UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 333-215435

Cheniere Corpus Christi Holdings, LLC

(Exact name of registrant as specified in its charter)

|

| |

| Delaware | 47-1929160 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

700 Milam Street, Suite 1900

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(713) 375-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| None | None | None |

Securities registered pursuant to Section 12(g) of the Act: None

The registrant meets the conditions set forth in General Instructions I(1)(a) and (b) of Form 10-K and is therefore filing this Form 10-K with the reduced disclosure format.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☒ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Note: The registrant is a voluntary filer not subject to the filing requirements of Sections 13 or 15(d) of the Securities Exchange Act of 1934. However, the registrant has filed all reports required pursuant to Sections 13 or 15(d) during the preceding 12 months as if the registrant was subject to such filing requirements.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | | | |

| | Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| | Non-accelerated filer | ☒ | | Smaller reporting company | ☐ |

| | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates: Not applicable

Indicate the number of shares outstanding of the issuer’s classes of common stock, as of the latest practicable date: Not applicable

Documents incorporated by reference: None

CHENIERE CORPUS CHRISTI HOLDINGS, LLC

TABLE OF CONTENTS

DEFINITIONS

As used in this annual report, the terms listed below have the following meanings:

Common Industry and Other Terms

|

| | |

| Bcf | | billion cubic feet |

| Bcf/d | | billion cubic feet per day |

| Bcf/yr | | billion cubic feet per year |

| Bcfe | | billion cubic feet equivalent |

| DOE | | U.S. Department of Energy |

| EPC | | engineering, procurement and construction |

| FERC | | Federal Energy Regulatory Commission |

| FTA countries | | countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas |

| GAAP | | generally accepted accounting principles in the United States |

| Henry Hub | | the final settlement price (in USD per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin |

| LIBOR | | London Interbank Offered Rate |

| LNG | | liquefied natural gas, a product of natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state |

| MMBtu | | million British thermal units, an energy unit |

| mtpa | | million tonnes per annum |

| non-FTA countries | | countries with which the United States does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted |

| SEC | | U.S. Securities and Exchange Commission |

| SPA | | LNG sale and purchase agreement |

| TBtu | | trillion British thermal units, an energy unit |

| Train | | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG |

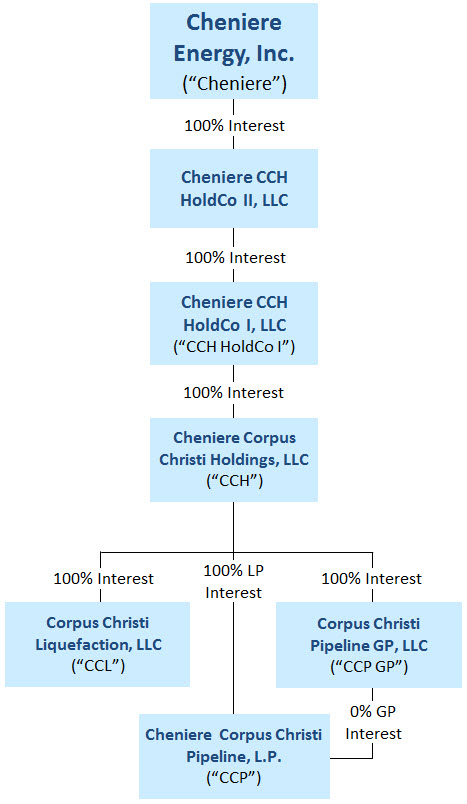

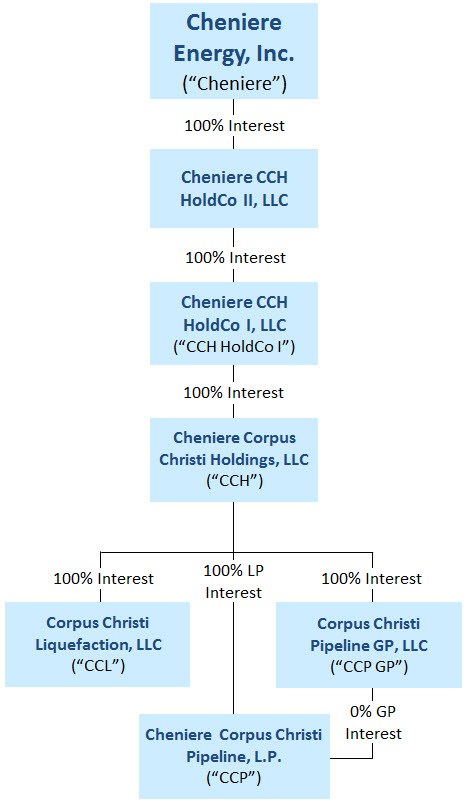

Abbreviated Legal Entity Structure

The following diagram depicts our abbreviated legal entity structure as of December 31, 2019, including our ownership of certain subsidiaries, and the references to these entities used in this annual report:

Unless the context requires otherwise, references to “CCH,” the “Company,” “we,” “us,” and “our” refer to Cheniere Corpus Christi Holdings, LLC and its consolidated subsidiaries.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical or present facts or conditions, included herein or incorporated herein by reference are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

| |

| • | statements that we expect to commence or complete construction of our proposed LNG terminal, liquefaction facility, pipeline facility or other projects, or any expansions or portions thereof, by certain dates, or at all; |

| |

| • | statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products; |

| |

| • | statements regarding any financing transactions or arrangements, or our ability to enter into such transactions; |

| |

| • | statements relating to the construction of our Trains and pipeline, including statements concerning the engagement of any EPC contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; |

| |

| • | statements regarding any SPA or other agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total natural gas liquefaction or storage capacities that are, or may become, subject to contracts; |

| |

| • | statements regarding counterparties to our commercial contracts, construction contracts and other contracts; |

| |

| • | statements regarding our planned development and construction of additional Trains or pipelines, including the financing of such Trains or pipelines; |

| |

| • | statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; |

| |

| • | statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections, or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs and cash flows, any or all of which are subject to change; |

| |

| • | statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; and |

| |

| • | any other statements that relate to non-historical or future information. |

All of these types of statements, other than statements of historical or present facts or conditions, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “achieve,” “anticipate,” “believe,” “contemplate,” “continue,” “estimate,” “expect,” “intend,” “plan,” “potential,” “predict,” “project,” “pursue,” “target,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this annual report are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained in this annual report are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements as a result of a variety of factors described in this annual report and in the other reports and other information that we file with the SEC. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise.

PART I

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

General

Cheniere Corpus Christi Holdings, LLC (“CCH”) is a Delaware limited liability company formed in September 2014 by Cheniere Energy, Inc. (“Cheniere”), a Houston-based energy infrastructure company primarily engaged in LNG-related businesses, to develop, construct, operate, maintain and own natural gas liquefaction and export facilities (the “Liquefaction Facilities”) and a 23-mile natural gas supply pipeline that interconnects the Corpus Christi LNG terminal with several interstate and intrastate natural gas pipelines (the “Corpus Christi Pipeline” and together with the Liquefaction Facilities, the “Liquefaction Project”) near Corpus Christi, Texas, through our subsidiaries Corpus Christi Liquefaction, LLC (“CCL”) and Cheniere Corpus Christi Pipeline, L.P. (“CCP”), respectively.

