Filed Pursuant to Rule 424(b)(3)

Registration No. 333-215272

COTTONWOOD COMMUNITIES, INC.

SUPPLEMENT NO. 5 DATED APRIL 2, 2019

TO THE PROSPECTUS DATED AUGUST 13, 2018

This document supplements, and should be read in conjunction with, the prospectus of Cottonwood Communities, Inc. dated August 13, 2018, supplement no. 1 dated October 10, 2018, supplement no. 2 dated November 19, 2018, supplement no. 3 dated December 18, 2018, and supplement no. 4 dated March 26, 2019. As used herein, the terms “we,” “our” and “us” refer to Cottonwood Communities, Inc. and, as required by context, Cottonwood Communities O.P., LP, which we refer to as our “Operating Partnership,” and to their subsidiaries. Capitalized terms used in this supplement have the same meanings as set forth in the prospectus. The purpose of this supplement is to disclose:

| |

| • | the status of the offering; |

| |

| • | an update to the additional suitability requirements for investors in California; |

| |

| • | additional risks related to an investment in us; |

| |

| • | information regarding distributions; |

| |

| • | our entry into an agreement to purchase a multifamily community in West Palm Beach, Florida; |

| |

| • | the restructuring of our advisor; |

| |

| • | an amendment to our operating partnership agreement; |

| |

| • | a change to our plan of distribution; |

| |

| • | “Management’s Discussion and Analysis of Financial Condition and Results of Operations” similar to that filed in our annual report on Form 10-K for the period ended December 31, 2018; and |

| |

| • | our audited financial statements and the notes thereto as of and for the year ended December 31, 2018. |

Status of the Offering

We commenced this offering of $750.0 million of shares of common stock on August 13, 2018. As of March 27, 2019, we had sold 1,710,513 shares of common stock in our public offering for aggregate gross offering proceeds of $17,078,127. Included in these amounts were 1,802 shares of common stock sold pursuant to our distribution reinvestment plan for aggregate gross offering proceeds of $18,021. Accordingly. as of March 27, 2019, there was approximately $732.9 million of shares available for sale in this offering.

We have met the minimum offering amount required for us to accept subscriptions from investors in all states where we are conducting this offering, except for Ohio, Pennsylvania and Washington, which have minimum offering amounts of $33.75 million, $33.75 million and $20.0 million, respectively. Subscribers from all states where we are conducting this offering, other than Ohio, Pennsylvania and Washington, should make their checks payable to “Cottonwood Communities, Inc.” Until we have raised aggregate gross offering proceeds of $33.75 million, $33.75 million, and $20.0 million, investors in Ohio, Pennsylvania and Washington, respectively, should continue to make their checks payable to “UMB Bank, N.A., as Escrow Agent for Cottonwood Communities, Inc.”

Suitability Standards

The following additional suitability standard for California investors in this offering supersedes and replaces the standard currently included in the prospectus:

| |

| • | California - Investors residing in California may not invest more than 10% of their net worth in us. |

Risk Factors

The following risk factor supplements the risk factors in the prospectus.

We expect to invest in real estate-related equity, which is subordinate to any indebtedness, but involves different rights.

We may invest from time to time in non-controlling equity positions and other real estate-related interests. Preferred equity investments are subordinate to any indebtedness obtained by the entity, but senior to the owners’ common equity. Preferred equity investments typically pay a dividend rather than interest payments and often have the right for such dividends to accrue if there is insufficient cash flow to pay currently. These interests are not secured by the underlying real estate, but upon the occurrence of a default, the preferred equity provider typically has the right to effectuate a change of control with respect to the ownership of the property.

Distributions Paid

On February 6, 2019, we paid distributions of $28,390 which related to distributions for daily record dates for each day in the period from December 18, 2018 through January 31, 2019. On March 7, 2019, we paid distributions of $29,890, which related to distributions for daily record dates for each day in the period from February 1, 2019 through February 28, 2019.

Distributions Declared

On March 18, 2019, our board of directors declared a cash distribution in the amount of $0.02465753 per share on the outstanding shares of our common stock to stockholders of record as of March 18, 2019. Also on March 18, 2019, our board of directors declared cash distributions on the outstanding shares of our common stock based on daily record dates for the period from March 19, 2019 through March 31, 2019, which we expect to pay in April 2019; the period from April 1, 2019 through April 30, 2019, which we expect to pay in May 2019; and the period from May 1, 2019 through May 31, 2019, which we expect to pay in June 2019. Investors may choose to receive cash distributions or purchase additional shares through our distribution reinvestment plan. Distributions for these periods will be calculated based on stockholders of record each day during these periods at a rate of $0.00136986 per share per day.

Potential Real Estate Acquisition

Luma at West Palm Beach

On March 28, 2019, we entered into a purchase and sale agreement with an unaffiliated third-party developer, to acquire a 245-unit, concrete and stucco multifamily community in West Palm Beach, Florida ("Luma at West Palm Beach"). The purchase price is $67,000,000, of which $1,000,000 was provided in earnest money, which is non-refundable except in certain limited circumstances, upon execution of the purchase and sale agreement.

The property's units feature high ceilings, granite countertops, designer tile, hurricane resistant windows, and screened-in patios/balconies. In addition, the property features several amenities, including a heated resort-style pool, dog park, tot lot, clubhouse, ventilated garages, conference room, cafe and lounge, pavilion with grills, kid playroom, and exercise facilities.

We expect the acquisition of the property to close in the second quarter of 2019 upon satisfaction of certain limited closing conditions. We intend to fund the purchase of the property with proceeds from this offering and debt proceeds. Although we expect to close in accordance with the terms of the purchase and sale agreement, there can be no assurance that events will not arise that could prevent us from acquiring this property. In some circumstances, if we fail to complete the acquisition, we may forfeit up to $1,000,000 of earnest money.

Luma at West Palm Beach encompasses 274,889 rentable square feet. Construction on Luma at West Palm Beach was completed in two phases, with the first phase delivered in the third quarter of 2017 and the second phase delivered in the first quarter of 2018 and was 88% occupied as of March 27, 2019. The average occupancy rate of Luma at West Palm Beach, calculated using financial information provided by the seller, for 2018, the first year in which construction was completed and primarily including the property's lease-up period, was 73.8%.

