Investor Presentation November 2018 NYSE: LBRT www.LibertyFrac.com

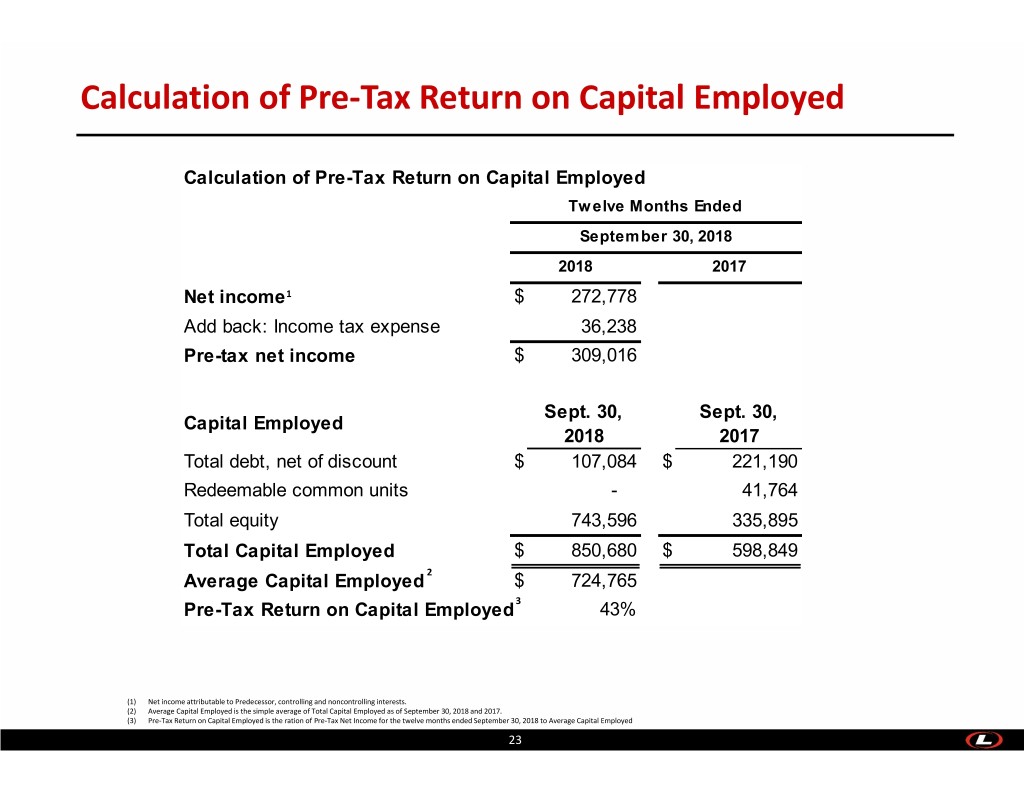

IMPORTANT DISCLOSURES FORWARD LOOKING STATEMENTS The information in this presentation includes “forward‐looking statements”. All statements, other than statements of historical fact included in this presentation regarding Liberty Oilfield Services Inc.’s (“Liberty” or the “Company”) strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward‐looking statements. When used in this presentation, the words “could”, “believe”, “anticipate”, “intend”, “estimate”, “expect”, “project” and similar expressions are intended to identify forward‐looking statements, although not all forward‐looking statements contain such identifying words. These forward‐looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Liberty disclaims any duty to update any forward‐looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Liberty cautions you that these forward‐looking statements are subject to all of the risks and uncertainties incident to hydraulic fracturing services, most of which are difficult to predict and many of which are beyond its control. These risks include, but are not limited to, a decline in demand for the Company’s services, capital spending by the oil and natural gas industry, hydrocarbon price volatility, competition within our service industry, reliance on a limited number of suppliers, environmental risks, regulatory changes, the inability to comply with the financial and other covenants and metrics in the Company’s credit facilities, cash flow and access to capital and the timing of capital expenditures and other risks, uncertainties and assumptions that are disclosed from time to time in Liberty’s filings with the Securities and Exchange Commission. Should one or more of the risks or uncertainties described in this presentation occur, or should underlying assumptions prove incorrect, Liberty’s actual results and plans could differ materially from those expressed in any forward‐looking statements. INDUSTRY AND MARKET DATA This presentation has been prepared by Liberty and includes market data and other statistical information from sources believed by Liberty to be reliable, including independent industry publications, government publications or other published independent sources. Some data are also based on Liberty’s good faith estimates, which are derived from its review of internal sources as well as the independent sources described above. Although Liberty believes these sources are reliable, it has not independently verified the information and cannot guarantee its accuracy and completeness. EBITDA, ADJUSTED EBITDA AND ROCE Liberty uses EBITDA, Adjusted EBITDA, and Pre‐Tax Return on Capital Employed (“ROCE”), financial and operational measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), in this presentation. EBITDA, Adjusted EBITDA, and ROCE are used as supplemental non‐GAAP financial and operational measures by Liberty’s management and by external users of Liberty’s financial statements, such as industry analysts, investors, lenders and rating agencies. Liberty believes EBITDA, Adjusted EBITDA, and ROCE are useful to external users of its consolidated and combined financial statements, such as industry analysts, investors, lenders and rating agencies because it allows them to compare its operating performance on a consistent basis across periods by removing the effects of capital structure (such as varying levels of interest expense), asset base (such as depreciation and amortization) and other items that impact the comparability of financial results from period to period. Liberty management believes EBITDA, Adjusted EBITDA, and ROCE provide useful information regarding the factors and trends affecting its business in addition to measures calculated under GAAP. Liberty defines EBITDA as net income (loss) before interest expense, income taxes, depreciation and amortization. Liberty defines Adjusted EBITDA as EBITDA adjusted to eliminate the effects of items such as new fleet or new basin start‐up costs, costs of asset acquisitions, gain or loss on the disposal of assets, asset impairment charges, bad debt reserves and non‐recurring expenses that management does not consider in assessing ongoing performance. Liberty excludes the foregoing items from net income (loss) in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within its industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as historic costs of depreciable assets, none of which are components of Adjusted EBITDA. Adjusted EBITDA is not a measure of net income (loss) or net cash provided by operating activities as determined by GAAP. Adjusted EBITDA should not be considered an alternative to net income, net cash provided by operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Liberty defines ROCE as the ratio of pre‐tax net income for the prior twelve month period to the simple average of total capital employed as of the beginning and end of such period. You should not consider EBITDA, Adjusted EBITDA or ROCE in isolation or as a substitute for an analysis of Liberty’s results as reported under GAAP. Because EBITDA, Adjusted EBITDA, and ROCE may be defined differently by other companies in Liberty’s industry, Liberty’s computations of EBITDA, Adjusted EBITDA, and ROCE may not be comparable to other similarly titled measures of other companies, thereby diminishing its utility. Please see slides 22 and 23 for a reconciliation and calculation of the non‐GAAP measures EBITDA, Adjusted EBITDA, and ROCE to the most directly comparable financial measures calculated in accordance with GAAP. 2 2

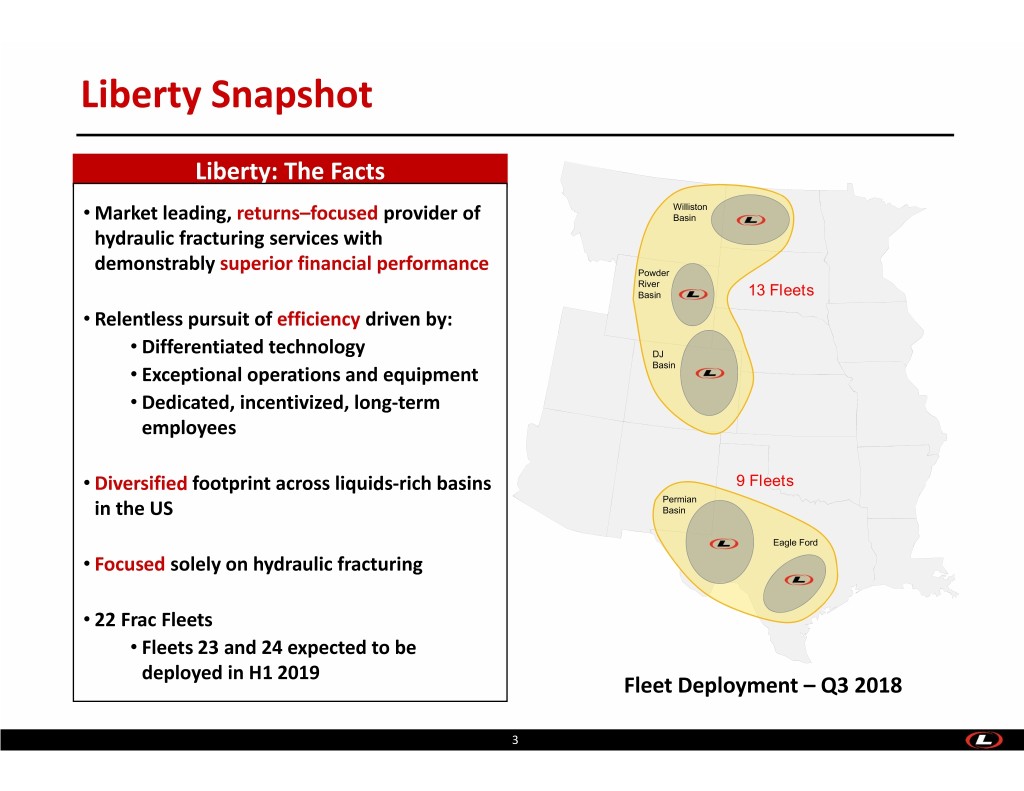

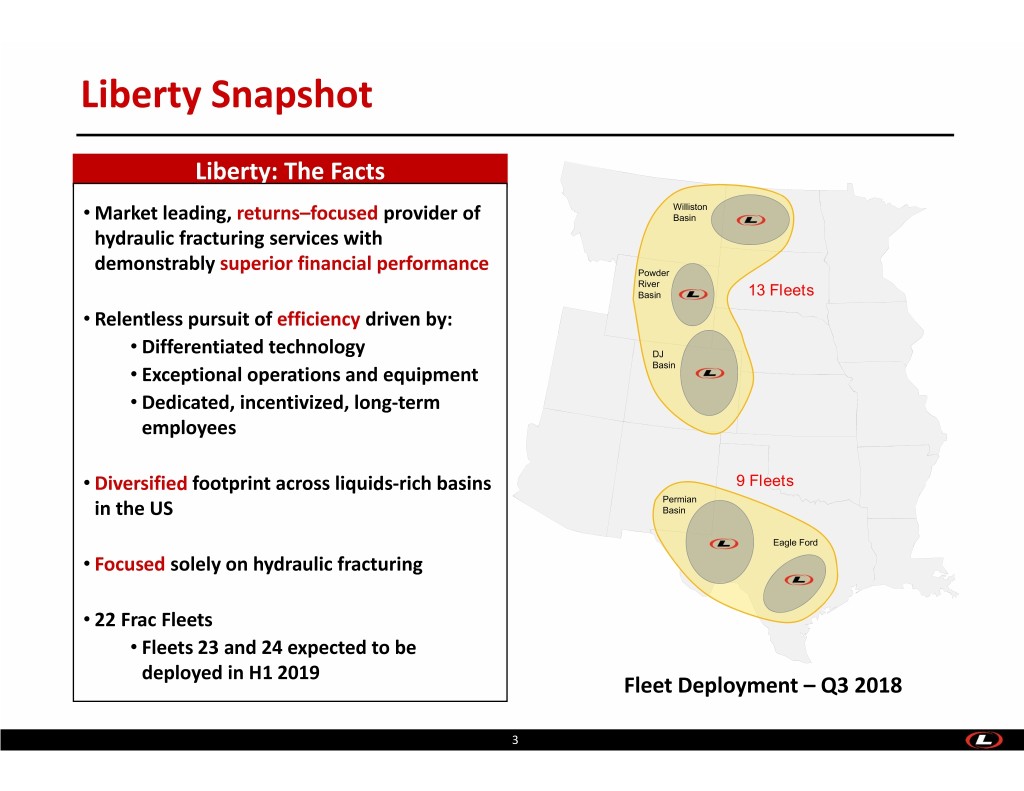

Liberty Snapshot Liberty: The Facts Williston • Market leading, returns–focused provider of Basin hydraulic fracturing services with demonstrably superior financial performance Powder River Basin 13 Fleets • Relentless pursuit of efficiency driven by: • Differentiated technology DJ • Exceptional operations and equipment Basin • Dedicated, incentivized, long‐term employees • Diversified footprint across liquids‐rich basins 9 Fleets Permian in the US Basin Eagle Ford • Focused solely on hydraulic fracturing • 22 Frac Fleets • Fleets 23 and 24 expected to be deployed in H1 2019 Fleet Deployment – Q3 2018 3