We are currently operating two Trains and are constructing one additional Train for a total production capacity of approximately 15 mtpa of LNG. The Liquefaction Project, once fully constructed, will contain three LNG storage tanks with aggregate capacity of approximately 10 Bcfe and two marine berths that can each accommodate vessels with nominal capacity of up to 266,000 cubic meters.

Our Business Strategy

Our primary business strategy for the Liquefaction Project is to develop, construct and operate assets supported by long-term, fixed fee contracts. We plan to implement our strategy by:

| |

| • | safely, efficiently and reliably maintaining and operating our assets, including our Trains; |

| |

| • | procuring natural gas and pipeline transport capacity to our facility; |

| |

| • | commencing commercial delivery for our long-term SPA customers, of which we have initiated for three of nine long-term SPA customers as of December 31, 2019; |

| |

| • | completing construction and commencing operation of Train 3 of the Liquefaction Project; |

| |

| ��� | making LNG available to our long-term SPA customers to generate steady and reliable revenues and operating cash flows; |

| |

| • | further expanding and/or optimizing the Liquefaction Project by leveraging existing infrastructure; and |

| |

| • | maintaining a prudent and cost-effective capital structure. |

Our Liquefaction Project

We are currently operating two Trains and one marine berth at the Liquefaction Project and are constructing one additional Train and marine berth. We have received authorization from the FERC to site, construct and operate Trains 1 through 3 of the Liquefaction Project. We completed construction of Trains 1 and 2 of the Liquefaction Project and commenced commercial operating activities in February 2019 and August 2019, respectively. The following table summarizes the project completion and construction status of Train 3 of the Liquefaction Project, including the related infrastructure, as of December 31, 2019:

|

| | | |

| | | Train 3 |

| Overall project completion percentage | | 74.8% |

| Completion percentage of: | | |

| Engineering | | 98.7% |

| Procurement | | 99.5% |

| Subcontract work | | 28.3% |

| Construction | | 49.5% |

| Expected date of substantial completion | | 1H 2021 |

The DOE has authorized the export of domestically produced LNG by vessel from the Corpus Christi LNG terminal to FTA countries for a 25-year term and to non-FTA countries for a 20-year term, both of which commenced in June 2019, up to a combined total of the equivalent of 767 Bcf/yr (approximately 15 mtpa) of natural gas. The terms of each of these authorizations began on the date of first export thereunder.

An application was filed in September 2019 to authorize additional exports from the Liquefaction Project to FTA countries for a 25-year term and to non-FTA countries for a 20-year term in an amount up to the equivalent of approximately 108 Bcf/yr of natural gas, for a total Liquefaction Project export of 875.16 Bcf/yr. The terms of the authorizations are requested to commence on the date of first commercial export from the Liquefaction Project of the volumes contemplated in the application. The application is currently pending before DOE.

Customers

CCL has entered into fixed price long-term SPAs generally with terms of 20 years (plus extension rights) with nine third parties for Trains 1 through 3 of the Liquefaction Project to make available an aggregate amount of LNG that is approximately 70% of the total production capacity from these Trains. Under these SPAs, the customers will purchase LNG from CCL on a free on board (“FOB”) basis for a price consisting of a fixed fee per MMBtu of LNG (a portion of which is subject to annual adjustment for inflation) plus a variable fee per MMBtu of LNG equal to approximately 115% of Henry Hub. The customers may elect to cancel or suspend deliveries of LNG cargoes, with advance notice as governed by each respective SPA, in which case the customers would still be required to pay the fixed fee with respect to the contracted volumes that are not delivered as a result of such cancellation or suspension. We refer to the fee component that is applicable regardless of a cancellation or suspension of LNG cargo deliveries under the SPAs as the fixed fee component of the price under our SPAs. We refer to the fee component that is applicable only in connection with LNG cargo deliveries as the variable fee component of the price under our SPAs. The variable fee under CCL’s SPAs entered into in connection with the development of the Liquefaction Project was sized at the time of entry into each SPA with the intent to cover the costs of gas purchases and transportation and liquefaction fuel to produce the LNG to be sold under each such SPA. The SPAs and contracted volumes to be made available under the SPAs are not tied to a specific Train; however, the term of each SPA generally commences upon the date of first commercial delivery for the applicable Train, as specified in each SPA.

In aggregate, the minimum fixed fee portion to be paid by the third-party SPA customers is approximately $550 million for Train 1, increasing to approximately $1.4 billion upon the date of first commercial delivery for Train 2 and further increasing to approximately $1.8 billion following the substantial completion of Train 3 of the Liquefaction Project.

The annual contracted cash flows from fixed fees of each buyer of LNG under CCL’s third-party SPAs that constitute more than 10% of CCL’s aggregate fixed fees under all its SPAs for Trains 1 through 3 of the Liquefaction Project are:

| |

| • | approximately $410 million from Endesa S.A. (“Endesa”); |

| |

| • | approximately $280 million from PT Pertamina (Persero) (“Pertamina”); and |

| |

| • | approximately $270 million from Naturgy LNG GOM, Limited (formerly known as Gas Natural Fenosa LNG GOM, Limited) (“Naturgy”), which is guaranteed by Naturgy Energy Group, S.A. (formerly known as Gas Natural SDG S.A.). |

The average annual contracted cash flow from fixed fees for all of our other SPAs with third-parties is approximately $790 million.

In addition, Cheniere Marketing International LLP (“Cheniere Marketing”), an indirect wholly-owned subsidiary of Cheniere, has agreements with CCL to purchase: (1) 15 TBtu per annum of LNG with an approximate term of 23 years, (2) any LNG produced by CCL in excess of that required for other customers at Cheniere Marketing’s option and (3) 0.85 mtpa of LNG with a term of up to seven years associated with an integrated production marketing (“IPM”) gas supply agreement, as described below.

The following table shows customers with revenues of 10% or greater of total revenues from external customers:

|

| | | | | | |

| | | Percentage of Total Revenues from External Customers |

| | | Year Ended December 31, |

| | | 2019 | | 2018 | | 2017 |

| Endesa | | 57% | | —% | | —% |

| Pertamina | | 23% | | —% | | —% |

Natural Gas Transportation, Storage and Supply

To ensure CCL is able to transport adequate natural gas feedstock to the Corpus Christi LNG terminal, it has entered into transportation precedent agreements to secure firm pipeline transportation capacity with CCP and certain third-party pipeline companies. CCL has entered into a firm storage services agreement with a third party to assist in managing variability in natural gas needs for the Liquefaction Project. CCL has also entered into enabling agreements and long-term natural gas supply contracts with third parties, and will continue to enter into such agreements, in order to secure natural gas feedstock for the Liquefaction Project. As of December 31, 2019, CCL had secured up to approximately 2,999 TBtu of natural gas feedstock through long-term natural gas supply contracts with remaining terms that range up to eight years, a portion of which is subject to the achievement of certain project milestones and other conditions precedent.

A portion of the natural gas feedstock transactions for CCL are IPM transactions, in which the natural gas producers are paid based on a global gas market price less a fixed liquefaction fee and certain costs incurred by us.

