Fourth Quarter 2023 Earnings Conference Call February 27, 2024 Exhibit 99.2

2 Disclaimers Forward Looking Statements: Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral or written presentations contain forward-looking statements within the meaning of federal securities laws that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward-looking statements. These forward-looking statements include, but are not limited to, the statements regarding the following: financial and operating guidance for future and uncompleted financial periods; financial strength and flexibility; potential for and projections of growth; return of cash to shareholders, stock repurchases and the payment of dividends, including the amount and timing thereof; cost reductions; crude oil throughput; crude oil market trends, including production, quality, pricing, demand, imports, exports and transportation costs; projected capital expenditures; the results of our refinery improvement plan; the performance of our joint venture investments, and the benefits, flexibility, returns and EBITDA therefrom; the potential for, and estimates of cost savings and other benefits from, acquisitions, divestitures, dropdowns and financing activities; long-term value creation from capital allocation; targeted internal rates of return on capital expenditures; execution of strategic initiatives and the benefits therefrom, including cash flow stability from business model transition and approach to renewable diesel; and access to crude oil and the benefits therefrom. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: uncertainty related to timing and amount of value returned to shareholders; risks and uncertainties with respect to the quantities and costs of crude oil we are able to obtain and the price of the refined petroleum products we ultimately sell, including uncertainties regarding future decisions by OPEC regarding production and pricing disputes between OPEC members and Russia; risks and uncertainties related to the integration by Delek Logistics of the Delaware Gathering business following its acquisition; Delek US’ ability to realize cost reductions; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, gathering, pricing, production and transportation capacity; gains and losses from derivative instruments; management's ability to execute its strategy of growth through acquisitions and the transactional risks associated with acquisitions and dispositions; acquired assets may suffer a diminishment in fair value as a result of which we may need to record a write-down or impairment in carrying value of the asset; changes in the scope, costs, and/or timing of capital and maintenance projects; the ability of the Wink to Webster joint venture to construct the long-haul pipeline; the ability of the Red River joint venture to expand the Red River pipeline; the possibility of litigation challenging renewable fuel standard waivers; the ability to grow the Midland Gathering System; operating hazards inherent in transporting, storing and processing crude oil and intermediate and finished petroleum products; our competitive position and the effects of competition; the projected growth of the industries in which we operate; general economic and business conditions affecting the geographic areas in which we operate; and other risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements to reflect events or circumstances that occur, or which Delek US or Delek Logistics becomes aware of, after the date hereof, except as required by applicable law or regulation.

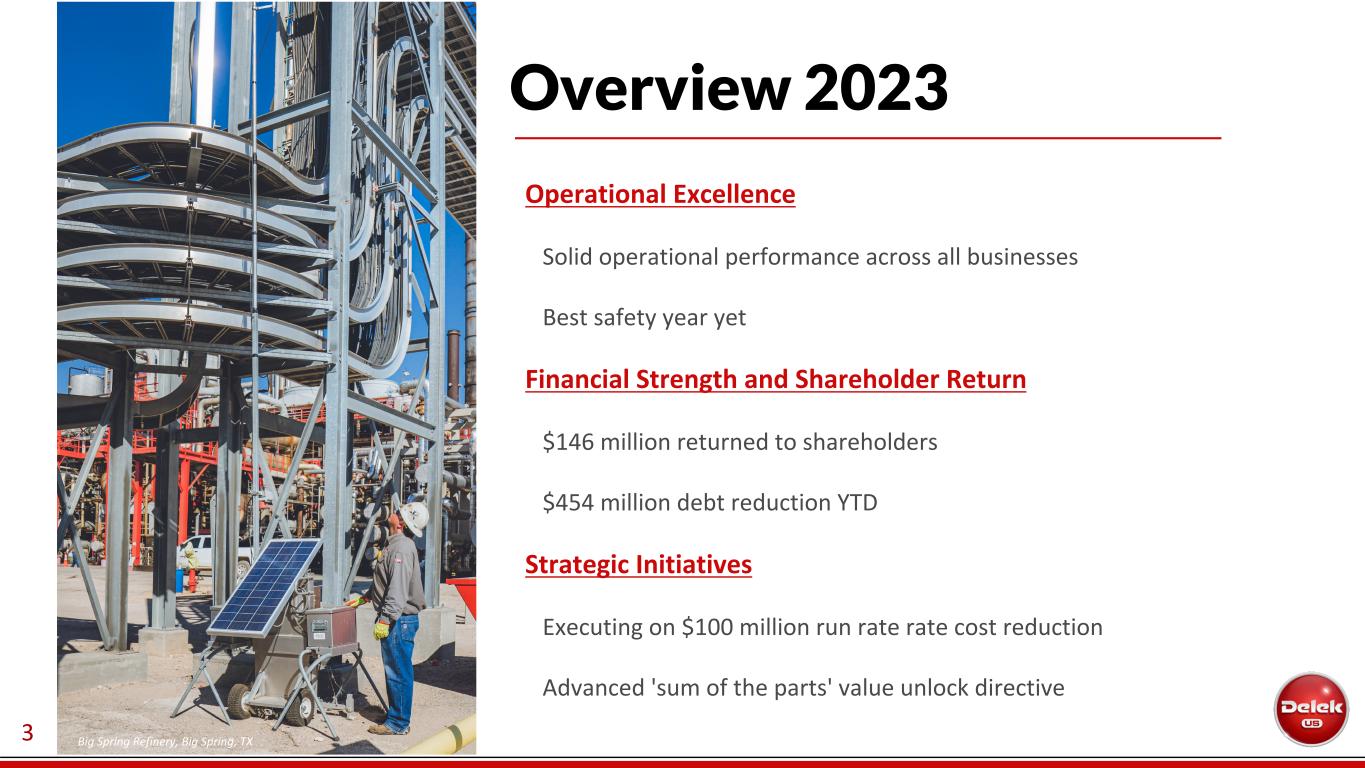

3 Overview 2023 Operational Excellence Solid operational performance across all businesses Best safety year yet Financial Strength and Shareholder Return $146 million returned to shareholders $454 million debt reduction YTD Strategic Initiatives Executing on $100 million run rate rate cost reduction Advanced 'sum of the parts' value unlock directive Big Spring Refinery, Big Spring, TX

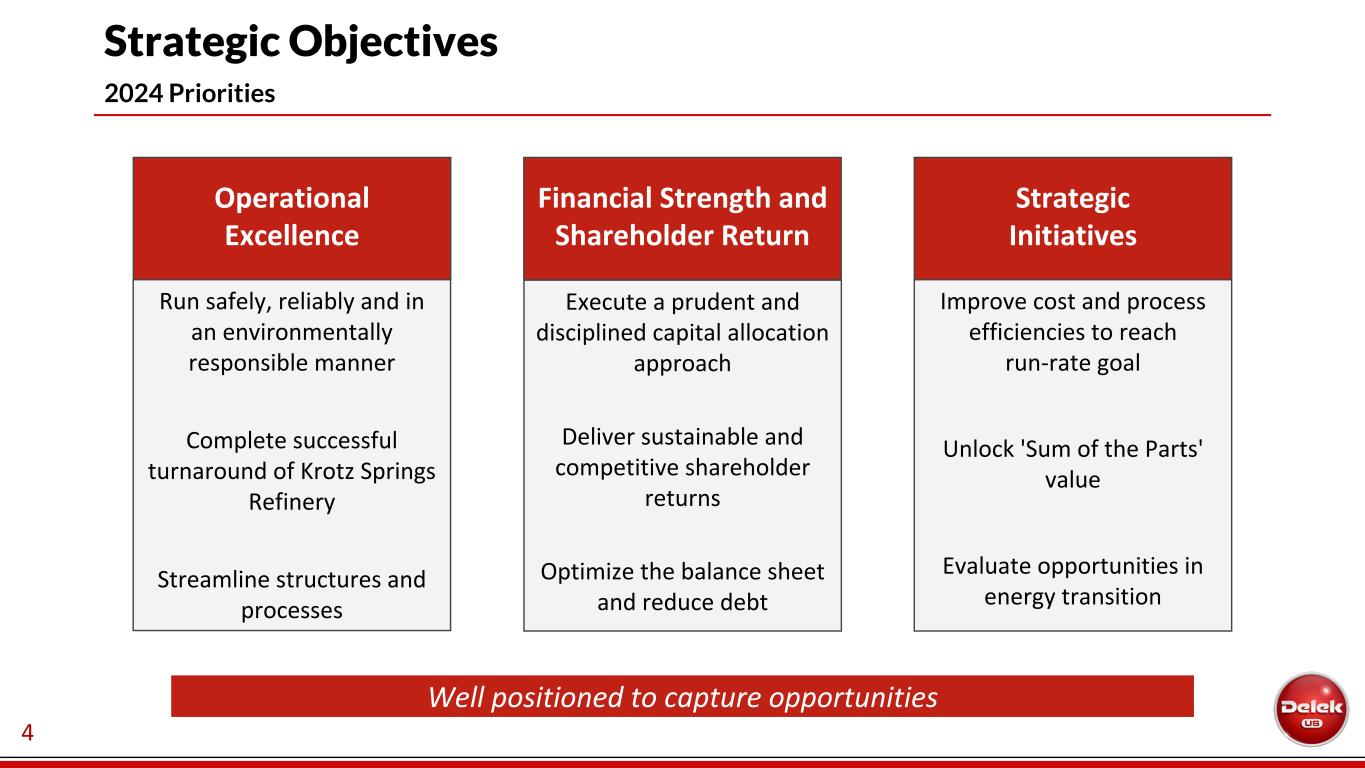

4 Well positioned to capture opportunities Strategic Objectives 2024 Priorities Run safely, reliably and in an environmentally responsible manner Complete successful turnaround of Krotz Springs Refinery Streamline structures and processes Execute a prudent and disciplined capital allocation approach Deliver sustainable and competitive shareholder returns Optimize the balance sheet and reduce debt Improve cost and process efficiencies to reach run-rate goal Unlock 'Sum of the Parts' value Evaluate opportunities in energy transition Financial Strength and Shareholder Return Operational Excellence Strategic Initiatives

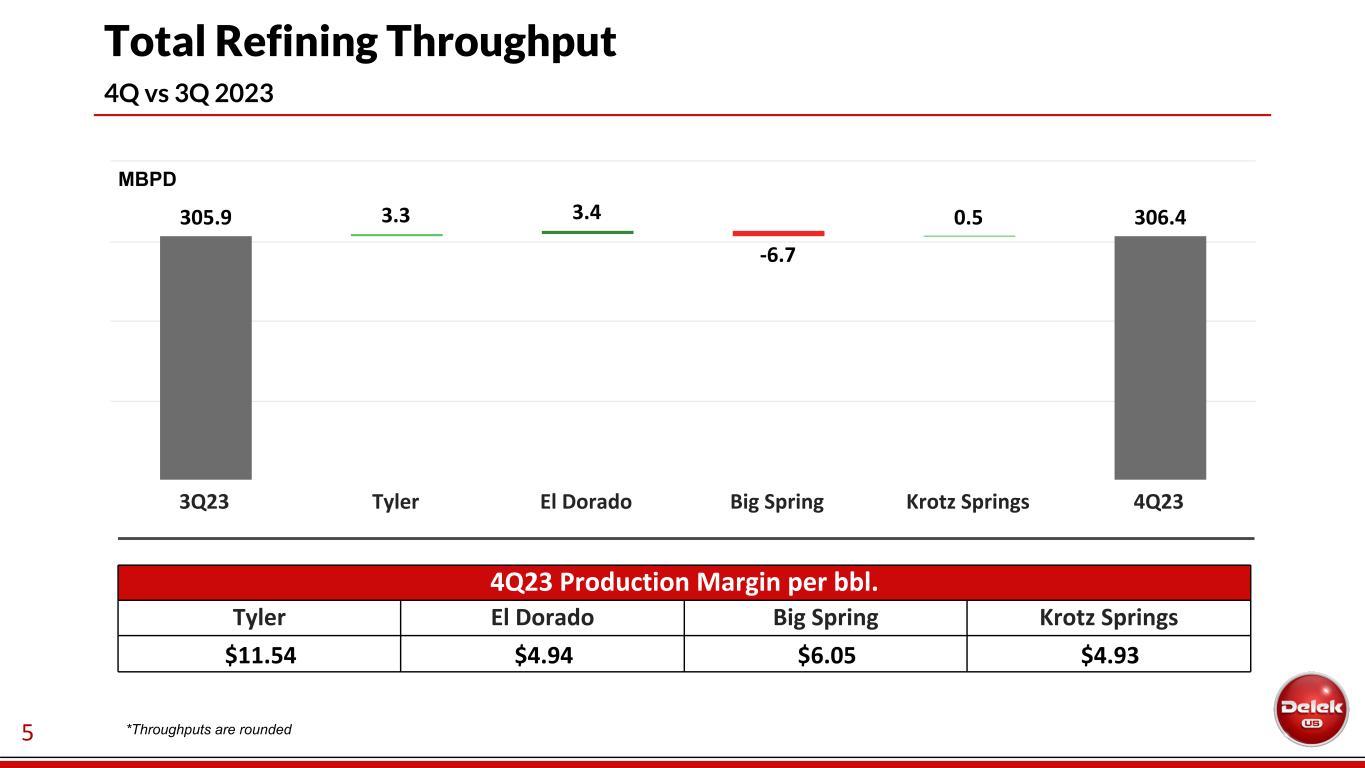

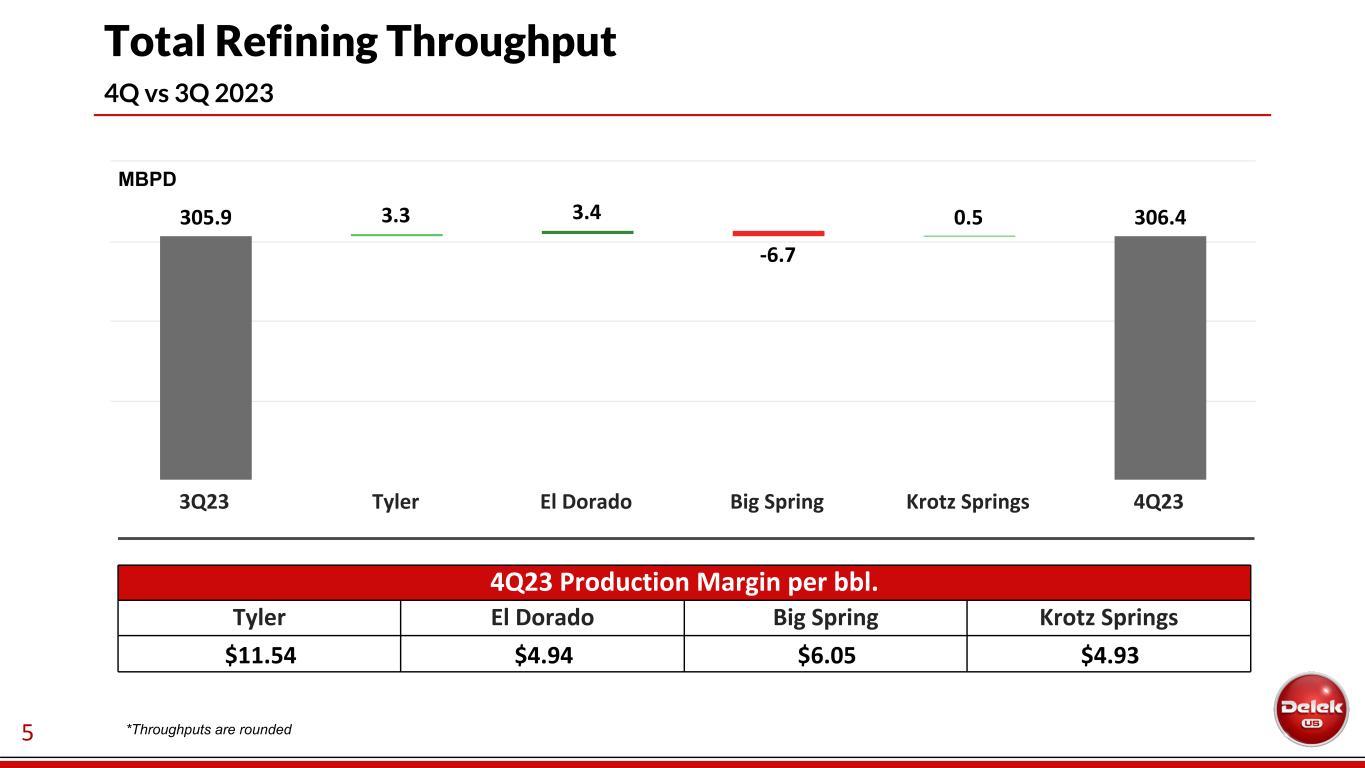

5 Total Refining Throughput 4Q vs 3Q 2023 4Q23 Production Margin per bbl. Tyler El Dorado Big Spring Krotz Springs $11.54 $4.94 $6.05 $4.93 305.9 3.3 3.4 -6.7 0.5 306.4 3Q23 Tyler El Dorado Big Spring Krotz Springs 4Q23 MBPD *Throughputs are rounded

