Delek US Holdings, Inc. J.P. Morgan Energy Conference June 2019

Disclaimers Forward Looking Statements: Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral and written presentations contain forward-looking statements within the meaning of federal securities laws that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. These forward-looking statements include, but are not limited to, the statements regarding the following: financial and operating guidance for future and uncompleted financial periods; future crude slates; financial strength and flexibility; potential for and projections of growth; return of cash to shareholders, stock repurchases and the payment of distributions and dividends, including the amount and timing thereof; crude oil throughput and optionality; crude oil market trends, including production, quality, pricing, demand, imports, exports and transportation costs; light production from shale plays and Permian growth; differentials including increases, trends and the impact thereof on crack spreads and refineries; pipeline takeaway capacity and projects related thereto; refinery complexity, configurations, utilization, crude oil slate flexibility, capacities, equipment limits and margins; the ability to add flexibility and increase margin potential at the Krotz Springs refinery; improved product netbacks; our ability to execute on our midstream initiatives, including the Big Spring Gathering System, expansion of the Red River pipeline and participating in a long-haul pipeline, and the benefits, flexibility, returns and EBITDA or adjusted EBITDA therefrom; the potential for, and estimates of cost savings and other benefits from, acquisitions, divestitures, dropdowns and financing activities; divestiture of non-core assets and matters pertaining thereto; the attainment of certain regulatory benefits; retail growth and the opportunities and value derived therefrom; long-term value creation from capital allocation; execution of strategic initiatives and the benefits therefrom; and access to crude oil and the benefits therefrom. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward-looking statements. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, pricing, production and transportation capacity; gains and losses from derivative instruments; management's ability to execute its strategy of growth, including through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance projects; the ability to obtain commitments and construct the long-haul pipeline; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements. Non-GAAP Disclosures: Delek US and Delek Logistics believe that the presentation of earnings before interest, taxes, depreciation and amortization ("EBITDA"), adjusted EBITDA, free cash flow, distributable cash flow and distribution coverage ratio provide useful information to investors in assessing their financial condition, results of operations and cash flow their business is generating. Distributable cash flow is calculated as net cash flow from operating activities plus or minus changes in assets and liabilities, less maintenance capital expenditures net of reimbursements and other adjustments not expected to settle in cash. EBITDA, adjusted EBITDA, free cash flow, distributable cash flow and distribution coverage ratio should not be considered as alternatives to net income, operating income, cash from operations or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, adjusted EBITDA, free cash flow, distributable cash flow and distribution coverage ratio have important limitations as analytical tools because they exclude some, but not all, items that affect net income. Additionally, because EBITDA, adjusted EBITDA, free cash flow, distributable cash flow and distribution coverage ratio may be defined differently by other companies in its industry, Delek US' and Delek Logistics’ definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see reconciliations of EBITDA, adjusted EBITDA, distributable cash flow and distribution coverage ratio to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP in the appendix. 2

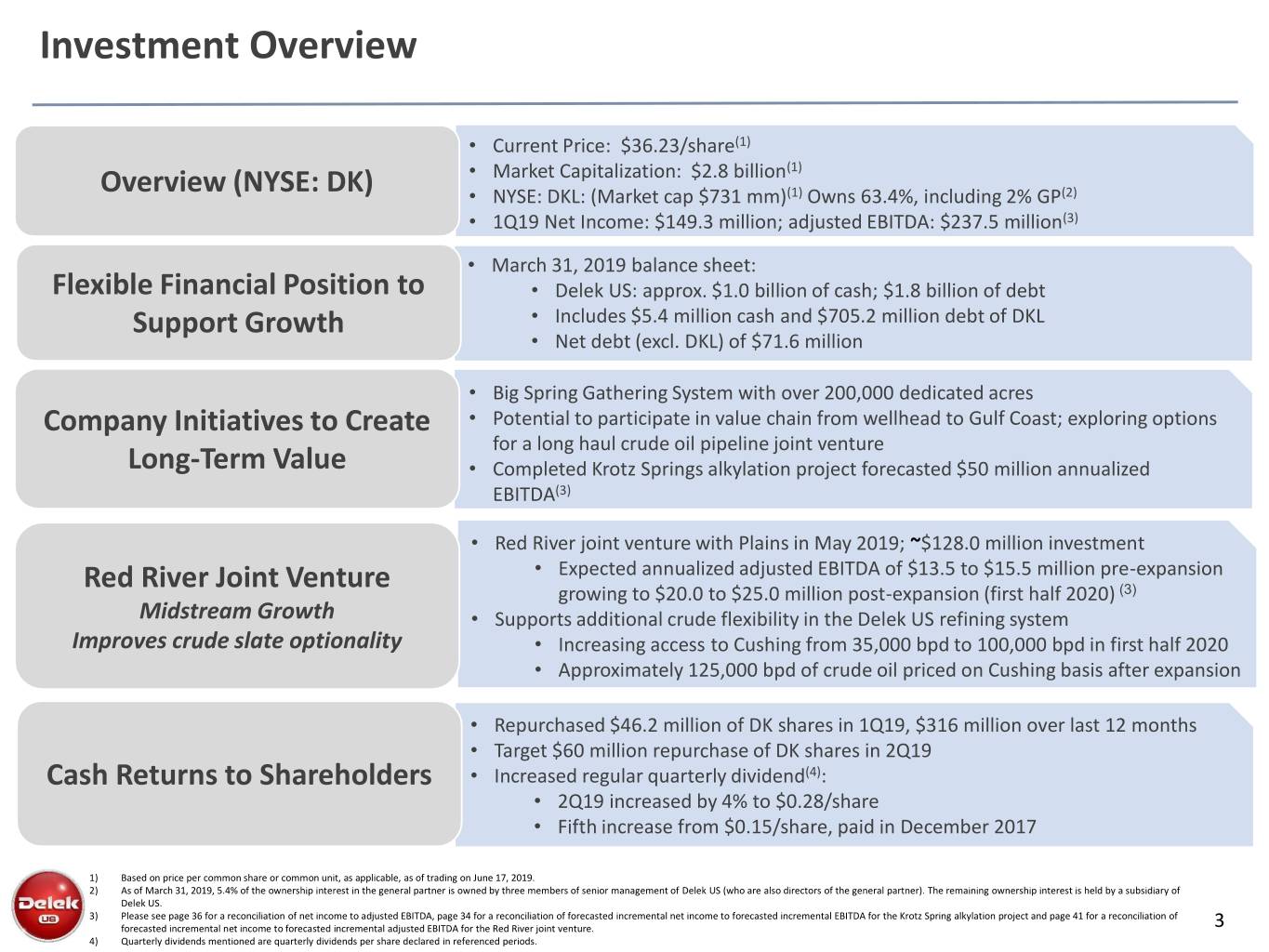

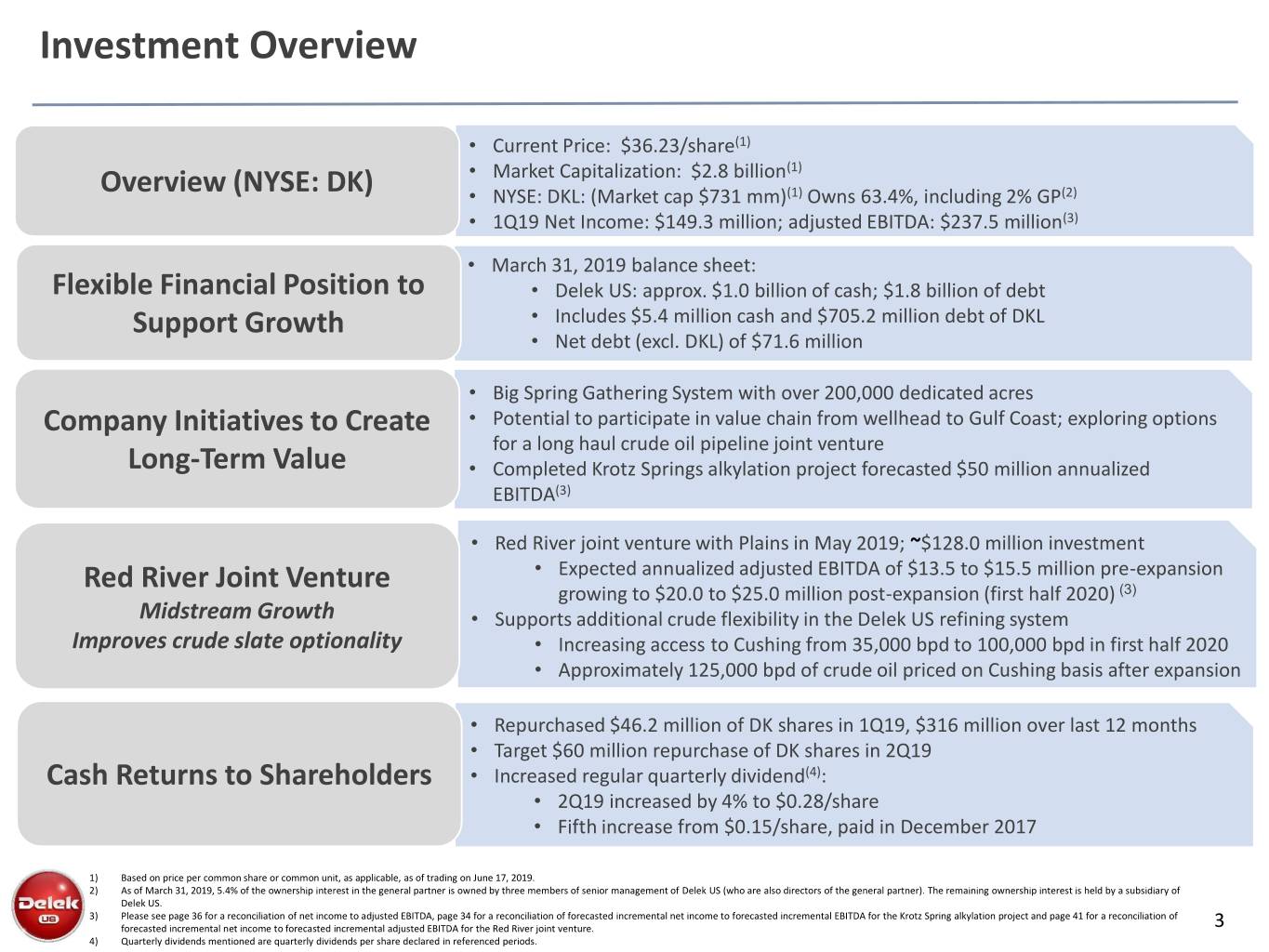

Investment Overview • Current Price: $36.23/share(1) • Market Capitalization: $2.8 billion(1) Overview (NYSE: DK) • NYSE: DKL: (Market cap $731 mm)(1) Owns 63.4%, including 2% GP(2) • 1Q19 Net Income: $149.3 million; adjusted EBITDA: $237.5 million(3) • March 31, 2019 balance sheet: Flexible Financial Position to • Delek US: approx. $1.0 billion of cash; $1.8 billion of debt Support Growth • Includes $5.4 million cash and $705.2 million debt of DKL • Net debt (excl. DKL) of $71.6 million • Big Spring Gathering System with over 200,000 dedicated acres Company Initiatives to Create • Potential to participate in value chain from wellhead to Gulf Coast; exploring options for a long haul crude oil pipeline joint venture Long-Term Value • Completed Krotz Springs alkylation project forecasted $50 million annualized EBITDA(3) • Red River joint venture with Plains in May 2019; ~$128.0 million investment Red River Joint Venture • Expected annualized adjusted EBITDA of $13.5 to $15.5 million pre-expansion growing to $20.0 to $25.0 million post-expansion (first half 2020) (3) Midstream Growth • Supports additional crude flexibility in the Delek US refining system Improves crude slate optionality • Increasing access to Cushing from 35,000 bpd to 100,000 bpd in first half 2020 • Approximately 125,000 bpd of crude oil priced on Cushing basis after expansion • Repurchased $46.2 million of DK shares in 1Q19, $316 million over last 12 months • Target $60 million repurchase of DK shares in 2Q19 Cash Returns to Shareholders • Increased regular quarterly dividend(4): • 2Q19 increased by 4% to $0.28/share • Fifth increase from $0.15/share, paid in December 2017 1) Based on price per common share or common unit, as applicable, as of trading on June 17, 2019. 2) As of March 31, 2019, 5.4% of the ownership interest in the general partner is owned by three members of senior management of Delek US (who are also directors of the general partner). The remaining ownership interest is held by a subsidiary of Delek US. 3) Please see page 36 for a reconciliation of net income to adjusted EBITDA, page 34 for a reconciliation of forecasted incremental net income to forecasted incremental EBITDA for the Krotz Spring alkylation project and page 41 for a reconciliation of forecasted incremental net income to forecasted incremental adjusted EBITDA for the Red River joint venture. 3 4) Quarterly dividends mentioned are quarterly dividends per share declared in referenced periods.

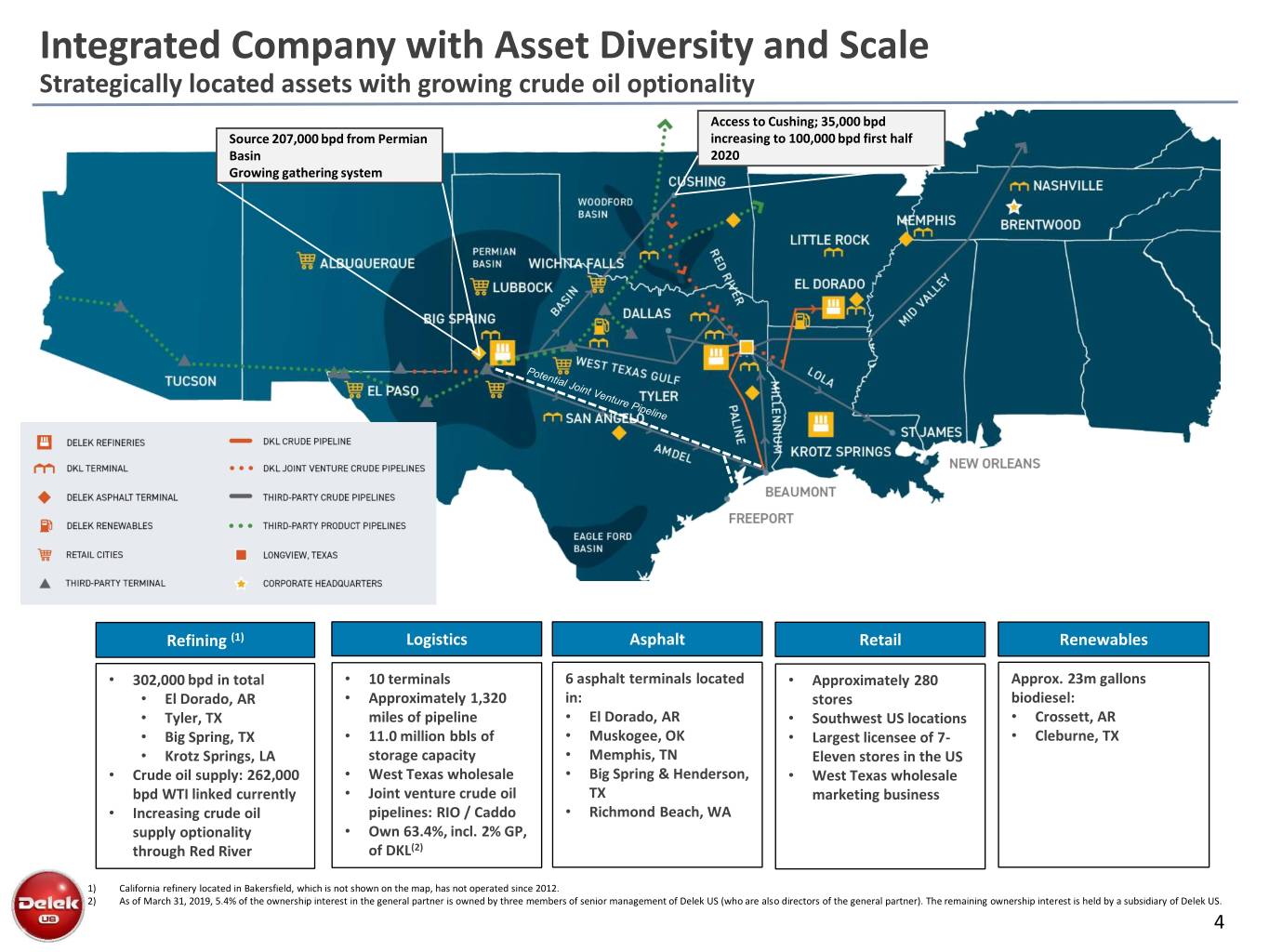

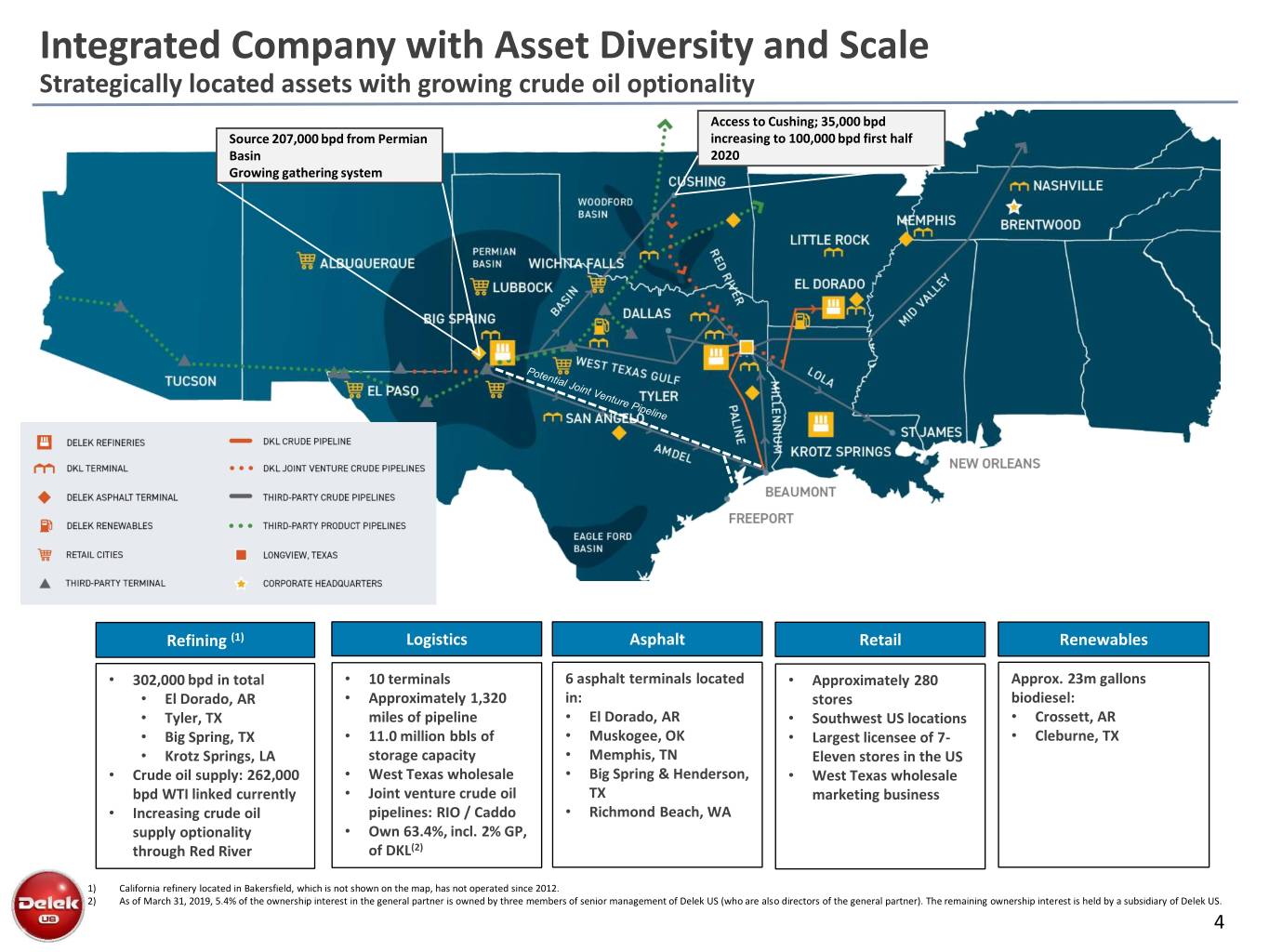

Integrated Company with Asset Diversity and Scale Strategically located assets with growing crude oil optionality Access to Cushing; 35,000 bpd Source 207,000 bpd from Permian increasing to 100,000 bpd first half Basin 2020 Growing gathering system Refining (1) Logistics Asphalt Retail Renewables • 302,000 bpd in total • 10 terminals 6 asphalt terminals located • Approximately 280 Approx. 23m gallons • El Dorado, AR • Approximately 1,320 in: stores biodiesel: • Tyler, TX miles of pipeline • El Dorado, AR • Southwest US locations • Crossett, AR • Big Spring, TX • 11.0 million bbls of • Muskogee, OK • Largest licensee of 7- • Cleburne, TX • Krotz Springs, LA storage capacity • Memphis, TN Eleven stores in the US • Crude oil supply: 262,000 • West Texas wholesale • Big Spring & Henderson, • West Texas wholesale bpd WTI linked currently • Joint venture crude oil TX marketing business • Increasing crude oil pipelines: RIO / Caddo • Richmond Beach, WA supply optionality • Own 63.4%, incl. 2% GP, through Red River of DKL(2) 1) California refinery located in Bakersfield, which is not shown on the map, has not operated since 2012. 2) As of March 31, 2019, 5.4% of the ownership interest in the general partner is owned by three members of senior management of Delek US (who are also directors of the general partner). The remaining ownership interest is held by a subsidiary of Delek US. 4

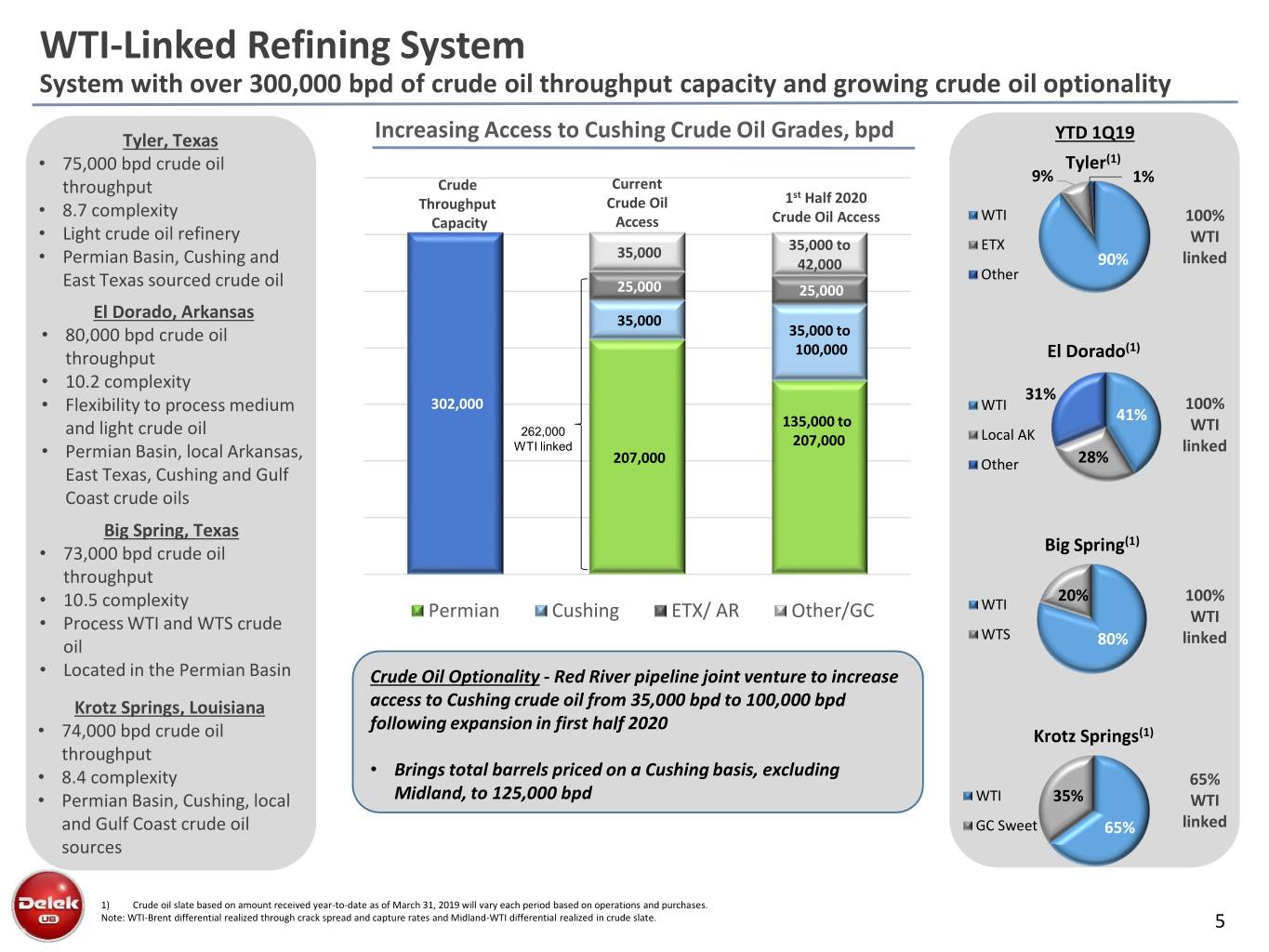

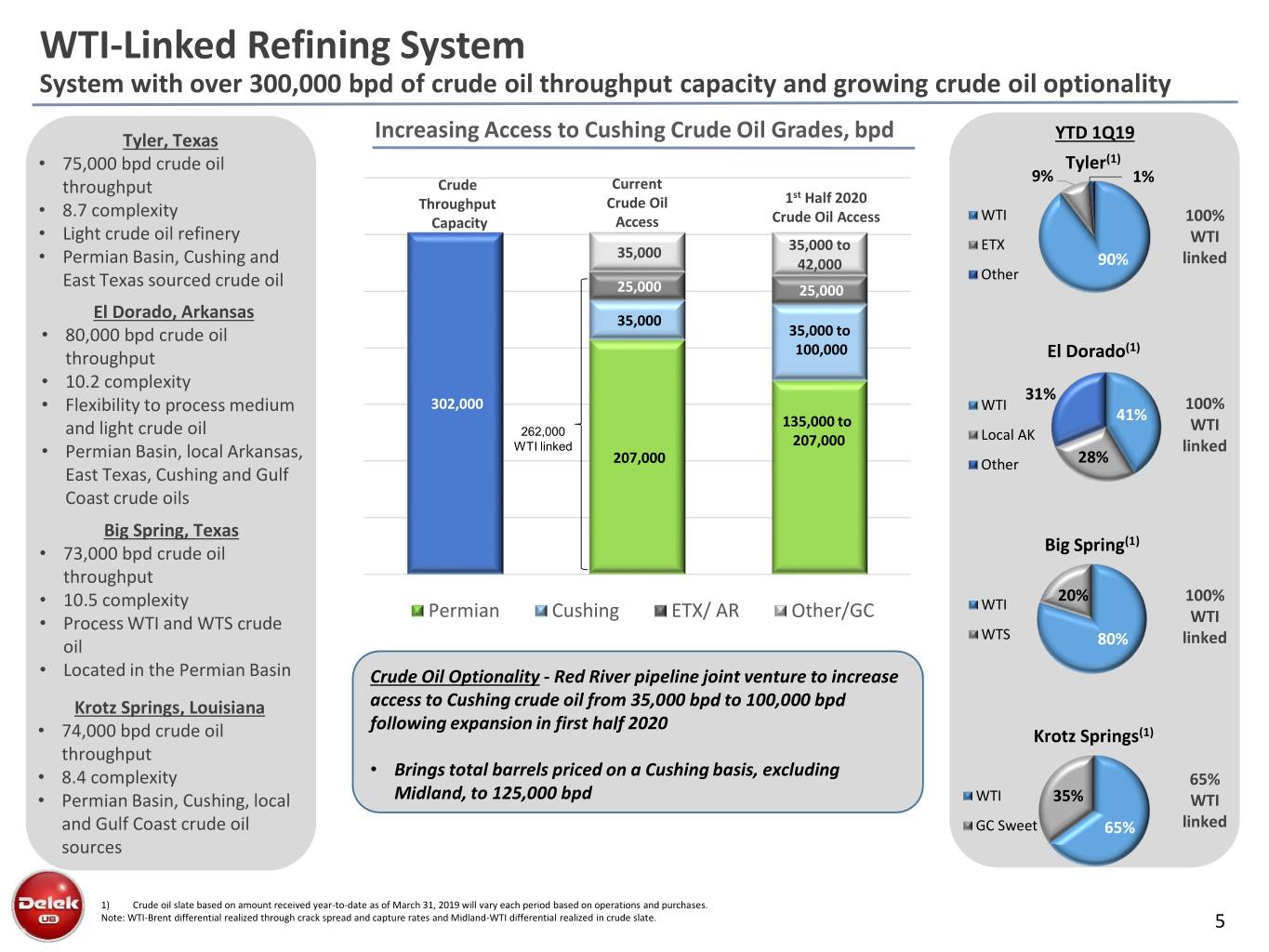

WTI-Linked Refining System System with over 300,000 bpd of crude oil throughput capacity and growing crude oil optionality Tyler, Texas Increasing Access to Cushing Crude Oil Grades, bpd YTD 1Q19 • 75,000 bpd crude oil Tyler(1) 9% Crude Current 1% throughput st Throughput Crude Oil 1 Half 2020 • 8.7 complexity WTI Capacity Access Crude Oil Access 100% • Light crude oil refinery ETX WTI 35,000 35,000 to • Permian Basin, Cushing and 42,000 90% linked East Texas sourced crude oil Other 25,000 25,000 El Dorado, Arkansas 35,000 • 80,000 bpd crude oil 35,000 to (1) throughput 100,000 El Dorado • 10.2 complexity 31% • Flexibility to process medium 302,000 WTI 100% 135,000 to 41% and light crude oil 262,000 WTI 207,000 Local AK • Permian Basin, local Arkansas, WTI linked linked 207,000 Other 28% East Texas, Cushing and Gulf Coast crude oils Big Spring, Texas (1) • 73,000 bpd crude oil Big Spring throughput • 20% 100% 10.5 complexity Permian Cushing ETX/ AR Other/GC WTI • Process WTI and WTS crude WTI WTS oil 80% linked • Located in the Permian Basin Crude Oil Optionality - Red River pipeline joint venture to increase Krotz Springs, Louisiana access to Cushing crude oil from 35,000 bpd to 100,000 bpd following expansion in first half 2020 • 74,000 bpd crude oil Krotz Springs(1) throughput • • 8.4 complexity Brings total barrels priced on a Cushing basis, excluding 65% • Permian Basin, Cushing, local Midland, to 125,000 bpd WTI 35% WTI and Gulf Coast crude oil GC Sweet 65% linked sources 1) Crude oil slate based on amount received year-to-date as of March 31, 2019 will vary each period based on operations and purchases. Note: WTI-Brent differential realized through crack spread and capture rates and Midland-WTI differential realized in crude slate. 5

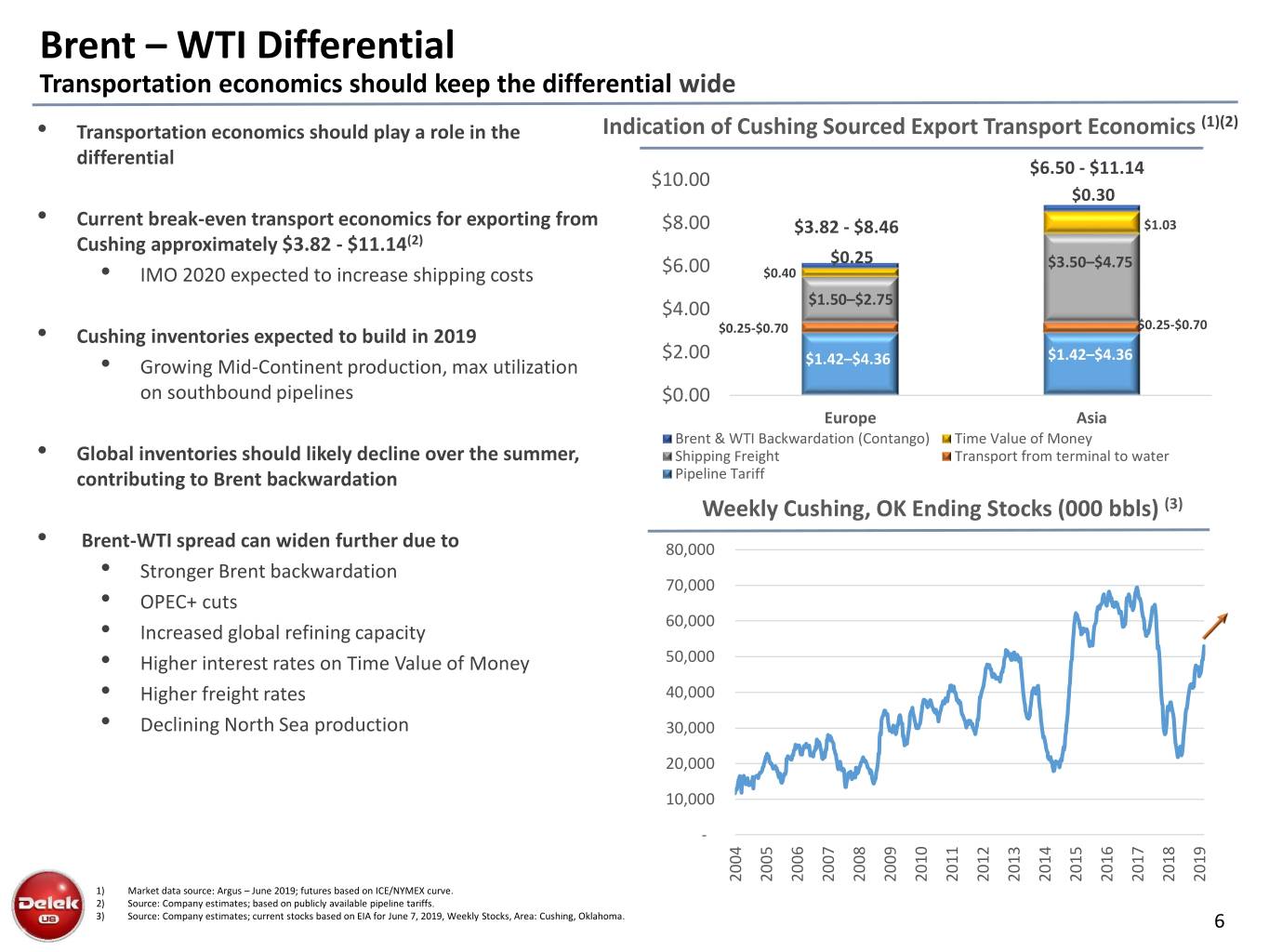

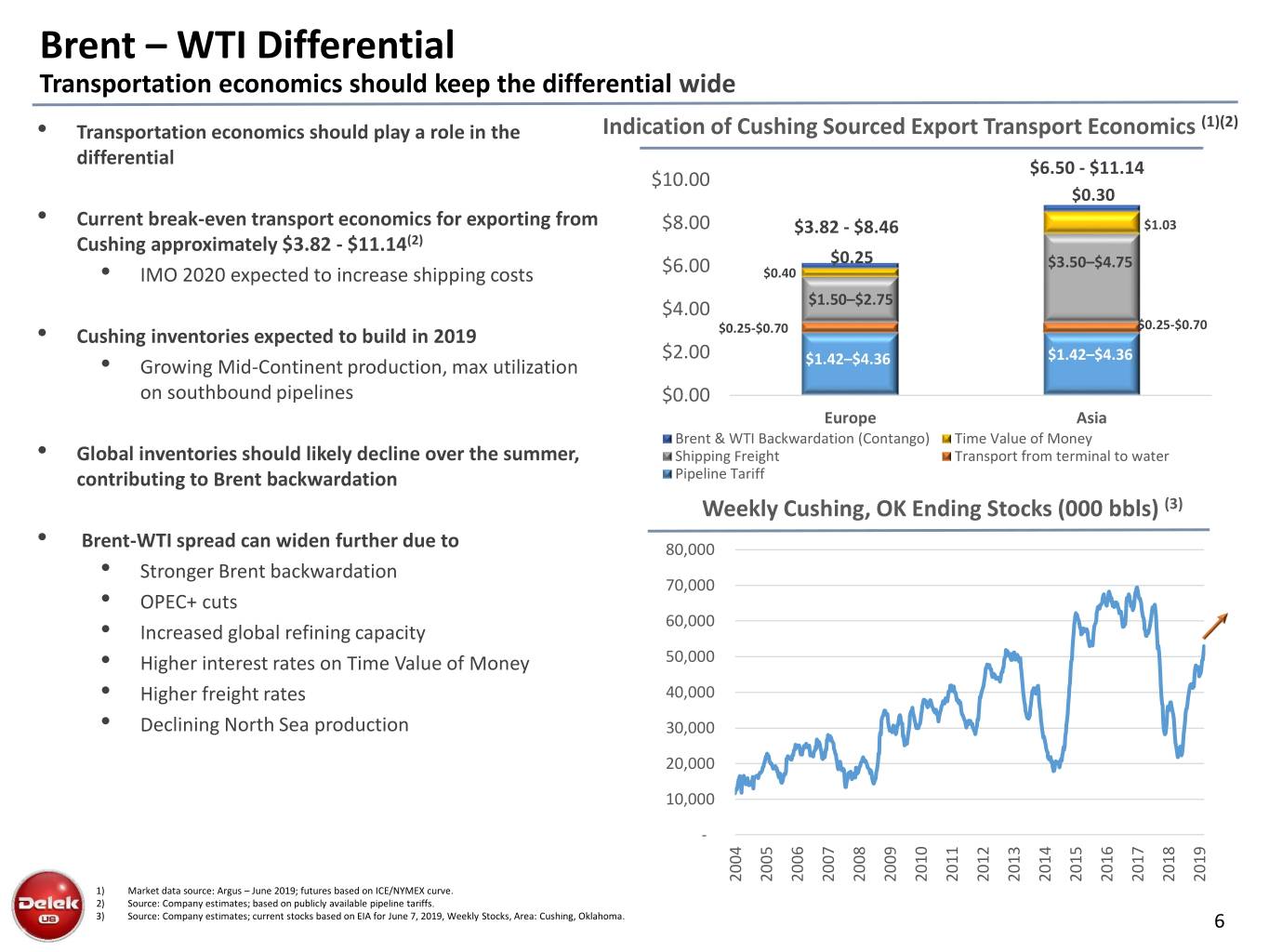

Brent – WTI Differential Transportation economics should keep the differential wide (1)(2) • Transportation economics should play a role in the Indication of Cushing Sourced Export Transport Economics differential $6.50 - $11.14 $10.00 $0.30 • Current break-even transport economics for exporting from $8.00 $3.82 - $8.46 $1.03 Cushing approximately $3.82 - $11.14(2) $0.25 $3.50–$4.75 • IMO 2020 expected to increase shipping costs $6.00 $0.40 $4.00 $1.50–$2.75 $0.25-$0.70 • Cushing inventories expected to build in 2019 $0.25-$0.70 $2.00 $1.42–$4.36 • Growing Mid-Continent production, max utilization $1.42–$4.36 on southbound pipelines $0.00 Europe Asia Brent & WTI Backwardation (Contango) Time Value of Money • Global inventories should likely decline over the summer, Shipping Freight Transport from terminal to water contributing to Brent backwardation Pipeline Tariff Weekly Cushing, OK Ending Stocks (000 bbls) (3) • Brent-WTI spread can widen further due to 80,000 • Stronger Brent backwardation 70,000 • OPEC+ cuts 60,000 • Increased global refining capacity • Higher interest rates on Time Value of Money 50,000 • Higher freight rates 40,000 • Declining North Sea production 30,000 20,000 10,000 - 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 1) Market data source: Argus – June 2019; futures based on ICE/NYMEX curve. 2) Source: Company estimates; based on publicly available pipeline tariffs. 3) Source: Company estimates; current stocks based on EIA for June 7, 2019, Weekly Stocks, Area: Cushing, Oklahoma. 6

