Akazoo January 2019 Investor Presentation Exhibit 99.2

Forward Looking Statements This presentation contains certain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended, based on the current expectations, estimates and projections of Modern Media Acquisition Corp. (“MMDM”) or Akazoo Limited (the “Company”) about the Company’s operations, industry, financial condition, performance, results of operations, and liquidity. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. Statements containing words such as “may,” “could,” “believe,” “anticipate,” “expect,” “intend,” “plan,” “project,” “projections,” “business outlook,” “estimate,” or similar expressions constitute forward-looking statements. Forward-looking statements represent management’s current expectations or predictions of future conditions, events or results. These forward-looking statements include, but are not limited to, statements about, or are based upon assumptions regarding the Company’s strategies and future financial performance; expectations or estimates about future business plans or objectives, prospective performance and opportunities, including revenues; customer acquisition and retention; operating expenses; market trends, including those in the markets in which the Company competes; liquidity; cash flows and uses of cash; capital expenditures; the Company’s ability to invest in growth initiatives and pursue acquisition opportunities; the Company’s products and services; pricing; marketing plans; competition; the anticipated benefits of the proposed business combination; the amount of any redemptions by existing holders of MMDM shares; the sources and uses of cash; the management and board composition of the combined company following the proposed business combination; the anticipated capitalization and enterprise value of the combined company; the continued listing of the combined company’s securities on Nasdaq; whether MMDM is able to successfully secure stockholder approval to amend its certificate of incorporation to extend the date by which MMDM must consummate its initial business combination (the “Extension”); and the structure, terms and timing of the proposed business combination. You are cautioned not to place undue reliance on these forward-looking statements, which reflect management's good faith beliefs, assumptions and expectations only as of the date hereof. Any such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties that may cause actual performance and results to differ materially from those predicted, many of which are beyond the Company’s control. Reported results should not be considered an indication of future performance. Except as required by law, we undertake no obligation to publicly release the results of any revision or update to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Use of Non-IFRS Financial Measures This presentation includes certain non-IFRS financial measures, including EBITDA and Adjusted Gross Profit. The Company defines (i) EBITDA as Earnings before interest, taxes, depreciation and amortization and (ii) Adjusted Gross Profit as gross profit plus media costs. You can find the reconciliation of these measures to the nearest comparable IFRS measures elsewhere in this presentation. Except as otherwise noted, all references herein to full-year periods refer to the Company’s fiscal year, which ends on December 31. The Company believes that these non-IFRS measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company’s management uses these non-IFRS measures to compare the Company’s performance to that of prior periods for trend analyses and for budgeting and planning purposes. The Company believes that the use of these non-IFRS financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Management of the Company does not consider these non-IFRS measures in isolation or as an alternative to financial measures determined in accordance with IFRS. We have not reconciled the non-IFRS forward looking information to their corresponding IFRS measures because we do not provide guidance for the various reconciling items such as provision for income taxes and depreciation and amortization, as certain items that impact these measures are out of our control or cannot be reasonably predicted without unreasonable efforts. You should review the Company’s financial statements, when available, and not rely on any single financial measure to evaluate the Company’s business. Other companies may calculate non-IFRS measures differently, and therefore the Company’s non-IFRS measures may not be directly comparable to similarly titled measures of other companies. Important Information

Use of the Forecasted Financial and Other Information This presentation contains forecasted financial and other information with respect to the Company’s projected subscribers, revenues, EBITDA, EBITDA margin and gross profit for the Company’s fiscal 2018, 2019, 2020, and 2021. Neither the independent auditors of MMDM nor the independent registered public accounting firm of the Company, audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These forecasts should not be relied upon as being necessarily indicative of future results. In this presentation, certain of the above-mentioned projections have been repeated (in each case, with an indication that the information is an estimate and is subject to the qualifications presented herein), for purposes of providing comparisons with historical data. The assumptions and estimates underlying the forecasted financial and other information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the forecasted financial and other information. Accordingly, there can be no assurance that the projections are indicative of the future performance of MMDM, the Company, or the combined company after completion of the proposed business combination, or that actual results will not differ materially from those presented in the forecasted financial and other information. Inclusion of the forecasted financial and other information in this presentation should not be regarded as a representation by any person that the results contained in the forecasted financial and other information will be achieved. Participants in the Solicitation Akazoo, MMDM, and their respective directors, executive officers and employees and other persons may be deemed to be participants in the solicitation of proxies from the holders of MMDM common stock in respect of the Extension and in respect of the proposed transaction between them. Information about MMDM’s directors and executive officers and their ownership of MMDM’s common stock is set forth in MMDM’s Annual Report on Form 10-K for the year ended March 31, 2018 filed with the Securities and Exchange Commission (the “SEC”), as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing. Other information regarding the interests of the participants in the proxy solicitation will be included in the proxy statement relating to MMDM’s special meeting to consider, among other things, the extension and in the Registration Statement (as defined below). These documents can be obtained free of charge as described below. Additional Information and Where to Find It In connection with the proposed transaction between Akazoo and MMDM, (referred to as “HoldCo”), the proposed new parent of Akazoo and MMDM (“HoldCo”), will file a Registration Statement on Form F-4 (the “Registration Statement”) containing a proxy statement/prospectus for MMDM stockholders. When completed, a proxy statement/prospectus and proxy card will be mailed to each stockholder of MMDM entitled to vote at the special meeting relating to the transaction. INVESTORS AND SECURITY HOLDERS OF MMDM ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT MMDM WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MMDM, AKAZOO AND THE TRANSACTION. The Registration Statement, proxy statement/prospectus and other relevant materials in connection with the transaction (when they become available), and any other documents filed by MMDM with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov) or by writing to Modern Media Acquisition Corp., 1180 Peachtree Street, N.E. Suite 2400, Atlanta, GA. Important Information

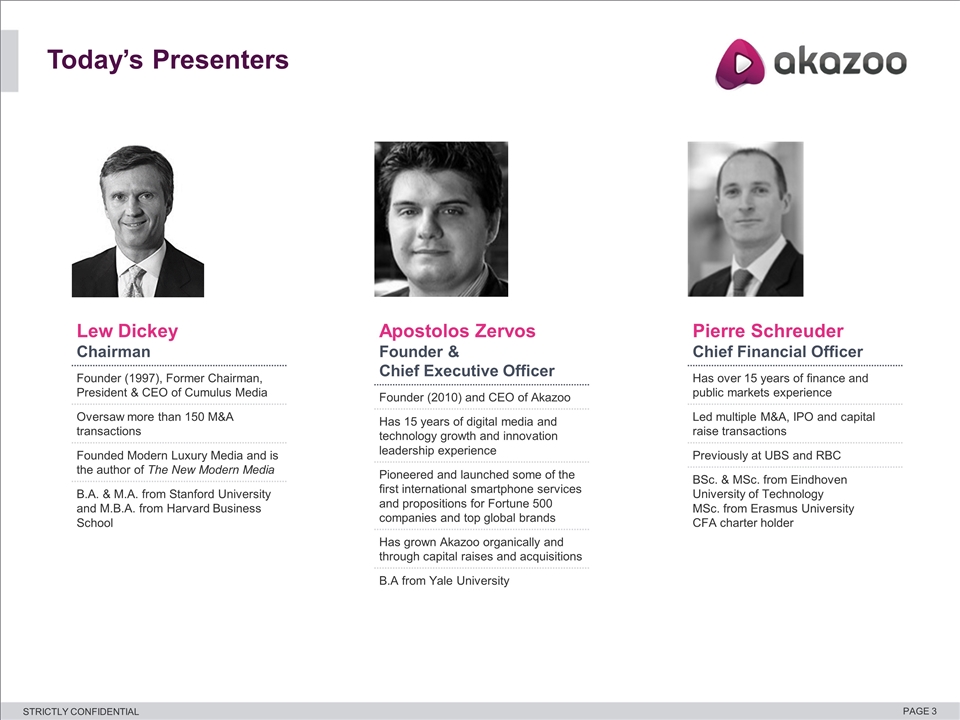

Today’s Presenters Lew Dickey Chairman Founder (1997), Former Chairman, President & CEO of Cumulus Media Oversaw more than 150 M&A transactions Founded Modern Luxury Media and is the author of The New Modern Media B.A. & M.A. from Stanford University and M.B.A. from Harvard Business School Apostolos Zervos Founder & Chief Executive Officer Founder (2010) and CEO of Akazoo Has 15 years of digital media and technology growth and innovation leadership experience Pioneered and launched some of the first international smartphone services and propositions for Fortune 500 companies and top global brands Has grown Akazoo organically and through capital raises and acquisitions B.A from Yale University Pierre Schreuder Chief Financial Officer Has over 15 years of finance and public markets experience Led multiple M&A, IPO and capital raise transactions Previously at UBS and RBC BSc. & MSc. from Eindhoven University of Technology MSc. from Erasmus University CFA charter holder

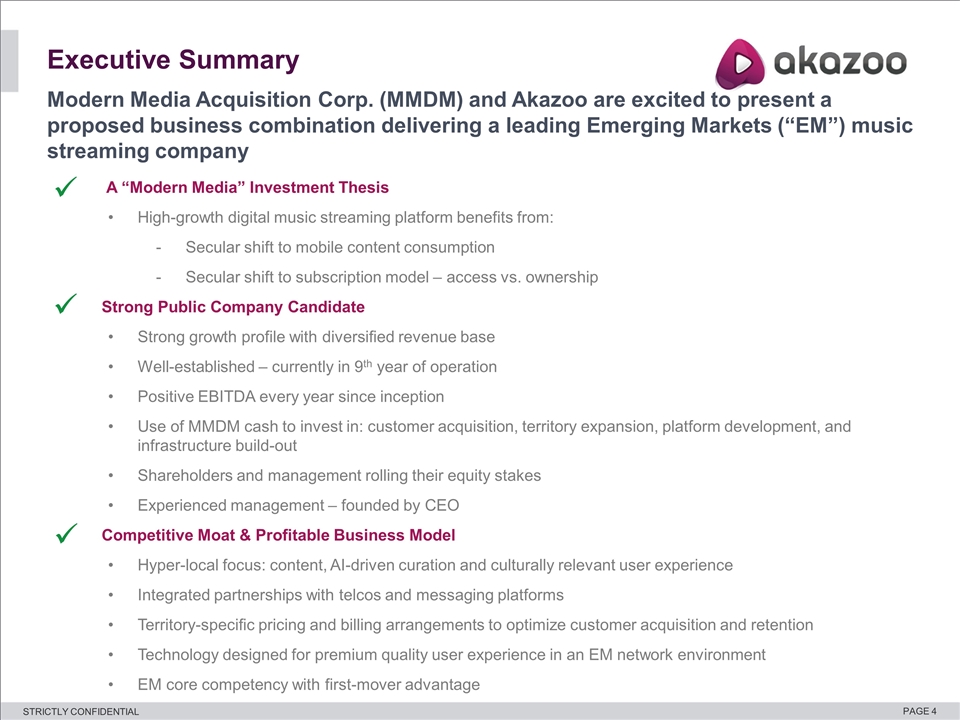

Executive Summary Modern Media Acquisition Corp. (MMDM) and Akazoo are excited to present a proposed business combination delivering a leading Emerging Markets (“EM”) music streaming company A “Modern Media” Investment Thesis High-growth digital music streaming platform benefits from: Secular shift to mobile content consumption Secular shift to subscription model – access vs. ownership Strong Public Company Candidate Strong growth profile with diversified revenue base Well-established – currently in 9th year of operation Positive EBITDA every year since inception Use of MMDM cash to invest in: customer acquisition, territory expansion, platform development, and infrastructure build-out Shareholders and management rolling their equity stakes Experienced management – founded by CEO Competitive Moat & Profitable Business Model Hyper-local focus: content, AI-driven curation and culturally relevant user experience Integrated partnerships with telcos and messaging platforms Territory-specific pricing and billing arrangements to optimize customer acquisition and retention Technology designed for premium quality user experience in an EM network environment EM core competency with first-mover advantage ü ü ü

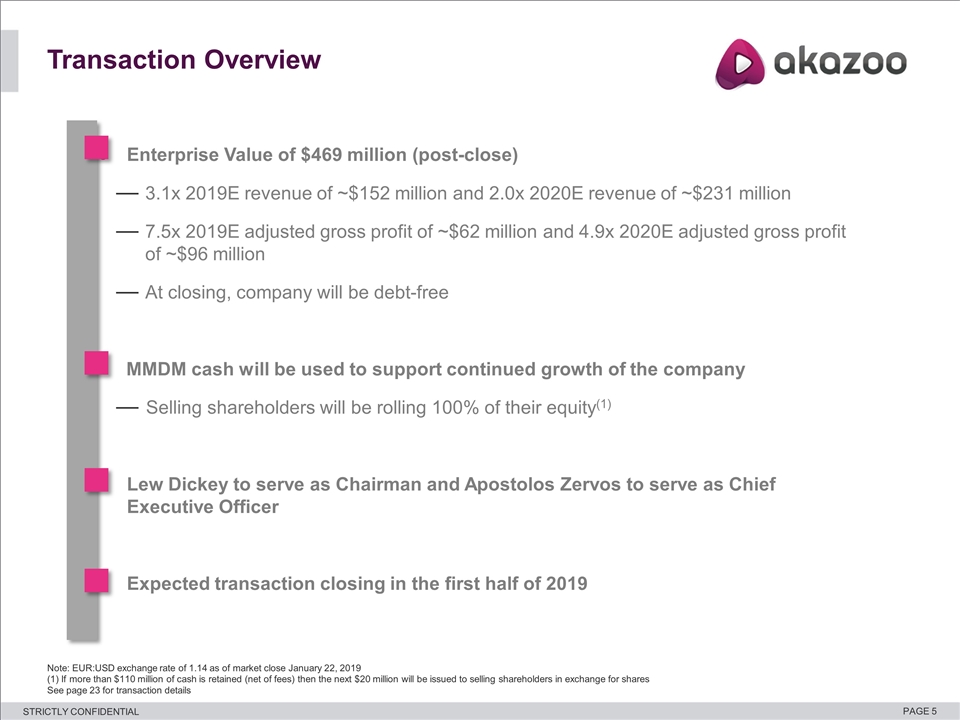

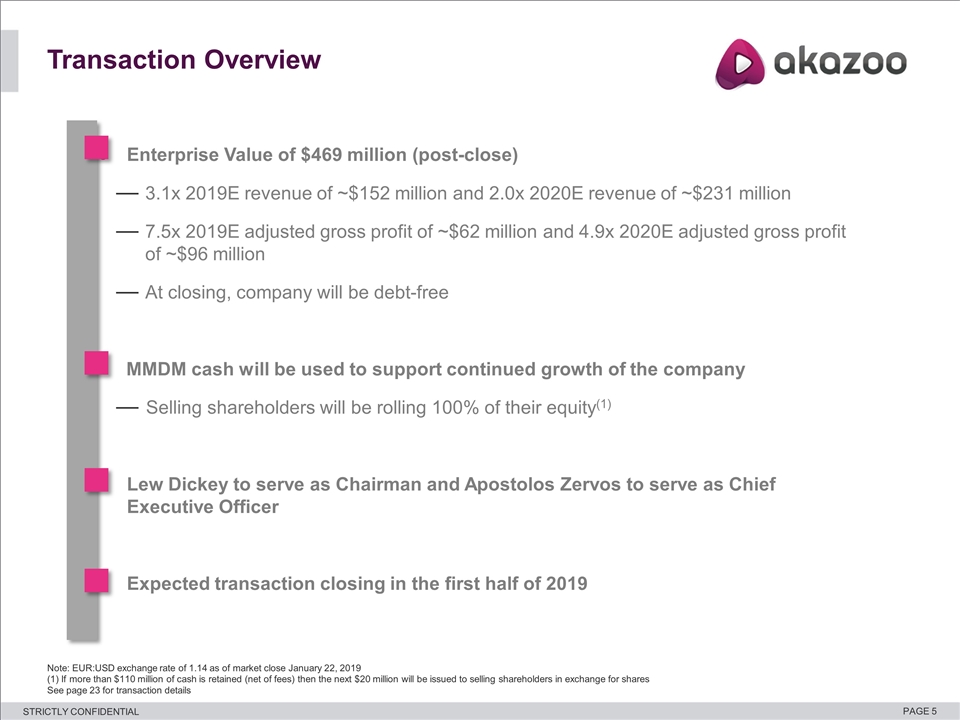

Enterprise Value of $469 million (post-close) 3.1x 2019E revenue of ~$152 million and 2.0x 2020E revenue of ~$231 million 7.5x 2019E adjusted gross profit of ~$62 million and 4.9x 2020E adjusted gross profit of ~$96 million At closing, company will be debt-free MMDM cash will be used to support continued growth of the company Selling shareholders will be rolling 100% of their equity(1) Lew Dickey to serve as Chairman and Apostolos Zervos to serve as Chief Executive Officer Expected transaction closing in the first half of 2019 Transaction Overview Note: EUR:USD exchange rate of 1.14 as of market close January 22, 2019 (1) If more than $110 million of cash is retained (net of fees) then the next $20 million will be issued to selling shareholders in exchange for shares See page 23 for transaction details

