UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 333-215435

Cheniere Corpus Christi Holdings, LLC

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 47-1929160 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

845 Texas Avenue, Suite 1250

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(713) 375-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| None | None | None |

Securities registered pursuant to Section 12(g) of the Act: None

The registrant meets the conditions set forth in General Instructions I(1)(a) and (b) of Form 10-K and is therefore filing this Form 10-K with the reduced disclosure format.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☒ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Note: The registrant is a voluntary filer not subject to the filing requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934. However, the registrant has filed all reports required pursuant to Sections 13 or 15(d) during the preceding 12 months as if the registrant was subject to such filing requirements.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates: Not applicable

Indicate the number of shares outstanding of the issuer’s classes of common stock, as of the latest practicable date: Not applicable

Documents incorporated by reference: None

CHENIERE CORPUS CHRISTI HOLDINGS, LLC

TABLE OF CONTENTS

DEFINITIONS

As used in this annual report, the terms listed below have the following meanings:

Common Industry and Other Terms

| | | | | | | | |

| ASU | | Accounting Standards Update |

| Bcf | | billion cubic feet |

| | |

| Bcf/yr | | billion cubic feet per year |

| Bcfe | | billion cubic feet equivalent |

| DAT | | delivered at terminal |

| DOE | | U.S. Department of Energy |

| EPC | | engineering, procurement and construction |

| ESG | | environmental, social and governance |

| FASB | | Financial Accounting Standards Board |

| FERC | | Federal Energy Regulatory Commission |

| FID | | final investment decision |

| FOB | | free-on-board |

| FTA countries | | countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas |

| GAAP | | generally accepted accounting principles in the United States |

| Henry Hub | | the final settlement price (in U.S. dollars per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin |

| IPM agreements | | integrated production marketing agreements in which the gas producer sells to us gas on a global LNG or natural gas index price, less a fixed liquefaction fee, shipping and other costs |

| | |

| LNG | | liquefied natural gas, a product of natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state |

| MMBtu | | million British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| mtpa | | million tonnes per annum |

| | |

| non-FTA countries | | countries with which the United States does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted |

| SEC | | U.S. Securities and Exchange Commission |

| SOFR | | Secured Overnight Financing Rate |

| SPA | | LNG sale and purchase agreement |

| TBtu | | trillion British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| Tcf | | trillion cubic feet |

| Train | | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG |

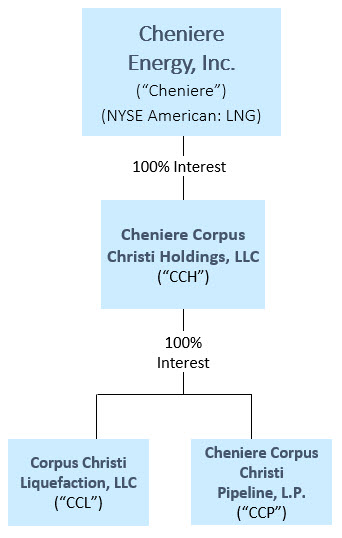

Abbreviated Legal Entity Structure

The following diagram depicts our abbreviated legal entity structure as of December 31, 2024, including our ownership of certain subsidiaries, and the references to these entities used in this annual report:

Unless the context requires otherwise, references to the “Company,” “we,” “us,” and “our” refer to Cheniere Corpus Christi Holdings, LLC and its consolidated subsidiaries.

In June 2022, as part of the internal restructuring of Cheniere’s subsidiaries, Cheniere contributed its equity interest in Corpus Christi Liquefaction Stage III, LLC (“CCL Stage III”), formerly a wholly owned direct subsidiary of Cheniere, to us, and CCL Stage III was subsequently merged with and into CCL, the surviving entity of the merger and our wholly owned subsidiary.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains certain statements that are, or may be deemed to be, “forward-looking statements.” All statements, other than statements of historical or present facts or conditions, included herein or incorporated herein by reference are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

•statements regarding our expected receipt of cash distributions from our subsidiaries;

•statements that we expect to commence or complete construction of our proposed LNG terminal, liquefaction facility, pipeline facility or other projects, or any expansions or portions thereof, by certain dates, or at all;

•statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products;

•statements regarding any financing transactions or arrangements, or our ability to enter into such transactions;

•statements regarding our future sources of liquidity and cash requirements;

•statements relating to the construction of our Trains and pipeline, including statements concerning the engagement of any EPC contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto;

•statements regarding any SPA or other agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total natural gas liquefaction or storage capacities that are, or may become, subject to contracts;

•statements regarding counterparties to our commercial contracts, construction contracts and other contracts;

•statements regarding our planned development and construction of additional Trains and pipelines, including the financing of such Trains and pipelines;

•statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities;

•statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections, or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs and cash flows, any or all of which are subject to change;

•statements relating to our goals, commitments and strategies in relation to environmental matters;

•statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions;

•any other statements that relate to non-historical or future information; and

All of these types of statements, other than statements of historical or present facts or conditions, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “achieve,” “anticipate,” “believe,” “contemplate,” “continue,” “estimate,” “expect,” “intend,” “plan,” “potential,” “predict,” “project,” “pursue,” “target,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this annual report are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained in this annual report are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements as a result of a variety of factors described in this annual report and in the other reports and other information that we file with the SEC. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise.

PART I

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

General

We are a Delaware limited liability company formed by Cheniere. We provide clean, secure and affordable LNG to integrated energy companies, utilities and energy trading companies around the world. We aspire to conduct our business in a safe and responsible manner, delivering a reliable, competitive and integrated source of LNG to our customers.

LNG is natural gas (methane) in liquid form. The LNG we produce is shipped all over the world, converted back into natural gas (called “regasification”) and then transported via pipeline to homes and businesses and used as an energy source that is essential for heating, cooking, other industrial uses and back up for intermittent energy sources. Natural gas is a cleaner-burning, abundant and affordable source of energy. When LNG is converted back to natural gas, it can be used instead of coal, which reduces the amount of pollution traditionally produced from burning fossil fuels, like sulfur dioxide and particulate matter that enters the air we breathe. Additionally, compared to coal, it produces significantly fewer carbon emissions. By liquefying natural gas, we are able to reduce its volume by 600 times so that we can load it onto special LNG carriers designed to keep the LNG cold and in liquid form for efficient transport overseas.

