Exhibit 99.2 Delek US Holdings, Inc. First Quarter 2019 Earnings Call May 6, 2019

Disclaimers Forward Looking Statements: Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral and written presentations contain forward-looking statements within the meaning of federal securities laws that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. These forward-looking statements include, but are not limited to, the statements regarding the following: financial and operating guidance for future and uncompleted financial periods; future crude slates; financial strength and flexibility; potential for and projections of growth; return of cash to shareholders, stock repurchases and the payment of dividends, including the amount and timing thereof; crude oil throughput; crude oil market trends, including production, quality, pricing, demand, imports, exports and transportation costs; light production from shale plays and Permian growth; differentials including increases, trends and the impact thereof on crack spreads and refineries; pipeline takeaway capacity and projects related thereto; refinery complexity, configurations, utilization, crude oil slate flexibility, capacities, equipment limits and margins; the ability to add flexibility and increase margin potential at the Krotz Springs refinery; improved product netbacks; our ability to execute on the midstream initiatives, including the Big Spring Gathering System and participating in a long-haul pipeline, and the benefits, flexibility, returns and EBITDA therefrom; the potential for, and estimates of cost savings and other benefits from, acquisitions, divestitures, dropdowns and financing activities; divestiture of non-core assets and matters pertaining thereto; the attainment of certain regulatory benefits; retail growth and the opportunities and value derived therefrom; long-term value creation from capital allocation; execution of strategic initiatives and the benefits therefrom; and access to crude oil and the benefits therefrom. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward-looking statements. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, pricing, production and transportation capacity; gains and losses from derivative instruments; management's ability to execute its strategy of growth through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance projects; the ability to obtain commitments and construct the long-haul pipeline; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements. Non-GAAP Disclosures: Delek US and Delek Logistics believe that the presentation of adjusted earnings per share (“adjusted EPS”), earnings before interest, taxes, depreciation and amortization ("EBITDA") and adjusted EBITDA provide useful information to investors in assessing their financial condition, results of operations and cash flow their business is generating. Adjusted EPS, EBITDA and adjusted EBITDA should not be considered as alternatives to net income, operating income, cash from operations or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. Adjusted EPS, EBITDA and adjusted EBITDA have important limitations as analytical tools because they exclude some, but not all, items that affect net income. Additionally, because adjusted EPS, EBITDA and adjusted EBITDA may be defined differently by other companies in its industry, Delek US' and Delek Logistics’ definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see reconciliations of adjusted EPS, EBITDA and adjusted EBITDA to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP in the appendix. 2

1Q19 Highlights • Strong performance in 1Q19 Segment Contribution Margin, $ in millions • Reported EPS of $1.90 and adjusted EPS of $1.54 (1) $400 $350 333.8 1Q18 1Q19 • Net Income of $149.3 million and adjusted EBITDA of 294.3 $237.5 million (1) $300 $250 • Improved results on year over year basis $200 152.3 • Adjusted EBITDA increased 126 percent year over year $150 133.2 $100 • Refining margin drove increase; benefited from crude oil 40.1 $50 36.3 11.9 10.2 differentials and sustainable commercial performance $0 • Logistics increased primarily due to the Big Spring drop ($50) (29.1)(10.8) down Total Refining Logistics Retail Corporate, Other Adjusted EPS Adjusted EBITDA Capital Expenditures by Segment, $ in millions $140 128.5 $1.54 $238 1Q18 1Q19 $120 $100 81.7 $80 70.1 $105 $60 51.5 40.7 $40 $0.26 $20 14.4 2.2 2.0 5.1 $0 0.9 1Q18 1Q19 1Q18 1Q19 Total Refining Logistics Retail Corporate, Other 1) See slides 12 and 13 for a reconciliation of adjusted net income per share to net income per share and adjusted EBITDA to net income. 3

1Q19 Highlights – Cash Flow • Financial position and cash flow Total Consolidated Cash Flows generation in 1Q19 supported 1,400 investment in the business and returning cash to shareholders $133.4 1,200 $1,079.3 • Operating cash flow from ($127.0 ) $989.7 1,000 continuing ops $133.4 million ($96.0 ) • Investing activities include cash capital expenditures of $124.0 800 million 600 • Total cash to returned to shareholders of $67.2 million 400 • Includes $46.2 million through repurchases 200 0 12/31/2018 Operating Cash Flow Investing Activities Financing Activities 3/31/2019 from Continuing Ops 4

