Exhibit 4.3

MANAGEMENT’S DISCUSSION AND ANALYSIS

The Management’s Discussion and Analysis (MD&A) of operations is provided to enable readers to assess the results of operations, liquidity and capital resources of AltaGas Ltd. (AltaGas or the Corporation) as at and for the year ended December 31, 2017. This MD&A, dated February 28, 2018, should be read in conjunction with the accompanying audited Consolidated Financial Statements and notes thereto of AltaGas as at, and for the year ended, December 31, 2017.

The Consolidated Financial Statements and comparative information have been prepared in accordance with United States (U.S.) generally accepted accounting principles (U.S. GAAP) and in Canadian dollars, unless otherwise indicated. Throughout this MD&A, references to GAAP refer to U.S. GAAP.

Abbreviations, acronyms and capitalized terms used in this MD&A that are not otherwise defined herein are used consistently with the definitions in the Annual Information Form.

This MD&A contains forward looking information (forward looking statements). Words such as “may”, “can”, “would”, “could”, “should”, “will”, “intend”, “plan”, “anticipate”, “believe”, “aim”, “seek”, “propose”, “contemplate”, “estimate”, “forecast”, “expect”, “project”, “target”, “potential”, “objective”, “continue”, “outlook”, “vision”, “opportunity” and similar expressions suggesting future events or future performance, as they relate to the Corporation or any affiliate of the Corporation, are intended to identify forward looking statements. In particular, this MD&A contains forward looking statements with respect to, among other things, business objectives, the anticipated benefits of acquisitions and other major projects, the anticipated timing of commercial operations, investment decisions, expenditures and licensing and permitting, expected growth and drivers of growth, capital expenditures (including in respect of the 2018 capital program, expected allocation per business segment and project and anticipated sources of financing thereof), results of operations, operational and financial performance, business projects, opportunities and financial results.

Specifically, such forward looking statements are set forth under the headings: “Overview of the Business”, “AltaGas’ Vision and Objective”, “Strategy”, “Strategy Execution”, “Developments Relating to the Pending WGL Acquisition”, “2018 Outlook”, “Growth Capital”, “Gas”, “Power”, “Utilities” and “Future Changes in Accounting Principles” and under those headings specifically include AltaGas’ expectations of growth in natural gas supply and demand for clean energy, prospects for growth, the potential for growth through acquisition and development of energy infrastructure and the expectation that such growth in infrastructure will enable AltaGas to establish a western energy hub in northeast British Columbia providing access to export markets off the west coast and access to new markets and higher netbacks to producers in the WCSB; AltaGas’ ability to maximize profitability of its assets and to add complementary services to its existing business segments; AltaGas’ belief that investing in low-risk, long-life energy assets will generate superior economic returns; AltaGas’ expectations regarding sources of utility like returns and long life cash flows; AltaGas’ expectations regarding diversification including impact on earnings and cash flow and reduction in exposure to commodity market volatility; expectations that expansion of business through acquisitions and organic growth will support dividend and capital growth; AltaGas’ belief that in recent years natural gas supply and demand fundamentals have been changing, and consequently there is renewed interest in natural gas an economically priced, clean-burning fuel; expectations that AltaGas will acquire or build gas gathering and processing infrastructure from, or on behalf of, producers wishing to redeploy capital to exploration and production activities rather than to non-core activities such as midstream services; AltaGas’ potential to move natural gas and NGLs to key markets including Asia; AltaGas’ ability to provide a fully integrated midstream service offering to its customers across the energy value chain; AltaGas’ ability to focus on developing and operating larger gas infrastructure projects and AltaGas’ cost of doing so; expectations regarding the decommissioning of nuclear and coal-fired generation and expected timeline for decommissioning; expectations that renewable power and natural gas-fired power generation will replace nuclear and coal-fired power generation and that AltaGas is in a position to take advantage of such replacement opportunities; expectations for rate base growth in the utilities segment including through the execution of strategic utility acquisitions and addition of customers; expectations as to AltaGas’ ability to maintain financial strength and flexibility, sufficient liquidity, an investment grade credit rating and ready access to capital markets; AltaGas’ belief that proactively hedging foreign exchange rates and commodity price exposure mitigates earnings volatility from commodity price risk and volume risk; AltaGas’ belief that it can help meet the growing demand for clean energy, while continuing to deliver sustainable benefits for its

AltaGas Ltd. – 2017

1

shareholders; expectations with respect to in-house construction expertise and competitive advantages of such expertise, including the ability to safely deliver capital projects on time and on budget; AltaGas’ belief that it delivers an effective balance between yield and growth; AltaGas’ belief that the growth prospects in each of WGL’s regulated utility, midstream energy services and commercial energy system business lines are complementary to AltaGas’ long-term vision; expectations for the increased use of natural gas, providing opportunities for AltaGas to invest in and optimize assets; expectations regarding the decrease in U.S. demand for import of gas, NGLs and crude oil and impact that has on netbacks for Canadian energy sector; AltaGas’ belief that energy market diversification is critical for Canadian producers; expectations regarding the supply of NGL and natural gas reserves, demands from Asia for such products and opportunities such supply and demand presents for investing in infrastructure outside of North America; expectations that AltaGas is uniquely positioned to provide a competitive service to producers; AltaGas’ ability to provide multiple outlets for producers to access the highest value markets; expectations that access to Asian markets provides diversity to producers; expectations relating to AltaGas’ access to Asian markets, including through AltaGas’ relationship with Idemitsu; expectations for opportunities arising from increased demand in North America for clean sources of power and that AltaGas is in a position to take advantage of such opportunities; expectations regarding expansion and re-contracting opportunities and that AltaGas is in a position to take advantage of such opportunities; AltaGas’ expectation that its greenfield and brownfield development sites throughout California could attract multi-year power purchase agreements; expectations that continued improvements to assets will enhance value by positioning the assets to operate under a wider variety of environmental conditions; expectations with respect to the expansion of Blythe Energy Center; expectations of further development and expansion of power assets; expectations of continued investment in high growth jurisdictions; AltaGas’ ability to achieve a balanced mix of energy infrastructure assets and expected time frame to reach such balance; expectations regarding the locational benefits of the Blythe facility; expectations for growth in the utilities segment as a result of expansion of and investment in existing distribution systems, acquisition of new franchises, fuel switching and development of natural gas storage opportunities; expectations that advancing energy export opportunities will provide higher netbacks to producers; expectations regarding 2018 normalized EBITDA (including expected contributions per business segment and sources of generation); projected growth in normalized EBITDA and normalized funds from operations (including per business segment and on a combined basis with WGL); expectations with respect to the WGL Acquisition including the expected closing date, ability to obtain, and timeline for obtaining, regulatory and other approvals, the aggregate cash consideration including the anticipated sources of financing thereof and anticipated indebtedness under the bridge facility, planned asset divestitures, anticipated benefits of the WGL Acquisition including the portfolio of assets of the combined entity, nature, number, value and timing of growth and investment opportunities available to AltaGas, the quality and growth potential of the assets, the strategic focus of the business, the combined rate base and rate base growth, expectations to accelerate AltaGas’ growth, the ability of the combined entity to target higher growth markets, high growth franchise areas, and other growth markets; expectations for the Cove Point LNG Terminal including anticipated completion timing, the stability of cash flows and of AltaGas’ business, the growth potential available to AltaGas in the midstream business, capabilities for connections to marine-based energy export opportunities, clean energy, natural gas generation and retail energy services, the significance and growth potential and expectations for growth in the Montney and Marcellus/Utica formations; expectations with respect to net capital expenditures; expectations with respect to AltaGas’ capital program and funding thereof; AltaGas’ belief that the WCSB has changed from a maturing basin to one capable of sustainable long-term growth via new low cost gas formations; AltaGas’ belief that market demand, including the demand generated from the LPG and potential LNG export projects on the west coast of North America provides significant long-term growth opportunities, and that AltaGas expects to capitalize on these opportunities; expectations with respect to opportunities to increase volumes by tying-in new wells and building or purchasing adjoining facilities to create larger processing infrastructure; expectations with respect to the North Pine Facility, Townsend Facility and Townsend 2A including, expected earnings and impact on earnings; expectations with respect to the proposed Ridley Island Propane Export Terminal including costs, propane transport capability, locational benefits, initial shipment capacity, connection capability, quality of transport options, sources of propane supply, AltaGas’ ability to construct new plants and develop new projects, expectations regarding tolling arrangements, expectations of being the first propane export terminal off the west coast of British Columbia, sale and purchase of liquefied petroleum gas from the terminal, relations with Aboriginal peoples and Astomos, offtake opportunities, expectations of serving growing demand in Asia and offering new markets to producers and timing of construction and commercial operations; expectations that new AltaGas infrastructure is expected to be larger scale facilities; expectations with respect to the Alton Natural Gas Storage Project including expected natural gas storage capacity, ability to increase reliability of gas supply to AltaGas’ distribution customers in the area, ability to continue working in a constructive manner with stakeholders, construction and brining timeline and storage in service date; expectations with respect