We own and operate a natural gas liquefaction and export facility located near Corpus Christi, Texas (the “Corpus Christi LNG Terminal”) through CCL, which has natural gas liquefaction facilities consisting of three operational Trains for a total production capacity of approximately 15 mtpa of LNG, three LNG storage tanks with aggregate capacity of approximately 10 Bcfe and two marine berths that can each accommodate vessels with nominal capacity of up to 266,000 cubic meters. We are constructing an expansion of the Corpus Christi LNG Terminal (the “Corpus Christi Stage 3 Project”) consisting of seven midscale Trains with an expected total production capacity of over 10 mtpa of LNG. We also own and operate through CCP an approximately 21-mile natural gas supply pipeline that interconnects the Corpus Christi LNG Terminal with several large interstate and intrastate natural gas pipelines (the “Corpus Christi Pipeline” and together with the existing assets at the Corpus Christi LNG Terminal and the Corpus Christi Stage 3 Project, the “Liquefaction Project”).

Our long-term counterparty arrangements form the foundation of our business and provide us with significant, stable, long-term cash flows, and include SPAs, in which our customers are generally required to pay a fixed fee with respect to the contracted volumes irrespective of their election to cancel or suspend deliveries of LNG cargoes, and IPM agreements, in which a gas producer sells natural gas to us on a global LNG or natural gas index price, less a fixed liquefaction fee, shipping and other costs. The SPAs also have a variable fee component, which is primarily indexed to Henry Hub and generally structured to cover the cost of natural gas purchases, transportation and liquefaction fuel consumed to produce LNG. Since we procure most of our feedstock for LNG production from the U.S., the structure of these contracts helps limit our exposure to fluctuations in U.S. natural gas prices. Through our SPAs and IPM agreements currently in effect, with approximately 16 years of weighted average remaining life as of December 31, 2024, we have contracted approximately 90% of the total anticipated production from the Liquefaction Project, excluding volumes that are contractually subject to additional liquefaction capacity beyond what is currently in construction or operation.

We remain focused on safety, operational excellence and customer satisfaction. Increasing demand for LNG has allowed us to expand our liquefaction infrastructure in a financially disciplined manner. We have increased available liquefaction capacity at our Liquefaction Project as a result of debottlenecking and other optimization projects. We believe these factors provide a foundation for additional growth in our portfolio of customer contracts in the future. We hold a significant land position at the Corpus Christi LNG Terminal, which provides opportunity for further liquefaction capacity expansion. In March 2023, CCL and another subsidiary of Cheniere submitted an application with the FERC under the Natural Gas Act of 1938, as amended (the “NGA”), for an expansion adjacent to the Liquefaction Project consisting of two midscale Trains with an expected total production capacity of approximately 3 mtpa of LNG (the “Midscale Trains 8 & 9 Project”), for which a positive Environmental Assessment was received in June 2024. This expansion may be developed and constructed by an affiliate of ours outside of the Liquefaction Project. The development of the Midscale Trains 8 & 9 Project or other projects, including infrastructure projects in support of natural gas supply and LNG demand, will require, among other things, acceptable commercial and financing arrangements before a positive FID is made.

Our Business Strategy

Our primary business strategy is to develop, construct and operate assets to meet our long-term customers’ energy demands. We plan to implement our strategy by:

•safely, efficiently and reliably operating and maintaining our assets, including our Trains;

•procuring natural gas and pipeline transport capacity to our facility;

•commencing commercial delivery for our long-term SPA customers, of which we have initiated for 14 of 15 third party long-term SPA customers as of December 31, 2024;

•completing our construction projects safely, on-time and on-budget;

•maximizing the production of LNG to serve our customers and generating steady and stable revenues and operating cash flows;

•further expanding and/or optimizing the Liquefaction Project by leveraging existing infrastructure;

•maintaining a prudent and cost-effective capital structure; and

•strategically identifying actionable and economic environmental solutions.

Our Business

We shipped our first LNG cargo in December 2018 and as of February 14, 2025, approximately 1,090 cumulative LNG cargoes totaling approximately 75 million tonnes of LNG have been produced, loaded and exported from the Liquefaction Project.

Below is a discussion of our operations. For further discussion of our contractual obligations and cash requirements related to these operations, refer to Liquidity and Capital Resources in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Liquefaction Project and Expansion Projects

The Liquefaction Project, as described above under the caption General, includes three Trains, three storage tanks, two marine berths and the construction of the Corpus Christi Stage 3 Project with seven midscale Trains. Additionally, in March 2023, CCL and another subsidiary of Cheniere submitted an application with the FERC under the NGA for the Midscale Trains 8 & 9 Project, for which a positive Environmental Assessment was received in June 2024. We expect to receive all remaining necessary regulatory approvals for the project in 2025.

The following table summarizes the project completion and construction status of the Corpus Christi Stage 3 Project as of December 31, 2024:

| | | | | | | | | | | |

| | |

| Overall project completion percentage | | 77.2% |

| Completion percentage of: | | |

| Engineering | | 97.2% |

| Procurement | | 97.2% |

| Subcontract work | | 88.2% |

| Construction | | 42.6% |

| Date of expected substantial completion | | 1H 2025 - 2H 2026 |

The following summarizes the volumes of natural gas for which we have received approvals from the FERC to site, construct and operate the Trains at the Liquefaction Project and the orders we have received from the DOE authorizing the export of domestically produced LNG by vessel from the Corpus Christi LNG Terminal through December 31, 2050:

| | | | | | | | | | | | | | | | | | | | | | | |

| FERC Approved Volume | | DOE Approved Volume (1) |

| (in Bcf/yr) | | (in mtpa) | | (in Bcf/yr) | | (in mtpa) |

| Trains 1 through 3 of the Liquefaction Project: | | | | | | | |

| FTA countries | 875.16 | | 17 | | 875.16 | | 17 |

| Non-FTA countries | 875.16 | | 17 | | 875.16 | | 17 |

| Corpus Christi Stage 3 Project: | | | | | | | |

| FTA countries | 582.14 | | 11.45 | | 582.14 | | 11.45 |

| Non-FTA countries | 582.14 | | 11.45 | | 582.14 | | 11.45 |

(1)Excludes 170 Bcf/yr to FTA countries authorized in July 2023 for the Midscale Trains 8 & 9 Project that is not effective until the date of first commercial export from the Midscale Trains 8 & 9 Project.

Natural Gas Supply, Transportation and Storage

CCL has secured natural gas feedstock for the Liquefaction Project through long-term natural gas supply agreements, including IPM agreements. Additionally, to ensure that CCL is able to transport and manage the natural gas feedstock to the Liquefaction Project, it has transportation precedent and other agreements to secure firm pipeline transportation and storage capacity from third parties and CCP.

Major Customers

Customers accounting for 10% or more of total consolidated revenues were as follows:

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Percentage of Total Revenues from External Customers |

| | | | Year Ended December 31, |

| | | | | | 2024 | | 2023 | | 2022 |

| Endesa Generación, S.A. (which subsequently assigned its SPA to Endesa S.A.) and Endesa S.A. | | | | | | 20% | | 22% | | 21% |

| PT Pertamina (Persero) | | | | | | 13% | | 15% | | 14% |

| Naturgy LNG GOM, Limited | | | | | | 13% | | 14% | | 14% |

| Trafigura Pte Ltd and affiliates | | | | | | * | | * | | 10% |

* Less than 10%

All of the above customers contribute to our LNG revenues through SPA contracts.