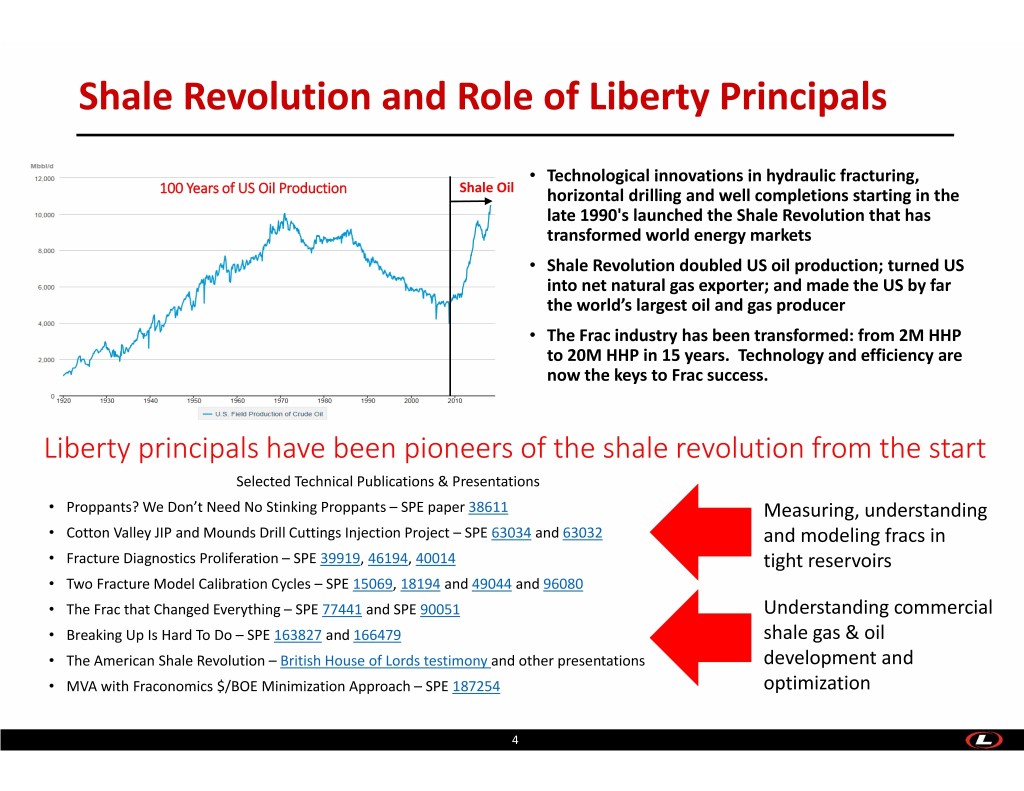

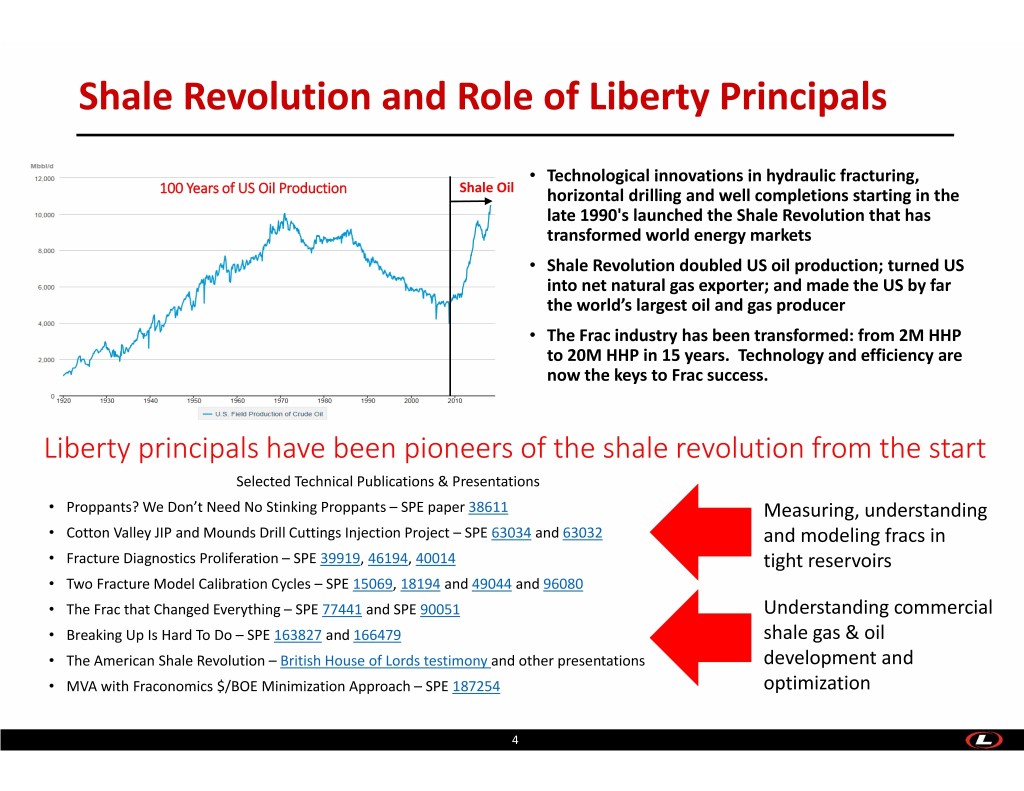

Shale Revolution and Role of Liberty Principals • Technological innovations in hydraulic fracturing, 100 Years of US Oil Production Shale Oil horizontal drilling and well completions starting in the late 1990's launched the Shale Revolution that has transformed world energy markets • Shale Revolution doubled US oil production; turned US into net natural gas exporter; and made the US by far the world’s largest oil and gas producer • The Frac industry has been transformed: from 2M HHP to 20M HHP in 15 years. Technology and efficiency are now the keys to Frac success. Liberty principals have been pioneers of the shale revolution from the start Selected Technical Publications & Presentations • Proppants? We Don’t Need No Stinking Proppants – SPE paper 38611 Measuring, understanding • Cotton Valley JIP and Mounds Drill Cuttings Injection Project – SPE 63034 and 63032 and modeling fracs in • Fracture Diagnostics Proliferation – SPE 39919, 46194, 40014 tight reservoirs • Two Fracture Model Calibration Cycles – SPE 15069, 18194 and 49044 and 96080 • The Frac that Changed Everything – SPE 77441 and SPE 90051 Understanding commercial • Breaking Up Is Hard To Do – SPE 163827 and 166479 shale gas & oil • The American Shale Revolution – British House of Lords testimony and other presentations development and • MVA with Fraconomics $/BOE Minimization Approach – SPE 187254 optimization 4

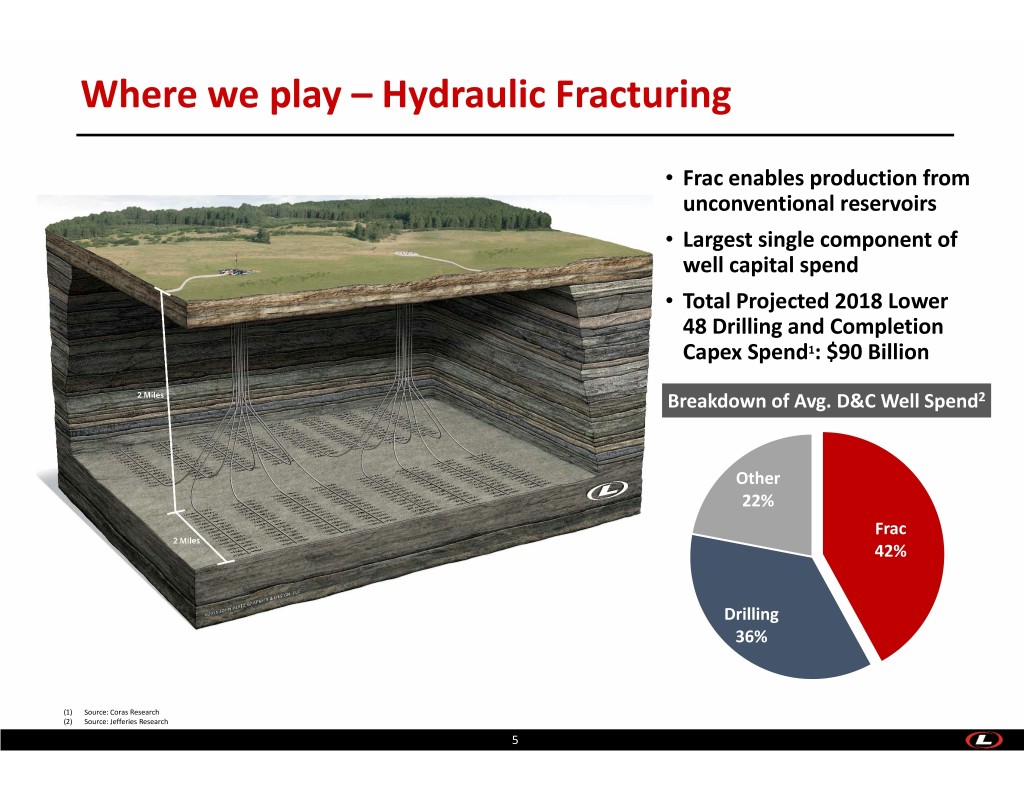

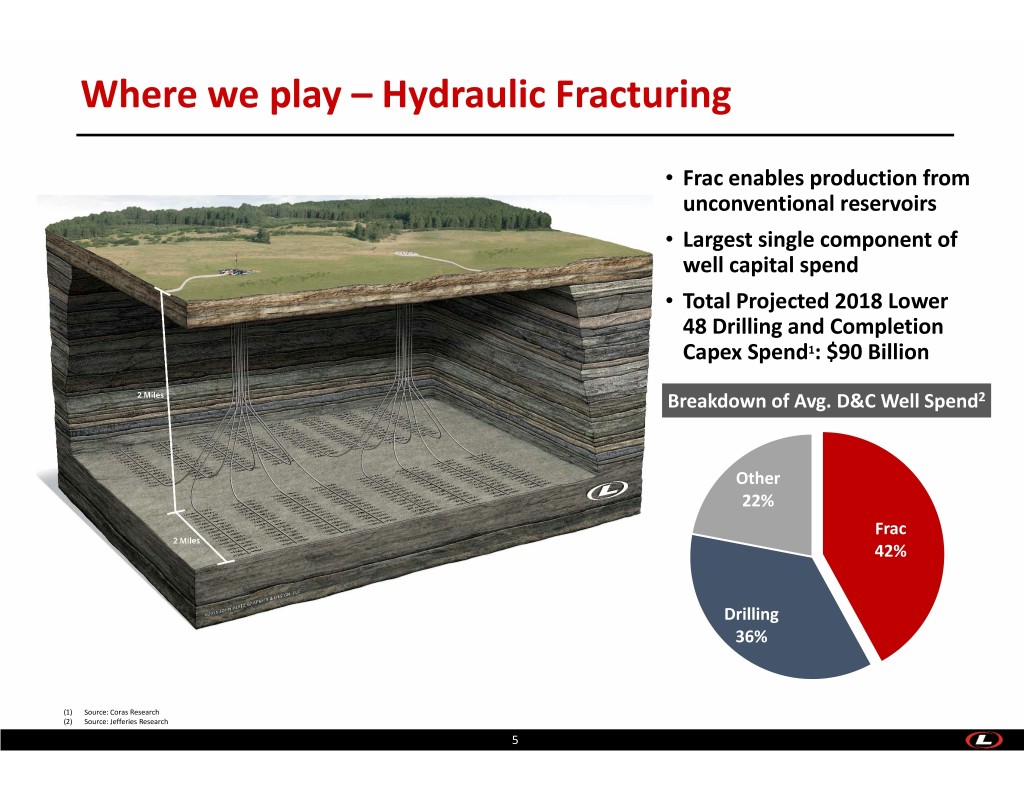

Where we play – Hydraulic Fracturing • Frac enables production from unconventional reservoirs • Largest single component of well capital spend • Total Projected 2018 Lower 48 Drilling and Completion Capex Spend1: $90 Billion Breakdown of Avg. D&C Well Spend2 Other 22% Frac 42% Drilling 36% (1) Source: Coras Research (2) Source: Jefferies Research 5

