EXHIBIT C2 Project Naranja DISCUSSION MATERIALS FOR THE BOARD OF DIRECTORS OF SATSUMA PHARMACEUTICALS, INC. APRIL 16, 2023 | CONFIDENTIAL

Table of Contents Page 1. Executive Summary 3 2. Financial Analyses 8 3. Selected Public Market Observations 14 4. Disclaimer 23 2 CONFIDENTIAL

Page 1. Executive Summary 3 2. Financial Analyses 8 3. Selected Public Market Observations 14 4. Disclaimer 23

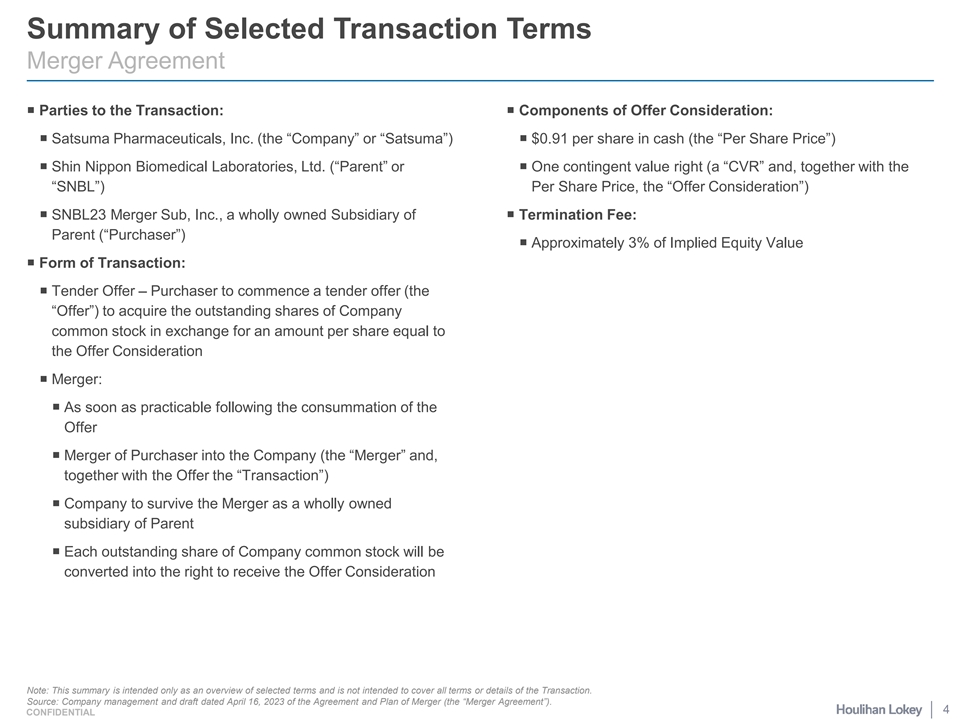

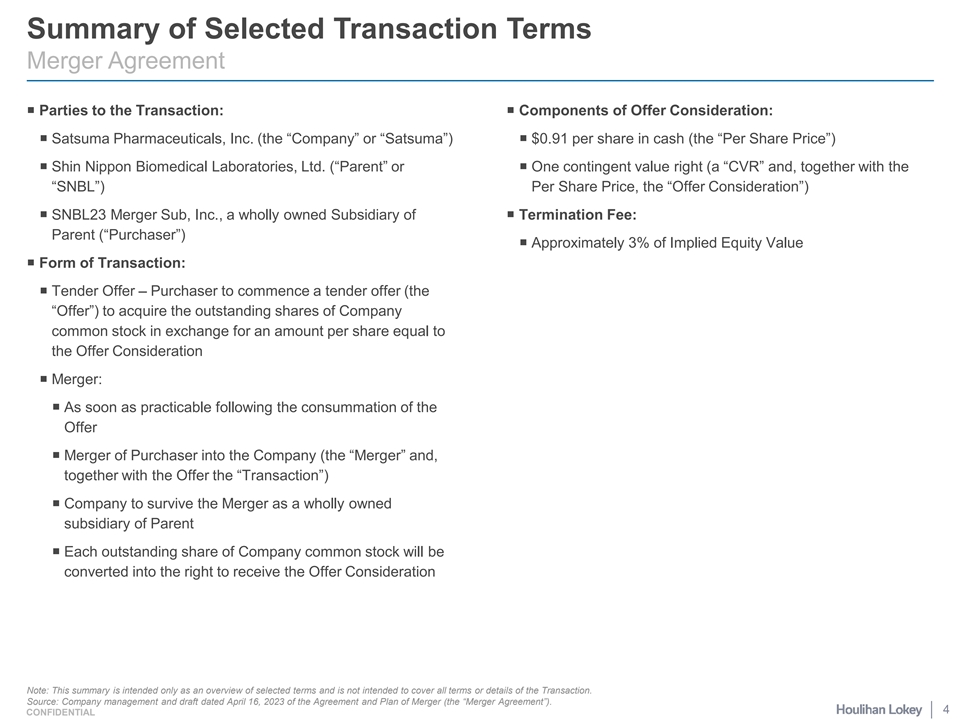

Summary of Selected Transaction Terms Merger Agreement ¡ Parties to the Transaction:¡ Components of Offer Consideration: ¡ Satsuma Pharmaceuticals, Inc. (the “Company” or “Satsuma”)¡ $0.91 per share in cash (the “Per Share Price”) ¡ Shin Nippon Biomedical Laboratories, Ltd. (“Parent” or ¡ One contingent value right (a “CVR” and, together with the “SNBL”) Per Share Price, the “Offer Consideration”) ¡ SNBL23 Merger Sub, Inc., a wholly owned Subsidiary of ¡ Termination Fee: Parent (“Purchaser”) ¡ Approximately 3% of Implied Equity Value ¡ Form of Transaction: ¡ Tender Offer – Purchaser to commence a tender offer (the “Offer”) to acquire the outstanding shares of Company common stock in exchange for an amount per share equal to the Offer Consideration ¡ Merger: ¡ As soon as practicable following the consummation of the Offer ¡ Merger of Purchaser into the Company (the “Merger” and, together with the Offer the “Transaction”) ¡ Company to survive the Merger as a wholly owned subsidiary of Parent ¡ Each outstanding share of Company common stock will be converted into the right to receive the Offer Consideration Note: This summary is intended only as an overview of selected terms and is not intended to cover all terms or details of the Transaction. Source: Company management and draft dated April 16, 2023 of the Agreement and Plan of Merger (the “Merger Agreement”). 4 CONFIDENTIAL