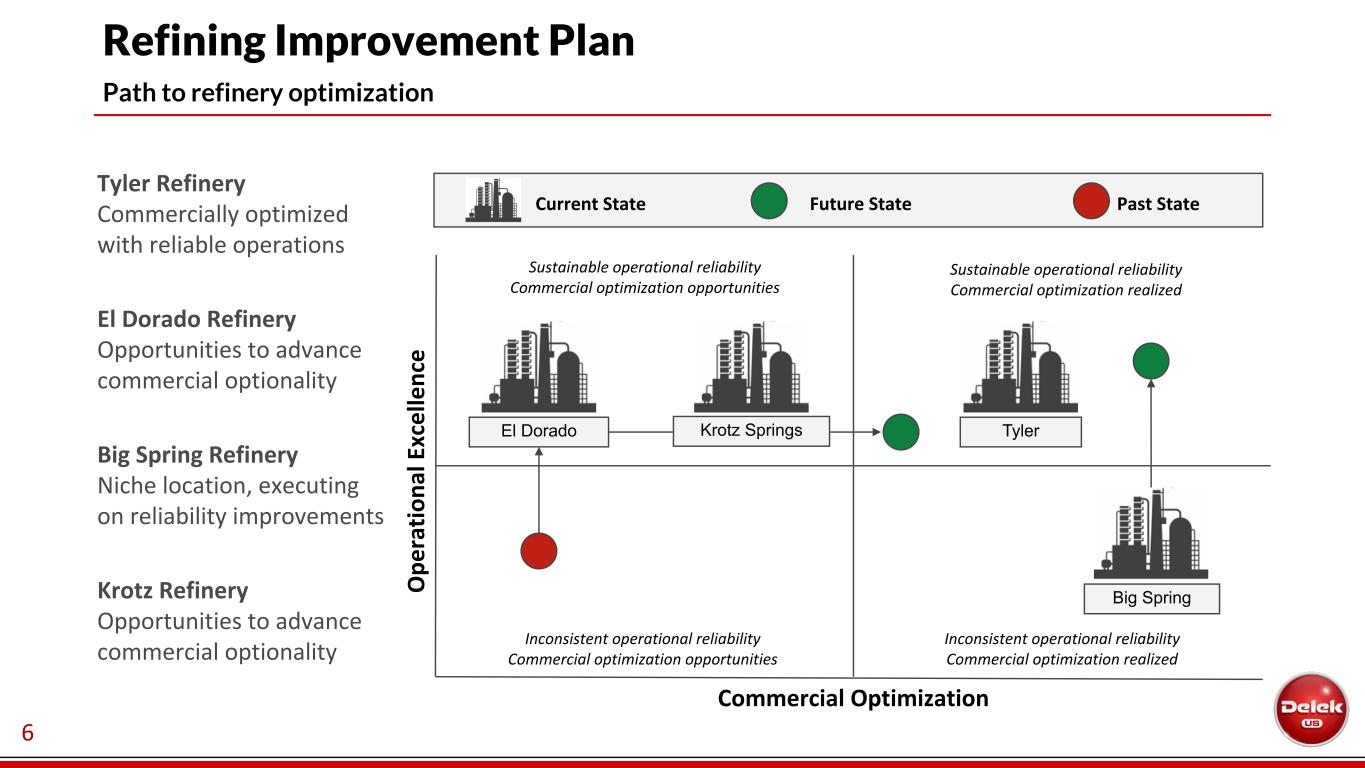

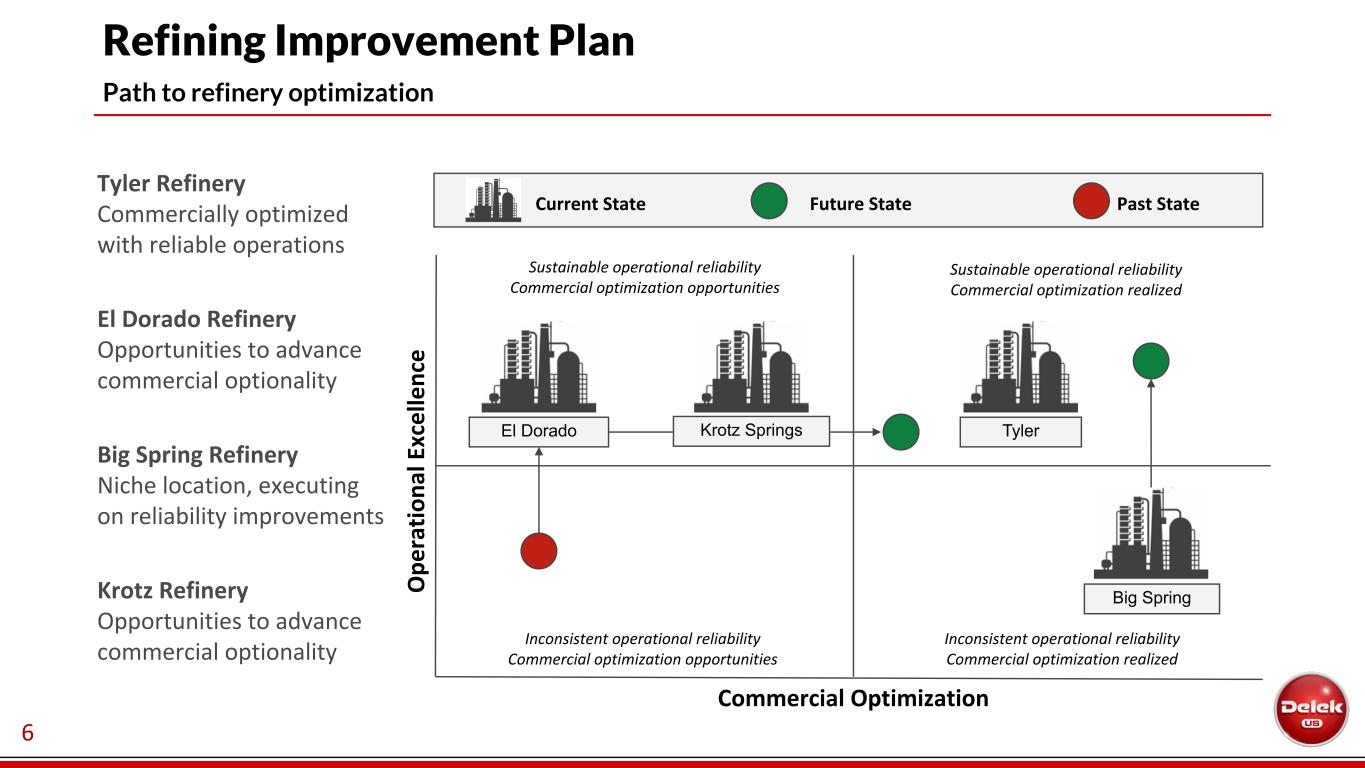

6 Inconsistent operational reliability Commercial optimization realized Refining Improvement Plan Path to refinery optimization O pe ra ti on al E xc el le nc e Commercial Optimization El Dorado TylerKrotz Springs Big Spring Tyler Refinery Commercially optimized with reliable operations El Dorado Refinery Opportunities to advance commercial optionality Big Spring Refinery Niche location, executing on reliability improvements Krotz Refinery Opportunities to advance commercial optionality Inconsistent operational reliability Commercial optimization opportunities Sustainable operational reliability Commercial optimization opportunities Sustainable operational reliability Commercial optimization realized Current State Future State Past State

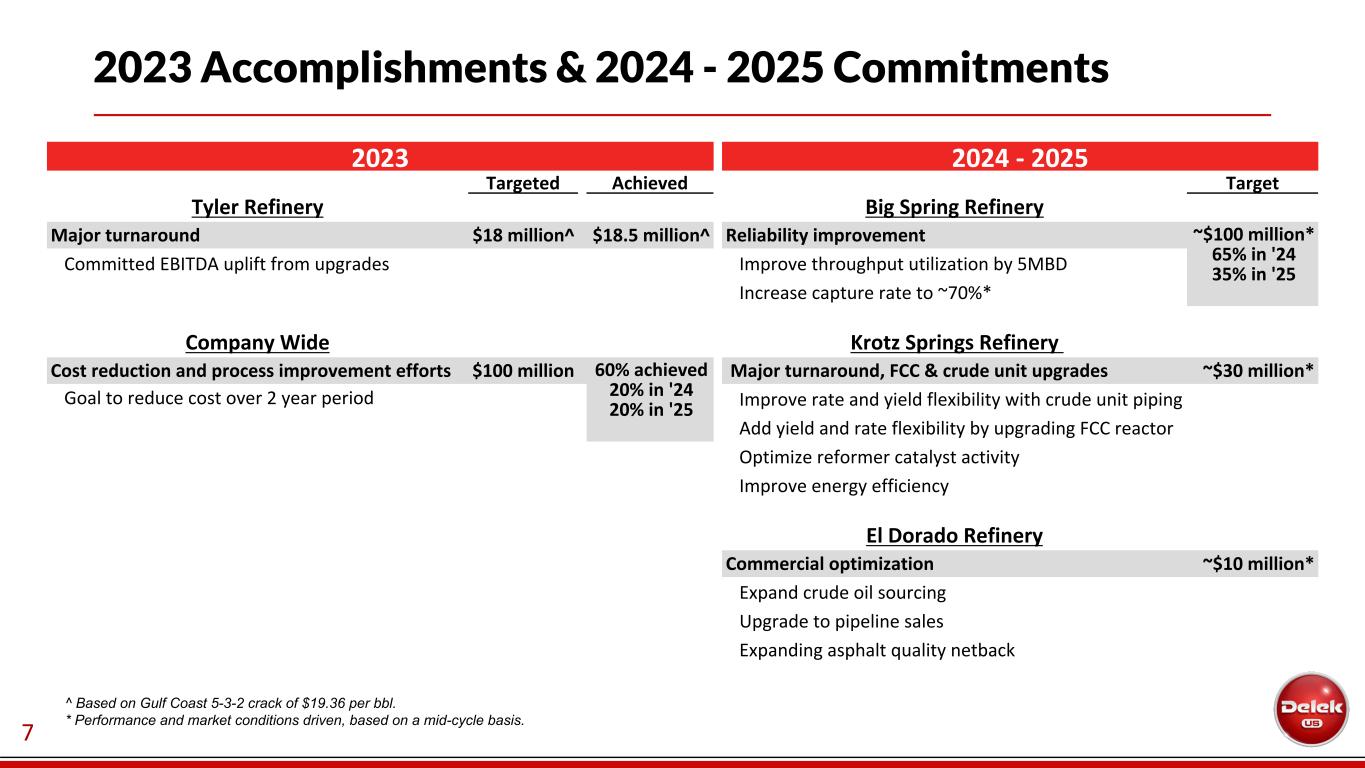

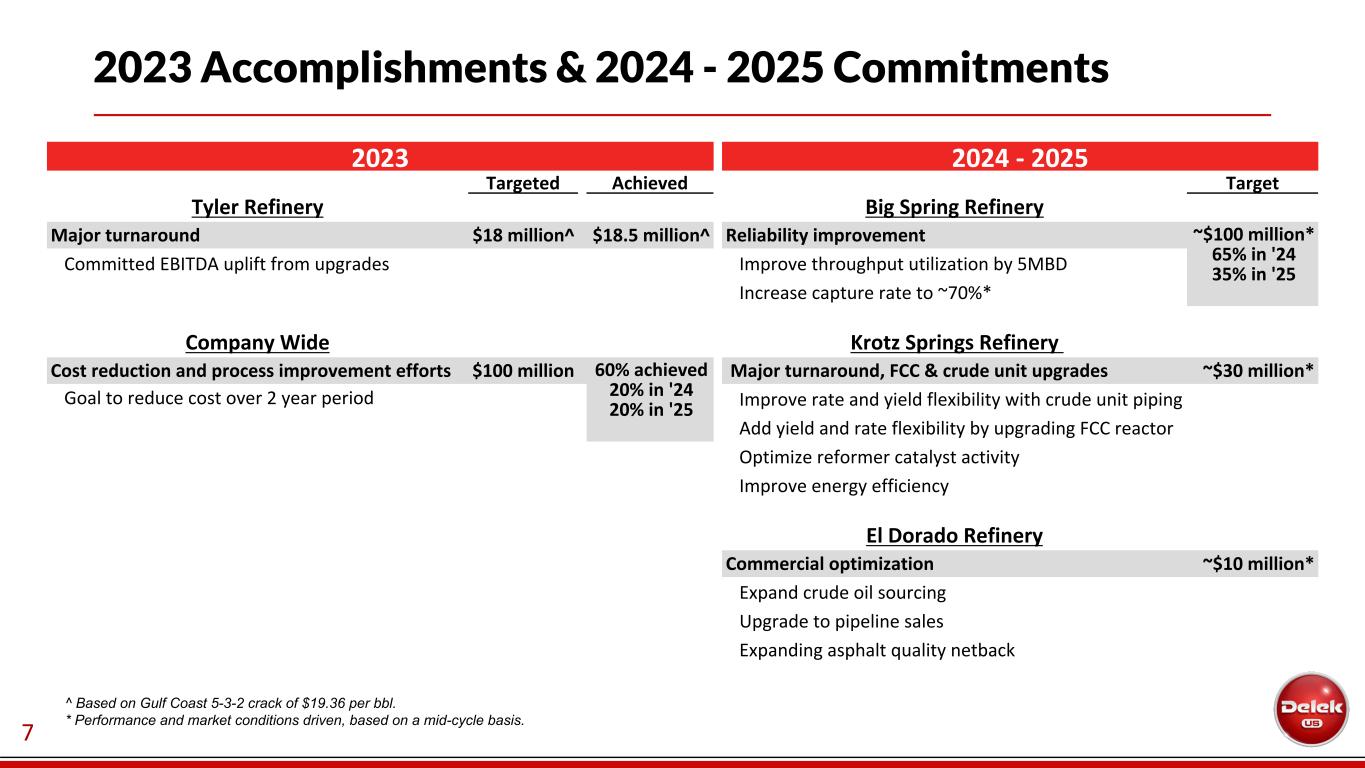

7 2023 Accomplishments & 2024 - 2025 Commitments ^ Based on Gulf Coast 5-3-2 crack of $19.36 per bbl. * Performance and market conditions driven, based on a mid-cycle basis. 2023 2024 - 2025 Targeted Achieved Target Tyler Refinery Big Spring Refinery Major turnaround $18 million^ $18.5 million^ Reliability improvement ~$100 million* 65% in '24 35% in '25 Committed EBITDA uplift from upgrades Improve throughput utilization by 5MBD Increase capture rate to ~70%* Company Wide Krotz Springs Refinery Cost reduction and process improvement efforts $100 million 60% achieved 20% in '24 20% in '25 Major turnaround, FCC & crude unit upgrades ~$30 million* Goal to reduce cost over 2 year period Improve rate and yield flexibility with crude unit piping Add yield and rate flexibility by upgrading FCC reactor Optimize reformer catalyst activity Improve energy efficiency El Dorado Refinery Commercial optimization ~$10 million* Expand crude oil sourcing Upgrade to pipeline sales Expanding asphalt quality netback

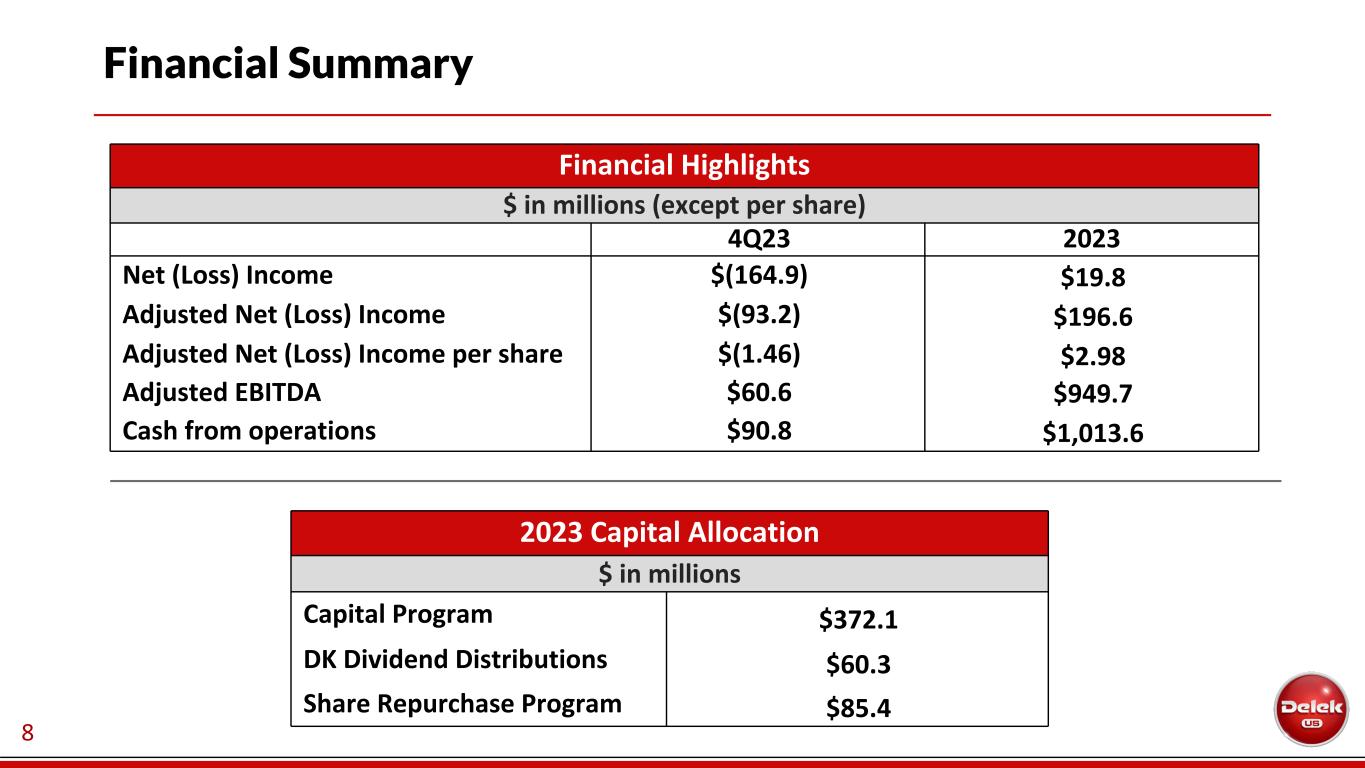

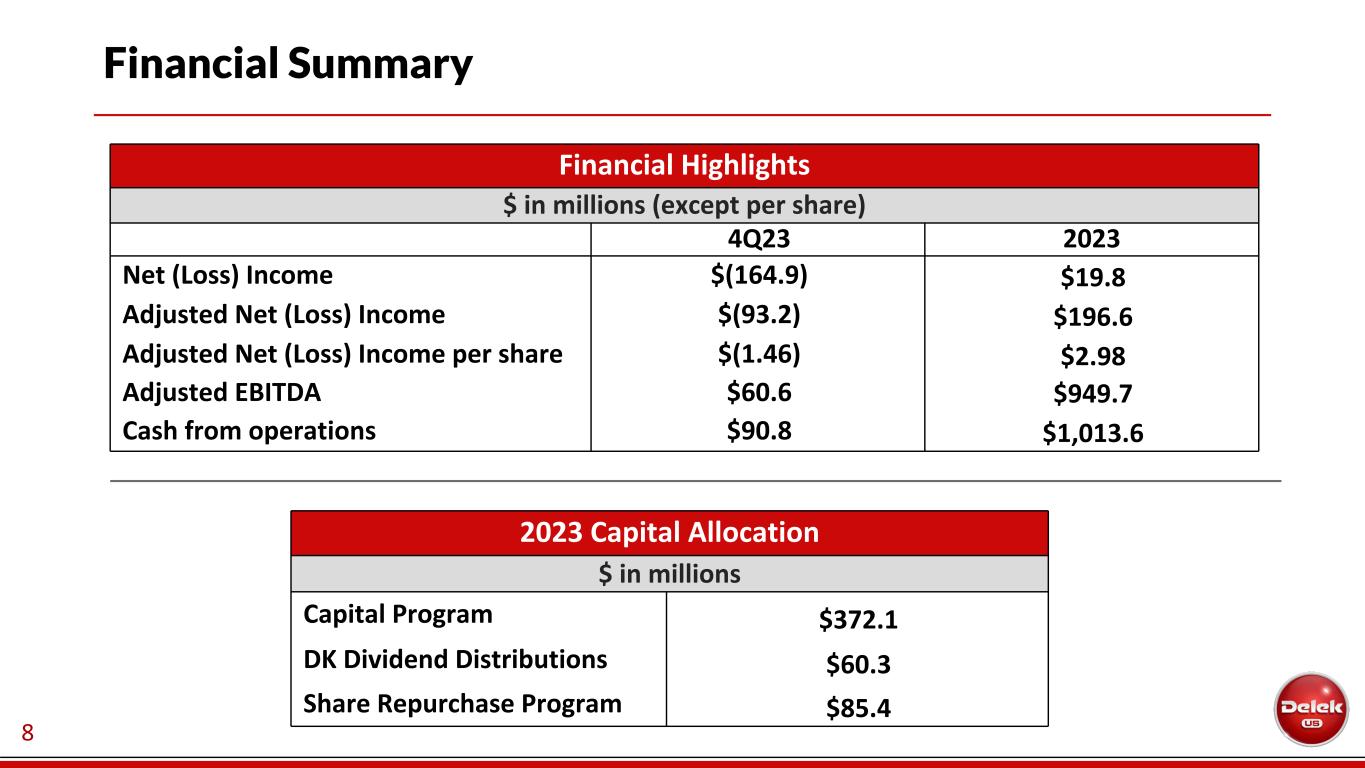

8 Financial Summary Financial Highlights $ in millions (except per share) 4Q23 2023 Net (Loss) Income $(164.9) $19.8 Adjusted Net (Loss) Income $(93.2) $196.6 Adjusted Net (Loss) Income per share $(1.46) $2.98 Adjusted EBITDA $60.6 $949.7 Cash from operations $90.8 $1,013.6 2023 Capital Allocation $ in millions Capital Program $372.1 DK Dividend Distributions $60.3 Share Repurchase Program $85.4

