Sincerely, |

|

Daniel Shaeffer Chief Executive Officer |

Sincerely, |

|

Daniel Shaeffer Chief Executive Officer |

| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| 1. | “Acquisition Proposal” are to any bona fide proposal or offer from any person (other than CCI or any of its subsidiaries) made after January 26, 2021, whether in one transaction or a series of related transactions, relating to any (i) merger, consolidation, share exchange, business combination or similar transaction involving CRII or any significant CRII subsidiary, (ii) sale or other disposition, by merger, consolidation, share exchange, business combination or any similar transaction, of any assets of CRII or any of its subsidiaries representing 20% or more of the consolidated assets of CRII, (iii) issue, sale or other disposition by CRII or CROP of securities representing 20% or more of the outstanding CROP partnership units, (iv) tender offer or exchange offer in which any person or group will acquire beneficial ownership, or the right to acquire beneficial ownership, of 20% or more of the outstanding CROP partnership units, or (v) recapitalization, restructuring, liquidation, dissolution or other similar type of transaction with respect to CRII in which a third party will acquire beneficial ownership of 20% or more of the outstanding shares of CROP partnership units. |

| 2. | “Amended and Restated Advisory Agreement” are to the Amended and Restated Advisory Agreement to be entered into by CCI, CROP and CCI Advisor following the CRII Merger; |

| 3. | “Amended and Restated CROP Partnership Agreement” are to the Fifth Amended and Restated Limited Partnership Agreement of CROP to be entered into effective as of the closing of the CROP Merger, subject to the CROP Partner Approvals; |

| 4. | “CC Advisors Promote” are to Cottonwood Communities Advisors Promote, LLC, a Delaware limited liability company; |

| 5. | “CCA” are to Cottonwood Communities Advisors, LLC, a Delaware limited liability company, the sole owner of CCI Advisor and the asset managers of CMRI and CMRII; |

| 6. | “CCA Note” are to the Amended and Restated Promissory Note of CCA dated January 1, 2021 in favor of CROP in the amount of $13 million; |

| 7. | “CCA Note Distribution” are to the distribution by CROP of the CCA Note to the holders of the CROP Participating Partnership Units and the subsequent distribution by CRII of its share of the CCA Note to its common stockholders; |

| 8. | “CCI” are to Cottonwood Communities, Inc., a Maryland corporation; |

| 9. | “CCI Advisor” are to CC Advisors III, LLC, a Delaware limited liability company, a wholly owned subsidiary of CCA and the advisor to CCI and CCOP; |

| 10. | “CCI Advisory Agreement” are to the Advisory Agreement dated as of August 13, 2020 among CCI, CCOP and CCI Advisor, as may be amended; |

| 11. | “CCI Board” are to the board of directors of CCI; |

| 12. | “CCI Bylaws” are to the bylaws of CCI; |

| 13. | “CCI Charter” are to the Articles of Amendment and Restatement of CCI, as supplemented and amended; |

| 14. | “CCI Common Stock” are to the shares of Class A common stock, $0.01 par value per share, of CCI, and where applicable in this information statement/prospectus, may also include the shares of Class T common stock, $0.01 per share, of CCI; |

| 15. | “CCI Parties” are to CCI, CCOP and Merger Sub; |

| 16. | “CCI Series 2016 Preferred Stock” are to the shares of Series 2016 preferred stock, $0.01 par value per share, of CCI, which will be issued to the holders of the CRII Series 2016 Preferred Stock; |

| 17. | “CCI Series 2017 Preferred Stock” are to the shares of Series 2017 preferred stock, $0.01 par value per share, of CCI, which will be issued to the holders of the CRII Series 2017 Preferred Stock; |

| 18. | “CCI Series 2019 Preferred Stock” are to the shares of Series 2019 preferred stock, $0.01 par value per share, of CCI; |

| 19. | “CCI Special Committee” are to the special committee of the CCI Board that was formed by the CCI Board to consider the Mergers and the other transactions contemplated by the Merger Agreements; |

| 20. | “CCOP” are to Cottonwood Communities O.P., LP., a Delaware limited partnership, the operating partnership of CCI; |

| 21. | “CCOP Common Unit” are to the common limited partner units of CCOP as set forth in the CCOP Partnership Agreement; |

| 22. | “CCOP General Partner Unit” are to the general partner units of CCOP issued to CCI as set forth in the CCOP Partnership Agreement; |

| 23. | “CCOP LTIP Units” are to the limited partner units of CCOP designated as LTIP Units as set forth in the CCOP Partnership Agreement and the documentation pursuant to which the LTIP Units are granted; |

| 24. | “CCOP Partnership Agreement” are to the Amended and Restated Limited Partnership Agreement of CCOP, dated as of February 1, 2020, as may be amended; |

| 25. | “CCOP Series 2019 Preferred Units” are to the preferred limited partner units of CCOP designated as Series 2019 Preferred Units as set forth in the CCOP Partnership Agreement; |

| 26. | “CCOP Special Limited Partner Interest” are to the limited partner interest in CCOP designated as a Special Limited Partner Interest as set forth in the CCOP Partnership Agreement; |

| 27. | “CCOP Special LTIP Units” are to the CCOP LTIP Units designated as Special LTIP Units in the documentation pursuant to which the CCOP LTIP Units are granted; |

| 28. | “CCMI” are to Cottonwood Communities Management, LLC, a Delaware limited liability company, a wholly owned subsidiary of Cottonwood Capital Management and the property manager of CCI, CCOP and their subsidiaries; |

| 29. | “CMOF” are to Cottonwood Multifamily Opportunity Fund, Inc., a fund sponsored by CCPM II; |

| 30. | “CCPM II” are to Cottonwood Capital Property Management II, LLC, a Delaware limited liability company, a wholly owned subsidiary of Cottonwood Capital Management and the property manager of CMRI, CMRI OP, CMRII, CMRII OP and their respective subsidiaries; |

| 31. | “CMRI” are to Cottonwood Multifamily REIT I, Inc., a Maryland corporation; |

| 32. | “CMRI Merger” are to the merger of CMRI with and into Merger Sub, with Merger Sub surviving the merger, pursuant to the CMRI Merger Agreement, and where applicable in this information statement/prospectus may also include the CMRI OP Merger; |

| 33. | “CMRI Merger Agreement” are to the Agreement and Plan of Merger, dated as of January 26, 2021, by and among CMRI, CMRI OP and the CCI Parties, as it may be amended from time to time; |

| 34. | “CMRI OP” are to Cottonwood Multifamily REIT I O.P., LP, a Delaware limited partnership, the operating partnership of CMRI; |

| 35. | “CMRI OP Merger” are to the merger of CMRI OP with and into CCOP or its successor, with CCOP or its successor surviving the merger, pursuant to the CMRI Merger Agreement; |

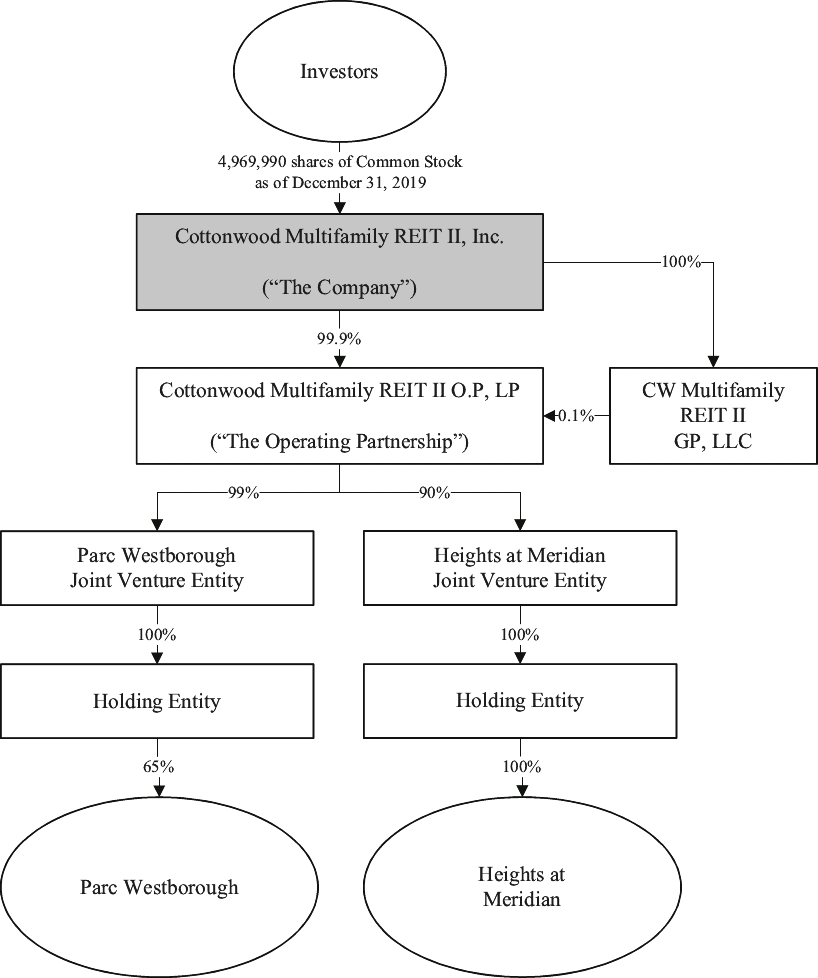

| 36. | “CMRII” are to Cottonwood Multifamily REIT II, Inc., a Maryland corporation; |

