Exhibit 99.1 Delek US Holdings, Inc. Investor Presentation October 2019

Disclaimers Forward Looking Statements: Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral and written presentations contain forward-looking statements within the meaning of federal securities laws that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. These forward-looking statements include, but are not limited to, the statements regarding the following: financial and operating guidance for future and uncompleted financial periods; future crude slates; financial strength and flexibility; potential for and projections of growth; return of cash to shareholders, stock repurchases and the payment of distributions and dividends, including the amount and timing thereof; crude oil throughput and optionality; crude oil market trends, including production, quality, pricing, demand, imports, exports and transportation costs; light production from shale plays and Permian growth; differentials including increases, trends and the impact thereof on crack spreads and refineries; takeaway capacity, and projects related thereto; refinery complexity, configurations, utilization, crude oil slate flexibility, capacities, equipment limits and margins; the ability to add flexibility and increase margin potential at the Krotz Springs refinery; improved product netbacks; the performance of our joint venture investments, including Red River and Wink to Webster, and the benefits, flexibility, returns and EBITDA or adjusted EBITDA therefrom; our ability to execute on the Big Spring Gathering System and the benefits, flexibility, returns and EBITDA or adjusted EBITDA therefrom; the performance and expected EBITDA from the Krotz Springs Alkylation unit; midstream growth and the benefits, returns and EBITDA or adjusted EBITDA therefrom; the potential for, and estimates of cost savings and other benefits from, acquisitions, divestitures, dropdowns and financing activities; divestiture of underperforming stores and other non-core assets and matters pertaining thereto; the attainment of certain regulatory benefits; retail growth and the opportunities and value derived therefrom; long-term value creation from capital allocation; execution of strategic initiatives and the benefits therefrom; and access to crude oil and the benefits therefrom. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward-looking statements. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, pricing, production and transportation capacity; gains and losses from derivative instruments; management's ability to execute its strategy of growth, including through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance projects; the ability of Wink to Webster joint venture to construct the long-haul pipeline; the ability of the Red River joint venture to expand the Red River pipeline; the ability to grow the Big Spring Gathering System; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements. Non-GAAP Disclosures: Delek US and Delek Logistics believe that the presentation of earnings before interest, taxes, depreciation and amortization ("EBITDA"), adjusted EBITDA, free cash flow, distributable cash flow and distribution coverage ratio provide useful information to investors in assessing their financial condition, results of operations and cash flow their business is generating. Distributable cash flow is calculated as net cash flow from operating activities plus or minus changes in assets and liabilities, less maintenance capital expenditures net of reimbursements and other adjustments not expected to settle in cash. EBITDA, adjusted EBITDA, free cash flow, distributable cash flow and distribution coverage ratio should not be considered as alternatives to net income, operating income, cash from operations or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, adjusted EBITDA, free cash flow, distributable cash flow and distribution coverage ratio have important limitations as analytical tools because they exclude some, but not all, items that affect net income. Additionally, because EBITDA, adjusted EBITDA, free cash flow, distributable cash flow and distribution coverage ratio may be defined differently by other companies in its industry, Delek US' and Delek Logistics’ definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see reconciliations of EBITDA, adjusted EBITDA, distributable cash flow and distribution coverage ratio to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP in the appendix. 2

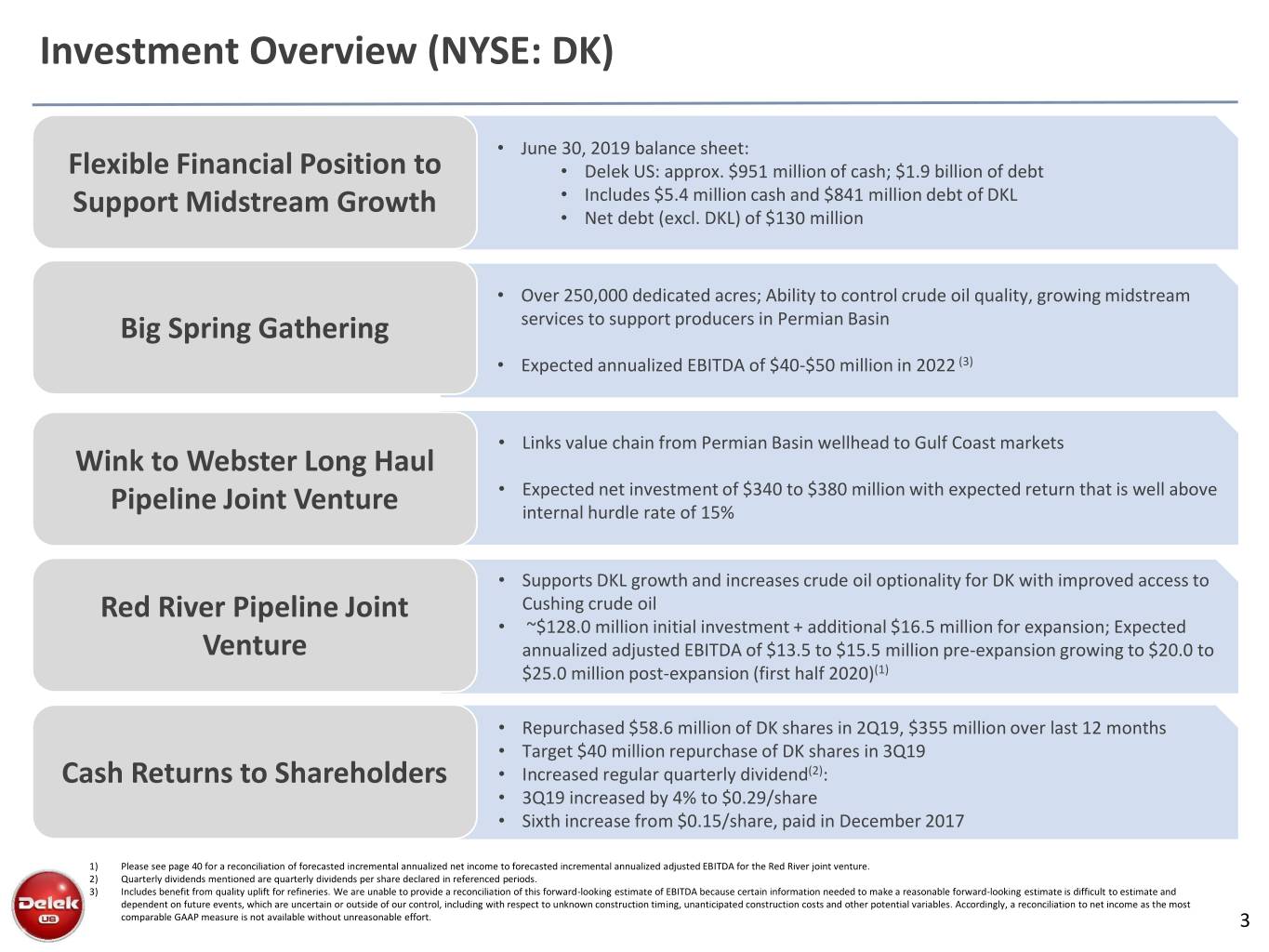

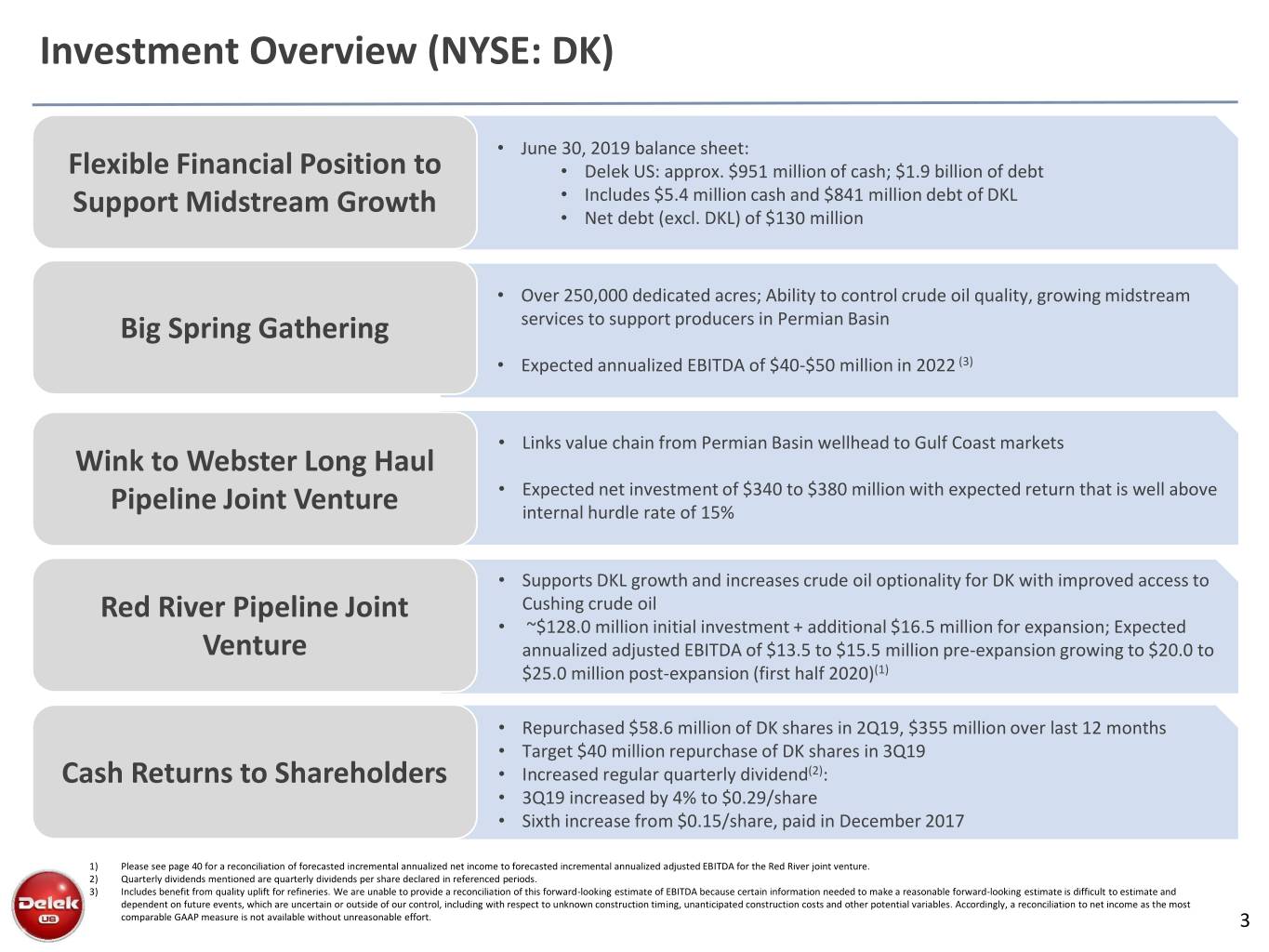

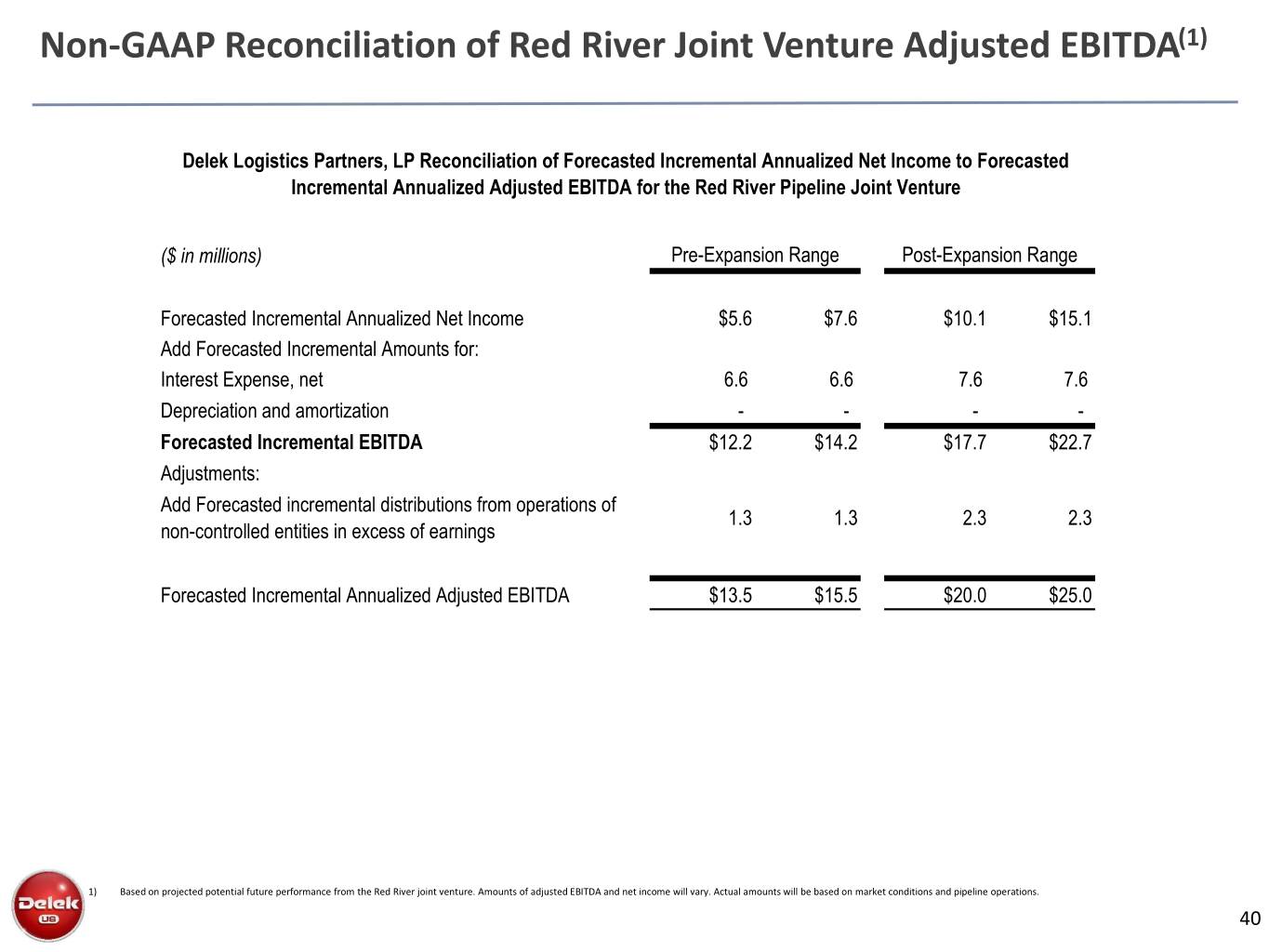

Investment Overview (NYSE: DK) • June 30, 2019 balance sheet: Flexible Financial Position to • Delek US: approx. $951 million of cash; $1.9 billion of debt • Includes $5.4 million cash and $841 million debt of DKL Support Midstream Growth • Net debt (excl. DKL) of $130 million • Over 250,000 dedicated acres; Ability to control crude oil quality, growing midstream Big Spring Gathering services to support producers in Permian Basin • Expected annualized EBITDA of $40-$50 million in 2022 (3) • Links value chain from Permian Basin wellhead to Gulf Coast markets Wink to Webster Long Haul • Expected net investment of $340 to $380 million with expected return that is well above Pipeline Joint Venture internal hurdle rate of 15% • Supports DKL growth and increases crude oil optionality for DK with improved access to Red River Pipeline Joint Cushing crude oil • ~$128.0 million initial investment + additional $16.5 million for expansion; Expected Venture annualized adjusted EBITDA of $13.5 to $15.5 million pre-expansion growing to $20.0 to $25.0 million post-expansion (first half 2020)(1) • Repurchased $58.6 million of DK shares in 2Q19, $355 million over last 12 months • Target $40 million repurchase of DK shares in 3Q19 Cash Returns to Shareholders • Increased regular quarterly dividend(2): • 3Q19 increased by 4% to $0.29/share • Sixth increase from $0.15/share, paid in December 2017 1) Please see page 40 for a reconciliation of forecasted incremental annualized net income to forecasted incremental annualized adjusted EBITDA for the Red River joint venture. 2) Quarterly dividends mentioned are quarterly dividends per share declared in referenced periods. 3) Includes benefit from quality uplift for refineries. We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. 3

Integrated Company with Asset Diversity and Scale Strategically located assets with growing crude oil optionality Access to Cushing; 35,000 bpd Source 207,000 bpd from Permian increasing to 100,000 bpd first half Basin 2020 • Growing gathering system • Wink to Webster JV Crude oil Pipeline CADDO RIO Refining (1) Logistics Asphalt Retail Renewables • 302,000 bpd in total • 10 terminals 6 asphalt terminals located • Approximately 263 Approx. 23m gallons • El Dorado, AR • Approximately 1,320 in: stores Biodiesel production • Tyler, TX miles of pipeline • El Dorado, AR • Southwest US locations capacity: • Big Spring, TX • 11.0 million bbls of • Muskogee, OK • Largest licensee of 7- • Crossett, AR • Krotz Springs, LA storage capacity • Memphis, TN Eleven stores in the US • Cleburne, TX • Crude oil supply: 262,000 • West Texas wholesale • Big Spring & Henderson, • West Texas wholesale bpd WTI linked currently • JV crude oil pipelines: TX marketing business • Increasing crude oil RIO / Caddo/ Red River • Richmond Beach, WA supply optionality • Own 63.4%, incl. 2% GP, through Red River of DKL(2) 1) California refinery located in Bakersfield, which is not shown on the map, has not operated since 2012. 2) As of June 30, 2019, 5.4% of the ownership interest in the general partner is owned by three members of senior management of Delek US (who are also directors of the general partner). The remaining ownership interest is held by a subsidiary of Delek US. 4

Long History of Opportunistic Acquisitions & Value Creation Being Nimble and Capturing Market Dislocations / Opportunities DKL Joint Ventures Increased Gathering RIO Pipeline East and West Texas 2011 Caddo Pipeline SALA Gathering Exp. Inv.: ~$104 mm Lion Oil acquisition 2012 2013 2014 2015 2018 2005 2011 2017 Nettleton Biodiesel Biodiesel 47% Acquired rest Tyler refinery & Paline Pipeline Acquired rest Pipeline Facility Facility ownership of Alon USA related assets $50 mm of Alon USA $12.3 mm $5.3 mm $11.1 mm in Alon USA Partners $68.1 mm(1) 2005 Current 2006 Acquisition Completed 2011 2014 2019 DKL Abilene & San Angelo 171 retail fuel & 2016 Lion refinery & Mt. Pleasant Red River terminals convenience stores Sold MAPCO related pipeline & terminals System Pipeline JV $55.1 mm & related assets for $535mm $228.7 mm(1) 2013 $11.1 mm (2) $128 mm $157.3 mm North Little Rock Product Terminal $5.0 mm 2014 2019 Frank 2017 Wink to Webster Thompson Acquired rest Long Haul JV 2012 2013 Transport of Alon USA $340 - $380 mm Big Sandy Tyler-Big Sandy $11.9 mm terminal & pipeline Pipeline $11.0 mm $5.7 mm 2018 Formed 2015 Big Spring 47% Gathering ownership in Alon USA (1) Includes logistic assets in purchase price. Purchase price includes working capital for refineries. (2) Mt. Pleasant includes $1.1 million of inventory. Refining Logistics/Midstream Retail 5

Midstream: Big Spring Gathering System Delek US’ Gathering Helps Control Crude Oil Quality and Cost into Refineries • Approximately 200-mile gathering system, 350Kbpd • Getting closer to wellhead allows control crude throughput capacity quality and cost • >250,000 dedicated acres; Points of origin: Howard, • Provides improvement in refining performance and Borden, Martin and Midland counties cost structure • Total terminal storage of 650K bbls; Connection to Delek • Potential future dropdown to DKL once ramped US’ Big Spring, TX terminal • Gathering increases access to barrels • Expected capital cost: • Creates optionality to place barrels: • $80 million spent in 2018 • Big Spring (local refinery) • Estimated $123 million spent in 2019 • Midland • Will continue to develop as acreage grows • Colorado City (access other refineries) • Forecasted annualized EBITDA benefit • Wink (to Gulf Coast) • $40 to $50 million in 2022 (1) • Control quality and blending opportunities 1) Includes benefit from quality uplift for refineries. We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. 2) Based on internal company projections; actual results will vary based on market conditions, operations and company performance. Please refer to the forward looking statement disclaimer on page 2 for additional considerations. 6

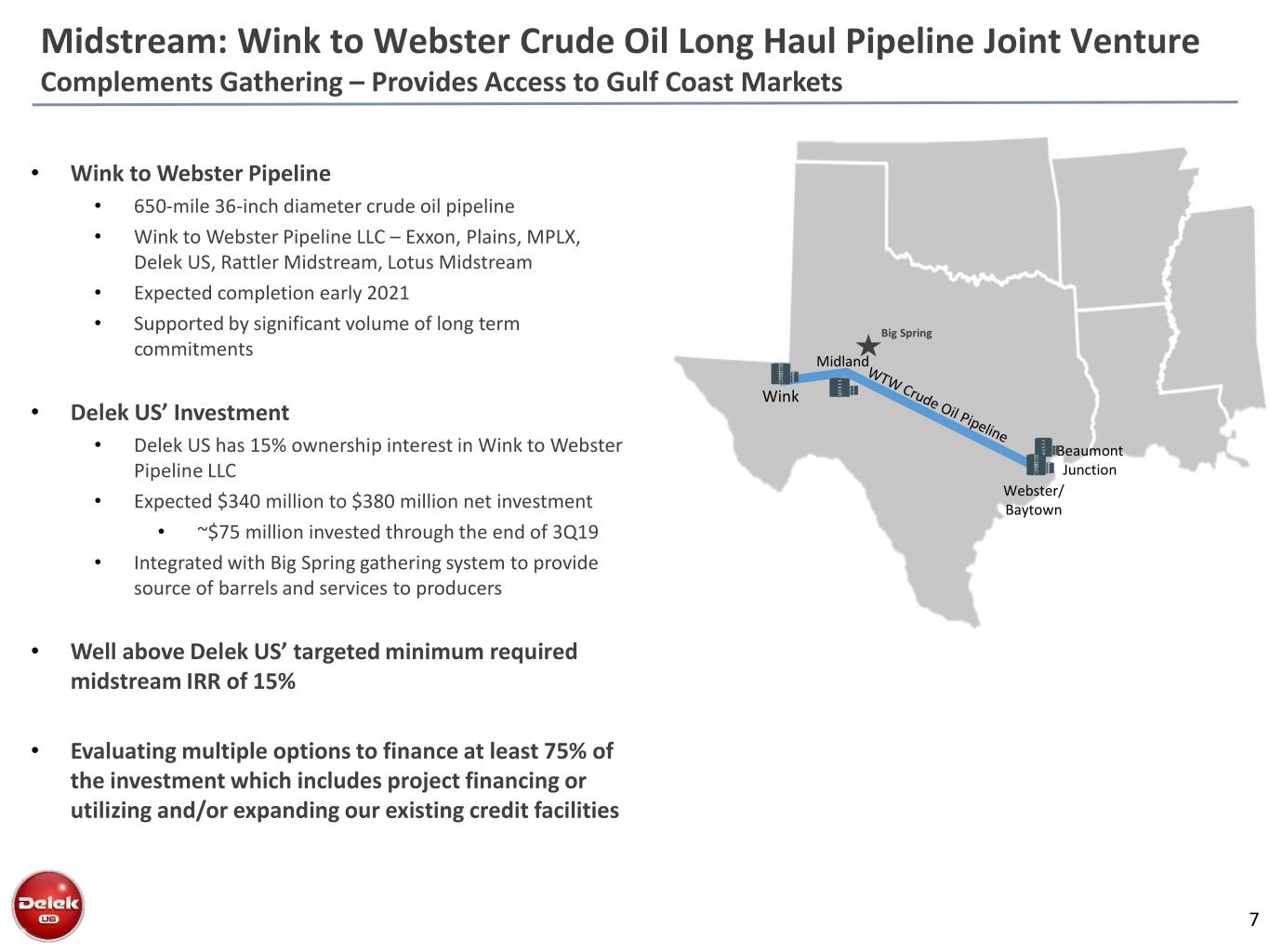

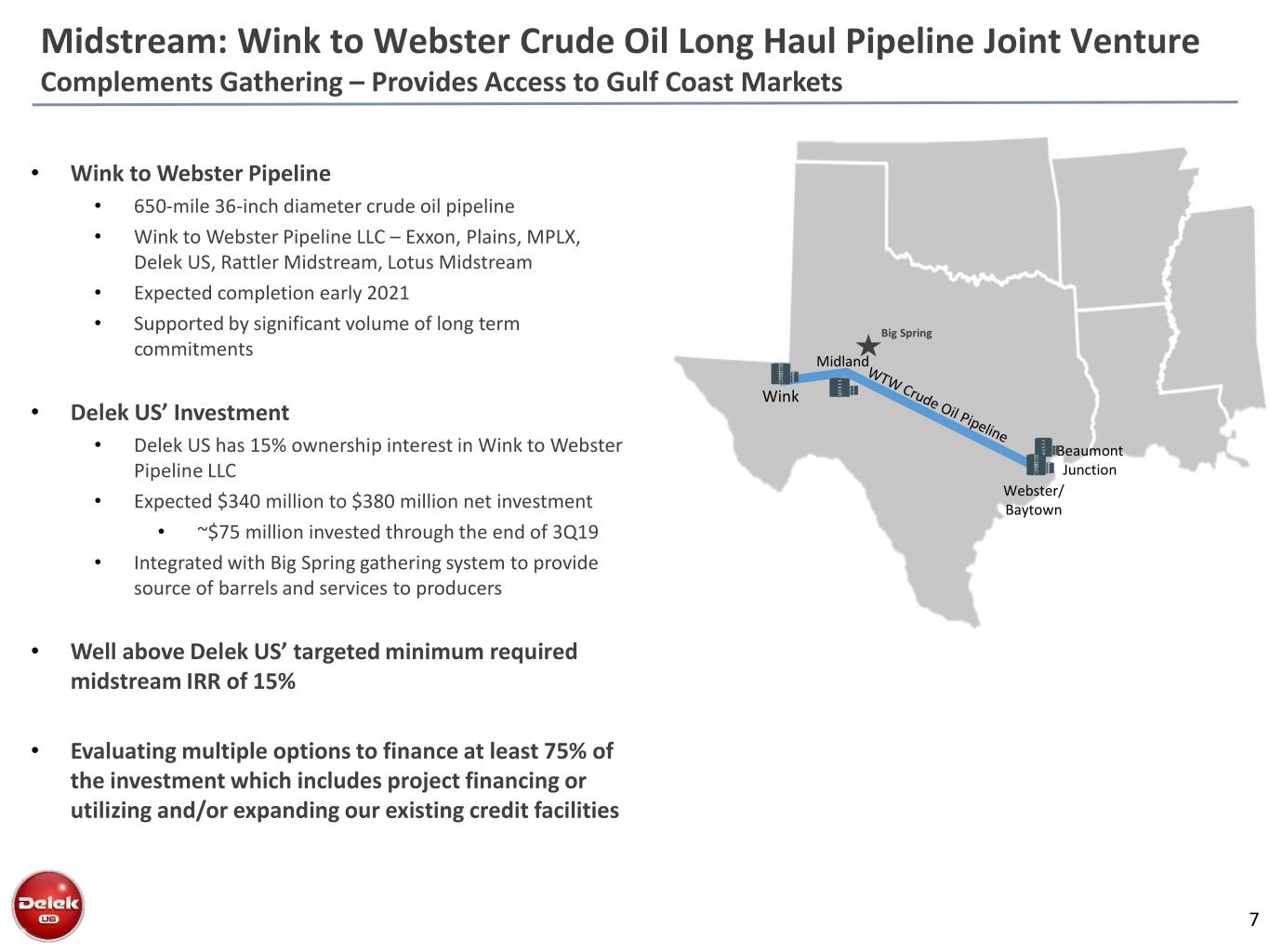

Midstream: Wink to Webster Crude Oil Long Haul Pipeline Joint Venture Complements Gathering – Provides Access to Gulf Coast Markets • Wink to Webster Pipeline • 650-mile 36-inch diameter crude oil pipeline • Wink to Webster Pipeline LLC – Exxon, Plains, MPLX, Delek US, Rattler Midstream, Lotus Midstream • Expected completion early 2021 • Supported by significant volume of long term Big Spring commitments Midland Wink • Delek US’ Investment • Delek US has 15% ownership interest in Wink to Webster Beaumont Pipeline LLC Junction Webster/ • Expected $340 million to $380 million net investment Baytown • ~$75 million invested through the end of 3Q19 • Integrated with Big Spring gathering system to provide source of barrels and services to producers • Well above Delek US’ targeted minimum required midstream IRR of 15% • Evaluating multiple options to finance at least 75% of the investment which includes project financing or utilizing and/or expanding our existing credit facilities 7

