Cheniere Energy, Inc. Barclays 2020 CEO Energy-Power Conference Jack Fusco, President and CEO September 9, 2020 NYSE American: LNG

Safe Harbor Statements Forward-Looking Statements This presentation contains certain statements that are, or may be deemed to be, “forward-looking • statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E capacities; of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical or • statements regarding our business strategy, our strengths, our business and operation plans or any other plans, present facts or conditions, included or incorporated by reference herein are “forward-looking forecasts, projections or objectives, including anticipated revenues, capital expenditures, maintenance and statements.” Included among “forward-looking statements” are, among other things: operating costs, run-rate SG&A estimates, cash flows, EBITDA, Adjusted EBITDA, distributable cash flow, • statements regarding the ability of Cheniere Energy Partners, L.P. to pay distributions to its unitholders distributable cash flow per share and unit, deconsolidated debt outstanding, and deconsolidated contracted or Cheniere Energy, Inc. to pay dividends to its shareholders or participate in share or unit buybacks; EBITDA, any or all of which are subject to change; • statements regarding Cheniere Energy, Inc.’s or Cheniere Energy Partners, L.P.’s expected receipt of • statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial cash distributions from their respective subsidiaries; items; • statements that Cheniere Energy Partners, L.P. expects to commence or complete construction of its • statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, proposed liquefied natural gas (“LNG”) terminals, liquefaction facilities, pipeline facilities or other requirements, permits, applications, filings, investigations, proceedings or decisions; projects, or any expansions or portions thereof, by certain dates or at all; • statements regarding our anticipated LNG and natural gas marketing activities; • statements that Cheniere Energy, Inc. expects to commence or complete construction of its proposed • statements regarding the outbreak of COVID-19 and its impact on our business and operating results, including LNG terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions any customers not taking delivery of LNG cargoes, the ongoing credit worthiness of our contractual thereof, by certain dates or at all; counterparties, any disruptions in our operations or construction of our Trains and the health and safety of our • statements regarding future levels of domestic and international natural gas production, supply or employees, and on our customers, the global economy and the demand for LNG; and consumption or future levels of LNG imports into or exports from North America and other countries • any other statements that relate to non-historical or future information. worldwide, or purchases of natural gas, regardless of the source of such information, or the These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” transportation or other infrastructure, or demand for and prices related to natural gas, LNG or other “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “goals,” ”guidance,” “opportunities,” hydrocarbon products; “plan,” “potential,” “project,” “propose,” “subject to,” “strategy,” “target,” and similar terms and phrases, or by use of • statements regarding any financing transactions or arrangements, or ability to enter into such future tense. Although we believe that the expectations reflected in these forward-looking statements are reasonable, transactions; they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should • statements regarding the amount and timing of share repurchases; not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. • statements relating to the construction of our proposed liquefaction facilities and natural gas Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a liquefaction trains (“Trains”) and the construction of our pipelines, including statements concerning the variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. and Cheniere Energy engagement of any engineering, procurement and construction ("EPC") contractor or other contractor Partners, L.P. Annual Reports on Form 10-K filed with the SEC on February 25, 2020 and Quarterly Reports on Form and the anticipated terms and provisions of any agreement with any EPC or other contractor, and 10-Q filed with the SEC on April 30, 2020, which are incorporated by reference into this presentation. All forward- anticipated costs related thereto; looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors.” These forward-looking statements are made as of the date of this presentation, and other than as • statements regarding any agreement to be entered into or performed substantially in the future, required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons including any revenues anticipated to be received and the anticipated timing thereof, and statements why actual results may differ, whether as a result of new information, future events or otherwise. regarding the amounts of total LNG regasification, natural gas, liquefaction or storage capacities that are, or may become, subject to contracts; • statements regarding counterparties to our commercial contracts, construction contracts and other Non-GAAP Financial Measures contracts; The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, as amended. A definition of these non-GAAP measures is included in the appendix. • statements regarding our planned development and construction of additional Trains or pipelines, including the financing of such Trains or pipelines; 2