| 37. | “CMRII Merger” are to the merger of CMRII with and into Merger Sub, with Merger Sub surviving the merger, pursuant to the CMRII Merger Agreement, and where applicable in this information statement/prospectus may also include the CMRII OP Merger; |

| 38. | “CMRII Merger Agreement” are to the Agreement and Plan of Merger, dated as of January 26, 2021, by and among CMRII, CMRII OP and the CCI Parties, as it may be amended from time to time; |

| 39. | “CMRII OP” are to Cottonwood Multifamily REIT II O.P., LP, a Delaware limited partnership, the operating partnership of CMRII; |

| 40. | “CMRII OP Merger” are to the merger of CMRII OP with and into CCOP or its successor, with CCOP or its successor surviving the merger, pursuant to the CMRII Merger Agreement; |

| 41. | “Code” are to the Internal Revenue Code of 1986, as amended; |

| 42. | “Combined Company” are to CCI and its consolidated subsidiaries (including the Surviving Entity) after the closing of the CRII Merger and the CROP Merger; |

| 43. | “Cottonwood Capital Management” are to Cottonwood Capital Management, Inc., a wholly owned subsidiary of CROP and the owner of the CCMI and CCPM II; |

| 44. | “CR Holdings” are to Cottonwood Residential Holdings, LLC, a Delaware limited liability, the sole owner of the CRII Voting Common Stock, and which is beneficially owned by Daniel Shaeffer, Chad Christensen, Gregg Christensen and Eric Marlin; |

| 45. | “CRII” are to Cottonwood Residential II, Inc., a Maryland corporation; |

| 46. | “CRII Board” are to the board of directors of CRII; |

| 47. | “CRII Bylaws” are to the bylaws of CRII; |

| 48. | “CRII Charter” are to the Articles of Incorporation of CRII, as supplemented and amended; |

| 49. | “CRII Common Stock” are to the shares of common stock, $0.01 par value per share, of CRII; |

| 50. | “CRII Merger” are to the merger of CRII with and into Merger Sub, with Merger Sub surviving the merger, pursuant to the CRII Merger Agreement, and where applicable in this information statement/prospectus may also include the CROP Merger; |

| 51. | “CRII Merger Agreement” are to the Agreement and Plan of Merger, dated as of January 26, 2021, by and among CRII, CROP and the CCI Parties, as it may be amended from time to time, a copy of which is attached as Annex A to this information statement/prospectus; |

| 52. | “CRII Non-Voting Common Stock” are to the shares of non-voting common stock, $0.01 par value per share, of CRII; |

| 53. | “CRII Parties” are to CRII and CROP; |

| 54. | “CRII Series 2016 Preferred Stock” are to the shares of Series 2016 preferred stock, $0.01 par value per share, of CRII; |

| 55. | “CRII Series 2017 Preferred Stock” are to the shares of Series 2017 preferred stock, $0.01 par value per share, of CRII; |

| 56. | “CRII Transaction Committee” are to the transaction committee of the CRII Board that was formed by the CRII Board to consider the CRII Merger and the other transactions contemplated by the CRII Merger Agreement; |

| 57. | “CRII Voting Common Stock” are to the shares of voting common stock, $0.01 par value per share, of CRII; |

| 58. | “CRII Voting Stockholder Approval” are to the approval of the CRII Merger by the holders of a majority of the outstanding CRII Voting Common Stock; |

| 59. | “CROP” are to Cottonwood Residential O.P., LP, a Delaware limited partnership, the operating partnership of CRII; |

| 60. | “CROP Common Units” are to the common limited partner units of CROP as set forth in the CROP Partnership Agreement; |

| 61. | “CROP LTIP Units” are to the limited partner units of CROP designated as LTIP Units as set forth in the CROP Partnership Agreement and the documentation pursuant to which the LTIP Units are granted; |

| 62. | “CROP Merger” are to the merger of CCOP with and into CROP, with CROP surviving the merger, pursuant to the CRII Merger Agreement; |

| 63. | “CROP Participating Partnership Units” refers to the CROP Common Units, the CROP LTIP Units, the CROP Special LTIP Units (but only to the extent entitled to distributions under the CROP Partnership Agreement) or the CROP general partner units, and excludes any CROP preferred units; |

| 64. | “CROP Partner Approvals” are to (i) the approval of the CRII Merger, the CROP Merger, the Tax Protection Agreement, the Amended and Restated Advisory Agreement and the Pre-Merger Transactions by the holders of a majority of the outstanding CROP Common Units held by limited partners of CROP (other than CRII’s management and certain of its affiliates) and (ii) the approval of the CROP Merger and the Amended and Restated CROP Partnership Agreement by the holders of a majority of the outstanding CROP Common Units held by limited partners of CROP; |

| 65. | “CROP Partnership Agreement” are to the Fourth Amended and Restated Limited Partnership Agreement of CROP, dated December 1, 2015, as amended; |

| 66. | “CROP Special LTIP Units” are to the CROP LTIP Units designated as Special LTIP Units in the documentation pursuant to which the CROP LTIP Units are granted; |

| 67. | “CROP Unit Split” are to the split of each CROP Participating Partnership Unit issued and outstanding immediately prior to the CROP Merger into 2.015 CROP Participating Partnership Units (as may be adjusted if the CCA Note Distribution is not effected), which will occur immediately prior to the effective time of the CROP Merger; |

| 68. | “DLA Piper” are to DLA Piper LLP (US); |

| 69. | “DRULPA” are to the Delaware Revised Uniform Limited Partnership Act or any successor statute; |

| 70. | “ERISA” are to the Employee Retirement Income Security Act of 1974, as amended; |

| 71. | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| 72. | “Fully Combined Company” are to CCI and its consolidated subsidiaries (including the Surviving Entity and CROP) assuming the closing of all of the Mergers; |

| 73. | “Goodwin Procter” are to Goodwin Procter LLP; |

| 74. | “HT Holdings” are to High Traverse Holdings, LLC, a Delaware limited liability company, which is beneficially owned by Daniel Shaeffer, Chad Christensen, Gregg Christensen and Eric Marlin; |

| 75. | “Investment Company Act” are to the Investment Company Act of 1940, as amended; |

| 76. | “Mergers” are to the CRII Merger, the CMRI Merger and the CMRII Merger, and where applicable in this information statement/prospectus may also include the CROP Merger, the CMRI OP Merger and the CMRII OP Merger; |

| 77. | “Merger Agreements” are to the CRII Merger Agreement, the CMRI Merger Agreement and the CMRII Merger Agreement; |

| 78. | “Merger Consideration” are to the conversion of each share of (i) CRII Common Stock issued and outstanding immediately prior to the effective time of the CRII Merger into the right to receive 2.015 shares of CCI Common Stock, as may be adjusted if the CCA Note Distribution is not effected, (ii) CRII Series 2016 Preferred Stock issued and outstanding immediately prior to the effective time of the CRII Merger into the right to receive one share of CCI Series 2016 Preferred Stock and (iii) CRII Series 2017 Preferred Stock issued and outstanding immediately prior to the effective time of the CRII Merger into the right to receive one share of CCI Series 2017 Preferred Stock, pursuant to the terms of the CRII Merger Agreement; |

| 79. | “Merger Sub” are to Cottonwood Communities GP Subsidiary, LLC, a Maryland limited liability company, a wholly owned subsidiary of CCI; |

| 80. | “MGCL” are to the Maryland General Corporation Law or any successor statute; |

| 81. | “ordinary course of business” are to an action taken by a person or entity that is consistent with past practice and similar in nature and magnitude to actions customarily taken without any authorization by the board of directors in the course of normal day-to-day operations; |

| 82. | “Outside Date” are to October 25, 2021; |

| 83. | “Piper Sandler” are to Piper Sandler & Co., the financial advisor of the CRII Transaction Committee; |

| 84. | “Pre-Merger Transactions” are to the following transactions that will occur prior to the effective time of the CRII Merger: (i) the redemption of all outstanding shares of CRII Voting Common Stock held by CR Holdings in exchange for an in-kind distribution by CRII of all of CROP’s interest in CCA, (ii) the issuance of 155,441 CROP Common Units in exchange for all of the remaining interests in CC Advisors Promote – Employee Investor, LLC and CC Advisors Promote – Incentive Grant Investor, LLC and (iii) the redemption of an aggregate of 306,584 CROP Common Units held by certain senior executives in exchange for $6.46 million of notes receivables in favor of CROP; |

| 85. | “REIT” are to a real estate investment trust; |

| 86. | “SDAT” are to the State Department of Assessments and Taxation of Maryland; |

