Fall 2021 Delek US Holdings, Inc. Strategy and Governance Update Exhibit 99.1

Disclaimers Forward Looking Statements: Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral and written presentations contain forward-looking statements within the meaning of federal securities laws that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward-looking statements. These forward-looking statements include, but are not limited to, the statements regarding the following: financial and operating guidance for future and uncompleted financial periods; financial strength and flexibility; potential for and projections of growth; return of cash to shareholders, stock repurchases and the payment of dividends, including the amount and timing thereof; cost reductions; crude oil throughput; crude oil market trends, including production, quality, pricing, demand, imports, exports and transportation costs; competitive conditions in the markets where our refineries are located; the performance of our joint venture investments, including Red River and Wink to Webster, and the benefits, flexibility, returns and EBITDA therefrom; the potential for, and estimates of cost savings and other benefits from, acquisitions, divestitures, dropdowns and financing activities; the attainment of certain regulatory benefits; long-term value creation from capital allocation; targeted internal rates of return on capital expenditures; execution of strategic initiatives and the benefits therefrom, including cash flow stability from business model transition and approach to renewable diesel; and access to crude oil and the benefits therefrom. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell, including uncertainties regarding future decisions by OPEC regarding production and pricing disputes between OPEC members and Russia; uncertainty relating to the impact of the COVID-19 outbreak on the demand for crude oil, refined products and transportation and storage services; Delek US’ ability to realize cost reductions; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, pricing, production and transportation capacity; gains and losses from derivative instruments; management's ability to execute its strategy of growth through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance projects; the ability of the Wink to Webster joint venture to construct the long-haul pipeline; the ability of the Red River joint venture to expand the Red River pipeline; the possibility of litigation challenging renewable fuel standard waivers; the ability to grow the Big Spring Gathering System; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements. Non-GAAP Disclosures: Our management uses certain “non-GAAP” operational measures to evaluate our operating segment performance and non-GAAP financial measures to evaluate past performance and prospects for the future to supplement our GAAP financial information presented in accordance with U.S. GAAP. These financial and operational non-GAAP measures are important factors in assessing our operating results and profitability and include: • Adjusting items - certain identified infrequently occurring items, non-cash items, and items that are not attributable to or indicative of our on-going operations or that may obscure our underlying results and trends; • Earnings before interest, taxes, depreciation and amortization ("EBITDA") - calculated as net income attributable to Delek US or Delek Logistics, as applicable, adjusted to add back interest expense, income tax expense, depreciation and amortization; • Adjusted Segment Earnings - calculated as reported GAAP contribution margin (or revenue less cost of materials and other and operating expenses) less estimated general and administrative expenses specific to the segment (and excluding allocations of corporate general and administrative expenses), adjusted to include gain (loss) from disposal of property and equipment, and adjusted to reflect the relevant Adjusting items (defined above). While this measure does not exactly represent EBITDA, it may be considered a reasonably comparable measure to EBITDA, in that it includes all identified material cash income and expense items, and excludes depreciation, amortization, interest and income taxes. This definition of Adjusted Segment Earnings (or, individually, Adjusted Refining Segment Earnings, Adjusted [Logistics] Midstream Segment Earnings or Adjusted Retail Segment Earnings) is specific to this communication only and the exhibits referenced herein, and may not correlate to the use of the term ‘Adjusted Contribution Margin’ or ‘Adjusted Segment Contribution Margin’ as a non-GAAP measure in other of our filings with the SEC. Accordingly, always refer to the respective Non-GAAP Disclosures section, included in each of our filings that contain non-GAAP measures, for more information regarding the use of and definition of non-GAAP measures and terms, as they relate to that specific SEC filing; and • Net debt- calculated as long-term debt (the most comparable GAAP measure) including both current and non-current portions, less cash and cash equivalents as of a specific balance sheet date. This is an important measure to monitor leverage and evaluate the balance sheet. We believe these non-GAAP measures are useful to investors, lenders, ratings agencies and analysts to assess our financial results and ongoing performance in certain segments because, when reconciled to their most comparable GAAP financial measure, they provide important information regarding trends that may aid in evaluating our performance as well improved relevant comparability between periods, to peers or to market metrics. Non-GAAP measures have important limitations as analytical tools, because they exclude some, but not all, items that affect contribution margin, operating income (loss), and net income (loss). These measures should not be considered substitutes for their most directly comparable U.S. GAAP financial measures. Additionally, because the non-GAAP measures referenced above may be defined differently by other companies in its industry, Delek US’s definition may not be comparable to similarly titled measures of other companies. See the accompanying tables in the appendix for a reconciliation of these non-GAAP measures to the most directly comparable GAAP measures. We are unable to provide a reconciliation of forward-looking estimates of EBITDA or other forward-looking non-GAAP measures because certain information needed to make a reasonable forward-looking estimate of net income or other forward-looking GAAP measures is difficult to estimate and dependent on future events, which are uncertain or outside of our control. Accordingly, a reconciliation to the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of the projected GAAP measure could vary substantially from projected non-GAAP measure. 2

Investment Overview (NYSE: DK) (1) Please see page 18 for a reconciliation of net debt (excl. DKL) (2) Factset as of 11/9/2021 • September, 30 2021 balance sheet: • Delek US: approx. $831 million of cash; $2.2 billion of debt • Includes $4.9 million cash and $901.4 million long-term debt of DKL • Net debt (excl. DKL) of $495.1 million(1) • Delek has established a ‘capital light’ approach to Renewable Diesel • $13.3 million option for 33% indirect interest in the net cash flow from a renewable diesel facility following its conversion • The facility will be able to produce up to 220mm gallons a year of renewable fuels • Estimated start-up first quarter 2022 • Provides diversification and stability relative to other business segments • Premium industry valuation multiples relative to traditional refining business • Compelling growth opportunity through new-to-industry (NTI) locations; resuming growth campaign • PADD 3 centric portfolio with product pricing tied to the Gulf Coast • Access to domestic, inland based crude feedstock typically trading at discount to global crudes • Niche market location for three of the four refineries serves as a competitive advantage Tangible Value in Delek Logistics (DKL) Renewable Diesel Retail Segment Refining Portfolio: Gulf Coast Centric; Niche Market Oriented Flexible Financial Position to Support Midstream Growth Invest ent Overview (NYSE: DK) • Total DK ownership in DKL 80% or 34.7 million units • Implied value of DK ownership in DKL of $1.6 billion(2) 3