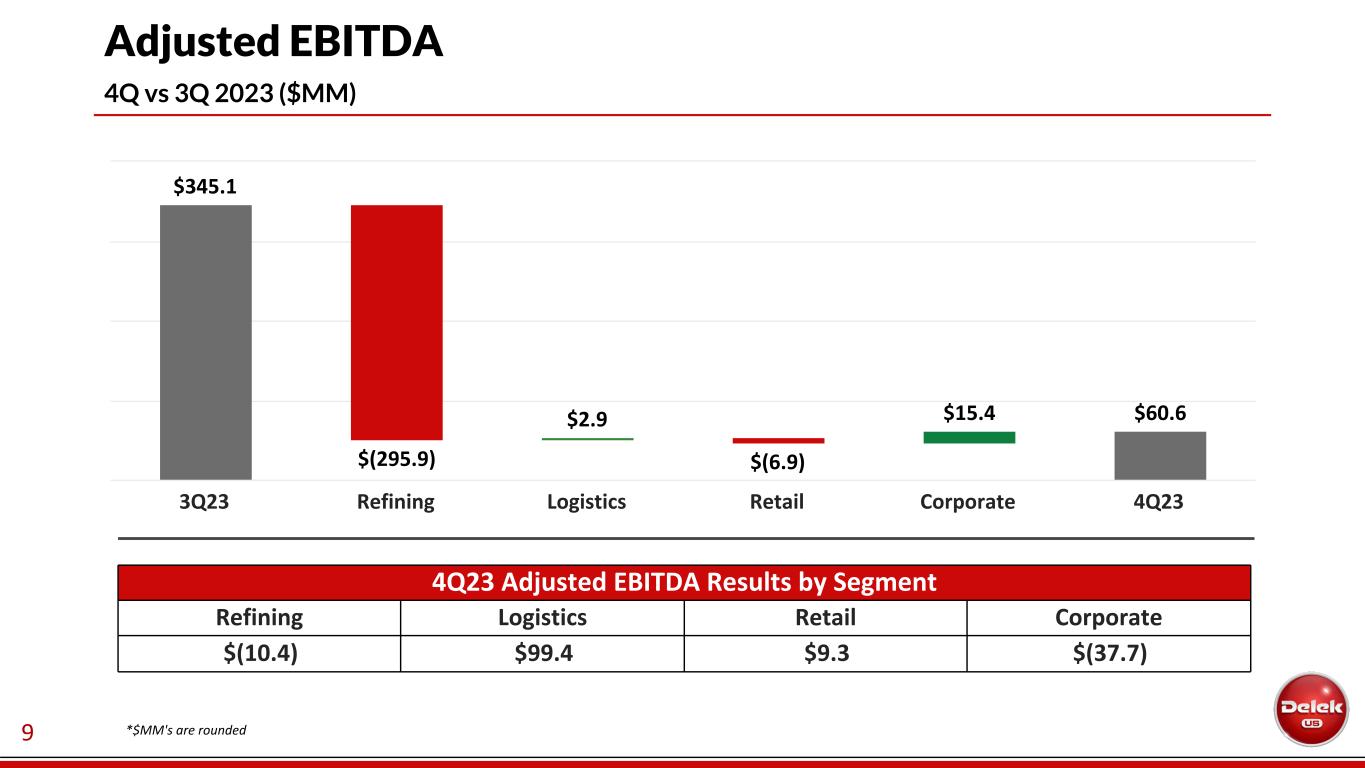

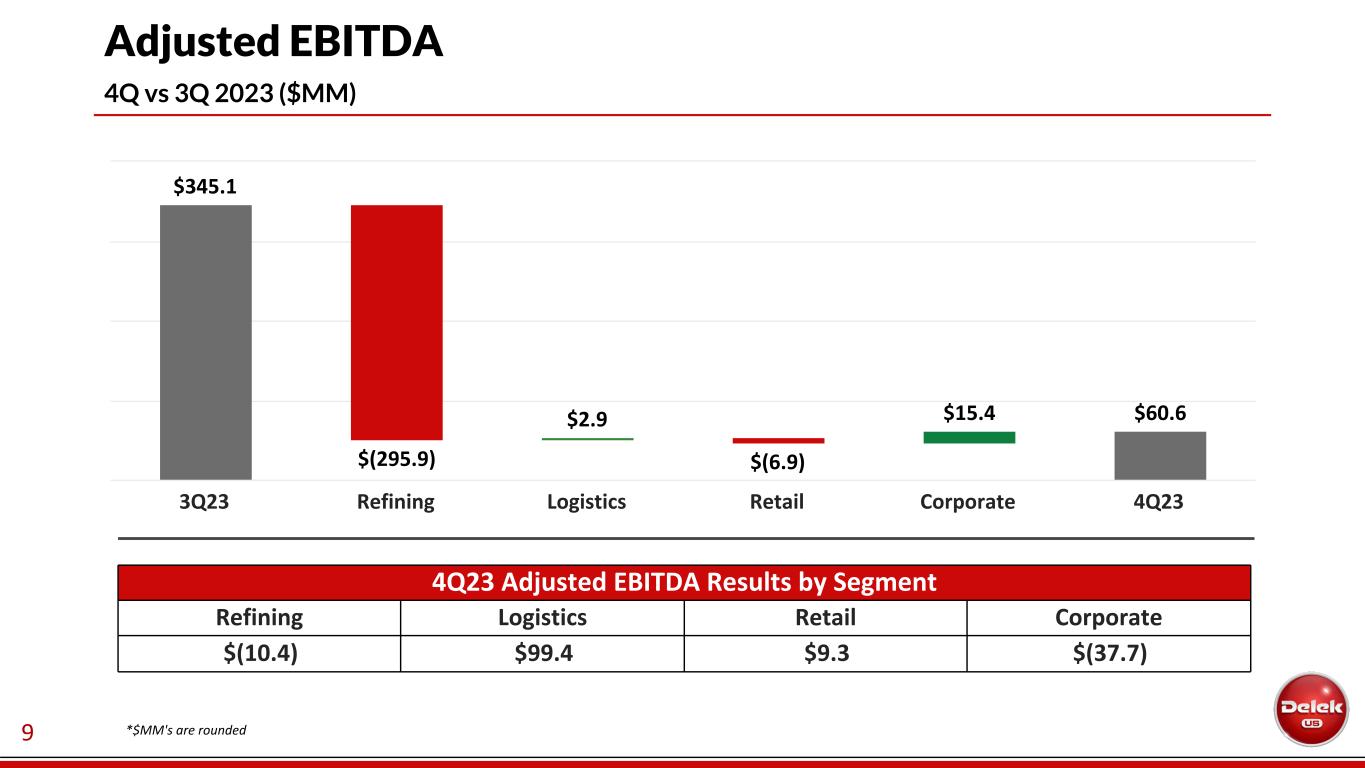

9 Adjusted EBITDA 4Q vs 3Q 2023 ($MM) 4Q23 Adjusted EBITDA Results by Segment Refining Logistics Retail Corporate $(10.4) $99.4 $9.3 $(37.7) $345.1 $(295.9) $2.9 $(6.9) $15.4 $60.6 3Q23 Refining Logistics Retail Corporate 4Q23 *$MM's are rounded

10 Consolidated Cash Flow 4Q vs 3Q 2023 ($MM) *includes cash and cash equivalents $901.7 $90.8 $(69.4) $(100.9) $822.2 9/30/2023 Cash Balance* Operating Activities Investing Activities Financing Activities 12/31/2023 Cash Balance*

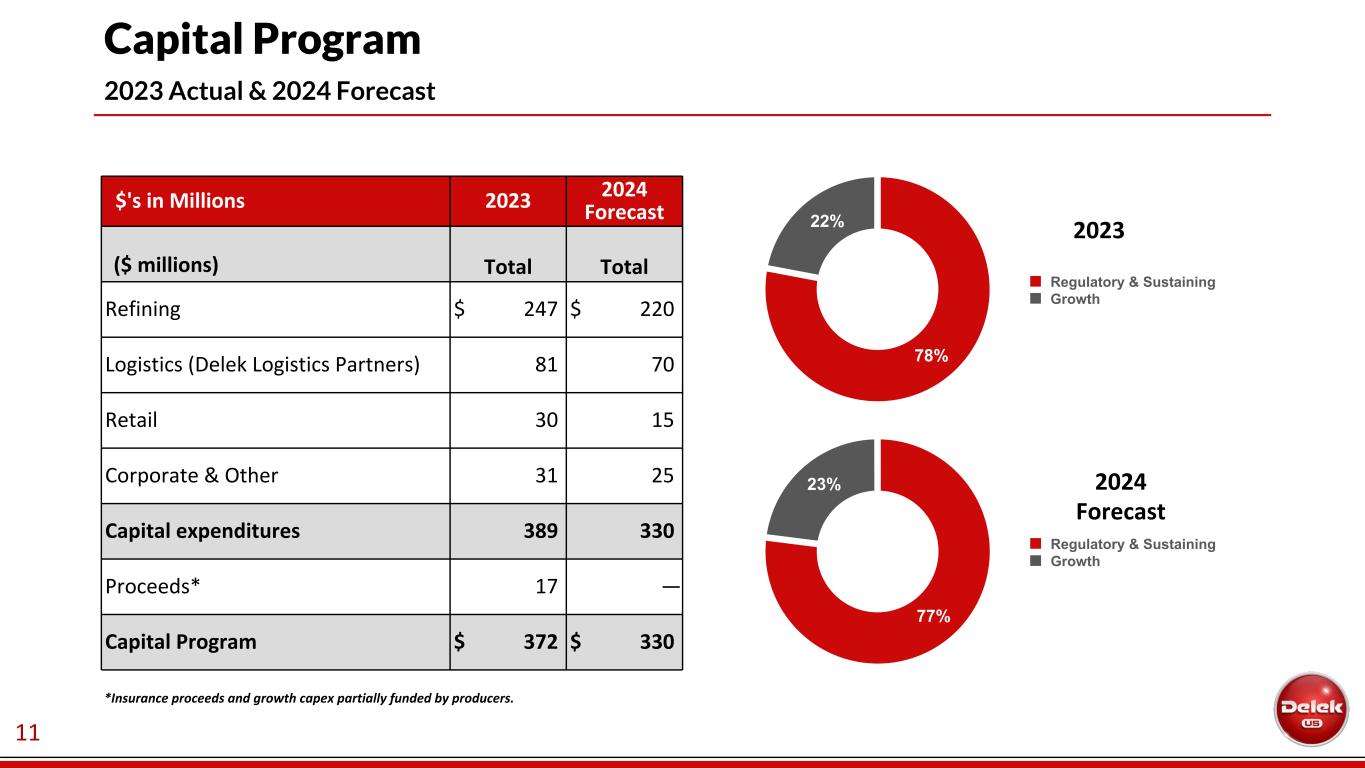

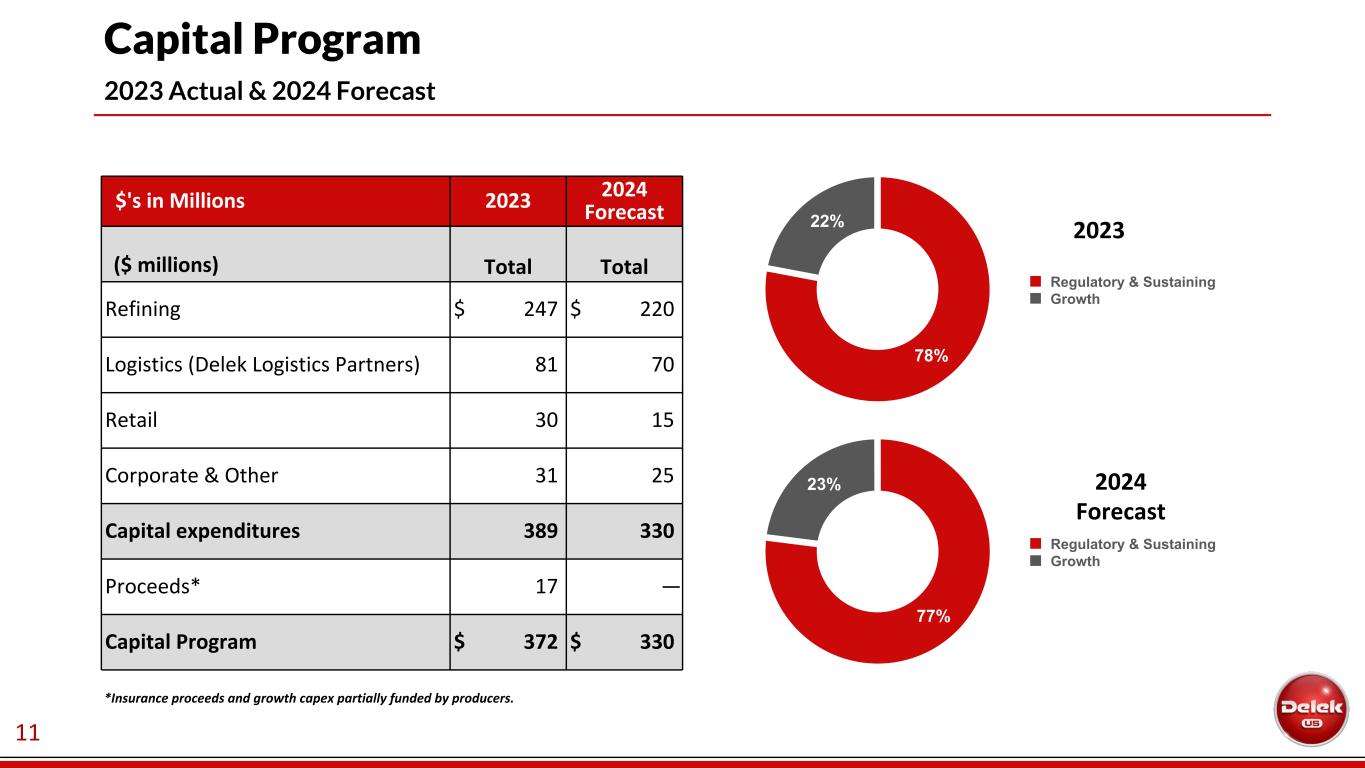

11 Capital Program 2023 Actual & 2024 Forecast $'s in Millions 2023 2024 Forecast ($ millions) Total Total Refining $ 247 $ 220 Logistics (Delek Logistics Partners) 81 70 Retail 30 15 Corporate & Other 31 25 Capital expenditures 389 330 Proceeds* 17 — Capital Program $ 372 $ 330 2023 77% 23% Regulatory & Sustaining Growth 2024 Forecast 78% 22% Regulatory & Sustaining Growth *Insurance proceeds and growth capex partially funded by producers.