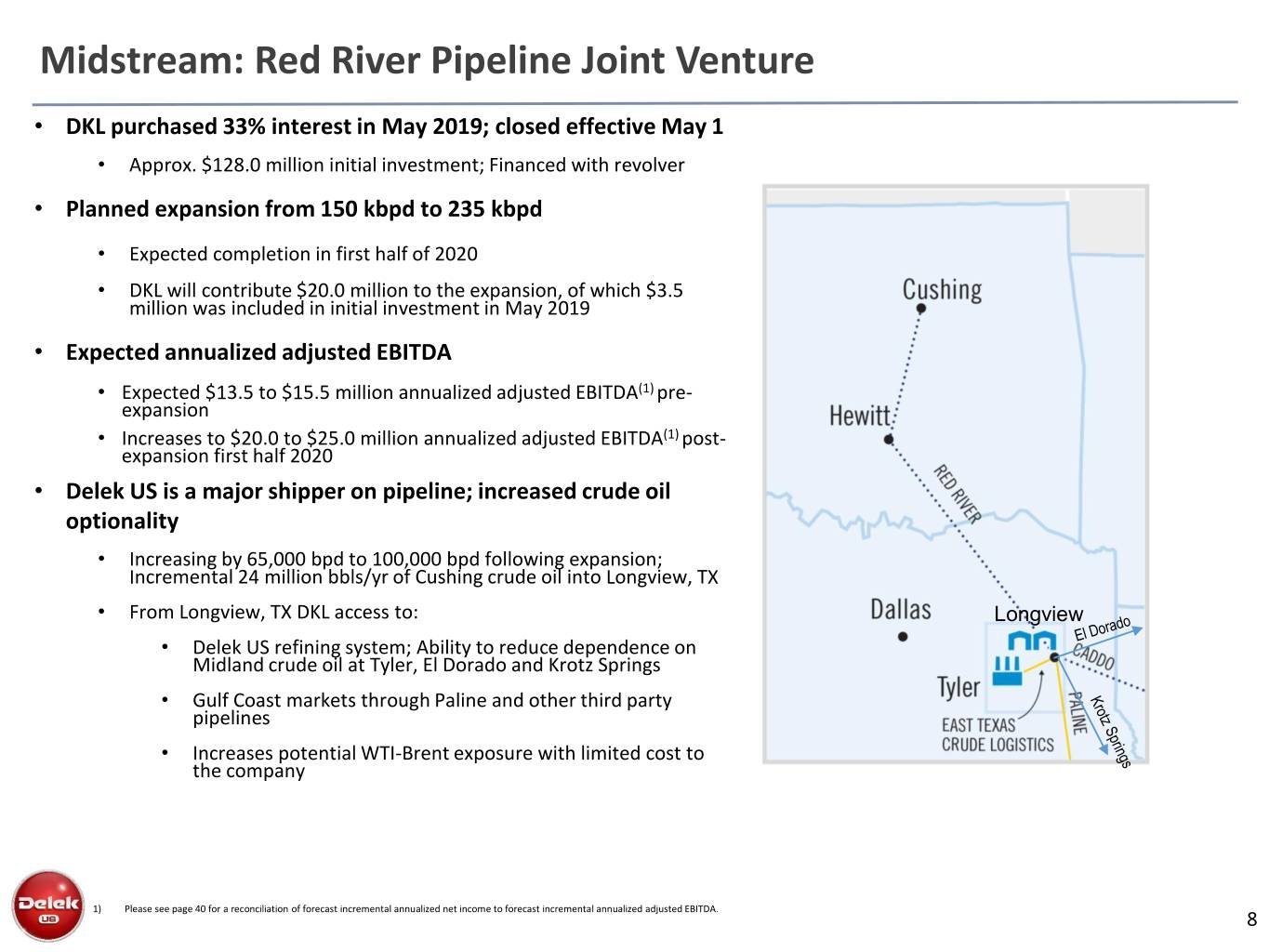

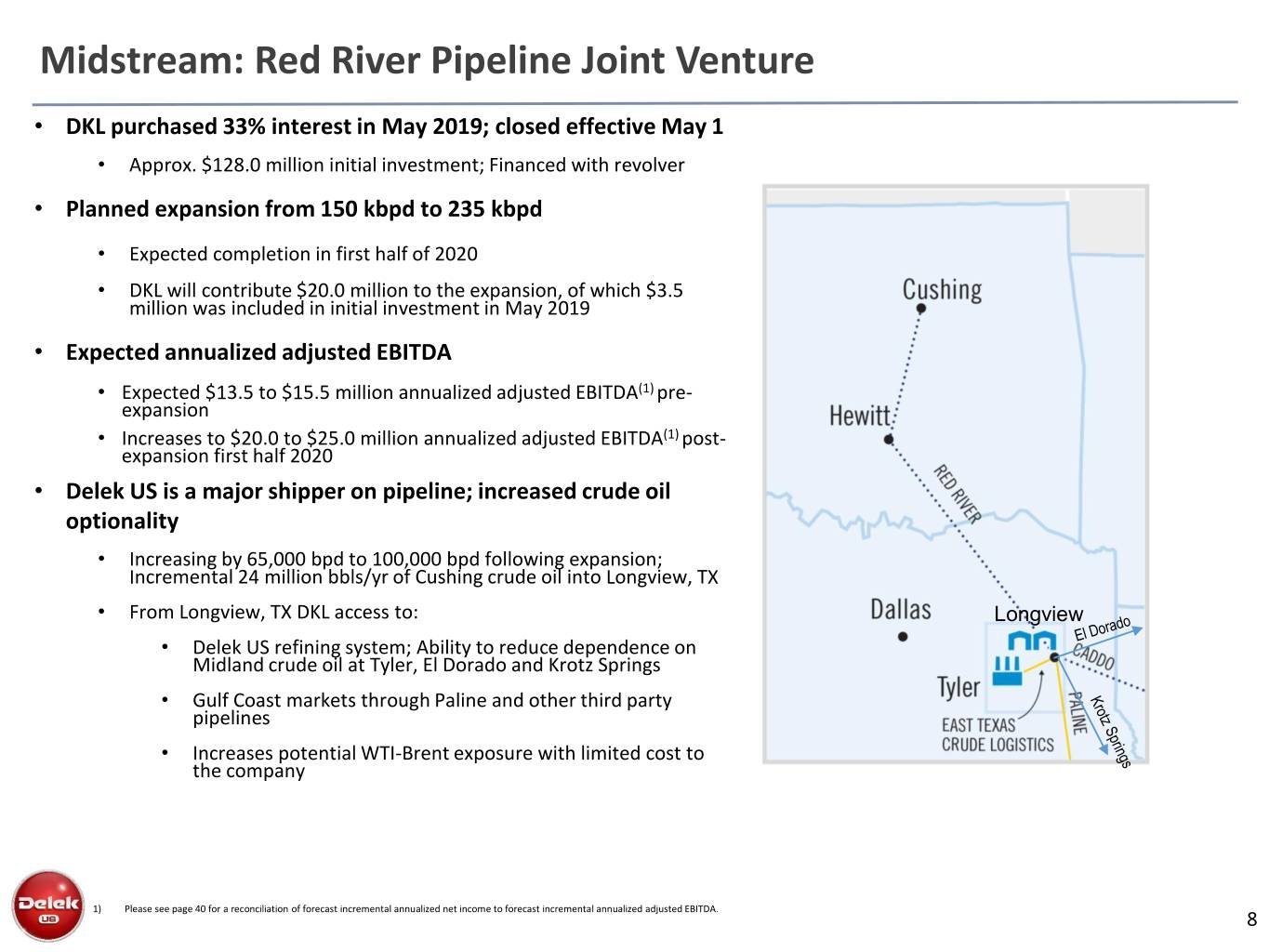

Midstream: Red River Pipeline Joint Venture • DKL purchased 33% interest in May 2019; closed effective May 1 • Approx. $128.0 million initial investment; Financed with revolver • Planned expansion from 150 kbpd to 235 kbpd • Expected completion in first half of 2020 • DKL will contribute $20.0 million to the expansion, of which $3.5 million was included in initial investment in May 2019 • Expected annualized adjusted EBITDA • Expected $13.5 to $15.5 million annualized adjusted EBITDA(1) pre- expansion • Increases to $20.0 to $25.0 million annualized adjusted EBITDA(1) post- expansion first half 2020 • Delek US is a major shipper on pipeline; increased crude oil optionality • Increasing by 65,000 bpd to 100,000 bpd following expansion; Incremental 24 million bbls/yr of Cushing crude oil into Longview, TX • From Longview, TX DKL access to: Longview • Delek US refining system; Ability to reduce dependence on Midland crude oil at Tyler, El Dorado and Krotz Springs • Gulf Coast markets through Paline and other third party pipelines • Increases potential WTI-Brent exposure with limited cost to the company 1) Please see page 40 for a reconciliation of forecast incremental annualized net income to forecast incremental annualized adjusted EBITDA. 8

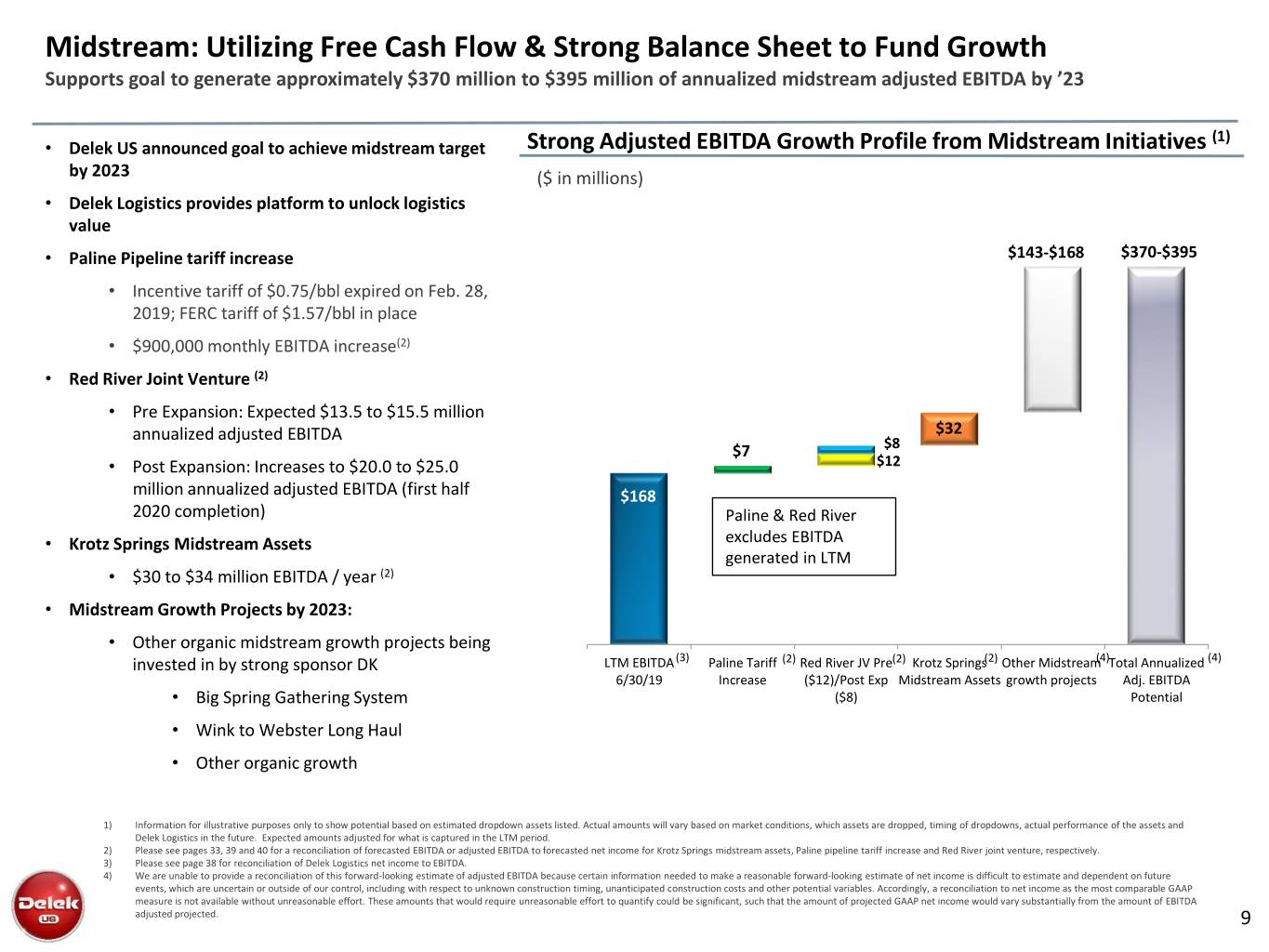

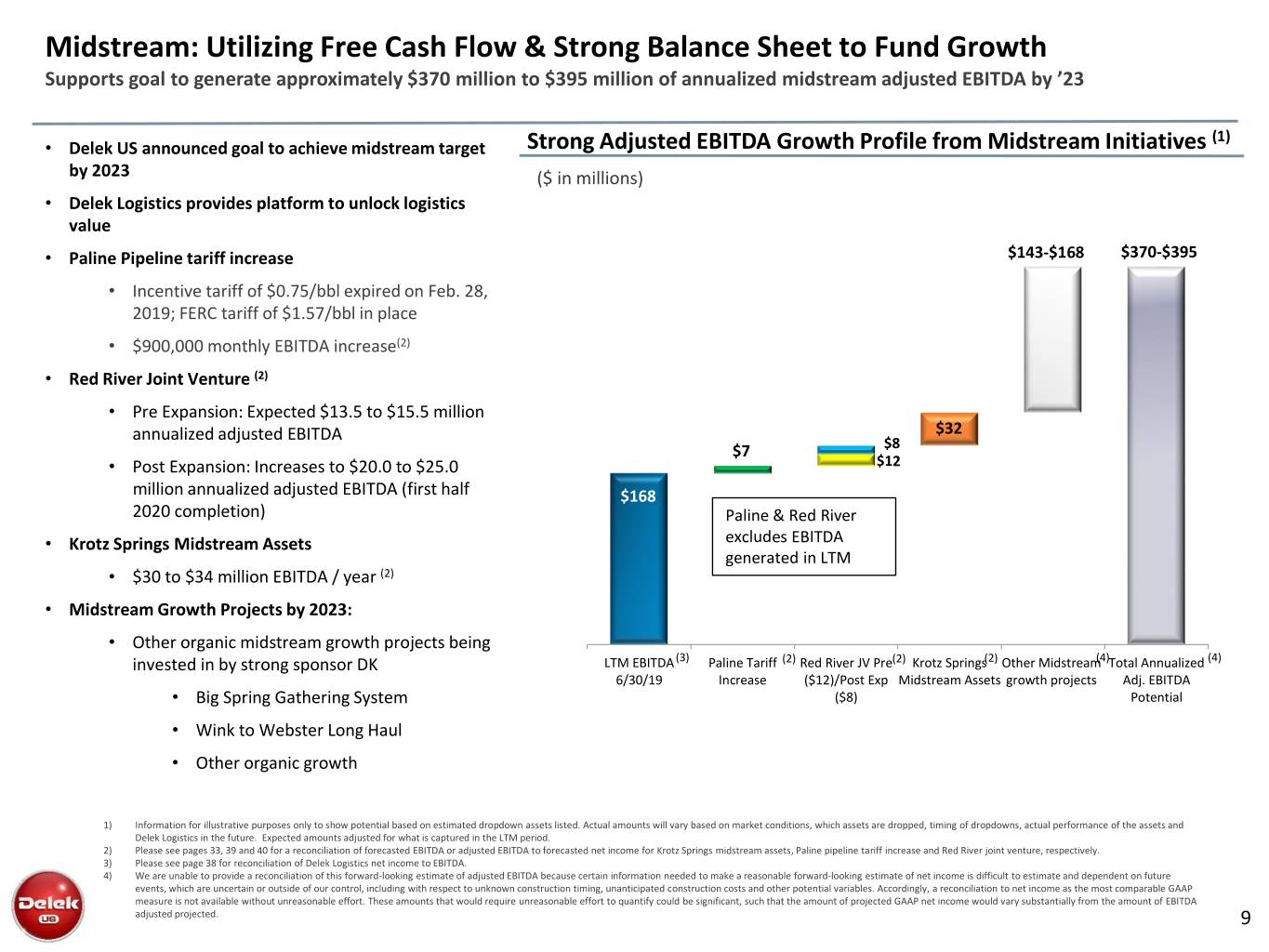

Midstream: Utilizing Free Cash Flow & Strong Balance Sheet to Fund Growth Supports goal to generate approximately $370 million to $395 million of annualized midstream adjusted EBITDA by ’23 (1) • Delek US announced goal to achieve midstream target Strong Adjusted EBITDA Growth Profile from Midstream Initiatives by 2023 ($ in millions) • Delek Logistics provides platform to unlock logistics value • Paline Pipeline tariff increase $143-$168 $370-$395 • Incentive tariff of $0.75/bbl expired on Feb. 28, 2019; FERC tariff of $1.57/bbl in place • $900,000 monthly EBITDA increase(2) • Red River Joint Venture (2) • Pre Expansion: Expected $13.5 to $15.5 million annualized adjusted EBITDA $32 $7 $8 • Post Expansion: Increases to $20.0 to $25.0 $12 million annualized adjusted EBITDA (first half $168 2020 completion) Paline & Red River • Krotz Springs Midstream Assets excludes EBITDA generated in LTM • $30 to $34 million EBITDA / year (2) • Midstream Growth Projects by 2023: • Other organic midstream growth projects being invested in by strong sponsor DK LTM EBITDA(3) Paline Tariff (2) Red River JV Pre(2) Krotz Springs(2) Other Midstream(4)Total Annualized (4) 6/30/19 Increase ($12)/Post Exp Midstream Assets growth projects Adj. EBITDA • Big Spring Gathering System ($8) Potential • Wink to Webster Long Haul • Other organic growth 1) Information for illustrative purposes only to show potential based on estimated dropdown assets listed. Actual amounts will vary based on market conditions, which assets are dropped, timing of dropdowns, actual performance of the assets and Delek Logistics in the future. Expected amounts adjusted for what is captured in the LTM period. 2) Please see pages 33, 39 and 40 for a reconciliation of forecasted EBITDA or adjusted EBITDA to forecasted net income for Krotz Springs midstream assets, Paline pipeline tariff increase and Red River joint venture, respectively. 3) Please see page 38 for reconciliation of Delek Logistics net income to EBITDA. 4) We are unable to provide a reconciliation of this forward-looking estimate of adjusted EBITDA because certain information needed to make a reasonable forward-looking estimate of net income is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of EBITDA adjusted projected. 9

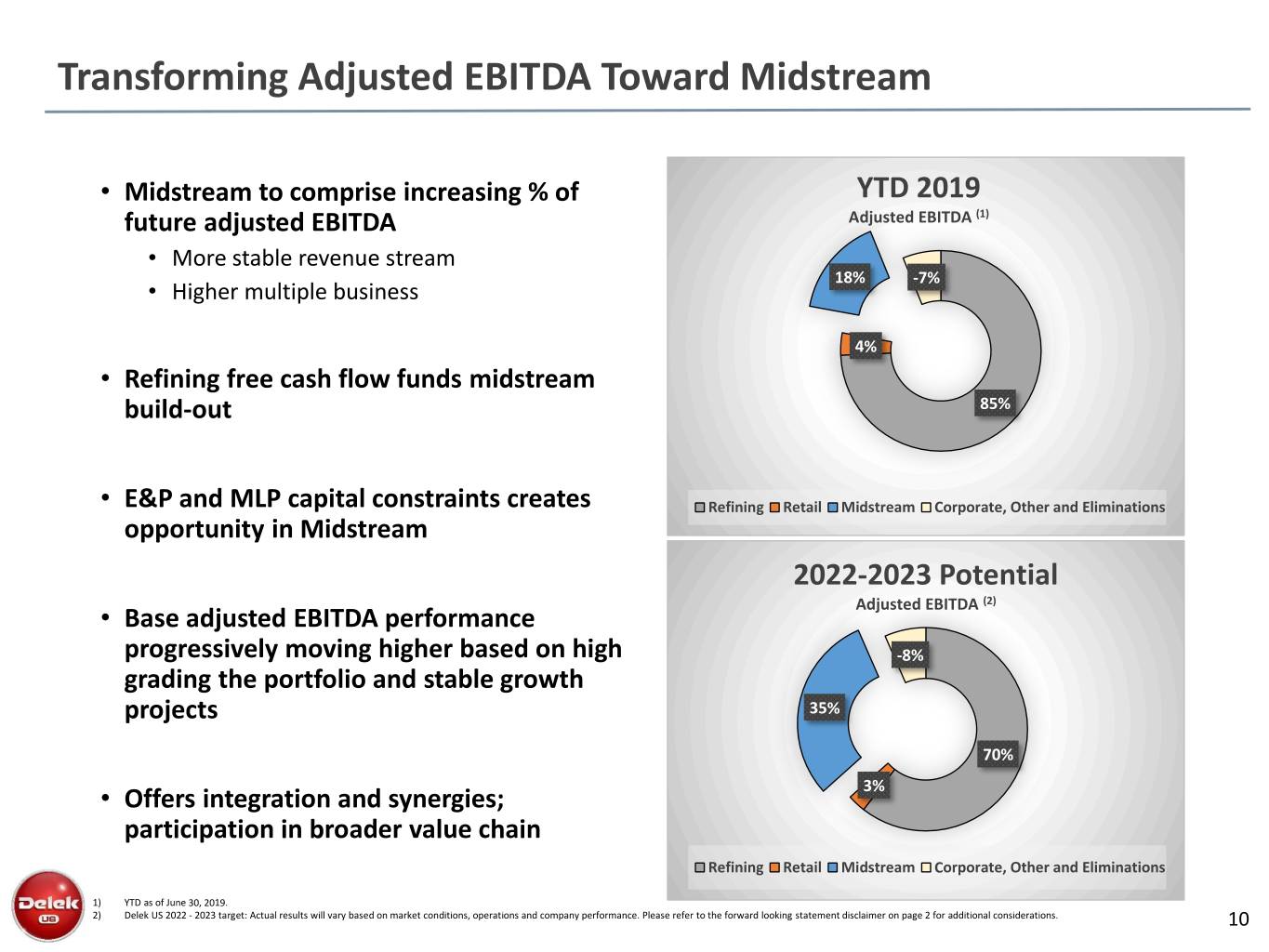

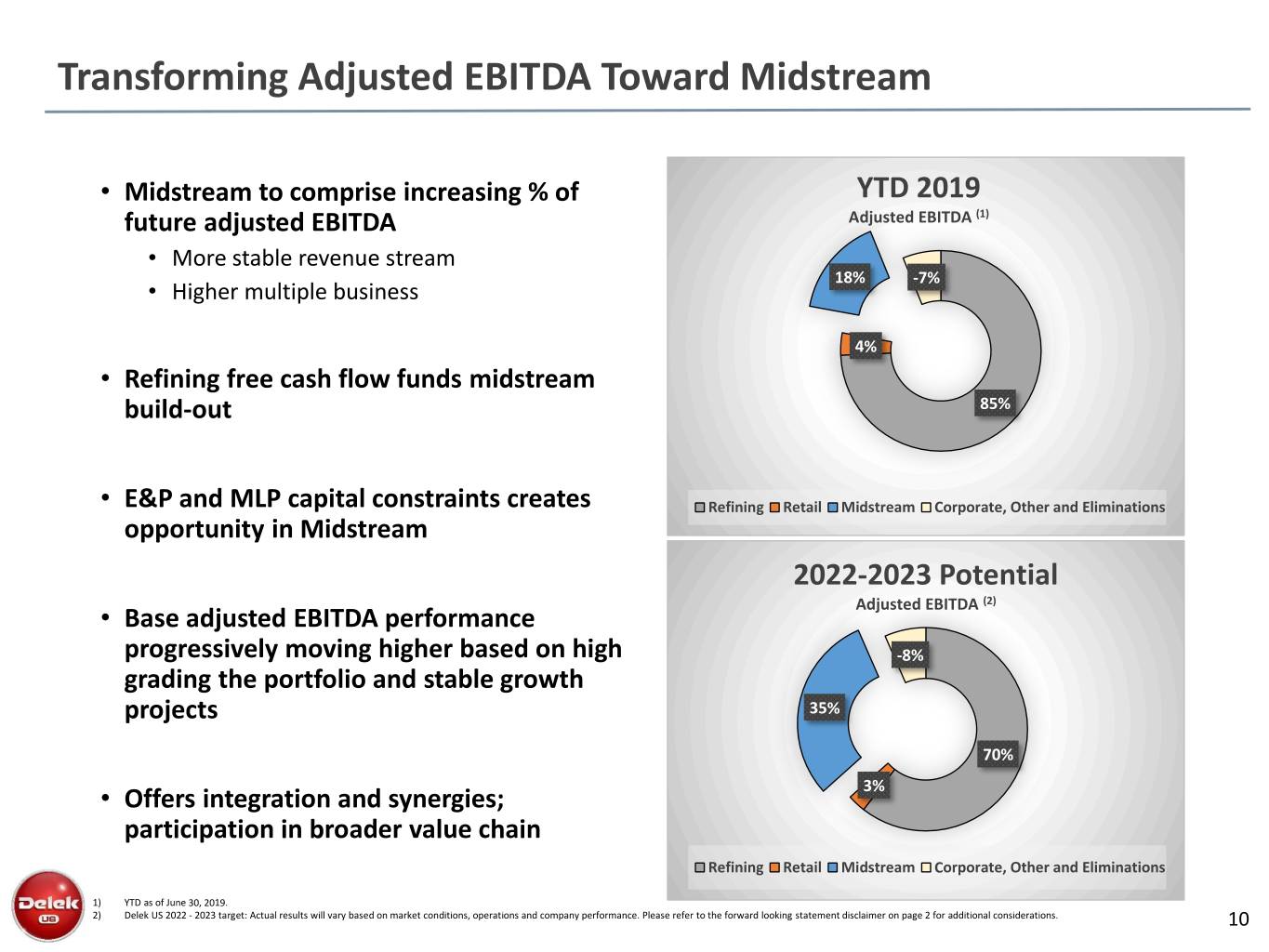

Transforming Adjusted EBITDA Toward Midstream • Midstream to comprise increasing % of YTD 2019 future adjusted EBITDA Adjusted EBITDA (1) • More stable revenue stream 18% -7% • Higher multiple business 4% • Refining free cash flow funds midstream build-out 85% • E&P and MLP capital constraints creates Refining Retail Midstream Corporate, Other and Eliminations opportunity in Midstream 2022-2023 Potential Adjusted EBITDA (2) • Base adjusted EBITDA performance progressively moving higher based on high -8% grading the portfolio and stable growth projects 35% 70% • Offers integration and synergies; 3% participation in broader value chain Refining Retail Midstream Corporate, Other and Eliminations 1) YTD as of June 30, 2019. 2) Delek US 2022 - 2023 target: Actual results will vary based on market conditions, operations and company performance. Please refer to the forward looking statement disclaimer on page 2 for additional considerations. 10