Extraordinary Challenges Reinforce Cheniere’s Resilience and Stability The resilience of our customer-oriented business and the professionalism and resolute focus of the Cheniere workforce continue to deliver outcomes which benefit all of our stakeholders COVID-19 Pandemic Reduced Cargoes Capital Markets Hurricane Laura Prioritizing the health and safety of our Business model operating as designed as Refinanced ~$5B of debt across the All employees safe and no significant workforce while ensuring business customers have exercised right to not lift Cheniere complex while capital markets damage to Sabine Pass continuity some LNG cargoes were under turmoil and the world was working from home Executed hurricane preparedness plan No interruptions to operations at our Reconfirmed FY2020 financial guidance and incident response protocols facilities due to COVID-19 amidst cargo cancellations and market Cost-effectively addressed near-term volatility maturities and higher-cost debt Resumed operations at Sabine Pass ahead Sabine Pass Train 6 completion timeline of plan and with zero safety incidents accelerated to 2H 2022 from 1H 2023 Operated facilities at maximum efficiency Eliminating converts simplifies our with reduced staffing and costs corporate structure and is expected to Meeting all obligations to our foundation Corpus Christi Train 3 commissioning reduce run-rate share count by ~15% and term customers despite downtime ahead of schedule Completed opportunistic maintenance work on all trains, safely and ahead of CCH upgraded to IG by Moody’s schedule 3

