Exhibit 99.1 Delek US Holdings, Inc. Investor Presentation September 2020

Disclaimers Forward Looking Statements: Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral and written presentations contain forward-looking statements within the meaning of federal securities laws that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. These forward-looking statements include, but are not limited to, the statements regarding the following: financial and operating guidance for future and uncompleted financial periods; future crude slates; financial strength and flexibility; potential for and projections of growth; return of cash to shareholders, stock repurchases and the payment of dividends, including the amount and timing thereof; crude oil throughput; crude oil market trends, including production, quality, pricing, demand, imports, exports and transportation costs; light production from shale plays and Permian growth; differentials including increases, trends and the impact thereof on crack spreads and refineries; pipeline takeaway capacity and projects related thereto; refinery complexity, configurations, utilization, crude oil slate flexibility, capacities, equipment limits and margins; the ability to add flexibility and increase margin potential at the Krotz Springs refinery; improved product netbacks; the performance of our joint venture investments, including Red River and Wink to Webster, and the benefits, flexibility, returns and EBITDA therefrom; our ability to execute on the Big Spring Gathering System and the benefits, flexibility, returns and EBITDA therefrom; the potential for, and estimates of cost savings and other benefits from, acquisitions, divestitures, dropdowns and financing activities; divestiture of non-core assets and matters pertaining thereto; the attainment of certain regulatory benefits; retail growth and the opportunities and value derived therefrom; long-term value creation from capital allocation; execution of strategic initiatives and the benefits therefrom, including revenue stability; and access to crude oil and the benefits therefrom. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward- looking statements. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell, including uncertainties regarding future decisions by OPEC regarding production and pricing disputes between OPEC members and Russia; uncertainty relating to the impact of the COVID-19 outbreak on the demand for crude oil, refined products and transportation and storage services; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, pricing, production and transportation capacity; gains and losses from derivative instruments; management's ability to execute its strategy of growth through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance projects; the ability of the Wink to Webster joint venture to construct the long-haul pipeline; the ability of the Red River joint venture to expand the Red River pipeline; the ability to grow the Big Spring Gathering System; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements. Non-GAAP Disclosures: Delek US and Delek Logistics believe that the presentation of earnings before interest, taxes, depreciation and amortization ("EBITDA"), adjusted EBITDA and distributable cash flow (“DCF”) provide useful information to investors in assessing their financial condition, results of operations and cash flow their business is generating. EBITDA, adjusted EBITDA and DCF should not be considered as alternatives to net income, operating income, cash from operations or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, adjusted EBITDA and DCF have important limitations as analytical tools because they exclude some, but not all, items that affect net income. Additionally, because EBITDA, adjusted EBITDA and DCF may be defined differently by other companies in its industry, Delek US' and Delek Logistics’ definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see reconciliations of EBITDA, adjusted EBITDA and DCF to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP in the appendix. 2

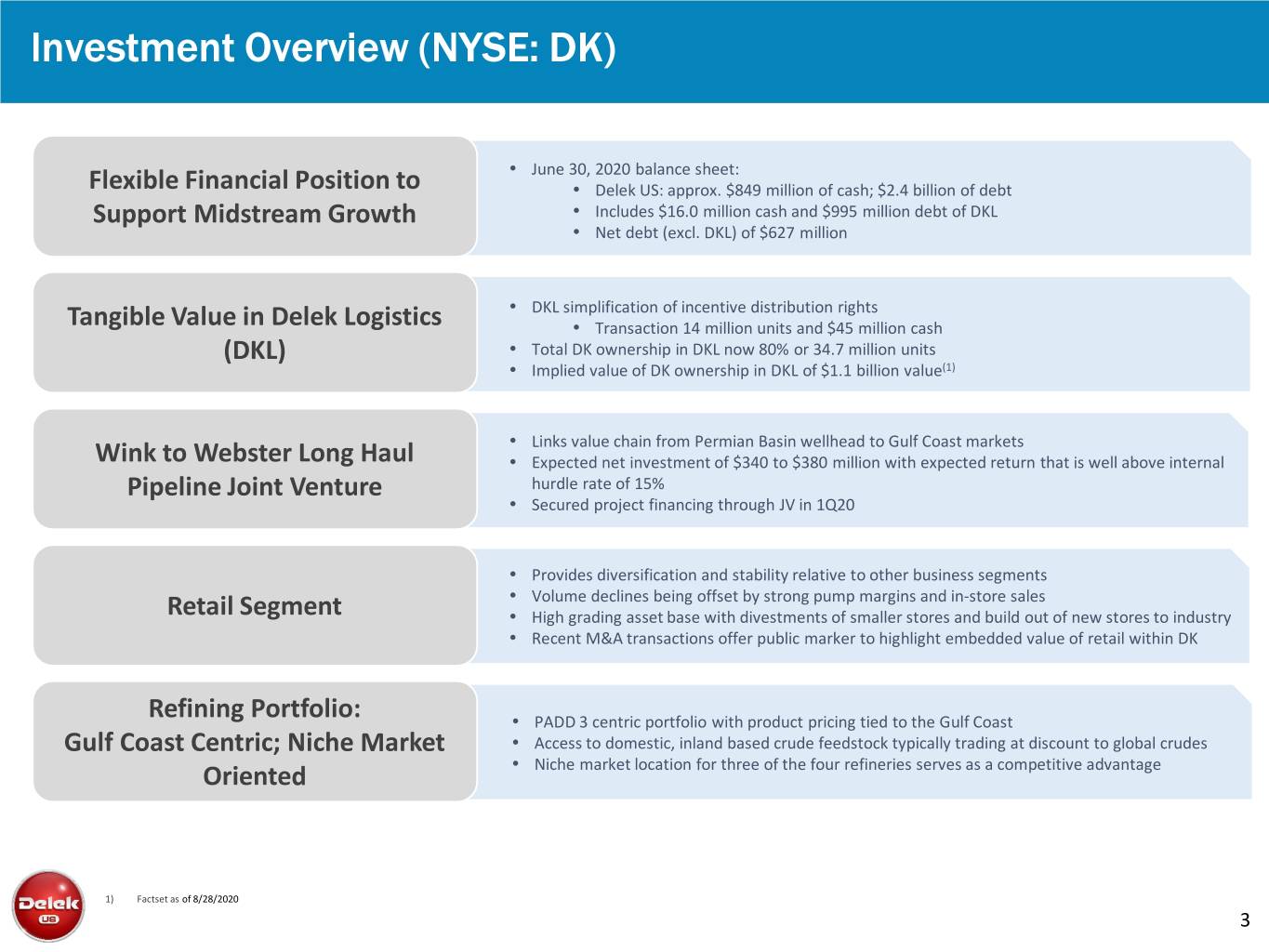

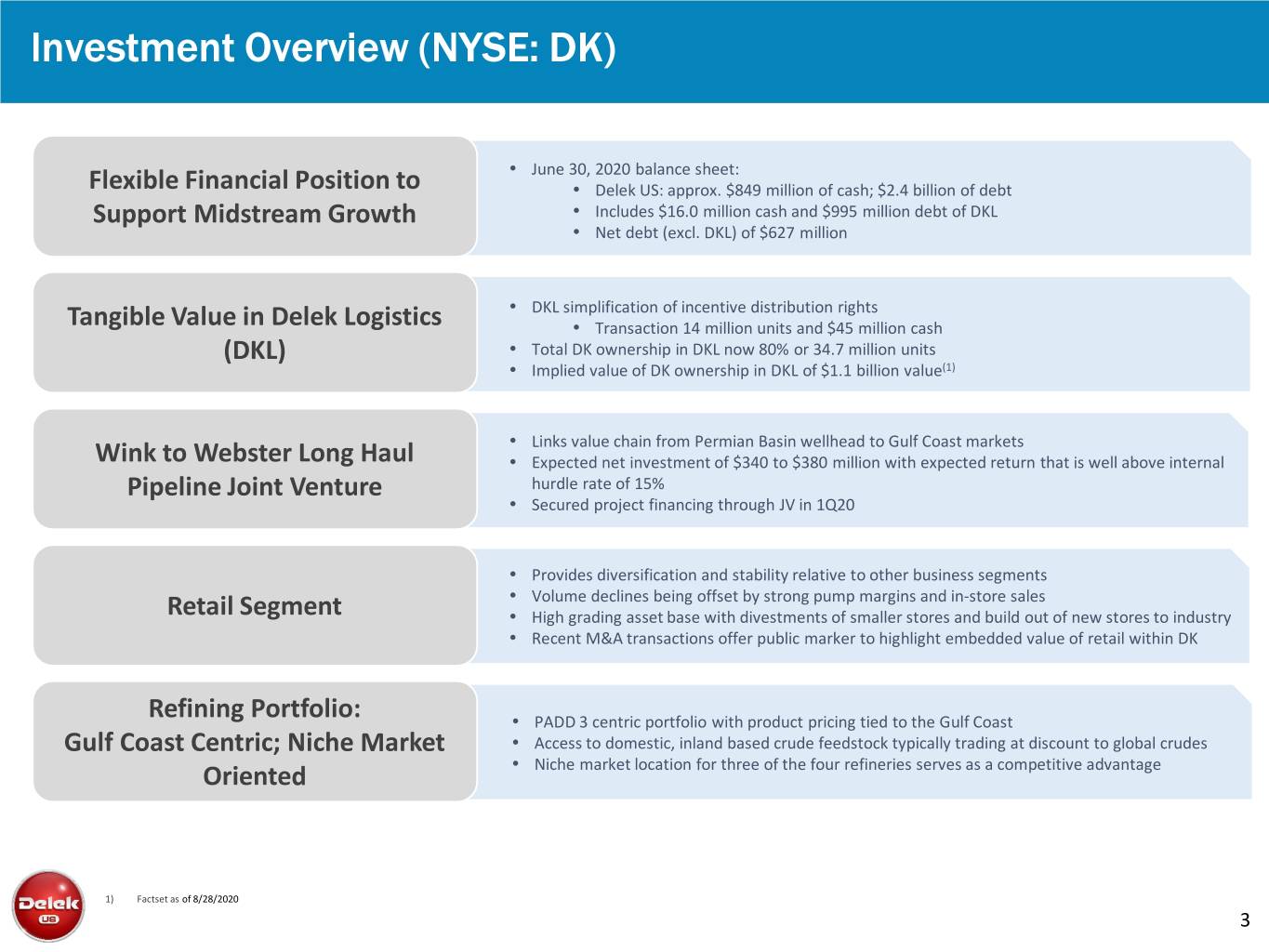

InvestmentInvestment OverviewOverview (NYSE:(NYSE: DK)DK) • June 30, 2020 balance sheet: Flexible Financial Position to • Delek US: approx. $849 million of cash; $2.4 billion of debt Support Midstream Growth • Includes $16.0 million cash and $995 million debt of DKL • Net debt (excl. DKL) of $627 million • DKL simplification of incentive distribution rights Tangible Value in Delek Logistics • Transaction 14 million units and $45 million cash (DKL) • Total DK ownership in DKL now 80% or 34.7 million units • Implied value of DK ownership in DKL of $1.1 billion value(1) • Links value chain from Permian Basin wellhead to Gulf Coast markets Wink to Webster Long Haul • Expected net investment of $340 to $380 million with expected return that is well above internal Pipeline Joint Venture hurdle rate of 15% • Secured project financing through JV in 1Q20 • Provides diversification and stability relative to other business segments • Volume declines being offset by strong pump margins and in-store sales Retail Segment • High grading asset base with divestments of smaller stores and build out of new stores to industry • Recent M&A transactions offer public marker to highlight embedded value of retail within DK Refining Portfolio: • PADD 3 centric portfolio with product pricing tied to the Gulf Coast Gulf Coast Centric; Niche Market • Access to domestic, inland based crude feedstock typically trading at discount to global crudes Oriented • Niche market location for three of the four refineries serves as a competitive advantage 1) Factset as of 8/28/2020 3

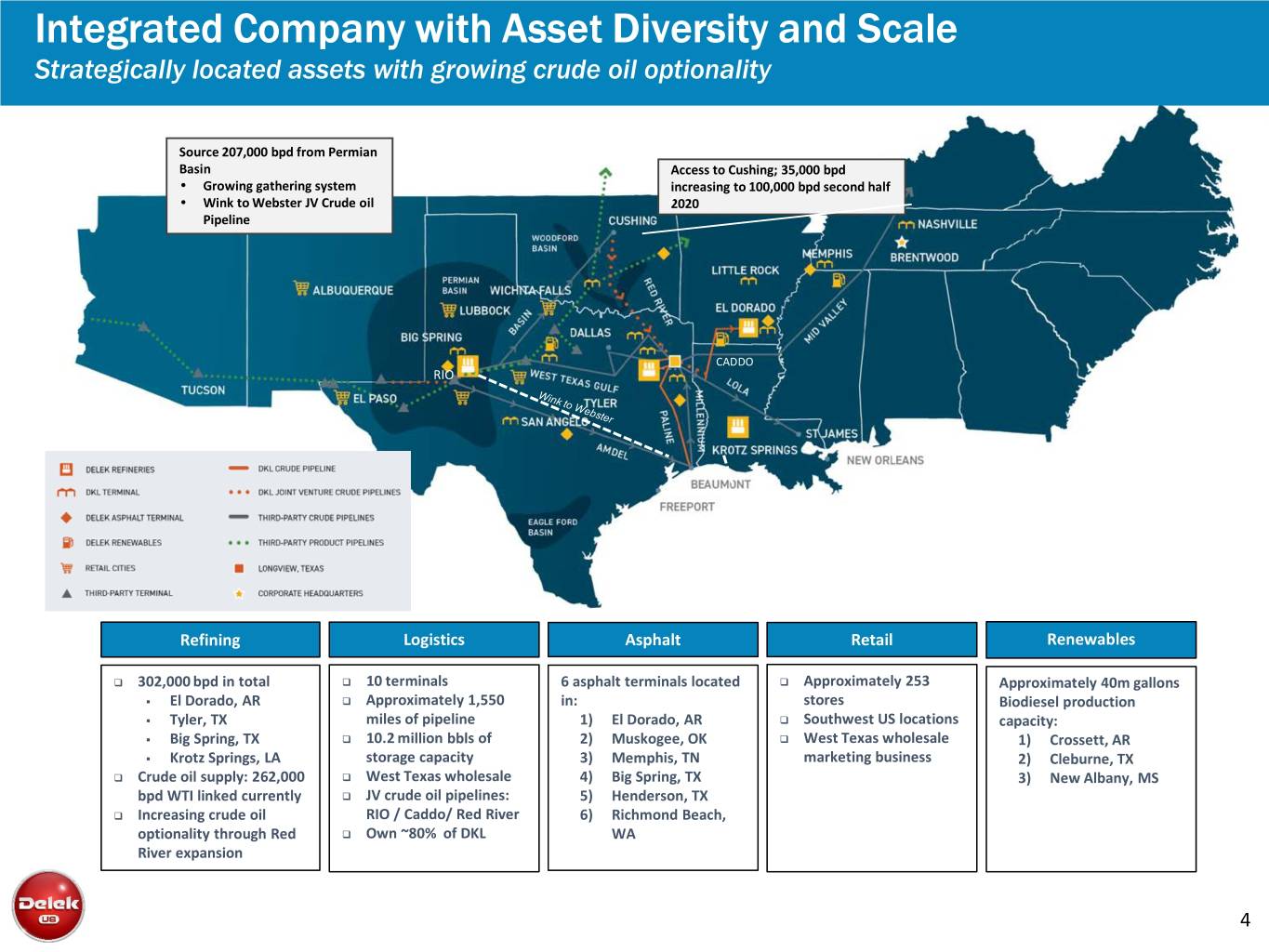

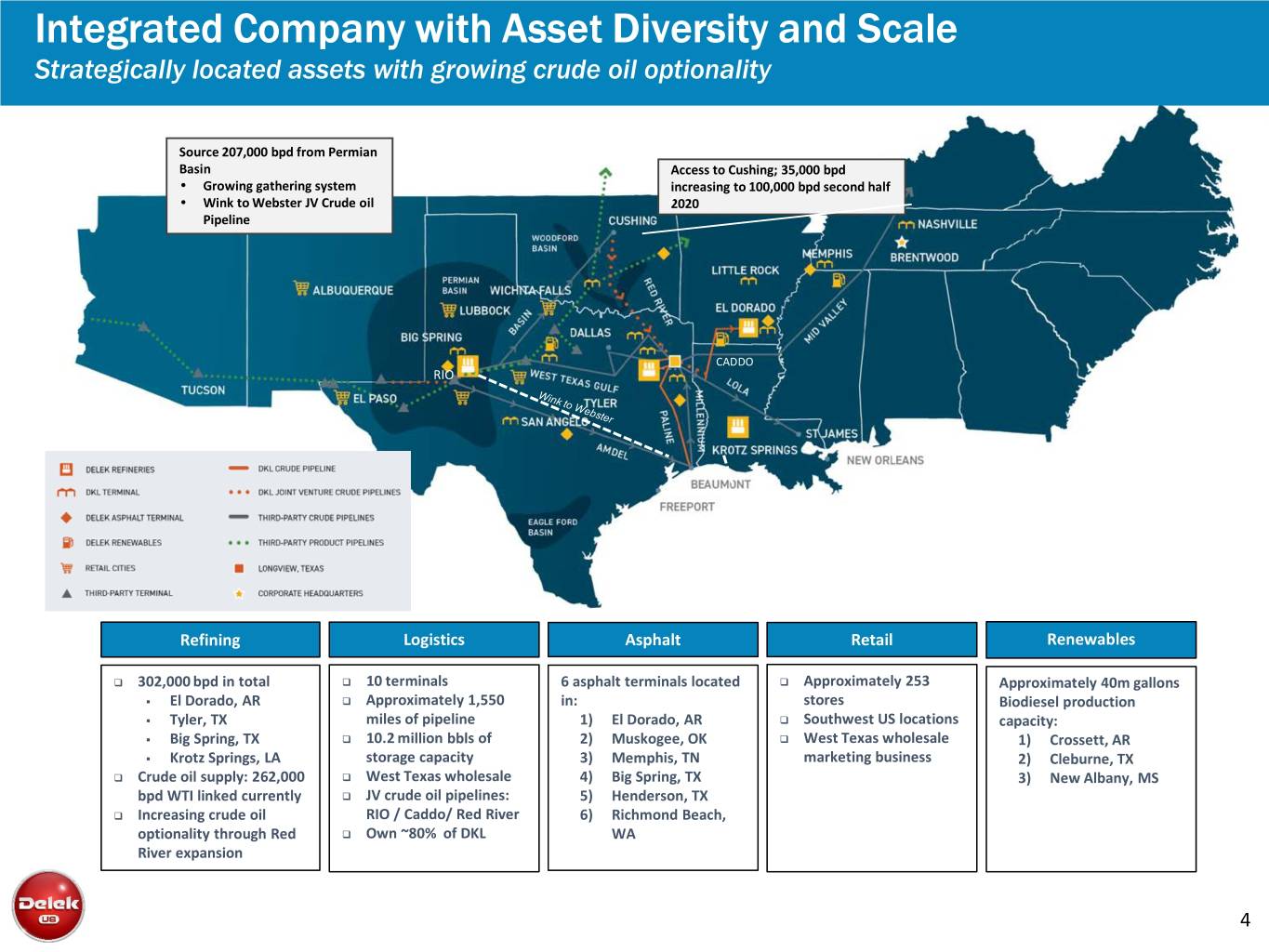

Integrated Company with Asset Diversity and Scale Strategically located assets with growing crude oil optionality Source 207,000 bpd from Permian Basin Access to Cushing; 35,000 bpd • Growing gathering system increasing to 100,000 bpd second half • Wink to Webster JV Crude oil 2020 Pipeline CADDO RIO Refining Logistics Asphalt Retail Renewables 302,000 bpd in total 10 terminals 6 asphalt terminals located Approximately 253 Approximately 40m gallons . El Dorado, AR Approximately 1,550 in: stores Biodiesel production . Tyler, TX miles of pipeline 1) El Dorado, AR Southwest US locations capacity: . Big Spring, TX 10.2 million bbls of 2) Muskogee, OK West Texas wholesale 1) Crossett, AR . Krotz Springs, LA storage capacity 3) Memphis, TN marketing business 2) Cleburne, TX Crude oil supply: 262,000 West Texas wholesale 4) Big Spring, TX 3) New Albany, MS bpd WTI linked currently JV crude oil pipelines: 5) Henderson, TX Increasing crude oil RIO / Caddo/ Red River 6) Richmond Beach, optionality through Red Own ~80% of DKL WA River expansion 4

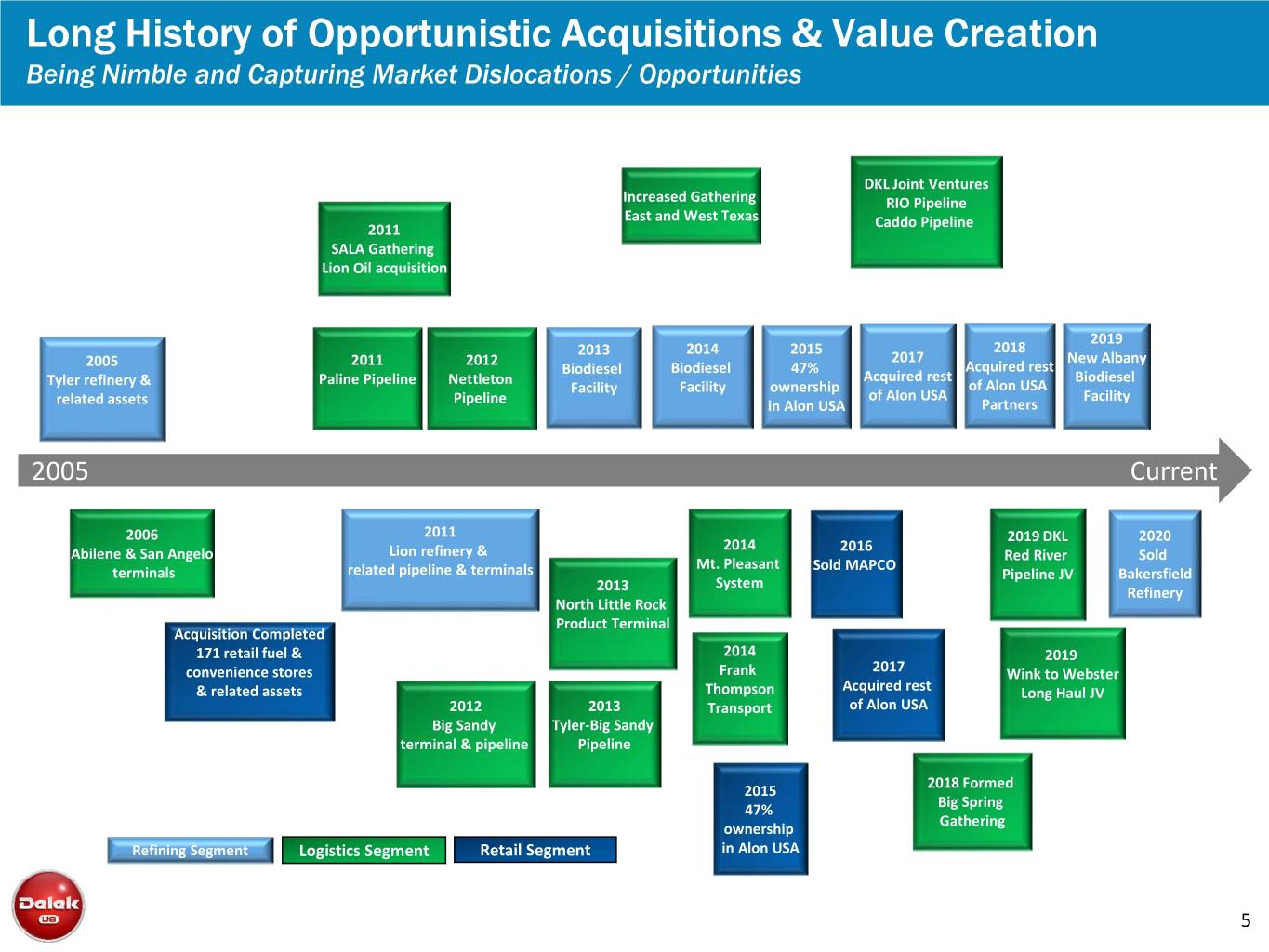

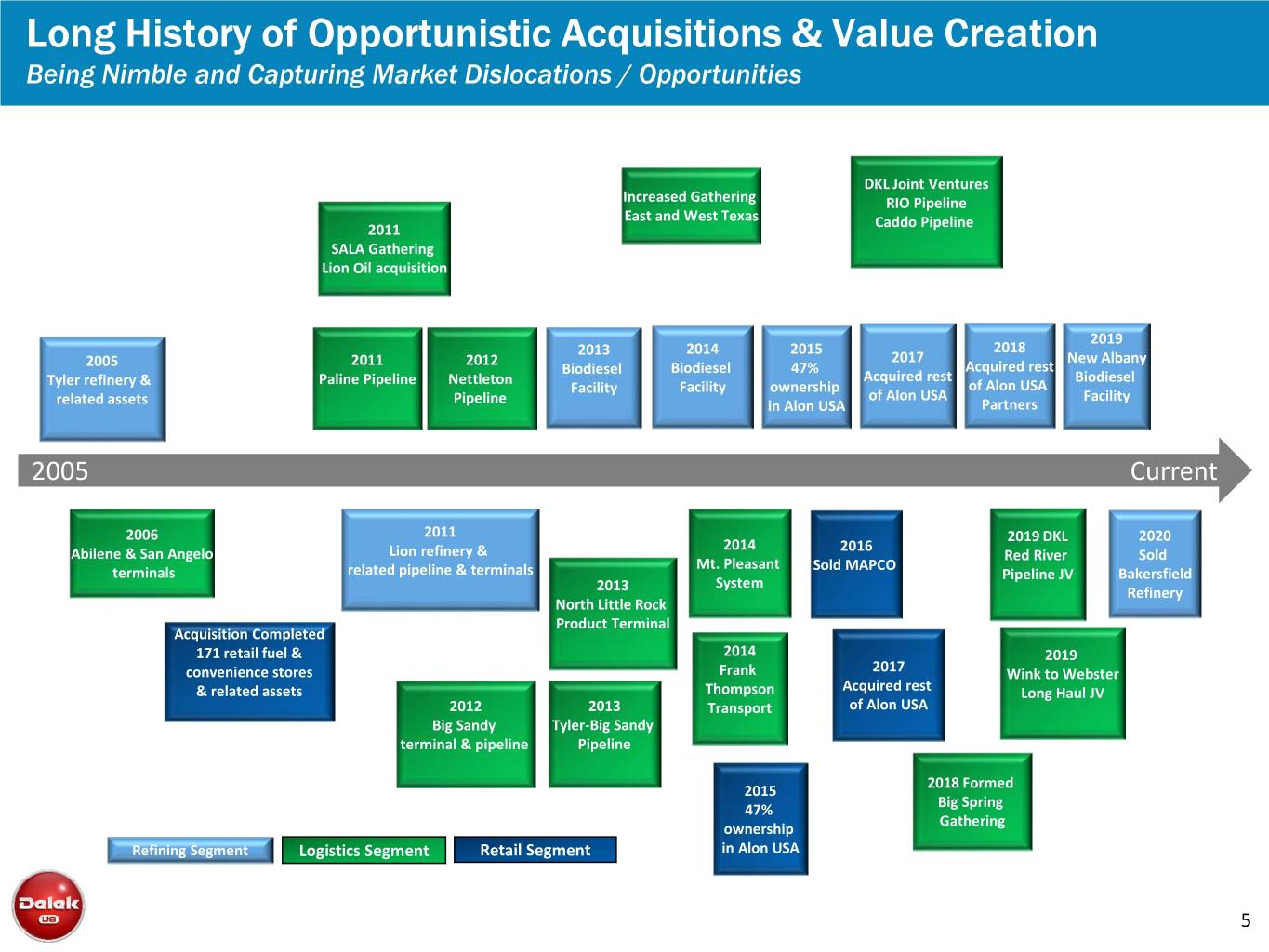

Long History of Opportunistic Acquisitions & Value Creation Being Nimble and Capturing Market Dislocations / Opportunities DKL Joint Ventures Increased Gathering RIO Pipeline East and West Texas 2011 Caddo Pipeline SALA Gathering Lion Oil acquisition 2019 2013 2014 2015 2018 2011 2012 2017 New Albany 2005 Biodiesel Biodiesel 47% Acquired rest Paline Pipeline Nettleton Acquired rest Biodiesel Tyler refinery & Facility Facility ownership of Alon USA of Alon USA Facility related assets Pipeline in Alon USA Partners 20052005 CurrentCurrent 2006 2011 2019 DKL 2020 2014 2016 Abilene & San Angelo Lion refinery & Red River Sold Mt. Pleasant Sold MAPCO terminals related pipeline & terminals Pipeline JV Bakersfield System 2013 Refinery North Little Rock Product Terminal Acquisition Completed 171 retail fuel & 2014 2019 convenience stores Frank 2017 Wink to Webster & related assets Thompson Acquired rest Long Haul JV 2012 2013 Transport of Alon USA Big Sandy Tyler-Big Sandy terminal & pipeline Pipeline 2018 Formed 2015 Big Spring 47% Gathering ownership Refining Segment Logistics Segment Retail Segment in Alon USA 5

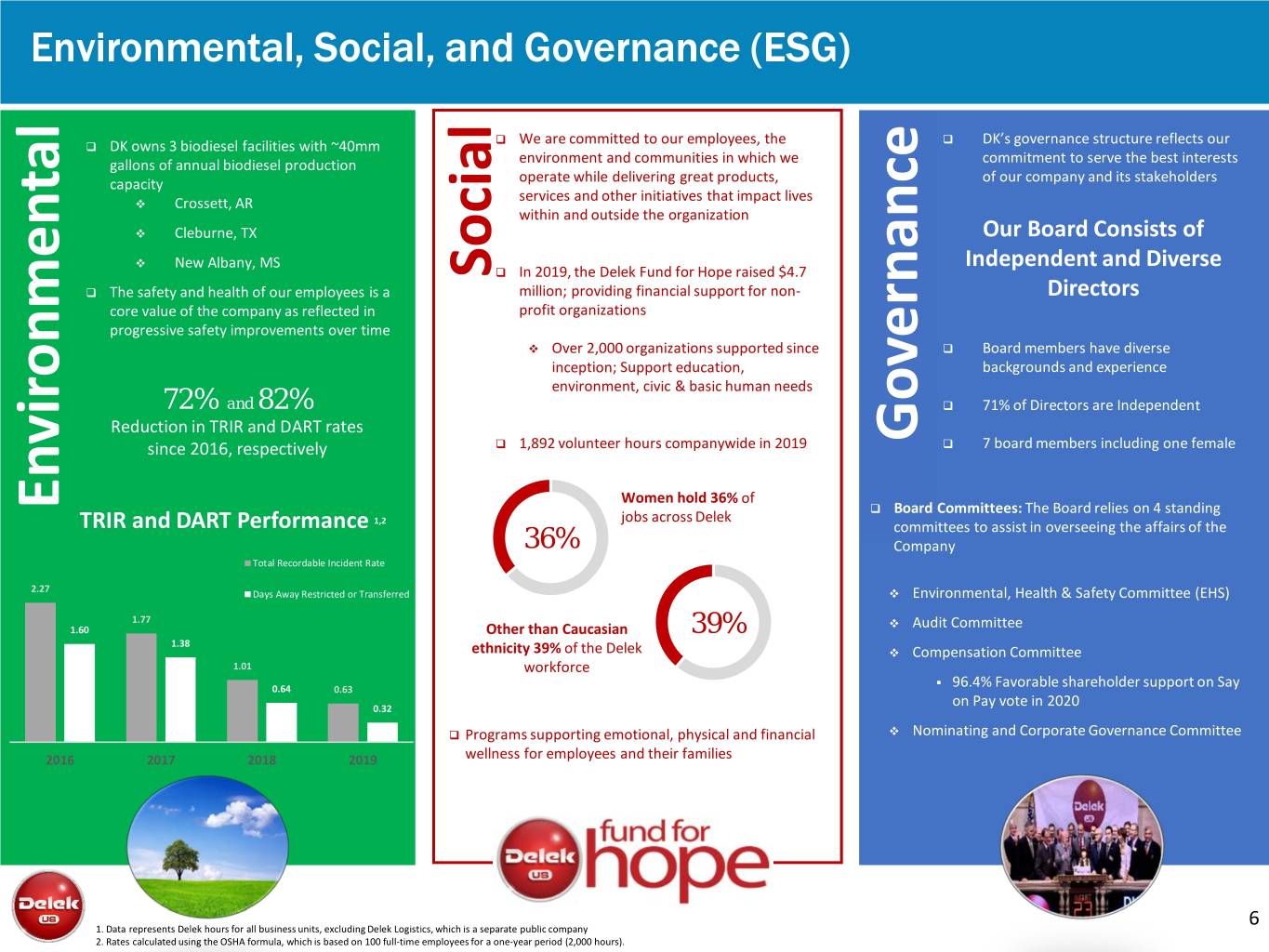

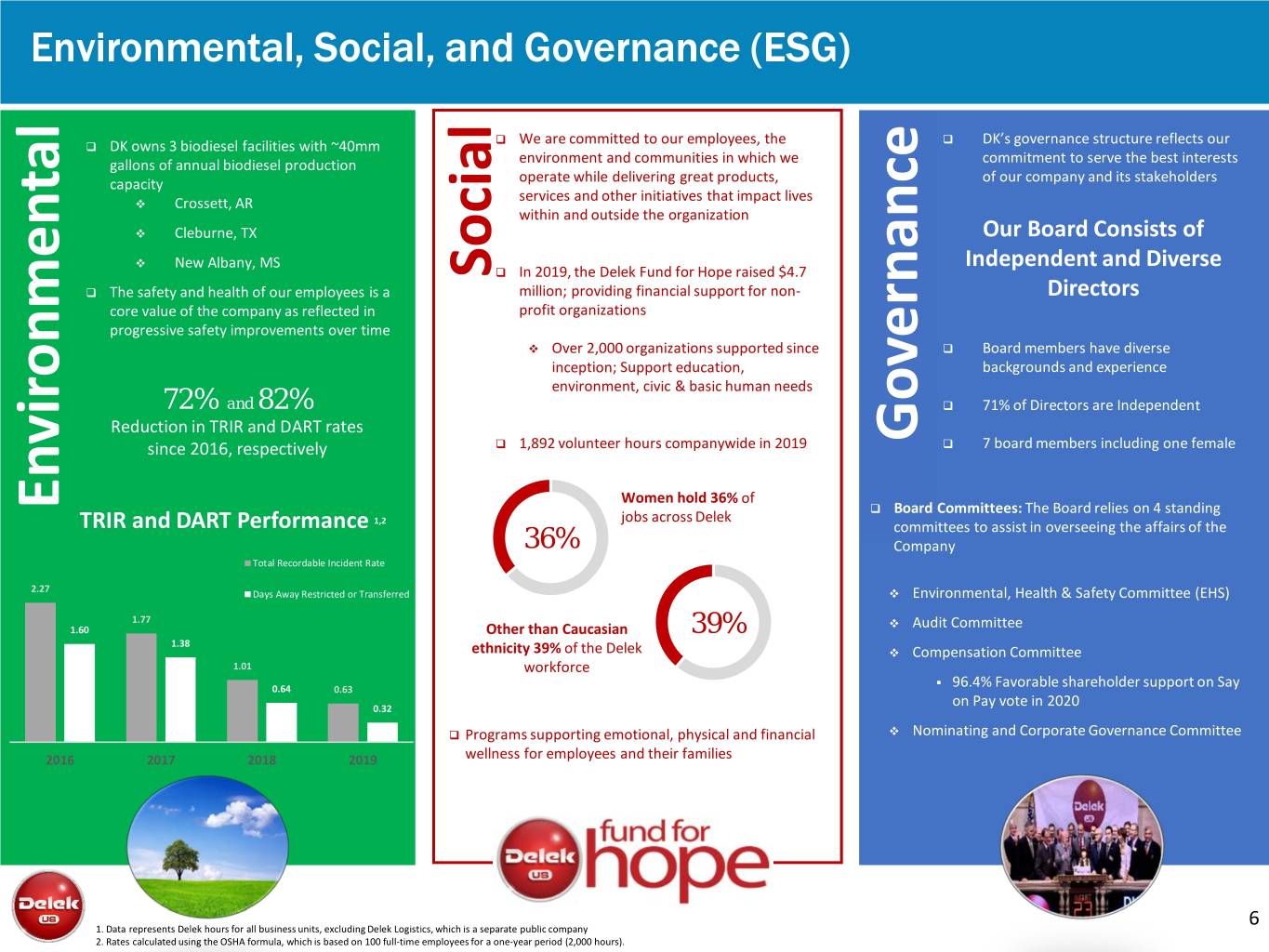

Environmental, Social, and Governance (ESG) We are committed to our employees, the DK’s governance structure reflects our DK owns 3 biodiesel facilities with ~40mm gallons of annual biodiesel production environment and communities in which we commitment to serve the best interests capacity operate while delivering great products, of our company and its stakeholders services and other initiatives that impact lives Crossett, AR within and outside the organization Cleburne, TX Our Board Consists of New Albany, MS Independent and Diverse Social In 2019, the Delek Fund for Hope raised $4.7 The safety and health of our employees is a million; providing financial support for non- Directors core value of the company as reflected in profit organizations progressive safety improvements over time Over 2,000 organizations supported since Board members have diverse inception; Support education, backgrounds and experience environment, civic & basic human needs 72% and 82% 71% of Directors are Independent Reduction in TRIR and DART rates Governance Governance since 2016, respectively 1,892 volunteer hours companywide in 2019 7 board members including one female Women hold 36% of Environmental Environmental Board Committees: The Board relies on 4 standing jobs across Delek TRIR and DART Performance 1,2 committees to assist in overseeing the affairs of the 36% Company Total Recordable Incident Rate 2.27 Days Away Restricted or Transferred Environmental, Health & Safety Committee (EHS) 1.77 Audit Committee 1.60 Other than Caucasian 39% 1.38 ethnicity 39% of the Delek Compensation Committee 1.01 workforce . 0.64 0.63 96.4% Favorable shareholder support on Say 0.32 on Pay vote in 2020 Programs supporting emotional, physical and financial Nominating and Corporate Governance Committee 2016 2017 2018 2019 wellness for employees and their families 1. Data represents Delek hours for all business units, excluding Delek Logistics, which is a separate public company 6 2. Rates calculated using the OSHA formula, which is based on 100 full-time employees for a one-year period (2,000 hours).