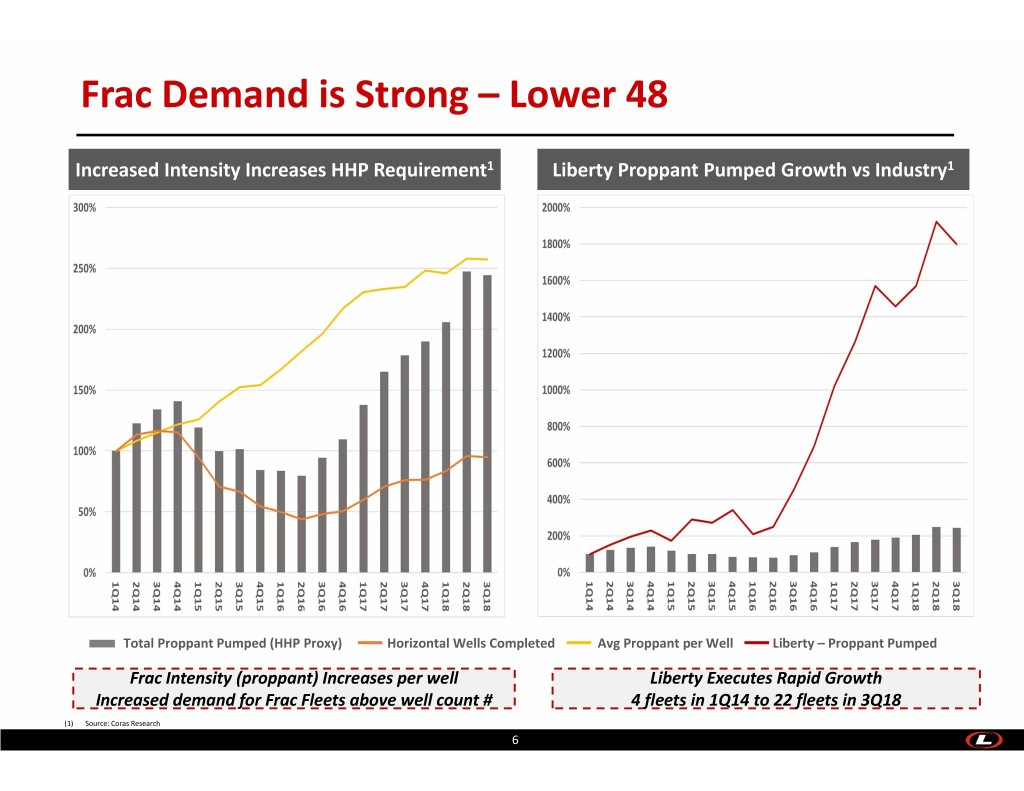

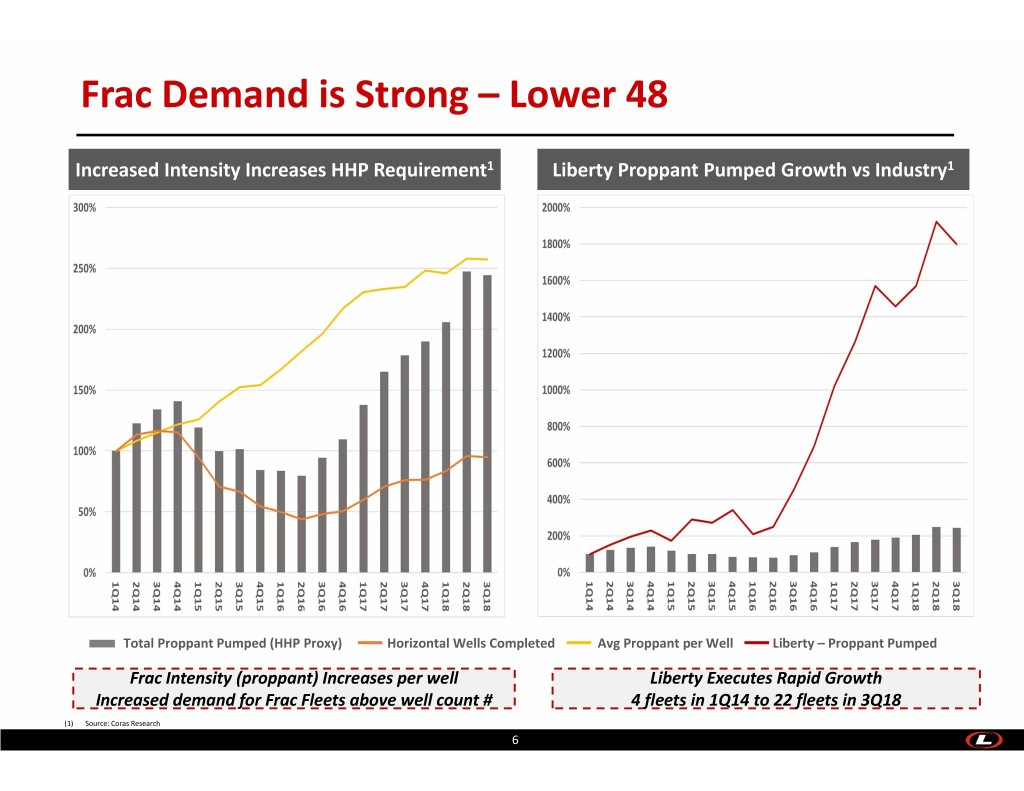

Frac Demand is Strong – Lower 48 Increased Intensity Increases HHP Requirement1 Liberty Proppant Pumped Growth vs Industry1 Total Proppant Pumped (HHP Proxy) Horizontal Wells Completed Avg Proppant per Well Liberty – Proppant Pumped Frac Intensity (proppant) Increases per well Liberty Executes Rapid Growth Increased demand for Frac Fleets above well count # 4 fleets in 1Q14 to 22 fleets in 3Q18 (1) Source: Coras Research 6

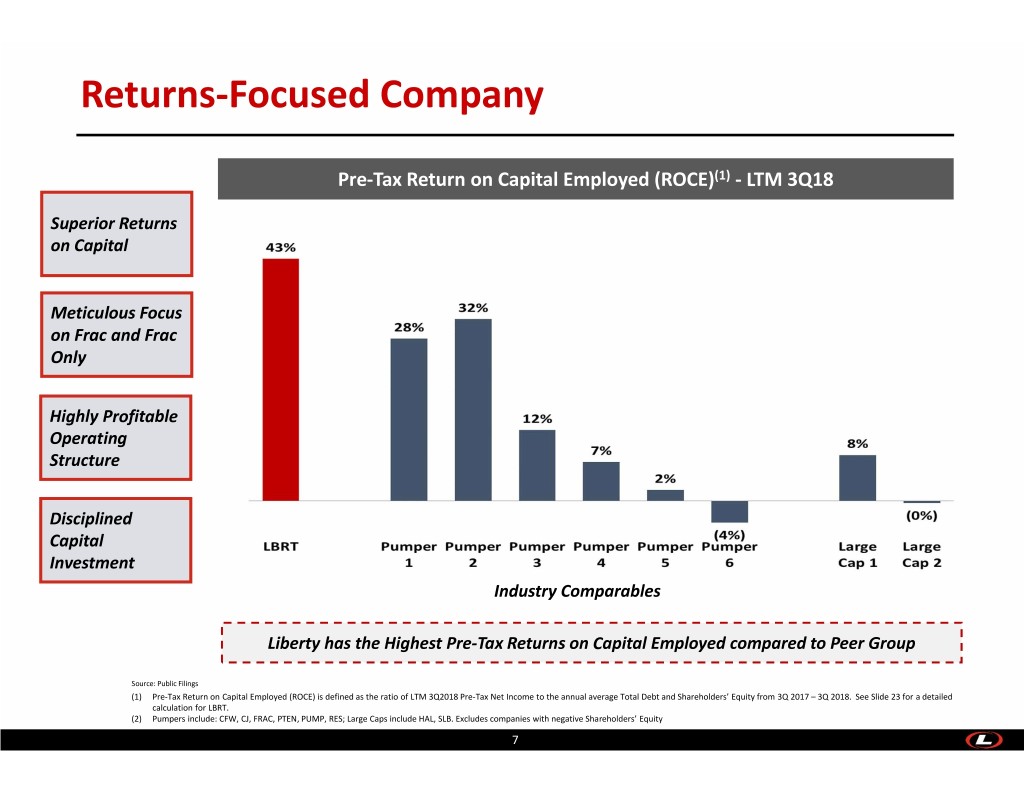

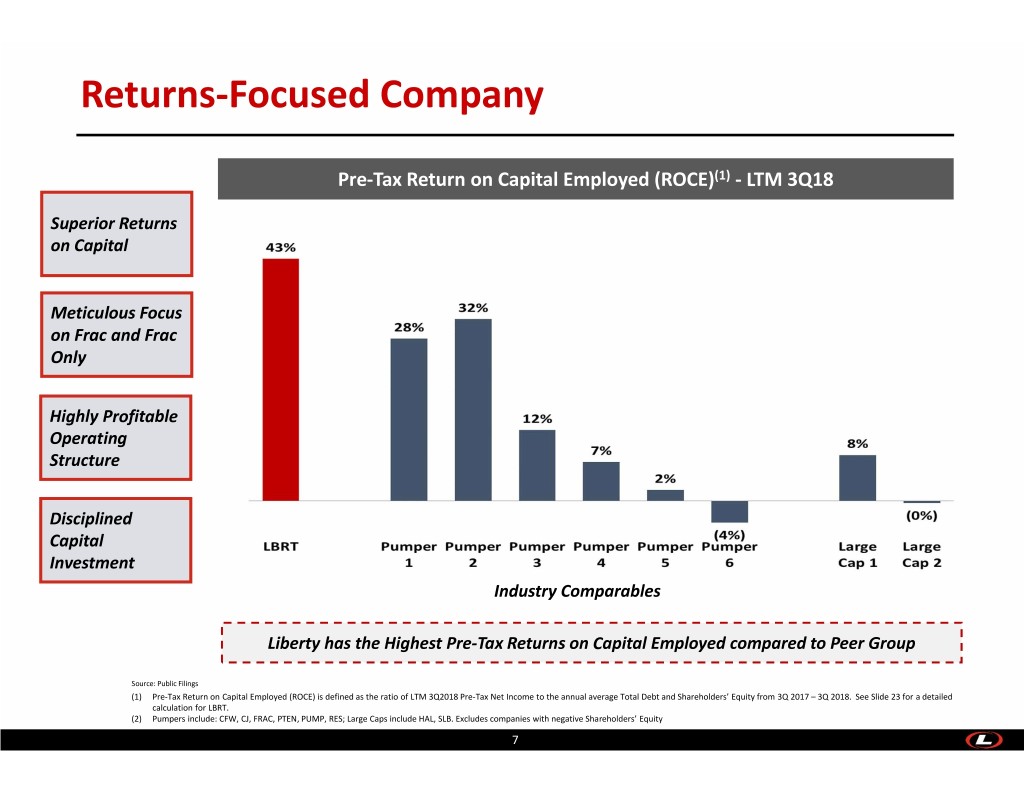

Returns‐Focused Company Pre‐Tax Return on Capital Employed (ROCE)(1) ‐LTM 3Q18 Superior Returns on Capital Meticulous Focus on Frac and Frac Only Highly Profitable Operating Structure Disciplined Capital Investment Industry Comparables Liberty has the Highest Pre‐Tax Returns on Capital Employed compared to Peer Group Source: Public Filings (1) Pre‐Tax Return on Capital Employed (ROCE) is defined as the ratio of LTM 3Q2018 Pre‐Tax Net Income to the annual average Total Debt and Shareholders’ Equity from 3Q 2017 – 3Q 2018. See Slide 23 for a detailed calculation for LBRT. (2) Pumpers include: CFW, CJ, FRAC, PTEN, PUMP, RES; Large Caps include HAL, SLB. Excludes companies with negative Shareholders’ Equity 7

