UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting material Pursuant to§240.14a-12 |

CSX Corporation

(Name of Registrant as Specified In Its Charter)

MANTLE RIDGE LP

MR ARGENT ADVISOR LLC

MANTLE RIDGE GP LLC

MR ARGENT FUND CE LP

MR ARGENT GP LLC

MR ARGENT OFFSHORE AB LTD.

MR ARGENT OFFSHORE BB LTD.

MR ARGENT OFFSHORE CB 01 LTD.

MR ARGENT OFFSHORE CB 02 LTD.

MR ARGENT OFFSHORE CB 03 LTD.

MR ARGENT OFFSHORE CB 04 LTD.

MR ARGENT OFFSHORE CB 05 LTD.

MR ARGENT OFFSHORE CB 07 LTD.

MR S AND P INDEX ANNUAL REPORTS LLC

PAUL C. HILAL

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

On April 27, 2017, Mantle Ridge LP issued the following presentation, which was also posted on www.CSXAdvisoryVote2017.com:

2017 CSX Annual Meeting Vote FOR the Item 5 Advisory Resolution in Order to Retain Hunter Harrison as CEO April 27, 2017 For additional information regarding the reimbursement resolution and Mantle Ridge’s recommendation please visit www.CSXAdvisoryVote2017.com

Agenda To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement 1 1 Appendix: Timeline 31 2 Appendix: Preview of 2018: Thoughts on Harrison's Compensation Package 33 3

Vote for Hunter Harrison to Remain CEO Mantle Ridge encourages shareholders to vote the GOLD PROXY CARD FOR the Advisory Resolution providing for Reimbursement so that Hunter Harrison will remain CEO of CSX To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

Vote for Hunter Harrison to Remain CEO This is NOT a contested situation. The CSX Board is seeking input and is not arguing for or against. The Board understands that Mantle Ridge is making the case for why shareholders should vote in favor. To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

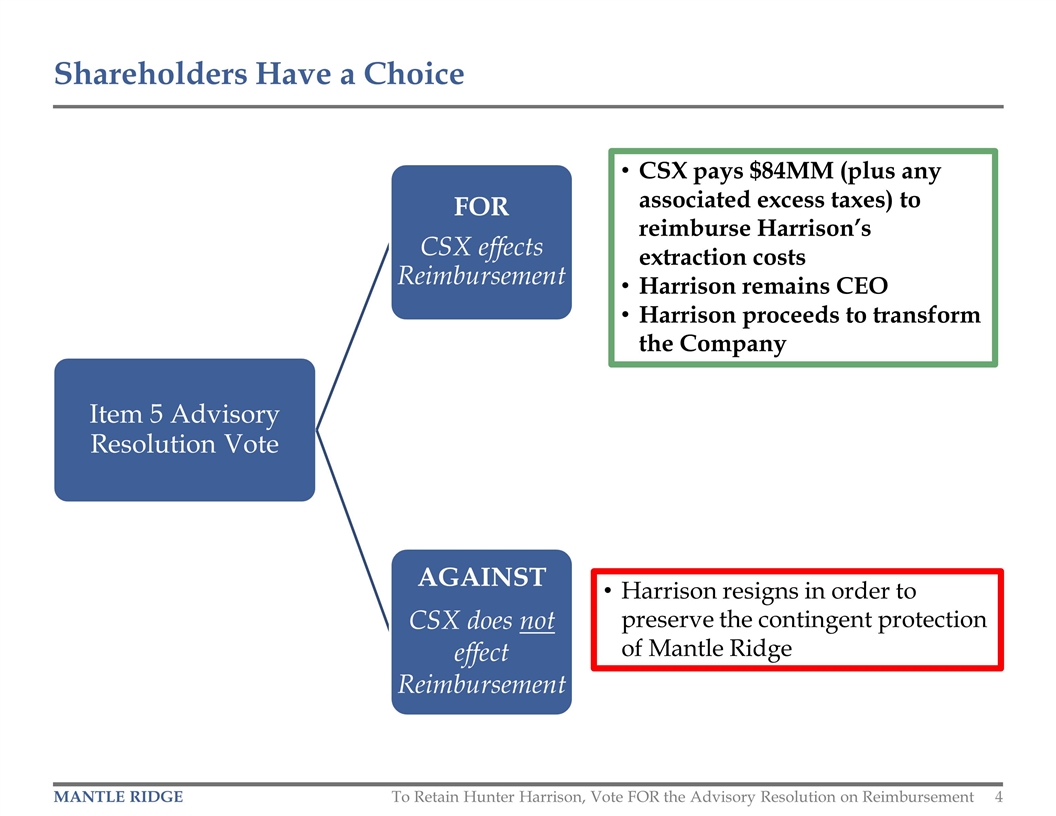

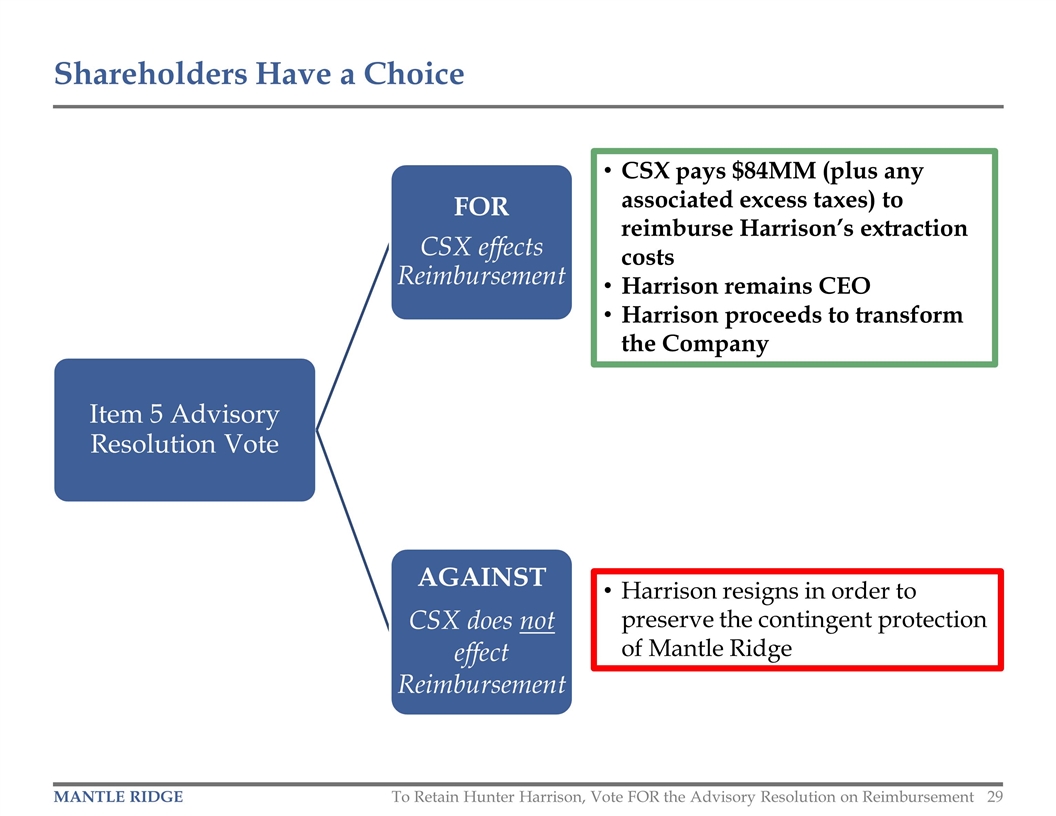

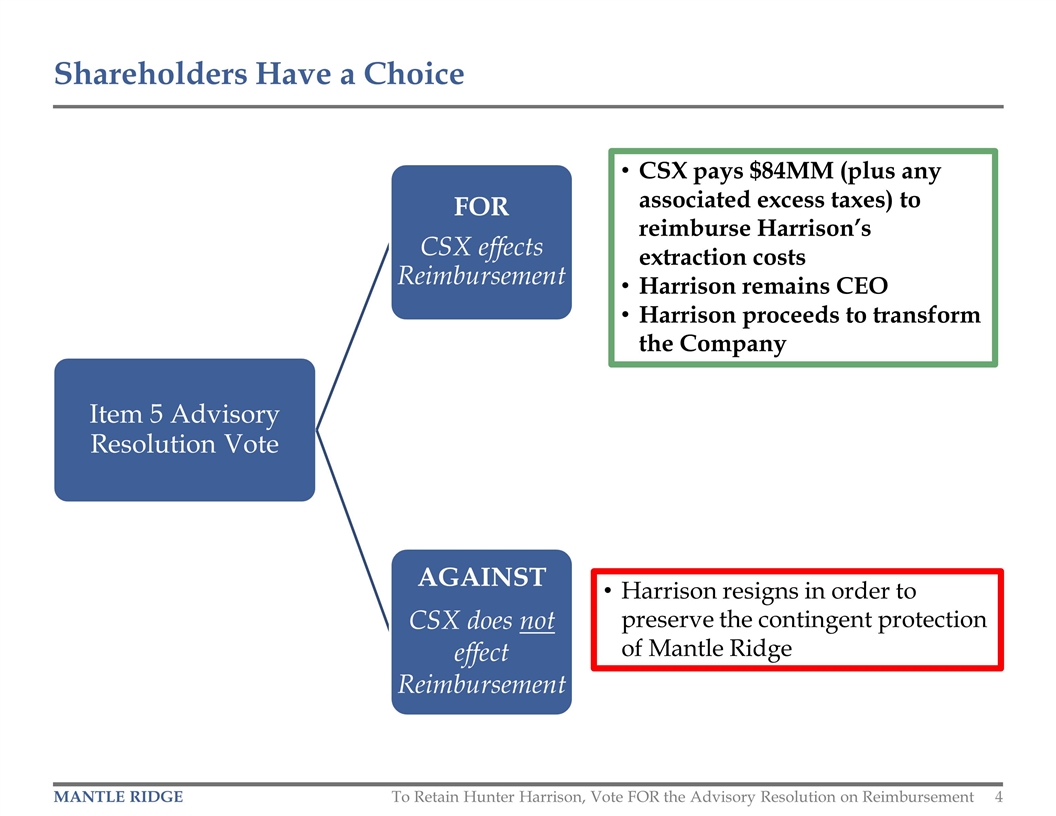

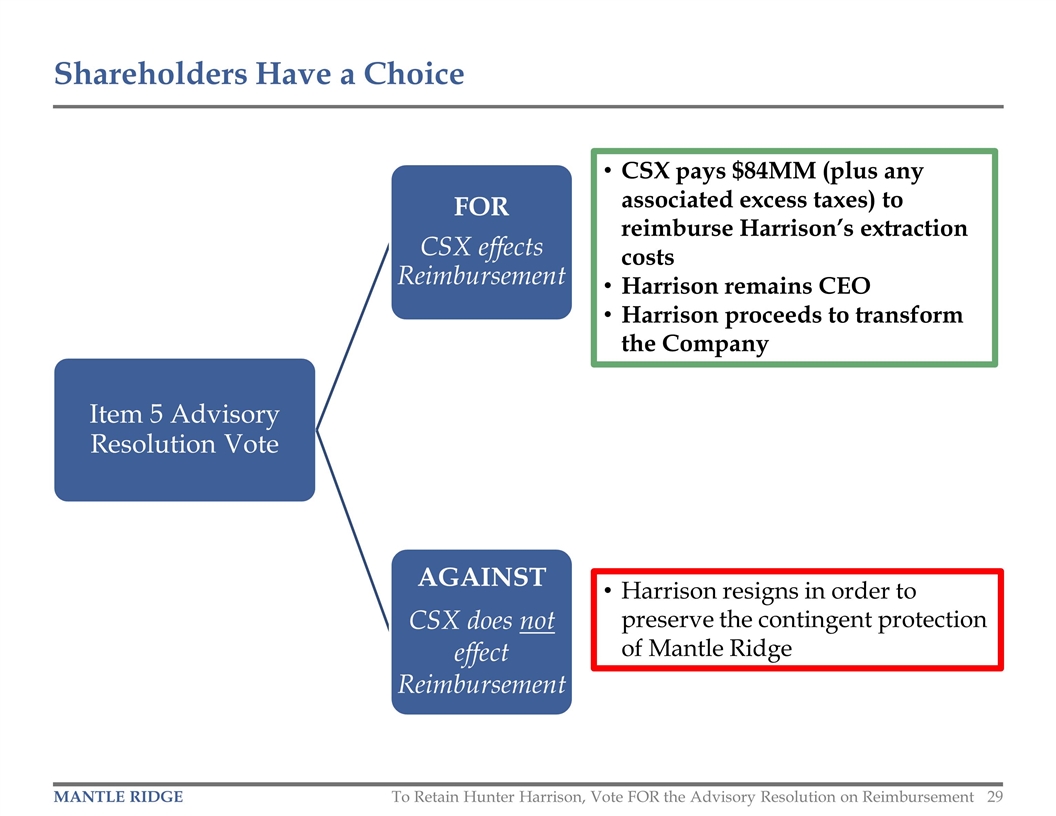

Shareholders Have a Choice CSX pays $84MM (plus any associated excess taxes) to reimburse Harrison’s extraction costs Harrison remains CEO Harrison proceeds to transform the Company Harrison resigns in order to preserve the contingent protection of Mantle Ridge To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement Item 5 Advisory Resolution Vote FOR CSX effects Reimbursement AGAINST CSX does not effect Reimbursement