Governmental Regulation

The Liquefaction Project is subject to extensive regulation under federal, state and local statutes, rules, regulations and laws. These laws require that we engage in consultations with appropriate federal and state agencies and that we obtain and maintain applicable permits and other authorizations. These rigorous regulatory requirements increase the cost of construction and operation, and failure to comply with such laws could result in substantial penalties and/or loss of necessary authorizations.

Federal Energy Regulatory Commission

The design, construction, operation, maintenance and expansion of the Liquefaction Project, the export of LNG and the purchase and transportation of natural gas in interstate commerce through the Corpus Christi Pipeline are highly regulated activities subject to the jurisdiction of the FERC pursuant to the NGA. Under the NGA, the FERC’s jurisdiction generally extends to the transportation of natural gas in interstate commerce, to the sale for resale of natural gas in interstate commerce, to

natural gas companies engaged in such transportation or sale and to the construction, operation, maintenance and expansion of LNG terminals and interstate natural gas pipelines.

The FERC’s authority to regulate interstate natural gas pipelines and the services that they provide generally includes regulation of:

•rates and charges, and terms and conditions for natural gas transportation, storage and related services;

•the certification and construction of new facilities and modification of existing facilities;

•the extension and abandonment of services and facilities;

•the administration of accounting and financial reporting regulations, including the maintenance of accounts and records;

•the acquisition and disposition of facilities;

•the initiation and discontinuation of services; and

•various other matters.

Under the NGA, our pipeline is not permitted to unduly discriminate or grant undue preference as to rates or the terms and conditions of service to any shipper, including its own marketing affiliate. Those rates, terms and conditions must be public, and on file with the FERC. In contrast to pipeline regulation, the FERC does not require LNG terminal owners to provide open-access services at cost-based or regulated rates. Although the provisions that codified the FERC’s policy in this area expired on January 1, 2015, we see no indication that the FERC intends to change its policy in this area. On February 18, 2022, the FERC updated its 1999 Policy Statement on certification of new interstate natural gas facilities and the framework for the FERC’s decision-making process, modifying the standards that the FERC uses to evaluate applications to include, among other things, reasonably foreseeable greenhouse gas (“GHG”) emissions that may be attributable to the project and the project’s impact on environmental justice communities. On March 24, 2022, the FERC rescinded the Policy Statement, re-issued it as a draft and it remains pending. At this time, we do not expect it to have a material adverse effect on our operations.

We are permitted to make sales of natural gas for resale in interstate commerce pursuant to a blanket marketing certificate granted by the FERC with the issuance of our Certificate of Public Convenience and Necessity to our marketing affiliates. Our sales of natural gas will be affected by the availability, terms and cost of pipeline transportation. As noted above, the price and terms of access to pipeline transportation are subject to extensive federal and state regulation.

In order to site, construct and operate the Liquefaction Project, we received and are required to maintain authorizations from the FERC under Section 3 of the NGA as well as other material governmental and regulatory approvals and permits. The Energy Policy Act of 2005 (the “EPAct”) amended Section 3 of the NGA to establish or clarify the FERC’s exclusive authority to approve or deny an application for the siting, construction, expansion or operation of LNG terminals, unless specifically provided otherwise in the EPAct amendments to the NGA. For example, nothing in the EPAct amendments to the NGA were intended to affect otherwise applicable law related to any other federal agency’s authorities or responsibilities related to LNG terminals or those of a state acting under federal law.

In March 2023, certain of our subsidiaries submitted an application with the FERC under the NGA for the Midscale Trains 8 & 9 Project, for which a positive Environmental Assessment was received in June 2024.

The FERC’s Standards of Conduct apply to interstate pipelines that conduct transmission transactions with an affiliate that engages in natural gas marketing functions. The general principles of the FERC Standards of Conduct are: (1) independent functioning, which requires transmission function employees to function independently of marketing function employees; (2) no-conduit rule, which prohibits passing transmission function information to marketing function employees; and (3) transparency, which imposes posting requirements to detect undue preference due to the improper disclosure of non-public transmission function information. We have established the required policies, procedures and training to comply with the FERC’s Standards of Conduct.

All of our FERC construction, operation, reporting, accounting and other regulated activities are subject to audit by the FERC, which may conduct routine or special inspections and issue data requests designed to ensure compliance with FERC rules, regulations, policies and procedures. The FERC’s jurisdiction under the NGA allows it to impose civil and criminal

penalties for any violations of the NGA and any rules, regulations or orders of the FERC up to approximately $1.5 million per day per violation, including any conduct that violates the NGA’s prohibition against market manipulation.

Several other governmental and regulatory approvals and permits are required throughout the life of the Liquefaction Project. In addition, our FERC orders require us to comply with certain ongoing conditions and reporting obligations and maintain other regulatory agency approvals throughout the life of the Liquefaction Project. For example, throughout the life of the Liquefaction Project, we are subject to regular reporting requirements to the FERC, the Department of Transportation’s (“DOT”) Pipeline and Hazardous Materials Safety Administration (“PHMSA”) and applicable federal and state regulatory agencies regarding the operation and maintenance of our facilities. To date, we have been able to obtain and maintain required approvals as needed, and the need for these approvals and reporting obligations has not materially affected our construction or operations.

DOE Export Licenses

The DOE has authorized the export of domestically produced LNG by vessel from the Corpus Christi LNG Terminal, as discussed in Liquefaction Project and Expansion Projects. Although it is not expected to occur, the loss of an export authorization could be a force majeure event under our SPAs.

Under Section 3 of the NGA, applications for exports of natural gas (including LNG) to FTA countries, which allow for national treatment for trade in natural gas, are “deemed to be consistent with the public interest” and shall be granted by the DOE without “modification or delay.” FTA countries currently recognized by the DOE for exports of LNG include Australia, Bahrain, Canada, Chile, Colombia, Dominican Republic, El Salvador, Guatemala, Honduras, Jordan, Mexico, Morocco, Nicaragua, Oman, Panama, Peru, Republic of Korea and Singapore. FTAs with Israel and Costa Rica do not require national treatment for trade in natural gas. Applications for export of LNG to non-FTA countries are considered by the DOE in a notice and comment proceeding whereby the public and other interveners are provided the opportunity to comment and may assert that such authorization would not be consistent with the public interest. In January 2024, the Biden Administration announced a temporary pause on pending decisions on exports of LNG to non-FTA countries until the DOE can update the underlying analyses for authorizations, which did not have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, or liquidity for the year ended December 31, 2024. The DOE publicly released the updated analyses on December 17, 2024, and has solicited public comments on the analyses. On January 20, 2025, President Trump signed an Executive Order revoking the Biden Administration pause and extending the time for public comment. We do not expect the publication of the analyses to have a material effect on future DOE non-FTA export authorizations. The Midscale Trains 8 & 9 Project is currently our only project pending non-FTA export approval with the DOE, although such approval is first subject to the receipt of regulatory permit approval from the FERC, responsive to our formal application in March 2023. See Liquefaction Project and Expansion Projects section above for FERC and DOE approved volumes on our existing Liquefaction Project.

