3 Bear Delaware Holding - NM, LLC and Subsidiaries Contents Consolidated Financial Statements Consolidated Balance Sheets 2 Consolidated Statements of Operations 3 Consolidated Statement of Changes in Member’s Equity 4 Consolidated Statements of Cash Flows 5 Notes to Consolidated Financial Statements 7

3 Bear Delaware Holding - NM, LLC and Subsidiaries Consolidated Balance Sheets (Unaudited) 2 March 31, December 31, 2022 2021 Assets Current assets: Cash and cash equivalents 833,871$ 6,896,120$ Trade accounts receivable and accrued revenues 19,645,433 15,121,133 Inventory 2,202,468 1,721,670 Prepaid and other current assets 663,372 777,777 Total current assets 23,345,144 24,516,700 Property, plant and equipment, net 342,032,721 325,719,789 Intangible assets, net 42,302,130 42,711,432 Other long-term assets 500,000 500,000 Total assets 408,179,995$ 393,447,921$ Liabilities and member’s equity Current liabilities: Accounts payable – trade 5,227,814$ 6,892,674$ Accounts payable – affiliates 482,742 174,303 Accrued liabilities 22,097,009 9,692,635 Total current liabilities 27,807,565 16,759,612 Long-term debt, net 68,910,031 69,045,741 Asset retirement obligations 2,232,677 2,189,816 Other long-term liabilities 290,028 - Total liabilities 99,240,301 87,995,169 Commitments and contingencies - Note 11 Member’s equity: Member’s capital 288,766,118 288,766,118 Accumulated earnings 20,173,576 16,686,634 Total member’s equity 308,939,694 305,452,752 Total liabilities and member’s equity 408,179,995$ 393,447,921$ See accompanying notes to consolidated financial statements.

3 Bear Delaware Holding - NM, LLC and Subsidiaries Consolidated Statements of Operations (Unaudited) 3 Predecessor Three months ended March 31, 2022 For the Period from March 23, 2021, through March 31, 2021 For the Period from January 1, 2021, through March 22, 2021 Revenues: Product sales 38,286,964$ 2,027,573$ 19,523,675$ Gathering services 9,890,337 815,232 7,286,505 Fuel revenue 525,592 49,339 595,842 Total revenues 48,702,893 2,892,144 27,406,022 Operating expenses: Gas purchases and other cost of product sales 31,730,324 1,534,142 17,725,824 Operations and maintenance 6,589,323 718,907 4,524,522 General and administrative 1,873,791 62,219 557,805 Depreciation, amortization, and accretion 4,430,062 432,354 3,540,029 44,623,500 2,747,622 26,348,180 Total operating income 4,079,393 144,522 1,057,842 Interest expense (592,451) (49,802) (432,098) Net income 3,486,942$ 94,720$ 625,744$ Total operating expenses Successor See accompanying notes to consolidated financial statements.

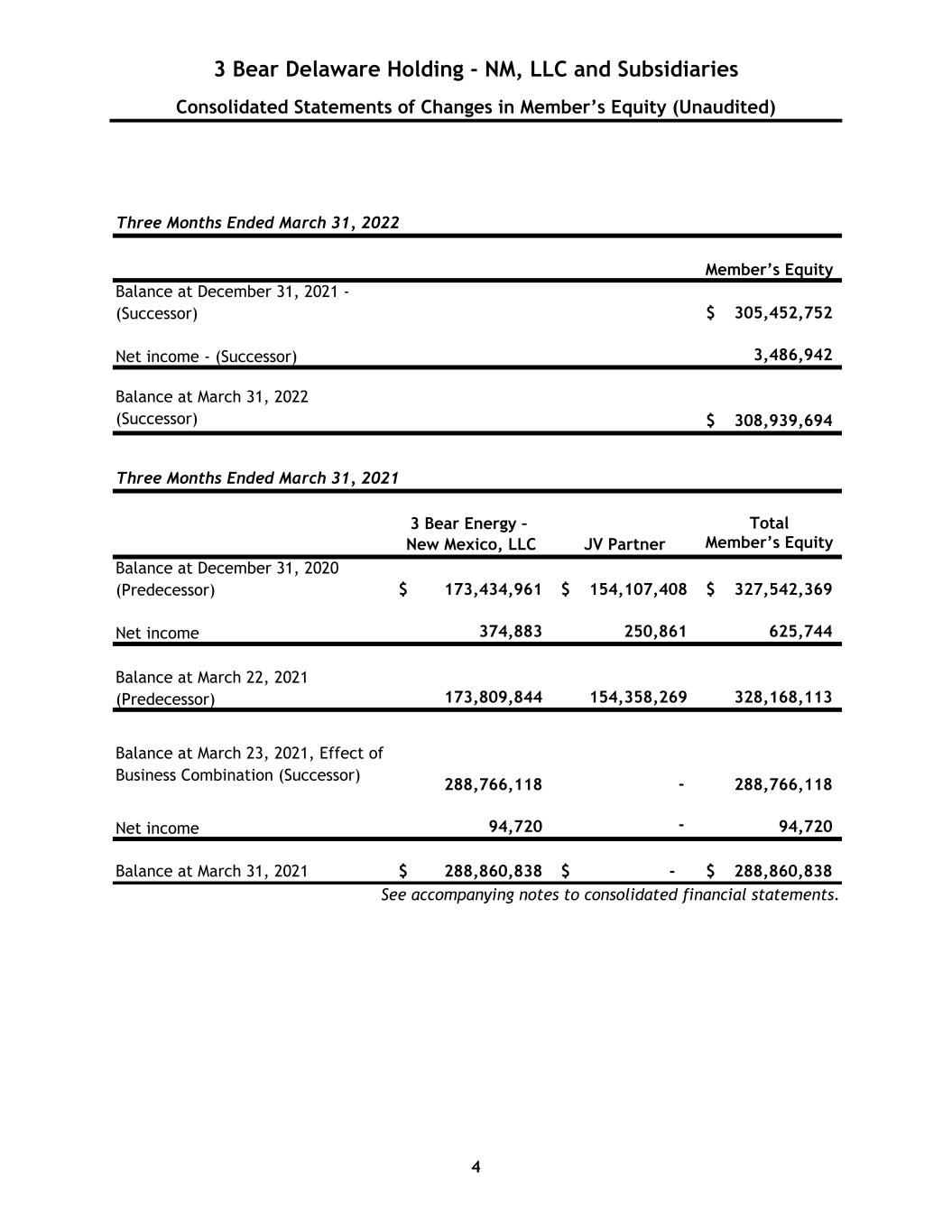

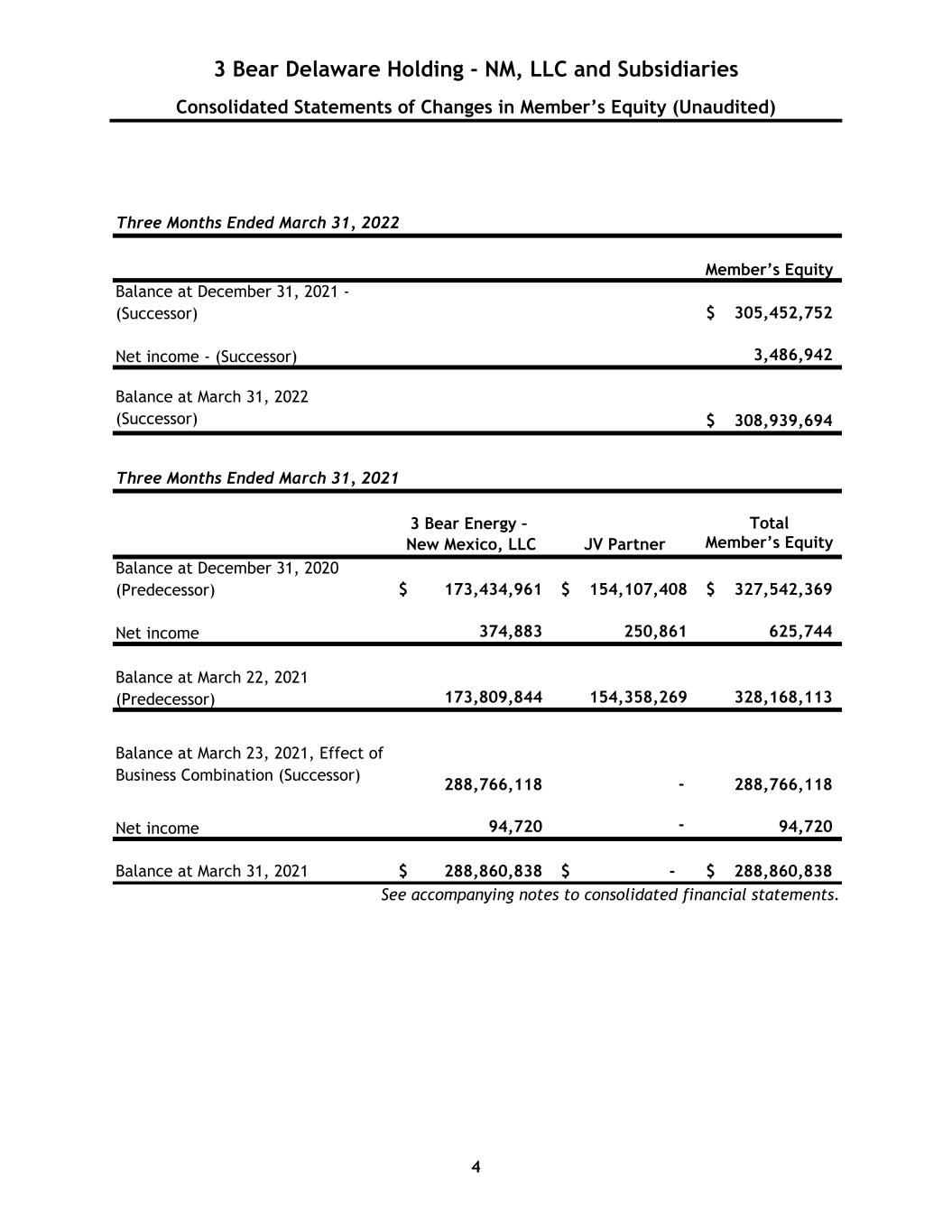

3 Bear Delaware Holding - NM, LLC and Subsidiaries Consolidated Statements of Changes in Member’s Equity (Unaudited) 4 Member’s Equity Balance at December 31, 2021 - (Successor) 305,452,752$ Net income - (Successor) 3,486,942 Balance at March 31, 2022 (Successor) 308,939,694$ 3 Bear Energy – Total New Mexico, LLC JV Partner Member’s Equity Balance at December 31, 2020 (Predecessor) 173,434,961$ 154,107,408$ 327,542,369$ Net income 374,883 250,861 625,744 Balance at March 22, 2021 (Predecessor) 173,809,844 154,358,269 328,168,113 Balance at March 23, 2021, Effect of Business Combination (Successor) 288,766,118 - 288,766,118 Net income 94,720 - 94,720 Balance at March 31, 2021 288,860,838$ $ - 288,860,838$ Three Months Ended March 31, 2022 Three Months Ended March 31, 2021 See accompanying notes to consolidated financial statements.

3 Bear Delaware Holding - NM, LLC and Subsidiaries Consolidated Statements of Cash Flows (Unaudited) 5 Predecessor Three months ended March 31, 2022 For the Period from March 23, 2021 through March 31, 2021 For the Period from January 1, 2021, through March 22, 2021 Cash flows from operating activities: Net income 3,486,942$ 94,720$ 625,744$ Adjustments to reconcile net income to net income to cash provided by (used in) operating activities Depreciation and amortization expense 3,977,899 426,612 3,487,193 Amortization of intangible assets 409,302 - 103,395 Accretion of asset retirement obligations 42,861 5,742 52,836 Amortization of debt issuance costs 86,239 5,074 46,542 Changes in operating assets and liabilities: Trade accounts receivable and accrued revenues (4,524,300) 3,788,779 (5,285,899) Inventory (480,798) 517,187 829,986 Prepaid and other current assets 114,405 (1) (45,167) Accounts payable – trade (622,781) (9,133,198) 11,208,396 Accounts payable – affiliate 308,439 208,397 (427,705) Accrued liabilities 7,186,706 1,883,569 692,409 Other long-term liabilities 290,028 - - Net cash provided by (used in) operating activities 10,274,942 (2,203,119) 11,287,730 Cash flows from investing activities: Purchase of property, plant and equipment (16,115,242) (145,918) (17,997,248) Net cash used in investing activities (16,115,242) (145,918) (17,997,248) Cash flows from financing activities: Proceeds from long-term debt - - 5,000,000 Payments on capital lease (7,074) 117 (6,624) Payment of debt issuance costs (214,874) - (16,949) Net cash provided by (used in) financing activities (221,949) 117 4,976,427 Net change in cash and cash equivalents (6,062,249) (2,348,920) (1,733,091) Cash and cash equivalents, at beginning of period 6,896,120 5,671,849 7,404,940 Cash and cash equivalents, at end of period 833,871$ 3,322,928$ 5,671,849$ Successor Continued.