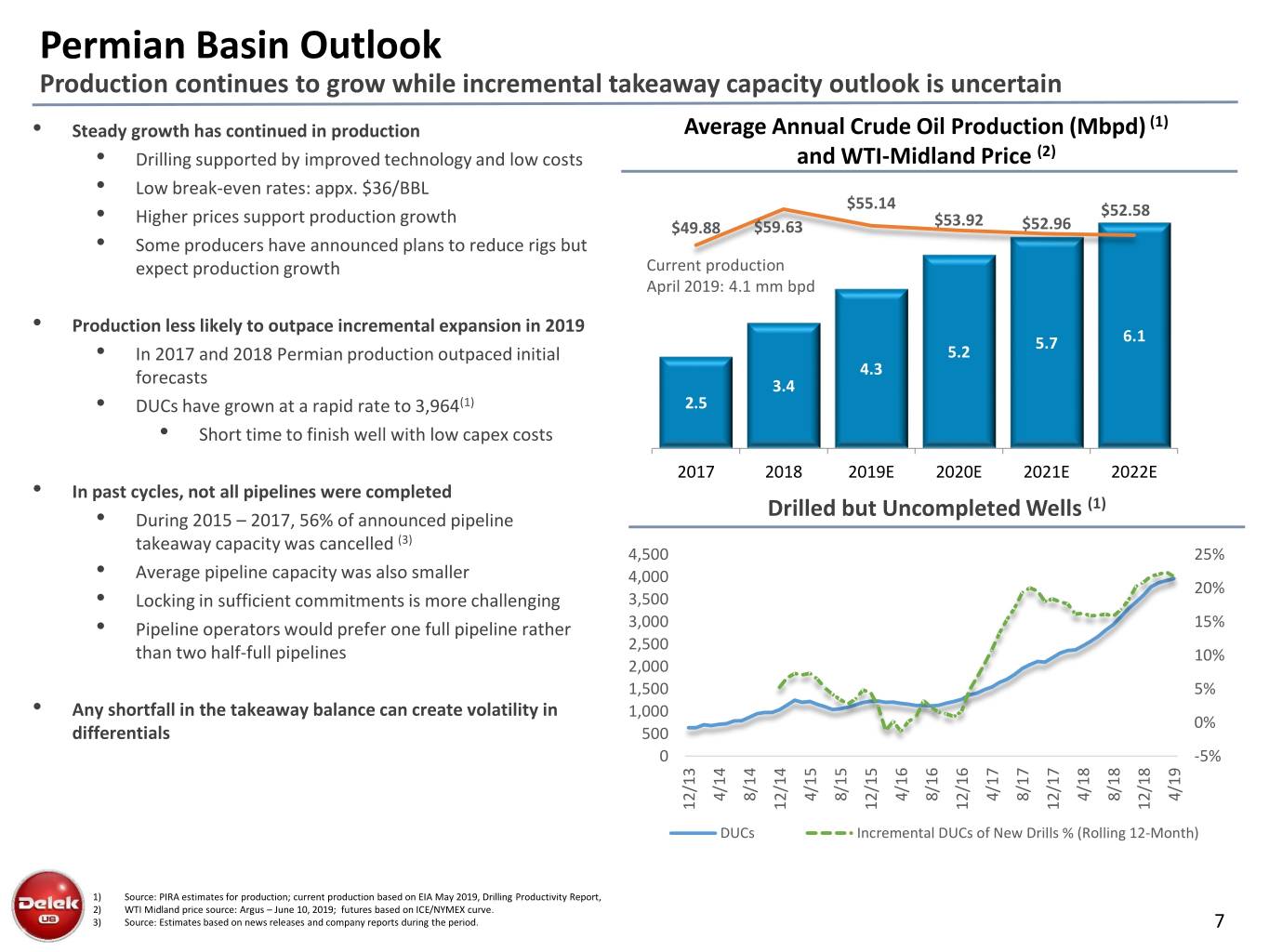

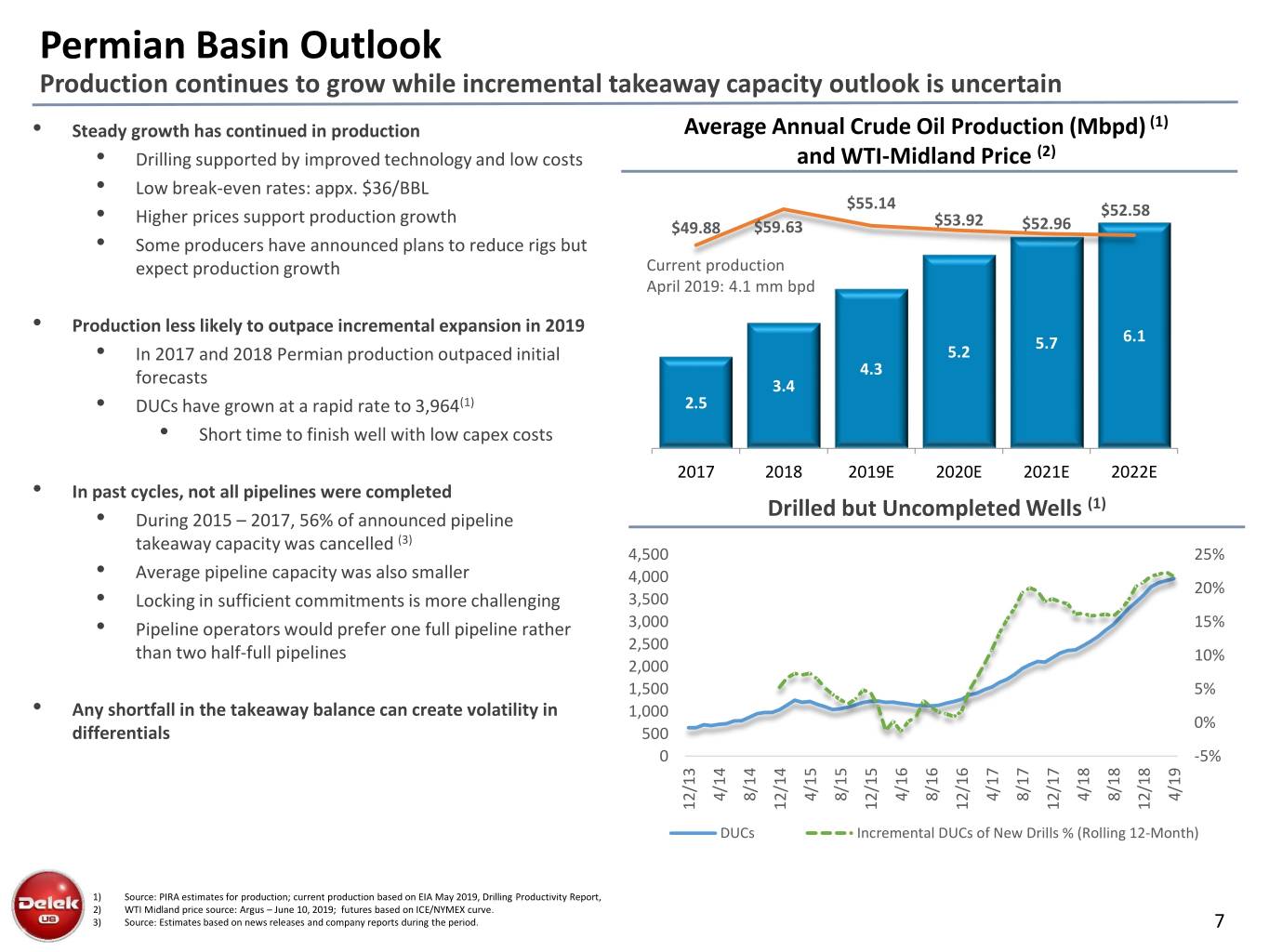

Permian Basin Outlook Production continues to grow while incremental takeaway capacity outlook is uncertain • Steady growth has continued in production Average Annual Crude Oil Production (Mbpd) (1) • Drilling supported by improved technology and low costs and WTI-Midland Price (2) • Low break-even rates: appx. $36/BBL 7.00 65.00 $55.14 • Higher prices support production growth $52.58 6.00 $49.88 $59.63 $53.92 $52.96 55.00 • Some producers have announced plans to reduce rigs but expect production growth 5.00 Current production 45.00 April 2019: 4.1 mm bpd 4.00 35.00 • Production less likely to outpace incremental expansion in 2019 3.00 5.7 6.1 25.00 • In 2017 and 2018 Permian production outpaced initial 5.2 2.00 4.3 15.00 forecasts 3.4 • DUCs have grown at a rapid rate to 3,964(1) 1.00 2.5 5.00 • Short time to finish well with low capex costs - (5.00) 2017 2018 2019E 2020E 2021E 2022E • In past cycles, not all pipelines were completed (1) • During 2015 – 2017, 56% of announced pipeline Drilled but Uncompleted Wells takeaway capacity was cancelled (3) 4,500 25% • Average pipeline capacity was also smaller 4,000 20% • Locking in sufficient commitments is more challenging 3,500 • Pipeline operators would prefer one full pipeline rather 3,000 15% 2,500 than two half-full pipelines 10% 2,000 1,500 5% • Any shortfall in the takeaway balance can create volatility in 1,000 0% differentials 500 0 -5% 8/17 4/14 8/14 4/15 8/15 4/16 8/16 4/17 4/18 8/18 4/19 12/18 12/13 12/14 12/15 12/16 12/17 DUCs Incremental DUCs of New Drills % (Rolling 12-Month) 1) Source: PIRA estimates for production; current production based on EIA May 2019, Drilling Productivity Report, 2) WTI Midland price source: Argus – June 10, 2019; futures based on ICE/NYMEX curve. 3) Source: Estimates based on news releases and company reports during the period. 7

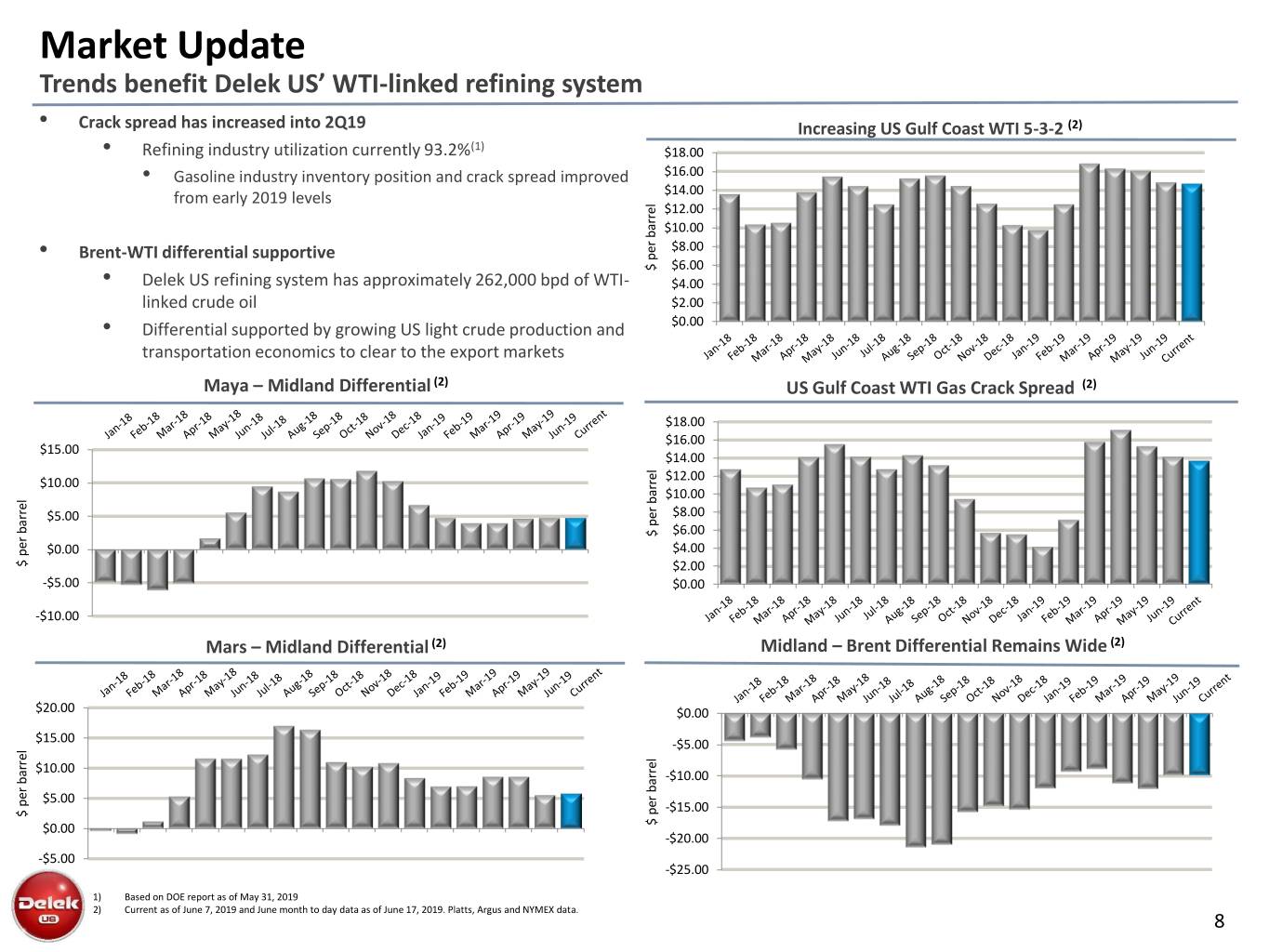

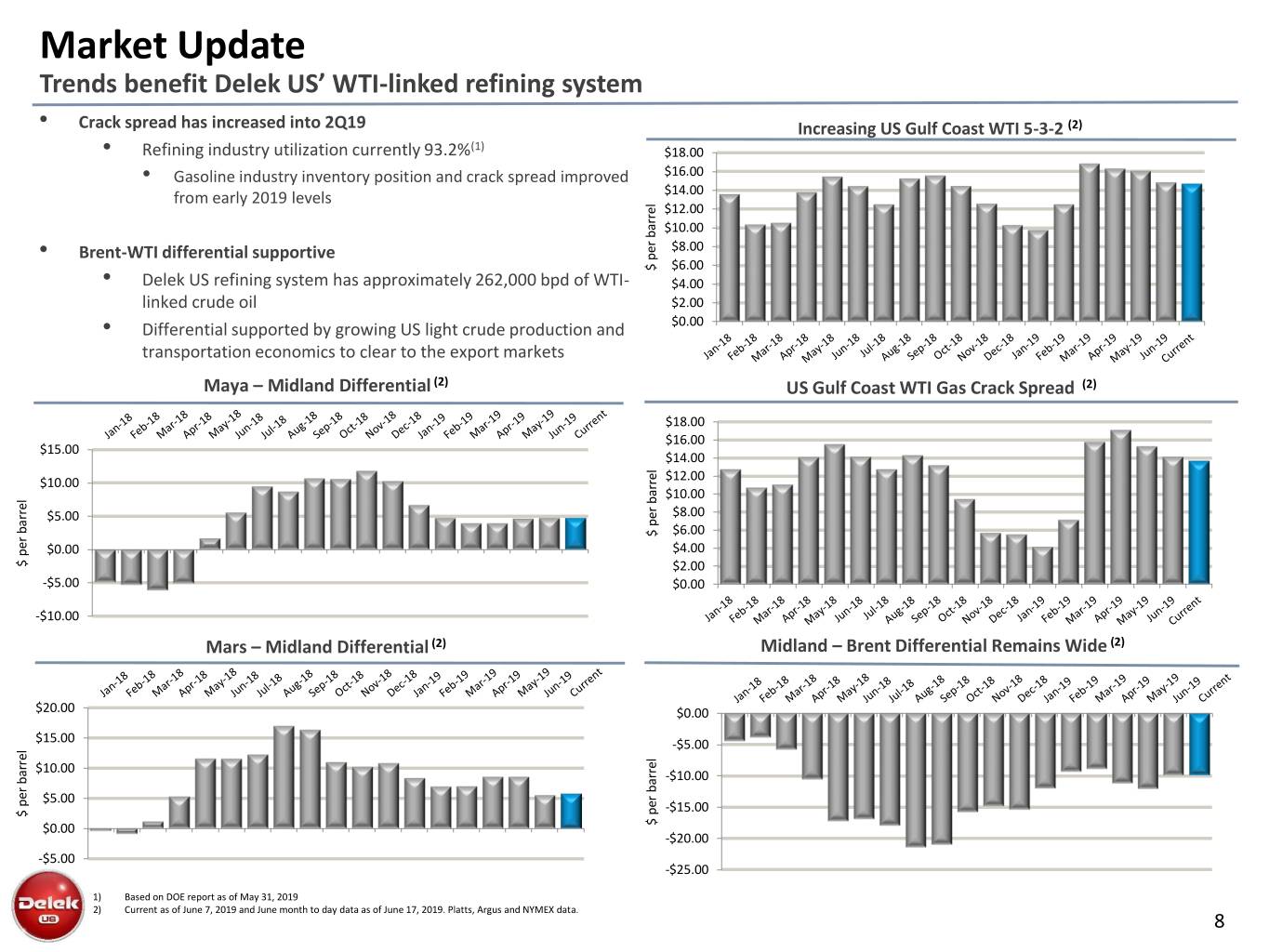

Market Update Trends benefit Delek US’ WTI-linked refining system • Crack spread has increased into 2Q19 Increasing US Gulf Coast WTI 5-3-2 (2) • Refining industry utilization currently 93.2%(1) $18.00 • Gasoline industry inventory position and crack spread improved $16.00 from early 2019 levels $14.00 $12.00 $10.00 • Brent-WTI differential supportive $8.00 $ per barrel per $ $6.00 • Delek US refining system has approximately 262,000 bpd of WTI- $4.00 linked crude oil $2.00 • Differential supported by growing US light crude production and $0.00 transportation economics to clear to the export markets Maya – Midland Differential (2) US Gulf Coast WTI Gas Crack Spread (2) $18.00 $16.00 $15.00 $14.00 $10.00 $12.00 $10.00 $5.00 $8.00 $ per barrel per $ $6.00 $0.00 $4.00 $ per barrel per $ $2.00 -$5.00 $0.00 -$10.00 Mars – Midland Differential (2) Midland – Brent Differential Remains Wide (2) $20.00 $0.00 $15.00 -$5.00 $10.00 -$10.00 $5.00 -$15.00 $ per barrel per $ $0.00 barrel per $ -$20.00 -$5.00 -$25.00 1) Based on DOE report as of May 31, 2019 2) Current as of June 7, 2019 and June month to day data as of June 17, 2019. Platts, Argus and NYMEX data. 8

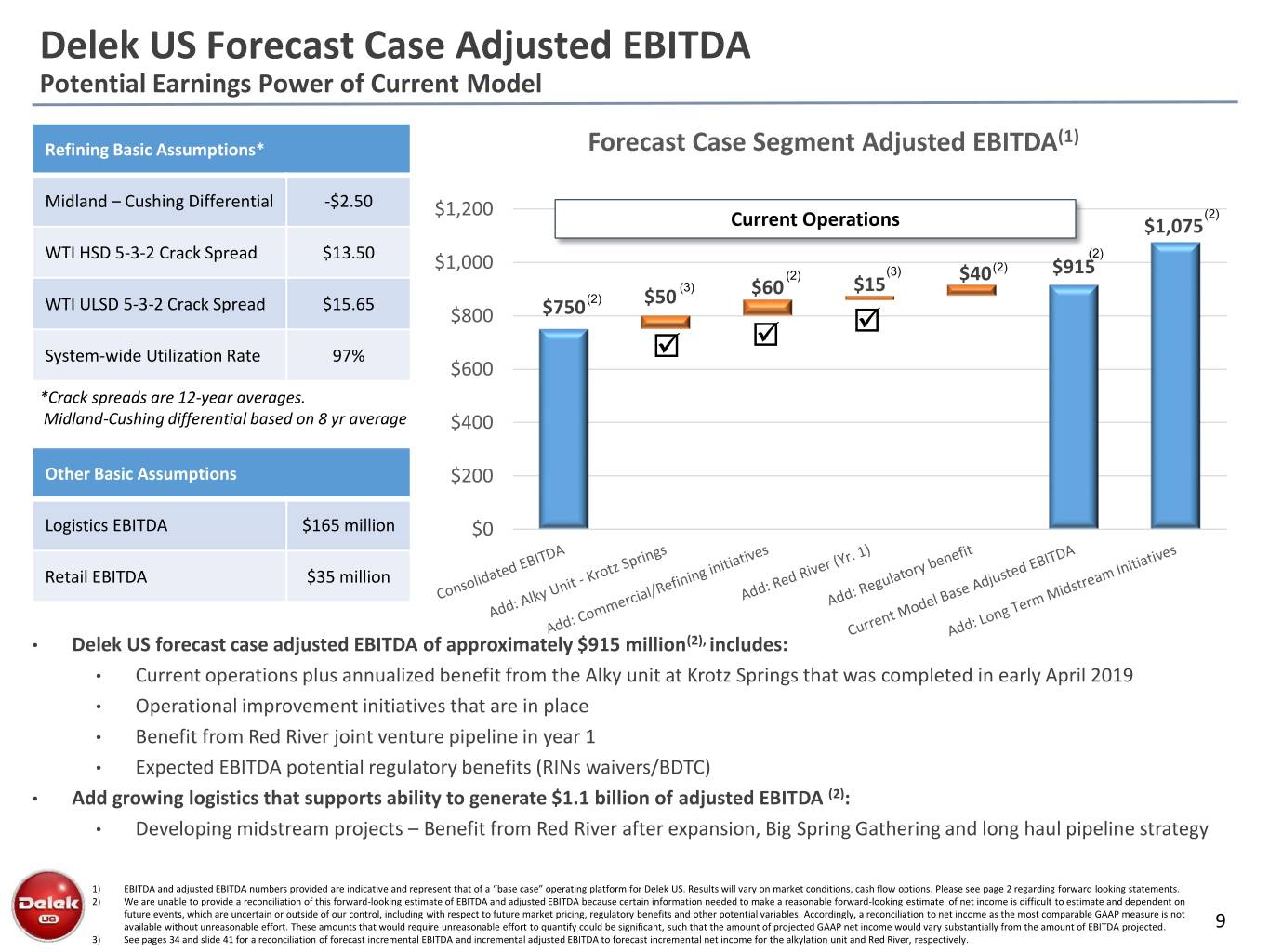

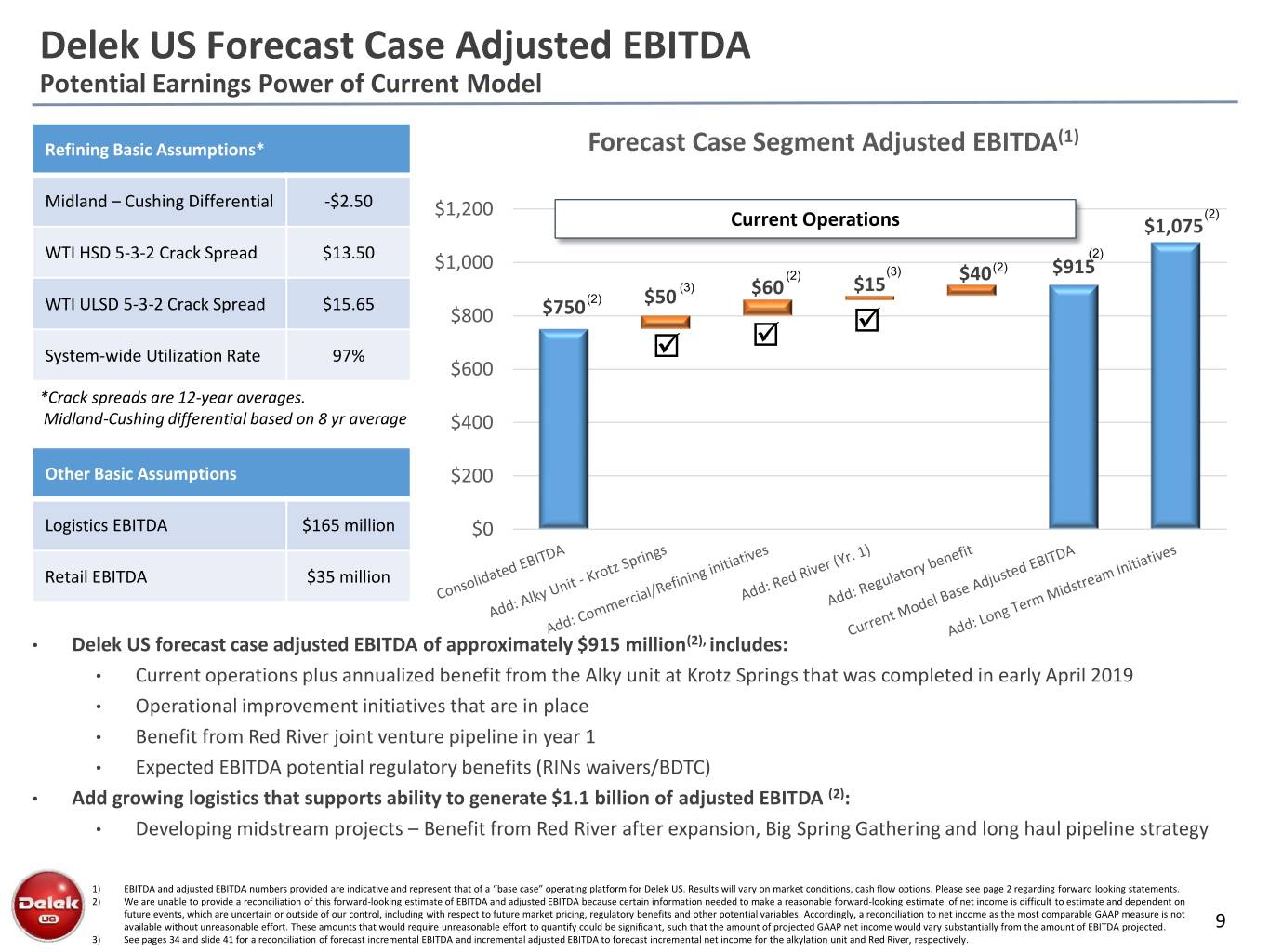

Delek US Forecast Case Adjusted EBITDA Potential Earnings Power of Current Model (1) Refining Basic Assumptions* Forecast Case Segment Adjusted EBITDA Midland – Cushing Differential -$2.50 $1,200 (2) Current Operations $1,075 WTI HSD 5-3-2 Crack Spread $13.50 (2) $1,000 (2) (2) (3) $40 $915 (3) $60 $15 WTI ULSD 5-3-2 Crack Spread $15.65 (2) $50 $800 $750 System-wide Utilization Rate 97% $600 *Crack spreads are 12-year averages. Midland-Cushing differential based on 8 yr average $400 Other Basic Assumptions $200 Logistics EBITDA $165 million $0 Retail EBITDA $35 million • Delek US forecast case adjusted EBITDA of approximately $915 million(2), includes: • Current operations plus annualized benefit from the Alky unit at Krotz Springs that was completed in early April 2019 • Operational improvement initiatives that are in place • Benefit from Red River joint venture pipeline in year 1 • Expected EBITDA potential regulatory benefits (RINs waivers/BDTC) • Add growing logistics that supports ability to generate $1.1 billion of adjusted EBITDA (2): • Developing midstream projects – Benefit from Red River after expansion, Big Spring Gathering and long haul pipeline strategy 1) EBITDA and adjusted EBITDA numbers provided are indicative and represent that of a “base case” operating platform for Delek US. Results will vary on market conditions, cash flow options. Please see page 2 regarding forward looking statements. 2) We are unable to provide a reconciliation of this forward-looking estimate of EBITDA and adjusted EBITDA because certain information needed to make a reasonable forward-looking estimate of net income is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to future market pricing, regulatory benefits and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of EBITDA projected. 9 3) See pages 34 and slide 41 for a reconciliation of forecast incremental EBITDA and incremental adjusted EBITDA to forecast incremental net income for the alkylation unit and Red River, respectively.

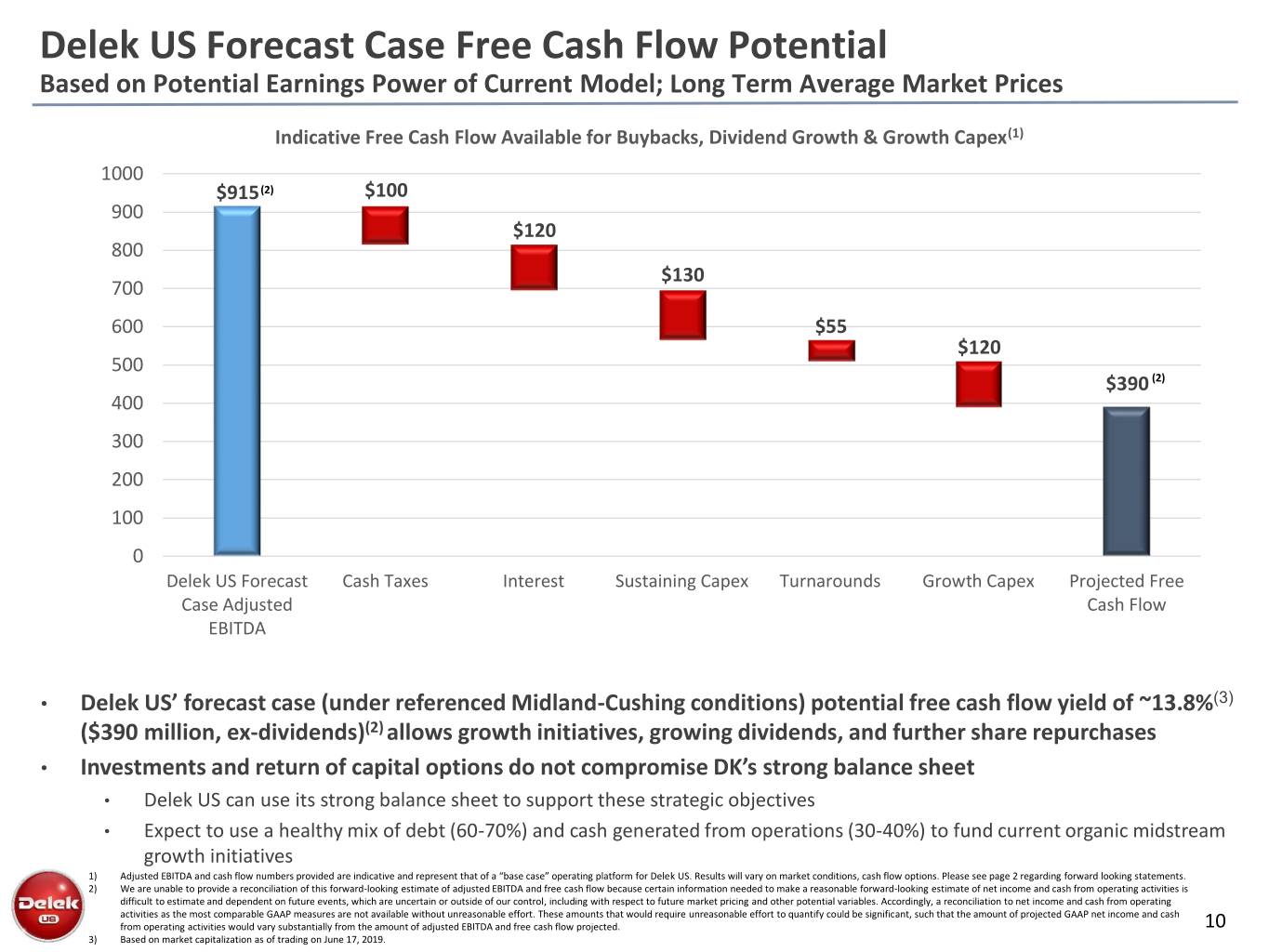

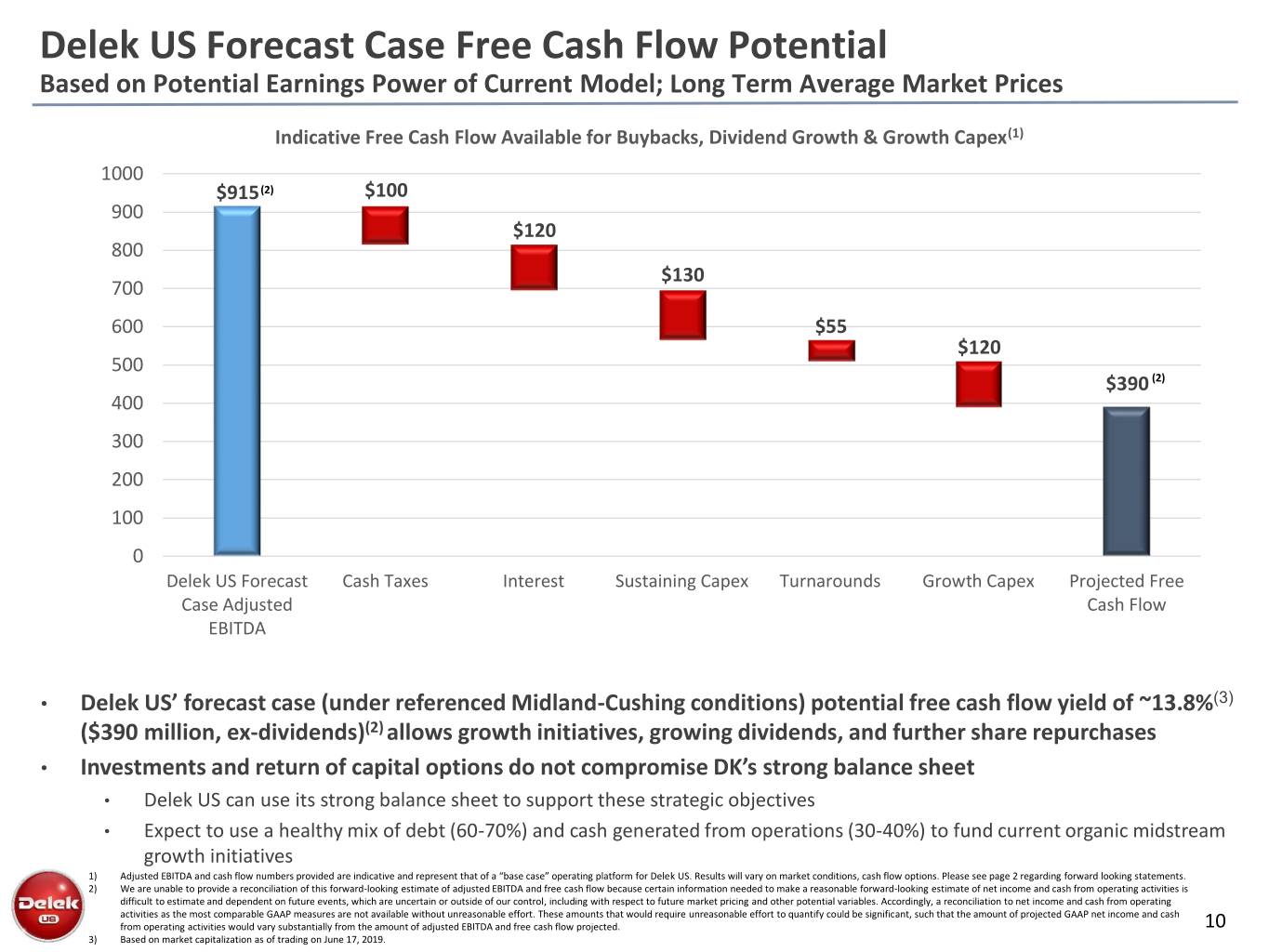

Delek US Forecast Case Free Cash Flow Potential Based on Potential Earnings Power of Current Model; Long Term Average Market Prices Indicative Free Cash Flow Available for Buybacks, Dividend Growth & Growth Capex(1) 1000 $915 (2) $100 900 $120 800 $130 700 600 $55 $120 500 $390 (2) 400 300 200 Sustaining100 Capex 0 Delek US Forecast Cash Taxes Interest Sustaining Capex Turnarounds Growth Capex Projected Free Case Adjusted Cash Flow EBITDA • Delek US’ forecast case (under referenced Midland-Cushing conditions) potential free cash flow yield of ~13.8%(3) ($390 million, ex-dividends)(2) allows growth initiatives, growing dividends, and further share repurchases • Investments and return of capital options do not compromise DK’s strong balance sheet • Delek US can use its strong balance sheet to support these strategic objectives • Expect to use a healthy mix of debt (60-70%) and cash generated from operations (30-40%) to fund current organic midstream growth initiatives 1) Adjusted EBITDA and cash flow numbers provided are indicative and represent that of a “base case” operating platform for Delek US. Results will vary on market conditions, cash flow options. Please see page 2 regarding forward looking statements. 2) We are unable to provide a reconciliation of this forward-looking estimate of adjusted EBITDA and free cash flow because certain information needed to make a reasonable forward-looking estimate of net income and cash from operating activities is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to future market pricing and other potential variables. Accordingly, a reconciliation to net income and cash from operating activities as the most comparable GAAP measures are not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income and cash from operating activities would vary substantially from the amount of adjusted EBITDA and free cash flow projected. 10 3) Based on market capitalization as of trading on June 17, 2019.