| 87. | “SEC” are to the U.S. Securities and Exchange Commission; |

| 88. | “Securities Act” are to the Securities Act of 1933, as amended; |

| 89. | “Superior Proposal” are to a written Acquisition Proposal made by a third party (except for purposes of this definition, the references in the definition of “Acquisition Proposal” to 20% will be replaced with 50%) which the CRII Board (based on the recommendation of the CRII Transaction Committee) determines in its good faith judgment (after consultation with its outside legal and financial advisors) to be more favorable from a financial point of view to the CRII stockholders than the CRII Merger and the CROP Merger and the other transactions contemplated by the CRII Merger Agreement (as it may be proposed to be amended by CCI). Such a determination of the CRII Board must be made in consultation with its outside legal and financial advisors, after taking into account (i)��all of the terms and conditions of the Acquisition Proposal and the CRII Merger Agreement (as it may be proposed to be amended by CCI) and (ii) the feasibility and certainty of consummation of such Acquisition Proposal on the terms proposed (taking into account such legal, financial, regulatory and other aspects of such Acquisition Proposal and conditions to consummation thereof as the CRII Transaction Committee determines in good faith to be material to such analysis). A Superior Proposal must provide for the repayment in full of the CCA Note at the time of and in connection with the consummation of such Superior Proposal. |

| 90. | “Surviving Entity” are to Merger Sub, a wholly owned subsidiary of CCI, after the effective time of the CRII Merger and the other Mergers, as applicable; |

| 91. | “Tax Protection Agreement” are to the tax protection agreement between CROP and HT Holdings dated January 26, 2021, which will become effective at the effective time of the CROP Merger; and |

| 92. | “TRS” are to a taxable REIT subsidiary. |

| Q: | What is the CRII Merger and what is the CROP Merger? |

| A: | The CRII Parties and the CCI Parties have entered into the CRII Merger Agreement pursuant to which CRII will merge with and into Merger Sub, with Merger Sub surviving the CRII Merger, such that following the CRII Merger, the Surviving Entity will continue as a wholly owned subsidiary of CCI. In accordance with the applicable provisions of the MGCL, the separate existence of CRII will cease at the effective time of the CRII Merger. In addition, CCOP will merge with and into CROP, with CROP surviving the CROP Merger. In accordance with the DRULPA, the separate existence of CCOP will cease at the effective time of the CROP Merger. |

| Q: | What is the CMRI Merger and what is the CMRII Merger? |

| Q: | What will happen in the CRII Merger? |

| A: | At the effective time of the CRII Merger, (i) each share of CRII Common Stock issued and outstanding immediately prior to the effective time of the CRII Merger will convert into the right to receive 2.015 shares of CCI Common Stock, as may be adjusted if the CCA Note Distribution is not effected, (ii) each share of CRII Series 2016 Preferred Stock issued and outstanding immediately prior to the effective time of the CRII Merger will convert into the right to receive one share of CCI Series 2016 Preferred Stock and (iii) each share of CRII Series 2017 Preferred Stock issued and outstanding immediately prior to the effective time of the CRII Merger will convert into the right to receive one share of CCI Series 2017 Preferred Stock. |

| Q: | What will happen in the CROP Merger? |

| Q: | Why am I receiving this information statement/prospectus? |

| A: | This document is being delivered to you as both an information statement of CRII and a prospectus of CCI in connection with the CRII Merger. CRII is utilizing this information statement/prospectus to notify the CRII stockholders that the holders of the CRII Voting Common Stock have delivered an irrevocable proxy to CCI with respect to their CRII Voting Common Stock to vote in favor of or act by written consent to approve the CRII Merger, and that no further approval of the CRII’s stockholders will be required to approve the CRII Merger. In addition, this information statement/prospectus constitutes the prospectus of CCI with respect to the shares of CCI Common Stock, CCI Series 2016 Preferred Stock and CCI Series 2017 Preferred Stock to be issued to the CRII stockholders pursuant to the CRII Merger Agreement. |

| Q: | How will the CCI stockholders be affected by the CRII Merger and the issuance of shares of CCI Common Stock in connection with the CRII Merger? |

| A: | After the CRII Merger, each CCI stockholder will continue to own the shares of CCI Common Stock that such stockholder held immediately prior to the effective time of the CRII Merger. As a result, each CCI stockholder will own shares of common stock in a larger company with more assets. However, because CCI will be issuing new shares of CCI Common Stock to the CRII stockholders in exchange for shares of CRII Common Stock in the CRII Merger, each outstanding share of CCI Common Stock immediately prior to the effective time of the CRII Merger will represent a smaller percentage of the aggregate number of shares of CCI Common Stock outstanding after the CRII Merger. In addition, after completion of the CROP Merger, CROP, the operating partnership of CCI following the CROP Merger, will have a substantially greater number of partnership units outstanding including limited partner units that are separate from the general partner interest to be held by CCI. |

| Q: | What vote is required to approve the CRII Merger? |

| A: | Under Section 3-105 of the MGCL and the CRII Charter, the approval of the CRII Merger by CRII’s stockholders requires the affirmative vote of the holders of a majority of the outstanding shares of CRII Voting Common Stock. All shares of CRII Voting Common Stock are held by CR Holdings. Under the terms of the Voting Agreement, CR Holdings and the beneficial holders of the CRII Voting Common Stock have delivered an irrevocable proxy to CCI with respect to their CRII Voting Common Stock to vote in favor of or act by written consent to approve the CRII Merger. Accordingly, the approval of the CRII Merger by CRII’s stockholders will be effected in accordance with Section 3-105 of the MGCL. No further approval of CRII’s stockholders will be required to approve the CRII Merger. As a result, CRII has not solicited and will not be soliciting your vote for approving the CRII Merger and does not intend to call a meeting of stockholders for purposes of voting on the approval of the CRII Merger. |

| Q: | Will CRII and CCI continue to pay dividends or distributions prior to the closing of the CRII Merger? |

| A: | Yes. The CRII Merger Agreement permits CRII to continue to pay regular distributions in accordance with past practice at a monthly rate not to exceed $0.0741666 per share of CRII Common Stock, and any distributions that are reasonably necessary to maintain CRII’s REIT qualification and avoid or reduce the imposition of U.S. federal income or excise tax. |

| Q: | Are there other transactions that the CRII stockholders should be aware of? |

| A: | Yes. Prior to the consummation of the CRII Merger, the appropriate parties will complete the Pre-Merger Transactions whereby (i) CRII will redeem all outstanding shares of CRII Voting Common Stock held by CR Holdings in exchange for an in-kind distribution by CRII of all of CROP’s interest in CCA, (ii) CROP will issue 155,441 CROP Common Units in exchange for all of the remaining interests in CC Advisors Promote – Employee Investor, LLC and CC Advisors Promote – Incentive Grant Investor, LLC and (iii) CROP will redeem an aggregate of 306,584 CROP Common Units held by HT Holdings in exchange for $6.46 million of notes receivables in favor of CROP. In addition, CCA issued a $13 million promissory note in favor of CROP, CROP entered into the Tax Protection Agreement with HT Holdings and certain CROP LTIP Units and CCOP LTIP Units will accelerate and vest in full in connection with the CRII Merger and the CROP Merger. For more details, see “Related Transactions and Agreements” beginning on page 129. |

| Q: | Will CCI continue to be advised by CCI Advisor after the CRII Merger? |

| A: | CCI Advisor is expected to continue to serve as the advisor of CCI after the CRII Merger. Prior to the consummation of the CRII Merger, CRII and CROP will complete a series of transactions that will result in CRII and CROP divesting their current interest in CCA, the sole owner of CCI Advisor, to an entity beneficially owned and controlled by Daniel Shaeffer, Chad Christensen and Gregg Christensen in exchange for the CRII Voting Common Stock. Following the redemption of the CRII Voting Common Stock, as part |

| Q: | Will CCMI continue to serve as CCI’s affiliated property manager after the CRII Merger? |

| A: | Upon the closing of the CRII Merger, CCI will acquire the personnel who have historically performed certain services for CCI on behalf of CCI Advisor, including property management, legal, accounting, property development oversight and certain services relating to construction management, shareholders, human resources, renter insurance and information technology. As a result, CCI will no longer engage CCMI, or any other affiliated property manager for property management services. In addition, as a result of the CRII Merger, CCI will directly employ the Chief Legal Officer and Chief Accounting Officer. CCI will continue to rely on the employees of CCI Advisor and its affiliates to serve as certain of our executive officers and for those services not provided by the personnel acquired. |

| Q: | What fees will CCI Advisor receive in connection with the CRII Merger? |

| A: | CCI Advisor will not receive any fees directly as a result of the CRII Merger, but it is expected to continue to receive fees as the advisor of the Combined Company pursuant to the Amended and Restated Advisory Agreement. See “The Companies—Cottonwood Communities, Inc.—Certain Transactions with Related Persons—Amended and Restated Advisory Agreement” beginning on page 76. |

| Q: | Do any of CRII’s executive officers or directors have interests in the CRII Merger that may differ from those of the CRII stockholders? |