The average effective monthly rental rate per unit, calculated as the monthly contractual base rental income, net of free rent, divided by the average units leased, calculated using financial information provided by the seller, 2018, the first year in which construction was completed, was $1,577.

We believe that Luma at West Palm Beach is suitable for its intended purpose and adequately insured; we do not intend to make any renovations in the near term at the property.

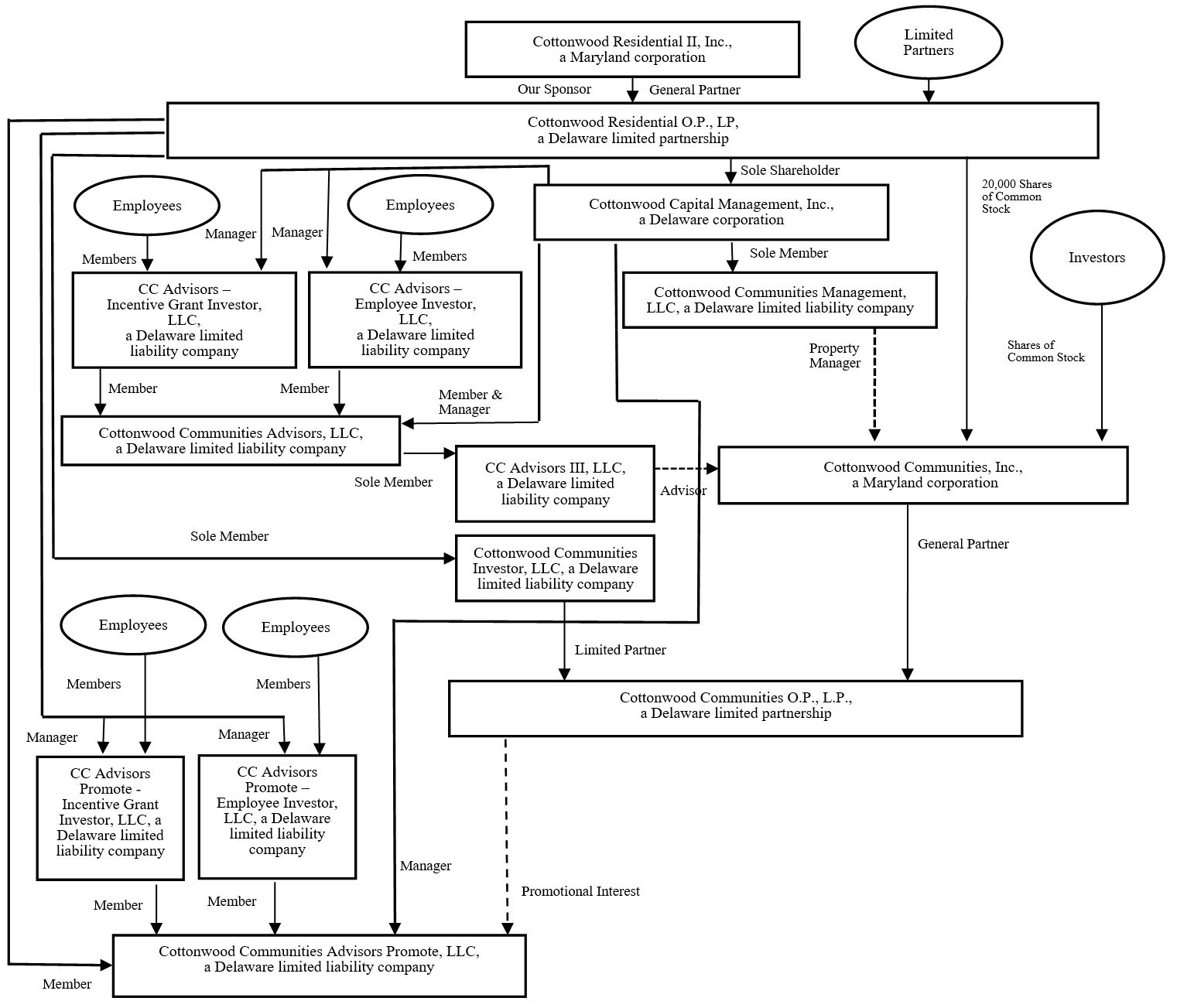

Restructuring of Advisor

As a result of the determination by our sponsor to restructure the ownership of the entity that provides our advisory services, effective March 1, 2019, the advisory agreement, as amended to remove references to property management services, has been assigned to a newly formed affiliate of our sponsor, CC Advisors III, LLC (“CC Advisors III”). As our new advisor, CC Advisors III, is responsible for the provision of our advisory services and for the payment of organization and offering expenses in this offering on our behalf and without reimbursement by us. Property management services will continue to be provided by Cottonwood Communities Management, LLC under separate property management agreements to be entered at the time we acquire a property.

Cottonwood Capital Management, Inc. wholly owns Cottonwood Communities Management, LLC and will continue to have an indirect ownership interest in the new advisor, CC Advisors III; however, two additional entities in which employees of Cottonwood Residential O.P., LP (“CROP”) and its affiliates have an ownership interest will also have an indirect ownership interest in our new advisor. As our advisor will be an affiliate of our sponsor, our new advisor will continue to rely on the same expertise and experience of the sponsor and its affiliates to provide our advisory services. In addition, as part of the restructuring, a new entity, Cottonwood Communities Advisors Promote, LLC (“CC Advisors Promote”), owns the promotional interest in us previously held by Cottonwood Communities Investor, LLC. The fees and services to be provided to us remain unchanged following these changes.