Construction

CCL entered into separate lump sum turnkey contracts with Bechtel Oil, Gas and Chemicals, Inc. (“Bechtel”) for the engineering, procurement and construction of Trains 1 through 3 of the Liquefaction Project under which Bechtel charges a lump sum for all work performed and generally bears project cost, schedule and performance risk unless certain specified events occur, in which case Bechtel may cause CCL to enter into a change order, or CCL agrees with Bechtel to a change order.

The total contract price of the EPC contract for Train 3, which is currently under construction, is approximately $2.4 billion, reflecting amounts incurred under change orders through December 31, 2019. As of December 31, 2019, we have incurred $2.0 billion under this contract.

Pipeline Facilities

In December 2014, the FERC issued a certificate of public convenience and necessity under Section 7(c) of the Natural Gas Act of 1938, as amended (the “NGA”), authorizing CCP to construct and operate the Corpus Christi Pipeline. The Corpus Christi Pipeline is designed to transport 2.25 Bcf/d of natural gas feedstock required by the Liquefaction Project from the existing regional natural gas pipeline grid. The construction of the Corpus Christi Pipeline was completed in the second quarter of 2018.

Governmental Regulation

The Liquefaction Project is subject to extensive regulation under federal, state and local statutes, rules, regulations and laws. These laws require that we engage in consultations with appropriate federal and state agencies and that we obtain and maintain applicable permits and other authorizations. These regulatory requirements increase the cost of construction and operation, and failure to comply with such laws could result in substantial penalties and/or loss of necessary authorizations.

Federal Energy Regulatory Commission

The design, construction, operation, maintenance and expansion of the Liquefaction Project, the import or export of LNG and the purchase and transportation of natural gas in interstate commerce through the Corpus Christi Pipeline are highly regulated activities subject to the jurisdiction of the FERC pursuant to the NGA. Under the NGA, the FERC’s jurisdiction generally extends to the transportation of natural gas in interstate commerce, to the sale for resale of natural gas in interstate commerce, to natural gas companies engaged in such transportation or sale, and to the construction, operation, maintenance and expansion of LNG terminals and interstate natural gas pipelines.

The FERC’s authority to regulate interstate natural gas pipelines and the services that they provide generally includes regulation of:

| |

| • | rates and charges, and terms and conditions for natural gas transportation, storage and related services; |

| |

| • | the certification and construction of new facilities and modification of existing facilities; |

| |

| • | the extension and abandonment of services and facilities; |

| |

| • | the administration of accounting and financial reporting regulations, including the maintenance of accounts and records; |

| |

| • | the acquisition and disposition of facilities; |

| |

| • | the initiation and discontinuation of services; and |

Under the NGA, our pipeline is not permitted to unduly discriminate or grant undue preference as to rates or the terms and conditions of service to any shipper, including its own marketing affiliate. Those rates, terms and conditions must be public, and on file with FERC. In contrast to pipeline regulation, the FERC does not require LNG terminal owners to provide open-access services at cost-based or regulated rates. Although the provisions that codified FERC’s policy in this area expired on January 1, 2015, we see no indication that the FERC intends to change its policy in this area.

We are permitted to make sales of natural gas for resale in interstate commerce pursuant to a blanket marketing certificate automatically granted by the FERC to our marketing affiliates. Our sales of natural gas will be affected by the availability, terms and cost of pipeline transportation. As noted above, the price and terms of access to pipeline transportation are subject to extensive federal and state regulation.

In order to site, construct and operate the Corpus Christi LNG terminal, we received and are required to maintain authorizations from the FERC under Section 3 of the NGA as well as other material governmental and regulatory approvals and permits. The Energy Policy Act of 2005 (the “EPAct”) amended Section 3 of the NGA to establish or clarify the FERC’s exclusive authority to approve or deny an application for the siting, construction, expansion or operation of LNG terminals, unless specifically provided otherwise in the EPAct, amendments to the NGA. For example, nothing in the EPAct amendments to the NGA were intended to affect otherwise applicable law related to any other federal agency’s authorities or responsibilities related to LNG terminals or those of a state acting under federal law.

In December 2014, the FERC issued an order granting CCL authorization under Section 3 of the NGA to site, construct and operate Trains 1 through 3 of the Liquefaction Project and issued a certificate of public convenience and necessity under Section 7(c) of the NGA authorizing construction and operation of the Corpus Christi Pipeline (the “December 2014 Order”). A party to the proceeding requested a rehearing of the December 2014 Order, and in May 2015, the FERC denied rehearing (the “Order Denying Rehearing”). The party petitioned the relevant Court of Appeals to review the December 2014 Order and the Order Denying Rehearing; that petition was denied on November 4, 2016. In June of 2018, CCL and CCP filed an application with the FERC for authorization under section 3 of the NGA to site, construct and operate additional facilities for the liquefaction and export of domestically-produced natural gas (“Corpus Christi Stage 3”) at the existing Liquefaction Project, which is being developed by a wholly owned subsidiary of Cheniere that is not owned or controlled by us. In November 2019, the FERC authorized CCP to construct and operate the pipeline for Corpus Christi Stage 3. The order is not subject to appellate court review.

On September 27, 2019, CCL filed a request with the FERC pursuant to section 3 of the NGA, requesting authorization to increase the total LNG production capacity of each terminal from currently authorized levels to an amount which reflects more accurately the capacity of each facility based on enhancements during the engineering, design and construction process, as well as operational experience to date. The requested authorizations do not involve construction of new facilities. Corresponding applications for authorization to export the incremental volumes were also submitted to the DOE.

The FERC’s Standards of Conduct apply to interstate pipelines that conduct transmission transactions with an affiliate that engages in natural gas marketing functions. The general principles of the FERC Standards of Conduct are: (1) independent functioning, which requires transmission function employees to function independently of marketing function employees; (2) no-conduit rule, which prohibits passing transmission function information to marketing function employees; and (3) transparency, which imposes posting requirements to detect undue preference due to the improper disclosure of non-public transmission function information. We have established the required policies, procedures and training to comply with the FERC’s Standards of Conduct.

All of our FERC construction, operation, reporting, accounting and other regulated activities are subject to audit by the FERC, which may conduct routine or special inspections and issue data requests designed to ensure compliance with FERC rules, regulations, policies and procedures. The FERC’s jurisdiction under the NGA allows it to impose civil and criminal penalties for any violations of the NGA and any rules, regulations or orders of the FERC up to $1.3 million per day per violation, including any conduct that violates the NGA’s prohibition against market manipulation.

Several other material governmental and regulatory approvals and permits will be required throughout the life of the Liquefaction Project. In addition, our FERC orders require us to comply with certain ongoing conditions, reporting obligations and maintain other regulatory agency approvals throughout the life of the Liquefaction Project. For example, throughout the life of the Liquefaction Project, we are subject to regular reporting requirements to the FERC, the U.S. Department of Transportation’s (“DOT”) Pipeline and Hazardous Materials Safety Administration (“PHMSA”) and applicable federal and state regulatory agencies regarding the operation and maintenance of our facilities. To date, we have been able to obtain and maintain required approvals as needed, and the need for these approvals and reporting obligations have not materially affected our construction or operations.