2

to access to the CN rail network and transport of propane to the Ridley Island Propane Export Terminal; expectations regarding AltaGas’ ability to underpin and nature of contract commitments including with respect to term and dedication, AltaGas’ ability to negotiate and execute definitive agreements and receive regulatory approvals, expected timeline for executing definitive agreements and being on-line, AltaGas’ expectation that development of these facilities will broaden AltaGas’ customer base and drive continued growth for AltaGas’ midstream and energy export strategies; AltaGas’ belief that the value of existing gas-fired facilities can be optimized through active management, origination and additional technological and operational enhancements; expectations relating to the MCP including cost, construction and in-service date; cost, location, connection capability to existing pipelines and gas supply opportunities; expectations that AltaGas is well-positioned to fund its growth capital and to take advantage of growth opportunities as they arise; expectations relating to AltaGas’ ability to fund its projects and business; expectations relating to the energy needs of California, including an increasing demand for non-gas resource adequacy; the potential for, and timing of, RFPs from western U.S. states; expectations relating to the Pomona Energy Storage Facility including AltaGas’ ability to operate the facility, potential expansion opportunities, potential size of expansion, expected energy storage capacity and available resource adequacy, battery run time, expectations regarding resource adequacy payments and AltaGas’ ability to earn additional revenue from energy from batteries and impact successful commercial operations has on AltaGas and on earnings; expectations relating to the Northwest Hydro Facilities including expected generation and contributions to earnings and seasonality impacts; expectations regarding gas processing volumes and disposition of smaller non-core assets; expectations regarding the U.S. dollar exchange rate, foreign exchange forward contracts, commodity hedge gains, and frac spread exposure; impact of facility turnarounds on earnings and timing of turnarounds; expected earnings from the utilities segment; AltaGas’ ability to focus on enhancing productivity and streamlining businesses; and expectations regarding the adoption of changes in accounting principles and impact on financial statements.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events and achievements to differ materially from those expressed or implied by such statements. Such statements reflect AltaGas’ current expectations, estimates and projections at the time the statement was made. Material assumptions include: expected commodity supply, demand and pricing; volumes and rates; exchange rates; inflation; interest rates; credit rating; regulatory approvals and policies; future operating and capital costs; project completion dates; capacity expectations; implications of recent U.S. tax legislation changes; the outcomes of significant commercial contract negotiations; financing of the WGL Acquisition; and timing and completion of the WGL Acquisition.

AltaGas’ forward looking statements are subject to certain risks and uncertainties which could cause results or events to differ from current expectations, including without limitation: access to and use of capital markets; market value of AltaGas’ securities; AltaGas’ ability to pay dividends; AltaGas’ ability to service or refinance its debt and manage its credit rating and risk; prevailing economic conditions; potential litigation; AltaGas’ relationships with external stakeholders, including Aboriginal stakeholders; volume throughput and the impacts of commodity pricing, supply, composition and other market risks; available electricity prices; interest rate, exchange rate and counterparty risks; the Harmattan Rep agreements; legislative and regulatory environment; underinsured losses; weather, hydrology and climate changes; the potential for service interruptions; availability of supply from Cook Inlet; availability of biomass fuel; AltaGas’ ability to economically and safely develop, contract and operate assets; AltaGas’ ability to update infrastructure on a timely basis; AltaGas’ dependence on certain partners; impacts of climate change and carbon taxing; effects of decommissioning, abandonment and reclamation costs; impact of labour relations and reliance on key personnel; cybersecurity risks; risks associated with the acquisition of WGL, the financing of the WGL Acquisition and the underlying business of WGL; and other factors set out in AltaGas’ continuous disclosure documents.

Many factors could cause AltaGas’ or any of its business segments’ actual results, performance or achievements to vary from those described in this MD&A including, without limitation, those listed above as well as the assumptions upon which they are based proving incorrect. These factors should not be construed as exhaustive. Should one or more of these risks or uncertainties materialize, or should assumptions underlying forward-looking statements prove incorrect, actual results may vary materially from those described in this MD&A as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected or targeted and such forward-looking statements included in this MD&A should not be unduly relied upon. The impact of any one assumption, risk, uncertainty or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent and AltaGas’ future decisions and actions will depend on management’s assessment of all information at the relevant time. These statements speak only as of the date of this MD&A.

3

AltaGas does not intend, and does not assume any obligation, to update these forward-looking statements except as required by law. The forward-looking statements contained in this MD&A are expressly qualified by these cautionary statements.

Financial outlook information contained in this MD&A about prospective financial performance, financial position or cash flows is based on assumptions about future events, including economic conditions and proposed courses of action, based on AltaGas management’s (Management) assessment of the relevant information currently available. Readers are cautioned that such financial outlook information contained in this MD&A should not be used for purposes other than for which it is disclosed herein.

Additional information relating to AltaGas, including its quarterly and annual MD&A and Consolidated Financial Statements, Annual Information Form, and press releases are available through AltaGas’ website at www.altagas.ca or through SEDAR at www.sedar.com.

ALTAGAS ORGANIZATION

The businesses of AltaGas are operated by AltaGas and a number of its subsidiaries including, without limitation, AltaGas Services (U.S.) Inc.; in regards to the gas business, AltaGas Extraction and Transmission Limited Partnership, AltaGas Pipeline Partnership, AltaGas Processing Partnership, AltaGas Northwest Processing Limited Partnership and Harmattan Gas Processing Limited Partnership; in regards to the power business, Coast Mountain Hydro Limited Partnership, Blythe Energy Inc. (Blythe), and AltaGas San Joaquin Energy Inc.; and, in regards to the utility business, AltaGas Utilities Inc. (AUI), Heritage Gas Limited (Heritage Gas), Pacific Northern Gas Ltd. (PNG), and SEMCO Energy, Inc. (SEMCO). SEMCO conducts its Michigan natural gas distribution business under the name SEMCO Energy Gas Company (SEMCO Gas) and its Alaska natural gas distribution business under the name ENSTAR Natural Gas Company (ENSTAR).

OVERVIEW OF THE BUSINESS

AltaGas, a Canadian corporation, is a North American diversified energy infrastructure company with a focus on owning and operating assets to provide clean and affordable energy to its customers. AltaGas has three business segments:

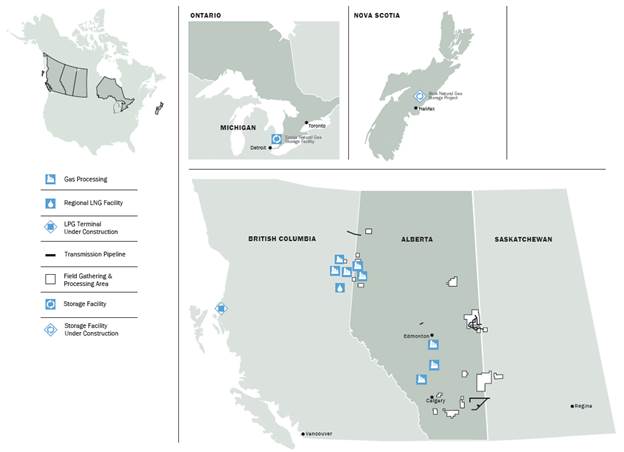

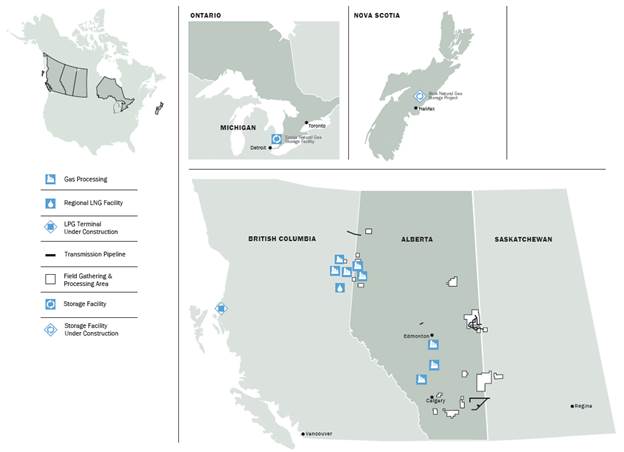

· Gas, which transacts more than 2 Bcf/d of natural gas and includes natural gas gathering and processing, natural gas liquids (NGL) extraction and fractionation, transmission, storage, natural gas and NGL marketing, and the Corporation’s indirectly held one-third interest in Petrogas Energy Corp. (Petrogas), through which AltaGas’ interest in the Ferndale Terminal is held;