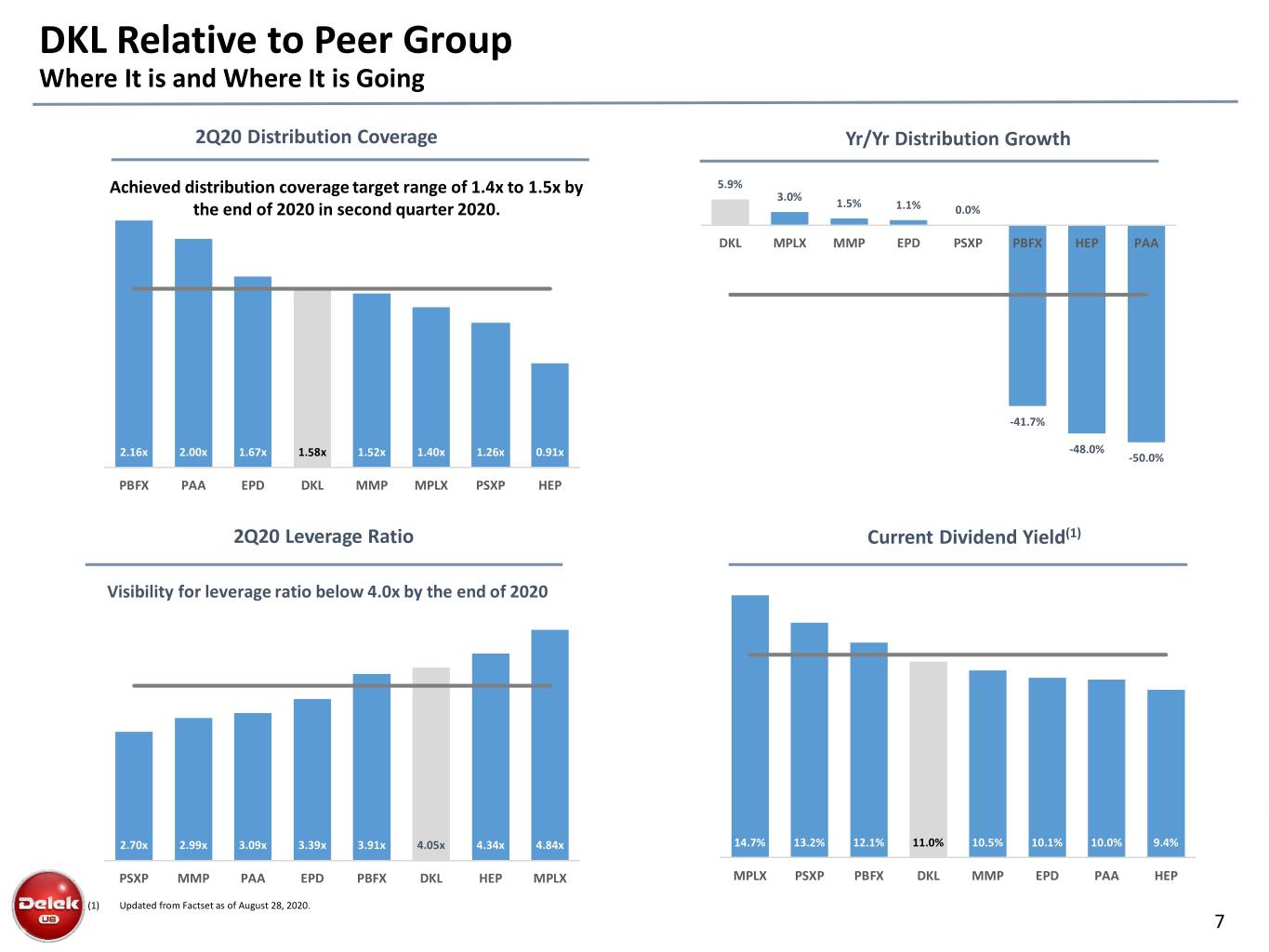

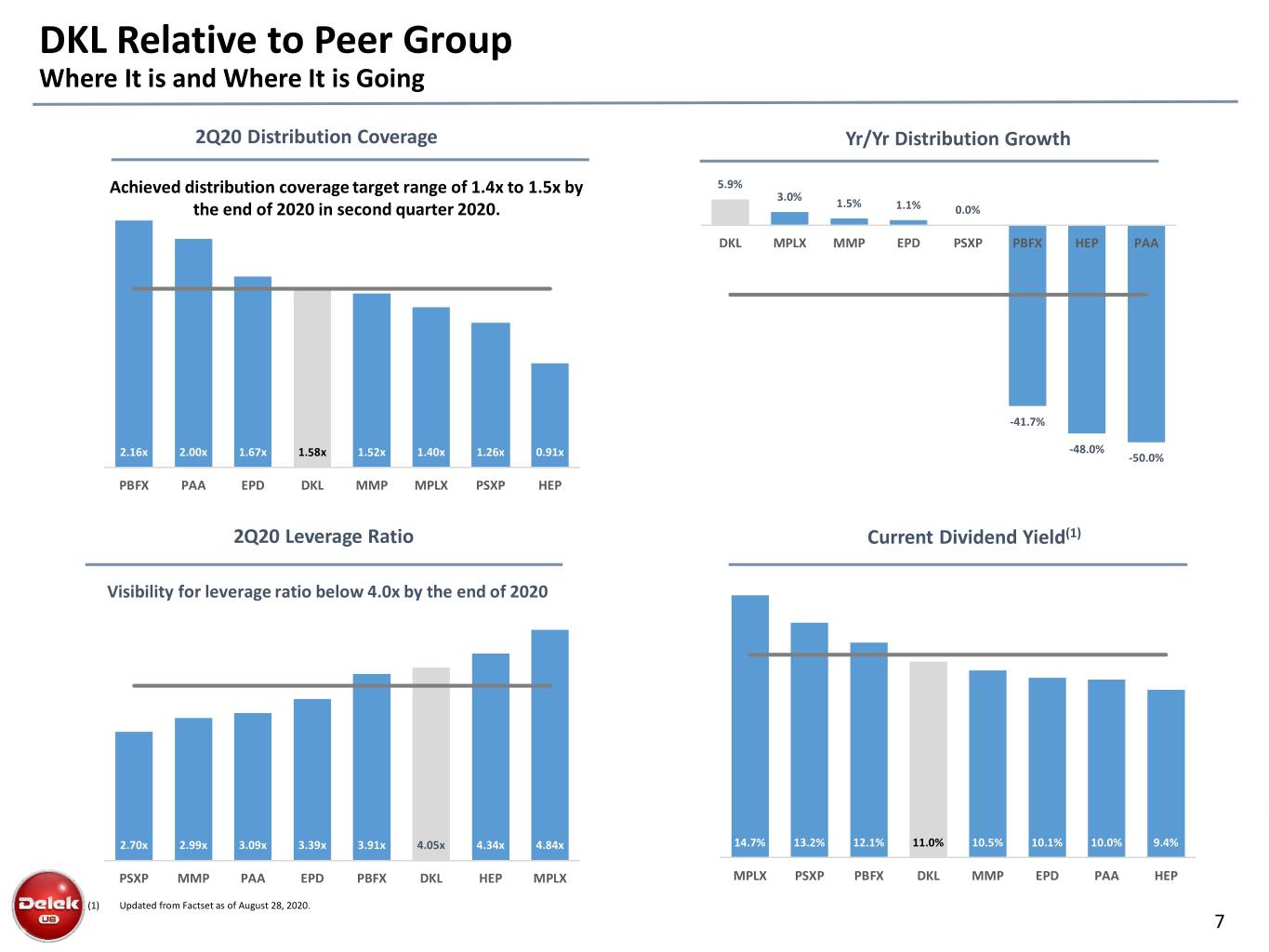

DKL Relative to Peer Group Where It is and Where It is Going 2Q20 Distribution Coverage Yr/Yr Distribution Growth 5.9% Achieved distribution coverage target range of 1.4x to 1.5x by 3.0% 1.5% the end of 2020 in second quarter 2020. 1.1% 0.0% DKL MPLX MMP EPD PSXP PBFX HEP PAA -41.7% -48.0% 2.16x 2.00x 1.67x 1.58x 1.52x 1.40x 1.26x 0.91x -50.0% PBFX PAA EPD DKL MMP MPLX PSXP HEP 2Q20 Leverage Ratio Current Dividend Yield(1) Visibility for leverage ratio below 4.0x by the end of 2020 2.70x 2.99x 3.09x 3.39x 3.91x 4.05x 4.34x 4.84x 14.7% 13.2% 12.1% 11.0% 10.5% 10.1% 10.0% 9.4% PSXP MMP PAA EPD PBFX DKL HEP MPLX MPLX PSXP PBFX DKL MMP EPD PAA HEP (1) Updated from Factset as of August 28, 2020. 7

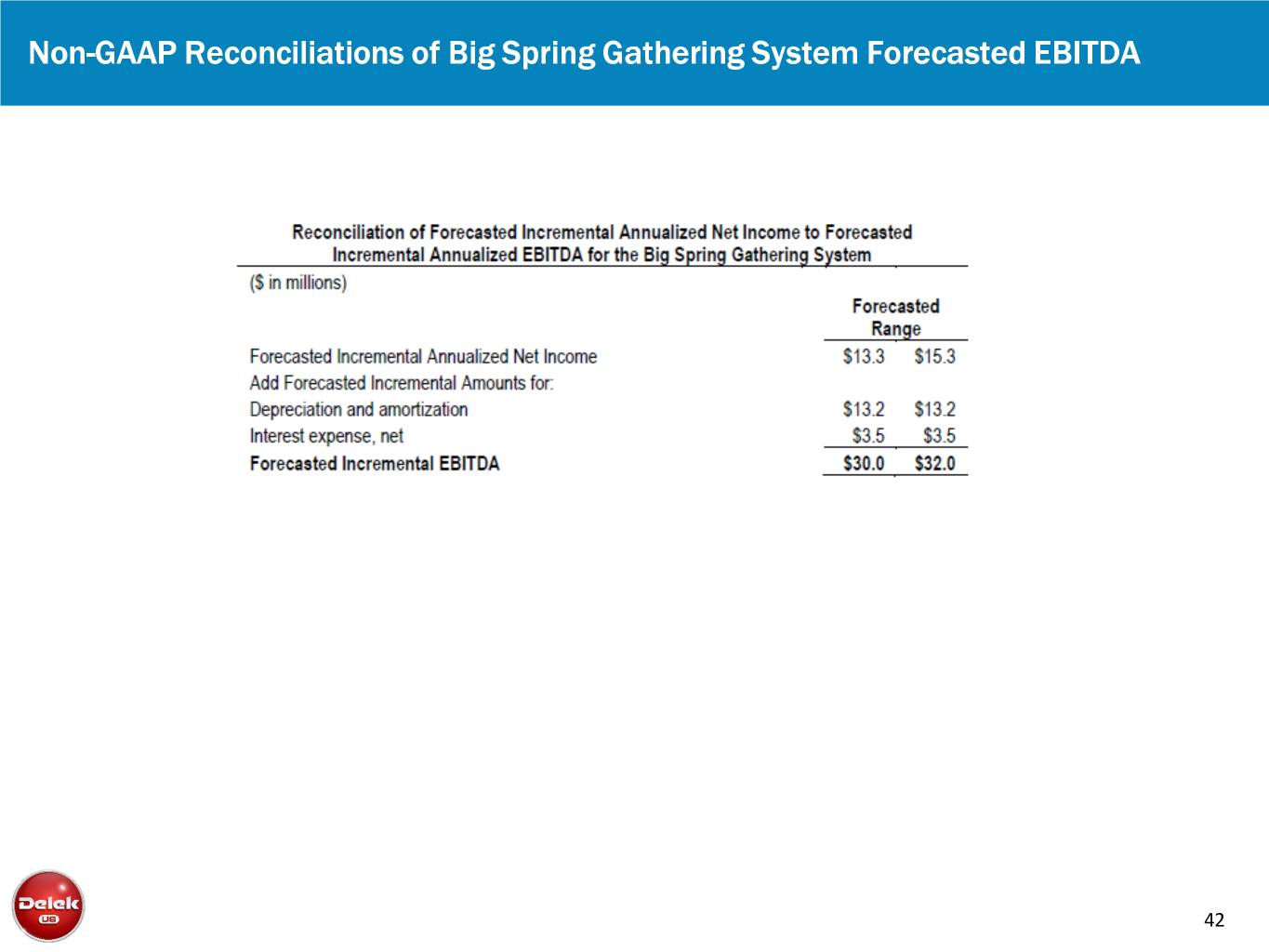

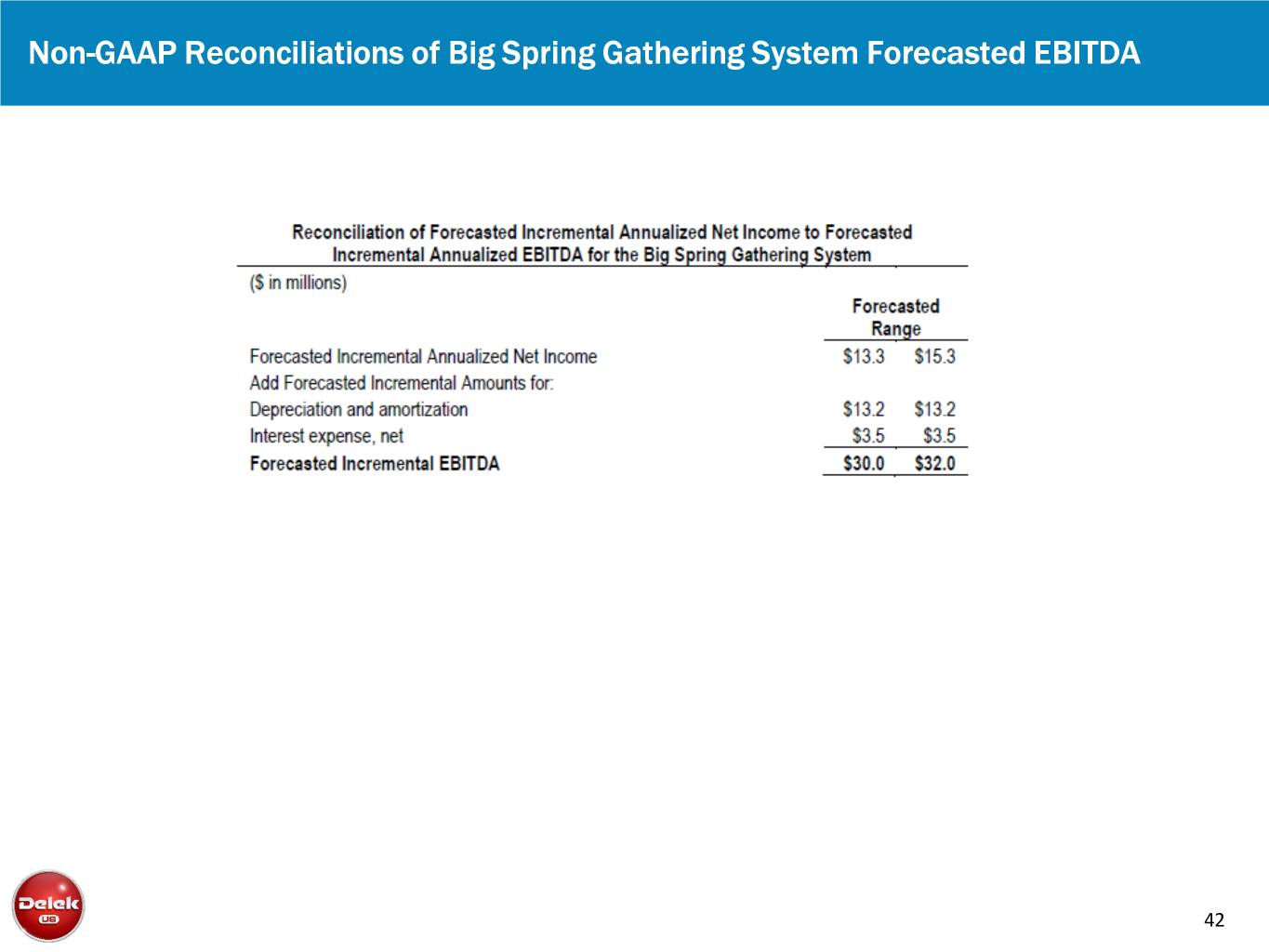

Midstream: Big Spring Gathering System Gathering Helps Control Crude Oil Quality and Cost into Refineries Getting closer to wellhead allows us to control crude quality and cost Big Spring Gathering System . Provides improvement in refining performance and cost structure Approximately 200-mile gathering system, Drop down to DKL completed in Q1 2020 Gathering increases access to barrels 350Kbpd throughput capacity . Creates optionality to place barrels: >275,000 dedicated acres; Big Spring (local refinery) Points of origin: Howard, Borden, Martin and Midland Midland counties Colorado City (access other refineries) Total terminal storage of 650K bbls; Wink (to Gulf Coast) Connection to Big Spring, TX terminal . Control quality and blending opportunities Delek Logistics Acquired 1Q20 Permian Supply vs. Takeaway Expected $30 - $32 million Annual EBITDA underpinned by MVC DK to DKL (1) MVC 120mbbl/d for Big Spring system in addition to 50mbbl/d connection to 3rd party pipeline system CAPEX potential of $33.8 million if requested by DK, matched with MVC providing 12.5% ROR Refining Capacity Wink to Webster Gathering Acess 1) Please see page 42 for a reconciliation of forecasted incremental annualized net income to forecasted EBITDA for the Big Spring Gathering System. 8

Midstream: Wink to Webster Crude Oil Long Haul Pipeline Joint Venture Complements Gathering – Provides Access to Gulf Coast Markets Wink to Webster Pipeline JV 650-mile 36-inch diameter crude oil pipeline Wink to Webster Pipeline LLC – Exxon, Plains, MPLX, Delek US, Rattler Midstream, Lotus Midstream Delek US’ Investment Total system expected completion 2021 . Delek US has 15% ownership interest in Wink to Webster Supported by significant volume of long term Pipeline LLC commitments . Expected $340 million to $380 million net investment . Integrated with Big Spring gathering system to provide source of barrels and services to producers Well above Delek US’ targeted minimum required midstream IRR of 15% Secured project financing for approximately 80% of Big Spring our investment Midland . ~$69 million reimbursement in 1Q20 Wink . Results in ~$75 million equity contribution; balance to be project financed Beaumont Junction Webster/ Baytown 9

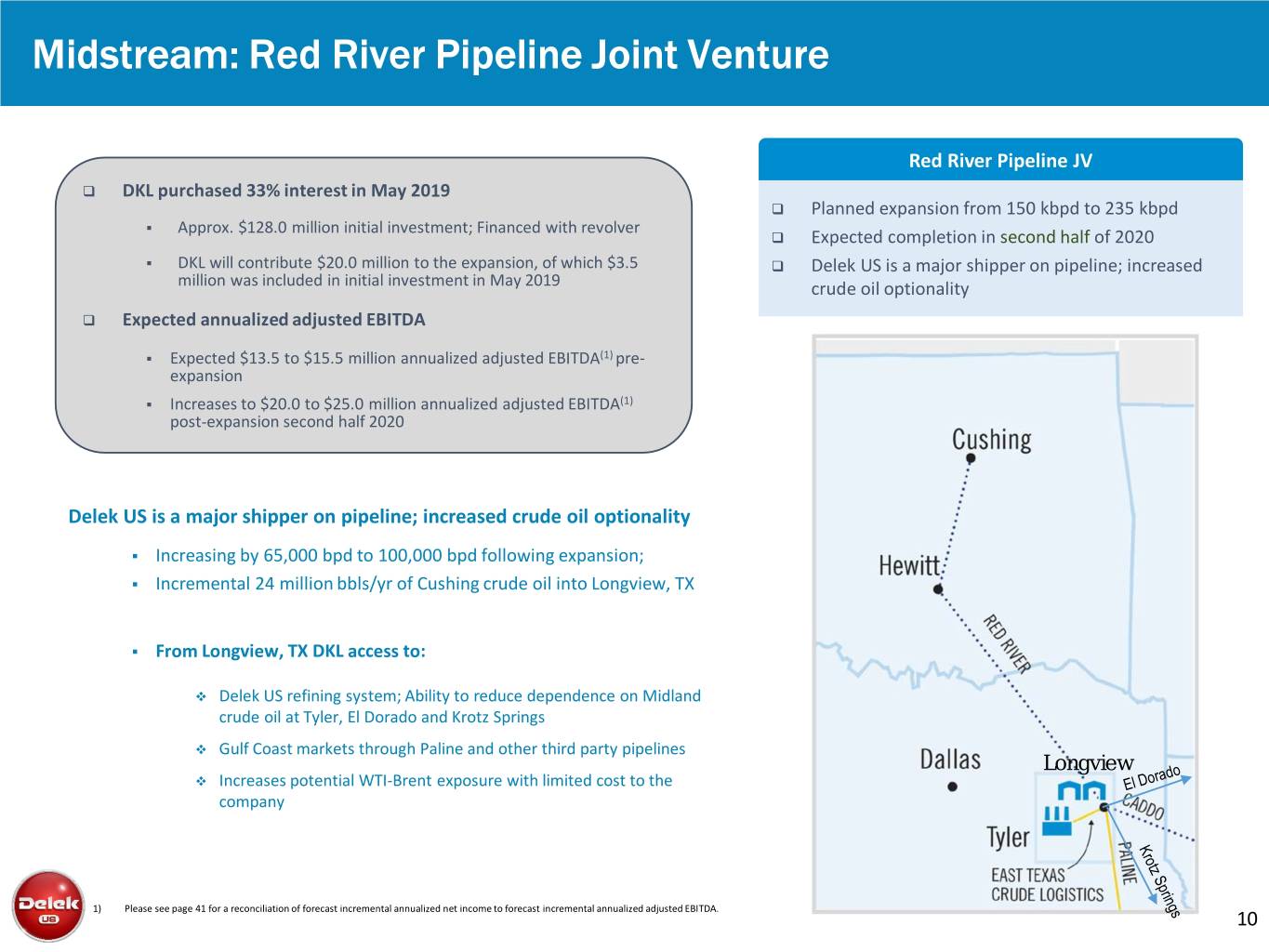

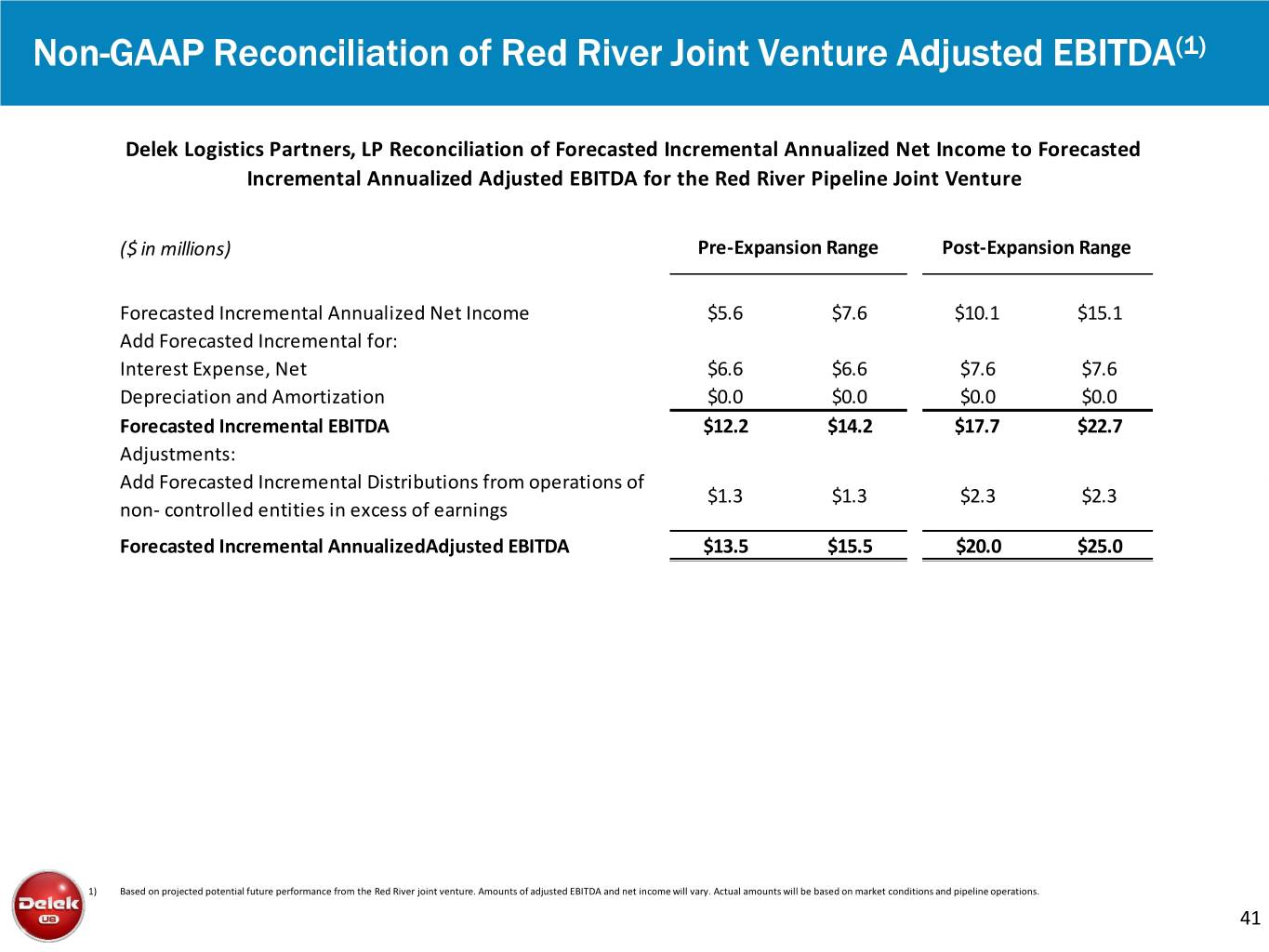

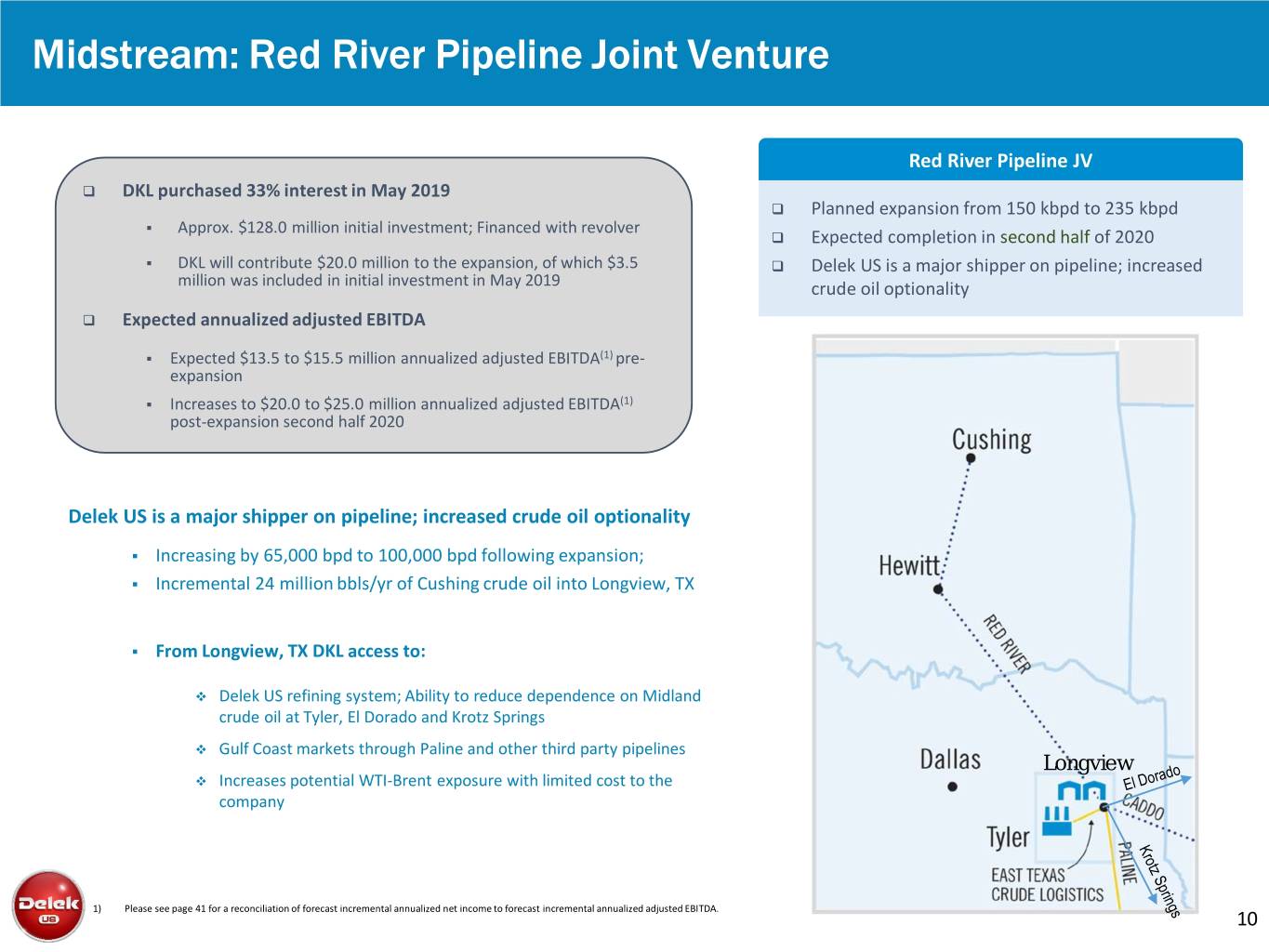

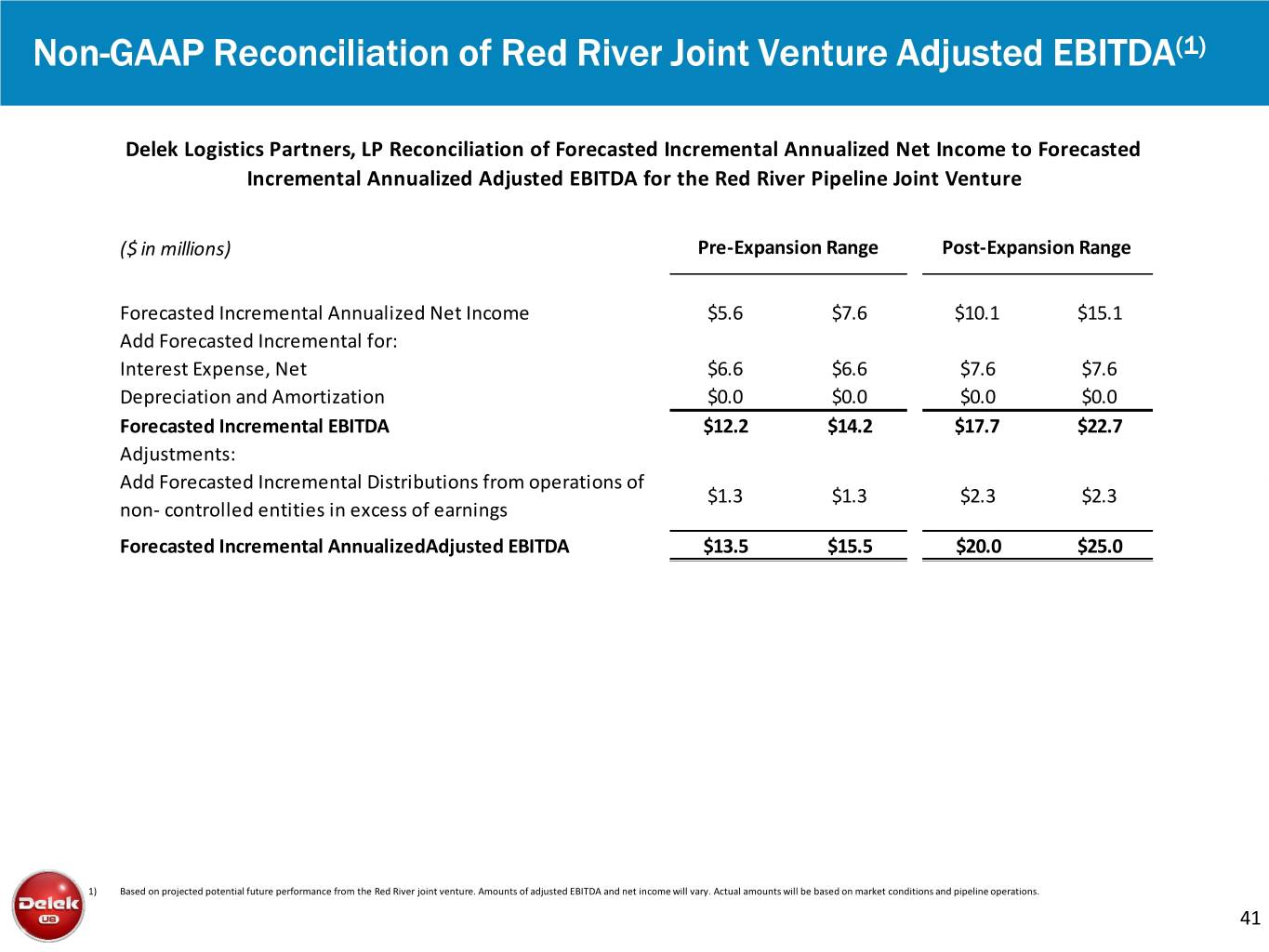

Midstream: Red River Pipeline Joint Venture Red River Pipeline JV DKL purchased 33% interest in May 2019 Planned expansion from 150 kbpd to 235 kbpd . Approx. $128.0 million initial investment; Financed with revolver Expected completion in second half of 2020 . DKL will contribute $20.0 million to the expansion, of which $3.5 Delek US is a major shipper on pipeline; increased million was included in initial investment in May 2019 crude oil optionality Expected annualized adjusted EBITDA . Expected $13.5 to $15.5 million annualized adjusted EBITDA(1) pre- expansion . Increases to $20.0 to $25.0 million annualized adjusted EBITDA(1) post-expansion second half 2020 Delek US is a major shipper on pipeline; increased crude oil optionality . Increasing by 65,000 bpd to 100,000 bpd following expansion; . Incremental 24 million bbls/yr of Cushing crude oil into Longview, TX . From Longview, TX DKL access to: Delek US refining system; Ability to reduce dependence on Midland crude oil at Tyler, El Dorado and Krotz Springs Gulf Coast markets through Paline and other third party pipelines Longview Increases potential WTI-Brent exposure with limited cost to the company 1) Please see page 41 for a reconciliation of forecast incremental annualized net income to forecast incremental annualized adjusted EBITDA. 10