The chart below shows the relationships among our company and various affiliates following the restructuring of our advisor:

Management Compensation

Effective as of March 28, 2019, we have amended the terms of the promotional interest from the Operating Partnership to require that our stockholders, together as a collective group (instead of us as general partner), receive distributions sufficient to provide a return of invested capital plus a 6% cumulative, non-compounded annual return on invested capital before Cottonwood Communities Investor, LLC can receive the promotional interest in the Operating Partnership. In addition, the separate one-time payment payable to Cottonwood Communities Investor, LLC following the termination or non-renewal of our advisory agreement for reasons unrelated to a liquidity event for our stockholders, will be in the form of an interest-bearing promissory note that is payable only after our stockholders have actually received distributions in the amount required before Cottonwood Communities Investor, LLC can receive the promotional interest. Provided, however, if the promissory note has not been repaid prior to a liquidity event for our stockholders, the promissory note shall be paid in full on the date of or immediately prior to the liquidity event. All other terms of the promotional interest remain as described in the prospectus. Effective as of March 1, 2019, the promotional interest is held by CC Advisors Promote.

Plan of Distribution

The following disclosure supersedes and replaces the corresponding disclosure in the prospectus.

Compensation of Dealer Manager and Soliciting Dealers

Our advisor will pay the dealer manager selling commissions up to 6% of the gross primary offering proceeds. The dealer manager may authorize certain other broker-dealers who are members of FINRA, who we refer to as soliciting dealers, to sell our shares. In the event of the sale of shares by soliciting dealers, the dealer manager will re-allow all of its selling commissions to the soliciting dealers. A soliciting dealer may elect to receive all or a portion of the re-allowed selling commissions upon the sale of the shares and the initial payment of selling commissions to the dealer manager, or in a series of installments over a period of up to seven years after the sale of the shares to which the selling commissions relate.

Our advisor will also pay the dealer manager a dealer manager fee up to 3% of the gross primary offering proceeds as compensation for acting as the dealer manager and for expenses incurred in connection with marketing our shares and wholesaler compensation. Of this dealer manager fee, Orchard Securities, LLC will pay up to 1.35% of the gross proceeds from the primary offering to certain wholesalers that may be employees of Cottonwood Residential Inc. or Cottonwood Residential O.P., LP. In addition, from this dealer manager fee, Orchard Securities, LLC will re-allow 1.00% of the gross proceeds from the primary offering to soliciting dealers as a non-accountable marketing and due diligence allowance, and in select cases up to 1.25% of the gross proceeds from the primary offering will be reallowed. In circumstances where 1.00% of offering proceeds are reallowed, the dealer manager fee will be 2.75%. The maximum amount of reimbursements would be based on factors such as the number of shares sold by soliciting dealers, the assistance of such soliciting dealers in marketing the offering, and due diligence expenses incurred.

Neither we nor our advisor will pay referral or similar fees to any accountants, attorneys, or other persons in connection with the distribution of the shares. We will not be responsible for paying any selling commissions or dealer manager fees. The maximum amount of non-transaction based items of compensation to be paid in connection with this offering, including, but not limited to the non-transaction based compensation allocated to dual-employees, will not exceed 1% of the gross primary offering proceeds. No dealer manager fees or selling commissions are payable for shares sold pursuant to our distribution reinvestment plan.

We will sell shares at a discount to the primary offering price of $10.00 per share through the following distribution channels in the event that the investor:

| |

| • | pays a broker a single fee, e.g., a percentage of assets under management, for investment advisory and broker services, which is frequently referred to as a “wrap fee”; |

| |

| • | has engaged the services of a registered investment advisor with whom the investor has agreed to pay compensation for investment advisory services or other financial or investment advice (other than a registered investment advisor that is also registered as a broker-dealer who does not have a fixed or “wrap fee” feature or other asset fee arrangement with the investor); or |

| |

| • | is investing through a bank acting as trustee or fiduciary. |

If an investor purchases shares through one of these channels in our primary offering, we will sell the shares at a 6.0% discount, or at $9.40 per share, reflecting that selling commissions are not paid in connection with such purchases. To ensure that

we receive proceeds equivalent to those received for sales of shares outside these channels our advisor has agreed to waive its asset management each month in an amount equivalent to the 6.0% discount provided to such purchasers in that month.

If an investor purchases shares in our primary offering net of commissions through a registered investment advisor that is affiliated with a soliciting dealer in a transaction in which the registered investment advisor is compensated on a fee-for-service basis by the investor, the dealer manager may reallow to the affiliated soliciting dealer up to 1% of the gross offering proceeds attributable to that transaction as a marketing fee, or up to 1.25% in select cases as described above. The marketing fee paid to soliciting dealers would be paid by the dealer manager out of its dealer manager fee. If an investor purchases shares in the offering through a registered investment advisor (or bank acting as a trustee or fiduciary) not affiliated with a soliciting dealer, the registered investment adviser may not receive any portion of the dealer manager fee. Neither the dealer manager nor its affiliates will compensate any person engaged (or bank acting as a trustee or fiduciary) as an investment advisor by a potential investor as an inducement for such investment advisor to advise favorably for an investment in us.

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the consolidated financial statements and notes thereto appearing elsewhere in this supplement. In addition to historical data, this discussion contains forward-looking statements about our business, operations and financial performance based on current expectations that involve risks, uncertainties and assumptions. Our actual results may differ materially from those in this discussion as a result of various factors, including but not limited to those discussed under "Risk Factors" in the prospectus.

Overview

Cottonwood Communities, Inc. is a Maryland corporation formed on July 27, 2016 to invest primarily in multifamily apartment communities and multifamily real estate-related assets throughout the United States. We will seek to invest at least 65% of our assets in stabilized multifamily apartment communities and up to 35% in mortgage loans, preferred equity investments, mezzanine loans or equity investments in a property or land which will be developed into a multifamily apartment community (including, by way of example, an existing multifamily apartment community that may require redevelopment capital for strategic repositioning within its market). We do not expect to be able to achieve the balance of these allocations until we have raised substantial proceeds in this offering. Although this is our current target portfolio, we may make adjustments to our target portfolio based on real estate market conditions and investment opportunities. We will not forego what we believe to be a good investment because it does not precisely fit our expected portfolio composition.