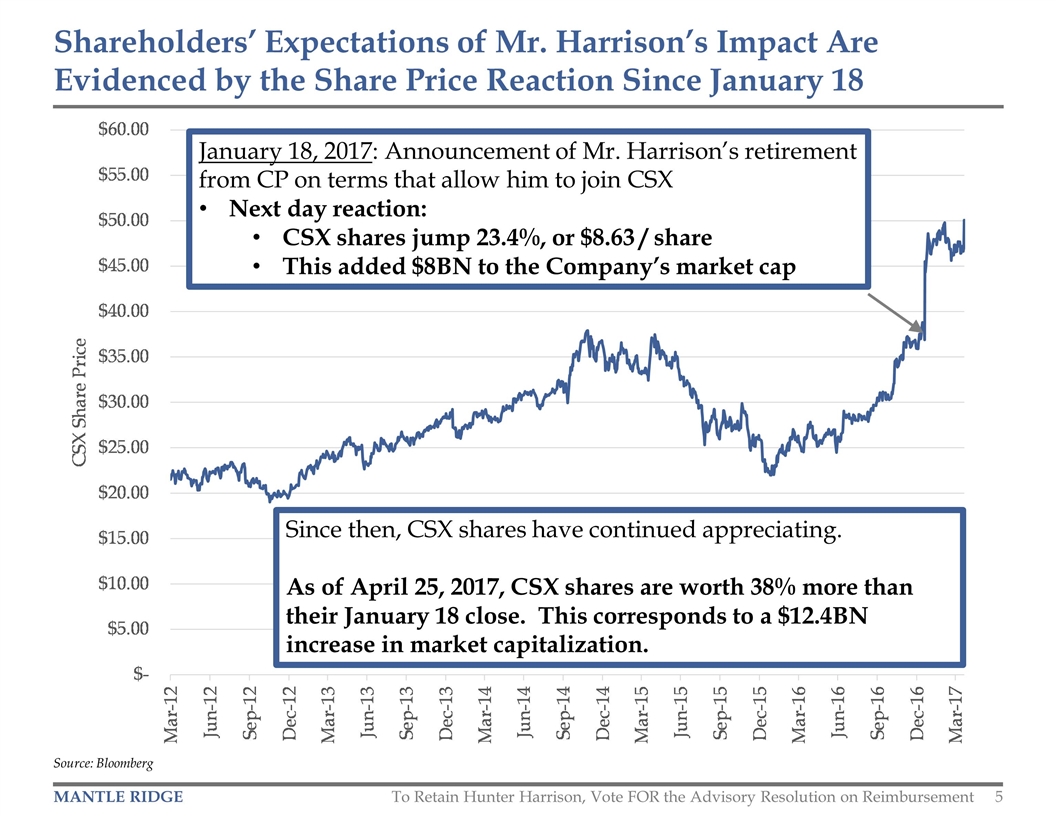

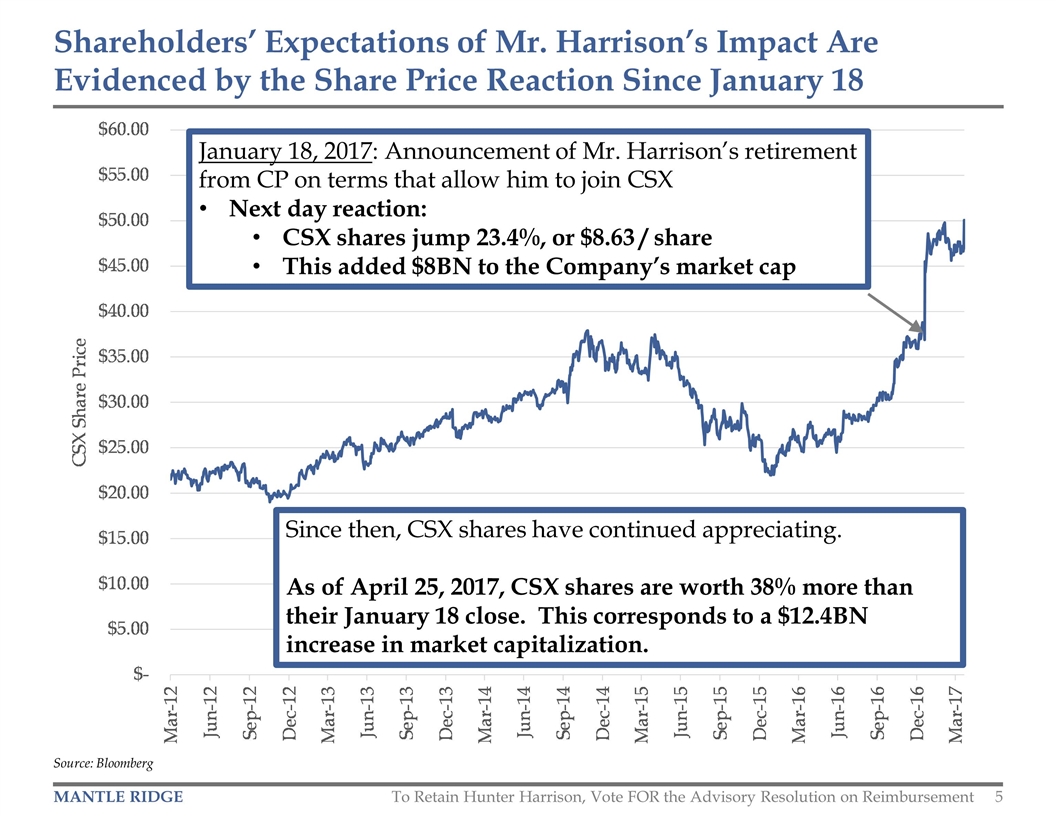

Shareholders’ Expectations of Mr. Harrison’s Impact Are Evidenced by the Share Price Reaction Since January 18 Source: Bloomberg January 18, 2017: Announcement of Mr. Harrison’s retirement from CP on terms that allow him to join CSX Next day reaction: CSX shares jump 23.4%, or $8.63 / share This added $8BN to the Company’s market cap Since then, CSX shares have continued appreciating. As of April 25, 2017, CSX shares are worth 38% more than their January 18 close. This corresponds to a $12.4BN increase in market capitalization. To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

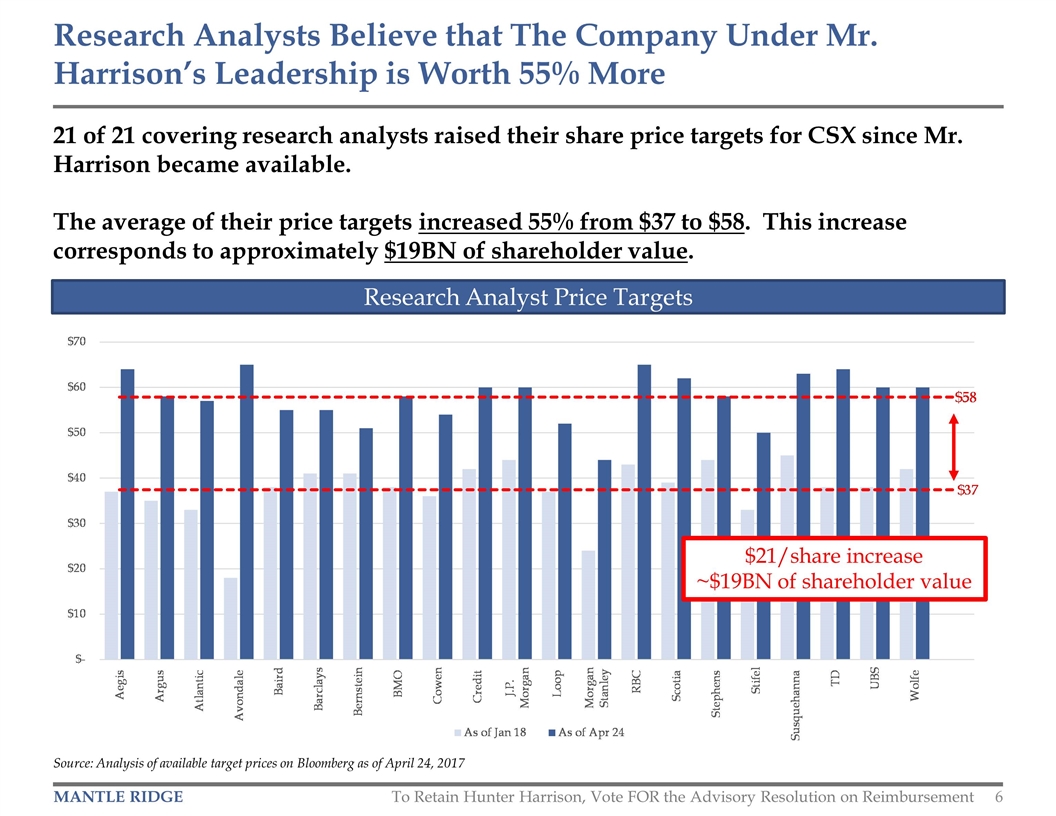

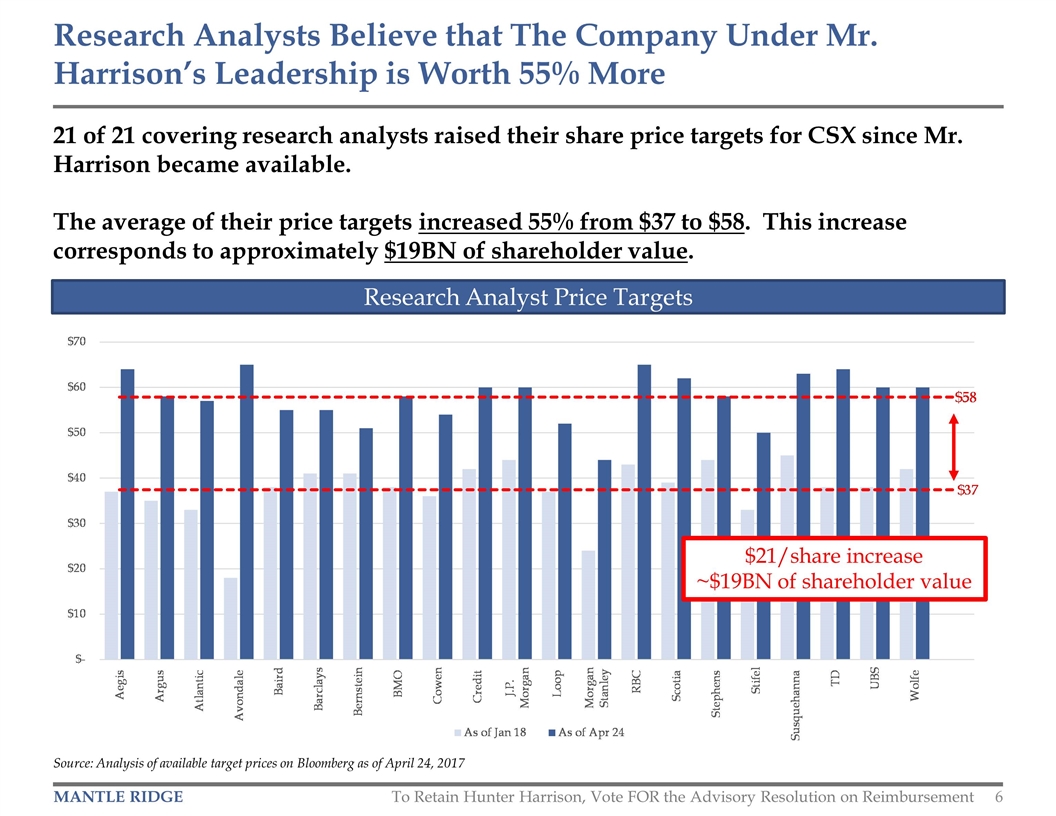

21 of 21 covering research analysts raised their share price targets for CSX since Mr. Harrison became available. The average of their price targets increased 55% from $37 to $58. This increase corresponds to approximately $19BN of shareholder value. Source: Analysis of available target prices on Bloomberg as of April 24, 2017 Research Analysts Believe that The Company Under Mr. Harrison’s Leadership is Worth 55% More Research Analyst Price Targets $21/share increase ~$19BN of shareholder value To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

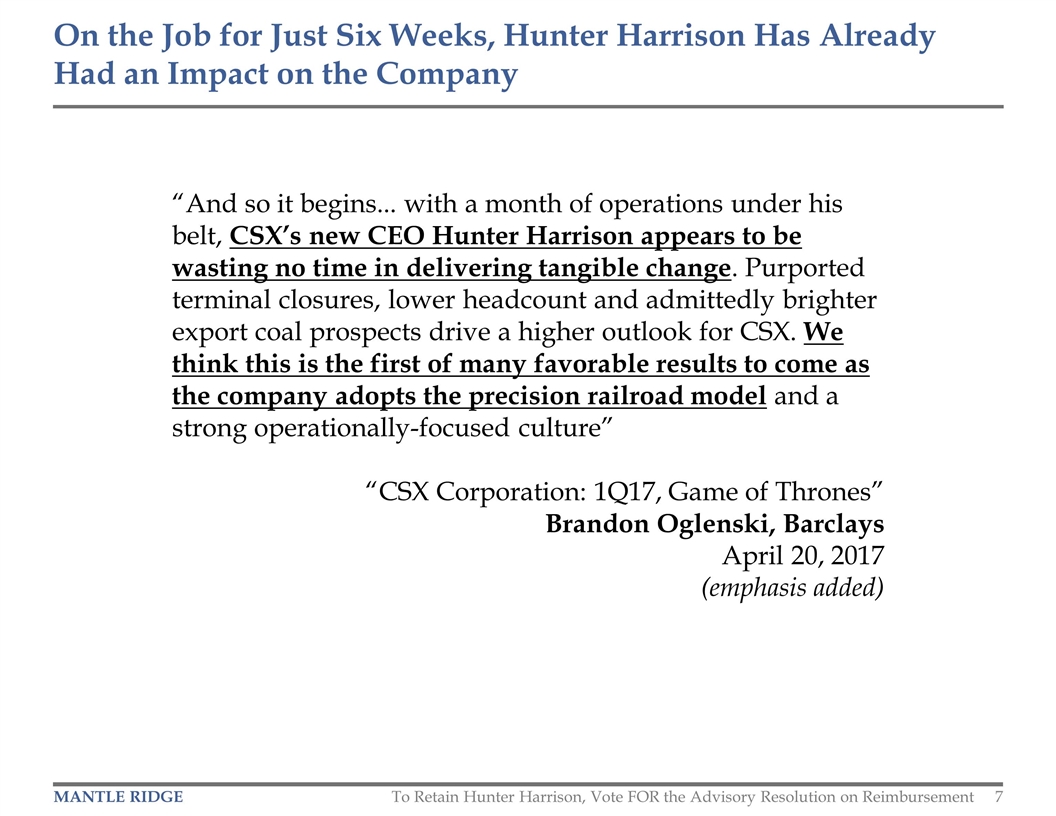

On the Job for Just Six Weeks, Hunter Harrison Has Already Had an Impact on the Company “And so it begins... with a month of operations under his belt, CSX’s new CEO Hunter Harrison appears to be wasting no time in delivering tangible change. Purported terminal closures, lower headcount and admittedly brighter export coal prospects drive a higher outlook for CSX. We think this is the first of many favorable results to come as the company adopts the precision railroad model and a strong operationally-focused culture” “CSX Corporation: 1Q17, Game of Thrones” Brandon Oglenski, Barclays April 20, 2017 (emphasis added) To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

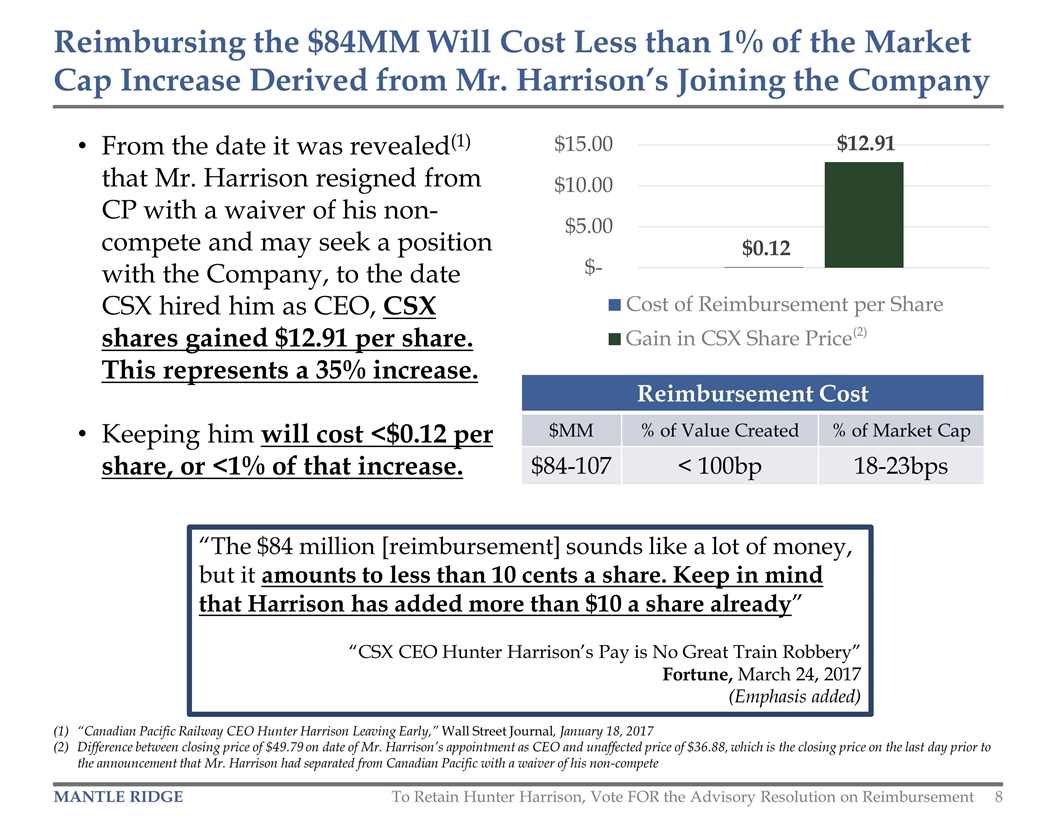

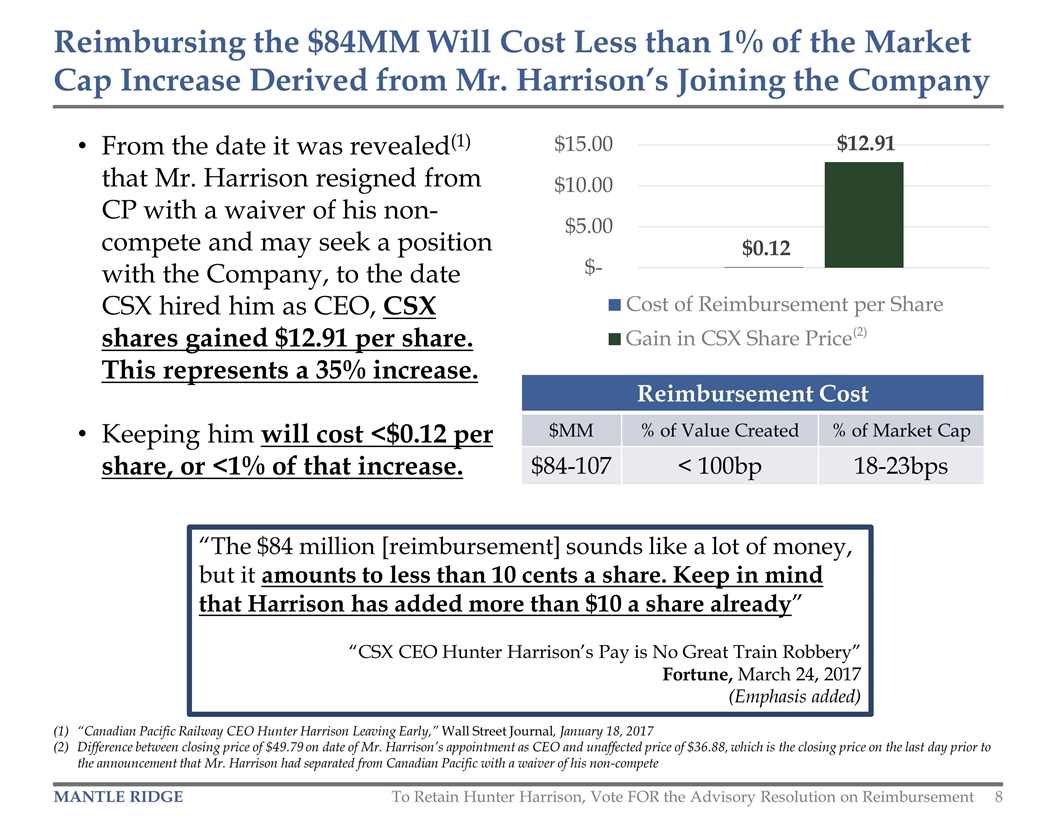

From the date it was revealed(1) that Mr. Harrison resigned from CP with a waiver of his non-compete and may seek a position with the Company, to the date CSX hired him as CEO, CSX shares gained $12.91 per share. This represents a 35% increase. Keeping him will cost <$0.12 per share, or <1% of that increase. Reimbursing the $84MM Will Cost Less than 1% of the Market Cap Increase Derived from Mr. Harrison’s Joining the Company “Canadian Pacific Railway CEO Hunter Harrison Leaving Early,” Wall Street Journal, January 18, 2017 Difference between closing price of $49.79 on date of Mr. Harrison’s appointment as CEO and unaffected price of $36.88, which is the closing price on the last day prior to the announcement that Mr. Harrison had separated from Canadian Pacific with a waiver of his non-compete Reimbursement Cost $MM % of Value Created % of Market Cap $84-107 < 100bp 18-23bps “The $84 million [reimbursement] sounds like a lot of money, but it amounts to less than 10 cents a share. Keep in mind that Harrison has added more than $10 a share already” “CSX CEO Hunter Harrison’s Pay is No Great Train Robbery” Fortune, March 24, 2017 (Emphasis added) (2) To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