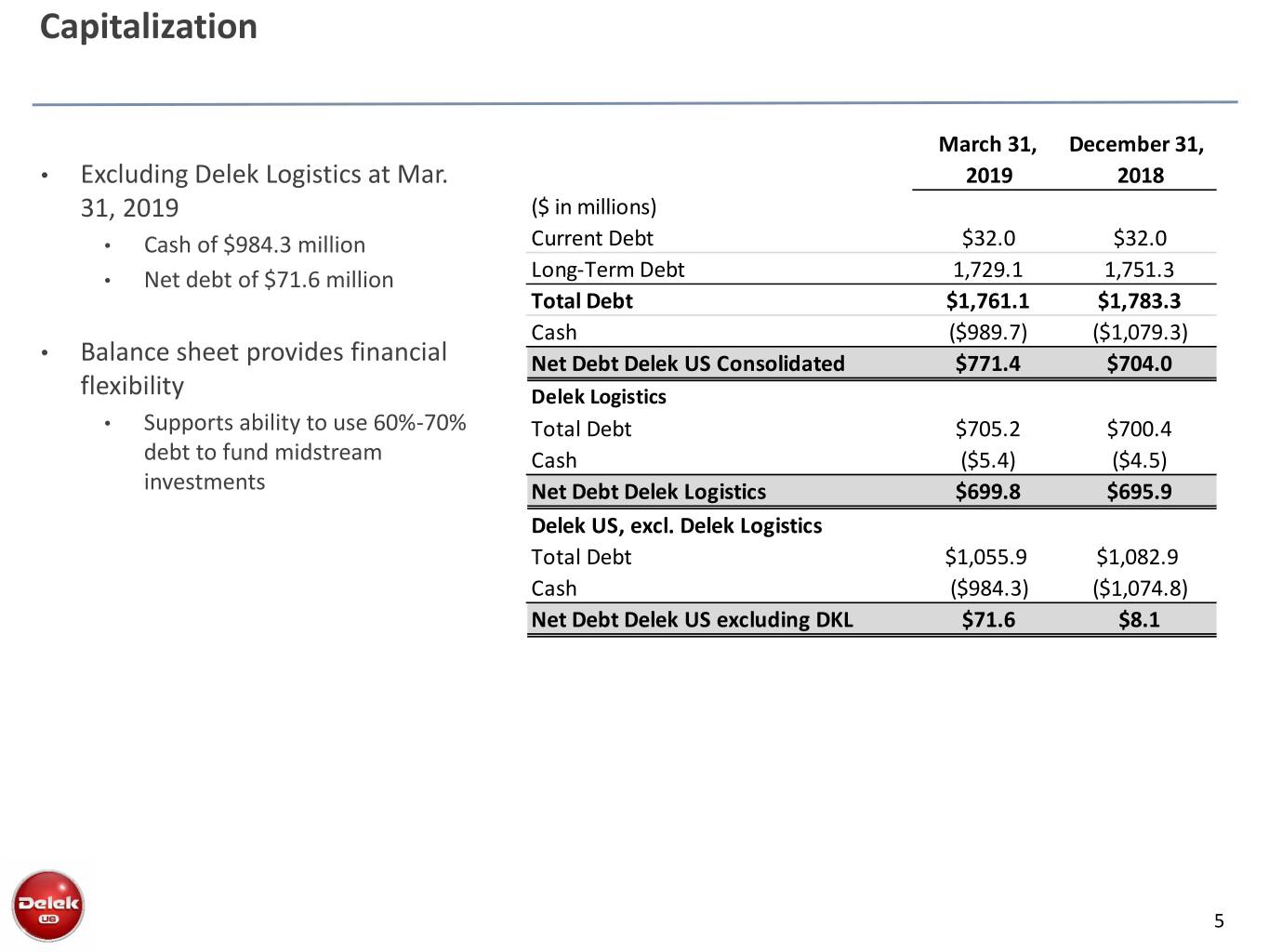

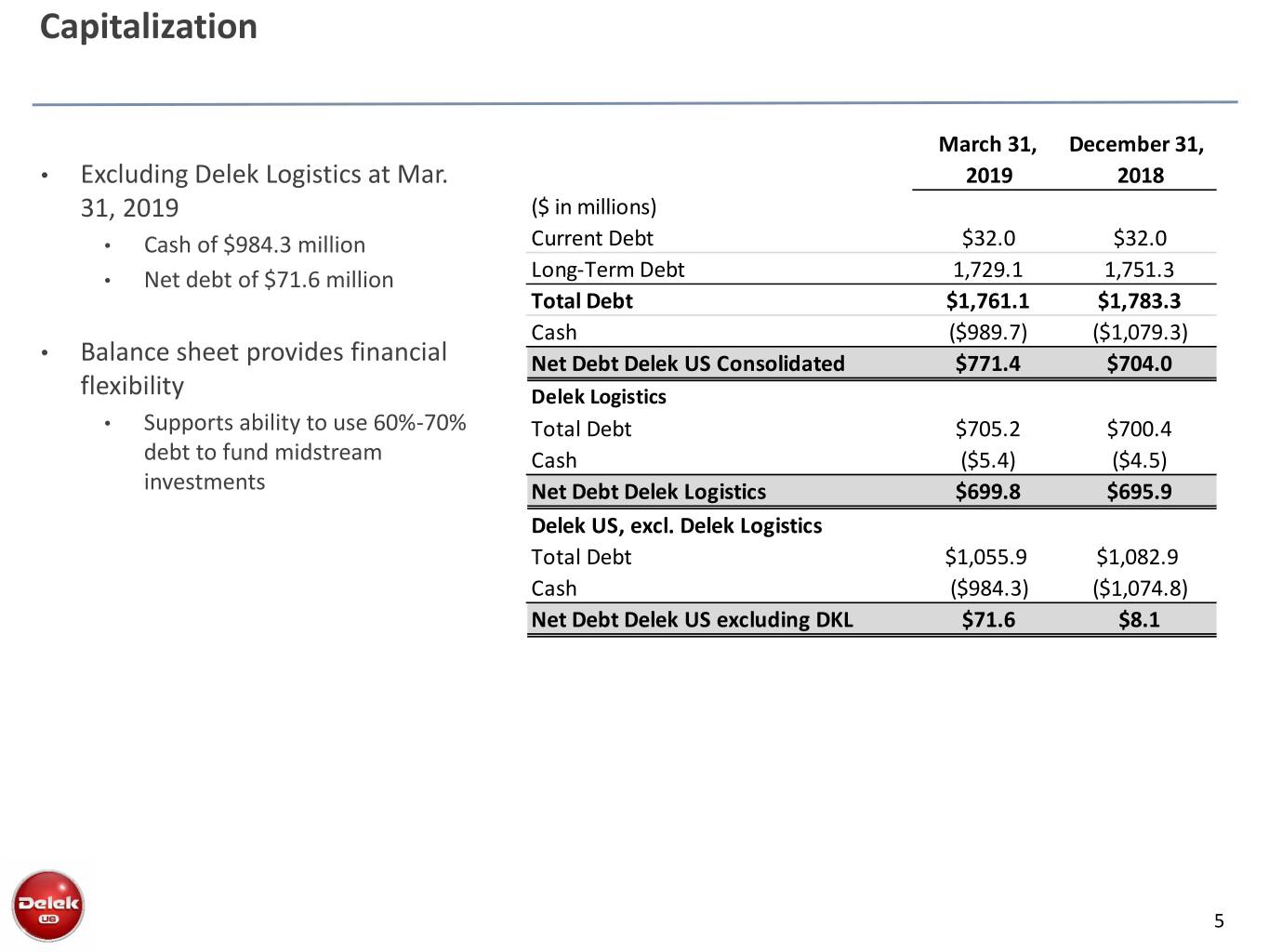

Capitalization March 31, December 31, • Excluding Delek Logistics at Mar. 2019 2018 31, 2019 ($ in millions) • Cash of $984.3 million Current Debt $32.0 $32.0 Long-Term Debt 1,729.1 1,751.3 • Net debt of $71.6 million Total Debt $1,761.1 $1,783.3 Cash ($989.7) ($1,079.3) • Balance sheet provides financial Net Debt Delek US Consolidated $771.4 $704.0 flexibility Delek Logistics • Supports ability to use 60%-70% Total Debt $705.2 $700.4 debt to fund midstream Cash ($5.4) ($4.5) investments Net Debt Delek Logistics $699.8 $695.9 Delek US, excl. Delek Logistics Total Debt $1,055.9 $1,082.9 Cash ($984.3) ($1,074.8) Net Debt Delek US excluding DKL $71.6 $8.1 5