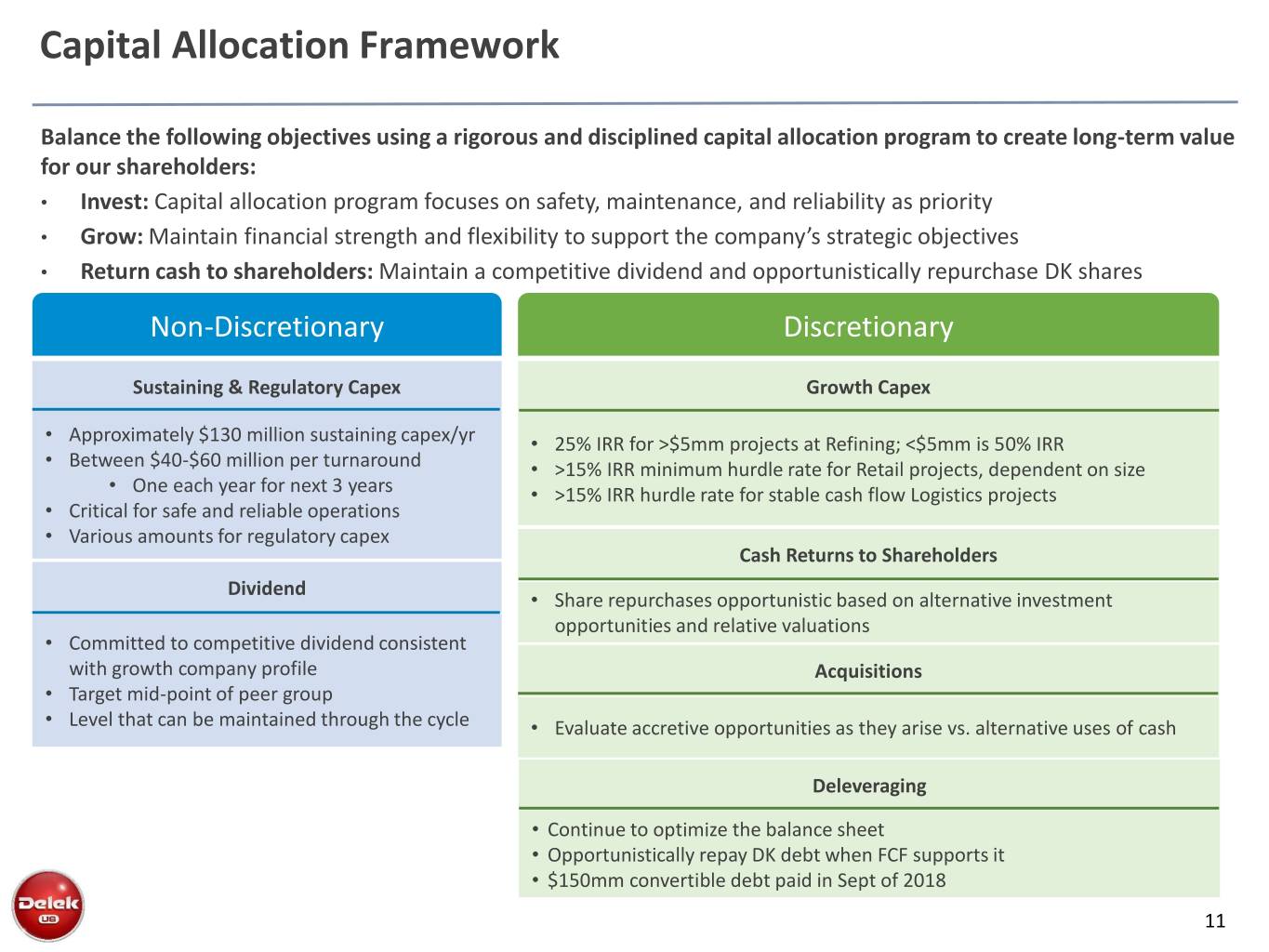

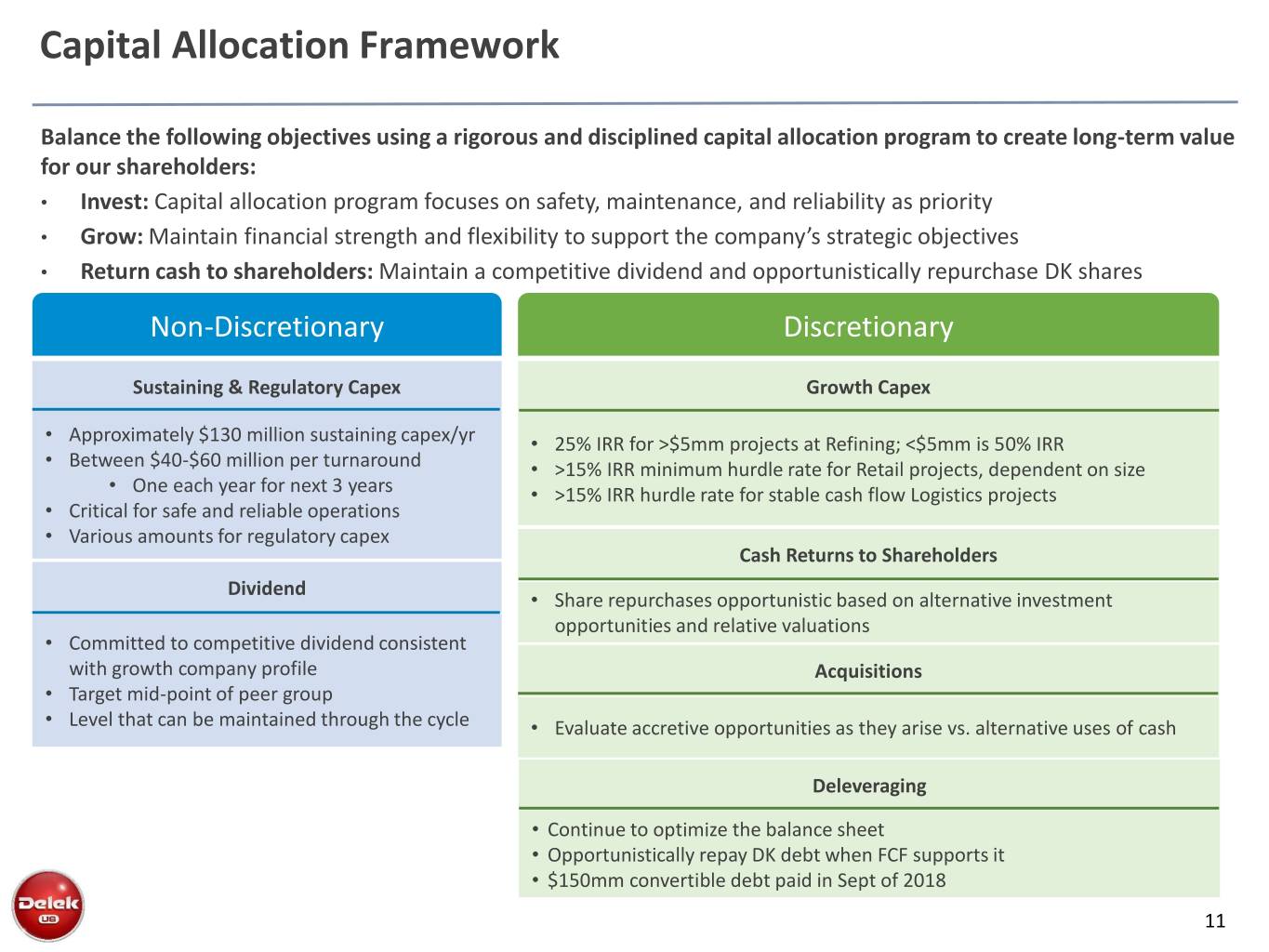

Capital Allocation Framework Balance the following objectives using a rigorous and disciplined capital allocation program to create long-term value for our shareholders: • Invest: Capital allocation program focuses on safety, maintenance, and reliability as priority • Grow: Maintain financial strength and flexibility to support the company’s strategic objectives • Return cash to shareholders: Maintain a competitive dividend and opportunistically repurchase DK shares Non-Discretionary Discretionary Sustaining & Regulatory Capex Growth Capex • Approximately $130 million sustaining capex/yr • 25% IRR for >$5mm projects at Refining; <$5mm is 50% IRR • Between $40-$60 million per turnaround • >15% IRR minimum hurdle rate for Retail projects, dependent on size • One each year for next 3 years • >15% IRR hurdle rate for stable cash flow Logistics projects • CriticalSustaining for safe and Capex reliable operations • Various amounts for regulatory capex Cash Returns to Shareholders Dividend • Share repurchases opportunistic based on alternative investment opportunities and relative valuations • Committed to competitive dividend consistent with growth company profile Acquisitions • Target mid-point of peer group • Level that can be maintained through the cycle • Evaluate accretive opportunities as they arise vs. alternative uses of cash Deleveraging • Continue to optimize the balance sheet • Opportunistically repay DK debt when FCF supports it • $150mm convertible debt paid in Sept of 2018 11

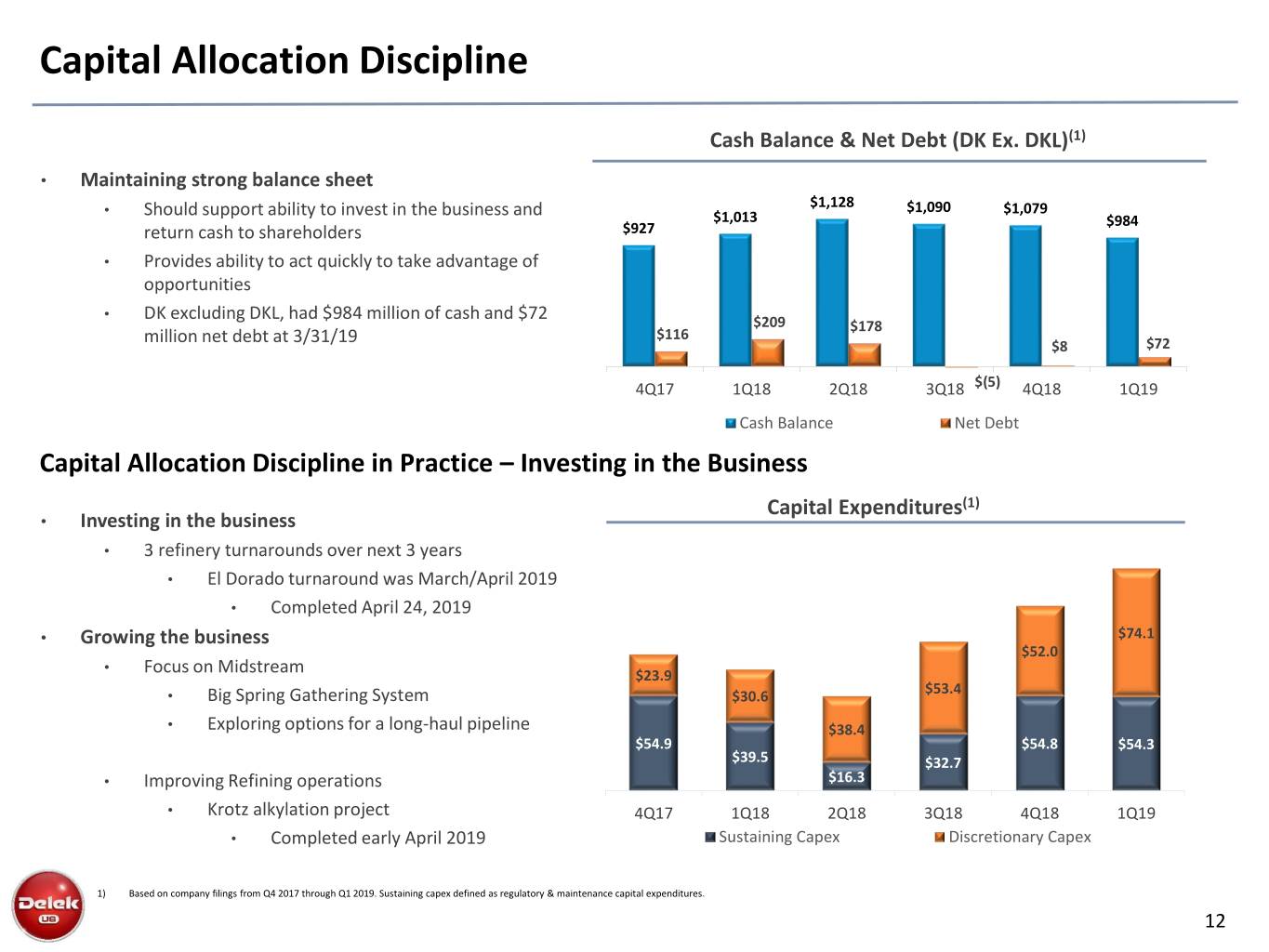

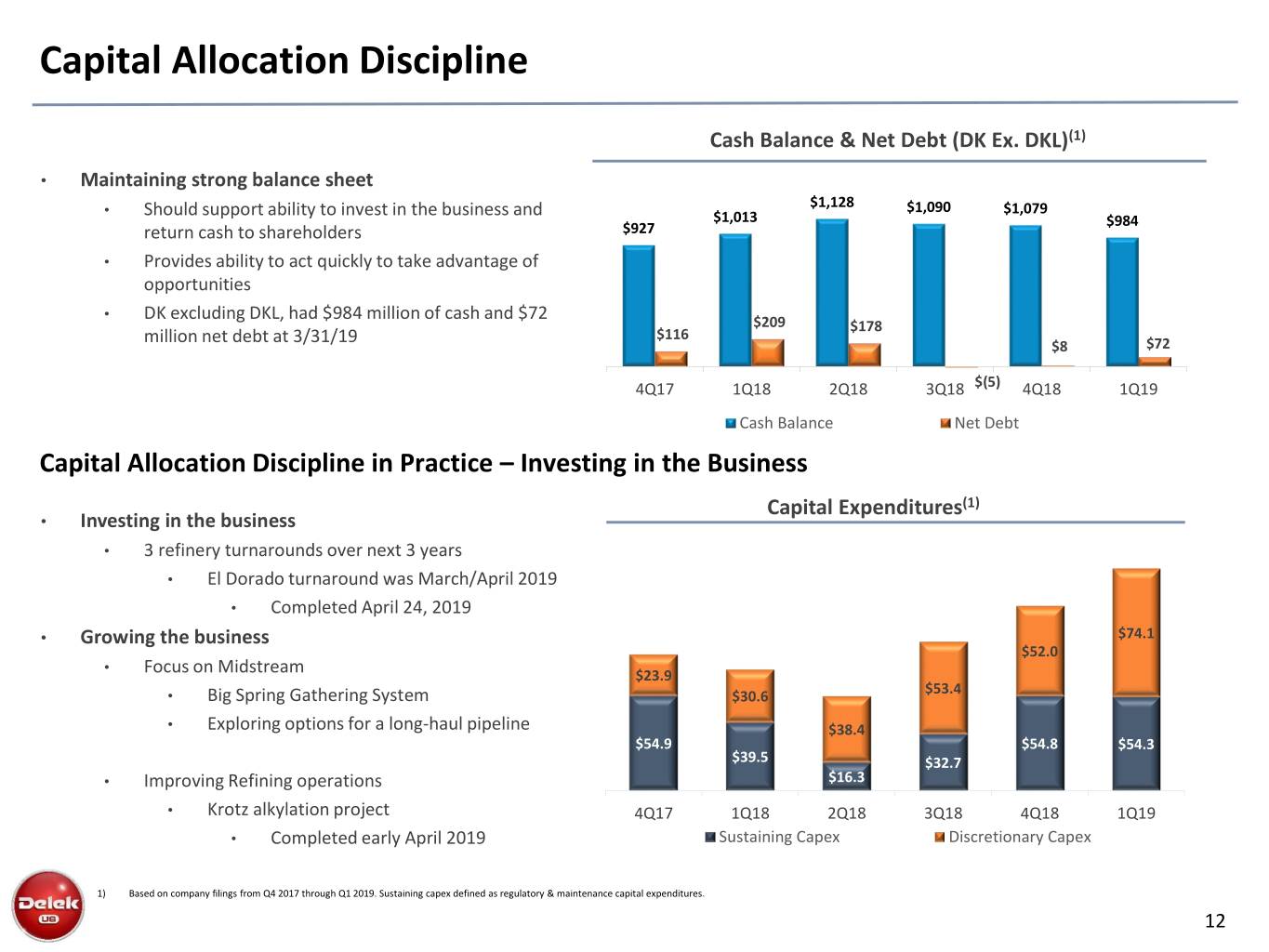

Capital Allocation Discipline Cash Balance & Net Debt (DK Ex. DKL)(1) • Maintaining strong balance sheet • Should support ability to invest in the business and $1,128 $1,090 $1,079 $1,013 $984 return cash to shareholders $927 • Provides ability to act quickly to take advantage of opportunities • DK excluding DKL, had $984 million of cash and $72 $209 $178 million net debt at 3/31/19 $116 $8 $72 4Q17 1Q18 2Q18 3Q18 $(5) 4Q18 1Q19 Cash Balance Net Debt Capital Allocation Discipline in Practice – Investing in the Business Capital Expenditures(1) • Investing in the business • 3 refinery turnarounds over next 3 years • El Dorado turnaround was March/April 2019 • Completed April 24, 2019 • Growing the business $74.1 $52.0 • Focus on Midstream $23.9 • Big Spring Gathering System $30.6 $53.4 • Exploring options for a long-haul pipeline $38.4 $54.9 $54.8 $54.3 $39.5 $32.7 • Improving Refining operations $16.3 • Krotz alkylation project 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 • Completed early April 2019 Sustaining Capex Discretionary Capex 1) Based on company filings from Q4 2017 through Q1 2019. Sustaining capex defined as regulatory & maintenance capital expenditures. 12

Capital Allocation Discipline in Practice – Cash Returned to Shareholders Delek US Cash Returned(1) LTM 1Q19 Cash Returned to Shareholders as % of Market Cap(2)(3) Expect to repurchase $60 million in 2Q19 16.0% 15% LTM 1Q19 returned $400.0 million or ~14.2% of current market cap to 14.0% 13% shareholders through buybacks and dividends(2) 12.0% 10.0% 9% 9% 8% 8.0% 7% $157.9 6.0% 4% $95.3 $92.1 4.0% $46.2 $25.0 $20.0 2.0% $12.7 $17.0 $20.8 $21.0 $20.9 $21.0 0.0% 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 PBF CVI PSX HFC VLO MPC DK Dividend Share Repurchases Dividends Declared ($/share) Dividend+Share Repurchases as % of LTM 1Q19 Net Income(2)(3) Raised quarterly dividend five times since 1Q18 to $0.28/share from 160% 144% $0.15/share $1.00 $0.95 $1.11 140% 120% $0.40 $0.96 102% $0.40 $0.60 $0.60 100% 84% $0.60 $0.60 $0.60 $0.60 80% 76% 56% 60% $0.33 $0.39 60% 44% $0.60 $0.15 $0.18 $0.55 40% $0.15 $0.21 20% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 E 0% PBF PSX HFC DK CVI VLO MPC Regular Special 1) Based on company filings from Q4 2017 through 1Q 2019. 2) Based on market capitalization as of trading on June 17, 2019. 3) Based on company filings, NASDAQ IR Insight, Factset 13

Growth and Market Opportunities

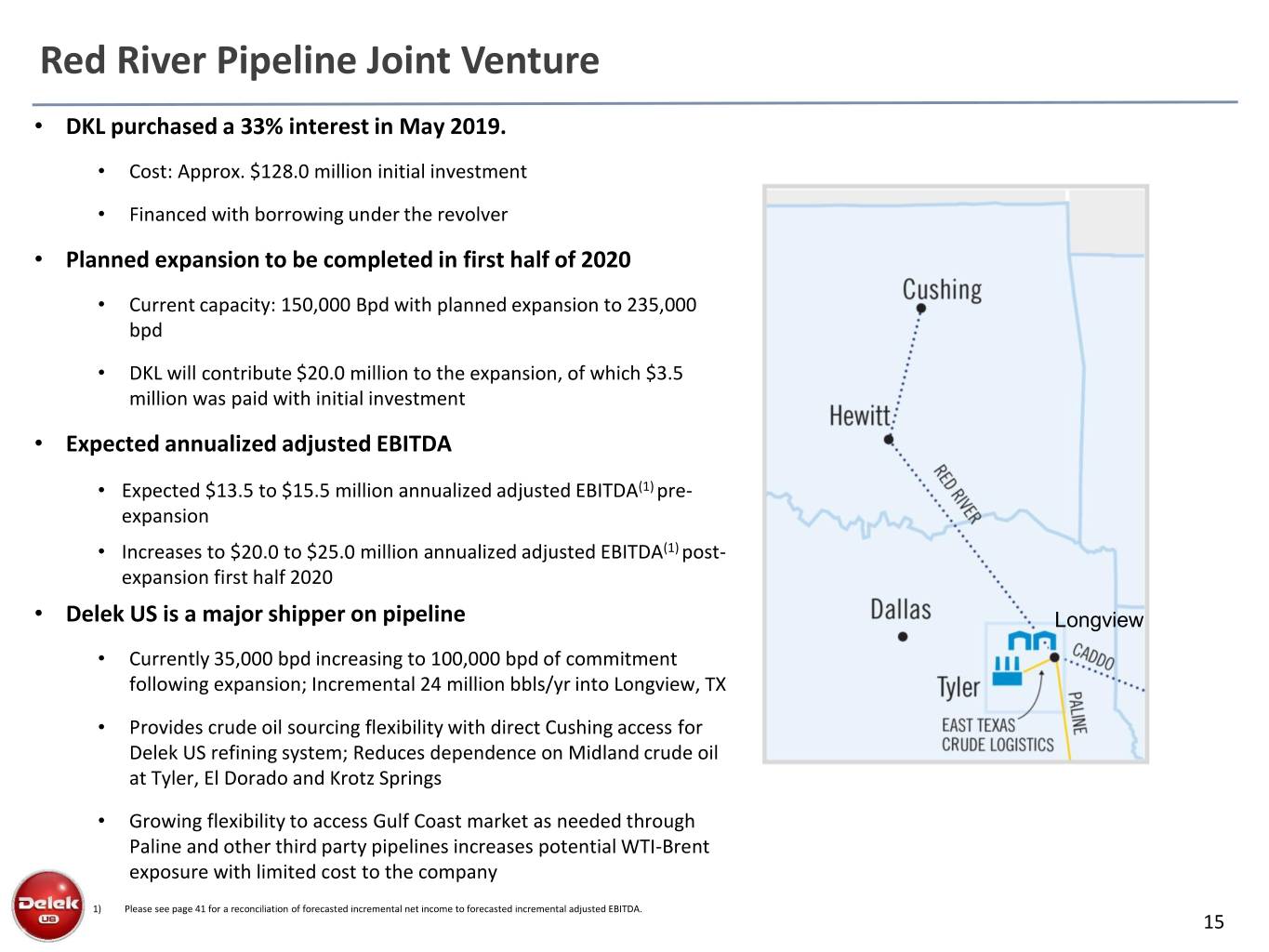

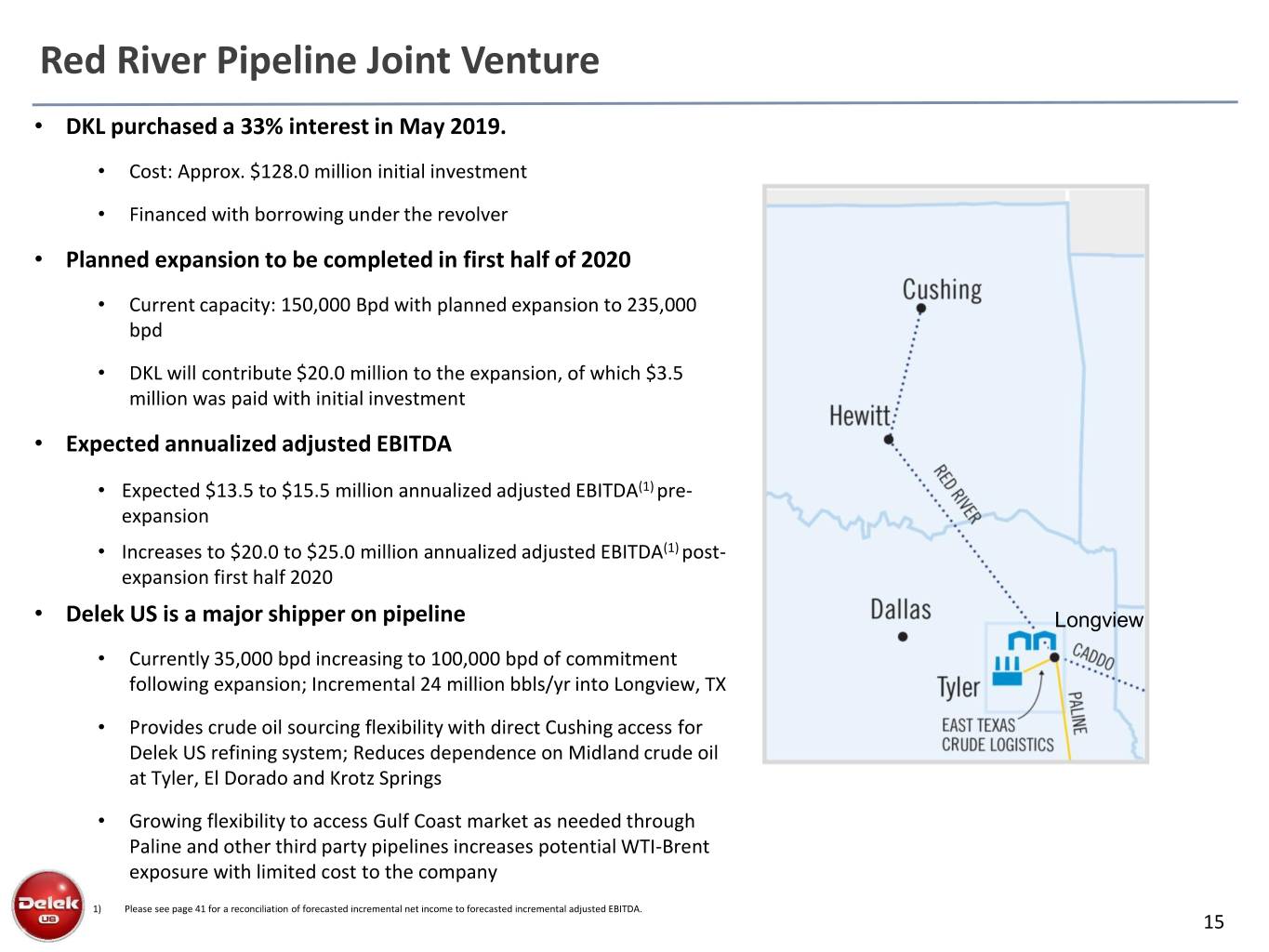

Red River Pipeline Joint Venture • DKL purchased a 33% interest in May 2019. • Cost: Approx. $128.0 million initial investment • Financed with borrowing under the revolver • Planned expansion to be completed in first half of 2020 • Current capacity: 150,000 Bpd with planned expansion to 235,000 bpd • DKL will contribute $20.0 million to the expansion, of which $3.5 million was paid with initial investment • Expected annualized adjusted EBITDA • Expected $13.5 to $15.5 million annualized adjusted EBITDA(1) pre- expansion • Increases to $20.0 to $25.0 million annualized adjusted EBITDA(1) post- expansion first half 2020 • Delek US is a major shipper on pipeline Longview • Currently 35,000 bpd increasing to 100,000 bpd of commitment following expansion; Incremental 24 million bbls/yr into Longview, TX • Provides crude oil sourcing flexibility with direct Cushing access for Delek US refining system; Reduces dependence on Midland crude oil at Tyler, El Dorado and Krotz Springs • Growing flexibility to access Gulf Coast market as needed through Paline and other third party pipelines increases potential WTI-Brent exposure with limited cost to the company 1) Please see page 41 for a reconciliation of forecasted incremental net income to forecasted incremental adjusted EBITDA. 15

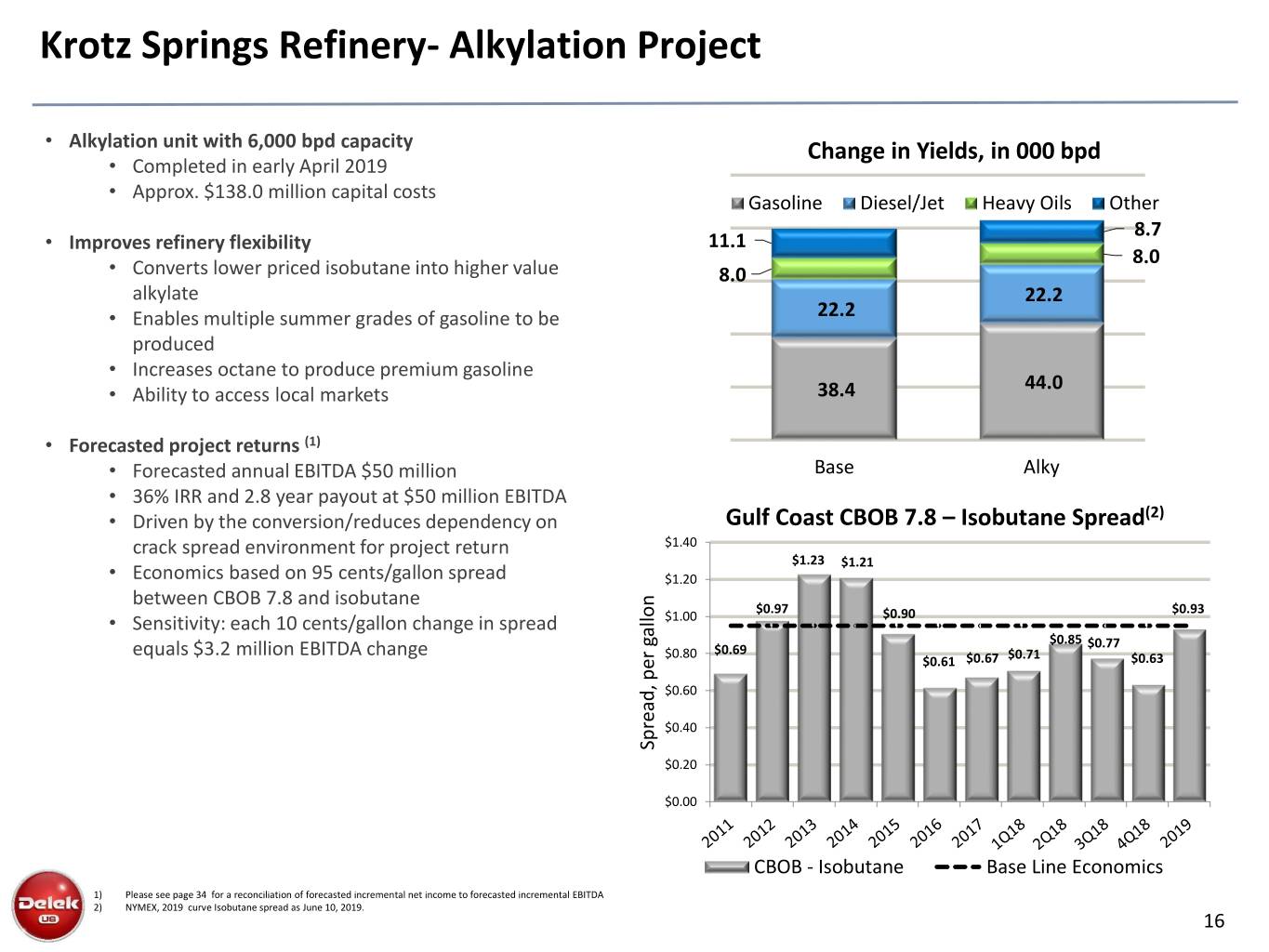

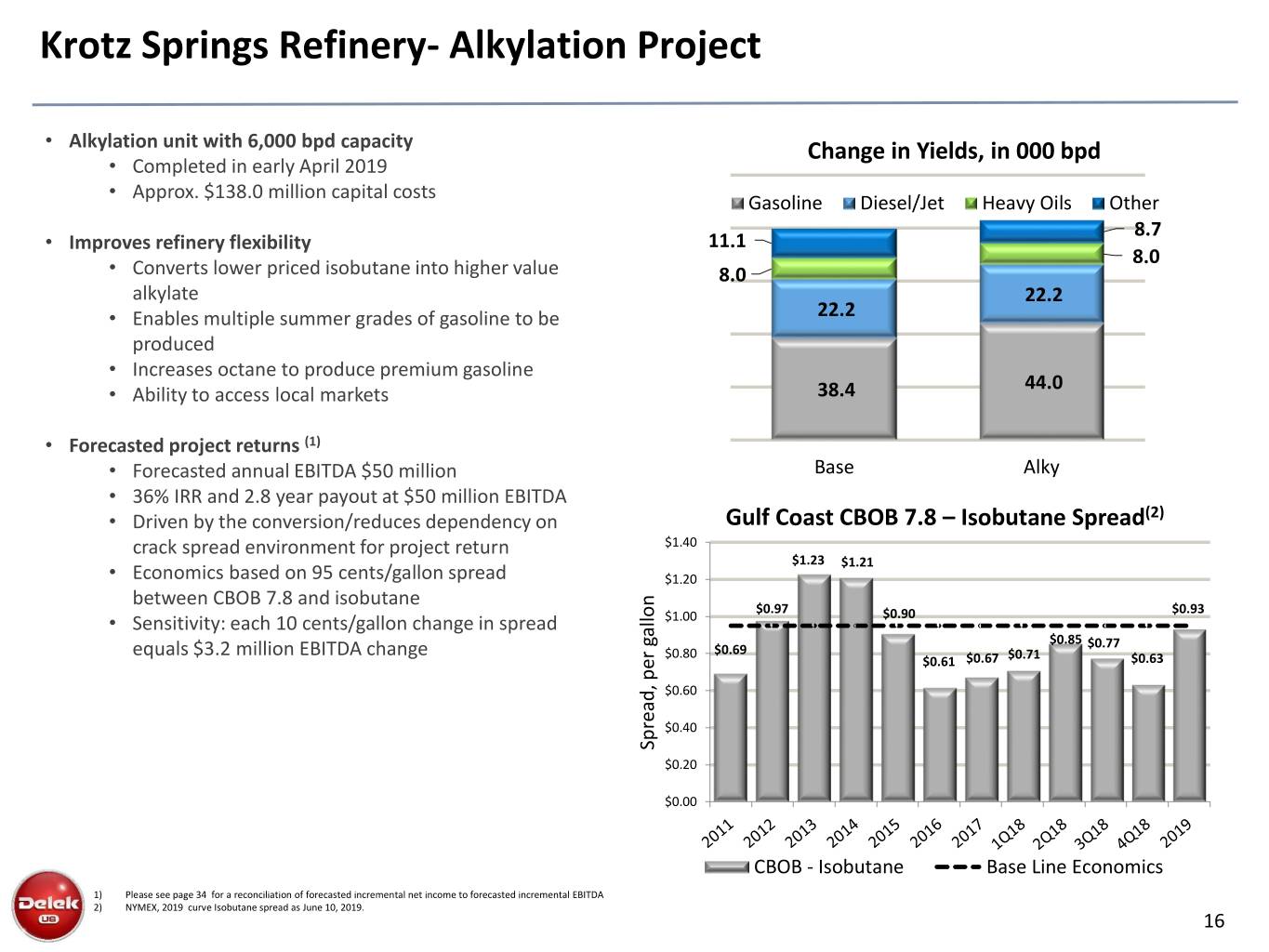

Krotz Springs Refinery- Alkylation Project • Alkylation unit with 6,000 bpd capacity Change in Yields, in 000 bpd • Completed in early April 2019 • Approx. $138.0 million capital costs Gasoline Diesel/Jet Heavy Oils Other 8.7 • Improves refinery flexibility 11.1 8.0 • Converts lower priced isobutane into higher value 8.0 alkylate 22.2 • Enables multiple summer grades of gasoline to be 22.2 produced • Increases octane to produce premium gasoline 44.0 • Ability to access local markets 38.4 • Forecasted project returns (1) • Forecasted annual EBITDA $50 million Base Alky • 36% IRR and 2.8 year payout at $50 million EBITDA • Driven by the conversion/reduces dependency on Gulf Coast CBOB 7.8 – Isobutane Spread(2) crack spread environment for project return $1.40 $1.23 $1.21 • Economics based on 95 cents/gallon spread $1.20 between CBOB 7.8 and isobutane $0.97 $0.93 • Sensitivity: each 10 cents/gallon change in spread $1.00 $0.90 $0.85 $0.77 equals $3.2 million EBITDA change $0.80 $0.69 $0.71 $0.61 $0.67 $0.63 $0.60 $0.40 Spread, per gallon per Spread, $0.20 $0.00 CBOB - Isobutane Base Line Economics 1) Please see page 34 for a reconciliation of forecasted incremental net income to forecasted incremental EBITDA 2) NYMEX, 2019 curve Isobutane spread as June 10, 2019. 16