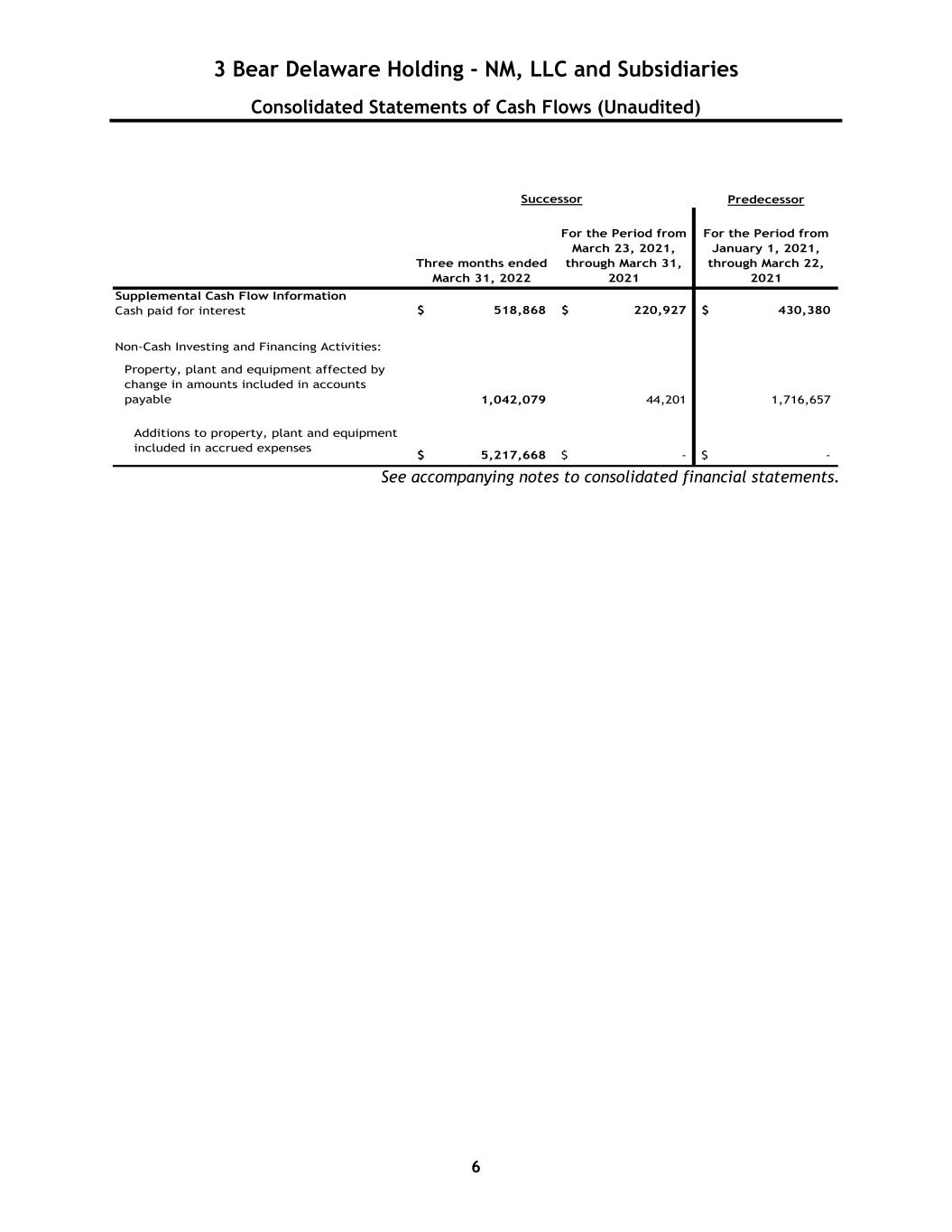

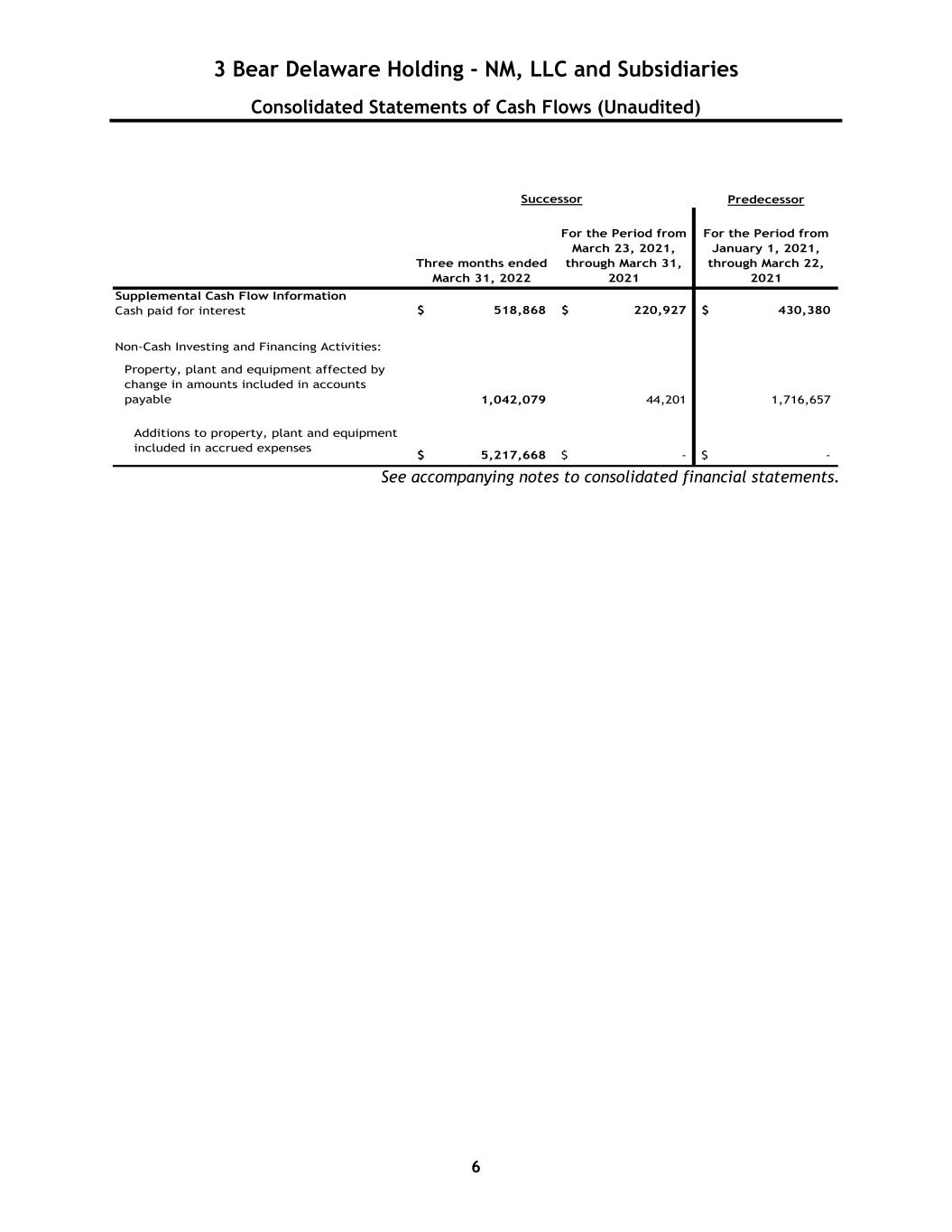

3 Bear Delaware Holding - NM, LLC and Subsidiaries Consolidated Statements of Cash Flows (Unaudited) 6 Predecessor Three months ended March 31, 2022 For the Period from March 23, 2021, through March 31, 2021 For the Period from January 1, 2021, through March 22, 2021 Supplemental Cash Flow Information Cash paid for interest 518,868$ 220,927$ 430,380$ Non-Cash Investing and Financing Activities: Property, plant and equipment affected by change in amounts included in accounts payable 1,042,079 44,201 1,716,657 Additions to property, plant and equipment included in accrued expenses 5,217,668$ -$ -$ Successor See accompanying notes to consolidated financial statements.

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 7 1. Description of Business Organization 3 Bear Delaware Holding - NM, LLC, (the “Company,” or “3BDH-NM”) was formed on June 19, 2017, as a limited liability company in the state of Delaware. The Limited Liability Agreement of the Company (the “Original LLC Agreement”) established 3 Bear Energy – New Mexico, LLC (“3BE-NM”), a wholly-owned subsidiary of 3 Bear Energy, LLC (“3Bear”), as the sole member of the Company. The Original LLC Agreement was amended on September 22, 2017 (the “Amended LLC Agreement”) to allow for an additional member (“JV Partner”) to join the partnership as a 49% member. The Amended LLC Agreement provided for up to $205.4 million of capital contributions from the JV Partner and 3BE-NM. The Board of Directors (the “Board”) approved additional projects from 2017 through 2021 as defined in the LLC agreement, providing for additional capital contributions up to a total of $476.9 million. On March 22, 2021, 3BE-NM purchased the remaining membership interests from the JV Partner. Concurrent with this purchase, the Amended LLC Agreement was amended to redeem the outstanding JV Partner units which resulted in the Company becoming a wholly-owned subsidiary of 3BE-NM. See Note 3. Information presented for the periods ended March 31, 2022 and 2021 is unaudited. Subsidiaries of the Company On May 7, 2017, the Company formed 3 Bear Delaware Operating – NM, LLC (“3BDO-NM”). 3BDO- NM was formed in order to manage the Company’s operations in the Delaware Basin in New Mexico. On June 27, 2017, 3Bear formed 3 Bear Field Services, LLC (“3BFS”). 3BFS was formed in order to manage the operations of the 3Bear’s assets and investments in New Mexico. Effective January 1, 2022, 3Bear contributed 3BFS to the Company. On September 11, 2017, the Company formed 3 Bear Energy – Lynch, LLC (“3BE-L”). 3BE-L was formed in order to manage the operations of a produced water disposal well. On September 11, 2017, the Company formed 3 Bear Energy – Cottonwood, LLC (“3BE-C”). 3BE-C was formed in order to manage the operations of a produced water disposal well. On December 17, 2019, the Company formed 3 Bear Hat Mesa II-NM, LLC (“3BHM”). 3BHM was formed to manage the Company’s crude gathering services. On March 3, 2020, the Company formed 3 Bear Delaware Marketing, LLC (“3BDM”). 3BDM was formed to allow for the Company to provide marketing services to producers. On September 14, 2021, the Company formed 3 Bear G & P Solutions, LLC (“3BGP”). 3BGP was formed to manage the Company’s gas gathering and processing services.

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 8 On September 14, 2021, the Company formed Neptune Recycling, LLC (“Neptune”). Neptune was formed to manage the Company’s water gathering and recycling services. Operations of the Company Primary operations consist of: (1) gathering, storing, compressing, treating, processing and selling natural gas; (2) treating, transporting and selling natural gas liquids (“NGLs”) and NGL products; (3) gathering, storing and terminaling crude oil; and (4) produced water handling and disposal (5) processing and selling the biproducts associated with the services outlined in 1-4. The Company’s operations are in the Delaware Basin in New Mexico. 2. Summary of Significant Accounting Policies Basis of Presentation The accompanying consolidated financial statements have been prepared in accordance with standards generally accepted in the United States of America (“GAAP”). The consolidated financial statements include the accounts and transactions of the Company and its wholly owned subsidiaries. Intercompany accounts and transactions between the entities have been eliminated in consolidation. The financial statements for the periods prior to the March 22, 2021, closing date are referred to as the “Predecessor” and the financial statements for the periods including and after the closing date are referred to as the “Successor”. The consolidated financial statements and related notes should be read in connection with the annual consolidated financial statements and notes and interim results may not be indicative of results for the whole year. Use of Estimates The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of assets and contingent liabilities as of the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from these estimates and such differences could be material. Liquidity and Capital Resources As of March 31, 2022, the Company had a consolidated net working capital deficit of approximately $4.5 million and accumulated earnings of approximately $20.2 million. The Company has projected positive cash flows from operations over the next 12 months and expects positive cash flows from operations. Management believes that it currently has sufficient cash and financing commitments to meet its funding requirements, including debt service through at least June 2023 and beyond. On April 8, 2022, the Company signed a definitive agreement for the sale of 100% of the equity interests of 3Bear Delaware Holding – NM, LLC, to a subsidiary of Delek Logistics Partners, LP for the price of $624.7 million as adjusted under the terms of the agreement. The transaction closed on June 1, 2022.

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 9 Accounting for Business Combinations The Company accounts for acquisitions under Accounting Standards Codification (“ASC”) 805, Business Combinations. Under ASC 805, any acquiring entity is required to recognize the assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at fair value as of the acquisition date. The determination of fair value involves the use of estimates and assumptions, along with the application of various valuation techniques. These estimates include projections of future cash flows related to specific assets and the assessment of future lives based on the expected future period of benefit of the asset. Related acquisition costs are expensed as incurred and are include in selling, general and administrative expense in the accompanying Consolidated Statements of Operations. The Company relied upon Level 3 inputs to value assets and liabilities that were acquired in the business combination that transpired on March 22, 2021 (See Note 3). See Note 7 for further discussion surrounding intangible assets. Cash and Cash Equivalents Cash and cash equivalents include all cash balances and highly liquid investments with an original maturity of three months or less. The Company’s cash and cash equivalents are maintained at one financial institution insured by the Federal Deposit Insurance Corporation (“FDIC”). At March 31, 2022, and December 31, 2021, the Company had amounts in excess of FDIC insured limits. The Company has never experienced losses related to these balances, and management believes that the risk is not significant. The Company had $0.6 million and $6.6 million of uninsured cash and cash equivalents as of March 31, 2022, and December 31, 2021, respectively. Trade Accounts Receivable and Accrued Revenues Accounts receivable are reported net of the allowance for doubtful accounts. Accrued revenues represent amounts due from producer customers that have yet to be invoiced. The Company’s assessment of the allowance for doubtful accounts is based on several factors, including the overall creditworthiness of the customer, existing economic conditions, and the amount and age of past due accounts. At March 31, 2022, and December 31, 2021, the Company determined an allowance for doubtful accounts was not considered necessary. Trade accounts receivable as of March 31, 2022, were $16,473,790 and accrued revenues were $3,171,643 respectively. Trade accounts receivable as of December 31, 2021, were $12,014,136 and accrued revenues were $3,106,997 respectively. Inventory Inventory, which consist primarily of crude oil, skim oil, and condensate, are recorded at the lower of weighted-average cost or net realizable value. Prepaid and Other Current Assets Prepaid and other current assets include items such as prepaid insurance and refundable deposits and represents amounts that are expected to be received or realized within twelve months.