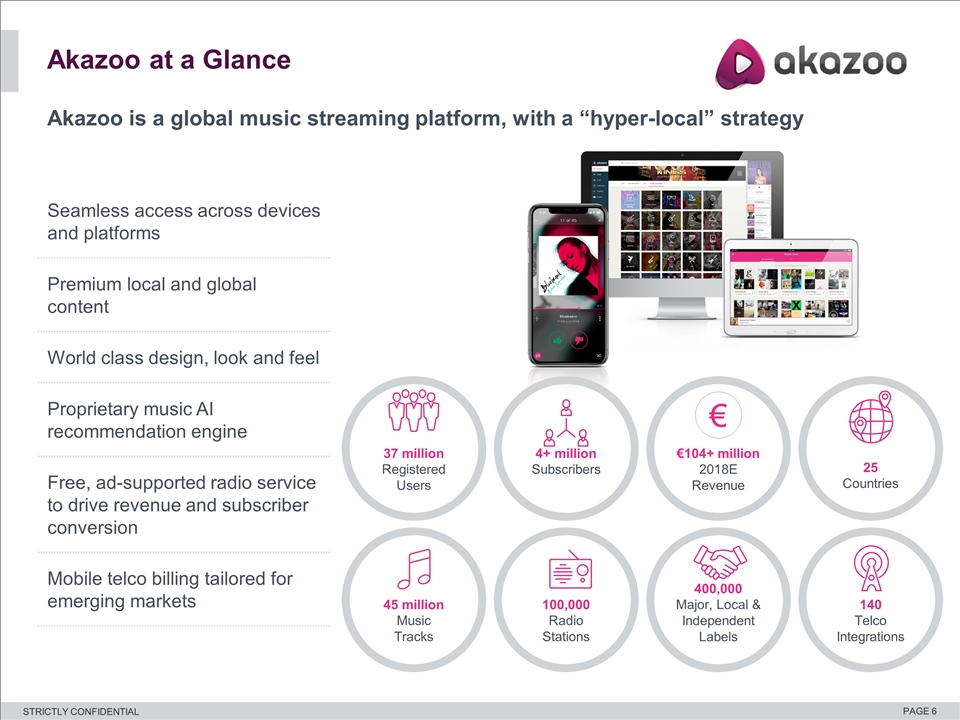

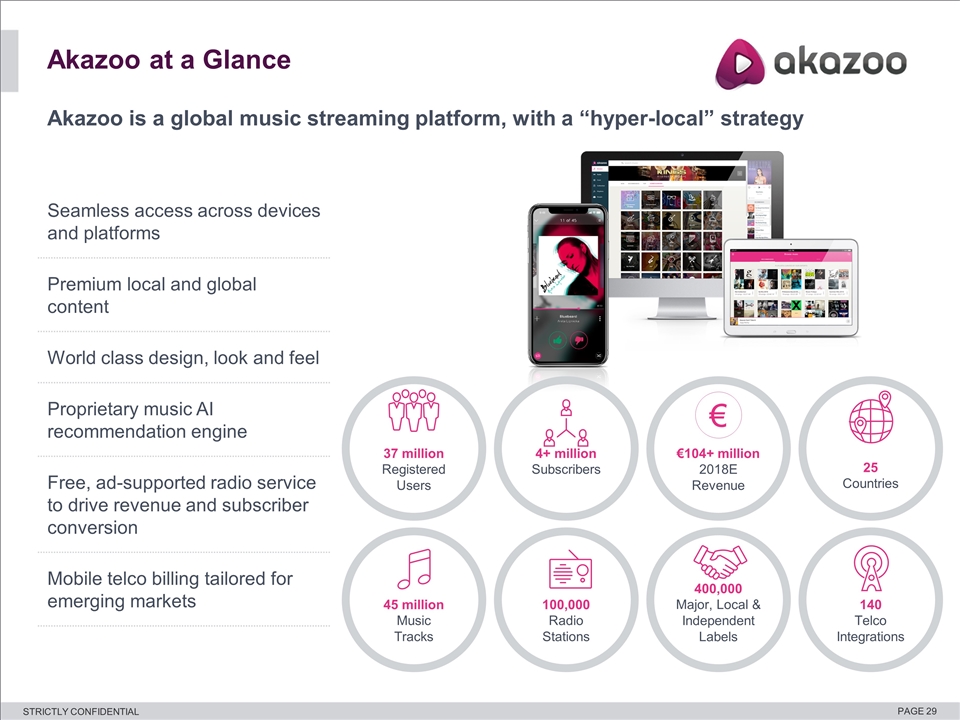

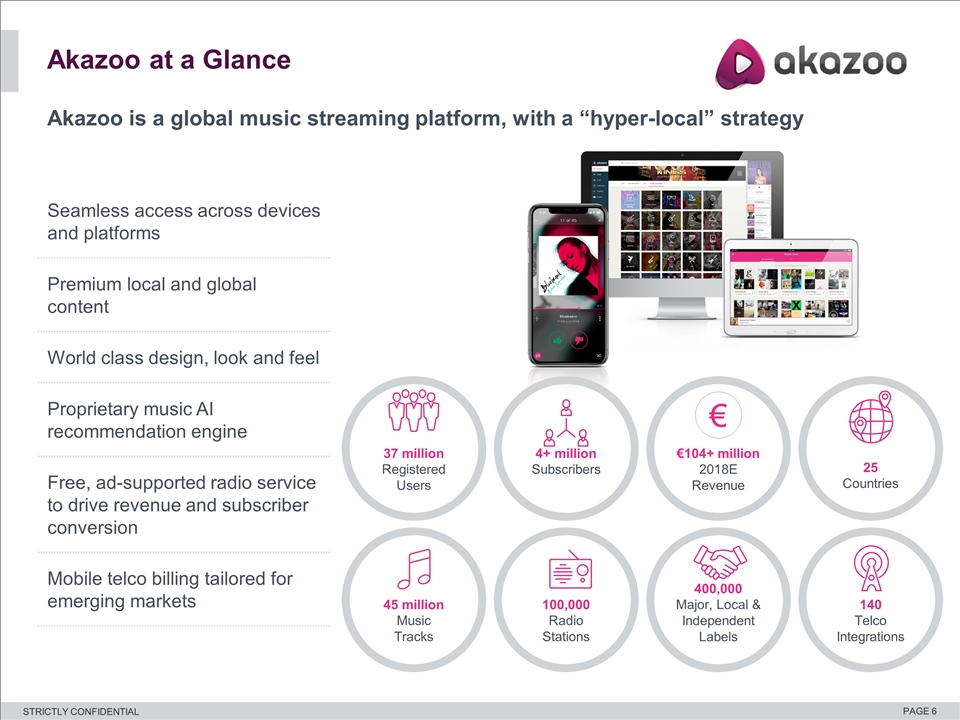

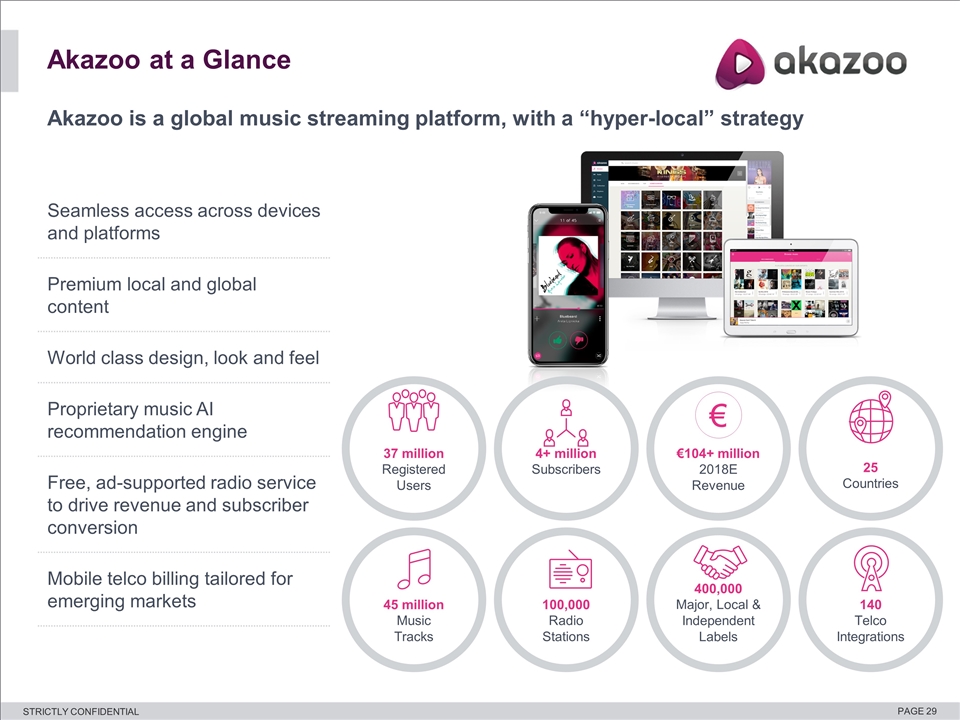

Akazoo is a global music streaming platform, with a “hyper-local” strategy Akazoo at a Glance Seamless access across devices and platforms Premium local and global content World class design, look and feel Proprietary music AI recommendation engine Free, ad-supported radio service to drive revenue and subscriber conversion Mobile telco billing tailored for emerging markets 37 million Registered Users €104+ million 2018E Revenue 140 Telco Integrations 400,000 Major, Local & Independent Labels 100,000 Radio Stations 25 Countries 45 million Music Tracks 4+ million Subscribers €

Market overview

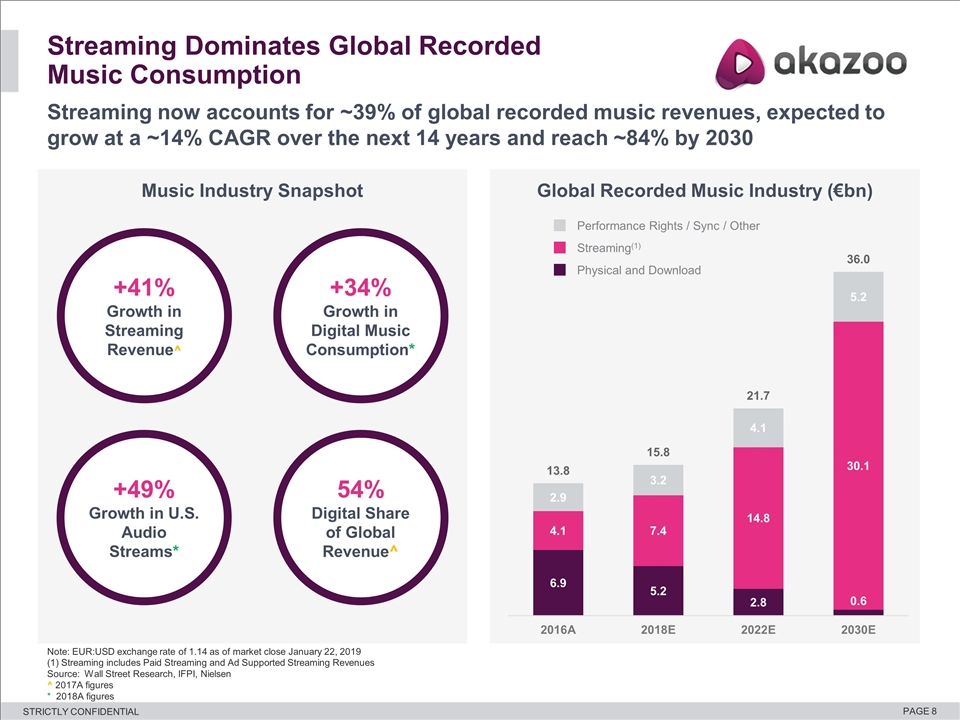

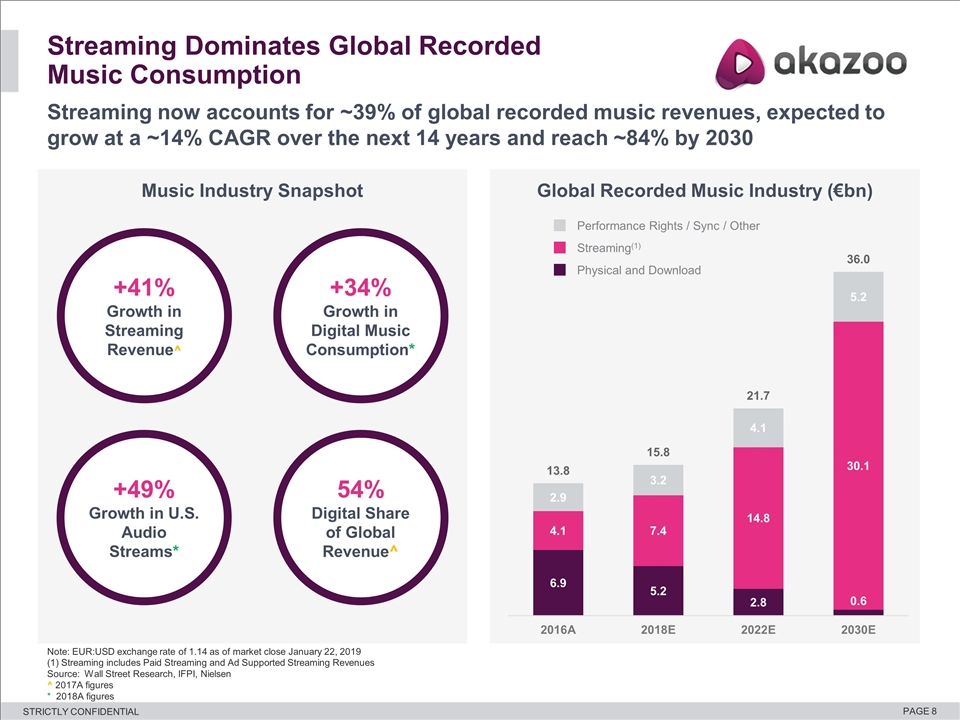

Global Recorded Music Industry (€bn) Note: EUR:USD exchange rate of 1.14 as of market close January 22, 2019 (1) Streaming includes Paid Streaming and Ad Supported Streaming Revenues Source: Wall Street Research, IFPI, Nielsen ^ 2017A figures * 2018A figures Streaming Dominates Global Recorded Music Consumption Streaming now accounts for ~39% of global recorded music revenues, expected to grow at a ~14% CAGR over the next 14 years and reach ~84% by 2030 Music Industry Snapshot +41% Growth in Streaming Revenue^ +34% Growth in Digital Music Consumption* +49% Growth in U.S. Audio Streams* 54% Digital Share of Global Revenue^ Performance Rights / Sync / Other Streaming(1) Physical and Download