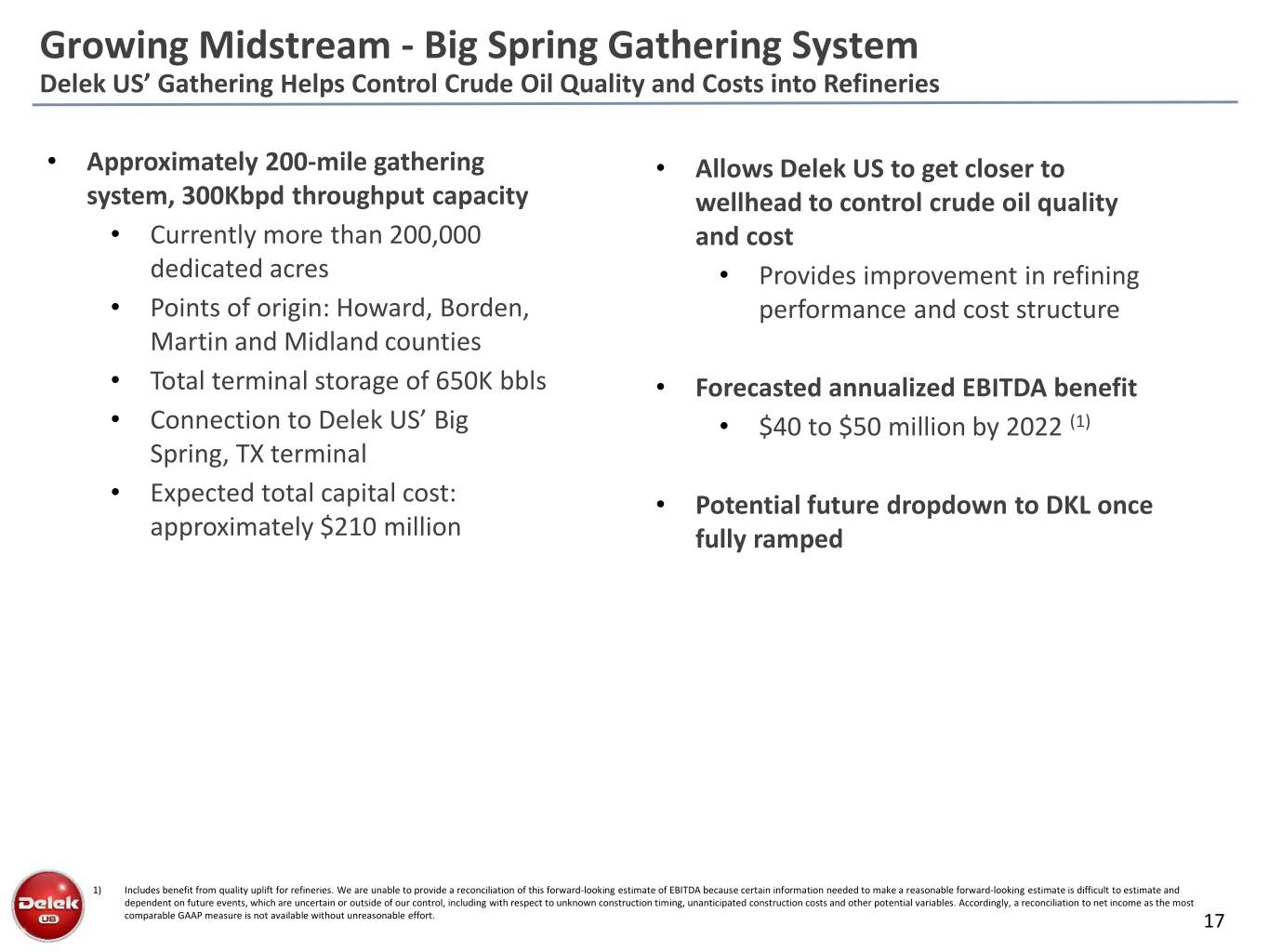

Growing Midstream - Big Spring Gathering System Delek US’ Gathering Helps Control Crude Oil Quality and Costs into Refineries • Approximately 200-mile gathering • Allows Delek US to get closer to system, 300Kbpd throughput capacity wellhead to control crude oil quality • Currently more than 200,000 and cost dedicated acres • Provides improvement in refining • Points of origin: Howard, Borden, performance and cost structure Martin and Midland counties • Total terminal storage of 650K bbls • Forecasted annualized EBITDA benefit • Connection to Delek US’ Big • $40 to $50 million by 2022 (1) Spring, TX terminal • Expected total capital cost: • Potential future dropdown to DKL once approximately $210 million fully ramped 1) Includes benefit from quality uplift for refineries. We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. 17

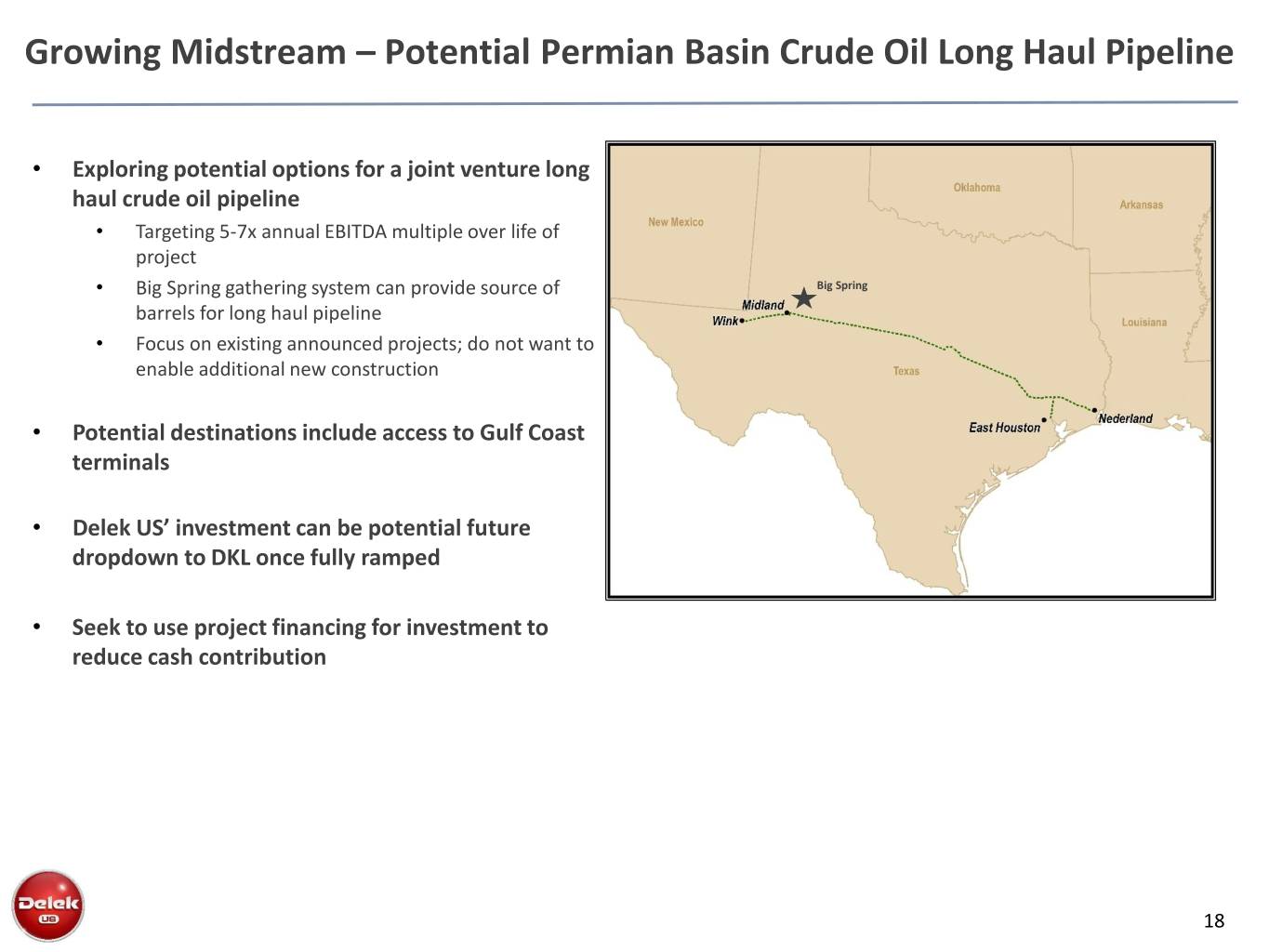

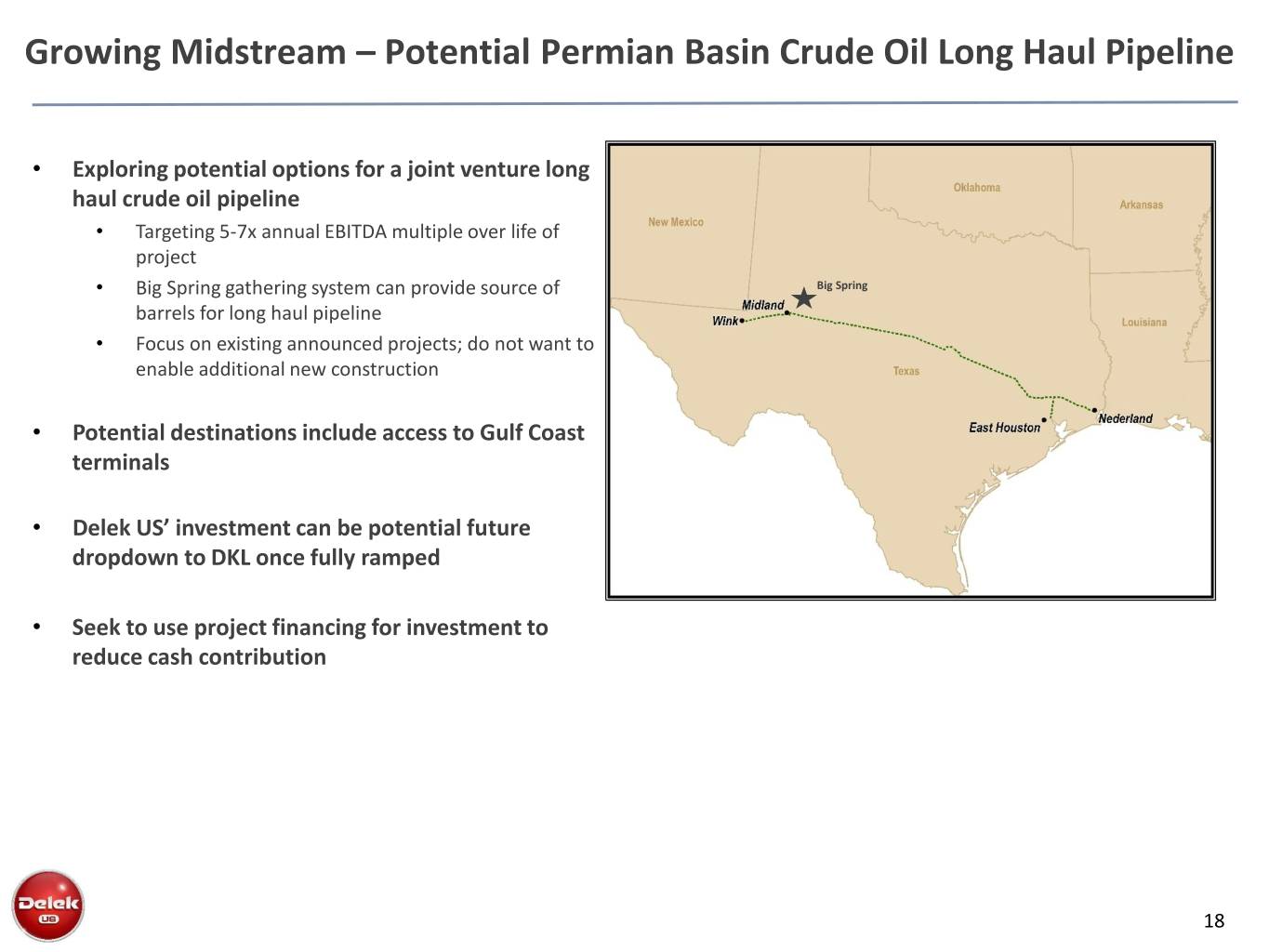

Growing Midstream – Potential Permian Basin Crude Oil Long Haul Pipeline • Exploring potential options for a joint venture long haul crude oil pipeline • Targeting 5-7x annual EBITDA multiple over life of project • Big Spring gathering system can provide source of Big Spring barrels for long haul pipeline • Focus on existing announced projects; do not want to enable additional new construction • Potential destinations include access to Gulf Coast terminals • Delek US’ investment can be potential future dropdown to DKL once fully ramped • Seek to use project financing for investment to reduce cash contribution 18

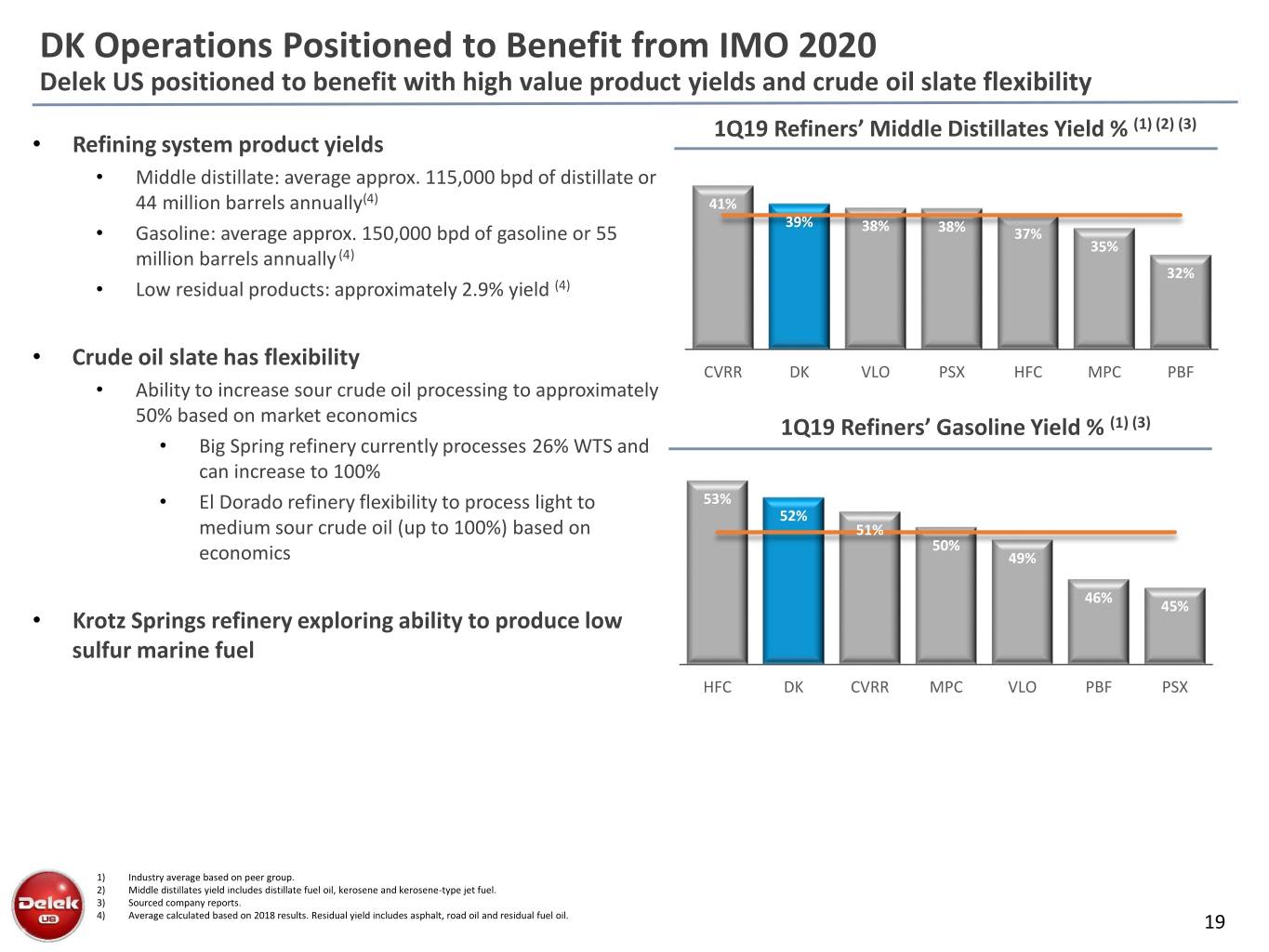

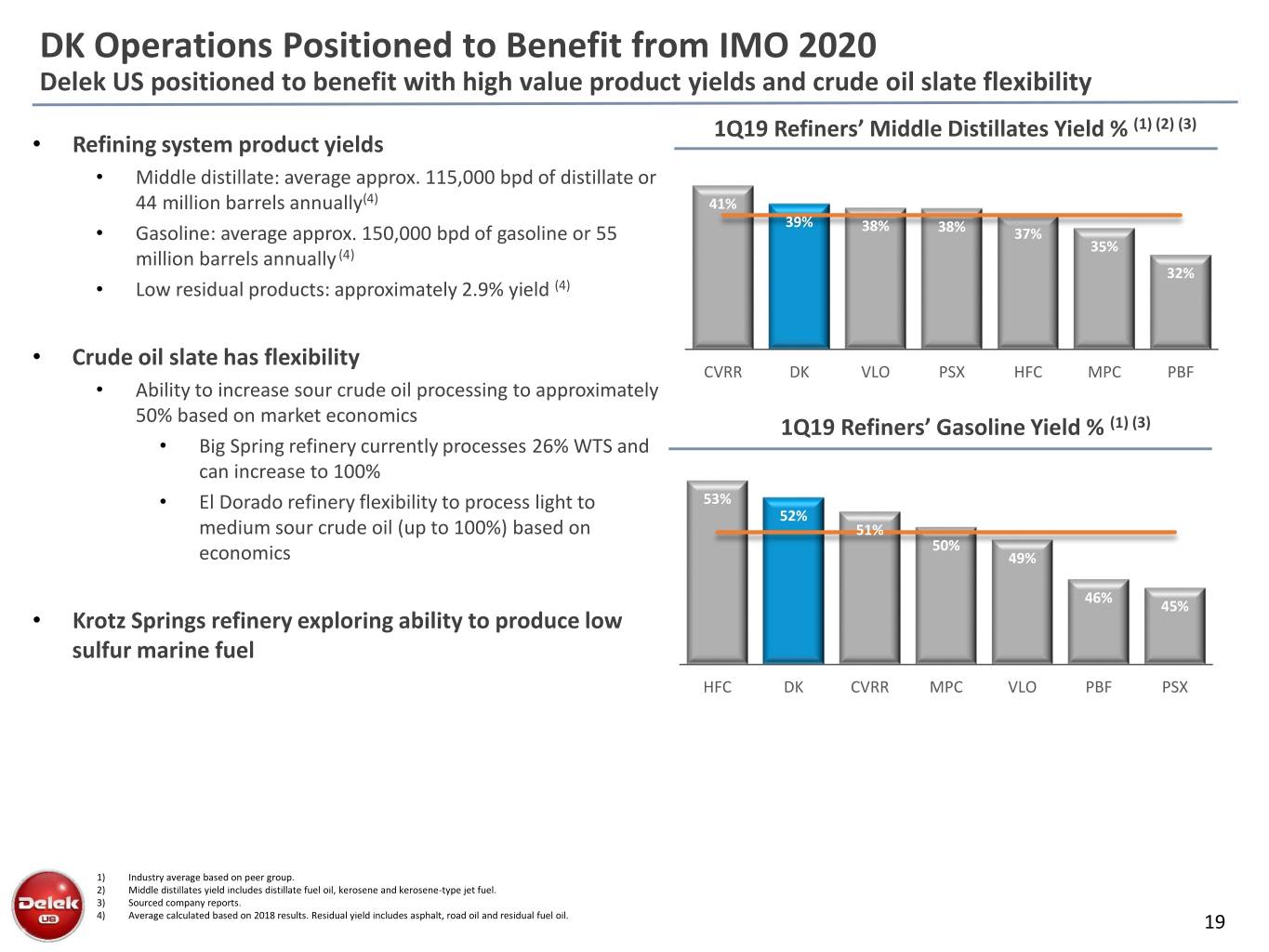

DK Operations Positioned to Benefit from IMO 2020 Delek US positioned to benefit with high value product yields and crude oil slate flexibility 1Q19 Refiners’ Middle Distillates Yield % (1) (2) (3) • Refining system product yields • Middle distillate: average approx. 115,000 bpd of distillate or 44 million barrels annually(4) 41% 39% • Gasoline: average approx. 150,000 bpd of gasoline or 55 38% 38% 37% 35% million barrels annually (4) 32% • Low residual products: approximately 2.9% yield (4) • Crude oil slate has flexibility CVRR DK VLO PSX HFC MPC PBF • Ability to increase sour crude oil processing to approximately 50% based on market economics 1Q19 Refiners’ Gasoline Yield % (1) (3) • Big Spring refinery currently processes 26% WTS and can increase to 100% • El Dorado refinery flexibility to process light to 53% 52% medium sour crude oil (up to 100%) based on 51% 50% economics 49% 46% 45% • Krotz Springs refinery exploring ability to produce low sulfur marine fuel HFC DK CVRR MPC VLO PBF PSX 1) Industry average based on peer group. 2) Middle distillates yield includes distillate fuel oil, kerosene and kerosene-type jet fuel. 3) Sourced company reports. 4) Average calculated based on 2018 results. Residual yield includes asphalt, road oil and residual fuel oil. 19

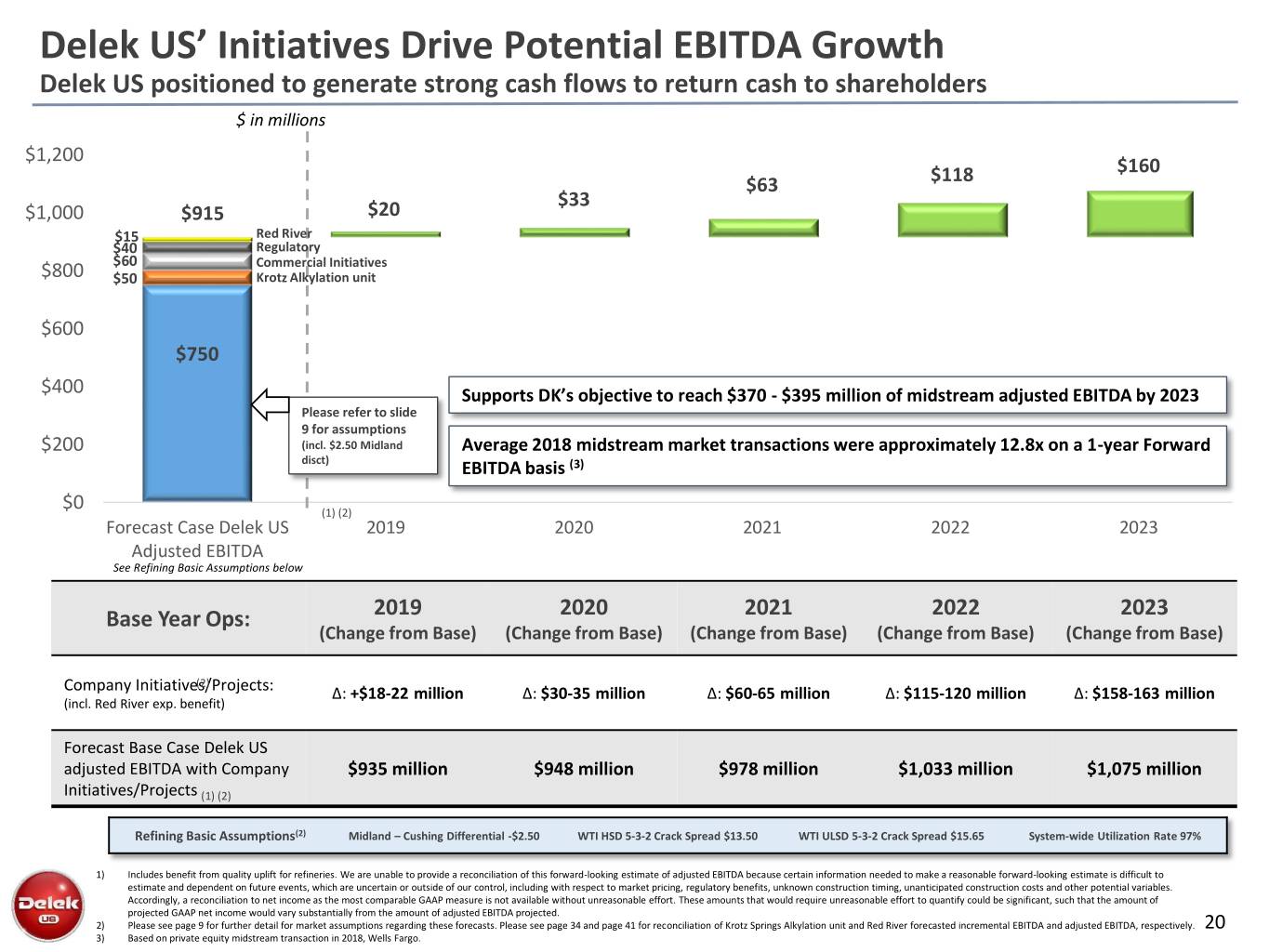

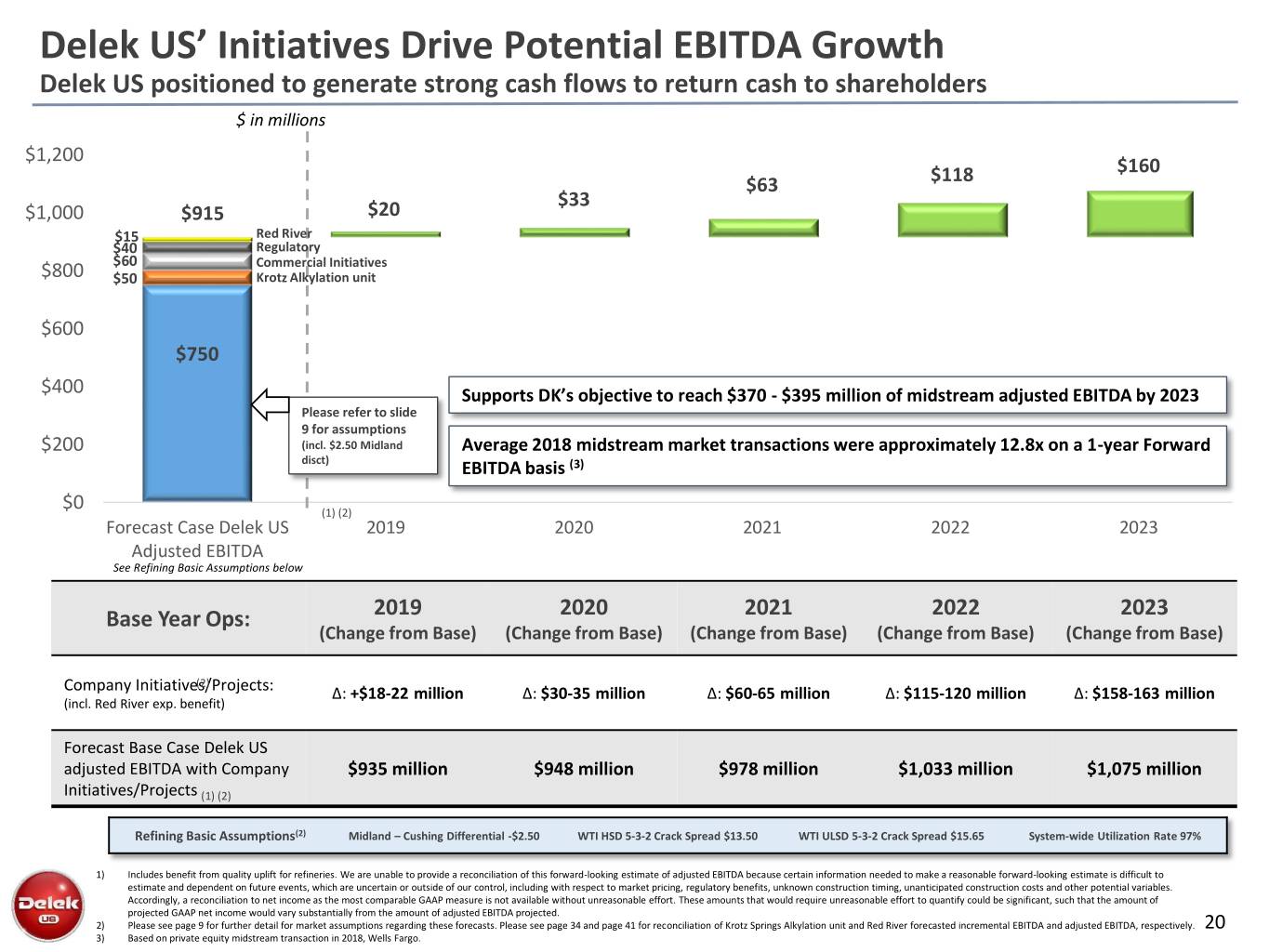

Delek US’ Initiatives Drive Potential EBITDA Growth Delek US positioned to generate strong cash flows to return cash to shareholders $ in millions $1,200 $160 $63 $118 $33 $1,000 $915 $20 $15 Red River $40 Regulatory $60 Commercial Initiatives $800 $50 Krotz Alkylation unit $600 $750 $400 Supports DK’s objective to reach $370 - $395 million of midstream adjusted EBITDA by 2023 Please refer to slide 9 for assumptions $200 (incl. $2.50 Midland Average 2018 midstream market transactions were approximately 12.8x on a 1-year Forward disct) EBITDA basis (3) $0 (1) (2) Forecast Case Delek US 2019 2020 2021 2022 2023 Adjusted EBITDA See Refining Basic Assumptions below Base Year Ops: 2019 2020 2021 2022 2023 (Change from Base) (Change from Base) (Change from Base) (Change from Base) (Change from Base) (2) Company Initiatives/Projects: Δ: +$18-22 million Δ: $30-35 million Δ: $60-65 million Δ: $115-120 million Δ: $158-163 million (incl. Red River exp. benefit) Forecast Base Case Delek US adjusted EBITDA with Company $935 million $948 million $978 million $1,033 million $1,075 million Initiatives/Projects (1) (2) Refining Basic Assumptions(2) Midland – Cushing Differential -$2.50 WTI HSD 5-3-2 Crack Spread $13.50 WTI ULSD 5-3-2 Crack Spread $15.65 System-wide Utilization Rate 97% 1) Includes benefit from quality uplift for refineries. We are unable to provide a reconciliation of this forward-looking estimate of adjusted EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to market pricing, regulatory benefits, unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of adjusted EBITDA projected. 2) Please see page 9 for further detail for market assumptions regarding these forecasts. Please see page 34 and page 41 for reconciliation of Krotz Springs Alkylation unit and Red River forecasted incremental EBITDA and adjusted EBITDA, respectively. 20 3) Based on private equity midstream transaction in 2018, Wells Fargo.

