UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM 10-K/A

Amendment No. 1

________________________________

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition period from __________ to __________

Commission file number: 000-56165

________________________________

Cottonwood Communities, Inc.

(Exact name of Registrant as specified in its charter)

________________________________

| | | | | | | | | | | | | | |

| Maryland | | 61-1805524 | |

| (State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) | |

1245 Brickyard Road, Suite 250, Salt Lake City, UT 84106

(Address of principal executive offices) (Zip code)

(801) 278-0700

(Registrant’s telephone number, including area code)

________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | Trading Symbols | Name of each exchange on which registered | |

| None | None | None | |

Securities registered pursuant to Section 12(g) of the Act:

Class T common stock, $0.01 par value per share

Class D common stock, $0.01 par value per share

Class I common stock, $0.01 par value per share

Class A common stock, $0.01 par value per share

Class TX common stock, $0.01 par value per share

________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ý | Smaller reporting company | ý | |

| | Emerging growth company | ý | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ý

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

The aggregate market value of the common stock held by non-affiliates of the registrant: No established market exists for the registrant’s common stock. The registrant publishes a net asset value (“NAV”), based on procedures and methodologies established by its board of directors, with an NAV on June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, of $20.7202 per share for each class of share of common stock outstanding. As of December 31, 2022, the NAV was $19.5788 per share for each class of share of common stock outstanding. There were 27,700,700 shares of common stock held by non-affiliates at June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter.

As of September 28, 2023, there were 4,592,944 shares of the registrant’s Class T common stock, 209,429 shares of the registrant’s Class D common stock, 4,353,406 shares of the registrant’s Class I common stock, and 24,322,768 shares of the registrant’s Class A common stock outstanding.

EXPLANATORY NOTE

Cottonwood Communities Inc. (the “Company,” “we,” “our,” or “us”) is filing this Amendment no. 1 on Form 10-K/A (this “Amendment” or this “Form 10-K/A”) to amend and restate certain items in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, originally filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 24, 2023 (the “Original Filing”).

In filing this Amendment, the Company is restating its previously issued audited consolidated financial statements as of and for the year ended December 31, 2022, as well as the unaudited consolidated quarterly financial information for the quarterly periods in the year ended December 31, 2022 (collectively, the “Affected Periods”) to account for an inaccurate presentation of the change in cash flows ascribed to financing and operating activities in the consolidated statement of cash flows as further described below. Those previously issued financial statements should no longer be relied upon. All material restatement information that relates to the error will be included in this Amendment, and the Company does not intend to separately amend the Quarterly Reports on Form 10-Q for the Affected Periods that the Company has previously filed with the SEC.

Accordingly, investors and other readers should rely only on the financial information and other disclosures regarding the Affected Periods in this Amendment and in any other future filings with the SEC (as applicable) and should not rely on any previously issued or filed reports, corporate presentations or similar communications relating to the Affected Periods. See Note 3 and Note 15 to the consolidated financial statements included in this Amendment, as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Restatement Background

Subsequent to the Original Filing, the Company identified an error in its historical financial statements for the year ended December 31, 2022 and the preceding quarterly periods of 2022 related to an inaccurate presentation of the change in cash flows ascribed to financing and operating activities in the consolidated statement of cash flows. The error was the result of the incorrect inclusion of accrued deferred offering costs related to the sale of the Company’s Class T and Class D shares in its public offering beginning in 2022 in the financing activity section of the consolidated statement of cash flows and in the changes in accounts payable, accrued expenses, and other liabilities in the operating activity section of the consolidated statement of cash flows. The error resulted in an understatement of cash provided by financing activities and an overstatement of cash provided by operating activities of $4.8 million for the year ended December 31, 2022.

On September 1, 2023, the audit committee of the board of directors of the Company concluded, after discussion with management, that the previously issued unaudited consolidated financial statements for the periods ended March 31, 2022, June 30, 2022 and September 30, 2022, included in the Company’s Quarterly Reports on Form 10-Q filed with the SEC on May 12, 2022, August 12, 2022, and November 9, 2022, respectively, and the audited consolidated financial statements for the year ended December 31, 2022 included in the Original Filing, and each as included in any reports, presentations or similar communications of the Company's financial results, should no longer be relied upon due to the error. As a result, the error requires a restatement of the financial statements for the Affected Periods (the "Restatement") which is reflected in this Amendment. The impact of the error is described in detail in Note 3 (annual impact) and Note 15 (quarterly impact) to the consolidated financial statements.

This Amendment also includes other immaterial previously unrecorded adjustments which affected additional paid-in capital, noncontrolling interest, the presentation of the change in deferred taxes as a separate line within the cash flows from operating activities section of the consolidated statements of cash flows, and movement of immaterial amounts from borrowings under mortgage notes and term loans in cash flows from financing activities to acquisitions of real estate, net of cash acquired, in cash flows from investing activities.

Internal Control Considerations

Management has reassessed its evaluation of the effectiveness of its internal control over financial reporting as of December 31, 2022 as further described in Part II, Item 9A of this Amendment, and concluded that a material weakness existed due to an assessment of the incremental risk of noncash activities on the consolidated statement of cash flows that was not effective. Therefore internal control over financial reporting and disclosure controls and procedures were not effective as of the year ended December 31, 2022. Management has taken steps to remediate the material weakness in our internal control over financial reporting.

Items Amended in this Amendment

For the convenience of the reader, this Amendment sets forth the Original Filing, with the exception of Part III, in its entirety, as amended for the changes related to the Restatement as well as certain additional changes discussed below. The following sections of the Original Filing have been amended as a result of the Restatement:

•Part I — Item 1A. Risk Factors

•Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

•Part II — Item 8. Financial Statements and Supplementary Data

•Part II — Item 9A. Controls and Procedures

•Part IV — Item 15. Exhibits, Financial Statement Schedules

In addition, Part II — Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities — Funds from Operations is being amended to include adjustments to core funds from operations to reflect current period presentation. In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), this Amendment includes new certifications specified in Rule 13a-14 under the Exchange Act, from the Company’s Chief Executive Officer and Chief Financial Officer dated as of the date of this Amendment. The Exhibit Index in Part IV — Item 15 is also being amended to reflect the inclusion of the updated exhibits.

Except as described above, this Amendment does not amend, update or change any other items or disclosures contained in the Original Filing, and accordingly, this Amendment does not reflect or purport to reflect any information or events occurring after March 24, 2023, the filing date of the Original Filing, or modify or update those disclosures affected by subsequent events. Accordingly, this Amendment should be read in conjunction with filings made with the SEC subsequent to the filing of the Original Filing.

Cottonwood Communities, Inc.

Form 10-K/A

For the Year Ended December 31, 2022

| | | | | | | | |

| Table of Contents |

| | Page |

| Part I | | |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Part II | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| Part IV | | |

| Item 15. | | |

| Item 16. | | |

| | |

Part I

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K/A contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act of 1934, as amended (the “Exchange Act”). Forward looking statements include statements about our business, including, in particular, statements about our plans, strategies and objectives. You can generally identify forward-looking statements by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. You should not rely on these forward-looking statements because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond our control. Our actual results, performance and achievements may be materially different from those expressed or implied by these forward-looking statements.