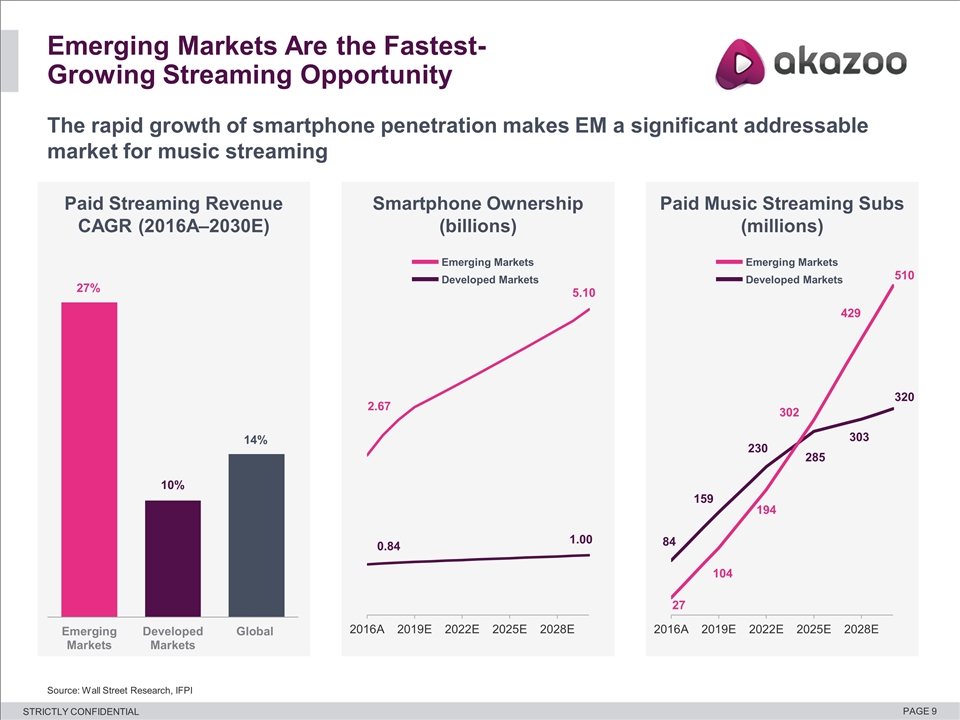

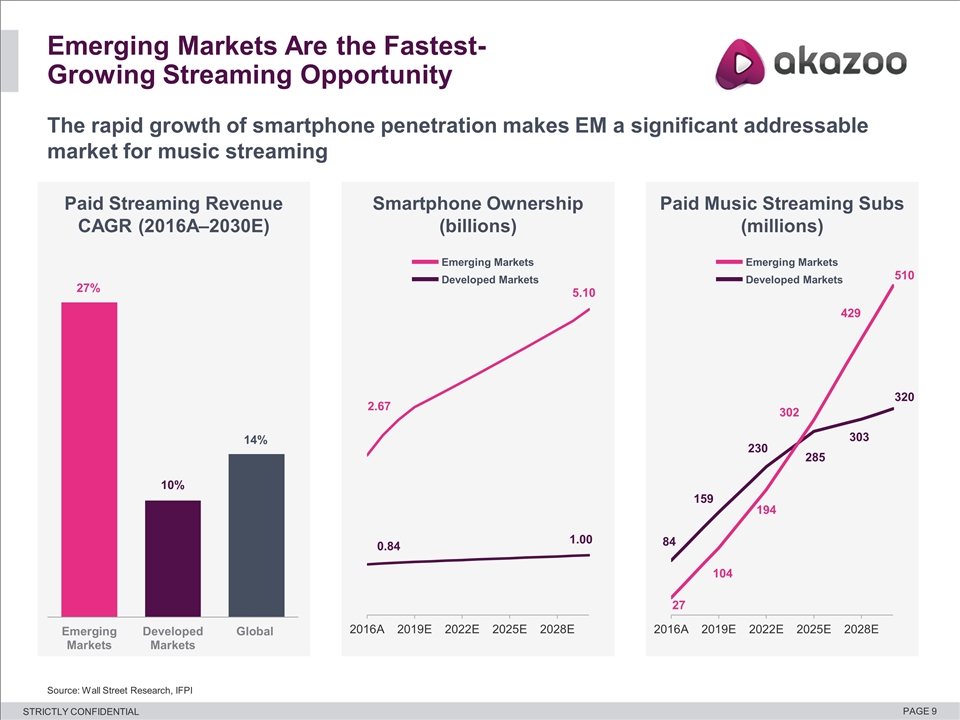

Paid Music Streaming Subs (millions) Smartphone Ownership (billions) Source: Wall Street Research, IFPI Emerging Markets Are the Fastest-Growing Streaming Opportunity The rapid growth of smartphone penetration makes EM a significant addressable market for music streaming Paid Streaming Revenue CAGR (2016A–2030E) Emerging Markets Developed Markets Emerging Markets Developed Markets

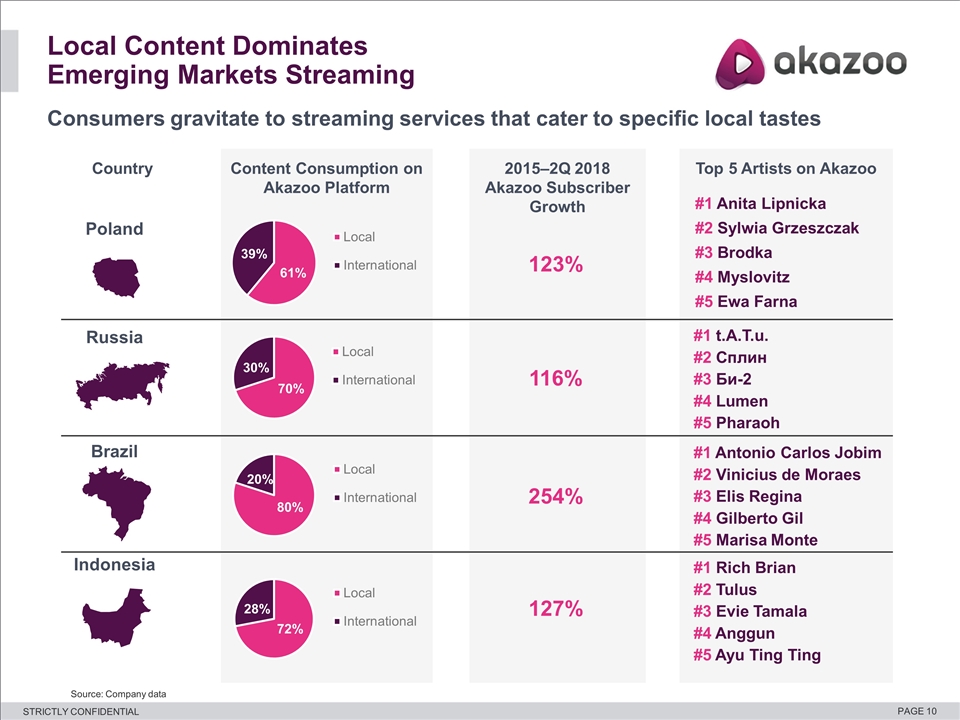

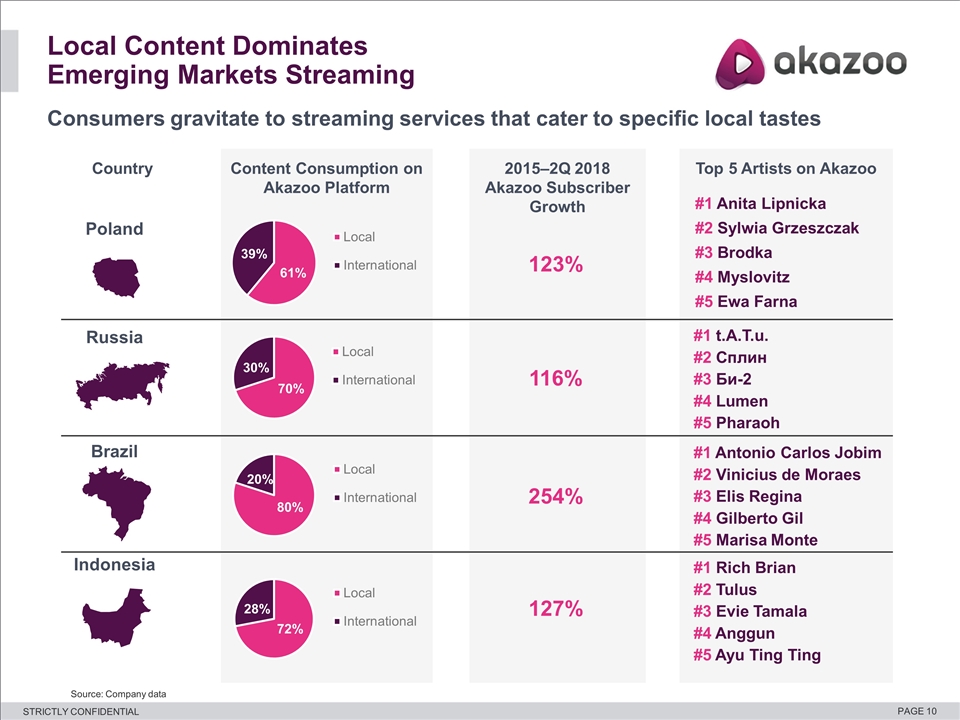

Top 5 Artists on Akazoo 2015–2Q 2018 Akazoo Subscriber Growth Content Consumption on Akazoo Platform Local Content Dominates Emerging Markets Streaming Consumers gravitate to streaming services that cater to specific local tastes Poland Russia Brazil Indonesia #1 Anita Lipnicka #2 Sylwia Grzeszczak #3 Brodka #4 Myslovitz #5 Ewa Farna #1 t.A.T.u. #2 Сплин #3 Би-2 #4 Lumen #5 Pharaoh #1 Antonio Carlos Jobim #2 Vinicius de Moraes #3 Elis Regina #4 Gilberto Gil #5 Marisa Monte #1 Rich Brian #2 Tulus #3 Evie Tamala #4 Anggun #5 Ayu Ting Ting 123% 116% 254% 127% Source: Company data Country

Company Overview

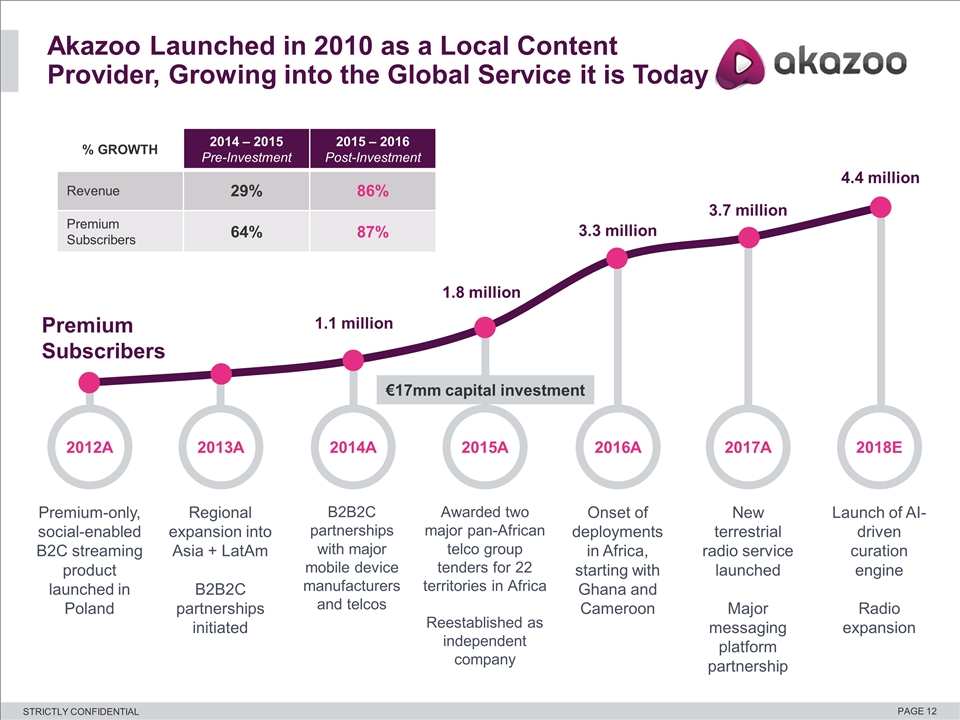

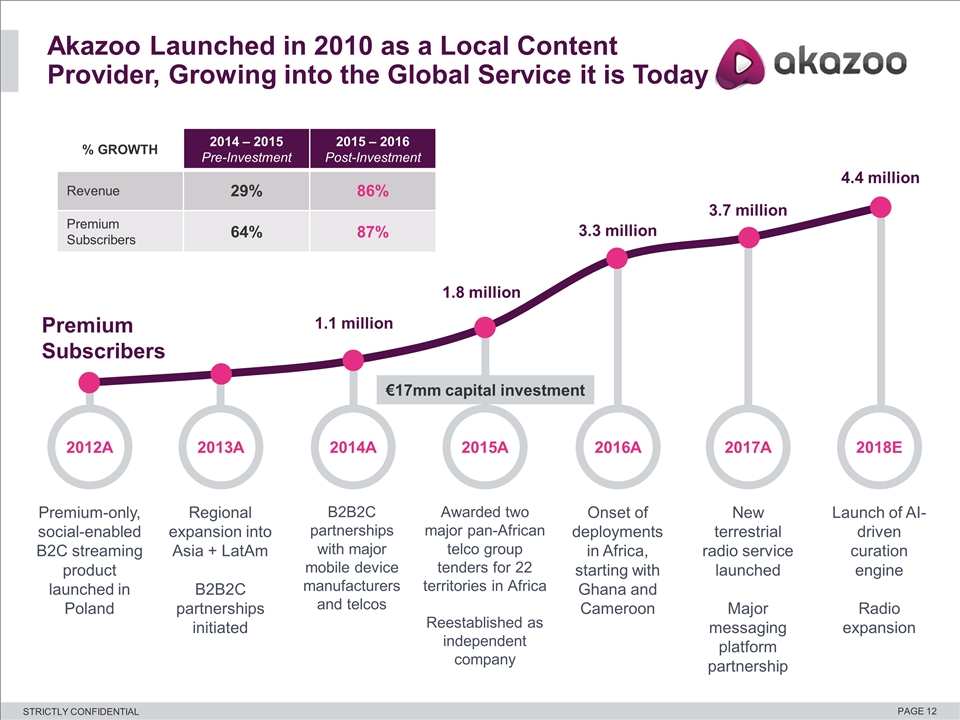

Akazoo Launched in 2010 as a Local Content Provider, Growing into the Global Service it is Today Premium-only, social-enabled B2C streaming product launched in Poland Regional expansion into Asia + LatAm B2B2C partnerships initiated B2B2C partnerships with major mobile device manufacturers and telcos Awarded two major pan-African telco group tenders for 22 territories in Africa Reestablished as independent company New terrestrial radio service launched Major messaging platform partnership Premium Subscribers 1.1 million 1.8 million 3.3 million 4.4 million Onset of deployments in Africa, starting with Ghana and Cameroon 3.7 million €17mm capital investment 2012A 2018E 2013A 2014A 2015A 2016A 2017A Launch of AI-driven curation engine Radio expansion % GROWTH 2014 – 2015 Pre-Investment 2015 – 2016 Post-Investment Revenue 29% 86% Premium Subscribers 64% 87%