Our investment objectives are to:

| |

| • | preserve, protect and return invested capital; |

| |

| • | pay stable cash distributions to stockholders; |

| |

| • | realize capital appreciation in the value of our investments over the long term; and |

| |

| • | provide a real estate investment alternative with lower expected volatility relative to public real estate companies whose securities trade daily on a stock exchange. |

There is no assurance that we will attain our investment objectives. Our charter places numerous limitations on us with respect to the manner in which we may invest our funds. In most cases these limitations cannot be changed unless our charter is amended, which may require the approval of our stockholders.

On August 13, 2018, the SEC declared effective this offering of up to $750,000,000 in shares of our common stock, through a primary offering of $675,000,000 of shares of common stock and a distribution reinvestment plan offering of up to $75,000,000 of shares of common stock. We are offering our shares for sale in the primary offering at $10.00 per share (with discounts available to certain categories of purchasers) and shares in the distribution reinvestment plan offering initially at $10.00 per share, all without any upfront costs or expenses charged to the investor. Any offering-related expenses will be paid by our advisor without reimbursement by us.

On December 18, 2018, we satisfied the minimum offering requirement in all states where we are conducting this offering (except Kansas, New York, Ohio, Pennsylvania and Washington) and our board of directors authorized the release of proceeds from escrow. As of such date, we issued and sold 247,054 shares of our common stock in this offering and the escrow agent released proceeds of $2,469,900 to us as payment for such shares. Subsequently we reached the New York and Kansas minimum offering amounts and admitted investors from both states. We intend to continue selling shares in this offering for which we will use the proceeds to make investments in accordance with our investment strategy and policies.

We operate under the direction of our board of directors. Upon the launch of this offering our board of directors retained Cottonwood Communities Management, LLC, to act as our advisor and property manager and conduct our operations and manage our portfolio of real estate investments, subject to the supervision of the board of directors. Effective March 1, 2019, as a result of the determination by our sponsor to restructure the ownership of the entity that provides our advisory services, our advisory services are provided by a newly formed affiliate of our sponsor, CC Advisors III, LLC. As an affiliate of our sponsor, our advisor will continue to rely on the same expertise and experience of the sponsor and its affiliates to provide our advisory services. Property management services will continue to be provided by Cottonwood Communities Management, LLC. See "Restructuring of Advisor" in this supplement for additional information regarding the change in our advisor. We have no paid employees.

We intend to qualify as a real estate investment trust beginning with the taxable year ending December 31, 2019. We utilize an UPREIT organizational structure to hold all or substantially all of our assets through Cottonwood Communities O.P., LP (the "Operating Partnership"). We are the general partner of the Operating Partnership.

Our entire activity since inception to December 31, 2018 was to prepare for this offering of our common stock. Except as described in this supplement, we have not identified any investment opportunities in which there is a reasonable probability we will invest as of the date of this supplement.

Multifamily Real Estate Outlook

We believe that current market dynamics and underlying fundamentals suggest the positive trends in United States multifamily housing will continue. Steady job growth, low unemployment, increased rentership rates, increasing household formation and aligned demographics provide the backdrop for strong renter demand. We believe that other factors impacting the prime United States renter demographic such as delayed major life decisions, increased levels of student debt and tight credit standards in the single-family home mortgage market also support the value proposition for owning multifamily apartment communities.

Results of Operations

As of December 31, 2018, we had not commenced active real estate operations as we broke escrow in this offering on December 18, 2018 and had not yet identified any investment opportunities in which to invest with the proceeds from this offering. For the year ended December 31, 2018, our results of operations consisted entirely of general and administrative expenses. We had no operating activity for the year ended December 31, 2017. As mentioned above, our advisor is paying all selling commissions, dealer manager fees and organizational and offering expenses related to our offering on our behalf without reimbursement by us.

Liquidity and Capital Resources

We are dependent upon the proceeds from this offering to conduct our proposed operations. We will obtain the capital required to purchase multifamily apartment communities and make investments in multifamily real estate-related assets and conduct our operations from the proceeds of this offering, from secured or unsecured financings from banks and other lenders, and from any undistributed funds from our operations. As of the date of this supplement, we have not made any investments. Our assets at December 31, 2018 consisted of $3,723,454 of cash and other assets.

If we are unable to raise substantial funds in this offering, we will make fewer investments resulting in less diversification in terms of the type, number, and size of investments we make and the value of an investment in us will fluctuate with the performance of the specific assets we acquire. Further, we will have certain fixed operating expenses regardless of whether we are able to raise substantial funds. Our inability to raise substantial funds would increase our fixed operating expenses as a percentage of gross income, reducing our net income and limiting our ability to make distributions. We do not expect to establish a permanent reserve from our offering proceeds for maintenance and repairs of real properties. However, to the extent that we have insufficient funds for such purposes, we may establish reserves from gross offering proceeds, out of cash flow from operations, or from net cash proceeds from the sale of properties.

We have no outstanding debt. We will target an aggregate loan-to-cost or loan-to-value ratio of 45% to 65% at the REIT level; provided, however, that we may obtain financing that is less than or exceeds such ratio in the discretion of our board of directors if the board of directors deems it to be in our best interest to obtain such financing. Although there is no limit on the amount we can borrow to acquire a single real estate investment, we may not leverage our assets with debt financing such that our borrowings are in excess of 300% of our net assets, unless a majority of our conflicts committee finds substantial justification for borrowing a greater amount and such excess borrowings are disclosed in our next quarterly report, along with the conflicts committee’s justification for such excess. Examples of such a substantial justification include obtaining funds for the following: (i) to repay existing obligations, (ii) to pay sufficient distributions to maintain REIT status, or (iii) to buy an asset where an

exceptional acquisition opportunity presents itself and the terms of the debt agreement and the nature of the asset are such that the debt does not increase the risk that we would become unable to meet our financial obligations as they became due. We anticipate that all financing obtained to acquire stabilized multifamily apartment communities will be non-recourse to the Operating Partnership and us (however, it is possible that some of these loans will require us to enter into guaranties with respect to certain non-recourse carve-outs). We may obtain recourse debt in connection with certain development transactions. The terms of any financing to be obtained are not currently known and we have not obtained any financing commitments for any multifamily apartment communities.