| A: | Some of CRII’s executive officers and directors have interests in the CRII Merger that are different from, or in addition to, their interests as CRII stockholders. The independent members of the CRII Board are aware of and considered these interests, among other matters, in evaluating the CRII Merger Agreement and the CRII Merger. For a description of these interests, refer to the section entitled “The CRII Merger—Interests of CRII’s and CCI’s Directors and Executive Officers in the CRII Merger” beginning on page 126. |

| Q: | When is the CRII Merger expected to be completed? |

| A: | CRII and CCI expect to complete the CRII Merger as soon as reasonably practicable following satisfaction or waiver of all of the required conditions set forth in the CRII Merger Agreement. If the conditions to closing the CRII Merger are satisfied or waived, it is currently expected that the CRII Merger will be completed in the second or third quarter of 2021. However, there is no guarantee that the conditions to the CRII Merger will be satisfied or that the CRII Merger will close on the expected timeline or at all. CRII and CCI have a mutual right to terminate the CRII Merger Agreement if the CRII Merger is not completed by the Outside Date. See “The CRII Merger Agreement—Termination of the CRII Merger Agreement—Termination by Either CRII or CCI” on page 170. |

| Q: | What are the anticipated U.S. federal income tax consequences to me of the proposed CRII Merger? |

| A: | The CRII Merger is intended to qualify as a “reorganization” within the meaning of Section 368(a) of the Code, and the closing of the CRII Merger is conditioned on the receipt by each of CRII and CCI of an opinion from its respective counsel to that effect. Assuming the CRII Merger qualifies as a reorganization, a holder of shares of CRII stock generally will not recognize gain or loss for U.S. federal income tax purposes upon the receipt of CCI stock in exchange for shares of CRII stock in connection with the CRII Merger. |

| Q: | How will my receipt of CCI Common Stock, CCI Series 2016 Preferred Stock and CCI Series 2017 Preferred Stock in exchange for my respective CRII Common Stock, CRII Series 2016 Preferred Stock and CRII Series 2017 Preferred Stock be recorded? Will I have to take any action in connection with the recording of such ownership of CCI stock? Will such shares of CCI stock be certificated or in book-entry form? |

| A: | Pursuant to the CRII Merger Agreement, as soon as practicable following the effective time of the CRII Merger, CCI will cause DST Systems, Inc., the exchange agent in connection with the CRII Merger, to |

| Q: | Will my shares of CCI stock be publicly traded? |

| A: | Shares of CCI stock are not publicly traded. |

| Q: | Are CRII stockholders entitled to appraisal rights? |

| A: | CRII stockholders are not entitled to exercise any rights of an objecting stockholder provided for under Title 3, Subtitle 2 of the MGCL in connection with the CRII Merger. |

| Q: | What do I need to do now? |

| A: | We encourage you to carefully read this information statement/prospectus to understand the terms of the CRII Merger and the other transactions contemplated by the CRII Merger Agreement. CRII will not be soliciting your vote for approving the CRII Merger and does not intend to call a meeting of stockholders for purposes of voting on the approval of the CRII Merger. |

| Q: | Who can answer my questions? |

| A: | If you have any questions about the CRII Merger or the other transactions contemplated by the CRII Merger Agreement or if you need additional copies of this information statement/prospectus, you should contact CCI or CRII: |

CCI: Cottonwood Communities, Inc. Attention: Amanda Geherty or Nancy Noble 1245 Brickyard Road, Suite 250 Salt Lake City, Utah 84106 (801) 278-0700 | | | CRII: Cottonwood Residential II, Inc. Attention: Amanda Geherty or Nancy Noble 1245 Brickyard Road, Suite 250 Salt Lake City, Utah 84106 (801) 278-0700 |

| • | each share of CRII Common Stock issued and outstanding immediately prior to the effective time of the CRII Merger will convert into the right to receive 2.015 shares of CCI Common Stock, |

| • | each share of CRII Series 2016 Preferred Stock issued and outstanding immediately prior to the effective time of the CRII Merger will convert into the right to receive one share of CCI Series 2016 Preferred Stock, and |

| • | each share of CRII Series 2017 Preferred Stock issued and outstanding immediately prior to the effective time of the CRII Merger will convert into the right to receive one share of CCI Series 2017 Preferred Stock. |

| • | each CCOP Series 2019 Preferred Unit issued and outstanding immediately prior to the effective time of the CROP Merger will convert into the right to receive one CROP Series 2019 Preferred Unit, |

| • | each CCOP LTIP Unit issued and outstanding immediately prior to the effective time of the CROP Merger will convert into the right to receive one CROP LTIP Unit, and each such CROP LTIP Unit will continue to have, and be subject to, the same terms and conditions (including vesting terms) set forth in the applicable CCOP vesting agreement, as in effect immediately prior to the effective time of the CROP Merger, |

| • | each CCOP Special LTIP Unit issued and outstanding immediately prior to the effective time of the CROP Merger will convert into the right to receive one CROP Special LTIP Unit, and each such CROP Special LTIP Unit will continue to have, and be subject to, the same terms and conditions (including vesting terms) set forth in the applicable CCOP vesting agreement, as in effect immediately prior to the effective time of the CROP Merger, |

| • | the CCOP Special Limited Partner Interest issued and outstanding immediately prior to the effective time of the CROP Merger will automatically be cancelled for no consideration and cease to exist, and |

| • | each CCOP General Partner Unit and each CCOP Common Unit issued and outstanding immediately prior to the effective time of the CROP Merger will convert into the right to receive one CROP Common Unit. |

| • | The Merger Consideration will not be adjusted in the event of any change in the relative values of CRII or CCI. |

| • | Completion of the CRII Merger is subject to many conditions and if these conditions are not satisfied or waived, the CRII Merger will not be completed, which could result in the expenditure of significant unrecoverable transaction costs. |

| • | Completion of the CRII Merger is not contingent upon completion of the CMRI Merger or the CMRII Merger. |

| • | Failure to complete the CRII Merger could negatively impact the future business and financial results of CRII. |

| • | The pendency of the CRII Merger, including as a result of the restrictions on the operation of CRII’s and CCI’s business during the period between signing the CRII Merger Agreement and the completion of the CRII Merger, could adversely affect the business and operations of CRII, CCI or both. |

| • | Some of the directors and executive officers of CRII have interests in seeing the CRII Merger completed that are different from, or in addition to, those of the CRII stockholders. |

| • | The CRII Merger Agreement prohibits CRII from soliciting proposals after January 26, 2021 and places conditions on its ability to accept a Superior Proposal, which may adversely affect the CRII stockholders. |

| • | CRII and CCI each expect to incur substantial expenses related to the CRII Merger. |

| • | The CRII Merger is not a liquidity event for the CRII stockholders or CROP limited partners. If a liquidity event is ever realized or if investors are otherwise able to sell their securities, the value received may be substantially less than what CRII, CROP or CCI could have obtained by effecting a liquidity event at this time and substantially less than what investors paid for their investment in CRII, CROP or CCI. |

| • | CRII stockholders’ ownership interests will be diluted by the CRII Merger. |

| • | Litigation challenging the CRII Merger may increase transaction costs and prevent the CRII Merger from becoming effective within the expected time frame. |

| • | the CRII Voting Stockholder Approval and the CROP Partner Approvals will have been obtained; |

| • | the receipt of opinions of counsel concerning certain tax matters; |

| • | the absence of any judgment, injunction, order or decree issued by any governmental authority of competent jurisdiction prohibiting the consummation of the CRII Merger, and the absence of any law that has been enacted, entered, promulgated or enforced by any governmental authority after the date of the CRII Merger Agreement that prohibits, restrains, enjoins or makes illegal the consummation of the CRII Merger or the other transactions contemplated by the CRII Merger Agreement; |

| • | the registration statement of which this information statement/prospectus is a part having been declared effective by the SEC, no stop order suspending the effectiveness of such registration statement having been issued by the SEC and no proceeding for that purpose will have been initiated by the SEC and not withdrawn; |

| • | the truth and accuracy of the representations and warranties of each party made in the CRII Merger Agreement as of the closing, subject to certain materiality standards; |

| • | the performance in all material respects with all agreements required by the CRII Merger Agreement to be performed by each party; |

| • | the absence of any change, event, circumstance or development arising during the period from the date of the CRII Merger Agreement until the effective time of the CRII Merger that has had or would have a material adverse effect on the other party; and |

| • | the receipt of the specified lender consents. |

| • | CRII receives an Acquisition Proposal that was not obtained in violation of the CRII Merger Agreement and such Acquisition Proposal is not withdrawn; |

| • | the CRII Transaction Committee has determined that such Acquisition Proposal constitutes a Superior Proposal and, after consultation with outside legal counsel and its financial advisor, that failure to take such action would be inconsistent with the duties of the directors of CRII under applicable Maryland law; |

| • | CRII has given CCI at least five business days’ prior written notice of its intention to take such action; and |

