s customers may suspend, reduce or terminate their obligations under the Company’s commercial agreements with them.

•Increased competition from other companies that provide midstream services, or from alternative fuel sources, could have a negative impact on the demand for the Company’s services.

•The Company’s exposure to commodity price risk may change over time and the Company cannot guarantee the terms of any existing or future agreements for its midstream services with its customers.

•The use of derivative financial instruments could result in material financial losses by us.

•The Company’s construction of new midstream assets may be subject to new or additional regulatory, environmental, political, contractual, legal and economic risks.

•The Company’s business involves many hazards and operational risks, some of which may not be fully covered by insurance.

•A shortage of equipment and skilled labor could reduce equipment availability and labor productivity and increase labor and equipment costs.

Environmental and Regulatory Risk Factors Related to the Company

•The Company operates in a highly regulated environment and its business and profitability could be adversely affected by actions by governmental entities, changes to current laws or regulations, or a failure to comply with laws or regulations.

•Changes to applicable tax laws and regulations or exposure to additional income tax liabilities could adversely affect our operating results and cash flows.

•Rate regulation, challenges by shippers to the rates the Company charges on its pipelines or changes in the jurisdictional characterization of some of the Company’s assets by federal, state or local regulatory agencies or a change in policy by those agencies may result in increased regulation of its assets, which may cause its operating expenses to increase, limit the rates it charges for certain services and decrease the amount of cash flows.

•Federal and state legislative and regulatory initiatives relating to pipeline safety, which are often subject to change, may result in more stringent regulations or enforcement and could subject the Company to increased operational costs, increased capital costs and potential operational delays.

•Increased regulation of hydraulic fracturing could result in reductions or delays in crude oil and natural gas production by the Company’s customers, which could reduce the throughput on its gathering and other midstream systems.

•Adoption of new or more stringent legal standards relating to induced seismic activity associated with produced-water disposal could affect the Company’s operations.

•The Company may incur significant liability under, or costs and expenditures to comply with, health, safety and environmental laws and regulations, which are complex and subject to frequent change.

•Legislation, executive orders and regulatory initiatives relating to climate change could have a material adverse effect on our business, demand for our services, financial condition, results of operations and cash flows, while potential physical effects of climate change could disrupt the Company’s operations, cause damage to its pipelines and other facilities and cause it to incur significant costs in preparing for or responding to those effects.

•Increasing attention to sustainability-related matters and conservation measures may adversely impact the Company’s business.

Risks Related to Ownership of Our Common Stock

•Entities controlled by Blackstone Inc. (“Blackstone”) and ISQ Global Fund II GP, LLC (“I Squared Capital”) are parties to the amended and restated stockholders agreement granting certain director designation rights and own a majority of the Company’s outstanding voting shares and thus could strongly influence all of the Company’s corporate actions.

•Potential future sales pursuant to registration rights granted by the Company and under Rule 144 may depress the market price for our shares of Class A Common Stock

•The Company’s ability to return capital to stockholders through dividends and stock repurchases depends on its ability to generate sufficient cash flows, which it may not be able to accomplish.

•The Company’s charter designates the Court of Chancery of the State of Delaware (the “Court of Chancery”) as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by its stockholders, which could limit its stockholders’ ability to obtain a favorable judicial forum for disputes with the Company or its directors, officers, employees or agents.

•If the Company fails to maintain an effective system of internal controls, it may not be able to report accurately its financial results or prevent fraud. As a result, current and potential holders of the Company’s equity could lose confidence in its financial reporting, which would harm its business and cost of capital.

•If the performance of the Company does not meet the expectations of investors, stockholders or financial analysts, the market price of the Company’s securities may decline.

•We cannot guarantee that our stock repurchase program will enhance long-term stockholder value.

General Risks

•Continuing or worsening inflationary issues and associated changes in monetary policy have resulted in and may result in additional increases to the cost of the Company’s services and personnel.

•The Company’s operations could be disrupted by natural or human causes beyond its control.

•Cybersecurity breaches of our IT systems could result in information theft, data corruption, operational disruption and/or financial loss.

•Changes in management’s estimates and assumptions may have a material impact on the Company’s Consolidated Financial Statements and financial or operational performance in any given period.

PART I

ITEMS 1 and 2. BUSINESS AND PROPERTIES

Overview

We are an integrated midstream energy company in the Permian Basin providing comprehensive gathering, transportation, compression, processing and treating services. Our core capabilities include a variety of service offerings including natural gas gathering, transportation, compression, treating and processing; NGLs stabilization and transportation; produced water gathering and disposal; and crude oil gathering, stabilization, storage and transportation. We have approximately 2.2 Bcf/d cryogenic natural gas processing capacity strategically located across Texas and New Mexico. Such capacity will increase to 2.4 Bcf/d once the Kings Landing Project is completed in mid-2025. As measured by processing capacity, we are the fourth largest natural gas processor in the Delaware Basin and fourth largest across the entire Permian Basin. In addition, we have equity interests in three long-term contracted pipelines transporting natural gas, NGLs, and crude oil from the Permian Basin to the U.S. Gulf Coast.

Significant Transactions and Recent Developments

Permian Resources Midstream Assets Acquisition

On December 10, 2024, the Company announced it has entered into a definitive agreement with Permian Resources Corporation (“Permian Resources”) to acquire certain natural gas and crude oil gathering systems assets, primarily located in Reeves County, Texas, for $178.4 million of cash consideration (“Permian Resources Midstream Acquisition”). The Permian Resources Midstream Acquisition provides a multi-stream opportunity for natural gas gathering, compression and processing, as well as crude gathering services for the Company. The transaction closed in early January 2025 following satisfaction of customary closing conditions.

Epic Crude Holdings, LP (“EPIC”) Equity Interest

During the third quarter 2024, the Company consummated the Equity Sale and Purchase Agreement with Dos Rios Crude Intermediate LLC to purchase a 12.5% equity interest in EPIC. The acquisition of additional interest is accounted for as a business acquisition pursuant to ASC 805, Business Combination (“ASC 805”). After completion of the transaction, the Company owned a 27.5% equity interest in EPIC. EPIC has over 800 miles of pipeline connecting the Delaware and Midland Basins to the U.S. Gulf Coast and has a capacity of 625 MBbl/d. The Company’s original 15% investment in EPIC had no assigned value through the acquisition of Altus Midstream Company during 2022, so the company resumed accounting for the EPIC investment using the equity method of accounting upon the closing of the additional 12.5% interest. Refer to Note 7—Equity Method Investments in the Notes to our Consolidated Financial Statements in this Annual Report Form 10-K for further information. Durango Acquisition

On June 24, 2024, the Company completed the acquisition of all of the membership interests of Durango Permian LLC and its wholly owned subsidiaries for an adjusted purchase price of approximately $785.7 million (“Durango Acquisition”). Refer to Note 3—Business Combinations in the Notes to our Consolidated Financial Statements in this Annual Report Form 10-K for further information. The Durango Acquisition significantly expands our footprint into New Mexico and the Northern Delaware Basin, expanding our processing capacity by over 200 MMcf/d and doubling our existing gathering pipeline mileage. An additional 200 MMcf/d of processing capacity will be added upon completion of the Kings Landing Project.