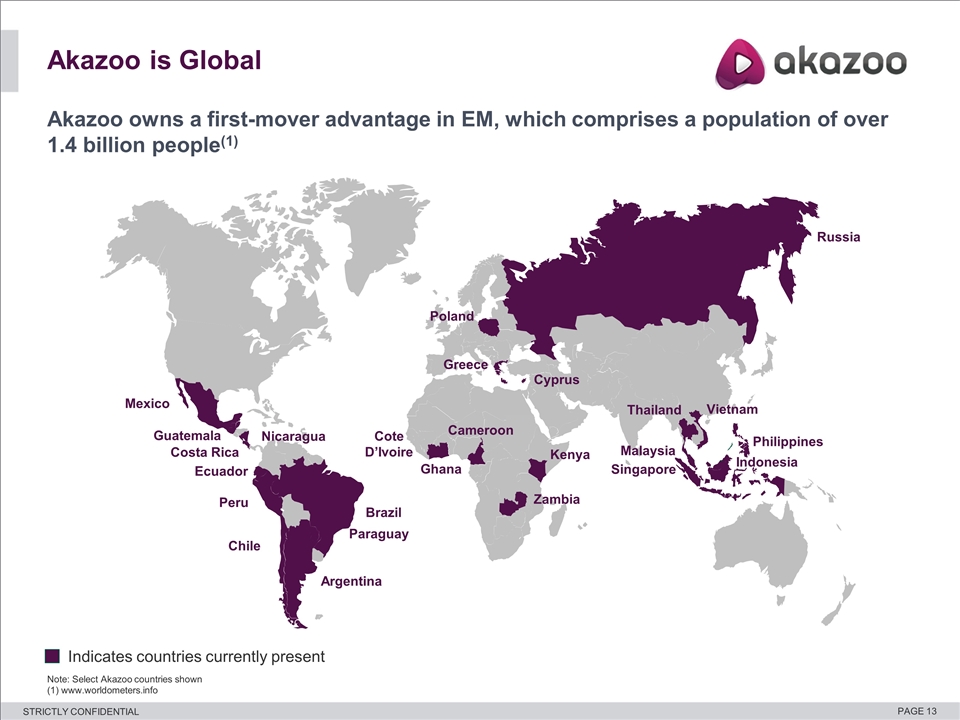

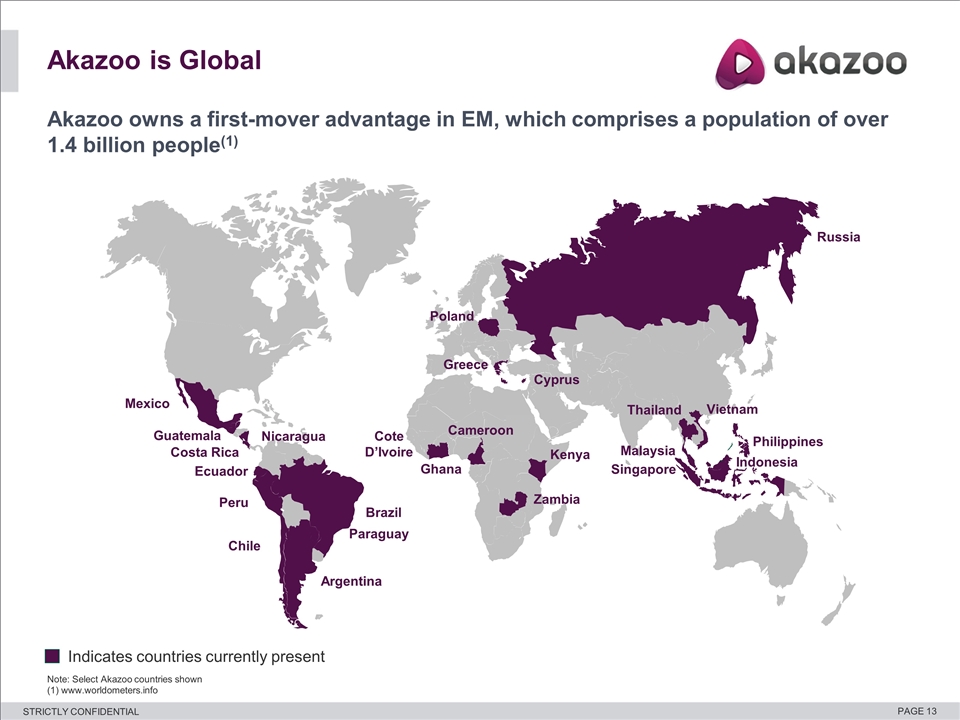

Indicates countries currently present Note: Select Akazoo countries shown (1) www.worldometers.info Akazoo is Global Akazoo owns a first-mover advantage in EM, which comprises a population of over 1.4 billion people(1) Mexico Brazil Poland Russia Greece Cyprus Thailand Vietnam Indonesia Malaysia Singapore Philippines Ecuador Nicaragua Guatemala Costa Rica Paraguay Chile Peru Argentina Cote D’Ivoire Cameroon Zambia Kenya Ghana

Sustainable and profitable growth Growth Strategy Built for Our Markets Hyper-local content strategy with global scale Cost-efficient customer acquisition through strategic partnerships Converting free, ad-supported radio users to paying premium subscribers Organic growth through increased penetration in existing markets plus launching new markets that meet criteria for success Minimizing churn through AI, attractive pricing and telco bundling models

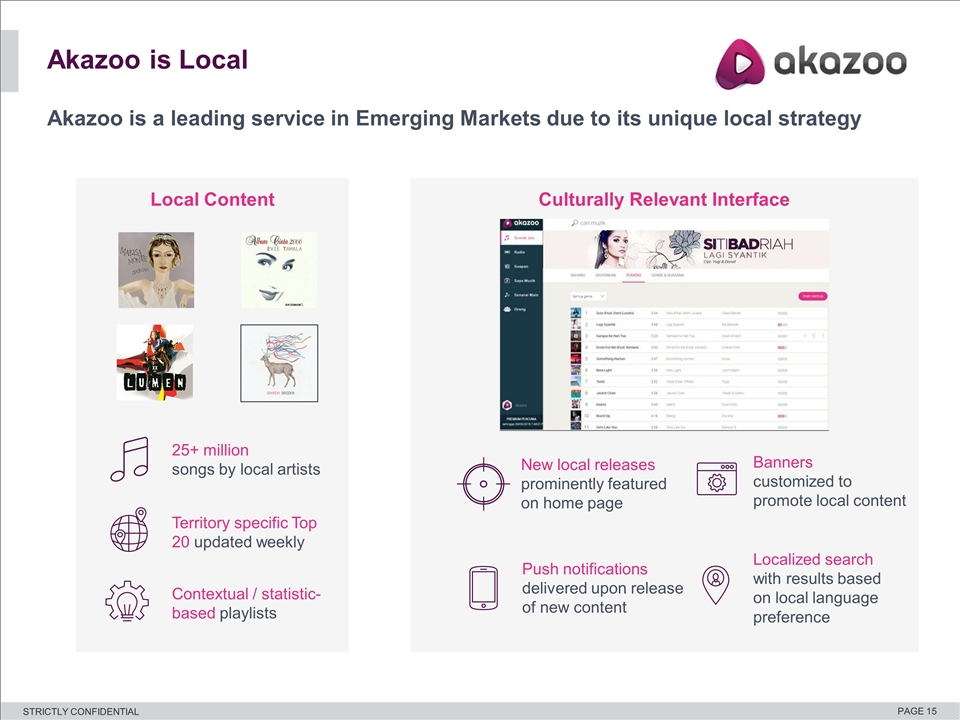

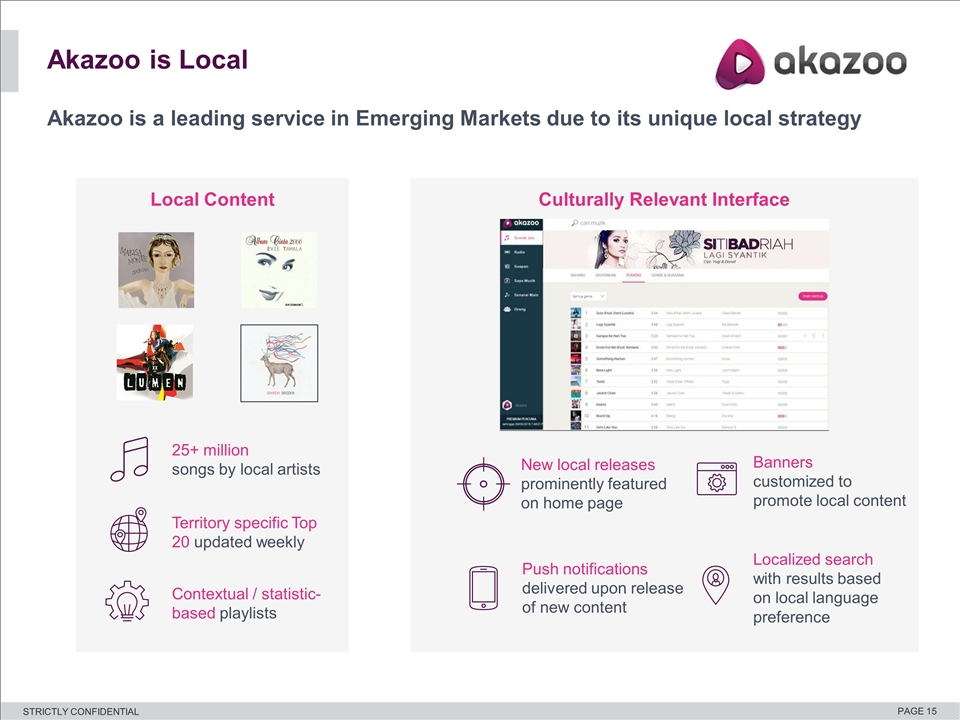

Culturally Relevant Interface Local Content Akazoo is a leading service in Emerging Markets due to its unique local strategy Akazoo is Local 25+ million songs by local artists Territory specific Top 20 updated weekly Contextual / statistic-based playlists New local releases prominently featured on home page Banners customized to promote local content Push notifications delivered upon release of new content Localized search with results based on local language preference

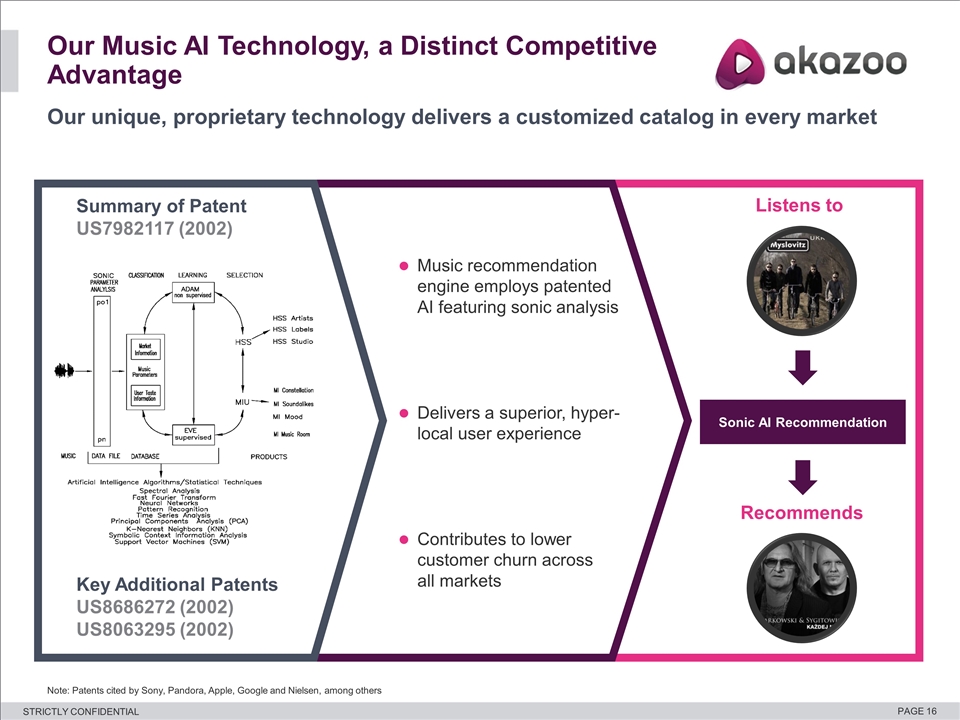

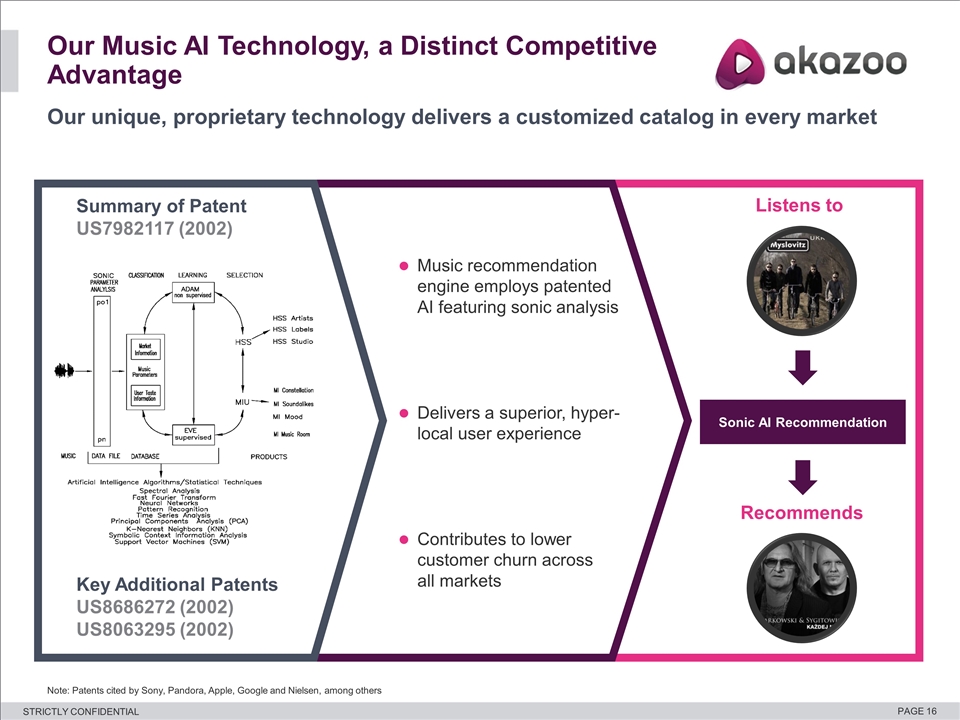

Note: Patents cited by Sony, Pandora, Apple, Google and Nielsen, among others Our unique, proprietary technology delivers a customized catalog in every market Our Music AI Technology, a Distinct Competitive Advantage Listens to Recommends Sonic AI Recommendation Music recommendation engine employs patented AI featuring sonic analysis Delivers a superior, hyper-local user experience Contributes to lower customer churn across all markets Key Additional Patents US8686272 (2002) US8063295 (2002) Summary of Patent US7982117 (2002)