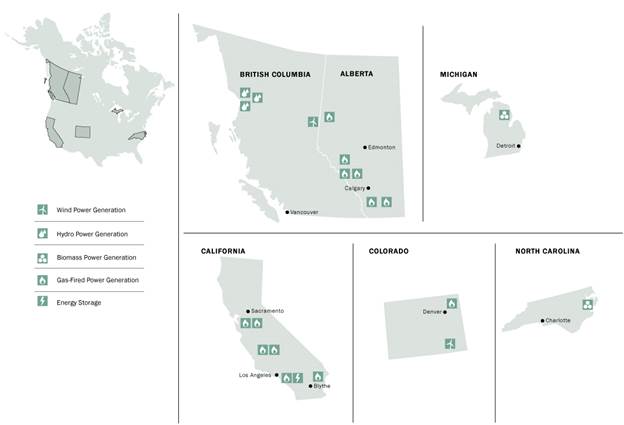

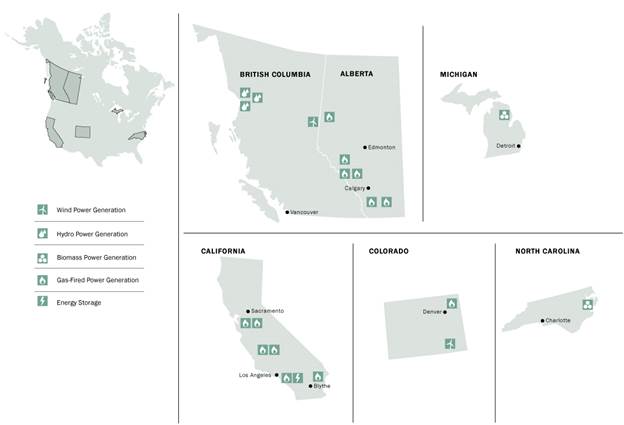

· Power, which includes 1,708 MW of gross capacity from natural gas-fired, hydro, wind, and biomass generation facilities, and energy storage assets located across North America; and

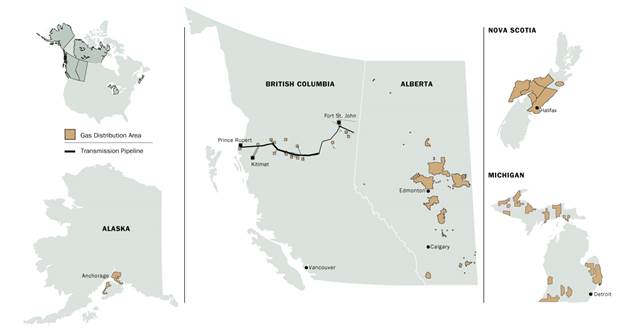

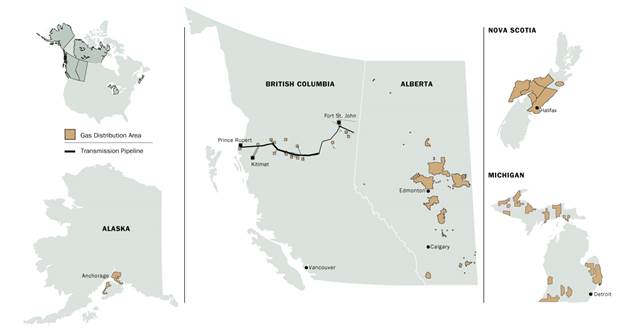

· Utilities, serving over 580,000 customers through ownership of regulated natural gas distribution utilities across North America and a regulated natural gas storage utility in the United States, delivering clean and affordable natural gas to homes and businesses.

As at December 31, 2017, AltaGas’ enterprise value exceeded $10 billion. With physical and economic links along the energy value chain, together with its experienced and talented workforce of more than 1,600 people, and its efficient, reliable and profitable assets, market knowledge and financial discipline, AltaGas has provided strong, stable and predictable returns to its investors. AltaGas focuses on maximizing the profitability of its assets, adding services that are complementary to its existing business segments, and growing through the acquisition and development of energy infrastructure.

2017 GROWTH HIGHLIGHTS

· On January 3, 2017, AltaGas announced a positive Final Investment Decision (FID) on the Ridley Island Propane Export Terminal (RIPET), having received approval from federal regulators. On May 5, 2017, AltaGas LPG Limited Partnership (AltaGas LPG), a wholly-owned subsidiary of AltaGas, and Vopak Development Canada Inc. (Vopak), a wholly-owned subsidiary of Koninklijke Vopak N.V. (Royal Vopak), a public company incorporated under the laws of the Netherlands,

4

formed the Ridley Island LPG Export Limited Partnership (RILE LP) for the development of RIPET. AltaGas’ subsidiaries hold a 70 percent interest in RILE LP, with Vopak holding the remaining 30 percent interest;

· On January 25, 2017, AltaGas entered into a definitive agreement (the Merger Agreement) to indirectly acquire WGL Holdings, Inc. (the WGL Acquisition). Pursuant to the Merger Agreement, following the consummation of the WGL Acquisition, WGL Holdings, Inc. (WGL) common shareholders will receive US$88.25 per common share in cash, which represents a total enterprise value of approximately US$7.2 billion, including the assumption of approximately US$2.7 billion of debt as at December 31, 2017;

· On June 29, 2017, AltaGas modified its existing take-or-pay agreement with Birchcliff Energy Ltd. (Birchcliff) to incent increased utilization of the Gordondale facility until late 2020. The modifications made apply solely to volumes above the existing take-or-pay volume commitments;

· In August 2017, the Michigan Public Service Commission (MPSC) approved SEMCO Gas’ application to construct, own, and operate the Marquette Connector Pipeline (MCP);

· In September 2017, the Regulatory Commission of Alaska (RCA) issued a decision on ENSTAR’s 2016 rate case. As a result, the rate increase implemented in the third quarter of 2016 was made permanent and a further permanent rate increase was implemented effective November 1, 2017;

· On October 1, 2017, commercial operations commenced at Townsend 2A, a 99 Mmcf/d shallow-cut gas processing facility located on the existing Townsend site, adjacent to the currently operating Townsend Facility;

· On December 1, 2017, commercial operations commenced with the first 10,000 Bbls/d train at the North Pine NGL Facility (the North Pine Facility), located approximately 40 km northwest of Fort St. John, British Columbia; and

· In December 2017, the power purchase agreement (PPA) at the Craven biomass facility was extended to December 31, 2027.

2017 FINANCIAL HIGHLIGHTS

(Normalized EBITDA, normalized funds from operations, normalized net income, net debt, and net debt to total capitalization ratio are non-GAAP financial measures. Please see Non-GAAP Financial Measures section of this MD&A.)

· Normalized EBITDA was $797 million, an increase of 14 percent compared to $701 million in 2016;

· Normalized funds from operations were $615 million ($3.60 per share), an 11 percent increase compared to $554 million ($3.52 per share) in 2016;

· Net income applicable to common shares was $30 million ($0.18 per share) compared to $155 million ($0.99 per share) in 2016;

· Normalized net income was $204 million ($1.19 per share), an increase of 33 percent compared to $153 million ($0.98 per share) in 2016;

· Net debt was $3.6 billion as at December 31, 2017, compared to $3.9 billion as at December 31, 2016;

· Net debt to total capitalization ratio was 44 percent as at December 31, 2017, compared to 46 percent as at December 31, 2016;

· In the first quarter of 2017, AltaGas completed the sale of 84.5 million subscription receipts at an issue price of $31 per subscription receipt for total gross proceeds of approximately $2.6 billion including the over-allotment option that was partially exercised;

· On February 22, 2017, AltaGas closed a public offering of 12.0 million cumulative 5-year minimum rate reset redeemable preferred shares, Series K, at a price of $25 per share for aggregate gross proceeds of $300 million;

· On March 15, 2017, AltaGas completed the sale of the Ethylene Delivery Systems (EDS) and the Joffre Feedstock Pipeline (JFP) transmission assets to Nova Chemicals Corporation (Nova Chemicals) for net proceeds of approximately $67 million;

· On October 4, 2017, AltaGas issued an aggregate of $450 million senior unsecured medium-term notes (MTNs) consisting of $200 million of MTNs with a coupon rate of 3.98 percent maturing on October 4, 2027, and $250 million of MTNs with a coupon rate of 4.99 percent maturing on October 4, 2047; and

5

· On October 18, 2017, the Board of Directors approved an increase in the monthly dividend by $0.0075 per common share to $0.1825 ($2.19 per common share annualized) effective for the November 2017 dividend, a 4.3 percent increase.