Gulf Coast Express Pipeline (“GCX”) Divestiture

On June 4, 2024, the Company sold its 16% equity interest in GCX pursuant to the GCX Purchase Agreement for an adjusted purchase price of $524.4 million (the "GCX Sale"), including a $30.0 million earn out in cash upon the approval by the GCX Board of Directors of one or more capital projects that achieve certain capacity expansion criteria. Refer to Note 7—Equity Method Investments in the Notes to our Consolidated Financial Statements in this Annual Report Form 10-K for further information.

Accounts Receivable Securitization Facility

On April 2, 2024, Kinetik Receivables LLC (“Kinetik Receivables”), a bankruptcy remote special purpose entity formed as a direct subsidiary of Kinetik Holdings, LP, a Delaware limited partnership (the “Partnership”), which is a subsidiary of the Company, entered into an accounts receivable securitization facility with an initial facility limit of $150.0 million (the “A/R Facility”) with PNC Bank, as the administrative agent, and certain purchasers party thereto from time to time, which has a scheduled termination date of April 1, 2025. Refer to Note 8—Debt and Financing Costs in the Notes to our Consolidated Financial Statements in this Annual Report Form 10-K for further information. Organizational Structure

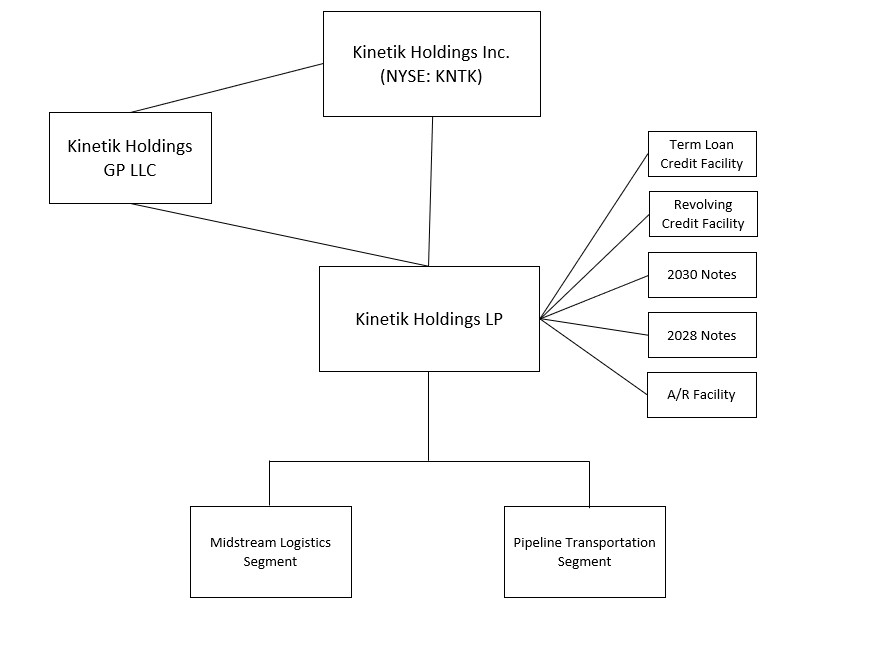

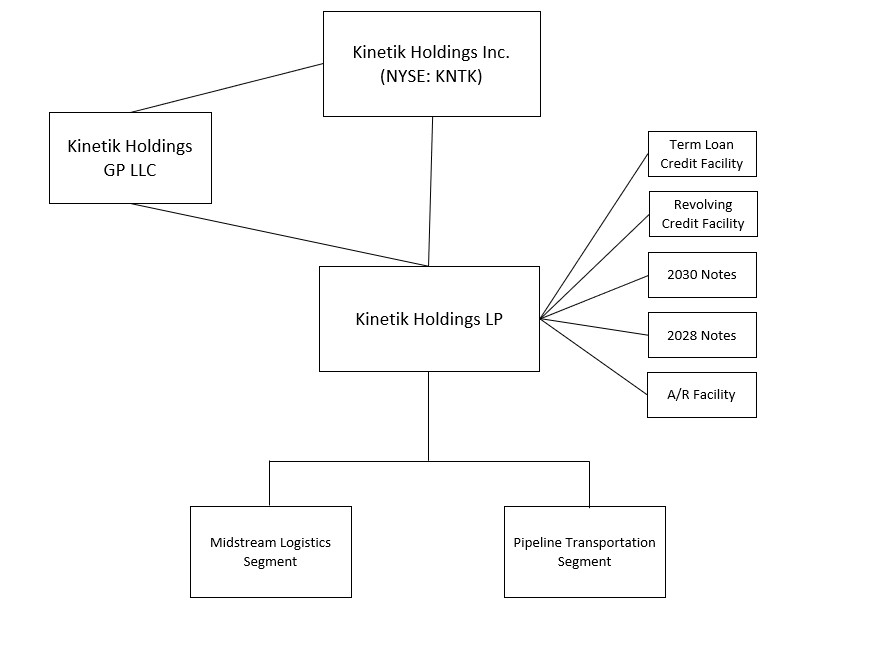

The Company is a holding company, whose only significant assets are ownership of the non-economic general partner interest and an approximate 38% limited partner interest in the Partnership. As the owner of the non-economic general partner interest in the Partnership, the Company is responsible for all operational, management and administrative decisions related to and consolidates the results of the Partnership and its subsidiaries. The Company also owns equity interests in three Permian Basin pipelines that have access to various points along the U.S. Gulf Coast. The Company’s operations are strategically located in the heart of the Delaware Basin in the Permian and the Company’s operational headquarters is located at 303 Veterans Airpark Lane in Midland, Texas 79705. The Company’s corporate office is located at 2700 Post Oak Boulevard, Suite 300, Houston, Texas 77056. The following chart summarizes our organizational structure as of December 31, 2024. For simplicity, certain entities and ownership interests have not been depicted.