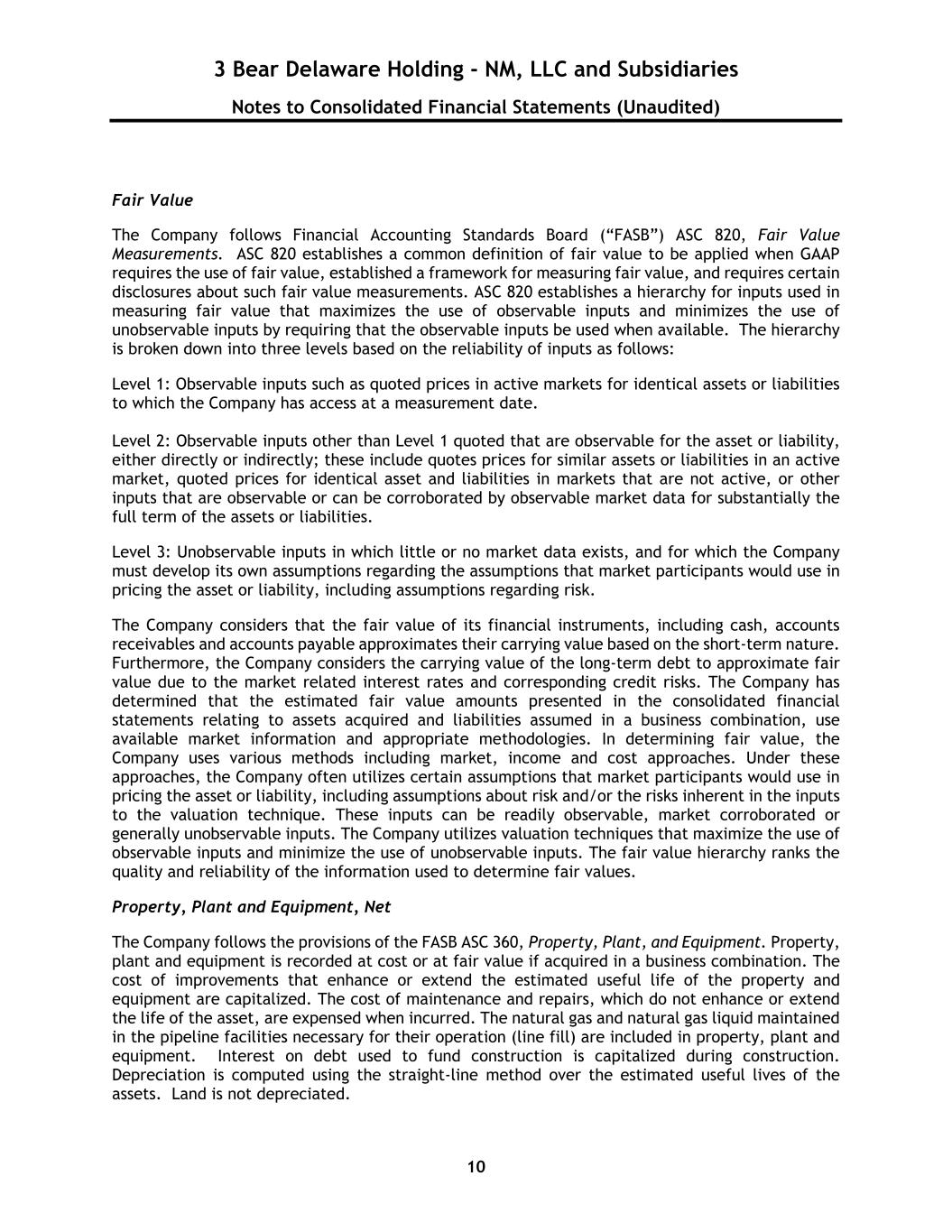

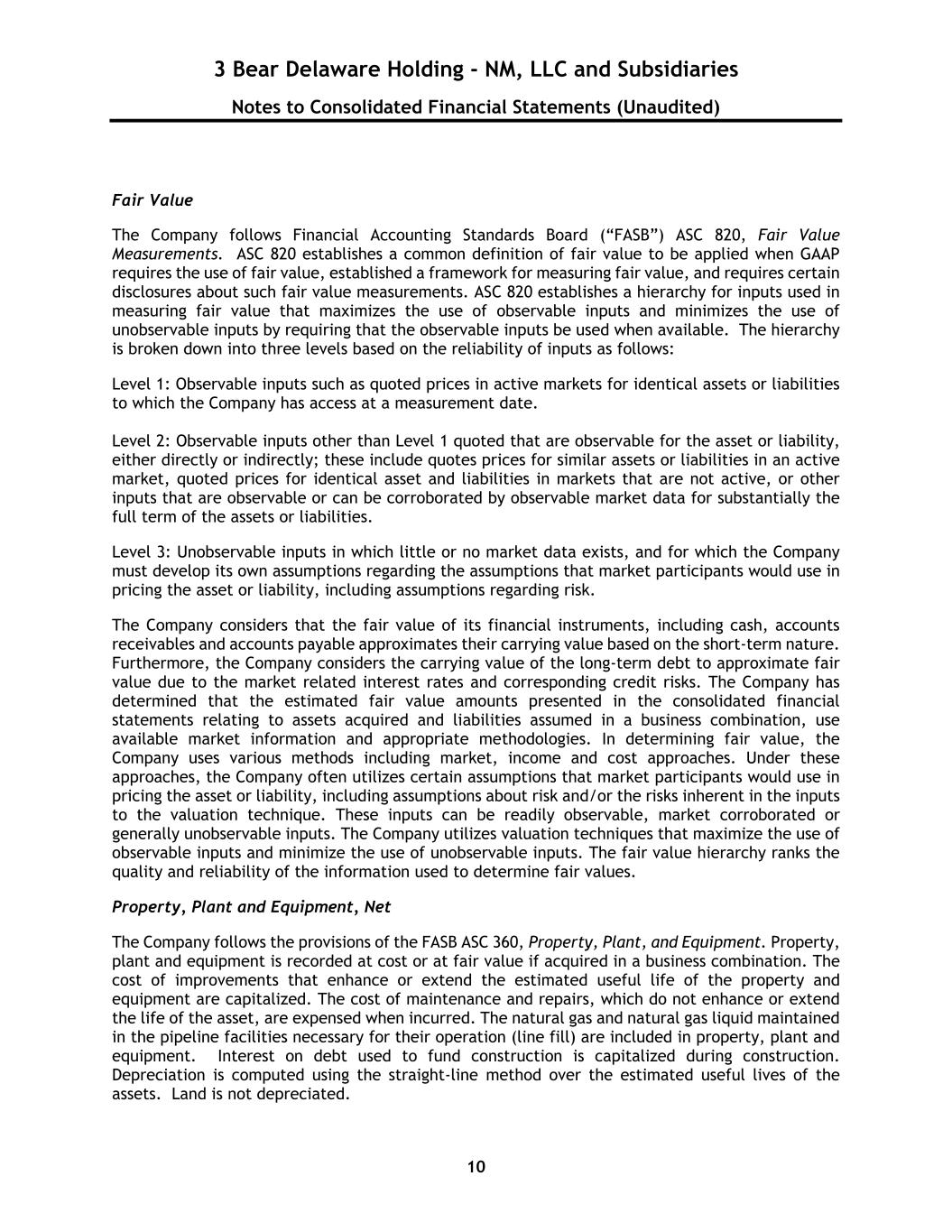

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 10 Fair Value The Company follows Financial Accounting Standards Board (“FASB”) ASC 820, Fair Value Measurements. ASC 820 establishes a common definition of fair value to be applied when GAAP requires the use of fair value, established a framework for measuring fair value, and requires certain disclosures about such fair value measurements. ASC 820 establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the observable inputs be used when available. The hierarchy is broken down into three levels based on the reliability of inputs as follows: Level 1: Observable inputs such as quoted prices in active markets for identical assets or liabilities to which the Company has access at a measurement date. Level 2: Observable inputs other than Level 1 quoted that are observable for the asset or liability, either directly or indirectly; these include quotes prices for similar assets or liabilities in an active market, quoted prices for identical asset and liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Level 3: Unobservable inputs in which little or no market data exists, and for which the Company must develop its own assumptions regarding the assumptions that market participants would use in pricing the asset or liability, including assumptions regarding risk. The Company considers that the fair value of its financial instruments, including cash, accounts receivables and accounts payable approximates their carrying value based on the short-term nature. Furthermore, the Company considers the carrying value of the long-term debt to approximate fair value due to the market related interest rates and corresponding credit risks. The Company has determined that the estimated fair value amounts presented in the consolidated financial statements relating to assets acquired and liabilities assumed in a business combination, use available market information and appropriate methodologies. In determining fair value, the Company uses various methods including market, income and cost approaches. Under these approaches, the Company often utilizes certain assumptions that market participants would use in pricing the asset or liability, including assumptions about risk and/or the risks inherent in the inputs to the valuation technique. These inputs can be readily observable, market corroborated or generally unobservable inputs. The Company utilizes valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs. The fair value hierarchy ranks the quality and reliability of the information used to determine fair values. Property, Plant and Equipment, Net The Company follows the provisions of the FASB ASC 360, Property, Plant, and Equipment. Property, plant and equipment is recorded at cost or at fair value if acquired in a business combination. The cost of improvements that enhance or extend the estimated useful life of the property and equipment are capitalized. The cost of maintenance and repairs, which do not enhance or extend the life of the asset, are expensed when incurred. The natural gas and natural gas liquid maintained in the pipeline facilities necessary for their operation (line fill) are included in property, plant and equipment. Interest on debt used to fund construction is capitalized during construction. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Land is not depreciated.

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 11 Construction in progress is stated at cost, which includes the cost of construction and other direct costs attributable to construction including internal development and interest costs that meet capitalization criteria. No provision for depreciation is made on construction in progress until such time as the relevant assets are completed and put into use. When items of property, plant and equipment are sold or otherwise disposed of, any gains or losses are reported in the statements of income. Gains or losses on the disposal of property, plant and equipment are recognized when they occur, which is generally at the time of closing or when the loss on the asset is determined. If a loss on disposal is expected such losses are recognized when the assets are classified as held for sale. The Company periodically evaluates the carrying value of long-lived assets, including property, plant and equipment, when circumstances indicate the carrying value of those assets may not be recoverable to determine if the asset is impaired. The carrying amount is not recoverable if it exceeds the sum of undiscounted cash flows expected to result from the use and eventual disposition of the asset. The Company considers various factors when determining if these assets should be evaluated for impairment. As of March 31, 2022, and December 31, 2021, the Company determined there were no indicators of an impairment. Contract Assets Contract assets represent consideration paid to customers and are accounted for under ASC 606 Revenue from Contracts with Customers. Contract assets are amortized as a reduction in the amount of revenue recognized as the performance obligations from the contract are satisfied based on the volume of production units delivered to the Company. The previously recognized contract assets were adjusted to fair value upon 3BE-NM's purchase of the remaining membership interest from the JV Partner on March 22, 2021, and are now included as part of the customer contracts intangible balance that is amortized over 30 years. Asset Retirement Obligations The Company records a liability for asset retirement obligations (“ARO”) only if and when a future asset retirement obligation with a determinable life is identified. The Company recognizes liabilities for the anticipated future costs of dismantlement and abandonment of their facilities by increasing the carrying amount of the related long-lived asset at the time the asset is acquired. The fair value of the asset retirement obligations is estimated using Level 3 inputs which comprise of expected future costs discounted to present value. The asset retirement cost is depreciated over the life of the asset. Accretion expense represents the increase to the discounted liability toward its expected settlement value and is included in depreciation, amortization, and accretion in the Consolidated Statements of Operations. For identified asset retirement obligations, the Company evaluates whether the expected date and related costs of retirement can be estimated. The Company records a liability in the period the obligation is incurred and estimable. An ARO is initially recorded at its estimated fair value with a corresponding increase to property, plant and equipment. This increase in property, plant and equipment is then depreciated over the useful life of the asset to which that liability relates. Accretion expense is recognized for changes in the fair value of the liability as a result of the passage of time, which is recorded as accretion expense on the Company’s Consolidated Statements of Operations. See Note 10 for further discussion of the Company’s AROs.