We may obtain a line of credit or other financing that will be secured by one or more of our assets. We may use the proceeds from any line of credit or financing to bridge the acquisition of, or acquire, multifamily apartment communities and multifamily real estate-related assets if our board of directors determines that we require such funds to acquire the multifamily apartment communities or real estate-related assets.

We intend to make an election to be taxed as a REIT under the Internal Revenue Code. To maintain our qualification as a REIT, we will be required to make aggregate annual distributions to our stockholders of at least 90% of our REIT taxable income (computed without regard to the dividends-paid deduction and excluding net capital gain). Our board of directors may authorize distributions in excess of those required for us to maintain REIT status depending on our financial condition and such other factors as our board of directors deems relevant. Provided we have sufficient available cash flow, we intend to make distributions on a monthly basis based on daily record dates. We have not established a minimum distribution level.

Cash Flows

On December 2, 2016, we were capitalized with a $200,000 investment by Cottonwood Residential O.P, LP. As of December 31, 2018, we had received proceeds from this offering of $3,209,900. As of March 27, 2019, proceeds from this offering were $17,078,127.

As of December 31, 2018, we had not paid any distributions.

Critical Accounting Policies

A critical accounting policy is one that is both important to our financial condition and results of operations and that involves some degree of uncertainty. The preparation of our financial statements requires significant management judgments, assumptions and estimates about matters that are inherently uncertain. These judgments affect the reported amounts of assets and liabilities and our disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. With different estimates or assumptions, materially different amounts could be reported in our financial statements. Additionally, other companies may utilize different estimates that may impact the comparability of our results of operations to those of companies in similar businesses. We believe that the estimates and assumptions listed below are those that will be critical to the portrayal of our financial condition and results of operations once we begin operations because they require the greatest subjective determinations.

Principles of Consolidation and Variable Interest Entities

In certain circumstances, we may acquire assets through joint ventures, mergers or other types of business combinations with other investors. In determining the consolidation treatment of these partially owned entities, we must determine whether the variable interest model would apply. Variable interest entities (“VIE”s) are entities in which equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. A VIE is required to be consolidated by its primary beneficiary, and only by its primary beneficiary, which is defined as the party with both the power to direct the activities of the VIE that most significantly impact the entity’s economic performance and the obligation to absorb losses or the right to receive benefits from the entity that could potentially be significant to the VIE.

There are judgments and estimates involved in determining if an entity in which we will make an investment will be a VIE and if so, if we will be the primary beneficiary. The determination of whether an entity is a VIE includes consideration of various factors. These factors include review of the formation and design of the entity, its organizational structure, including decision-making ability and relevant financial agreements, and analysis of the forecasted cash flows of the entity. We make an initial determination upon acquisition of a VIE, and reassesses the initial evaluation of an entity as a VIE upon the occurrence of certain events. A change in judgments, assumptions and estimates could result in consolidating an entity that had not been previously consolidated or accounting for an investment on the equity method that had been previously consolidated, the effects of which could be material to our results of operations and financial condition.

For more information regarding our significant accounting policies, including a brief description of recent accounting pronouncements that could have a material impact on our financial statements, see Note 3 to the consolidated financial statements included elsewhere in this supplement.

|

| |

| Index to Consolidated Financial Statements |

| | |

| |

| |

| |

| |

| |

| |

Report of Independent Registered Public Accounting Firm

To the Stockholders and Board of Directors

Cottonwood Communities, Inc.:

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated balance sheets of Cottonwood Communities, Inc. and subsidiaries (the Company) as of December 31, 2018 and 2017, the related consolidated statements of operations, stockholders’ equity, and cash flows for each of the years in the two‑year period ended December 31, 2018, and the related notes (collectively, the consolidated financial statements). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2018 and 2017, and the results of its operations and its cash flows for each of the years in the two‑year period ended December 31, 2018, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/KPMG LLP

We have served as the Company’s auditor since 2016.

Denver, Colorado

March 29, 2019

|

| | | | | | | | |

| Cottonwood Communities, Inc. |

| Consolidated Balance Sheets |

| | | | | |

| | | December 31, |

| | | 2018 | | 2017 |

| Assets | | | | |

| Cash and cash equivalents | | $ | 3,406,175 |

| | $ | 200,000 |

|

| Other assets | | 317,279 |

| | — |

|

| Total assets | | 3,723,454 |

| | 200,000 |

|

| Liabilities and equity | | | | |

| Liabilities | | | | |

| Related party payables | | $ | 128,617 |

| | $ | — |

|

| Accounts payable and accrued liabilities | | 29,146 |

| | — |

|

| Total liabilities | | 157,763 |

| | — |

|

| Commitments and contingencies (Note 6) | |

| |

|

| Stockholders' equity | | | | |

| Preferred stock, $0.01 par value; 100,000,000 shares authorized | | — |

| | — |

|

| Common stock, $0.01 par value, 1,000,000,000 shares authorized; 366,654 and 20,000 shares issued and outstanding at December 31, 2018 and 2017, respectively | | 3,667 |