For a discussion of some of the risks and uncertainties, although not all risks and uncertainties, that could cause actual results to differ materially from those presented in our forward-looking statements, see the risks identified in “Summary Risk Factors” below and in Part I, Item 1A of this Annual Report on Form 10-K/A (the “Annual Report”).

SUMMARY RISK FACTORS

The following is a summary of the principal risks that could adversely affect our business, financial condition, results of operations and cash flows and an investment in our common stock. This summary highlights certain of the risks that are discussed further in this Annual Report but does not address all the risks that we face. For additional discussion of the risks summarized below and a discussion of other risks that we face, see “Risk Factors” in Part I, Item 1A of this Annual Report.

•There is no public trading market for shares of our common stock and the repurchase of shares by us will likely be the only way to dispose of your shares. Our share repurchase program provides stockholders with the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and may choose to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month in our discretion. In addition, repurchases are subject to available liquidity and other significant restrictions. Further, our board of directors may modify or suspend our share repurchase program if in its reasonable judgment it deems a suspension to be in our best interest and the best interest of our stockholders, such as when a repurchase request would place an undue burden on our liquidity, adversely affect our operations or risk having an adverse impact on the company that would outweigh the benefit of the repurchase offer.

•The offering price and repurchase price for shares of our common stock are generally based on our prior month’s NAV plus, in the case of our offering price, applicable upfront selling commissions and dealer manager fees, and are not based on any public trading market. In addition to being up to a month old when share purchases and repurchases take place, our NAV does not currently represent our enterprise value and may not accurately reflect the actual prices at which our assets could be liquidated on any given day, the value a third party would pay for all or substantially all of our shares, or the price that our shares would trade at on a national stock exchange. Furthermore, our board of directors may amend our NAV procedures from time to time. Although there will be independent appraisals of our properties, the appraisal of properties is inherently subjective and our NAV may not accurately reflect the actual price at which our properties could be liquidated on any given day.

•Investing in commercial real estate assets involves certain risks, including, but not limited to: changes in values caused by global, national, regional or local economic performance, the performance of the real estate sector, unemployment, stock market volatility and other impacts of the COVID-19 pandemic, demographic or capital market conditions; increases in interest rates and lack of availability of financing; vacancies, fluctuations in the average occupancy and rental rates for our residential properties; and residents experiencing financial hardships (resulting in an inability to pay rent). In particular, the current combination of the continued economic slowdown, rapidly rising interest rates and significant inflation (or the perception that any of these events may continue) as well as a lack of lending activity in the debt markets have contributed to considerable weakness in the commercial real estate markets. Continued disruptions in the financial markets and economic uncertainty could adversely affect our operations.

•We depend on our advisor to identify suitable investments and to manage our investments. There is no assurance that we will be able to successfully achieve our investment objectives.

•We have paid distributions from offering proceeds and may continue to fund distributions with offering proceeds. We have not established a limit on the amount of proceeds from our offering that we may use to fund distributions. To the extent we fund distributions from sources other than our cash flow from operations, we will have less funds available for investment in multifamily apartment communities and multifamily real estate-related assets and the overall return to our stockholders may be reduced. Distributions may also be paid from other sources such as borrowings, advances or the deferral of fees and expense reimbursements. During the early stages of our operations, these distributions may constitute a return of capital.

•Some of our officers and certain of our directors are also officers and directors of our sponsor, our advisor or its affiliates. As a result, our officers and affiliated directors are subject to conflicts of interest.

•We pay certain fees and expenses to our advisor and its affiliates. These fees were not negotiated at arm’s length and therefore may be higher than fees payable to unaffiliated third parties.

•Development projects in which we invest will be subject to potential development and construction delays which could result in increased costs and risks and may hinder our operating results and ability to make distributions.

•We may incur significant debt in certain circumstances, including through the issuance of preferred equity that is accounted for as debt. Our use of leverage increases the risk of an investment in us. Loans we obtain may be collateralized by some or all of our investments, which will put those investments at risk of forfeiture if we are unable to pay our debts. Principal and interest payments on these loans and dividend payments on our preferred shares reduce the amount of money that would otherwise be available for other purposes.

•Volatility in the debt markets could affect our ability to obtain financing for investments or other activities related to real estate assets and the diversification or value of our portfolio, potentially reducing cash available for distribution to our stockholders or our ability to make investments. In addition, volatility in the debt markets could negatively impact our loans with variable interest rates.

•As a result of the Restatement, we have identified a material weakness in our internal control over financial reporting, and solely as a result of the material weakness, our management has concluded that our disclosure controls and procedures and internal controls over financial reporting were not effective as of December 31, 2022, which conclusion could harm our business. The Restatement and related identification of a material weakness in our internal controls over financial reporting could subject us to increased risk of litigation.

•If we fail to continue to qualify as a real estate investment trust (“REIT”), it would adversely affect our operations and our ability to make distributions to our stockholders because we will be subject to United States federal income tax at regular corporate rates with no ability to deduct distributions made to our stockholders.

In light of the significant uncertainties inherent in these forward looking statements, the inclusion of this information should not be regarded as a representation by us or any other person that our objectives and plans, which we consider to be reasonable, will be achieved. Except as otherwise required by federal securities laws, we do not undertake to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

ITEM 1. BUSINESS

References herein to the “Company,” “CCI,” “we,” “us,” or “our” refer to Cottonwood Communities, Inc., a Maryland corporation, and its subsidiaries, unless the context specifically requires otherwise.

General Description of Business and Operations

Cottonwood Communities, Inc. invests in a diverse portfolio of multifamily apartment communities and multifamily real estate-related assets throughout the United States. We are externally managed by our advisor, CC Advisors III, LLC (“CC Advisors III”), a wholly owned subsidiary of our sponsor, Cottonwood Communities Advisors, LLC (“CCA”). We were incorporated in Maryland in 2016. We own all of our assets through our operating partnership. Our operating partnership was Cottonwood Communities O.P., LP (“CCOP”) prior to the CRII Merger (defined below) and is Cottonwood Residential O.P., LP (“CROP” or the “Operating Partnership”) after the CRII Merger. We are the sole member of the sole general partner of the Operating Partnership and own general partner interests in the Operating Partnership alongside third-party limited partners.

Cottonwood Communities, Inc. is a non-traded, perpetual-life, NAV REIT. We qualified as a REIT for U.S. federal income tax purposes beginning with the taxable year ended December 31, 2019. We generally will not be subject to U.S. federal income taxes on our taxable income to the extent we annually distribute all of our net taxable income to stockholders and maintain our qualification as a REIT.

As December 31, 2022, we had received gross proceeds of $295.5 million from the sale of our common stock and $127.0 million from the sale of our Series 2019 Preferred Stock. We have contributed our net proceeds to the Operating Partnership in exchange for a corresponding number of mirrored OP units in the Operating Partnership (“CROP Units”). CROP has primarily used the net proceeds to make investments in real estate, multifamily real estate-related assets, and conduct its real estate-related operations.

