Investor Presentation November 2019 NYSE: LBRT www.LibertyFrac.com

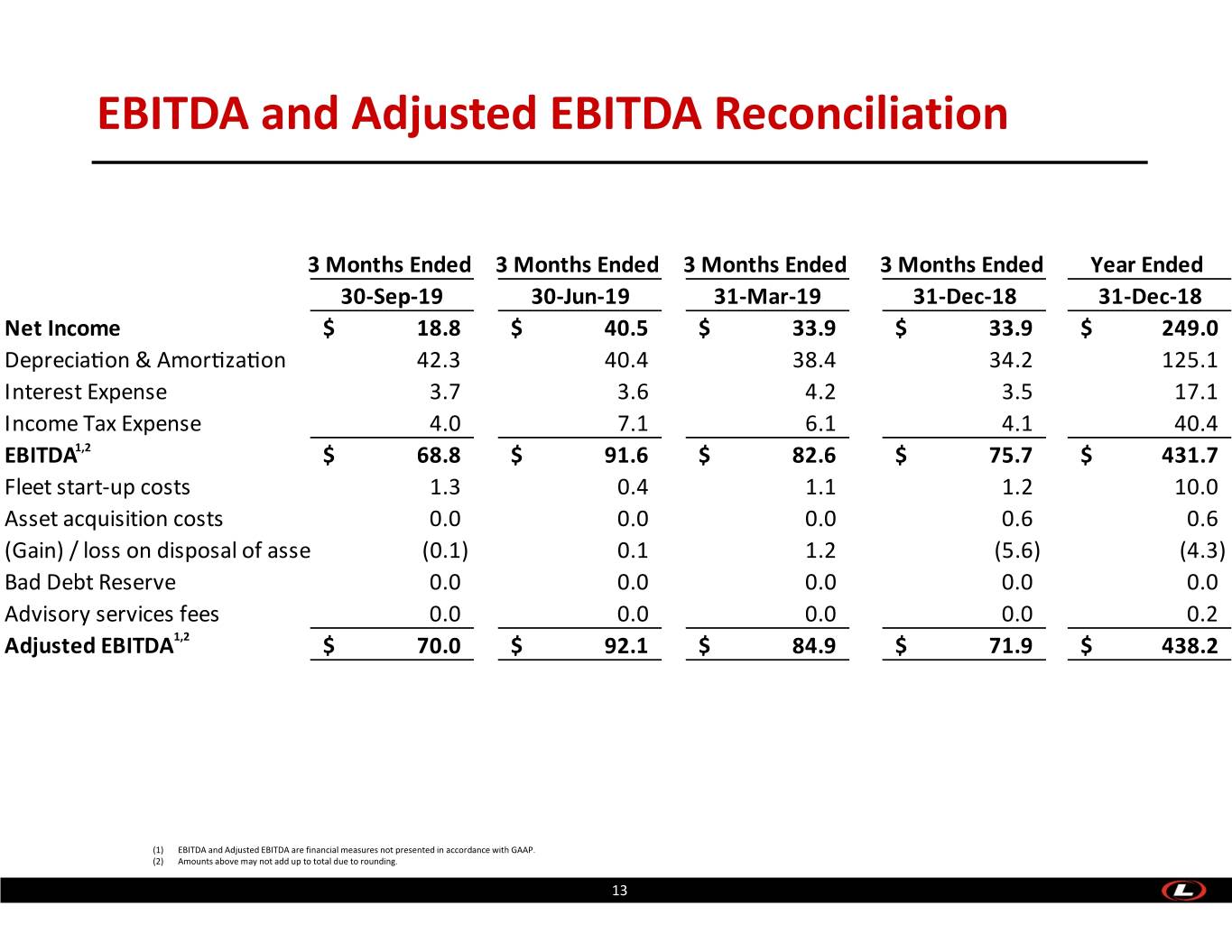

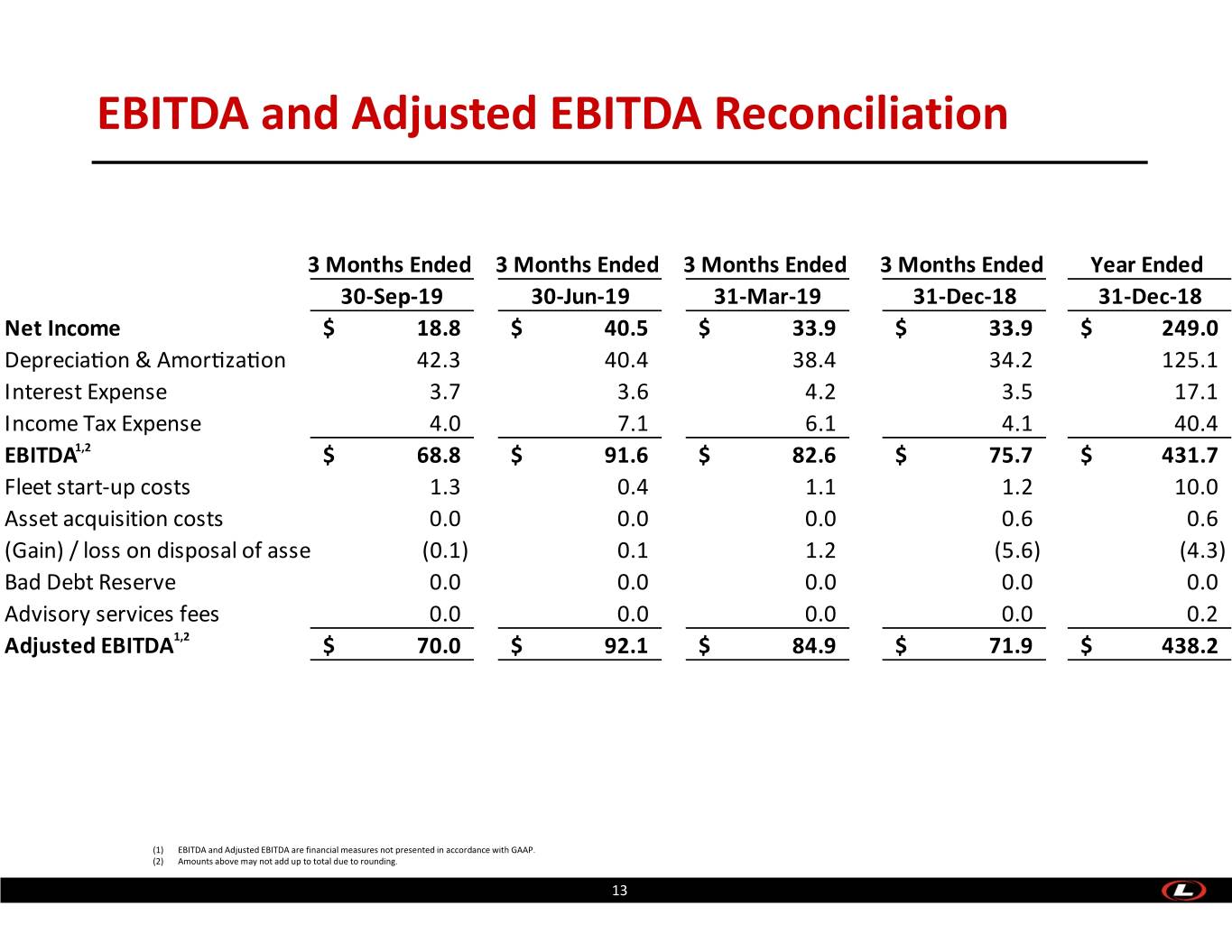

IMPORTANT DISCLOSURES FORWARD LOOKING STATEMENTS The information in this presentation includes “forward‐looking statements”. All statements, other than statements of historical fact included in this presentation regarding Liberty Oilfield Services Inc.’s (“Liberty” or the “Company”) strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward‐looking statements. When used in this presentation, the words “could”, “believe”, “anticipate”, “intend”, “estimate”, “expect”, “project” and similar expressions are intended to identify forward‐looking statements, although not all forward‐looking statements contain such identifying words. These forward‐looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Liberty disclaims any duty to update any forward‐looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Liberty cautions you that these forward‐looking statements are subject to all of the risks and uncertainties incident to hydraulic fracturing services, most of which are difficult to predict and many of which are beyond its control. These risks include, but are not limited to, a decline in demand for the Company’s services, capital spending by the oil and natural gas industry, hydrocarbon price volatility, competition within our service industry, reliance on a limited number of suppliers, environmental risks, regulatory changes, the inability to comply with the financial and other covenants and metrics in the Company’s credit facilities, cash flow and access to capital and the timing of capital expenditures. Should one or more of the risks or uncertainties described in this presentation occur, or should underlying assumptions prove incorrect, Liberty’s actual results and plans could differ materially from those expressed in any forward‐looking statements. INDUSTRY AND MARKET DATA This presentation has been prepared by Liberty and includes market data and other statistical information from sources believed by Liberty to be reliable, including independent industry publications, government publications or other published independent sources. Some data are also based on Liberty’s good faith estimates, which are derived from its review of internal sources as well as the independent sources described above. Although Liberty believes these sources are reliable, it has not independently verified the information and cannot guarantee its accuracy and completeness. EBITDA AND ADJUSTED EBITDA Liberty uses EBITDA and Adjusted EBITDA, financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), in this presentation. EBITDA and Adjusted EBITDA are used as supplemental non‐GAAP financial measures by Liberty’s management and by external users of Liberty’s financial statements, such as industry analysts, investors, lenders and rating agencies. Liberty believes EBITDA and Adjusted EBITDA are useful to external users of its consolidated and combined financial statements, such as industry analysts, investors, lenders and rating agencies because it allows them to compare its operating performance on a consistent basis across periods by removing the effects of capital structure (such as varying levels of interest expense), asset base (such as depreciation and amortization) and other items that impact the comparability of financial results from period to period. Liberty management believes EBITDA and Adjusted EBITDA provide useful information regarding the factors and trends affecting its business in addition to measures calculated under GAAP. Liberty defines EBITDA as net income (loss) before interest expense, income taxes, depreciation and amortization. Liberty defines Adjusted EBITDA as EBITDA adjusted to eliminate the effects of items such as new fleet or new basin start‐up costs, costs of asset acquisitions, gain or loss on the disposal of assets, asset impairment charges, bad debt reserves and non‐recurring expenses that management does not consider in assessing ongoing performance. Liberty excludes the foregoing items from net income (loss) in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within its industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as historic costs of depreciable assets, none of which are components of Adjusted EBITDA. Adjusted EBITDA is not a measure of net income (loss) or net cash provided by operating activities as determined by GAAP. Adjusted EBITDA should not be considered an alternative to net income, net cash provided by operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. You should not consider Adjusted EBITDA in isolation or as a substitute for an analysis of Liberty’s results as reported under GAAP. Because Adjusted EBITDA may be defined differently by other companies in Liberty’s industry, Liberty’s computations of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies, thereby diminishing its utility. Please see Slide 13 for a reconciliation of the non‐GAAP measures EBITDA and Adjusted EBITDA to net income, Liberty’s most directly comparable financial measures calculated in accordance with GAAP. 22