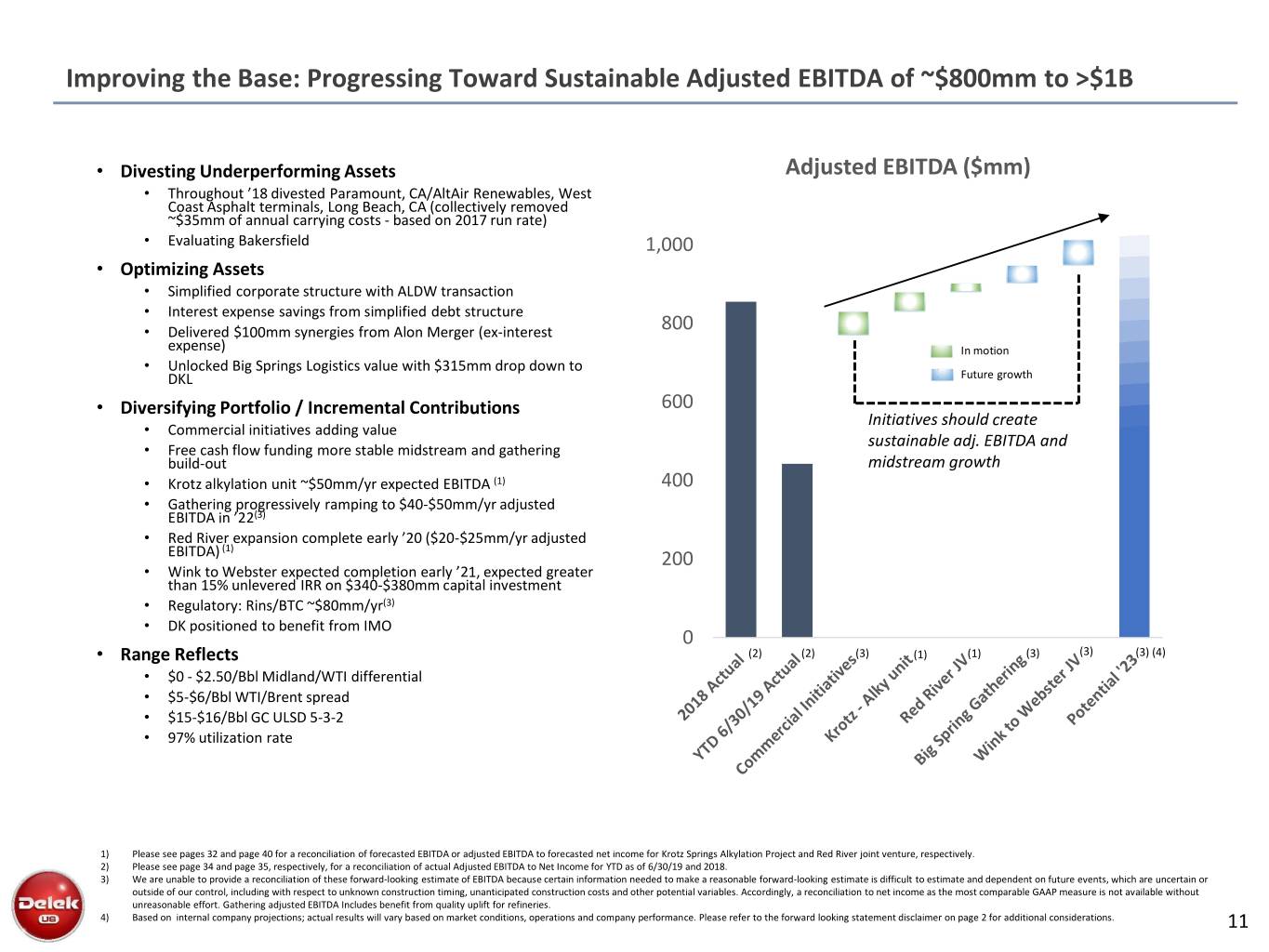

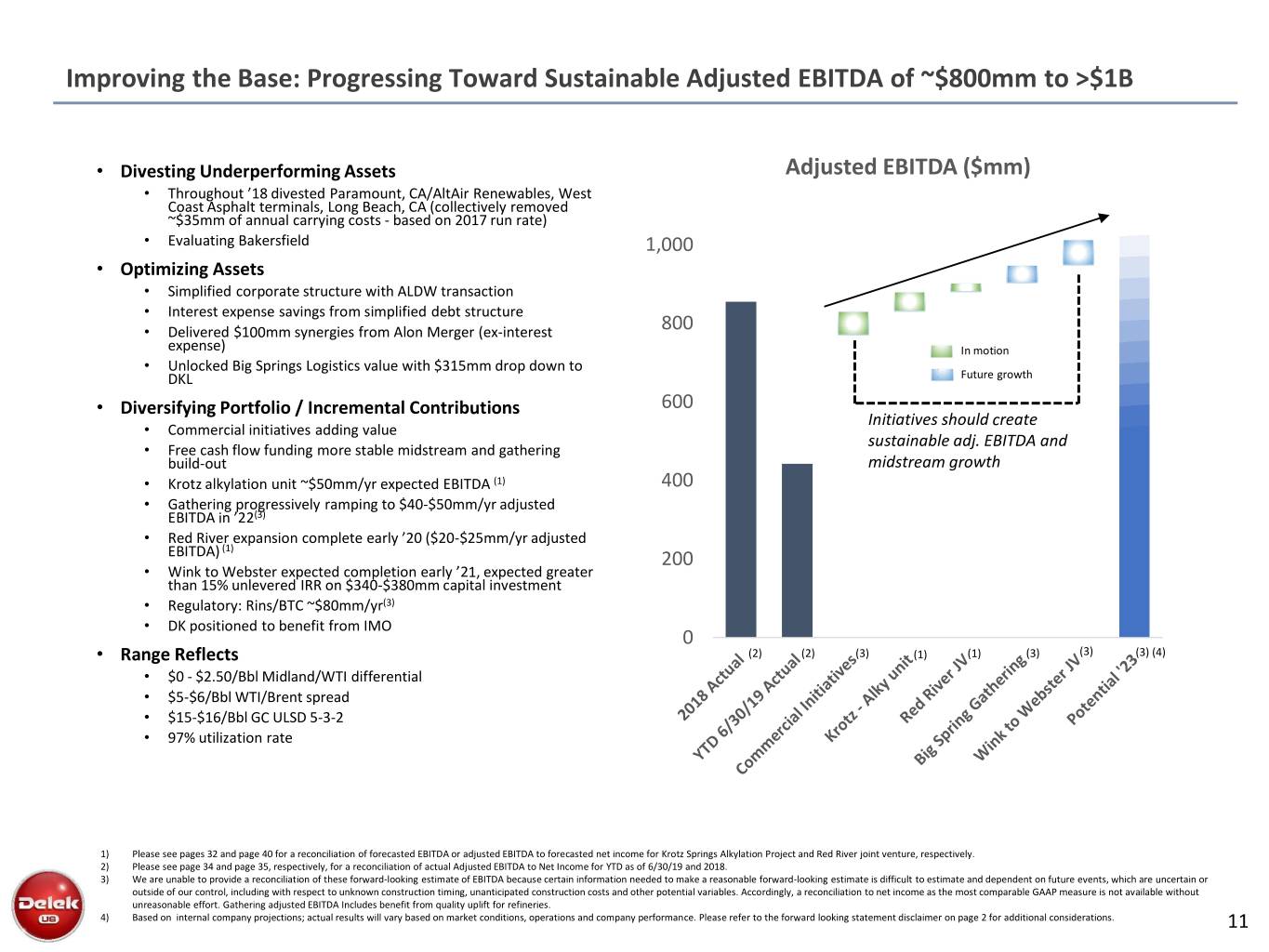

Improving the Base: Progressing Toward Sustainable Adjusted EBITDA of ~$800mm to >$1B • Divesting Underperforming Assets Adjusted EBITDA ($mm) • Throughout ’18 divested Paramount, CA/AltAir Renewables, West Coast Asphalt terminals, Long Beach, CA (collectively removed ~$35mm of annual carrying costs - based on 2017 run rate) • Evaluating Bakersfield 1,000 • Optimizing Assets • Simplified corporate structure with ALDW transaction • Interest expense savings from simplified debt structure • Delivered $100mm synergies from Alon Merger (ex-interest 800 expense) In motion • Unlocked Big Springs Logistics value with $315mm drop down to DKL Future growth • Diversifying Portfolio / Incremental Contributions 600 Initiatives should create • Commercial initiatives adding value sustainable adj. EBITDA and • Free cash flow funding more stable midstream and gathering build-out midstream growth • Krotz alkylation unit ~$50mm/yr expected EBITDA (1) 400 • Gathering progressively ramping to $40-$50mm/yr adjusted EBITDA in ’22(3) • Red River expansion complete early ’20 ($20-$25mm/yr adjusted (1) EBITDA) 200 • Wink to Webster expected completion early ’21, expected greater than 15% unlevered IRR on $340-$380mm capital investment • Regulatory: Rins/BTC ~$80mm/yr(3) • DK positioned to benefit from IMO 0 • Range Reflects (2) (2) (3) (1) (1) (3) (3) (3) (4) • $0 - $2.50/Bbl Midland/WTI differential • $5-$6/Bbl WTI/Brent spread • $15-$16/Bbl GC ULSD 5-3-2 • 97% utilization rate 1) Please see pages 32 and page 40 for a reconciliation of forecasted EBITDA or adjusted EBITDA to forecasted net income for Krotz Springs Alkylation Project and Red River joint venture, respectively. 2) Please see page 34 and page 35, respectively, for a reconciliation of actual Adjusted EBITDA to Net Income for YTD as of 6/30/19 and 2018. 3) We are unable to provide a reconciliation of these forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. Gathering adjusted EBITDA Includes benefit from quality uplift for refineries. 4) Based on internal company projections; actual results will vary based on market conditions, operations and company performance. Please refer to the forward looking statement disclaimer on page 2 for additional considerations. 11

Retail: Diversifies EBITDA Stream • ~80% integration with existing downstream operations offering synergies and competitive advantage • Operate approximately 263 C-stores in Central and West Texas and New Mexico • Divesting underperforming stores • Net store count declines into ’20 • Rebrand 7-Eleven stores to DK by ’21 • Implement interior re-branding/re-imaging • Longer-term build out new to industry (NTI) stores 12

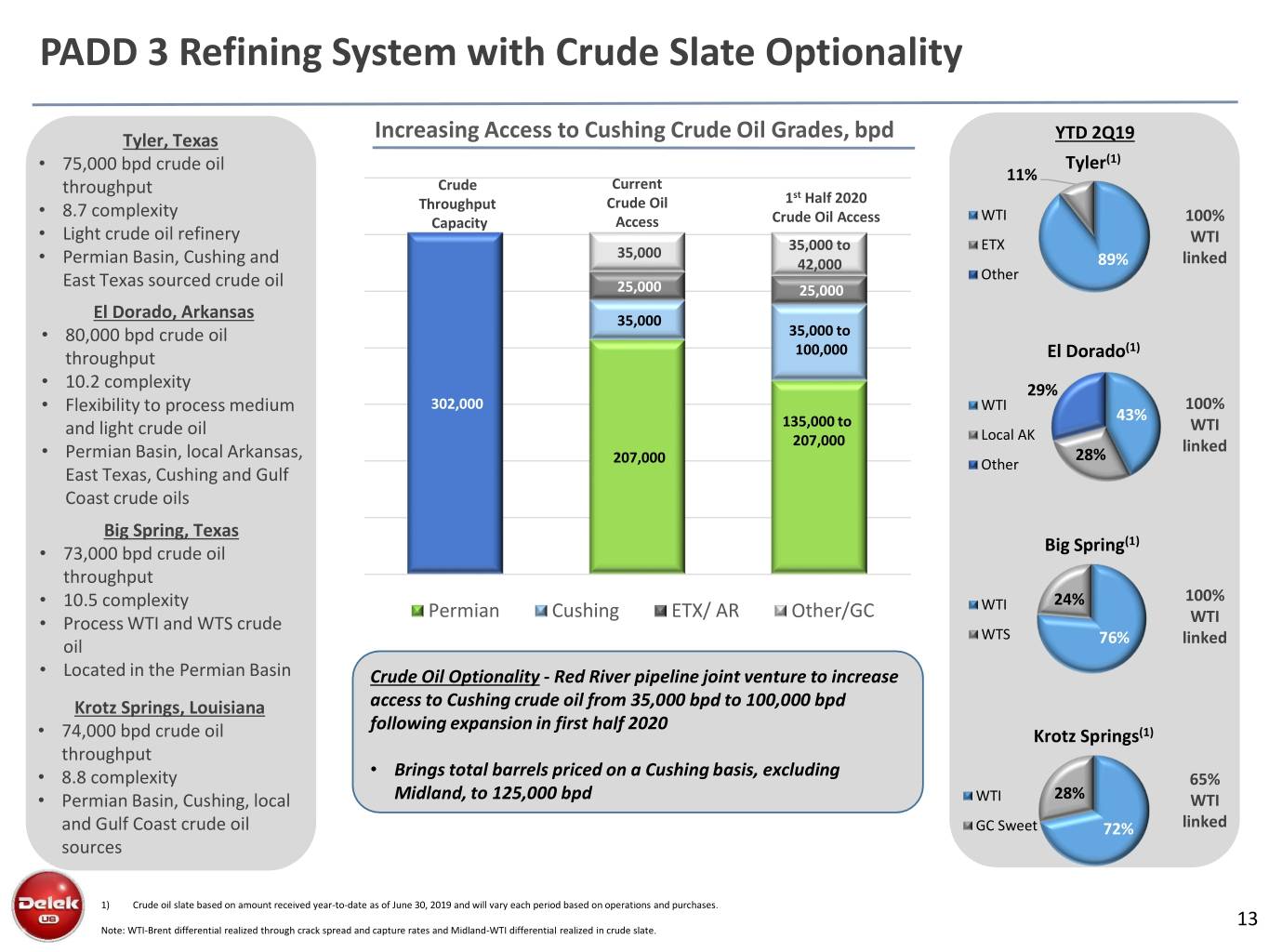

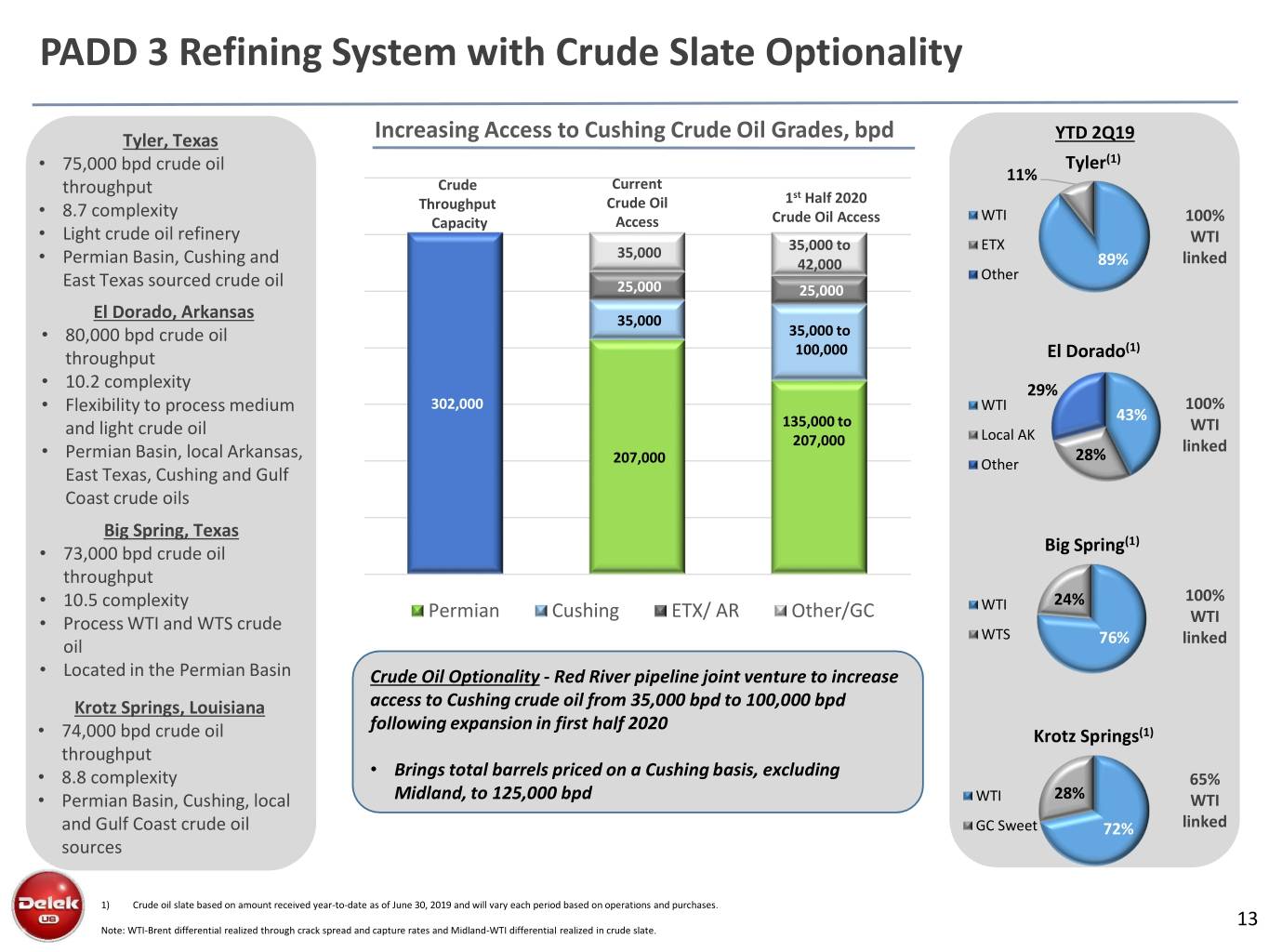

PADD 3 Refining System with Crude Slate Optionality Tyler, Texas Increasing Access to Cushing Crude Oil Grades, bpd YTD 2Q19 • 75,000 bpd crude oil Tyler(1) 11% Crude Current throughput st Throughput Crude Oil 1 Half 2020 • 8.7 complexity WTI Capacity Access Crude Oil Access 100% • Light crude oil refinery ETX WTI 35,000 35,000 to • Permian Basin, Cushing and 42,000 89% linked East Texas sourced crude oil Other 25,000 25,000 El Dorado, Arkansas 35,000 • 80,000 bpd crude oil 35,000 to (1) throughput 100,000 El Dorado • 10.2 complexity 29% • Flexibility to process medium 302,000 WTI 100% 43% and light crude oil 135,000 to WTI 207,000 Local AK • Permian Basin, local Arkansas, 28% linked 207,000 Other East Texas, Cushing and Gulf Coast crude oils Big Spring, Texas (1) • 73,000 bpd crude oil Big Spring throughput • 24% 100% 10.5 complexity Permian Cushing ETX/ AR Other/GC WTI • Process WTI and WTS crude WTI WTS oil 76% linked • Located in the Permian Basin Crude Oil Optionality - Red River pipeline joint venture to increase Krotz Springs, Louisiana access to Cushing crude oil from 35,000 bpd to 100,000 bpd following expansion in first half 2020 • 74,000 bpd crude oil Krotz Springs(1) throughput • • 8.8 complexity Brings total barrels priced on a Cushing basis, excluding 65% • Permian Basin, Cushing, local Midland, to 125,000 bpd WTI 28% WTI and Gulf Coast crude oil GC Sweet 72% linked sources 1) Crude oil slate based on amount received year-to-date as of June 30, 2019 and will vary each period based on operations and purchases. 13 Note: WTI-Brent differential realized through crack spread and capture rates and Midland-WTI differential realized in crude slate.

Niche Market = Margin Strength Permian Centric Assets Offer Advantaged Access Indication of Permian/Brent Export Economics (1) • Transportation economics should set the differential; barrels need incentive to clear market $10.00 ~$7-9/bbl • Incremental barrel must be exported $8.00 • Permian should remain discounted to Brent ~$5-6/bbl • IMO 2020 expected to increase shipping costs $6.00 • Pipeline tariff renegotiations have reduced costs $4.00 $2.00 • Midland • Permian key driver of domestic production growth $0.00 Europe Asia New Permian pipes divert crude from Cushing • Pipeline Tariff Transport from terminal to water • Gulf Coast export constraints remain a variable Shipping Freight Time Value of Money • Refining downtime to cause ebb/flow of diffs 2019 Net Income / Bbl of Refined Products Sold ($/Bbl) (2) • DK top tier per barrel metrics 1H19 despite compressing differentials $6.00 $5.64 $5.00 $4.76 • Red River creates optionality to access Cushing bbls • 65mbbl/d expansion in 1H20 $4.00 • Currently access ~75mmbbl Midland crude annually; $3.00 $1/bbl move in Midland to Cushing equates to $75mm $2.22 annually $2.00 $1.51 Red River creates optionality to reduce down to $0.65 • $1.00 $0.42 50mmbbl Midland annually; $1/bbl change would equate to $50mm annually $0.00 HFC DK VLO PSX MPC PBF 1) Illustrative of market dynamics October 2019. 2) Source: Simmons Energy; August 6, 2019 14

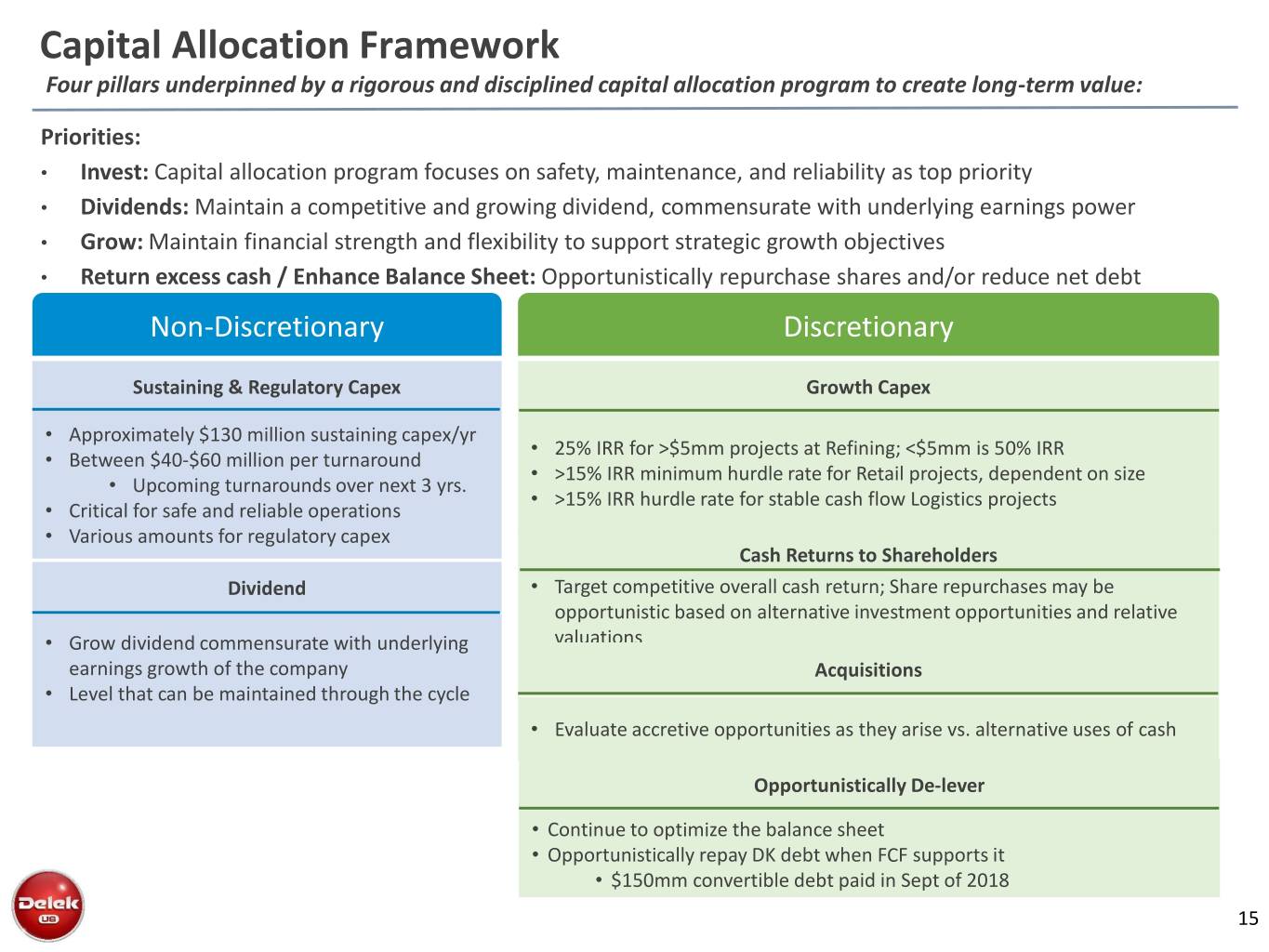

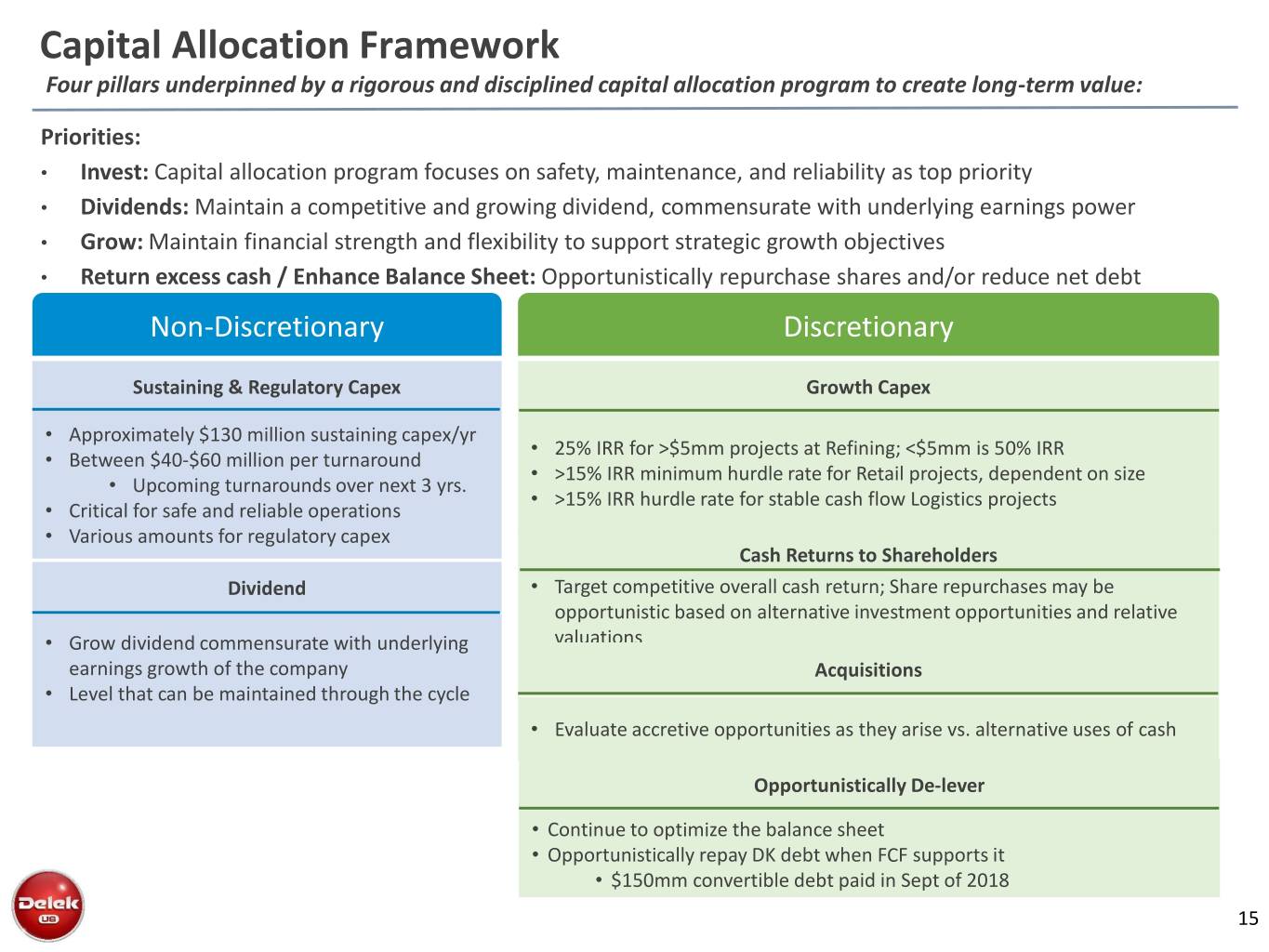

Capital Allocation Framework Four pillars underpinned by a rigorous and disciplined capital allocation program to create long-term value: Priorities: • Invest: Capital allocation program focuses on safety, maintenance, and reliability as top priority • Dividends: Maintain a competitive and growing dividend, commensurate with underlying earnings power • Grow: Maintain financial strength and flexibility to support strategic growth objectives • Return excess cash / Enhance Balance Sheet: Opportunistically repurchase shares and/or reduce net debt Non-Discretionary Discretionary Sustaining & Regulatory Capex Growth Capex • Approximately $130 million sustaining capex/yr • 25% IRR for >$5mm projects at Refining; <$5mm is 50% IRR • Between $40-$60 million per turnaround • >15% IRR minimum hurdle rate for Retail projects, dependent on size • Upcoming turnarounds over next 3 yrs. • >15% IRR hurdle rate for stable cash flow Logistics projects • CriticalSustaining for safe and Capex reliable operations • Various amounts for regulatory capex Cash Returns to Shareholders Dividend • Target competitive overall cash return; Share repurchases may be opportunistic based on alternative investment opportunities and relative • Grow dividend commensurate with underlying valuations earnings growth of the company Acquisitions • Level that can be maintained through the cycle • Evaluate accretive opportunities as they arise vs. alternative uses of cash Opportunistically De-lever • Continue to optimize the balance sheet • Opportunistically repay DK debt when FCF supports it • $150mm convertible debt paid in Sept of 2018 15

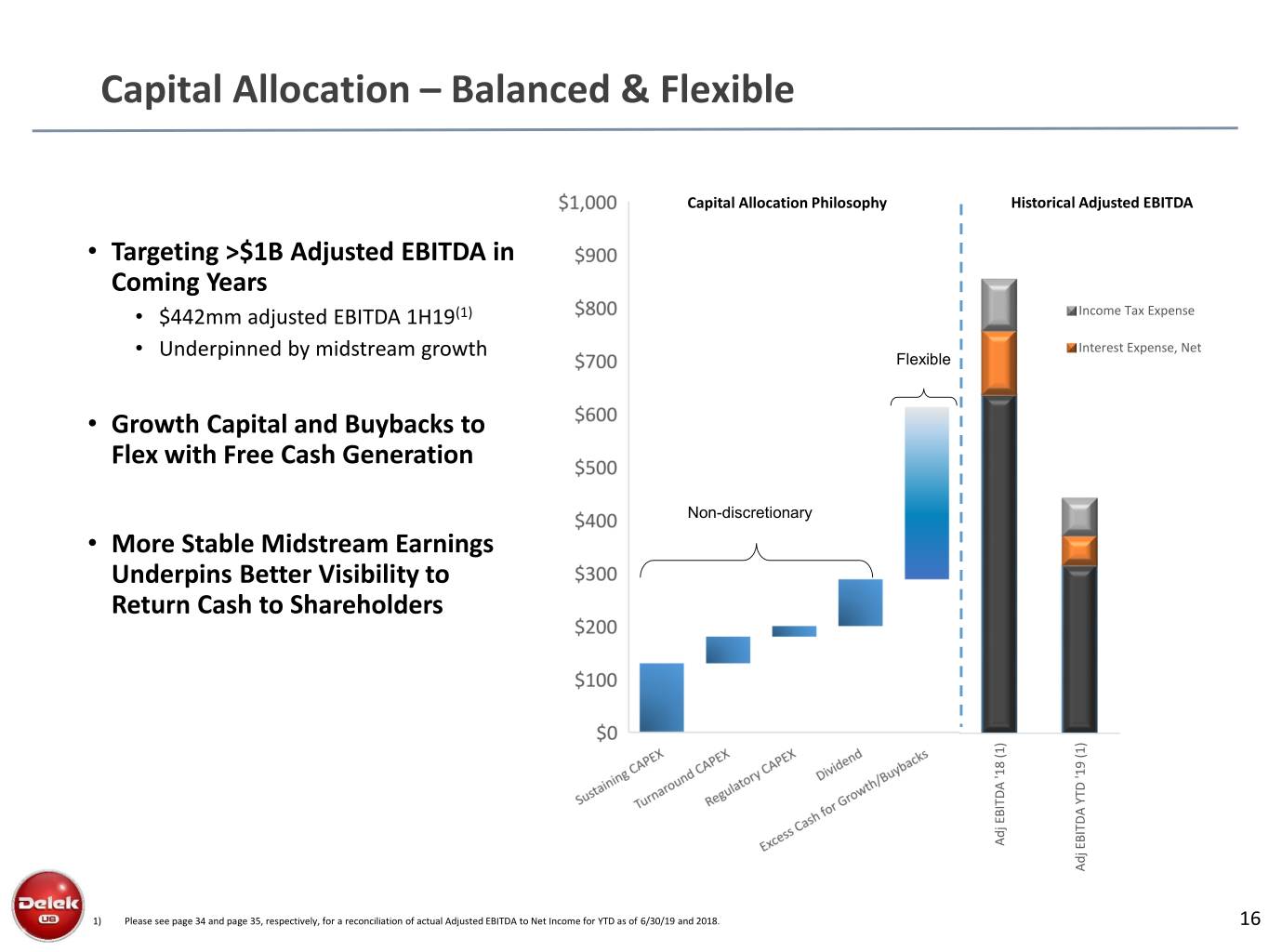

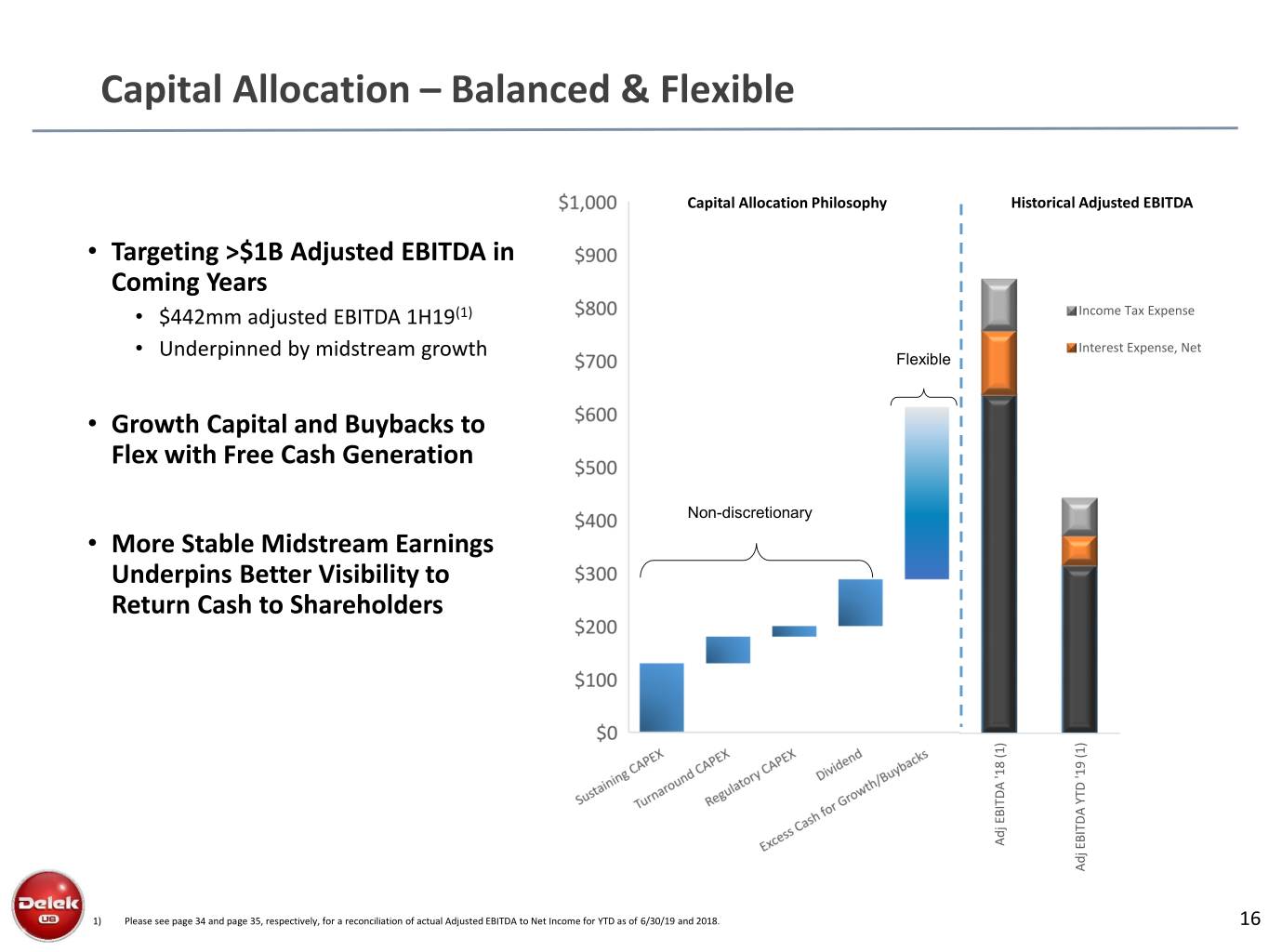

Capital Allocation – Balanced & Flexible Capital Allocation Philosophy Historical Adjusted EBITDA • Targeting >$1B Adjusted EBITDA in Coming Years • $442mm adjusted EBITDA 1H19(1) Income Tax Expense Interest Expense, Net • Underpinned by midstream growth Flexible • Growth Capital and Buybacks to Flex with Free Cash Generation Non-discretionary • More Stable Midstream Earnings Underpins Better Visibility to Return Cash to Shareholders Adj EBITDA '18 (1) '18 EBITDA Adj Adj EBITDA YTD '19 (1) YTD '19 EBITDA Adj 1) Please see page 34 and page 35, respectively, for a reconciliation of actual Adjusted EBITDA to Net Income for YTD as of 6/30/19 and 2018. 16