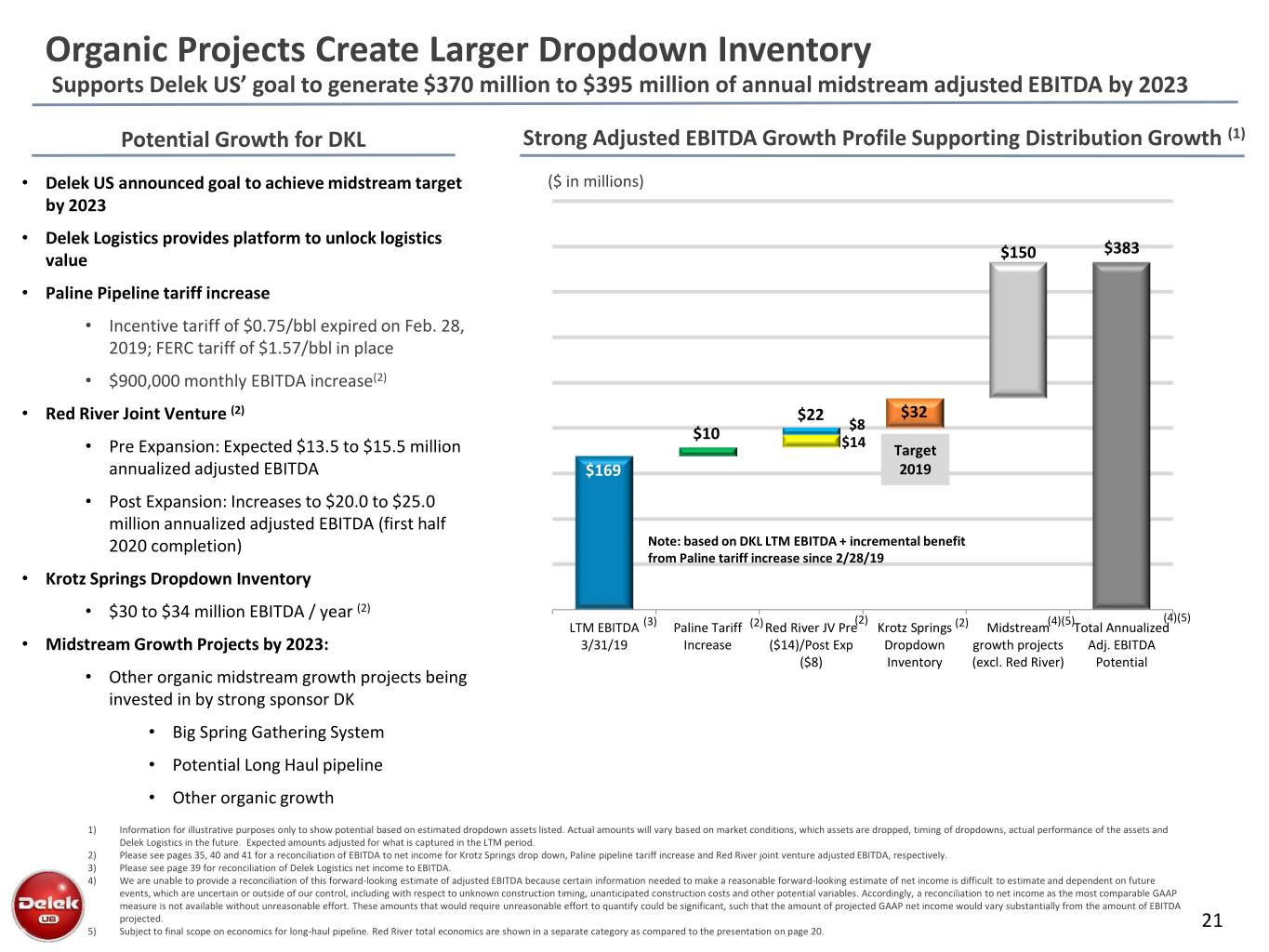

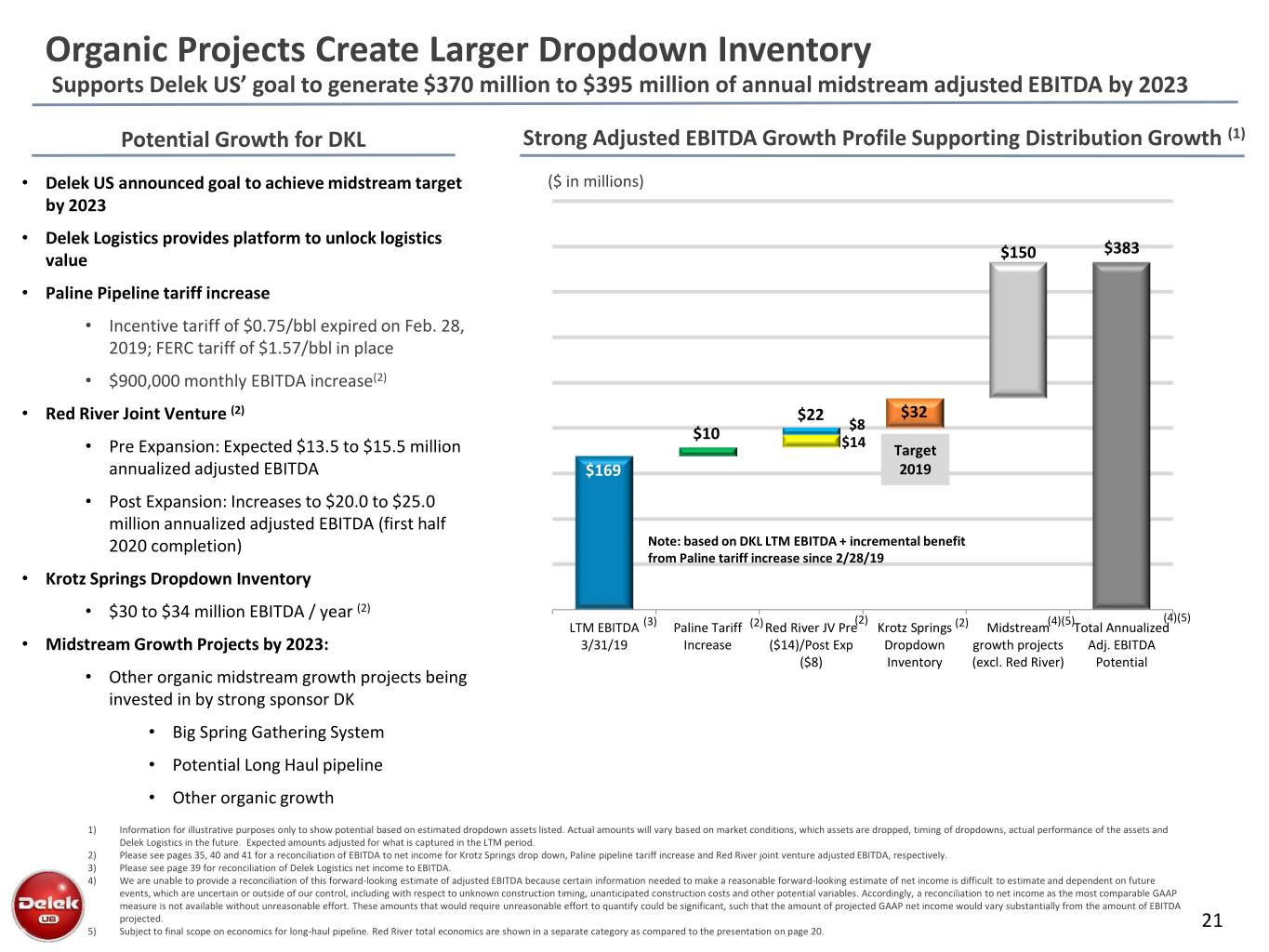

Organic Projects Create Larger Dropdown Inventory Supports Delek US’ goal to generate $370 million to $395 million of annual midstream adjusted EBITDA by 2023 Potential Growth for DKL Strong Adjusted EBITDA Growth Profile Supporting Distribution Growth (1) • Delek US announced goal to achieve midstream target ($ in millions) by 2023 • Delek Logistics provides platform to unlock logistics $383 value $150 • Paline Pipeline tariff increase • Incentive tariff of $0.75/bbl expired on Feb. 28, 2019; FERC tariff of $1.57/bbl in place • $900,000 monthly EBITDA increase(2) • Red River Joint Venture (2) $22 $32 $8 $10 $14 • Pre Expansion: Expected $13.5 to $15.5 million Target annualized adjusted EBITDA $169 2019 • Post Expansion: Increases to $20.0 to $25.0 million annualized adjusted EBITDA (first half 2020 completion) Note: based on DKL LTM EBITDA + incremental benefit from Paline tariff increase since 2/28/19 • Krotz Springs Dropdown Inventory • (2) $30 to $34 million EBITDA / year (2) (4)(5) (4)(5) LTM EBITDA (3) Paline Tariff (2)Red River JV Pre Krotz Springs (2) Midstream Total Annualized • Midstream Growth Projects by 2023: 3/31/19 Increase ($14)/Post Exp Dropdown growth projects Adj. EBITDA ($8) Inventory (excl. Red River) Potential • Other organic midstream growth projects being invested in by strong sponsor DK • Big Spring Gathering System • Potential Long Haul pipeline • Other organic growth 1) Information for illustrative purposes only to show potential based on estimated dropdown assets listed. Actual amounts will vary based on market conditions, which assets are dropped, timing of dropdowns, actual performance of the assets and Delek Logistics in the future. Expected amounts adjusted for what is captured in the LTM period. 2) Please see pages 35, 40 and 41 for a reconciliation of EBITDA to net income for Krotz Springs drop down, Paline pipeline tariff increase and Red River joint venture adjusted EBITDA, respectively. 3) Please see page 39 for reconciliation of Delek Logistics net income to EBITDA. 4) We are unable to provide a reconciliation of this forward-looking estimate of adjusted EBITDA because certain information needed to make a reasonable forward-looking estimate of net income is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of EBITDA projected. 5) Subject to final scope on economics for long-haul pipeline. Red River total economics are shown in a separate category as compared to the presentation on page 20. 21

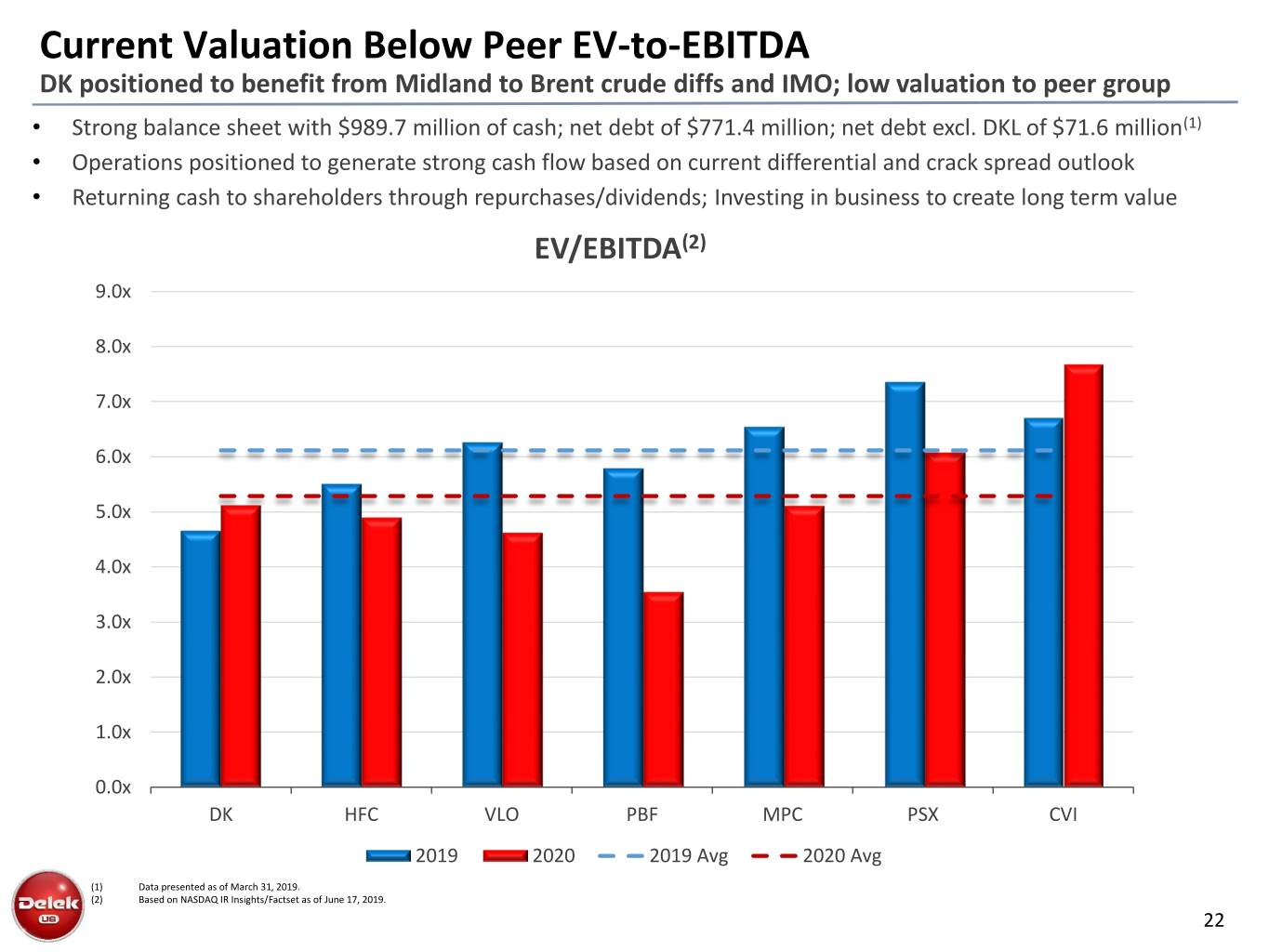

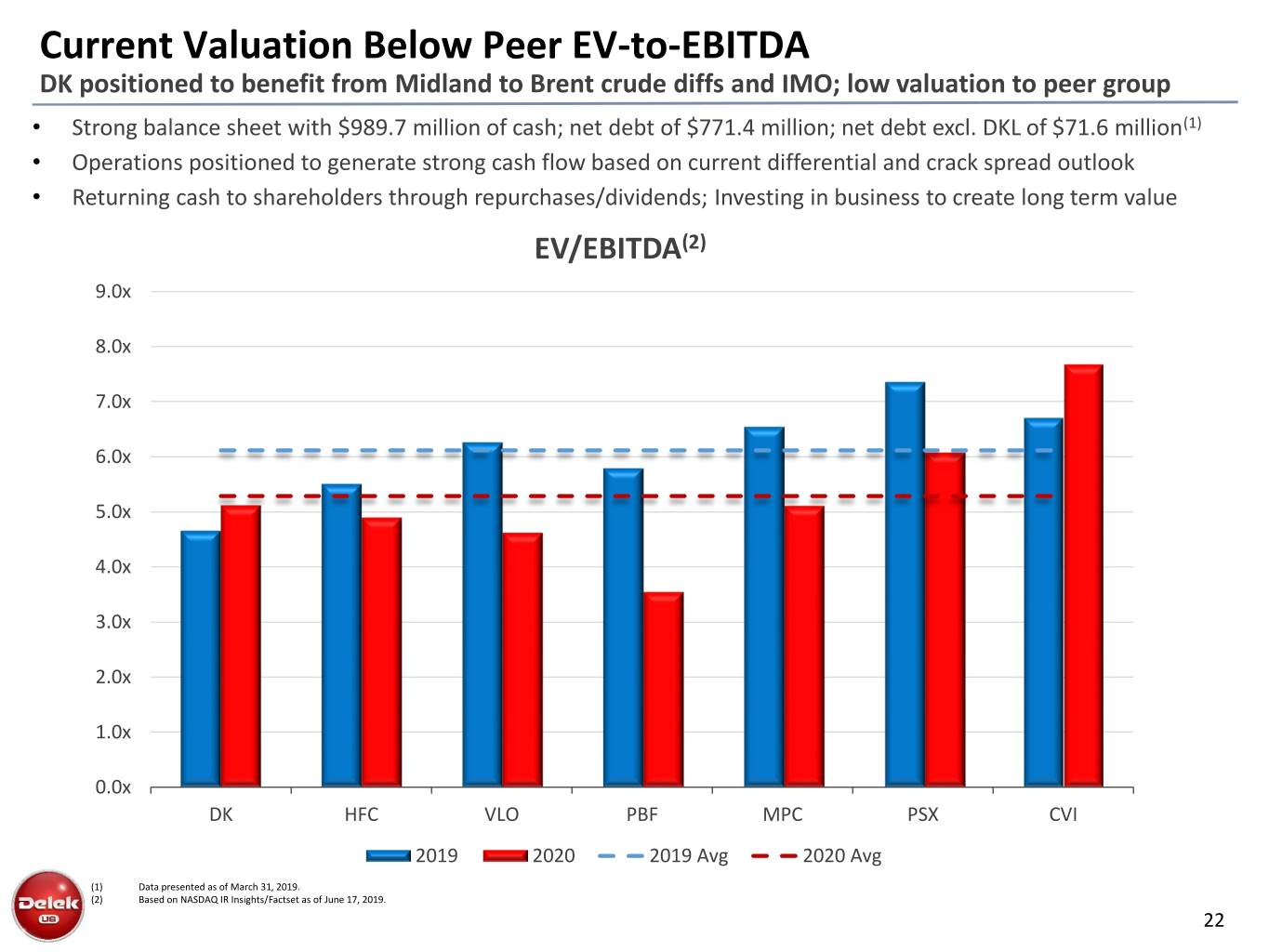

Current Valuation Below Peer EV-to-EBITDA DK positioned to benefit from Midland to Brent crude diffs and IMO; low valuation to peer group • Strong balance sheet with $989.7 million of cash; net debt of $771.4 million; net debt excl. DKL of $71.6 million(1) • Operations positioned to generate strong cash flow based on current differential and crack spread outlook • Returning cash to shareholders through repurchases/dividends; Investing in business to create long term value EV/EBITDA(2) 9.0x 8.0x 7.0x 6.0x 5.0x 4.0x 3.0x 2.0x 1.0x 0.0x DK HFC VLO PBF MPC PSX CVI 2019 2020 2019 Avg 2020 Avg (1) Data presented as of March 31, 2019. (2) Based on NASDAQ IR Insights/Factset as of June 17, 2019. 22

An Integrated and Financial Flexibility to Diversified Refining, Support Strategic Logistics and Marketing Company Objectives Invest in the Business to Permian Focused Focus on Long-Term Operate Reliably and Refining System Shareholder Returns Safely Growing Midstream Platform to Diversify EBITDA Stream

Appendix

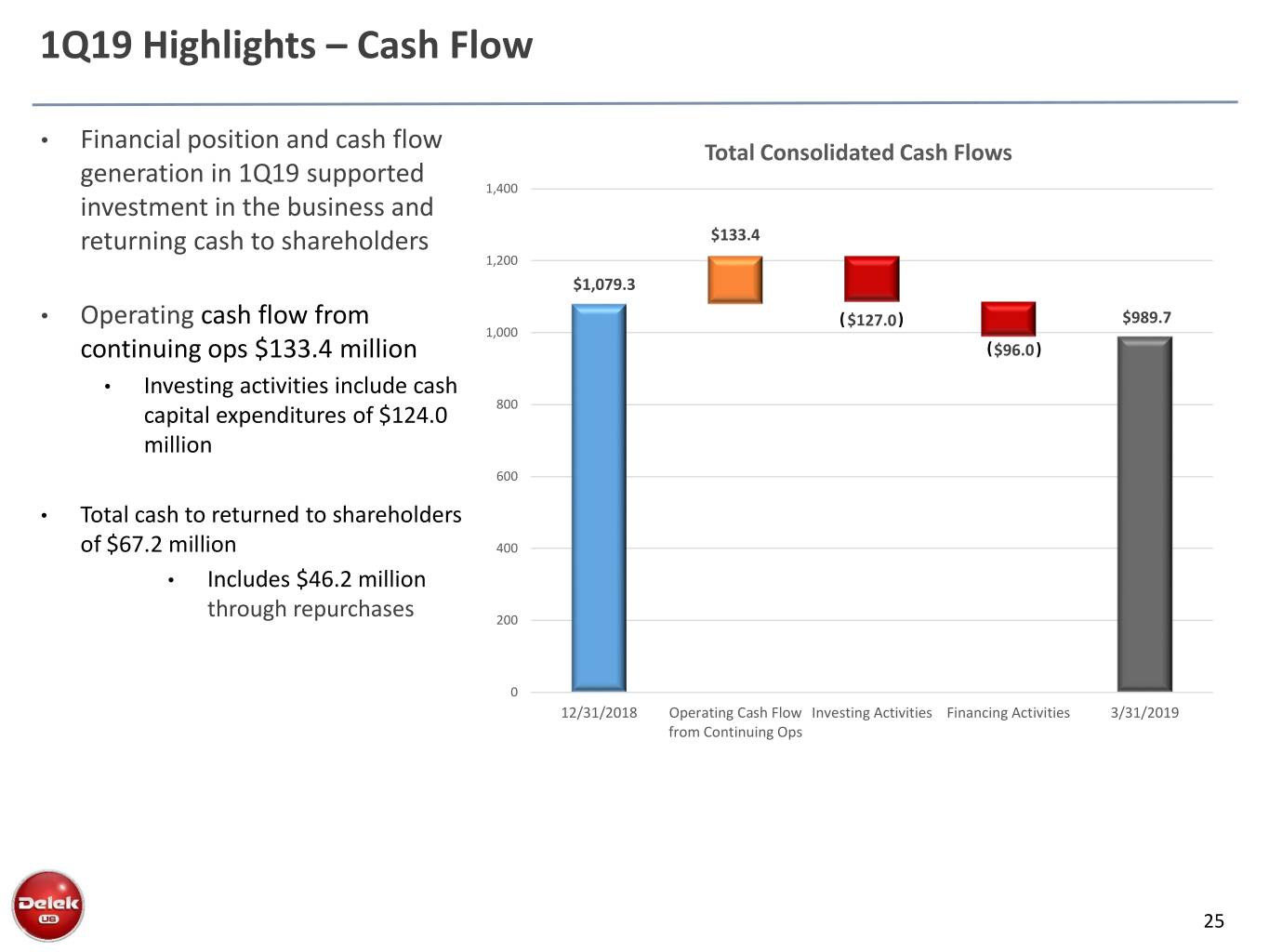

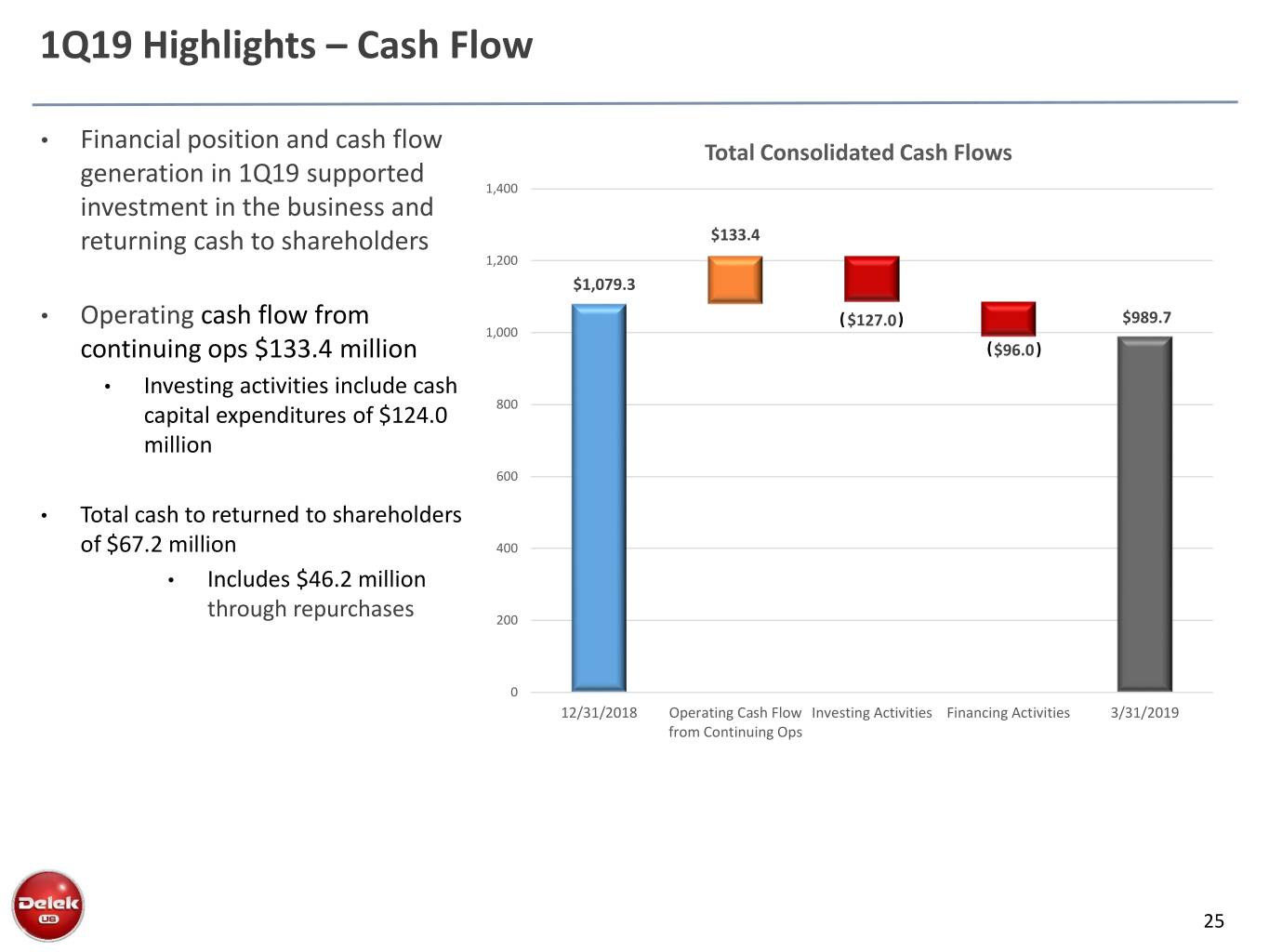

1Q19 Highlights – Cash Flow • Financial position and cash flow Total Consolidated Cash Flows generation in 1Q19 supported 1,400 investment in the business and returning cash to shareholders $133.4 1,200 $1,079.3 • Operating cash flow from ( $127.0) $989.7 1,000 continuing ops $133.4 million ($96.0 ) • Investing activities include cash capital expenditures of $124.0 800 million 600 • Total cash to returned to shareholders of $67.2 million 400 • Includes $46.2 million through repurchases 200 0 12/31/2018 Operating Cash Flow Investing Activities Financing Activities 3/31/2019 from Continuing Ops 25

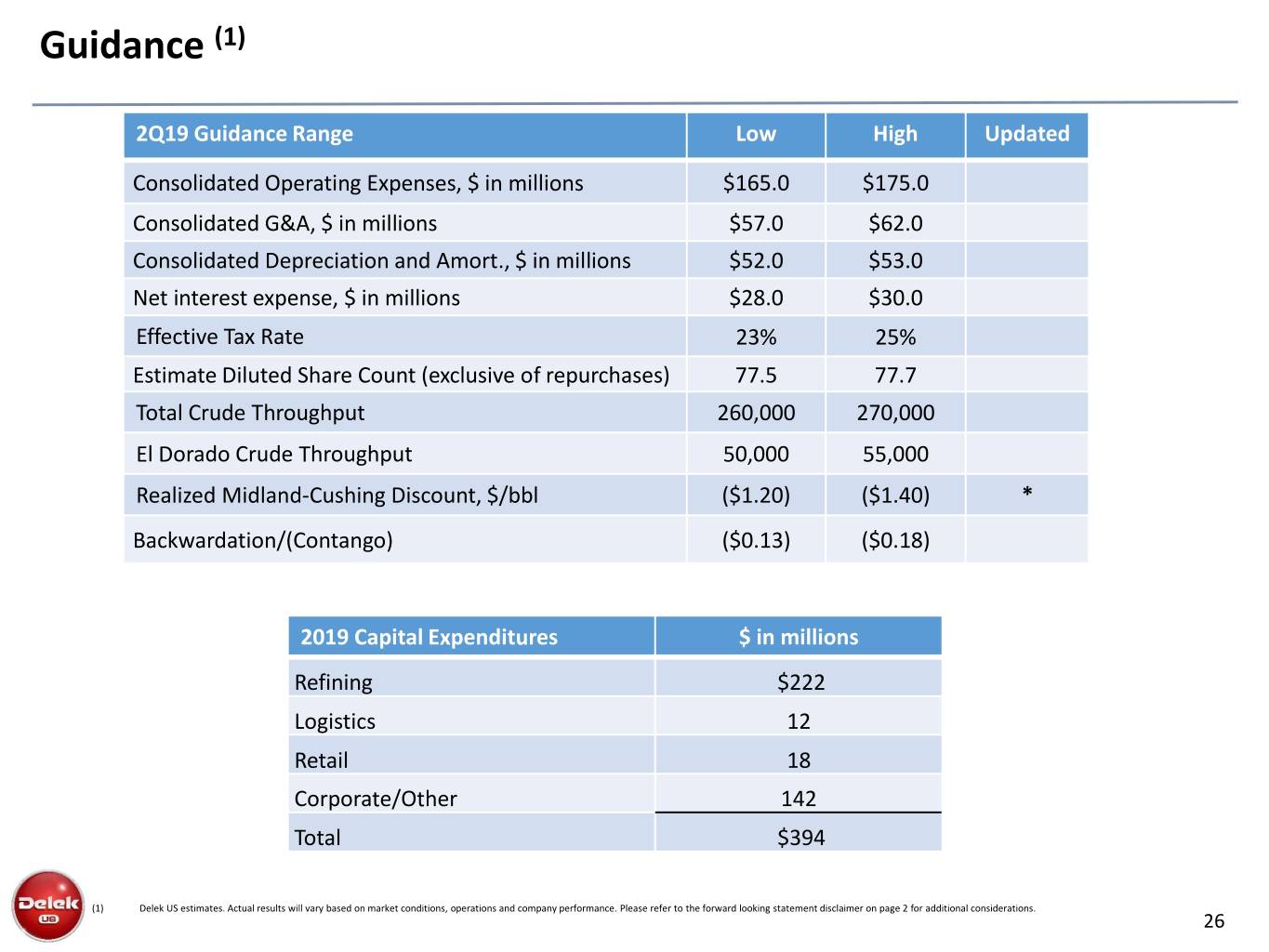

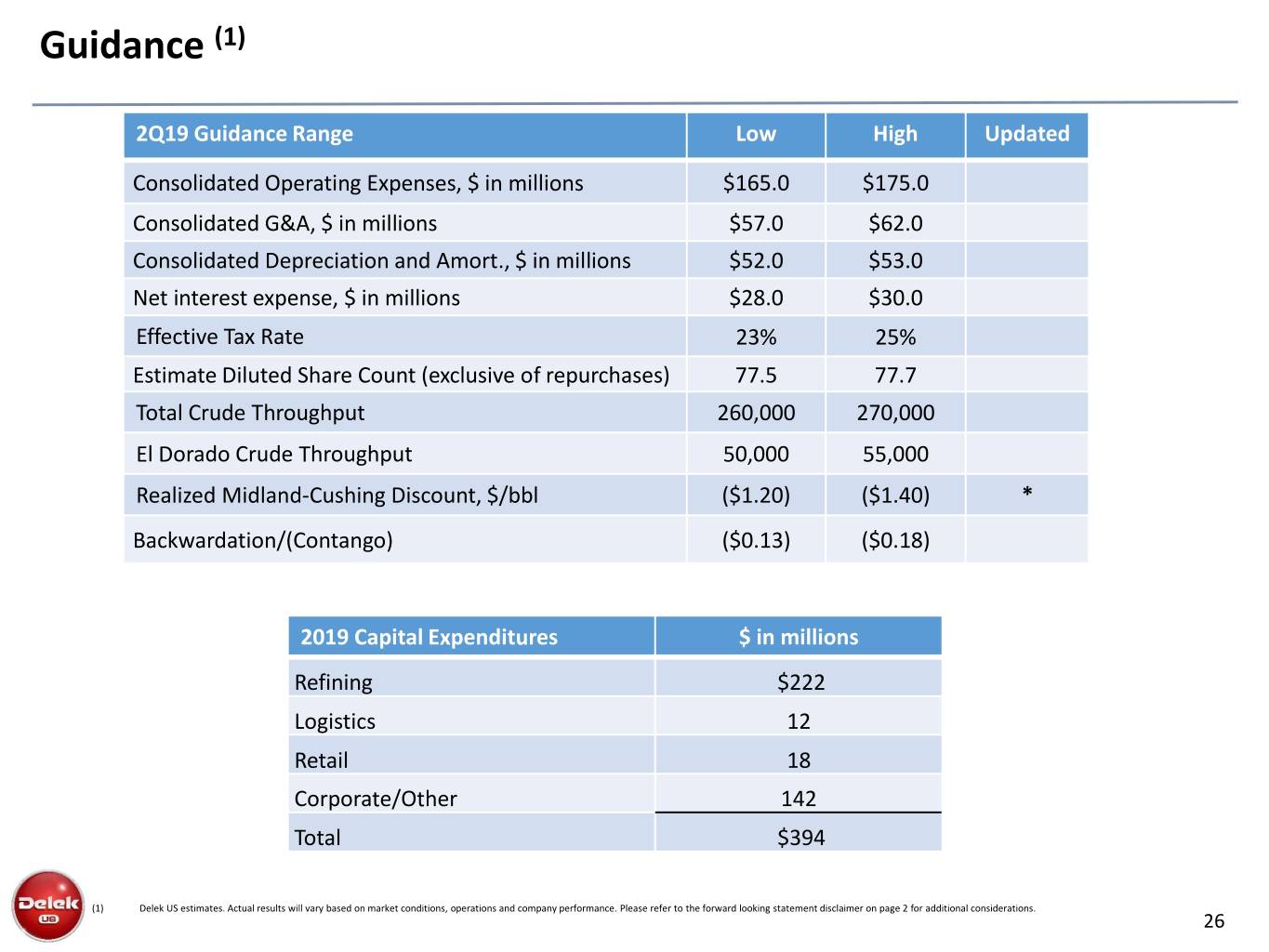

Guidance (1) 2Q19 Guidance Range Low High Updated Consolidated Operating Expenses, $ in millions $165.0 $175.0 Consolidated G&A, $ in millions $57.0 $62.0 Consolidated Depreciation and Amort., $ in millions $52.0 $53.0 Net interest expense, $ in millions $28.0 $30.0 Effective Tax Rate 23% 25% Estimate Diluted Share Count (exclusive of repurchases) 77.5 77.7 Total Crude Throughput 260,000 270,000 El Dorado Crude Throughput 50,000 55,000 Realized Midland-Cushing Discount, $/bbl ($1.20) ($1.40) * Backwardation/(Contango) ($0.13) ($0.18) 2019 Capital Expenditures $ in millions Refining $222 Logistics 12 Retail 18 Corporate/Other 142 Total $394 (1) Delek US estimates. Actual results will vary based on market conditions, operations and company performance. Please refer to the forward looking statement disclaimer on page 2 for additional considerations. 26

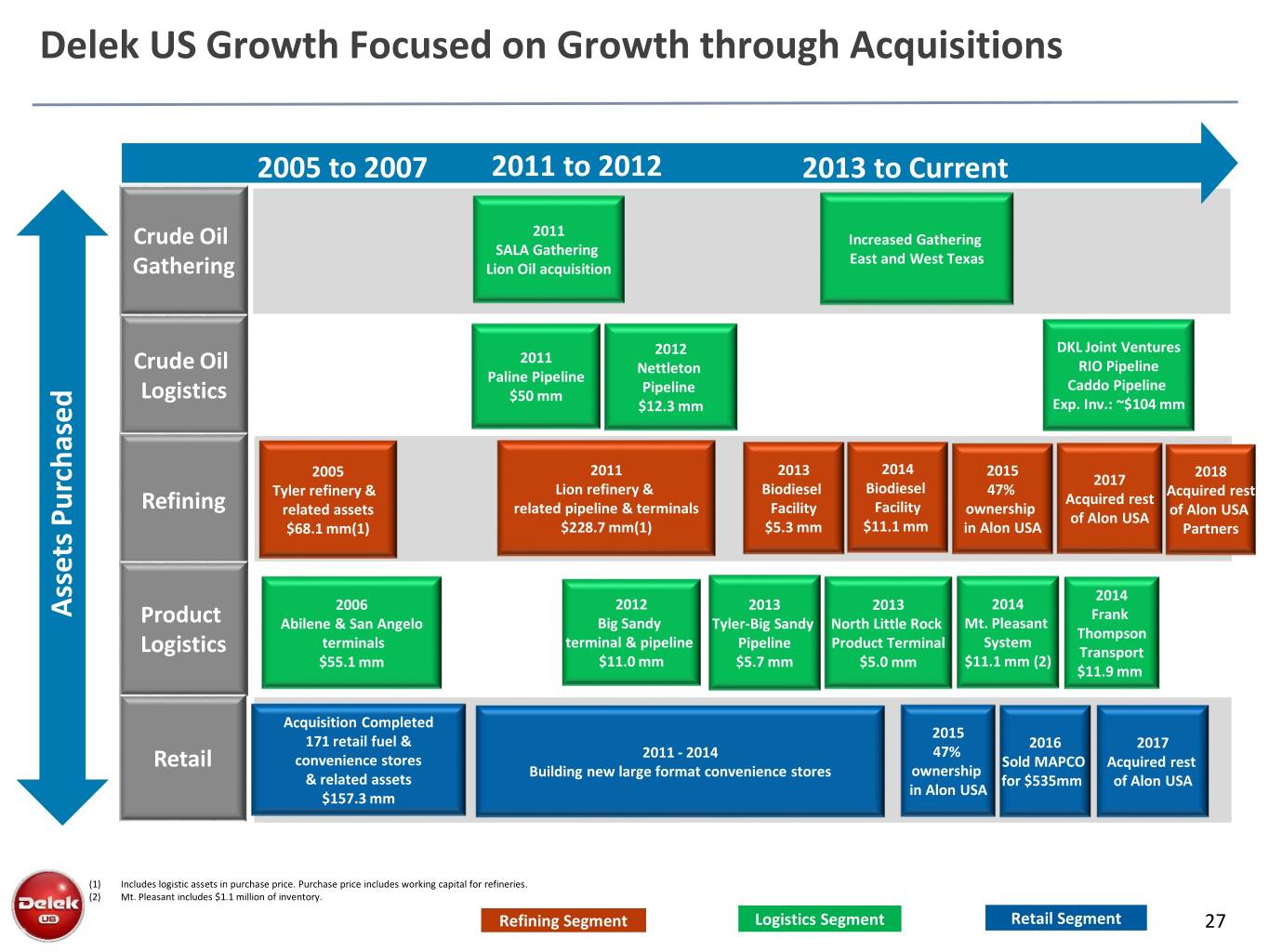

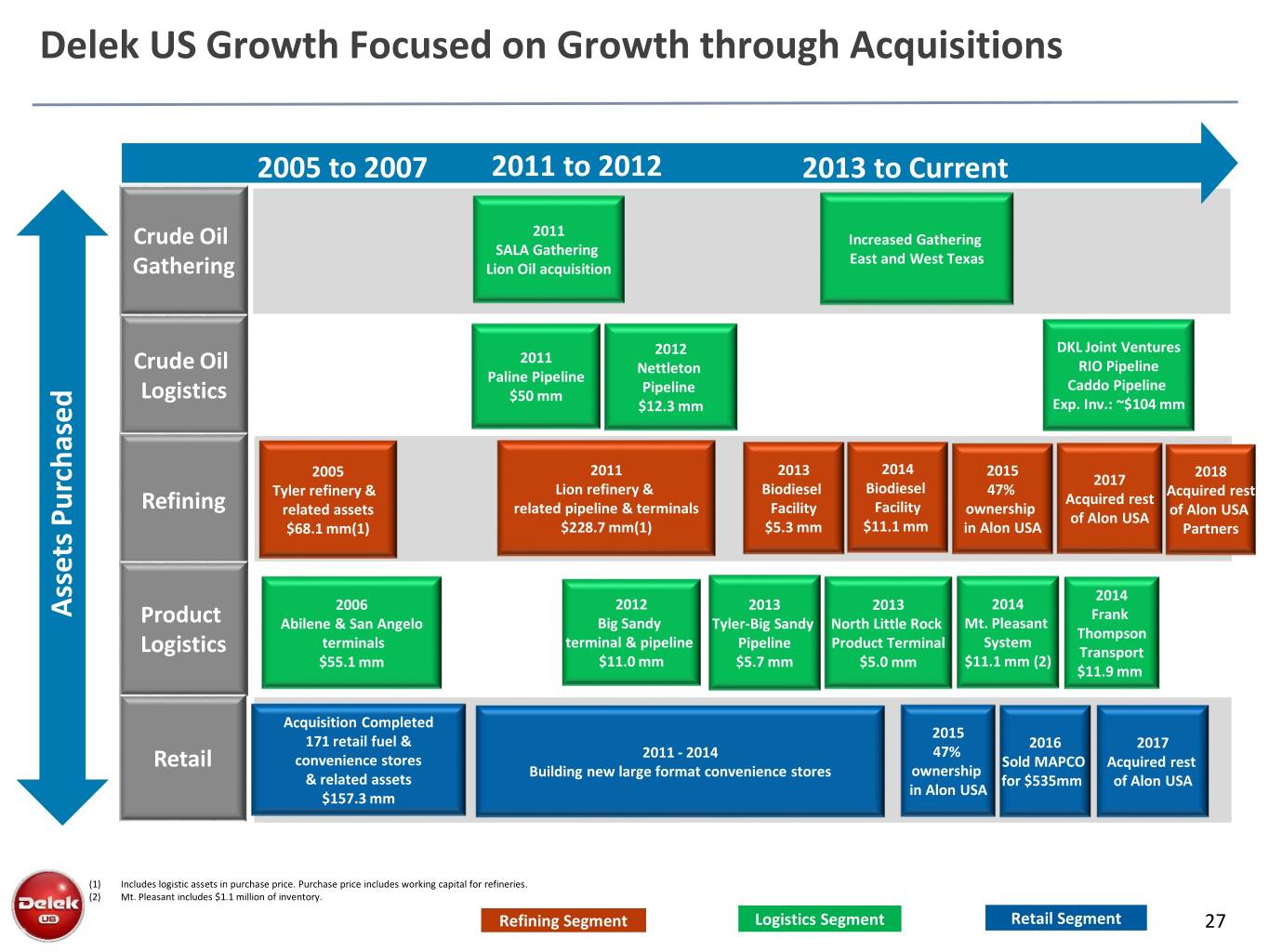

Delek US Growth Focused on Growth through Acquisitions 2005 to 2007 2011 to 2012 2013 to Current 2011 Crude Oil Increased Gathering SALA Gathering East and West Texas Gathering Lion Oil acquisition 2012 DKL Joint Ventures 2011 Crude Oil Nettleton RIO Pipeline Paline Pipeline Pipeline Caddo Pipeline Logistics $50 mm $12.3 mm Exp. Inv.: ~$104 mm 2005 2011 2013 2014 2015 2018 2017 Tyler refinery & Lion refinery & Biodiesel Biodiesel 47% Acquired rest Acquired rest Refining related assets related pipeline & terminals Facility Facility ownership of Alon USA of Alon USA $68.1 mm(1) $228.7 mm(1) $5.3 mm $11.1 mm in Alon USA Partners 2014 2006 2012 2013 2013 2014 Assets Purchased Assets Frank Product Abilene & San Angelo Big Sandy Tyler-Big Sandy North Little Rock Mt. Pleasant Thompson terminals terminal & pipeline Pipeline Product Terminal System Logistics Transport $55.1 mm $11.0 mm $5.7 mm $5.0 mm $11.1 mm (2) $11.9 mm Acquisition Completed 2015 171 retail fuel & 2016 2017 2011 - 2014 47% convenience stores Sold MAPCO Acquired rest Retail Building new large format convenience stores ownership & related assets for $535mm of Alon USA in Alon USA $157.3 mm (1) Includes logistic assets in purchase price. Purchase price includes working capital for refineries. (2) Mt. Pleasant includes $1.1 million of inventory. Refining Segment Logistics Segment Retail Segment 27