DOE Export License

The DOE has authorized the export of domestically produced LNG by vessel from the Corpus Christi LNG terminal as discussed in Our Liquefaction Project. Although it is not expected to occur, the loss of an export authorization could be a force majeure event under our SPAs.

Under Section 3 of the NGA applications for exports of natural gas to FTA countries, which allow for national treatment for trade in natural gas, are “deemed to be consistent with the public interest” and shall be granted by the DOE without “modification or delay.” FTA countries currently recognized by the DOE for exports of LNG include Australia, Bahrain, Canada, Chile, Colombia, Dominican Republic, El Salvador, Guatemala, Jordan, Mexico, Morocco, Nicaragua, Oman, Panama, Peru, Republic of Korea and Singapore. Applications for export of LNG to non-FTA countries are considered by the DOE in a notice and comment proceeding whereby the public and other interveners are provided the opportunity to comment and may assert that such authorization would not be consistent with the public interest.

Pipeline and Hazardous Materials Safety Administration

The Liquefaction Project is subject to regulation by PHMSA. PHMSA is authorized by the applicable pipeline safety laws to establish minimum safety standards for certain pipelines and LNG facilities. The regulatory standards PHMSA has established are applicable to the design, installation, testing, construction, operation, maintenance and management of natural gas and hazardous liquid pipeline facilities and LNG facilities that affect interstate or foreign commerce. PHMSA has also established training, worker qualification and reporting requirements.

In October 2019, PHMSA published final rules revising its regulations governing the safety of certain gas transmission pipelines (effective July 1, 2020) and established new enforcement procedures for the issuance of temporary emergency orders (effective December 2, 2019).

PHMSA performs inspections of pipeline and LNG facilities and has authority to undertake enforcement actions, including issuance of civil penalties up to approximately $218,000 per day per violation, with a maximum administrative civil penalty of approximately $2 million for any related series of violations.

Other Governmental Permits, Approvals and Authorizations

Construction and operation of the Liquefaction Project requires additional permits, orders, approvals and consultations to be issued by various federal and state agencies, including the DOT, U.S. Army Corps of Engineers (“USACE”), U.S. Department of Commerce, National Marine Fisheries Services, U.S. Department of the Interior, U.S. Fish and Wildlife Service, the U.S. Environmental Protection Agency (the “EPA”), U.S. Department of Homeland Security, the Texas Commission on Environmental Quality (“TCEQ”) and the Railroad Commission of Texas (“RRC”).

The USACE issues its permits under the authority of the Clean Water Act (Section 404) and the Rivers and Harbors Act (Section 10) (the “Section 10/404 Permit”). The EPA administers the Clean Air Act, and has delegated authority to the TCEQ to issue the Title V Operating Permit (the “Title V Permit”) and the Prevention of Significant Deterioration Permit (the “PSD Permit”). These two permits are issued by the TCEQ.

Commodity Futures Trading Commission (“CFTC”)

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) amended the Commodity Exchange Act to provide for federal regulation of the over-the-counter derivatives market and entities, such as us, that participate in that market. The regulatory regime created by the Dodd-Frank Act is designed primarily to (1) regulate certain participants in the swaps markets, including entities falling within the categories of “Swap Dealer” and “Major Swap Participant,” (2) require clearing and exchange trading of standardized swaps of certain classes as designated by the CFTC, (3) increase swap market transparency through robust reporting and recordkeeping requirements, (4) reduce financial risks in the derivatives market by imposing margin or collateral requirements on both cleared and, in certain cases, uncleared swaps, (5) provide the CFTC with expanded authority to establish position limits on certain physical commodity futures and options contracts and their economically equivalent swaps as it finds necessary and appropriate and (6) otherwise enhance the rulemaking and enforcement authority of the CFTC and the SEC regarding the derivatives markets. Most of the regulations are already in effect, while other rules and regulations, including the proposed margin rules, position limits and commodity clearing requirements, remain to be finalized or effectuated. Therefore, the impact of those rules and regulations on our business continues to be uncertain.

A provision of the Dodd-Frank Act requires the CFTC, in order to diminish or prevent excessive speculation in commodity markets, to adopt rules, as it finds necessary and appropriate, imposing new position limits on certain physical commodity futures contracts and options thereon, as well as economically equivalent swaps traded on registered swap trading platforms and on over-the-counter swaps that perform a significant price discovery function with respect to certain markets. In that regard, the CFTC has re-proposed position limits rules that would modify and expand the applicability of limits on speculative positions in certain physical commodity futures contracts and economically equivalent futures, options and swaps for or linked to certain physical commodities, including Henry Hub natural gas, that market participants may hold, subject to limited exemptions for certain bona fide hedging and other types of transactions. It is uncertain at this time whether, when and in what form the CFTC’s proposed new position limits rules may become final and effective.

Pursuant to rules adopted by the CFTC, certain interest rate swaps and index credit default swaps must be cleared through a derivatives clearing organization and executed on an exchange or swap execution facility. The CFTC has not yet proposed to designate swaps in any other asset classes, including swaps relating to physical commodities, for mandatory clearing and trade execution, but could do so in the future. Although we expect to qualify for the end-user exception from the mandatory clearing and exchange-trading requirements applicable to any swaps that we enter into to hedge our commercial risks, the mandatory clearing and exchange-trading requirements may apply to other market participants, including our counterparties (who may be registered as Swap Dealers), with respect to other swaps, and the application of such rules may change the market cost and general availability in the market of swaps of the type we enter into to hedge our commercial risks and, thus, the cost and availability of the swaps that we use for hedging.

As required by provisions of the Dodd-Frank Act, the CFTC and federal banking regulators have adopted rules to require Swap Dealers and Major Swap Participants, including those that are regulated financial institutions, to collect initial and/or variation margin with respect to uncleared swaps from their counterparties that are financial end users, registered swap dealers or major swap participants. These rules do not require collection of margin from non-financial-entity end users who qualify for the end user exception from the mandatory clearing requirement or from non-financial end users or certain other counterparties in certain instances. We expect to qualify as such a non-financial-entity end user with respect to the swaps that we enter into to hedge our commercial risks.

Any new rules or changes to existing rules promulgated under the Dodd-Frank Act could (1) impair the availability of derivatives, (2) materially increase the cost of, or decrease the liquidity of, the derivatives we use to hedge, (3) significantly alter the terms and conditions of derivatives and (4) potentially increase our exposure to less creditworthy counterparties. Further, any resulting reduction in the use of derivatives could make cash flow more volatile and less predictable, which in turn could adversely affect our ability to plan for and fund capital expenditures.

Pursuant to the Dodd-Frank Act, the CFTC has adopted additional anti-manipulation and anti-disruptive trading practices regulations that prohibit, among other things, manipulative, deceptive or fraudulent schemes or material misrepresentation in the futures, options, swaps and cash markets. In addition, separate from the Dodd-Frank Act, our use of futures and options on commodities is subject to the Commodity Exchange Act and CFTC regulations, as well as the rules of futures exchanges on which any of these instruments are executed. Should we violate any of these laws and regulations, we could be subject to a CFTC or an exchange enforcement action and material penalties, possibly resulting in changes in the rates we can charge.