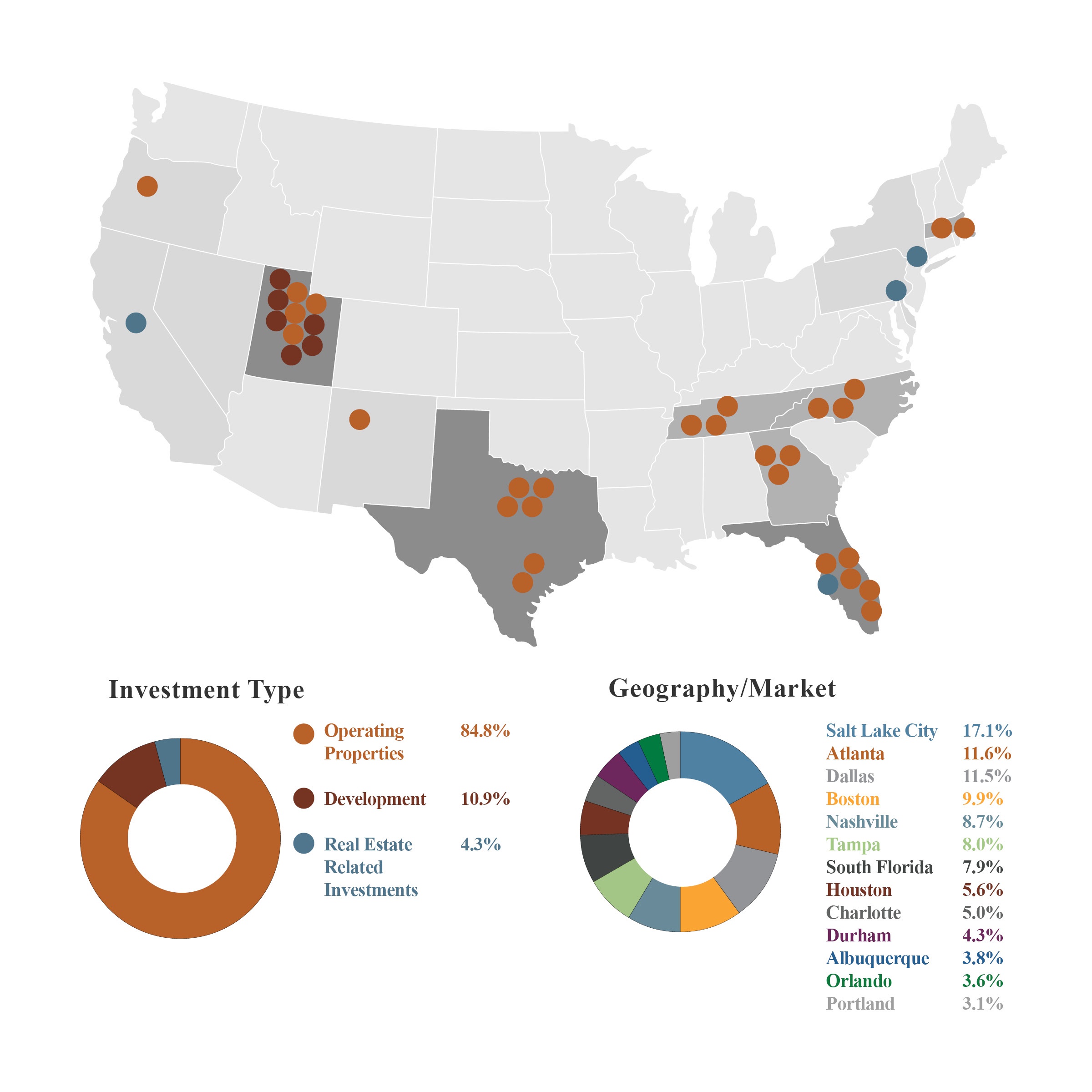

As December 31, 2022, we had a portfolio of $2.6 billion in total assets, with 84.8% of our equity value in operating properties, 10.9% in development and 4.3% in real estate-related investments. We also currently manage approximately 10,100 units in stabilized assets, including approximately 8,000 units in stabilized properties we own or have ownership interests in. The following presents our real estate portfolio by market and investment type by fair value as of December 31, 2022:

Investment Objectives

Our investment objectives are to:

•preserve, protect and return invested capital;

•pay stable cash distributions to stockholders;

•realize capital appreciation in the value of our investments over the long term; and

•provide a real estate investment alternative with lower expected price volatility relative to public real estate companies whose securities trade daily on a stock exchange.

We seek to invest at least 65% of our assets in stabilized multifamily apartment communities and up to 35% in mortgage loans, preferred equity investments, mezzanine loans or equity investments in a property or land which will be developed into a multifamily apartment community.

The CMOF Merger

On July 8, 2022, we entered into an agreement and plan of merger with Cottonwood Multifamily Opportunity Fund, Inc. (“CMOF”) and its operating partnership (the “CMOF OP”) to merge CMOF with and into our wholly owned subsidiary and the CMOF OP with and into CROP through the exchange of stock-for-stock and units-for-units (the “CMOF Merger”). The CMOF Merger closed on September 27, 2022.

CROP was a joint venture partner with CMOF in all three of CMOF’s investments: Park Avenue (development project), Cottonwood on Broadway (development project) and Block C, a joint venture owning land held for development for two projects called Westerly and Millcreek North. Following the CMOF Merger, we acquired CMOF’s interest in these joint ventures increasing our percentage ownership interest in the joint ventures as follows: Park Avenue, 100.0%, Cottonwood on Broadway, 100.0% and Block C, 79.0%. The remaining interests in Block C are held by some of our officers and affiliated directors, either directly or indirectly.

The 2021 Mergers

On January 26, 2021, we entered into separate agreements with three affiliated REITs and their respective operating partnerships to merge through the exchange of stock-for-stock and units-for-units, respectively. The merger with Cottonwood Residential II, Inc. (“CRII”) and its operating partnership (CROP) (the “CRII Merger”) closed on May 7, 2021. The mergers with Cottonwood Multifamily REIT I, Inc. (“CMRI”) and its operating partnership (the “CMRI Merger”) and with Cottonwood Multifamily REIT II, Inc. (“CMRII”) and its operating partnership (the “CMRII Merger”) closed on July 15, 2021. We refer to the CRII Merger, the CMRI Merger and the CMRII Merger as the “2021 Mergers.”

Through the 2021 Mergers we acquired interests in 22 stabilized multifamily apartment communities, four multifamily development projects, one structured investment, and land held for development. We also acquired CRII’s property management business and its employees, an advisory contract with CMOF, and personnel who performed certain administrative and other services for us, including legal, accounting, property development oversight and certain services relating to construction management, stockholder relations, human resources, renter insurance and information technology.

CC Advisors III continues to manage our business as our external advisor pursuant to an amended and restated advisory agreement. With the exception of our Chief Legal Officer, Chief Operating Officer, Chief Accounting Officer, and Chief Development Officer, we do not employ our executive officers.

Refer to Note 1 of the consolidated financial statements in this Annual Report on Form 10-K/A for further description of the CMOF Merger and the 2021 Mergers.

Our Offerings

From August 13, 2018 to December 22, 2020 we conducted an initial public offering of our Class A and Class TX (formerly Class T) common stock (the “Initial Offering”), raising $122.0 million. The Initial Offering ended December 2020 while we pursued the 2021 Mergers. On November 4, 2021, after the 2021 Mergers were completed, we registered with the SEC our ongoing offering of up to $1.0 billion of shares of common stock (the “Follow-on Offering”), consisting of up to $900.0 million in shares of common stock offered in a primary offering (the “Primary Offering”) and $100.0 million in shares under our distribution reinvestment plan (the “DRP Offering”). As of December 31, 2022, we had raised gross proceeds of $173.5 million from the Follow-on Offering, including $2.5 million proceeds from the DRP Offering.