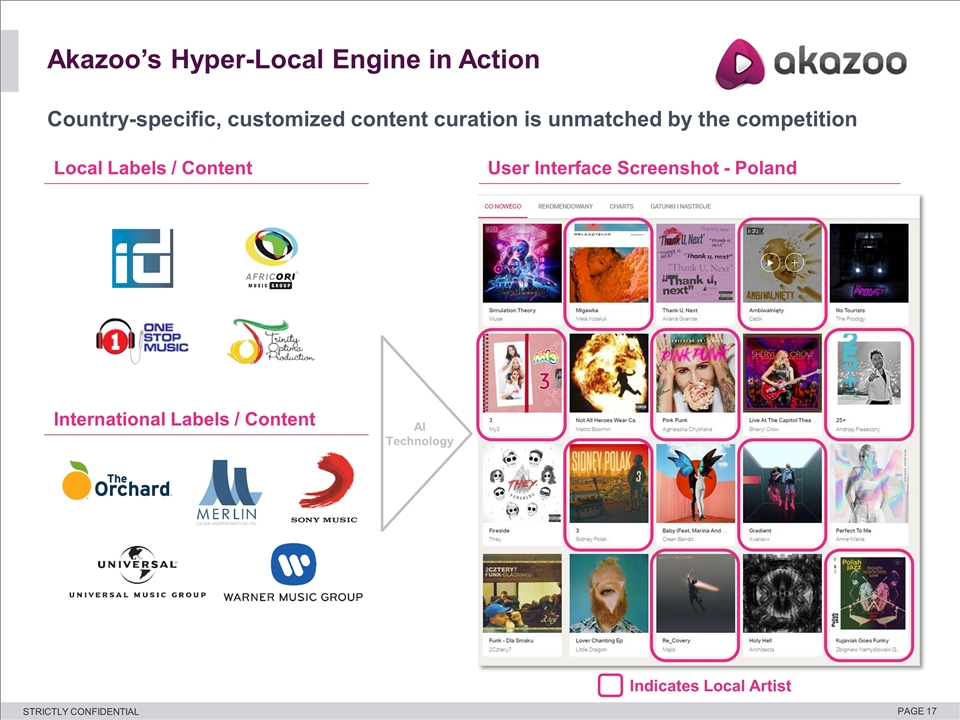

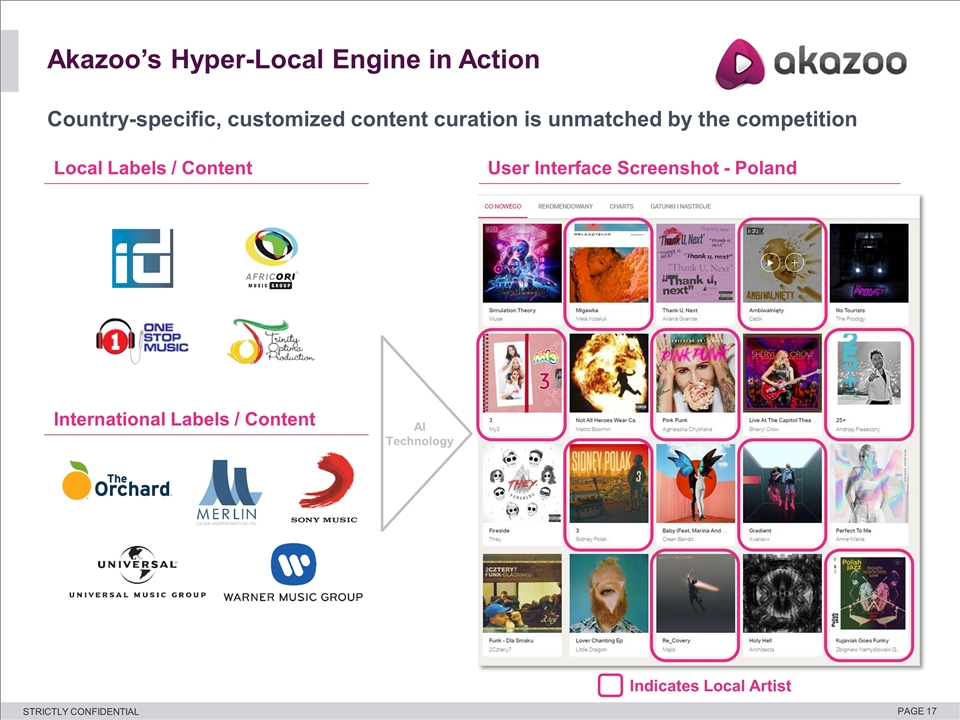

Akazoo’s Hyper-Local Engine in Action Country-specific, customized content curation is unmatched by the competition Indicates Local Artist User Interface Screenshot - Poland Local Labels / Content International Labels / Content AI Technology

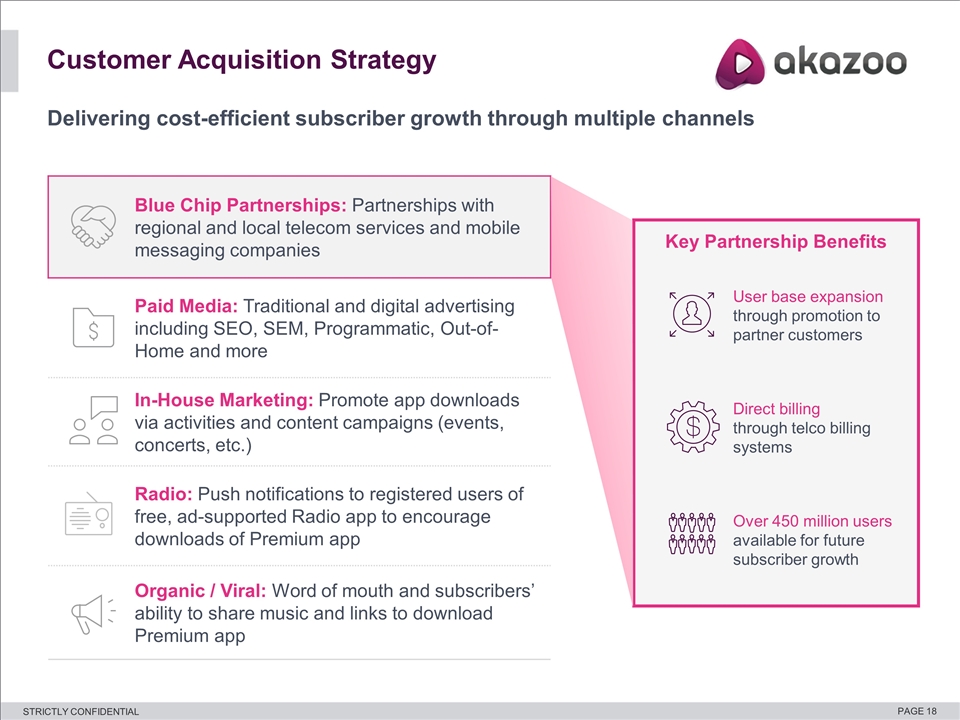

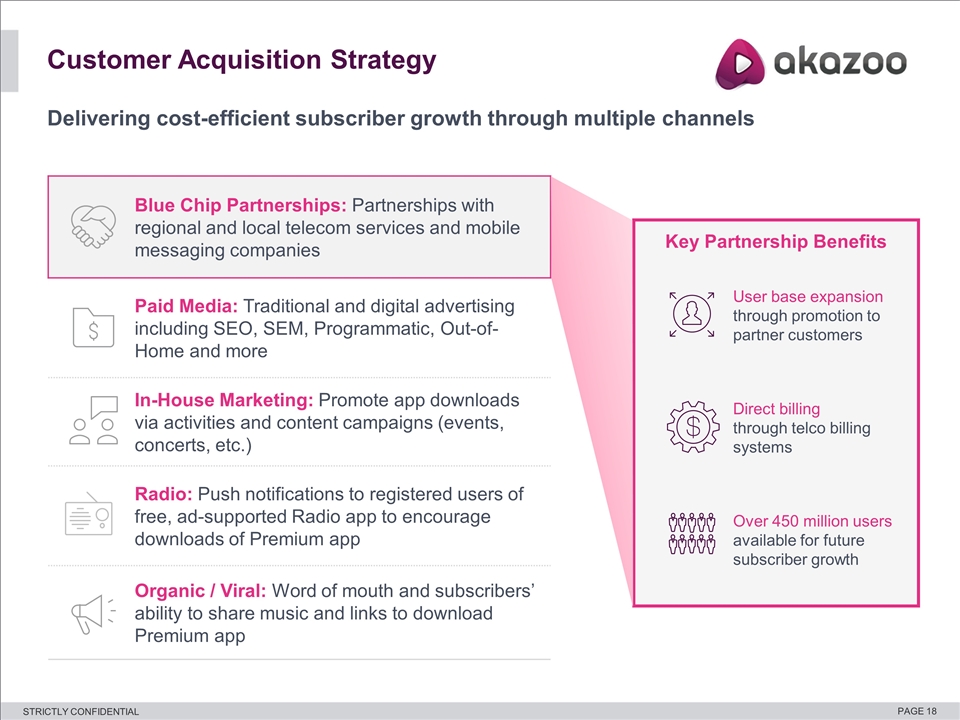

Delivering cost-efficient subscriber growth through multiple channels Customer Acquisition Strategy Blue Chip Partnerships: Partnerships with regional and local telecom services and mobile messaging companies Paid Media: Traditional and digital advertising including SEO, SEM, Programmatic, Out-of-Home and more In-House Marketing: Promote app downloads via activities and content campaigns (events, concerts, etc.) Radio: Push notifications to registered users of free, ad-supported Radio app to encourage downloads of Premium app Organic / Viral: Word of mouth and subscribers’ ability to share music and links to download Premium app Key Partnership Benefits User base expansion through promotion to partner customers Direct billing through telco billing systems Over 450 million users available for future subscriber growth

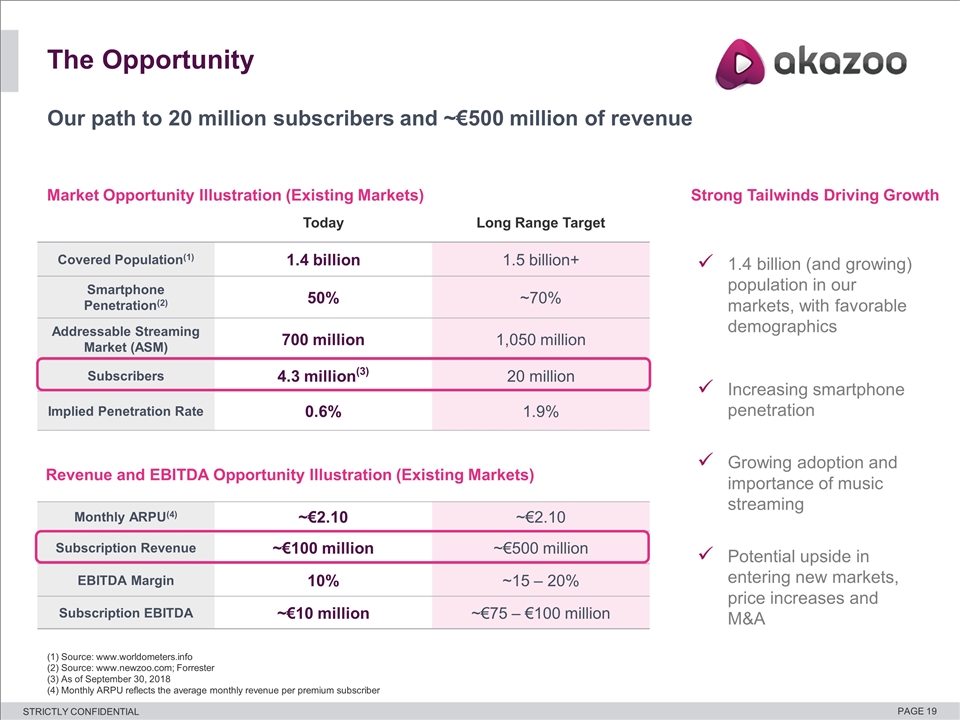

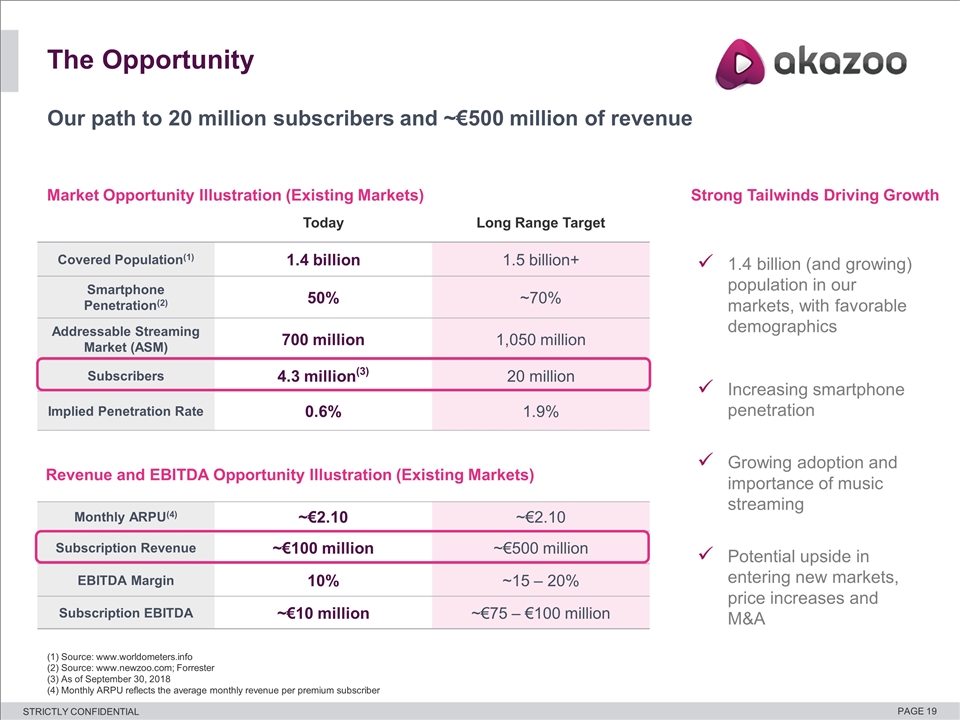

Our path to 20 million subscribers and ~€500 million of revenue (1) Source: www.worldometers.info (2) Source: www.newzoo.com; Forrester (3) As of September 30, 2018 (4) Monthly ARPU reflects the average monthly revenue per premium subscriber The Opportunity Today Long Range Target Covered Population(1) 1.4 billion 1.5 billion+ Smartphone Penetration(2) 50% ~70% Addressable Streaming Market (ASM) 700 million 1,050 million Subscribers 4.3 million(3) 20 million Implied Penetration Rate 0.6% 1.9% 1.4 billion (and growing) population in our markets, with favorable demographics Increasing smartphone penetration Growing adoption and importance of music streaming Potential upside in entering new markets, price increases and M&A Strong Tailwinds Driving Growth Market Opportunity Illustration (Existing Markets) Monthly ARPU(4) ~€2.10 ~€2.10 Subscription Revenue ~€100 million ~€500 million EBITDA Margin 10% ~15 – 20% Subscription EBITDA ~€10 million ~€75 – €100 million Revenue and EBITDA Opportunity Illustration (Existing Markets)