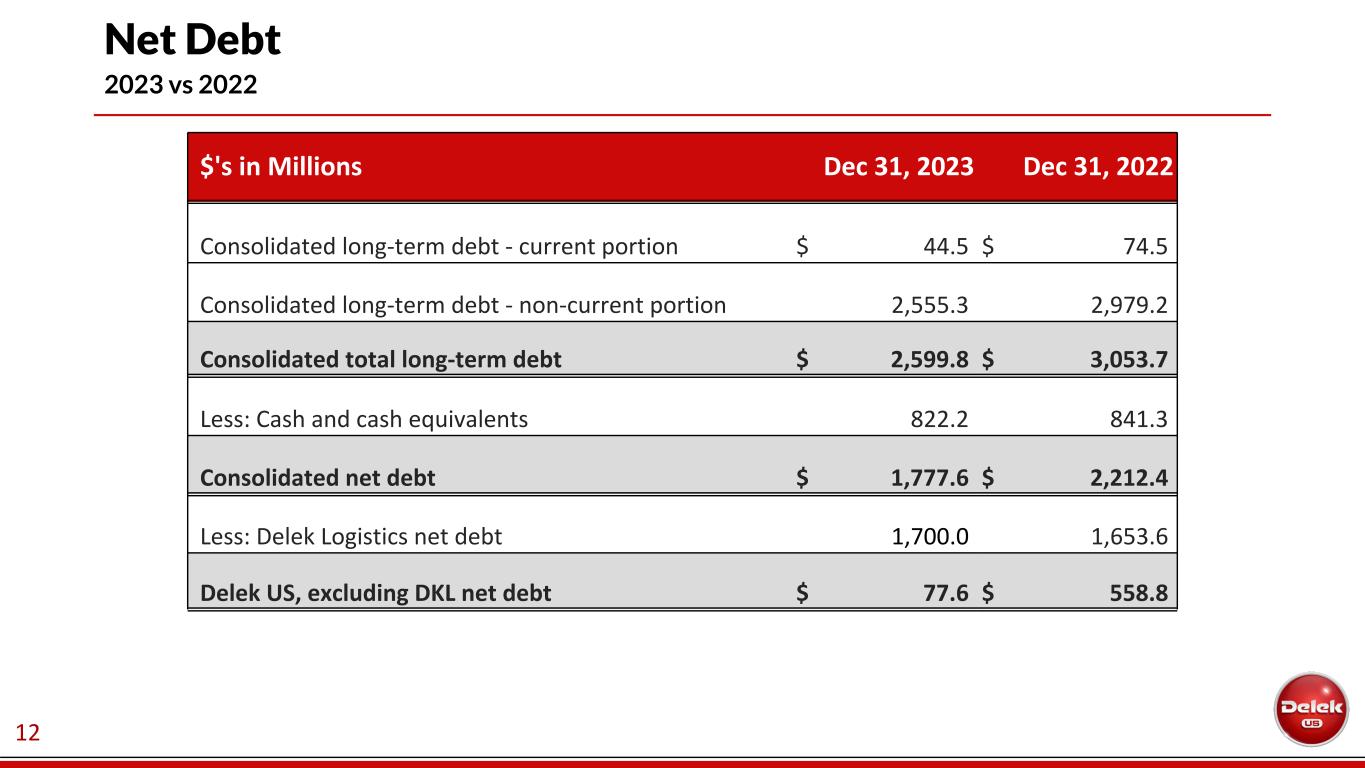

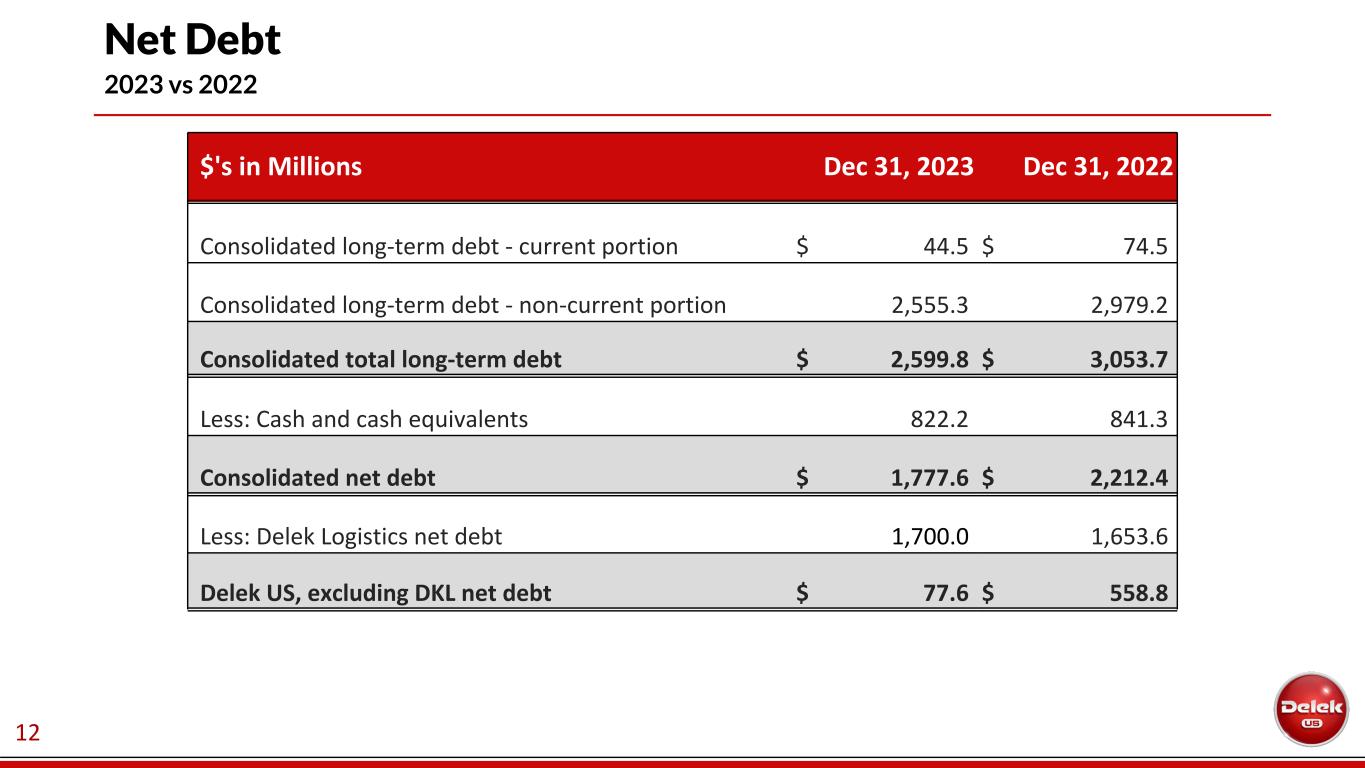

12 Net Debt 2023 vs 2022 $'s in Millions Dec 31, 2023 Dec 31, 2022 Consolidated long-term debt - current portion $ 44.5 $ 74.5 Consolidated long-term debt - non-current portion 2,555.3 2,979.2 Consolidated total long-term debt $ 2,599.8 $ 3,053.7 Less: Cash and cash equivalents 822.2 841.3 Consolidated net debt $ 1,777.6 $ 2,212.4 Less: Delek Logistics net debt 1,700.0 1,653.6 Delek US, excluding DKL net debt $ 77.6 $ 558.8

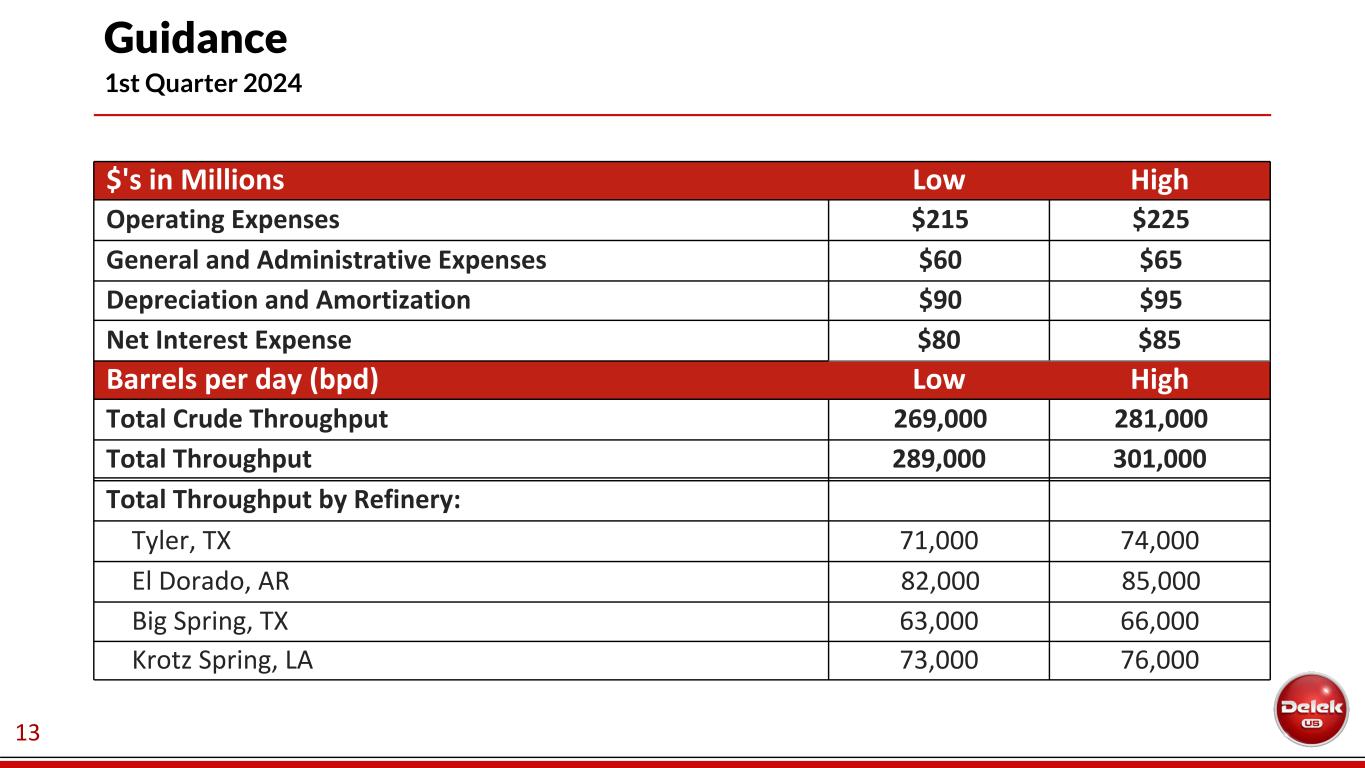

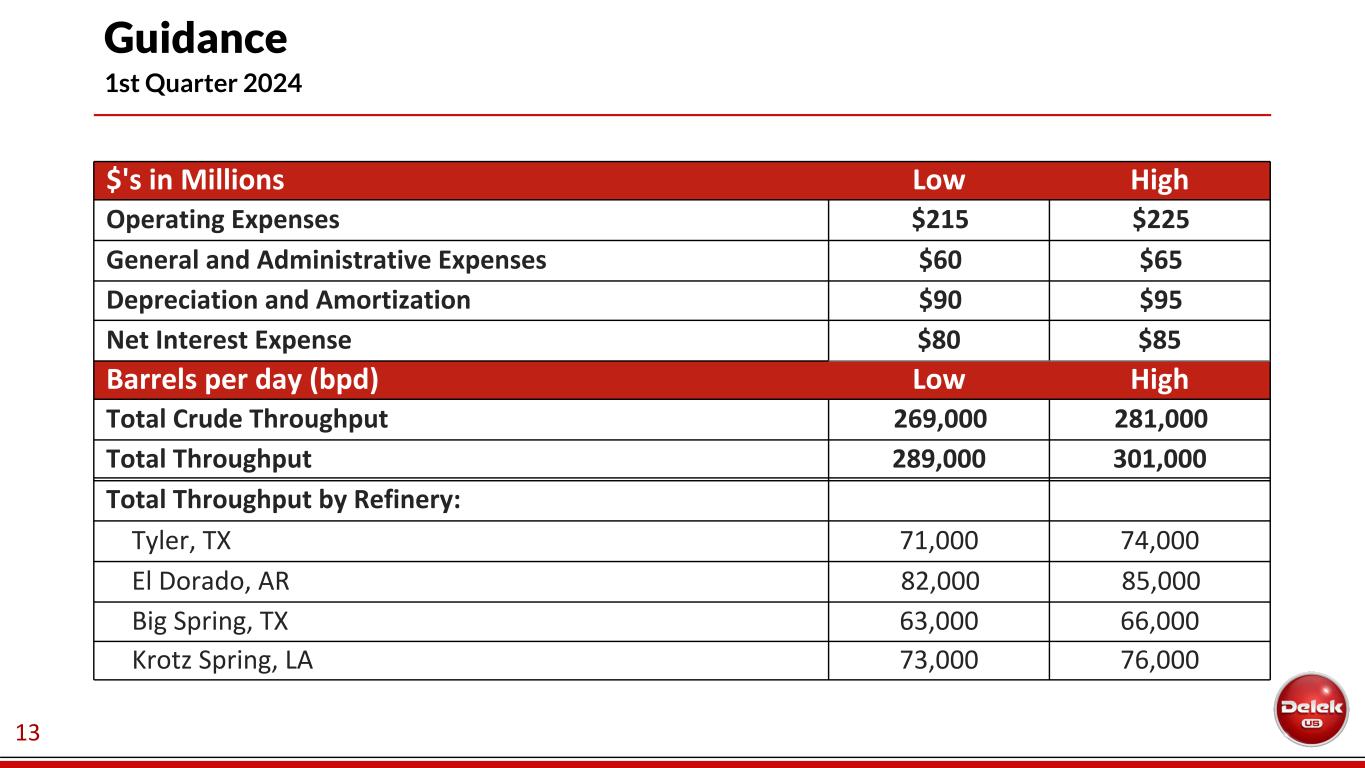

13 Guidance 1st Quarter 2024 $'s in Millions Low High Operating Expenses $215 $225 General and Administrative Expenses $60 $65 Depreciation and Amortization $90 $95 Net Interest Expense $80 $85 Barrels per day (bpd) Low High Total Crude Throughput 269,000 281,000 Total Throughput 289,000 301,000 Total Throughput by Refinery: Tyler, TX 71,000 74,000 El Dorado, AR 82,000 85,000 Big Spring, TX 63,000 66,000 Krotz Spring, LA 73,000 76,000

14 Supplemental Slides

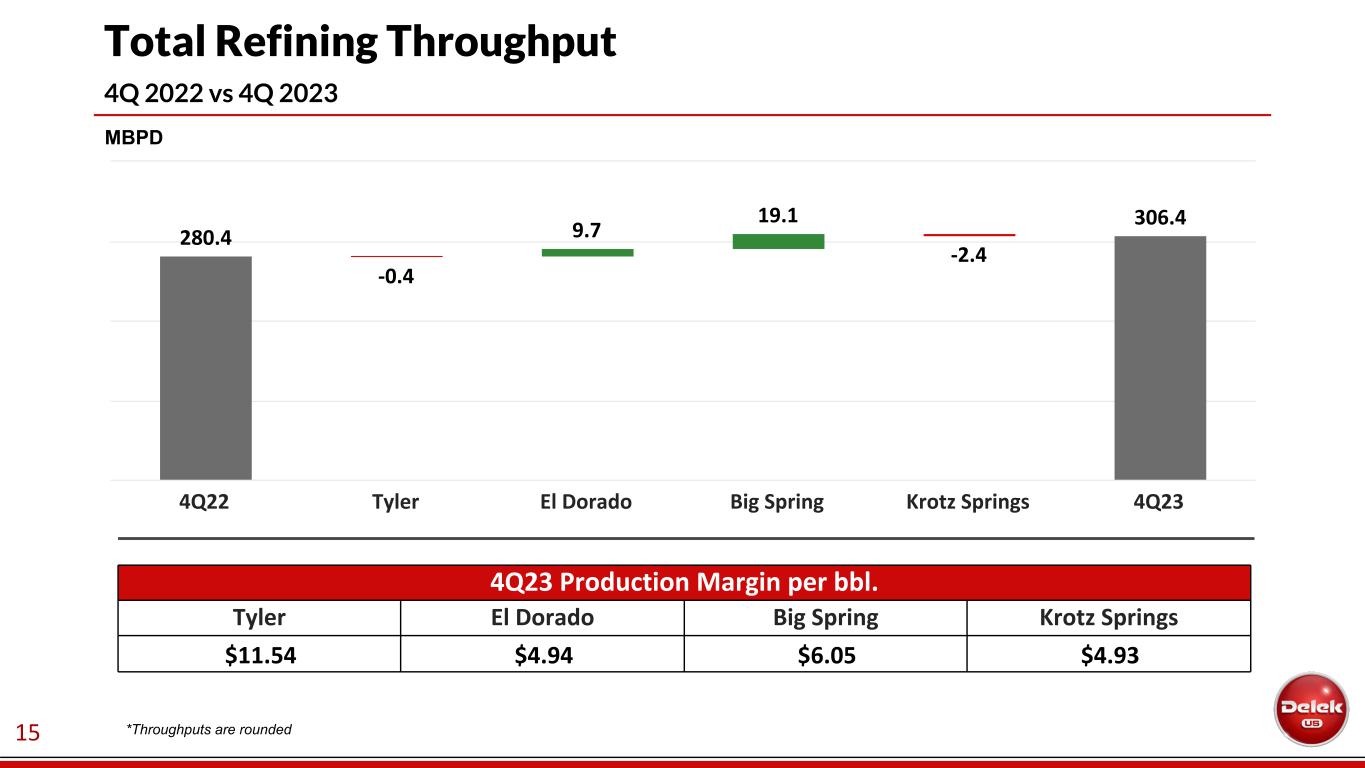

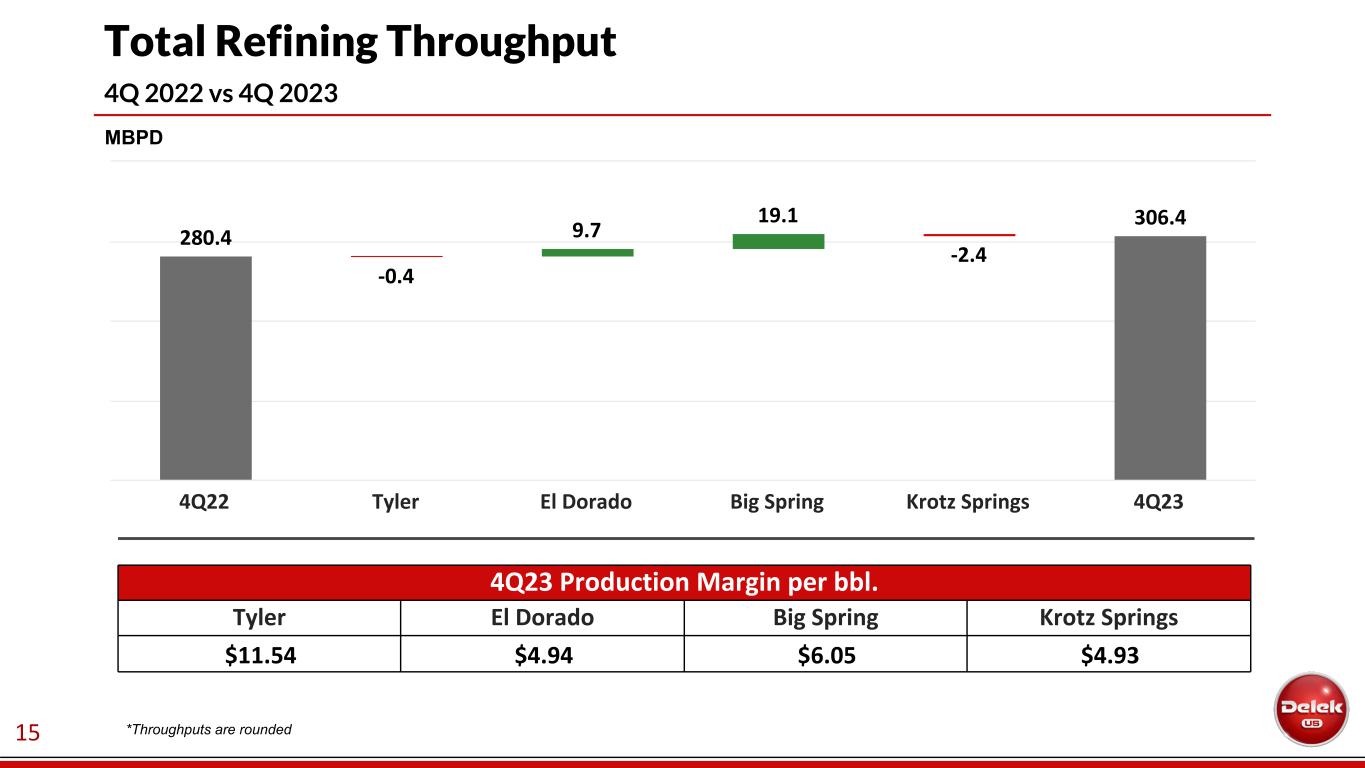

15 Total Refining Throughput 4Q 2022 vs 4Q 2023 4Q23 Production Margin per bbl. Tyler El Dorado Big Spring Krotz Springs $11.54 $4.94 $6.05 $4.93 280.4 -0.4 9.7 19.1 -2.4 306.4 4Q22 Tyler El Dorado Big Spring Krotz Springs 4Q23 MBPD *Throughputs are rounded