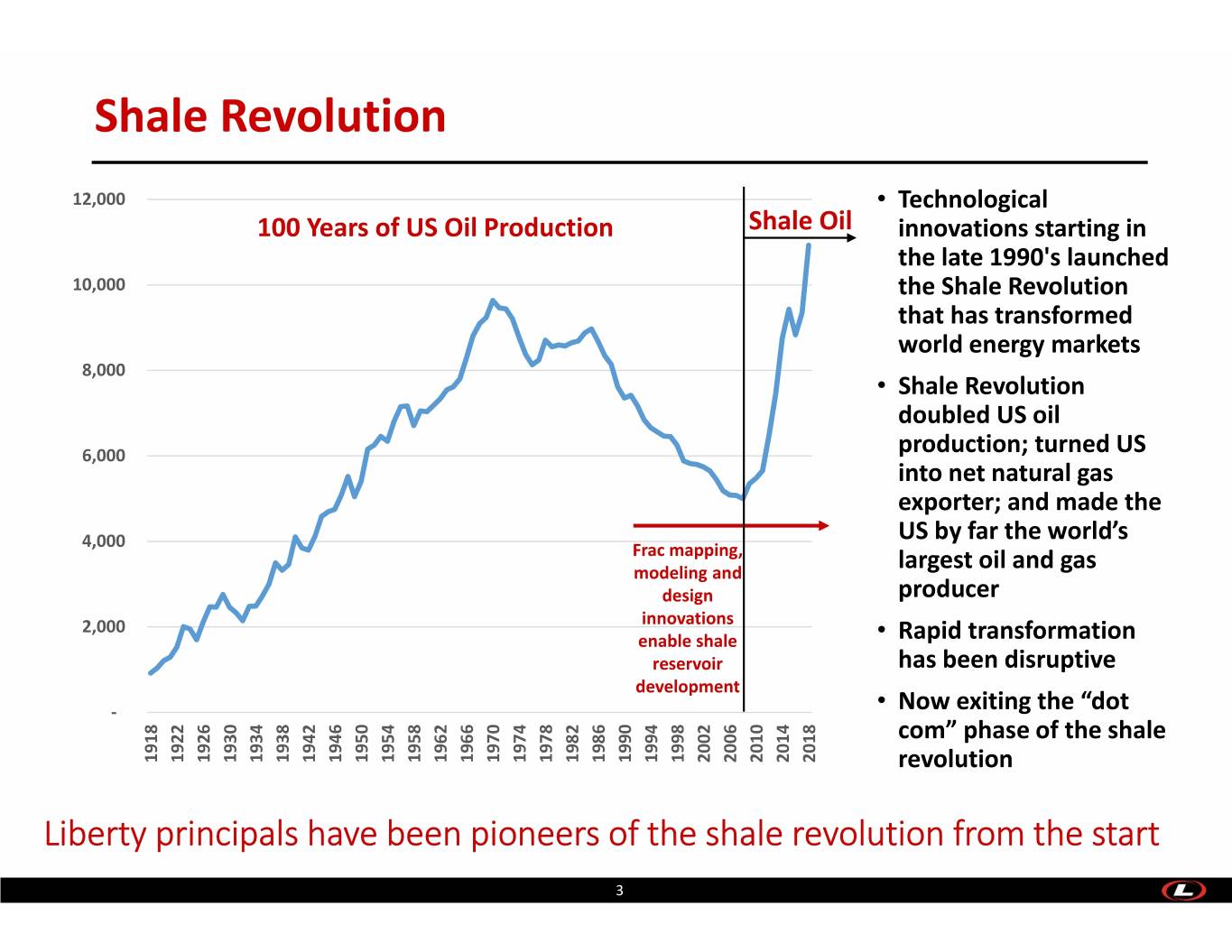

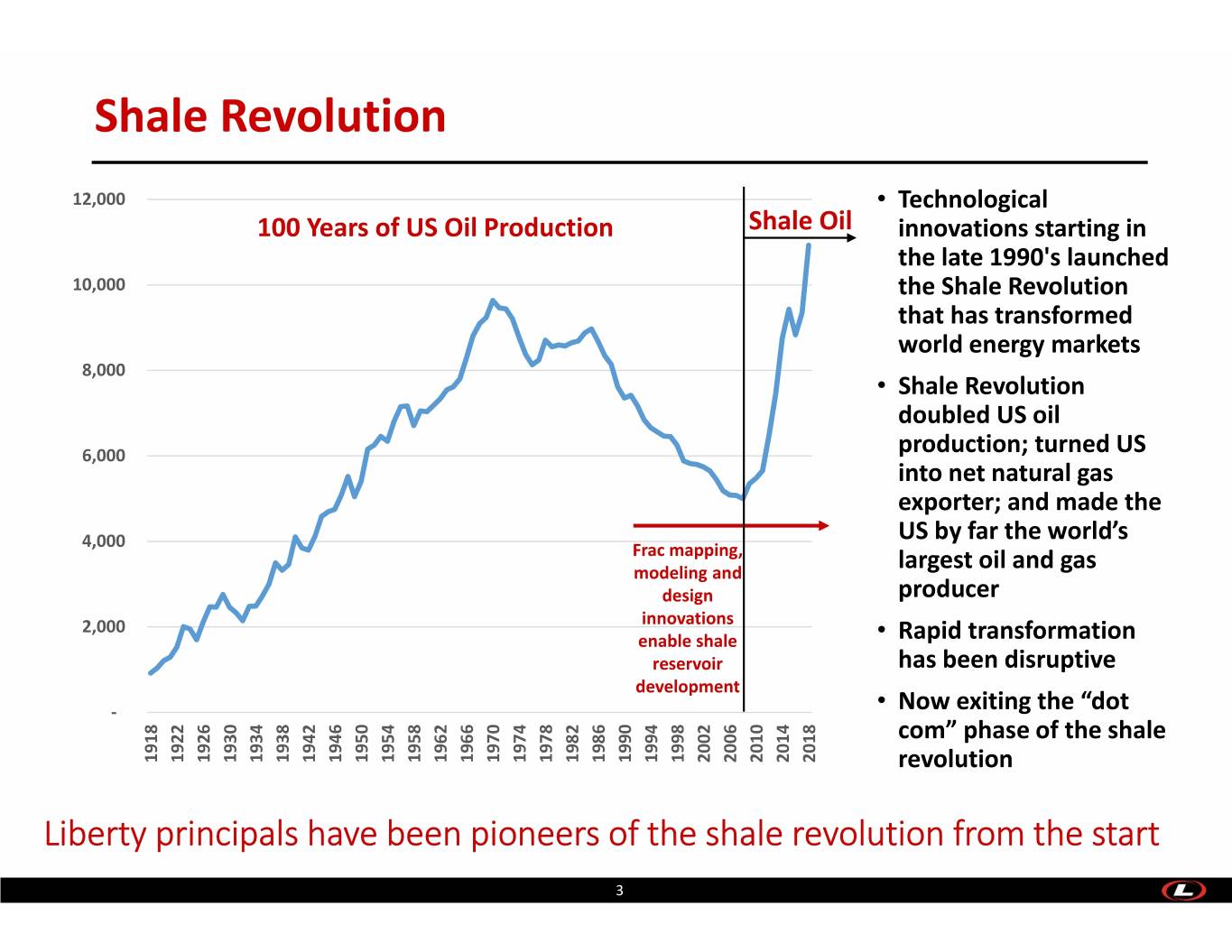

Shale Revolution 12,000 • Technological 100 Years of US Oil Production Shale Oil innovations starting in the late 1990's launched 10,000 the Shale Revolution that has transformed world energy markets 8,000 • Shale Revolution doubled US oil 6,000 production; turned US into net natural gas exporter; and made the US by far the world’s 4,000 Frac mapping, modeling and largest oil and gas design producer 2,000 innovations enable shale • Rapid transformation reservoir has been disruptive development ‐ • Now exiting the “dot com” phase of the shale 1918 1922 1926 1930 1934 1938 1942 1946 1950 1954 1958 1962 1966 1970 1974 1978 1982 1986 1990 1994 1998 2002 2006 2010 2014 2018 revolution Liberty principals have been pioneers of the shale revolution from the start 3