On November 8, 2019 we commenced a best-efforts private placement offering exempt from registration under the Securities Act pursuant to which we offered a maximum of $128.0 million in shares of Series 2019 Preferred Stock to accredited investors at a purchase price of $10.00 per share (the “2019 Private Offering”). By March 2022, the 2019 Private Offering was fully subscribed.

On December 13, 2022, we commenced a second best-efforts private placement offering exempt from registration under the Securities Act pursuant to which we are offering a maximum of $100.0 million in shares of our Series 2023 Preferred Stock to accredited investors at a purchase price of $10.00 per share (the "2023 Private Offering" and together with the 2019 Private Offering, the “Private Offerings”).

NAV-Based Perpetual-Life Strategy

During 2021 we implemented changes to our public offering and business in pursuit of an NAV-based, perpetual-life strategy. We believe these changes, discussed below, enhance our equity capital raising efforts, diversify and grow our portfolio for the benefit of our stockholders, and increase liquidity to our stockholders in excess of what was previously available. We also believe being a perpetual-life REIT allows us to acquire and manage our investment portfolio in a more active and flexible manner by not limiting us with a predetermined operational period or the need to provide a “liquidity” event at the end of that period.

New Share Classes

We restructured the classes of shares we offer in our public offering. We renamed our prior Class T shares as Class TX shares and authorized and designated three new classes of shares: Class T, Class D and Class I shares for sale in our primary public offering. Class T, Class D and Class I shares have different upfront selling commissions and dealer manager fees, and different ongoing distribution fees payable to the dealer manager and reallowed to participating broker-dealers. We believe that having a number of different share classes with different distribution compensation structures improves our ability to sell shares and raise capital in the current market.

Revised Advisory Fee Structure

On May 7, 2021, we entered into an amended and restated advisory agreement and CROP entered into the Fifth Amended and Restated Limited Partnership Agreement. These agreements revised the compensation payable and the expenses that may be reimbursed to our advisor and its affiliates for its services to be consistent with that of a perpetual-life NAV REIT.

Monthly NAV Determinations

On May 27, 2021, our board of directors, including a majority of our independent directors, adopted valuation procedures that contain a comprehensive set of methodologies to be used in connection with the calculation of a NAV of the company and performed our initial NAV calculation. Since our initial determination of an NAV, we have determined and disclosed monthly our NAV per share for each share class as of the last calendar day of the prior month. We believe more frequent NAV calculations improves our ability to offer and repurchase our shares at the most fair prices, and also improves visibility and transparency into our performance.

Revised Share Repurchase Program

Following the CRII Merger, our board of directors adopted a revised share repurchase program (the “SRP”). The SRP as revised provides that we may make monthly redemptions with an aggregate value of up to 5% of our NAV each quarter. In addition, we removed the funding restrictions from the SRP. For Class T, Class D and Class I shares, the redemption price equals the most recently disclosed monthly NAV, or 95% of the most recently disclosed NAV if the shares have been held for less than a year. For Class A shares, the repurchase price is at a declining discount to NAV depending on how long the stockholder has held the shares submitted for repurchase and is 100% of NAV after a six-year hold period.

Charter Amendment

In connection with our perpetual-life-strategy we sought and obtained stockholder approval to remove Article XVIII from our charter. Article XVIII was inconsistent with a perpetual-life-strategy as it required that if we did not list our shares of common stock on a national securities exchange by August 13, 2028, we must either seek stockholder approval of the liquidation of the company; or postpone the decision of whether to liquidate the company if a majority of the board of directors

determines that liquidation is not then in the best interests of our stockholders. On December 17, 2021, we filed Articles of Amendment with the State Department of Assessment and Taxation of the State of Maryland to remove Article XVIII from our charter.

Economic Dependency

We are dependent on our advisor and its affiliates for certain services that are essential to us, including the identification, evaluation, negotiation, origination, acquisition and disposition of investments; and management of our business. In the event that our advisor is unable to provide these services, we will be required to obtain such services from other sources.

Competitive Market Factors

The success of our investment portfolio depends, in part, on our ability to invest in multifamily apartment communities that provide attractive and stable returns. We face competition from various entities for investment opportunities in multifamily apartment community properties, including other REITs, pension funds, insurance companies, investment funds and companies, partnerships, and developers. Many of these entities have substantially greater financial resources than we do and may be able to accept more risk than we can prudently manage. Our competitors may also be willing to accept lower returns on their investments and may succeed in buying the assets that we have targeted for acquisition. Competition from these entities may reduce the number of suitable investment opportunities offered to us or increase the bargaining power of property owners seeking to sell. Although we believe that we are well-positioned to compete effectively in each facet of our business, there is competition in our market sector and there can be no assurance that we will compete effectively or that we will not encounter increased competition in the future that could limit our ability to conduct our business effectively.

Furthermore, we face competition from other multifamily apartment communities for tenants. This competition could reduce occupancy levels and revenues at our multifamily apartment communities, which would adversely affect our operations. We expect to face competition from many sources. We will face competition from other multifamily apartment communities both in the immediate vicinity and in the larger geographic market where our apartment communities will be located. Overbuilding of multifamily apartment communities may occur. If so, this will increase the number of apartment units available and may decrease occupancy and apartment rental rates.

Compliance with Federal, State and Local Environmental Law

Under various federal, state and local environmental laws, ordinances and regulations, a current or previous real property owner or operator may be liable for the cost of removing or remediating hazardous or toxic substances on, under or in such property. These costs could be substantial. Such laws often impose liability whether or not the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. Environmental laws also may impose restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require substantial expenditures. Environmental laws provide for sanctions for noncompliance and may be enforced by governmental agencies or, in certain circumstances, by private parties. Certain environmental laws and common law principles could be used to impose liability for the release of and exposure to hazardous substances, including asbestos-containing materials. Third parties may seek recovery from real property owners or operators for personal injury or property damage associated with exposure to released hazardous substances. The cost of defending against claims of liability, of complying with environmental regulatory requirements, of remediating any contaminated property, or of paying personal injury claims could reduce the amounts available for distribution to our stockholders.

We intend to subject our multifamily apartment communities to an environmental assessment prior to acquisition; however, we may not be made aware of all the environmental liabilities associated with a property prior to its purchase. There may be hidden environmental hazards that may not be discovered prior to acquisition. The costs of investigation, remediation or removal of hazardous substances may be substantial. In addition, the presence of hazardous substances on one of our properties, or the failure to properly remediate a contaminated property, could adversely affect our ability to sell or rent the property or to borrow using the property as collateral.

Human Capital Resources

Our external advisor, CC Advisors III, through its team of real estate professionals, selects our investments and manages our business, subject to the direction and oversight of our board of directors.