Sabine Pass Post Hurricane Laura Picture as of August 27, 2020 4

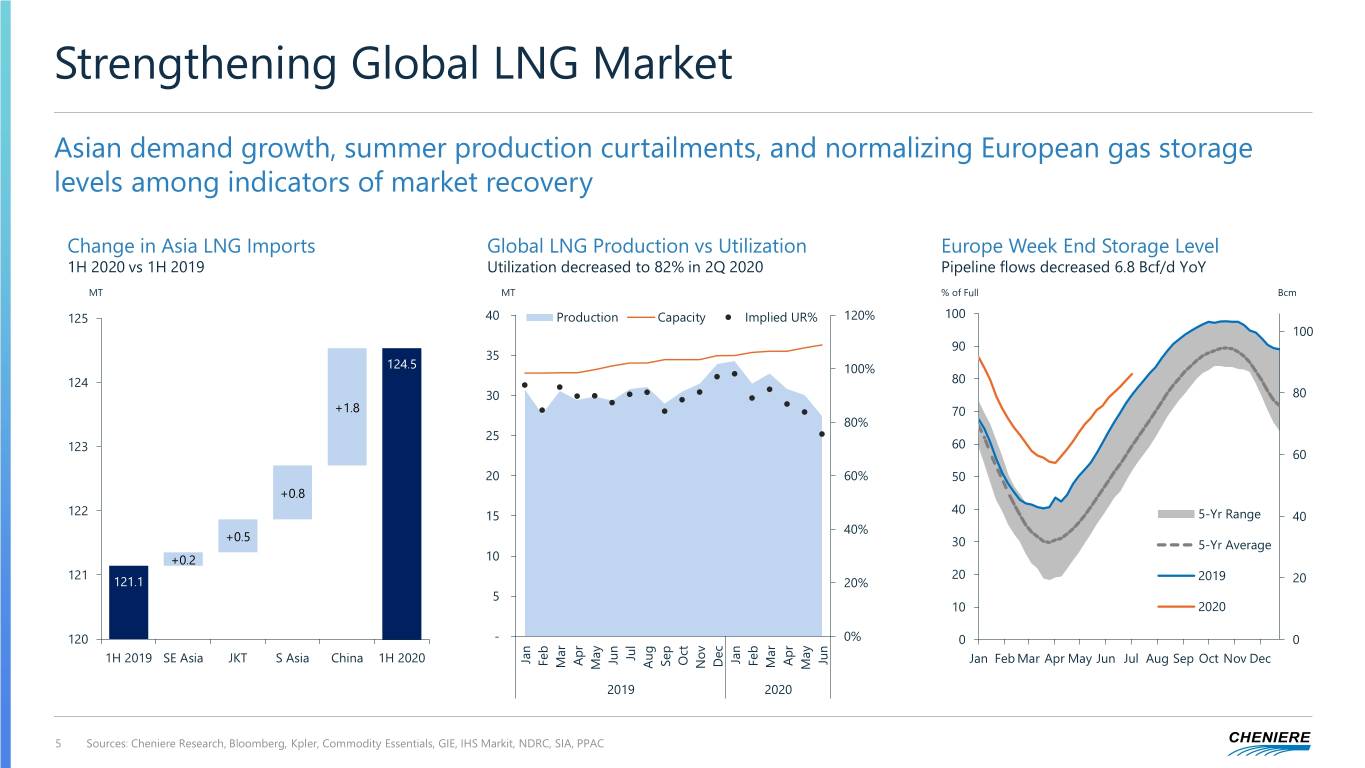

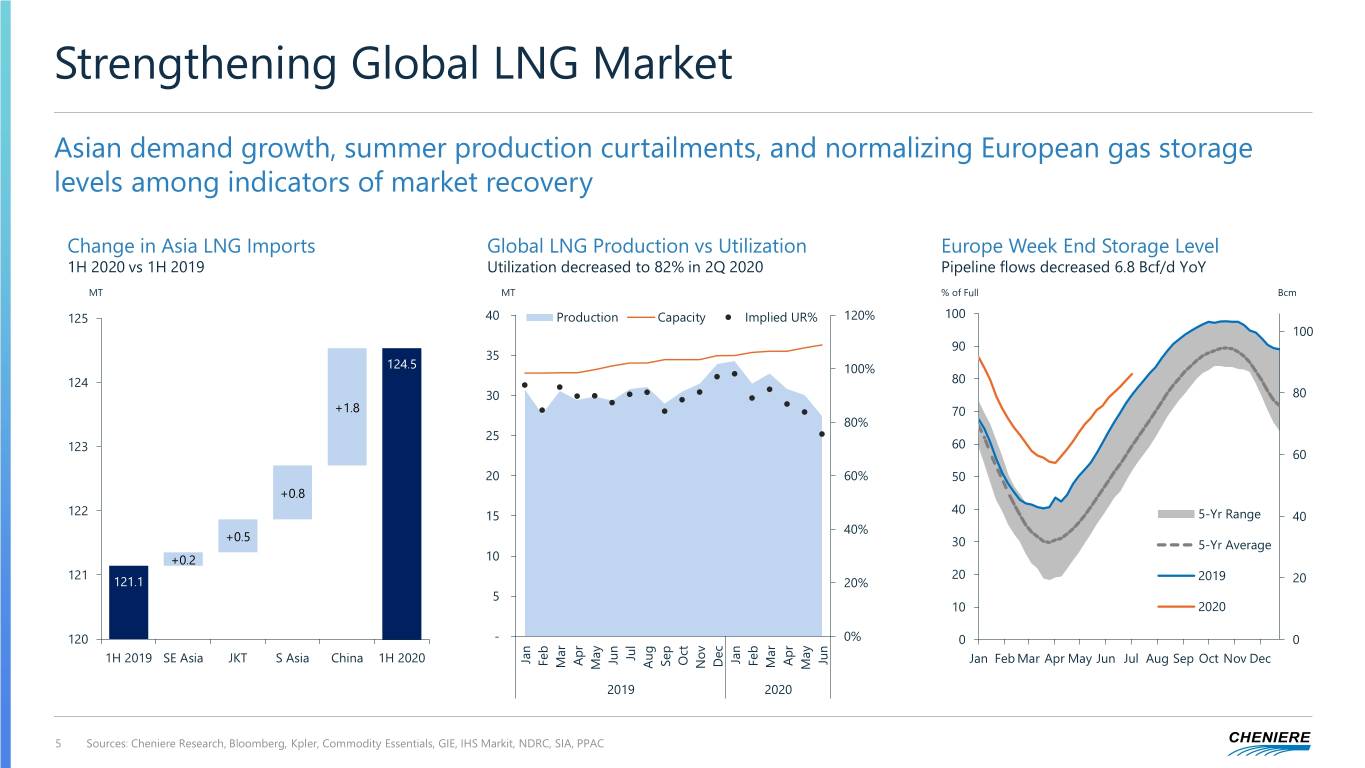

Strengthening Global LNG Market Asian demand growth, summer production curtailments, and normalizing European gas storage levels among indicators of market recovery Change in Asia LNG Imports Global LNG Production vs Utilization Europe Week End Storage Level 1H 2020 vs 1H 2019 Utilization decreased to 82% in 2Q 2020 Pipeline flows decreased 6.8 Bcf/d YoY MT MT % of Full Bcm 125 40 Production Capacity Implied UR% 120% 100 100 90 35 124.5 100% 124 80 30 80 +1.8 70 80% 25 123 60 60 20 60% 50 +0.8 40 122 15 5-Yr Range 40 40% +0.5 30 5-Yr Average +0.2 10 121 20 2019 121.1 20% 20 5 10 2020 120 - 0% 0 0 Jul Jan Jan Jun 1H 2019 SE Asia JKT S Asia China 1H 2020 Jun Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Oct Apr Apr Feb Feb Sep Dec Mar Mar Aug Nov May May 2019 2020 5 Sources: Cheniere Research, Bloomberg, Kpler, Commodity Essentials, GIE, IHS Markit, NDRC, SIA, PPAC

Long-Term LNG Market Fundamentals Intact Global LNG Supply Expected FIDs 2020-2021 Over 100 mtpa of incremental LNG supply needed by 2030 Before and After Market Shocks mtpa mtpa 600 100 ~96 550 Supply New Early 2019 After COVID-19 80 500 LNG Trade Forecast +100 mtpa 450 60 400 Under Construction ~44 40 350 ~30 300 Operational 20 250 ~3 200 0 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2020 2021 Some LNG