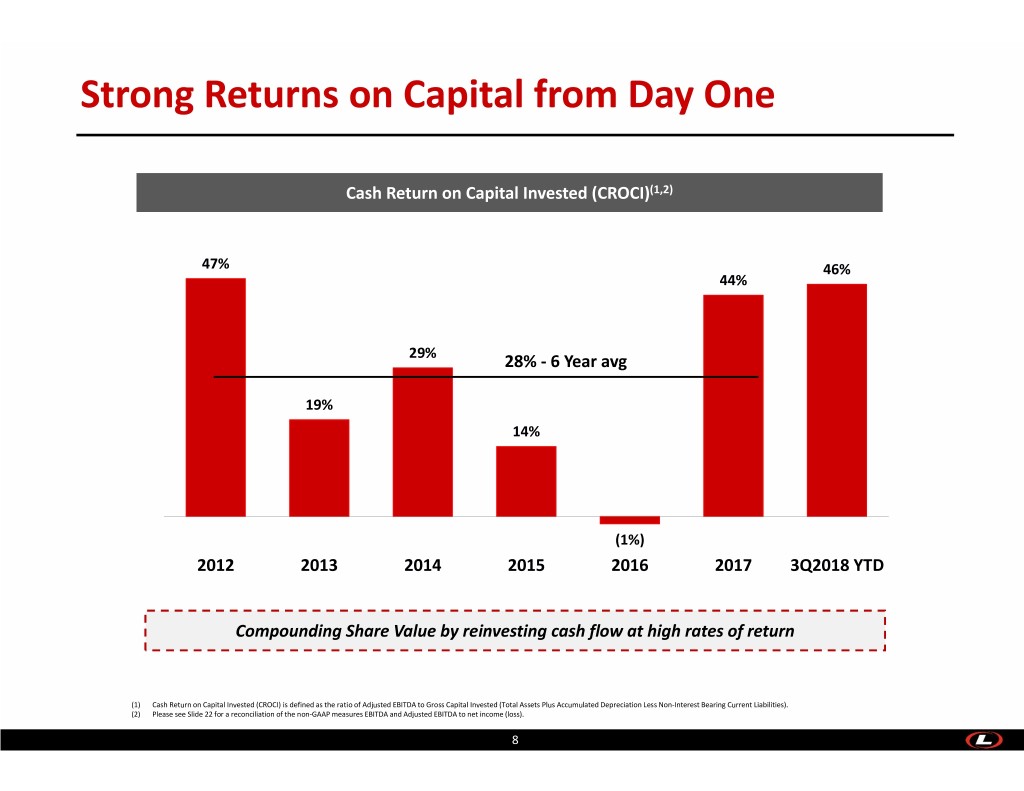

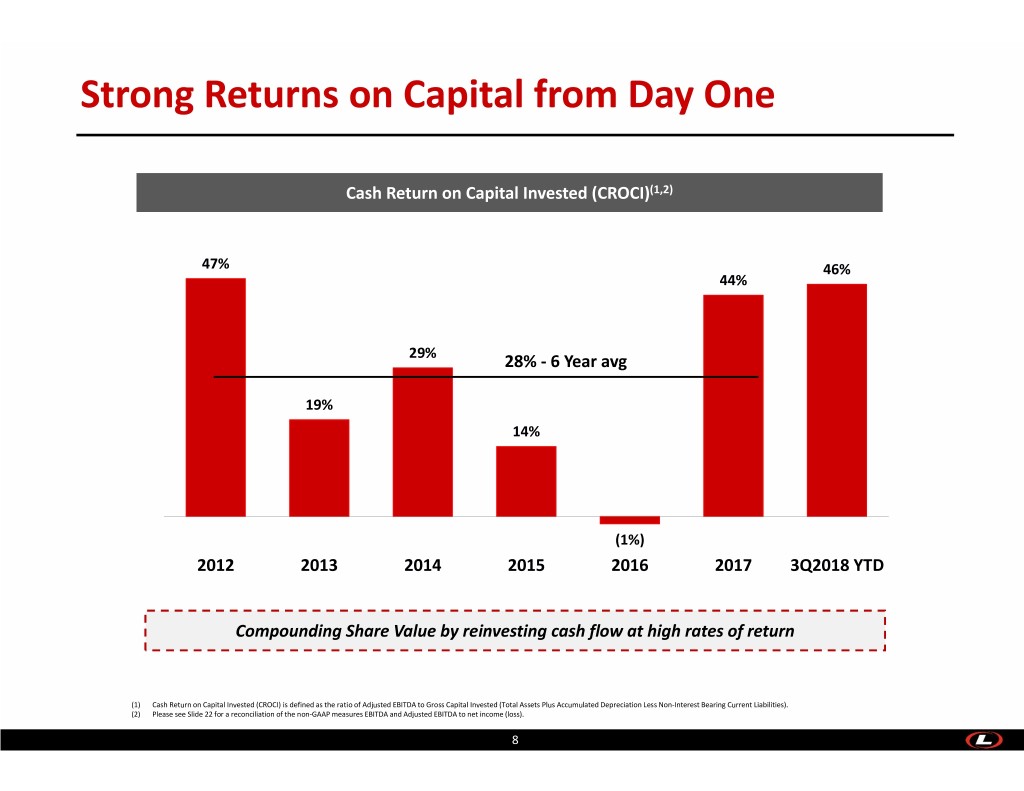

Strong Returns on Capital from Day One Cash Return on Capital Invested (CROCI)(1,2) 47% 46% 44% 29% 28% ‐ 6 Year avg 19% 14% (1%) 2012 2013 2014 2015 2016 2017 3Q2018 YTD Compounding Share Value by reinvesting cash flow at high rates of return (1) Cash Return on Capital Invested (CROCI) is defined as the ratio of Adjusted EBITDA to Gross Capital Invested (Total Assets Plus Accumulated Depreciation Less Non‐Interest Bearing Current Liabilities). (2) Please see Slide 22 for a reconciliation of the non‐GAAP measures EBITDA and Adjusted EBITDA to net income (loss). 8

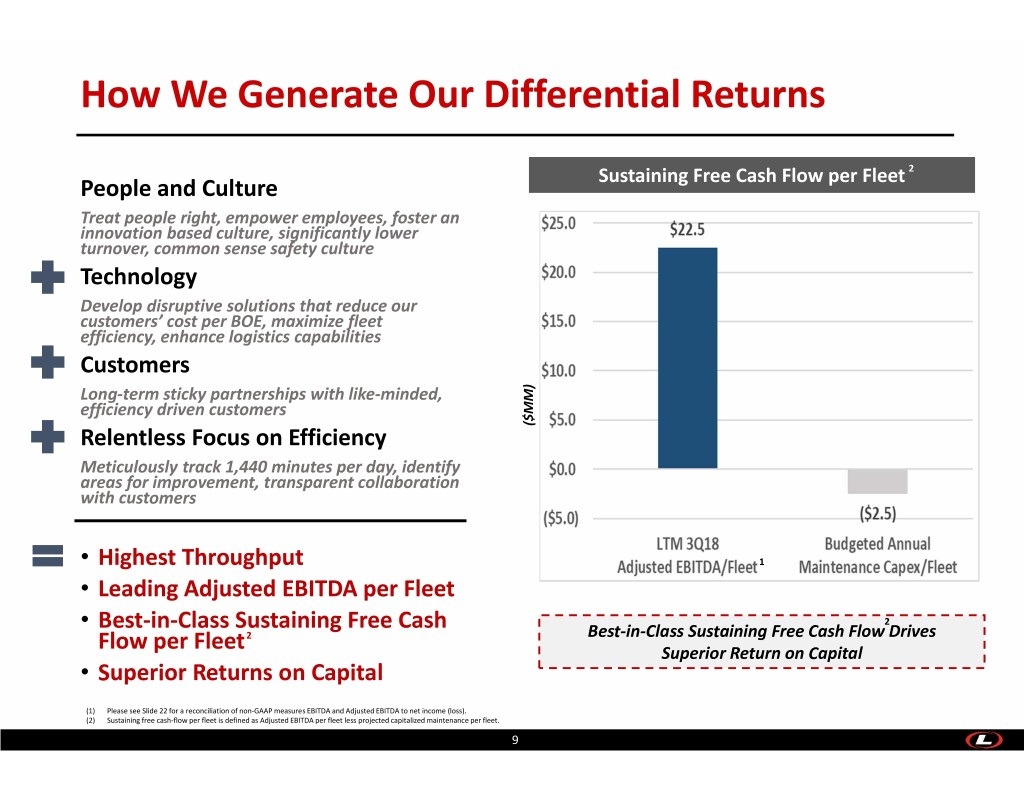

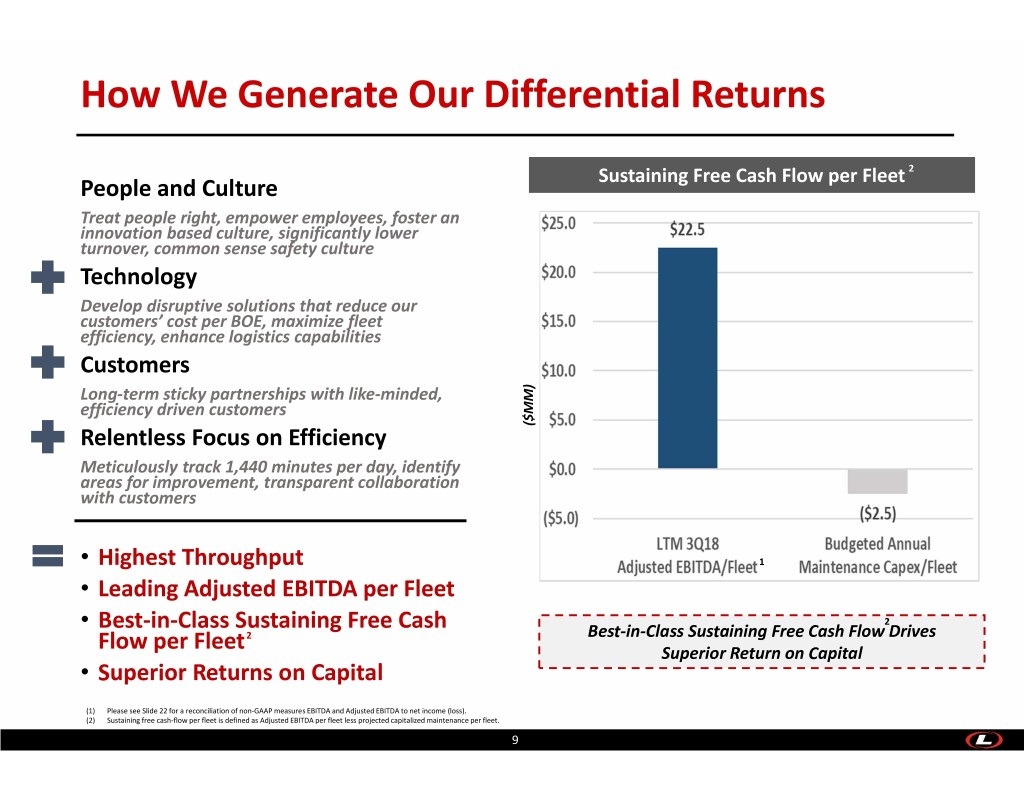

How We Generate Our Differential Returns Sustaining Free Cash Flow per Fleet 2 People and Culture Treat people right, empower employees, foster an innovation based culture, significantly lower turnover, common sense safety culture Technology Develop disruptive solutions that reduce our customers’ cost per BOE, maximize fleet efficiency, enhance logistics capabilities Customers Long‐term sticky partnerships with like‐minded, efficiency driven customers ($MM) Relentless Focus on Efficiency Meticulously track 1,440 minutes per day, identify areas for improvement, transparent collaboration with customers • Highest Throughput 1 • Leading Adjusted EBITDA per Fleet • Best‐in‐Class Sustaining Free Cash 2 2 Best‐in‐Class Sustaining Free Cash Flow Drives Flow per Fleet Superior Return on Capital • Superior Returns on Capital (1) Please see Slide 22 for a reconciliation of non‐GAAP measures EBITDA and Adjusted EBITDA to net income (loss). (2) Sustaining free cash‐flow per fleet is defined as Adjusted EBITDA per fleet less projected capitalized maintenance per fleet. 9