Industry Overview

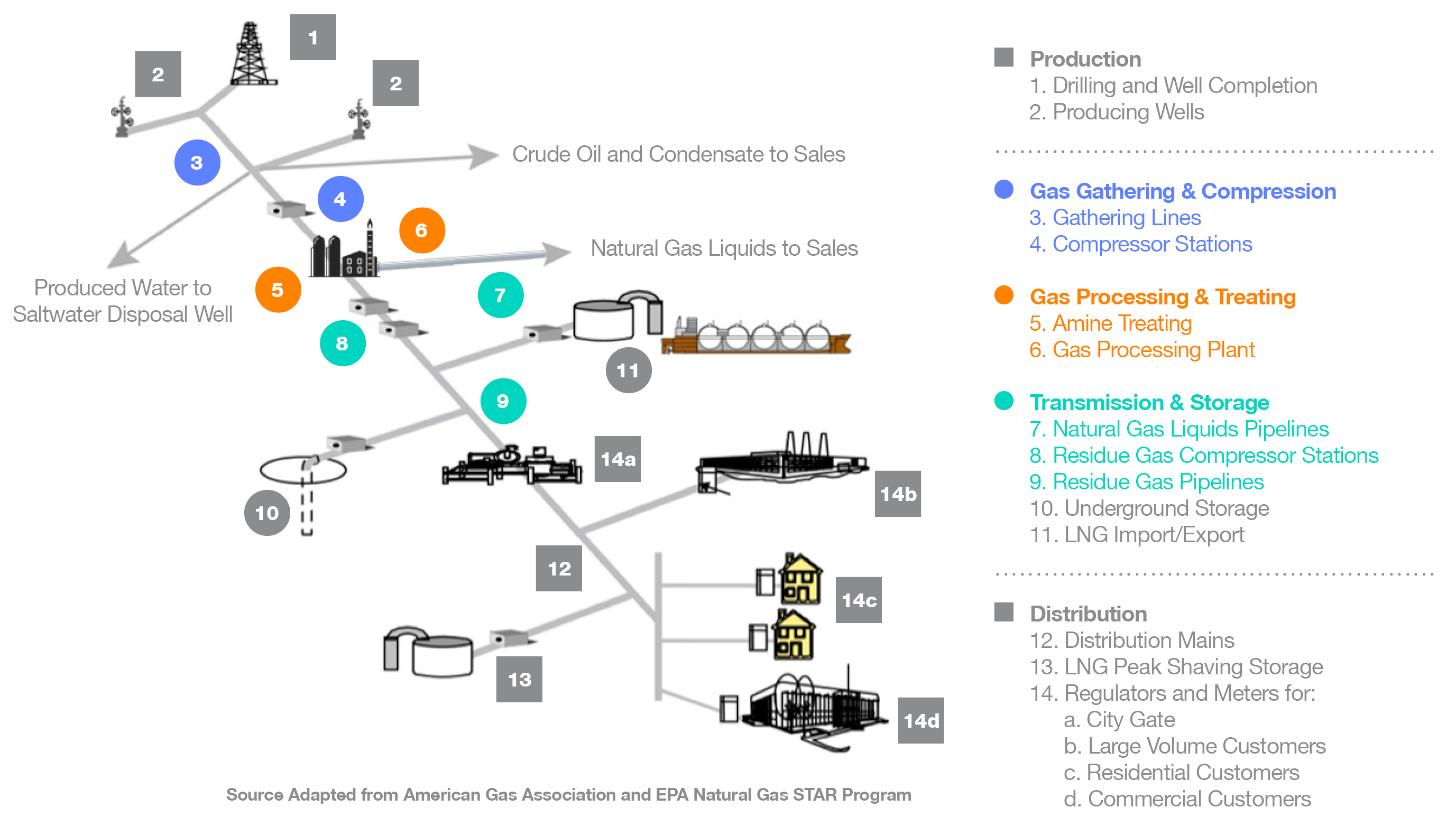

The following diagram illustrates the Company’s primary operations along the midstream value chain:

The midstream industry is the link between the exploration and production of natural gas and crude oil and condensate and the delivery of its salable commodity components to end-user markets. The midstream industry is generally characterized by regional competition based on the proximity of gathering systems and processing plants to natural gas and crude oil and condensate producing wells.

Our Operating Segments and Properties

We have two operating segments which are strategic business units with differing products and services. The activities of each of our reportable segments from which the Company earns revenues, records equity income or losses and incurs expenses are described below:

Midstream Logistics

The Midstream Logistics segment provides three service offerings: 1) gas gathering and processing, 2) crude oil gathering, stabilization and storage services and 3) water gathering and disposal.

Gas Gathering and Processing

The Midstream Logistics segment provides gas gathering and processing services with over 3,900 miles of low and high-pressure steel pipeline located throughout the Delaware Basin, including over 2,300 miles of gas pipeline acquired through the Durango Acquisition. An additional 214 miles of gathering pipeline was added to our system through the Permian Resources Midstream Acquisition closed during January 2025. Gas processing assets are centralized at seven processing complexes with total cryogenic processing capacity of approximately 2.2 Bcf/d: Diamond Cryogenic complex (720 MMcf/d), the Pecos Bend complex (540 MMcf/d), the East Toyah complex (460 MMcf/d), the Pecos complex (260 MMcf/d), Maljamar ( 150 MMcf/d), Dagger Draw (75 MMcf/d) and the Sierra Grande complex (60 MMcf/d). Current residue gas outlets are the El Paso Natural Gas Pipeline, Energy Transfer Comanche Trail Pipeline and Transwestern Pipeline, ONEOK Roadrunner Pipeline, Whitewater Aqua Blanca Pipeline, Permian Highway Pipeline LLC (“PHP”), New Mexico Gas Company and the Company’s wholly owned and operated Delaware Link Pipeline. NGL outlets are Energy Transfer’s Lone Star NGL Pipeline, Targa’s Grand Prix

NGL Pipeline and Enterprise’s Shin Oak NGL Pipeline (“Shin Oak”), which are accessed through Kinetik NGL, our wholly owned and operated intrabasin NGL pipelines.

Crude Oil Gathering, Stabilization, and Storage Services

The Midstream Logistics segment provides crude oil gathering, stabilization and storage services throughout the Texas Delaware Basin. Crude gathering assets are centralized at the Caprock Stampede Terminal and the Pinnacle Sierra Grande Terminal. The system includes approximately 220 miles of gathering pipeline and 90,000 barrels of crude storage. The crude facilities have connections for takeaway transportation into Plains’s Central 285, North 285 and Wolfbone Ranch, and Plains Oryx’s Orla & Central Mentone and Energy Transfer’s Judith facilities. An additional 75 miles of gathering pipeline was added to our crude gathering assets through the Permian Resources Midstream Acquisition closed during January 2025.

Water Gathering and Disposal

In addition, the Midstream Logistics segment provides water gathering and disposal services through assets located in northern Reeves County, Texas. The system includes over 360 miles of gathering pipeline and approximately 580,000 barrels per day of permitted disposal capacity.

Pipeline Transportation

As of December 31, 2024, the Pipeline Transportation segment consists of three equity method investment (“EMI”) pipelines originating in the Permian Basin with various access points to the U.S. Gulf Coast, and our wholly owned and operated pipelines, Kinetik NGL and Delaware Link Pipelines. The pipelines transport crude oil, natural gas and NGLs within the Permian Basin and to the U.S. Gulf Coast. For a more in-depth discussion of the estimated capital resources, liquidity and timing associated with each EMI pipeline, please see Part IV, Item 15, Note 7—Equity Method Investments, set forth in this Annual Report. Permian Highway Pipeline

The Company owns an approximately 55.5% equity interest in PHP, which is also owned and operated by Kinder Morgan Texas Pipeline, LLC (“Kinder Morgan”). PHP transports natural gas from the Waha area in northern Pecos County, Texas to the Katy, Texas area with connections to the U.S. Gulf Coast and Mexico markets. PHP was placed in service in January 2021, with the total capacity of 2.1 Bcf/d fully subscribed under long-term contracts. In December 2023, PHP’s expansion project was put into service and its total capacity was increased to 2.65 Bcf/d.

Breviloba, LLC

The Company owns a 33.0% equity interest in Shin Oak, which is owned by Breviloba, LLC (“Breviloba”), and operated by Enterprise Products Operating LLC. Shin Oak transports NGLs from the Permian Basin to Mont Belvieu, Texas. Shin Oak was placed in service during 2019, with total capacity of over 600 MBbl/d.