CP required full and fair value for releasing Mr. Harrison from his non-compete Through first-hand experience, the CP Board fully understood the value Mr. Harrison would bring to another railroad, and expected to be fairly compensated for narrowing his non-compete Mr. Harrison effectively prepaid his own extraction cost (which amounted to over $90MM) for the benefit of CSX and its shareholders; Mantle Ridge committed that, solely under the contingency that he did not work at CSX, it would protect him against $84MM of that cost We believe that this two-step process – first freeing Mr. Harrison from CP and his non-compete, and second presenting him to CSX – was the only way to effect the hiring of Mr. Harrison as CEO of CSX CSX Could Not Have Hired Mr. Harrison Without Having Incurred This Cost – Either Directly or Indirectly To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement Shareholders who believe that CSX should have been willing to pay the $84MM directly to CP in order to hire Mr. Harrison should also support reimbursing the same costs incurred in advance on their behalf

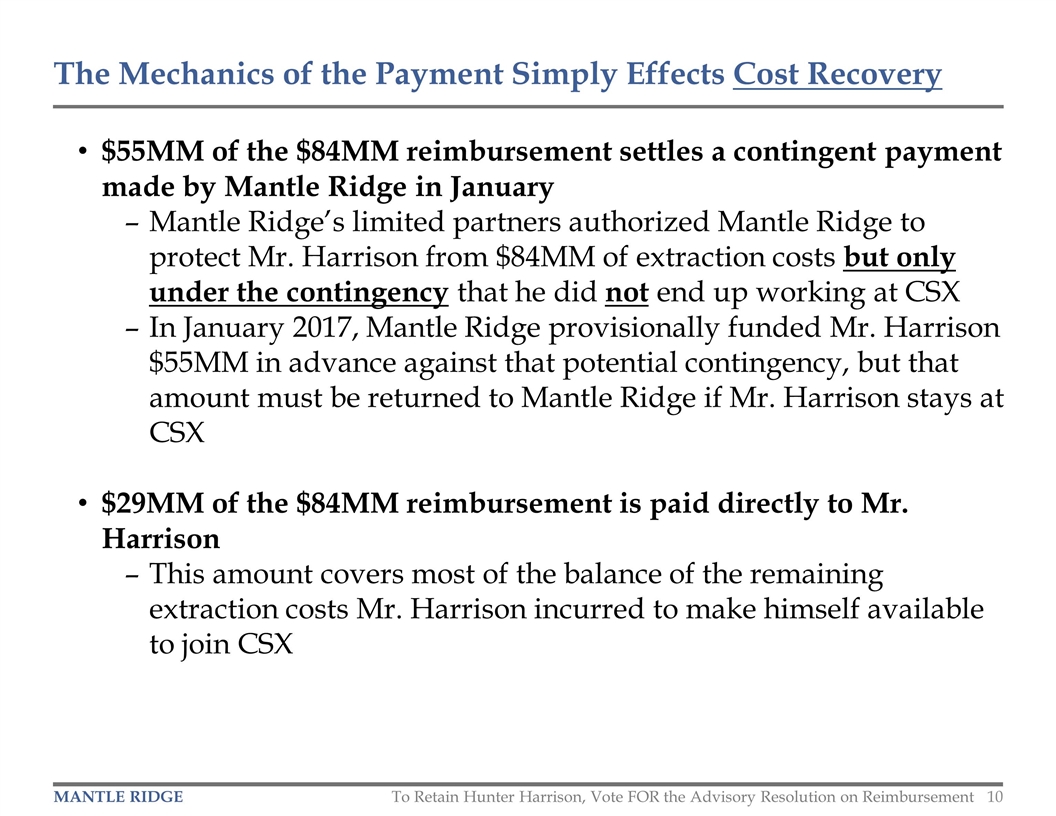

$55MM of the $84MM reimbursement settles a contingent payment made by Mantle Ridge in January Mantle Ridge’s limited partners authorized Mantle Ridge to protect Mr. Harrison from $84MM of extraction costs but only under the contingency that he did not end up working at CSX In January 2017, Mantle Ridge provisionally funded Mr. Harrison $55MM in advance against that potential contingency, but that amount must be returned to Mantle Ridge if Mr. Harrison stays at CSX $29MM of the $84MM reimbursement is paid directly to Mr. Harrison This amount covers most of the balance of the remaining extraction costs Mr. Harrison incurred to make himself available to join CSX The Mechanics of the Payment Simply Effects Cost Recovery To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

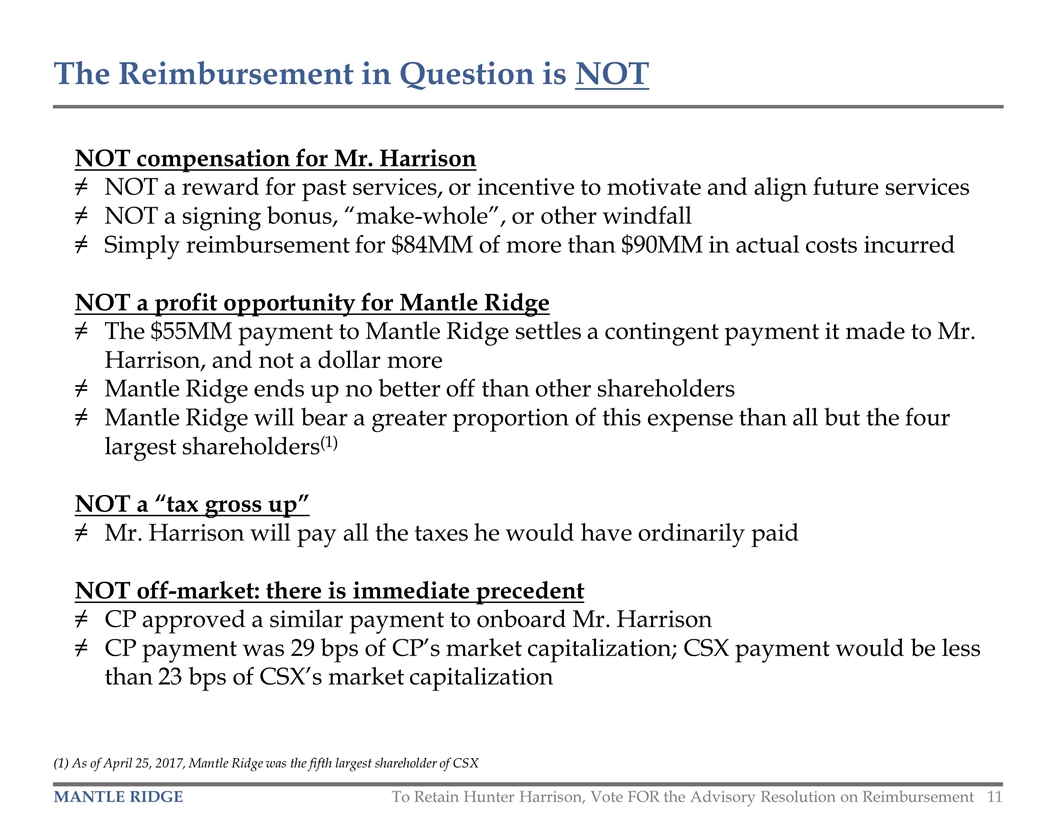

The Reimbursement in Question is NOT (1) As of April 25, 2017, Mantle Ridge was the fifth largest shareholder of CSX NOT compensation for Mr. Harrison NOT a reward for past services, or incentive to motivate and align future services NOT a signing bonus, “make-whole”, or other windfall Simply reimbursement for $84MM of more than $90MM in actual costs incurred NOT a profit opportunity for Mantle Ridge The $55MM payment to Mantle Ridge settles a contingent payment it made to Mr. Harrison, and not a dollar more Mantle Ridge ends up no better off than other shareholders Mantle Ridge will bear a greater proportion of this expense than all but the four largest shareholders(1) NOT a “tax gross up” Mr. Harrison will pay all the taxes he would have ordinarily paid NOT off-market: there is immediate precedent CP approved a similar payment to onboard Mr. Harrison CP payment was 29 bps of CP’s market capitalization; CSX payment would be less than 23 bps of CSX’s market capitalization To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

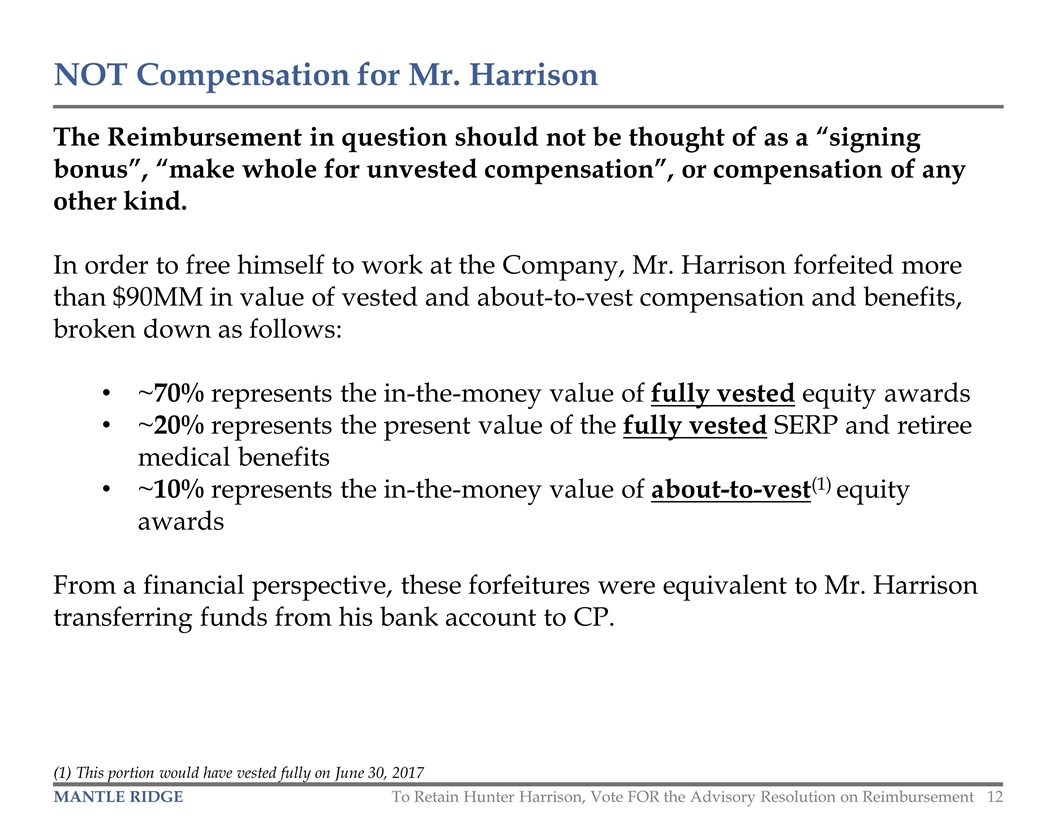

The Reimbursement in question should not be thought of as a “signing bonus”, “make whole for unvested compensation”, or compensation of any other kind. In order to free himself to work at the Company, Mr. Harrison forfeited more than $90MM in value of vested and about-to-vest compensation and benefits, broken down as follows: ~70% represents the in-the-money value of fully vested equity awards ~20% represents the present value of the fully vested SERP and retiree medical benefits ~10% represents the in-the-money value of about-to-vest(1) equity awards From a financial perspective, these forfeitures were equivalent to Mr. Harrison transferring funds from his bank account to CP. NOT Compensation for Mr. Harrison (1) This portion would have vested fully on June 30, 2017 To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

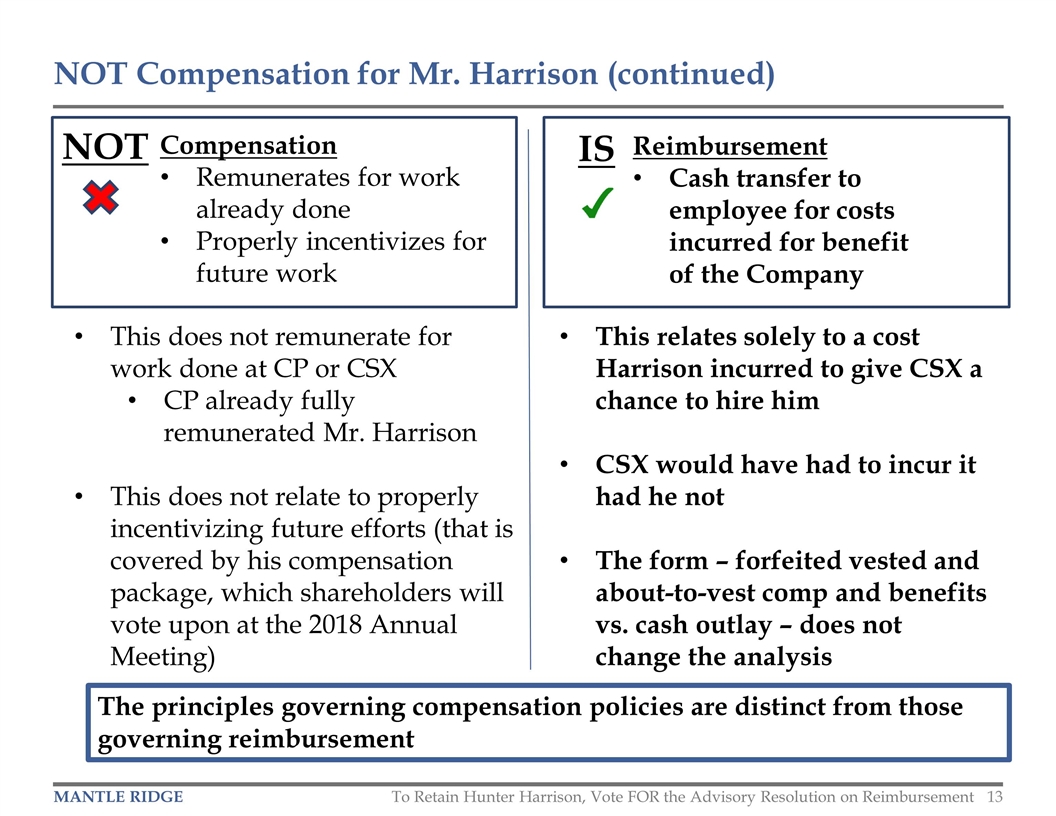

Compensation Remunerates for work already done Properly incentivizes for future work NOT Compensation for Mr. Harrison (continued) Reimbursement Cash transfer to employee for costs incurred for benefit of the Company This does not remunerate for work done at CP or CSX CP already fully remunerated Mr. Harrison This does not relate to properly incentivizing future efforts (that is covered by his compensation package, which shareholders will vote upon at the 2018 Annual Meeting) NOT IS This relates solely to a cost Harrison incurred to give CSX a chance to hire him CSX would have had to incur it had he not The form – forfeited vested and about-to-vest comp and benefits vs. cash outlay – does not change the analysis The principles governing compensation policies are distinct from those governing reimbursement To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