As of March 21, 2023, we employ 308 individuals, including our Chief Legal Officer, Chief Operating Officer, Chief Accounting Officer, and Chief Development Officer with 228 employees serving as “site” employees at our properties

responsible for maintenance and leasing and the remainder considered corporate-level employees supporting our operations. We also rely on employees of our advisor for the management of our business and the employment of certain of our executive officers.

Our employees are responsible for performing various operational services for us, including property management, legal, accounting, property development oversight and certain services relating to construction management, stockholders, human resources, and information technology. Although we did not have employees until May 7, 2021, many of the same individuals who are now our employees have been involved in our operations through their employment with our advisor, affiliated property manager and their affiliates for an average of over four years. Approximately 50% of our employees are women and approximately 47% are members of racial or ethnic minority groups. We consider our relations with our employees to be good; none of our employees are represented by a labor union.

We believe the caliber and well-being of our people to be critical to our ability to attract talent and sustain an appealing company culture that promotes diversity, inclusion, transparency, innovation, teamwork, and excellence. To support these goals and objectives we provide best-in-class training resources, both in person and virtually, to develop the skills and talents of our people and to prevent discrimination and harassment. We dedicate significant time and attention to building a bench of talent that has a wide array of abilities and interests, and that is capable of promoting continuity and succession, when necessary.

We offer competitive and equitable compensation and benefits packages that include medical, dental, vision, disability and life insurance, 401k and HSA plans with company-matching contributions, equity grants, paid time off, as well as other resources and programs that support the health and well-being of our associates and their families. We frequently benchmark these compensation and benefits packages against industry peers and those of similar disciplines.

Principal Executive Office

Our principal executive offices are located at 1245 Brickyard Road, Suite 250, Salt Lake City, Utah 84106. Our website address is www.cottonwoodcommunities.com.

Available Information

Access to copies of our Annual Report on Form 10-K/A, quarterly reports on Form 10-Q, current reports on Form 8-K, including exhibits to these reports, proxy statements and other filings with the SEC, including amendments to such filings, may be obtained free of charge at our website, www.cottonwoodcommunities.com, or through the SEC’s website, http://www.sec.gov. These filings are available promptly after we file them with, or furnish them to, the SEC.

Item 1A. Risk Factors

The following are some of the risks and uncertainties that could cause our actual results to differ materially from those presented in our forward-looking statements. The risks and uncertainties described below are not the only ones we face but do represent those risks and uncertainties that we believe are material to us. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also harm our business. Our stockholders may be referred to as “you” or “your” in this Item 1A. “Risk Factors” section.

Risks Related to an Investment in our Common Stock

We have held most of our current investments for only a limited period of time and you will not have the opportunity to evaluate our future investments before we make them, which makes your investment more speculative.

We have held most of our current investments for a limited period of time. Further, we are considered to be a “blind pool,” and are not able to provide you with information to assist you in evaluating the merits of any specific properties or structured investments that we may acquire. Because we have not held our current investments for a long period of time, it may be difficult for you to evaluate our success in achieving our investment objectives. We will continue to seek to invest substantially all of our future net offering proceeds, after the payment of fees and expenses, in the acquisition of or investment in interests in properties and structured investments. However, because you will be unable to evaluate the economic merit of our future investments before we make them, you will have to rely entirely on the ability of our advisor to select suitable and successful investment opportunities. These factors increase the risk that your investment may not generate returns comparable to other real estate investment alternatives.

There is no public trading market for the shares of our common stock and we do not anticipate that there will be a public trading market for our shares; therefore, your ability to dispose of your shares will likely be limited to repurchase by us. If you do sell your shares to us, you may receive less than the price you paid.

There is no current public trading market for shares of our common stock, and we do not expect that such a market will ever develop. Therefore, the repurchase of your shares by us will likely be the only way for you to dispose of your shares. We will repurchase shares at a price equal to the transaction price of the class of shares being repurchased on the date of repurchase (which will generally be equal to our prior month’s NAV per share, which will be our most recently disclosed NAV at such time) and not based on the price at which you initially purchased your shares. We may repurchase your shares if you fail to maintain a minimum account balance of $500 of shares, even if your failure to meet the minimum account balance is caused solely by a decline in our NAV. Repurchases will be made at the transaction price in effect on the repurchase date, with the following exceptions (collectively, the “Early Repurchase Deduction”): (i) Class T, Class D and Class I shares that have not been outstanding for at least one year will be repurchased at 95.0% of the transaction price, (ii) Class A and Class TX shares that have been outstanding for at least five years and less than six years will be repurchased at 95.0% of the transaction price, (iii) Class A and Class TX shares that have been outstanding for at least three years and less than five years will be repurchased at 90.0% of the transaction price and (iv) Class A and Class TX shares that have been outstanding for at least one year and less than three years will be repurchased at 85.0% of the transaction price.

For purposes of the Early Repurchase Deduction, the holding period is measured from the date the stockholder acquired the share (the “Acquisition Date”) through the first calendar day immediately following the prospective repurchase date. With respect to holders of Class A shares who acquired their shares pursuant to a merger transaction the Acquisition Date is the date the holder acquired the corresponding share that was exchanged in the merger transaction. In addition, with respect to Class A and Class TX shares acquired through our distribution reinvestment plan or issued pursuant to a stock dividend, the shares will be deemed to have been acquired on the same date as the initial share to which the distribution reinvestment plan share or stock dividend relate. The Acquisition Date for stockholders who received shares of our common stock in exchange for their CROP Units is measured as of the date the exchange occurred and they received shares of our common stock. The Early Repurchase Deduction will also generally apply to minimum account repurchases. With respect to Class T, Class D and Class I shares, the Early Repurchase Deduction will not apply to shares acquired through the Company’s distribution reinvestment plan or issued pursuant to a stock dividend. Such Early Repurchase Deductions will inure indirectly to the benefit of our remaining stockholders. As a result of this and the fact that our NAV will fluctuate, you may receive less than the price you paid for your shares upon repurchase by us pursuant to our share repurchase program.

Your ability to have your shares repurchased through our share repurchase program is limited. We may choose to repurchase fewer shares than have been requested to be repurchased, in our discretion at any time, and the amount of shares we may repurchase is subject to caps. Further, our board of directors may modify or suspend our share repurchase program if it deems such action to be in our best interest and the best interest of our stockholders.

We may choose to repurchase fewer shares than have been requested in any particular month to be repurchased under our share repurchase program, or none at all, in our discretion at any time. We may repurchase fewer shares than have been requested to be repurchased due to lack of readily available funds because of adverse market conditions beyond our control, the need to maintain liquidity for our operations or because we have determined that investing in real property or other illiquid investments is a better use of our capital than repurchasing our shares. In addition, the total amount of shares that we will repurchase is limited, in any calendar month, to shares whose aggregate value (based on the repurchase price per share on the date of the repurchase) is no more than 2% of the aggregate NAV of our common stock outstanding as of the last day of the previous calendar month and, in any calendar quarter, to shares whose aggregate value is no more than 5% of the aggregate NAV of our common stock outstanding as of the last day of the previous calendar quarter. Further, our board of directors may modify or suspend our share repurchase program if in its reasonable judgment it deems a suspension to be in our best interest and the best interest of our stockholders, such as when a repurchase request would place an undue burden on our liquidity, adversely affect our operations or risk having an adverse impact on the company that would outweigh the benefit of the repurchase offer. Once the share repurchase program is suspended, our board of directors must consider at least quarterly whether the continued suspension of the share repurchase program is in our best interest and the best interest of our stockholders. Our board of directors cannot terminate our share repurchase program absent a liquidity event which results in stockholders receiving cash or securities listed on a national securities exchange or where otherwise required by law. If the full amount of all shares of our common stock requested to be repurchased in any given month are not repurchased, funds will be allocated pro rata based on the total number of shares of common stock being repurchased without regard to class and subject to the volume limitation. All unsatisfied repurchase requests must be resubmitted after the start of the next month or quarter, or upon the recommencement of the share repurchase program, as applicable.