Environmental Regulation

The Liquefaction Project is subject to various federal, state and local laws and regulations relating to the protection of the environment and natural resources. These environmental laws and regulations require significant expenditures for compliance, can affect the cost and output of operations and may impose substantial penalties for non-compliance and substantial liabilities for pollution. Many of these laws and regulations, such as those noted below, restrict or prohibit impacts to the environment or the types, quantities and concentration of substances that can be released into the environment and can lead to substantial administrative, civil and criminal fines and penalties for non-compliance.

Clean Air Act (“CAA”)

The Liquefaction Project is subject to the federal CAA and comparable state and local laws. We may be required to incur certain capital expenditures over the next several years for air pollution control equipment in connection with maintaining or obtaining permits and approvals addressing air emission-related issues. We do not believe, however, that our operations, or the construction and operations of our liquefaction facilities, will be materially and adversely affected by any such requirements.

In 2009, the EPA promulgated and finalized the Mandatory Greenhouse Gas Reporting Rule requiring annual reporting of greenhouse gas (“GHG”) emissions from stationary sources in a variety of industries. In 2010, the EPA expanded the rule to include reporting obligations for LNG terminals. In addition, the EPA has defined GHG emissions thresholds that would subject GHG emissions from new and modified industrial sources to regulation if the source is subject to PSD Permit requirements due to its emissions of non-GHG criteria pollutants. While the EPA subsequently took a number of additional actions primarily relating to GHG emissions from the electric power generation and the oil and gas exploration and production industries, those rules have largely been stayed or repealed including by amendments adopted by the EPA on February 23, 2018, additional proposed amendments to new source performance standards for the oil and gas industry on September 24, 2019, and the EPA’s June 19, 2019 adoption of the Affordable Clean Energy rule for power generation.

From time to time, Congress has considered proposed legislation directed at reducing GHG emissions. In addition, many states have already taken regulatory action to monitor and/or reduce emissions of GHGs, primarily through the development of GHG emission inventories or regional GHG cap and trade programs. It is not possible at this time to predict how future regulations or legislation may address GHG emissions and impact our business. However, future regulations and laws could result in increased compliance costs or additional operating restrictions and could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Coastal Zone Management Act (“CZMA”)

The siting and construction of the Corpus Christi LNG terminal within the coastal zone is subject to the requirements of the CZMA. The CZMA is administered by the states (in Texas, by the General Land Office). This program is implemented to ensure that impacts to coastal areas are consistent with the intent of the CZMA to manage the coastal areas.

Clean Water Act (“CWA”)

The Liquefaction Project is subject to the federal CWA and analogous state and local laws. The CWA imposes strict controls on the discharge of pollutants into the navigable waters of the United States, including discharges of wastewater and storm water runoff and fill/discharges into waters of the United States. Permits must be obtained prior to discharging pollutants into state and federal waters. The CWA is administered by the EPA, the USACE and by the states (in Texas, by the TCEQ).

Resource Conservation and Recovery Act (“RCRA”)

The federal RCRA and comparable state statutes govern the generation, handling and disposal of solid and hazardous wastes and require corrective action for releases into the environment. When such wastes are generated in connection with the operations of our facilities, we are subject to regulatory requirements affecting the handling, transportation, treatment, storage and disposal of such wastes.

Protection of Species, Habitats and Wetlands

Various federal and state statutes, such as the Endangered Species Act (the “ESA”), the Migratory Bird Treaty Act (“MBTA”), the CWA and the Oil Pollution Act, prohibit certain activities that may adversely affect endangered or threatened animal, fish and plant species and/or their designated habitats, wetlands, or other natural resources. If our Corpus Christi LNG terminal or the Corpus Christi Pipeline adversely affects a protected species or its habitat, we may be required to develop and follow a plan to avoid those impacts. In that case, siting, construction or operation may be delayed or restricted and cause us to incur increased costs.

In August 2019, the U.S. Fish and Wildlife Service (the “FWS”) announced a series of changes to the rules implementing the ESA, including revisions to the regulations governing interagency cooperation, listing species and delisting critical habitat, and prohibitions related to threatened wildlife and plants. The revisions are intended to streamline these processes and create more flexibility for the FWS when making ESA-related decisions.

In addition, in December 2017, the Department of Interior’s (“DOI’s”) Solicitor’s Office issued an official opinion that the MBTA’s broad prohibition on “taking” migratory birds applies only to affirmative actions and does prohibit incidental harm. In April 2018 the FWS issued guidance consistent with the DOI’s opinion and on January 30, 2020, the FWS issued a proposed rule defining the scope of the MBTA to cover only actions directed at migratory birds, their nests or their eggs.

We do not believe that our operations, or the construction and operations of our Liquefaction Project, will be materially and adversely affected by these recent regulatory actions.

Market Factors and Competition

If and when CCL needs to replace any existing SPA or enter into new SPAs, CCL will compete on the basis of price per contracted volume of LNG with other natural gas liquefaction projects throughout the world. Cheniere is currently constructing and operating natural gas liquefaction facilities in Cameron Parish, Louisiana through its subsidiary Sabine Pass Liquefaction, LLC (“SPL”), which has entered into fixed price SPAs with third parties for the sale of LNG from Trains 1 through 6 of these natural gas liquefaction facilities, and may continue to enter into commercial agreements with respect to this natural gas liquefaction facility that might otherwise have been entered into with respect to Train 3. Revenues associated with any incremental volumes of the Liquefaction Project, including those made available to Cheniere Marketing, will also be subject to market-based price competition. Many of the companies with which we compete are major energy corporations with longer operating histories, more development experience, greater name recognition, greater financial, technical and marketing resources and greater access to markets than us. Our affiliates have proximity to our customers, with offices located in Houston, London, Singapore, Beijing and Tokyo.

Our ability to enter into additional long-term SPAs to underpin the development of additional Trains, sale of LNG by Cheniere Marketing, or development of new projects is subject to market factors. These factors include changes in worldwide supply and demand for natural gas, LNG and substitute products, the relative prices for natural gas, crude oil and substitute products in North America and international markets, the rate of fuel switching for power generation from coal, nuclear or oil to natural gas and economic growth in developing countries. In addition, our ability to obtain additional funding to execute our business strategy is subject to the investment community’s appetite for investment in LNG and natural gas infrastructure and our ability to access capital markets.

We expect that global demand for natural gas and LNG will continue to increase as nations seek more abundant, reliable and environmentally cleaner fuel alternatives to oil and coal. Global demand for natural gas is projected by the International Energy Agency to grow by approximately 27 trillion cubic feet (“Tcf”) between 2018 and 2030 and 39 Tcf between 2018 and 2035. LNG’s share is seen growing from about 11% in 2018 to about 16% of the global gas market in 2030 and 18% in 2035. Wood Mackenzie Limited (“WoodMac”) forecasts that global demand for LNG will increase by approximately 79%, from approximately 316 mtpa, or 15.2 Tcf, in 2018, to approximately 566 mtpa, or 27.2 Tcf, in 2030 and to 678 mtpa or 32.6 Tcf in 2035. WoodMac also forecasts LNG production from existing operational facilities and new facilities already under construction will be able to supply the market with approximately 469 mtpa in 2030, declining to 430 mtpa in 2035. This will result in a market need for construction of an additional approximately 97 mtpa of LNG production by 2030 and about 248 mtpa by 2035. We believe the capital and operating costs of the uncommitted capacity of our Liquefaction Project is competitive with new proposed projects globally and we are well-positioned to capture a portion of this incremental market need.