Pipeline and Hazardous Materials Safety Administration

The Liquefaction Project is subject to regulation by PHMSA, who is authorized by the applicable pipeline safety laws to establish minimum safety standards for certain pipelines and LNG facilities. The regulatory standards PHMSA has established are applicable to the design, installation, testing, construction, operation, maintenance and management of natural gas and hazardous liquid pipeline facilities and LNG facilities that affect interstate or foreign commerce. PHMSA has also established training, worker qualification and reporting requirements.

PHMSA performs inspections of pipeline and LNG facilities and has authority to undertake enforcement actions, including issuance of civil penalties up to approximately $273,000 per day per violation, with a maximum administrative civil penalty of approximately $2.7 million for any related series of violations.

Other Governmental Permits, Approvals and Authorizations

Construction and operation of the Liquefaction Project requires additional permits, orders, approvals and consultations to be issued by various federal and state agencies, including the DOT, U.S. Army Corps of Engineers (“USACE”), U.S. Department of Commerce, National Marine Fisheries Service, U.S. Department of the Interior, U.S. Fish and Wildlife Service, the U.S. Environmental Protection Agency (the “EPA”), U.S. Department of Homeland Security, the Texas Commission on Environmental Quality (“TCEQ”) and the Railroad Commission of Texas.

The USACE issues its permits under the authority of the Clean Water Act (“CWA”) (Section 404) and the Rivers and Harbors Act (Section 10). The EPA administers the Clean Air Act (“CAA”) and has delegated authority to the TCEQ to issue the Title V Operating Permit and the Prevention of Significant Deterioration Permit. These two permits are issued by the TCEQ.

Commodity Futures Trading Commission (“CFTC”)

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) amended the Commodity Exchange Act to provide for federal regulation of the over-the-counter derivatives market and entities, such as us, that participate in those markets. The CFTC has enacted a number of regulations pursuant to the Dodd-Frank Act.

As required by the Dodd-Frank Act, the CFTC and federal banking regulators also adopted rules requiring swap dealers (as defined in the Dodd-Frank Act), including those that are regulated financial institutions, to collect initial and/or variation margin with respect to uncleared swaps from their counterparties that are financial end users, registered swap dealers or major swap participants. These rules do not require collection of margin from non-financial-entity end users who qualify for the end user exception from the mandatory clearing requirement or from non-financial end users or certain other counterparties in certain instances. We qualify as a non-financial-entity end user with respect to the swaps that we enter into to hedge our commercial risks.

Pursuant to the Dodd-Frank Act, the CFTC adopted additional anti-manipulation and anti-disruptive trading practices regulations that prohibit, among other things, manipulative, deceptive or fraudulent schemes or material misrepresentation in the futures, options, swaps and cash markets. In addition, separate from the Dodd-Frank Act, our use of futures and options on commodities is subject to the Commodity Exchange Act and CFTC regulations, as well as the rules of futures exchanges on which any of these instruments are executed. Should we violate any of these laws and regulations, we could be subject to a CFTC or an exchange enforcement action and material penalties, possibly resulting in changes in the rates we can charge.

Environmental Regulation

The Liquefaction Project is subject to various federal, state and local laws and regulations relating to the protection of the environment and natural resources. These environmental laws and regulations can affect the cost and output of operations and may impose substantial penalties for non-compliance and substantial liabilities for pollution, as further described in the risk factor Existing and future safety, environmental and similar laws and governmental regulations could result in increased compliance costs or additional operating costs or construction costs and restrictions in Risks Relating to Regulations within Item 1A. Risk Factors. Many of these laws and regulations, such as those noted below, restrict or prohibit impacts to the environment or the types, quantities and concentration of substances that can be released into the environment and can lead to substantial administrative, civil and criminal fines and penalties for non-compliance.

Clean Air Act

The Liquefaction Project is subject to the federal CAA and comparable state and local laws. We may be required to incur certain capital expenditures over the next several years for air pollution control equipment in connection with maintaining or obtaining permits and approvals addressing air emission-related issues. However, we do not believe any such requirements will have a material adverse effect on our operations or the construction of our Liquefaction Project.

On February 28, 2022, the EPA removed a stay of formaldehyde standards in the National Emission Standards for Hazardous Air Pollutants (“NESHAP”) Subpart YYYY for stationary combustion turbines located at major sources of hazardous air pollutant (“HAP”) emissions. Owners and operators of lean remix gas-fired turbines and diffusion flame gas-fired turbines at major sources of HAP that were installed after January 14, 2003 were required to comply with NESHAP Subpart YYYY by March 9, 2022 and demonstrate initial compliance with those requirements by September 5, 2022. We do not believe that the construction and operation of our Liquefaction Project will be materially and adversely affected by such regulatory actions.

We are supportive of regulations reducing GHG emissions over time. Since 2009, the EPA has promulgated and finalized multiple GHG emissions regulations related to reporting and reductions of GHG emissions from our facilities. On December 2, 2023, the EPA issued final rules to reduce methane and volatile organic compounds (“VOC”) emissions from

new, existing and modified emission sources in the oil and gas sector. These regulations require monitoring of methane and VOC emissions at our compressor stations. We do not believe such regulations will have a material adverse effect on our operations, financial condition or results of operations.

From time to time, Congress has considered proposed legislation directed at reducing GHG emissions. On August 16, 2022, President Biden signed H.R. 5376 (P.L. 117-169), the Inflation Reduction Act of 2022 (“IRA”) which includes a charge on methane emissions above a certain methane intensity threshold for facilities that report their GHG emissions under the EPA’s Greenhouse Gas Emissions Reporting Program Part 98 regulations. The charge started at $900 per metric ton of methane in 2024, increased to $1,200 per metric ton in 2025, and is increasing to $1,500 per metric ton in 2026 and beyond. On November 12, 2024, the EPA finalized a rule to impose and collect the methane emissions charge authorized under the IRA. We do not believe the methane charge will have a material adverse effect on our operations, financial condition or results of operations.

The timing, extent and impact of these rules and other Biden Administration initiatives remain uncertain as the Trump Administration has undertaken steps to delay their implementation, and to review, repeal and potentially replace them.