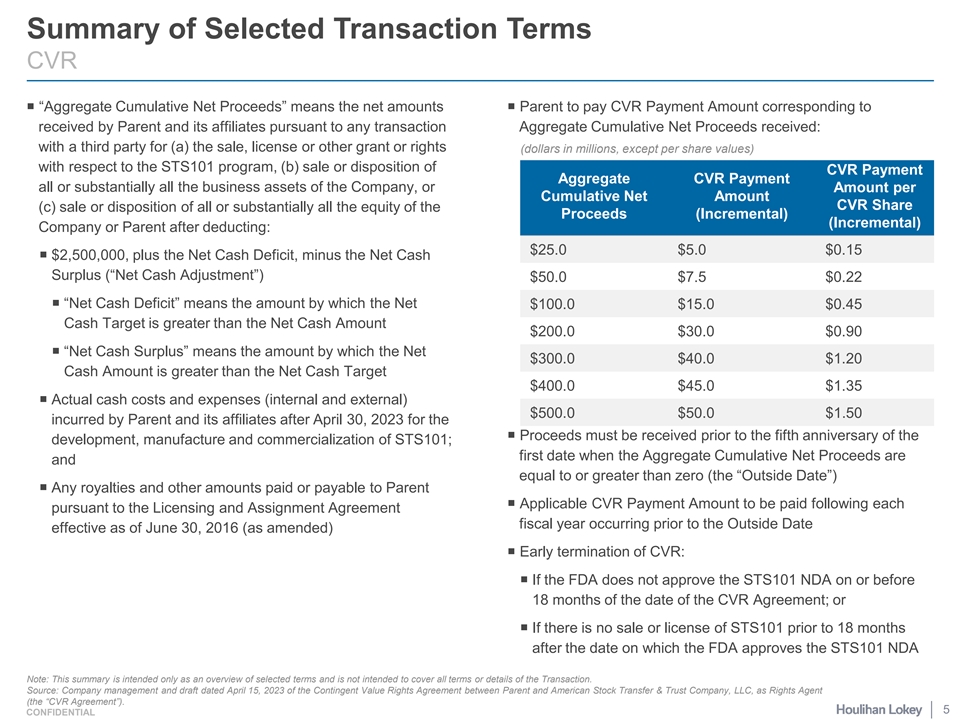

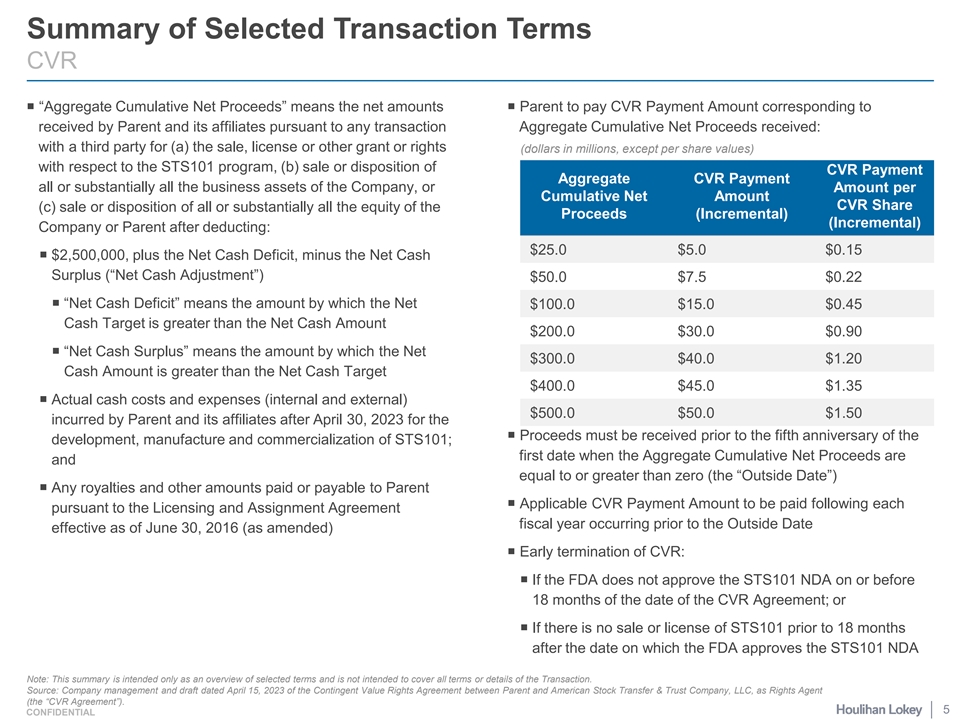

Summary of Selected Transaction Terms CVR ¡ “Aggregate Cumulative Net Proceeds” means the net amounts ¡ Parent to pay CVR Payment Amount corresponding to received by Parent and its affiliates pursuant to any transaction Aggregate Cumulative Net Proceeds received: with a third party for (a) the sale, license or other grant or rights (dollars in millions, except per share values) with respect to the STS101 program, (b) sale or disposition of CVR Payment Aggregate CVR Payment all or substantially all the business assets of the Company, or Amount per Cumulative Net Amount CVR Share (c) sale or disposition of all or substantially all the equity of the Proceeds (Incremental) (Incremental) Company or Parent after deducting: $25.0 $5.0 $0.15 ¡ $2,500,000, plus the Net Cash Deficit, minus the Net Cash Surplus (“Net Cash Adjustment”) $50.0 $7.5 $0.22 ¡ “Net Cash Deficit” means the amount by which the Net $100.0 $15.0 $0.45 Cash Target is greater than the Net Cash Amount $200.0 $30.0 $0.90 ¡ “Net Cash Surplus” means the amount by which the Net $300.0 $40.0 $1.20 Cash Amount is greater than the Net Cash Target $400.0 $45.0 $1.35 ¡ Actual cash costs and expenses (internal and external) $500.0 $50.0 $1.50 incurred by Parent and its affiliates after April 30, 2023 for the ¡ Proceeds must be received prior to the fifth anniversary of the development, manufacture and commercialization of STS101; first date when the Aggregate Cumulative Net Proceeds are and equal to or greater than zero (the “Outside Date”) ¡ Any royalties and other amounts paid or payable to Parent ¡ Applicable CVR Payment Amount to be paid following each pursuant to the Licensing and Assignment Agreement fiscal year occurring prior to the Outside Date effective as of June 30, 2016 (as amended) ¡ Early termination of CVR: ¡ If the FDA does not approve the STS101 NDA on or before 18 months of the date of the CVR Agreement; or ¡ If there is no sale or license of STS101 prior to 18 months after the date on which the FDA approves the STS101 NDA Note: This summary is intended only as an overview of selected terms and is not intended to cover all terms or details of the Transaction. Source: Company management and draft dated April 15, 2023 of the Contingent Value Rights Agreement between Parent and American Stock Transfer & Trust Company, LLC, as Rights Agent (the “CVR Agreement”). 5 CONFIDENTIAL

Certain Assumptions and Limitations ¡ The Board of Directors (the “Board”) of the Company has requested that Houlihan Lokey Capital, Inc. (“Houlihan Lokey”) provide an opinion (the “Opinion”) to the Board as to whether, as of the date of the Opinion, the Offer Consideration to be received by the holders of Company Common Stock other than Parent, Purchaser and their respective affiliates (the “Excluded Holders”) in the Transaction pursuant to the Agreements is fair, from a financial point of view, to such holders (other than the Excluded Holders). ¡ Houlihan Lokey has been advised, and for purposes of its analyses and the Opinion is directed to rely upon and assume, that ¡ (i) the Company is a clinical-stage biopharmaceutical company with a limited operating history and no products approved for commercial sale; ¡ (ii) the Company has incurred significant losses since its inception and anticipates that it will continue to incur significant losses for the foreseeable future; ¡ (iii) the Company’s business is entirely dependent on the successful development, regulatory approval and commercialization of STS101, the Company’s only product candidate under development; ¡ (iv) previously, in the Company’s Phase 3 EMERGE and SUMMIT studies, STS101 did not demonstrate a statistically significant difference as compared to placebo on either of the co-primary endpoints; ¡ (v) the Company’s financial statements for the year ending December 31, 2023 were prepared assuming the Company would continue as a going concern; ¡ (vi) the Company’s financial condition raises substantial doubt as to its ability to continue as a going concern; ¡ (vii) the Company’s cash, cash equivalents and marketable securities would be insufficient to enable the Company to fund normal operations for a period of one year or more were it to continue to pursue development and commercialization of STS101; ¡ (viii) the Company will require substantial additional financing to achieve its goals; ¡ (ix) the Company has been unsuccessful in obtaining financing on terms acceptable to it; ¡ (x) the Company does not believe that funding will be available to it, will be obtained on terms favorable to it or will provide it with sufficient funds to meet its objectives; ¡ (xi) the Company does not plan to raise additional financing; ¡ (xii) the Company’s failure to conclude the Transaction or an alternative strategic transaction will force it to consider other strategic alternatives such as wind-down and dissolution; ¡ (xiii) the values the Company receives for its assets in liquidation or dissolution could be significantly lower than the values reflected in the Company’s financial statements; and ¡ (xiv) any proceeds the holders of Company common stock would receive in a liquidation and dissolution of the Company would be materially less on a per-share basis than the Per Share Price to be received by such holders in the proposed Transaction. Source: Company management, Merger Agreement, and public filings. 6 CONFIDENTIAL

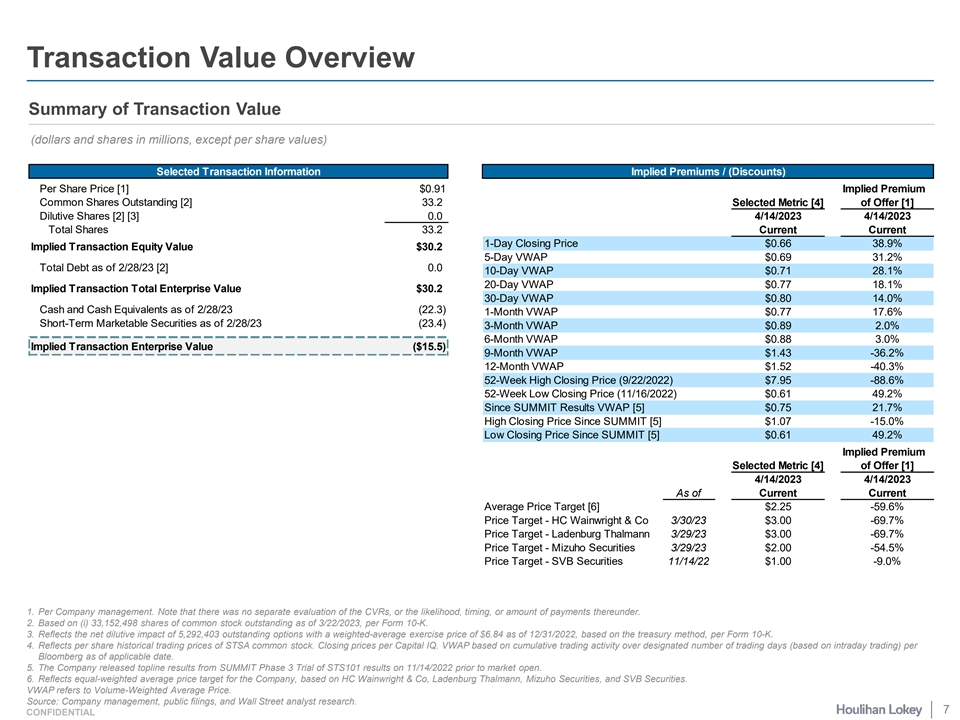

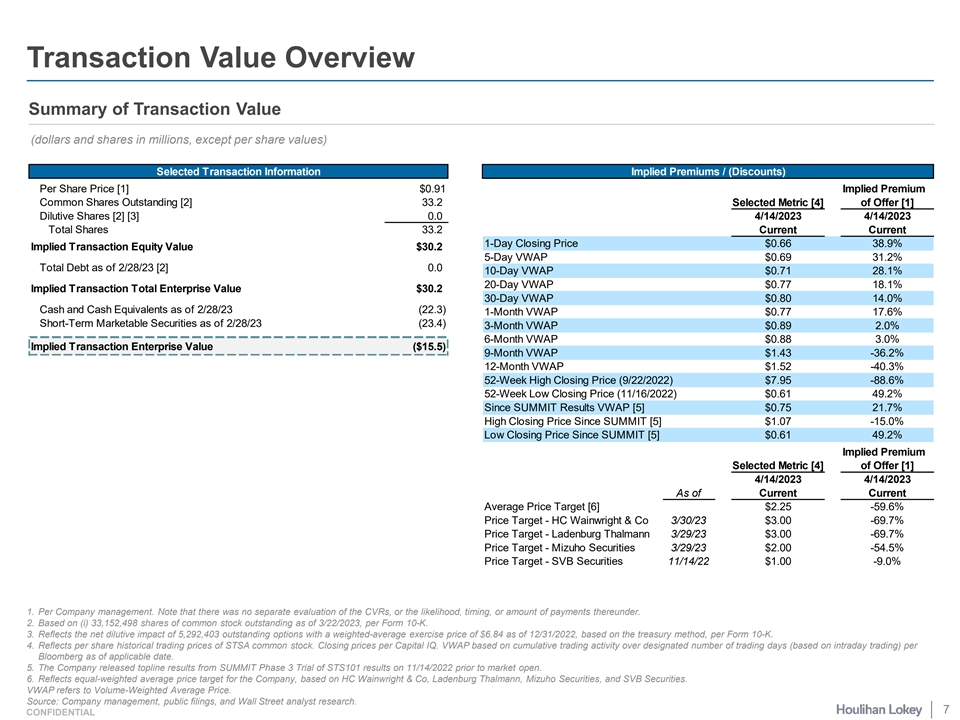

Transaction Value Overview Summary of Transaction Value (dollars and shares in millions, except per share values) Selected Transaction Information Implied Premiums / (Discounts) Per Share Price [1] $0.91 Implied Premium Common Shares Outstanding [2] 33.2 Selected Metric [4] of Offer [1] Dilutive Shares [2] [3] 0.0 4/14/2023 4/14/2023 Total Shares 33.2 Current Current 1-Day Closing Price $0.66 38.9% Implied Transaction Equity Value $30.2 5-Day VWAP $0.69 31.2% Total Debt as of 2/28/23 [2] 0.0 10-Day VWAP $0.71 28.1% 20-Day VWAP $0.77 18.1% Implied Transaction Total Enterprise Value $30.2 30-Day VWAP $0.80 14.0% Cash and Cash Equivalents as of 2/28/23 (22.3) 1-Month VWAP $0.77 17.6% Short-Term Marketable Securities as of 2/28/23 (23.4) 3-Month VWAP $0.89 2.0% 6-Month VWAP $0.88 3.0% Implied Transaction Enterprise Value ($15.5) 9-Month VWAP $1.43 -36.2% 12-Month VWAP $1.52 -40.3% 52-Week High Closing Price (9/22/2022) $7.95 -88.6% 52-Week Low Closing Price (11/16/2022) $0.61 49.2% Since SUMMIT Results VWAP [5] $0.75 21.7% High Closing Price Since SUMMIT [5] $1.07 -15.0% Low Closing Price Since SUMMIT [5] $0.61 49.2% Implied Premium Selected Metric [4] of Offer [1] 4/14/2023 4/14/2023 As of Current Current Average Price Target [6] $2.25 -59.6% Price Target - HC Wainwright & Co 3/30/23 $3.00 -69.7% Price Target - Ladenburg Thalmann 3/29/23 $3.00 -69.7% Price Target - Mizuho Securities 3/29/23 $2.00 -54.5% Price Target - SVB Securities 11/14/22 $1.00 -9.0% 1. Per Company management. Note that there was no separate evaluation of the CVRs, or the likelihood, timing, or amount of payments thereunder. 2. Based on (i) 33,152,498 shares of common stock outstanding as of 3/22/2023, per Form 10-K. 3. Reflects the net dilutive impact of 5,292,403 outstanding options with a weighted-average exercise price of $6.84 as of 12/31/2022, based on the treasury method, per Form 10-K. 4. Reflects per share historical trading prices of STSA common stock. Closing prices per Capital IQ. VWAP based on cumulative trading activity over designated number of trading days (based on intraday trading) per Bloomberg as of applicable date. 5. The Company released topline results from SUMMIT Phase 3 Trial of STS101 results on 11/14/2022 prior to market open. 6. Reflects equal-weighted average price target for the Company, based on HC Wainwright & Co, Ladenburg Thalmann, Mizuho Securities, and SVB Securities. VWAP refers to Volume-Weighted Average Price. Source: Company management, public filings, and Wall Street analyst research. 7 CONFIDENTIAL