| • | CCI and CRII have negotiated in good faith during such notice period to enable CCI to propose in writing revisions to the terms of the CRII Merger Agreement such that it would cause such Superior Proposal to no longer constitute a Superior Proposal. |

| • | the CRII Merger has not occurred on or before the Outside Date; |

| • | there is any final, non-appealable order issued by a governmental authority of competent jurisdiction that permanently restrains or otherwise prohibits the transactions contemplated by the CRII Merger Agreement; or |

| • | the CRII Voting Stockholder Approval and the CROP Partner Approvals have not been obtained. |

| • | any of the CRII Parties have breached any of its representations or warranties or failed to perform any of its obligations, covenants or agreements set forth in the CRII Merger Agreement, which breach or failure to perform (i) would result in a failure of CRII to satisfy certain closing conditions and (ii) cannot be cured or, if curable, is not cured by CRII by the earlier of 20 days following written notice of such breach or failure from CCI to CRII and two business days before the Outside Date; or |

| • | at any time prior to obtaining the CRII Voting Stockholder Approval and the CROP Partner Approvals if (i) the CRII Board has made an Adverse Recommendation Change or (iv) CRII has materially violated any of its obligations described in “The CRII Merger Agreement—Covenants and Agreements—No Solicitation; Change in Recommendation.” |

| • | any of the CCI Parties have breached any of its representations or warranties or failed to perform any of its obligations, covenants or agreements set forth in the CRII Merger Agreement, which breach or failure to perform (i) would result in a failure of CCI to satisfy certain closing conditions and (ii) cannot be cured or, if curable, is not cured by CCI by the earlier of 20 days following written notice of such breach or failure from CRII to CCI and two business days before the Outside Date subject to certain exceptions; or |

| • | at any time prior to obtaining the CRII Voting Stockholder Approval and the CROP Partner Approvals to permit CRII to enter into an alternative acquisition agreement with respect to a Superior Proposal, so long as the termination payment described below in “—Termination Payment and Expense Reimbursement” below is made in full to CCI prior to or concurrently with such termination. |

| | | As of September 30, 2020 | | | As of December 31, | ||||||||||

| | | 2019 | | | 2018 | | | 2017 | | | 2016(1) | ||||

Balance Sheet data | | | | | | | | | | | |||||

Total real estate assets, net | | | $195,626 | | | $70,927 | | | $— | | | $— | | | $— |

Total assets | | | 204,843 | | | 119,376 | | | 3,724 | | | 200 | | | 200 |

Credit facilities, net | | | 83,261 | | | 34,990 | | | — | | | — | | | — |

Preferred stock, net | | | 18,525 | | | 809 | | | — | | | — | | | — |

Total liabilities | | | 106,030 | | | 37,080 | | | 158 | | | — | | | — |

Total stockholders' equity | | | 98,813 | | | 82,296 | | | 3,566 | | | 200 | | | 200 |

| | | For the Nine Months Ended September 30, 2020 | | | As of December 31, | ||||||||||

| | | 2019 | | | 2018 | | | 2017 | | | 2016(1) | ||||

Operating Data | | | | | | | | | | | |||||

Total revenues | | | $7,967 | | | $2,842 | | | $— | | | $— | | | $— |

Net loss | | | (6,756) | | | (3,296) | | | (100) | | | — | | | — |

Net loss per common share - basic and diluted | | | (0.65) | | | (0.70) | | | (3.13) | | | — | | | — |

Other Data | | | | | | | | | | | |||||

Net cash provided by (used in) operating activities | | | 175 | | | (459) | | | (4) | | | — | | | — |

Net cash used in investing activities | | | (79,054) | | | (38,130) | | | — | | | — | | | — |

Net cash provided by financing activities | | | 39,192 | | | 82,925 | | | 3,210 | | | — | | | — |

Distributions declared to common stockholders | | | 3,906 | | | 2,370 | | | — | | | — | | | — |

Distributions declared per common share | | | 0.38 | | | 0.50 | | | — | | | — | | | — |

Weighted average shares outstanding | | | 10,413 | | | 4,711 | | | 32 | | | 20 | | | — |

FFO(2) | | | (1,127) | | | (558) | | | — | | | — | | | — |

FFO per common share(2) | | | (0.11) | | | (0.12) | | | — | | | — | | | — |

Core FFO(2) | | | 762 | | | (472) | | | — | | | — | | | — |

Core FFO per common share(2) | | | 0.07 | | | (0.10) | | | — | | | — | | | — |

| (1) | Period from July 27, 2016 (Inception) to December 31, 2016. CCI was capitalized on December 2, 2016 with a $0.2 million investment by CROP. |

| (2) | For additional information on how CCI calculates FFO, FFO per common share, Core FFO, Core FFO per common share and a reconciliation to net loss and net loss per common share, see Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Funds From Operations” in CCI’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2020 and CCI’s Annual Report on Form 10-K for the year ended December 31, 2019, attached as Annex F and Annex E, respectively to this information statement/prospectus. |

| | | As of September 30, 2020 | | | As of December 31, | ||||

| | | 2019 | | | 2018 | ||||

Balance Sheet data | | | | | | | |||

Total real estate and real estate-related investments, net | | | $770,657 | | | $748,836 | | | $674,768 |

Total assets | | | 905,076 | | | 860,732 | | | 760,253 |

Mortgage notes, net | | | 620,214 | | | 568,451 | | | 513,663 |

Preferred stock, net | | | 142,634 | | | 139,986 | | | 136,879 |

Foreign notes | | | 46,424 | | | 44,829 | | | 22,355 |

Total liabilities | | | 837,201 | | | 773,660 | | | 692,246 |

Total CRII stockholders' equity | | | 1,776 | | | 4,262 | | | — |

| | | For the Nine Months Ended September 30, 2020 | | | For the Year Ended December 31, | ||||

| | | 2019 | | | 2018 | ||||

Operating Data | | | | | | | |||

Total revenues | | | 81,783 | | | 100,465 | | | 94,510 |

Equity in earnings (losses) of unconsolidated real estate entities | | | 485 | | | 1,179 | | | 2,396 |

Net loss attributable to common stockholders | | | (517) | | | (929) | | | (1) |

Net loss per common share - basic and diluted | | | (2.08) | | | (4.94) | | | — |

Other Data | | | | | | | |||

Net cash provided by (used in) operating activities | | | 24,369 | | | 14,419 | | | 8,037 |

Net cash provided by (used in) investing activities | | | (45,775) | | | (18,899) | | | (24,782) |

Net cash (used in) provided by financing activities | | | 30,138 | | | 11,280 | | | 28,834 |

Distributions declared to common stockholders | | | 167 | | | 166 | | | — |

Distributions declared per common share | | | 0.67 | | | 0.89 | | | 0.89 |

Distributions declared to limited partners | | | 10,077 | | | 13,079 | | | 13,486 |

Distributions declared per limited partnership units(1) | | | 0.67 | | | 0.89 | | | 0.89 |

Weighted average common shares outstanding, basic and diluted | | | 249 | | | 188 | | | 0.05 |

Weighted average limited partnership units outstanding, basic and diluted(1) | | | 15,268 | | | 14,740 | | | 14,387 |

Total weighted average common shares and limited partnership units, basic and outstanding(1) | | | 15,517 | | | 14,928 | | | 14,387 |

FFO(2) | | | 7,773 | | | (3,756) | | | (19,450) |

FFO per common share and limited partnership unit, basic and diluted(1)(2) | | | 0.50 | | | (0.25) | | | (1.35) |

Core FFO(2) | | | 13,315 | | | 7,910 | | | 12,181 |

Core FFO per common share and limited partnership unit, basic and diluted(1)(2) | | | 0.86 | | | 0.53 | | | 0.85 |

| (1) | Limited partnership units represent operating partnership units not owned by common stockholders, which share in the profits, losses and cash distributions of the operating partnership as defined in the partnership agreement, subject to certain special allocations. |

| (2) | For additional information on how CRII calculates FFO, FFO per common share, Core FFO, Core FFO per common share and a reconciliation to net loss and net loss per common share, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Funds From Operations (FFO)” in CRII’s unaudited interim condensed consolidated financial statements for the nine months ended September 30, 2020 and CRII’s “Management’s Discussion and Results of Operations – Funds From Operations (FFO)” in CRII’s audited financial statements for the year ended December 31, 2019, attached as Annex D and Annex C, respectively, to this information statement/prospectus. |

| | | As of September 30, 2020 | |||||||||||||

| | | CCI Historical | | | CRII Historical | | | Autonomous Entity Adjustments | | | CRII Pro Forma Transaction Accounting Adjustments | | | Pro Forma Combined Company | |

Balance Sheet data | | | | | | | | | | | |||||

Total real estate and real estate-related investments, net | | | $195,626 | | | $770,657 | | | $17 | | | $359,450 | | | $1,325,750 |

Total assets | | | 204,843 | | | 905,075 | | | (8,384) | | | 357,369 | | | 1,458,903 |

Credit facilities, net | | | 83,261 | | | — | | | — | | | — | | | 83,261 |

Mortgage notes, net | | | — | | | 620,214 | | | — | | | 18,894 | | | 639,108 |

Preferred stock, net | | | 18,525 | | | 142,634 | | | — | | | 1,726 | | | 162,885 |