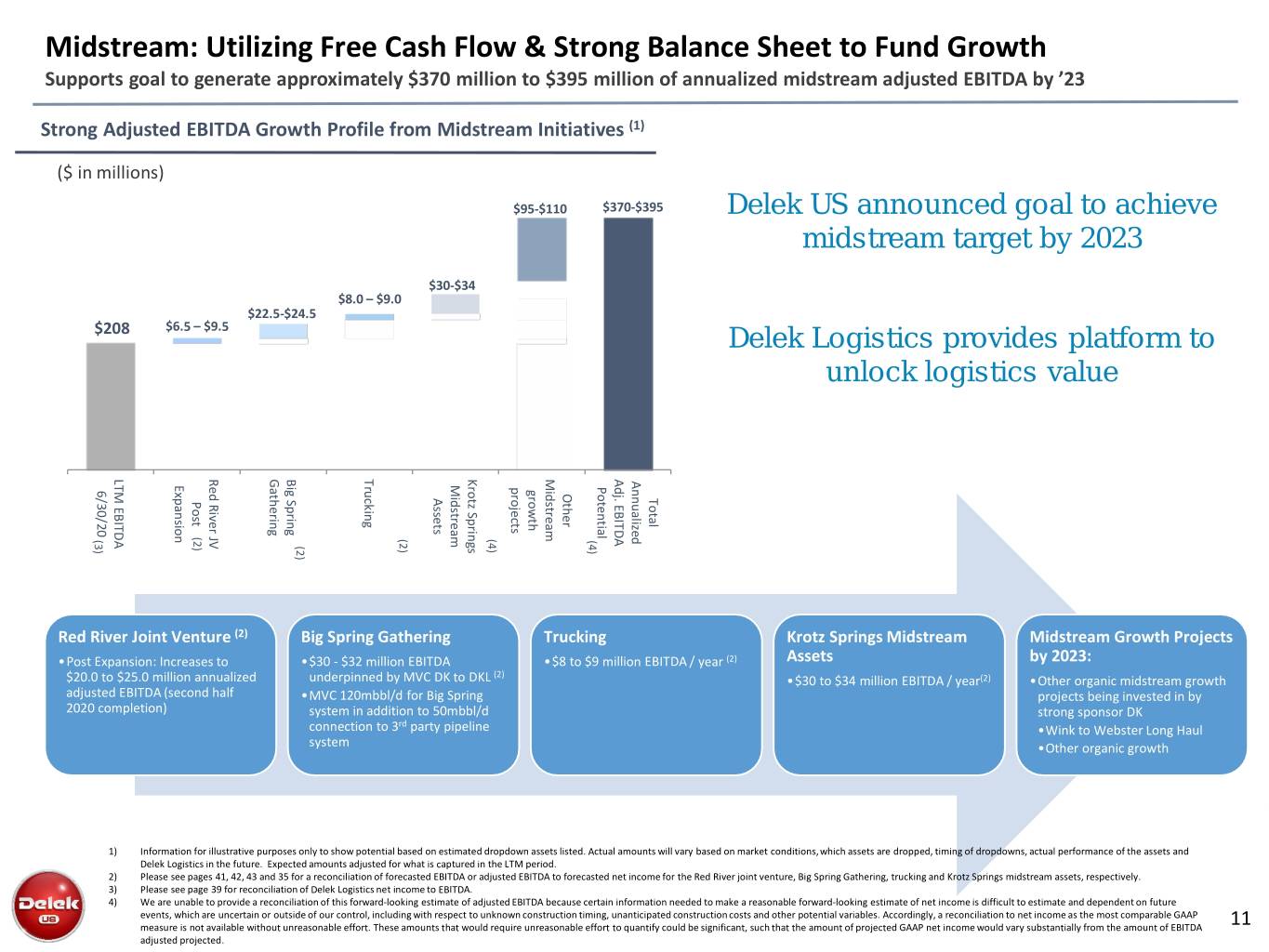

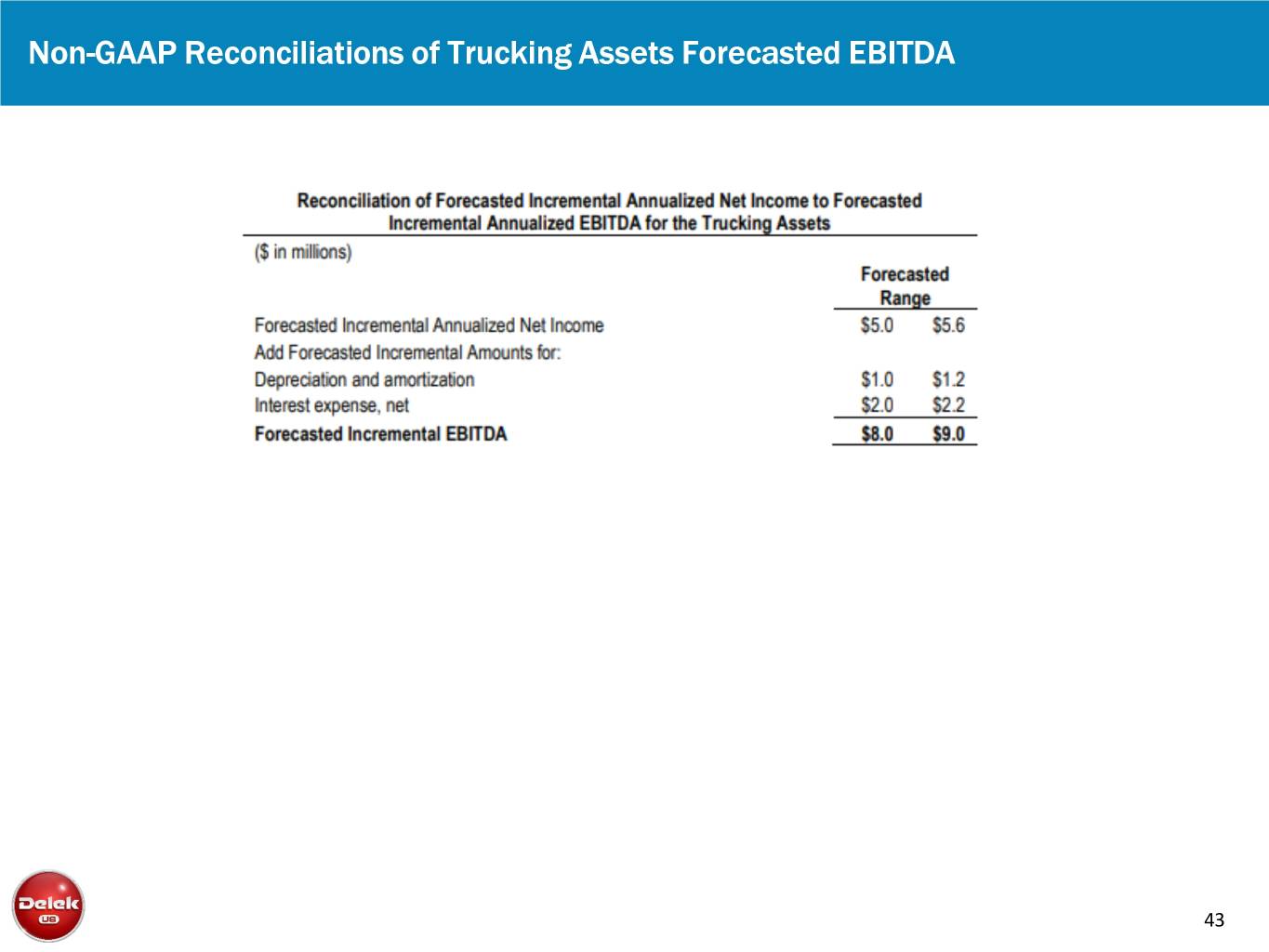

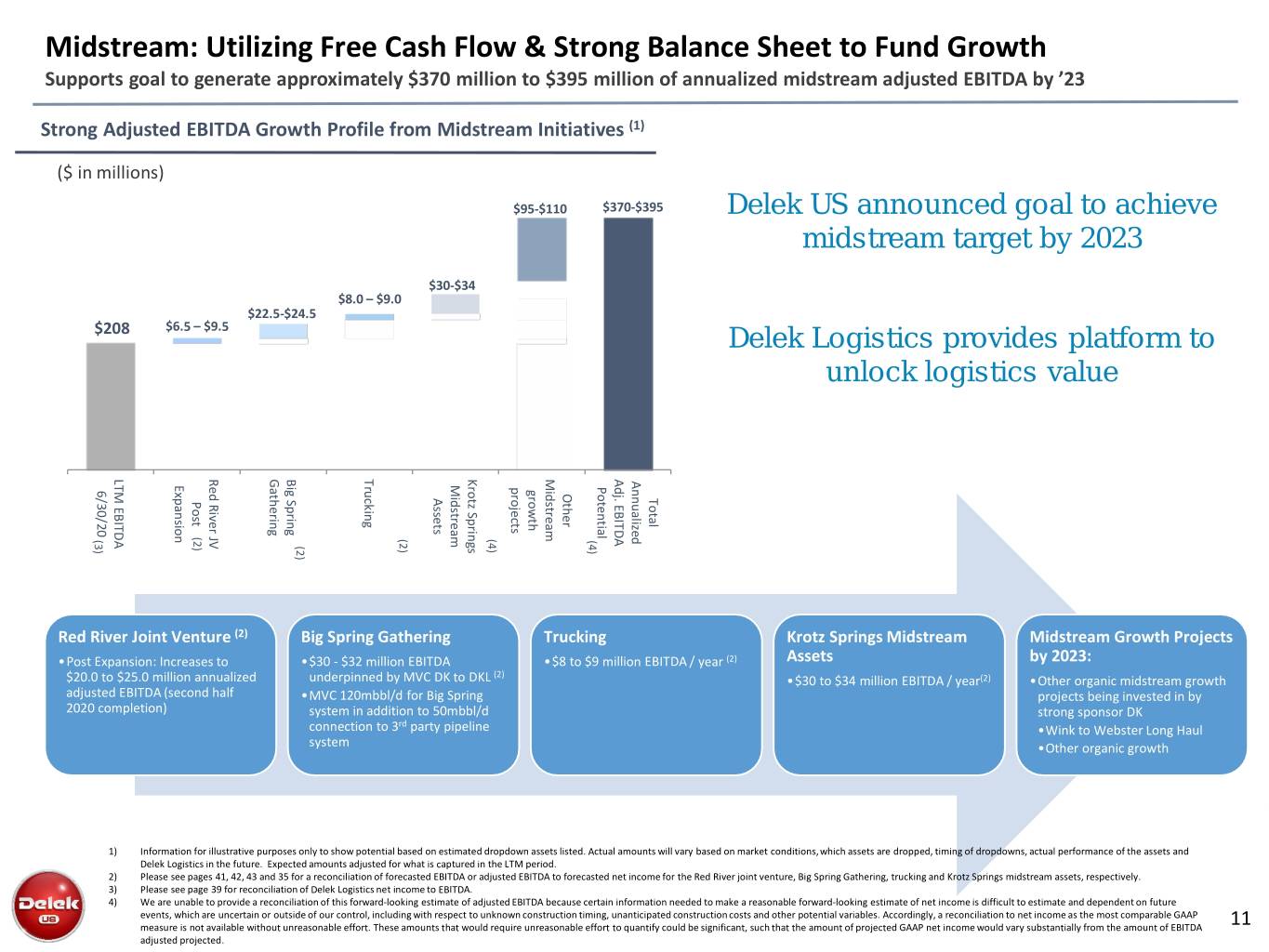

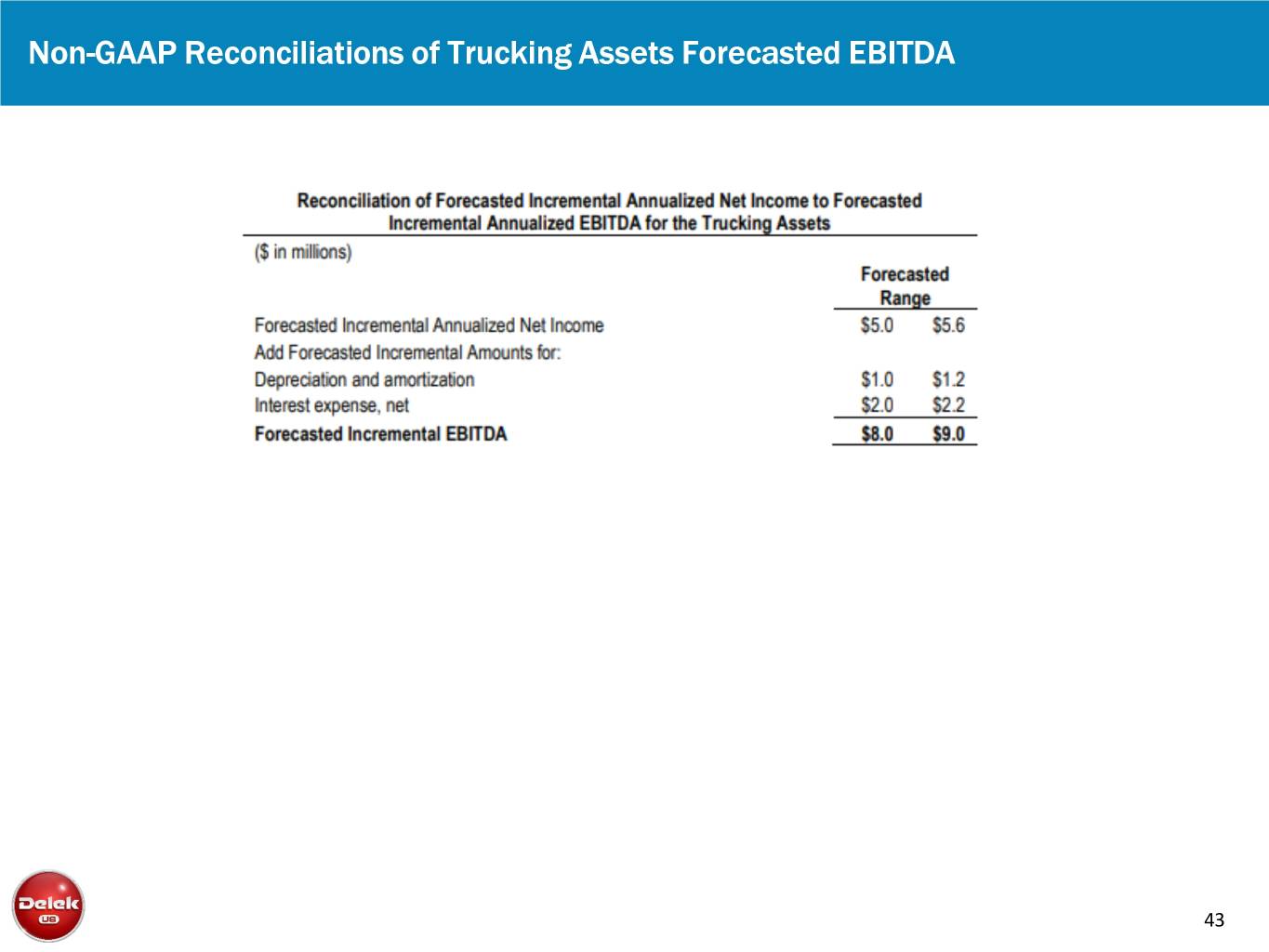

MidstreamMidstream:: UtilizingUtilizing Free Free Cash Cash Flow Flow & Strong & Strong Balance Balance Sheet to Sheet Fund toGrowth Fund Growth Supports goal to generate approximately $370 million to $395 million of annualized midstream adjusted EBITDA by ’23 Supports goal to generate approximately $370 million to $395 million of annualized midstream adjusted EBITDA by ’23 Strong Adjusted EBITDA Growth Profile from Midstream Initiatives (1) ($ in millions) $95-$110 $370-$395 Delek US announced goal to achieve midstream target by 2023 $30-$34 $8.0 – $9.0 $22.5-$24.5 $6.5 – $9.5 $208 Delek Logistics provides platform to unlock logistics value LTM EBITDA LTM RiverRed JV Midstream Adj. EBITDA Adj. Gathering Trucking Krotz Springs Big Spring Big Annualized Midstream Expansion Potential projects growth 6/30/20 Other Assets Total Post (2) (2) (4) (3) (4) (2) Red River Joint Venture (2) Big Spring Gathering Trucking Krotz Springs Midstream Midstream Growth Projects •Post Expansion: Increases to •$30 - $32 million EBITDA •$8 to $9 million EBITDA / year (2) Assets by 2023: (2) $20.0 to $25.0 million annualized underpinned by MVC DK to DKL •$30 to $34 million EBITDA / year(2) •Other organic midstream growth adjusted EBITDA (second half •MVC 120mbbl/d for Big Spring projects being invested in by 2020 completion) system in addition to 50mbbl/d strong sponsor DK rd connection to 3 party pipeline •Wink to Webster Long Haul system •Other organic growth 1) Information for illustrative purposes only to show potential based on estimated dropdown assets listed. Actual amounts will vary based on market conditions, which assets are dropped, timing of dropdowns, actual performance of the assets and Delek Logistics in the future. Expected amounts adjusted for what is captured in the LTM period. 2) Please see pages 41, 42, 43 and 35 for a reconciliation of forecasted EBITDA or adjusted EBITDA to forecasted net income for the Red River joint venture, Big Spring Gathering, trucking and Krotz Springs midstream assets, respectively. 3) Please see page 39 for reconciliation of Delek Logistics net income to EBITDA. 4) We are unable to provide a reconciliation of this forward-looking estimate of adjusted EBITDA because certain information needed to make a reasonable forward-looking estimate of net income is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of EBITDA 11 adjusted projected.

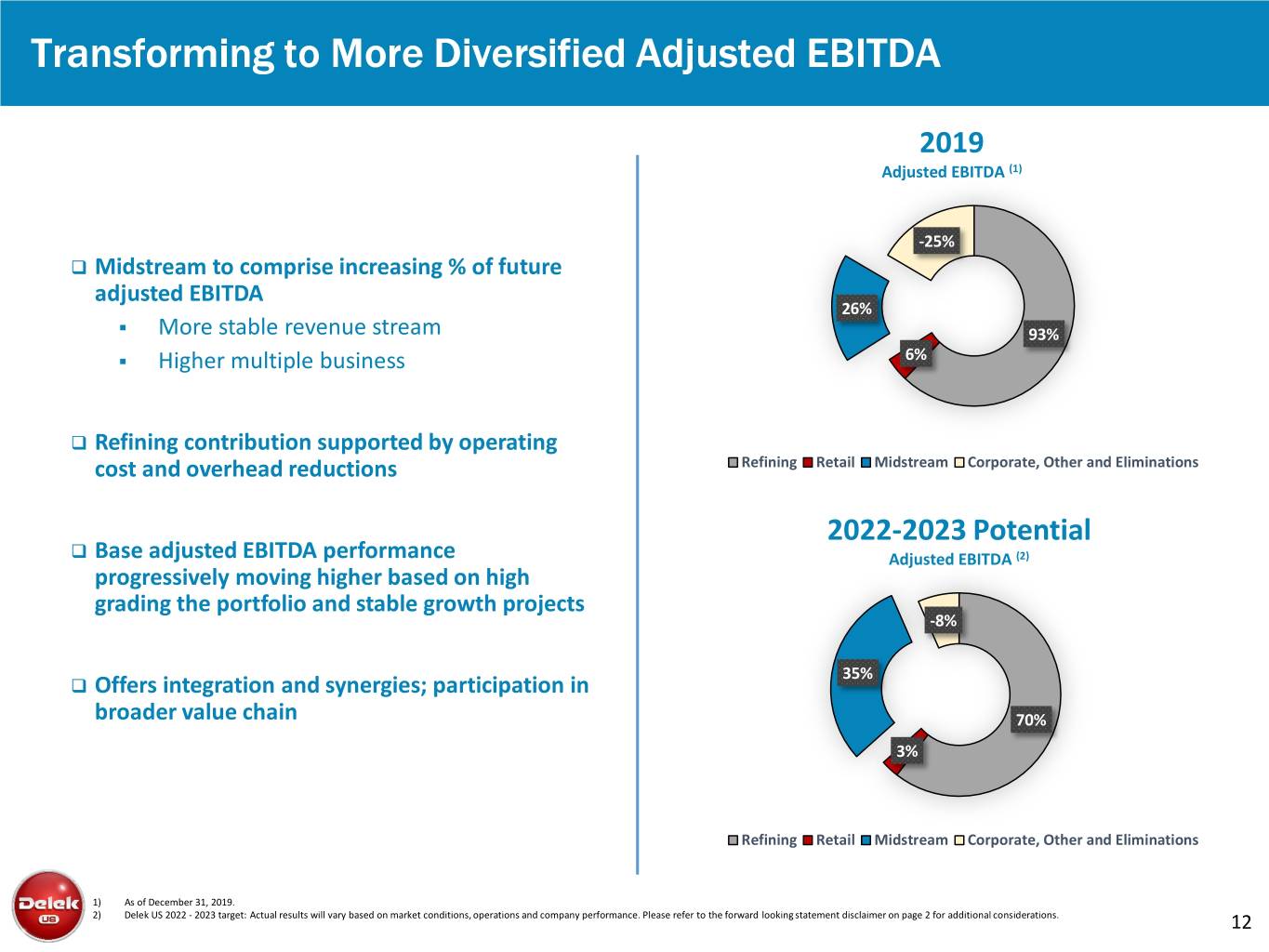

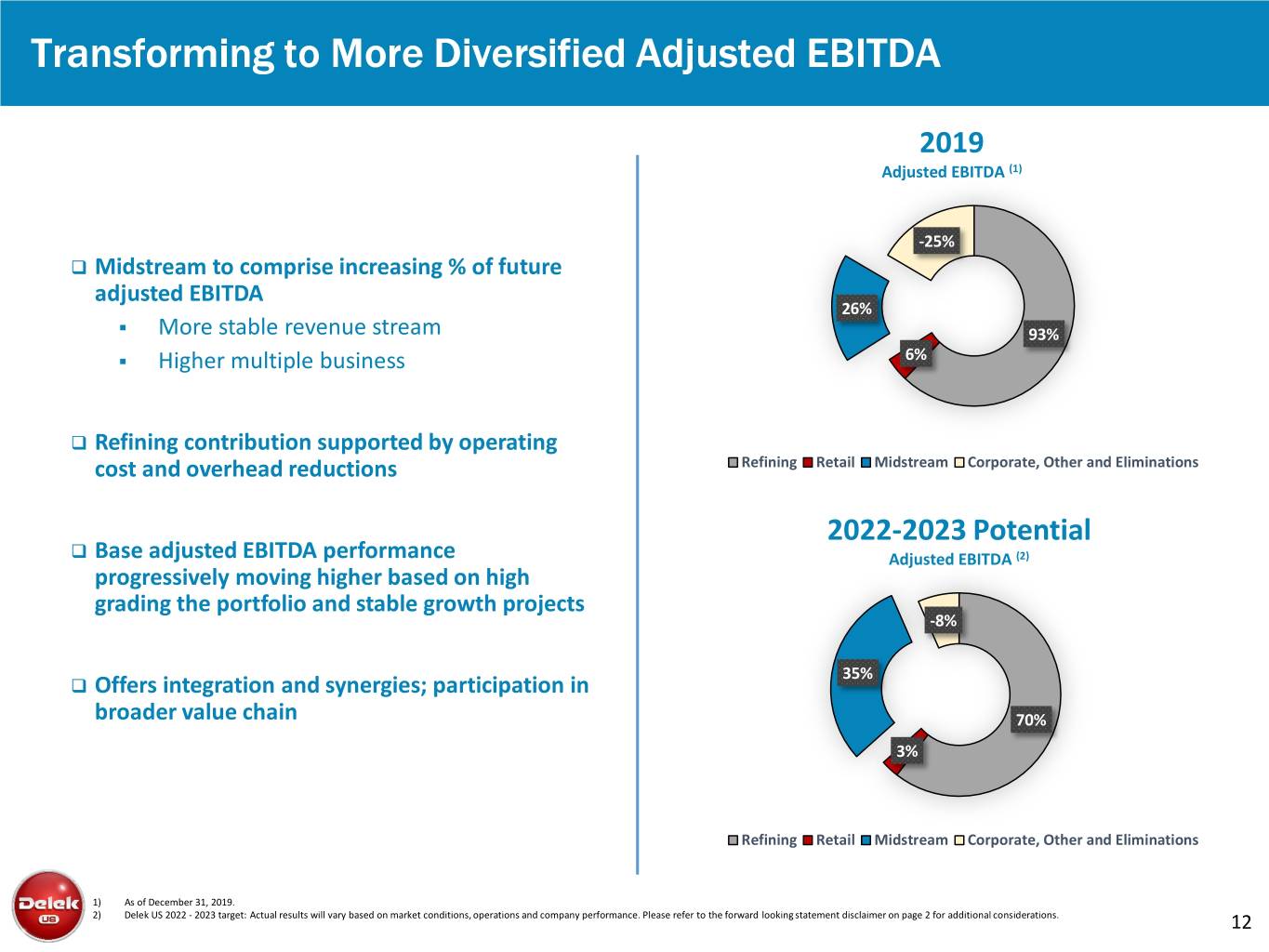

Transforming to More Diversified Adjusted EBITDA 2019 Adjusted EBITDA (1) -25% Midstream to comprise increasing % of future adjusted EBITDA 26% . More stable revenue stream 93% . Higher multiple business 6% Refining contribution supported by operating cost and overhead reductions Refining Retail Midstream Corporate, Other and Eliminations 2022-2023 Potential Base adjusted EBITDA performance Adjusted EBITDA (2) progressively moving higher based on high grading the portfolio and stable growth projects -8% 35% Offers integration and synergies; participation in broader value chain 70% 3% Refining Retail Midstream Corporate, Other and Eliminations 1) As of December 31, 2019. 2) Delek US 2022 - 2023 target: Actual results will vary based on market conditions, operations and company performance. Please refer to the forward looking statement disclaimer on page 2 for additional considerations. 12

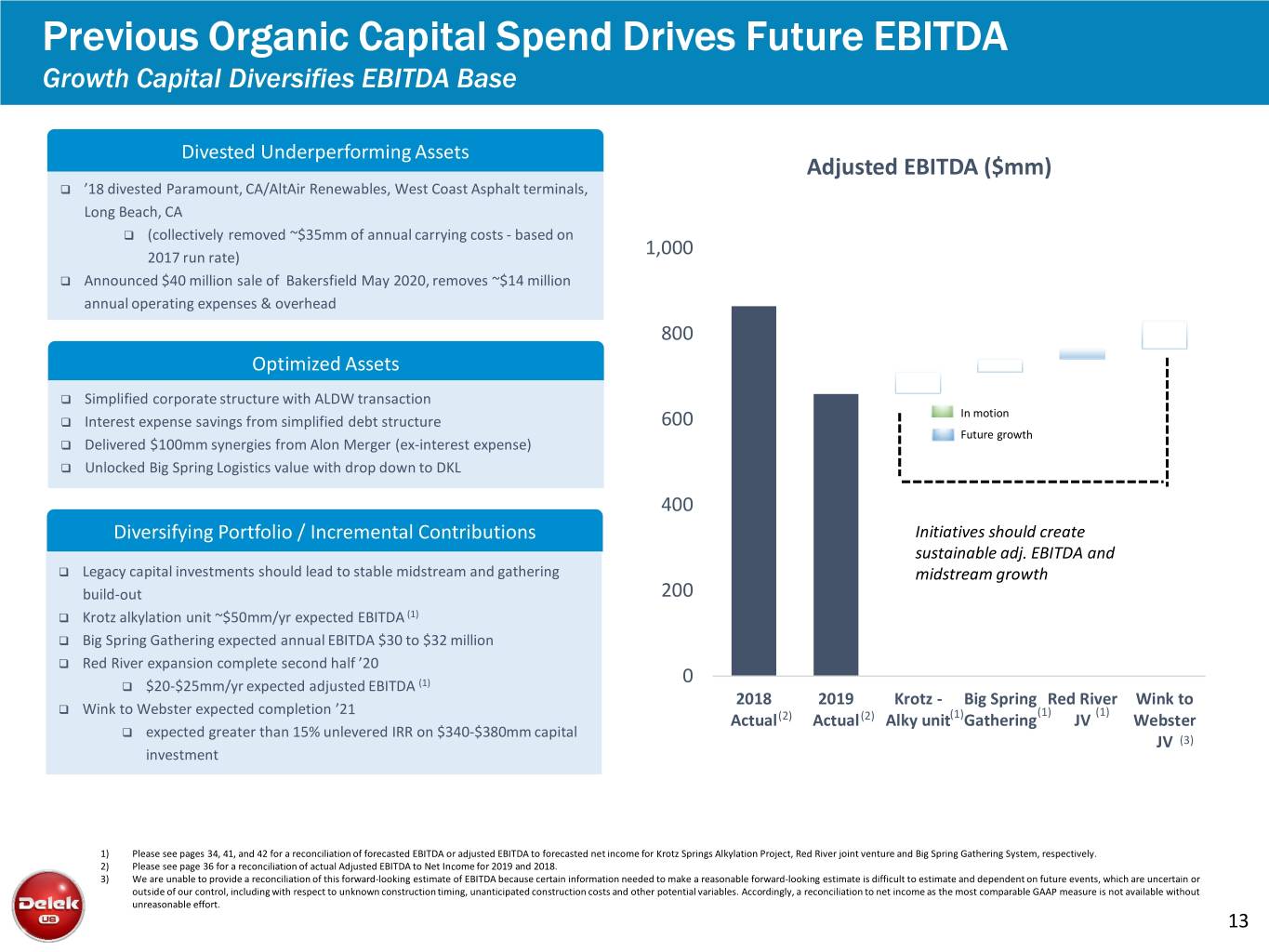

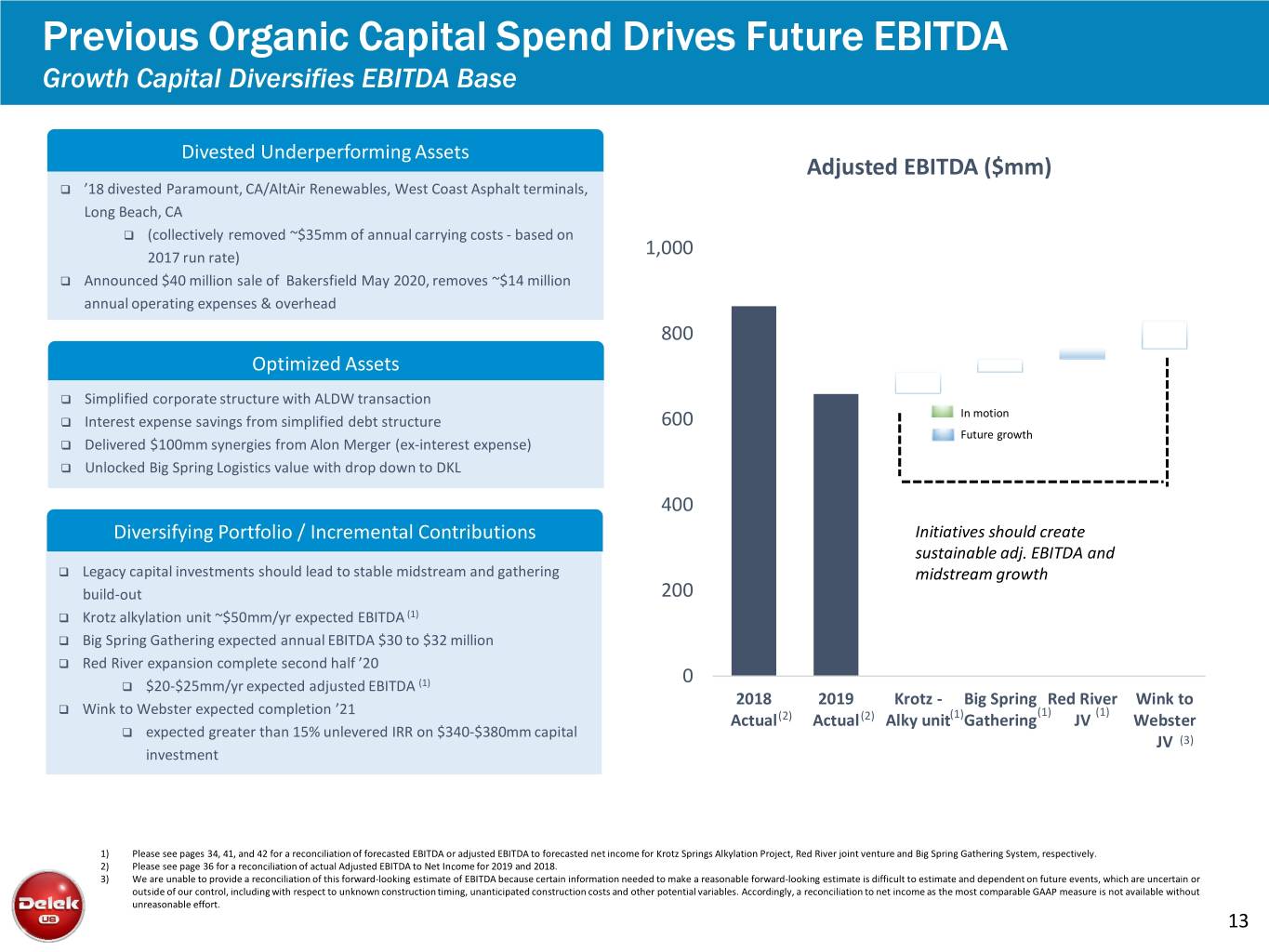

Previous Organic Capital Spend Drives Future EBITDA Growth Capital Diversifies EBITDA Base Divested Underperforming Assets Adjusted EBITDA ($mm) ’18 divested Paramount, CA/AltAir Renewables, West Coast Asphalt terminals, Long Beach, CA (collectively removed ~$35mm of annual carrying costs - based on 2017 run rate) 1,000 Announced $40 million sale of Bakersfield May 2020, removes ~$14 million annual operating expenses & overhead 800 Optimized Assets Simplified corporate structure with ALDW transaction In motion Interest expense savings from simplified debt structure 600 Future growth Delivered $100mm synergies from Alon Merger (ex-interest expense) Unlocked Big Spring Logistics value with drop down to DKL 400 Diversifying Portfolio / Incremental Contributions Initiatives should create sustainable adj. EBITDA and Legacy capital investments should lead to stable midstream and gathering midstream growth build-out 200 Krotz alkylation unit ~$50mm/yr expected EBITDA (1) Big Spring Gathering expected annual EBITDA $30 to $32 million Red River expansion complete second half ’20 $20-$25mm/yr expected adjusted EBITDA (1) 0 2018 2019 Krotz - Big Spring Red River Wink to Wink to Webster expected completion ’21 (1) (1) Actual(2) Actual(2) Alky unit(1)Gathering JV Webster expected greater than 15% unlevered IRR on $340-$380mm capital JV (3) investment 1) Please see pages 34, 41, and 42 for a reconciliation of forecasted EBITDA or adjusted EBITDA to forecasted net income for Krotz Springs Alkylation Project, Red River joint venture and Big Spring Gathering System, respectively. 2) Please see page 36 for a reconciliation of actual Adjusted EBITDA to Net Income for 2019 and 2018. 3) We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. 13

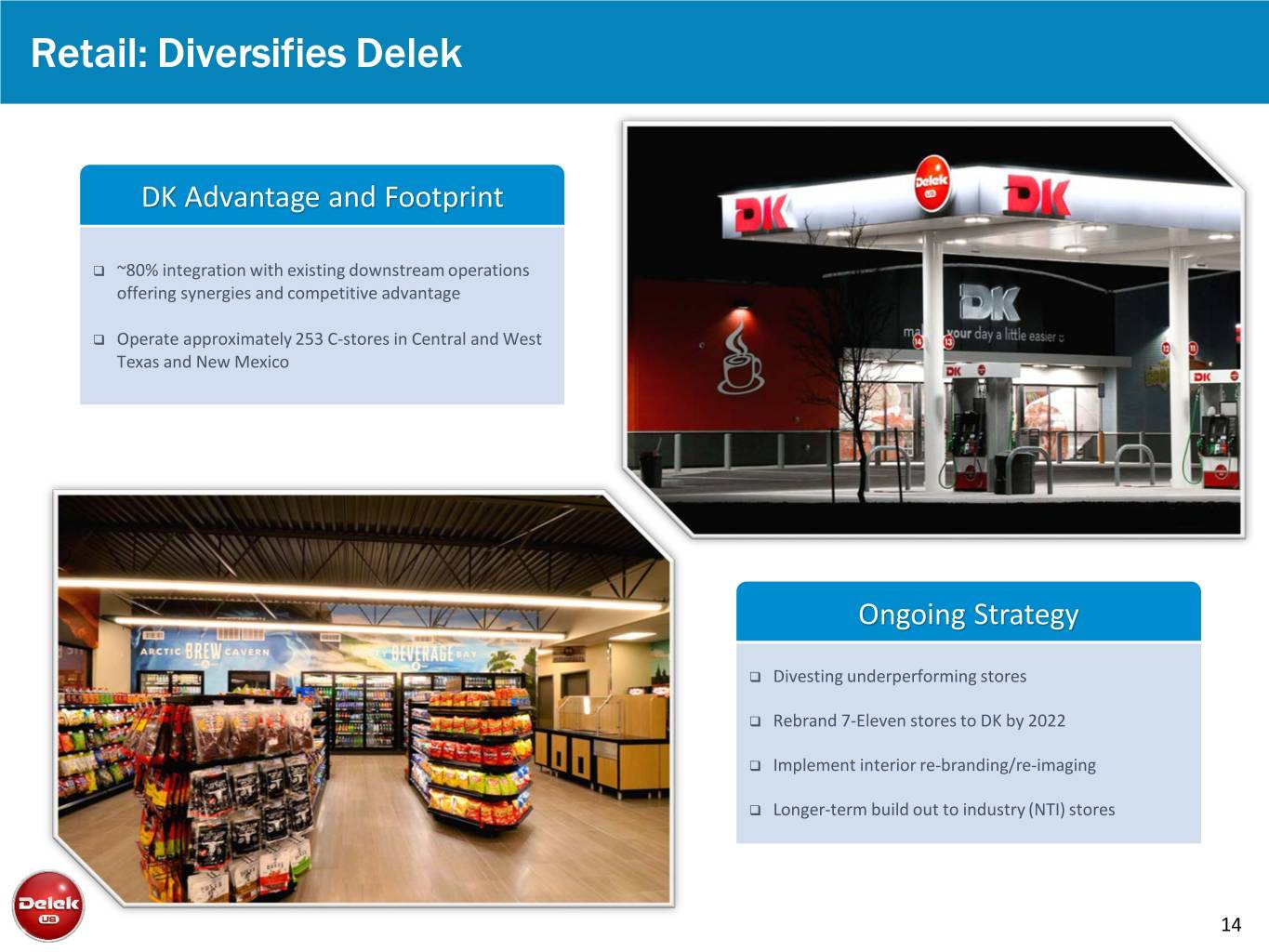

Retail: Diversifies Delek DK Advantage and Footprint ~80% integration with existing downstream operations offering synergies and competitive advantage Operate approximately 253 C-stores in Central and West Texas and New Mexico Ongoing Strategy Divesting underperforming stores Rebrand 7-Eleven stores to DK by 2022 Implement interior re-branding/re-imaging Longer-term build out to industry (NTI) stores 14