Page 1. Executive Summary 3 2. Financial Analyses 8 3. Selected Public Market Observations 14 4. Disclaimer 23

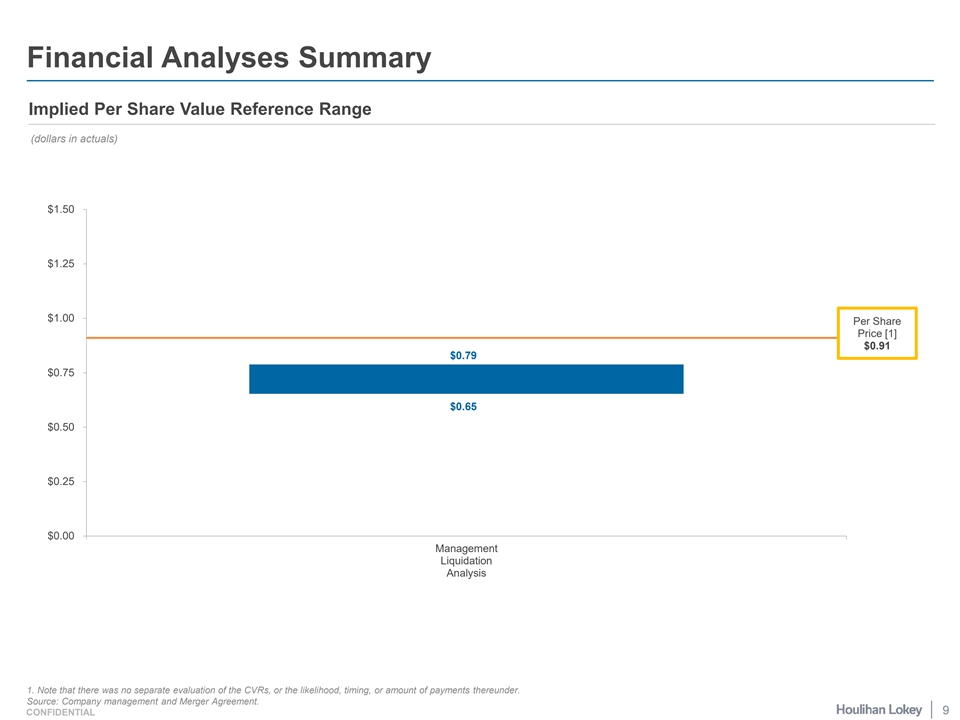

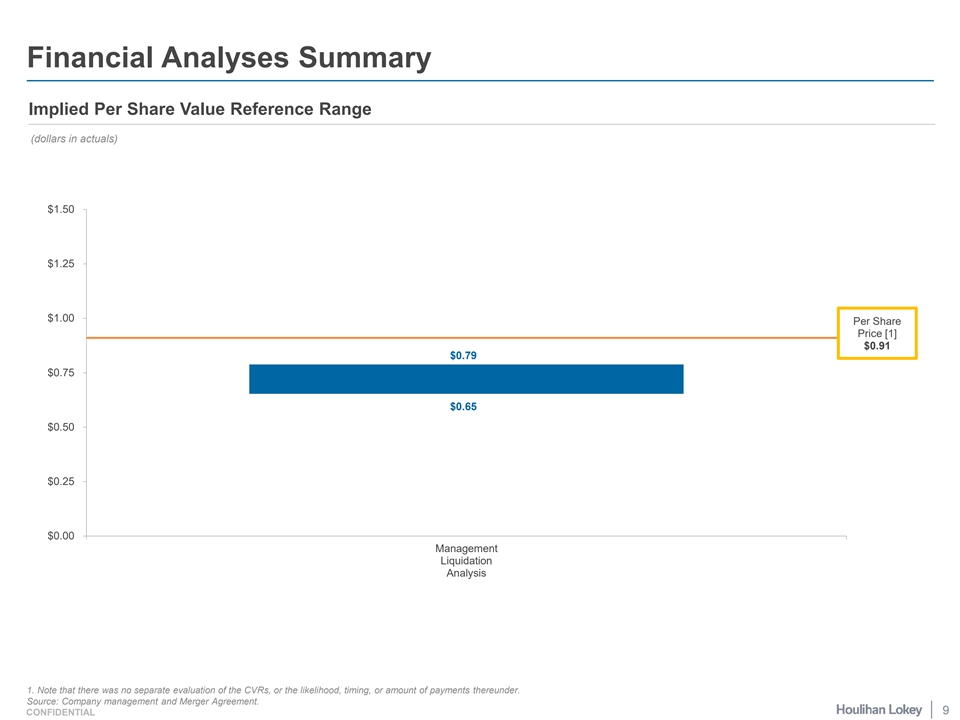

Financial Analyses Summary Implied Per Share Value Reference Range (dollars in actuals) $1.50 $1.25 $1.00 Per Share Price [1] $0.91 $0.79 $0.75 $0.65 $0.50 $0.25 $0.00 Management Liquidation Analysis 1. Note that there was no separate evaluation of the CVRs, or the likelihood, timing, or amount of payments thereunder. Source: Company management and Merger Agreement. 9 CONFIDENTIAL

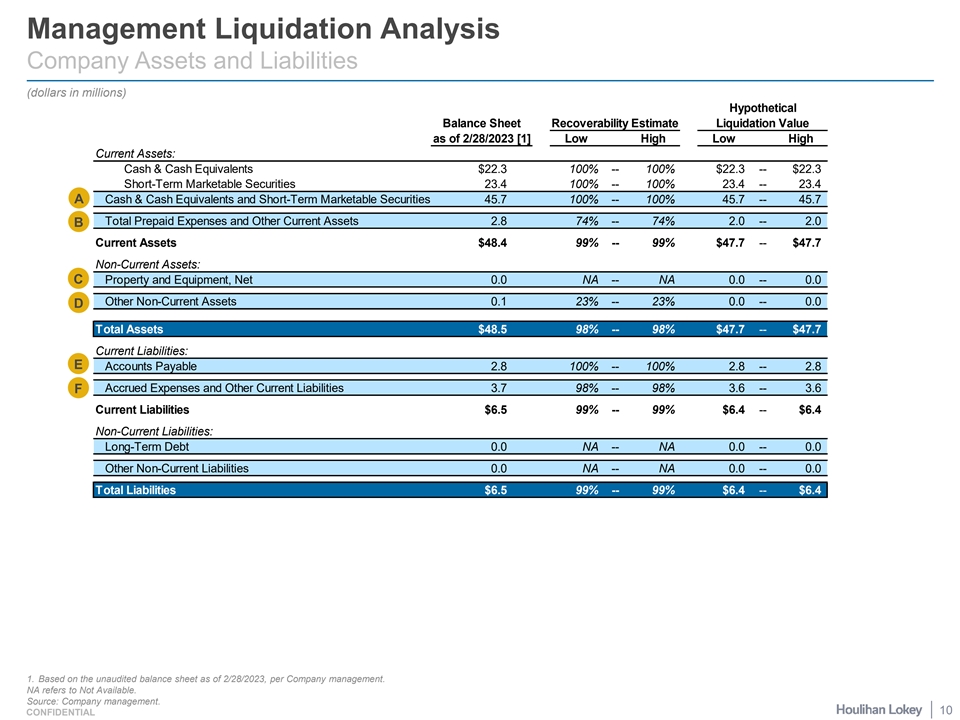

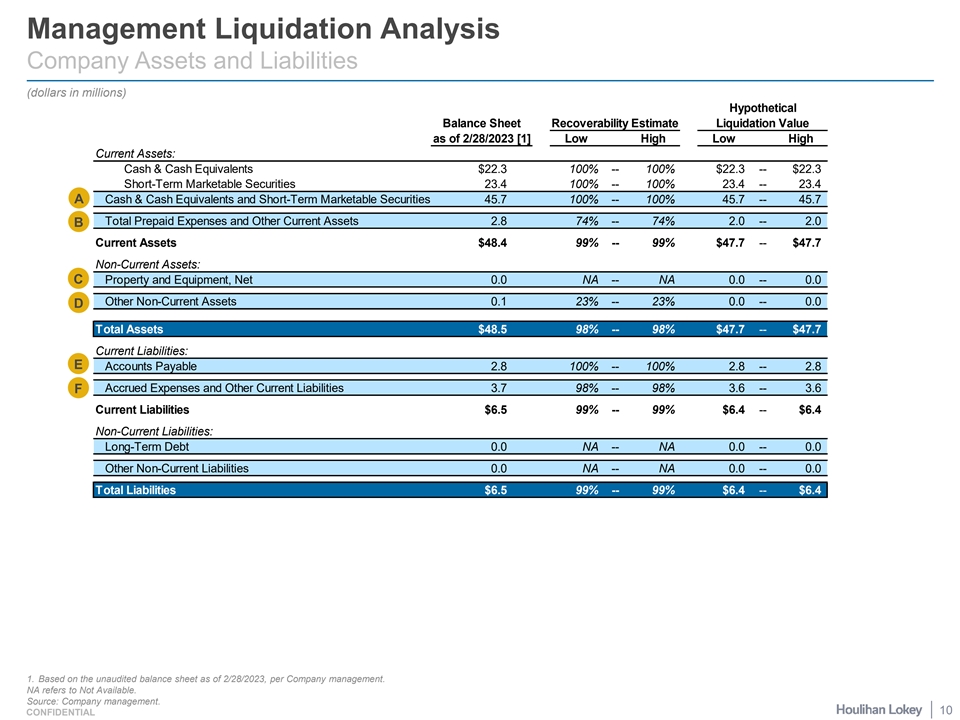

Management Liquidation Analysis Company Assets and Liabilities (dollars in millions) Hypothetical Balance Sheet Recoverability Estimate Liquidation Value as of 2/28/2023 [1] Low High Low High Current Assets: Cash & Cash Equivalents $22.3 100% -- 100% $22.3 -- $22.3 Short-Term Marketable Securities 23.4 100% -- 100% 23.4 -- 23.4 A Cash & Cash Equivalents and Short-Term Marketable Securities 45.7 100% -- 100% 45.7 -- 45.7 Total Prepaid Expenses and Other Current Assets 2.8 74% -- 74% 2.0 -- 2.0 B Current Assets $48.4 99% -- 99% $47.7 -- $47.7 Non-Current Assets: C Property and Equipment, Net 0.0 NA -- NA 0.0 -- 0.0 Other Non-Current Assets 0.1 23% -- 23% 0.0 -- 0.0 D Total Assets $48.5 98% -- 98% $47.7 -- $47.7 Current Liabilities: E Accounts Payable 2.8 100% -- 100% 2.8 -- 2.8 Accrued Expenses and Other Current Liabilities 3.7 98% -- 98% 3.6 -- 3.6 F Current Liabilities $6.5 99% -- 99% $6.4 -- $6.4 Non-Current Liabilities: Long-Term Debt 0.0 NA -- NA 0.0 -- 0.0 Other Non-Current Liabilities 0.0 NA -- NA 0.0 -- 0.0 Total Liabilities $6.5 99% -- 99% $6.4 -- $6.4 1. Based on the unaudited balance sheet as of 2/28/2023, per Company management. NA refers to Not Available. Source: Company management. 10 CONFIDENTIAL