| | 200 |

|

| Additional paid-in capital | | 3,662,233 |

| | 199,800 |

|

| Accumulated deficit | | (100,209 | ) | | — |

|

| Total stockholders' equity | | 3,565,691 |

| | 200,000 |

|

| Total liabilities and stockholders' equity | | $ | 3,723,454 |

| | $ | 200,000 |

|

| | | | | |

| See accompanying notes to consolidated financial statements |

|

| | | | | | | | |

| Cottonwood Communities, Inc. |

| Consolidated Statements of Operations |

| | | | | |

| | | Year Ended December 31, |

| | | 2018 | | 2017 |

| Expenses | | | | |

| General and administrative expenses | | $ | 100,209 |

| | $ | — |

|

| Total expenses | | 100,209 |

| | — |

|

| Net loss | | $ | (100,209 | ) | | $ | — |

|

| | | | | |

| Weighted-average shares outstanding | | 32,053 |

| | 20,000 |

|

| Net loss per common share - basic and diluted | | $ | (3.13 | ) | | $ | — |

|

| | | | | |

| See accompanying notes to consolidated financial statements |

|

| | | | | | | | | | | | | | | | | | | |

| Cottonwood Communities, Inc. |

| Consolidated Statement of Stockholders' Equity |

| | | | | | | | | | | |

| | | Stockholders' Equity | | |

| | | Common Stock | | Additional Paid-In Capital | | Accumulated Deficit | | |

| | | Shares | | Amount | | | | Total Equity |

| Balance at December 31, 2016 | | 20,000 |

| | $ | 200 |

| | $ | 199,800 |

| | $ | — |

| | $ | 200,000 |

|

| Balance at December 31, 2017 | | 20,000 |

| | $ | 200 |

| | $ | 199,800 |

| | $ | — |

| | $ | 200,000 |

|

| Issuance of common stock | | 346,654 |

| | 3,467 |

| | 3,462,433 |

| | — |

| | 3,465,900 |

|

| Net loss | | — |

| | — |

| | — |

| | (100,209 | ) | | (100,209 | ) |

| Balance at December 31, 2018 | | 366,654 |

| | $ | 3,667 |

| | $ | 3,662,233 |

| | $ | (100,209 | ) | | $ | 3,565,691 |

|

| | | | | | | | | | | |

| See accompanying notes to consolidated financial statements |

|

| | | | | | | | |

| Cottonwood Communities, Inc. |

| Consolidated Statements of Cash Flows |

| | | | | |

| | | For the Year Ended December 31, |

| | | 2018 | | 2017 |

| Operating activities | | | | |

| Net loss | | $ | (100,209 | ) | | $ | — |

|

| Changes in operating assets and liabilities | | | | |

| Other assets | | (61,279 | ) | | — |

|

| Related party payables | | 128,617 |

| | — |

|

| Accounts payable and accrued liabilities | | 29,146 |

| | — |

|

| Net cash used in operating activities | | $ | (3,725 | ) | | $ | — |

|

| Financing activities | | | | |

| Issuance of common stock | | 3,209,900 |

| | — |

|

| Net cash provided by financing activities | | $ | 3,209,900 |

| | $ | — |

|

| Net increase in cash | | $ | 3,206,175 |

| | $ | — |

|

| Cash at beginning of period | | 200,000 |

| | 200,000 |

|

| Cash at end of period | | $ | 3,406,175 |

| | $ | 200,000 |

|

| Supplemental schedule of non-cash financing activities | | | | |

| Proceeds receivable for issuance of common stock | | $ | 256,000 |

| | $ | — |

|

| | | | | |

| See accompanying notes to consolidated financial statements |

| |

| 1. | Organization and Business |

Cottonwood Communities, Inc. (the "Company") is a Maryland corporation formed on July 27, 2016 that intends to qualify as a real estate investment trust ("REIT"). The Company was formed to invest in multifamily apartment communities and real estate related assets located throughout the United States. The Company is the sole general partner of Cottonwood Communities O.P., LP, a Delaware limited partnership (the “Operating Partnership”). Substantially all of our business is conducted through the Operating Partnership. Unless the context indicates otherwise, the “Company,” “we,” “our” or “us” refers to Cottonwood Communities, Inc. and its consolidated subsidiaries, including the Operating Partnership. We are externally managed by Cottonwood Communities Management, LLC (our “advisor”), an affiliate of Cottonwood Residential O.P., LP ("CROP"), and have no employees. Refer to Note 8 for changes in the advisor that occurred in 2019.

As of December 31, 2018, we have neither purchased nor contracted to purchase any investments. Except as described in Note 8, we have not identified any investment opportunities in which there is a reasonable probability we will invest.

Our charter authorizes the issuance of up to 1,100,000,000 shares of capital stock, of which 1,000,000,000 shares are designated as common stock and 100,000,000 are designated as preferred stock.

On December 2, 2016, the Company was capitalized with a $200,000 investment by CROP.

On August 13, 2018, we registered with the Securities and Exchange Commission (the "SEC") an offering of up to $750,000,000 in shares of common stock, consisting of up to $675,000,000 in shares in our primary offering (the "Offering") and up to $75,000,000 in shares pursuant to our distribution reinvestment plan (the "DRP Offering”). The price for shares of common stock in our offering is $10.00 per share (with discounts available to certain categories of purchasers) and the price for shares of common stock in our DRP Offering is initially $10.00 per share, all without any upfront costs or expenses charged to the investor. Any offering-related expenses are paid by our advisor without reimbursement by us.

The terms of the Offering require the Company to deposit all subscription proceeds in an escrow account with an escrow agent until we receive subscriptions aggregating at least $2,000,000 in shares of common stock (including shares purchased by the advisor, its affiliates and our directors and officers). On December 18, 2018, we satisfied the minimum offering requirement and our board of directors authorized the release of proceeds from escrow. As of December 31, 2018, we have issued and sold 346,654 shares of common stock in the Offering and received proceeds of $3,209,900.

| |

| 3. | Summary of Significant Accounting Policies |

Basis of Presentation

The accompanying consolidated financial statements and related notes are prepared on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles (“GAAP”).

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and its consolidated subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Cash and cash equivalents

Cash and cash equivalents consist of amounts the Company has on deposit with a major commercial financial institution.

Income Taxes

We intend to qualify as a REIT and to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, beginning with the year ending December 31, 2019.

To qualify as a REIT, we must meet certain organizational and operational requirements, including a requirement to distribute at least 90% of our taxable income to our stockholders. As a REIT, we generally are not subject to federal corporate income tax on that portion of our taxable income that is currently distributed to stockholders.

If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax on our taxable income at regular corporate income tax rates and generally will not be permitted to qualify for treatment as a REIT for federal income tax purposes for the four taxable years following the year during which qualification is lost unless the Internal Revenue Service grants us relief under certain statutory provisions. Such an event could materially and adversely affect our net income and net cash available for distribution to stockholders. However, we intend to organize and operate in such a manner as to qualify for treatment as a REIT.