Asphalt 6 asphalt terminals located in: 1) El Dorado, AR 2) Muskogee, OK 3) Memphis, TN 4) Big Spring, TX 5) Henderson, TX 6) Richmond Beach, WA Refining 302,000 bpd in total El Dorado, AR Tyler, TX Big Spring, TX Krotz Springs, LA Crude oil supply: 262,000 bpd WTI linked currently Increasing crude oil optionality through Red River expansion Logistics 10 terminals Approximately 1,550 miles of pipeline 10.2 million bbls of storage capacity West Texas wholesale JV crude oil pipelines: RIO / Caddo / Red River Own ~80% of DKL Source 207,000 bpd from Permian Basin • Growing gathering system • Wink to Webster JV Crude Oil Pipeline Cushing Optionality: 100,000 bpd RIO CADDO Renewables Approximately 40m gallons biodiesel production capacity: 1) Crossett, AR 2) Cleburne, TX 3) New Albany, MS Integrated Company with Asset Diversity and Scale Strategically located assets with growing crude oil optionality Retail Approximately 250 stores Southwest US locations West Texas wholesale marketing business 4

5 Aligning Our Portfolio with the Most Attractive Opportunities Divestitures Over $800 million in proceeds since 2016 from well-timed divestitures to enhance our portfolio composition Dropdowns Asset dropdowns to DKL have created substantial value at both DK and DKL Joint Ventures Joint ventures have provided DK and DKL with low-cost opportunities to expand operations and increase cash flows Acquisitions Built a strong portfolio by strategically acquiring complementary assets 2019A Adj. Segment Earnings(1) 2022E Targeted Adj. Segment Earnings(1) (1) See definition in Non-GAAP Disclosures discussion on page 2 and reconciliation to GAAP measure on page 17 Refining Midstream & Retail Projected growth from midstream and retail (excludes upside from new stores) 61% 39% Focus on diversifying cash flow streams and reducing cash flow volatility Track record of actively managing our portfolio 75% 25%

Long-term Capital Allocation Framework Four pillars underpinned by a rigorous and disciplined capital allocation program to create long-term value Priorities: • Invest: Capital allocation program focuses on safety, maintenance, and reliability as top priority • Cash Returns: Maintain a competitive cash return profile commensurate with underlying earnings power • Grow: Maintain financial strength and flexibility to support strategic growth objectives • Enhance Balance Sheet / Return Excess Cash: Reduce net debt and/or opportunistically return additional cash Sustaining Capex • Approximately $100 million sustaining capex/yr • Between $40-$75 million per turnaround • Critical for safe and reliable operations • Various amounts for regulatory capex Sustaining & Regulatory Capex Non-Discretionary • At this juncture, free cash flow used for balance sheet improvement over share buybacks or dividends Cash Returns Discretionary Growth Capex • 25% IRR for >$5mm projects at Refining; <$5mm is 50% IRR • >15% IRR minimum hurdle rate for Retail projects, dependent on size • >15% IRR hurdle rate for stable cash flow Logistics projects Cash Returns to Shareholders • Target competitive overall cash return • Continue to evaluate dividend reinstatement / share buybacks versus growth capex / investment opportunities Acquisitions • Evaluate accretive opportunities as they arise vs. alternative uses of cash Opportunistically De-lever • Continue to optimize the balance sheet • Opportunistically repay DK debt when FCF supports it 6