Financials & transaction overview

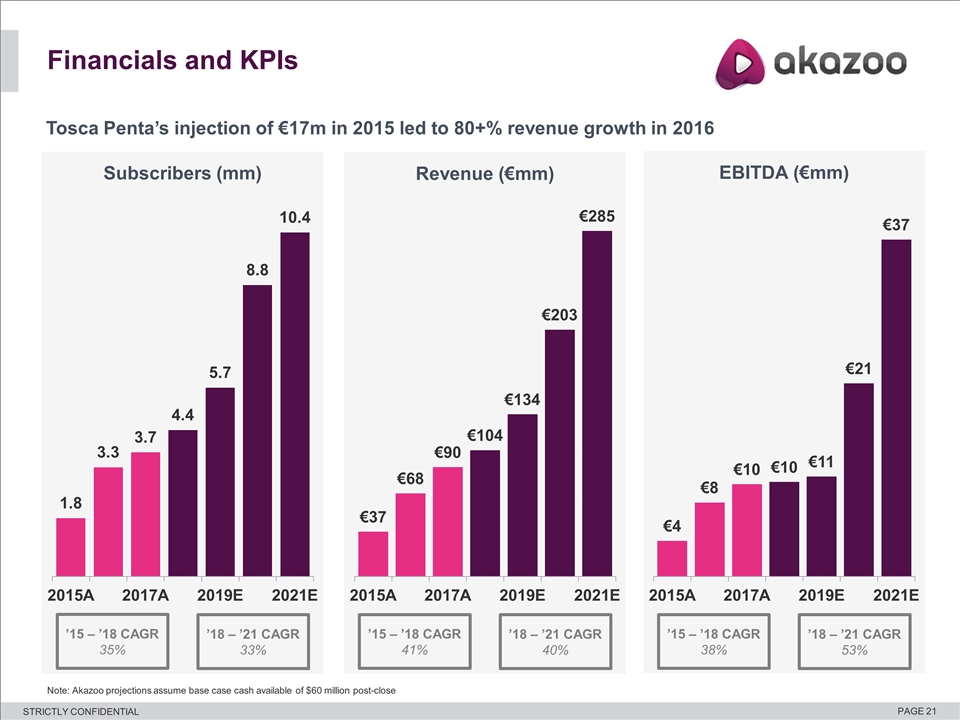

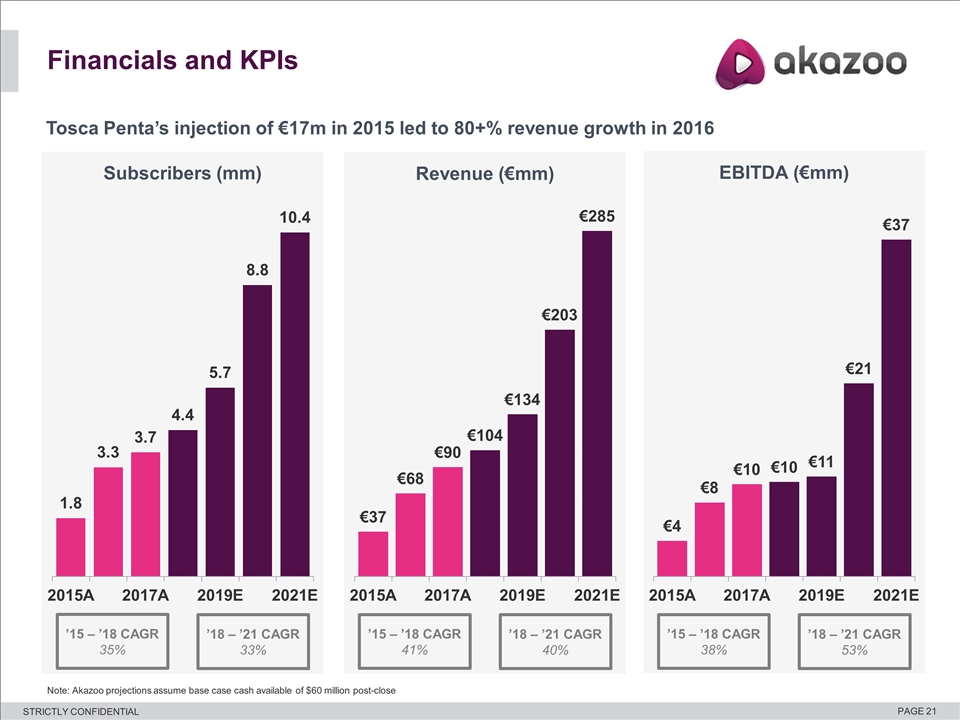

EBITDA (€mm) Revenue (€mm) Subscribers (mm) Financials and KPIs ’15 – ’18 CAGR 35% Tosca Penta’s injection of €17m in 2015 led to 80+% revenue growth in 2016 ’15 – ’18 CAGR 41% ’15 – ’18 CAGR 38% ’18 – ’21 CAGR 33% ’18 – ’21 CAGR 40% ’18 – ’21 CAGR 53% Note: Akazoo projections assume base case cash available of $60 million post-close

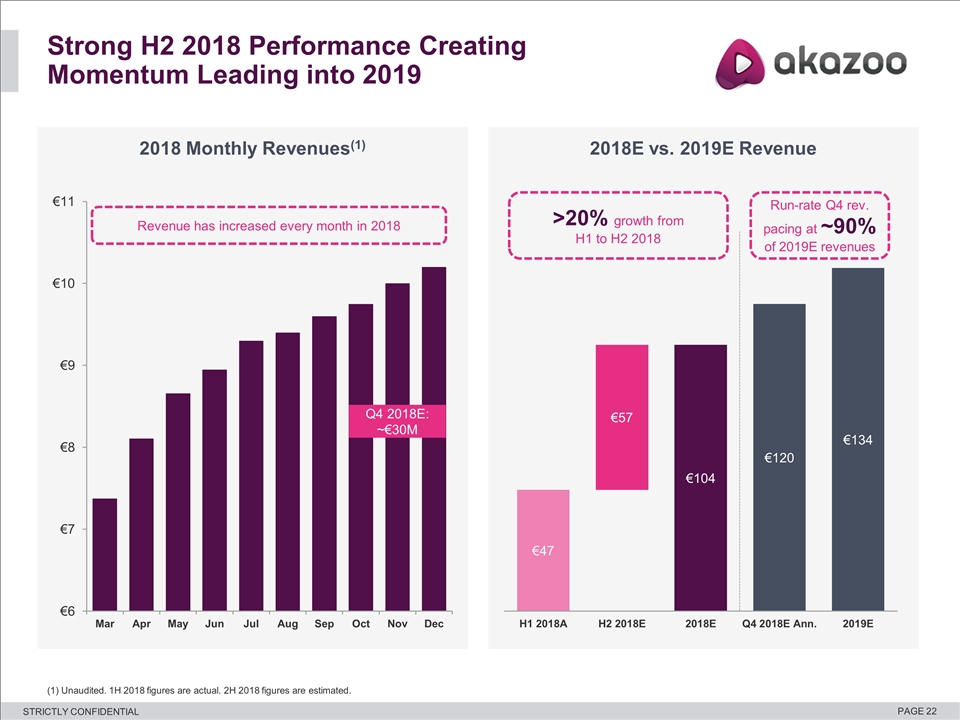

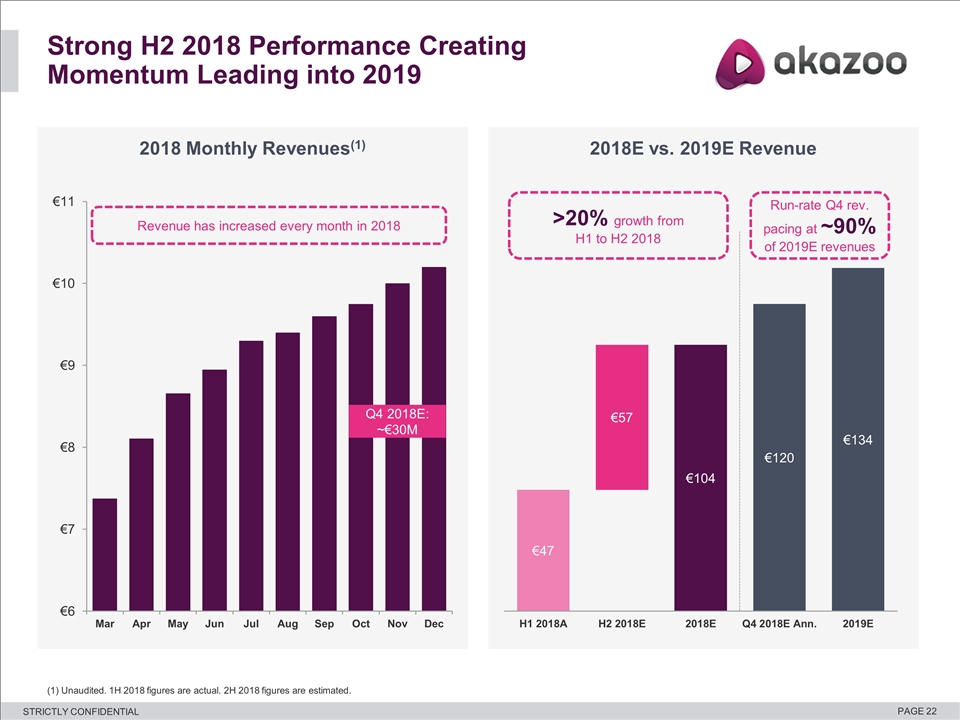

2018E vs. 2019E Revenue 2018 Monthly Revenues(1) (1) Unaudited. 1H 2018 figures are actual. 2H 2018 figures are estimated. >20% growth from H1 to H2 2018 Revenue has increased every month in 2018 Q4 2018E: ~€30M Strong H2 2018 Performance Creating Momentum Leading into 2019 Run-rate Q4 rev. pacing at ~90% of 2019E revenues