Mantle Ridge will be treated the same as other shareholders As CEO Mr. Harrison will drive benefit to all shareholders; it makes sense therefore that all CSX shareholders should share the cost of recruiting him Post-Reimbursement, as the Company’s fifth-largest shareholder, Mantle Ridge will bear more of the $84MM in Extraction Cost than all but the four larger shareholders The $55MM payment to Mantle Ridge proposed in the Reimbursement serves solely to settle the provisional payment it made to Mr. Harrison in January 2017 against the contingency he would not work for CSX; that provisional payment must be returned to Mantle Ridge if Mr. Harrison stays at the Company Mantle Ridge seeks no compensation for costs it uniquely bears for the benefit of all shareholders – advisor costs; direct and opportunity costs of extensive engagement with the Board and the Company; etc. NOT a Profit Opportunity for Mantle Ridge If the Reimbursement is made, Mantle Ridge will have served solely to catalyze placement of Mr. Harrison at the Company To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

The Indemnity in the Reimbursement is NOT a backdoor “tax gross up” The tax indemnity that the Company would assume serves only to insulate Mr. Harrison from any excess taxes associated with the transaction structure. The indemnity DOES NOT COVER ORDINARY-COURSE INCOME TAXES that Mr. Harrison would have otherwise have had to pay on his forfeited compensation and benefits had he not entered into this arrangement. Mr. Harrison will bear all of his ordinary course income taxes. NOT a “Tax Gross Up” To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

CP reimbursed Mr. Harrison for analogous costs he incurred in 2012 In January of 2012, Canadian National threatened to cut off ~$40MM dollars worth of Mr. Harrison’s vested compensation and benefits if he made an effort to become CEO of Canadian Pacific Mr. Harrison was unwilling to accept this cost To facilitate Mr. Harrison’s joining CP, Pershing Square extended to him contingent insurance protection analogous to the protection Mantle Ridge provided to facilitate Mr. Harrison’s joining CSX The protection expired if Mr. Harrison accepted a position at CP To induce Mr. Harrison to become CEO of CP, the CP Board approved protecting Mr. Harrison from the ~$40MM of costs The amount CP paid was ~29 bps of CP’s market capitalization(1) In this analogous case, CSX is being asked to effect a reimbursement amounting to less than 23 bps of CSX’s current market capitalization NOT Off-Market: There is Immediate Precedent (1) At the time of Mr. Harrison’s appointment to CEO of Canadian Pacific on June 28, 2012 To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

Reimbursement of $84MM of the costs Hunter Harrison incurred (plus any associated excess taxes) to make himself available to lead CSX, and prevent his resignation A fair and reasonable way to retain Hunter Harrison as CEO An extraordinarily attractive choice from the perspective of cost and benefit Substantively equivalent to the question of whether CSX should have paid $84MM to CP had the two companies negotiated directly The Reimbursement in Question IS THIS IS: To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

The Value Created by Mr. Harrison’s Joining CSX Can Disappear as Quickly as it Appeared “Nixing the $84 million would send Harrison packing and the share price tumbling.” “CSX CEO Hunter Harrison’s Pay is No Great Train Robbery” Fortune March 24, 2017 If the Company does not reimburse the $84MM, Mr. Harrison will resign Without Mr. Harrison, the transformation into a Precision Scheduled Railroad could not happen The Company would suffer great disruption, and shareholders will not benefit from the improvements currently anticipated in the share price The market value of the Company will likely adjust to reflect this adverse change To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

In Our View, No Other Executive Can Deliver Nearly as Much Value to the Company as Mr. Harrison ‘“Hunter’s 72 years old but very passionate, energetic and, of course, knows railroad operations better than anybody else,” [Asok] Chaudhuri [,Principle of Heritage Capital and former board member and 26 year veteran of CSX,] said. … “He is probably the single most revered and respected rail executive in the country today in the sense of producing results,” Chaudhuri said.’ “CSX’s road to efficiency: more cuts” Jacksonville Daily Record March 28, 2017 (emphasis added) Ordinarily, many CEO candidates can create comparable value for a Company. This case is different. In our view Mr. Harrison, his record, and his ability to deliver value to the Company are, by a wide margin, without peer in the industry. We believe this view is widely held, and is a key consideration in evaluating whether retaining Mr. Harrison is worth the cost of reimbursing him. To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

Railroader of the Year, Railway Age (2002) CEO of the Year, Globe and Mail (2007) International Executive of the Year, Canadian Chamber of Commerce (2009) Railroad Innovator Award, Progressive Railroading (2009) “Turnaround Ace,” Globe and Mail (2014) Railroader of the Year, Railway Age (2015) He Has Received More Top Accolades than Any Other Industry Executive To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

Mr. Harrison’s Record is Extraordinary, Unparalleled and Consistent "He's demonstrated, time and again, a unique gift to run a railroad," said Sandy Pomeroy, a portfolio manager at Neuberger Berman, which owned 1.2 percent of CSX shares as of Sept. 30 and is the Company's 10th largest shareholder. "It's hard to imagine he can't go into CSX and improve operations faster.” “CSX shareholder backs Harrison for CEO as activist swoops in” Reuters January 25, 2017 (emphasis added) “Hunter is three-for-three on turning around railroads, and I’m highly confident he will go four-for-four,” said [Jim] Hall, whose Calgary-based firm [Mawer Investment Management] oversees about $40 billion in assets and owns shares of both Canadian National and Canadian Pacific.” “CSX Investors Are All Ears for Harrison Pitch to Run Carrier ” Bloomberg News January 25, 2017 (emphasis added) To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

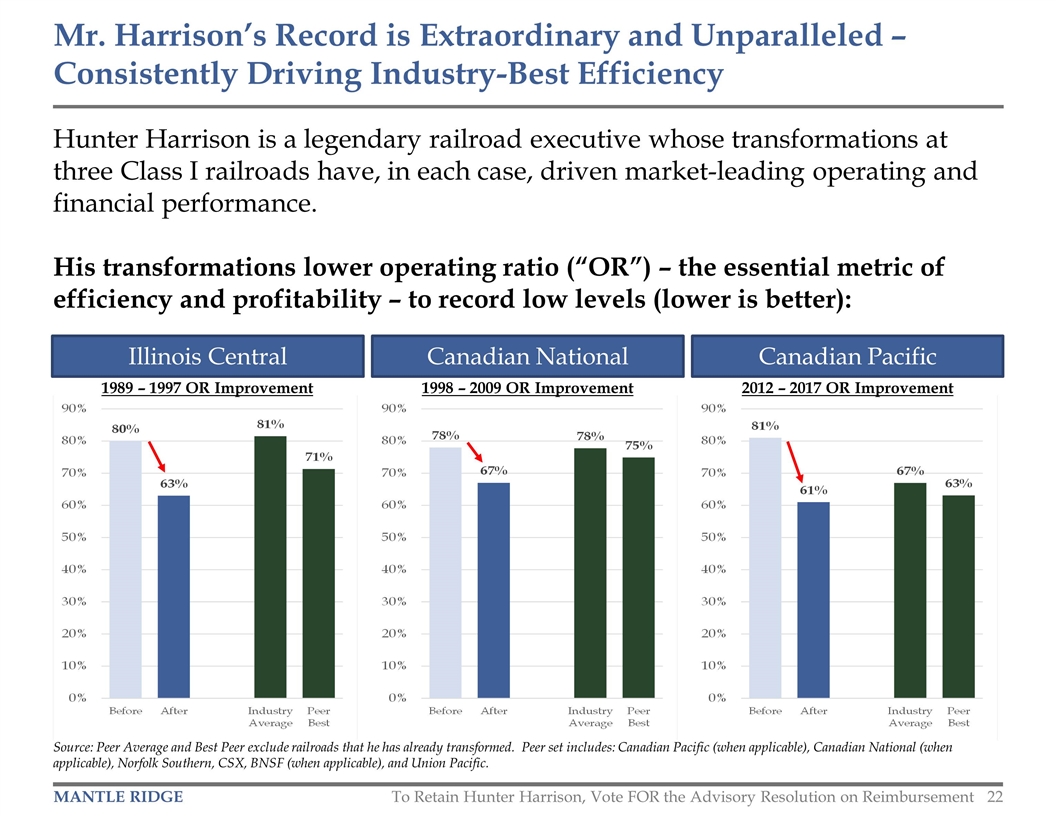

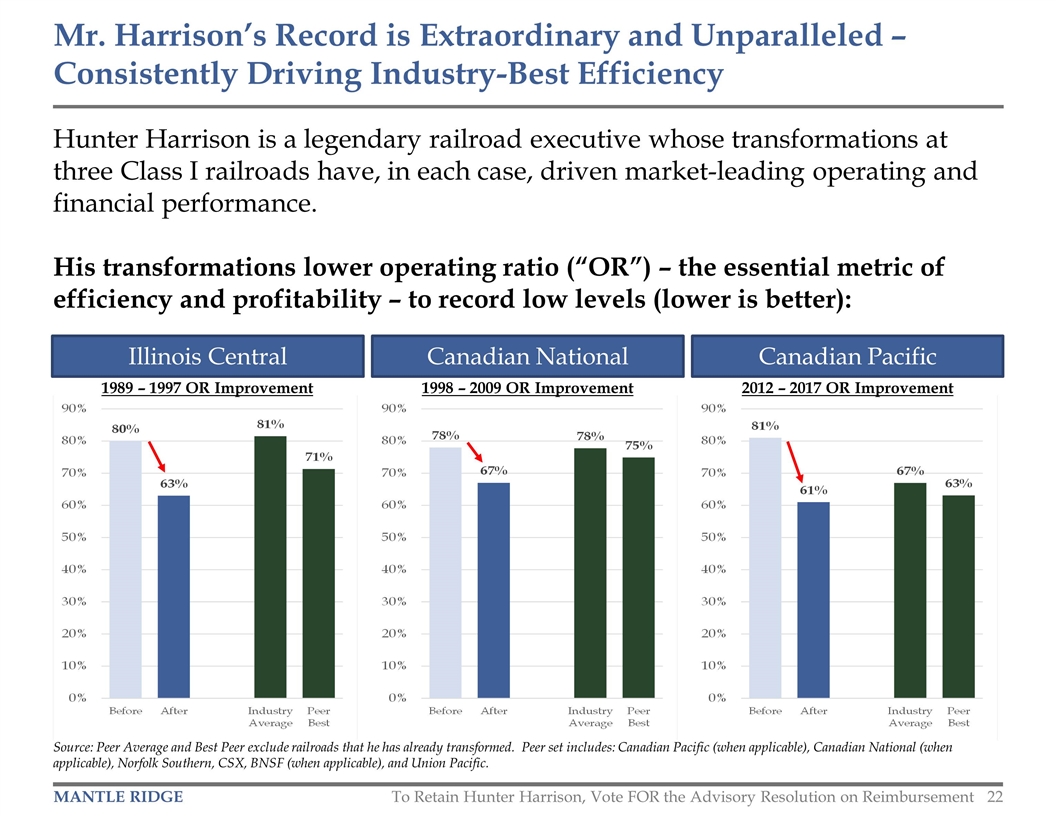

Hunter Harrison is a legendary railroad executive whose transformations at three Class I railroads have, in each case, driven market-leading operating and financial performance. His transformations lower operating ratio (“OR”) – the essential metric of efficiency and profitability – to record low levels (lower is better): Mr. Harrison’s Record is Extraordinary and Unparalleled – Consistently Driving Industry-Best Efficiency Source: Peer Average and Best Peer exclude railroads that he has already transformed. Peer set includes: Canadian Pacific (when applicable), Canadian National (when applicable), Norfolk Southern, CSX, BNSF (when applicable), and Union Pacific. Illinois Central Canadian National Canadian Pacific 1989 – 1997 OR Improvement 1998 – 2009 OR Improvement 2012 – 2017 OR Improvement To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

His transformations have created enormous shareholder value, and consistently created more value than the industry average or his best peers did during the comparable periods. Mr. Harrison Consistently Creates Tremendous Shareholder Value – Outpacing the Industry Average and Next Best Peer Source: Peer Average and Best Peer exclude railroads that he has already transformed. Peer set includes: Canadian Pacific (when applicable), Canadian National (when applicable), Norfolk Southern, CSX, BNSF (when applicable), and Union Pacific. Illinois Central Canadian National Canadian Pacific 1989 – 1997 TSR 1998 – 2009 TSR 2012 – 2017 TSR To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

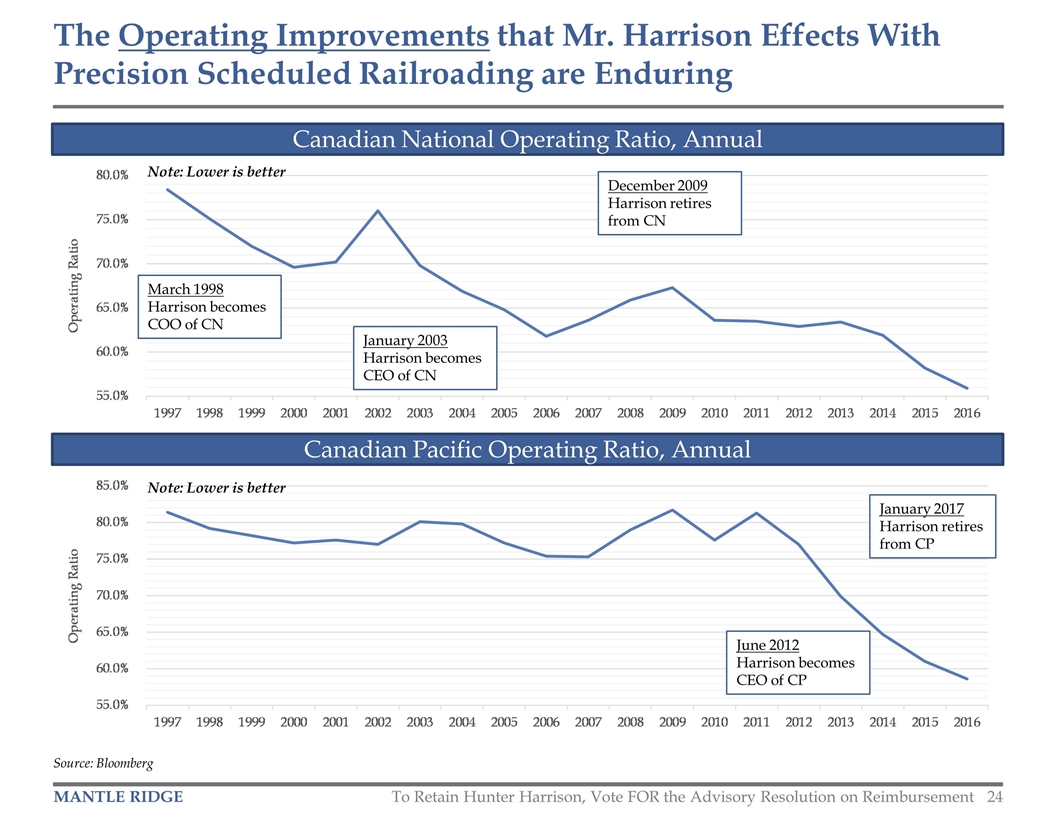

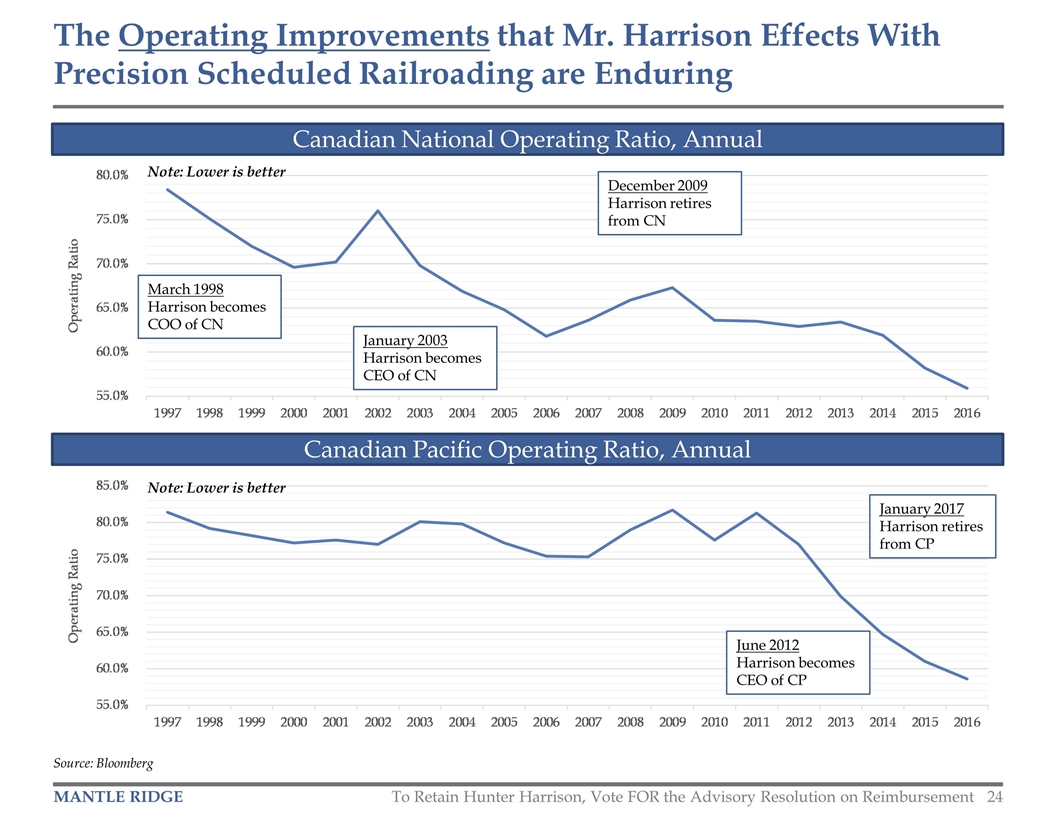

The Operating Improvements that Mr. Harrison Effects With Precision Scheduled Railroading are Enduring Source: Bloomberg Canadian National Operating Ratio, Annual Canadian Pacific Operating Ratio, Annual January 2003 Harrison becomes CEO of CN December 2009 Harrison retires from CN June 2012 Harrison becomes CEO of CP January 2017 Harrison retires from CP March 1998 Harrison becomes COO of CN Note: Lower is better Note: Lower is better To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