Coastal Zone Management Act (“CZMA”)

The siting and construction of the Liquefaction Project within the coastal zone is subject to the requirements of the CZMA. The CZMA is administered by the states (in Texas, by the General Land Office). This program is implemented to ensure that impacts to coastal areas are consistent with the intent of the CZMA to manage the coastal areas.

Clean Water Act

The Liquefaction Project is subject to the federal CWA and analogous state and local laws. The CWA imposes strict controls on the discharge of pollutants into the navigable waters of the United States, including discharges of wastewater and storm water runoff and fill/discharges into waters of the United States. Permits must be obtained prior to discharging pollutants into state and federal waters. The CWA is administered by the EPA, the USACE and by the states (in Texas, by the TCEQ). The CWA regulatory programs, including the Section 404 dredge and fill permitting program and Section 401 water quality certification program carried out by the states, are frequently the subject of shifting agency interpretations and legal challenges, which at times can result in permitting delays.

Resource Conservation and Recovery Act (“RCRA”)

The federal RCRA and comparable state statutes govern the generation, handling and disposal of solid and hazardous wastes and require corrective action for releases into the environment. When such wastes are generated in connection with the operations of our facilities, we are subject to regulatory requirements affecting the handling, transportation, treatment, storage and disposal of such wastes.

Protection of Species, Habitats and Wetlands

Various federal and state statutes, such as the Endangered Species Act, the Migratory Bird Treaty Act, the CWA and the Oil Pollution Act, prohibit certain activities that may adversely affect endangered or threatened animal, fish and plant species and/or their designated habitats, wetlands, or other natural resources. If our Liquefaction Project adversely affects a protected species or its habitat, we may be required to develop and follow a plan to remediate those impacts. In that case, siting, construction or operations may be delayed or restricted and cause us to incur increased costs.

It is not possible at this time to predict how future regulations or legislation may address protection of species, habitats and wetlands and impact our business. However, we do not believe such regulatory actions will have a material adverse effect on our operations or the construction of our Liquefaction Project.

Market Factors and Competition

Market Factors

Our ability to enter into additional long-term SPAs to underpin the development of additional Trains or develop new projects is subject to market factors. These factors include changes in worldwide supply and demand for natural gas, LNG and substitute products, the relative prices for natural gas, crude oil and substitute products in North America and international markets, the extent of energy security needs in the European Union and elsewhere, the rate of fuel switching from coal, nuclear or oil to natural gas and other overarching factors such as global economic growth and the pace of any transition from fossil-based systems of energy production and consumption to alternative energy sources. In addition, our ability to obtain additional funding to execute our business strategy is subject to the investment community’s appetite for investment in LNG and natural gas infrastructure and our ability to access capital markets.

We expect that global demand for natural gas and LNG will continue to increase as nations seek more abundant, reliable and environmentally cleaner fuel alternatives to oil and coal. Market participants around the globe have shown commitments to environmental goals consistent with many policy initiatives that we believe are constructive for LNG demand and infrastructure growth. Currently, significant amounts of money are being invested across Europe and Asia in natural gas projects under construction, and more continues to be earmarked to planned projects globally. In Europe, there are various plans to install more than 75 mtpa of import capacity over the near-term to secure access to LNG and displace Russian gas imports. In India, there are more than 5,600 kilometers of gas pipelines under construction to expand the gas distribution network and increase access to natural gas. And in China, billions of U.S. dollars have already been invested and hundreds of billions of U.S. dollars are expected to be further invested all along the natural gas value chain to enable growth and decrease harmful emissions. Furthermore, some of the existing integrated liquefaction facilities outside of the U.S. have been experiencing issues related to reduced feed gas as a result of depleting upstream resources. Global supply contributions from these plants have been decreasing and LNG supply growth is expected to help support these shortages.

As a result of these dynamics, we expect natural gas and LNG to continue to play an important role in satisfying energy demand going forward. In its forecast published in the third quarter of 2024, Wood Mackenzie Limited (“WoodMac”) forecasted that global demand for LNG would increase by approximately 61%, from approximately 418 mtpa, or 20.1 Tcf, in 2023, to 675 mtpa, or 32.4 Tcf, in 2040 and by approximately 65% to 691 mtpa or 33.1 Tcf in 2050. WoodMac also forecasted LNG production from existing operational facilities and new facilities already under construction would be able to supply the market with approximately 532 mtpa in 2040, declining to 463 mtpa in 2050. This could result in a market need for construction of an additional approximately 142 mtpa of LNG production by 2040 and about 227 mtpa by 2050. As a cleaner burning fuel with lower emissions than coal or liquid fuels in power generation, we expect natural gas and LNG to play a central role in balancing grids, serving as back up for intermittent energy sources and contributing to a low carbon energy system globally. We believe the capital and operating costs of the uncommitted capacity of our Liquefaction Project, as well as our proposed expansion is competitive with new proposed projects globally and we are well-positioned to capture a portion of this incremental market need.

As described above under the caption General, we have limited exposure to oil price movements as we have contracted a significant portion of our LNG production capacity under long-term SPAs and IPM agreements, which are structured to generate fixed fees in addition to variable fees indexed to Henry Hub or international LNG pricing. Refer to General for further discussion of our long-term agreements.

Competition

Despite the long term nature of our SPAs, when CCL needs to replace or amend any existing SPA or enter into new SPAs, CCL will compete with other natural gas liquefaction projects throughout the world primarily on the basis of price per contracted volume of LNG at that time, as well as attributes such as commercial innovation, reliable production and customer-focused operations to provide flexible and tailored solutions to LNG buyers. Our competition includes our affiliate Sabine Pass Liquefaction, LLC (“SPL”), which operates six Trains at a natural gas liquefaction facility in Cameron Parish, Louisiana (the “SPL Project”). Revenues associated with any incremental volumes of the Liquefaction Project sold outside of CCL’s long-term SPAs, including those made available to Cheniere Marketing International LLP (“Cheniere Marketing”), will also be subject to market-based price competition.

Corporate Responsibility

As described in Market Factors and Competition, we expect that global demand for natural gas and LNG will continue to increase as nations seek more abundant, reliable and environmentally cleaner fuel alternatives to oil and coal. Our vision is to provide clean, secure and affordable energy to the world. This vision underpins our focus on responding to the world’s shared energy challenges — expanding the global supply of clean, secure and affordable energy, improving air quality, reducing emissions and supporting the transition to a lower-carbon future. Our approach to corporate responsibility is guided by our Climate and Sustainability Principles: Transparency, Science, Supply Chain and Operational Excellence. In August 2024, we published Energy Secured, Benefits Delivered, our fifth Corporate Responsibility (“CR”) report, which details our approach and progress on ESG matters. Our CR report is available at www.cheniere.com/our-responsibility/reporting-center. Information on our website, including the CR report, is not incorporated by reference into this Annual Report on Form 10-K.