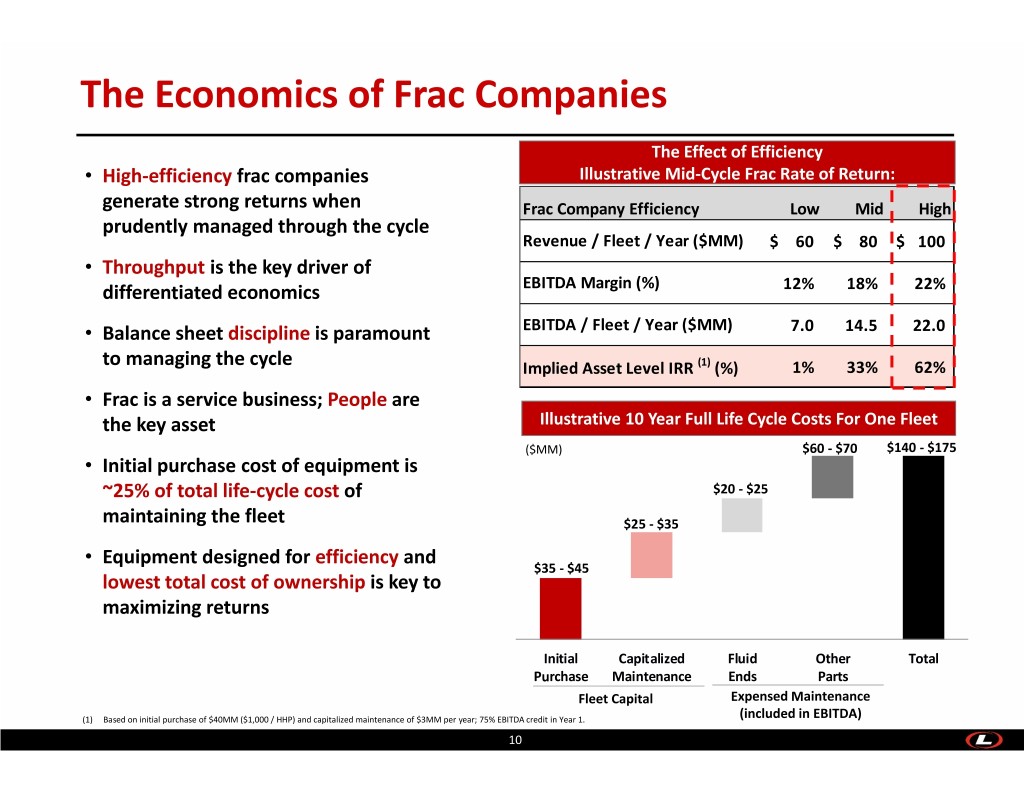

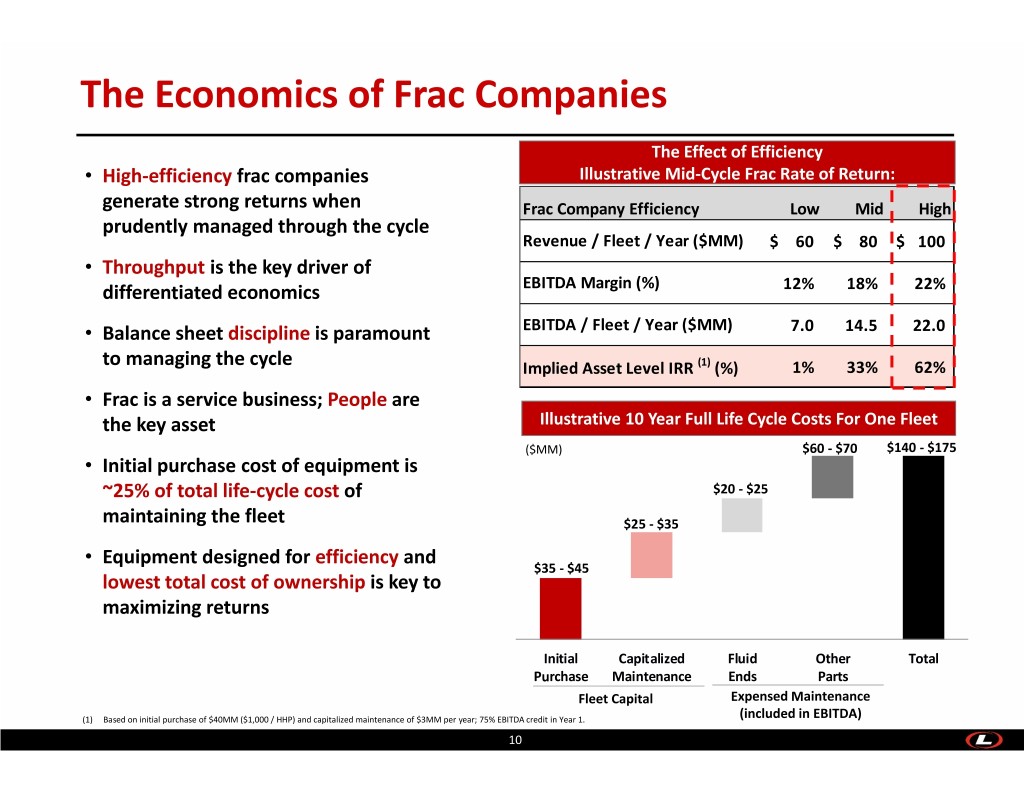

The Economics of Frac Companies The Effect of Efficiency • High‐efficiency frac companies Illustrative Mid‐Cycle Frac Rate of Return: generate strong returns when Frac Company Efficiency Low Mid High prudently managed through the cycle Revenue / Fleet / Year ($MM) $ 60 $ 80 $ 100 • Throughput is the key driver of differentiated economics EBITDA Margin (%) 12% 18% 22% • Balance sheet discipline is paramount EBITDA / Fleet / Year ($MM) 7.0 14.5 22.0 to managing the cycle Implied Asset Level IRR (1) (%) 1% 33% 62% • Frac is a service business; People are the key asset Illustrative 10 Year Full Life Cycle Costs For One Fleet ($MM) $60 ‐ $70 $140 ‐ $175 • Initial purchase cost of equipment is ~25% of total life‐cycle cost of $20 ‐ $25 maintaining the fleet $25 ‐ $35 • Equipment designed for efficiency and $35 ‐ $45 lowest total cost of ownership is key to maximizing returns Initial Capitalized Fluid Other Total Purchase Maintenance Ends Parts Fleet Capital Expensed Maintenance (1) Based on initial purchase of $40MM ($1,000 / HHP) and capitalized maintenance of $3MM per year; 75% EBITDA credit in Year 1. (included in EBITDA) 10

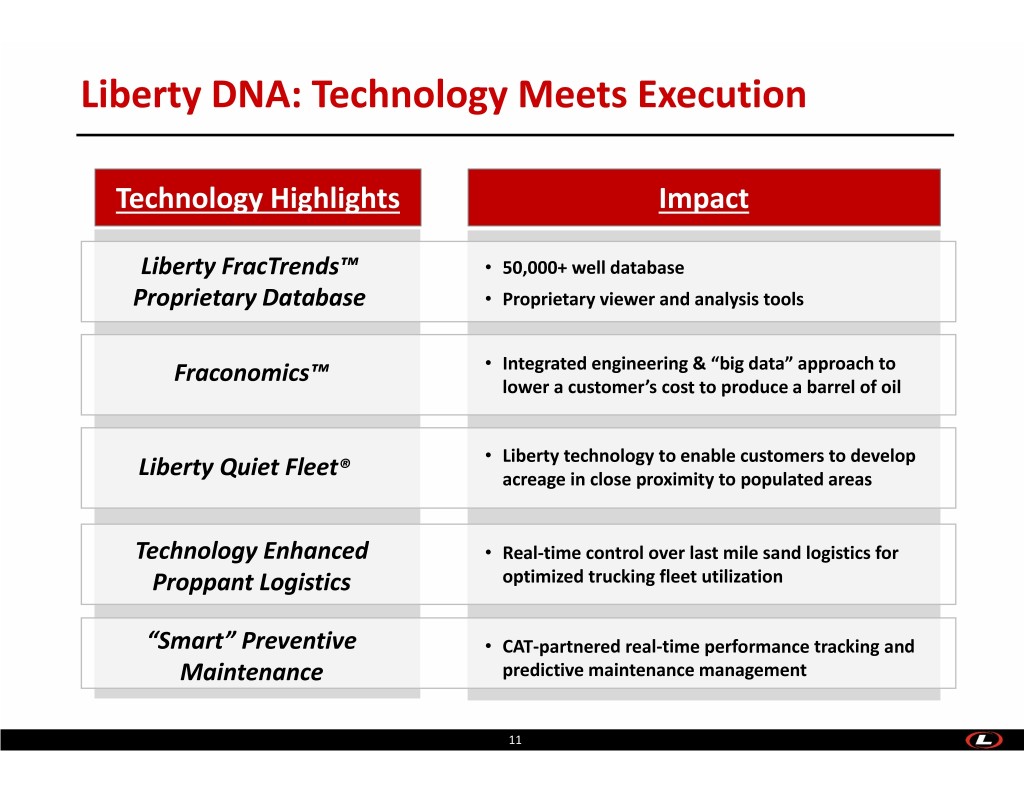

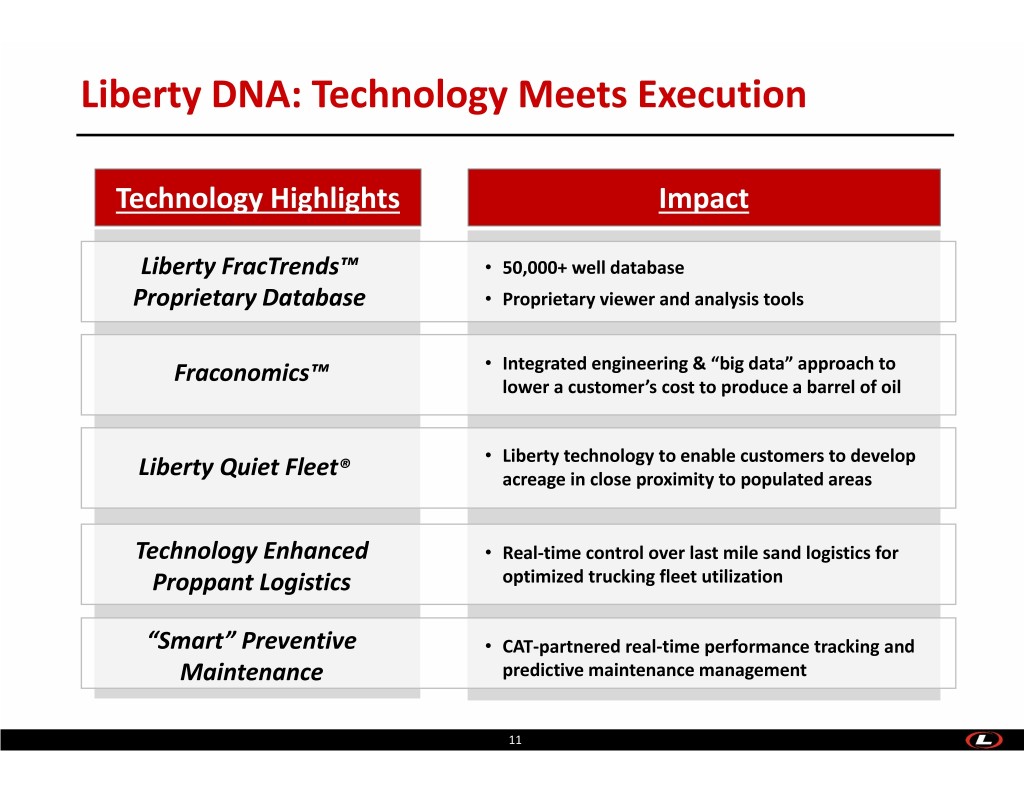

Liberty DNA: Technology Meets Execution Technology Highlights Impact Liberty FracTrends™ • 50,000+ well database Proprietary Database • Proprietary viewer and analysis tools Fraconomics™ • Integrated engineering & “big data” approach to lower a customer’s cost to produce a barrel of oil • Liberty technology to enable customers to develop Liberty Quiet Fleet® acreage in close proximity to populated areas Technology Enhanced • Real‐time control over last mile sand logistics for Proppant Logistics optimized trucking fleet utilization “Smart” Preventive • CAT‐partnered real‐time performance tracking and Maintenance predictive maintenance management 11