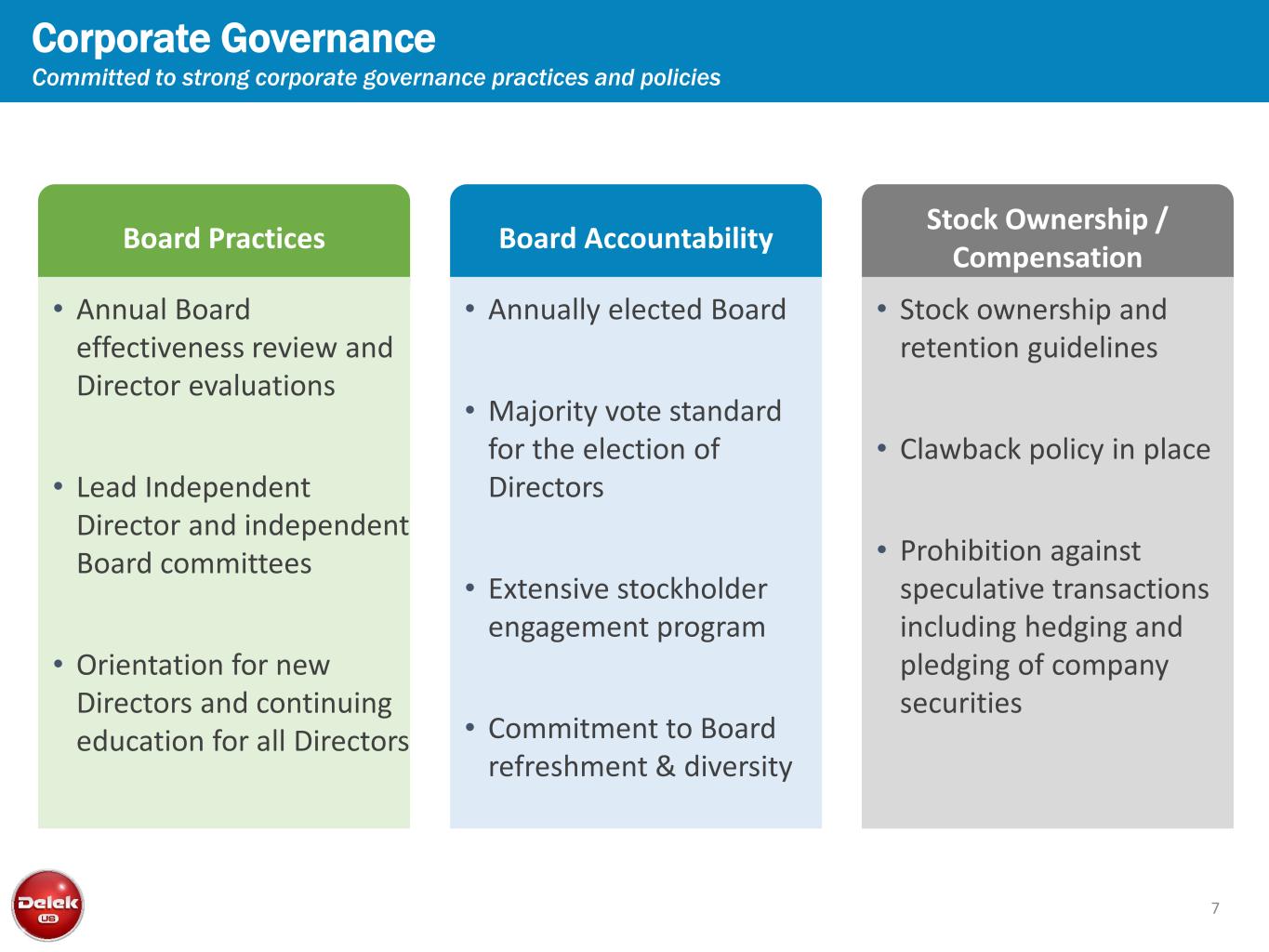

7 Corporate Governance Committed to strong corporate governance practices and policies Board Practices • Annual Board effectiveness review and Director evaluations • Lead Independent Director and independent Board committees • Orientation for new Directors and continuing education for all Directors Board Accountability • Annually elected Board • Majority vote standard for the election of Directors • Extensive stockholder engagement program • Commitment to Board refreshment & diversity Stock Ownership / Compensation • Stock ownership and retention guidelines • Clawback policy in place • Prohibition against speculative transactions including hedging and pledging of company securities