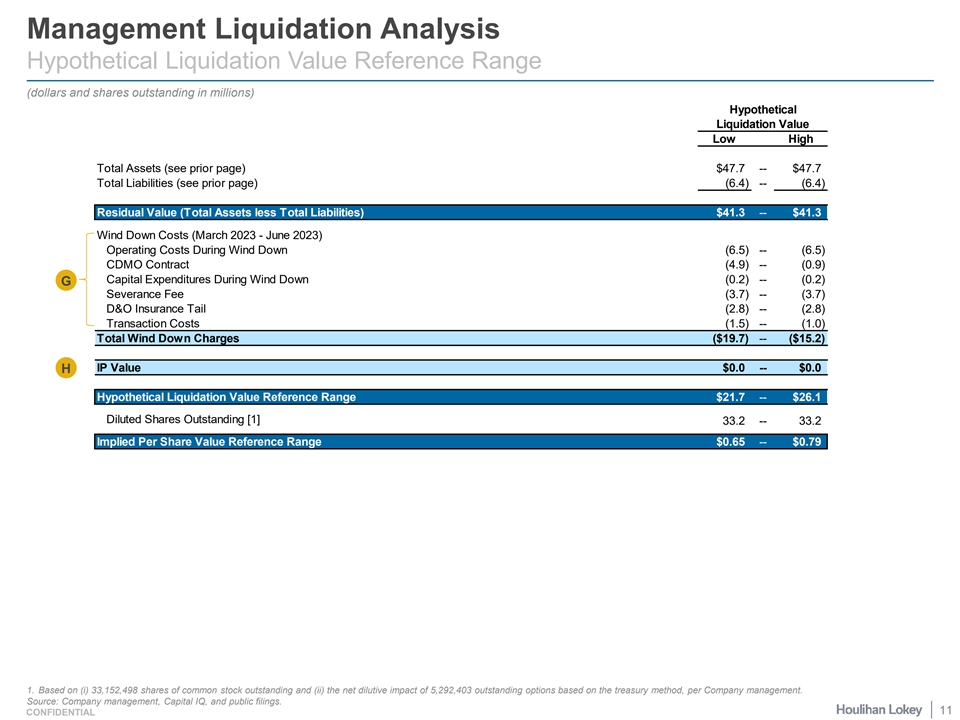

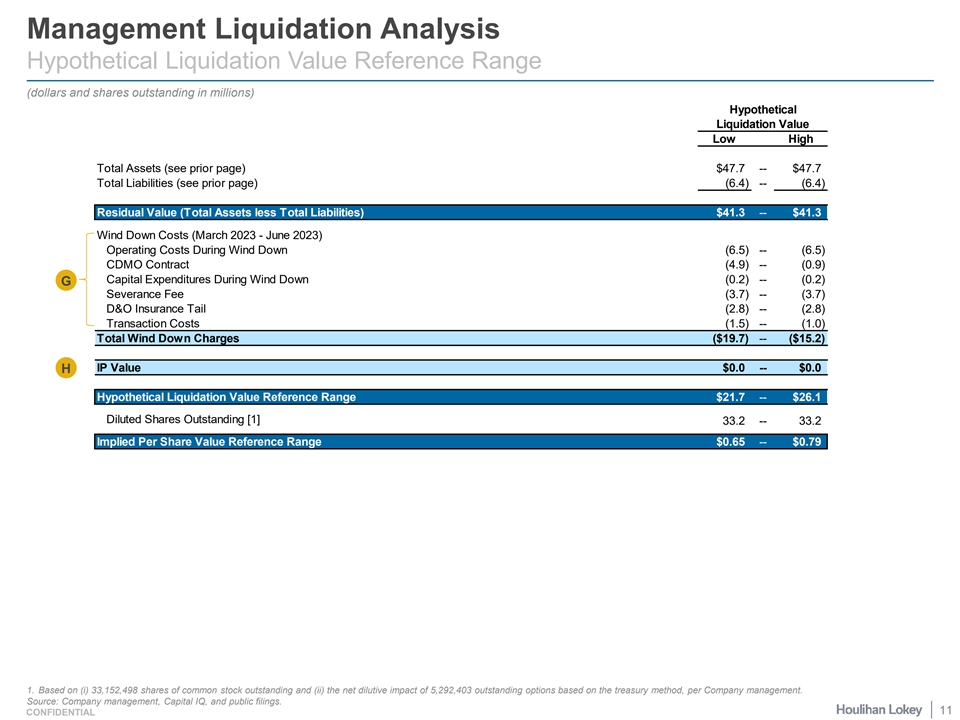

Management Liquidation Analysis Hypothetical Liquidation Value Reference Range (dollars and shares outstanding in millions) Hypothetical Liquidation Value Low High Total Assets (see prior page) $47.7 -- $47.7 Total Liabilities (see prior page) (6.4) -- (6.4) Residual Value (Total Assets less Total Liabilities) $41.3 -- $41.3 Wind Down Costs (March 2023 - June 2023) Operating Costs During Wind Down (6.5) -- (6.5) CDMO Contract (4.9) -- (0.9) Capital Expenditures During Wind Down (0.2) -- (0.2) G Severance Fee (3.7) -- (3.7) D&O Insurance Tail (2.8) -- (2.8) Transaction Costs (1.5) -- (1.0) Total Wind Down Charges ($19.7) -- ($15.2) IP Value $0.0 -- $0.0 H Hypothetical Liquidation Value Reference Range $21.7 -- $26.1 Diluted Shares Outstanding [1] 33.2 -- 33.2 Implied Per Share Value Reference Range $0.65 -- $0.79 1. Based on (i) 33,152,498 shares of common stock outstanding and (ii) the net dilutive impact of 5,292,403 outstanding options based on the treasury method, per Company management. Source: Company management, Capital IQ, and public filings. 11 CONFIDENTIAL

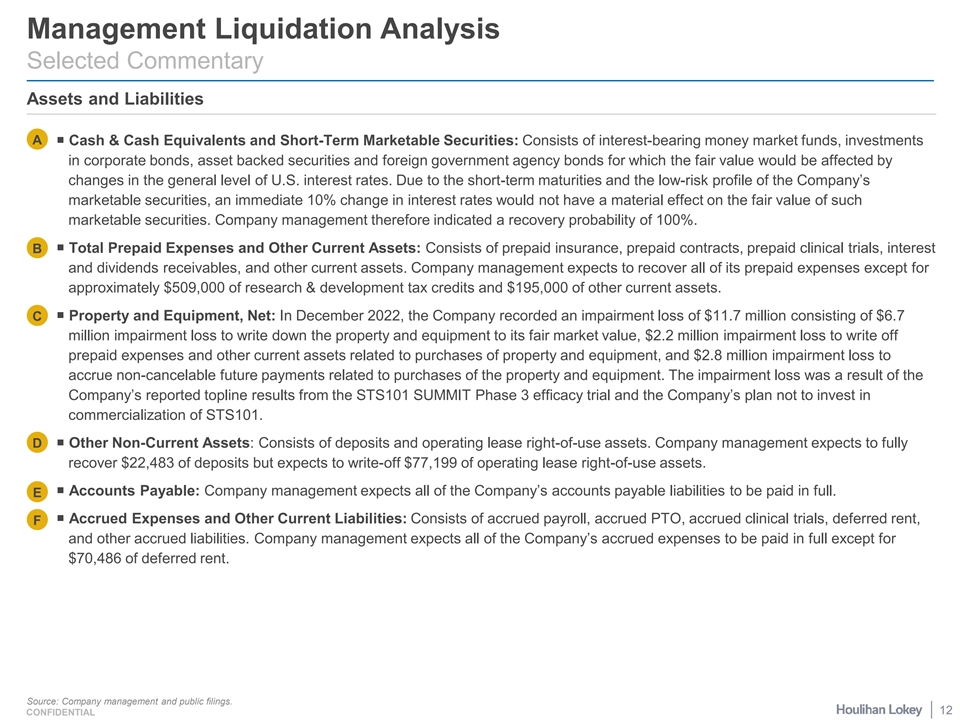

Management Liquidation Analysis Selected Commentary Assets and Liabilities A¡ Cash & Cash Equivalents and Short-Term Marketable Securities: Consists of interest-bearing money market funds, investments in corporate bonds, asset backed securities and foreign government agency bonds for which the fair value would be affected by changes in the general level of U.S. interest rates. Due to the short-term maturities and the low-risk profile of the Company’s marketable securities, an immediate 10% change in interest rates would not have a material effect on the fair value of such marketable securities. Company management therefore indicated a recovery probability of 100%. B¡ Total Prepaid Expenses and Other Current Assets: Consists of prepaid insurance, prepaid contracts, prepaid clinical trials, interest and dividends receivables, and other current assets. Company management expects to recover all of its prepaid expenses except for approximately $509,000 of research & development tax credits and $195,000 of other current assets. C¡ Property and Equipment, Net: In December 2022, the Company recorded an impairment loss of $11.7 million consisting of $6.7 million impairment loss to write down the property and equipment to its fair market value, $2.2 million impairment loss to write off prepaid expenses and other current assets related to purchases of property and equipment, and $2.8 million impairment loss to accrue non-cancelable future payments related to purchases of the property and equipment. The impairment loss was a result of the Company’s reported topline results from the STS101 SUMMIT Phase 3 efficacy trial and the Company’s plan not to invest in commercialization of STS101. D¡ Other Non-Current Assets: Consists of deposits and operating lease right-of-use assets. Company management expects to fully recover $22,483 of deposits but expects to write-off $77,199 of operating lease right-of-use assets. ¡ Accounts Payable: Company management expects all of the Company’s accounts payable liabilities to be paid in full. E ¡ Accrued Expenses and Other Current Liabilities: Consists of accrued payroll, accrued PTO, accrued clinical trials, deferred rent, F and other accrued liabilities. Company management expects all of the Company’s accrued expenses to be paid in full except for $70,486 of deferred rent. Source: Company management and public filings. 12 CONFIDENTIAL

Management Liquidation Analysis Selected Commentary (cont.) Wind-Down Costs and IP Value ¡ Wind-Down Costs: Company management indicated that it would take until approximately June 2023 for a shareholder vote on the G dissolution of the business to be held. During this time, the Company would incur approximately $15.2 million to $19.2 million in expenses. ¡ Operating Costs: Represents payroll; travel; office and facilities; consulting and professional services; research & development; chemistry, manufacturing, and controls (“CMC”); clinical and regulatory; and selling, general, and administrative expenses during the approximately three-month period of operational wind down. Partially offset by interest income earned during the same period. ¡ CDMO Contract: Represents costs associated with a significant Contract Development and Manufacturing Organization ( CDMO ). Per Company management, the low end of the range is based on an expected minimum spend of $940,000 to wind down the contract. The high end of the range includes an additional $3,968,000 payment in connection with a contract amendment that became effective on April 1, 2023. ¡ Capital Expenditures: Represents costs to shut down existing packaging lines, storage and tooling, per Company management. ¡ Severance Fee: Represents severance fees paid to employees and certain executives. Per Company management, based on amounts stipulated in selected employment contracts plus three-months severance for all other employees. ¡ D&O Insurance Tail: Current D&O insurance is set to expire in September 2023. Represents the estimated price of tail coverage policy for D&O insurance, per Company management. ¡ Transaction Costs: Represents legal and financial advisor sunk costs, in the event the Transaction is not consummated. Per Company management, low end assumes $1,500,000 and high end assumes $1,000,000. H ¡ IP Value: Per Company management, the IP would have no residual value based on the following factors: ¡ Results of the Phase 3 SUMMIT trial, in which STS101 did not achieve statistical superiority to placebo on the co-primary outcome measures; ¡ Projected need for substantial additional capital were the Company to continue to develop STS101 through potential regulatory approval and pursue independent commercialization of STS101; ¡ Current and anticipated future capital market conditions, in which the Company is unable to raise financing; and ¡ The significant decrease in the Company's stock price that occurred following its announcement of the SUMMIT trial result. Source: Company management and public filings. 13 CONFIDENTIAL