As of December 31, 2018, we had incurred a net operating loss of $100,209. We had a deferred tax asset of approximately $25,000 associated with this net operating loss. This deferred tax asset was fully reserved for as we do not expect to realize the tax benefit due to the expectation that we will qualify for REIT status for the tax year ending December 31, 2019.

Organization and Offering Costs

Organization costs include all expenses incurred in connection with our formation, including but not limited to legal fees and other costs to incorporate the Company. Offering costs include all expenses incurred in connection with the Offering, including legal, accounting, printing, mailing and filing fees, escrow charges and transfer agent fees, dealer manager fees and selling commissions. All organization and offering costs are paid by our advisor. We will not incur any liability for or reimburse our advisor for any of these organizational and offering costs. As of December 31, 2018, offering costs incurred by our advisor were approximately $1,513,000.

| |

| 4. | Related-Party Transactions |

Advisory Agreement

On August 13, 2018, we entered an advisory agreement with our advisor. Per the terms of our advisory agreement, and in exchange for the fees discussed below, our advisor will make decisions related to the structuring, acquisition, management, financing and disposition of our assets in accordance with our investment objectives, guidelines, policies and limitations. Our advisor will also manage day-to-day operations, retain property managers, and perform other duties. These activities are all subject to oversight by our board of directors.

Contingent Acquisition Fee

After stockholders have received, or are deemed to have received (with respect to a merger or a listing), together as a collective group, aggregate distributions sufficient to provide a return of their invested capital, plus a cumulative, noncompounded annual return on their investment (a “Required Return”), our advisor will receive a contingent acquisition fee from us that is a percentage of the cost of investments acquired or originated by us, or the amount to be funded by us to acquire or originate loans, including acquisition and origination expenses and any debt attributable to such investments plus significant capital expenditures related to the development, construction or improvement of the investment as follows: 1% contingent acquisition fee if stockholders receive a 6% Required Return; and 2% additional contingent acquisition fee if stockholders receive a 13% Required Return. The contingent acquisition fee is immediately payable when each Required Return has been met. The fee is based on all assets we have acquired even if no longer in our portfolio. To the extent we acquire any assets after satisfying the return threshold, the contingent acquisition fee will be immediately payable at the closing of the acquisition.

If our advisor agreement is terminated before August 13, 2028 for any reason other than our advisor’s fraud, willful misconduct or gross negligence, our advisor will receive a 3% contingent acquisition fee less the amount of any prior payments of contingent acquisition fees to our advisor.

Acquisition Expense Reimbursement

Subject to the limitations contained in our charter, our advisor will receive reimbursement from us for all out-of-pocket expenses incurred in connection with the selection and acquisition or origination of investments, whether or not we ultimately acquire the property or other real estate-related investment.

Contingent Financing Fee

After our stockholders have received, or are deemed to have received (with respect to a merger or a listing), together as a collective group, aggregate distributions sufficient to provide a return of their invested capital, plus a Required Return of 13%, our advisor will receive from us a contingent financing fee of 1% of the original principal amount of any financing obtained or assumed by us.

The contingent financing fee is payable upon satisfying the return threshold with respect to any financing obtained or assumed by us prior to satisfaction of the return threshold and at the closing of new financing following satisfaction of the return threshold. If our advisor agreement is terminated before August 13, 2028 for any reason other than the advisor’s fraud, willful misconduct or gross negligence, the payment of the contingent financing fee will be immediately due and payable.

Property Management Fee

Our advisor will receive from us a property management fee in an amount up to 3.5% of the annual gross revenues of our multifamily apartment communities that it manages. Our advisor may subcontract the performance of its property management duties to third parties and will pay a portion of its property management fee to the third parties with whom it subcontracts for these services.

Asset Management Fee

Our advisor will receive an annual asset management fee, paid monthly, in an amount equal to 1.25% of gross assets as of the last day of the prior month. In this context, “gross assets” means (i) the gross book value of our assets until such time as our board of directors has established a net asset value of our assets, and (ii) after our board of directors has established a net asset value of our assets, the gross asset value of our assets based on the net asset value determination; provided that, the value of any assets acquired after our determination of a net asset value will be the gross book value of the assets until such assets are included in a net asset value determination.

Under various agreements, we have engaged or will engage our advisor or its affiliates to provide certain services that are essential to us, including asset management services and other administrative responsibilities for the Company including accounting services and investor relations. Because of these relationships, we are dependent upon our advisor. If these companies were unable to provide us with the respective services, we would be required to find alternative providers of these services.

| |

| 6. | Commitments and Contingencies |

Litigation

As of December 31, 2018, we were not subject to any material litigation nor were we aware of any material litigation threatened against us.

Distribution Reinvestment Plan

We have adopted a distribution reinvestment plan whereby stockholders may elect to have us apply their dividends and other distributions to the purchase of additional shares of common stock. Participants in the plan will acquire common stock at the per share price effective on the date of purchase (initially $10.00).

Share Repurchase Program

We have a share repurchase program whereby, on a quarterly basis, stockholders may request that we repurchase all or any portion of their shares. We may choose to repurchase all, some or none of the shares that have been requested to be repurchased at our discretion, subject to limitations in the share repurchase plan. The total amount of aggregate repurchases shares will be limited to 5% of the weighted average number of shares of common stock outstanding during the prior calendar year. In addition, during any calendar year, we may redeem only the number of shares that we could purchase with the amount of net proceeds from the sale of shares under our distribution reinvestment plan during the prior calendar year.

Except for Exceptional Repurchases (as defined in the share repurchase program), the repurchase price is subject to the following discounts, depending on how long a redeeming stockholder has held each share:

|

| | |

| Share Purchase Anniversary | Repurchase Price as a Percentage of Estimated Value (1) |

| Less than 1 year | No repurchase allowed |

|

| 1 year - 2 years | 85 | % |

| 3 years - 4 years | 90 | % |

| 5 years and thereafter | 95 | % |

| A stockholder’s death or complete disability, less than 2 years | 95 | % |

| A stockholder’s death or complete disability, 2 years or more | 100 | % |

|

| |

| (1) | For the purposes of the share repurchase program, the “estimated value per share” will initially be equal to the purchase price per share at which the original purchaser or purchasers of the shares bought its shares from us, and the purchase price per share will be adjusted to reflect any stock dividends, combinations, splits, recapitalizations or any similar transaction with respect to the shares outstanding.