ALTAGAS’ VISION AND OBJECTIVE

AltaGas’ vision is to be a leading North American diversified energy infrastructure company. The Corporation’s overall objective is to generate superior economic returns by investing in low-risk, long-life energy assets. The Corporation focuses on assets underpinned by contracts with strong counterparties and regulated assets, both of which provide stable utility-like returns and long-life cash flows. Diversification increases the stability of earnings and cash flows and reduces AltaGas’ exposure to commodity market volatility. AltaGas’ earnings are underpinned by three business segments, and within each segment there is further diversification: by customer and service type in the Gas segment; by fuel source, customer, and geography within the Power segment; and by regulatory jurisdiction in the Utilities segment. The Corporation also focuses on expanding its business through acquisitions and organic growth to further support dividend and capital growth. AltaGas believes that in the long-term, the abundant supply of natural gas in North America and the increasing global demand for clean energy will continue to provide opportunities for sustained growth across all of its business segments. Superior service, safety, and reliability are also integral to AltaGas’ customer value proposition.

STRATEGY

Consistent with its mandate of overseeing and directing the Corporation’s strategic direction, AltaGas’ Board of Directors (Board of Directors) is actively engaged in regular review of the Corporation’s strategy. The Corporation continually assesses the macro and micro-economic trends impacting its business and seeks opportunities to generate value for shareholders, including through acquisitions, dispositions or other strategic transactions. Opportunities pursued by AltaGas must meet strategic, operating and financial criteria.

The Corporation’s long-term strategy is to grow in attractive areas and maintain a long-term, balanced mix of energy infrastructure assets across its Gas, Power and Utilities business segments. AltaGas’ business strategy is underpinned by the growing demand for clean energy with natural gas as a key fuel source.

Owning and Operating Energy Infrastructure

Natural gas supply and demand fundamentals and the demand for clean energy have consistently underpinned the Corporation’s strategy. In recent years, the supply and demand fundamentals have been changing. Abundant supply of natural gas in North America, driven by new technology that has improved the economics of unconventional gas plays, has been positive news for North American energy consumers and has led to renewed interest in natural gas as an economically priced, clean-burning fuel. As a result, the use of natural gas for power generation, household, and commercial and industrial uses has increased substantially, providing significant opportunities across AltaGas’ Gas, Power and Utilities segments to invest in and optimize its assets.

In the Gas segment, AltaGas’ strategy is to provide a fully-integrated midstream service offering to its customers across the energy value chain. As part of this strategy, the Corporation builds and acquires gas gathering and processing infrastructure on behalf of, or from, producers wishing to redeploy capital to exploration and production activities, rather than to non-core activities such as midstream services. Canada produces a surplus of gas, NGL and crude oil. The U.S. has traditionally been the sole export market for this surplus, but with the U.S. now having a surplus as well, its demand for import of these products has decreased. As a result, netbacks have been less attractive for Canadian producers. AltaGas believes that energy market diversification is critical for the Canadian energy sector. Investing in infrastructure for export outside of North America provides an opportunity for Canadian producers to align the vast supply of NGL and natural gas reserves with the growing demand from Asia. AltaGas is uniquely positioned to provide producers with a competitive service offering across the integrated value chain, from wellhead to end markets by way of export terminals. Access to Asian markets provides market diversity to producers, especially those in the Montney, Deep Basin, and Duvernay regions under development in northeastern British Columbia and western Alberta. AltaGas is uniquely positioned to deliver higher netbacks to producers for their NGL by establishing a western

6

energy hub in northeast British Columbia, through RIPET, which is currently under construction, and through its ownership interest in Petrogas and the Ferndale Terminal. AltaGas also has access to Asian markets through its relationship with Idemitsu Kosan Co.,Ltd. (Idemitsu), which owns 51 percent of Astomos Energy Corporation (Astomos), the largest liquefied petroleum gas (LPG) importer in Japan (Mitsubishi Corporation owns the remaining 49 percent of Astomos). On January 25, 2017, the Corporation announced its pending acquisition of WGL. WGL has a growing midstream business with investments in gas gathering infrastructure and regulated gas pipelines in the Marcellus/Utica gas formation located in the northeast United States with capabilities for connections to marine-based energy export opportunities via the North American Atlantic coast through the Cove Point LNG Terminal in Maryland being developed by a third party, which is currently in the final stages of commissioning. The combined enterprise will be uniquely positioned with key gas midstream assets in both the Marcellus/Utica and Montney gas formations, which are two of North America’s most prolific gas basins. Further information on the pending acquisition of WGL can be found in the Developments Relating to the Pending WGL Acquisition section of this MD&A.

There has been an increase in the demand in North America for clean sources of highly flexible power to complement the significant growth in renewable power, while also helping to fill the void as coal and nuclear power declines. The Power segment is focused on developing, building, owning, and operating a diversified portfolio of clean energy assets that reduce the Corporation’s carbon footprint and on meeting North America’s demand for clean energy. AltaGas is positioned to take advantage of this opportunity. In California, the California Independent System Operator (CAISO) has stated that up to 15,000 MW of fast ramping flexible capacity is required to meet the needs of the current 50 percent Renewable Portfolio Standard of California by 2030 given planned retirements of once-through cooling gas facilities, as well as the planned retirement of the Diablo Canyon nuclear plant. With the retirements of traditional generating assets and the increased variability of a growing renewable asset base, the demand for highly-responsive generation and energy storage assets is increasing. In northern California, the Corporation is focused on owning generation assets in locally constrained areas near load pockets as local resource adequacy needs result in more opportunities for expansion, re-contracting and energy storage. AltaGas is well positioned in northern California with the acquisition of the San Joaquin Facilities and Ripon in 2015. In southern California, there has been an increasing demand for non-gas resource adequacy as evidenced by the Aliso Canyon storage request for proposals (RFPs), which has resulted in the successful bidding, construction and operation of the Pomona Energy Storage Facility, located in the east Los Angeles load pocket. This site is well suited for future development of additional battery storage. The Corporation expects further development and expansion opportunities to arise from existing sites, including Ripon, as well as third party sites similar to the recently completed Pomona Energy Storage Facility. The Corporation’s pending acquisition of WGL fits synergistically with this strategy. WGL owns a growing non-regulated contracted power business, with a focus on distributed generation and energy efficiency assets throughout the United States. WGL also owns a retail gas and power marketing business serving approximately 222,000 customers across five states in the U.S. Further information on the pending acquisition of WGL can be found in the Developments Relating to the Pending WGL Acquisition section of this MD&A.

In the Utilities segment, the Corporation is focused on finding innovative ways to continue to safely and reliably deliver clean and affordable natural gas to more customers. AltaGas focuses on growing rate base through adding customers, including serving power plants within service jurisdictions, and through consumers fuel switching as abundant natural gas supply provides a clean low-cost energy alternative. In addition, the Utilities segment continues to invest in existing distribution systems through pipeline replacement and system betterment programs to ensure safe, reliable service for AltaGas’ customers as well as to meet increased residential and commercial demand. The Marquette Connector Pipeline that will be constructed in Marquette, Michigan by SEMCO Gas will provide approximately 35,000 customers in its service territory with needed redundancy and additional supply options. The Alton Natural Gas Storage Project currently under construction in Nova Scotia will help increase reliability of supply and lower costs for AltaGas’ natural gas distribution customers in that area. The Corporation also seeks to execute strategic utility acquisitions and dispositions when opportunities arise as demonstrated by the Corporation’s pending acquisition of WGL, which is the sole common shareholder of Washington Gas Light Company (Washington Gas), a regulated natural gas utility headquartered in Washington, D.C., serving more than 1.2 million customers in Maryland, Virginia, and the District of Columbia. Further information on the pending acquisition of WGL can be found in the Developments Relating to the Pending WGL Acquisition section of this MD&A.

