PRIOR PERFORMANCE SUMMARY

The information presented in this section represents the historical experience of real estate programs, which we refer to as “prior real estate programs,” sponsored by Cottonwood Residential Inc., Cottonwood Residential O.P., LP and their affiliates. The following summary is qualified in its entirety by reference to the Prior Performance Tables, which may be found in Appendix C of this prospectus. Investors in our shares should not assume that they will experience returns, if any, comparable to those experienced by investors in the prior real estate programs. Investors who purchase our shares will not thereby acquire any ownership interest in any of the entities to which the following information relates.

Experience and Background of Cottonwood Residential O.P., LP

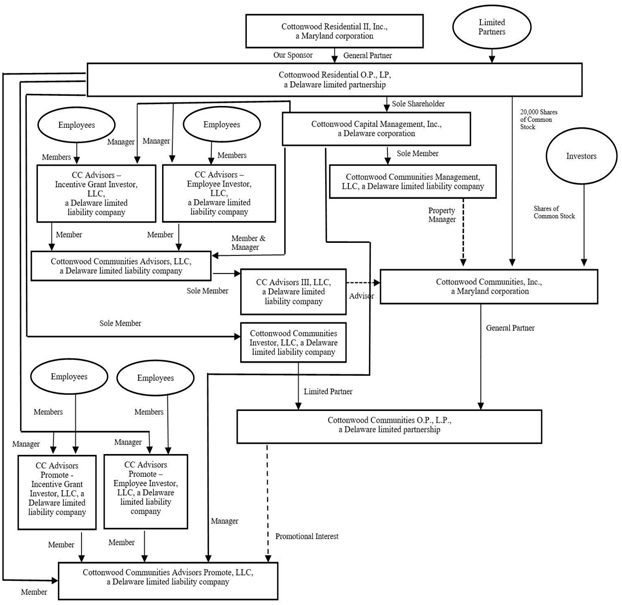

Our advisor, CC Advisors III, LLC, is a recently formed affiliate of Cottonwood Residential O.P., LP. Prior to September 2018, Cottonwood Residential, Inc., formed on September 24, 2009, was the sole general partner of Cottonwood Residential O.P., LP. Cottonwood Residential II, Inc. was added as a general partner of Cottonwood Residential O.P., LP following a decision by Cottonwood Residential, Inc. to commence a plan to liquidate and restructure its subsidiaries, including Cottonwood Residential O.P., LP.

Cottonwood Residential, Inc. did all of its investing through Cottonwood Residential O.P., LP, its operating partnership. Following the implementation of Cottonwood Residential, Inc.’s plan to liquidate and the admission of Cottonwood Residential II, Inc. as a general partner of Cottonwood Residential O.P., LP, Cottonwood Residential II, Inc. will manage the investing activities of Cottonwood Residential O.P., LP. Since Cottonwood Residential O.P., LP’s formation in 2009, Cottonwood Residential O.P., LP, has grown into an industry-leading, fully integrated, national multifamily platform. As of December 31, 2018, Cottonwood Residential O.P., LP provides property and asset management services to a platform of multifamily assets representing approximately 15,300 multifamily apartment units across 13 states with over $2.0 billion in value.

Cottonwood Residential O.P., LP also has a significant investment platform, holding ownership interests in 29 multifamily apartment communities and other related assets, 25 properties of which represent approximately 7,200 existing units, and 4 properties under development which represent approximately 1,000 additional units, all of which account for approximately $950.0 million in total gross asset value as of December 31, 2018. Since the formation of Cottonwood Residential, Inc.’s and Cottonwood Residential O.P., LP’s investment platform in 2009, Cottonwood Residential, Inc. and Cottonwood Residential O.P., LP have secured capital commitments through contributions by direct property owners, broker-dealer networks and institutional investors totaling over $700 million.

Cottonwood Residential O.P., LP secured a $127 million commitment in 2011 and an additional $25 million commitment in 2014 from affiliates of FrontRange Capital Partners and Equity Resource Investments to capitalize on attractive multifamily investment opportunities within its managed platform. In addition, in 2015, Cottonwood Residential, Inc. secured an additional $52.5 million debt commitment and $52.5 million equity commitment from Equity Resource Investments. In 2018, Cottonwood Residential O.P., LP repaid all of the outstanding debt and equity investments made by FrontRange Capital Partners and Equity Resource Investments.

Prior Performance of Cottonwood Residential, Inc., Cottonwood Residential O.P., LP and their Affiliates

Cottonwood Residential O.P., LP has become the manager of 11 limited liability companies which were formed to accept the contribution of tenant in common interests in multifamily apartment communities formerly owned by tenant in common owners or which were converted from Delaware statutory trusts. These limited liability companies accepted the contribution of undivided interests in real estate in exchange for limited liability company interests. Approximately 76 investors participated in these limited liability companies. All of the limited liability companies acquired multifamily apartment communities, of which eight were located in the southeastern United States, two were located in the southwestern United States and one was located in the northwestern United States. All of the properties were previously owned. As of December 31, 2018, six of the properties have been sold.

90