We plan to establish an estimated net asset value (“NAV”) per share of its common stock based on valuations of its assets and liabilities no later than 150 days following the second anniversary of the date of breaking escrow in the Offering, and annually thereafter. Upon our establishment of an estimated NAV per share, the estimated NAV per share will be the estimated value per share pursuant to the share repurchase program. |

No shares were redeemed during the years ended December 31, 2018 and 2017.

Our board of directors may, in its sole discretion, amend, suspend or terminate our share repurchase program for any reason upon 15 days’ notice to our stockholders.

7. Quarterly Financial Information (Unaudited)

The following table presents our quarterly results:

|

| | | | | | | | | | | | | | | |

| | For the Three Months Ended |

| | March 31, 2018 | | June 30, 2018 | | September 30, 2018 | | December 31, 2018 |

| Total revenues | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

| General and administrative expenses | 963 |

| | 1,109 |

| | — |

| | 98,137 |

|

| Net loss | $ | 963 |

| | $ | 1,109 |

| | $ | — |

| | $ | 98,137 |

|

| Net loss per share, basic and diluted | $ | (0.05 | ) | | $ | (0.06 | ) | | $ | — |

| | $ | (1.45 | ) |

No activity incurred during the year ended December 31, 2017.

8. Subsequent Events

We have evaluated subsequent events up until the date the consolidated financial statements are issued for recognition or disclosure and have determined there are none to be reported or disclosed in the consolidated financial statements other than those mentioned below.

Status of the Offering

As of March 27, 2019, we had sold 1,710,513 shares of common stock in our public offering for aggregate gross offering proceeds of $17,078,127. Included in these amounts were 1,802 shares of common stock sold pursuant to our distribution reinvestment plan for aggregate gross offering proceeds of $18,021.

Distributions

We paid the following distributions for daily record dates for each day in the periods below: |

| | |

| Period | | Amount |

| December 18, 2018 - January 31, 2019 | | $28,390 |

| February 1, 2019 - February 28, 2019 | | $29,890 |

On March 18, 2019, our board of directors declared a cash distribution in the amount of $0.02465753 per share on the outstanding shares of our common stock to stockholders of record as of March 18, 2019. Also on March 18, 2019, our board of directors declared cash distributions on the outstanding shares of our common stock based on daily record dates for the period from March 19, 2019 through March 31, 2019, which we expect to pay in April 2019; the period from April 1, 2019 through April 30, 2019, which we expect to pay in May 2019; and the period from May 1, 2019 through May 31, 2019, which we expect to pay in June 2019. Investors may choose to receive cash distributions or purchase additional shares through our distribution reinvestment plan. Distributions for these periods will be calculated based on stockholders of record each day during these periods at a rate of $0.00136986 per share per day.

Restructuring of Advisor

On March 28, 2019, we entered various agreements with our advisor and property manager, Cottonwood Communities Management, LLC ("CC Management"), and its affiliates, to restructure the ownership of the entity that provides our advisory services. Effective March 1, 2019, our advisory services are provided by a newly formed affiliate of our sponsor, CC Advisors III, LLC (“CC Advisors III”). Cottonwood Capital Management, Inc. (“Cottonwood Capital Management”) wholly owns CC Management and will continue to have an indirect ownership interest in the new advisor, CC Advisors III; however, two additional entities in which employees of Cottonwood Residential O.P., LP ("CROP") have an ownership interest will also have an indirect ownership interest in our new advisor. As our advisor will be an affiliate of our sponsor, our new advisor will continue to rely on the same expertise and experience of the sponsor and its affiliates to provide our advisory services. Property management services will continue to be provided by CC Management under separate property management agreements to be entered at the time we acquire a property. In addition, we consented to the assignment of the promotional interest held by Cottonwood Communities Investor, LLC, the sole limited partner of the Operating Partnership, to Cottonwood Communities Advisors Promote, LLC.

Amendment to Operating Partnership Agreement

On March 28, 2019, as general partner of the Operating Partnership, we amended the partnership agreement of Cottonwood Communities OP, LP to require that our stockholders, together as a collective group, instead of us as general partner, receive distributions sufficient to provide the return required before Cottonwood Communities Investor, LLC can receive the promotional interest in the Operating Partnership. In addition, the amendment provides that if the separate one-time payment is payable to Cottonwood Communities Investor, LLC following the termination or non-renewal of our advisory agreement for reasons unrelated to a liquidity event for our stockholders, the payment shall be in the form of an interest-bearing promissory note that is payable after our stockholders have actually received distributions in the amount required before Cottonwood Communities Investor, LLC can receive the promotional interest. In addition, if the promissory note has not been repaid prior to a liquidity event for our stockholders, the promissory note shall be paid in full on the date of or immediately prior to the liquidity event. As of March 1, 2019, pursuant to the agreements described above, the promotional interest is held by Cottonwood Communities Advisors Promote, LLC.

Amendment to Dealer Manager Agreement

On March 28, 2019, we amended our Dealer Manager Agreement with Cottonwood Communities Management, Inc. and Orchard Securities, LLC. The amendment provides that the reallowance of the dealer manager fee for a non-accounting marketing and due diligence allowance shall be limited to 1.00% of the gross proceeds from the primary offering, except in select cases when it may be up to 1.25% of the gross proceeds from the primary offering. In circumstances where 1.00% of offering proceeds are reallowed, the dealer manager fee will be 2.75%.

Identification of Property for Investment

On March 28, 2019, we entered into a purchase agreement with Luma at West Palm Beach, LLC, an unaffiliated third party, to acquire Luma at West Palm Beach, a 245-unit, elevator-serviced, concrete and stucco community in West Palm Beach, Florida. The purchase price is $67,000,000, of which $1,000,000 was provided in non-refundable earnest money upon execution of the purchase agreement.