7

Maintain Financial Strength and Flexibility

Integral to AltaGas’ strategy is maintaining financial strength and flexibility, an investment grade credit rating, and ready access to capital markets. Financial discipline and effective risk management are fundamental cornerstones of the Corporation’s strategy. AltaGas seeks to optimize risk and reward, ensuring that returns are commensurate with the level of risk assumed. AltaGas’ financing strategy is to ensure the Corporation has sufficient liquidity to meet its capital requirements and to do so at the lowest cost possible. As a growth-oriented energy infrastructure company, AltaGas creates value for its investors through minimizing its cost of capital and maximizing its return on invested capital, which ensures operating cash flows are maintained and growing. The Corporation develops and executes financing plans and strategies to ensure investment grade credit ratings, diversity in its funding sources, and ready access to capital markets.

A key element of the Corporation’s stable business model is mitigating its exposure to certain market price risks as well as volume risk. In addition to its diversification strategy, the Corporation has developed risk management processes that mitigate earnings volatility from commodity price risk and volume risk. AltaGas proactively hedges foreign exchange rates and commodity price exposures when it is prudent to do so. As well, the continued management of counterparty credit risk remains an ongoing priority. AltaGas partially mitigates the foreign exchange exposure on its U.S. investments by incorporating U.S. dollar (US$) denominated capital, both debt and preferred shares, into its financing strategy.

Continue to Develop Organizational Capability to Support the Strategy

AltaGas recognizes that to be successful in operating and constructing energy infrastructure, specific core competencies are required. To that end, the Corporation continues to focus on hiring and training the required competencies to execute its strategy, and ensuring that the performance management processes support the long-term objective of creating shareholder value.

Sustainability

AltaGas adheres to a strong set of core values, which reinforce its commitment to integrating sustainability fundamentals into every aspect of the business. AltaGas recognizes the broad range of stakeholders that are reached through its operations, and is focused on owning and operating assets that provide clean and affordable energy to its customers. As the Corporation continues to evolve and expand its diversified energy assets, AltaGas will continue to operate in a safe, reliable manner, while working closely with governments, regulatory agencies and stakeholders to maintain positive relationships. By balancing economic priorities with AltaGas’ social and environmental values, AltaGas believes it can help meet the growing global demand for clean energy, while continuing to deliver sustainable benefits to its shareholders.

Focus on Project Delivery

AltaGas has the internal capabilities and resources to safely deliver capital projects on time and on budget, in close partnership with Aboriginal peoples and community stakeholders. AltaGas has significant in-house construction expertise, demonstrated by the successful completion of more than $2.2 billion in projects since 2012, which provides a significant competitive advantage. Cost efficiency and strong operating performance are the drivers for increasing value as the Corporation continues to build out its portfolio of assets. Key initiatives continue to increase proficiency in managing costs and include upgrades to cost tracking systems and implementing best practice procurement strategies.

STRATEGY EXECUTION

AltaGas has successfully executed its strategy to create shareholder value and to maintain financial strength and flexibility, growing from under $6 billion in assets five years ago to total assets of over $10 billion at the end of 2017. In the last five years, the Corporation has reported a 19 percent compound annual growth rate in normalized EBITDA and a 9 percent compound annual growth rate in dividends per share. AltaGas delivers an effective balance between yield and growth. The pending acquisition of WGL supports AltaGas’ long-term vision by reinforcing AltaGas’ strategy of focusing on high quality, low risk and long-lived assets to achieve a diversified long-term growing business mix in three key energy infrastructure segments. The pending acquisition is expected to accelerate the Corporation’s growth, resulting in combined total assets of over $22 billion. AltaGas expects to continue investing in attractive high growth jurisdictions and is focused on achieving a balanced mix of energy infrastructure assets over the medium to long-term. The attractive growth prospects in each of WGL’s regulated utility, midstream energy services and commercial energy system business lines, of which the large majority are regulated and/or under

8

long-term contracts, is complementary to AltaGas’ long-term vision. Please refer to the Developments Relating to the Pending WGL Acquisition section of this MD&A for further information.

AltaGas continues to progress its integrated northeast British Columbia strategy. Construction was completed ahead of schedule and approximately $5 million under budget at Townsend 2A and this asset entered service on October 1, 2017. NGL produced from Townsend 2A is transported to the North Pine Facility via pipelines owned by AltaGas. On December 1, 2017, commercial operations commenced with the first 10,000 Bbls/d NGL separation train at the North Pine Facility, which was completed ahead of schedule and approximately $15 million under budget. The North Pine Facility is connected to existing AltaGas infrastructure in the region and has access to the CN rail network, allowing for the transportation of propane from the North Pine Facility to RIPET. AltaGas strives to meet producer needs for new markets and higher netbacks by advancing energy export projects. On January 3, 2017, AltaGas announced a positive FID for the construction of RIPET, a propane export terminal on Ridley Island near Prince Rupert, British Columbia. This propane export facility is expected to be the first LPG export terminal off the west coast of Canada, and is being designed to ship up to 1.2 million tonnes per annum. Please refer to the Growth Capital section in this MD&A for further details regarding RIPET.

AltaGas continues to drive its strategy to grow its highly contracted, clean power generation portfolio. The Power segment consists entirely of clean energy assets with approximately 74 percent and 26 percent of generation capacity from gas-fired and renewables sources, respectively. In the fourth quarter of 2016, AltaGas safely commissioned the Pomona Energy Storage Facility, located at the existing Pomona facility in the east Los Angeles Basin of Southern California. AltaGas continues to evaluate a future expansion of the facility based on Southern California Edison’s (SCE) potential procurement of additional energy storage in the Los Angeles Basin to further improve system reliability, including in relation to the ongoing concerns over the Aliso Canyon gas storage facility. As Publicly Owned Utilities (POUs), Investor Owned Utilities (IOUs), and Community Choice Aggregators (CCAs) add renewable resources to meet California’s renewable portfolio standard obligations as well as the California Public Utilities Commission’s (CPUC) energy storage procurement target of 1,325 MW, sites with strong solar and wind characteristics as well as cost effective transmission interconnections are in high demand. AltaGas expects that its greenfield and brownfield development sites throughout California, which are well suited for renewable, energy storage or both renewable and energy storage projects, could attract multi-year power purchase agreements through the standard RFP process. In addition, AltaGas is actively engaged in a strategy to optimize the value of its gas-fired facilities once they come off of their respective PPAs (between 2020 and 2022). This includes evaluating further enhancements to the facilities to improve the value of energy and ancillary services, selling resource adequacy (RA) to IOUs, POUs and CCAs, and the near term monetization of specific surplus assets and associated offsite infrastructure. For example, AltaGas’ Ripon facility has been awarded an RA contract for June through September 2018. Similar to the Pomona Energy Storage project, the market and operation knowledge gained from winning an RA contract will further advance AltaGas’ California strategy.

Continued enhancements have been made to AltaGas’ $1 billion investment in the Northwest Hydro Facilities, including numerous operational and mechanical facility improvements focused on increased efficiency and reliability. The continued improvements, particularly at Forrest Kerr, enhance value by positioning the assets to operate under a wider variety of environmental conditions. In 2017 the facilities showed incremental productivity growth of greater than 6 percent, and though seasonally lower fall volumes limited total output, the facilities entered 2018 better positioned to deliver incremental generation.

Across the five separate utility franchises throughout North America, AltaGas continues to focus on safely and reliably delivering customers clean, affordable energy. In 2017, AltaGas achieved customer growth across all utilities, and grew rate base by expanding its existing infrastructure through system upgrade programs and organic growth opportunities. In August 2017, SEMCO Gas received approval of its application to construct, own and operate the Marquette Connector Pipeline, allowing SEMCO Gas to provide needed redundancy and additional supply options to its existing customers as well as additional natural gas capacity to Michigan’s Upper Peninsula to allow for growth. Please refer to the Growth Capital section in this MD&A for further details regarding the MCP.

9

In 2017, the Corporation enhanced its financial strength and flexibility through a combination of internally-generated cash flows, the Premium DividendTM, Dividend Reinvestment and Optional Cash Purchase Plan (DRIP), and the issuance of approximately $750 million of preferred shares and MTNs. In addition, AltaGas also completed the sale of 84.5 million subscription receipts at an issue price of $31 per subscription receipt for total gross proceeds of approximately $2.6 billion (see Subscription Receipts section in this MD&A for further details). AltaGas maintained sufficient liquidity and a strong balance sheet throughout the year and exited 2017 with approximately $2.0 billion of available credit facilities and debt-to-total capitalization of 44 percent. AltaGas entered 2018 well positioned to fund its growth capital and to take advantage of growth opportunities such as the pending acquisition of WGL. Please refer to the Developments Relating to the Pending WGL Acquisition section of this MD&A.