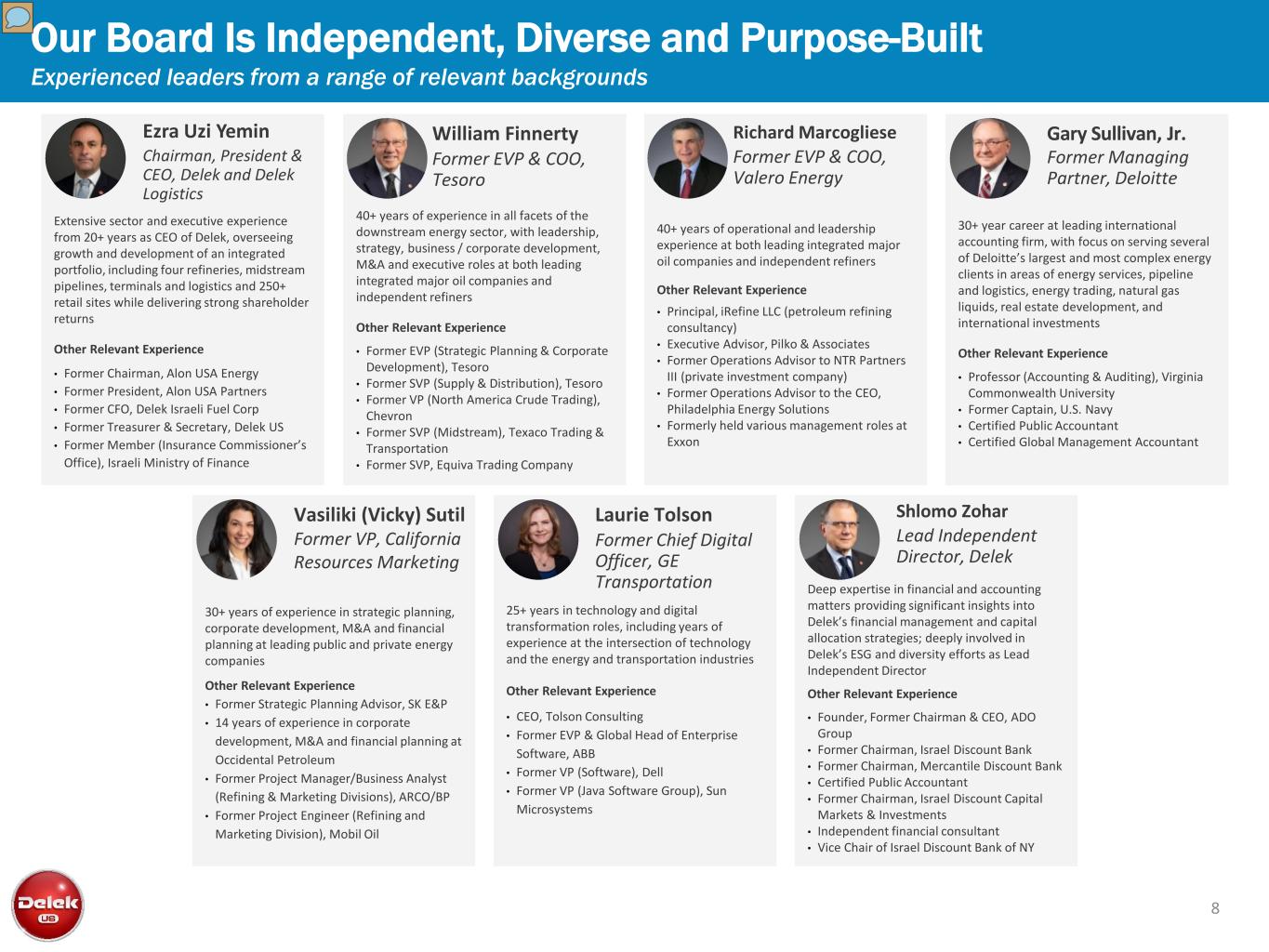

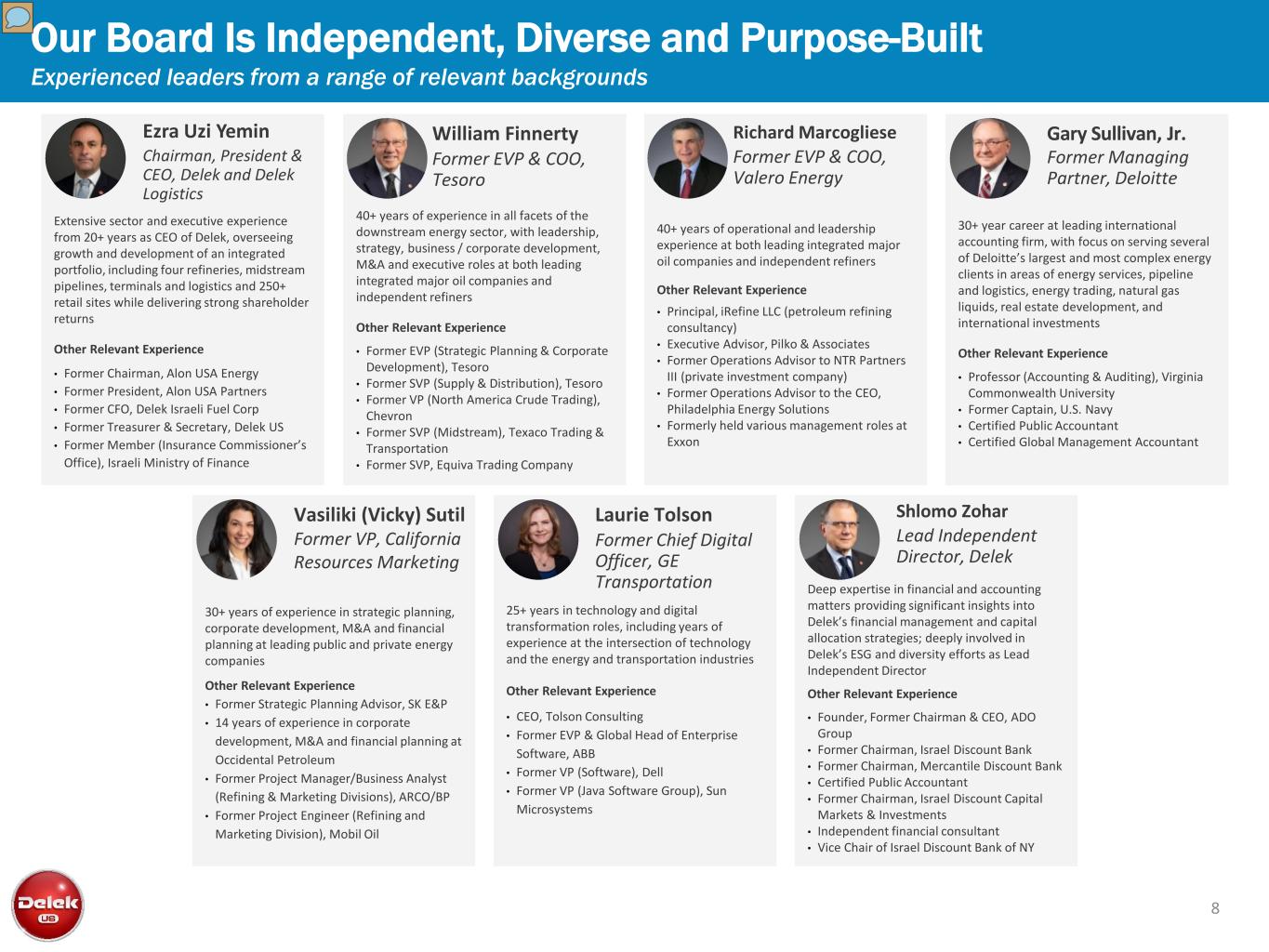

8 Ezra Uzi Yemin Chairman, President & CEO, Delek and Delek Logistics Extensive sector and executive experience from 20+ years as CEO of Delek, overseeing growth and development of an integrated portfolio, including four refineries, midstream pipelines, terminals and logistics and 250+ retail sites while delivering strong shareholder returns Other Relevant Experience • Former Chairman, Alon USA Energy • Former President, Alon USA Partners • Former CFO, Delek Israeli Fuel Corp • Former Treasurer & Secretary, Delek US • Former Member (Insurance Commissioner’s Office), Israeli Ministry of Finance Shlomo Zohar Lead Independent Director, Delek Deep expertise in financial and accounting matters providing significant insights into Delek’s financial management and capital allocation strategies; deeply involved in Delek’s ESG and diversity efforts as Lead Independent Director Other Relevant Experience • Founder, Former Chairman & CEO, ADO Group • Former Chairman, Israel Discount Bank • Former Chairman, Mercantile Discount Bank • Certified Public Accountant • Former Chairman, Israel Discount Capital Markets & Investments • Independent financial consultant • Vice Chair of Israel Discount Bank of NY William Finnerty Former EVP & COO, Tesoro 40+ years of experience in all facets of the downstream energy sector, with leadership, strategy, business / corporate development, M&A and executive roles at both leading integrated major oil companies and independent refiners Other Relevant Experience • Former EVP (Strategic Planning & Corporate Development), Tesoro • Former SVP (Supply & Distribution), Tesoro • Former VP (North America Crude Trading), Chevron • Former SVP (Midstream), Texaco Trading & Transportation • Former SVP, Equiva Trading Company Richard Marcogliese Former EVP & COO, Valero Energy 40+ years of operational and leadership experience at both leading