EPIC Crude Oil Pipeline

The Company owns a 27.5% equity interest in EPIC, which is operated by EPIC Consolidated Operations, LLC. EPIC transports crude oil from Orla, Texas in Northern Reeves County to the Port of Corpus Christi, Texas. EPIC has over 800 miles of pipeline connecting the Delaware and Midland Basins and has a capacity of 625 MBbl/d.

Kinetik NGL Pipelines

The Kinetik NGL Pipelines consist of approximately 96 miles of NGL pipelines connecting our East Toyah and Pecos complexes to Waha, including our 20-inch Dewpoint pipeline that spans 40 miles, and our 30 mile, 20-inch Brandywine Pipeline connecting to our Diamond Cryogenic complex. The Kinetik NGL pipeline system has a capacity that approximate 580 MBbl/d.

Delaware Link Pipeline

The Delaware Link Pipeline consists of approximately 40 miles of 30-inch diameter pipeline with a capacity of approximately 1.0 Bcf/d that provides additional transportation capacity to Waha. The project reached commercial in-service in October 2023.

The following table summarizes our ownership and capacity of properties in our Pipeline Transportation segment as of December 31, 2024:

| | | | | | | | | | | |

| Asset | Ownership Interest | Approximate Pipeline System Miles | Capacity |

| Pipeline Transportation | | | |

| | | |

| PHP | 55.5% | 435 | 2.65 Bcf/d |

| Breviloba | 33.0% | 668 | 600 MBbl/d |

| EPIC | 27.5% | 800 | 625 MBbl/d |

| Kinetik NGL Pipelines | 100.0% | 126 | 580 MBbl/d |

| | | |

| Delaware Link Pipeline | 100.0% | 40 | 1.0 Bcf/d |

| | |

Title to Properties and Permits

Certain pipelines connecting our facilities are constructed on rights-of-way granted by the apparent record owners of the property and in some instances these rights-of-way are revocable at the election of the grantor. In several instances, lands over which rights-of-way have been obtained could be subject to prior liens that have not been subordinated to the right-of-way grants. We have obtained permits from public authorities to cross over or under, or to lay pipelines in or along, watercourses, county roads, municipal streets and state highways and, in some instances, these permits are revocable at the election of the grantor. These permits may also be subject to renewal from time to time and we will generally seek renewal or arrange alternative means of transport through additional investment or commercial agreements. We have also obtained permits from railroad companies to cross over or under lands or rights-of-way, many of which are also revocable at the grantor’s election.

We believe we have satisfactory permits and/or title to all our material rights-of-way. We also believe that we have satisfactory title to all our material assets.

Competition

The business of providing gathering, compression, processing and transmission services for natural gas and NGLs is highly competitive. The Company faces intense competition in obtaining natural gas and NGL volumes, including from major integrated and independent exploration and production companies, interstate and intrastate pipelines, and other companies that gather, compress, treat, process, transmit or market natural gas and NGLs. Competition for supplies is primarily based on geographic location of facilities in relation to production or markets, the reputation, efficiency and reliability of the midstream company, and the pricing arrangements offered by the midstream company. For areas where acreage is not dedicated to the Company, the Company will compete with similar enterprises in providing additional gathering, compression, processing and transmission services in the same area of operation.

Human Capital

At Kinetik, we recognize that our employees are our greatest asset, and their success is our success, and as such, we strive to prioritize their well-being, engagement and professional growth. We also strive to retain top talent by fostering a culture that emphasizes health and safety, respect for employees and continuous development. As of December 31, 2024, we had approximately 460 employees. None of these employees are covered by collective bargaining agreements.

Health and Safety. The Company’s Environmental, Health and Safety (“EHS”) Management System lays out our requirements, processes, and guidelines for process safety and occupational health and safety. We dedicate a safety team, led by the Director of Health and Safety and supported by our VP of Operations Risk Management and Reliability, to oversee our health and safety program. Our focus on achieving zero incidents has led us to establish a robust health and safety program that transcends mere compliance, fostering a culture where safety is driven by intrinsic motivation. We utilize computer-based tools for tracking environmental impacts, managing safety and risks and monitoring key performance metrics. We set ambitious and measurable safety targets to support our commitment to the safety and well-being of our employees and those around us. In 2024, our Total Recordable Incident Rate was 0.75 and our Motor Vehicle Incident Rate was 1.36.

Through effective engagement, recognition and incentive programs, we aim to cultivate a culture of excellence that results in a more engaged and productive workforce. The Kinetik Employee Engagement Program (“KEEP”) gives employees a straightforward line of communication to report hazards, suggest improvements, or recognize coworkers. This initiative, rooted in the “See Something, Say Something” philosophy, promotes shared learning and operational excellence. In 2024, employees

submitted 365 KEEP Cards, leading to 229 proactive risk mitigation actions.

In addition, we believe that a strong safety culture begins with a well-trained workforce. In 2024, our employees collectively completed over 18,000 hours of EHS-related training. Field-based employees averaged 45 hours of EHS training each, covering a variety of topics such as environmental compliance, Company EHS policies, OSHA regulations, driver safety and emergency response.

Cultivating an Empowered Workforce We are committed to cultivating an empowered workforce and believe that fostering a culture of appreciation empowers our workforce and inspires them to consistently deliver outstanding performance. We employ a mix of formal and informal recognition strategies, including monetary and non-monetary incentives that celebrate employee performance, service milestones and exceptional contributions in safety, compliance, innovation and teamwork. In October 2024, we contracted third-party providers to conduct our 2024 Engagement Survey in order to maximize our culture and leadership effectiveness. The results of the survey are to be discussed among the leadership team to reflect upon what we are doing right and where there may be gaps and opportunities for improvement. In 2024, we also conducted focus group interviews across key locations to gain deeper insights from our employees. These sessions provide more detailed feedback and guide our efforts to make Kinetik a world-class organization and employer of choice.

At Kinetik, we strive to ensure our employees are actively involved and embody Kinetik’s values every day. We involve our employees in a variety of initiatives, from volunteering at community events to participating in donation drives and celebrating special occasions together. We also believe that fostering an environment where all individuals feel valued, respected and included helps to ensure everyone can contribute to their fullest potential, leading to enhanced decision making, increased innovation, improved retention and overall success. Along with annually acknowledging our Code of Business Conduct (the “Code of Conduct”), as part of our ongoing commitment to equal employment opportunity, all employees are required to complete various training regarding our workplace policies.

Regulation of Operations

Natural Gas Pipeline Regulation

Under the Natural Gas Act (“NGA”), the Federal Energy Regulatory Commission (“FERC”) regulates the transportation of natural gas in interstate commerce. Intrastate transportation of natural gas is largely regulated by the state in which such transportation takes place. To the extent that the Company’s intrastate natural gas transportation systems transport natural gas in interstate commerce, the rates, terms and conditions of such services are subject to FERC jurisdiction under Section 311 of the Natural Gas Policy Act of 1978 (“NGPA”). The NGPA regulates, among other things, the provision of transportation services by an intrastate natural gas pipeline on behalf of a local distribution company or an interstate natural gas pipeline. Under Section 311 of the NGPA, rates charged for interstate transportation must be fair and equitable, and amounts collected in excess of fair and equitable rates are subject to refund with interest. The terms and conditions of service set forth in the Company’s statement of operating conditions for transportation service under Section 311 of the NGPA are also subject to FERC review and approval. Failure to observe the service limitations applicable to transportation services under Section 311, failure to comply with the rates approved by the FERC for Section 311 service, or failure to comply with the terms and conditions of service established in the pipeline’s FERC-approved statement of operating conditions could result in a change of jurisdictional status and/or the imposition of administrative, civil and criminal remedies.