Page 1. Executive Summary 3 2. Financial Analyses 8 3. Selected Public Market Observations 14 4. Disclaimer 23

Trading Snapshot Public Market Trading Overview (shares outstanding and dollars in millions, except per share values and where otherwise noted) Public Market Enterprise Value Derivation Selected Market Information as of April 14, 2023 Closing Stock Price as of April 14, 2023 $0.66 10-Day Average Closing Price [4] $0.72 Common Shares Outstanding [1] 33.2 1-Month Average Closing Price [4] $0.79 Dilutive Shares [2] 0.0 3-Month Average Closing Price [4] $0.89 Total Shares 33.2 6-Month Average Closing Price [4] $1.57 Market Value of Equity $21.7 52-Week High Closing Price [4] $7.95 Debt [3] $0.0 52-Week Low Closing Price [4] $0.61 Preferred Stock [3] $0.0 Minority Interest [3] $0.0 Other Market Information Cash and Cash Equivalents [3] ($16.4) 90-Day Average Daily Trading Volume (in millions) [4] 0.2 Short-Term Marketable Securities [3] ($36.1) % of Total Shares Outstanding 0.5% Public Market Enterprise Value ($30.8) % of Total Public Float 0.6% 90-Day Average Daily Trading Value (in millions) [4] $0.2 % of Market Value of Equity 0.7% Number of Analysts Covering the Company [5] 5 Total Public Float [6] 29.9 % of Total Shares Outstanding 90.1% Historical VWAP [7] (dollars per share) 1-Day 5-Day 10-Day 20-Day 1-Month 3-Month 6-Month 9-Month 12-Month $0.68 $0.69 $0.71 $0.77 $0.77 $0.89 $0.88 $1.43 $1.52 1. Based on (i) 33,152,498 shares of common stock outstanding as of 3/22/2023, per Form 10-K. 2. Reflects the net dilutive impact of 5,292,403 outstanding options with a weighted-average exercise price of $6.84 as of 12/31/2022, based on the treasury method, per Form 10-K. 3. Per Form 10-K. 4. Per Capital IQ. 5. Per Bloomberg and Wall Street analyst research. 6. Based on (i) 33,152,498 shares of common stock outstanding as of 3/22/2023, per Form 10-K less (ii) 485,297 shares owned by individuals/insiders and (iii) 2,794,113 shares owned by SNBL, per Capital IQ. 7. VWAP based on cumulative trading activity over designated number of trading days (based on intraday trading), per Bloomberg. VWAP refers to Volume-Weighted Average Price. Source: Bloomberg, Capital IQ, and public filings. 15 CONFIDENTIAL

Stock Trading History Since IPO [1] Daily Volume (millions) Closing Stock Price ($) $40.00 120.0 9/10/20: Topline EMERGE results did not show statistically Current Stock Price = $0.66 [2] significant differences between $35.00 either dosage strength of 100.0 STS101 and placebo on co- primary endpoints of freedom $30.00 from pain and most bothersome symptom at two hours post- administration. 80.0 $25.00 11/14/22: Topline SUMMIT results were not statistically $20.00 60.0 superior to placebo at two hours post-administration on the co- primary endpoints of freedom from pain and most bothersome $15.00 symptom. 40.0 $10.00 20.0 $5.00 $0.00 0.0 Satsuma Pharmaceuticals, Inc. Daily Trading Volume 1. Since IPO refers to 9/13/2019, when the Company began publicly trading. 2. As of 4/14/2023 close. Source: Capital IQ and public filings. 16 CONFIDENTIAL

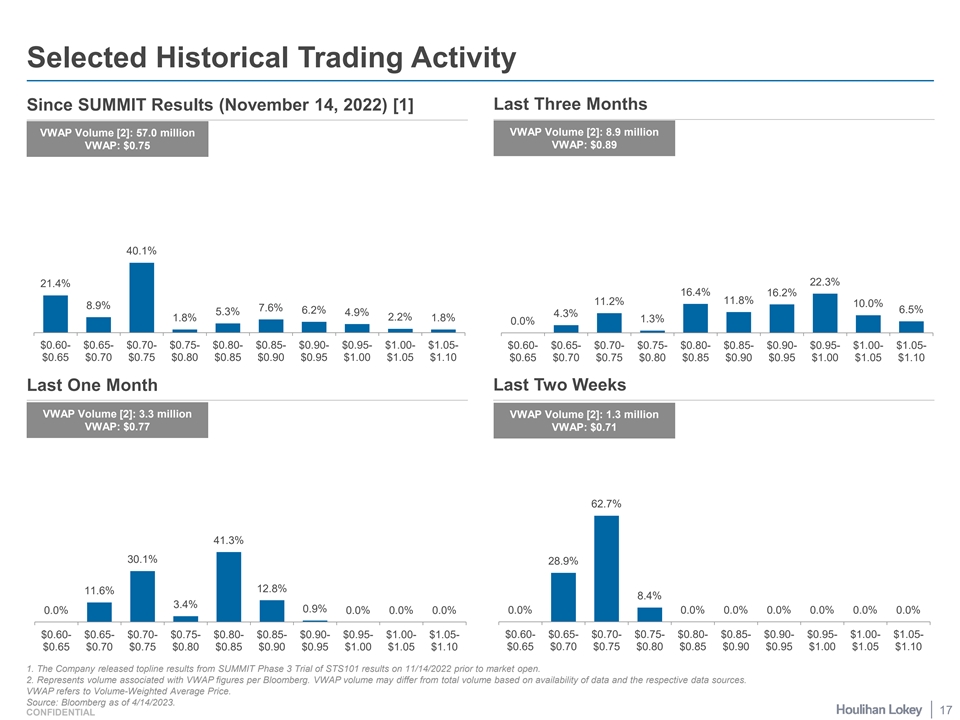

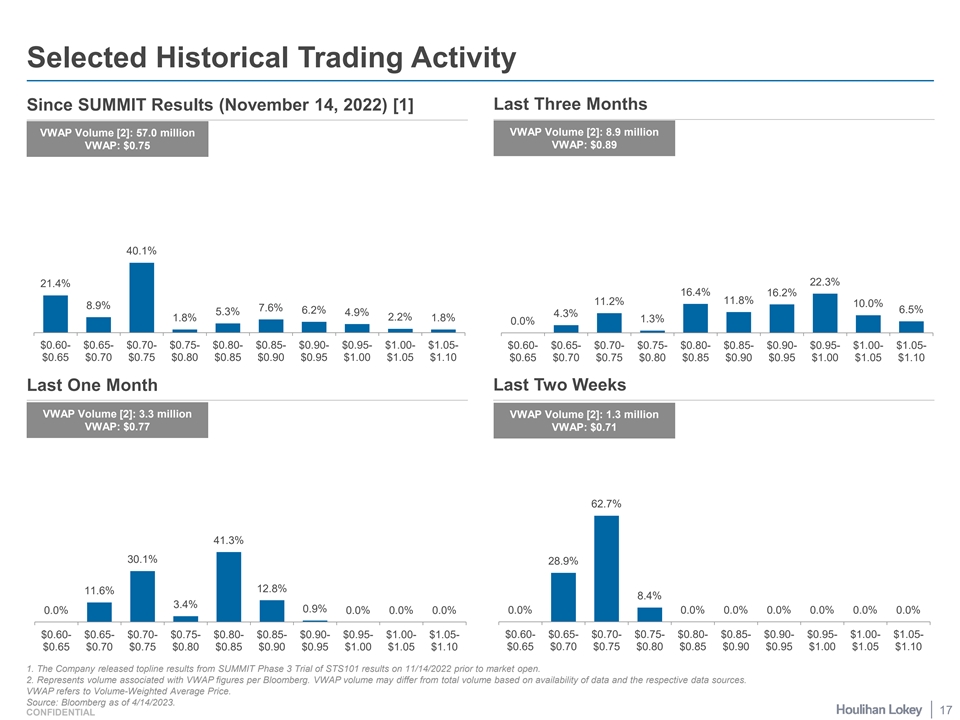

Selected Historical Trading Activity Since SUMMIT Results (November 14, 2022) [1] Last Three Months VWAP Volume [2]: 8.9 million VWAP Volume [2]: 57.0 million VWAP: $0.75 VWAP: $0.89 40.1% 22.3% 21.4% 16.4% 16.2% 11.8% 11.2% 10.0% 8.9% 7.6% 6.2% 6.5% 5.3% 4.9% 4.3% 1.8% 2.2% 1.8% 1.3% 0.0% $0.60- $0.65- $0.70- $0.75- $0.80- $0.85- $0.90- $0.95- $1.00- $1.05- $0.60- $0.65- $0.70- $0.75- $0.80- $0.85- $0.90- $0.95- $1.00- $1.05- $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 $1.00 $1.05 $1.10 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 $1.00 $1.05 $1.10 Last One Month Last Two Weeks VWAP Volume [2]: 3.3 million VWAP Volume [2]: 1.3 million VWAP: $0.77 VWAP: $0.71 62.7% 41.3% 30.1% 28.9% 12.8% 11.6% 8.4% 3.4% 0.9% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% $0.60- $0.65- $0.70- $0.75- $0.80- $0.85- $0.90- $0.95- $1.00- $1.05- $0.60- $0.65- $0.70- $0.75- $0.80- $0.85- $0.90- $0.95- $1.00- $1.05- $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 $1.00 $1.05 $1.10 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 $1.00 $1.05 $1.10 1. The Company released topline results from SUMMIT Phase 3 Trial of STS101 results on 11/14/2022 prior to market open. 2. Represents volume associated with VWAP figures per Bloomberg. VWAP volume may differ from total volume based on availability of data and the respective data sources. VWAP refers to Volume-Weighted Average Price. Source: Bloomberg as of 4/14/2023. 17 CONFIDENTIAL