Capital Allocation Discipline Cash Balance & Net Debt (DK Ex. DKL)(1) • Maintaining strong balance sheet • Should support ability to invest in the business and $1,128 $1,090 $1,079 $1,013 $984 return cash to shareholders $927 $946 • Provides ability to act quickly to take advantage of opportunities • DK excluding DKL, had $946 million of cash and $130 $209 $178 million net debt at 6/30/19 $116 $130 $8 $72 4Q17 1Q18 2Q18 3Q18 $(5) 4Q18 1Q19 2Q19 Cash Balance Net Debt Capital Allocation Discipline in Practice – Investing in the Business (1) • Investing in the business Capital Expenditures • Upcoming refinery turnarounds over next 3 years • El Dorado turnaround was March/April 2019 • Completed April 24, 2019 • Growing the business $74.1 $52.0 • Focus on Midstream $23.9 $38.2 $53.4 • Big Spring Gathering System capital spending $30.6 • Joint Venture Contributions $38.4 • Wink to Webster long haul pipeline joint $54.9 $54.8 $54.3 $47.8 $39.5 $32.7 venture $16.3 • Red River Joint Venture 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Sustaining Capex Discretionary Capex • Improving Refining operations • Krotz alkylation project (Completed April 2019) 1) Based on company filings from Q4 2017 through Q2 2019. Sustaining capex defined as regulatory & maintenance capital expenditures. Capital expenditures does not include joint venture contributions. 17

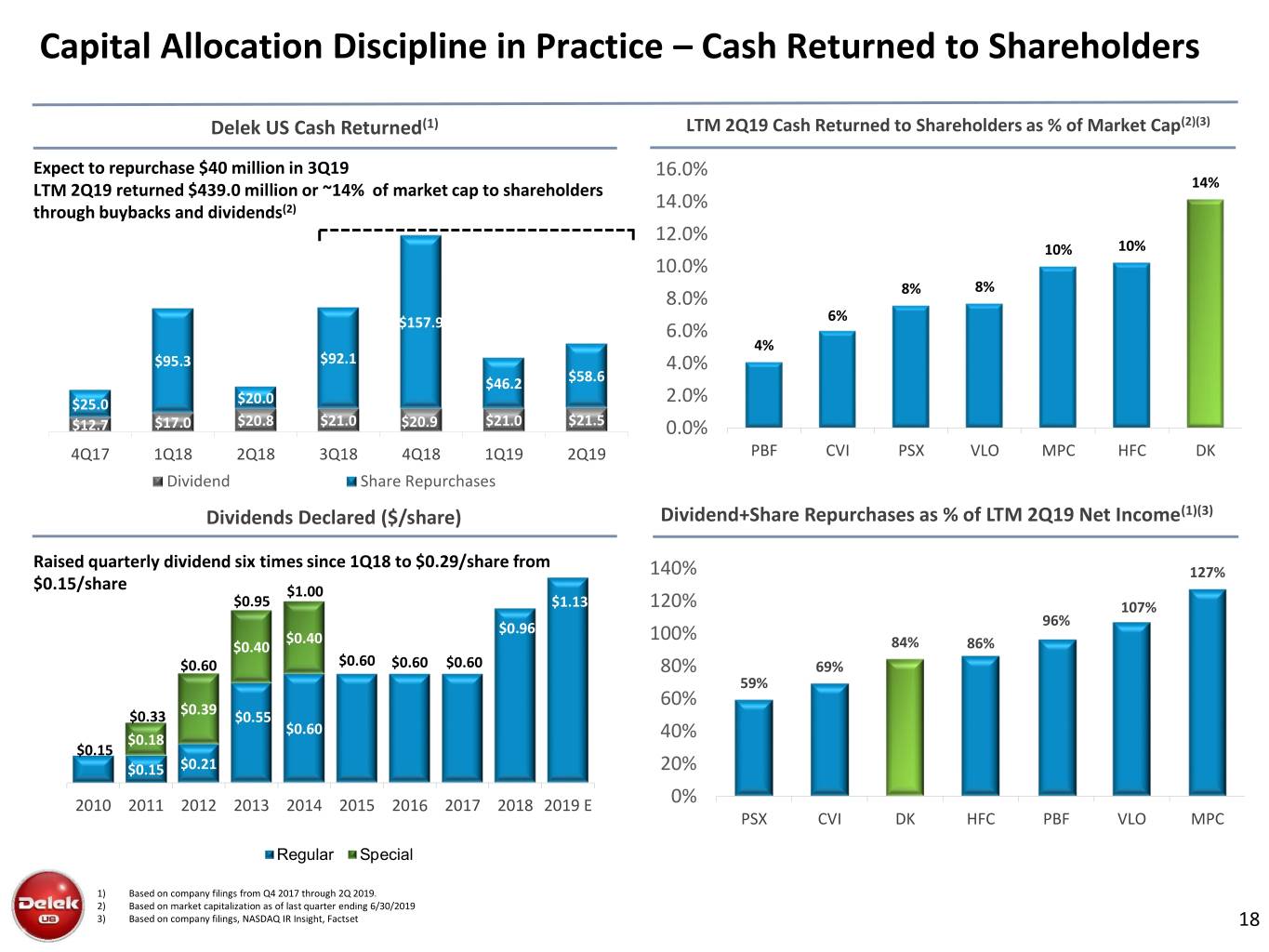

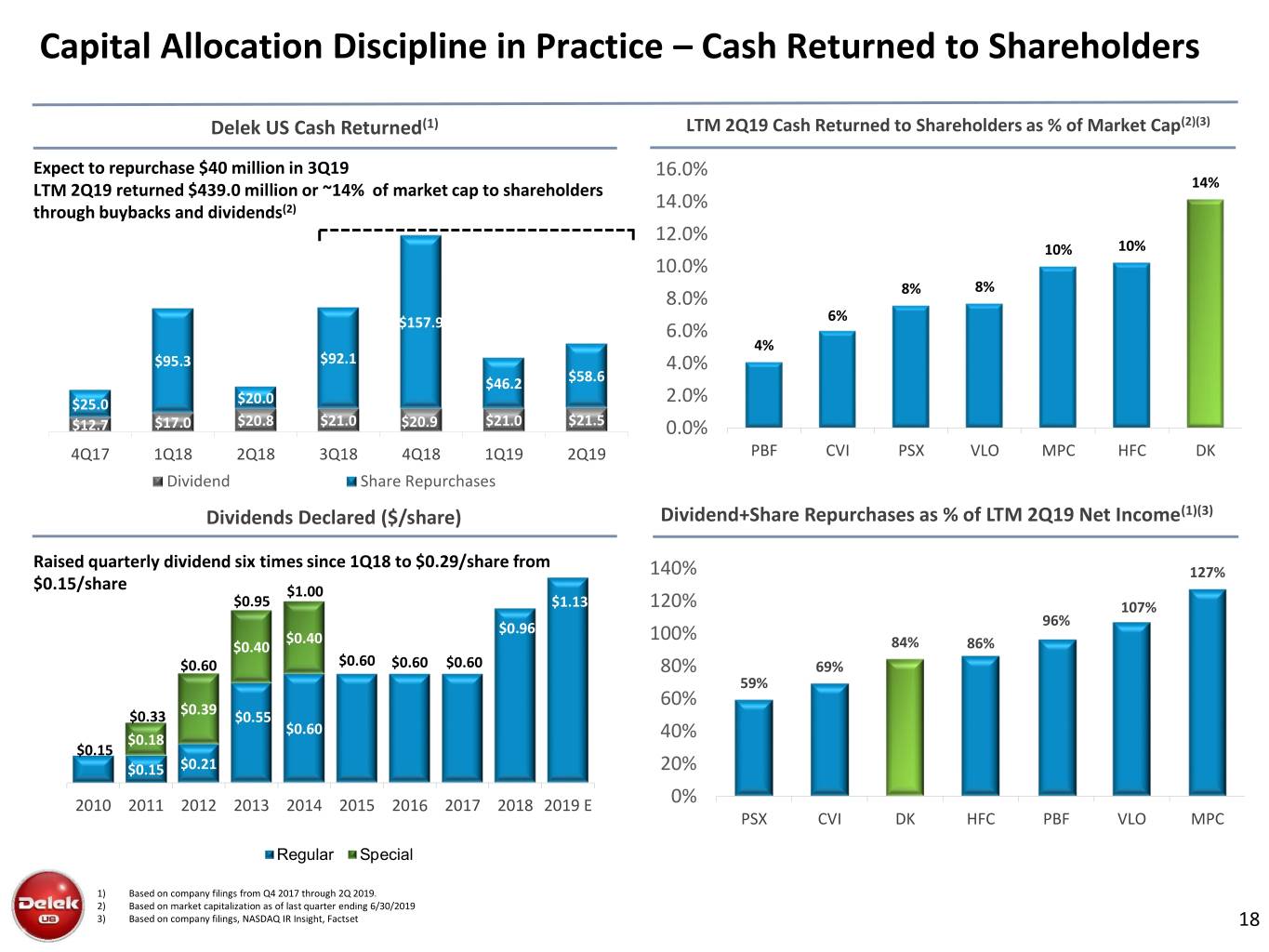

Capital Allocation Discipline in Practice – Cash Returned to Shareholders Delek US Cash Returned(1) LTM 2Q19 Cash Returned to Shareholders as % of Market Cap(2)(3) Expect to repurchase $40 million in 3Q19 16.0% LTM 2Q19 returned $439.0 million or ~14% of market cap to shareholders 14% 14.0% through buybacks and dividends(2) 12.0% 10% 10% 10.0% 8% 8.0% 8% 6% $157.9 6.0% 4% $95.3 $92.1 4.0% $46.2 $58.6 $25.0 $20.0 2.0% $12.7 $17.0 $20.8 $21.0 $20.9 $21.0 $21.5 0.0% 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 PBF CVI PSX VLO MPC HFC DK Dividend Share Repurchases Dividends Declared ($/share) Dividend+Share Repurchases as % of LTM 2Q19 Net Income(1)(3) Raised quarterly dividend six times since 1Q18 to $0.29/share from 140% 127% $0.15/share $1.00 $0.95 $1.13 120% 107% $0.96 96% $0.40 100% 84% 86% $0.40 $0.60 $0.60 $0.60 $0.60 $0.60 80% 69% 59% 60% $0.33 $0.39 $0.55 $0.60 $0.18 40% $0.15 $0.15 $0.21 20% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 E 0% PSX CVI DK HFC PBF VLO MPC Regular Special 1) Based on company filings from Q4 2017 through 2Q 2019. 2) Based on market capitalization as of last quarter ending 6/30/2019 3) Based on company filings, NASDAQ IR Insight, Factset 18

Market Opportunities & Valuation

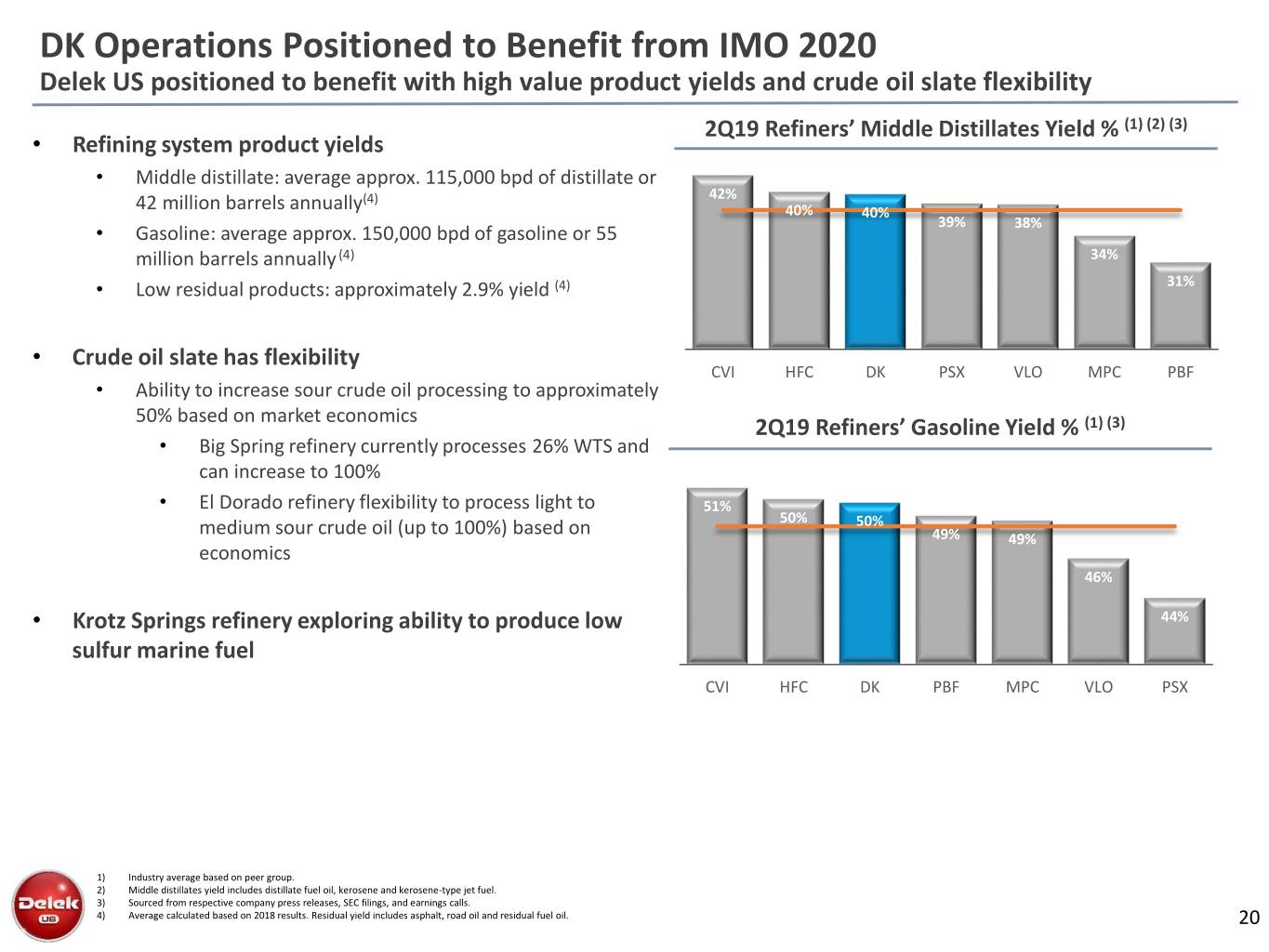

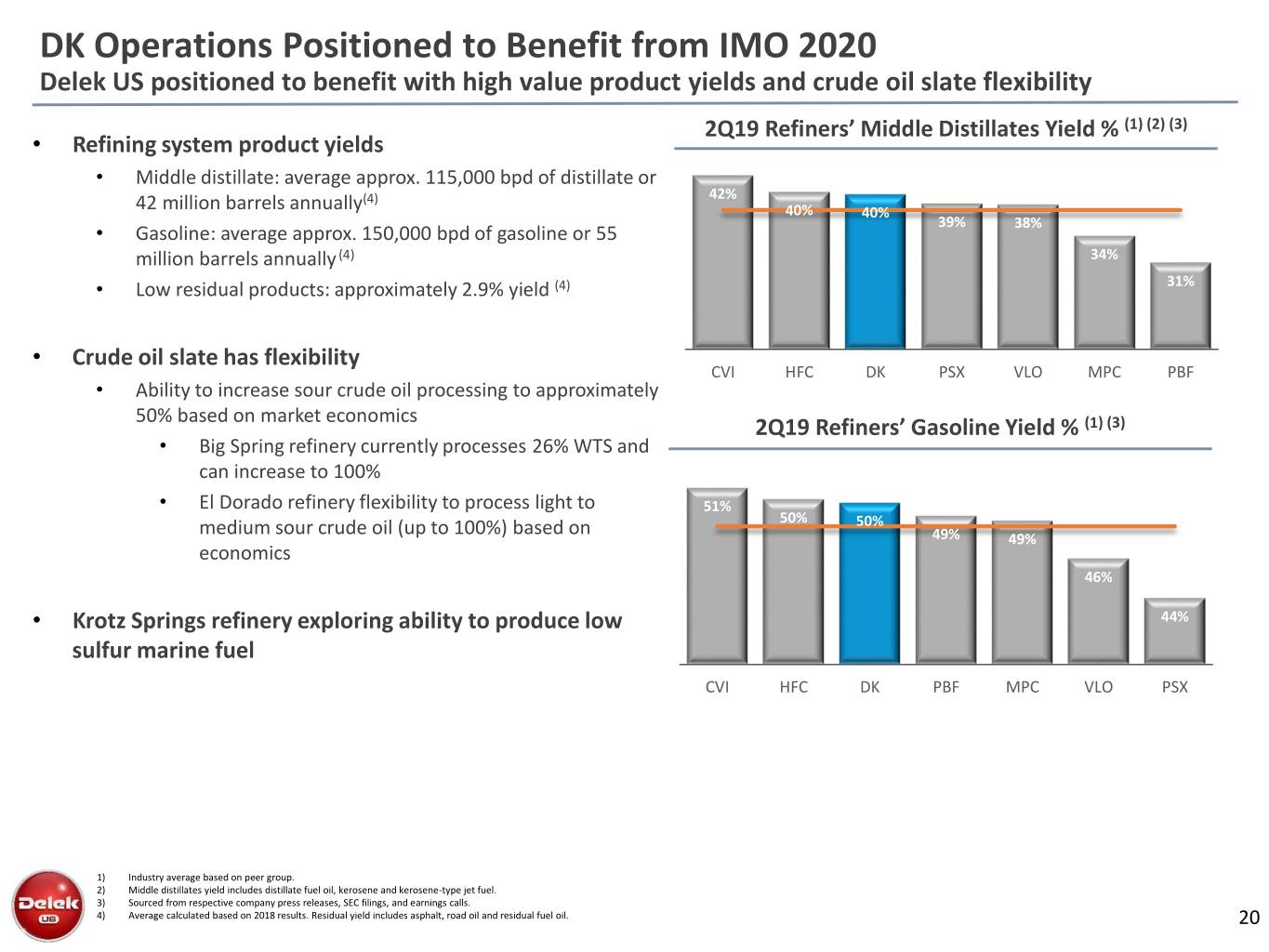

DK Operations Positioned to Benefit from IMO 2020 Delek US positioned to benefit with high value product yields and crude oil slate flexibility 2Q19 Refiners’ Middle Distillates Yield % (1) (2) (3) • Refining system product yields • Middle distillate: average approx. 115,000 bpd of distillate or (4) 42% 42 million barrels annually 40% 40% 39% 38% • Gasoline: average approx. 150,000 bpd of gasoline or 55 million barrels annually (4) 34% • Low residual products: approximately 2.9% yield (4) 31% • Crude oil slate has flexibility CVI HFC DK PSX VLO MPC PBF • Ability to increase sour crude oil processing to approximately 50% based on market economics 2Q19 Refiners’ Gasoline Yield % (1) (3) • Big Spring refinery currently processes 26% WTS and can increase to 100% • El Dorado refinery flexibility to process light to 51% medium sour crude oil (up to 100%) based on 50% 50% 49% 49% economics 46% • Krotz Springs refinery exploring ability to produce low 44% sulfur marine fuel CVI HFC DK PBF MPC VLO PSX 1) Industry average based on peer group. 2) Middle distillates yield includes distillate fuel oil, kerosene and kerosene-type jet fuel. 3) Sourced from respective company press releases, SEC filings, and earnings calls. 4) Average calculated based on 2018 results. Residual yield includes asphalt, road oil and residual fuel oil. 20

Valuation Opportunity • Energy sector severely discounted versus broader market Metrics vs. S&P 500 (3) • DK earnings stream to become more stable with midstream growth '19E P/E Multiple 10-yr avg P/E DK 9.6 x 10.6 x • Consistently growing dividend results in yield well S&P 500 18.05 15.3 x above S&P 500 average Current Dividend Yield DK 3.1% • Midstream & Retail EBITDA potential “alone” S&P 500 1.9% support current equity value Return on Equity (LTM 2Q19) Partial Segment Sum of Parts DK 27.7% S&P 500 15.9% Midstream '19E Price to Book '23E EBITDA ($mm)* (1) (2) EBITDA Multiple DK 1.6 $383 8.0 x 10.0 x S&P 500 3.2 $3,060 $3,825 Retail Marketing '23E EBITDA ($mm) (1) EBITDA Multiple $35 8.0 x 10.0 x $280 $350 Enterprise Value ($MM) Enterprise Value ($MM) $3,340 $4,175 DK Consolidated Net Debt 2Q19* $965 $965 Less DKL minority interest $272 $272 Equity Value ($MM) $2,103 $2,938 3Q19 est. share count (mm) 74 74 Equity Value ($/share) $28 $39 Mid-Pt $34 Refining Value $0** * Midstream growth funded w/ combination of project financing and free cash flow ** Net of corporate expenses 1) We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate of net income is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of EBITDA projected. 2) Please refer to page 7 for additional midstream information. 3) Bloomberg as of 09/27/2019 21

An Integrated and Financial Flexibility to Diversified Refining, Support Strategic Logistics and Marketing Company Objectives Invest in the Business to Permian Focused Focus on Long-Term Operate Reliably and Refining System Shareholder Returns Safely Growing Midstream Platform to Diversify EBITDA Stream

Appendix

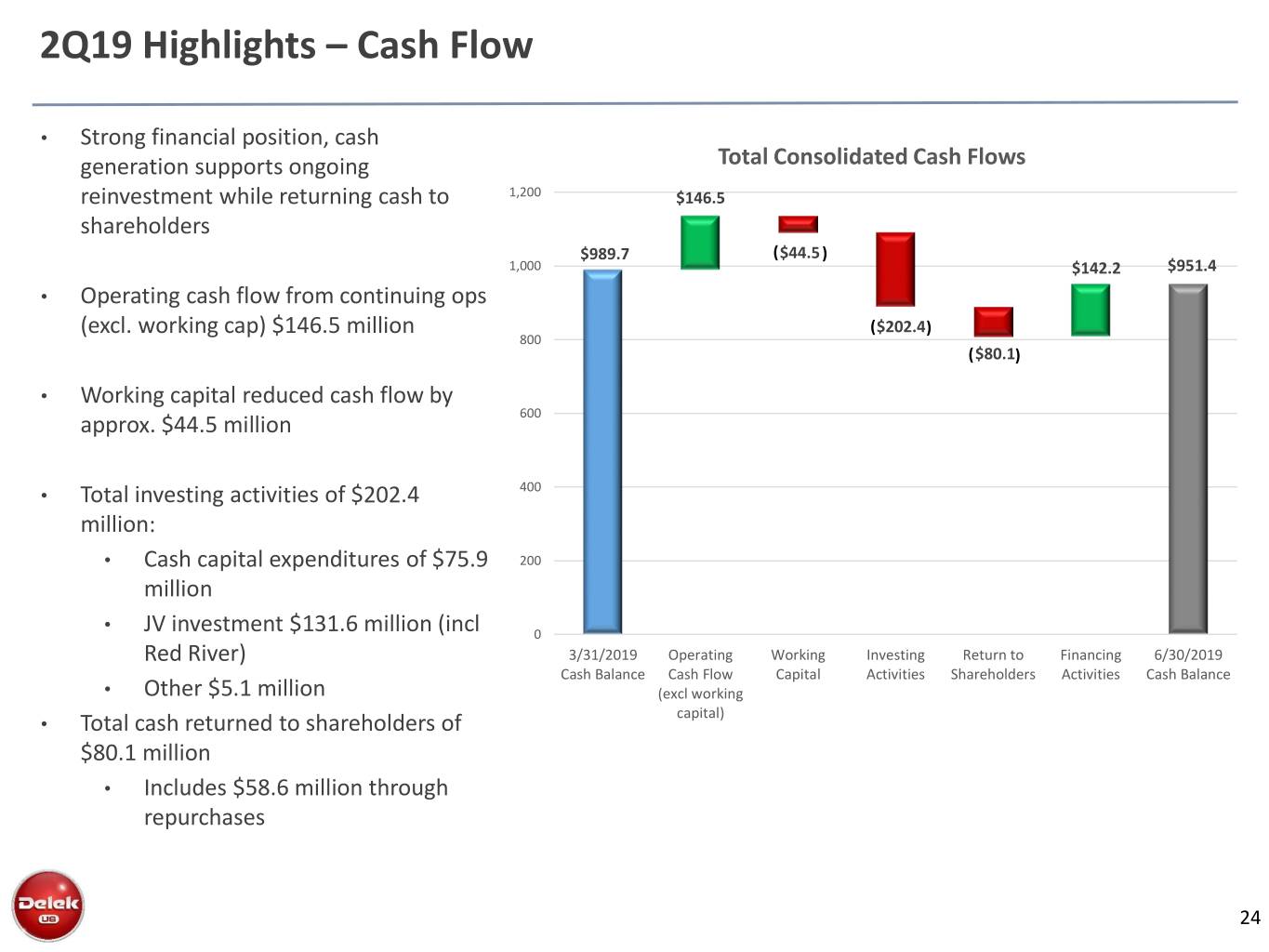

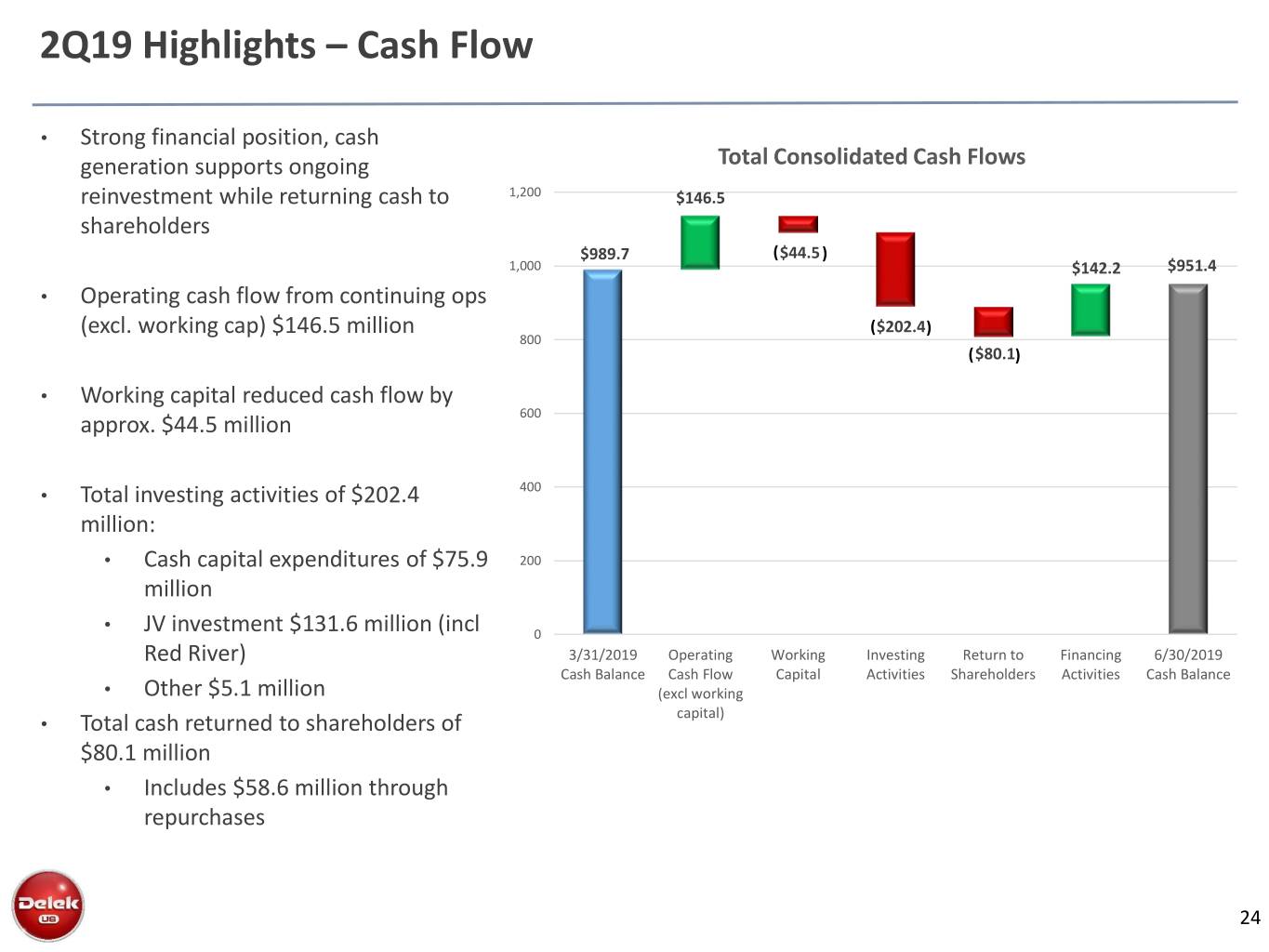

2Q19 Highlights – Cash Flow • Strong financial position, cash generation supports ongoing Total Consolidated Cash Flows reinvestment while returning cash to 1,200 $146.5 shareholders $989.7 ($44.5) 1,000 $142.2 $951.4 • Operating cash flow from continuing ops (excl. working cap) $146.5 million ($202.4 ) 800 ($80.1) • Working capital reduced cash flow by approx. $44.5 million 600 • Total investing activities of $202.4 400 million: • Cash capital expenditures of $75.9 200 million • JV investment $131.6 million (incl 0 Red River) 3/31/2019 Operating Working Investing Return to Financing 6/30/2019 Cash Balance Cash Flow Capital Activities Shareholders Activities Cash Balance • Other $5.1 million (excl working capital) • Total cash returned to shareholders of $80.1 million • Includes $58.6 million through repurchases 24