The Company’s Intrastate natural gas operations are also subject to regulation by various agencies in Texas, principally the Railroad Commission of Texas (“TRRC”). The Company’s intrastate pipeline operations are also subject to the Texas Utilities Code and the Texas Natural Resources Code, as implemented by the TRRC. Generally, the TRRC is vested with authority to ensure that rates, operations and services of gas utilities, including intrastate pipelines, are just and reasonable and not discriminatory. The rates the Company charges for transportation services are deemed just and reasonable under Texas law unless challenged in a customer or TRRC complaint. Failure to comply with the Texas Utilities Code or the Texas Natural Resources Code can result in the imposition of administrative, civil and criminal remedies.

Natural Gas Gathering Regulation

Section 1(b) of the NGA exempts natural gas gathering facilities from the jurisdiction of the FERC. The Company believes that its natural gas gathering pipelines meet the traditional tests the FERC has used to establish whether a pipeline is a gathering pipeline that is not subject to FERC jurisdiction. However, the distinction between FERC-regulated transmission services and federally unregulated gathering services has been the subject of substantial litigation and varying interpretations. In addition, the FERC’s determinations as to whether a pipeline is a gathering pipeline are made on a case-by-case basis, so the classification and regulation of the Company’s natural gas pipeline system could be subject to change based on future determinations by the FERC and the courts. State regulation of gathering facilities generally includes various safety, environmental and, in some circumstances, nondiscriminatory take requirements and complaint-based rate regulation.

The Company’s natural gas gathering facilities in Texas are subject to regulation by the TRRC under the Texas Utilities Code and the Texas Natural Resources Code in the same manner as described above for intrastate pipeline transportation facilities. The Company’s natural gas gathering pipeline system is also subject to ratable take and common purchaser statutes in Texas. The ratable take statute generally requires gatherers to take, without undue discrimination, natural gas production that may be tendered to the gatherer for handling. Similarly, the common purchaser statute generally requires gatherers to purchase without undue discrimination as to source of supply or producer. These statutes are designed to prohibit discrimination in favor of one producer over another producer or one source of supply over another source of supply. In New Mexico, the Company’s natural gas gathering facilities are subject to regulation by numerous governmental agencies, including the New Mexico Public Regulation Commission (“NMPRC”).

Crude Oil and Natural Gas Liquids Pipeline Regulation

Transmission services rendered by the Company are subject to the regulation of the TRRC. The TRRC has the authority to regulate rates, though it generally has not investigated the rates or practices of intrastate pipelines in the absence of shipper complaints.

Pipeline Safety Regulations

Some of the Company’s pipelines are subject to regulation by the U.S. Department of Transportation’s (“DOT”) Pipeline and Hazardous Materials Safety Administration (“PHMSA”) pursuant to the Natural Gas Pipeline Safety Act of 1968 (“NGPSA”), with respect to natural gas, and the Hazardous Liquids Pipeline Safety Act of 1979 (“HLPSA”), with respect to NGLs. The NGPSA and HLPSA regulate safety requirements in the design, construction, operation, and maintenance of natural gas, crude oil, and NGL pipeline facilities, while the Pipeline Safety Improvement Act of 2002 (“PSIA”) establishes mandatory inspections for all U.S. crude oil, NGL, and natural gas transmission pipelines in high consequence areas (“HCAs”), the violation of which can result in administrative, civil and criminal penalties, including civil fines, injunctions, or both.

PHMSA regularly revises its pipeline safety regulations. States are largely preempted by federal law from regulating pipeline safety for interstate lines but most are certified by the DOT to assume responsibility for enforcing federal intrastate pipeline regulations and inspection of intrastate pipelines. States may adopt stricter standards for intrastate pipelines than those imposed by the federal government for interstate lines; however, states vary considerably in their authority and capacity to address pipeline safety. State standards may include requirements for facility design and management in addition to requirements for pipelines. For example, the TRRC and NMPRC have adopted rules that require operators of natural gas and hazardous liquid gathering lines in rural areas to report accidents, conduct investigations and perform necessary corrective action. Due to the possibility of new or amended laws and regulations or reinterpretation of existing laws and regulations, there can be no assurance that future compliance with PHMSA or state requirements will not have a material adverse effect on the Company’s financial condition, results of operations, or cash flows.

Environmental and Occupational Health and Safety

The Company complies with the requirements of the Occupational Safety and Health Administration (“OSHA”) and comparable state laws that regulate the protection of the health and safety of workers. The Company believes that its operations are in substantial compliance with OSHA requirements, including general industry standards, hazard communication, record keeping requirements and monitoring of occupational exposure to regulated substances.

Our business operations are also subject to numerous environmental and occupational health and safety laws and regulations imposed at the federal, regional, state and local levels. The activities the Company conducts in connection with the gathering, compression, dehydration, treatment, processing and transportation of natural gas and gathering, stabilization, transportation and storage of crude oil are subject to, or may become subject to, stringent environmental regulation and we

could incur costs related to the cleanup of third-party sites to which we have sent regulated substances for disposal or equipment for cleaning, and for damages to natural resources or other claims relating to releases of regulated substances at or from such third-party sites. The Company has implemented a number of programs and policies designed to monitor and pursue continued operation of our activities in a manner consistent with environmental and occupational health and safety laws and regulations. To that end, the Company has incurred and will continue to incur operating and capital expenditures to comply with these laws and regulations. Some of these environmental compliance costs may be material and have an adverse effect on our business, financial condition and results of operations.

Certain existing environmental and occupational health and safety laws and regulations include the following U.S. legal standards, which may be amended from time to time:

•the Clean Air Act, which restricts the emission of air pollutants from many sources and imposes various pre-construction, operational, monitoring and reporting requirements, and which the EPA has relied upon as authority for adopting climate change regulatory initiatives relating to GHG emissions;

•the Clean Water Act, which regulates discharges of pollutants to state and federal waters as well as establishing the extent to which waterways are subject to federal jurisdiction and rulemaking as protected waters of the United States;

•the Comprehensive Environmental Response, Compensation and Liability Act of 1980, which imposes liability on generators, transporters and arrangers of hazardous substances at sites where releases, or threatened releases, of such hazardous substances has occurred;

•the Resource Conservation and Recovery Act (“RCRA”), which governs the generation, treatment, storage, transport and disposal of solid wastes, including hazardous wastes;

•the Oil Pollution Act, which imposes liability for removal costs and damages arising from an oil spill in waters of the United States on owners and operators of onshore facilities, pipelines and other facilities;

•the National Environmental Policy Act, which requires federal agencies to evaluate major agency actions that have the potential to significantly impact the environment, to include the preparation of an Environmental Assessment to assess potential direct, indirect, and cumulative impacts of the proposed project, and, if necessary, prepare a more detailed Environmental Impact Statement that may be made available to the public for comment;

•the Safe Drinking Water Act, which ensures the quality of the nation’s public drinking through adoption of drinking water standards and controlling the injection of waste fluids into below-ground formations that may adversely affect drinking water sources;

•the Endangered Species Act, which imposes restrictions on activities that may adversely affect federally identified endangered and threatened species or their habitats, to include the implementation of operating restrictions or a temporary, seasonal or permanent ban in affected areas;

•the Emergency Planning and Community Right-to-Know Act, which requires the implementation of a safety hazard communication program and the dissemination of information to employees, local emergency planning committees, and response departments on toxic chemicals use and inventories;

•the Occupational Safety and Health Act, which establishes workplace standards for the protection of both the health and safety of employees, to include the implementation of hazard communications programs to inform employees about hazardous substances in the workplace, the potential harmful effects of those substances and appropriate control measures; and

•the DOT regulations relating to the advancement of safe transportation of energy and hazardous materials and emergency response preparedness.