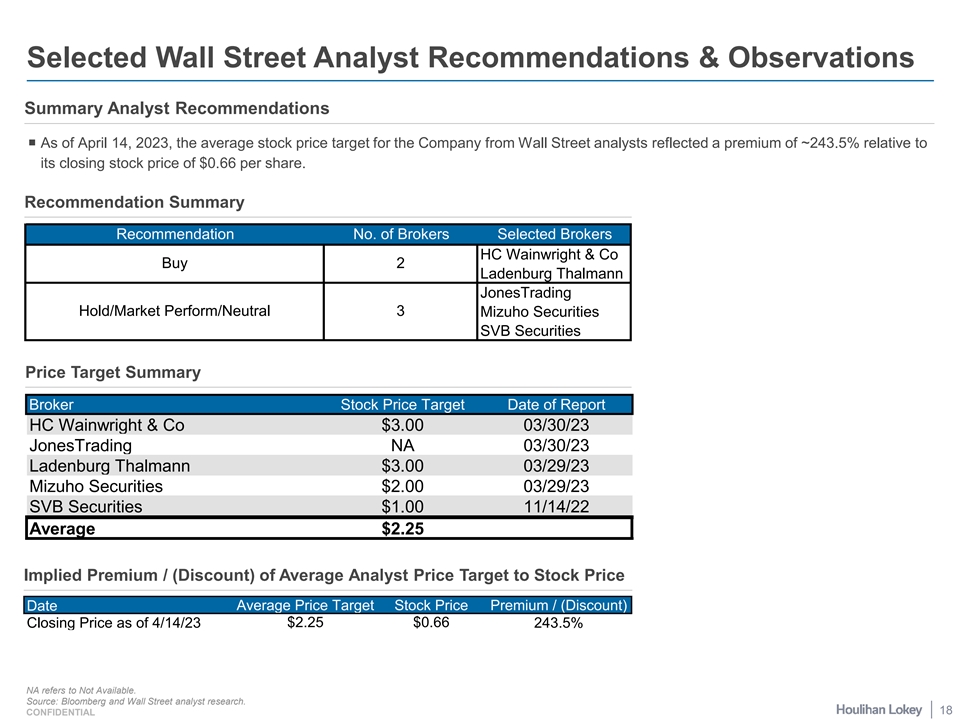

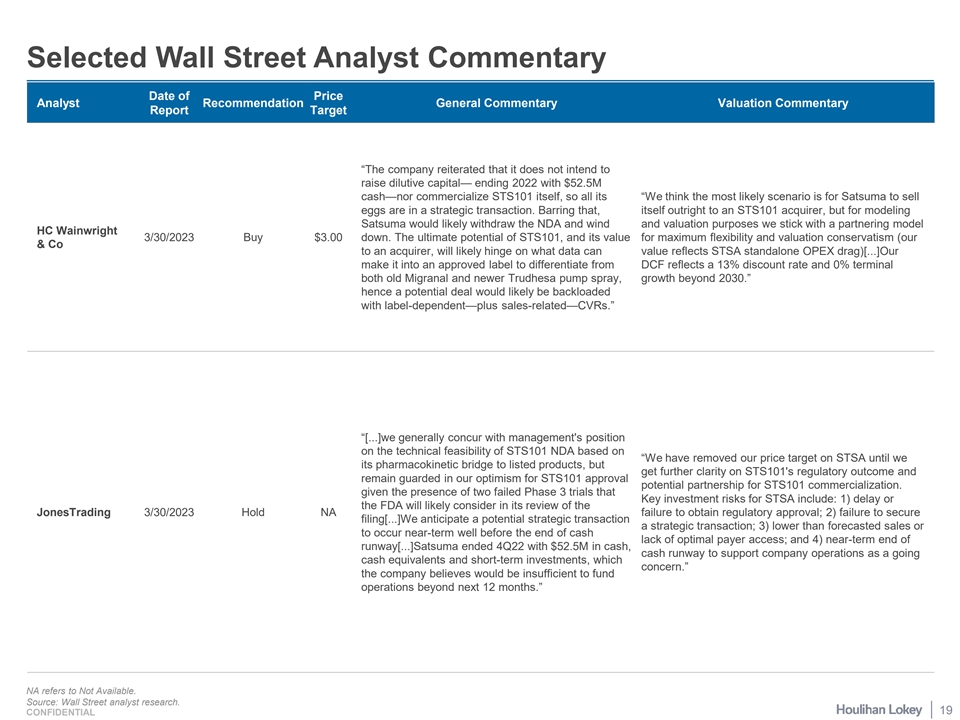

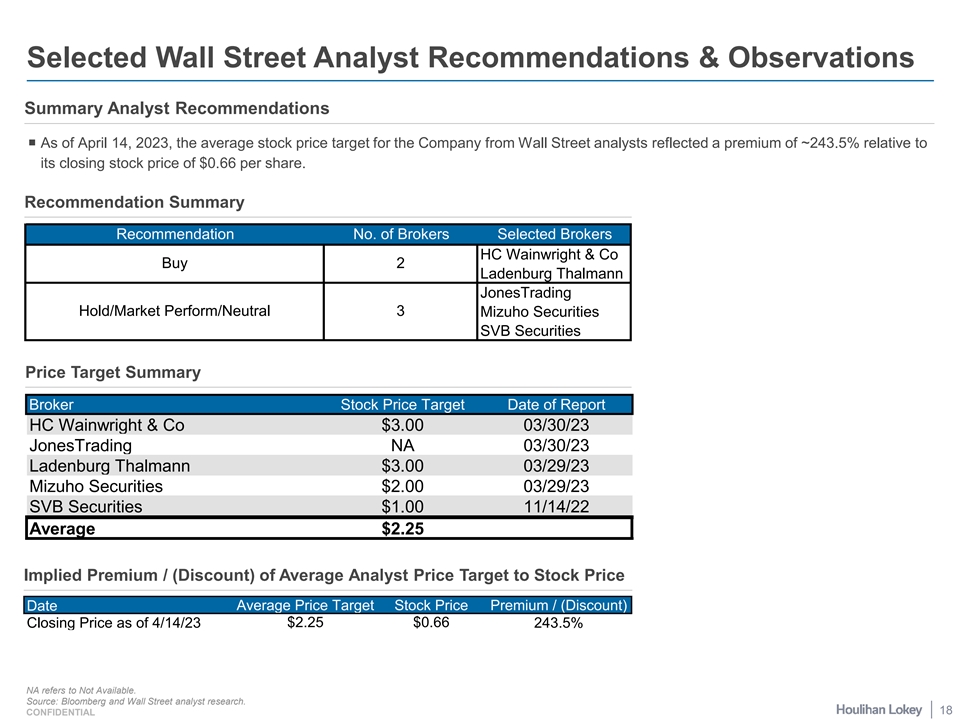

Selected Wall Street Analyst Recommendations & Observations Summary Analyst Recommendations ¡ As of April 14, 2023, the average stock price target for the Company from Wall Street analysts reflected a premium of ~243.5% relative to its closing stock price of $0.66 per share. Recommendation Summary Recommendation No. of Brokers Selected Brokers HC Wainwright & Co Buy 2 Ladenburg Thalmann JonesTrading Hold/Market Perform/Neutral 3 Mizuho Securities SVB Securities Price Target Summary Broker Stock Price Target Date of Report HC Wainwright & Co $3.00 03/30/23 JonesTrading NA 03/30/23 Ladenburg Thalmann $3.00 03/29/23 Mizuho Securities $2.00 03/29/23 SVB Securities $1.00 11/14/22 Average $2.25 Implied Premium / (Discount) of Average Analyst Price Target to Stock Price Date Average Price Target Stock Price Premium / (Discount) Closing Price as of 4/14/23 $2.25 $0.66 243.5% NA refers to Not Available. Source: Bloomberg and Wall Street analyst research. 18 CONFIDENTIAL

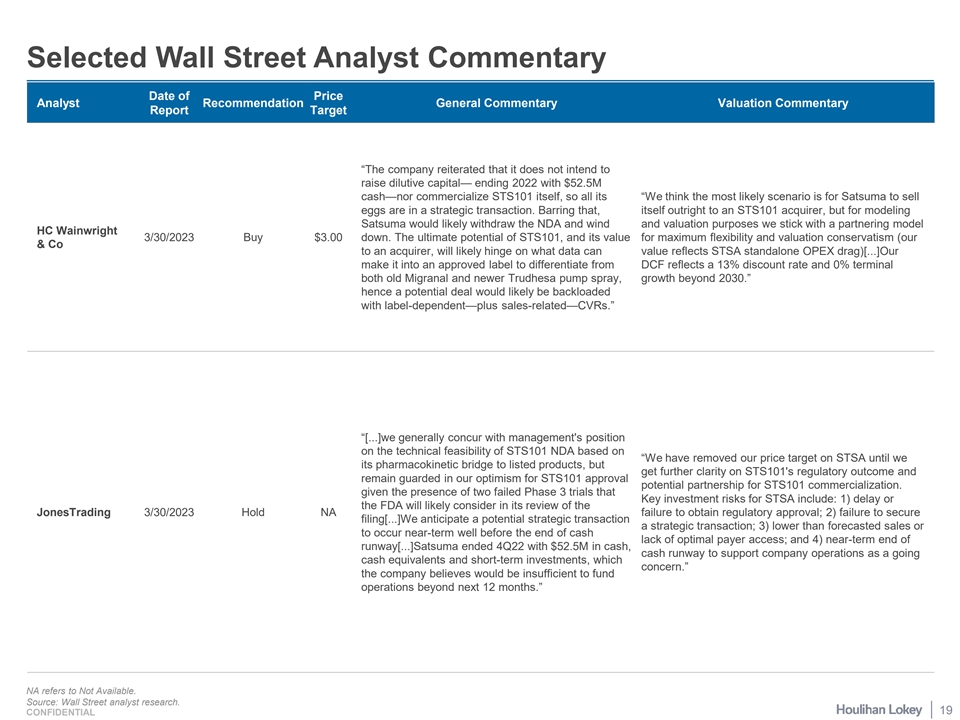

Selected Wall Street Analyst Commentary Date of Price Analyst Recommendation General Commentary Valuation Commentary Report Target “The company reiterated that it does not intend to raise dilutive capital— ending 2022 with $52.5M cash—nor commercialize STS101 itself, so all its “We think the most likely scenario is for Satsuma to sell eggs are in a strategic transaction. Barring that, itself outright to an STS101 acquirer, but for modeling Satsuma would likely withdraw the NDA and wind and valuation purposes we stick with a partnering model HC Wainwright 3/30/2023 Buy $3.00 down. The ultimate potential of STS101, and its value for maximum flexibility and valuation conservatism (our & Co to an acquirer, will likely hinge on what data can value reflects STSA standalone OPEX drag)[...]Our make it into an approved label to differentiate from DCF reflects a 13% discount rate and 0% terminal both old Migranal and newer Trudhesa pump spray, growth beyond 2030.” hence a potential deal would likely be backloaded with label-dependent—plus sales-related—CVRs.” “[...]we generally concur with management's position on the technical feasibility of STS101 NDA based on “We have removed our price target on STSA until we its pharmacokinetic bridge to listed products, but get further clarity on STS101's regulatory outcome and remain guarded in our optimism for STS101 approval potential partnership for STS101 commercialization. given the presence of two failed Phase 3 trials that Key investment risks for STSA include: 1) delay or the FDA will likely consider in its review of the JonesTrading 3/30/2023 Hold NA failure to obtain regulatory approval; 2) failure to secure filing[...]We anticipate a potential strategic transaction a strategic transaction; 3) lower than forecasted sales or to occur near-term well before the end of cash lack of optimal payer access; and 4) near-term end of runway[...]Satsuma ended 4Q22 with $52.5M in cash, cash runway to support company operations as a going cash equivalents and short-term investments, which concern.” the company believes would be insufficient to fund operations beyond next 12 months.” NA refers to Not Available. Source: Wall Street analyst research. 19 CONFIDENTIAL