During 2017, the Board of Directors approved a dividend increase of approximately 4 percent from $2.10 per share to $2.19 per share on an annualized basis. The dividend increase reflects the success of AltaGas’ strong operational and financial performance across its three business segments, as well as the stability and sustainability of its cash flows.

2018 OUTLOOK

AltaGas expects the WGL Acquisition to close in mid-2018. As a combined entity, AltaGas expects normalized EBITDA to increase by approximately 25 to 30 percent and normalized funds from operations to increase by approximately 15 to 20 percent.

Included in the above forecast are AltaGas’ expectations of normalized EBITDA and normalized FFO being reduced by approximately 5 percent as a result of the U.S. tax reform. The impact to normalized net income is expected to be neutral. The lower tax rates at the combined regulated Utilities will provide customers with decreased rates while providing the opportunity to drive rate base growth. The U.S. non-regulated Gas and Power segments are expected to record higher normalized net income as a result of the lower U.S. federal tax rate, partially offset by limitations on the deductibility of interest expense for U.S. tax purposes.

The WGL Acquisition is expected to drive growth in all three business segments. The combined Utilities segment is expected to have the largest contribution to EBITDA, followed by the Gas segment. Specifically for Utilities, the combined segment is expected to have an overall rate base of approximately $5 billion and is expected to grow through planned capital investments in 2018. The number of customers is also expected to increase by approximately 1.2 million. The Gas segment is expected to benefit from the addition of WGL’s pipeline investments in the prolific Marcellus/Utica gas resource regions as well as a gas supply agreement associated with the Cove Point LNG Terminal which is in the final stages of commissioning. WGL’s investment in the Stonewall Gas Gathering System is currently in-service and WGL expects the Central Penn and Mountain Valley pipelines to be operational by the end of 2018. The Gas segment will also benefit from a full year of contributions from AltaGas’ Townsend 2A and the first train of the North Pine Facility. Finally, the Power segment is expected to benefit from the addition of WGL’s distributed generation assets to its portfolio. For further information on the WGL Acquisition see Developments Relating to the Pending WGL Acquisition section of this MD&A.

The overall forecasted normalized EBITDA and funds from operations for the combined business include assumptions around the timing of closing of the WGL Acquisition, the U.S./Canadian dollar exchange rate, the impact of certain contemplated asset monetizations and other financing initiatives as part of the WGL financing plan, and the impact of U.S. tax reform. Any variance from AltaGas’ current assumptions could impact the forecasted increase to normalized EBITDA and funds from operations.

On a standalone basis, excluding the WGL Acquisition and potential asset monetizations, AltaGas expects a moderate increase to both normalized EBITDA and funds from operations in 2018 compared to 2017 related to its base business, mainly as a result of growth in the Gas segment. The moderate increase to normalized EBITDA and funds from operations for AltaGas’ standalone base business is primarily due to full year contributions from Townsend 2A and the first train of the North Pine Facility, higher realized frac spread mainly due to higher hedged prices, higher expected earnings from the Northwest Hydro Facilities due to contractual price increases and continued efficiency improvements, and rate base growth at certain of the Utilities. These increases may be partially offset by the impact of a weaker U.S. dollar on reported results of the U.S. assets, the impact of

TM Denotes trademark of Canaccord Genuity Corp.

10

planned turnarounds at the Harmattan and JEEP facilities, and the expiry of the PPA at the Ripon facility in the second quarter of 2018. The U.S. tax reform is expected to be immaterially negative to normalized EBITDA and funds from operations for AltaGas’ U.S. businesses while, on a net income basis, the impact of the U.S. tax reform is expected to be immaterially positive. This 2018 outlook does not include any potential upside associated with new developments in either the Gas or Power segments.

AltaGas estimates an average of approximately 10,000 Bbls/d will be exposed to frac spreads prior to hedging activities. For 2018, AltaGas has frac hedges in place for approximately 7,500 Bbls/d at an average price of approximately $33/Bbl excluding basis differentials.

SENSITIVITY ANALYSIS

AltaGas’ financial performance is affected by factors such as changes in commodity prices, exchange rates and weather. The following table illustrates the approximate effect of these key variables on AltaGas’ expected normalized EBITDA for 2018 (excluding WGL).

Factor | | Increase or

decrease | | Approximate impact

on normalized EBITDA

($ millions) | |

Natural gas liquids fractionation spread(1) | | $1/Bbl | | 1 | |

Degree day variance from normal - Canadian utilities(2) | | 5 percent | | 2 | |

Degree day variance from normal - U.S. utilities(3) | | 5 percent | | 4 | |

Change in CAD per US$ exchange rate | | $0.05 | | 14 | |

(1) Based on approximately 75 percent of frac spread exposed NGL volumes being hedged.

(2) Degree days - Canadian utilities relate to AUI and Heritage Gas service areas. A degree day is the cumulative extent to which the daily mean temperature falls below 15 degrees Celsius at AUI and 18 degrees Celsius at Heritage Gas. Normal degree days are based on a 20-year rolling average. Positive variances from normal lead to increased delivery volumes from normal expectations. Degree day variances do not materially affect the results of PNG as the British Columbia Utilities Commission (BCUC) has approved a rate stabilization mechanism for its residential and small commercial customers.

(3) Degree days - U.S. utilities relate to SEMCO Gas and ENSTAR service areas. For U.S. utilities degree days are a measure of coldness determined daily as the number of degrees the average temperature during the day in question is below 65 degrees Fahrenheit. Degree days for a particular period are determined by adding the degree days incurred during each day of the period. Normal degree days for a particular period are the average of degree days during the prior 15 years for SEMCO Gas and during the prior 10 years for ENSTAR.

DEVELOPMENTS RELATING TO THE PENDING WGL ACQUISITION

On January 25, 2017, the Corporation entered into the Merger Agreement to indirectly acquire WGL. Pursuant to the Merger Agreement, following the consummation of the WGL Acquisition, WGL common shareholders will receive US$88.25 per common share in cash, which represents a total enterprise value of approximately US$7.2 billion, including the assumption of approximately US$2.7 billion of debt as at December 31, 2017.

WGL is a diversified energy infrastructure company and the sole common shareholder of Washington Gas, a regulated natural gas utility headquartered in Washington, D.C., serving approximately 1.2 million customers in Maryland, Virginia, and the District of Columbia. WGL has a growing midstream business with investments in natural gas gathering infrastructure and regulated gas pipelines in the Marcellus/Utica gas formation located in the northeast United States, with capabilities for connections to marine-based energy export opportunities via the North American Atlantic coast through the Cove Point LNG Terminal in Maryland being developed by a third party, which is currently in the final stages of commissioning. WGL also owns contracted clean power assets, with a focus on distributed generation and energy efficiency assets throughout the United States. In addition, WGL has a retail gas and power marketing business with approximately 222,000 customers in Maryland, Virginia, Delaware, Pennsylvania and the District of Columbia. Upon completion of the WGL Acquisition, AltaGas expects that it will have over $22 billion of assets and approximately 1.8 million rate regulated gas customers.

Consummation of the WGL Acquisition is subject to certain closing conditions, including certain regulatory and government approvals, including approval by the Public Service Commission of the District of Columbia (PSC of DC), the Maryland Public Service Commission (PSC of MD), the Commonwealth of Virginia State Corporation Commission (SCC of VA), the United States

11

Federal Energy Regulatory Commission (FERC), and the Committee on Foreign Investment in the United States (CFIUS), as well as expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (HSR Act).

Regulatory applications were filed with the PSC of DC, the PSC of MD, and the SCC of VA on April 24, 2017. On the same date, AltaGas and WGL also filed their voluntary Joint Notice to the CFIUS, and an application with FERC. On May 10, 2017, WGL common shareholders voted in favor of the Merger Agreement governing the proposed WGL Acquisition. On July 6, 2017, FERC approved the transaction, finding it to be consistent with the public interest. Also as of July 17, 2017, when the waiting period required by Section 7A(b)(1) of the HSR Act expired, the merger was deemed approved by the Federal Trade Commission and the Department of Justice, such approval being valid for one year. On July 28, 2017, CFIUS provided its approval for the WGL Acquisition. On October 20, 2017, the SCC of VA approved the WGL Acquisition. In Maryland, the hearing before the PSC of MD concluded on October 16, 2017, and on December 4, 2017 AltaGas and WGL announced that they had reached a settlement agreement with several of the intervenors in the Maryland proceeding. As a result, AltaGas and WGL filed a stipulation with the PSC of MD to extend the deadline for issuing its decision. The PSC of MD approved this request moving the date for a decision to on or before April 4, 2018. The hearing before the PSC of DC concluded on December 13, 2017, and a decision is expected to follow in the first half of 2018. On January 11, 2018, pursuant to the terms of the Merger Agreement, AltaGas elected to extend the Outside Date (as defined in the Merger Agreement) to July 23, 2018.