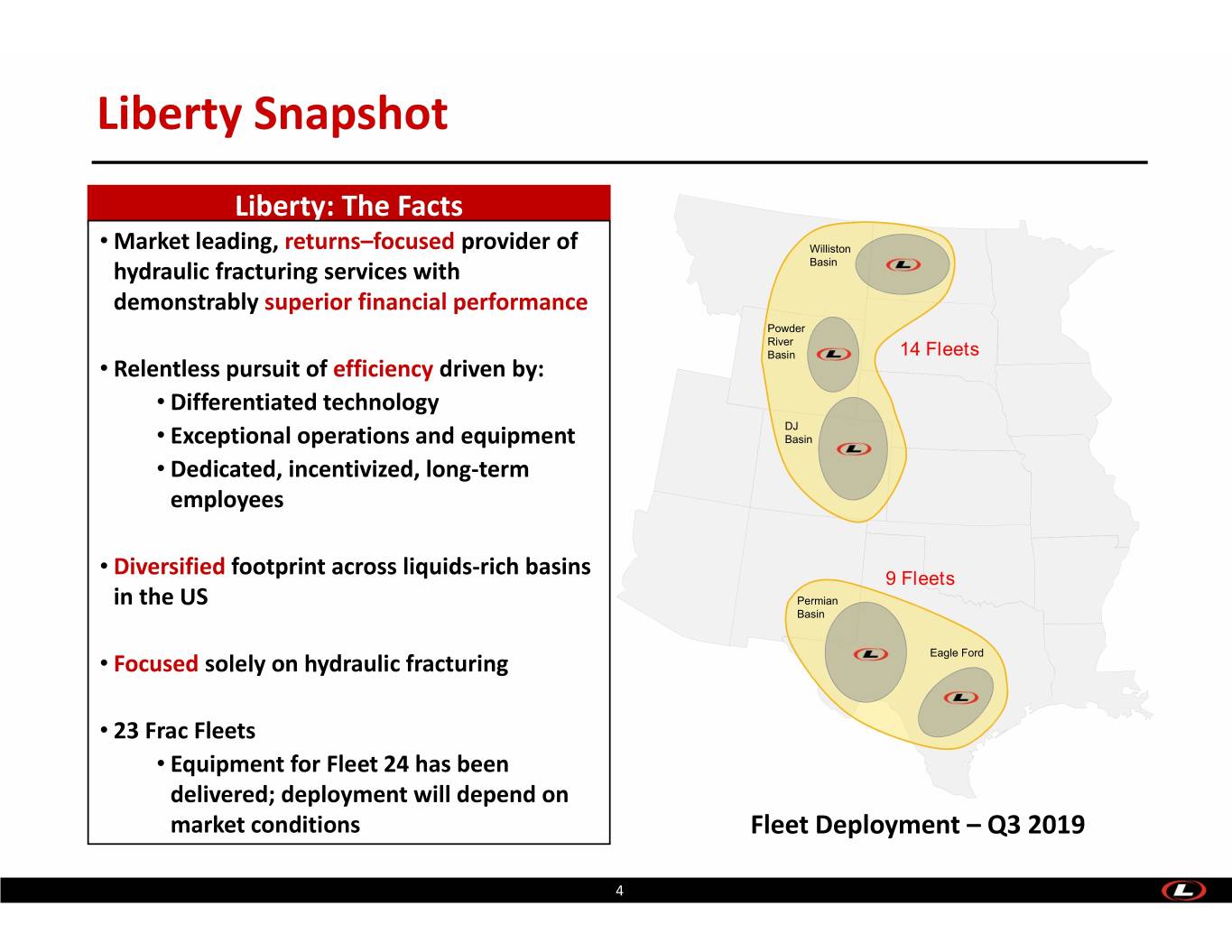

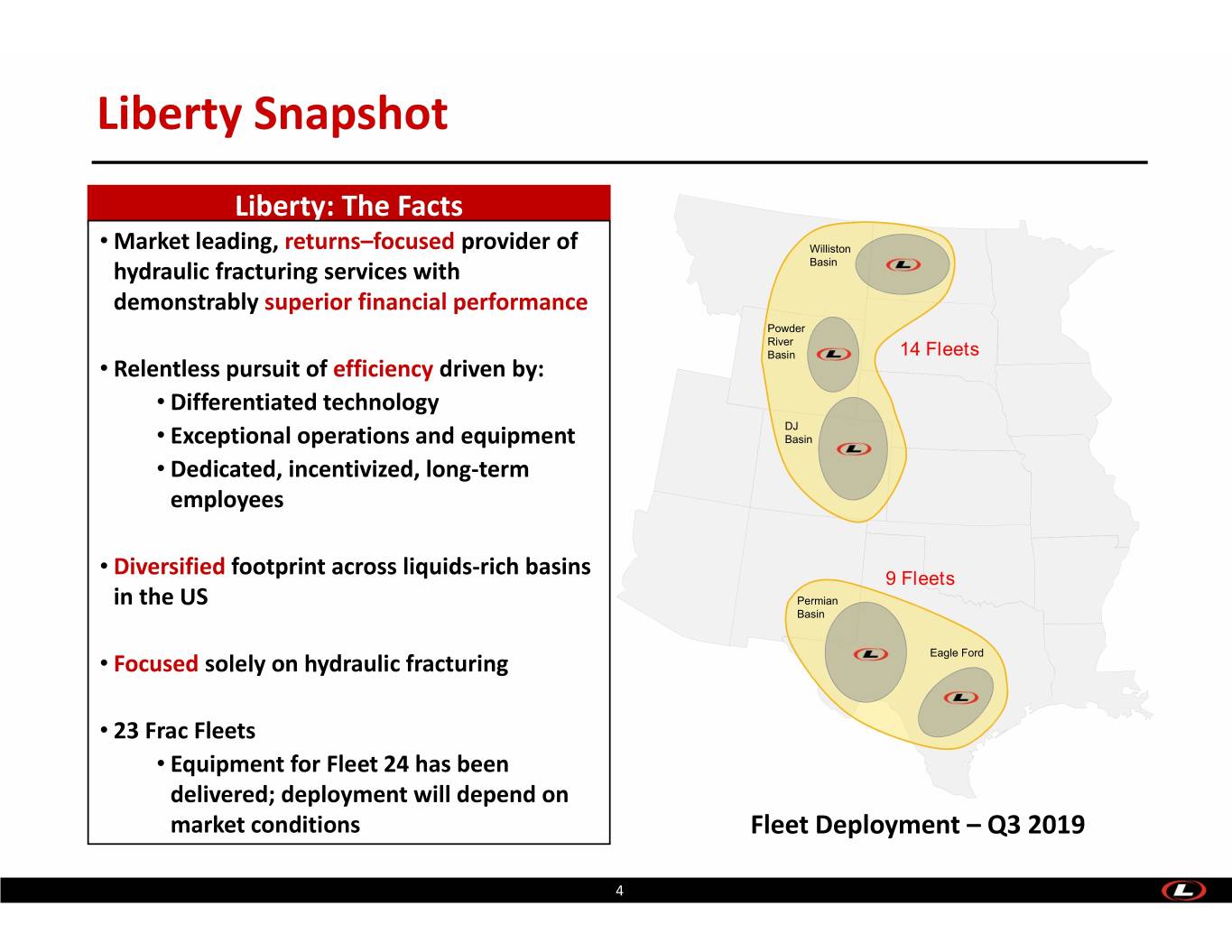

Liberty Snapshot Liberty: The Facts • Market leading, returns–focused provider of Williston hydraulic fracturing services with Basin demonstrably superior financial performance Powder River Basin 14 Fleets • Relentless pursuit of efficiency driven by: • Differentiated technology DJ • Exceptional operations and equipment Basin • Dedicated, incentivized, long‐term employees • Diversified footprint across liquids‐rich basins 9 Fleets in the US Permian Basin • Focused solely on hydraulic fracturing Eagle Ford • 23 Frac Fleets • Equipment for Fleet 24 has been delivered; deployment will depend on market conditions Fleet Deployment – Q3 2019 4