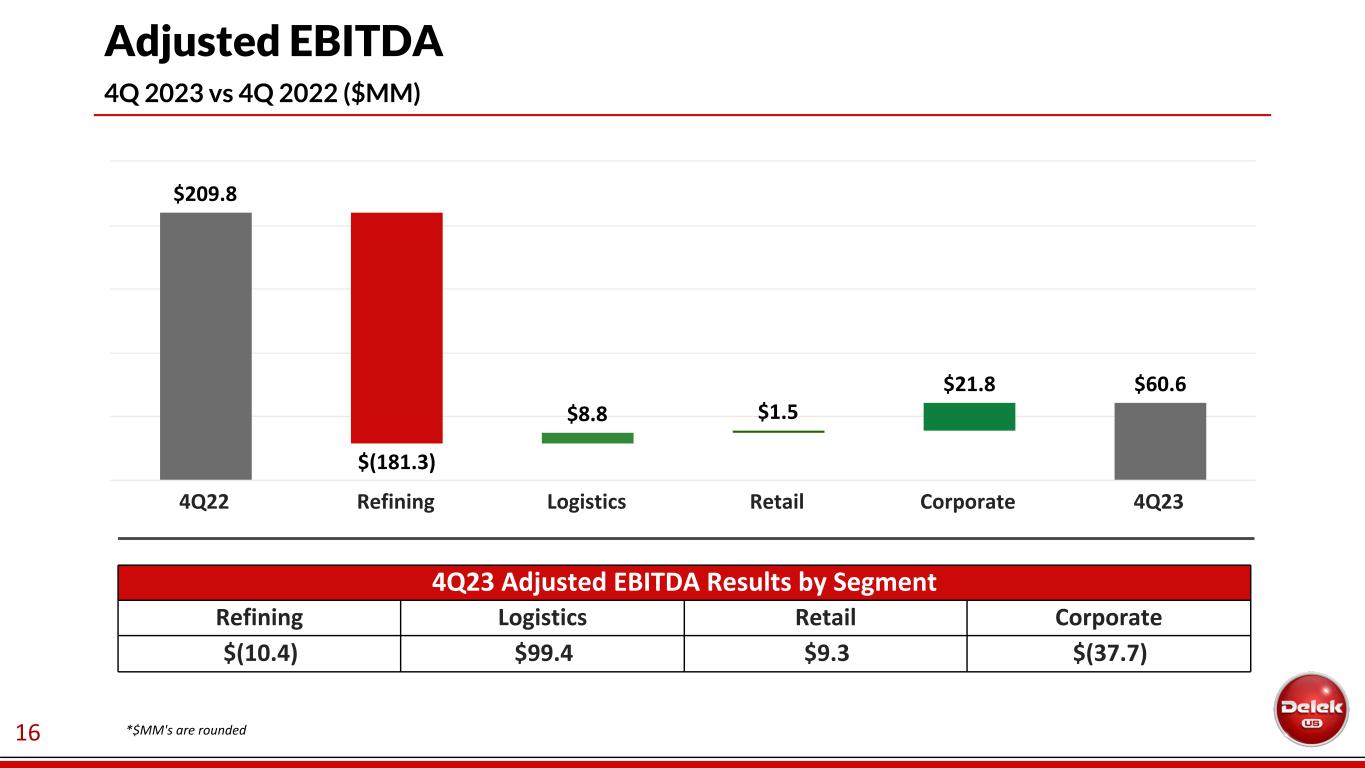

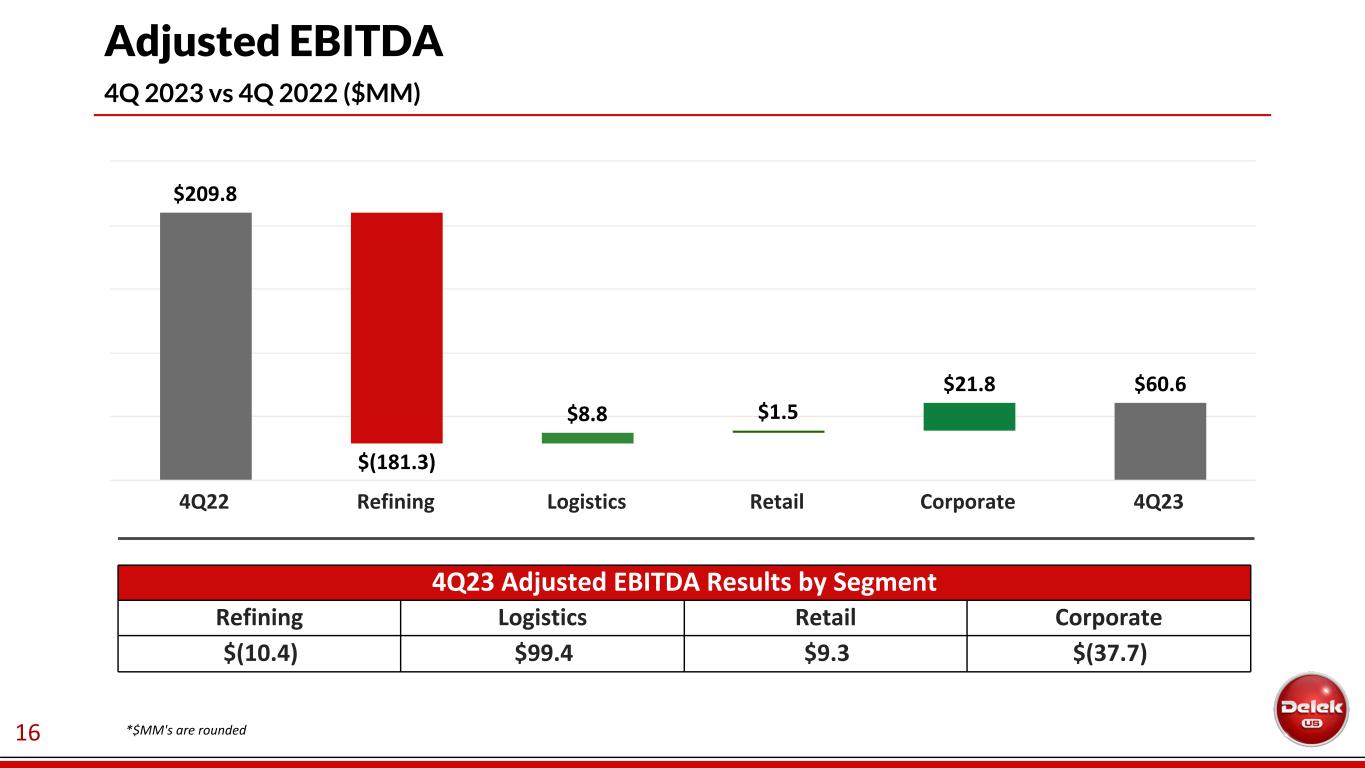

16 Adjusted EBITDA 4Q 2023 vs 4Q 2022 ($MM) 4Q23 Adjusted EBITDA Results by Segment Refining Logistics Retail Corporate $(10.4) $99.4 $9.3 $(37.7) $209.8 $(181.3) $8.8 $1.5 $21.8 $60.6 4Q22 Refining Logistics Retail Corporate 4Q23 *$MM's are rounded

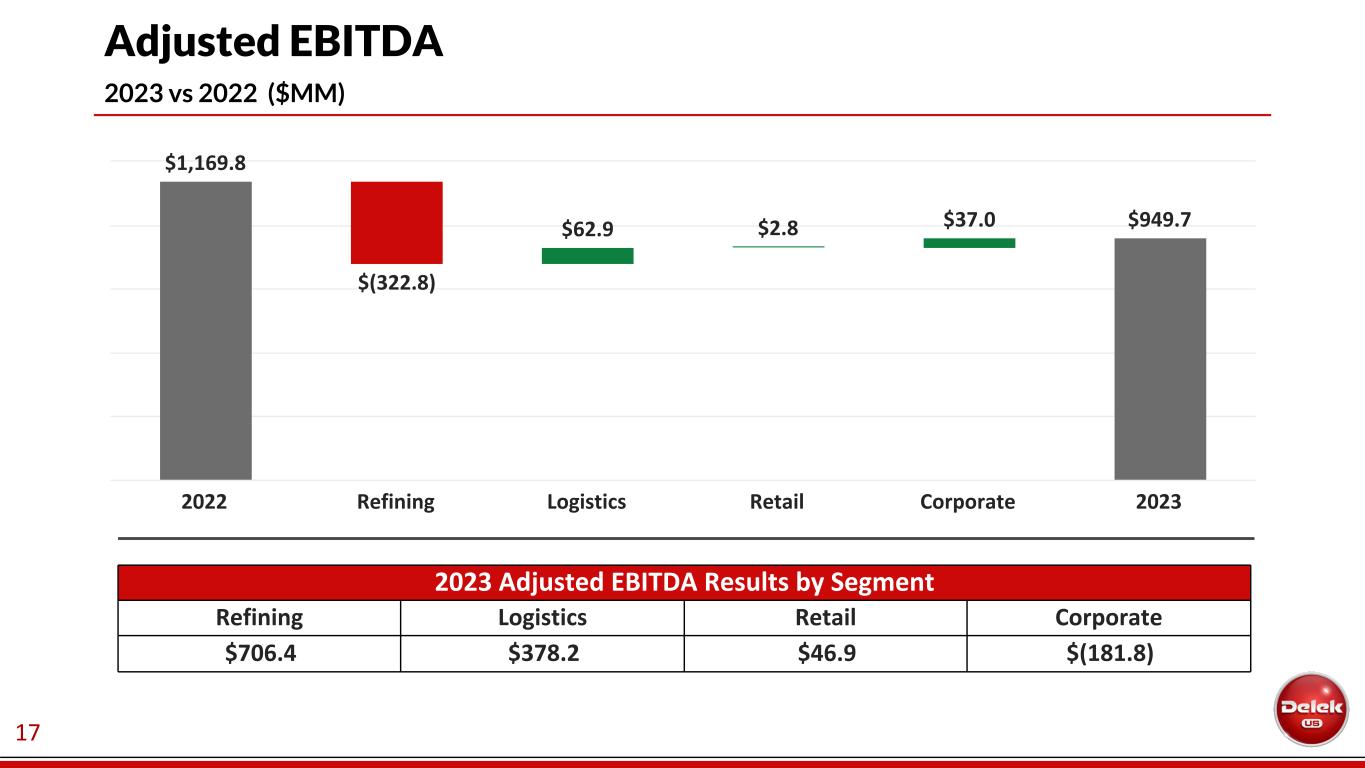

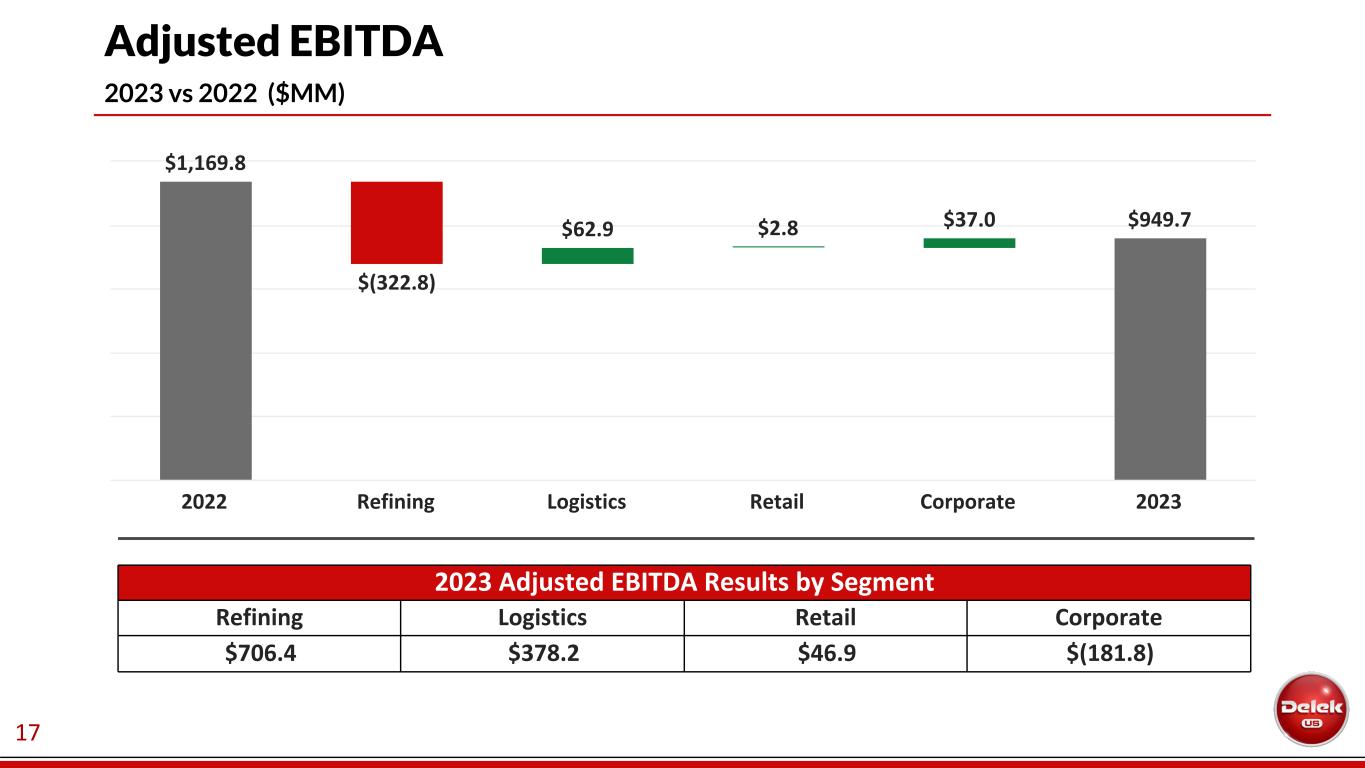

17 Adjusted EBITDA 2023 vs 2022 ($MM) 2023 Adjusted EBITDA Results by Segment Refining Logistics Retail Corporate $706.4 $378.2 $46.9 $(181.8) $1,169.8 $(322.8) $62.9 $2.8 $37.0 $949.7 2022 Refining Logistics Retail Corporate 2023