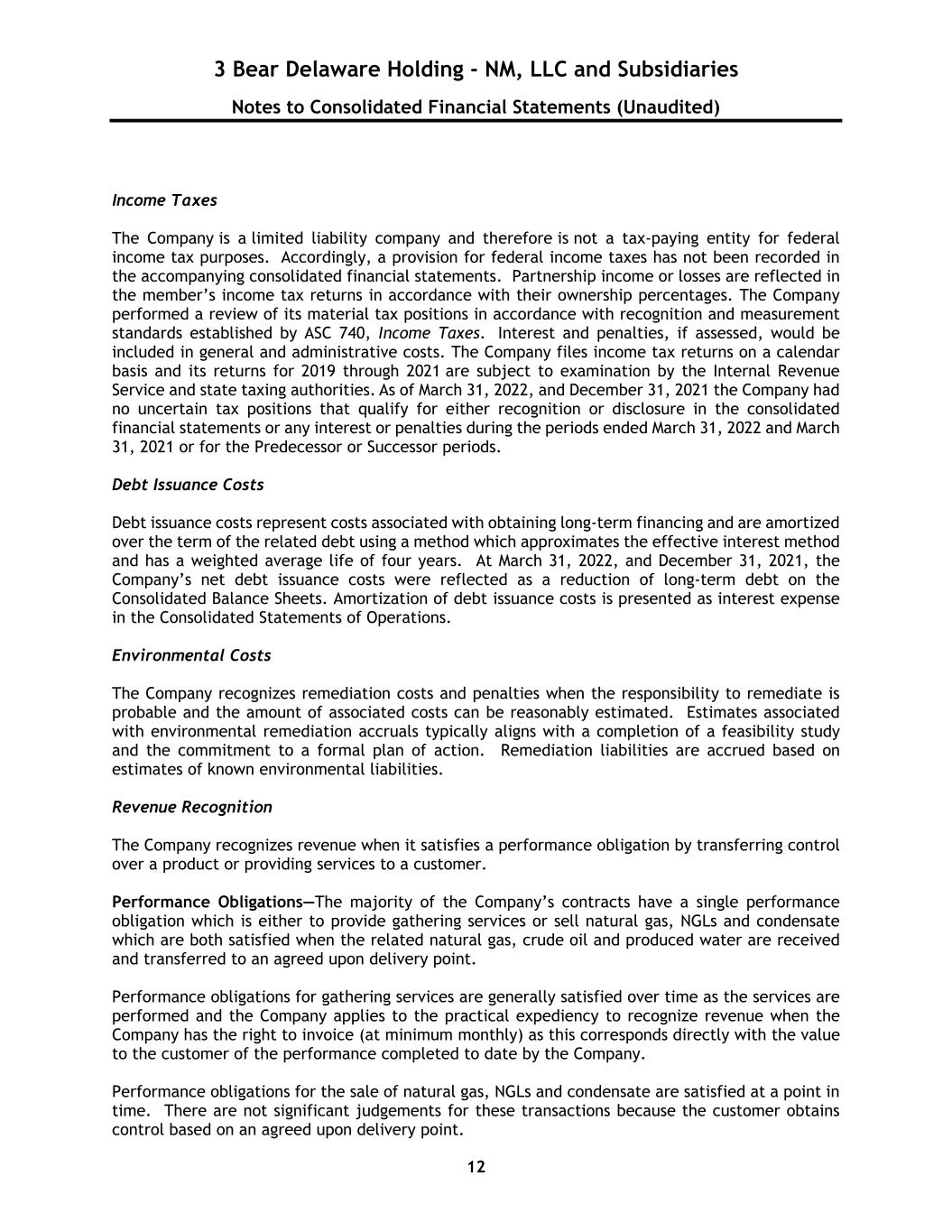

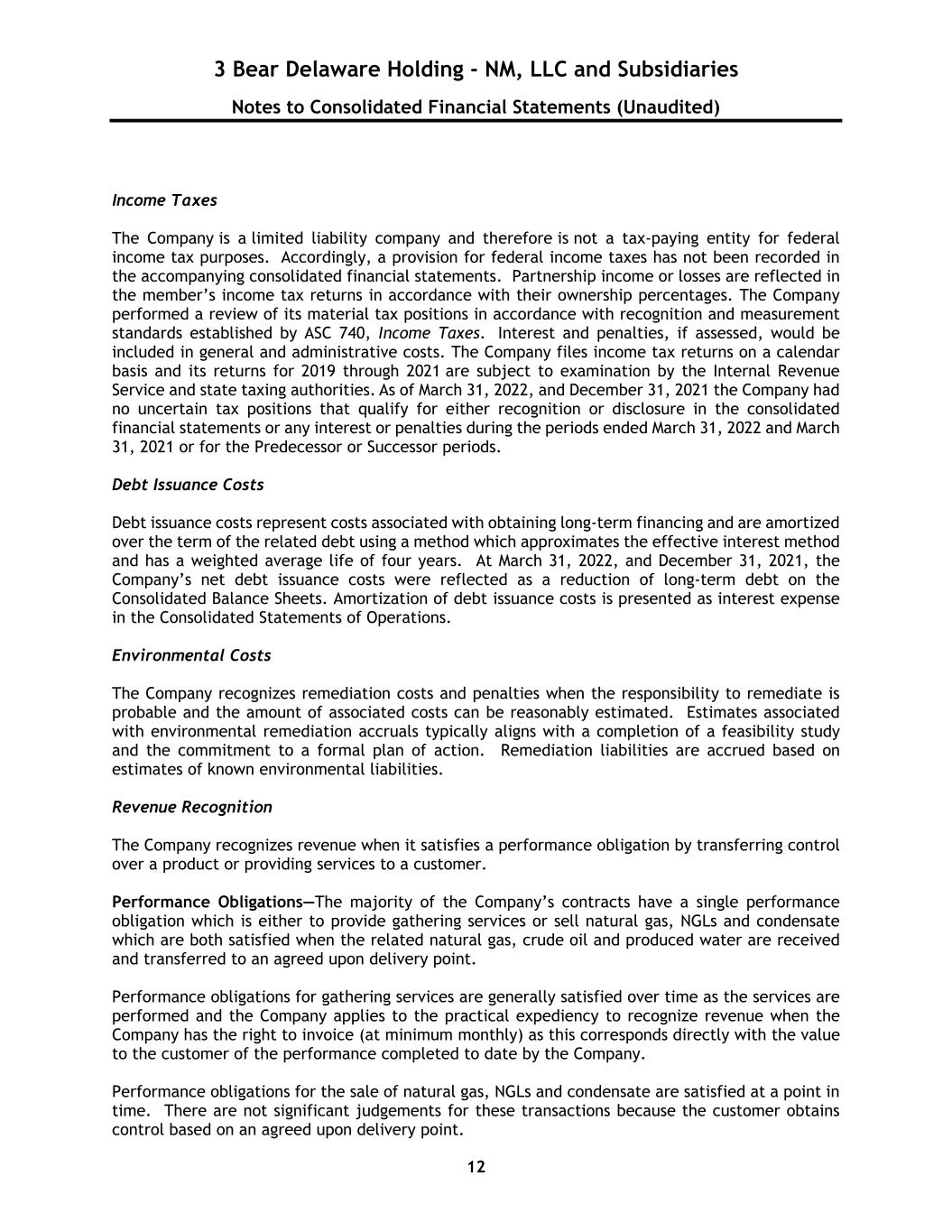

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 12 Income Taxes The Company is a limited liability company and therefore is not a tax-paying entity for federal income tax purposes. Accordingly, a provision for federal income taxes has not been recorded in the accompanying consolidated financial statements. Partnership income or losses are reflected in the member’s income tax returns in accordance with their ownership percentages. The Company performed a review of its material tax positions in accordance with recognition and measurement standards established by ASC 740, Income Taxes. Interest and penalties, if assessed, would be included in general and administrative costs. The Company files income tax returns on a calendar basis and its returns for 2019 through 2021 are subject to examination by the Internal Revenue Service and state taxing authorities. As of March 31, 2022, and December 31, 2021 the Company had no uncertain tax positions that qualify for either recognition or disclosure in the consolidated financial statements or any interest or penalties during the periods ended March 31, 2022 and March 31, 2021 or for the Predecessor or Successor periods. Debt Issuance Costs Debt issuance costs represent costs associated with obtaining long-term financing and are amortized over the term of the related debt using a method which approximates the effective interest method and has a weighted average life of four years. At March 31, 2022, and December 31, 2021, the Company’s net debt issuance costs were reflected as a reduction of long-term debt on the Consolidated Balance Sheets. Amortization of debt issuance costs is presented as interest expense in the Consolidated Statements of Operations. Environmental Costs The Company recognizes remediation costs and penalties when the responsibility to remediate is probable and the amount of associated costs can be reasonably estimated. Estimates associated with environmental remediation accruals typically aligns with a completion of a feasibility study and the commitment to a formal plan of action. Remediation liabilities are accrued based on estimates of known environmental liabilities. Revenue Recognition The Company recognizes revenue when it satisfies a performance obligation by transferring control over a product or providing services to a customer. Performance Obligations—The majority of the Company’s contracts have a single performance obligation which is either to provide gathering services or sell natural gas, NGLs and condensate which are both satisfied when the related natural gas, crude oil and produced water are received and transferred to an agreed upon delivery point. Performance obligations for gathering services are generally satisfied over time as the services are performed and the Company applies to the practical expediency to recognize revenue when the Company has the right to invoice (at minimum monthly) as this corresponds directly with the value to the customer of the performance completed to date by the Company. Performance obligations for the sale of natural gas, NGLs and condensate are satisfied at a point in time. There are not significant judgements for these transactions because the customer obtains control based on an agreed upon delivery point.