The vast majority of our assets consist of properties that cannot generally be readily liquidated without impacting our ability to realize full value upon their disposition. Therefore, we may not always have a sufficient amount of cash to immediately satisfy repurchase requests. Should repurchase requests, in our judgment, place an undue burden on our liquidity, adversely affect our operations or risk having an adverse impact on the company as a whole, or should we otherwise determine that investing our liquid assets in real properties or other illiquid investments rather than repurchasing our shares is in the best interests of the Company as a whole, then we may choose to repurchase fewer shares than have been requested to be repurchased, or none at all. Because we are not required to authorize the recommencement of the share repurchase program within any specified period of time, we may effectively terminate the plan by suspending it indefinitely. As a result, your ability to have your shares repurchased by us may be limited and at times you may not be able to liquidate your investment.

We have incurred net losses under GAAP in the past and may incur net losses in the future, and we have an accumulated deficit and may continue to have an accumulated deficit in the future.

For the years ended December 31, 2022 and 2021, we had consolidated net losses of $34.0 million and $106.9 million, respectively. As of December 31, 2022 and 2021, we had accumulated deficits of $71.5 million and $55.9 million, respectively. These amounts largely reflect the expense of real estate depreciation and amortization in accordance with GAAP, which was $54.6 million and $63.4 million during these periods. In addition, the years ended December 31, 2022 and 2021, also included $20.3 million and $51.8 million of charges related to the performance participation allocation.

Net loss and accumulated deficit are calculated and presented in accordance with GAAP, which, among other things, requires depreciation of real estate investments. We calculate depreciation on a straight-line basis. As a result, our operating results imply that the value of our real estate investments will decrease evenly over a set time period. However, we believe that the value of real estate investments will fluctuate over time based on market conditions. Thus, in addition to GAAP financial metrics, management reviews certain non-GAAP financial metrics, including funds from operations, or FFO and Core FFO. FFO measures operating performance that excludes gains or losses from sales of depreciable properties, real estate-related depreciation and amortization and after adjustments for our share of consolidated and unconsolidated entities. Core FFO excludes other items recorded under GAAP that we believe are not indicative of operating performance, including the accretion of discounts on preferred stock, share-based compensation, the promote from an incentive allocation agreement (tax effected), gains on derivatives, legal costs and settlements, acquisition fees and expenses, and amortization of above or below intangible lease assets and liabilities. See Part II, Item 5. “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities - Funds from Operations” for considerations on how to review this metric.

Economic events that may cause our stockholders to request that we repurchase their shares may materially adversely affect our cash flow and our results of operations and financial condition.

Economic events affecting the U.S. economy, such as the general negative performance of the real estate sector, could cause our stockholders to seek to sell their shares to us pursuant to our share repurchase program at a time when such events are adversely affecting the performance of our assets. Even if we decide to satisfy all resulting repurchase requests, our cash flow could be materially adversely affected. In addition, if we determine to sell assets to satisfy repurchase requests, we may not be able to realize the return on such assets that we may have been able to achieve had we sold at a more favorable time, and our results of operations and financial condition, including, without limitation, breadth of our portfolio by property type and location, could be materially adversely affected.

Repurchases of common stock or CROP Units our advisor or the Special Limited Partner elects to receive in lieu of fees or distributions will reduce cash available for distribution to our stockholders.

Our advisor or the Special Limited Partner may choose to receive our common stock or CROP Units in lieu of certain fees or distributions. Under certain circumstances CROP Units or shares of our common stock received as payment for management fees are required to be repurchased, in cash at the holder’s election, and there may not be sufficient cash to make such a repurchase payment; therefore, we may need to use cash from operations, borrowings, offering proceeds or other sources to make the payment, which will reduce cash available for distribution to you or for investment in our operations. Repurchases of our shares or CROP Units from our advisor paid to our advisor as a management fee are not subject to the monthly and quarterly volume limitations or the Early Repurchase Deduction, and such repurchases may receive priority over other shares submitted for repurchase during such period. Repurchases of our shares or CROP Units from the Special Limited Partner distributed to the Special Limited Partner with respect to its performance participation interest are not subject to any requirement that the units be held for at least one year but are subject to the other provisions regarding the exchange right as contemplated by the Partnership Agreement.

We are required to pay substantial compensation to our advisor and its affiliates, which may be increased or decreased by a majority of our board of directors, including a majority of the independent directors. Payment of fees and expenses to our advisor and its affiliates reduces the cash available for distribution and increases the risk that you will not be able to recover the amount of your investment in our shares.

Pursuant to our agreements with our advisor and its affiliates, we are obligated to pay substantial compensation to the advisor and its affiliates. Subject to limitations in our charter, the fees, compensation, income, expense reimbursements, interests and other payments that we are required to pay to the advisor and its affiliates may increase or decrease if such change is approved by a majority of our board of directors, including a majority of the independent directors. The compensation payable by us to our advisor and its affiliates may not be on terms that would result from arm’s-length negotiations, is payable whether or not our stockholders receive distributions, and is based on our NAV, which our advisor is responsible for determining. These payments to the advisor and its affiliates will decrease the amount of cash we have available for operations and new investments and could negatively impact our NAV, our ability to pay distributions and your overall return.

Purchases and repurchases of shares of our common stock are made based on the most recently disclosed NAV per share at such time, which is generally the prior month’s NAV per share of our common stock.

Generally, our offering price per share and the price at which we make repurchases of our shares will equal the prior month’s NAV per share plus, in the case of our offering price, applicable upfront selling commissions and dealer manager fees. The NAV per share as of the date on which you make your subscription request or repurchase request may be significantly different than the offering price you pay or the repurchase price you receive. In addition, in cases where we believe there has been a material change (positive or negative) to our NAV per share since the end of the prior month, we may offer shares at a price that we believe reflects the NAV per share of such stock more appropriately than the prior month’s NAV per share (including by updating a previously disclosed offering price) or suspend our offering and/or our share repurchase program. In such cases, the offering price and repurchase price will be our most recently disclosed NAV per share at such time.

Valuations and appraisals of our properties, real estate-related assets and real estate-related liabilities are estimates of value and may not necessarily correspond to realizable value.