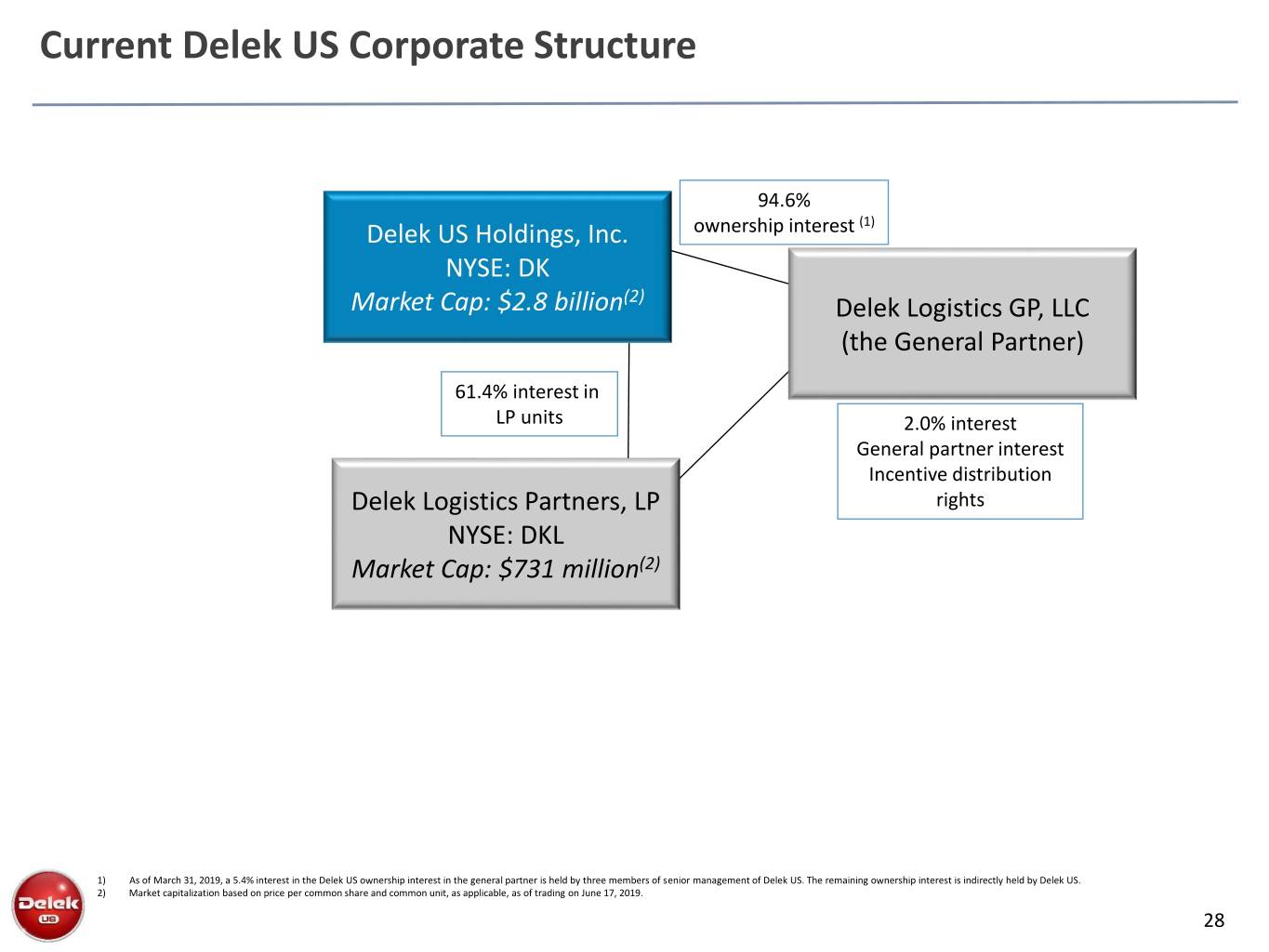

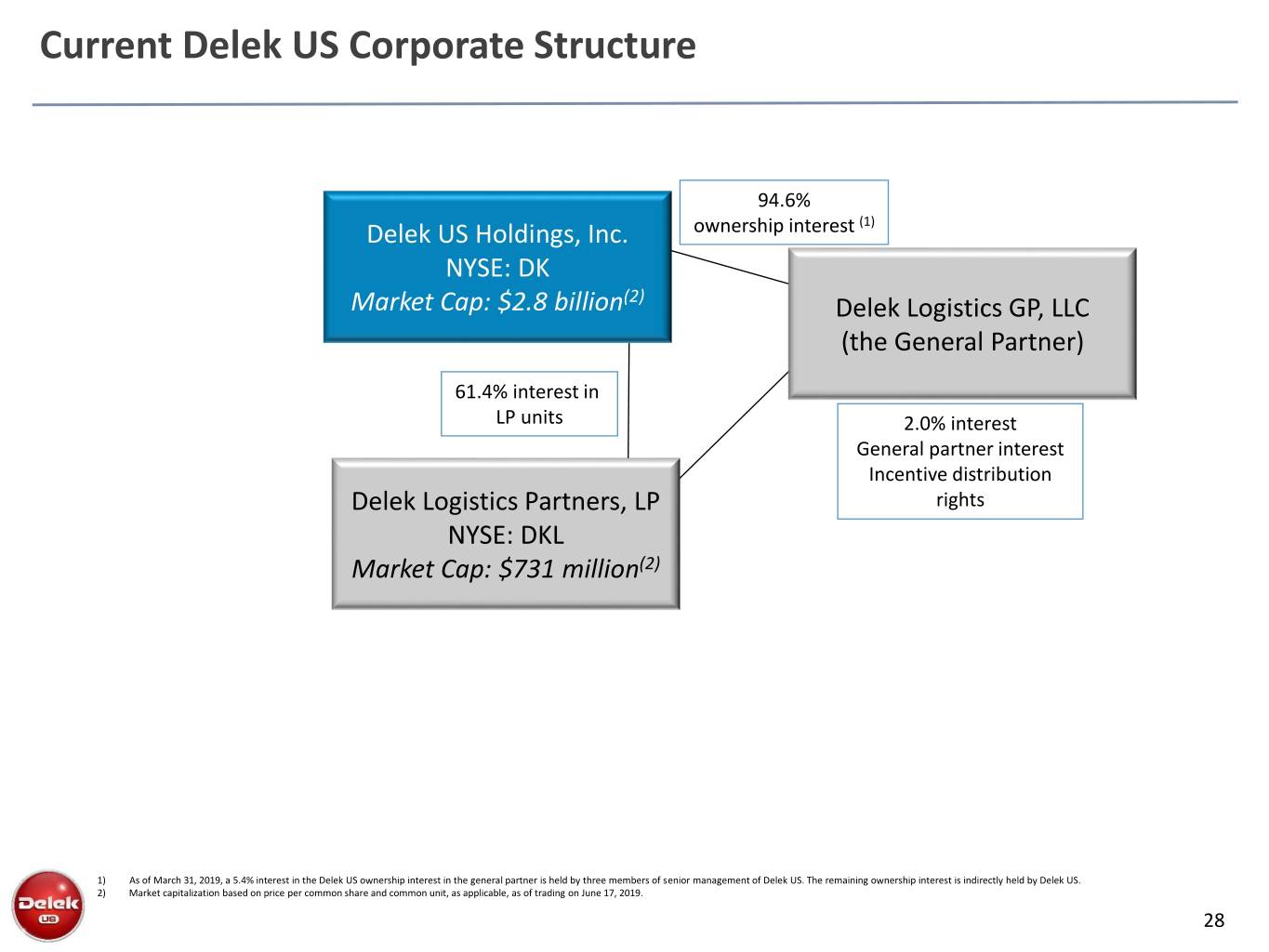

Current Delek US Corporate Structure 94.6% Delek US Holdings, Inc. ownership interest (1) NYSE: DK Market Cap: $2.8 billion(2) Delek Logistics GP, LLC (the General Partner) 61.4% interest in LP units 2.0% interest General partner interest Incentive distribution Delek Logistics Partners, LP rights NYSE: DKL Market Cap: $731 million(2) 1) As of March 31, 2019, a 5.4% interest in the Delek US ownership interest in the general partner is held by three members of senior management of Delek US. The remaining ownership interest is indirectly held by Delek US. 2) Market capitalization based on price per common share and common unit, as applicable, as of trading on June 17, 2019. 28

Market Data

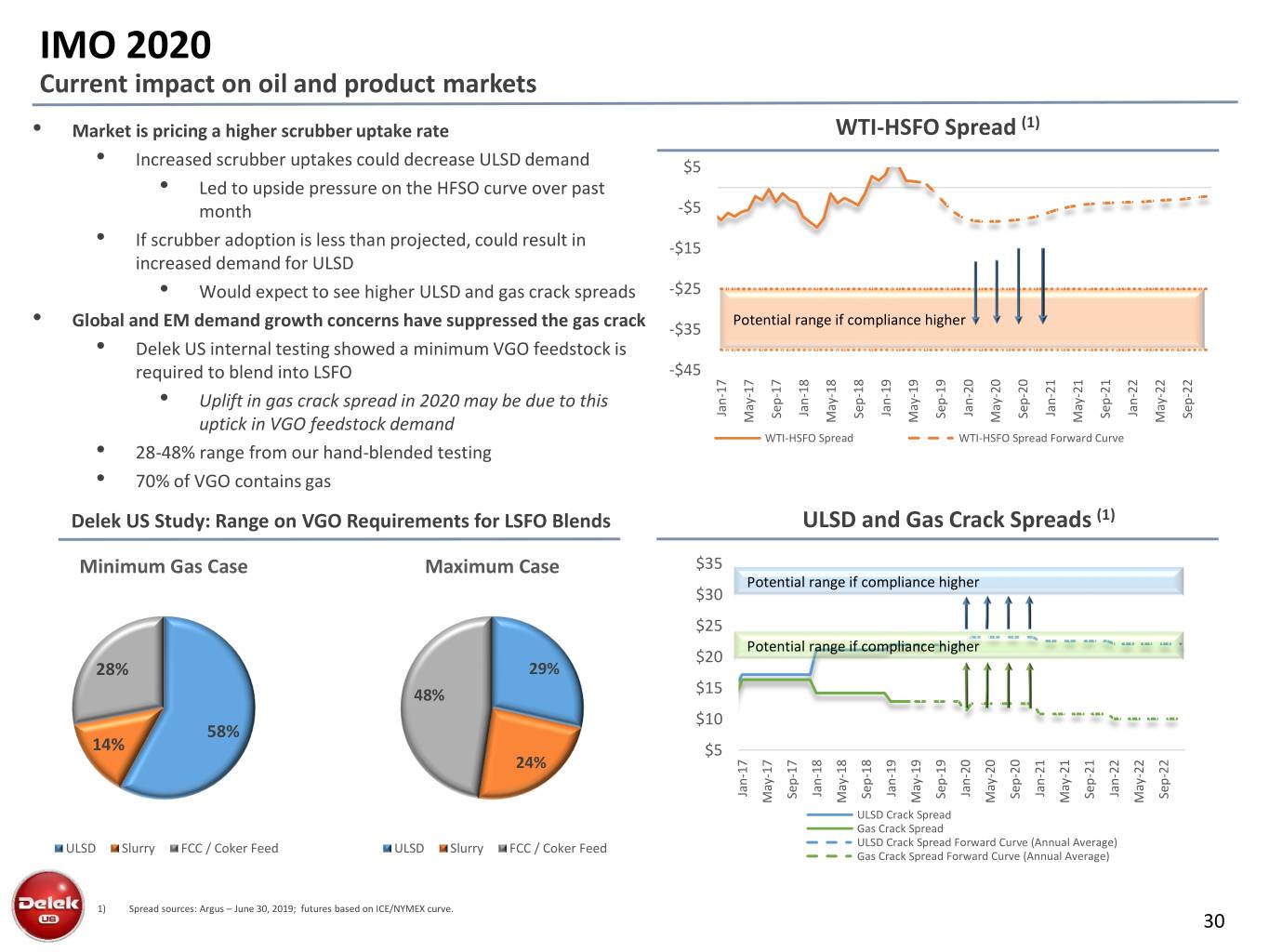

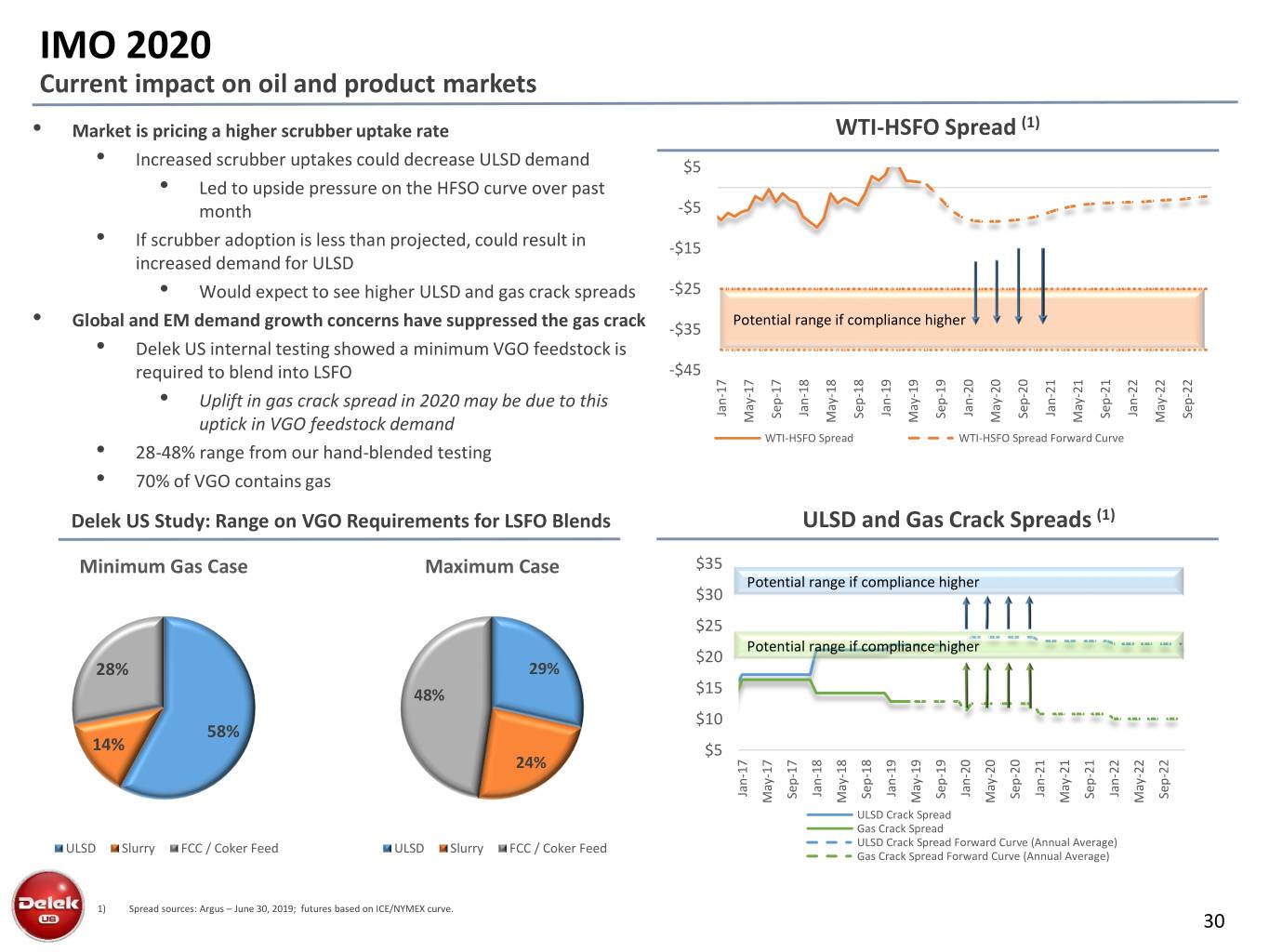

IMO 2020 Current impact on oil and product markets • Market is pricing a higher scrubber uptake rate WTI-HSFO Spread (1) • Increased scrubber uptakes could decrease ULSD demand $5 • Led to upside pressure on the HFSO curve over past month -$5 • If scrubber adoption is less than projected, could result in -$15 increased demand for ULSD • Would expect to see higher ULSD and gas crack spreads -$25 Potential range if compliance higher • Global and EM demand growth concerns have suppressed the gas crack -$35 • Delek US internal testing showed a minimum VGO feedstock is required to blend into LSFO -$45 • Uplift in gas crack spread in 2020 may be due to this Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Sep-17 Sep-18 Sep-19 Sep-20 Sep-21 Sep-22 May-18 May-19 May-20 May-21 May-22 uptick in VGO feedstock demand May-17 WTI-HSFO Spread WTI-HSFO Spread Forward Curve • 28-48% range from our hand-blended testing • 70% of VGO contains gas Delek US Study: Range on VGO Requirements for LSFO Blends ULSD and Gas Crack Spreads (1) Minimum Gas Case Maximum Case $35 Potential range if compliance higher $30 $25 Potential range if compliance higher $20 28% 29% 48% $15 $10 58% 14% $5 24% Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Sep-17 Sep-18 Sep-19 Sep-20 Sep-21 Sep-22 May-17 May-18 May-19 May-20 May-21 May-22 ULSD Crack Spread Gas Crack Spread ULSD Slurry FCC / Coker Feed ULSD Slurry FCC / Coker Feed ULSD Crack Spread Forward Curve (Annual Average) Gas Crack Spread Forward Curve (Annual Average) 1) Spread sources: Argus – June 30, 2019; futures based on ICE/NYMEX curve. 30

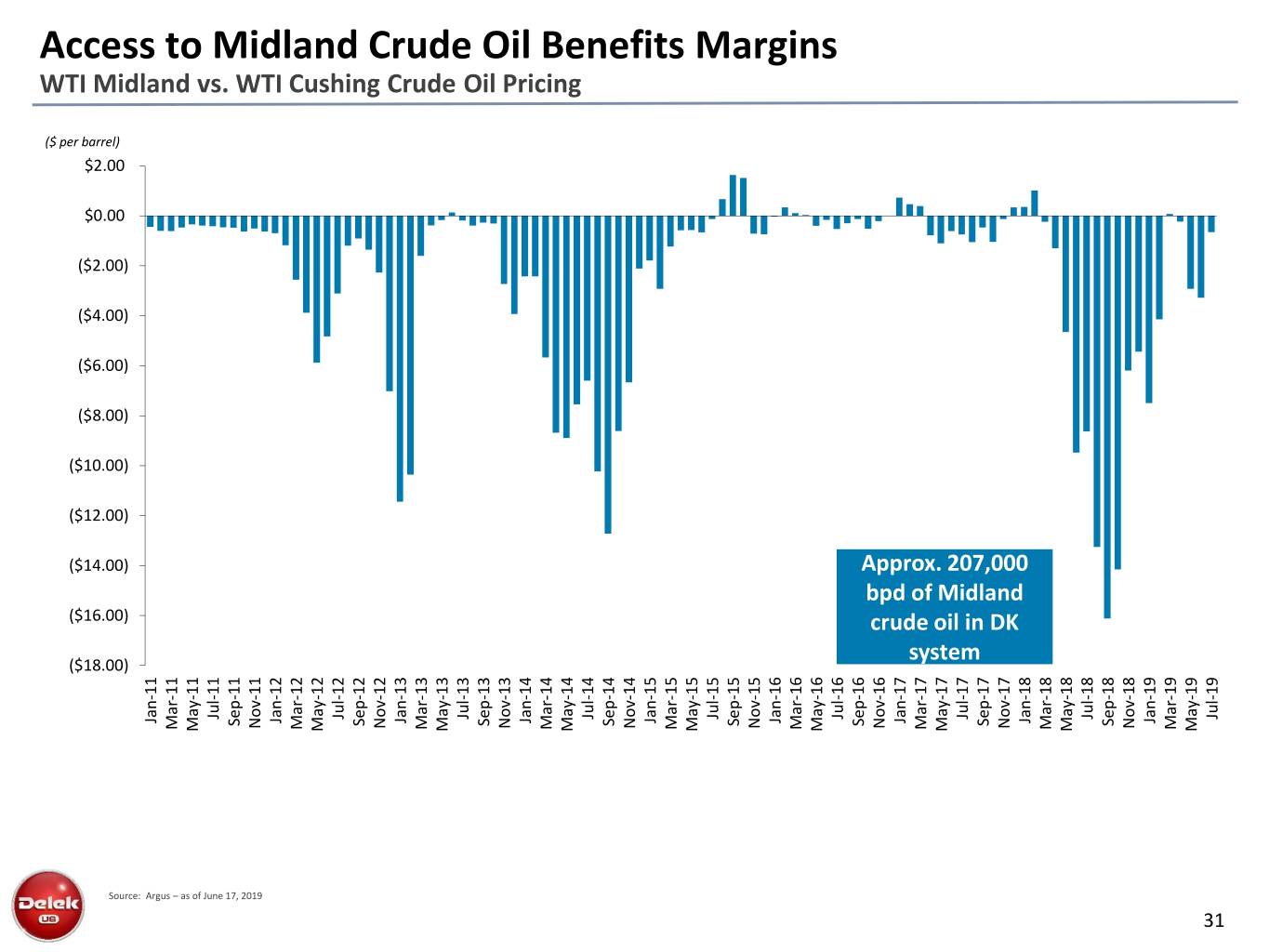

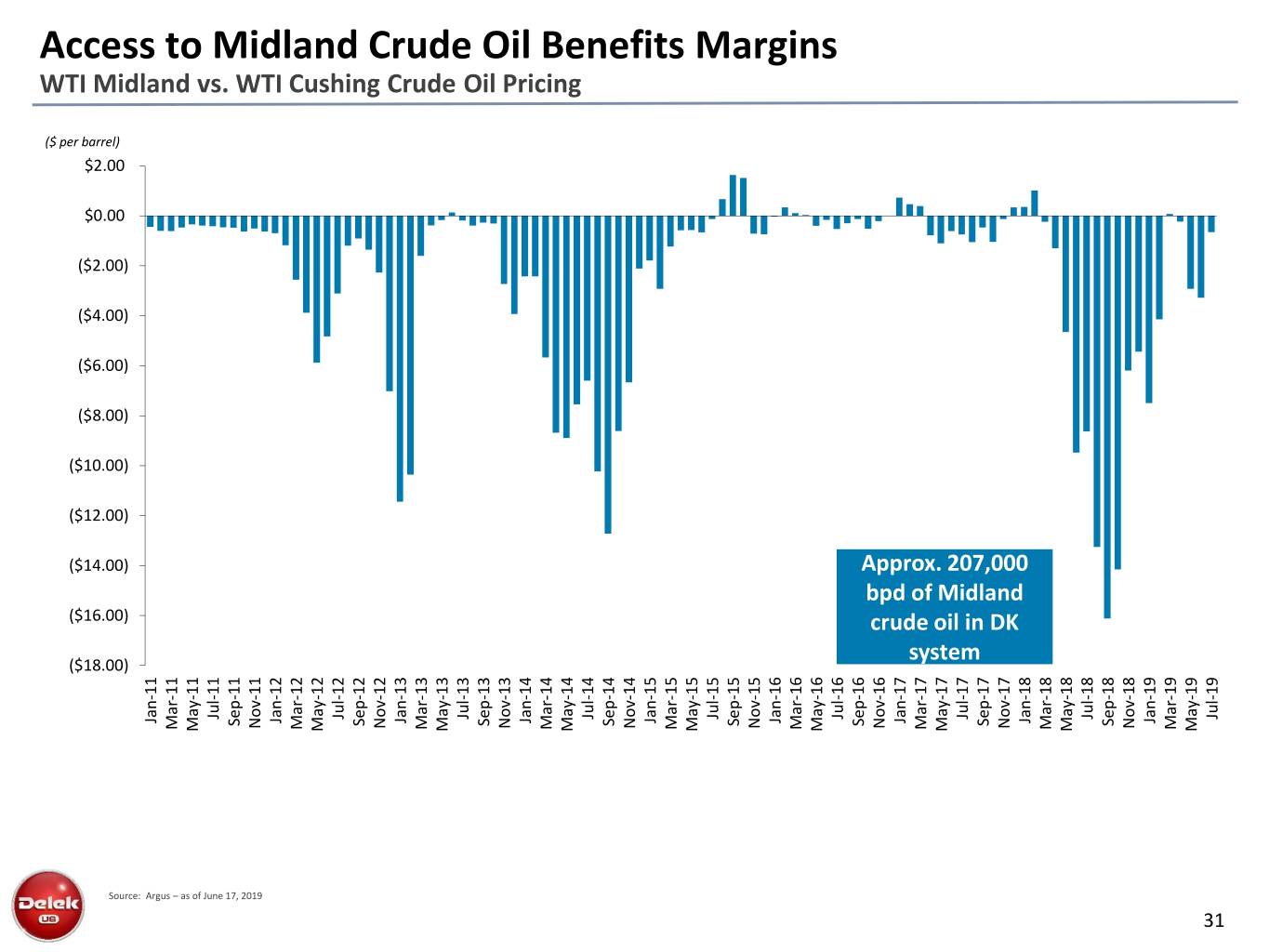

Access to Midland Crude Oil Benefits Margins WTI Midland vs. WTI Cushing Crude Oil Pricing ($ per barrel) $2.00 $0.00 ($2.00) ($4.00) ($6.00) ($8.00) ($10.00) ($12.00) ($14.00) Approx. 207,000 bpd of Midland ($16.00) crude oil in DK system ($18.00) Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 Jul-16 Jul-17 Jul-18 Jul-19 Jan-13 Jan-11 Jan-12 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 Sep-15 Sep-11 Sep-12 Sep-13 Sep-14 Sep-16 Sep-17 Sep-18 Nov-11 Nov-12 Nov-13 Nov-14 Nov-15 Nov-16 Nov-17 Nov-18 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 May-18 May-11 May-12 May-13 May-14 May-15 May-16 May-17 May-19 Source: Argus – as of June 17, 2019 31

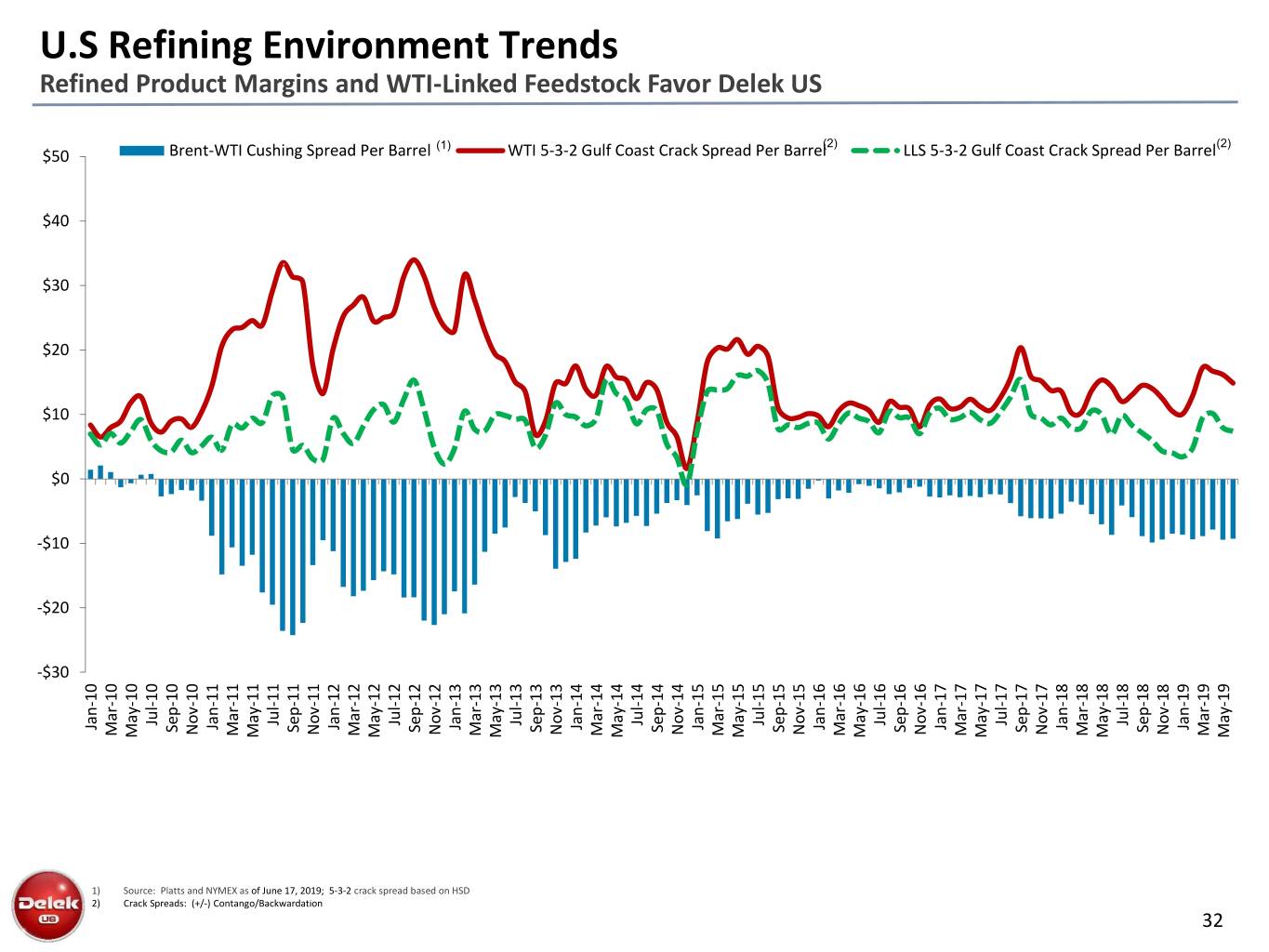

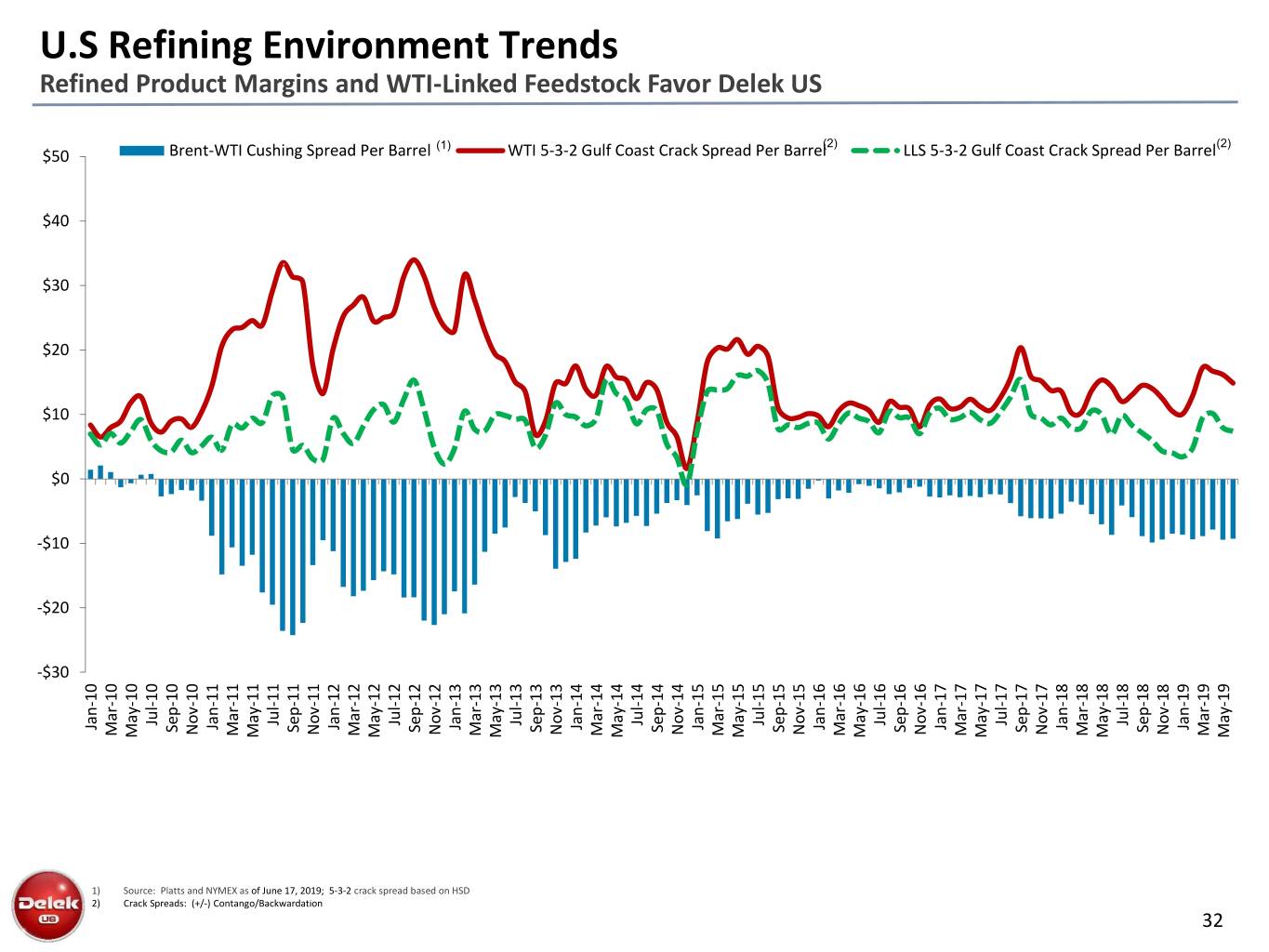

U.S Refining Environment Trends Refined Product Margins and WTI-Linked Feedstock Favor Delek US (1) (2) (2) $50 Brent-WTI Cushing Spread Per Barrel WTI 5-3-2 Gulf Coast Crack Spread Per Barrel LLS 5-3-2 Gulf Coast Crack Spread Per Barrel $40 $30 $20 $10 $0 -$10 -$20 -$30 Jul-16 Jul-17 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 Jul-18 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 Sep-10 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16 Sep-17 Sep-18 Nov-10 Nov-11 Nov-12 Nov-13 Nov-14 Nov-15 Nov-16 Nov-17 Nov-18 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 May-12 May-10 May-11 May-13 May-14 May-15 May-16 May-17 May-18 May-19 1) Source: Platts and NYMEX as of June 17, 2019; 5-3-2 crack spread based on HSD 2) Crack Spreads: (+/-) Contango/Backwardation 32