Cheniere’s climate strategy is to measure and mitigate emissions so that it may better position its LNG supplies to remain competitive in a lower carbon future and provide energy, economic and environmental security to its customers across the world. To maximize the environmental benefits of our LNG, we believe it is important to develop our climate goals and strategies based on an accurate and holistic assessment of the emissions profile of our LNG, accounting for all steps in the supply chain.

Consequently, Cheniere has collaborated with natural gas midstream companies, technology providers and leading academic institutions on life-cycle assessment (“LCA”) models, quantification, monitoring, reporting and verification (“QMRV”) of GHG emissions and other research and development projects. Cheniere also co-founded and sponsored the Energy Emissions Modeling and Data Lab (“EEMDL”), a multidisciplinary research and education initiative led by the University of Texas at Austin in collaboration with Colorado State University and the Colorado School of Mines. In addition, Cheniere commenced providing Cargo Emissions Tags (“CE Tags”) to its long-term customers in June 2022, and in October 2022 joined the Oil and Gas Methane Partnership (“OGMP”) 2.0, the United Nations Environment Programme’s (“UNEP”) flagship oil and gas methane emissions reporting and mitigation initiative. To ensure transparency and rigor, Cheniere works with academics and scientists to publish methodologies and results in multiple peer-reviewed journals.

Our total incremental expenditures related to climate initiatives, including capital expenditures, were not material to our Consolidated Financial Statements during the years ended December 31, 2024, 2023 and 2022. However, as governments consider and implement actions to reduce GHG emissions and the transition to a lower-carbon economy continues to evolve, as described in Market Factors and Competition, we expect the scope and extent of our future climate and sustainability initiatives to evolve accordingly. While we have not incurred material direct expenditures related to climate change, we are proactive in our management of climate risks and opportunities, including compliance with existing and future government regulations. We face certain business and operational risks associated with physical impacts from climate change, such as exposure to severe weather events or changes in weather patterns, in addition to transition risks. Please see Item 1A. Risk Factors for additional discussion.

Subsidiaries

Substantially all of our assets are held by our subsidiaries. We conduct most of our business through these subsidiaries, including the operation of our Liquefaction Project.

Employees

We have no employees. We have contracts with subsidiaries of Cheniere for operations, maintenance and management services. See Note 11—Related Party Transactions of our Notes to Consolidated Financial Statements for a discussion of such services agreements with our affiliate entities. As of December 31, 2024, Cheniere and its subsidiaries had 1,714 full-time employees, including 505 employees who directly supported the Liquefaction Project.

Available Information

Our principal executive offices are located at 845 Texas Avenue, Suite 1250, Houston, Texas 77002, and our telephone number is (713) 375-5000. Our internet address is www.cheniere.com. We provide public access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports as soon as reasonably practicable after we electronically file those materials with, or furnish those materials to, the SEC under the

Securities Exchange Act of 1934, as amended (the “Exchange Act”). These reports may be accessed free of charge through our internet website. We make our website content available for informational purposes only. The website should not be relied upon for investment purposes and is not incorporated by reference into this Form 10-K. The SEC maintains an internet site (www.sec.gov) that contains reports and other information regarding issuers.

ITEM 1A. RISK FACTORS

The following are some of the important risk factors that could adversely affect our business, financial condition, results of operations or cash flows or have other adverse impacts, and could cause actual results to differ materially from estimates or expectations contained in our forward-looking statements. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also adversely affect our business, contracts, financial condition, operating results, cash flows, liquidity and prospects.

The risk factors in this report are grouped into the following categories:

Risks Relating to Our Financial Matters

An inability to source capital to supplement our available cash resources and existing credit facilities could cause us to have inadequate liquidity and could materially and adversely affect us.

As of December 31, 2024, we had $113 million of restricted cash and cash equivalents, $4.7 billion of available commitments under our credit facilities and $4.9 billion of total debt outstanding (before unamortized discount and debt issuance costs). We incur, and will incur, significant interest expense relating to financing the assets at the Corpus Christi LNG Terminal, and we anticipate drawing on current committed facilities and/or incurring additional debt to finance the construction of the Corpus Christi Stage 3 Project as well as the Midscale Trains 8 & 9 Project if a positive FID is made. Our ability to fund our capital expenditures and refinance our indebtedness may depend on our ability to access additional project financing as well as the debt capital markets. A variety of factors beyond our control could impact the availability or cost of capital, including domestic or international economic conditions, increases in key benchmark interest rates and/or credit spreads, the adoption of new or amended banking or capital market laws or regulations, lending institutions’ evolving policies on financing businesses linked to fossil fuels and the repricing of market risks and volatility in capital and financial markets. Our financing costs could increase or future borrowings may be unavailable to us or unsuccessful, which could cause us to be unable to pay or refinance our indebtedness or to fund our other liquidity needs. We also may rely on borrowings under our credit facilities to fund our capital expenditures. If any of the lenders in the syndicates backing these facilities was unable to perform on its commitments, we may need to seek replacement financing, which may not be available as needed, or may be available in more limited amounts or on more expensive or otherwise unfavorable terms.

Our ability to generate cash is substantially dependent upon the performance by customers under long-term contracts that we have entered into, and we could be materially and adversely affected if any significant customer fails to perform its contractual obligations for any reason.

Our future results and liquidity are substantially dependent upon performance by our customers to make payments under long-term contracts. As of December 31, 2024, we had SPAs with a total of 15 different third party customers.

While substantially all of our long-term third party customer arrangements are executed with a creditworthy parent company or secured by a parent company guarantee or other form of collateral, we are nonetheless exposed to credit risk in the event of a customer default that requires us to seek recourse.

Additionally, our long-term SPAs entitle the customer to terminate their contractual obligations upon the occurrence of certain events which include, but are not limited to: (1) if we fail to make available specified scheduled cargo quantities; (2) delays in the commencement of commercial operations; and (3) under the majority of our SPAs upon the occurrence of certain events of force majeure.

Although we have not had a history of material customer default or termination events, the occurrence of such events are largely outside of our control and may expose us to unrecoverable losses. We may not be able to replace these customer arrangements on desirable terms, or at all, if they are terminated. As a result, our business, contracts, financial condition, operating results, cash flow, liquidity and prospects could be materially and adversely affected.

Our use of derivative instruments, including our IPM agreements, to manage risks could adversely affect our earnings reported under GAAP and our liquidity.