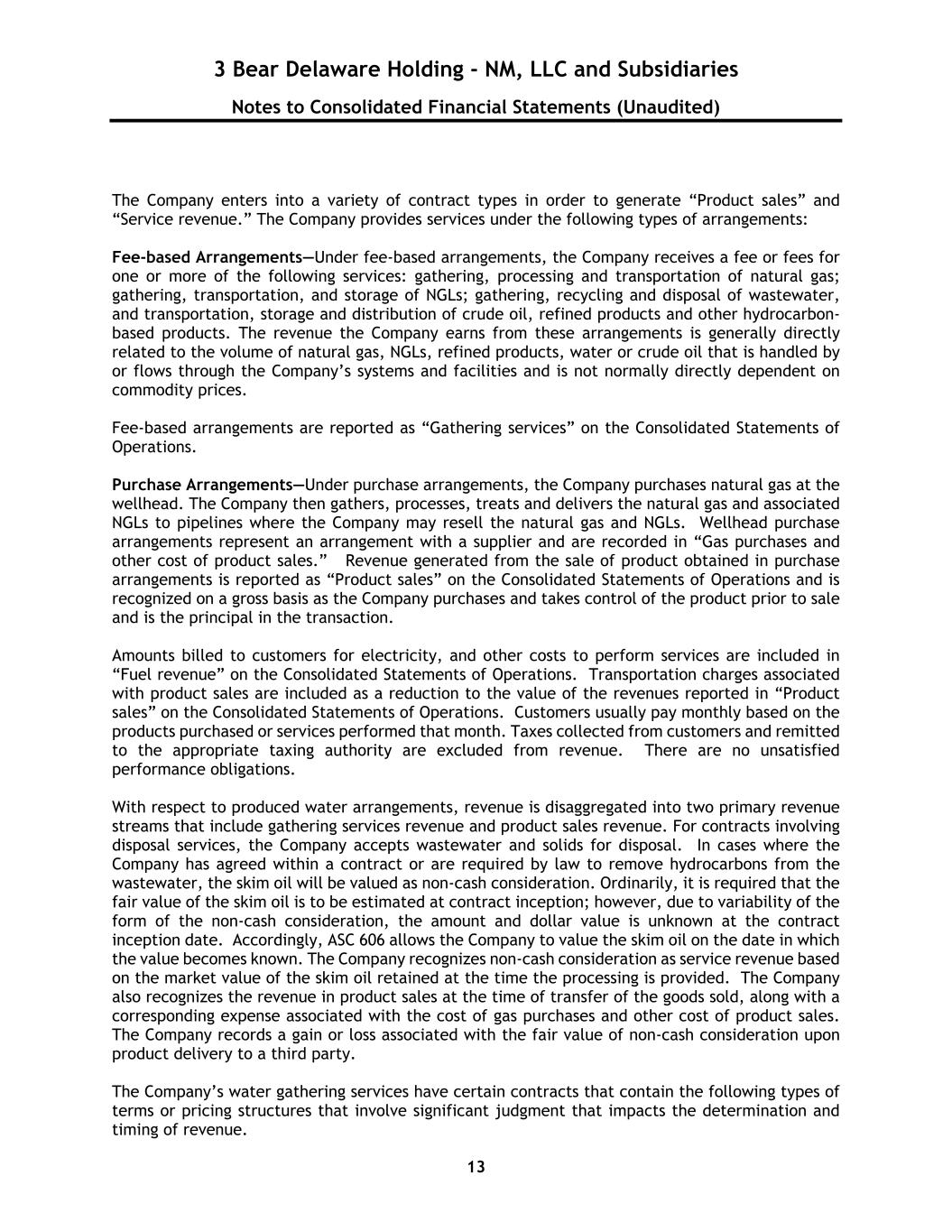

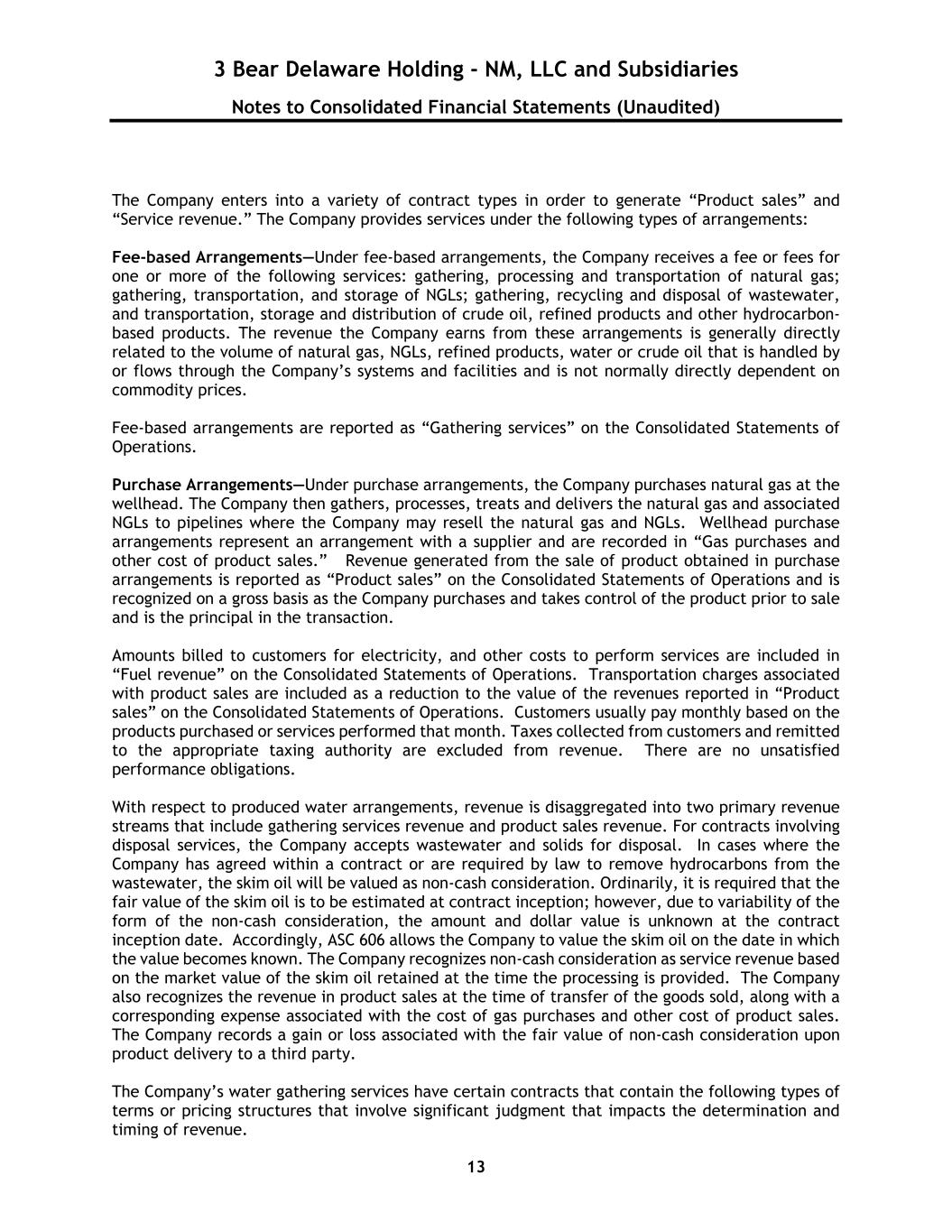

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 13 The Company enters into a variety of contract types in order to generate “Product sales” and “Service revenue.” The Company provides services under the following types of arrangements: Fee-based Arrangements—Under fee-based arrangements, the Company receives a fee or fees for one or more of the following services: gathering, processing and transportation of natural gas; gathering, transportation, and storage of NGLs; gathering, recycling and disposal of wastewater, and transportation, storage and distribution of crude oil, refined products and other hydrocarbon- based products. The revenue the Company earns from these arrangements is generally directly related to the volume of natural gas, NGLs, refined products, water or crude oil that is handled by or flows through the Company’s systems and facilities and is not normally directly dependent on commodity prices. Fee-based arrangements are reported as “Gathering services” on the Consolidated Statements of Operations. Purchase Arrangements—Under purchase arrangements, the Company purchases natural gas at the wellhead. The Company then gathers, processes, treats and delivers the natural gas and associated NGLs to pipelines where the Company may resell the natural gas and NGLs. Wellhead purchase arrangements represent an arrangement with a supplier and are recorded in “Gas purchases and other cost of product sales.” Revenue generated from the sale of product obtained in purchase arrangements is reported as “Product sales” on the Consolidated Statements of Operations and is recognized on a gross basis as the Company purchases and takes control of the product prior to sale and is the principal in the transaction. Amounts billed to customers for electricity, and other costs to perform services are included in “Fuel revenue” on the Consolidated Statements of Operations. Transportation charges associated with product sales are included as a reduction to the value of the revenues reported in “Product sales” on the Consolidated Statements of Operations. Customers usually pay monthly based on the products purchased or services performed that month. Taxes collected from customers and remitted to the appropriate taxing authority are excluded from revenue. There are no unsatisfied performance obligations. With respect to produced water arrangements, revenue is disaggregated into two primary revenue streams that include gathering services revenue and product sales revenue. For contracts involving disposal services, the Company accepts wastewater and solids for disposal. In cases where the Company has agreed within a contract or are required by law to remove hydrocarbons from the wastewater, the skim oil will be valued as non-cash consideration. Ordinarily, it is required that the fair value of the skim oil is to be estimated at contract inception; however, due to variability of the form of the non-cash consideration, the amount and dollar value is unknown at the contract inception date. Accordingly, ASC 606 allows the Company to value the skim oil on the date in which the value becomes known. The Company recognizes non-cash consideration as service revenue based on the market value of the skim oil retained at the time the processing is provided. The Company also recognizes the revenue in product sales at the time of transfer of the goods sold, along with a corresponding expense associated with the cost of gas purchases and other cost of product sales. The Company records a gain or loss associated with the fair value of non-cash consideration upon product delivery to a third party. The Company’s water gathering services have certain contracts that contain the following types of terms or pricing structures that involve significant judgment that impacts the determination and timing of revenue.

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 14 Tiered Pricing—For contracts with tiered pricing provisions, the period in which the tiers are earned and settled (i.e. the “reset period”) may vary from monthly to over a period of multiple months. If the tiered pricing is based on a month, the fee is allocated to the distinct daily service to which it relates. If the tiered pricing spans across multiple reporting periods, the total transaction price is estimated at the beginning of each reset period, based on the expected volumes. Estimates of variable consideration are revised at each reporting date throughout each reset period. For the successor and predecessor periods, there was no adjustment required from the amounts billed to customers. For all of the Company’s disposal contracts, revenue will be recognized over time utilizing the output method based on the volume of wastewater or solids accepted from the customer. For contracts that involve the sale of recovered hydrocarbons and recycled wastewater, revenue will be recognized at a point in time, based on when control of the product is transferred to the customer. Quantities of natural gas or NGLs over-delivered or under-delivered related to imbalance agreements with customers, producers or pipelines are recorded monthly as prepaid expenses or accrued liabilities using current market prices or the weighted-average prices of natural gas or NGLs at the plant or system. These balances are settled with deliveries of natural gas or NGLs, or with cash. Amounts at March 31, 2022, and December 31, 2021, were included in accrued liabilities and were immaterial. 3. Business Combination On March 22, 2021, 3BE-NM acquired the JV Partner’s remaining membership interests in the Company, which was accounted for as a business combination under ASC 805, Business Combinations (the “Business Combination”). The Company elected to apply pushdown accounting as a result of the change in ownership of the Company. Fair value estimates are based on a complex series of judgments about future events and uncertainties and rely heavily on estimates and assumptions. The judgments used to determine the estimated fair value assigned to each class of assets acquired and liabilities assumed, as well as asset lives and the expected future cash flows and related discount rates, can impact the Company’s financial statements. Significant Level 3 inputs used for the model included the estimated future cash flows, the expected period the cash flows are expected to be generated, and the discount rates.

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 15 The following table summarizes the allocation of the consideration transferred to the identified assets acquired and liabilities assumed as of the acquisition date (Rounded): Cash consideration $ 32,000,000 Contingent consideration 2,700,000 Fair value of 3BE-NM’s previously held interest in the Company 173,000,000 Total consideration transferred $ 207,700,000 Fair Value of Assets Acquired Cash and cash equivalents $ 5,672,000 Accounts receivable 17,333,000 Inventory 731,000 Prepaid and other current assets 540,000 Gathering systems and facilities 303,341,000 Land 2,480,000 Intangible assets 43,983,000 Other long-term assets 500,000 Total Fair Value of Assets Acquired $ 374,580,000 Fair Value of Liabilities Assumed Accounts payable $ 19,575,000 Accrued liabilities 4,457,000 Asset retirement obligations 2,068,000 Long-term debt 59,714,000 Total Fair Value of Liabilities Assumed $ 85,814,000 Fair value of net identifiable assets $ 288,766,000 Bargain purchase gain $ 81,066,000 Transaction costs associated with the Business Combination were approximately $203,000 and were recorded as general and administrative expenses in the consolidated statement of operations for the period from March 23, 2021, to December 31, 2021 (Successor). The fair value of the net identifiable assets exceeded the consideration transferred which resulted in the recognition of a bargain purchase gain. The bargain purchase gain was recorded by the Company as an adjustment to member’s equity. The bargain purchase gain resulted from the JV Partner needing to sell its remaining ownership interest at a lack of a competitive bidding process due to restrictions in the Amended LLC Agreement. 4. Agreements and Transactions with Related Parties 3 Bear Field Services, LLC The Company has no employees (operating or maintenance). Facility and general and administrative services, including insurance not directly paid by the Company are provided to the Company under a System Operating Agreement (SOA), effective on September 22, 2017, with 3 Bear Field Services, LLC (“3BFS”), a separate wholly-owned subsidiary of 3Bear. Under the SOA, the Company is required to reimburse 3BFS for any direct costs or expense (other than general and administration services) incurred by 3BFS on the Company’s behalf. Additionally, the Company pays 3BFS a monthly service fee (adjusted annually based on the Company’s prior year’s annual EBITDA), for centralized corporate functions provided by 3BFS on the Company’s

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 16 behalf, including legal, accounting, cash management, insurance administration, risk management, health, safety and environmental, information technology, human resources, payroll, taxes and engineering. Except with respect to the service fee, there is no limit on the reimbursements the Company will make to 3BFS under the SOA for other expense and expenditures incurred or payment made on the Company’s behalf. The SOA shall continue for a term of five years, and from year to year thereafter unless terminated in accordance with the agreement. Effective with the March 22, 2021, purchase of the JV membership interests in 3BDH, the SOA was amended to increase the monthly service fee to reflect actual costs incurred. Effective January 1, 2022, 3Bear contributed 3BFS to the Company. The contribution effectively terminated the SOA agreement. The Company incurred the following fees associated with the SOA: Successor Predecessor Three months ended For the Period from March 23, 2021 through For the Period from January 1, 2021 through March 31, March 31, March 22, 2022 2021 2021 Labor and benefits included in property, plant and equipment -$ 31,761$ 285,844$ Direct expenses included in operations and maintenance expense - 181,699 1,635,287 Management fee included in general and administrative expenses - 16,321 146,888 Total -$ 229,781$ 2,068,019$ As of March 31, 2022, and December 31, 2021, amounts payable to affiliates, associated with the SOA, were included in accounts payable – affiliate, totaling $0 and $174,303, respectively. Contracts with JV Partner In August 2017, the Company entered into a crude oil gathering agreement, a gas gathering processing and purchase agreement, and a produced water gathering agreement with a US oil and natural gas exploration and production company, and the sole owner of the JV Partner. Effective after March 22, 2021, the JV Partner is no longer an affiliate of the Company. Certain members with interest in 3 Bear’s investor units perform professional services for the Company. Legal and consulting fees paid to these firms was $0 and $151,000 for the three months ended March 31, 2022, and the period from March 23 to March 31, 2021 (Successor), respectively, and $140,000 for the period from January 1 to March 22, 2021 (Predecessor). 5. Revenue The transaction price in the Company’s contracts is primarily based on the volume of natural gas, crude oil or produced water transferred by the Company’s gathering systems to the customers’ agreed upon delivery point multiplied by the contractual rate. For contracts containing noncash consideration such as condensate and skim oil, the Company recognizes revenue based on the market value of the product retained at the time the processing is provided. The Company also recognizes the revenue in product sales at the time of transfer of the goods sold, and a corresponding cost in gas purchases and other cost of product sales.

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 17 Contract Assets Prior to the 3BE-NM’s purchase of the remaining membership interest for the JV Partner, the contract assets relate to consideration paid to third parties for their commitment to use the Company’s services. These assets were amortized over 10 years based on estimated production volumes during the period compared to total projected production volumes over the life of the associated contracts and presented as a reduction of revenue. The contract asset was adjusted to zero upon acquisition of the remaining membership interest from the JV partner on March 22, 2021, and remeasured to fair value and presented within the customer contracts intangible assets as further described in Note 7. The following table provides information about contract assets from contracts with customers: Successor Predecessor For the Period from For the Period from March 23, 2021, January 1, 2021, Three months ended through through March 31, March 31, March 22, 2022 2021 2021 Contract assets, beginning of period -$ -$ 16,723,419$ Additions - - - Amortization of contract assets - - (103,395) Contract assets, end of period -$ -$ 16,620,024$ Significant Customers and Concentrations of Credit Risk As of and for the periods ended December 31, 2021, and March 22, 2021, revenues and accounts receivable from the Company’s customers with greater than 10% of total revenues or accounts receivable was as follows: As of March 31, 2022, and for the Period Ended March 31, 2022 (Successor) Revenues Accounts and Accrued Receivables Customer A $ 22,780,061 $ 9,129,687 Customer B $ 8,171,995 $ 3,274,147 Customer C $ 4,691,250 $ 1,800,000

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 18 For the Period from March 22, 2021 to March 31, 2021 (Successor) Revenues Accounts and Accrued Receivables Customer A $ 798,258 $ 3,828,416 Customer B $ 813,121 $ 1,681,386 Customer D $ 260,156 $ 1,560,445 As of March 22, 2021, and for the Period from January 1, 2021 to March 22, 2021 (Predecessor) Revenues Accounts and Accrued Receivables Customer B $ 8,334,495 $ 868,265 Customer A $ 8,182,149 $ 3,030,158 Customer D $ 2,666,600 $ 1,300,289 6. Property, Plant and Equipment, Net Property, plant and equipment consisted of the following: Estimated Useful Life (in years) March 31, 2022 December 31, 2021 Gathering facilities, processing systems and related equipment 25-30 326,409,166$ 323,156,134$ Land N/A 2,480,000 2,480,000 Construction in progress N/A 25,616,024 8,583,758 Other property and equipment 3-6 261,033 255,498 Total property, plant and equipment 354,766,224 334,475,390 Less accumulated depreciation (12,733,503) (8,755,601) Property, plant and equipment, net 342,032,721$ 325,719,789$ Depreciation expense was approximately $4.0 million and $0.4 million for the three months ended March 31, 2022 (Successor), and the period from March 23 to March 31, 2021 (Successor), respectively, and $3.5 million for the period from January 1 to March 22, 2021 (Predecessor). No Interest was capitalized (including amortization of debt issuance costs) for the Successor or Predecessor periods. The Company has approximately $57.6 million of additional estimated project costs associated with construction in progress projects that are expected to be completed within the next year.