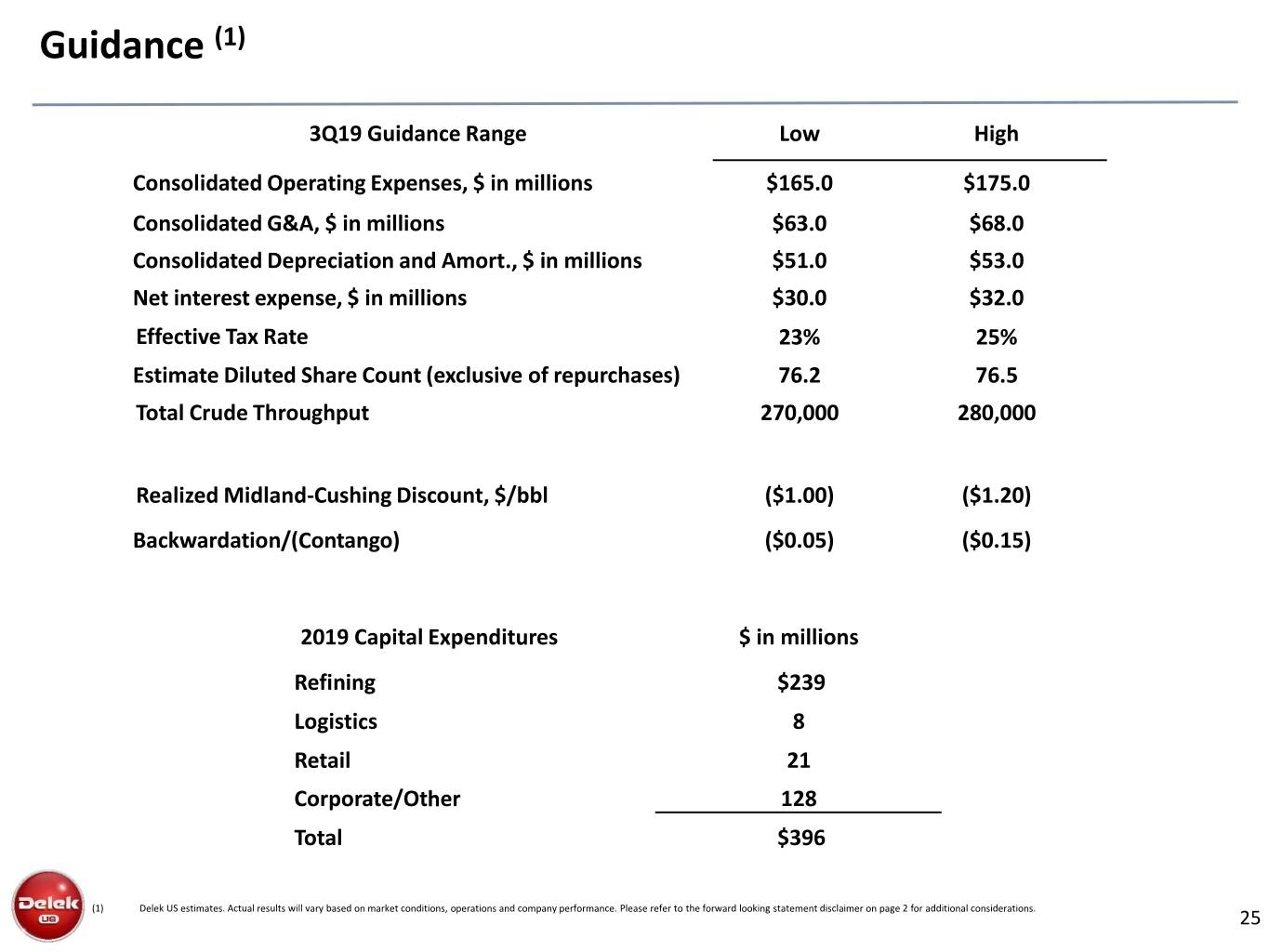

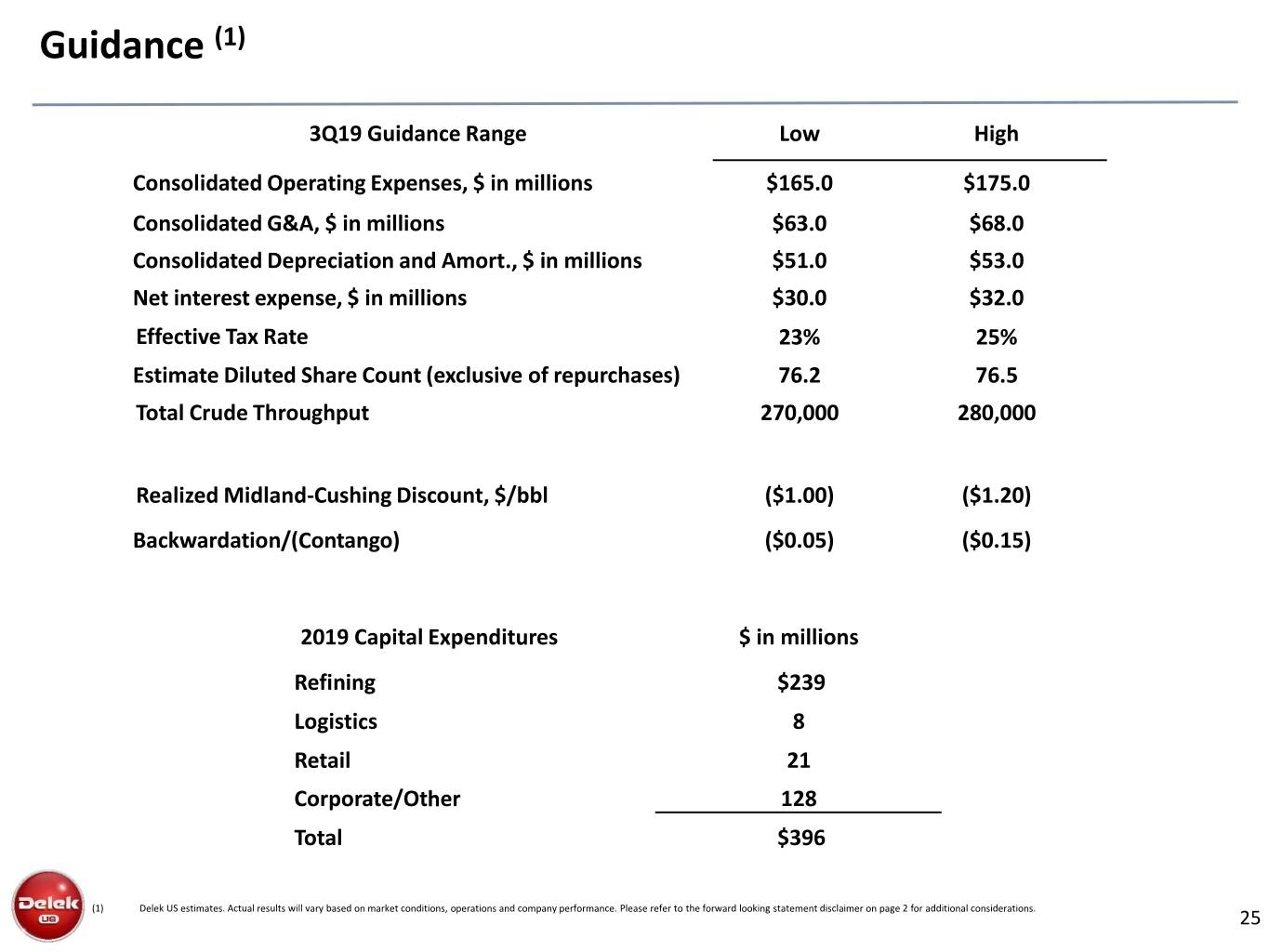

Guidance (1) 3Q19 Guidance Range Low High Consolidated Operating Expenses, $ in millions $165.0 $175.0 Consolidated G&A, $ in millions $63.0 $68.0 Consolidated Depreciation and Amort., $ in millions $51.0 $53.0 Net interest expense, $ in millions $30.0 $32.0 Effective Tax Rate 23% 25% Estimate Diluted Share Count (exclusive of repurchases) 76.2 76.5 Total Crude Throughput 270,000 280,000 Realized Midland-Cushing Discount, $/bbl ($1.00) ($1.20) Backwardation/(Contango) ($0.05) ($0.15) 2019 Capital Expenditures $ in millions Refining $239 Logistics 8 Retail 21 Corporate/Other 128 Total $396 (1) Delek US estimates. Actual results will vary based on market conditions, operations and company performance. Please refer to the forward looking statement disclaimer on page 2 for additional considerations. 25

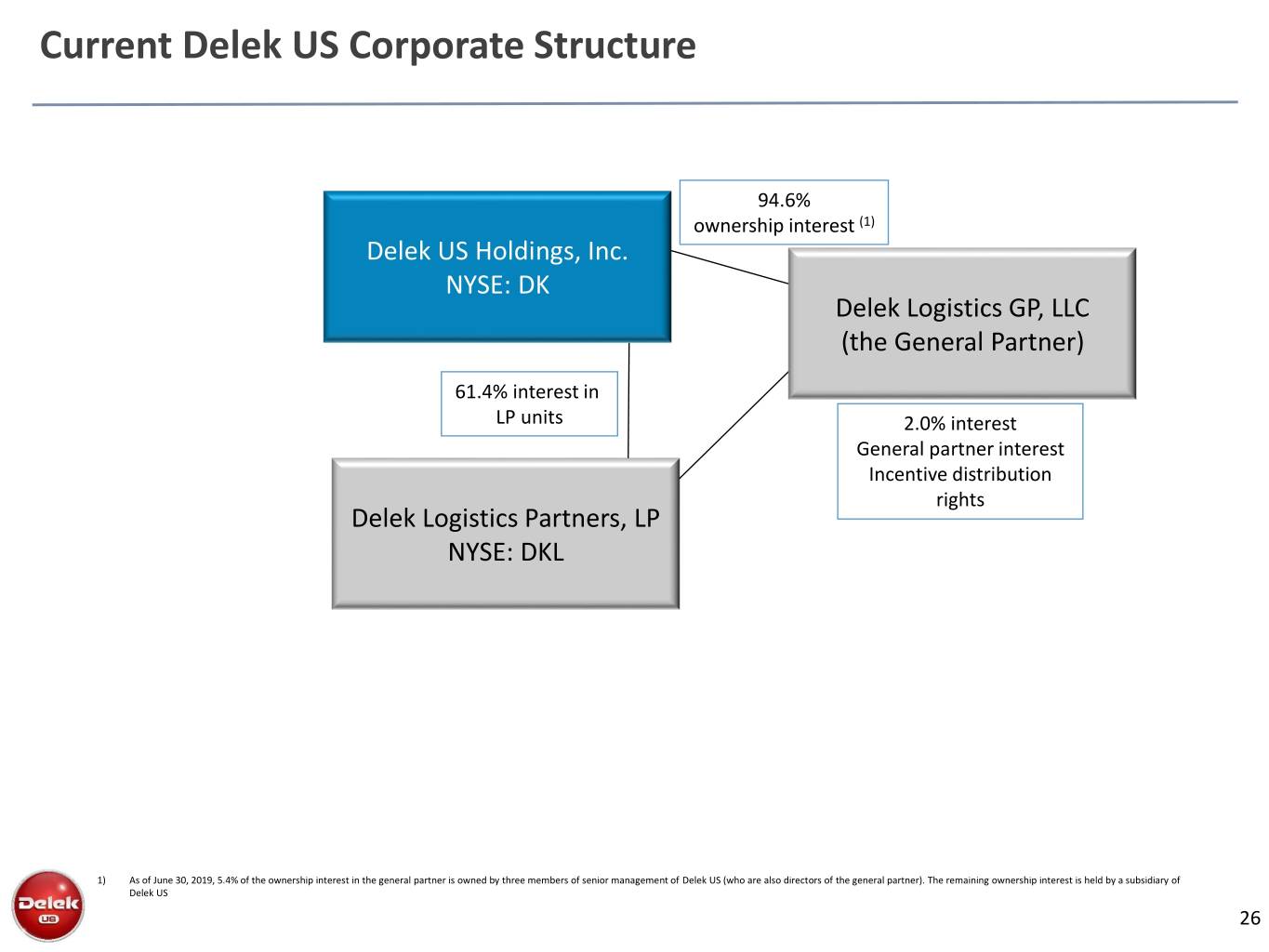

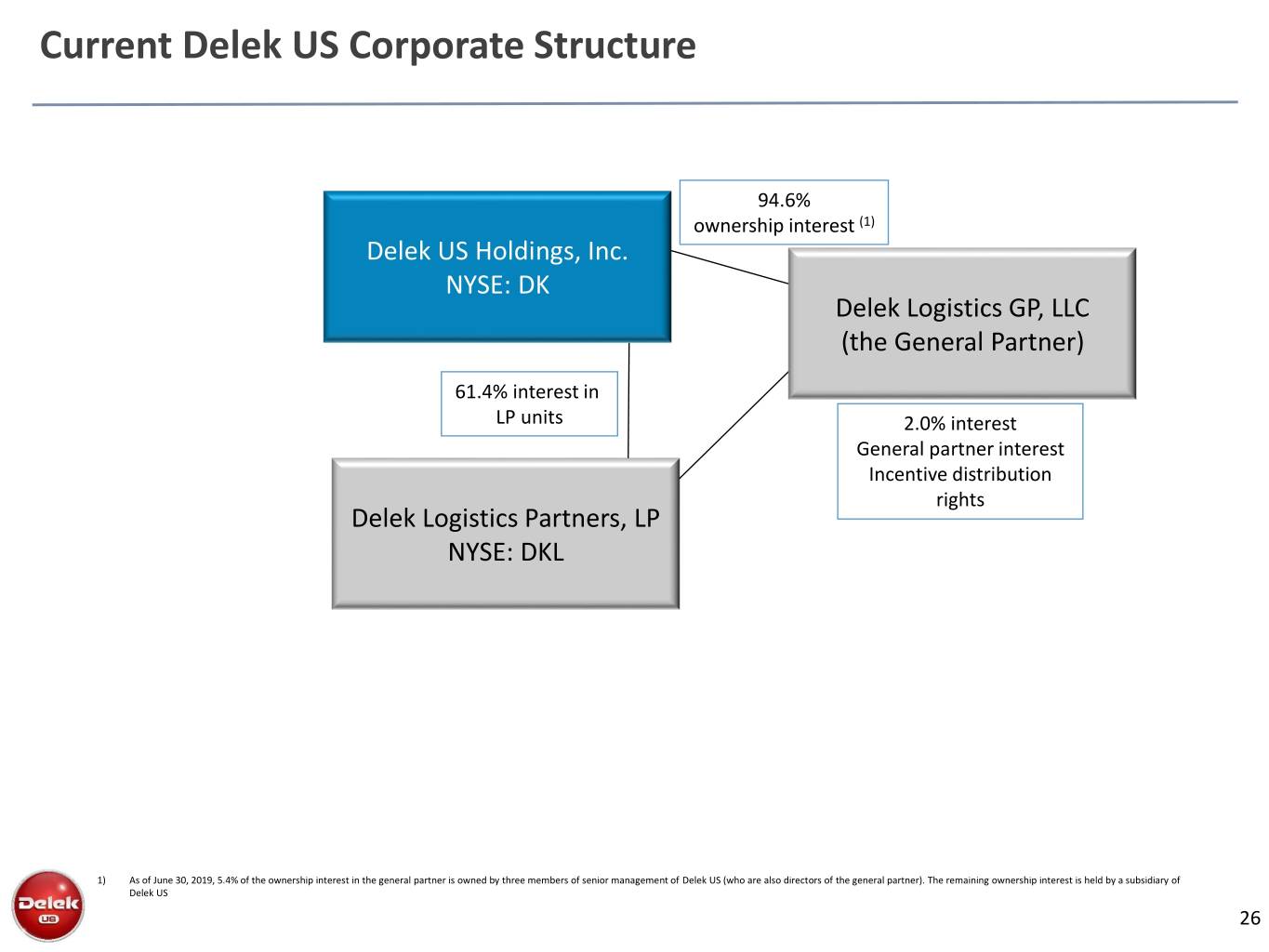

Current Delek US Corporate Structure 94.6% ownership interest (1) Delek US Holdings, Inc. NYSE: DK Delek Logistics GP, LLC (the General Partner) 61.4% interest in LP units 2.0% interest General partner interest Incentive distribution rights Delek Logistics Partners, LP NYSE: DKL 1) As of June 30, 2019, 5.4% of the ownership interest in the general partner is owned by three members of senior management of Delek US (who are also directors of the general partner). The remaining ownership interest is held by a subsidiary of Delek US 26

Market Data

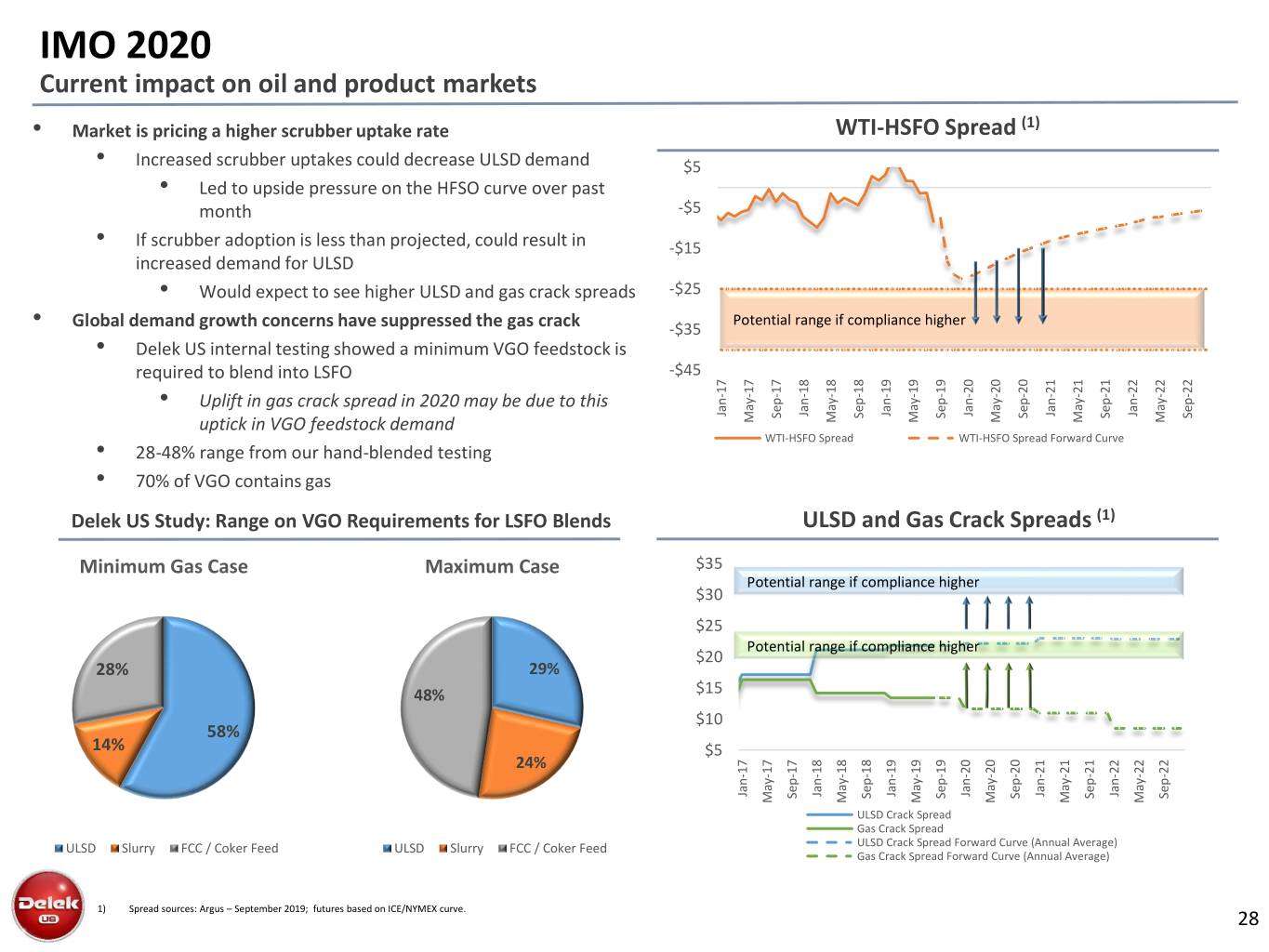

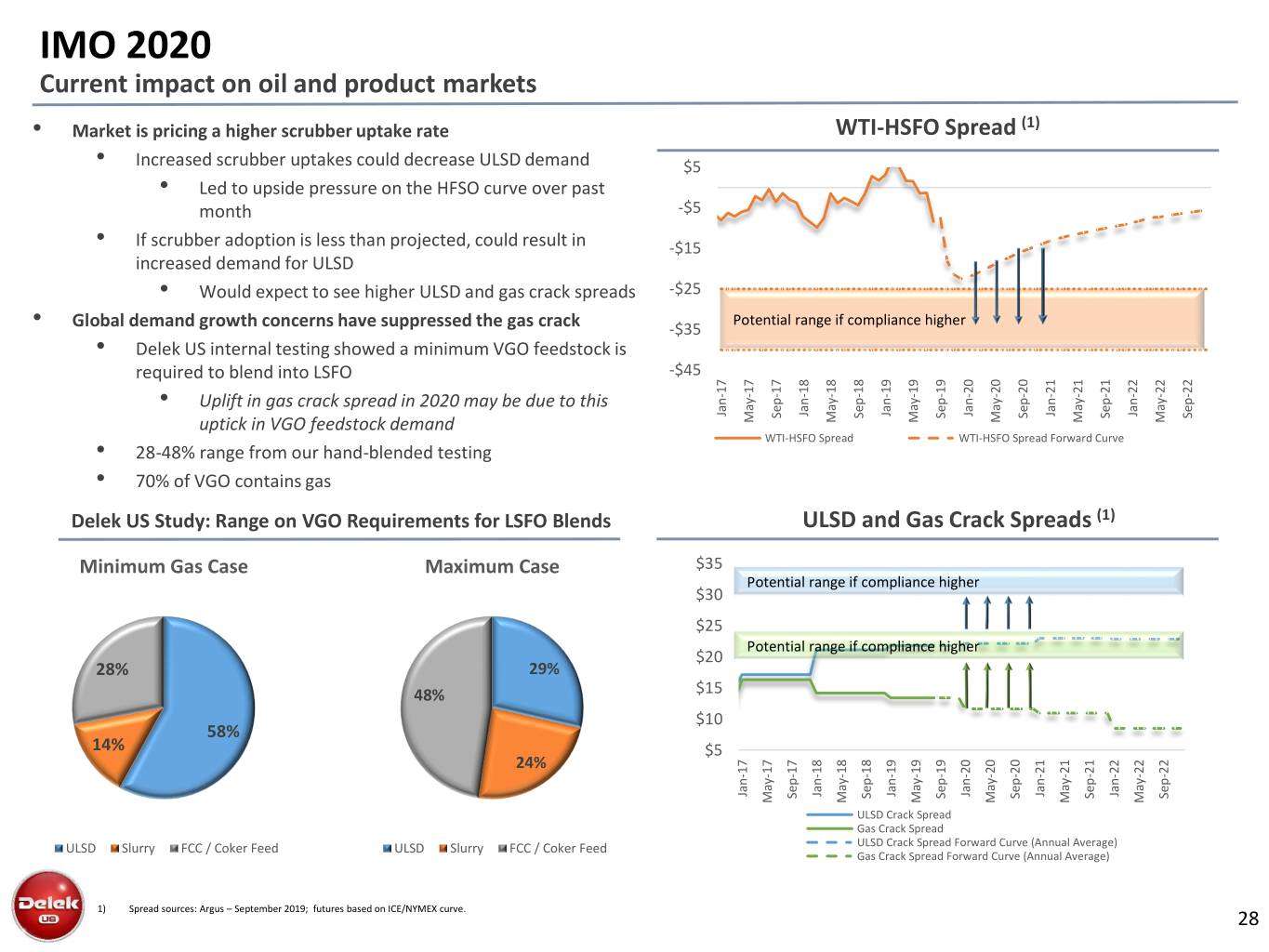

IMO 2020 Current impact on oil and product markets • Market is pricing a higher scrubber uptake rate WTI-HSFO Spread (1) • Increased scrubber uptakes could decrease ULSD demand $5 • Led to upside pressure on the HFSO curve over past month -$5 • If scrubber adoption is less than projected, could result in -$15 increased demand for ULSD • Would expect to see higher ULSD and gas crack spreads -$25 Potential range if compliance higher • Global demand growth concerns have suppressed the gas crack -$35 • Delek US internal testing showed a minimum VGO feedstock is required to blend into LSFO -$45 • Uplift in gas crack spread in 2020 may be due to this Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Sep-21 Sep-17 Sep-18 Sep-19 Sep-20 Sep-22 May-18 May-19 May-20 May-21 May-22 uptick in VGO feedstock demand May-17 WTI-HSFO Spread WTI-HSFO Spread Forward Curve • 28-48% range from our hand-blended testing • 70% of VGO contains gas Delek US Study: Range on VGO Requirements for LSFO Blends ULSD and Gas Crack Spreads (1) Minimum Gas Case Maximum Case $35 Potential range if compliance higher $30 $25 Potential range if compliance higher $20 28% 29% 48% $15 $10 58% 14% $5 24% Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Sep-18 Sep-17 Sep-19 Sep-20 Sep-21 Sep-22 May-17 May-18 May-19 May-20 May-21 May-22 ULSD Crack Spread Gas Crack Spread ULSD Slurry FCC / Coker Feed ULSD Slurry FCC / Coker Feed ULSD Crack Spread Forward Curve (Annual Average) Gas Crack Spread Forward Curve (Annual Average) 1) Spread sources: Argus – September 2019; futures based on ICE/NYMEX curve. 28