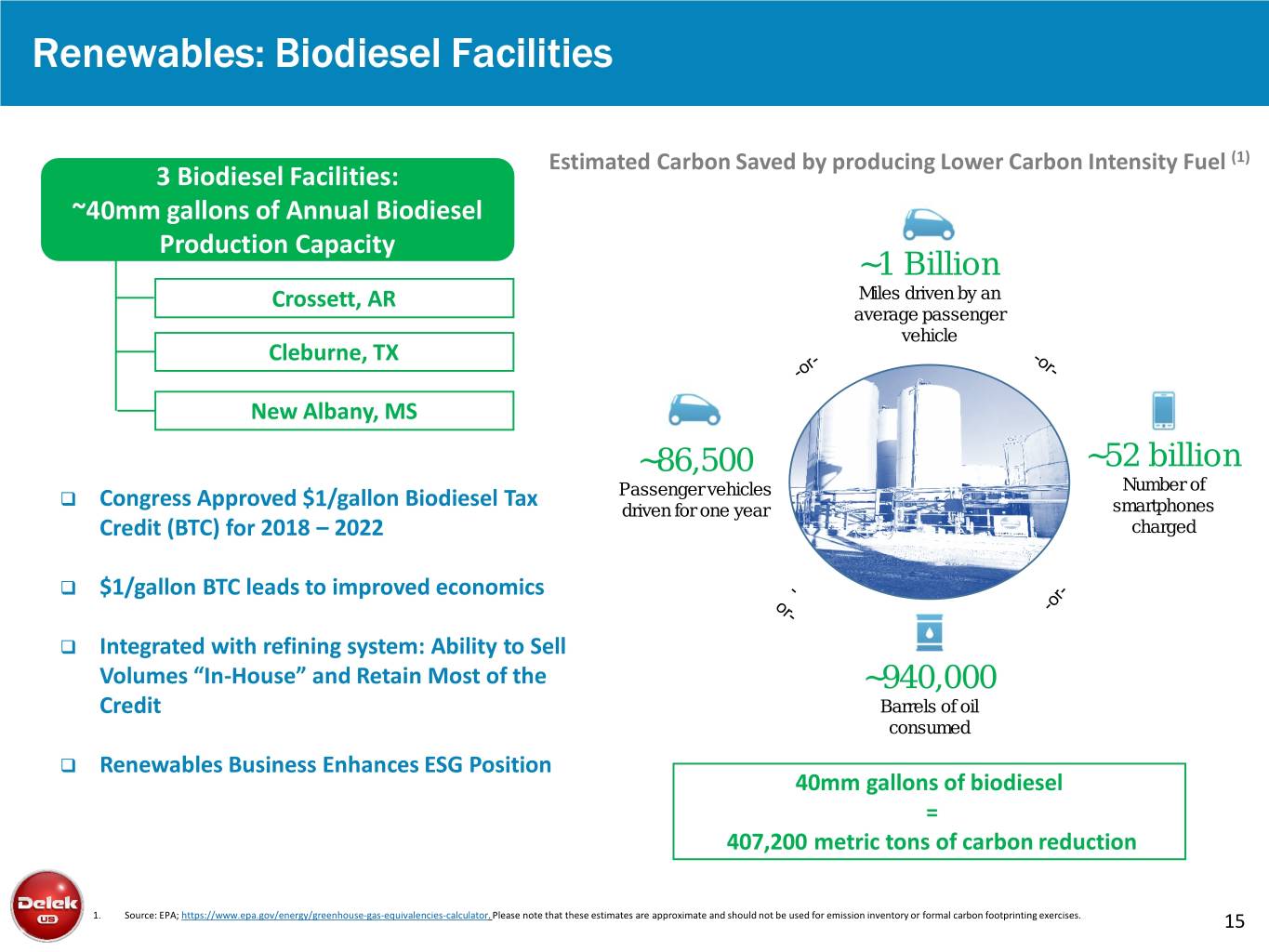

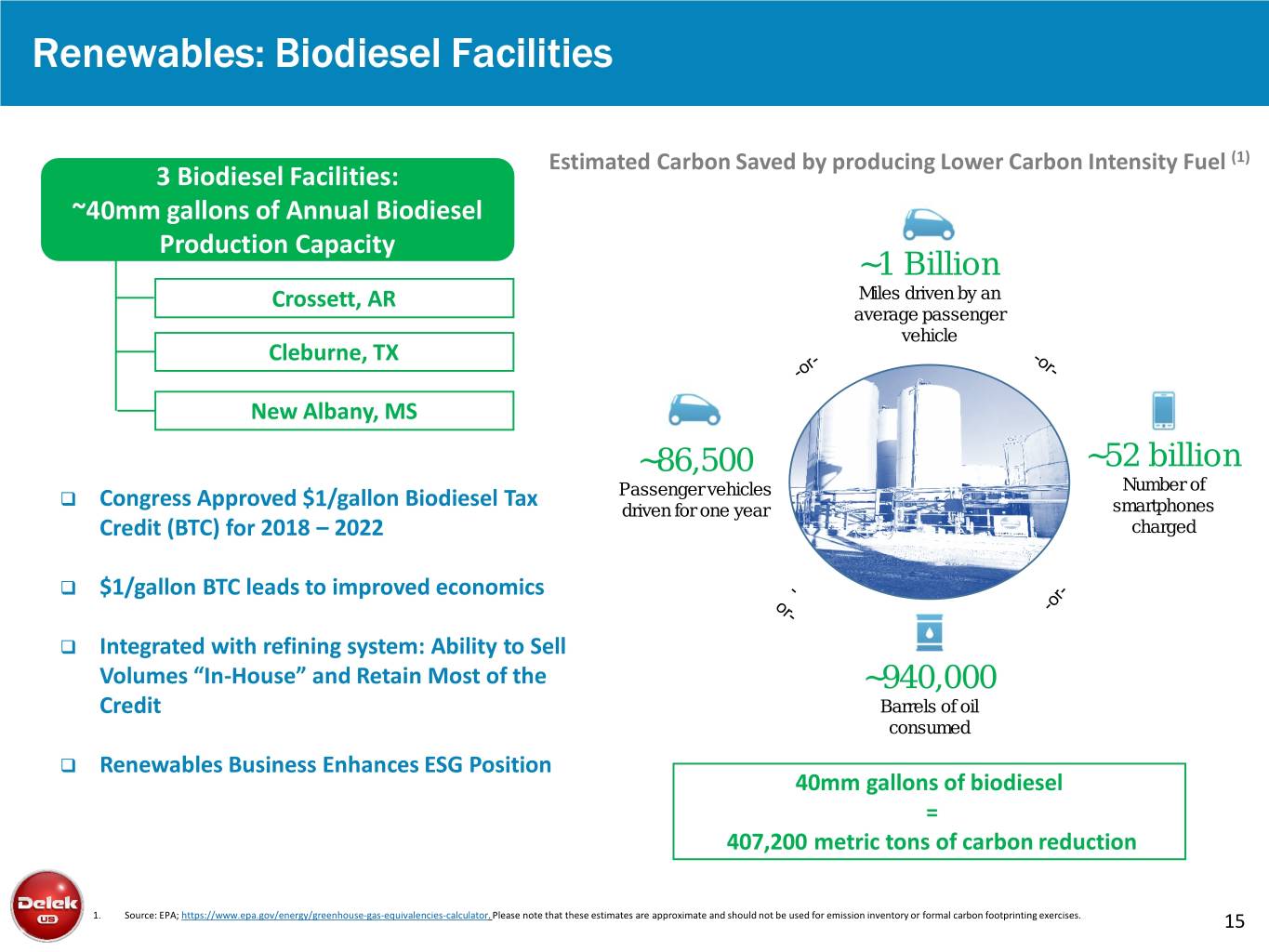

Renewables: Biodiesel Facilities Estimated Carbon Saved by producing Lower Carbon Intensity Fuel (1) 3 Biodiesel Facilities: ~40mm gallons of Annual Biodiesel Production Capacity ~1 Billion Crossett, AR Miles driven by an average passenger vehicle Cleburne, TX New Albany, MS : ~86,500 ~52 billion Number of Passenger vehicles Congress Approved $1/gallon Biodiesel Tax driven for one year smartphones Credit (BTC) for 2018 – 2022 charged $1/gallon BTC leads to improved economics Integrated with refining system: Ability to Sell Volumes “In-House” and Retain Most of the ~940,000 Credit Barrels of oil consumed Renewables Business Enhances ESG Position 40mm gallons of biodiesel = 407,200 metric tons of carbon reduction 1. Source: EPA; https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator. Please note that these estimates are approximate and should not be used for emission inventory or formal carbon footprinting exercises. 15

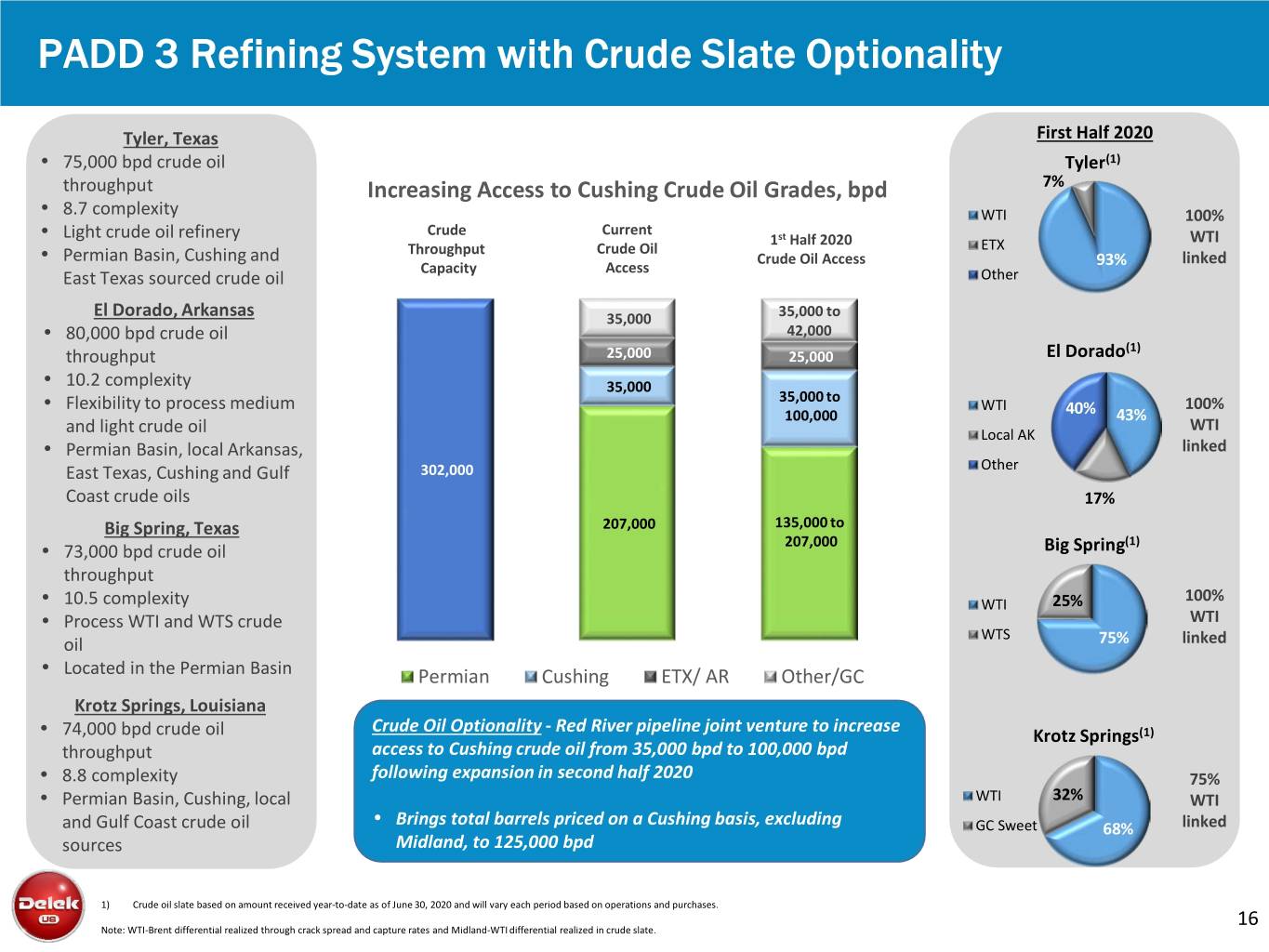

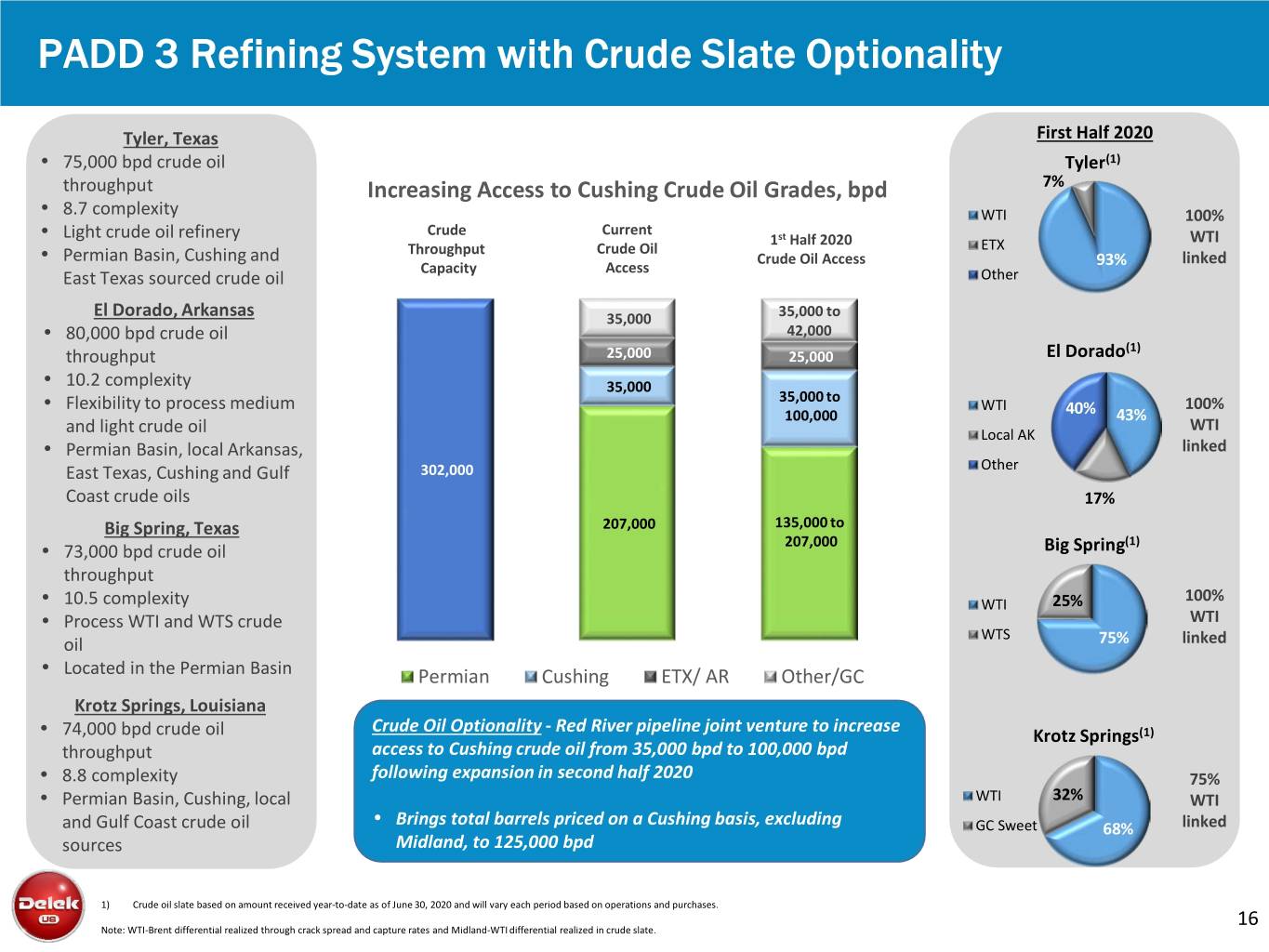

PADD 3 Refining System with Crude Slate Optionality Tyler, Texas First Half 2020 • 75,000 bpd crude oil Tyler(1) throughput Increasing Access to Cushing Crude Oil Grades, bpd 7% • 8.7 complexity WTI 100% Crude Current • Light crude oil refinery 1st Half 2020 WTI Throughput Crude Oil ETX • Permian Basin, Cushing and Crude Oil Access linked Capacity Access 93% East Texas sourced crude oil Other El Dorado, Arkansas 35,000 35,000 to • 80,000 bpd crude oil 42,000 (1) throughput 25,000 25,000 El Dorado • 10.2 complexity 35,000 • Flexibility to process medium 35,000 to WTI 100% 100,000 40% 43% WTI and light crude oil Local AK • Permian Basin, local Arkansas, linked East Texas, Cushing and Gulf 302,000 Other Coast crude oils 17% Big Spring, Texas 207,000 135,000 to 207,000 (1) • 73,000 bpd crude oil Big Spring throughput • 10.5 complexity WTI 25% 100% • Process WTI and WTS crude WTI WTS oil 75% linked • Located in the Permian Basin Permian Cushing ETX/ AR Other/GC Krotz Springs, Louisiana Crude Oil Optionality - Red River pipeline joint venture to increase • 74,000 bpd crude oil Krotz Springs(1) throughput access to Cushing crude oil from 35,000 bpd to 100,000 bpd • 8.8 complexity following expansion in second half 2020 75% • Permian Basin, Cushing, local WTI 32% WTI • Brings total barrels priced on a Cushing basis, excluding and Gulf Coast crude oil GC Sweet 68% linked sources Midland, to 125,000 bpd 1) Crude oil slate based on amount received year-to-date as of June 30, 2020 and will vary each period based on operations and purchases. Note: WTI-Brent differential realized through crack spread and capture rates and Midland-WTI differential realized in crude slate. 16

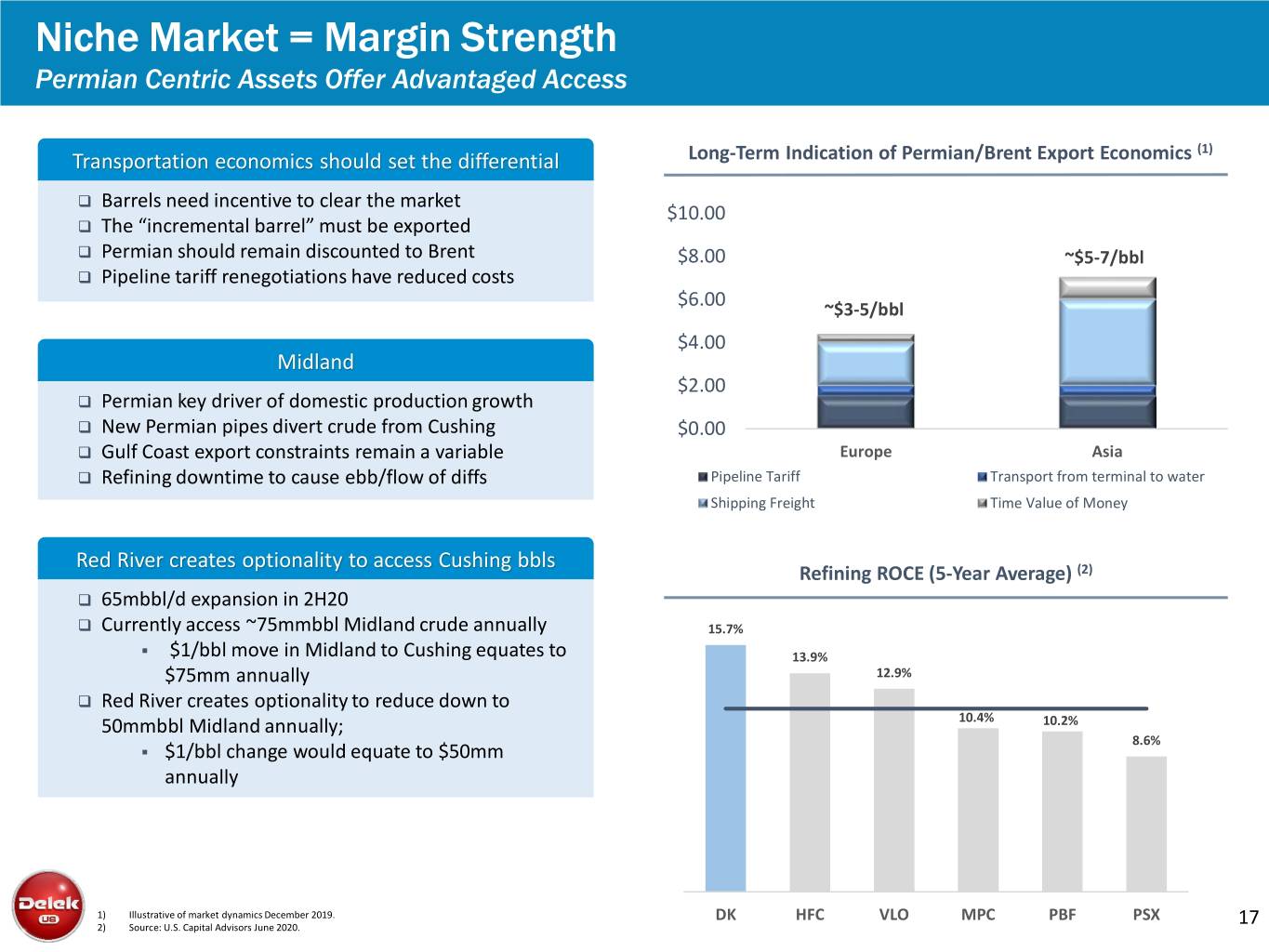

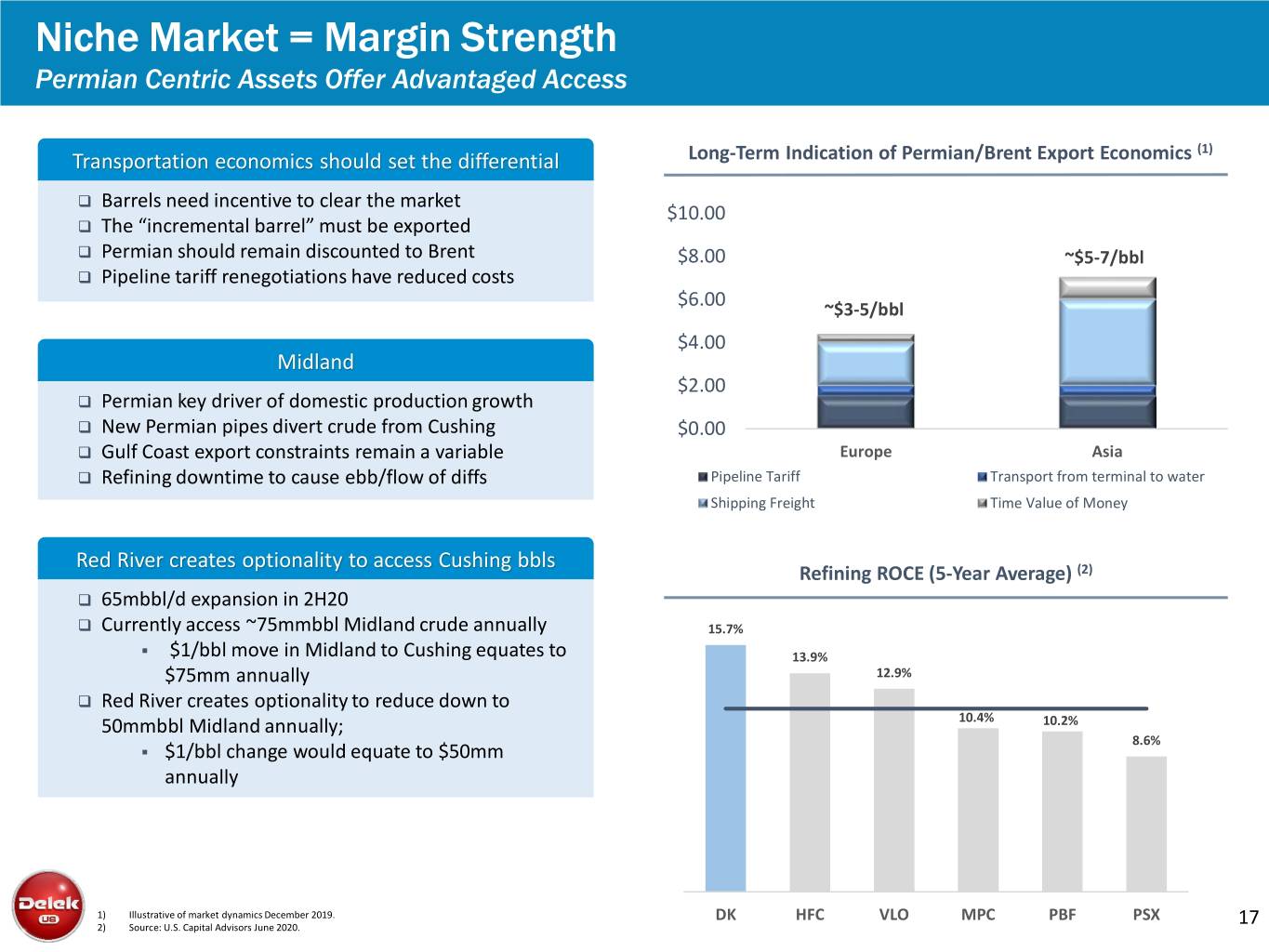

Niche Market = Margin Strength Permian Centric Assets Offer Advantaged Access (1) Transportation economics should set the differential Long-Term Indication of Permian/Brent Export Economics Barrels need incentive to clear the market $10.00 The “incremental barrel” must be exported Permian should remain discounted to Brent $8.00 ~$5-7/bbl Pipeline tariff renegotiations have reduced costs $6.00 ~$3-5/bbl $4.00 Midland $2.00 Permian key driver of domestic production growth New Permian pipes divert crude from Cushing $0.00 Gulf Coast export constraints remain a variable Europe Asia Refining downtime to cause ebb/flow of diffs Pipeline Tariff Transport from terminal to water Shipping Freight Time Value of Money Red River creates optionality to access Cushing bbls Refining ROCE (5-Year Average) (2) 65mbbl/d expansion in 2H20 Currently access ~75mmbbl Midland crude annually 15.7% . $1/bbl move in Midland to Cushing equates to 13.9% $75mm annually 12.9% Red River creates optionality to reduce down to 50mmbbl Midland annually; 10.4% 10.2% 8.6% . $1/bbl change would equate to $50mm annually 1) Illustrative of market dynamics December 2019. DK HFC VLO MPC PBF PSX 2) Source: U.S. Capital Advisors June 2020. 17

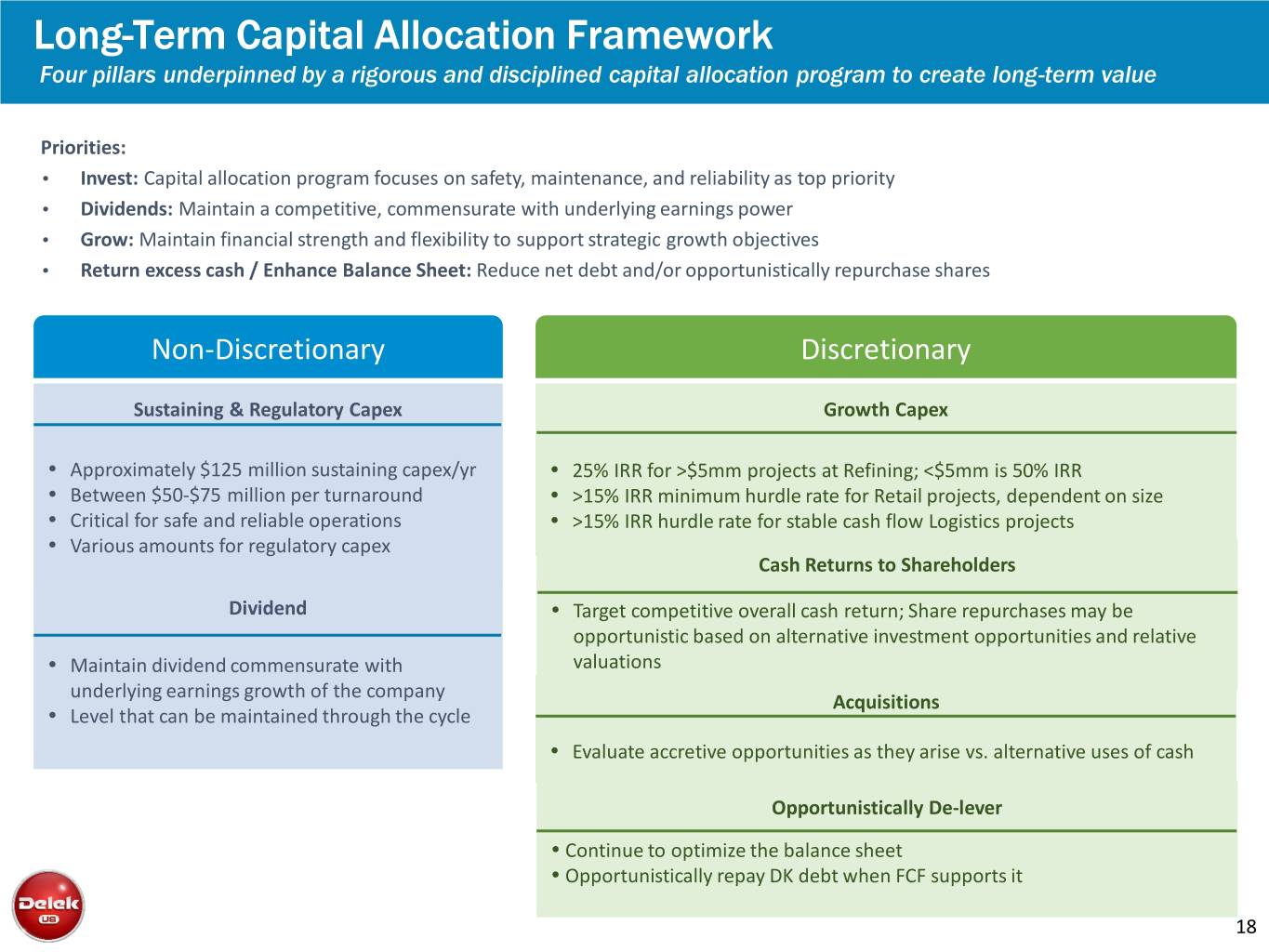

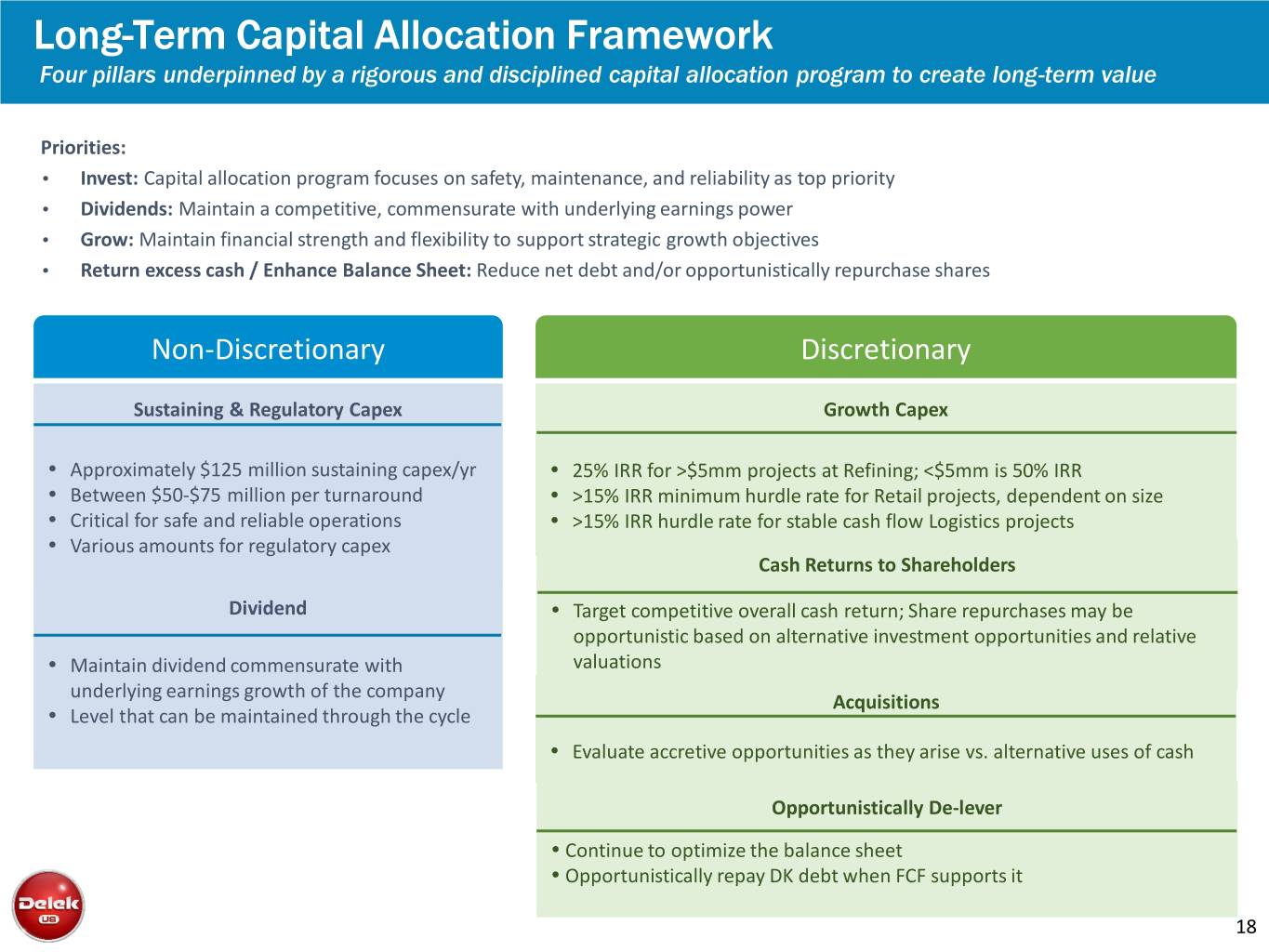

Long-Term Capital Allocation Framework Four pillars underpinned by a rigorous and disciplined capital allocation program to create long-term value Priorities: • Invest: Capital allocation program focuses on safety, maintenance, and reliability as top priority • Dividends: Maintain a competitive, commensurate with underlying earnings power • Grow: Maintain financial strength and flexibility to support strategic growth objectives • Return excess cash / Enhance Balance Sheet: Reduce net debt and/or opportunistically repurchase shares Non-Discretionary Discretionary Sustaining & Regulatory Capex Growth Capex • Approximately $125 million sustaining capex/yr • 25% IRR for >$5mm projects at Refining; <$5mm is 50% IRR • Between $50-$75 million per turnaround • >15% IRR minimum hurdle rate for Retail projects, dependent on size • CriticalSustaining for safe and Capex reliable operations • >15% IRR hurdle rate for stable cash flow Logistics projects • Various amounts for regulatory capex Cash Returns to Shareholders Dividend • Target competitive overall cash return; Share repurchases may be opportunistic based on alternative investment opportunities and relative • Maintain dividend commensurate with valuations underlying earnings growth of the company Acquisitions • Level that can be maintained through the cycle • Evaluate accretive opportunities as they arise vs. alternative uses of cash Opportunistically De-lever • Continue to optimize the balance sheet • Opportunistically repay DK debt when FCF supports it 18