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 19 7. Intangible Assets, Net Identifiable intangible assets as of March 31, 2022, consist of customer contracts with third parties. The intangible asset balance as of March 31, 2022, and December 31, 2021, was as follows: Intangible Assets March 31, 2022 December 31, 2021 Customer contracts $43,983,000 $43,983,000 Accumulated amortization (1,680,870) (1,271,568) Intangible assets, net $42,302,130 $42,711,432 The customer contracts are being amortized over a straight-line basis over a weighted average of approximately 29 years as this approximates the timing that the economic benefit of the customer contracts is expected to be received. Amortization expense for the Company’s intangible assets was $0.4 million for the three months ended March 31, 2022. As of March 31,2022, estimated future amortization expense for each of the five succeeding years and thereafter is as follows: Period or Year Ending December 31, Remainder of 2022 1,227,908$ 2023 1,637,211 2024 1,637,211 2025 1,637,211 2026 1,637,211 Thereafter 34,525,378 Total 42,302,130$ 8. Accrued Liabilities Accrued liabilities consisted of the following: March 31,2022 December 21, 2021 Gas purchases and other cost of revenues 11,626,211$ 7,039,518$ Accrued property, plant and equipment additions 7,062,383 - Operating expenses 3,243,303 2,449,167 Interest 115,362 128,738 Other 284,911 75,212 Total accrued liabilities 22,332,170$ 9,692,635$

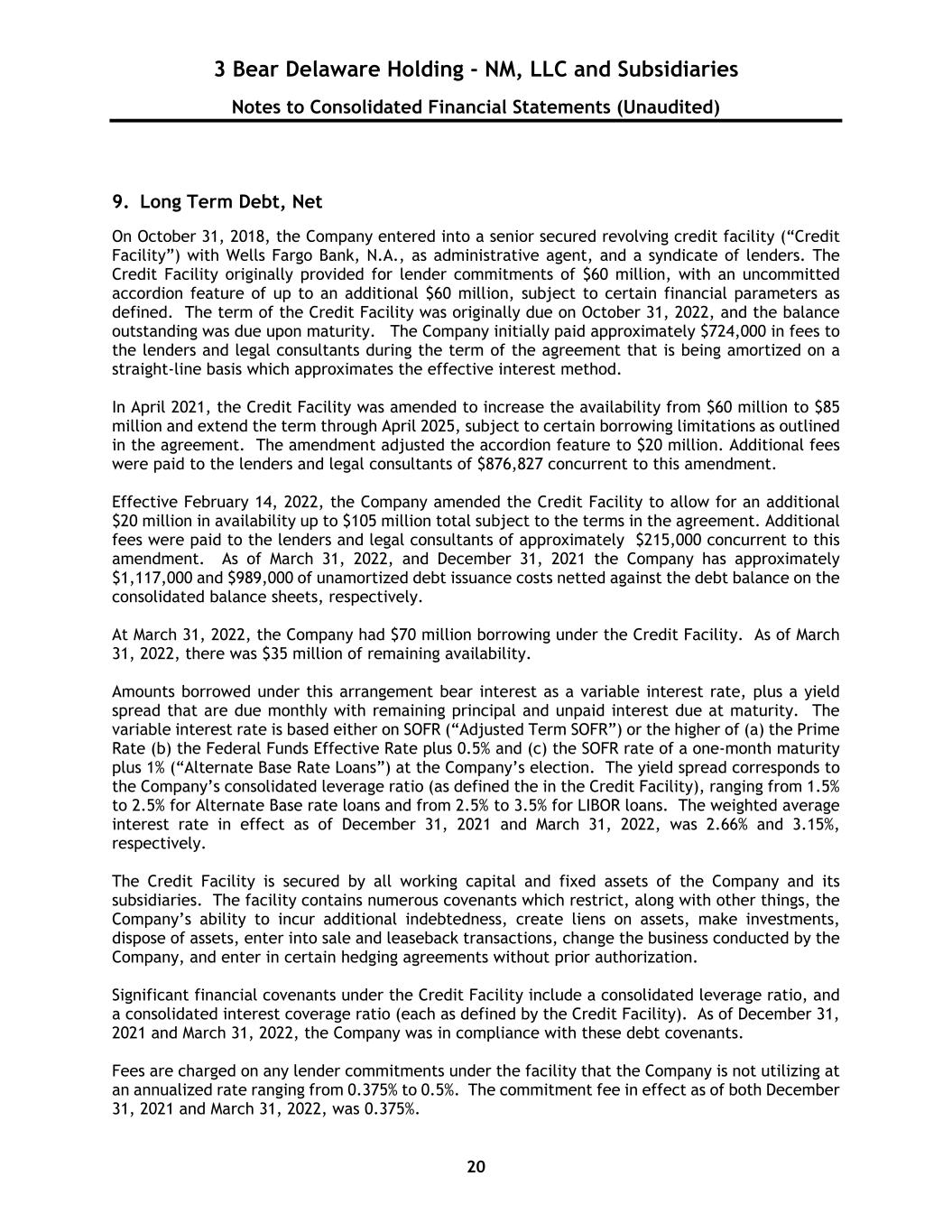

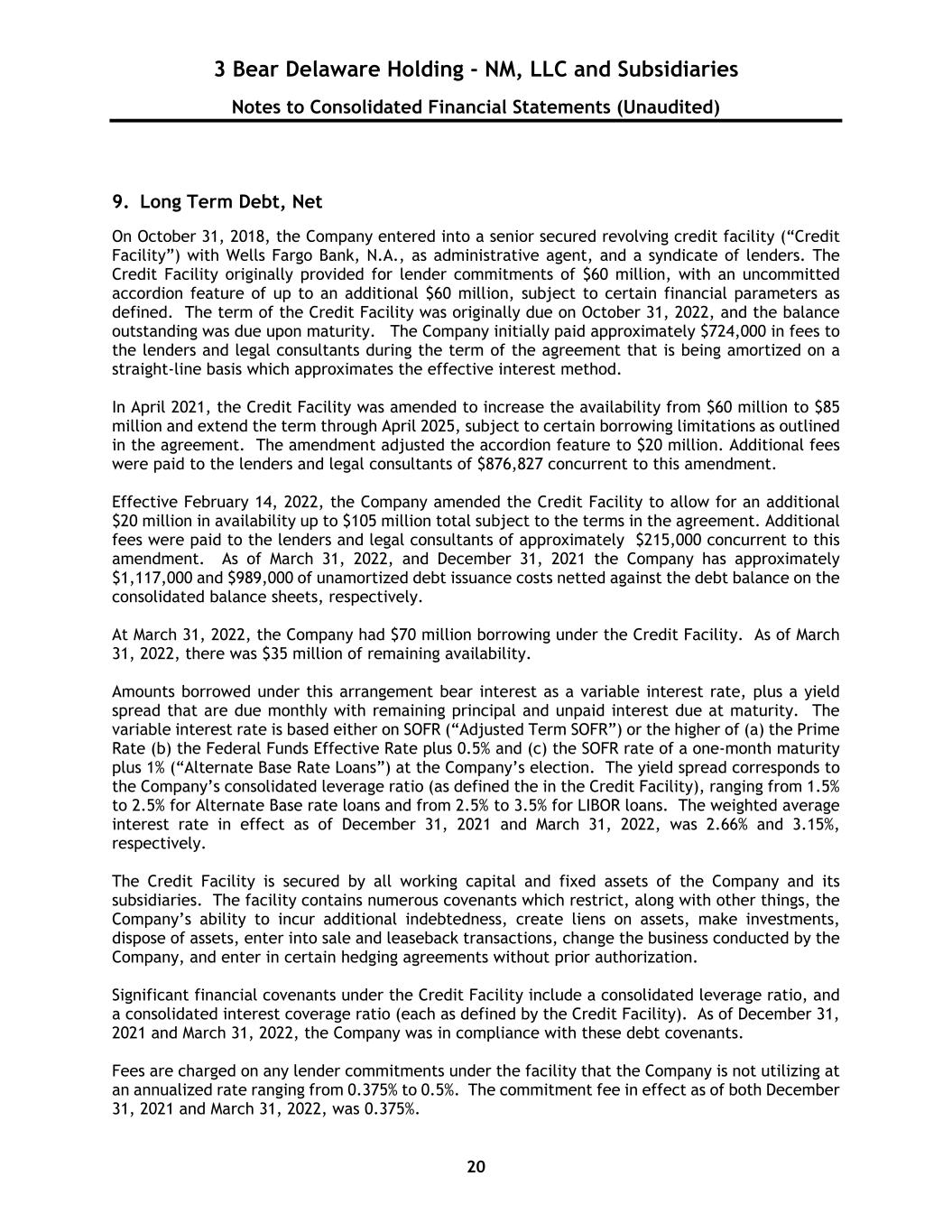

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 20 9. Long Term Debt, Net On October 31, 2018, the Company entered into a senior secured revolving credit facility (“Credit Facility”) with Wells Fargo Bank, N.A., as administrative agent, and a syndicate of lenders. The Credit Facility originally provided for lender commitments of $60 million, with an uncommitted accordion feature of up to an additional $60 million, subject to certain financial parameters as defined. The term of the Credit Facility was originally due on October 31, 2022, and the balance outstanding was due upon maturity. The Company initially paid approximately $724,000 in fees to the lenders and legal consultants during the term of the agreement that is being amortized on a straight-line basis which approximates the effective interest method. In April 2021, the Credit Facility was amended to increase the availability from $60 million to $85 million and extend the term through April 2025, subject to certain borrowing limitations as outlined in the agreement. The amendment adjusted the accordion feature to $20 million. Additional fees were paid to the lenders and legal consultants of $876,827 concurrent to this amendment. Effective February 14, 2022, the Company amended the Credit Facility to allow for an additional $20 million in availability up to $105 million total subject to the terms in the agreement. Additional fees were paid to the lenders and legal consultants of approximately $215,000 concurrent to this amendment. As of March 31, 2022, and December 31, 2021 the Company has approximately $1,117,000 and $989,000 of unamortized debt issuance costs netted against the debt balance on the consolidated balance sheets, respectively. At March 31, 2022, the Company had $70 million borrowing under the Credit Facility. As of March 31, 2022, there was $35 million of remaining availability. Amounts borrowed under this arrangement bear interest as a variable interest rate, plus a yield spread that are due monthly with remaining principal and unpaid interest due at maturity. The variable interest rate is based either on SOFR (“Adjusted Term SOFR”) or the higher of (a) the Prime Rate (b) the Federal Funds Effective Rate plus 0.5% and (c) the SOFR rate of a one-month maturity plus 1% (“Alternate Base Rate Loans”) at the Company’s election. The yield spread corresponds to the Company’s consolidated leverage ratio (as defined the in the Credit Facility), ranging from 1.5% to 2.5% for Alternate Base rate loans and from 2.5% to 3.5% for LIBOR loans. The weighted average interest rate in effect as of December 31, 2021 and March 31, 2022, was 2.66% and 3.15%, respectively. The Credit Facility is secured by all working capital and fixed assets of the Company and its subsidiaries. The facility contains numerous covenants which restrict, along with other things, the Company’s ability to incur additional indebtedness, create liens on assets, make investments, dispose of assets, enter into sale and leaseback transactions, change the business conducted by the Company, and enter in certain hedging agreements without prior authorization. Significant financial covenants under the Credit Facility include a consolidated leverage ratio, and a consolidated interest coverage ratio (each as defined by the Credit Facility). As of December 31, 2021 and March 31, 2022, the Company was in compliance with these debt covenants. Fees are charged on any lender commitments under the facility that the Company is not utilizing at an annualized rate ranging from 0.375% to 0.5%. The commitment fee in effect as of both December 31, 2021 and March 31, 2022, was 0.375%.