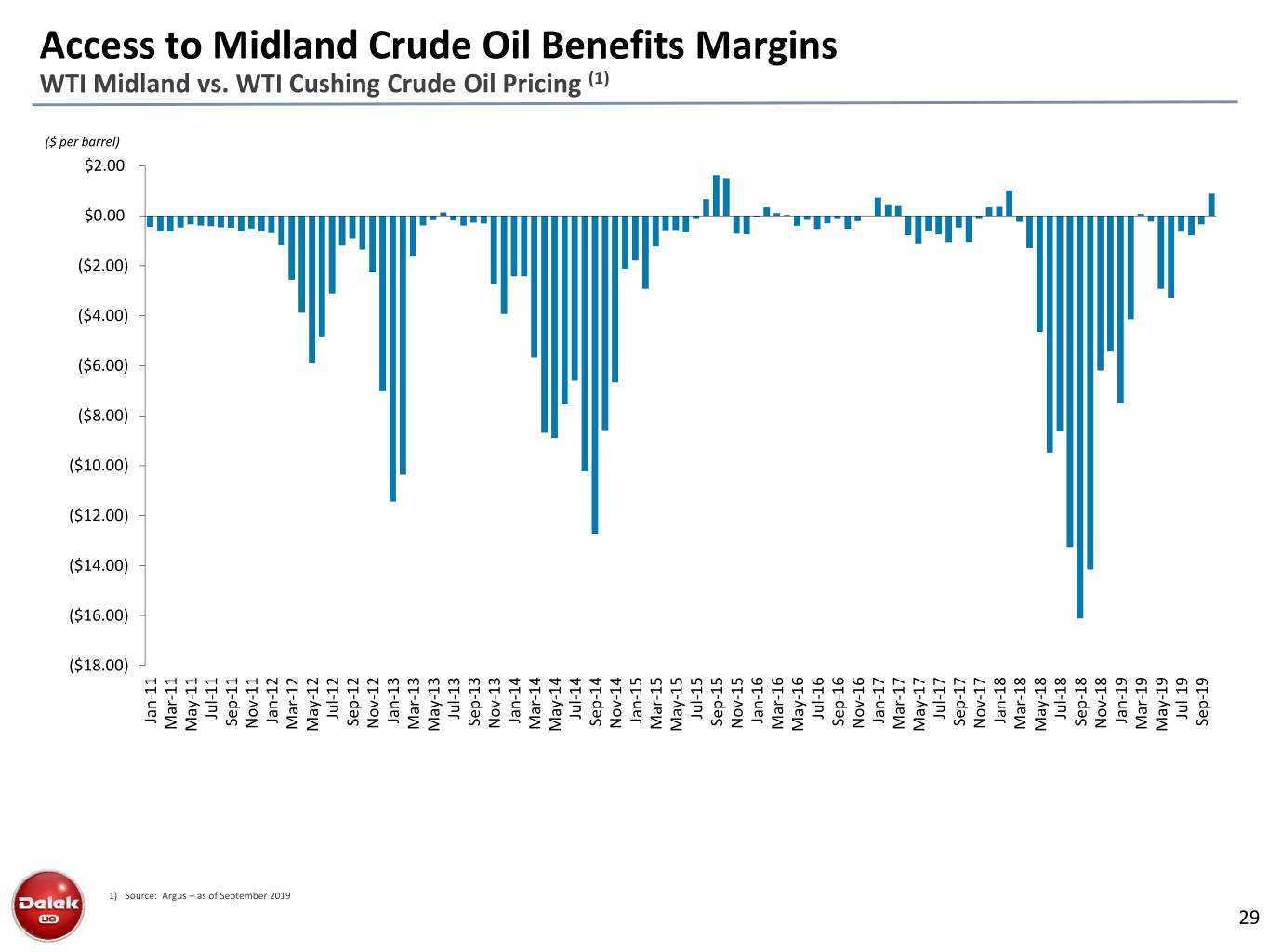

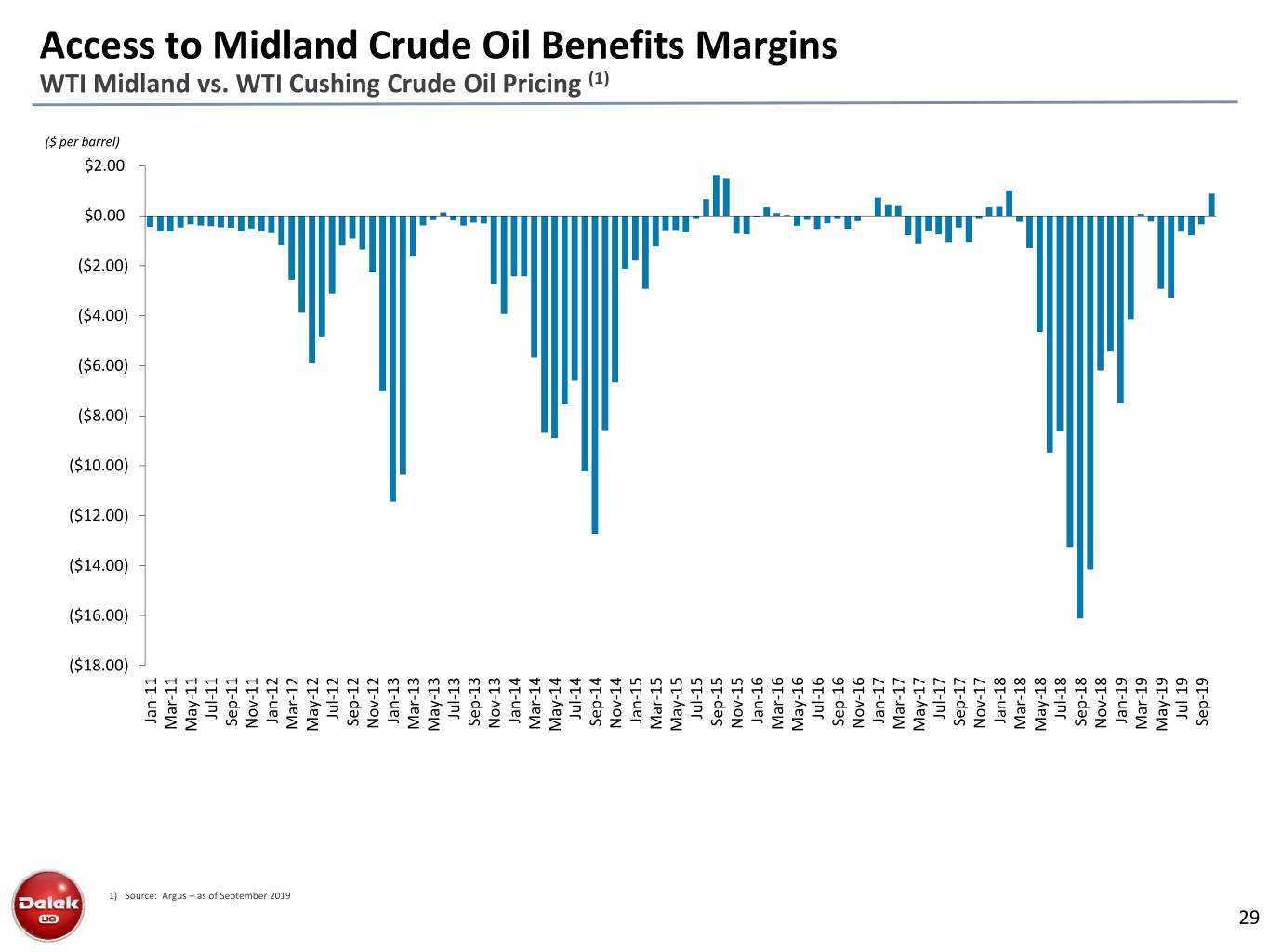

Access to Midland Crude Oil Benefits Margins WTI Midland vs. WTI Cushing Crude Oil Pricing (1) ($ per barrel) $2.00 $0.00 ($2.00) ($4.00) ($6.00) ($8.00) ($10.00) ($12.00) ($14.00) ($16.00) ($18.00) Jul-19 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 Jul-16 Jul-17 Jul-18 Jan-19 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16 Sep-17 Sep-18 Sep-19 Nov-11 Nov-12 Nov-13 Nov-14 Nov-15 Nov-16 Nov-17 Nov-18 Mar-19 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 May-19 May-11 May-12 May-13 May-14 May-15 May-16 May-17 May-18 1) Source: Argus – as of September 2019 29

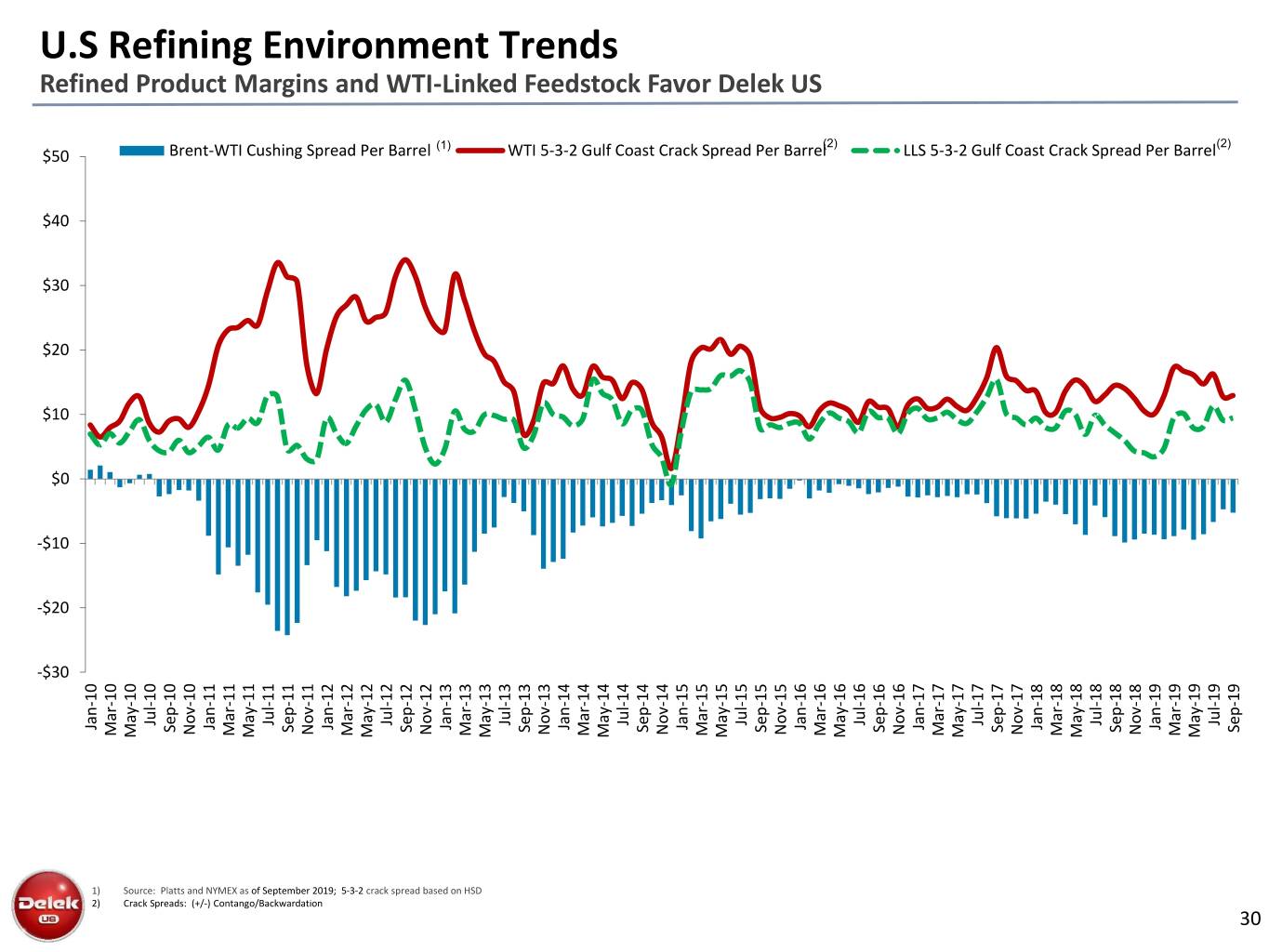

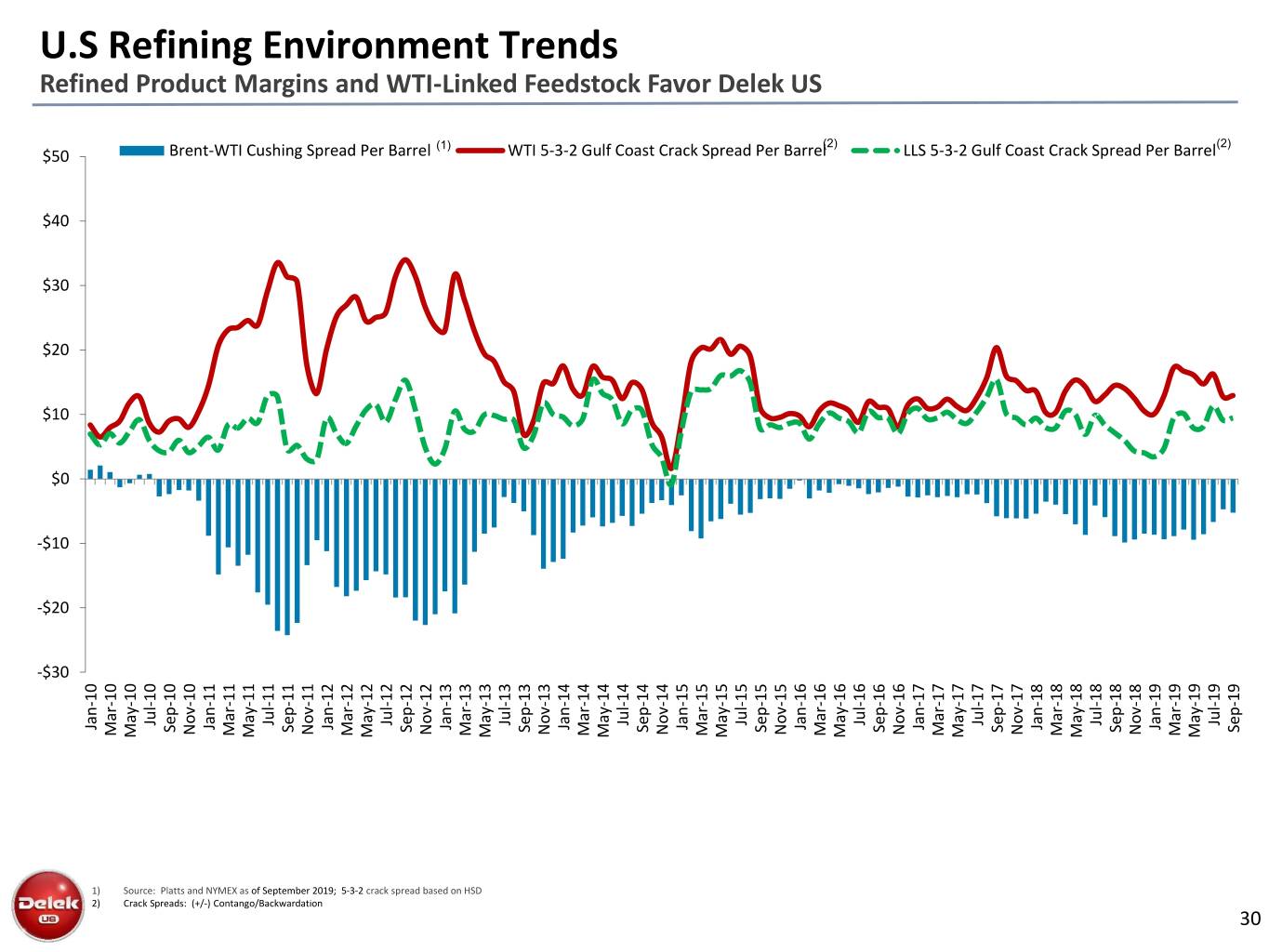

U.S Refining Environment Trends Refined Product Margins and WTI-Linked Feedstock Favor Delek US (1) (2) (2) $50 Brent-WTI Cushing Spread Per Barrel WTI 5-3-2 Gulf Coast Crack Spread Per Barrel LLS 5-3-2 Gulf Coast Crack Spread Per Barrel $40 $30 $20 $10 $0 -$10 -$20 -$30 Jul-10 Jul-11 Jul-12 Jul-13 Jul-14 Jul-15 Jul-16 Jul-17 Jul-18 Jul-19 Jan-15 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-16 Jan-17 Jan-18 Jan-19 Sep-10 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 Sep-16 Sep-17 Sep-18 Sep-19 Nov-11 Nov-10 Nov-12 Nov-13 Nov-14 Nov-15 Nov-16 Nov-17 Nov-18 Mar-17 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-18 Mar-19 May-19 May-10 May-11 May-12 May-13 May-14 May-15 May-16 May-17 May-18 1) Source: Platts and NYMEX as of September 2019; 5-3-2 crack spread based on HSD 2) Crack Spreads: (+/-) Contango/Backwardation 30

Reconciliations

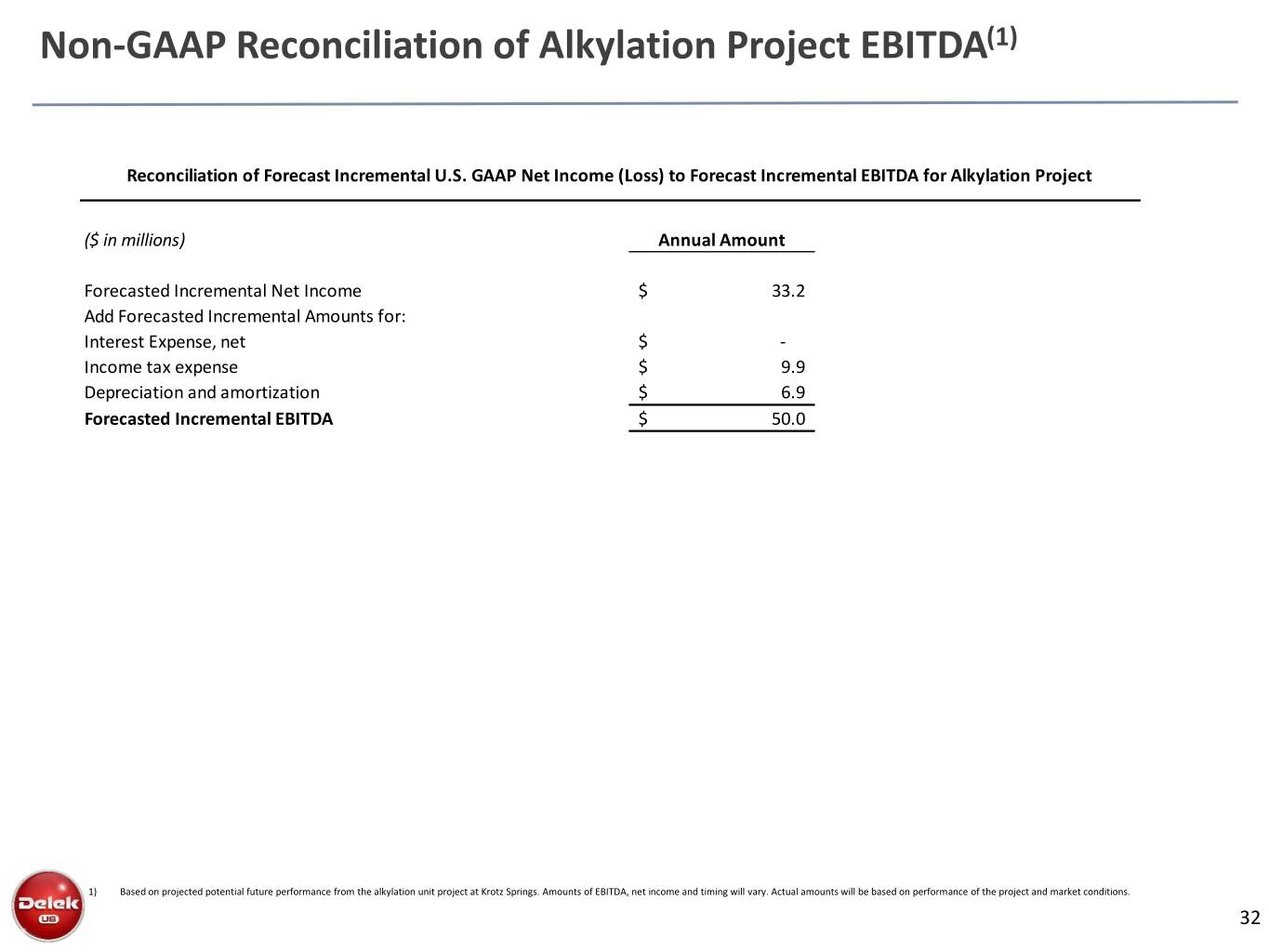

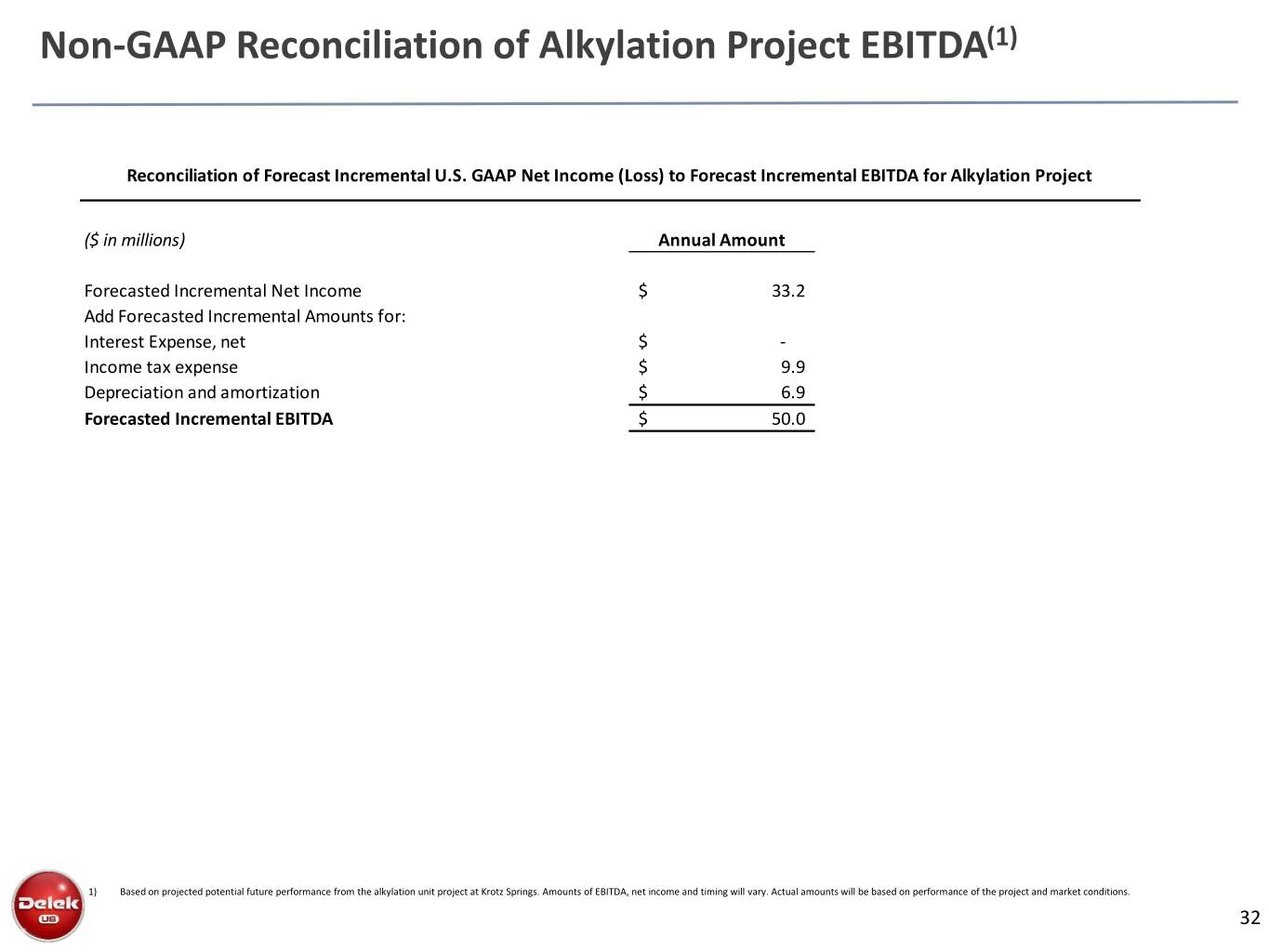

Non-GAAP Reconciliation of Alkylation Project EBITDA(1) Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA for Alkylation Project ($ in millions) Annual Amount Forecasted Incremental Net Income $ 33.2 Add Forecasted Incremental Amounts for: Interest Expense, net $ - Income tax expense $ 9.9 Depreciation and amortization $ 6.9 Forecasted Incremental EBITDA $ 50.0 1) Based on projected potential future performance from the alkylation unit project at Krotz Springs. Amounts of EBITDA, net income and timing will vary. Actual amounts will be based on performance of the project and market conditions. 32

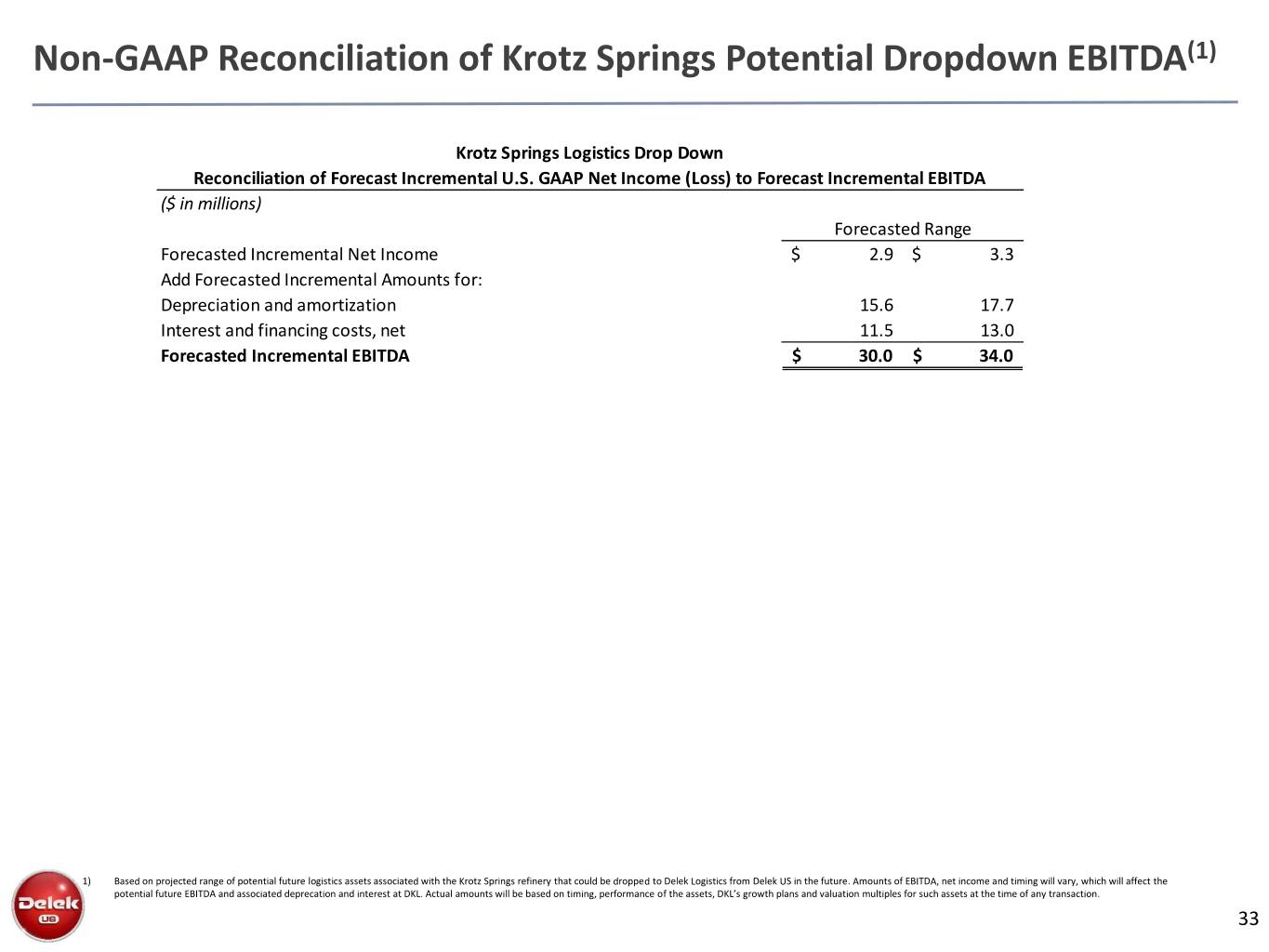

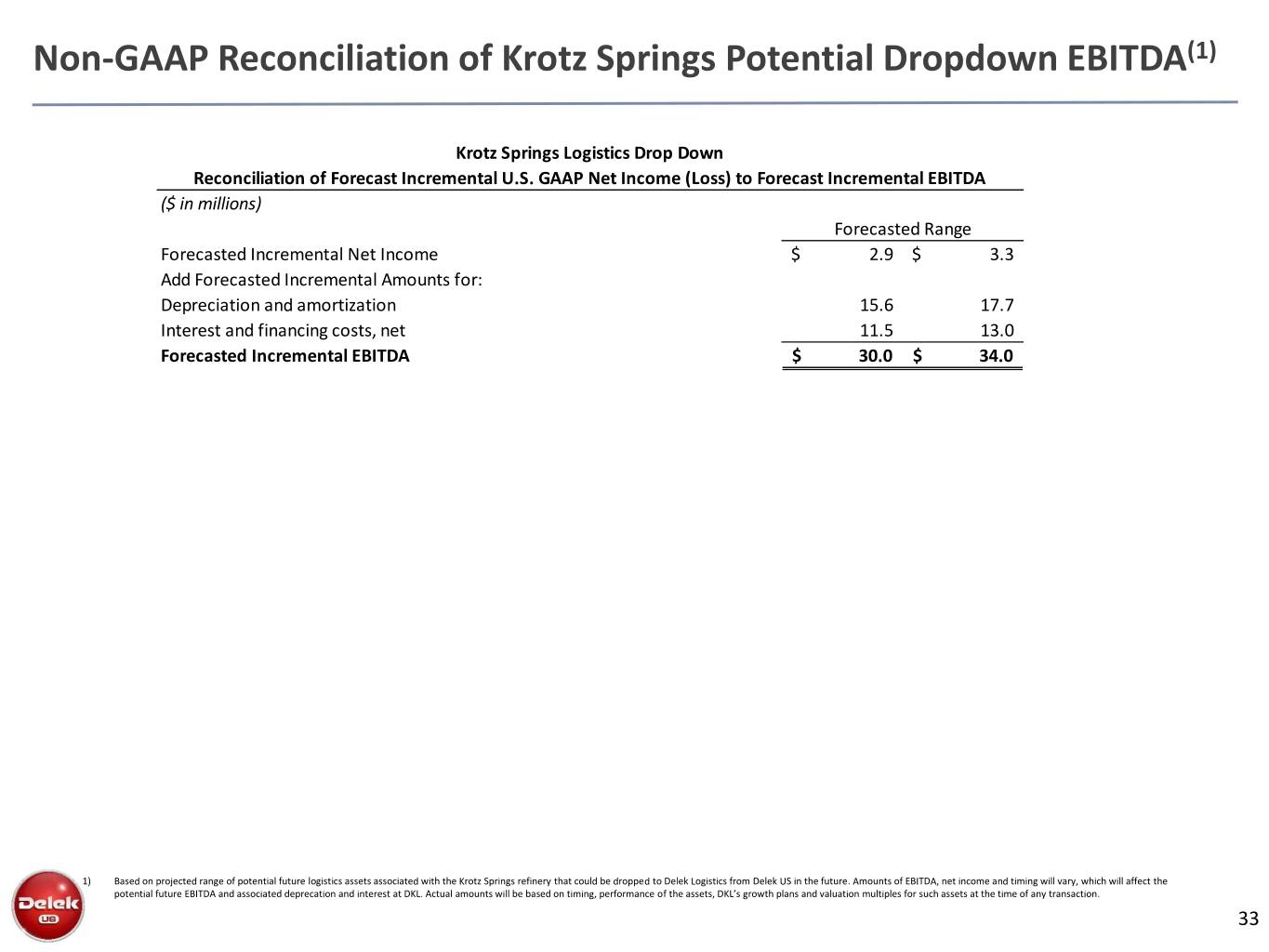

Non-GAAP Reconciliation of Krotz Springs Potential Dropdown EBITDA(1) Krotz Springs Logistics Drop Down Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA ($ in millions) Forecasted Range Forecasted Incremental Net Income $ 2.9 $ 3.3 Add Forecasted Incremental Amounts for: Depreciation and amortization 15.6 17.7 Interest and financing costs, net 11.5 13.0 Forecasted Incremental EBITDA $ 30.0 $ 34.0 1) Based on projected range of potential future logistics assets associated with the Krotz Springs refinery that could be dropped to Delek Logistics from Delek US in the future. Amounts of EBITDA, net income and timing will vary, which will affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts will be based on timing, performance of the assets, DKL’s growth plans and valuation multiples for such assets at the time of any transaction. 33