integrated major oil companies and independent refiners Other Relevant Experience • Principal, iRefine LLC (petroleum refining consultancy) • Executive Advisor, Pilko & Associates • Former Operations Advisor to NTR Partners III (private investment company) • Former Operations Advisor to the CEO, Philadelphia Energy Solutions • Formerly held various management roles at Exxon Gary Sullivan, Jr. Former Managing Partner, Deloitte 30+ year career at leading international accounting firm, with focus on serving several of Deloitte’s largest and most complex energy clients in areas of energy services, pipeline and logistics, energy trading, natural gas liquids, real estate development, and international investments Other Relevant Experience • Professor (Accounting & Auditing), Virginia Commonwealth University • Former Captain, U.S. Navy • Certified Public Accountant • Certified Global Management Accountant Vasiliki (Vicky) Sutil Former VP, California Resources Marketing 30+ years of experience in strategic planning, corporate development, M&A and financial planning at leading public and private energy companies Other Relevant Experience • Former Strategic Planning Advisor, SK E&P • 14 years of experience in corporate development, M&A and financial planning at Occidental Petroleum • Former Project Manager/Business Analyst (Refining & Marketing Divisions), ARCO/BP • Former Project Engineer (Refining and Marketing Division), Mobil Oil Laurie Tolson Former Chief Digital Officer, GE Transportation 25+ years in technology and digital transformation roles, including years of experience at the intersection of technology and the energy and transportation industries Other Relevant Experience • CEO, Tolson Consulting • Former EVP & Global Head of Enterprise Software, ABB • Former VP (Software), Dell • Former VP (Java Software Group), Sun Microsystems Our Board Is Independent, Diverse and Purpose-Built Experienced leaders from a range of relevant backgrounds