On March 15, 2023, the EPA announced finalization of its Good Neighbor Plan (the “Plan”) to reduce nitrogen oxide pollution from power plants and other industrial facilities from 23 upwind states which the EPA determined are significantly contributing to National Ambient Air Quality Standards (NAAQS) nonattainment and interfering with maintenance of the 2015 ozone NAAQS in downwind states. As part of the Plan, the EPA announced that it would be issuing further emissions controls from industrial sectors, including new and existing reciprocating internal combustion engines of a certain size used in pipeline transportation of natural gas. Beginning in 2026, the Plan will apply to all impacted engines unless compliance schedule extensions are granted by the EPA, determined on an engine-by-engine basis. The Plan, however, has been challenged in multiple federal courts, and the Supreme Court held oral arguments on the challenges to the rule in February 2024 (specifically, whether to freeze the Plan while litigation continues in the courts). In June 2024, the Supreme Court halted enforcement of the Plan while it is contested in the lower courts. Although a decision remains pending at this time and we cannot predict how the Court may ultimately rule. The Plan could have material financial impacts on our natural gas business in relation to the costs necessary to comply with the Plan, the timing of compliance, equipment shortages, potential operational disruptions, and the availability of and costs associated with the purchase of offsets.

There are also state and local jurisdictions where we operate in the U.S. that have, are developing, or are considering developing, similar environmental and occupational health and safety laws. Any failure by the Company to comply with these laws and regulations could result in adverse effects upon our business to include the (i) assessment of sanctions, including administrative, civil, and criminal penalties; (ii) imposition of investigatory, remedial, and corrective action obligations or the incurrence of capital expenditures; (iii) occurrence of delays or cancellations in the permitting, development or expansion of projects; and (iv) issuance of injunctions restricting or prohibiting some or all of our activities in a particular area. Some environmental laws provide for citizen suits which allow for environmental organizations to act in place of the government and sue operators for alleged violations of environmental law. The ultimate financial impact arising from environmental laws and regulations is not clearly known nor determinable as existing standards are subject to change and new standards continue to evolve.

Environmental laws and regulations are frequently subject to change. More stringent environmental laws that apply to our operations and the operations of our customers may result in increased operating costs and capital expenditures for compliance, including, but not limited to, those related to the emission of GHGs and climate change. Given the long-term trend toward increasing regulation, future federal and/or state GHG regulations of the oil and gas industry remain a significant possibility.

Trends in environmental and worker health and safety regulation over time has been to typically place increasing restrictions and limitations on activities that could result in adverse effects to the environment or expose workers to injury. These changes in environmental and worker safety laws and regulations, or reinterpretations or enforcement policies that may arise in the future and result in increasingly stringent or costly waste management or disposal, pollution control, remediation or worker health and safety-related requirements, may have a material adverse effect on our business, operations and financial condition. We may not have insurance or be fully covered by insurance against all risks relating to environmental or occupational health and safety, and we may be unable to pass on the increased cost of compliance arising from such risks to our customers. We regularly review regulatory and environmental issues as they pertain to the Company and we consider these as part of our general risk management approach.

Insurance

Our business has operating risks normally associated with the gathering, stabilization, transportation and storage of crude oil and gathering, compression, dehydration, treatment, processing and transportation of natural gas, which could cause damage to life or property. In accordance with industry practice, we maintain insurance against some, but not all, potential operating losses. For some operating risks, the Company may not obtain insurance if the cost of available insurance is excessive relative to the risks presented; in such a case, if a significant operating accident or other event occurs which is not fully covered by the insurance the Company has, this could adversely affect our operations and business. As we continue to grow, we will continue to evaluate our policy limits and deductibles as they relate to the overall cost and scope of our insurance program.

Sustainability

Overview

The Company is committed to advancing a safer, cleaner, and more reliable energy future and believes that integrating environmental, safety, governance, and community considerations into our business decisions is essential to creating value for its stakeholders. In August 2024, the Company published its fiscal year 2023 Sustainability Report (“Report”). The Report focused on four key areas: Governance, Environment, People and Community Engagement.

Governance

The Kinetik Board consists of 11 Directors and is led by the Chairman of the Board and the Lead Independent Director. The Board exercises general supervision over the Company’s business, operations, strategy and risk management programs. To assist the Board in its oversight role, the Board’s committees consist of the Audit Committee, Compensation Committee and Governance and Sustainability Committee.

We firmly believe that commitment to an actionable sustainability strategy makes for a stronger, more resilient company and drives better performance. As such, we embed sustainability responsibilities throughout our organization by ensuring we have ownership and accountability at all levels. In both 2024 and 2023, our compensation program tied 20% of all salaried employees’ at-risk pay, including executives, to the achievement of specific sustainability goals, including those related to methane emissions and health and safety. The Governance and Sustainability Committee supported the Compensation Committee in establishing the specific parameters of the metrics.

In addition, the Company has developed an Enterprise Risk Management (“ERM”) program across all functional areas and mechanisms for identifying, prioritizing, and mitigating risks. We evaluate risks across the enterprise on a regular basis, examining the potential impact to our operating flexibility, along with the financial and reputational impact of such risks. Our Audit Committee of the Board has ultimate oversight over the ERM process, reviewing ongoing assessments of the company’s risk management processes and system of internal control. Our Executive Vice President, Chief Administrative Officer and Chief Accounting Officer has functional oversight over the Enterprise Risk function.

Furthermore, we are committed to conducting business in accordance with the highest ethical standards. Our Code of Conduct is designed to deter wrong-doing and promote honest and ethical conduct in every aspect of our business dealings. Our Code of Conduct details our policy regarding corruption, antitrust violations, insider dealings, gifts and entertainment, conflicts of interest, validity of financial information, amongst others. The Audit Committee is responsible for overseeing business ethics issues, and our General Counsel and Chief Compliance Officer oversees the day-to-day responsibilities for ethics and compliance. The Company also recognizes the importance of receiving, retaining and addressing concerns from our directors, officers, employees and other stakeholders seriously and expeditiously. We use a confidential third-party Ethics Hotline to enable anyone to report concerns. The Ethics Hotline is monitored by our Human Resources and Legal departments, as well as the Chair of the Audit Committee. Any critical concerns are communicated to the Audit Committee Chair immediately, and any other concerns are reported to the Audit Committee during quarterly meetings or as otherwise appropriate. In addition, all employees were required to complete Insider Trading and Anti-Bribery and Corruption training. In 2024, no critical concerns were reported.