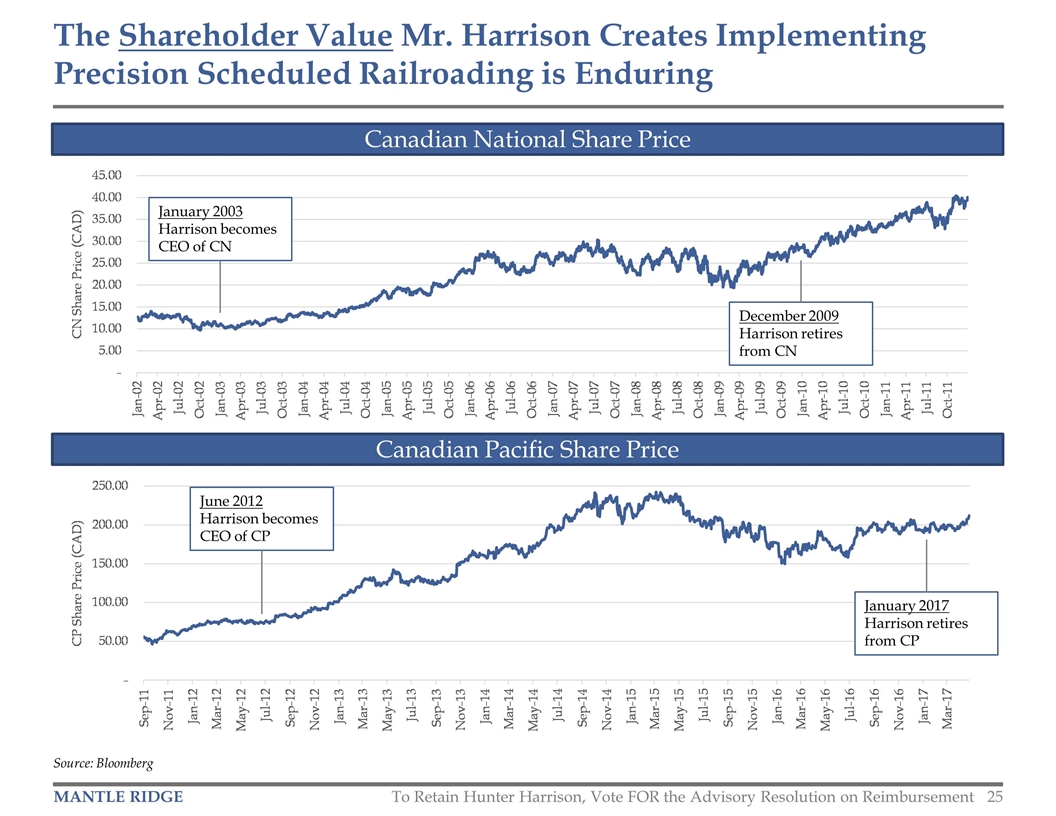

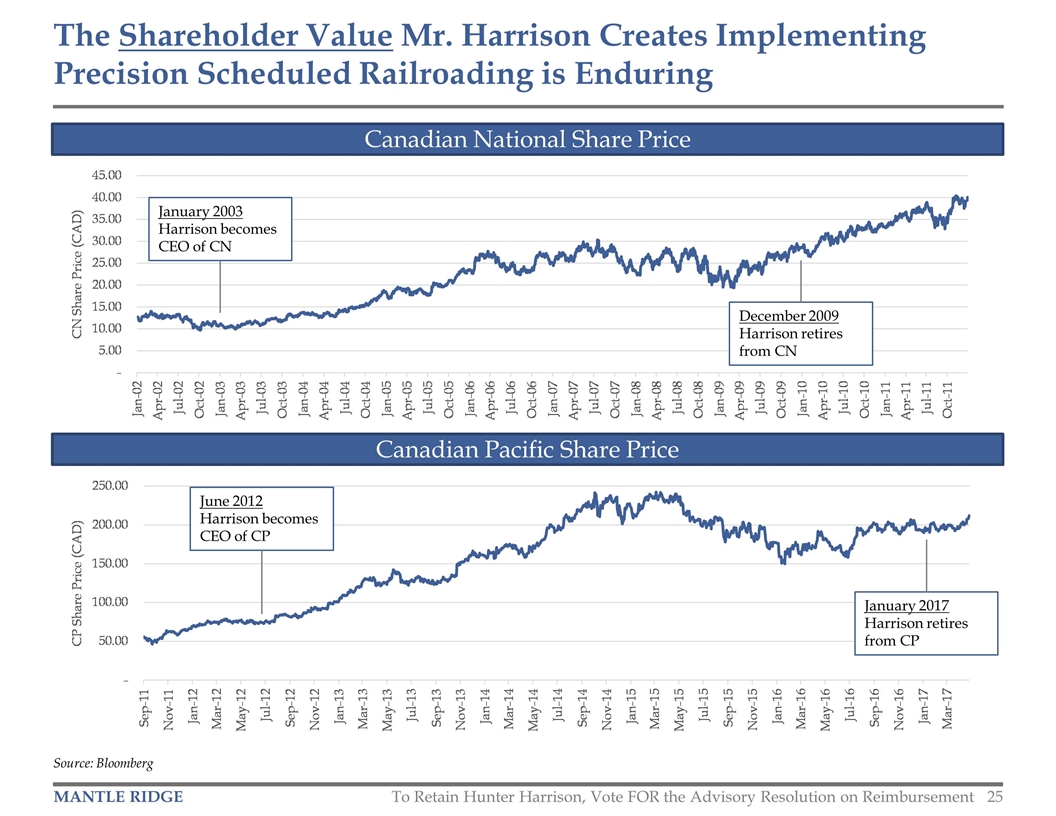

The Shareholder Value Mr. Harrison Creates Implementing Precision Scheduled Railroading is Enduring Source: Bloomberg Canadian National Share Price Canadian Pacific Share Price January 2003 Harrison becomes CEO of CN December 2009 Harrison retires from CN June 2012 Harrison becomes CEO of CP January 2017 Harrison retires from CP To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

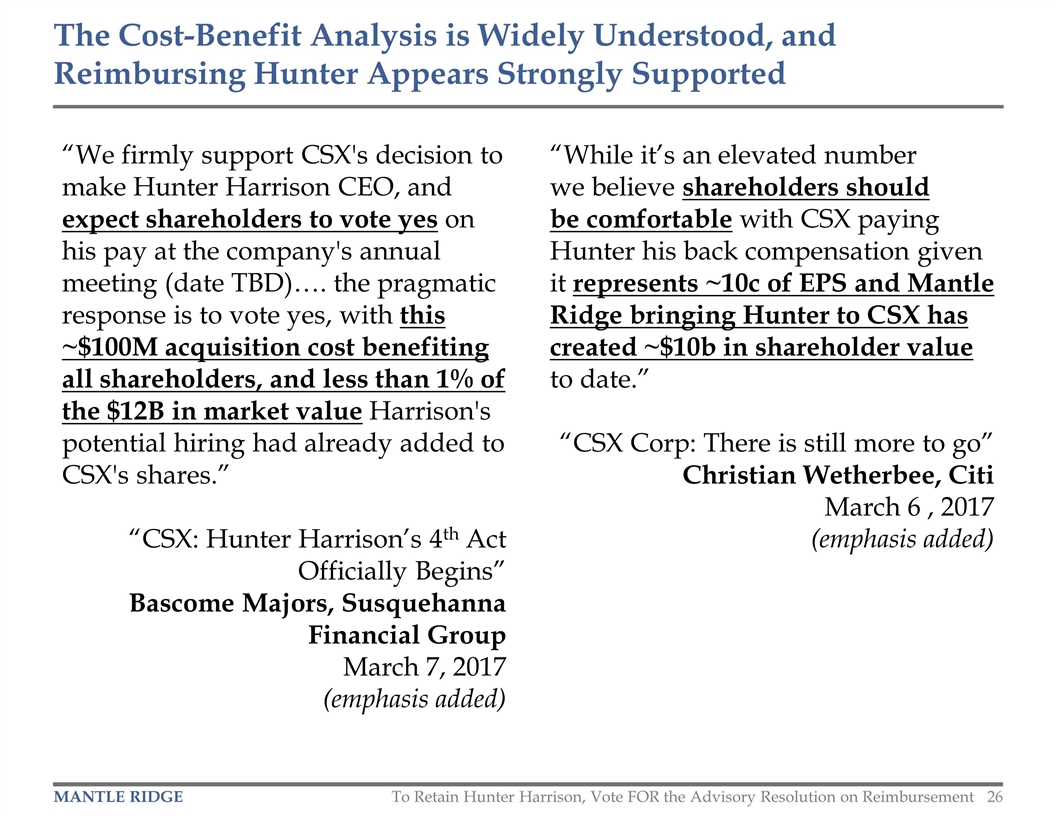

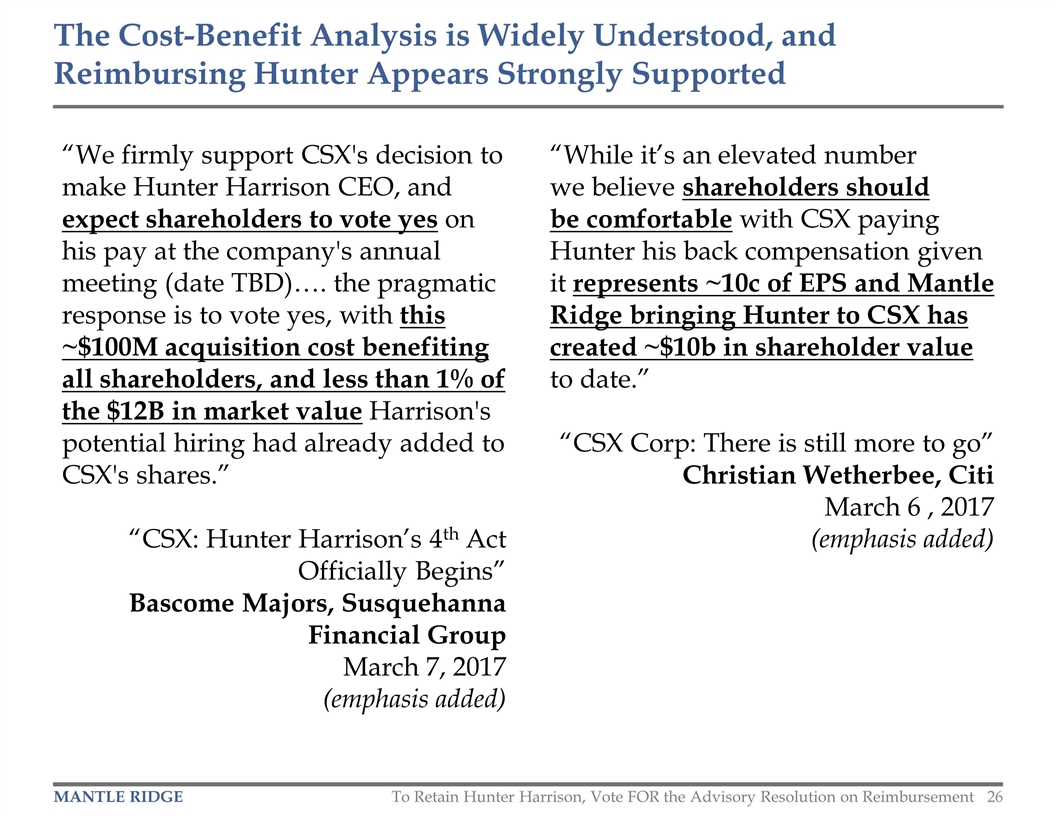

The Cost-Benefit Analysis is Widely Understood, and Reimbursing Hunter Appears Strongly Supported “While it’s an elevated number we believe shareholders should be comfortable with CSX paying Hunter his back compensation given it represents ~10c of EPS and Mantle Ridge bringing Hunter to CSX has created ~$10b in shareholder value to date.” “CSX Corp: There is still more to go” Christian Wetherbee, Citi March 6 , 2017 (emphasis added) “We firmly support CSX's decision to make Hunter Harrison CEO, and expect shareholders to vote yes on his pay at the company's annual meeting (date TBD)…. the pragmatic response is to vote yes, with this ~$100M acquisition cost benefiting all shareholders, and less than 1% of the $12B in market value Harrison's potential hiring had already added to CSX's shares.” “CSX: Hunter Harrison’s 4th Act Officially Begins” Bascome Majors, Susquehanna Financial Group March 7, 2017 (emphasis added) To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