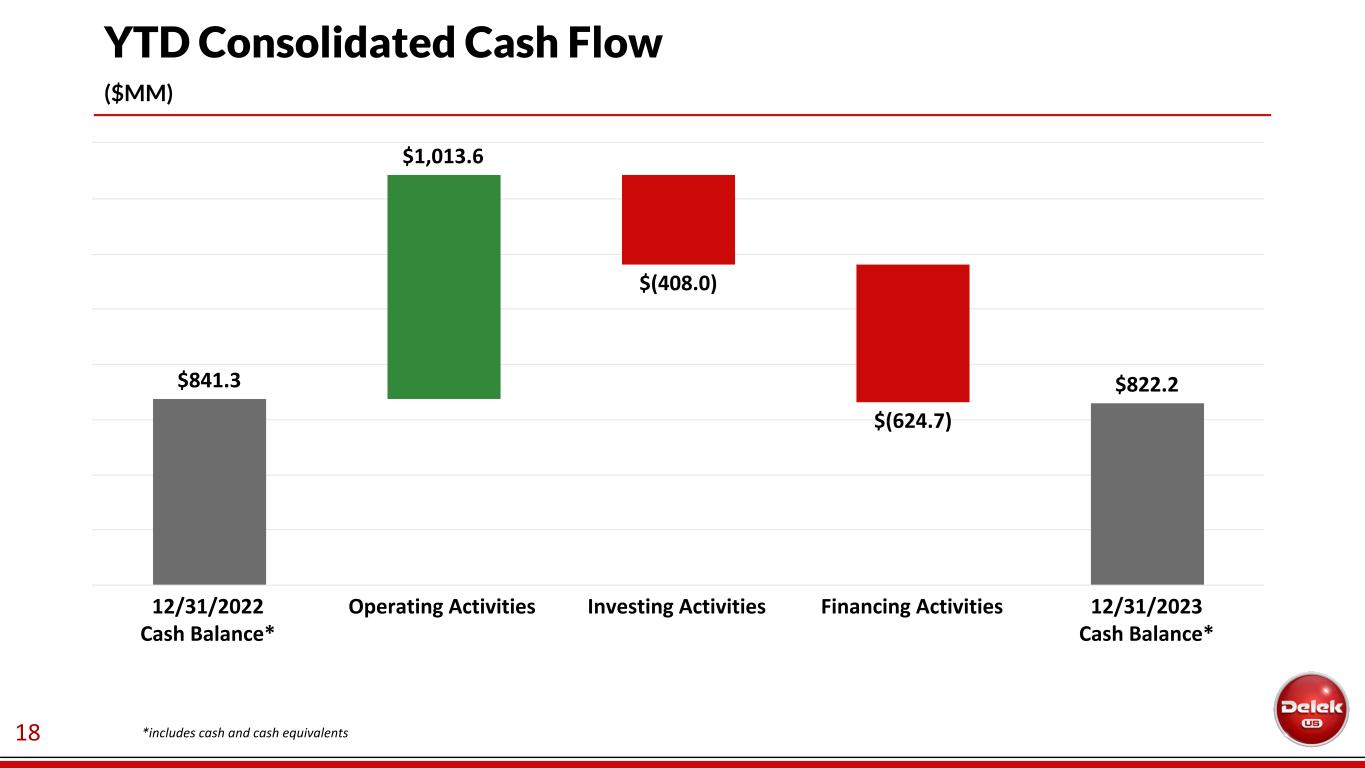

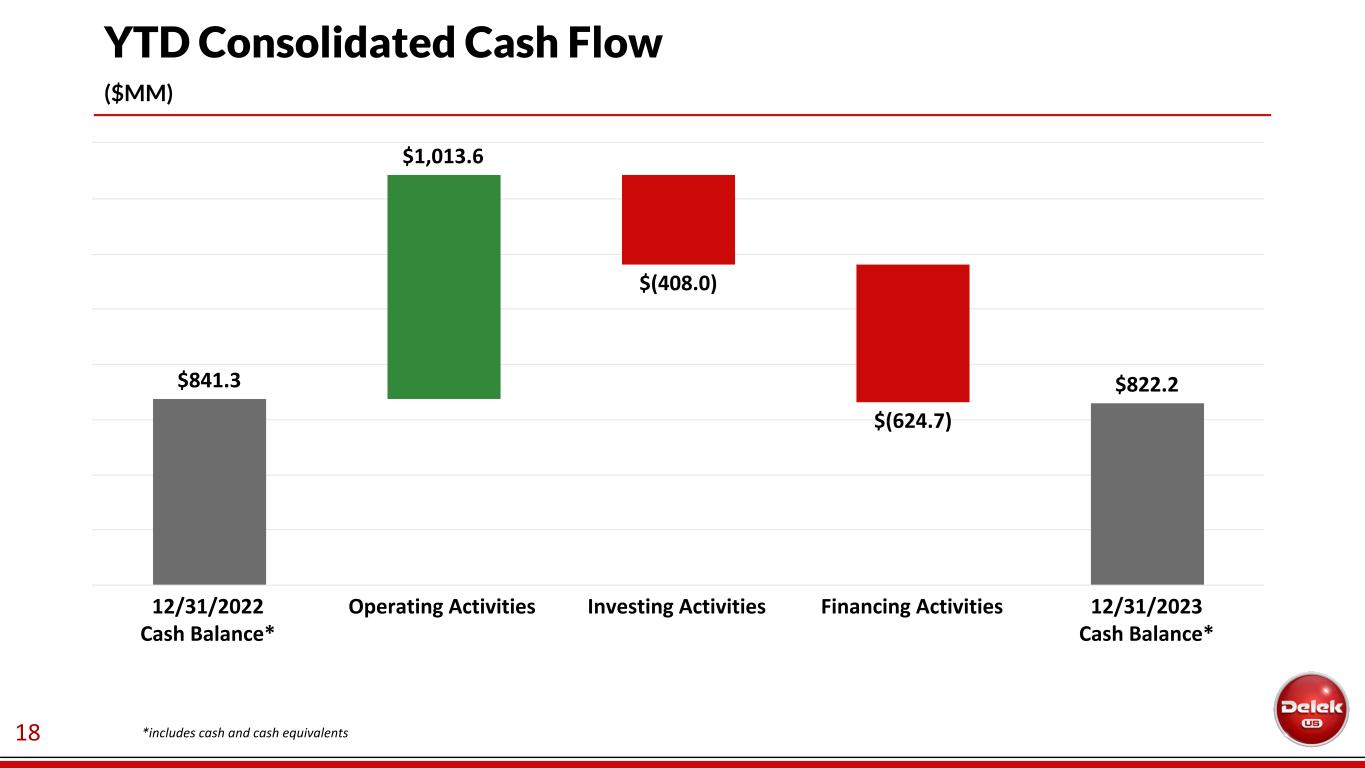

18 YTD Consolidated Cash Flow ($MM) *includes cash and cash equivalents $841.3 $1,013.6 $(408.0) $(624.7) $822.2 12/31/2022 Cash Balance* Operating Activities Investing Activities Financing Activities 12/31/2023 Cash Balance*

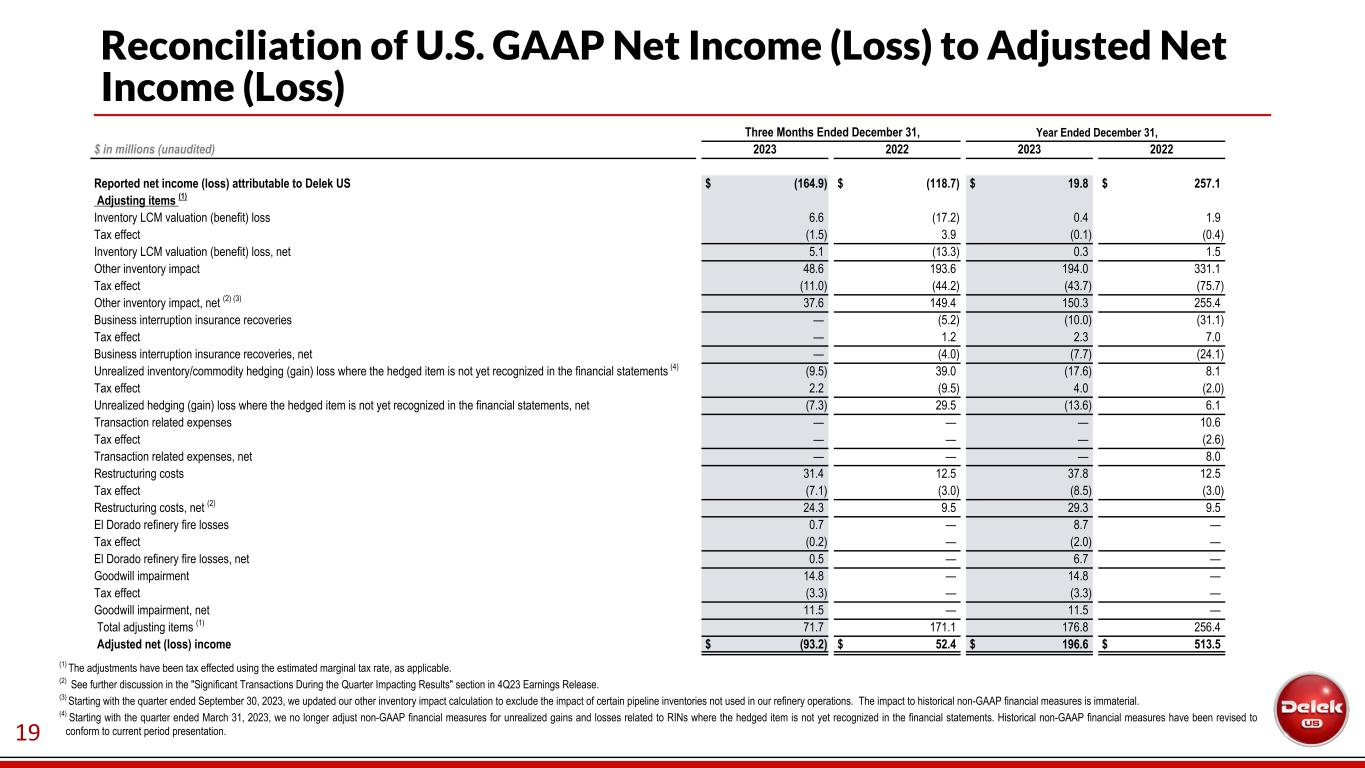

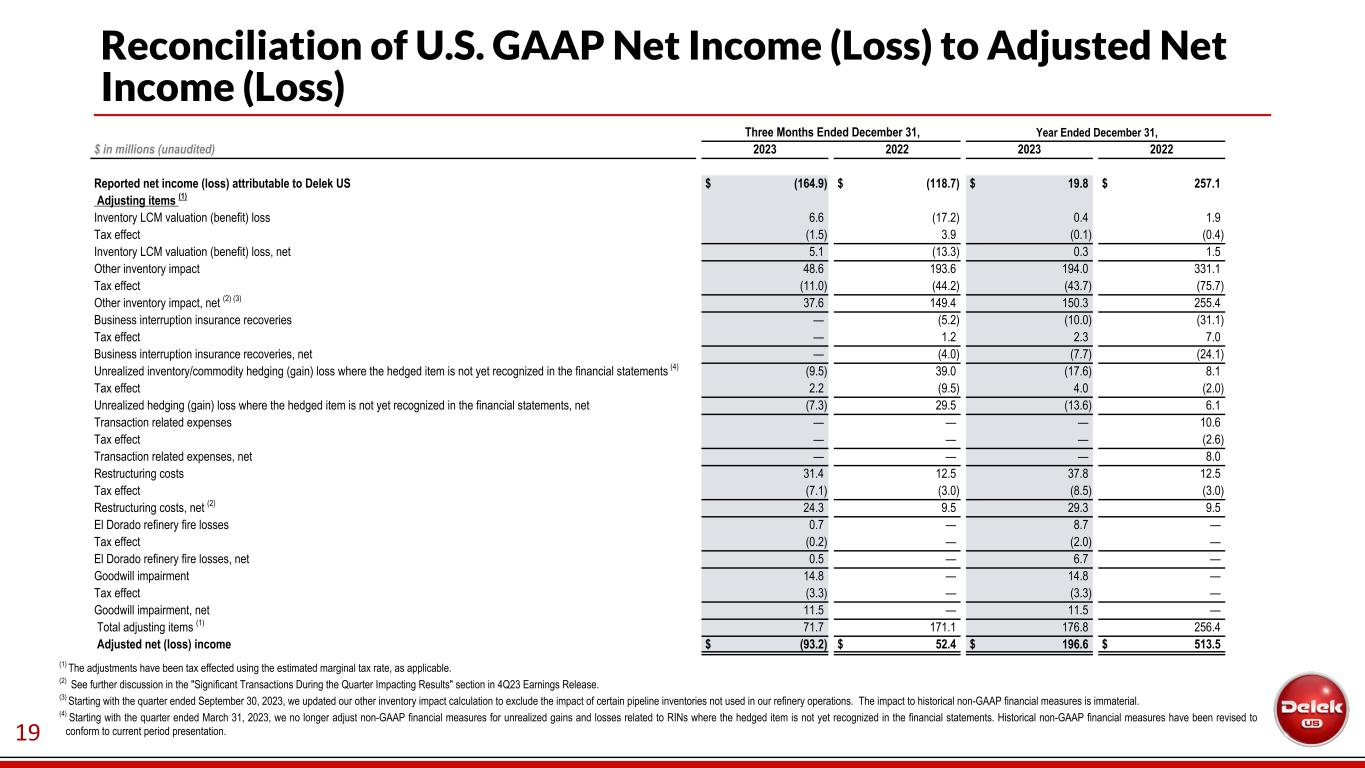

19 Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted Net Income (Loss) (1) The adjustments have been tax effected using the estimated marginal tax rate, as applicable. (2) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section in 4Q23 Earnings Release. (3) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial. (4) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation. Three Months Ended December 31, Year Ended December 31, $ in millions (unaudited) 2023 2022 2023 2022 Reported net income (loss) attributable to Delek US $ (164.9) $ (118.7) $ 19.8 $ 257.1 Adjusting items (1) Inventory LCM valuation (benefit) loss 6.6 (17.2) 0.4 1.9 Tax effect (1.5) 3.9 (0.1) (0.4) Inventory LCM valuation (benefit) loss, net 5.1 (13.3) 0.3 1.5 Other inventory impact 48.6 193.6 194.0 331.1 Tax effect (11.0) (44.2) (43.7) (75.7) Other inventory impact, net (2) (3) 37.6 149.4 150.3 255.4 Business interruption insurance recoveries — (5.2) (10.0) (31.1) Tax effect — 1.2 2.3 7.0 Business interruption insurance recoveries, net — (4.0) (7.7) (24.1) Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (4) (9.5) 39.0 (17.6) 8.1 Tax effect 2.2 (9.5) 4.0 (2.0) Unrealized hedging (gain) loss where the hedged item is not yet recognized in the financial statements, net (7.3) 29.5 (13.6) 6.1 Transaction related expenses — — — 10.6 Tax effect — — — (2.6) Transaction related expenses, net — — — 8.0 Restructuring costs 31.4 12.5 37.8 12.5 Tax effect (7.1) (3.0) (8.5) (3.0) Restructuring costs, net (2) 24.3 9.5 29.3 9.5 El Dorado refinery fire losses 0.7 — 8.7 — Tax effect (0.2) — (2.0) — El Dorado refinery fire losses, net 0.5 — 6.7 — Goodwill impairment 14.8 — 14.8 — Tax effect (3.3) — (3.3) — Goodwill impairment, net 11.5 — 11.5 — Total adjusting items (1) 71.7 171.1 176.8 256.4 Adjusted net (loss) income $ (93.2) $ 52.4 $ 196.6 $ 513.5