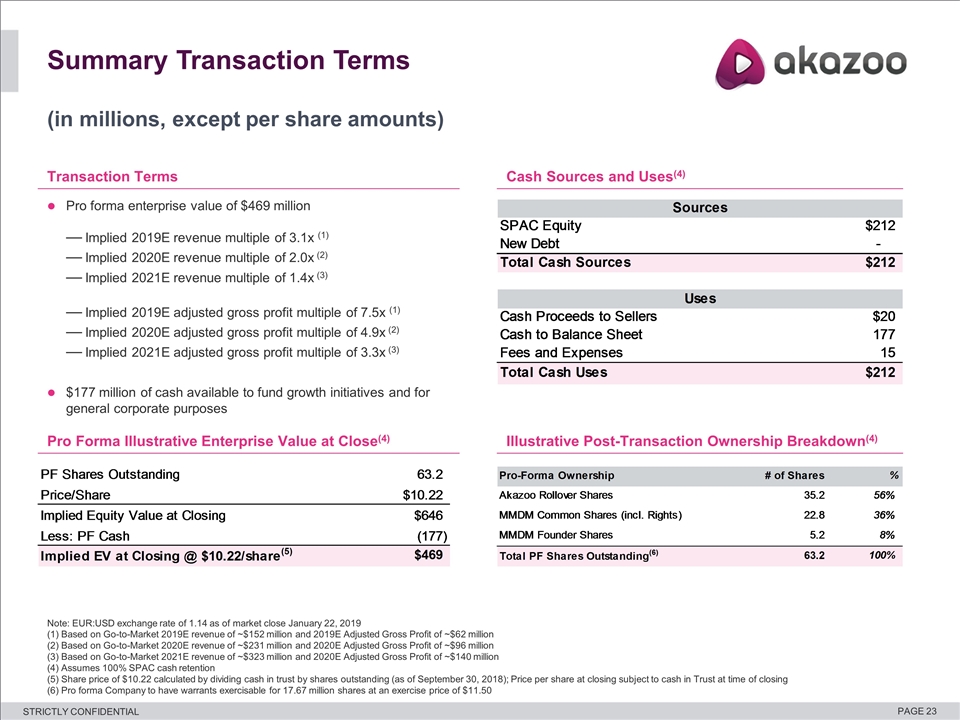

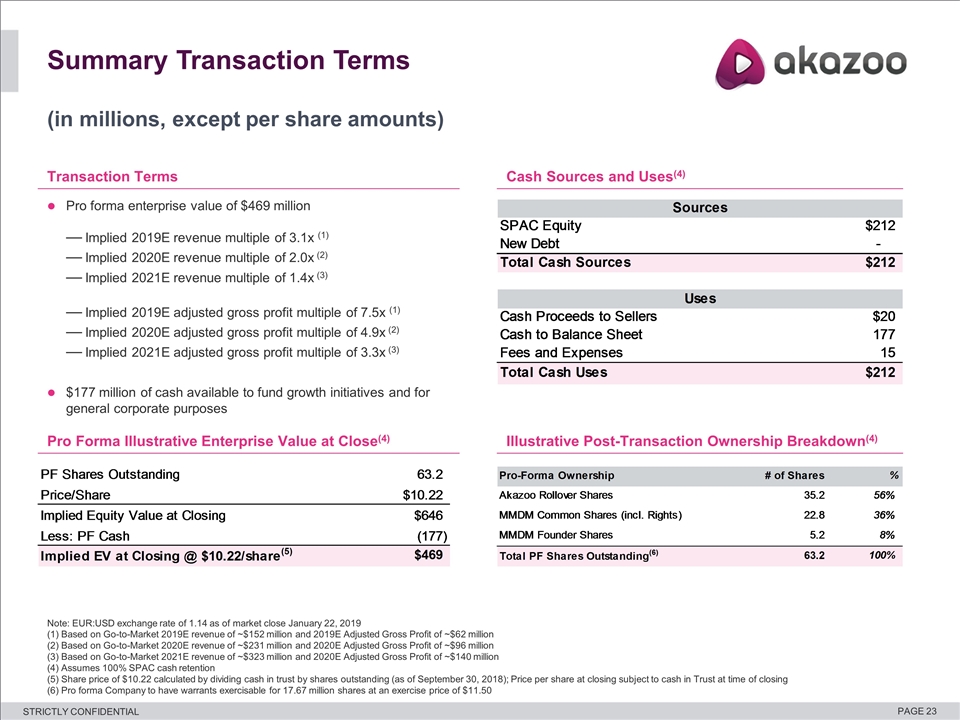

Note: EUR:USD exchange rate of 1.14 as of market close January 22, 2019 (1) Based on Go-to-Market 2019E revenue of ~$152 million and 2019E Adjusted Gross Profit of ~$62 million (2) Based on Go-to-Market 2020E revenue of ~$231 million and 2020E Adjusted Gross Profit of ~$96 million (3) Based on Go-to-Market 2021E revenue of ~$323 million and 2020E Adjusted Gross Profit of ~$140 million (4) Assumes 100% SPAC cash retention (5) Share price of $10.22 calculated by dividing cash in trust by shares outstanding (as of September 30, 2018); Price per share at closing subject to cash in Trust at time of closing (6) Pro forma Company to have warrants exercisable for 17.67 million shares at an exercise price of $11.50 Pro forma enterprise value of $469 million Implied 2019E revenue multiple of 3.1x (1) Implied 2020E revenue multiple of 2.0x (2) Implied 2021E revenue multiple of 1.4x (3) Implied 2019E adjusted gross profit multiple of 7.5x (1) Implied 2020E adjusted gross profit multiple of 4.9x (2) Implied 2021E adjusted gross profit multiple of 3.3x (3) $177 million of cash available to fund growth initiatives and for general corporate purposes Cash Sources and Uses(4) Pro Forma Illustrative Enterprise Value at Close(4) Illustrative Post-Transaction Ownership Breakdown(4) Transaction Terms Summary Transaction Terms (in millions, except per share amounts)

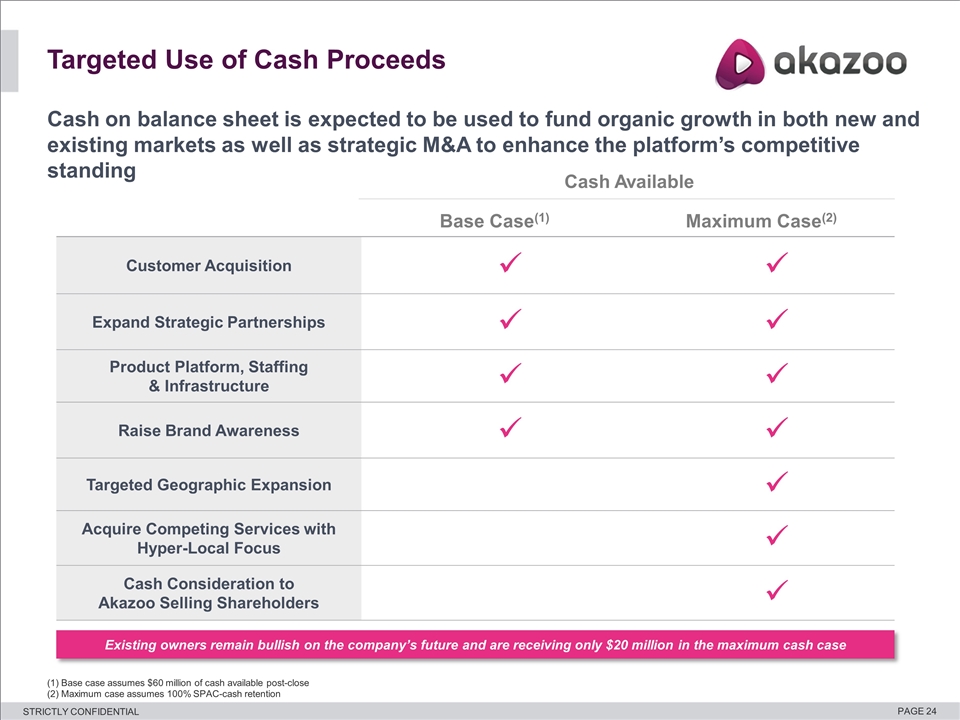

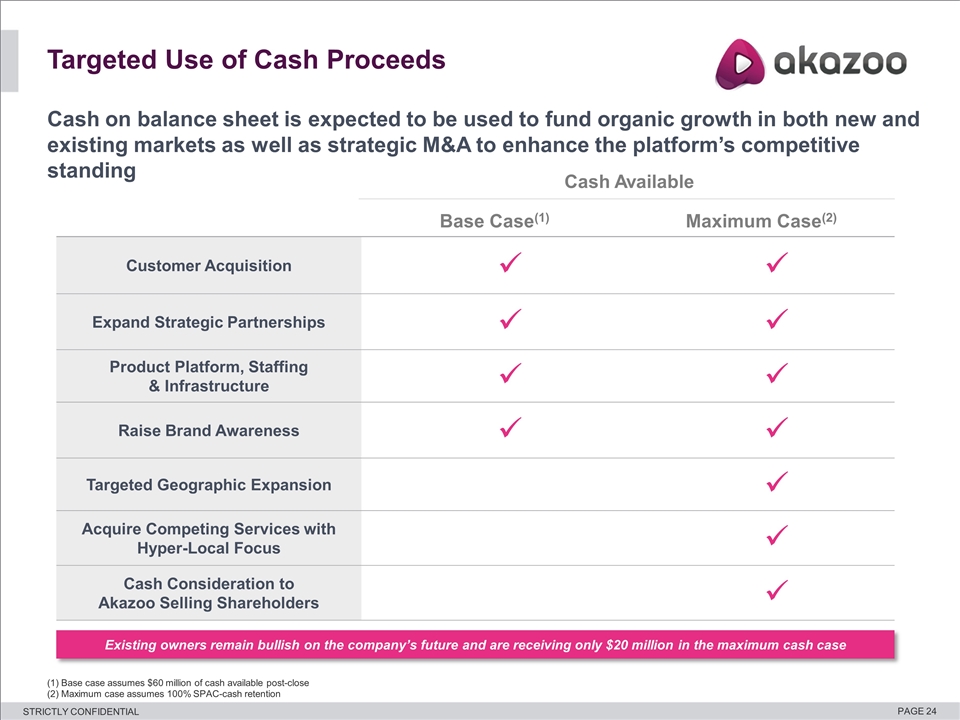

Targeted Use of Cash Proceeds Cash on balance sheet is expected to be used to fund organic growth in both new and existing markets as well as strategic M&A to enhance the platform’s competitive standing Existing owners remain bullish on the company’s future and are receiving only $20 million in the maximum cash case Base Case(1) Maximum Case(2) Customer Acquisition ü ü Expand Strategic Partnerships ü ü Product Platform, Staffing & Infrastructure ü ü Raise Brand Awareness ü ü Targeted Geographic Expansion ü Acquire Competing Services with Hyper-Local Focus ü Cash Consideration to Akazoo Selling Shareholders ü Cash Available (1) Base case assumes $60 million of cash available post-close (2) Maximum case assumes 100% SPAC-cash retention

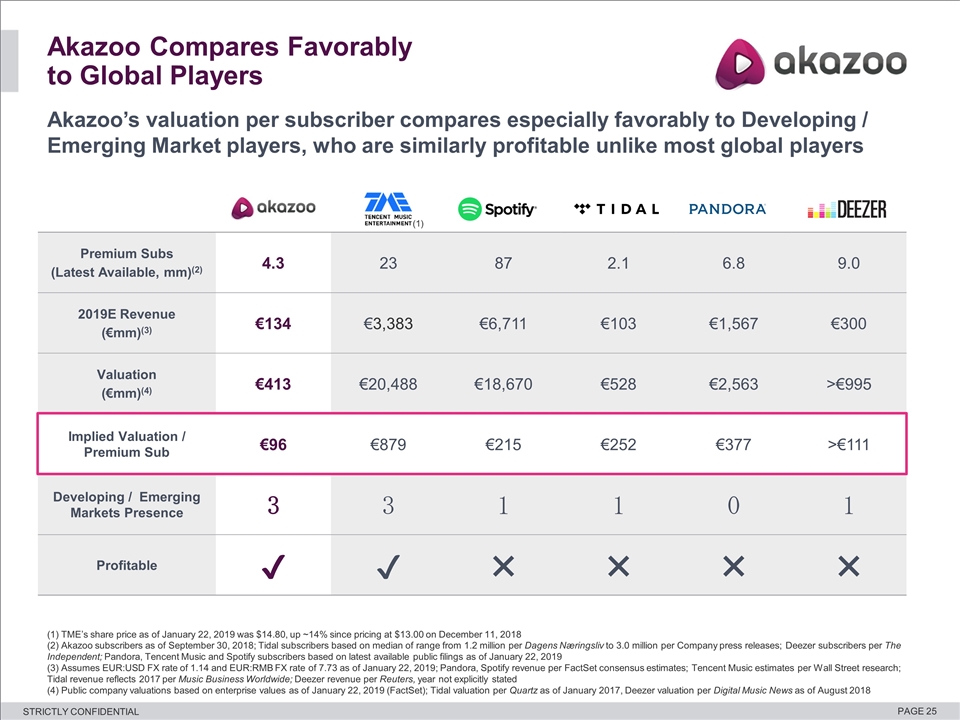

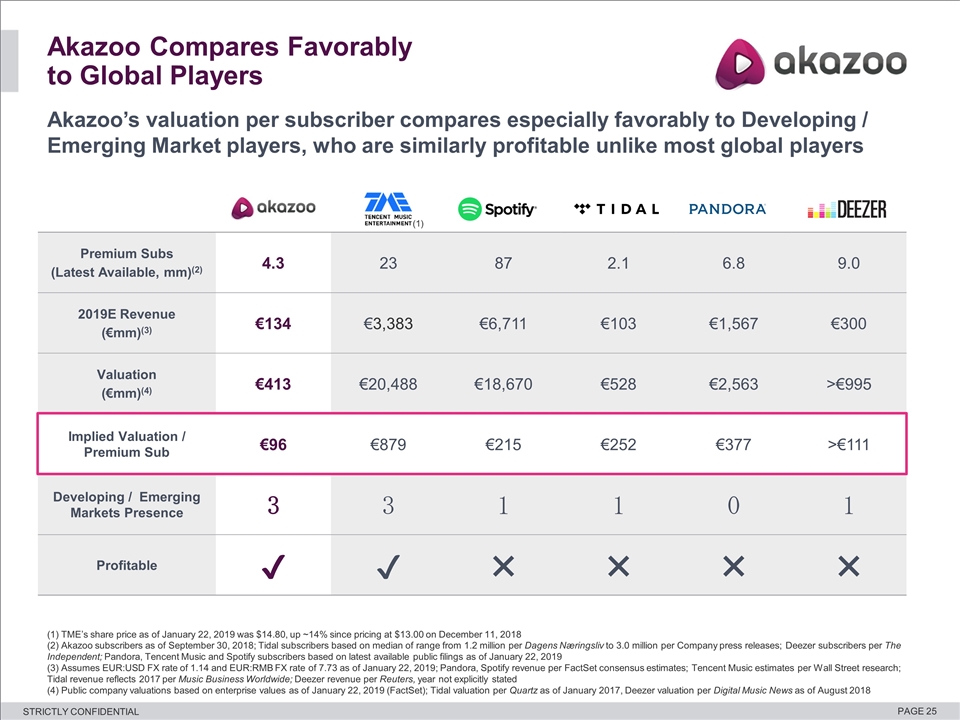

Premium Subs (Latest Available, mm)(2) 4.3 23 87 2.1 6.8 9.0 2019E Revenue (€mm)(3) €134 €3,383 €6,711 €103 €1,567 €300 Valuation (€mm)(4) €413 €20,488 €18,670 €528 €2,563 >€995 Implied Valuation / Premium Sub €96 €879 €215 €252 €377 >€111 Developing / Emerging Markets Presence 3 3 1 1 0 1 Profitable ✔ ✔ ❌ ❌ (1) TME’s share price as of January 22, 2019 was $14.80, up ~14% since pricing at $13.00 on December 11, 2018 (2) Akazoo subscribers as of September 30, 2018; Tidal subscribers based on median of range from 1.2 million per Dagens Næringsliv to 3.0 million per Company press releases; Deezer subscribers per The Independent; Pandora, Tencent Music and Spotify subscribers based on latest available public filings as of January 22, 2019 (3) Assumes EUR:USD FX rate of 1.14 and EUR:RMB FX rate of 7.73 as of January 22, 2019; Pandora, Spotify revenue per FactSet consensus estimates; Tencent Music estimates per Wall Street research; Tidal revenue reflects 2017 per Music Business Worldwide; Deezer revenue per Reuters, year not explicitly stated (4) Public company valuations based on enterprise values as of January 22, 2019 (FactSet); Tidal valuation per Quartz as of January 2017, Deezer valuation per Digital Music News as of August 2018 Akazoo Compares Favorably to Global Players Akazoo’s valuation per subscriber compares especially favorably to Developing / Emerging Market players, who are similarly profitable unlike most global players (1)