We use derivative instruments to manage our commodity-related price risk. The extent of our derivative position at any given time depends on our assessment of risks and related exposures for these commodities. We currently account for our derivatives at fair value, with immediate recognition of changes in the fair value in earnings, as described in Note 2—Summary of Significant Accounting Policies of our Notes to Consolidated Financial Statements. Such valuations are primarily valued based on estimated forward commodity prices and are more susceptible to variability particularly when markets are volatile, which could have a significant adverse effect on our earnings reported under GAAP. For example, as described in Results of Operations in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, our net income for the years ended December 31, 2024 and 2023 included gains of $1.0 billion and $5.8 billion, respectively, resulting from changes in the fair values of our derivatives (before tax and the impact of non-controlling interests), substantially all of which were related to commodity derivative instruments indexed to international LNG prices, mainly our IPM agreements. These transactions and other derivative transactions have and may continue to result in substantial volatility in results of operations reported under GAAP, particularly in periods of significant commodity, currency or financial market variability. For certain of these instruments, in the absence of actively quoted market prices and pricing information from external sources, the value of these financial instruments involves management’s judgment or use of estimates. Changes in the underlying assumptions or use of alternative valuation methods could affect the reported fair value of these contracts.

In addition, our liquidity may be adversely impacted by the cash margin requirements of the respective commodity exchanges or over-the-counter arrangements, or the failure of a counterparty to perform in accordance with a contract. As of December 31, 2024 and 2023, we had collateral posted with counterparties by us of $5 million and $3 million, respectively, which are included in other current assets, net in our Consolidated Balance Sheets.

Risks Relating to Our Operations and Industry

Catastrophic weather events or other disasters could result in an interruption of our operations, a delay in the construction of our Liquefaction Project, damage to our Liquefaction Project and increased insurance costs, all of which could adversely affect us.

Weather events such as major hurricanes and winter storms have caused interruptions or temporary suspension in construction or operations at our facilities or caused minor damage to our Liquefaction Project. In August 2020, we entered into an arrangement with our affiliate to provide the ability, in limited circumstances, to potentially fulfill commitments to LNG buyers from the other facility in the event operational conditions impact operations at the Corpus Christi LNG Terminal or at our affiliate’s terminal. During the year ended December 31, 2021, four TBtu was loaded at our facilities for our affiliate pursuant to this agreement. Our risk of loss related to weather events or other disasters is limited by contractual provisions in our SPAs, which can provide under certain circumstances relief from operational events, and partially mitigated by insurance we maintain. Aggregate direct and indirect losses associated with the aforementioned weather events, net of insurance reimbursements, have not historically been material to our Consolidated Financial Statements, and we believe our insurance coverages maintained, existence of certain protective clauses within our SPAs and other risk management strategies mitigate our exposure to material losses. However, future adverse weather events and collateral effects, or other disasters such as explosions, fires, floods or severe droughts, could cause damage to, or interruption of operations at our terminal or related infrastructure, which could impact our operating results, increase insurance premiums or deductibles paid and delay or increase costs associated with the construction and development of the Liquefaction Project or our other facilities. Our LNG terminal infrastructure and LNG facility located in or near Corpus Christi, Texas are designed in accordance with requirements of 49 Code of Federal Regulations Part 193, Liquefied Natural Gas Facilities: Federal Safety Standards, and all applicable industry codes and standards.

Disruptions to the third party supply of natural gas to our pipeline and facilities could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We depend upon third party pipelines and other facilities that provide gas delivery options to our Liquefaction Project. If any pipeline connection were to become unavailable for current or future volumes of natural gas due to repairs, damage to the facility, lack of capacity, failure to replace contracted firm pipeline transportation capacity on economic terms, or any other reason, our ability to receive natural gas volumes to produce LNG or to continue shipping natural gas from producing regions or to end markets could be adversely impacted. Such disruptions to our third party supply of natural gas may also be caused by weather events or other disasters described in the risk factor Catastrophic weather events or other disasters could result in an interruption of our operations, a delay in the construction of our Liquefaction Project, damage to our Liquefaction Project and increased insurance costs, all of which could adversely affect us. While certain contractual provisions in our SPAs can limit the potential impact of disruptions, and historical indirect losses incurred by us as a result of disruptions to our third party supply of natural gas have not been material, any significant disruption to our natural gas supply where we may not be protected could result in a substantial reduction in our revenues under our long-term SPAs or other customer arrangements, which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We may not be able to purchase or receive physical delivery of sufficient natural gas to satisfy our delivery obligations under the SPAs, which could have a material adverse effect on us.

Under the SPAs with our customers, we are required to make available to them a specified amount of LNG at specified times. The supply of natural gas to our Liquefaction Project to meet our LNG production requirements timely and at sufficient quantities is critical to our operations and the fulfillment of our customer contracts. However, we may not be able to purchase or receive physical delivery of natural gas as a result of various factors, including composition changes in the quality of feed gas received from third parties, non-delivery or untimely delivery by our suppliers, depletion of natural gas reserves within regional basins and disruptions to pipeline operations as described in the risk factor Disruptions to the third party supply of natural gas to our pipeline and facilities could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects. Our risk is in part mitigated by the diversification of our natural gas supply and transportation across suppliers and pipelines, and regionally across basins, and additionally, we have provisions within our supplier contracts that provide certain protections against non-performance. Further, provisions within our SPAs provide certain protection against force majeure events. While historically we have not incurred significant or prolonged disruptions to our natural gas supply that have resulted in a material adverse impact to our operations, due to the criticality of natural gas supply to our production of LNG, our failure to purchase or receive physical delivery of sufficient quantities of natural gas under circumstances where we may not be protected could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Our ability to complete development and/or construction of additional Trains, including the Midscale Trains 8 & 9 Project, will be contingent on our ability to obtain additional funding. If we are unable to obtain sufficient funding, we may be unable to fully execute our business strategy.

We continuously pursue liquefaction expansion opportunities and other projects along the LNG value chain. As described further in Items 1. and 2. Business and Properties, we are currently developing the Midscale Trains 8 & 9 Project. The commercial development of an LNG facility takes a number of years and requires a substantial capital investment that is dependent on sufficient funding and commercial interest, among other factors.

We will require significant additional funding to be able to commence construction of the Midscale Trains 8 & 9 Project, or any additional expansion projects, which we may not be able to obtain at a cost that results in positive economics, or at all. The inability to achieve acceptable funding may cause a delay in the development or construction of the Midscale Trains 8 & 9 Project, any additional Trains or any additional expansion projects, and we may not be able to complete our business plan, which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Cost overruns and delays in the completion of our expansion projects, including the Corpus Christi Stage 3 Project and the Midscale Trains 8 & 9 Project, as well as difficulties in obtaining sufficient financing to pay for such costs and delays, could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Our investment decision on the Corpus Christi Stage 3 Project and any potential future expansion of LNG facilities, including the Midscale Trains 8 & 9 Project, relies on cost estimates developed initially through front end engineering and design studies. However, due to the size and duration of construction of an LNG facility, the actual construction costs may be significantly higher than our current estimates as a result of many factors, including but not limited to changes in scope and the ability of Bechtel Energy Inc. (“Bechtel”) and our other contractors to execute successfully under their agreements. Although our major EPC contracts are fixed price, as construction progresses, we may decide or be forced to submit change orders to our contractor, including change orders to comply with existing or future environmental or other regulations. Any change orders could result in longer construction periods, higher construction costs, including increased commodity prices (particularly nickel and steel) and escalating labor costs, or both. Additionally, our SPAs generally provide that the customer may terminate that SPA if the relevant Train does not timely commence commercial operations. As a result, any significant construction delay, whatever the cause, could have a material adverse impact on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Significant increases in the cost of a liquefaction project or significant construction delays could impact the commercial viability of the project as well as require us to obtain additional sources of financing to fund our operations until the applicable liquefaction project is fully constructed (which could cause further delays), thereby negatively impacting our business and limiting our growth prospects. While historically we have not experienced cost overruns or construction delays that have had a significant adverse impact on our operations, factors giving rise to such events in the future may be outside of our control and could have a material adverse effect on our current or future business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We are subject to significant construction and operating hazards and uninsured risks, one or more of which may create significant liabilities and losses for us.