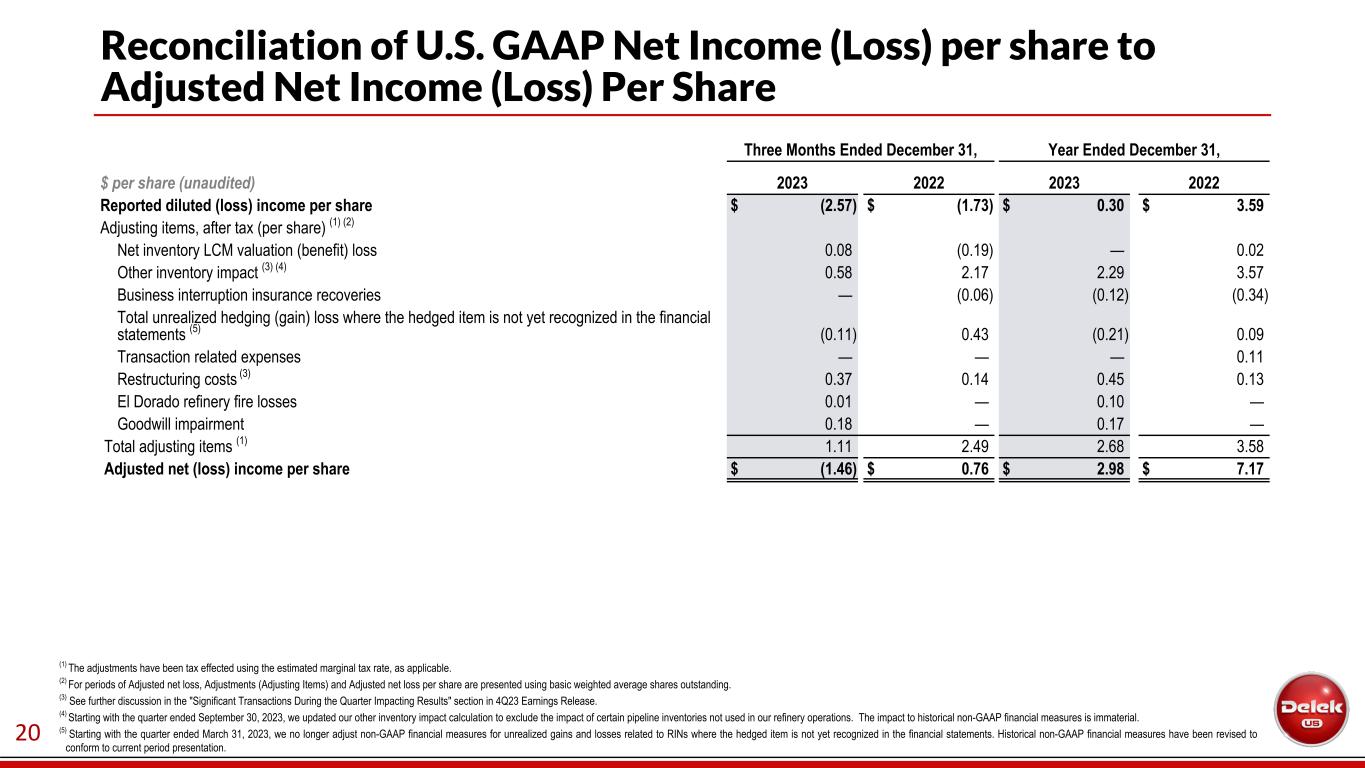

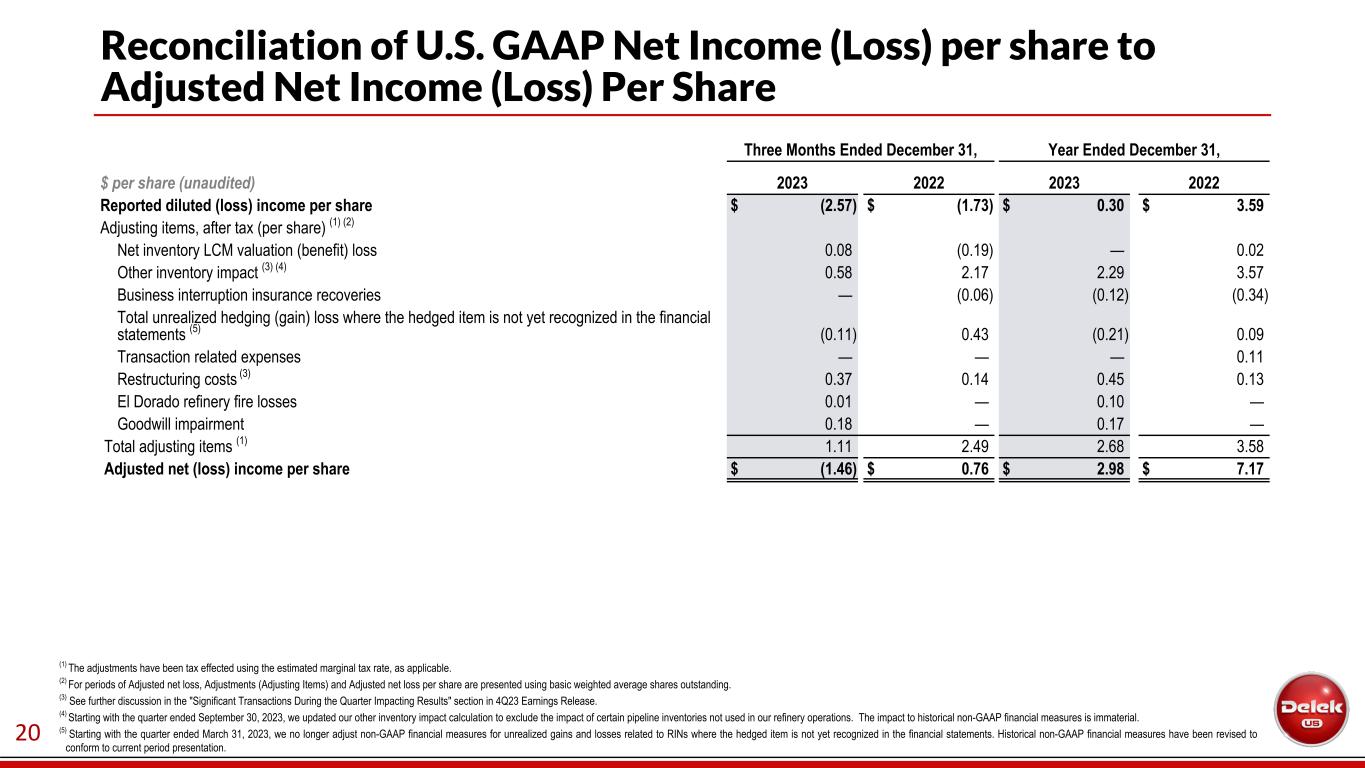

20 Reconciliation of U.S. GAAP Net Income (Loss) per share to Adjusted Net Income (Loss) Per Share Three Months Ended December 31, Year Ended December 31, $ per share (unaudited) 2023 2022 2023 2022 Reported diluted (loss) income per share $ (2.57) $ (1.73) $ 0.30 $ 3.59 Adjusting items, after tax (per share) (1) (2) Net inventory LCM valuation (benefit) loss 0.08 (0.19) — 0.02 Other inventory impact (3) (4) 0.58 2.17 2.29 3.57 Business interruption insurance recoveries — (0.06) (0.12) (0.34) Total unrealized hedging (gain) loss where the hedged item is not yet recognized in the financial statements (5) (0.11) 0.43 (0.21) 0.09 Transaction related expenses — — — 0.11 Restructuring costs (3) 0.37 0.14 0.45 0.13 El Dorado refinery fire losses 0.01 — 0.10 — Goodwill impairment 0.18 — 0.17 — Total adjusting items (1) 1.11 2.49 2.68 3.58 Adjusted net (loss) income per share $ (1.46) $ 0.76 $ 2.98 $ 7.17 (1) The adjustments have been tax effected using the estimated marginal tax rate, as applicable. (2) For periods of Adjusted net loss, Adjustments (Adjusting Items) and Adjusted net loss per share are presented using basic weighted average shares outstanding. (3) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section in 4Q23 Earnings Release. (4) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial. (5) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation.

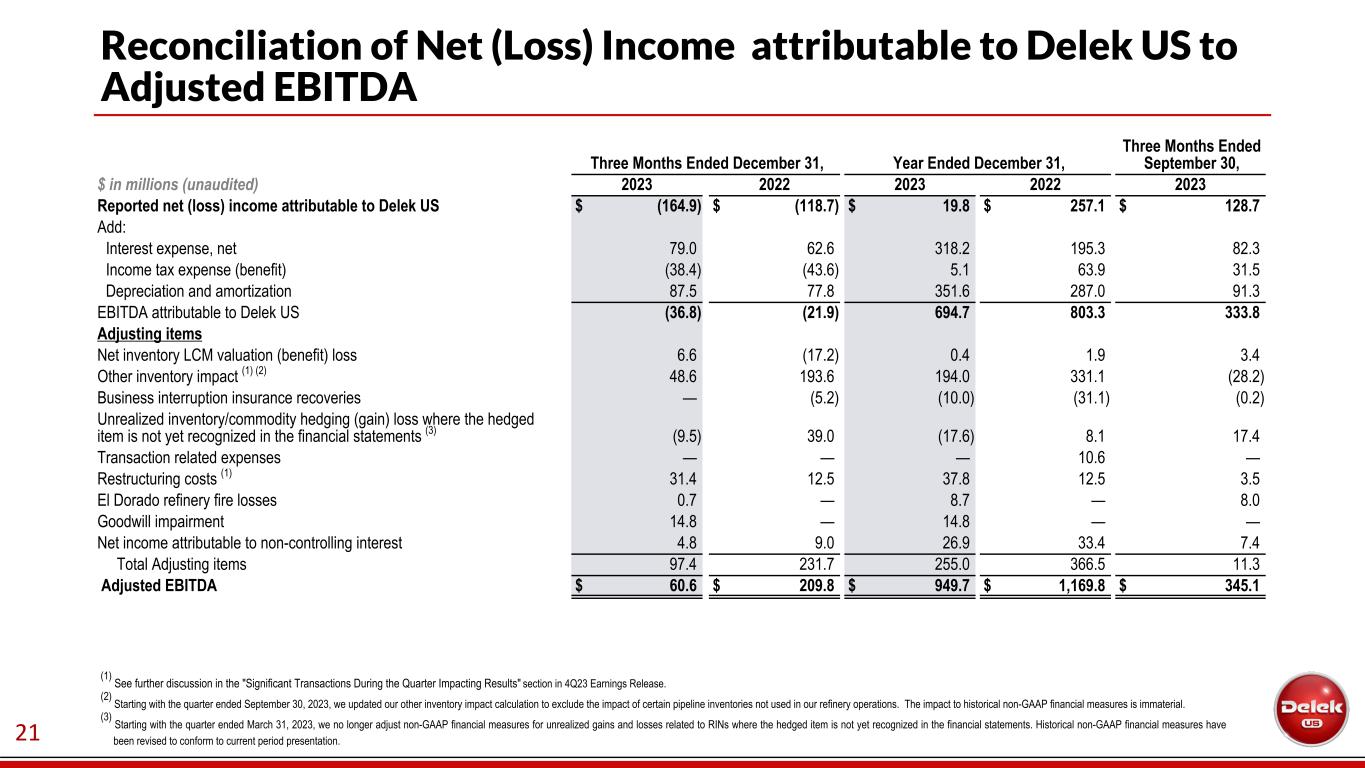

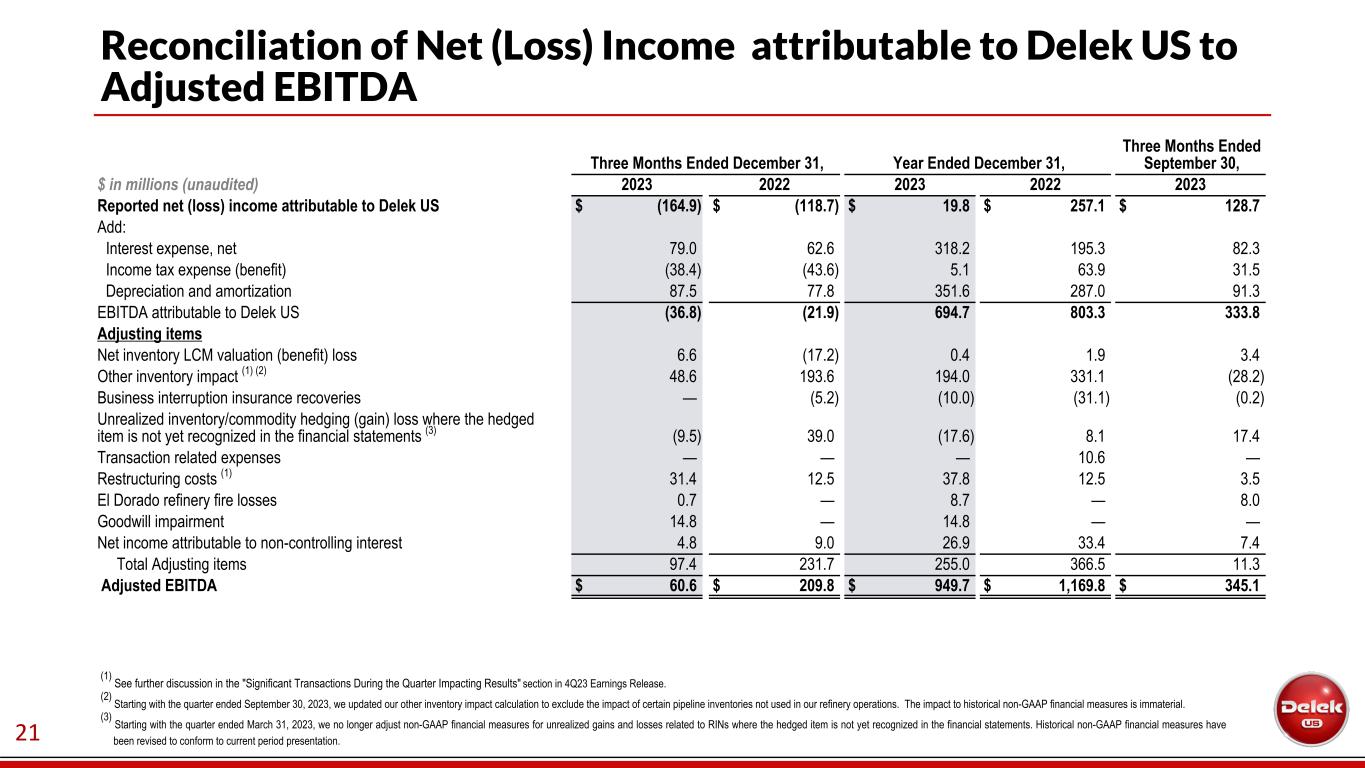

21 Reconciliation of Net (Loss) Income attributable to Delek US to Adjusted EBITDA Three Months Ended December 31, Year Ended December 31, Three Months Ended September 30, $ in millions (unaudited) 2023 2022 2023 2022 2023 Reported net (loss) income attributable to Delek US $ (164.9) $ (118.7) $ 19.8 $ 257.1 $ 128.7 Add: Interest expense, net 79.0 62.6 318.2 195.3 82.3 Income tax expense (benefit) (38.4) (43.6) 5.1 63.9 31.5 Depreciation and amortization 87.5 77.8 351.6 287.0 91.3 EBITDA attributable to Delek US (36.8) (21.9) 694.7 803.3 333.8 Adjusting items Net inventory LCM valuation (benefit) loss 6.6 (17.2) 0.4 1.9 3.4 Other inventory impact (1) (2) 48.6 193.6 194.0 331.1 (28.2) Business interruption insurance recoveries — (5.2) (10.0) (31.1) (0.2) Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) (9.5) 39.0 (17.6) 8.1 17.4 Transaction related expenses — — — 10.6 — Restructuring costs (1) 31.4 12.5 37.8 12.5 3.5 El Dorado refinery fire losses 0.7 — 8.7 — 8.0 Goodwill impairment 14.8 — 14.8 — — Net income attributable to non-controlling interest 4.8 9.0 26.9 33.4 7.4 Total Adjusting items 97.4 231.7 255.0 366.5 11.3 Adjusted EBITDA $ 60.6 $ 209.8 $ 949.7 $ 1,169.8 $ 345.1 (1) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section in 4Q23 Earnings Release. (2) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial. (3) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation.

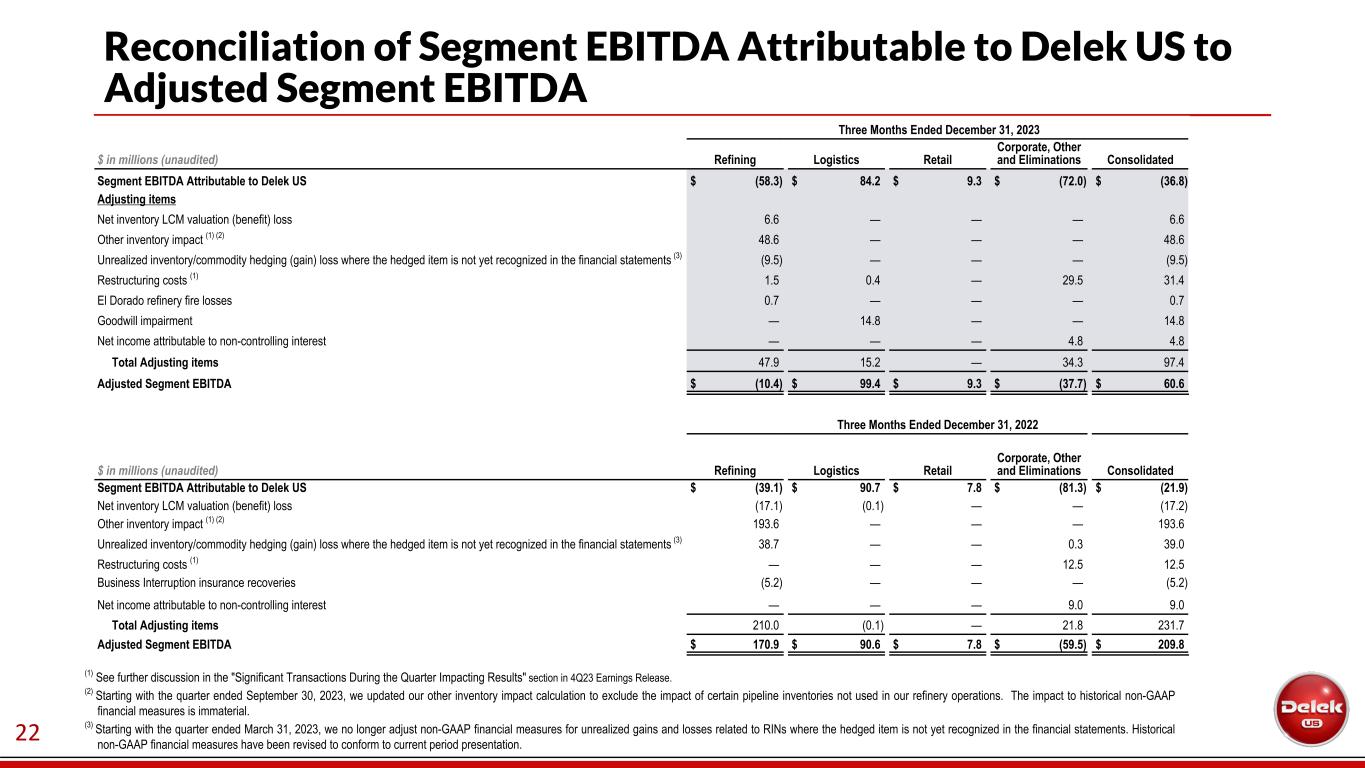

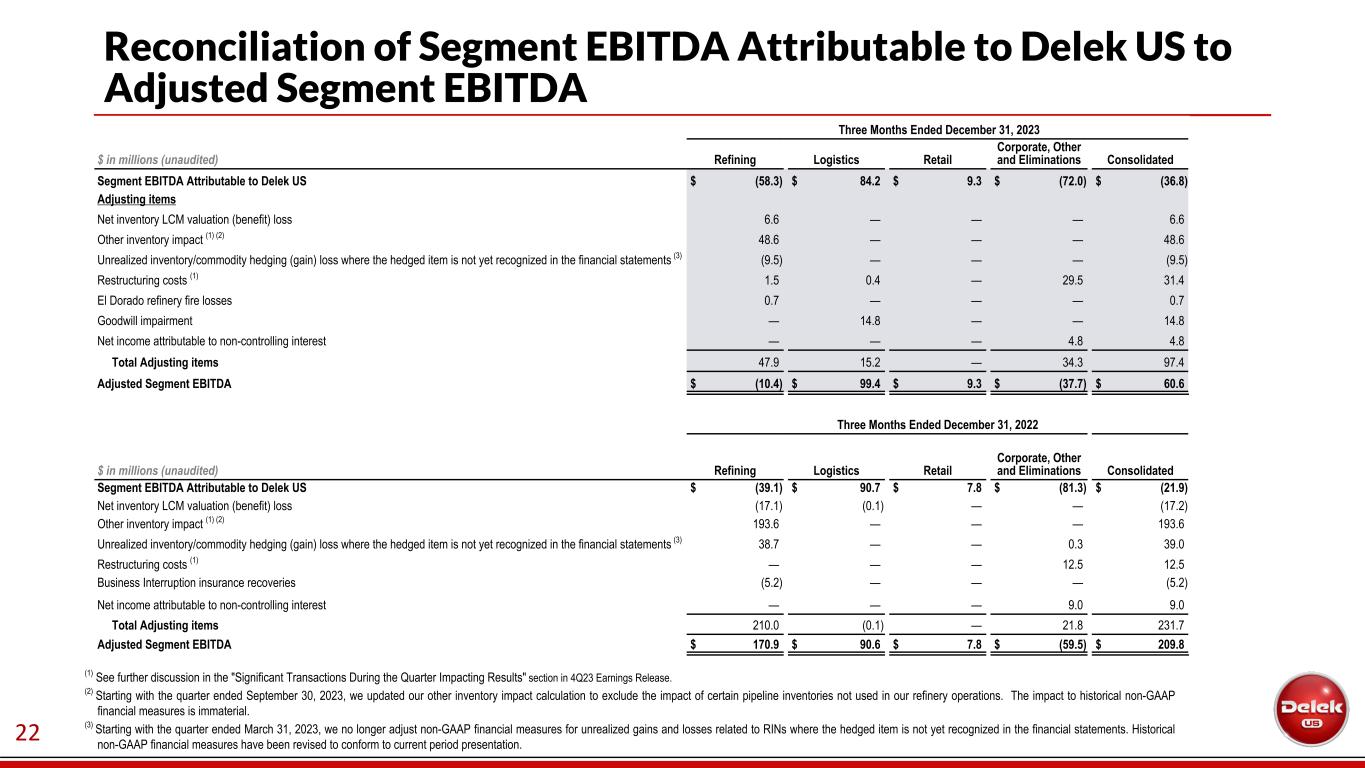

22 Reconciliation of Segment EBITDA Attributable to Delek US to Adjusted Segment EBITDA Three Months Ended December 31, 2023 $ in millions (unaudited) Refining Logistics Retail Corporate, Other and Eliminations Consolidated Segment EBITDA Attributable to Delek US $ (58.3) $ 84.2 $ 9.3 $ (72.0) $ (36.8) Adjusting items Net inventory LCM valuation (benefit) loss 6.6 — — — 6.6 Other inventory impact (1) (2) 48.6 — — — 48.6 Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) (9.5) — — — (9.5) Restructuring costs (1) 1.5 0.4 — 29.5 31.4 El Dorado refinery fire losses 0.7 — — — 0.7 Goodwill impairment — 14.8 — — 14.8 Net income attributable to non-controlling interest — — — 4.8 4.8 Total Adjusting items 47.9 15.2 — 34.3 97.4 Adjusted Segment EBITDA $ (10.4) $ 99.4 $ 9.3 $ (37.7) $ 60.6 (1) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section in 4Q23 Earnings Release. (2) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial. (3) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation. Three Months Ended December 31, 2022 $ in millions (unaudited) Refining Logistics Retail Corporate, Other and Eliminations Consolidated Segment EBITDA Attributable to Delek US $ (39.1) $ 90.7 $ 7.8 $ (81.3) $ (21.9) Net inventory LCM valuation (benefit) loss (17.1) (0.1) — — (17.2) Other inventory impact (1) (2) 193.6 — — — 193.6 Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) 38.7 — — 0.3 39.0 Restructuring costs (1) — — — 12.5 12.5 Business Interruption insurance recoveries (5.2) — — — (5.2) Net income attributable to non-controlling interest — — — 9.0 9.0 Total Adjusting items 210.0 (0.1) — 21.8 231.7 Adjusted Segment EBITDA $ 170.9 $ 90.6 $ 7.8 $ (59.5) $ 209.8