AltaGas believes that closing of the WGL Acquisition will occur in mid-2018. AltaGas plans to fund the WGL Acquisition with the proceeds from its aggregate $2.6 billion bought deal and private placement of subscription receipts, which closed in the first quarter of 2017 (see Subscription Receipts section below). In addition, AltaGas has US$3 billion available under its fully committed bridge facility, which can be drawn at the time of closing. With all funding required for the closing of the WGL Acquisition in place, AltaGas can evaluate and pursue its asset sale process in a prudent and timely fashion in step with the regulatory process and consistent with AltaGas’ long term strategic vision. Management has presently identified a total of over $4.0 billion of assets from AltaGas’ Gas, Power and Utilities business segments in respect of which it is evaluating various options for monetization that could include the sale of either minority and/or controlling interests. Management expects to realize over $2 billion from its asset sale process in 2018. With the present optionality available to AltaGas and in light of a number of factors including recent developments in the California Resource Adequacy markets, AltaGas has discontinued the previously announced sale process of its California power assets. AltaGas will instead continue to pursue other structuring and commercial opportunities to unlock the value of the California assets. Additional financing steps could include offerings of senior debt, hybrid securities, and equity-linked securities (including preferred shares), subject to prevailing market conditions.

Subscription Receipts

On February 3, 2017, the Corporation issued approximately 80.7 million subscription receipts pursuant to a private placement and public offering to partially fund the WGL Acquisition at a price of $31 each for total gross proceeds of approximately $2.5 billion. On March 3, 2017, the over-allotment option was partially exercised for an additional 3.8 million subscription receipts for gross proceeds of approximately $118 million. The sale of the additional subscription receipts pursuant to the over-allotment option brings the aggregate gross proceeds to approximately $2.6 billion. Each subscription receipt entitles the holder to automatically receive one common share upon closing of the WGL Acquisition. While the subscription receipts remain outstanding, holders will be entitled to receive cash payments (Dividend Equivalent Payments) per subscription receipt that are equal to dividends declared on each common share. Such Dividend Equivalent Payments will have the same record date as the related common share dividend and will be paid to holders of the subscription receipts concurrently with the payment date of each such common share dividend. The Dividend Equivalent Payments will be paid first out of any interest on the escrowed funds and then out of the escrowed funds. If the Merger Agreement is terminated after the common share dividend declaration date, but before the common share dividend record date, subscription receipt holders of record on the termination date shall receive a pro-rata payment of the dividend as the Dividend Equivalent Payment. If the Merger Agreement is terminated on a record date or following a record date but on or prior to the dividend payment date, holders will be entitled to receive the full Dividend Equivalent Payment.

The net proceeds from the sale of the subscription receipts are held by an escrow agent pending, among other things, receipt of all regulatory and government approvals required to finalize the WGL Acquisition and confirmation that the parties to the Merger

12

Agreement are able to complete the WGL Acquisition in all material respects in accordance with the terms of the Merger Agreement, but for the payment of the purchase price, and AltaGas has available to it all other funds required to complete the WGL Acquisition. If the escrow release notice and direction is not delivered on or prior to 5:00 pm (Calgary time) on September 4, 2018, the Corporation will be required to make a termination payment equal to the aggregate issue price of such holder’s subscription receipts plus any unpaid Dividend Equivalent Payments owing to such holders of subscription receipts.

GROWTH CAPITAL

Based on projects currently under review, development or construction, AltaGas expects net capital expenditures in the range of $500 to $600 million (excluding WGL) for 2018. AltaGas’ Gas segment will account for approximately 55 to 60 percent of the total capital expenditures, while AltaGas’ Utilities segment will account for approximately 25 to 30 percent and the Power segment will account for the remainder. Gas and Power maintenance capital is expected to be approximately $25 to $35 million of the total capital expenditures in 2018. The majority of AltaGas’ capital expenditures is focused on the continued construction at RIPET as well as maintaining and growing rate base at its existing utilities. The Corporation continues to focus on enhancing productivity and streamlining businesses, including the disposition of smaller non-core assets.

AltaGas’ 2018 committed capital program is expected to be funded through internally-generated cash flow and the DRIP. If required, the Corporation also has sufficient borrowing capacity available under its credit facilities, as well as access to capital markets.

Following the close of the WGL Acquisition (expected close date in mid-2018), the consolidated 2018 capital program on a combined basis including capital for WGL, is expected to be in the range of approximately $1.0 to $1.3 billion. Close to half of this total will be allocated to the Gas segment, with the majority of the remaining expected capital for the Utilities segment, followed by the Power segment. AltaGas expects that the largest portion of WGL’s 2018 capital program subsequent to close will be allocated to investments in the Central Penn and Mountain Valley gas pipeline developments in the Marcellus region. Capital allocated to WGL’s utilities business will represent most of the remaining 2018 capital subsequent to close, with spending consistent with recent levels.

Ridley Island Propane Export Terminal

On January 3, 2017, AltaGas reached a positive FID on RIPET, having received approval from federal regulators. AltaGas has executed long-term agreements securing land tenure along with rail and marine infrastructure on Ridley Island.

RIPET is expected to be the first propane export facility off the west coast of Canada. The site is near Prince Rupert, British Columbia, and is subleased from Ridley Terminals Inc. (RTI), which has a headlease with the Prince Rupert Port Authority (PRPA). The site has a locational advantage given very short shipping distances to markets in Asia, notably a 10-day shipping time compared to 25 days from the U.S. Gulf Coast. The brownfield site also benefits from excellent railway access and ample deep water access to the Pacific Ocean. AltaGas’ arrangements with RTI give AltaGas access to extensive land and water rights and a world class marine jetty, which allows for the efficient loading of Very Large Gas Carriers that can access key global markets. Propane from British Columbia and Alberta will be transported to the facility using 50-60 rail cars per day through the existing CN rail network. The construction cost of RIPET is estimated to be approximately $450 to $500 million and RIPET is expected to ship 1.2 million tonnes of propane per annum (which is equivalent to approximately 40,000 Bbls/d of export capacity).

On May 5, 2017, AltaGas LPG, a wholly-owned subsidiary of AltaGas, and Vopak, a wholly-owned subsidiary of Royal Vopak, a public company incorporated under the laws of the Netherlands, formed RILE LP to develop, own, and operate RIPET. AltaGas’ subsidiaries hold a 70 percent interest while Vopak holds a 30 percent interest in RILE LP. The construction cost of RIPET will be funded by AltaGas LPG and Vopak in proportion to their respective interests in RILE LP. As part of the arrangements, AltaGas entered into a long-term agreement for the capacity of RIPET with RILE LP, and AltaGas and certain of its subsidiaries will provide construction and operating services to RILE LP. RILE LP will be consolidated by AltaGas.

13

Based on production from its existing facilities and forecasts from new plants under construction and in active development, AltaGas anticipates having physical volumes equal to approximately 50 percent of the expected capacity of 1.2 million tonnes per annum. The remaining 50 percent is expected to be supplied by producers and other suppliers. AltaGas has entered into negotiations with a number of producers and other suppliers and expects to underpin approximately 40 percent of RIPET’s annual expected capacity under tolling arrangements with producers and other suppliers.

AltaGas LPG and Astomos have entered into a multi-year agreement for the purchase of at least 50 percent of the 1.2 million tonnes per annum of propane expected to be available to be shipped from RIPET each year. Commercial discussions with Astomos and several third party off-takers for further capacity commitments are proceeding.

Construction of RIPET commenced during the second quarter of 2017 and is proceeding pursuant to an agreement with RILE LP. AltaGas is using its self-perform model that has been successfully used to execute its other projects on time and on budget. Crews have completed work on the concrete outer wall for the propane tank and the inner steel tank roof was installed at the end of January 2018. The balance of plant fabrication and civil work is on track and the first modules are scheduled to be installed in the first quarter of 2018. All long-lead equipment has been ordered with delivery schedules aligned with the construction schedule. RIPET is expected to be in-service in the first quarter of 2019.

Alton Natural Gas Storage Project

Solution mining for cavern development of the Alton Natural Gas Storage Project, located near Truro, Nova Scotia is considered feasible to begin in 2018. The Nova Scotia Minister of Environment is expected to make a decision on the Industrial Approval (IA) appeal by Sipekne’katik First Nation (SFN) in the first half of 2018. In the meantime, the IA remains in effect for the project. AltaGas continues to work constructively with governments, regulators, and SFN. The Alton Natural Gas Storage Project is expected to provide up to 10 Bcf of natural gas storage capacity. The first phase of storage service is now expected to commence in 2021.