Desired Board Skill / Characteristic # of Directors Leadership Experience Public Co. Board 6 / 7 Public Co. C-Suite 4 / 7 Industry-Specific Experience Refining 5 / 7 Retail 2 / 7 Finance and Transaction Experience Finance / Accounting 5 / 7 M&A 6 / 7 Technology Digital Transformation / Innovation 3 / 7 Cybersecurity 2 / 7 Independent Oversight, Risk Management and Diversity Corporate Governance 5 / 7 Environmental, Health & Safety 4 / 7 Gender Diversity 2 / 7 100% Fully-independent Board committees ~86% Independent Directors Independent Board Leadership Regular executive sessions Lead Independent Director 9 Board Composition Aligned with Our Strategy

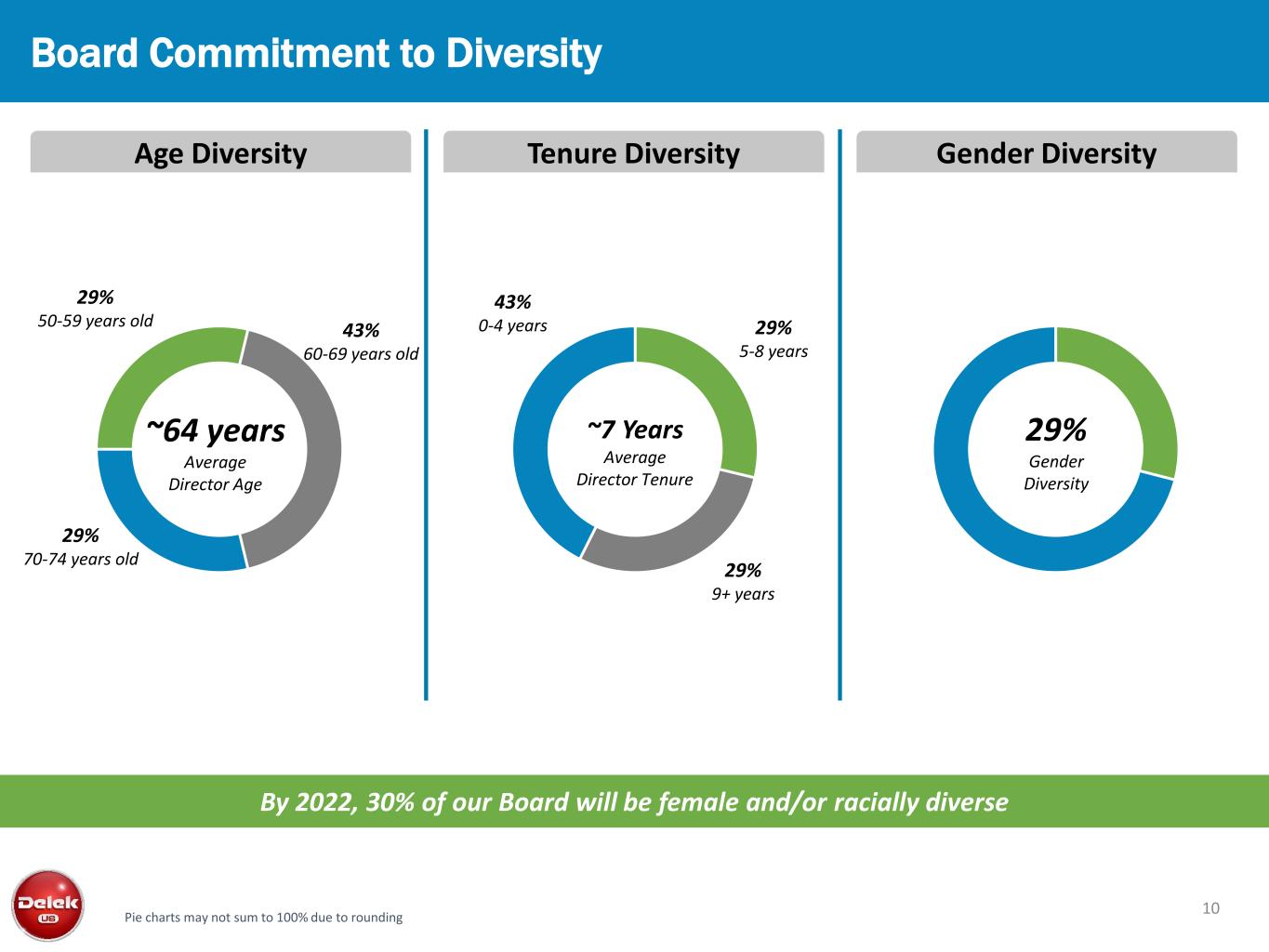

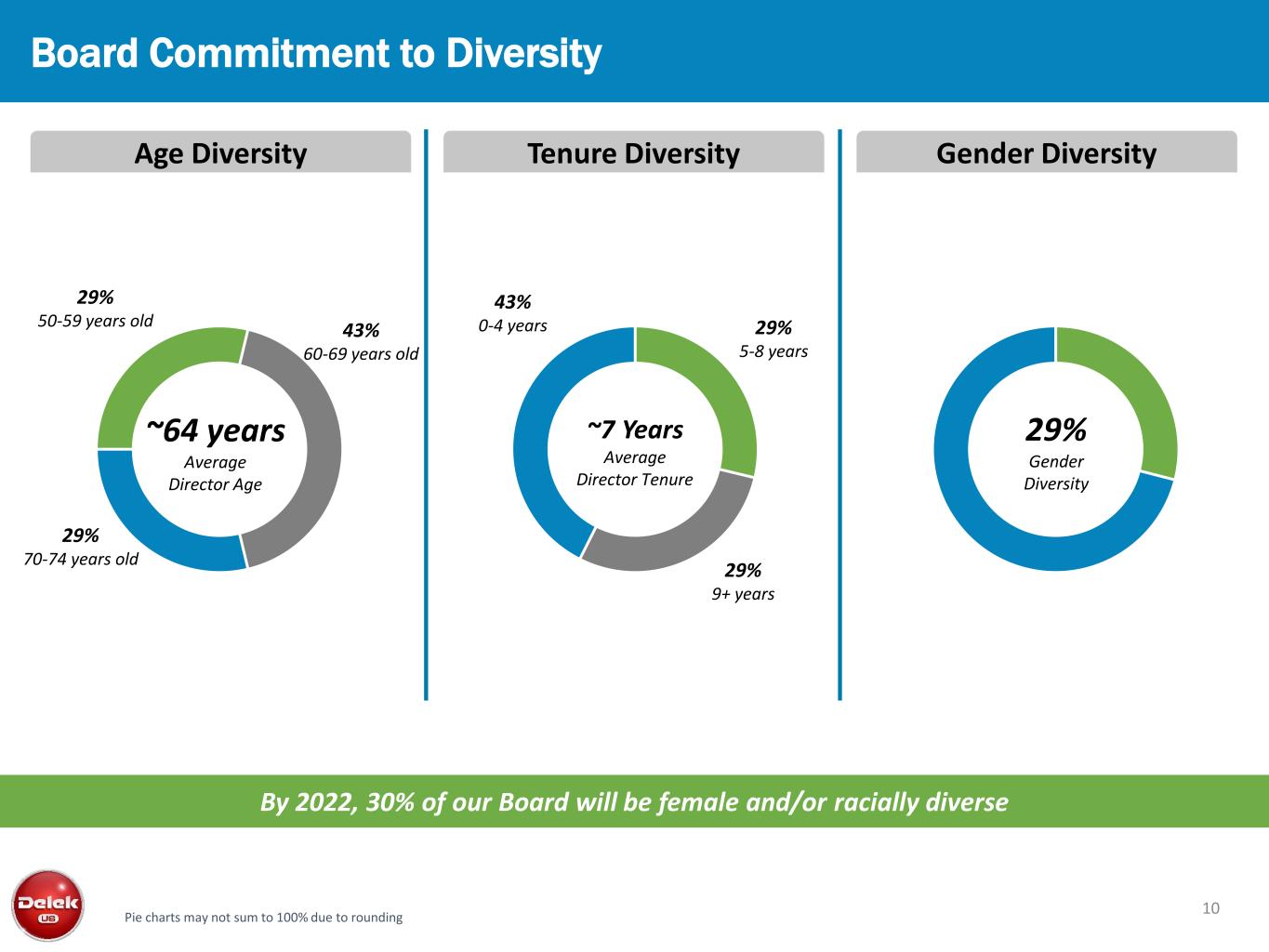

10 Board Commitment to Diversity Age Diversity Pie charts may not sum to 100% due to rounding Tenure Diversity Gender Diversity 43% 60-69 years old 29% 70-74 years old 29% 50-59 years old ~64 years Average Director Age 29% 9+ years ~7 Years Average Director Tenure 43% 0-4 years 29% Gender Diversity By 2022, 30% of our Board will be female and/or racially diverse 29% 5-8 years