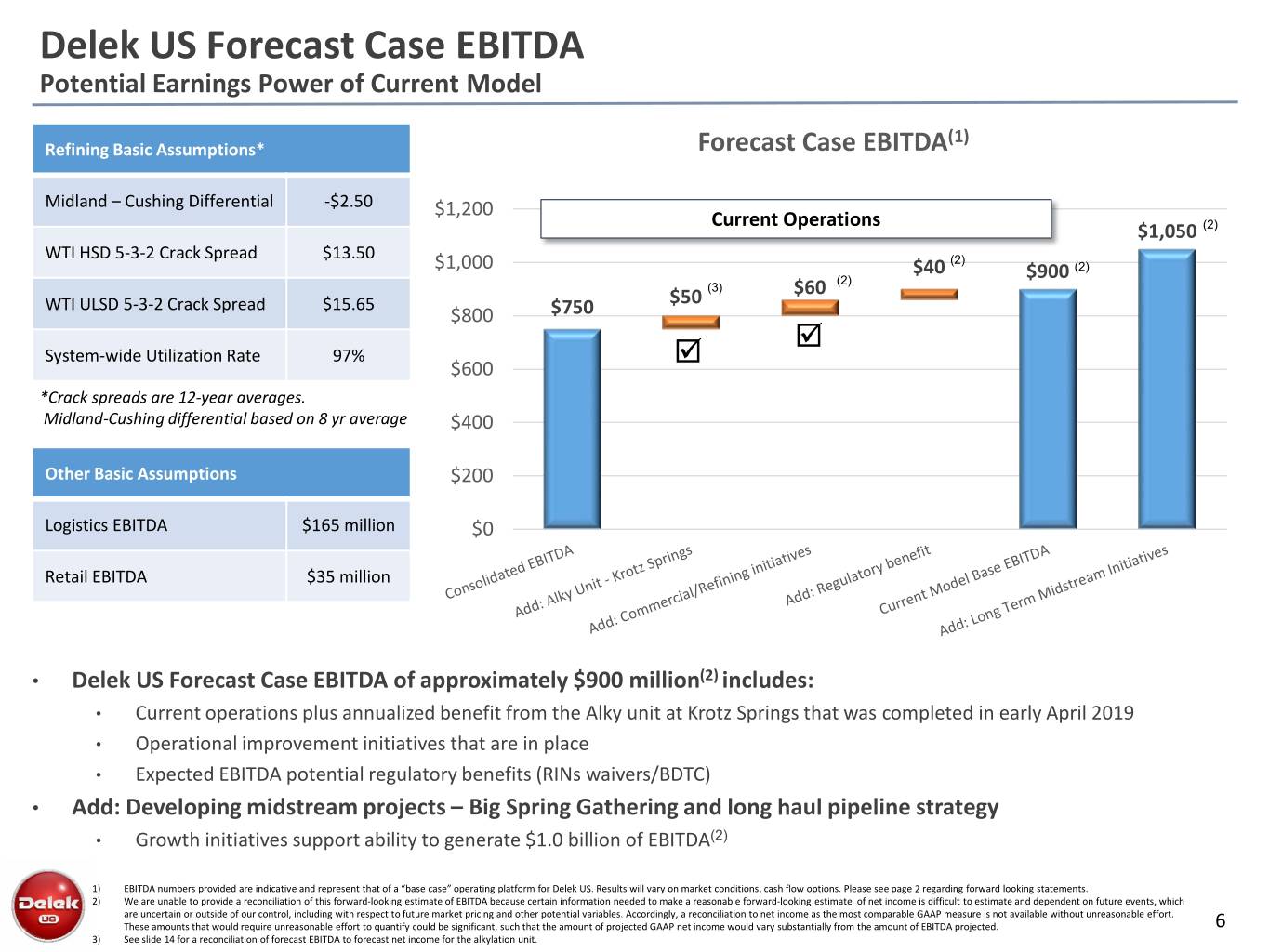

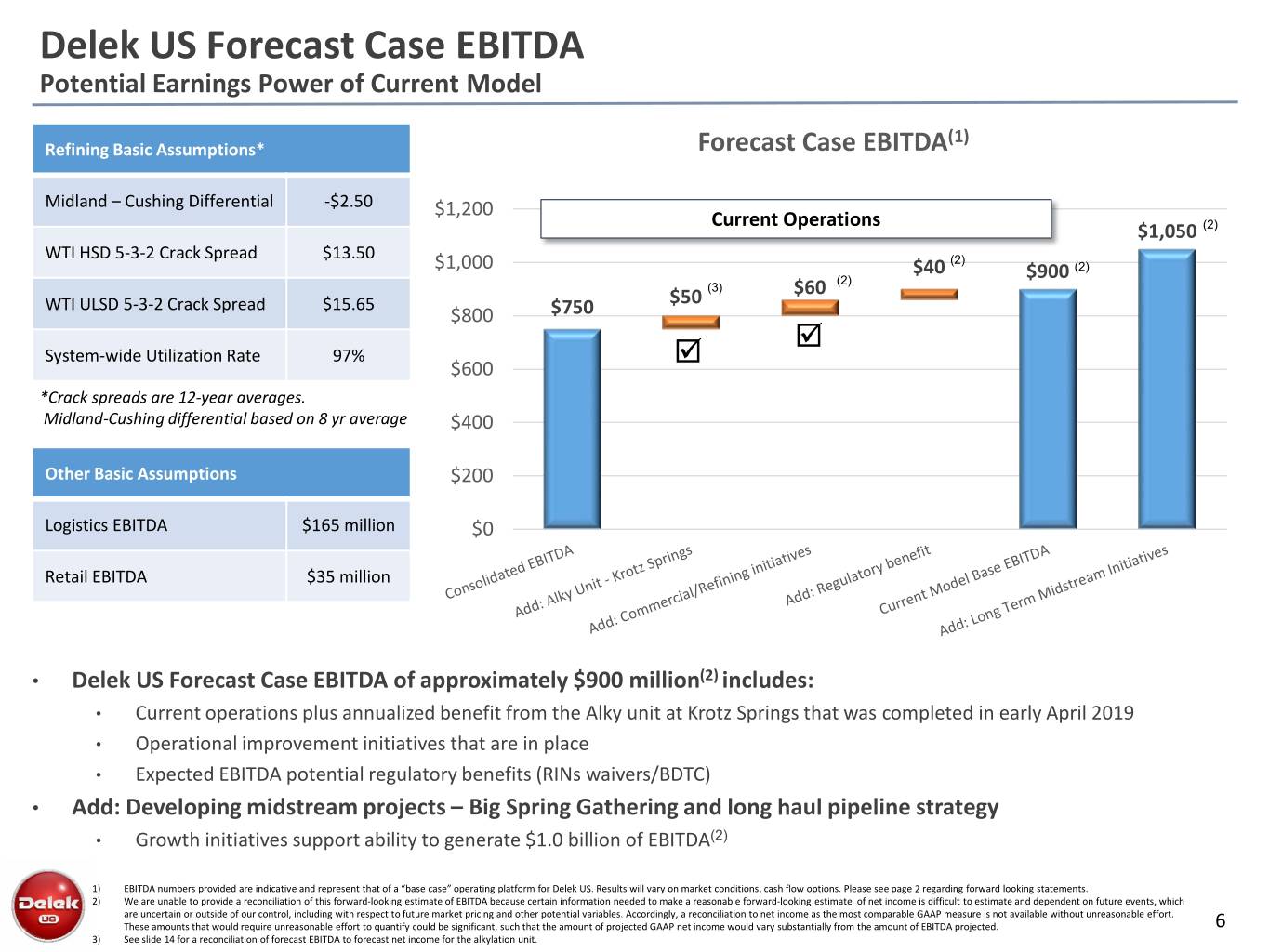

Delek US Forecast Case EBITDA Potential Earnings Power of Current Model (1) Refining Basic Assumptions* Forecast Case EBITDA Midland – Cushing Differential -$2.50 $1,200 Current Operations $1,050 (2) WTI HSD 5-3-2 Crack Spread $13.50 (2) $1,000 $40 (2) (2) $900 (3) $60 WTI ULSD 5-3-2 Crack Spread $15.65 $50 $800 $750 System-wide Utilization Rate 97% $600 *Crack spreads are 12-year averages. Midland-Cushing differential based on 8 yr average $400 Other Basic Assumptions $200 Logistics EBITDA $165 million $0 Retail EBITDA $35 million • Delek US Forecast Case EBITDA of approximately $900 million(2) includes: • Current operations plus annualized benefit from the Alky unit at Krotz Springs that was completed in early April 2019 • Operational improvement initiatives that are in place • Expected EBITDA potential regulatory benefits (RINs waivers/BDTC) • Add: Developing midstream projects – Big Spring Gathering and long haul pipeline strategy • Growth initiatives support ability to generate $1.0 billion of EBITDA(2) 1) EBITDA numbers provided are indicative and represent that of a “base case” operating platform for Delek US. Results will vary on market conditions, cash flow options. Please see page 2 regarding forward looking statements. 2) We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate of net income is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to future market pricing and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of EBITDA projected. 6 3) See slide 14 for a reconciliation of forecast EBITDA to forecast net income for the alkylation unit.

Guidance 2Q19 Guidance Range Low High Consolidated Operating Expenses, $ in millions $165.0 $175.0 Consolidated G&A, $ in millions $57.0 $62.0 Consolidated Depreciation and Amort., $ in millions $52.0 $53.0 Net interest expense, $ in millions $28.0 $30.0 Effective Tax Rate 23% 25% Estimate Diluted Share Count (exclusive of repurchases) 77.5 77.7 Total Crude Throughput 260,000 270,000 El Dorado Crude Throughput 50,000 55,000 Realized Midland-Cushing Discount, $/bbl ($1.30) ($1.50) Backwardation/(Contango) ($0.13) ($0.18) 7