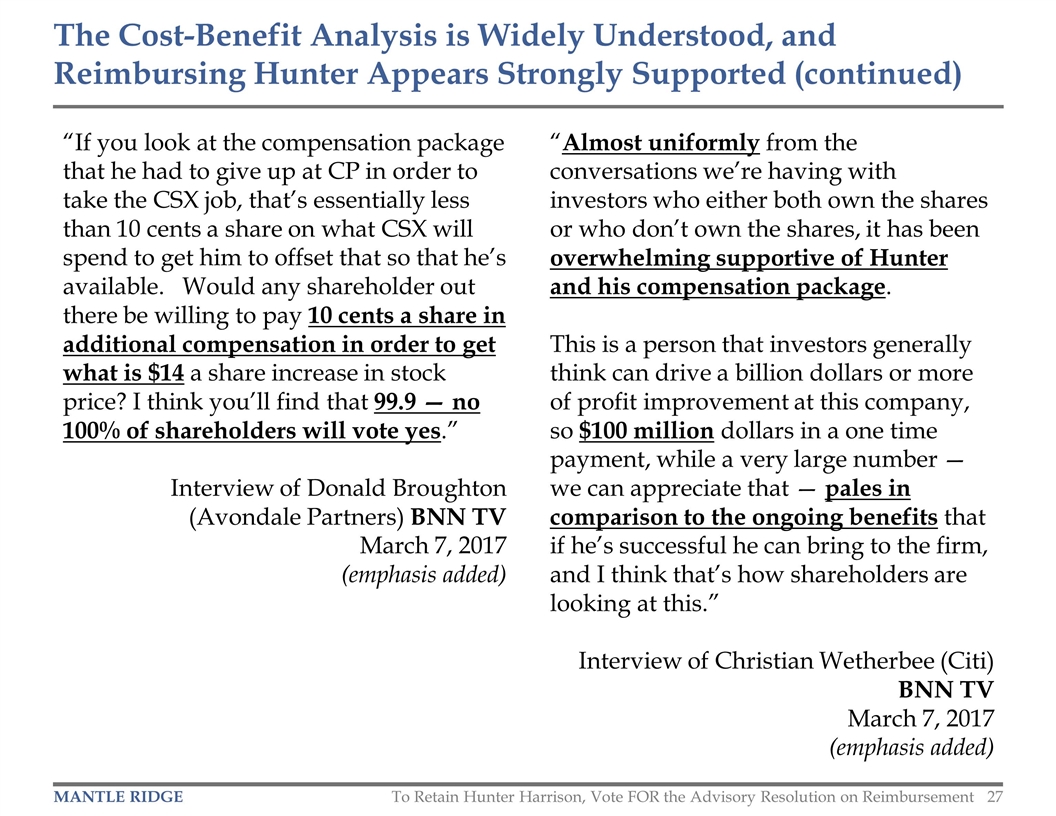

The Cost-Benefit Analysis is Widely Understood, and Reimbursing Hunter Appears Strongly Supported (continued) “If you look at the compensation package that he had to give up at CP in order to take the CSX job, that’s essentially less than 10 cents a share on what CSX will spend to get him to offset that so that he’s available. Would any shareholder out there be willing to pay 10 cents a share in additional compensation in order to get what is $14 a share increase in stock price? I think you’ll find that 99.9 — no 100% of shareholders will vote yes.” Interview of Donald Broughton (Avondale Partners) BNN TV March 7, 2017 (emphasis added) “Almost uniformly from the conversations we’re having with investors who either both own the shares or who don’t own the shares, it has been overwhelming supportive of Hunter and his compensation package. This is a person that investors generally think can drive a billion dollars or more of profit improvement at this company, so $100 million dollars in a one time payment, while a very large number — we can appreciate that — pales in comparison to the ongoing benefits that if he’s successful he can bring to the firm, and I think that’s how shareholders are looking at this.” Interview of Christian Wetherbee (Citi) BNN TV March 7, 2017 (emphasis added) To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

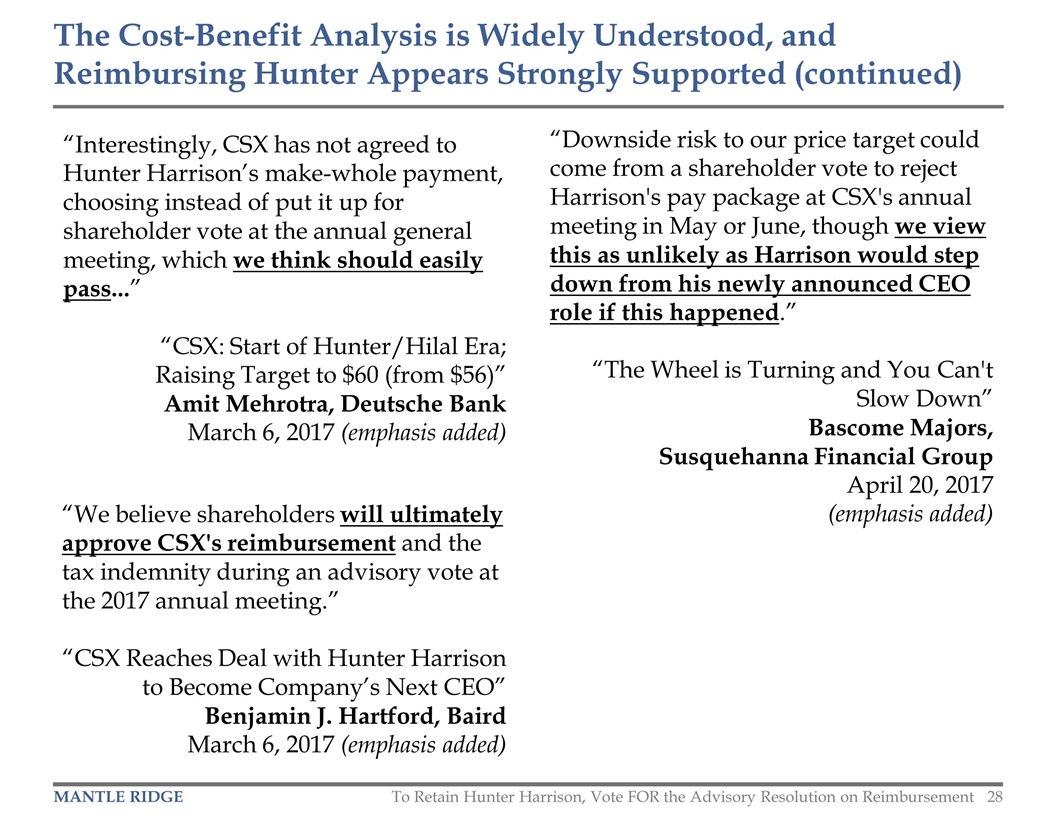

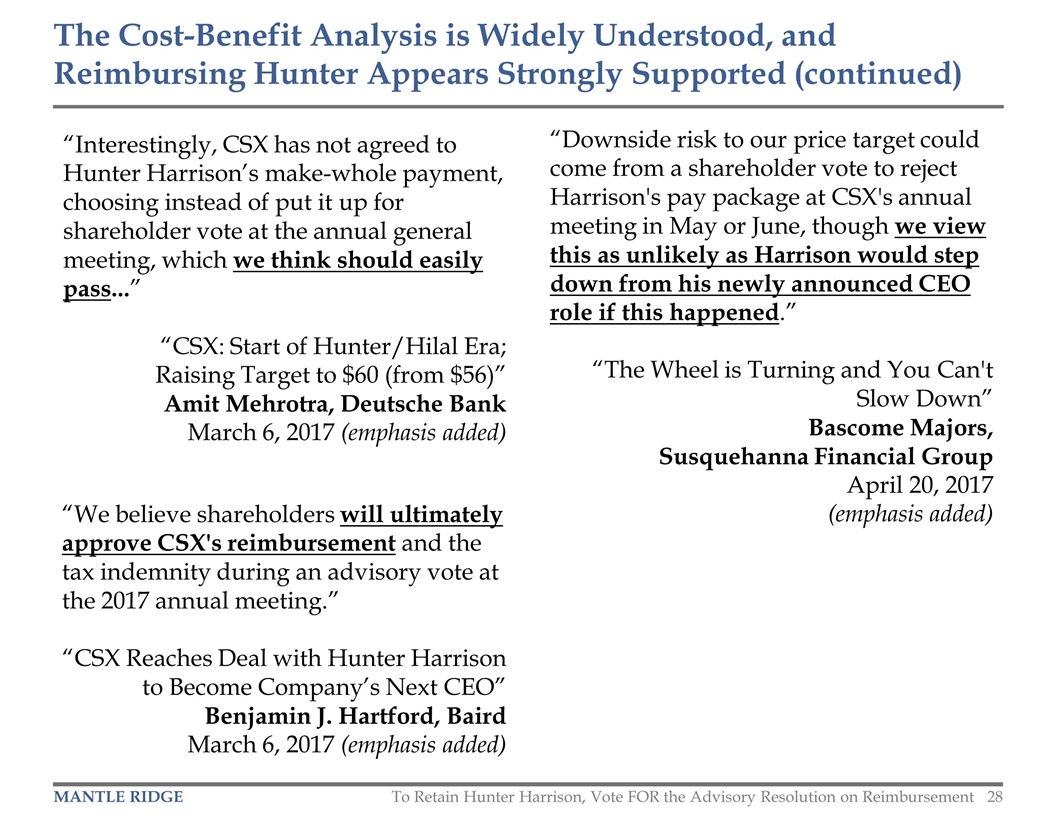

The Cost-Benefit Analysis is Widely Understood, and Reimbursing Hunter Appears Strongly Supported (continued) “Interestingly, CSX has not agreed to Hunter Harrison’s make-whole payment, choosing instead of put it up for shareholder vote at the annual general meeting, which we think should easily pass...” “CSX: Start of Hunter/Hilal Era; Raising Target to $60 (from $56)” Amit Mehrotra, Deutsche Bank March 6, 2017 (emphasis added) “We believe shareholders will ultimately approve CSX's reimbursement and the tax indemnity during an advisory vote at the 2017 annual meeting.” “CSX Reaches Deal with Hunter Harrison to Become Company’s Next CEO” Benjamin J. Hartford, Baird March 6, 2017 (emphasis added) “Downside risk to our price target could come from a shareholder vote to reject Harrison's pay package at CSX's annual meeting in May or June, though we view this as unlikely as Harrison would step down from his newly announced CEO role if this happened.” “The Wheel is Turning and You Can't Slow Down” Bascome Majors, Susquehanna Financial Group April 20, 2017 (emphasis added) To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

Shareholders Have a Choice CSX pays $84MM (plus any associated excess taxes) to reimburse Harrison’s extraction costs Harrison remains CEO Harrison proceeds to transform the Company Harrison resigns in order to preserve the contingent protection of Mantle Ridge To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement Item 5 Advisory Resolution Vote FOR CSX effects Reimbursement AGAINST CSX does not effect Reimbursement

Vote for Hunter Harrison to Remain CEO Mantle Ridge encourages shareholders to vote the GOLD PROXY CARD FOR the Advisory Resolution providing for Reimbursement so that Hunter Harrison will remain CEO of CSX To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement

Agenda To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement 1 1 Appendix: Timeline 31 2 Appendix: Preview of 2018: Thoughts on Harrison's Compensation Package 33 3

Mantle Ridge and Hunter Harrison proposed that he retire from CP early with a waiver of his non-compete that would allow him to work at a number of Class I railroads including CSX CP was willing to grant the waiver, but only if Mr. Harrison incurred more than $90MM in extraction costs by forfeiting fully vested (~90%) and about-to-vest (~10%) compensation and benefits Mantle Ridge and Mr. Harrison believed that if CSX were to hire Mr. Harrison, it would cover the extraction costs; but Mr. Harrison was unwilling to take the risk of bearing those costs himself if CSX did not Mantle Ridge’s limited partners authorized Mantle Ridge to protect Mr. Harrison from $84MM of extraction costs but only under the contingency that he did not end up working at CSX or another company selected by Mantle Ridge (this protection ends if Mr. Harrison remains CEO of CSX past July 5, 2017) Mr. Harrison left CP and incurred the extraction cost, and Mantle Ridge paid Mr. Harrison $55MM in advance against the contingency that its protection would come due CSX hired Mr. Harrison as CEO, and seeks guidance from shareholders as to whether to reimburse $84MM of extraction costs (plus any associated excess taxes) Mr. Harrison made clear he will resign from CSX in order to retain the Mantle Ridge protection if CSX does not agree to the Reimbursement Timeline Summary Appendix: Timeline

Agenda To Retain Hunter Harrison, Vote FOR the Advisory Resolution on Reimbursement 1 1 Appendix: Timeline 31 2 Appendix: Preview of 2018: Thoughts on Harrison's Compensation Package 33 3