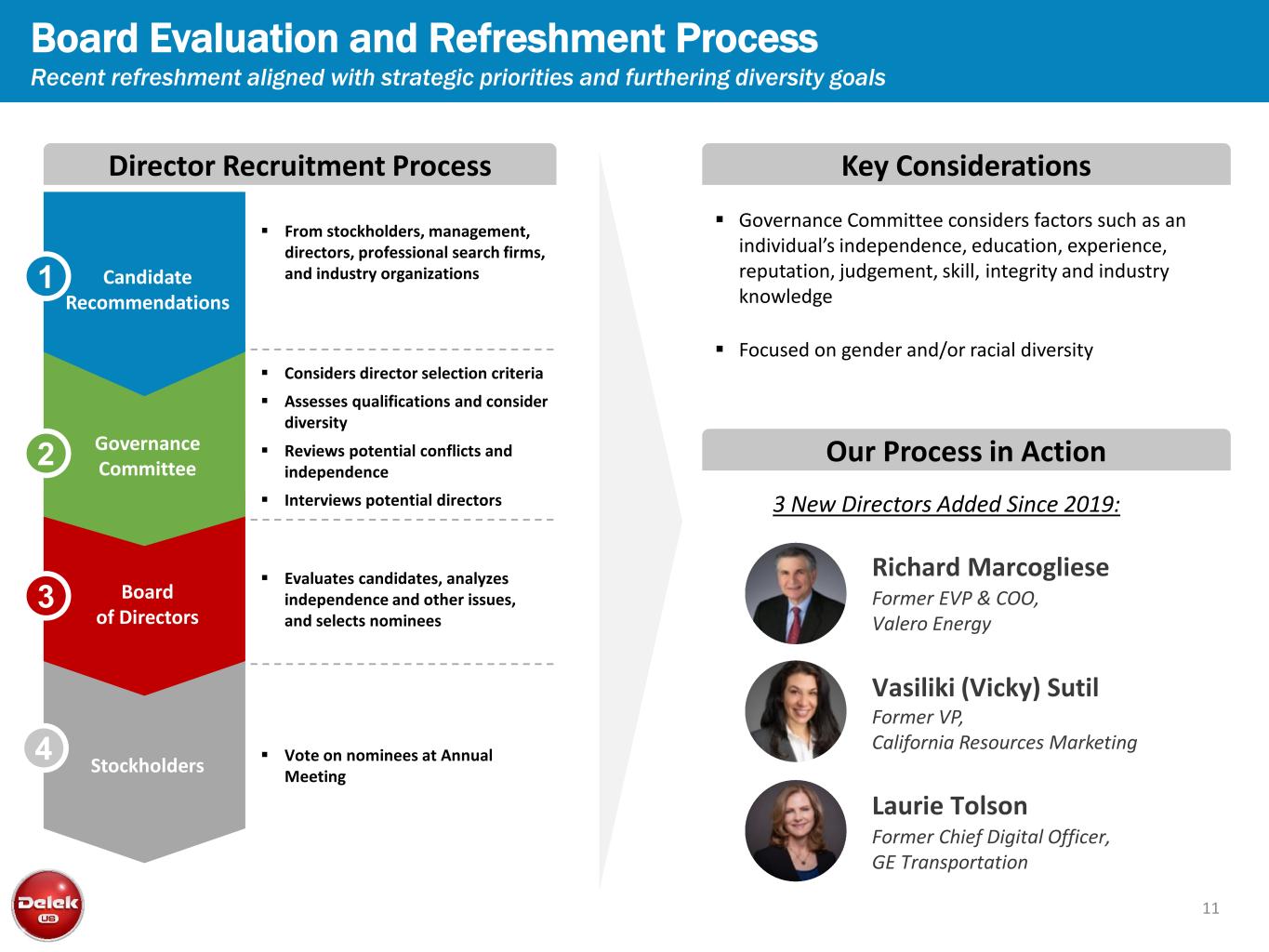

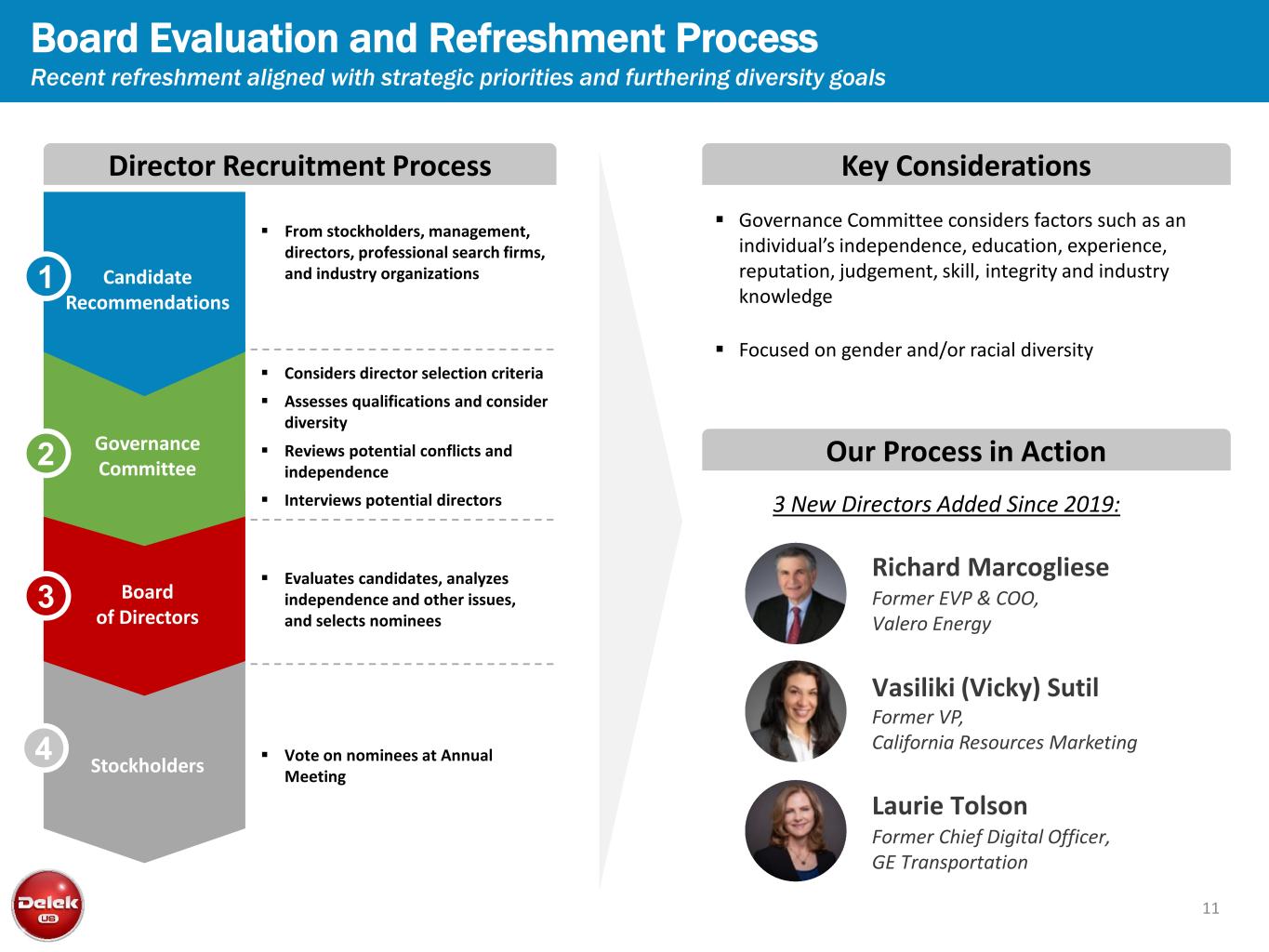

11 Board Evaluation and Refreshment Process Recent refreshment aligned with strategic priorities and furthering diversity goals Key ConsiderationsDirector Recruitment Process Our Process in Action Richard Marcogliese Former EVP & COO, Valero Energy Vasiliki (Vicky) Sutil Former VP, California Resources Marketing Laurie Tolson Former Chief Digital Officer, GE Transportation 3 New Directors Added Since 2019: Governance Committee considers factors such as an individual’s independence, education, experience, reputation, judgement, skill, integrity and industry knowledge Focused on gender and/or racial diversity From stockholders, management, directors, professional search firms, and industry organizations Considers director selection criteria Assesses qualifications and consider diversity Reviews potential conflicts and independence Interviews potential directors Evaluates candidates, analyzes independence and other issues, and selects nominees Vote on nominees at Annual MeetingStockholders Board of Directors Governance Committee Candidate Recommendations 1 2 3 4

12 Board Committees and Risk Oversight Our approach to committee composition and responsibilities Board Role in Risk Oversight • The Board considers oversight of risk management to be a responsibility of the entire Board as well as its committees • Committees provide regular updates and report to the Board on areas of material risk in their purview • In addition, committees provide oversight and guidance over different aspects of ESG in connection with our projects and operations Audit Committee Compensation Committee Environment, Health and Safety (EHS) Committee Nominating and Corporate Governance Committee Technology Committee • Monitors, assesses and develops policies relating to the Company’s financial, commercial, liquidity, credit, regulatory, and enterprise risks, among others • Discusses risk management in the context of governance matters and oversees Board succession planning and committee composition • Oversees the ERM program and cybersecurity (operational and information security) risks and receives regular reports from senior management on these risk oversight topics • Oversees risks associated with our compensation program design, policies and practices as well as financial and reputational risks associated with our compensation program Sutil (C) Marcogliese (C) Sullivan Jr. Zohar TolsonFinnerty Finnerty SutilSullivan Jr. (C) Marcogliese Sutil Finnerty (C) Tolson (C) Marcogliese Sullivan Jr. Tolson Zohar • Review, assesses and mitigates risks-related to technological developments, digitalization and information security