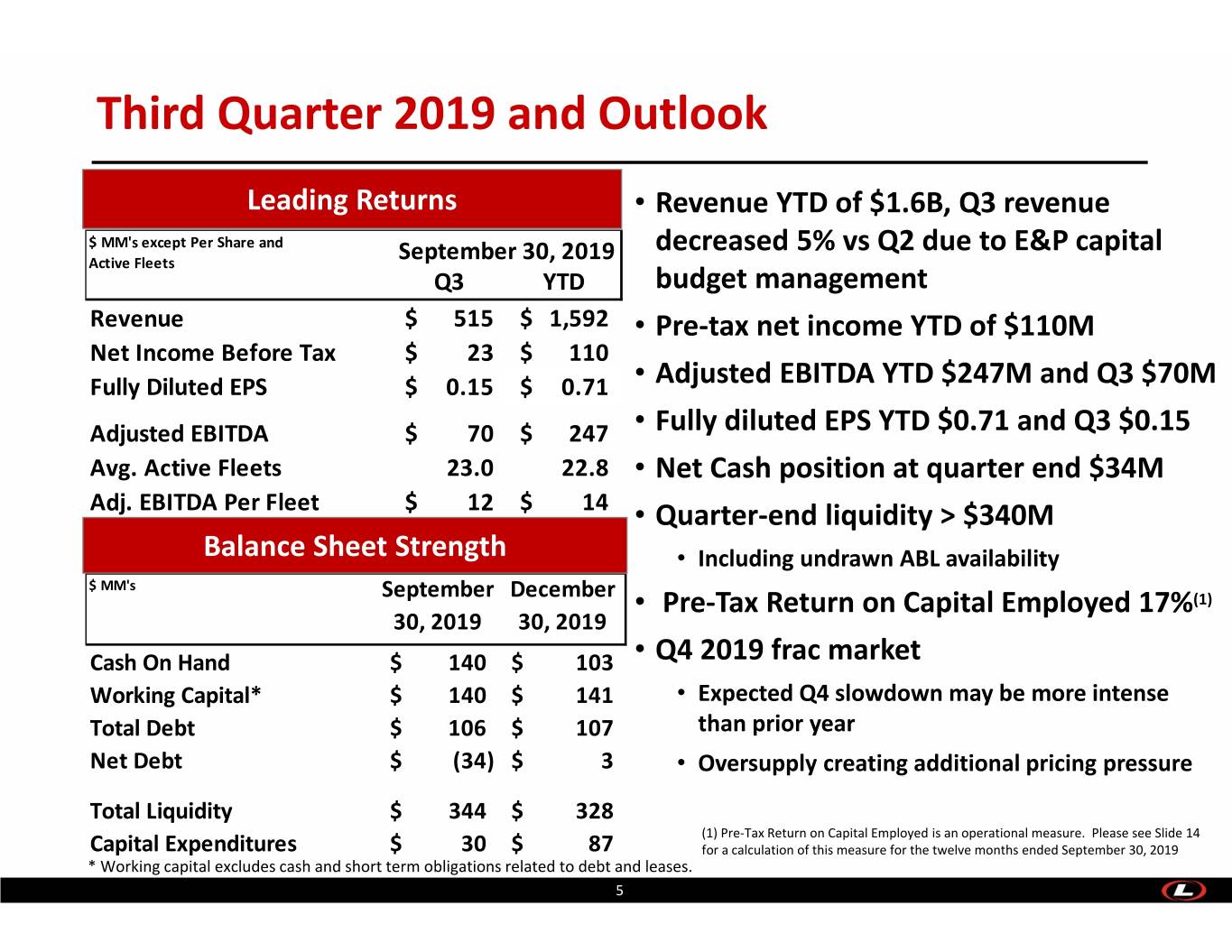

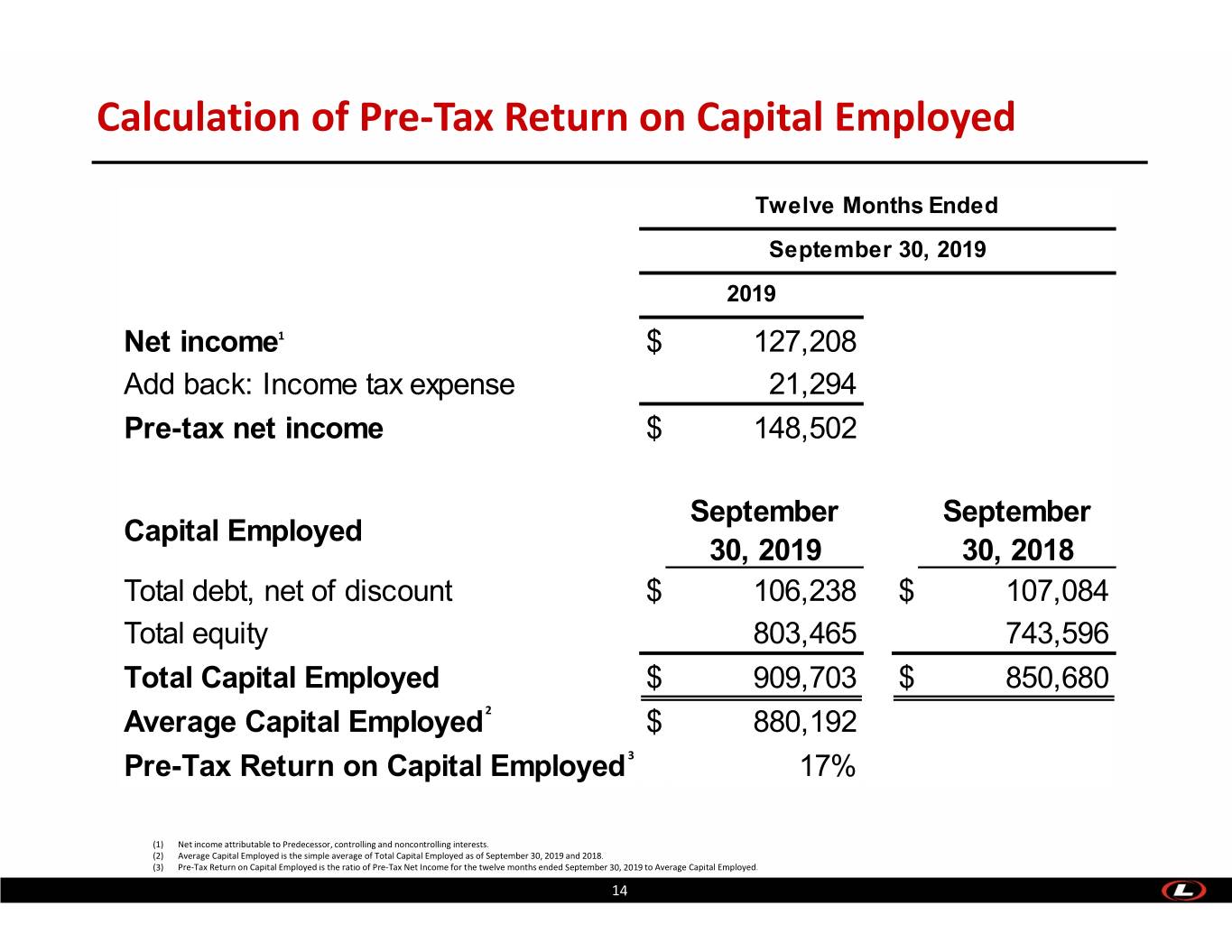

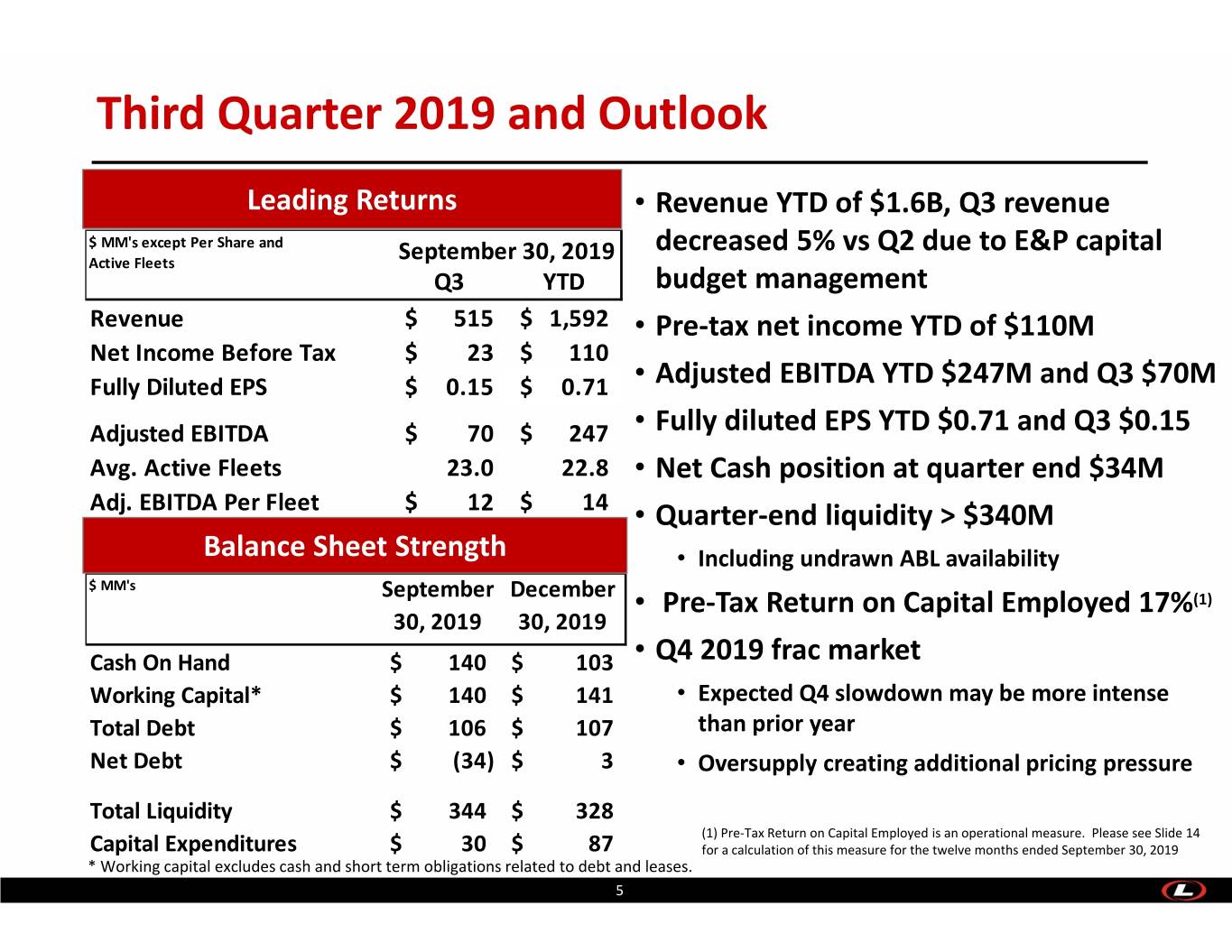

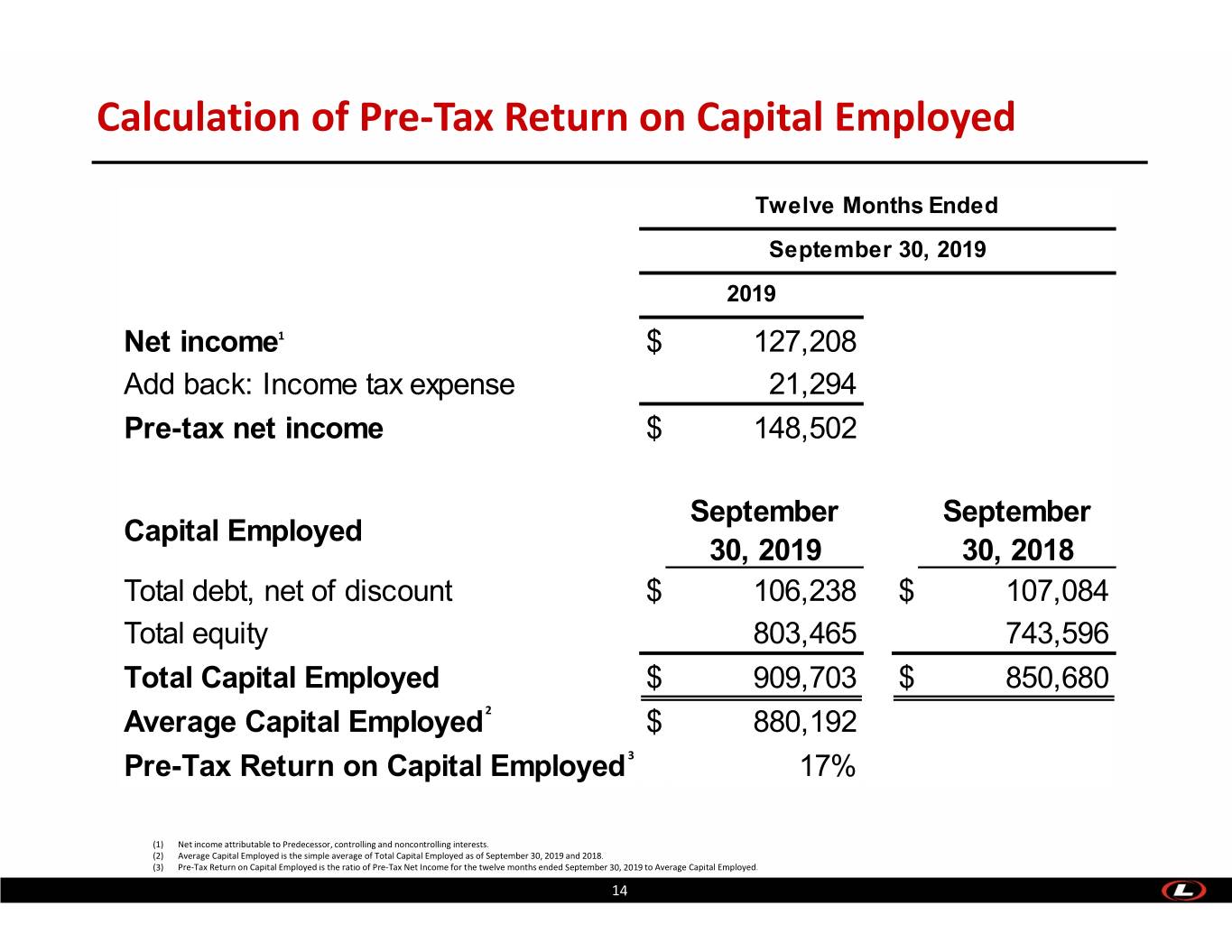

Third Quarter 2019 and Outlook Leading Returns • Revenue YTD of $1.6B, Q3 revenue $ MM's except Per Share and decreased 5% vs Q2 due to E&P capital Active Fleets September 30, 2019 Q3 YTD budget management Revenue$ 515 $ 1,592 • Pre‐tax net income YTD of $110M Net Income Before Tax$ 23 $ 110 Fully Diluted EPS$ 0.15 $ 0.71 • Adjusted EBITDA YTD $247M and Q3 $70M Adjusted EBITDA$ 70 $ 247 • Fully diluted EPS YTD $0.71 and Q3 $0.15 Avg. Active Fleets 23.0 22.8 • Net Cash position at quarter end $34M Adj. EBITDA Per Fleet$ 12 $ 14 • Quarter‐end liquidity > $340M Balance Sheet Strength • Including undrawn ABL availability $ MM's September December • Pre‐Tax Return on Capital Employed 17%(1) 30, 2019 30, 2019 Cash On Hand$ 140 $ 103 • Q4 2019 frac market Working Capital*$ 140 $ 141 • Expected Q4 slowdown may be more intense Total Debt$ 106 $ 107 than prior year Net Debt$ (34) $ 3 • Oversupply creating additional pricing pressure Total Liquidity$ 344 $ 328 (1) Pre‐Tax Return on Capital Employed is an operational measure. Please see Slide 14 Capital Expenditures$ 30 $ 87 for a calculation of this measure for the twelve months ended September 30, 2019 * Working capital excludes cash and short term obligations related to debt and leases. 5

YTD 2019 Cash Flow and Shareholder Returns • YTD 2019 Adjusted EBITDA of $247M • YTD 2019 Capex of $125M • ~ $175M projected for full year • ~$65M maintenance Capex • ~$110M growth and technology investment • $130M of Cash returned to shareholders since IPO • $0.05 Quarterly dividend since Q3 2018 • 5% of post‐IPO shares repurchased since IPO • $97M remaining of second $100M share repurchase authorization 6