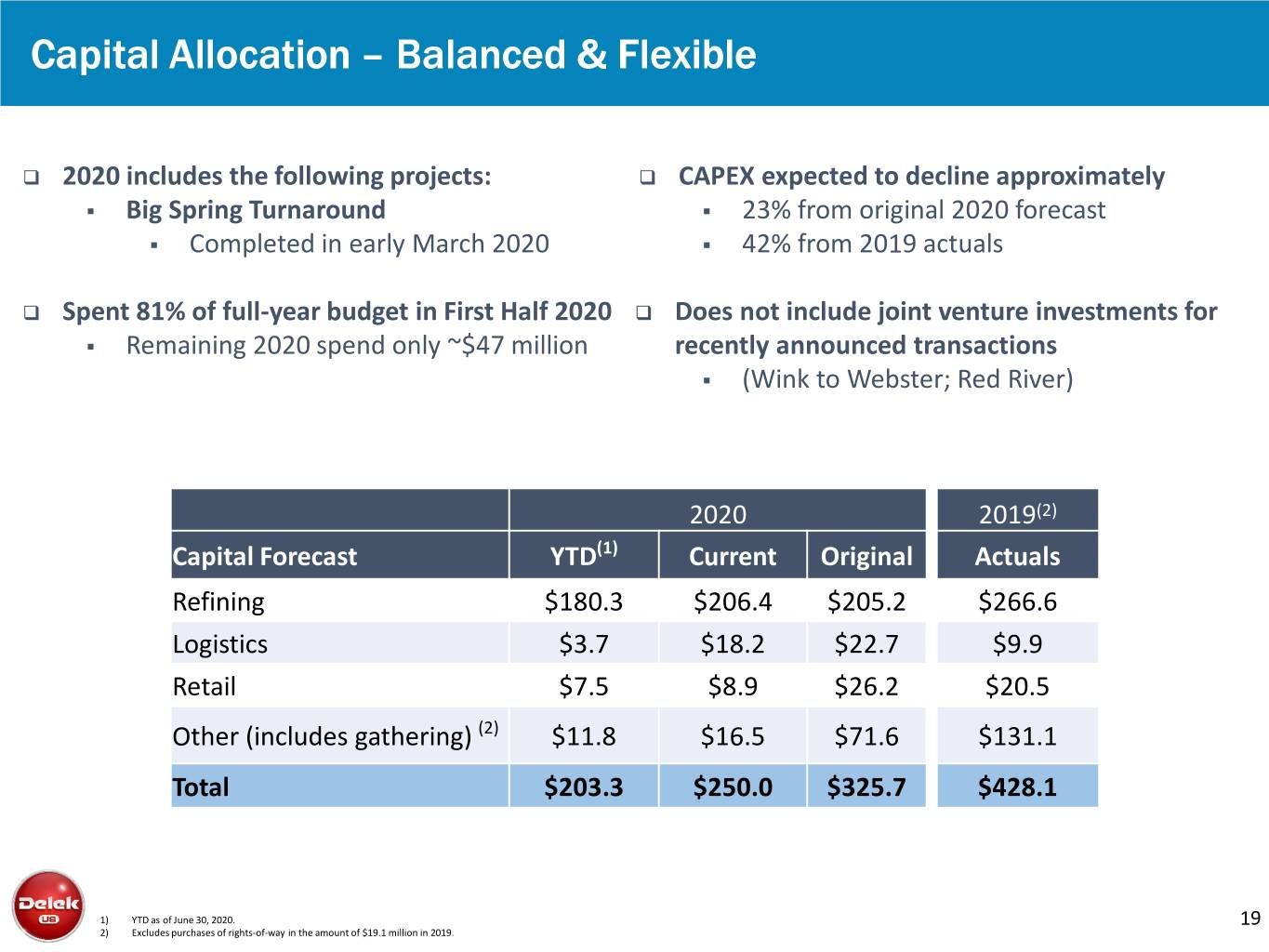

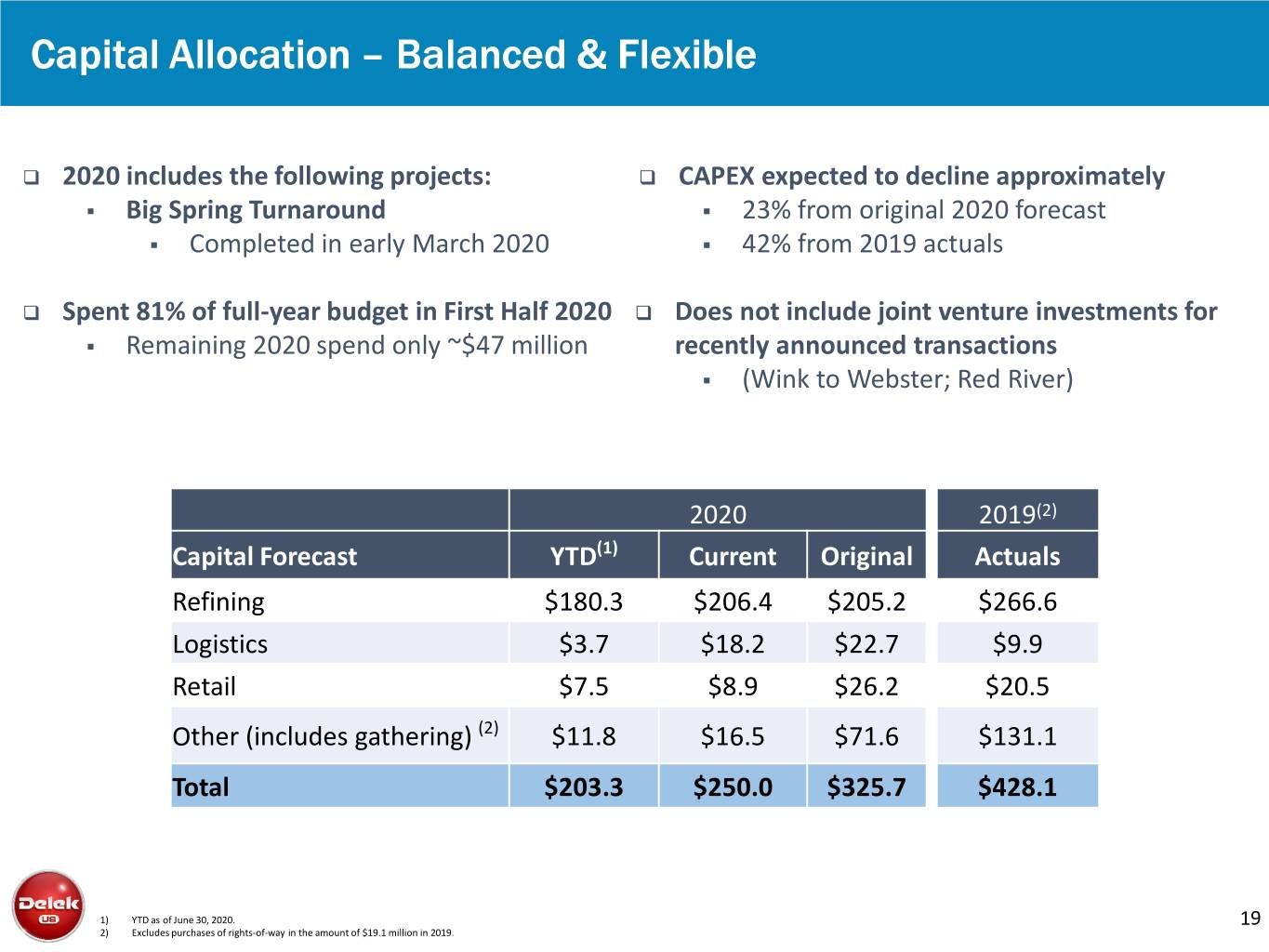

Capital Allocation – Balanced & Flexible 2020 includes the following projects: CAPEX expected to decline approximately . Big Spring Turnaround . 23% from original 2020 forecast . Completed in early March 2020 . 42% from 2019 actuals Spent 81% of full-year budget in First Half 2020 Does not include joint venture investments for . Remaining 2020 spend only ~$47 million recently announced transactions . (Wink to Webster; Red River) 2020 2019(2) Capital Forecast YTD(1) Current Original Actuals Refining $180.3 $206.4 $205.2 $266.6 Logistics $3.7 $18.2 $22.7 $9.9 Retail $7.5 $8.9 $26.2 $20.5 Other (includes gathering) (2) $11.8 $16.5 $71.6 $131.1 Total $203.3 $250.0 $325.7 $428.1 1) YTD as of June 30, 2020. 19 2) Excludes purchases of rights-of-way in the amount of $19.1 million in 2019.

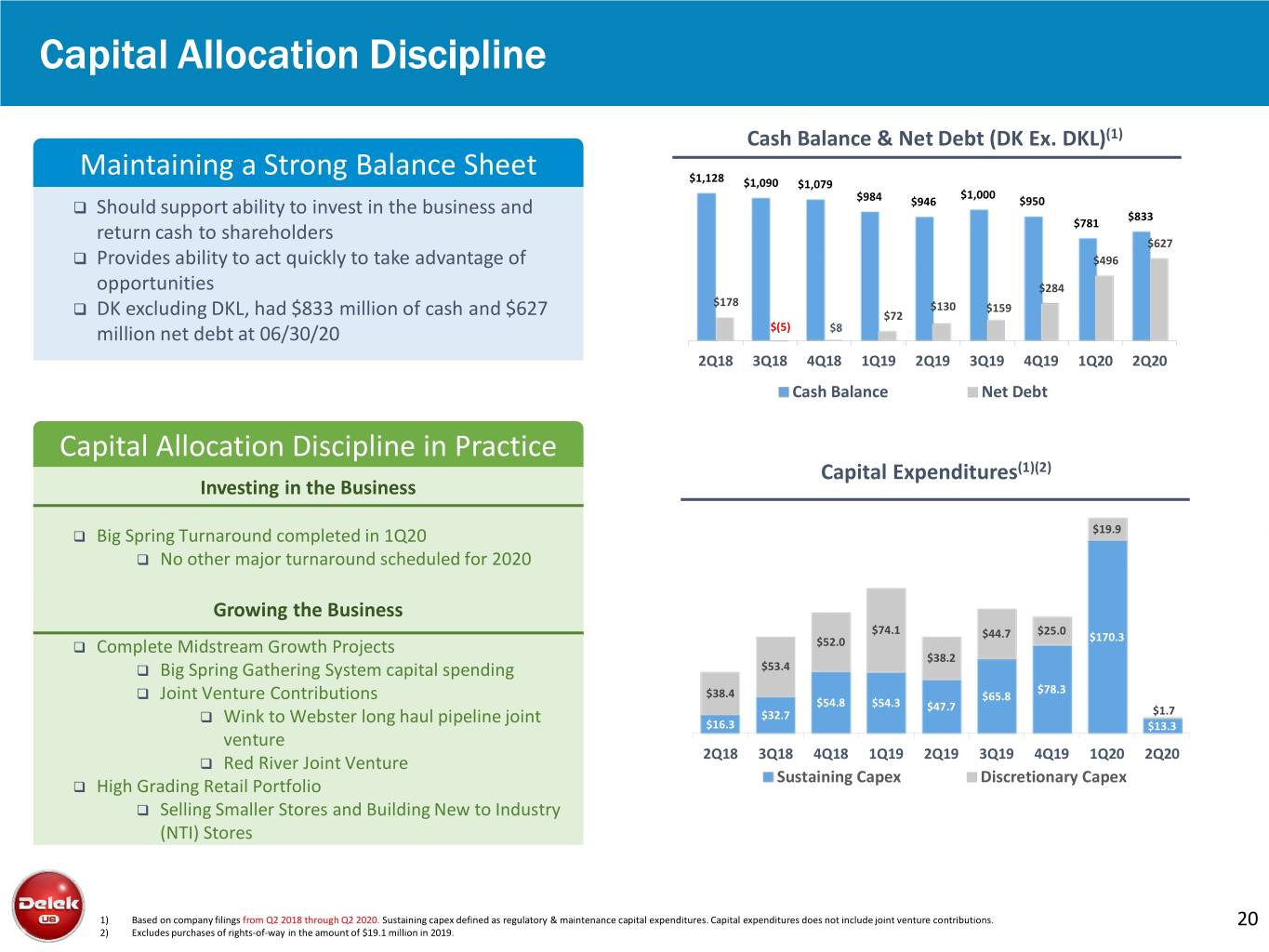

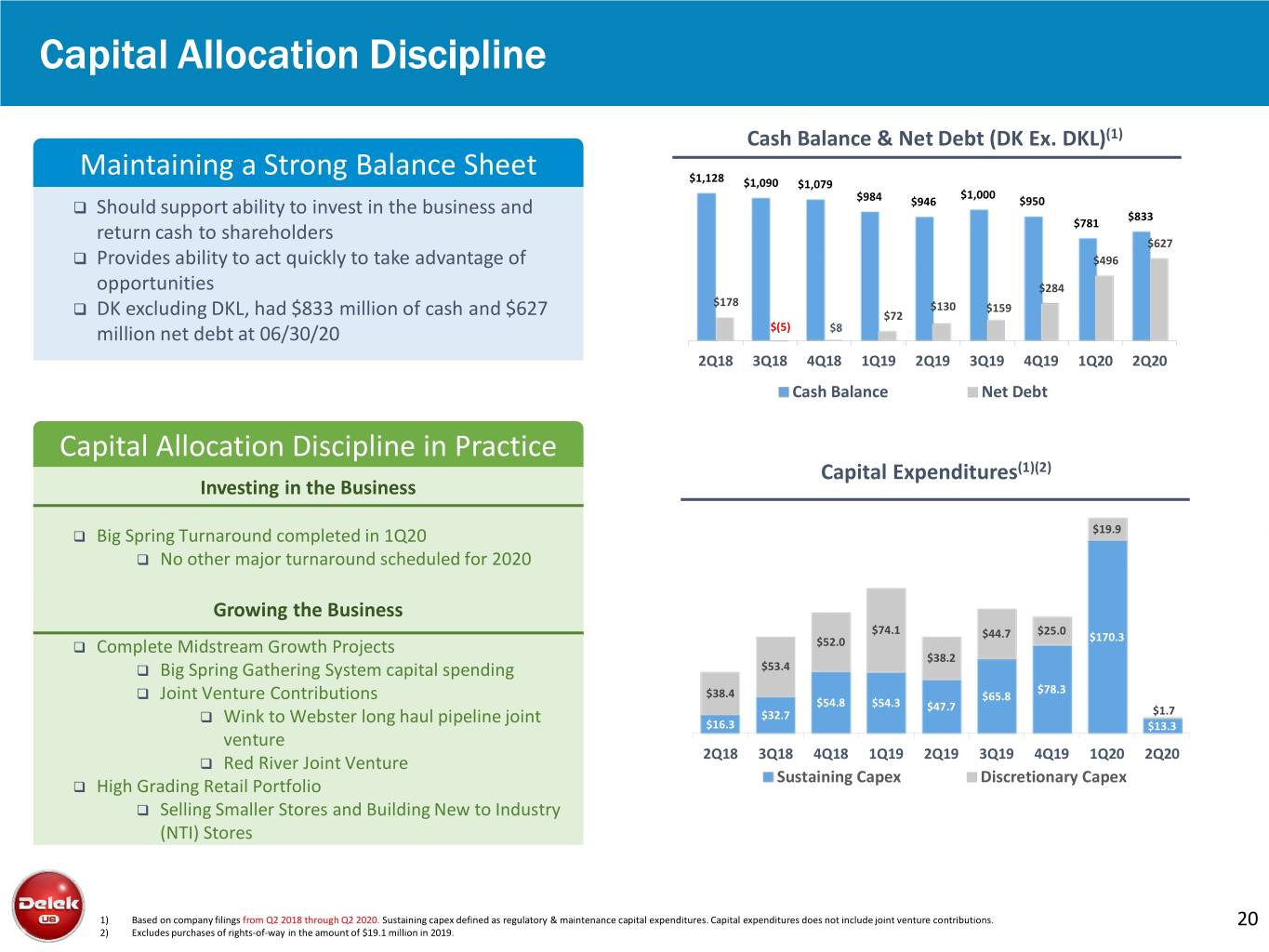

Capital Allocation Discipline Cash Balance & Net Debt (DK Ex. DKL)(1) Maintaining a Strong Balance Sheet $1,128 $1,090 $1,079 $984 $1,000 $946 $950 Should support ability to invest in the business and $833 $781 return cash to shareholders $627 Provides ability to act quickly to take advantage of $496 opportunities $284 $178 $130 $159 DK excluding DKL, had $833 million of cash and $627 $72 million net debt at 06/30/20 $(5) $8 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Cash Balance Net Debt Capital Allocation Discipline in Practice Capital Expenditures(1)(2) Investing in the Business Big Spring Turnaround completed in 1Q20 $19.9 No other major turnaround scheduled for 2020 Growing the Business $74.1 $25.0 $44.7 $170.3 Complete Midstream Growth Projects $52.0 $38.2 Big Spring Gathering System capital spending $53.4 $78.3 Joint Venture Contributions $38.4 $65.8 $54.8 $54.3 $47.7 $32.7 $1.7 Wink to Webster long haul pipeline joint $16.3 $13.3 venture 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Red River Joint Venture Sustaining Capex Discretionary Capex High Grading Retail Portfolio Selling Smaller Stores and Building New to Industry (NTI) Stores 1) Based on company filings from Q2 2018 through Q2 2020. Sustaining capex defined as regulatory & maintenance capital expenditures. Capital expenditures does not include joint venture contributions. 20 2) Excludes purchases of rights-of-way in the amount of $19.1 million in 2019.

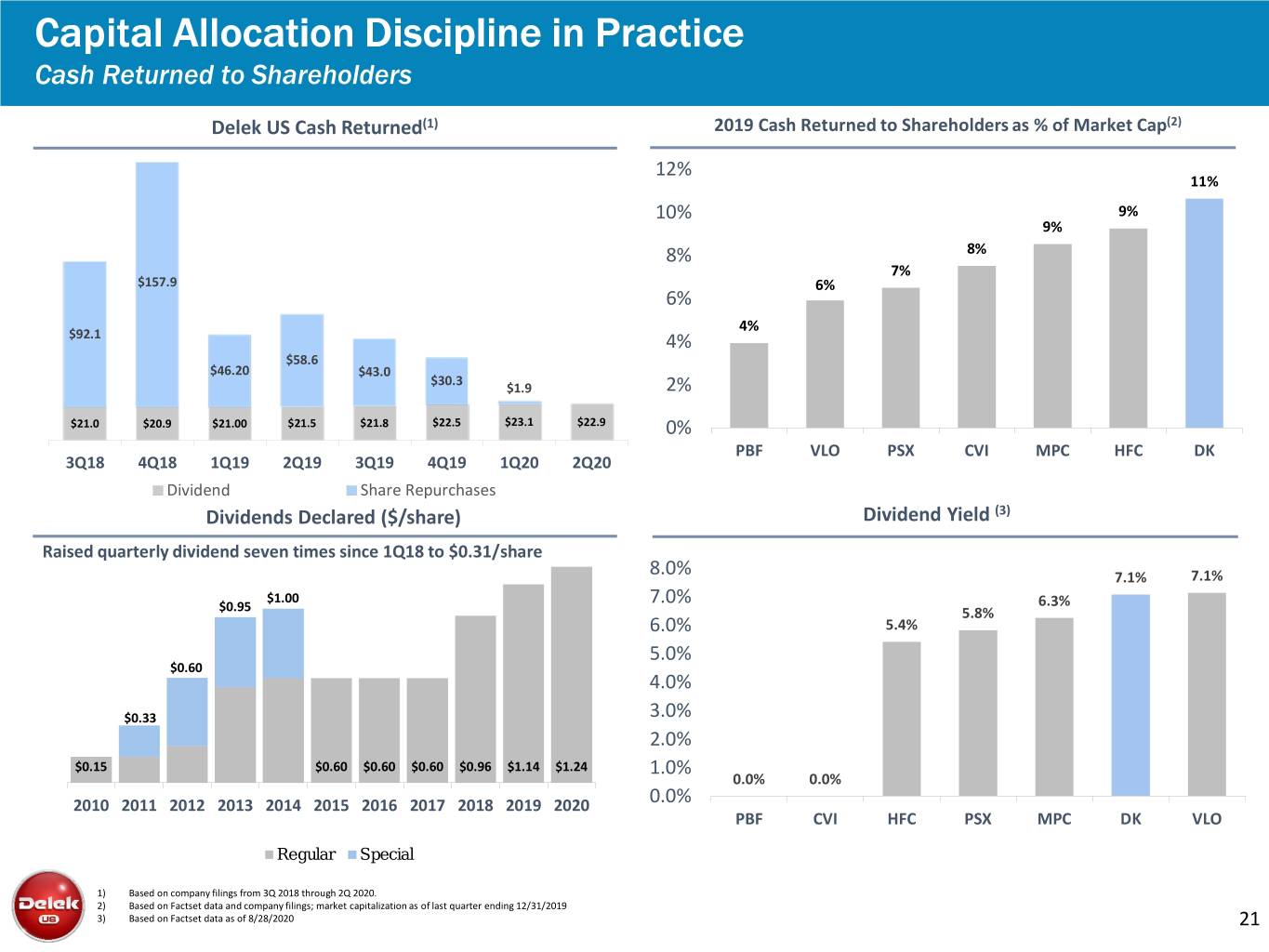

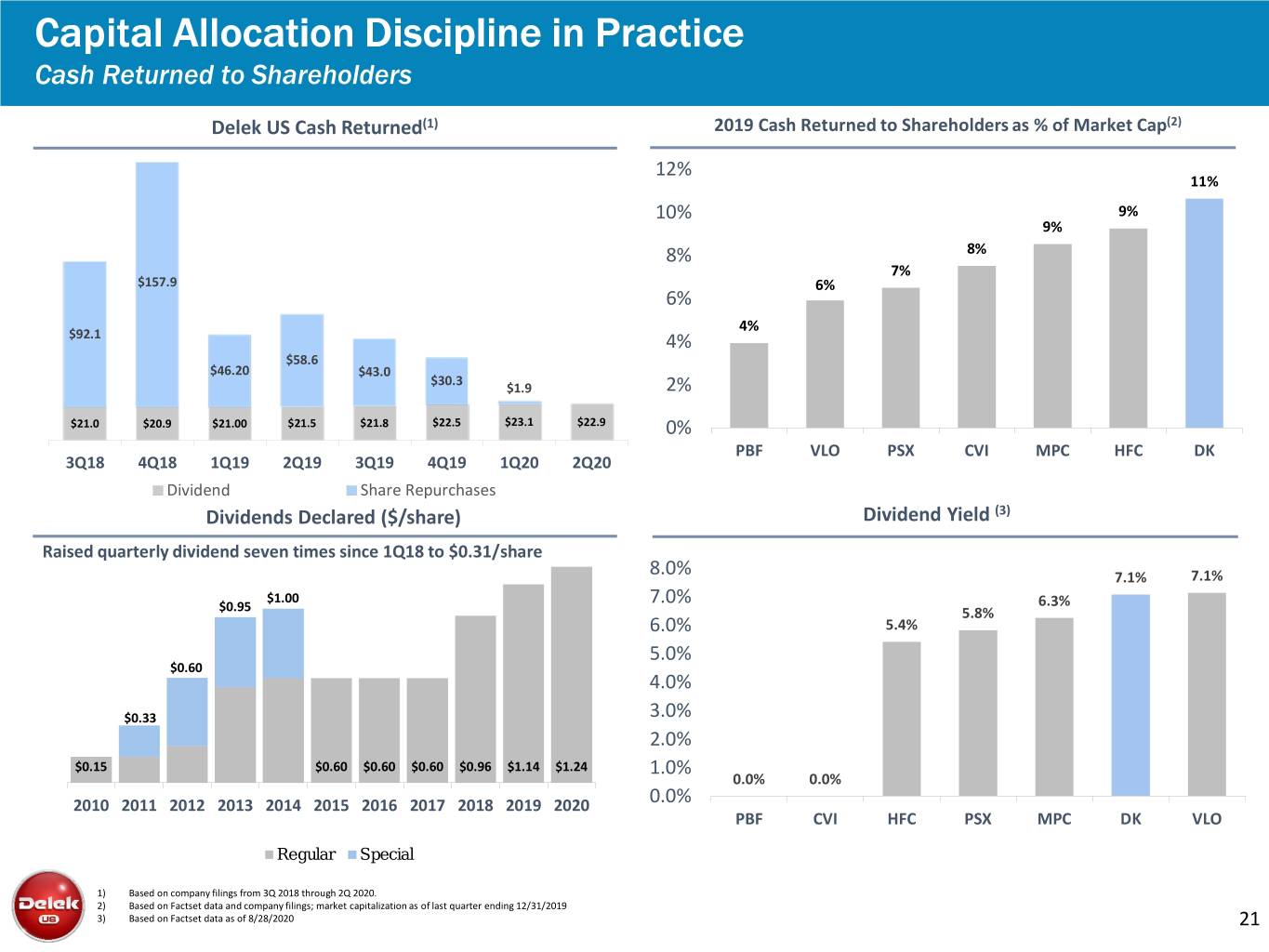

Capital Allocation Discipline in Practice Cash Returned to Shareholders Delek US Cash Returned(1) 2019 Cash Returned to Shareholders as % of Market Cap(2) 12% 11% 10% 9% 9% 8% 8% 7% $157.9 6% 6% 4% $92.1 4% $58.6 $46.20 $43.0 $30.3 $1.9 2% $21.0 $20.9 $21.00 $21.5 $21.8 $22.5 $23.1 $22.9 0% PBF VLO PSX CVI MPC HFC DK 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Dividend Share Repurchases Dividends Declared ($/share) Dividend Yield (3) Raised quarterly dividend seven times since 1Q18 to $0.31/share 8.0% 7.1% 7.1% $1.00 7.0% 6.3% $0.95 5.8% 6.0% 5.4% 5.0% $0.60 4.0% $0.33 3.0% 2.0% $0.15 $0.60 $0.60 $0.60 $0.96 $1.14 $1.24 1.0% 0.0% 0.0% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 0.0% PBF CVI HFC PSX MPC DK VLO Regular Special 1) Based on company filings from 3Q 2018 through 2Q 2020. 2) Based on Factset data and company filings; market capitalization as of last quarter ending 12/31/2019 3) Based on Factset data as of 8/28/2020 21

Market Opportunities & Valuation

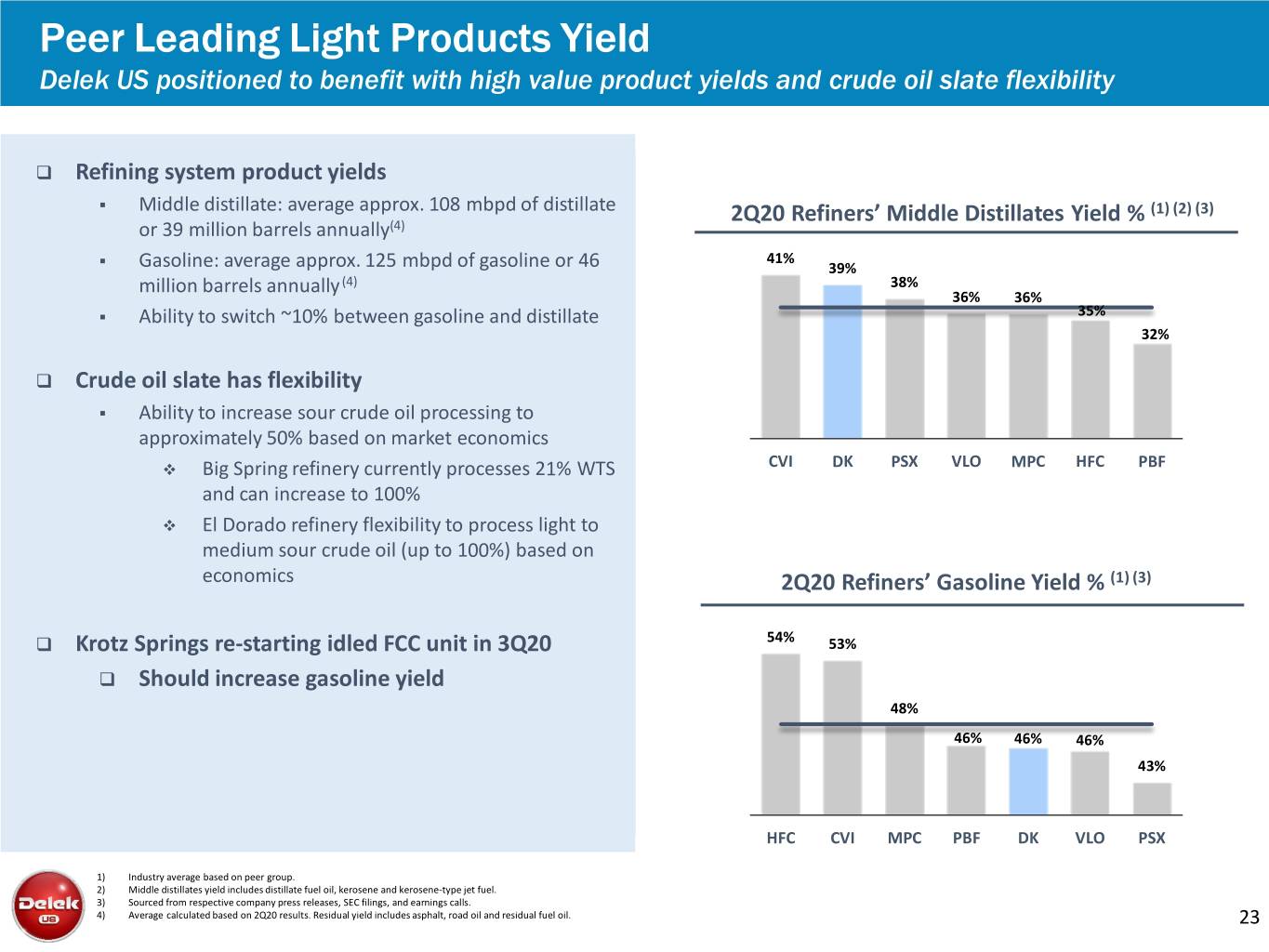

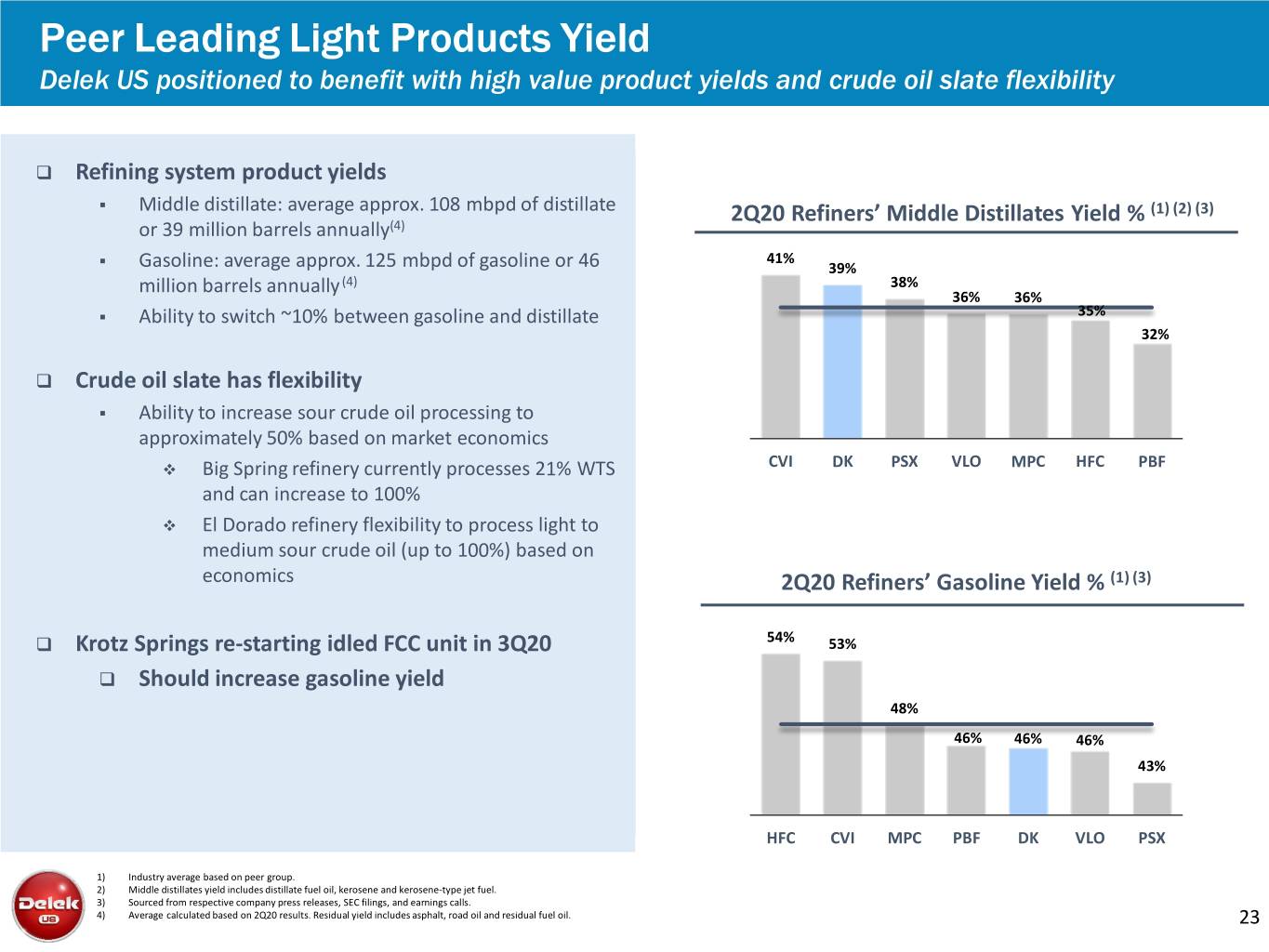

Peer Leading Light Products Yield Delek US positioned to benefit with high value product yields and crude oil slate flexibility Refining system product yields . Middle distillate: average approx. 108 mbpd of distillate 2Q20 Refiners’ Middle Distillates Yield % (1) (2) (3) or 39 million barrels annually(4) . 41% Gasoline: average approx. 125 mbpd of gasoline or 46 39% million barrels annually (4) 38% 36% 36% . Ability to switch ~10% between gasoline and distillate 35% 32% Crude oil slate has flexibility . Ability to increase sour crude oil processing to approximately 50% based on market economics Big Spring refinery currently processes 21% WTS CVI DK PSX VLO MPC HFC PBF and can increase to 100% El Dorado refinery flexibility to process light to medium sour crude oil (up to 100%) based on economics 2Q20 Refiners’ Gasoline Yield % (1) (3) Krotz Springs re-starting idled FCC unit in 3Q20 54% 53% Should increase gasoline yield 48% 46% 46% 46% 43% HFC CVI MPC PBF DK VLO PSX 1) Industry average based on peer group. 2) Middle distillates yield includes distillate fuel oil, kerosene and kerosene-type jet fuel. 3) Sourced from respective company press releases, SEC filings, and earnings calls. 4) Average calculated based on 2Q20 results. Residual yield includes asphalt, road oil and residual fuel oil. 23