Environmental Responsibility

The Company is committed to being a good steward of the environment and prioritizes climate change as a key issue. We are committed to contributing to global solutions by responsibly reducing the adverse environmental impact of our operations while pursuing economic growth and energy security. 100% of our debt capital structure is linked to sustainability performance, including performance targets related to GHG and methane emission intensity. The Company is in the process of gathering 2024 GHG emission data at the time this Annual Report on Form 10-K is filed with the SEC.

In line with our commitment, the Company not only complies with applicable federal, state, and local regulations but also actively engages in voluntary initiatives aimed at reducing GHG and criteria air emissions. Initiatives started in 2022 included:

•pneumatics upgrades;

•installation of electric compression;

•leak detection and repair (“LDAR”);

•advanced monitoring technologies;

•New Energy Ventures; and

•renewable energy and energy efficiency.

In 2023, we significantly advanced our efforts to reduce methane emissions by converting 3,742 natural gas-driven pneumatics and pumps to instrument air at seven compressor stations. These conversions reduced annual methane emissions from natural gas-driven pneumatics by approximately 50%. At the end of 2024, 68% of our gas plants and compressor stations were operating on instrument air. In 2024, we continued to expand our electric compression fleet, supported by a grant from the Texas Commission on Environmental Quality (“TCEQ”) and the Texas Emissions Reduction Plan (“TERP”) program's New Technology Implementation Grant (“NTIG”). We perform leak detection surveys through an independent third party to maintain thorough, unbiased inspections. We created an internal LDAR SWAT team to focus on improving the leak repair time, further minimizing emissions. We continue to leverage cutting-edge methane monitoring and detection technologies. Our operations and support teams are equipped with and trained to operate handheld leak detection devices. We also operate fixed continuous emissions monitoring cameras and sensor-based continuous emission technologies at strategic locations. In addition, we conduct regular aerial surveys of our facilities using Optical Gas Imaging (“OGI”) technology to provide high-resolution images of methane and volatile organic compounds. We elevated our decarbonization efforts by establishing the New Energy Ventures (“NEV”) team, who focuses on advancing emissions reduction through innovative technologies and other clean energy opportunities. In 2024, NEV partnered with Infinium in Project Roadrunner, which features a long-term agreement to supply CO2 from our Permian Basin operations for reuse in the production of ultra-low carbon eFuels. In addition, we received approval from the US Environmental Protection Agency (“EPA”) for the Monitoring, Reporting and Verification (“MRV”) Plan for three Class II Acid Gas Injection (“AGI”) wells at our Maljamar and Dagger Draw processing facilities, which were acquired through the Durango Acquisition. The MRV Plan enables the Company to economically benefit from sequestered carbon dioxide (“CO2”) through 45Q tax credits. We focus on reducing our Scope 2 GHG emissions through implementing energy efficiency measures and sourcing renewable energy.

While we use relatively insignificant amounts of water in our direct operations compared to upstream operations and other industries, we recognize the importance of conserving water in a water-scarce region and remain committed to minimizing our water consumption and strive to only use what is necessary. Through our partnership with the Oilfield Water Stewardship Council, we work with a community of peers to establish and standardize relevant performance metrics that support responsible water management and stewardship. We had no violations or penalties related to our Water Management program in 2024 and 2023.

Our Waste Management program, tailored for both of our gathering and processing operations and our produced water management operations, address the identification, characterization, disposition, reporting, and recordkeeping requirements of various waste streams generated during routine operations, general office/administrative tasks, facility maintenance, onsite corrective remediation actions, and excavation and construction activities. All wastes are evaluated to determine their characteristics and regulatory status as hazardous/non-hazardous, industrial, RCRA-exempt, or universal, and each category requires specific handling and disposal processes. We are committed to meeting our regulatory requirements. We had no violations or penalties related to our Waste Management program in 2024 and 2023.

At Kinetik, we are committed to responsibly constructing, maintaining and operating our facilities. Our Process Safety and Risk Management program and Pipeline Integrity Management program are designed to ensure the effective implementation of process safety and asset integrity practices. As part of our regulatory obligations, we subject ourselves to periodic process safety management audits required by OSHA. Furthermore, we undergo routine audits and inspections conducted by TRRC, NM PRC, and PHMSA, ensuring adherence to stringent safety and operational standards. In 2024, we underwent 13 pipeline integrity and safety audits and three process safety inspections by regulators, resulting in one immaterial regulatory penalty.

Our pipeline network spans over 4,500 miles. To ensure safe and efficient operations, we employ both risk-based and prescriptive inspection schedules for our pipeline systems. This schedule takes into account factors such as the potential for internal or external corrosion, soil erosion, adverse weather conditions, or the likelihood of damage from nearby construction activities. Spill prevention and control are fundamental to our operations and the community at large as we work to ensure the integrity of our pipelines and facilities and prevent any contamination of waterways or land. During the operation of our pipelines and facilities, we strictly adhere to spill prevention controls and have robust Spill Prevention, Control, and Countermeasure plans and Emergency Response Plans in place.

The Company believes that its operations are in substantial compliance with applicable environmental regulations and attempts to anticipate future regulatory requirements that might be imposed and plan accordingly. While any new or amended laws and regulations or reinterpretation of existing laws and regulations would not be expected to be any more burdensome to the Company than to other, similarly situated operators, there can be no assurance that future compliance with any new environmental requirements will not have an adverse effect on the Company’s financial condition, results of operations or cash flows.

Social Responsibility

We recognize that people are our greatest asset and that their success is our success. We prioritize a safe working environment and offer a comprehensive suite of benefits to all our employees to ensure the well-being and development of our people. See additional information regarding employee initiatives in Part I—Item 1. and 2. Business and Properties—Human Capital in this Annual Report. We take pride in being a responsible neighbor and a positive influence in the communities where we live and operate; as such, we continue to encourage our team to give back to the communities where they live and work, providing employees with eight hours of paid volunteer time each year. Volunteer hours totaled 421 and 533 hours in 2024 and 2023, respectively. We also made donations to various causes identified by our employees and our communities. We contributed over $1.9 million and $1.2 million to various initiatives in 2024 and 2023, respectively. To further show our commitment to communities where we live and operate, we made a significant commitment to support the Permian Strategic Partnership, joining forces to foster a better quality of life for Permian Basin residents. We also partner with Be A Resource (“BEAR”), a charitable organization dedicated to improving lives by offering hope and help for at-risk and CPS-involved children in the greater Houston area and are a sponsor of Texas’ Sponsor a Highway program, helping keep our interstates safe and beautiful.

We recognize that building strong relationships with our local communities and landowners is essential for the sustainable growth and success of our operations in West Texas, as they provide us with the right-of-way to place pipelines and other facilities on their properties. We aim to provide them with accurate and timely information about activities that may affect their properties, and we work hard to mitigate any negative impacts on their properties, the environment, and surrounding communities by implementing best practices for construction and maintenance of facilities.