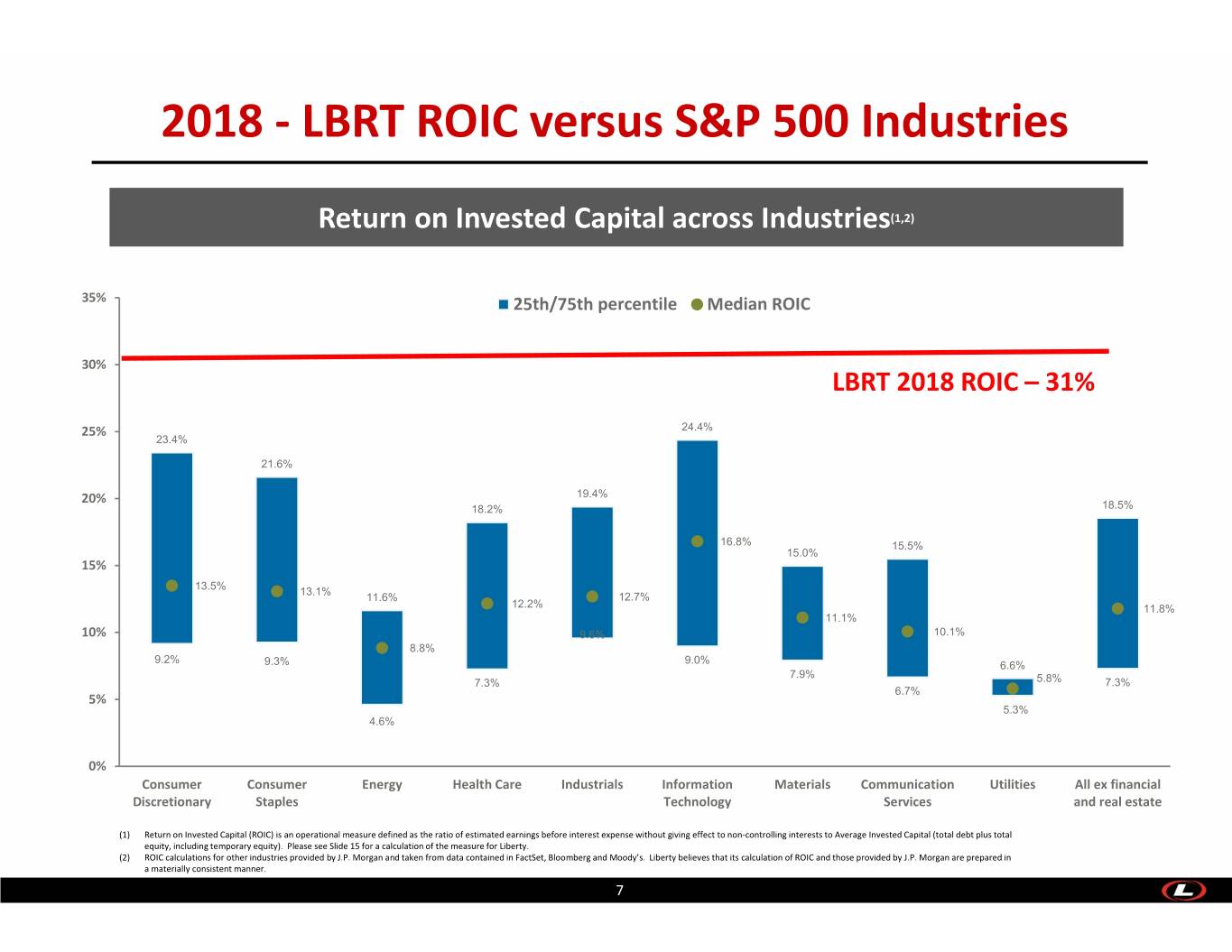

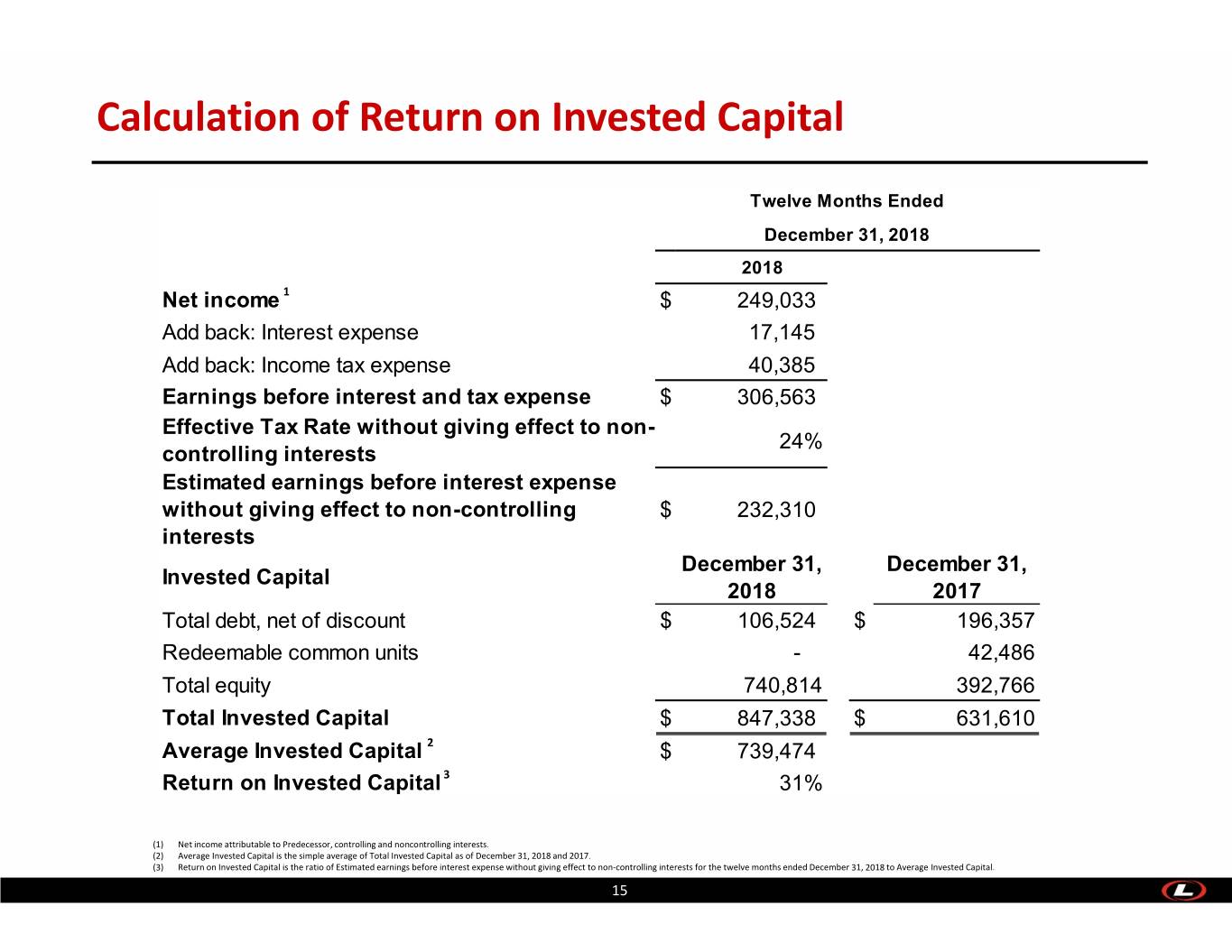

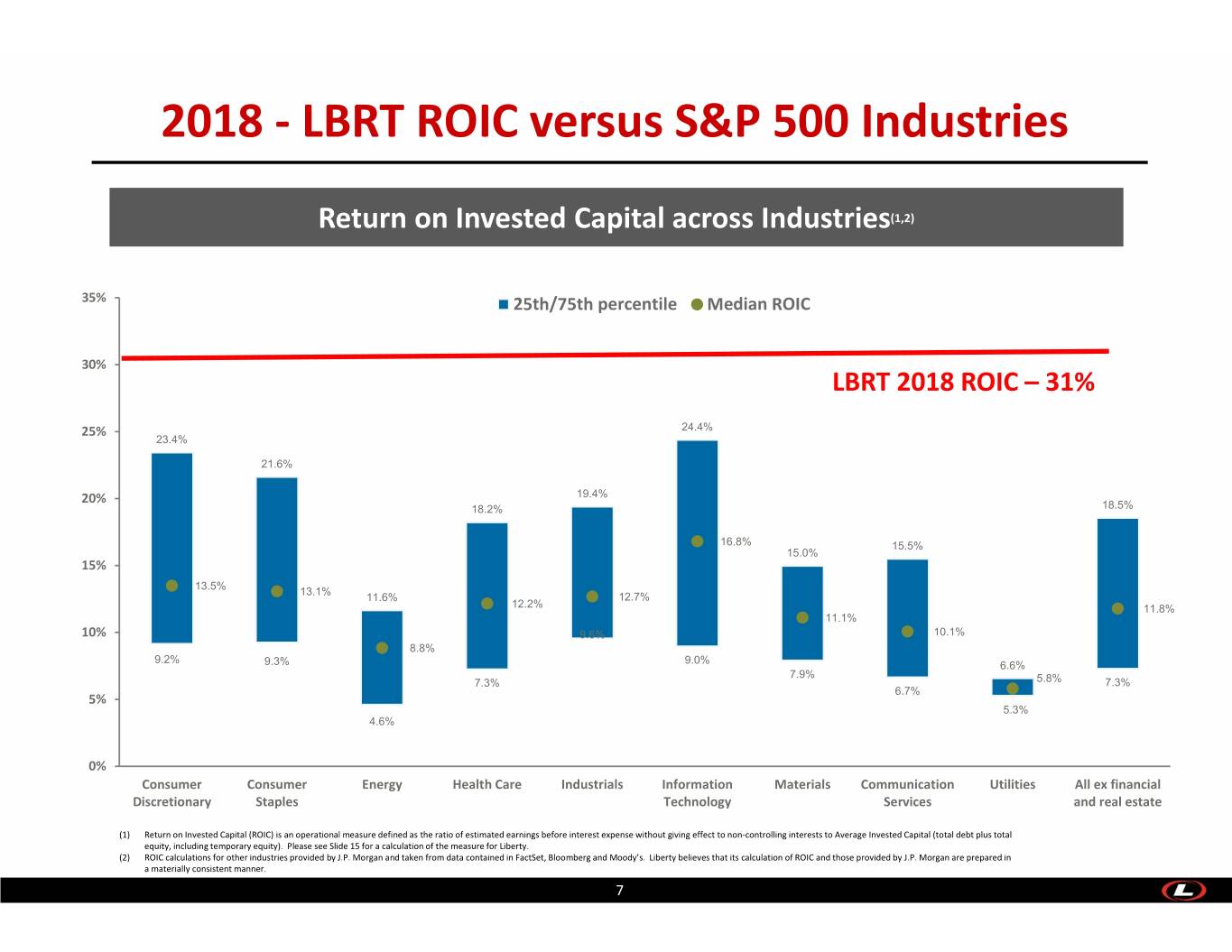

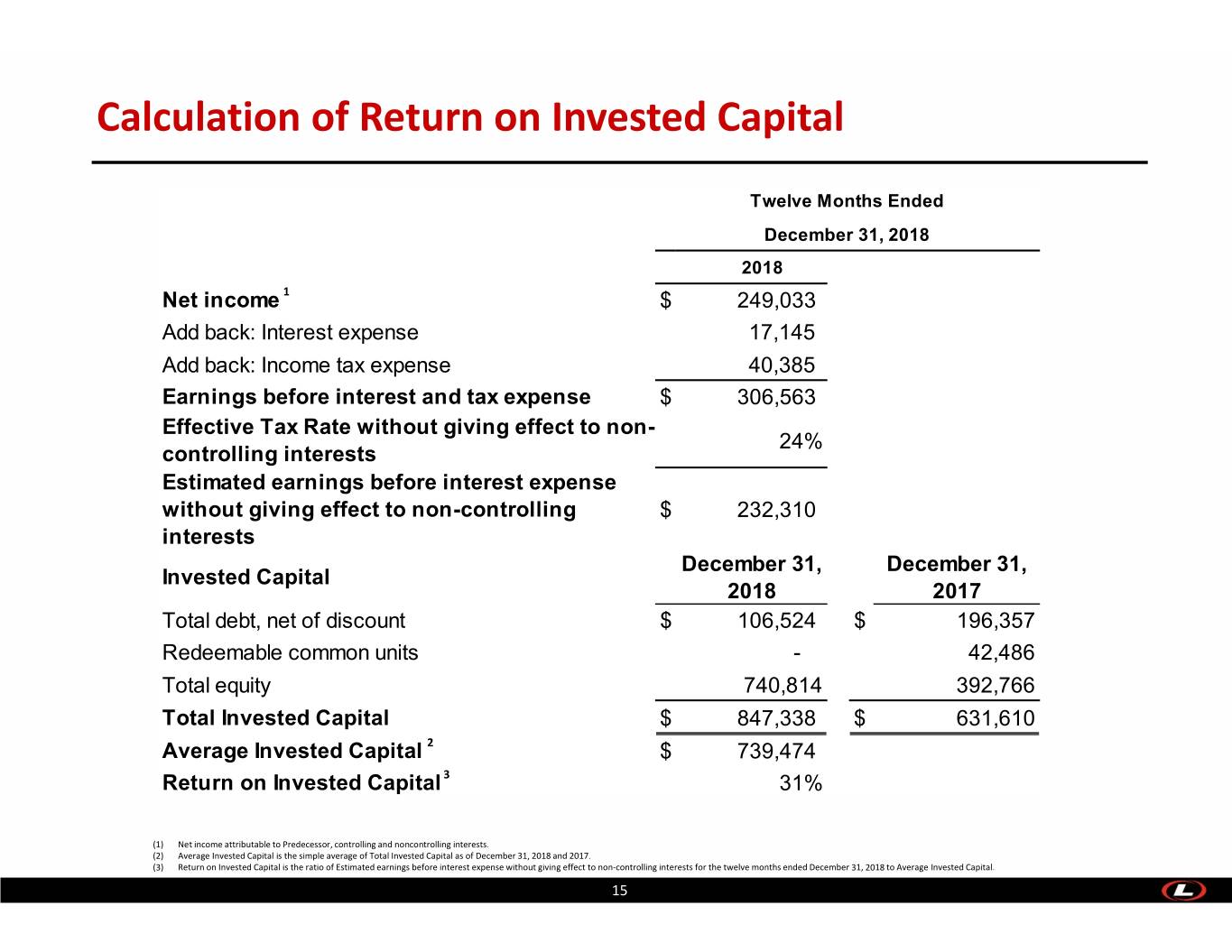

2018 ‐ LBRT ROIC versus S&P 500 Industries Return on Invested Capital across Industries(1,2) 35% 25th/75th percentile Median ROIC 30% LBRT 2018 ROIC – 31% 25% 24.4% 23.4% 21.6% 20% 19.4% 18.2% 18.5% 16.8% 15.5% 15.0% 15% 13.5% 13.1% 11.6% 12.7% 12.2% 11.8% 11.1% 10% 9.6% 10.1% 8.8% 9.2% 9.3% 9.0% 6.6% 7.9% 7.3% 5.8% 7.3% 6.7% 5% 5.3% 4.6% 0% Consumer Consumer Energy Health Care Industrials Information Materials Communication Utilities All ex financial Discretionary Staples Technology Services and real estate (1) Return on Invested Capital (ROIC) is an operational measure defined as the ratio of estimated earnings before interest expense without giving effect to non‐controlling interests to Average Invested Capital (total debt plus total equity, including temporary equity). Please see Slide 15 for a calculation of the measure for Liberty. (2) ROIC calculations for other industries provided by J.P. Morgan and taken from data contained in FactSet, Bloomberg and Moody’s. Liberty believes that its calculation of ROIC and those provided by J.P. Morgan are prepared in a materially consistent manner. 7