Our LNG terminal business has limited exposure to the decline in oil prices as we have contracted a significant portion of our LNG production capacity under long-term sale and purchase agreements. These agreements contain fixed fees that are required to be paid even if the customers elect to cancel or suspend delivery of LNG cargoes. As of January 31, 2020, U.S. natural gas prices indicate that LNG exported from the U.S. continues to be competitively priced, supporting the opportunity for U.S. LNG to fill uncontracted future demand through the execution of long-term and medium-term contracting of LNG from our terminal.

Subsidiaries

Our assets are generally held by our subsidiaries. We conduct most of our business through these subsidiaries, including the development, construction and operation of our Liquefaction Project.

Employees

We have no employees. We have contracts with Cheniere and its subsidiaries for operations, maintenance and management services. As of January 31, 2020, Cheniere and its subsidiaries had 1,530 full-time employees, including 330 employees who directly supported the Liquefaction Project. See Note 12—Related Party Transactions of our Notes to Consolidated Financial Statements for a discussion of the services agreements pursuant to which general and administrative services are provided to CCL and CCP.

Available Information

Our principal executive offices are located at 700 Milam Street, Suite 1900, Houston, Texas 77002, and our telephone number is (713) 375-5000. Our internet address is www.cheniere.com. We provide public access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports as soon as reasonably practicable after we electronically file those materials with, or furnish those materials to, the SEC under the Exchange Act. These reports may be accessed free of charge through our internet website. We make our website content available for informational purposes only. The website should not be relied upon for investment purposes and is not incorporated by reference into this Form 10-K. The SEC maintains an internet site (www.sec.gov) that contains reports and other information regarding issuers.

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates or expectations contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, contracts, financial condition, operating results, cash flows, liquidity and prospects.

The risk factors in this report are grouped into the following categories:

| |

| • | Risks Relating to Our Financial Matters; and |

| |

| • | Risks Relating to the Completion of Our Liquefaction Facilities and the Development and Operation of Our Business. |

Risks Relating to Our Financial Matters

Our existing level of cash resources, operating cash flow and significant debt could cause us to have inadequate liquidity and could materially and adversely affect our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

As of December 31, 2019, we had no cash and cash equivalents, $79.7 million of current restricted cash and $10.2 billion of total debt outstanding on a consolidated basis (before unamortized debt issuance costs), excluding $470.8 million of outstanding letters of credit. We incur, and will incur, significant interest expense relating to the assets at the Liquefaction Project. Our ability to refinance our indebtedness will depend on our ability to access the capital markets. A variety of factors beyond our control could impact the availability or cost of capital, including domestic or international economic conditions, increases in key benchmark interest rates and/or credit spreads, the adoption of new or amended banking or capital market laws or regulations and the repricing of market risks and volatility in capital and financial markets. Our financing costs could increase or future borrowings or equity offerings may be unavailable to us or unsuccessful, which could cause us to be unable to pay or refinance our indebtedness or to fund our other liquidity needs.

We have not always been profitable historically, and we have not historically had positive operating cash flow. We may not achieve profitability or generate positive operating cash flow in the future.

We had net losses of $374.3 million and $48.7 million for the years ended December 31, 2019 and 2017, respectively. In addition, our net cash flow used in operating activities was $33.4 million, $60.2 million and $64.3 million for the years ended December 31, 2019, 2018 and 2017, respectively. In the future, we may incur operating losses and experience negative operating cash flow. We may not be able to reduce costs, increase revenues or reduce our debt service obligations sufficiently to maintain our cash resources, which could cause us to have inadequate liquidity to continue our business.

We will continue to incur significant capital and operating expenditures while we develop and construct the Liquefaction Project. Any delays beyond the expected development period for Train 3 could cause operating losses and negative operating cash flows. Our future liquidity may also be affected by the timing of receipt of cash flows under SPAs in relation to the incurrence of project and operating expenses. Moreover, many factors (including factors beyond our control) could result in a disparity between liquidity sources and cash needs, including factors such as construction delays and breaches of agreements. Our ability to generate any significant positive operating cash flow and achieve profitability in the future is dependent on our ability to successfully and timely complete the applicable Train.

Our ability to generate cash is substantially dependent upon the performance by customers under long-term contracts that we have entered into, and we could be materially and adversely affected if any customer fails to perform its contractual obligations for any reason.

Our future results and liquidity are substantially dependent upon performance by our customers to make payments under long-term contracts. As of December 31, 2019, we had SPAs with nine third-party customers. We are dependent on each customer’s continued willingness and ability to perform its obligations under its SPA. We are exposed to the credit risk of any guarantor of these customers’ obligations under their respective SPA in the event that we must seek recourse under a guaranty. If any customer fails to perform its obligations under its SPA, our business, contracts, financial condition, operating results, cash flow, liquidity and prospects could be materially and adversely affected, even if we were ultimately successful in seeking damages from that customer or its guarantor for a breach of the SPA.

Each of our customer contracts is subject to termination under certain circumstances.

Each of our SPAs contains various termination rights allowing our customers to terminate their SPAs, including, without limitation: (1) upon the occurrence of certain events of force majeure; (2) if we fail to make available specified scheduled cargo quantities; and (3) delays in the commencement of commercial operations. We may not be able to replace these SPAs on desirable terms, or at all, if they are terminated.

Our use of hedging arrangements may adversely affect our future operating results or liquidity.

To reduce our exposure to fluctuations in the price, volume and timing risk associated with the purchase of natural gas, we use futures, swaps and option contracts traded or cleared on the Intercontinental Exchange and the New York Mercantile Exchange or over-the-counter options and swaps with other natural gas merchants and financial institutions. Hedging arrangements could expose us to risk of financial loss in some circumstances, including when:

| |

| • | expected supply is less than the amount hedged; |

| |

| • | the counterparty to the hedging contract defaults on its contractual obligations; or |

| |

| • | there is a change in the expected differential between the underlying price in the hedging agreement and actual prices received. |

The use of derivatives also may require the posting of cash collateral with counterparties, which can impact working capital when commodity prices change.

The regulatory and other provisions of the Dodd-Frank Act and the rules adopted thereunder and other regulations could adversely affect our ability to hedge risks associated with our business and our operating results and cash flows.

The provisions of the Dodd-Frank Act and the rules adopted and to be adopted by the CFTC, the SEC and other federal regulators establishing federal regulation of the over-the-counter (“OTC”) derivatives market and entities like us that participate

in that market may adversely affect our ability to manage certain of our risks on a cost effective basis. Such laws and regulations may also adversely affect our ability to execute our strategies with respect to hedging our exposure to variability in expected future cash flows attributable to the future sale of our LNG inventory and to price risk attributable to future purchases of natural gas to be utilized as fuel to operate our LNG terminal and to secure natural gas feedstock for our liquefaction facilities.