projects out and others delayed, Over 200 mtpa of global demand tightening mid-2020s market and enhancing growth projected by 2030 Cheniere’s competitive position Source: Wood Mackenzie Global Gas Markets Long-Term Outlook H1 2020 and Bloomberg 6 Note: Expected FIDs estimated by Cheniere Research utilizing project disclosures and sources above

Execution Driving Production and Cash Flow Growth Plant outperformance, maintenance optimization and debottlenecking opportunities have led to higher expected run-rate production levels and increased cash flow generation capability Run-Rate Liquefaction Capacity Per Train1 • Added production increases size of marketing (CMI) ~9% increase in production guidance in three years portfolio • As platform continues to grow, expect to contract more than 85% of total production capacity Jun-19 4.7 5.0 • Open marketing production capacity is strategic for: +9% • Fulfilling third party cargo obligations • Ability to provide bridging volumes to customers Nov-18 4.4 4.9 • Continuing to contract on short, medium, and long- term basis to migrate cash flow from low-multiple spot market to higher multiple contracted market Apr-17 4.3 4.6 4 4.2 4.4 4.6 4.8 5 Production trending toward higher end of 4.7 – 5.0 mtpa per Train range 7 1. Run-rate liquefaction capacity per Train adjusted for the expected impacts of planned and unplanned maintenance, debottlenecking and maintenance optimization, and overdesign.