Reconciliations

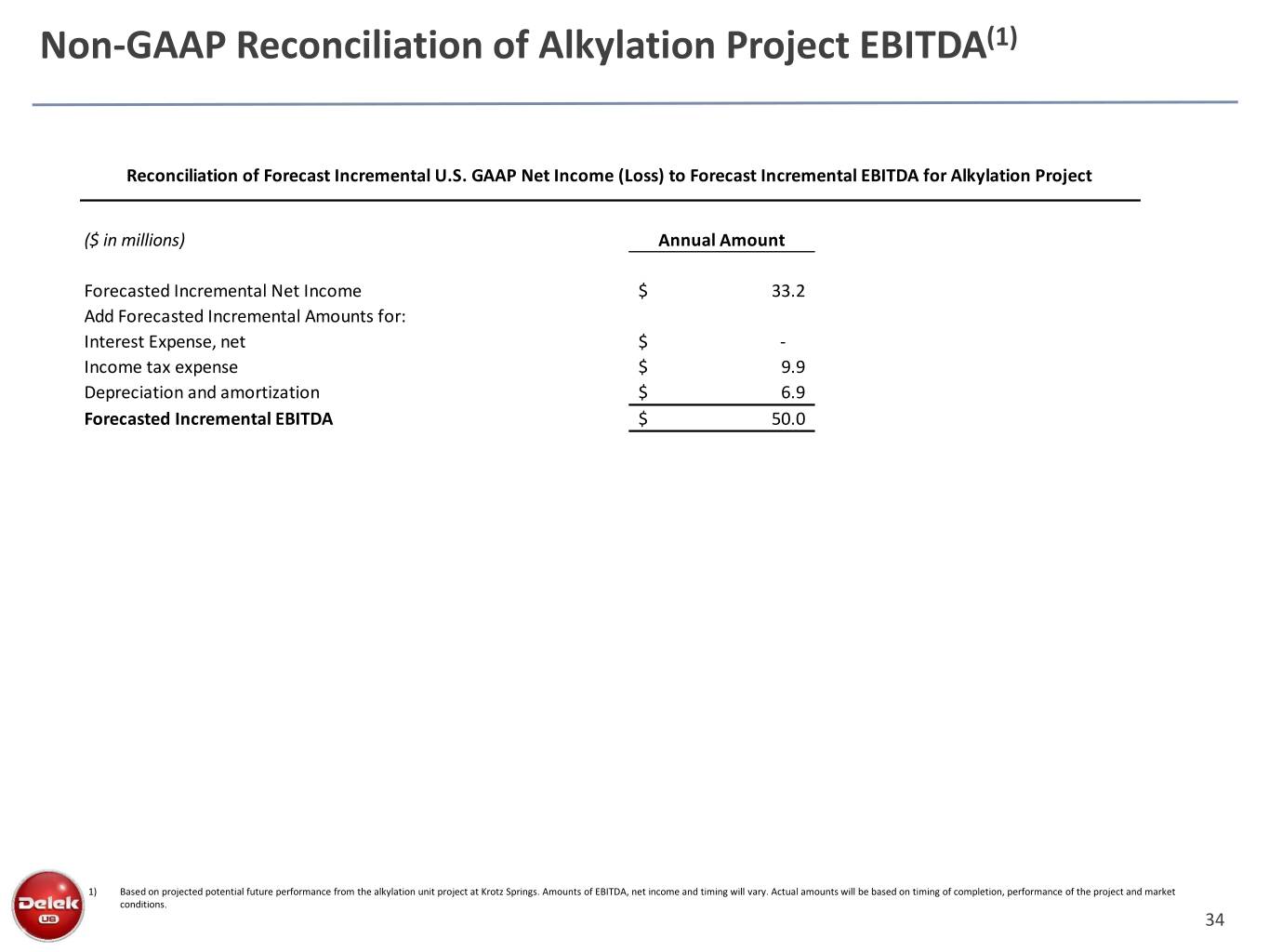

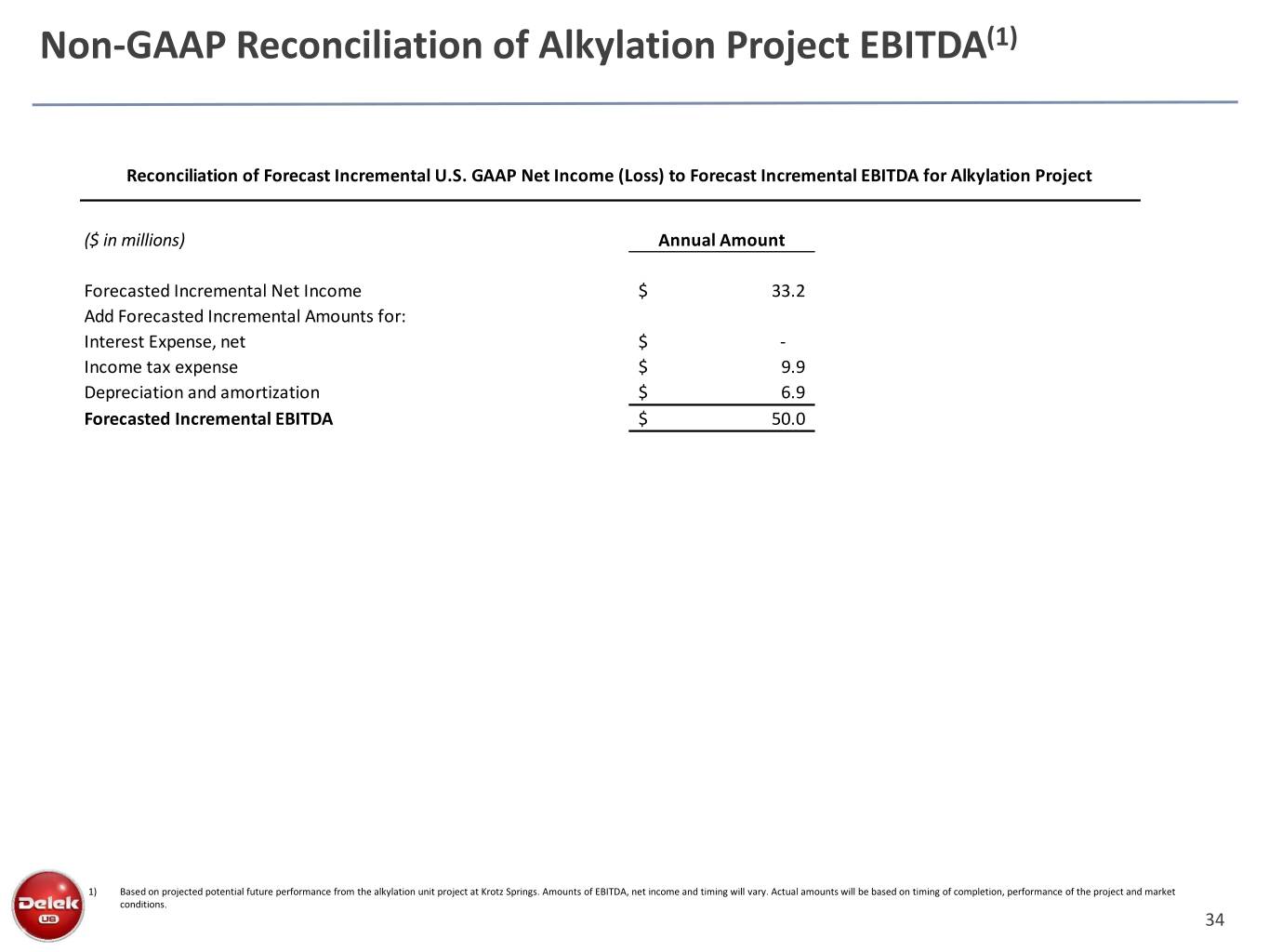

Non-GAAP Reconciliation of Alkylation Project EBITDA(1) Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA for Alkylation Project ($ in millions) Annual Amount Forecasted Incremental Net Income $ 33.2 Add Forecasted Incremental Amounts for: Interest Expense, net $ - Income tax expense $ 9.9 Depreciation and amortization $ 6.9 Forecasted Incremental EBITDA $ 50.0 1) Based on projected potential future performance from the alkylation unit project at Krotz Springs. Amounts of EBITDA, net income and timing will vary. Actual amounts will be based on timing of completion, performance of the project and market conditions. 34

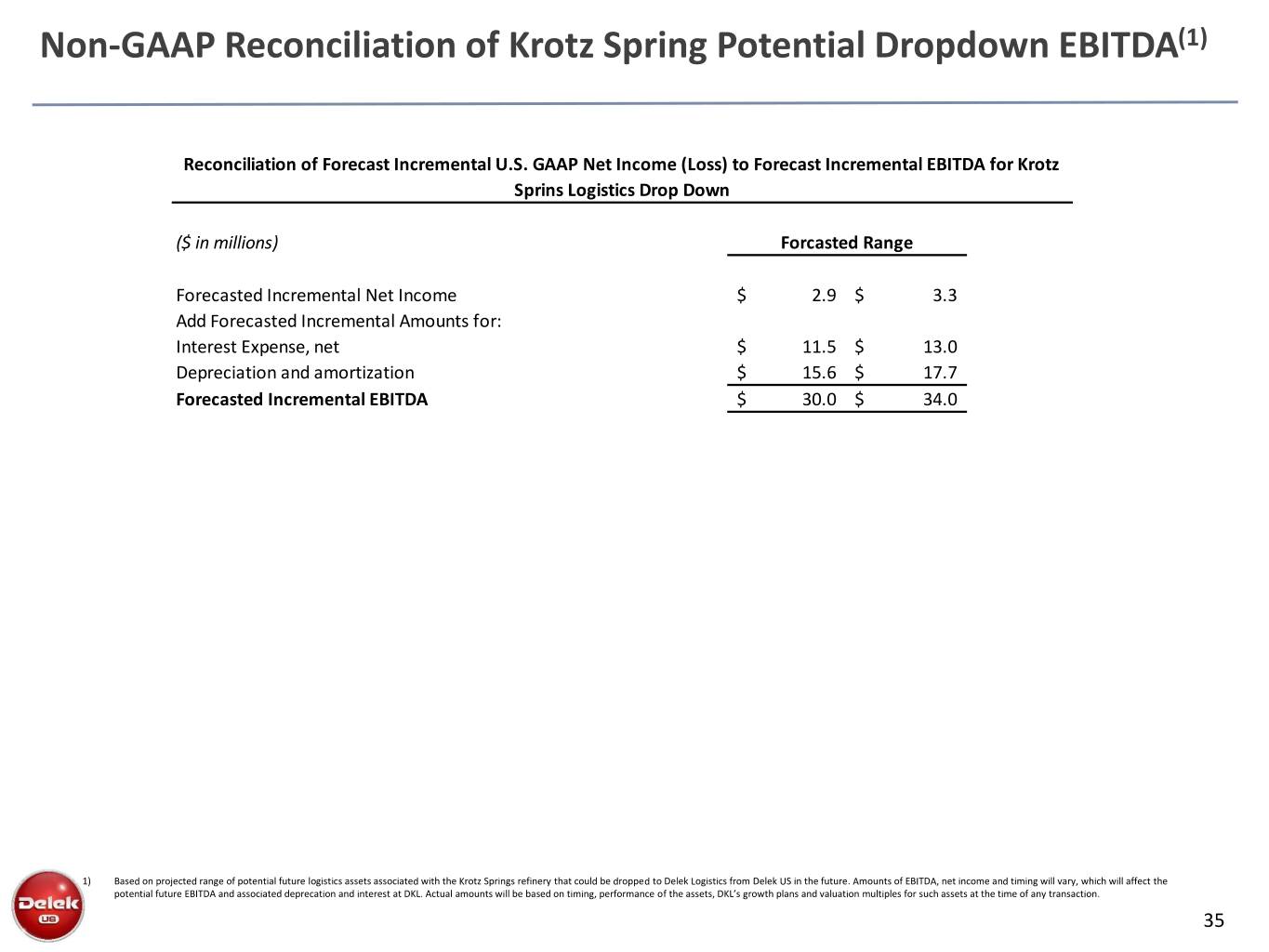

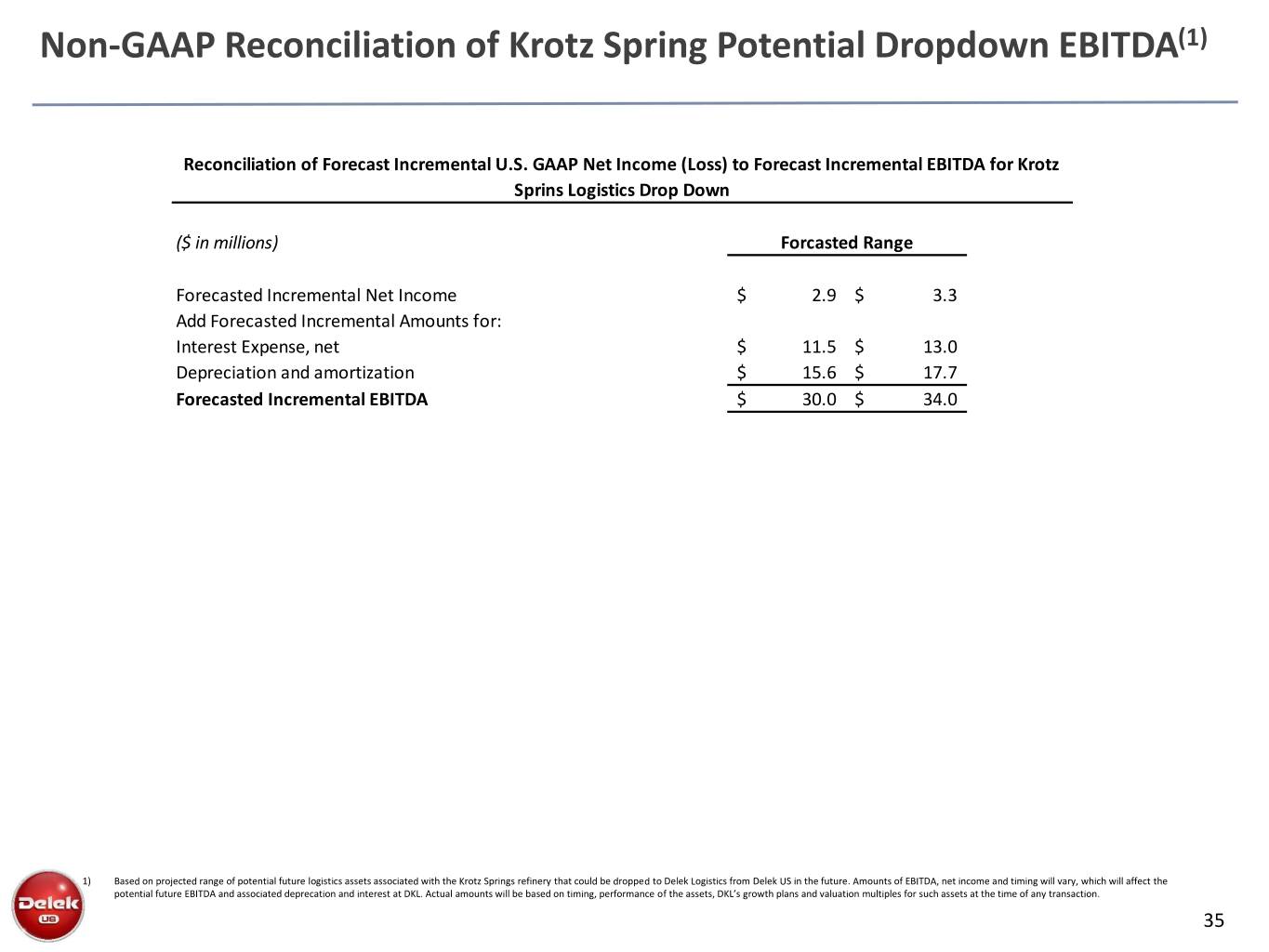

Non-GAAP Reconciliation of Krotz Spring Potential Dropdown EBITDA(1) Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA for Krotz Sprins Logistics Drop Down ($ in millions) Forcasted Range Forecasted Incremental Net Income $ 2.9 $ 3.3 Add Forecasted Incremental Amounts for: Interest Expense, net $ 11.5 $ 13.0 Depreciation and amortization $ 15.6 $ 17.7 Forecasted Incremental EBITDA $ 30.0 $ 34.0 1) Based on projected range of potential future logistics assets associated with the Krotz Springs refinery that could be dropped to Delek Logistics from Delek US in the future. Amounts of EBITDA, net income and timing will vary, which will affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts will be based on timing, performance of the assets, DKL’s growth plans and valuation multiples for such assets at the time of any transaction. 35

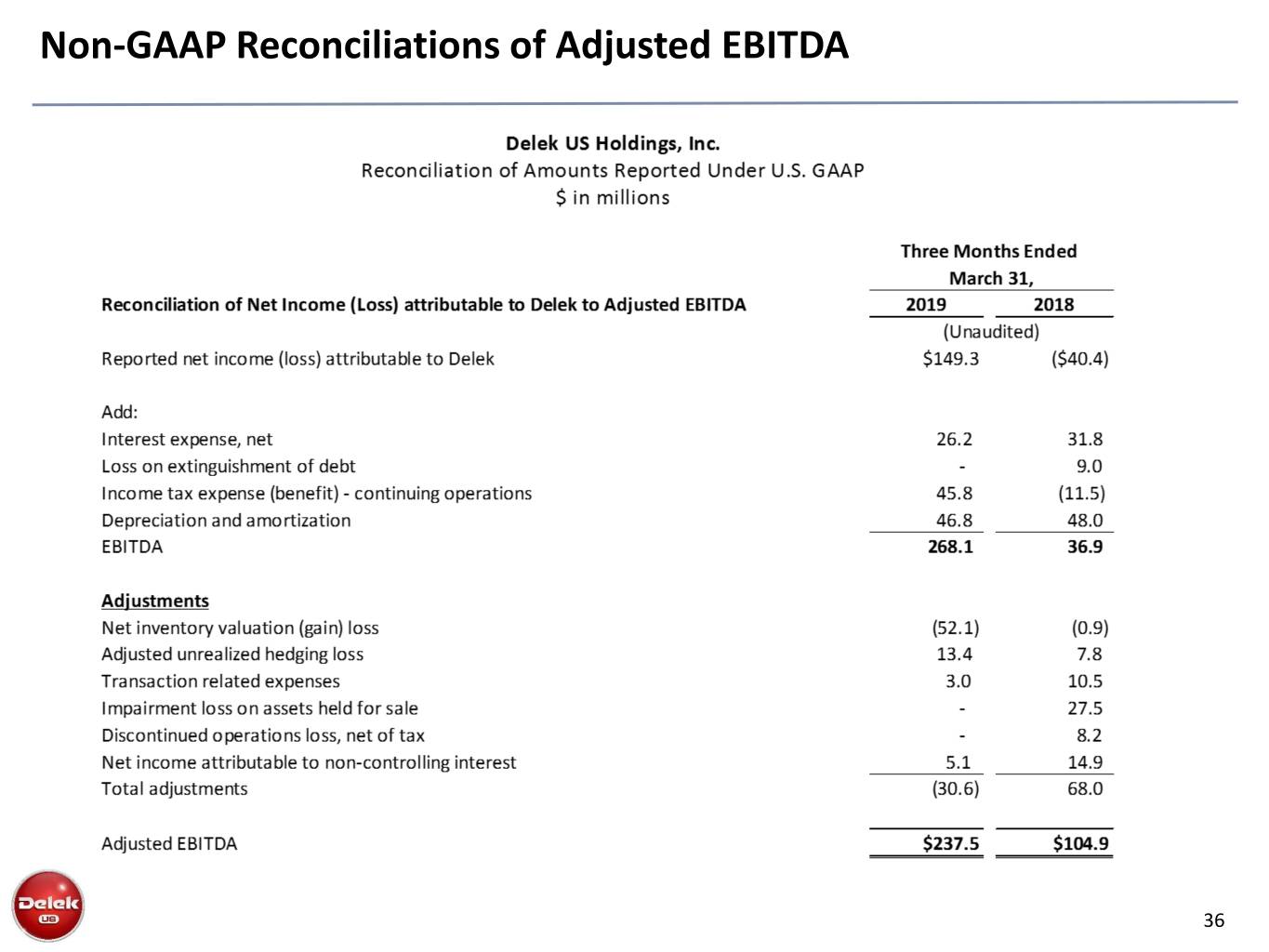

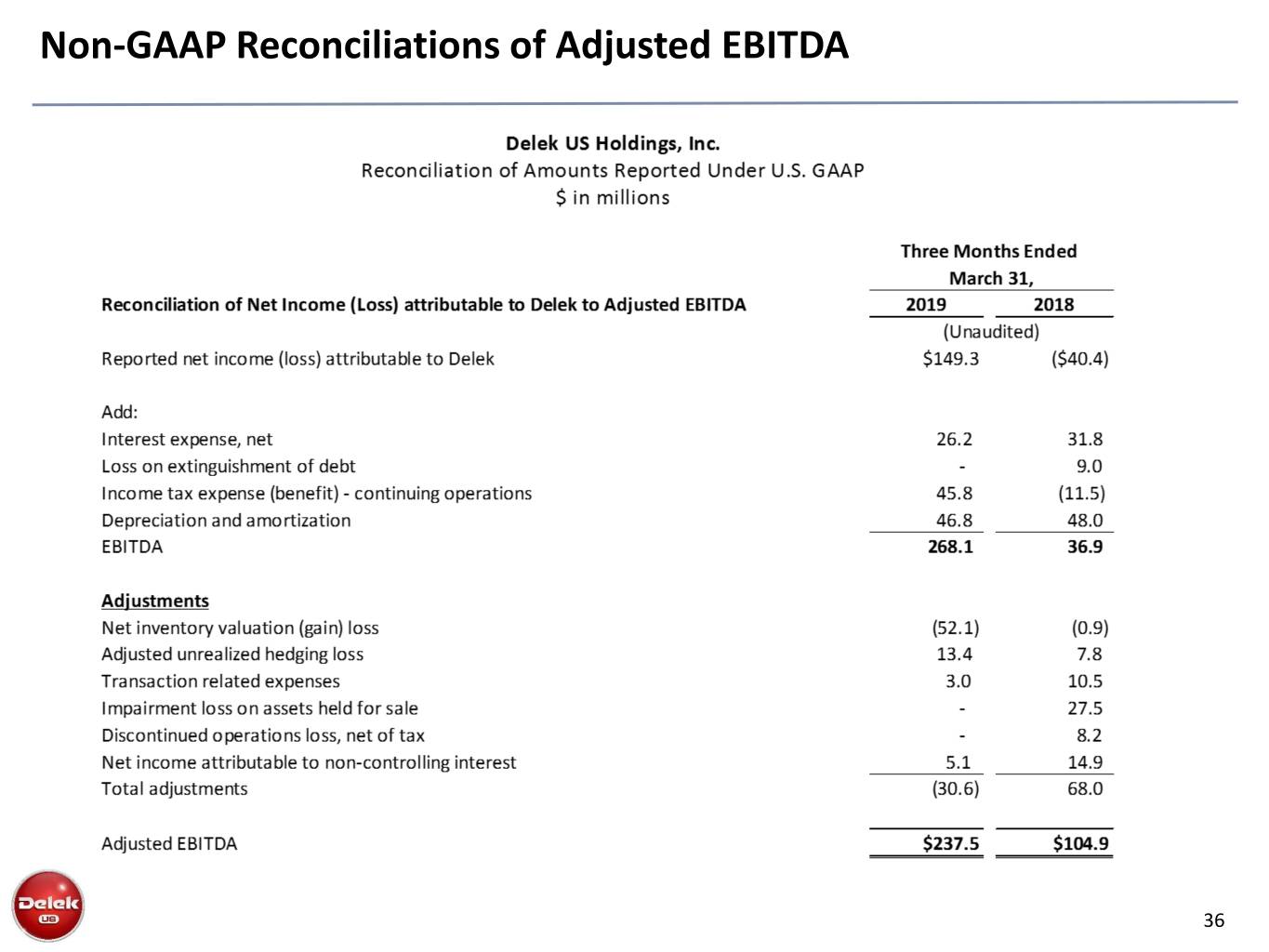

Non-GAAP Reconciliations of Adjusted EBITDA 36

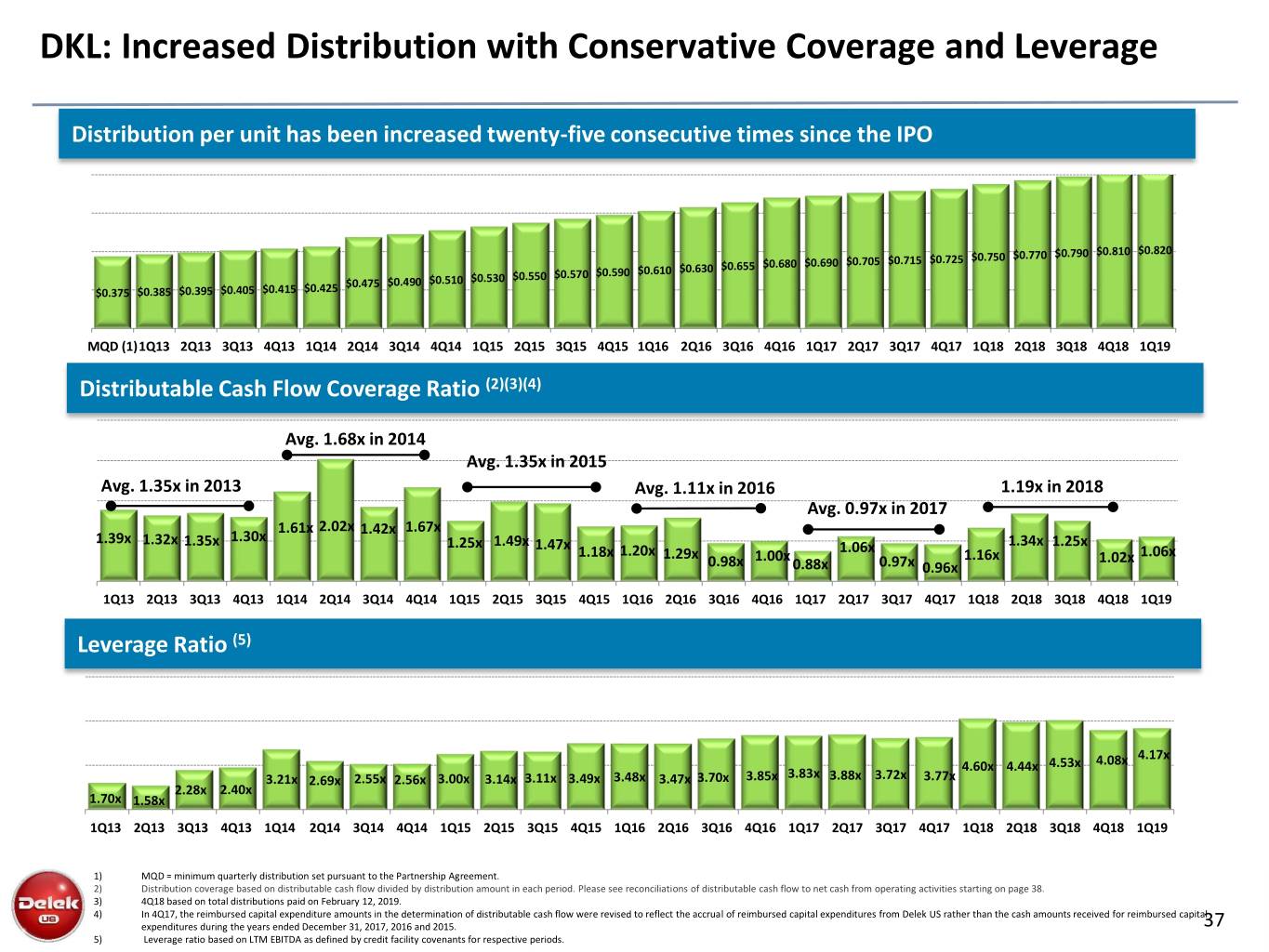

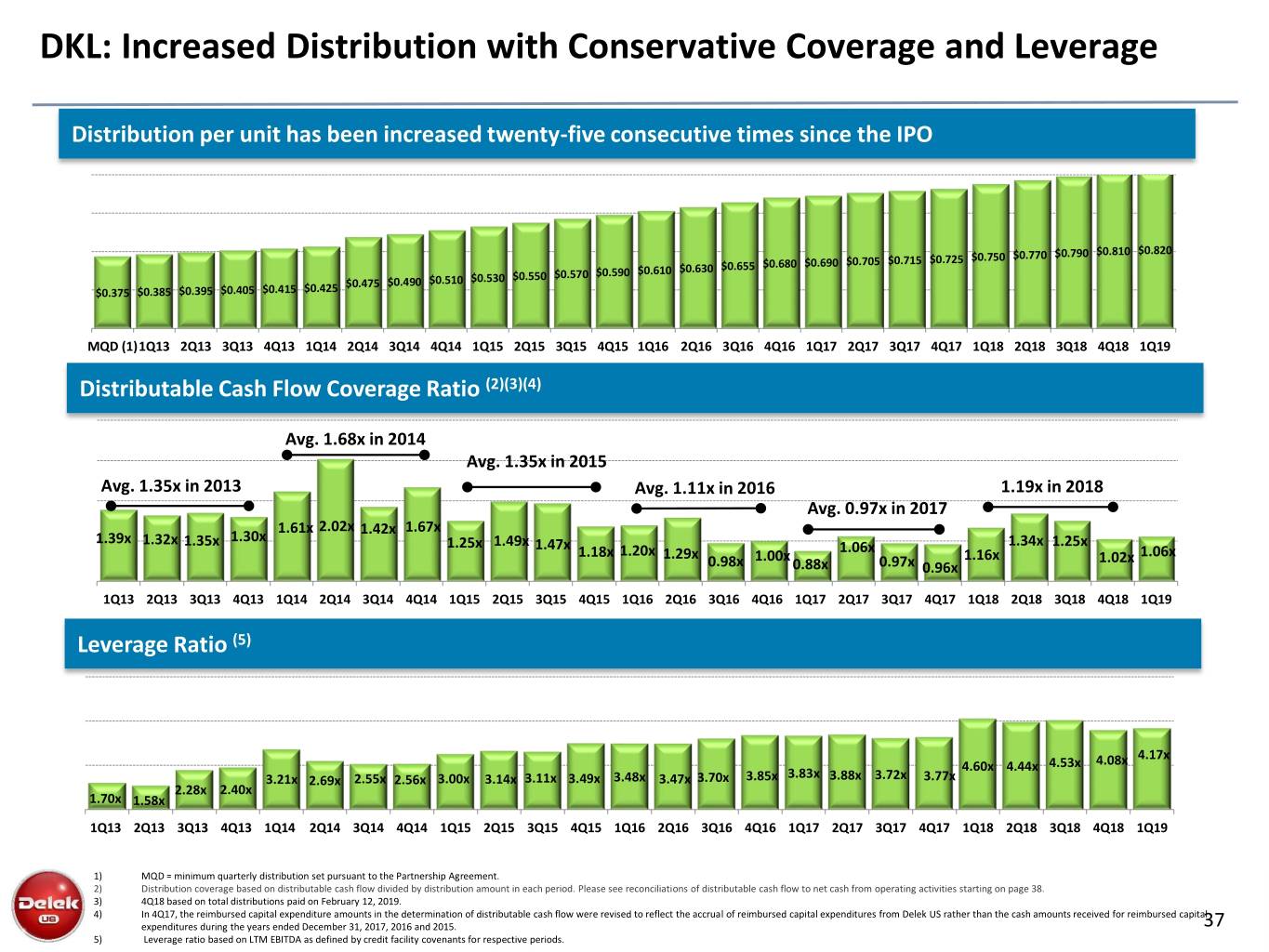

DKL: Increased Distribution with Conservative Coverage and Leverage Distribution per unit has been increased twenty-five consecutive times since the IPO $0.770 $0.790 $0.810 $0.820 $0.705 $0.715 $0.725 $0.750 $0.630 $0.655 $0.680 $0.690 $0.550 $0.570 $0.590 $0.610 $0.475 $0.490 $0.510 $0.530 $0.375 $0.385 $0.395 $0.405 $0.415 $0.425 MQD (1)1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 Distributable Cash Flow Coverage Ratio (2)(3)(4) Avg. 1.68x in 2014 Avg. 1.35x in 2015 Avg. 1.35x in 2013 Avg. 1.11x in 2016 1.19x in 2018 Avg. 0.97x in 2017 1.61x 2.02x 1.42x 1.67x 1.39x 1.30x 1.32x 1.35x 1.25x 1.49x 1.47x 1.06x 1.34x 1.25x 1.18x 1.20x 1.29x 1.00x 1.16x 1.02x 1.06x 0.98x 0.88x 0.97x 0.96x 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 Leverage Ratio (5) 4.17x 4.53x 4.08x 3.83x 4.60x 4.44x 3.21x 2.69x 2.55x 2.56x 3.00x 3.14x 3.11x 3.49x 3.48x 3.47x 3.70x 3.85x 3.88x 3.72x 3.77x 2.28x 2.40x 1.70x 1.58x 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 1) MQD = minimum quarterly distribution set pursuant to the Partnership Agreement. 2) Distribution coverage based on distributable cash flow divided by distribution amount in each period. Please see reconciliations of distributable cash flow to net cash from operating activities starting on page 38. 3) 4Q18 based on total distributions paid on February 12, 2019. 4) In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek US rather than the cash amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015. 37 5) Leverage ratio based on LTM EBITDA as defined by credit facility covenants for respective periods.