The CFTC has re-proposed position limits rules that would modify and expand the applicability of position limits on the amounts of certain speculative futures contracts, as well as economically equivalent options, futures and swaps for or linked to certain physical commodities, including Henry Hub natural gas, that market participants may hold, subject to limited exemptions for certain bona fide hedging positions and other types of transactions. To the extent the revised CFTC position limits proposal becomes final, our ability to execute our hedging strategies described above could be limited. It is uncertain at this time whether, when and in what form the CFTC’s proposed new position limits rules may become final and effective.

Under the Dodd-Frank Act and the rules adopted thereunder, certain swaps may be required to be cleared through a derivatives clearing organization. While the CFTC has designated certain interest rate swaps and index credit default swaps for mandatory clearing, it has not yet finalized rules designating any physical commodity swaps, for mandatory clearing or mandatory exchange trading. Further, we qualify for the end-user exception from the mandatory clearing and trade execution requirements for our swaps entered into to hedge our commercial risks. If we fail to qualify for that exception as to any swap we enter into and have to clear that swap through a derivatives clearing organization, we could be required to post margin (or post higher margin than if we entered into an uncleared OTC swap) with respect to such swap, our cost of entering into and maintaining such swap could increase and we would not enjoy the same flexibility with the cleared swaps that we enjoy with the uncleared OTC swaps we enter into. Moreover, the application of the mandatory clearing and trade execution requirements to other market participants, such as swap dealers, may change the market cost and general availability in the market of swaps of the type we enter into to hedge our commercial risks and, thus, the cost and availability of the swaps that we use for hedging.

As required by the Dodd-Frank Act, the CFTC and federal banking regulators have adopted rules to require certain market participants to collect and post initial and/or variation margin with respect to uncleared swaps from their counterparties that are financial end users and certain registered swap dealers and major swap participants. Although we believe we will not be required to post margin with respect to any uncleared swaps we enter into in the future, were we required to post margin as to our uncleared swaps in the future, our cost of entering into and maintaining swaps would be increased. Our counterparties that are subject to the regulations imposing the Basel III capital requirements on them may increase the cost to us of entering into swaps with them or, although not required to collect margin from us under the margin rules, contractually require us to post collateral with them in connection with such swaps in order to offset their increased capital costs or to reduce their capital costs to maintain those swaps on their balance sheets.

The Dodd-Frank Act also imposes other regulatory requirements on swaps market participants, including end users of swaps, such as regulations relating to swap documentation, reporting and recordkeeping, and certain business conduct rules applicable to swap dealers and major swap participants. Together with the Basel III capital requirements on certain swaps market participants, the regulatory requirements of the Dodd-Frank Act and the rules thereunder relating to swaps and derivatives market participants could significantly increase the cost of derivative contracts (including through requirements to post margin or collateral), materially alter the terms of derivative contracts, reduce the availability of derivatives to protect against certain risks that we encounter and reduce our ability to monetize or restructure our existing derivative contracts and to execute our hedging strategies. If, as a result of the swaps regulatory regime discussed above, we were to reduce our use of swaps to hedge our risks, such as commodity price risks that we encounter in our operations, our operating results and cash flows may become more volatile and could be otherwise adversely affected.

The Federal Reserve Board also has proposed rules that would limit certain physical commodity activities of financial holding companies. Such rules, if adopted, may adversely affect our ability to execute our strategies by restricting our available counterparties for certain types of transactions, limiting our ability to obtain certain services, and reducing liquidity in physical and financial markets. It is uncertain at this time whether, when and in what form the Federal Reserve’s proposed rules regarding financial holding companies may become final and effective.

We expect that our hedging activities will remain subject to significant and developing regulations and regulatory oversight. However, the full impact of the various U.S. (and non-U.S.) regulatory developments in connection with these activities will not be known with certainty until such derivatives market regulations are fully implemented and related market practices and structures are fully developed.

Risks Relating to the Completion of Our Liquefaction Facilities and the Development and Operation of Our Business

Our ability to complete construction of the Liquefaction Project depends on our ability to obtain sufficient equity funding to cover the remaining capital costs. If we are unable to obtain sufficient equity funding, we may experience delays in completing, or we may not be able to complete, construction of the Liquefaction Project.

In May 2018, we amended and restated the existing equity contribution agreement with Cheniere (the “Equity Contribution Agreement”) pursuant to which Cheniere agreed to provide cash contributions up to approximately $1.1 billion, not including $2.0 billion previously contributed under the original equity contribution agreement. As of December 31, 2019, we have received $557.9 million in contributions under the Equity Contribution Agreement. Cheniere is only required to make additional contributions under the Equity Contribution Agreement after the commitments under our credit facility (“CCH Credit Facility”) have been reduced to zero and to the extent certain cash flows from operations of the Liquefaction Project are unavailable to fund Liquefaction Project costs.

The insufficiency of equity contributions to meet the equity-funded portion of our finance plan for the remaining costs to construct the Liquefaction Project may cause a delay in development of our Trains and we may not be able to complete Train 3. Even if we are able to obtain alternative equity funding, the funding may be inadequate to cover any increases in costs and may not be sufficient to mitigate the impact of delays in completion of Train 3, which may cause a delay in the receipt of revenues projected therefrom or cause a loss of one or more customers in the event of significant delays. Any significant construction delay, whatever the cause, could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Cost overruns and delays in the completion of one or more Trains, as well as difficulties in obtaining sufficient financing to pay for such costs and delays, could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

The actual construction costs of Train 3 and any additional Trains may be significantly higher than our current estimates as a result of many factors, including change orders under existing or future EPC contracts resulting from the occurrence of certain specified events that may give Bechtel the right to cause us to enter into change orders or resulting from changes with which we otherwise agree. We have already experienced increased costs due to change orders. As construction progresses, we may decide or be forced to submit change orders to our contractor that could result in longer construction periods, higher construction costs or both, including change orders to comply with existing or future environmental or other regulations.

Delays in the construction of one or more Trains beyond the estimated development periods, as well as change orders to the EPC contracts with Bechtel or any future EPC contract related to additional Trains, could increase the cost of completion beyond the amounts that we estimate, which could require us to obtain additional sources of financing to fund our operations until the applicable liquefaction project is fully constructed (which could cause further delays). Our ability to obtain financing that may be needed to provide additional funding to cover increased costs will depend, in part, on factors beyond our control. Accordingly, we may not be able to obtain financing on terms that are acceptable to us, or at all. Even if we are able to obtain financing, we may have to accept terms that are disadvantageous to us or that may have a material adverse effect on our current or future business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We are dependent on Bechtel and other contractors for the successful completion of the Liquefaction Project.

Timely and cost-effective completion of the Liquefaction Project in compliance with agreed specifications is central to our business strategy and is highly dependent on the performance of Bechtel and our other contractors under their agreements. The ability of Bechtel and our other contractors to perform successfully under their agreements is dependent on a number of factors, including their ability to:

| |

| • | design and engineer each Train to operate in accordance with specifications; |

| |

| • | engage and retain third-party subcontractors and procure equipment and supplies; |

| |

| • | respond to difficulties such as equipment failure, delivery delays, schedule changes and failure to perform by subcontractors, some of which are beyond their control; |

| |

| • | attract, develop and retain skilled personnel, including engineers; |

| |

| • | post required construction bonds and comply with the terms thereof; |

| |

| • | manage the construction process generally, including coordinating with other contractors and regulatory agencies; and |

| |

| • | maintain their own financial condition, including adequate working capital. |

Although some agreements may provide for liquidated damages if the contractor fails to perform in the manner required with respect to certain of its obligations, the events that trigger a requirement to pay liquidated damages may delay or impair the operation of the Liquefaction Project, and any liquidated damages that we receive may not be sufficient to cover the damages that we suffer as a result of any such delay or impairment. The obligations of Bechtel and our other contractors to pay liquidated damages under their agreements are subject to caps on liability, as set forth therein.