Foreign notes | | | — | | | 46,424 | | | — | | | 2,219 | | | 48,643 |

Total liabilities | | | 106,030 | | | 837,200 | | | (1,037) | | | 22,839 | | | 965,032 |

Total stockholders' equity | | | 98,813 | | | 1,776 | | | (1,776) | | | 26,004 | | | 124,817 |

Total noncontrolling interests | | | — | | | 66,099 | | | (5,571) | | | 308,526 | | | 369,054 |

| | | | | | | | | | |||||||

| | | For the Nine Months Ended September 30, 2020 | |||||||||||||

Operating Data | | | | | | | | | | | |||||

Total revenues | | | $7,967 | | | $81,783 | | | $(3,197) | | | $— | | | $86,553 |

Equity in earnings (losses) of unconsolidated real estate entities | | | 1,273 | | | 485 | | | — | | | (4,980) | | | (3,222) |

Net loss attributable to common stockholders | | | (6,756) | | | (517) | | | 463 | | | (1,988) | | | (8,798) |

Net loss per common share - basic and diluted | | | $(0.65) | | | $(2.08) | | | $— | | | $(0.05) | | | $(0.19) |

| | | | | | | | | | | ||||||

| | | For the Year Ended December 31, 2019 | |||||||||||||

Operating Data | | �� | | | | | | | | | |||||

Total revenues | | | $2,842 | | | $100,465 | | | $(2,971) | | | $— | | | $100,336 |

Equity in earnings (losses) of unconsolidated real estate entities | | | 273 | | | 1,179 | | | — | | | (8,559) | | | (7,107) |

Net loss attributable to common stockholders | | | (3,296) | | | (929) | | | 1,495 | | | (11,011) | | | (13,741) |

Net loss per common share - basic and diluted | | | (0.70) | | | (4.94) | | | — | | | (0.30) | | | (0.33) |

| | | As of September 30, 2020 | |||||||||||||||||||

| | | CCI Historical | | | CRII Historical | | | CMRI Historical | | | CMRII Historical | | | Autonomous Entity Adjustments | | | Fully Combined Pro Forma Transaction Accounting Adjustments | | | Pro Forma Fully Combined Company | |

Balance Sheet data | | | | | | | | | | | | | | | |||||||

Total real estate and real estate-related investments, net | | | $195,626 | | | $770,657 | | | $28,064 | | | $38,491 | | | $(66,566) | | | $359,450 | | | $1,325,722 |

Total assets | | | 204,843 | | | 905,075 | | | 28,585 | | | 38,809 | | | (75,025) | | | 352,309 | | | 1,454,596 |

Credit facilities, net | | | 83,261 | | | — | | | — | | | — | | | — | | | — | | | 83,261 |

Mortgage notes, net | | | — | | | 620,214 | | | — | | | — | | | — | | | 18,894 | | | 639,108 |

Preferred stock, net | | | 18,525 | | | 142,634 | | | — | | | — | | | — | | | 1,726 | | | 162,885 |

Foreign notes | | | — | | | 46,424 | | | — | | | — | | | — | | | 2,219 | | | 48,643 |

Total liabilities | | | 106,030 | | | 837,200 | | | 2,735 | | | 2,942 | | | (1,095) | | | 17,833 | | | 965,645 |

Total stockholders' equity | | | 98,813 | | | 1,776 | | | 25,850 | | | 35,867 | | | (63,493) | | | 146,510 | | | 245,323 |

Total noncontrolling interests | | | — | | | 66,099 | | | — | | | — | | | (10,437) | | | 187,966 | | | 243,628 |

| | | | | | | | | | | | | | | ||||||||

| | | For the Nine Months Ended September 30, 2020 | |||||||||||||||||||

Operating data | | | | | | | | | | | | | | | |||||||

Total revenues | | | $7,967 | | | $81,783 | | | $— | | | $— | | | $(3,197) | | | $— | | | $86,553 |

Equity in earnings (losses) of unconsolidated real estate entities | | | 1,273 | | | 485 | | | (739) | | | (221) | | | 960 | | | (4,980) | | | (3,222) |

Net loss attributable to common stockholders | | | (6,756) | | | (517) | | | (2,032) | | | (1,239) | | | 1,115 | | | (3,201) | | | (12,630) |

Net loss per common share - basic and diluted | | | (0.65) | | | (2.08) | | | (0.41) | | | (0.25) | | | — | | | (0.08) | | | (0.24) |

| | | For the Year Ended December 31, 2019 | |||||||||||||||||||

Operating data | | | | | | | | | | | | | | | |||||||

Total revenues | | | $2,842 | | | $100,465 | | | $— | | | $— | | | $(2,025) | | | $— | | | $101,282 |

Equity in earnings (losses) of unconsolidated real estate entities | | | 273 | | | 1,179 | | | (1,323) | | | (2,350) | | | 2,174 | | | (8,559) | | | (8,606) |

Net loss attributable to common stockholders | | | (3,296) | | | (929) | | | (2,654) | | | (3,603) | | | 2,289 | | | (16,798) | | | (24,991) |

Net loss per common share - basic and diluted | | | (0.70) | | | (4.94) | | | (0.53) | | | (0.72) | | | — | | | (0.40) | | | (0.53) |

| | | CCI Historical | | | CRII Historical | | | CMRI Historical | | | CMRII Historical | | | Pro Forma Combined | | | Pro Forma Fully Combined | |

As of September 30, 2020 | | | | | | | | | | | | | ||||||

Book value per share of common stock | | | $8.54 | | | $8.32 | | | $5.27 | | | $7.35 | | | $10.40 | | | $10.67 |

| | | | | | | | | | | | | |||||||

For the nine months ended September 30, 2020 | | | | | | | | | | | | | ||||||

Distributions declared per share of common stock | | | $0.38 | | | $0.67 | | | $0.43 | | | $0.39 | | | $0.38 | | | $0.38 |

Income (loss) per share from continuing operations | | | $(0.65) | | | $(2.08) | | | $(0.41) | | | $(0.25) | | | $(0.17) | | | $(0.22) |

| | | | | | | | | | | | | |||||||

For the year ended December 31, 2019 | | | | | | | | | | | | | ||||||

Distributions declared per share of common stock | | | $0.50 | | | $0.89 | | | $0.58 | | | $0.53 | | | $0.50 | | | $0.50 |

Income (loss) per share from continuing operations | | | $(0.70) | | | $(4.94) | | | $(0.53) | | | $(0.72) | | | $(0.33) | | | $(0.53) |

| | | Total Distributions to Common Stockholders and Common Limited Partners (dollars in thousands) | | | Distributions Declared Per Common Share and Common Unit(1) | |

First Quarter 2019 | | | $3,284 | | | $0.2225 |

Second Quarter 2019 | | | 3,296 | | | $0.2225 |

Third Quarter 2019 | | | 3,327 | | | $0.2225 |

Fourth Quarter 2019 | | | 3,338 | | | $0.2225 |

Total | | | $13,245 | | |

| | | Total Distributions to Common Stockholders and Common Limited Partners (dollars in thousands) | | | Distributions Declared Per Common Share and Common Unit(1) | |

First Quarter 2020 | | | $3,427 | | | $0.2225 |

Second Quarter 2020 | | | 3,414 | | | $0.2225 |

Third Quarter 2020 | | | 3,403 | | | $0.2225 |

Total | | | $10,244 | | |

| (1) | Assumes the share/unit was issued and outstanding each day during the period presented. |

Period | | | Total Distributions Paid to Common Stockholders | | | Distributions Declared Per Common Share(1) |