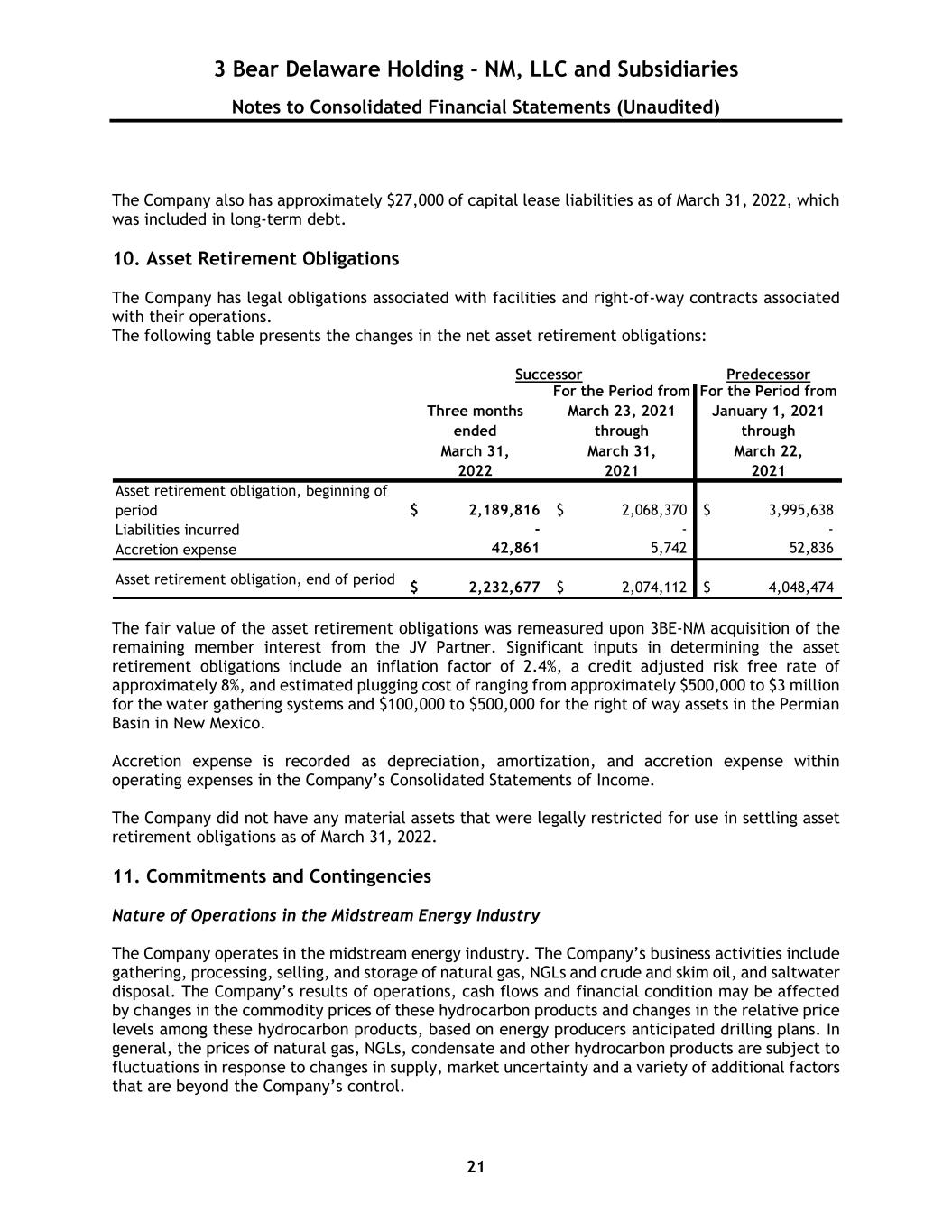

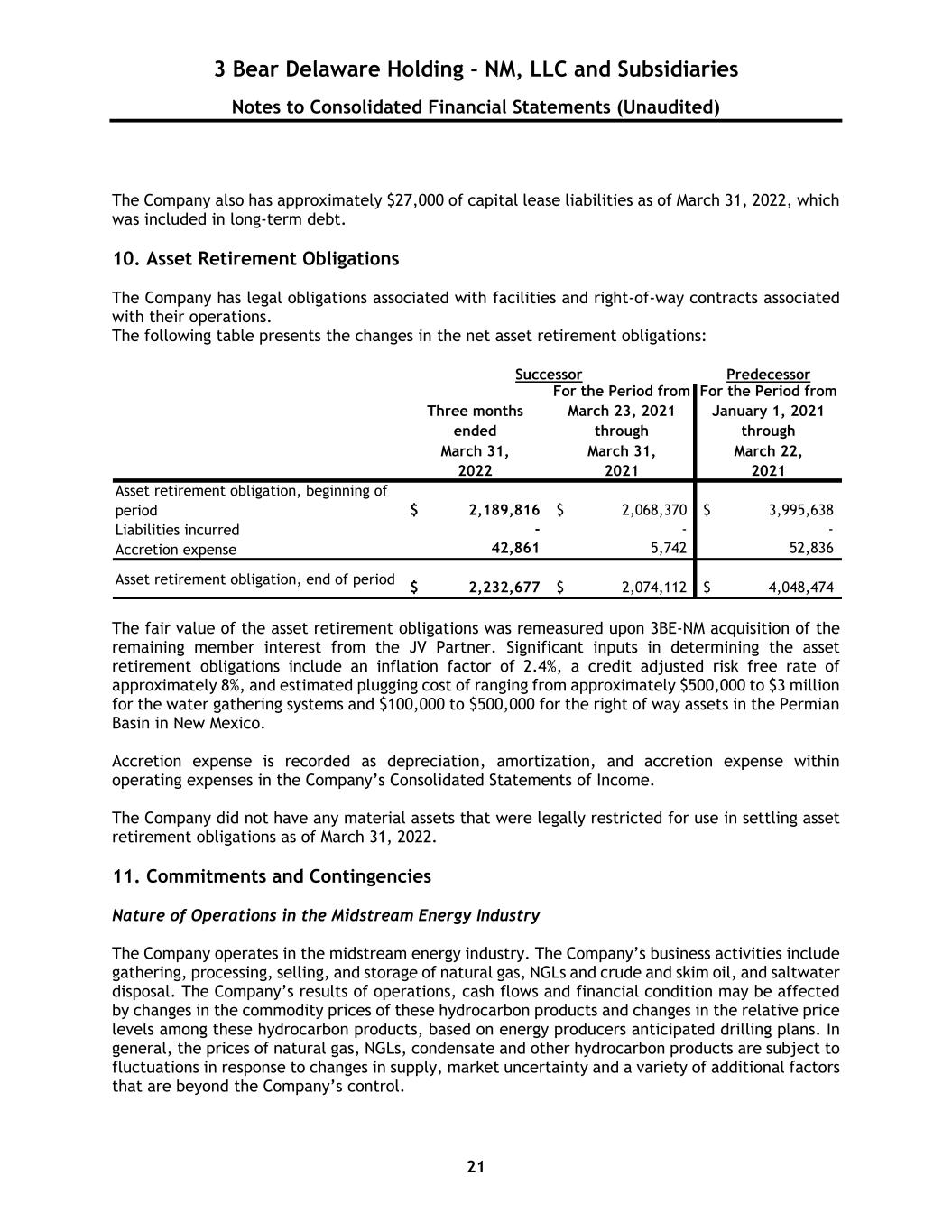

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 21 The Company also has approximately $27,000 of capital lease liabilities as of March 31, 2022, which was included in long-term debt. 10. Asset Retirement Obligations The Company has legal obligations associated with facilities and right-of-way contracts associated with their operations. The following table presents the changes in the net asset retirement obligations: Successor Predecessor Three months ended For the Period from March 23, 2021 through For the Period from January 1, 2021 through March 31, March 31, March 22, 2022 2021 2021 Asset retirement obligation, beginning of period 2,189,816$ 2,068,370$ 3,995,638$ Liabilities incurred - - - Accretion expense 42,861 5,742 52,836 Asset retirement obligation, end of period 2,232,677$ 2,074,112$ 4,048,474$ The fair value of the asset retirement obligations was remeasured upon 3BE-NM acquisition of the remaining member interest from the JV Partner. Significant inputs in determining the asset retirement obligations include an inflation factor of 2.4%, a credit adjusted risk free rate of approximately 8%, and estimated plugging cost of ranging from approximately $500,000 to $3 million for the water gathering systems and $100,000 to $500,000 for the right of way assets in the Permian Basin in New Mexico. Accretion expense is recorded as depreciation, amortization, and accretion expense within operating expenses in the Company’s Consolidated Statements of Income. The Company did not have any material assets that were legally restricted for use in settling asset retirement obligations as of March 31, 2022. 11. Commitments and Contingencies Nature of Operations in the Midstream Energy Industry The Company operates in the midstream energy industry. The Company’s business activities include gathering, processing, selling, and storage of natural gas, NGLs and crude and skim oil, and saltwater disposal. The Company’s results of operations, cash flows and financial condition may be affected by changes in the commodity prices of these hydrocarbon products and changes in the relative price levels among these hydrocarbon products, based on energy producers anticipated drilling plans. In general, the prices of natural gas, NGLs, condensate and other hydrocarbon products are subject to fluctuations in response to changes in supply, market uncertainty and a variety of additional factors that are beyond the Company’s control.