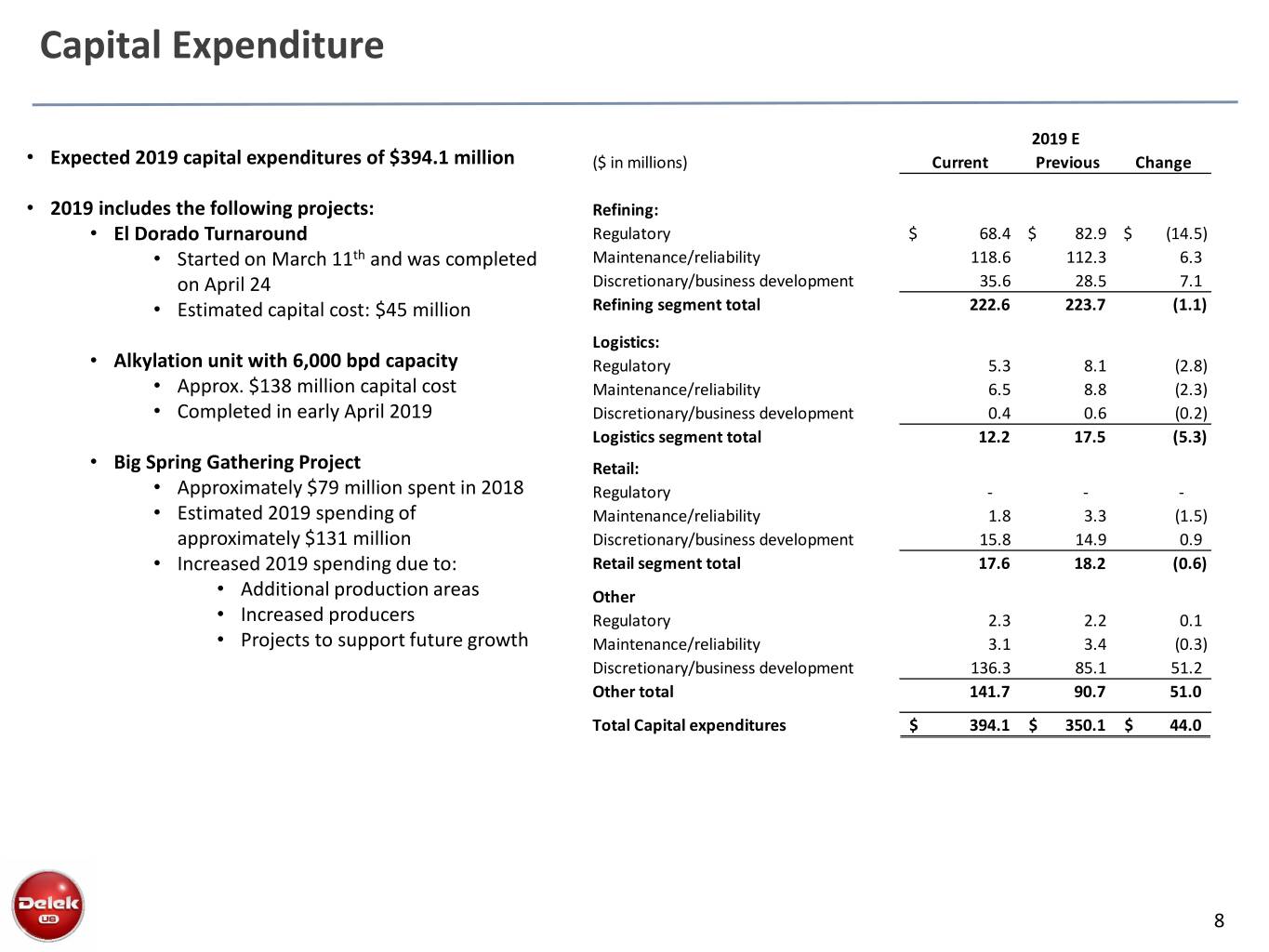

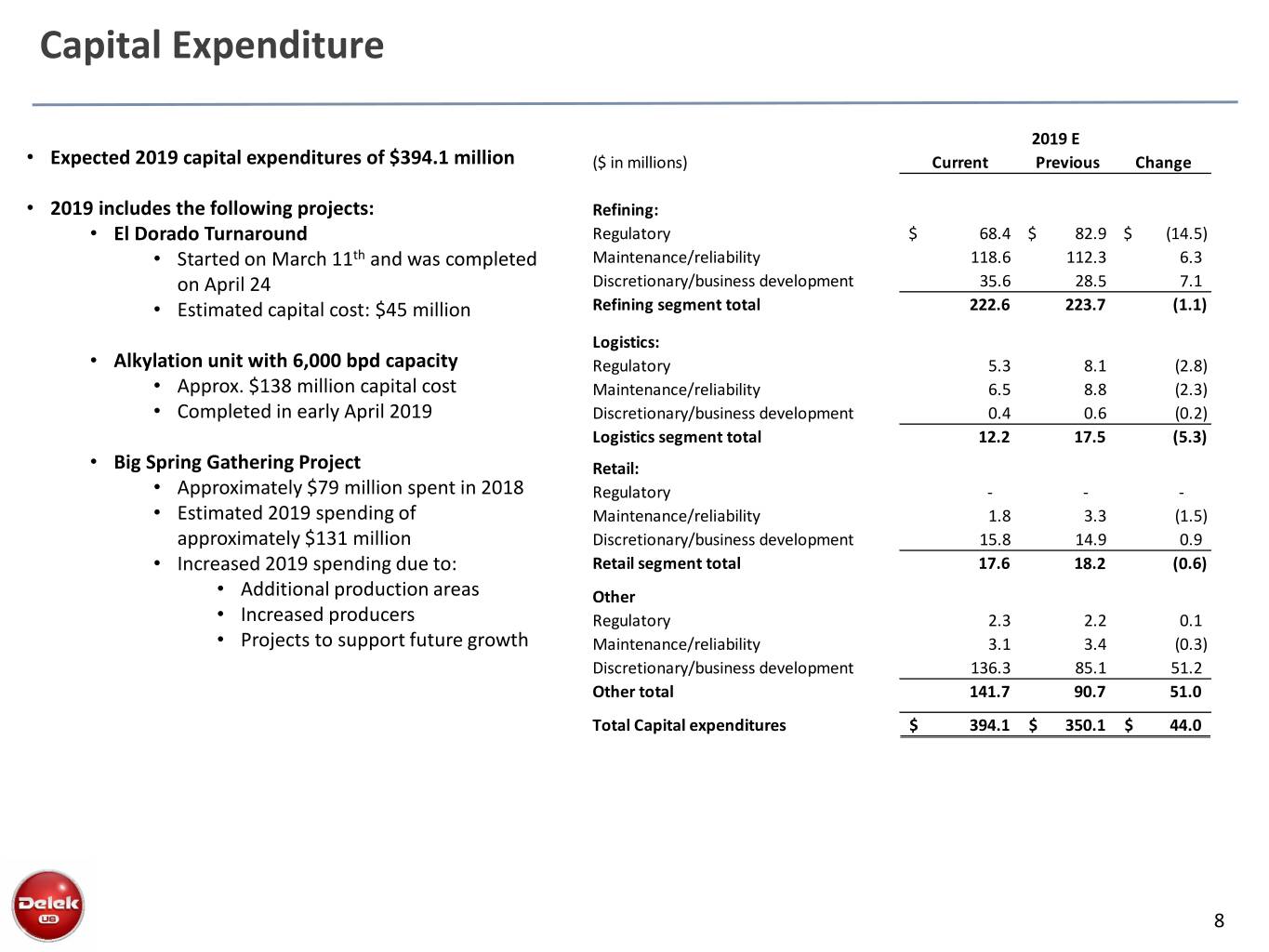

Capital Expenditure 2019 E • Expected 2019 capital expenditures of $394.1 million ($ in millions) Current Previous Change • 2019 includes the following projects: Refining: • El Dorado Turnaround Regulatory $ 68.4 $ 82.9 $ (14.5) • Started on March 11th and was completed Maintenance/reliability 118.6 112.3 6.3 on April 24 Discretionary/business development 35.6 28.5 7.1 • Estimated capital cost: $45 million Refining segment total 222.6 223.7 (1.1) Logistics: • Alkylation unit with 6,000 bpd capacity Regulatory 5.3 8.1 (2.8) • Approx. $138 million capital cost Maintenance/reliability 6.5 8.8 (2.3) • Completed in early April 2019 Discretionary/business development 0.4 0.6 (0.2) Logistics segment total 12.2 17.5 (5.3) • Big Spring Gathering Project Retail: • Approximately $79 million spent in 2018 Regulatory - - - • Estimated 2019 spending of Maintenance/reliability 1.8 3.3 (1.5) approximately $131 million Discretionary/business development 15.8 14.9 0.9 • Increased 2019 spending due to: Retail segment total 17.6 18.2 (0.6) • Additional production areas Other • Increased producers Regulatory 2.3 2.2 0.1 • Projects to support future growth Maintenance/reliability 3.1 3.4 (0.3) Discretionary/business development 136.3 85.1 51.2 Other total 141.7 90.7 51.0 Total Capital expenditures $ 394.1 $ 350.1 $ 44.0 8