The valuation methodologies used to value our properties and certain real estate-related assets involve subjective judgments regarding such factors as comparable sales, rental revenue and operating expense data, known contingencies, the capitalization or discount rate, and projections of future rent and expenses based on appropriate analysis. As a result, valuations and appraisals of our properties, real estate-related assets and real estate-related liabilities are only estimates of current market value. Ultimate realization of the value of an asset or liability depends to a great extent on economic and other conditions beyond our control and the control of Altus Group U.S. Inc. (the “Independent Valuation Advisor”) and other parties involved in the valuation of our assets and liabilities. Further, these valuations may not necessarily represent the price at which an asset or liability would sell, because market prices of assets and liabilities can only be determined by negotiation between a willing buyer and seller. Valuations used for determining our NAV also are generally made without consideration of the expenses that would be incurred by us in connection with disposing of assets and liabilities. Therefore, the valuations of our properties, our investments in real estate-related assets and our liabilities may not correspond to the timely realizable value upon a sale of those assets and liabilities. In addition to being a month old when share purchases and repurchases take place, our NAV does not currently represent enterprise value and may not accurately reflect the actual prices at which our assets could be liquidated on any given day, the value a third party would pay for all or substantially all of our shares, or the price that our shares would trade at on a national stock exchange. There will be no retroactive adjustment in the valuation of such assets or liabilities, the price of our shares of common stock, the price we paid to repurchase shares of our common stock or NAV-based fees we paid to our advisor and the dealer manager to the extent such valuations prove to not accurately reflect the true estimate of value and are not a precise measure of realizable value. Because the price you will pay for shares of our common stock in our offering, and the price at which your shares may be repurchased by us pursuant to our share repurchase program, are generally based on our estimated NAV per share, you may pay more than realizable value or receive less than realizable value for your investment.

Our NAV per share amounts may change materially if the appraised values of our properties materially change from prior appraisals or the actual operating results for a particular month differ from what we originally budgeted for that month.

Our properties are appraised monthly by either the Independent Valuation Advisor or a third-party appraiser (the “Third-Party Appraisal Firm”). When these appraisals are considered by our advisor for purposes of determining our NAV, there may be a material change in our NAV per share amounts for each class of our common stock from those previously reported. In addition, actual operating results for a given month may differ from what we originally budgeted for that month, which may cause a material increase or decrease in the NAV per share amounts. We will not retroactively adjust the NAV per share of each class reported for the previous month. Therefore, because a new annual appraisal may differ materially from the

prior appraisal or the actual results from operations may be better or worse than what we previously budgeted for a particular month, the adjustment to take into consideration the new appraisal or actual operating results may cause the NAV per share for each class of our common stock to increase or decrease, and such increase or decrease will occur in the month the adjustment is made.

New acquisitions may be valued for purposes of our NAV at less than what we pay for them, which would dilute our NAV, or at more than what we pay for them, which would be accretive to our NAV.

Pursuant to our valuation guidelines, the acquisition price of a newly acquired property will serve as the basis for the initial monthly appraisal performed by the Independent Valuation Advisor. The price we pay to acquire a property will provide a meaningful data point to the Independent Valuation Advisor in its determination of the initial fair market value of the property; however, the Independent Valuation Advisor may conclude that the price we paid to acquire a property is higher or lower than the current fair market value of the property, which shall be used for purposes of determining our NAV. This is true whether the acquisition is funded with cash, equity or a combination thereof. When we obtain the first appraisal performed by the Independent Valuation Advisor on a property, it may not appraise at a value equal to the purchase price, which could negatively affect our NAV. Large portfolio acquisitions, in particular, may require a “portfolio premium” to be paid by us in order to be a competitive bidder, and this “portfolio premium” may not be taken into consideration in calculating our NAV. We may make acquisitions (with cash or equity) of any size without stockholder approval, and such acquisitions may be dilutive or accretive to our NAV. In addition, acquisition expenses we incur in connection with new acquisitions will negatively impact our NAV.

The NAV per share that we publish may not necessarily reflect changes in our NAV that are not immediately quantifiable.

From time to time, we may experience events with respect to our investments that may have a material impact on our NAV. For example, and not by way of limitation, changes in governmental rules, regulations and fiscal policies, environmental legislation, acts of God, terrorism, social unrest, civil disturbances and major disturbances in financial markets may cause the value of a property to change materially. Similarly, negotiations, disputes and litigation that involve us and other parties may ultimately have a positive or negative impact on our NAV. The NAV per share of each class of our common stock as published for any given month may not reflect such extraordinary events to the extent that their financial impact is not immediately quantifiable. As a result, the NAV per share that we publish may not necessarily reflect changes in our NAV that are not immediately quantifiable, and the NAV per share of each class published after the announcement of a material event may differ significantly from our actual NAV per share for such class until such time as the financial impact is quantified and our NAV is appropriately adjusted in accordance with our valuation guidelines. The resulting potential disparity in our NAV may inure to the benefit of stockholders submitting for repurchase or stockholders not submitting for repurchase and new purchasers of our common stock, depending on whether our published NAV per share for such class is overstated or understated.

The realizable value of specific properties may change before the value is adjusted by the Independent Valuation Advisor and reflected in the calculation of our NAV.

Our valuation guidelines generally provide that the Independent Valuation Advisor will adjust a real property’s valuation, as necessary, based on known events that have a material impact on the most recent value (adjustments for non-material events may also be made). We are dependent on our advisor to be reasonably aware of material events specific to our properties (such as tenant disputes, damage, litigation and environmental issues, as well as positive events) that may cause the value of a property to change materially and to promptly notify the Independent Valuation Advisor so that the information may be reflected in our real property portfolio valuation. Events may transpire that, for a period of time, are unknown to us or the Independent Valuation Advisor that may affect the value of a property, and until such information becomes known and is processed, the value of such asset may differ from the value used to determine our NAV. In addition, although we may have information that suggests a change in value of a property may have occurred, there may be a delay in the resulting change in value being reflected in our NAV until such information is appropriately reviewed, verified and processed. For example, we may receive an unsolicited offer, from an unrelated third party, to sell one of our assets at a price that is materially different than the price included in our NAV. Or, we may be aware of a change in collection, or a potential contract for capital expenditure. Where possible, adjustments generally are made based on events evidenced by proper final documentation. It is possible that an adjustment to the valuation of a property may occur prior to final documentation if the Independent Valuation Advisor determines that events warrant adjustments to certain assumptions that materially affect value. However, to the extent that an event has not yet become final based on proper documentation, its impact on the value of the applicable property may not be reflected (or may be only partially reflected) in the calculation of our NAV.

NAV calculations are not governed by governmental or independent securities, financial or accounting rules or standards. Our board of directors, including a majority of our independent directors, may adopt changes to the valuation guidelines.

The methods used by our advisor to calculate our NAV, including the components used in calculating our NAV, is not prescribed by rules of the SEC or any other regulatory agency. Further, there are no accounting rules or standards that prescribe which components should be used in calculating NAV, and our NAV is not audited by our independent registered public accounting firm. We calculate and publish our NAV solely for purposes of establishing the price at which we sell and repurchase shares of our common stock, and you should not view our NAV as a measure of our historical or future financial condition or performance. The components and methodology used in calculating our NAV may differ from those used by other companies now or in the future.

In addition, calculations of our NAV, to the extent that they incorporate valuations of our assets and liabilities, are not prepared in accordance with generally accepted accounting principles. These valuations may differ from liquidation values that could be realized in the event that we were forced to sell assets.