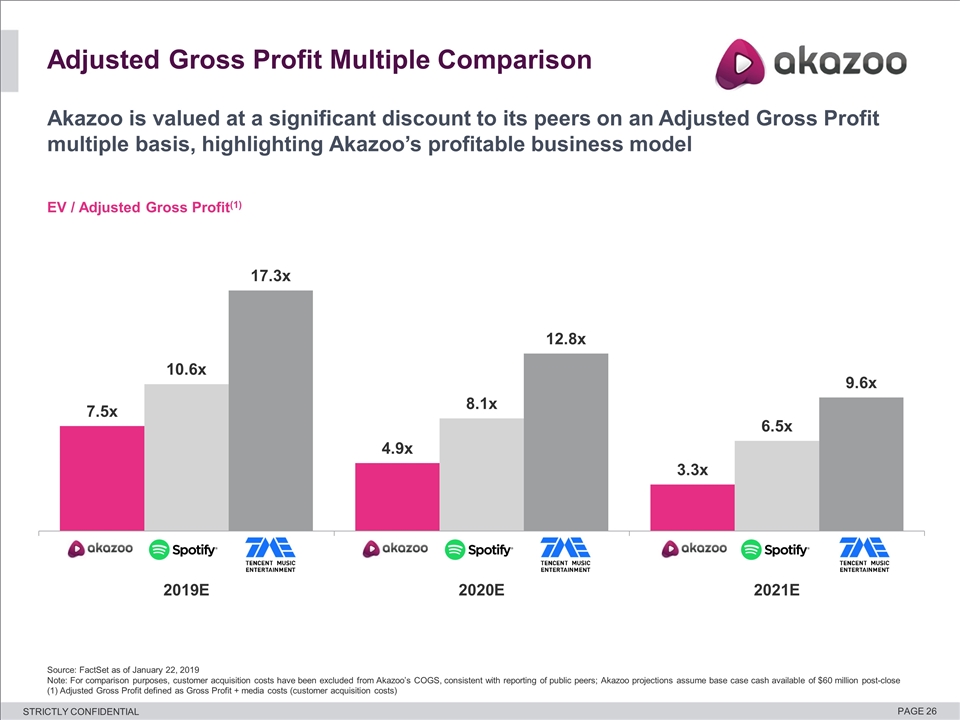

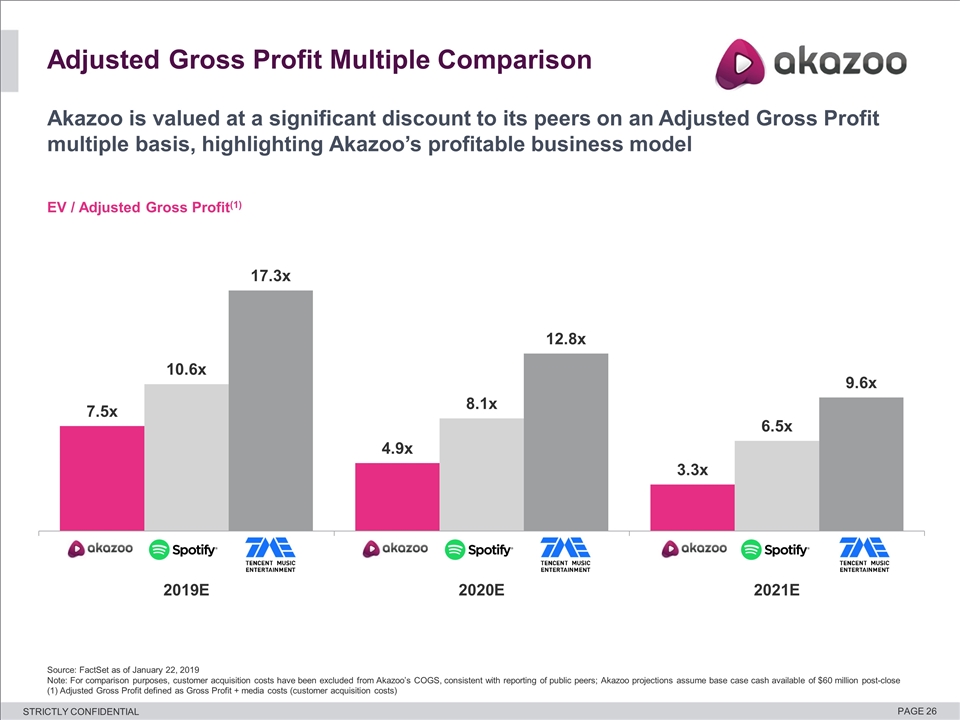

Akazoo is valued at a significant discount to its peers on an Adjusted Gross Profit multiple basis, highlighting Akazoo’s profitable business model Source: FactSet as of January 22, 2019 Note: For comparison purposes, customer acquisition costs have been excluded from Akazoo’s COGS, consistent with reporting of public peers; Akazoo projections assume base case cash available of $60 million post-close (1) Adjusted Gross Profit defined as Gross Profit + media costs (customer acquisition costs) EV / Adjusted Gross Profit(1) Adjusted Gross Profit Multiple Comparison

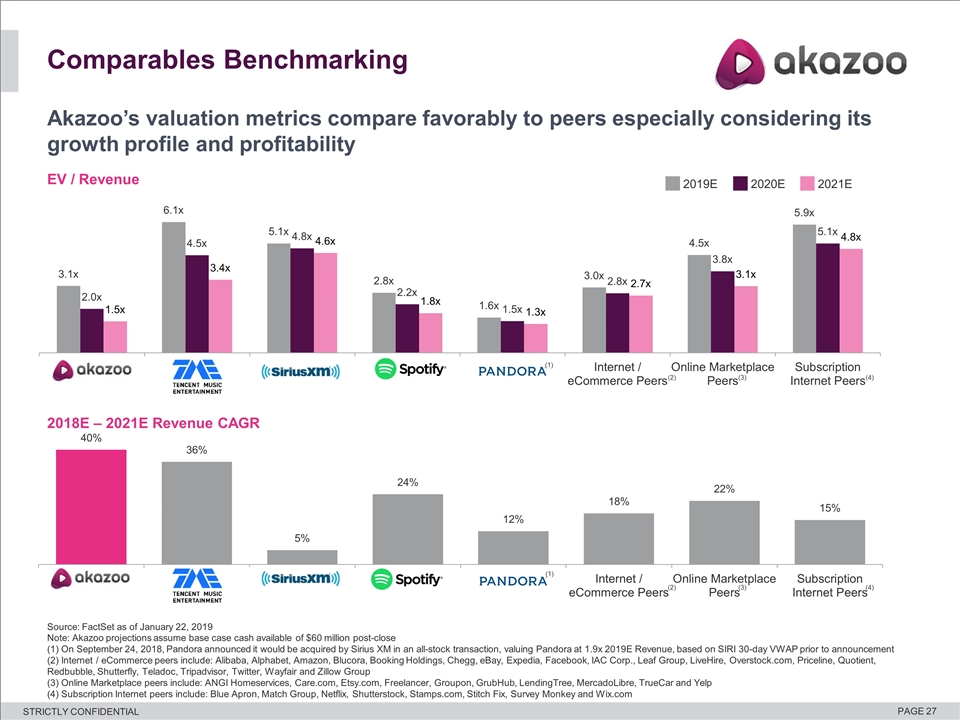

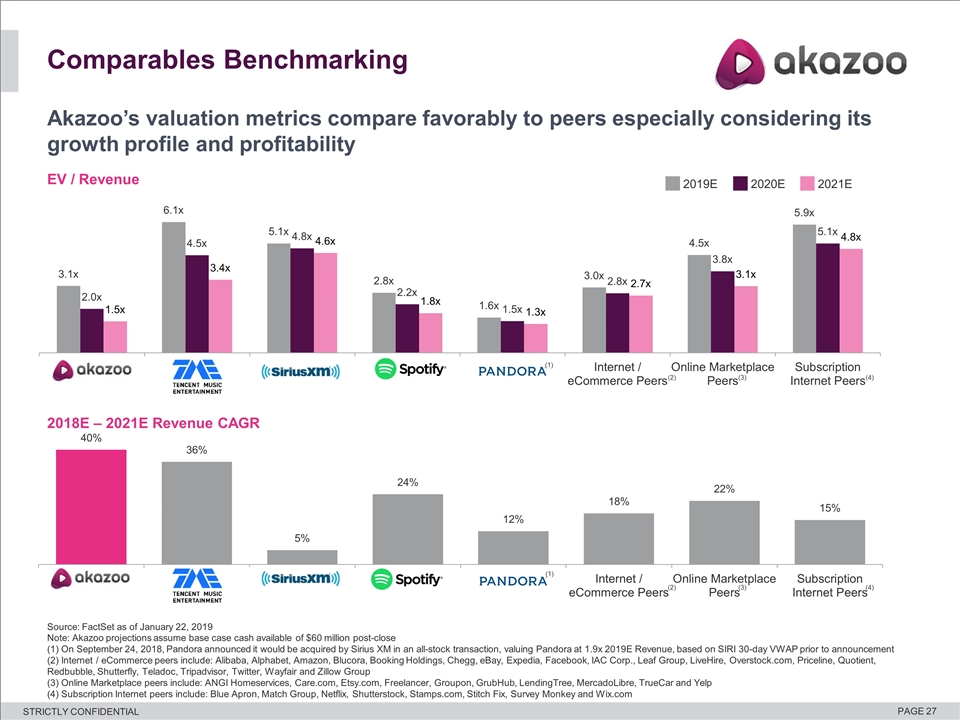

Akazoo’s valuation metrics compare favorably to peers especially considering its growth profile and profitability Source: FactSet as of January 22, 2019 Note: Akazoo projections assume base case cash available of $60 million post-close (1) On September 24, 2018, Pandora announced it would be acquired by Sirius XM in an all-stock transaction, valuing Pandora at 1.9x 2019E Revenue, based on SIRI 30-day VWAP prior to announcement (2) Internet / eCommerce peers include: Alibaba, Alphabet, Amazon, Blucora, Booking Holdings, Chegg, eBay, Expedia, Facebook, IAC Corp., Leaf Group, LiveHire, Overstock.com, Priceline, Quotient, Redbubble, Shutterfly, Teladoc, Tripadvisor, Twitter, Wayfair and Zillow Group (3) Online Marketplace peers include: ANGI Homeservices, Care.com, Etsy.com, Freelancer, Groupon, GrubHub, LendingTree, MercadoLibre, TrueCar and Yelp (4) Subscription Internet peers include: Blue Apron, Match Group, Netflix, Shutterstock, Stamps.com, Stitch Fix, Survey Monkey and Wix.com 2018E – 2021E Revenue CAGR EV / Revenue Comparables Benchmarking (1) (2) (4) 2019E 2020E 2021E (3) (1) (2) (4) (3)

Akazoo is a global music streaming platform, with a “hyper-local” strategy Akazoo at a Glance Seamless access across devices and platforms Premium local and global content World class design, look and feel Proprietary music AI recommendation engine Free, ad-supported radio service to drive revenue and subscriber conversion Mobile telco billing tailored for emerging markets 37 million Registered Users €104+ million 2018E Revenue 140 Telco Integrations 400,000 Major, Local & Independent Labels 100,000 Radio Stations 25 Countries 45 million Music Tracks 4+ million Subscribers €

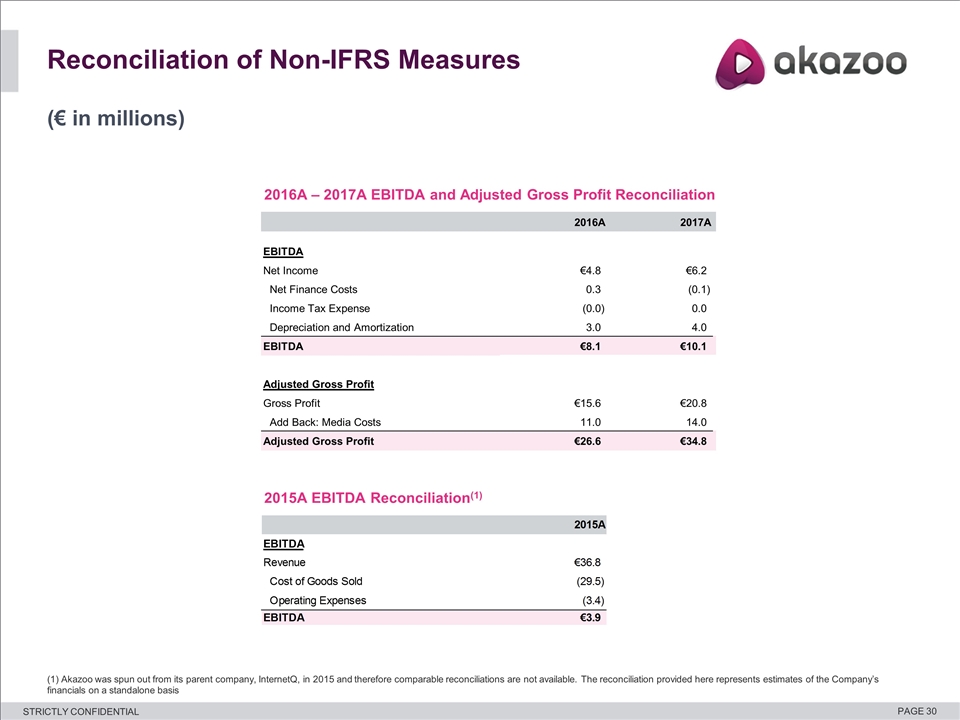

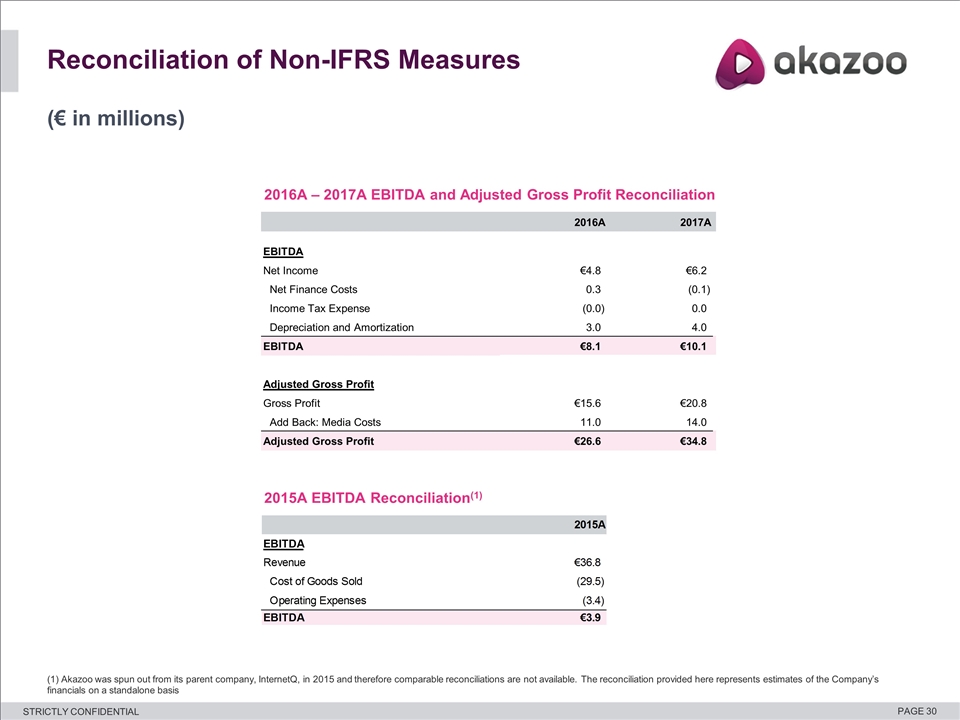

(€ in millions) (1) Akazoo was spun out from its parent company, InternetQ, in 2015 and therefore comparable reconciliations are not available. The reconciliation provided here represents estimates of the Company’s financials on a standalone basis 2015A EBITDA Reconciliation(1) 2016A – 2017A EBITDA and Adjusted Gross Profit Reconciliation Reconciliation of Non-IFRS Measures 2016A 2017A EBITDA Net Income €4.8 €6.2 Net Finance Costs 0.3 (0.1) Income Tax Expense (0.0) 0.0 Depreciation and Amortization 3.0 4.0 EBITDA €8.1 €10.1 Adjusted Gross Profit Gross Profit €15.6 €20.8 Add Back: Media Costs 11.0 14.0 Adjusted Gross Profit €26.6 €34.8