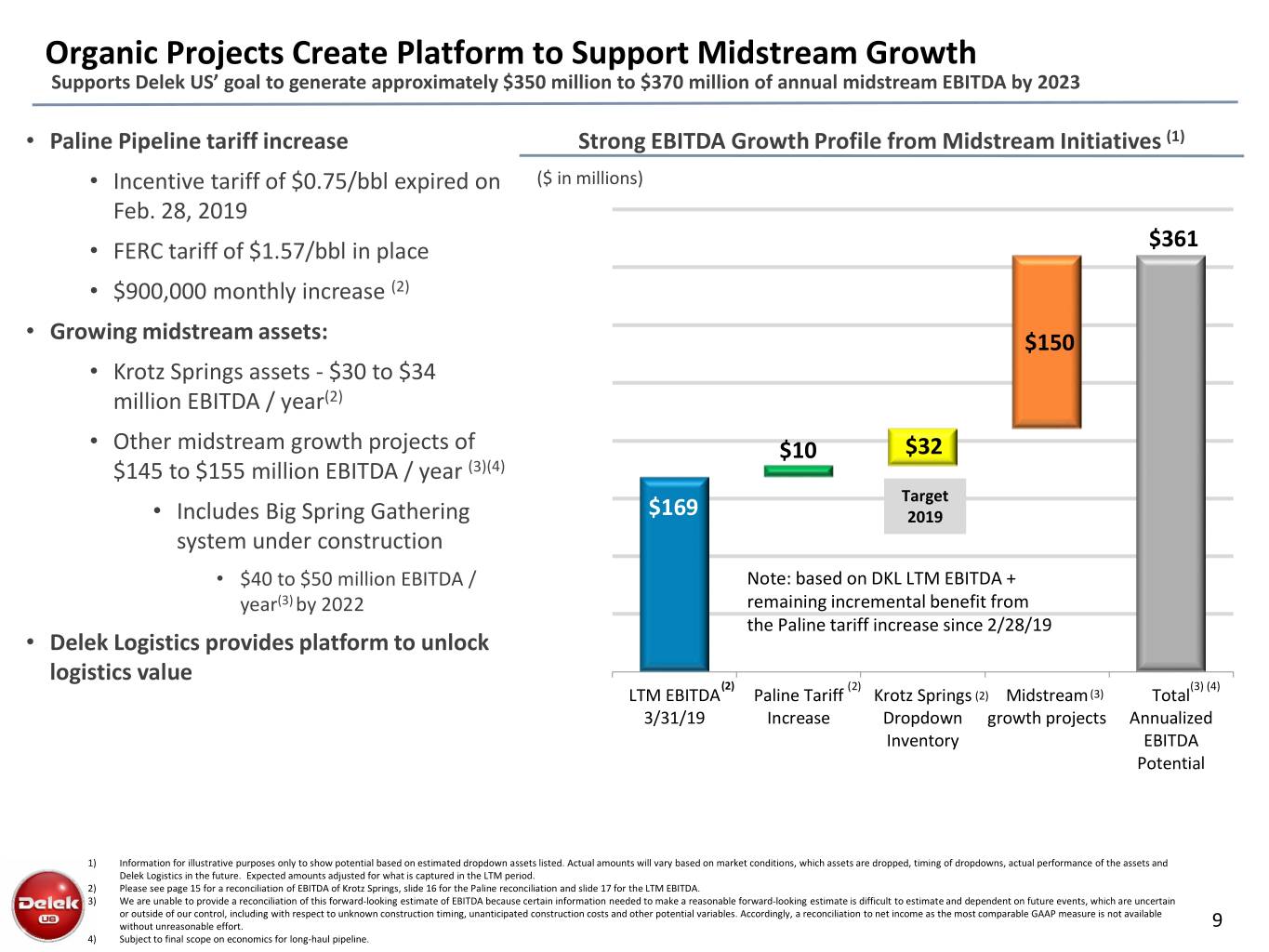

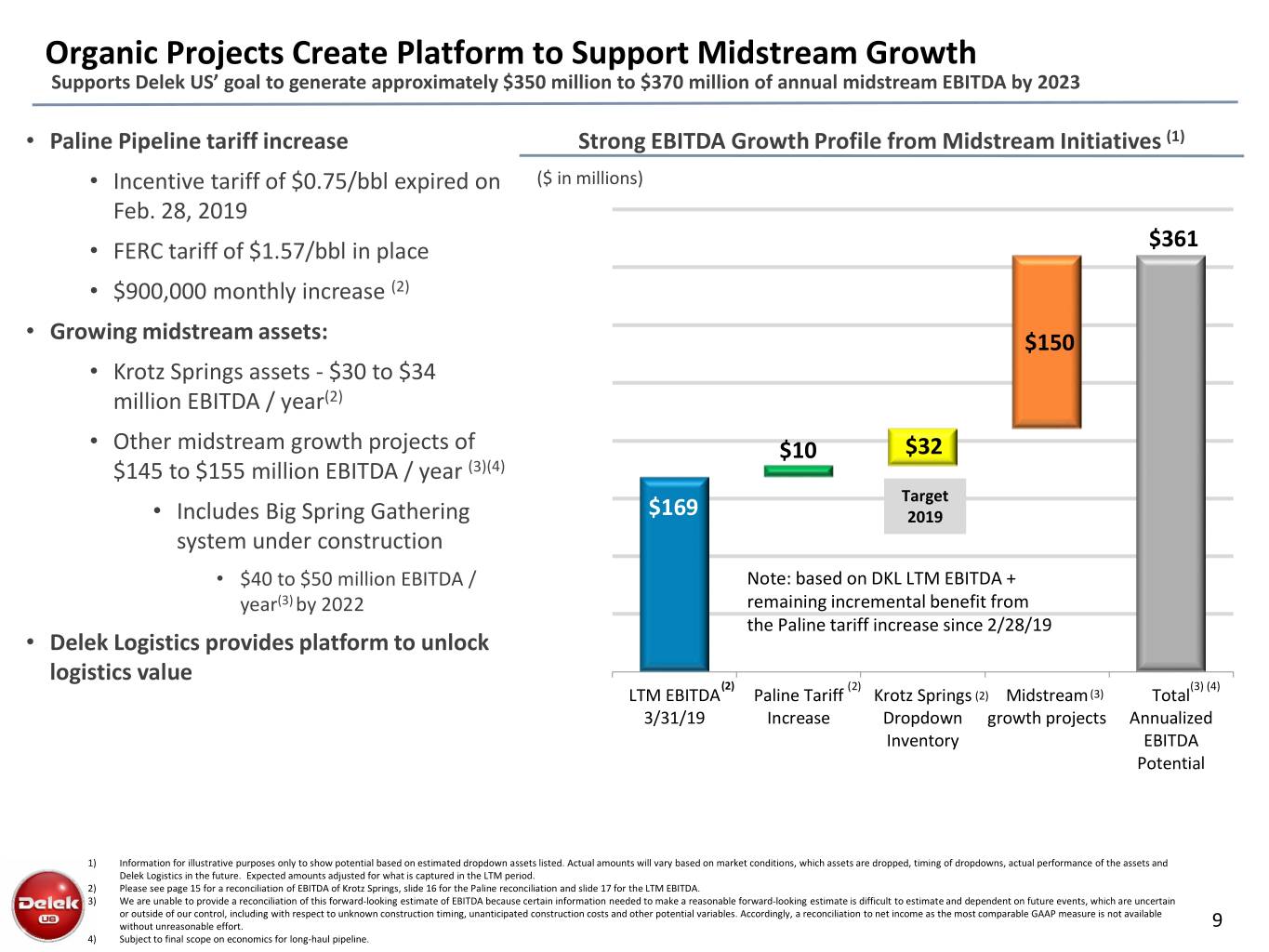

Organic Projects Create Platform to Support Midstream Growth Supports Delek US’ goal to generate approximately $350 million to $370 million of annual midstream EBITDA by 2023 • Paline Pipeline tariff increase Strong EBITDA Growth Profile from Midstream Initiatives (1) • Incentive tariff of $0.75/bbl expired on ($ in millions) Feb. 28, 2019 $361 • FERC tariff of $1.57/bbl in place • $900,000 monthly increase (2) • Growing midstream assets: $150 • Krotz Springs assets - $30 to $34 million EBITDA / year(2) • Other midstream growth projects of $10 $32 $145 to $155 million EBITDA / year (3)(4) Target • Includes Big Spring Gathering $169 2019 system under construction • $40 to $50 million EBITDA / Note: based on DKL LTM EBITDA + year(3) by 2022 remaining incremental benefit from the Paline tariff increase since 2/28/19 • Delek Logistics provides platform to unlock logistics value (2) (2) (3) (4) LTM EBITDA Paline Tariff Krotz Springs (2) Midstream (3) Total 3/31/19 Increase Dropdown growth projects Annualized Inventory EBITDA Potential 1) Information for illustrative purposes only to show potential based on estimated dropdown assets listed. Actual amounts will vary based on market conditions, which assets are dropped, timing of dropdowns, actual performance of the assets and Delek Logistics in the future. Expected amounts adjusted for what is captured in the LTM period. 2) Please see page 15 for a reconciliation of EBITDA of Krotz Springs, slide 16 for the Paline reconciliation and slide 17 for the LTM EBITDA. 3) We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. 9 4) Subject to final scope on economics for long-haul pipeline.