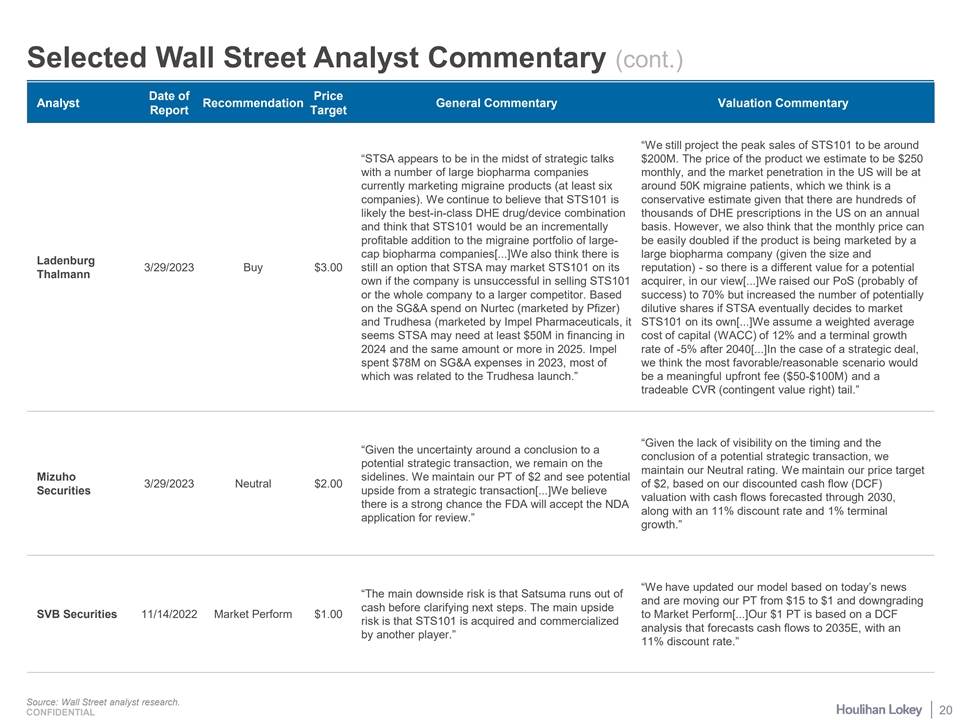

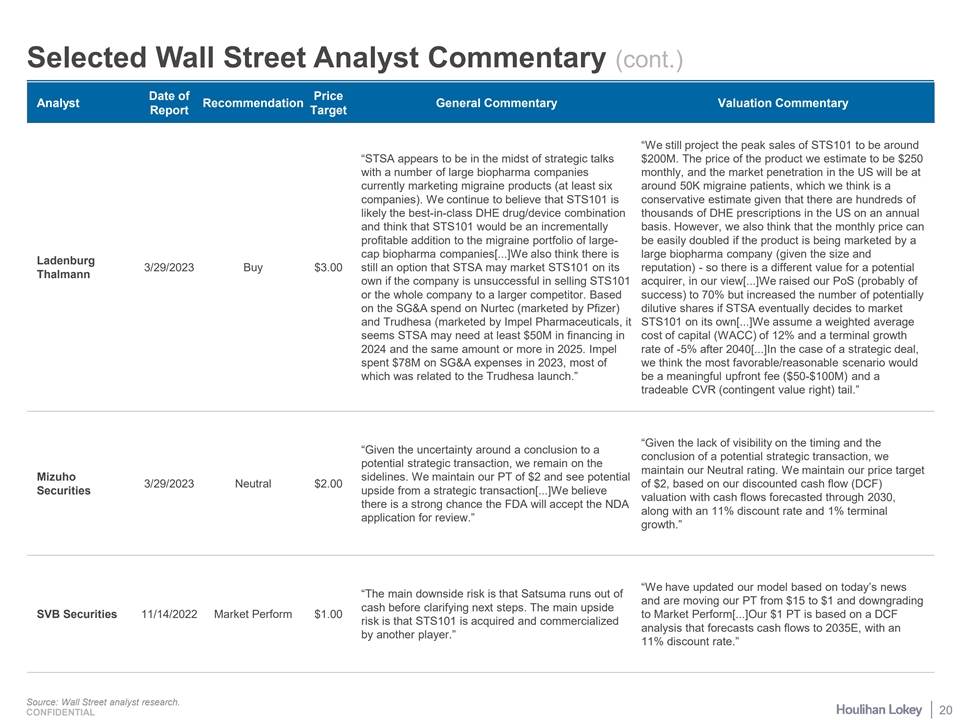

Selected Wall Street Analyst Commentary (cont.) Date of Price Analyst Recommendation General Commentary Valuation Commentary Report Target “We still project the peak sales of STS101 to be around “STSA appears to be in the midst of strategic talks $200M. The price of the product we estimate to be $250 with a number of large biopharma companies monthly, and the market penetration in the US will be at currently marketing migraine products (at least six around 50K migraine patients, which we think is a companies). We continue to believe that STS101 is conservative estimate given that there are hundreds of likely the best-in-class DHE drug/device combination thousands of DHE prescriptions in the US on an annual and think that STS101 would be an incrementally basis. However, we also think that the monthly price can profitable addition to the migraine portfolio of large- be easily doubled if the product is being marketed by a cap biopharma companies[...]We also think there is large biopharma company (given the size and Ladenburg 3/29/2023 Buy $3.00 still an option that STSA may market STS101 on its reputation) - so there is a different value for a potential Thalmann own if the company is unsuccessful in selling STS101 acquirer, in our view[...]We raised our PoS (probably of or the whole company to a larger competitor. Based success) to 70% but increased the number of potentially on the SG&A spend on Nurtec (marketed by Pfizer) dilutive shares if STSA eventually decides to market and Trudhesa (marketed by Impel Pharmaceuticals, it STS101 on its own[...]We assume a weighted average seems STSA may need at least $50M in financing in cost of capital (WACC) of 12% and a terminal growth 2024 and the same amount or more in 2025. Impel rate of -5% after 2040[...]In the case of a strategic deal, spent $78M on SG&A expenses in 2023, most of we think the most favorable/reasonable scenario would which was related to the Trudhesa launch.” be a meaningful upfront fee ($50-$100M) and a tradeable CVR (contingent value right) tail.” “Given the lack of visibility on the timing and the “Given the uncertainty around a conclusion to a conclusion of a potential strategic transaction, we potential strategic transaction, we remain on the maintain our Neutral rating. We maintain our price target Mizuho sidelines. We maintain our PT of $2 and see potential 3/29/2023 Neutral $2.00 of $2, based on our discounted cash flow (DCF) Securities upside from a strategic transaction[...]We believe valuation with cash flows forecasted through 2030, there is a strong chance the FDA will accept the NDA along with an 11% discount rate and 1% terminal application for review.” growth.” “We have updated our model based on today’s news “The main downside risk is that Satsuma runs out of and are moving our PT from $15 to $1 and downgrading cash before clarifying next steps. The main upside SVB Securities 11/14/2022 Market Perform $1.00 to Market Perform[...]Our $1 PT is based on a DCF risk is that STS101 is acquired and commercialized analysis that forecasts cash flows to 2035E, with an by another player.” 11% discount rate.” Source: Wall Street analyst research. 20 CONFIDENTIAL

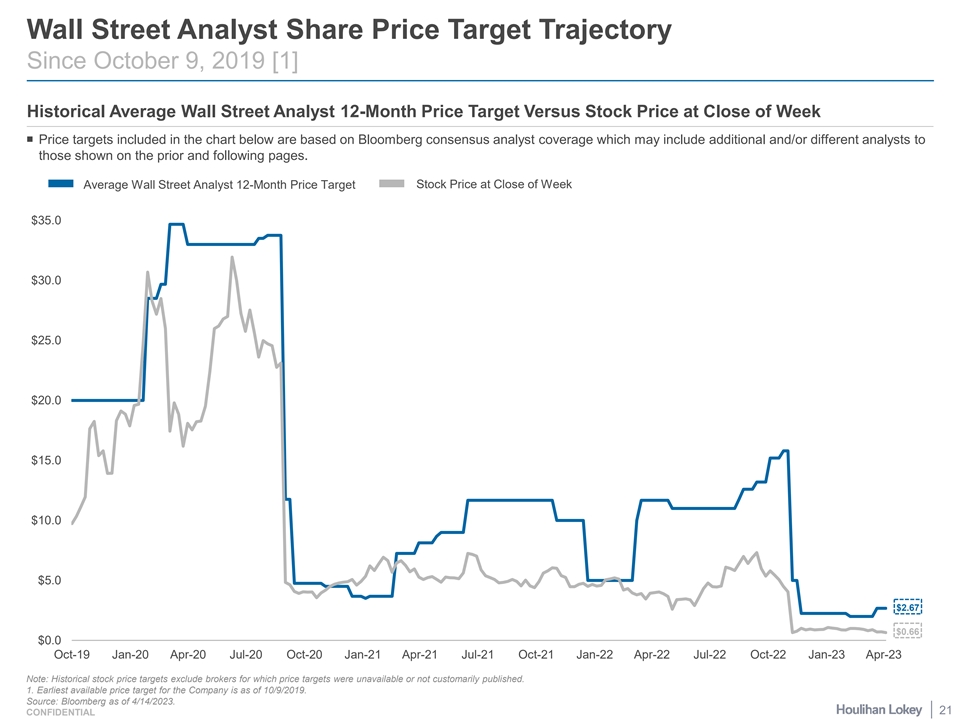

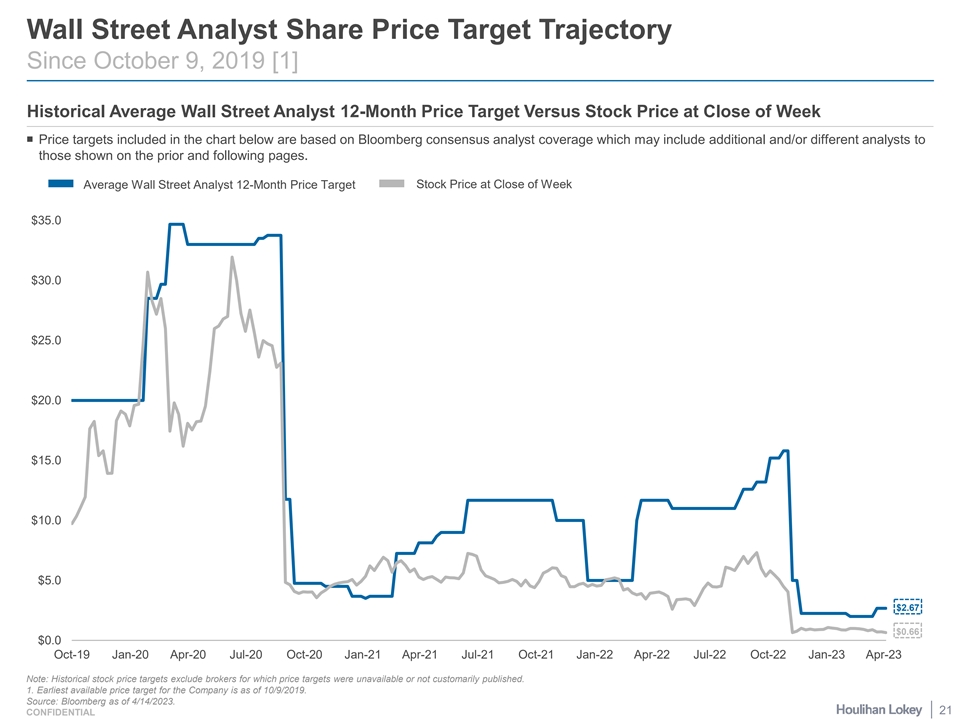

Wall Street Analyst Share Price Target Trajectory Since October 9, 2019 [1] Historical Average Wall Street Analyst 12-Month Price Target Versus Stock Price at Close of Week ¡ Price targets included in the chart below are based on Bloomberg consensus analyst coverage which may include additional and/or different analysts to those shown on the prior and following pages. Stock Price at Close of Week Average Wall Street Analyst 12-Month Price Target $35.0 $30.0 $25.0 $20.0 $15.0 $10.0 $5.0 $2.67 $0.66 $0.0 Oct-19 Jan-20 Apr-20 Jul-20 Oct-20 Jan-21 Apr-21 Jul-21 Oct-21 Jan-22 Apr-22 Jul-22 Oct-22 Jan-23 Apr-23 Note: Historical stock price targets exclude brokers for which price targets were unavailable or not customarily published. 1. Earliest available price target for the Company is as of 10/9/2019. Source: Bloomberg as of 4/14/2023. 21 CONFIDENTIAL