Non-GAAP Reconciliations of Adjusted EBITDA Delek US Holdings, Inc. Reconciliation of Amounts Reported Under U.S. GAAP $ in millions Three Months Ended June Six Months Ended June 30, 30, Reconciliation of Net Income (Loss) attributable to Delek to Adjusted EBITDA 2019 2018 2019 2018 (Unaudited) (Unaudited) Reported net income (loss) attributable to Delek $77.3 $79.1 $226.6 $38.7 Add: Interest expense, net 29.5 30.6 55.7 62.4 Loss on extinguishment of debt - - - 9.0 Income tax expense (benefit) - continuing operations 24.6 32.8 70.4 21.3 Depreciation and amortization 50.1 49.2 96.9 97.2 EBITDA 181.5 191.7 449.6 228.6 Adjustments Net inventory valuation (gain) loss 0.6 (1.0) (51.5) (1.9) Adjusted unrealized hedging loss 8.5 (2.4) 21.8 5.4 Transaction related expenses 0.3 2.6 3.3 13.2 Impairment loss on assets held for sale - - - 27.5 Non-operating, pre-acquistion litigation contingent losses and related legal expenses 6.7 - 6.7 - Gain on sale of the asphalt business - (13.2) - (13.2) Discontinued operations loss, net of tax 0.8 0.8 0.8 9.0 Net income attributable to non-controlling interest 6.5 7.6 11.6 22.5 Total adjustments 23.4 (5.6) (7.3) 62.5 Adjusted EBITDA $204.9 $186.1 $442.3 $291.1 34

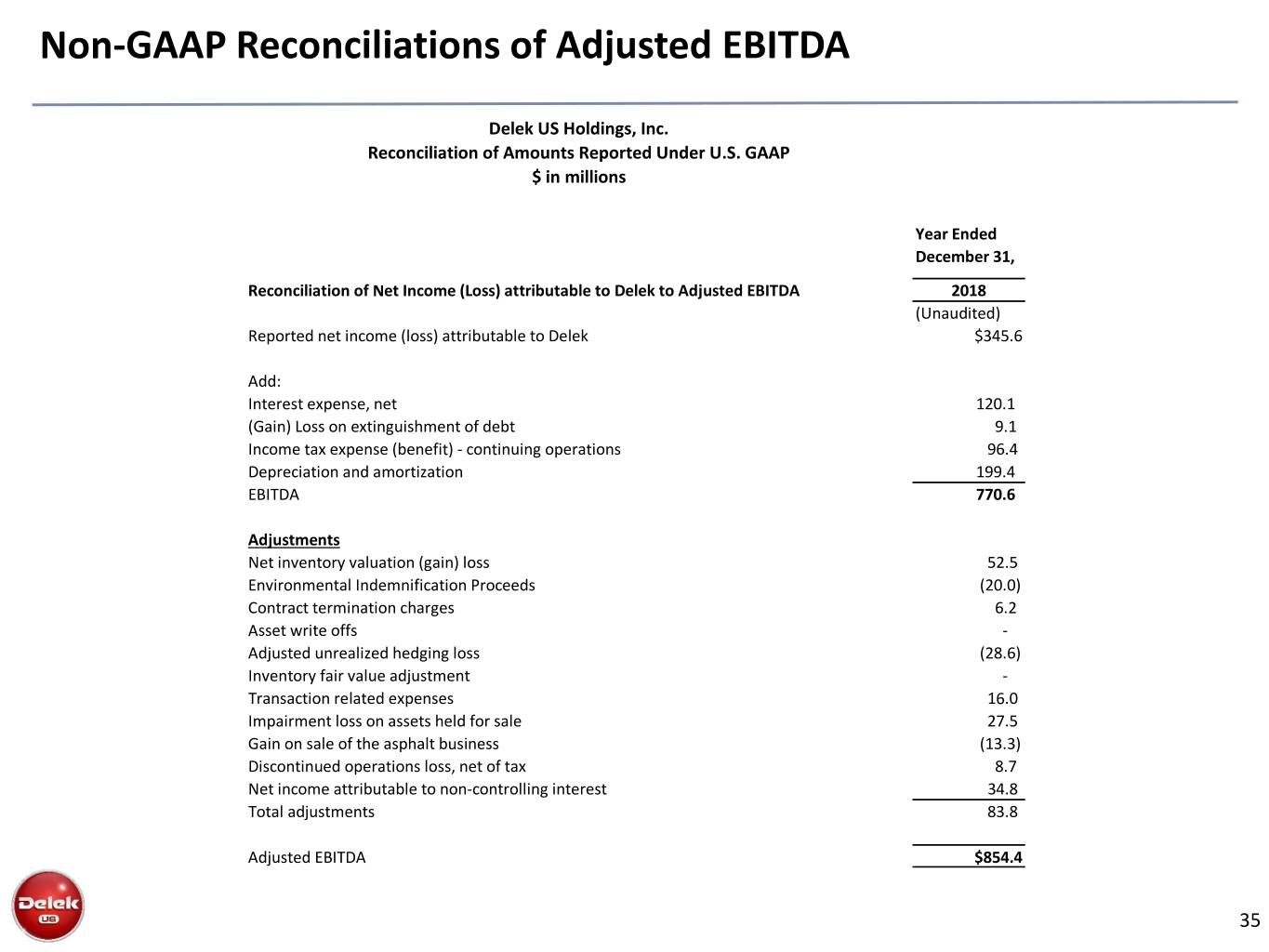

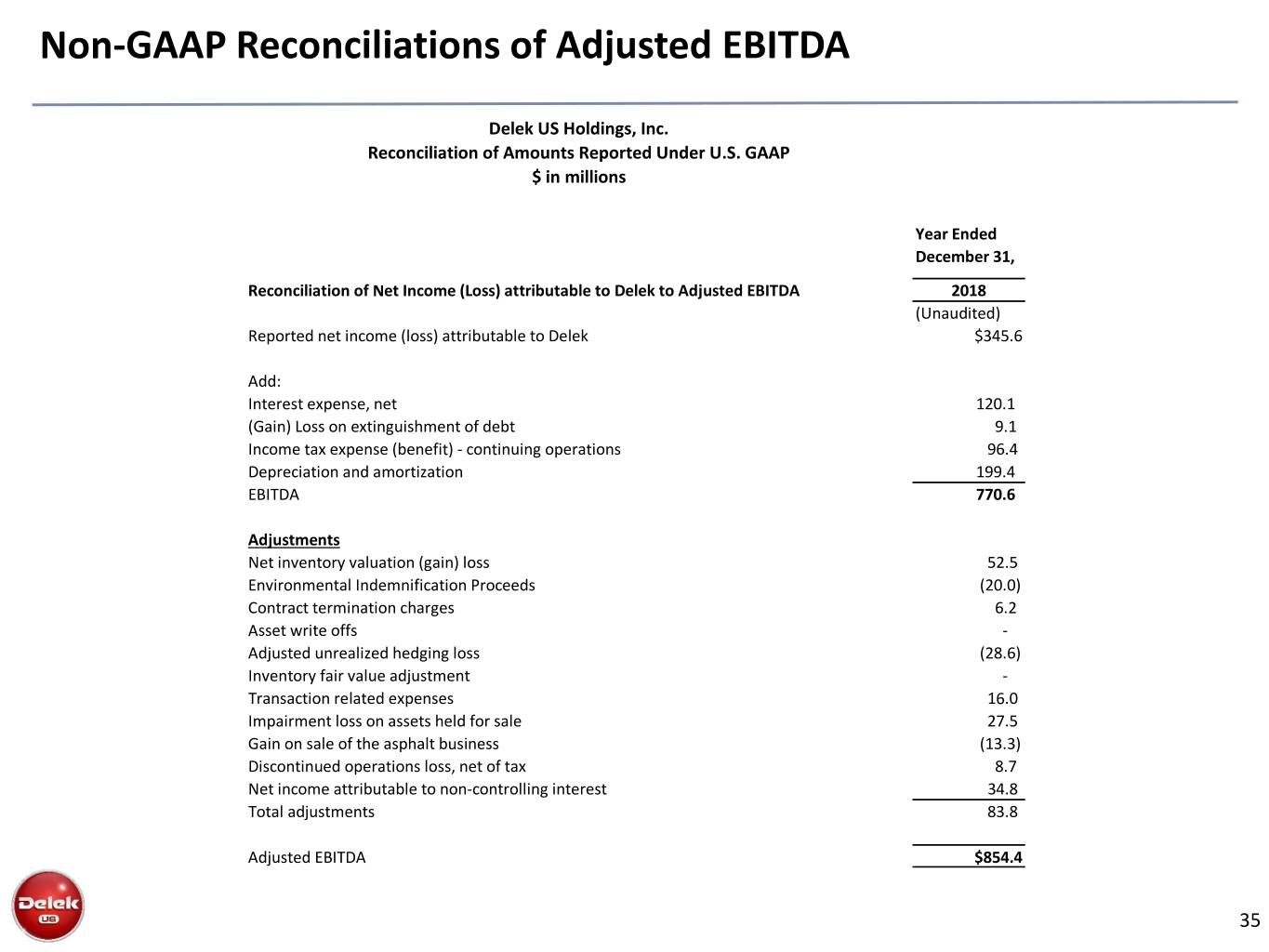

Non-GAAP Reconciliations of Adjusted EBITDA Delek US Holdings, Inc. Reconciliation of Amounts Reported Under U.S. GAAP $ in millions Year Ended December 31, Reconciliation of Net Income (Loss) attributable to Delek to Adjusted EBITDA 2018 (Unaudited) Reported net income (loss) attributable to Delek $345.6 Add: Interest expense, net 120.1 (Gain) Loss on extinguishment of debt 9.1 Income tax expense (benefit) - continuing operations 96.4 Depreciation and amortization 199.4 EBITDA 770.6 Adjustments Net inventory valuation (gain) loss 52.5 Environmental Indemnification Proceeds (20.0) Contract termination charges 6.2 Asset write offs - Adjusted unrealized hedging loss (28.6) Inventory fair value adjustment - Transaction related expenses 16.0 Impairment loss on assets held for sale 27.5 Gain on sale of the asphalt business (13.3) Discontinued operations loss, net of tax 8.7 Net income attributable to non-controlling interest 34.8 Total adjustments 83.8 Adjusted EBITDA $854.4 35

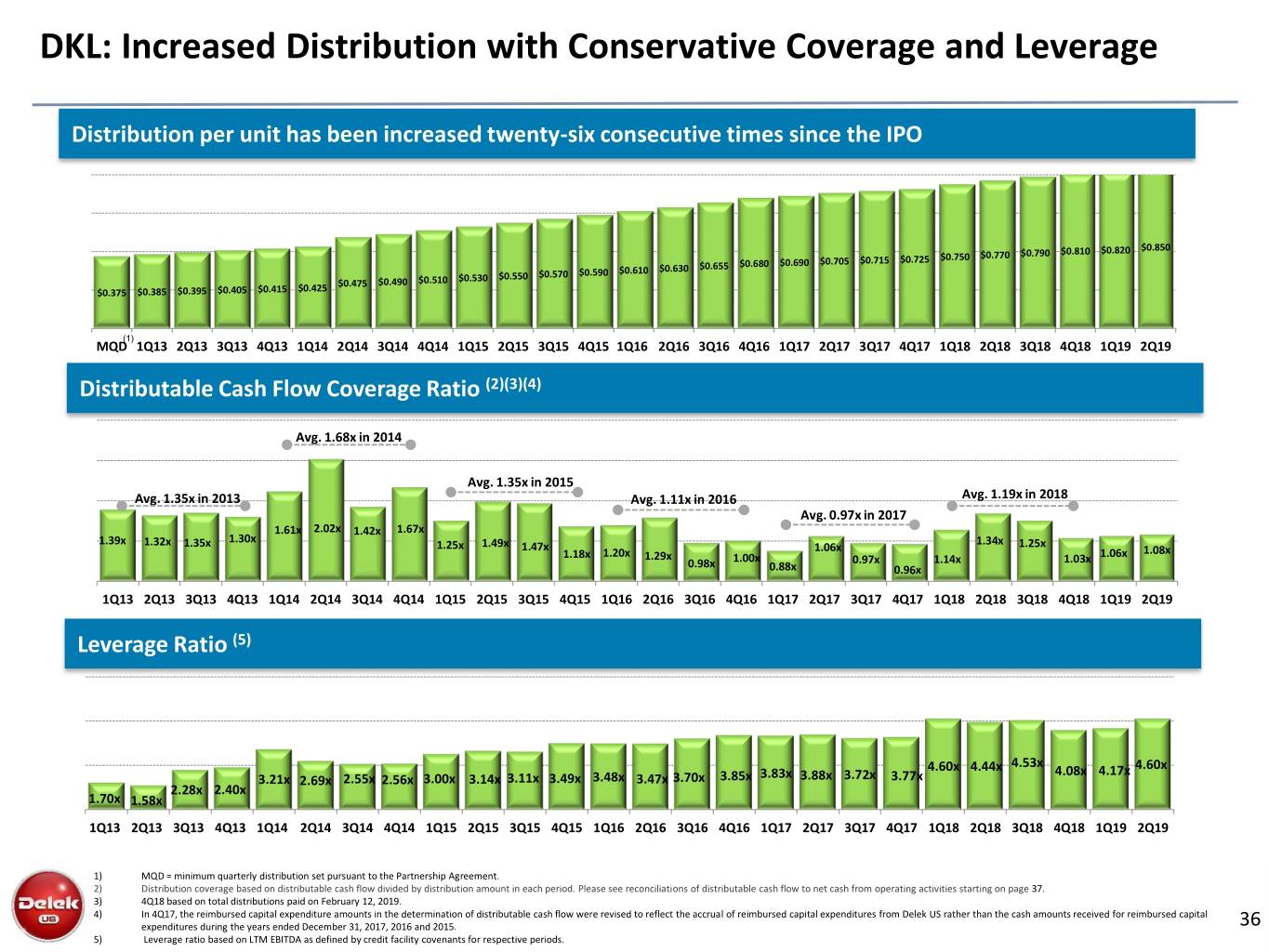

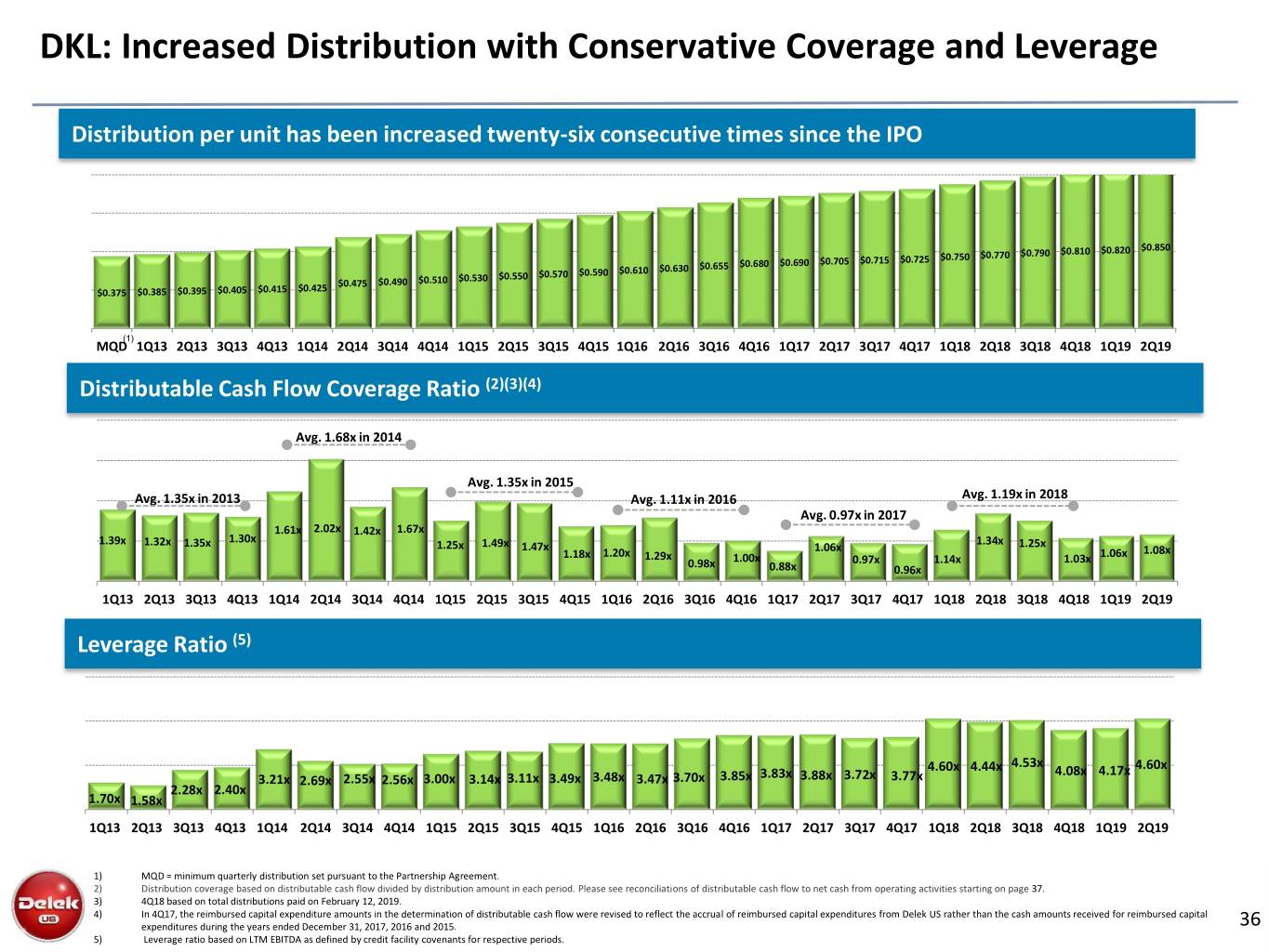

DKL: Increased Distribution with Conservative Coverage and Leverage Distribution per unit has been increased twenty-six consecutive times since the IPO $0.810 $0.820 $0.850 $0.750 $0.770 $0.790 $0.680 $0.690 $0.705 $0.715 $0.725 $0.610 $0.630 $0.655 $0.550 $0.570 $0.590 $0.475 $0.490 $0.510 $0.530 $0.375 $0.385 $0.395 $0.405 $0.415 $0.425 (1) MQD 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Distributable Cash Flow Coverage Ratio (2)(3)(4) Avg. 1.68x in 2014 Avg. 1.35x in 2015 Avg. 1.35x in 2013 Avg. 1.11x in 2016 Avg. 1.19x in 2018 Avg. 0.97x in 2017 1.61x 2.02x 1.42x 1.67x 1.39x 1.30x 1.34x 1.32x 1.35x 1.25x 1.49x 1.47x 1.06x 1.25x 1.18x 1.20x 1.29x 1.06x 1.08x 0.98x 1.00x 0.97x 1.14x 1.03x 0.88x 0.96x 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Leverage Ratio (5) 4.53x 4.60x 3.83x 4.60x 4.44x 4.08x 4.17x 3.21x 2.69x 2.55x 2.56x 3.00x 3.14x 3.11x 3.49x 3.48x 3.47x 3.70x 3.85x 3.88x 3.72x 3.77x 2.28x 2.40x 1.70x 1.58x 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 1) MQD = minimum quarterly distribution set pursuant to the Partnership Agreement. 2) Distribution coverage based on distributable cash flow divided by distribution amount in each period. Please see reconciliations of distributable cash flow to net cash from operating activities starting on page 37. 3) 4Q18 based on total distributions paid on February 12, 2019. 4) In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek US rather than the cash amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015. 36 5) Leverage ratio based on LTM EBITDA as defined by credit facility covenants for respective periods.

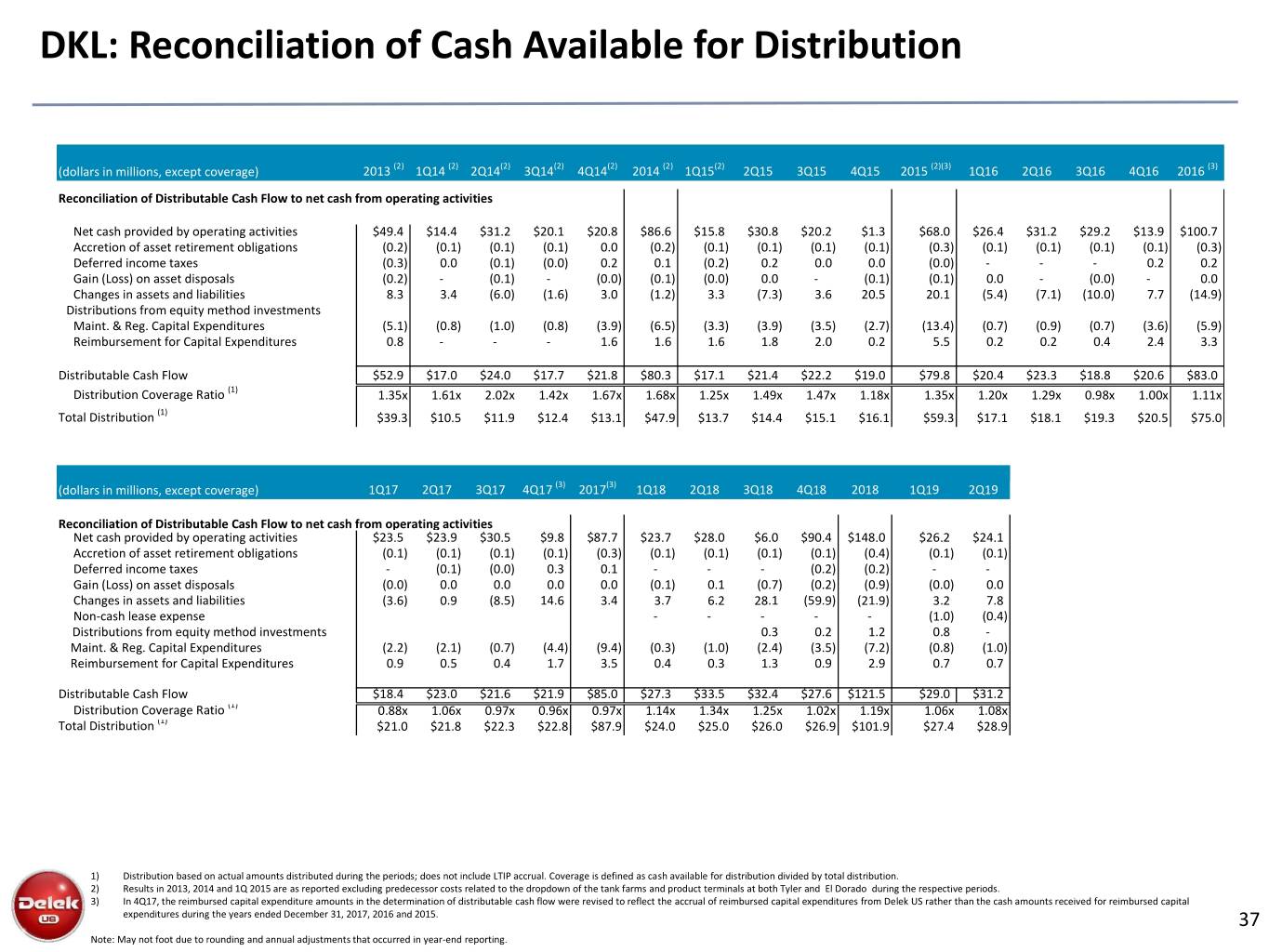

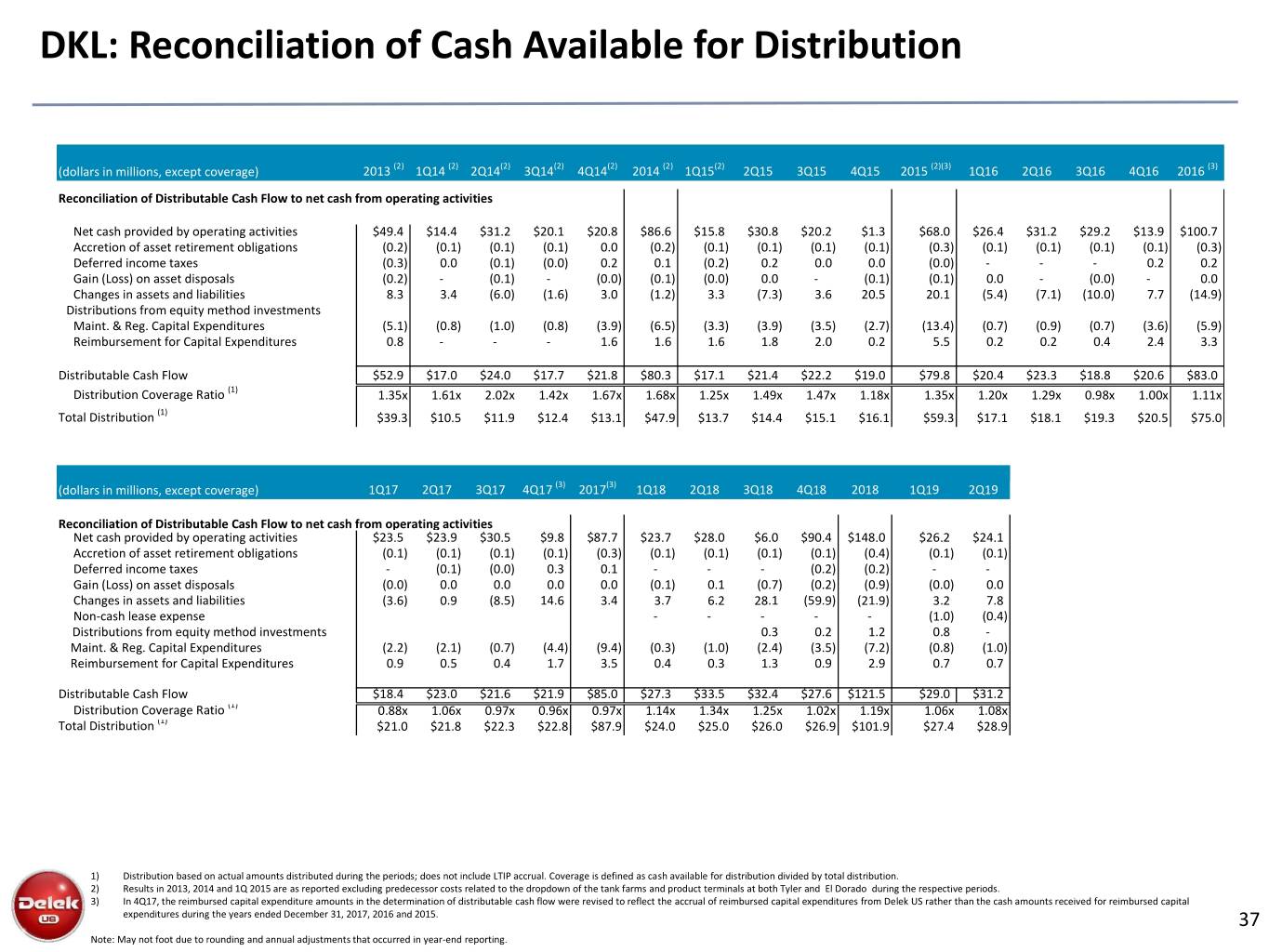

DKL: Reconciliation of Cash Available for Distribution 4 (dollars in millions, except coverage) Q2013 (2) 1Q14 (2) 2Q14(2) 3Q14(2) 4Q14(2) 2014 (2) 1Q15(2) 2Q15 3Q15 4Q15 2015 (2)(3) 1Q16 2Q16 3Q16 4Q16 2016 (3) Reconciliation of Distributable Cash Flow to net cash from operating activities Net cash provided by operating activities $49.4 $14.4 $31.2 $20.1 $20.8 $86.6 $15.8 $30.8 $20.2 $1.3 $68.0 $26.4 $31.2 $29.2 $13.9 $100.7 Accretion of asset retirement obligations (0.2) (0.1) (0.1) (0.1) 0.0 (0.2) (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.3) Deferred income taxes (0.3) 0.0 (0.1) (0.0) 0.2 0.1 (0.2) 0.2 0.0 0.0 (0.0) - - - 0.2 0.2 Gain (Loss) on asset disposals (0.2) - (0.1) - (0.0) (0.1) (0.0) 0.0 - (0.1) (0.1) 0.0 - (0.0) - 0.0 Changes in assets and liabilities 8.3 3.4 (6.0) (1.6) 3.0 (1.2) 3.3 (7.3) 3.6 20.5 20.1 (5.4) (7.1) (10.0) 7.7 (14.9) Distributions from equity method investments Maint. & Reg. Capital Expenditures (5.1) (0.8) (1.0) (0.8) (3.9) (6.5) (3.3) (3.9) (3.5) (2.7) (13.4) (0.7) (0.9) (0.7) (3.6) (5.9) Reimbursement for Capital Expenditures 0.8 - - - 1.6 1.6 1.6 1.8 2.0 0.2 5.5 0.2 0.2 0.4 2.4 3.3 Distributable Cash Flow $52.9 $17.0 $24.0 $17.7 $21.8 $80.3 $17.1 $21.4 $22.2 $19.0 $79.8 $20.4 $23.3 $18.8 $20.6 $83.0 Distribution Coverage Ratio (1) 1.35x 1.61x 2.02x 1.42x 1.67x 1.68x 1.25x 1.49x 1.47x 1.18x 1.35x 1.20x 1.29x 0.98x 1.00x 1.11x Total Distribution (1) $39.3 $10.5 $11.9 $12.4 $13.1 $47.9 $13.7 $14.4 $15.1 $16.1 $59.3 $17.1 $18.1 $19.3 $20.5 $75.0 4 (dollars in millions, except coverage) Q 1Q17 2Q17 3Q17 4Q17 (3) 2017(3) 1Q18 2Q18 3Q18 4Q18 2018 1Q19 2Q19 Reconciliation of Distributable Cash Flow to net cash from operating activities Net cash provided by operating activities $23.5 $23.9 $30.5 $9.8 $87.7 $23.7 $28.0 $6.0 $90.4 $148.0 $26.2 $24.1 Accretion of asset retirement obligations (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.4) (0.1) (0.1) Deferred income taxes - (0.1) (0.0) 0.3 0.1 - - - (0.2) (0.2) - - Gain (Loss) on asset disposals (0.0) 0.0 0.0 0.0 0.0 (0.1) 0.1 (0.7) (0.2) (0.9) (0.0) 0.0 Changes in assets and liabilities (3.6) 0.9 (8.5) 14.6 3.4 3.7 6.2 28.1 (59.9) (21.9) 3.2 7.8 Non-cash lease expense - - - - - (1.0) (0.4) Distributions from equity method investments 0.3 0.2 1.2 0.8 - Maint. & Reg. Capital Expenditures (2.2) (2.1) (0.7) (4.4) (9.4) (0.3) (1.0) (2.4) (3.5) (7.2) (0.8) (1.0) Reimbursement for Capital Expenditures 0.9 0.5 0.4 1.7 3.5 0.4 0.3 1.3 0.9 2.9 0.7 0.7 Distributable Cash Flow $18.4 $23.0 $21.6 $21.9 $85.0 $27.3 $33.5 $32.4 $27.6 $121.5 $29.0 $31.2 Distribution Coverage Ratio (1) 0.88x 1.06x 0.97x 0.96x 0.97x 1.14x 1.34x 1.25x 1.02x 1.19x 1.06x 1.08x Total Distribution (1) $21.0 $21.8 $22.3 $22.8 $87.9 $24.0 $25.0 $26.0 $26.9 $101.9 $27.4 $28.9 1) Distribution based on actual amounts distributed during the periods; does not include LTIP accrual. Coverage is defined as cash available for distribution divided by total distribution. 2) Results in 2013, 2014 and 1Q 2015 are as reported excluding predecessor costs related to the dropdown of the tank farms and product terminals at both Tyler and El Dorado during the respective periods. 3) In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek US rather than the cash amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015. 37 Note: May not foot due to rounding and annual adjustments that occurred in year-end reporting.