First Quarter 2019 | | | $58,045 | | | $0.125 |

Second Quarter 2019 | | | 341,012 | | | $0.125 |

Third Quarter 2019 | | | 687,111 | | | $0.125 |

Fourth Quarter 2019 | | | 917,907 | | | $0.125 |

First Quarter 2020 | | | 1,126,131 | | | $0.125 |

Second Quarter 2020 | | | 1,292,163 | | | $0.125 |

Third Quarter 2020 | | | 1,383,845 | | | $0.125 |

| (1) | Assumes the share was issued and outstanding each day during the period presented. |

| • | changes in the respective businesses, operations, assets, liabilities and prospects of CRII and CCI; |

| • | CCI’s failure to complete the CMRI Merger or the CMRII Merger; |

| • | changes in the estimated value per share of either the shares of CRII Common Stock or CCI Common Stock; |

| • | interest rates, general market and economic conditions and other factors generally affecting the businesses of CRII and CCI; |

| • | federal, state and local legislation, governmental regulation and legal developments in the businesses in which CRII and CCI operate; |

| • | dissident stockholder activity, including any stockholder litigation challenging the transaction; |

| • | acquisitions, disposals or new development opportunities; and |

| • | other factors beyond the control of CRII and CCI, including those described or referred to elsewhere in this “Risk Factors” section. |

| • | CRII being required, under certain circumstances, to pay to CCI a termination payment equal to $10,703,000 (or $11,154,000 if the CCA Note Distribution is not effected) or all of CCI’s expenses related to pursing the CRII Merger and the CROP Merger if the CRII Voting Stockholder Approval or the CROP Partner Approvals are not obtained; |

| • | CRII having to pay certain costs relating to the CRII Merger, such as legal, accounting, financial advisor, filing, printing and mailing fees; and |

| • | the diversion of CRII management focus and resources from operational matters and other strategic opportunities while working to implement the CRII Merger. |

| • | vulnerability of the Combined Company to general adverse economic and industry conditions; |

| • | limiting the Combined Company’s ability to obtain additional financing to fund future working capital, capital expenditures and other general corporate requirements; |

| • | requiring the use of a substantial portion of the Combined Company’s cash flow from operations for the payment of principal and interest on its indebtedness, thereby reducing its ability to use its cash flow to fund working capital, acquisitions, capital expenditures and general corporate requirements; |

| • | limiting the Combined Company’s flexibility in planning for, or reacting to, changes in its business and its industry; |

| • | putting the Combined Company at a disadvantage compared to its competitors with less indebtedness; and |

| • | limiting the Combined Company’s ability to access capital markets. |

| • | it would be subject to U.S. federal corporate income tax on its net income for the years it did not qualify for taxation as a REIT (and, for such years, would not be allowed a deduction for dividends paid to stockholders in computing its taxable income); |

| • | it could be subject to the federal alternative minimum tax for taxable years prior to January 1, 2018 and possibly increased state and local taxes; |

| • | unless it is entitled to relief under applicable statutory provisions, neither it nor any “successor” company could elect to be taxed as a REIT until the fifth taxable year following the year during which it was disqualified; and |

| • | for five years following re-election of REIT status, upon a taxable disposition of an asset owned as of such re-election, it could be subject to corporate level tax with respect to any built-in gain inherent in such asset at the time of re-election. |

| • | a CCI stockholder would be able to sell its shares at the $10.00 offering price; |

| • | a CCI stockholder would ultimately realize distributions per share equal to the $10.00 offering price upon liquidation of CCI’s assets and settlement of its liabilities or a sale of CCI; |

| • | CCI Common Stock would trade at the $10.00 offering price on a national securities exchange; |

| • | a third party would offer the $10.00 offering price in an arm’s-length transaction to purchase all or substantially all of the CCI Common Stock; or |

| • | the methodologies used to estimate the value per share would be acceptable to FINRA or for compliance with ERISA reporting requirements. |

| • | pursuant to Section 3(a)(1)(A), is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities (the “primarily engaged test”); or |

| • | pursuant to Section 3(a)(1)(C), is engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire “investment securities” having a value exceeding 40% of the value of such issuer’s total assets (exclusive of United States government securities and cash items) on an unconsolidated basis (the “40% test”). “Investment securities” excludes United States government securities and securities of majority-owned subsidiaries that are not themselves investment companies and are not relying on the exception from the definition of investment company under Section 3(c)(1) or Section 3(c)(7) (relating to private investment companies). |

| • | stagger the CCI Board into three classes; |

| • | require a two-thirds stockholder vote for removal of directors; |

| • | provide that only the CCI Board can fix the size of the board; |

| • | provide that all vacancies on the CCI Board, however created, may be filled only by the affirmative vote of a majority of the remaining directors in office; and |

| • | require that special stockholder meetings may only be called by holders of a majority of the voting shares entitled to be cast at the meeting. |

| • | the election or removal of directors; |

| • | the amendment of the CCI Charter, except that the CCI Board may amend the CCI Charter without stockholder approval to increase or decrease the aggregate number of shares of stock of CCI, to |

| • | the liquidation or dissolution of CCI; and |

| • | a merger, consolidation, conversion, statutory share exchange or sale or other disposition of substantially all of CCI’s assets. |

| • | the ability of CRII and CROP to obtain the CRII Voting Stockholder Approval and CROP Partner Approvals; |

| • | the satisfaction or waiver of other conditions in the CRII Merger Agreement; |

| • | the risk that the CRII Merger or other transactions contemplated by the CRII Merger Agreement may not be completed in the time frame expected by the parties or at all; |

| • | the occurrence of any event, change or other circumstances that could give rise to the termination of the CRII Merger Agreement and that a termination under certain circumstances could cause CRII to pay CCI a termination payment, as described under “The CRII Merger Agreement—Termination of the CRII Merger Agreement” beginning on page 170; |

| • | the ability of CCI to complete the CMRI Merger and the CMRII Merger; |

| • | the ability of CCI to acquire and dispose of properties, including properties to be acquired in the Mergers; |

| • | changes in national, regional and local economic conditions; |

| • | changes in financial markets and interest rates, or to the business or financial condition of CRII, CCI, the Combined Company, the Fully Combined Company or their respective businesses; |

| • | the nature and extent of future competition; |

| • | the ability of CRII, CCI, the Combined Company or the Fully Combined Company to maintain its qualification as a REIT due to economic, market, legal, tax or other considerations; |

| • | the availability to CCI, CRII, the Combined Company or the Fully Combined Company of financing and capital; and |

| • | those additional risks and factors discussed in reports or prospectuses filed with the SEC by CCI from time to time, including those discussed under the heading “Risk Factors” in this information statement/prospectus. |

| • | Asset Management Fee. CCI Advisor will receive a monthly asset management fee equal to 0.0625% of the gross asset value or GAV of CROP (subject to a cap of 0.125% of net asset value or NAV of the operating partnership), before giving effect to any accruals (related to the month for which the asset management fee is being calculated) for the asset management fee, distribution fees in connection with a securities offering, the Performance Allocation (as defined in the Amended and Restated CROP Partnership Agreement) or any distributions. The GAV and NAV of CROP will be determined in accordance with the valuation guidelines adopted by the CCI Board and reflective of the ownership interest held by CROP in such gross assets. If CCI owns assets other than through CROP, CCI will pay a corresponding fee. |

| • | Organization and Offering Expenses. CCI will reimburse CCI Advisor for any organization and offering expenses that it incurs on CCI’s behalf as and when incurred. Following the CRII Merger, CCI Advisor will no longer be obligated to pay the organization and offering expenses associated with the Offering with the exception of the deferred selling commission associated with Class T shares (which we expect to be renamed as Class TX) sold under the current offering structure. After the termination of the primary offering, CCI Advisor will reimburse CCI to the extent that the organization and offering expenses that CCI incurs exceed 15% of the gross proceeds from any public offering. |

| • | Expense Reimbursement. Subject to the limitations on total operating expenses (as described further under “—Certain Transactions with Related Persons—Our Relationship with CCI Advisor—Other Fees and Reimbursable Expenses”), CCI Advisor will be entitled to reimbursement of all costs and expenses incurred by it or its affiliates on CCI’s behalf, provided that CCI Advisor is responsible for the expenses related to any and all personnel of CCI Advisor who provide investment advisory services pursuant to the Amended and Restated Advisory Agreement (including, without limitation, each of CCI’s executive officers and any directors who are also directors, officers or employees of CCI Advisor or any of its affiliates), including, without limitation, salaries, bonuses and other wages, payroll taxes and the cost of employee benefit plans of such personnel, and costs of insurance with respect to such personnel; provided that CCI will be responsible for the personnel costs of CCI employees even if they are also directors or officers of CCI Advisor or any of its affiliates except as provided for in a transitional services agreement to be negotiated among the parties. |

| • | Performance Allocation. The current promotional interest in CCOP held by Cottonwood Communities Advisors Promote, LLC will be replaced by a performance participation to be held by CCI Advisor. So long as the advisory agreement with CCI Advisor (the “Special Limited Partner” for purposes of this discussion) has not been terminated (including by means of non-renewal), the Special Limited Partner will hold a performance participation interest in CROP that entitles it to receive an allocation from CROP equal to 12.5% of the Total Return, subject to a 5% Hurdle Amount, with a Catch-Up (each term as defined in the Amended and Restated CROP Partnership Agreement). Such allocation will be made annually and accrue monthly. See “Summary of Amended and Restated CROP Partnership Agreement—Performance Allocation” for additional information about the performance participation payable to CCI Advisor. |

| • | Contingent Acquisition Fees and Contingent Financing Fees. If the Amended and Restated Advisory Agreement is terminated other than for cause (or non-renewal or termination by CCI Advisor), the Contingent Acquisition Fees and Contingent Financing Fees provided for in the current advisory agreement will be due and payable in an amount equal to approximately $22 million (if the termination occurs in year one) reduced by 10% each year thereafter. |

Property Name | | | Location | | | Investment Type | | | Purchase Date | | | Number of Units | | | Purchase Price/ Commitment | | | Secured Debt Outstanding | | | Occupancy Rate(5) | | | Monthly Net Effective Rent |

Cottonwood West Palm | | | West Palm Beach, FL | | | Wholly owned | | | 05/30/2019 | | | 245 | | | $63,923,500 | | | $35,995,000(3) | | | 97.6% | | | $1,751 |