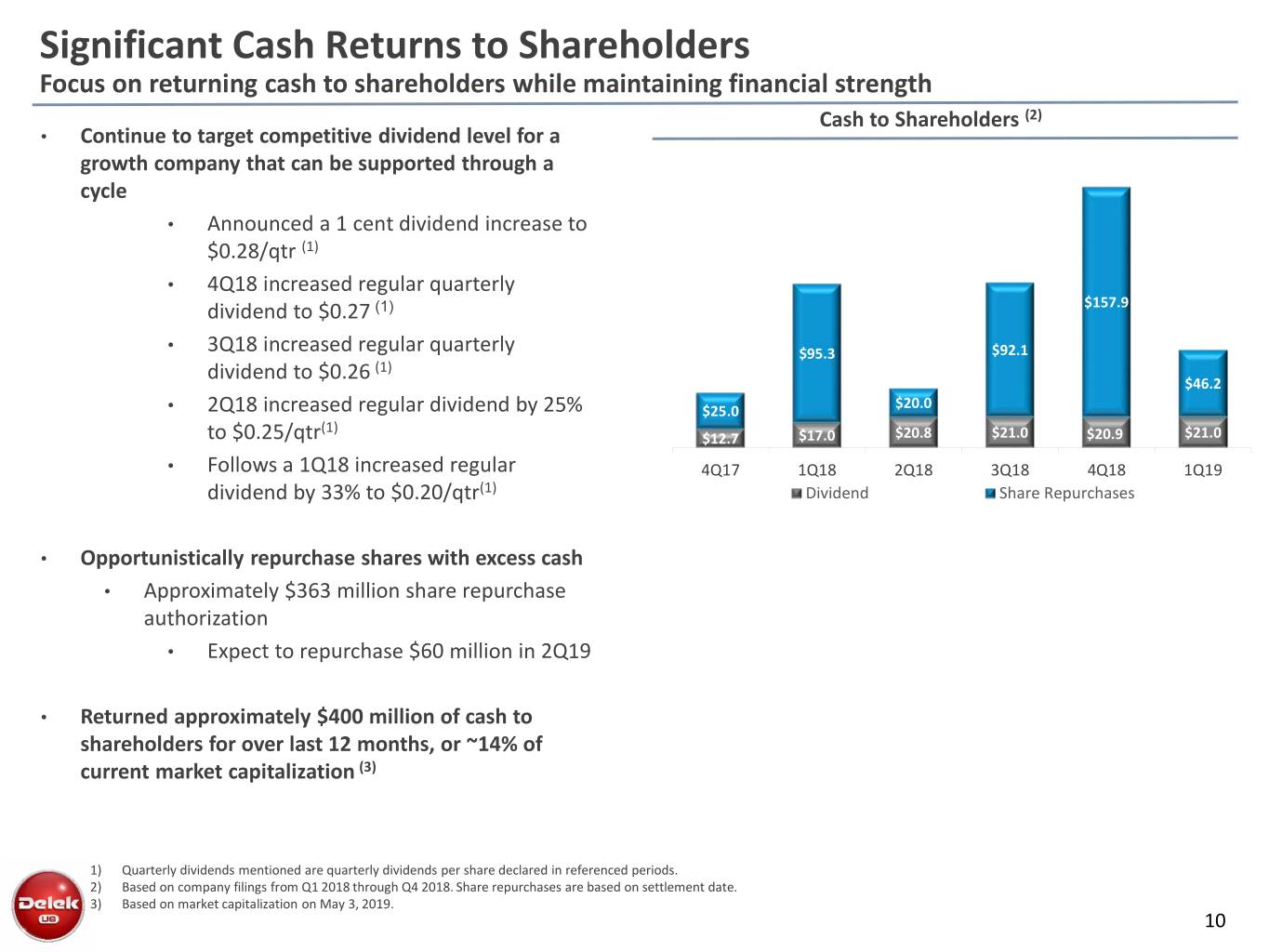

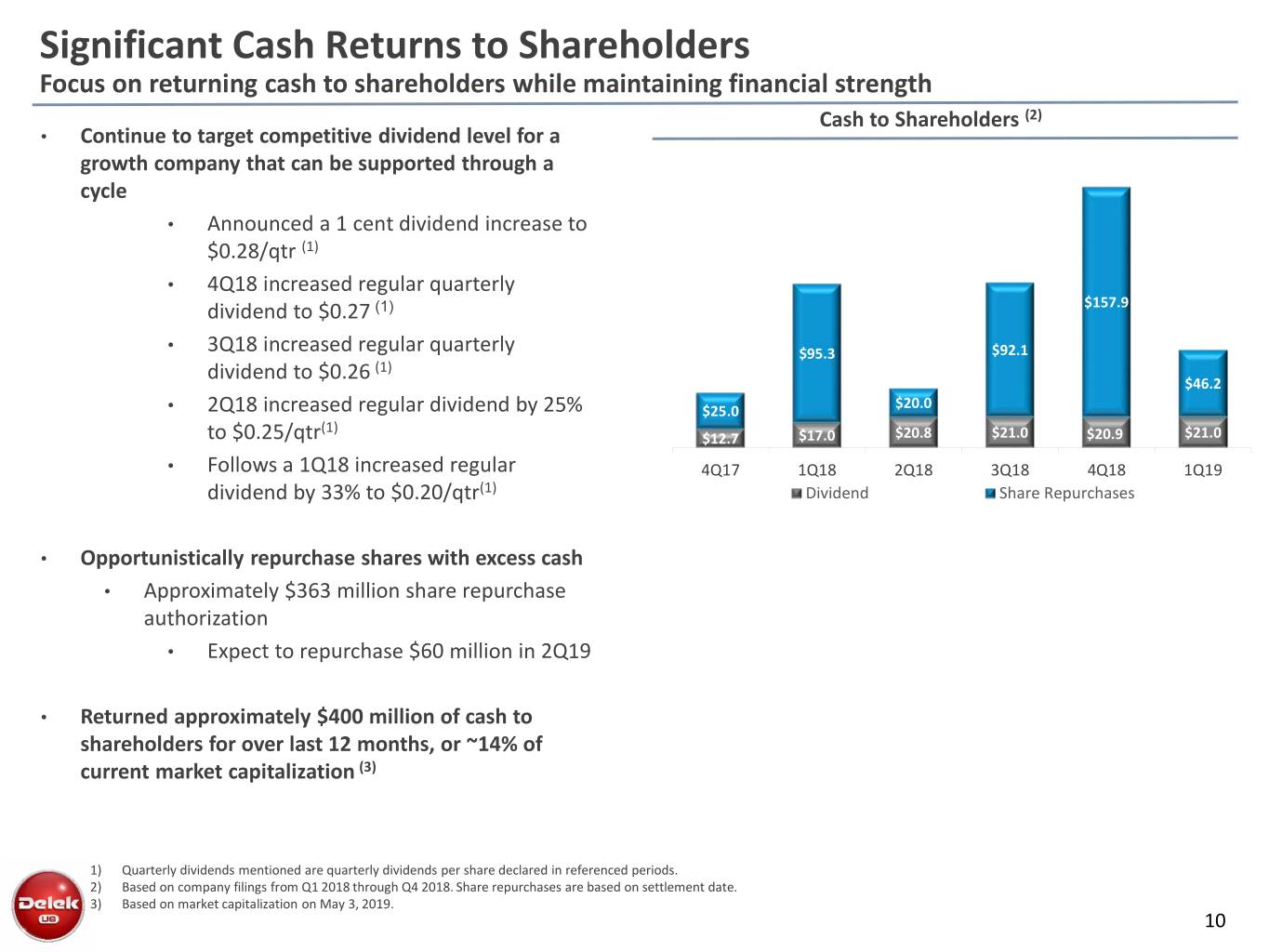

Significant Cash Returns to Shareholders Focus on returning cash to shareholders while maintaining financial strength Cash to Shareholders (2) • Continue to target competitive dividend level for a growth company that can be supported through a cycle • Announced a 1 cent dividend increase to $0.28/qtr (1) • 4Q18 increased regular quarterly dividend to $0.27 (1) $157.9 • 3Q18 increased regular quarterly $95.3 $92.1 (1) dividend to $0.26 $46.2 $20.0 • 2Q18 increased regular dividend by 25% $25.0 (1) to $0.25/qtr $12.7 $17.0 $20.8 $21.0 $20.9 $21.0 • Follows a 1Q18 increased regular 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 dividend by 33% to $0.20/qtr(1) Dividend Share Repurchases • Opportunistically repurchase shares with excess cash • Approximately $363 million share repurchase authorization • Expect to repurchase $60 million in 2Q19 • Returned approximately $400 million of cash to shareholders for over last 12 months, or ~14% of current market capitalization (3) 1) Quarterly dividends mentioned are quarterly dividends per share declared in referenced periods. 2) Based on company filings from Q1 2018 through Q4 2018. Share repurchases are based on settlement date. 3) Based on market capitalization on May 3, 2019. 10

Questions and Answers Significant Organic Focus on Long-Term Growth / Margin Shareholder Returns Improvement Opportunities An Integrated and Permian Focused Diversified Refining, Financial Flexibility Refining System Logistics and Marketing Company Complementary Logistics Systems

Non-GAAP Reconciliations of Adjusted Net Income Delek US Holdings, Inc. Reconciliation of Amounts Reported Under U.S. GAAP per share data Three Months Ended March 31, Reconciliation of U.S. GAAP Income (loss) per share to Adjusted Net Income per share 2019 2018 (Unaudited) Reported diluted income per share $1.90 ($0.49) Adjustments, after tax (per share) (1) Net inventory valuation (gain) (0.52) (0.01) Adjusted unrealized hedging loss 0.13 0.07 Transaction related expenses 0.03 0.10 Tax Cuts and Jobs Act adjustment (benefit) - (0.09) Impairment loss on assets held for sale - 0.33 Loss on extinguishment of debt - 0.08 Discontinued operations loss - 0.10 Net Income attributable to non-controlling interest of discontinued operations - 0.10 Tax adjustment related to unrealizable deferred taxes created in Big Spring Asset Acquisition - 0.07 Total adjustments (0.36) 0.75 Adjusted net income per share $1.54 $0.26 (1) The tax calculation is based on the appropriate marginal income tax rate related to each adjustment and for each respective time period, which is applied to the adjusted items in the calculation of adjusted net income in all periods. 12