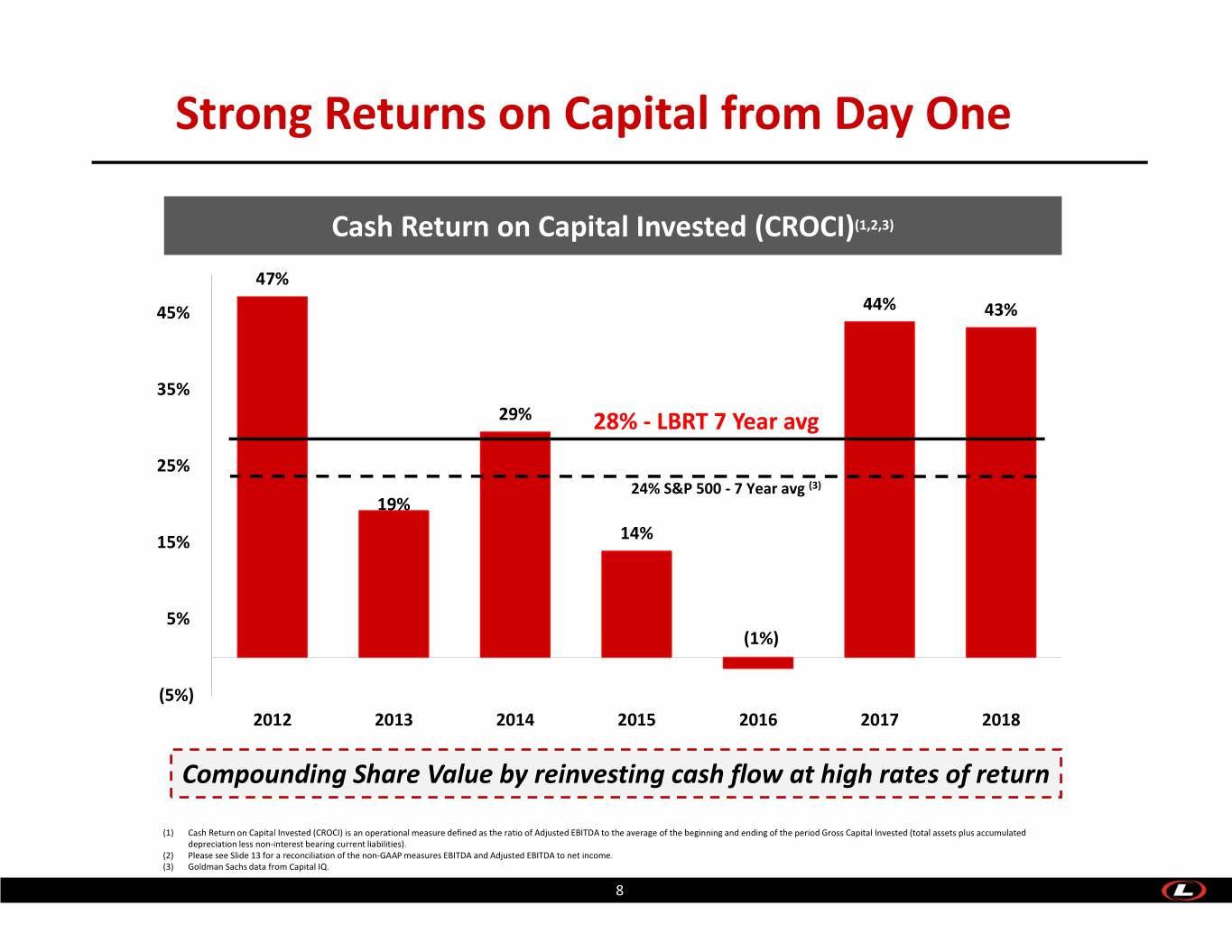

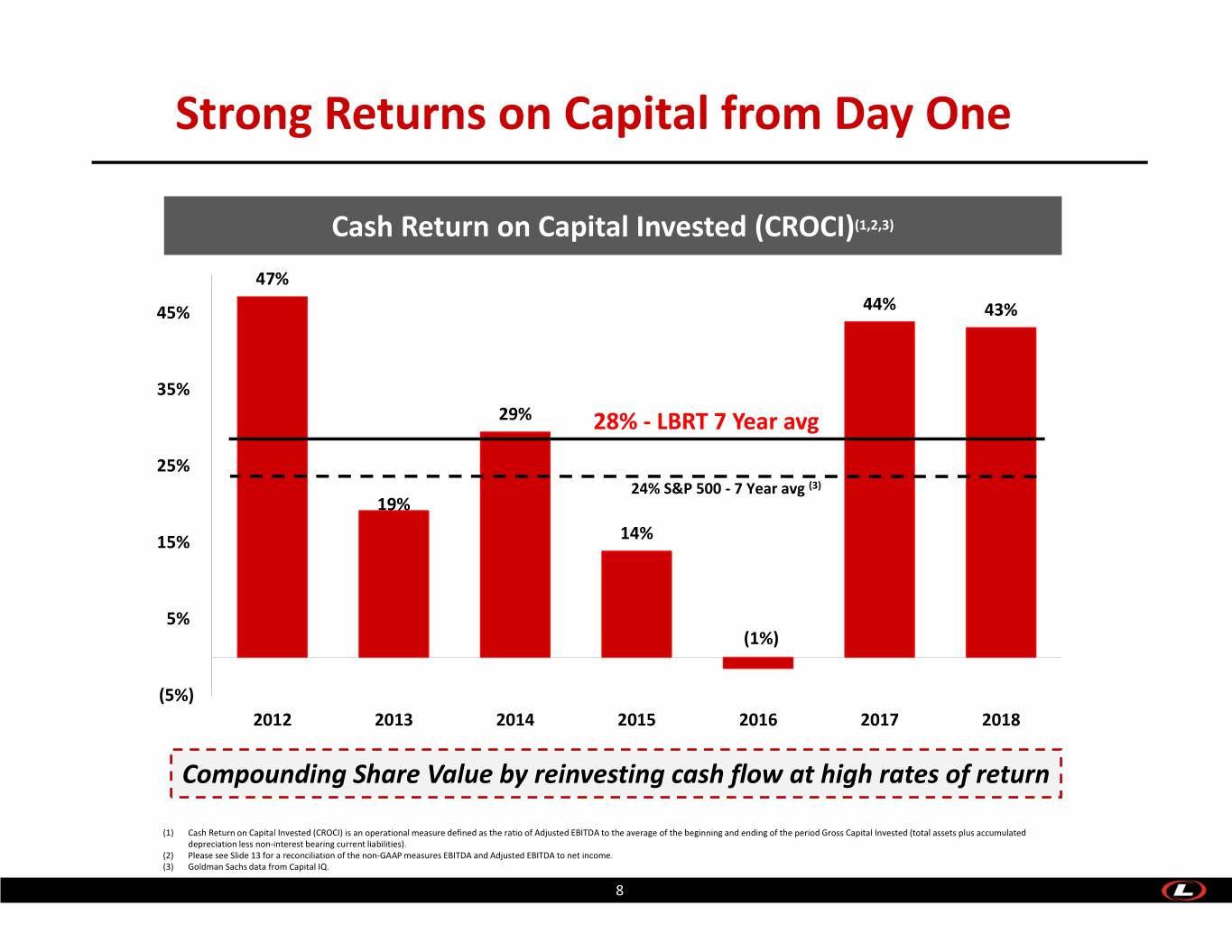

Strong Returns on Capital from Day One Cash Return on Capital Invested (CROCI)(1,2,3) 47% 45% 44% 43% 35% 29% 28% ‐ LBRT 7 Year avg 25% 24% S&P 500 ‐ 7 Year avg (3) 19% 15% 14% 5% (1%) (5%) 2012 2013 2014 2015 2016 2017 2018 Compounding Share Value by reinvesting cash flow at high rates of return (1) Cash Return on Capital Invested (CROCI) is an operational measure defined as the ratio of Adjusted EBITDA to the average of the beginning and ending of the period Gross Capital Invested (total assets plus accumulated depreciation less non‐interest bearing current liabilities). (2) Please see Slide 13 for a reconciliation of the non‐GAAP measures EBITDA and Adjusted EBITDA to net income. (3) Goldman Sachs data from Capital IQ. 8

How We Generate Our Differential Returns People and Culture 2 Treat people right, empower employees, foster an innovation based culture, significantly lower turnover, common sense safety culture Technology Develop disruptive solutions that reduce our customers’ cost per BOE, maximize fleet efficiency, enhance logistics capabilities Customers Long‐term sticky partnerships with like‐minded, efficiency driven customers Relentless Focus on Efficiency Meticulously track 1,440 minutes per day, identify areas for improvement, transparent collaboration with customers 9