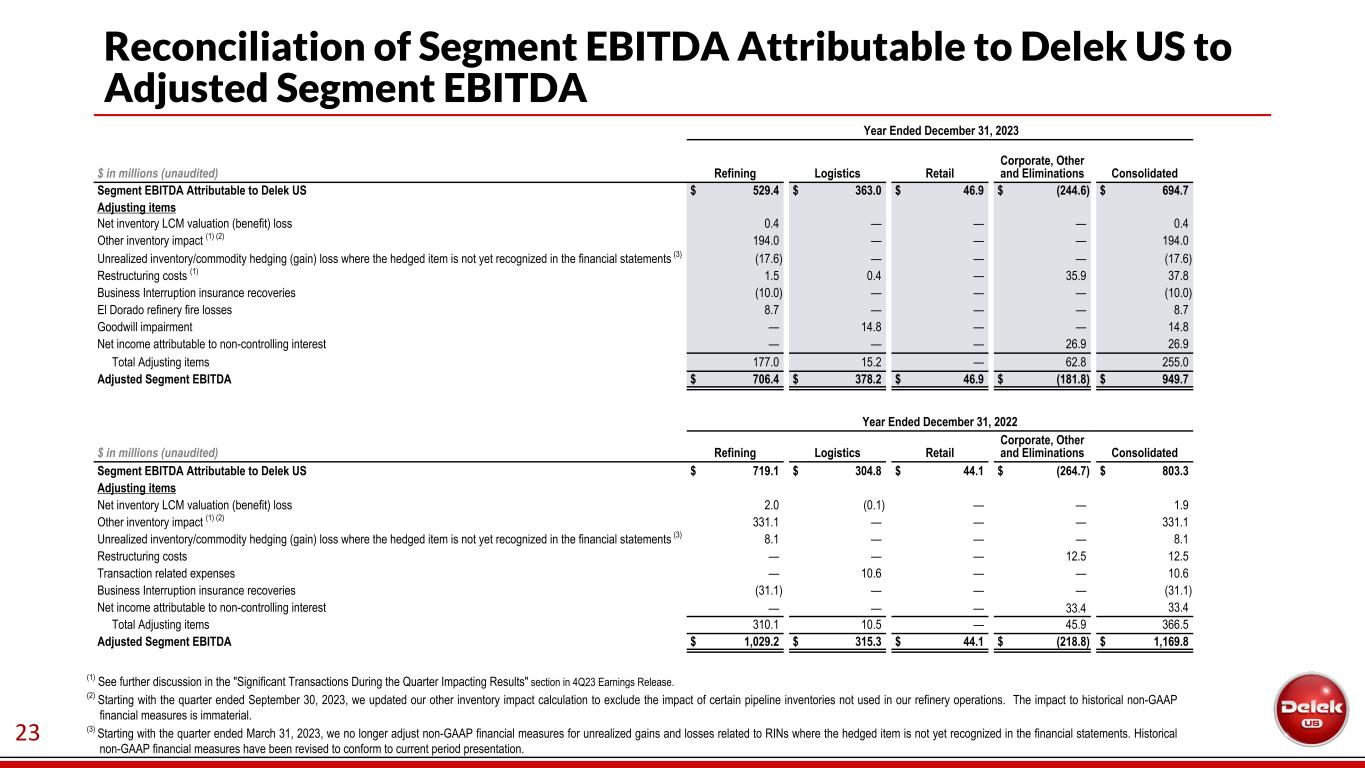

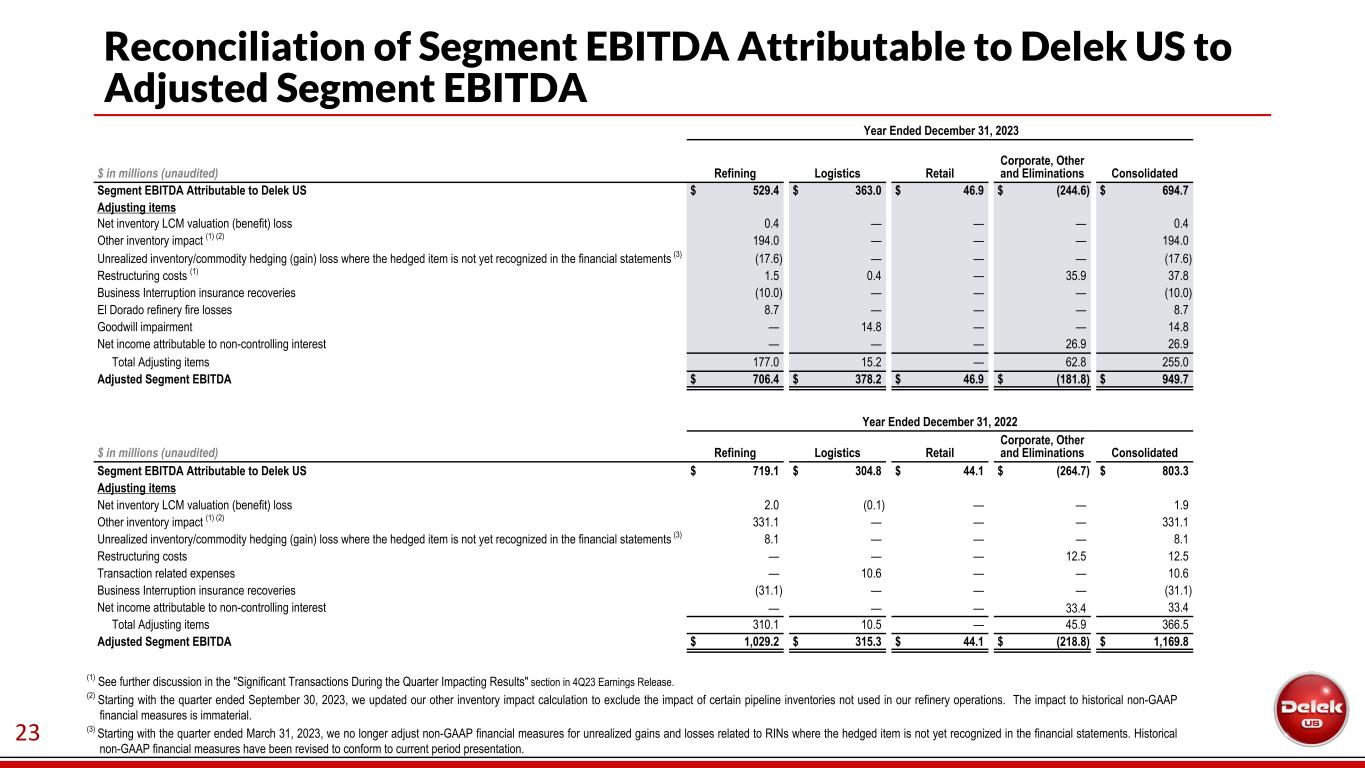

23 Reconciliation of Segment EBITDA Attributable to Delek US to Adjusted Segment EBITDA (1) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section in 4Q23 Earnings Release. (2) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial. (3) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation. Year Ended December 31, 2023 $ in millions (unaudited) Refining Logistics Retail Corporate, Other and Eliminations Consolidated Segment EBITDA Attributable to Delek US $ 529.4 $ 363.0 $ 46.9 $ (244.6) $ 694.7 Adjusting items Net inventory LCM valuation (benefit) loss 0.4 — — — 0.4 Other inventory impact (1) (2) 194.0 — — — 194.0 Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) (17.6) — — — (17.6) Restructuring costs (1) 1.5 0.4 — 35.9 37.8 Business Interruption insurance recoveries (10.0) — — — (10.0) El Dorado refinery fire losses 8.7 — — — 8.7 Goodwill impairment — 14.8 — — 14.8 Net income attributable to non-controlling interest — — — 26.9 26.9 Total Adjusting items 177.0 15.2 — 62.8 255.0 Adjusted Segment EBITDA $ 706.4 $ 378.2 $ 46.9 $ (181.8) $ 949.7 Year Ended December 31, 2022 $ in millions (unaudited) Refining Logistics Retail Corporate, Other and Eliminations Consolidated Segment EBITDA Attributable to Delek US $ 719.1 $ 304.8 $ 44.1 $ (264.7) $ 803.3 Adjusting items Net inventory LCM valuation (benefit) loss 2.0 (0.1) — — 1.9 Other inventory impact (1) (2) 331.1 — — — 331.1 Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) 8.1 — — — 8.1 Restructuring costs — — — 12.5 12.5 Transaction related expenses — 10.6 — — 10.6 Business Interruption insurance recoveries (31.1) — — — (31.1) Net income attributable to non-controlling interest — — — 33.4 33.4 Total Adjusting items 310.1 10.5 — 45.9 366.5 Adjusted Segment EBITDA $ 1,029.2 $ 315.3 $ 44.1 $ (218.8) $ 1,169.8

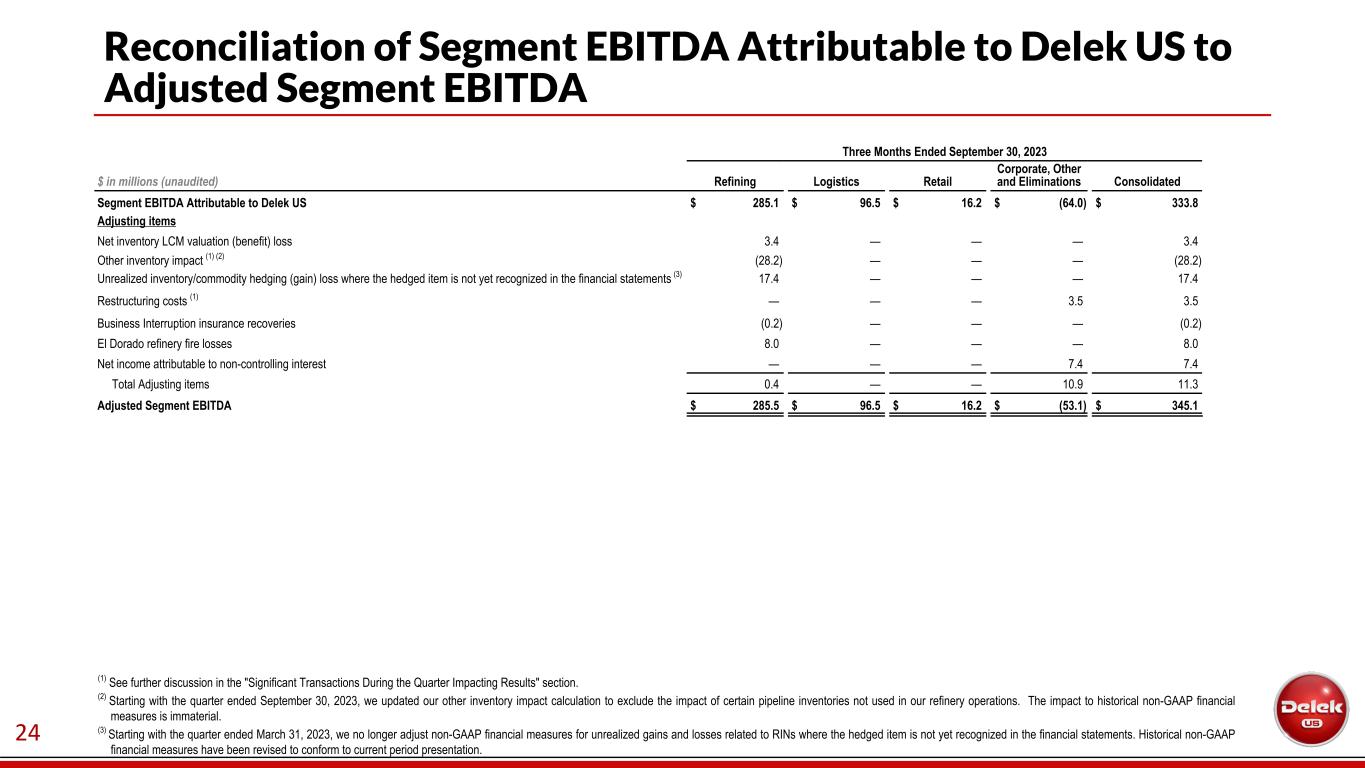

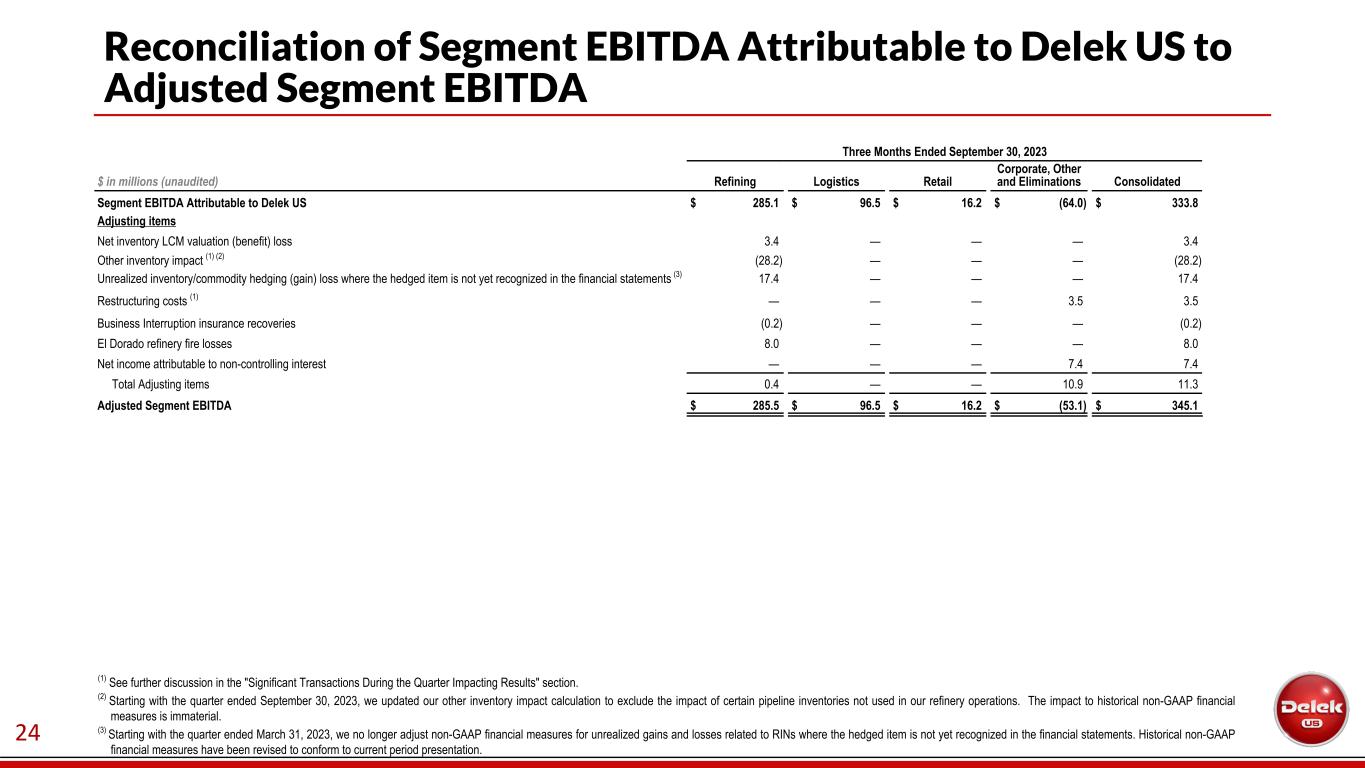

24 Reconciliation of Segment EBITDA Attributable to Delek US to Adjusted Segment EBITDA Three Months Ended September 30, 2023 $ in millions (unaudited) Refining Logistics Retail Corporate, Other and Eliminations Consolidated Segment EBITDA Attributable to Delek US $ 285.1 $ 96.5 $ 16.2 $ (64.0) $ 333.8 Adjusting items Net inventory LCM valuation (benefit) loss 3.4 — — — 3.4 Other inventory impact (1) (2) (28.2) — — — (28.2) Unrealized inventory/commodity hedging (gain) loss where the hedged item is not yet recognized in the financial statements (3) 17.4 — — — 17.4 Restructuring costs (1) — — — 3.5 3.5 Business Interruption insurance recoveries (0.2) — — — (0.2) El Dorado refinery fire losses 8.0 — — — 8.0 Net income attributable to non-controlling interest — — — 7.4 7.4 Total Adjusting items 0.4 — — 10.9 11.3 Adjusted Segment EBITDA $ 285.5 $ 96.5 $ 16.2 $ (53.1) $ 345.1 (1) See further discussion in the "Significant Transactions During the Quarter Impacting Results" section. (2) Starting with the quarter ended September 30, 2023, we updated our other inventory impact calculation to exclude the impact of certain pipeline inventories not used in our refinery operations. The impact to historical non-GAAP financial measures is immaterial. (3) Starting with the quarter ended March 31, 2023, we no longer adjust non-GAAP financial measures for unrealized gains and losses related to RINs where the hedged item is not yet recognized in the financial statements. Historical non-GAAP financial measures have been revised to conform to current period presentation.