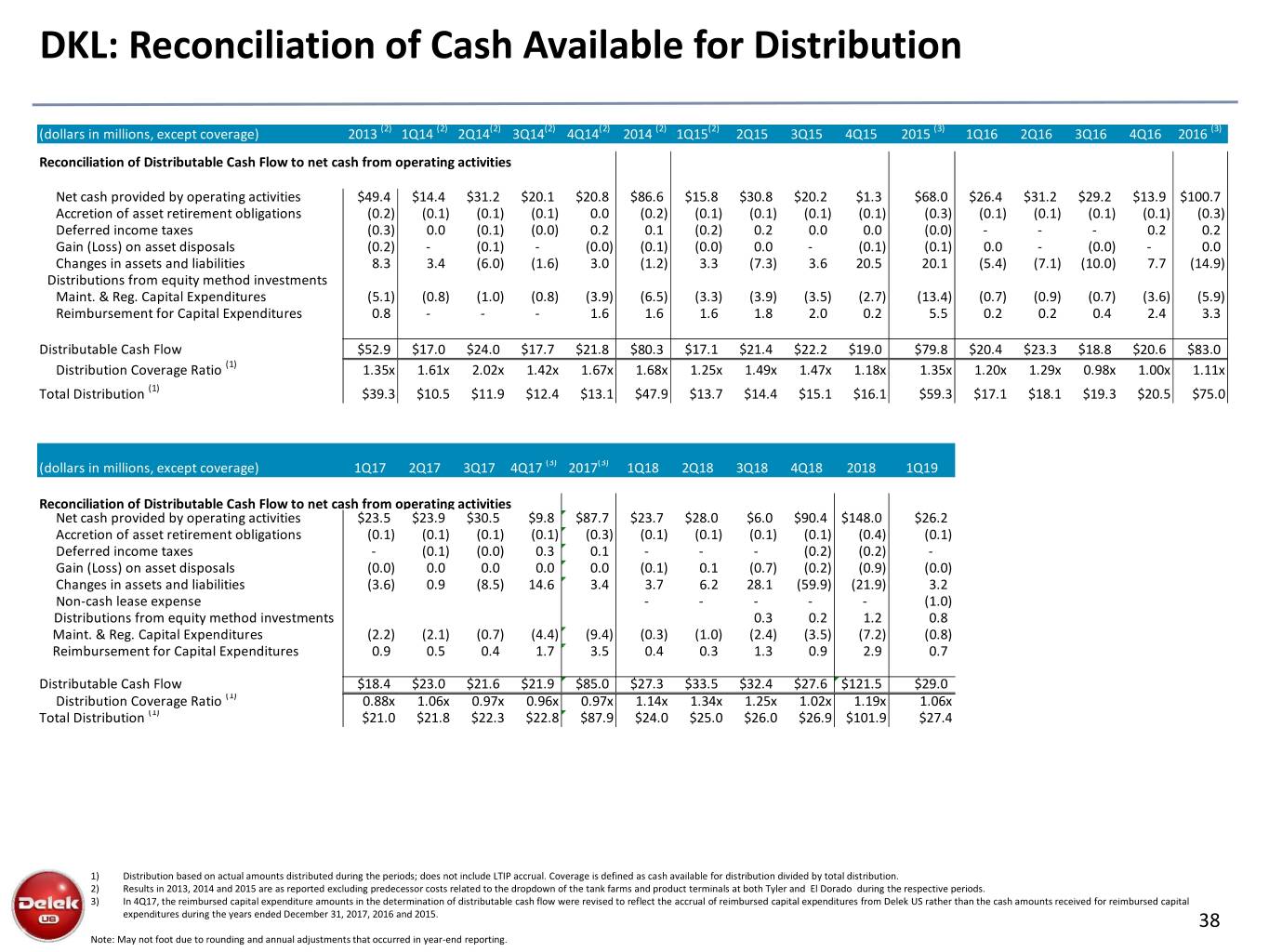

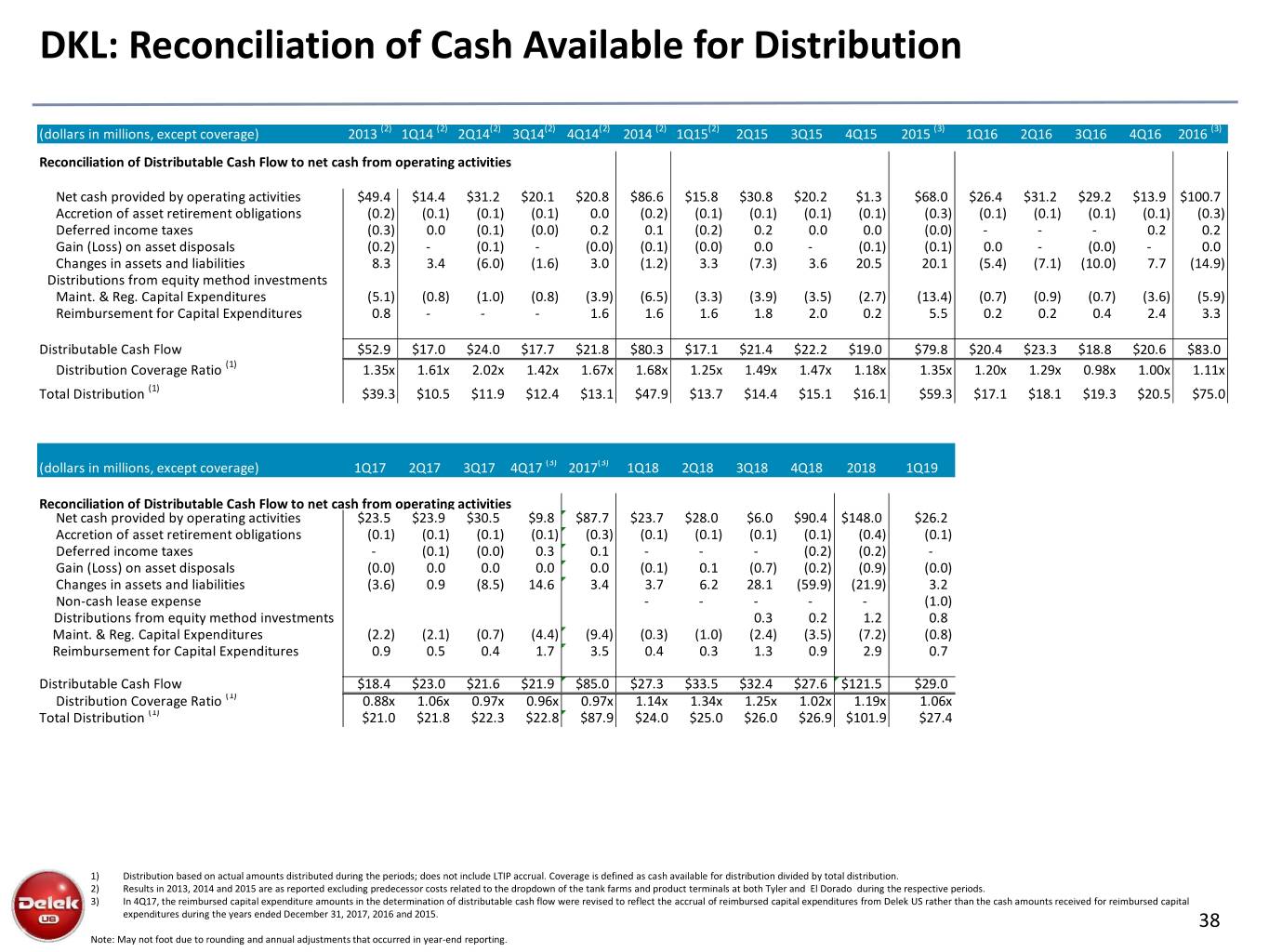

DKL: Reconciliation of Cash Available for Distribution (dollars in millions, except coverage) 2013 (2) 1Q14 (2) 2Q14(2) 3Q14(2) 4Q14(2) 2014 (2) 1Q15(2) 2Q15 3Q15 4Q15 2015 (3) 1Q16 2Q16 3Q16 4Q16 2016 (3) Reconciliation of Distributable Cash Flow to net cash from operating activities Net cash provided by operating activities $49.4 $14.4 $31.2 $20.1 $20.8 $86.6 $15.8 $30.8 $20.2 $1.3 $68.0 $26.4 $31.2 $29.2 $13.9 $100.7 Accretion of asset retirement obligations (0.2) (0.1) (0.1) (0.1) 0.0 (0.2) (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.3) Deferred income taxes (0.3) 0.0 (0.1) (0.0) 0.2 0.1 (0.2) 0.2 0.0 0.0 (0.0) - - - 0.2 0.2 Gain (Loss) on asset disposals (0.2) - (0.1) - (0.0) (0.1) (0.0) 0.0 - (0.1) (0.1) 0.0 - (0.0) - 0.0 Changes in assets and liabilities 8.3 3.4 (6.0) (1.6) 3.0 (1.2) 3.3 (7.3) 3.6 20.5 20.1 (5.4) (7.1) (10.0) 7.7 (14.9) Distributions from equity method investments Maint. & Reg. Capital Expenditures (5.1) (0.8) (1.0) (0.8) (3.9) (6.5) (3.3) (3.9) (3.5) (2.7) (13.4) (0.7) (0.9) (0.7) (3.6) (5.9) Reimbursement for Capital Expenditures 0.8 - - - 1.6 1.6 1.6 1.8 2.0 0.2 5.5 0.2 0.2 0.4 2.4 3.3 Distributable Cash Flow $52.9 $17.0 $24.0 $17.7 $21.8 $80.3 $17.1 $21.4 $22.2 $19.0 $79.8 $20.4 $23.3 $18.8 $20.6 $83.0 Distribution Coverage Ratio (1) 1.35x 1.61x 2.02x 1.42x 1.67x 1.68x 1.25x 1.49x 1.47x 1.18x 1.35x 1.20x 1.29x 0.98x 1.00x 1.11x Total Distribution (1) $39.3 $10.5 $11.9 $12.4 $13.1 $47.9 $13.7 $14.4 $15.1 $16.1 $59.3 $17.1 $18.1 $19.3 $20.5 $75.0 (dollars in millions, except coverage) 1Q17 2Q17 3Q17 4Q17 (3) 2017(3) 1Q18 2Q18 3Q18 4Q18 2018 1Q19 Reconciliation of Distributable Cash Flow to net cash from operating activities Net cash provided by operating activities $23.5 $23.9 $30.5 $9.8 $87.7 $23.7 $28.0 $6.0 $90.4 $148.0 $26.2 Accretion of asset retirement obligations (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.4) (0.1) Deferred income taxes - (0.1) (0.0) 0.3 0.1 - - - (0.2) (0.2) - Gain (Loss) on asset disposals (0.0) 0.0 0.0 0.0 0.0 (0.1) 0.1 (0.7) (0.2) (0.9) (0.0) Changes in assets and liabilities (3.6) 0.9 (8.5) 14.6 3.4 3.7 6.2 28.1 (59.9) (21.9) 3.2 Non-cash lease expense - - - - - (1.0) Distributions from equity method investments 0.3 0.2 1.2 0.8 Maint. & Reg. Capital Expenditures (2.2) (2.1) (0.7) (4.4) (9.4) (0.3) (1.0) (2.4) (3.5) (7.2) (0.8) Reimbursement for Capital Expenditures 0.9 0.5 0.4 1.7 3.5 0.4 0.3 1.3 0.9 2.9 0.7 Distributable Cash Flow $18.4 $23.0 $21.6 $21.9 $85.0 $27.3 $33.5 $32.4 $27.6 $121.5 $29.0 Distribution Coverage Ratio (1) 0.88x 1.06x 0.97x 0.96x 0.97x 1.14x 1.34x 1.25x 1.02x 1.19x 1.06x Total Distribution (1) $21.0 $21.8 $22.3 $22.8 $87.9 $24.0 $25.0 $26.0 $26.9 $101.9 $27.4 1) Distribution based on actual amounts distributed during the periods; does not include LTIP accrual. Coverage is defined as cash available for distribution divided by total distribution. 2) Results in 2013, 2014 and 2015 are as reported excluding predecessor costs related to the dropdown of the tank farms and product terminals at both Tyler and El Dorado during the respective periods. 3) In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek US rather than the cash amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015. 38 Note: May not foot due to rounding and annual adjustments that occurred in year-end reporting.

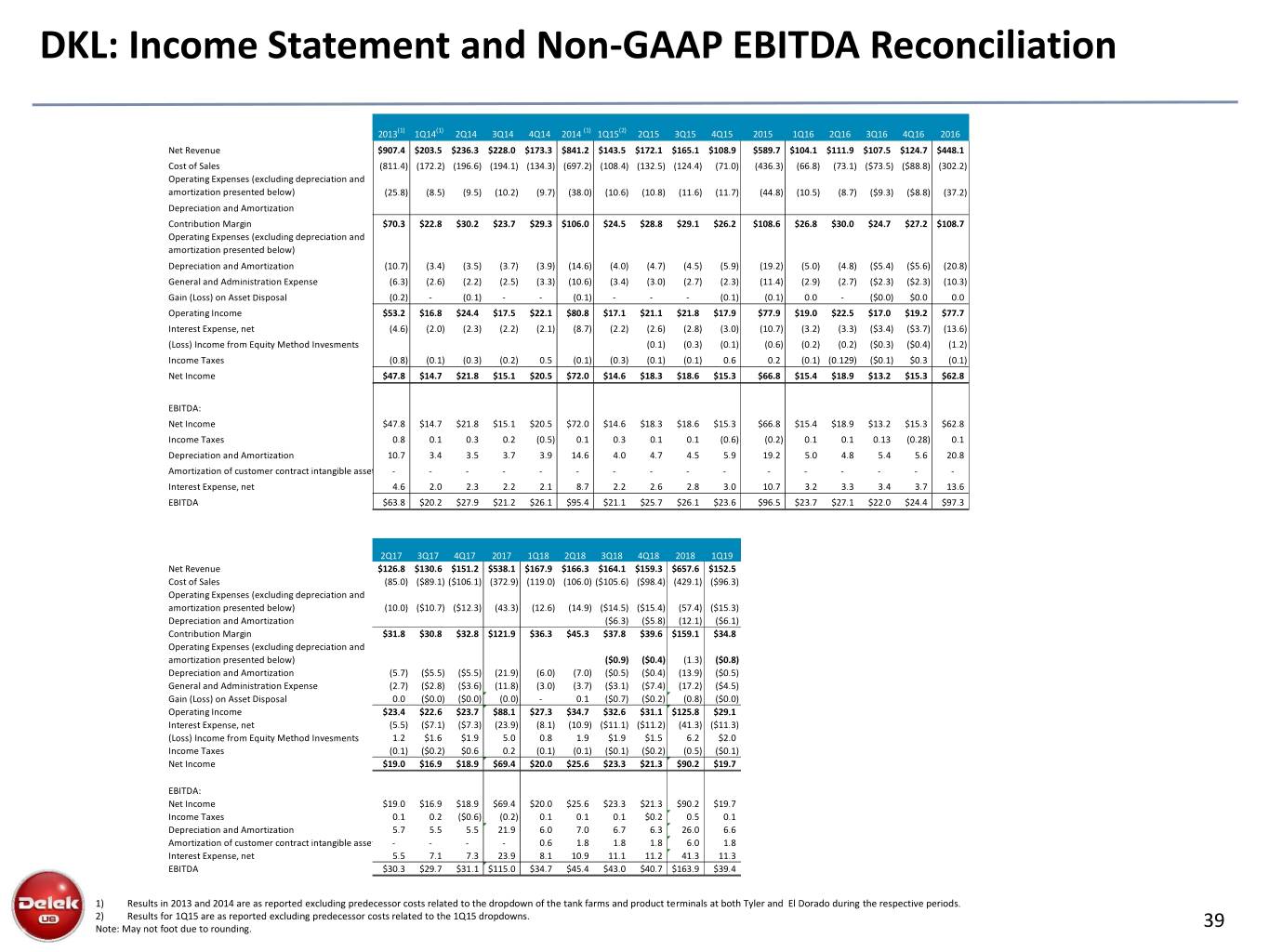

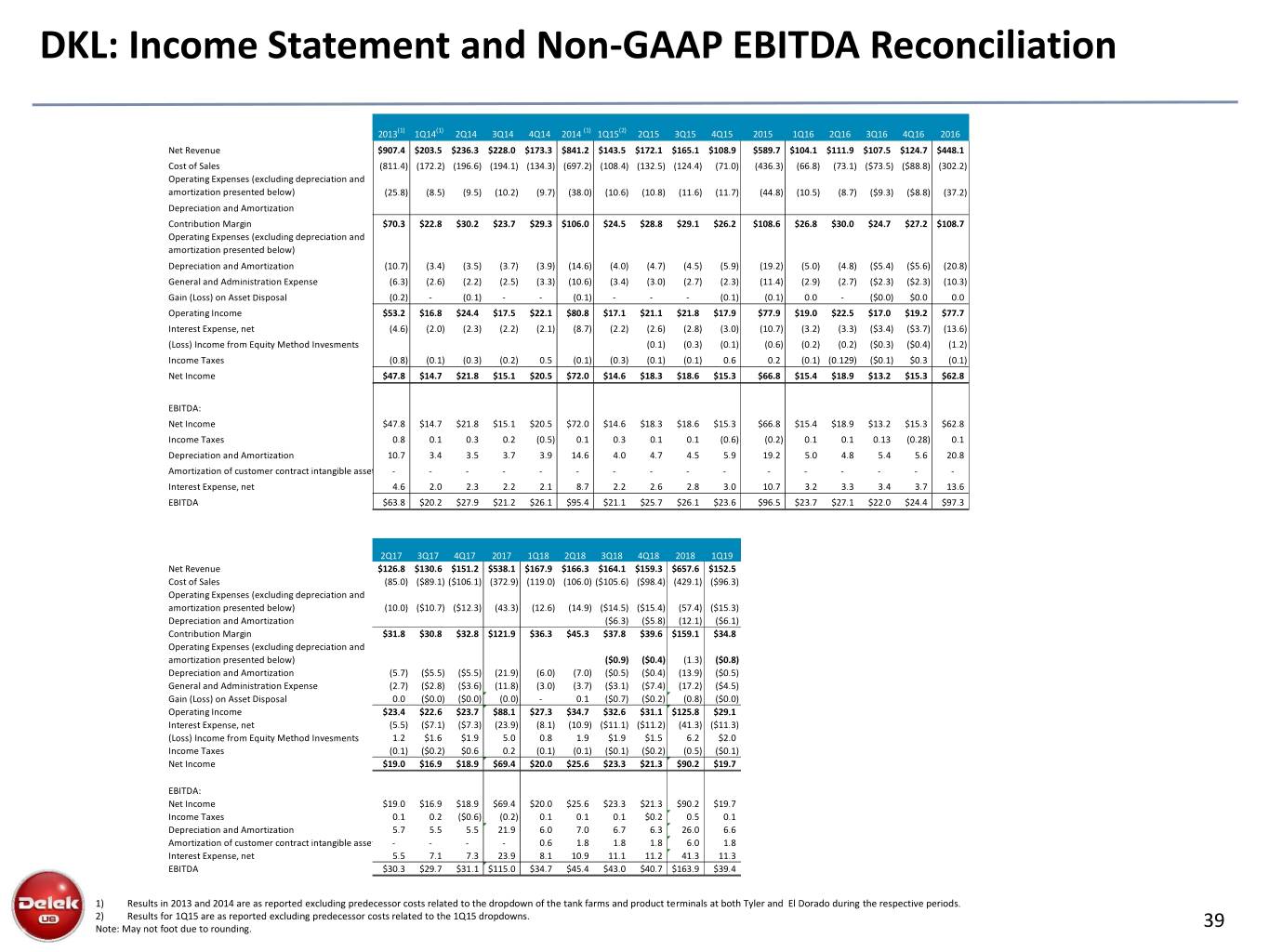

DKL: Income Statement and Non-GAAP EBITDA Reconciliation 2013(1) 1Q14(1) 2Q14 3Q14 4Q14 2014 (1) 1Q15(2) 2Q15 3Q15 4Q15 2015 1Q16 2Q16 3Q16 4Q16 2016 Net Revenue $907.4 $203.5 $236.3 $228.0 $173.3 $841.2 $143.5 $172.1 $165.1 $108.9 $589.7 $104.1 $111.9 $107.5 $124.7 $448.1 Cost of Sales (811.4) (172.2) (196.6) (194.1) (134.3) (697.2) (108.4) (132.5) (124.4) (71.0) (436.3) (66.8) (73.1) ($73.5) ($88.8) (302.2) Operating Expenses (excluding depreciation and amortization presented below) (25.8) (8.5) (9.5) (10.2) (9.7) (38.0) (10.6) (10.8) (11.6) (11.7) (44.8) (10.5) (8.7) ($9.3) ($8.8) (37.2) Depreciation and Amortization Contribution Margin $70.3 $22.8 $30.2 $23.7 $29.3 $106.0 $24.5 $28.8 $29.1 $26.2 $108.6 $26.8 $30.0 $24.7 $27.2 $108.7 Operating Expenses (excluding depreciation and amortization presented below) Depreciation and Amortization (10.7) (3.4) (3.5) (3.7) (3.9) (14.6) (4.0) (4.7) (4.5) (5.9) (19.2) (5.0) (4.8) ($5.4) ($5.6) (20.8) General and Administration Expense (6.3) (2.6) (2.2) (2.5) (3.3) (10.6) (3.4) (3.0) (2.7) (2.3) (11.4) (2.9) (2.7) ($2.3) ($2.3) (10.3) Gain (Loss) on Asset Disposal (0.2) - (0.1) - - (0.1) - - - (0.1) (0.1) 0.0 - ($0.0) $0.0 0.0 Operating Income $53.2 $16.8 $24.4 $17.5 $22.1 $80.8 $17.1 $21.1 $21.8 $17.9 $77.9 $19.0 $22.5 $17.0 $19.2 $77.7 Interest Expense, net (4.6) (2.0) (2.3) (2.2) (2.1) (8.7) (2.2) (2.6) (2.8) (3.0) (10.7) (3.2) (3.3) ($3.4) ($3.7) (13.6) (Loss) Income from Equity Method Invesments (0.1) (0.3) (0.1) (0.6) (0.2) (0.2) ($0.3) ($0.4) (1.2) Income Taxes (0.8) (0.1) (0.3) (0.2) 0.5 (0.1) (0.3) (0.1) (0.1) 0.6 0.2 (0.1) (0.129) ($0.1) $0.3 (0.1) Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 EBITDA: Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 Income Taxes 0.8 0.1 0.3 0.2 (0.5) 0.1 0.3 0.1 0.1 (0.6) (0.2) 0.1 0.1 0.13 (0.28) 0.1 Depreciation and Amortization 10.7 3.4 3.5 3.7 3.9 14.6 4.0 4.7 4.5 5.9 19.2 5.0 4.8 5.4 5.6 20.8 Amortization of customer contract intangible assets - - - - - - - - - - - - - - - - Interest Expense, net 4.6 2.0 2.3 2.2 2.1 8.7 2.2 2.6 2.8 3.0 10.7 3.2 3.3 3.4 3.7 13.6 EBITDA $63.8 $20.2 $27.9 $21.2 $26.1 $95.4 $21.1 $25.7 $26.1 $23.6 $96.5 $23.7 $27.1 $22.0 $24.4 $97.3 2Q17 3Q17 4Q17 2017 1Q18 2Q18 3Q18 4Q18 2018 1Q19 Net Revenue $126.8 $130.6 $151.2 $538.1 $167.9 $166.3 $164.1 $159.3 $657.6 $152.5 Cost of Sales (85.0) ($89.1) ($106.1) (372.9) (119.0) (106.0) ($105.6) ($98.4) (429.1) ($96.3) Operating Expenses (excluding depreciation and amortization presented below) (10.0) ($10.7) ($12.3) (43.3) (12.6) (14.9) ($14.5) ($15.4) (57.4) ($15.3) Depreciation and Amortization ($6.3) ($5.8) (12.1) ($6.1) Contribution Margin $31.8 $30.8 $32.8 $121.9 $36.3 $45.3 $37.8 $39.6 $159.1 $34.8 Operating Expenses (excluding depreciation and amortization presented below) ($0.9) ($0.4) (1.3) ($0.8) Depreciation and Amortization (5.7) ($5.5) ($5.5) (21.9) (6.0) (7.0) ($0.5) ($0.4) (13.9) ($0.5) General and Administration Expense (2.7) ($2.8) ($3.6) (11.8) (3.0) (3.7) ($3.1) ($7.4) (17.2) ($4.5) Gain (Loss) on Asset Disposal 0.0 ($0.0) ($0.0) (0.0) - 0.1 ($0.7) ($0.2) (0.8) ($0.0) Operating Income $23.4 $22.6 $23.7 $88.1 $27.3 $34.7 $32.6 $31.1 $125.8 $29.1 Interest Expense, net (5.5) ($7.1) ($7.3) (23.9) (8.1) (10.9) ($11.1) ($11.2) (41.3) ($11.3) (Loss) Income from Equity Method Invesments 1.2 $1.6 $1.9 5.0 0.8 1.9 $1.9 $1.5 6.2 $2.0 Income Taxes (0.1) ($0.2) $0.6 0.2 (0.1) (0.1) ($0.1) ($0.2) (0.5) ($0.1) Net Income $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 $21.3 $90.2 $19.7 EBITDA: Net Income $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 $21.3 $90.2 $19.7 Income Taxes 0.1 0.2 ($0.6) (0.2) 0.1 0.1 0.1 $0.2 0.5 0.1 Depreciation and Amortization 5.7 5.5 5.5 21.9 6.0 7.0 6.7 6.3 26.0 6.6 Amortization of customer contract intangible assets - - - - 0.6 1.8 1.8 1.8 6.0 1.8 Interest Expense, net 5.5 7.1 7.3 23.9 8.1 10.9 11.1 11.2 41.3 11.3 EBITDA $30.3 $29.7 $31.1 $115.0 $34.7 $45.4 $43.0 $40.7 $163.9 $39.4 1) Results in 2013 and 2014 are as reported excluding predecessor costs related to the dropdown of the tank farms and product terminals at both Tyler and El Dorado during the respective periods. 2) Results for 1Q15 are as reported excluding predecessor costs related to the 1Q15 dropdowns. Note: May not foot due to rounding. 39

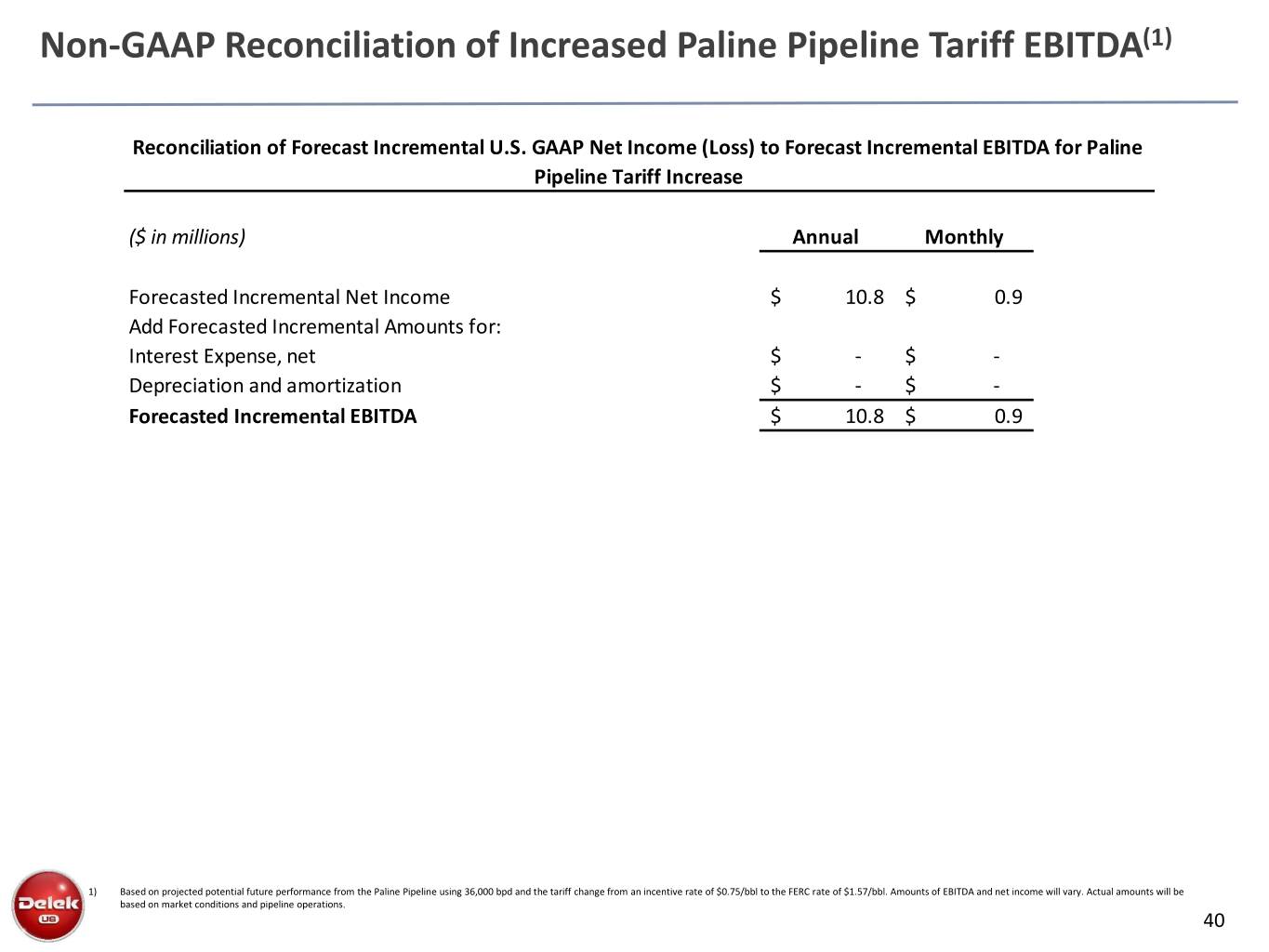

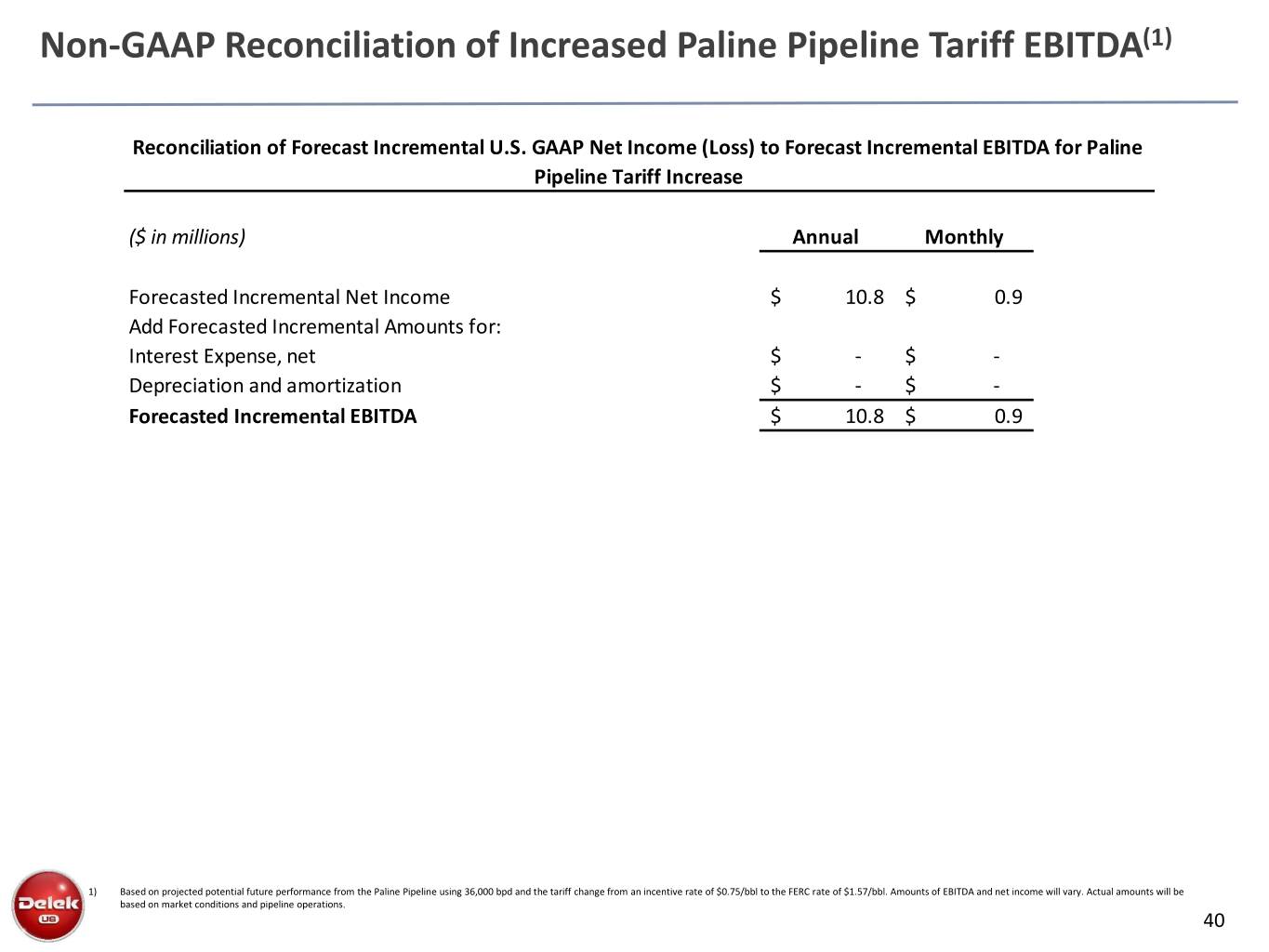

Non-GAAP Reconciliation of Increased Paline Pipeline Tariff EBITDA(1) Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA for Paline Pipeline Tariff Increase ($ in millions) Annual Monthly Forecasted Incremental Net Income $ 10.8 $ 0.9 Add Forecasted Incremental Amounts for: Interest Expense, net $ - $ - Depreciation and amortization $ - $ - Forecasted Incremental EBITDA $ 10.8 $ 0.9 1) Based on projected potential future performance from the Paline Pipeline using 36,000 bpd and the tariff change from an incentive rate of $0.75/bbl to the FERC rate of $1.57/bbl. Amounts of EBITDA and net income will vary. Actual amounts will be based on market conditions and pipeline operations. 40

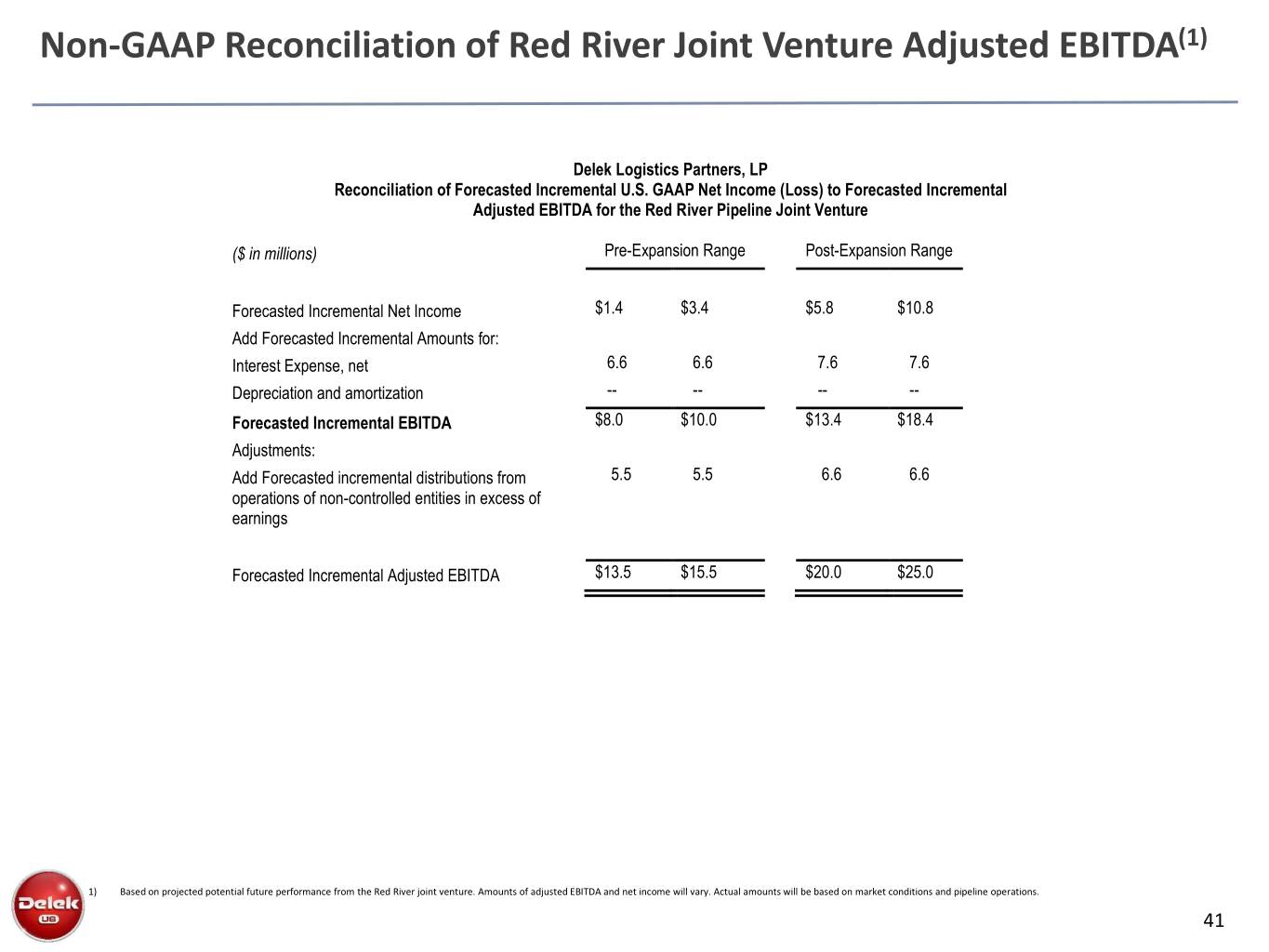

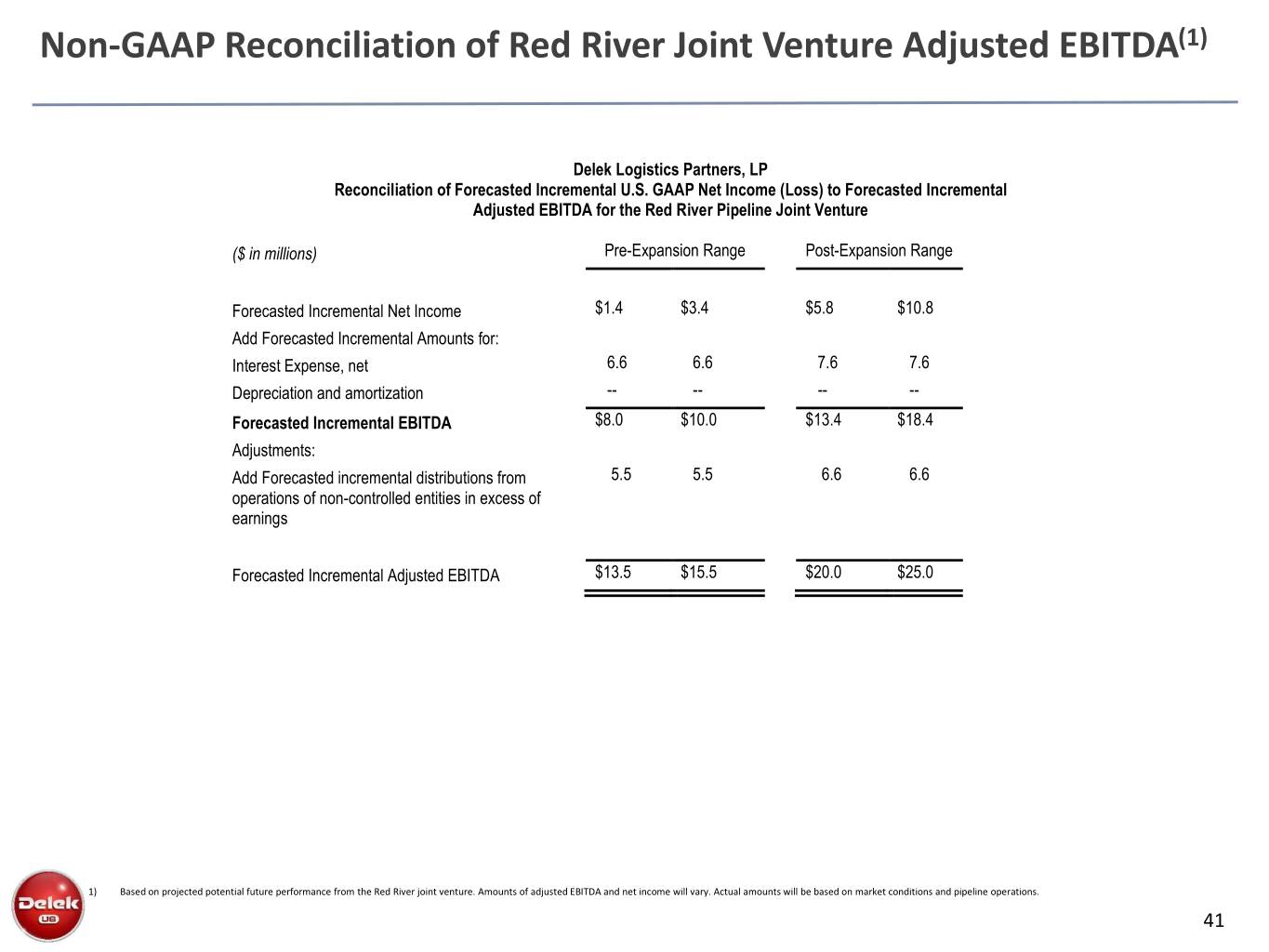

Non-GAAP Reconciliation of Red River Joint Venture Adjusted EBITDA(1) Delek Logistics Partners, LP Reconciliation of Forecasted Incremental U.S. GAAP Net Income (Loss) to Forecasted Incremental Adjusted EBITDA for the Red River Pipeline Joint Venture ($ in millions) Pre-Expansion Range Post-Expansion Range Forecasted Incremental Net Income $1.4 $3.4 $5.8 $10.8 Add Forecasted Incremental Amounts for: Interest Expense, net 6.6 6.6 7.6 7.6 Depreciation and amortization -- -- -- -- Forecasted Incremental EBITDA $8.0 $10.0 $13.4 $18.4 Adjustments: Add Forecasted incremental distributions from 5.5 5.5 6.6 6.6 operations of non-controlled entities in excess of earnings Forecasted Incremental Adjusted EBITDA $13.5 $15.5 $20.0 $25.0 1) Based on projected potential future performance from the Red River joint venture. Amounts of adjusted EBITDA and net income will vary. Actual amounts will be based on market conditions and pipeline operations. 41

Investor Relations Contact: Assi Ginzburg Keith Johnson Executive Vice President, CFO Vice President of Investor Relations 615-224-1158 615-435-1366