Dolce Twin Creeks | | | Allen, TX | | | B-Note | | | 07/31/2019 | | | 366 | | | 10,000,000(1) | | | — | | | — | | | — |

Cottonwood One Upland | | | Boston, MA | | | Wholly owned | | | 03/19/2020 | | | 262 | | | 103,600,000 | | | 35,500,000(4) | | | 92.4% | | | 2,344 |

Lector 85 | | | Ybor City, FL | | | Preferred Equity | | | 08/15/2019 | | | 254 | | | 9,990,000 | | | — | | | — | | | — |

Vernon Boulevard | | | Queens, NY | | | Preferred Equity | | | 07/23/2020 | | | 534 | | | 15,000,000 | | | — | | | — | | | — |

Riverfront | | | West Sacramento, CA | | | Preferred Equity | | | 11/30/2020 | | | 285 | | | 15,091,649(2) | | | — | | | — | | | — |

Total/Weighted Average | | | | | | | 1,946 | | | $217,515,149 | | | $71,495,000 | | | 94.9% | | | $2,057 | |||||

| (1) | As of December 31, 2020, we had funded $8,205,862 of the amount committed. |

| (2) | As of December 31, 2020, we had funded $2,680,148 of the amount committed. |

| (3) | There is no limit on the amount we can draw on the Berkadia Credit Facility as long as we maintain certain loan-to-value ratios and other requirements as set forth in the loan documents. |

| (4) | We may obtain advances secured against Cottonwood One Upland up to $67,600,000 on our JP Morgan Credit Facility, as well as finance other future acquisitions up to $125,000,000 as long as we maintain certain loan-to-value ratios and other requirements as set forth in the loan documents. |

| • | preserve, protect and return invested capital; |

| • | pay stable cash distributions to our stockholders; |

| • | realize capital appreciation in the value of our investments over the long term; and |

| • | provide a real estate investment alternative with lower expected volatility relative to public real estate companies whose securities trade daily on a stock exchange. |

| • | Location. From a geographic perspective, we have the competitive advantage of flexibility, and we may invest where our advisor identifies unique opportunities, market dislocation or mispriced assets. Our advisor generally targets investment locations with enduring value and high barriers to entry (such as time-consuming regulatory hurdles for new construction), and where minimal competitive supply is planned or under construction and there exist opportunities to buy assets below replacement cost. Buying an asset below replacement cost offers a margin of safety for property owners, typically, ensuring that no new construction will be completed until values rise to justify new (competing) product. Our advisor also seeks to anticipate broader market capital flows and invest where economic growth is expected to drive resident demand but new supply is not yet on the horizon. Additional investment location considerations by our advisor include: |

| • | Local Industry and Employment. Certain employment sectors, such as financial services, information technology and healthcare, are better-positioned for higher employee earnings potential, enhancing price elasticity of rents. |

| • | Demographics. Locations with a higher concentration of the prime renter demographic with above average incomes will drive increased demand for renting apartments. |

| • | Infill Locations. Sites within markets or sub-markets undergoing redevelopment programs, land recycling initiatives or that generally exhibit high barrier to entry characteristics offer, in the opinion of our advisor, better investment prospects over the long run. |

| • | Accessibility to Key Attractions. Focus on local block-by-block details (the sub-market within a sub-market) during the investment selection process, including walkability scores, public transportation, crime rates, projected employment growth and access to popular dining, entertainment and retail venues, as well as sought after school districts. |

| • | Time Horizon. Our portfolio will generally consist of illiquid real estate investments. Though we expect the average holding period for our stabilized operating assets to be between five and ten years, |

| • | Asset-Specific Attributes. The management team of our advisor has extensive experience investing in, and managing institutional multifamily apartment communities. Our advisor investigates each investment opportunity in the context of comparable communities to assess relative market position, functionality, suite of amenity offerings, unit-specific features and obsolescence. Site inspections are an important aspect of our advisor’s underwriting process. For example, under-managed or under-capitalized assets represent a unique investment opportunity to stabilize and/or refurbish the community to maximize operating performance and long-term value. |

| • | Leverage. Downside risk of short-term fluctuations in market values or cash flow can be mitigated by using appropriately conservative leverage policies. Excess leverage during market corrections often result in property owners being forced to sell or liquidate assets at inopportune times. We expect to finance the purchase of our stabilized multifamily apartment communities using a loan-to-cost or loan-to-value ratio of 45% to 65% at the REIT level. |

| • | Financial Due Diligence. A preliminary review of each investment opportunity will be conducted in order to screen the attractiveness of each transaction. The preliminary review is followed by an initial projection based on macro- and micro-economic analyses. Projection assumptions are developed from analysis of historical operating performance, communications with management, and analysis of research reports generated from real estate brokerage firms, investment banks, consultants and other pertinent resources. The advisor will also leverage a broad network of contacts in developing investment projections, such as strategic partners, local developers, appraisers, industry experts, third-party consultants, outside counsel, accountants and tax advisors. As necessary, third-party accounting consultants may be used to review relevant books and records, confirm cash flow information provided by a seller and conduct other similar types of analysis. |

| • | Physical Due Diligence. Our advisor will hire third-party consultants, as necessary, to prepare reports on environmental and engineering matters. Conclusions from such consultants’ reports may influence the financial projections for an investment or lead our advisor to terminate the pursuit of an investment. Our advisor and/or property manager will also spend time in the surrounding market and visit competitive properties to better understand market dynamics. |

| • | Legal and Tax Due Diligence. Our advisor will work closely with outside counsel to review diligence materials and negotiate applicable legal and property specific documents pertaining to any investment opportunity. The scope of legal and tax diligence will be broad and include (as appropriate) review of property title and survey, existing and/or new loan documents, leases, management agreements and purchase contracts. Additionally, our advisor will work with tax advisors to structure investments in an efficient manner. |

| • | the ratio of the amount of the investment to the value of the property by which it is secured; |

| • | the amount of existing debt on the property and the priority thereof relative to our prospective investment; |

| • | the property’s potential for capital appreciation; |

| • | expected levels of rental and occupancy rates; |

| • | current and projected cash flow of the property; |

| • | potential for rental increases; |

| • | the degree of liquidity of the investment; |

| • | the geographic location of the property; |

| • | the condition and use of the property; |

| • | the property’s income-producing capacity; |

| • | the quality, experience and creditworthiness of the borrower; and |

| • | general economic conditions in the area where the property is located. |

| • | invest more than 10% of our total assets in unimproved property or mortgage loans on unimproved property, which we define as property not acquired for the purpose of producing rental or other operating income or on which there is no development or construction in progress or planned to commence within one year; |

| • | make or invest in mortgage loans unless an appraisal is available concerning the underlying property, except for those mortgage loans insured or guaranteed by a government or government agency; |

| • | make or invest in mortgage loans, including construction loans, on any one property if the aggregate amount of all mortgage loans on such property would exceed an amount equal to 85% of the appraised value of such property as determined by appraisal, unless substantial justification exists for exceeding such limit because of the presence of other underwriting criteria; |

| • | make an investment if the related acquisition fees and expenses are not reasonable or exceed 6% of the contract purchase price for the asset, provided that the investment may be made if a majority of the directors (including a majority of the members of our conflicts committee) not otherwise interested in the transaction determines that the transaction is commercially competitive, fair and reasonable to us; |

| • | acquire equity securities unless a majority of our directors (including a majority of the members of our conflicts committee) not otherwise interested in the transaction approve such investment as being fair, competitive and commercially reasonable, provided that investments in equity securities in “publicly traded entities” that are otherwise approved by a majority of our directors (including a majority of the |

| • | invest in real estate contracts of sale, otherwise known as land sale contracts, unless the contract is in recordable form and is appropriately recorded in the chain of title; |

| • | invest in commodities or commodity futures contracts, except for futures contracts when used solely for the purpose of hedging in connection with our ordinary business of investing in real estate assets and mortgages; |

| • | issue equity securities on a deferred payment basis or other similar arrangement; |

| • | issue debt securities in the absence of adequate cash flow to cover debt service unless the historical debt service coverage (in the most recently completed fiscal year), as adjusted for known changes, is sufficient to service that higher level of debt as determined by the board of directors or a duly authorized executive officer; |

| • | issue equity securities that are assessable after we have received the consideration for which our board of directors authorized their issuance; |

| • | issue redeemable equity securities (as defined in the Investment Company Act), which restriction has no effect on our share repurchase program or the ability of our operating partnership to issue redeemable partnership interests; or |

| • | make distributions in kind, except for distributions of readily marketable securities, distributions of beneficial interests in a liquidating trust established for our dissolution and the liquidation of our assets in accordance with the terms of our charter or distributions that meet all of the following conditions: (i) our board of directors advises each stockholder of the risks associated with direct ownership of the property, (ii) our board of directors offers each stockholder the election of receiving such in kind distributions and (iii) in kind distributions are made only to those stockholders who accept such offer. |

| • | pursuant to Section 3(a)(1)(A), is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities (the “primarily engaged test”); or |