The construction and operation of the Liquefaction Project are, and will be, subject to the inherent risks associated with these types of operations as discussed throughout our risk factors, including explosions, breakdowns or failures of equipment, operational errors by vessel or tug operators, pollution, release of toxic substances, fires, hurricanes and adverse weather conditions and other hazards, each of which could result in significant delays in commencement or interruptions of operations and/or in damage to or destruction of our facilities or damage to persons and property. In addition, our operations and the facilities and vessels of third parties on which our operations are dependent face possible risks associated with acts of aggression or terrorism.

We do not, nor do we intend to, maintain insurance against all of these risks and losses. We may not be able to maintain desired or required insurance in the future at rates that we consider reasonable. Although losses incurred as a result of self insured risk have not been material historically, the occurrence of a significant event not fully insured or indemnified against could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

We are dependent on our EPC partners and other contractors for the successful completion of the Corpus Christi Stage 3 Project and any potential expansion projects, including the Midscale Trains 8 & 9 Project.

Timely and cost-effective completion of the Corpus Christi Stage 3 Project and any potential expansion projects, including the Midscale Trains 8 & 9 Project, in compliance with agreed specifications is central to our business strategy and is highly dependent on the performance of our EPC partners, including Bechtel, and our other contractors under their agreements. The ability of our EPC partners and our other contractors to perform successfully under their agreements is dependent on a number of factors, including their ability to:

•design and engineer each Train to operate in accordance with specifications;

•engage and retain third party subcontractors and procure equipment and supplies;

•respond to difficulties such as equipment failure, delivery delays, schedule changes and failure to perform by subcontractors, some of which are beyond their control;

•attract, develop and retain skilled personnel, including engineers;

•post required construction bonds and comply with the terms thereof;

•manage the construction process generally, including coordinating with other contractors and regulatory agencies; and

•maintain their own financial condition, including adequate working capital.

Although some agreements may provide for liquidated damages if the contractor fails to perform in the manner required with respect to certain of its obligations, the events that trigger a requirement to pay liquidated damages may delay or impair the operation of the Corpus Christi Stage 3 Project and any potential expansion projects, including the Midscale Trains 8 & 9 Project, and any liquidated damages that we receive may not be sufficient to cover the damages that we suffer as a result of any such delay or impairment. The obligations of EPC partners and our other contractors to pay liquidated damages under their agreements are subject to caps on liability, as set forth therein.

Furthermore, we may have disagreements with our contractors about different elements of the construction process, which could lead to the assertion of rights and remedies under their contracts and increase the cost of the Corpus Christi Stage 3 Project and any potential expansion projects, including the Midscale Trains 8 & 9 Project, or result in a contractor’s unwillingness to perform further work. If any contractor is unable or unwilling to perform according to the negotiated terms and timetable of its respective agreement for any reason or terminates its agreement, we would be required to engage a substitute contractor. This would likely result in significant project delays and increased costs, which could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Cyclical or other changes in the demand for and price of LNG and natural gas may adversely affect our LNG business and the performance of our customers and could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Our LNG business and the development of domestic LNG facilities and projects generally is based on assumptions about the future availability and price of natural gas and LNG and the prospects for international natural gas and LNG markets. Natural gas and LNG prices have been, and are likely to continue to be, volatile and subject to wide fluctuations in response to one or more of the following factors:

•competitive liquefaction capacity in North America;

•insufficient or oversupply of natural gas liquefaction or receiving capacity worldwide;

•insufficient LNG tanker capacity;

•weather conditions, including temperature volatility resulting from climate change, and extreme weather events may lead to unexpected distortion in the balance of international LNG supply and demand;

•reduced demand and lower prices for natural gas;

•increased natural gas production deliverable by pipelines, which could suppress demand for LNG;

•decreased oil and natural gas exploration activities which may decrease the production of natural gas, including as a result of any potential ban on production of natural gas through hydraulic fracturing;

•cost improvements that allow competitors to provide natural gas liquefaction capabilities at reduced prices;

•changes in supplies of, and prices for, alternative energy sources, which may reduce the demand for natural gas;

•changes in regulatory, tax or other governmental policies regarding exported LNG, natural gas or alternative energy sources, which may reduce the demand for exported LNG and/or natural gas;

•political conditions in customer regions;

•sudden decreases in demand for LNG as a result of natural disasters or public health crises, including the occurrence of a pandemic, and other catastrophic events;

•adverse relative demand for LNG compared to other markets, which may decrease LNG exports from North America; and

•cyclical trends in general business and economic conditions that cause changes in the demand for natural gas.

Adverse trends or developments affecting any of these factors could result in decreases in the price of LNG and/or natural gas, which could materially and adversely affect our LNG business and the performance of our customers, and could have a material adverse effect on our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Failure of exported LNG to be a long term competitive source of energy for international markets could adversely affect our customers and could materially and adversely affect our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Operations of the Liquefaction Project are dependent upon the ability of our SPA customers to deliver LNG supplies from the United States, which is primarily dependent upon LNG being a competitive source of energy internationally. The success of our business plan is dependent, in part, on the extent to which LNG can, for significant periods and in significant volumes, be supplied from the United States and delivered to international markets at a lower cost than the cost of alternative energy sources. Through the use of improved exploration technologies, additional sources of natural gas may be discovered outside the United States, which could increase the available supply of natural gas outside the United States and could result in natural gas in those markets being available at a lower cost than LNG exported to those markets.

Political instability in foreign countries that import or export natural gas, or strained relations between such countries and the United States, may also impede the willingness or ability of LNG purchasers or suppliers and merchants in such countries to import LNG from the United States. Furthermore, some foreign purchasers or suppliers of LNG may have economic or other reasons to obtain their LNG from non-U.S. markets or from our competitors’ liquefaction facilities in the United States.