Non-GAAP Reconciliations of Adjusted EBITDA Delek US Holdings, Inc. Reconciliation of Amounts Reported Under U.S. GAAP $ in millions Three Months Ended March 31, Reconciliation of Net Income (Loss) attributable to Delek to Adjusted EBITDA 2019 2018 (Unaudited) Reported net income (loss) attributable to Delek $149.3 ($40.4) Add: Interest expense, net 26.2 31.8 Loss on extinguishment of debt - 9.0 Income tax expense (benefit) - continuing operations 45.8 (11.5) Depreciation and amortization 46.8 48.0 EBITDA 268.1 36.9 Adjustments Net inventory valuation (gain) loss (52.1) (0.9) Adjusted unrealized hedging loss 13.4 7.8 Transaction related expenses 3.0 10.5 Impairment loss on assets held for sale - 27.5 Discontinued operations loss, net of tax - 8.2 Net income attributable to non-controlling interest 5.1 14.9 Total adjustments (30.6) 68.0 Adjusted EBITDA $237.5 $104.9 13

Non-GAAP Reconciliations of Adjusted EBITDA Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA for Alkylation Project ($ in millions) Annual Amount Forecasted Incremental Net Income $ 33.2 Add Forecasted Incremental Amounts for: Interest Expense, net $ - Income tax expense $ 9.9 Depreciation and amortization $ 6.9 Forecasted Incremental EBITDA $ 50.0 14