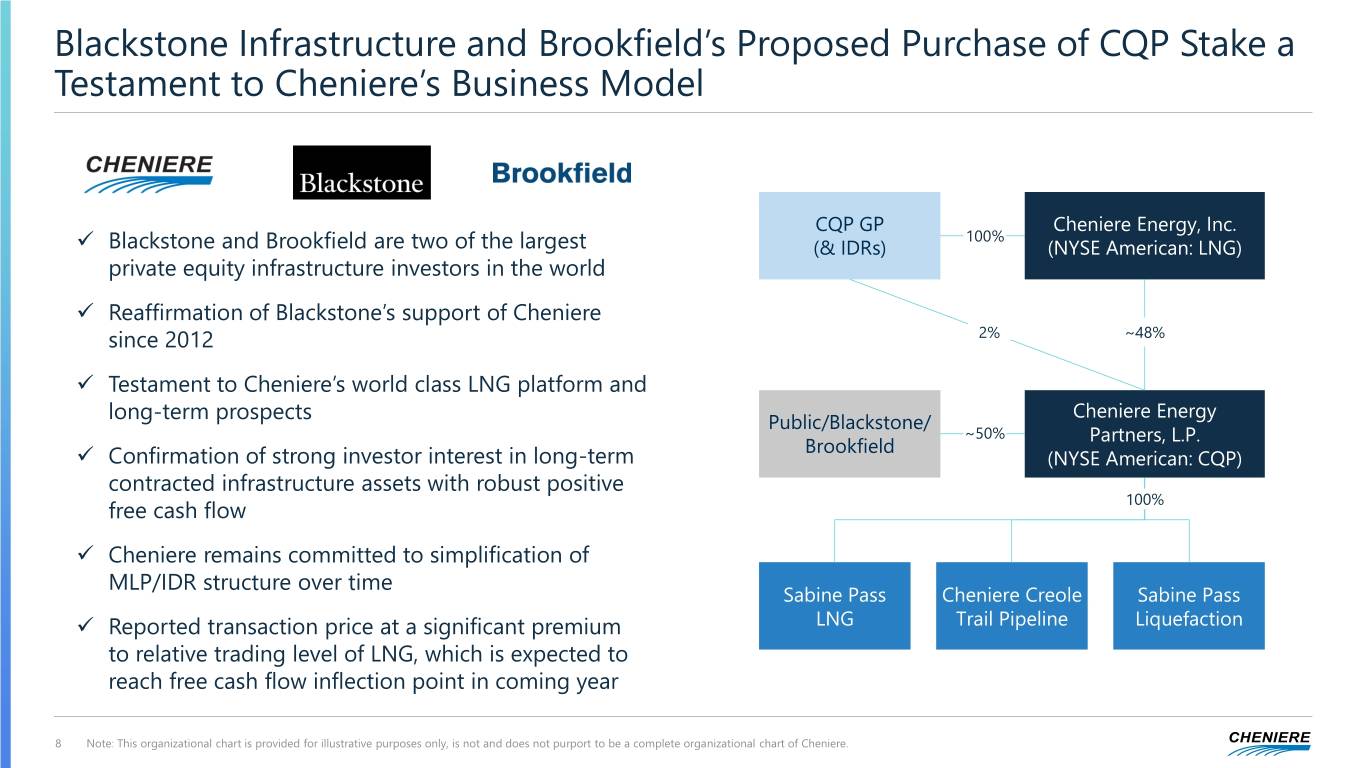

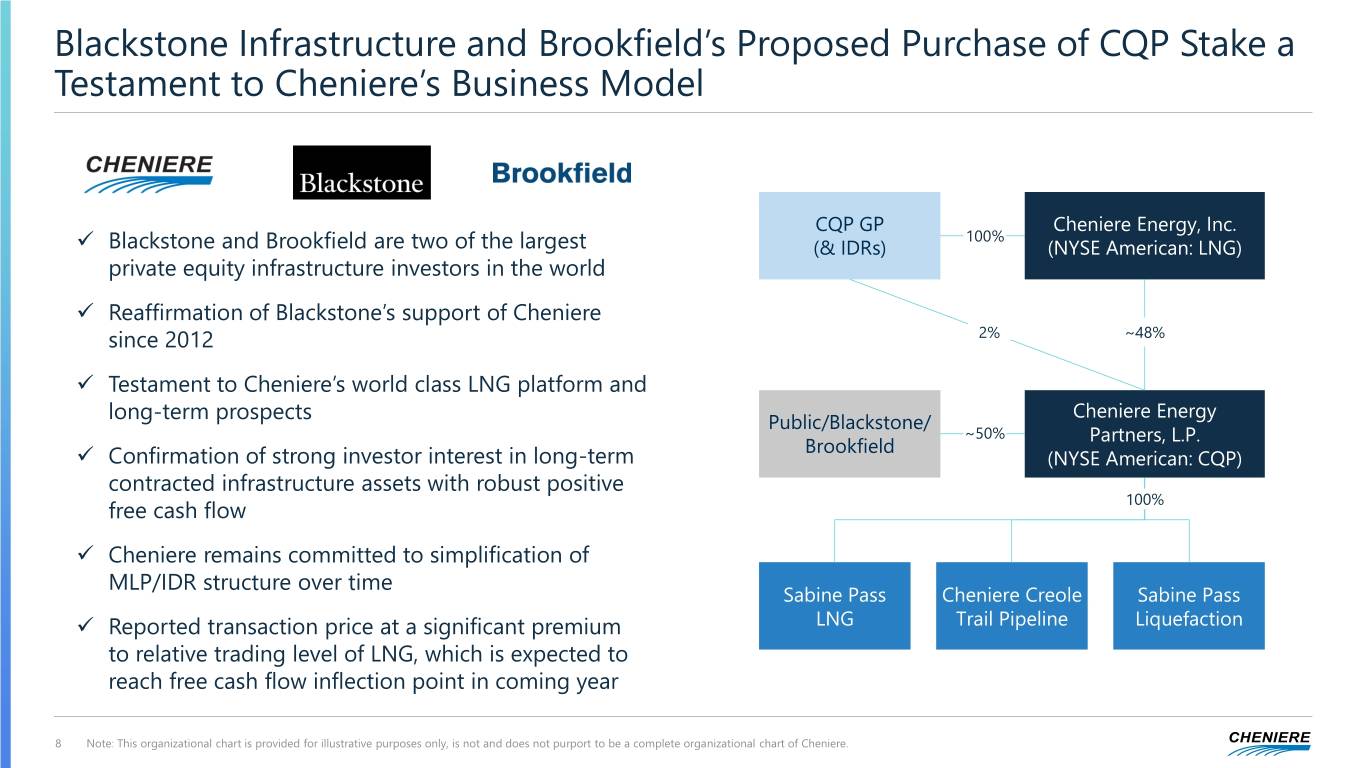

Blackstone Infrastructure and Brookfield’s Proposed Purchase of CQP Stake a Testament to Cheniere’s Business Model CQP GP Cheniere Energy, Inc. 100% ✓ Blackstone and Brookfield are two of the largest (& IDRs) (NYSE American: LNG) private equity infrastructure investors in the world ✓ Reaffirmation of Blackstone’s support of Cheniere since 2012 2% ~48% ✓ Testament to Cheniere’s world class LNG platform and Cheniere Energy long-term prospects Public/Blackstone/ ~50% Partners, L.P. Brookfield ✓ Confirmation of strong investor interest in long-term (NYSE American: CQP) contracted infrastructure assets with robust positive free cash flow 100% ✓ Cheniere remains committed to simplification of MLP/IDR structure over time Sabine Pass Cheniere Creole Sabine Pass ✓ Reported transaction price at a significant premium LNG Trail Pipeline Liquefaction to relative trading level of LNG, which is expected to reach free cash flow inflection point in coming year 8 Note: This organizational chart is provided for illustrative purposes only, is not and does not purport to be a complete organizational chart of Cheniere.

Free Cash Flow Inflection Point Expected in 2021 Completion of Corpus Christi Train 3 expected to reduce capital commitments and increase operational cash flow, leaving significant amount of free cash flow for capital allocation priorities Unlevered Capex Unprecedented 9-train capex