Furthermore, we may have disagreements with our contractors about different elements of the construction process, which could lead to the assertion of rights and remedies under their contracts and increase the cost of the Liquefaction Project or result in a contractor’s unwillingness to perform further work on the Liquefaction Project. If any contractor is unable or unwilling to perform according to the negotiated terms and timetable of its respective agreement for any reason or terminates its agreement, we would be required to engage a substitute contractor. This would likely result in significant project delays and increased costs, which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We have historically not had any revenues or positive cash flows. Our ability to achieve profitability and generate positive operating cash flow in the future is subject to significant uncertainty.

We will continue to incur significant capital and operating expenditures while we develop and construct the Liquefaction Project. We began to generate cash flow from operations in the first quarter of 2019 when substantial completion of Train 1 was achieved.

Any delays beyond the construction of Train 3 or the development period for any future Train we may develop could result in operating losses and negative operating cash flows. Our future liquidity may also be affected by the timing of construction financing availability in relation to the incurrence of construction costs and other outflows and by the timing of receipt of cash flow under SPAs in relation to the incurrence of project and operating expenses. Moreover, many factors (including factors beyond our control) could result in a disparity between liquidity sources and cash needs, including factors such as construction delays and breaches of agreements. Our ability to generate any significant positive operating cash flows and achieve profitability in the future is dependent on our ability to successfully and timely complete the applicable Train.

We are relying on estimates for the future capacity ratings and performance capabilities of the Liquefaction Project, and these estimates may prove to be inaccurate.

We are relying on third parties, principally Bechtel, for the design and engineering services underlying our estimates of the future capacity ratings and performance capabilities of the Liquefaction Project. If any Train, when actually constructed, fails to have the capacity ratings and performance capabilities that we intend, our estimates may not be accurate. Failure of any of our Trains to achieve our intended capacity ratings and performance capabilities could prevent us from achieving the commercial start dates under our SPAs and could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

If third-party pipelines and other facilities interconnected to our pipeline and facilities are or become unavailable to transport natural gas, this could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We depend upon third-party pipelines and other facilities that provide gas delivery options to our Liquefaction Project. If the construction of new or modified pipeline connections is not completed on schedule or any pipeline connection were to become unavailable for current or future volumes of natural gas due to repairs, damage to the facility, lack of capacity or any other reason, our ability to meet our SPA obligations and continue shipping natural gas from producing regions or to end markets could be restricted, thereby reducing our revenues which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Failure to obtain and maintain approvals and permits from governmental and regulatory agencies with respect to the design, construction and operation of our facilities, the development and operation of our pipeline and the export of LNG could impede operations and construction and could have a material adverse effect on us.

The design, construction and operation of interstate natural gas pipelines, LNG terminal, including the Liquefaction Project and other facilities, and the import and export of LNG and the purchase and transportation of natural gas, are highly regulated activities. Approvals of the FERC and DOE under Section 3 and Section 7 of the NGA, as well as several other material governmental and regulatory approvals and permits, including several under the CAA and the CWA, are required in order to construct and operate an LNG facility and an interstate natural gas pipeline and export LNG. Although the FERC has issued orders under Section 3 of the NGA authorizing the siting, construction and operation of the three Trains and related facilities of the Liquefaction Project and Section 7 of the NGA authorizing the siting, construction and operation of the Corpus Christi Pipeline, the FERC orders require us to comply with certain ongoing conditions and obtain certain additional approvals in conjunction with ongoing construction and operations of the Liquefaction Project. We will be required to obtain similar approvals and permits with respect to any expansion or modification of our liquefaction and pipeline facilities. We cannot control the outcome of the regulatory review and approval processes. Certain of these governmental permits, approvals and authorizations are or may be subject to rehearing requests, appeals and other challenges.

Authorizations obtained from the FERC, DOE and other federal and state regulatory agencies also contain ongoing conditions, and additional approval and permit requirements may be imposed. We do not know whether or when any such approvals or permits can be obtained, or whether any existing or potential interventions or other actions by third parties will interfere with our ability to obtain and maintain such permits or approvals. If we are unable to obtain and maintain the necessary approvals and permits, including as a result of untimely notices or filings, we may not be able to recover our investment in our projects. Additionally, government disruptions, such as a U.S. government shutdown, may delay or halt our ability to obtain and maintain necessary approvals and permits. There is no assurance that we will obtain and maintain these governmental permits, approvals and authorizations, or that we will be able to obtain them on a timely basis, and failure to obtain and maintain any of these permits, approvals or authorizations could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Delays in the completion of Train 3 could lead to reduced revenues or termination of one or more of the SPAs by our customers.

Any delay in completion of Train 3 could cause a delay in the receipt of revenues projected therefrom or cause a loss of one or more customers in the event of significant delays. In particular, each of our SPAs provides that the customer may terminate that SPA if the relevant Train does not timely commence commercial operations. As a result, any significant construction delay, whatever the cause, could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Our Corpus Christi Pipeline and its FERC gas tariffs are subject to FERC regulation.

The Corpus Christi Pipeline is subject to regulation by the FERC under the NGA and the Natural Gas Policy Act of 1978 (the “NGPA”). The FERC regulates the purchase and transportation of natural gas in interstate commerce, including the construction and operation of pipelines, the rates, terms and conditions of service and abandonment of facilities. Under the NGA, the rates charged by the Corpus Christi Pipeline must be just and reasonable, and we are prohibited from unduly preferring or unreasonably discriminating against any person with respect to pipeline rates or terms and conditions of service. If we fail to comply with all applicable statutes, rules, regulations and orders, the Corpus Christi Pipeline could be subject to substantial penalties and fines.

In addition, as a natural gas market participant, should we fail to comply with all applicable FERC-administered statutes, rules, regulations and orders, we could be subject to substantial penalties and fines. Under the EPAct, the FERC has civil penalty authority under the NGA and the NGPA to impose penalties for current violations of up to $1.3 million per day for each violation.

Pipeline safety integrity programs and repairs may impose significant costs and liabilities on us.

The PHMSA requires pipeline operators to develop integrity management programs to comprehensively evaluate certain areas along their pipelines and to take additional measures to protect pipeline segments located in “high consequence areas” where a leak or rupture could potentially do the most harm. As an operator, we are required to:

| |

| • | perform ongoing assessments of pipeline integrity; |

| |

| • | identify and characterize applicable threats to pipeline segments that could impact a “high consequence area”; |

| |

| • | improve data collection, integration and analysis; |

| |

| • | repair and remediate the pipeline as necessary; and |

| |

| • | implement preventative and mitigating actions. |