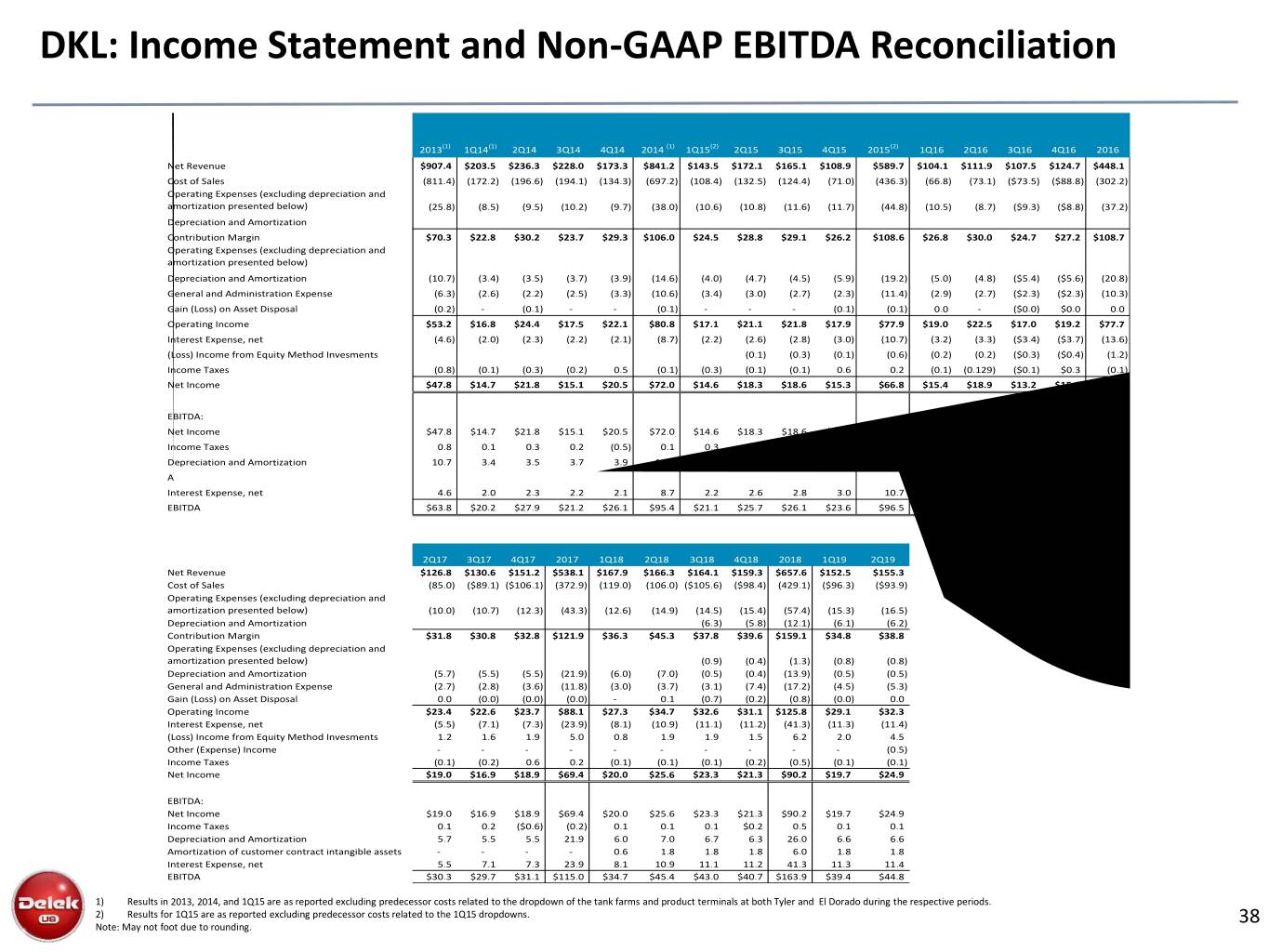

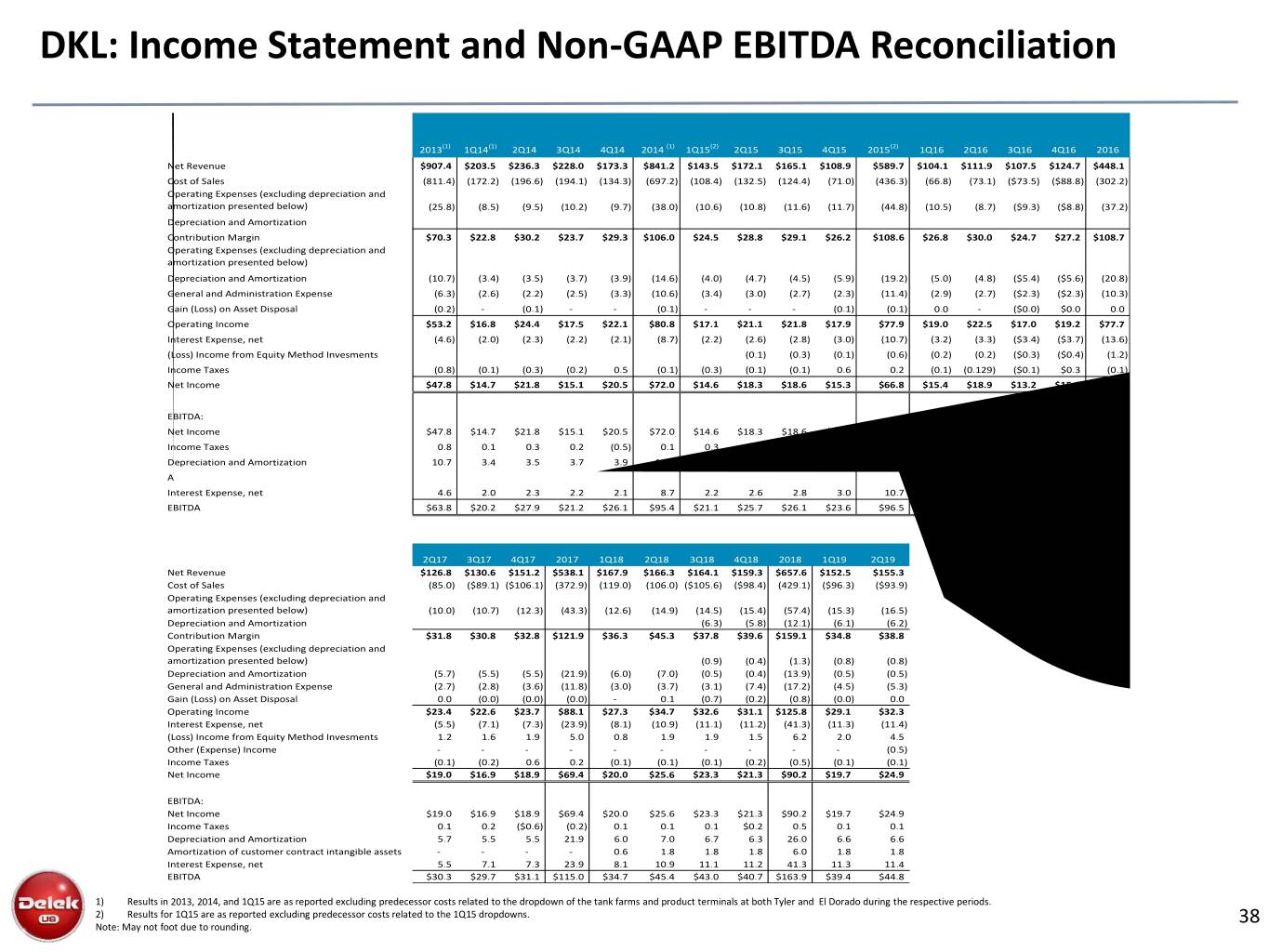

DKL: Income Statement and Non-GAAP EBITDA Reconciliation 4 Q2013(1) 1Q14(1) 2Q14 3Q14 4Q14 2014 (1) 1Q15(2) 2Q15 3Q15 4Q15 2015(2) 1Q16 2Q16 3Q16 4Q16 2016 Net Revenue $907.4 $203.5 $236.3 $228.0 $173.3 $841.2 $143.5 $172.1 $165.1 $108.9 $589.7 $104.1 $111.9 $107.5 $124.7 $448.1 Cost of Sales (811.4) (172.2) (196.6) (194.1) (134.3) (697.2) (108.4) (132.5) (124.4) (71.0) (436.3) (66.8) (73.1) ($73.5) ($88.8) (302.2) Operating Expenses (excluding depreciation and amortization presented below) (25.8) (8.5) (9.5) (10.2) (9.7) (38.0) (10.6) (10.8) (11.6) (11.7) (44.8) (10.5) (8.7) ($9.3) ($8.8) (37.2) Depreciation and Amortization Contribution Margin $70.3 $22.8 $30.2 $23.7 $29.3 $106.0 $24.5 $28.8 $29.1 $26.2 $108.6 $26.8 $30.0 $24.7 $27.2 $108.7 Operating Expenses (excluding depreciation and amortization presented below) Depreciation and Amortization (10.7) (3.4) (3.5) (3.7) (3.9) (14.6) (4.0) (4.7) (4.5) (5.9) (19.2) (5.0) (4.8) ($5.4) ($5.6) (20.8) General and Administration Expense (6.3) (2.6) (2.2) (2.5) (3.3) (10.6) (3.4) (3.0) (2.7) (2.3) (11.4) (2.9) (2.7) ($2.3) ($2.3) (10.3) Gain (Loss) on Asset Disposal (0.2) - (0.1) - - (0.1) - - - (0.1) (0.1) 0.0 - ($0.0) $0.0 0.0 Operating Income $53.2 $16.8 $24.4 $17.5 $22.1 $80.8 $17.1 $21.1 $21.8 $17.9 $77.9 $19.0 $22.5 $17.0 $19.2 $77.7 Interest Expense, net (4.6) (2.0) (2.3) (2.2) (2.1) (8.7) (2.2) (2.6) (2.8) (3.0) (10.7) (3.2) (3.3) ($3.4) ($3.7) (13.6) (Loss) Income from Equity Method Invesments (0.1) (0.3) (0.1) (0.6) (0.2) (0.2) ($0.3) ($0.4) (1.2) Income Taxes (0.8) (0.1) (0.3) (0.2) 0.5 (0.1) (0.3) (0.1) (0.1) 0.6 0.2 (0.1) (0.129) ($0.1) $0.3 (0.1) Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 EBITDA: Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 Income Taxes 0.8 0.1 0.3 0.2 (0.5) 0.1 0.3 0.1 0.1 (0.6) (0.2) 0.1 0.1 0.13 (0.28) 0.1 Depreciation and Amortization 10.7 3.4 3.5 3.7 3.9 14.6 4.0 4.7 4.5 5.9 19.2 5.0 4.8 5.4 5.6 20.8 Amortization of customer contract intangible assets - - - - - - - - - - - - - - - - Interest Expense, net 4.6 2.0 2.3 2.2 2.1 8.7 2.2 2.6 2.8 3.0 10.7 3.2 3.3 3.4 3.7 13.6 EBITDA $63.8 $20.2 $27.9 $21.2 $26.1 $95.4 $21.1 $25.7 $26.1 $23.6 $96.5 $23.7 $27.1 $22.0 $24.4 $97.3 1 Q 2Q17 3Q17 4Q17 2017 1Q18 2Q18 3Q18 4Q18 2018 1Q19 2Q19 Net Revenue $126.8 $130.6 $151.2 $538.1 $167.9 $166.3 $164.1 $159.3 $657.6 $152.5 $155.3 Cost of Sales (85.0) ($89.1) ($106.1) (372.9) (119.0) (106.0) ($105.6) ($98.4) (429.1) ($96.3) ($93.9) Operating Expenses (excluding depreciation and amortization presented below) (10.0) (10.7) (12.3) (43.3) (12.6) (14.9) (14.5) (15.4) (57.4) (15.3) (16.5) Depreciation and Amortization (6.3) (5.8) (12.1) (6.1) (6.2) Contribution Margin $31.8 $30.8 $32.8 $121.9 $36.3 $45.3 $37.8 $39.6 $159.1 $34.8 $38.8 Operating Expenses (excluding depreciation and amortization presented below) (0.9) (0.4) (1.3) (0.8) (0.8) Depreciation and Amortization (5.7) (5.5) (5.5) (21.9) (6.0) (7.0) (0.5) (0.4) (13.9) (0.5) (0.5) General and Administration Expense (2.7) (2.8) (3.6) (11.8) (3.0) (3.7) (3.1) (7.4) (17.2) (4.5) (5.3) Gain (Loss) on Asset Disposal 0.0 (0.0) (0.0) (0.0) - 0.1 (0.7) (0.2) (0.8) (0.0) 0.0 Operating Income $23.4 $22.6 $23.7 $88.1 $27.3 $34.7 $32.6 $31.1 $125.8 $29.1 $32.3 Interest Expense, net (5.5) (7.1) (7.3) (23.9) (8.1) (10.9) (11.1) (11.2) (41.3) (11.3) (11.4) (Loss) Income from Equity Method Invesments 1.2 1.6 1.9 5.0 0.8 1.9 1.9 1.5 6.2 2.0 4.5 Other (Expense) Income - - - - - - - - - - (0.5) Income Taxes (0.1) (0.2) 0.6 0.2 (0.1) (0.1) (0.1) (0.2) (0.5) (0.1) (0.1) Net Income $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 $21.3 $90.2 $19.7 $24.9 EBITDA: Net Income $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 $21.3 $90.2 $19.7 $24.9 Income Taxes 0.1 0.2 ($0.6) (0.2) 0.1 0.1 0.1 $0.2 0.5 0.1 0.1 Depreciation and Amortization 5.7 5.5 5.5 21.9 6.0 7.0 6.7 6.3 26.0 6.6 6.6 Amortization of customer contract intangible assets - - - - 0.6 1.8 1.8 1.8 6.0 1.8 1.8 Interest Expense, net 5.5 7.1 7.3 23.9 8.1 10.9 11.1 11.2 41.3 11.3 11.4 EBITDA $30.3 $29.7 $31.1 $115.0 $34.7 $45.4 $43.0 $40.7 $163.9 $39.4 $44.8 1) Results in 2013, 2014, and 1Q15 are as reported excluding predecessor costs related to the dropdown of the tank farms and product terminals at both Tyler and El Dorado during the respective periods. 2) Results for 1Q15 are as reported excluding predecessor costs related to the 1Q15 dropdowns. Note: May not foot due to rounding. 38

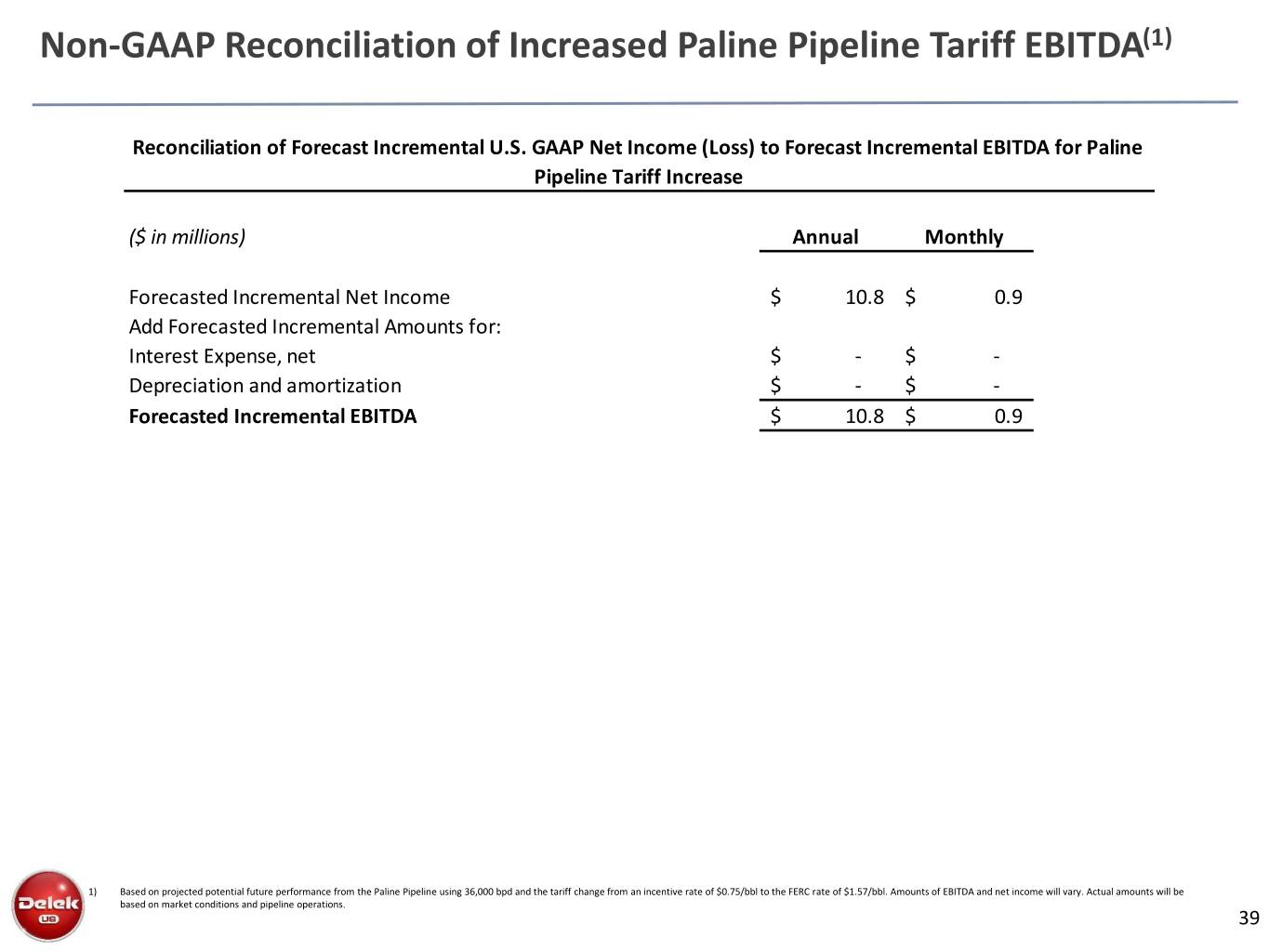

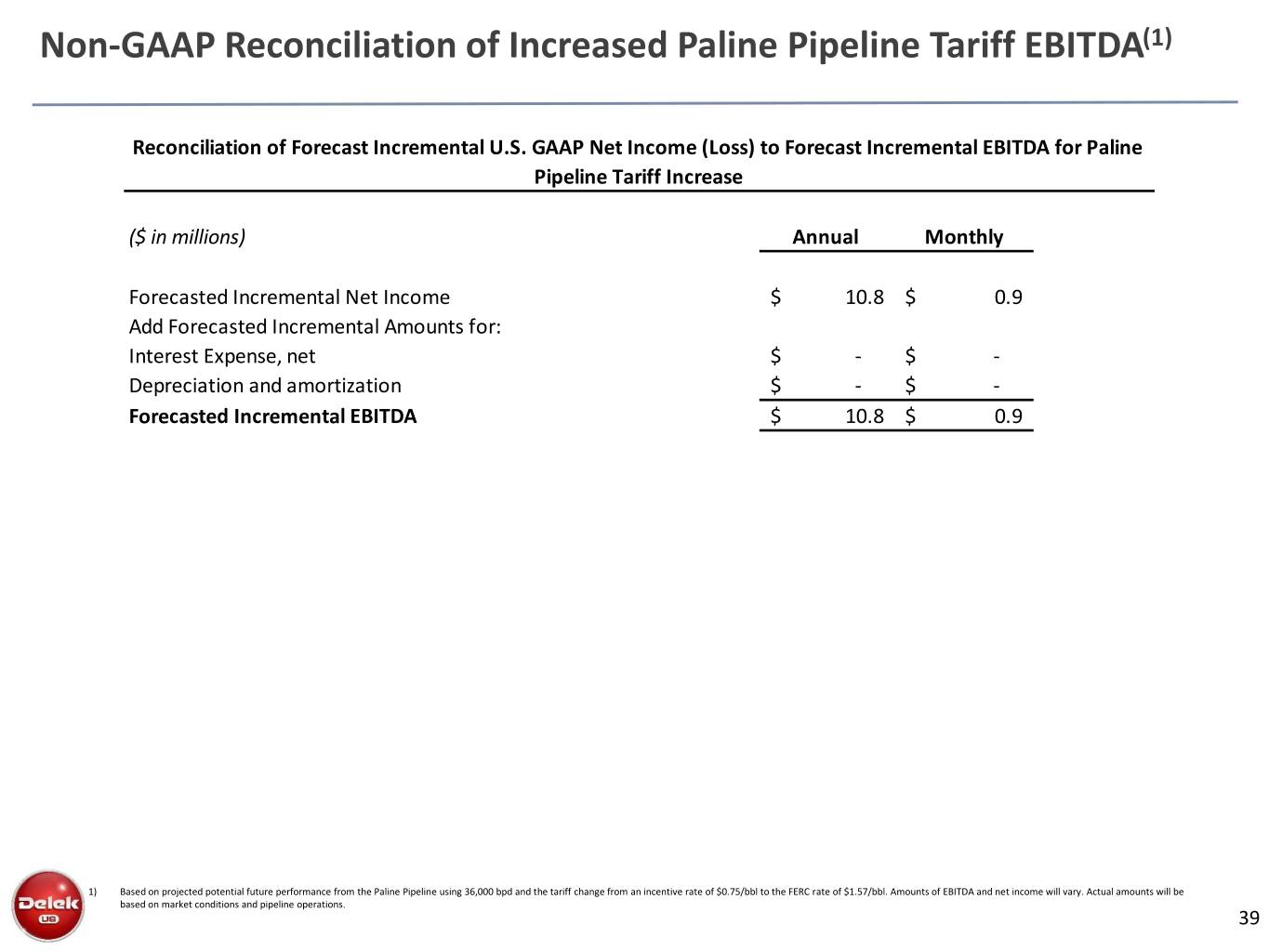

Non-GAAP Reconciliation of Increased Paline Pipeline Tariff EBITDA(1) Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA for Paline Pipeline Tariff Increase ($ in millions) Annual Monthly Forecasted Incremental Net Income $ 10.8 $ 0.9 Add Forecasted Incremental Amounts for: Interest Expense, net $ - $ - Depreciation and amortization $ - $ - Forecasted Incremental EBITDA $ 10.8 $ 0.9 1) Based on projected potential future performance from the Paline Pipeline using 36,000 bpd and the tariff change from an incentive rate of $0.75/bbl to the FERC rate of $1.57/bbl. Amounts of EBITDA and net income will vary. Actual amounts will be based on market conditions and pipeline operations. 39

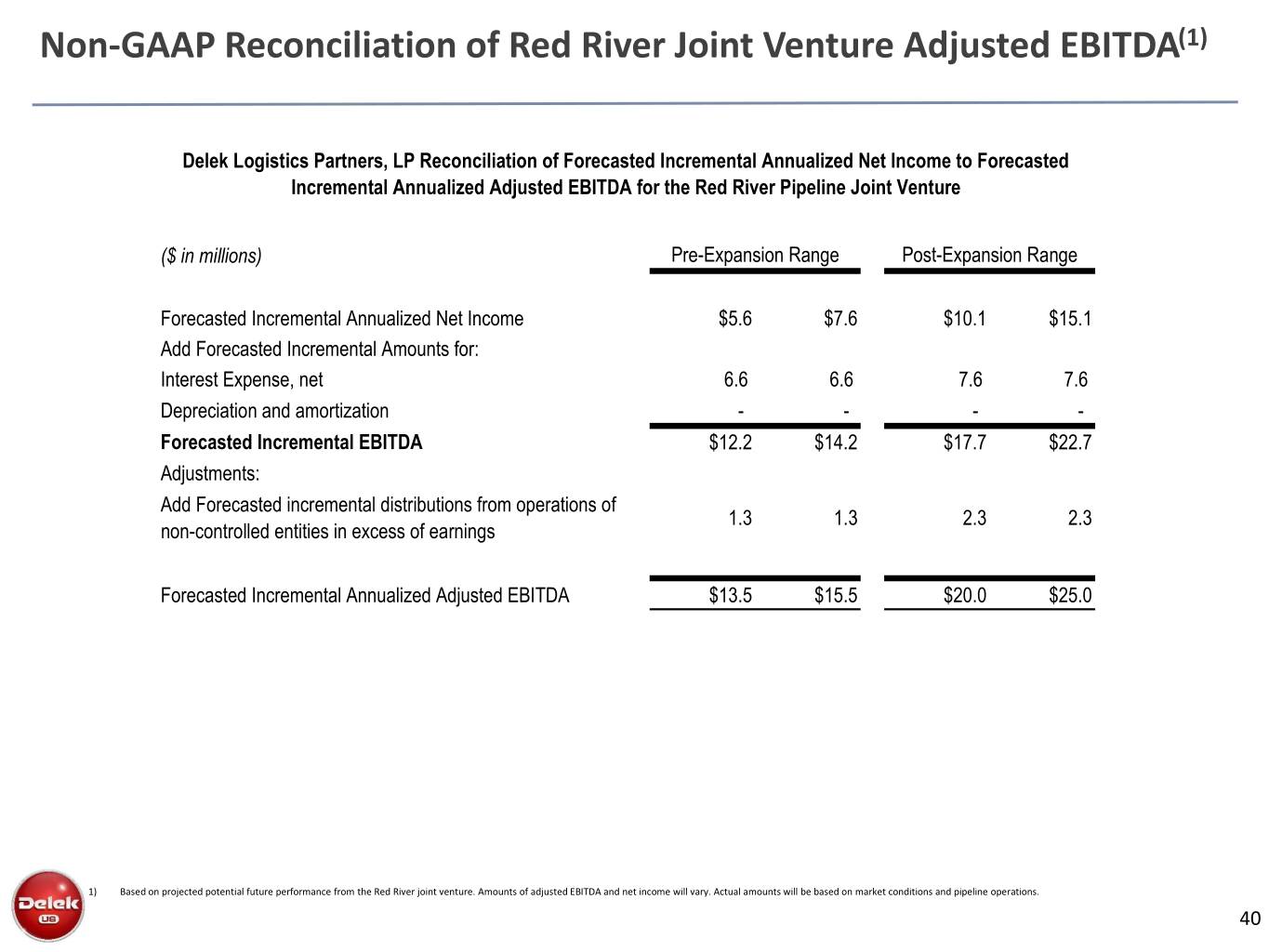

Non-GAAP Reconciliation of Red River Joint Venture Adjusted EBITDA(1) Delek Logistics Partners, LP Reconciliation of Forecasted Incremental Annualized Net Income to Forecasted Incremental Annualized Adjusted EBITDA for the Red River Pipeline Joint Venture ($ in millions) Pre-Expansion Range Post-Expansion Range Forecasted Incremental Annualized Net Income $5.6 $7.6 $10.1 $15.1 Add Forecasted Incremental Amounts for: Interest Expense, net 6.6 6.6 7.6 7.6 Depreciation and amortization - - - - Forecasted Incremental EBITDA $12.2 $14.2 $17.7 $22.7 Adjustments: Add Forecasted incremental distributions from operations of 1.3 1.3 2.3 2.3 non-controlled entities in excess of earnings Forecasted Incremental Annualized Adjusted EBITDA $13.5 $15.5 $20.0 $25.0 1) Based on projected potential future performance from the Red River joint venture. Amounts of adjusted EBITDA and net income will vary. Actual amounts will be based on market conditions and pipeline operations. 40

Investor Relations Contacts: Blake Fernandez, SVP IR/Market Intelligence 615-224-1312