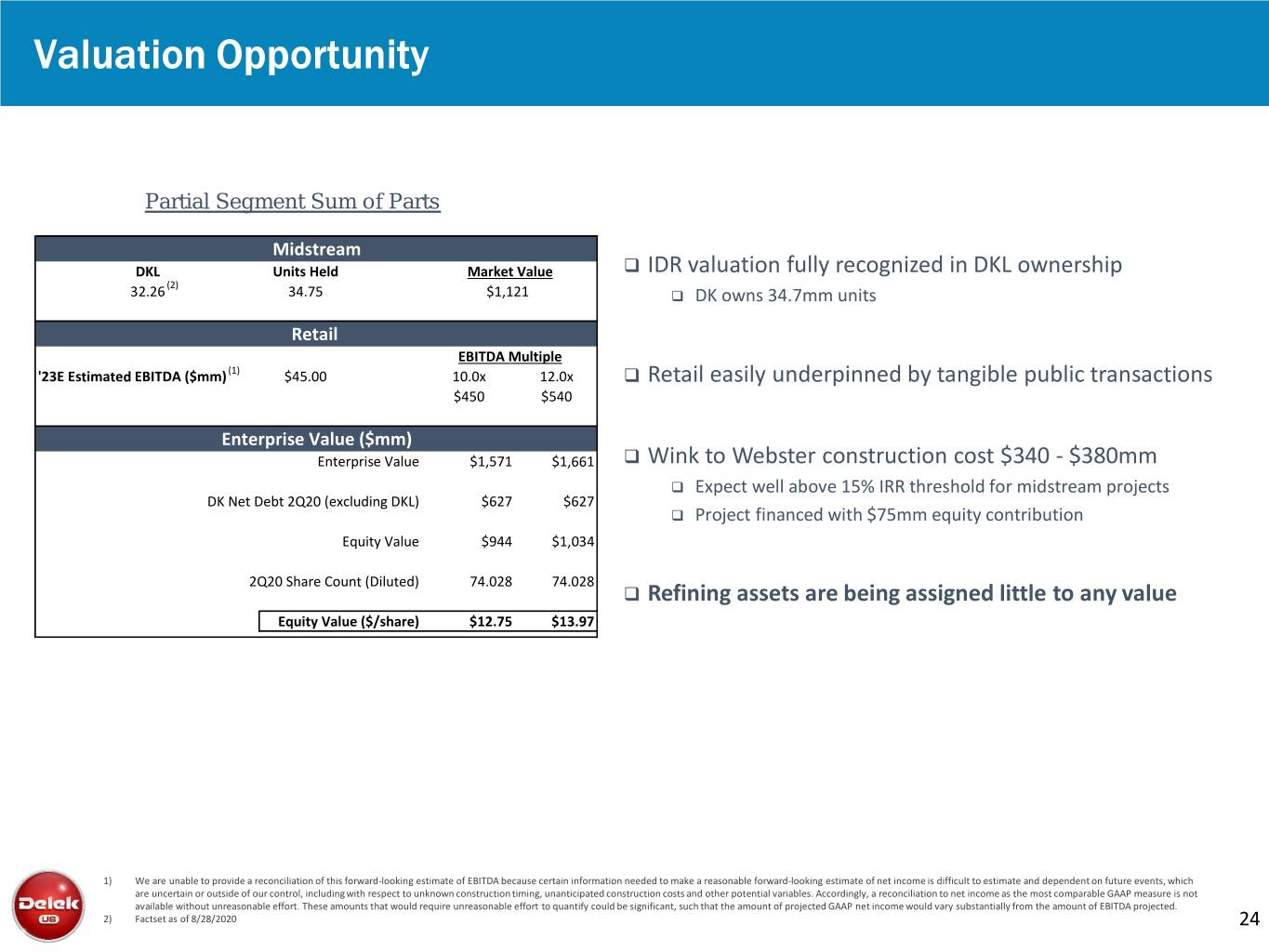

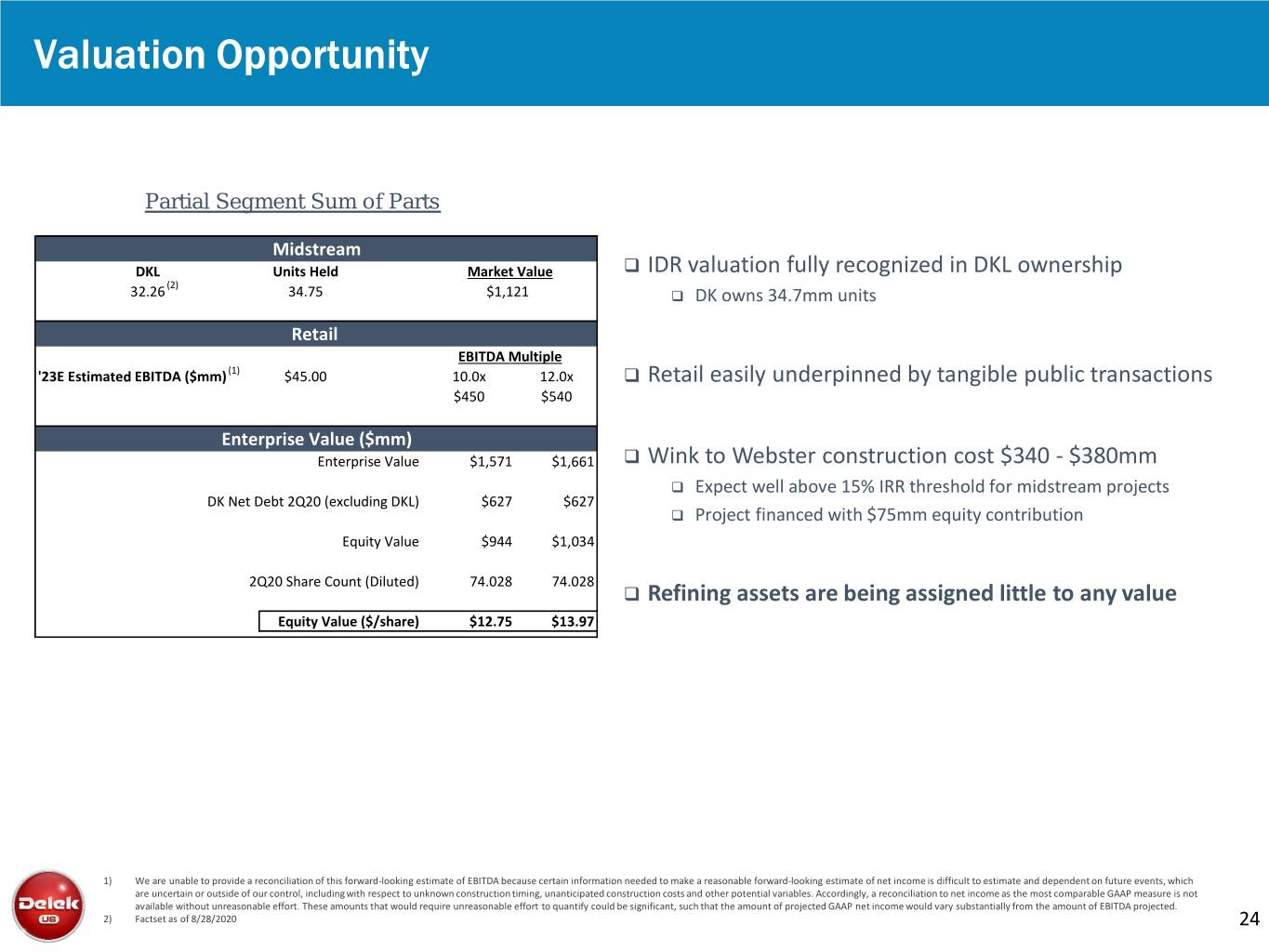

Valuation Opportunity Partial Segment Sum of Parts Midstream DKL Units Held Market Value IDR valuation fully recognized in DKL ownership (2) 32.26 34.75 $1,121 DK owns 34.7mm units Retail EBITDA Multiple '23E Estimated EBITDA ($mm) (1) $45.00 10.0x 12.0x Retail easily underpinned by tangible public transactions $450 $540 Enterprise Value ($mm) Enterprise Value $1,571 $1,661 Wink to Webster construction cost $340 - $380mm Expect well above 15% IRR threshold for midstream projects DK Net Debt 2Q20 (excluding DKL) $627 $627 Project financed with $75mm equity contribution Equity Value $944 $1,034 2Q20 Share Count (Diluted) 74.028 74.028 Refining assets are being assigned little to any value Equity Value ($/share) $12.75 $13.97 1) We are unable to provide a reconciliation of this forward-looking estimate of EBITDA because certain information needed to make a reasonable forward-looking estimate of net income is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of EBITDA projected. 2) Factset as of 8/28/2020 24

An Integrated and Financial Flexibility to Diversified Refining, Support Strategic Logistics and Retail Company Objectives Permian Focused Invest in the Business to Refining System with Focus on Long-Term Operate Reliably and Increasing Access to Shareholder Returns Safely Cushing Growing Midstream Platform to Diversify EBITDA Stream

Appendix

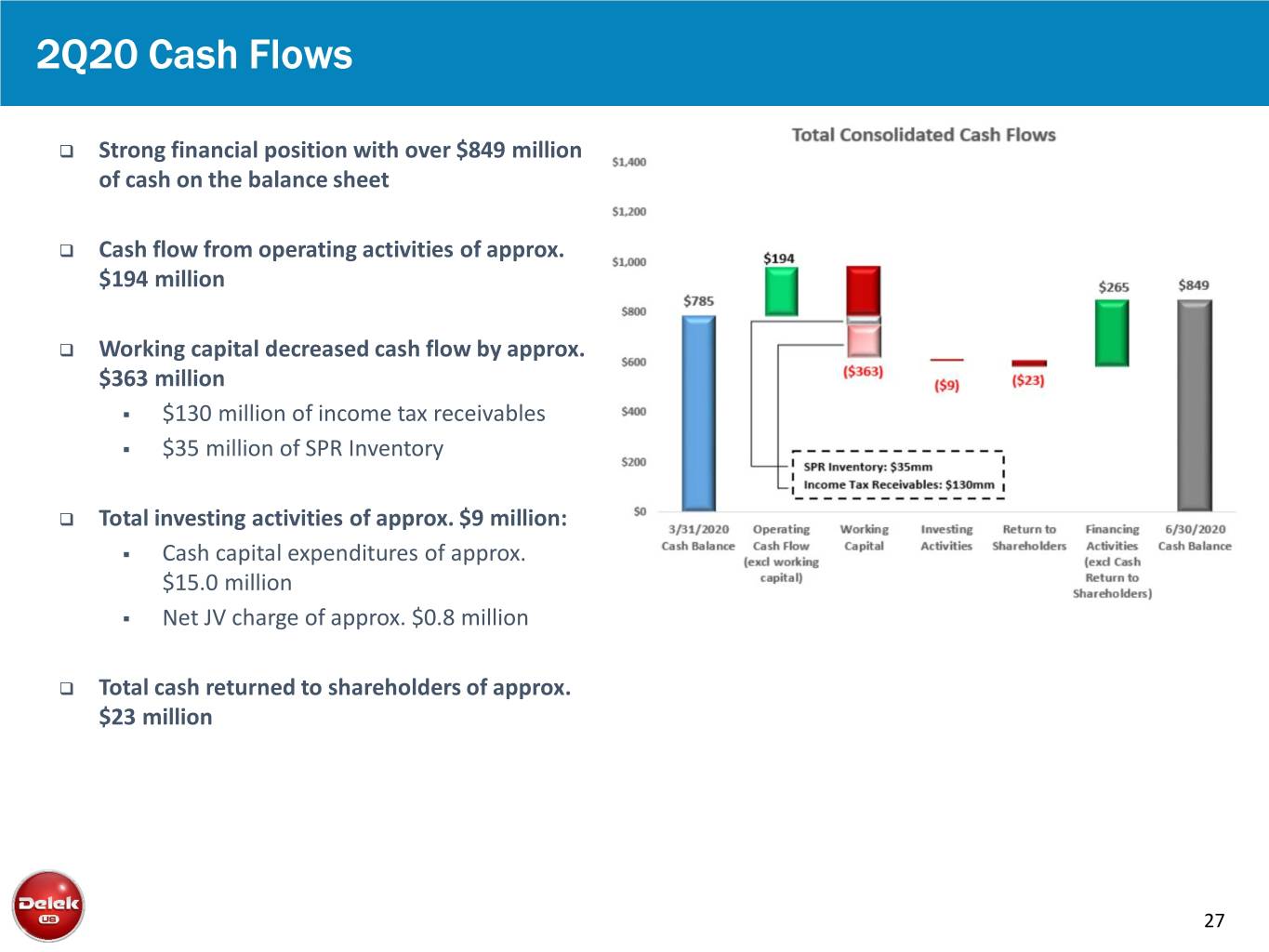

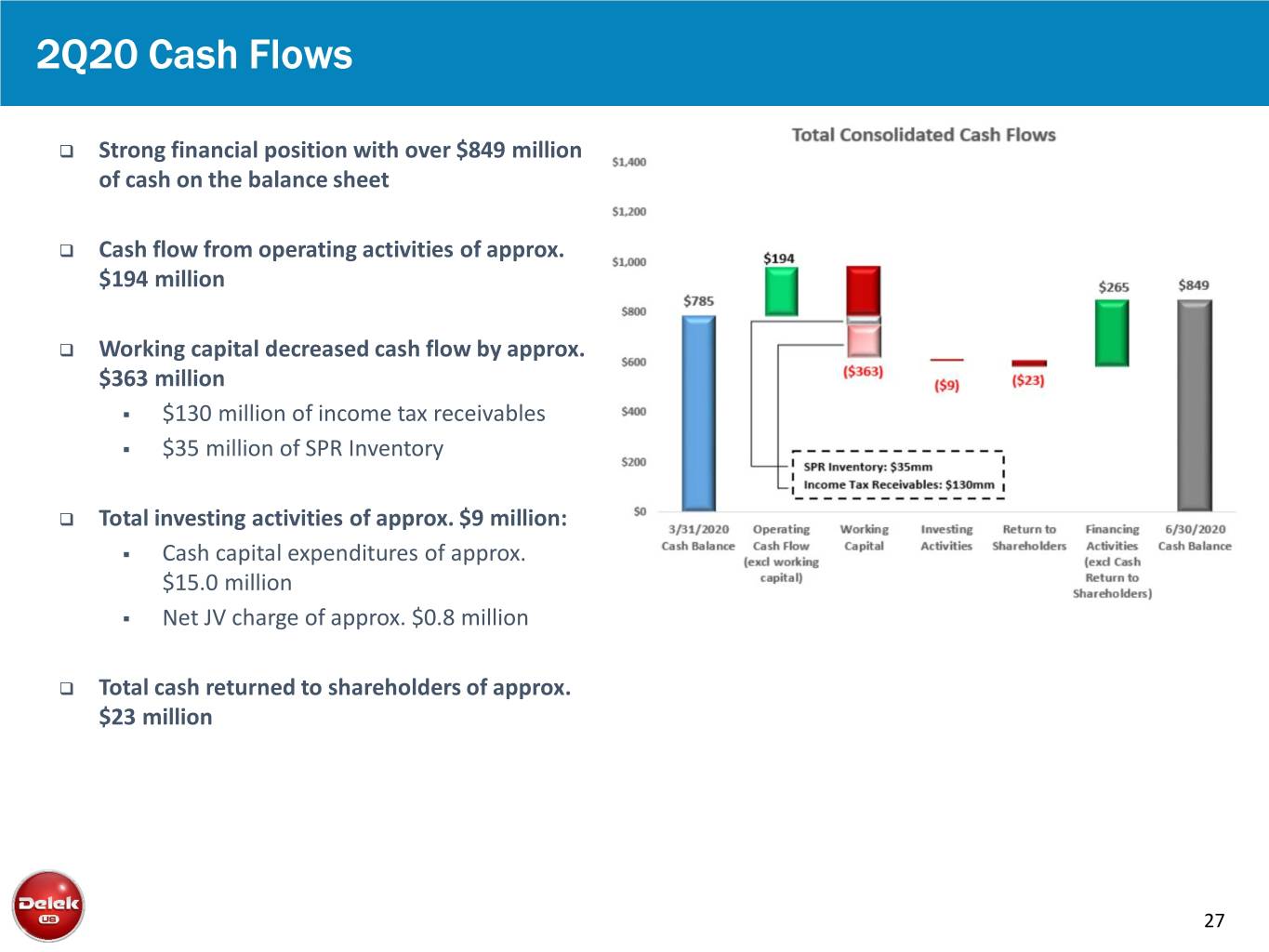

2Q20 Cash Flows Strong financial position with over $849 million of cash on the balance sheet Cash flow from operating activities of approx. $194 million Working capital decreased cash flow by approx. $363 million . $130 million of income tax receivables . $35 million of SPR Inventory Total investing activities of approx. $9 million: . Cash capital expenditures of approx. $15.0 million . Net JV charge of approx. $0.8 million Total cash returned to shareholders of approx. $23 million 27

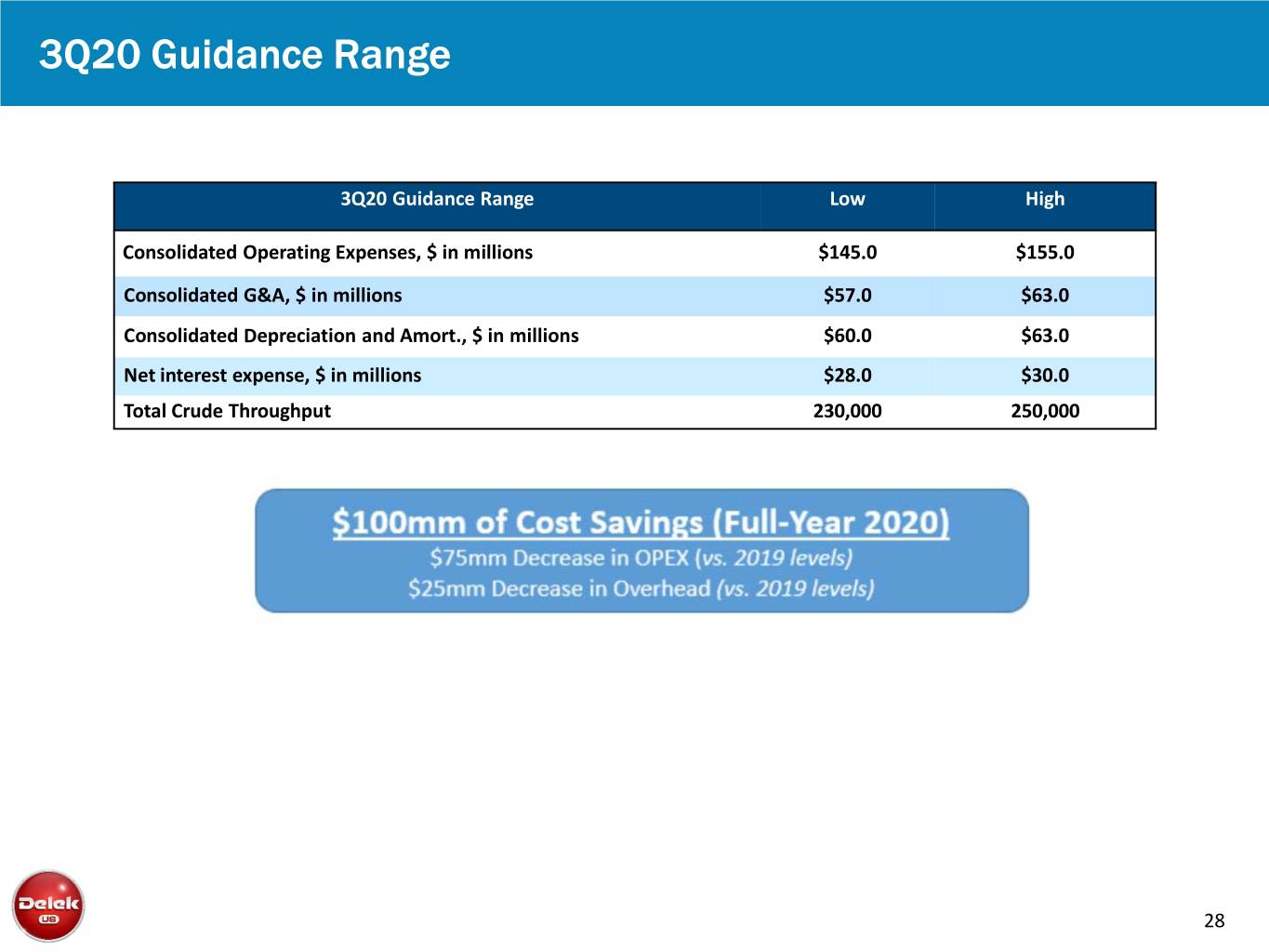

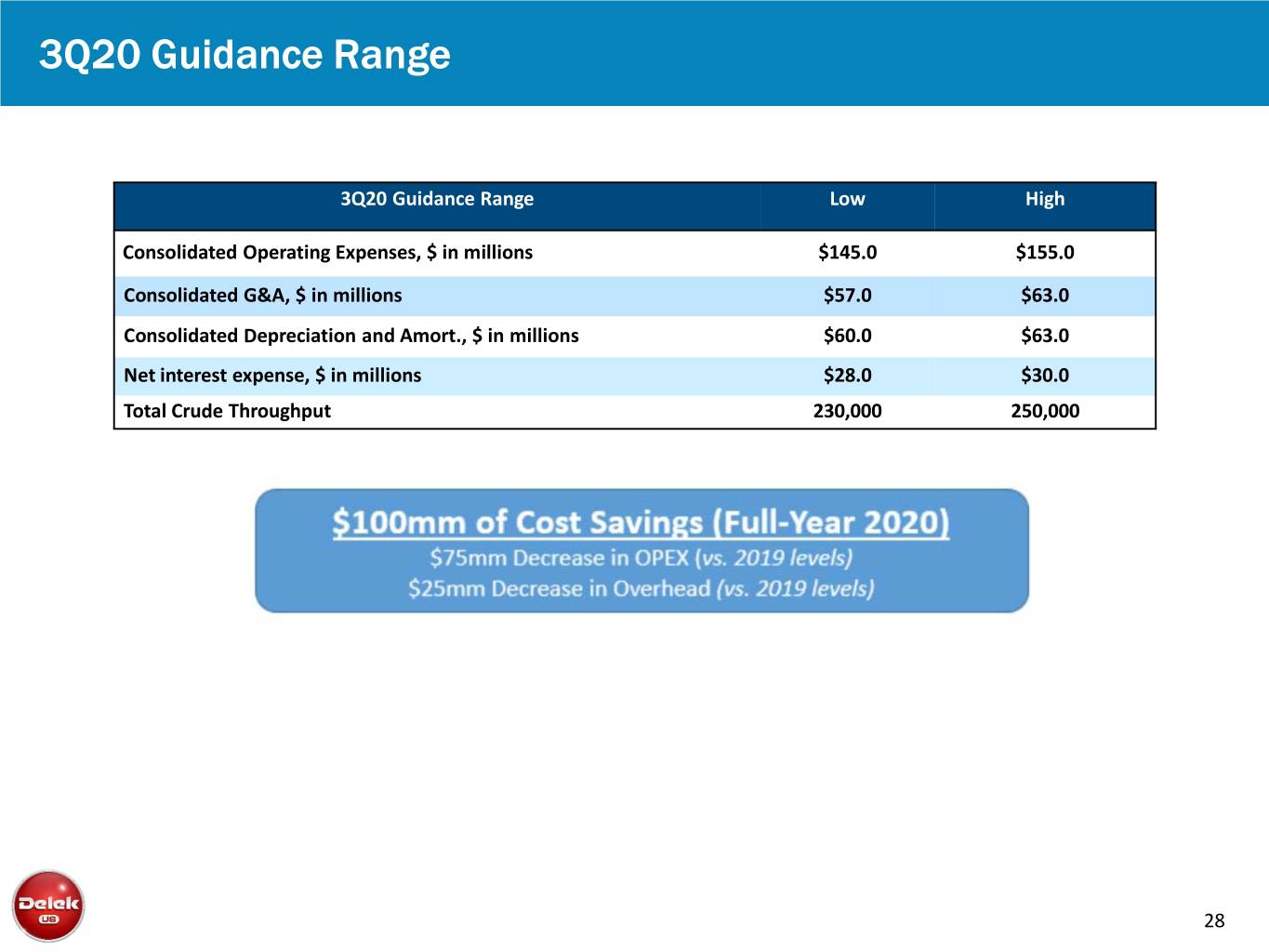

3Q20 Guidance Range 3Q20 Guidance Range Low High Consolidated Operating Expenses, $ in millions $145.0 $155.0 Consolidated G&A, $ in millions $57.0 $63.0 Consolidated Depreciation and Amort., $ in millions $60.0 $63.0 Net interest expense, $ in millions $28.0 $30.0 Total Crude Throughput 230,000 250,000 28

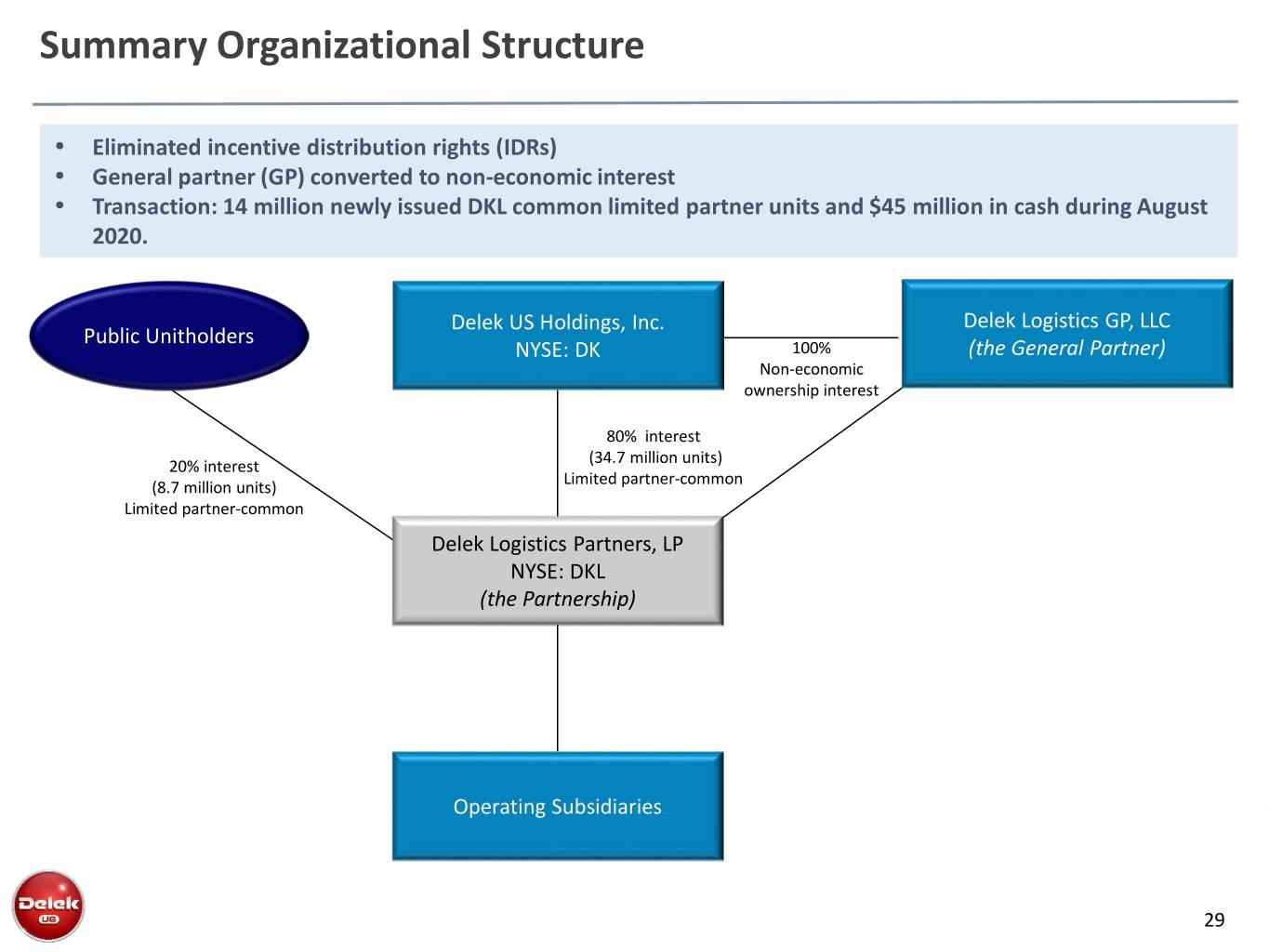

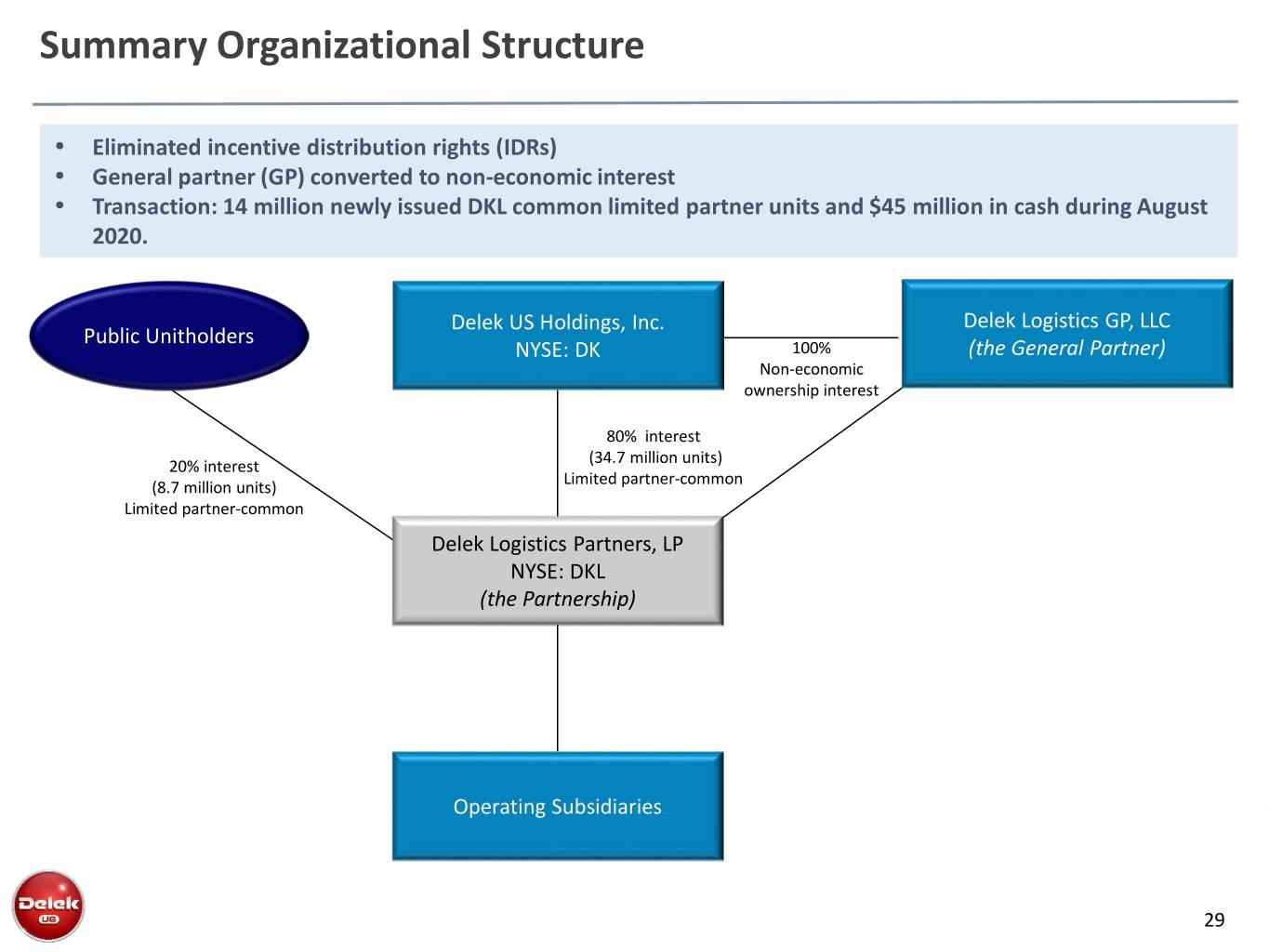

Summary Organizational Structure • Eliminated incentive distribution rights (IDRs) • General partner (GP) converted to non-economic interest • Transaction: 14 million newly issued DKL common limited partner units and $45 million in cash during August 2020. Delek US Holdings, Inc. Delek Logistics GP, LLC Public Unitholders NYSE: DK 100% (the General Partner) Non-economic ownership interest 80% interest (34.7 million units) 20% interest Limited partner-common (8.7 million units) Limited partner-common Delek Logistics Partners, LP NYSE: DKL (the Partnership) Operating Subsidiaries 29

Market Data

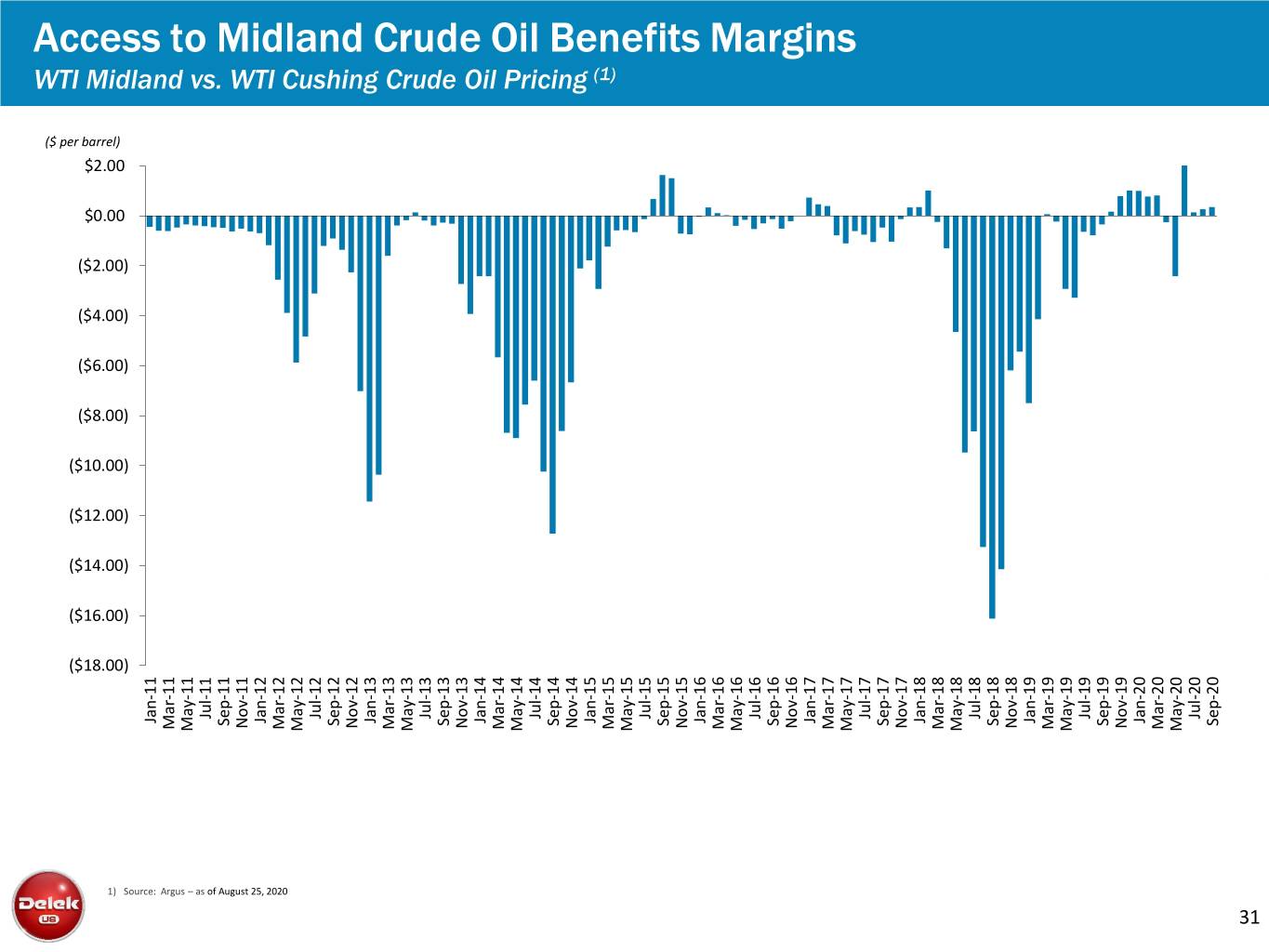

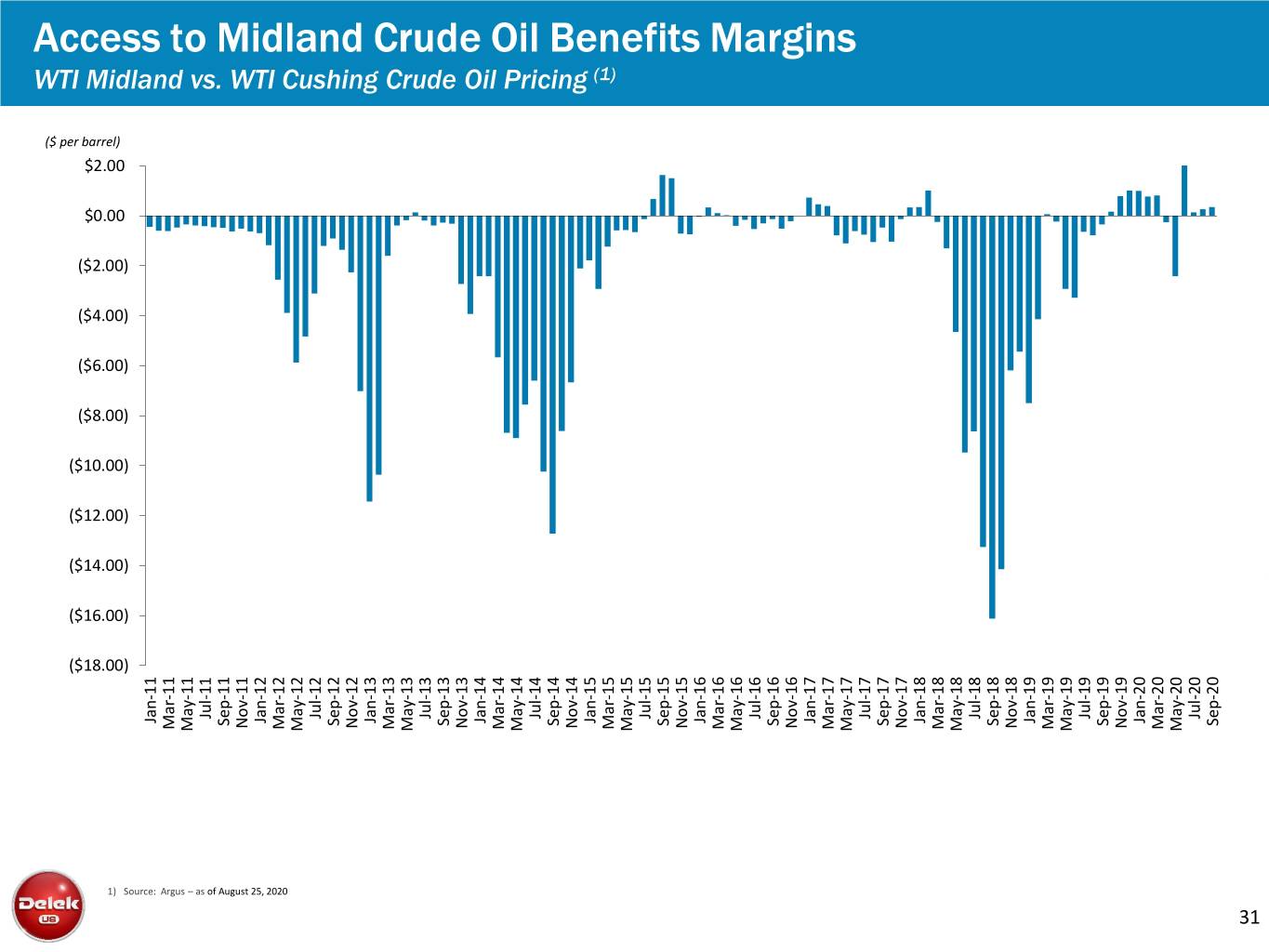

WTI WTI Midland vs. Pricing WTI Oil CrudeCushing AccessMidland to Crude OilBenefits Margins ($ per($ barrel) ($18.00) ($16.00) ($14.00) ($12.00) ($10.00) ($8.00) ($6.00) ($4.00) ($2.00) $0.00 $2.00 1) Source: Source: Argus Jan-11 Mar-11 – as as May-11 of August 25, 2020 August of Jul-11 Sep-11 Nov-11 Jan-12 Mar-12 May-12 Jul-12 Sep-12 Nov-12 Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13 Jan-14 Mar-14 May-14 Jul-14 Sep-14 Nov-14 Jan-15 (1) Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 May-16 Jul-16 Sep-16 Nov-16 Jan-17 Mar-17 May-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar-18 May-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar-19 May-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar-20 May-20 Jul-20 Sep-20 31