We aim to develop a supply chain that aligns with our core values and sustainability and business objectives. Our Supplier Code of Conduct (“Supplier Code”) promotes responsible practices across our value chain, outlining expectations for ethics, compliance, safety, environmental stewardship, human rights and setting a benchmark for our suppliers to adhere to our high standards. To measure our suppliers against our standards, we utilize ISNetworld, a resource for connecting with safe, qualified contractors and suppliers. We also implemented sustainability focused measures into our Contractor Management program to gain valuable insights into our suppliers’ sustainability performance, which enable us to understand their sustainability practices and identify opportunities for improvement.

Available Information

The Company’s website is www.kinetik.com. The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Proxy Statements, Current Reports on Form 8-K, amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, and other filings with the SEC are available at https://ir.kinetik.com/overview/default.aspx under the heading “Financials”—“SEC Filings”, as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the SEC. These reports are also available on the SEC’s website at www.sec.gov. In addition to reports filed or furnished with the SEC, we publicly disclose material information from time to time in press releases, at annual meetings of shareholders, in publicly accessible conferences and investor presentations, and through our website. In addition, the Company’s Code of Conduct, Corporate Governance Guidelines, charters of the Audit Committee, Compensation Committee, Governance and Sustainability Committee, and other corporate governance materials are available on the Investor Relations section of the Company’s website. The information contained on the Company’s website as referenced in this report is not, and should not be deemed to be, part of or incorporated by reference into this report. Requests for a copy of any of the above-referenced reports and corporate governance documents may be directed in writing to: Investor Relations, Kinetik Holdings Inc., 2700 Post Oak Blvd, Suite 300 Houston, TX 77056 or by calling (713) 621-7330.

ITEM 1A. RISK FACTORS

We operate in rapidly changing economic and technological environments that present numerous risks, many of which are driven by factors that we cannot control or predict. The following discussion, as well as our discussion in Part II—Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 7A—Quantitative and Qualitative Disclosures About Market Risk, highlights some of these risks. The risks described below are not exhaustive and you should carefully consider these risks and uncertainties before investing in our securities.

Business and Operational Risks

The majority of the Company’s operating assets are currently located in the Permian Basin, making it vulnerable to risks associated with operating in a single geographic area.

The majority of the Company’s wholly owned midstream assets are currently located in the Delaware Basin which is part of the broader Permian Basin. As a result of this concentration, the Company will be disproportionately exposed to the impact of regional supply and demand factors, delays or interruptions of production from wells in this area caused by governmental regulation, obtaining rights-of-way, market limitations, water shortages or restrictions, drought related conditions, or other weather-related conditions or interruption of the processing or transportation of crude oil, natural gas and water. If any of these factors were to impact the Permian Basin more than other producing regions, the Company’s business, financial condition and results of operations could be adversely affected relative to other midstream companies that have a more geographically diversified asset portfolio.

Because of the natural decline in production from existing wells, the Company’s success depends, in part, on its ability to maintain or increase throughput volumes on its midstream systems, which depends on its customers’ levels of development and completion activity on its dedicated acreage.

The level of crude oil and natural gas volumes handled by the Company’s midstream systems depends on the level of production from crude oil and natural gas wells dedicated to its midstream systems, which may be less than expected and which will naturally decline over time. To maintain or increase throughput levels on its midstream systems, the Company must obtain production from wells completed by customers on acreage dedicated to its midstream systems or execute agreements with other third parties in its areas of operation.

The Company has no control over producers’ levels of development and completion activity in its areas of operation, the amount of reserves associated with wells connected to its systems, or the rate at which production from a well declines. In addition, the Company has no control over producers or their exploration and development decisions, which may be affected by, among other things:

•the availability and cost of capital;

•the prevailing and projected prices of crude oil, natural gas and NGLs; fewer project opportunities or assumption of risk that results in weaker or more volatile financial performance than expected;

•assets that vary in age and were constructed over many decades which may cause our inspection, maintenance or repair costs to increase in the future;

•political and economic conditions and events in foreign oil, natural gas and NGL producing countries, including embargoes, disrupted global supply chains, continued hostilities in the Middle East and other sustained military campaigns, the armed conflict in Ukraine and associated economic sanctions on Russia;

•increase in interest rates and rising or sustained inflation;

•levels of crude oil and natural gas reserves;

•contractor or supplier non-performance, weather, geological or other factors;

•Consolidation in the upstream and midstream sector and the resulting changes in the strategic importance customers assign to development in certain acreage or locations in the Delaware Basin as opposed to other areas, which could adversely affect the financial and operational resources devoted to development of their acreage dedicated to the Company;

•increased levels of taxation related to the exploration and production of crude oil, natural gas and NGLs;

•environmental or other governmental regulations, including those related to the prorationing of oil and gas production, the availability of permits, the regulation of hydraulic fracturing, and a governmental determination that multiple facilities are to be treated as a single source for air permitting purposes;

•the costs of producing and ability to produce crude oil, natural gas and NGLs and the availability and costs of drilling rigs, pipeline transportation facilities and other equipment; and

•potential tariff to be imposed by the Trump Administration on crude oil, natural gas and NGLs and other imported supplies and equipment.

Due to these and other factors, even if reserves are known to exist in areas served by the Company’s midstream assets, producers may choose not to develop those reserves. If producers choose not to develop their reserves or they choose to slow their development rate in the Company’s areas of operation, utilization of its midstream systems will be below anticipated levels. Reductions in development activity, coupled with the natural decline in production from its current dedicated acreage, could materially reduce our revenue and affect adversely our business, financial condition, results of operations, and cash flows.

The acquisition or divestiture of businesses and assets is part of our strategy. We may experience difficulties completing acquisitions or divestitures or integrating new businesses and properties, and we may be unable to achieve the benefits we expect from the completed and any future acquisitions or divestitures.

Part of the Company’s business strategy includes acquiring additional businesses and assets and/or divesting certain assets or portions of our business. We cannot provide any assurance that we will be able to find complementary acquisition targets or complete such acquisitions or achieve the desired results from any acquisitions we do complete. Any acquired businesses or assets will be subject to many of the same risks as our existing businesses and may not achieve the levels of performance that we anticipate. We may evaluate potential divestiture opportunities with respect to portions of our business from time to time that support our growth initiatives and may determine to proceed with a divestiture opportunity if and when we believe such opportunity is consistent with our business strategy.

We may not realize the anticipated operating advantages and cost savings associated with any acquisition. Integration of acquired businesses or assets involves a number of risks, including (i) the loss of key customers of the acquired business; (ii) demands on management related to the increase in our size; (iii) the diversion of management’s attention from the management of daily operations; (iv) difficulties in implementing or unanticipated costs of accounting, budgeting, reporting, internal controls and other systems; and (v) difficulties in the retention and assimilation of necessary employees.

Difficulties in integration may be magnified if we make multiple acquisitions over a relatively short period of time. Because of difficulties in combining and expanding operations, we may not be able to achieve the cost savings and other size-related benefits that we hoped to achieve after these acquisitions, which could materially and adversely affect our financial condition and results of operations.

We also may not recognize the anticipated benefits of dispositions or other divestitures we may pursue in the future. If we do not realize the expected strategic, economic or other benefits of any divestiture transaction, it could materially and adversely affect our financial condition and results of operations.