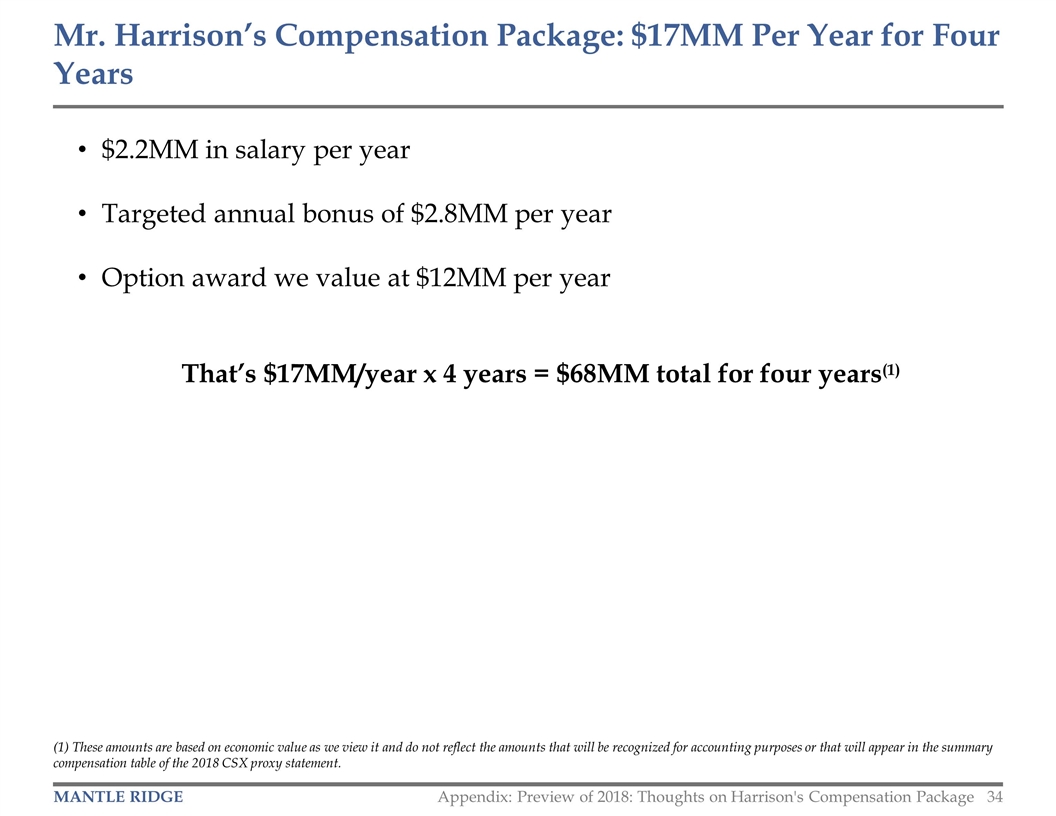

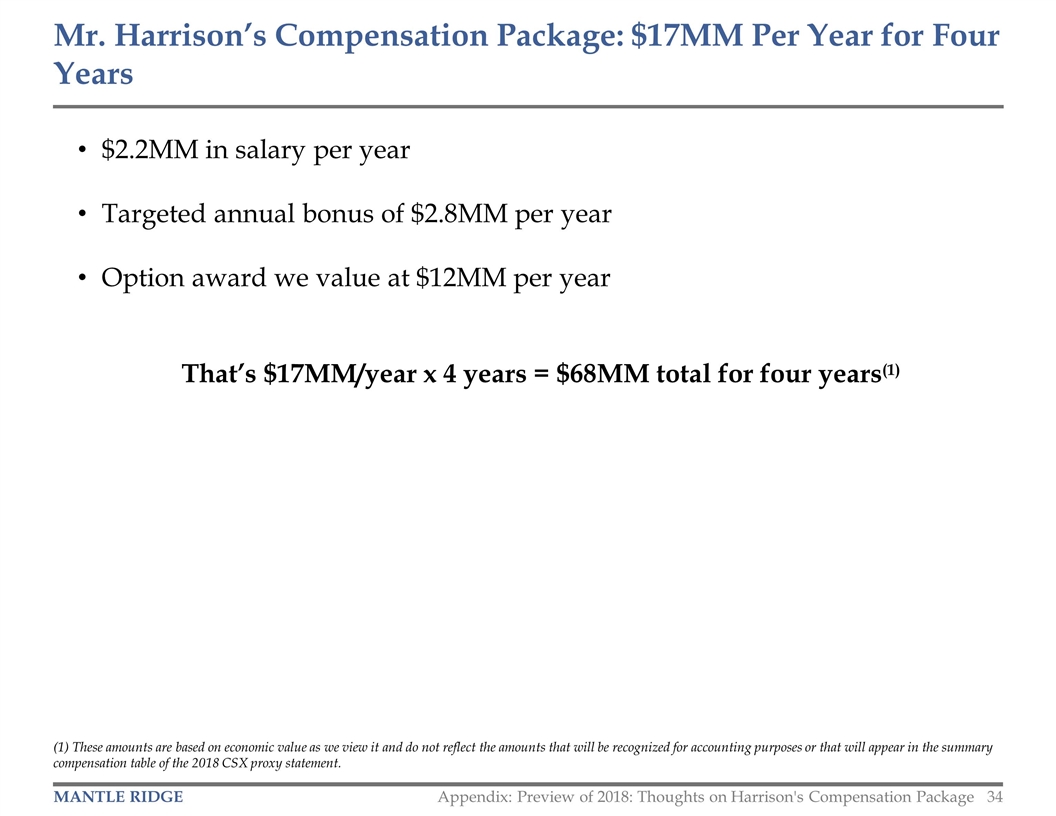

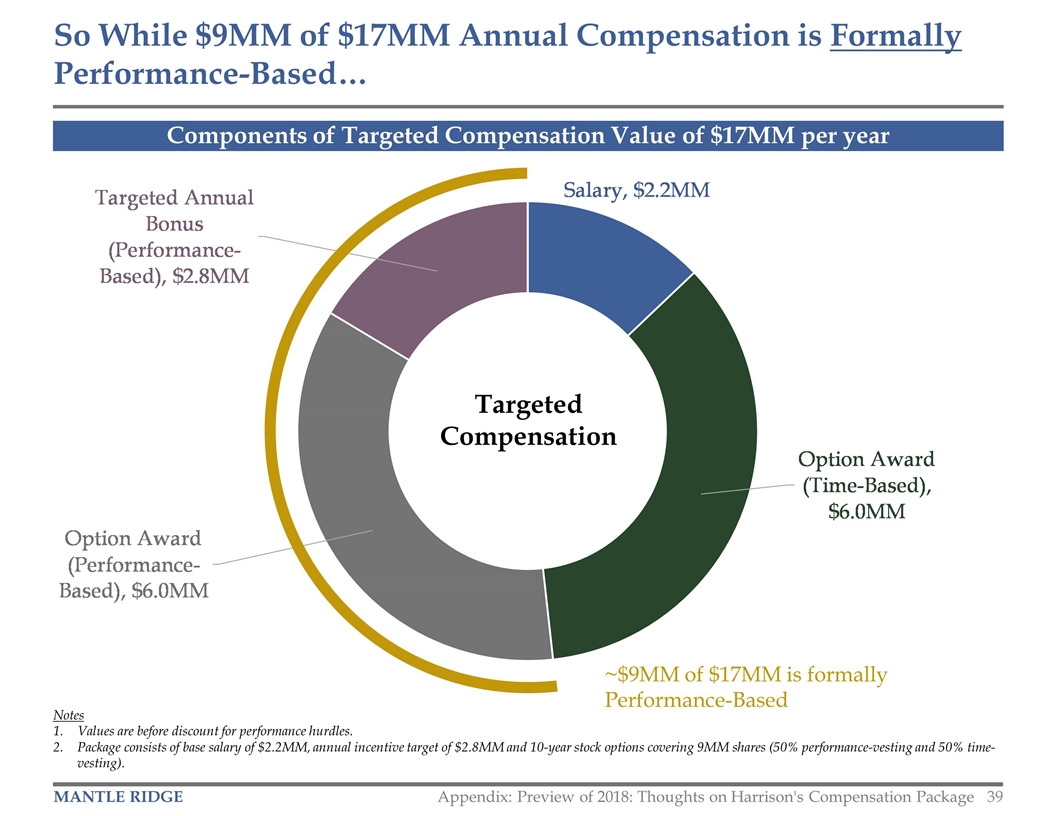

$2.2MM in salary per year Targeted annual bonus of $2.8MM per year Option award we value at $12MM per year That’s $17MM/year x 4 years = $68MM total for four years(1) Mr. Harrison’s Compensation Package: $17MM Per Year for Four Years (1) These amounts are based on economic value as we view it and do not reflect the amounts that will be recognized for accounting purposes or that will appear in the summary compensation table of the 2018 CSX proxy statement. Appendix: Preview of 2018: Thoughts on Harrison's Compensation Package

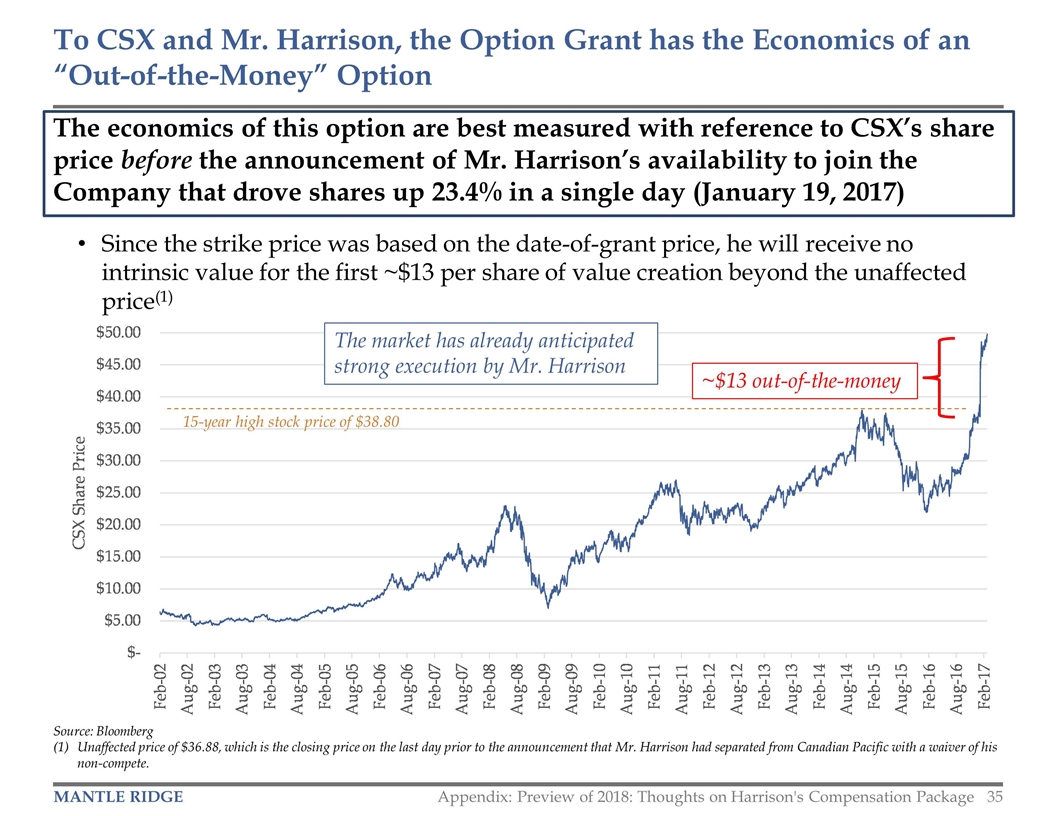

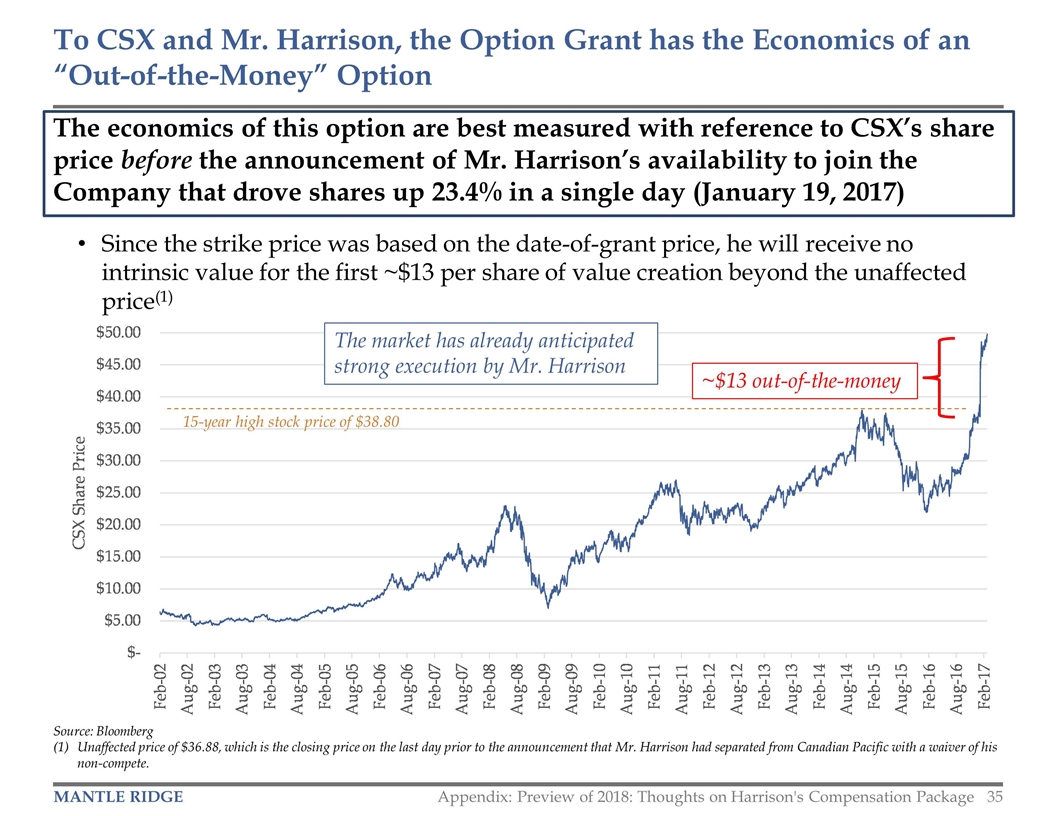

The economics of this option are best measured with reference to CSX’s share price before the announcement of Mr. Harrison’s availability to join the Company that drove shares up 23.4% in a single day (January 19, 2017) Since the strike price was based on the date-of-grant price, he will receive no intrinsic value for the first ~$13 per share of value creation beyond the unaffected price(1) To CSX and Mr. Harrison, the Option Grant has the Economics of an “Out-of-the-Money” Option The market has already anticipated strong execution by Mr. Harrison ~$13 out-of-the-money 15-year high stock price of $38.80 Source: Bloomberg Unaffected price of $36.88, which is the closing price on the last day prior to the announcement that Mr. Harrison had separated from Canadian Pacific with a waiver of his non-compete. Appendix: Preview of 2018: Thoughts on Harrison's Compensation Package

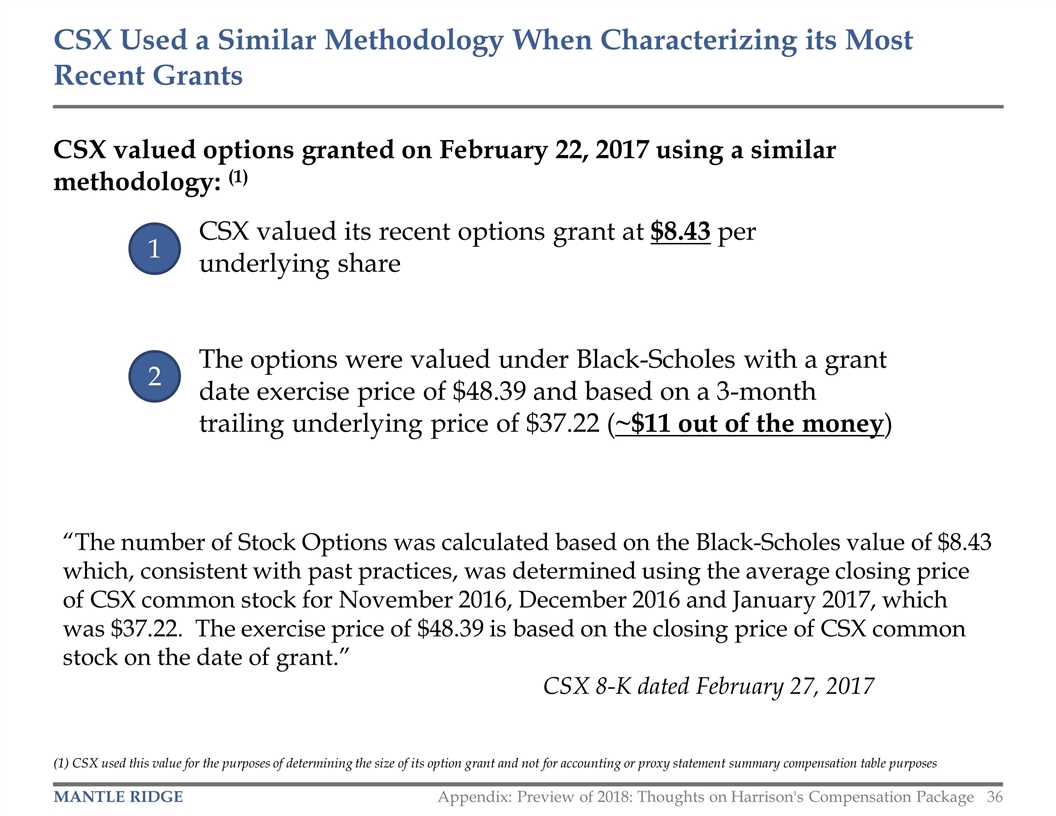

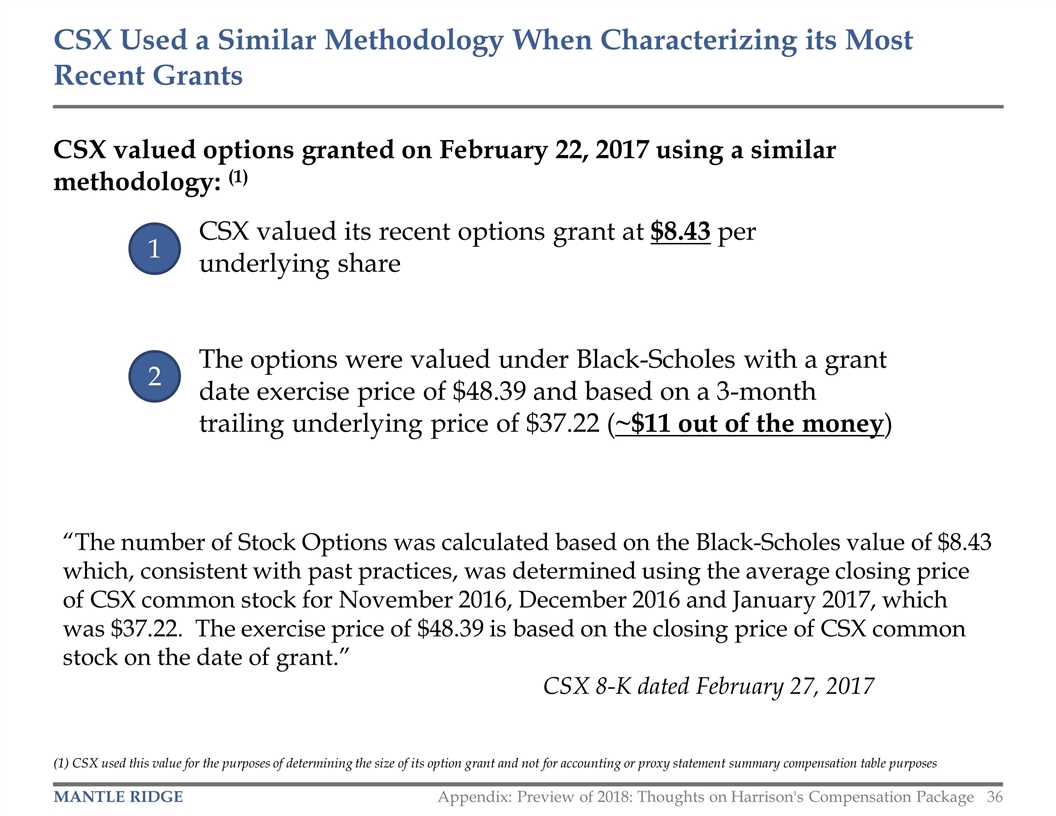

(1) CSX used this value for the purposes of determining the size of its option grant and not for accounting or proxy statement summary compensation table purposes CSX valued options granted on February 22, 2017 using a similar methodology: (1) CSX Used a Similar Methodology When Characterizing its Most Recent Grants “The number of Stock Options was calculated based on the Black-Scholes value of $8.43 which, consistent with past practices, was determined using the average closing price of CSX common stock for November 2016, December 2016 and January 2017, which was $37.22. The exercise price of $48.39 is based on the closing price of CSX common stock on the date of grant.” CSX 8-K dated February 27, 2017 1 2 CSX valued its recent options grant at $8.43 per underlying share The options were valued under Black-Scholes with a grant date exercise price of $48.39 and based on a 3-month trailing underlying price of $37.22 (~$11 out of the money) Appendix: Preview of 2018: Thoughts on Harrison's Compensation Package