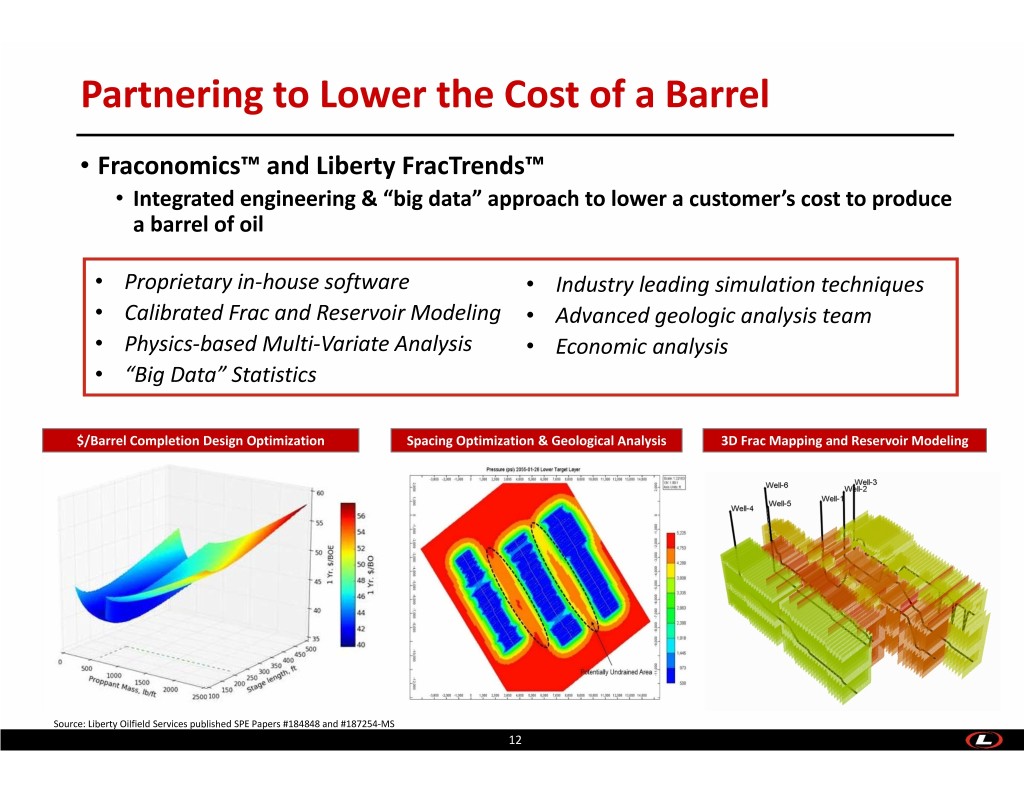

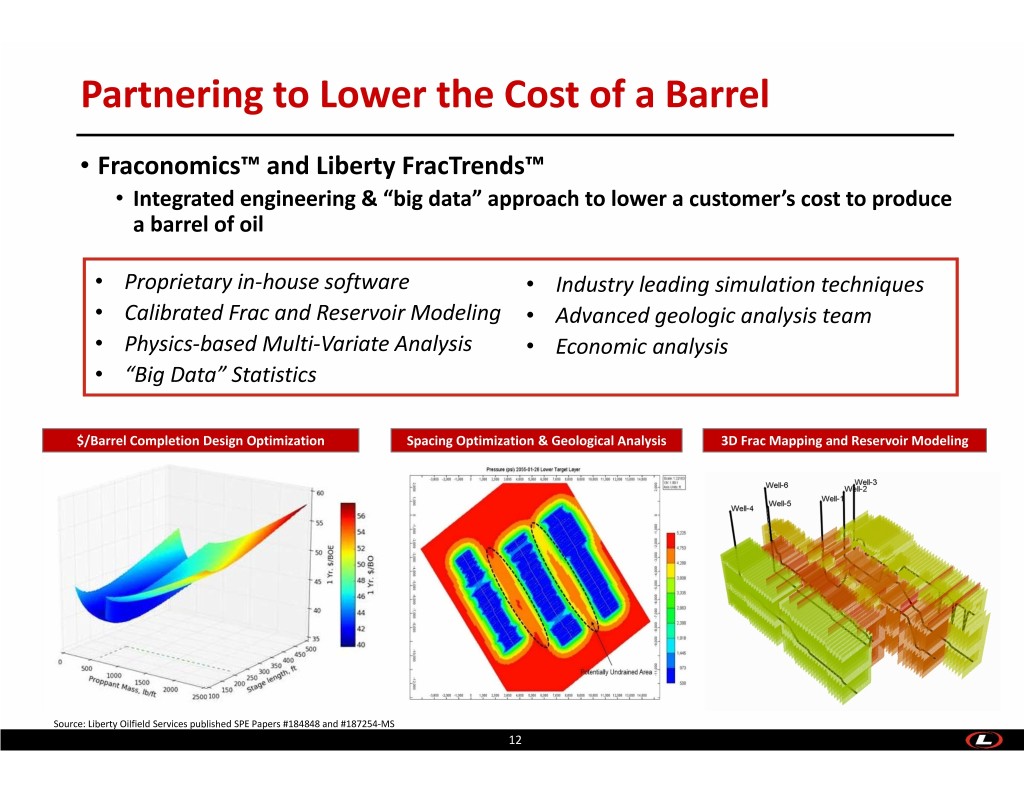

Partnering to Lower the Cost of a Barrel • Fraconomics™ and Liberty FracTrends™ • Integrated engineering & “big data” approach to lower a customer’s cost to produce a barrel of oil • Proprietary in‐house software • Industry leading simulation techniques • Calibrated Frac and Reservoir Modeling • Advanced geologic analysis team • Physics‐based Multi‐Variate Analysis • Economic analysis • “Big Data” Statistics $/Barrel Completion Design Optimization Spacing Optimization & Geological Analysis 3D Frac Mapping and Reservoir Modeling Source: Liberty Oilfield Services published SPE Papers #184848 and #187254‐MS 12

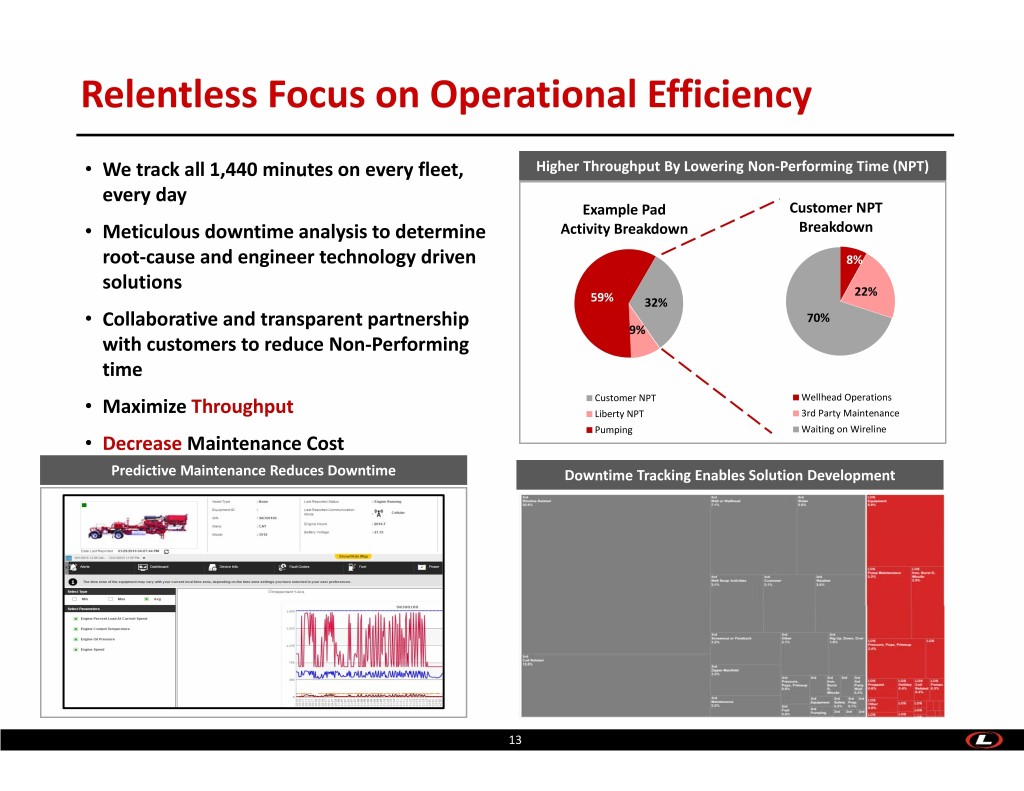

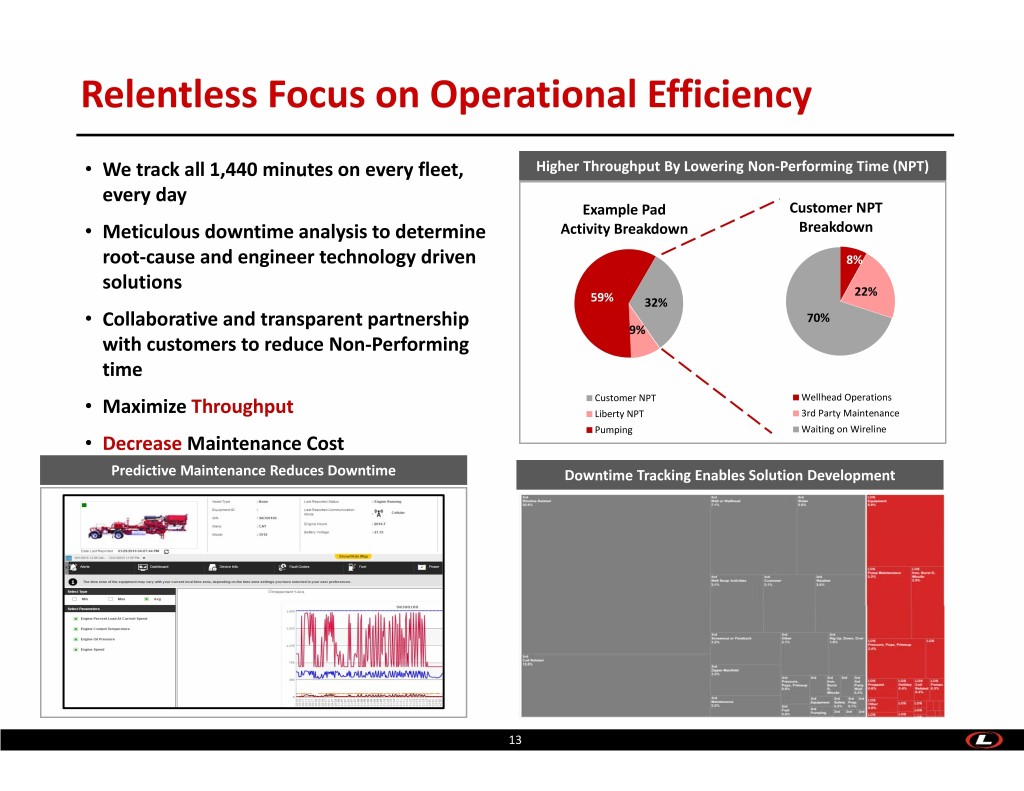

Relentless Focus on Operational Efficiency • We track all 1,440 minutes on every fleet, Higher Throughput By Lowering Non‐Performing Time (NPT) every day Example Pad Customer NPT • Meticulous downtime analysis to determine Activity Breakdown Breakdown root‐cause and engineer technology driven 8% solutions 22% 59% 32% • 70% Collaborative and transparent partnership 9% with customers to reduce Non‐Performing time Customer NPT Wellhead Operations • Maximize Throughput Liberty NPT 3rd Party Maintenance Pumping Waiting on Wireline • Decrease Maintenance Cost Predictive Maintenance Reduces Downtime Downtime Tracking Enables Solution Development 13

Liberty – The Employer of Choice Employee‐centered culture which attracts and retains high potential talent • Get the best talent and you win • Lower personnel turnover • Zero layoffs during the 2014 ‐ 2016 downturn • Safety first ‐ incident rate less than half of industry average • Highly variable compensation linked to safety, throughput, profitability and return on capital • Experienced, Incentivized Crews = Higher Throughput = Partner of Choice Source: Company disclosure, OSHA 14

Liberty Purpose‐Built Fleet ~ 1.2 Million HHP ~1.2 Million HHP Owned/Under Construction Expected in the Field by H1 2019 Liberty Purpose‐ Liberty Quiet Liberty High Liberty Pump Down The Liberty Fleet Built Frac Fleets FleetTM Frac Fleets Pressure Frac Fleets & Pump Services 11 fleets of 40,000 9 fleets of 40,000 4 fleets upsized to 24 fleets of 5,000 24 Frac Fleets all HHP each HHP each 50,000 HHP each HHP each + 3 Misc. with Pump Down (16 Pumps/fleet) (16 Pumps/fleet) (20 Pumps/fleet) Pumping Service Support Fleets Support customers in Delaware basin (63 Pumps total) and Eagle Ford Pump Down on every frac fleet to improve efficiency 440,000 HHP 360,000 HHP 200,000 HHP 158,000 HHP ~1.2 Million HHP 15

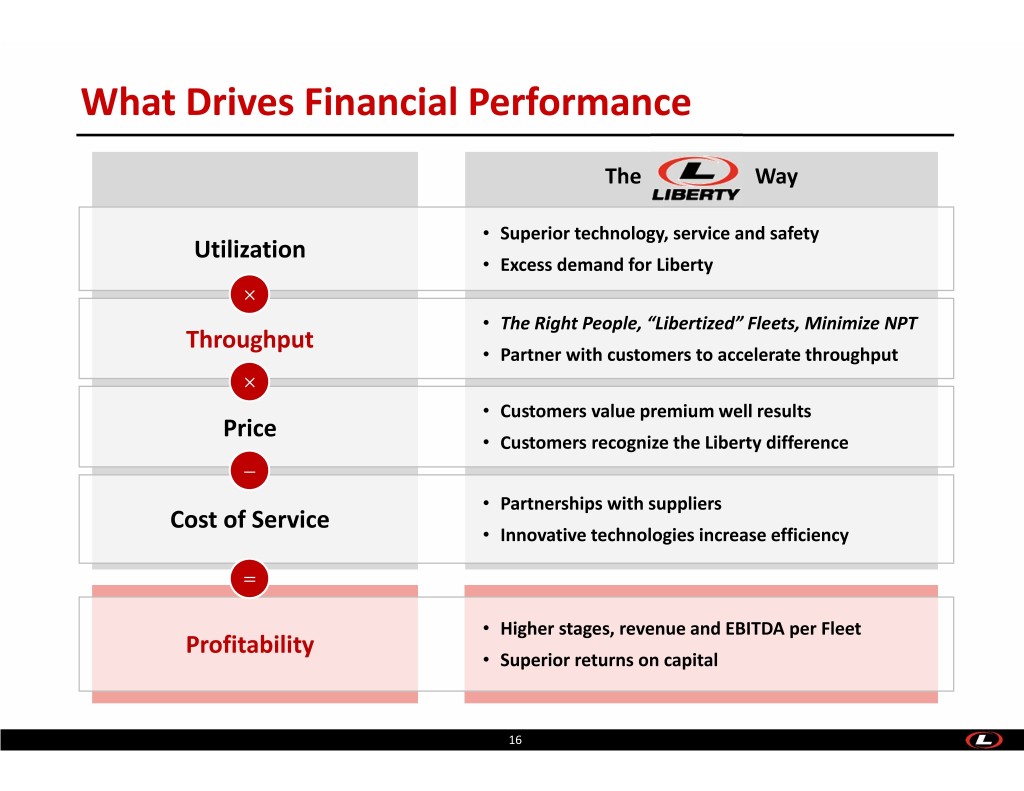

What Drives Financial Performance The Way • Superior technology, service and safety Utilization • Excess demand for Liberty ൈ • The Right People, “Libertized” Fleets, Minimize NPT Throughput • Partner with customers to accelerate throughput ൈ • Customers value premium well results Price • Customers recognize the Liberty difference െ • Partnerships with suppliers Cost of Service • Innovative technologies increase efficiency ൌ • Higher stages, revenue and EBITDA per Fleet Profitability • Superior returns on capital 16