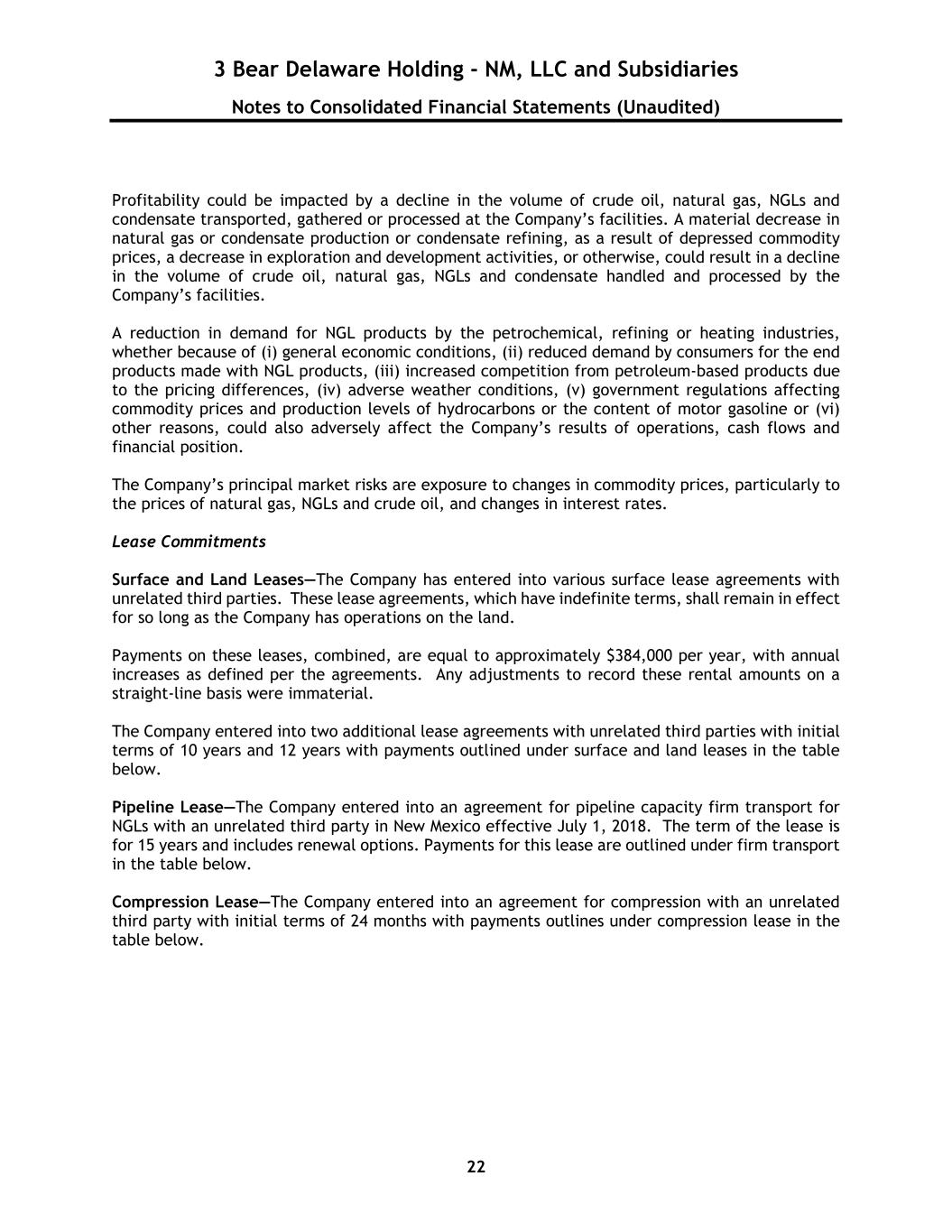

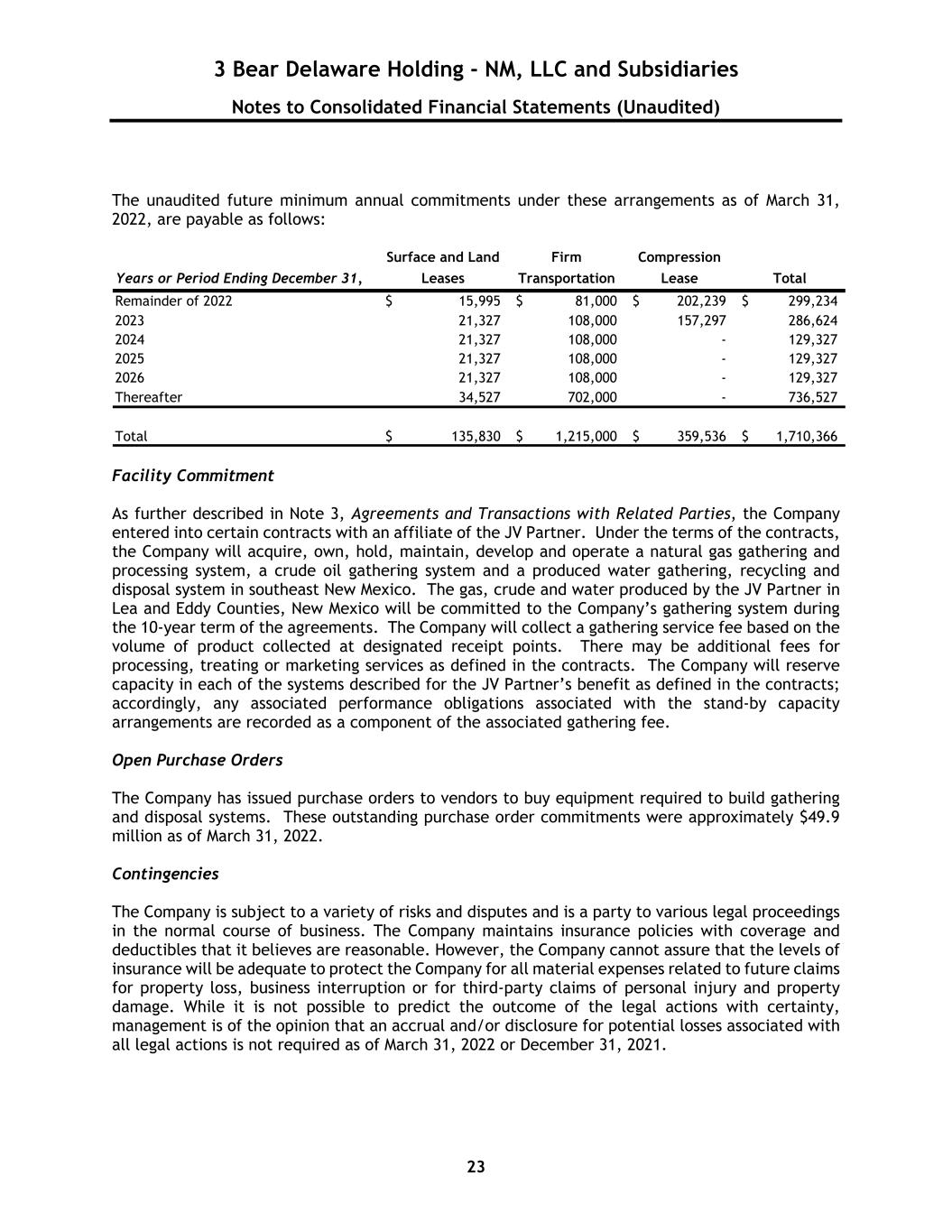

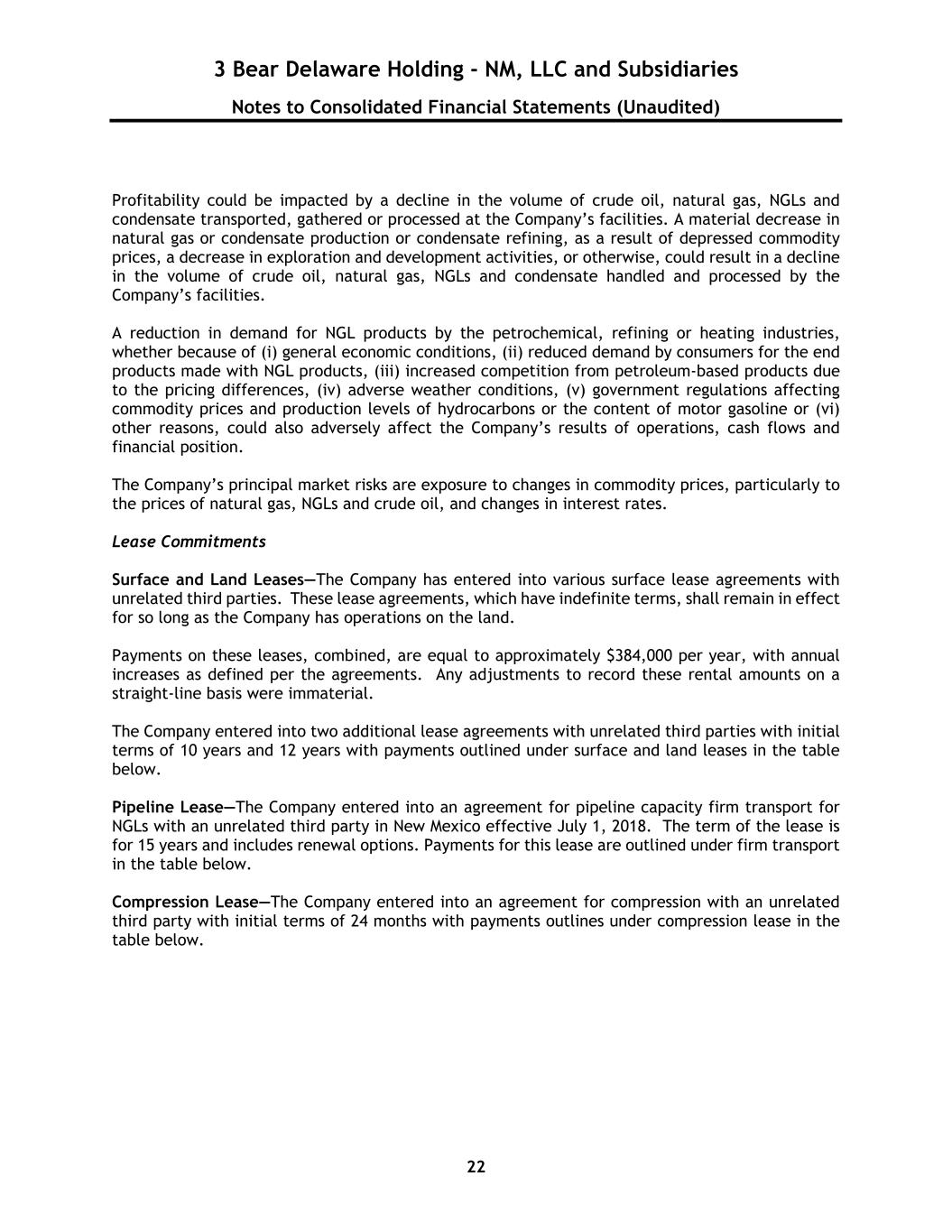

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 22 Profitability could be impacted by a decline in the volume of crude oil, natural gas, NGLs and condensate transported, gathered or processed at the Company’s facilities. A material decrease in natural gas or condensate production or condensate refining, as a result of depressed commodity prices, a decrease in exploration and development activities, or otherwise, could result in a decline in the volume of crude oil, natural gas, NGLs and condensate handled and processed by the Company’s facilities. A reduction in demand for NGL products by the petrochemical, refining or heating industries, whether because of (i) general economic conditions, (ii) reduced demand by consumers for the end products made with NGL products, (iii) increased competition from petroleum-based products due to the pricing differences, (iv) adverse weather conditions, (v) government regulations affecting commodity prices and production levels of hydrocarbons or the content of motor gasoline or (vi) other reasons, could also adversely affect the Company’s results of operations, cash flows and financial position. The Company’s principal market risks are exposure to changes in commodity prices, particularly to the prices of natural gas, NGLs and crude oil, and changes in interest rates. Lease Commitments Surface and Land Leases—The Company has entered into various surface lease agreements with unrelated third parties. These lease agreements, which have indefinite terms, shall remain in effect for so long as the Company has operations on the land. Payments on these leases, combined, are equal to approximately $384,000 per year, with annual increases as defined per the agreements. Any adjustments to record these rental amounts on a straight-line basis were immaterial. The Company entered into two additional lease agreements with unrelated third parties with initial terms of 10 years and 12 years with payments outlined under surface and land leases in the table below. Pipeline Lease—The Company entered into an agreement for pipeline capacity firm transport for NGLs with an unrelated third party in New Mexico effective July 1, 2018. The term of the lease is for 15 years and includes renewal options. Payments for this lease are outlined under firm transport in the table below. Compression Lease—The Company entered into an agreement for compression with an unrelated third party with initial terms of 24 months with payments outlines under compression lease in the table below.

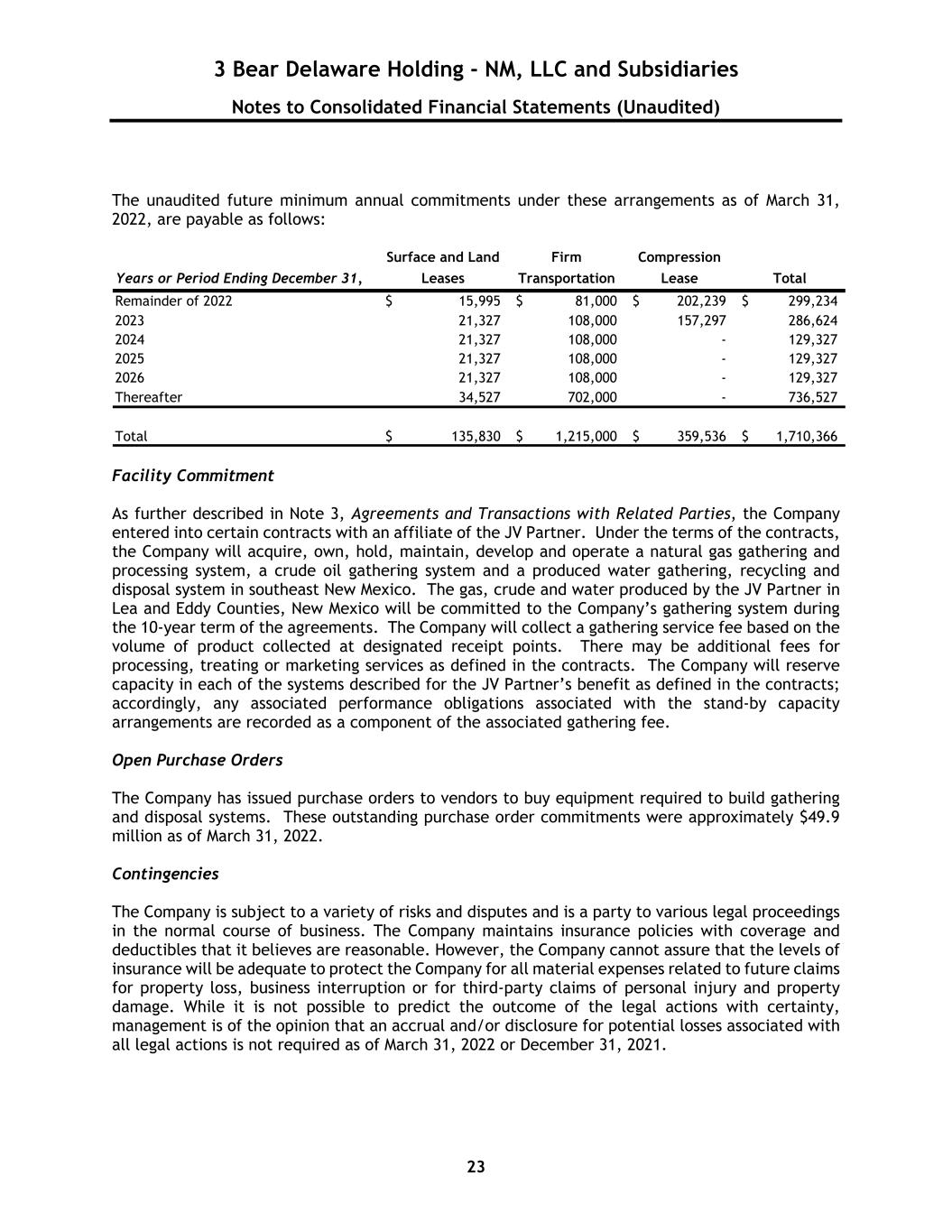

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 23 The unaudited future minimum annual commitments under these arrangements as of March 31, 2022, are payable as follows: Surface and Land Firm Compression Years or Period Ending December 31, Leases Transportation Lease Total Remainder of 2022 15,995$ 81,000$ 202,239$ 299,234$ 2023 21,327 108,000 157,297 286,624 2024 21,327 108,000 - 129,327 2025 21,327 108,000 - 129,327 2026 21,327 108,000 - 129,327 Thereafter 34,527 702,000 - 736,527 Total 135,830$ 1,215,000$ 359,536$ 1,710,366$ Facility Commitment As further described in Note 3, Agreements and Transactions with Related Parties, the Company entered into certain contracts with an affiliate of the JV Partner. Under the terms of the contracts, the Company will acquire, own, hold, maintain, develop and operate a natural gas gathering and processing system, a crude oil gathering system and a produced water gathering, recycling and disposal system in southeast New Mexico. The gas, crude and water produced by the JV Partner in Lea and Eddy Counties, New Mexico will be committed to the Company’s gathering system during the 10-year term of the agreements. The Company will collect a gathering service fee based on the volume of product collected at designated receipt points. There may be additional fees for processing, treating or marketing services as defined in the contracts. The Company will reserve capacity in each of the systems described for the JV Partner’s benefit as defined in the contracts; accordingly, any associated performance obligations associated with the stand-by capacity arrangements are recorded as a component of the associated gathering fee. Open Purchase Orders The Company has issued purchase orders to vendors to buy equipment required to build gathering and disposal systems. These outstanding purchase order commitments were approximately $49.9 million as of March 31, 2022. Contingencies The Company is subject to a variety of risks and disputes and is a party to various legal proceedings in the normal course of business. The Company maintains insurance policies with coverage and deductibles that it believes are reasonable. However, the Company cannot assure that the levels of insurance will be adequate to protect the Company for all material expenses related to future claims for property loss, business interruption or for third-party claims of personal injury and property damage. While it is not possible to predict the outcome of the legal actions with certainty, management is of the opinion that an accrual and/or disclosure for potential losses associated with all legal actions is not required as of March 31, 2022 or December 31, 2021.

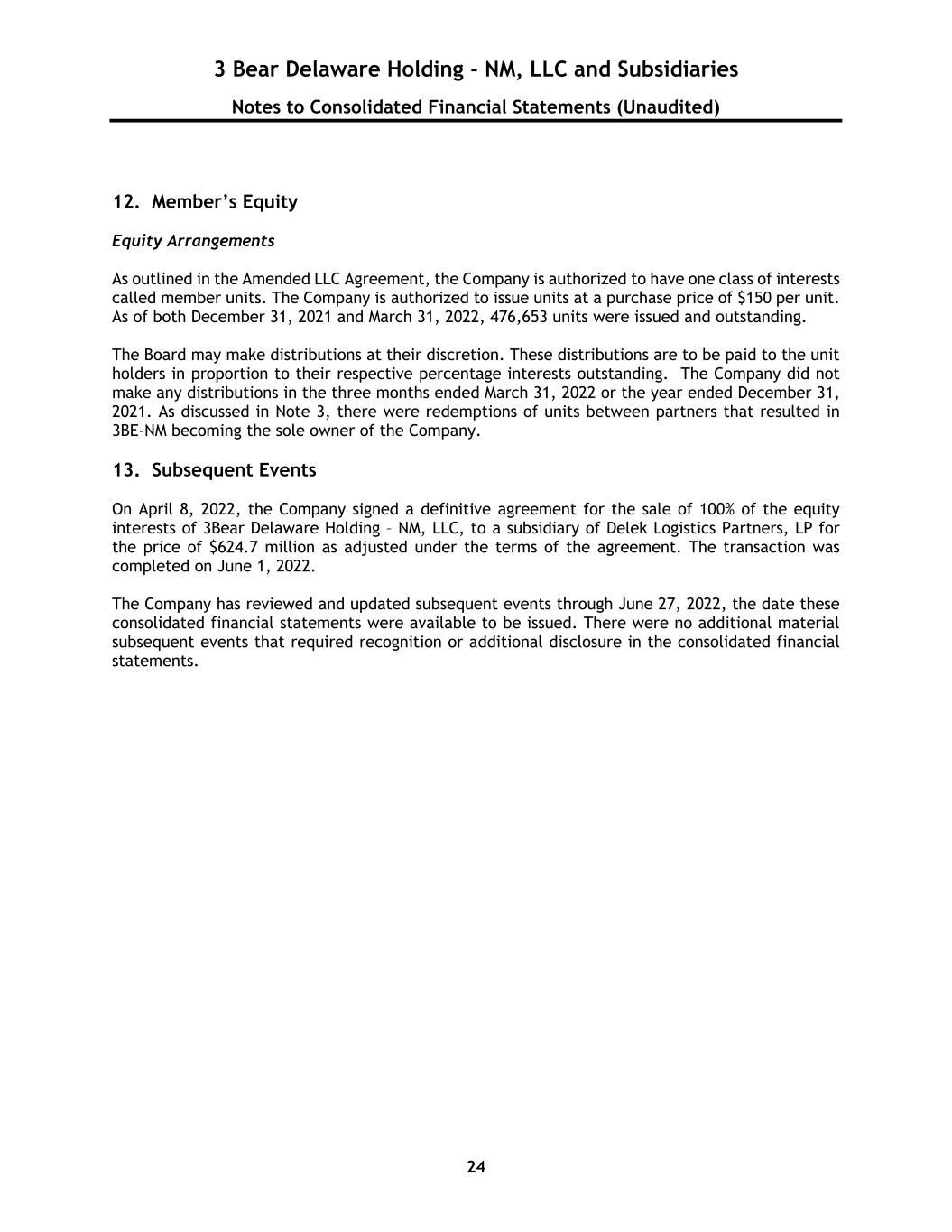

3 Bear Delaware Holding - NM, LLC and Subsidiaries Notes to Consolidated Financial Statements (Unaudited) 24 12. Member’s Equity Equity Arrangements As outlined in the Amended LLC Agreement, the Company is authorized to have one class of interests called member units. The Company is authorized to issue units at a purchase price of $150 per unit. As of both December 31, 2021 and March 31, 2022, 476,653 units were issued and outstanding. The Board may make distributions at their discretion. These distributions are to be paid to the unit holders in proportion to their respective percentage interests outstanding. The Company did not make any distributions in the three months ended March 31, 2022 or the year ended December 31, 2021. As discussed in Note 3, there were redemptions of units between partners that resulted in 3BE-NM becoming the sole owner of the Company. 13. Subsequent Events On April 8, 2022, the Company signed a definitive agreement for the sale of 100% of the equity interests of 3Bear Delaware Holding – NM, LLC, to a subsidiary of Delek Logistics Partners, LP for the price of $624.7 million as adjusted under the terms of the agreement. The transaction was completed on June 1, 2022. The Company has reviewed and updated subsequent events through June 27, 2022, the date these consolidated financial statements were available to be issued. There were no additional material subsequent events that required recognition or additional disclosure in the consolidated financial statements.