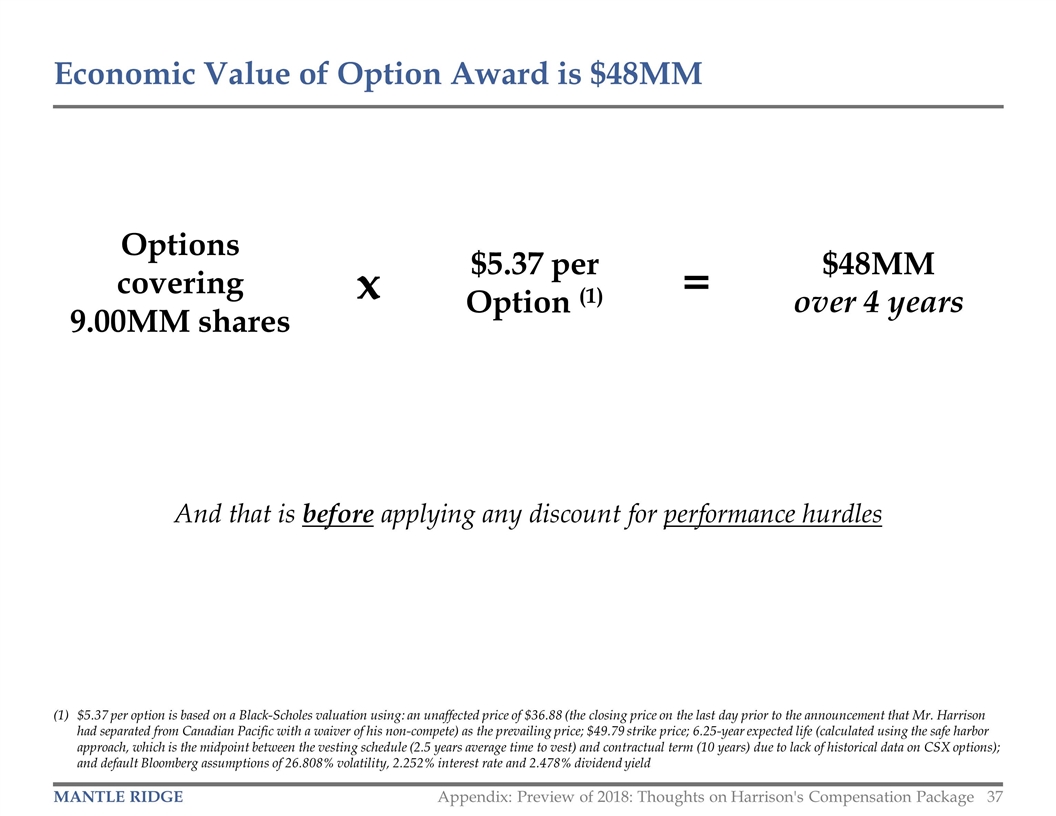

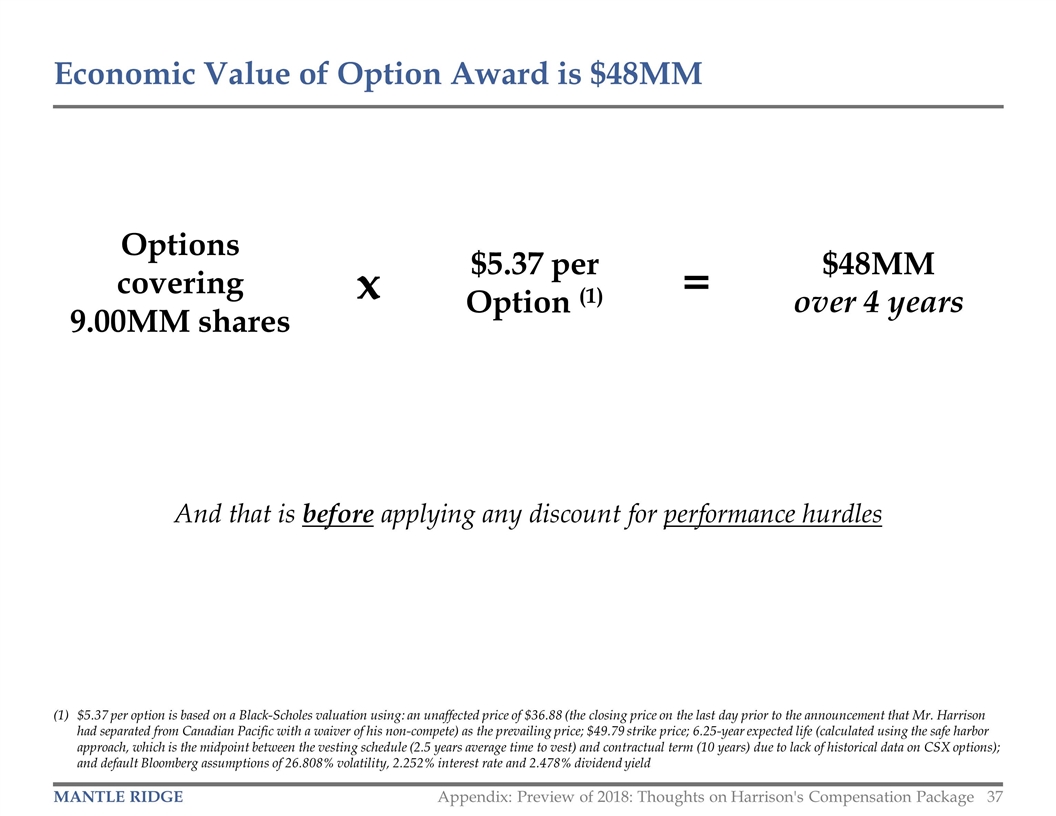

$5.37 per option is based on a Black-Scholes valuation using: an unaffected price of $36.88 (the closing price on the last day prior to the announcement that Mr. Harrison had separated from Canadian Pacific with a waiver of his non-compete) as the prevailing price; $49.79 strike price; 6.25-year expected life (calculated using the safe harbor approach, which is the midpoint between the vesting schedule (2.5 years average time to vest) and contractual term (10 years) due to lack of historical data on CSX options); and default Bloomberg assumptions of 26.808% volatility, 2.252% interest rate and 2.478% dividend yield And that is before applying any discount for performance hurdles Economic Value of Option Award is $48MM Options covering 9.00MM shares x $5.37 per Option (1) = $48MM over 4 years Appendix: Preview of 2018: Thoughts on Harrison's Compensation Package

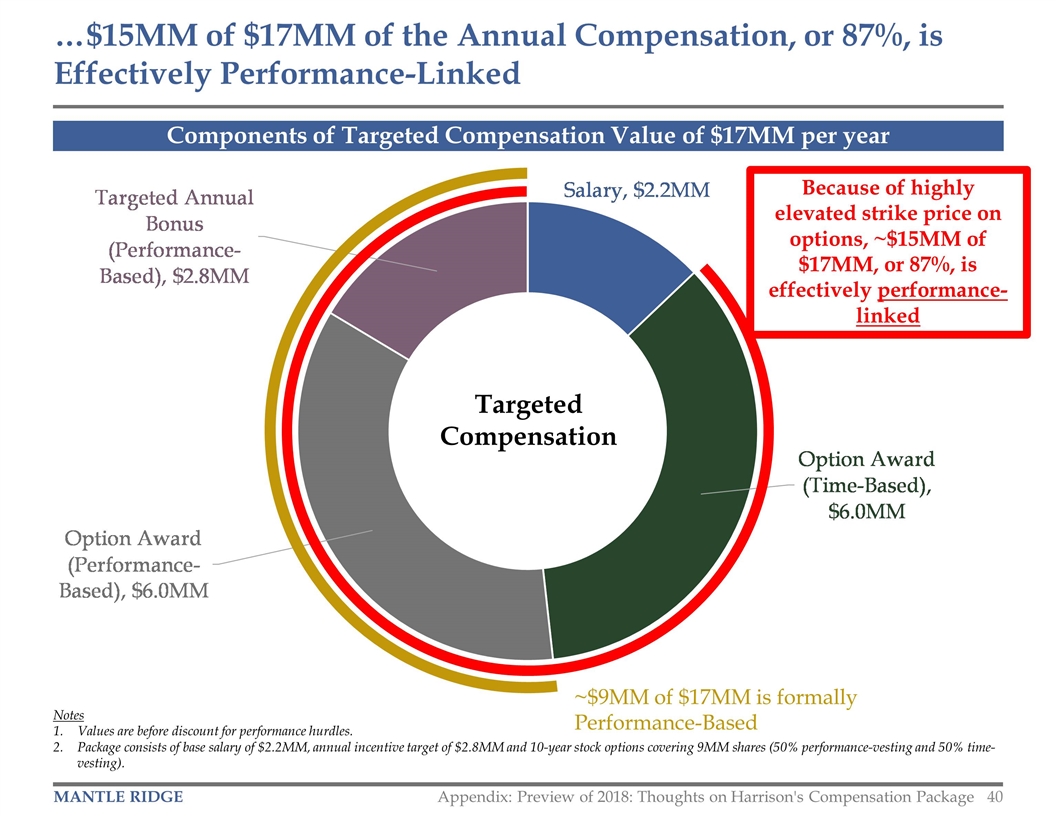

50% of the options are performance-vesting with robust performance goals 50% of the options are time-vesting at an elevated strike price The strike price is $49.79, or almost $13 per share over the unaffected price(1) Mr. Harrison will need to create ~$13 per share of value (a 35% increase from the Company’s unaffected price) before the options he received will have intrinsic value The Option Award is Effectively Out-of-the-Money, So Highly-Aligned and “At Risk” Unaffected price of $36.88, which is the closing price on the last day prior to the announcement that Mr. Harrison had separated from Canadian Pacific with a waiver of his non-compete Such a dynamic is highly unusual Appendix: Preview of 2018: Thoughts on Harrison's Compensation Package

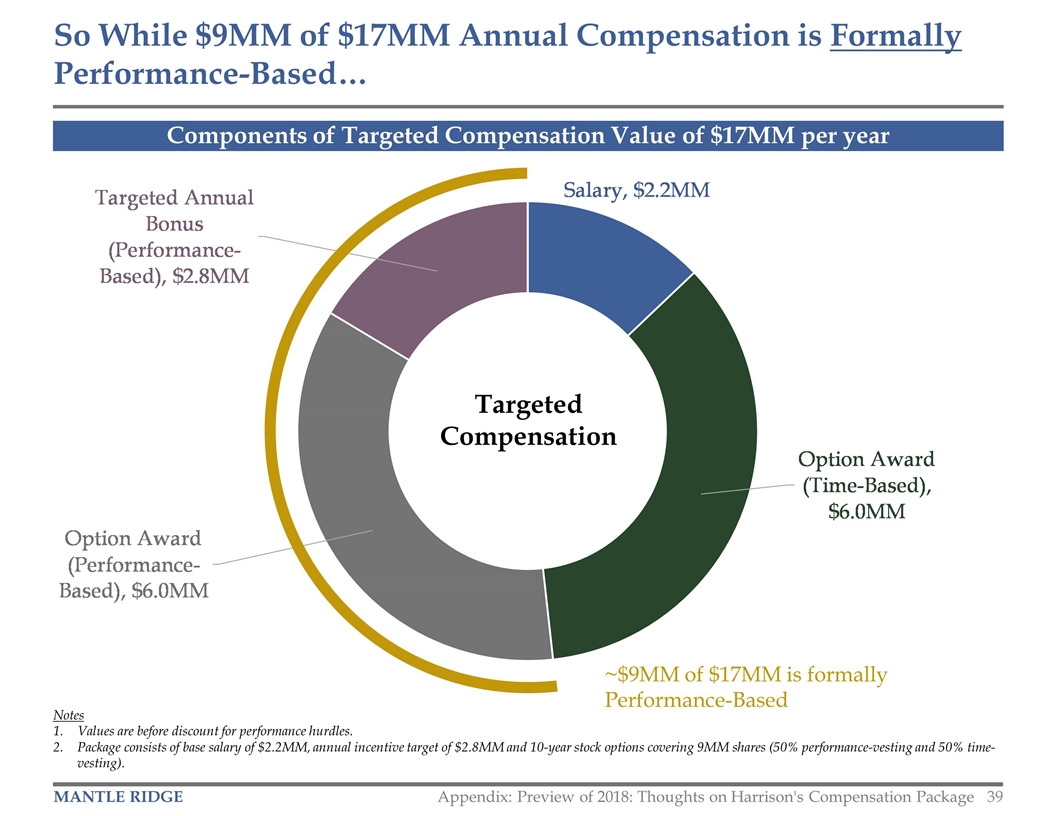

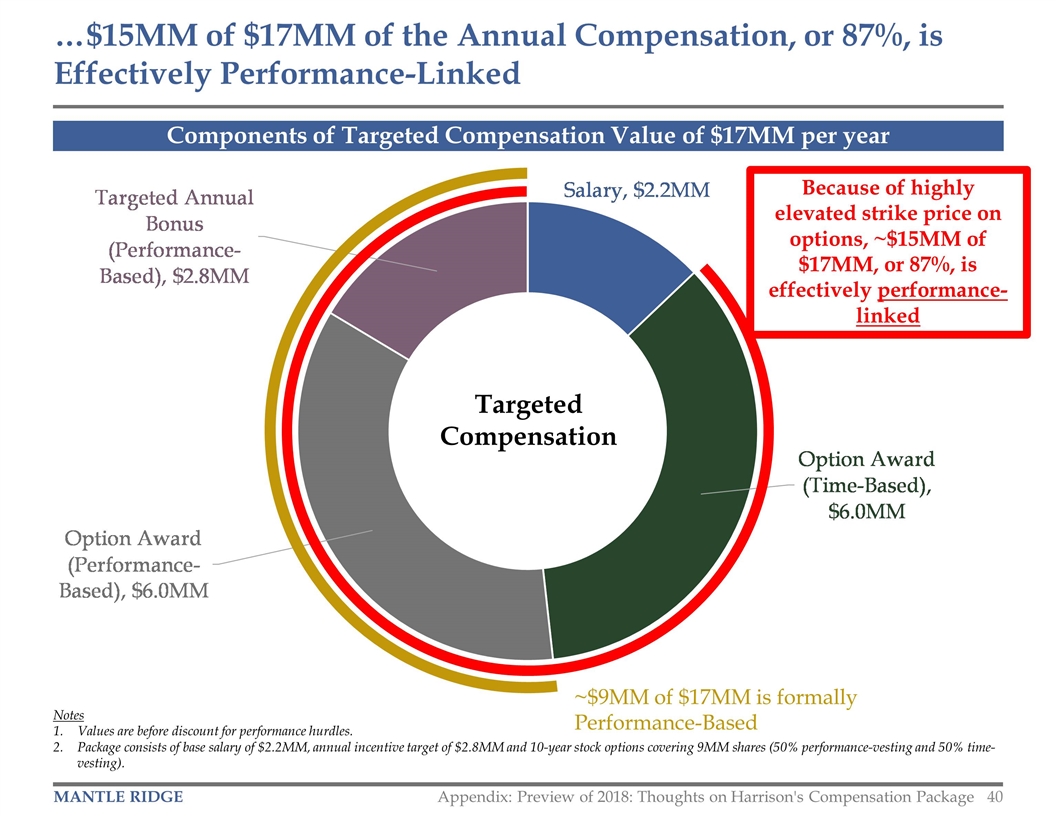

Notes Values are before discount for performance hurdles. Package consists of base salary of $2.2MM, annual incentive target of $2.8MM and 10-year stock options covering 9MM shares (50% performance-vesting and 50% time-vesting). Components of Targeted Compensation Value of $17MM per year So While $9MM of $17MM Annual Compensation is Formally Performance-Based… ~$9MM of $17MM is formally Performance-Based Targeted Compensation Appendix: Preview of 2018: Thoughts on Harrison's Compensation Package

Notes Values are before discount for performance hurdles. Package consists of base salary of $2.2MM, annual incentive target of $2.8MM and 10-year stock options covering 9MM shares (50% performance-vesting and 50% time-vesting). Components of Targeted Compensation Value of $17MM per year …$15MM of $17MM of the Annual Compensation, or 87%, is Effectively Performance-Linked Targeted Compensation Because of highly elevated strike price on options, ~$15MM of $17MM, or 87%, is effectively performance-linked ~$9MM of $17MM is formally Performance-Based Appendix: Preview of 2018: Thoughts on Harrison's Compensation Package

Notice PRESENTATION DISCLAIMER This presentation contains information and other content (“Third Party Content”) relating to CSX Corporation (the “Company”) by persons not affiliated with Mantle Ridge LP (“Mantle Ridge”), including as derived from SEC filings and other reports by the Company and other third parties not affiliated with Mantle Ridge. Neither Mantle Ridge nor its affiliates shall be responsible or have any liability for any misinformation contained in any third party filing or report or any Third Party Content. Although Mantle Ridge believes that the information included herein is substantially accurate in all material respects, Mantle Ridge makes no representation or warranty, express or implied, as to the accuracy or completeness of such information, and expressly disclaims any liability relating to such information. Mantle Ridge disclaims any obligation to update the information and other content contained in this presentation. FORWARD LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”), regarding, among other things, the benefits of Precision Scheduled Railroading. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date thereof. Mantle Ridge undertakes no obligation to publicly release the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Appendix: Preview of 2018: Thoughts on Harrison's Compensation Package