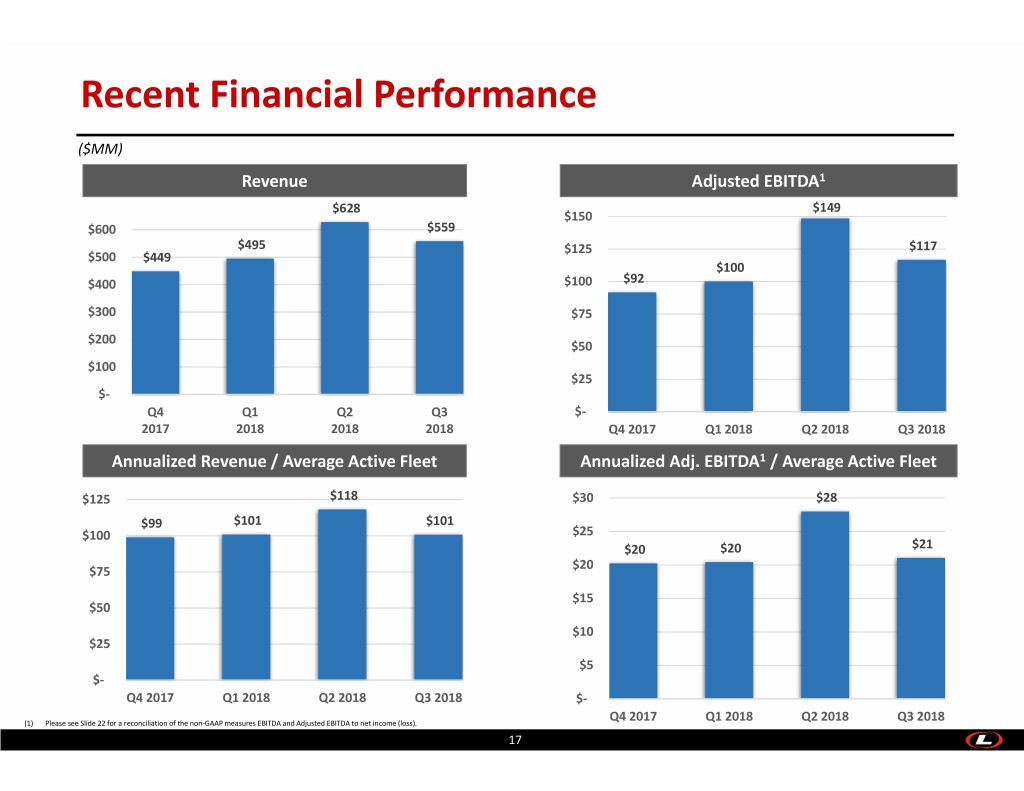

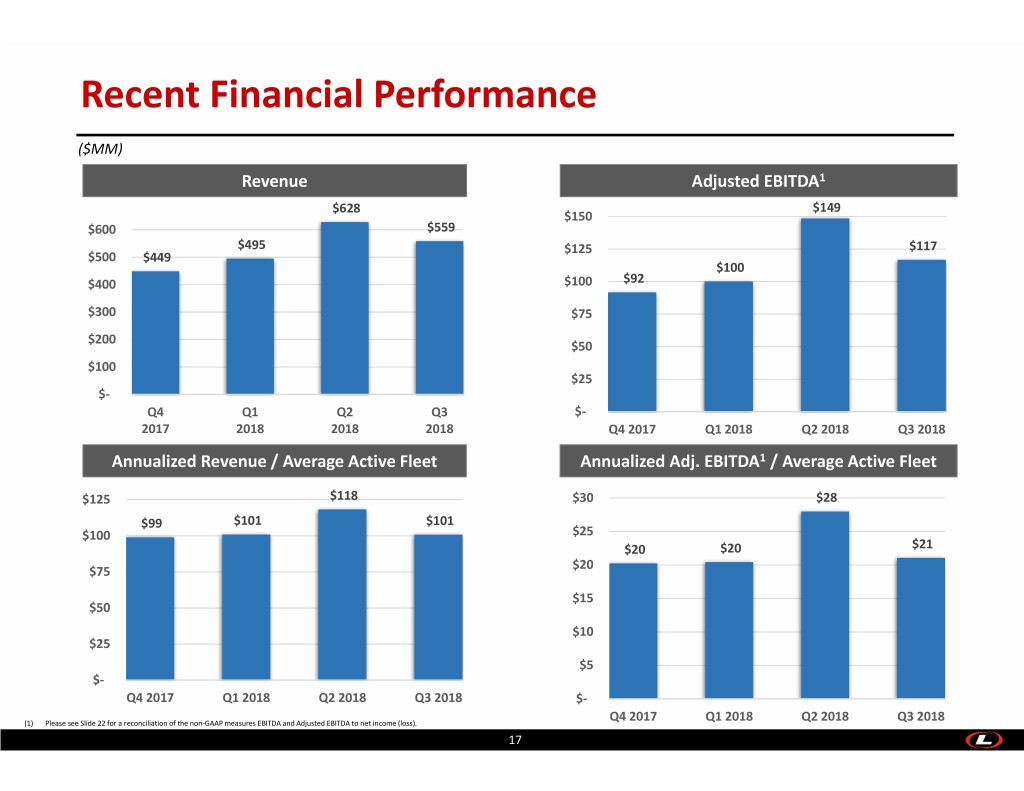

Recent Financial Performance ($MM) Revenue Adjusted EBITDA1 $628 $149 $150 $600 $559 $495 $125 $117 $500 $449 $100 $400 $100 $92 $300 $75 $200 $50 $100 $25 $‐ Q4 Q1 Q2 Q3 $‐ 2017 2018 2018 2018 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Annualized Revenue / Average Active Fleet Annualized Adj. EBITDA1 / Average Active Fleet $125 $118 $30 $28 $99 $101 $101 $100 $25 $20 $20 $21 $20 $75 $15 $50 $10 $25 $5 $‐ Q4 2017 Q1 2018 Q2 2018 Q3 2018 $‐ (1) Please see Slide 22 for a reconciliation of the non‐GAAP measures EBITDA and Adjusted EBITDA to net income (loss). Q4 2017 Q1 2018 Q2 2018 Q3 2018 17

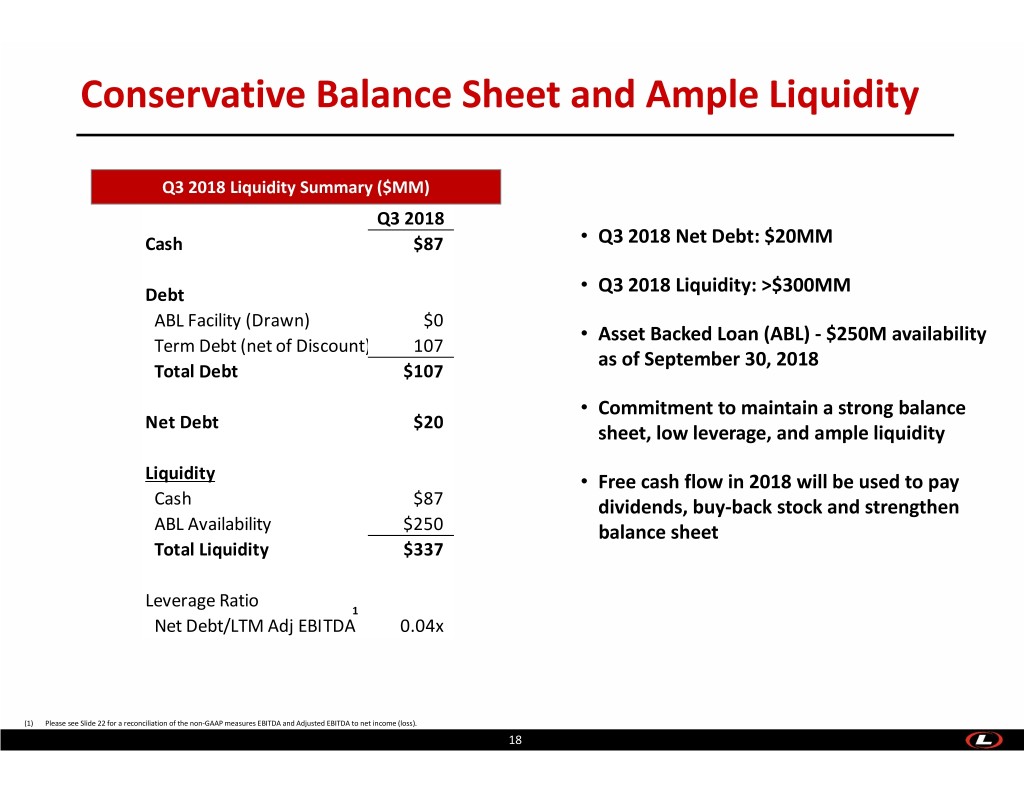

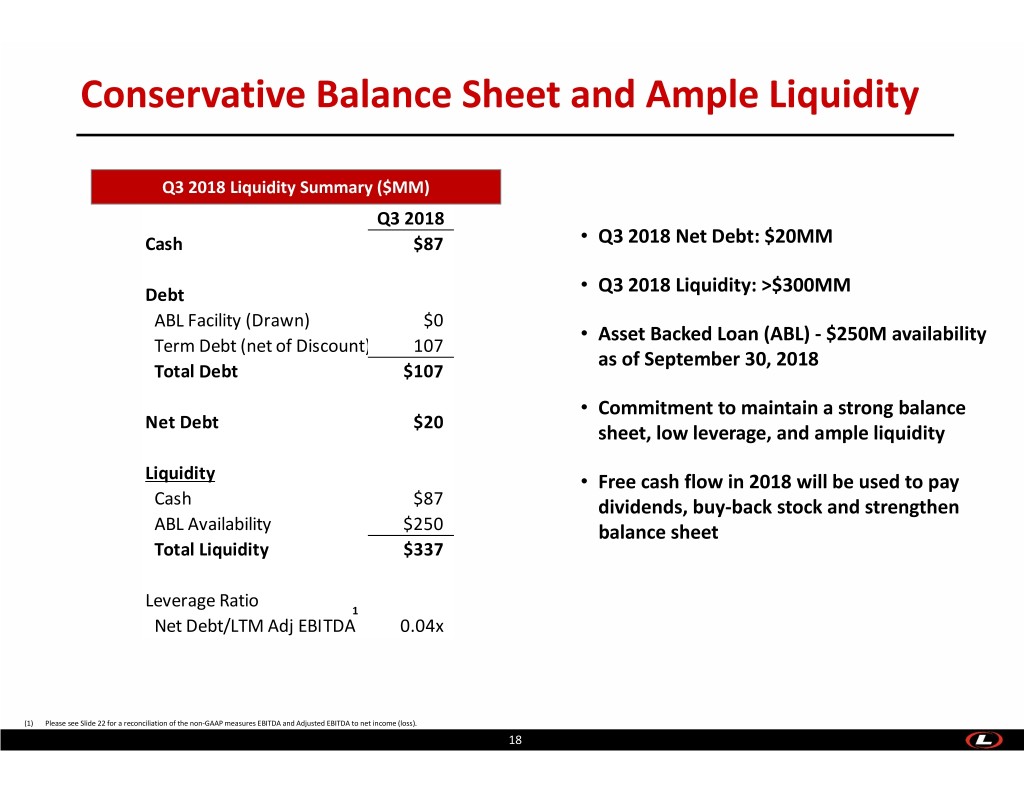

Conservative Balance Sheet and Ample Liquidity Q3 2018 Liquidity Summary ($MM) Q3 2018 Cash $87 • Q3 2018 Net Debt: $20MM Debt • Q3 2018 Liquidity: >$300MM ABL Facility (Drawn) $0 • Asset Backed Loan (ABL) ‐ $250M availability Term Debt (net of Discount) 107 as of September 30, 2018 Total Debt $107 • Commitment to maintain a strong balance Net Debt $20 sheet, low leverage, and ample liquidity Liquidity • Free cash flow in 2018 will be used to pay Cash $87 dividends, buy‐back stock and strengthen ABL Availability $250 balance sheet Total Liquidity $337 Leverage Ratio 1 Net Debt/LTM Adj EBITDA 0.04x (1) Please see Slide 22 for a reconciliation of the non‐GAAP measures EBITDA and Adjusted EBITDA to net income (loss). 18