program winding down • Less than $0.5bn remaining unlevered capex at CCL Train 3 (1H 2021 completion) SPL CCL • ~$1.0bn remaining unlevered capex at SPL Train 6 (2H 2022 completion) Debt Reduction is Capital Allocation Priority • Capital allocation short- and medium-term to be focused on using excess capital for debt reduction, moving toward investment grade leverage metrics 2015 2016 2017 2018 2019 2020e 2021e 2022e • Target investment-grade rating at Cheniere level in early to mid 2020s CEI Consolidated EBITDA1 Over $10bn of available cash estimated in next 5 years • Once CCL Train 3 operational, free cash flow expected to ramp up at Cheniere level • ~$0.75 of every incremental dollar of CQP distributions goes to Cheniere through IDR structure currently in high splits • Once SPL Train 6 is online, projected ~$2.5-$2.9bn of annual distributable cash flow1 • Sufficient available cash to manage balance sheet, provide capital returns and fund 2015 2016 2017 2018 2019 2020e … Run-rate Stage 3 growth upon commercialization 1. Consolidated Adjusted EBITDA and Distributable Cash Flow are non-GAAP measures. A definition of these non-GAAP measures is included in the appendix. We have not made any forecast of Net income (loss) attributable 9 to common stockholders, the most comparable GAAP measure, on a run-rate basis and we are unable to reconcile differences between forecasts of run-rate distributable cash flow and Net income (loss) attributable to common stockholders.