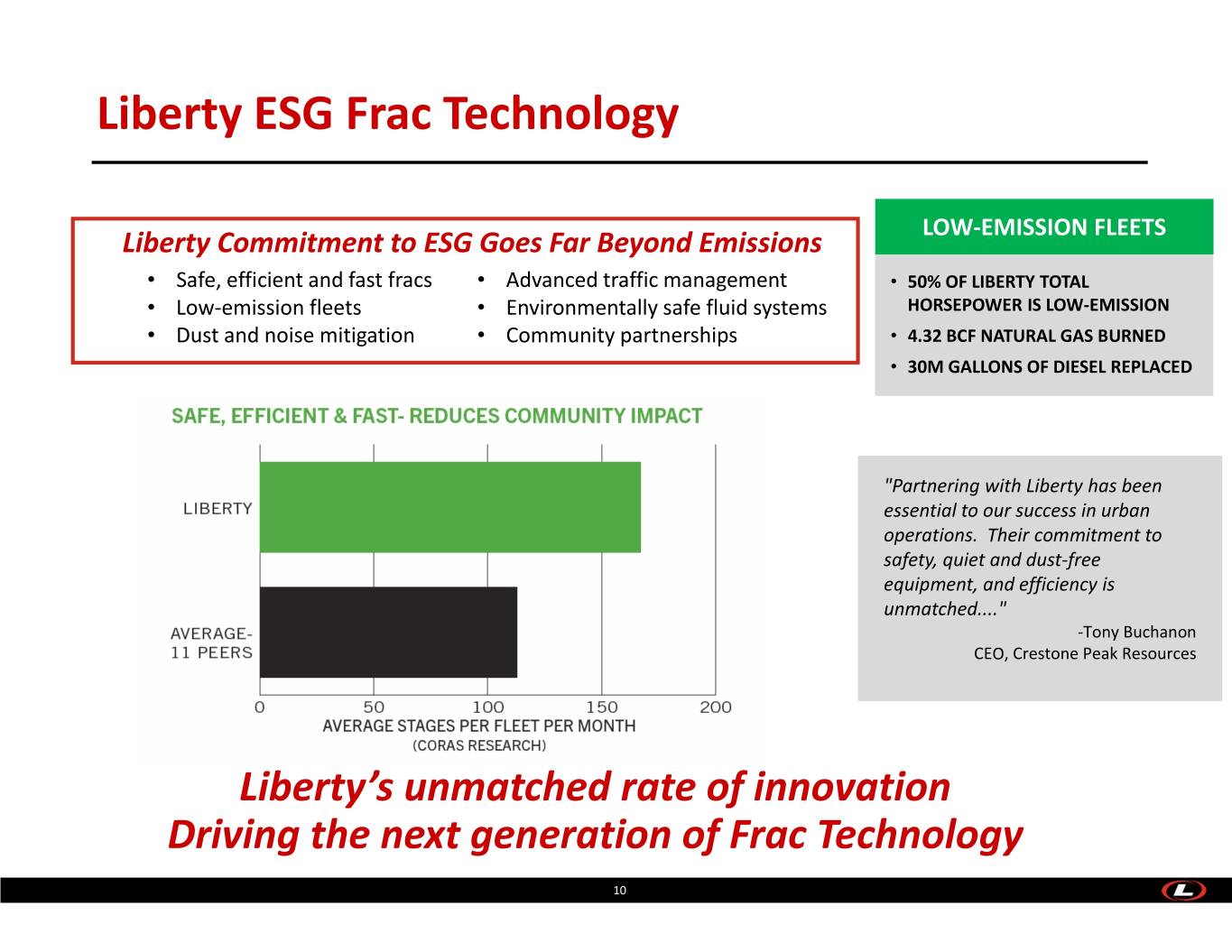

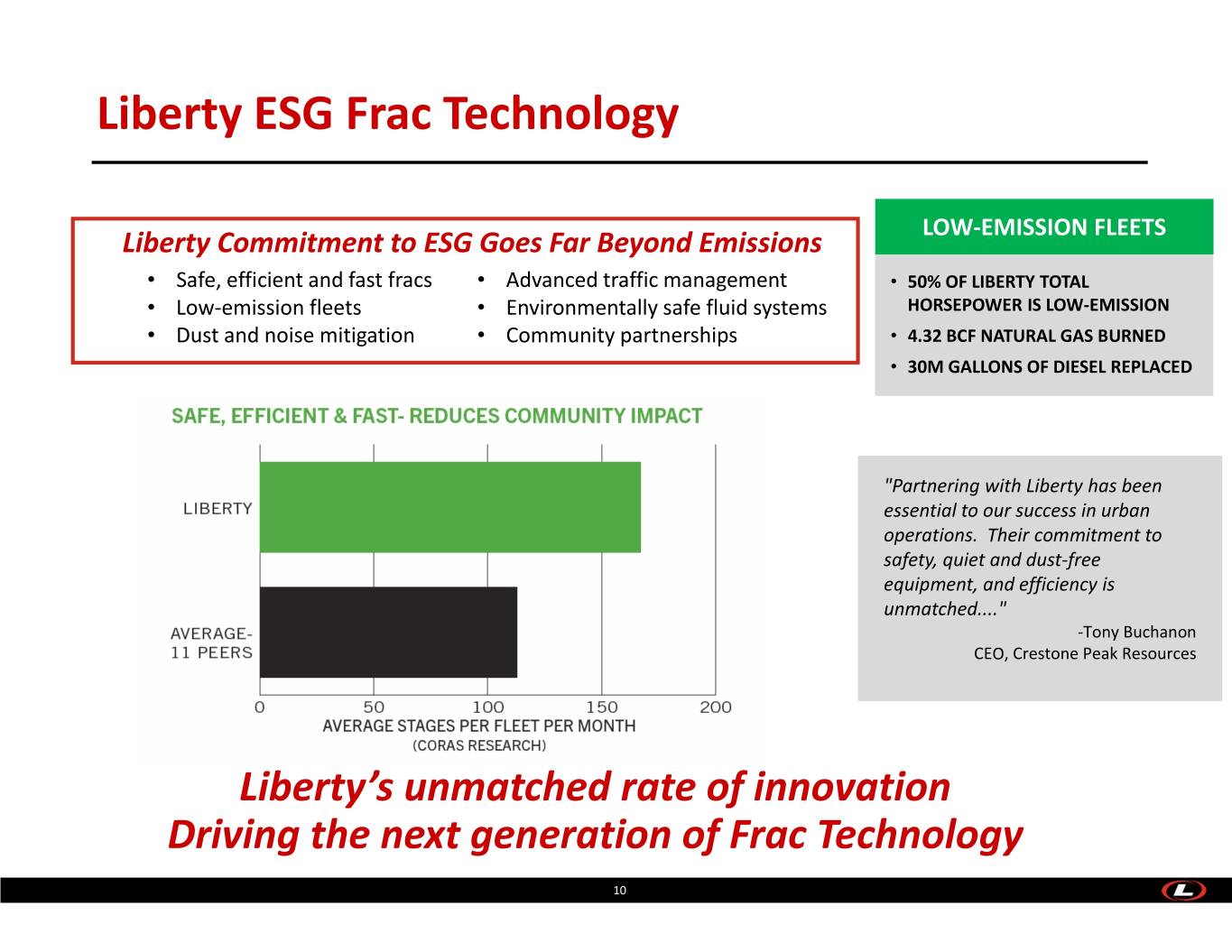

Liberty ESG Frac Technology LOW‐EMISSION FLEETS Liberty Commitment to ESG Goes Far Beyond Emissions • Safe, efficient and fast fracs • Advanced traffic management • 50% OF LIBERTY TOTAL • Low‐emission fleets • Environmentally safe fluid systems HORSEPOWER IS LOW‐EMISSION • Dust and noise mitigation • Community partnerships • 4.32 BCF NATURAL GAS BURNED • 30M GALLONS OF DIESEL REPLACED "Partnering with Liberty has been essential to our success in urban operations. Their commitment to safety, quiet and dust‐free equipment, and efficiency is unmatched...." ‐Tony Buchanon CEO, Crestone Peak Resources Liberty’s unmatched rate of innovation 10 Driving the next generation of Frac Technology 10

Our Strategy – Maximize per Share Value 1 Disciplined Organic Growth 2 Reinvest Cashflow at High Rates of Return 3 Return Capital to Shareholders Investment Highlights 4 Balance sheet strength – low leverage and ample liquidity 5 Highly competitive Tech Nerds ‐ unmatched rate of innovation Long‐term Partnerships with Customers, Suppliers and our 6 People 11

Appendix NYSE: LBRT www.LibertyFrac.com

EBITDA and Adjusted EBITDA Reconciliation 3 Months Ended 3 Months Ended 3 Months Ended 3 Months Ended Year Ended 30‐Sep‐19 30‐Jun‐19 31‐Mar‐19 31‐Dec‐18 31‐Dec‐18 Net Income $ 18.8 $ 40.5 $ 33.9 $ 33.9 $ 249.0 Deprecia�on & Amor�za�on 42.3 40.4 38.4 34.2 125.1 Interest Expense 3.7 3.6 4.2 3.5 17.1 Income Tax Expense 4.0 7.1 6.1 4.1 40.4 EBITDA1,2 $ 68.8 $ 91.6 $ 82.6 $ 75.7 $ 431.7 Fleet start‐up costs 1.3 0.4 1.1 1.2 10.0 Asset acquisition costs 0.0 0.0 0.0 0.6 0.6 (Gain) / loss on disposal of asse (0.1) 0.1 1.2 (5.6) (4.3) Bad Debt Reserve 0.0 0.0 0.0 0.0 0.0 Advisory services fees 0.0 0.0 0.0 0.0 0.2 Adjusted EBITDA1,2 $ 70.0 $ 92.1 $ 84.9 $ 71.9 $ 438.2 (1) EBITDA and Adjusted EBITDA are financial measures not presented in accordance with GAAP. (2) Amounts above may not add up to total due to rounding. 13

Calculation of Pre‐Tax Return on Capital Employed Twelve Months Ended September 30, 2019 2019 Net income1 $ 127,208 Add back: Income tax expense 21,294 Pre-tax net income $ 148,502 September September Capital Employed 30, 2019 30, 2018 Total debt, net of discount $ 106,238 $ 107,084 Total equity 803,465 743,596 Total Capital Employed $ 909,703 $ 850,680 Average Capital Employed2 $ 880,192 Pre-Tax Return on Capital Employed3 17% (1) Net income attributable to Predecessor, controlling and noncontrolling interests. (2) Average Capital Employed is the simple average of Total Capital Employed as of September 30, 2019 and 2018. (3) Pre‐Tax Return on Capital Employed is the ratio of Pre‐Tax Net Income for the twelve months ended September 30, 2019 to Average Capital Employed. 14

Calculation of Return on Invested Capital Twelve Months Ended December 31, 2018 2018 Net income 1 $ 249,033 Add back: Interest expense 17,145 Add back: Income tax expense 40,385 Earnings before interest and tax expense $ 306,563 Effective Tax Rate without giving effect to non- 24% controlling interests Estimated earnings before interest expense without giving effect to non-controlling $ 232,310 interests December 31, December 31, Invested Capital 2018 2017 Total debt, net of discount $ 106,524 $ 196,357 Redeemable common units - 42,486 Total equity 740,814 392,766 Total Invested Capital $ 847,338 $ 631,610 Average Invested Capital 2 $ 739,474 Return on Invested Capital 3 31% (1) Net income attributable to Predecessor, controlling and noncontrolling interests. (2) Average Invested Capital is the simple average of Total Invested Capital as of December 31, 2018 and 2017. (3) Return on Invested Capital is the ratio of Estimated earnings before interest expense without giving effect to non‐controlling interests for the twelve months ended December 31, 2018 to Average Invested Capital. 15