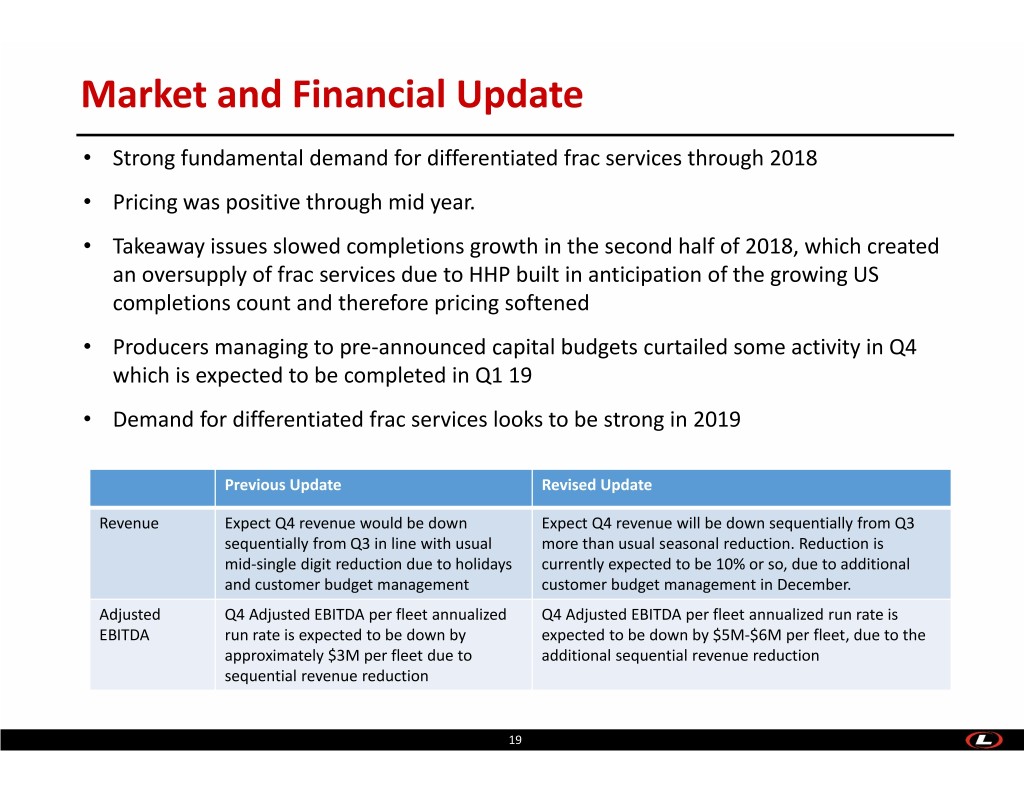

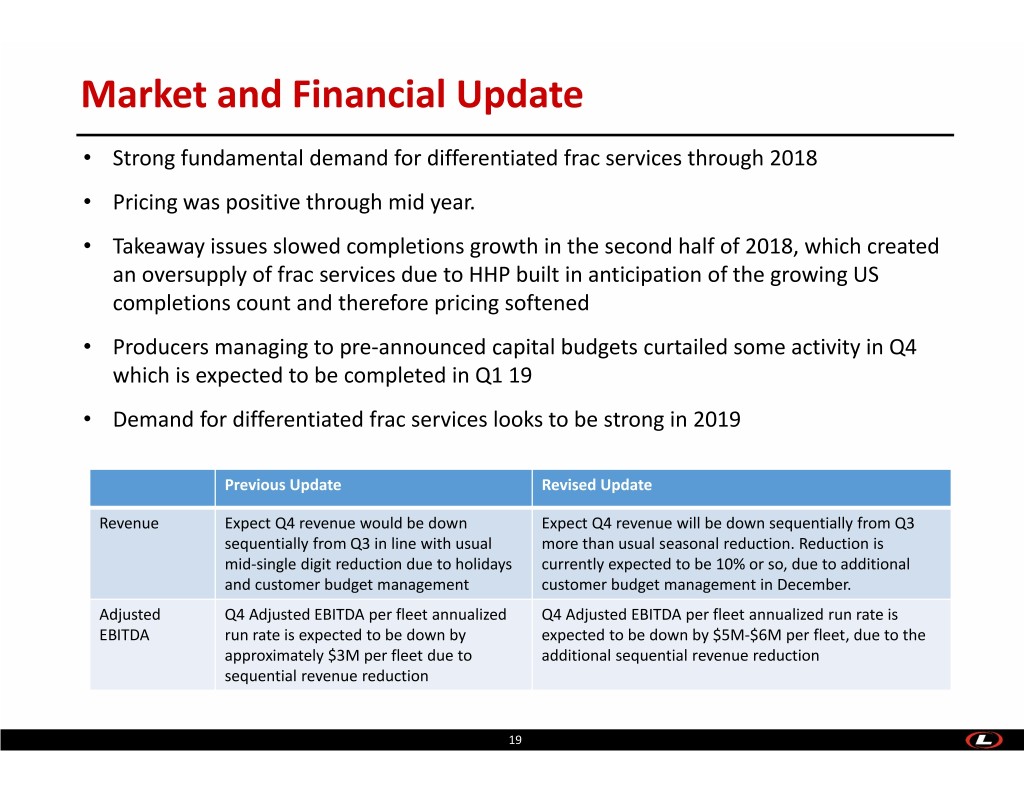

Market and Financial Update • Strong fundamental demand for differentiated frac services through 2018 • Pricing was positive through mid year. • Takeaway issues slowed completions growth in the second half of 2018, which created an oversupply of frac services due to HHP built in anticipation of the growing US completions count and therefore pricing softened • Producers managing to pre‐announced capital budgets curtailed some activity in Q4 which is expected to be completed in Q1 19 • Demand for differentiated frac services looks to be strong in 2019 Previous Update Revised Update Revenue Expect Q4 revenue would be down Expect Q4 revenue will be down sequentially from Q3 sequentially from Q3 in line with usual more than usual seasonal reduction. Reduction is mid‐single digit reduction due to holidays currently expected to be 10% or so, due to additional and customer budget management customer budget management in December. Adjusted Q4 Adjusted EBITDA per fleet annualized Q4 Adjusted EBITDA per fleet annualized run rate is EBITDA run rate is expected to be down by expected to be down by $5M‐$6M per fleet, due to the approximately $3M per fleet due to additional sequential revenue reduction sequential revenue reduction 19

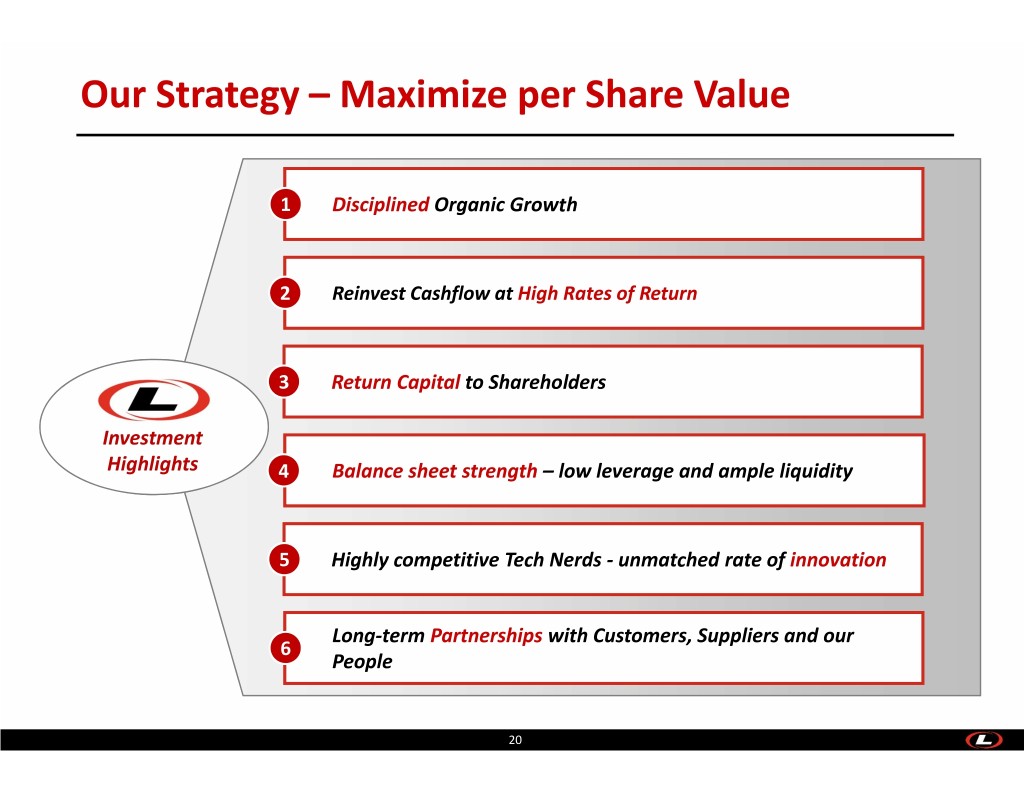

Our Strategy – Maximize per Share Value 1 Disciplined Organic Growth 2 Reinvest Cashflow at High Rates of Return 3 Return Capital to Shareholders Investment Highlights 4 Balance sheet strength – low leverage and ample liquidity 5 Highly competitive Tech Nerds ‐ unmatched rate of innovation Long‐term Partnerships with Customers, Suppliers and our 6 People 20

Appendix NYSE: LBRT www.LibertyFrac.com

Adjusted EBITDA Reconciliation 3 Months Ended 3 Months Ended 3 Months Ended 3 Months Ended Year Ended 30‐Sep‐18 30‐Jun‐18 31‐Mar‐18 31‐Dec‐17 31‐Dec‐17 Net Income (loss)$ 66.4 $ 94.7 $ 54.0 $ 57.7 $ 168.5 Deprecia�on & Amor�za�on 32.3 30.6 28.0 25.6 81.5 Interest Expense 3.6 3.5 6.5 5.3 12.6 Income Tax Expense 12.2 15.9 8.1 ‐ ‐ EBITDA1,2 $ 114.6 $ 144.7 $ 96.6 $ 88.7 $ 262.6 Fleet start‐up costs 2.2 3.3 3.3 3.2 14.0 Asset acquisition costs ‐ ‐ ‐ (0.5) 2.5 (Gain) / loss on disposal of asse t 0.7 0.5 0.1 0.2 0.1 Advisory services fees ‐ ‐ 0.2 0.3 1.5 Adjusted EBITDA1,2 $ 117.5 $ 148.5 $ 100.2 $ 91.8 $ 280.7 (1) EBITDA and Adjusted EBITDA are financial measures not presented in accordance with GAAP. (2) Amounts above may not add up to total due to rounding 22

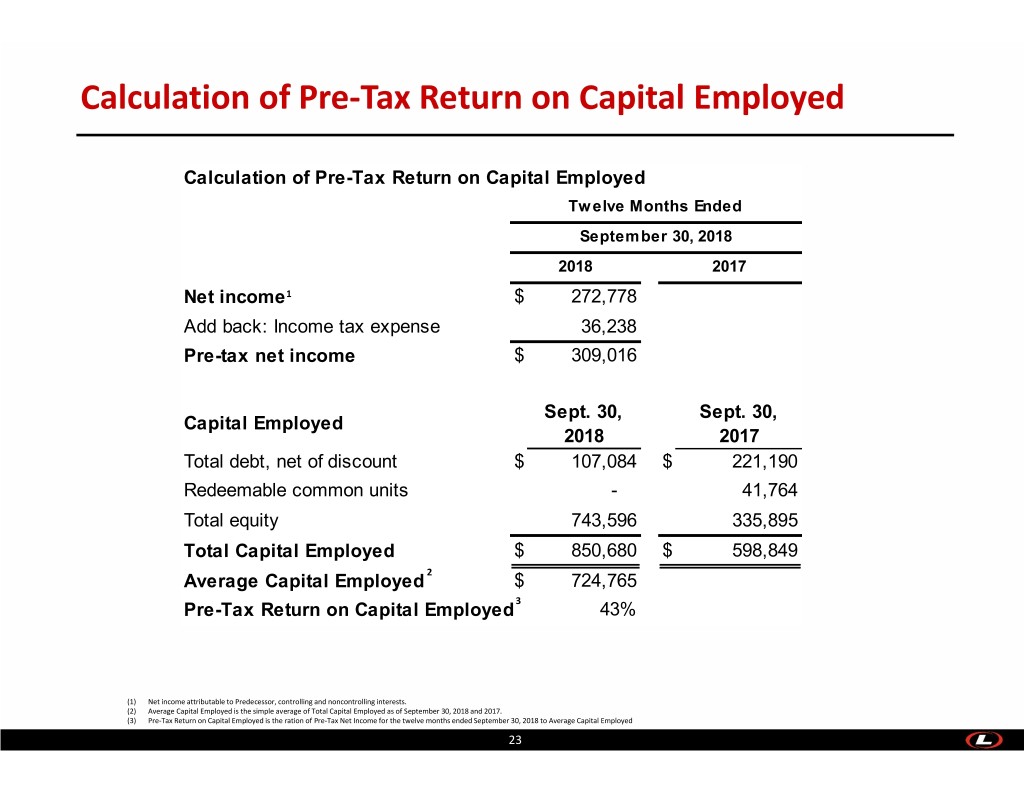

Calculation of Pre‐Tax Return on Capital Employed Calculation of Pre-Tax Return on Capital Employed Twelve Months Ended September 30, 2018 2018 2017 Net income1 $ 272,778 Add back: Income tax expense 36,238 Pre-tax net income $ 309,016 Sept. 30, Sept. 30, Capital Employed 2018 2017 Total debt, net of discount $ 107,084 $ 221,190 Redeemable common units - 41,764 Total equity 743,596 335,895 Total Capital Employed $ 850,680 $ 598,849 Average Capital Employed2 $ 724,765 Pre-Tax Return on Capital Employed3 43% (1) Net income attributable to Predecessor, controlling and noncontrolling interests. (2) Average Capital Employed is the simple average of Total Capital Employed as of September 30, 2018 and 2017. (3) Pre‐Tax Return on Capital Employed is the ration of Pre‐Tax Net Income for the twelve months ended September 30, 2018 to Average Capital Employed 23