Cheniere: Resilient. Stable. Flexible. Competitive. • Cheniere’s resilience and stability reinforced amid extraordinary challenges • Supply and demand dynamics in short-term market strengthening • Long-term LNG market fundamentals intact • Cheniere’s competitive position improving as industry projects delayed • Production at Sabine Pass and Corpus Christi at high end of guidance range • Balance sheet management underway progressing toward leverage targets • Positive free cash flow generation inflection point expected in 2021 • Blackstone and Brookfield investment a testament to Cheniere’s business model and long-term stability and prospects 10

Cheniere Energy, Inc. Barclays 2020 CEO Energy-Power Conference Jack Fusco, President and CEO September 9, 2020 NYSE American: LNG

Non-GAAP Measures Regulation G Reconciliations This presentation contains non-GAAP financial measures. Consolidated Adjusted EBITDA, Distributable Cash Flow, Distributable Cash Flow per Share, and Distributable Cash Flow per Unit are non-GAAP financial measures that we use to facilitate comparisons of operating performance across periods. These non-GAAP measures should be viewed as a supplement to and not a substitute for our U.S. GAAP measures of performance and the financial results calculated in accordance with U.S. GAAP and reconciliations from these results should be carefully evaluated. Consolidated Adjusted EBITDA represents net income (loss) attributable to Cheniere before net income (loss) attributable to the non-controlling interest, interest, taxes, depreciation and amortization, adjusted for certain non-cash items, other non-operating income or expense items, and other items not otherwise predictive or indicative of ongoing operating performance, as detailed in the following reconciliation. Consolidated Adjusted EBITDA is not intended to represent cash flows from operations or net income (loss) as defined by U.S. GAAP and is not necessarily comparable to similarly titled measures reported by other companies. We believe Consolidated Adjusted EBITDA provides relevant and useful information to management, investors and other users of our financial information in evaluating the effectiveness of our operating performance in a manner that is consistent with management’s evaluation of business performance. We believe Consolidated Adjusted EBITDA is widely used by investors to measure a company’s operating performance without regard to items such as interest expense, taxes, depreciation and amortization which vary substantially from company to company depending on capital structure, the method by which assets were acquired and depreciation policies. Further, the exclusion of certain non-cash items, other non-operating income or expense items, and items not otherwise predictive or indicative of ongoing operating performance enables comparability to prior period performance and trend analysis. Consolidated Adjusted EBITDA is calculated by taking net income (loss) attributable to common stockholders before net income (loss) attributable to non-controlling interest, interest expense, net of capitalized interest, changes in the fair value and settlement of our interest rate derivatives, taxes, depreciation and amortization, and adjusting for the effects of certain non-cash items, other non-operating income or expense items, and other items not otherwise predictive or indicative of ongoing operating performance, including the effects of modification or extinguishment of debt, impairment expense and loss on disposal of assets, changes in the fair value of our commodity and foreign currency exchange (“FX”) derivatives, non-cash compensation expense, and non-recurring costs related to our response to the COVID-19 outbreak. We believe the exclusion of these items enables investors and other users of our financial information to assess our sequential and year- over-year performance and operating trends on a more comparable basis and is consistent with management’s own evaluation of performance. Distributable Cash Flow is defined as cash received, or expected to be received, from Cheniere’s ownership and interests in CQP and Cheniere Corpus Christi Holdings, LLC, cash received (used) by Cheniere’s integrated marketing function (other than cash for capital expenditures) less interest, taxes and maintenance capital expenditures associated with Cheniere and not the underlying entities. Management uses this measure and believes it provides users of our financial statements a useful measure reflective of our business’s ability to generate cash earnings to supplement the comparable GAAP measure. Distributable Cash Flow per Share and Distributable Cash Flow per Unit are calculated by dividing Distributable Cash Flow by the weighted average number of common shares or units outstanding. We believe Distributable Cash Flow is a useful performance measure for management, investors and other users of our financial information to evaluate our performance and to measure and estimate the ability of our assets to generate cash earnings after servicing our debt, paying cash taxes and expending sustaining capital, that could be used for discretionary purposes such as common stock dividends, stock repurchases, retirement of debt, or expansion capital expenditures. Management uses this measure and believes it provides users of our financial statements a useful measure reflective of our business’s ability to generate cash earnings to supplement the comparable GAAP measure. Distributable Cash Flow is not intended to represent cash flows from operations or net income (loss) as defined by U.S. GAAP and is not necessarily comparable to similarly titled measures reported by other companies. Non-GAAP measures have limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. 12

Investor Relations Contacts Randy Bhatia Vice President, Investor Relations – (713) 375-5479, randy.bhatia@cheniere.com Megan Light Director, Investor Relations – (713) 375-5492, megan.light@cheniere.com ®2020 Cheniere Energy, Inc. Copyrights - All Rights Reserved