Ownership Summary (shares in thousands) Common Stock [1] Holder Shares % Outstanding BML Capital Management, LLC 6,440.0 19.4% RA Capital Management, L.P. 5,914.3 17.8% Shin Nippon Biomedical Laboratories, Ltd. (TSE:2395) 2,794.1 8.4% 2,488.6 7.5% New Enterprise Associates, Inc. 920.5 2.8% The Vanguard Group, Inc. 816.9 2.5% Driehaus Capital Management LLC Geode Capital Management, LLC 409.1 1.2% Kollins MBA, John A. (President, CEO & Director) 310.9 0.9% Two Sigma Investments, LP 291.9 0.9% Acadian Asset Management LLC 275.1 0.8% All Other 12,491.1 37.7% Total 33,152.5 100.0% Shin Nippon Biomedical Laboratories, Ltd. Quarterly Ownership (shares in thousands) 8.1% 8.1% 8.8% 8.4% 8.4% 5.0% 8.9% 8.1% 8.1% 3,000 2,794.1 2,794.1 2,794.1 2,794.1 2,560.8 2,560.8 2,560.8 2,560.8 2,500 2,000 1,561.7 1,500 1,000 500 0 12/31/2020 3/31/2021 6/30/2021 9/30/2021 12/31/2021 3/31/2022 6/30/2022 9/30/2022 12/31/2022 Common Stock Held 1. Based on common shares outstanding as of 3/22/2023 per Company’s Form 10-K for the period ended 12/31/2022. Source: Capital IQ and public filings. 22 CONFIDENTIAL

Page 1. Executive Summary 3 2. Financial Analyses 8 3. Selected Public Market Observations 14 4. Disclaimer 23

Disclaimer This presentation, and any supplemental information (written or oral) or other documents provided in connection therewith (collectively, the “materials”), are provided solely for the information of the Board of Directors (the “Board”) of Satsuma Pharmaceuticals, Inc. (the “Company”) by Houlihan Lokey in connection with the Board’s consideration of a potential transaction (the “Transaction”) involving the Company. This presentation is incomplete without reference to, and should be considered in conjunction with, any supplemental information provided by and discussions with Houlihan Lokey in connection therewith. Any defined terms used herein shall have the meanings set forth herein, even if such defined terms have been given different meanings elsewhere in the materials. The materials are for discussion purposes only. Houlihan Lokey expressly disclaims any and all liability, whether direct or indirect, in contract or tort or otherwise, to any person in connection with the materials. The materials were prepared for specific persons familiar with the business and affairs of the Company for use in a specific context and were not prepared with a view to public disclosure or to conform with any disclosure standards under any state, federal or international securities laws or other laws, rules or regulations, and none of the Board, the Company or Houlihan Lokey takes any responsibility for the use of the materials by persons other than the Board. The materials are provided on a confidential basis solely for the information of the Board and may not be disclosed, summarized, reproduced, disseminated or quoted or otherwise referred to, in whole or in part, without Houlihan Lokey’s express prior written consent. Notwithstanding any other provision herein, the Company (and each employee, representative or other agent of the Company) may disclose to any and all persons without limitation of any kind, the tax treatment and tax structure of any transaction and all materials of any kind (including opinions or other tax analyses, if any) that are provided to the Company relating to such tax treatment and structure. However, any information relating to the tax treatment and tax structure shall remain confidential (and the foregoing sentence shall not apply) to the extent necessary to enable any person to comply with securities laws. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. income or franchise tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. income or franchise tax treatment of the transaction. If the Company plans to disclose information pursuant to the first sentence of this paragraph, the Company shall inform those to whom it discloses any such information that they may not rely upon such information for any purpose without Houlihan Lokey’s prior written consent. Houlihan Lokey is not an expert on, and nothing contained in the materials should be construed as advice with regard to, legal, accounting, regulatory, insurance, tax or other specialist matters. Houlihan Lokey’s role in reviewing any information was limited solely to performing such a review as it deemed necessary to support its own advice and analysis and was not on behalf of the Board. The materials necessarily are based on financial, economic, market and other conditions as in effect on, and the information available to Houlihan Lokey as of, the date of the materials. Although subsequent developments may affect the contents of the materials, Houlihan Lokey has not undertaken, and is under no obligation, to update, revise or reaffirm the materials. The materials are not intended to provide the sole basis for evaluation of the Transaction and do not purport to contain all information that may be required. The materials do not address the underlying business decision of the Company or any other party to proceed with or effect the Transaction, or the relative merits of the Transaction as compared to any alternative business strategies or transactions that might be available for the Company or any other party. The materials do not constitute any opinion, nor do the materials constitute a recommendation to the Board, the Company, any security holder of the Company or any other party as to how to vote or act with respect to any matter relating to the Transaction or otherwise or whether to buy or sell any assets or securities of any company. Houlihan Lokey’s only opinion is the opinion, if any, that is actually delivered to the Board. In preparing the materials Houlihan Lokey has acted as an independent contractor and nothing in the materials is intended to create or shall be construed as creating a fiduciary or other relationship between Houlihan Lokey and any party. The materials may not reflect information known to other professionals in other business areas of Houlihan Lokey and its affiliates. 24 CONFIDENTIAL

Disclaimer (cont.) The preparation of the materials was a complex process involving quantitative and qualitative judgments and determinations with respect to the financial, comparative and other analytic methods employed and the adaption and application of these methods to the unique facts and circumstances presented and, therefore, is not readily susceptible to partial analysis or summary description. Furthermore, Houlihan Lokey did not attribute any particular weight to any analysis or factor considered by it, but rather made qualitative judgments as to the significance and relevance of each analysis and factor. Each analytical technique has inherent strengths and weaknesses, and the nature of the available information may further affect the value of particular techniques. Accordingly, the analyses contained in the materials must be considered as a whole. Selecting portions of the analyses, analytic methods and factors without considering all analyses and factors could create a misleading or incomplete view. The materials reflect judgments and assumptions with regard to industry performance, general business, economic, regulatory, market and financial conditions and other matters, many of which are beyond the control of the participants in the Transaction. Any estimates of value contained in the materials are not necessarily indicative of actual value or predictive of future results or values, which may be significantly more or less favorable. Any analyses relating to the value of assets, businesses or securities do not purport to be appraisals or to reflect the prices at which any assets, businesses or securities may actually be sold. The materials do not constitute a valuation opinion or credit rating. In preparing the materials, Houlihan Lokey has not conducted any physical inspection or independent appraisal or evaluation of any of the assets, properties or liabilities (contingent or otherwise) of the Company or any other party and has no obligation to evaluate the solvency of the Company or any other party under any law. All budgets, projections, estimates, financial analyses, reports and other information with respect to operations (including, without limitation, estimates of potential cost savings and synergies) reflected in the materials have been prepared by management of the relevant party or are derived from such budgets, projections, estimates, financial analyses, reports and other information or from other sources, which involve numerous and significant subjective determinations made by management of the relevant party and/or which such management has reviewed and found reasonable. The budgets, projections and estimates (including, without limitation, estimates of potential cost savings and synergies) contained in the materials may or may not be achieved and differences between projected results and those actually achieved may be material. Houlihan Lokey has relied upon representations made by management of the Company and other participants in the Transaction that such budgets, projections and estimates have been reasonably prepared in good faith on bases reflecting the best currently available estimates and judgments of such management (or, with respect to information obtained from public sources, represent reasonable estimates), and Houlihan Lokey expresses no opinion with respect to such budgets, projections or estimates or the assumptions on which they are based. The scope of the financial analysis contained herein is based on discussions with the Company (including, without limitation, regarding the methodologies to be utilized), and Houlihan Lokey does not make any representation, express or implied, as to the sufficiency or adequacy of such financial analysis or the scope thereof for any particular purpose. Houlihan Lokey has assumed and relied upon the accuracy and completeness of the financial and other information provided to, discussed with or reviewed by it without (and without assuming responsibility for) independent verification of such information, makes no representation or warranty (express or implied) in respect of the accuracy or completeness of such information and has further relied upon the assurances of the Company and other participants in the Transaction that they are not aware of any facts or circumstances that would make such information inaccurate or misleading. In addition, Houlihan Lokey has relied upon and assumed, without independent verification, that there has been no change in the business, assets, liabilities, financial condition, results of operations, cash flows or prospects of the Company or any other participant in the Transaction since the respective dates of the most recent financial statements and other information, financial or otherwise, provided to, discussed with or reviewed by Houlihan Lokey that would be material to its analyses, and that the final forms of any draft documents reviewed by Houlihan Lokey will not differ in any material respect from such draft documents. 25 CONFIDENTIAL

Disclaimer (cont.) The materials are not an offer to sell or a solicitation of an indication of interest to purchase any security, option, commodity, future, loan or currency. The materials do not constitute a commitment by Houlihan Lokey or any of its affiliates to underwrite, subscribe for or place any securities, to extend or arrange credit, or to provide any other services. In the ordinary course of business, certain of Houlihan Lokey’s affiliates and employees, as well as investment funds in which they may have financial interests or with which they may co-invest, may acquire, hold or sell, long or short positions, or trade or otherwise effect transactions, in debt, equity, and other securities and financial instruments (including loans and other obligations) of, or investments in, the Company, any Transaction counterparty, any other Transaction participant, any other financially interested party with respect to any transaction, other entities or parties that are mentioned in the materials, or any of the foregoing entities’ or parties’ respective affiliates, subsidiaries, investment funds, portfolio companies and representatives (collectively, the “Interested Parties”), or any currency or commodity that may be involved in the Transaction. Houlihan Lokey provides mergers and acquisitions, restructuring and other advisory and consulting services to clients, which may have in the past included, or may currently or in the future include, one or more Interested Parties, for which services Houlihan Lokey has received, and may receive, compensation. Although Houlihan Lokey in the course of such activities and relationships or otherwise may have acquired, or may in the future acquire, information about one or more Interested Parties or the Transaction, or that otherwise may be of interest to the Board or the Company, Houlihan Lokey shall have no obligation to, and may not be contractually permitted to, disclose such information, or the fact that Houlihan Lokey is in possession of such information, to the Board or the Company or to use such information on behalf of the Board or the Company. Houlihan Lokey’s personnel may make statements or provide advice that is contrary to information contained in the materials. 26 CONFIDENTIAL

CORPORATE FINANCE FINANCIAL RESTRUCTURING FINANCIAL AND VALUATION ADVISORY HL.com 27 CONFIDENTIAL