13 Environmental, Social, and Governance (ESG) Published Sustainability Report in November 2021 The safety and health of our employees is a core value of the company as reflected in progressive safety improvements over time Target zero workplace accidents and injuries During 2019 (the last year for which industry statistics are available), Delek’s TRIR measure was approximately 1/4 of the industry average Disclosure of whistleblower stats En vi ro nm en ta l So ci al G ov er na nc e We measure our environmental performance daily, review our progress with the EHS Committee quarterly, and publicly report annually Recently announced our 1st greenhouse gas (GHG) emissions reductions target as we seek to align our business with the Paris Climate Accords: We will cut our Scope 1 and 2 emissions 34% by 2030 1st disclosure of our Scope 3 emissions 1st disclosure of our hazardous waste production Implemented a sustainability screening process for capital projects Delek observes responsible, ethical and transparent business practices. Led by our Board of Directors and executive leadership team, we strive to deliver market competitive returns to investors while providing tangible benefits to all of our stakeholders Board members have diverse backgrounds and experience Added two female directors since 2019 85.7% of Directors are independent Independent lead director, elected annually By 2022, not less than 30% of our Board of Directors will be female and/or racially diverse. Published new public policies on ESG-related topics Environmental Policy Diversity, Equity, & Inclusion (DE&I) Policy • Implemented by a newly-created Senior Director for DE&I Human Rights Policy Conflict Minerals Policy Super Social Standards Consistent with our Mission, Vision and Core Values, Delek believes that a diverse workforce composed of individuals with a variety of personal and professional backgrounds and identities makes our company stronger We are committed to increasing the diversity of our already inclusive workforce and generating greater professional and economic opportunities for all employees. Achieving these mutually-supportive goals will make us stronger, more agile and resilient In 2021, we established four new Employee Resource Groups, further reinforcing our commitment to fostering a diverse and inclusive workplace 2018 Delek US Refining 27 2019 Delek US Refining 28 2020 Delek US Refining 26 Carbon Intensity of Refining Business Unit(1) (1) metric tons CO2e per 1,000 barrels of refinery throughput of crude and other feedstocks Enhanced Transparency in 2021 Sustainability Report Comprehensive TCFD response First SASB- aligned report Published our first EEO-1 demographic disclosure table Total employees by gender and ethnicity Manager and above by gender Manager and above by race Future disclosures to align with Science- Based Targets Initiative

14 Executive Compensation Philosophy and Design Compensation aligned with our strategic priorities Incentive Pay Aligned with Strategy 2021 CEO Target Pay Mix Annual Incentive Plan Equity-Based Long-Term Incentive Award Type of Plan Goals Components ~84% Of CEO pay is comprised of Variable CompensationFixed Compensation Variable Compensation Profitability 60% based on adjusted EPS and relative ROIC metrics Environmental and Safety Metrics 10% based on safety metrics 5% attributed to Tier 1 and 2 events 5% attributed to environmental metrics (spills & releases, flaring hours and water exceedances) Operational Performance 20% for relative performance in refinery operational availability and utilization Performance-based RSUs based on relative TSR Time-vested RSUs over three-year period Shareholder Value Creation ~79% Of CEO pay is comprised of Long- Term Compensation Short-Term Compensation Long-Term Compensation

15 Our Path to Delivering Long-Term Shareholder Value Growing Midstream Platform to Diversify EBITDA Stream Financial Flexibility to Support Strategic Objectives An Integrated and Diversified Refining, Logistics and Retail Company Invest in the Business to Operate Reliably and Safely Permian Focused Refining System with Increasing Access to Cushing Focus on Long-Term Shareholder Returns Experienced, Diverse Board with a Range of Skill Sets to Drive Value

Reconciliations

17 Reconciliation of GAAP to Non-GAAP Delek US Holdings, Inc. Reconciliation of Amounts Reported Under U.S. GAAP (In millions) Refining Logistics (Midstream) Retail Reported segment contribution margin $777.9 $173.4 $58.5 Less: General and administrative expenses 134.1 20.8 23.8 Add: Gain (loss) on sale of assets (0.1) 0.2 3.0 643.7 152.8 37.7 Adjusting items: Net inventory LCM valuation benefit (52.2) (0.1) - Unrealized inventory/commodity hedging gain where the hedged item is not yet recognized in the financial statements 18.7 0.4 - Retroactive biodiesel tax credit (36.0) - - Non-operating, pre-acquisition litigation contingent losses and related legal expenses 6.7 - - Total adjusting items: (62.8) 0.3 - Adjusted segment earnings $580.9 $153.1 $37.7 Year Ended December 31, 2019 (1) An adjustment for the portion of the retroactive biodiesel tax credit reenacted in December 2019 but that was attributable to 2018 has been adjusted out of the year ended December 31, 2019 (1)

18 Net Debt Reconciliation (1) Numbers may not foot due to rounding ($ in millions) 3Q-19 4Q-19 1Q-20 2Q-20 3Q-20 4Q-20 1Q-21 2Q-21 3Q-21 Current Portion of Long-Term Debt $65 $36 $31 $33 $33 $33 $13 $46 $63 Long-Term Debt $1,935 $2,031 $2,186 $2,422 $2,441 $2,315 $2,354 $2,198 $2,159 Total Debt $2,000 $2,067 $2,217 $2,455 $2,474 $2,348 $2,367 $2,244 $2,222 Cash $1,006 $955 $785 $849 $808 $788 $794 $833 $831 Net Debt Delek US Consolidated $994 $1,112 $1,432 $1,606 $1,666 $1,560 $1,573 $1,411 $1,391 Delek Logistics Total Debt $841 $833 $940 $995 $1,006 $992 $983 $929 $901 Cash $6 $6 $4 $16 $6 $4 $13 $2 $5 Stockholder Equity - - - - - - - - - Net Debt Delek Logistics $834 $827 $936 $979 $1,000 $988 $970 $927 $896 Delek US, ex. Delek Logistics Total Debt $1,159 $1,234 $1,277 $1,460 $1,468 $1,356 $1,385 $1,315 $1,321 Cash $1,000 $949 $781 $833 $802 $784 $781 $831 $826 Net Debt Delek US excluding DKL $159 $284 $496 $627 $666 $573 $604 $485 $495 (1)

Investor Relations Contacts Blake Fernandez SVP IR/Market Intelligence 615-224-1312 Kaley Weinstein Senior IR Analyst 267-701-0111