Additionally, errors may occur in calculating our NAV, which could impact the price at which we sell and repurchase shares of our common stock and the amount of the advisor’s management fee and the Special Limited Partner’s performance participation interest. If such errors were to occur, our advisor, depending on the circumstances surrounding each error and the extent of any impact the error has on the price at which shares of our common stock were sold or repurchased or on the amount of our advisor’s management fee or the Special Limited Partner’s performance participation interest, may determine in its sole discretion to take certain corrective actions in response to such errors, including, subject to our advisor’s policies and procedures, making adjustments to prior NAV calculations.

Each year our board of directors, including a majority of our independent directors, will review the appropriateness of our valuation guidelines and may, at any time, adopt changes to the valuation guidelines.

We will face significant competition for multifamily apartment communities and multifamily real estate-related assets, which may limit our ability to acquire suitable investments and achieve our investment objectives or make distributions.

We compete to acquire multifamily apartment communities and multifamily real estate-related assets with other REITs, real estate limited partnerships, pension funds and their advisors, bank and insurance company investment accounts, and other entities. Many of our competitors have greater financial resources, and a greater ability to borrow funds to acquire properties, than we do. We cannot be sure that the board of directors and our advisor will be successful in obtaining suitable investments on financially attractive terms or that, if investments are made, our objectives will be achieved.

If we are unable to find suitable investments or if we raise substantial offering proceeds in a short period of time and are unable to invest all of the offering proceeds promptly, we may not be able to achieve our investment objectives or make distributions.

The more money we raise, the greater our challenge will be to invest all of our offering proceeds on attractive terms. If we are unable to promptly find suitable multifamily apartment communities or multifamily real estate-related assets, we will hold the proceeds from our offerings in an interest-bearing account, invest the proceeds in short-term investments, or pay down lines of credit. We could also suffer from delays in locating suitable investments. Our reliance on our advisor and sponsor and the real estate professionals that such persons retain to identify suitable investments for us at times when such persons are simultaneously seeking to identify suitable investments for other affiliated programs could also delay the investment of the proceeds of our offerings. Delays we encounter in the selection and acquisition of income-producing multifamily apartment communities or the acquisition or origination of multifamily real estate-related assets would likely limit our ability to make distributions to you and reduce your overall returns.

Furthermore, where we acquire properties prior to the start of construction or during the early stages of construction, it will typically take several years to complete construction and rent available space. Therefore, you could suffer delays in the receipt of distributions attributable to those particular properties.

Our success is dependent on general market and economic conditions.

The real estate industry generally and the success of our investment activities in particular will both be affected by global and national economic and market conditions generally and by the local economic conditions where our properties are located. These factors may affect the level and volatility of real estate prices, which could impair our profitability or result in losses. In addition, general fluctuations in the market prices of securities and interest rates may affect our investment opportunities and the value of our investments. Our sponsor’s financial condition may be adversely affected by a significant economic downturn and it may be subject to legal, regulatory, reputational and other unforeseen risks that could have a material adverse effect on its businesses and operations (including our advisor).

A recession, slowdown and/or sustained downturn in the U.S. real estate market, and to a lesser extent, the global economy (or any particular segment thereof) would have a pronounced impact on us, the value of our assets and our profitability, impede the ability of our assets to perform under or refinance their existing obligations, and impair our ability to effectively deploy our capital or realize upon investments on favorable terms. We could also be affected by any overall weakening of, or disruptions in, the financial markets. Any of the foregoing events could result in substantial losses to our business, which losses will likely be exacerbated by the presence of leverage in our investments capital structures.

For example, during the financial crisis, the availability of debt financing secured by commercial real estate was significantly restricted as a result of a prolonged tightening of lending standards. Due to the uncertainties created in the credit market, real estate investors were unable to obtain debt financing on attractive terms, which adversely affected investment returns on acquisitions and their ability to even make acquisitions or tenant improvements to existing holdings. Most recently, on March 10, 2023, Silicon Valley Bank (“SVB”) was closed by the California Department of Financial Protection and Innovation, which appointed the FDIC as receiver. Although the Department of the Treasury, the Federal Reserve and the FDIC issued a joint statement on March 12, 2023 that all depositors of SVB would have access to all of their money after only one business day of closure, including funds held in uninsured deposit accounts, if another depository institution is subject to other adverse conditions in the financial or credit markets, it could impact access to our cash or cash equivalents and could adversely impact our operating liquidity and financial performance. In addition, if any parties with whom we conduct business are unable to access funds pursuant to such instruments or lending arrangements with such a financial institution, such parties’ ability to pay their obligations to us or to enter into new commercial arrangements requiring additional payments to us could be adversely affected. Any future financial market disruptions may force us to use a greater proportion of our offering proceeds to finance our acquisitions and fund tenant improvements, reducing the number of acquisitions we would otherwise make.

Recent macroeconomic trends, including inflation and rising interest rates, may adversely affect our business, financial condition and results of operations.

During the year ended December 31, 2022, inflation in the United States accelerated and is currently expected to continue at an elevated level in the near-term. Beginning in 2022, in an effort to combat inflation and restore price stability, the Federal Reserve significantly raised its benchmark federal funds rate, which led to increases in interest rates in the credit markets. The Federal Reserve may continue to raise the federal funds rate, which will likely lead to higher interest rates in the credit markets and the possibility of slowing economic growth and/or a recession. Additionally, U.S. government policies implemented to address inflation, including actions by the Federal Reserve to increase interest rates, could negatively impact consumer spending and adversely impact the broader economy, resulting in job losses for many of our residents.

Rising inflation could also have an adverse impact on our financing costs (either through near-term borrowings on our variable rate debt, including our credit facilities, or refinancing of existing debt at higher interest rates), and general and administrative expenses and property operating expenses, as these costs could increase at a rate higher than our rental and other revenue. To the extent our exposure to increases in interest rates is not eliminated through interest rate caps or other protection agreements, such increases may also result in higher debt service costs, which will adversely affect our cash flows. Historically, during periods of increasing interest rates, real estate valuations have generally decreased due to rising capitalization rates, which tend to move directionally with interest rates. Consequently, prolonged periods of higher interest rates may negatively impact the valuation of our real estate assets. Although the extent of any prolonged periods of higher interest rates remains unknown at this time, negative impacts to our cost of capital may adversely affect our future business plans and growth, at least in the near term.

We may not be able to operate our business successfully or generate sufficient revenue to make or sustain distributions to our stockholders.

We cannot assure you that we will be able to operate our business successfully or implement our operating policies and strategies. We can provide no assurance that our performance will replicate the past performance of CROP, Cottonwood

Residential, CRII or any program sponsored by CROP, Cottonwood Residential, or CRII. Our investment returns could be substantially lower than the returns achieved by CROP, Cottonwood Residential, and CRII. The results of our operations depend on several factors, including the availability of opportunities for the acquisition of target assets, the level and volatility of interest rates, the availability of short and long-term financing, and conditions in the financial markets and economic conditions.

We are dependent upon our advisor and its affiliates and any adverse changes in the financial health of our advisor or its affiliates or our relationship with them could hinder our operating performance and the return on our stockholders’ investment.

We are dependent on our advisor to manage our operations and our portfolio of multifamily apartment communities and multifamily real estate-related assets. Any adverse change in the financial condition of our advisor or our relationship with our advisor could hinder its ability to successfully manage our operations and our portfolio of investments.