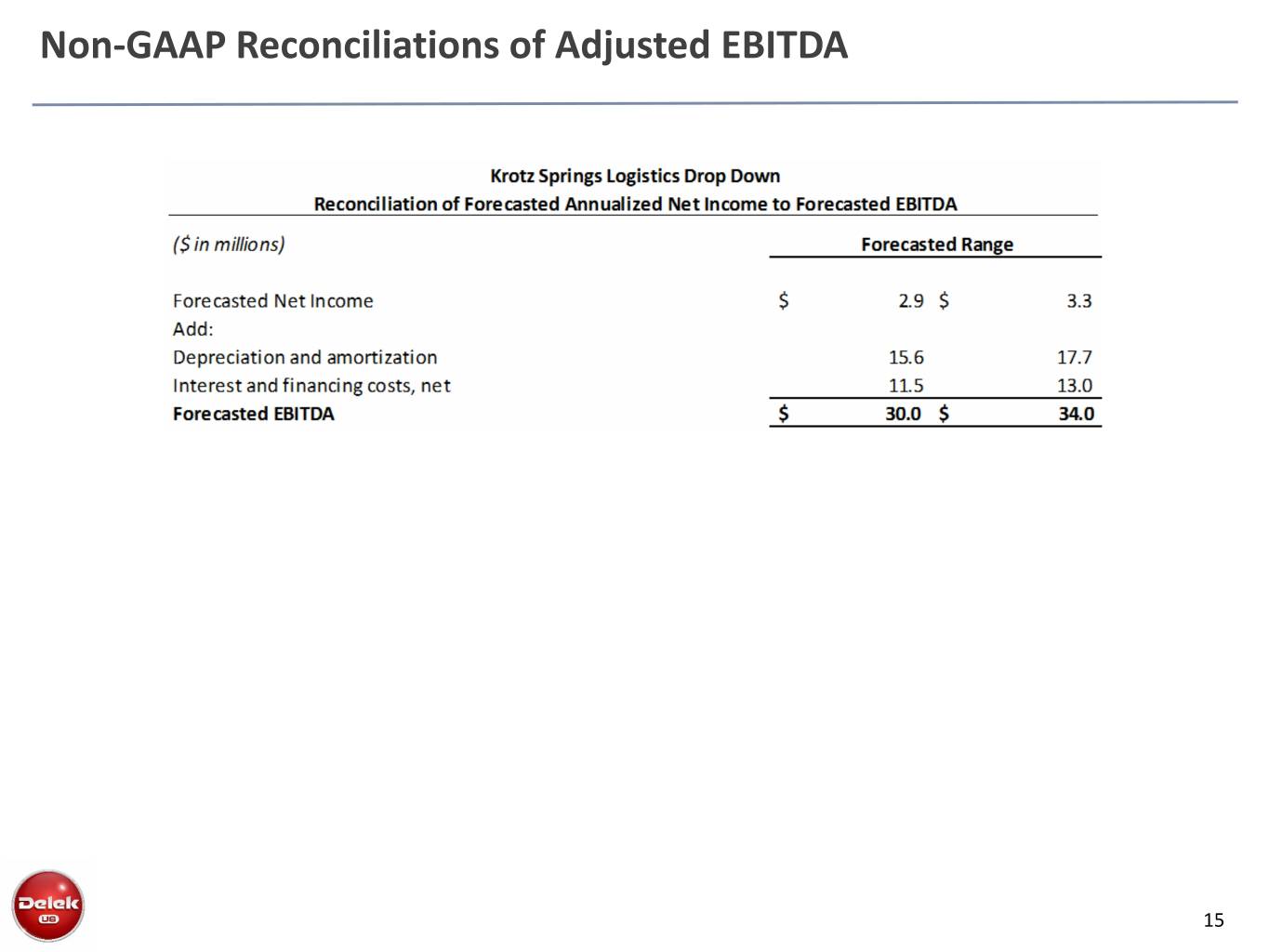

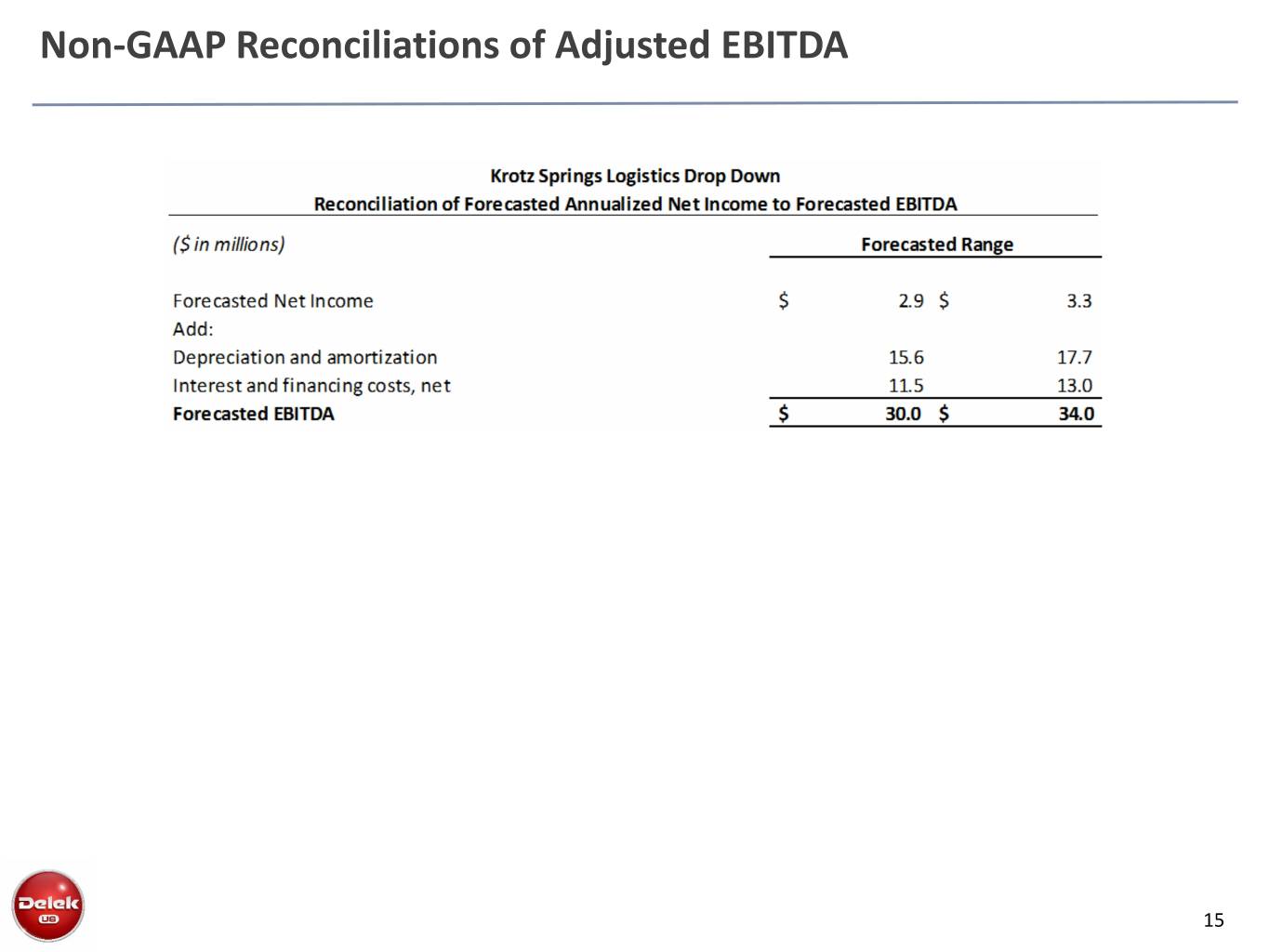

Non-GAAP Reconciliations of Adjusted EBITDA 15

Non-GAAP Reconciliation of Increased Paline Pipeline Tariff EBITDA(1) Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA for Paline Pipeline Tariff Increase ($ in millions) Annual Monthly Forecasted Incremental Net Income $ 10.8 $ 0.9 Add Forecasted Incremental Amounts for: Interest Expense, net $ - $ - Depreciation and amortization $ - $ - Forecasted Incremental EBITDA $ 10.8 $ 0.9 1) Based on projected potential future performance from the Paline Pipeline using 36,000 bpd and the tariff change from an incentive rate of $0.75/bbl to the FERC rate of $1.57/bbl. Amounts of EBITDA and net income will vary. Actual amounts will be based on market conditions and pipeline operations. 16

DKL: Income Statement and Non-GAAP EBITDA Reconciliation 2013(1) 1Q14(1) 2Q14 3Q14 4Q14 2014 (1) 1Q15(2) 2Q15 3Q15 4Q15 2015 1Q16 2Q16 3Q16 4Q16 2016 Net Revenue $907.4 $203.5 $236.3 $228.0 $173.3 $841.2 $143.5 $172.1 $165.1 $108.9 $589.7 $104.1 $111.9 $107.5 $124.7 $448.1 Cost of Sales (811.4) (172.2) (196.6) (194.1) (134.3) (697.2) (108.4) (132.5) (124.4) (71.0) (436.3) (66.8) (73.1) ($73.5) ($88.8) (302.2) Operating Expenses (excluding depreciation and amortization presented below) (25.8) (8.5) (9.5) (10.2) (9.7) (38.0) (10.6) (10.8) (11.6) (11.7) (44.8) (10.5) (8.7) ($9.3) ($8.8) (37.2) Depreciation and Amortization Contribution Margin $70.3 $22.8 $30.2 $23.7 $29.3 $106.0 $24.5 $28.8 $29.1 $26.2 $108.6 $26.8 $30.0 $24.7 $27.2 $108.7 Operating Expenses (excluding depreciation and amortization presented below) Depreciation and Amortization (10.7) (3.4) (3.5) (3.7) (3.9) (14.6) (4.0) (4.7) (4.5) (5.9) (19.2) (5.0) (4.8) ($5.4) ($5.6) (20.8) General and Administration Expense (6.3) (2.6) (2.2) (2.5) (3.3) (10.6) (3.4) (3.0) (2.7) (2.3) (11.4) (2.9) (2.7) ($2.3) ($2.3) (10.3) Gain (Loss) on Asset Disposal (0.2) - (0.1) - - (0.1) - - - (0.1) (0.1) 0.0 - ($0.0) $0.0 0.0 Operating Income $53.2 $16.8 $24.4 $17.5 $22.1 $80.8 $17.1 $21.1 $21.8 $17.9 $77.9 $19.0 $22.5 $17.0 $19.2 $77.7 Interest Expense, net (4.6) (2.0) (2.3) (2.2) (2.1) (8.7) (2.2) (2.6) (2.8) (3.0) (10.7) (3.2) (3.3) ($3.4) ($3.7) (13.6) (Loss) Income from Equity Method Invesments (0.1) (0.3) (0.1) (0.6) (0.2) (0.2) ($0.3) ($0.4) (1.2) Income Taxes (0.8) (0.1) (0.3) (0.2) 0.5 (0.1) (0.3) (0.1) (0.1) 0.6 0.2 (0.1) (0.129) ($0.1) $0.3 (0.1) Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 EBITDA: Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 Income Taxes 0.8 0.1 0.3 0.2 (0.5) 0.1 0.3 0.1 0.1 (0.6) (0.2) 0.1 0.1 0.13 (0.28) 0.1 Depreciation and Amortization 10.7 3.4 3.5 3.7 3.9 14.6 4.0 4.7 4.5 5.9 19.2 5.0 4.8 5.4 5.6 20.8 Amortization of customer contract intangible asset - - - - - - - - - - - - - - - - Interest Expense, net 4.6 2.0 2.3 2.2 2.1 8.7 2.2 2.6 2.8 3.0 10.7 3.2 3.3 3.4 3.7 13.6 EBITDA $63.8 $20.2 $27.9 $21.2 $26.1 $95.4 $21.1 $25.7 $26.1 $23.6 $96.5 $23.7 $27.1 $22.0 $24.4 $97.3 2Q17 3Q17 4Q17 2017 1Q18 2Q18 3Q18 4Q18 2018 1Q19 Net Revenue $126.8 $130.6 $151.2 $538.1 $167.9 $166.3 $164.1 $159.3 $657.6 $152.5 Cost of Sales (85.0) ($89.1) ($106.1) (372.9) (119.0) (106.0) ($105.6) ($98.4) (429.1) ($96.3) Operating Expenses (excluding depreciation and amortization presented below) (10.0) ($10.7) ($12.3) (43.3) (12.6) (14.9) ($14.5) ($15.4) (57.4) ($15.3) Depreciation and Amortization ($6.3) ($5.8) (12.1) ($6.1) Contribution Margin $31.8 $30.8 $32.8 $121.9 $36.3 $45.3 $37.8 $39.6 $159.1 $34.8 Operating Expenses (excluding depreciation and amortization presented below) ($0.9) ($0.4) (1.3) ($0.8) Depreciation and Amortization (5.7) ($5.5) ($5.5) (21.9) (6.0) (7.0) ($0.5) ($0.4) (13.9) ($0.5) General and Administration Expense (2.7) ($2.8) ($3.6) (11.8) (3.0) (3.7) ($3.1) ($7.4) (17.2) ($4.5) Gain (Loss) on Asset Disposal 0.0 ($0.0) ($0.0) (0.0) - 0.1 ($0.7) ($0.2) (0.8) ($0.0) Operating Income $23.4 $22.6 $23.7 $88.1 $27.3 $34.7 $32.6 $31.1 $125.8 $29.1 Interest Expense, net (5.5) ($7.1) ($7.3) (23.9) (8.1) (10.9) ($11.1) ($11.2) (41.3) ($11.3) (Loss) Income from Equity Method Invesments 1.2 $1.6 $1.9 5.0 0.8 1.9 $1.9 $1.5 6.2 $2.0 Income Taxes (0.1) ($0.2) $0.6 0.2 (0.1) (0.1) ($0.1) ($0.2) (0.5) ($0.1) Net Income $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 $21.3 $90.2 $19.7 EBITDA: Net Income $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 $21.3 $90.2 $19.7 Income Taxes 0.1 0.2 ($0.6) (0.2) 0.1 0.1 0.1 $0.2 0.5 0.1 Depreciation and Amortization 5.7 5.5 5.5 21.9 6.0 7.0 6.7 6.3 26.0 6.6 Amortization of customer contract intangible asset - - - - 0.6 1.8 1.8 1.8 6.0 1.8 Interest Expense, net 5.5 7.1 7.3 23.9 8.1 10.9 11.1 11.2 41.3 11.3 EBITDA $30.3 $29.7 $31.1 $115.0 $34.7 $45.4 $43.0 $40.7 $163.9 $39.4 1) Results in 2013 and 2014 are as reported excluding predecessor costs related to the dropdown of the tank farms and product terminals at both Tyler and El Dorado during the respective periods. 2) Results for 1Q15 are as reported excluding predecessor costs related to the 1Q15 dropdowns. Note: May not foot due to rounding. 17