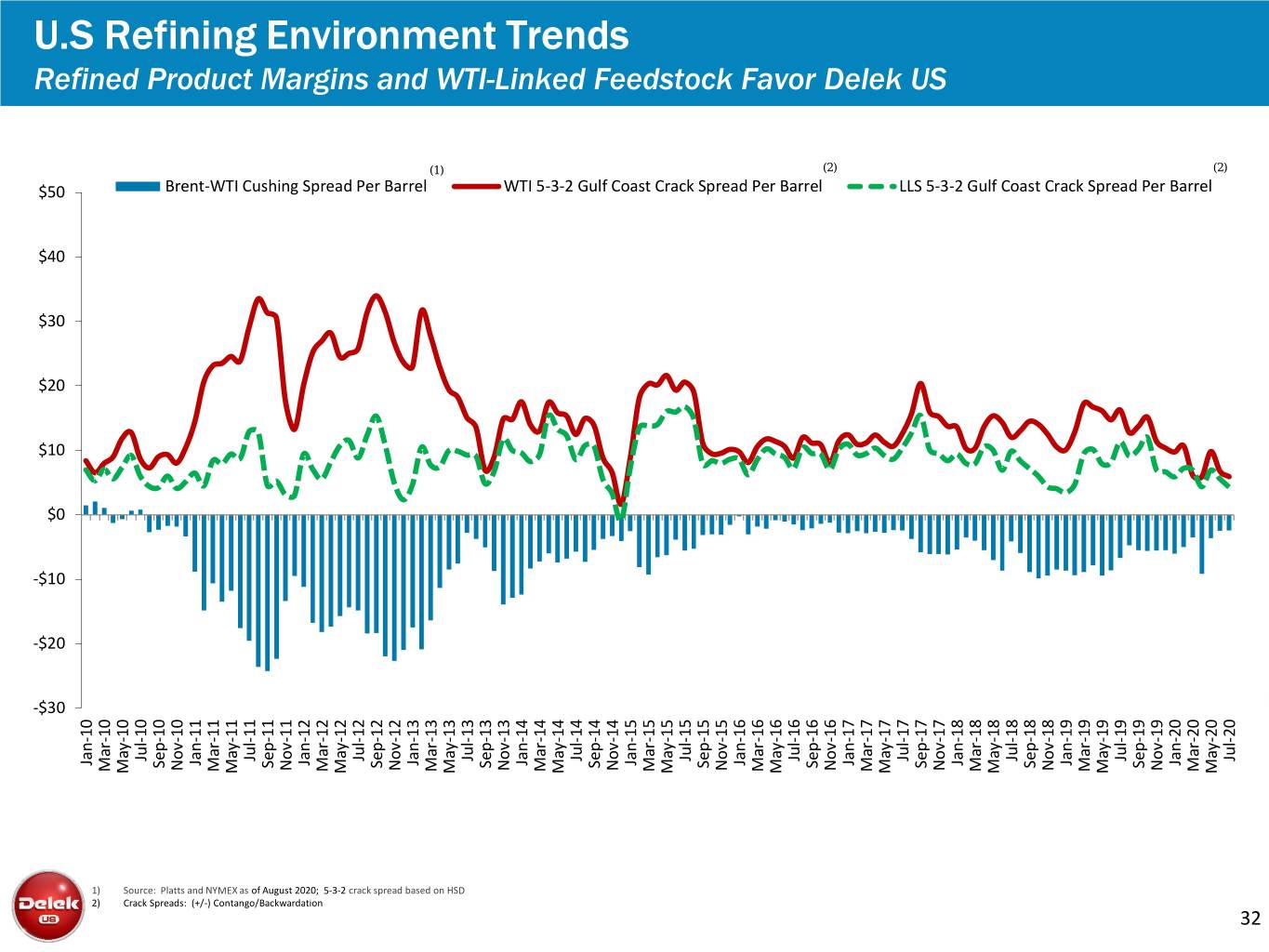

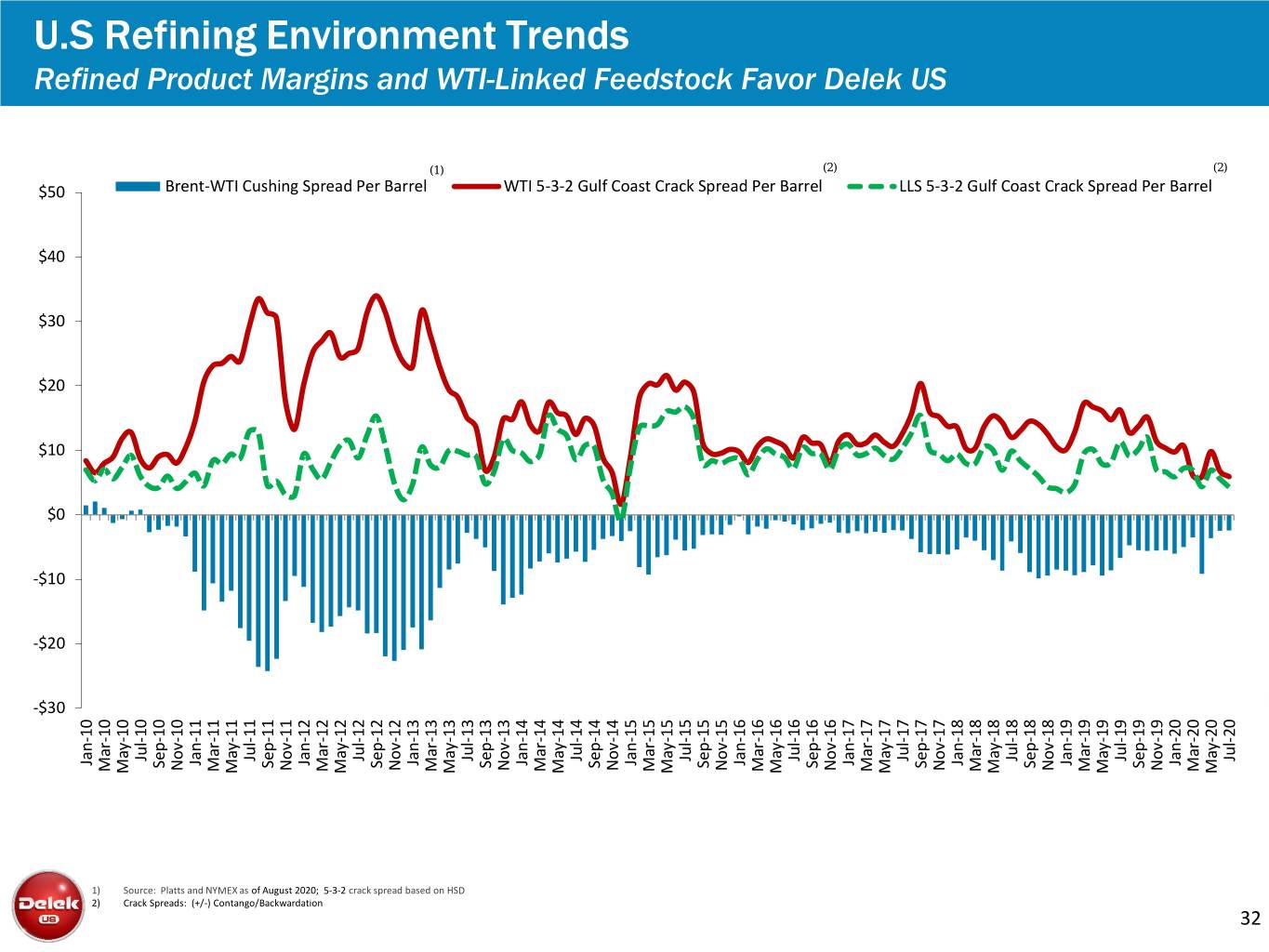

-$30 -$20 -$10 Refined Product Margins and WTI and Margins Product Refined Trends Environment Refining U.S $10 $20 $30 $40 $50 $0 2) 1) Jan-10 Mar-10 Crack Crack Source: May-10 Spreads: (+/ Jul-10 Platts Sep-10 Barrel Per Spread Cushing Brent-WTI and NYMEX as as NYMEX and Nov-10 - Jan-11 ) Contango/Backwardation ) Mar-11 May-11 of August Jul-11 Sep-11 2020; 5- 2020; Nov-11 Jan-12 3 Mar-12 - 2 crack spreadon HSDbased May-12 Jul-12 Sep-12 Nov-12 Jan-13 Mar-13 (1) May-13 Jul-13 - Sep-13 Delek USFeedstockLinked Favor Nov-13 WTIGulf 5-3-2 Coast CrackSpread Per Barrel Jan-14 Mar-14 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 May-16 Jul-16 Sep-16 (2) Nov-16 Jan-17 Mar-17 May-17 Jul-17 LLS 5-3-2 Gulf Coast Crack Spread Per Barrel Sep-17 Nov-17 Jan-18 Mar-18 May-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar-19 May-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar-20 May-20 (2) 32 Jul-20

Reconciliations

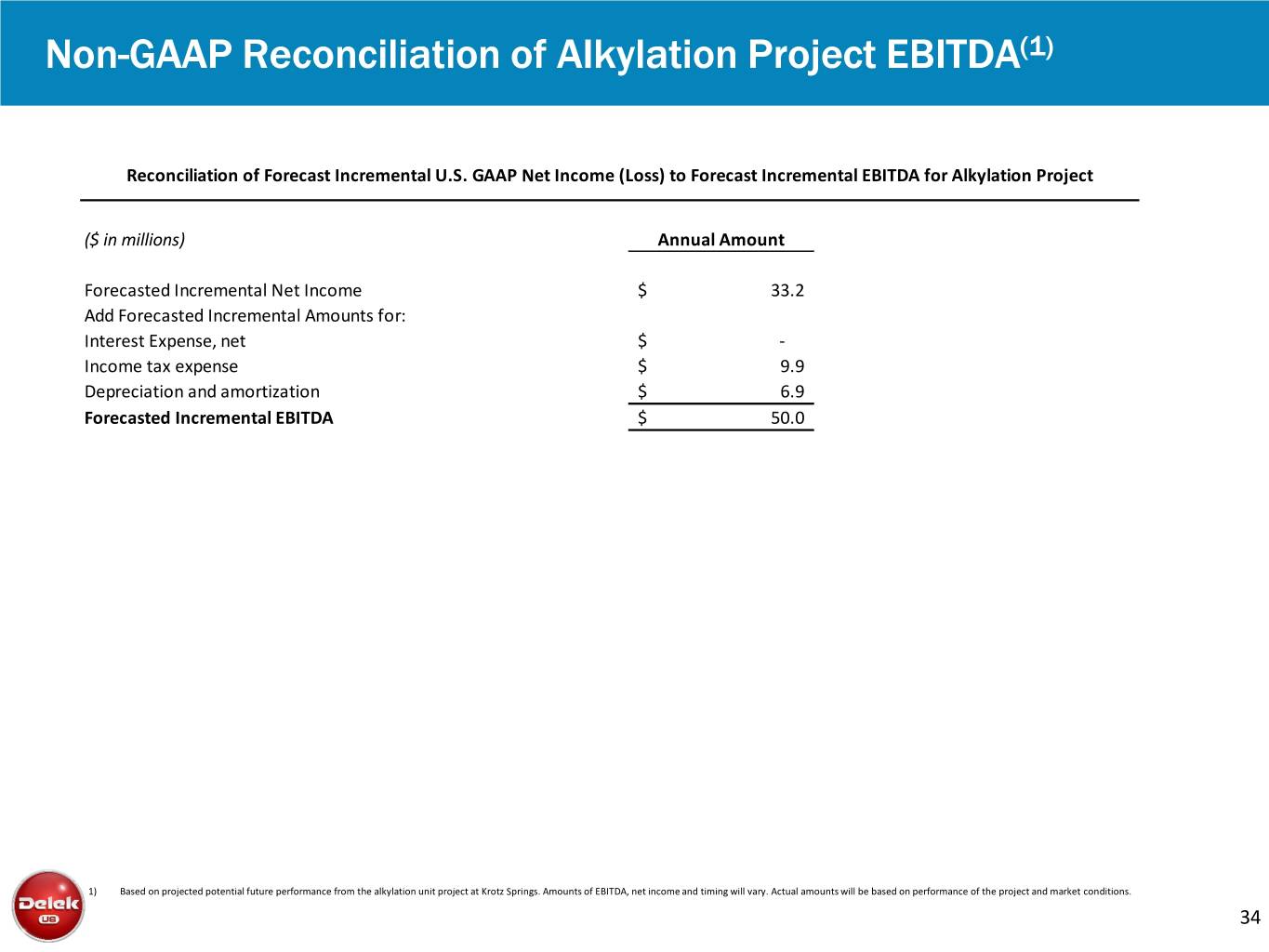

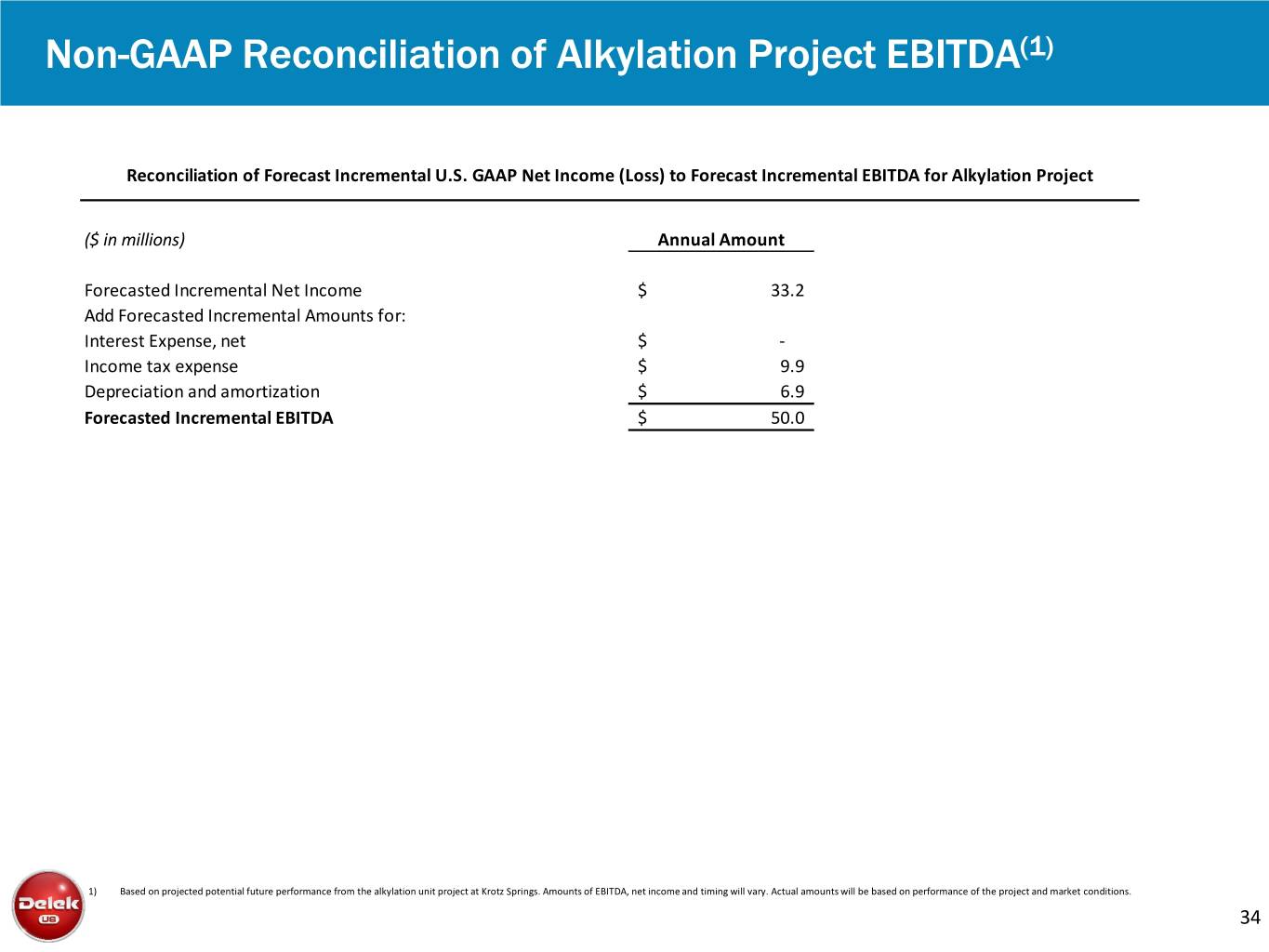

Non-GAAP Reconciliation of Alkylation Project EBITDA(1) Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA for Alkylation Project ($ in millions) Annual Amount Forecasted Incremental Net Income $ 33.2 Add Forecasted Incremental Amounts for: Interest Expense, net $ - Income tax expense $ 9.9 Depreciation and amortization $ 6.9 Forecasted Incremental EBITDA $ 50.0 1) Based on projected potential future performance from the alkylation unit project at Krotz Springs. Amounts of EBITDA, net income and timing will vary. Actual amounts will be based on performance of the project and market conditions. 34

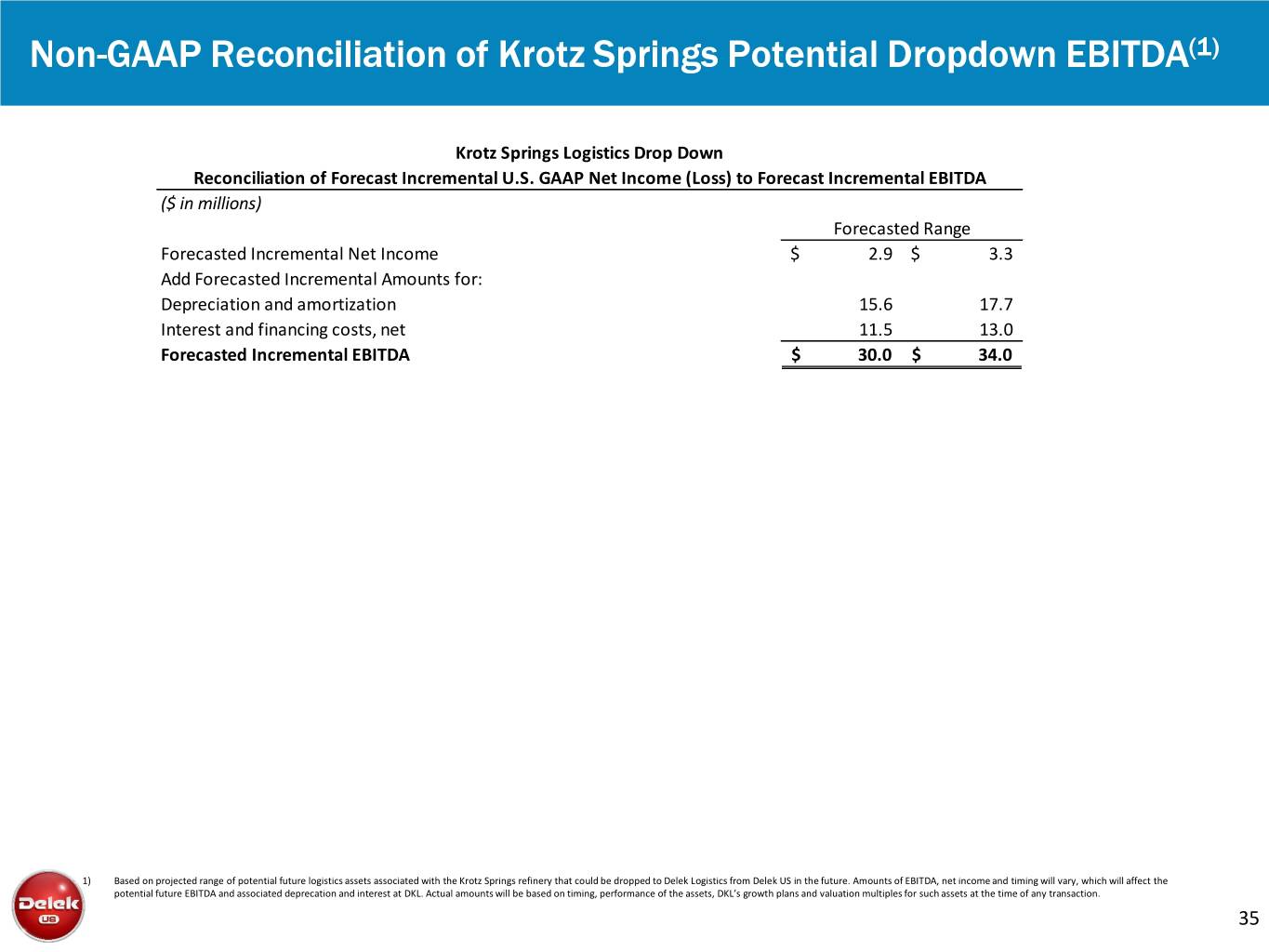

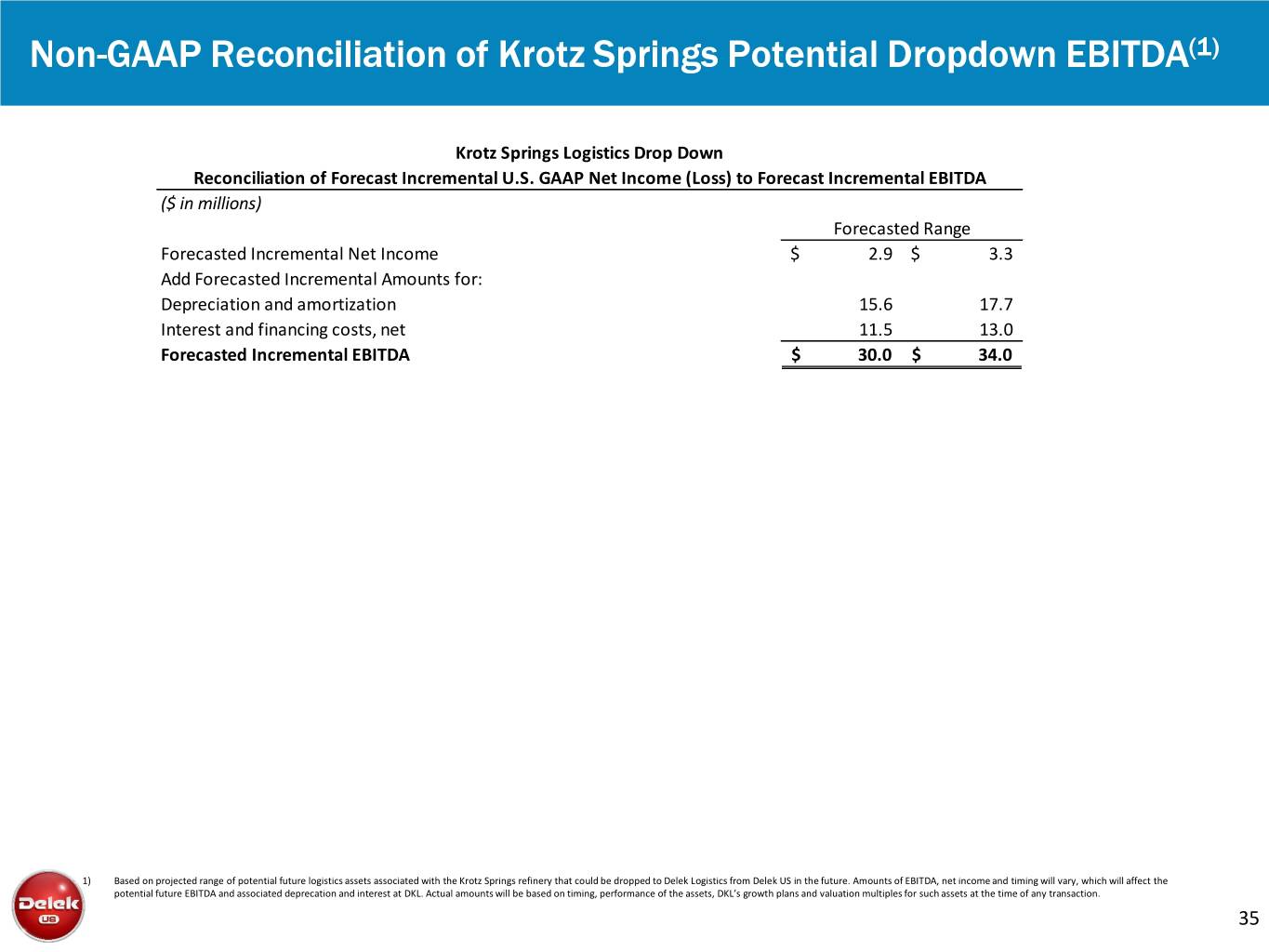

Non-GAAP Reconciliation of Krotz Springs Potential Dropdown EBITDA(1) Krotz Springs Logistics Drop Down Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA ($ in millions) Forecasted Range Forecasted Incremental Net Income $ 2.9 $ 3.3 Add Forecasted Incremental Amounts for: Depreciation and amortization 15.6 17.7 Interest and financing costs, net 11.5 13.0 Forecasted Incremental EBITDA $ 30.0 $ 34.0 1) Based on projected range of potential future logistics assets associated with the Krotz Springs refinery that could be dropped to Delek Logistics from Delek US in the future. Amounts of EBITDA, net income and timing will vary, which will affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts will be based on timing, performance of the assets, DKL’s growth plans and valuation multiples for such assets at the time of any transaction. 35