Marquette Connector Pipeline

On August 23, 2017, the MPSC approved SEMCO Gas’ application to construct, own, and operate the MCP. The MCP is a proposed new pipeline that will connect the Great Lakes Gas Transmission Pipeline to the Northern Natural Gas Pipeline in Marquette, Michigan, which will provide system redundancy and increase deliverability, reliability and diversity of supply to SEMCO Gas’ approximately 35,000 customers in Michigan’s Western Upper Peninsula. The MCP is estimated to cost between US$135 to $140 million. Engineering and property acquisitions are expected to begin in 2018 and construction is expected to be completed in 2019, with an anticipated in-service date by the end of the fourth quarter of 2019, which is earlier than the initial estimate of mid-2020.

GAS

Description of Assets

AltaGas’ Gas segment serves customers primarily in the Western Canada Sedimentary Basin (WCSB) and transacts more than 2 Bcf/d of natural gas including natural gas gathering and processing, NGL extraction and fractionation, transmission, storage, and natural gas and NGL marketing. Gas gathering systems move natural gas from producing wells to processing facilities where impurities and certain hydrocarbon components are removed. The gas is then compressed to meet downstream pipelines’ operating specifications for transportation. Extraction and fractionation facilities reprocess natural gas to extract and recover ethane and NGL. As at December 31, 2017, AltaGas owned approximately 1.7 Bcf/d of extraction processing capacity and approximately 1.1 Bcf/d of raw field gas processing capacity. The Gas segment also includes an equity investment in Petrogas through AltaGas Idemitsu Joint Venture Limited Partnership (AIJVLP).

Transmission pipelines deliver natural gas and NGL to distribution systems, end-users or other downstream pipelines. AltaGas uses its market knowledge and expertise to create value by buying and reselling natural gas; providing gas transportation, storage, and gas and NGL marketing for producers; and sourcing gas supply for some of the Corporation’s processing assets. The Gas segment also includes expansion and greenfield projects under development or construction, including RIPET and the Alton Natural Gas Storage Project discussed under the Growth Capital section of this MD&A.

14

Specifically, the Gas segment includes:

· Interests in five NGL extraction plants with net licensed inlet capacity of 1.7 Bcf/d. The extraction assets provide stable fixed-fee or cost-of-service type revenues and margin based revenues. The natural gas supply to AltaGas’ extraction plants, with the exception of Harmattan and Younger extraction plants, depends on natural gas demand pull from residential, commercial and industrial usage inside and outside of Western Canada, and gas liquids demand pull from the Alberta petrochemical market and propane heating. Natural gas supply to Younger extraction plant (Younger) is dependent on the amount of raw natural gas processed at the McMahon gas plant, which is based on the robust natural gas producing region of northeastern British Columbia. Harmattan’s raw natural gas supply is based on producer activity in the west-central region of Alberta. Harmattan is the only deep-cut and full fractionation plant in the area;

· Four natural gas transmission systems with combined transportation capacity of approximately 0.6 Bcf/d. The transmission assets provide stable take-or-pay based revenues;

· Approximately 30 gathering and processing facilities in Western Canada and a network of approximately 5,000 km of gathering and sales lines that gather natural gas upstream of processing facilities and deliver natural gas into downstream pipeline systems that feed North American natural gas markets. The field facilities provide fee-for-service revenues based on volumes processed as well as revenues based on take-or-pay contracts. A significant portion of contracts flow through operating costs to the producers;

· �� 50 percent ownership of the 5.3 Bcf Sarnia natural gas storage facility connected to the Dawn Hub in Eastern Canada;

· The Alton Natural Gas Storage Project under construction;

· Natural gas and NGL marketing and gas transportation services to optimize the value of the infrastructure assets and meet customer needs;

· 50 percent ownership in AIJVLP, with the remaining 50 percent owned by Idemitsu;

· AIJVLP holds a two-thirds ownership interest in Petrogas, a leading North American integrated midstream company, with an extensive logistics network consisting of over 1,800 rail cars and 24 rail and truck terminals providing key infrastructure, supply logistics and marketing expertise. Petrogas also owns and operates the Ferndale Terminal;

15

· A 15-year strategic alliance between AltaGas and Painted Pony Energy Ltd. (Painted Pony) for the development of processing infrastructure and marketing services for natural gas and NGL. Since the formation of the strategic alliance in 2014, AltaGas completed the 198 Mmcf/d shallow-cut gas processing facility (the Townsend Facility) including the related egress pipelines and truck terminal, and the 99 Mmcf/d Townsend 2A (collectively the Townsend facilities). AltaGas is the operator of these facilities and is also the marketer for Painted Pony’s gas and NGL;

· The first train of the North Pine Facility near Fort St. John, British Columbia with capacity to fractionate 10,000 Bbls/d of propane plus NGL mix, and 6,000 Bbls/d of condensate terminaling capacity and two eight inch diameter NGL supply pipelines (the North Pine Pipelines), each approximately 40 km in length;

· The Ridley Island Propane Export Terminal in British Columbia under construction; and

· A regional liquefied natural gas (RLNG) facility in Dawson Creek, British Columbia, which came into service in February 2018.

Capitalize on Opportunities

AltaGas plans to grow its gas business by expanding and optimizing strategically-located assets and by adding new assets to serve customers by providing access to new markets, including Asia. New infrastructure is expected to be larger scale facilities supporting the vast reserves in North America. While providing safe and reliable service, AltaGas pursues opportunities in the Gas segment to deliver value to its customers and enhance long-term shareholder value. The Corporation’s objectives are to:

· Capitalize on the infrastructure growth opportunities associated with growing natural gas and liquids supply in North America;

· Provide a fully-integrated midstream service offering including gas and NGL gathering and processing, fractionation, and transportation facilities, and logistics and marketing services to its customers across the energy value chain, with higher producer netbacks resulting from export access to higher value markets, including Asia;

· Maintain strong relationships with local communities, Aboriginal peoples, governments, and regulatory bodies;

· Maximize profitability of existing facilities by increasing capacity, utilization and efficiency;

· Mitigate volume risk through contractual structures, redeployment of equipment and expansion of geographic reach;

· Coordinate between facilities, business segments and product lines to improve efficiencies and maximize profits; and

· Expand into new natural gas infrastructure markets such as RLNG.

In recent years, the WCSB has changed from a maturing basin to one capable of sustainable long-term growth via new low cost gas formations such as the Montney. The emergence of unconventional gas plays in the WCSB such as the Montney, as well as increased focus on horizontal multi-fracturing and completions technology, have resulted in abundant natural gas supply and associated liquids. Market demand, including the demand generated from the LPG and potential LNG export projects on the west coast of North America, provides significant long-term growth opportunities for the Corporation’s Gas segment. AltaGas expects to capitalize on these opportunities by increasing throughput at facilities, by increasing working interests in existing plants, and by acquiring and constructing new facilities such as liquefaction, refrigeration, natural gas processing, extraction, fractionation, storage and transmission pipelines. AltaGas’ 15-year strategic alliance with Painted Pony is an example of the Corporation’s ability to partner with producers to provide a fully-integrated service offering.

The Corporation also expects there to be opportunities to increase volumes by tying-in new wells and building or purchasing adjoining facilities and systems to create larger processing infrastructure to capture operating synergies and enhance its competitive advantage. The strategic location of some of its existing gas processing infrastructure is expected to benefit from growing natural gas production in northeastern British Columbia and western Alberta, in response to the development of unconventional sources of gas, such as the Montney and Duvernay shale plays. The Townsend facilities and the related infrastructure are examples of AltaGas’ ability to capitalize on energy infrastructure growth opportunities. In December 2017, AltaGas entered commercial operations at the first train of the North Pine Facility, which provides NGL processing capacity to producers in the area and is connected to the Townsend facilities through pipelines. The North Pine Facility is well connected by rail to Canada’s west coast including RIPET. Through the Townsend facilities, the North Pine Facility and RIPET currently under construction, AltaGas is well positioned to provide a fully integrated midstream service offering while also providing access to higher netback markets for producer NGL. The Gordondale facility and the Blair Creek facility are also meeting liquids extraction

16

needs in the Montney area as producers seek to increase netbacks by capitalizing on liquids-rich gas in this prolific area. Overall, the diverse nature of AltaGas’ natural gas and NGL infrastructure is expected to provide ongoing opportunities for AltaGas to increase throughput, utilization and profitability.