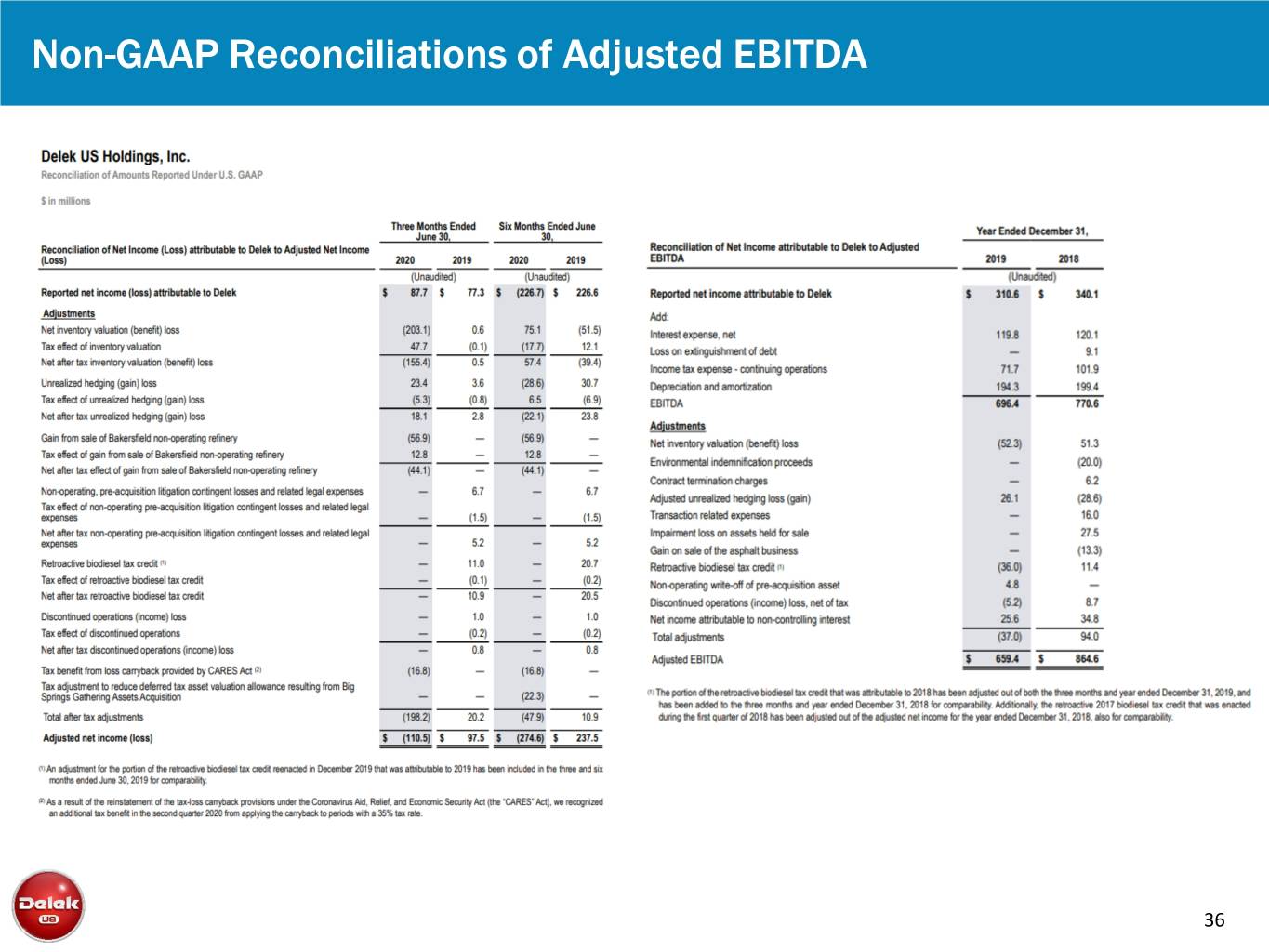

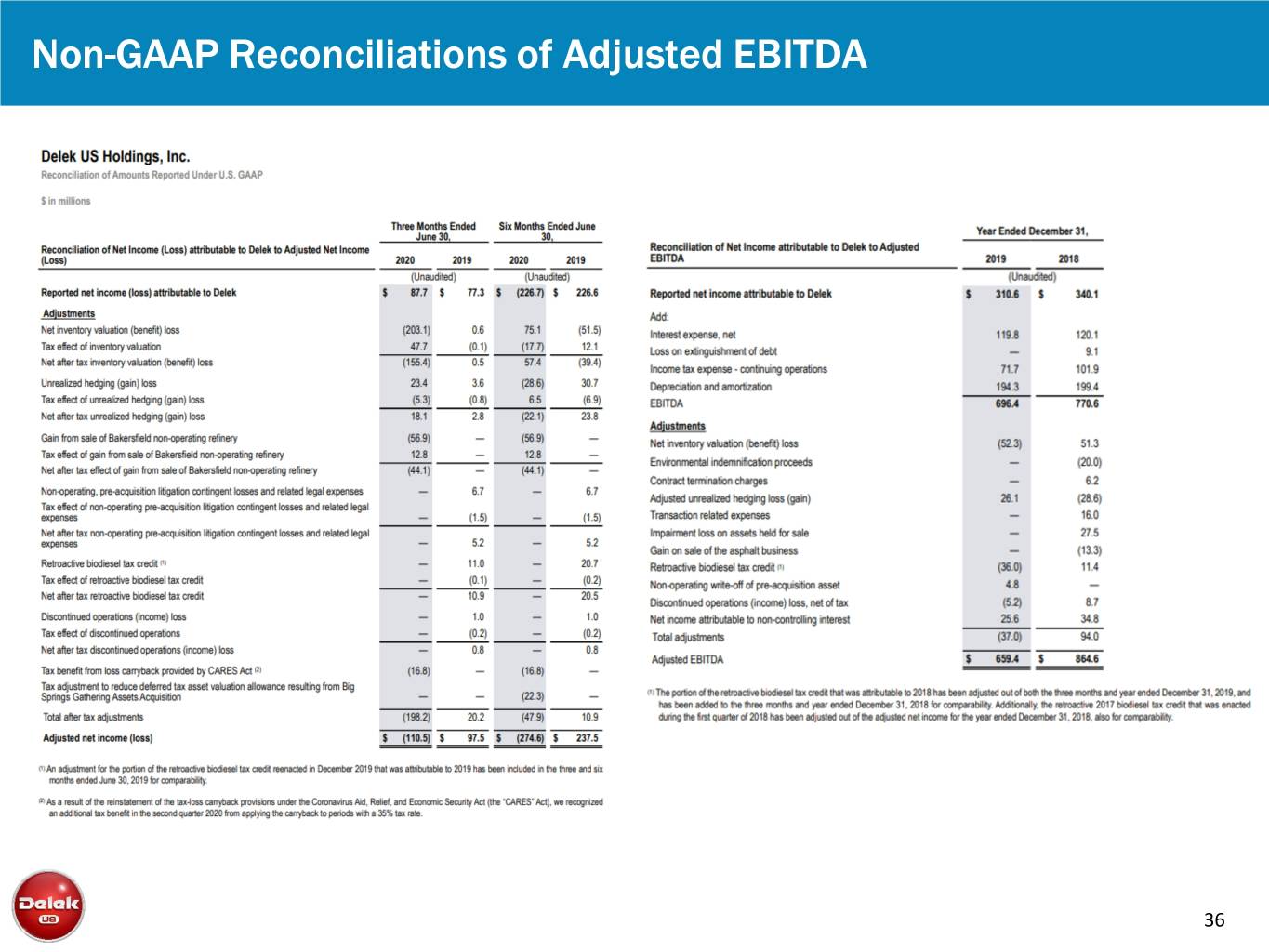

Non-GAAP Reconciliations of Adjusted EBITDA 36

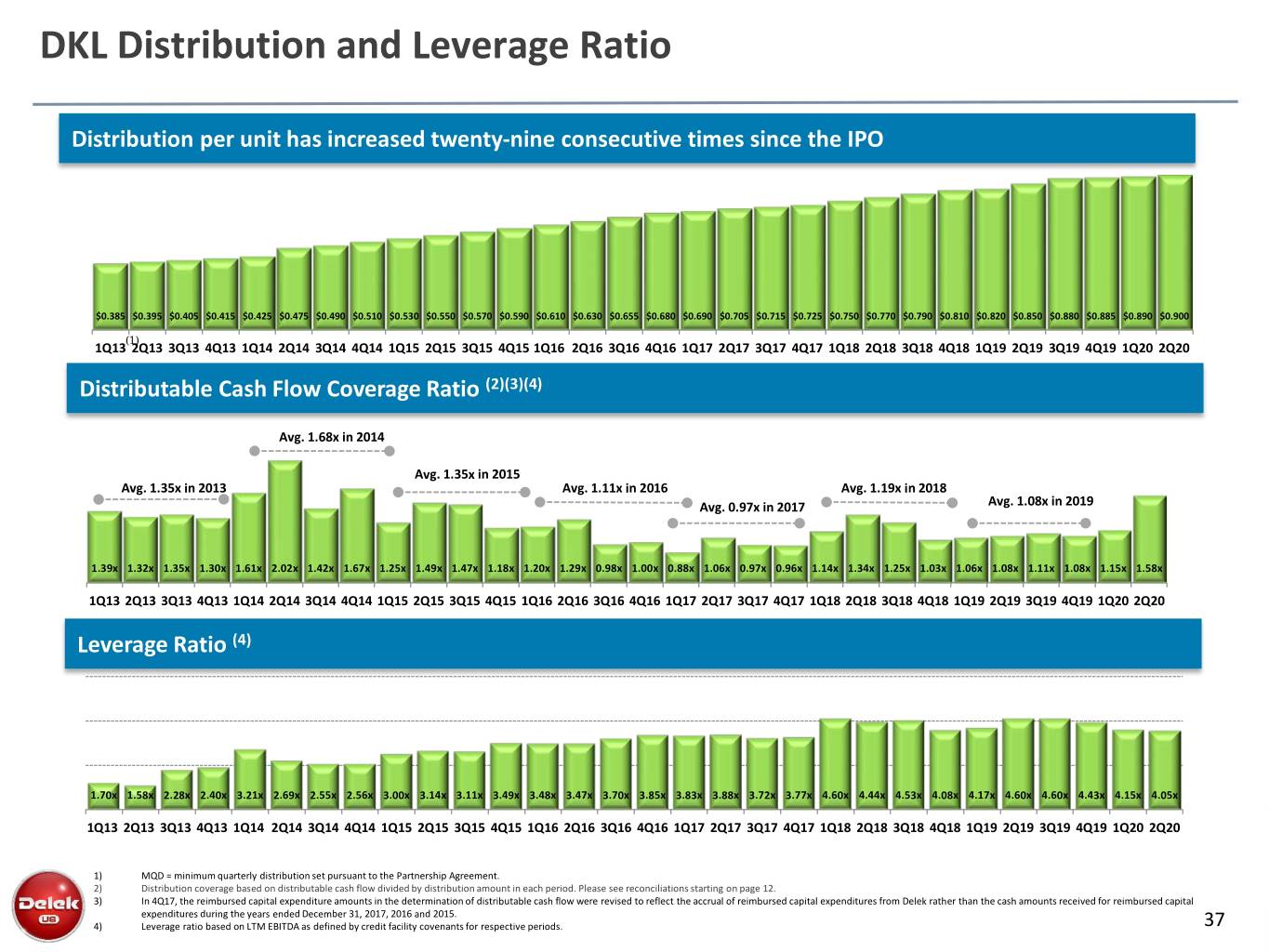

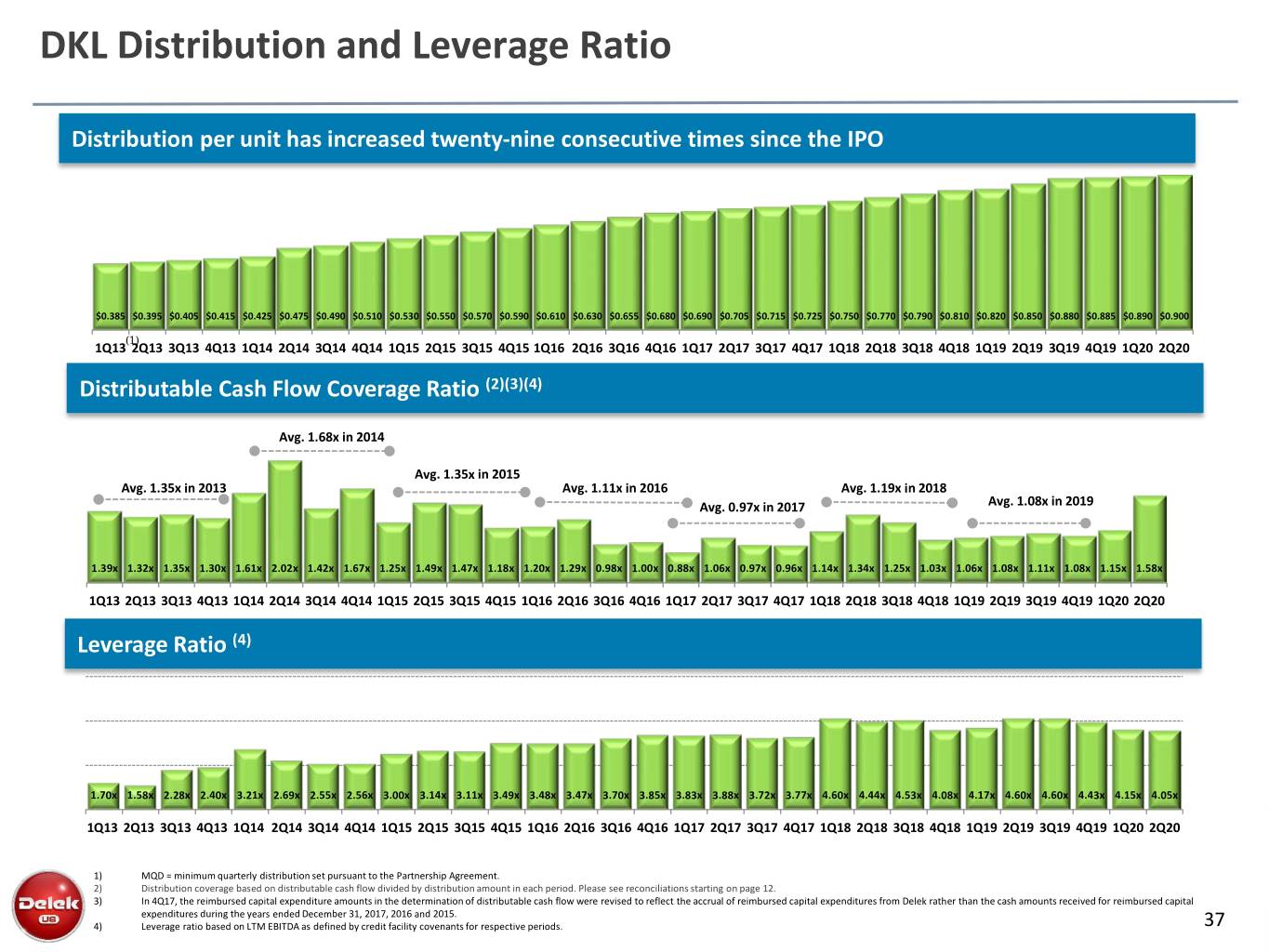

DKL Distribution and Leverage Ratio Distribution per unit has increased twenty-nine consecutive times since the IPO $0.385 $0.395 $0.405 $0.415 $0.425 $0.475 $0.490 $0.510 $0.530 $0.550 $0.570 $0.590 $0.610 $0.630 $0.655 $0.680 $0.690 $0.705 $0.715 $0.725 $0.750 $0.770 $0.790 $0.810 $0.820 $0.850 $0.880 $0.885 $0.890 $0.900 (1) 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Distributable Cash Flow Coverage Ratio (2)(3)(4) Avg. 1.68x in 2014 Avg. 1.35x in 2015 Avg. 1.35x in 2013 Avg. 1.11x in 2016 Avg. 1.19x in 2018 Avg. 0.97x in 2017 Avg. 1.08x in 2019 1.39x 1.32x 1.35x 1.30x 1.61x 2.02x 1.42x 1.67x 1.25x 1.49x 1.47x 1.18x 1.20x 1.29x 0.98x 1.00x 0.88x 1.06x 0.97x 0.96x 1.14x 1.34x 1.25x 1.03x 1.06x 1.08x 1.11x 1.08x 1.15x 1.58x 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Leverage Ratio (4) 1.70x 1.58x 2.28x 2.40x 3.21x 2.69x 2.55x 2.56x 3.00x 3.14x 3.11x 3.49x 3.48x 3.47x 3.70x 3.85x 3.83x 3.88x 3.72x 3.77x 4.60x 4.44x 4.53x 4.08x 4.17x 4.60x 4.60x 4.43x 4.15x 4.05x 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 1) MQD = minimum quarterly distribution set pursuant to the Partnership Agreement. 2) Distribution coverage based on distributable cash flow divided by distribution amount in each period. Please see reconciliations starting on page 12. 3) In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek rather than the cash amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015. 4) Leverage ratio based on LTM EBITDA as defined by credit facility covenants for respective periods. 37

DKL: Reconciliation of Distributable Cash Flow (dollars in millions, except coverage) 2013 (2) 1Q14 (2) 2Q14(2) 3Q14(2) 4Q14(2) 2014 (2) 1Q15(2) 2Q15 3Q15 4Q15 2015 (2)(3) 1Q16 2Q16 3Q16 4Q16 2016 (3) Reconciliation of Distributable Cash Flow to net cash from operating activities Net cash provided by operating activities $49.4 $14.4 $31.2 $20.1 $20.8 $86.6 $15.8 $30.8 $20.2 $1.3 $68.0 $26.4 $31.2 $29.2 $13.9 $100.7 Accretion of asset retirement obligations (0.2) (0.1) (0.1) (0.1) 0.0 (0.2) (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.3) Deferred income taxes (0.3) 0.0 (0.1) (0.0) 0.2 0.1 (0.2) 0.2 0.0 0.0 (0.0) - - - 0.2 0.2 Gain (Loss) on asset disposals (0.2) - (0.1) - (0.0) (0.1) (0.0) 0.0 - (0.1) (0.1) 0.0 - (0.0) - 0.0 Changes in assets and liabilities 8.3 3.4 (6.0) (1.6) 3.0 (1.2) 3.3 (7.3) 3.6 20.5 20.1 (5.4) (7.1) (10.0) 7.7 (14.9) Distributions from equity method investments Maint. & Reg. Capital Expenditures (5.1) (0.8) (1.0) (0.8) (3.9) (6.5) (3.3) (3.9) (3.5) (2.7) (13.4) (0.7) (0.9) (0.7) (3.6) (5.9) Reimbursement for Capital Expenditures 0.8 - - - 1.6 1.6 1.6 1.8 2.0 0.2 5.5 0.2 0.2 0.4 2.4 3.3 Distributable Cash Flow $52.9 $17.0 $24.0 $17.7 $21.8 $80.3 $17.1 $21.4 $22.2 $19.0 $79.8 $20.4 $23.3 $18.8 $20.6 $83.0 Distribution Coverage Ratio (1) 1.35x 1.61x 2.02x 1.42x 1.67x 1.68x 1.25x 1.49x 1.47x 1.18x 1.35x 1.20x 1.29x 0.98x 1.00x 1.11x Total Distribution (1) $39.3 $10.5 $11.9 $12.4 $13.1 $47.9 $13.7 $14.4 $15.1 $16.1 $59.3 $17.1 $18.1 $19.3 $20.5 $75.0 (dollars in millions, except coverage) 1Q17 2Q17 3Q17 4Q17 (3) 2017(3) 1Q18 2Q18 3Q18 4Q18 2018 1Q19 2Q19 3Q19 4Q19 2019 1Q20 2Q20 Reconciliation of Distributable Cash Flow to net cash from operating activities Net cash provided by operating activities $23.5 $23.9 $30.5 $9.8 $87.7 $23.7 $28.0 $6.0 $90.4 $148.0 $26.2 $24.1 $34.3 $45.8 $130.4 $34.8 $37.5 Accretion of asset retirement obligations (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.4) (0.1) (0.1) (0.1) (0.1) (0.4) (0.1) (0.1) Deferred income taxes - (0.1) (0.0) 0.3 0.1 - - - (0.2) (0.2) - - (0.1) (0.6) (0.7) (1.3) (0.9) Gain (Loss) on asset disposals (0.0) 0.0 0.0 0.0 0.0 (0.1) 0.1 (0.7) (0.2) (0.9) (0.0) 0.0 0.1 0.1 0.2 0.1 - Changes in assets and liabilities (3.6) 0.9 (8.5) 14.6 3.4 3.7 6.2 28.1 (59.9) (21.9) 3.2 7.8 3.2 (14.8) (0.6) 5.6 19.3 Non-cash lease expense - - - - - (1.0) (0.4) (1.1) 2.4 (0.2) (2.9) (0.4) Distributions from equity method investments 0.3 0.2 1.2 0.8 - - - 0.8 0.1 1.6 Maint. & Reg. Capital Expenditures (2.2) (2.1) (0.7) (4.4) (9.4) (0.3) (1.0) (2.4) (3.5) (7.2) (0.8) (1.0) (3.7) (2.9) (8.5) (0.9) (0.1) Reimbursement for Capital Expenditures 0.9 0.5 0.4 1.7 3.5 0.4 0.3 1.3 0.9 2.9 0.7 0.7 1.2 3.2 5.8 0.0 0.0 Distributable Cash Flow $18.4 $23.0 $21.6 $21.9 $85.0 $27.3 $33.5 $32.4 $27.6 $121.5 $29.0 $31.2 $33.7 $33.0 $126.9 $35.5 $57.0 Distribution Coverage Ratio (1) 0.88x 1.06x 0.97x 0.96x 0.97x 1.14x 1.34x 1.25x 1.02x 1.19x 1.06x 1.08x 1.11x 1.08x 1.08x 1.15x 1.58x Total Distribution (1) $21.0 $21.8 $22.3 $22.8 $87.9 $24.0 $25.0 $26.0 $26.9 $101.9 $27.4 $28.9 $30.3 $30.6 $117.3 $30.9 $36.0 1) Distribution based on actual amounts distributed during the periods; does not include LTIP accrual. Coverage is defined as cash available for distribution divided by total distribution. 2) Results in 2013, 2014 and 2015 are as reported excluding predecessor costs related to the dropdown of the tank farms and product terminals at both Tyler and El Dorado during the respective periods. 3) In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek US rather than the cash amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015. 38 Note: May not foot due to rounding and annual adjustments that occurred in year-end reporting.

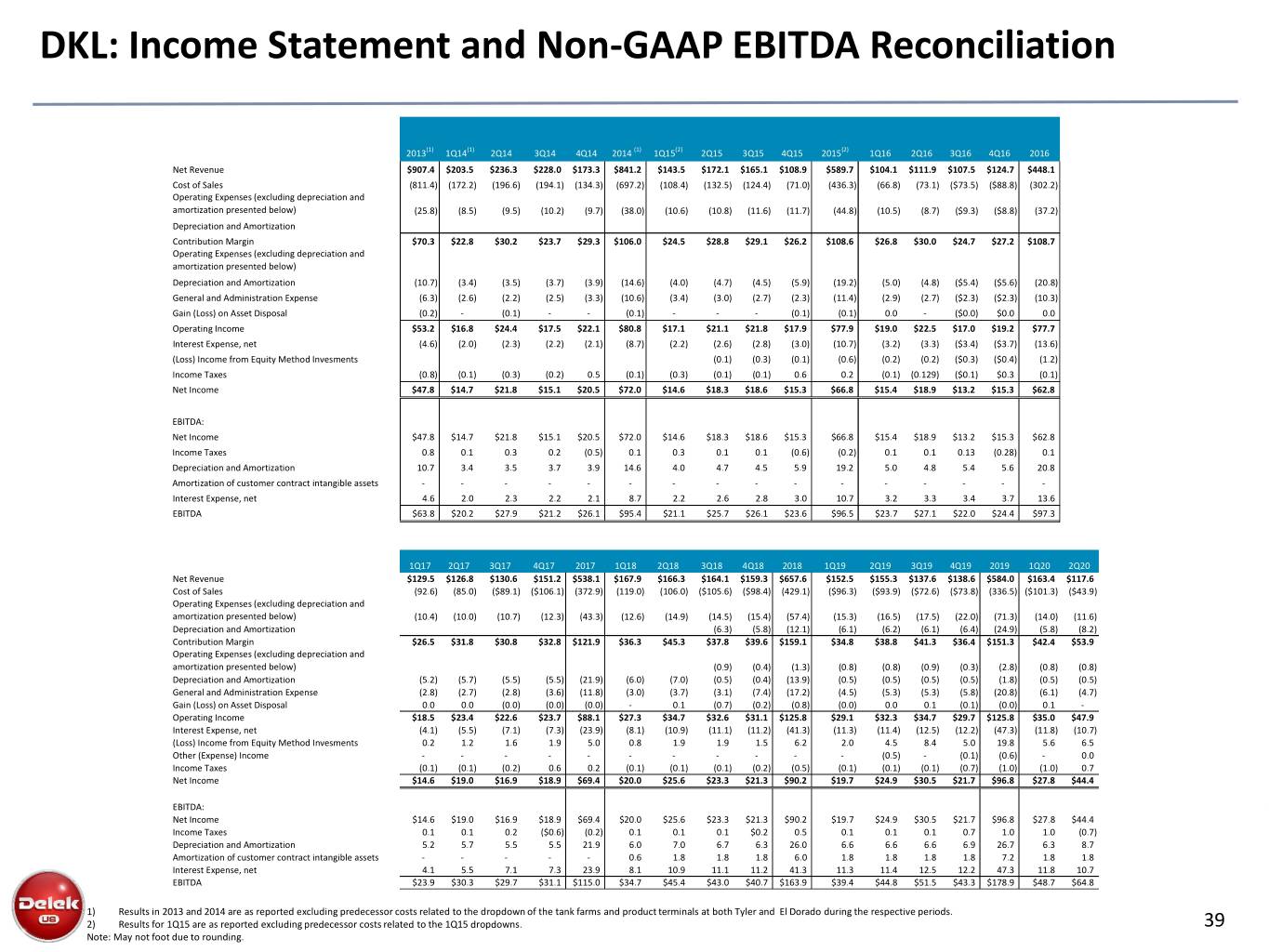

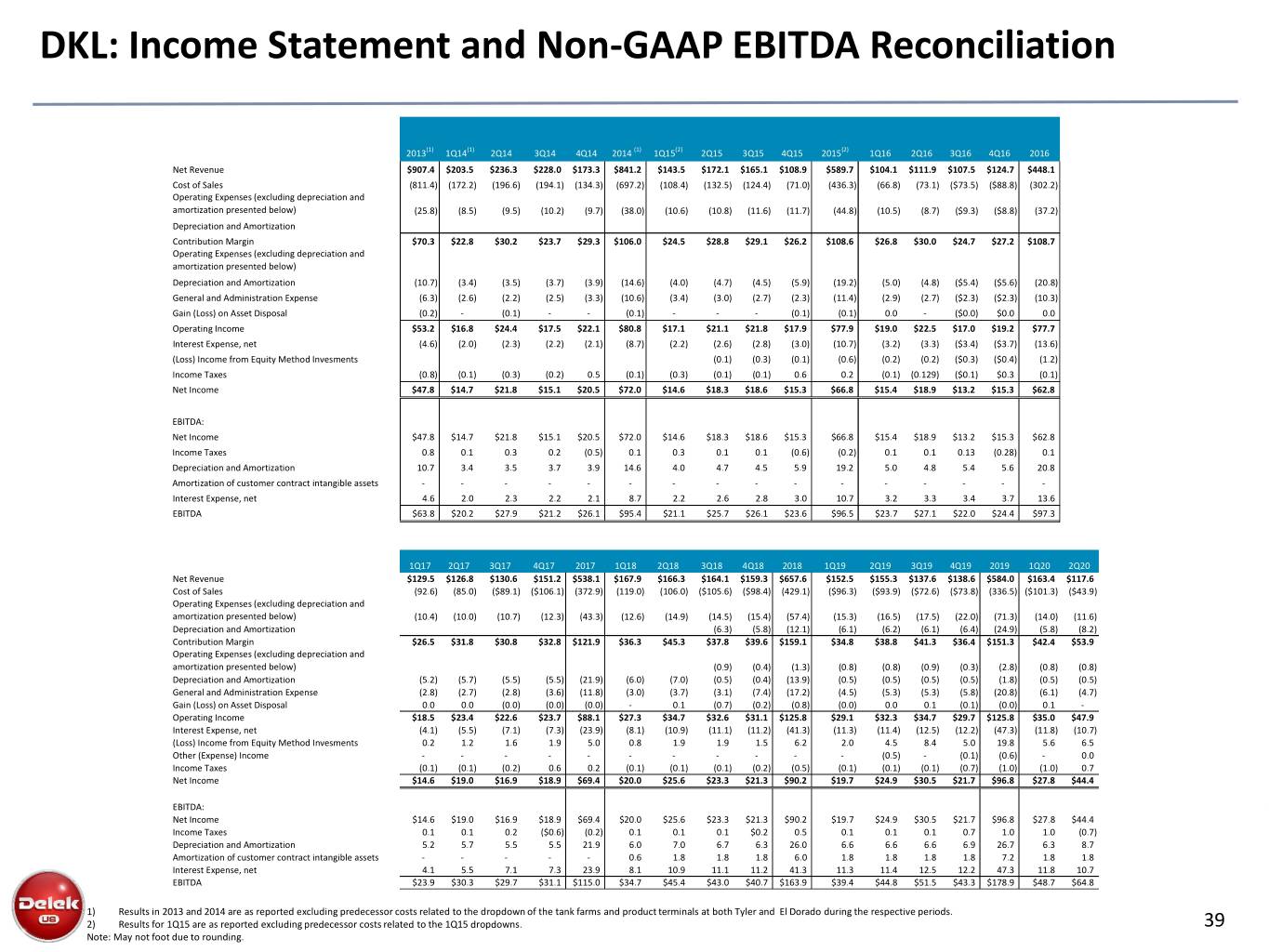

DKL: Income Statement and Non-GAAP EBITDA Reconciliation 2013(1) 1Q14(1) 2Q14 3Q14 4Q14 2014 (1) 1Q15(2) 2Q15 3Q15 4Q15 2015(2) 1Q16 2Q16 3Q16 4Q16 2016 Net Revenue $907.4 $203.5 $236.3 $228.0 $173.3 $841.2 $143.5 $172.1 $165.1 $108.9 $589.7 $104.1 $111.9 $107.5 $124.7 $448.1 Cost of Sales (811.4) (172.2) (196.6) (194.1) (134.3) (697.2) (108.4) (132.5) (124.4) (71.0) (436.3) (66.8) (73.1) ($73.5) ($88.8) (302.2) Operating Expenses (excluding depreciation and amortization presented below) (25.8) (8.5) (9.5) (10.2) (9.7) (38.0) (10.6) (10.8) (11.6) (11.7) (44.8) (10.5) (8.7) ($9.3) ($8.8) (37.2) Depreciation and Amortization Contribution Margin $70.3 $22.8 $30.2 $23.7 $29.3 $106.0 $24.5 $28.8 $29.1 $26.2 $108.6 $26.8 $30.0 $24.7 $27.2 $108.7 Operating Expenses (excluding depreciation and amortization presented below) Depreciation and Amortization (10.7) (3.4) (3.5) (3.7) (3.9) (14.6) (4.0) (4.7) (4.5) (5.9) (19.2) (5.0) (4.8) ($5.4) ($5.6) (20.8) General and Administration Expense (6.3) (2.6) (2.2) (2.5) (3.3) (10.6) (3.4) (3.0) (2.7) (2.3) (11.4) (2.9) (2.7) ($2.3) ($2.3) (10.3) Gain (Loss) on Asset Disposal (0.2) - (0.1) - - (0.1) - - - (0.1) (0.1) 0.0 - ($0.0) $0.0 0.0 Operating Income $53.2 $16.8 $24.4 $17.5 $22.1 $80.8 $17.1 $21.1 $21.8 $17.9 $77.9 $19.0 $22.5 $17.0 $19.2 $77.7 Interest Expense, net (4.6) (2.0) (2.3) (2.2) (2.1) (8.7) (2.2) (2.6) (2.8) (3.0) (10.7) (3.2) (3.3) ($3.4) ($3.7) (13.6) (Loss) Income from Equity Method Invesments (0.1) (0.3) (0.1) (0.6) (0.2) (0.2) ($0.3) ($0.4) (1.2) Income Taxes (0.8) (0.1) (0.3) (0.2) 0.5 (0.1) (0.3) (0.1) (0.1) 0.6 0.2 (0.1) (0.129) ($0.1) $0.3 (0.1) Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 EBITDA: Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 Income Taxes 0.8 0.1 0.3 0.2 (0.5) 0.1 0.3 0.1 0.1 (0.6) (0.2) 0.1 0.1 0.13 (0.28) 0.1 Depreciation and Amortization 10.7 3.4 3.5 3.7 3.9 14.6 4.0 4.7 4.5 5.9 19.2 5.0 4.8 5.4 5.6 20.8 Amortization of customer contract intangible assets - - - - - - - - - - - - - - - - Interest Expense, net 4.6 2.0 2.3 2.2 2.1 8.7 2.2 2.6 2.8 3.0 10.7 3.2 3.3 3.4 3.7 13.6 EBITDA $63.8 $20.2 $27.9 $21.2 $26.1 $95.4 $21.1 $25.7 $26.1 $23.6 $96.5 $23.7 $27.1 $22.0 $24.4 $97.3 1Q17 2Q17 3Q17 4Q17 2017 1Q18 2Q18 3Q18 4Q18 2018 1Q19 2Q19 3Q19 4Q19 2019 1Q20 2Q20 Net Revenue $129.5 $126.8 $130.6 $151.2 $538.1 $167.9 $166.3 $164.1 $159.3 $657.6 $152.5 $155.3 $137.6 $138.6 $584.0 $163.4 $117.6 Cost of Sales (92.6) (85.0) ($89.1) ($106.1) (372.9) (119.0) (106.0) ($105.6) ($98.4) (429.1) ($96.3) ($93.9) ($72.6) ($73.8) (336.5) ($101.3) ($43.9) Operating Expenses (excluding depreciation and amortization presented below) (10.4) (10.0) (10.7) (12.3) (43.3) (12.6) (14.9) (14.5) (15.4) (57.4) (15.3) (16.5) (17.5) (22.0) (71.3) (14.0) (11.6) Depreciation and Amortization (6.3) (5.8) (12.1) (6.1) (6.2) (6.1) (6.4) (24.9) (5.8) (8.2) Contribution Margin $26.5 $31.8 $30.8 $32.8 $121.9 $36.3 $45.3 $37.8 $39.6 $159.1 $34.8 $38.8 $41.3 $36.4 $151.3 $42.4 $53.9 Operating Expenses (excluding depreciation and amortization presented below) (0.9) (0.4) (1.3) (0.8) (0.8) (0.9) (0.3) (2.8) (0.8) (0.8) Depreciation and Amortization (5.2) (5.7) (5.5) (5.5) (21.9) (6.0) (7.0) (0.5) (0.4) (13.9) (0.5) (0.5) (0.5) (0.5) (1.8) (0.5) (0.5) General and Administration Expense (2.8) (2.7) (2.8) (3.6) (11.8) (3.0) (3.7) (3.1) (7.4) (17.2) (4.5) (5.3) (5.3) (5.8) (20.8) (6.1) (4.7) Gain (Loss) on Asset Disposal 0.0 0.0 (0.0) (0.0) (0.0) - 0.1 (0.7) (0.2) (0.8) (0.0) 0.0 0.1 (0.1) (0.0) 0.1 - Operating Income $18.5 $23.4 $22.6 $23.7 $88.1 $27.3 $34.7 $32.6 $31.1 $125.8 $29.1 $32.3 $34.7 $29.7 $125.8 $35.0 $47.9 Interest Expense, net (4.1) (5.5) (7.1) (7.3) (23.9) (8.1) (10.9) (11.1) (11.2) (41.3) (11.3) (11.4) (12.5) (12.2) (47.3) (11.8) (10.7) (Loss) Income from Equity Method Invesments 0.2 1.2 1.6 1.9 5.0 0.8 1.9 1.9 1.5 6.2 2.0 4.5 8.4 5.0 19.8 5.6 6.5 Other (Expense) Income - - - - - - - - - - - (0.5) - (0.1) (0.6) - 0.0 Income Taxes (0.1) (0.1) (0.2) 0.6 0.2 (0.1) (0.1) (0.1) (0.2) (0.5) (0.1) (0.1) (0.1) (0.7) (1.0) (1.0) 0.7 Net Income $14.6 $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 $21.3 $90.2 $19.7 $24.9 $30.5 $21.7 $96.8 $27.8 $44.4 EBITDA: Net Income $14.6 $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 $21.3 $90.2 $19.7 $24.9 $30.5 $21.7 $96.8 $27.8 $44.4 Income Taxes 0.1 0.1 0.2 ($0.6) (0.2) 0.1 0.1 0.1 $0.2 0.5 0.1 0.1 0.1 0.7 1.0 1.0 (0.7) Depreciation and Amortization 5.2 5.7 5.5 5.5 21.9 6.0 7.0 6.7 6.3 26.0 6.6 6.6 6.6 6.9 26.7 6.3 8.7 Amortization of customer contract intangible assets - - - - - 0.6 1.8 1.8 1.8 6.0 1.8 1.8 1.8 1.8 7.2 1.8 1.8 Interest Expense, net 4.1 5.5 7.1 7.3 23.9 8.1 10.9 11.1 11.2 41.3 11.3 11.4 12.5 12.2 47.3 11.8 10.7 EBITDA $23.9 $30.3 $29.7 $31.1 $115.0 $34.7 $45.4 $43.0 $40.7 $163.9 $39.4 $44.8 $51.5 $43.3 $178.9 $48.7 $64.8 1) Results in 2013 and 2014 are as reported excluding predecessor costs related to the dropdown of the tank farms and product terminals at both Tyler and El Dorado during the respective periods. 2) Results for 1Q15 are as reported excluding predecessor costs related to the 1Q15 dropdowns. 39 Note: May not foot due to rounding.

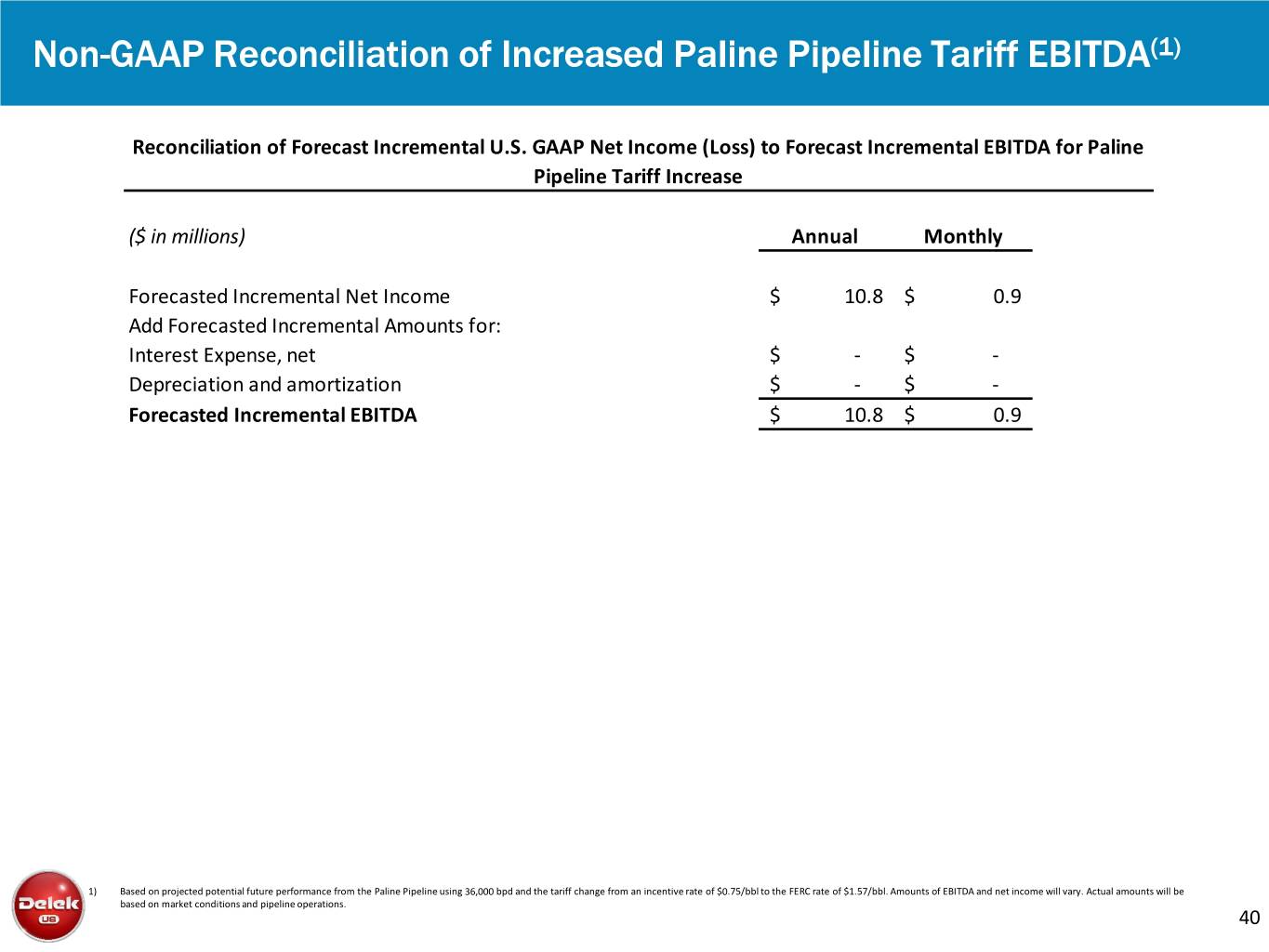

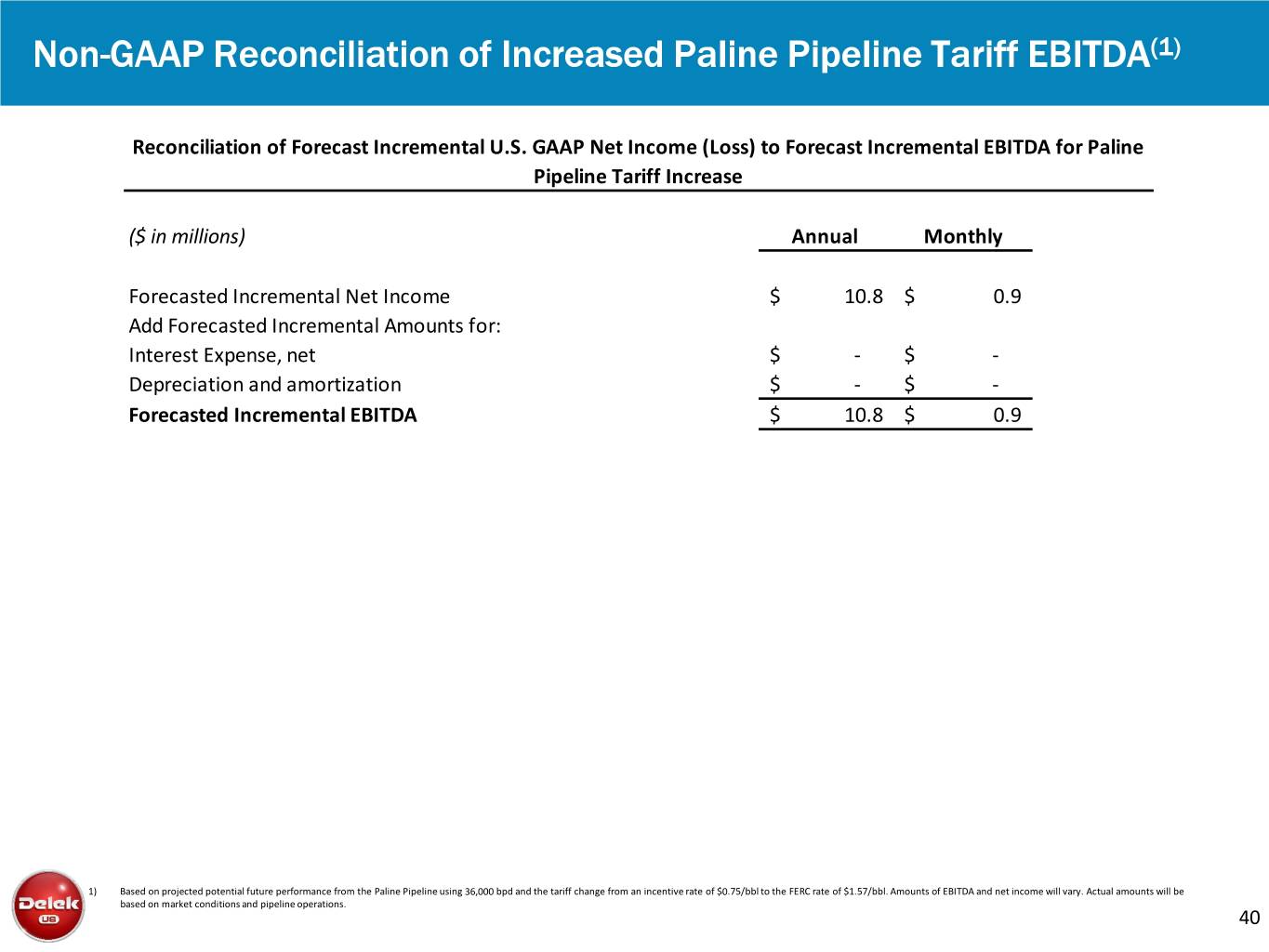

Non-GAAP Reconciliation of Increased Paline Pipeline Tariff EBITDA(1) Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA for Paline Pipeline Tariff Increase ($ in millions) Annual Monthly Forecasted Incremental Net Income $ 10.8 $ 0.9 Add Forecasted Incremental Amounts for: Interest Expense, net $ - $ - Depreciation and amortization $ - $ - Forecasted Incremental EBITDA $ 10.8 $ 0.9 1) Based on projected potential future performance from the Paline Pipeline using 36,000 bpd and the tariff change from an incentive rate of $0.75/bbl to the FERC rate of $1.57/bbl. Amounts of EBITDA and net income will vary. Actual amounts will be based on market conditions and pipeline operations. 40

Non-GAAP Reconciliation of Red River Joint Venture Adjusted EBITDA(1) Delek Logistics Partners, LP Reconciliation of Forecasted Incremental Annualized Net Income to Forecasted Incremental Annualized Adjusted EBITDA for the Red River Pipeline Joint Venture ($ in millions) Pre-Expansion Range Post-Expansion Range Forecasted Incremental Annualized Net Income $5.6 $7.6 $10.1 $15.1 Add Forecasted Incremental for: Interest Expense, Net $6.6 $6.6 $7.6 $7.6 Depreciation and Amortization $0.0 $0.0 $0.0 $0.0 Forecasted Incremental EBITDA $12.2 $14.2 $17.7 $22.7 Adjustments: Add Forecasted Incremental Distributions from operations of $1.3 $1.3 $2.3 $2.3 non- controlled entities in excess of earnings Forecasted Incremental AnnualizedAdjusted EBITDA $13.5 $15.5 $20.0 $25.0 1) Based on projected potential future performance from the Red River joint venture. Amounts of adjusted EBITDA and net income will vary. Actual amounts will be based on market conditions and pipeline operations. 41

Non-GAAP Reconciliations of Big Spring Gathering System Forecasted EBITDA 42

Non-GAAP Reconciliations of Trucking Assets Forecasted EBITDA 43

Investor Relations Contacts: Blake Fernandez, SVP IR/Market Intelligence 615-224-1312